51

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period fromto. |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report |

Commission file number: 001-34476

BANCO SANTANDER (Brasil)(BRASIL) S.A.

(Exact name of Registrant as specified in its charter)

SANTANDER (BRAZIL) BANK, INC.

(Translation of Registrant’s name into English)

Federative Republic of Brazil

(Jurisdiction of incorporation)incorporation or organization)

Avenida Presidente Juscelino Kubitschek, 2,041 and 2,235 – Bloco2041, Suite 281, Block A

Condomínio WTORRE JK, Vila Olímpia

Nova Conceição

São Paulo, São Paulo SP 04543-011

Federative Republic of Brazil

(Address of principal executive offices)

Mercedes Pacheco, Managing Director – Senior Legal Counsel

Banco Santander, S.A.

New York Branch

45 E. 53rd Street

New York, New York New York 10022(212)

(212) 350-3604

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Trading | Name of each exchange on which registered |

| Units, each composed of | SANB11 | New York Stock Exchange* |

| Common Shares, no par value | SANB3 | New York Stock Exchange* |

| Preferred Shares, no par value | SANB4 | New York Stock Exchange* |

| American Depositary Shares, each representing one unit (or a right to receive one unit) which is composed of 1 common share, no par value, and 1 preferred share, no par value, of Banco Santander (Brasil) S.A. | BSBR | New York Stock Exchange |

| * | Not for trading purposes, but only in connection with the listing of American Depositary Shares pursuant to the requirements of the Securities and Exchange Commission. |

and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Title of each Class |

| 7.375% Tier 1 Subordinated Perpetual Notes |

| 6.000% Tier 2 Subordinated Notes due 2024 |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Title of Class | Number of Shares Outstanding |

| Common shares | |

| Preferred shares |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes☒ No☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐No☒

Yes☐ No☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes☒ No☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes☒ No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”,filer,” “accelerated filer”,filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer☒ | Accelerated Filer☐ | Non-accelerated Filer☐ | Emerging growth company☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

☐ U.S. GAAP

☒International Financial Reporting Standards as issued by the International Accounting Standards Board

☐ Other

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐Item 17☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes☐No☒

table of contents

Page

Presentation of Contents

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial and Other Information

General

In this annual report, the terms “Santander Brasil,” the “Bank,” “we,” “us,” “our,” “our company” and “our organization” meanrefer to Banco Santander (Brasil) S.A. and its consolidated subsidiaries, unless otherwise indicated. References to “Banco Real” mean Banco ABN AMRO Real S.A. and ABN AMRO Brasil Dois Participações S.A. and their respective consolidated subsidiaries, unless otherwise indicated. References to “Banespa” mean Banco do Estado de São Paulo S.A. – Banespa, one of our predecessor entities. The term “Santander Spain” means Banco Santander S.A. References to “Santander Group” mean the worldwide operations of the Santander Spain conglomerate, as indirectly controlled by Santander Spain and its consolidated subsidiaries, including Santander Brasil.

All references herein to the “real,” “reais” or “R$” are to the Brazilianreal, the official currency of Brazil. All references to “U.S. dollars,” “dollars” or “U.S.$” are to United States (or “U.S.”) dollars. All references to “euro,” “euros” or “€” are to the common legal currency of the member states participating in the European Economic and Monetary Union. References to “CI$” are to Cayman Islands dollars. References to “£” are to United Kingdom pounds sterling. See “Item 3. Key Information—A. Selected Financial Data—Exchange Rates” for information regarding exchange rates for the Brazilian currency.

Solely for the convenience of the reader, we have translated certain amounts included in “Item 3. Key Information—A. Selected Financial Data” and elsewhere in this annual report fromreais into U.S. dollars using the exchange rate as reported by the Brazilian Central Bank (Banco Central do Brasil), or the “Brazilian Central Bank,” as of December 31, 2019,2022, which was R$4.03075.2177 to U.S.$1.00, or on the indicated dates (subject, on any applicable date, to rounding adjustments). We make no representation that thereal or U.S. dollar amounts actually represent or could have been or could be converted into U.S. dollars at the rates indicated, at any particular exchange rate or at all.

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

Consolidated Financial Statements

We maintain our books and records inreais, our functional currency and the presentation currency for our consolidated financial statements.

This annual report contains our consolidated financial statements as of December 31, 2019, 2018 and 2017, and for the years ended December 31, 2019, 20182022, 2021 and 2017.2020. Such consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or “IFRS”IFRS (as defined in “—Certain Definitions”), as issued by the International Accounting Standards Board, or “IASB”IASB (as defined in “—Certain Definitions”) and interpretations issued by the IFRS Interpretation Committee, or “IFRIC”.Committee. Our consolidated financial statements as of and for the years ended December 31, 2019, 20182022, 2021 and 20172020 have been audited by PricewaterhouseCoopers Auditores Independentes or “PwC.” PwC isLtda., an independent registered public accounting firm, whose report and unqualified opinion is included herein.

IFRS differs in certain significant aspects in comparison with the generally accepted accounting principles in the United States, or “U.S. GAAP”.U.S. GAAP. IFRS also differs in certain significant aspects in comparison with the Brazilian GAAP (as defined below).GAAP. Appendix I to our audited consolidated financial statements for the years ended December 31, 2019, 20182022, 2021 and 2017,2020, included herein, contains information relating to certain differences between IFRS and Brazilian GAAP.

Under Brazilian law, we areAs required by the Brazilian Central Bank toand Brazilian law, we must prepare our consolidated financial statements according toin accordance with IFRS. However, we will also continue to prepare statutory financial statements in accordance with accounting practicesthe Brazilian GAAP, as established by Law No. 6,404, dated December 15, 1976, as amended by Law 11,638, orby: (i) Brazilian Corporate Law; (ii) the “Brazilian Corporate Law” and standards established by the

7

National Monetary Council ((CMN - Conselho Monetário Nacional), or “CMN,”; (iii) the Brazilian Central Bank and document template providedincluding the regulatory reports set forth in the AccountingStandard Chart of Accounts for NationalBrazilian Financial System Institutions (Plano Contábil das Instituições do Sistema Financeiro Nacional), and(iv) the Brazilian Securities and Exchange Commission ((CVM – Comissão de Valores Mobiliários), or “CVM,” to the extent that such practices do not conflict with the rules of the Brazilian Central Bank,Bank; (v) the Accounting Pronouncements Committee (C(CPC – Comitê de Pronunciamentos Contábeis), to the extent that such practices are approved by the Brazilian Central Bank,Bank; (vi) the National Council of Private Insurance (Conselho Nacional de Seguros Privados),; and (vii) the Superintendence of Private Insurance ((SUSEP - Superintendência de Seguros Privados), or “SUSEP.” We refer to such Brazilian accounting practices as “Brazilian GAAP.”which is responsible for the supervision and control of the markets for insurance, open private pension funds and capitalization bonds in Brazil. See “Item 4. Information on the Company—B. Business Overview—Regulation and Supervision—Other Applicable Laws and Regulations—Auditing Requirements.”Requirements” for additional information.

| 1 |

The Getnet Spin-Off

We completed the Spin-Off of our merchant acquiring business, conducted through Getnet and its consolidated subsidiaries, on October 26, 2021. As a result of the Spin-Off, Santander Brasil’s share capital was reduced by a total amount of R$2 billion, without the cancellation of shares, with Santander Brasil’s share capital decreasing from R$57 billion as of December 31, 2020 to R$55 billion as of December 31, 2021, and we stopped consolidating Getnet within our results of operations on March 31, 2021. Furthermore, on April 15, 2021, we entered into a partnership agreement with Getnet, or the “Getnet Partnership Agreement,” which provides a framework for our relationship with Getnet following the Spin-Off. For additional information, see “Item 4. Information on the Company—A. History and Development of the Company—Important Events—Spin-Off of Getnet” and notes 3, 13 and 27 to our audited consolidated financial statements included elsewhere in this annual report.

Market Share and Other Information

We obtained the market and competitive position data, including market forecasts, used throughout this annual report from internal surveys, market research, publicly available information and industry publications. These data are updated to the latest available information as of the date of this annual report. We have made these statements on the basis of information from third-party sources that we believe are reliable, such as the Brazilian association of savings and mortgage financing entities (Associação Brasileira das Entidades de Crédito Imobiliário e Poupança) or “ABECIP”; the Brazilian association of credit card companies (Associação Brasileira de Empresas de Cartões de Crédito e Serviços) or “ABECS”; the Brazilian association of leasing companies (Associação Brasileira de Empresas de Leasing); the national associationNational Association of financialFinancial and capital markets entitiesCapital Markets Entities (Associação Brasileira das Entidades dos Mercados Financeiro e de Capitais) or “ANBIMA”; the Brazilian Central Bank; the Brazilian social and economic development bankDevelopment Bank (Banco Nacional de Desenvolvimento Econômico e Social) or “BNDES”; the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística) or the “IBGE”; the Brazilian bank federationBank Federation (Federação Brasileira de Bancos), or “FEBRABAN”; the national federationNational Federation of private retirementPrivate Retirement and life insuranceLife Insurance (Federação Nacional de Previdência Privada e Vida); the Getúlio Vargas Foundation (Fundação Getúlio Vargas) or “FGV”; the Brazilian Central Bank systemInformation System (Sistema de Informações do Banco Central); the SUSEP; and the CVM, among others.

Certain Definitions

Unless otherwise indicated or the context otherwise requires, all references to:

“ADRs” mean American Depositary Receipts representing ADSs.

“ADSs” mean American Depositary Shares.

“B3” means the B3 S.A. – Brasil, Bolsa, Balcão, or the São Paulo Stock Exchange.

“Brazil” means the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil.

“Brazilian Central Bank” means the Central Bank of Brazil (Banco Central do Brasil).

“Brazilian Corporate Law” means Brazilian Law No. 6,404/76, as amended.

“Brazilian GAAP” means the generally accepted accounting principles in Brazil.

“CDI Rate” is the overnight interbank deposit rate (Certificado de Depósito Interbancário), which is the average daily interbank deposit rate in Brazil (at the end of each month and annually) for the given year.

