SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 |

| Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended | |

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from ________ to ________. |

Commission file number 0-16945

SIGNET GROUP plc

(Exact name of Registrant as specified in its charter)

ENGLAND

(Jurisdiction of incorporation or organization)

Zenith House

The Hyde

London NW9 6EW

England

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

None

None

Securities registered or to be registered pursuant to Section 12(g) of the Act:

American Depositary Shares

Ordinary Shares of 0.5 pence each

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| Ordinary Shares of 0.5 pence each | ||

| Class A Dollar Deferred Shares of $0.01 each | 0 | |

| Class B Dollar Deferred Shares of $1.00 each | 0 |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ![]() No

No ![]()

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ![]() Item 18

Item 18

EXPLANATORY NOTE |

| 2002/03 Group highlights | ||||||

| Sales | up | 1.9% | (1) | to | £1,608.0m | |

| Operating profit | up | 7.7% | (1) | to | £216.2m | |

| Profit before tax | up | 9.2% | (1) | to | £199.7m | |

| Earnings per share(2) | up | 5.6% | (1) | to | 7.5p | |

| Dividend per share | up | 17.9% | to | 2.11p | ||

| Return on capital employed(2) | up from | 23.3% | to | 23.8% | ||

| Gearing | down from | 29.7% | to | 20.1% | ||

| 2003/04 | ||||||

| Group highlights | ||||||

| reported | at constant | |||||

| basis | exchange rates | |||||

| • | Sales: £1,617.2m | up 0.6% | up 7.3% | |||

| • | Operating profit: £222.3m | up 3.9%(2) | up 11.2% | |||

| • | Profit before | up 6.0%(2) | up 13.0% | |||

| • | Earnings per share | up 6.7%(2) | up 12.7% | |||

| • | Dividend per share: 2.501p | up 18.5% | ||||

| • | Return on capital employed(3) up from 24.1%(2) to 24.8% | |||||

| • | Gearing(3) down from 20.7%(2) to 11.0% | |||||

| ||||||

| (1) | See page 25 for reconciliation to Generally Accepted Accounting Principles figures. | |

| (2) | 1999/00 to 2002/03 restated for the implementation of FRS 17 – ‘Retirement Benefits’. | |

| (3) | Earnings per share, | |

| (4) | 53 week year. | |

Annual Report & Accounts |

Signet Group plc is an English public limited company, whose shares are listed on the London Stock Exchange (under the symbol “SIG”) and whose American Depositary Shares are quoted on the Nasdaq National Market (under the symbol “SIGY”).

This document comprises the Annual Report & Accounts of the Group in accordance with United Kingdom requirements and the Annual Report on Form 20-F to be filed with the United States Securities and Exchange Commission.requirements.

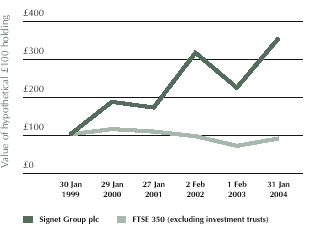

In this Annual Report, “1998/99”, “1999/00”, “2000/01”, “2001/02”, “2002/03”, “2003/04” and “2003/04”“2004/05”, refer to, as appropriate, the 52 weeks ended 30 January 1999, 29 January 2000, the 52 weeks ended 27 January 2001, the 53 weeks ended 2 February 2002, the 52 weeks ended 1 February 2003, the 52 weeks ended 31 January 2004 and the 52 weeks ending 3129 January 2004.2005.

This Annual Report contains translations of certain pound sterling amounts into US dollars at a rate of $1.64$1.82 = £1.00,£1, which was the noon buying rate in New York City for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on 3130 January 2003.These2004. These translations should not be construed as representations that the pound sterling amounts actually represent such US dollar amounts or could be converted into US dollars at the rate indicated. On 2624 March 20032004 the Noon Buying Rate was $1.57$1.84 = £1.00.£1.

Cautionary statement regarding forward-looking statements

The Company desires to take advantage of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 with respect to the forward-looking statements about its financial performance and objectives in this Annual Report. Readers are referred to “Risk and other factors” on pages 2829 to 32.33.

Contents

Signet Group plc 1

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 1 |

Chairman’s statement

Results

Group results

In the 52 weeksyear to 1 February 200331 January 2004 the Group built furthercontinued to build on theits well established growth trend of the last eight years.

Profitrecord. On a reported basis profit before tax rose to £199.7£211.9 million compared to £182.8(2002/03: £199.9 million in the 53 week period last year. This represented a 16.2%restated for FRS 17 – ‘Retirement Benefits’) reflecting an underlying increase on a comparable 52 week basisof 13.0% at constant exchange rates. Earnings per share rosewere 8.0p (2002/03: 7.5p restated), up 6.7% on a reported basis and 12.7% at constant exchange rates. Like for like sales advanced by 4.9% with total sales at £1,617.2 million (2002/03: £1,608.0 million), up 7.3% at constant exchange rates.

The strong underlying performance of the Group and the proven success of its strategies should not be obscured by the effect of the significant weakening in the average US dollar exchange rate from 7.1p$1.53/£1 to 7.5p,$1.68/£1. This adversely impacted the tax rate having increasedtranslation of the US division’s sales and operating profit into pounds sterling, thereby depressing Group results as anticipated from 34.5% to 35.5%. Likereported.

In 2003/04 the US started well with a strong performance during the Valentine’s Day period. However trading during the rest of the first half was adversely affected by the Iraq War. The second half year saw a marked improvement in the retail environment culminating in a particularly strong outcome in the fourth quarter, when like for like sales rose by 5.3%7.2%. The division again outperformed the speciality jewellery sector and totalgained further market share.

The UK business similarly had a good start to the year but was also affected by the geo-political situation in the first half. The division consistently outperformed the general retail sector and enjoyed an excellent Christmas season when like for like sales grewincreased by 6.7%. Ernest Jones continued to £1,608.0outperform with like for like sales for the year up 8.4%.

The Group invested £109.8 million (2001/02 53 weeks: £1,578.1in fixed and working capital during the year. The cash inflow was £42.7 million (2002/03: £33.7 million), a 7.9% increase on a comparable 52 week basis at constant exchange rates.

Net and net debt was reducedfell to £140.1£79.9 million at the year end (2(1 February 2002: £201.72003: £140.1 million), £27.9. £17.5 million of the improvement beingwas accounted for by exchange rate movement.translation. Gearing fell(net debt to 20.1% (2shareholders’ funds) at 31 January 2004 was 11.0% (1 February 2002: 29.7%)2003: 20.7% restated). Interest cover (operating profit divided by net interest cost) was a very comfortable 13.1 times.

Overall these were strong results given comparison with a 53 week period, a weaker US dollar and a softening in the trading environment on both sides of the Atlantic in the last quarter.Dividend

The US business did extremely well in a challenging retail market. The division continued to implement its proven strategy and again outperformed the speciality jewellery sector.

The UK division also had a very encouraging outcome. Like for like sales growth again exceeded that of the general retail market, with Ernest Jones achieving a particularly good result.

PeopleI would again like to thank all management and staff on both sides of the Atlantic for their hard work and professionalism which has contributed to the further progress of the Group during the year.

I am pleased to welcome Russell Walls to the Board. He joined the Group as a non-executive director in August 2002 and will chair the Audit Committee from 1 April 2003.

Ian Dahl resigned from the Board and from his position as Chief Executive of the UK jewellery division with effect from 30 September 2002. The Board thanks him for his contribution to the Group during his period of office.

Richard Miller, Chief Financial Officer of the US division, who has been with the Group for 21 years and has been an alternate director since 1994, will be retiring in April 2003. The Board expresses its appreciation for his contribution to the Group.

Dividend

The Board is pleased to recommend a 20%20.0% increase in the final dividend to 1.80p2.16p per share (2001/02: 1.50p)(2002/03: 1.80p), the total for the year being 2.110p2.501p per share (2001/02: 1.789p)(2002/03: 2.11p). See note 8 regarding dividends to US holders of ordinary shares and ADSs. The full year dividend cover wasis 3.2 times (2002/03: 3.6 times (2001/02: 3.9 times).

Future dividend policy will continue to take into account of earnings, cash flow, gearing and the needs of the business.

People

I would like to thank management and staff for their invaluable contribution to the Group’s success during the past year.

Dale Hilpert joined the Group as a non-executive director in September 2003 and was appointed to the Audit Committee in January 2004. He has wide experience of US retailing and I am sure will make a significant contribution.

