“$” and “U.S. dollars” refer to the legal currency of the United States;

“ADSs” refers to our American depositary shares, each of which represents 100 ordinary shares; “Cayman Companies Law” refers to the Companies Law (2011 Revision) of the Cayman Islands (as amended); “China” and the “PRC” refer to the People’s Republic of China, excluding, for the purposes of this | |||

“Ku6 Holding” refers to Ku6 Holding Limited and its subsidiaries, affiliates and predecessor entities;

“ordinary shares” refers to our auditedordinary shares, par value $0.00005 per share;

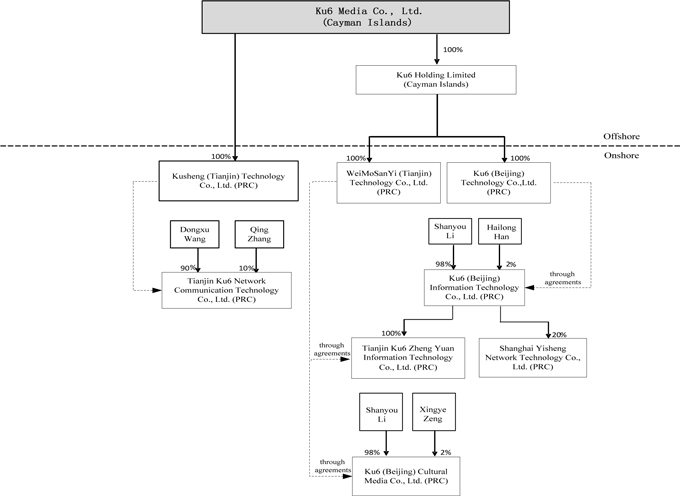

“our consolidated financial statements asaffiliated entities” refers to Ku6 (Beijing) Information Technology Co., Ltd., or Ku6 Information Technology, Tianjin Ku6 Zheng Yuan Information Technology Co., Ltd., or Tianjin Ku6 Zheng Yuan, Ku6 (Beijing) Cultural Media Co., Ltd., or Ku6 Cultural, and Tianjin Ku6 Network Communication Technology Co., Ltd., or Tianjin Ku6 Network;

“our PRC subsidiaries” refers to Ku6 (Beijing) Technology Co., Ltd., or Beijing WFOE, WeiMoSanYi (Tianjin) Technology Co., Ltd., or Tianjin WFOE, and Kusheng (Tianjin) Technology Co., Ltd., or Tianjin Ku6 Network WFOE;

“RMB” and “Renminbi” refer to the legal currency of December 31, 2008China;

“Shanda Interactive” refers to Shanda Interactive Entertainment Limited, a Cayman Islands company;

“Shanda Group” refers to Shanda Interactive and 2007its subsidiaries and forconsolidated affiliated entities, including, unless the years ended December 31, 2008, 2007context requires otherwise, Ku6 Media Co., Ltd. and 2006.its subsidiaries and consolidated affiliated entities;

“we,” “us,” “our company” and “our” refer to Ku6 Media Co., Ltd. and its subsidiaries, consolidated affiliated entities and predecessor entities.

FORWARD-LOOKING INFORMATION

This annual report on Form 20-F contains forward-looking statements that are based on our current expectations, assumptions, estimates and projections about us and our industry. All statements other than statements of ahistorical fact in this form are forward-looking nature.statements. These forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “believe,” “is/are made underlikely to” or other similar expressions. The forward-looking statements included in this form relate to, among others:

our goals and strategies;

our future business development, financial condition and results of operations;

our projected revenues, earnings, profits and other estimated financial information;

expected changes in our margins and certain costs or expenditures;

expected continued acceptance of our new revenue model;

our plans to expand and diversify the “safe harbor” provisionssources of our revenues;

expected changes in the U.S. Private Securities Litigation Reform Actrespective shares of 1995. You can identifyour revenues from particular sources;

our plans for staffing, research and development and regional focus;

our plans to launch new products and services;

our plans for strategic partnerships with other businesses;

our acquisition and divestiture strategy, and our ability to successfully integrate past or future acquisitions with our existing operations and complete planned divestitures;

competition in the PRC online video industry;

the outcome of ongoing, or any future, litigation or arbitration;

changes in PRC governmental preferential tax treatment and financial incentives we currently qualify for and expect to qualify for; and

PRC governmental policies relating to media and the Internet and Internet content providers and to the provision of advertising over the Internet.

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements by terminology such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,” “believes,” “seeks, “estimates”are reasonable, we cannot assure you that our expectations will turn out to be correct. Our actual results could be materially different from and similar statements. The accuracy of these statements may be impacted by a number of businessworse than our expectations. Important risks and uncertaintiesfactors that could cause our actual results to differbe materially different from those projected or anticipated, including but not limited to those risks and uncertainties identified under the section headingour expectations are generally set forth in Item 3.D. “Risk Factors” below.

Not Applicable.

Not Applicable.

3

A. Selected Financial Data

The following table presents certain selected consolidated financial information for our business. You should read the following information in conjunction with our audited consolidated financial statements, the notes thereto and Item 55. “Operating and Financial Review and Prospects” included elsewhere in this annual report on Form 20-F. The following data as of December 31, 20082010 and 20072011 and for the years ended December 31, 2008, 20072009, 2010 and 20062011 has been derived from our audited consolidated financial statements for those years and should be read in conjunction with those statements, which are included in this annual report beginning on page F-1. The following data as of December 31, 2006, 2005 and 2004 and for the years ended December 31, 2005 and 2004 have also2009 has been derived from our audited consolidated financial statements for those years, which are not included in this annual report on Form 20-F. Our auditedreport. The data as of December 31, 2007 and 2008 and for the years ended December 31, 2007 and 2008 has been derived from unaudited consolidated financial statements for the foregoing periods werenot included in this annual report. Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or USU.S. GAAP.

| For the Year Ended December 31, | ||||||||||||||||||||

| 2008 | 2007 | 2006 | 2005(1) | 2004(1) | ||||||||||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||||||||||

Historical Condensed Consolidated Statement of Operations Data | ||||||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Wireless value-added services | $ | 42,672 | $ | 50,038 | $ | 62,512 | $ | 56,063 | $ | 43,173 | ||||||||||

| Recorded music | 11,287 | 10,489 | 6,203 | — | — | |||||||||||||||

| Total revenues | 53,959 | 60,527 | 68,715 | 56,063 | 43,173 | |||||||||||||||

| Cost of revenues: | ||||||||||||||||||||

| Wireless value-added services | 32,840 | 36,394 | 40,672 | 28,635 | 18,053 | |||||||||||||||

| Recorded music | 6,730 | 6,233 | 3,553 | — | — | |||||||||||||||

| Total cost of revenues | 39,570 | 42,627 | 44,225 | 28,635 | 18,053 | |||||||||||||||

| Gross profit | 14,389 | 17,900 | 24,490 | 27,428 | 25,120 | |||||||||||||||

| Operating expenses | 22,669 | 61,462 | 19,882 | 14,277 | 10,436 | |||||||||||||||

| Operating (loss) income from continuing operations | (8,280 | ) | (43,562 | ) | 4,608 | 13,151 | 14,684 | |||||||||||||

| Interest income | 1,613 | 2,313 | 2,529 | 1,390 | 28 | |||||||||||||||

| Interest expense | — | (179 | ) | (45 | ) | (27 | ) | (312 | ) | |||||||||||

| Gain on reduction of acquisition payable | 5,000 | — | — | — | — | |||||||||||||||

| Foreign exchange loss | (8,990 | ) | — | — | — | — | ||||||||||||||

| Other income, net | 247 | 466 | 315 | 330 | ||||||||||||||||

| (Loss) income before provision for income taxes, earnings in equity investments, minority interest and discontinued operations | (10,410 | ) | (40,962 | ) | 7,407 | 14,844 | 14,400 | |||||||||||||

| Income tax expense (credit) | 486 | (182 | ) | 205 | (323 | ) | — | |||||||||||||

| Net (loss) income from continuing operations after income taxes before minority interests | (10,896 | ) | (40,780 | ) | 7,202 | 14,521 | 14,400 | |||||||||||||

| Minority interests | 337 | (688 | ) | (562 | ) | — | — | |||||||||||||

| Equity in earnings (losses) of affiliate | 64 | (63 | ) | — | — | — | ||||||||||||||

| Impairment for Investment in equity affiliate | (1,871 | ) | — | — | — | — | ||||||||||||||

| Net (loss) income from continuing operations | (12,366 | ) | (41,531 | ) | 6,640 | 14,521 | 14,400 | |||||||||||||