8

| 2 |

“CMN” means the National Monetary Council (Conselho Monetário Nacional).

“COPOM” means the Brazilian Monetary Policy Committee (Comitê de Política Monetária).

“CPC” means the Accounting Pronouncements Committee (Comitê de Pronunciamentos Contábeis).

“CSLL” means the Brazilian social contribution over net income (Contribuição Social Sobre o Lucro Líquido).

“CVM” means the Brazilian Securities and Exchange Commission (Comissão de Valores Mobiliários).

“ESG” is an acronym for the words “environmental,” “social” and “governance.”

“Exchange Act” means the U.S. Securities Exchange Act of Contents1934, as amended.

“FGTS” means the Brazilian governmental employee severance indemnity fund (fundo de garantia por tempo de serviço).

“GDP” means gross domestic product.

“Getnet” means Getnet Adquirência e Serviços para Meios de Pagamento S.A. Getnet was one of our subsidiaries until the completion of the Spin-Off. For additional information on the Spin-Off of Getnet, see “Item 4. Information on the Company—A. History and Development of the Company— Important Events—Spin-Off of Getnet” and notes 3, 13 and 27 to our audited consolidated financial statements included elsewhere in this annual report.

“IASB” means the International Accounting Standards Board.

“IBGC” means the Brazilian Institute of Corporate Governance (Instituto Brasileiro de Governança Corporativa).

“IFRS” means International Financial Reporting Standards as issued by the IASB.

“IPCA” means the Brazilian consumer prices index (Índice de Preços ao Consumidor – Amplo), as calculated by IBGE.

“IGP-M” means the Brazilian general index of market prices (Índice Geral de Preços – Mercado), as calculated by the FGV.

“IOF” means the Brazilian tax on financial transactions (imposto sobre operações financeiras).

“IRPJ” means the Brazilian federal corporate income tax (imposto sobre a renda de pessoas jurídicas).

“LGPD” means Law No. 13,709/2018, or the Brazilian General Data Protection Act (Lei Geral de Proteção de Dados).

“ISS” means the Brazilian municipal services tax (imposto sobre serviços de qualquer natureza).

“NYSE” means the New York Stock Exchange.

“PIX” means the Brazilian Central Bank’s instant payment scheme.

“Santander Spain” mean Banco Santander, S.A. and its consolidated subsidiaries.

“Santander Group” mean the worldwide operations of the Santander Spain conglomerate, as indirectly controlled by Santander Spain and its consolidated subsidiaries, including Getnet and Santander Brasil.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

| 3 |

FORWARD-LOOKING STATEMENTS“SELIC” means the Brazilian Special Settlement and Custody System (Sistema Especial de Liquidação e Custódia), a system intended for custody of book-entry securities issued by the National Treasury Office and for the registration and settlement of transactions involving such securities.

“SMEs” means small and medium-sized enterprises.

“Spin-Off” means the distribution of all of the units, common shares and preferred shares of Getnet to holders of Santander Brasil units, common shares and preferred shares, including holders of Santander Brasil units represented by Santander Brasil ADSs, on a pro rata basis (excluding treasury shares), completed on October 26, 2021. For additional information on the Spin-Off of Getnet, see “Item 4. Information on the Company—A. History and Development of the Company— Important Events—Spin-Off of Getnet” and notes 3, 13 and 27 to our audited consolidated financial statements included elsewhere in this annual report.

“SUSEP” means the Superintendence of Private Insurance (Superintendência de Seguros Privados).

“TJLP” means the Long-Term Interest Rate (Taxa de Juros de Longo Prazo), the interest rate applied by the BNDES for long-term financing (at the end of the period).

“U.S. GAAP” means the generally accepted accounting principles in the United States.

“UN” means the United Nations.

“United States” or “U.S.” means the United States of America.

| 4 |

Forward-Looking Statements

This annual report contains estimates and forward-looking statements subject to risks and uncertainties, principally in “Item 3. Key Information—D. Risk Factors,” “Item 5. Operating and Financial Review and Prospects” and “Item 4. Information on the Company—B. Business Overview.Overview” and “Item 5. Operating and Financial Review and Prospects.” Some of the matters discussed concerning our business operations and financial performance include estimates and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995.

Our estimates and forward-looking statements are based mainly on our current expectations and estimates or projections of future events and trends, which affect or may affect our businesses and results of operations. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to certain risks and uncertainties and are made in light of information currently available to us. Our estimates and forward-looking statements may be influenced by the following factors, among others:

| · | general economic, political, social and business conditions in Brazil, including the impact of the current international economic environment and the macroeconomic conditions in |

| · | exposure to various types of inflation and interest rate risks, and the Brazilian |

| · | exposure to the sovereign debt of Brazil; |

| · | the effect of interest rate fluctuations on our obligations under employee pension funds; |

| · | exchange rate volatility; |

| · | infrastructure and labor force deficiencies in Brazil; |

| · | economic developments and perception of risk in other countries, including a global downturn; |

| · |

| increasing competition and consolidation in the Brazilian financial services industry; |

| · | extensive regulation by the Brazilian government and the Brazilian Central Bank, among others; |

| · | changes in reserve requirements; |

| · | changes in taxes or other fiscal assessments; |

| · | potential losses associated with an increase in the level of nonperforming loans or non-performance by counterparties to other types of financial instruments; |

| · | the effects of the ongoing war between Russia and the Ukraine or the 2019 coronavirus, or “COVID-19,” on the general economic and business conditions in Brazil, Latin America and globally; |

| · | climate-related conditions, regulations, targets and weather events; |

| · | uncertainty over the scope of actions that may be required by us, governments and others to achieve goals relating to climate, environmental and social matters, as well as the evolving nature of underlying science and industry and governmental standards and regulations; a decrease in the rate of growth of our loan portfolio; |

| · | potential prepayment of our loan and investment portfolio; |

| · | potential increase in our cost of funding, in particular with relation to short-term deposits; |

| · | a default on, or a ratings downgrade of, the sovereign debt of Brazil or |

| · | restrictions on the |

9

| 5 |

| · | the effectiveness of our credit risk management policies; |

| · | our ability to adequately manage market and operational risks; |

| · | potential deterioration in the value of the collateral securing our loan portfolio; |

| · | changes in energy prices; |

| · | failure to adequately protect ourselves against risks relating to cybersecurity; |

| · | our dependence on the proper functioning of information technology systems; |

| · | our ability to protect personal data; |

| · | our ability to protect ourselves against cybersecurity risks; |

| · | our ability to protect our reputation; |

| · | our ability to detect and prevent money laundering and other illegal activities; |

| · | our ability to manage the growth of our operations; |

| · | our ability to successfully and effectively integrate acquisitions or to evaluate risks arising from asset acquisitions; and |

| · | other risk factors as set forth under “Item 3. Key Information—D. Risk Factors” in this annual report. |

The words “believe,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “forecast,” “commitment,” “commit,” “focus,” “pledge” and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements are intended to be accurate only as of the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking statements. You should therefore not make any investment decision based on these estimates and forward-looking statements.

| 6 |

The forward-looking statements contained in this report speak only as of the date of this report. We do not undertake to update any forward-looking statement to reflect events or circumstances after that date or to reflect the occurrence of unanticipated events.

10

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| 1A. Directors and Senior Management |

Not applicable.

| 1B. Advisers |

Not applicable.

| 1C. Auditors |

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

| 2A. Offer Statistics |

Not applicable.

| 2B. Method and Expected Timetable |

Not applicable.

| 3A. Selected Financial Data |

FinancialThe following tables set forth the selected financial information forof Santander Brasil as of and for the years ended December 31, 2019, 2018, 2017, 20162022, 2021 and 2015 has been2020 derived from our audited consolidated financial statements prepared in accordance with IFRS as issued by the IASB. See “Item 18. Financial Statements.” This financial information should be read in conjunction with our audited consolidated financial statements the related notes and “Item 5. Operating and Financial Review and Prospects”Prospects,” as well as our audited consolidated financial statements and the related notes thereto included within this annual report.

In the year ended December 31, 2021, we revisited the accounting treatment of electric energy sales contracts, which no longer include the amount of the principal and, therefore, only the adjustments to fair value and interest determined in these transactions are recorded in equity accounts. The financial information as of and for the year ended December 31, 2020 presented in this annual report already reflects the aforementioned adjustments. See note 8 to our audited consolidated financial statements included elsewhere in this annual report.

Income Statement Data

| For the Year Ended December 31, | For the Year Ended December 31, | |||||||||||||||||||||||||||||||||||||||

| 2019 | 2019 | 2018 | 2017 | 2016 | 2015 | 2022 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||||

| (in millions of U.S.$)(1) | (in millions of R$) | (in millions of U.S.$)(1) | (in millions of R$) | |||||||||||||||||||||||||||||||||||||

| Interest and similar income | 18,072 | 72,841 | 70,478 | 71,418 | 77,146 | 69,870 | 22,084 | 115,225 | 77,987 | 62,775 | ||||||||||||||||||||||||||||||

| Interest expense and similar charges | (7,076 | ) | (28,520 | ) | (28,557 | ) | (36,472 | ) | (46,560 | ) | (38,533 | ) | (12,979 | ) | (67,722 | ) | (26,669 | ) | (18,332 | ) | ||||||||||||||||||||

| Net interest income | 10,996 | 44,321 | 41,921 | 34,946 | 30,586 | 31,337 | 9,104 | 47,503 | 51,318 | 44,443 | ||||||||||||||||||||||||||||||

| Income from equity instruments | 5 | 19 | 33 | 83 | 259 | 143 | 7 | 38 | 90 | 34 | ||||||||||||||||||||||||||||||

| Income from companies accounted for by the equity method | 37 | 149 | 66 | 72 | 48 | 116 | 38 | 199 | 144 | 112 | ||||||||||||||||||||||||||||||

| Fee and commission income | 5,059 | 20,392 | 17,728 | 15,816 | 13,548 | 11,797 | 4,070 | 21,238 | 20,388 | 20,607 | ||||||||||||||||||||||||||||||

| Fee and commission expense | (1,161 | ) | (4,679 | ) | (3,596 | ) | (3,094 | ) | (2,571 | ) | (2,314 | ) | (1,219 | ) | (6,362 | ) | (5,115 | ) | (4,378 | ) | ||||||||||||||||||||