Lee Abraham, who joined the Group in 1994 as a non-executive director, retired in January 2004. On behalf of the Board I thank him for his invaluable contribution during his tenure of office and wish him a long and happy retirement.

Current tradingOverall the

The Group has had a generally satisfactoryvery encouraging start to the year. Bothcurrent year, including a particularly strong performance over the Valentine’s Day period. However account must be taken of soft sales comparatives in the early part of last year and the present weakness of the US and the UK businesses had strong Valentine’s Day performances. Subsequent trading has been affected by inclement weather in the US, the timing of Easter and the geopolitical situation.dollar.

James McAdam, Chairman,Chairman2624 March 20032004

2 Signet Group plc

| 2 | Signet Group plc Annual Report & Accounts year ended 31 January 2004 |

Group Chief Executive’s review

IntroductionGroup like for like sales increased by 5.3%, with both the US and UK businesses exceeding the performance of the general retail sector in their respective markets.

Group operating profit rose to £216.2£222.3 million from £200.7£213.9 million (restated), an increase of 7.7% (14.8% on a comparable 52 week basis11.2% at constant exchange rates).Therates (3.9% on a reported basis). The operating margin increased to 13.4% (2001/02: 12.7%)13.7% (2002/03: 13.3% restated), and the return on capital employed (“ROCE”) increased to 23.8% (2001/02: 23.3%)was 24.8% (2002/03: 24.1% restated). The year saw a further strengthening of the balance sheet after investment in fixed and working capital of £121.3 million.

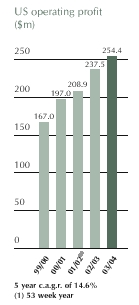

The US business continued to build on its competitive strengths in a fluctuating and uncertain trading environment. Operating profit rose from £145.1 million to £155.2 million, an increase of 7.0% (15.6% increase on a 52 week basis atAt constant exchange rates). Consolidation within the US speciality jewellery sector continues andrates the US division’s share ofoperating profit rose 7.1% but, on a reported basis, the speciality market is estimatedweaker US dollar resulted in a 2.4% decline to have risen over£151.4 million (2002/03: £155.2 million). The compound annual growth in reported operating profit during the last five years has been 14.3%. The continued introduction of well tested initiatives in all areas has enabled the business to circa 6.7% from circa 4.7%build further on its competitive strengths.

In 2003/04 like for like sales rose by 4.6% and total dollar sales by 8.0%. LikeOver the last five years like for like sales have risenincreased at a compound annual growth rate of 6.6%5.5% and total dollar sales by 12.1%. Underpinning this has been the strong performance by both mall stores and Jared, the Group’s off-mall destination concept which now accounts for over 15% of the same period. During last year 6% was addedUS division’s sales. Jared is still relatively immature and should make an increasing contribution to sellingthe like for like sales growth in the future.

Selling space with the increasehas increased over the last five years by some 66% (including the acquisition of 137 Marks & Morgan stores in 2000/01), with just over half accounted for by Jared. In 2003/04 space rose by 7%. This year growth is expected to be some 8%, the majority again being some 64%. A core objective of the US businessattributed to Jared. The longer term target is for space to increase selling space by 6% – 8% per annum the majorityand this would result in an approximate doubling of this being related to expansionUS space over a ten year period.

The US division’s market share of the speciality jewellery sector has increased to some 7.0% (2002/03: circa 6.9%) and there are further opportunities for growth. Supply chain efficiencies continue to be identified enabling the division to offer consumers better value than that provided by our main competitors. Training and motivation of staff remain central to achieving superior customer service and therefore resources devoted to staff development continue to be increased. Kay national television advertising continues to be increased and within two years Jared concept. Inis expected to have sufficient scale to use this medium. Increasing like for like sales and additional space will provide the longer term the potential is for over 200 Jared stores generating sales of over $1 billion. Space growth and improved store productivity should contribute furtheropportunity to leveraging ofleverage both central overhead costs and marketing expenditure. Continued enhancement of customer service is another key aim. It is planned to achieve this throughexpenditure, benefiting results as well as reinforcing the implementation of leading edge operating systems and procedures, which should result in staff spending less time on administrative functions. New merchandising initiatives, including branding programmes, continue to be identified, tested and developed. A continued shift to broadcast advertising is increasing brand name awareness and driving footfall.division’s competitive position.

The UK business took a further significant step forwardachieved an increase of 18.4% in its strategy to increase store productivityoperating profit and make existing space work harder. Operating profit rose by 10.4% (13.2% on a comparable 52 week basis). Like5.5% in like for like sales in the year increased by 5.2%, the compound annual growth rate oversales. Over the last five years being 5.3%. Average

compound annual growth in operating profit was 19.9% and 6.7% in like for like sales.

The UK strategy of driving sales per store duringby increasing the same period increased from £589,000average transaction value, predominantly through greater diamond participation continues to £747,000. The drive to gain market share in diamonds, which is a core objectiveprove successful. Diamond jewellery now accounts for 26% of the division’s sales mix compared with 18% in 1998/99. During that period diamond sales grew 50% faster than the UK diamond market. Further major initiatives to support this strategy are at an early stage of implementation. When developing such initiatives the UK business benefits from its ability to draw on the US division’s best practices particularly in the selling of diamonds. For example the new store format, which is based on US experience, enables greater interaction between the salesperson and the customer. The concept was implemented in a further 35 locations (24 H.Samuel and 11 Ernest Jones) in 2003/04, bringing the total to just under 10% of the portfolio. The performance of the refurbished stores continues to show considerable success.The compound annual growth ratebe encouraging and the increase in diamond sales is significant. It is intended to roll out the new design across the store base as part of the diamond category over the last fivenormal investment cycle.

years was 14.4% per annum, a peformance which was considerably ahead of the 8.9% recorded by the overall diamond market. A range of initiatives being implemented in merchandising, store operations, marketing and real estate will continue to assist the business in achieving its strategic targets, as will the continuing transfer of best practise from the US division.

Signet is committed to managing the social, ethical and environmental risks and responsibilities facing the Group. In 2002/03 the focus was on developing an environmental policy, reviewing the environmental management systems and implementing the Kimberley Process, which regulates the trade in rough diamonds. See pages 97 to 99 for a report on these matters.

US (71%(69% of Group sales)

Details of the US division’s performance are set out below:

| Like | ||||||||||||

| for like | ||||||||||||

| 2002/03 | 2001/02 | Change | change | |||||||||

| £m | £m | % | % | |||||||||

| Sales | 1,134.4 | 1,126.0 | +0.7 | (1) | +5.4 | |||||||

| Operating profit | 155.2 | 145.1 | +7.0 | (2) | ||||||||

| Operating margin % | 13.7 | % | 12.9 | % | ||||||||

| ROCE % | 21.5 | % | 20.4 | % | ||||||||

| 2003/04 | 2002/03 | Change | Like for like change | |||||||

| £m | £m | % | % | |||||||

| Sales | 1,116.2 | 1,134.4 | -1.6 | (1) | +4.6 | |||||

| Operating profit | 151.4 | 155.2 | -2.4 | (2) | ||||||

| Operating margin | 13.6 | % | 13.7 | % | ||||||

| ROCE | 20.5 | % | 21.5 | % | ||||||

| (1) | ||

| (2) |

Costs, gross margin and inventories remained under tight control. Significant benefits were obtained from a number of management initiatives, including the development of the Leo Diamond®and three-stone diamond jewellery ranges, increased levels of staff training, expansion of television advertising and continued investment in real estate.

The increase in operating margin and ROCE reflectedwas broadly in line with last year, reflecting leverage fromof like for like sales growth which more than offsethas largely compensated for the adverse impact of an increase in immature store space.space and the slightly lower gross margin. The gross margin rate was slightly down on last year’s level due tomovement reflects the impact of the anticipated changes in sales mix. Themix and the increase in the pricegold prices offset by a range of gold bullion had limited effect on the year but could have greater impactmanagement initiatives. A similar movement in the current year.gross margin is anticipated in 2004/05. The proportion of sales through the in-house credit card decreased towas broadly similar at 49.3% (2002/03: 49.5% (2001/02: 50.4%).The. The bad debt charge was at the bottom of the range of the last sixeight years at 3.0%2.8% of total sales (2001/02: 3.2%(2002/03: 3.0%).This was before.

The quality of customer service continued to be a $2.2 million one-off benefitcritical factor behind the strong performance, particularly in the fourth quarter. The number of staff benefiting from the better than anticipated performance of the residue of the acquired Marks & Morgan receivables portfolio.central training programmes increased, and in-store training was also expanded.

