As filed with the Securities and Exchange Commission on February 21, 202320, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark one)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20222023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from ___________________________ to ___________________________

Commission file number 001-05146-01

KONINKLIJKE PHILIPS NV

(Exact name of Registrant as specified in its charter)

ROYAL PHILIPS

(Translation of Registrant's name into English)

The Netherlands

(Jurisdiction of incorporation or organization)

Philips Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Address of principal executive offices)

Marnix van Ginneken, Chief ESG & Legal Officer

+31 2059 77232, marnix.van.ginneken@philips.com, Philips Center, Amstelplein 2, 1096 BC Amsterdam, The Netherlands

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares - par value | PHG | New York Stock Exchange | ||

| Euro (EUR) 0.20 per share |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

| Class | Outstanding at December 31, | |

| KONINKLIJKE PHILIPS NV | ||

| Common Shares par value EUR 0.20 per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer," "accelerated filer,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer ☒ Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the

effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

Contents

- 1Introduction

- 2Forward-looking statements

- 3Form 20-F cross reference table

- 4Message from the CEO

- 5Board of Management and Executive Committee

- 6Strategy and Businesses

- 7Financial performance

- 8Environmental, Social and Governance

- 9Risk management

- 10Supervisory Board

- 11Supervisory Board report

- 12Corporate governance

- 12.1Introduction

- 12.2Board of Management and Executive Committee

- 12.3Supervisory Board

- 12.4Other Board-related matters

- 12.5General Meeting of Shareholders

- 12.6Annual financial statements and external audit

- 12.7Stichting Preferente Aandelen Philips

- 12.8Major shareholders

- 12.9Corporate information

- 12.10Additional information

- 13Group financial statements

- 13.1Controls and Procedures

- 13.2Reports of the independent auditor

- 13.3Independent auditor’s report on internal control over financial reporting

- 13.4Independent auditor’s report on the consolidated financial statements

- 13.5Consolidated statements of income

- 13.6Consolidated statements of comprehensive income

- 13.7Consolidated balance sheets

- 13.8Consolidated statements of cash flows

- 13.9Consolidated statements of changes in equity

- 13.10Notes to the Consolidated financial statements

- 14Further information

- 15Exhibits

1Introduction

This document contains information required for the Annual Report on Form 20-F for the year ended December 31, 20222023 of Koninklijke Philips N.V. (the 20222023 Form 20-F). Reference is made to the Form 20-F cross reference table herein. Only (i) the information in this document that is referenced in the Form 20-F cross reference table, (ii) this introduction and the cautionary statement “forward-looking statements” on the next two pages and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. Any additional information in this document which is not referenced in the Form 20-F cross reference table, or the Exhibits themselves, shall not be deemed to be so incorporated by reference, shall not be part of the 20222023 Form 20-F and is furnished to the Securities and Exchange Commission for information only.

References to Philips

References to the Company or company, to Philips or the (Philips) Group or group, relate to Koninklijke Philips N.V. and its subsidiaries, as the context requires. Royal Philips refers to Koninklijke Philips N.V.

IFRS based information

The audited consolidated financial statements as of December 31, 20222023 and 2021,2022, and for each of the years in the three-year period ended December 31, 2022,2023, included in the 20222023 Form 20-F have been prepared in accordance with International Financial Reporting Standards (IFRS) as endorsed by the European Union (EU). All standards and interpretations issued by the International Accounting Standards Board (IASB) and the IFRS Interpretations Committee effective 20222023 have been endorsed by the EU; consequently, the accounting policies applied by Philips also comply with IFRS as issued by the IASB. These accounting policies have been applied by group entities.

Use of non-IFRS information

In presenting and discussing the Philips financial position, operating results and cash flows, management uses certain financial measures that are not measures of financial performance or liquidity under IFRS (‘non-IFRS’). These non-IFRS measures should not be viewed in isolation as alternatives to the equivalent IFRS measure and should be used in conjunction with the most directly comparable IFRS measures. Non-IFRS measures do not have standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. A reconciliation of these non-IFRS measures to the most directly comparable IFRS measures is contained in this document. Reference is made in Reconciliation of non-IFRS information.

Third-party market share data

Statements regarding market share, contained in this document, including those regarding Philips’ competitive position, are based on outside sources such as specialized research institutes, industry and dealer panels in combination with management estimates. Where full year information regarding 20222023 is not yet available to Philips, market share statements may also be based on estimates and projections prepared by management and/or based on outside sources of information. Management's estimates of rankings are based on order intake or sales, depending on the business.

Documents on display

Philips’ SEC filings are publicly available through the SEC’s website at www.sec.gov. The SEC website contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Philips’ internet address is www.philips.com/investor. The contents of any websites referred to herein shall not be considered a part of or incorporated by reference into this document.

For definitions and abbreviations reference is made in Definitions and abbreviations

Due to rounding, amounts may not add up precisely to the totals provided in this report.

2Forward-looking statements

Pursuant to provisions of the United States Private Securities Litigation Reform Act of 1995, Philips is providing the following cautionary statement.

This document, including the information referred to in the Form 20-F cross reference table, contains certain forward-looking statements with respect to the financial condition, results of operations and business of Philips and certain of the plans and objectives of Philips with respect to these items, in particular, among other statements, certain statements in Item 4 “Information on the Company” with regard to management objectives, market trends, market standing, product volumes, business risks, the statements in Item 5 “Operating and financial review and prospects” with regards to trends in results of operations, margins overall, market trends, risk management, exchange rates, the statements in Item 8 “Financial Information” relating to legal proceedings and goodwill and statements in Item 11 “Quantitative and qualitative disclosure about market risks” relating to risk caused by derivative positions, interest rate fluctuations and other financial exposure are forward-looking in nature. Forward-looking statements can be identified generally as those containing words such as “anticipates”, “assumes”, “believes”, “estimates”, “expects”, “should”, “will”, “will likely result”, “forecast”, “outlook”, “projects”, “may” or similar expressions. By their nature, these statements involve risk and uncertainty because they relate to future events and circumstances and there are many factors that could cause actual results and developments to differ materially from those expressed or implied by these statements.

These factors include but are not limited to: Philips’ ability to gain leadership in health informatics in response to developments in the health technology industry; Philips’ ability to transform its business model tokeep pace with the changing health technology solutions and services;environment; macroeconomic and geopolitical changes; integration of acquisitions and their delivery on business plans and value creation expectations; securing and maintaining Philips’ intellectual property rights, and unauthorized use of third-party intellectual property rights; ability to meet expectations with respect to ESG-related matters; failure of products and services to meet quality or security standards, adversely affecting patient safety and customer operations; breach of cybersecurity; challenges in connection with Philips’ strategy to improve executionsimplifying our organization and other business performance initiatives;our ways of working; the resilience of Philips'our supply chain; attracting and retaining personnel; COVID-19 and other pandemics; challenges to drivein driving operational excellence and speed in bringing innovations to market; compliance with regulations and standards including quality, product safety and (cyber) security; compliance with business conduct rules and regulations including privacy and upcoming ESG disclosure and due diligence requirements; treasury and financing risks; tax risks; reliability of internal controls, financial reporting and management process; global inflation.

As a result, Philips’ actual future results may differ materially from the plans, goals and expectations set forth in such forward-looking statements. For a discussion of factors that could cause future results to differ from such forward-looking statements, reference is made to the information in Risk factors.

3Form 20-F cross reference table

Only (i) the information in this document that is referenced in the Form 20-F cross reference table, (ii) the Introduction and the cautionary statements concerning forward-looking statements of this report on pages 5-6,6-7, and (iii) the Exhibits shall be deemed to be filed with the Securities and Exchange Commission for any purpose. The content of Philips’ websites and other websites referenced herein should not be considered to be a part of or incorporated into the 20222023 Form 20-F. Any additional information which is not referenced in the Form 20-F cross reference table or the Exhibits themselves shall not be deemed to be so incorporated by reference, shall not be part of the 20222023 Form 20-F and is furnished to the Securities and Exchange Commission for information only.

The table below sets out the location in this document of the information required by SEC Form 20-F. The exact location is included in the column ‘Location in this document’. The column “Page”page number refers to the starting page of the section for reference only (and is not intended to refer to the starting page of the specific subsection, if applicable).

4Message from the CEO

Dear Stakeholder,

The challenges of a world in turmoil amplify the sense of urgency I feel to make sure Philips isdelivers on its purpose and becomes an even stronger force for good, so people everywhere can look after their health and well-being and access the care they need, with us focusing on where we can help, from the hospital to the home.

In January 2023, we announced our multi-year plan to create value with sustainable impact. Throughout the year, Philips teams around the world worked relentlessly, in a company withvolatile environment, to deliver on the first phase of that plan, laying a strong market leadership positions, an extensive customer base, strong innovation portfolio, talented employees,foundation for sustained future success.

Our products and a global purpose-driven brand. Yet, asservices reached 1.9 billion people in 2023, including 221 million in underserved communities – taking us closer to our 2022goal of improving 2.5 billion lives per year by 2030, including 400 million in underserved communities.

Our improved operational performance underlines, we are not extractingwas driven by significant progress on the full valuethree pillars of our businesses and have disappointed many stakeholders.

My priority as CEO isplan to address operational challenges, improve performance, and drive progressivecreate value creation through a strategy offor all our stakeholders: 1) focused organic growthgrowth; 2) scalable people- and an innovation model shiftpatient-centric innovation; and 3) focus on execution to increase the impact of patient- and people-centric innovation at scale. Execution will be the key value driver, with three clear priorities around improvingenhance patient safety and quality, creating more reliablestrengthen our supply chain reliability, and resilient supply chains,establish a simplified, agile operating model.

We achieved our raised 2023 outlook with strong sales growth, improved profitability, and simplifyingstrong cash flow, despite the way weuncertainties brought about by an increasingly turbulent geopolitical environment. While the order book remains strong in absolute terms, order intake was down, for which the necessary improvement actions are under way. There is still a lot of work so we are more agile and competitive.

Addressing priority challenges – improved execution as key value driver

Our first priority is to rebuild Philips’ reputation around patient safety and quality. The recall of specific Respironics sleep therapy devices and ventilators let down the patients who depended on them, and the doctors caring for those patients. We apologize deeply for that and are working hard to restore trust with all stakeholders. By year-end, following the substantial ramp-up of capacity, Philips Respironics had completed around 90% of the production required for the delivery of replacement devices to patients.

In consultation with regulators around the world, we have also been conducting a comprehensive test and research program to better understand the potential health risks associated with the use of affected devices. I am very conscious that 18 months is long, but this work had to be done, thoroughly.but 2023 represents a good start, and it reinforces our confidence in delivering on our three-year plan.

