For the fiscal year ended December 31,

As filed with the Securities and Exchange Commission on March 3, 2006

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 20-F

| Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 | |

| OR | |

| Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, | |

| OR | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-15170

GlaxoSmithKline plc

(Exact name of Registrant as specified in its charter)

| Title of Each Class | Name of Each Exchange On Which Registered |

| American Depositary Shares, each representing 2 Ordinary Shares, Par value 25 pence | New York Stock Exchange |

Securities registered or to be registered to Section 12(g) of the Act:

None

(Title of class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

![]() Yes

Yes ![]() No

No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

![]() Yes

Yes ![]() No

No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

![]() Yes

Yes

![]() No

No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (check one):

Large accelerated filer ![]() Acccelerated filer

Acccelerated filer ![]() Non-accelerated filer

Non-accelerated filer ![]()

Indicate by check mark which financial statement item the Registrantregistrant has elected to follow.

![]() Item 17

Item 17

![]() Item 18

Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

![]() Yes

Yes ![]() No

No

GlaxoSmithKline plc is an English public limited company. Its shares are listed on the London Stock Exchange and the New York Stock Exchange.

GlaxoSmithKline plc acquired Glaxo Wellcome plc and SmithKline Beecham plc on 27th December 2000 by way of a scheme of arrangement for the merger of the two companies which became effective on 27th December 2000.

This report is the Annual Report of GlaxoSmithKline plc for the year ended 31st December 2002. It comprises in a single document the Annual Report of the company in accordance with United Kingdom requirements and the Annual Report on Form 20-F to the Securities and Exchange Commission in the United States of America.

A summary report on the year, the Annual Review 2002, intended for the investor not needing the full detail of the Annual Report, is produced as a separate document. The Annual Review includes the joint statement by the Chairman and the Chief Executive Officer, a summary review of operations, summary financial statements and a summary remuneration report.

The Annual Review is issued to all shareholders. The Annual Report is issued to shareholders who have elected to receive it. Both documents are available on GlaxoSmithKline’s corporate website – at www.gsk.com.

WebsiteGlaxoSmithKline’s website, www.gsk.com gives additional information on the Group. Information made available on the website does not constitute part of this Annual Report.

| |

| |

| Do more, feel better, live longer | |

JP Garnier (left) and Sir Christopher Gent (right)

“Thanks to the efforts of our employees around the world,

2005 was a very successful year for GSK. Not only

was it our best year ever from a financial standpoint,

we also made substantial progress with our pipeline

of innovative medicines and vaccines.”

JP Garnier, Chief Executive Officer

An interview with Sir Christopher Gent, Chairman and JP Garnier, Chief Executive Officer

2005: a year of success and progress

GSK delivered an excellent financial performance in 2005. Turnover of £21.7 billion grew by 7% at constant exchange rates (CER). Earnings per share (EPS) were 82.6p, with growth of 18% at CER, putting GSK in the top tier of global pharmaceutical companies in terms of performance.

“These figures confirm the excellent growth of our key products and the efficiency of our global operations,” says JP.

GSK’s performance was driven by sales of key pharmaceutical products. “Sales ofSeretide/Advair,Avandia,Coreg,LamictalandValtrexall continued their impressive growth,” says JP. “We also saw good performance from a number of newer products, includingAvodartfor enlarging prostate,Boniva/Bonvivafor osteoporosis andRequipfor Restless Legs Syndrome, which all show great promise for the future, both for patients and GSK.’

“Looking into 2006, the strong growth seen from key products and from our vaccines business is expected to continue and we anticipate an EPS growth of around 10% at CER.”

Pipeline progress

GSK continues to meet the challenge of increasing Research & Development (R&D) productivity to discover new medicines faster and more economically. The company’s pipeline is one of the largest and most promising in the industry, with 149 projects in clinical development (as at the end of February 2006), including 95 new chemical entities (NCEs), 29 product line extensions (PLEs) and 25 vaccines.

“In 2006, we anticipate further good news on GSK’s late-stage pipeline, which is developing at a fast pace. Eight major new assets are scheduled to enter phase III in 2006, doubling our late-stage pipeline,” says JP.

Year of the vaccine

2005 was a landmark year for GSK’s vaccines business. Sales increased by 15% and the company made a number of significant strategic acquisitions. “The acquisition of ID Biomedical was an important move for GSK,” says JP, “which strengthened our position in the global flu vaccine market, and increased our ability to prepare for and respond to a potential flu pandemic.”

“The pharmaceutical industry is making a

positive improvement to people’s lives. It

has a noble purpose. It develops medicines

and vaccines that save lives and make

people feel better.”

Sir Christopher Gent, Chairman

“We also acquired a plant in Marietta, Pennsylvania which will give us access to tissue culture technology in our vaccine manufacturing. The acquisition of Corixa gives us valuable adjuvant technology, enabling us to boost human immune response to our vaccines.”

GSK also made good progress on its pipeline of new vaccines. “We expect five major vaccine launches in the next five years,” says JP. “Perhaps most exciting isCervarixfor cervical cancer, which we expect to file for approval in Europe in March 2006 and in the USA by the end of the year.”

Improving access to medicines

GSK continues to seek new ways of improving access to its medicines for people who need them, but are least able to obtain them. This challenge is particularly acute in the developing world, where GSK has been offering many of its medicines and vaccines at not-for-profit prices for some years.

GSK Annual Report 2005 01 |

However, addressing this challenge is something GSK cannot do alone. The work of GSK with organisations such as the Bill & Melinda Gates Foundation highlights the benefits of public-private partnerships. They provide a way for companies such as GSK and the private sector to work together. Typically, GSK provides the R&D, technology, manufacturing and distribution expertise, while other partners and governments help fund the development and delivery costs.

In 2005, GSK entered three groundbreaking public-private partnerships to develop vaccines against the biggest causes of death in the developing world today – AIDS, malaria and tuberculosis.

“Public-private partnerships use the

respective strengths of the partners

and bring out the best of each. Most

importantly, it is a model that works.”

Reaching out to patients

In 2005, GSK introduced and strengthened a number of initiatives aimed at improving patients’ understanding of GSK’s medicines, and programmes to help gain access to them. These initiatives include GSK’s pioneering Clinical Trial Register, which was expanded to contain 2,125 summaries of clinical trials by the end of 2005.

In the USA, GSK is placing more emphasis on education and the patient in direct-to-consumer advertising, and providing people with advice on GSK’s programmes and the industry’s Partnerships for Prescriptions Assistance which help people gain access to the medicines they need.

“Through these and other initiatives, we are seeking to differentiate GSK as a company finding solutions to the healthcare challenges that society faces. I believe we are well on the way to achieving that,” says Sir Christopher.

A broader contribution

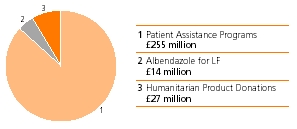

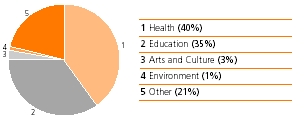

GSK's global community investment activities in 2005 were valued at £380 million, equivalent to 5.6% of Group profit before tax.

The year saw a number of natural disasters, including the Asian tsunami, the Guatemalan hurricane, the New Orleans floods and the earthquake that struck parts of India and Pakistan. GSK was quick to respond to help victims of these tragedies. “My thanks go to our employees for their response to these crises. It makes me proud to lead an organisation with such committed and compassionate people, who can respond so effectively to help people in real need,” says JP.

For these disasters alone, GSK contributed more than £3 million in cash and donated medicines and vaccines valued at over £14 million towards the relief efforts.

“The tragedies during the year brought home to me the extent to which the pharmaceutical industry is making a positive improvement to people’s lives,” says Sir Christopher. “It has a noble purpose. It develops medicines and vaccines that save lives and make people feel better.”

Being human

We continue to meet the challenges of improving productivity in R&D and ensuring patients have access to medicines, even in the poorest parts of the world. This Report highlights some of the work we have done to implement our strategies to meet these challenges. Behind each one is a human story.

We thank all our employees for their efforts in 2005. Their commitment and passion, both individually and through their teamwork, have helped us make GSK the success it is today. We also appreciate the great support our employees receive from their families for the work they are doing at GSK.