Signet Group plc 3

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 3 |

Group Chief Executive’s review (continued)

Increased staff productivity was achieved through the merchandisemulti-year programme aimed at reducing and simplifying in-store administrative functions.

In mall stores the successful development of major merchandising programmes manysuch as the Leo Diamond® range, three-stone jewellery and solitaire diamonds continued; new initiatives included the “right hand ring” and fashion products featuring gold and multi-colour gemstones; all these will be further expanded in 2004/05. In Jared the development of which have been developed and tested over a number of years. An example was the Leo Diamond range whereand luxury watches including Rolex, Tag Heuer and Omega continued to prove successful; new product tests of branded and designer merchandise such as Hearts On Fire Diamonds and Scott Kay jewellery were encouraging. The Leo Diamond is exclusive to Signet in both the GroupUS and the UK. It has exclusive rights. Leo Diamonds have morea patented cut resulting in greater brilliance than normallya conventionally cut stonesdiamond of similar sizeequal quality. The capability to direct source loose diamonds and quality.The range was first tested in Jared stores during Christmas 2000, rolled out to 300 mall stores in 2001, and by Christmas 2002 it was in allutilise contract manufacturing for some 55% of the division’s stores.Three-stone diamond jewellery merchandise is another exampleremains a significant competitive advantage across the division. Initiatives to increase further the efficiency of a range that has been successfully developed over a number of years.

Staff training was undertaken at a record level in 2002/03, with emphasis on improving product knowledge and selling skills. A longer term programme has also been introduced to reduce and simplify administrative functions carried out in the stores, thereby allowing sales staff more time to serve customers. This programme has already contributed some improvement in stock losses.supply chain are being explored.

Marketing events and promotional activity proved to be particularly successful during critical selling periods such as Valentine’s Day, Mother’s Day and Christmas. BroadcastTelevision advertising was further extendedexpanded and Kay television advertising impressions were increased by 16%7% over the Christmas period.The romanceperiod, with the Leo Diamond range featured strongly. Both research and appreciation basedcustomer feedback about the advertising theme, “Every kiss begins with Kay”, once more proved successfulcontinued to be very positive. Television advertising for Jared was expanded from ten markets to 22 markets, covering about 75% of its sales, and this was reflected in heightening name recognition.the strong sales performance. The Leo Diamond was featured strongly in this advertising.The annual gross marketing spend amounted to 6.4% of sales (2001/02: 6.3%(2002/03: 6.4%), the increase reflecting growth in the number of Jared stores where the advertising spend is higher than for mall stores..

Jared now has sales of over $250$300 million and its like for like sales performance was significantly aheada portfolio of that of the rest of the division.The79 stores, equivalent in space terms to about 340 mall stores. The Jared concept is the primary vehicle for US space growth and in the period a further 12 stores were opened. The chain is still relatively immature with some 45% of stores opened bringingin the total up to 67 suchlast 30 months. The 15 Jared stores that have reached maturity in aggregate achieved the target level of sales and store contribution (set at the endtime of the period. Jared television advertising was expanded from three marketsinvestment) in 2001 to ten markets over Christmas 2002 and will be developed further in 2003. An initiativetheir fifth year of trading. During 2004/05 it is intended to increase salesthe level of luxury watchescentral support so that openings in Jaredfuture years can be increased to 15 – 20 stores was also launched.per annum.

In 2002/032003/04 total fixed and working capital investment in the US business was £33.1$138.3 million (2001/02: £41.0 million, £38.6 million at constant exchange rates).The enhancement(2002/03: $146.6 million). The increase in space of 7% by the year end was as planned, including the trial of ten Kay stores in off-mall locations. This test showed some encouraging results and expansionwill be extended to ten additional sites in 2004/05. The programme of refurbishment and relocation further enhanced the quality of the real estate portfolio continued, although at the lower end of the planned range.This reflected the tightened investment criteria in place to take account of the uncertain trading environment.store portfolio.

The change in store numbers by chain is shown in the following table:

Total | Kay | Regional | Jared | |||||||

| 2 February 2002 | 1,025 | 667 | 303 | 55 | ||||||

| Openings | 48 | 22 | 14 | 12 | ||||||

| Closures | (23 | ) | (13 | ) | (10 | ) | – | |||

| 1 February 2003 | 1,050 | 676 | 307 | 67 | ||||||

| Total | Kay | Regional | Jared | ||||||

| 1 February 2003 | 1,050 | 676 | 307 | 67 | |||||

| Openings | 69 | 49 | (1) | 8 | 12 | ||||

| Closures | (16 | ) | (8 | ) | (8 | ) | – | ||

| 31 January 2004 | 1,103 | 717 | (1) | 307 | 79 | ||||

| (1) | Includes ten off-mall stores. |

In 2003/042004/05 it is planned to refurbishcontinue with the consistent programme of real estate investment, with the refurbishment or relocaterelocation of approximately 90 stores and toan increase in selling space by circa 7%of about 8%. A further 1215 new Jared stores shouldare expected to account for some 65%two-thirds of the increase, the remainder comprising up to 3025 net mall store openings and a trial of up to 10the additional ten Kay stores in outdoor centres.off-mall locations. Total US capital expenditure is expected to be some $80 – $85 million in 2004/05.

UK (29%(31% of Group sales)

Details of the UK division’s performance are set out below:

Like | ||||||||||

for like | ||||||||||

2002/03 | 2001/02 | Change | change | |||||||

£m | £m | % | % | |||||||

| Sales | ||||||||||

| H.Samuel | 279.1 | 277.3 | +0.6 | +2.6 | ||||||

| Ernest Jones | 188.0 | 168.5 | +11.6 | +9.4 | ||||||

| Other | 6.5 | 6.3 | ||||||||

| Total | 473.6 | 452.1 | +4.8 | (1) | +5.2 | |||||

| Operating profit | 67.0 | 60.7 | +10.4 | (2) | ||||||

| Operating margin % | 14.1 | % | 13.4 | % | ||||||

| ROCE % | 38.0 | % | 39.4 | % | ||||||

| 2003/04 | 2002/03(1) | Change | Like for like change | ||||||

| £m | £m | % | % | ||||||

| Sales | |||||||||

| H.Samuel | 285.8 | 279.1 | +2.4 | +3.5 | |||||

| Ernest Jones | 209.4 | 188.0 | +11.4 | +8.4 | |||||

| Other | 5.8 | 6.5 | |||||||

| Total | 501.0 | 473.6 | +5.8 | +5.5 | |||||

| Operating profit | 76.6 | 64.7 | +18.4 | ||||||

| Operating margin | 15.3 | % | 13.7 | % | |||||

| ROCE | 47.1 | % | 41.2 | % | |||||

The strategy to improve store productivity by increasing the average transaction value again proved successful, despite an increasingly challenging trading environment. Benefit was gained from a range of management initiatives.The initial phase of a trial of new store designs was expanded.

The gross margin rate was slightly ahead of last year. Increasedyear, which together with increased store productivity contributed to the improved operating margin while the decrease in ROCE reflected the benefit of the 53rd week in 2001/02 and higher investment in diamond inventory.ROCE. H.Samuel average sales per store rose by 1.5%4.4% to £677,000 (2001/02: £667,000)£707,000 (2002/03: £677,000) and Ernest Jones (including Leslie Davis) by 12.1%6.9% to £1,030,000 (2001/02: £919,000)£1,101,000 (2002/03: £1,030,000).

4 Signet Group plc

The average retail price of items sold increased by 6.5%6.4% to £33 (2001/02: £31)£35.00 (2002/03: £32.91) in H.Samuel and by 9.2%6.9% to £130 (2001/02: £119)£139.24 (2002/03: £130.27) in Ernest Jones. Diamond assortments were further enhanced, withenhanced; three-stone jewellery performed well, the Leo Diamond range being rolled outwas expanded in Ernest Jones and the number of H.Samuel’s stores stocking the Forever Diamonds range being tested in H.Samuel.Diamond increased from 50 to 120. Diamond sales again achievedcontinued to achieve an above average increase and outpaced the growth in the UK diamond market; they now account for 25%26% of the division’s sales mix (18%

| 4 | Signet Group plc Annual Report & Accounts year ended 31 January 2004 |

(19% in H.Samuel and 35%36% in Ernest Jones). This represents a significantan increase on five years agoin diamond sales of nearly 100% since 1998/99 when diamonds accounted for 16%the present strategy was launched.

The quality of the mix (14% in H.Samuel and 28% in Ernest Jones).