Patient safety and quality

Resolving the consequences of the Respironics recall for our patients and customers is a key focus area, and I am encouraged by the test resultsapologize for the first-generation DreamStation devices, that account fordistress caused. Globally, over two thirds99% of the registered affected devices:sleep therapy device registrations that are complete and actionable have been remediated, while the prevalence of visible foam degradation is low, and the emissionremediation of the detected volatile organic compounds and particulates are within the applicable safety limits and not expected to result in appreciable harm to health in patients.ventilator devices remains ongoing.

We are fully committed to completingcomplying with the terms of the consent decree agreed with the US Department of Justice (DOJ), representing the US Food and Drug Administration (FDA), which primarily focuses on Philips Respironics recallin the US. The proposed consent decree will provide Philips Respironics with a roadmap of defined actions, milestones, and testing program in 2023. Wedeliverables to demonstrate compliance with regulatory requirements and to restore the business. Further details will also implementbecome available once the consent decree has been finalized and submitted to the relevant US court for approval.

As well as implementing all measures agreed with the US Food & Drug Administration (FDA)FDA and US Department of Justice, including a consent decree, andDOJ in connection with the Respironics recall, we will continue to rebuild tiesrelations with the FDA and other national regulators. We have putIn October, Philips Respironics received preliminary court approval for the leadershipclass action settlement that would resolve all or nearly all private economic loss claims in the US related to the recall. The settlement does not include or constitute any admission of liability, wrongdoing, or fault by any of the Philips parties. The previously disclosed litigation, including the personal injury and end-to-end organization in placemedical monitoring claims, and have invested significantly in doing so. Acrossinvestigation by the company, we have assignedDOJ related to the highest priority to making the necessary step-up inRespironics recall are ongoing.

Driving progress on priorities

With patient safety and quality managementthe number one priority, oversight now resides at Executive Committee level, and we have elevated leadershipa new organization in place, with stronger processes and more effective early warning systems in the businesses. We are pro-actively addressing quality improvements and first-time-right design. One of the most inspiring events of the year took place in October – a company-wide Timeout for Patient Safety and Quality. All 70,000 employees came together in their teams to discuss how we are moving forward on patient safety and quality, and how to Executive Committee level.take it further.

An integral aspect of quality is the abilityIn our drive to deliver and install equipment on time and to the required specifications. To this end, we are taking decisive action to make our supply chaincreate more reliable and predictable, by securing near-termresilient supply redesigningchains, we have significantly reduced our high-risk components and pruning our portfolio,inventories, and moving fromthe actions we have taken continued to have a ‘one size fits all’positive impact on our sales and service levels. We continue to strengthen further through regionalization of the supply chain structurebase and manufacturing capability to better respond to local requirements with a more agile, tailoredshorter value chain model per business, with dedicated and upgraded domain expertise. This will secure more deliveries, drive faster order-book conversion and build down inventory.chain.

We are also simplifyingstarted the way we workshift to drive accountability and agility, with the aim of unlocking significant productivity and margin gains. This simplificationour new, simplified operating model – with end-to-end businesses with single accountability and more focused targets, supported by a much leaner enterprise layer, strong regions and a reinvigorated impact culture – and completed the realignment of workforce roles and reporting lines. This included the difficult but necessary reduction of approximately 8,000 roles to date, out of the planned reduction of 10,000 roles by 2025.

Reflecting our changing culture of patient-people- and people-centricity,patient-centricity, accountability and impact, our Executive Committee was strengthened with the arrival of four new members in 2023, each bringing valuable experience and skills to the work of our leadership team. We also welcome the decision by Exor to take a 15% minority stake in our company – a sign of confidence in our plan, our people, and our future. And we marked the 100th anniversary of Philips in China, a remarkable achievement.

The opportunity to deliver better care for more people

Today, millions of people around the world have little or no access to basic healthcare, and climate change is impacting both environmental and human health. Healthcare is simply not working as it needs to. There are not enough doctors and nurses to address the growing demand for care. In parallel, rising costs are stretching financial budgets to the limit.

That’s why we are advocating for systemic change, driven by all ecosystem players, that addresses technology, clinical practice, financing and regulation as a whole. Change that delivers better, more productive healthcare that works for everyone. Without this change, communities all around the world will increasingly face challenges to get the care they need.

Focusing our efforts on where we can make a difference, we want to help more healthcare providers help more patients, in a sustainable way, and empower more people to take care of their health and well-being – by applying our combined capabilities in innovation, impactdesign and clear accountability –sustainability.

There is a primary enablerlot of work to drive flawless execution.be done, but we see the potential for a future where health systems run smoothly, efficiently and sustainably, with doctors and nurses seeing the patient at the right time and at the right point of care. Where they can be confident that the right choice is also the easy choice, with simpler workflows enabling them to give patients the best care and best experience.

The set of measures we have taken includesWith real-time and predictive insights supporting collaboration across the very difficult, yet necessary decisions announcedpatient journey. And AI being used in October 2022a responsible manner to optimize workflows and January 2023improve efficiency, so that clinical staff get the time and space to reduce our workforce by 4,000 employeesfocus on what matters and then a further 6,000 respectively, as we drive a major step-up in productivity. We will strive to implement these reductions with due respectwhat they do best: caring for every employee affected and in line with all local rules and regulations.their patients.

We believesee a future where it is also easier for people everywhere to look after their health and well-being. For example, with solutions helping more parents and babies in the first 1,000 days and supporting the connection between good oral care and good overall health.

Recognizing that together, these measureshuman health and environmental health go hand in hand, we are collaborating with our customers and suppliers to decarbonize healthcare and so create a more sustainable and resilient industry.

Looking ahead

While realistic about the challenging economic environment, geopolitical risks, and uncertainties around ongoing litigation, I am confident we will help us establish the culture, capabilities and infrastructure neededcontinue to consistently execute and deliver as a reliable patient- and people-centric health technology company.

Focused organic growth in Diagnosis & Treatment, Connected Care and Personal Health

As well as restoringon our reputation as a responsible patient- and people-centric innovation leader in health technology, we urgently need to get back on coursemulti-year plan to create value with sustainable impact. To do this, we will drive organic growth through scaleimpact – helping consumers lead healthy lives and leadership:

Focusing investmentshealthcare providers deliver efficient, high-quality care toaccelerate growthpatients inImage Guided Therapy, Ultrasound and Monitoring, where we have strong #1 or #2 positions, and expand our leadership position in Personal HealthScaling our new Enterprise Informatics businessDriving margin improvement in Diagnostic ImagingRestoring the Sleep & Respiratory Care business.

We will leverage our distinctive market positions, especially our strong presence in North America and many international markets, while further localizing to support our leadership position in China.

Patient- and people-centric innovation at scale

We will continue to invest significantly in innovation, but are making a number of important changes to increase the impact of our patient- and people-driven innovation. Focusing our resources on fewer, better-resourced and more impactful projects, we will concentrate a higher proportion of our R&D resources in the businesses to ensure that innovation is done closer to our customers. We will scale and accelerate innovations, driven by the business and supported by rightsized corporate research, with patient safety, quality and sustainability at the core of innovation design. The technological and business model innovation that Philips brings to healthcare across care settings – often as part of long-term partnerships – is critical, making care delivery more convenient and sustainable.

2022 performance

Looking back on last year, sales increased nominally to EUR 17.8 billion, while several factors weighed down on profitability. Performance was impacted by our efforts to mitigate supply chain and inflationary pressures and the revenue and cost consequences of the Philips Respironics sleep recall, whilst at the same time dealing with global challenges such as the COVID situation in China, volatile demand and supply, and the war in Ukraine. As we worked through the operational challenges, we progressedsustainable way. Based on our ongoing actions to enhance execution priorities in the fourth quarter and saw initial signs of improvement.

I find it greatly encouraging that, despite our recent difficulties, Philips’ purpose, strategy and solutions resonate strongly with customers, as evidenced by the around 100 long-term strategic partnerships we entered into with hospitals and health systems around the world in 2022, and by the continued strength of our order book.

Delivering on our ESG commitments

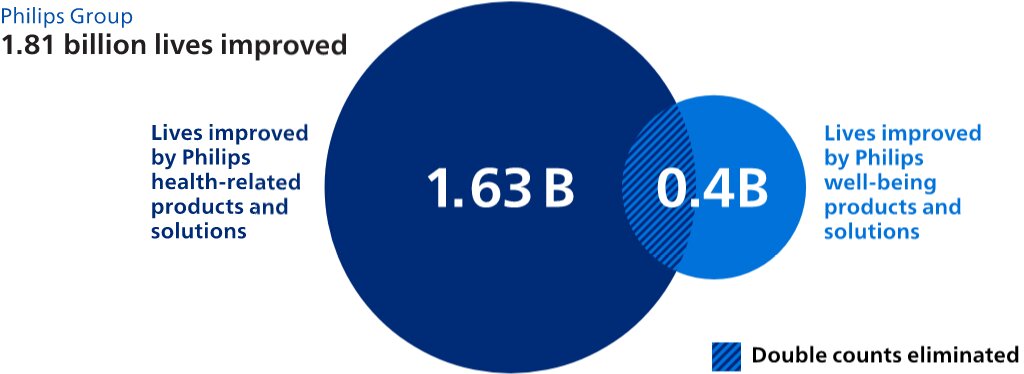

Environmental, Social & Governance (ESG) are three key dimensions defining our approach to doing business responsibly and sustainably. In 2022, we reached 1.81 billion people with our products and services, including 202 million in underserved communities – taking us a step closer to our goal of improving 2 billion lives per year by 2025, including 300 million in underserved communities.