| Gains (losses) on financial assets and liabilities (net) | 611 | 2,463 | (2,783 | ) | 969 | 3,016 | (20,002 | ) | 796 | 4,153 | 222 | 12,998 | ||||||||||||||||||||||||||||

| Exchange differences (net) | 105 | 546 | (2,002 | ) | (24,701 | ) | ||||||||||||||||||||||||||||||||||

| 7 |

11

| Other operating income (expenses) net | (161 | ) | (841 | ) | (1,119 | ) | (873 | ) | ||||||||

| Total income | 12,740 | 66,475 | 63,926 | 48,242 | ||||||||||||

| Administrative expenses | (3,496 | ) | (18,240 | ) | (17,316 | ) | (17,115 | ) | ||||||||

| Depreciation and amortization | (496 | ) | (2,586 | ) | (2,434 | ) | (2,579 | ) | ||||||||

| Provisions (net)(2) | (233 | ) | (1,215 | ) | (2,179 | ) | (1,657 | ) | ||||||||

| Impairment losses on financial assets (net)(3) | (4,759 | ) | (24,829 | ) | (17,113 | ) | (17,450 | ) | ||||||||

| Impairment losses on other assets (net) | (31 | ) | (161 | ) | (166 | ) | (85 | ) | ||||||||

| Gains (losses) on disposal of assets not classified as non-current assets held for sale | 4 | 22 | (15 | ) | 231 | |||||||||||

| Gains (losses) on non-current assets held for sale not classified as discontinued operations | 21 | 109 | 48 | 77 | ||||||||||||

| Operating income before tax | 3,752 | 19,575 | 24,750 | 9,664 | ||||||||||||

| Income taxes | (1,003 | ) | (5,235 | ) | (9,191 | ) | 3,787 | |||||||||

| Consolidated net income for the period | 2,748 | 14,339 | 15,559 | 13,451 |

| Exchange differences (net) | (692 | ) | (2,789 | ) | (2,806 | ) | 605 | 4,575 | 10,084 | |||||||||||||||

| Other operating income (expenses) | (275 | ) | (1,108 | ) | (1,056 | ) | (672 | ) | (625 | ) | (347 | ) | ||||||||||||

| Total income | 14,580 | 58,769 | 49,507 | 48,725 | 48,837 | 30,814 | ||||||||||||||||||

| Administrative expenses | (4,203 | ) | (16,942 | ) | (16,792 | ) | (16,121 | ) | (14,920 | ) | (14,515 | ) | ||||||||||||

| Depreciation and amortization | (593 | ) | (2,392 | ) | (1,740 | ) | (1,662 | ) | (1,483 | ) | (1,490 | ) | ||||||||||||

| Provisions (net)(2) | (913 | ) | (3,682 | ) | (2,000 | ) | (3,309 | ) | (2,725 | ) | (4,001 | ) | ||||||||||||

| Impairment losses on financial assets (net)(3) | (3,317 | ) | (13,370 | ) | (12,713 | ) | (12,338 | ) | (13,301 | ) | (13,634 | ) | ||||||||||||

| Impairment losses on other assets (net) | (33 | ) | (131 | ) | (508 | ) | (457 | ) | (114 | ) | (1,221 | ) | ||||||||||||

| Gains (losses) on disposal of assets not classified as non-current assets held for sale | 3 | 11 | (25 | ) | (64 | ) | 4 | 781 | ||||||||||||||||

| Gains (losses) on non-current assets held for sale not classified as discontinued operations | 2 | 10 | 182 | (260 | ) | 87 | 50 | |||||||||||||||||

| Operating profit before tax | 5,526 | 22,273 | 15,910 | 14,514 | 16,384 | (3,216 | ) | |||||||||||||||||

| Income taxes | (1,400 | ) | (5,642 | ) | (3,110 | ) | (5,376 | ) | (8,919 | ) | 13,050 | |||||||||||||

| Consolidated Profit for the Year | 4,126 | 16,631 | 12,800 | 9,138 | 7,465 | 9,834 |

| (1) | Translated for convenience only using the selling rate as reported by the Brazilian Central Bank as of December 31, |

| (2) | Mainly provisions for tax risks and legal obligations, and judicial and administrative proceedings of labor and civil lawsuits. For further discussion, see notes |

| (3) |

Earnings and Dividend per Share Information

| For the Year Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| Basic and Diluted Earnings per 1,000 shares | ||||||||||||

| From continuing and discontinued operations (1) | ||||||||||||

| Basic Earnings per shares (reais) | ||||||||||||

| Common Shares | 1,831.43 | 1,981.65 | 1,713.45 | |||||||||

| Preferred Shares | 2,014.57 | 2,179.82 | 1,884.80 | |||||||||

| Diluted Earnings per shares (reais) | ||||||||||||

| Common Shares | 1,831.43 | 1,981.65 | 1,713.45 | |||||||||

| Preferred Shares | 2,014.57 | 2,179.82 | 1,884.80 | |||||||||

| Basic Earnings per shares (U.S. dollars) (2) | ||||||||||||

| Common Shares | 351.00 | 355.10 | 329.72 | |||||||||

| Preferred Shares | 386.10 | 390.61 | 362.69 | |||||||||

| Diluted Earnings per shares (U.S. dollars) (2) | ||||||||||||

| Common Shares | 351.00 | 355.10 | 329.72 | |||||||||

| Preferred Shares | 386.10 | 390.61 | 362.69 | |||||||||

| From continuing operations | ||||||||||||

| Basic Earnings per shares (reais) | ||||||||||||

| Common Shares | 1,831.43 | 1,981.65 | 1,713.45 | |||||||||

| Preferred Shares | 2,014.57 | 2,179.82 | 1,884.80 | |||||||||

| Diluted Earnings per shares (reais) | ||||||||||||

| Common Shares | 1,831.43 | 1,981.65 | 1,713.45 | |||||||||

| Preferred Shares | 2,014.57 | 2,179.82 | 1,884.80 | |||||||||

| Basic Earnings per shares (U.S. dollars) (2) | ||||||||||||

| Common Shares | 351.00 | 355.10 | 329.72 | |||||||||

| Preferred Shares | 386.10 | 390.61 | 362.69 | |||||||||

| Diluted Earnings per shares (U.S. dollars) (2) | ||||||||||||

| Common Shares | 351.00 | 355.10 | 329.72 | |||||||||

| Preferred Shares | 386.10 | 390.61 | 362.69 | |||||||||

| Dividends and interest on capital per 1,000 shares (undiluted) | ||||||||||||

| Common Shares (reais) | 1,035.69 | 1,231.79 | 1,693.28 | |||||||||

| Preferred Shares (reais) | 1,139.27 | 1,354.97 | 1,631.71 | |||||||||

| Common Shares (U.S. dollars)(2) | 198.50 | 220.73 | 325.84 | |||||||||

| Preferred Shares (U.S. dollars)(2) | 218.35 | 242.80 | 313.99 | |||||||||

| Weighted average share outstanding (in thousands) – basic | ||||||||||||

| For the Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Basic and Diluted Earnings per 1,000 shares | ||||||||||||||||||||

| From continuing and discontinued operations(1) | ||||||||||||||||||||

| Basic Earnings per shares (reais) | ||||||||||||||||||||

| Common Shares | 2,094.83 | 1,604.34 | 1,133.43 | 929.93 | 1,236.96 | |||||||||||||||

| Preferred Shares | 2,304.32 | 1,764.78 | 1,246.77 | 1,022.92 | 1,360.66 | |||||||||||||||

| Diluted Earnings per shares (reais) | ||||||||||||||||||||

| Common Shares | 2,094.83 | 1,604.34 | 1,132.44 | 929.03 | 1,235.79 | |||||||||||||||

| Preferred Shares | 2,304.32 | 1,764.78 | 1,245.69 | 1,021.93 | 1,359.36 | |||||||||||||||

| Basic Earnings per shares (U.S. dollars) (2) | ||||||||||||||||||||

| Common Shares | 519.72 | 414.05 | 342.63 | 285.34 | 316.78 | |||||||||||||||

| Preferred Shares | 571.69 | 455.45 | 376.90 | 313.87 | 348.46 | |||||||||||||||

| Diluted Earnings per shares (U.S. dollars) (2) | ||||||||||||||||||||

| Common Shares | 519.72 | 414.05 | 342.33 | 285.06 | 316.48 | |||||||||||||||

| Preferred Shares | 571.69 | 455.45 | 376.57 | 313.57 | 348.13 | |||||||||||||||

| From continuing operations | ||||||||||||||||||||

| Basic Earnings per shares (reais) | ||||||||||||||||||||

| Common Shares | 2,094.83 | 1,604.34 | 1,133.43 | 929.93 | 1,236.96 | |||||||||||||||

| Preferred Shares | 2,304.32 | 1,764.78 | 1,246.77 | 1,022.92 | 1,360.66 | |||||||||||||||

| Diluted Earnings per shares (reais) | ||||||||||||||||||||

| Common Shares | 2,094.83 | 1,604.34 | 1,132.44 | 929.03 | 1,235.79 | |||||||||||||||

| Preferred Shares | 2,304.32 | 1,764.78 | 1,245.69 | 1,021.93 | 1,359.36 | |||||||||||||||

| Basic Earnings per shares (U.S. dollars) (2) | ||||||||||||||||||||

| Common Shares | 519.72 | 414.05 | 342.63 | 285.34 | 316.78 | |||||||||||||||

| Preferred Shares | 571.69 | 455.45 | 376.90 | 313.87 | 348.46 | |||||||||||||||

| Diluted Earnings per shares (U.S. dollars) (2) | ||||||||||||||||||||

| Common Shares | 519.72 | 414.05 | 342.33 | 285.06 | 316.48 | |||||||||||||||

| Preferred Shares | 571.69 | 455.45 | 376.57 | 313.57 | 348.13 | |||||||||||||||

| Dividends and interest on capital per 1,000 shares (undiluted) | ||||||||||||||||||||