In May 2010, we sold all of our 51% interest in Beijing Huayi Brothers Music Co., Ltd., or Huayi Music, to Huayi Brothers Media Corporation. In August 2010, we completed the disposal of our remaining wireless value-added services, or WVAS, and recorded music businesses to Shanda Interactive and also acquired from Shanda Interactive the control of Shanghai Yisheng Network Technology Co., Ltd., or Yisheng, an online audio business. The initial acquisition of the online audio business from Shanda Interactive was accounted for as an acquisition under common control and the disposal of the WVAS and recorded music businesses, including Huayi Music, was accounted for as discontinued operations in accordance with U.S. GAAP in our consolidated financial statements. On August 11, 2011, we have ceased to control Yisheng as a 100% controlled consolidated affiliated entity and we currently hold a 20% interest in Yisheng.

4

| For the Year Ended December 31, | ||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||

| (in thousands of U.S. dollars, except for share and per share data) | ||||||||||||||||||||

Historical Condensed Consolidated Statement of Operations Data | ||||||||||||||||||||

Net revenues: | ||||||||||||||||||||

Advertising | ||||||||||||||||||||

Third parties | — | — | 758 | 15,854 | 11,146 | |||||||||||||||

Related parties | — | — | 279 | 702 | 8,076 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total net revenues | — | — | 1,037 | 16,556 | 19,222 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cost of revenues: | ||||||||||||||||||||

Advertising | ||||||||||||||||||||

Third parties | — | — | (557 | ) | (40,083 | ) | (30,501 | ) | ||||||||||||

Related parties | — | — | — | (376 | ) | (379 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total cost of revenues | — | — | (557 | ) | (40,459 | ) | (30,880 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross profit (loss) | — | — | 480 | (23,903 | ) | (11,658 | ) | |||||||||||||

Operating expenses | (2,738 | ) | (2,401 | ) | (7,130 | ) | (29,703 | ) | (37,912 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating loss from continuing operations | (2,738 | ) | (2,401 | ) | (6,650 | ) | (53,606 | ) | (49,570 | ) | ||||||||||

Interest income | 2,084 | 1,432 | 356 | 57 | 170 | |||||||||||||||

Interest expense | (179 | ) | — | — | (31 | ) | (1,119 | ) | ||||||||||||

Gain on reduction of acquisition payable | — | 5,000 | — | — | — | |||||||||||||||

Foreign exchange loss | — | (8,990 | ) | — | — | — | ||||||||||||||

Other income, net | 105 | — | 2 | 0 | 1,294 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss before income tax benefit from continuing operations | (728 | ) | (4,959 | ) | (6,292 | ) | (53,580 | ) | (49,226 | ) | ||||||||||

Income tax benefit | — | — | 14 | 41 | 99 | |||||||||||||||

Equity in loss of affiliated company, net of tax | — | — | — | — | (263 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss from continuing operations, net of tax | (728 | ) | (4,959 | ) | (6,278 | ) | (53,539 | ) | (49,390 | ) | ||||||||||

| For the Year Ended December 31, | ||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | ||||||||||||||||

| (in thousands of U.S. dollars, except for share and per share data) | ||||||||||||||||||||

Discontinued operations: | ||||||||||||||||||||

Loss from operations of discontinued operations, net of tax | (40,727 | ) | (7,744 | ) | (21,778 | ) | (3,383 | ) | — | |||||||||||

Gain from disposal of discontinued operations, net of tax | 193 | 413 | 222 | 4,487 | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

(Loss) income from discontinued operations, net of tax | (40,534 | ) | (7,331 | ) | (21,556 | ) | 1,104 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss | (41,262 | ) | (12,290 | ) | (27,834 | ) | (52,435 | ) | (49,390 | ) | ||||||||||

Less: Net loss attributable to the non-controlling interests from continuing operations | — | — | 257 | 681 | 46 | |||||||||||||||

Less: Net (income) loss attributable to the non-controlling interests and redeemable non-controlling interests from discontinued operations | (688 | ) | 337 | 4,183 | 244 | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss attributable to Ku6 Media Co., Ltd. | (41,950 | ) | (11,953 | ) | (23,395 | ) | (51,510 | ) | (49,344 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss from continuing operations, net of tax, attributable to Ku6 Media Co., Ltd. | (728 | ) | (4,959 | ) | (6,021 | ) | (52,858 | ) | (49,344 | ) | ||||||||||

(Loss) income from discontinued operations, net of tax, attributable to Ku6 Media Co., Ltd. | (41,222 | ) | (6,994 | ) | (17,374 | ) | 1,348 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss attributable to Ku6 Media Co., Ltd. | (41,950 | ) | (11,953 | ) | (23,395 | ) | (51,510 | ) | (49,344 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Loss per share, basic and diluted | ||||||||||||||||||||

Loss from continuing operations attributable to Ku6 Media Co., Ltd. ordinary shareholders | — | — | (0.00 | ) | (0.02 | ) | (0.01 | ) | ||||||||||||

(Loss) income from discontinued operations attributable to Ku6 Media Co., Ltd. ordinary shareholders | (0.02 | ) | (0.01 | ) | (0.01 | ) | 0.00 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net loss attributable to Ku6 Media Co., Ltd. ordinary shareholders | (0.02 | ) | (0.01 | ) | (0.01 | ) | (0.02 | ) | (0.01 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Weighted average shares used in per share calculation—basic and diluted | 2,172,208,190 | 2,185,615,129 | 2,196,291,947 | 3,096,421,097 | 4,265,277,638 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Historical Condensed Consolidated Balance Sheet Data Cash and cash equivalents Restricted cash Short term investments Accounts receivable, net Other current assets Property and equipment, net Goodwill Other assets Total assets Current liabilities Non-current liabilities Total liabilities Redeemable non-controlling interests Ordinary shares ($0.00005 par value; 12,000,000,000 shares authorized; 2,174,784,440, 2,193,343,740, 2,200,194,040, 3,481,174,498 and 5,019,786,036 shares issued and outstanding as of December 31, 2007, 2008, 2009, 2010 and 2011, respectively) Other Ku6 Media Co., Ltd. shareholders’ equity Non-controlling interests Total liabilities, redeemable non-controlling interests and shareholders’ equity As of December 31, 2007 2008 2009 2010 2011 (in thousands of U.S. dollars, except for share data) 65,979 59,473 49,744 27,295 26,750 — — — — 3,600 — — 10,000 — — 14,691 12,658 4,062 8,461 3,517 8,777 5,580 2,155 9,051 20,424 1,636 980 1,472 8,003 3,593 5,621 3,157 2,099 6,896 6,233 8,890 6,476 1,976 27,264 24,673 105,594 88,324 71,508 86,970 88,790 14,467 6,316 13,783 36,406 33,111 877 316 421 4,926 4,826 15,344 6,632 14,204 41,332 37,937 — — 371 — — 109 110 110 174 251 85,474 76,799 54,966 45,572 50,602 4,667 4,783 1,857 (108 ) — 105,594 88,324 71,508 86,970 88,790

