UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, |

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-16125

(Exact name of Registrant as specified in its charter)

ASE Technology Holding Co., Ltd.

Advanced Semiconductor Engineering, Inc.

(Translation of Registrant’s Name into English)

REPUBLIC OF CHINA

(Jurisdiction of Incorporation or Organization)

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaohsiung, Taiwan

Republic of China

(Address of Principal Executive Offices)

Joseph Tung

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, Taiwan, 110

Republic of China

Tel: 886-2-6636-5678

Fax: 882-2-2757-6121

Email: ir@aseglobal.com

(Name,Email:ir@aseglobal.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on which Registered |

| Common Shares, par value NT$10.00 each | The New York Stock Exchange* |

*Traded in the form of American Depositary Receipts evidencing American Depositary Shares (the “ADSs”), each

representing fivetwo common shares of Advanced Semiconductor Engineering, Inc. ASE Technology Holding Co., Ltd.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

7,909,741,8964,321,629,382 Common Shares, par value NT$10 each**

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and large accelerated filer”l “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company ☐ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

** As a result of the exercise of employee stock options subsequent to December 31, 2015,2018, as of MarchJanuary 31, 2016,2019, we had 7,918,272,8964,322,321,982 shares outstanding.

Page

| SUBSIDIARY INFORMATION | |

| Item 11. Quantitative and Qualitative Disclosures about Market Risk | |

| Item 12. Description of Securities Other Than Equity Securities |

i

ii

Unless the context otherwise requires, references in this annual report to:

| · | “ |

| · | “2016 Bonds” are to RMB500.0 million 4.250% Guaranteed Bonds due September 20, 2016, issued by Anstock Limited; |

| · | “2018 Convertible Bonds” are to US$400.0 million Zero Coupon Convertible Bonds due September 5, 2018, issued by the Company; |

| · | “2018 NTD-linked Convertible Bonds” are to US$200.0 million NTD-linked Zero Coupon Convertible Bonds due March 27, 2018, issued by the Company; |

| · | “ |

| · | “ASE Chung Li” are to ASE (Chung Li) Inc., a company previously incorporated under the laws of the |

| · | “ASE Electronics” are to ASE Electronics Inc., a company incorporated under the laws of the |

| · | “ASE Japan” are to ASE Japan Co. Ltd., a company incorporated under the laws of Japan; |

| · | “ASE Korea” are to ASE (Korea) Inc., a company incorporated under the laws of the Republic of Korea; |

| · | “ASE Material” are to ASE Material Inc., a company previously incorporated under the laws of the |

| · | “ASE Shanghai” are to ASE (Shanghai) Inc., a company incorporated under the laws of the |

| · | “ASE Test” are to ASE Test Limited, a company incorporated under the laws of Singapore; |

| · | “ASE |

| · | “ASE Test Taiwan” are to ASE Test, Inc., a company incorporated under the laws of the |

| · | “ASEEE” are to ASE Embedded Electronics Inc., a company incorporated under the laws of the R.O.C.; |

| · | “ASEH,” the “Company,” “ASE Technology Holding,” “we,” “us” or “our” are to ASE Technology Holding Co., Ltd. and, unless the context requires otherwise, its subsidiaries; |

| · | “ASEKS” are to ASE (KunShan) Inc., a company incorporated under the laws of the |

| · | “ASEN” are to Suzhou ASEN Semiconductors Co., Ltd., a company incorporated under the laws of the |

| · | “ASESH AT” are to ASE Assembly & Test (Shanghai) Limited, formerly known as Global Advanced Packaging Technology Limited, or GAPT, a company incorporated under the laws of the |

1

| · | “ASEWH” are to ASE (Weihai), Inc., a company incorporated under the laws of the |

1

| · | “Deposit Agreement” are to deposit agreement dated September 29, 2000 among Citibank, N.A., as depositary, holders and beneficial owners of ADSs and us, which was filed as an exhibit to our registration statement on post-effective amendment No. 2 to Form F-6 on September 16, 2003, and its two amendments, which were filed as an exhibit to our registration statement on post-effective amendment No. 1 to Form F-6 on April 3, 2006 and our registration statement on post-effective amendment No. 2 to Form F-6 on October 25, 2006; |

| · | “EEMS Test Singapore” are to EEMS Test Singapore Pte. Ltd., a company incorporated under the laws of Singapore, which changed its name to ASE Singapore II Pte. Ltd. and was subsequently merged into ASE Singapore Pte. Ltd. on January 1, 2011; |

| · | “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended; |

| · | “FSC” are to the Financial Supervisory Commission of the Republic of China; |

| · | “Green Bonds” are to US$300.0 million 2.125% Guaranteed Bonds due July 24, 2017, offered by Anstock II Limited, our wholly owned subsidiary incorporated in the Cayman Islands; |

| · | “Hung Ching” are to Hung Ching Development & Construction Co. Ltd., a company incorporated under the laws of the |

| · | “IFRS” are to International Financial Reporting Standards, International Accounting Standards and Interpretations as issued by the International Accounting Standards Board; |

| · | “ISE Labs” are to ISE Labs, Inc., a corporation incorporated under the laws of the State of California; |

| · | “Initial SPIL Tender Offer” are to ASE’s offer to purchase 779,000,000 common shares (including common shares represented by outstanding American depositary shares) of SPIL through concurrent tender offers in the |

| · | “Joint Share Exchange Agreement” are to the joint share exchange agreement entered into between ASE and SPIL on June 30, 2016; |

| · | “Korea” or “South Korea” are to the Republic of Korea; |

| · | “Mainland Investors Regulations” are to the Regulations Governing Securities Investment and Futures Trading in Taiwan by Mainland Area Investors; |

| · | “MOEAIC” are to Investment Commission, the |

| · | “NYSE” are to New York Stock Exchange; |

| · | “PowerASE” are to PowerASE Technology, Inc., a company incorporated under the laws of the |

| · | “ |

| · | “P.R.C.” are to the People’s Republic of China and excludes Taiwan, Macau and Hong Kong; |

2

| · | “ |

| · | “QDII” are to qualified domestic institutional investors; |

| · | “Republic of China”, the |

| · | “ |

| · | “SEC” are to the Securities and Exchange Commission of the U.S.; |

| · | “Second SPIL Tender Offer” are to ASE’s offer to purchase 770,000,000 common shares (including common shares represented by outstanding American depositary shares) of SPIL through concurrent tender offers in the |

2

| · | “Securities Act” are to the U.S. Securities Act of 1933, as amended; |

| · | “Share Exchange” is the statutory share exchange pursuant to the laws of the Republic of China, through which ASEH will (i) acquire all issued shares of ASE in exchange for shares of ASEH using the share exchange ratio as described in “Item 10. Additional information—Material Contract”, and (ii) acquire all issued shares of SPIL using the cash consideration as described in “Item 10. Additional information—Material Contract.” |

| · | “SiP” are to system-in-package; |

| · | “SPIL” are to Siliconware Precision Industries Co., |

| · | “SPIL Acquisition” are to ASEH’s effort to effect an acquisition of 100% of the common shares and American depositary shares of SPIL pursuant to the Joint Share Exchange Agreement; |

| · | “Taiwan-IFRS” are to the Regulations Governing the Preparation of Financial Reports by Securities Issuers, the IFRS as well as related guidance translated by Accounting Research and Development Foundation and endorsed by the FSC; |

| · | “Tessera” are to Tessera, Inc., a company that filed a suit against the Company and its U.S. subsidiary, ASE (U.S.) Inc.; |

| · | “TWSE” are to Taiwan Stock Exchange; |

| · | “UGJQ” are to Universal Global Technology (Shanghai) Co., Ltd., a company incorporated under the laws of the |

| · | “UGKS” are to Universal Global Technology (Kunshan) Co. Ltd., a company incorporated under the laws of the |

| · | “UGTW” are to Universal Global Scientific Industrial Co. Ltd., a company incorporated under the laws of the |

| · | “Universal |

| · | “Universal Scientific Industrial Shanghai” are to Universal Scientific Industrial (Shanghai) Co., Ltd., a company incorporated under the laws of the |

| · | “U.S.” refers to United States of America; |

3

| · | “U.S. GAAP” are to accounting principles generally accepted in the U.S.; |

| · | “USI Inc.” are to USI Inc., a company incorporated under the laws of the |

| · | “USI Mexico” are to Universal Scientific Industrial De Mexico S.A. DE C.V., a company incorporated under the laws of Mexico; |

| · | “USISZ” are to |

| · | “Wuxi Tongzhi” are to Wuxi Tongzhi Microelectronics Co., Ltd., a company incorporated under the laws of the |