We are grateful for the significant contribution of Tachi Yamada, Chairman of R&D and Executive Director, who is to retire in June 2006, and we welcome Moncef Slaoui, who will succeed Tachi with effect from 1st June 2006. We would also like to thank Jack Ziegler, President of GSK Consumer Healthcare, who retired from the company in January 2006, and welcome his successor, John Clarke. We also thank Dr Lucy Shapiro, who is to retire as a Non-Executive Director at the company’s Annual General Meeting in May 2006, and we welcome Tom de Swaan, who joined the Board in January 2006 as a new Non-Executive Director.

|  |

| Sir Christopher Gent | JP Garnier |

| Chairman | Chief Executive Officer |

| GSK Annual Report 2005 |

| 02 |

| Contents |

| Report of the Directors | |

| Financial summary | 4 |

| Description of business | 5 |

| Corporate governance | 27 |

| Remuneration Report | 37 |

| Operating and financial review and prospects | 55 |

| Financial statements | |

| Directors’ statements of responsibility | 82 |

| Independent Auditors’ report | 83 |

| Consolidated income statement | 84 |

| Consolidated balance sheet | 85 |

| Consolidated cash flow statement | 86 |

| Consolidated statement of recognised income and expense | 88 |

| Notes to the financial statements | 89 |

| Investor information | |

| Financial record | 166 |

| Shareholder information | 176 |

| Taxation information for shareholders | 180 |

| Glossary of terms | 181 |

| Cross reference to Form 20-F | 182 |

| The Annual Report was approved by the Board of Directors on | |

| GSK Annual Report 2005 |

| 03 |

| Financial summary | ||||||||

| 2001 | Increase | |||||||

| 2002 | (restated) | |||||||

| Statutory results | £m | £m | £% | CER% | ||||

| Sales | 21,212 | 20,489 | 4 | 7 | ||||

| Trading profit | 5,662 | 4,697 | 21 | 26 | ||||

| Profit before taxation | 5,506 | 4,517 | 22 | 28 | ||||

| Earnings/Net income | 3,915 | 3,053 | 28 | 35 | ||||

| Basic earnings per share | 66.2 | p | 50.3 | p | 32 | 38 | ||

| Dividends per share | 40.0 | p | 39.0 | p | ||||

| Merger, restructuring and disposal of subsidiaries | ||||||||

| Trading profit | (1,032 | ) | (1,356 | ) | ||||

| Profit before taxation | (1,011 | ) | (1,652 | ) | ||||

| Earnings/Net income | (712 | ) | (1,330 | ) | �� | |||

| Business performance | ||||||||

| Sales | 21,212 | 20,489 | 4 | 7 | ||||

| Trading profit | 6,694 | 6,053 | 11 | 15 | ||||

| Profit before taxation | 6,517 | 6,169 | 6 | 11 | ||||

| Adjusted earnings/Net income | 4,627 | 4,383 | 6 | 11 | ||||

| Adjusted earnings per share | 78.3 | p | 72.3 | p | 8 | 13 | ||

| Financial summary |

| Growth | ||||||||

| 2005 | 2004 | |||||||

| £m | £m | CER% | £% | |||||

| Turnover | 21,660 | 19,986 | 7 | 8 | ||||

| Operating profit | 6,874 | 5,756 | 16 | 19 | ||||

| Profit before taxation | 6,732 | 5,779 | 13 | 16 | ||||

| Profit after taxation for the year | 4,816 | 4,022 | 17 | 20 | ||||

| Profit attributable to minority interests | 127 | 114 | ||||||

| Profit attributable to shareholders | 4,689 | 3,908 | ||||||

| Earnings per share | 82.6 | p | 68.1 | p | 18 | 21 | ||

| Diluted earnings per share | 82.0 | p | 68.0 | p | ||||

| Dividends per share | 44 | p | 42 | p | ||||

| Net cash inflow from operating activities | 5,958 | 4,944 | ||||||

| Net assets | 7,570 | 5,937 | ||||||

Business performance, whichHistory and development of the company

GlaxoSmithKline plc is a public limited company incorporated on 6th December 1999 under English law. Its shares are listed on the primary performance measure used by management, is presented after excluding merger items, integration and restructuring costsLondon Stock Exchange and the disposalNew York Stock Exchange. On 27th December 2000 the company acquired Glaxo Wellcome plc and SmithKline Beecham plc, both English public limited companies, by way of businesses. Management believes that exclusiona scheme of these non-recurring items provides a better comparison of business performancearrangement for the periods presented. Statutory results include these non-recurring items. This information is provided asmerger of the two companies. Both Glaxo Wellcome and SmithKline Beecham were major global healthcare businesses.

GSK plc and its subsidiary and associated undertakings constitute a supplement to that includedmajor global healthcare group engaged in the consolidated statementcreation, discovery, development, manufacture and marketing of profitpharmaceutical and loss on pages 76consumer health-related products.

GSK has its corporate head office in London. It also has operational headquarters in Philadelphia and 77 preparedResearch Triangle Park, USA, and operations in accordancesome 119 countries, with products sold in over 130 countries. The principal research and development (R&D) facilities are in the UK, GAAP.the USA, Japan, Italy, Spain and Belgium. Products are currently manufactured in some 37 countries.

The major markets for the Group’s products are the USA, France, Japan, the UK, Italy, Germany and Spain.

| Business segments GSK operates principally in two industry segments: | |

| • | Pharmaceuticals (prescription pharmaceuticals and vaccines) |

| • | Consumer Healthcare (over-the-counter medicines, oral care and nutritional healthcare). |

The Group, as a multinational business, operates in many countries and earns revenues and incurs costs in many currencies. The results of the Group, as reported in sterling, are therefore affected by movements in exchange rates between sterling and overseas currencies. The Group uses the averageAverage exchange rates prevailing during the yearperiod are used to translate the results and cash flows of overseas companiessubsidiary and associated undertakings and joint ventures into sterling. Period end rates are used to translate the net assets of those undertakings. The currencies which most influence these translations are the US dollar, the Euro and the Japanese Yen. During 2002 average sterling exchange rates were stronger against the US dollar and the Japanese Yen by four per cent and seven per cent, respectively, and weaker against the Euro by one per cent, compared with 2001.

In order to illustrate underlying performance, it is the Group’s practice to discuss its results in terms of constant exchange rate (CER) growth. This represents growth calculated as if the exchange rates used to determine the results of overseas companies in sterling had remained unchanged from those used in the previous year. The discussion in this report is therefore in terms of CER unless otherwise stated.

£% represents growth at actual exchange rates. CER% represents growth at constant exchange rates.

During 2002 FRS 19 ‘Deferred tax’ has been implemented by the Group. This FRS requires deferred tax to be accounted for on a full provision basis, rather than a partial provision basis as in 2001 and earlier years. This change has been accounted for as a prior year adjustment and comparative information has been restated as necessary.

£% represents growth at actual exchange rates.

Cautionary statement regarding forward-looking statements

The Group's reports filed with or furnished to the US Securities and Exchange Commission (SEC), including this document and written information released, or oral statements made, to the public in the future by or on behalf of the Group, may contain forward-looking statements. Forward-looking statements give the Group's current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts. They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results. The Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Forward-looking statements involve inherent risks and uncertainties. The Group cautions investors that a number of important factors, including those in this document, could cause actual results to differ materially from those contained in any forward-looking statement. Such factors include, but are not limited to, those discussed under ‘Risk factors’ on pages 64 and 6571 to 74 of this Annual Report.

| GSK Annual Report 2005 |

| 04 |

Joint statement by the Chairman and the Chief Executive Officer

The purpose of GlaxoSmithKline is to deliver medicines that have a positive impact on the quality of human life. We have chosen this fundamental and challenging objective as the theme of this year’s Annual Review.

We are pleased to report that 2002 was a year of significant progress in establishing GlaxoSmithKline as one of the world’s leading pharmaceutical companies. We achieved strong financial results in 2002, despite the entry of generic competition in the USA to Augmentin, one of our major products.

Our progress stems from the Group’s key strengths: a broadly based product portfolio, strong financial capability and a promising early stage pipeline of products. We have built on each of these core attributes in 2002 and we are confident that they will help GlaxoSmithKline to continue to deliver success in the future.

While achieving business success it is essential that we demonstrate to all our stakeholders, around the world, how we conduct our business with integrity and continue to make a positive contribution to society.