Staff training remains a priority, with focus on improving product knowledge, particularly in respect of diamonds. During the year increased training support was given to store managers and a more structured training programme introduced. Progress in improving customer service, wasas monitored throughby a mystery shopper programme.programme, continues to improve and is critical to success in selling diamonds. Training systems were further improved with the implementation of a progressive multi-year programme which has drawn on the experience of the US division and nearly all UK staff were involved in this programme in 2003/04. Further steps were taken to simplify and reduce administrative tasks being carried out in the stores.

In 2002/03 new store formats wereAdditional improvements took place in the design and distribution of catalogues. While they presently remain the major marketing support, television advertising was tested in 17 locations (15for both H.Samuel and 2 Ernest Jones).The new designs enable improved interaction with the customerJones and better presentation of the diamond range by replacing the formerwill be further developed in 2004/05.

In 2003/04 the trial will be extended, with the planned newtotal fixed and refurbished stores utilising the new formats.

Fixedworking capital investment principally in the store portfolio, amounted to £16.4UK business was £27.5 million (2001/02: £18.8(2002/03: £25.5 million). Four newErnest Jones saw five openings and 11 H.Samuel stores were opened and eight closed. Ernest Jones saw eight openings and no closures. At the year end there were 610604 stores (418(407 H.Samuel and 192197 Ernest Jones). In total 42A similar pattern of store openings and closures is planned for 2004/05. It is intended to refurbish up to 80 stores were refurbished in the period compared with 93 in 2001/02. Capital expenditure was atnew store format during 2004/05, and a similar levelnumber the following year. Primarily as a result of the increased programme of refurbishment, total capital expenditure in the UK is expected to last year as more large key stores were refurbished, including 13 under the new format. Some 32 further stores are scheduled for refurbishmentincrease from £18 million to some £30 – £35 million in 2003/04.2004/05.

![]()

Terry Burman,

Group Chief Executive,2624 March 20032004

Signet Group plc 5

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 5 |

2002/03 | 2002/03(1) | 2001/02(2) | 2000/01 | 1999/00 | 1998/99 | ||||||||||

£m | $m | £m | £m | £m | £m | ||||||||||

| Sales | 1,608.0 | 2,637.1 | 1,578.1 | 1,387.3 | 1,136.5 | 991.2 | |||||||||

| Operating profit | 216.2 | 354.6 | 200.7 | 178.7 | 139.1 | 102.3 | |||||||||

| Net interest payable | (16.5 | ) | (27.1 | ) | (17.9 | ) | (15.9 | ) | (11.4 | ) | (13.1 | ) | |||

| Profit before tax | 199.7 | 327.5 | 182.8 | 162.8 | 127.7 | 89.2 | |||||||||

| Taxation | (70.8 | ) | (116.1 | ) | (63.1 | ) | (52.1 | ) | (38.3 | ) | (24.0 | ) | |||

| Profit for the period | 128.9 | 211.4 | 119.7 | 110.7 | 89.4 | 65.2 | |||||||||

| Earnings per share(3) | 7.5p | $0.12 | 7.1p | 6.6p | 5.3p | 3.9p | |||||||||

| Dividend per share | 2.110p | $0.0346 | 1.789p | 1.625p | 1.450p | 1.000p | |||||||||

| Capital expenditure | 49.5 | 81.2 | 59.8 | 56.2 | 39.3 | 30.9 | |||||||||

| Investment in fixed and working capital | 121.3 | 198.9 | 108.1 | 132.0 | 83.2 | 56.9 | |||||||||

| Depreciation and amortisation | 37.8 | 62.0 | 34.7 | 30.6 | 27.8 | 27.6 | |||||||||

| Net debt | 140.1 | 229.8 | 201.7 | 229.1 | 91.6 | 111.5 | |||||||||

| Shareholders’ funds (as restated)(4) | 696.5 | 1,142.3 | 679.7 | 565.4 | 448.3 | 379.6 | |||||||||

| Gearing(3) | 20.1% | 29.7% | 40.5% | 20.4% | 29.4% | ||||||||||

| Return on capital employed(3) | 23.8% | 23.3% | 25.2% | 24.1% | 19.5% | ||||||||||

| Store numbers (at end of period): | |||||||||||||||

| US | 1,050 | 1,025 | 999 | 827 | 788 | ||||||||||

| UK | 610 | 606 | 605 | 606 | 606 | ||||||||||

| Percentage increase/(decrease) | |||||||||||||||

| in like for like sales: | |||||||||||||||

| US | 5% | 1% | 6% | 11% | 10% | ||||||||||

| UK | 5% | 9% | 9% | 5% | (1)% | ||||||||||

| Average sales per store (000’s):(5) | |||||||||||||||

| US | 1,088 | 1,665 | 1,125 | 1,117 | 939 | 823 | |||||||||

| UK | 747 | 1,143 | 735 | 665 | 613 | 580 | |||||||||

| Number of employees | |||||||||||||||

| (full-time equivalents) | 14,160 | 13,525 | 12,520 | 11,450 | 10,919 | ||||||||||

Five year financial summary

| 2003/04 | 2003/04 | (1) | 2002/03 | 2001/02 | 2000/01 | 1999/00 | |||||||

| as restated | (2) | as restated | (2)(3) | as restated | (2)(4) | as restated | (2)(4) | ||||||

| £m | $m | £m | £m | £m | £m | ||||||||

| Sales | 1,617.2 | 2,943.3 | 1,608.0 | 1,578.1 | 1,387.3 | 1,136.5 | |||||||

| Operating profit | 222.3 | 404.6 | 213.9 | 198.8 | 176.8 | 137.3 | |||||||

| Net interest payable | (10.4 | ) | (18.9 | ) | (14.0 | ) | (15.0 | ) | (12.7 | ) | (8.7 | ) | |

| Profit before tax | 211.9 | 385.7 | 199.9 | 183.8 | 164.1 | 128.6 | |||||||

| Taxation | (74.7 | ) | (136.0 | ) | (70.8 | ) | (63.4 | ) | (52.5 | ) | (38.6 | ) | |

| Profit for the period | 137.2 | 249.7 | 129.1 | 120.4 | 111.6 | 90.0 | |||||||

| Earnings per share(5) | 8.0p | $0.15 | 7.5p | 7.1p | 6.7p | 5.4p | |||||||

| Dividend per share (£) | 2.501p | 2.110p | 1.789p | 1.625p | 1.450p | ||||||||

| Dividend per share ($) | $0.0420 | $0.0323 | $0.0258 | $0.0242 | $0.0235 | ||||||||

| Capital expenditure | 50.9 | 92.6 | 49.5 | 59.8 | 56.2 | 39.3 | |||||||

| Investment in fixed and working capital | 109.8 | 199.8 | 121.3 | 108.1 | 132.0 | 83.2 | |||||||

| Depreciation and amortisation | 40.4 | 73.5 | 37.8 | 34.7 | 30.6 | 27.8 | |||||||

| Net debt | 79.9 | 145.4 | 140.1 | 201.7 | 229.1 | 91.6 | |||||||

| Shareholders’ funds | 727.6 | 1,324.2 | 678.4 | 683.7 | 583.0 | 470.4 | |||||||

| Shares in issue(million) | 1,726.2 | 1,713.8 | 1,706.0 | 1,685.7 | 1,679.9 | ||||||||

| Gearing(5) | 11.0% | 20.7% | 29.5% | 39.3% | 19.5% | ||||||||

| Return on capital employed(5) | 24.8% | 24.1% | 23.6% | 25.7% | 24.6% | ||||||||

| Store numbers (at end of period): | |||||||||||||

| US | 1,103 | 1,050 | 1,025 | 999 | 827 | ||||||||

| UK | 604 | 610 | 606 | 605 | 606 | ||||||||

| Percentage increase in like for like sales: | |||||||||||||

| US | 5% | 5% | 1% | 6% | 11% | ||||||||

| UK | 6% | 5% | 9% | 9% | 5% | ||||||||

| Average sales per store (£’000s)(6): | |||||||||||||

| US | 1,040 | 1,088 | 1,125 | 1,117 | 939 | ||||||||

| UK | 824 | 747 | 735 | 665 | 613 | ||||||||

| Number of employees | |||||||||||||

| (full-time equivalents) | 14,502 | 14,160 | 13,525 | 12,520 | 11,450 | ||||||||

| (1) | Amounts in pounds sterling are translated into US dollars solely for the convenience of the reader, at a rate of £1.00 to |

| (2) | During 2003/04 the Group adopted FRS17 – ‘Retirement Benefits’. The adoption of the standard resulted in a prior year adjustment (see note 17 on page 75). |

| (3) | 53 week |

| During 2001/02 the Group adopted FRS19 – ‘Deferred Tax’. The adoption of the standard resulted in a prior year adjustment (see note 17 on page 75). | |

| (5) | Earnings per share, gearing and return on capital employed are defined on |

| Including only stores operated for the full financial period. |

The financial data included in the Five year financial summary above has been derived, in part, from the consolidated accounts for such periods included elsewhere in this Annual Report.TheReport. The financial data should be read in conjunction with the accounts, including the notes thereto, and the Financial review included on pages 2221 to 27.28.

