| | The estimated fair value of the common shares of the Company for options granted in October 2007, was determined to be USD5.90 based on the mid-point of our estimated range of the initial public offering price and after applying a discount of 9.16% to account for inherent business risk and lack of marketability. For options granted on January 28, 2008, the fair value of the reporting unit is compared with its carrying value (including goodwill). If the fair value of the reporting unit is less than its carrying value, an indication of goodwill impairment exists for the reporting unit and the entity must perform step two of the impairment test (measurement). Under step two, an impairment loss is recognized for any excess of the carrying amount of the reporting unit’s goodwill over the implied fair value of that goodwill. The implied fair value of goodwill is determined by allocating the fair value of the reporting unit in a manner similar to a purchase price allocation and the residual fair value after this allocation is the implied fair value of the reporting unit goodwill. Fair value of the reporting unit is determined using a discounted cash flow analysis. If the fair value of the reporting unit exceeds its carrying value, step two does not need to be performed.The Company performs its annual impairment review of goodwill at March 31, and when a triggering event occurs between annual impairment tests. No impairment loss was recorded for any of the periods presented. (s)Employee benefit plans As stipulated by the regulations of the PRC, the Company’s PRC subsidiaries are required to contribute to various defined contribution plans, organized by municipal and provincial governments on behalf of their employees. The contributions to these plans are based on certain percentages of the employee’s standard salary base as determined by the local Social Security Bureau. The Group has no other obligation for the payment of employee benefits associated with these plans beyond the annual contributions described above. Employee benefit expenses recognized under these plans for the years ended March 31, 2010, 2011 and 2012 is allocated to the following expense items: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Cost of revenues | | 3,236,060 | | 3,461,455 | | 3,847,873 | | Research and development | | 2,685,212 | | 3,553,612 | | 3,694,142 | | Sales and marketing | | 3,282,329 | | 3,649,029 | | 3,551,100 | | General and administrative | | 2,065,290 | | 2,109,344 | | 2,206,793 | | Total employee benefit expenses | | 11,268,891 | | 12,773,440 | | 13,299,908 | |

F-17

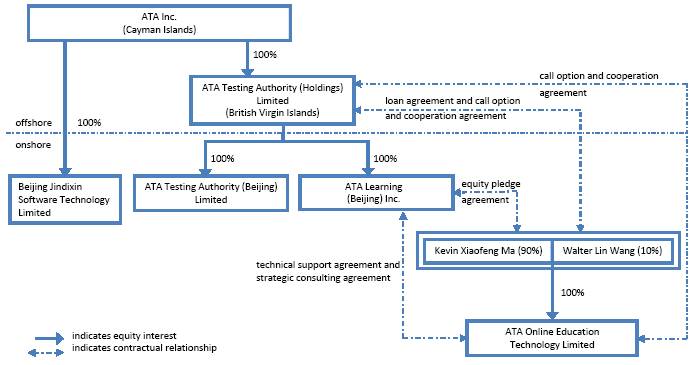

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (t)Earnings (loss) per share Basic earnings (loss) per share is computed by dividing net earnings (loss) by the weighted average number of common shares outstanding during the year using the two-class method. Under the two-class method, net income is allocated between common shares and other participating securities based on their participating rights in undistributed earnings. The Company’s nonvested shares relating to the share-based awards under the share incentive plan were considered participating securities since the holders of these securities have non-forfeitable rights to cash dividends. Diluted earnings (loss) per share is calculated by dividing net earnings (loss) adjusted for the effect of dilutive common equivalent shares, if any, by the weighted average number of common and dilutive common equivalent shares outstanding during the year. Common equivalent shares consist of common shares issuable upon the exercise of outstanding share options and warrants (using the treasury stock method). Common equivalent shares in the diluted earnings (loss) per share computation are excluded to the effect that they would be anti-dilutive. In calculating the diluted earnings (loss) per share, the undistributed earnings are not reallocated to the participating securities and the common and dilutive common equivalent shares. (u)Segment reporting The Group has one operating segment, testing and training services. Substantially all of the Group’s operations and customers are located in the PRC. Consequently, no geographic information is presented. (v)Variable Interest Entity(“VIE”) PRC regulations prohibit direct foreign ownership of business entities that engage in internet content provision (“ICP’’) services in the PRC. The Company and its subsidiaries are foreign owned business entities under the PRC law and accordingly are prohibited from providing ICP services in the PRC, including having ownership of entities engaged in providing such services. ATA Online provides ICP online test preparation services in the PRC. The Group has no legal ownership interest in ATA Online. The legal ownership interests of ATA Online are held by Mr. Kevin Xiaofeng Ma, the Company’s co-founder, chairman and chief executive officer and Mr. Walter Lin Wang, the Company’s co-founder, director and president, both of whom are also the beneficial owners of the Company. Therefore, the legal owners of ATA Online are also ultimate beneficial owners of the Company’s wholly owned PRC subsidiaries. A series of contractual agreements, including loan agreements, a call option and cooperation agreement, an equity pledge agreement, a technical support agreement, and a strategic consulting service agreement (collectively, the “VIE Agreements”) were entered among ATA BVI, ATA Learning, ATA Online, Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang. As a result of the VIE Agreements and as described below, the financial statements of ATA Online are consolidated in the Company’s consolidated financial statements. ATA Online is determined to be a VIE because although Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang are the equity holders of ATA Online, (i) their equity investment of RMB10 million in ATA Online was financed by the Group and (ii) they do not participate in any profit or loss of ATA Online. In addition, Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang are considered de facto agents of the Group because: (i) Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang’s equity investment in ATA Online was financed by loans from the Group, (ii) Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang are the executive officers of the Group, and (iii) Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang cannot sell, transfer or encumber their interest in ATA Online without the prior written approval of the Group. Further, although the Group does not have an equity investment in ATA Online, the Group has other variable interests in ATA Online through, among others, (i) the Group’s subordinated loans to Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang (used by them to finance their equity investment in ATA Online) and other subordindated loans to ATA Online, (ii) the Group’s right, under the loan agreement, to receive all the dividends declared by ATA Online through its equity holders and (iii) the Group’s exclusive purchase option to acquire (or to have the Group’s designee acquire) 100% of the equity interest or assets in ATA Online for a consideration equal to the loans provided by the Group to Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang, to the extent permitted under PRC law. As a result of these variable interests, the Group has the obligation to absorb the expected losses and the right to receive expected residual returns of ATA Online. F-18