3

We publish our financial statements in New Taiwan dollars, the lawful currency of the ROC.R.O.C. In this annual report, references to “United States dollars,” “U.S. dollars” and “US$” are to the currency of the United States; references to “New Taiwan dollars,” “NT dollars” and “NT$” are to the currency of the ROC;R.O.C.; references to “RMB” are to the currency of the PRC;P.R.C.; references to “JP¥” are to the currency of Japan; references to “MYR” are to the currency of Malaysia; references to “SGD” are to the currency of Republic of Singapore; references to “KRW” are to the currency of Republic of Korea; and references to “EUR” are to the currency of the European Union. Unless otherwise noted, all translations from NT dollars to U.S. dollars were made at the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve System of the United States (the “Federal Reserve Board”) as of December 31, 2015,2018, which was NT$32.79=30.61=US$1.00, and all translations from RMB to U.S. dollars were made at the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve Board as of December 31, 2015,2018, which was RMB6.4778=RMB6.8755=US$1.00. All amounts translated into U.S. dollars in this annual report are provided solely for your convenience and no representation is made that the NT dollar, RMB or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or NT dollars/RMB, as the case may be, at any particular rate or at all. On April 22, 2016,19, 2019, the exchange rate between NT dollars and U.S. dollars as set forth in the H.10 weekly statistical release by the Federal Reserve Board was NT$32.36=30.82=US$1.00. On April 22, 2016,19, 2019, the exchange rate between RMB and U.S. dollars as set forth in the H.10 weekly statistical release by the Federal Reserve Board was RMB6.5004 =US$RMB6.7032=US$1.00.

4

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Although these forward-looking statements, which may include statements regarding our future results of operations, financial condition or business prospects, are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to identify these forward-looking statements in this annual report. Our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied in these forward-looking statements for a variety of reasons, including risks associated with cyclicality and market conditions in the semiconductor or electronics industry; changes in our regulatory environment, including our ability to comply with new or stricter environmental regulations and to resolve environmental liabilities; demand for the outsourced semiconductor packaging, testing and electronic manufacturing services we offer and for such outsourced services generally; the highly competitive semiconductor or manufacturing industry we are involved in; our ability to introduce new technologies in order to remain competitive; international business activities; our business strategy; our future expansion plans and capital expenditures; the uncertainties as to whether we can complete the acquisition of 100% of SPIL shares not otherwise owned by ASE; the strained relationship between the ROCR.O.C. and the PRC;P.R.C.; general economic and political conditions; the recent global economic crisis; possible disruptions in commercial activities caused by natural or human-induced disasters; fluctuations in foreign currency exchange rates; and other factors. For a discussion of these risks and other factors, see “Item 3. Key Information—Risk Factors.”

5

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

The following tables present selected consolidated financial data for ASEH as of and for the year ended December 31, 2018, and ASE as of and for the years ended December 31, 2014, 2015, 2016 and 2017.

The selected consolidated statements of comprehensive income data and cash flow data for the years ended December 31, 2013, 20142016, 2017 and 2015,2018, and the selected consolidated balance sheet data as of December 31, 20142017 and 20152018 set forth below are derived from our audited consolidated financial statements included in this annual report and should be read in conjunction with, and are qualified in their entirety by reference to, these consolidated financial statements, including the notes thereto. The selected consolidated statements of comprehensive income data and cash flow data for the year ended December 31, 20122014 and 2015 and the selected consolidated balance sheet data as of December 31, 20122014, 2015 and 20132016 set forth below are derived from our audited consolidated financial statements not included herein.

Our consolidated financial statements have been prepared and presented in accordance with IFRS. Until and including our consolidated financial statements included in our annual report on Form 20-F for the year ended December 31, 2012, we prepared our consolidated financial statements in accordance with ROC GAAP with reconciliations to U.S. GAAP.

We adopted IFRS for certain filings with the SEC, starting from the filing of our annual report on Form 20-F for the year ended December 31, 2013. Historical financial results as of and for the year ended December 31, 2012 included herein have been adjusted and presented in accordance with IFRS, which differs from the results included in our annual report on Form 20-F for the year ended December 31, 2012. Meanwhile, as required by the FSC, we adopted Taiwan-IFRS for reporting of our annual and interim consolidated financial statements in the ROC beginning on January 1, 2013. Taiwan-IFRS differs from IFRS in certain respects, including, but not limited to the extent that any new or amended standards or interpretations applicable under IFRS may not be timely endorsed by the FSC. See “Item 3. Key Information—Risk Factors—Risks Relating to Our Business—Our adoption of new financial reporting standards, effective January 1, 2013, may have material impact on our financial statements thereafter” for more information.

Following our adoption of IFRS for SEC filing purposes, pursuant to the rule amendments adopted by the SEC that became effective on March 4, 2008, we were no longer required to reconcile our consolidated financial statements with U.S. GAAP. Historical selected

ASEH was formed pursuant to the consummation of the Share Exchange on April 30, 2018. ASE is ASEH’s predecessor entity; therefore, the financial and operational results of ASEH for periods before the Share Exchange were prepared under the assumption that ASEH owned 100% shareholdings of ASE. The related assets and liabilities in ASEH’s financial data, asbefore the date of andincorporation, was recognized based on the carrying amounts of those in ASE’s financial data. The financial data of ASEH for 2018 consists the year ended December 31, 2011 derived from our consolidated financial statements prepared in accordance with ROC GAAP have not been included below.results of:

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| IFRS | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| NT$ | NT$ | NT$ | NT$ | US$ | ||||||||||||||||

| (in millions, except earnings per share and per ADS data) | ||||||||||||||||||||

| Statement of Comprehensive Income Data: | ||||||||||||||||||||

| Operating revenues | 193,972.4 | 219,862.4 | 256,591.4 | 283,302.5 | 8,639.9 | |||||||||||||||

| Operating costs | (157,342.7 | ) | (177,040.4 | ) | (203,002.9 | ) | (233,167.3 | ) | (7,110.9 | ) | ||||||||||

| Gross profit | 36,629.7 | 42,822.0 | 53,588.5 | 50,135.2 | 1,529.0 | |||||||||||||||

| Operating expenses | (18,922.6 | ) | (20,760.4 | ) | (23,942.7 | ) | (25,250.6 | ) | (770.1 | ) | ||||||||||

| Other operating income and expenses, net | 83.2 | (1,348.2 | ) | 228.7 | (251.5 | ) | (7.6 | ) | ||||||||||||

| Profit from operations | 17,790.3 | 20,713.4 | 29,874.5 | 24,633.1 | 751.3 | |||||||||||||||

| Non-operating income (expense), net | (1,181.6 | ) | (1,343.6 | ) | (1,339.4 | ) | 660.1 | 20.1 | ||||||||||||

| · | ASE Technology Holding Co., Ltd. and SPIL for the period from April 30, 2018 through December 31, 2018; and |

| · | ASE, the predecessor entity of ASEH for the twelve months ended December 31, 2018. |

6

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| IFRS | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| NT$ | NT$ | NT$ | NT$ | US$ | ||||||||||||||||

| (in millions, except earnings per share and per ADS data) | ||||||||||||||||||||

| Profit before income tax | 16,608.7 | 19,369.8 | 28,535.1 | 25,293.2 | 771.4 | |||||||||||||||

| Income tax expense | (2,960.4 | ) | (3,499.6 | ) | (5,666.0 | ) | (4,311.1 | ) | (131.5 | ) | ||||||||||

| Profit for the year | 13,648.3 | 15,870.2 | 22,869.1 | 20,982.1 | 639.9 | |||||||||||||||

| Attributable to | ||||||||||||||||||||

| Owners of the Company | 13,191.6 | 15,404.5 | 22,228.6 | 20,013.5 | 610.4 | |||||||||||||||

| Non-controlling interests | 456.7 | 465.7 | 640.5 | 968.6 | 29.5 | |||||||||||||||

| 13,648.3 | 15,870.2 | 22,869.1 | 20,982.1 | 639.9 | ||||||||||||||||

| Other comprehensive income (loss), net of income tax | (3,830.7 | ) | 3,233.3 | 5,504.4 | (147.6 | ) | (4.5 | ) | ||||||||||||

| Total comprehensive income for the year | 9,817.6 | 19,103.5 | 28,373.5 | 20,834.5 | 635.4 | |||||||||||||||

