As filed with the Securities and Exchange Commission on April 29, 2009

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One) | | |

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the fiscal year ended December 31, 20082010 |

| OR |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

| o | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

Date of event requiring this shell company report ___________

For the transition period from ___________ to ___________

Commission file numbernumber: 001-10306

THE ROYAL BANK OF SCOTLAND GROUP plc

(Exact (Exact name of Registrant as specified in its charter)

United Kingdom

(Jurisdiction of incorporation or organization)

RBS Gogarburn, PO Box 1000, Edinburgh EH12 1HQ, United Kingdom

(Address of principal executive offices)

Miller McLean, Group General Counsel andAileen Taylor, Group Secretary, Tel: +44 (0) 131 523 2333,626 4099, Fax: +44 (0) 131 626 3081

PO Box 1000, Gogarburn, Edinburgh EH12 1HQ

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | Name of each exchange on which registered |

| American Depositary Shares, each representing 20 ordinary shares, nominal value £0.25 per share | | New York Stock Exchange |

| Ordinary shares, nominal value £0.25 per share | | New York Stock Exchange* |

| American Depositary Shares Series F, H, L, M, N, P, Q, R, S, T and U each representing one Non-Cumulative Dollar Preference Share, Series F, H, L, M, N, P, Q, R, S, T and U respectively | | New York Stock ExchangeExchange |

| Dollar Perpetual Regulatory tier one securities, Series 1 | New York Stock Exchange |

| Senior Floating Rate Notes due 2013 | New York Stock Exchange |

| 3.400% Senior Notes due 2013 | New York Stock Exchange |

| 3.250% Senior Notes due 2014 | New York Stock Exchange |

| 3.950% Senior Notes due 2015 | New York Stock Exchange |

| 4.875% Senior Notes due 2015 | New York Stock Exchange |

| 4.375% Senior Notes due 2016 | New York Stock Exchange |

| 5.625% Senior Notes due 2020 | New York Stock Exchange |

| 6.125% Senior Notes due 2021 | New York Stock Exchange |

| ______________________________________ |

| * Not for trading, but only in connection with the registration of American Depositary Shares representing such ordinary shares pursuant to the requirements of the Securities and Exchange Commission. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

_______________

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2008,2010, the close of the period covered by the annual report:

| Ordinary shares of 25 pence each | 39,456,004,899 | | Non-cumulative dollar preference shares, Series F, H and L to U | | 308,015,000 | 58,458,130,868 | Non-cumulative dollar preference shares, Series F, H and L to U | 209,609,154 |

| Non-voting Deferred Shares | 2,660,556,304 | | Non-cumulative convertible dollar preference shares, Series 1 | | 1,000,000 | |

| B Shares | | 51,000,000,000 | Non-cumulative convertible dollar preference shares, Series 1 | 64,772 |

| Dividend Access Share | | 1 | Non-cumulative euro preference shares, Series 1 to 3 | 2,044,418 |

| 11% cumulative preference shares | 500,000 | | Non-cumulative euro preference shares, Series 1 to 3 | | 2,526,000 | 500,000 | Non-cumulative convertible sterling preference shares, Series 1 | 14,866 |

| 5½% cumulative preference shares | 400,000 | | Non-cumulative convertible sterling preference shares, Series 1 | | 200,000 | 400,000 | Non-cumulative sterling preference shares, Series 1 | 54,442 |

| | | | Non-cumulative sterling preference shares, Series 1 and 2 | | 5,750,000 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities ActAct.

Yes x NoYes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o NoYes x No

Note — checking– Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

xYes x oNoo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

oYes oNoo

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x

| Large accelerated filer xAccelerated filer o Non-Accelerated filer o | Non-accelerated filer o

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

oU.S. GAAP

ox International Financial Reporting Standards as issued by the International Accounting Standards Board

xo Othero

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

oItem 17 o Item 18o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o NoYes x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes o Noo

SEC Form 20-F cross reference guide

| Item | Item Caption | Pages |

| | | |

| PART I | | | |

| 1 | Identity of Directors, Senior Management and Advisers | Not applicable |

| | |

| 2 | Offer Statistics and Expected Timetable | Not applicable applicable |

| | |

| 3 | Key Information | |

| | | | 8-9, 299-302, 333-334, 341, 375-376 |

| | Capitalisation and indebtedness | Not applicable |

| | Reasons for the offer and use of proceeds | Not applicable |

| | | | |

4 | | 7, 352-369 |

| | | |

| 4 | Information on the Company | |

| History and development of the Company | 5-6, 170-171, 281-282, 380-381, 399 |

| Business overview | 5-6, 170-171, 318-323, 342-345 |

| Organisational structure | 5-6, 275 |

| Property, plant and equipment | 279-280, 345 |

| | | |

| Unresolved Staff Comments | Not applicable |

| | | | |

| | | |

4A | Unresolved Staff Comments | |

| 5 | Operating and Financial Review and Prospects | |

| | | | 6, 8-58, 270-272, 342-345 |

| | | | 55-56, 63-81, 82-86, 87-123, 129, 181-196, 199-203, 208-209, 217, 233-235, 240-244, 262-26357-58, 66-84, 241-268, 270-274, 279-280, 301-302, 308, 315-317, 340-341 |

| | Research and development, patents, licences etc | Not applicable |

| | | | 5-7, 352-369 |

| Off balance sheet arrangements | 157-160, 307-308 |

| Contractual obligations | 74-80, 303-305 |

| | | | |

| | | |

| 6 | Directors, Senior Management and Employees | |

| | | | 166-169 |

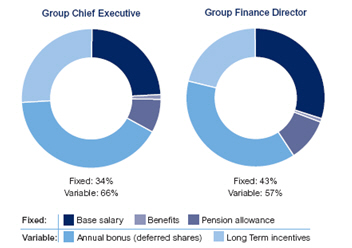

| Compensation | 187-204, 230-237, 324 |

| Board practices | 173, 175-182, 189-190,197-203 |

| Employees | 27, 171, 230-231 |

| Share ownership | 200-202, 205 |

| | | | |

| | | |

| | | |

| | | |

| 7 | Major Shareholders and Related Party Transactions | |

| | | | 173, 345 |

| | | | 324-326 |

| | Interests of experts and counsel | Not applicable |

| | |

| 8 | Financial Information | |

| | | | 170, 207-331, 376 |

| Significant changes | 6, 326 |

| | | | |

| Item | Item Caption | Pages |

| | | |

| 9 | The Offer and Listing | |

| | Offer and listing details | 374-375 |

| | Plan of distribution | Not applicable |

| | Markets | 373 |

| | Selling shareholders | Not applicable |

| | Dilution | Not applicable |

| | Expenses of the issue | Not applicable |

| | | |

| 10 | Additional Information | |

| | Share capital | Not applicable |

| | Memorandum and articles of association | 380-389 |

| | Material contracts | 345-350 |

| | Exchange controls | 380 |

| | Taxation | 377-380 |

| | Dividends and paying agents | Not applicable |

| | Statement of experts | Not applicable |

| | Documents on display | 389 |

| | Subsidiary information | Not applicable |

| | | |

| 11 | Quantitative and Qualitative Disclosure about Market Risk | 59-164, 241-265, 270-274 |

| | | |

| 12 | Description of Securities other than Equity Securities | 351 |

| | | |

| | | |

| PART II | | |

| 13 | Defaults, Dividend Arrearages and Delinquencies | Not applicable |

| | | |

| 14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | Not applicable |

| | | |

| 15 | Controls and Procedures | 183, 184, 208 |

| | | |

| 16 | [Reserved] | |

| | A Audit Committee Financial Expert | 179-182 |

| | B Code of Ethics | 171, 389 |

| | C Principal Accountant Fees and Services | 179-182, 237 |

| | D Exemptions from the Listing Standards for Audit Committees | Not applicable |

| | E Purchases of Equity Securities by the Issuer and Affiliated Purchasers | Not applicable |

