| Income tax expense | The Company estimates the income tax amount payable for transactions where the Treasury’s Claim cannot be clearly determined. Additionally, the Company evaluates the recoverability of assets due to deferred taxes considering whether some or all of the assets will not be recoverable.| Upon the improper determination of the provision for income tax, the Company will be bound to pay additional taxes, including fines and compensatory and punitive interest. | · | Allowance for doubtful accounts; | · A periodic review is conducted of receivables risks in the Company’s clients’ portfolios. Bad debts based on the expiration of account receivables and account receivables’ specific conditions. | Trading properties; |

· | Impairment testingImproper recognition of goodwill and other non-current assets; |

· | Venture capital organization; |

· | Aquisitioncharges / reimbursements of assets carried out between entities under common control; |

· | Biological assets and agricultural produce at the point of harvest; |

Business combinations – purchase price allocation

We account for the acquisition of subsidiaries using the acquisition method. Accounting for business combinations requires us the determination of the fair value of the various assets and liabilities of the acquired business. We use all available information to make these fair value determinations, and for major acquisitions, may hire an independent appraisal firm to assist us in making these fair value estimates. In some instances, assumptions with respect to the timing and amount of future revenues and expenses associated with an asset might have to be used in determining its fair value.

Actual timing and amount of net cash flows from revenues and expenses related to that asset over time may differ materially from those initial estimates, and if the timing is delayed significantly or if the net cash flows decline significantly, the asset could become impaired.

During the fiscal year ended June 30, 2015, we did not acquire new businesses.

Fair Value of Financial Instruments

Fair values of derivative financial instruments are computed with reference to quoted market prices on trade exchanges, when available. The fair values of financial instruments that are not traded in an active market are determined by using valuation techniques. We use our judgment to select a variety of methods and make assumptions that are based on market conditions existing at statement of financial position. When no quoted prices in an active market are available, fair values (particularly with derivatives) are based on recognized valuation methods.

The Company developed an internal valuation model to determine the fair value of the IDBD shares under these circumstances. This model is principally based and is sensitive to the number of shares eligible to be tendered. In one end of the spectrum, all of the shares outstanding may be tendered, and on the opposite end, only the Creditors’ shares are eligible for tendering as per the judge’s ruling. The objective of the methodology is to arrive at a fair value of the IDBD’s share by subtracting from the quoted market price the value of the right to participate in the tender offer embedded in such quoted price. The relative weight of the “right to participate in the tender offer” embedded in IDBD’s quoted market price is sensitive and varies depending on the number of shares deemed eligible for tendering. Each scenario reflects a different number of shares eligible for tendering. A probability of occurrence has been assigned to each scenario based on available evidence. This methodology results in a weighted-probability value representing the fair value of IDBD’s shares recognized in the financial statements. The Company considers this value as a reasonable proxy for the fair value of the IDBD share.

We use a range of valuation models for the measurement of Level 2 and Level 3 instruments, details of which may be obtained from the following table:

Description | Pricing model | | Pricing method | | Parameters | | Range | allowance for bad debt. | Foreign currency-contractsHybrid financial instrument related to the non-recourse loan from Koor (Adama) | Present·The value methodof Adama’s shares. ·Unobserved data underlying the binomial model applied to the determination of the embedded derivative instruments’ value. | | Theoretical price | | Money market curve, interest-rate curve; Foreign exchange curve. | | | - | Changes in losses or profits resulting from the variation in the fair value of the embedded derivative, and variations in the book amount of the primary contract recognized as revenues or expenses from financing. | Commitment to tender offer IDBDLevel 2 and 3 financial instruments | Black-Scholes | | Theoretical price | | Main assumptions used by the Company are: ·Projected discounted income as per discount rate ·Values determined in accordance with the company’s shares in equity funds on the basis of its financial statements, based on fair value or investment assessments. ·Comparable market multiple (EV/GMV ratio). ·Underlying asset price;price (market price) and share price volatility (historical) and interest-rate curve (NIS rate curve). | | Underlying asset price

3.5 to 4.7

Share price volatility

30% to 40%

Money market interest rate 0.7%(Libor curve).

| Wrong recognition of a charge to 1% | income. | Other BorrowingsProbability estimate of contingent liabilities | Weighted probabilityWhether more economic resources may be spent in relation to litigation against the Company; such estimate is based on legal advisors’ opinions. | Charge / reversal of the difference between market price and the Commitmentprovision in relation to tender offer of shares in IDBD | | Theoretical price | | Underlying asset price; share price volatility (historical) and interest-rate curve (NIS rate curve). IRSA 2017 interest-rate and scenario weights. | | Underlying asset price

1.55 to 2.35

Share price volatility

60% to 80%

Money market interest rate 0.02% to 0.9%

| a claim. | IDBD SharesBiological assets | Weighted probabilityMain assumptions used in valuation are: yields, operating costs, selling expenses, future of the difference between market price and the Commitment to tender offer of shares in IDBD | | Theoretical price | | Underlying asset price; share price volatility (historical) and interest-rate curve (NIS rate curve). IRSA 2017 interest-rate and scenario weights. | | Underlying asset price

1.55 to 2.35

Share price volatility

60% to 80%

Money market interest rate 0.02% to 0.9%

| | Call option of Arcos

| Discounted cash flow | | | - | | Projected income and discounted interestsales prices, discount rate. | | | - | | Interest rate swaps

| Cash flow | | Theoretical price | | Interest rate and cash flow forward contract. | | | - | | Preferred sharesWrong recognition/valuation of Condor | Binomial tree | | Theoretical price | | Underlying asset price (market price), share price volatility (historical) and money market interest-rate curve (Libor rate). | | Underlying asset price 1.96 to 2.65

Share price volatility 56% to 76%

Money market interest rate 0.67% to

0.83%

| | Warrants of Condor | Black-Scholes | | Theoretical price | | Underlying asset price (market price), share price volatility (historical) and money market interest-rate curve (Libor rate). | | Underlying asset price 1.96 to 2.65

Share price volatility 56% to 76%

Money market interest rate 0.67% to

0.83%

| biological assets. See sensitivities modeled on these parameters in Note 14. |

Allowance for Doubtful Accounts

We maintain an allowance for trade receivables to account for estimated losses resulting from the inability of customers to make required payments. When evaluating the adequacy of an allowance for trade receivables, we base our estimates on the aging of accounts receivable balances and historical write-off experience, customer credit worthiness and changes in customer payment terms.

If the financial condition of customers were to deteriorate, actual write-offs might be higher than expected.

Taxation

We are subject to income taxes in numerous jurisdictions. Our tax charge on ordinary activities is the sum of the total current and deferred tax charges. The calculation of the Company’s total tax charge necessarily involves a degree of estimation and judgment in respect of certain items whose tax treatment may not be always determined with certainty due to interpretation. The final resolution of some of these items may give rise to material profits, losses and/or cash flows. The complexity of our structure makes the estimation and judgment more challenging. The resolution of issues may not always be within our control and may depend on the efficiency of legal action, if necessary. Issues can, and often do, take many years to resolve. Payments in respect of tax liabilities for an accounting period result from payments on account and on the final resolution of open items. As a result there can be substantial differences between the tax charge in the consolidated income statement and tax payments.

We recognize deferred tax assets only to the extent it is probable that future taxable profit will be available against which the temporary differences can be utilized. We assess the realizability of deferred tax assets by considering whether it is probable that some portion or all of the deferred tax assets will not be realized. We consider the scheduled reversal of deferred tax liabilities, projected future taxable income and tax planning strategies in making this assessment.

The amounts recognized in our Audited Consolidated Financial Statements in respect of each matter are derived from our best estimate and judgment as described in Note 5 to our Audited Consolidated Financial Statements.

Trading Properties

Trading properties include land and work in progress in respect of development sites with a view to sale. Trading properties are carried at the lower of cost or net realizable value. On each development, judgment is required to assess whether the cost of land and any associated construction work in progress is in excess of its net realizable value. Net realizable value is the estimated selling price in the ordinary course of business less estimated costs to completion and estimated selling costs.

The estimation of the net realizable value of our trading properties under development is inherently subjective due to a number of factors, including their complexity, unusually large size, the substantial expenditure required and long timescales to completion. In addition, as a result of these timescales to completion, the plans associated with these developments could be subject to significant variation. As a result, the net realizable values of our trading properties are subject to a degree of uncertainty and are made on the basis of assumptions, which may not prove to be accurate.

If actual results differ from the assumptions upon which the external valuer has based its valuation, this may have an impact on the net realizable value of our trading properties, which would in turn have an effect on our financial condition.

Impairment Testing of Goodwill and Other Non-current Assets

IFRS requires us to undertake an annual test for impairment of its property, plant and equipment, investment property and finite-lived intangible assets, to test for impairment if events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Impairment testing is an area involving management judgment, requiring assessment as to whether the carrying value of assets can be supported by the net present value of future cash flows derived from such assets using cash flow projections which have been discounted at an appropriate rate. In calculating the net present value of the future cash flows, we are required to make certain assumptions in respect of highly uncertain matters including management’s expectations of estimates of future cash flows, market rents for similar properties in the same location and condition, and discount rates.

For purposes of the impairment testing, we group assets at the lowest levels for which there are separately identifiable cash flows, known as cash generating units or CGUs. Given the nature of our assets and activities, most of our individual assets do not generate independent cash flows that are independent of those from CGUs. Therefore, we estimate the recoverable amount of the CGU to which the asset belongs, except where the fair value less costs to sell of the individual asset is higher than its book value; or the value in use of the asset can be estimated as being close to its fair value less costs to sell, where fair value can be reliably determined.

Generally, we consider each shopping center, office building and undeveloped property as a separate CGU. Details of the methods, estimates and assumptions we make in our annual impairment testing of goodwill are included in Note 6 in the Consolidated Financial Statements. No impairment of goodwill was identified.