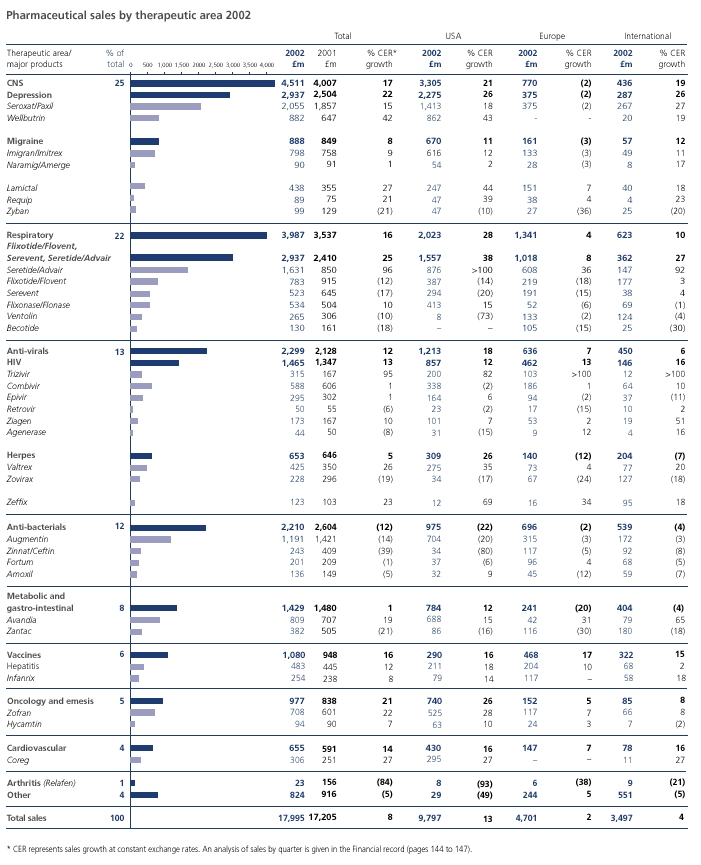

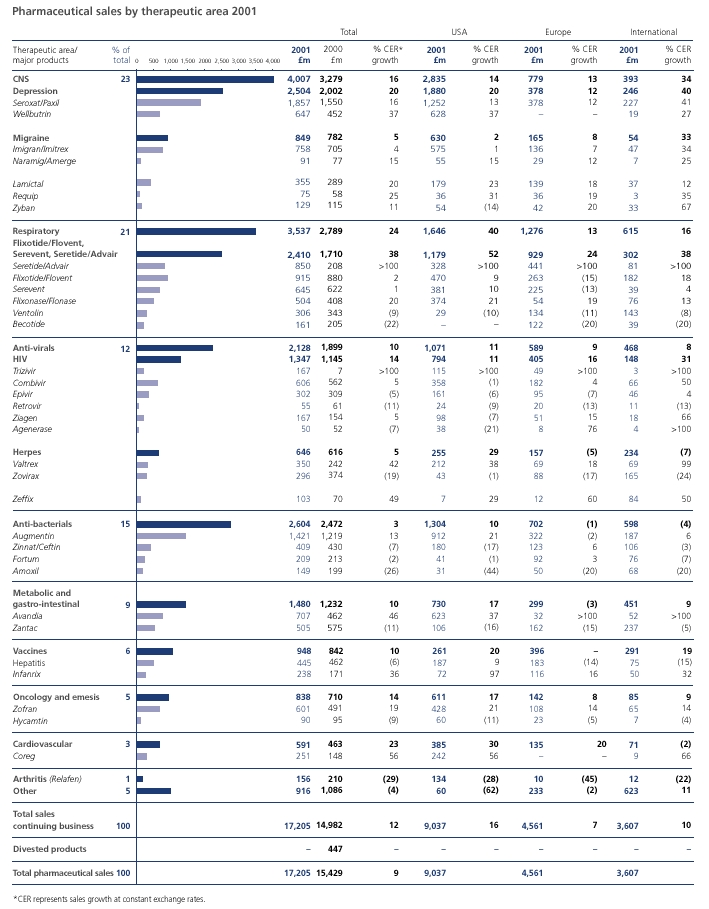

Good financial performanceWe delivered a very solid financial performance in 2002 in a challenging operating environment. Global pharmaceutical sales grew eight per cent to nearly £18 billion and US pharmaceutical sales grew 13 per cent, despite generic competition to Augmentin. The Group demonstrated continued financial strength with total sales up seven per cent and business performance trading profit up 15 per cent. There were strong performances from our key therapy areas including central nervous system, respiratory, anti-virals and vaccines.

Our business performance earnings per share grew by 13 per cent, delivering on our guidance and demonstrating the continuing financial strength that will provide the Group with a sound platform for the future.

GlaxoSmithKline has made good progress with its merger and manufacturing restructuring plans and we remain on track to deliver forecast total annual merger and manufacturing restructuring savings of at least £1.8 billion by 2003. We are not stopping there; our continuous improvement programme, Operational Excellence, is delivering additional savings and will continue to do so.

New product growth drives commercial strengthThe success of our new products is providing the fuel for future growth, with new products now representing 27 per cent of total pharmaceutical sales, up 36 per cent in 2002. Sales of Seretide/Advair for asthma, now our second largest product, continued to grow impressively, up 96 per cent to £1.6 billion. We recently launched Avandamet for type 2 diabetes and Avodart for benign prostatic hyperplasia, as well as important line extensions of Augmentin and Paxil. During 2003-2004 we look forward to launching 12 new compounds and line extensions. These include Levitra, a new treatment for erectile dysfunction, which we are co-promoting with Bayer, and Wellbutrin XL, a new and improved version of our successful anti-depressant.

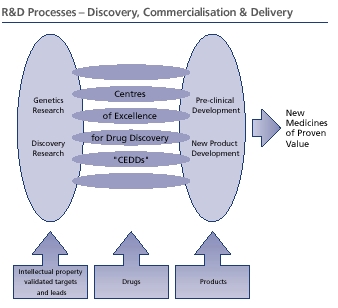

Creating the most productive R&D organisationAt the outset of the merger we rethought the way R&D was carried out at GlaxoSmithKline, with the aim of creating the most productive R&D organisation in the industry. We established six therapeutically focused Centres of Excellence for Drug Discovery (CEDDs). The CEDDs are nimble and entrepreneurial with the range of skills and scale of resources required to drive mid-stage development projects through to their key decision point, proof of concept, before large-scale phase III clinical trials.

After two years of activity by the new R&D organisation, we are seeing significant progress as we advance our promising early stage pipeline of pharmaceutical products through clinical development. GlaxoSmithKline has 123 projects in clinical development, of which 61 are new chemical entities in a number of therapy areas, and 23 new vaccines. The number of new chemical entities starting phase II clinical trials has more than doubled since the merger. We are confident that, as these and our phase I pipeline move through development, we will build the best late stage pharmaceutical pipeline in the industry. We plan to provide a detailed update on progress in R&D towards the end of 2003.

Success as partner of choiceThe size and quality of our global R&D organisation, together with the strength of our sales and marketing teams, have enabled GlaxoSmithKline to become the partner of choice in the industry. We have signed an unprecedented 24 major external collaborations in the last two years which has helped to boost our product portfolio. It has also provided some exciting new opportunities in a number of areas of unmet medical need such as erectile dysfunction, obesity and HIV.

Patent challengesOver the last year there have been a number of developments involving the patents on some of our key products.

In July, in the USA, the first generic version of Augmentin was launched. This followed a ruling by a federal judge that our Augmentin patents were invalid. We are appealing against this decision, in the firm belief that our patents are valid. Meanwhile, we have already offset some of the impact of generics with recent successful launches of new improved versions of Augmentin - the ES and XR formulations.

GlaxoSmithKline is also involved in litigation over the patents on Wellbutrin SR and Zyban in the USA. We are awaiting the outcome of our appeal against a judgement last year in favour of Andrx Corporation, which has applied to market generic versions of the products.

| Description of business | |

Seroxat/Paxil continues to be subject to threat of generic competition, particularly in the USA.

A federal judge in Chicago recently ruled that GlaxoSmithKline’s patent in the USA covering the hemihydrate form ofPaxil was valid but not infringed by generics company Apotex’s product. We believe our patent to be infringed by Apotex’s product and will appeal against the ruling. Also, we will continue to pursue litigation for infringement of other patents relating to Paxil against Apotex and other generics companies in the USA.

As a result of these pending matters, the possible timing of generic competition to Paxil in the USA is unclear. Consequently, GlaxoSmithKline’s published earnings guidance for 2003 remains as previously stated. The guidance is for high single digit percentage growth in business performance earnings per share at constant exchange rates, assuming there is no generic competition to Paxil in the USA. If a generic launch of paroxetine hydrochloride became imminent, GlaxoSmithKline would reassess this guidance.

Uptake of Paxil CR, our enhanced form of the antidepressant launched in 2002, has been excellent and it now represents over 30 per cent of Paxil’s new prescriptions in the USA. We also have patent challenges to a number of other products such as Zofran and Lamictal. These cases illustrate an industry-wide trend in which generics companies are filing more patent challenges earlier. We will obviously defend our intellectual property vigorously.

Contribution to societyMissionThe responsible behaviour of all types of organisations, including multinational companies, governments and charities, is high on the public agenda. Last year, in our first report of corporate and social responsibility, we set out our commitment to reflecting ethical, social and environmental concerns in our business decisions. Our second report, updating our activities in 2002, is being published at the same time as this Annual Report and covers the issues that have generated significant interest from stakeholders.

