QuickLinksUNITED STATES

-- Click here to rapidly navigate through this documentSECURITIES AND EXCHANGE COMMISSION

FORM 20-F

Registration Statement Pursuant to Section 12(b) or 12(g) of The Securities Exchange Act of 1934 |

OR

Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 for the fiscal year ended December 31, |

OR

Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

OR

Shell Company Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

Commission file number 0-30752

AETERNA ZENTARIS INC.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s Name into English)

Canada

(Jurisdiction of Incorporation)

1405 du Parc-Technologique Blvd.

Quebec City, Quebec

Canada, G1P 4P5

(Address of Principal Executive Offices)

Dennis Turpin

Telephone: 418-652-8525

E-mail: dturpin@aezsinc.com

1405 du Parc-Technologique Blvd.

Quebec City, Quebec

Canada, G1P 4P5

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |||

Common Shares | Nasdaq Global Market | |||

| Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the ACT:NONE

Indicate the number of outstanding shares of each of the issuer'sissuer’s classes of capital or common stock as at the close of the period covered by the annual report: 83,429,914104,762,096 common shares as at December 31, 2010.2011.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o¨ No ýx

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o¨ No ýx

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ýx No o¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes o¨ No ýx

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or, or a non-accelerated filer. See definitions of "accelerated filer"“accelerated filer” and "large“large accelerated filer"filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer | Non-accelerated filer |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other |

If "other"“other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 o¨ Item 18 ý¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o¨ No ýx

Basis of Presentation

General

Except where the context otherwise requires, all references in this annual report on Form 20-F ("(“Form 20-F"20-F”) to the "Company"“Company”, "Aeterna“Aeterna Zentaris Inc."”, "we"“we”, "us"“us”, "our"“our” or similar words or phrases are to Aeterna Zentaris Inc. and its subsidiaries, taken together. In this annual report, references to "$"“$” and "US$"“US$” are to United States dollars, references to “CAN$” are to Canadian dollars and references to "CAN$"“EUR” are to Canadian dollars.euros. Unless otherwise indicated, the statistical and financial data contained in this annual report are presented as at December 31, 2010.2011.

This annual report on Form 20-F also contains certain information regarding products or product candidates that may potentially compete with our products and product candidates, and such information has been primarily derived from information made publicly available by the companies developing such potentially competing products and product candidates and has not been independently verified by Aeterna Zentaris Inc.

Forward-Looking Statements

This annual report contains forward-looking statements made pursuant to the safe harbor provisions of the U.S. Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which could cause the Company'sCompany’s actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, among others, the availability of funds and resources to pursue our research and development (“R&D&D”) projects, the successful and timely completion of clinical studies, the ability of the Company to take advantage of business opportunities in the pharmaceutical industry, uncertainties related to the regulatory process and general changes in economic conditions. Investors should consult the Company'sCompany’s quarterly and annual filings with the Canadian and U.S. securities commissions for additional information on risks and uncertainties relating to the forward-looking statements. Investors are cautioned not to rely on these forward-looking statements. The Company does not undertake to update these forward-looking statements and we disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-lookingforwards-looking statements contained herein to reflect future results, events or developments except if we are required to do so by a governmental authority or applicable law.