Venture Capital Organization

We generally account for our investments in associates under the equity method. However, IAS 28 “Investments in Associates” provides an exemption from applying the equity method where investments in associates are held through “Venture Capital Organizations” (VCO) or venture capital entities, as defined in Spanish, even when we are not a VCO. This type of investment may be accounted for at fair value with changes in net income for the years because such measure proves to be more useful to users of financial statements than the equity method.

Acquisition of Assets Carried Out Between Entities Under Common Control

The Company has elected to recognize acquisition of assets or groups of assets carried out between entities under common control who also qualify as “Business Combination” according to IFRS 3, using the acquisition method.

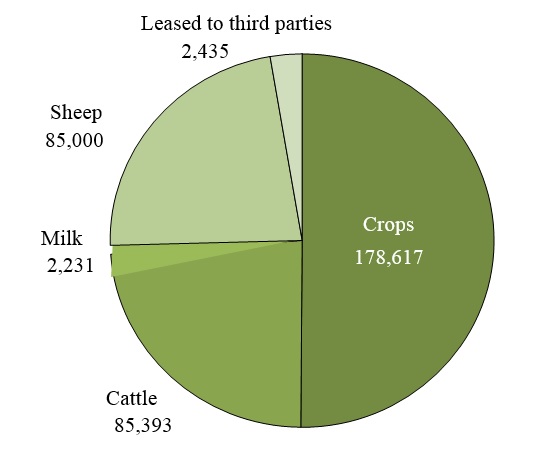

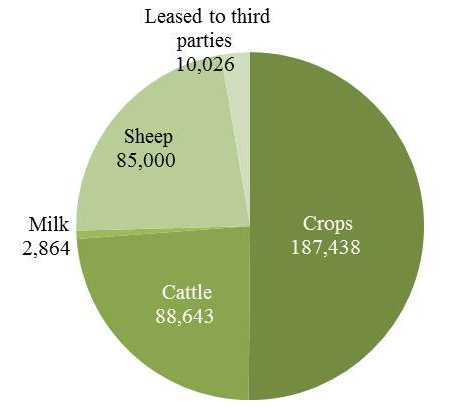

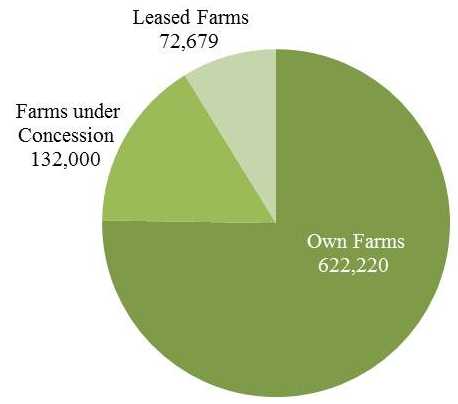

Biological Assets and Agricultural Produce at the Point of Harvest

We measure biological assets, which include unharvested crops, beef and dairy cattle, sheep, and sugarcane plantations (at initial recognition, when the biological asset has attained significant biological growth, and at each subsequent measurement reporting date) and agricultural produce, which include harvested crop, raw meat, raw milk, wool and others, at fair value less costs to sell. We measure biological assets that have not attained significant biological growth or when the impact of biological transformation on price is not expected to be material, at cost less any impairment losses, which approximates fair value.

When an active market exists for biological assets, we use the quoted market price in the most relevant market as a basis to determine the fair value of our biological assets, as in the case of cattle. For other biological assets where there is neither an active market or market-determined prices during the growth cycle, we determine their fair value through the use of discounted cash flow (“DCF”) valuation.

The DCF method requires us to populate the models with highly subjective assumptions, including observable and unobservable inputs. The models we use to estimate the fair value of our biological assets are generally based on data not observable in the market, and the use of unobservable inputs is significant to the overall valuation of the assets.

The key assumptions used in our models include future market prices, estimated yields at the point of harvest, and estimated costs of harvesting and other costs.

The market prices used in our DCF models are determined by reference to observable data in the relevant market for the agricultural produce. We estimate our harvesting costs and other costs based on historical and statistical data. We estimate yields based on several factors, including the location of the farmland, soil type, environmental conditions, infrastructure and other restrictions and growth at the time of measurement. Yields are subject to a high degree of uncertainty and may be affected by several factors out of our control, including but not limited to extreme or unusual weather conditions, plagues and other diseases.

All of these assumptions are highly sensitive. Reasonable shifts in assumptions including but not limited to increases or decreases in prices, costs and discount factors used may result in a significant increase or decrease to the fair value of biological assets recognized at any given time. Cash flows are projected based on estimated production. Estimates of production in themselves are dependent on various assumptions, in addition to those described above, including but not limited to several factors such as location, environmental conditions and other restrictions. Changes in these estimates could materially impact on estimated production, and could therefore affect estimates of future cash flows used in the assessment of fair value (the valuation models and their assumptions are reviewed annually, and, if necessary, adjusted).

Further details on valuation methods, sensitivity analysis and other factors is included in Note 5 to our Audited Consolidated Financial Statements.

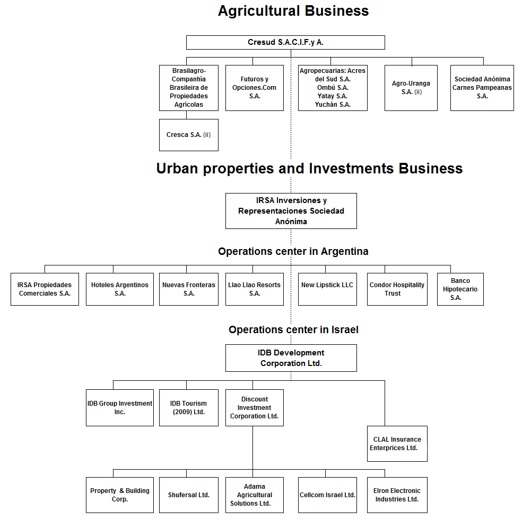

Business Segment Information IFRS 8 requires an entity to report financial and descriptive information about its reportable segments, which are operating segments or aggregations of operating segments that meet specified criteria. Operating segments are componentscomponent of an entity about which separate financial information is available that is evaluated regularly by the chief operating decision maker (“CODM”). SuchCODM. According to IFRS 8, the CODM represents a function whereby strategic decisions are made and resources are assigned. The CODM function is carried out by the Company’s Executive Committee in deciding how to allocate resources and in assessing performance, without prejudicePresident of the powersCompany, Mr. Eduardo S. Elsztain. In addition, and responsibilitiesdue to the acquisition of IDBD, two responsibility levels have been established for resource allocation and assessment of results of the management body, that is to say,two operations centers, through executive committees in Argentina and Israel. As a result of the Boardcontrol of Directors. CODM evaluatesIDBD, the businessCompany reports its financial and equity performance based on the differencesnew segment structure. Comparative information has been modified to reflect the new organization insofar as possible. Segment information is reported from the perspective of products and services: (i) agricultural business and (ii) urban properties and investment business. In addition, this last segment is reported divided from the geographic point of view in two Operations Centers to manage its global interests: Argentina and Israel. Within each operations center, the Company considers separately the various activities being developed, which represent reporting operating segments given the nature of its products, services, operations and risks. The amount reported forManagement believes the operating segment clustering in each segment item isoperations center reflects similar economic characteristics in each region, as well as similar products and services offered, types of clients and regulatory environments. Agricultural business: In the measure reported tothird quarter, we have changed the presentation of the agricultural business segments which are reviewed by the CODM for these purposes. In turn,a better alignment with the Boardcurrent business vision and the metrics used to such end. Four operating segments (crops, cattle, dairy and sugarcane) have been aggregated into a single operating segment named “Agricultural production”. Management consider for the aggregation the nature of Directors’ management is assessed by the Shareholders’ Meeting, which isproduction processes (growing of biological assets), the governance body.methods used to distribute their products and the nature of the regulatory environment (agricultural business). Therefore this quarter three segments are considered: Operating segments identified are disclosedThe "Agricultural production" segment consists of planting, harvesting and sale of crops as reportable segments if they meet anywheat, corn, soybeans, cotton and sunflowers; breeding, purchasing and/or fattening of free-range cattle for sale to slaughterhouses and local livestock auction markets; breeding and/or purchasing dairy cows for the following quantitative thresholds:production of raw milk for sale to local milk and milk-related products producers; and planting, harvesting and sale of sugarcane.

· | The operating segment’s reported revenue, including both sales to external customers and inter-segment sales or transfers, is 10% or more of the combined revenue, internal and external, of all operating segments; |

The “Land transformation and sales” segment comprises gains from the disposal and development of farmlands activities · | The absolute amount of its reported profit or loss is 10% or more of the greater, in absolute amount, of: |

· | the combined reported profit of all operating segments that do not report a loss; and |

· | the combined reported loss of all operating segments that report a loss. |

· | Its assets are 10% or more of the combined assets of all operating segments. |

As well as this, the operating segments that do not meet anyThe "Other segments" column includes, principally, agricultural services (for example, irrigation); leasing of the quantitative thresholds can be considered as reportable segments if the management estimates that this information could be useful for the users of the financial statements.

If, after determining reportable segments in accordance with the preceding quantitative thresholds, the total external revenue attributableour farms to those segments amounts to less than 75% of the total Company’s consolidated external revenue, additional segments are identified as reportable segments, even if they do not meet the thresholds described above, until at least 75% of the Company’s consolidated external revenue is included in reportable segments. Once the 75% of the Company’s consolidated external revenue is included in reportable segments, the remaining operating segments may be aggregatedthird parties; feedlot farming, slaughtering and processing in the "All other segments" column.

Segment information has been preparedmeat refrigeration plant; and classified according to different types of businesses in which the Company conducts its activities. The Company operates in two businesses areas, namely, Agricultural business and Investment and Development Properties business.brokerage activities, among others.