The Corporate and Social Responsibility Report also includes some indicators to show our progress in addressing these issues.

Corporate responsibility is an integral part of our business and inherent in our mission. GlaxoSmithKline makes a significant positive contribution to society around the world, through the medicines, vaccines and healthcare products that we research, develop, manufacture and sell.

Our products must improve people’s lives and ensure a profitable and sustainable future for our business. We also understand that stakeholders, including employees, want to know how we make this profit, and need to be reassured of the sound ethical basis for our business.

Our focus on making a contribution to improving healthcare and alleviating suffering in the developing world has never been greater. Significant progress has been made towards tackling the enormous challenge of HIV/AIDS. By the end of 2002, we had secured some 120 arrangements to supply preferentially-priced HIV/AIDS medicines to 50 of the world’s poorest countries. Shipments of these medicines to the developing world continue to grow significantly year on year. In September 2002, we further reduced the preferential prices of our HIV/AIDS medicines by up to 33 per cent.

Positive Action, our international programme of HIV/AIDS education, care and support has now been established for ten years backing international programmes in 32 countries.

GlaxoSmithKline is a key partner in the global effort to eliminate lymphatic filariasis. This disabling and disfiguring disease currently affects 120 million people and threatens a further one billion in some of the poorest nations of the world. To date, GlaxoSmithKline has donated 145 million tablets as part of our 20-year commitment to eradicate this disease.

The Guardian newspaper’s ‘Giving List’ recently recognised that GlaxoSmithKline’s total global community expenditure in 2001 was greater than that of any other British company. We increased our comprehensive programme of social investment in 2002, investing £239 million in support of global community programmes, product donations and charitable contributions.

Corporate governanceCorporate governance continues to be a high profile issue with the publication of the Higgs Review of the role and effectiveness of Non-Executive Directors and Sir Robert Smith’s Report on audit committees. In the USA, the Sarbanes-Oxley Act became law in July 2002 and will have an impact on GlaxoSmithKline in relation to certification of the Annual Report on Form 20-F, disclosure processes, our relationship with external auditors, internal controls and a number of governance issues. GlaxoSmithKline regularly undertakes thorough reviews of the Group’s internal control systems and is committed to remaining a leader in governance processes and structure.

AcknowledgementsOur business is to discover effective medicines and healthcare products for people throughout the world and, as a result, create shareholder value. We are in a great position to build on the success of the last year, to build the best pipeline in the industry and launch further new products. We extend our thanks to all our employees who are so committed to making this happen.

Bob Ingram, Chief Operating Officer and President, Pharmaceutical Operations, retired at the end of December but will continue to work part-time as Vice Chairman of Pharmaceuticals and special advisor to the Group. We would like to express our appreciation for his contribution to the company and in particular for his significant role in making the merger a success.

On behalf of the Board and the Corporate Executive Team, we also thank you, our shareholders, for your support and hope that you share our enthusiasm for our company and look forward to its continued success in 2003.

The business

History and development of the company

GlaxoSmithKline plc, and its subsidiary and associated undertakings, constitute a major global healthcare group engaged in the creation and discovery, development, manufacture and marketing of pharmaceutical and consumer health-related products.

GlaxoSmithKline has its corporate head office in the London area at:

GlaxoSmithKline also has operational headquarters in Philadelphia, PA and Research Triangle Park, NC, USA, and operations in some 102 countries, with products sold in over 150 countries. The principal research and development (R&D) facilities are in the UK, the USA, Japan, Italy and Belgium. Products are currently manufactured in some 38 countries.

The major markets for the Group’s products are the USA, Japan, France, Germany, the UK and Italy.

GlaxoSmithKline plc is a public limited company incorporated on 6th December 1999 under English law. On 27th December 2000 the company acquired Glaxo Wellcome plc and SmithKline Beecham plc, both English public limited companies, by way of a scheme of arrangement for the merger of the two companies. Both Glaxo Wellcome and SmithKline Beecham were major global healthcare businesses.

On 1st October 2001 Glaxo Wellcome plc changed its name to GlaxoSmithKline Services plc and on 28th March 2002 became GlaxoSmithKline Services Unlimited. Historical references to Glaxo Wellcome plc in this document have not been changed.

Business segmentsGlaxoSmithKline operates principally in two industry segments:

| live longer. | ||

| Our Spirit |

| We undertake our quest with the enthusiasm of entrepreneurs, excited by the constant search for innovation. We value performance achieved with integrity. We will attain success as a world class global leader with each and every one of our people contributing with passion and an unmatched sense of urgency. | ||||

Annual Report and Review

This report is the Annual Report of GlaxoSmithKline plc for the year ended 31st December 2005, prepared in accordance with United Kingdom requirements.

A summary report on the year, the Annual Review 2005, intended for the investor not needing the full detail of the Annual Report, is produced as a separate document.

The Annual Review includes the joint statement by the Chairman and the Chief Executive Officer, a summary review of operations, summary financial statements and a summary remuneration report.

The Annual Review is issued to all shareholders. The Annual Report is issued to shareholders who have elected to receive it. Both documents are available on GlaxoSmithKline’s corporate website at www.gsk.com.

The Description of business discusses the strategy, activities, resources and operating environment of the business and identifies developments and achievements in 2005, under the following headings:

| Strategy and business drivers | ||||

| Business drivers | ||||

| Build the best product pipeline in the industry | ||||

| Achieve commercial and operational excellence | 14 | |||

| Improve access to medicines | 15 | |||

| Be the best place for the best people to do their best work | 16 | |||

| Global manufacturing and supply | 17 | |||

| Corporate responsibility and community investment | 18 | |||

| Products and competition | ||||

| Pharmaceutical | ||||

| Consumer Healthcare | ||||

| Regulatory environment | ||||

| Regulation | ||||

| Intellectual property | ||||

| Responsibility for environment, health and safety | ||||

Discussion of the Group’s management structures and corporate governance procedures is set out in Corporate governance (pages 27 to 36).

The Remuneration Report gives details of the Group’s policies on Directors’ remuneration and the amounts earned by Directors and senior management in 2005 (pages 37 to 54).

Discussion of the Group’s operating and financial performance and financial resources is given in the Operating and financial review and prospects (pages 55 to 80).

In this report:

‘GlaxoSmithKline’, the ‘Group’ or ‘GSK’ means GlaxoSmithKline plc and its subsidiary undertakings.

The ‘company’ means GlaxoSmithKline plc.

‘GlaxoSmithKline share’ means an Ordinary Share of GlaxoSmithKline plc of 25p.

American Depositary Share (ADS) represents two GlaxoSmithKline shares.

Throughout this report, figures quoted for market size, market share and market growth rates relate to the 12 months ended 30th September 2005 (or later where available). These are GSK’s estimates based on the most recent data from independent external sources, valued in sterling at relevant exchange rates. Figures quoted for product market share reflect sales by GSK and licensees.

Brand names appearing in italics throughout this report are trademarks either owned by and/or licensed to GlaxoSmithKline or associated companies, with the exception ofBaycolandLevitra, trademarks of Bayer,Boniva/Bonviva, a trademark of Roche,Entereg, a trademark of Adolor Corporation in the USA,Hepsera, a trademark of Gilead Sciences in some countries including the USA,Integrilin, a trademark of Millennium Pharmaceuticals,Micropump, a trademark of Flamel Technologies,Natrecor, a trademark of Scios and Janssen,Navelbine, a trademark of Pierre Fabre Médicament,Nicoderm, a trademark of Sanofi-Aventis, Elan, Novartis or GlaxoSmithKline in certain countries,Pritor, a trademark of Boehringer Ingelheim andVesicare, a trademark of Yamanouchi Pharmaceuticals, and in Japan and South Korea a trademark of Astellas Pharmaceuticals, all of which are used in certain countries under license by the Group.

05 | ||||

| Description of business |

| Strategy and business drivers |

GlaxoSmithKline is addressing the key challenges that face both the pharmaceutical industry and society as a whole:

| • | improving productivity in research and development |

| • | ensuring patients have access to new medicines |

The strategies to meet these challenges focus on several business drivers:

Build the best product pipeline in the industry

The Group is aiming to create the best product pipeline in the industry for the benefit of patients, consumers and society. This includes developing a focused portfolio strategy to support the pipeline and manage the full life cycle of compounds from their launch as prescription medicines through to becoming over-the-counter products where appropriate. This strategy includes selective in-licensing and efficient execution of development, commercialisation and the supply chain processes.