| 8 |

12

| Common Shares | 3,787,533 | 3,802,851 | 3,800,140 | |||||||||

| Preferred Shares | 3,648,674 | 3,666,423 | 3,664,666 | |||||||||

| Weighted average shares outstanding (in thousands) – diluted | ||||||||||||

| Common Shares | 3,787,533 | 3,802,851 | 3,800,140 | |||||||||

| Preferred Shares | 3,648,674 | 3,666,423 | 3,664,666 |

| Common Shares (reais) | 1,378.87 | 841.68 | 801.63 | 666.21 | 784.90 | |||||||||||||||

| Preferred Shares (reais) | 1,516.76 | 925.85 | 881.80 | 732.83 | 863.39 | |||||||||||||||

| Common Shares (U.S. dollars)(2) | 342.09 | 217.22 | 242.33 | 204.42 | 201.01 | |||||||||||||||

| Preferred Shares (U.S. dollars)(2) | 376.30 | 238.94 | 266.57 | 224.86 | 221.11 | |||||||||||||||

| Weighted average share outstanding (in thousands) – basic | ||||||||||||||||||||

| Common Shares | 3,802,303 | 3,807,386 | 3,822,057 | 3,828,555 | 3,839,159 | |||||||||||||||

| Preferred Shares | 3,663,444 | 3,668,527 | 3,683,145 | 3,689,696 | 3,700,299 | |||||||||||||||

| Weighted average shares outstanding (in thousands) – diluted(3) | ||||||||||||||||||||

| Common Shares | 3,802,303 | 3,807,386 | 3,825,313 | 3,832,211 | 3,842,744 | |||||||||||||||

| Preferred Shares | 3,663,444 | 3,668,527 | 3,686,401 | 3,693,352 | 3,703,884 |

| (1) | Per share amounts reflect the effects of the bonus share issue and reverse share split for each period presented. |

| (2) | Translated for convenience only using the selling rate as reported by the Brazilian Central Bank as of December 31, |

Balance Sheet Data

| As of December 31, | ||||||||||||||||

| 2022 | 2022 | 2021 | 2020 | |||||||||||||

| (in millions of U.S.$) (1) | (in millions of R$) | |||||||||||||||

| Assets | ||||||||||||||||

| Cash and balances with the Brazilian Central Bank | 4,217 | 22,003 | 16,657 | 20,149 | ||||||||||||

| Financial assets held for trading | — | — | — | — | ||||||||||||

| Financial Assets Measured At Fair Value Through Profit Or Loss | 11,221 | 58,547 | 18,859 | 60,900 | ||||||||||||

| Financial Assets Measured At Fair Value Through Profit Or Loss Held For Trading | 16,259 | 84,834 | 70,571 | 95,843 | ||||||||||||

| Non-Trading Financial Assets Mandatorily Measured At Fair Value Through Profit Or Loss | 409 | 2,134 | 870 | 500 | ||||||||||||

| Financial Assets Measured At Fair Value Through Other Comprehensive Income | 10,623 | 55,426 | 101,242 | 109,740 | ||||||||||||

| Financial Assets Measured At Amortized Cost | 127,225 | 663,824 | 633,241 | 554,925 | ||||||||||||

| Hedging derivatives | 334 | 1,741 | 342 | 743 | ||||||||||||

| Non-current assets held for sale | 134 | 699 | 816 | 1,093 | ||||||||||||

| Investments in associates and joint ventures | 331 | 1,728 | 1,233 | 1,095 | ||||||||||||

| Tax assets | 8,902 | 46,446 | 41,757 | 41,064 | ||||||||||||

| Other assets | 1,586 | 8,275 | 6,049 | 7,222 | ||||||||||||

| Property, plant and equipment | 1,570 | 8,191 | 8,784 | 9,537 | ||||||||||||

| Intangible assets | 6,057 | 31,603 | 30,787 | 30,766 | ||||||||||||

| Total assets | 188,867 | 985,451 | 931,208 | 933,578 | ||||||||||||

| Average total assets* | 189,409 | 988,277 | 942,177 | 854,615 | ||||||||||||

| Liabilities | ||||||||||||||||

| Financial liabilities held for trading (2) | 7,809 | 40,747 | 36,953 | 75,020 | ||||||||||||

| Financial Liabilities Measured At Fair Value Through Profit Or Loss | 1,710 | 8,922 | 7,460 | 7,038 | ||||||||||||

| Financial liabilities at amortized cost | 152,420 | 795,284 | 750,094 | 707,289 | ||||||||||||

| Deposits from the Brazilian Central Bank and deposits from credit institutions | 22,247 | 116,079 | 121,006 | 131,657 | ||||||||||||

| Customer deposits | 93,902 | 489,953 | 468,961 | 445,814 | ||||||||||||

| Marketable debt securities | 20,530 | 107,121 | 79,037 | 56,876 | ||||||||||||

| Debt Instruments Eligible to Compose Capital | 3,744 | 19,538 | 19,641 | 13,120 | ||||||||||||

| Other financial liabilities | 11,996 | 62,593 | 61,449 | 59,823 | ||||||||||||

| Hedging derivatives | — | — | 447 | 145 | ||||||||||||

| Provisions (3) | 1,747 | 9,115 | 11,604 | 13,815 | ||||||||||||

| Tax liabilities | 1,497 | 7,811 | 8,175 | 10,130 | ||||||||||||

| Other liabilities | 2,471 | 12,892 | 10,501 | 14,051 | ||||||||||||

| As of December 31, | ||||||||||||||||||||||||

| 2019 | 2019 | 2018 | 2017 | 2016 | 2015 | |||||||||||||||||||

| (in millions of U.S.$)(1) | (in millions of R$) | |||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||

| Cash and balances with the Brazilian Central Bank(2) | 4,993 | 20,127 | 19,464 | 20,642 | 26,285 | 89,143 | ||||||||||||||||||

| Financial assets held for trading | - | - | - | 86,271 | 131,245 | 50,537 | ||||||||||||||||||

| Financial Assets Measured At Fair Value Through Profit Or Loss | 8,024 | 32,342 | 43,712 | - | - | - | ||||||||||||||||||

| Financial Assets Measured At Fair Value Through Profit Or Loss Held For Trading | 14,147 | 57,021 | 68,852 | - | - | - | ||||||||||||||||||

| Non-Trading Financial Assets Mandatorily Measured At Fair Value Through Profit Or Loss | 42 | 171 | 917 | - | - | - | ||||||||||||||||||

| Other financial assets at fair value through profit or loss | - | - | - | 1,692 | 1,711 | 2,080 | ||||||||||||||||||

| Available-for-sale financial assets | - | - | - | 85,823 | 57,815 | 68,265 | ||||||||||||||||||

| Financial Assets Measured At Fair Value Through Other Comprehensive Income | 23,847 | 96,120 | 85,437 | - | - | - | ||||||||||||||||||

| Held to maturity investments | - | - | - | 10,214 | 10,048 | 10,098 | ||||||||||||||||||

| Loans and receivables(2) | - | - | - | 368,729 | 333,997 | 306,269 | ||||||||||||||||||

| Financial Assets Measured At Amortized Cost (2) | 117,766 | 474,681 | 429,731 | - | - | - | ||||||||||||||||||

| Hedging derivatives | 84 | 340 | 344 | 193 | 223 | 1,312 | ||||||||||||||||||

| Non-current assets held for sale | 329 | 1,325 | 1,380 | 1,155 | 1,338 | 1,237 | ||||||||||||||||||

| Investments in associates and joint ventures | 266 | 1,071 | 1,053 | 867 | 990 | 1,061 | ||||||||||||||||||

| Tax assets | 8,336 | 33,599 | 31,566 | 28,826 | 28,753 | 34,770 | ||||||||||||||||||

| Other assets | 1,256 | 5,061 | 4,800 | 4,578 | 5,104 | 3,802 | ||||||||||||||||||

| Tangible assets | 2,427 | 9,782 | 6,589 | 6,510 | 6,646 | 7,006 | ||||||||||||||||||

| Intangible assets | 7,591 | 30,596 | 30,019 | 30,202 | 30,237 | 29,814 | ||||||||||||||||||

| Total assets | 189,108 | 762,237 | 723,865 | 645,703 | 634,393 | 605,395 | ||||||||||||||||||

| Average total assets* | 182,476 | 735,507 | 685,531 | 637,511 | 605,646 | 571,918 | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||

| Financial liabilities held for trading | - | - | - | 49,323 | 51,620 | 42,388 | ||||||||||||||||||

| Financial Liabilities Measured At Fair Value Through Profit Or Loss Held For Trading | 11,428 | 46,065 | 50,939 | - | - | - | ||||||||||||||||||

| Financial Liabilities Measured At Fair Value Through Profit Or Loss | 1,320 | 5,319 | 1,946 | - | - | - | ||||||||||||||||||

| Financial liabilities at amortized cost | 142,712 | 575,230 | 547,295 | 478,881 | 471,579 | 457,282 | ||||||||||||||||||

| 9 |

| Total liabilities | 167,654 | 874,771 | 825,234 | 827,488 | ||||||||||||

| Stockholders’ equity | 21,977 | 114,669 | 109,047 | 106,205 | ||||||||||||

| Other Comprehensive Income | (860 | ) | (4,486 | ) | (3,406 | ) | (428 | ) | ||||||||

| Non-controlling interests | 95 | 497 | 334 | 313 | ||||||||||||

| Total stockholders’ equity | 21,212 | 110,680 | 105,974 | 106,090 | ||||||||||||

| Total liabilities and stockholders’ equity | 188,867 | 985,451 | 931,208 | 933,578 | ||||||||||||

| Average interest-bearing liabilities* | 128,995 | 673,056 | 647,752 | 573,429 | ||||||||||||

| Average total stockholders’ equity* | 24,696 | 128,849 | 105,070 | 101,531 |

* The average annual balance sheet data has been calculated based upon the average of the monthly balances at 13 dates: as of December 31 of the prior year and for each of the month-end balances of the 12 subsequent months.

(1) Translated for convenience only using the selling rate as reported by the Brazilian Central Bank as of December 31, 2022, for reais into U.S. dollars of R$5.2177 to U.S.$1.00.