The Company’s Agricultural business is further comprised of eight reportable segments: (the reporting segments of crops, cattle, dairy, sugarcane, agricultural rentals and services and other segments are included within “Agriculture” activities): · | The “Crops” Segment consists of planting, harvesting and sale of crops as wheat, corn, soybeans, cotton, and sunflowers. The Company is focused on the long-term performance of the land and seeksamounts corresponding to maximize the use of the land through crop rotation; the use of technology and techniques. In this way, the type and quantity of harvested crops change in each agricultural campaign.

|

· | The “Cattle” Segment consists of breeding, purchasing and/ or fattening of free-range beef cattle for sale to meat processors and local livestock auction markets.

|

· | The “Dairy” Segment consists of breeding and/ or purchasing dairy cows for the production of raw milk for sale to local milk and milk-related products producers.

|

· | The “Sugarcane” Segment consists of planting, harvesting and sale of sugarcane.

|

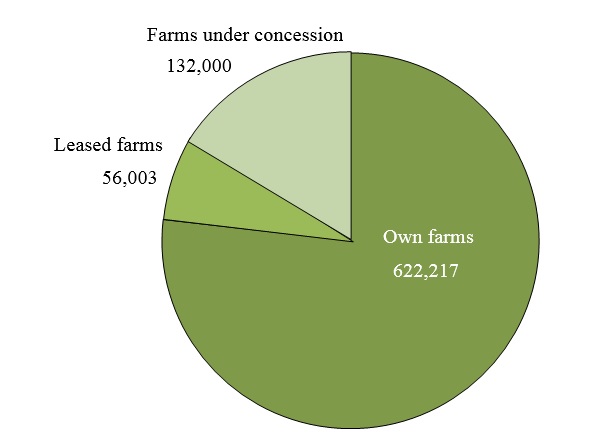

· | The “Agriculture Rentals and Services” Segment consists of services (for example: irrigation) and leasing of the Company’s farms to third parties.

|

· | The “Land Transformation and Sales” Segment comprises gains from the disposal and development of farmlands activities.

|

· | The “Agro-industrial” Segment consists of feedlot farming and the slaughtering and processing in the meat refrigerating plant. Feedlot farming is distinctive and requires specific care and diets which differ from those provided to free-range cattle. This activity represents a separate operating segment due to the distinctive characteristics of the cattle feedlot system and the industrialized meat processing in the packing plant.

|

· | The "Other Segments" column consists of the aggregation of the remaining operating segments, which do not meet the quantitative thresholds for disclosure includes the brokerage and sale of inputs activities.

|

The Company’s Urban Properties and Investments business is further comprised of six operative segments:

· | The “Shopping Center Properties” Segment includes results from the commercial exploitation and development of shopping centers. Such results originate mainly from the lease and the delivery of services related to the lease of commercial facilities and other spaces in the Company’s shopping centers.

|

· | The “Offices” Segment includes the operating results of our lease of office space and other rental properties and service revenues related to this activity.

|

· | The “Development and Sale of Properties” Segment includes the operating results of the sales of undeveloped parcels of land and/or trading properties, as the results related with its development and maintenance. Also included in this segment are the results of the sales of real property intended for rent, sales of hotels and other properties included in the International segment.

|

· | The “Hotels” Segment includes the operating results of the Company’s hotels principally comprised of room, catering and restaurant revenues.

|

· | The “International” Segment includes the return on investments in subsidiaries and/or associates that mainly operate in the United States in relation to the lease of office buildings and hotels in that country and the return on investment in IDBD at fair value.

|

· | The "Financial Operations and Others" Segment primarily includes the financial activities carried out by the Company's associates, Banco Hipotecario S.A. and Tarshop S.A. and consumer finance residual financial operations of APSAMedia S.A. (currently merged with IRSA Commercial Properties). The e-commerce activities conducted through the associate Avenida Inc. are also included until the first quarter of the current fiscal year. This investment began to be considered a financial asset from the second quarter of this fiscal year.

|

For ease of presentation, the following table present summarized information for the two lines of business of the Company, i.e. agriculture and Urban Properties and Investments activities. The following tables represent the reportable segments of each of the Company’s lines of business.

Below is a summarized analysis of the lines of business of the Company for the yearsfiscal year ended June 30, 2015 and 2014, and 2013.have been retroactively adjusted to reflect changes in segment information.

| | | Year ended June 30, 2015 | | | | | Agricultural business (I) | | | Urban properties and investments (II) | | | Total | | | Revenues | | | 2,361,010 | | | | 2,547,062 | | | | 4,908,072 | | | Costs | | | (3,385,675 | ) | | | (633,467 | ) | | | (4,019,142 | ) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | | | 1,347,447 | | | | - | | | | 1,347,447 | | | Changes in the net realizable value of agricultural produce after harvest | | | (34,471 | ) | | | - | | | | (34,471 | ) | | Gross Profit | | | 288,311 | | | | 1,913,595 | | | | 2,201,906 | | | Gain from disposal of investment properties | | | - | | | | 1,150,230 | | | | 1,150,230 | | | Gain from disposal of farmlands | | | 569,521 | | | | - | | | | 569,521 | | | General and administrative expenses | | | (246,470 | ) | | | (378,125 | ) | | | (624,595 | ) | | Selling expenses | | | (284,830 | ) | | | (195,866 | ) | | | (480,696 | ) | | Other operating results, net | | | (18,123 | ) | | | 28,679 | | | | 10,556 | | | Profit from operations | | | 308,409 | | | | 2,518,513 | | | | 2,826,922 | | | Share of profit / (loss) of associates and joint ventures | | | 846 | | | | (1,036,256 | ) | | | (1,035,410 | ) | | Segment Profit | | | 309,255 | | | | 1,482,257 | | | | 1,791,512 | | | Investment properties | | | 77,202 | | | | 3,493,645 | | | | 3,570,847 | | | Property, plant and equipment | | | 2,078,497 | | | | 256,891 | | | | 2,335,388 | | | Trading properties | | | - | | | | 136,084 | | | | 136,084 | | | Goodwill | | | 8,395 | | | | 24,440 | | | | 32,835 | | | Units to be received under barters | | | - | | | | 90,486 | | | | 90,486 | | | Biological assets | | | 586,847 | | | | - | | | | 586,847 | | | Inventories | | | 495,919 | | | | 23,134 | | | | 519,053 | | | Interests in associates and joint ventures | | | 33,343 | | | | 2,381,670 | | | | 2,415,013 | | | Total segment assets | | | 3,280,203 | | | | 6,406,350 | | | | 9,686,553 | |

| | | Year ended June 30, 2014 | | | | | Agricultural business (I) | | | Urban properties and investments (II) | | | Total | | | Revenues | | | 1,812,108 | | | | 2,155,760 | | | | 3,967,868 | | | Costs | | | (2,617,972 | ) | | | (648,279 | ) | | | (3,266,251 | ) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | | | 1,172,739 | | | | - | | | | 1,172,739 | | | Changes in the net realizable value of agricultural produce after harvest | | | (17,447 | ) | | | - | | | | (17,447 | ) | | Gross Profit | | | 349,428 | | | | 1,507,481 | | | | 1,856,909 | | | Gain from disposal of investment properties | | | - | | | | 230,918 | | | | 230,918 | | | Gain from disposal of farmlands | | | 91,356 | | | | - | | | | 91,356 | | | General and administrative expenses | | | (239,630 | ) | | | (300,066 | ) | | | (539,696 | ) | | Selling expenses | | | (208,932 | ) | | | (150,109 | ) | | | (359,041 | ) | | Other operating results, net | | | (29,540 | ) | | | (47,922 | ) | | | (77,462 | ) | | (Loss) / Profit from operations | | | (37,318 | ) | | | 1,240,302 | | | | 1,202,984 | | | Share of profit / (loss) of associates and joint ventures | | | 11,479 | | | | (436,766 | ) | | | (425,287 | ) | | Segment (Loss) / Profit | | | (25,839 | ) | | | 803,536 | | | | 777,697 | | | Investment properties | | | 51,432 | | | | 3,540,437 | | | | 3,591,869 | | | Property, plant and equipment | | | 2,417,078 | | | | 237,860 | | | | 2,654,938 | | | Trading properties | | | - | | | | 143,059 | | | | 143,059 | | | Goodwill | | | 10,428 | | | | 24,784 | | | | 35,212 | | | Units to be received under barters | | | - | | | | 85,077 | | | | 85,077 | | | Assets held for sale | | | - | | | | 1,357,866 | | | | 1,357,866 | | | Biological assets | | | 651,582 | | | | - | | | | 651,582 | | | Inventories | | | 432,634 | | | | 17,220 | | | | 449,854 | | | Interests in associates and joint ventures | | | 37,226 | | | | 1,966,019 | | | | 2,003,245 | | | Total segment assets | | | 3,600,380 | | | | 7,372,322 | | | | 10,972,702 | |