| For the Year Ended December 31, | ||||||||||||||||||||

| 2008 | 2007 | 2006 | 2005(1) | 2004(1) | ||||||||||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||||||||||

| Discontinued operations: | ||||||||||||||||||||

| Net (loss) income from discontinued operations, net of tax | — | (612 | ) | (836 | ) | 4,098 | 2,840 | |||||||||||||

| Gain from disposal of discontinued operations | 413 | 193 | — | — | — | |||||||||||||||

| Net income (loss) from discontinued operations, net of tax | 413 | (419 | ) | (836 | ) | 4,098 | 2,840 | |||||||||||||

| Net (loss) income | (11,953 | ) | (41,950 | ) | 5,804 | 18,619 | 17,240 | |||||||||||||

| Deemed dividends on Series A convertible preference shares | — | — | — | — | (40 | ) | ||||||||||||||

| Net (loss) income attributable to holders of ordinary shares | $ | (11,953 | ) | $ | (41,950 | ) | $ | 5,804 | $ | 18,619 | $ | 17,200 | ||||||||

| Net (loss) income per share, basic | $ | (0.01 | ) | $ | (0.02 | ) | $ | 0.00 | $ | 0.01 | $ | 0.01 | ||||||||

| Net (loss) income per share, diluted | $ | (0.01 | ) | $ | (0.02 | ) | $ | 0.00 | $ | 0.01 | $ | 0.01 | ||||||||

| Shares used in calculating basic (loss) income per share | 2,185,615,129 | 2,172,208,190 | 2,189,748,563 | 2,092,089,848 | 1,208,512,142 | |||||||||||||||

| Shares used in calculating diluted (loss) income per share | 2,185,615,129 | 2,172,208,190 | 2,208,758,636 | 2,129,228,961 | 1,572,887,775 | |||||||||||||||

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||||||||||

Historical Condensed Consolidated Balance Sheet Data | ||||||||||||||||||||

| Cash | $ | 59,473 | $ | 65,979 | $ | 74,597 | $ | 75,959 | $ | 8,714 | ||||||||||

| Accounts receivable, net | 12,658 | 14,691 | 13,449 | 18,089 | 11,883 | |||||||||||||||

| Other current assets | 5,580 | 8,777 | 3,342 | 2,297 | 2,133 | |||||||||||||||

| Property and equipment, net | 980 | 1,636 | 1,954 | 2,536 | 2,617 | |||||||||||||||

| Goodwill | 3,157 | 5,621 | 39,621 | 23,869 | 20,412 | |||||||||||||||

| Other assets | 6,476 | 8,890 | 7,027 | 4,953 | 705 | |||||||||||||||

| Total assets | $ | 88,324 | $ | 105,594 | $ | 139,990 | $ | 127,703 | $ | 46,464 | ||||||||||

5

| As of and for the Year Ended December 31, | ||||||||||||||||||||

| 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||||||||

| (in thousands of U.S. dollars, except percentages) | ||||||||||||||||||||

| Current liabilities | $ | 6,316 | $ | 14,467 | $ | 12,960 | $ | 7,636 | $ | 8,743 | ||||||||||

| Non-current liabilities | 316 | 877 | 851 | 843 | — | |||||||||||||||

| Total liabilities | $ | 6,632 | $ | 15,344 | $ | 13,811 | $ | 8,479 | $ | 8,743 | ||||||||||

| Minority interests | $ | 4,783 | $ | 4,667 | $ | 3,359 | $ | 605 | $ | — | ||||||||||

| Series A convertible preference shares (16,924,497 shares issued and outstanding as of December 31, 2004, and nil issued and outstanding as of December 31, 2005 to 2008) | — | — | — | — | 17 | |||||||||||||||

| Ordinary shares (2,193,343,740, 2,174,784,440, 2,163,031,740, 2,229,754,340 and 1,186,672,000 shares issued and outstanding as of December 31, 2008, 2007, 2006, 2005 and 2004, respectively) | 110 | 109 | 108 | 111 | 59 | |||||||||||||||

| Other shareholders’ equity | 76,799 | 85,474 | 122,712 | 118,508 | 37,645 | |||||||||||||||

| Total liabilities, minority interests and shareholders’ equity | $ | 88,324 | $ | 105,594 | $ | 139,990 | $ | 127,703 | $ | 46,464 | ||||||||||

Other Historical Condensed Consolidated Financial Data: | ||||||||||||||||||||

| Gross profit margin | ||||||||||||||||||||

| Wireless value-added services | 23.0 | % | 27.3 | % | 34.9 | % | 48.9 | % | 58.2 | % | ||||||||||

| Recorded music | 40.4 | % | 40.6 | % | 42.7 | % | — | — | ||||||||||||

| Total gross profit margin | 26.7 | % | 29.6 | % | 35.6 | % | 48.9 | % | 58.2 | % | ||||||||||

(Loss) income from continuing operations margin(1) | (15.3 | %) | (72.0 | %) | 6.7 | % | 23.5 | % | 34.0 | % | ||||||||||

Net (loss) income from continuing operations margin(1) | (22.9 | %) | (68.6 | %) | 9.7 | % | 25.9 | % | 33.4 | % | ||||||||||

Net (loss) income margin(1) | (22.2 | %) | (69.3 | %) | 8.4 | % | 33.2 | % | 39.9 | % | ||||||||||

| Depreciation | 990 | 1,269 | 1,580 | 1,461 | �� | 1,335 | ||||||||||||||

| Amortization | 2,338 | 2,375 | 1,901 | 478 | 651 | |||||||||||||||

| Capital expenditure | 349 | 864 | 957 | 1,289 | 1,871 | |||||||||||||||

We present our historical consolidated financial statements in U.S. dollars. In addition, certain pricing information is presented in U.S. dollars and certainCertain contractual amounts that are in Renminbi include adescribed in this annual report are translated into U.S. dollar equivalentamounts solely for the convenience of the reader. Except as otherwise specified, this pricing information and these contractual amounts are translated at RMB6.8225 = US$1.00,a rate of RMB6.2939 to $1.00, the prevailing rate on December 31, 2008. The translations are not a representation that the Renminbi amounts could actually be converted to U.S. dollars at this rate. For a discussion of the exchange rates used for the presentation of our financial statements, see note 2(m) to our audited consolidated financial statements.

