(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report.

51,849,241

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

þ Yes No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes þ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of theSecurities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þ Yes No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer þ | Non-accelerated filer |

| ||

Indicate by check mark which financial statement item the Registrant has elected to follow.

Item 17 þItem 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes þ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the Registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes No

- ii -

- iii -

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements concerning our operations and planned future acquisitions within the meaning of the safe harbor for such statements under the Private Securities Litigation Reform Act of 1995. Any statements that involve discussions with respect to predictions, expectations, belief, plans, projections, objectives, assumptions or future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, could”, “might”, or “will” be taken to occur or be achieved) are not statements of historical fact and may be “forward looking statements” and are intended to identify forward-looking statements, which include statements relating to, among other things, our ability to continue to successfully compete in its market. You are cautioned not to place undue reliance on forward looking statements. These forward-looking statements are based on the beliefs of our management as well as on assumptions made by and information currently available to us at the time such statements were made. Forward lookingWe undertake no obligation to update forward-looking statements should circumstances or estimates or opinions change. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward looking statements, including, without limitation,

uncertainty of production at our mineral exploration properties;

risks related to our ability to finance the failurecontinued exploration of our mineral properties;

risks related to no Proven Mineral Reserves or Probable Mineral Reserves;

our history of losses and expectation of future losses;

risks related to factors beyond our control;

risks and uncertainties associated with new mining operations;

risks related to our ability to obtain adequate financing on a timely basis and other for our planned development activities;

lack of infrastructure at our mineral exploration properties;

risks and uncertainties. uncertainties relating to the interpretation of drill results and the geology, grade and continuity of our mineral deposits;

unpredictable risks and hazards related to mining operations;

risks related to governmental regulations, including environmental regulations;

commodity price fluctuations;

our ability to attract and retain qualified personnel;

uncertainties related to title to our mineral properties;

risks related to reclamation activities on our properties;

risks related to political instability and unexpected regulator change;

currency fluctuations;

increased competition in the mining industry for properties and qualified personnel;

risks related to some of our directors and officers involvement with other natural resource companies;

enforcement of U.S. judgments and laws in Canada;

our ability to attract and retain qualified management;

our classification as a passive foreign investment company under the Internal Revenue Code.

-iv / v - |

Actual results could differ materially from those projected in the forward-looking statements as a result of the matters set out or incorporated in this Annual Report generally and certain economic and business factors, some of which may be beyond our control. Some of the important risks and uncertainties that could effect forward looking statements as described further in this document under the headings “Risk Factors”, “History and Development of the Company”, “Business Overview”, “Descriptions of Properties” and “Operating and Financial Review and Prospects”.

- iv -

In this Annual Report, “we”, “us”, “our”, “Silver Standard”, “the Company” and “the Company”company” refer to Silver Standard Resources Inc., a company incorporated under theCompany Act (British(British Columbia), and its subsidiaries.

-vi - |

- v -

GLOSSARY OF GEOLOGICAL TERMS

DEFINITIONS AND ABBREVIATIONS

alteration — - usually referring to chemical reactions in a rock mass resulting from the passage of hydrothermal fluids.

breccia — - rock consisting of more or less angular fragments in a matrix of finer-grained material or cementing material.

claim — - that portion of public mineral lands, which a party has staked or marked out in accordance with provincial or state mining laws, to acquire the right to explore for the minerals under the surface.

conglomerate — - rock composed of mostly rounded fragments which are of gravel size or larger in a finer grained matrix.

crystalline — - means the specimen is made up of one or more groups of crystals.

cut-off grade — - the minimum grade of mineralization that delimits mineralization that has a reasonable prospect of economic extraction from mineralization that does not have a reasonable prospect of economic extraction.

deposit - a natural occurrence of a useful mineral of sufficient extent and degree to invite exploitation.

dilution - results from the mixing in of unwanted gangue or waste rock with the ore during mining.

dolomite - a magnesium bearing limestone usually containing at least 15% magnesium carbonate.

dyke — - a tabular body of igneous rock that cuts across the structure of adjacent rocks or cuts massive rocks.

dilutionfault — results from the mixing in of unwanted gangue or waste rock with the ore during mining.

dolomite — a magnesium bearing limestone usually containing at least 15% magnesium carbonate.

fault — - a fracture in a rock where there has been displacement of the two sides.

feasibility studymeans a detailed study of a deposit in which all geological, engineering, operating, economic and other relevant factors are engineered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production.

g/t — - grams per tonne.

gangue — - term used to describe worthless minerals or rock waste mixed in with the valuable minerals.

geophysics — - the study of the physical properties of rocks, minerals, and mineral deposits.

grade — - the concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t) or ounces per ton (oz/t). The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from throughout the deposit.

hectare — - a square of 100 metres on each side.

host rock — - the rock within which the ore deposit occurs.

-vii - |

igneous — - means a rock formed by the cooling of molten silicate material.

- vi -

Indicated Mineral Resource — - is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

induced polarization method — - the method used to measure various electrical responses to the passage of alternating currents of different frequencies through near-surface rocks or to the passage of pulses of electricity.

Inferred Mineral Resource — - is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

intrusion — - general term for a body of igneous rock formed below the surface.

limestone — - sedimentary rock that is composed mostly of carbonates, the two most common of which are calcium and magnesium carbonates.

massive—- a geologic body more than 100 millimeters in thickness.

Measured Mineral Resource — - is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

Mineral Reserve —-is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

Mineral Resource- — is a concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

-viii - |

mineralization- vii -

mineralization — usually implies minerals of value occurring in rocks.

net profits interestroyalty —- a royalty based on the profit, allowing for costs directly related to production. The expenses that the operator deducts from revenue are defined in the royalty agreement. Payments generally begin after payback of capital costs. The royalty holder is not responsible for contributing to capital expenses, covering operating losses or environmental liabilities.

net smelter return–– means the amount actually paid to the mine or mill owner from the sale of ore, minerals and other materials or concentrates mined and removed from mineral properties. This type ofroyalty provides

net smelter return royalty– a royalty paid from cash flow that is free of any operating or capital costs and environmental liabilities.

outcrop — - means an exposure of rock at the earth’s surface.

porphyry– a rock with conspicuous large grains in a fine grained ground mass.

oz/ton — - ounces per ton.

plunge - the vertical angle between a horizontal plane and the line of maximum elongation of a body.

Preliminary Feasibility Study — - is a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established and where an effective method of mineral processing has been determined. This Study must includedetermined, and includes a financial analysis based on reasonable assumptions of technical, engineering, legal, operating, economic, social, and economicenvironmental factors and the evaluation of other relevant factors which are sufficient for a qualified personQualified Person, acting reasonably, to determine if all or part of the Mineral Resource may be classified as a Mineral Reserve. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

Probable Mineral Reserve — - is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Studystudy must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

Proven Mineral Reserve — - is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Studystudy must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. This definition is from the Canadian Institute of Mining, Metallurgy and Petroleum Standards on Mineral Resources and Mineral Reserves adopted on August 20, 2000.December 11, 2005.