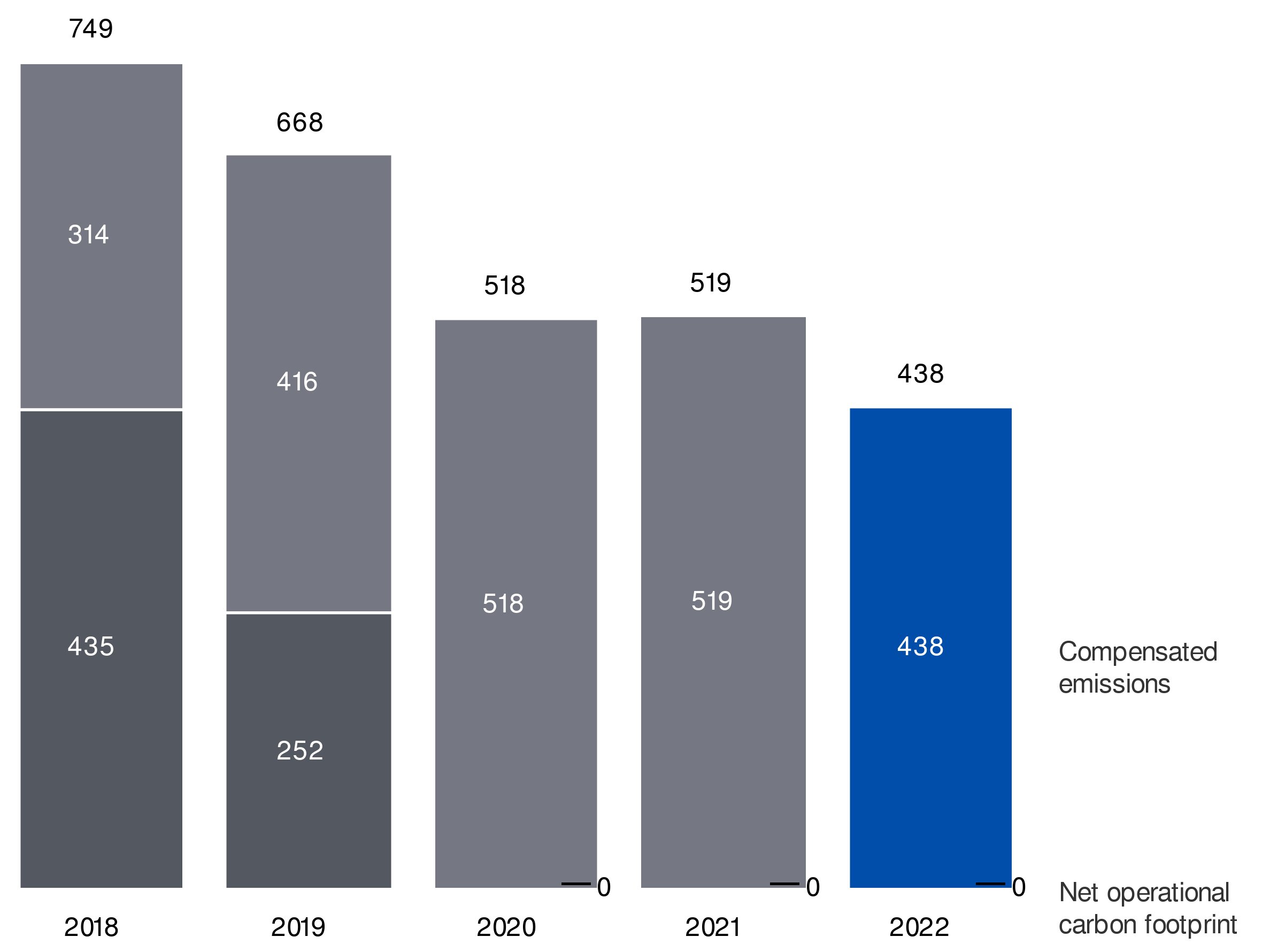

We continued to work hard to deliver on our other key ESG commitments. For example, our updated carbon reduction targets were approved by the Science Based Targets initiative (SBTi), and we were included in CDP’s climate action ‘A-List’ for the 10th year in a row. We see increasing momentum within the healthcare industry and on the part of our customers to reduce their environmental impact, and we are well placed – with innovations such as our BlueSeal magnet for helium-free-for-life MR and our Circular portfolio – to support that trend and help create a sustainable infrastructure for the future of healthcare.

Looking ahead

We remain cautious in light of the subdued economic outlook for the year, staffing and inflationary pressures facing our customers, geopolitical risks, supply and demand volatility, and uncertainties around ongoing consent decree negotiations, litigation and Department of Justice investigations. Nevertheless, we expect that, by prioritizingdriving patient safety and quality, tightening our focus on innovationincreasing supply chain reliability, and strengthening our category leadership areas, while at the same time improving execution and taking a disciplined approach to capital,further simplifying how we will be able to progressively create value with sustainable impact. work – we expect further performance improvement in 2024.

Against this background, and reflecting the importance we attach to dividend stability, we propose to maintain the dividend at EUR 0.85 per share, to be distributed fully in shares.

On behalf of the Executive Committee, I would like to acknowledge, once again, that 2022 has been very disappointing and we carry accountability for the plan to bring Philips back to where it belongs. I want to thank our consumers, our customers and their patients, for their understanding – and our suppliers and ecosystem partners for their support, – over this past year.and the Supervisory Board for their support and guidance. I appreciatealso want to express my deep gratitude to our employees' hard workemployees for their dedication to improving people’s lives and willingnessour company’s performance, and to embrace change and drive performance improvement. And I wish to thank our shareholders and other stakeholders for their continued support in these challenging times.support.

As I am honored to have been tasked with leading our company and am heartened by the support I have encountered from our employees and customers, investors and other stakeholders.look ahead, I am realistic about the challenges we face, butoptimistic about building on the momentum we have full confidence increated, and excited about delivering on our planpurpose – for the benefit of actionpatients, customers and am firm in my resolve to lead Philips back to a position of strength in aconsumers the world that needs meaningful innovation.over.

Roy Jakobs

Chief Executive Officer

5Board of Management and Executive Committee

Royal Philips has a two-tier board structure consisting of a Board of Management and a Supervisory Board, each of which is accountable to the General Meeting of Shareholders for the fulfillment of its respective duties. The Board of Management is entrusted with the management of the company. The other members of the Executive Committee have been appointed to support the Board of Management in the fulfilment of its managerial duties. Please also refer to Board of Management and Executive Committee within the chapter Corporate governance.

Members of the Board of Management

Roy Jakobs

Chairman of the Board of Management and the Executive Committee (since October

Roy Jakobs joined Philips in 2010 and has held various global leadership positions across the company, starting as Chief Marketing & Strategy Officer for Philips Lighting. In 2012, he became Market Leader for Philips Middle East & Turkey, leading the Healthcare, Consumer, and Lighting businesses out of Dubai. Subsequently, he became Business Leader of Domestic Appliances, based in Shanghai, in 2015. In 2018, Roy joined the Executive Committee as Chief Business Leader of the Personal Health businesses and in early 2020 he started as Chief Business Leader of Connected Care. Prior to his career at Philips, he held various management positions at Royal Dutch Shell and Reed Elsevier.

Abhijit Bhattacharya

Born 1961, Indian

Executive Vice President

Member of the Board of Management (since December 20152015)

Chief Financial Officer

Abhijit Bhattacharya first joined Philips in 1987 and has held multiple senior leadership positions across various businesses and functions in Europe, Asia Pacific and the US. Between 2010 – 2014, he was the Head of Investor Relations of Philips, and subsequently, CFO of Philips Healthcare, Philips’ largest sector at the time. Prior to 2010, Abhijit was Head of Operations & Quality at ST-Ericsson, the joint venture of ST Microelectronics and Ericsson, and he was CFO of NXP’s largest business group.

Marnix van Ginneken

Born 1973, Dutch

Executive Vice President

Member of the Board of Management (since November 20172017)

Chief ESG & Legal Officer

Marnix van Ginneken joined Philips in 2007 and became Head of Group Legal in 2010. In 2014, Marnix became Chief Legal Officer of Royal Philips and Member of the Executive Committee. In 2017 he was appointed to the Board of Management. He is responsible for ESG/Sustainability,driving ESG efforts across the company, including Sustainability. He is also responsible for Legal, Intellectual Property & Standards and Government & Public affairs. Since January 1, 2024 he is Chairman of the Board of the Philips Foundation. In 2011, he is alsowas appointed Professor of International Corporate Governance at the Erasmus School of Law in Rotterdam. Before joining Philips, Marnix worked for Akzo Nobel and as an attorney in a private practice.

Other members of the Executive Committee

as of December 31, 2022

Willem Appelo

Chief Operations Officer

Andy Ho

Chief Market Leader of Philips Greater China

Deeptha Khanna

Chief Business Leader Personal Health

Bert van Meurs

Chief Business Leader Image Guided Therapy and

Edwin Paalvast

Chief Market Leader of International

Shez Partovi

Chief Innovation & Strategy Officer

Vitor Rocha Jeff DiLullo

Chief Market Leader of Philips North America

Daniela SeabrookHeidi Sichien

Chief

Kees WesdorpSteve C de Baca

Chief Patient Safety and Quality Officer

Julia Strandberg

Chief Business Leader

This page reflects the composition of the Executive Committee as per December 31, 2022. As announced on December 8, 2022, Kees Wesdorp left the company on January 1, 2023, with Bert van Meurs (Chief Business Leader for the Image Guided Therapy businesses) temporarily expanding his role to include the leadership of the Precision Diagnosis businesses. As announced on January 30, 2023, Steve C. de Baca and Jeff DiLullo joined the Executive Committee, effective February 6, 2023, as Chief Patient Safety & Quality Officer and Chief Market Leader of Philips North America, respectively. As such, Mr DiLullo succeeds Vitor Rocha, who left the company effective as per the same date. Philips expects to announce new leaders for its Connected Care businesses (which was the responsibility of Roy Jakobs until his appointment as CEO) as well as for its Precision Diagnosis businesses, in 2023. For a current overview of the Executive Committee members, see also https://www.philips.com/a-w/about/executive-committee.html

6Strategy and Businesses

6.1Our strategic focus

A strategy of focused organic growth, founded on clear choices in business and innovation, and improved execution

OverToday, most healthcare systems are struggling to keep up with the past 10 years, Philips has undergone a transformation to reshape its portfolio and become a focused health technology company. As a result, we are active in highly attractive segments that offer significant potential for growth and margin expansion.

These markets are attractive due to the underlying growth of demand for access to healthcare from an aging and growing population. This in turn fuels theever-rising need for, meaningful innovation to address the risingand cost of, healthcare, spending andwhile systemic staff shortages and makefinancial resource constraints increase the pressure. Climate change is impacting both environmental and human health, compounding the stress on our healthcare more efficientsystems and productive, while driving better outcomes.

influencing consumer behavior. At Philips, we view the provision and collection of data from patient monitors, imaging devices, and Electronic Medical Records as the foundation upon which Artificial Intelligence (AI) propositions can be built to turn clinical data into actionable insights for patients, providers, and consumers. In addition to providing clinical insights, the same system, informatics and service solutions also provide improved operational forecasting – something our customers have been requesting since COVID-19 to help them improve productivity.

When we perform all of the above for a particular health condition, such as cardiac disease, we establish domain expertise across various sites of care for that disease state. Our healthcare customers are asking for integrated innovations that enable them to care for patientstime, in both in the hospital and in outpatient settings. In parallel we continue to provide impactful consumer health propositions

Creating value with sustainable impact

2022 was a difficult year for Philips as its business and financial performance suffered due to challenges in execution, quality and supply, and a complex operating model. Going forward, Philips will address these operational challenges, improve performance, and drive progressive value creation through a strategy of a) focused organic growth, b) scalable patient- and people-centric innovation, and c) focus on reliable execution, prioritizing patient safety and quality, supply chain reliability, and a simplified operating model. All supported by a reinvigorated culture of accountability, empowerment and strengthened health technology talent and capabilities.

