This Annual Report contains statements that constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, and the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this Annual Report can be identified, in some instances, by the use of words such as “will,” “shall,” “target,” “expect,” “aim,” “hope,” “anticipate,” “should,” “may,” “might,” “assume,” “estimate,” “plan,” “intend,” “believe” and similar language or other formulations of a similar meaning or, in each case, the negative thereofformulations thereof. Other forward-looking statements can be identified in the context in which the statements are made or by the forward-looking nature of discussions of strategy, plans or intentions. These statements appear in a number of places in this Annual Report including, without limitation, certain statements made in “Item 3. Key Information—Risk Factors,” “Item 4. Information on the Company,” “Item 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures About Market Risk” and include statements regarding our intent, belief or current expectations with respect to, among other things:

| · | the effect on our results of operations of competition in telecommunications markets; |

| · | trends affecting our business financial condition, |

| · | acquisitions, investments or |

| · | our capital expenditures plan; |

| · | our estimated availability of funds; |

| · | our ability to repay debt with estimated future cash flows; |

| · | our shareholder remuneration policies; |

| · | supervision and regulation of the telecommunications sectors where we have significant operations; |

| · | our strategic partnerships; and |

| · | the potential for growth and competition in current and anticipated areas of our business. |

Such forward-looking statements are not guarantees of future performance and involve numerous risks and uncertainties, and actual results may differ materially from those anticipated in the forward-looking statements as a result of various factors. The risks and uncertainties involved in our businessbusinesses that could affect the matters referred to in such forward-looking statements include but are not limited to:

| · | changes in general economic, business or political conditions in the domestic or international markets in which we operate or have material investments that may affect demand for our services; |

| · |

| · | existing or worsening conditions in the international financial markets; |

| · | the impact of current, pending or future legislation and regulation in countries where we operate, as well as any failure to renew or obtain the necessary licenses, authorizations and concessions to carry out our operations and the impact of limitations in spectrum capacity; |

| · | compliance with anti-corruption laws and regulations and economic sanctions programs; |

| · | customers’ perceptions of services offered by us; |

| · | the actions of existing and potential competitors in each of our markets as well as the potential effects of technological changes; |

| · | failure of suppliers to provide necessary equipment and services on a timely basis; |

| · | the impact of unanticipated network |

| · | the effect of reports suggesting that |

| · | the impact of impairment charges on our goodwill and assets as a result of changes in the regulatory, business or political environment; |

| · | potential liability resulting from our internet access and hosting services arising from illegal or illicit use of the internet, including the inappropriate dissemination or modification of consumer data; and |

| · | the outcome of pending |

Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date of this Annual Report. We do not undertake noany obligation to release publicly the result ofupdate any revisions to these forward-looking statements whichthat may be made to reflect events or circumstances after the date of this Annual Report including, without limitation, changes in our business or acquisition strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

Our ordinary shares, nominal value €1.001.00 euro per share, are currently listed on each of the Madrid, Barcelona, Bilbao and Valencia stock exchanges (collectively, the “Spanish Stock Exchanges”) and are quoted through the Automated Quotation System under the symbol “TEF.” They are also listed on various foreign stock exchanges such as the London and Buenos Aires stock exchanges. American Depositary Shares (“ADSs”ADSs”), each representing the right to receive one ordinary share, are listed on the New York Stock Exchange and on the Lima Stock Exchange. ADSs are evidenced by American Depositary Receipts (“ADRs”ADRs”) issued under a Deposit Agreement with Citibank, N.A., as Depositary. During 2011 our shares were delisted from the Tokyo Stock Exchange, and our BDRs were delisted from the Sao Paulo Stock Exchange.

As used herein, “Telefó“Telefónica,” “Telefó“Telefónica Group,” “Group”“Group”, the “Company” and terms such as “we,“we,” “us”“us” and “our”“our” mean Telefónica, S.A. and its consolidated subsidiaries, unless the context requires otherwise.

As used herein, “Atento”“Atento” means Atento, Holding, Inversiones y Teleservicios, S.A. and its consolidated subsidiaries, unless the context requires otherwise.

Below are definitions of certain technical terms used in this Annual Report:

“Final client accesses”means accesses provided directly to our business are as follows:residential and corporate clients.

“Fixed telephony accesses”includes public switched telephone network, or PSTN, lines (including public use telephony), and integrated services digital network, or ISDN, lines and circuits. For purposes of calculating our number of

“MVNO”means mobile virtual network operator, which is a mobile operator that is not entitled to use spectrum for the provision of mobile services. Consequently, an MVNO must subscribe to an access agreement with a mobile network operator in order to provide mobile access to their customers. An MVNO pays such mobile network operator for using the infrastructure to facilitate coverage to their customers.

“VoIP”means voice over Internet protocol.

“Wholesale accesses”means accesses we provide to our competitors, who then sell services over such accesses to their residential and corporate clients.

“Wholesale ADSL”means accesses of broad band or fiber that we provide to our competitors, who then sell services over such accesses to their residential and corporate clients.

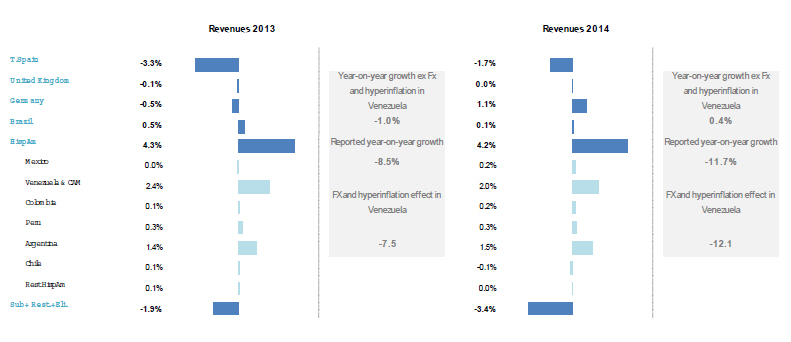

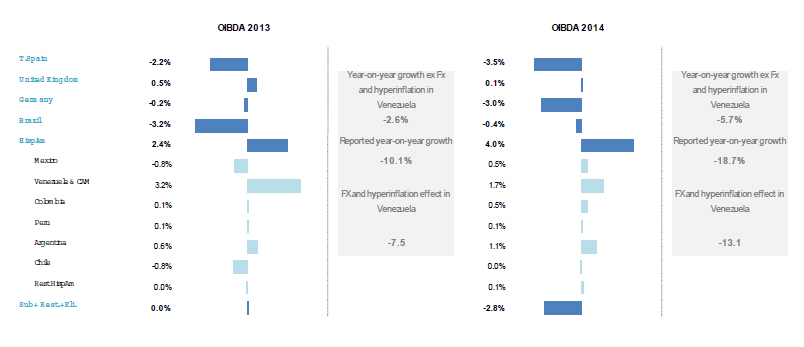

In this Annual Report we make certain comparisons in local currency or on a “constant euro basis” or “excluding foreign exchange rate effects” in order to present an analysis of the development of our results of operations from year-to-year without the effects of currency fluctuations. To make comparisons on a local currency basis, we compare financial items in the relevant local currency for the periods indicated as recorded in the relevant local currency for such periods. To make comparisons on a “constant euro basis” or “excluding foreign exchange rate effects,” we convert the relevant financial item into euro using the prior year’s average euro to relevant local currency exchange rate. In addition, we present certain financial information excluding the effects of Venezuela being considered a hyperinflationary economy in 2009, 20102012, 2013 and 20112014 by eliminating all adjustments made as a result of such consideration.

In this Annual Report, references to “US“U.S. dollars,” “dollars” or “$,” are to United States dollars, references to “pounds sterling,” “sterling” or “£” are to British pounds sterling, references to “reais” refer to Brazilian reais and references to “euro”, “euros” or “€” are to the single currency of the participating member states in the Third Stage of the European Economic and Monetary Union pursuant to the treaty establishing the European Community, as amended from time to time.

Our consolidated financial statements as of December 31, 20102013 and 2011,2014, and for the years ended December 31, 2009, 20102012, 2013 and 20112014 included elsewhere in this Annual Report including the notes thereto (the “Consolidated Financial Statements”), are prepared in conformity with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Item 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

Not applicable.

Not applicable.

| Offer Statistics and Expected Timetable |

Not applicable.

| Key Information |

The following table presents certain selected consolidated financial data. It is to be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and the Consolidated Financial Statements. The consolidated income statement and cash flow data for the years ended December 31, 2009, 20102012, 2013 and 20112014 and the consolidated statement of financial position data as of December 31, 20102013 and 20112014 set forth below are derived from, and are qualified in their entirety by reference to the Consolidated Financial Statements. The consolidated income statement and cash flow data for the years ended December 31, 20072010 and 20082011 and the consolidated statement of financial position data as of December 31, 2007, 20082010, 2011 and 20092012 set forth below are derived from Telefónica, S.A.’s consolidated financial statements for such years, which are not included herein.