(2) In the year ended December 31, 2021, we revisited the accounting treatment of electric energy sales contracts, which no longer include the amount of the principal and, therefore, only the adjustments to fair value and interest determined in these transactions are recorded in equity accounts, The financial information as of and for the year ended December 31, 2020 presented in this annual report already reflects the aforementioned adjustments. See note 8 to our audited consolidated financial statements included elsewhere in this annual report.

13

labor and civil lawsuits.

| Deposits from the Brazilian Central Bank and deposits from credit institutions | 24,629 | 99,271 | 99,023 | 79,375 | 78,634 | 69,451 | ||||||||||||||||||

| Customer deposits | 83,488 | 336,515 | 304,198 | 276,042 | 247,445 | 243,043 | ||||||||||||||||||

| Marketable debt securities | 18,285 | 73,702 | 74,626 | 70,247 | 99,843 | 94,658 | ||||||||||||||||||

| Subordinated debts | - | - | 9,886 | 519 | 466 | 8,097 | ||||||||||||||||||

| Debt Instruments Eligible to Compose Capital | 2,525 | 10,176 | 9,780 | 8,437 | 8,312 | 9,959 | ||||||||||||||||||

| Other financial liabilities | 13,786 | 55,566 | 49,783 | 44,261 | 36,879 | 32,073 | ||||||||||||||||||

| Hedging derivatives | 50 | 201 | 224 | 163 | 311 | 2,377 | ||||||||||||||||||

| Provisions(3) | 4,052 | 16,332 | 14,696 | 13,987 | 11,776 | 11,410 | ||||||||||||||||||

| Tax liabilities | 2,719 | 10,960 | 8,075 | 8,248 | 6,095 | 5,253 | ||||||||||||||||||

| Other liabilities | 2,709 | 10,921 | 9,095 | 8,014 | 8,199 | 6,850 | ||||||||||||||||||

| Total liabilities | 164,991 | 665,028 | 632,270 | 558,615 | 549,581 | 525,559 | ||||||||||||||||||

| Stockholders’ equity | 23,994 | 96,711 | 91,882 | 87,425 | 85,435 | 83,532 | ||||||||||||||||||

| Other Comprehensive Income | (21 | ) | (86 | ) | (879 | ) | (774 | ) | (1,348 | ) | (4,132 | ) | ||||||||||||

| Non-controlling interests | 145 | 583 | 593 | 437 | 726 | 435 | ||||||||||||||||||

| Total Stockholders’ Equity | 24,117 | 97,209 | 91,595 | 87,088 | 84,812 | 79,835 | ||||||||||||||||||

| Total liabilities and stockholders’ equity | 189,108 | 762,237 | 723,865 | 645,703 | 634,393 | 605,395 | ||||||||||||||||||

| Average interest-bearing liabilities* | 121,861 | 491,187 | 463,388 | 416,816 | 408,067 | 400,008 | ||||||||||||||||||

| Average total stockholders’ equity* | 23,777 | 95,836 | 89,263 | 87,868 | 84,283 | 81,475 |

Selected Consolidated Ratios (*)

| As of and for the Year Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| (%) | ||||||||||||

| Profitability and performance | ||||||||||||

| Return on average total assets | 1.5 | 1.7 | 1.6 | |||||||||

| Asset quality | ||||||||||||

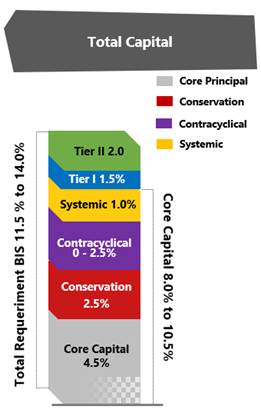

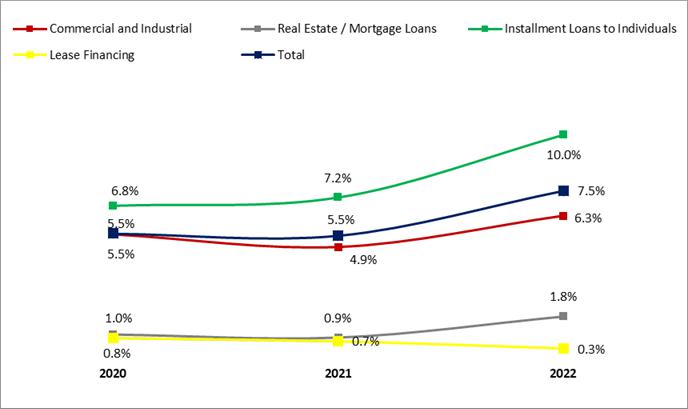

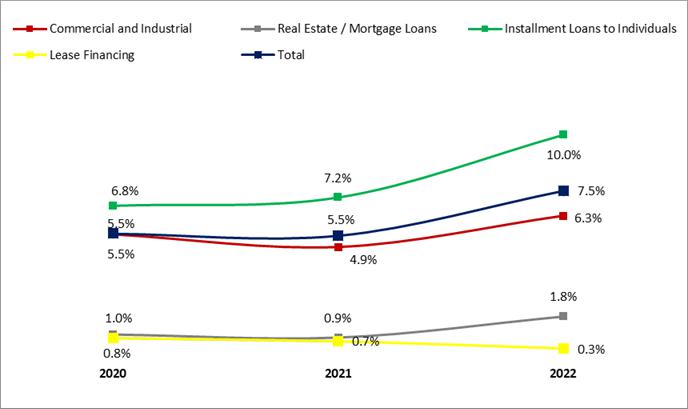

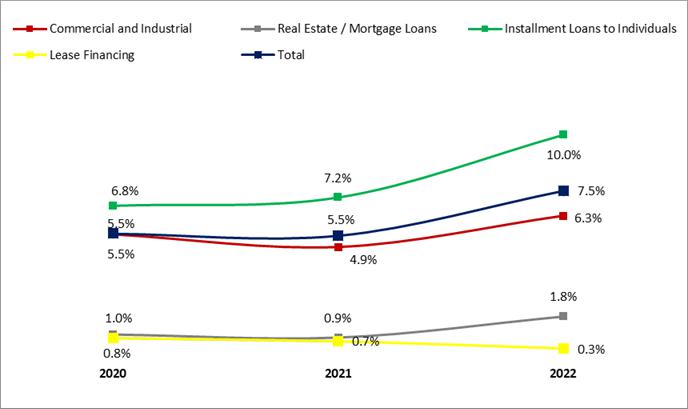

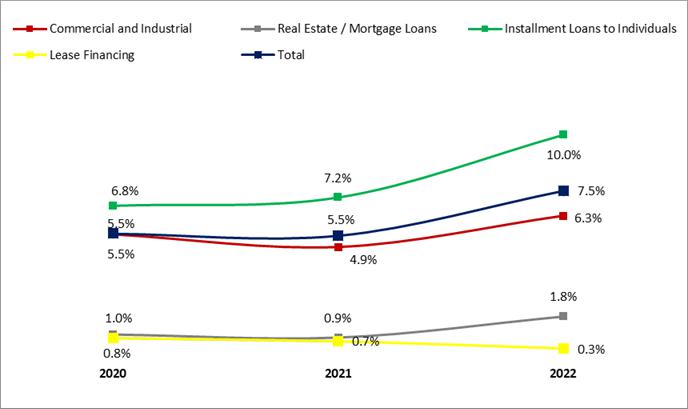

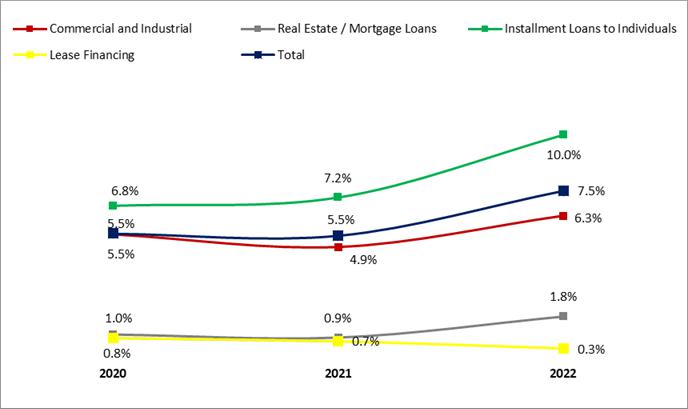

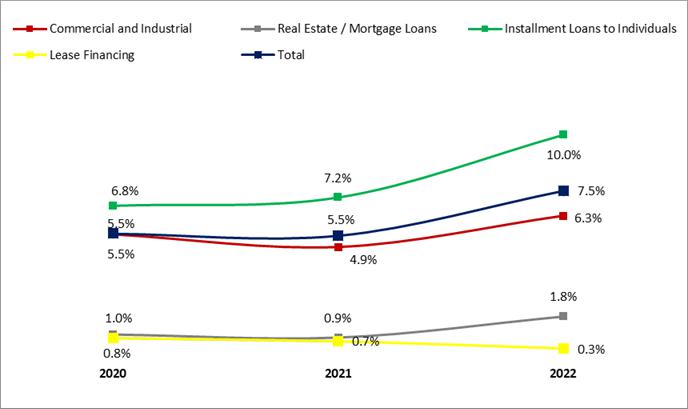

| Impaired assets as a percentage of loans and advances to customers (gross) (1) | 7.5 | 5.5 | 5.5 | |||||||||

| Impaired assets as a percentage of total assets (1) | 4.0 | 2.9 | 2.5 | |||||||||

| Impairment losses to customers as a percentage of impaired assets(1) (2) | 86.7 | 105.9 | 103.8 | |||||||||

| Impairment losses to customers as a percentage of loans and advances to customers (gross) (3) | 6.5 | 5.8 | 5.8 | |||||||||

| Derecognized assets as a percentage of loans and advances to customers (gross) | 3.7 | 3.0 | 3.7 | |||||||||

| Impaired assets as a percentage of stockholders’ equity (1) | 35.6 | 25.5 | 21.8 | |||||||||