Further selected financial data is shown on pages 107115 and 108.The116. The accounts of the Group have been prepared in accordance with UK GAAP, which differ in certain respects from US GAAP. See pages 8894 to 96102 for information on the material differences between UK GAAP and US GAAP that affect the Group’s profit and shareholders’ funds.

| 6 | Signet Group plc Annual Report & Accounts year ended 31 January 2004 |

US operating review

OverviewSignetSignet’s US division is the second largest US speciality retail jeweller in the United States with an approximate market share of 6.7%, operating 1,050 stores in 45 states at 1 February 2003. In 2002/03 total7.0%. Total US sales in the year to 31 January 2004 were $1,736$1,875 million (2001/02: $1,621(2002/03: $1,736 million). At the year end the Group operated 983division had 1,103 stores comprising 1,014 mall jewellery stores and 67as well as 79 destination superstores and ten stores being trialled in off-mall shopping centres. Its mall stores trade nationwide as Kay Jewelers (“Kay”), and regionally under a number of well established and recognised names.Thenames. The destination superstores trade as Jared The Galleria Of Jewelry (“Jared”), the nation’s largest and fastest growing chain of off-mall destination jewellery stores.

In the mediumlonger term it is planned to grow like for like sales, and to increase US space by about 6% to– 8% per annum, and to grow like for like sales, with Jared accounting for a majority of the planned space growth.

Competitive advantages

Management attributes its consistentthe division’s success in the US speciality retail jewellery retail market to a range of competitive advantages in merchandising, store operations, marketing and real estate.Theseestate. These are reflected in the US division’s average sales per store and operating profit margin, both of which are substantially higher than that of other quoted mid-market mallmall-based speciality retail jewellers operating stores of similar size. The principal competitive advantages are summarised below, and all are explained in greater detail on pages 8 to 13.

| • | Merchandising |

| Management believes that in comparison to its competitors Signet has greater capacity and expertise to direct source | |

• Merchandising

diamonds (i.e. to purchase loose polished diamonds which are supplied to contract manufacturers who produce finished merchandise), and this facility allows the Group to provide superior value and quality to the consumer. Diamond jewellery accounts for approximately 70% of total annual merchandise sales. The division’s sophisticated merchandising systems track, forecast and respond to consumer preferences and provide competitive advantage by ensuring high in-stock positions of key merchandise assortments and fast-movingfaster moving items. It is

• Store operations

The salesperson’s

| • | Store operations |

| The sales associate’s ability to communicate and explain the value and quality of the merchandise plays a significant part in a retail jewellery purchase. Therefore, the US division has developed specialised training for its retail personnel, and its size provides leverage of training resources and systems. | |

| • | Marketing |

| Kay is one of a very limited number of US speciality retail jewellery brands with a presence large enough to justify national network television advertising, the most cost effective way to attract customers, enter new markets and increase brand recognition. | |

Following successful trials in 2002/03, the number of Jared TV markets during Christmas 2003 was doubled, from ten markets covering about 35% of the merchandise plays a significant part in a diamond sale.Therefore, the US division has developed specialised training for itschain’s sales associates, and its size allows it to leverage training resources and systems.

• Marketing

Kay is one of only two US speciality jewellery retail brands with a nationwide presence large enough to justify national network television advertising, the most cost effective way to attract customers and increase brand recognition.

• Real estate

Strict criteria are followed when evaluating real estate investment and management believes that the quality22 markets supporting about 75% of its sales.

| • | Real estate |

| Strict criteria are followed when evaluating real estate investment, and management believes that the quality of its store portfolio is superior to that of its competitors. | |

Initiatives in 2003/04

Specific initiatives to that of its competitors.strengthen the Group’s competitive position included:

| • | expansion of the Leo Diamond range, |

| • | expansion of the Jared luxury watch range, |

| • | record level of training, |

| • | further development of systems for greater operational efficiency, |

| • | increased national TV advertising for Kay, |

| • | expansion of Jared TV advertising programme, |

| • | space increase of 7%, and |

| • | test of Kay off-mall store format. |

Market place

Total US jewellery sales, including watches and fashion jewellery, are estimated by the US Department of Commerce to have been $53

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 7 |

US operating review (continued)

$54 billion in 2002 (2001:2003 (2002: $51 billion).

In the US total jewellery market sales and have risen at a compound annual growth rate of 6%5.8% over the last 20 years. In 20022003 the market grew by about 4%6%. Management believes that the primary driver ofmajor contributors to the relatively steady market growth in the market has beeninclude the bridal, fashion accessory and gift giving nature of the majority of US jewellery sales.sales to the middle mass market, with the bridal category including engagement rings, wedding rings and anniversary jewellery. Signet has an approximate 3.3%3.5% share of the total US jewellery market (including watches and fashion jewellery).market.

The US speciality retail market in which the division competes is approximately $26$27 billion (2001:(2002: $25 billion). Speciality retail jewellery sales have risen at a compound annual growth rate of 5.6%4.5% from 19971998 to 2002 (US Department2003 (see graph below), outperforming other comparable sectors, and over the last three more challenging years performing in line with the general retail sector. Over the same period Signet’s total US sales (excluding the acquisition of Commerce). Over a similar period total Signet US salesMarks & Morgan) rose at a compound annual growth rate of 12.8%10.3%. Signet has some 6.7%

Growth of the US speciality retail jewellery market.Retail Sales

Management believes that the longer term outlook for jewellery sales is encouraging due togiven the growth in disposable income and the increasing numbers of women in the work place and favourable demographics; the fastest growing segment of the US population is the 45 to 64 year olds, who have

spent more per capita on jewellery than any other segment over the years 1998 to 2002 (US Department of Commerce).force.

The US retail jewellery industry is very competitive and highly fragmented. Management believes that the five largest speciality jewellery retailers account for some 22.5%approximately 22% of speciality jewellery sales, and thesecollectively have gained market share over the past five years. This trend provides significant opportunity for the more competitive businesses in the sector, and it is believed

that Signet is well positioned to gain further market share. In the broader total US retail jewellery market Signet competes against other formats such as department stores, discount outlets, television home shopping and Internet shopping. Management believes that the business also competes with non-jewellery retailers for consumers’ discretionary dollar spend.spending.

The US division’s largest speciality jewellery competitor is Zale Corporation, which has a speciality market share of about 7.9%7.8%. Competition is also encountered from a limited number of large regional retail jewellery chains and smaller regional chains (those operating fewer than 100 stores) andas well as independent retail jewellery stores, which account for over 70% of the speciality market.

Store operations

Signet’s US stores offer a selection of jewellery lines at keypopular price points with an emphasis on fine diamonds,diamond jewellery, which account for some 69%70% of merchandise sales. In 2002/032003/04 the average retail price of all merchandise sold was approximately $267 (2001/02: $257)$288 (2002/03: $267).

Signet conducts its US retail operations through three marketing divisions: Kay, regional chains and Jared. Kay and the regional chains are primarilypredominantly located in regional and super-regional enclosed malls, with approximately 47%75% of the stores being in prime centre court locations.Thelocations. The average mall store contains approximately 1,1551,154 square feet of selling space and 1,4441,442 square feet of total space.Thespace. The design and appearance of stores is standardised within each chain.

Details of recent investment in the store portfolio are set out below:

| Number of stores | ||||||||

2002/03 | 2001/02 | 2000/01 | ||||||

| Store refurbishments | ||||||||

| and relocations | 71 | 91 | 99 | |||||

| New mall stores | 36 | 41 | 40 | |||||

| New Jared stores | 12 | 12 | 15 | |||||

| Fixed capital expenditure | £28m | £37m | £40m | |||||

| Total investment(1) | £63m | £68m | £72m | |||||

| Number of stores | |||||||

| 2003/04 | 2002/03 | 2001/02 | |||||

| Store refurbishments and relocations | 61 | 71 | 91 | ||||

| New mall stores | 47 | 36 | 41 | ||||

| New off-mall stores | |||||||

| – Jared stores | 12 | 12 | 12 | ||||

| – Kay off-mall stores | 10 | – | – | ||||

| Fixed capital expenditure | $42m | $38m | $51m | ||||

| Total investment(1) | $98m | $92m | $96m | ||||

| (1) Fixed and working capital investment in new space and refurbishments/relocations. | |||||||

Management believes that the US division’s prime real estate portfolio, together with its regular investment in mall store refurbishments and relocations, are competitive advantages that help build store traffic. Superior like for like sales growth is normally achieved for a number of years following such investment in a store.Theinvestment. The typical benefits from refurbishments, which

| 8 | Signet Group plc Annual Report & Accounts year ended 31 January 2004 |

normally occur on a ten year cycle, include an increase in linear footage of display cases positioned on the store frontage, improved lighting and better access to the store.