Our Consolidated Financial Statements have been prepared in accordance with IFRS as issued by the IASB.

The basis of presentation and principles of consolidation areis described in detail in NotesNote 2 and 3(q), respectively, to our Consolidated Financial Statements.

As of or for the year ended December 31, | ||||||||||||||||||||

2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||

| (in millions of euro, except share and per share data) | ||||||||||||||||||||

Revenues | 56,441 | 57,946 | 56,731 | 60,737 | 62,837 | |||||||||||||||

Other income | 4,264 | 1,865 | 1,645 | 5,869 | 2,107 | |||||||||||||||

Supplies | (17,907 | ) | (17,818 | ) | (16,717 | ) | (17,606 | ) | (18,256 | ) | ||||||||||

Personnel expenses | (7,893 | ) | (6,762 | ) | (6,775 | ) | (8,409 | ) | (11,080 | ) | ||||||||||

Other expenses | (12,081 | ) | (12,312 | ) | (12,281 | ) | (14,814 | ) | (15,398 | ) | ||||||||||

Depreciation and amortization | (9,436 | ) | (9,046 | ) | (8,956 | ) | (9,303 | ) | (10,146 | ) | ||||||||||

Operating income | 13,388 | 13,873 | 13,647 | 16,474 | 10,064 | |||||||||||||||

Share of profit (loss) of associates | 140 | (161 | ) | 47 | 76 | (635 | ) | |||||||||||||

Net finance expense | (2,851 | ) | (2,821 | ) | (2,767 | ) | (2,537 | ) | (2,782 | ) | ||||||||||

Net exchange differences | 7 | 24 | (540 | ) | (112 | ) | (159 | ) | ||||||||||||

| Net financial expense | (2,844 | ) | (2,797 | ) | (3,307 | ) | (2,649 | ) | (2,941 | ) | ||||||||||

| Profit before tax from continuing operations | 10,684 | 10,915 | 10,387 | 13,901 | 6,488 | |||||||||||||||

Corporate income tax | (1,565 | ) | (3,089 | ) | (2,450 | ) | (3,829 | ) | (301 | ) | ||||||||||

| Profit for the year from continuing operations | 9,119 | 7,826 | 7,937 | 10,072 | 6,187 | |||||||||||||||

| Profit after taxes from discontinued operations | — | — | — | — | — | |||||||||||||||

Profit for the year | 9,119 | 7,826 | 7,937 | 10,072 | 6,187 | |||||||||||||||

Non-controlling interests | (213 | ) | (234 | ) | (161 | ) | 95 | (784 | ) | |||||||||||

| Profit for the year attributable to equity holders of the parent | 8,906 | 7,592 | 7,776 | 10,167 | 5,403 | |||||||||||||||

| Weighted average number of shares (thousands) | 4,758,707 | 4,645,852 | 4,552,656 | 4,522,228 | 4,511,165 | |||||||||||||||

| Basic and diluted earnings per share from continuing operations attributable to equity holders (euro)(1) | 1.87 | 1.63 | 1.71 | 2.25 | 1.20 | |||||||||||||||

| Basic and diluted earnings per share attributable to equity holders of the parent (euro)(1) | 1.87 | 1.63 | 1.71 | 2.25 | 1.20 | |||||||||||||||

Earnings per ADS (euro)(1)(2) | 1.87 | 1.63 | 1.71 | 2.25 | 1.20 | |||||||||||||||

| Weighted average number of ADS (thousands)(2) | 4,758,707 | 4,645,852 | 4,552,656 | 4,522,228 | 4,511,165 | |||||||||||||||

Cash dividends per ordinary share (euro) | 0.65 | 0.90 | 1.00 | 1.30 | 1.52 | |||||||||||||||

| Consolidated Statement of Financial Position Data | ||||||||||||||||||||

Cash and cash equivalents | 5,065 | 4,277 | 9,113 | 4,220 | 4,135 | |||||||||||||||

Property, plant and equipment | 32,460 | 30,545 | 31,999 | 35,797 | 35,463 | |||||||||||||||

Total assets | 105,873 | 99,896 | 108,141 | 129,775 | 129,623 | |||||||||||||||

Non-current liabilities | 58,044 | 55,202 | 56,931 | 64,599 | 69,662 | |||||||||||||||

Equity (net) | 22,855 | 19,562 | 24,274 | 31,684 | 27,383 | |||||||||||||||

Capital stock | 4,773 | 4,705 | 4,564 | 4,564 | 4,564 | |||||||||||||||

Consolidated Cash Flow Data | ||||||||||||||||||||

Net cash from operating activities | 15,551 | 16,366 | 16,148 | 16,672 | 17,483 | |||||||||||||||

Net cash used in investing activities | (4,592 | ) | (9,101 | ) | (9,300 | ) | (15,861 | ) | (12,497 | ) | ||||||||||

Net cash used in financing activities | (9,425 | ) | (7,765 | ) | (2,281 | ) | (5,248 | ) | (4,912 | ) | ||||||||||

11

| Millions of euros | 2010 | 2011 | 2012 | 2013 | 2014 |

| Revenues | 60,737 | 62,837 | 62,356 | 57,061 | 50,377 |

| Other income | 5,869 | 2,107 | 2,323 | 1,693 | 1,707 |

| Supplies | (17,606) | (18,256) | (18,074) | (17,041) | (15,182) |

| Personnel expenses | (8,409) | (11,080) | (8,569) | (7,208) | (7,098) |

| Other expenses | (14,814) | (15,398) | (16,805) | (15,428) | (14,289) |

| Depreciation and amortization | (9,303) | (10,146) | (10,433) | (9,627) | (8,548) |

| OPERATING INCOME | 16,474 | 10,064 | 10,798 | 9,450 | 6,967 |

| Share of (loss) profit of associates | 76 | (635) | (1,275) | (304) | (510) |

| Net finance expense | (2,537) | (2,782) | (3,062) | (2,696) | (2,519) |

| Net exchange differences | (112) | (159) | (597) | (170) | (303) |

| Net financial expense | (2,649) | (2,941) | (3,659) | (2,866) | (2,822) |

| PROFIT BEFORE TAX FROM CONTINUING OPERATIONS | 13,901 | 6,488 | 5,864 | 6,280 | 3,635 |

| Corporate income tax | (3,829) | (301) | (1,461) | (1,311) | (383) |

| PROFIT FOR THE YEAR FROM CONTINUING OPERATIONS | 10,072 | 6,187 | 4,403 | 4,969 | 3,252 |

| Profit after taxes from discontinued operations | − | − | − | − | − |

| PROFIT FOR THE YEAR | 10,072 | 6,187 | 4,403 | 4,969 | 3,252 |

| Non-controlling interests | 95 | (784) | (475) | (376) | (251) |

| PROFIT FOR THE YEAR ATTRIBUTABLE TO EQUITY HOLDERS OF THE PARENT | 10,167 | 5,403 | 3,928 | 4,593 | 3,001 |

| Weighted average number of shares (thousands)(1) | 4,705,217 | 4,693,707 | 4,603,539 | 4,627,912 | 4,606,389 |

| Basic and diluted earnings per share from continuing operations attributable to equity holders of the parent (euro)(1) | 2.16 | 1.15 | 0.85 | 0.99 | 0.61 |

| Basic and diluted earnings per share attributable to equity holders of the parent (euro)(1) | 2.16 | 1.15 | 0.85 | 0.99 | 0.61 |

| Earnings per ADS (euro)(1)(2) | 2.16 | 1.15 | 0.85 | 0.99 | 0.61 |

| Weighted average number of ADS (thousands)(1)(2) | 4,705,217 | 4,693,707 | 4,603,539 | 4,627,912 | 4,606,389 |

| Cash dividends per ordinary share (euro) | 1.30 | 1.52 | 0.82 | 0.35 | 0.75 |

| Consolidated Statement of Financial Position Data | |||||

| Cash and cash equivalents | 4,220 | 4,135 | 9,847 | 9,977 | 6,529 |

| Property, plant and equipment | 35,802 | 35,469 | 35,021 | 31,040 | 33,343 |

| Total assets | 129,775 | 129,623 | 129,773 | 118,862 | 122,299 |

| Non-current liabilities | 64,599 | 69,662 | 70,601 | 62,236 | 62,311 |

| Equity (net) | 31,684 | 27,383 | 27,661 | 27,482 | 30,289 |

| Capital stock | 4,564 | 4,564 | 4,551 | 4,551 | 4,657 |

| Consolidated Cash Flow Data | |||||

| Net cash from operating activities | 16,672 | 17,483 | 15,213 | 14,344 | 12,193 |

| Net cash used in investing activities | (15,861) | (12,497) | (7,877) | (9,900) | (9,968) |

| Net cash used in financing activities | (5,248) | (4,912) | (1,243) | (2,685) | (4,041) |

| (1) | The per share and per ADS computations for all periods presented have been presented using the weighted average number of shares and ADSs, respectively, outstanding for each period, and have been adjusted to reflect the stock dividends which occurred during the periods presented, as if these had occurred at the beginning of the earliest period |

| (2) | Until January 20, 2011, each ADS represented the right to receive three ordinary shares. Since January 21, 2011, each ADS represents the right to receive one ordinary share. The above figures have been restated accordingly. Figures do not include any charges of the ADS Depositary. |

Exchange Rate Information

As used in this Annual Report, the term “Noon Buying Rate” refers to the rate of exchange for euro, expressed in U.S. dollars per euro, in the City of New York for cable transfers payable in foreign currencies as certified by the Federal Reserve Bank of New York for customs purposes. The Noon Buying Rate certified by the New York Federal Reserve Bank for the euro on March 23, 2012February 20, 2015 was $1.3263 = €1.00.$1.1372= 1.00 euro. The following tables describe, for the periods and dates indicated, information concerning the Noon Buying Rate for the euro. Amounts are expressed in U.S. dollars per €1.00.1.00 euro.

