UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-16125

(Exact name of Registrant as specified in its charter)

Advanced Semiconductor Engineering, Inc.ASE Technology Holding Co., Ltd.

(Translation of Registrant’s Name into English)

REPUBLIC OF CHINA

(Jurisdiction of Incorporation or Organization)

26 Chin Third Road

Nantze Export Processing Zone

Nantze, Kaohsiung, Taiwan

Republic of China

(Address of Principal Executive Offices)

Joseph Tung

Room 1901, No. 333, Section 1 Keelung Rd.

Taipei, Taiwan, 110

Republic of China

Tel: 886-2-6636-5678

Fax: 882-2-2757-6121

Email:ir@aseglobal.com

(Name, Telephone, Email and/or Facsimile numberNumber and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on which Registered |

| Common Shares, par value NT$10.00 each | ASX | The New York Stock Exchange* |

*Traded in the form of American Depositary Receipts evidencing American Depositary Shares (the “ADSs”), each

representing fivetwo common shares of Advanced Semiconductor Engineering, Inc.ASE Technology Holding Co., Ltd.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

7,944,875,346As of December 31, 2019, 4,329,883,632 Common Shares, par value NT$10 each*each were outstanding.**

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☒ No ☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☐☒ No ☒☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and large accelerated filer”“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☒ | Accelerated filer ☐ | Non-accelerated filer ☐ | Emerging growth company ☐ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

** As a result of the exercise of employee stock options subsequent to December 31, 2016,2019, as of MarchJanuary 31, 2017,2020, we had 8,273,546,046 shares4,331,603,182 Common Shares outstanding.

Page

i

ii

Unless the context otherwise requires, references in this annual report to:

| · | “2018 Convertible Bonds” are to US$400.0 million Zero Coupon Convertible Bonds due September 5, 2018, issued by the Company; |

| · | “2018 NTD-linked Convertible Bonds” are to US$200.0 million NTD-linked Zero Coupon Convertible Bonds due March 27, 2018, issued by the Company; |

| · | “ASDI” are to ASDI Assistance Direction S.A.S., a simplified limited liability company (société par actions simplifiée) organized under the laws of France; | |

| · | “ASE,” |

| · | “ASE Chung Li” are to ASE (Chung Li) Inc., a company previously incorporated under the laws of the |

| · | “ASE Electronics” are to ASE Electronics Inc., a company incorporated under the laws of the |

| · | “ASE Japan” are to ASE Japan Co. Ltd., a company incorporated under the laws of Japan; |

| · | “ASE Korea” are to ASE (Korea) Inc., a company incorporated under the laws of the Republic of Korea; |

| · | “ASE Material” are to ASE Material Inc., a company previously incorporated under the laws of the |

| · | “ASE Shanghai” are to ASE (Shanghai) Inc., a company incorporated under the laws of the |

| · | “ASE Test” are to ASE Test Limited, a company incorporated under the laws of Singapore; |

| · | “ASE |

| · | “ASE Test Taiwan” are to ASE Test, Inc., a company incorporated under the laws of the |

| · | “ASEEE” are to ASE Embedded Electronics Inc., a company incorporated under the laws of the R.O.C.; |

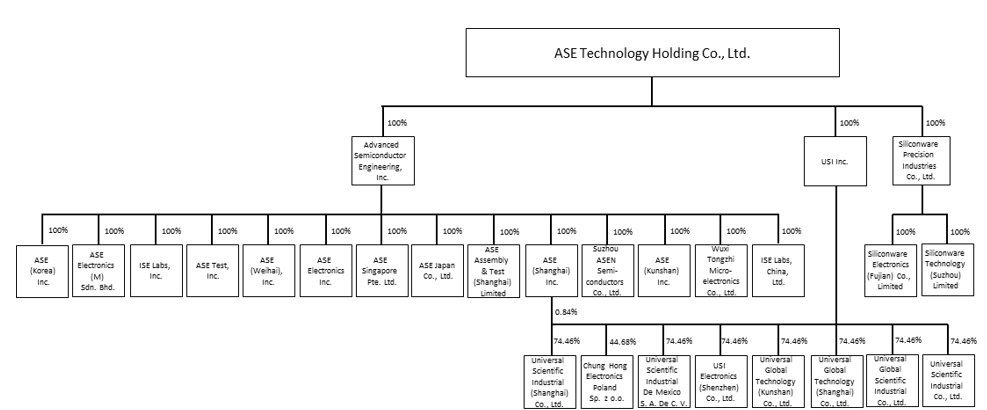

| · | “ASEH,” the “Company,” “ASE Technology Holding,” “we,” “us” or “our” are to ASE Technology Holding Co., Ltd. and, unless the context requires otherwise, its subsidiaries; |

| · | “ASEKS” are to ASE (KunShan) Inc., a company incorporated under the laws of the |

| · | “ASEN” are to Suzhou ASEN Semiconductors Co., Ltd., a company incorporated under the laws of the |

| · | “ASESH AT” are to ASE Assembly & Test (Shanghai) Limited, formerly known as Global Advanced Packaging Technology Limited, or GAPT, a company incorporated under the laws of the |

1

| · | “ASEWH” are to ASE (Weihai), Inc., a company incorporated under the laws of the |

| · | “ |

1

| · | “Deposit Agreement” are to the deposit agreement, dated |

| · | “EEMS Test Singapore” are to EEMS Test Singapore Pte. Ltd., a company incorporated under the laws of Singapore, which changed its name to ASE Singapore II Pte. Ltd. and was subsequently merged into ASE Singapore Pte. Ltd. on January 1, 2011; |

| · | “EMS” are to electronic manufacturing services; |

| · | “EU” are to the European Union; | |

| · | “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended; |

| · | “FAFG” are to Financiere AFG S.A.S., a simplified limited liability company (société par actions simplifiée) organized under the laws of France; |

| · | “FSC” are to the Financial Supervisory Commission of the Republic of China; |

| · | “Green Bonds” are to US$300.0 million 2.125% Guaranteed Bonds due July 24, 2017, offered by Anstock II Limited, our wholly owned subsidiary incorporated in the Cayman |

| · | “Hung Ching” are to Hung Ching Development & Construction Co. Ltd., a company incorporated under the laws of the |

| · | “IFRS” are to International Financial Reporting Standards, International Accounting Standards and Interpretations as issued by the International Accounting Standards Board; |

| · | “ISE Shanghai” are to ISE Labs, China, Ltd., a company incorporated under the laws of the P.R.C.; | |

| · | “ISE Labs” are to ISE Labs, Inc., a corporation incorporated under the laws of the State of California; |

| · | “Initial SPIL Tender Offer” are to ASE’s offer to purchase 779,000,000 common shares (including common shares represented by outstanding American depositary shares) of SPIL through concurrent tender offers in the |

| · | “Joint Share Exchange Agreement” are to the joint share exchange agreement entered into between ASE and SPIL on June 30, 2016; |

| · | “Korea” or “South Korea” are to the Republic of Korea; |

| · | “Mainland Investors Regulations” are to the Regulations Governing Securities Investment and Futures Trading in Taiwan by Mainland Area Investors; |

| · | “MOEAIC” are to Investment Commission, the |

2

| · | “NYSE” are to New York Stock Exchange; |

| · | “PowerASE” are to PowerASE Technology, Inc., a company incorporated under the laws of the |

| · | “ |

| · | “P.R.C.” are to the People’s Republic of China and excludes Taiwan, Macau and Hong Kong; |

| · | “ |

| · | “QDII” are to qualified domestic institutional investors; |

| · | “Republic of China”, the |

2

| · | “ |

| · | “SEC” are to the Securities and Exchange Commission of the U.S.; |

| · | “Second SPIL Tender Offer” are to ASE’s offer to purchase 770,000,000 common shares (including common shares represented by outstanding American depositary shares) of SPIL through concurrent tender offers in the |

| · | “Securities Act” are to the U.S. Securities Act of 1933, as amended; |

| · | “SF” are to Siliconware Electronics (Fujian) Co., Limited, a company incorporated under the laws of the P.R.C.; |

| · | “Share Exchange” is the statutory share exchange pursuant to the laws of the Republic of China, through which ASEH (i) acquired all issued shares of ASE in exchange for shares of ASEH using the share exchange ratio as described in “Item 10. Additional information—Material Contract” and (ii) acquired all issued shares of SPIL using the cash consideration as described in “Item 10. Additional information—Material Contract”; |

| · | “SiP” are to system-in-package; |

| · | “SPIL” or “SPIL Group” are to Siliconware Precision Industries Co., |

| · | “SPIL Acquisition” are to |

3

| · | “SZ” are to Siliconware Technology (Suzhou) Limited, a company incorporated under the laws of the P.R.C.; |