6

The following table sets forth the high and low noon buyinginformation regarding exchange rates for cable transfers between Renminbi and U.S. dollar as certifieddollars for customs purposes by the periods indicated:

| Exchange Rate | ||||||||||||||||

Period | Period End | Average(1) | High | Low | ||||||||||||

| (RMB per US$1.00) | ||||||||||||||||

2007 | 7.2946 | 7.5806 | 7.8127 | 7.2946 | ||||||||||||

2008 | 6.8225 | 6.9193 | 7.2946 | 6.7800 | ||||||||||||

2009 | 6.8259 | 6.8295 | 6.8470 | 6.8176 | ||||||||||||

2010 | 6.6000 | 6.7603 | 6.8330 | 6.6000 | ||||||||||||

2011 | 6.2939 | 6.4475 | 6.6364 | 6.2939 | ||||||||||||

September | 6.3780 | 6.3885 | 6.3975 | 6.3780 | ||||||||||||

October | 6.3547 | 6.3710 | 6.3825 | 6.3534 | ||||||||||||

November | 6.3765 | 6.3564 | 6.3839 | 6.3400 | ||||||||||||

December | 6.2939 | 6.3482 | 6.3733 | 6.2939 | ||||||||||||

2012 | ||||||||||||||||

January | 6.3080 | 6.3172 | 6.3330 | 6.2940 | ||||||||||||

February | 6.2935 | 6.2997 | 6.3120 | 6.2935 | ||||||||||||

March (through March 23, 2012) | 6.3021 | 6.3145 | 6.3315 | 6.2982 | ||||||||||||

Source: Federal Reserve Bank of New York for each of periods indicated below.

| Noon Buying Rate | ||||||||

| RMB per US$1.00 | ||||||||

| High | Low | |||||||

| December 2008 | 6.8842 | 6.8225 | ||||||

| January 2009 | 6.8403 | 6.8225 | ||||||

| February 2009 | 6.8470 | 6.8241 | ||||||

| March 2009 | 6.8438 | 6.8240 | ||||||

| April 2009 | 6.8361 | 6.8180 | ||||||

| May 2009 | 6.8265 | 6.8176 | ||||||

| Average Noon Buying Rate | ||||

| RMB per US$1.00 | ||||

| 2004 | 8.2768 | |||

| 2005 | 8.1826 | |||

| 2006 | 7.9579 | |||

| 2007 | 7.5806 | |||

| 2008 | 6.9193 | |||

| 2009 (through May 30) | 6.8326 | |||

| (1) | Annual averages were calculated by using the average of the exchange rates on the last day of each month during the relevant year. Monthly averages were calculated by using the average of the daily rates during the relevant month. |

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

Risks Related to Our Wireless Value-added Services

We depend on China Mobile, China Unicomhave a short operating history in a new and China Telecom,unproven market, which makes it difficult to evaluate our future prospects and may increase the threerisk that we will not be successful.

We entered the online video business in January 2010 when we acquired Ku6 Holding. As we subsequently disposed of the WVAS and recorded music businesses in August 2010 and a 80% interest in the online audio business in August 2011, we are currently operating the online video business as our principal telecommunications network operators in China, for the major portionbusiness and generate substantially all of our revenue,revenues from online advertising. However, we only have a short operating history in this new and any loss or deterioration ofunproven market that may not develop as expected, if at all. This short operating history makes it difficult to effectively assess our relationship with China Mobile, China Unicom and China Telecom, due to the recent government imposed restructurings or otherwise, may result in severe disruptions tofuture prospects. You should consider our business operations and prospects in light of the loss of a major portion of our revenue.

We have a limited term (generally one year for China Mobilehistory of losses, and onewe may be unable to achieve or two years for China Unicom). We usually renew these agreements or enter into new ones when the prior agreements expire, but on occasion the renewal or new agreements can be delayed by periods of one month or more. China Telecom and its provincial affiliates have recently entered into new agreements with us in connection with the network assets that they acquired from China Unicom (as discussed below).

sustain profitability.

7

growth of the online video industry and the first quarteronline advertising market;

the transition from long-form professional content to short-form user-generated content, or UGC;

the continued growth and maintenance of 2009our user base;

our ability to control our costs and expenses; and

our ability to provide new advertising services to meet the demands of our advertising customers.

Many of these factors are beyond our control. For example, our revenues and profitability depend on the continuous development of the online advertising market in China and brand advertisers’ allocation of more budgets to online video industry. We cannot assure you that online advertising, as a new marketing channel, will become more widely accepted in China or that the advertisers will increase their spending on online video websites. We may continue to incur additional losses in future periods.

We operate in a highly competitive market and we do not restore profitability, the market price of our ADSs may decline.

We face significant competition, primarily from those companies that operate online video websites in China, which our management estimates to currently number over one hundred. A large number of independent online video sites, such as Youku.com and Tudou.com, compete against us. In addition, Chinese Internet portals, including Sina.com, Sohu.com and Baidu.com, and some of China’s major TV networks, such as China Central Television, or CCTV, Phoenix Satellite TV and Hunan Satellite TV, which have longer operating histories and more experience in attracting and retaining users and managing customers than we do, have launched their own video businesses. We also face competition from Internet video streaming platforms based on the P2P technology, such as PPS and PPTV. We compete with these companies for users and advertisers. Our competitors may compete with us in a variety of ways, including by conducting brand promotions and other marketing activities and making acquisitions. In addition, certain online video websites may continue to derive their revenues from providing content that infringes third-party copyright and may not monitor their websites for any such changes becauseinfringing content. As a result, we aremay be placed at a disadvantage to some of these websites that do not ableincur similar costs as we do with respect to predict if the telecom operators will unilaterally amendcontent monitoring. Some of our contracts with them.

8

In addition, Internet streaming of content represents only one of many existing and potential new technologies for viewing video. Many users maintain simultaneous relationships with multiple video providers and can easily shift from one provider to another. For example, users may subscribe to cable, buy a DVD, and download a movie from Apple iTunes or other sources, or some combination thereof. New competitors may be able to launch new businesses at a relatively low cost.

We also face competition from other types of advertising media, such as newspapers, magazines, yellow pages, billboards and other forms of outdoor media, television and radio. Most large companies in China allocate, and will likely continue to allocate, most of their marketing budgets to traditional advertising media and only a small portion of their budgets to online marketing and other forms of advertising media. If these companies do not devote a larger portion of their marketing budgets to online marketing services provided by our online video business, or if our existing customers reduce the amount they spend on online marketing, our results of operations and future growth prospects could be adversely affected.

Our 2.5G revenues were negatively affectedWe require a significant amount of cash to fund our operations. We cannot assure you that we can meet our working capital requirements or other capital needs through improved operating results or additional financings in 2008 by the delayed expansionamounts or on terms acceptable to us, or at all.

The operation of 2.5G mobile networks by the telecom operators. If this trend continuesan online video business requires significant upfront capital expenditures as well as continuous, substantial investment in content, technology and infrastructure. In order to implement our development strategies to expand our infrastructure and optimize our services across Internet-enabled devices, and further expand and diversify our revenue sources, we may incur additional capital needs in the future. We reported net losses attributable to our company of $23.4 million, $51.5 million and profitability$49.3 million for the years ended December 31, 2009, 2010 and 2011, respectively. As of December 31, 2011, we had cash and cash equivalents of $26.8 million and net current assets of $21.2 million. Our net cash used in operating activities in 2011 was $39.2 million. We cannot assure you that we will be able to generate sufficient cash flows or otherwise maintain sufficient working capital to finance our anticipated operations and capital expenditure requirements, as well as achieve projected cash collections from customers and contain expenses and cash used in operations. Achievement of better operating performance is not assured and management expects to continue to implement its liquidity plans, which includes reducing operating expenses. In addition, various matters may impact our liquidity such as:

inability to achieve planned operating results that could increase liquidity requirements beyond those considered in our business plan;

changes in financial market conditions or our business condition that could limit our access to existing credit facilities or make new financings more costly or even unfeasible; and

changes in China’s currency exchange control regulations that could limit our ability to access cash in China to meet liquidity requirements for our operations in China or elsewhere.