Page

| 1 | ||||||||||

Item 1. | 1 | |||||||||

1 | ||||||||||

B. Advisors | 1 | |||||||||

C. Auditors | 1 | |||||||||

Item 2. | 1 | |||||||||

| 1 | ||||||||||

| 1 | ||||||||||

Item 3. | 1 | |||||||||

| 1 | |||||||||

C. Reasons for the offer and | ||||||||||

| ||||||||||

| 5 | ||||||||||

Item 4. | ||||||||||

| Information on the Company | 21 | ||||||||

A. | History and development of the Company | 21 | ||||||||

B. | Business overview | |||||||||

| 61 | ||||||||||

| 61 | ||||||||||

Item 4A. | ||||||||||

Item 5. | ||||||||||

| ||||||||||

| Operating and Financial Review and Prospects | |||||||||

Item 6. | Directors, Senior Management and Employees | |||||||||

| 93 | ||||||||||

B. Compensation | 96 | |||||||||

| 113 | ||||||||||

D. Employees | 114 | |||||||||

| 114 | ||||||||||

Item 7. | ||||||||||

| Major Shareholders and Related Party Transactions | |||||||||

A. | Major shareholders | |||||||||

B. | Related party transactions | |||||||||

C. | Interests of experts and counsel | |||||||||

Item 8. | Financial Information | |||||||||

A. | Consolidated statements and other financial information | |||||||||

| 115 | ||||||||||

Item 9. | ||||||||||

| ||||||||||

| 116 | ||||||||||

C. Markets | 116 | |||||||||

| 116 | ||||||||||

E. Dilution | 117 | |||||||||

| 117 | ||||||||||

Item 10. | ||||||||||

| 117 | ||||||||||

| 117 | ||||||||||

| 127 | |||||||||

E. Taxation | 130 | ||||||||

| 136 | |||||||||

| 136 | |||||||||

| 136 | |||||||||

| 137 | |||||||||

Item 11. | |||||||||

Item 12. | |||||||||

| |||||||||

| 139 | |||||||||

| |||||||||

| |||||||||

| A. | Debt securities | ||||||||

| |||||||||

|

| ||||||||

| 139 | ||||||||

| 139 | |||||||||

| 140 | |||||||||

Item 13. | Defaults, Dividend Arrearages and Delinquencies | 140 | |||||||

Item 14. | Material Modification to the Rights of Security Holders and Use of Proceeds | ||||||||

Item 15. | Controls and Procedures | ||||||||

Item 16A. | Audit Committee Financial Expert | ||||||||

Item 16B. | Code of Ethics | ||||||||

Item 16C. | Principal Accountant Fees and Services | ||||||||

A. | Audit Fees | ||||||||

B. | Audit-related Fees | ||||||||

C. | Tax Fees | ||||||||

D. | All Other Fees | ||||||||

E. | Audit Committee Pre-Approval Policies and Procedures | ||||||||

Item 16D. | Exemptions from the Listing Standards for Audit Committees | ||||||||

Item 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | ||||||||

Item 16F. | Changes in | ||||||||

Item 16G. | Corporate Governance | ||||||||

Item 16H. | Mine Safety Disclosure | 143 | |||||||

Item 17. | |||||||||

Item 18. | Financial Statements | ||||||||

Item 19. | Exhibits | ||||||||

Item 1. Identity of Directors, Senior Management and Advisers

A. Directors and senior management

Not applicable.

Not applicable.

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

B. Method and expected timetable

Not applicable.

The consolidated statement of comprehensive loss data set forth in this Item 3.A with respect to the years ended December 31, 2011 and 2010, and the consolidated statement of financial position data as at December 31, 2011 and 2010, have been derived from the audited consolidated financial statements listed in Item 18, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). The consolidated statement of operations data set forth in this Item 3.A with respect to the years ended December 31, 2010, 2009, 2008 and 2008,2007, and the consolidated balance sheet data as at December 31, 20102009, 2008 and 2009,2007, have been derived from the audited consolidated financial statements listed in Item 18, which have been prepared in accordance with Canadian generally accepted accounting principles ("Canadian GAAP"), except as otherwise described therein. The consolidated statement of operations data set forth in this Item 3.A with respect to the years ended December 31, 2007 and 2006, and the consolidated balance sheet data as at December 31, 2008, 2007 and 2006, have been derived from otherour previous consolidated financial statements not included herein, and have beenwhich were prepared in accordance with Canadian GAAP, except as otherwise described therein. The selected financial data should be read in conjunction with our audited consolidated financial statements and the related notes included elsewhere in this annual report, and "Item“Item 5. — Operating and Financial Review and Prospects"Prospects” of this annual report.