| · | “Taiwan-IFRS” are to the Regulations Governing the Preparation of Financial Reports by Securities Issuers, the IFRS as well as related guidance translated by Accounting Research and Development Foundation and endorsed by the FSC; |

| · | “Tessera” are to Tessera Technologies, Inc. |

| · | “TWSE” are to Taiwan Stock Exchange; |

| · | “UGJQ” are to Universal Global Technology (Shanghai) Co., Ltd., a company incorporated under the laws of the |

| · | “UGKS” are to Universal Global Technology (Kunshan) Co. Ltd., a company incorporated under the laws of the |

| · | “UGPL” are to Chung Hong Electronics Poland Sp. z o.o., a company incorporated under the laws of Poland; |

| · | “UGTW” are to Universal Global Scientific Industrial Co. Ltd., a company incorporated under the laws of the |

| · | “Universal |

| · | “USIFR” are to Universal Scientific Industrial (France), a simplified limited liability company (société par actions simplifiée) organized under the laws of France; |

| · | “USI Shanghai” are to Universal Scientific Industrial (Shanghai) Co., Ltd., a company incorporated under the laws of the |

| · | “U.S.” refers to the United States of America; |

| · | “U.S. GAAP” are to accounting principles generally accepted in the U.S.; | |

| · | “USI Group” are to USI Inc. and its subsidiaries. Prior to the 2016 USI Group Restructuring, USI Group are to USI Industrial and its subsidiaries; | |

| · | “USI Inc.” are to USI Inc., a company incorporated under the laws of the | |

| · | “USI Mexico” are to Universal Scientific Industrial | |

| · | “USISZ” are to | |

| · | “Wuxi Tongzhi” are to Wuxi Tongzhi Microelectronics Co., Ltd., a company incorporated under the laws of the | |

3

We publish our financial statements in New Taiwan dollars, the lawful currency of the ROC.R.O.C. In this annual report, references to “United States dollars,” “U.S. dollars” and “US$” are to the currency of the United States; references to “New Taiwan dollars,” “NT dollars” and “NT$” are to the currency of the ROC;R.O.C.; references to “RMB” are to the currency of the PRC;P.R.C.; references to “JP¥” are to the currency of Japan; references to “MYR” are to the currency of Malaysia; references to “SGD” are to the currency of the Republic of Singapore; references to “KRW” are to the currency of the Republic of Korea; and references to “EUR” are to the currency of the European Union.EU; and references to “PLN” are to the currency of the Poland. Unless otherwise noted, all translations from NT dollars to U.S. dollars were made at the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve System of the United States (the “Federal Reserve Board”) as of December 30, 2016,31, 2019, which was NT$32.40=29.91=US$1.00, and all translations from RMB to U.S. dollars were made at the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve Board as of December 30, 2016,31, 2019, which was RMB6.9430=RMB6.9618=US$1.00. All amounts translated into U.S. dollars in this annual report are provided solely for your convenience and no representation is made that the NT dollar, RMB or U.S. dollar amounts referred to herein could have been or could be converted into U.S. dollars or NT dollars/RMB, as the case may be, at any particular rate or at all. On April 14, 2017,March 13, 2020, the exchange rate between NT dollars and U.S. dollars as set forth in the H.10 weekly statistical release by the Federal Reserve Board was NT$30.31=30.13=US$1.00. On April 14, 2017,March 13, 2020, the exchange rate between RMB and U.S. dollars as set forth in the H.10 weekly statistical release by the Federal Reserve Board was RMB6.8835 =US$RMB7.0079=US$1.00.

4

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Although these forward-looking statements, which may include statements regarding our future results of operations, financial condition or business prospects, are based on our own information and information from other sources we believe to be reliable, you should not place undue reliance on these forward-looking statements, which apply only as of the date of this annual report. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to identify these forward-looking statements in this annual report. Our actual results of operations, financial condition or business prospects may differ materially from those expressed or implied in these forward-looking statements for a variety of reasons, including risks associated with cyclicality and market conditions in the semiconductor or electronics industry; changes in our regulatory environment, including our ability to comply with new or stricter environmental regulations and to resolve environmental liabilities; demand for the outsourced semiconductor packaging, testing and electronic manufacturing servicesEMS we offer and for such outsourced services generally; the highly competitive semiconductor or manufacturing industry we are involved in; our ability to introduce new technologies in order to remain competitive; international business activities; our business strategy; our future expansion plans and capital expenditures; the uncertainties as to whether we can complete the share exchange contemplated by the Joint Share Exchange Agreement between us and SPIL; the strained relationship between the ROCR.O.C. and the PRC;P.R.C.; general economic and political conditions; the recent global economic crisis; possible disruptions in commercial activities caused by natural or human-induced disasters; fluctuations in foreign currency exchange rates; and other factors. For a discussion of these risks and other factors, see “Item 3. Key Information—Risk Factors.”

5

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

The following tables present selected consolidated financial data for ASEH as of and for the years ended December 31, 2018 and 2019, and ASE as of and for the years ended December 31, 2015, 2016 and 2017.

The selected consolidated statements of comprehensive income data and cash flow data for the years ended December 31, 2014, 20152017, 2018 and 2016,2019, and the selected consolidated balance sheet data as of December 31, 20152018 and 20162019 set forth below are derived from our audited consolidated financial statements included in this annual report and should be read in conjunction with, and are qualified in their entirety by reference to, these consolidated financial statements, including the notes thereto. The selected consolidated statements of comprehensive income data and cash flow data for the yearyears ended December 31, 20122015 and 20132016 and the selected consolidated balance sheet data as of December 31, 20122015 and 20132016 and 2017 set forth below are derived from our audited consolidated financial statements not included herein.

Our consolidated financial statements have been prepared and presented in accordance with IFRS. Until and including our consolidated financial statements included in our annual report on Form 20-F for the year ended December 31, 2012, we prepared our consolidated financial statements in accordance with ROC GAAP with reconciliations to U.S. GAAP.

We adopted IFRS for certain filings with the SEC, starting from the filing of our annual report on Form 20-F for the year ended December 31, 2013. Historical financial results as of and for the year ended December 31, 2012 included herein have been adjusted and presented in accordance with IFRS, which differs from the results included in our annual report on Form 20-F for the year ended December 31, 2012. Meanwhile, as required by the FSC, we adopted Taiwan-IFRS for reporting of our annual and interim consolidated financial statements in the ROC beginning on January 1, 2013. Taiwan-IFRS differs from IFRS in certain respects, including, but not limited to the extent that any new or amended standards or interpretations applicable under IFRS may not be timely endorsed by the FSC.

Following our adoption of IFRS for SEC filing purposes, pursuant to the rule amendments adopted by the SEC that became effective on March 4, 2008, we were no longer required to reconcile our consolidated financial statements with U.S. GAAP.

| As of and for the Year Ended December 31, | |||||||||||

| IFRS | 2015 (Retrospectively Adjusted)(1) | 2016 (Retrospectively Adjusted)(1) | 2017 (Retrospectively Adjusted)(1) | 2018(2) | 2019 | ||||||

| NT$ | NT$ | NT$ | NT$ | NT$ | US$ | ||||||

| (in millions, except earnings per share and per ADS data) | |||||||||||

| Statement of Comprehensive Income Data: | |||||||||||

| Operating revenues | 283,302.5 | 274,884.1 | 290,441.2 | 371,092.4 | 413,182.2 | 13,814.2 | |||||

| Operating costs | (233,167.3) | (221,696.9) | (237,708.9) | (309,929.4) | (348,871.4) | (11,664.0) | |||||

| Gross profit | 50,135.2 | 53,187.2 | 52,732.3 | 61,163.0 | 64,310.8 | 2,150.2 | |||||

| Operating expenses | (25,250.6) | (26,526.8) | (27,513.7) | (34,515.3) | (40,784.4) | (1,363.6) | |||||

| Other operating income and expenses, net | (251.5) | (800.3) | 108.6 | 371.6 | (268.6) | (9.0) | |||||

| Profit from operations | 24,633.1 | 25,860.1 | 25,327.2 | 27,019.3 | 23,257.8 | 777.6 | |||||

| Non-operating income, net | 378.7 | 2,108.6 | 5,693.5 | 4,918.4 | 22.0 | 0.7 | |||||

| Profit before income tax | 25,011.8 | 27,968.7 | 31,020.7 | 31,937.7 | 23,279.8 | 778.3 | |||||

| Income tax expense | (4,311.1) | (5,390.8) | (6,523.6) | (4,513.4) | (5,011.2) | (167.5) | |||||

| Profit for the year | 20,700.7 | 22,577.9 | 24,497.1 | 27,424.3 | 18,268.6 | 610.8 | |||||

| Attributable to | |||||||||||

| Owners of the Company | 19,732.1 | 21,324.4 | 22,819.1 | 26,220.7 | 17,060.6 | 570.4 | |||||