| Attributable to | ||||||||||||||||||||

| Owners of the Company | 9,420.4 | 18,509.6 | 27,394.3 | 19,940.4 | 608.1 | |||||||||||||||

| Non-controlling interests | 397.2 | 593.9 | 979.2 | 894.1 | 27.3 | |||||||||||||||

| 9,817.6 | 19,103.5 | 28,373.5 | 20,834.5 | 635.4 | ||||||||||||||||

| Earnings per common share(1): | ||||||||||||||||||||

| Basic | 1.77 | 2.05 | 2.89 | 2.62 | 0.08 | |||||||||||||||

| Diluted | 1.73 | 1.99 | 2.79 | 2.51 | 0.08 | |||||||||||||||

| Dividends per common share(2) | 2.05 | 1.05 | 1.29 | 2.00 | 0.06 | |||||||||||||||

| Earnings per equivalent ADS(1): | ||||||||||||||||||||

| Basic | 8.86 | 10.26 | 14.46 | 13.08 | 0.40 | |||||||||||||||

| Diluted | 8.65 | 9.96 | 13.93 | 12.55 | 0.38 | |||||||||||||||

| Number of common shares(3): | ||||||||||||||||||||

| Basic | 7,445.5 | 7,508.5 | 7,687.9 | 7,652.8 | 7,652.8 | |||||||||||||||

| Diluted | 7,568.2 | 7,747.6 | 8,220.7 | 8,250.1 | 8,250.1 | |||||||||||||||

| Number of equivalent ADSs | ||||||||||||||||||||

| Basic | 1,489.1 | 1,501.7 | 1,537.6 | 1,530.6 | 1,530.6 | |||||||||||||||

| Diluted | 1,513.6 | 1,549.5 | 1,644.1 | 1,650.0 | 1,650.0 | |||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||

| Current assets | 97,495.6 | 132,176.5 | 159,955.2 | 156,732.8 | 4,779.9 | |||||||||||||||

| Investments - non-current(4) | 2,267.8 | 2,345.5 | 2,409.3 | 38,328.0 | 1,168.9 | |||||||||||||||

| Property, plant and equipment, net | 127,197.8 | 131,497.3 | 151,587.1 | 149,997.1 | 4,574.5 | |||||||||||||||

| Intangible assets | 12,361.3 | 11,953.6 | 11,913.3 | 11,888.6 | 362.6 | |||||||||||||||

| Long-term prepayment for lease | 4,164.1 | 4,072.3 | 2,586.0 | 2,556.2 | 77.9 | |||||||||||||||

| Others(5) | 4,236.0 | 4,676.9 | 5,267.9 | 5,765.5 | 175.8 | |||||||||||||||

| Total assets | 247,722.6 | 286,722.1 | 333,718.8 | 365,268.2 | 11,139.6 | |||||||||||||||

| Short-term debts(6) | 36,884.9 | 44,618.2 | 41,176.0 | 36,983.4 | 1,127.9 | |||||||||||||||

| Current portion of long-term debts | 3,213.8 | 6,016.5 | 2,835.5 | 16,843.3 | 513.7 | |||||||||||||||

| Long-term debts(7) | 44,591.7 | 50,166.5 | 55,375.8 | 66,535.1 | 2,029.1 | |||||||||||||||

| Other liabilities(8) | 53,211.8 | 60,176.9 | 78,640.1 | 78,700.1 | 2,400.1 | |||||||||||||||

| Total liabilities | 137,902.2 | 160,978.1 | 178,027.4 | 199,061.9 | 6,070.8 | |||||||||||||||

| Share capital | 76,047.7 | 78,180.3 | 78,715.2 | 79,185.7 | 2,414.9 | |||||||||||||||

| Non-controlling interests | 3,505.7 | 4,128.4 | 8,209.9 | 11,492.5 | 350.5 | |||||||||||||||

| Equity attributable to owners of the Company | 106,314.7 | 121,615.6 | 147,481.5 | 154,713.8 | 4,718.3 | |||||||||||||||

| Cash Flow Data: | ||||||||||||||||||||

| Capital expenditures | (39,029.5 | ) | (29,142.7 | ) | (39,599.0 | ) | (30,280.1 | ) | (923.5 | ) | ||||||||||

| Depreciation and amortization | 23,435.9 | 25,470.9 | 26,350.8 | 29,518.7 | 900.2 | |||||||||||||||

| Net cash inflow from operating activities | 33,038.0 | 41,296.0 | 45,863.5 | 57,548.3 | 1,755.1 | |||||||||||||||

| Net cash outflow from investing activities | (43,817.8 | ) | (29,925.8 | ) | (38,817.9 | ) | (63,351.4 | ) | (1,932.0 | ) | ||||||||||

| Net cash inflow (outflow) from financing activities | 8,455.8 | 12,794.9 | (2,797.0 | ) | 8,636.3 | 263.4 | ||||||||||||||

| As of and for the Year Ended December 31, | ||||||||||||||||||||||||

| IFRS | 2014 (Retrospectively Adjusted)(1) | 2015 (Retrospectively Adjusted)(1) | 2016 (Retrospectively Adjusted)(1) | 2017 (Retrospectively Adjusted)(1) | 2018(2) | |||||||||||||||||||

| NT$ | NT$ | NT$ | NT$ | NT$ | US$ | |||||||||||||||||||

| (in millions, except earnings per share and per ADS data) | ||||||||||||||||||||||||

| Statement of Comprehensive Income Data: | ||||||||||||||||||||||||

| Operating revenues | 256,591.4 | 283,302.5 | 274,884.1 | 290,441.2 | 371,092.4 | 12,123.2 | ||||||||||||||||||

| Operating costs | (203,002.9 | ) | (233,167.3 | ) | (221,696.9 | ) | (237,708.9 | ) | (309,929.4 | ) | (10,125.1 | ) | ||||||||||||

| Gross profit | 53,588.5 | 50,135.2 | 53,187.2 | 52,732.3 | 61,163.0 | 1,998.1 | ||||||||||||||||||

| Operating expenses | (23,942.7 | ) | (25,250.6 | ) | (26,526.8 | ) | (27,513.7 | ) | (34,515.3 | ) | (1,127.5 | ) | ||||||||||||

| Other operating income and expenses, net | 228.7 | (251.5 | ) | (800.3 | ) | 108.6 | 371.6 | 12.1 | ||||||||||||||||

| Profit from operations | 29,874.5 | 24,633.1 | 25,860.1 | 25,327.2 | 27,019.3 | 882.7 | ||||||||||||||||||

| Non-operating income (expense), net | (1,339.4 | ) | 378.7 | 2,108.6 | 5,693.5 | 4,918.4 | 160.7 | |||||||||||||||||

| Profit before income tax | 28,535.1 | 25,011.8 | 27,968.7 | 31,020.7 | 31,937.7 | 1,043.4 | ||||||||||||||||||

| Income tax expense | (5,666.0 | ) | (4,311.1 | ) | (5,390.8 | ) | (6,523.6 | ) | (4,513.4 | ) | (147.5 | ) | ||||||||||||

| Profit for the year | 22,869.1 | 20,700.7 | 22,577.9 | 24,497.1 | 27,424.3 | 895.9 | ||||||||||||||||||

| Attributable to | ||||||||||||||||||||||||

| Owners of the Company | 22,228.6 | 19,732.1 | 21,324.4 | 22,819.1 | 26,220.7 | 856.6 | ||||||||||||||||||

| Non-controlling interests | 640.5 | 968.6 | 1,253.5 | 1,678.0 | 1,203.6 | 39.3 | ||||||||||||||||||

| 22,869.1 | 20,700.7 | 22,577.9 | 24,497.1 | 27,424.3 | 895.9 | |||||||||||||||||||

| Other comprehensive income (loss), net of income tax | 5,504.4 | (147.5 | ) | (7,959.3 | ) | (4,637.9 | ) | (852.6 | ) | (27.8 | ) | |||||||||||||

| Total comprehensive income for the year | 28,373.5 | 20,553.2 | 14,618.6 | 19,859.2 | 26,571.7 | 868.1 | ||||||||||||||||||

| Attributable to | ||||||||||||||||||||||||

| Owners of the Company | 27,394.3 | 19,659.1 | 13,957.0 | 18,524.1 | 25,620.5 | 837.0 | ||||||||||||||||||

| Non-controlling interests | 979.2 | 894.1 | 661.6 | 1,335.1 | 951.2 | 31.1 | ||||||||||||||||||