| | F Change in Registrant’s Certifying Accountant | Not applicable |

| | G Corporate Governance | 175-178 |

| | | |

| PART III | | |

| 17 | Financial Statements | Not applicable |

| | | |

| 18 | Financial Statements | 207-331 |

| | | |

| 19 | Exhibits | 400-402 |

| | | |

| | Signature | 403 |

Item | Item Caption | Pages |

| | | |

9 | The Offer and Listing | |

| | | |

| | Plan of distribution | Not applicable |

| | | |

| | Selling shareholders | Not applicable |

| | Dilution | Not applicable |

| | Expenses of the issue | Not applicable |

10 | Additional Information | |

| | Share capital | Not applicable |

| | | |

| | | |

| | | |

| | | |

| | Dividends and paying agents | Not applicable |

| | Statement of experts | Not applicable |

| | | |

| | Subsidiary information | Not applicable |

11 | | |

12 | Description of Securities other than Equity Securities | Not applicable |

PART II | | |

13 | Defaults, Dividend Arrearages and Delinquencies | Not applicable |

14 | Material Modifications to the Rights of Security Holders and Use of Proceeds | Not applicable |

15 | | |

16 | [Reserved] | |

16 | A | | |

| B | | |

| C | | |

| D | Exemptions from the Listing Standards for Audit Committees | Not applicable |

| E | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | |

| F | Change in Registrant’s Certifying Accountant | Not applicable |

| G | Corporate Governance | |

PART III | | |

17 | Financial Statements | Not applicable |

18 | | |

19 | | |

| | |

Business Review| Form 20-F | Business review |

| Contents |

| 2 | |

3 | |

| 4 | |

| 5 | Description of business |

6 | Recent developments |

136 | Competition |

217 | Risk factors |

218 | |

| 9 | Summary consolidated income statement |

2412 | |

3425 | |

5354 | |

55 | |

56 | |

| 57 | |

| 58 | Capital resources |

| 59 | Risk capitaland balance sheet management |

| 59 | Introduction |

| 66 | Balance sheet management |

| 66 | - Capital |

| 74 | - Funding and liquidity managementrisk |

| 83 | - Interest rate risk |

| 84 | - Structural foreign currency exposures |

| 85 | - Equity risk |

| 86 | Risk management |

| 86 | - Credit risk |

| 133 | - Market risk |

| 139 | - Insurance risk |

| 139 | - Operational risk |

| 142 | - Regulatory risk |

| 143 | - Reputation risk |

| 143 | - Pension risk |

| 144 | - Other risk exposures |

| 161 | Asset Protection Scheme |

| Presentation of information | Business review |

In this document, and unless specified otherwise, the term ‘company’ or ‘RBSG’ means The Royal Bank of Scotland Group plc, ‘RBS’, 'RBS Group',‘RBS Group’ or the ‘Group’ means the company and its subsidiaries, ‘the Royal Bank’ means The Royal Bank of Scotland plc and ‘NatWest’ means National Westminster Bank Plc.

The company publishes its financial statements in pounds sterling (‘£’ or ‘sterling’). The abbreviations ‘£m’ and ‘£bn’ represent millions and thousands of millions of pounds sterling, respectively, and references to ‘pence’ represent pence in the United Kingdom (‘UK’). Reference to ‘dollars’ or ‘$’ are to United States of America (‘US’) dollars. The abbreviations ‘$m’ and ‘$bn’ represent millions and thousands of millions of dollars, respectively, and references to ‘cents’ represent cents in the US. The abbreviation ‘€’ represents the ‘euro’, the European single currency, and the abbreviations ‘€m’ and ‘€bn’ represent millions and thousands of millions of euros, respectively.

Certain information in this report is presented separately for domestic and foreign activities. Domestic activities primarily consist of the UK domestic transactions of the Group. Foreign activities comprise the Group’sGroup's transactions conducted through those offices in the UK specifically organised to service international banking transactions and transactions conducted through offices outside the UK.

The geographic analysis in the Business Review, including the average balance sheet and interest rates, changes in net interest income and average interest rates, yields, spreads and margins in this report have been compiled on the basis of location of office –- UK and overseas. Management believes that this presentation provides more useful information on the Group’sGroup's yields, spreads and margins of the Group’sGroup's activities than would be provided by presentation on the basis of the domestic and foreign activities analysis used elsewhere in this report as it more closely reflects the basis on which the Group is managed. ‘UK’ in this context includes domestic transactions and transactions conducted through the offices in the UK which service international banking transactions.

The results, assets and liabilities of individual business units are classified as trading or non-trading based on their predominant activity. Although this method may result in some non-trading activity being classified as trading, and vice versa, the Group believes that any resulting misclassification is not material.

International Financial Reporting Standards

As required by the Companies Act 19852006 and Article 4 of the European Union IAS Regulation, the consolidated financial statements of the Group are prepared in accordance with International Financial Reporting Standards issued by the International Accounting Standards Board (IASB) and interpretations issued by the International Financial Reporting Interpretations Committee of the IASB (together ‘IFRS’) as adopted by the European Union. ItThey also compliescomply with IFRS as issued by the IASB. On implementation of IFRS on 1 January 2005, the Group took advantage of the option in IFRS 1 ‘First-time Adoption of International Financial Reporting Standards’ to implement IAS 39 ‘Financial Instruments: Recognition and Measurement’, IAS 32 ‘Financial Instruments: Disclosure and Presentation’ and IFRS 4 ‘Insurance Contracts’ from 1 January 2005 without restating its 2004 income statement and balance sheet. The date of transition to IFRS for the Group and the company and the date of their opening IFRS balance sheets was 1 January 2004.

Acquisition ofRBS Holdings N.V. (formerly ABN AMRO Holding N.V.)

On 17 OctoberIn 2007, RFS Holdings B.V. (‘RFS Holdings’), a companywhich was jointly owned by RBS, Fortis Bank Nederland (Holding) N.V. (‘Fortis’)RBSG, the Dutch State (successor to Fortis) and Banco Santander S.A. (‘Santander’(the “Consortium Members”) (together the ‘consortium members’) and controlled by RBS, completed the acquisition of ABN AMRO Holding N.V. (‘ABN AMRO’).

On 3 October 2008, the State of the Netherlands acquired Fortis Bank Nederland (Holding) N.V. including the Fortis participation in RFS Holdings that representsB.V. has now substantially completed the acquired activities of ABN AMRO and their participation in Dutch insurance activities.

RFS Holdings is implementing an orderly separation of the business units of ABN AMRO with RBS retainingHolding N.V.. As part of this reorganisation, on 6 February 2010, the followingbusinesses of ABN AMRO business units:Holding N.V. acquired by the Dutch State were legally demerged from those acquired by the Group and were transferred into a newly established company, ABN AMRO Bank N.V. (save for certain assets and liabilities acquired by the Dutch State that were not part of the legal separation and which will be transferred to the Dutch State as soon as possible).

· | Continuing businesses of Business Unit North America; |

Legal separation of ABN AMRO Bank N.V. occurred on 1 April 2010, with the shares in that entity being transferred by ABN AMRO Holding N.V (renamed RBS Holdings N.V. at legal separation) to a holding company called ABN AMRO Group N.V., which is owned by the Dutch State.

· | Business Unit Global Clients and wholesale clients in the Netherlands (including former Dutch wholesale clients) and Latin America (excluding Brazil); |

· | Business Unit Asia (excluding Saudi Hollandi); and |

· | Business Unit Europe (excluding Antonveneta). |

Following legal separation, RBS Holdings N.V. has one direct subsidiary, The Royal Bank of Scotland N.V. (RBS N.V.), a fully operational bank within the Group. RBS N.V. is independently rated and regulated by the Dutch Central Bank. Certain other assets willwithin RBS N.V. continue to be shared by the consortium members.Consortium Members.