Consolidated Statements of Operations Data

Comprehensive Loss

(in thousands of US dollars, except share and per share data)

Derived from financial statements prepared in accordance with IFRS

| Years ended December 31, | ||||||||

| 2011 | 2010 | |||||||

| $ | $ | |||||||

Revenues | ||||||||

Sales and royalties | 31,306 | 24,857 | ||||||

License fees and other | 4,747 | 2,846 | ||||||

| 36,053 | 27,703 | |||||||

Operating expenses | ||||||||

Cost of sales | 27,560 | 18,700 | ||||||

Research and development costs, net of refundable tax credits and grants | 24,517 | 21,257 | ||||||

Selling, general and administrative expenses | 16,170 | 12,552 | ||||||

| 68,247 | 52,509 | |||||||

Loss from operations | (32,194) | (24,806) | ||||||

Finance income | 6,239 | 1,800 | ||||||

Finance costs | (8) | (5,445) | ||||||

Net finance income (costs) | 6,231 | (3,645) | ||||||

Loss before income taxes | (25,963) | (28,451) | ||||||

Income tax expense | (1,104) | - | ||||||

Net loss | (27,067) | (28,451) | ||||||

Other comprehensive (loss) income: | ||||||||

Foreign currency translation adjustments | (789) | 1,001 | ||||||

Actuarial gain (loss) on defined benefit plans | (1,335) | 191 | ||||||

Comprehensive loss | (29,191) | (27,259) | ||||||

Net loss per share | ||||||||

Basic and diluted | (0.29) | (0.38) | ||||||

Weighted average number of shares outstanding | ||||||||

Basic and diluted | 94,507,988 | 75,659,410 | ||||||

Consolidated Statements of Operations Data

(in thousands of US dollars, except share and per share data)

Derived from financial statements prepared in accordance with Canadian GAAP

| | Years Ended December 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||

| | $ | $ | $ | $ | $ | ||||||||||||

Revenues | 27,703 | 63,237 | 38,478 | 42,068 | 38,799 | ||||||||||||

Operating expenses | |||||||||||||||||

Cost of sales, excluding depreciation and amortization | 18,700 | 16,501 | 19,278 | 12,930 | 11,270 | ||||||||||||

Research and development costs | 20,546 | 44,217 | 57,448 | 39,248 | 27,422 | ||||||||||||

Research and development tax credits and grants | (687) | (403) | (343) | (2,060) | (1,564) | ||||||||||||

Selling, general and administrative expenses | 11,875 | 16,040 | 17,325 | 20,403 | 16,478 | ||||||||||||

Depreciation and amortization | |||||||||||||||||

Property, plant and equipment | 1,005 | 3,285 | 1,515 | 1,562 | 2,816 | ||||||||||||

Intangible assets | 1,492 | 7,555 | 5,639 | 4,004 | 6,148 | ||||||||||||

Impairment of long-lived assets held for sale | — | — | — | 735 | — | ||||||||||||

| 52,931 | 87,195 | 100,862 | 76,822 | 62,570 | |||||||||||||

Loss from operations | (25,228) | (23,958) | (62,384) | (34,754) | (23,771) | ||||||||||||

Other income (expenses) | |||||||||||||||||

Unrealized gain on held-for-trading financial instrument | 687 | — | — | — | — | ||||||||||||

Interest income | 207 | 349 | 868 | 1,904 | 1,441 | ||||||||||||

Interest expense | |||||||||||||||||

Long-term debt and convertible term loans | — | — | — | (85) | (1,270) | ||||||||||||

Other | (26) | (5) | (118) | — | (163) | ||||||||||||

Foreign exchange gain (loss) | 1,170 | (1,110) | 3,071 | (1,035) | 319 | ||||||||||||

Loss on disposal of long-lived assets held for sale | — | — | (35) | — | — | ||||||||||||