Noon Buying Rate | ||||||||||||||||

Year ended December 31, | Period end | Average (1) | High | Low | ||||||||||||

2007 | 1.4603 | 1.3797 | 1.4862 | 1.2904 | ||||||||||||

2008 | 1.3919 | 1.4698 | 1.6010 | 1.2446 | ||||||||||||

2009 | 1.4332 | 1.3955 | 1.5100 | 1.2547 | ||||||||||||

2010 | 1.3269 | 1.3261 | 1.4536 | 1.1959 | ||||||||||||

2011 | 1.2973 | 1.4002 | 1.3875 | 1.2926 | ||||||||||||

2012 (through March 23, 2012) | 1.3263 | 1.3105 | 1.3463 | 1.2682 | ||||||||||||

| Noon Buying Rate | ||||

| Year ended December 31, | Period end | Average (1) | High | Low |

| 2010 | 1.3269 | 1.3218 | 1.4536 | 1.1959 |

| 2011 | 1.2973 | 1.4002 | 1.4875 | 1.2926 |

| 2012 | 1.3186 | 1.2909 | 1.3463 | 1.2062 |

| 2013 | 1.3779 | 1.3303 | 1.3816 | 1.2774 |

| 2014 | 1.2101 | 1.3155 | 1.3816 | 1.2447 |

| 2015 (through February 20, 2015) | 1.1372 | 1.1516 | 1.2015 | 1.1279 |

Source: Federal Reserve Bank of New York.

| (1) | The average of the Noon Buying Rates for the euro on the last day reported of each month during the relevant period. |

Noon Buying Rate | ||||||||

Month ended | High | Low | ||||||

September 30, 2011 | 1.4283 | 1.3446 | ||||||

October 31, 2011 | 1.4172 | 1.3281 | ||||||

November 30, 2011 | 1.3803 | 1.3244 | ||||||

December 31, 2011 | 1.3487 | 1.2926 | ||||||

January 31, 2012 | 1.3192 | 1.2682 | ||||||

February 29, 2012 | 1.3463 | 1.3087 | ||||||

March 31, 2012 (through March 23, 2012) | 1.3320 | 1.3025 | ||||||

| Noon Buying Rate | ||

| Month ended | High | Low |

| August 31, 2014 | 1.3436 | 1.3150 |

| September 30, 2014 | 1.3136 | 1.2628 |

| October 31, 2014 | 1.2812 | 1.2517 |

| November 30, 2014 | 1.2554 | 1.2394 |

| December 31, 2014 | 1.2504 | 1.2101 |

| January 31, 2015 | 1.2015 | 1.1279 |

| February 28, 2015 (through February 20, 2015) | 1.1462 | 1.1300 |

Monetary policy within the member states of the euro zone is set by the European Central Bank. The European Central Bank has set the objective of containing inflation and will adjust interest rates in line with this policy without taking account of other economic variables such as the rate of unemployment. It has further declared that it will not set an exchange rate target for the euro.

Our ordinary shares are quoted on the Spanish stock exchangesStock Exchanges in euro. Currency fluctuations may affect the dollar equivalent of the euro price of our shares listed on the Spanish stock exchangesStock Exchanges and, as a result, the market price of our ADSs, which are listed on the New York Stock Exchange. Currency fluctuations may also affect the dollar amounts received by holders of ADSs on conversion by the depositary of any cash dividends paid in euro on the underlying shares.

Our consolidated results are affected by fluctuations between the euro and the currencies in which the revenues and expenses of some of our consolidated subsidiaries are denominated and recorded (principally the Brazilian real, the pound sterling, the Venezuelan Bolivar fuerte (see Note 2 to our Consolidated Financial Statements), the Argentine peso, the Chilean peso, the Czech koruna (crown), the Peruvian nuevo sol, the Chilean peso, the Colombian peso, the Mexican peso and the Colombian peso)Venezuelan bolívar fuerte). See Note 3 (b) to our Consolidated Financial Statements for information on the exchange rate translation methodology we used in preparing our consolidated financial information.

Not applicable.

Not applicable.

Group-related risks

Worsening of the economic and political environment could negatively affect Telefónica’s business.

Telefónica’s international presence enables the diversification of its activities across countries and regions, but it is affected by various legislations, as well as the political and economic environments of the countries in which it operates. Any adverse developments or even uncertainties in this regard, including exchange-rate or sovereign-risk fluctuations, may adversely affect the business, financial position, cash flows and/or the performance of some or all of the Group’s financial indicators.

With respect to the other information containedeconomic environment, the Telefónica Group’s business is impacted by overall economic conditions in this Annual Report,each of the countries in which it operates. Economic conditions may adversely affect the level of demand of existing and prospective investors should carefully considercustomers, as they may no longer deem critical the risks described below before making any investment decision. The risks described below are notservices offered by the only ones that we face. Additional risks not currently known to us or that we currently deem immaterial may also impair our businessGroup. Factors such as high debt levels, ongoing restructuring of the banking sector, the implementation of pending structural reforms and resultscontinued fiscal austerity measures could hinder more dynamic growth in Europe and, in turn, the consumption and volume of operations. Ourdemand for the Group's services, which could materially adversely affect the Group’s business, financial condition, results of operations and cash flow couldflows.

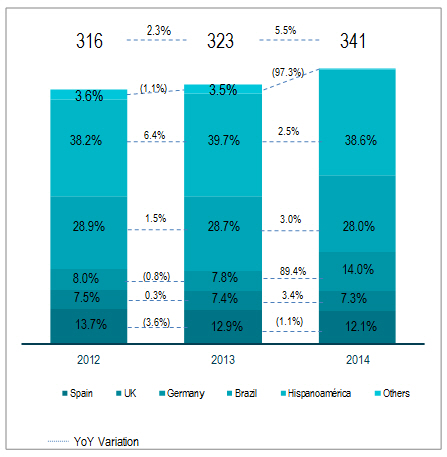

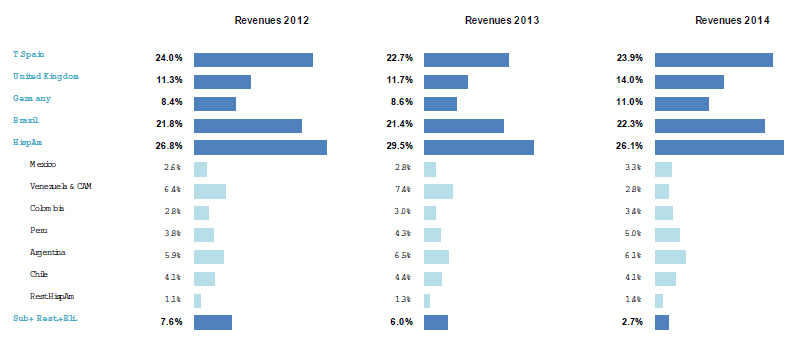

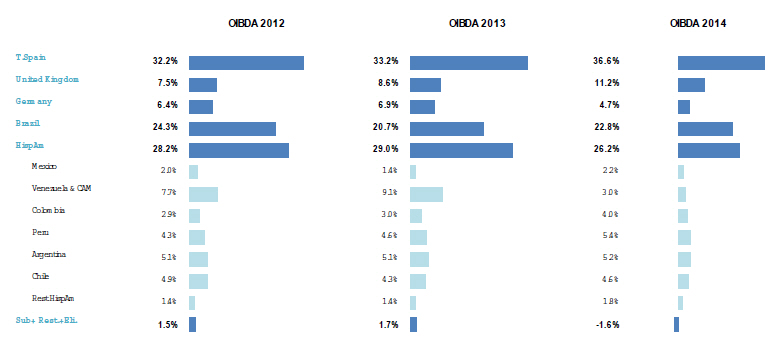

The soft economic recovery in Europe together with low inflation rates, and the risk of deflation, has led and may still lead to monetary and fiscal easing from key players, with a view to creating a relatively benign scenario for Europe. In this region, the Telefónica Group generated 23.9% of its total revenues in Spain, 14.0% in the United Kingdom and 11.0% in Germany in 2014.