| Non-controlling interests | 968.6 | 1,253.5 | 1,678.0 | 1,203.6 | 1,208.0 | 40.4 | |||||

| 20,700.7 | 22,577.9 | 24,497.1 | 27,424.3 | 18,268.6 | 610.8 | ||||||

| Other comprehensive loss, net of income tax | (147.5) | (7,959.3) | (4,637.9) | (852.6) | (4,370.6) | (146.1) | |||||

| Total comprehensive income for the year | 20,553.2 | 14,618.6 | 19,859.2 | 26,571.7 | 13,898.0 | 464.7 | |||||

| Attributable to | |||||||||||

| Owners of the Company | 19,659.1 | 13,957.0 | 18,524.1 | 25,620.5 | 13,122.2 | 438.7 | |||||

| Non-controlling interests | 894.1 | 661.6 | 1,335.1 | 951.2 | 775.8 | 26.0 | |||||

| 20,553.2 | 14,618.6 | 19,859.2 | 26,571.7 | 13,898.0 | 464.7 | ||||||

| Earnings per common share(3): | |||||||||||

| Basic | 5.16 | 5.57 | 5.59 | 6.18 | 4.01 | 0.13 | |||||

| Diluted | 4.95 | 4.66 | 5.19 | 6.07 | 3.91 | 0.13 | |||||

| Dividends per common share(4) | 2.00 | 1.60 | 1.40 | 2.50 | 2.50 | 0.08 | |||||

| Earnings per equivalent ADS(3)(4): | |||||||||||

| Basic | 10.31 | 11.13 | 11.18 | 12.35 | 8.02 | 0.27 | |||||

| Diluted | 9.90 | 9.31 | 10.38 | 12.14 | 7.82 | 0.26 | |||||

| Number of common shares(3)(6): | |||||||||||

| Basic | 3,826.4 | 3,831.4 | 4,080.4 | 4,245.2 | 4,252.0 | 4,252.0 | |||||

| Diluted | 4,125.0 | 4,142.1 | 4,184.6 | 4,251.1 | 4,262.8 | 4,262.8 | |||||

| Number of equivalent ADSs(3): | |||||||||||

| Basic | 1,913.2 | 1,915.7 | 2,040.2 | 2,122.6 | 2,126.0 | 2,126.0 | |||||

| Diluted | 2,062.5 | 2,071.0 | 2,092.3 | 2,125.6 | 2,131.4 | 2,131.4 | |||||

6

| As of and for the Year Ended December 31, | ||||||||||||||||||||||||

| IFRS | 2012 | 2013 | 2014 | 2015 (Retrospectively Adjusted) | 2016 | |||||||||||||||||||

| NT$ | NT$ | NT$ | NT$ | NT$ | US$ | |||||||||||||||||||

| (in millions, except earnings per share and per ADS data) | ||||||||||||||||||||||||

| Statement of Comprehensive Income Data: | ||||||||||||||||||||||||

| Operating revenues | 193,972.4 | 219,862.4 | 256,591.4 | 283,302.5 | 274,884.1 | 8,484.1 | ||||||||||||||||||

| Operating costs | (157,342.7 | ) | (177,040.4 | ) | (203,002.9 | ) | (233,167.3 | ) | (221,689.9 | ) | (6,842.3 | ) | ||||||||||||

| Gross profit | 36,629.7 | 42,822.0 | 53,588.5 | 50,135.2 | 53,194.2 | 1,641.8 | ||||||||||||||||||

| Operating expenses | (18,922.6 | ) | (20,760.4 | ) | (23,942.7 | ) | (25,250.6 | ) | (26,485.7 | ) | (817.5 | ) | ||||||||||||

| Other operating income and expenses, net | 83.2 | (1,348.2 | ) | 228.7 | (251.5 | ) | (800.3 | ) | (24.7 | ) | ||||||||||||||

| Profit from operations | 17,790.3 | 20,713.4 | 29,874.5 | 24,633.1 | 25,908.2 | 799.6 | ||||||||||||||||||

| Non-operating income (expense), net(1) | (1,181.6 | ) | (1,343.6 | ) | (1,339.4 | ) | 378.7 | 2,116.9 | 65.4 | |||||||||||||||

| Profit before income tax | 16,608.7 | 19,369.8 | 28,535.1 | 25,011.8 | 28,025.1 | 865.0 | ||||||||||||||||||

| Income tax expense | (2,960.4 | ) | (3,499.6 | ) | (5,666.0 | ) | (4,311.1 | ) | (5,390.8 | ) | (166.4 | ) | ||||||||||||

| Profit for the year | 13,648.3 | 15,870.2 | 22,869.1 | 20,700.7 | 22,634.3 | 698.6 | ||||||||||||||||||

| Attributable to | ||||||||||||||||||||||||

| Owners of the Company | 13,191.6 | 15,404.5 | 22,228.6 | 19,732.1 | 21,361.6 | 659.3 | ||||||||||||||||||

| Non-controlling interests | 456.7 | 465.7 | 640.5 | 968.6 | 1,272.7 | 39.3 | ||||||||||||||||||

| 13,648.3 | 15,870.2 | 22,869.1 | 20,700.7 | 22,634.3 | 698.6 | |||||||||||||||||||

| Other comprehensive income (loss), net of income tax | (3,830.7 | ) | 3,233.3 | 5,504.4 | (147.5 | ) | (7,959.3 | ) | (245.7 | ) | ||||||||||||||

| Total comprehensive income for the year | 9,817.6 | 19,103.5 | 28,373.5 | 20,553.2 | 14,675.0 | 452.9 | ||||||||||||||||||

| Attributable to | ||||||||||||||||||||||||

| Owners of the Company | 9,420.4 | 18,509.6 | 27,394.3 | 19,659.1 | 13,994.1 | 431.9 | ||||||||||||||||||

| Non-controlling interests | 397.2 | 593.9 | 979.2 | 894.1 | 680.9 | 21.0 | ||||||||||||||||||

| 9,817.6 | 19,103.5 | 28,373.5 | 20,553.2 | 14,675.0 | 452.9 | |||||||||||||||||||

| Earnings per common share(1) (2): | ||||||||||||||||||||||||

| Basic | 1.77 | 2.05 | 2.89 | 2.58 | 2.79 | 0.09 | ||||||||||||||||||

| Diluted | 1.73 | 1.99 | 2.79 | 2.48 | 2.33 | 0.07 | ||||||||||||||||||

| Dividends per common share(3) | 2.05 | 1.05 | 1.29 | 2.00 | 1.60 | 0.05 | ||||||||||||||||||

| Earnings per equivalent ADS(1) (2): | ||||||||||||||||||||||||

| Basic | 8.86 | 10.26 | 14.46 | 12.89 | 13.94 | 0.43 | ||||||||||||||||||

| Diluted | 8.65 | 9.96 | 13.93 | 12.38 | 11.67 | 0.36 | ||||||||||||||||||

| Number of common shares(4): | ||||||||||||||||||||||||

| Basic | 7,445.5 | 7,508.5 | 7,687.9 | 7,652.8 | 7,662.9 | 7,662.9 | ||||||||||||||||||

| Diluted | 7,568.2 | 7,747.6 | 8,220.7 | 8,250.1 | 8,284.1 | 8,284.1 | ||||||||||||||||||

| Number of equivalent ADSs | ||||||||||||||||||||||||

| Basic | 1,489.1 | 1,501.7 | 1,537.6 | 1,530.6 | 1,532.6 | 1,532.6 | ||||||||||||||||||

| Diluted | 1,513.6 | 1,549.5 | 1,644.1 | 1,650.0 | 1,656.8 | 1,656.8 | ||||||||||||||||||

| Balance Sheet Data: | ||||||||||||||||||||||||

| Current assets | 97,495.6 | 132,176.5 | 159,955.2 | 156,732.8 | 142,789.7 | 4,407.1 | ||||||||||||||||||

| Investments - non-current(1)(5) | 2,267.8 | 2,345.5 | 2,409.3 | 38,046.6 | 50,861.3 | 1,569.8 | ||||||||||||||||||

| Property, plant and equipment, net | 127,197.8 | 131,497.3 | 151,587.1 | 149,997.1 | 143,880.2 | 4,440.7 | ||||||||||||||||||

| Intangible assets | 12,361.3 | 11,953.6 | 11,913.3 | 11,888.6 | 12,119.9 | 374.1 | ||||||||||||||||||

| Long-term prepayment for lease | 4,164.1 | 4,072.3 | 2,586.0 | 2,556.2 | 2,237.0 | 69.0 | ||||||||||||||||||

| Others(6) | 4,236.0 | 4,676.9 | 5,267.9 | 5,765.6 | 6,063.1 | 187.2 | ||||||||||||||||||