| 28,373.5 | 20,553.2 | 14,618.6 | 19,859.2 | 26,571.7 | 868.1 | |||||||||||||||||||

| Earnings per common share(3) (4): | ||||||||||||||||||||||||

| Basic | 5.78 | 5.16 | 5.57 | 5.59 | 6.18 | 0.20 | ||||||||||||||||||

| Diluted | 5.57 | 4.95 | 4.66 | 5.19 | 6.07 | 0.20 | ||||||||||||||||||

| Dividends per common share(5) | 1.29 | 2.00 | 1.60 | 1.40 | 2.50 | 0.08 | ||||||||||||||||||

| Earnings per equivalent ADS(3) (4): | ||||||||||||||||||||||||

| Basic | 11.57 | 10.31 | 11.13 | 11.18 | 12.35 | 0.40 | ||||||||||||||||||

| Diluted | 11.14 | 9.90 | 9.31 | 10.38 | 12.14 | 0.40 | ||||||||||||||||||

| Number of common shares(3)(6): | ||||||||||||||||||||||||

| Basic | 3,844.0 | 3,826.4 | 3,831.4 | 4,080.4 | 4,245.2 | 138.7 | ||||||||||||||||||

| Diluted | 4,110.3 | 4,125.0 | 4,142.1 | 4,184.6 | 4,251.1 | 138.9 | ||||||||||||||||||

| Number of equivalent ADSs(3) | ||||||||||||||||||||||||

| Basic | 1,922.0 | 1,913.2 | 1,915.7 | 2,040.2 | 2,122.6 | 69.3 | ||||||||||||||||||

| Diluted | 2,055.2 | 2,062.5 | 2,071.0 | 2,092.3 | 2,125.6 | 69.4 | ||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||||||

| Current assets | 159,955.2 | 156,732.8 | 142,789.7 | 144,938.3 | 201,558.9 | 6,584.7 | ||||||||||||||||||

| Investments - non-current(7) | 2,409.3 | 38,046.6 | 50,853.0 | 49,876.8 | 11,545.9 | 377.2 | ||||||||||||||||||

| Property, plant and equipment | 151,587.1 | 149,997.1 | 143,880.2 | 135,168.4 | 214,592.6 | 7,010.5 | ||||||||||||||||||

| Intangible assets | 11,913.3 | 11,888.6 | 12,107.6 | 11,341.4 | 80,872.1 | 2,642.0 | ||||||||||||||||||

| Long-term prepayments for lease | 2,586.0 | 2,556.2 | 2,237.0 | 8,851.3 | 10,764.8 | 351.7 | ||||||||||||||||||

| Others(8) | 5,267.9 | 5,765.6 | 6,063.1 | 13,746.1 | 14,727.6 | 481.2 | ||||||||||||||||||

| Total assets | 333,718.8 | 364,986.9 | 357,930.6 | 363,922.3 | 534,061.9 | 17,447.3 | ||||||||||||||||||

| Short-term debts(9) | 41,176.0 | 36,983.4 | 20,955.5 | 17,962.5 | 43,263.5 | 1,413.4 | ||||||||||||||||||

| Current portion of long-term debts(10) | 2,835.5 | 16,843.3 | 16,341.1 | 14,441.3 | 10,796.2 | 352.7 | ||||||||||||||||||

| Long-term debts(11) | 55,375.8 | 66,535.1 | 74,354.9 | 44,501.5 | 144,336.9 | 4,715.3 | ||||||||||||||||||

| Other liabilities(12) | 78,640.1 | 78,700.1 | 79,437.9 | 85,706.8 | 116,637.4 | 3,810.5 | ||||||||||||||||||

| Total liabilities | 178,027.4 | 199,061.9 | 191,089.4 | 162,612.1 | 315,034.0 | 10,291.9 | ||||||||||||||||||

| Share capital | 78,715.2 | 79,185.7 | 79,568.0 | 87,380.8 | 43,217.1 | 1,411.9 | ||||||||||||||||||

| Non-controlling interests | 8,209.9 | 11,492.5 | 12,000.6 | 13,190.1 | 17,639.5 | 576.2 | ||||||||||||||||||

7

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| IFRS | 2012 | 2013 | 2014 | 2015 | ||||||||||||||||

| NT$ | NT$ | NT$ | NT$ | US$ | ||||||||||||||||

| (in millions, except earnings per share and per ADS data) | ||||||||||||||||||||

| Segment Data: | ||||||||||||||||||||

| Operating revenues: | ||||||||||||||||||||

| Packaging | 104,298.3 | 112,603.9 | 121,336.5 | 116,607.3 | 3,556.2 | |||||||||||||||

| Testing | 22,657.0 | 24,732.2 | 25,874.7 | 25,191.9 | 768.3 | |||||||||||||||

| Electronic manufacturing services | 62,747.7 | 78,530.6 | 105,784.4 | 138,242.1 | 4,216.0 | |||||||||||||||

| Others | 4,269.4 | 3,995.7 | 3,595.8 | 3,261.2 | 99.4 | |||||||||||||||

| Gross profit: | ||||||||||||||||||||

| Packaging | 19,812.5 | 23,673.7 | 33,040.2 | 30,348.5 | 925.5 | |||||||||||||||

| Testing | 7,601.0 | 9,079.4 | 9,632.0 | 9,025.7 | 275.3 | |||||||||||||||

| Electronic manufacturing services | 7,241.3 | 8,054.3 | 9,118.9 | 9,433.4 | 287.7 | |||||||||||||||

| Others | 1,974.9 | 2,014.6 | 1,797.4 | 1,327.6 | 40.5 | |||||||||||||||

__________________

| As of and for the Year Ended December 31, | ||||||||||||||||||||||||

| IFRS | 2014 (Retrospectively Adjusted)(1) | 2015 (Retrospectively Adjusted)(1) | 2016 (Retrospectively Adjusted)(1) | 2017 (Retrospectively Adjusted)(1) | 2018(2) | |||||||||||||||||||

| NT$ | NT$ | NT$ | NT$ | NT$ | US$ | |||||||||||||||||||

| (in millions, except earnings per share and per ADS data) | ||||||||||||||||||||||||

| Equity attributable to owners of the Company | 147,481.5 | 154,432.4 | 154,840.6 | 188,120.1 | 201,388.4 | 6,579.2 | ||||||||||||||||||

| Cash Flow Data: | ||||||||||||||||||||||||

| Capital expenditures | (39,599.0 | ) | (30,280.1 | ) | (26,714.2 | ) | (24,699.2 | ) | (41,386.4 | ) | (1,352.1 | ) | ||||||||||||

| Depreciation and amortization | 26,350.8 | 29,518.7 | 29,470.4 | 29,205.2 | 42,688.9 | 1,394.6 | ||||||||||||||||||

| Net cash inflow from operating activities | 45,863.5 | 57,548.3 | 52,107.9 | 47,430.8 | 51,074.7 | 1,668.6 | ||||||||||||||||||

| Net cash outflow from investing activities | (38,817.9 | ) | (63,351.4 | ) | (43,159.5 | ) | (16,086.2 | ) | (129,542.3 | ) | (4,232.0 | ) | ||||||||||||

| Net cash inflow (outflow) from financing activities | (2,797.0 | ) | 8,636.3 | (21,087.0 | ) | (19,323.4 | ) | 83,111.4 | 2,715.2 | |||||||||||||||

| Segment Data: | ||||||||||||||||||||||||

| Operating revenues: | ||||||||||||||||||||||||

| Packaging | 121,336.5 | 116,607.3 | 125,282.8 | 126,225.1 | 178,308.2 | 5,825.2 | ||||||||||||||||||

| Testing | 25,874.7 | 25,191.9 | 27,031.8 | 26,157.3 | 35,903.2 | 1,172.9 | ||||||||||||||||||

| Electronic manufacturing services | 105,784.4 | 138,242.1 | 115,395.1 | 133,948.0 | 151,890.4 | 4,962.1 | ||||||||||||||||||

| Others | 3,595.8 | 3,261.2 | 7,174.4 | 4,110.8 | 4,990.6 | 163.0 | ||||||||||||||||||

| Gross profit: | ||||||||||||||||||||||||

| Packaging | 33,040.2 | 30,348.5 | 28,524.6 | 28,785.3 | 33,669.0 | 1,099.9 | ||||||||||||||||||

| Testing | 9,632.0 | 9,025.7 | 9,980.6 | 9,303.6 | 12,289.5 | 401.5 | ||||||||||||||||||