If we cannot meet our liquidity needs through improved operating results, we may need to obtain financings from financial institutions or issue debt securities. For example, on June 29, 2011, we issued $50,000,000 aggregate principal amount of senior convertible bonds to Shanda Media Group Limited (formerly known as Shanda Music Group Limited), or Shanda Media, a wholly owned subsidiary of Shanda Interactive. These senior convertible bonds were to mature in three years after issuance, but based on our working capital position, we redeemed the senior convertible bonds on September 30, 2011. We cannot assure you that we will be furtherable to obtain any future financings if required under commercially reasonable terms, or at all. In addition, we may have to obtain additional funding through equity offerings. For example, pursuant to a share purchase agreement dated April 1, 2011, we issued 1,538,461,538 ordinary shares to Shanda Media for an aggregate purchase price of $50,000,000 (or $0.0325 per ordinary share). We may have to issue and sell additional securities to meet our liquidity needs, but our ability to sell our securities is not assured. Any additional issuance of securities would dilute the ownership of our shareholders and ADS holders. Our ability to obtain additional financings in the future is subject to a number of uncertainties, including:

our future business development, financial condition and results of operations;

general market conditions for financing activities by companies in our industry; and

macroeconomic, political and other conditions in China and elsewhere.

If we cannot obtain sufficient capital to meet our capital expenditure needs, we may not be able to execute our growth strategies and our business, financial condition and prospects may be materially and adversely affected.

The online video industry in China and user acceptance of our online video content may not grow as quickly as expected, which may adversely affect our revenues and business prospects.

Our business prospects depend on the continuing development of the online video industry in China. As an emerging industry, China’s online video industry has experienced substantial growth in recent years in terms of both users and content. We cannot assure you, however, that the online video industry will continue to grow as rapidly as it has in the past. With the development of technology, new forms of media may emerge and render online video websites less attractive to users. Growth of the online video industry is affected by numerous factors, such as users’ general online video experience, technological innovations, development of Internet and Internet-based services, regulatory changes, especially regulations affecting copyrights, and the macroeconomic environment. If the online video industry in China does not grow as quickly as expected or if we fail to benefit from such growth by successfully implementing our business strategies, our user traffic may decrease and our business and prospects may be adversely affected.

We operate in a rapidly evolving industry. If we fail to keep up with the technological developments and users’ changing requirements, our business, results of operations and prospects may be materially and adversely affected.

The online video industry is rapidly evolving and subject to continuous technological changes and changes in industry standards. Our success will depend on our ability to keep up with the changes in technology and user behavior resulting from 2.5G WVAS declined from $17.4 million for fiscal year 2007 to $11.3 million for fiscal year 2008, representing a declinethe technological developments. For example, the development of 35.1%. Our 2.5G value-added services declinedbroadband enabled the enjoyment of high definition videos online. In addition, the number of people accessing the Internet via devices other than personal computers, including mobile phones and other hand-held devices, has increased in part because ofrecent years. With the telecom operators’ decision to delay expanding capacity or building out 2.5G mobile networks as they awaited the issuanceintroduction of 3G licenses.mobile services by all three mobile carriers in China in 2009, we expect this trend to continue. If thiswe do not adapt our products and services to such changes in an effective and timely manner, we may suffer from a decreased user traffic, which may result in a reduced number of advertisers using our online advertising services. Furthermore, changes in technologies may require substantial capital expenditures in product development as well as in modification of products, services or infrastructure. Failure in keeping up with technological development may result in our products and services being less attractive, which in turn, may materially and adversely affect our business, results of operations and prospects.

We generate substantially all of our revenues from online advertising. If we fail to retain existing advertisers or attract new advertisers to advertise on our website or if we are unable to collect accounts receivable from the advertisers or advertising agencies in a timely manner, our financial condition, results of operations and prospects may be materially and adversely affected.

We generate substantially all of our revenues from online advertising. The online advertising market doesis new and rapidly evolving, particularly in China. As a result, many of our current and potential advertising clients have limited experience using the Internet for advertising purposes and historically have not growdevoted a significant portion of their advertising budget to Internet-based advertising. Moreover, changes in government policy could restrict or curtail our online advertising services. For example, in 2006 and evolve2007, the PRC government enacted a series of regulations, administrative instructions and policies to restrict online medical advertising.

We retain existing advertisers and attract new advertisers by maximizing return on their investment. If, however, our advertisers determine that their expenditures on online video websites do not generate expected returns, they may allocate a portion or all of their advertising budgets to other advertising channels such as television, newspapers and magazines and reduce or discontinue business with us. Since most of our advertisers are not bound by long-term contracts, they may amend or terminate advertising arrangements with us easily without incurring liabilities. Failure to retain existing advertisers or attract new advertisers to advertise on our website may materially and adversely affect our business, financial condition, results of operations and prospects.

Historically, we entered into a majority of our online advertising agreements with various third-party advertising agencies. Beginning in the second quarter of 2011, we have relied on Shanghai Shengyue Advertising Ltd., or Shengyue, an affiliate wholly owned by Shanda Interactive, as our advertising agency for sales to, and collection of payments from, a majority of our advertisers. The financial soundness of our advertisers and Shengyue may affect our collection of accounts receivable. Any inability of our advertisers or Shengyue to pay us in a timely manner or in the timeframe thatmay adversely affect our liquidity and cash flows.

If we fail to continue to anticipate user preferences and provide products and services to attract and retain users, we may not be able to generate sufficient user traffic to remain competitive.

Our success depends on our ability to generate sufficient user traffic through provision of attractive products and services. To attract and retain users and compete against our competitors, we must continue to offer high-quality content that provides our users with a satisfactory online video experience. To this end, we must continue to produce new in-house content and encourage more UGC, while balancing the value of each type of content to our advertising services. For example, with UGC, users can upload and share their own videos and spend a longer time on our website, and a “community-like” environment enhances users’ loyalty to our website and such network effect broadens advertisers’ reach of audience; and with our in-house productions, we tailor such content to users’ preferences based on our industry experience and combine these productions with targeted advertising services such as product placements, which benefits both the users and our advertisers.

Based on the feedback on our website design and our statistics regarding users’ watching behavior, we keep developing new website features that appeal to users, such as designing more user-friendly content searching tools, creating additional interactive social functions or offering better website compatibility with new Internet-enabled devices. We need to continuously anticipate user preferences and industry changes and respond to such changes in a timely and effective manner. If we fail to cater to the needs and preferences of our users and, as a result, fail to deliver satisfactory user experience, we may suffer from reduced user traffic and our business and results of operations may be materially and adversely affected.

The success of our business depends on our ability to maintain and enhance our brand.

We believe that maintaining and enhancing our Ku6 brand is of significant

is of significant sustainableimportance to the success of our business. Since the online video market is highly competitive, a well-recognized brand is critical to increasing our user base and, in turn, enhancing our attractiveness to advertisers. We believe that the importance of brand recognition will increase as the number of Internet users in China grows. In order to attract and retain Internet users and advertisers, we may need to substantially increase our expenditures for creating and maintaining brand loyalty. Our success in promoting and enhancing our brand, as well as our ability to remain competitive, will also depend on our success in offering high-quality content, features and functionality. If we fail to promote our brand successfully or if visitors to our website or advertisers do not perceive our content and services to be of high quality, we may not be able to continue growing our business and attracting users and advertisers.

Our quarterly revenues and operating results may fluctuate, which makes our results of operations difficult to predict and may cause our quarterly results of operations to fall short of expectations.