-ix - |

Qualified Person– means an individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association.

reclamation bond – a financial instrument or cash usually required when mechanized work is contemplated on a mineral claim. The bond may be used to reclaim any workings or put right any damage, if the reclamation of the mineral claim does not satisfy the requirements of the regulations.

sedimentary — - a rock formed from cemented or compacted sediments.

sediments — - are composed of the debris resulting from the weathering and breakup of other rocks that have been deposited by or carried to the oceans by rivers, or left over from glacial erosion or sometimes from wind action.

sericite- viii -

sericite — a fine-grained variety of mica occurring in small scales, especially in schists.

shear zone — - where a fault affects a width of rock rather than being a single clean break, the width of affected rock is referred to as the shear zone. The term implies movement, i.e. shearing.

silicate — - most rocks are made up of a small number of silicate minerals ranging from quartz (SiO2) to more complex minerals such as orthoclase feldspar (KAlSi3O8) or hornblende (Ca2Na(Mg,Fe)4(Al,Fe,Ti)Si8)22(OH)2).

sill — - tabular intrusion which is sandwiched between layers in the host rock.

stockwork – a mineral deposit consisting of a three-dimensional network of closely spaced planar or irregular veinlets.

sulphide –- a mineral compound characterized by the linkage of sulphur with a metal.

tailings — - material rejected from a mill after recoverable valuable minerals have been extracted.

tailings pond — - a pond in which tailings are disposed.

tuff — - a finer grained pyroclastic rock made up mostly of ash and other fine grained volcanic material.

veins — - the mineral deposits that are found filling openings in rocks created by faults or replacing rocks on either side of faults.

waste — - rock which is not ore. Usually referred to that rock which has to be removed during the normal course of mining in order to get at the ore.

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7,Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are Canadian geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards.

In this Annual Report references to “Canadian “CanadianNational Instrument 43-101”43-101” are references to National Instrument 43-101, Standards of Disclosure for Mineral Projects, of the Canadian Securities Administrators and references to “CIM Standards”“CIM Standards” are references to Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council on August 20, 2000December 11, 2005 as may be amended from time to time by the CIM.

-x - |

Cautionary Note to U.S. Investors concerning estimates of Measured Mineral Resources and Indicated Mineral Resources.

This Annual Report uses the terms “Measured Mineral Resource” and “Indicated Mineral Resource.” We advise U.S. investors that while such terms are recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize them.U.S. investors are cautioned not to assume that any part or all of the Mineral Resources in these categories will ever be converted into Mineral Reserves.

Cautionary Note to U.S. Investors concerning estimates of Inferred Mineral Resources.

This Annual Report uses the term “Inferred Mineral Resources.” We advise U.S. investors that while such term is recognized and permitted under Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies.U.S. investors are cautioned not to assume that any part or all of an Inferred Mineral Resource exists, or is economically or legally mineable.

-xi - |

- ix -

- x -

PART I

Item 1 | Identity of Directors, Senior Management and Advisers |

A. Directors and Senior Management This Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, as such, there is no requirement to provide any information under this item. B. Advisers This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item. C. Auditors This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item. Item 2 Offer Statistics and Expected Timetable This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item. Item 3 Key Information A. Selected Financial Data The following table summarizes certain of our selected financial data. This information should be read in conjunction with the more detailed financial statements included in this Annual Report. Table No. 1 Selected Financial Data (expressed in thousands of Canadian dollars, except per share and number of shares data) Year ended Year ended Dec 31, 2004 Year ended Dec 31, 2003 Year ended Dec 31, 2002 Year ended Dec 31, 2001 1. Revenues Nil Nil Nil Nil Nil 2. Loss for period(1) $5,870 $1,518 $3,938 $2,198 $3,377 3. Loss per common share(1) $0.11 $0.03 $0.10 $0.06 $0.13 4. Total assets $219,288 $217,457 $92,812 $81,096 $48,685 5. Long term obligations and redeemable preferred stock(2) $Nil $Nil $75 $249 $143 6. Share capital $219,971 $217,502 $113,537 $99,510 $66,108 7. Cash dividends per common share Nil Nil Nil Nil Nil 8. Number of shares 51,849,241 51,576,802 42,604,832 39,190,887 30,913,953 (1) All of our operations are continuing. (2) No preferred stock has been issued. (3) Certain comparative figures have been restated including amounts relating to future income tax liabilities by increasing mineral property costs and future income tax liabilities. -1- The selected financial data is presented in Table 1 above and in the financial statements in accordance with generally accepted accounting principles (“GAAP”) prevailing in Canada as of the dates shown. The selected financial data under U.S. GAAP for the above periods is indicated below in Table 2: Table No. 2 Selected Financial Data (expressed in thousands of Canadian dollars, except per share and number of shares data) Year ended Dec 31, 2005 Year ended Dec 31, 2004 Year ended Dec 31, 2003 Year ended Dec 31, 2002 Year ended Dec 31, 2001 1. Revenues Nil Nil Nil Nil Nil 2. Loss for period(1) $26,581 $61,680 $14,099 $19,282 $15,317 3. Loss per common share(1) $0.51 $1.28 $0.35 $0.54 $0.58 4. Total assets $57,865 $69,718 $26,993 $19,463 $6,163 5. Long term obligations and redeemable preferred stock(2) $Nil Nil $75 $249 $143 6. Share capital $218,773 $216,875 $113,706 $99,679 $66,603 7. Cash dividends per common share Nil Nil Nil Nil Nil 8. Number of shares 51,849,241 51,576,802 42,604,832 39,190,887 30,913,953 (1) All of our operations are continuing. (2) No preferred stock has been issued. (3) Certain comparative figures have been restated. -2 - Reference should be made to note U.S./Canadian Dollar Exchange RatesItem 1 Identity of Directors, Senior Management and AdvisersA. Directors and Senior Management Advisers AuditorsItem 2 Offer Statistics and Expected Timetable Key InformationA. Selected Financial Data Year ended

Dec 31, 2003Year ended

Dec 31, 2002Year ended

Dec 31, 2001Year ended

Dec 31, 2000Year ended

Dec 31, 19991. Revenues Nil Nil Nil Nil Nil 2. Loss for period* $3,938 $2,198 $3,377 $1,705 $1,264 3. Loss per common share* $0.10 $0.06 $0.13 $0.08 $0.07 4. Total assets $85,213 $74,748 $45,399 $31,070 $26,655 5. Long term

obligations and

redeemable preferred stock**$75 $249 $143 $165 Nil 6. Capital stock $113,537 $99,510 $66,108 $52,078 $46,120 7. Cash dividends

per common shareNil Nil Nil Nil Nil 8. Number of shares $42,604,832 $39,190,887 $30,913,953 $24,266,458 $20,438,047

Dec 31, 2005

Restated(3)

Restated(3)

Restated(3)

Restated(3)* All of our operations are continuing.** No preferred stock has been issued.- 1 -

Restated(3) Year ended

Dec 31, 2003

restatedYear ended

Dec 31, 2002

restatedYear ended

Dec 31, 2001

restatedYear ended

Dec 31, 2000

restatedYear ended

Dec 31, 1999

restated1. Revenues Nil Nil Nil Nil $30 2. Loss for period* $14,099 $19,282 $15,317 $5,777 $8,672 3 Loss per common share* $0.35 $0.54 $0.58 $0.26 $0.49 4 Total assets $26,993 $19,463 $6,163 $3,765 $3,434 5. Long term

obligations and

redeemable preferred stock**$75 $249 $143 $165 Nil 6. Capital stock $113,706 $99,679 $66,603 $52,247 $46,289 7. Cash dividends

per common shareNil Nil Nil Nil Nil 8. Number of shares $42,604.832 $39,190,887 $30,913,953 $24,266,458 $20,438,047 * All of our operations are continuing.** No preferred stock has been issued.1819 to the consolidated financial statements for a description of material differences between Canadian and U.S. GAAP.- 2 -

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian dollars (Cdn$). The Government of Canada permits a floating exchange rate to determine the value of the Canadian dollar against the U.S. dollar (US$). In this Annual Report all references to “$” and “Cdn$” refer to Canadian Dollars, all references to “US$” refer to United States Dollars and all references to “A$” refer to Australian Dollars.