| Electronic manufacturing services | 9,118.9 | 9,433.4 | 11,234.8 | 13,562.5 | 14,278.8 | 466.5 | ||||||||||||||||||

| Others | 1,797.4 | 1,327.6 | 3,447.3 | 1,080.9 | 925.7 | 30.2 | ||||||||||||||||||

| (1) | Financial data for ASE, except for earnings per common share, earnings per equivalent ADS, number of common shares and number of equivalent ADSs which have been retrospectively adjusted to reflect share exchange ratio stated in the Joint Share Exchange Agreement for the years ended December 31, 2014, 2015, 2016 and 2017. For details about the Joint Share Exchange Agreement, see “Item 10. Additional information—Material Contract.” |

| (2) | Financial data for ASEH are derived from the results of: (a) ASE Technology Holding Co., Ltd. and SPIL for the period from April 30, 2018 through December 31, 2018; and (b) ASE, the predecessor entity of ASEH, for the twelve months ended December 31, 2018. |

| (3) | We retrospectively adjusted the earnings per common share, earnings per equivalent ADS, number of common shares and number of equivalent ADSs in accordance with share exchange ratio stated in the Joint Share Exchange Agreement for the years ended December 31, 2014, 2015, 2016 and 2017, which differ from the results included in our annual reports on Form 20-F for the years ended December 31, 2014, 2015, 2016 and 2017. For details about the Joint Share Exchange Agreement, see “Item 10. Additional information—Material Contract.” |

| (4) | The denominators for diluted earnings per common share and diluted earnings per equivalent ADS are calculated to account for the potential diluted factors, such as employees’ compensation, the exercise of options and conversion of our convertible bonds into our common shares. |

| Dividends per common share issued as a cash dividend, a stock dividend and distribution from capital surplus. |

| Represents the weighted average number of shares after retroactive adjustments to give effect to stock |

| Including available-for-sale financial assets — non-current and investments accounted for using the equity method for the years ended December 31, 2014, 2015, 2016 and 2017. Starting from 2018, upon initial application of IFRS 9 “Financial Instruments” (“IFRS 9”), the category includes financial assets at fair value through profit or loss — non-current, financial assets at fair value through other comprehensive income — non-current and investments accounted for using the equity method. See note 3 to our consolidated financial statements included herein for further information regarding the initial application of IFRS 9. |

| Including investment properties, deferred tax assets, other financial assets — non-current and other non-current assets. |

8

| Including short-term bank loans and short-term bills payable. |

| Including current portion of long-term borrowings and current portion of capital lease obligations. |

| (11) | Including bonds payable, long-term borrowings (consisted of bank loans and bills payable) and capital lease obligations. |

| Including (x) current liabilities other than short-term debts and current portion of long-term debts and (y) non-current liabilities other than long-term debts. |

Exchange Rates

Fluctuations in the exchange rate between NT dollars and U.S. dollars will affect the U.S. dollar equivalent of the NT dollar price of our common shares on the Taiwan Stock ExchangeTWSE and, as a result, will likely affect the market price of the ADSs. Fluctuations will also affect the U.S. dollar conversion by the depositary under our ADS deposit agreement referred to below of cash dividends paid in NT dollars on, and the NT dollar proceeds received by the depositary from any sale of, common shares represented by ADSs, in each case, according to the terms of the deposit agreement dated September 29, 2000 and as amended and supplemented from time to time among us, Citibank N.A., as depositary, and the holders and beneficial owners from time to time of the ADSs, which we refer to as the deposit agreement.

The following table sets forth, for the periods indicated, information concerning the number of NT dollars for which one U.S. dollar could be exchanged. The exchange rates reflect the exchange rates set forth in the H.10 statistical release of the Federal Reserve Board.

| Exchange Rate | ||||||||||||||||

Average(1) | High | Low | Period End | |||||||||||||

| 2011 | 29.42 | 30.67 | 28.50 | 30.27 | ||||||||||||

| 2012 | 29.47 | 30.28 | 28.96 | 29.05 | ||||||||||||

| 2013 | 29.73 | 30.20 | 28.93 | 29.83 | ||||||||||||

| 2014 | 30.38 | 31.80 | 29.85 | 31.60 | ||||||||||||

| 2015 | 31.80 | 33.17 | 30.37 | 32.79 | ||||||||||||

| October | 32.44 | 32.81 | 31.92 | 32.46 | ||||||||||||

| November | 32.61 | 32.87 | 32.43 | 32.53 | ||||||||||||

| December | 32.79 | 33.01 | 32.53 | 32.79 | ||||||||||||

| 2016 | ||||||||||||||||

| January | 33.43 | 33.74 | 33.14 | 33.43 | ||||||||||||

| February | 33.24 | 33.51 | 32.95 | 33.22 | ||||||||||||

| March | 32.59 | 33.09 | 32.16 | 32.18 | ||||||||||||

| April (through April 22, 2016) | 32.33 | 32.44 | 32.11 | 32.36 | ||||||||||||

_________________

On April 22, 2016, the exchange rate as set forth in the H.10 weekly statistical release by the Federal Reserve Board was NT$32.36=US$1.00.

8

CAPITALIZATION AND INDEBTEDNESS

Not applicable.

REASON FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

Risks Relating to the SPIL Acquisition

Due to the SPIL Acquisition, our financial and operational results for 2018 may not be comparable with prior periods

ASEH was formed pursuant to the consummation of the Share Exchange on April 30, 2018. ASE is ASEH’s predecessor entity; therefore, the financial and operational results of ASEH for periods before the Share Exchange were prepared under the assumption that ASEH owned 100% shareholdings of ASE. The financial and operational results before April 30, 2018 reflect the business operations of ASE prior to the establishment of ASEH. The financial and operational results for the second quarter of 2018 reflect the business operations of ASE starting from April 1, 2018 and the business operations of ASEH starting from April 30, 2018. The financial and operational results after April 30, 2018, including third quarter and fourth quarter of 2018, reflect the combined operations after the SPIL Acquisition. Therefore, the financial and operational results of these quarters may not be comparable and the consolidated financial information for periods after the SPIL Acquisition may not be comparable with the consolidated financial information for the prior periods. In addition, the audited consolidated financial statements for the year ended December 31, 2018 may not be comparable to that of the prior years.

There may be risks associated with our current holding company structure.

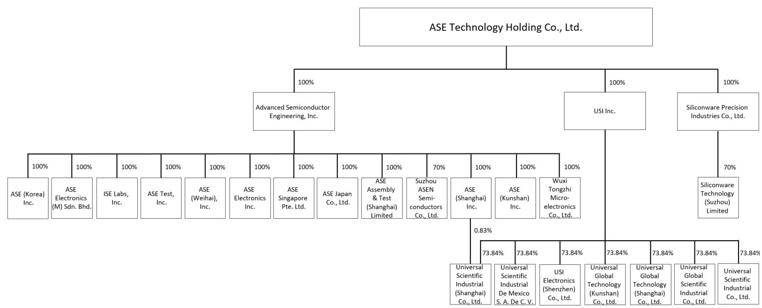

We entered into the Joint Share Exchange Agreement with SPIL in June 2016, pursuant to which ASEH, a holding company in Taiwan, holds 100% of the equity interests in both ASE and SPIL such that ASE and SPIL became wholly owned subsidiaries of ASEH. Other than the aforementioned change in corporate structure, ASE and SPIL maintained independent operations as each did before the consummation of the SPIL Acquisition. The common shares of ASE and SPIL were delisted from the TWSE. The ADSs of ASE and SPIL were delisted from NYSE and NASDAQ, respectively, and became eligible for deregistration under the Exchange Act. Subsequently, the common shares of ASEH were listed on the TWSE, and the ADSs of ASEH were listed on the NYSE. The implementation of such corporate structure restructuring plan may result in contingent risks, including increase in tax liabilities or trading discounts relating to a holding company discount that may become apparent in the future. For details about the Joint Share Exchange Agreement, see “Item 10. Additional Information—Material Contract.”

9

The SAMR Anti-Monopoly Bureau may ultimately take unfavorable actions against us even if we fully comply with the 24 months Hold-Separate conditions.

On November 24, 2017, we received approval from the Ministry of Commerce of the People’s Republic of China (“MOFCOM”) for the Share Exchange under the condition that ASE and SPIL maintain independent operations, among other conditions, for 24 months (“Hold-Separate conditions”). On April 10, 2018, the Anti-Monopoly Bureau under the newly-formed State Administration for Market Regulation (“SAMR”) assumed MOFCOM’s responsibility for antitrust enforcement and continues to monitor our compliance with relevant antitrust laws. While we abide by the Hold-Separate conditions, the Anti-Monopoly Bureau has the authority to and may further impose more restrictive conditions without advance notice.