Criteria for investment in real estate remains stringent, reflecting the more difficult trading environment. For mallstringent. Signet seeks sites corner locations with high footfall in superior malls, are targeted.in particularly units located on busy centre court locations.

Jared locations are typically free-standing sites in “power strip” shopping complexes with high visibility and traffic flow, and positioned close to the street and often near a major mall. In addition, thehighway. The retail centres in which Jared stores operate normally contain strong retail co-tenancies,cotenancies, including other destination stores such as Borders Books, Best Buy, Home Depot,Toys “R” Us and Bed, Bath & Beyond. This type of shopping centre is known as a “power strip” mall.

In 2002/032003/04 there was a net increase in storeUS division total selling space of approximately 6%7%, a similar level toin line with the previoustarget of 6% – 8% growth per year.

8 Signet Group plc

In 2003/042004/05 it is planned to open up to 12about 15 Jared stores and up tostores. Some 45 mall stores, the majority of which will be Kay. In addition a trial ofKay in the enclosed mall format, and up to 10ten additional off-mall Kay stores in outdoor centres is planned.locations will

also be opened. Approximately 20 mall stores are planned for closure. PlannedThe programme should result in a net openings should increase in retail space by up to a further 7%of approximately 8% by the end of 2003/04. 2004/05.

Signet may consider selective purchases of mall stores that meet its acquisition criteria regarding location, quality of real estate, customer base and price.return on investment.

Kay

The expansion of Kay as a nationwide chain is an important element of the US growth strategy. Kay, with 676717 primarily mall stores in 4550 states at 131 January 2004 (1 February 2003 (2 February 2002: 6672003: 676 stores), is targeted at the middle income consumer. It is believed that in the longer term there is potential to expand the Kay chain by around 200 mall stores (net of closures). The average retail price of merchandise sold in the Kay chain during 2002/032003/04 was $242 (2001/02: $236). The$257 (2002/03: $242) and average sales per Kay store were $1,490,000 (2001/02: $1,430,000)$1,548,000 (2002/03: $1,490,000).

A test of Kay stores in off-mall shopping centres was commenced in 2003/04 with the opening of ten stores, and it is intended that a further ten will be opened in 2004/05. Kay stores in this format are expected to have a lower capital expenditure and lower

The following table sets out information concerning the US stores operated by Signet during the period indicated:

| 2003/04 | 2002/03 | 2001/02 | ||||

| Number of stores: | ||||||

| Total opened during the year(1) | 69 | 48 | 53 | |||

| Kay(2) | 49 | 22 | 29 | |||

| Regional chains | 8 | 14 | 12 | |||

| Jared | 12 | 12 | 12 | |||

| Total closed during the year | (16 | ) | (23 | ) | (27 | ) |

| Kay | (8 | ) | (13 | ) | (12 | ) |

| Regional chains | (8 | ) | (10 | ) | (15 | ) |

| Jared | – | – | – | |||

| Total open at the end of the year | 1,103 | 1,050 | 1,025 | |||

| Kay(2) | 717 | 676 | 667 | |||

| Regional chains | 307 | 307 | 303 | |||

| Jared | 79 | 67 | 55 | |||

| Increase in space | 7% | 6% | 6% | |||

| Percentage increase in like for like sales | 4.6% | 5.4% | 0.6% | |||

| Average sales per store in thousands (total)(3) | $1,747 | $1,665 | $1,597 | |||

| Average sales per store in thousands (excluding Jared)(3) | $1,549 | $1,511 | $1,475 | |||

| (1) | Figures for stores opened during the year are adjusted for the impact of conversions of format between Kay and regional chains. |

| (2) | Includes test of Kay stores in off-mall shopping centres. |

| (3) | Based upon stores operated for the full financial year. |

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 9 |

US operating review (continued)

sales per store at maturity than that of the Kay chain average. Management believes that the off-mall Kay format may present a potential opportunity to grow the chain in new shopping centres that have not been considered previously.

Regional chainsIn order to increase market share in selected geographic areas Signet also operates US mall stores under a variety of established regional trade names:names (see Description of property, page 20). The leading brands include JB Robinson Jewelers, Marks & Morgan Jewelers Belden Jewelers, Friedlander’s Jewelers, Goodman Jewelers, LeRoy’s Jewelers, Osterman Jewelers, Roger’s Jewelers, Shaw’s Jewelers and WeisfieldBelden Jewelers. At 1 February 200331 January 2004 307 regional stores operated in 3031 states (2(1 February 2002: 3032003: 307 stores). The opening of new regional chain stores is considered if real estate satisfying the investment criteria becomes available in their respective trading areas.areas or in adjacent areas where marketing support can be cost effective. The average retail price of merchandise sold in the regional chains during 2002/032003/04 was $265 (2001/02: $263)

$281 (2002/03: $265). The average sales per store in the regional chains were $1,558,000 (2001/02: $1,575,000)$1,550,000 (2002/03: $1,558,000).

Jared

Jared is the leading off-mall destination speciality retail jewellery chain in its sector of the market. Its main competitors are independent operators, with the next largest chain having approximately one-third as many22 stores. If Jared waswere a

The following table sets out information concerning the US stores operated by Signet during the periods indicated:

| 2002/03 | 2001/02 | 2000/01 | ||||||||||

| Number of stores: | ||||||||||||

| Acquired during the year(1) | nil | nil | 137 | |||||||||

| Total opened during the year(2) | 48 | 53 | 55 | |||||||||

| Kay | 22 | 29 | 32 | |||||||||

| Regional chains | 14 | 12 | 8 | |||||||||

| Jared | 12 | 12 | 15 | |||||||||

| Total closed, or sold during the year(2) | (23 | ) | (27 | ) | (20 | ) | ||||||

| Kay | (13 | ) | (12 | ) | (5 | ) | ||||||

| Regional chains | (10 | ) | (15 | ) | (15 | ) | ||||||

| Jared | nil | nil | nil | |||||||||

| Total open at the end of the year | 1,050 | 1,025 | 999 | |||||||||

| Kay | 676 | 667 | 650 | |||||||||

| Regional chains | 307 | 303 | 306 | |||||||||

| Jared | 67 | 55 | 43 | |||||||||

| Increase in space | 6% | 6% | 26% | |||||||||

| Percentage increase in like for like sales | 5.4% | 0.6% | 5.9% | |||||||||

| Average sales per store in thousands (total)(3) | $1,665 | $1,597 | $1,631 | |||||||||

| Average sales per store in thousands (excluding Jared)(3) | $1,511 | $1,475 | $1,526 | |||||||||

Signet Group plc 9

stand-alone operation it would be the eighthseventh largest US speciality jewellery company by sales.

Jared targets an underserved sector at the upper end of the middle market. The customer profile is of a more mature, higher income customer than that of Signet’s US mall stores. An important advantage of a destination store is that the potential customer visits the store with the intention of making a jewellery purchase, whereas in thea mall there is a greater possibility of the intended spend being diverted.diverted to non-jewellery purchases.

EachThe following map shows the number and locations of Kay, regional and Jared is about five times the size, with five times the inventory of a Signet US mall store. stores at 31 January 2004:

| 10 | Signet Group plc Annual Report & Accounts year ended 31 January 2004 |

The typical Jared store ishas about 5,8004,700 square feet.feet of selling space and 5,900 square feet of total space. Its size permits significantly expanded product ranges and enhanced customer services, including in-store repair and custom design facilities. A private viewing room is available for customers when required. There are also complimentary refreshments and a children’s play area.

There were 6779 Jared stores at 131 January 2004 (1 February 2003 (2 February 2002: 552003: 67 stores).The. The average retail price of merchandise sold in Jared stores during 2002/032003/04 was $558 (2001/02: $522)$586 (2002/03: $558), which was more than double that of a Signet US mall store. The average sales per Jared store were $4,310,000 (2001/02: $4,284,000)$4,603,000 (2002/03: $4,310,000).