Focused organic growth

Having transformed to become a health technology company in recent years, we will now focus on extracting the full value of our strong portfolio with leading positions.

We will focus investments to accelerate growth and margin expansion in areas – Image Guided Therapy, Ultrasound, Monitoring, and Personal Health – where we have strong #1 or #2 positions. In 2022, approximately 70% of our sales were generated by businesses with such leadership positions in the hospital and the home. We will also scalehome, emerging technologies and AI are affecting our new Enterprise Informatics business, drive margin improvement in Diagnostic Imaging, and restore Sleep & Respiratory Care.lives like never before.

Scalable patient- and people-centric innovation

Philips’At Philips, our purpose –is to improve people’s health and well-being through meaningful innovation. As such, we see huge opportunities to make a difference through innovation, design, and sustainability – is at the centerpartnering with our healthcare customers to increase productivity and deliver better care for more people through our innovation platforms of everything we do. This core principle has never beenmonitoring, imaging, interventional and enterprise informatics. And empowering more relevant than it is in these challenging times. people to take care of their health and well-being through our personal health propositions.

Our plan to create value with sustainable impact

As a leading health technology company, we believe that – viewedPhilips is committed to driving progressive value creation through the lensa strategy of customer needs –focused organic growth, scalable patient- and people-centric innovation, can improve people’s health and healthcare outcomes, as well as makingfocus on reliable execution.

Philips has significant strengths to build on. We have a portfolio of patient- and people-centric innovations in hardware, software, AI and services, supporting care more convenient and sustainable, both in the hospital and at home.

Given our global presence, strong enterprise informatics platforms, (ambulatory) monitoring and imaging data, as well as our capabilities to support care across settings, we believe Philips is well positioned to do this, and – leveraging our strong clinical, consumer and Environmental, Social & Governance (ESG) franchise, and our strong brand – do it in a convenient and sustainable way.

In the consumer domain, we develop innovative solutions that support healthier lifestyles, prevent disease, and help people to live well with chronic illness, also in the home and community settings.

In clinics and hospitals,home. And we are teaming up with healthcare providers to innovatethe preferred strategic and transforminnovation partner for many customers across the way care is delivered. globe.

A strategy of focused growth

We listen closely tooperate in growing market segments, where attractive margins provide a foundation for sustainable value creation. To deliver on our customers’ needs and togetherstrategy, we co-create solutions that help our customers improve outcomes, patient and staff experience and productivity.make clear portfolio choices. We are embedding AIconcentrating our resources on areas where we have strong positions and data science in our propositionscan accelerate growth and expand margins more quickly – for instance, applying the power of predictive data analyticsImage Guided Therapy, Monitoring, Ultrasound, and artificial intelligence at the point of care – to leverage the value of data in the clinical and operational domains, aiding clinical decision making and improving the quality and efficiency of healthcare services. Increasingly, we are working together with our health systems customers in novel business models, including outcome-oriented payment models, that align their interests and ours in long-term partnerships.

Going forward,Personal Health. In doing so, we will focus our innovation on where we see customer needs evolving. To improve outcomes, we willto support clinical workflows in areas where we have domain leadership, e.g.such as cardiology, and that build on our deep strength in the ICU. ToIntensive Care Unit (ICU) and Cath Lab.

In Diagnostic Imaging, our goal is to help healthcare providers who need to do more with less. We will do so by leveraging our differentiating, AI-enabled innovations to increase their imaging workflow productivity, departmental efficiency and financial sustainability and, by doing so, improve our margins and drive uptake of our services supporting care pathways.

We help our customers to unlock actionable insights from pools of medical imaging data, vital signs (patient monitoring) data and insights generated with the support of artificial intelligence (AI) to optimize care delivery across the patient journey. With the scaling of our end-to-end multi-vendor Enterprise Informatics business, we aim to grow our platforms such as radiology, pathology and remote care delivery across health systems and care settings, while building long-term customer relationships, generating recurring revenue and enabling the hardware business to maintain a competitive advantage.

Additionally, we remain committed to rebuilding our position in Sleep & Respiratory Care while continuing to resolve the effects of the Respironics recall.

Scalable patient- and people-centric innovation

At Philips, we’ve been innovating to improve lives for over 130 years. People’s needs are at the very heart of how we innovate and design for sustainable impact with a system having‘safety and quality first’ mindset.

Innovation is our core strength and will continue to contend with high patient volumes, staff shortagesbe our core differentiator. Recent industry trends have accelerated the adoption of technology within healthcare. We are embracing these trends and rising costs, we will enhance care pathways and operational workflows through integrated technology infrastructure, and we will leverageshifting our (enterprise) informatics and hardware innovation to lower costsa more patient- and reduce the burden on staff. To improve the delivery of care outside the hospital,people-centric model closer to our customers. This starts with asking: What do people – in our case, patients and clinicians, nurses and technicians, consumers – really need? And how can we will utilize our consumer/home experience and our strength in data and informatics to connect andbest support care for patients,healthcare professionals with better outcomes, across settings.their workflow?

In doing so, we will leverage leading technologies across our portfolio. To name just a handful, by way of example: our Ingenia Ambition MR system with BlueSeal magnet that offers helium-free-for-life operation; our Azurion suite of interventional cardiology solutions; our IntelliVue MX750 and MX850 patient monitors and MCOT ambulatory cardiac ePatch offering comprehensive monitoring capabilities across sites of care; and our multi-vendor, multi-modality, multi-site Radiology Operations Command Center virtualized imaging solution.

While we continue to invest significantly in innovation, we are making a number of important changes to increase the impact of our patient- and people-driven innovation and generate better returns. Moving forward, we will focus our resources on a smaller number of projects and products with greater potential for impact. We will scale and accelerate innovations, driven by the business and supported by rightsized Group research, with patient safety, quality and sustainability at the core of design. By bringing our central innovation activities into the heart of the businesses, we are bringingfocusing our systemefforts and software innovation closerresources on fewer projects offering greater scale and impact on patient outcomes and care providers’ clinical, operational and sustainability challenges. We do this by balancing new, breakthrough innovations and continuous optimized lifecycle management, through upgrades and services, of Philips products and systems already deployed in care settings. We bring together expertise across the product lifecycle, from research through serviceability, to ensure our customers.innovations drive maximum impact for our customers and consumers – delivering a superior experience and value, with minimum environmental impact.

Focus on improvedExecution as the value driver

Enabled by a culture of patient- and people-centricity, accountability and impact, supported by strong health technology capabilities, we see effective execution

The as the key value driver of our plan and a key driver for change. We are focusing on:

- Patient safety and quality – remains our

performance improvement is improved execution grounded in three decisive actions:- highest priority

- End-to-end supply chain resilience

- A simplified operating model with an agile way of working

First, patient safety and quality: putting thisquality is at the heart of (business) innovation,everything we do. We have stepped up accountability for patient safety and quality, for example, by elevating oversight to the function to Executive Committee level, and embedding itcreating a new organization, with stronger processes and more effective early warning systems in our culture, e.g. bythe businesses, as well as giving all employees dedicated patient safety and quality objectives;

Second, we are re-shaping our supply chain reliability: movingset-up so we can ensure reliable delivery of products and services and deliver our order book. We have moved away from being organized around central functions to a centralized ‘one size fits all’structure where we align procurement and supply chain to our businesses. A more regionalized structure combined with dual sourcing that can work effectively even when volatile conditions emerge in different parts of the world. We are pruning our product portfolio, which includes a long tail of smaller product lines and older generations of our products. We also have a dedicated team redesigning products and components to aincrease our resilience to more volatile demand.

Finally, we are implementing our simplified operating model to enable us to better serve patients, customers and consumers, as well as ensuring that our cost of organization remains competitive in an inflationary and cost-driven environment, and that we are more agile dedicated end-to-end set-up per business,in responding to changes in the market. Prime accountability has been assigned to the businesses, supported by lean Functions and pruning and redesigning products;

Driving impact for people and accountable leadershipplanet

Building on our strong heritage in environmental sustainability and social impact, we have operationalized our purpose by adopting a fully integrated approach to doing business responsibly and sustainably. We are partnering with empowered teams.stakeholders to drive environmental, social and governance (ESG) priorities and make a global impact. For example:

- We aim to improve the lives of 2.5 billion people a year, including 400 million in underserved communities, by 2030

- We will continue to operate carbon-neutrally and are partnering with customers and suppliers on reducing emissions across the full value chain in line with science-based targets

- We aim to increase circular revenues from 15% of sales in 2020 to 25% of sales by 2025

Our ambitionDelivering on our plan

With our global reach, market leadership positions, deep clinical and technological insights, and customer-centric, patient- and people-focused innovation, capability, we believe Philips is well placedpositioned to create further value inhelp deliver real change across healthcare. Fueled by our purpose and supported by a changingreinvigorated culture of accountability and empowerment, as well as strengthened health and care world.

Wetechnology capabilities, we aim to improve the lives of 2 billion people a year by 2025, including 300 million in underserved communities, rising to 2.5 billion and 400 million respectively by 2030. This is one of the comprehensive set of commitments we have deployed across all the Environmental, Social and Governance (ESG) dimensions that help guide the execution of our strategy and support our contribution to UN Sustainable Development Goals 3 (Ensure healthy lives and promote well-being for all at all ages), 12 (Ensure sustainable consumption and production patterns) and 13 (Take urgent action to combat climate change and its impacts).

We strive to deliver superior, long-termprogressively create value to patients, customers, consumers and shareholders, while acting responsibly towards our planet and society, in partnership with our stakeholders. We believe that, executed with rigor, discipline and quality, the strategic imperatives outlined above, in combination with a relentless focus on execution, will put us back on track for a future of progressive value creation with sustainable impact.

6.2How we create value with sustainable impact

BasedThe overview below is based on the International Integrated Reporting Council framework we useand includes resource inputs, value outcomes and societal impact across various resources to create value with sustainable impact for our stakeholders.financial and Environmental, Social and Governance (ESG) dimensions.