| Total assets(1) | 247,722.6 | 286,722.1 | 333,718.8 | 364,986.9 | 357,951.2 | 11,047.9 | ||||||||||||||||||

| Short-term debts(7) | 36,884.9 | 44,618.2 | 41,176.0 | 36,983.4 | 20,955.5 | 646.8 | ||||||||||||||||||

| Current portion of long-term debts | 3,213.8 | 6,016.5 | 2,835.5 | 16,843.3 | 16,341.1 | 504.3 | ||||||||||||||||||

| Long-term debts(8) | 44,591.7 | 50,166.5 | 55,375.8 | 66,535.1 | 74,354.9 | 2,294.9 | ||||||||||||||||||

| Other liabilities(9) | 53,211.8 | 60,176.9 | 78,640.1 | 78,700.1 | 79,437.9 | 2,451.8 | ||||||||||||||||||

| Total liabilities | 137,902.2 | 160,978.1 | 178,027.4 | 199,061.9 | 191,089.4 | 5,897.8 | ||||||||||||||||||

| Share capital | 76,047.7 | 78,180.3 | 78,715.2 | 79,185.7 | 79,568.0 | 2,455.8 | ||||||||||||||||||

| Non-controlling interests | 3,505.7 | 4,128.4 | 8,209.9 | 11,492.5 | 11,984.0 | 369.9 | ||||||||||||||||||

| Equity attributable to owners of the Company(1) | 106,314.7 | 121,615.6 | 147,481.5 | 154,432.4 | 154,877.8 | 4,780.2 | ||||||||||||||||||

| Cash Flow Data: | ||||||||||||||||||||||||

| Capital expenditures | (39,029.5 | ) | (29,142.7 | ) | (39,599.0 | ) | (30,280.1 | ) | (26,714.2 | ) | (824.5 | ) | ||||||||||||

| Depreciation and amortization | 23,435.9 | 25,470.9 | 26,350.8 | 29,518.7 | 29,422.3 | 908.1 | ||||||||||||||||||

| Net cash inflow from operating activities | 33,038.0 | 41,296.0 | 45,863.5 | 57,548.3 | 52,107.9 | 1,608.3 | ||||||||||||||||||

| Net cash outflow from investing activities | (43,817.8 | ) | (29,925.8 | ) | (38,817.9 | ) | (63,351.4 | ) | (43,159.5 | ) | (1,332.1 | ) | ||||||||||||

| Net cash inflow (outflow) from financing activities | 8,455.8 | 12,794.9 | (2,797.0 | ) | 8,636.3 | (21,087.0 | ) | (650.8 | ) | |||||||||||||||

| Segment Data: | ||||||||||||||||||||||||

| Operating revenues: | ||||||||||||||||||||||||

| Packaging | 104,298.3 | 112,603.9 | 121,336.5 | 116,607.3 | 125,282.8 | 3,866.8 | ||||||||||||||||||

| Testing | 22,657.0 | 24,732.2 | 25,874.7 | 25,191.9 | 27,031.8 | 834.3 | ||||||||||||||||||

| Electronic manufacturing services | 62,747.7 | 78,530.6 | 105,784.4 | 138,242.1 | 115,395.1 | 3,561.6 | ||||||||||||||||||

| Others | 4,269.4 | 3,995.7 | 3,595.8 | 3,261.2 | 7,174.4 | 221.4 | ||||||||||||||||||

| Gross profit: | ||||||||||||||||||||||||

| Packaging | 19,812.5 | 23,673.7 | 33,040.2 | 30,348.5 | 28,524.5 | 880.4 | ||||||||||||||||||

| Testing | 7,601.0 | 9,079.4 | 9,632.0 | 9,025.7 | 9,980.6 | 308.0 | ||||||||||||||||||

| Electronic manufacturing services | 7,241.3 | 8,054.3 | 9,118.9 | 9,433.4 | 11,234.8 | 346.8 | ||||||||||||||||||

| Others | 1,974.9 | 2,014.6 | 1,797.4 | 1,327.6 | 3,454.3 | 106.6 | ||||||||||||||||||

| As of and for the Year Ended December 31, | |||||||||||

| IFRS | 2015 (Retrospectively Adjusted)(1) | 2016 (Retrospectively Adjusted)(1) | 2017 (Retrospectively Adjusted)(1) | 2018(2) | 2019 | ||||||

| NT$ | NT$ | NT$ | NT$ | NT$ | US$ | ||||||

| (in millions, except earnings per share and per ADS data) | |||||||||||

| Balance Sheet Data: | |||||||||||

| Current assets | 156,732.8 | 142,789.7 | 144,938.3 | 201,558.9 | 202,001.1 | 6,753.6 | |||||

| Investments - non-current(7) | 38,046.6 | 50,853.0 | 49,876.8 | 11,545.9 | 15,017.4 | 502.1 | |||||

| Property, plant and equipment | 149,997.1 | 143,880.2 | 135,168.4 | 214,592.6 | 232,093.3 | 7,759.7 | |||||

| Right-of-use assets(8) | - | - | - | - | 9,792.2 | 327.4 | |||||

| Intangible assets | 11,888.6 | 12,107.6 | 11,341.4 | 80,872.1 | 79,222.8 | 2,648.7 | |||||

| Long-term prepayments for lease(8) | 2,556.2 | 2,237.0 | 8,851.3 | 10,764.8 | - | - | |||||

| Others(8)(9) | 5,765.6 | 6,063.1 | 13,746.1 | 14,727.6 | 19,096.9 | 638.5 | |||||

| Total assets | 364,986.9 | 357,930.6 | 363,922.3 | 534,061.9 | 557,223.7 | 18,630.0 | |||||

| Short-term debts(10) | 36,983.4 | 20,955.5 | 17,962.5 | 43,263.5 | 37,339.0 | 1,248.4 | |||||

| Current portion of long-term debts(11) | 16,843.3 | 16,341.1 | 14,441.3 | 10,796.2 | 5,995.6 | 200.4 | |||||

| Long-term debts(12) | 66,535.1 | 74,354.9 | 44,501.5 | 144,336.9 | 177,414.1 | 5,931.6 | |||||

| Other liabilities(12) | 78,700.1 | 79,437.9 | 85,706.8 | 116,637.4 | 123,672.7 | 4,134.9 | |||||

| Total liabilities | 199,061.9 | 191,089.4 | 162,612.1 | 315,034.0 | 344,421.4 | 11,515.3 | |||||

| Share capital | 79,185.7 | 79,568.0 | 87,380.8 | 43,217.1 | 43,305.3 | 1,447.9 | |||||

| Non-controlling interests | 11,492.5 | 12,000.6 | 13,190.1 | 17,639.5 | 13,374.9 | 447.2 | |||||

| Equity attributable to owners of the Company | 154,432.4 | 154,840.6 | 188,120.1 | 201,388.4 | 199,427.4 | 6,667.5 | |||||

| Cash Flow Data: | |||||||||||

| Capital expenditures | (30,280.1) | (26,714.2) | (24,699.2) | (41,386.4) | (56,810.2) | (1,899.4) | |||||

| Depreciation and amortization | 29,518.7 | 29,470.4 | 29,205.2 | 42,688.9 | 50,466.8 | 1,687.3 | |||||

| Net cash inflow from operating activities | 57,548.3 | 52,107.9 | 47,430.8 | 51,074.7 | 72,303.3 | 2,417.4 | |||||

| Net cash outflow from investing activities | (63,351.4) | (43,159.5) | (16,086.2) | (129,542.3) | (54,579.1) | (1,824.8) | |||||

| Net cash inflow (outflow) from financing activities | 8,636.3 | (21,087.0) | (19,323.4) | 83,111.4 | (6,498.8) | (217.3) | |||||

| Segment Data: | |||||||||||

| Operating revenues: | |||||||||||

| Packaging | 116,607.3 | 125,282.8 | 126,225.1 | 178,308.2 | 198,916.8 | 6,650.5 | |||||

| Testing | 25,191.9 | 27,031.8 | 26,157.3 | 35,903.2 | 42,658.7 | 1,426.2 | |||||

| EMS | 138,242.1 | 115,395.1 | 133,948.0 | 151,890.4 | 165,789.5 | 5,543.0 | |||||

| Others | 3,261.2 | 7,174.4 | 4,110.8 | 4,990.6 | 5,817.2 | 194.5 | |||||

| Gross profit: | |||||||||||

| Packaging | 30,348.5 | 28,524.6 | 28,785.3 | 33,669.0 | 34,539.0 | 1,154.8 | |||||