Operations Center in Argentina

| | | Year ended June 30, 2013 | | | | | Agricultural business (I) | | | Urban properties and investments (II) | | | Total | | | Revenues | | | 1,355,430 | | | | 1,728,248 | | | | 3,083,678 | | | Costs | | | (2,045,779 | ) | | | (601,236 | ) | | | (2,647,015 | ) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | | | 888,493 | | | | - | | | | 888,493 | | | Changes in the net realizable value of agricultural produce after harvest | | | 11,756 | | | | - | | | | 11,756 | | | Gross Profit | | | 209,900 | | | | 1,127,012 | | | | 1,336,912 | | | Gain from disposal of investment properties | | | - | | | | 177,999 | | | | 177,999 | | | Gain from disposal of farmlands | | | 149,584 | | | | - | | | | 149,584 | | | General and administrative expenses | | | (153,675 | ) | | | (198,773 | ) | | | (352,448 | ) | | Selling expenses | | | (173,976 | ) | | | (117,230 | ) | | | (291,206 | ) | | Other operating results, net | | | 3,345 | | | | 92,425 | | | | 95,770 | | | Profit from operations | | | 35,178 | | | | 1,081,433 | | | | 1,116,611 | | | Share of profit / (loss) of associates and joint ventures | | | 9,191 | | | | (20,864 | ) | | | (11,673 | ) | | Segment Profit | | | 44,369 | | | | 1,060,569 | | | | 1,104,938 | | | | | | | | | | | | | | | | | Investment properties | | | 25,317 | | | | 4,306,984 | | | | 4,332,301 | | | Property, plant and equipment | | | 1,675,420 | | | | 231,734 | | | | 1,907,154 | | | Trading properties | | | - | | | | 129,677 | | | | 129,677 | | | Goodwill | | | 6,438 | | | | 75,852 | | | | 82,290 | | | Units to be received under barters | | | - | | | | 93,225 | | | | 93,225 | | | Biological assets | | | 402,594 | | | | - | | | | 402,594 | | | Inventories | | | 239,010 | | | | 16,428 | | | | 255,438 | | | Interests in associates and joint ventures | | | 31,223 | | | | 1,154,830 | | | | 1,186,053 | | | Total segment assets | | | 2,380,002 | | | | 6,008,730 | | | | 8,388,732 | |

Within this center, IRSA operates in the following segments:

The “Shopping centers” segment includes assets and results of the activity of shopping centers portfolio, principally comprised of lease and service revenues related to rental of commercial space and other spaces in the shopping centers of the Company. (I) | Agriculture line of business: |

The “Office and others” segment includes the assets and the operating results of the activity of lease of office space and other rental properties and service revenues related to this activity.The “Sales and developments” segment includes assets and the operating results of the sales of undeveloped parcels of land and/or trading properties, as the results related with its development and maintenance. Also included in this segment are the results of the sales of real property intended for rent, sales of hotels and other properties included in the International segment. The “Hotels” segment includes the operating results of the hotels principally comprised of room, catering and restaurant revenues. The “International” segment primarily includes assets and operating profit or loss from business related to associates Condor and Lipstick. Through these associates, the Company derives revenue from hotels and an office building in United States, respectively. Until September 30, 2014, this segment included revenue from a subsidiary that owned the building located at 183 Madison Ave in New York, United States, which was sold on September 29, 2014. Additionally, until October 11, 2015, this international segment only included results from the investment in IDBD carried at fair value. The “Financial operations and others” segment primarily includes the financial activities carried out by BHSA and Tarshop and other residual financial operations. The following tables presentCODM periodically reviews the reportable segmentsresults and certain asset categories and assesses performance of the agriculture line of business of the Company for the years ended June 30, 2015, 2014 and 2013: | | | June 30, 2015 | | | | | Agriculture | | | | | | | | | | | | | | | | | Crops | | | Cattle | | | Dairy | | | Sugarcane | | | Agricultural Rental and services | | | Agricultural Subtotal | | | Land Transformation and Sales | | | Agro-industrial | | | Other segments | | | Total Agricultural business | | | Revenues (i) | | | 986,717 | | | | 143,562 | | | | 71,940 | | | | 197,828 | | | | 37,175 | | | | 1,437,222 | | | | - | | | | 806,018 | | | | 117,770 | | | | 2,361,010 | | | Costs | | | (1,795,443 | ) | | | (224,556 | ) | | | (133,259 | ) | | | (368,172 | ) | | | (19,201 | ) | | | (2,540,631 | ) | | | (9,002 | ) | | | (739,201 | ) | | | (96,841 | ) | | | (3,385,675 | ) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | | | 918,319 | | | | 166,734 | | | | 74,919 | | | | 187,475 | | | | - | | | | 1,347,447 | | | | - | | | | - | | | | - | | | | 1,347,447 | | | Changes in the net realizable value of agricultural produce after harvest | | | (34,474 | ) | | | 3 | | | | - | | | | - | | | | - | | | | (34,471 | ) | | | - | | | | - | | | | - | | | | (34,471 | ) | | Gross Profit / (Loss) | | | 75,119 | | | | 85,743 | | | | 13,600 | | | | 17,131 | | | | 17,974 | | | | 209,567 | | | | (9,002 | ) | | | 66,817 | | | | 20,929 | | | | 288,311 | | | Gain from disposal of farmlands | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 569,521 | | | | - | | | | - | | | | 569,521 | | | General and administrative expenses | | | (159,036 | ) | | | (25,753 | ) | | | (4,920 | ) | | | (19,821 | ) | | | (2,140 | ) | | | (211,670 | ) | | | (2,106 | ) | | | (25,334 | ) | | | (7,360 | ) | | | (246,470 | ) | | Selling expenses | | | (160,378 | ) | | | (20,109 | ) | | | (3,667 | ) | | | (7,770 | ) | | | (717 | ) | | | (192,641 | ) | | | (2,383 | ) | | | (77,146 | ) | | | (12,660 | ) | | | (284,830 | ) | | Other operating results, net | | | (8,636 | ) | | | (3,158 | ) | | | (773 | ) | | | (1,669 | ) | | | (336 | ) | | | (14,572 | ) | | | (4,601 | ) | | | (288 | ) | | | 1,338 | | | | (18,123 | ) | | Profit / (Loss) from Operations | | | (252,931 | ) | | | 36,723 | | | | 4,240 | | | | (12,129 | ) | | | 14,781 | | | | (209,316 | ) | | | 551,429 | | | | (35,951 | ) | | | 2,247 | | | | 308,409 | | | Share of profit of associates | | | 845 | | | | 1 | | | | - | | | | - | | | | - | | | | 846 | | | | - | | | | - | | | | - | | | | 846 | | | Segment Profit / (Loss) | | | (252,086 | ) | | | 36,724 | | | | 4,240 | | | | (12,129 | ) | | | 14,781 | | | | (208,470 | ) | | | 551,429 | | | | (35,951 | ) | | | 2,247 | | | | 309,255 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Investment properties | | | - | | | | - | | | | - | | | | - | | | | 77,202 | | | | 77,202 | | | | - | | | | - | | | | - | | | | 77,202 | | | Property, plant and equipment | | | 1,420,781 | | | | 187,100 | | | | 21,951 | | | | 293,386 | | | | 28,681 | | | | 1,951,899 | | | | 53,522 | | | | 18,102 | | | | 54,974 | | | | 2,078,497 | | | Goodwill | | | 5,352 | | | | - | | | | - | | | | 2,400 | | | | - | | | | 7,752 | | | | - | | | | - | | | | 643 | | | | 8,395 | | | Biological assets | | | 57,813 | | | | 375,357 | | | | 40,555 | | | | 113,122 | | | | - | | | | 586,847 | | | | - | | | | - | | | | - | | | | 586,847 | | | Inventories | | | 307,853 | | | | 58,529 | | | | 1,010 | | | | 2,418 | | | | - | | | | 369,810 | | | | - | | | | 23,415 | | | | 102,694 | | | | 495,919 | | | Interests in associates | | | 30,530 | | | | 20 | | | | - | | | | - | | | | - | | | | 30,550 | | | | - | | | | - | | | | 2,793 | | | | 33,343 | | | Total segment assets (ii) | | | 1,822,329 | | | | 621,006 | | | | 63,516 | | | | 411,326 | | | | 105,883 | | | | 3,024,060 | | | | 53,522 | | | | 41,517 | | | | 161,104 | | | | 3,280,203 | |

(i) | Of all of the Company’s revenues corresponding to the agricultural business, Ps. 1,668.86 million is originated in Argentina and Ps. 692.15 million in other countries, principally Brazil which acconts for Ps. 553.97 million. |

(ii) Of all of the Company’s assets included in the segmentoperating segments corresponding to the agricultural business Ps. 1,378.99 million is located in Argentina and Ps. 1,902.36 million in other countries, principally Brazil for Ps. 1,187.37 million.