Loss on disposal of equipment | (28) | — | (44) | (28) | — | ||||||||||||

Gain on disposal of long-term investment | — | — | — | — | 409 | ||||||||||||

| 2,010 | (766) | 3,742 | 756 | 736 | |||||||||||||

Share in the results of an affiliated company | — | — | — | — | 1,575 | ||||||||||||

Loss before income taxes from continuing operations | (23,218) | (24,724) | (58,642) | (33,998) | (21,460) | ||||||||||||

Income tax (expense) recovery | — | — | (1,175) | 1,961 | 29,037 | ||||||||||||

Net (loss) earnings from continuing operations | (23,218) | (24,724) | (59,817) | (32,037) | 7,577 | ||||||||||||

Net (loss) earnings from discontinued operations | — | — | — | (259) | 25,813 | ||||||||||||

Net (loss) earnings for the year | (23,218) | (24,724) | (59,817) | (32,296) | 33,390 | ||||||||||||

Net (loss) earnings per share from continuing operations | |||||||||||||||||

Basic | (0.31) | (0.43) | (1.12) | (0.61) | 0.14 | ||||||||||||

Diluted | (0.31) | (0.43) | (1.12) | (0.61) | 0.14 | ||||||||||||

Net earnings per share from discontinued operations | |||||||||||||||||

Basic | — | — | — | — | 0.50 | ||||||||||||

Diluted | — | — | — | — | 0.48 | ||||||||||||

Net (loss) earnings per share | |||||||||||||||||

Basic | (0.31) | (0.43) | (1.12) | (0.61) | 0.64 | ||||||||||||

Diluted | (0.31) | (0.43) | (1.12) | (0.61) | 0.62 | ||||||||||||

Weighted average number of shares | |||||||||||||||||

Basic | 75,659,410 | 56,864,484 | 53,187,470 | 53,182,803 | 52,099,290 | ||||||||||||

Diluted | 75,659,410 | 56,864,484 | 53,187,470 | 53,182,803 | 52,549,260 | ||||||||||||

| Years Ended December 31, | ||||||||||||

| 2009 | 2008 | 2007 | ||||||||||

| $ | $ | $ | ||||||||||

Revenues | 63,237 | 38,478 | 42,068 | |||||||||

|

| |||||||||||

Operating expenses | ||||||||||||

Cost of sales, excluding depreciation and amortization | 16,501 | 19,278 | 12,930 | |||||||||

Research and development costs | 44,217 | 57,448 | 39,248 | |||||||||

Research and development tax credits and grants | (403 | ) | (343 | ) | (2,060) | |||||||

Selling, general and administrative expenses | 16,040 | 17,325 | 20,403 | |||||||||

Depreciation and amortization | ||||||||||||

Property, plant and equipment | 3,285 | 1,515 | 1,562 | |||||||||

Intangible assets | 7,555 | 5,639 | 4,004 | |||||||||

Impairment of long-lived assets held for sale | — | — | 735 | |||||||||

|

| |||||||||||

| 87,195 | 100,862 | 76,822 | ||||||||||

|

| |||||||||||

Loss from operations | (23,958 | ) | (62,384 | ) | (34,754) | |||||||

|

| |||||||||||

Other income (expenses) | ||||||||||||

Interest income | 349 | 868 | 1,904 | |||||||||

Interest expense | (5 | ) | (118 | ) | (85) | |||||||

Foreign exchange gain (loss) | (1,110 | ) | 3,071 | (1,035) | ||||||||

Loss on disposal of long-lived assets held for sale | — | (35 | ) | — | ||||||||

Loss on disposal of equipment | — | (44 | ) | (28) | ||||||||

|

| |||||||||||

| (766 | ) | 3,742 | 756 | |||||||||

|

| |||||||||||

Loss before income taxes from continuing operations | (24,724 | ) | (58,642 | ) | (33,998) | |||||||

Income tax (expense) recovery | — | (1,175 | ) | 1,961 | ||||||||

|

| |||||||||||

Net loss from continuing operations | (24,724 | ) | (59,817 | ) | (32,037) | |||||||