GSK’s R&D organisation measures productivity by the number and innovation of the products it creates, and also by the commercial value of these products and their ability to address the unmet needs of all consumers. This includes patients, healthcare professionals, budget holders and regulators, each with their own perspective on what constitutes a valuable new product.

Further details are given on pages 7 to 13.

Achieve commercial and operational excellence

GSK links research and commercial operations closely in order to maximise the value of the portfolio. As compounds are developed and tested, marketing campaigns and sales efforts are planned. Where appropriate within markets, the Group aims to build strong relationships with patients and consumers as the ultimate users of its medicines.

Common approaches to management processes and business functions are used by an internationally diverse and talented management team in order to create and sustain competitive advantage in all markets. Further details are given on page 14.

Improve access to medicines

GSK has created extensive programmes designed to improve the healthcare of people who have limited access to medicines both in the developed and developing world. These are set out in the ‘Improve access to medicines’ section of this report (page 15).

Be the best place for the best people to do their best work

The single greatest source of competitive advantage of any organisation is its people. The Group’s ambition is to be the place where great people apply their energy and passion to make a difference in the world. Their skills and intellect are key components in the successful implementation of the Group’s strategy. The work environment supports an informed, empowered and resilient workforce, in which the Group values and draws on the diverse knowledge, perspectives, experience, and styles of the global community. Further details are given on page 16.

Corporate Responsibility

In working to meet these challenges and implement these business drivers, GSK recognises that it has a responsibility to support the delivery of better healthcare and education in under-served communities and to connect business decisions to ethical, social and environmental concerns. GSK’s commitment to these is outlined on pages 18 to 19, with more information available in the Corporate Responsibility Report, which is available on the website at www.gsk.com

| GSK Annual Report 2005 |

| 06 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

Research and Development – Pharmaceuticals

GSK’s strategic intent is to become the indisputable leader in the industry. This success depends on the bedrock of the Group’s business – a vibrant and productive Research and Development (R&D) function that develops new ways to help patients while supporting existing products.

Focus on the Patient

R&D’s focus on the patient involves seeking the views of patients and their families for an understanding of the most important aspects of their disease and the impact it has on their lives. This information, in conjunction with discussions with key opinion leaders, is then used to shape drug development programmes so that new medicines are likely to benefit patients.

Finding candidate compounds

Two components are needed in the early stages of finding new medicines – targets that can be shown to affect mechanisms of important pathological processes in human disease and compounds able to modulate the behaviour of specific targets.

Many diseases arise through complex interactions between gene variants and environmental factors. Within GSK, Genetics Research aims to take advantage of this by identifying genes which influence common diseases with large unmet medical needs and major patient burdens. These insights help in the search for targets with known relevance to the disease, and hence a greater chance of delivering benefit to the patients.

Discovery Research (DR) produces the lead compounds that may influence targets which form the basis of drug discovery efforts in GSK’s Centres of Excellence for Drug Discovery (CEDDs). In 2005, DR performed over 90 million assays and provided the CEDDs with 50 high-quality new lead compounds. Investment in DR has been focused on increasing the quality and quantity of the lead compounds available.

Selecting the best candidate molecules

The fundamental steps in turning a lead compound into a drug candidate are optimising it for potency, efficacy and safety and then demonstrating the validity of the therapeutic hypothesis through early clinical trials of the resulting candidate.

These steps are helped by rapid, informed decision making and creative solutions to the issues that inevitably arise in this phase of development. GSK has designed the CEDDs, which are focused on specific disease areas, to be nimble and entrepreneurial. There are seven CEDDs, based in Europe and the USA:

| • | Biopharmaceuticals – Stevenage, UK |

| • | Cardiovascular & Urogenital Diseases – Upper Merion, USA |

| • | Metabolic & Viral Diseases – Research Triangle Park, USA |

| • | Microbial, Musculoskeletal & Proliferative Diseases, including cancer –Upper Providence, USA |

| • | Neurology & Gastrointestinal Diseases – Harlow, UK |

| • | Psychiatry – Verona, Italy |

| • | Respiratory and Inflammation – Stevenage, UK. |

Each CEDD is responsible for assessing the safety and other development characteristics of lead compounds in preclinical screens, some of which may involve using animals. This allows the selection of the best candidate for a new medicine. Once this is achieved, the CEDDs are responsible for demonstrating that the compound has satisfied a proof of therapeutic concept during mid-stage clinical trials.

A decision is then made on whether the information available justifies the compound’s progression into late-stage drug development, where large-scale clinical trials are conducted to register and commercialise the product.

During 2005 18 compounds entered clinical trials for the first time.

A GSK research facility focusing on new therapies in the treatment of neurodegenerative illnesses, such as Alzheimer’s disease, was opened in Singapore in 2005.

The application of experimental medicine is a major opportunity for the industry. An important tool in this field is clinical imaging, which enables visualisation of changes in the body made in response to the administration of a new medicine. In 2005 world-class imaging experts were recruited from both the USA and UK, as GSK prepared to open the Clinical Imaging Centre at the Hammersmith Hospital in London in 2006. In addition, R&D has established global collaborations with academic imaging centres that make it a leader in application of imaging for drug discovery and development.

Converting candidates to medicines

Preclinical Development (PCD) includes a wide range of activities throughout the entire drug development process. It is also involves the enhancement of existing products by devising more convenient formulations. Early in the development process, the metabolism and safety of compounds are evaluated in laboratory animals before testing in humans. The testing required in animals is highly regulated (see Animals and research, page 10).

PCD researchers investigate appropriate dosage forms (for example, tablets or inhalers) and develop formulations to enhance a drug’s effectiveness and ease of use by the patient. Processes and supporting analytical methods for drug synthesis and product formulation and delivery are scaled up to meet increasing supply requirements. This leads to the technical transfer of the processes and methods to manufacturing. The New Product Supply process, a partnership between R&D and Global Manufacturing and Supply, ensures that a robust product is developed for large-scale commercial manufacturing and launch.

To provide focus for the development process, all the major functional components of clinical, medical, biomedical data, regulatory and safety are integrated into a single management organisation, Worldwide Development (WWD).

GSK’s Medicine Development Centres (MDCs), which provide a focus for late-stage development, are responsible for creating value through the delivery of full product development plans, managing the day-today operational activities for the late-stage development portfolio and ensuring strong partnerships with the CEDDs and Global Commercial Strategy (GCS).

| GSK Annual Report 2005 |

| 07 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

| Continued |

The MDCs are based at the major USA and UK sites and are aligned with the following therapeutic areas:

| • | Cardiovascular/Metabolic |

| • | Infectious Diseases including Diseases of the Developing World (DDW) |

| • | Musculoskeletal/Inflammation/Gastrointestinal/Urology |

| • | Neuroscience (Psychiatry/Neurology) |

| • | Oncology |

| • | Respiratory. |

These teams are responsible for maximising the worldwide development opportunities for each product within their remit so that all the information needed to support the registration, safety programmes, pricing and formulary negotiations is available when needed. Commercial input from Global Commercial Strategy ensures that regional marketing needs are integrated into any development plans at an early stage.

In addition, R&D is investigating new ways of operating to enable it to respond to the variety of external pressures on the industry, such as increasing regulatory stringency, so that it is positioned to ensure that effective new medicines reach patients as soon as possible.

GSK believes that pharmacogenetic research, which correlates genetic data with response to medicine, will help to reduce pipeline attrition and improve productivity. R&D is collecting DNA samples in clinical studies to identify pharmacogenetic information that can help predict a patient’s response. This information is intended to define patient groups likely to gain benefit from treatment, or to suffer a side effect, as the compound progresses through development in the clinic. Ultimately, pharmacogenetics promises to provide physicians with information to help them select the medicine and dose most likely to benefit their patient.

During 2005, R&D has taken several approaches to improving productivity in clinical trials, including an increasing use of countries outside Western Europe and the USA and the introduction of direct electronic data capture in most new clinical trials. These improvements in productivity will continue going forward.

All clinical trials sponsored by GSK, irrespective of where they take place, are conducted according to international standards of good clinical practice and applicable laws and regulations. The protocols are reviewed by the external regulatory agencies in the relevant countries where required and all protocols are considered by an Ethics Review Committee, whose remit covers the site where the study will take place. Safety data is routinely collected throughout development programmes and is reported to national and regional regulatory agencies in line with applicable regulations.

The GSK Global Safety Board is responsible internally for approving pivotal studies and investigating any issues related to patient safety arising during the development programme. During 2005, GSK took a further step in making information from its clinical trials widely and easily available by extending its Clinical Trial Register, a public website on which clinical trials data are published. Regulatory authorities will continue to be informed of the data generated so they may be reassured of the safety and efficacy of GSK’s products. The Clinical Trial Register will enhance the ability of clinicians to make informed clinical judgements to benefit their patients.