Resource inputs

Human

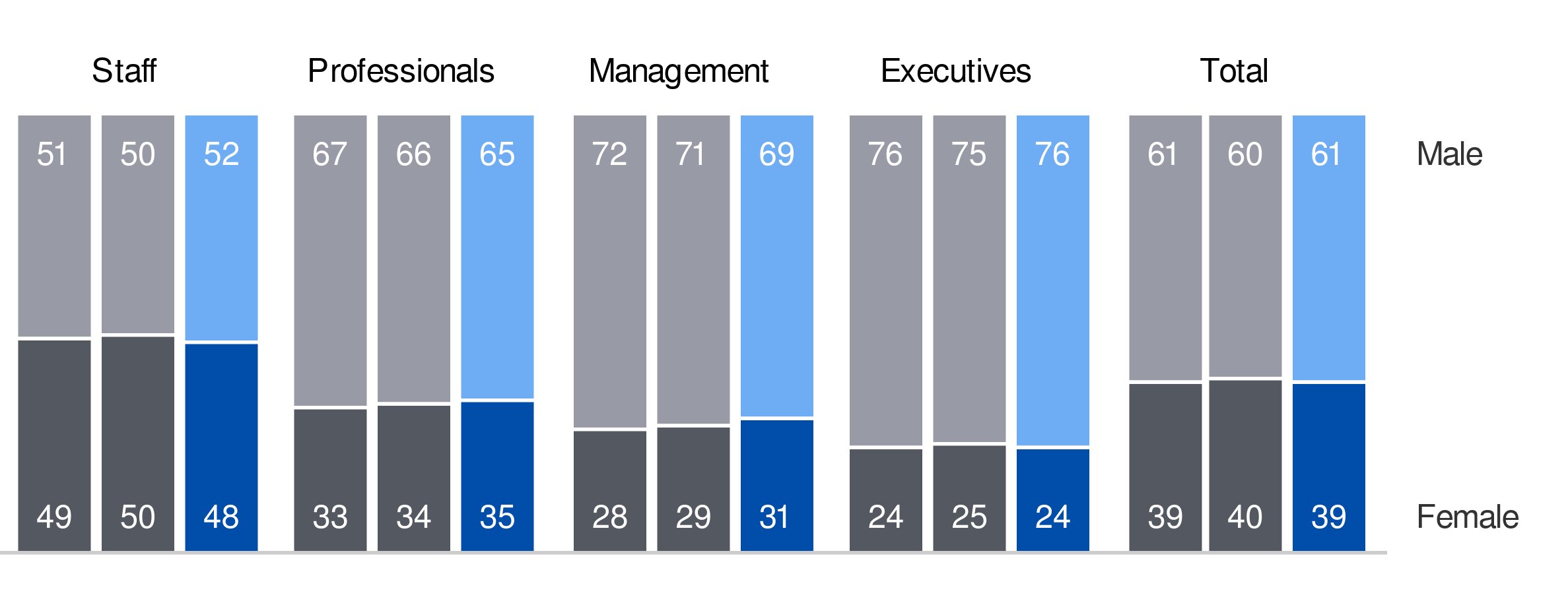

- Employees

77,233,69,656, 120-plus nationalities, 39% female Philips University 1,344,956Training 3,670,963 courses,1,880,4162,987,260 hours,1,009,4593,578,199 training completions32,74230,558 employees ingrowthGrowth geographies- Focus on Inclusion & Diversity

Intellectual

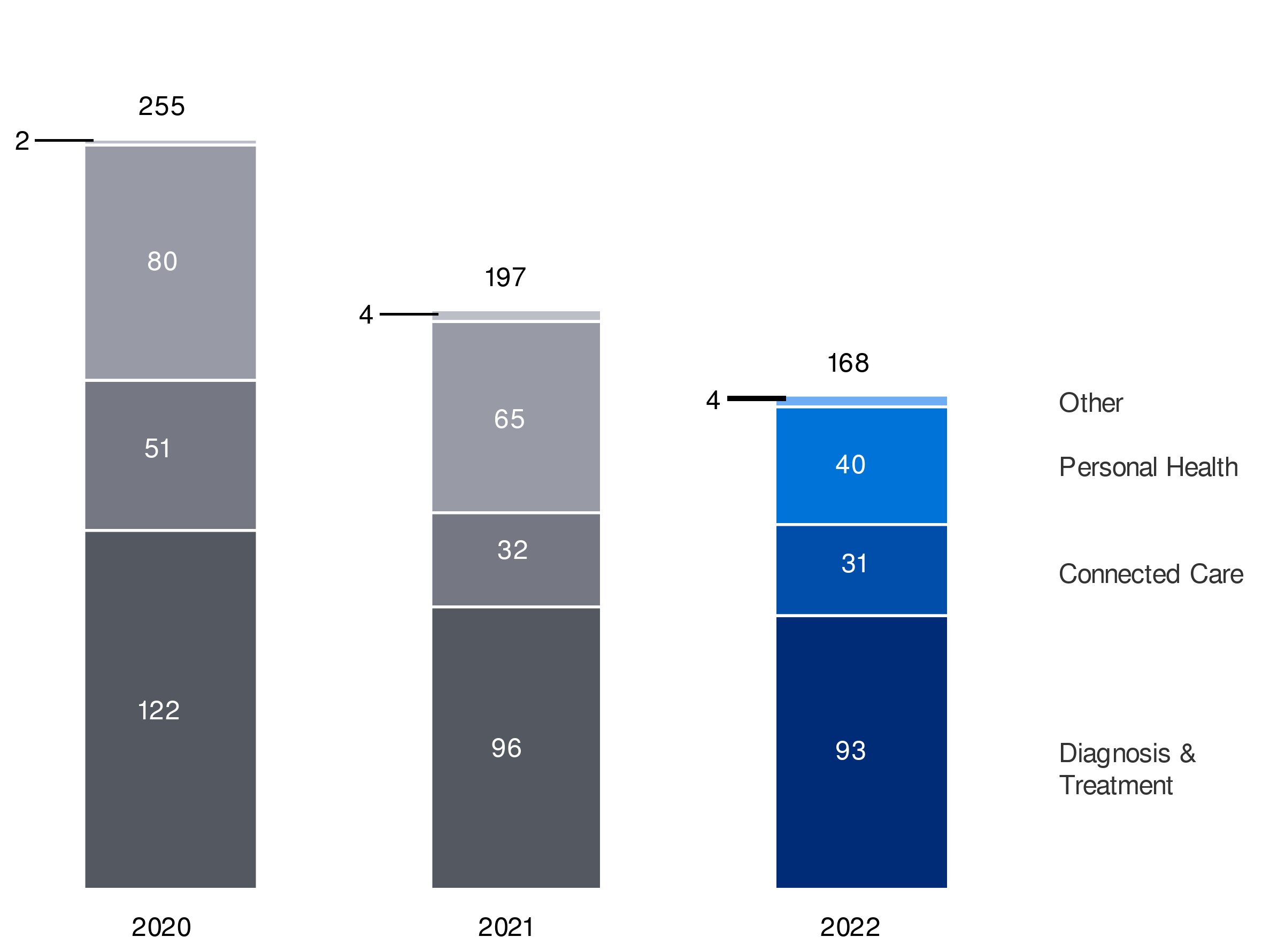

- Invested in R&D EUR

2.11.9 billion(Green(Green/EcoDesigned Innovation EUR168142 million) - Employees in R&D

11,69010,833

Financial

- Equity EUR

13.312.1 billion - Net debt*) EUR

7.05.8 billion

Manufacturing

- Employees in production

39,74235,281 - Industrial sites 23, cost of materials used EUR

4.34.6 billion - Total assets EUR

3129 billion - Capital expenditures on property, plant and equipment EUR

444345 million

Natural

- Energy used in manufacturing

338.1 gigawatt322,532 megawatt hours - Water used

677,632661,076 m3 - 'Closing the loop' on all our professional medical equipment by 2025

Social

- Philips Foundation

- Stakeholder engagement

- Volunteering policy

Value outcomes

Human

- Employee Engagement Index

77%73% favorable - Sales per employee EUR

230,817260,840 - Safety 172 Total Recordable Cases

Intellectual

- New patent filings

920795 - Royalties EUR

419.0434.2 million 171160 design awards for the Philips brand

Financial

- Comparable sales growth*)

(2.8)%6.0% - Adjusted EBITA*) as a % of sales

7.4%10.6% - Free cash flow*) EUR

(961)1,582 million

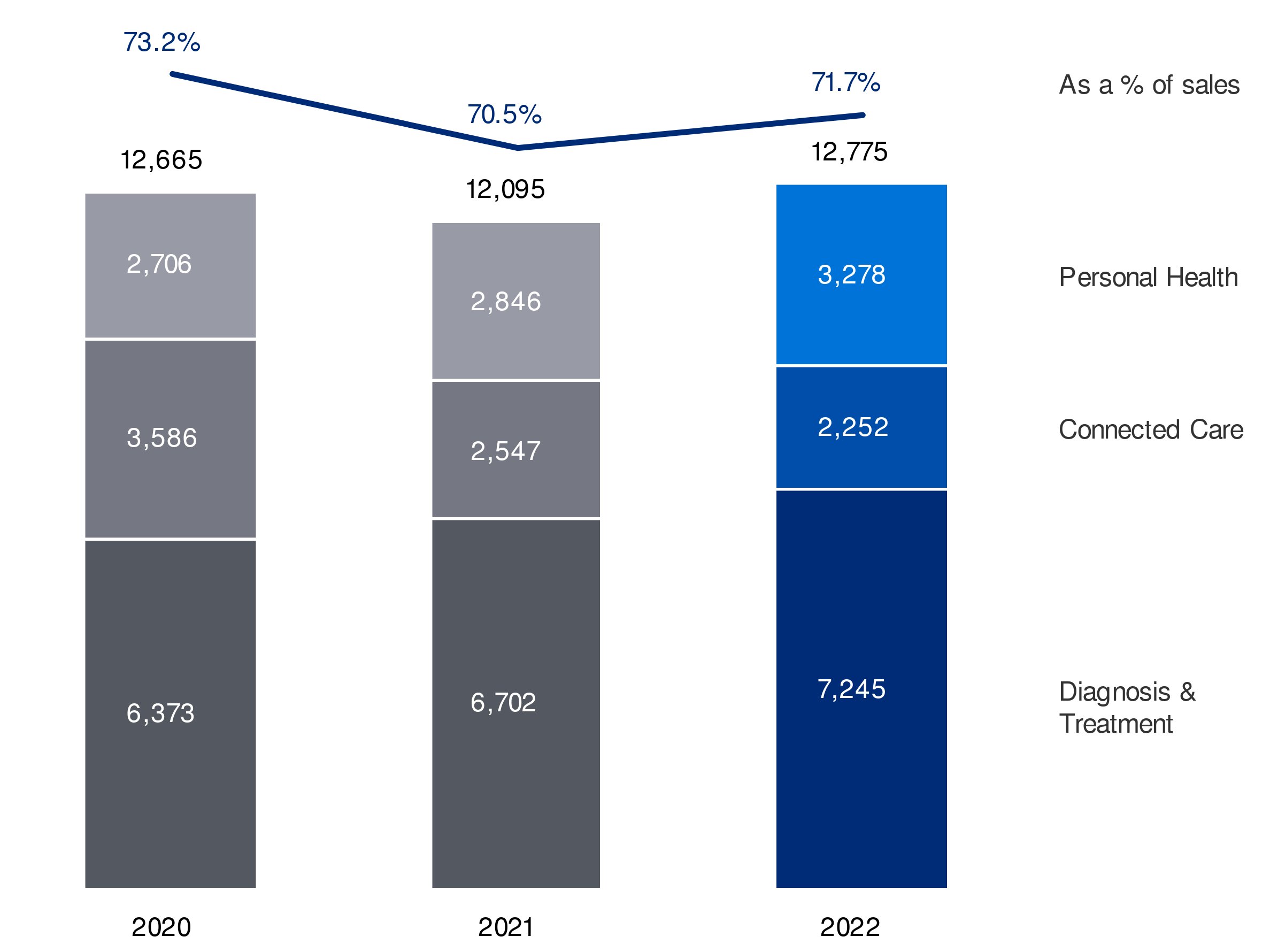

Manufacturing

- EUR

12.112.4 billion revenues from goods sold

Natural

71.7%70.5% Green/EcoDesigned Revenues18%20.0% revenues from circular propositions- Net CO2 emissions from own operations down to zero kilotonnes