Table No. 3 below sets out the rate of exchange for the Canadian dollar at December 31, 2005, December 31, 2004, December 31, 2003, December 31, 2002 December 31, 2001, December 31, 2000 and December 31, 1999,2001, the average rates for the period, and the range of high and low rates for the period. Table No. 4 sets out the high and low rates of exchange for the Canadian dollar for each month during the previous six months.

For purposes of these tables, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The tables set out the number of Canadian dollars required under that formula to buy one U.S. dollar. The average rate in Table No. 3 means the average of the exchange rates on the last day of each month during the period.

Table No. 3

U.S. Dollar/Canadian Dollar Exchange Rates for Five Most Recent Financial Years

Average | High | Low | Close | |||||

| Average | High | Low | Close | |||||

Fiscal Year Ended December 31, 2005 | 1.21 | 1.27 | 1.15 | 1.17 | ||||

Fiscal Year Ended December 31, 2004 | 1.30 | 1.40 | 1.18 | 1.20 | ||||

| Fiscal Year Ended December 31, 2003 | 1.40 | 1.58 | 1.29 | 1.40 | 1.58 | 1.29 | 1.29 | |

| Fiscal Year Ended December 31, 2002 | 1.57 | 1.61 | 1.51 | 1.58 | 1.57 | 1.61 | 1.51 | 1.58 |

| Fiscal Year Ended December 31, 2001 | 1.55 | 1.60 | 1.49 | 1.59 | 1.55 | 1.60 | 1.49 | 1.59 |

| Fiscal Year Ended December 31, 2000 | 1.48 | 1.56 | 1.43 | 1.52 | ||||

| Fiscal Year Ended December 31, 1999 | 1.49 | 1.54 | 1.44 | 1.47 | ||||

Table No. 4

U.S. Dollar/Canadian Dollar Exchange Rates for Previous Six Months

| November | December | January | February | March | April | |||||||

September | October | November | December | January | February | |||||||

| High | 1.32 | 1.30 | 1.34 | 1.33 | 1.37 | 1.18 | 1.19 | 1.20 | 1.17 | 1.17 | 1.16 | |

| Low | 1.31 | 1.29 | 1.32 | 1.30 | 1.16 | 1.17 | 1.15 | 1.14 | ||||

On April 30, 2004,March 29, 2006, the exchange rate of Canadian dollars into United States dollars, based upon the noon buying rate in New York City for cable transfers payable in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York, was US$1.01.00 equals Cdn$1.37.1.17.

-3 - |

B. Capitalization and IndebtednessTable of Contents

B. | Capitalization and Indebtedness |

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

C. | Reasons for the Offer and Use of Proceeds |

This Form 20-F is being filed as an annual report under the Exchange Act, and, as such, there is no requirement to provide any information under this item.

- 3 -

D. | Risk Factors |

D. Risk Factors

Our exploration programs may not result in a commercial mining operation.

Mineral exploration involves significant risk because few properties that are explored contain bodies of ore that would be commercially economic to develop into producing mines. Our mineral properties are without a known body of commercial ore and our proposed programs are an exploratory search for ore. We do not know whethercannot provide any assurance that our current exploration programs will result in any commercial mining operation. If the exploration programs do not result in the discovery of commercial ore, we will be required to acquire additional properties and write-off all of our investments in our existing properties.

We may not have sufficient funds to complete further exploration programs.

We have limited financial resources (working capital of approximately $40.344 million at December 31, 2005), do not generate operating revenue, and must finance our exploration activity by other means.means, including financing through joint ventures, debt financing or equity financing. We do not know whethercannot provide any assurance that additional funding will be available for further exploration of our projects or to fulfil our anticipated obligations under our existing property agreements. If we fail to obtain additional financing, we will have to delay or cancel further exploration of our properties, and we could lose all of our interest in our properties.

We do not have Proven Mineral Reserves or Probable Mineral Reserves.

We have not established the presence of any Proven Mineral Reserves or Probable Mineral Reserves at any of our mineral properties. We cannot provide any assurance that future feasibility studies will establish Proven Mineral Reserves or Probable Mineral Reserves at our properties. The failure to establish Proven Mineral Reserves or Probable Mineral Reserves could restrict our ability to successfully implement our strategies for long-term growth.

We have a history of losses and expect to incur losses for the foreseeable future.

We have incurred losses during each of the following periods and expect to incur losses for the foreseeable future:

$5.870 million for the year ended December 31, 2005;

$1.518 million for the year ended December 31, 2004;

$3.938 million for the year ended December 31, 2003;

-4 - |

$2.198 million for the year ended December 31, 2002; and

$3.377 million for the year ended December 31, 2001.

As of December 31, 2005, we had an accumulated deficit of $43.524 million. We expect to continue to incur losses unless and until such time as one or more of our properties enter into commercial production and generate sufficient revenues to fund our continuing operations. If our exploration programs successfully locate an economic ore body, we will be subject to additional risks associated with mining including those set out inthis Item 3.D – “Risk Factors” under the heading “We have no revenue from operations and no ongoing mining operations of any kind.”

Factors beyond our control may determine whether any mineral deposits we discover are sufficiently economic to be developed into a mine.

The determination of whether our mineral deposits are economic is affected by numerous factors beyond our control. These factors include:

the metallurgy of the mineralization forming the mineral deposit;

market fluctuations for precious metals;

the proximity and capacity of natural resource markets and processing equipment; and

government regulations governing prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection.

We have no revenue from operations and no ongoing mining operations of any kind.

We are a mineral exploration company and have no revenues from operations and no ongoing mining operations of any kind. Our properties are in the exploration stage, and we have not defined or delineated any proven or probable reserves on any of our properties. If our exploration programs successfully locate an economic ore body, we will be subject to additional risks associated with mining:

We will require additional funds to place the ore body into commercial production. Substantial expenditures will be required to:

establish ore reserves through drilling;

develop metallurgical processes to extract the metals from the ore; and

construct the mining and processing facilities at any site chosen for mining.

The sources of external financing that we may use for these purposes include public or private offerings of debt, convertible notes and equity. In addition, we may enter into one or more strategic alliances and may utilize one or a combination of all these alternatives. We cannot provide any assurance that the financing alternative chosen by us will be available on acceptable terms, or at all. If additional financing is not available, we may have to postpone the development of, or sell, the property.

The majority of our property interests are not located in developed areas and as a result may not be served by appropriate

road access;

water and power supply; and

other support infrastructure.

-5 - |

These items are often needed for development of a commercial mine. If we cannot procure or develop roads, water, power and other infrastructure at a reasonable cost, it may not be economic to develop properties, where our exploration has otherwise been successful, into a commercial mining operation.