In addition, the Group’s business may be materially adversely affected by anyother possible effects from the economic crisis, including possible insolvency of key customers and suppliers.

In Latin America, the most important challenge is the exchange-rate risk in Venezuela and Argentina, given the negative impact that a depreciation in their currencies could have on cash flows from both countries. International financial conditions may be unfavorable and may lead to potential periods of volatility linked to the evolution of the developed financial markets (especially long-term interest rates in the United States affected by the U.S. Federal Reserve’s intervention that are not discounted in the market), an economic slowdown in Asia (a key region for Latin America) and slow progress with structural reforms projects in the majority of these risks,countries limiting potential for higher growth rates. Among the most significant macroeconomic risk factors in the region are the high inflation rates, negative economic growth and investors could lose all or parthigh internal and external funding needs in Venezuela. These funding needs are significant and are affected by the recent fall in oil prices, which is the main and almost sole source of their investment.foreign currency in the country. These factors are affecting Venezuela’s competitiveness and may result in a currency

In relation to the political environment, the Group’s investments and operations and investments are located in Latin America and we are therefore exposedcould be affected by a series of risks related to risks inherent in operating and investing in Latin America.

“Country risk” factors include the following:

| · | government regulation or administrative |

| · | abrupt exchange-rate fluctuations may occur mainly due to high levels of inflation and both fiscal and external deficits with the resulting exchange-rate overvaluation. This movement could lead to strong exchange-rate depreciation in the context of a floating exchange rate regime, a significant devaluation off the back of abandoning fixed exchange rates regimes or the introduction of varying degrees of restrictions on capital movement. For example, in Venezuela, the official U.S. dollar to bolívar fuerte exchange rate is established by the Central Bank of Venezuela and the Minister of Finance, with an alternative market for attracting foreign currency through the Complementary System for Administration of Foreign Currency (Sistema Complementario de Administración de Divisas or “SICAD”) regular and selective auctions. In February 2015, a new Exchange Rate Agreement was established, including the regulations for the Foreign Exchange Marginal System (SIMADI), and the Central Bank of Venezuela published on February 18, 2015 a weighted average exchange rate equal to 172.1 bolívares to the U.S. dollar for the markets referred to in chapters II and IV of such Exchange Rate Agreement. Additionally, the acquisition or use of foreign currencies by Venezuelan or Argentinean companies (in some cases) to pay foreign debt or dividends is subject to the pre-authorization of the relevant authorities. Also, the Argentinean peso, despite its recent stability, continues to be under the threat of a sustained accelerated depreciation |

| · | governments may expropriate or nationalize assets, make adverse tax decisions or increase their participation in the economy and in companies; |

| · | economic-financial downturns, political instability and civil disturbances may negatively affect the Telefónica Group’s operations in such countries; and |

| · |

The Group's financial condition and results of operations may be adversely affected if we doit does not effectively manage ourits exposure to foreign currency exchange rate,rates, interest raterates or financial investment risks.

To illustrate the sensitivity of market riskfinancial expenses to a change in the normal course of our business, including, above all, the impact of changesshort-term interest rates at December 31, 2014: (i) a 100 basis points increase in interest rates in all currencies in which Telefónica has a financial position at that date would lead

to an increase in financial expenses of 111 million euros, (ii) whereas a 100 basis points decrease in interest rates in all currencies except the euro, the U.S. dollar and the pound sterling (these to zero rates in order to avoid negative rates), would lead to a reduction in financial expenses of 68 million euros. These calculations were made using the same balance position in each currency and same balance position equivalent at such date and bearing in mind the derivative financial instruments arranged.

According to the Group's calculations, the impact on results and specifically changes in the value of a 10% depreciation of Latin American currencies against the U.S. dollar and a 10% depreciation of the rest of the currencies against the euro would result in exchange rates. We uselosses of 76 million euros, primarily due to the weakening of the Venezuelan bolivar and the Argentinean peso. These calculations were made using the same balance position in each currency with an impact on profit or loss at such date, including derivative instruments in place. For the year ended December 31, 2014, 22.8% of the Telefónica Group's operating income before depreciation and amortization (OIBDA) was concentrated in Telefónica Brazil, 26.2% in Telefónica Hispanoamérica and 11.2% in the Telefónica United Kingdom.

The Telefónica Group uses a variety of strategies to manage this risk,these risks, mainly through the use of financial derivatives, which themselves are suceptiblealso expose us to risks,risk, including counterparty risk. OurFurthermore, the Group’s risk management strategies may not achieve theirthe desired effect, which could adversely affect ourthe Group’s business, financial condition, and results of operations.operations and cash flows.

Existing or worsening conditions in the international financial markets may limit ourthe Group's ability to finance, and consequently, the ability to carry out ourits business plan.

The operation,performance, expansion and upgradingimprovement of ourthe Telefónica Group's networks, the development and distribution of ourthe Telefónica Group's services as well asand products, the development and implementation of the Company's strategic plan, the development and implementation of new technologies or license awardthe renewal processes,of licenses as well as expansion of our business in countries where we operate may require a substantial amount of financing.

In 2013 the Telefónica Group issued bonds mainly (i) in euro totaling 3,250 million euros with an average coupon of 3.690%; (ii) in dollars totaling 2,000 million U.S. dollars with an average coupon of 3.709%; and (iii) in Swiss Francs totaling 225 million Swiss francs with an annual coupon of 2.595%. The Telefónica Group also issued undated deeply subordinated securities in euros totaling 1,750 million euros with an average coupon of 6.902%; and in sterling pounds totaling 600 million sterling pounds with a coupon of 6.750%. In 2014 the Telefónica Group issued bonds mainly in the European market with a maturity of eight years totaling 1,250 million euros with an annual coupon of 2.242%, and bonds with a fifteen-year maturity totaling 800 million euros with an annual coupon of 2.932%. In addition, if our credit ratings were downgraded, our capacity to raise capitalthe Telefónica Group issued undated deeply subordinated securities in 2014 totaling 2,600 million euros with an average coupon of 5.075%.

Despite having its gross debt maturities profile covered for more than two years, obtaining financing on the international capital markets could also be impaired,restricted, in terms of access and cost. Although following recent downgradescost, if Telefónica's credit ratings are revised downwards, either due to lower solvency or operating performance, or as a result of a downgrade in our long-term debt wethe rating for Spanish sovereign risk by rating agencies. Any of these situations could have successfully tappeda negative impact on the capital markets in several instances, we can give no assurance regarding ourGroup's ability to raise capital in the international capital markets on a timely basis or at all, or at interest rates acceptable to us.meet its debt maturities.

Moreover, market conditions maycould make it more difficultharder to renew our unused bilateralexisting undrawn credit facilities, 24%lines, 8% of which, as ofat December 31, 2011 are2014, were scheduled to mature prior to December 31, 2012. Finally,2015.

In addition, the currentimpact of the sovereign debt crisis and the rating downgrades in certain Eurozone countries should be taken into account. Any deterioration in the sovereign debt markets, doubts about developments in European projects (such as implementation of the banking union project, the results of the elections in Europe, including Spain among others, or progress towards fiscal integration), as well as further credit restrictions by the banking sector could have an adverse effect on the Telefónica Group's ability to access funding and/or liquidity, which could have a significant adverse effect on the Group's businesses, financial situation may also make it more difficultposition, results of operations and costly for us to raise additional equity capital.cash flows.

Risks Relating to Ourthe Group’s Industry

In this regards, the relevant markets. While we pursueTelefónica Group pursues its license renewals toin the extent provided byterms referred in their respective contractual terms, weconditions, though it cannot guarantee that weit will always complete this process successfully or onunder the most beneficial terms for us.the Group. In many cases we must satisfycomplying with certain obligations is required, including, among others, minimum specified quality, standards, service and coverage conditionsstandards and capital investment thresholds in order to qualify for renewal.investment. Failure to comply with these obligations could result in the imposition of fines, revision of the contractual terms, or even the revocation or forfeiture of the license, authorization or concession.

Regulation of spectrum and government concessions

In Europe, the amendments by the EU Parliament to the Commission’s proposal on the “Digital Single Market” (the “DSM”) package of measures are currently being discussed by the European Council. The “DSM” measures include important measures affecting, inter alia, spectrum regulation. Although these measures are not yet final, they could have significant implications as they include new provisions on secondary markets, criteria to apply at auctions, renewals and terms of licenses, etc.