| | | June 30, 2014 | | | | | Agriculture | | | | | | | | | | | | | | | | | Crops | | | Cattle | | | Dairy | | | Sugarcane | | | Agricultural Rental and services | | | Agricultural Subtotal | | | Land Transformation and Sales | | | Agro-industrial | | | Other segments | | | Total Agricultural business | | | Revenues (i) | | | 836,822 | | | | 90,315 | | | | 53,935 | | | | 123,851 | | | | 29,142 | | | | 1,134,065 | | | | - | | | | 554,084 | | | | 123,959 | | | | 1,812,108 | | | Costs | | | (1,540,681 | ) | | | (160,660 | ) | | | (104,334 | ) | | | (206,751 | ) | | | (17,374 | ) | | | (2,029,800 | ) | | | (8,228 | ) | | | (479,689 | ) | | | (100,255 | ) | | | (2,617,972 | ) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | | | 868,351 | | | | 145,321 | | | | 62,840 | | | | 96,227 | | | | - | | | | 1,172,739 | | | | - | | | | - | | | | - | | | | 1,172,739 | | | Changes in the net realizable value of agricultural produce after harvest | | | (17,624 | ) | | | 177 | | | | - | | | | - | | | | - | | | | (17,447 | ) | | | - | | | | - | | | | | | | | (17,447 | ) | | Gross Profit / (Loss) | | | 146,868 | | | | 75,153 | | | | 12,441 | | | | 13,327 | | | | 11,768 | | | | 259,557 | | | | (8,228 | ) | | | 74,395 | | | | 23,704 | | | | 349,428 | | | Gain from disposal of farmlands | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 91,356 | | | | - | | | | - | | | | 91,356 | | | General and administrative expenses | | | (147,193 | ) | | | (27,183 | ) | | | (5,746 | ) | | | (28,261 | ) | | | (2,669 | ) | | | (211,052 | ) | | | (1,130 | ) | | | (16,880 | ) | | | (10,568 | ) | | | (239,630 | ) | | Selling expenses | | | (117,829 | ) | | | (13,854 | ) | | | (2,249 | ) | | | (4,871 | ) | | | (779 | ) | | | (139,582 | ) | | | (3,873 | ) | | | (54,751 | ) | | | (10,726 | ) | | | (208,932 | ) | | Other operating results, net | | | (29,355 | ) | | | (1,999 | ) | | | (417 | ) | | | 104 | | | | (222 | ) | | | (31,889 | ) | | | (82 | ) | | | (868 | ) | | | 3,299 | | | | (29,540 | ) | | Profit / (Loss) from Operations | | | (147,509 | ) | | | 32,117 | | | | 4,029 | | | | (19,701 | ) | | | 8,098 | | | | (122,966 | ) | | | 78,043 | | | | 1,896 | | | | 5,709 | | | | (37,318 | ) | | Share of profit of associates | | | 11,029 | | | | 7 | | | | - | | | | - | | | | - | | | | 11,036 | | | | - | | | | - | | | | 443 | | | | 11,479 | | | Segment Profit / (Loss) | | | (136,480 | ) | | | 32,124 | | | | 4,029 | | | | (19,701 | ) | | | 8,098 | | | | (111,930 | ) | | | 78,043 | | | | 1,896 | | | | 6,152 | | | | (25,839 | ) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Investment properties | | | - | | | | - | | | | - | | | | - | | | | 51,432 | | | | 51,432 | | | | - | | | | - | | | | - | | | | 51,432 | | | Property, plant and equipment | | | 1,701,388 | | | | 158,507 | | | | 19,451 | | | | 423,902 | | | | 9,794 | | | | 2,313,042 | | | | 51,534 | | | | 18,930 | | | | 33,572 | | | | 2,417,078 | | | Goodwill | | | 6,745 | | | | - | | | | - | | | | 3,025 | | | | - | | | | 9,770 | | | | - | | | | - | | | | 658 | | | | 10,428 | | | Biological assets | | | 154,630 | | | | 312,068 | | | | 37,263 | | | | 142,873 | | | | - | | | | 646,834 | | | | - | | | | 65 | | | | 4,683 | | | | 651,582 | | | Inventories | | | 302,052 | | | | 28,881 | | | | 651 | | | | 1,702 | | | | - | | | | 333,286 | | | | - | | | | 25,878 | | | | 73,470 | | | | 432,634 | | | Interests in associates | | | 34,395 | | | | 23 | | | | - | | | | - | | | | - | | | | 34,418 | | | | - | | | | - | | | | 2,808 | | | | 37,226 | | | Total segment assets (ii) | | | 2,199,210 | | | | 499,479 | | | | 57,365 | | | | 571,502 | | | | 61,226 | | | | 3,388,782 | | | | 51,534 | | | | 44,873 | | | | 115,191 | | | | 3,600,380 | |

(i) Of allurban properties and investment business of the Company’s revenues corresponding to the agricultural business, Ps. 1,277.62 million is originated inoperations center Argentina and Ps. 534.49 million in other countries, principally Brazil which accounts for Ps. 415.02 million.

(ii) Of allbased on a measure of profit or loss of the Company’s assets includedsegment composed by the operating income plus the equity in earnings of joint ventures and associates. The valuation criteria used in preparing this information are consistent with IFRS standards used for the segment corresponding topreparation of the agricultural business, Ps. 1,252.06 million is located in Argentina and Ps. 2,348.32 million in other countries, principally Brazil which accountsAudited Consolidated Financial Statements, except for Ps. 1,727.36 million.the following:

| | | June 30, 2013 | | | | | Agriculture | | | | | | | | | | | | | | | | | Crops | | | Cattle | | | Dairy | | | Sugarcane | | | Agricultural Rental and services | | | Agricultural Subtotal | | | Land Transformation and Sales | | | Agro-industrial | | | Other segments | | | Total Agricultural business | | | Revenues (i) | | | 750,376 | | | | 82,939 | | | | 38,818 | | | | 160,259 | | | | 30,834 | | | | 1,063,226 | | | | - | | | | 208,921 | | | | 83,283 | | | | 1,355,430 | | | Costs | | | (1,227,832 | ) | | | (147,290 | ) | | | (74,826 | ) | | | (302,206 | ) | | | (12,052 | ) | | | (1,764,206 | ) | | | (5,675 | ) | | | (204,681 | ) | | | (71,217 | ) | | | (2,045,779 | ) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | | | 572,081 | | | | 79,336 | | | | 40,741 | | | | 197,317 | | | | - | | | | 889,475 | | | | - | | | | - | | | | (982 | ) | | | 888,493 | | | Changes in the net realizable value of agricultural produce after harvest | | | 11,801 | | | | (45 | ) | | | - | | | | - | | | | - | | | | 11,756 | | | | - | | | | - | | | | - | | | | 11,756 | | | Gross Profit / (Loss) | | | 106,426 | | | | 14,940 | | | | 4,733 | | | | 55,370 | | | | 18,782 | | | | 200,251 | | | | (5,675 | ) | | | 4,240 | | | | 11,084 | | | | 209,900 | | | Gain from disposal of farmlands | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 149,584 | | | | - | | | | - | | | | 149,584 | | | General and administrative expenses | | | (89,585 | ) | | | (13,719 | ) | | | (3,125 | ) | | | (24,163 | ) | | | (4,416 | ) | | | (135,008 | ) | | | (572 | ) | | | (10,986 | ) | | | (7,109 | ) | | | (153,675 | ) | | Selling expenses | | | (115,923 | ) | | | (11,482 | ) | | | (1,842 | ) | | | (4,006 | ) | | | (1,711 | ) | | | (134,964 | ) | | | (10,628 | ) | | | (21,507 | ) | | | (6,877 | ) | | | (173,976 | ) | | Other operating results, net | | | (11,014 | ) | | | (3,545 | ) | | | (803 | ) | | | (27 | ) | | | (1,135 | ) | | | (16,524 | ) | | | (147 | ) | | | (1,305 | ) | | | 21,321 | | | | 3,345 | | | Profit / (Loss) from Operations | | | (110,096 | ) | | | (13,806 | ) | | | (1,037 | ) | | | 27,174 | | | | 11,520 | | | | (86,245 | ) | | | 132,562 | | | | (29,558 | ) | | | 18,419 | | | | 35,178 | | | Share of profit of associates | | | 8,117 | | | | - | | | | - | | | | - | | | | - | | | | 8,117 | | | | - | | | | 16 | | | | 1,058 | | | | 9,191 | | | Segment Profit / (Loss) | | | (101,979 | ) | | | (13,806 | ) | | | (1,037 | ) | | | 27,174 | | | | 11,520 | | | | (78,128 | ) | | | 132,562 | | | | (29,542 | ) | | | 19,477 | | | | 44,369 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Investment properties | | | - | | | | - | | | | - | | | | - | | | | 25,317 | | | | 25,317 | | | | - | | | | - | | | | - | | | | 25,317 | | | Property, plant and equipment | | | 1,115,211 | | | | 136,824 | | | | 21,440 | | | | 303,283 | | | | 456 | | | | 1,577,214 | | | | 58,026 | | | | 20,287 | | | | 19,893 | | | | 1,675,420 | | | Goodwill | | | 4,443 | | | | - | | | | - | | | | 1,995 | | | | - | | | | 6,438 | | | | - | | | | - | | | | - | | | | 6,438 | | | Biological assets | | | 56,395 | | | | 197,136 | | | | 28,134 | | | | 111,063 | | | | - | | | | 392,728 | | | | - | | | | 66 | | | | 9,800 | | | | 402,594 | | | Inventories | | | 154,730 | | | | 23,184 | | | | 433 | | | | 939 | | | | - | | | | 179,286 | | | | - | | | | 10,419 | | | | 49,305 | | | | 239,010 | | | Interests in associates | | | 28,858 | | | | - | | | | - | | | | - | | | | - | | | | 28,858 | | | | - | | | | - | | | | 2,365 | | | | 31,223 | | | Total segment assets (ii) | | | 1,359,637 | | | | 357,144 | | | | 50,007 | | | | 417,280 | | | | 25,773 | | | | 2,209,841 | | | | 58,026 | | | | 30,772 | | | | 81,363 | | | | 2,380,002 | |

(i) | Of all of the Company’s revenues corresponding to the agricultural business, Ps. 803.9 million is originatedOperating results of joint ventures: Cresca, Cyrsa, NPSF, Puerto Retiro, Baicom and Quality are evaluated by the CODM applying proportional consolidation method. Under this method the income/loss generated and assets, are reported in Argentina and Ps. 551.6 million in other countries, principally Brazil which accounts for Ps. 453.2 million. |

(ii) Of all of the Company’s assets included in the segment corresponding to the agricultural business, Ps. 883.1 million is located in Argentina and Ps. 1,496.9 million in other countries, principally Brazil which accounts for Ps. 1,190.1 million.