Our quarterly revenues and operating results have fluctuated in the past and may continue to fluctuate depending upon a number of factors, many of which are out of our control. For these reasons, comparing our operating results on a period-to-period basis may not be meaningful, and you should not rely on our past results as an indication of our future performance. Our quarterly and annual revenues and costs and expenses as a percentage of our revenues may be significantly different from our 2.5G business.historical or projected rates. Our operating results in future quarters may fall below expectations. Any of these events could cause the price of our ADSs to fall. Other factors that may affect our financial results include, among others:

global economic conditions;

our ability to maintain and increase user traffic;

our ability to attract and retain advertisers;

changes in government policies or regulations, or their enforcement; and

geopolitical events or natural disasters such as war, threat of war, earthquake or epidemics.

Our operating results tend to be seasonal. For instance, we may have slightly lower revenues during the first quarter of each year primarily due to the Chinese New Year holidays in that quarter. In addition, advertising spending in China has historically been cyclical, reflecting overall economic conditions as well as the budgeting and buying patterns of our customers.

The Chinese governmentWe may not be able to manage our expansion effectively.

Our net revenues grew significantly from $1.0 million in 2009 to $16.6 million in 2010 and further to $19.2 million in 2011. To manage the further expansion of our business and the telecomgrowth of our operations and personnel, we need to continuously expand and enhance our infrastructure and technology, and improve our operational and financial systems, procedures and controls. We also need to expand, train and manage our growing employee base. In addition, our management will be required to maintain and expand our relationships with content providers, advertisers, advertising agencies and other third parties. We cannot assure you that our current infrastructure, systems, procedures and controls will be adequate to support our expanding operations. If we fail to manage our expansion effectively, our business, results of operations and prospects may be materially and adversely affected.

We may be subject to administrative actions by PRC regulatory authorities and other liabilities because of advertisements shown on our website.

Under PRC advertising laws and regulations, we are obligated to monitor the advertising content shown on our website to ensure that such content is true, accurate and in full compliance with applicable laws and regulations. In addition, where a special government review is required for specific types of advertisements prior to website posting, such as advertisements relating to pharmaceuticals, medical instruments, agrochemicals and veterinary pharmaceuticals, we are obligated to confirm that such review has been performed and approval has been obtained from competent governmental authority, which is generally the local branch of the State Administration for Industry and Commerce, or the SAIC. Violation of these laws and regulations may subject us to penalties, including fines, confiscation of our advertising income, orders to cease dissemination of the advertisements and orders to publish an announcement correcting the misleading information. In circumstances involving serious violations, such as posting a pharmaceutical product advertisement without approval, or posting an advertisement for fake pharmaceutical products, PRC governmental authorities may force us to terminate our advertising operation or revoke our licenses. Furthermore, advertisers, advertising operators or advertising distributors, including us, may preventbe subject to civil liability if they infringe on the legal rights and interests of third parties.

A majority of the advertisements shown on our website are provided to us from distributing,by advertising agencies on behalf of advertisers. We cannot assure you that all the content contained in such advertisements is true and accurate as required by the advertising laws and regulations, especially given the uncertainty in the application of these laws and regulations. For example, Article 38 of the Advertisement Law provides that an advertisement operator who knows or should have known the posted advertisement is false or fraudulent will be subject to joint and several liabilities. However, for the determination of the truth and accuracy of the advertisements and the actual or constructive knowledge of the website, there are no implementing rules or official interpretations, and such a determination is at the sole discretion of the relevant local branch of the SAIC, which results in uncertainty in the application of these laws and regulations.

If we are found to be in violation of applicable PRC advertising laws and regulations in the future, we may be subject to liability for, content that any of them believe is inappropriate.

9

10

11

We may need to adjustrecord impairment charges to earnings if our revenues in the subsequent periods in which these revenuesacquisition goodwill or acquired intangible assets are confirmed. Actual revenues may differ from prior estimates when unexpected variations in billing and transmission failures occur. Recognizing revenues on an accrual basis could potentially require us to later make adjustments to our financial statements if the telecom operators’ billing statements and cash payments are different from our estimates, which could adversely affect our reputation and the market price of our ADSs.

12

13

As part of our affiliated musicexpansion and diversification strategy, we may acquire or invest in companies

Disruption or failure of our systems could impair our users’ online video experience and adversely affect our reputation.

Our ability to provide users with a high-quality online video experience depends on the continuous and reliable operation of our systems. We cannot assure you that such products or eventswe will be successful releasesable to procure sufficient bandwidth in a timely manner or that any producton acceptable terms or events will generate revenues sufficientat all. Failure to coverdo so may significantly impair user experience on our website and decrease the costoverall effectiveness of developmentour website to both users and advertisers. Disruptions, failures, unscheduled service interruptions or organization.

If we experience frequent or persistent service disruptions, whether caused by failures of our own systems or those of third-party service providers, our users’ experience may be adverselynegatively affected, by the difficultywhich in enforcing copyrights and retaining popular artists, and therefore may not grow as fast as anticipated.

14

Undetected programming errors could adversely affect user experience and may subject us to unforeseen liabilities.

The Chinese market for WVASvideo programs, including advertising video programs, on our website may contain programming errors that may only become apparent after their release. We receive user feedback in connection with programming errors affecting their user experience from time to time, and such errors may also come to our attention during our monitoring process. We generally have been able to resolve such programming errors in a timely manner. However, we cannot assure you that we will be able to detect and resolve all these programming errors effectively. Undetected audio or video programming errors or defects may adversely affect user experience and cause our advertisers to reduce their use of our services, any of which could materially and adversely affect our business and results of operations.

Our operations depend on the performance of the Internet infrastructure and telecommunications networks in China and third-party service providers.

Our products and services depend on the ability of our users to access the Internet. Therefore, the successful operation of our business depends on the performance of the Internet infrastructure and telecommunications networks in China. Almost all access to the Internet is changing rapidlymaintained through state-owned telecommunications operators under the administrative control and is intensely competitive. We compete principallyregulatory supervision of China’s Ministry of Industry and Information Technology, or the MIIT. Moreover, we have entered into contracts with four groupsvarious subsidiaries of 2G, 2.5G and 3Ga limited number of telecommunications service providers in China,each province and rely on them to provide us with data communications capacity through local telecommunications lines and Internet data centers to host our servers. We have limited access to alternative networks or services in the event of disruptions, failures or other problems with China’s Internet infrastructure or the telecommunications networks provided by telecommunications service providers. Our Ku6.com website regularly serves a large number of users and advertisers. With the expansion of our business, we may be required to upgrade our technology and infrastructure to keep up with the increasing traffic on our websites. However, we have no control over the costs of the services provided by telecommunications service providers. If the prices we pay for telecommunications and Internet services rise significantly, our results of operations may be materially and adversely affected. If Internet access fees or other charges to Internet users increase, our user traffic may decline and our business may be hurt. Our servers, which include companies that focus primarilyare partly hosted at third-party Internet data centers, are vulnerable to break-ins, sabotage and vandalism. The occurrence of a natural disaster or entirelya closure of an Internet data center by a third-party provider without adequate notice could result in lengthy service interruptions. Moreover, the agreements we have entered into with domestic telecommunications carriers to host our servers typically have terms of approximately one year and are renewable subject to early termination. If we are not able to renew such hosting services agreements with the telecommunications carriers when they expire and are not able to enter into agreements with alternative carriers at commercially reasonable terms or at all, the quality and stability of our services may be adversely affected. In addition, our domain names are resolved into Internet protocol (IP) addresses by systems of third-party domain name registrars and registries. Any interruptions or failures of those service providers’ systems, which are beyond our control, could significantly disrupt our own services.

If we experience frequent or persistent system failures on these markets, major Internet portal operatorsour websites, whether due to interruptions and failures of our own information technology and communications systems or those of third-party service providers we rely upon, our reputation and brand could be permanently harmed. The steps we take to increase the reliability and redundancy of our systems are expensive, may reduce our operating margin and may not be successful in China, nichereducing the frequency or duration of service interruptions.