| Testing | 9,025.7 | 9,980.6 | 9,303.6 | 12,289.5 | 14,536.9 | 486.0 | |||||

| EMS | 9,433.4 | 11,234.8 | 13,562.5 | 14,278.8 | 14,491.4 | 484.5 | |||||

| Others | 1,327.6 | 3,447.3 | 1,080.9 | 925.7 | 743.5 | 24.9 | |||||

__________________

7

| (1) |

| (2) | Financial data for ASEH are derived from the results of: (a) ASE Technology Holding Co., Ltd. and SPIL for the period from April 30, 2018 through December 31, 2018; and (b) ASE, the predecessor entity of ASEH, for the twelve months ended December 31, 2018. |

| (3) | We retrospectively adjusted the earnings per common share, earnings per equivalent ADS, number of common shares and number of equivalent ADSs in accordance with share exchange ratio stated in the Joint Share Exchange Agreement for the years ended December 31, 2015, 2016 and 2017, which differ from the results included in our annual |

| The denominators for diluted earnings per common share and diluted earnings per equivalent ADS are calculated to account for the potential diluted factors, such as employees’ compensation, the exercise of options and conversion of our convertible bonds into our common shares. |

| Dividends per common share issued as a cash dividend |

| Represents the weighted average number of shares after retroactive adjustments to give effect to |

| Starting from 2019, upon initial application of IFRS 16 “Leases,” long-term prepayments for lease were reclassified to related assets, such as right-of-use assets and investment properties. See note 3 to our consolidated financial statements included herein for further information regarding the initial application of IFRS 16. |

| (9) | Including investment properties, deferred tax assets, other financial assets |

| Including short-term bank loans and short-term bills payable. |

| (12) | Data as of December 31, 2015, 2016, 2017 and 2018 included bonds payable, long-term borrowings (consisted of bank loans and bills payable) and capital lease obligations. Starting from 2019, upon initial application of IFRS 16 “Leases,” the category included bonds payable, long-term borrowings (consisted of bank loans and bills payable) and lease liabilities – non-current. See note 3 to our consolidated financial statements included herein for further information regarding the initial application of IFRS 16. |

| Including (x) current liabilities other than short-term debts and current portion of long-term debts and (y) non-current liabilities other than long-term debts. |

7

Exchange Rates

Fluctuations in the exchange rate between NT dollars and U.S. dollars will affect the U.S. dollar equivalent of the NT dollar price of our common shares on the TWSE and, as a result, will likely affect the market price of the ADSs. Fluctuations will also affect the U.S. dollar conversion by the depositary under our ADS deposit agreement referred to below of cash dividends paid in NT dollars on, and the NT dollar proceeds received by the depositary from any sale of, common shares represented by ADSs, in each case, according to the terms of the deposit agreement dated September 29, 2000 and as amended and supplemented from time to time among us, Citibank N.A., as depositary, and the holders and beneficial owners from time to time of the ADSs, which we refer to as the deposit agreement.

8

The following table sets forth, for the periods indicated, information concerning the number of NT dollars for which one U.S. dollar could be exchanged. The exchange rates reflect the exchange rates set forth in the H.10 statistical release of the Federal Reserve Board.

Exchange Rate | ||||

Average(1) | High | Low | Period End | |

| 2012 | 29.47 | 30.28 | 28.96 | 29.05 |

| 2013 | 29.73 | 30.20 | 28.93 | 29.83 |

| 2014 | 30.38 | 31.80 | 29.85 | 31.60 |

| 2015 | 31.80 | 33.17 | 30.37 | 32.79 |

| 2016 | ||||

| October | 31.59 | 31.79 | 31.36 | 31.54 |

| November | 31.75 | 32.01 | 31.41 | 31.92 |

| December | 32.00 | 32.42 | 31.72 | 32.40 |

| 2017 | ||||

| January | 31.65 | 32.37 | 31.19 | 31.19 |

| February | 30.85 | 31.17 | 30.61 | 30.64 |

| March | 30.65 | 31.03 | 30.14 | 30.38 |

| April (through April 14, 2017) | 30.47 | 30.63 | 30.31 | 30.31 |

On April 14, 2017, the exchange rate as set forth in the H.10 weekly statistical release by the Federal Reserve Board was NT$30.31=US$1.00.

CAPITALIZATION AND INDEBTEDNESS

Not applicable.

REASON FOR THE OFFER AND USE OF PROCEEDS

Not applicable.

Risks Relating to the SPIL Acquisition

Due to the SPIL Acquisition, our financial and operational results of annual and interim periods may not be comparable.

ASEH was formed pursuant to the consummation of the Share Exchange on April 30, 2018. ASE is ASEH’s predecessor entity; therefore, the financial and operational results of ASEH for periods before the Share Exchange were prepared under the assumption that ASEH owned 100% shareholdings of ASE. The financial and operational results before April 30, 2018 reflect the business operations of ASE. The financial and operational results for the second quarter of 2018 reflect the business operations of ASE starting from April 1, 2018 and the business operations of ASEH starting from April 30, 2018. The financial and operational results after April 30, 2018 reflect the combined operations after the SPIL Acquisition. Therefore, the financial and operational results of annual and interim periods may not be comparable.

There may be risks associated with our current holding company structure.

We entered into the Joint Share Exchange Agreement with SPIL in June 2016, pursuant to which ASEH, a holding company in Taiwan, holds 100% of the equity interests in both ASE and SPIL such that ASE and SPIL became wholly owned subsidiaries of ASEH. The common shares of ASE and SPIL were delisted from the TWSE. The ADSs of ASE and SPIL were delisted from NYSE and NASDAQ, respectively, and became eligible for deregistration under the Exchange Act. Subsequently, the common shares of ASEH were listed on the TWSE, and the ADSs of ASEH were listed on the NYSE. The implementation of such corporate structure restructuring plan may result in contingent risks, including increase in tax liabilities or trading discounts relating to a holding company discount that may become apparent in the future. For details about the Joint Share Exchange Agreement, see “Item 10. Additional Information—Material Contract.”

8

Risks Relating to Our Business

Since we are dependent on the highly cyclical semiconductor and electronics industries and conditions in the markets for the end-use applications of our products, our revenues and net income may fluctuate significantly.

Our business is affected by market conditions in the highly cyclical semiconductor and electronics industries. Most of our customers operate in this industry, and variations in order levels from our customers and service fee rates may result in volatility in our revenues and net income. From time to time, the semiconductor and electronics industries have experienced significant, and sometimes prolonged, downturns. As our business is, and will continue to be, dependent on the requirements for independent packaging, testing and electronic manufacturing services,EMS, any future downturn in the industry would reduce demand for our services. For example, in the fourth quarter of 2008, the global economic crisis resulted in a significant deterioration in demand for our customers’ products, which in turn affected demand for our services and adversely affected our operating results. Although demand has recovered, we expect there to be continued downward pressure on our average selling prices and continued volatility with respect to our sales volumes in the future. If we cannot reduce our costs or adjust our product mix to sufficiently offset any decline in sales volumes, our profitability will suffer, and we may incur losses.

Market conditions in the semiconductor and electronics industries depend to a large degree on conditions in the markets for the end-use applications of various products, such as communications, computing and consumer electronics products. Any deterioration of conditions in the markets for the end-use applications would reduce demand for our services, and would likely have a material adverse effect on our financial condition and results of operations. In 2016,2019, approximately52.2% 52.5%,11.5% 14.6% and36.3% 32.9% of our operating revenues from packaging and testing were attributed to the packaging and testing of semiconductors used in communications, computing and consumer electronics/industrial/automotive/other applications, respectively. In the same year, approximately50.6% 37.4%,16.9% 11.3%,18.4% 34.6%,7.2% 11.3% and6.0% 5.4% of our operating revenues from electronic manufacturing servicesEMS were attributed to the communications, computing,computers and storage, consumer electronics applications, industrial and automotive applications and other, respectively. Across end-use applications, our customers face intense competition and significant shifts in demand, which could put pricing pressure on our services and may adversely affect our revenues and net income.

9

A reversal or slowdown in the outsourcing trend for semiconductor packaging and testing services and electronic manufacturing servicesEMS could adversely affect our growth prospects and profitability.

Semiconductor manufacturers that have their own in-house packaging and testing capabilities, known as integrated device manufacturers and original equipment manufacturers, have increasingly outsourced stages of the production process, including packaging, testing, electronic manufacturing and assembly, to independent companies in order to reduce costs, eliminate product complexity and meet fast-to-market requirements. In addition, the availability of advanced independent semiconductor manufacturing services has also enabled the growth of so-called “fabless” semiconductor companies that focus exclusively on design and marketing and outsource their manufacturing, packaging and testing requirements to independent companies. We cannot assure you that these manufacturers and companies will continue to outsource their packaging, testing and manufacturing requirements to third parties like us. Furthermore, during an economic downturn, these integrated device manufacturers typically rely more on their own in-house packaging and testing capabilities, therefore decreasing their need to outsource. A reversal of, or a slowdown in, this outsourcing trend could result in reduced demand for our services and adversely affect our growth prospects and profitability.