In making determinations about whether to proceed to the next stage of development, we must rely upon estimated calculations as to the mineral reserves and grades of mineralization on our properties. Until ore is actually mined and processed, mineral reserves and grades of

mineralization must be considered as estimates only. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling which may prove to be unreliable. We cannot provide any assurance that:

these estimates will be accurate;

resource or other mineralization figures will be accurate; or

this mineralization can be mined or processed profitably.

Any material changes in mineral reserve estimates and grades of mineralization will affect the economic viability of the placing of a property into production and a property’s return on capital.

Our resource estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for silver, gold, tin, zinc, lead and copper may render portions of our mineralization uneconomic and result in reduced reported mineralization. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition. We cannot provide any assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

Mining operations often encounter unpredictable risks and hazards that add expense or cause delay. These include:

unusual or unexpected geological formations;

metallurgical and other processing problems;

metal losses;

environmental hazards;

power outages;

labour disruptions;

industrial accidents;

periodic interruptions due to inclement or hazardous weather conditions;

flooding, explosions, fire, rockbursts, cave-ins, landslides, and;

inability to obtain suitable or adequate machinery, equipment or labour.

We may become subject to liabilities in connection with:

pollution;

cave-ins; or

-6 - |

hazards against which we cannot insure against or which we may elect not to insure.

The payment of these liabilities could require the use of financial resources that would otherwise be spent on mining operations.

Mining operations and exploration activities are subject to national and local laws and regulations governing:

prospecting, development, mining and production;

exports and taxes;

labour standards, occupational health and mine safety;

waste disposal, toxic substances, land use and environmental protection.

In order to comply, we may be required to make capital and operating expenditures or to close an operation until a particular problem is remedied. In addition, if our activities violate any such laws and regulations, we may be required to compensate those suffering loss or damage, and may be fined if convicted of an offence under such legislation.

Our profitability and long-term viability will depend, in large part, on the market price of silver, gold, tin, zinc, lead and copper. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

global or regional consumption patterns;

supply of, and demand for, silver, gold, tin, zinc, lead and copper;

speculative activities;

expectations for inflation; and

political and economic conditions.

We cannot predict the effect of these factors on metals prices.

In order to bring our mineral properties into production we will experience significant growth in our operations. We expect this growth to create new positions and responsibilities for management personnel and increase demands on our operating and financial systems. There can be no assurance that we will successfully meet these demands and effectively attract and retain additional qualified personnel to manage our anticipated growth. The failure to attract such qualified personnel to manage growth effectively could have a material adverse effect on our business, financial condition and results of operations.

We are subject to significant governmental regulations.

Our exploration activities are subject to extensive federal, state, provincial, territorial and local laws and regulations governing various matters, including:

environmental protection;

management and use of toxic substances and explosives;

management of natural resources;

exploration of mineral properties;

exports;

-7 - |

- 4 -

- 5 -

price controls;

taxation;

labor standards and occupational health and safety, including mine safety; and

historic and cultural preservation.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining or curtailing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our activities and delays in the exploration of our properties.

Our properties may be subject to uncertain title.

We own, lease or have under option, unpatented and patented mining claims, mineral claims or concessions which constitute our property holdings. The ownership and validity, or title, of unpatented mining claims and concessions are often uncertain and may be contested. We have not conducted surveys of all of the claims in which we hold direct or indirect interests. A successful claim contesting our title to a property will cause us to lose our rights to explore and, if warranted, develop that property. This could result in our not being compensated for our prior expenditures relating to the property.

Land reclamation requirements for our exploration properties may be burdensome.

Although variable depending on location and the governing authority, land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance. Reclamation may include requirements to:

control dispersion of potentially deleterious effluents; and

reasonably re-establish pre-disturbance land forms and vegetation.

In order to carry out reclamation obligations imposed on us in connection with our mineral exploration, we must allocate financial resources that might otherwise be spent on further exploration programs.

Political or economic instability or unexpected regulatory change in the countries where our properties are located could adversely affect our business.

Certain of our properties are located in countries, provinces and states more likely to be subject to political and economic instability, or unexpected legislative change, than is usually the case in certain other countries, provinces and states. Our mineral exploration activities could be adversely affected by:

political instability and violence;

war and civil disturbance;

expropriation or nationalization;

changing fiscal regimes;

fluctuations in currency exchange rates;

high rates of inflation;

-8 - |

- 6 -

underdeveloped industrial and economic infrastructure; and

unenforceability of contractual rights;

any of which may adversely affect our business in that country.

We may be adversely affected by fluctuations in foreign exchange rates.

We maintain our bank accounts mainly in Canadian and U.S. dollars. Any appreciation in the currencies of Argentina, Australia, Chile, Mexico or other countries where we carryout exploration activities against the Canadian or U.S. dollar will increase our costs of carrying out operations in such countries. In addition, any decrease in the U.S. dollar against the Canadian dollar will result in a loss on our books to the extent we hold funds in U.S. dollars.

We face industry competition in the acquisition of exploration properties and the recruitment and retention of qualified personnel.

We compete with other exploration companies, many of which have greater financial resources than us or are further in their development, for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. Competition for exploration resources at all levels is currently very intense, particularly affecting the availability of manpower, drill rigs and supplies. If we require and are unsuccessful in acquiring additional mineral properties or personnel, we will not be able to grow at the rate we desire or at all.

Some of our directors and officers have conflicts of interest as a result of their involvement with other natural resource companies.

Some our directors and officers are directors or officers of other natural resource or mining-related companies such as, at present, Mr. Quartermain who serves as a director and officer of Radiant Resources Inc. (formerly Pacific Sapphire Company Ltd.) and as a director of Canplats Resources Corporation, IAMGold Corporation, (formerly Repadre Capital Corporation), Vista Gold Corporation, Paso Rico Resources Ltd., Esperanzaand Minco Silver Corporation (formerly Reliant Ventures Ltd.) and Strathmore Minerals Corp.Corporation. These associations may give rise to conflicts of interest from time to time. As a result of these conflicts of interest, we may miss the opportunity to participate in certain transactions, which may have a material, adverse effect on our financial position.

Enforcement of judgments or bringing actions outside the United States against us and our directors and officers may be difficult.

We are organized under the law of and headquartered in British Columbia, Canada, and none of our directors and officers are citizens or residents of the United States.States, other than our Vice President, Project Development. In addition, a substantial part of our assets are located outside the United States and Canada. As a result, it may be difficult or impossible for an investor to (a) enforce in courts outside the United States judgments against us and our directors and officers obtained in United States’ courts based upon the civil liability provisions of United States’ federal securities laws or (b) bring in courts outside the United States an original action against us and our directors and officers to enforce liabilities based upon such United States’ securities laws.

Item 4 InformationWe may experience difficulty attracting and retaining qualified management to grow our business, which could have a material adverse effect on our business and financial condition.

We are dependent on the Companyservices of key executives including our President and Chief Executive Officer and other highly skilled and experienced executives and personnel focused on advancing our corporate objectives as well as the identification of new opportunities for growth and funding. Due to our relatively small size, the loss of these persons or our inability to attract and retain additional highly skilled employees required for our activities may have a material adverse effect on our business and financial condition.