62,000107,000 tonnes (estimated)materialsfrom products, parts and packaging used to put products on the market- Waste

22,80219,375 tonnes, of which 91%repurposedrecirculated

Social

- Brand value USD

12.811.2 billion (Interbrand) - Partnerships with UNICEF, Red Cross, Amref and Ashoka

Societal impact

Human

- Employee benefit expenses EUR

6,9526,903 million, all staff paid at least a Living Wage - Appointed

71%81% of our senior positions from internal sources 30%31% of Leadership positions held by women

Intellectual

- Around

55%48% of revenues from new products and solutions introduced in the last three years - Approximately 70% of sales from leadership positions

Financial

- Market capitalization EUR

1219 billion at year-end - Long-term credit rating

A-BBB+1, Baa12, BBB+3**) - Dividend EUR

741749 million

Manufacturing

- 100% electricity from renewable sources

Natural

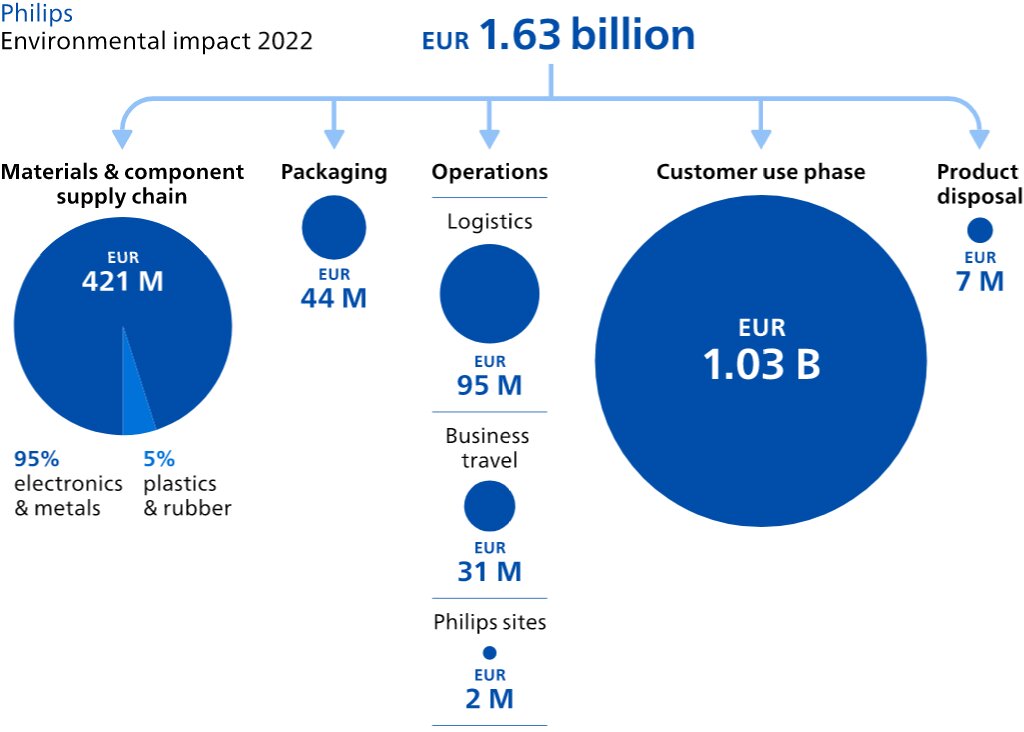

- Environmental impact of Philips operations up to EUR

128261 million - All 23/23 industrial sites 'Zero Waste to Landfill' at year-end

20222023 - Updated CO2 reductions approved by the Science Based Targets initiative

Social

1.811.88 billion Lives Improved, of which202221 million in underserved communities (including2.21.4 million via Philips Foundation)459,000723,000 employees impacted at suppliers participating in the 'Beyond Auditing' program- Total tax contribution EUR

3,4693,051 million (taxes paid/withheld) Income tax benefit EUR 113 million; the effectiveCorporate income taxrate is 6.5%paid EUR 152 million