In the first five years of trading a Jared store is projected to have a faster rate of like for like sales growth than that of a mature mall store.store at maturity. At the end of this period the projected operating margin is expected to have risen to around that of the mature mall stores,store at maturity, with a greater return on capital employed. At 1 February 2003 about one quarter31 January 2004 some 45% of the Jared stores had been open for less than 1830 months and only seven15 had been open for more than five years.

Since the first Jared store opened in 1993, the concept has been continually evaluated, developed and refined. Management believes that the chain enjoys a number of competitive advantages, including benefit from the US division’s economies of scale such as leveraging the home officedivision’s established infrastructure, access to a pool of experienced store management, and availability of capital required to develop and grow the brand.

Management believes that the Jared concept has considerable growth potential and over 100 suitable markets have been identified for future expansion, with many of these markets able to support multiple locations. Accordingly, in the longer term, the chain has the potential to expand nationwide to over 200 stores, nationwide, generating annual sales of over $1 billion.

The following map showsbillion based on the number and locationscurrent performance of Kay, regional stores andexisting Jared stores at 1 February 2003:stores.

10 Signet Group plc

Management, personnel, training and incentives

A retail jewellery sale normally requires face-to-face interaction between the customer and the salesperson,sales associate, during which the items being considered are removed from the display cases and presented one at a time withwhile their qualities being described. It is believed that the quality of store sales staff with the necessary product knowledge to communicate the competitive value of the merchandise is criticalare explained to the success of the business. Furthermore, consumercustomer. Consumer surveys indicate that a key factor in the retail purchase of jewellery is the customer’s confidence in the salesperson.sales associate. In order to allow staff more time for selling and customer service, a series of “World Class Store Systems” initiatives were taken. These have resulted in further

improvements in special orders capabilities and upgrades to point of sale computers to enable improvements in store administration.

It is believed that highly trained store sales staff with the necessary product knowledge to communicate the competitive value of the merchandise are critical to the success of the business. The US division’s substantial training and incentive programmes for all levels of store staff are designed to play an important role in recruiting, educating and retaining qualified store staff. The preferred practice is to promote store managers district managers and regional vice-presidentsof all levels from within the organisation thereby helpingin order to maintain continuity and familiarity with store operations, sales training, selling methods and corporate culture.

Store personnel must complete basic training within 90 days of being employed.There are also in-house sales training seminars for all sales staff and classes for store managers. Supplementing the seminars are in-store computer based training and testing programmes, as well as role-playing workshops conducted to strengthen and reinforce selling skills.company practice.

Retail sales personnel are encouraged to achievebecome Certified Diamontologist statusDiamontologists by graduating from a comprehensive diamond correspondence course provided by the Diamond Council of America. Approximately 50%63% of full time sales staff who have completed their probationary period are Certified Diamontologists or are training to become certified. Employees often continue their professional development through completion of correspondence courses on gemstones.

The US division also devotes substantial resources to training its store managers, and conducts a number of management and career development programmes at its corporate headquarters.These programmes are tailored to address specialised areas such as the managing of high volume mall stores and Jared stores. Additional training is provided at the annual managers’ meeting.

All store personnel are required to meet daily performance standards and establish and commit to goals.The store information system provides a comparisongoals. After completion of actual performance with the previous day’s targets. Individual goals and performance are factored into promotion decisions.

Store employees who have completed basic training, sales staff are paid a commission based on their individual sales performance throughand on meeting monthly incentive programmes designed to promote customer service and operating efficiencies.The commission can increase significantly if the store as a whole achieves certain sales goals for the month.

In addition to sales-based incentives, bonuses based on the profitability of stores are paid to store managers. Bonuses paid to district managers are based on the achievement of certain objectives for the stores under their control, including sales and margin goals, operating cost control, profitability, training and compliance with loss prevention matters. Conteststargets. Sales contests and incentive programmes are frequently run whichalso reward achievement of specific goals with travel or additional cash awards. In 2002/03addition to sales based incentives, bonuses are paid to store managers and district managers based on the achievement of key performance objectives. In 2003/04 approximately 23% (2002/03: 22% (2001/02: 21%) of store personnel remuneration was incentive based.incentive-based.

Management believes that the retention and recruitment of highly qualified and well trainedwell-trained staff in the US divisional headquartershead office in Akron, Ohio are key factors inessential to supporting the storesstores. A comprehensive in-house curriculum supplements specific job training and sales staff.Training of home office personnel includes emphasis onemphasises the importance of the working partnership between stores and headquarters. A comprehensive in-house curriculum supplements specific job training and includes product knowledge, time management, performance management, diversity in the workplace and basic and advanced computer training.

Head office management receives in-house training in motivation, coaching and feedback, creative problem solving, communication, presentation skills and leadership. They may also participate in outside seminars provided by technical organisations or development specialists.

Part of allUS head office performance-based bonuses isare mainly based on the profitabilityperformance of the US division. Alldivision against predetermined annual profit targets. Promotion decisions for all non-management head office personnel must meet ser viceare based on performance against service level and production requirements, and performance against these goals is a significant factor in promotion decisions. Bonuses paid to home officegoals; for managers they are also based on profit targetsannual objectives and performance against individual job requirements.

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 11 |

US operating review (continued)

Merchandising and purchasing

It is believed that the selection, availability and value for money of Signet’s merchandise are centralall factors that are critical to its success. The range of merchandise offered and the high level of stock availability are supported in the US business by extensive and continuous research and testing. Best-selling

Signet Group plc 11

products are identified and their rapid replenishment ensured with thoroughthrough analysis of product trials.Thistrials. This approach, along with the direct sourcing of loose polished diamonds, enables the division to deliver a focused assortment of merchandise to maximise sales, minimise discounting and accelerate inventory turn.

Sophisticated inventory management systems enablingfor merchandise testing, assortment planning, allocation and replenishment have been developed and implemented. A model inventory plan is in place for each store and is periodically reviewed and updated. Approximately 70%two-thirds of the merchandise is available for sale incommon to all the US division mall stores, with the remainder allocated to reflect demand in particular markets.

The inventory management team works closely with the marketing team to determine merchandise quantities for promotional events. It is believed that the merchandising and inventory management systems, as well as improvements in the productivity of the centralised distribution centre, have allowed the division to achieve inventory turns superiorcomparable to those of most of its quoted competitors. In 2002/03 the average cost of inventory ascompetitors although it has a percentage of annual sales increased to 36.8% (2001/02: 36.0%), reflecting the immaturity of recently added space.more immature store base.

Programmes have been developed in conjunction with certain vendors for the provision of branded jewellery merchandise. For example, the Leo Diamond range is sold exclusively by Signet in the US and the UK. This diamond has a patented cut resulting in greater brilliance than a conventional diamond of equal colour, clarity and weight, and comes with its own independent certification known as the “Return Of Light”.The Leo Diamond range became available in all US stores during the year, and was also expanded to include a broader selection of cuts and styles. Management believes that the US division’s merchandising process, market share and relationship with suppliers position the business as an ideal partner to launch new branding initiatives.

Other merchandising initiatives offer a distinctive product selection. For example, in Jared an opportunity to increase watch sales and thereby also attract additional customer traffic washas been identified. Therefore a major ongoing initiative has been taken to increase the number of Jared stores that stock premium watch brands, with particular emphasis onincluding Rolex,Tag Heuer, Omega and Omega.Tissot. Another example is the promotion of “right hand rings”, diamond fashion rings intended to be worn on the right hand rather than as bridal jewellery, which is traditionally worn on the left ring finger. De Beers specifically marketed this product in its nationwide print advertising throughout 2003/04, and is expected to continue to do so in 2004/05.

In 2002/032003/04 the bridal category accounted for approximately 43%44% of merchandise sold. This has been a category ofsold, continuing the steady growth in sales over the past fourfive years.