-9 - |

A. HistoryUnder U.S. federal tax rules, we may be classified as a passive foreign investment company (a “PFIC”), which may result in special and Developmentgenerally unfavorable U.S. federal tax consequences to our U.S. shareholders.

As a non-U.S. corporation, we may be a PFIC depending on the percentage of our gross income which is “passive”, within the meaning of the U.S. Internal Revenue Code of 1986, as amended, or the percentage of our assets that produce or are held to produce passive income. We were a PFIC in our 2005 taxable year, and we may be a PFIC in subsequent taxable years. If we are a PFIC for any taxable year during a U.S. shareholder’s holding period in our common stock, such U.S. shareholder may be subject to increased U.S. federal income tax liability on the sale of common shares or on the receipt of dividends. See Item 10.E – “Taxation”. The PFIC rules are complex and may be unfamiliar to U.S. shareholders. Accordingly, U.S. shareholders are urged to consult their own tax advisors concerning the application of the PFIC rules to their investment in our common shares.

Item 4 | Information on the Company |

A. | History and Development of the Company |

General Background

General Background

We were incorporated in British Columbia, Canada, on December 11, 1946 under the name “Silver Standard Mines, Limited (NPL)” and changed our name to “Silver Standard Mines Limited” on July 18, 1979. We changed our name to “Consolidated Silver Standard Mines Limited” and consolidated our common stock on a 1-for-5 basis on August 9, 1984. All references to the number of shares or per share data in this Annual Report refer to consolidated shares/data, unless otherwise indicated. We changed our name to “Silver Standard Resources Inc.” on April 9, 1990.

- 7 -

On May 12, 2005, our shareholders adopted new articles as required by the new British ColumbiaTableBusiness Corporations Actand authorized an increase in our authorized capital from 100,000,000 common shares without par value to an unlimited number of Contentscommon shares without par value.

Our head office and registered and records office is located at: Suite 1180 —- 999 West Hastings Street, Vancouver, British Columbia, Canada V6C 2W2. The contact person is Robert A. Quartermain, President. The telephone number is (604) 689-3846; the facsimile number is (604) 689-3847. We do not have a registered agent in the United States.

In June 2003, our wholly owned subsidiary MaverickMarch 2005, we entered into an agreement with Esperanza Silver Inc. acquired from Vista Gold Corporation and Vista Nevada Corp. an option to acquire a 55% interest in(“Esperanza”) for the Maverick Springs Projectevaluation of mineral prospects located in northern Nevada, representing all of the silver resources hosted in the project.central Peru. See Item 4.B —- “Business Overview”.

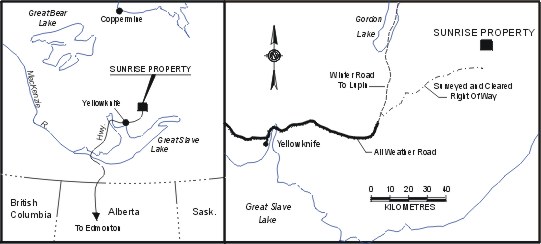

In June 2003,September 2005, we acquired from Northern Hemisphere Development Corp. and Aber Diamond Corporationentered into a 100% interest injoint venture agreement with Esperanza for the Sunrise Lake deposit located in Canada’s Northwest Territories.exploration of the San Luis Project. See Item 4.B —- “Business Overview”.

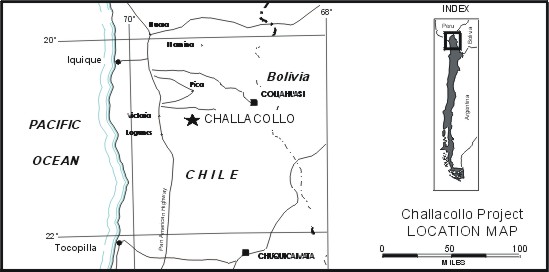

In August 2003,November 2005, we exercised our optionannounced agreements with Mexicana del Arco, S.A. de C.V. and Industrial Minera Mexico, S.A. de C.V. to acquire a 100% interest in the Challocollo projectVeta Colorada Project located in Region One of Northern Chile. See Item 4.B — “Business Overview”.

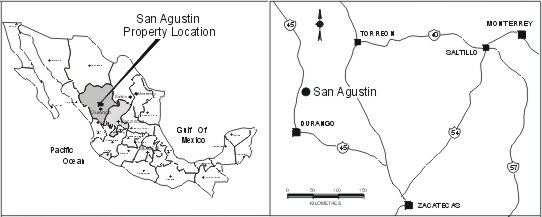

In October 2003, we announced a new silver discovery at our 100% owned La Pitarrilla property in DurangoChihuahua State, Mexico. See Item 4.B —- “Business Overview”.

In February 2004,January 2006, we exercisedcompleted the acquisition of all of the shares of Sociedad Minera Berenguela S.A., the holder of the rights to the Berenguela Project located in Peru. See Item 4.B - “Business Overview”.

-10 - |

In March 2006, we entered into an agreement with Pan American Silver Corp. (“Pan American”) to sell our option to acquire a 100%50% interest in the San Marcial SilverManantial Espejo Project located in Mexico.Argentina to Pan American. See Item 4.B —- “Business Overview”.

In March 2004, we acquired from Sociedad Minera Berenguela S.A. and Fossores Ltd. an option to acquire all of the silver resources contained in the Berenguela project in Peru and all of the data for the project. See Item 4.B — “Business Overview”.

In this Annual Report all references to “$” and “Cdn$” refer to Canadian Dollars and all references to “US$” refer to United States Dollars.

The information contained in this Annual Report is current as at December 31, 2003,2005, other than where a different date is specified.

B. | Business Overview |

B. Business Overview

All disclosure about our exploration properties in this Annual Report conforms to the standards of United States Securities and Exchange Commission Industry Guide 7,Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations, other than disclosure of “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which are geological and mining terms as defined in accordance with Canadian National Instrument 43-101 under the guidelines set out in the CIM Standards. U.S. investors in particular are advised to read carefully the definitions of these terms as well as the explanatory and cautionary notes in the Glossary, and the cautionary notes below, regarding use of these terms.

We are engaged in the exploration of silver properties in Argentina, Australia, Canada, Chile, Mexico, Peru and the United States and the acquisition of silver properties, if warranted, throughout the world. We are an exploration stage company and none of our properties are currently beyond the advanced exploration stage. There is no assurance that a commercially viable mineral deposit exists on any of our properties and further exploration work may be required before a final evaluation as to the economic and legal feasibility is determined. For further information, see Item 3.D – “Risk Factors”.