In addition, the main allocation criteria for the 700 MHz band of “Digital Dividend II” (the second spectrum allocation process from television operators to electronic communications services) will be defined in the coming years. This could require new cash outflows ahead of the Group’s previously anticipated schedule (it is expected that the spectrum will be available between 2018 and 2021).

Nevertheless, Germany will be the first country in Europe to award spectrum in the 700 MHz band. On January 29, 2015, the German regulator (“BNetzA”) published respective final decisions on the spectrum allocation proceedings and on the auction conditions of the 700 MHz and 1500 MHz bands. The auction will also include the spectrum corresponding to GSM licenses – the entire 900 MHz band and most of the 1800 MHz band (which will expire at the end of 2016) –. Interested bidders may submit applications by March 6, 2015. The auction (Simultaneous Multi-Round Auction) will take place in the second quarter of 2015.

On July 4, 2014, BNetzA adopted a decision concerning the frequency aspects of the Telefónica Deutschland Holding AG merger with E-Plus Mobilfunk GmbH & Co KG (“E-Plus”). BNetzA has instructed Telefónica Deutschland (the surviving entity after the merger takes place) to anticipate the termination of its rights of use in the 900 / 1800 MHz bands by December 31, 2015, (instead of December 31, 2016), if Telefónica Deutschland does not reacquire these frequencies at the above-mentioned auction proceeding. Both Telefónica Deutschland and E-Plus have legally challenged this BNetzA decisionon August 4, 2014. The German regulator also announced that, once the auction of spectrum mentioned above is over, it will perform a frequency distribution analysis, and determine whether any additional action is needed, particularly in the area of the 2GHz spectrum band granted to Telefonica Deutschland.

In addition, and within the framework of the conditions imposed by the European Commission in connection with the merger, the surviving entity of the merger is obliged to offer up to 2x10 MHz in the 2600 MHz as well as up to 2x10 MHz in the 2100 MHz spectrum band to one potential new mobile network operator. This offer is open to any potential new mobile network operator that had declared a respective interest by December 31, 2014 and to the operator with whom Telefónica Deutschland has signed the network access agreement (Drillisch Group).

On December 26, 2014, the Spanish Government adopted a law in which it delayed, to a maximum period ended on April 1, 2015, the effective delivery of the frequencies in the 800 MHz spectrum which are part of the "Digital Dividend" (the spectrum allocation process from television operators to electronic communications services), and which were expected to be delivered on January 1, 2015 to the already awarded mobile operators. The license term has been extended accordingly to April 24, 2031.

In the United Kingdom a significant increase in the annual license fees charged for the use of the spectrum in 900 MHz and 1800 MHz bands has been proposed by the regulator (the Office of Communications (“Ofcom”)). The outcome of it remains uncertain. Separately, the United Kingdom Government announced recently an agreement with the United Kingdom mobile operators, including Telefonica United Kingdom, under which the mobile operators would accept a 90% geographic coverage obligation for voice and text services. Given the agreement, Ofcom has agreed to consider the impact of the geographic coverage obligation on its valuation of annual fees for 900 MHz and 1800 MHz spectrum. This is expected to delay Ofcom’s decision.In addition, on November 7, 2014, Ofcom released a public consultation on the award of 2.3 GHz and 3.4 GHz bands that is expected to take place in late 2015 or early 2016.

In Latin America, spectrum auctions are expected to take place implying potential cash outflows to obtain additional spectrum or to meet the coverage requirements associated with these licenses. Specifically, the procedures expected to take place in 2015 are:

| · | Peru:The government announced plans to auction the 700 MHz spectrum band in the first half of 2015 (three blocks of 2x15 MHz have been defined). |

| · | Costa Rica: Costa Rica’s government has communicated its intention to auction spectrum in the 1800 MHz and AWS bands during 2015. |

| · | Mexico: The Federal Institute of Telecommunications (Instituto Federal de Telecomunicaciones) (“IFT”) published its Annual Program for Frequency Use and Development 2015. The program specifies IFT’s intention to award Advanced Wireless Services “AWS” concessions during the course of 2015. |

Further to the above, certain administrations may not have announced their intention to release new spectrum and may do so during the year. The above does not include processes announced via general statements by administrations, which involve bands not key to Telefónica’s needs. Telefónica may also seek to acquire spectrum on the secondary market should opportunities arise.

In Argentina, on December 1, 2014, the Secretary of Communication through Resolution 85/2014 officially awarded Telefónica Argentina the block 1710-1720/2110-2120 for a period of 15 years, and the 700 MHz block (703-713/758-768 MHz) is expected to be officially transferred to Telefónica Argentina during 2015.

In the state of São Paulo, Telefónica Brasil provides local and national long-distance Commuted Fixed Telephony Service (CFTS) under the public regime, through a concession agreement, which will be in force until 2025. In this regard, in June 27, 2014, as established in the concession agreement, the National Telecommunications Agency (Agência Nacional de Telecomunicações) (“ANATEL”) issued a public consultation for the revision of the concession agreement. Such public

consultation revising the concession agreement ended on December 26, 2014 and allowed contributions on certain topics such as service universalization, rates and fees and quality of services, among others. Definitive conditions will be published in 2015.

Additionally, in Colombia the Information and Communication Technologies (“ITC”) Ministry issued a Resolution on March 27, 2014 to renew 850 MHz/1900 MHz licenses for 10 additional years. The reversion of assets and the liquidation of the concession contract will be discussed until May 2015, taking into consideration the terms of the contract, and the Constitutional Court’s review of Law 422 of 1998, which established the reversion of only the radio-electric frequencies.

In Peru, an application for partial renewal of the concessions for the provision of the fixed-line service for another five years has been issued, although assurance has been given by the “Ministry of Transport and Communications” (Ministerio de Transportes y Comunicaciones) in previous renewals, that the concession will remain in force until November 2027. Also, a new law has been enacted establishing mobile virtual network operator (MVNOs) and Rural Mobile Infrastructure Operators (RMIOs) in the Peruvian market.

In Mexico, in light of the constitutional reform resulting from the “Pact for Mexico” political initiative, it is expected that a publicly-owned wholesale network, which will offer wholesale services in the 700 MHz band, will be created. As of today, the funding and the marketing model of this project have not yet been determined.

Telefónica Móviles Chile, S.A. was awarded spectrum on the 700 MHz (2x10 MHz) band in March 2014. A third party provider opposed this allocation of spectrum on the basis that it would exceed the limit spectrum of 60 MHz established by a judgment of the Supreme Court of January 27, 2009. This cap was established for the AWS auction held in 2009, but not for subsequent auctions (2600 MHz and 700 MHz). In a judgment on December 31, 2014, the court of appeals rejected the third party claim. Consequently, the regulator is in a position to adopt a Decree awarding the concession to Telefónica.

The consolidated investment in spectrum acquisitions and renewals in 2014 amounted to 1,294.2 million euros.

The Company’s failure to obtain sufficient or appropriate spectrum capacity in the jurisdictions discussed above or any others in which it operates or its inability to assume the related costs, could have an adverse impact on its ability to launch and provide new services and on the Company’s ability to maintain the quality of existing services, which may adversely affect the Group’s business, financial condition, results of operations and cash flows.

Regulation of wholesale and retail charges

In terms of roaming, the regulated “Eurotariffs” were reduced on July 1, 2014 (in the wholesale market, the price of data was reduced by 67%, the price of call by 50%; and in the retail market, the price of data was reduced by 55%, the price of outgoing voice call by 21%, the price of incoming voice call by 28% and the price of outgoing texts by 25%), as per the regulation approved in 2012. The structural roaming solutions which could lead to a price decrease in the intra-European Union roaming services also took effect in July 2014. Furthermore, the package of DSM measures mentioned above, which is under discussion, also includes a proposal to eliminate European Union roaming charges as of a yet to be determined date. However, the European Parliament proposed the “end of roaming” by December 15, 2015 in a proposal known as “Roaming Like at Home”.

The decreases in wholesale mobile network termination rates (“MTR”) in Europe are also noteworthy. In the United Kingdom, wholesale MTRs have been reduced to 0.845 ppm (pence/minute) from April 1, 2014 (representing a 0.3% reduction compared to the previous rates). In a consultation document published in June 2014, Ofcom has proposed a further reduction to 0.545 ppm, from April 1, 2015.

In Germany, on September 3, 2014, the BNetzA adopted a proposal to reduce MTRs. The new prices will gradually decrease to 0.0172 euro/minute from December 1, 2014, and in a second stage, from 0.0172 euro/minute to 0.0166 euro/minute from December 1, 2015 until the end of November 2016. The European Commission has requested that the German regulator withdraw or amend its latest decision on mobile termination rates, in force as at the date of this Annual Report. There is a risk that the European Commission will initiate infringement proceedings against Germany, and rates may be further reduced.