Net loss from discontinued operations | — | — | (259) | |||||||||

|

| |||||||||||

Net loss for the year | (24,724 | ) | (59,817 | ) | (32,296) | |||||||

|

| |||||||||||

Net loss per share from continuing operations | ||||||||||||

Basic and diluted | (0.43 | ) | (1.12 | ) | (0.61) | |||||||

Net loss per share | ||||||||||||

Basic and diluted | (0.43 | ) | (1.12 | ) | (0.61) | |||||||

Weighted average number of shares | ||||||||||||

Basic and diluted | 56,864,484 | 53,187,470 | 53,182,803 | |||||||||

TableConsolidated Statements of ContentsOperations Data

(in thousands of US dollars, except share and per share data)

Derived from reconciliation to US GAAP

| | Years Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

| | $ | $ | $ | $ | $ | |||||||||||

Net (loss) earnings for the year | (29,165) | (16,794) | (56,070) | (37,428) | 34,262 | |||||||||||

Of which: | ||||||||||||||||

Net (loss) earnings from continuing operations | (29,165) | (16,794) | (56,070) | (36,415) | 8,449 | |||||||||||

Net (loss) earnings from discontinued operations | — | — | — | (1,013) | 25,813 | |||||||||||

Net (loss) earnings per share from continuing operations | ||||||||||||||||

Basic | (0.39) | (0.30) | (1.05) | (0.68) | 0.16 | |||||||||||

Diluted | (0.39) | (0.30) | (1.05) | (0.68) | 0.16 | |||||||||||

Net (loss) earnings per share from discontinued operations | ||||||||||||||||

Basic | — | — | — | (0.02) | 0.50 | |||||||||||

Diluted | — | — | — | (0.02) | 0.49 | |||||||||||

Net (loss) earnings per share | ||||||||||||||||

Basic | (0.39) | (0.30) | (1.05) | (0.70) | 0.66 | |||||||||||

Diluted | (0.39) | (0.30) | (1.05) | (0.70) | 0.65 | |||||||||||

Weighted average number of shares | ||||||||||||||||

Basic | 75,659,410 | 56,864,484 | 53,187,470 | 53,182,803 | 52,099,290 | |||||||||||

Diluted | 75,659,410 | 56,864,484 | 53,187,470 | 53,182,803 | 52,549,260 | |||||||||||

| Years ended December 31, | ||||||||||||

| 2009* | 2008* | 2007* | ||||||||||

| $ | $ | $ | ||||||||||

Net loss for the year | (16,794 | ) | (56,070 | ) | (37,428 | ) | ||||||

Of which: | ||||||||||||

Net loss from continuing operations | (16,794 | ) | (56,070 | ) | (36,415 | ) | ||||||

Net loss from discontinued operations | — | — | (1,013 | ) | ||||||||

Net loss per share from continuing operations | ||||||||||||

Basic and diluted | (0.30 | ) | (1.05 | ) | (0.68 | ) | ||||||

Net loss per share from discontinued operations | ||||||||||||

Basic and diluted | — | — | (0.02 | ) | ||||||||

Net loss per share | ||||||||||||

Basic and diluted | (0.30 | ) | (1.05 | ) | (0.70 | ) | ||||||

Weighted average number of shares | ||||||||||||

Basic and diluted | 56,864,484 | 53,187,470 | 53,182,803 | |||||||||

TableConsolidated Statement of ContentsFinancial Position Data

Consolidated Balance Sheet Data

(in thousands of US dollars)

Derived from financial statements prepared in accordance with IFRS for 2011 and 2010, and Canadian GAAP for 2009, 2008 and 2007

| As at December 31, | ||||||||||||||||||||||||||||||||||||

| | As at December 31, | 2011 | 2010 | 2009* | 2008* | 2007* | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | 2007 | 2006 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||

| | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||

Cash and cash equivalents | 31,998 | 38,100 | 49,226 | 10,272 | 8,939 | 46,881 | 31,998 | 38,100 | 49,226 | 10,272 | ||||||||||||||||||||||||||