(II) Urban properties and investments

The following tables present the reportable segments of the Urban Properties and Investments line of business of the Company for the years ended June 30, 2015, 2014 and 2013:

| | | June 30, 2015 | | | | | Shopping Center Properties | | | Offices | | | Sales and developments | | | Hotels | | | International | | | Financial operations and others | | | Total Urban Properties and Investments | | | Revenues (i) | | | 1,778,310 | | | | 332,728 | | | | 13,707 | | | | 396,297 | | | | 25,873 | | | | 147 | | | | 2,547,062 | | | Costs | | | (291,183 | ) | | | (36,368 | ) | | | (19,457 | ) | | | (278,672 | ) | | | (7,121 | ) | | | (666 | ) | | | (633,467 | ) | | Gross Profit / (Loss) | | | 1,487,127 | | | | 296,360 | | | | (5,750 | ) | | | 117,625 | | | | 18,752 | | | | (519 | ) | | | 1,913,595 | | | Gain from disposal of investment properties | | | - | | | | - | | | | 1,150,230 | | | | - | | | | - | | | | - | | | | 1,150,230 | | | General and administrative expenses | | | (136,151 | ) | | | (58,971 | ) | | | (49,690 | ) | | | (77,567 | ) | | | (55,746 | ) | | | - | | | | (378,125 | ) | | Selling expenses | | | (112,825 | ) | | | (21,130 | ) | | | (9,146 | ) | | | (52,386 | ) | | | - | | | | (379 | ) | | | (195,866 | ) | | Other operating results, net | | | (48,810 | ) | | | (117,610 | ) | | | 13,093 | | | | (461 | ) | | | 184,886 | | | | (2,419 | ) | | | 28,679 | | | Profit / (Loss) from Operations | | | 1,189,341 | | | | 98,649 | | | | 1,098,737 | | | | (12,789 | ) | | | 147,892 | | | | (3,317 | ) | | | 2,518,513 | | | Share of profit / (loss) of associates and joint ventures | | | - | | | | (2,570 | ) | | | (1,712 | ) | | | 1,254 | | | | (1,191,116 | ) | | | 157,888 | | | | (1,036,256 | ) | | Segment Profit / (Loss) | | | 1,189,341 | | | | 96,079 | | | | 1,097,025 | | | | (11,535 | ) | | | (1,043,224 | ) | | | 154,571 | | | | 1,482,257 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Investment properties | | | 2,320,845 | | | | 978,125 | | | | 187,824 | | | | - | | | | - | | | | 6,851 | | | | 3,493,645 | | | Property, plant and equipment | | | 48,345 | | | | 30,599 | | | | 1,242 | | | | 175,386 | | | | 1,319 | | | | - | | | | 256,891 | | | Trading properties | | | 1,484 | | | | - | | | | 134,600 | | | | - | | | | - | | | | - | | | | 136,084 | | | Goodwill | | | 13,719 | | | | 6,180 | | | | 4,541 | | | | - | | | | - | | | | - | | | | 24,440 | | | Units to be received under barters | | | - | | | | - | | | | 90,486 | | | | - | | | | - | | | | - | | | | 90,486 | | | Inventories | | | 15,711 | | | | - | | | | 497 | | | | 6,926 | | | | - | | | | - | | | | 23,134 | | | Investments in associates and joint ventures | | | - | | | | 20,746 | | | | 46,555 | | | | - | | | | 909,911 | | | | 1,404,458 | | | | 2,381,670 | | | Total segment assets (ii) | | | 2,400,104 | | | | 1,035,650 | | | | 465,745 | | | | 182,312 | | | | 911,230 | | | | 1,411,309 | | | | 6,406,350 | |

(i) Of all of the Company’s revenues corresponding to urban properties and investment business, Ps. 2,522 million is originated in Argentina and Ps. 26 million in United States.

(ii) Of all of the Company’s assets included in urban properties and investment business, Ps. 5,389 million is located in Argentina and Ps. 1,639 million in other countries, principally in Israel for Ps. 907.0 million and Uruguay for Ps. 106.0 million, respectively.

| | | June 30, 2014 | | | | | Shopping Center Properties | | | Offices | | | Sales and developments | | | Hotels | | | International | | | Financial operations and others | | | Total Urban Properties and Investments | | | Revenues (i) | | | 1,383,008 | | | | 271,159 | | | | 85,531 | | | | 331,562 | | | | 83,926 | | | | 574 | | | | 2,155,760 | | | Costs | | | (296,688 | ) | | | (45,367 | ) | | | (34,963 | ) | | | (216,768 | ) | | | (53,510 | ) | | | (983 | ) | | | (648,279 | ) | | Gross Profit / (Loss) | | | 1,086,320 | | | | 225,792 | | | | 50,568 | | | | 114,794 | | | | 30,416 | | | | (409 | ) | | | 1,507,481 | | | Gain from disposal of investment properties | | | (82 | ) | | | - | | | | 231,000 | | | | - | | | | - | | | | - | | | | 230,918 | | | General and administrative expenses | | | (101,538 | ) | | | (41,945 | ) | | | (37,466 | ) | | | (59,585 | ) | | | (59,476 | ) | | | (56 | ) | | | (300,066 | ) | | Selling expenses | | | (73,427 | ) | | | (20,751 | ) | | | (13,706 | ) | | | (42,335 | ) | | | - | | | | 110 | | | | (150,109 | ) | | Other operating results, net | | | (46,568 | ) | | | (3,060 | ) | | | 8,137 | | | | (2,680 | ) | | | (895 | ) | | | (2,856 | ) | | | (47,922 | ) | | Profit / (Loss) from Operations | | | 864,705 | | | | 160,036 | | | | 238,533 | | | | 10,194 | | | | (29,955 | ) | | | (3,211 | ) | | | 1,240,302 | | | Share of profit / (loss) of associates and joint ventures | | | - | | | | (895 | ) | | | 6,368 | | | | 789 | | | | (616,313 | ) | | | 173,285 | | | | (436,766 | ) | | Segment Profit / (Loss) | | | 864,705 | | | | 159,141 | | | | 244,901 | | | | 10,983 | | | | (646,268 | ) | | | 170,074 | | | | 803,536 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Investment properties | | | 2,275,053 | | | | 834,480 | | | | 423,442 | | | | - | | | | - | | | | 7,462 | | | | 3,540,437 | | | Property, plant and equipment | | | 20,455 | | | | 36,415 | | | | 3,744 | | | | 175,745 | | | | 1,501 | | | | - | | | | 237,860 | | | Trading properties | | | 1,484 | | | | - | | | | 141,575 | | | | - | | | | - | | | | - | | | | 143,059 | | | Goodwill | | | 8,582 | | | | 11,661 | | | | 4,541 | | | | - | | | | - | | | | - | | | | 24,784 | | | Units to be received under barters | | | - | | | | - | | | | 85,077 | | | | - | | | | - | | | | - | | | | 85,077 | | | Assets held for sale (iii) | | | - | | | | - | | | | - | | | | - | | | | 1,357,866 | | | | - | | | | 1,357,866 | | | Inventories | | | 10,625 | | | | - | | | | 584 | | | | 6,011 | | | | - | | | | - | | | | 17,220 | | | Investments in associates and joint ventures | | | - | | | | 23,208 | | | | 38,289 | | | | 22,129 | | | | 628,658 | | | | 1,253,735 | | | | 1,966,019 | | | Total segment assets (ii) | | | 2,316,199 | | | | 905,764 | | | | 697,252 | | | | 203,885 | | | | 1,988,025 | | | | 1,261,197 | | | | 7,372,322 | |

(i) Of all of the Company’s revenues corresponding to urban properties and investment business, Ps. 2,072 million is originated in Argentina and Ps. 84 million in United States.

(ii) Of all of the Company’s assets included in urban properties and investment business, Ps. 5,273 million is located in Argentina and Ps. 2,099 million in other countries, principally in United States for Ps. 1,988 million.

(iii) See Note 44 to the Audited Consolidated Financial Statements for details.

| | | June 30, 2013 | | | | | Shopping Center Properties | | | Offices | | | Sales and developments | | | Hotels | | | International | | | Financial operation and others | | | Total Urban Properties and Investments | | | Revenues (i) | | | 1,103,044 | | | | 217,171 | | | | 141,996 | | | | 225,836 | | | | 38,998 | | | | 1,203 | | | | 1,728,248 | | | Costs | | | (245,528 | ) | | | (46,975 | ) | | | (106,558 | ) | | | (169,071 | ) | | | (31,587 | ) | | | (1,517 | ) | | | (601,236 | ) | | Gross Profit / (Loss) | | | 857,516 | | | | 170,196 | | | | 35,438 | | | | 56,765 | | | | 7,411 | | | | (314 | ) | | | 1,127,012 | | | Gain from disposal of investment properties | | | - | | | | - | | | | 177,999 | | | | - | | | | - | | | | - | | | | 177,999 | | | General and administrative expenses | | | (67,597 | ) | | | (34,984 | ) | | | (32,901 | ) | | | (49,883 | ) | | | (13,158 | ) | | | (250 | ) | | | (198,773 | ) | | Selling expenses | | | (58,907 | ) | | | (11,360 | ) | | | (16,456 | ) | | | (28,919 | ) | | | - | | | | (1,588 | ) | | | (117,230 | ) | | Other operating results, net | | | (45,020 | ) | | | (247 | ) | | | 6,342 | | | | (369 | ) | | | 135,082 | | | | (3,363 | ) | | | 92,425 | | | Profit / (Loss) from Operations | | | 685,992 | | | | 123,605 | | | | 170,422 | | | | (22,406 | ) | | | 129,335 | | | | (5,515 | ) | | | 1,081,433 | | | Share of profit / (loss) of associates and joint ventures | | | - | | | | (2,514 | ) | | | 1,569 | | | | 83 | | | | (82,552 | ) | | | 62,550 | | | | (20,864 | ) | | Segment Profit / (Loss) | | | 685,992 | | | | 121,091 | | | | 171,991 | | | | (22,323 | ) | | | 46,783 | | | | 57,035 | | | | 1,060,569 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Investment properties | | | 2,249,180 | | | | 857,782 | | | | 447,363 | | | | - | | | | 744,587 | | | | 8,072 | | | | 4,306,984 | | | Property, plant and equipment | | | 17,385 | | | | 29,830 | | | | 3,972 | | | | 180,348 | | | | 199 | | | | - | | | | 231,734 | | | Trading properties | | | 1,484 | | | | 106 | | | | 128,087 | | | | - | | | | - | | | | - | | | | 129,677 | | | Goodwill | | | 8,582 | | | | 11,661 | | | | 4,540 | | | | - | | | | 51,069 | | | | - | | | | 75,852 | | | Units to be received under barters | | | - | | | | - | | | | 93,225 | | | | - | | | | - | | | | - | | | | 93,225 | | | Inventories | | | 10,003 | | | | - | | | | 463 | | | | 5,962 | | | | - | | | | - | | | | 16,428 | | | Investments in associates and joint ventures | | | - | | | | 23,385 | | | | 32,759 | | | | 21,339 | | | | 802 | | | | 1,076,545 | | | | 1,154,830 | | | Total segment assets (ii) | | | 2,286,634 | | | | 922,764 | | | | 710,409 | | | | 207,649 | | | | 796,657 | | | | 1,084,617 | | | | 6,008,730 | |

(i) | Of all of the Company’s revenues corresponding to urban properties and investment business, Ps. 1,689 million is originated in Argentina and Ps. 39 million in United States, respectively. |

(ii) | Of all of the Company’s assets included in the urban properties and investment business, Ps. 5,131 million is located in Argentina and Ps. 877 million in other countries, principally in United States for Ps. 797 million. |

The agricultural business, which includes cattle, dairy cattle and agroindustrial activities are mainly concentrated in Argentina. The crop activities of the Company are primarily concentrated in Argentina, Brazil, Bolivia and Paraguay, while sugar cane production is developed in Brazil and Bolivia.