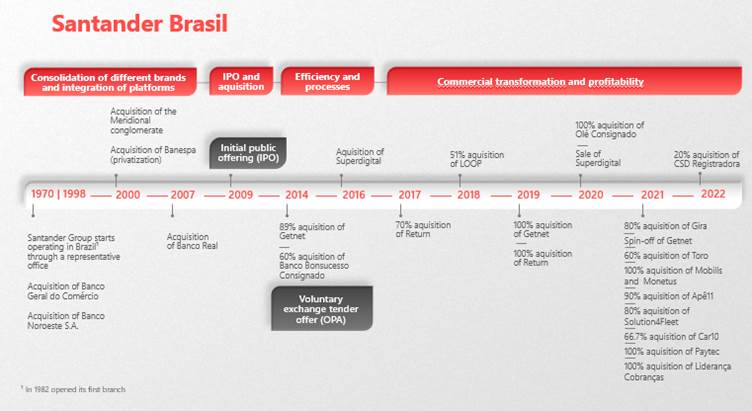

| Capital adequacy | ||||||||||||

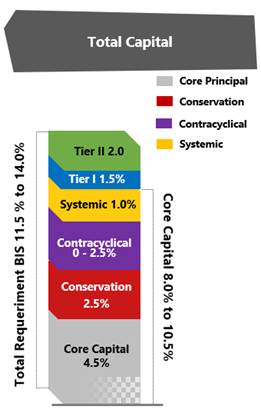

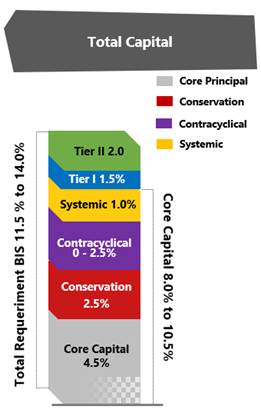

| Basel capital adequacy ratio (4) | 13.9 | 14.9 | 15.3 | |||||||||

| Efficiency | ||||||||||||

| Efficiency ratio (5) | 27.4 | 27.1 | 35.5 | |||||||||

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (%) | ||||||||||||||||||||

| Profitability and performance | ||||||||||||||||||||

| Return on average total assets | 2.3 | 1.9 | 1.4 | 1.2 | 1.7 | |||||||||||||||

| Asset quality | ||||||||||||||||||||

| Impaired assets as a percentage of loans and advances to customers (gross)(1) | 6.7 | 7.0 | 6.7 | 7.0 | 7.0 | |||||||||||||||

| Impaired assets as a percentage of total assets(1) | 3.1 | 3.1 | 3.0 | 3.0 | 3.1 | |||||||||||||||

| Impairment losses to customers as a percentage of impaired assets(1) (4) | 87.8 | 90.3 | 80.5 | 87.0 | 81.9 | |||||||||||||||

| Impairment losses to customers as a percentage of loans and advances to customers (gross) (5) | 5.9 | 6.3 | 5.4 | 6.1 | 5.7 | |||||||||||||||

| Derecognized assets as a percentage of loans and advances to customers (gross) | 4.3 | 3.5 | 4.7 | 4.3 | 4.4 | |||||||||||||||

| Impaired assets as a percentage of stockholders’ equity(1) | 24.3 | 24.5 | 22.0 | 22.3 | 23.3 | |||||||||||||||

| Capital adequacy | ||||||||||||||||||||

| Basel capital adequacy ratio(2) | 15.0 | 15.1 | 15.8 | 16.3 | 15.7 | |||||||||||||||

| Efficiency | ||||||||||||||||||||

| Efficiency ratio(3) | 28.8 | 33.9 | 33.1 | 30.6 | 47.1 | |||||||||||||||

See also “Item 4. Information on the Company—B. Business Overview—Selected Statistical Information—Selected Credit Ratios.”

| * | The average annual balance sheet data has been calculated based upon the average of the monthly balances at 13 dates: as of December 31 of the prior year and for each of the month-end balances of the 12 subsequent months. |

| (1) | Impaired assets include all loans and advances past due by more than 90 days and other doubtful credits. For further information, |

| (2) |

14

Supervision—Capital Adequacy and Leverage – Basel.”

| In |

| In |

| (4) | Basel capital adequacy ratio is measured pursuant to Brazilian Central Bank rules. |

| (5) | Efficiency ratio is determined by dividing administrative expenses by total income. |

See also “Item 4. Information on the Company—B. Business Overview—Selected Statistical Information—Selected Credit Ratios.”

| 10 |

Selected Consolidated Ratios, Including Non-GAAP Ratios (*)

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (%) | ||||||||||||||||||||

| Profitability and performance | ||||||||||||||||||||

| Net yield(1) | 6.8 | 6.9 | 6.4 | 6.2 | 6.6 | |||||||||||||||

| Return on average stockholders’ equity(2) | 17.4 | 14.3 | 10.4 | 8.9 | 12.1 | |||||||||||||||

| Adjusted return on average stockholders’ equity(2) | 24.7 | 21.0 | 15.4 | 13.3 | 18.5 | |||||||||||||||

| Average stockholders’ equity as a percentage of average total assets(2)(*) | 13.0 | 13.0 | 13.8 | 13.9 | 14.2 | |||||||||||||||

| Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill(2)(*) | 9.6 | 9.3 | 9.8 | 9.7 | 9.8 | |||||||||||||||

| Asset quality | ||||||||||||||||||||

| Impaired assets as a percentage of credit risk exposure (3) | 6.0 | 6.2 | 5.8 | 6.3 | 6.0 | |||||||||||||||

| Impaired assets as a percentage of stockholders’ equity excluding goodwill(2)(3) | 34.4 | 35.5 | 32.6 | 33.5 | 36.1 | |||||||||||||||

| Liquidity | ||||||||||||||||||||

| Loans and advances to customers, net as a percentage of total funding(4) | 62.9 | 60.6 | 62.7 | 58.0 | 59.3 | |||||||||||||||

| Efficiency | ||||||||||||||||||||

| Adjusted efficiency ratio(5) | 28.2 | 30.3 | 32.5 | 34.9 | 34.8 | |||||||||||||||

| As of and for the Year Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| (%) | ||||||||||||

| Profitability and performance | ||||||||||||

| Net yield (1) | 5.3 | 5.9 | 6.0 | |||||||||

| Return on average stockholders’ equity (2) | 11.1 | 14.8 | 13.3 | |||||||||

| Adjusted return on average stockholders’ equity (2) | 14.2 | 20.2 | 18.4 | |||||||||

| Average stockholders’ equity as a percentage of average total assets (2)(*) | 13.0 | 11.2 | 11.9 | |||||||||

| Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill (2)(*) | 10.5 | 8.4 | 8.8 | |||||||||

| Asset quality | ||||||||||||

| Impaired assets as a percentage of credit risk exposure (3) | 6.7 | 4.9 | 5.0 | |||||||||

| Impaired assets as a percentage of stockholders’ equity excluding goodwill (2)(3) | 47.4 | 34.5 | 29.8 | |||||||||

| Liquidity | ||||||||||||

| Loans and advances to customers, net as a percentage of total funding (4) | 67.0 | 70.2 | 76.3 | |||||||||

| Efficiency | ||||||||||||

| Adjusted efficiency ratio (5) | 27.5 | 28.2 | 27.8 | |||||||||

(*)

| (*) | The average annual balance sheet data has been calculated based upon the average of the monthly balances at 13 dates: at December 31 of the prior year and for each of the month-end balances of the 12 subsequent months. |

| (1) | “Net yield” is defined as net interest income (including dividends on equity securities) divided by average interest earning assets. |

| (2) | “Adjusted return on average stockholders’ equity,” “Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill” and “Impaired assets as a percentage of stockholders’ equity excluding goodwill” are non-GAAP financial measures which adjust “Return on average stockholders’ equity,” “Average stockholders’ equity as a percentage of average total assets” and “Impaired assets as a percentage of stockholders’ equity” to exclude the goodwill arising from the acquisition of Banco Real in 2008, Banco Olé Bonsucesso Consignado S.A. (formerly known as Banco Bonsucesso Consignado S.A.), or Banco Olé, in 2015 (60%) and 2020 (40%), and others, as further discussed in note 13 to our audited consolidated financial statements included elsewhere in this annual report. Our calculation of these non-GAAP financial measures may differ from the calculation of similarly titled measures used by other companies. We believe that these non-GAAP financial measures supplement the GAAP information provided to investors regarding the substantial impact of the R$27 billion goodwill arising from the acquisition of Banco Real during the year ended December 31, 2008, the R$1.1 billion goodwill arising from the acquisition of Getnet and Super both during 2014, the acquisition of an interest in Banco Olé in 2015. Accordingly, we believe that the non-GAAP financial measures presented are useful to investors. The limitation associated with the exclusion of goodwill from stockholders’ equity is that it has the effect of excluding a portion of the total investment in our assets. We compensate for this limitation by also considering stockholders’ equity including goodwill. |

| (3) | Credit risk exposure is the sum of the amortized cost amounts of loans and advances to customers (including impaired assets), guarantees and documentary credits. We include off-balance sheet information in this measure to better demonstrate our total managed credit risk. The reconciliation of the measure to the most comparable IFRS measure is disclosed in the table of non-GAAP financial measures presented immediately after these notes. |

| (4) | Total funding is the sum of financial liabilities at amortized cost, excluding other financial liabilities. For a breakdown of the components of total funding, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Liquidity and Funding.” |

| (5) | Adjusted efficiency ratio excludes the effects of the hedge for investments held abroad. This exclusion affects the income tax, gains (losses) on financial assets and liabilities and exchange rate differences line items but does not affect the “Net income from continuing operations” line item because the adjustment to gains (losses) on financial assets and liabilities and exchange rate difference is offset by the adjustment to income tax. Our management believes that the adjusted efficiency ratio provides a more consistent framework for evaluating and conducting business, as a result of excluding from our revenues the effect of the volatility caused by possible gains and losses on our hedging strategies for tax purposes. The adjusted efficiency ratio excluding the effects of the hedge for investments held abroad is a non-GAAP measure. For further information, see the table below and “—Reconciliation of Non-GAAP Measures and Ratios to Their Most Directly Comparable IFRS Financial Measures.” |

| For the Year Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| (in millions of R$, except percentages) | ||||||||||||

| Effects of the hedge for investments held abroad | (129 | ) | 2,512 | 13,583 | ||||||||

| Efficiency ratio | 27.4 | % | 27.1 | % | 35.5 | % | ||||||

| Adjusted efficiency ratio | 27.5 | % | 28.2 | % | 27.8 | % | ||||||

| 11 |

(1) “Net yield” is defined as net interest income divided by average interest earning assets.