Presentation of information continued | Business review |

Statutory results

RFS Holdings is jointly owned by the consortium members. It is controlled by the company and is therefore fully consolidated in its financial statements. Consequently, theThe statutory results of the Group for the year ended 31 December 2007 and 2008 include the results and financial position of RFS Holdings, the entity that acquired ABN AMRO for 76 days and the full year respectively.(see page 2). The interests of Fortis, and its successor the State of the Netherlands and Santander in RFS Holdings are included in minoritynon-controlling interests.

Glossary

A glossary of terms is detailed on pages 390 to 395.

2| Forward-looking statements | Business review |

Business review continued

Certain sections in this document contain ‘forward-looking statements’ as that term is defined in the United States Private Securities Litigation Reform Act of 1995, such as statements that include the words ‘expect’, ‘estimate’, ‘project’, ‘anticipate’, ‘believes’, ‘should’, ‘intend’, ‘plan’, ‘could’, ‘probability’, ‘risk’, ‘Value-at-Risk (VaR)’, ‘target’, ‘goal’, ‘objective’, ‘will’, ‘endeavour’, ‘outlook’, ‘optimistic’, ‘prospects’ and similar expressions or variations on such expressions.

In particular, this document includes forward-looking statements relating, but not limited toto: the Group’s restructuring plans, capitalisation, portfolios, net interest margin, capital ratios, liquidity, risk-weighted assets, return on equity (ROE), cost:income ratios, leverage and loan:deposit ratios, funding and risk profile; the Group’s future financial performance; the level and extent of future impairments and write-downs; the protection provided by the Asset Protection Scheme (APS); and the Group’s potential exposures to various types of market risks, such as interest rate risk, foreign exchange rate risk and commodity and equity price risk. SuchThese statements are based on current plans, estimates and projections, and are subject to inherent risks, uncertainties and uncertainties.other factors which could cause actual results to differ materially from the future results expressed or implied by such forward-looking statements. For example, certain of the market risk disclosures are dependent on choices about key model characteristics and assumptions and are subject to various limitations. By their nature, certain of the market risk disclosures are only estimates and, as a result, actual future gains and losses could differ materially from those that have been estimated.

Other factors that could cause actual results to differ materially from those estimated by the forward-looking statements contained in this document include, but are not limited to: general economic conditionsthe full nationalisation of the Group or other resolution procedures under the Banking Act 2009; the global economy and instability in the UKglobal financial markets, and their impact on the financial industry in general and on the Group in particular; the financial stability of other financial institutions, and the Group’s counterparties and borrowers; the ability to complete restructurings on a timely basis, or at all, including the disposal of certain Non-Core assets and assets and businesses required as part of the EC State Aid restructuring plan; organisational restructuring; the ability to access sufficient funding to meet liquidity needs; the extent of future write-downs and impairment charges caused by depressed asset valuations; the inability to hedge certain risks economically; costs or exposures borne by the Group arising out of the origination or sale of mortgages or mortgage-backed securities in the United States; the value and effectiveness of any credit protection purchased by the Group; unanticipated turbulence in interest rates, yield curves, foreign currency exchange rates, credit spreads, bond prices, commodity prices, equity prices and basis, volatility and correlation risks; changes in the credit ratings of the Group; ineffective management of capital or changes to capital adequacy or liquidity requirements; changes to the valuation of financial instruments recorded at fair value; competition and consolidation in the banking sector; HM Treasury exercising influence over the operations of the Group; the ability of the Group to attract or retain senior management or other key employees; regulatory or legal changes (including those requiring any restructuring of the Group’s operations) in the United Kingdom, the United States and other countries in which the Group has significant business activitiesoperates or investments, including thea change in United States;Kingdom Government policy; changes to regulatory requirements relating to capital and liquidity; changes to the monetary and interest rate policies of the Bank of England, the Board of Governors of the Federal Reserve System and other G7 central banks; inflation; deflation; unanticipated turbulenceimpairments of goodwill; pension fund shortfalls; litigation and regulatory investigations; general operational risks; insurance claims; reputational risk; general geopolitical and economic conditions in interest rates, foreign currency exchange rates, commodity pricesthe UK and equity prices;in other countries in which the Group has significant business activities or investments, including the United States; the ability to achieve revenue benefits and cost savings from the integration of certain of RBS Holdings N.V.’s (formerly ABN AMRO Holding N.V.) businesses and assets; changes in UK and foreign laws, regulations, accounting standards and taxes;taxes, including changes in competitionregulatory capital regulations and pricing environments; naturalliquidity requirements; the participation of the Group in the APS and other disasters; the inabilityeffect of the APS on the Group’s financial and capital position; the ability to hedge certain risks economically;access the adequacycontingent capital arrangements with HM Treasury; the conversion of loss reserves; acquisitionsthe B shares in accordance with their terms; limitations on, or restructurings; technological changes; changesadditional requirements imposed on, the Group’s activities as a result of HM Treasury’s investment in consumer spending and saving habits;the Group; and the success of the Group in managing the risks involved in the foregoing.

The forward-looking statements contained in this document speak only as of the date of this report,announcement, and the Group does not undertake to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

ForThe information, statements and opinions contained in this document do not constitute a further discussionpublic offer under any applicable legislation or an offer to sell or solicitation of certain risks faced by the Group, see Risk factors on pages 13any offer to 20.buy any securities or financial instruments or any advice or recommendation with respect to such securities or other financial instruments.

| Business review | Business review |

Business review

Introduction

The Royal Bank of Scotland Group plc is the holding company of a large global banking and financial services group. Headquartered in Edinburgh, the Group operates in the United Kingdom, the United States and internationally through its two principal subsidiaries, the Royal Bank and NatWest. Both the Royal Bank and NatWest are major UK clearing banks whose origins go back over 275 years. In the United States, the Group’sGroup's subsidiary Citizens is a large commercial banking organisation. TheGlobally, the Group has a large and diversified customer base and provides a wide range of products and services to personal, commercial and large corporate and institutional customers.customers in over 50 countries.

Following a placing and open offeroffers in December 2008 referred to herein as the First Placing and Open Offer, Her Majesty'sin April 2009, HM Treasury in the United Kingdom (HM Treasury) owned approximately 58%70.3% of the enlarged ordinary share capital of the company and £5 billion of non-cumulative sterling preference shares.company. In AprilDecember 2009, the company issued a further £25.5 billion of new capital to HM Treasury. This new capital took the form of B shares, which do not generally carry voting rights at general meetings of ordinary shareholders but are convertible into ordinary shares by way of a second placing and open offer, referred to hereinqualify as core tier one capital. Following the Second Placing and Open Offer, the proceeds from which were used in full to fund the redemptionissuance of the B shares, HM Treasury's holding of ordinary shares of the company remained at 70.3% although its economic interest rose to 84.4%.

During the year, the company converted non-cumulative convertible preference shares held by HM Treasury at 101% of their issue price together withinto ordinary shares in the accrued dividend and the commissions payable to HM Treasury under the Second Placing and Open Offer Agreement. The Second Placing and Open Offer was underwritten by HM Treasury and ascompany. As a result, HM Treasury currently owns approximately 70% ofTreasury’s holding in the enlargedcompany’s ordinary share capital of the company.shares reduced to 67.8% and its economic interest reduced to 82.8%.

The Group had total assets of £2,401.7£1,453.6 billion and owners’owners' equity of £58.9£75.1 billion at 31 December 2008.2010. The Group’sGroup's capital ratios, which include the equity minority interest of The State of the Netherlands and Santander in ABN AMRO, were a totalTotal capital ratio of 14.114.0 per cent.,cent, a coreCore Tier 1 capital ratio of 6.810.7 per cent.cent and a Tier 1 capital ratio of 10.012.9 per cent., ascent, at 31 December 2008.2010.