We also depend significantly on relationships with leading technology providers and the telecom operators.

15

We have been and expect we will continue to be exposed to intellectual property infringement and other claims, including claims based on content posted on our businesswebsite, which could be time-consuming and costly to defend and may be severely disrupted. In addition, if any of these key executives result in substantial damage awards and/or employees joins a competitor or forms a competing company, we could lose customers and suppliers and incur additional expensescourt orders that may prevent us from continuing to recruit and train personnel. Eachprovide certain of our executive officers has entered into an employment agreement and a confidentiality, non-competition and non-solicitation agreement with us. As we believe is customaryexisting services.

Our success depends, in our industry in China, we do not maintain key-man life insurance for any of our key executives.

16

We have been and may continue to be subject to claims for defamation, negligence, infringement of third-party copyright and other rights, such as privacy and image rights, or other claims based on the nature or content of videos or other information provided by Ku6 Holding or our users on our financial condition.

17

Due to the significant number of videos uploaded by users, which currently amounts to an average of approximately 150,000 files on payments of dividends by our subsidiary are implemented under Chinese law,a daily basis, we may not be able to accessidentify all content that may infringe on third-party rights. Thus, our internal source of funds.

Additionally, although we have not previously been subject to legal actions for copyright infringement in jurisdictions other than the PRC, it is possible that we may be subject to such claims in the future. Many ofSuch other jurisdictions may impose different protections for copyrights, and the factors that cause such fluctuationclaims may result in potentially larger damages awards than have been imposed in the PRC. For example, although our operations are outsidein the PRC and our control. Steady revenuessite is targeted at audiences in Asia, our site includes some English-language content and results of operations will depend largely on our ability to:

We may not be able to adequately protect our intellectual property rights, and we may be exposedany failure to infringement claims by third parties.protect our intellectual property rights could adversely affect our revenues and competitive position.

We believe the copyrights, service marks,that trademarks, trade secrets, patents, copyrights and other intellectual property we use are important componentsto our business. We rely on a combination of trademark, copyright, patent and trade secret protection laws in China and other jurisdictions, as well as confidentiality procedures and contractual provisions to protect our WVAS.intellectual property and our brand. We have invested significant resources to develop our own intellectual property and acquire licenses to use and distribute the intellectual property of others for our online video site; failure to maintain or protect these rights could harm our business. In addition, our affiliated music companies are substantially dependent on their ability to protect their rights over their music content. Anyany unauthorized use of suchour intellectual property by third parties may adversely affect our current and future revenue from such servicesrevenues and software, as well as our reputation. For example, rampant piracy in China has negatively affected offline sales of CDs and tapes by our affiliated music companies, and if piracy becomes a problem in online distribution channels, their financial results would be further materially adversely affected. We rely primarily on the intellectual property laws and contractual arrangements with our employees, clients, business partners and others to protect such intellectual property rights. Third parties may be able to obtain and use such intellectual property without authorization. Furthermore, the

The validity, enforceability and scope of protection available under intellectual property laws with respect to the Internet industry in China are uncertain and still evolving. Implementation and enforcement of PRC intellectual property-related laws have historically been deficient and ineffective. Accordingly, protection of intellectual property in the Internet, wireless value-added and music industriesrights in China is uncertain and still evolving, and these laws may not protect intellectual property rights to the same extentbe as the laws of some other jurisdictions. In particular, the intellectual property law in China is less developed thaneffective as in the United States or other western countries. Furthermore, policing unauthorized use of proprietary technology is difficult and historically, China has often not protected private parties’expensive, and we may need to resort to litigation to enforce or defend patents issued to us or our other intellectual property or to determine the enforceability, scope and validity of our proprietary rights to the same extent asor those of others. Such litigation and an adverse determination in any such parties might enjoy in the United States. Moreover, litigation, may be necessary in the future to enforce our intellectual property rights, whichif any, could result in substantial costs and diversion of our resources and management attention.

Changes in government policies or regulations may have a material and adverse effect on our business, financial condition, results of operations and cash flows.

Our online video business is subject to strict government regulations in the PRC. Under the current PRC regulatory scheme, a number of regulatory agencies, including the State Administration of Radio, Film, and Television, or SARFT, the Ministry of Culture, the Ministry of Industry and Information Technology, or MIIT, the General Administration of Press and Publication, or GAPP, and the State Council Information Office, or SCIO, jointly regulate all major aspects of the Internet industry, including the online video industry. Operators must obtain various government approvals and licenses, including an Internet content provider license, or ICP license, and an Internet audio/video program transmission license, prior to the commencement of online video operations. We have obtained the licenses and permits essential for our business operations. We have obtained the ICP license, the Internet audio/video program transmission license (currently covering the Internet user uploaded audio/video program service) and a permit from the Beijing Drug Administration to post approved non-prescription drug advertisement on our website We currently operate a current events channel on our website, which includes audio/video content relating to current topics and social events.

Any of these actions by the PRC government may have a material and adverse effect on our results of operations. In addition, the PRC government may promulgate regulations restricting the types and content of advertisements that may be transmitted online, which could have a direct adverse impact on our business.

Our ability to operate effectively could be impaired if we fail to attract and retain our executive officers.

Our success depends, in part, upon the continuing contributions of our executive officers. Although we have an employment agreement with our chief financial officer and the third-party human resources agency that we use has an employment agreement with our chief executive officer, we cannot assure you that we will be able to retain these executive officers. The loss of the services of any of our executive officers or the failure to attract other executive officers could have a material adverse effect on our business overall financial condition and results of operations.

or our business prospects.

18

Insurance companies in China currently do not offer limited businessas extensive an array of insurance products andas insurance companies do not, to our knowledge, offer business liability insurance. As a result, wein more developed economies. We do not have any business liability or disruption insurance coverage forto cover our operations. Moreover, while business disruption insurance is available, weWe have determined that the costs of insuring for these risks of disruption and costthe difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. Any uninsured occurrence of the insurance are such that we do not require it at this time. Any business disruption litigation or natural disaster mightmay result in our incurring substantial costs and the diversion of resources, particularly ifwhich could have an adverse effect on our results of operations and financial condition.

Regulation and censorship of information disseminated over the Internet in China may adversely affect our business and subject us to liability for information displayed on or linked to our websites.

The PRC government has adopted regulations governing Internet access and the distribution of news and other information over the Internet. Under these regulations, Internet content providers and Internet publishers are prohibited from posting or displaying over the Internet content that, among other things, violates PRC laws and regulations, impairs the national dignity of China, or is reactionary, obscene, superstitious, fraudulent or defamatory. Furthermore, Internet content providers are also prohibited from displaying content that may be deemed by relevant government authorities as “socially destabilizing” or leaking “state secrets” of the PRC. Failure to comply with these requirements may result in the revocation of licenses to provide Internet content and other licenses and the closure of the concerned websites. In the past, failure to comply with such requirements has resulted in the closure of certain websites. The website operator may also be held liable for such censored information displayed on or linked to the website.

In addition, the MIIT has published regulations that subject website operators to potential liability for content displayed on their websites and the actions of users and others using their systems, including liability for violations of PRC laws and regulations prohibiting the dissemination of content deemed to be socially destabilizing. The Ministry of Public Security has the authority to order any local Internet service provider to block any Internet website at its sole discretion. From time to time, the Ministry of Public Security has stopped the dissemination over the Internet of information that it affectsbelieves to be socially destabilizing. The State Secrecy Bureau is also authorized to block any website it deems to be leaking State secrets or failing to meet the relevant regulations relating to the protection of State secrets in the dissemination of online information. Furthermore, we are required to report any suspicious content to relevant governmental authorities, and to undergo computer security inspections. If we fail to implement the relevant safeguards against security breaches, our technology platform whichwebsites may be shut down and our business and ICP licenses may be revoked.