Extending the use of existing products

Once a product is launched, it is important to establish additional ways in which patients can be helped. This can be through investigating whether any other illnesses may be treated with the product or by the development of additional, more convenient dosage forms. Some developments reflect feedback from patients and the medical professions, while others are the result of continuing research into disease and its causes.

Examples of the importance of lifecycle management to GSK include the new indication of restless leg syndrome forRequipand monthly dosing ofBonivato simplify its administration for prevention of osteoporosis. Line extensions add significant value to the product portfolio. Recent examples, such asAugmentin ES/XR,Seroxat/Paxil CRandWellbutri n XL, achieved sales of £888 million in 2005.

Productivity

The challenge of increasing R&D productivity continued in 2005. Programmes to identify associations between diseases and genes have helped point to areas of research more likely to produce new ways of helping patients. Increased automation in screening has provided higher quality lead compounds more quickly.

Progress of the portfolio is communicated to investors and the media at regular intervals during the year. A major presentation on the vaccine portfolio was held in June and on the oncology and supportive care portfolio in November 2005. Details of GSK’s product development pipeline are given on pages 11 to 13.

Managing the portfolio

With improved productivity, more compounds are progressed into later phases of development. This progress, however, puts demands on our R&D resources and it is important to look objectively at the portfolio. Key projects reaching significant milestones are reviewed each month by the Product Management Board (PMB), which is responsible for determining if an asset has met criteria for passing into the next phase of development.

GSK continues to identify compounds from other companies that would enhance the portfolio and to create innovative collaborations to ensure that the Group is regarded as the partner of choice for large and small companies.

In 2005 a specific Centre of Excellence for External Drug Discovery was created. This small internal management team is responsible for delivering compounds with clinical proof of concept by establishing and managing long-term strategic collaborations with biotechnology companies, small- and mid-sized pharmaceutical companies, and academic institutions. The Group has committed funding for two years to these collaborations, with an option to renew for an additional three years.

In-licensing

In-licensing or co-marketing/co-promotion agreements concluded in 2005 were:

| • | The development and commercialisation of Vertex Pharmaceuticals Inc.’s VX-409, Nav1.8 Na-channel blocker plus back-up molecules for pain (preclinical) |

| • | The development and promotion of Allergan Inc.’s Botox in Japan and China |

| • | The development and commercialisation of a renin inhibitor program (preclinical) with Vitae Pharmaceuticals Inc. |

| GSK Annual Report 2005 |

| 08 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

| Continued |

| • | The exercise of an option for Theravance Inc.’s inhaled muscarinic antagonist / beta 2 agonist programme (preclinical) |

| • | The exercise of options for Human Genome Science Inc.’s LymphoStat B (completed Phase IIa) for rheumatoid arthritis and systematic lupus erythematosus and mapatumumab TRAIL R1 monoclonal antibody for various cancer indications (Phase II). |

Discontinuations

All R&D carries a risk of failure. Lead compounds showing positive activity against a validated target may prove insufficiently safe to introduce to humans or impossible to manufacture on a commercial scale. Also, compounds may not show the expected benefits in patients in large scale clinical testing. These discontinuations occur despite extensive predictive testing.

Late-stage projects terminated during 2005 in Phase III included aplaviroc (873140) and 695634, both for HIV,Avandiafor psoriasis andLamictal XRfor schizophrenia.

Research and development – GSK vaccines

The majority of GSK’s vaccine R&D activities are conducted at its biologicals headquarters in Rixensart, Belgium. These include clinical development, regulatory strategy, commercial strategy, scaling up, vaccine production, packaging and all other support functions. Over 1,500 scientists are devoted to developing new vaccines and more cost-effective and convenient combination vaccines to prevent infections that cause serious medical problems worldwide. GSK is also targeting therapeutic vaccines that may prevent relapse in cancer patients.

Vaccine discovery involves many collaborations with academia and the biotech industry worldwide and allows identification of new vaccine antigens which are then expressed in yeast, bacteria or mammalian cells and purified to a very high level.

This is followed by formulation of the clinical lots of the vaccine. This may involve mixing antigens with selected novel proprietary adjuvants, which are designed to stimulate a good immune response. The first step is to evaluate the safety and efficacy of the candidate vaccine in a preclinical setting, usually involving an animal model. The candidate vaccine is then tested in clinical trials in healthy individuals to evaluate safety and effectiveness in inducing an immune response to protect the body from infection encountered later in a natural setting (Phase I/II). Large-scale field trials in healthy individuals follow to establish safety and efficacy in a cross section of the population (Phase III).

The results obtained during clinical trials and data regarding the development of a quality and large-scale production process and facilities are then combined into a regulatory file which is submitted to the authorities in the various countries where the vaccine is to be made available.

After launch, post marketing studies of considerable size are set up to assess vaccination programmes’ impact and to monitor vaccine safety (Phase IV).

Vaccine manufacturing is particularly complex as it requires the use of living micro-organisms. Sophisticated quality assurance and quality control procedures are in place to ensure both quality and safety of the vaccines and this commonly includes animal use. Due to their biological nature, health authorities may subject vaccines to a second control to guarantee the highest quality standards.

In 2005, GSK made a number of investments that strengthen its vaccine capabilities:

| • | a significant increase in flu vaccine manufacturing and development capacity by: | |

| – | acquiring ID Biomedical, a North American developer of vaccines for infectious diseases and producer of influenza vaccines with sites in Canada and the USA, for £874 million | |

| – | investing over £64 million in extending its German vaccine facility | |

| – | purchasing a vaccine R&D and manufacturing site in the USA | |

| • | acquiring US based Corixa Corporation, a developer of innovative vaccine adjuvants, for approximately £150 million | |

| • | entering into three groundbreaking public-private partnerships to develop vaccines against the three biggest killers in the developing world, AIDS, malaria and tuberculosis. | |

| GSK expects to launch five major new vaccines within the next five years: | ||

| • | a human papilloma virus vaccine preventing cervical cancer | |

| • | the USA and EU launch of a vaccine against rotavirus induced gastroenteritis and the strengthening of its presence in international markets | |

| • | a vaccine against pneumococcal disease | |

| • | an improved vaccine for influenza | |

| • | vaccine combinations against meningitis. | |

The strength of GSK’s vaccine pipeline is expected to provide opportunities for GSK to deliver new vaccines for many years to come.

Research and development – Consumer Healthcare

R&D has aligned itself closely with the new Consumer Healthcare operating model and structure. For the Global brands, it now mirrors the commercial structure with R&D teams paired with commercial teams and located in the principal centres for Consumer Healthcare R&D at Weybridge in the UK and in Parsippany in the USA; with this co-location, these sites are now termed Innovation Centres. The focus of R&D is on the identification and rapid development of novel products that bring benefits to consumers in the over-the-counter (OTC), oral care and nutritional healthcare markets.

Diseases of the developing world

Continued investment in research into diseases that disproportionately affect the developing world is essential if there is to be a long-term improvement in the health of people who live in these regions. As part of GSK’s response to this challenge, it operates a drug discovery unit, dedicated to finding new medicines for these diseases, based at Tres Cantos, Spain. The work undertaken in Tres Cantos focuses on malaria and tuberculosis which, together with work elsewhere in the Group on HIV/AIDS and vaccines, means GSK is addressing the prevention and treatment of all three of the World Health Organization’s (WHO) top priority diseases.

| GSK Annual Report 2005 |

| 09 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

| Continued |

GSK currently has 14 clinical programmes of relevance to the developing world, eight of which are aimed at producing vaccines and medicines for diseases that disproportionately affect developing countries.

Public/private partnerships (PPP) remain essential to fund research where there is no commercially viable market for a potential product. GSK is a leader in working with PPP and continues to collaborate closely with many governments, academic centres, United Nations’ agencies and other global funding bodies in this area, to maximise expertise and knowledge. This has the dual benefit of encouraging research and development and accelerating access to the medicines in the developing world. For example, in 2005, GSK announced partnerships with the Global Alliance for TB Drug Development, the Aeras Global TB Vaccine Foundation and the International AIDS Vaccine Initiative. GSK’s malaria ‘falcipain inhibitors’ project was chosen for the Medicines for Malaria Venture ‘project of the year’ award.

Animals and research

For ethical, regulatory and scientific reasons, research using animals remains a small but vital part of research and development of new medicines and vaccines. GSK only uses animals where there is no alternative and only in the numbers required for each test. The Group strives to exceed regulatory standards in the care and use of the animals it uses and undergoes internal and external review to assure these standards.

The vast majority of the experimental methods do not use animals. GSK is actively engaged in research to develop and validate more tests that either avoid the use of animals in research or reduce the numbers needed. When animals are used in research unnecessary pain or suffering is scrupulously avoided.