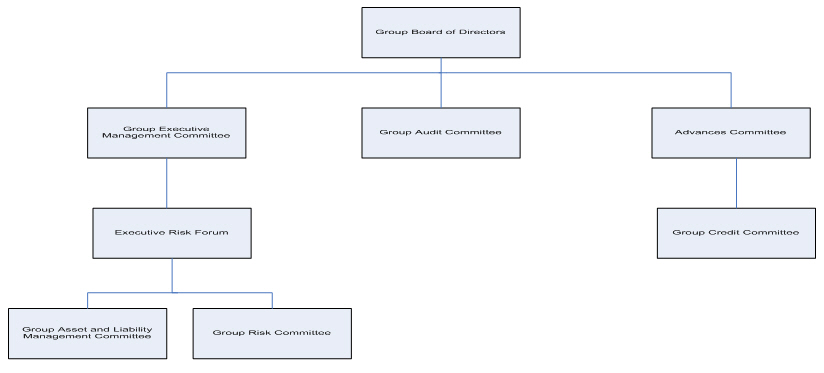

Organisational structure and business overview

The Group’s activities are organised in the following business divisions: Global Markets (comprising Global Banking & Markets and Global Transaction Services), Regional Markets (comprising UK Retail & Commercial Banking, US Retail & Commercial Banking, Europe & Middle East Retail & Commercial Banking and Asia Retail & Commercial Banking), RBS Insurance and Group Manufacturing. A description of each of the divisions is given below.on a divisional basis as follows:

Global Banking & Markets(GBM) is a leading banking partner to major corporations and financial institutions around the world, providing an extensive range of debt and equity financing, risk management and investment services to its customers. In 2008 the division was organised along four principal business lines: rates, currencies, and commodities, including RBS Sempra Commodities LLP (the commodities-marketing joint venture between RBS and Sempra Energy which was formed on 1 April 2008); equities; credit markets; and asset and portfolio management.

Following RBS’s strategic review, GBM is planning to re-focus its business around its core corporate and institutional clients, concentrating its activities in major financial centres and scaling back its presence elsewhere. It will exit illiquid proprietary trading and balance sheet-heavy niche products segments.

Globally, the intention is for GBM to move increasingly towards a “hub-and- spoke” model. Risk will be managed from regional hubs. It is intended that distribution and coverage will be delivered from a mix of hub countries and a scaled-back presence in some local offices. The aim, over time, will be to reduce much of the on-shore trading activity outside the key financial centres.

Assets, products and geographies that fit GBM’s new client-focused proposition will be defined as “core” and will remain within the division. Assets, business lines and some geographies that are non-core will be transferred to the new Non-Core Bank. These non-core activities accounted for approximately £205 billion of third party assets at end 2008.

Global Transaction Services ranks among the top five global transaction services providers, offering global payments, cash and liquidity management, as well as trade finance, United Kingdom and international merchant acquiring and commercial card products and services. It includes the Group’s corporate money transmission activities in the United Kingdom and the United States.

Following RBS’s strategic review, Global Transaction Services intends to reduce its international network while retaining the capability to serve multinational clients globally.

The business also plans to increase efficiency through development of a lower cost front and back-office operating model and explore joint ventures for growth and selective disposals.

UK Retail & Commercial Banking (RBS UK) comprises retail, corporate and commercial banking and wealth management services. It supplies financial services through both the RBS and NatWest brands.

UK Retail Banking offers a fullcomprehensive range of banking products and related financial services to the personal market. It serves customers through two of the largestRBS and NatWest networks of branches and ATMs in the United Kingdom, and also through telephone and internet channelschannels. UK Retail launched the Retail Customer Charter in June 2010 and according to Gfk NOP,progress against the commitments made will be formally reported every six months.

UK Corporate is the second largest provider of personal current accounts. The division also issues credit and charge cards, including through other brands such as MINT.

UK Business & Commercial Banking is the largesta leading provider of banking, finance, and risk management services to the corporate and SME sector in the United Kingdom. It offers a full range of banking products and related financial services through a nationwide network of relationship managers, and also through telephone and internet channels. The product range includes asset finance in which, according to the Finance Lease Association, it has a strong market presence through the Lombard brand.

According to Ph. Group, UK Corporate Banking holds the largest market share in the United Kingdom of relationships with larger companies, offering a full range of banking, finance, and risk management services.

UK Wealth Management provides private banking and investment services in the UK through Coutts & Co and Adam & Co., Company, offshore banking through

RBS International, NatWest Offshore and NatWest Offshore.Isle of Man Bank, and international private banking through RBS Coutts.

Global Transaction Services (GTS) ranks among the top five global transaction services providers, offering global payments, cash and liquidity management, and trade finance and commercial card products and services. It includes the Group's corporate money transmission activities in the United Kingdom and the United States.

Ulster Bank is the leading retail and business bank in Northern Ireland and the third largest banking group on the island of Ireland. It provides a comprehensive range of financial services. The Retail Markets division which has a network of 236 branches, operates in the personal and financial planning sectors. The Corporate Markets division provides services to SME business customers, corporates and institutional markets.

US Retail & Commercial Banking provides financial services primarily through the Citizens and Charter One brands.

Citizens US Retail & Commercial is engaged in retail and corporate banking activities through its branch network in 12 states in the United States and through non-branch offices in other states. Citizens

The divisions discussed above are collectively referred to as Retail & Commercial.

Global Banking & Markets (GBM) is a large commercialleading banking organization.

Following RBS’s strategic review, Citizens intendspartner to invest in its core business through increased marketing activitymajor corporations and targeted technology investments while reducing activity in its out-of-footprint national businesses in consumer and commercial finance.

This strategy will allow Citizens to become fully funded from its own customer deposits over time, and will support a low risk profile.

Europe & Middle East Retail & Commercial Banking comprises Ulster Bank andfinancial institutions around the Group’s combined retail and commercial businesses in Europe and the Middle East.

Ulster Bank provides a comprehensiveworld, providing an extensive range of financial services across the island of Ireland. Its retail banking arm has a network of branchesdebt and operates in the personal, commercial and wealthequity financing, risk management sectors, while its corporate markets operations provides services in the corporate and institutional markets.

The retail and commercial businesses in Europe and the Middle East have smaller activities in Romania, Kazakhstan and the United Arab Emirates. Following RBS’s strategic review, RBS has decided to exit sub-scale retail and commercial activities outside its core markets in the United Kingdom, Europe and the United States.

Business review continued

Asia Retail & Commercial Banking is present in markets including India, Pakistan, China, Taiwan, Hong Kong, Indonesia, Malaysia and Singapore. It provides financial services across four segments: affluent banking, cards and consumer finance, business banking and international wealth management, which offers private banking and investment services to clients in selectedits customers. The division is organised along six principal business lines: money markets; rates flow trading; currencies and commodities; equities; credit and mortgage markets through the RBS Coutts brand.and portfolio management & origination.

Following RBS’s strategic review, RBS has decided to exit sub-scale retail and commercial activities outside its core markets in the United Kingdom, Europe and the United States.

RBS Insurance sells and underwrites retail and SMEprovides a wide range of general insurance over the telephone and internet, asproducts to consumers through a number of well as through brokers and partnerships. Itsknown brands includeincluding; Direct Line, Churchill and Privilege, which sell generalPrivilege. It also provides insurance services for third party brands through its UKI Partnerships division. In the commercial sector, its NIG and Direct Line for Business operations provide insurance products for businesses via brokers or direct to the customer, as well as Green Flag and NIG.respectively. Through its international division, RBS Insurance sells general insurance, mainly motor, in Spain, Germany and Italy. In addition to insurance services, RBS Insurance continues to provide support and reassurance to millions of UK motorists through its Green Flag breakdown recovery service and Tracker stolen vehicle recovery and telematics business.

Central Functions comprises Group and corporate functions, such as treasury, funding and finance, risk management, legal, communications and human resources. The IntermediaryCentre manages the Group's capital resources and Broker division sells general insurance products through independent brokers.Group-wide regulatory projects and provides services to the operating divisions.