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) Neither Mr. Kevin Xiaofeng Ma, Mr. Walter Lin Wang or the Group individually had both (i) the power to direct activities of ATA Online that most significantly impact ATA Online’s economic performance and (ii) the obligation to absorb the expected losses and the right to receive expected residual return of ATA Online (collectively referred to as a “Controlling Financial Interest”). However, because the Group collectively with Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang had a Controlling Financial Interest, management performed an evaluation to determine the party that is most closely associated with ATA Online. Management has concluded that the Group is most closely associated with ATA Online and therefore is the primary beneficiary of ATA Online because: (i) The legal equity holders of ATA Online, Mr. Kevin Xiaofeng Ma and Mr. Walter Lin Wang are the de facto agents of the Group; (ii) The Group is exposed to the variability associated with the anticipated economic performance of ATA Online because of (a) the Group’s obligation to absorb the expected losses (through the loans described above) and the right to receive expected residual return of ATA Online (through the call option agreement), (b) the Group’s right to receive all the dividends declared by ATA Online through its equity holders, and (c) the Group’s right to receive a service fee under the technical support agreement and strategic consulting service agreement; (iii) Under the call option and cooperation agreement, ATA Online and its equity holders cannot sell, assign, mortgage or dispose any of ATA Online’s assets or operations and cannot enter into any transaction which may materially affect ATA Online’s assets, liability, operations, equity or other legal rights without the Group’s prior written consent; and (iv) The design of ATA Online is to allow the Group to provide ICP online test preparation services in the PRC. Accordingly, the financial statements of ATA Online are consolidated in the Company’s consolidated financial statements. All of the equity (net assets) and net incomes or losses of ATA Online are attributed to the Company; therefore, non-controlling interest in ATA Online is not presented in the Company’s consolidated financial statements. The key terms of these VIE Agreements are as follows: Loan agreements: ATA BVI lent to ATA Online’s equity holders, Mr. Kevin Xiaofeng Ma, and Mr. Walter Lin Wang, interest free loans in the amount of RMB10 million for the sole purpose of investing in ATA Online as ATA Online’s registered capital. The equity holders of ATA Online can only repay the loans by transferring all of their legal ownership interest in ATA Online to ATA BVI or to a third party designated by ATA BVI. The equity holders of ATA Online are required to pay to ATA BVI all dividend received from ATA Online. The initial terms of the loans are ten years, which may be extended upon the agreement of ATA BVI and ATA Online’s equity holders. The approval of ATA Online is not required for the renewal of the loan agreements nor can ATA Online terminate the loan agreement during the contract term. ATA BVI lent RMB 1 million on October 27, 2006 and RMB 9 million on July 7, 2009. As of March 31, 2012, the remaining terms of the loan agreements are 4.6 years and 7.3 years for the loans of RMB 1 million and RMB 9 million, respectively, assuming no renewal of the agreement. Technical support agreement: ATA Learning has the exclusive right to provide technical support services to ATA Online. ATA Online pays a quarterly service fee to ATA Learning. The service fees are mutually agreed by both parties, and are determined based on certain objective criteria such as the actual services required by ATA Online and the actual labor costs, as determined by the number of days and personnel involved, incurred by ATA Learning for providing the services during the relevant period. During the periods presented, no technical support service was requested by ATA Online and therefore, ATA Learning did not charge ATA Online any service fees under the agreement. The term of this agreement is ten years, automatically renewable for successive one year terms unless ATA Learning notifies ATA Online of its intention not to renew 30 days before the relevant term expires. ATA Online may not terminate this agreement during its term or upon its expiration. The agreement was entered into on October 27, 2006 with a remaining term of 4.6 years as of March 31, 2012, assuming no renewal of the agreement. Strategic consulting service agreement: ATA Learning provides ATA Online with strategic consulting and related services to ATA Online. The fees for these services are determined by ATA Learning and calculated monthly but paid quarterly based on actual time spent providing the services. ATA Learning has the right to adjust the fees payable by ATA Online in accordance with its performance. During the periods presented, no strategic consulting service was requested by ATA Online and therefore, ATA Learning did not charge ATA Online any service fees under the agreement. The term of this agreement is twenty years, automatically renewable for successive one year terms unless ATA Learning notifies ATA Online of its intention not to renew 30 days before the relevant term expires. ATA Online can only terminate this agreement if ATA Learning fails to perform its obligation under this agreement. The agreement was entered into on October 27, 2006 with a remaining term of 14.6 years as of March 31, 2012, assuming no renewal of the agreement. F-19

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) Call option and cooperation agreement: Through the call option and cooperation agreement entered into among ATA BVI, ATA Online and its equity holders, ATA BVI or any party designated by ATA BVI, has an exclusive purchase option to acquire the equity interest in ATA Online from its equity holders or acquire ATA Online’s assets at any time when permitted by applicable Chinese laws and regulations. The proceeds from the exercise of the call option will be applied to repay the loans under the loan agreements described above. Further, without ATA BVI’s prior written consent, ATA Online or its equity holders cannot sell, assign, mortgage or dispose any of ATA Online’s assets or operation, cannot enter into any transaction which may materially affect ATA Online’s assets, liability, operation, equity or other legal rights, and cannot distribute any dividend to its equity holders. ATA BVI is also obligated to provide financial support to ATA Online’s operation to which ATA BVI has no recourse right if ATA Online cannot repay such financing due to its losses. This agreement has an indefinite term and can only be terminated with the unanimous consent of all parties, except that ATA BVI may terminate this agreement with 30 days prior notice to the other parties. Equity pledge agreement: To secure the payment obligations of ATA Online under the technical support agreement and the strategic consulting service agreement described above, ATA Online’s equity holders have pledged to ATA Learning their entire equity ownership interests in ATA Online. Under this agreement, equity holders of ATA Online may not transfer the pledged equity interest without ATA Learning’s prior written consent. This agreement will also be binding upon successors of the pledgor and transferees of the pledged equity interest. The term of the pledge is the same as the term of the strategic consulting service agreement. ATA Online may terminate this agreement upon the completion of its contractual obligations under the technical support agreement and the strategic consulting service agreement as described above. As of March 31, 2012, the remaining term of this agreement is 14.6 years, assuming no renewal of the strategic consulting service agreement. Risks and uncertainties of the VIE Agreements: The Company relies on the VIE Agreements to operate and control ATA Online. However, these contractual arrangements may not be as effective as direct equity ownership in providing the Company with control over ATA Online. Any failure by ATA Online or its equity holders to perform their obligations under the VIE Agreements would have a material adverse effect on the financial position and financial performance of the Company. All the VIE Agreements are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. The legal system in the PRC is not as developed as some other jurisdictions, such as the United States. As a result, uncertainties in the PRC legal system could limit the Company’s ability to enforce these contractual arrangements. In addition, if the legal structure and the VIE Agreements were found to be in violation of any existing or future PRC laws and regulations, the Company may be subject to fines or other legal or administrative sanctions. In the opinion of management, based on the legal opinion obtained from the Company’s PRC legal counsel, the above contractual arrangements are legally binding and enforceable and do not violate current PRC laws and regulations. However, there are uncertainties regarding the interpretation and application of existing and future PRC laws and regulations. Accordingly, the Company cannot be assured that PRC regulatory authorities will not ultimately take a contrary view to its opinion. If the current ownership structure of the Company and the VIE Agreements are found to be in violation of any existing or future PRC laws and regulations, the PRC government could: ·revoke the Company’s business and operating licenses; ·levy fines on the Company; ·confiscate any of the Company’s income that they deem to be obtained through illegal operations; ·shut down a portion or all of the Company’s servers or block a portion or all of the Company’s web site; ·discontinue or restrict the Company’s operations in the PRC; ·impose conditions or requirements with which the Company may not be able to comply; ·require the Company to restructure the Company’s corporate and contractual structure; ·take other regulatory or enforcement actions that could be harmful to the Company’s business. F-20