GSK understands that use of animals for research purposes commands a high level of public interest. The GlaxoSmithKline Public Policy Position ‘The care and ethical use of animals in research’, and further information and reports, are available on the website, www.gsk.com, or from Secretariat.

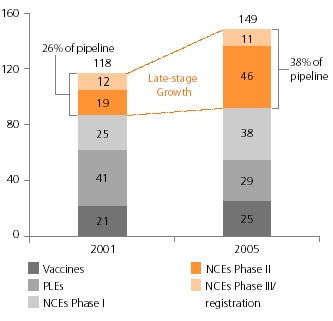

GSK’s pipeline

The chart on the right shows new chemical entities (NCE) and product line extensions (PLE) for projects in the clinic in 2001 and 2005. At the end of February 2006, GSK had nearly 200 pharmaceutical and vaccine projects in development. Of these, 149 are in the clinic comprising 95 NCEs, 29 PLEs and 25 vaccines, compared with 118 in 2001. Since 2001 the number of projects in the late stages of development has increased from 31 to 57.

This maturity in the late stage pipeline is expected to lead to an increase in registrations in the coming years. The content of the drug development portfolio will change over time as new compounds progress from discovery to development and from development to the market. Owing to the nature of the drug development process, many of these compounds, especially those in early stages of investigation, may be terminated as they progress through development. Phase I NCEs with multiple indications are counted only once. NCEs in later phases are counted by each indication. For competitive reasons, new projects in pre-clinical development have not been disclosed and some project types may not have been identified.

GSK’s submissions to the regulatory authorities in the USA and EU for the first time and approvals during 2005 were:

| USA | Europe | |||

| Submission | 5 | 7 | ||

| Approval | 6 | 6 | ||

| 11 | 13 | |||

In 2006, the late-stage pipeline is expected to expand further with eight major assets anticipated to enter phase III development. Also, in 2006, GSK anticipates seven products will be approved and/or launched and seven product filings are planned. For further details of these developments expected in 2006 see the GSK outlook on page 71.

GSK’s policy is to obtain patent protection on all significant products discovered or developed through its R&D activities. Patent protection for new active ingredients is available in all significant markets. Protection can also be obtained for new pharmaceutical formulations and manufacturing processes, and for new medical uses and special devices for administering products.

| Key | |

| (v) | Vaccine |

| (p) | Pharmaccine |

| * | Compounds in Shionogi-GlaxoSmithKline Pharmaceuticals LLC joint |

| venture | |

| † | In-license or other alliance relationship with third party |

| S | Date of first submission |

| A | Date of first regulatory approval (for MAA, this is the first EU |

| approval letter) | |

| AL | Approvable letter indicates that ultimately approval can be given |

| subject to resolution of deficiencies | |

| MAA | Marketing authorisation application (Europe) |

| NDA | New drug application (USA) |

| Phase I | Evaluation of clinical pharmacology, usually conducted in volunteers |

| Phase II | Determination of dose and initial evaluation of efficacy, conducted in a small number of patients |

| Phase III | Large comparative study (compound versus placebo and/or established treatment) in patients to establish clinical benefit and safety |

| GSK Annual Report 2005 |

| 10 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

| continued |

| Estimated filing dates | ||||||||||

| Compound/Product | Type | Indication | Phase | MAA | NDA | |||||

| Cardiovascular & Metabolic | ||||||||||

| 256073 | high affinity nicotinic acid receptor (HM74A) agonist | dyslipidaemia | I | |||||||

| 681323 | p38 kinase inhibitor | atherosclerosis (also rheumatoid arthritis & chronicobstructive pulmonary disease, COPD) | I | |||||||

| 813893 | factor Xa inhibitor | prevention of stroke in atrial fibrillation | I | |||||||

| 856553 | p38 kinase inhibitor | atherosclerosis (also rheumatoid arthritis & COPD) | I | |||||||

| rilapladib† | lipoprotein-associated phospholipase A2 (Lp-PLA2) inhibitor | atherosclerosis | I | |||||||

| 501516† | peroxisome proliferator-activator receptor(PPAR) delta agonist | dyslipidaemia | II | |||||||

| 590735 | PPAR alpha agonist | dyslipidaemia | II | |||||||

| odiparcil† | indirect thrombin inhibitor | prevention of thrombotic complications of cardiovascular disease | II | |||||||

| darapladib† | Lp-PLA2 inhibitor | atherosclerosis | ll/III | |||||||

| Arixtra | synthetic factor Xa inhibitor | treatment of acute coronary syndrome | III | 2006 | 2006 | |||||

| Coreg CR† | beta blocker | hypertension & congestive heart failure – once-daily | Submitted | N/A | S:Dec05 | |||||

| Metabolic projects | ||||||||||

| 625019 | PPAR pan agonist | type 2 diabetes | I | |||||||

| 716155† | glucagon-like peptide 1 agonist | type 2 diabetes | I | |||||||

| 856464 | melanin concentrating hormone antagonist | obesity | I | |||||||

| radafaxine | noradrenaline/dopamine re-uptake inhibitor | obesity (also fibromyalgia, neuropathic pain & depression) | I | |||||||

| 189075† | sodium dependent glucose transport (SGLT2) inhibitor | type 2 diabetes | II | |||||||

| 677954 | PPAR pan agonist | type 2 diabetes | II | |||||||

| 869682† | SGLT2 inhibitor | obesity | II | |||||||

| denagliptin | dipeptidyl peptidase lV (DPP IV) inhibitor | type 2 diabetes | II | |||||||

| solabegron | beta3 adrenergic agonist | type 2 diabetes (also overactive bladder) | II | |||||||

| Avandamet XR | PPAR gamma agonist + metformin | type 2 diabetes – extended release | III | 2007 | ||||||

| Avandia+ simvastatin | PPAR gamma agonist + statin | type 2 diabetes | III | 2007 | ||||||

| Avandaryl† | PPAR gamma agonist + sulphonylurea | type 2 diabetes – fixed dose combination | Approved | S:May05 | A:Dec05 | |||||

| Infectious Diseases | ||||||||||

| 565154 | oral pleuromutilin | treatment of bacterial infections | I | |||||||

| 742510 | oral pleuromutilin | treatment of bacterial infections | I | |||||||

| 270773† | phospholipid anti-endotoxin emulsion | sepsis | II | |||||||

| farglitazar | PPAR gamma agonist | hepatic fibrosis | II | |||||||

| sitamaquine | 8-aminoquinoline | treatment of visceral leishmaniasis | II | N/A | ||||||

| chlorproguanil, dapsone + | antifolate + artemisinin | treatment of uncomplicated malaria | IIl | 2007 | N/A | |||||

| artesunate (CDA)† | ||||||||||

| Etaquine† | 8-aminoquinoline | malaria | III | |||||||

| Altabax(retapamulin) | topical pleuromutilin | bacterial skin infections | Submitted | 2006 | S:Nov05 | |||||

| Antivirals | ||||||||||

| 825780† | DNA antiviral vaccine | HIV infection | I | |||||||

| brecanavir† | aspartyl protease inhibitor | HIV infection | II | |||||||

| Relenza† | neuraminidase inhibitor | influenza prophylaxis | Submitted | S:Nov05 | S:Nov05 | |||||

| Musculoskeletal, Inflammation, Gastrointestinal & Urology | ||||||||||

| 221149 | oxytocin antagonist | threatened pre-term labour | I | |||||||

| 232802 | 3G-selective oestrogen receptor modulator | treatment of menopausal symptoms | I | |||||||

| 267268 | vitronectin integrin antagonist | age-related macular degeneration | I | |||||||

| 366074† | potassium channel opener | overactive bladder | I | |||||||

| relacatib† | cathepsin K inhibitor | osteoporosis & osteoarthritis (also bone metastases) | I | |||||||

| 751689† | calcium antagonist | osteoporosis | I | |||||||

| 768974† | parathyroid hormone agonist | osteoporosis | I | |||||||

| 786034 | tyrosine kinase inhibitor | psoriasis | I | |||||||

| 842470† | PDE IV inhibitor (topical) | atopic dermatitis | I | |||||||

| 876008† | corticotrophin releasing factor (CRF1) antagonist | irritable bowel syndrome (also depression & anxiety) | I | |||||||

| dutasteride + testosterone | 5-alpha reductase inhibitor + testosterone | hypogonadism – fixed dose combination | I | |||||||

| solabegron | beta3 adrenergic agonist | overactive bladder (also type 2 diabetes) | I | |||||||

| 270384 | endothelial cell adhesion molecule inhibitor | inflammatory bowel disease | II | |||||||