- 8 -

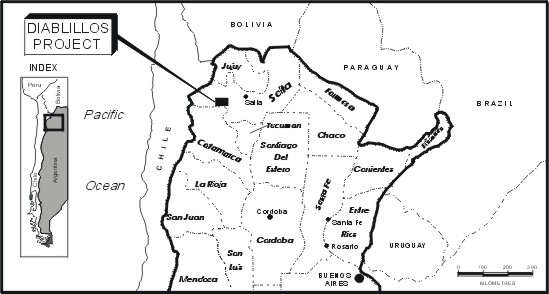

We have fivetwo principal mineral property interests: (1) the Pirquitas Project in the Province of Jujuy, Argentina and (2) the Pitarrilla Project in Durango State, Mexico. We have four secondary mineral property interests: the Bowdens Project in Australia, the Shafter Silver Project in Texas, U.S.A., a 50% interest (which may be increased to 80% by funding certain expenditures) in the San Luis Project located in the Ancash Department of Peru and a 50% interest in the Manantial Espejo Project in the Province of Santa Cruz, Argentina (2) the Bowdens Silver Project in the Mudgee District of Australia, (3) a 43.4%(which interest in the Pirquitas Project in the Province of Jujuy, Argentina, (4) La Pitarrilla in Durango State, Mexico and (5) the Shafter Silver Project in Texas, U.S.A.we have agreed to sell to Pan American, see Item 4.B - “Business Overview - Secondary Properties”). We also have eight secondary properties: the Challacollo Silver Project in Chile,nine tertiary mineral property interests: the Diablillos Project in Argentina, an optionthe Berenguela Project in Peru, the right to acquire the Veta Colorada Project in Mexico, the Challacollo Project in Chile, a 55% interest in the Maverick Springs Project in northern Nevada, U.S.A., an option to acquire all of the in-ground silver at the Berenguela Project in Peru, the San Marcial Silver Project in Mexico, the San Agustin Property in Durango State, Mexico, the Silvertip Property in northern British Columbia, Canada and the Sunrise Lake Deposit in the Northwest Territories, Canada; andCanada. We also have two long-term properties:property interests: the Candelaria Minemine in west central Nevada, U.S.A. and the Sulphurets Project in British Columbia, Canada. WeIn categorizing our projects, we consider, among other things, the priority of the project for the ensuing year, proposed expenditures in respect of the project for the ensuing year and the stage of exploration of the project.

In addition, we have severalformed a strategic alliance with Minco to jointly pursue silver opportunities in China, an agreement with Esperanza for the evaluation of mineral prospects in central Peru and a number of other property holdings in Argentina, Australia, Canada, Chile, Mexico Chile and Canada,the United States, which are not considered principal, secondary or long-term properties.

-11 - |

Principal Properties

Pirquitas Project

Under an agreement dated June 21, 2002, we acquired from Stonehill Institutional Partners, L.P., Stonehill Offshore Partners Limited and Stonehill Capital Management, LLC a 43.4% interest in Sunshine Argentina, Inc., a Delaware corporation, the holder of the rights to the Pirquitas Project located in the Province of Jujuy, Argentina. The total purchase price for the 43.4% interest was:

the payment at closing of US$3,000,000 in cash; and

the issuance of a US$1,340,000 convertible debenture, with a term of one year, exercise price of Cdn$5.80 per share and interest rate of 10% per annum.

The debenture was fully converted by the holder by December 31, 2002 into 360,636 common shares in our capital. At the time of the acquisition of 43.4% interest in Sunshine Argentina, Inc., we became the operator of the Pirquitas Project

Under an agreement dated October 20, 2004, we acquired from Elliott International L.P., The Liverpool Limited Partnership and Highwood Partners, L.P. a 56.6% interest in Sunshine Argentina, Inc., for a 100% total interest, on the issuance of 2.663 million common shares in our capital.

We currently own 100% of the issued and outstanding shares in the capital of Sunshine Argentina, Inc. for a 100% interest in the Pirquitas Project.

Pitarrilla Project

We acquired by staking the original mineral claim covering the Pitarrilla Project in November 2002, acquired two contiguous claims by staking in 2003 and 2004 and applied for a fourth contiguous claim by staking in 2005. In addition, in 2004/2005 we acquired two adjoining claims, the Pena and Pena 1 claims, on payment of US$300,000 and a third adjoining claim, the America claim, on payment of US$250,000. We have agreed to pay the following finder’s fee to La Cuesta International, Inc. in respect of our acquisition of the Pitarrilla Project:

US$5,000 in cash following the staking of the property (paid);

the greater of (i) US$5,000 and (ii) 2% of our direct exploration expenditures on the Property, payable every six months; and

a 0.25% net smelter returns royalty applicable to all gold and silver produced from the property;

provided that the maximum amount payable in respect of the finder’s fee is an aggregate of US$500,000.

We currently own a 100% interest in the Pitarrilla Project, subject to the above described finder’s fee capped at US$500,000.

Secondary Properties

Bowdens Project

We entered into an agreement on December 23, 1996 with Golden Shamrock Mines Limited as amended by an amending agreement dated August 4, 1997, to acquire all of the issued shares of GSM Exploration Pty Limited (“GSM Exploration”) (now known as Silver Standard Australia Pty Limited) at a cost of US$6,712,845. The acquisition of the shares of GSM Exploration was completed on August 22, 1997.

-12 - |

At the time, the only asset of GSM Exploration was the Bowdens Project located in New South Wales, Australia, which it acquired from CRA Exploration Pty Limited (“CRA Exploration”) (now known as Rio Tinto Exploration Pty Limited) pursuant to the terms of a tenement sale agreement dated August 11, 1994. Under the terms of the tenement sale agreement, CRA Exploration had the right, among other things, to:

receive a payment of A$1,429,397 on GSM Exploration making a decision to mine in respect of the Bowdens Project;

reacquire up to a 51% interest in the Bowdens Project in the event gold and silver resources are delineated on the Bowdens Project in excess of A$800,000,000 or base metal resources are delineated on the Bowdens Project in excess of A$3,000,000,000 within the six month period following the decision to mine; and

reacquire a 100% interest in the Bowdens Project at no cost in the event GSM Exploration did not make a decision to mine in respect of the Bowdens Project by August 11, 1999.

On July 31, 1997, prior to completing the acquisition of the shares of GSM Exploration, we entered into an agreement with CRA Exploration under which CRA Exploration agreed to release all of its rights to reacquire an interest in the Bowdens Project in return for:

the issuance of 160,000 of our common shares (which have since been issued);

the payment of A$1,500,000 on the commencement of commercial production on the Bowdens Project; and

the granting of a royalty of 2% of net smelter returns reducing to 1% of net smelter returns after the payment of US$5,000,000 in royalties.

Accordingly, with the completion of the acquisition of the shares of GSM Exploration and the signing of the agreement with CRA Exploration, we own the following interest in the Bowdens Project:

100% of the shares of GSM Exploration for a 100% interest in the Bowdens Project;

subject to the rights of CRA Exploration to receive:

payment of A$1,500,000 on the commencement of commercial production on the Bowdens Project; and

a royalty of 2% of net smelter returns reducing to 1% of net smelter returns after the payment of US$5,000,000 in royalties.

Shafter Silver Project

On September 19, 2000 we entered into an agreement with SSR Acquisition, Inc. (our wholly-owned subsidiary), Coastal Capital Partners L.P., John H. Bailey, Peter Galli, Carolyn E. Galli, Mark Fidler, Kathleen Fidler and David Fraser. Under the agreement, we acquired 91.8% of the issued shares of Silver Assets, Inc. in consideration of the payment of US$0.00654 per share for a total purchase price of US$599,305.15. On November 9, 2000, a short-form merger between SSR Acquisition, Inc. and Silver Assets, Inc. was effected (under the laws of the State of California), under which we acquired the remaining issued shares of Silver Assets, Inc. for US$0.00654 per share. The purchase price for 100% of the issued shares of Silver Assets, Inc. was US$693,601 (Cdn$1,024,293).