Following RBS’s strategic review, RBS

Business reviewcontinued | Business review |

Non-Core Division manages separately assets that the Group intends to run off or dispose of. The division contains a range of businesses and asset portfolios primarily from the GBM division, linked to proprietary trading, higher risk profile asset portfolios including excess risk concentrations, and other illiquid portfolios. It also includes a number of other portfolios and businesses including regional markets businesses that the Group has decided to retain RBS Insurance.concluded are no longer strategic.

Group ManufacturingBusiness Services comprises the Group’s worldwide manufacturing operations. It supports the customer-facing businesses and provides operational technology, customer support in telephony, account management, lending and money transmission, global purchasing, property and other services. Group ManufacturingBusiness Services drives efficiencies and supports income growth across multiple brands and channels by using a single, scalable platform and common processes wherever possible. It also leverages the Group’sGroup's purchasing power and has becomeis the Group's centre of excellence for managing large-scale and complex change.

The Centre comprises group and corporate functions, such as capital raising, finance, risk management, legal, communications and human resources. The Centre manages the Group’s capital resources and Group-wide regulatory projects and provides services For reporting purposes, Business Services costs are allocated to the operating divisions.divisions above. It is not deemed a reportable segment.

RFS Holdings minority interest comprises those activitiesBusiness divestments

To comply with EC State Aid requirements the Group has agreed a series of ABN AMRO that are attributablerestructuring measures to be implemented over a four year period from December 2009. This will supplement the other consortium members.

Sharemeasures in the strategic plan previously announced by the Group. These include divesting RBS Insurance, 80.01% of shared assets comprises the Group's shareGlobal Merchant Services and substantially all of the unallocated assets of ABN AMRO.

Non-core division

RBS intends to create during the second quarter of 2009 a non-core division to manage separately approximately £240 billion of third party assets, £145 billion of derivative balances and £155 billion of risk weighted assets that it intends to run off or dispose of over the next three to five years. The division will contain primarily assets from the GBM division linked to proprietary trading portfolios, excess risk concentrations and other illiquid portfolios. It will also include excess risk concentrations from other divisionsSempra Commodities JV business, as well as divesting the RBS branch-based business in England and Wales and the NatWest branches in Scotland, along with the Direct SME customers across the UK.

Recent developments

Gender equality in insurance contracts

On 1 March 2011, the European Court of Justice (ECJ) upheld a number of small Regional Markets businessesruling that RBS has concludedinsurers are no longer strategic.

allowed to use gender as a rating factor across the Insurance industry. This will have a significant impact on the insurance industry in calculating premiums and determining benefits. The Group is currently working through the findings, and any consequences arising will be rectified by December 2012 in line with the ruling from the ECJ. At this stage, it is not possible to estimate the impact which the ECJ's ruling may have on the Group's businesses, financial position or profitability.

Budget update

HM Treasury Asset Protection Scheme and additional capital raising

Personal current accounts

On 26 February 2009, RBS confirmed29 March 2011, the OFT published its intended participationupdate report in relation to personal current accounts. This noted further progress in improving consumer control over the Asset Protection Scheme (“APS”). The arrangements between RBSuse of unarranged overdrafts. In particular, the Lending Standards Board has led on producing standards and HM Treasury will, if completed, allow RBS to secure asset protection in respect of some of its riskiest assets that enhances its financial strength and provides improved stability for customers and depositors, and also enhances RBS’s ability to lend into the UK market.

Issuance of capital

On or after the proposed implementation of the APS, HM Treasury will subscribe for £13 billion of B Shares. The arrangements for the subscription of these B Shares are to be determined and the proceeds of such issue will, if such B Shares are issued, be used to increase further the Group’s Core Tier 1 capital. A summary of the expected terms of the B Shares is set out below. HM Treasury will also commit to subscribe for an additional £6 billion of B Shares at RBS’s option. The detailed terms of such option remain to be agreed between RBS and HM Treasury.

Scheme amount

RBS intends to participate in the APS in respect of assets with a par value of approximately £325 billion and a carrying value net of impairments and write downs of approximately £302 billion as at 1 January 2009.

First loss

The agreement would see RBS bear the first loss amount relating to the assets in the APS up to £19.5 billion (after taking into account historic impairments and write downs). Losses arising in respect of the assets after the first loss amount would be borne 90 per cent. by HM Treasury and 10 per cent. by RBS. The APS will, if entered into, apply to losses incurred on the protected assets on or after 1 January 2009.

Fee and issuance of capital

If it enters into the APS, RBS will pay a participation fee of £6.5 billion to HM Treasury. On 26 February 2009, RBS announced that it would issue £6.5 billion of B Shares, and the participation fee may be funded through the proceeds of such issuance. The £6.5 billion of B Shares, which will be issued if RBS enters into the APS, will be in addition to, and on the same terms as, the B Shares referred to above and will constitute Core Tier 1 capital. In addition, RBS has agreed in principle that, if it enters into the APS, it would not claim certain UK tax losses and allowances.

Assets

Specific assetsguidance to be included in the APS will be subject to the approval of HM Treasury. The assets would be drawn from RBS’s and certain of its affiliates’ portfolios of corporate and leveraged loans, commercial and residential property loans, structured credit assets and such other assets as HM Treasury and RBS agree are to be included in the APS. It is also envisaged that the APS may include structured synthetic assets and counterparty risk exposures associated with certain derivatives transactions with monoline insurers and credit derivative product companies. RBS expects that the APS will protect: £225 billion of third party assets, £44 billion of undrawn commitments, and £33 billion in other counterparty risk exposures.

Capital ratios

The APS and proceeds of the issue of B Shares are expected to improve the consolidated capital ratios of RBS by (i) substituting risk weight applicable to the UK Government for that of the protected assets; and (ii) the subscription for the B Shares by HM Treasury (being both the £6.5 billion of B Shares, the proceeds of which may be used to fund the fee for the APS and the additional £13 billion of B Shares to be issued on or after the implementation of the APS). Based on total covered assets of approximately £325 billion, risk weighted assets would reduce by approximately £144 billion. As an illustration, if the Company had issued £19.5 billion of B Sharesa revised Lending Code published on 31 December 2008 offset by the expected £6 billion reduction of first loss exposure under the APS from Core Tier 1 capital in accordance with the FSA Handbook, and with the redemption of the preference shares issued to HM Treasury (“Preference Share Redemption”), RBS expects there would have been a significant increase to the Core Tier 1 ratio.

In addition, RBSMarch 2011. The OFT will continue to look at variousmonitor the market based and/or internal capital management opportunitiesand will consider the need for, and appropriate timing of, further update reports in light of other developments, in particular the work of the Independent Commission on Banking. The OFT intends to generate and further strengthen Core Tier 1 capital.

conduct a more comprehensive review of the market in 2012.

US dollar clearing activities

Business review continued

Term

WhileJustice and RBS N.V. filed a joint status report with the U.S. District Court notifying it is intended that the APSparties would apply toseek an extension of the protected assets until their maturity, RBS’s participation in the APS would be capable of termination in whole or in part by mutual agreementduration of RBS N.V.’s deferred prosecution agreement until 31 December 2011. The request states that RBS N.V. and HM Treasury.

Managementthe Department of Justice have agreed to seek the assets

extension to allow RBS would be requiredN.V. sufficient time to fulfil its obligations under the APS to manage the assets in accordance with certain asset management requirements as referred to in the APS. These would include, amongst others, (i) reporting requirements to provide financial, risk and performance data in respect of the protected assets and to monitor compliance with the APS, (ii) the adoption of oversight and control procedures with respect to the management of the protected assets, (iii) requirements in relation to organisational structure, staffing, resourcing, systems and controls required for implementation, administration and monitoring compliance with the APS and (iv) the monitoring and management of conflicts of interest and potential conflicts of interest. As the APS is intended to apply to losses on protected assets arising from 1 January 2009, RBS has agreed with HM Treasury certain interim arrangements (in force with immediate effect) relating to the management of those assets likely to be part of the APS.