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) If the imposition of any of these government actions, or any inability to enforce the contractual arrangements upon a breach, causes the Company to lose its ability to direct the activities of ATA Online or receive substantially all the economic benefits and residual returns from ATA Online and the Company is not able to restructure its ownership structure and operations in a satisfactory manner, the Company would no longer be able to consolidate the financial results of ATA Online in the Company’s consolidated financial statements. Total assets, total liability, equity, net sales, net income and cash flows of the Company would be significantly less than the reported amount in the consolidated financial statements of the Company. In the opinion of management, the likelihood of loss in respect of the Company’s current ownership structure or VIE Agreements is remote based on current facts and circumstances. The assets and liabilities of ATA Online as of March 31, 2011 and 2012 and the net revenue and net income (loss) for the years ended March 31, 2010, 2011 and 2012 are as follows: | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | | | | | | | Cash | | 16,336,725 | | 26,474,179 | | Accounts receivable, net | | 1,319,497 | | 12,839,077 | | Prepayment and other current assets | | 637,939 | | 1,260,738 | | Total current assets | | 18,294,161 | | 40,573,994 | | Property and equipment, net | | 1,009,373 | | 680,857 | | Total assets | | 19,303,534 | | 41,254,851 | | | | | | | | Accrued expenses and other payables | | 1,107,108 | | 4,785,359 | | Amounts due to related parties | | 10,468,931 | | 4,213,631 | | Deferred revenue | | 2,108,560 | | 854,095 | | Total liabilities | | 13,684,599 | | 9,853,085 | |

| | Year ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | | | | | | | | | Net revenue | | 11,072,200 | | 21,022,662 | | 49,782,361 | | Net income (loss) | | (8,537,032 | ) | 3,590,196 | | 25,782,832 | |

Amounts due to related parties represent the amount due to ATA BVI and ATA Inc.’s other subsidiaries, which are eliminated on consolidation. All of the assets of ATA Online can be used only to settle obligations of ATA Online. None of the assets of ATA Online has been pledged or collateralized. The creditors of ATA Online do not have recourse to the general credit of ATA BVI or the Company. F-21

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (w)Recently issued accounting standards In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation of Comprehensive Income. Under this ASU, an entity will have the option to present the components of net income and comprehensive income in either one or two consecutive financial statements. The ASU eliminates the option in U.S. GAAP to present other comprehensive income in the statement of changes in equity. An entity should apply the ASU retrospectively. For a public entity, the ASU is effective for fiscal years beginning after December 15, 2011, and interim and annual periods thereafter. Early adoption is permitted. In December 2011, the FASB decided to defer the effective date of those changes in ASU 2011-05 that relate only to the presentation of reclassification adjustments in the statement of income by issuing ASU 2011-12, Comprehensive Income (Topic 220): Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items Out of Accumulated Other Comprehensive income in Accounting Standards Update 2011-05. The Company plans to implement the provisions of ASU 2011-05 by presenting a single continuous statement of comprehensive income in fiscal year 2012. (3)ACCOUNTS RECEIVABLE, NET Accounts receivable, net is summarized as follows: | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | Accounts receivable | | 74,989,794 | | 111,944,576 | | Less: Allowance for doubtful accounts | | (27,938,198 | ) | (30,100,005 | ) | Accounts receivable, net | | 47,051,596 | | 81,844,571 | |

F-22

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) Management performs ongoing credit evaluations of its customers’ financial condition and generally does not require collateral on accounts receivable. The activity in the allowance for doubtful accounts for accounts receivable for the years ended March 31, 2010, 2011 and 2012 is as follows: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Beginning allowance for doubtful accounts | | 3,198,960 | | 29,934,512 | | 27,938,198 | | Additions charged to bad debt expense | | 27,052,862 | | 2,235,627 | | 2,350,990 | | Write-off of accounts receivable | | (317,310 | ) | (4,231,941 | ) | (189,183 | ) | Ending allowance for doubtful accounts | | 29,934,512 | | 27,938,198 | | 30,100,005 | |

F-23

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (4)PREPAID EXPENSES AND OTHER CURRENT ASSETS Prepaid expenses and other current assets consist of the following: | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | Prepaid business tax | | 481,688 | | 287,925 | | Income tax receivable | | — | | 4,934,777 | | Deferred income tax assets (note 10) | | 5,494,322 | | 4,233,996 | | Advances to employees | | 1,417,299 | | 1,090,425 | | Other current assets | | 2,643,036 | | 5,135,612 | | Total prepaid expenses and other current assets | | 10,036,345 | | 15,682,735 | |

(5)PROPERTY AND EQUIPMENT, NET Property and equipment, net consist of the following: | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | | | | | | | Building | | 53,049,213 | | 53,049,213 | | Computer equipment | | 20,252,736 | | 21,672,897 | | Furniture, fixtures and office equipment | | 532,624 | | 516,794 | | Software | | 11,976,549 | | 12,261,549 | | Motor vehicles | | 1,935,402 | | 1,885,402 | | Leasehold improvements | | 8,062,114 | | 9,018,139 | | | | 95,808,638 | | 98,403,994 | | Less: accumulated depreciation and amortization | | (32,768,460 | ) | (38,513,688 | ) | Property and equipment, net | | 63,040,178 | | 59,890,306 | |

Total depreciation expenses for the year ended March 31, 2010, 2011 and 2012 were, RMB 9,962,811, RMB 10,785,073, and RMB 8,519,426, respectively. F-24

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (6)INTANGIBLE ASSETS, NET The following table summarizes the Company’s intangible assets, all of which were acquired during the year ended March 31, 2009, as of March 31, 2011 and 2012. | | March 31, 2012 | | | | | | | | | | Weighted | | | | Gross | | | | Net | | Average | | | | carrying | | Accumulated | | carrying | | Amortization | | | | amount | | amortization | | amount | | Period | | | | RMB | | RMB | | RMB | | Years | | ETS TOEIC license | | 24,126,706 | | (7,495,275 | ) | 16,631,431 | | 10 | | Testing service technology | | 800,000 | | (800,000 | ) | — | | 3 | | Customer relationships | | 1,300,000 | | (334,165 | ) | 965,835 | | 12 | | | | | | | | | | | | Total intangible assets | | 26,226,706 | | (8,629,440 | ) | 17,597,266 | | | |

| | March 31, 2011 | | | | | | | | | | Weighted | | | | Gross | | | | Net | | Average | | | | carrying | | Accumulated | | carrying | | Amortization | | | | amount | | amortization | | amount | | Period | | | | RMB | | RMB | | RMB | | Years | | ETS TOEIC license | | 24,126,706 | | (5,089,214 | ) | 19,037,492 | | 10 | | Testing service technology | | 800,000 | | (555,556 | ) | 244,444 | | 3 | | Customer relationships | | 1,300,000 | | (225,832 | ) | 1,074,168 | | 12 | | | | | | | | | | | | Total intangible assets | | 26,226,706 | | (5,870,602 | ) | 20,356,104 | | | |

ETS TOEIC license represents the amounts paid to Educational Testing Service (“ETS”) under a master distributor agreement for the exclusive right to market, distribute, administer and sell the Test of English for International Communication (“TOEIC”) in mainland PRC for ten years commencing from March 2009. Amortization expenses for intangible assets were RMB 2,787,670, RMB 2,850,487 and RMB 2,758,838 for the year ended March 31, 2010, 2011 and 2012, respectively. Estimated amortization expense is RMB 2,514,394 for each of the next five years. F-25

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (7)ACCRUED EXPENSES AND OTHER PAYABLES Accrued expenses and other payables consist of the following: | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | Business and other taxes payable | | 5,294,775 | | 4,701,736 | | Accrued payroll and welfare | | 8,518,040 | | 17,688,960 | | Accrued test monitoring fees | | 7,420,546 | | 12,379,899 | | Accrued discounts to customers | | 2,077,500 | | 2,077,500 | | Accrued certificates costs | | 3,992,682 | | 8,126,036 | | Royalty fees payable | | 5,998,771 | | 8,651,161 | | Income taxes payable | | 70,190 | | 1,173,344 | | Accrued professional service expenses | | 3,904,802 | | 669,155 | | Accrued marketing fees | | 776,859 | | 416,766 | | Payable for purchase of property and equipment | | 322,477 | | 349,090 | | Other current liabilities | | 9,970,327 | | 7,498,774 | | Total accrued expenses and other payables | | 48,346,969 | | 63,732,421 | |

Other current liabilities as of March 31, 2011 and 2012 mainly include accrued traveling expenses, rental expenses, meeting expense and other operating expenses. (8)DEFERRED REVENUES Deferred revenues consist of the following: | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | Testing services | | 4,743,451 | | 19,316,486 | | Test-based education services | | 10,289,540 | | 5,178,840 | | Test preparation and training solutions | | 2,108,561 | | 854,095 | | Other revenue — licensing fees from authorized test centers centers | | 5,255,089 | | 4,362,115 | | Other revenue — others | | 527,579 | | 721,668 | | Total deferred revenues | | 22,924,220 | | 30,433,204 | | | | | | | | Representing: | | | | | | Current deferred revenues | | 19,100,619 | | 27,333,088 | | Non-current deferred revenues | | 3,823,601 | | 3,100,116 | |

F-26

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (9)NET REVENUES The components of net revenues for the years ended March 31, 2010, 2011 and 2012 are as follows: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Testing services | | 187,158,128 | | 243,103,305 | | 290,881,289 | | Test preparation and training solutions | | 11,149,124 | | 15,426,587 | | 26,996,054 | | Other revenue * | | 46,724,291 | | 45,373,919 | | 34,208,217 | | Total revenues, net | | 245,031,543 | | 303,903,811 | | 352,085,560 | |

*Includes net revenues from test-based educational services of RMB31,786,398, RMB25,727,038 and RMB12,614,294 for the year ended March 31, 2010, 2011 and 2012, respectively. Product sales are included in test preparation and training solutions revenue and other revenue. Other revenue primarily includes test-based educational services, licensing fees from authorized test centers, test development services, test certificate services, and test administration software product sales. (10)INCOME TAXES Cayman Islands and British Virgin Islands Under the current laws of the Cayman Islands and the British Virgin Islands, the Group is not subject to any income tax in these jurisdictions. People’s Republic of China The Company’s consolidated PRC entities file separate income tax returns. On March 16, 2007, the National People’s Congress passed the new Enterprise Income Tax Law (“new EIT Law”) which statutory income tax rate is 25% effective from January 1, 2008. According to the new EIT Law, entities that qualify as “high-and-new technology enterprises eligible for key support from the State” (“HNTE”) are entitled to a preferential income tax rate of 15%. The Company’s PRC entities are subject to income tax at 25%, unless otherwise specified. F-27

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) In December 2008, ATA Testing received approval from the tax authority that it qualified as an HNTE. The certificate entitled ATA Testing to the preferential income tax rate of 15% effective retroactively from January 1, 2008 to December 31, 2010. As of March 31, 2011, ATA Testing’s applicable income tax rate from January 1, 2011 onwards was 25%. In October 2011, ATA Testing received approval from the tax authority on its renewal as an HNTE which entitled it to the preferential income tax rate of 15% effective retroactively from January 1, 2011 to December 31, 2013. ATA Testing’s applicable income tax rate from January 1, 2014 onwards is 25%. In December 2009, ATA Learning, ATA Online and Beijing JDX received approvals from the tax authorities that they qualified as HNTEs. The certificates entitled them to the preferential income tax rate of 15% effectively retroactively from January 1, 2009 to December 31, 2011. ATA Learning, ATA Online and Beijing JDX are subject to income tax at 25% from calendar year 2012 onwards unless they can requalify as HNTEs. The new EIT Law and its relevant regulations impose a withholding tax at 10%, unless reduced by a tax treaty or agreement, for dividends distributed by a PRC-resident enterprise to its immediate holding company outside the PRC for earnings generated beginning on January 1, 2008. Undistributed earnings generated prior to January 1, 2008 are exempt from withholding tax. As of March 31, 2012, the Company has not provided for income taxes on earnings of RMB 106,942,884 generated by its PRC consolidated entities since January 1, 2008 as the Company plans to reinvest these earnings indefinitely in the PRC. As of March 31, 2012, the unrecognized deferred income tax liability related to these earnings was RMB 10,694,288. The earnings (loss) before income taxes were generated in the following jurisdictions: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Cayman Islands and British Virgin Islands | | (20,124,920 | ) | (11,433,911 | ) | (15,598,329 | ) | PRC | | (9,482,925 | ) | 34,500,214 | | 85,778,881 | | Earnings (loss) before income taxes | | (29,607,845 | ) | 23,066,303 | | 70,180,552 | |

Income tax expense (benefit) recognized in the consolidated statements of operations consists of the following: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | PRC | | | | | | | | Current | | 6,030,052 | | 7,203,811 | | 13,189,414 | | Deferred | | (287,906 | ) | (3,891,524 | ) | 1,149,668 | | Total income tax expense | | 5,742,146 | | 3,312,287 | | 14,339,082 | |

The actual income tax expense reported in the consolidated statements of operations differs from the respective amount computed by applying the PRC statutory income tax rate of 25% for each of the years ended March 31, 2010, 2011 and 2012 to earnings (loss) before income taxes due to the following: F-28

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Computed “expected” income tax expense (benefit) | | (7,401,961 | ) | 5,766,576 | | 17,545,138 | | Increase (decrease) in valuation allowance | | 3,717,333 | | (1,379,408 | ) | (2,035,788 | ) | Preferential income tax rate | | (4,171,783 | ) | (4,486,178 | ) | (8,301,350 | ) | Entities not subject to income tax | | 2,907,301 | | 1,695,485 | | 833,483 | | Non-deductible expenses | | | | | | | | Entertainment | | 675,360 | | 1,308,601 | | 1,344,639 | | Share-based compensation | | 1,873,929 | | 1,162,993 | | 3,066,099 | | Advertising | | 397,341 | | — | | — | | Bad debt loss | | 6,478,275 | | — | | 47,296 | | Tax exempt income | | (1,790 | ) | — | | — | | Changes in tax rates | | 1,227,604 | | — | | 2,032,901 | | Tax rate differential | | — | | (1,503,124 | ) | (53,254 | ) | Prior year tax return true up | | — | | 450,139 | | — | | Other | | 40,537 | | 297,203 | | (140,082 | ) | Actual income tax expense | | 5,742,146 | | 3,312,287 | | 14,339,082 | |

The applicable PRC statutory tax rate is used since the Group’s taxable income is generated in the PRC. The tax effects of the Group’s temporary differences that give rise to significant portions of the deferred income tax assets and liabilities are as follows. | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | Deferred income tax assets: | | | | | | Tax loss carryforwards | | 3,753,133 | | 479,411 | | Property and equipment, net | | 1,745,019 | | 1,859,136 | | Allowance for doubtful accounts | | 802,700 | | 912,399 | | Write-down of inventories | | 599,145 | | 579,644 | | Accrued expenses and other payables | | 4,197,747 | | 4,021,629 | | Total gross deferred income tax assets | | 11,097,744 | | 7,852,219 | | Less: valuation allowance | | (3,693,312 | ) | (1,657,524 | ) | Net deferred income tax assets | | 7,404,432 | | 6,194,695 | | Deferred income tax liabilities: | | | | | | Intangible assets acquired in JDX acquisition: | | | | | | Testing service technology | | 41,111 | | — | | Customer relationships | | 260,452 | | 241,494 | | Total gross deferred income tax liabilities | | 301,563 | | 241,494 | | Net deferred income tax assets | | 7,102,869 | | 5,953,201 | |

F-29

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) | | March 31, | | | | 2011 | | 2012 | | | | RMB | | RMB | | Current deferred income tax assets, included in prepaid expenses and other current assets | | 5,494,322 | | 4,233,996 | | Non-current deferred income tax assets, included in other assets | | 1,721,394 | | 1,859,136 | | Non-current deferred income tax liabilities | | (112,847 | ) | (139,931 | ) | Net deferred income tax assets | | 7,102,869 | | 5,953,201 | |

The increase (decrease) in the valuation allowance for the years ended March 31, 2010, 2011 and 2012 were RMB3,717,333, RMB(1,379,408) and RMB(2,035,788), respectively. As of March 31, 2012, the valuation allowance of RMB1,657,524 was mainly related to the deferred income tax assets of entities at cumulative losses. As of March 31, 2012, management believes it is more likely than not that the Group will realize the deferred income tax assets, net of the valuation allowance. The amount of the deferred income tax assets, however, considered realizable as of March 31, 2012 could be reduced in the near term if estimates of future taxable income are reduced. As of March 31, 2012, the Group has net tax loss carry forwards for PRC income tax purpose of RMB 1,917,644, if unused, will be expired by December 31, 2015. For the years ended March 31, 2010, 2011 and 2012, the Group had no unrecognized tax benefits, and thus no related interest and penalties were recorded. Also, the Group does not expect that the amount of unrecognized tax benefits will significantly increase within the next twelve months. According to the PRC Tax Administration and Collection Law, the statute of limitation is three years if the underpayment of taxes is due to computational errors made by the taxpayer or the withholding agent. The statute of limitation is extended to five years under special circumstances where the underpayment of taxes is more than RMB 100,000. In the case of transfer pricing issues, the statute of limitation is ten years. There is no statute of limitation in the case of tax evasion. The income tax return of each of the Company’s PRC consolidated entities is subject to examination by the relevant tax authorities for the calendar tax years beginning in 2007. F-30

Table of Contents ATA INC. Notes to the Consolidated Financial Statements (Continued) (11)SHARE BASED COMPENSATION Shares transferred from a principal shareholder to an officer In March 2010, the Company’s CEO, who is also a principal shareholder, agreed to transfer 150,000 common shares of the Company to the newly appointed CFO. The shares were fully vested on the CFO’s employment date. Compensation expense of RMB 2,201,321, which was measured based on the fair value of the shares at the CFO’s employment date, was recognized in the consolidated statement of operations for the year ended March 31, 2010. 2005 Share incentive plan In April 2005, the Company adopted a share incentive plan (the “2005 Plan”), pursuant to which the Company is authorized to issue options to officers, employees, directors and consultants of the Group to purchase up to 2,894,000 of its common shares. In October 2007, the Company’s board of directors approved an increase in the number of shares reserved for issuance under the 2005 Plan to 3,310,300 shares. The 2005 Plan expires in ten years. Options awards provide for accelerated vesting if there is a change in control (as defined in the 2005 Plan). 2008 Share incentive plan On January 7, 2008, the Company adopted a share incentive plan (the “2008 Plan”), pursuant to which the Company is authorized to issue options and other share-based awards to officers, employees, directors and consultants of the Group to purchase up to 336,307 of its common shares, plus, unless the board of directors determines a lesser amount, an annual increase on January 1 of each calendar year beginning in 2009 equal to the lesser of 1) one percent of the number of shares issued and outstanding on December 31 of the immediately preceding calendar year, and 2) 336,307 shares. The 2008 Plan expires in ten years. Options awards provide for accelerated vesting if there is a change in control (as defined in the 2008 Plan). As of March 31, 2012, 1,681,535 shares were reserved for issuance under the 2008 Plan. Under both the 2005 Plan and 2008 Plan, share options are generally granted with 25% vesting on the first anniversary of the grant date and the remaining 75% vesting ratably over the following 36 months, unless a shorter or longer duration is established at the time of the option grant. Share options are granted at an exercise price equal to the fair market value of the Company’s share at the date of grant and expire 10 years from the grant date. Under the 2008 Plan, nonvested shares are granted with a graded vesting as to 25% at the end of each year from the grant date over 4 years. For the graded vesting share options and nonvested shares, the Company recognizes the compensation cost over the requisite service period for each separately vesting portion of the award as if the award is, in substance, multiple awards. In February 2010, the Company extended the exercise period of one employee’s vested share options. The modification resulted in additional compensation expense of RMB 869,859 being recognized in the consolidated statement of operations for the year ended March 31, 2010. F-31

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued) | | | | Weighted | | Weighted | | Aggregate | | | | | | average | | remaining | | intrinsic | | | | Number of | | exercise | | contractual | | value | | | | shares | | USD | | Years | | USD | | Outstanding at March 31, 2009 | | 3,235,468 | | 3.13 | | | | | | Granted | | 300,000 | | 2.12 | | | | | | Exercised | | — | | — | | | | | | Forfeited | | (90,742 | ) | 3.52 | | | | | | Expired | | (31,475 | ) | 3.60 | | | | | | Outstanding at March 31, 2010 | | 3,413,251 | | 2.98 | | | | | | Granted | | — | | — | | | | | | Exercised | | (43,884 | ) | 3.60 | | | | | | Forfeited | | (225 | ) | 3.60 | | | | | | Expired | | (106,492 | ) | 3.32 | | | | | | Outstanding at March 31, 2011 | | 3,262,650 | | 2.96 | | | | | | Granted | | — | | — | | | | | | Exercised | | (27,864 | ) | 3.60 | | | | | | Forfeited | | — | | — | | | | | | Expired | | (446,444 | ) | 3.60 | | | | | | Outstanding at March 31, 2012 | | 2,788,342 | | 2.85 | | | | | | Vested and expected to vest at March 31, 2012 | | 2,788,342 | | 2.85 | | 4.1 | | 2,006,567 | | Exercisable as of March 31, 2012 | | 2,638,342 | | 2.89 | | 3.9 | | 1,802,507 | |

The aggregate intrinsic value of options outstanding and exercisable at March 31, 2012, was calculated based on the closing price of the Company’s common shares on March 31, 2012. The total intrinsic value of options exercised in the years ended March 31, 2010, 2011 and 2012 are USD nil, USD 10,175 and USD 28,775 respectively. In March 2011, certain individuals exercised 43,884 share options with an exercise price of USD3.6 per share. The proceeds of USD157,982 (RMB1,035,796) were not received by the Company as of March 31, 2011 and a receivable from shareholders of RMB 1,035,796 was recorded in the shareholders’ equity. The Company received the proceeds in May 2011. F-32

Table of Contents Information relating to options outstanding and exercisable as of March 31,2012 is as follows: Options outstanding as of March 31, 2012 | | Options exercisable as of March 31, 2012 | | | | Exercise | | Remaining | | | | Exercise | | Remaining | | Number of | | Price | | Contractual | | Number | | Price | | Contractual | | Shares | | per Share | | Life | | of Shares | | per Share | | Life | | | | USD | | Years | | | | USD | | Years | | 1,312,600 | | 2.26 | | 3.1 | | 1,312,600 | | 2.26 | | 3.1 | | 707,000 | | 3.60 | | 3.7 | | 707,000 | | 3.60 | | 3.7 | | 250,000 | | 3.60 | | 4.6 | | 250,000 | | 3.60 | | 4.6 | | 109,000 | | 3.60 | | 5.7 | | 109,000 | | 3.60 | | 5.7 | | 100,000 | | 4.75 | | 5.5 | | 100,000 | | 4.75 | | 5.5 | | 9,742 | | 2.69 | | 6.9 | | 9,742 | | 2.69 | | 6.9 | | 300,000 | | 2.12 | | 8.0 | | 150,000 | | 2.12 | | 8.0 | | 2,788,342 | | 2.85 | | 4.1 | | 2,638,342 | | 2.89 | | 3.9 | |

The weighted-average grant-date fair value of options granted during the years ended March 31, 2010, 2011 and 2012 was USD 1.240, USD nil and USD nil per share, respectively. The Company calculated the fair value of the share options on the date of grant using the Binomial option-pricing valuation model. The assumptions used in the valuation model are summarized as follows: F-33

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued)

|

| Year Ended March 31, |

|

|

| 2010 |

| 2011 |

| 2012 |

| Expected weighted average volatility | | 67 | % | — | | — | | Expected dividends | | — | | — | | — | | Suboptimal exercise factor | | 2.0x | | — | | — | | Risk-free interest rate (per annum) | | 3.89 | % | — | | — | | Estimated weighted average fair value at grant date of underlying common shares was the Company’s IPO price of USD4.75 per share; for options granted after January 28, 2008, the fair value of underlying common shares was one half of the closing price of the Company’s ADSs on grant date.(per share) | | USD2.15 | | — | | — | |

The expected volatility was based on implied volatilities from traded options of comparable publicly traded training and testing services companies operating in the United States and historical volatility of the Company’s stock. The suboptimal exercise factor is related to the period of time the options are expected to be outstanding. The risk-free rate for periods within the contractual life of the option is based on the United States treasury yield curve in effect at the time of grant. Compensation expense for share options is allocated to the following expense items: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Cost of revenues | | 85,478 | | 568 | | — | | Research and development | | 125,032 | | 1,450 | | — | | Sales and marketing | | 100,714 | | 6,897 | | 42,914 | | General and administrative | | 1,547,184 | | 1,636,369 | | 547,231 | | Total share based compensation expenses | | 1,858,408 | | 1,645,284 | | 590,145 | |

As of March 31, 2012, RMB 403,261 of total unrecognized compensation expense related to nonvested share options is expected to be recognized over a weighted average period of approximately 2 years. Nonvested shares A summary of the nonvested shares activities for the year ended March 31, 2010, 2011 and 2012 is presented below: F-34

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued) | | | | Weighted

average | | | | Number | | grant date | | | | of shares | | fair value | | | | | | USD | | Outstanding at March 31, 2009 | | 269,000 | | 1.995 | | Granted | | 237,549 | | 3.714 | | Vested | | (65,750 | ) | 1.995 | | Forfeited | | (9,750 | ) | 1.995 | | Outstanding at March 31, 2010 | | 431,049 | | 2.943 | | Granted | | 20,000 | | 1.655 | | Vested | | (120,121 | ) | 2.865 | | Forfeited | | (24,928 | ) | 2.209 | | Outstanding at March 31, 2011 | | 306,000 | | 2.949 | | Granted | | 1,060,000 | | 4.963 | | Vested | | (116,245 | ) | 2.076 | | Forfeited | | (103,005 | ) | 4.470 | | Outstanding at March 31, 2012 | | 1,146,750 | | 4.788 | |

The total fair value of shares vested during the years ended March 31, 2010, 2011 and 2012, was USD 114,076, USD 219,615 and USD 527,371 respectively. Compensation expense recognized for nonvested shares for the years ended March 31, 2010, 2011 and 2012 is allocated to the following expense items: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Cost of revenues | | 226,767 | | 140,900 | | 71,691 | | Research and development | | 390,608 | | 194,527 | | 189,462 | | Sales and marketing | | 561,363 | | 595,713 | | 344,226 | | General and administrative | | 2,257,251 | | 2,075,547 | | 11,068,873 | | Total share based compensation expenses | | 3,435,989 | | 3,006,687 | | 11,674,252 | |

As of March 31, 2012, RMB 21,592,099 of total unrecognized compensation expense related to nonvested shares is expected to be recognized over a weighted average period of approximately 3.31 years. F-35

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued) (12)COMMON SHARES The Company’s board of directors approved a share repurchase program on November 13, 2008 to repurchase up to USD5 million worth of its outstanding ADSs from time to time in open-market transactions. On February 12, 2010, the Company’s board of director reviewed and approved the continuation of the share repurchase program through March 31, 2011. For the year ended March 31, 2010, 2011 and 2012, the Company repurchased 681,538, nil and nil common shares at a repurchase price of RMB 11,896,328, RMB nil and RMB nil, respectively. In March 2010, the Company retired 1,233,752 treasury shares that was repurchased during the year ended March 31, 2009 and 2010 for RMB 22,023,189. The excess of the repurchase price over the par value of the retired common shares (RMB 84,910) of RMB 21,938,279, was charged to additional paid-in capital. (13)SPECIAL CASH DIVIDEND On June 1, 2011, the Company’s board of directors declared a special cash dividend of USD0.215 per common share, or USD0.43 per ADS. The total amount of cash distributed in the dividend was USD9.8 million (RMB 63,634,726) was paid from the cash held by ATA Inc. in August 2011. (14)STATUTORY RESERVES In accordance with the relevant laws and regulations of the PRC, the Company’s PRC consolidated entities are required to transfer 10% of their respective after tax profit, as determined in accordance with PRC accounting standards and regulations to a general reserve fund until the balance of the fund reaches 50% of the registered capital of the respective entity. The transfer to this general reserve fund must be made before distribution of dividends can be made. As of March 31, 2011 and 2012, the PRC consolidated entities had appropriated RMB 7,160,263 and RMB 10,598,807, respectively, to the general reserve fund, which is restricted for distribution to the Company.

(15)COMMITMENTS AND CONTINGENCIES Lease commitments The Group entered into non-cancelable operating leases, primarily for office space, for initial terms of three to five years. Minimum rent payments under operating leases are recognized on a straight-line basis over the term of the lease, including any periods of free rent. Future minimum lease payments under non-cancelable operating leases (with initial or remaining lease terms in excess of one year) as of March 31, 2012 are: F-36

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued)

|

| Minimum |

|

|

| Lease Amount |

|

|

| Compensation expense for share options is allocated to the following expense items:RMB |

|

| | | | | | | | | | | | | | | | | | | | | Year Ended March 31, | | | | | 2008 | | | 2009 | | | 2010 | | | 2010 | | | | | RMB | | | RMB | | | RMB | | | USD | | | Cost of revenues | | | 264,362 | | | | 125,494 | | | | 85,478 | | | | 12,523 | | | Research and development | | | 482,378 | | | | 271,753 | | | | 125,032 | | | | 18,318 | | | Sales and marketing | | | 2,132,663 | | | | 1,054,751 | | | | 100,714 | | | | 14,755 | | | General and administrative | | | 4,373,117 | | | | 3,785,636 | | | | 1,547,184 | | | | 226,667 | | | | | | | | | | | | | | | | Total share based compensation expenses | | | 7,252,520 | | | | 5,237,634 | | | | 1,858,408 | | | | 272,263 | | | | | | | | | | | | | | | |

Year ended: | | As of | | March 31, 2010, RMB2,816,796 of total unrecognized compensation expense related to non-vested share options is expected to be recognized over a weighted average period of approximately 2.1 years.2013 | | 6,081,036 | | March 31, 2014 | | 3,935,597 | | March 31, 2015 | | Nonvested shares226,511 | | March 31, 2016 | | — | | | | A summary of the nonvested shares activities for the year ended March 31, 2009 and 2010 is presented below: |

F - 302017

| | | | | | | | | | | | | | | | Weighted average | | | | Number | | grant date | | | | of shares | | fair value | | | | | | | | | | | | | Outstanding at March 31, 2008 | | | — | | | | — | | | Granted | | | 274,000 | | | | 1.995 | | | Vested | | | — | | | | — | | | Forfeited | | | (5,000 | ) | | | 1.995 | | | | | | | | | Outstanding at March 31, 2009 | | | 269,000 | | | | 1.995 | | | | | | | | | Granted | | | 237,549 | | | | 3.714 | | | Vested | | | (65,750 | ) | | | 1.995 | | | Forfeited | | | (9,750 | ) | | | 1.995 | | | | | | | | | Outstanding at March 31, 2010 | | | 431,049 | | | | 2.943 | | | | | | | |

| | The total fair value of shares vested during the years ended March 31, 2009 and 2010, was RMB nil and RMB778,660 (US$114,076) respectively.— | | | |

| Compensation expense recognized for nonvested shares for the years ended March 31, 2008, 2009 and 2010 is allocated to the following expense items:10,243,144 |

|

| | | | | | | | | | | | | | | | | | | | Year Ended March 31, | | | | | 2008 | | | 2009 | | | 2010 | | | 2010 | | | | | RMB | | | RMB | | | RMB | | | USD | | | Cost of revenues | | | — | | | | 49,912 | | | | 226,767 | | | | 33,222 | | | Research and development | | | — | | | | 91,944 | | | | 390,608 | | | | 82,241 | | | Sales and marketing | | | — | | | | 128,722 | | | | 561,363 | | | | 57,225 | | | General and administrative | | | — | | | | 89,317 | | | | 2,257,251 | | | | 330,694 | | | | | | | | | | | | | | | Total share based compensation expenses | | | — | | | | 359,895 | | | | 3,435,989 | | | | 503,382 | | | | | | | | | | | | | | |

| | As of March 31, 2010, RMB5,415,581 of total unrecognized compensation expense related to nonvested shares is expected to be recognized over a weighted average period of approximately 2.1 years. | | |

(14) | | COMMON SHARES | |

| | | On January 7, 2008, the board of directors of the Company approved to increase the authorized share capital of the Company to USD5 million consisting of 500 million common shares, effective on February 1, 2008. | | | | In February 2008, upon the completion of the Company’s IPO and exercise of the over-allotment options by the underwriters, the Company issued 10,000,226 common shares, representing 5,000,113 ADS (See note 1). | | | | On March 31, 2005, the Company issued 6,628,369 Series A convertible shares to two investors — SAIF and Winning King Ltd. In conjunction with the issuance of Series A convertible shares, the Company also issued a warrant to purchase 883,783 Series A-1 convertible shares at an exercise price of USD3.3945 (RMB27.2119) per share. On May 1, 2006, SAIF exercised the warrant. The exercise of the warrant resulted in the issuance of Series A-1 convertible shares at a price of RMB24,049,448 (USD3,000,000). Upon the completion of the Company’s IPO on February 1, 2008, all issued and outstanding Series A and Series A-1 convertible preferred shares were converted into 11,730,554 common shares. |

F - 31

Rental expense for operating leases (except leases with a term of one month or less that are not renewed) for the years ended March 31, 2010, 2011 and 2012 were RMB 5,485,788, RMB 5,446,033 and RMB 5,159,138 respectively. | | In September 2008, the Company retired 3,579,320 treasury shares that was originally repurchased in 2005 for RMB16,106,940. The excess of the repurchase price over the par value of the retired common shares (RMB295,799) of RMB15,811,141, was charged to additional paid-in capital. In addition, the Company retired 7 common shares that were forfeited by shareholders when transferring their common shares in exchange for ADSs. | | | | In April 2008, as described in note 13, two employees exercised their options to purchase 1,369,862 common shares at a total price of RMB5,226,173, which was paid by one-year non-interest bearing notes payable of the same amount to the Company. The excess of the total exercise price over the par value of the common shares (RMB95,895) of RMB5,130,278, was recorded in additional paid-in capital. The notes receivable from the two employees of RMB5,226,173 was recorded in shareholders’ equity as a contra-equity item and was repaid in April 2009. | | | | In April and May 2008, warrants to purchase 547,944 common shares at an exercise price of USD0.545 per share were exercised by the warrant holder. The excess of the total exercise price over the par value of the common shares (RMB38,437) of RMB2,054,176, was recorded in additional paid-in capital. | | | | As described in note 3, the Company issued warrants to purchase 126,803 of its common shares to certain selling shareholders of the acquiree. During the year ended March 31, 2009, the selling shareholders exercised the warrant and purchased 126,803 common shares at a total exercise price of RMB4,660,677. The excess of the total exercise price over the par value of the common shares (RMB8,876) of RMB4,651,801 was recorded in additional paid-in capital. | | | | The Company’s board of directors approved a share repurchase program on November 13, 2008 to repurchase up to USD5 million worth of its outstanding ADSs from time to time in open-market transactions. On February 12, 2010, the Company’s board of director reviewed and approved to continue the share repurchase program through March 31, 2011. As of March 31, 2010, the Company repurchased 616,876 ADSs, representing 1,233,752 common shares at a total repurchase price of RMB22,023,189 (USD3,226,463). In March 2010, the Company retired 1,233,752 treasury shares that was repurchased in fiscal 2009 and 2010 for RMB22,023,189 (USD3,226,463). The excess of the repurchase price over the par value of the retired common shares (RMB84,910) of RMB21,938,279, was charged to additional paid-in capital. | |

| (15) | | STATUTORY RESERVES | |

| | | In accordance with the relevant laws and regulations of the PRC, the Company’s PRC consolidated entities are required to transfer 10% of their respective after tax profit, as determined in accordance with PRC accounting standards and regulations to a general reserve fund until the balance of the fund reaches 50% of the registered capital of the respective entity. The transfer to this general reserve fund must be made before distribution of dividends can be made. For the year ended March 31, 2008, 2009 and 2010, the PRC consolidated entities appropriated RMB102,597, RMB3,334,751 and RMB2,746,864, respectively, to the general reserve fund, which is restricted for distribution to the Company. | | |

(16) | | COMMITMENTS AND CONTINGENCIES | |

| | | Lease commitments(16) EARNINGS (LOSS) PER COMMON SHARE | | | | The Group entered into non-cancelable operating leases, primarily for office space, for initial terms of three to five years. | | | | Minimum rent payments under operating leases are recognized on a straight-line basis over the term of the lease, including any periods of free rent. | | | | Future minimum lease payments under non-cancelable operating leases (with initial or remaining lease terms in excess of one year) as of March 31, 2010 are: |

F - 32

Basic and diluted earnings (loss) per common share are calculated as follows: | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | | | RMB | | RMB | | RMB | | Numerator: | | | | | | | | Net earnings (loss) | | (35,349,991 | ) | 19,754,016 | | 55,841,470 | | Less: Dividends paid to participating securities | | — | | — | | (1,476,269 | ) | Net earnings attributable to participating securities | | — | | (162,360 | ) | — | | Net earnings (loss) available to common shareholders | | (35,349,991 | ) | 19,591,656 | | 54,365,201 | | Denominator: | | | | | | | | Denominator for basic earnings (loss) per share: | | | | | | | | Weighted average common shares outstanding | | 44,789,512 | | 44,469,182 | | 44,713,418 | | Plus: Incremental shares issuable upon exercise of share options | | — | | — | | 951,469 | | Denominator for diluted earnings (loss) per share | | 44,789,512 | | 44,469,182 | | 45,664,887 | | Basic earnings (loss) per common share | | (0.79 | ) | 0.44 | | 1.22 | | Diluted earnings (loss) per common share | | (0.79 | ) | 0.44 | | 1.19 | |

The following table summarizes potential common shares outstanding excluded from the calculation of diluted earnings (loss) per share for the years ended March 31, 2010, 2011 and 2012, because their effect is anti-dilutive: | | Year ended March 31, | | | | 2010 | | 2011 | | 2012 | | Shares issuable under share options | | 3,413,251 | | 3,262,650 | | 100,000 | |

F-37

| | | | | | | Minimum | | | | Lease Amount | | Year ended: | | RMB | | March 31, 2011 | | | 5,342,596 | | March 31, 2012 | | | 5,083,750 | | March 31, 2013 | | | 4,934,420 | | March 31, 2014 | | | 2,743,158 | | March 31, 2015 | | | — | | | | | | | | | 18,103,924 | | | | | |

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued) (17)ATA INC. (“ Parent Company”) The following presents condensed financial information of the Parent Company only. Condensed Balance Sheets | | March 31, | | | | 2011 | | 2012 | | 2012 | | | | RMB | | RMB | | USD | | Cash | | 116,818,694 | | 48,532,826 | | 7,706,681 | | Prepaid expenses and other current assets | | 1,308,978 | | 840,201 | | 133,418 | | Investments in subsidiaries | | 247,228,859 | | 317,670,591 | | 50,443,921 | | Total assets | | 365,356,531 | | 367,043,618 | | 58,284,020 | | | | | | | | | | Accrued expenses and other current liabilities | | 1,293,531 | | 629,047 | | 99,888 | | Total liabilities | | 1,293,531 | | 629,047 | | 99,888 | | | | | | | | | | Common shares | | 3,428,840 | | 3,442,803 | | 546,694 | | Receivable from shareholders | | (1,035,796 | ) | — | | — | | Additional paid in capital | | 491,585,143 | | 440,832,695 | | 70,001,222 | | Accumulated other comprehensive loss | | (22,217,189 | ) | (26,004,399 | ) | (4,129,321 | ) | Accumulated deficit | | (107,697,998 | ) | (51,856,528 | ) | (8,234,463 | ) | Total shareholders’ equity | | 364,063,000 | | 366,414,571 | | 58,184,132 | | Total liabilities and shareholders’ equity | | 365,356,531 | | 367,043,618 | | 58,284,020 | |

F-38

| | Rental expense for operating leases (except leases with a term of one month or less that are not renewed) for the years ended March 31, 2008, 2009 and 2010 were RMB5,152,429, RMB5,067,740 and RMB5,485,788, respectively. | |

| (17) | | EARNINGS (LOSS) PER SHARE | |

| | | Basic and diluted earnings (loss) per common share are calculated as follows: |

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued) Condensed Statements of Operations | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | 2012 | | | | RMB | | RMB | | RMB | | USD | | | | | | | | | | | | Operating expenses | | (11,663,959 | ) | (8,754,744 | ) | (7,487,523 | ) | (1,188,968 | ) | Investment income (loss) | | (23,643,581 | ) | 27,535,955 | | 60,175,402 | | 9,555,443 | | Interest income | | 12,696 | | 97,045 | | 377,333 | | 59,918 | | Foreign currency exchange gains (losses), net | | (55,147 | ) | 875,760 | | 2,776,258 | | 440,851 | | Earnings(loss) before income taxes | | (35,349,991 | ) | 19,754,016 | | 55,841,470 | | 8,867,244 | | Income tax expense | | — | | — | | — | | — | | Net income (loss) | | (35,349,991 | ) | 19,754,016 | | 55,841,470 | | 8,867,244 | |

F-39

| | | | | | | | | | | | | | | | | Year Ended March 31, | | | | | 2008 | | | 2009 | | | 2010 | | | | | RMB | | | RMB | | | RMB | | | Net earnings (loss) | | | 20,169,779 | | | | 22,810,215 | | | | (35,349,991 | ) | | Denominator for basic earnings (loss) per share: | | | | | | | | | | | | | | Weighted average common shares outstanding | | | 25,442,650 | | | | 45,376,008 | | | | 44,789,512 | | | | | | | | | | | | | | Plus: Incremental shares issuable upon exercise of share options and vesting of nonvested shares | | | 2,062,324 | | | | 1,027,986 | | | | — | | | Exercise of warrants | | | 481,125 | | | | 27,524 | | | | — | | | Conversion of convertible preferred shares | | | 9,775,462 | | | | — | | | | — | | | | | | | | | | | | | | Denominator for diluted earnings (loss) per share | | | 37,761,561 | | | | 46,431,518 | | | | 44,789,512 | | | | | | | | | | | | | | | | | | | | | | | | | | | | Basic earnings (loss) per common share | | | 0.79 | | | | 0.50 | | | | (0.79 | ) | | | | | | | | | | | | | Diluted earnings (loss) per common share | | | 0.53 | | | | 0.49 | | | | (0.79 | ) | | | | | | | | | | | |

Table of Contents ATA INC.

Notes to the Consolidated Financial Statements (Continued) Condensed Statements of Cash Flows | | Year Ended March 31, | | | | 2010 | | 2011 | | 2012 | | 2012 | | | | RMB | | RMB | | RMB | | USD | | Net cash used in operating activities | | (12,425,281 | ) | (8,122,776 | ) | (4,529,639 | ) | (719,276 | ) | Cash flows from investing activities : | | | | | | | | | | Payments of investment in subsidiaries | | (94,398,750 | ) | — | | — | | — | | Advances to (collection from) subsidiaries | | (68,744 | ) | (5,139 | ) | 1,140,127 | | 181,044 | | Payment for JDX acquisition | | (2,305,553 | ) | — | | — | | — | | Net cash provided by (used in) investing activities | | (96,773,047 | ) | (5,139 | ) | 1,140,127 | | 181,044 | | | | | | | | | | | | Cash flows from financing activities : | | | | | | | | | | Proceeds from exercise of share options | | — | | — | | 631,844 | | 100,333 | | Cash paid for repurchase of common shares | | (11,896,328 | ) | — | | — | | — | | Collection of receivable from shareholders | | 5,226,173 | | — | | 1,035,796 | | 164,477 | | Special cash dividend | | — | | — | | (63,634,726 | ) | (10,104,760 | ) | Net cash used in financing activities | | (6,670,155 | ) | — | | (61,967,086 | ) | (9,839,950 | ) | | | | | | | | | | | Effect of foreign exchange rate changes on cash | | (330,780 | ) | (4,039,042 | ) | (2,929,270 | ) | (465,148 | ) | Net decrease in cash | | (116,199,263 | ) | (12,166,957 | ) | (68,285,868 | ) | (10,843,330 | ) | Cash at beginning of year | | 245,184,914 | | 128,985,651 | | 116,818,694 | | 18,550,011 | | Cash at end of year | | 128,985,651 | | 116,818,694 | | 48,532,826 | | 7,706,681 | | | | | | | | | | | | Supplemental disclosures of cash flow information : | | | | | | | | | | Non-cash investing and financing activities: | | | | | | | | | | Receivable from shareholders for exercise of common share options | | — | | 1,035,796 | | — | | — | |

F-40

| | The following table summarizes potential common shares outstanding excluded from the calculation of diluted earnings (loss) per share for the years ended March 31, 2008, 2009 and 2010, because their effect is anti-dilutive: |

| | | | | | | | | | | | | | | | | Year Ended March 31, | | | | | 2008 | | | 2009 | | | 2010 | | | | | | | | | | | | | | | | | Shares issuable under share options and nonvested shares | | | 491,800 | | | | 186,668 | | | | 3,844,300 | | | Shares issuable upon exercise common share warrants | | | 126,803 | | | | — | | | | — | |

F - 33

|