In the event that the Hold-Separate conditions cannot be satisfied, we may re-evaluate our interest in SPIL and may consider, among other legally permissible alternatives, to dispose our SPIL shares at a loss, which may significantly affect our financial position. If we receive more restrictive antitrust related conditions from the Anti-Monopoly Bureau, we may face greater difficulties in successfully integrating SPIL into our existing organization or in realizing anticipated benefits and cost synergies afterwards. Each of these risks could have a material adverse effect on our business and operations, including our relationship with customers, suppliers, employees and other constituencies, or otherwise adversely affect our financial condition and results of operations.

Risks Relating to Our Business

Since we are dependent on the highly cyclical semiconductor and electronics industries and conditions in the markets for the end-use applications of our products, our revenues and net income may fluctuate significantly.

Our business is affected by market conditions in the highly cyclical semiconductor and electronics industries. Most of our customers operate in this industry, and variations in order levels from our customers and service fee rates may result in volatility in our revenues and net income. From time to time, the semiconductor and electronics industries have experienced significant, and sometimes prolonged, downturns. As our business is, and will continue to be, dependent on the requirements for independent packaging, testing and electronic manufacturing services, any future downturn in the industry would reduce demand for our services. For example, in the fourth quarter of 2008, the global economic crisis resulted in a significant deterioration in demand for our customers’ products, which in turn affected demand for our services and adversely affected our operating results. Although demand has recovered, we expect there to be continued downward pressure on our average selling prices and continued volatility with respect to our sales volumes in the future. If we cannot reduce our costs or adjust our product mix to sufficiently offset any decline in sales volumes, our profitability will suffer, and we may incur losses.

Market conditions in the semiconductor and electronics industries depend to a large degree on conditions in the markets for the end-use applications of various products, such as communications, computing and consumer electronics products. Any deterioration of conditions in the markets for the end-use applications would reduce demand for our services, and would likely have a material adverse effect on our financial condition and results of operations. In 2015,2018, approximately 54.7%49.9%, 11.1%14.0% and 34.2%36.1% of our operating revenues from packaging and testing were attributed to the packaging and testing of semiconductors used in communications, computing and consumer electronics/industrial/automotive/other applications, respectively. In the same year, approximately 53.2%35.7%, 14.3%14.2%, 18.7%34.3%, 8.1%10.0% and 4.9%5.8% of our operating revenues from electronic manufacturing services were attributed to the communications, computing,computers and storage, consumer electronics applications, industrial and automotive applications, respectively. Across end-use applications, our customers face intense competition and significant shifts in demand, which could put pricing pressure on our services and may adversely affect our revenues and net income.

10

A reversal or slowdown in the outsourcing trend for semiconductor packaging and testing services and electronic manufacturing services could adversely affect our growth prospects and profitability.

Semiconductor manufacturers that have their own in-house packaging and testing capabilities, known as integrated device manufacturers and original equipment manufacturers, have increasingly outsourced stages of the production process, including packaging, testing, electronic manufacturing and assembly, to independent companies in order to reduce costs, eliminate product complexity and meet fast-to-market requirements. In addition, the availability of advanced independent semiconductor manufacturing services has also enabled the growth of so-called “fabless” semiconductor companies that focus exclusively on design and marketing and outsource their manufacturing, packaging and testing requirements to independent companies. We cannot assure you that these manufacturers and companies will continue to outsource their packaging, testing and manufacturing requirements to third parties like us. Furthermore, during an economic downturn, these integrated device manufacturers typically rely more on their own in-house packaging and testing capabilities, therefore decreasing their need to outsource. A reversal of, or a slowdown in, this outsourcing trend could result in reduced demand for our services and adversely affect our growth prospects and profitability.

9

Any global economic downturn could adversely affect the demand for our products and services, and a protracted global economic crisis would have a material adverse effect on us.

The global financial markets experienced significant disruptions in 2008 and the United States, Europe and other economies went into recession. The recovery from the lows of 2008 and 2009 was uneven and it is facing new challenges, including a European sovereign debt crisis that began in 2011, a referendum in the United Kingdom in June 2016, in which the majority of voters voted in favor of an exit from the European Union (“Brexit”), and continuing high unemployment rates in much of the world. It is unclear what the long-term impact of the European sovereign debt crisis will be and uncertainty remains over the long-term effects of the expansionary monetary and fiscal policies that have been adopted by the central banks and financial authorities of some of the world’s leading economies. There are also increased uncertainty in the wake of Brexit, which has resulted in downgrade of the credit ratings of the United Kingdom and an increase in volatility in the global financial markets. Any economic downturn or crisis may cause our customers to do the following:

| · | cancel or reduce planned expenditures for our products and services; |

| · | seek to lower their costs by renegotiating their contracts with us; |

| · | consolidate the number of suppliers they use, which may result in our loss of customers; and |

| · | switch to lower-priced products or services provided by our competitors. |

Any uncertainty or significant volatility in global economic conditions may also make it difficult for our customers to accurately forecast and plan future business activities and may have a material adverse effect on us.

If we are unable to compete favorably in the highly competitive markets of semiconductor packaging and testing and electronic manufacturing services, our revenues and net income may decrease.

The markets of semiconductor packaging and testing and electronic manufacturing services are very competitive. We face competition from a number of sources, including other independent semiconductor packaging and testing companies, integrated device manufacturers, and other electronic manufacturing services providers with large-scale manufacturing capabilities who can quickly react to market changes. We believe that the principal competitive factors in our industry are:

| · | technological expertise; |

| · | the ability to provide total solutions to our customers, including integrated design, manufacturing, packaging and testing and electronic manufacturing services; |

| · | ability to offer interconnect technologies at an optimal scale for our businesses; |

11

| · | range of package types and testing platforms available; |

| · | the ability to work closely with our customers at the product development stage; |

| · | responsiveness and flexibility; |

| · | fast-to-market product development; |

| · | capacity; |

| · | diversity in facility locations; |

| · | production yield; and |

10

| · | price. |

We face increasing competition, as most of our customers obtain services from more than one source. Rapid technological advances and aggressive pricing strategies by our competitors may continue to increase competition. Our ability to compete depends on factors both within and outside of our control and may be constrained by the distinct characteristics and production requirements of individual products. We cannot assure you that we will be able to continue to improve production efficiency and maintain reasonable profit for all of our products.

In addition, some of our competitors may have superior financial, marketing, manufacturing, research and development and technological resources than we do. For example, the central government of the PRCP.R.C. as well as provincial and municipal governments have provided various incentives to domestic companies in the semiconductor industry, including major semiconductor testing and packaging providers, such as Jiangsu Changjiang Electronics Technology Co., Ltd. Similarly, our customers may face competition from their competitors in the PRC,P.R.C., and such competitors may also receive significant subsidies from the PRCP.R.C. government. As we are downstream suppliers, the impact of such government policies on competition and price pressure of our customers may negatively impact our own business. Increasing competition may lead to declines in product prices and profitability and could have a material adverse effect on our business, financial condition, results of operations and future prospects.

Our profitability depends on our ability to respond to rapid technological changes in the semiconductor industry.

The semiconductor industry is characterized by rapid increases in the diversity and complexity of semiconductors. As a result, we expect that we will need to constantly offer more sophisticated packaging and testing technologies and processes in order to respond to competitive industry conditions and customer requirements. We have successfully combined our packaging, testing and materials technologies with the expertise of electronic manufacturing services at the systems level to develop our SiP business. SuccessWe also entered into multiple technology license agreements with DECA Technologies Inc. to advance our fan-out technology. There is, however, no assurance that our development efforts for our SiP business or the use of alicensed technology to further advance our fan-out technology will be successful.

Additionally, in August 2018, we resolved to sell our 30.0% equity interest of ASEN to Tsinghua Unigroup Ltd.. We believe the strategic relationship with Tsinghua Unigroup Ltd. will allow us to expand our opportunities in the P.R.C.’s fast-growing semiconductor market. Although we expect this strategic relationship will expand our opportunities in the semiconductor market, we cannot assure you that this relationship will be productive or lead to sustainable commercial success. We continue to develop new product depends on a number of factors such as product acceptance by the market. New products are developed in anticipation of future demand. We cannot assure youHowever, there is no assurance that the launch of any new product will be successful or that whether we will be able to produce sufficient quantities of these products to meet market demand. If we fail to develop, or obtain access to, advances in packaging or testing technologies or processes, we may become less competitive and less profitable. In addition, advances in technology typically lead to declining average selling prices for semiconductors packaged or tested with older technologies or processes. As a result, if we cannot reduce the costs associated with our services, the profitability of a given service and our overall profitability may decrease over time.