(2) “Adjusted returnSee also “Item 4. Information on average stockholders’ equity,” “Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill” and “Impaired assets as a percentage of stockholders’ equity excluding goodwill” are non-GAAP financial measures which adjust “Return on average stockholders’ equity,” “Average stockholders’ equity as a percentage of average total assets” and “Impaired assets as a percentage of stockholders’ equity,” to exclude the goodwill arising from the acquisition of Banco Real in 2008, Getnet Adquirência e Serviços para Meios de Pagamento S.A., or “GetNet” and Super Pagamentos e Administração de Meios Eletrônicos Ltda., or “Super”, both in 2014, Banco Olé Consignado S.A. (current name of Banco Consignado S.A.) in 2015, and BW Guirapá I S.A. in 2016. Our calculation of these non-GAAP financial measures may differ from the calculation of similarly titled measures used by other companies. We believe that these non-GAAP financial measures supplement the GAAP information provided to investors regarding the substantial impact of the R$27 billion goodwill arising from the acquisition of Banco Real during the year ended December 31, 2008, the R$1.1 billion goodwill arising from the acquisition of GetNet and Super both during 2014, the acquisition of an interest in Banco Olé Consignado S.A. in 2015. Accordingly, we believe that the non-GAAP financial measures presented are useful to investors. The limitation associated with the exclusion of goodwill from stockholders’ equity is that it has the effect of excluding a portion of the total investment in our assets. We compensate for this limitation by also considering stockholders’ equity including goodwill.

(3)Company—B. Business Overview—Selected Statistical Information—Selected Credit risk exposure is the sum of the amortized cost amounts of loans and advances to customers (including impaired assets), guarantees and documentary credits. We include off-balance sheet information in this measure to better demonstrate our total managed credit risk. The reconciliation of the measure to the most comparable IFRS measure is disclosed in the table of non-GAAP financial measures presented immediately after these notes.

(4) Total funding is the sum of financial liabilities at amortized cost, excluding other financial liabilities. For a breakdown of the components of total funding, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Liquidity and Funding.Ratios.”

(5) Adjusted efficiency ratio excludes the effect of the hedge for investments held abroad. This exclusion affects the income tax, gains (losses) on financial assets and liabilities and exchange rate differences line items but does not affect the “Net profit from continuing operations” line item because the adjustment to gains (losses) on financial assets and liabilities and exchange rate difference is offset by the adjustment to income tax. Our management believes that the adjusted efficiency ratio provides a more consistent framework for evaluating and conducting business, as a result of excluding from our revenues the effect of the volatility caused by possible gains and losses on our hedging strategies for tax purposes. For more details, see the table below.

| For the Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (in millions of R$, except percentages) | ||||||||||||||||||||

| Effects of the hedge for investments held abroad | 1,264 | 5,867 | 810 | (6,140 | ) | 10,919 | ||||||||||||||

| Efficiency ratio | 28.8 | % | 33.9 | % | 33.1 | % | 30.6 | % | 47.1 | % | ||||||||||

| Adjusted efficiency ratio | 28.2 | % | 30.3 | % | 32.5 | % | 34.9 | % | 34.8 | % | ||||||||||

15

Reconciliation of Non-GAAP Measures and Ratios to Their Most Directly Comparable IFRS Financial Measures

Reconciliation of Non-GAAP Ratios to Their Most Directly Comparable IFRS Financial Measures

The information in the table below presents the calculation of specified non-GAAP financial measures to the most directly comparable IFRS financial measures. Our calculation of these non-GAAP financial measures may differ from the calculation of similarly titled measures used by other companies. We believe that these non-GAAP financial measures supplement the GAAP information provided to investors regarding the substantial impact of the R$1.1 billion goodwill arising from the acquisition of GetNetGetnet and Super both during 2014, the acquisition of Banco Olé Bonsucesso Consignado S.A. in 2015 and the significance of other factors affecting stockholders’ equity and the related ratios. See “Item 4. Information on the Company—A. History and Development of the Company—Important Events.” The limitation associated with the exclusion of goodwill from stockholders’ equity is that it has the effect of excluding a portion of the total investment in our assets. We compensate for this limitation by also considering stockholders’ equity including goodwill, as set forth in the above tables. Accordingly, while we believe that the non-GAAP financial measures presented are useful to investors and support their analysis, the non-GAAP financial measures have important limitations as analytical tools, and investors should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP measures including under IFRS.

| As of and for the Year Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| (in millions of R$, except as otherwise indicated) | ||||||||||||

| Return on average stockholders’ equity: | ||||||||||||

| Consolidated net income for the period | 14,339 | 15,559 | 13,451 | |||||||||

| Average stockholders’ equity (*) | 128,849 | 105,070 | 101,531 | |||||||||

| Return on average stockholders’ equity (*) | 11.1 | % | 14.8 | % | 13.2 | % | ||||||

| Adjusted return on average stockholders’ equity(*): | ||||||||||||

| Consolidated net income for the period | 14,339 | 15,559 | 13,451 | |||||||||

| Average stockholders’ equity(*) | 128,849 | 105,070 | 101,531 | |||||||||

| Average goodwill(*) | 27,928 | 27,967 | 28,513 | |||||||||

| Average stockholders’ equity excluding goodwill(*) | 100,921 | 77,103 | 73,018 | |||||||||

| Adjusted return on average stockholders’ equity(*) | 14.2 | % | 20.2 | % | 18.4 | % | ||||||

| Average stockholders’ equity as a percentage of average total assets(*): | ||||||||||||

| Average stockholders’ equity(*) | 128,849 | 105,070 | 101,531 | |||||||||

| Average total assets(*) | 988,277 | 942,177 | 854,615 | |||||||||

| Average stockholders’ equity as a percentage of average total assets(*) | 13.0 | % | 11.2 | % | 11.9 | % | ||||||

| Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill(*): | ||||||||||||

| Average stockholders’ equity(*) | 128,849 | 105,070 | 101,531 | |||||||||

| Average goodwill(*) | 27,928 | 27,967 | 28,513 | |||||||||

| Average stockholders’ equity excluding goodwill(*) | 100,921 | 77,103 | 73,018 | |||||||||

| Average total assets(*) | 988,277 | 942,177 | 854,615 | |||||||||

| Average goodwill(*) | 27,928 | 27,967 | 28,513 | |||||||||

| Average total assets excluding goodwill(*) | 960,349 | 914,210 | 826,102 | |||||||||

| Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill(*) | 10.5 | % | 8.4 | % | 8.8 | % | ||||||

| Impaired assets as a percentage of stockholders’ equity: | ||||||||||||

| Impaired assets | 39,224 | 26,923 | 23,176 | |||||||||

| Stockholders’ equity | 110,680 | 105,974 | 106,090 | |||||||||

| Impaired assets as a percentage of stockholders’ equity | 35.4 | % | 25.4 | % | 21.8 | % | ||||||

| Impaired assets as a percentage of stockholders’ equity excluding goodwill: | ||||||||||||

| Impaired assets | 39,224 | 26,923 | 23,176 | |||||||||

| Stockholders’ equity | 110,680 | 105,974 | 106,090 | |||||||||

| Goodwill | 27,889 | 27,915 | 28,360 | |||||||||

| Stockholders’ equity excluding goodwill | 82,791 | 78,059 | 77,730 | |||||||||

| Impaired assets as a percentage of stockholders’ equity excluding goodwill | 47.4 | % | 34.5 | % | 29.8 | % | ||||||

| Impaired assets as a percentage of loans and receivables: | ||||||||||||

| Loans and advances to customers, gross | 524,655 | 493,355 | 417,822 | |||||||||

| Impaired assets | 39,224 | 26,923 | 23,176 | |||||||||

| Impaired assets as a percentage of loans and receivables | 7.5 | % | 5.5 | % | 5.5 | % | ||||||

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (in millions of R$, except as otherwise indicated) | ||||||||||||||||||||

| Return on average stockholders’ equity: | ||||||||||||||||||||

| Consolidated profit for the year | 16,631 | 12,800 | 9,138 | 7,465 | 9,834 | |||||||||||||||

| Average stockholders’ equity (*) | 95,836 | 89,263 | 87,868 | 84,283 | 81,475 | |||||||||||||||

| Return on average stockholders’ equity (*) | 17.4 | % | 14.3 | % | 10.4 | % | 8.9 | % | 12.1 | % | ||||||||||

| Adjusted return on average stockholders’ equity(*): | ||||||||||||||||||||

| Consolidated profit for the year | 16,631 | 12,800 | 9,138 | 7,465 | 9,834 | |||||||||||||||

| Average stockholders’ equity(*) | 95,836 | 89,263 | 87,868 | 84,283 | 81,475 | |||||||||||||||

| Average goodwill(*) | 28,213 | 28,176 | 28,360 | 28,343 | 28,376 | |||||||||||||||

| Average stockholders’ equity excluding goodwill(*) | 67,623 | 61,087 | 59,508 | 55,940 | 53,130 | |||||||||||||||

| Adjusted return on average stockholders’ equity(*)(3) | 24.6 | % | 21.0 | % | 15.4 | % | 13.3 | % | 18.5 | % | ||||||||||

| Average stockholders’ equity as a percentage of average total assets(*): | ||||||||||||||||||||

| Average stockholders’ equity(*) | 95,836 | 89,263 | 87,868 | 84,283 | 81,475 | |||||||||||||||

| Average total assets(*) | 735,507 | 685,531 | 637,511 | 605,646 | 571,918 | |||||||||||||||

| Average stockholders’ equity as a percentage of average total assets(*) | 13.0 | % | 13.0 | % | 13.8 | % | 13.9 | % | 14.2 | % | ||||||||||

| Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill(*): | ||||||||||||||||||||

| Average stockholders’ equity(*) | 95,836 | 89,263 | 87,868 | 84,283 | 81,475 | |||||||||||||||