Although we dependattempt to monitor the content in our websites, we are not able to control or restrict the content of other Internet content providers linked to or accessible through our websites, or content generated or placed on our websites by our users. To the extent that PRC regulatory authorities find any content displayed on our websites objectionable, they may require us to limit or eliminate the dissemination of such information on our websites. If third-party websites linked to or accessible through our website operate unlawful activities such as online gambling on their websites, PRC regulatory authorities may require us to report such unlawful activities to relevant authorities and to remove the links to such websites, or they may suspend or shut down the operation of such websites. PRC regulatory authorities may also temporarily block access to certain websites for deliverya period of time for reasons beyond our control. Any of these actions may reduce our user traffic and adversely affect our business. In addition, we may be subject to penalties for violations of those regulations arising from information displayed on or linked to our websites, including a suspension or shutdown of our WVAS.

We have a material weakness in our internal control over financial reporting. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results or prevent fraud.

We are subject to reporting obligations under the U.S. securities laws. The Securities and Exchange Commission, or the SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, adopted rules requiring every public company to include a management report on the effectiveness of such company’s internal control over financial reporting in its annual report, which contains management’s assessment of the effectiveness of the company’s internal control over financial reporting.report. In addition, an independent registered public accounting firm for a public company must attest to and report on the effectiveness of thesuch company’s internal control over financial reporting. Accordingly,

Our management concluded that our management assessedinternal control over financial reporting was effective as of December 31, 2011 and our effectiveness ofindependent registered public accounting firm has issued an attestation report concluding that our internal control over financial reporting was effective in all material aspects. However, we had identified a material weakness in our internal control over financial reporting as of December 31, 2008 using2010 relating to a lack of sufficient competent accounting personnel with appropriate levels of accounting knowledge and experience to address complex U.S. GAAP accounting issues and prepare financial statements and related disclosures under U.S. GAAP and we cannot assure you that we will be able to maintain the criteria set forth in the report “Internal Control — Integrated Framework” published by the Committeeeffectiveness of Sponsoring Organizations of the Treadway Commission (know as COSO). This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting as temporary rules of the SEC permit us to provide only our management’s report in this annual report.

Furthermore, we may need to incur additional costs and use additional management and other resources in an effort to comply with Section 404 of the Sarbanes-Oxley Act and other requirements going forward.

19

We will be classified as a PFIC for U.S. tax purposes for a taxable year if either (a) 75% or more of our gross income for such taxable year is passive income or (b) 50% or more of the average percentagequarterly value, generally determined by fair market value, of our assets during such taxable year consists of assets that either produce passive income or are held for the production of passive income. For such purposes, if we directly or indirectly own 25% or more of the shares of another corporation, we generally will be treated as if we (a) held directly a proportionate share of the other corporation’s assets and (b) received directly a proportionate share of the other corporation’s income. The determination of whether or not we are a PFIC is made on an annual basis and depends on the composition of our income and assets, including goodwill, from time to time. We believe that we were a PFIC for taxable years 2006, 2007, and 2008 and are likely2009 and it is not clear whether we were a PFIC for taxable year 2011.That determination is subject to uncertainty because of the uncertain characterization of our assets and income for purposes of the PFIC rules. If we were a PFIC for 2006, 2007, 2008, 2009 or 2011 and you held ordinary shares or ADSs during any such taxable years, we would continue to be classifiedtreated as a PFIC with respect to those ordinary shares or ADSs for the currentall succeeding years during which you hold them, even if we cease to be a PFIC in taxable years ending after 2011. Because our PFIC status for any taxable year of 2009, although such determination cannotwill not be made with certaintydeterminable until after the end of the taxable year and will depend on the composition of our income and assets and the market value of our assets for such taxable year, which may be, in part, based on the market price of our ordinary shares or ADSs (which may be especially volatile), there can be no assurance we will not be a PFIC for any taxable year. Such characterization could result in adverse U.S. federal income tax consequences to a U.S. investor. For example,In general, if we are a PFIC, then “excess distributions” to a U.S. investor and any gain realized by a U.S. investor on the sale or other disposition of our ordinary shares or ADSs will be allocated ratably over the U.S investor’s holding period for the ADSs,ordinary shares or ADSs; the amount allocated to the current taxable year of receipt of the distribution or disposition and any year prior to our becoming a PFIC will be taxed as ordinary income,income; and the amount allocated to each of the other taxable yearsyear will be subject to tax at the highest rate of tax in effect for the applicable class of taxpayer for that year. Additionally, an interest charge for the deemed deferral benefit will be imposed with respect to the resulting tax attributable to each such other taxable year and the U.S. investor will be subject to U.S. tax reporting requirements. Some of these adverse tax consequences may be avoidedAlternatively, if thewe are a PFIC and if our ADSs are “regularly traded” on a “qualified exchange,” a U.S. investor makescould make a “mark-to-market”mark-to-market election that would result in tax treatment different from the general tax treatment for the ADSs.

Given the complexity of the issues regarding our classification as a PFIC, U.S. investors are urged to consult their own tax advisors for guidance as to the U.S. federal, state and local and other tax consequences of our status as a PFIC in light of thetheir particular circumstances, applicable to such U.S. investor, as well as the availability of and procedures for making a mark-to-market or other available election. For further discussion of the adverse U.S. federal income tax consequences of our classification as a PFIC, see Item 10.E. “Additional Information—Taxation—United States“Taxation—U. S. Federal Income Taxation” below.

Anti-takeover provisions in our charter documents could make an acquisition of us, whichWe may be beneficialdeemed a PRC resident enterprise under the EIT Law and be subject to PRC taxation on our shareholders, more difficult and may prevent attempts by our shareholders to replaceworldwide income.

The PRC Enterprise Income Tax Law, or remove our current management.

Dividends that we receive from our PRC subsidiaries are subject to PRC withholding tax.

In accordance with the EIT Law and its implementation rules, dividends which arise from profits of foreign invested enterprises, or FIEs, earned after January 1, 2008, are subject to a 10% withholding tax. There are no rights comparable to appraisal rights, which would otherwise ordinarily beundistributed earnings of our subsidiaries located in the PRC that are available to dissenting shareholdersfor distribution as of United States corporations. Also, our Cayman Islands counsel is aware of only a few reported cases of derivative actions having been brought in a Cayman Islands court. Such actions are ordinarily available in respect of United States corporations in U.S. courts. Finally, Cayman Islands companies mayDecember 31, 2011. In addition, we (i) do not have standingany present plan to initiate shareholder derivative actions before the federal courts of the United States. As a result,pay any cash dividends on our public shareholders may face different considerations in protecting their interests in actions against the management, directors or our controlling shareholders than would shareholders of a corporation incorporated in a jurisdictionordinary shares in the United States,foreseeable future and (ii) intend to retain most of our ability to protectavailable funds and any future earnings for use in the operation and expansion of our interests may be limited if we are harmedbusiness in a mannerthe PRC. Accordingly, no provision has been made for the PRC dividend withholding taxes that would otherwise enable usbe payable upon distributions of dividends by our PRC subsidiaries to sue in a United States federal court.

us. Any future dividends that we will receive from our PRC subsidiaries will be subject to PRC withholding tax.

20