12

Our operating results are subject to significant fluctuations, which could adversely affect the market value of your investment.

Our operating results have varied significantly from period to period and may continue to vary in the future. Downward fluctuations in our operating results may result in decreases in the market price of our common shares and the ADSs. Among the more important factors affecting our quarterly and annual operating results are the following:

| · | changes in general economic and business conditions, particularly the cyclical nature of the semiconductor and electronics industries and the markets served by our customers; |

| · | our ability to quickly adjust to unanticipated declines or shortfalls in demand and market prices; |

| · | changes in prices for our products or services; |

| · | volume of orders relative to our packaging, testing and manufacturing capacity; |

| · | changes in costs and availability of raw materials, equipment and labor; |

| · | our ability to obtain or develop substitute raw materials with lower cost; |

| · | our ability to successfully develop or market new products or services; |

11

| · | our ability to successfully manage product mix in response to changes in market demand and differences in margin associated with different products; |

| · | timing of capital expenditures in anticipation of future orders; |

| · | our ability to acquire or design and produce cost-competitive interconnect materials, and provide integrated solutions for electronic manufacturing services; |

| · | fluctuations in the exchange rate between the NT dollar or RMB and foreign currencies, especially the U.S. dollar; and |

| · | typhoons, earthquakes, drought, epidemics, tsunami and other natural disasters, as well as industrial and other incidents such as fires and power outages. |

Due to the factors listed above, our future operating results or growth rates may be below the expectations of research analysts and investors. If so, the market price of our common shares and the ADSs, and thus the market value of your investment, may fall.

Due to our high percentage of fixed costs, we may be unable to maintain our gross margin at past levels if we are unable to achieve relatively high capacity utilization rates.

Our operations, in particular our testing operations, are characterized by relatively high fixed costs. We expect to continue to incur substantial depreciation and other expenses in connection with our acquisitions of equipment and facilities. Our profitability depends not only on the pricing levels for our services or products, but also on utilization rates for our machinery and equipment, commonly referred to as “capacity utilization rates.” In particular, increases or decreases in our capacity utilization rates can significantly affect gross margins since the unit cost generally decreases as fixed costs are allocated over a larger number of units. In periods of low demand, we experience relatively low capacity utilization rates in our operations, which leads to reduced margins. For example, in the fourth quarter of 2008, we experienced lower than anticipated utilization rates in our operations due to a significant decline in worldwide demand for our packaging and testing services, which resulted in reduced margins during that period. Although capacity utilization rates have recovered since 2009, we cannot assure you that we will be able to maintain or surpass our past gross margin levels if we cannot consistently achieve or maintain relatively high capacity utilization rates.

13

If we are unable to manage our expansion or investments effectively, our growth prospects may be limited and our future profitability and core business operations may be adversely affected.

We have significantly expanded our operations through both organic growthacquisitions and acquisitionsjoint ventures in recent years. For example,In 2010, we acquired the controlling interest of Universal Scientific in 2010Industrial to expand our product offering scope to electronic manufacturing services;services. In May 2015, we also entered into a joint venture agreement with TDK Corporation in May 2015 to further expand our business in embedded substrates. WeIn June 2016, we entered into the Joint Share Exchange Agreement with SPIL to take advantage of the synergy effect of business combination between SPIL and ASE. In February 2018, we entered into a joint venture agreement with Qualcomm Incorporated to expand our SiP business. In August 2018, to advance our global supply system and expand our commercial reach in Europe, we entered into an equity transfer agreement with Chung Hong Electronics (Suzhou) Co., Ltd. to acquire its 60.0% equity in its Polish subsidiary Chung Hong Electronics Poland SP.Z.O.O. In August 2018, we also entered into a joint venture framework contract and shareholder agreement with Cancon Information Industry Co., Ltd. to align corporate resources and advance our position in the field of secure and controllable high-performance server products. In October 2018, we entered into a share capital and reserves increase agreement with Jinhua Integrated Circuit Co., Ltd. to jointly invest in Siliconware Electronics (Fujian) Co., Limited to form a strategic alliance to secure stable orders; this agreement however has been paused and will not be continued in the foreseeable future. In January 2019, we entered into a project investment agreement with China Merchants Group of Huizhou Daya Bay Economic and Technological Development Zone of Guangdong Province, to set up a wholly-owned subsidiary in Huizhou Daya Bay Economic and Technological Development Zone to address the growing needs of our capacity expansion and the development of our business in South China.

While we expect that we will continue to expand our operations in the future. The purpose of our expansion is mainlyfuture to provide total solutions to existing customers or to attract new customers and broaden our product range for a variety of end-use applications. However,offerings, rapid expansion may place a strain on our managerial, technical, financial, operational and other resources. As a result of our expansion, we have implemented and will continue to implement additional operational and financial controls and hire and train additional personnel. Any failure to manage our growth effectively could lead to inefficiencies and redundancies and result in reduced growth prospects and profitability.

In addition, we have recently made several investments in the real estate development businesses mostly in China. The PRCP.R.C. property market is volatile and may experience undersupply or oversupply and property price fluctuations. The central and local governments frequently adjust monetary and other fiscal policies to prevent and curtail the overheating of the economy. Such policies may lead to changes in market conditions, including price instability and imbalance of supply and demand in respect of office, residential, retail, entertainment, cultural and intellectual properties. We may continue to make investments in this area in the future and our diversification in this industry may put pressure on our managerial, financial, operational and other resources. Our exposure to risks related to real estate development may also increase over time as a result of our expansion into such a business. There can be no assurance that our investments in such a business will yield the anticipated returns and that our expansion into such a business, including the resulting diversion of management’s attention, will not adversely affect our core business operations.

12

We may not be successful in pursuing mergers and acquisitions. Any mergers or acquisitions we make may lead to a diversion of management resources.

Our future success may depend on acquiring businesses and technologies, making investments or forming joint ventures that complement, enhance or expand our current product offerings or otherwise offer us growth opportunities. In pursuing such acquisitions, we may face competition from other companies in the semiconductor industry. Our ability to acquire or invest in suitable targets may be limited by applicable laws and regulations in Taiwan,the R.O.C., P.R.C., the United States and other jurisdictions where we do business. Even if we are successful in making such acquisitions or investments, we may have to expend substantial amounts of cash, incur debt, assume loss-making divisions and incur other types of expenses. We may also face challenges in successfully integrating any acquired companies into our existing organization or in creating the anticipated cost synergies.synergistic benefits. Each of these risks could have a material adverse effect on our business, financial condition and results of operations.

14

The financial performance of our equity method investments could adversely affect our results of operations.

As part of our business strategy, we have and may continue to pursue acquisitions of businesses and assets, strategic alliances and joint ventures. We currently have equity investments in certain entities and the accounting treatment applied for these investments varies depending on a number of factors, including, but not limited to, our percentage ownership and the level of influence or control we have over the relevant entity. Any losses experienced by these entities could adversely affect our results of operations and the value of our investment. In addition, if these entities were to fail and cease operations, we may lose the entire value of our investment and the stream of any shared profits.

For example, on September 22, 2015, upon the expiration of the Initial SPIL Tender Offer period, we acquired 779,000,000 common shares (including those represented by American depositary shares) of SPIL through the Initial SPIL Tender Offer. We subsequently acquired an additional 258,300,000 common shares of SPIL (including those represented by American depositary shares) through open market purchases in March and April 2016. As of April 28, 2016, we beneficially own 1,037,300,000 common shares of SPIL (calculated as the sum of 935,596,800 common shares of SPIL and 101,703,200 common shares of SPIL underlying 20,340,640 American depositary shares of SPIL), representing 33.29% of the issued and outstanding share capital of SPIL (calculated based on 3,116,361,139 common shares of SPIL (including those represented by American depositary shares) outstanding as of March 31, 2016 as reported in SPIL’s annual report on Form 20-F for the year ended December 31, 2015). See “Item 4. Information on the Company— History and Development of the Company—Acquisition of Common Shares and American Depositary Shares of SPIL.” Although we are currently a 33.29% shareholder of SPIL, we currently do not control SPIL and do not have the power to direct SPIL or its management. As the investment in SPIL is accounted for by the equity method, to the extent that SPIL has net losses, our financial results will be adversely affected to the extent of our pro rata portion of these losses. In addition, as we currently do not control SPIL and do not have the power to direct SPIL or its management, we do not have access to SPIL’s books and records and may not be able to obtain SPIL’s financial information on a timely basis. SPIL’s reporting time for its financial statements may affect our ability to timely report our own financial statements or meet scheduled announcements for earnings releases.