Any global economic downturn could adversely affect the demand for our products and services, and a protracted global economic crisis would have a material adverse effect on us.

The global financial markets experienced significant disruptions in 2008 and the United States, Europe and other economies went into recession. The recovery from the lows of 2008 and 2009 was uneven and it is facing new challenges, including a European sovereign debt crisis that began in 2011, a referendum in the United Kingdom in June 2016, in which the majority of voters voted in favor of an exit from the European Union (“Brexit”), and continuing high unemployment rates in much of the world. It is unclear what the long-term impact of the European sovereign debt crisis will be and uncertainty remains over the long-term effects of the expansionary monetary and fiscal policies that have been adopted by the central banks and financial authorities of some of the world’s leading economies. There are also increased uncertainty in the wake of Brexit, which has resulted in downgrade of the credit ratings ofOn January 31, 2020, the United Kingdom ceased to be a member state of the EU. As of the date of this filing until December 31, 2020, the EU and an increase in volatility in the global financial markets.United Kingdom will negotiate the terms of their future relationship. It remains unclear how the Brexit would affect the fiscal, monetary and regulatory landscape within the United Kingdom, the EU and globally. Any economic downturn or crisis may cause our customers to do the following:

cancel or reduce planned expenditures for our products and services. Any uncertainty or significant volatility in global economic conditions may also make it difficult for our customers to accurately forecast and plan future business activities and may have a material adverse effect on us.

9

If we are unable to compete favorably in the highly competitive markets of semiconductor packaging and testing and electronic manufacturing services,EMS, our revenues and net income may decrease.

The markets of semiconductor packaging and testing and electronic manufacturing servicesEMS are very competitive. We face competition from a number of sources, including other independent semiconductor packaging and testing companies, integrated device manufacturers, and other electronic manufacturing servicesEMS providers with large-scale manufacturing capabilities who can quickly react to market changes. We believe that the principal competitive factors in our industry are:

| · | technological expertise; |

10

| · | the ability to provide total solutions to our customers, including integrated design, manufacturing, packaging and testing and |

| · | ability to offer interconnect technologies at an optimal scale for our businesses; |

| · | range of package types and testing platforms available; |

| · | the ability to work closely with our customers at the product development stage; |

| · | responsiveness and flexibility; |

| · | fast-to-market product development; |

| · | capacity; |

| · | diversity in facility locations; |

| · | production yield; and |

| · | price. |

We face increasing competition, as most of our customers obtain services from more than one source. Rapid technological advances and aggressive pricing strategies by our competitors may continue to increase competition. Our ability to compete depends on factors both within and outside of our control and may be constrained by the distinct characteristics and production requirements of individual products. We cannot assure you that we will be able to continue to improve production efficiency and maintain reasonable profit for all of our products.

In addition, some of our competitors may have superior financial, marketing, manufacturing, research and development and technological resources than we do. For example, the central government of the PRCP.R.C. as well as provincial and municipal governments have provided various incentives to domestic companies in the semiconductor industry, including major semiconductor testing and packaging providers, such as Jiangsu Changjiang Electronics Technology Co., Ltd. Similarly, our customers may face competition from their competitors in the PRC,P.R.C., and such competitors may also receive significant subsidies from the PRCP.R.C. government. As we are downstream suppliers, the impact of such government policies on competition and price pressure of our customers may negatively impact our own business. Increasing competition may lead to declines in product prices and profitability and could have a material adverse effect on our business, financial condition, results of operations and future prospects.

10

Our profitability depends on our ability to respond to rapid technological changes in the semiconductor industry.

The semiconductor industry is characterized by rapid increases in the diversity and complexity of semiconductors. As a result, we expect that we will need to constantly offer more sophisticated packaging and testing technologies and processes in order to respond to competitive industry conditions and customer requirements. We have successfully combined our packaging, testing and materials technologies with the expertise of electronic manufacturing servicesEMS at the systems level to develop our SiP business. SuccessWe also entered into multiple technology license agreements with DECA to advance our fan-out technology. There is, however, no assurance that our development efforts for our SiP business or the use of alicensed technology to further advance our fan-out technology will be successful.

We continue to develop new product depends on a number of factors such as product acceptance by the market. New products are developed in anticipation of future demand. We cannot assure youHowever, there is no assurance that the launch of any new product will be successful or that whether we will be able to produce sufficient quantities of these products to meet market demand. If we fail to develop, or obtain access to, advances in packaging or testing technologies or processes, we may become less competitive and less profitable. In addition, advances in technology typically lead to declining average selling prices for semiconductors packaged or tested with older technologies or processes. As a result, if we cannot reduce the costs associated with our services, the profitability of a given service and our overall profitability may decrease over time.

Our operating results are subject to significant fluctuations, which could adversely affect the market value of your investment.

Our operating results have varied significantly from period to period and may continue to vary in the future. Downward fluctuations in our operating results may result in decreases in the market price of our common shares and the ADSs. Among the more important factors affecting our quarterly and annual operating results are the following:

11

| · | changes in general economic and business conditions, particularly the cyclical nature of the semiconductor and electronics industries and the markets served by our customers; |

| · | our ability to quickly adjust to unanticipated declines or shortfalls in demand and market prices; |

| · | changes in prices for our products or services; |

| · | volume of orders relative to our packaging, testing and manufacturing capacity; |

| · | changes in costs and availability of raw materials, equipment and labor; |

| · | our ability to obtain or develop substitute raw materials with lower cost; |

| · | our ability to successfully develop or market new products or services; |

| · | our ability to successfully manage product mix in response to changes in market demand and differences in margin associated with different products; |

| · | timing of capital expenditures in anticipation of future orders; |

| · | our ability to acquire or design and produce cost-competitive interconnect materials, and provide integrated solutions for |

| · | fluctuations in the exchange rate between the NT dollar or RMB and foreign currencies, especially the U.S. dollar; and |

| · | typhoons, earthquakes, drought, epidemics, tsunami and other natural disasters, as well as industrial and other incidents such as fires and power outages. |

11

Due to the factors listed above, our future operating results or growth rates may be below the expectations of research analysts and investors. If so, the market price of our common shares and the ADSs, and thus the market value of your investment, may fall.

Due to our high percentage of fixed costs, we may be unable to maintain our gross margin at past levels if we are unable to achieve relatively high capacity utilization rates.

Our operations, in particular our testing operations, are characterized by relatively high fixed costs. We expect to continue to incur substantial depreciation and other expenses in connection with our acquisitions of equipment and facilities. Our profitability depends not only on the pricing levels for our services or products, but also on utilization rates for our machinery and equipment, commonly referred to as “capacity utilization rates.” In particular, increases or decreases in our capacity utilization rates can significantly affect gross margins since the unit cost generally decreases as fixed costs are allocated over a larger number of units. In periods of low demand, we experience relatively low capacity utilization rates in our operations, which leads to reduced margins. For example, in the fourth quarter of 2008, we experienced lower than anticipated utilization rates in our operations due to a significant decline in worldwide demand for our packaging and testing services, which resulted in reduced margins during that period. Although capacity utilization rates have recovered since 2009, weWe cannot assure you that we will be able to maintain or surpass our past gross margin levels if we cannot consistently achieve or maintain relatively high capacity utilization rates.

If we are unable to manage our expansion or investments effectively, our growth prospects may be limited and our future profitability and core business operations may be adversely affected.

We have significantly expanded our operations through both organic growthacquisitions and acquisitionsjoint ventures in recent years. For example,our expansion or investments, see “Item 4. Information on the Company—Business Overview—Strategy—Strategically Expand and Streamline Production Capacity.”

While we acquired the controlling interest of Universal Scientific in 2010 to expand our product offering scope to electronic manufacturing services; we also entered into a joint venture agreement with TDK Corporation in May 2015 to further expand our business in embedded substrates; furthermore, we entered into the Joint Share Exchange Agreement with SPIL in June 2016 to take advantage of the synergy effect of business combination between SPIL and us. We expect that we will continue to expand our operations in the future. The purpose of our expansion is mainlyfuture to provide total solutions to existing customers or to attract new customers and broaden our product range for a variety of end-use applications. However,offerings, rapid expansion may place a strain on our managerial, technical, financial, operational and other resources. As a result of our expansion, we have implemented and will continue to implement additional operational and financial controls and hire and train additional personnel. Any failure to manage our growth effectively could lead to inefficiencies and redundancies and result in reduced growth prospects and profitability.