Short-term investments | 1,934 | — | 493 | 31,115 | 51,550 | — | 1,934 | — | 493 | 31,115 | ||||||||||||||||||||||||||

Working capital | 30,688 | 29,745 | 39,554 | 37,325 | 85,413 | 42,254 | 29,444 | 29,745 | 39,554 | 37,325 | ||||||||||||||||||||||||||

Restricted cash | 827 | 878 | — | — | — | 806 | 827 | 878 | — | — | ||||||||||||||||||||||||||

Total assets | 76,574 | 86,262 | 108,342 | 123,363 | 223,491 | 75,369 | 61,448 | 86,262 | 108,342 | 123,363 | ||||||||||||||||||||||||||

Long-term debt and payable | 90 | 143 | 172 | — | 687 | |||||||||||||||||||||||||||||||

Warrant liability short-term | 42 | 955 | * | * | * | |||||||||||||||||||||||||||||||

Warrant liability long-term | 9,162 | 13,412 | * | * | * | |||||||||||||||||||||||||||||||

Long-term payable | 29 | 90 | 143 | 172 | — | |||||||||||||||||||||||||||||||

Share capital | 60,149 | 41,203 | 30,566 | 30,566 | 168,466 | 101,884 | 60,900 | 41,203 | 30,566 | 30,566 | ||||||||||||||||||||||||||

Shareholders' equity | 12,439 | 9,226 | 21,475 | 88,591 | 178,879 | |||||||||||||||||||||||||||||||

Shareholders’ (deficiency) equity | (4,546 | ) | (17,575 | ) | 9,226 | 21,475 | 88,591 | |||||||||||||||||||||||||||||

| * | We adopted IFRS in 2011 with a transition date of January 1, 2010. The selected financial information for the years ended December 31, 2009, 2008 and 2007 is derived from financial statements that were presented in accordance with Canadian GAAP and has not been restated in accordance with IFRS. Consequently, the selected financial information for the years ended December 31, 2009, 2008 and 2007 may not be comparable with the corresponding selected financial information for the years ended December 31, 2011 and 2010. Please refer to “Critical Accounting Policies, Estimates and Judgments” for the policy differences between Canadian GAAP and IFRS. |

US GAAP

| | As at December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||

| | $ | $ | $ | $ | $ | |||||||||||

Cash and cash equivalents | 31,998 | 38,100 | 49,226 | 10,272 | 8,939 | |||||||||||

Short-term investments | 1,934 | — | 493 | 31,115 | 51,550 | |||||||||||

Working capital | 29,733 | 29,745 | 39,554 | 37,325 | 85,413 | |||||||||||

Restricted cash | 827 | 878 | — | — | — | |||||||||||

Total assets | 74,853 | 84,116 | 100,001 | 109,182 | 209,143 | |||||||||||

Warrant liability, short-term | 955 | — | — | — | — | |||||||||||

Warrant liability, long-term | 13,412 | 1,351 | — | — | — | |||||||||||

Long-term debt and payable | 90 | 143 | 172 | — | 687 | |||||||||||

Share capital | 52,318 | 33,226 | 22,589 | 22,589 | 160,489 | |||||||||||

Shareholders' (deficiency) equity | (3,649) | 5,729 | 13,134 | 74,410 | 169,704 | |||||||||||

TableConsolidated Statement of ContentsFinancial Position Data

B. Capitalization(in thousands of US dollars)

Derived from financial statements prepared in accordance with IFRS for 2011 and indebtedness2010, and US GAAP for 2009, 2008 and 2007

| As at December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009* | 2008* | 2007* | ||||||||||||||||

| $ | $ | $ | $ | $ | ||||||||||||||||

Cash and cash equivalents | 46,881 | 31,998 | 38,100 | 49,226 | 10,272 | |||||||||||||||