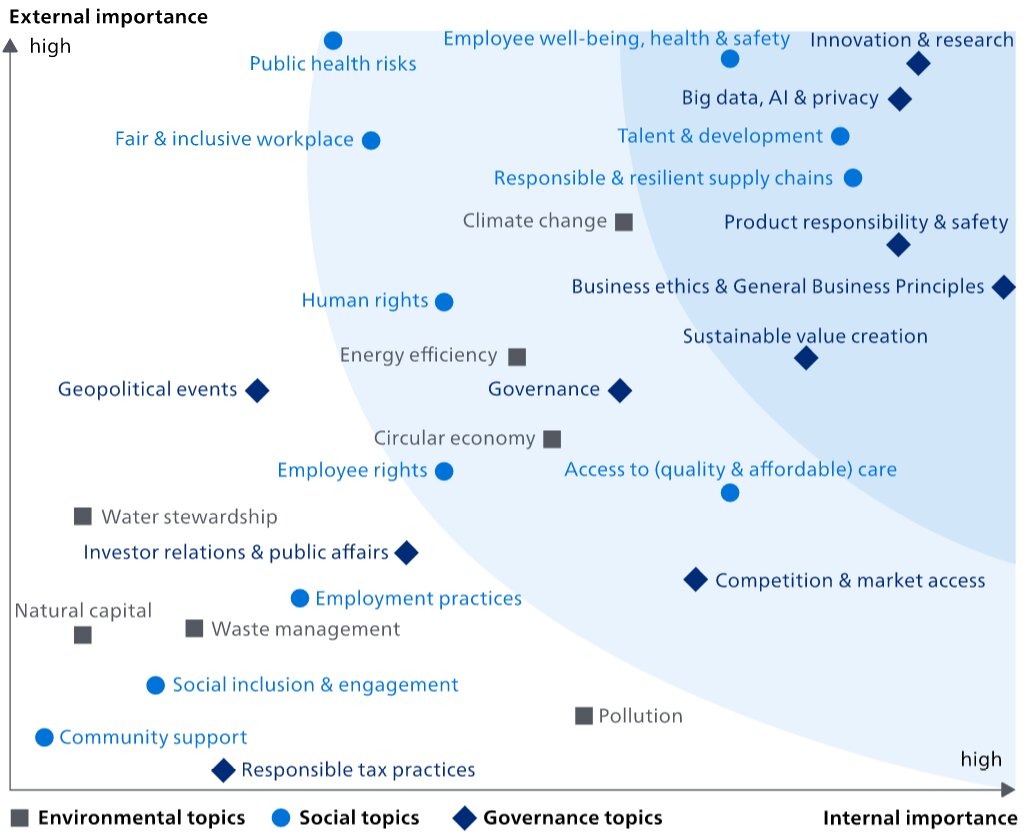

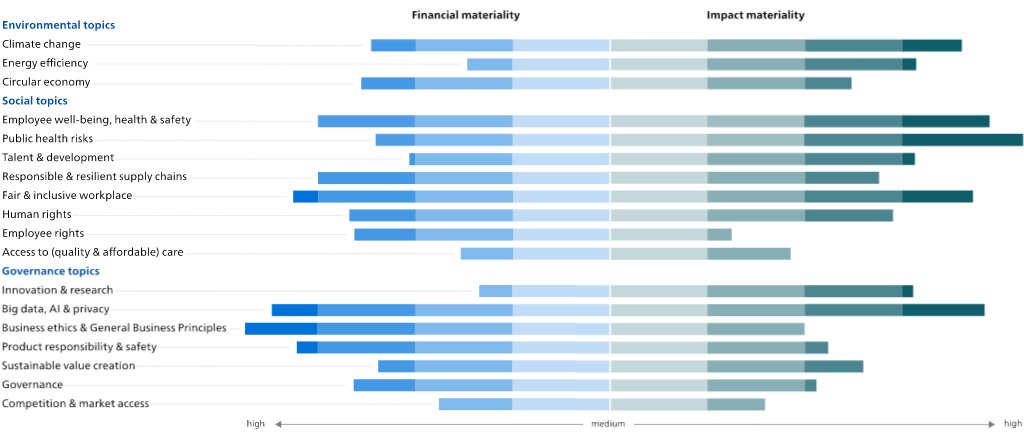

6.3Double Materiality analysisAssessment

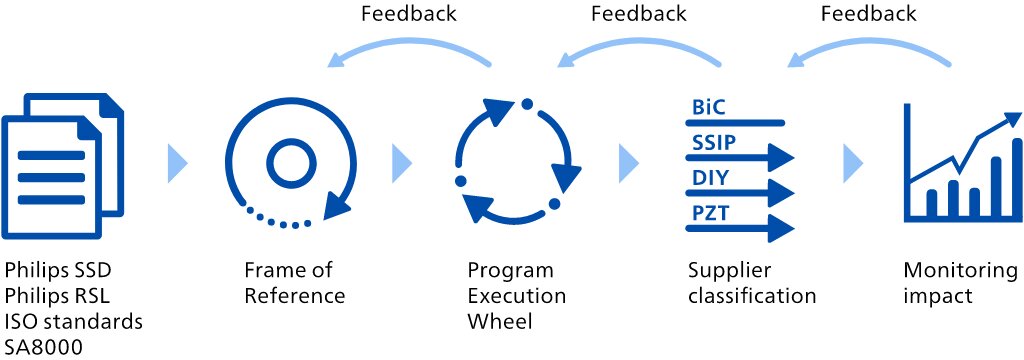

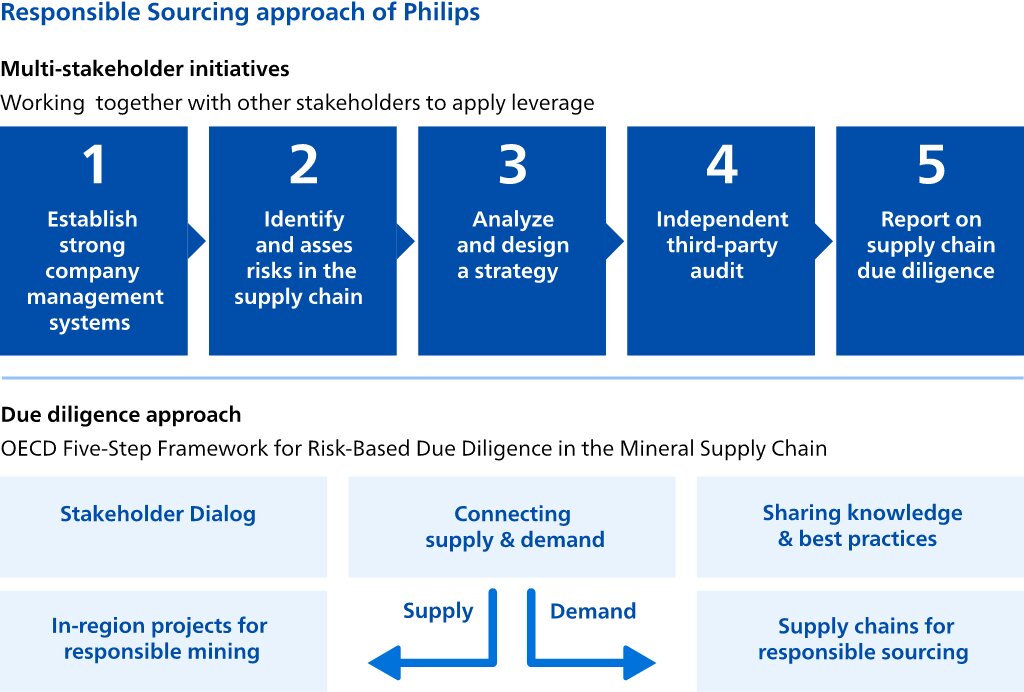

We identify the Environmental, Social and Governance topics which we believe have the greatest impact on our business and the greatest level of concern to stakeholders along our value chain, for instance patient safety and quality. We do this through a multi-stakeholder process. Please refer to Working with stakeholders and advocacy for more information. Assessing these topics enables us to prioritize and focus upon the most material topics and effectively address these in our policies, programs, targets and targets.actions. We do this with reference to the GRI standard and identify and assess impacts on an ongoing basis, for example through discussions with our customers, suppliers, investors, employees, peer companies, social partners, regulators, NGOs, and academics. We also conduct a benchmark exercise, carry out trend analysis and run media searches to provide input for our materiality analysis. GRI has not yet published a sector standard for the healthcare industry. Philips’ impact on society at large is covered through our Lives Improved metric and the Environmental Profit & Loss account, as well as a number of other KPIs addressed in Environmental, Social and Governance. The result of our impact materiality assessment you will find below.

Similar to 2021,2022, we used an evidence-based approach to materiality analysis,assessment, powered by a third-party AI-based application. The application allows automated sifting and analysis of millions of data points from publicly available sources, including corporate reports, mandatory regulations and voluntary initiatives, as well as news. In our 2022 materiality analysis, we identified a list of topics that are material to our businesses. With this data-driven approach to materiality analysisassessment we have incorporated a wider range of data and stakeholders than was ever possible before and managed to get an evidence-based perspective on regulatory, strategic and reputational risks and opportunities. Topics were prioritized through a survey sent to a large and diverse set of internal and external stakeholders, combined with input from the application.

Public health risks emerged as a new material topic in 2020, as a result of the COVID-19 pandemic, and it was assessed as a material topic in 2022 as well.

Changes in 20222023

On theboth external and internal importance axis, the most significant increases compared to 20212022 were Sustainable value creation, Geopolitical events, ResponsibleWaste management and Resilient Supply Chains, TalentSocial inclusion & development, and Energy efficiency.engagement. Innovation & research went down on both axes. On the internal importance axis, there werewas a significant increasesdecrease on Pollution, Governance, Access to (quality and affordable) care, Competition & market access, and Talent & development.Pollution.

Double materiality

After completing the regular impact materiality analysis,assessment, we completed a preliminary 'double materiality' analysis,assessment, in preparation for the upcoming requirements of the EU Corporate Sustainability Reporting Directive (CSRD). The double materiality analysisassessment addresses both financial materiality (the impact of society on Philips) as well as impact materiality (the impact of Philips on society): we only included the high and medium material topics listed above.from impact materiality and/or financial materiality. The data sources used for the financial materiality include corporate reports, mandatory regulations with sanctions, voluntary initiatives by e.g. central banks, and Sustainability Accounting Standards Board (SASB) accounting metrics. For impact materiality, we included sustainability data from corporate reports or sustainability reports, coverage in the news and voluntary initiatives and regulation. We calibrated the financial and impact materiality with a team of internal experts from Enterprise Risk Management, Group Control, Internal Audit, Insurance and Risk Management and Sustainability and aligned with our Enterprise Risk Management assessment. After this calibration the financial impact of Product responsibility & safety, Geopolitical events, and Big data, AI & Cybersecurity were increased. The results of the double materiality analysis are depicted below.

From the financial materiality analysis,assessment, the topics that ranked highest were: (1) from the environmental topics, Circular economy, and Climate change; (2) from the social topics, Fair & inclusive workplace, Employee well-being, healthProduct responsibility & safety, and Responsible & resilient supply chains;(2) Geopolitical events, and (3) from the governance topics,Big data, AI & Cybersecurity, as well as Business ethics & General Business Principles, Big data & privacy, and Product responsibility & safety.business principles.

From the impact materiality analysis,assessment, the topics that ranked the highest were: (1) from the environmentalEnvironmental topics, Climate change, and Energy efficiency; (2) from the socialSocial topics, Public health risks and Employee well-being, health & safety, and FairAccess to (quality & inclusive workplace;affordable) care; and (3) from the governanceGovernance topics, Big data, AI & privacyCybersecurity, and InnovationCompetition & research.market access. These topics are all covered in more detail in the Annual Report 20222023 and monitored regularly.

The outcome of the double materiality assessment did not result in any significant changes in the material topics identified.identified from impact materiality.

The results of our materiality assessment have been reviewed and approved by the Philips ESG CommitteeBoard of Management and will be used to prepare for the upcoming EU legislation.

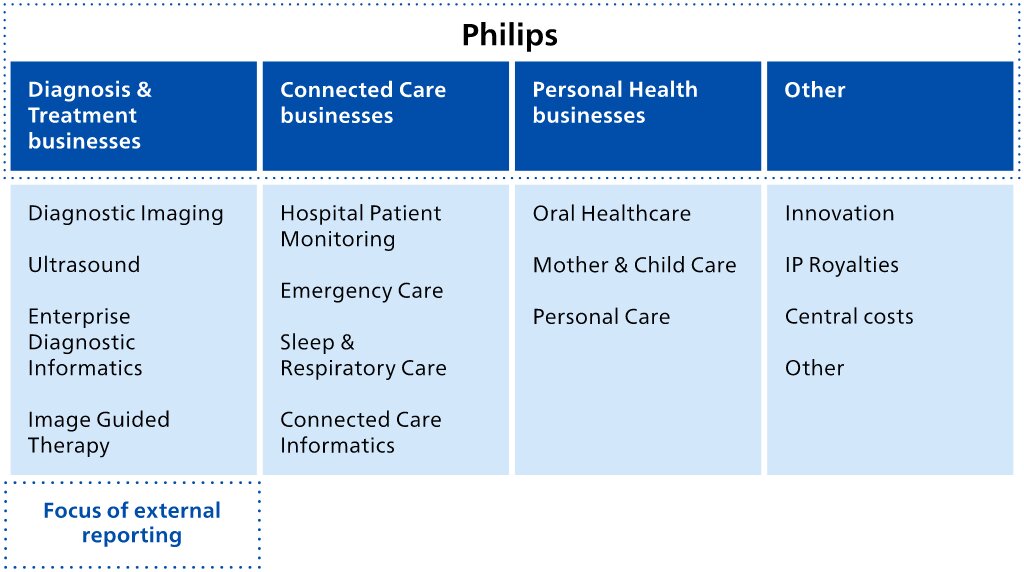

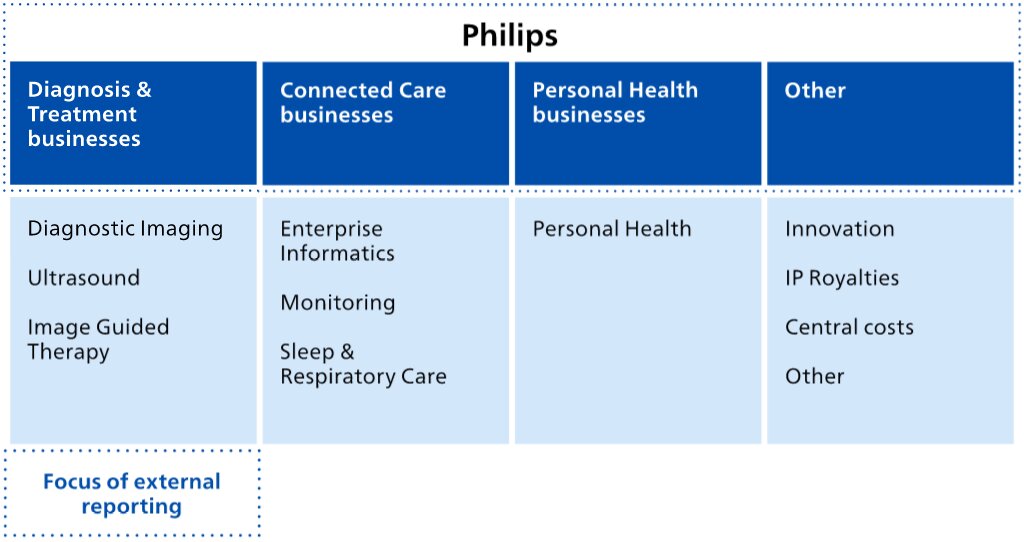

6.4Our businessesbusiness structure

Our reporting structure in 2022

Koninklijke Philips N.V. (Royal Philips) is the parent company of the Philips Group. In 2022,As announced on January 30, 2023, Philips has changed its operating model to end-to-end businesses with single accountability in order to make the reportablecompany more agile in its drive to create value with sustainable impact. The segments were Diagnosis & Treatment, businesses, Connected Care businesses, and Personal Health businesses,are each having been responsible for the management of itstheir business worldwide.activity worldwide, and are made up of the six businesses shown below. Additionally, Royal Philips identifies the segment Other.

Philips Group

Total sales by reportable segment

| Diagnosis & Treatment | |

| Connected Care | |

| Personal Health | 20% |

| Other |

Our reporting structure in 2023 and beyond

As announced on January 30, 2023, Philips is changing its operating model to end-to-end businesses with single accountability. In 2023, the businesses will be as follows.