12

In addition, we have recently made several investments in the real estate development businesses mostly in China. The PRCP.R.C. property market is volatile and may experience undersupply or oversupply and property price fluctuations. The central and local governments frequently adjust monetary and other fiscal policies to prevent and curtail the overheating of the economy. Such policies may lead to changes in market conditions, including price instability and imbalance of supply and demand in respect of office, residential, retail, entertainment, cultural and intellectual properties. Our exposure to risks related to real estate development may also increase over time as a result of our expansion into such a business. We may continue to make investments in this area in the future and our diversification in this industry may put pressure on our managerial, financial, operational and other resources. Our exposure to risks related to real estate development may also increase over time as a result of our expansion into such a business. There can be no assurance that our investments in such a business will yield the anticipated returns and that our expansion into such a business, including the resulting diversion of management’s attention, will not adversely affect our core business operations.

12

We may not be successful in pursuing mergers and acquisitions. Any mergers or acquisitions we make may lead to a diversion of management resources.

Our future success may depend on acquiring businesses and technologies, making investments or forming joint ventures that complement, enhance or expand our current product offerings or otherwise offer us growth opportunities. In pursuing such acquisitions, we may face competition from other companies in the semiconductor industry. Our ability to acquire or invest in suitable targets may be limited by applicable laws and regulations in Taiwan, the United States and other jurisdictions where we do business. Even if we are successful in making such acquisitions or investments, we may have to expend substantial amounts of cash, incur debt, assume loss-making divisions and incur other types of expenses. We may also face challenges in successfully integrating any acquired companies into our existing organization or in creating the anticipated cost synergies. Each of these risks could have a material adverse effect on our business, financial condition and results of operations.

The financial performance of our equity method investments could adversely affect our results of operations.

As part of our business strategy, we have and may continue to pursue acquisitions of businesses and assets, strategic alliances and joint ventures. We currently have equity investments in certain entities and the accounting treatment applied for these investments varies depending on a number of factors, including, but not limited to, our percentage ownership,our percentage of membership of investee’s board and the level of influence we have over the relevant entity. Any losses experienced by these entities could adversely affect our results of operations and the value of our investment. In addition, if these entities were to fail and cease operations, we may lose the entire value of our investment and the stream of any shared profits.

For example, on September 22, 2015, upon the expiration of the Initial SPIL Tender Offer period, we acquired 779,000,000 common shares (including those represented by American depositary shares) of SPIL through the Initial SPIL Tender Offer. We subsequently acquired an additional 258,300,000 common shares of SPIL (including those represented by American depositary shares) through open market purchases in March and April 2016. As of April 21, 2017, we beneficially own 1,037,300,000 common shares of SPIL (calculated as the sum of 988,847,740 common shares of SPIL and 48,452,260 common shares of SPIL underlying 9,690,452 American depositary shares of SPIL), representing 33.29% of the issued and outstanding share capital of SPIL (calculated based on 3,116,361,139 common shares of SPIL (including those represented by American depositary shares) outstanding as of March 31, 2017 as reported in SPIL’s annual report on Form 20-F for the year ended December 31, 2016). See “Item 4. Information on the Company— History and Development of the Company—Acquisition of Common Shares and American Depositary Shares of SPIL.” Although we are currently a 33.29% shareholder of SPIL, we currently do not control SPIL and do not have the power to direct SPIL or its management. As the investment in SPIL is accounted for using the equity method, to the extent that SPIL has net losses, our financial results will be adversely affected to the extent of our pro rata portion of these losses. In addition, as we currently do not control SPIL and do not have the power to direct SPIL or its management, we do not have access to SPIL’s books and records and may not be able to obtain SPIL’s financial information on a timely basis. SPIL’s reporting time for its financial statements may affect our ability to timely report our own financial statements or meet scheduled announcements for earnings releases.

13

There can be no assurance that we will be able to maintain or enhance the value or performance of our investee companies or that we will achieve the returns or benefits sought from such investments. If our interests differ from those of other investors in our investee companies, we may not be able to enjoy synergies with the investee and it may adversely affect our financial results or financial condition.

We may not be successfulrecognized impairment charges of nil, NT$521.0 million and NT$400.2 million (US$13.4 million) in 2017, 2018 and 2019, respectively, in our acquisition of 100% of SPIL shares not otherwise owned by us.

On September 22, 2015, upon the expiration of the Initial SPIL Tender Offer period, we acquired 779,000,000 common shares (including those represented by American depositary shares) of SPIL through the Initial SPIL Tender Offer. In December 2015, following an announcement by SPIL that it plans to issue 1,033 million shares, if approved by SPIL shareholders, to a third party pursuant to a share placement agreement, we submitted a written proposal to SPIL’s Board proposing to acquire all SPIL shares not otherwise owned by ASE, contingent upon the termination of the share purchase agreement, and later launched the Second SPIL Tender Offer on December 29, 2015 to offer to purchase up to 770,000,000 common shares of SPIL (including those represented by American depositary shares). On March 17, 2016, we announced that the Second SPIL Tender Offer was unsuccessful because the Taiwan Fair Trade Commission (the “TFTC”) did not render its decision before the expiration of the Second SPIL Tender Offer. The TFTC subsequently suspended its review on March 23, 2016. Notwithstanding the failure of the Second SPIL Tender Offer, we continued to seek control of SPIL, with the purpose of effecting an acquisition of 100% of the common shares and American depositary shares of SPIL. Under the Joint Share Exchange Agreement, a holding company in Taiwan will be established that would hold 100% ofinvestments under the equity interestsmethod. See note 14 to our consolidated financial statements included in this annual report and see “Item 5. Operating and Financial Review and Prospects—Operating Results and Trend Information—Critical Accounting Policies and Estimates—Valuation of both ASE and SPIL such that ASE and SPIL would be wholly owned subsidiaries of such holding company, which would maintain all current operations of ASE and SPIL in Taiwan. See “Item 4. Information on the Company— History and Development of the Company—Acquisition of Common Shares and American Depositary Shares of SPIL.Investments.”

The successful consummation of the SPIL Acquisition is subject to a number of factors, including, among other things, obtaining all necessary antitrust or other regulatory approvals in Taiwan, the United States, the PRC and other jurisdictions where we do business. Although we have obtained regulatory approvals in Taiwan, in the event these conditions cannot be satisfied, we may re-evaluate our interest in SPIL and may consider, among other legally permissible alternatives, to dispose our SPIL shares at a loss, which may significantly affect our financial position. Notwithstanding the above, even if we are successful in consummating the SPIL Acquisition, we may face challenges in successfully integrating SPIL into our existing organization or in realizing anticipated benefits and cost synergies. Each of these risks could have a material adverse effect on our business and operations, including our relationship with customers, suppliers, employees and other constituencies, or otherwise adversely affect our financial condition and results of operations.

There may be risks associated with the proposed holding company structure of SPIL Acquisition.

We entered into the Joint Share Exchange Agreement with SPIL in June 2016, pursuant to which ASE Holding, a holding company in Taiwan, will hold 100% of the equity interests in both ASE and SPIL such that ASE and SPIL will become wholly owned subsidiaries of ASE Holding. The proposed holding company will maintain all current operations of ASE and SPIL in Taiwan. The common shares of ASE and SPIL will be delisted from the TWSE. The ADSs of ASE and SPIL will be delisted from NYSE and NASDAQ, respectively, and will become eligible for deregistration under the Exchange Act. Subsequently, the common shares of ASE Holding will be listed on the TWSE, and the ADSs of ASE Holding will be listed on the NYSE. The implementation of such corporate structure restructuring plan may require approvals from relevant regulators and may result in unforeseen contingent risks, including increase in tax liabilities or trading discounts relating to a holding company discount that may become apparent in the future.

The packaging and testing businesses are capital intensive. If we cannot obtain additional capital when we need it, our growth prospects and future profitability may be adversely affected.

The packaging and testing business is capital intensive. We will need capital to fund the expansion of our facilities as well as fund our research and development activities in order to remain competitive. We believe that our existing cash, marketable securities, expected cash flow from operations and existing credit lines under our loan facilities will be sufficient to meet our capital expenditures, working capital, cash obligations under our existing debt and lease arrangements, and other requirements for at least the next twelve months. However, future capacity expansions or market or other developments may cause us to require additional funds. Our ability to obtain external financing in the future is subject to a variety of uncertainties, including:

14

| · | our future financial condition, results of operations and cash flows; |

| · | general market conditions for financing activities by semiconductor or electronics companies; and |

| · | economic, political and other conditions in Taiwan and elsewhere. |

If we are unable to obtain funding in a timely manner or on acceptable terms, our results of operations and financial conditions may be materially and adversely affected.

Restrictive covenants and broad default provisions in our existing debt agreements may materially restrict our operations as well as adversely affect our liquidity, financial condition and results of operations.