In Spain, the National Regulatory & Competition Authority (Comisión Nacional de los Mercados y la Competencia) has adopted a final decision on the third round analysis of the wholesale market for fixed call termination. From November 1,

2014, a symmetric fixed termination rate (“FTR”) of 0.0817 euro cents/minute applies, based on pure bottom-up long run incremental costs (“BU-LRIC”) meaning that billing must be entirely conducted on a “per second” basis, without a peak/off-peak differentiation. The decision therefore eliminates the asymmetry in FTRs that existed since 2006 when alternative network operators were allowed to charge up to 30% above Telefónica’s per minute local FTR. It also brings forth an important reduction in average termination prices for Telefónica (by 80%) in comparison to the former applicable tariffs.

In Latin America, there are also moves to review MTRs leading to these being reduced. Thus, for example, developments in Mexico are among the most relevant, where the IFT has declared the América Móvil Group a preponderant operator in the telecommunications market. As a result, on March 26, 2014, it introduced, among others, special regulations on asymmetric interconnection rates. In that sense, the Federal Telecommunications and Broadcasting law, effective as of August 13, 2014, imposed several obligations on the preponderant operator, which are quite extensive and, in principle, potentially significantly beneficial to Telefónica’s competitive position, particularly with regards to the measures imposed on preponderant operators (to the extent they nominally retain such qualification). With regards to MTR, Telefónica México filed an administrative appeal against the 2011 resolutions of the Federal Telecommunications Commission of México (Cofetel) regarding mobile network termination rates (representing a 61% reduction compared to the previous rates). As of the date of this Annual Report, no ruling has been made on this appeal. Recently, IFT determined the mobile termination rates for 2012, and Telefónica México filed an injunction against this rate. Once these appeals have been concluded, the rates applied may be further reduced retroactively. As of the date of this Annual Report, IFT has not approved the termination rates for 2013, 2014 or 2015 for Telefónica México.

In Brazil, at the end of 2012, ANATEL launched the “Plano Geral de Metas de Competição” (“PGMC”) regarding fixed-mobile rate adjustment reductions until February 2016 and amending the previous reduction conditions (75% of the 2013 rate in 2014 and 50% of the 2013 rate in 2015). In order to complement reductions and approach the cost of the services according to a financial cost model, on July 7, 2014, ANATEL published reference values for MTR taking effect from 2016 to 2019. Such reductions are approximately 44% per year. Furthermore, there are several legislative initiatives that aim to abolish the basic fee of fixed-telephony service. “Price protection” practices (reimbursement of differences in prices of a product to customers if this falls within a relative short period of time) may also have a negative impact in Telefónica Brasil, in both economic and image terms.

In Chile, a tariff decree was issued to set fixed-line termination charges for the 2014-2019 periods. The new tariff entered into effect on May 8, 2014 and applies a reduction of 37% in prices against those charged for the period prior to such tariff. A tariff decree has been issued for mobile networks covering the 2014-2019 five-year period. Such tariff decree entered into effect on January 25, 2014 and implies a reduction of 74.7% with respect to the previous rates. After a review by the general comptroller (Contraloría General) an additional 1.7% reduction was approved on May 27, 2014.

In Ecuador the rate-related risks relate to a reduction in rural and urban telephony charges, a reimbursement of top-up balances, as well as rounding to the nearest minute.

The implementation of the Enabling Act (Ley Habilitante) in Venezuela also confers full powers to the President to implement price control measures. Under this Act, in January 2014, an organic fair price law was issued, which caps the revenue of related enterprises at 30% of their operating costs. In relation to MTRs with the national operator of reference (Compañía Anónima Nacional Teléfonos de Venezuela) (“CANTV”), these have been reduced by 6% compared to the previous rates. In November 2014, near the end of the term allowing the enactment of laws autonomously granted to the President of the Republic, new important decree-laws were enacted, in particular, the Reform of the Law on Foreign Investment, in which, among other things, new requirements for the return of foreign investment were established; the Reform of the Antitrust Law, which was predominantly aimed at enhancing monopoly control regulation and increasing penalties for infringement; and the Reform of the Exchange Crimes Law, which increased economic sanctions.

In Colombia, on us,December 30, 2014, the Colombian regulator (“CRC”) enacted Resolution 4660 establishing a gradual reduction for MTRs. The glide path initiates in 2015 in 32.88 Colombian pesos per minute representing a decrease of 41.7% and then descends approximately 42.2% in 2016 and 42.2% in 2017 (each such reduction being as compared to the previous year). This regulatory measure also imposes asymmetric MTRs to the dominant provider (the América Móvil Group), imposing the final rate established in the glide path from 2015 to 2017. The CRC also regulated the charges for national roaming and the SMS termination rates, setting a reduction of 41.5% in 2015, 39.6% in 2016 and 43.3% in 2017 (each such reduction being as compared to the previous year).

Regulation of universal services

Further to its formal obligation to review the scope of the Universal Service Directive (the set of basic electronic communication services whose provision is guaranteed to any user requesting it, regardless of its location, with a specified quality at an affordable price), the European Commission is expected to undertake a public consultation in the months following the date of this Annual Report, which if significant,may include both the potential inclusion of broadband in its scope and a possible reduction of some of the current universal service obligations. Depending on the terms that will be set forth in the new regulation, implementation at a local level could lead to higher costs for both the universal service provider and the operators forced to finance the universal service.

The last Plano Geral de Metas de Universalização (“PGMU”) was published in Brazil on June 30, 2011 and applies to the 2011-2015 period. This sets goals for public phones, low cost fixed-lines and coverage density in rural and poor areas with 2.5GHz/450 MHz. Also according to such PGMU, the assets assigned to the provision of the services described in the public concession agreement are considered reversible assets. In 2014, ANATEL issued a public consultation with its proposals for the 2015-2020 period universalization targets. The agency’s proposal focuses on reducing the distance between public telephones and backhaul’s expansion.

Regulation of fiber networks

In December 2014, the Spanish National Regulatory & Competition Authority (Comisión Nacional de los Mercados y la Competencia) has conducted a public consultation on the regulatory obligations for broadband market regulation in Spain. As a result of this consultation,the new regulation that will apply to NGN (Next Generation Networks) could be approved in the fourth quarter of 2015 and will last for at least three years. This could increase Telefónica's regulatory obligations in Spain and the ability of other operators to compete in such market.

In Colombia, the regulatory authority CRC published a regulatory project for transmission capacity between municipalities through fiber networks or connectivity to impose open network and elements access through a mandatory offer for those enterprises that have overcapacity and have some unused installed network elements. This project will be discussed in the first half of 2015.

Regulations on privacy

In Europe, a new Data Protection Regulation is undergoing the European legislative process which, as the date of this Annual Report, is not expected to end before mid-2015. This could lead to certain critical provisions laid down in the current draft of the regulation (presently under debate) being worded in such a way that stops or hinders Telefónica from launching some services, that focus on the processing of personal data.

In Brazil, triggered by the approval of Civil Rights Framework for Internet Governance, which provides certain generic rules about data protection, the Ministry of Justice could in the near future, adopt the final version of the Draft Personal Data Protection Act. This could lead to a greater number of obligations for operators in relation to the collection of personal data of telecom services users and further restrictions on the treatment of such data.

Regulation of functional separation

The principles established in Europe’s common regulatory framework, adopted in 2009 and transposed in the national legislation of each Member State in which Telefónica operates could result in lossgreater regulatory pressure on the local competitive environment. Specifically, this framework supports the possibility of national regulators (in specific cases and under exceptional conditions) forcing operators with significant market sharepower and harmvertically-integrated operators to ourseparate their wholesale and retail businesses at a functional level. They would therefore be required to offer equal wholesale terms to third-party operators that acquire these products.

Regulation of network neutrality

In Europe, national regulators are seeking to strengthen their supervision of operators with regard to the blocking of access, discrimination of applications or Internet service quality. The European Parliament and the Council are simultaneously debating the draft of the European DSM Regulation proposed by the European Commission that, among other things, deals with the principle of network neutrality. The regulation of network neutrality could directly affect

possible future business models of Telefónica and may affect the network management or differentiation of characteristics and quality of Internet access service.

Telefónica is present in countries where net neutrality has already been ruled, such as Chile, Colombia, Peru and more recently Brazil, but this remains a live issue and with varying degrees of development in other countries where it operates. In Germany, the Economy Minister withdrew a draft law that it published on June 20, 2013, to regulate net neutrality, especially with regard to the blocking and discrimination of content and Internet services. It plans to submit a new draft after the EU has settled on a position on net neutrality within the DSM approach, which might occur in early 2015. In addition, one German region (Bundesland of Thuringia) has passed a new law (which applies only in such region) with the aim that broadcasting and tele-media may not be blocked, limited or treated differently from other data traffic.