At the time of our acquisition of Silver Assets, Inc., its sole asset was a 90.56% interest in Rio Grande Mining Company (“Rio Grande”), the holder of the Shafter Silver Project located near Shafter, Texas. On February 4, 2002, the Nevada Secretary of State accepted a filing document that effected our acquisition of the remaining 9.44% outstanding minority stockholdings in Rio Grande. The cost of acquiring the minority stockholding was US$55,053 and is to be paid out over time as shares are surrendered. In late 2005, US$49,000 in unclaimed minority stockholding interests were remitted to states of last known residence in settlement of our obligations for the minority stock holdings of Rio Grande.

-13 - |

Prior to our acquisition Silver Assets, Inc. and Rio Grande, Rio Grande purchased all of the “major” outstanding royalties on metal production from the Shafter Silver Project. One of these royalties was a 6.25 percent net smelter return royalty payable to Cyprus Amax out of future mining revenues, which Rio Grande purchased from Cyprus Amax for $50,000 cash and a $475,000 note. Following our acquisition of Silver Assets, Inc.:

we made the final payment of US$75,000 plus interest due to Cypress Amax under the US$475,000 note; and

we acquired one of the two remaining royalties on metal production from the Shafter Silver Project of 6.5% on the Chavez-Miller portion of the property, covering an area of approximately 137.4 hectares, for US$117,500.

The only remaining material royalty on metal production from the Shafter Silver Project is a 6.25% royalty on a narrow strip of land, covering an area of 10 acres, leased from the State of Texas that contains only a minor amount of the Mineral Resource.

With the acquisition of the minority stockholdings in Silver Assets, Inc. and Rio Grande, we own a 100% interest in the Shafter Silver Project, subject to the above described royalty payable to the State of Texas.

San Luis Project

On March 22, 2005, we entered into an agreement with Esperanza for the evaluation of mineral prospects in central Peru. Under the evaluation agreement,

we agreed to contribute US$300,000; and

Esperanza agreed to contribute US$200,000 and certain know-how;

to carry out agreed upon evaluation programs for mineral prospects, with Esperanza acting as operator. In the event Esperanza acquires or proposes to acquire any mineral property as a result of an evaluation program, we may elect to enter into a joint venture with Esperanza for the exploration of the mineral property on the following terms:

we will initially hold a 50% interest in the joint venture and Esperanza will initially hold a 50% interest in the joint venture;

we may elect on the formation of the joint venture to increase our interest in the joint venture to 55% by funding the first US$500,000 in exploration expenditures;

once we incur the first US$500,000 in exploration expenditures or, if we do not elect to increase our interest to 55%, following the formation of the joint venture, we will incur with Esperanza US$1.5 million in exploration expenditures in proportion to our respective interests in the joint venture;

once we incur with Esperanza US$1.5 million in exploration expenditures, we may elect to increase our interest in the joint venture to 70% by paying all costs required to be incurred to complete a feasibility study; and

-14 - |

if we elect to increase our interest to 70% by completing a feasibility study, on completion of the feasibility study we may elect to increase our interest in the joint venture to 80% by paying all costs required to be incurred to place the property into commercial production.

In August 2005, Esperanza advised us of the acquisition of certain mineral concessions, known as the San Luis Project, as the result of an evaluation program carried out under the evaluation agreement. On September 6, 2005, we entered into a joint venture agreement with Esperanza for the exploration of the San Luis Project (the “San Luis Joint Venture”) on the terms set out above and elected to increase our interest in the joint venture to 55% by funding the first US$500,000 in exploration expenditures. As at December 31, 2005, we had incurred $135,000 (US$108,000) in exploration expenditures on the San Luis Project, with a further US$392,000 to be incurred to earn a 55% interest in the San Luis Joint Venture.

We currently hold a 50% interest in the San Luis Joint Venture and have elected to increase our interest in the San Luis Joint Venture to 55%.

Manantial Espejo Project

On November 4, 1998, we entered into an agreement with Triton Mining Corporation (“Triton Mining”), a wholly-owned subsidiary of Black Hawk Mining Inc., a Toronto Stock Exchange listed company, pursuant to which we acquired an option to acquire a 50% interest in Minera Triton Argentina S.A. (“Minera Triton”), a wholly-owned subsidiary of Triton Mining. In order to exercise the option, we were required to:

make staged cash option payments to Triton Mining of US$1,536,500 (paid); and

incur exploration expenditures on the Manantial Espejo Project of US$4.5 million by December 31, 2001, extendable to December 31, 2002 in certain circumstances.

At the time we acquired our option to acquire a 50% interest in Minera Triton:

Minera Triton owned 80% of the issued and outstanding shares of Compania Minera Altovalle S.A. (“Altovalle”), an Argentine corporation, which owned certain mineral properties known as the “Manantial Espejo Project” located in the Santa Cruz Province of Argentina.

The remaining 20% of the shares of Altovalle were owned by Barrick Exploraciones Argentinas S.A., a subsidiary of Barrick Gold Corporation, (“Barrick Gold”).

Under the terms of the Altovalle shareholders’ agreement between Minera Triton and Barrick Gold, on completion of a feasibility study for the Manantial Espejo Project, Barrick Gold was required to elect to either:

|

increase its interest in Altovalle to 40% by paying Minera Triton 40% of its reasonable costs incurred in respect of the Manantial Espejo Project; or

sell its interest in Altovalle to Minera Triton for US$5.00 per ounce of gold plus US$0.06 per ounce of silver contained in the proven and probable reserve supporting the feasibility study with any ounces of gold or silver mined in addition to the ounces contemplated in the proven and probable reserve in the feasibility study subject to a 3% net smelter returns royalty.

In addition, under the terms of the Altovalle shareholders’ agreement between Minera Triton and Barrick Gold, the following royalties were payable to Barrick Gold:

- 9 -a payment of 60 cents (US) per tonne of ore mined from the Manantial Espejo Project and fed to process with a maximum of 1 million tonnes; and

0.5% net smelter returns royalty derived from the production of minerals from the Manantial Espejo Project.

-15 - |

At the time we acquired an option to acquire a 50% interest in Minera Triton, Minera Triton held its interest in Altovalle and the Manantial Espejo Project subject to a net smelter returns royalty granted to Repadre Capital Corporation (“Repadre Capital”) equal to 1.5% of 80% of net smelter returns in respect of production from the Manantial Espejo Project.

In August 2001, in order to increase our interest in Altovalle and the Manantial Espejo Project from an option to acquire 50% interest in Minera Triton, we acquired Barrick Gold’s 20% interest in Altovalle and terminated Barrick Gold’s rights under the Altovalle shareholders’ agreement by:

issuing to Barrick Gold 400,000 of our common shares valued at $920,000;

granting to Barrick Gold a royalty of US$5.00 per ounce of gold plus US$0.06 per ounce of silver contained in the proven and probable reserve supporting the feasibility study for the Manantial Espejo Project payable prior to the commencement of construction of a mine at the Manantial Espejo Project;

granting to Barrick Gold a 3% net smelter returns royalty on any ounces of gold or silver mined in addition to the ounces contemplated in the proven and probable reserve in the feasibility study;

agreeing to maintain in place the following royalties payable to Barrick Gold:

the payment of 60 cents (US) per tonne of ore mined from the Manantial Espejo Project and fed to process with a maximum of 1 million tonnes; and

0.5% net smelter returns royalty derived from the production of minerals from the Manantial Espejo Project.