We are a party to numerous loans and other agreements relating to the incurrence of debt, many of which may include restrictive covenants and broad default provisions. In general, covenants in the agreements governing our existing debt, and debt we may incur in the future, may materially restrict our operations, including our ability to incur debt, pay dividends, make certain investments and payments, other than in connection with restructurings of consolidated entities, and encumber or dispose of assets. In addition, any global economic deterioration or ineffective expansion may cause us to incur significant net losses or force us to assume considerable liabilities. We cannot assure you that we will be able to remain in compliance with our financial covenants, which, as a result, may lead to a default. This may thereby restrict our ability to access unutilized credit facilities or the global capital markets to meet our liquidity needs. Furthermore, a default under oneany agreement by us or one of our subsidiaries may also trigger cross-defaults under our other agreements. In the event of default, we may not be able to cure the default or obtain a waiver on a timely basis. An event of default under any agreement timely governing our existing or future debt, if not cured or waived, could have a material adverse effect on our liquidity, financial condition and results of operations.

13

We have on occasion failed to comply with certain financial covenants in some of our loan agreements. Such non-compliance may also have, through broadly worded cross-default provisions, resulted in default under some of the agreements governing our other existing debt. For example, we failed to comply with certain financial covenants in some of our loan agreements as a result of our acquisition of the controlling interest of Universal Scientific Industrial in February 2010, for which we have timely obtained waivers from our counterparties. With respect to our syndicated loan agreement for financing the SPIL Acquisition, the banks agreed to exempt debt/equity ratio from assessment before June 30, 2018. If we are unable to timely remedyrectify any of ourpossible non-compliance under such loan agreements or obtain applicable waivers or amendments, we would breach our financial covenants and our financial condition would be adversely affected. As of December 31, 2016,2019, we were not in breach of any of the financial covenants under our existing loan agreements, although we cannot provide any assurance that we will not breach any of such financial covenants in the future.

We depend on select personnel and could be affected by the loss of their services.

We depend on the continued service of our executive officers and skilled technical personnel. Our business could suffer if we lose the services of any of these personnel and cannot adequately replace them. Although some of these management personnel have entered into employment agreements with us, they may nevertheless leave before the expiration of these agreements. We are not insured against the loss of the services of any of our personnel. In addition, these proceedings may divert these and other employees’ attention from our business operations.

In addition, we may be required to increase substantially the number of these employees in connection with our expansion plans, and there is intense competition for their services in this industry. We may not be able to either retain our present personnel or attract additional qualified personnel as and when needed. In addition, we may need to increase employee compensation levels in order to attract and retain our existing officers and employees and the additional personnel that we expect to require. Furthermore, a portion of the workforce at our facilities in Taiwan are foreign workers employed under work permits, which are subject to government regulations on renewal and other terms. Consequently, our business could also suffer if the Taiwan regulations relating to the employment of foreign workers were to become significantly more restrictive or if we are otherwise unable to attract or retain these workers at a reasonable cost.

The ongoing proceeding involving Dr. Tien Wu may have an adverse impact on our business and cause our common shares and ADS price to decline.

Dr. Tien Wu, ASEH’s director and chief operating officer, was involved in a criminal proceeding brought by the Taiwan Kaohsiung District Prosecutors Office. The indictment alleged that Dr. Tien Wu violated Article 157-1 of the R.O.C. Securities and Exchange Act for insider trading activities involving SPIL common shares conducted during the period when the Initial SPIL Tender Offers, the Second SPIL Tender Offers and negotiations of the memorandum of understanding in relation to SPIL Acquisition took place. Dr. Tien Wu was accused of tipping off a friend about the aforementioned tender offers and negotiation ahead of the public announcements. After an investigation that spanned over two years, the Taiwan Kaohsiung District Court pronounced its judgment on February 5, 2020 that Dr. Tien Wu is found to be NOT guilty. On March 20, 2020, the Taiwan Kaohsiung District Prosecutors Office filed an appeal against the February 5, 2020 judgement. This matter will continue to be litigated in the Taiwan High Court Kaohsiung Branch Court. ASEH has reinforced internal control measures after this incident and no ASEH directors are expected to become party to any current or future litigation related to Dr. Tien Wu.

1514

On October 26, 2018, the R.O.C. Securities and Futures Investors Protection Center filed a civil lawsuit against Dr. Tien Wu and ASEH, requesting the court to remove him from ASEH’s board based on Article 10-1 of the Securities Investor and Futures Trader Protection Act. No judicial conclusion has been reached yet for this proceeding. There is no assurance that this proceeding or the further scrutiny from regulators will not generate publicity or media attention. Any negative publicity in connection to this legal proceeding may adversely affect ASEH’s brand and reputation and result in a material adverse impact on their business operations and prospects. As ASEH depends on the continued service of its executive officers and is not insured against the loss of service of any of their personnel, ASEH’s business operations could suffer if it loses the service of any executive officers, including Dr. Tien Wu, and cannot adequately replace them.

If we are unable to obtain additional packaging and testing equipment or facilities in a timely manner and at a reasonable cost, our competitiveness and future profitability may be adversely affected.

The semiconductor packaging and testing businesses are capital intensive and require significant investment in expensive equipment manufactured by a limited number of suppliers. The market for semiconductor packaging and testing equipment is characterized, from time to time, by intense demand, limited supply and long delivery cycles. Our operations and expansion plans depend on our ability to obtain a significant amount of such equipment from a limited number of suppliers. From time to time we have also leased certain equipment. We have no binding supply agreements with any of our suppliers and acquire our packaging and testing equipment on a purchase order basis, which exposes us to changing market conditions and other substantial risks. For example, shortages of capital equipment could result in an increase in the price of equipment and longer delivery times. Semiconductor packaging and testing also require us to operate sizeable facilities. If we are unable to obtain equipment or facilities in a timely manner, we may be unable to fulfill our customers’ orders, which could adversely affect our growth prospects as well as financial condition and results of operations. See “Item 4. Information on the Company—Business Overview—Equipment.”

Fluctuations in exchange rates could result in foreign exchange losses.

Currently, the majority of our revenues are denominated in U.S. dollars, with a portion denominated in NT dollars and Japanese yen. Our operating costs and operating expenses, on the other hand, are incurred in several currencies, primarily NT dollars, U.S. dollars, RMB, Japanese yen, Korean won, as well as, to a lesser extent, Singapore dollars and Malaysian ringgit.ringgit and Polish zloty. In addition, a substantial portion of our capital expenditures, primarily for the purchase of packaging and testing equipment, has been, and is expected to continue to be, denominated in U.S. dollars, with the remainder in Japanese yen. Fluctuations in exchange rates, primarily among the U.S. dollar and Japanese yen against the NT dollar the Japanese yen and RMB, will affect our costs and operating margins. In addition, these fluctuations could result in exchange losses and increased costs in NT dollar and other local currency terms. Despite hedging and mitigating techniques implemented by us, fluctuations in exchange rates have affected, and may continue to affect, our financial condition and results of operations. We recognized net foreign exchange gains of NT$3,502.6 million in 2017, net foreign exchange losses of NT$1,222.0 million and NT$713.21,015.6 million in 2014 and 2015, respectively,2018 and net foreign exchange gains of NT$1,928.41,125.7 million (US$59.537.6 million) in 2016.2019. We cannot assure you that we will achieve foreign exchange gains in the future. See “Item 11. Quantitative and Qualitative Disclosures about Market Risk—Market Risk—Foreign Currency Exchange Rate Risk.”

The loss of a large customer or disruption of our strategic alliance or other commercial arrangements with semiconductor foundries and providers of other complementary semiconductor manufacturing services may result in a decline in our revenues and profitability.

Although we have a large customer base, we have derived and expect to continue to derive a large portion of our revenues from a small group of customers during any particular period due in part to the concentration of market share in the semiconductor and electronics industries. Our five largest customers together accounted for approximately 40.3%46.4%, 48.2%46.2% and42.0% 51.1% of our operating revenues in 2014, 20152017, 2018 and 2016,2019, respectively. One customer accounted for more than 10.0% of our operating revenues in 2014, 20152017 and 2016.2018. For our operating revenues in 2019, two of our customers individually accounted for more than 10.0% of our operating revenues. The demand for our services from a customer is directly dependent upon that customer’s level of business activity, which could vary significantly from year to year. Our key customers typically operate in the cyclical semiconductor and electronic business and, in the past, have varied, and may vary in the future, order levels significantly from period to period. Some of these companies are relatively small, have limited operating histories and financial resources, and are highly exposed to the cyclicality of the industry. We cannot assure you that these customers or any other customers will continue to place orders with us in the future at the same levels as in past periods. The loss of one or more of our significant customers, or reduced orders by any one of them, and our inability to replace these customers or make up for such orders, could adversely affect our revenues and profitability. In addition, we have in the past reduced, and may in the future be requested to reduce, our prices to limit the level of order cancellations. Any price reduction would likely reduce our margins and profitability.

15