If changes to regulation such as those described above, or otherwise, occur in the various jurisdictions where the Telefónica Group operates, it could have a material adverse effect on its business, financial performancecondition, results of operations and future growth.cash flows.

For further information regarding the matters discussed above and other aspectsa detailed description of these regulations see Appendix VII of the regulatory environmentsConsolidated Financial Statements “Key Regulatory Issues and Concessions and Licenses Held by the Telefónica Group”.

The Telefónica Group is exposed to risks in relation to compliance with anti-corruption laws and regulations and economic sanctions programs.

The Telefónica Group is required to comply with the laws and regulations of various jurisdictions where it conducts operations. In particular, the Group’s international operations are subject to the U.S. Foreign Corrupt Practices Act of 1977 (“FCPA”) and the United Kingdom Bribery Act of 2010 (the “Bribery Act”), and economic sanction programs, including those administered by the United Nations, the European Union and the United States, including the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”). The FCPA prohibits providing anything of value to foreign officials for the purposes of obtaining or retaining business or securing any improper business advantage. As part of the Telefónica Group’s business, it may deal with entities, the employees of which our businesses operate, see “Item 4. Informationare considered foreign officials for purposes of the FCPA. In addition, economic sanctions programs restrict the Group’s business dealings with certain sanctioned countries, individuals and entities.

Although the Group has internal policies and procedures designed to ensure compliance with applicable anti-corruption laws and sanctions regulations, there can be no assurance that such policies and procedures will be sufficient or that the Group’s employees, directors, officers, partners, agents and service providers will not take actions in violation of the Group’s policies and procedures (or otherwise in violation of the relevant anti-corruption laws and sanctions regulations) for which the Group or they may be ultimately held responsible. Violations of anti-corruption laws and sanctions regulations could have a material adverse effect on the Company—Business Overview—Regulation.”Group’s business, reputation, results of operations and financial condition.

Customers' perceptions of the assistance and services offered are critical to operating in highlyhighly-competitive markets. The ability to predict and respond to the changing needs and demands of customers affects the Company's competitive marketsposition relative to other technology sector companies, and its ability to extract the industry in which we operate is subjectvalue generated during this process of transformation. Failure to do so adequately could have an adverse impact on the Group's business, financial condition, results of operations and cash flows.

Company may not be able to adequately foresee and respond to technological changes and sector trends.

In a sector characterized by rapid technological change, it is essential to be able to offer the products and services demanded by the market and consider the impacts of changes which requires usin the life cycle of technical assets, secure margins and select the right investments to continuously adapt to such changes and to upgrade our existing networks.make.

Failure to do so effectivelyadequately could have an adverse impact on ourthe Group's business, financial condition, results of operations and financial condition. See “Item 4. Information on the Company—Business Overview—Competition.”cash flows.

New products and technologies arise constantly, while theand their development of existing products and technologies can render obsolete the products and services we offerthe Telefónica Group offers and the technologies we use.technology it uses. This can force us to investmentmeans that Telefónica must invest in the development of new products, technology and services so that weit can continue to compete effectively with current or future competitors. Such investments can reducecompetitors, and which may result in the decrease of the Group's profits and revenue margins we obtain.margins. In this respect, margins from traditional voice and data business are shrinking, while new sources of revenues are arisingderiving from mobile Internet.Internet and connectivity services that are being launched. Research and development costs amounted to 1,111 million euros and 1,046 million euros in 2014 and 2013, respectively; representing an increase of 6.2% from 1,046 million euros in 2013. These expenses represented 2.2% and 1.8% of the Group's consolidated revenue, respectively. These figures have been calculated using the guidelines established in the Organization for Economic Cooperation and Development (OECD) manual. One technology that telecommunications operators, including usTelefónica (in Spain and Latin America), are focused on is the new FTTx-type network, which offers broadband access using optical fiber with superior services, such as highInternet speed Internet andof up to 100MB or HD television services. However, significantsubstantial investment is required to deploy these networks, which entails fully or partially substituting the copper wireloop access with fiber optic cables. Currently, minimalfiber. While an increasing demand for the capabilities offered by these new networks to end users could make it difficult to quantifyexists, the high level of the investments requires a continuous analysis of the return on investmentinvestment.

The explosion of the digital market and justifyentry of new players in communications market, such as MVNOs, Internet companies or device manufacturers, may cause the high investment. In addition, manyloss of these networks upgrade tasksvalue of certain assets, and affect the Group’s ability to offer new products or services are not entirely under our controlgenerate income. Therefore, it is necessary to update the business model, encouraging the pursuit of incomes and may be affected by applicable regulations.

The existence of telecommunications services and products, we like other companiescritical suppliers in the industry we depend uponsupply chain, especially in areas such as network infrastructure, information systems or handsets, with a high concentration in a small number of major suppliers, for essential productsposes risks that may affect the Company’s operations, and services, mainlymay cause legal contingencies or damages to the Company's image in the event that inappropriate practices are produced by a participant in the supply chain.

As of December 31, 2014, the Telefónica Group depended on six handset suppliers and 11 network infrastructure and mobile handsets.suppliers, which together accounted for 80% of the awarded contracts for the year then ended. These suppliers may, among other things, extend delivery times, raise prices and limit supply due to their own shortagesstock shortfalls and business requirements.

If these suppliers fail to deliver products and services to the Telefónica Group on a timely basis, it could jeopardize our network deployment and expansion plans, which in some cases could adversely affect ourthe Telefónica Group's ability to satisfy ourits license terms and requirements, andor otherwise have a material,an adverse effectimpact on our businesses,the Group's business, financial condition, results of operations and financial condition.cash flows.

Unanticipated network interruptions as a result of system failures, whether accidental or otherwise, including those due to network, hardware or software, failures,stealing of infrastructure elements or cyber-attacks, which affect the quality of or cause an interruption in ourthe Telefónica Group's service, could result inlead to customer dissatisfaction, reduced revenues and traffic, and costly repairs, penalties or other measures

imposed by regulatory authorities and could harm ourthe Telefónica Group's image and reputation. We attempt

Telefónica attempts to mitigate these risks through a number of measures, including backup systems and protective systems such as firewalls, virus scanners and buildingother physical and logical security. However, these measures are not effective under all circumstancesalways effective. Although the Telefónica Group has insurance policies to cover these types of incidents, and cannot avert every action or event that could damage or disrupt our technical infrastructure. Although we carry business interruption insurance, our insurance policythe claims and loss in revenue caused by service interruptions to date have been covered by these policies, these policies may not provide coverage in amountsbe sufficient to compensate us for any losses we may incur.cover all possible monetary losses.

The mobiletelecommunications industry may be harmedaffected by concerns stemming from actual or perceived health risks associated with radio frequency emissions.the possible effects of electromagnetic fields, emitted by mobile devices and base stations, may have on human health.

The adoption of new measures by governments or anyadministrations or other regulatory interventions in this respect, and any future assessment on the adverse impact of which could materially and adverselyelectromagnetic fields on health, may negatively affect ourthe business, financial conditions, results of operations and financial condition.cash flows of the Telefónica Group.

Although the recognition of impairments of tangible,property, plant and equipment, intangible assets and financial assets resultresults in a non-cash charge on the income statement, such charge wouldit could adversely affect ourthe results of the Telefónica Group’s operations. In this respect, the Telefónica Group has experienced impairments on certain of its investments, affecting its results of operations in the year in which they were experienced. For example, with respect to the investment in Telco, S.p.A. (“Telco”), value adjustments were made in fiscal years 2013 and 2014 with a negative impact of 267 million euros and 464 million euros, respectively.

The Telefónica Group's networks carry and store large volumes of confidential, personal and corporate data, and its Internet access and hosting services may lead to claims for illegal or illicit use of the Internet.

The Telefónica Group's networks carry and store large volumes of confidential, personal and business data, through both voice and data traffic. The Telefónica Group stores increasing quantities and types of customer data in both business and consumer segments. Despite its best efforts to prevent it, the Telefónica Group may be found liable for any loss, transfer, or inappropriate modification of the customer data or general public data stored on its servers or transmitted through its networks, any of which could involve many people and have an impact on the Group's reputation, or lead to legal claims and liabilities that are difficult to measure in advance.

In addition, the Telefónica Group’s Internet access and hosting servers could lead to claims for illegal or unlawful use of the Internet. Telefónica, like other telecommunications providers, may be held liable for any loss, transfer or inappropriate modification of the customer data stored on its servers or carried by its networks.