Impact on the capital structure of the Company

If the additional £6 billion of B Shares are subscribed for by HM Treasury and £25.5 billion of B Shares convert mandatorily, or are converted by HM Treasury, into ordinary shares in the hands of HM Treasury, the percentage of HM Treasury’s ownership of RBS’s ordinary shares will be 84.4 per cent., with shareholders experiencing a corresponding dilution to their interests in the company. However, without prejudice to rights arising on the mandatory conversion into ordinary shares, HM Treasury shall not be entitled to exercise its option to convert B Shares into ordinary shares for as long as it holds 75 per cent. or more of the ordinary shares or if the exercise of such option would result in it holding 75 per cent. or more of the ordinary shares. Further details regarding the effect of the B Shares on the dividends payable are set out below.

Conditions to accession to the Scheme

Implementation of the APS for RBS will be subject to further due diligence by HM Treasury and its advisers, documentation and satisfaction of applicable conditions (including the application criteria and asset eligibility criteria of the APS), adoption of a prescribed remuneration policy in respect of assets managed under the APS and conditions precedent to accession in the APS, including state aid, regulatory and shareholder approvals. RBS has agreed to provide certain information to HM Treasury in the period prior to RBS’s proposed accession, including

(i) an indicative list of the Proposed Assets, with a view to agreeing such list by 30 April 2009;

(ii) information and data relating to the Proposed Assets for the purposes of HM Treasury’s due diligence; and

(iii) access to RBS’s premises, books, records, senior executives, relevant personnel and professional advisers.

As at the date of this document, the timing for the implementation of the APS is still to be determined. The proposed entry by the Company into the APS and any associated capitalisation would constitute a related party transaction for the purposes of the Listing Rules requiring the approval of Independent Shareholders. Therefore if the Company is to participate in the APS, it will convene a further general meeting to seek Independent shareholder approval and a circular explaining the proposals and containing the relevant general meeting notice will be sent to Shareholders in due course, although no prospectus will be required.

Terms and conditions of the B Shares

At the same time as it announced RBS plc’s intended participation in the APS, RBS announced that it expected to issue to HM Treasury (i) £6.5 billion of B Shares at the time of entering into the APS and (ii) a further £13 billion of B Shares on or after implementation of the APS. RBS also announced that it had been agreed with HM Treasury that, at RBS’s option, a further £6 billion of B Shares could be issued to HM Treasury. The detailed terms of this option remain to be agreed between RBS and HM Treasury. All of these B Shares are expected to constitute Core Tier 1 capital and will be issued on the same terms. Key terms of the B Shares are expected to include the following:

• Nominal value and issue price: £0.50 per B Share.

• Ranking: on a winding-up, holders of the B Shares will rank pari passu with the holders of any other classes of Ordinary Shares and junior to preference shareholders. For these purposes, on a winding-up each holder of a B Share will be deemed to hold one Ordinary Share of RBS for every B Share held at the date of the commencement of such winding-up (the “Winding Up Ratio”).

• Dividend entitlement: non-cumulative dividends will be declared at the discretion of RBS, which dividends shall be paid in priority to any dividend on any other class of ordinary share capital. If declared, dividends on the B Shares will be paid semi-annually in arrear. The first such semi-annual dividend in respect of any financial year shall be payable on the date that is three business days after the record date in respect of the interim dividend payable on the Ordinary Shares in respect of such financial year, if such interim dividend on the Ordinary Shares is to be paid. The second such semi-annual dividend in respect of any financial year shall be payable on the date that is three business days after the record date in respect of the final dividend payable on the Ordinary Shares in respect of such financial year, if such final dividend on the Ordinary Shares is to be paid. If no interim dividend on the Ordinary Shares is to be paid in respect of any financial year, the first semi-annual dividend on the B Shares in respect of such financial year, if to be paid, shall be payable on 31 October in such financial year, and if no final dividend on the Ordinary Shares is to be paid in respect of any financial year the second semi-annual dividend on the B Shares in respect of such financial year, if to be paid, shall be payable on 31 May in the immediately following financial year.

• If to be paid, the dividend per B Share will be equivalent to (i) 7 per cent. of the issue price of each B Share multiplied by the number of days in the period from (and including) the immediately preceding Relevant Date (as defined below) or, in the case of the first semi annual dividend in 2009, the date of issue to (but excluding) the current Relevant Date divided by 365 (or 366 in a leap year) or (ii) in the case of any second semi-annual dividend in respect of any financial year, if greater and if a dividend or dividends or other distribution(s) is/are paid or made (whether interim or final) on the Ordinary Shares in respect of the period from (but excluding) the Relevant Date falling on (or nearest to) one year prior to the current Relevant

Business review continued

Date to (and including) the current Relevant Date, 250 per cent. (the “Participation Rate”) of the aggregate amount of such dividend(s) or distribution(s) per Ordinary Share less the amount of the first semi-annual dividend (if any) paid in respect of such financial year. “Relevant Date” means each date on which RBS pays a semi-annual dividend or, if no such payment has been made, 31 October in respect of the first semi-annual dividend in respect of any financial year and 31 May in the immediately following financial year in respect of the second semi-annual dividend in respect of any financial year.

• Scrip dividends: if RBS decides to pay a dividend on the B Shares in respect of a semi-annual period and either (i) no dividend has been paid on the Ordinary Shares and/or distribution made thereon in respect of the same period or (ii) a dividend has been paid and/or a distribution has been made thereon otherwise than in cash in respect of the same period, RBS may in its discretion determine that the dividend on the B Shares in respect of the corresponding period shall be paid in whole or in part by RBS issuing further B Shares to the holders of B Shares. The number of further B Shares to be issued to each holder shall be such number of B Shares as shall be certified by an independent investment bank (acting as expert) to equal the value in cash of the dividend otherwise payable on the B Shares in respect of the relevant period.

• Restrictions following non-payment of dividend: if RBS decides not to pay any semi-annual dividend on the B Shares in cash or otherwise, then until such time as semi-annual dividends on the B Shares have been resumed in full RBS will be prohibited from paying dividends or other distributions (whether in cash or otherwise) on, or redeeming, purchasing or otherwise acquiring, (i) its Ordinary Shares or (ii) any other securities of RBS or any other member of the Group ranking or expressed to rank pari passu with the Ordinary Shares and the B Shares on a winding-up, either issued by RBS or, where issued by another member of the Group, where the terms of the securities benefit from a guarantee or support agreement entered into by RBS which ranks or is expressed to rank pari passu with the Ordinary Shares and the B Shares on a winding-up.

• Redemption rights: none, but RBS may purchase the B Shares subject to applicable laws and FSA consent.

• Conversion rights: at any time a holder of a B Share may deliver a notice to RBS requesting conversion of B Shares into Ordinary Shares of RBS. All B Shares shall automatically and mandatorily convert into Ordinary Shares if the volume weighted average trading price of the Ordinary Shares for 20 complete trading days in any 30 trading day period equals or exceeds £0.65 per Ordinary Share. The number of Ordinary Shares to be issued upon conversion will be determined by dividing the aggregate issue price (£0.50 per B Share) of the B Shares being converted by the Conversion Price. The conversion price of the B Shares will be £0.50 (the “Conversion Price”).

• Limitations on optional conversion: without prejudice to the provisions above concerning the mandatory conversion of the B Shares, HM Treasury shall not be entitled to exercise its option to convert B Shares into Ordinary Shares to the extent that it holds 75 per cent. or more of the Ordinary Shares or to the extent that the exercise of such option would result in it holding 75 per cent. or more of the Ordinary Shares.