There can be no assurance that we will be able to maintain or enhance the value or performance of our investee companies including SPIL, or that we will achieve the returns or benefits sought from such investments. If our interests differ from those of other investors in our investee companies, we may not be able to enjoy synergies with the investee and it may adversely affect our financial results or financial condition.

We maydid not be successfulrecognize impairment loss in 2016 and 2017 in our acquisitioninvestment using the equity method of 100%accounting. In 2018, we evaluated the recoverable amount of SPIL shares not otherwise ownedour equity method investments, Deca Technologies Inc., by us.

On September 22, 2015, upon the expirationpresent value of the Initial SPIL Tender Offer period,cash flow projection made by equity method investment’s management with a discount rate of 14.1%. The recoverable amount was lower than its carrying amount, therefore, we acquired 779,000,000 common shares (including those represented by American depositary shares)recognized impairment charges of SPIL through the Initial SPIL Tender Offer. In December 2015, following an announcement by SPIL that it plans to issue 1,033NT$521.0 million shares, if approved by SPIL shareholders, to a third party pursuant to a share placement agreement, we submitted a written proposal to SPIL’s Board proposing to acquire all SPIL shares not otherwise owned by ASE, contingent upon the termination of the share purchase agreement, and later launched the Second SPIL Tender Offer on December 29, 2015 to offer to purchase up to 770,000,000 common shares of SPIL (including those represented by American depositary shares). On March 17, 2016, we announced that the Second SPIL Tender Offer was unsuccessful because the Taiwan Fair Trade Commission (the “TFTC”) did not render its decision before the expiration of the Second SPIL Tender Offer. The TFTC subsequently suspended its review on March 23, 2016. Notwithstanding the failure of the Second SPIL Tender Offer, we announced that we will continue to seek to obtain control of SPIL, with the purpose of effecting an acquisition of 100% of the common shares and American depositary shares of SPIL not owned by us (“SPIL Merger”)(US$17.0 million). See “Item 4. Information on the Company— History5. Operating and DevelopmentFinancial Review and Prospects—Operating Results and Trend Information—Critical Accounting Policies and Estimates—Valuation of the Company—Acquisition of Common Shares and American Depositary Shares of SPIL.Investments.”

13

The successful consummation of the SPIL Merger is subject to a number of factors, including, among other things, obtaining all necessary antitrust or other regulatory approvals in Taiwan, the United States and other jurisdictions where we do business. In the event these conditions cannot be satisfied, we may re-evaluate our interest in SPIL and may consider, among other legally permissible alternatives, to dispose our SPIL shares at a loss, which may significantly affect our financial position. In addition, the interest we acquired in SPIL from the Initial SPIL Tender Offer is currently being reviewed by the ROC court. See “Item 8. Financial Information—Consolidated Statements and Other Financial Information—Legal Proceedings” for more information. If a dismissal is not granted or a settlement is not reached, such a lawsuit could result in substantial costs to ASE and divert management’s attention and resources, which may cause a material adverse effect on our results of operations, financial condition and business. We are also unable to quantify the harm to our reputation should any adverse findings be made against us. If our interest in SPIL from the Initial Tender Offer is voided by ROC courts, we may not realize the anticipated synergies, cost savings and benefits and growth opportunities that would otherwise have resulted from our acquisition of 779,000,000 common shares of SPIL.

Notwithstanding the above, even if we are successful in consummating the SPIL Merger, we may face challenges in successfully integrating SPIL into our existing organization or in realizing anticipated benefits and cost synergies. Each of these risks could have a material adverse effect on our business and operations, including our relationship with customers, suppliers, employees and other constituencies, or otherwise adversely affect our financial condition and results of operations.

There may be risks associated with the proposed holding company structure.

We announced in March 2016 that upon the successful completion of the SPIL Merger, we plan to establish a holding company in Taiwan that will hold 100% of the equity interests in both ASE and SPIL such that ASE and SPIL will be wholly owned subsidiaries of such holding company. The proposed holding company will maintain all current operations of ASE and SPIL in Taiwan. The implementation of such corporate structure restructuring plan may require approvals from relevant regulators and may result in unforeseen contingent risks, including increase in tax liabilities or trading discounts relating to a holding company discount that may become apparent in the future.

The packaging and testing businesses are capital intensive. If we cannot obtain additional capital when we need it, our growth prospects and future profitability may be adversely affected.

The packaging and testing business is capital intensive. We will need capital to fund the expansion of our facilities as well as fund our research and development activities in order to remain competitive. We believe that our existing cash, marketable securities, expected cash flow from operations and existing credit lines under our loan facilities will be sufficient to meet our capital expenditures, working capital, cash obligations under our existing debt and lease arrangements, and other requirements for at least the next twelve months.However, future capacity expansions or market or other developments may cause us to require additional funds. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including:

| · | our future financial condition, results of operations and cash flows; |

| · | general market conditions for financing activities by semiconductor or electronics companies; and |

| · | economic, political and other conditions in Taiwan and elsewhere. |

If we are unable to obtain funding in a timely manner or on acceptable terms, our results of operations and financial conditions may be materially and adversely affected.

14

Restrictive covenants and broad default provisions in our existing debt agreements may materially restrict our operations as well as adversely affect our liquidity, financial condition and results of operations.

We are a party to numerous loans and other agreements relating to the incurrence of debt, many of which may include restrictive covenants and broad default provisions. In general, covenants in the agreements governing our existing debt, and debt we may incur in the future, may materially restrict our operations, including our ability to incur debt, pay dividends, make certain investments and payments, other than in connection with restructurings of consolidated entities, and encumber or dispose of assets. In addition, any global economic deterioration or ineffective expansion may cause us to incur significant net losses or force us to assume considerable liabilities. We cannot assure you that we will be able to remain in compliance with our financial covenants, which, as a result, may lead to a default. This may thereby restrict our ability to access unutilized credit facilities or the global capital markets to meet our liquidity needs. Furthermore, a default under oneany agreement by us or one of our subsidiaries may also trigger cross-defaults under our other agreements. In the event of default, we may not be able to cure the default or obtain a waiver on a timely basis. An event of default under any agreement timely governing our existing or future debt, if not cured or waived, could have a material adverse effect on our liquidity, financial condition and results of operations.

15

We have on occasion failed to comply with certain financial covenants in some of our loan agreements. Such non-compliance may also have, through broadly worded cross-default provisions, resulted in default under some of the agreements governing our other existing debt. For example, we failed to comply with certain financial covenants in some of our loan agreements as a result of our acquisition of the controlling interest of Universal Scientific Industrial in February 2010, for which we have timely obtained waivers from our counterparties. If we are unable to timely remedyrectify any of ourpossible non-compliance under such loan agreements or obtain applicable waivers or amendments, we would breach our financial covenants and our financial condition would be adversely affected. As of December 31, 2015,2018, we were not in breach of any of the financial covenants under our existing loan agreements, although we cannot provide any assurance that we will not breach any of such financial covenants in the future.

We depend on select personnel and could be affected by the loss of their services.

We depend on the continued service of our executive officers and skilled technical personnel. Our business could suffer if we lose the services of any of these personnel and cannot adequately replace them. Although some of these management personnel have entered into employment agreements with us, they may nevertheless leave before the expiration of these agreements. We are not insured against the loss of the services of any of our personnel. In addition, these proceedings may divert these and other employees’ attention from our business operations.

In addition, we may be required to increase substantially the number of these employees in connection with our expansion plans, and there is intense competition for their services in this industry. We may not be able to either retain our present personnel or attract additional qualified personnel as and when needed. In addition, we may need to increase employee compensation levels in order to attract and retain our existing officers and employees and the additional personnel that we expect to require. Furthermore, a portion of the workforce at our facilities in Taiwan are foreign workers employed by us under work permits, which are subject to government regulations on renewal and other terms. Consequently, our business could also suffer if the Taiwan regulations relating to the employment of foreign workers were to become significantly more restrictive or if we are otherwise unable to attract or retain these workers at a reasonable cost.

The ongoing proceeding involving Dr. Tien Wu may have an adverse impact on our business and cause our common shares and ADS price to decline.