In most countries in which the Telefónica Group operates, the provision of its Internet access and hosting services (including the operation of websites with shelf-generated content) are regulated under a limited liability regime applicable to the content that it makes available to the public as a technical service provider, particularly content protected by copyright or similar laws. However, regulatory changes have been introduced imposing additional obligations on access providers (such as blocking access to a website) as part of the struggle against some illegal or illicit uses of the Internet, notably in Europe.

Any of the foregoing could have an adverse impact on the business, financial position, results of operations and consequently, our ability to achieve our growth targets. For example, we have faced several corrections regardingcash flows of the value of certain of our assets that have impacted our results of operations for the year in which the corrections were made. In 2011, an impairment loss was recognized on our stake in Telco, S.p.A., which, among other effects, resulted in a negative impact of €620 million, reducing the value of our stake in Telecom Italia, S.p.A. This value is evaluated at each reporting date for indications of impairment losses.Group.

Telefónica and antitrustTelefónica Group companies are party to lawsuits, tax claims and other legal proceedings in the ordinary course of our business,their businesses, the finalfinancial outcome of which is generally uncertain.unpredictable. An adverse outcome in, or any settlement of,in these or other proceedings that may be assertedcould result in the futuresignificant costs and may have a material adverse effect on ourthe Group's business, financial condition, results of operations, reputation and cash flow.flows. In particular, regarding tax and antitrust claims, the Telefónica Group has open judicial procedures in Peru concerning the clearance of previous years' income tax, for which a contentious-administrative appeal is currently pending, as well as in Brazil, with CADE’s (Conselho Administrativo de Defesa Ecônomica) resolution with regard to the acquisition of a 50% stake in Vivo and with certain open tax procedures, primarily relating to the CIMS (a Brazilian tax on telecommunication services). Further details on these matters are provided in Notes 21 and 17 of the Consolidated Financial Statements.

| Information on the Company |

Overview

Telefónica, S.A., is a corporation duly organized and existing under the laws of the Kingdom of Spain, incorporated on April 19, 1924. We are:

| · | a diversified telecommunications group which provides a comprehensive range of services through one of the world’s largest and most modern telecommunications networks; |

| · | focused on providing telecommunications services; and |

| · | present principally in Europe and Latin America. |

The following significant events occurred in 2011:2014:

| · | On |

The exchange rate of 6.3 bolívares per U.S. dollar was used in the translation of the financial information of Venezuelan subsidiaries for the entirety of 2013.

During 2014, by virtue of certain Exchange Agreements the allocations conducted through the Complementary System for Administration of Foreign Currency (SICAD I), to which Telefónica Venezuela had access for imports, were expanded and, in addition, a new exchange mechanism with a more widespread use was put in place, called SICAD II.

The exchange rates resulting in the last allocations of SICAD I and SICAD II before December 31, 2014 were 12.0 and 49.988 bolívares per U.S. dollar, respectively.

In the absence of SICAD I auctions since mid-October 2014, and the lack of expectations of new auctions close to 2014 year-end, in a macroeconomic context aggravated by the fall of the oil price, the Company has decided to take as a reference the rate resulting in the allocations conducted through SICAD II for translating the financial statements of the Venezuelan subsidiaries. The Company considers that it is the most representative among the available official exchange rates at 2014 year-end for the monetary translation of the accounting figures of transactions, cash flows and balances.

The main impacts of using this new exchange rate in the Telefónica Group’s consolidated financial statements as of December 31, 2014 were as follows:

| - | A decrease in |

| - | As part of the decrease mentioned in the preceding paragraph, the value in euros of the net financial assets denominated in bolívares decreased by approximately 2,700 million euros, as per the balance as of December 31, 2014. |

| - | The results from the Telefónica’s subsidiaries in Venezuela have been translated at the new exchange rate. This implied a reduction in operating income before depreciation and amortization (OIBDA) and profit of the year of, approximately, 1,730 and 660 million euros, respectively. |

| · | On January 28, 2014, after obtaining the relevant regulatory approval, the sale of Telefónica Czech Republic, a.s. ("Telefónica Czech Republic") was completed. As a result of the sale, Telefónica held a 4.9% stake in Telefónica Czech Republic, which it subsequently sold in October 2014 for 160 million euros. |

| · | On |

Within this framework, Telefónica created the role of the Chief Commercial Digital Officer, who is responsible for fostering revenue growth. On the cost side, the Company strengthened the role of the Chief Global Resources Officer. Both Officers report directly to the Chief Operating Officer (COO), as do the local business CEOs for Spain, Brazil, Germany and the United Kingdom, in addition to the Latin American Unit, which now excludes Brazil.

| · | On February 27, 2014, the Board of Directors of Telefónica agreed to determine the amount of the 2014 dividend at 0.75 euro per share, payable in two tranches: |

- 0.40 euro per share in cash in the second quarter of 2015.

-0.35 euro per share by means of a "scrip dividend" in the fourth quarter of 2014.

| · | On May 6, 2014, Telefónica submitted a |

| · | On May 7, 2014, Telefónica paid a dividend of 0.40 euro per share in cash (dividend distribution charged against 2014 net income) corresponding to the second tranche of the 2013 dividend which |

| · | On May 30, 2014, Telefónica's Annual General Shareholders' Meeting took place on second call with the attendance, present or represented, of 54.81% of the share capital. In this meeting, all the resolutions submitted by the Board of Directors for deliberation and approval were approved by majority of votes. |

| · | On June 2, 2014, Telefónica's subsidiary Telefónica de Contenidos, S.A.U. ("Telefónica Contenidos") executed a share purchase agreement with PRISA in connection with PRISA’s stake in DTS. The price agreed amounts to 750 million euros, subject to customary adjustments at closing. The closing of this purchase agreement is subject to obtaining the relevant authorization of the competition authorities and to the approval of a representative panel of the banks financing PRISA. |

| · | On July 2, 2014, Telefónica Deutschland received the EU Commission's conditional clearance to acquire the E-Plus Group from the Dutch telecommunication corporation Koninklijke KPN N.V. In connection with such |

conditional clearance, on June 25, 2014, Telefónica Deutschland signed an agreement with the Drillisch Group according to which the latter agreed to acquire, in addition to the agreed capacity to provide services to its existing customers through Telefónica Deutschland's or the E-Plus Group’s networks, 20% of the capacity of all mobile networks that belong to Telefónica Deutschland after the acquisition of the E-Plus Group. The 20% capacity will be reached gradually over a 5-year period. In addition, the Drillisch Group will have the right to acquire up to an additional 10% of capacity of the aforementioned mobile networks.

Telefónica Deutschland will grant the Drillisch Group, through a Mobile Bitstream Access model, access to the future joint network of Telefónica Deutschland and the E-Plus Group, as well as to the existing and future technology developments on that network, which the Drillisch Group will be able to offer to its customers. Final clearance for the acquisition was given on August 29, 2014. On October 1, 2014, Telefónica Deutschland completed the acquisition of E-Plus, following its execution of a capital increase intended to fund such acquisition. Telefónica maintains a stake of 62.1% in Telefónica Deutschland, which now includes 100% of the E-Plus Group, while the Dutch company Koninklijke KPN N.V. holds a 20.5% stake, and the rest is free float.

| · | On July 4, 2014, Telefónica de Contenidos acquired 22% of the share capital of DTS owned by Mediaset España Comunicación, S.A. ("Mediaset") for consideration of 295 million euros. |

A payment of 30 million euros has been agreed as consideration for the waiver of Mediaset's pre-emptive rights relating the stake held by PRISA in DTS. Pursuant to the agreement, Mediaset will receive (i) 10 million euros in the event that Telefónica de Contenidos closes the acquisition of the 56% stake of DTS held by PRISA and, in that case, (ii) up to 30 million euros depending on the evolution of the Pay-TV customers in Spain of the Telefónica Group during the four years following the closing of such acquisition.

| · | On July 7, 2014, Telefónica reached an agreement with Reti Televisive Italiane S.p.A. ("RTI") for the acquisition by Telefónica of an 11.11% stake of the capital of a newly created company, which will consolidate the Pay-TV business of the Mediaset Group in Italy, currently commercialized under the name of "Mediaset Premium". The purchase price is 100 million euros. |

| · | On July |

| · | On September |

The final closing of the operation is subject to obtaining the relevant regulatory authorizations (including telecommunication and anti-trust approval). On December 22, 2014, ANATEL approved the acquisition of GVT, although the resolution about the acquisition by Vivendi, S.A. of the 1,110 million of ordinary shares of Telecom Italia is still pending. As of the date of this Annual Report, CADE continues to analyze the process.

| · | On September 30, 2014, Telefónica |

With this acquisition, Telefónica Brasil, S.A. has reached its goal of ensuring the necessary spectrum for its medium- and long-term expansion of the 4G service in order to meet the growing demand for mobile access to high-speed Internet.

| · | On October 10, 2014, the |

| · | The free-of-charge allotment rights derived from the capital increase were allotted to Telefónica |