• Voting rights before conversion: holders of the B Shares will only have voting rights in limited circumstances (resolutions varying/abrogating class rights and resolutions to wind up, or in relation to the winding-up of, RBS). If entitled to vote, on a poll holders of B Shares will have two votes for each B Share held. HM Treasury shall not be so entitled to vote the B Shares to the extent the votes cast on such B Shares, together with any other votes which HM Treasury is entitled to cast in respect of any Ordinary Shares held by or on behalf of HM Treasury, would exceed 75 per cent. of the total votes eligible to be cast on a resolution proposed at a general meeting of RBS.

• Voting rights after conversion: HM Treasury shall not be entitled to vote in respect of Ordinary Shares acquired by it as a result of the conversion of B Shares into Ordinary Shares to the extent that votes cast on such Ordinary Shares, together with any other votes which HM Treasury is entitled to cast in respect of any other Ordinary Shares held by or on behalf of HM Treasury, would exceed 75 per cent. of the total votes eligible to be cast on a resolution proposed at a general meeting of RBS.

• Pre-emption rights: HM Treasury shall agree that it shall not exercise any pre-emption rights it may be entitled to as a holder of B Shares in respect of future issues of Ordinary Shares.

• Ordinary Share buy-back: for as long as any B Shares remain outstanding, RBS may not purchase any of its Ordinary Shares.

• Listing: the B Shares will not initially be listed. HM Treasury is entitled to require RBS to seek a listing of the B Shares.

• Adjustment events: the Winding Up Ratio and Participation Rate shall be subject to anti-dilution adjustments. The Conversion Price shall be adjusted in accordance with standard Euro-market anti-dilution adjustments other than customary change of control adjustments or extraordinary dividend adjustments (to the extent compensated by dividends paid at the Participation Rate).

Second Placing and Open Offer

Background to the Second Placing and Open Offer

In 2008 the Board concluded that the Group needed to strengthen its capital base and to accomplish this two capital raisings were carried out. A £12 billion rights issue was completed in June 2008. Then, due to a severe deterioration in financial markets and economic conditions, a further capital raising totalling £20 billion was completed in December 2008. Of the £20 billion raised in December, £15 billion was in the form of Ordinary Shares, and £5 billion was in the form of Preference Shares purchased entirely by HM Treasury. As a result of this capital raising, HM Treasury acquired approximately 57.9 per cent. of the issued ordinary share capital of the Company. The intention of the Board was that HM Treasury’s holding of Preference Shares would be redeemed as soon as practicable.

In the last few weeks of 2008 the continuing dislocation in financial markets and significant uncertainties in credit conditions, together with the sharp deterioration in economic conditions, negatively impacted the trading performance of many financial institutions globally, including RBS. As a result, RBS incurred significant credit impairment losses and credit market write downs.

In view of the above, the Board, in conjunction with HM Treasury, decided to take steps to improve the quality of the Group’s capital base by carrying out the Second Placing and Open Offer, and using the proceeds to redeem the Preference Shares held by HM Treasury. Shareholders were able to apply to subscribe for £5.37 billion of new ordinary shares pro rata to their existing shareholdings at a fixed price of 31.75 pence per share by way of the open offer.

The capital restructuring resulting from the Second Placing and Open Offer removed the £0.6 billion annual cost of the preference share dividend and created £5 billion of additional Core Tier 1 capital, which provides a higher quality level of capital support against the impact on the Group’s business of any further deterioration in economic and financial market conditions. Following the Second Placing and Open Offer, HM Treasury currently own approximately 70.3 per cent. of the issued ordinary share capital of the company.

Various initiatives, such as the Asset Protection Scheme (“APS”) and the Credit Guarantee Scheme, are being progressed by the UK Government to stabilise the UK banking system further and enhance support for the economy. The stated aims of the APS and the Credit Guarantee Scheme are to reinforce the stability of the financial system, to increase confidence and capacity to lend, and in turn to support the recovery of the UK economy. The other initiatives are expected to focus on asset and funding risks which are central to freeing up additional lending capacity whilst augmenting the impact of the capital measures described above.

By participating in the APS, the Group will be able to free up its lending capacity. Consequently, the Group announced on 26 February 2009 that it would increase its lending to UK homeowners and businesses subject to the Group’s ordinary course credit and pricing criteria on the Group’s normal contractual terms by £25 billion over the next 12 months. The increased lending will be split £9 billion to mortgage lending and the remaining £16 billion to business lending. Similar levels of lending have been committed to in 2010. This latest commitment supersedes the lending commitments the Group announced in October 2008 and in January 2009 and builds on NatWest’s and RBS plc’s recently announced pledge to continue to provide committed overdrafts and no increased pricing for small business customers until at least the end of 2009. These lending commitments will cease if RBS does not participate in the APS and Credit Guarantee Scheme by 1 June 2009 or will reduce if it participates in only one of the APS or Credit Guarantee Scheme prior to 1 June 2009.

While redemption of the Preference Shares allows the resumption of a sustainable and progressive dividend policy for the Ordinary Shares (it was a term of the Preference Shares that no such dividends may be paid while the Preference Shares were in issue), it is not the Board’s intention to pay a dividend on the Ordinary Shares in 2009. If the B Shares are issued as announced on 26 February 2009, no cash dividend may be paid on the Ordinary Shares unless the cash dividend payable in respect of the same period on the B Shares is paid in full, and no scrip dividend may be paid on the Ordinary Shares unless the cash or scrip dividend payable in respect of the same period on the B Shares is paid in full.

Impact of the Second Placing and Open Offer and the Preference Share Redemption on RBS

The effect of the Second Placing and Open Offer and the Preference Share Redemption was to improve the quality of RBS’s regulatory capital by increasing RBS’s Core Tier 1 ratio; the Tier 1 ratio was not affected. The Second Placing and Open Offer and the Preference Share Redemption had no other impact on RBS’s balance sheet. The Preference Shares carried a coupon of 12 per cent. at the discretion of the Board while the new shares issued in connection with the Second Placing and Open Offer rank pari passu with the existing shares of the company for any dividend payments. Accordingly, other than the elimination of the annual distribution at the discretion of the Board in respect of the preference share coupon, and the inclusion of the new shares in the payment of any future dividends on RBS’s ordinary shares, the Placing and Open Offer and Preference Share Redemption had no impact on the Group’s income statement.

Sale of Bank of China Investment

On 14 January 2009, the Group (through RBS China Investment Sarl.) sold its entire 4.26 per cent stake in Bank of China for HKD18.4 billion.

Debt Tender and Exchange Offer

On 26 March 2009, RBS Financing Limited ("RBSF"), a subsidiary of the Group, launched a cash tender offer in the United States (the “RBSF US Tender Offer”) for any and all of the outstanding securities of ten different series previously issued by the Group and certain of its affiliates. Concurrently therewith, RBSF also launched a cash tender offer outside of the United States (the “RBSF Non-US Tender Offer”) for five different series of securities previously issued by The Royal Bank and certain of its affiliates and an offer outside of the United States to exchange (the “RBSF Exchange Offer”) any or all of the outstanding securities of fourteen different series previously issued by The Royal Bank and certain of its affiliates for new senior unsecured notes of The Royal Bank.

The RBSF Tender Offers and the RBSF Exchange Offer expired on 22 April 2009. In the RBSF US Tender Offer, an aggregate of approximately US $4.1 billion principal amount of securities were validly tendered, resulting in an aggregate purchase consideration paid for the tendered securities of approximately US $1.7 billion.

In the RBSF Non-US Tender Offer, an aggregate of approximately €2.3 billion principal amount of Euro-denominated securities and approximately US $264 million principal amount of Dollar-denominated securities were validly tendered, resulting in aggregate purchase consideration paid for the tendered securities of approximately €1.1 billion and US $100 million, respectively.

In the RBSF Exchange Offer, an aggregate of approximately £3.5 billion principal amount of securities were validly offered for exchange and exchanged for new senior unsecured notes of The Royal Bank in an aggregate principal amount of approximately £1.8 billion.