Short-term investments | — | 1,934 | — | 493 | 31,115 | |||||||||||||||

Working capital | 42,254 | 29,444 | 29,745 | 39,554 | 37,325 | |||||||||||||||

Restricted cash | 806 | 827 | 878 | — | — | |||||||||||||||

Total assets | 75,369 | 61,448 | 84,116 | 100,001 | 109,182 | |||||||||||||||

Warrant liability, short-term | 42 | 955 | * | * | * | |||||||||||||||

Warrant liability, long-term | 9,162 | 13,412 | 1,351 | * | * | |||||||||||||||

Long-term payable | 29 | 90 | 143 | 172 | — | |||||||||||||||

Share capital | 101,884 | 60,900 | 33,226 | 22,589 | 22,589 | |||||||||||||||

Shareholders’ (deficiency) equity | (4,546 | ) | (17,575 | ) | 5,729 | 13,134 | 74,410 | |||||||||||||

| * | We adopted IFRS in 2011 with a transition date of January 1, 2010. The selected financial information for the years ended December 31, 2009, 2008 and 2007 is derived from financial statements that were presented in accordance with Canadian GAAP and has not been restated in accordance with IFRS. Consequently, the selected financial information for the years ended December 31, 2009, 2008 and 2007 may not be comparable with the corresponding selected financial information for the years ended December 31, 2011 and 2010. Please refer to “Critical Accounting Policies, Estimates and Judgments” for the policy differences between Canadian GAAP and IFRS. |

| B. | Capitalization and indebtedness |

Not applicable.

C. Reasons for the offer and use of proceeds

| C. | Reasons for the offer and use of proceeds |

Not applicable.

D. Risk factors

| D. | Risk factors |

Risks Relating to Us and Our Business

Investments in biopharmaceutical companies are generally considered to be speculative.

The prospects for companies operating in the biopharmaceutical industry may generally be considered to be uncertain, given the very nature of the industry and, accordingly, investments in biopharmaceutical companies should be considered to be speculative.

We have a history of operating losses and we may never achieve or maintain operating profitability.

Our product candidates remain at the development stage, and we have incurred substantial expenses in our efforts to develop products. Consequently, we have incurred recurrent operating losses and, as disclosed in our audited consolidated financial statements as at December 31, 20102011 and December 31, 20092010 and for the years ended December 31, 2010, 20092011 and 2008,2010, we had an accumulated deficit of $150.8$189.0 million as at December 31, 2010.2011. Our operating losses have adversely impacted, and will continue to adversely impact, our working capital, total assets and shareholders' equity.shareholders’ deficiency. We do not expect to reach operating profitability in the immediate future, and our expenses are likely to increase as we continue to expand our research and development ("R&D")&D and clinical study programs and our sales and marketing activities and seek regulatory approval for our product candidates. Even if we succeed in developing new commercial products, we expect to incur additional operating losses for at least the next several years. If we ultimately do not ultimately generate sufficient revenue from commercialized products and achieve or maintain operating profitability, an investment in our securities could result in a significant or total loss.

Our clinical trials may not yield results which will enable us to obtain regulatory approval for our products, and a setback in any of our clinical trials would likely cause a drop in the price of our securities.