The shopping center properties of the Company are all located in Argentina, the country of domicile of the Company. Substantially, offices and other rental properties of the Company are located in Argentina. Properties of the Company located in the United States, are disclosed in column "International". Hotels of the Company are located in Argentina and the United States. The trading properties of the Company are also located in Argentina and Uruguay.

During the fiscal years ended as of June 30, 2015, 2014 and 2013, the “Office” segment revenues include Ps.52,693 million, Ps.44,067 million and Ps.34,229 million, which represent 16% of the segment’s total revenues in the three fiscal years and are derived from activities of a single tenant.

Starting in the fourth quarter of the 2015 fiscal year, the Company modified the presentation of the income statement with respectline-by-line based on the percentage held in joint ventures rather than in a single item as required by IFRS. Management believes that the proportional consolidation method provides more useful information to understand the financial information by segments,business return. Moreover, operating results of EHSA joint venture is accounted for better alignment and consistency withunder the current business model and metrics used by the CODM and how they consider and analyse segmentequity method. Management believes that, in this case, this method provides more adequate information for purposesthis type of assessing operating performance by segment. This change in segment information presentation affectedinvestment, given its low materiality and considering it is a company without direct trade operations, where the presentationmain asset consists of information relating toan indirect interest of 25% of LRSA.

Operating results from the shopping centers and offices segments. This revised form of presentation excludes fromdo not include the income statement by segment the common maintenanceamounts attributable to building arrangement expenses and expenses relating to the collective promotion fundfunds ("FPC", as per its Spanish acronym) as well as any revenues relating tototal recovered costs, whether by way of building administration expenses or other concepts included under financial results (for example default interest and other concepts). The CODM examines the recovery of such expenses. Only thenet amount from both concepts (total surplus or deficit represented by the net amount between suchbuilding administration expenses and related revenues is included in the income statement by segment.

The Company has used this revised segment presentation in the comparative discussion of the results of operations for the fiscal years included below.

In addition, in the fourth quarter of the 2015 fiscal year, the Company has modified how it presents the gain/loss on the sale of investment property in segment information, which is revised by CODM. The information revised by CODM includes the gain/loss on the sale of investment properties within salesFPC and development segment, regardless of the segment where the property would have been originally located. These modifications affected the segments of sales and development and international. Considering that in the comparative periods presented there were not sales of investment properties in the international segment, it was not necessary to retroactively adjust the amounts pertaining to prior fiscal years.

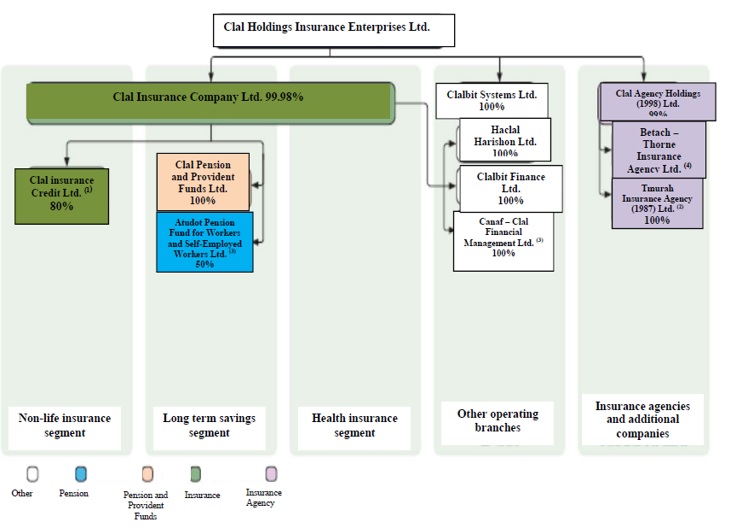

recoverable expenses). The asset categories examined by the CODM regularly reviews the following categories of assets:are: investment properties;properties, property, plant and equipment;equipment, trading properties; goodwill; rightsproperties, inventories, right to receive future units under barter agreements; inventories; biological assets; investments in associates; and theagreements, investment in the Entertainment Holding S.A. joint venture.associates and goodwill. The aggregatesum of these assets, classified by business segment, is reported under “assets by segment”. Assets are disclosed in these financial statements as “operatingallocated to each segment assets”. The measurement principles for the operating segment assets are based on the IFRS principles adoptedoperations and/or their physical location. Within the operations center in Argentina, most revenue from its operating segments is derived from, and their assets are located in, Argentina, except for earnings of associates included in the preparation“International” segment located in United States. Revenues for each reporting segments derive from a large and diverse client base and, therefore, there is no revenue concentration in any particular segment. Operations Center in Israel Within this center, IRSA operates in the following segments: · The “Real Estate” segment includes assets and operating income derived from business related to the subsidiary PBC. Through PBC, we operate rental properties and residential properties in Israel, United States and other parts of the consolidated financial statements, exceptworld and carries out commercial projects in Las Vegas. · The “Supermarkets” segment includes assets and operating income derived from the business of Shufersal which operates a supermarket chain in Israel. · The “Agrochemicals” segment includes income derived from the activities of Adama which is accounted for as an associate using the equity method of accounting Adama is specialized in agrochemicals, particularly for the Company’s shareproduction of crops for consumption. · The “Telecommunications” segment includes assets and operating income from the business of Cellcom which is telecommunication service provider that offers mobile phone services, fixed line phone services, data and Internet, among others. · The “Insurance” segment includes the operations of Clal which is one of the joint ventures Cresca S.A., CYRSA S.A., Nuevo Puerto Santa Fe S.A., Puerto Retiro S.A., Baicom Networks S.A.,most important insurance groups in Israel, and Quality Invest S.A., which are all reportedis mainly engaged in pension and social security insurance, among others. As indicated in Note 16 to the CODM under the proportionate consolidation method. Under this method, eachour Audited Consolidated Financial Statements, 51% of the operatingcontrolling shares of Clal are held in trust as specified in a judicial order of the Israel Securities Commission in order to comply with the requirement that the controlling shares of Clal be offered for sale to a third party; as a result, the Company is not fully consolidated on a line-by-line basis but rather in a single line as a financial instrument at fair value, as required by IFRS. · The “Others” segment assets reported to the CODM includes the proportionate share of the Company in the same operating assets of these joint ventures. As an example, the investment properties amount reported to the CODM includes (i) the investment property balanceand income derived from other diverse business activities, such as per the statement of financial position plus (ii) the Company’s share of the investment properties of these joint ventures. Under IFRS 11, the investment properties of these joint ventures are included together with all other of the joint ventures’ nettechnological developments, tourism, oil and gas assets, in the single line item titled “Investments in associateselectronics, and joint ventures” in the statement of financial position.others. The CODM evaluatesperiodically reviews the results and certain asset categories and assesses performance of business segmentsthis operating segment based on segment profit, defined as profit or loss from operations before financing and taxes. The measurement principles for the Company’s segment reporting structure are based on the IFRS principles adopted in the Consolidated Financial Statements, except for the Company’s sharea measure of profit or loss of the segment composed by the operating income plus the equity in earnings of joint ventures.ventures and associates. The valuation criteria used in preparing this information are consistent with IFRS standards used for the preparation of the Audited Consolidated Financial Statements. At the timeAs indicated under Note 2 of assessing the performance of business segments and deciding upon the allocation of resources, the Executive Committee uses information on operating income assets and liabilities of each such segment In theour Audited Consolidated Financial Statements, the transactionsCompany decided to consolidate income derived from its operations center in Israel with a three month lag, as adjusted for the effects of significant transactions; hence, operating results of IDBD for the period extending from October 11, 2015 (the date of acquisition of control) through March 31, 2016 are included in the Company’s comprehensive income for the fiscal year ended June 30, 2016.