At the time of the acquisition of Barrick Gold’s interest, we were not contemplating the subsequent transactions in 2002 described below with Triton Mining and Pan American. No gain or loss was recorded on the completion of this transaction with Barrick.

Under our option agreement for the acquisition of a 50% interest in Minera Triton, we agreed with Triton Mining that if either party acquired Barrick Gold’s 20% interest in the Manantial Espejo Project the acquiring party would offer one-half of the 20% interest to the other party for 50% of the acquisition cost. Accordingly, we transferred to Triton Mining one-half of the 20% interest (representing 10%, valued at $460,000) and cash of $125,000 in exchange for a 40% direct interest in the Sulphurets property. The net allocation of the $528,000 purchase cost of the 40% Sulphurets property interest was $499,000 to the Sulphurets property, $21,000 to working capital (including $8,000 cash) and $8,000 for reclamation deposits. We agreed to accept the 40% interest in the Sulphurets property we did not already own as consideration for the 10% interest in Manantial Espejo Project in order to increase our interest in the Sulphurets property to 100%. No gain or loss was recorded on the completion of this transaction.

On January 22, 2002, we received from Triton Mining an offer to sell to us all of its interest in the Manantial Espejo Project pursuant to the terms of the right of first refusal contained in the shareholders’ agreements for Minera Triton and Altovalle. On February 22, 2002, we elected to exercise our right of first refusal and entered into an agreement with Triton Mining under which we agreed to purchase Triton Mining’s remaining interest in Altovalle and the Manantial Espejo Project for US $2,000,000,US$2,000,000, which at the time consisted of:

- 10 -the ownership of a 10% interest in Altovalle for a 10% interest in the Manantial Espejo Project; and

-16 - |

the ownership of a 100% interest in Minera Triton for a 80% interest in the Manantial Espejo Project, subject to our option to acquire a 50% interest in Minera Triton. At the time, under our option to acquire a 50% interest in Minera Triton, we had made all required option payments (totalling US$1,536,500) and incurred US$4.1 million of the US$4.5 million required to be incurred by us to exercise our option and acquire a 50% interest in Minera Triton.

Concurrently with entering into the agreement with Triton Mining, we entered into an agreement with Pan American Silver Corp. (“Pan American”) to sell to Pan American:

the ownership of a 50% interest in Minera Triton for a 40% interest in the Manantial Espejo Project; and

the ownership of a 10% interest in Altovalle for a 10% interest in the Manantial Espejo Project;

in consideration of the payment of US$2,000,000 in cash or common shares and the obligation to contribute the first US$3,000,000 towards mine construction once a production decision is made for the Manantial Espejo Project.

On March 27, 2002, we concurrently closed our agreements with Triton Mining and Pan American and paid the cash and share consideration we received from Pan American, for the sale of the interest in the Manantial Espejo Project, to Triton Mining as consideration for its remaining interest in the Manantial Espejo Project. As part of our acquisition of Triton Mining’s interest, we deemed our option to acquire a 50% interest in Minera Triton to be exercised. As part of the sale to Pan American of an interest in the Manantial Espejo Project, we entered into a joint venture agreement with Pan American for the exploration and development of the Manantial Espejo Project. Under the terms of the joint venture agreement, we will remain operator of the project until a decision is made to complete a feasibility study. Thereafter, Pan American will be the operator of the project until the commencement of commercial production. On commencement of commercial production, we, together with Pan American, will form an operating company to act as operator of the project, which will be owned by the two of us in proportion to our respective interests in the project. All costs and expenses incurred in respect of the project shall be incurred by the two of us in proportion to our respective interests in the joint venture.

On March 27, 2002, we also acquired from Repadre Capital all of Repadre Capital’s interest in the net smelter returns royalty granted to Repadre Capital by Minera Triton equal to 1.5% of 80% of net smelter returns in respect of production from the Manantial Espejo Project. The purchase price for the royalty interest was US$200,000. We also agreed to sell a 50% interest in the royalty we acquired from Repadre Capital to Pan American for US$100,000.

In November 2002, Pan American acquired from Barrick Gold all of Barrick Gold’s rights to receive a royalty from the Manantial Espejo Project of US$5.00 per ounce of gold plus US$0.06 per ounce of silver contained in the proven and probable reserve supporting the feasibility study for the project with any ounces of gold or silver mined in addition to the ounces contemplated in the proven and probable reserve in the feasibility study subject to a 3% net smelter returns royalty. In December 2002, we acquired from Pan American a 50% interest in the royalty for US$300,000.

On March 21, 2006, we entered into an agreement with Pan American to sell to Pan American all of our 50% interest in the Manantial Espejo Project, including all shareholder loans and interests in royalties, in consideration of the issue to us of 1.95 million common shares of Pan American, having a value of US$46.3 million as of March 21, 2006. In addition, if Pan American sells all or a portion of the Manantial Espejo Project at anytime over the next 3 years, we will receive 50% of the sale proceeds, after deducting Pan American’s acquisition and other project costs. The agreement with Pan American is subject to regulatory approval and is expected close on April 10, 2006.

-17 - |

WithOn completion of the sale of our 50% interest in the Manantial Espejo Project to Pan American, we will have no interest in the Manantial Espejo Project.

Until the completion of the above described transactions,sale of our interest in the Manantial Espejo Project to Pan American, we currentlywill continue to have the following interest in the Manantial Espejo Project:

- 11 -

| the ownership of a 50% interest in Minera Triton for a 40% |

Bowdens Silver Project

We entered into an agreement on December 23, 1996 with Golden Shamrock Mines Limited as amended by an amending agreement dated August 4, 1997, to acquire all of the issued shares of GSM Exploration Pty Limited (“GSM Exploration”) (now known as Silver Standard Australia Pty Limited) at a cost of US$6,712,845. The acquisition of the shares of GSM Exploration was completed on August 22, 1997. At the time, the only asset of GSM Exploration was the Bowdens Silver Project, which it acquired from CRA Exploration Pty Limited (“CRA Exploration”) (now known as Rio Tinto Exploration Pty Limited) pursuant to the terms of a tenement sale agreement dated August 11, 1994. Under the terms of the tenement sale agreement, CRA Exploration had the right, among other things, to:

On July 31, 1997, prior to completing the acquisition of the shares of GSM Exploration, we entered into an agreement with CRA Exploration under which CRA Exploration agreed to release all of its rights to reacquire an interest in the Bowdens Silver ProjectManantial Espejo Project; and

the ownership of a 10% interest in return for:

Accordingly, with the completion of the acquisition of the shares of GSM Exploration and the signing of the agreement with CRA Exploration, we own the followingAltovalle for a 10% interest in the Bowdens Silver Project:Manantial Espejo Project;

- 12 -

Pirquitas Project

Under an agreement dated June 21, 2002, we acquired from Stonehill Institutional Partners, L.P., Stonehill Offshore Partners Limited and Stonehill Capital Management, LLC a 43.4% interest in Sunshine Argentina, Inc., a Delaware corporation, the holder of the rights to the Pirquitas Project. The total purchase price for the 43.4% interest was: