The following table sets forth information as to the period end, average, the high and the low exchange rate for Canadian Dollars and U.S. Dollars for the periods indicated based on the noon buying rate in New York City for cable transfers in Canadian Dollars as certified for customs purposes by the Federal Reserve Bank of New York (Canadian dollar = US$1).

| Year Ended | ||||

| January 31, | Average | Period End | High | Low |

| 2005 | 1.2960 | 1.2380 | 1.3968 | 1.1774 |

| 2006 | 1.2060 | 1.1439 | 1.2704 | 1.1439 |

| 2007 | 1.1358 | 1.1792 | 1.1824 | 1.0990 |

| 2008 | 1.0603 | 1.0022 | 1.1853 | 0.9170 |

| 2009 | 1.0849 | 1.2364 | 1.2969 | 0.9719 |

Year Ended January 31, | Average | Period End | High | Low |

| 2003 | 1.5655 | 1.5286 | 1.6112 | 1.5108 |

| 2004 | 1.3803 | 1.3265 | 1.5315 | 1.2690 |

| 2005 | 1.2961 | 1.2396 | 1.3970 | 1.1775 |

| 2006 | 1.2061 | 1.1436 | 1.2703 | 1.1436 |

| 2007 | 1.1357 | 1.1792 | 1.1824 | 1.0989 |

The following table sets forth the high and low exchange rate for the past six months.months based on the noon buying rate. As of July 25, 2007,August 10, 2009, the exchange rate was CDN$1.04231.0848 for each US$1.

| Month | High | Low |

| February 2009 | 1.2890 | 1.2192 |

| March 2009 | 1.3000 | 1.2245 |

| April 2009 | 1.2643 | 1.1940 |

| May 2009 | 1.1872 | 1.0872 |

| June 2009 | 1.1625 | 1.0827 |

| July 2009 | 1.1655 | 1.0790 |

Month | High | Low |

| January 2007 | 1.1824 | 1.1647 |

| February 2007 | 1.1852 | 1.1586 |

| March 2007 | 1.181 | 1.153 |

| April 2007 | 1.1583 | 1.068 |

| May 2007 | 1.1136 | 1.0707 |

| June 2007 | 1.0727 | 1.0579 |

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

In addition to the other information presented in this Annual Report, the following should be considered carefully in evaluating the Company and its business. This Annual Report contains forward-looking statements that involve riskrisks and uncertainties. The Company’s actual results may differ materially from the results discussed in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed below and elsewhere in this Annual Report.

We will be required to raise additional capital to mine our properties.

The Company is currently in the exploration stage of its properties. If the Company determines based on its most recent information that it is feasible to begin operations on its properties, the Company will be required to raise additional capital in order to develop and bring the properties into production. TheThe commercial quantities of ore cannot be accurately predicted.

Whether an ore body will be commercially viable depends on a number of factors including the particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as mineral prices and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in a mineral deposit being unprofitable.The mining industry is highly speculative and involves substantial risks

. The mining industry, from exploration, development and production is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but from finding mineral deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of minerals acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. The combination of such factors may result in the Company not receiving an adequate return on investment capital.The Company’s properties are all at the exploration stage and have no proven reserves

. All of theThe Company’s mineral exploration efforts may be unsuccessful

. Despite exploration work on its mineral claims, no known bodies of commercial ore or economic deposits have been established on any of the Company’s properties. In addition, the Company is at the exploration stage on all of its properties and substantial additional work will be required in order to determine if any economic deposits occur on the Company’s properties. Even in the event commercial quantities of minerals are discovered, the exploration properties might not be brought into a state of commercial production. Finding mineral deposits is dependent on a number of factors, including the technical skill of exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent on a number of factors, some of which are particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as metal prices.7

Competition for mineral land

. There is a limited supply of desirable mineral lands available for acquisition, claim staking or leasing in the areas where the Company contemplates expanding its operations and conducting exploration activities. Many participants are engaged in the mining business, including large, established mining companies. Accordingly, there can be no assurance that the Company will be able to compete successfully for new mining properties.Uncertainty of exploration and development programs

. TheLicenses and permits

. The operations of the Company require licenses and permits from various governmental authorities. The Company believes that it holds all necessary licenses and permits under applicable laws and regulations and believes that it is presently complying in all material respects with the terms of such licenses and permits. However, such licenses and permits are subject to change in various circumstances. There can be no guarantee that the Company will be able to obtain or maintain all necessary licenses and permits as are required to explore and develop its properties, commence construction or operation of mining facilities and properties under exploration or development or to maintain continued operations that economically justify the cost.Litigation.

Although the Company is not currently subject to litigation, it may become involved in disputes with other parties in the future which may result in litigation. Any litigation could be costly and time consuming and could divertAcquisitions

. The Company undertakes evaluations of opportunities to acquire additional mining properties. Any resultant acquisitions may be significant in size, may change the scale of the8

Conflict of interest.

Certain directors and officers of the Company are officers and/or directors of, or are associated with, other natural resource companies that acquire interests in mineral properties. Such associations may give rise to conflicts of interest from time to time. The directors are required by law, however, to act honestly and in good faith with a view to the best interests of the Company and its shareholders and to disclose any personal interest which they may have in any material transaction which is proposed to be entered into with the Company and to abstain from voting as a director for the approval of any such transaction.Uncertainty of continuing as a going concern.

The continuation of the Company and the recoverability of mineral property costs depends upon its ability to discover economically recoverable mineral reserves, attain profitable operations and generate cash flow from operations and/or to raise equity capital through the sale of its securities. TheLimited and volatile trading volume.

Although theVolatility of share price.

In recent years, securities markets in Canada have experienced a high level of price volatility. The market price of many resource companies, particularly those, like the Company, that are considered speculative exploration companies, have experienced wide fluctuations in price, resulting in substantial losses to investors who have sold their shares at a low price point. These fluctuations are based only in part on the level of progress of exploration, and can reflect general economic and market trends, world events or investor sentiment, and may sometimes bear no apparent relation to any objective factors or criteria. During theDifficulty for United States investors to effect service of process against the Company.

The Company is incorporated under the laws of the Province of British Columbia, Canada. Consequently, it will be difficult for United States investors toThe Company has incurred net losses since ourits inception and expect losses to continue.

There are no assurances that we will discover minerals on a commercially viable basis.

The Company’s ability to generate revenues and profits is expected to occur through exploration, development and production of its existing properties as well as through acquisitions of interests in new properties. Substantial expenditures will be incurred in an attempt to establish the economic feasibility of mining operations by identifying mineral deposits and establishing ore reserves through drilling and other techniques, developing metallurgical processes to extract metals from ore, designing facilities and planning mining operations.9

The economic feasibility of a project depends on numerous factors, including the cost of mining and production facilities required to extract the desired minerals, the total mineral deposits that can be mined using a given facility, the proximity of the mineral deposits to a user of the minerals, and the market price of the minerals at the time of sale. There is no assurance that existing or future exploration programs or acquisitions will result in the identification of deposits that can be mined profitably.

The Company'sCompany’s exploration activities are subject to various federal, state and local laws and regulations.

Market price is highly speculative.

The market prices of metals are highly speculative and volatile. Instability in metal prices may affect the interest in mining properties and the exploration, development and production of such properties. If gold prices substantially decline, this may adversely affect the Company’s ability to raise capital to explore for existing and new mineral properties.The Company operates in a highly competitive industry

. The Company competes with other developmental resource companies which have similar operations, and many competitors have operations and financial resources and industry experience greater than those of the Company. The Company may encounter increasing competition from other mining companies in its efforts to acquire mineral properties and hire experienced resource industry professionals. Increased competition inPenny stock rules may make it more difficult to trade the Company’s common shares.

TheThe Company is subject to foreign currency fluctuations

Item 4.

Information on the CompanyCautionary Note to United States Investors

The Company describes its properties utilizing mining terminology such as “measured resources” and “indicated resources” that are required by Canadian regulations but are not recognized by the SEC.United States investors are cautioned not to assume that any part of the mineral deposits in these categories will ever be converted into reserves.

10

A. History and Development of the Company

The Company was organized under theCompany Actof the Province of British Columbia, Canada on January 22, 1981 under the name of Carol Energy Corporation, which name was changed to Coral Energy Corporation on March 3, 1982, and to Coral Gold Corp. on September 9, 1987. On September 14, 2004, the Company changed it name to Coral Gold Resources Ltd in conjunction with a 10 to 1 share consolidation. The principal executive office of the Company is located at 455 Granville Street, Suite 400, Vancouver, British Columbia V6C 1T1, and its telephone number is 604-682-3701.

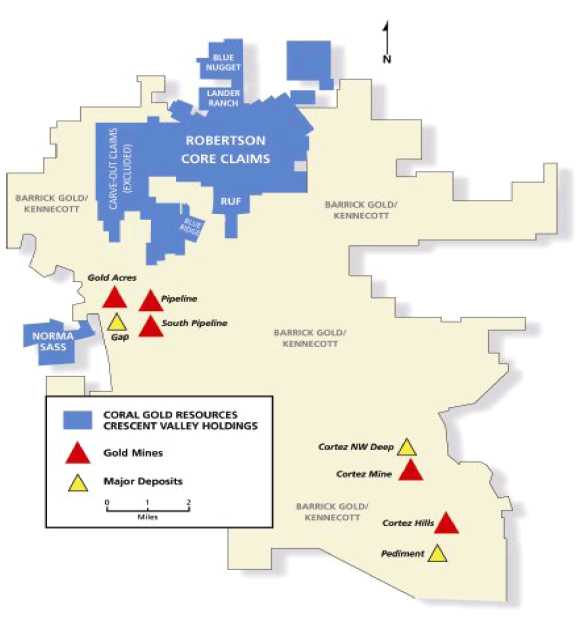

The Company is a natural resource company primarily engaged in the exploration and development of natural resource properties. OurIts principal business activities have been the exploration of certain mineral properties located in the States of Nevada and California in the United States. Since fiscal 2004, we have made aggregate principal capital2007, the Company has spent $5,343,825 on mineral property acquisition and exploration expenditures of $2,936,348 on ourits properties known as the Robertson Mining Claims located in the State of Nevada. The Robertson Mining Claims comprise three separate claim groups known as: (i) the Robertson Property;Core Claims; (ii) the Carve Out Claims, and (iii) the Norma Sass and Ruf Claims. Of the aggregate capital expenditures of $2,936,348, $2,894,520 was spent on the Robertson Property and $41,829 was spent on the Norma Sass and Ruf Claims.

In the 2006 fiscal year, the Company completed the purchase of 1,391,860 shares of Marcus Corporation, which we refer to as "Marcus"“Marcus”, representing 98.49% of the total issued shares of Marcus. Marcus is a non-reporting Nevada corporation, which owns the Marcus mining claims, consisting of 39 unpatented lode claims and two placer claims, and which comprise a portion of the Company’s Robertson Property. By acquiring Marcus, the Company now controls Marcus and owns an indirect interest in the mining lease between the Company and Marcus, which provides for an annual advanced royalty to Marcus of US$12,000, and a 5% net smelter returns royalty up to a maximum payment of US$2.5 million.

In consideration of the acquisition, the Company issued one common share of the Company for every four common shares of Marcus, for a total of 347,964 common shares of the Company. In addition, each tendering Marcus shareholder received a non-transferable share purchase warrant, permitting such shareholders to purchase one additional common share of the Company at an exercise price of $2.00 per share for a period of up to two years from the closing date of the acquisition, for every two shares of the Company received on the share exchange.

Please refer to noteNote 6 of the financial statements (Item 17) for information regarding the Company'sCompany’s principal capital expenditures on its mineral properties.

At the AnnnualAnnual General Meeting of the Company on July 17, 2007, the shareholders of the Company passed an ordinary resolution amending the Company'sCompany’s share structure by subdividing the Company'sCompany’s issued share capital of 8,267,360 common shares without par value into 24,802,080 common shares without par value, every one common share being subdivided into three common shares, referred to as the "Subdivision"“Subdivision”. For the purpose of this Annual Report, all amounts with respect to the Company's common shares and options do not take into account the Subdivision as it has yet to be implemented.

B. Business Overview

Operations and Principal Activities

Presently, the Company’s principal business activity is the exploration of mineral properties. The Company is in the process of exploring its mineral properties and has not yet determined whether its mineral properties contain ore reserves that are economically recoverable. There is no assurance that a commercially viable mineral deposit exists on any of the Company'sCompany’s properties, and future exploration will be required before final evaluation as to the economic and legal feasibility is determined.

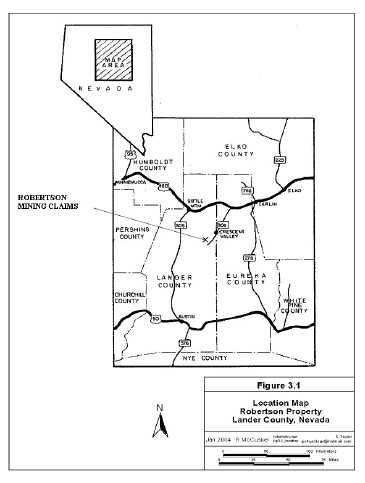

The Company’s mining claims are located in the states of Nevada and California in the United States. The Company’s present principal exploration activities have been focused on the Robertson Mining Claims located in Crescent Valley, Nevada.

During the fiscal year ended January 31, 1999, the Company entered into an option agreement dated October 8, 1998, which we refer to as the "Option Agreement"“Option Agreement”, with Placer Dome U.S. Inc., referred to as "Placer"“Placer”, which was later assigned by Placer to the Cortez Joint Venture, doing business as Cortez Gold Mines (a joint venture owned by Placer and KennecottMinerals), which we refer to as "Cortez"“Cortez”.

Effective December 30, 1999, pursuant to the terms of the Option Agreement, Cortez elected to terminate the Option Agreement. This required the Company to post its own security for the reclamation bond for the Robertson Property and obtain a full release of Placer’s guarantee of the original reclamation bond. In order to satisfy its obligations under the Option Agreement, the Company spent a large portion of fiscal year 2003 conducting reclamation on the Robertson Property to reduce its US$2,000,000 reclamation bond that Placer had guaranteed for the Company. The Company was able to obtain a release of Placer'sPlacer’s guarantee by conducting sufficient reclamation work to reduce the bonding requirement, and by raising sufficient funds to provide satisfactory alternative security of the reclamation bond. The reclamation bond was reduced to US$786,100 during the fiscal year ended 2003, for which the Company posted cash. In fiscal year ended 2006, with more reclamation work having been completed and accounted for, the reclamation bond was further reduced to US$228,205. In fiscal year ended 2007, with further drilling activities being proposed and performed, the required reclamation bond was increased to US$282,268. The costIn fiscal year ended 2008, additional planned exploration activities in Nevada were approved and the required reclamation bond was increased to the CompanyUS$319,400 and then again in fiscal year ended 2009 up to conduct the reclamation and other associated costs was approximately US$25,887 (year ended January 31, 2007) (US$263,017 since 2003).

The Company received a preliminary assessment report entitled “Update of the Geological Report on the Robertson Property” dated April 25, 2006 on the gold resources at its Robertson Property situated on the Battle Mountain – Eureka Trend (Cortez Trend) in Lander County, Nevada. The Report was prepared by Robert T. McCusker, Consulting Geologist, a “qualified person” in accordance with the requirements ofNational Instrument 43-101implemented by the Canadian Securities Administration, referred to as "NI 43-101"“NI 43-101”.

During fiscal 2007,2006, the Company completed a major drilling programat its 100-percent-owned Robertson Property located on the Cortez gold trend in eastern Lander County, Nevada, USA. Drilling was completed in two phases.

| in (1) the Distal Zone; (2) on the northeast flank of Altenburg Hill; (3) in the gravel-covered area between the |

During 2007, the Company receivedcompleted two deep flooded reverse circulation drill holes, TV07-1 and TV07-2, to depths of 2,990 ft and 3,450 ft, respectively. The drilling was designed to test the lower plate of the Roberts Mountains thrust fault (RMTF) for high-grade Carlin-type mineralization hosted by favorable carbonate strata. TV07-1 intersected a permitthick sequence of fine grained siliceous sedimentary and volcanic rocks followed by biotite and quartz hornfels equivalents in the upper plate of the RMTF. Although the hole failed to reach the lower plate of the RMTF, it did intersect a number of narrow low-grade zones. TV07-2 was collared along a dike-filled splay of the Try fault zone and intersected a sequence of mostly fine grained siliceous sedimentary rocks and hornfels to 3,080 ft, at which point altered and mineralized limy mudstone in the lower plate was encountered. Beginning at 3,280 ft, the hole returned 200 ft of weakly to strongly anomalous gold values ranging from 0.031 to 2.190 ppm gold, including four 10-ft-thick intervals that exceed 0.01 oz Au/t.

In the US Bureaufiscal year ending January 31, 2008, the Company purchased 100% interest in the 72 claims comprising the Fanny Komp/Elwood Wright lease which forms part of Land Management to drill four deep holes (3 – 5,000 feet) onthe core area of the Robertson Property and drilling commenced in July 2007.

12

In calendar 2006, Coral Gold’s field staff carried out programs of detailed structural geological mapping, geochemical soil sampling, gravity geophysics and airborne magnetometric interpretation to define areasFebruary 2008, the Company received the final NI 43-101 compliantMineral Resource Estimate for the deep drilling program.

The zones included in the Beacon Hill estimate are located within the Robertson’s Core Claims only. Beacon Hill reported the following updated resource estimate:

| Zone (Core Claims) | Qty | Grade | Qty | Grade | Contained | ||||||||||

| (Tons) | oz Au/ton | (Tonnes) | g Au/tonne | oz Au | |||||||||||

| Distal | 10,355,041 | 0.0335 | 9,376,398 | 1.148 | 346,893 | ||||||||||

| 39A | 25,010,247 | 0.0287 | 22,690,382 | 0.984 | 717,794 | ||||||||||

| Triplet Gulch | 5,904,713 | 0.0269 | 5,357,012 | 0.922 | 158,837 | ||||||||||

| Outside | 2,187,500 | 0.0208 | 1,984,595 | 0.713 | 45,500 | ||||||||||

| Gold Pan Oxide | 7,049,181 | 0.0262 | 6,395,323 | 0.898 | 184,689 | ||||||||||

| Altenburg Hill Oxide | 4,558,402 | 0.0208 | 4,135,580 | 0.713 | 94,815 | ||||||||||

| Porphyry Oxide | 19,121,927 | 0.0213 | 17,348,243 | 0.730 | 407,297 | ||||||||||

| Gold Pan Sulphide | 12,053,279 | 0.0208 | 10,935,258 | 0.713 | 250,708 | ||||||||||

| Altenburg Hill Sulphide | 584,016 | 0.0176 | 529,845 | 0.603 | 10,279 | ||||||||||

| Porphyry Sulphide | 4,480,533 | 0.0223 | 4,064,934 | 0.765 | 99,916 | ||||||||||

| TOTALS | 91,284.800 | 0.0250 | 82,817,600 | 0.870 | 2,316,728 |

For details on claim and gold zone locations, please see corresponding maps and diagrams at the Company’s website atwww.coralgold.com. The information contained in the Company’s website does not form part of this Annual Report.

Resource estimate parameters:

- Gold ounces were calculated on the basis of US$600/oz Au and 70% Au recovery.

- The 0.015 ozAu/ton cut-off grade utilized to report the resource was derived from a mining cost of US$1.02/ton, process cost of US$5.00/ton and waste cost of US$1.14/ton.

- The mineral resources in the table above were estimated using the CIM Standards on Mineral Resources and Reserves.

- The database comprised a total of 1,160 drill holes,

drilled in calendar 2006 into the existing computer block model. Meanwhile application will be made for permits for533,453 feet (162,638 metres) of drillingto further expand the Distal, 39AandPorphyry/Altenburg Hill Zones. A series of core holes are also planned for metallurgical test work to add to existing information at101,757 gold assays. - The inferred resource covers 6 distinct and separate areas; Distal, 39A, Gold Pan, Porphyry, Altenburg Hill, Southern Area and

Porphyry/then all remaining blocks outside these areas that warrant inclusion as an inferred resource. In addition, Gold Pan, Porphyry and AltenburgHill.

The Company commissioned Beacon Hill to not only update the Robertson resource estimate but to also outline a program for continued development of the Core Claims in 2008 and beyond. Beacon Hill recommended a three-pronged development approach:

13

| 1) | Additional exploratory and definition drilling to increase the resource base and also the level of confidence in the resource to the indicated and/or measured categories. | |

| 2) | Complete a metallurgical program to enhance the metallurgical data. | |

| 3) | Commence a Preliminary Assessment Study on the mineralized zones within the Robertson Property to determine which of the zones have the greater potential for viability. The zones can then be prioritized for development. |

Beacon Hill recommended the following drilling on the Core Claims:

Phase I:52 RC holes ranging in depth from 500 ft to 1,200 ft and totaling 37,600 ft, to focus on:

- 39A Zone:Ten holes totaling 8,400 ft drilled along the southeast and northeast margins of the zone to test for additional high-grade mineralization.

- Distal Zone:Ten holes totaling 12,000 ft drilled in the Distal Zone, which remains open for discovery of high- grade mineralization in all directions.

- Altenburg Hill/South Porphyry Area:Twenty holes totaling 10,000 ft as infill and offset drilling on the northeast flank of Altenburg Hill and in the gravel- covered area south of the Porphyry Zone.

- Triplet Gulch:Twelve wide-spaced RC holes totaling 7,200 ft to test potential continuity and grade of inferred mineralization.

Phase II:should consist of 21 diamond core holes (HQ diameter) ranging from 300-ft to 1,000-ft-deep and totaling 11,900 ft. The purpose of core drilling is to provide geological data on the controls of mineralization, acquire geotechnical data (RQD and specific gravity), confirm grade and continuity and provide material for metallurgical testing. Drilling has been recommended as follows:

- 39A Zone:Six “twin” core holes totaling 5,000 ft focused in areas of higher grade mineralization.

- Distal Zone:Four pre-collared “twin” core holes totaling 2,400 ft drilled to confirm grade and geological controls.

- Altenburg Hill/South Porphyry Area:Six (or more) “twin” core holes totaling 3,000 ft to provide ore-grade oxide mineralization for metallurgical studies and confirm the grade and continuity of mineralization.

- Gold Pan Zone:Five shallow “twin” core holes totaling 1,500 ft drilled mainly to provide ore-grade oxide mineralization for metallurgical studies and to confirm grade, continuity and geological controls for mineralization.

Mr. Garth D. Kirkham, P.Geo., and Mr. Peter Stokes, P.Eng., of Beacon Hill and Mr. Robert McCusker, Consultant Geologist and Project Manager, are responsible for preparing the report and are “qualified persons” in accordance with NI 43-101. Messrs Kirkham, Stokes and McCusker are independent of the Company as defined by NI 43-101.

Deep drilling in 2007 encountered Carlin-type geochemistry including gold in the important lower plate host rocks for Carlin-type structure beneath the Roberts Mountains thrust fault. The gold intercepts indicate a Carlin type system in Lower Plate rocks on a western part of the property. Follow up mapping, rock sampling and infill gravity surveys in 2008 lead to the Company’s identification of a new lower plate target zone that extends from the coral deep hole, 2 km to the south. The West Deep Carlin-type target adds significant discovery potential to the Robertson Property for a world-class gold deposit. The target zone lies north of the Pipeline Mine open pit along a projected mineralized fault and fracture system that controls gold within that deposit. Considerably more drilling on the Robertson West Deep target is warranted. While the Company would prefer to continue drilling and expanding these targets in 2009, the Company must wait and see what unfolds in the equity markets and its ability to raise additional exploration capital. In addition, the Company continues to seek joint venture partners for a proposed deep drilling program to follow up the successful results from the 2007 drilling program which intersected enormous gold values in the Lower Plate limestone sequence at the Robertson Property.

14

In February 2009, the Company completed a Reverse Circulation drilling program at the Robertson Property. The program totaled 22,835 ft of drilling in 33 vertical holes which ranged in depth from 500 to 1200 ft. The holes were located on the Altenburg Hill, South Porphyry, 39A and Distal zones in order to increase the gold resource in these zones. Hole locations can be viewed in maps on our website at www.coralgold.com. The information contained in the Company’s website does not form part of this Annual Report.

Robert McCusker, Consultant Geologist supervised the drill programs as a “Qualified Person” for NI 43-101.

Norma Sass and Ruf Claims – Operations and Activities

Effective December 31, 1999, the Company and Levon Resources Ltd., referred to as "Levon"“Levon”, entered into a fourth amending agreement whereby Levon could earn an undivided 50% interest in the Norma Sass and Ruf Claims upon completion of certain terms. This agreement was further amended effective December 31, 2001 (but signed on October 3, 2002), whereby Levon was transferred a 33-1/3%33.3% interest in the Company’s interest in the Norma Sass and Ruf claims, in consideration of 300,000 common shares of Levon previously issued to the Company and the prior payment of $350,294 for exploration work. The Company currently owns a 66-2/3%66.6% interest in the Norma Sass and Ruf claims (subject to certain royalties to underlying property owners, as described below), following the execution of the December 2001 fifth amending agreement with Levon.

On December 4, 2002, the Company granted an option to acquire 33-1/3%33.3% of the Company’s interest in the Norma Sass and Ruf Claims to Goldfranchise Corporation, referred to as “Goldfranchise”. In order to earn the interest, Goldfranchise was required to:

In January 2005, wethe Company announced the formation of an exploration agreement with Agnico-Eagle Mines Limited, referred to as "Agnico-Eagle"“Agnico-Eagle”. The agreement coverscovered our Norma Sass, Blue Nugget and Lander Ranch claims. The Norma Sass agreement also includesincluded our partnership with Levon. Under the agreement, Agnico-Eagle cancould earn a 51% interest in the Norma Sass, Blue Nugget and Lander Ranch claims by completing at least 45,000 feet of exploration drilling and paying certain advance royalties. At its option, Agnico-Eagle may acquire the claim leases from the underlying owners for its benefit and Agnico-Eagle shall be deemed to have earned an additional 24% interest. Agnico-Eagle will then have the option of acquiring the remaining 25% interest by producing a positive feasibility study and making a positive production decision.

Agnico-Eagle mobilized a reverse circulation drill supplied by Lang Exploratory Drilling of Elko, Nevada to the Norma Sass property on May 15, 2006. Drilling commenced on the Lander Ranch target area and Agnico-Eagle drilled 15,000 ft. in 12 to 15 holes on the Norma Sass and related properties. In February 2007, Agnico-Eagle Mines Ltd. has notified the Company that it would not be continuing its option on Company'sthe Company’s Norma Sass, Lander Ranch and Blue Nugget properties because of other corporate priorities. The Company has beenwas pleased with the work done by Agnico-Eagle during the past two years. Theyas they successfully showed depths to the lower plate sequence across the Norma Sass ground and extended the area of gold mineralization at Lander Ranch.

In September 2008, the Company entered into an exploration, development and mine operating agreement (the “Agreement”) with Barrick Gold Exploration Inc. (“Barrick”), wherein Barrick was granted the option to acquire up to a 75% interest in the Company’s and Levon’s interests in the Norma Sass Property, Nevada, consisting of 36 unpatented mining claims.

Barrick may earn a 60% interest by incurring total exploration expenditures of at least US$3 million in annual installments by December 31, 2014. Barrick may earn an additional 10% (for an aggregate interest of 70%) by incurring an additional US$1.5 million by December 31, 2015. Barrick may earn an additional 5% (for an aggregate interest of 75%) by carrying the Company and Levon through to commercial production.

15

Alternatively, at the time of earning either its 60% or 70% interest, Barrick may be given the option to buy-out the Company’s and Levon’s joint interest by paying US$6 million and granting them a 2% net smelter returns royalty.

In May 2009, Barrick announced that plans are underway to do target delineation work in the second quarter followed by deep drilling in the third quarter on the Norma Sass property, Cortez Gold Trend, Nevada. Norma Sass is a 36-claim property immediately west of the Pipeline Mine open pit. Norma Sass was optioned to Barrick as disclosed above.

Norma Sass’ proximity to Pipeline, offers the deep discovery potential Barrick is pursuing. They have completely remapped and reinterpreted the Pipeline open pit geology since their acquisition of Placer Dome, and have a new stratigraphic model for the host rocks and structural setting of the gold deposit.

Barrick has notified the Company that they will commence the drilling of the planned holes in September 2009.

June Claims

The Company announced the completion of a mineral lease with option to purchase agreement to explore, develop, and exploit six lode mining claims located in Lander County, State of Nevada (the “June Claims”). The June Claims are adjacent to the Company’s View Claims in the northwest section of its Robertson Property. The agreement is for an initial term of 4 years in consideration of the payment of an annual rent of US$25,000, renewable in successive four year terms, provided that the rent will be reviewing resultsincrease by US$5,000 every four years. The property is subject to a royalty charge of Agnico-Eagle’s exploration programs in order3% of net smelter returns (“NSR”), subject to plan further work.

Reclamation Activities

The Company spent approximately $16,175$176,672 on reclamation and maintenance in fiscal year 20072009 on the Robertson Property. The Company is reclaiming past mining and exploration related disturbances to public lands as required by the Bureau of Land Management (“BLM”) and the Nevada Department of Environmental Protection referred(“NDEP”).

In August 2008, SRK Consulting prepared an “Aerial Survey Ground Truthing and Revised Cost Estimate” Report for the Company, which following amendments and revisions was submitted to as the "Bureau".

The report outlined and updated results of reclamation done by the Company at the Robertson Property up to 2008.

The BLM and NDEP replied with required changes and updates in March/April 2009 and a revised “Aerial Survey Ground Truthing and Revised Cost Estimate” was prepared by SRK Consulting on June 10, 2009 and submitted to the BLM and NDEP. The Company is awaiting acceptance of the report.

In other reclamation activity, The Company resolved confusion concerning disturbance at Mill Gulch (in the Robertson Core area) and at the Company’s JDN claims in the Hilltop area. The BLM agreed in July 2008 that the Company is not responsible for the land disturbance at Mill Gulch. The disturbance was caused by placer gold mining activity before the Company’s involvement at Robertson.

In the Try/View area of the Robertson Property the Company renewed the Notice of Intent to allow further deep drilling. The bond covering this area was increased to approximately $37,000.

In the core area of the Robertson Property, the Company also submitted a new “Storm Water Pollution Prevention Plan” and technical report which was approved by the BLM and NDEP in June 2009.

16

In addition the Company has authorized SRK Consulting to prepare:

(a) Comprehensive Permit, List and Schedules (a diary of permitting requirements); and

(b) memo of existing reclamation status and planning for further reclamation.

During the year ended January 31, 2007,2009, additional planned exploration activities were approved by the Bureau. Therefore,BLM. Accordingly, the BureauBLM increased the amount of the required reclamation deposit to US$282,268.

Competition

The mining industry in which the Company is engaged is highly competitive. Competitors include well-capitalized mining companies, independent mining companies and other companies having financial and other resources far greater than those of the Company. The companies compete with other mining companies in connection with the acquisition of gold and other precious metal properties. In general, properties with a higher grade of recoverable mineral and/or which are more readily minable afford the owners a competitive advantage in that the cost of production of the final mineral product is lower. Thus, a degree of competition exists between those engaged in the mining industries to acquire the most valuable properties. As a result, the Company may eventually be unable to acquire attractive gold mining properties.

Dependence on Customers and Suppliers

The Company is not dependent upon a single or few customers or suppliers for revenues or its operations.

Government Regulation

We are subject to various federal and state laws and regulations including environmental laws and regulations. Environmental regulations impose, among other things, restrictions, liabilities and obligations in connection with the generation, handling, use, storage, transportation, treatment and disposal of hazardous substances and waste and in connection with spills, releases and emissions of various substances to the environment. Environmental regulation also requires that facility sites and other properties associated with our operations be operated, maintained, abandoned and reclaimed to the satisfaction of applicable regulatory authorities. In addition, certain types of operations, including exploration and development projects and changes to certain existing projects, may require the submission and approval of environmental impact assessments or permit applications. Compliance with environmental regulation can require significant expenditures, including expenditures for clean up costs and damages arising out of contaminated properties and failure to comply with environmental regulations may result in the imposition of fines and penalties. We believe that we are in substantial compliance with such laws and regulations. However, such laws and regulations may change in the future in a manner which will increase the burden and cost of compliance.

Certain laws and governmental regulations may impose liability on us for personal injuries, clean-up costs, environmental damages and property damages, as well as administrative, civil and criminal penalties. We maintain limited insurance coverage for sudden and accidental environmental damages, but do not maintain insurance coverage for the full potential liability that could be caused by sudden and accidental environmental damage. Accordingly, we may be subject to liability or may be required to cease production from properties in the event of such damages.

Environmental Regulations

The Company’s exploration programs in Nevada and California are subject to state and federal regulations regarding environmental considerations. All operations involving the exploration for the production of minerals are subject to existing laws and regulations relating to exploration procedures, safety precautions, employee health and safety, air quality standards, pollution of streams and fresh water sources, odor, noise, dust and other environmental protection controls adopted by federal, state and local governmental authorities as well as the rights of adjoining property owners. The Company may be required to prepare and present to federal, state or local authorities data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment.

17

All requirements imposed by any such authorities may be costly, time consuming and may delay commencement or continuation of exploration or production operations. Future legislation may significantly emphasize the protection of the environment, and, as a consequence, the activities of the Company may be more closely regulated to further the cause of environmental protection. Such legislation, as well as further interpretation of existing laws in the United States, may require substantial increases in equipment and operating costs to the Company and delays, interruptions, or a termination of operations, the extent of which cannot be predicted. Environmental problems known to exist at this time in the United States may not be in compliance with regulations that may come into existence in the future. This may have a substantial impact upon the capital expenditures required of the Company in order to deal with such problem and could substantially reduce earnings. At the present time, the Company’s exploration activities in Nevada are in compliance with all known environmental requirements.

The regulatory bodies that directly regulate the Company'sCompany’s activities are the Bureau of Land Management (Federal) and the Nevada Department of Environmental Protection (State).

C. Organizational Structure

The Company has two wholly-owned subsidiaries, Coral Energy Corporation of California, a California corporation which holds title to the Company’s California property, and Coral Resources, Inc., a Nevada corporation, which holds title to the Company’s mining claims located in Nevada. In the 2006 fiscal year, the Company completed the purchase of 1,391,860 shares, representing 98.49% of the issued shares, of Marcus, a Nevada Corporation that owns the Marcus mining claims, consisting of 39 unpatented lode claims and two placer claims, and which comprise a portion of the Company’s Robertson Property.

D. Property, Plant and Equipment

Presently, the Company is an “exploration stage company”, as all of the Company’s properties are currently in the exploratory stage of development. In order to determine if a commercially viable mineral deposit exists in any of the Company’s properties, further geological work will need to be done and a final evaluation based upon the results obtained to conclude economic and legal feasibility.

The Company’s primary focus has been on the Robertson Mining Claims, in Nevada, United States.

Robertson Mining Claims, Nevada, U.S.A.

The Robertson Mining Claims are located in Crescent Valley, Nevada on the western flanks of the Shoshone Range, 28 miles to the southeast of Battle Mountain, Nevada, which lies some 230 miles northeast of Reno, Nevada. The Robertson Mining Claims comprise approximately 11,000 acres in the Bullion Mining District, Lander County, Nevada, and currently include 724 unpatented and patented lode and placer mining claims. The Robertson Mining Claims are recorded undercomprise three separate claim groups known as: (i) the Robertson Property;Core Claims; (ii) the Carve-Out Claims;Carve Out Claims, and (iii) the Norma Sass and Ruf Claims,Claims. as described more particularly below.

These mining claims have been acquired over a period of several years from different sources. The entire Robertson Mining Claims are subject to a 3% net smelter royalty to Geomex Development Eighth Partnership, referred to as "Geomex 8"“Geomex 8”, which royalty shall cease at such time as the sum of US$1,250,000 has been paid to Geomex 8, and various mining leases requiring minimum annual advanced royalties ranging from 2% to 8% of net smelter returns.

There is no underground or surface plant or equipment located on the Robertson Mining Claims.

(i) Robertson Property

The Robertson Property is the subject of twothree technical reports dated January 15, 2004, and April 25, 2006 and January 27, 2008. The first two technical reports were prepared by Robert T. McCusker, P.Geol. in accordance with NI 43-101, which we refer to as the "McCusker Reports"“McCusker Reports”. The following historical information concerningthird and most recent report was prepared by Beacon Hill of Vancouver, British Columbia referred hereinto as the “Beacon Hill Report”. The zones included in the Beacon Hill estimate are located within the Robertson’s Core claims only. The Company’s other Claim blocks, including Norma Sass, Lander Ranch, Ruf, Blue Nugget and the Excluded claims (joint ventured with Cortez Gold Mines), were not part of the estimate.

Property Description and Location

The Robertson Property is extracted from the McCusker Reports. The reader is referred to the entire text of the McCusker Reports, copies of which are available under the Company’s filings on EDGAR at www.sec.gov and on SEDAR at www.sedar.com.

In 2001, a boundary agreement between the Company and the Cortez resolved claim boundary overlaps and seniority issues along the east and south sides of the Robertson claim block. This agreement required both parties to amend and/or abandon certain claims in order to achieve the agreed upon boundary. This was completed during the 2002-2003 assessment year.

Approximately 17361 of the 532495 of the claims that comprise the Robertson Property are controlled by the Company through six mining leases and option agreements. The claimsCore Claims held by the Company under lease or option agreements require minimum advance royalty payments and production royalties in the event of production. Total annual payments for the various leases and minimum advance royalties are US$55,800.36,000.

A summary compilation of the terms of these agreements are presented in the Tabletable below:

Mining Lease and Option Agreements

| Advance | ||||

| Number of | Production | Royalty | ||

| Company/Date | Claims | Option Payment | Royalty | Payment |

| Tenabo Gold Mining Co. | ||||

| Nov. 30, 1975 | 13 | $2M | 8% NSR | $12,000/yr |

| Northern Nevada Au, Inc. | ||||

| Sept. 30, 1986 | 12 | $ - | 4% GSR | $9,600/yr |

| Albany Gold Corp. | ||||

| (Geomex) | All | $1.25M | 3% NSR | Nil |

| Mauzy, et al | ||||

| Apr. 21, 1989 | 36 | $1.5M | 2% NSR | $14,400/yr |

Company/Date | Number of Claims | Option Payment | Production Royalty | Advance Royalty Payment |

| Tenabo Gold Mining Co. Nov. 30, 1975 | 13 | $2M | 8% NSR | $12,000/yr |

| Fannie Komp Sept. 16, 1986 | 76 | $1M | 5% NSR | $24,000/yr |

| Florence Johnson Nov. 5, 1986 | 16 | $50,000 | 5% GSR | $1,800/yr |

| Northern Nevada Au, Inc. Sept. 30, 1986 | 12 | $0.3M | 4% GSR | $9,600/yr |

| Albany Gold Corp. (Geomex) | All | $1.25M | 3% NSR | None/yr |

| Mauzy, et al Apr. 21, 1989 | 36 | $0.75M | 2% NSR | $14,400/yr |

Annual federal rental fees of US$44,300,81,760, payable to the BLM, and Notice of Intent to Hold Mining Claims have been filed for the 2005-20062009-2010 assessment year.

Environmental Liabilities

In 1988-89, the Company operated a small open pit gold mining operation and heap leach facility on the Robertson Property. The resulting disturbances include three small open pit mines, waste dumps, haul roads, drill roads, open drill holes, and a 350,000 ton heap leach facility and related recovery plant. In 1994, a reclamation plan was prepared by Amax Gold Exploration Inc., referred to as "Amax"“Amax”, and submitted to the Battle Mountain office of the BLM.

21

The cost to perform the reclamation of the Robertson mine site was estimated at that time to be US$2,000,000. In 2001, the Company began reclamation activities which were accelerated in 2002, with the recontouring of waste dumps, reclamation of the leach pad, haul roads and the filling of all open drill holes. As a result of this activity, in June 2003, the BLM reduced the bonding requirements for the project to US$406,000. The Company currently maintains a required performance bond with the Nevada State Office of the BLM. The Company is working with the BLM and the United States Department of Interior in efforts to further reduce the bond.

In March 2003, on behalf of the Company, SRK Consulting submitted a final plan for permanent closure with the BLM and Nevada Division of Environmental Protection, referred to as the "NDEP".NDEP. The closure plan was been approved by both agencies. The major component of the closure plan was the installation of a site fluid management system. As a result of this work, during 2004 the BLM lowered the bonding requirements to $226,205. The Company currently maintains a required performance bond with the Nevada State Office of the BLM.BLM in the amount of US$389,360. The Company is working with the BLM and the United States Department of Interior in efforts to further reduce the bond.

Permitting

In 2002, the Company submitted and was granted a five year renewal of Water Pollution Control Permit (NEV60035) by the NDEP for the Robertson Property. In addition, the Company continues to conduct reclamation and exploration activities under a Plan of Operation (NV067688) approved in 1989 by the Bureau of Land Management.

During the period 2000 through 2003, no exploration activity was conducted on the Robertson Property. However, during that period a significant amount of surface reclamation was completed on the property. As a result, new exploration activities in reclaimed areas will require submission and approval of an Amendment to the Plan of Operation. Additionally, theNational Historic Preservation Actrequires that all operators on public lands conduct an archeological survey of the proposed sites of new disturbance. Much of the Robertson Property has been previously cleared under various surveys conducted by Amax. Recent and planned future exploration activities by the Company have moved outside the area covered by previous archeological surveys. It is possible that future exploration will experience delays in receiving approval because additional surveys will be required by state and federal agencies. In 2004-05,

During 2004 through 2006, the Company conducted exploratory drilling under a series of amendments to the Plan of Operation which were approved by the Battle Mountain office of the BLM and NDEP.

There are no known environmental or threatened and endangered species issues at the Robertson Property that would provide grounds for denial of approval of an Amended Plan of Operation.

History and Exploration

The Robertson Property is located in the Tenabo area, a sub-district of the Bullion mining district. Historic lode mining in this district dates from 1905 and Placerplacer gold was discovered in many of the dry washes in the Tenabo area in 1916. Between 1937-39,1937 and 1939, a small dragline dredge and washing plant operated in the district, and a dredge was reported by Humphrey to be operating in lower Mill Gulch in 1945.

During the period 1966-70,1966 through 1970, a number of companies explored the district in search of porphyry copper-style mineralization. In 1968, while drilling a series of shallow rotary holes near the Gold Pan mine, Superior Oil discovered a small, but relatively high-grade zone of gold at shallow depths in what is now known as the Gold Pan zone. However, with additional drilling, Superior Oil quickly lost interest in the district. They were soon followed by a number of mainly Vancouver-based junior mining companies, including Placer Development (1974-75), Teck Corporation (1977), Aaron Mining Ltd. (1975-86), and E & B Exploration Ltd. (1980-81), all of whomwhich sporadically explored the Tenabo area with limited success. A summary of the drilling completed by these companies prior to the Company’s involvement (1986) is presented in the table below:

22

Summary of Pre-Coral Drilling Activities at Robertson Property

| Date of | Number and Type of | Drill | ||

| Company | Activity | Holes Drilled | Footage(ft) | Target |

| Superior Oil | 1968-70 | 92 Conv. Rotary | c. 32,000 | Gold Pan |

| Placer Development | 1973-74 | 23 Conv. Rotary | c. 3,500 | none |

| Teck Corporation | 1977 | None | none | none |

| Aaron Mining Ltd. | 1977 | 7 Conv. Rotary | c.300 | Gold Quartz |

| E & B Exploration Ltd. | 1980-81 | 148 Rev. Circulation | 30,807 | Gold Pan |

| Totals | 270 | 66,607 |

Modern open pit mining and heap leaching began as early as 1974, when Aaron Mining Ltd., referred to as "Aaron"“Aaron”, initiated a pilot leach operation on the Robertson Property. During the period 1978-80,From 1978 through 1980, Aaron expanded its leaching operations and continued exploration and began consolidating and acquiring claims in the district.

In 1986, the Company acquired Aaron'sAaron’s interest in the Robertson Property and immediately began a series of major drilling programs beginning in 1986 and continuing until 1989. Mining operations on the Robertson Property commenced in 1988, but were suspended less than one year later. During the operating life of the Robertson Property mine, approximately 350,000 tons of low-grade material was placed on leach pads from which about 6,200 ounces of gold were recovered.

During the period 1986 through 1989, the Company completed approximately 380 reverse circulation drill holes and seven diamond drill holes, totaling about 109,377 ft. Much of this drilling was focused in four resources areas including the Gold Pan, Gold Quartz, Gold Quartz extension (also called Gold Quartz West) and the Triplet Gulch areas. The purpose of this drilling was to determine the limits and continuity of mineralization within these zones. Nearly all of the reverse circulation holes were drilled vertically to an average depth of about 300 ft.

During the later stages of the Company’s exploration program, theythe Company completed two “deep” reverse circulation holes that reached depths of 1,400 ft and 1,810 ft, respectively. In addition to resource definition, the Company also embarked on a program of district-wide exploratory and follow-up drilling of numerous surface anomalies.

In 1990, the Company and Amax entered into an amended and restated option and earn-in Agreementagreement in which Amax could earn a 60% interest in the Robertson Property by producing a bankable feasibility study. From 1990, until theyAmex withdrew from the venture in 1996, Amax completed an exploration program that included drilling 338 reverse circulation holes and 62 diamond drill holes, totaling over 176,000 ft.

In 1998, Cortez, entered into an option and earn-in agreement with the Company in which Cortez could earn a 70% interest in the Robertson Property by producing a bankable feasibility study. The focus of theirCortez’s exploration was to expand the 39A zone and test a number of outlying targets. During 1999, Cortez completed 46 reverse circulation drill holes and a single flood rotary hole, totaling 57,000 feet. Of the 13 holes directed at expanding the 39A zone, only two holes, 99401 and 99413, encountered significant mineralization. This drilling program did little to expand the resource. Of the remaining holes drilled by Cortez, only two holes (99406 and 99419) encountered significant mineralization. Both holes were designed to offset and/or follow up existing drill intersections and surface gold anomalies.

After completing this drilling program, Cortez declared its interest in renegotiating the terms of the Option Agreement with the Company. When the Company declined, Cortez subsequently terminated the Option Agreement on December 30, 1999, and did not earn an interest in the Robertson Property.

During 2004 and 2005, the Company conducted three drilling programs consisting of 32 reverse circulation holes totaling 24,020 feetft on the Robertson Property. The focus of this exploration was to expand and further define the 39A Zone, test the "deep"“deep” Gold Pan Zone for extensions of the 39A Zone and offset previous ore-grade intersections in the "distal“distal target area"area”.

23

The Phase I and Phase II drilling programs in 2006 totaled 35,615 ft of reverse circulation drilling in 46 holes. Depths ranged from 450 ft to 1,500 ft. Due to the relatively flat-lying nature of mineralization at Robertson, all holes were drilled vertically.

The 2007 deep drilling program on the Robertson Property encountered Carlin-type mineralization, locally with strongly anomalous gold values, in the lower plate of the Robert Mountains thrust fault. The program consisted of two flooded reverse circulation drill holes totaling 6,450 ft.

In 2008, the Company entered into a contract for 37,600-feet of reverse circulation drilling on the Company’s 100% owned Robertson property at Crescent Valley, Nevada. The agreement, signed with Lang Exploratory Drilling of Salt Lake City, Utah, began in April following permit approval from the BLM.

In Phase I, the Company drilled 52 reverse circulation holes and Phase II included 11,000 ft of diamond drilling.

Both Phase I and Phase II were aimed at expanding and upgrading Robertson’s 2.3 million-ounce inferred resource. In February 2008, Beacon Hill reported the Robertson resource, to date situated in a small portion of the property, had increased by more than 110% from the previous calculation. The updated resource was calculated from work completed in 2006 and 2007. With the 2008 drilling, the Company hoped to upgrade a significant portion of the inferred resources into the measured and indicated categories.

The reverse circulation drilling of Phase I ranged in depth from 500 to 1,200 ft. The work was focused on key, shallow-lying zones locally exposed on surface and also potentially in an open pit mining configuration. Some of the new resources remained open to expansion on strike and at depth.

The planned 21 diamond drill holes of Phase II ranged from 300 to 1,000 ft in depth. Phase II drilling would:

1) provide geological data on the controls of mineralization;

3) help confirm grade and continuity; and

4) provide material for metallurgical testing.

The Company continued to reevaluate all past Robertson exploration data and apply some new insights into gold controls in the Cortez Gold Trend, preparing for the 2008 resource expansion drilling.

To help derive exploration priorities to expand the current resource with the 2008 drilling campaign, a series of in-house, draft open pit shapes had been modeled around the 2008 NI 43-101 compliant inferred resource.

The inferred resource estimate of 2.3 million ounces of gold grading 0.0250 oz/ton (0.870 g/tonne was announced in February 2008 and a NI 43-101 compliant report is posted on the Company’s website for review athttp://www.coralgold.com/i/pdf/Robertson43-101Final.pdf. The information contained in the Company’s website does not form part of this Annual Report.

The loosely constrained open pit shapes were calculated at the posted resource cut off grades, for gold prices that range from $600 to $2000 per ounce gold. For simplicity, off site toll milling was considered and loosely estimated Nevada operating costs were used to produce non engineered, simple and idealized open pit shape alternatives. The point of the exercise is not to mimic or consider production alternatives, but provide semi quantitative exploration insight into where added resources might be most effective in any future open pit alternatives.

In February 2009, the Company completed its reverse circulation drilling program at the Robertson Property in Crescent Valley, Nevada, USA.

24

The program totaled 22,835 ft of drilling in 33 vertical holes which ranged in depth from 500 to 1200 ft. The holes were located on the Altenburg Hill, South Porphyry, 39A and Distal zones in order to increase the gold resource in these zones. Hole locations can be viewed in maps on the Company’s website atwww.coralgold.com. The information contained in the Company’s website does not form part of this Annual Report.

Geological Setting

Geologically, the Robertson Property consists of a series of relatively flat-lying, vertically stacked thrust sheets that form part of the Roberts Mountain allochthon, which is composed of siliciclastic rocks of Ordovician through Devonian age. The district is dominated by a very thick sequence of middle to late Devonian Slaven Chert composed mainly of argillite, chert, lesser siltstone and shale, and minor intermediate volcanic rocks. Structurally overlying the Slaven Chert along the north and east sides of the district are a sequence of rusty brown weathering siltstone, sandstone and very minor limestone of the Silurian Elder Sandstone.

Intruding the thick Paleozoic sequence is an elliptical-shaped, composite granodiorite stock (or lacolith) of Eocene age. The orientation of the principal axis of the stock is approximately east-west. Associated with it are numerous dikes, sills and plugs that vary in composition from diorite, the earliest known intrusion, to rhyolite, the latest. Most of the identified gold resources, including the Porphyry, Gold Pan and 39A zones, lie along or near the northern contact of the composite stock. A series of narrow and laterally continuous (up to 1,600 ft) intrusive “pebble” dikes extend northward from the northern contact of the granodiorite stock. Near contacts with the Tertiary intrusions, many of the sedimentary and volcanic rocks, and early phases of the stock, have undergone significant thermal metamorphism, intense recrystallization, bleaching and pervasive metasomatism. Many of these rocks have been converted to layered sequences of biotite, “quartz” and calc-silicate hornfels, marble, exoskarn and endoskarn.

Mineralization at the Robertson Property is strongly controlled by a system of low and high-angle faults and related fracture zones. Less commonly, brecciation associated with axial plane shear zones developed in isoclinal folds are also important hosts for mineralization, locally. Although individual structures host ore-grade gold, higher grades commonly occur where one or more structures intersect.

Deposit Types and Mineralization

The Company has been focusing its exploration activities on four zones localized along the northern contact of the Tenabo stock forming the general east-west trend. These zones are the Porphyry, Gold Pan, Altenburg Hill and 39A zones. The Porphyry, Gold Pan and Altenburg Hill zones occur in highly fractured hornfels and skarn units at the contact of the granodiorite stock, whereas the 39A zone is localized at the intersection of two high-angle faults in retrograde-altered hornfels.

The following is a summary of the main minerals identified at the Robertson Property:

| Native gold | Native silver | Electrum | Pyrite |

| Pyrrhotite | Marcasite | Arsenopyrite | Stibnite |

| Chalcopyrite | Sphalerite | Galena | Bournonite |

| Acanthite | Loellingite | Gersdorffite | Tetradymite |

| Petzite | Hessite | Hedleyite | Tellurobismuthite |

| Altaite | Tetrhedrite | Bornite | Chalcocite |

| Covellite | Digenite | Native copper | Cuprite |

| Chysocolla | Azurite | Goethite | Magnetite |

| Hematite | Illmenite | Scorodite |

Mineral Resource Estimates

In late 2005, an independent third party was contracted by the Company to undertake a Preliminary Assessment of the currently defined mineral resources at the Robertson Property. The results of this study are reported in a NI 43-101 compliant technical report dated April 25, 2006 prepared by R. T. McCusker entitled "Update“Update of the Geological Report on the Robertson Property"Property”.

25

The purpose for this study was to update the 2001 resource estimate, include results from the 2004-2005 drilling programs in the estimate and examine the effect of higher gold price on the economics of the existing resources. The mineral resource estimates of the Porphyry and combined 39A/Gold Pan Zones were conducted by an independent third party and a qualified person pursuant to NI 43-101. The Altenburg Hill and distal Target inferred mineral resources were estimated by R. T. McCusker, a qualified person pursuant to NI 43-101. A summary of the mineral resources estimated to be present on the Robertson Property are presented in the following Table.

| Measured mineral resources | Indicated mineral resources | Total measured and indicated | Inferred mineral resources | |||||||||

| Short | Gold | Contained | Short | Gold | Contained | Short | Gold | Contained | Short | Gold | ||

| tons | Grade | ozs | tons | Grade | ozs | tons | Grade | ozs | Tons | Grade | Contained | |

| Zone | (000s) | (oz/ton) | (000s) | (000s) | (oz/ton) | (000s) | (000s) | (oz/ton) | (000s) | (000s) | (oz/ton) | ozs (000s) |

| Porphyry(1) | 10,600 | 0.020 | 212 | 2,100 | 0.018 | 37 | 12,700 | 0.020 | 249 | |||

| 39A/Gold Pan(2) | 10,200 | 0.044 | 450 | 10,200 | 0.044 | 450 | 4,900 | 0.039 | 192 | |||

| Altenburg Hill(1) | 3,500 | 0.018 | 63 | |||||||||

| Distal Target(3) | 1,008 | 0.178 | 179 | |||||||||

| Total | 10,600 | 0.020 | 212 | 12,300 | 0.040 | 487 | 22,900 | 0.031 | 699 | 9,408 | 0.046 | 434 |

| (1) | Estimates calculated using a 0.010 oz Au/t cutoff grade. | |

| (2) | Estimates calculated using a 0.015 oz Au/t cutoff grade. | |

| (3) | Estimates calculated using a 0.05 oz Au/t cutoff grade. |

It should be noted that the resource classifications applied by an independent third party and R. T. McCusker conform to the Canadian Institute of Mining, Metallurgy and Petroleum definitions for measured, indicated and inferred mineral resources, respectively, pursuant to usage under NI 43-101. Further, it should also be noted that mineral resources that are not mineral reserves do not have demonstrated economic viability.

The zones included in the Beacon Hill estimate are located within the Robertson’s Core claims only. The Company’s other claim blocks, including Norma Sass, Lander Ranch, Ruf, Blue Nugget and the Excluded claims (joint ventured with Cortez Gold Mines), were not part of the estimate.

Cautionary Note to U.S. Investors concerning Estimates of Measured, Indicated and Inferred Resources

This section uses the terms “measured resources” and “indicated resources.” The Company advises United States investors that while those terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them

This section uses the term "inferred resources"“inferred resources”. We advise United States investors that while this term is recognized and required by Canadian regulations, the U.S. Securities and Exchange Commission does not recognize it.

26

Robertson Inferred Resources 2008 (by Beacon Hill)

| Zone | Tons | Oz/tAu | Ounces |

| Distal | 10,335,041 | 0.0335 | 346,224 |

| 39A | 25,010,247 | 0.0287 | 717,794 |

| South Zone | 5,904,713 | 0.0269 | 158,837 |

| Outside | 2,187,500 | 0.0208 | 45,500 |

| Gold Pan Oxide | 7,049,181 | 0.0262 | 184,689 |

| Altenburg Hill Oxide | 4,558,402 | 0.0208 | 94,815 |

| Porphyry Oxide | 19,121,927 | 0.0213 | 407,297 |

| Gold Pan Sulphide | 12,053,279 | 0.0208 | 250,708 |

| Altenburg Hill Sulphide | 584,016 | 0.0176 | 10,279 |

| Porphyry Sulphide | 4,480,533 | 0.0223 | 99,916 |

| TOTAL | 91,284,840 | 0.0253 | 2,309,506 |

- Gold ounces were calculated on the basis of US$600/oz Au and 70% Au recovery.

- The 0.015 ozAu/ton cut-off grade, utilized to report the resource, was derived from a mining cost of US$1.02/ton, process cost of US$5.00/ton and waste cost of US$1.14/ton.

The mineral resources in the table above were estimated using the CIM Standards on Mineral Resource 2006 (by R.T. McCusker)

Measured mineral resources | Indicated mineral resources | Total measured and indicated | Inferred mineral resources | |||||||||||||||||||||||||||||||||||||||||||||

| Zone | Short tons (000s) | Gold Grade (oz/ton) | Contained ozs (000s) | Short tons (000s) | Gold Grade (oz/ton) | Contained ozs (000s) | Short tons (000s) | Gold Grade (oz/ton) | Contained ozs (000s) | Short Tons (000s) | Gold Grade (oz/ton) | Contained ozs (000s) | ||||||||||||||||||||||||||||||||||||

Porphyry(1) | 10,600 | 0.020 | 212 | 2,100 | 0.018 | 37 | 12,700 | 0.020 | 249 | |||||||||||||||||||||||||||||||||||||||

39A/Gold Pan(1) | 10,200 | 0.044 | 450 | 10,200 | 0.044 | 450 | 4,900 | 0.039 | 192 | |||||||||||||||||||||||||||||||||||||||

Altenburg Hill(1) | 3,500 | 0.018 | 63 | |||||||||||||||||||||||||||||||||||||||||||||

Distal Target(1) | 1,008 | 0.178 | 179 | |||||||||||||||||||||||||||||||||||||||||||||

Total | 10,600 | 0.020 | 212 | 12,300 | 0.040 | 487 | 22,900 | 0.031 | 699 | 9,408 | 0.046 | 434 | ||||||||||||||||||||||||||||||||||||

This resource is compliant with NI 43-101.

Data Used for Estimate

A total of 1,204 drill holes were supplied for the Robertson Property in Lander County, Nevada which are the combined drill holes for the Gold Pan, 39A, Porphyry, Altenburg Hill and Lower Triplet Gulch zones in addition to areas that due tohave drilling but lie outside the low-grade naturemain areas of interest. The drill holes within the database included collars, downhole surveys, assays, and lithology.

Solids models of the main ore zones within the Robertson mineralDeposit were created that encompass the Gold Pan, 39A, Porphyry, Altenburg Hill, Distal and Triplet Gulch deposit areas. The ore zones to be included within the solids model and then to be used for constraining the interpolation procedure are split into an Oxide Zone and a Sulphide Zone where sufficient data existed to do so which included the Gold Pan, 39A, Porphyry and Altenburg Hill areas. Due to its depth, the Distal zone is considered to be sulphide material.

Approximately 200 historic core samples were analyzed for dry bulk density using the volume displacement method. Densities for both ore and waste are primarily related to lithology, argillization, calc-silicate content and sulfide content. The average density for country rock was determined to be 12.2 cu ft/ton and 15.5 cu ft/ton for alluvium (2 determinations). These are historic determinations, which appear to be located for the most part, within the Porphyry Zone however, the exact locations are not known. The relative scarcity of specific gravity data is the primary reason for the resources they are sensitivebeing categorized as inferred and it is recommended that a comprehensive program to determine localized specific gravity be undertaken for future studies.

Estimate Method

The estimation plan includes the following items:

- Storage of the mineralized zone code and percentage of mineralization.

- Application of density based on limited SG measurements.

- Estimation of the grades for Au using ordinary kriging.

27

- Ellipsoid orientation was orthogonal and ranges were set to 300 feet in the northing and easting whilst 200 feet in elevation.

The estimation strategy employed a minimum of four composites and a maximum of 15 with a maximum of two from any one drillhole.

Also, an octant search was used as it aids in declustering the estimate. This means that it helps to avoid over-influence of individual drill holes or sectors being overly informed, avoiding the use of samples that clustered together and thereby redundant. The maximum number of parameters including gold recovery, operating costs, capital costcomposites allowed in any one octant was two.

Conclusions

It can be concluded that the Robertson Property is one of merit and gold price. Estimated net revenue generated byis worthy of additional development work to enhance the 39A/Gold Panresource base and Porphyry resources atincrease the level of confidence in the resource. It is also concluded that a gold pricePreliminary Assessment be completed to ascertain the potential viability of $550/ounce and 683,000 ounces of recoverable gold generates a net revenue of $97.5 million, which makes the resources uneconomic as evaluated.

Proposed Exploration

The Company believes that there is a potential for discovery of additional mineral resources on the Robertson Property. The Company plans to continue to explore the Robertson Property or seek third party partners for further exploration.

(ii) Carve-Out Claims, Nevada, U.S.A.

Under the terms of an Exploration and Mining Venture Agreement dated July 11, 1997, Barrick, formerly Placer, holds an undivided 61% interest and the Company has a 39% interest carried to production in the Carve-Out Claims.

Beginning in 1997 and continuing through 1998, Cortez conducted a series of exploratory drilling programs on the Carve-Out Claims with limited success. In 2002, the Company conducted a drilling program on the Carve-Out Claims with follow-up drilling in the immediate vicinity of existing drill holes with mixed results. To date, no significant mineral resources have been discovered on the Carve-Out Claims. However, the wide-space deep drilling has established the presence of scattered significant gold values, anomalous levels of Carlin-type trace elements, key structural components and the occurrence of a preferred host strata.

The Company plans to rely on Cortez to further explore the property for mineral resources.

There is no underground or surface plant or equipment located on the Carve-Out Claims, nor any known body of commercial ore.

No further work on the Carve-Out Claims is proposed at this time.

(iii) Norma Sass and Ruf Claims, Nevada, U.S.A

The Company currently owns a 66-2/3%66.6% interest in the Norma Sass and Ruf Claims, which originally were a part of the Carve-Out Claims, after an option agreement with Levon was amended on October 3, 2002 transferring to Levon a 33-1/3 percent33.3% interest in the Norma Sass and Ruf Claims. Levon is a British Columbia company also engaged in the exploration of precious minerals and has four directors in common to the Company.

In January 2005, we announced the formation of an exploration agreement with Agnico-Eagle. The agreement covers our the Norma Sass, Blue Nugget and Lander Ranch claims. The Norma Sass agreement also includes our partnership with Levon. Under the agreement, Agnico-Eagle can earn a 51% interest in the Norma Sass, Blue Nugget and Lander Ranch claims by completing at least 45,000 feetft of exploration drilling and paying certain advance royalties. At its option, Agnico-Eagle may acquire the claim leases from the underlying owners for its benefit and Agnico-Eagle shall be deemed to have earned an additional 24% interest. Agnico-Eagle will then have the option of acquiring the remaining 25% interest by producing a positive feasibility study and making a positive production decision.

28

At the fifth anniversary and every year thereafter until production occurs, the advance royalty payment will be US$150,000 per annum. All advance royalty payments will be credited towards Agnico-Eagle'sAgnico-Eagle’s payment of a royalty of 2.5% net smelter returns from production to the Company and Levon. Agnico-Eagle has reserved the right to purchase 1% of this net smelter returns royalty (to reduce the royalty to the Company and Levon to 1.5%) for a cash payment of US$1.0 million. The Company and Levon have agreed to share in any benefits from the agreement with Agnico-Eagle in proportion to their current respective interests in the Norma Sass Property.

In February 2007, Agnico-Eagle Mines Ltd. has notified the Company that it would not be continuing its option on Company'sCompany’s Norma Sass, Lander Ranch and Blue Nugget properties because of other corporate priorities. The Company has beenwas pleased with the work done by Agnico-Eagle during the past two years.Agnico-Eagle. They successfully showed depths to the lower plate sequence across the Norma Sass ground and extended the area of gold mineralization at Lander Ranch. The Company will beis reviewing results of Agnico-Eagle’s exploration programs in order to plan further work.

In September 2008 the Company entered into an exploration, development and mine operating agreement with Barrick, wherein Barrick is granted the option to acquire up to a 75% interest in the Company’s and Levon interests in the Norma Sass Property, Nevada, consisting of 36 unpatented mining claims.

Barrick may earn a 60% interest by incurring total exploration expenditures of at least US $3 million in annual installments by December 31, 2014. Barrick may earn an additional 10% (for an aggregate interest of 70%) by incurring an additional US $1.5 million by December 31, 2015. Barrick may earn an additional 5% (for an aggregate interest of 75%) by carrying the Company and Levon through to commercial production.

Alternatively, at the time of earning either its 60% or 70% interest, Barrick may be given the option to buy-out the Company’s and Levon’s joint interest by paying US $6 million and granting them a 2% net smelter returns royalty.

In May 2009, Barrick announced that plans are underway to do target delineation work in the second quarter followed by deep drilling in the third quarter on the Norma Sass property, Cortez Gold Trend, Nevada. Norma Sass is a 36-claim property immediately west of the Pipeline Mine open pit. Norma Sass was optioned to Barrick as mentioned in the above paragraph.

There is no underground or surface plant or equipment located on the Norma Sass and Ruf Claims, nor any known body of commercial ore.

(iv) June Claims

The Company announced the completion of a mineral lease with option to purchase agreement to explore, develop, and exploit six lode mining claims located in Lander County, State of Nevada (the “June Claims”). The June Claims are adjacent to the Company’s View Claims in the northwest section of its Robertson Property. The agreement is for an initial term of 4 years in consideration of the payment of an annual rent of US$25,000, renewable in successive four year terms, provided that the rent will increase by US$5,000 every four years. The property is subject to a royalty charge of 3% of net smelter returns (“NSR”), subject to the Company’s exclusive right to purchase the NSR for US$1,000,000 per percentage point upon notice to the Lessors. The Company also has the exclusive right to purchase the property, subject to the NSR, for US $1,000,000 upon notice to the Lessors. No further work on the June Claims is proposed at this time.

(v) JDN Claims, Nevada, U.S.A

. (formerly known as the JD Mining Claim)On December 16, 1986, the Company acquired six mining claims on 550 acres of land near Crescent Valley (Lander County), Nevada for US$10,000. The Company located an additional 28 unpatented lode mining claims covering some 30 acres in May 1996 and acquired a 100% interest by staking the “JDN Claims”. The JDN Claims are located approximately three miles north of the Robertson Mining Claims.

29