| Average goodwill(*) | 28,213 | 28,176 | 28,360 | 28,343 | 28,376 | |||||||||||||||

| Average stockholders’ equity excluding goodwill(*) | 67,623 | 61,087 | 59,508 | 55,940 | 53,130 | |||||||||||||||

| Average total assets(*) | 735,507 | 685,531 | 637,511 | 605,646 | 571,918 | |||||||||||||||

| Average goodwill(*) | 28,213 | 28,176 | 28,360 | 28,343 | 28,376 | |||||||||||||||

| Average total assets excluding goodwill(*) | 707,294 | 657,355 | 609,151 | 577,334 | 543,542 | |||||||||||||||

| Average stockholders’ equity excluding goodwill as a percentage of average total assets excluding goodwill(*) | 9.6 | % | 9.3 | % | 9.8 | % | 9.7 | % | 9.8 | % | ||||||||||

| Impaired assets as a percentage of stockholders’ equity: | ||||||||||||||||||||

| Impaired assets | 23,426 | 22,426 | 19,145 | 18,887 | 18,599 | |||||||||||||||

| Stockholders’ equity | 97,209 | 91,595 | 87,088 | 84,813 | 79,835 | |||||||||||||||

| Impaired assets as a percentage of stockholders’ equity | 24.1 | % | 24.5 | % | 22.0 | % | 22.3 | % | 23.3 | % | ||||||||||

| 12 |

16

| Impaired assets as a percentage of credit risk exposure: | ||||||||||||

| Loans and advances to customers, gross | 524,655 | 493,355 | 417,822 | |||||||||

| Guarantees | 57,379 | 53,420 | 48,282 | |||||||||

| Credit risk exposure | 582,034 | 546,755 | 466,115 | |||||||||

| Impaired assets | 39,244 | 26,923 | 23,176 | |||||||||

| Impaired assets as a percentage of credit risk exposure | 6.7 | % | 4.9 | % | 5.0 | % | ||||||

| Loans and advances to customers, net as a percentage of total funding: | ||||||||||||

| Loans and advances to customers, gross | 524,655 | 493,355 | 417,822 | |||||||||

| Impairment losses(1) | 34,025 | 28,511 | 24,054 | |||||||||

| Total funding(2) | 732,691 | 688,645 | 647,465 | |||||||||

| Loans and advances to customers, net as a percentage of total funding(2) | 67.0 | % | 67.5 | % | 60.8 | % | ||||||

| Impaired assets as a percentage of stockholders’ equity excluding goodwill: | ||||||||||||||||||||

| Impaired assets | 23,426 | 22,426 | 19,145 | 18,887 | 18,599 | |||||||||||||||

| Stockholders’ equity | 97,209 | 91,595 | 87,088 | 84,813 | 79,835 | |||||||||||||||

| Goodwill | 28,375 | 28,378 | 28,364 | 28,355 | 28,333 | |||||||||||||||

| Stockholders’ equity excluding goodwill | 68,834 | 63,217 | 58,724 | 56,458 | 51,502 | |||||||||||||||

| Impaired assets as a percentage of stockholders’ equity excluding goodwill | 34.0 | % | 35.5 | % | 32.6 | % | 33.5 | % | 36.1 | % | ||||||||||

| Impaired assets as a percentage of loans and receivables: | ||||||||||||||||||||

| Loans and advances to customers, gross | 347,257 | 321,933 | 287,829 | 268,438 | 267,266 | |||||||||||||||

| Impaired assets | 23,426 | 22,426 | 19,145 | 18,887 | 18,599 | |||||||||||||||

| Impaired assets as a percentage of loans and receivables | 6.7 | % | 7.0 | % | 6.7 | % | 7.0 | % | 7.0 | % | ||||||||||

| Impaired assets as a percentage of credit risk exposure: | ||||||||||||||||||||

| Loans and advances to customers, gross | 347,257 | 321,933 | 287,829 | 268,438 | 267,266 | |||||||||||||||

| Guarantees | 44,313 | 42,260 | 42,645 | 33,265 | 43,611 | |||||||||||||||

| Credit risk exposure | 391,569 | 364,182 | 330,474 | 301,703 | 310,887 | |||||||||||||||

| Impaired assets | 23,426 | 22,426 | 19,145 | 18,887 | 18,599 | |||||||||||||||

| Impaired assets as a percentage of credit risk exposure | 6.0 | % | 6.2 | % | 5.8 | % | 6.3 | % | 6.0 | % | ||||||||||

| Loans and advances to customers, net as a percentage of total funding: | ||||||||||||||||||||

| Loans and advances to customers, gross | 347,257 | 321,933 | 287,829 | 268,438 | 267,266 | |||||||||||||||

| Impairment losses(1) | 20,557 | 20,242 | 15,409 | 16,435 | 15,233 | |||||||||||||||

| Total Funding(2) | 519,664 | 497,513 | 434,620 | 434,502 | 425,209 | |||||||||||||||

| Loans and advances to customers, net as a percentage of total funding(2) | 62.4 | % | 60.6 | % | 62.7 | % | 58.0 | % | 59.3 | % |

| (*) | The average annual balance sheet data has been calculated based upon the average of the monthly balances at 13 dates: at December 31 of the prior year and for each of the month-end balances of the 12 subsequent months. |

| (1) | Provision for impairment losses of loans and advances to customers. |

| (2) | Total funding is the sum of financial liabilities at amortized cost, excluding |

The table below presents the reconciliation of our adjusted efficiency ratio to the most directly comparable IFRS financial measures for each of the periods presented.

| As of and for the Year Ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| (in millions of R$, except as otherwise indicated) | ||||||||||||

| Efficiency ratio | ||||||||||||

| Administrative expenses | 18,240 | 17,316 | 17,115 | |||||||||

| Total income | 66,475 | 63,926 | 48,242 | |||||||||

| of which: | ||||||||||||

| Gains (losses) on financial assets and liabilities (net) and exchange differences (net) | 4,699 | (1,781 | ) | (11,703 | ) | |||||||

| Efficiency ratio | 27.4 | % | 27.1 | % | 35.5 | % | ||||||

| Total Income | 66,475 | 63,926 | 48,242 | |||||||||

| Effects of the hedge for investments held abroad | (129 | ) | 2,512 | 13,583 | ||||||||

| Total income excluding effects of the hedge for investments held abroad | 66,346 | 66,438 | 61,825 | |||||||||

| Administrative expenses | 18,240 | 17,316 | 17,115 | |||||||||

| Efficiency ratio adjusted for effects of the hedge for investments held abroad | 27.5 | % | 26.1 | % | 27.7 | % | ||||||

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| (in millions of R$, except as otherwise indicated) | ||||||||||||||||||||

| Efficiency ratio | ||||||||||||||||||||

| Administrative expenses | 16,942 | 16,792 | 16,121 | 14,920 | 14,515 | |||||||||||||||

| Total income | 58,769 | 49,507 | 48,725 | 48,837 | 30,814 | |||||||||||||||

| of which: | ||||||||||||||||||||

| Gains (losses) on financial assets and liabilities (net) and exchange differences (net) | (326 | ) | (5,589 | ) | 1,574 | 7,591 | (9,918 | ) | ||||||||||||

| Efficiency ratio | 28.8 | % | 33.9 | % | 33.1 | % | 30.6 | % | 47.1 | % | ||||||||||

| Total Income | 58,769 | 49,507 | 48,725 | 48,837 | 30,814 | |||||||||||||||

| Effects of the hedge for investments held abroad | 1,264 | 5,867 | 810 | 6,140 | (10,919 | ) | ||||||||||||||

| Total income excluding effects of the hedge for investments held abroad | 57,505 | 43,640 | 47,915 | 42,697 | 41,733 | |||||||||||||||

| Administrative expenses | 16,942 | 16,792 | 16,121 | 14,920 | 14,515 | |||||||||||||||

| Efficiency ratio adjusted for effects of the hedge for investments held abroad | 29.5 | % | 38.5 | % | 33.6 | % | 34.9 | % | 34.8 | % | ||||||||||

Reconciliation of Non-GAAP Measures to Their Most Directly Comparable IFRS Financial Measures

The information in the table below presents the calculation of specified non-GAAP financial measures from each of their most directly comparable IFRS financial measures. Our calculation of these non-GAAP financial measures may differ from the calculation of similarly titled measures used by other companies. We believe that these non-GAAP financial measures supplement the GAAP information provided to investors regarding effects of the hedge for investments held abroad. The limitation associated with the exclusion of effects of the hedge for investments held abroad is that it has the effect

17

of excluding a portion of gains/losses on(see also note 23 to our audited consolidated financial assets and liabilities (net) plus exchange differences (net) line item, which is offset by excluding a portionstatements included elsewhere in the Income tax line item.this annual report). Accordingly, while we believe that the non-GAAP financial measures presented are useful to investors and support their analysis, the non-GAAP financial measures have important limitations as analytical tools, and investors should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP measures including under IFRS.

| 13 |

| As of and for the year ended December 31, | ||||||||||||

| 2022 | 2021 | 2020 | ||||||||||

| (in millions of R$, except as otherwise indicated) | ||||||||||||

| Gains (losses) on financial assets and liabilities (net) plus exchange differences (net) | 4,699 | (1,781 | ) | (11,703 | ) | |||||||

| Effects of the hedge for investments held abroad (1) | (129 | ) | 2,512 | 13,583 | ||||||||

| Adjusted Gains (losses) on financial assets and liabilities (net) plus exchange differences (net) | 4,828 | (4,293 | ) | (25,286 | ) | |||||||

| Total income | 66,475 | 63,926 | 48,242 | |||||||||

| Effects on hedge for investment held abroad (1) | (129 | ) | 2,512 | 13,583 | ||||||||

| Adjusted total income | 66,346 | 66,438 | 61,825 | |||||||||

| Operating income before tax | 19,575 | 24,750 | 9,664 | |||||||||

| Effects of the hedge for investment held abroad (1) | (129 | ) | 2,512 | 13,583 | ||||||||

| Adjusted operating income before tax | 19,445 | 27,262 | 23,247 | |||||||||

| Income taxes | (5,235 | ) | (9,191 | ) | 3,787 | |||||||