| 274150 | selective iNOS inhibitor | rheumatoid arthritis (also migraine) | II | |||||||

| 681323 | p38 kinase inhibitor | rheumatoid arthritis (also atherosclerosis & COPD) | II | |||||||

| 683699† | dual alpha4 integrin antagonist (VLA4) | inflammatory bowel disease (also multiple sclerosis) | II | |||||||

| 856553 | p38 kinase inhibitor (oral) | rheumatoid arthritis (also atherosclerosis & COPD) | II | |||||||

| casopitant | NK1 antagonist | overactive bladder (also depression & anxiety, chemotherapy induced & postoperative nausea & vomiting) | II | |||||||

| mepolizumab | anti-IL5 monoclonal antibody | eosinophilic esophagitis (also asthma & nasal polyposis) | II | |||||||

| rosiglitazone XR | PPAR gamma agonist | rheumatoid arthritis (also Alzheimer’s disease) | II | |||||||

| Avodart+ alpha blocker | 5-alpha reductase inhibitor + alpha blocker | benign prostatic hyperplasia – fixed dose combination | III | 2007 | 2007 | |||||

| Avodart | 5-alpha reductase inhibitor | reduction in the risk of prostate cancer | III | |||||||

| Entereg/Entrareg† | peripheral mu-opioid antagonist | opioid induced GI symptoms | III | 2007 | 2007 | |||||

| mepolizumab | anti-IL5 monoclonal antibody | hypereosinophilic syndrome (also asthma & nasal polyposis) | III | 2006 | 2006 | |||||

| Entereg/Entrareg† | peripheral mu-opioid antagonist | post operative ileus | Approvable | 2007 | AL:Jul05 | |||||

| Boniva/Bonviva† | bisphosphonate | treatment of postmenopausal osteoporosis | Approved | S:Apr05 | A:Jan06 | |||||

| – i.v. injection | ||||||||||

| GSK Annual Report 2005 |

| 11 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

| continued |

| Estimated filing dates | ||||||||||

| Compound/Product | Type | Indication | Phase | MAA | NDA | |||||

| Neurosciences | ||||||||||

| 163090 | presynaptic mixed 5HT1 antagonist | depression & anxiety | I | |||||||

| 189254 | histamine H3 antagonist | dementia | I | |||||||

| 234551† | endothelin A antagonist | stroke | I | |||||||

| 406725 | gap junction blocker | migraine, epilepsy & neuropathic pain | I | |||||||

| 644784 | dual-acting COX-2 inhibitor | acute & chronic pain conditions (including neuropathic pain) & schizophrenia | I | |||||||

| 737004† | endothelin A antagonist | stroke | I | |||||||

| 823296 | NK1 antagonist | depression & anxiety | I | |||||||

| 842166 | non-cannabinoid CB2 agonist | inflammatory pain | I | |||||||

| 876008† | CRF1 antagonist | depression & anxiety (also irritable bowel syndrome) | I | |||||||

| radafaxine | noradrenaline/dopamine re-uptake inhibitor | fibromyalgia & neuropathic pain (also obesity) | I | |||||||

| 274150 | selective iNOS inhibitor | migraine (also rheumatoid arthritis) | II | |||||||

| 372475† | triple (5HT/noradrenaline/dopamine) re-uptake inhibitor | depression and attention deficit hyperactivity disorder | II | |||||||

| 468816 | glycine antagonist | smoking cessation | II | |||||||

| 683699† | dual alpha4 integrin antagonist (VLA4) | multiple sclerosis (also inflammatory bowel disease) | II | |||||||

| 705498 | transient receptor potential vanilloid-1 (TRPV1) antagonist | acute migraine | II | |||||||

| 742457 | 5HT6 antagonist | dementia | II | |||||||

| 773812 | mixed 5HT/dopaminergic antagonist | schizophrenia | II | |||||||

| casopitant | NK1 antagonist | depression & anxiety (also overactive bladder, chemotherapy induced & postoperative nausea & vomiting) | II | |||||||

| radafaxine | noradrenaline/dopamine re-uptake inhibitor | depression (also obesity) | II | |||||||

| rosiglitazone XR | PPAR gamma agonist | Alzheimer's disease (also rheumatoid arthritis) | II | |||||||

| talnetant | NK3 antagonist | schizophrenia | II | |||||||

| vestipitant + paroxetine | NK1 antagonist + selective serotonin re-uptake inhibitor | depression & anxiety | II | |||||||

| 406381 | dual-acting COX-2 inhibitor | acute & chronic pain | III | |||||||

| Lamictal | sodium channel inhibitor | bipolar disorder – acute treatment | III | N/A | 2006 | |||||

| Lamictal XR | sodium channel inhibitor | epilepsy – once-daily | III | 2006 | ||||||

| Requipextended release | non-ergot dopamine agonist | restless legs syndrome | III | 2006 | ||||||

| Requip Modutab/XL | non-ergot dopamine agonist | Parkinson’s disease – once-daily controlled release | Submitted | S:Dec05 | 2006 | |||||

| 24 hour† | formulation | |||||||||

| Trexima† | 5HT1 agonist + naproxen | migraine – fixed dose combination | Submitted | N/A | S:Aug05 | |||||

| Wellbutrin XL† | noradrenaline/dopamine re-uptake inhibitor | seasonal affective disorder | Submitted | S:Dec04 | ||||||

| Wellbutrin XL† | noradrenaline/dopamine re-uptake inhibitor | depression | Approved | 2006 | A:Aug03 | |||||

| Oncology | ||||||||||

| 559448† | thrombopoietin agonist | thrombocytopaenia | I | |||||||

| 743921† | kinesin spindle protein (KSP) inhibitor | cancer | I | |||||||

| elacridar | oral bioenhancer | cancer | I | |||||||

| relacatib† | cathepsin K inhibitor | bone metastases (also osteoporosis & osteoarthritis) | I | |||||||

| casopitant | NK1 antagonist | postoperative nausea & vomiting (also overactive bladder, depression & anxiety) | II | 2007 | 2007 | |||||

| casopitant | NK1 antagonist | chemotherapy induced nausea & vomiting (also overactive bladder, depression & anxiety) | II | |||||||

| ethynylcytidine† | selective RNA polymerase inhibitor | solid tumours | II | |||||||

| iboctadekin† | recombinant human IL18 immunomodulator | immunologically-sensitive cancers (melanoma & renal cell) | II | |||||||

| ispinesib† | KSP inhibitor | non-small cell lung cancer & other tumours | II | |||||||

| pazopanib | vascular endothelial growth factor (VEGF) tyrosine kinase inhibitor | solid tumours | II | |||||||

| vestipitant | NK1 antagonist | postoperative nausea & vomiting | II | |||||||

| eltrombopag† | thrombopoietin agonist | thrombocytopaenia | III | 2006/07 | 2006/07 | |||||

| Hycamtin | topo-isomerase I inhibitor | ovarian cancer first-line therapy | III | 2007 | 2007 | |||||

| Hycamtin | topo-isomerase I inhibitor | small cell lung cancer second-line therapy – oral formulation | III | 2007 | 2007 | |||||

| Tykerb/Tycerb | ErbB-2 and epidermal growth factor receptor (EGFR) dual kinase inhibitor | breast cancer (also renal, head & neck cancers) | III | 2006/07 | 2006/07 | |||||

| Hycamtin | topo-isomerase I inhibitor | cervical cancer second-line therapy | Submitted | 2006 | S:Dec05 | |||||

| Arranon | guanine arabinoside prodrug | acute lymphoblastic leukaemia & lymphomas | Approved | 2006 | A:Oct05 | |||||

| Hycamtin | topo-isomerase I inhibitor | small cell lung cancer second-line therapy | Approved | A:Jan06 | A:Nov98 | |||||

| GSK Annual Report 2005 |

| 12 |

| REPORT OF THE DIRECTORS |

| Description of business |

| Build the best product pipeline in the industry |

| continued |

| Estimated filing dates | ||||||||||

| Compound/Product | Type | Indication | Phase | MAA | NDA | |||||

| Respiratory | ||||||||||

| 256066 | PDE IV inhibitor (inhaled) | asthma, COPD & allergic rhinitis | I | |||||||

| 656398† | muscarinic acetylcholine antagonist | COPD | I | |||||||

| 856553 | p38 kinase inhibitor (oral) | COPD (also atherosclerosis & rheumatoid arthritis) | I | |||||||

| 870086 | novel glucocorticoid agonist | asthma | I | |||||||

| 961081† | muscarinic antagonist, beta2 agonist | COPD | I | |||||||

| 159797† | long-acting beta2 agonist | COPD, also COPD & asthma in combination with a glucocorticoid agonist | II | |||||||