6.4.1Diagnosis & Treatment businesses in 2022segment

Our Diagnosis & Treatment businesses create value through their unique portfolio of innovative solutions – consisting of systems, smart devices, software and services, powered by AI-enabled informatics –solutions that support precision diagnosis and minimally invasive treatment in therapeutic areas such as cardiology, peripheral vascular, neurology, surgery, and oncology. With these solutions, we enable our customers to realize the full potential of the Quadruple Aim – better health outcomes, improved patient and staff experience, and lower cost of care.

Serving diagnostic enterprise imaging markets globally, weour goal is to improve customer performance in the radiology/imaging workflow. We see significant opportunity to enable precision diagnosis while at the same time supporting adjacent needs for care orchestration across care pathways and increasing departmental productivity. We do this through smart diagnostic systems, connected workflow solutions, and integrated AI-supported diagnostics and pathway informatics, drivinginformatics. These drive enterprise-wide operational efficiency and helpinghelp clinicians to provide an early and definitive diagnosis, enabling them to select tailored care pathways with predictable outcomes for every patient, both inside and outside the hospital.

We also provide integrated solutions combining imaging systems, and diagnostic monitoring data and therapeutic devices, which optimize interventional procedures to deliver more effective treatment, better outcomes and higher productivity. Building upon our leading-edge Image Guided Therapy System – Azurion system, we continue to innovate, optimizing clinical and operational lab performance through advances in workflow and integration for routine procedures, and expanding the role of image-guided interventions to treat new groups of patients such as those with complex diseases including various cardiovascular conditions, stroke and lung cancer and spine disorders.cancer. We are also innovating the way we engage with our customers, using new business models across different care settings, including out-of-hospital settings such as office-based labs and ambulatory surgical centers, which offer clear clinical, financial and operational benefits.

In 2022, Philips completed the acquisition of Vesper Medical Inc. a US-based medical technology company that develops minimally-invasive peripheral vascular devices. Vesper Medical will further expand Philips’ portfolio of diagnostic and therapeutic devices with an advanced venous stent portfolio for the treatment of deep venous disease.

In 2022,2023, the Diagnosis & Treatment segment consisted of the following areas of business:businesses:

- Precision Diagnosis, consisting of:

- Diagnostic

Imaging:Imaging:- Diagnostic X-ray business unit – systems with associated software to optimize diagnostic imaging quality and improve efficiency and productivity for the hospital

- Magnetic Resonance Imaging

(MRI), withbusiness unit – helium-free-for-life operations, bundled with associated AI-enabled software to streamline workflows, optimize diagnostic quality, and improve patientexperience; X-ray systems, together with associated software to streamline workflows and optimize diagnostic quality;experience - Computed Tomography AMI business unit – advanced and efficient

Computed Tomography (CT)systems and software, including detector-based Spectral CT and molecular and hybrid imaging solutions for nuclear medicine

- Ultrasound

:business unit – echography solutions focused on diagnosis, treatment planning and guidance for cardiology, general imaging, obstetrics/gynecology, and point-of-care applications, as well as proprietary AI-enabled and intelligent software capabilities to enable early, advanced diagnostics and timely interventions, and remote capabilities to enable tele-ultrasound operations and training Enterprise Diagnostic Informatics: a suite of integrated multivendor products and services that deliver a comprehensive platform designed to connect clinical data and optimize workflows around every step in the patient’s journey across a range of diagnostic (radiology, point-of-care, laboratory) and clinical (oncology, cardiology, neurology) service lines

- Diagnostic

- Image Guided

Therapy:Therapy, consisting of:- Image Guided Therapy Systems business unit – integrated interventional systems that combine information from imaging systems, interventional devices, navigation tools, monitoring patient data and patient health records, supported by AI, to provide interventional staff with the control and information they need to perform procedures

efficiently;efficiently - Image Guided Therapy Devices business unit – interventional diagnostic and therapeutic devices to treat coronary artery and peripheral vascular disease

- Image Guided Therapy Systems business unit – integrated interventional systems that combine information from imaging systems, interventional devices, navigation tools, monitoring patient data and patient health records, supported by AI, to provide interventional staff with the control and information they need to perform procedures

Diagnosis & Treatment

Total sales by business

| Image Guided Therapy |

Revenue is predominantly earned through the sale of products, leasing, customer services fees, recurring per-procedure fees for disposable devices, and software license fees. For certain offerings, per-study fees or outcome-based fees are earned over the contract term.

Sales channels are a mix of a direct sales force, especially in all the larger markets, third-party distributors and an online sales portal. This varies by product, market and price segment. Our sales organizations have an intimate knowledge of technologies and clinical applications, as well as the solutions necessary to solve problems for our customers.

Under normal circumstances, salesSales at Philips’ Diagnosis & Treatment businesses are generally higher in the second half of the year, largely due to the timing of customer spending patterns.

At year-end 2022,2023, Diagnosis & Treatment had around 33,00028,397 employees worldwide.

2022 business2023 highlights

At RSNA23, Philips received FDA clearance to marketannounced a raft of new innovations, including next-generation EPIQ Elite 10.0 and Affiniti ultrasound systems that increase diagnostic confidence and workflow efficiency, BlueSeal MRI Mobile, the world’s first and only mobile MRI system with helium-free operations, and new AI-enabled cloud solutions that enhance radiology efficiency and clinical confidence.

Philips launched its new MR 7700 3.0T MR system, which features an enhanced gradient system for Philips’ highest image qualitydesigned to deliver outstanding imaging results and speed to support confident diagnosis for every patient.

Five top hospitals in Shanghai, with a precision diagnosis. Philips also received FDA clearance for its SmartSpeed MR acceleration software, adding AI data collection algorithms tototal of more than 10,000 beds, installed Philips’ existing Compressed SENSE MR engine for higher image resolution with three times faster scan times and virtually no loss in image quality.

By combining theadvanced Spectral CT 7500 scanner with the Azurion with FlexArm image-guided therapyimaging system, Philips has developed a fully integrated hybrid angio CT suite solution for single-room, single-sessionhelping physicians deliver first-time-right diagnosis and treatment in areas such as oncology, stroke, and trauma care.

In radiotherapy, the AI-enabled Philips MR for Calculating Attenuation (MRCAT) Head and Neck radiotherapy application expands the range of MR-only workflows for cancer patients, advancing comprehensive and personalized cancer care through precision oncology solutions.fast, low-dose X-ray scans.

Philips further expanded its leading ultrasound portfolio with the FDA market clearance for its newlaunch of the Ultrasound 5000 Compact system to deliver5500 CV, which delivers cart-based premium image quality in compact formultrasound exams for point-of-care, cardiology generaland vascular patients at the bedside.

Philips IntraSight Mobile received approval from the Chinese regulatory authority, paving the way for its commercial introduction in the Chinese market. IntraSight Mobile combines imaging and obstetricsphysiology applications on a mobile system for peripheral and gynecology applications.coronary artery disease therapy.

Building on Philips’ leading position in interventional cardiology solutions,Philips expanded its image-guided therapy portfolio with the companylaunch of Philips Zenition 10, which provides a cost-effective imaging solution to guide high-volume routine surgery, as well as complex orthopedic and trauma procedures. Philips also launched the latest versionZenition 30 Image Guided Therapy Mobile C-arm. Its workflow-enhancing features and excellent image quality enable surgeons to deliver enhanced care to more patients, helping alleviate the staff shortages faced by many hospitals.

Through the WE-TRUST study, Philips is driving innovation in stroke treatment. The trial examines the impact of its EchoNavigator image-guidance tool, which integrates live ultrasound, interventional X-ray imagingthe direct-to-angio treatment pathway on clinical outcomes, facilitated by a helical scan in the angio suite developed by Philips to reduce time to treatment. With 16 leading stroke centers and advanced 3D heart modelshospitals around the world involved in the trial and 100 patients enrolled, the WE-TRUST study has already achieved the scale and momentum needed to help interventional teams treat structural heart disease with greater ease and efficiency.

To improve outcomesdeliver a reliable evidence base on the potential benefits of the Direct to Angio Suite pathway for patients undergoing endovascularsuspected of having a large vessel occlusion (LVO) ischemic stroke – a treatment physicians now have accesspathway that focuses squarely on addressing the fact that the faster a patient is treated, the more likely they are to advanced new 3D image-guidance capabilities through Philips’ Zenition mobile C-arm system, which offers enhanced clinical accuracy and efficiency.

Philips is successfully expanding into interventional oncology withrecover. Another significant milestone was the installationpublication of its innovative lung cancer diagnosis and treatment solution Lung Suite in hospitals in Belgium, France, Israel, and the UK. Based on Philips Azurion, this solution enhances the accuracy of biopsy procedures and provides a therapy option for immediate treatment of early-stage lung cancer patients.

Inferior Vena Cava (IVC) filters are used to treat patients with venous thromboembolism, in which blood clots formhealth economics analysis results in the deep veinsJournal of the leg and groin andNeuroInterventional Surgery, demonstrating that this new stroke care pathway can travel through the circulatory system, but research has shown that they may have long-term complications. In the United States, the first patients were successfully treated for Inferior Vena Cava (IVC) filter removal using Philips' CavaClear solution – the only FDA-cleared solution for advanced IVC filter removal.save over USD 3,000 per patient.

6.4.2Connected Care businessessegment

With technology constantly advancing and becoming increasingly pervasive in 2022

Thehealthcare, the Connected Care businesses aim to connect and elevate care for all. Philips connects patients and caregivers across care settings, delivering clinical, operational and therapeutic solutions that help our customers address the Quadruple Aim ofdeliver better health outcomes, improvedimprove the patient and staff experience, and lower the cost of care. Aftercare across care settings. In 2023, the years of the COVID pandemic, which has accelerated the digital transformation of healthcare, in 2022 the volatile global economic situation continued to put additional pressure on customer budgets and worsened trends such as staff shortages, as well as increasing the need for solutions that enable more effective, sustainable and convenient care in hospital, clinics and the home.home – especially enabled by strong informatics and AI.

Philips’The Sleep & Respiratory Care business in particular facedcontinued to face multiple operational regulatory and supply-chainregulatory challenges in 2022,2023, but action has been taken to address these throughimprove the decision to establishability of the Sleep & Respiratory Care as an organization with end-to-end accountability, spanning product creation through to customer fulfillment (pending the outcome of consultation with workers councils in a number of countries). Therecorrectly assess potential patient safety or quality issues. Philips has been a reset toreaffirmed its core activities, which put patient safety front and center in everything we do, and we believe that the implementation of a new simplified organization, which for Sleep & Respiratory Care began in 2022, will help to achieve this, as well as to improve productivity and increase agility. In the course of the year, Sleep & Respiratory Care gradually returned to the market for sleep therapy devices outside the US. For information about the Philips Respironics recall and related remediation effort, please refer to Quality & Regulatory and patient safety.