The table below sets out Signet’s US merchandise sales mix as a percentage of sales:

| Merchandise mix | |||||||||

| Percentage of sales | |||||||||

| 2002/03 | 2001/02 | 2000/01 | |||||||

| % | % | % | |||||||

| Diamonds | 69 | 67 | 66 | ||||||

| Gold jewellery | 8 | 10 | 11 | ||||||

| Gemstones | 10 | 10 | 11 | ||||||

| Watches | 6 | 6 | 7 | ||||||

| Repairs | 7 | 7 | 5 | ||||||

| 100 | 100 | 100 | |||||||

| Merchandise mix | |||||||

| Percentage of sales | |||||||

| 2003/04 | 2002/03 | 2001/02 | |||||

| % | % | % | |||||

| Diamonds and diamond jewellery | 70 | 69 | 67 | ||||

| Gold jewellery | 8 | 8 | 10 | ||||

| Gemstone jewellery | 10 | 10 | 10 | ||||

| Watches | 6 | 6 | 6 | ||||

| Repairs | 6 | 7 | 7 | ||||

| 100 | 100 | 100 | |||||

Approximately 55% of US diamond merchandise sold is acquiredsourced through contract manufacturing. Under this approach,manufacturing; Signet purchases loose polished diamonds on the world market and outsources the casting, assembly and finishing operations to third parties. It is believed that this approach results in a competitive cost and quality advantage. Contract casting and the setting of loose diamonds are generally utilised on basic items or programmes with proven non-volatile historical sales patterns that represent a lower risk of over or under purchasing. This purchasing strategy also allows the buyers to gain a detailed understanding of the manufacturing cost structure and improves the prospects of obtainingnegotiating better pricing for the supply of finished products.

Merchandise considered likely to have less predictable sales patterns is purchased complete as finished product. This strategy provides the opportunity to hold shelfreserve stock withheld by vendors and to make supplier returns or exchanges, thereby reducing the risk of over or under purchasing.

Merchandise held on consignment is used to enhance product selection and test new designs. This minimises exposure to changes in fashion trends and obsolescence whilst givingand provides the flexibility to return non-performing merchandise. At 1 February 200331 January 2004 the US division held approximately $116$144 million (2(1 February 2002: $1332003: $116 million) of merchandise on consignment (see note 12 on page 67)72).

In 2002/032003/04 the five largest suppliers collectively accounted for approximately 26% (2002/03: 29% (2001/02: 25%) of total US purchases, with the largest supplier accounting for approximately 10% (2002/03: 13% (2001/02: 9%).

12 Signet Group plc

Marketing and advertising

Store brand name recognition by consumers is believed to be an important factor in jewellery retailing, as the products themselves are predominantly unbranded. Signet continues to strengthen and promote its US brands and build store brand name recognition

| 12 | Signet Group plc Annual Report & Accounts year ended 31 January 2004 |

through a range of media advertising including television, radio, print, catalogues, direct mail, point-of-salepoint of sale signage, in-store displays and the Internet. Established strategic marketing and advertising research programmes provide a strong understanding of jewellery customers and their purchasing profiles.

Gross advertising and marketing expenditure was increased by 9.0%8.6% to $110.4$119.9 million in 2002/03 (2001/02: $101.32003/04 (2002/03: $110.4 million), primarily as a result ofto support total mall sales growth and the continued expansion of the Jared concept and total mall sales growth.concept. Gross expenditure as a percentage of sales was 6.4% (2001/02: 6.3%(2002/03: 6.4%). The total expenditure for advertising and marketing support for Kay and each of the regional brands was approximately 6% of their respective total sales for the year.

Advertising activities are concentrated duringon periods when customers are expected to be most receptive to the marketing message. During the 20022003 Christmas trading period the number of Kay television impressions increased by 16% and radio7%. The proportion of television advertising weights by 8% against the previous Christmas trading period. Over the last four years TV advertising for Kayexpenditure to sales has increased, by two and a half times, and the cost of network television advertising is leveraged as the number of stores increases. The romance and appreciation based theme of its advertising programme continues to beutilise the tag line “Every kiss begins with Kay”, which has improved name recognition of thisthe chain.

Promotional campaigns for Jared and regional chains use cost-effective regional radio advertising supplemented by direct mail as a cost effectivethe primary medium to support and enhance name recognition. AFor the regional chains the campaigns are supported by direct mail. For Jared a regional television advertising test for Jaredprogramme was expanded to ten22 selected markets in 2002/03 from three in 2001/02 in order to gain a better understanding of the dynamics of advertising Jared on television. Whenmarkets. Management believes that when the Jared chain reaches the critical mass to justify national network television advertising, the most efficient and cost effectivecost-effective form of marketing, such a programme would enhance brand name recognition will be enhanced nationwide, and givethus providing improved access to prime store real estate sites in large, high-costhigh cost advertising markets.markets and increased marketing leverage.

Each year the US division produces 11 catalogues that feature a wide selection of merchandise and are prominently displayed in stores. Catalogues are also mailed direct to targeted customers.

Statistical and technology-basedtechnology based systems are employed to support a direct marketing programme that uses a proprietary database of over 1819 million names to

strengthen the relationship with customers.Thecustomers. The programme targets current customers with special savings and merchandise offers during the key trading periods. In addition, invitations to special promotional in-store events hosted in stores are extended throughout the year.

During 2002/03 marketingEach of the US brands now has an informational web site and during 2003/04 the Jared site was enhanced. The expanded web sites for Jared (www.jared.com), J.B.Kay, JB Robinson (www.jbrobinson.com) and Marks & Morgan (www.marksandmorgan.com) were developed and launched, and the web site for Kay (www.kay.com) was upgraded.The web sitesJared display a selection of the stores’ merchandise assortments, includeprovide store locators,locations, and allow for customer registration and the ability to compile a gift “wish list”.credit application on-line.

Credit operationsVarious Signet USManagement regards the provision of an in-house credit programme as a competitive advantage for a number of reasons. It allows management to establish and implement customer service standards in the context of the business. It also provides a database of regular customers and their spending patterns. Investment in systems and management of credit offerings appropriate for the business can also be facilitated in a more cost-efficient manner than if managed by a third party provider. Furthermore it is believed that the various credit programmes offered help to establish long-term relationships with customers and complement the marketing strategy by encouraging additional purchases and higher unit sales. Management regards the provision of an in-house credit programme as a competitive advantage for a number of reasons. It provides opportunities for greater contact with customers. It also allows management to establish and implement customer service standards in the context of the business. It is believed that investment in systems and management of credit offerings appropriate for the business is also facilitated in a more cost-efficient manner than by a third party provider.

The table on page 14below presents data related to the in-house credit business for the past three financial years. TheSince the credit accounts were centralised in 1994 the credit offer and performance hashave been consistent, and despite the credit terms have remained largely unchangedmore recent challenging environment there has been a steady improvement in seven years.performance over the economic cycle. The average outstanding balance at year end was $688 (2001/02: $660)$729 (2002/03: $688). With a stable monthly collection rate of approximately 14.5%, the

The credit portfolio turns approximately every seven months. Bad debt expense in 2002/03 was 6.0% of credit sales before a $2.2 million one-off benefit frommonths and the better than anticipated performance of the residue of the acquired Marks & Morgan receivables portfolio. Itmonthly collection rate has ranged between 6.0%increased to 6.8% of credit sales over the seven year period 1996/97 to 2002/03. In-house credit sales represented 49.5% of total US sales in 2002/03 (50.4% in 2001/02)approximately 14.8%. Certain programmes offer interest-free financing. In most states customers are offered optional third party credit insurance.

Centralised credit authorisation and collection processes are based at the US headquarters in Akron, Ohio. Credit applications are evaluated by the scoring of credit application data and data obtained through on-line access to third party credit bureaux. The centralised system is capable of

Signet Group plc 13

| In-house credit operations | ||||||||||||||||

| 2003/04 | 2002/03 | 2001/02 | ||||||||||||||

| 2002/03 | 2001/02 | 2000/01 | ||||||||||||||

| Credit sales ($m) | 859.6 | 817.2 | 724.0 | 924.3 | 859.6 | 817.2 | ||||||||||

| Credit sales as % of total sales | 49.5% | 50.4% | 49.7% | 49.3% | 49.5% | 50.4% | ||||||||||

| Number of active credit accounts at year end | 798,761 | 799,043 | 793,792 | 807,272 | 798,761 | 799,043 | ||||||||||

| Average outstanding account balance ($) | 688 | 660 | 652 | 729 | 688 | 660 | ||||||||||

| Average monthly collection rates | 14.5% | 13.9% | 13.9% | 14.8% | 14.5% | 13.9% | ||||||||||

| Bad debt as % of total sales | 3.0%(1 | ) | 3.2% | 3.4% | 2.8% | 3.0% | (1) | 3.2% | ||||||||

| Bad debt as % of credit sales | 6.0%(1 | ) | 6.3% | 6.8% | 5.6% | 6.0% | (1) | 6.3% | ||||||||

| (1) | Before a $2.2 million |

| Signet Group plc Annual Report & Accounts year ended 31 January 2004 | 13 |

US operating review (continued)