Litigation Update

Note 32 of the Notes on the Accounts provides disclosure regarding, among other things, litigation claims in the United Kingdom. With respect to the claims regarding unarranged overdraft charges, the Group and other banks appealed against the orders of the High Court. On 26 February 2009, the Court of Appeal delivered its judgment and rejected the appeals. The House of Lords has granted the Group and other banks leave to appeal the Court of Appeal’s decision. That further appeal is scheduled to take place on 23 June 2009. With respect to class action complaints filed in the United States District Court for the Southern District of New York, complaints relating to public filings in connection with the broad class of RBS publicly traded securities between 26 June 2007 and 19 January 2009 are included in the description of class action complaints in Note 32.

Strategic review

RBS has embarked on a sweeping restructuring of the Group that will fit its activities to the goals outlined above. While the details of the strategic plan will be refined over the coming weeks to take account of the final agreements reached with HM Treasury in respect of RBS’s participation in the APS, the plan is expected to include the following:

• RBS will create a “Non-Core” division of RBS during the second quarter of 2009, separately managed, but within the existing legal structures of the Group and matrix managed to donating divisions where necessary. RBS currently intends that this division will have approximately £240 billion of third party assets, £145 billion of derivative balances and £155 billion of risk-weighted assets, comprising individual assets, portfolios and businesses of the Group that RBS intends to run off or dispose of during the next three to five years. The specific timetable will vary in each case but will be as fast as RBS judges consistent with optimising shareholder value and risk. Approximately 90 per cent. of the Non-Core division will consist of GBM assets, primarily linked to proprietary portfolios, excess risk concentrations and illiquid ‘originate and hold’ asset portfolios. The rest of the Non-Core division will be risk concentrations, ‘out of footprint’ assets and smaller, less advantaged businesses within our Regional Markets activities across the world. As part of this effort it is intended that RBS’s representation in approximately 36 of the 54 countries it operates in around the world will be significantly

Business review continued

reduced or sold. RBS will remain strong in all its major existing global hubs, however. Given the commercial and human sensitivity of these issues, detail on this will not be given until the interim results. The income, expenses, impairments and credit market and other trading asset write downs associated with the Non-Core Division in 2008 were approximately £3.9 billion, £1.1 billion, £3.2 billion and £9.2 billion respectively.

• In addition to eliminating expenses associated with the Non-Core division, RBS has launched a restructuring plan to make efficiency savings across the Group, aimed at achieving run-rate reductions by 2011 of greater than £2.5 billion (16 per cent. of 2008 cost base) at constant exchange rates. This will involve a wide range of re-engineering and other measures and, regrettably, reductions in employment. This target excludes any impact of inflation, incentive pay movements or cost reductions arising from business exits or the impact of new projects (if any). It includes the £0.5 billion of ABN AMRO integration benefits previously announced but not reflected in 2008 expenses. We will book one-off charges against these actions over the next three years, with run-rate cost savings expected to provide ‘payback’ in 1.5 to 1.75 years.

• RBS plans to retain each of its major business divisions since it believes, with intensive restructuring, they can meet the attractive business characteristics outlined as targets above. In many cases the restructuring of these businesses to achieve RBS’s goals will be far-reaching, nevertheless. The greatest element of restructuring will be in GBM as signalled above. A substantial shrinkage of size, product and geographic scope will take place. This should leave GBM positioned profitably around those of its existing core strengths that rest on profitable customer franchise business with significantly less illiquid risk overall.

• At all times RBS will responsibly compare the value to RBS of each of its businesses with realistic alternatives and take different action if they prove compelling. However, the distressed and pessimistic state of markets for financial assets and businesses offers little immediate encouragement in that regard.

• Alongside our business restructuring activities will be substantive changes to management and internal processes. There will continue to be changes of personnel as RBS promotes and reassigns internal talent and add to its ranks externally. The Manufacturing division will re-align with the customer facing businesses. Businesses will have clear bottom-line returns, allocated equity and balance sheet and funding goals. While RBS drives for profit, there will be a concentration on earnings quality and sustainability, driven by strategic plans, to ensure alignment of our businesses to their markets and their risk targets. People evaluation and incentivisation will meet best practice levels to support the revised mission of the Company. This will be underpinned by a full suite of risk and funding constraints, including concentration limits.

RBS has already begun this major change programme. To carry it through in parallel with running its continuing business in difficult markets will test management capacity. RBS expects to be successful overall, though it will inevitably have setbacks and make mistakes along the way. But there is no alternative. RBS must change in a far-reaching way. If it does that, the strength, quality and power that are already present in RBS business across the world will have the chance to shine through once again.

Relationship with major shareholder

The UK Government currently owns 70.3 per cent. of the issued ordinary share capital of RBS. The UK Government’s shareholding in RBS is currently held by the Solicitor for the Affairs of HM Treasury as nominee for HM Treasury and managed by UK Financial Investments Limited (“UKFI”), a company wholly owned by HM Treasury. No formal relationship agreement has been concluded between RBS and the UK Government, although the relationship falls within the scope of the framework document between HM Treasury and UKFI published on 2 March 2009. This document states that UKFI will manage the UK financial institutions in which HM Treasury holds an interest “on a commercial basis and will not intervene in day-to-day management decisions of the Investee Companies (including with respect to individual lending or remuneration decisions)”, which is designed to ensure that control of the relationship is not abused. This document also makes it clear that such UK financial institutions will continue to be separate economic units with independent powers of decision and “will continue to have their own independent boards and management teams, determining their own strategies and commercial policies (including business plans and budgets).”

These goals are consistent with the stated public policy aims of the UK Government, as articulated in a variety of public announcements.

In the framework document between UKFI and HM Treasury, UKFI stated that its goal was to “develop and execute an investment strategy for disposing of the investments [in the banks] in an orderly and active way through sale, redemption, buy-back or other means within the context of an overarching objective of protecting and creating value for the taxpayer as shareholder, paying due regard to the maintenance of financial stability and to acting in a way that promotes competition.”

It was also stated that UKFI intended to “engage robustly with banks’ boards and management, holding both strategy and financial performance to account, and taking a strong interest in getting the incentives structures right on the board and beyond—accounting properly for risk and avoiding inefficient rewards for failure.”

In this connection, RBS announced on 17 February 2009 that it had reached an agreement with UKFI in respect of certain changes to its remuneration policy. RBS has also undertaken to conduct a review of its strategy and UKFI has been actively engaged in reviewing the output of this review.

In connection with its proposed access to the APS (further details of which are set out above), RBS has undertaken to provide lending to creditworthy UK homeowners and businesses in a commercial manner. RBS’s compliance with this commitment will be subject to a monthly reporting process to the UK Government. The lending commitment does not require RBS to lend in excess of its single name or sectoral risk concentration limits or otherwise to engage in uncommercial practices.

RBS, in common with other financial institutions, also works closely with a number of UK Government departments and agencies on various industry-wide initiatives that are intended to support the UK Government’s objective of supporting stability in the wider financial system.

Other than in relation to these areas, however, the UK Government has confirmed publicly that its intention is to allow the financial institutions in which it holds an interest to operate their business independently.

Following consultation with UKFI and other major institutional shareholders the Nominations Committee recommended the appointment of Philip Hampton to the Board of Directors, which approved the appointment.

As a result of the UK Government’s holding, the UK Government and UK Government controlled bodies became related parties of the Group. The Group enters into transactions with many of these bodies on an arms' length basis.

The Group is not a party to any transaction with the UK Government or any UK Government controlled body involving goods or services which is material to the Group, or any such transaction that is unusual in its nature or conditions. To the Group's knowledge, the Group does not believe it is a party to any transaction with the UK Government or any UK Government controlled body involving goods or services which is material to the UK Government or any UK Government controlled body, however, given the nature and extent of the UK Government controlled bodies, the Group may not know whether a transaction is material for such a party.