Furthermore, comparative information has not been modified for as of that date the Company did not exercise control over IDBD. The assessment of this investment was part of the international segment of the urban properties and balances between related parties which may affect more than one segment are eliminated.investment business in the operations center in Argentina. Goods and services exchanged between segments are calculated on the basis of market prices. Intercompany transactions between segments, if any, are eliminated. Business segments involving the urban properties and investments business from the operations center in Argentina where the CODM evaluated assets under the proportional consolidation method, each reported asset includes the proportional share of the Company in the same class of assets of the associates and/or joint ventures. Only as an example, the investment properties amount reported to the CODM includes (i) the balance investment properties as per the statement of financial position plus (ii) the Company’s share of the investment properties of these joint ventures. Within the agricultural business, most revenue from its operating segments are generated from and their assets are located in Argentina and Brazil, mainly. Within the operations center in Israel, most revenue from its operating segments are derived from, and their assets are located in, Israel, except for part of earnings from the Real Estate segment, which are generated from activities outside Israel, mainly in United States. Within the agricultural business and the urban properties and investments business from the operations center in Argentina, the assets categories reviewed by the CODM are: investment properties, property, plant and equipment, trading properties, inventories, biological assets, right to receive future units under barter agreements, investment in joint ventures and associates and goodwill. The aggregate of these assets, classified by business segment, are disclosed as “segment assets”. Assets are allocated to each segment based on the operations and/or their physical location. Below is a summarized analysis of the lines of business of the Company for the year ended June 30, 2016: | | Agricultural business | | Urban properties and investments business | | Total | | | | | Operations Center in Argentina | | Operations Center in Israel | | Subtotal | | | | | | | | | (in million of Ps.) | | | | | | Revenues | 2,912 | | 3,284 | | 28,229 | | 31,513 | | 34,425 | | Costs | (3,821) | | (839) | | (20,481) | | (21,320) | | (25,141) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | 1,717 | | - | | - | | - | | 1,717 | | Changes in the net realizable value of agricultural produce after harvest | 208 | | - | | - | | - | | 208 | | Gross profit | 1,016 | | 2,445 | | 7,748 | | 10,193 | | 11,209 | | Gain from disposal of investment properties | - | | 1,056 | | 45 | | 1,101 | | 1,101 | | Loss from disposal of farmlands | (2) | | - | | - | | - | | (2) | | General and administrative expenses | (314) | | (554) | | (1,387) | | (1,941) | | (2,255) | | Selling expenses | (338) | | (264) | | (5,686) | | (5,950) | | (6,288) | | Other operating results, net | (70) | | 32 | | - | | 32 | | (38) | | Profit from operations | 292 | | 2,715 | | 720 | | 3,435 | | 3,727 | Share of profit / (loss) of joint ventures and associates | 23 | | 96 | | 338 | | 434 | | 457 | | Segment profit | 315 | | 2,811 | | 1,058 | | 3,869 | | 4,184 | | | | | | | | | | | | Investment properties | 11 | | 3,340 | | - | | 3,340 | | 3,351 | Property, plant and equipment | 2,736 | | 244 | | - | | 244 | | 2,980 | Trading properties | - | | 253 | | - | | 253 | | 253 | Goodwill | 10 | | 25 | | - | | 25 | | 35 | Rights to receive future units under barter agreements | - | | 90 | | - | | 90 | | 90 | Biological assets | 1,144 | | - | | - | | - | | 1,144 | Inventories | 660 | | 28 | | - | | 28 | | 688 | Interests in joint ventures and associates | 54 | | 964 | | - | | 964 | | 1,018 | Operating assets from Operations Center in Israel | - | | - | | 146,989 | | 146,989 | | 146,989 | Total segment assets | 4,615 | | 4,944 | | 146,989 | | 151,933 | | 156,548 | | | | | | | | | | | | Operating liabilities from Operations Center in Israel | - | | - | | 132,865 | | 132,865 | | 132,865 |

Below is a summarized analysis of the lines of business of the Company for the year ended June 30, 2015: | | Agricultural business | | Urban properties and investments business | | Total | | | | | Operations Center in Argentina | | | | | | | (in million of Ps.) | | | | Revenues | 2,395 | | 2,547 | | 4,942 | | Costs | (3,419) | | (633) | | (4,052) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | 1,347 | | - | | 1,347 | | Changes in the net realizable value of agricultural produce after harvest | (34) | | - | | (34) | | Gross profit | 289 | | 1,914 | | 2,203 | | Gain from disposal of investment properties | - | | 1,150 | | 1,150 | | Gain from disposal of farmlands | 570 | | - | | 570 | | General and administrative expenses | (247) | | (378) | | (625) | | Selling expenses | (286) | | (195) | | (481) | | Other operating results, net | (19) | | 29 | | 10 | | Profit from operations | 307 | | 2,520 | | 2,827 | | Share of profit / (loss) of joint ventures and associates | 1 | | (1,037) | | (1,036) | | Segment profit | 308 | | 1,483 | | 1,791 | | | | | | | | | Investment properties | 77 | | 3,494 | | 3,571 | | Property, plant and equipment | 2,079 | | 256 | | 2,335 | | Trading properties | - | | 136 | | 136 | | Goodwill | 8 | | 25 | | 33 | | Rights to receive future units under barter agreements | - | | 90 | | 90 | | Biological assets | 588 | | - | | 588 | | Inventories | 496 | | 23 | | 519 | | Interests in joint ventures and associates | 33 | | 2,382 | | 2,415 | | Total segment assets | 3,281 | | 6,406 | | 9,687 |

Below is a summarized analysis of the lines of business of the Company for the year ended June 30, 2014: | | Agricultural business | | Urban properties and investments business | | Total | | | | | Operations Center in Argentina | | | | | | | (in million of Ps.) | | | | Revenues | 1,813 | | 2,157 | | 3,970 | | Costs | (2,617) | | (649) | | (3,266) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | 1,172 | | - | | 1,172 | | Changes in the net realizable value of agricultural produce after harvest | (17) | | - | | (17) | | Gross profit | 351 | | 1,508 | | 1,859 | | Gain from disposal of investment properties | - | | 231 | | 231 | | Gain from disposal of farmlands | 91 | | - | | 91 | | General and administrative expenses | (241) | | (300) | | (541) | | Selling expenses | (210) | | (150) | | (360) | | Other operating results, net | (29) | | (49) | | (78) | | (Loss) / Profit from operations | (38) | | 1,240 | | 1,202 | | Share of profit / (loss) of joint ventures and associates | 11 | | (437) | | (426) | | Segment (loss) / profit | (27) | | 803 | | 776 | | | | | | | | | Investment properties | 51 | | 3,539 | | 3,590 | | Property, plant and equipment | 2,417 | | 238 | | 2,655 | | Trading properties | - | | 143 | | 143 | | Goodwill | 11 | | 26 | | 37 | | Rights to receive future units under barter agreements | - | | 85 | | 85 | | Assets held for sale | - | | 1,358 | | 1,358 | | Biological assets | 652 | | - | | 652 | | Inventories | 433 | | 18 | | 451 | | Interests in joint ventures and associates | 37 | | 1,966 | | 2,003 | | Total segment assets | 3,601 | | 7,373 | | 10,974 |

Agriculture line of business: The following tables present the reportable segments of the agriculture line of business: | | June 30, 2016 | | | Agricultural production | | Land transformation and sales | | Others | | Total Agricultural business (i) | | | (in million of Ps.) | | Revenues | 1,689 | | - | | 1,223 | | 2,912 | | Costs | (2,727) | | (9) | | (1,085) | | (3,821) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | 1,717 | | - | - | - | | 1,717 | Changes in the net realizable value of agricultural produce after harvest | 208 | | - | - | - | | 208 | | Gross profit / (loss) | 887 | | (9) | | 138 | | 1,016 | | Loss from disposal of farmlands | - | | (2) | | - | | (2) | | General and administrative expenses | (256) | | (1) | | (57) | | (314) | | Selling expenses | (247) | | - | | (91) | | (338) | | Other operating results, net | (72) | | - | | 2 | | (70) | | Profit / (Loss) from operations | 312 | | (12) | | (8) | | 292 | | Share of profit / (loss) of associates | 26 | | - | | (3) | | 23 | | Segment profit / (loss) | 338 | | (12) | | (11) | | 315 | | | | | | | | | | | Investment properties | - | - | - | | 11 | | 11 | | Property, plant and equipment | 2,673 | | 13 | | 50 | | 2,736 | | Goodwill | 10 | | - | | - | | 10 | | Biological assets | 1,144 | | - | | - | | 1,144 | | Inventories | 499 | | - | | 161 | | 660 | | Investments in associates | 54 | | - | | - | | 54 | | Total segment assets (ii) | 4,380 | | 13 | | 222 | | 4,615 |

(i) From all of the Company’s revenues corresponding to Agricultural Business, Ps. 2,212 million are originated in Argentina and Ps. 700 million in other countries, principally in Brazil for Ps. 503 million. (ii) From all of the Company’s assets included in the segment corresponding to Agricultural Business, Ps. 2,062 million are located in Argentina and Ps. 2,556 million in other countries, principally in Brazil for Ps. 1,470 million. | | June 30, 2015 | | | Agricultural production | | Land transformation and sales | | Others | | Total Agricultural business (i) | | | (in million of Ps.) | | Revenues | 1,400 | | - | | 995 | | 2,395 | | Costs | (2,545) | | (9) | | (865) | | (3,419) | | Initial recognition and changes in the fair value of biological assets and agricultural produce at the point of harvest | 1,347 | | - | | - | | 1,347 | Changes in the net realizable value of agricultural produce after harvest | (34) | | - | | - | | (34) | | Gross profit / (loss) | 168 | | (9) | | 130 | | 289 | | Gain from disposal of farmlands | - | | 570 | | - | | 570 | | General and administrative expenses | (210) | | (2) | | (35) | | (247) | | Selling expenses | (193) | | (2) | | (91) | | (286) | | Other operating results, net | (15) | | (5) | | 1 | | (19) | | (Loss) / Profit from operations | (250) | | 552 | | 5 | | 307 | | Share of profit of associates | 1 | | - | | - | | 1 | | Segment (loss) / profit | (249) | | 552 | | 5 | | 308 | | | | | | | | | | | Investment properties | - | | - | | 77 | | 77 | | Property, plant and equipment | 1,997 | | 13 | | 69 | | 2,079 | | Goodwill | 7 | | - | | 1 | | 8 | | Biological assets | 587 | | - | | 1 | | 588 | | Inventories | 370 | | - | | 126 | | 496 | | Investments in associates | 33 | | - | | - | | 33 | | Total segment assets (ii) | 2,994 | | 13 | | 274 | | 3,281 |