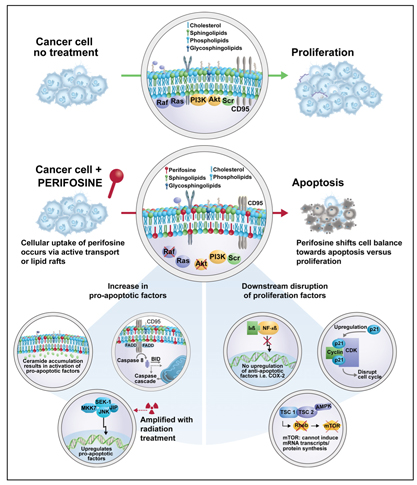

We will only receive regulatory approval for a product candidate if we can demonstrate in carefully designed and conducted clinical trials that the product candidate is both safe and effective. We do not know whether our pending or any future clinical trials will demonstrate sufficient safety and efficacy to obtain the requisite regulatory approvals or will result in marketable products. Unfavorable data from those studies could result in the withdrawal of marketing approval for approved products or an extension of the review period for developmental products. For example, our partner Keryx is conducting phase 3 trials of perifosine for the treatment of colorectal cancer and multiple myeloma. The enrollment of the trial in colorectal cancer has been completed and results of this trial are expected in the near future. If the results of this clinical trial are unfavorable, it would likely adversely affect our and our partners’ perifosine development programs. In addition, unfavorable results in this trial could adversely affect our stock price. Clinical trials are inherently lengthy, complex, expensive and uncertain processes and have a high risk of failure. It typically takes many years to complete testing, and failure can occur at any stage of testing. Results attained in pre-clinicalpreclinical testing and early clinical studies, or trials, may not be indicative of results that are obtained in later studies.

None of our product candidates has to date received regulatory approval for its intended commercial sale. We cannot market a pharmaceutical product in any jurisdiction until it has completed rigorous pre-clinicalpreclinical testing and clinical trials and passed such jurisdiction'sjurisdiction’s extensive regulatory approval process. In general, significant research and development and clinical studies are required to demonstrate the safety and efficacy of our product candidates before we can submit regulatory applications. Pre-clinicalPreclinical testing and clinical development are long, expensive and uncertain processes. Preparing, submitting and advancing applications for regulatory approval is complex, expensive and time-consuming and entails significant uncertainty. Data obtained from pre-clinicalpreclinical and clinical tests can be interpreted in different ways, which could delay, limit or prevent regulatory approval. It may take us

many years to complete the testing of our product candidates and failure can occur at any stage of this process. In addition, we have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approval in the United States, in Canada and abroad and, accordingly, we may encounter unforeseen problems and delays in the approval process. Though we may engage a clinicalcontract research organization (a “CRO”) with experience in conducting regulatory trials, errors in the conduct, monitoring and/or auditing could invalidate the results from a regulatory perspective. Even if a product candidate is approved by the United States Food and Drug Administration ("FDA"(the “FDA”), the Canadian Therapeutic Products Directorate or any other regulatory authority, we may not obtain approval for an indication whose market is large enough to recoup our investment in that product candidate. In addition, there can be no assurance that we will ever obtain all or any required regulatory approvals for any of our product candidates.

We are currently developing our product candidates based on R&D activities, pre-clinicalpreclinical testing and clinical trials conducted to date, and we may not be successful in developing or introducing to the market these or any other new products or technology. If we fail to develop and deploy new products successfully and on a timely basis, we may become non-competitive and unable to recoup the R&D and other expenses we incur to develop and test new products.

Interim results of pre-clinicalpreclinical or clinical studies do not necessarily predict their final results, and acceptable results in early studies might not be obtained in later studies. Safety signals detected during clinical studies and pre-clinicalpreclinical animal studies may require us to do additional studies, which could delay the development of the drug or lead to a decision to discontinue development of the drug. Product candidates in the later stages of clinical development may fail to show the desired safety and efficacy traits despite positive results in initial clinical testing. Results from earlier studies may not be indicative of results from future clinical trials and the risk remains that a pivotal program may generate efficacy data that will be insufficient for the approval of the drug, or may raise safety concerns that may prevent approval of the drug. Interpretation of the prior pre-clinicalpreclinical and clinical safety and efficacy data of our product candidates may be flawed and there can be no assurance that safety and/or efficacy concerns from the prior data were overlooked or misinterpreted, which in subsequent, larger studies appear and prevent approval of such product candidates.

Furthermore, we may suffer significant setbacks in advanced clinical trials, even after promising results in earlier studies. Based on results at any stage of clinical trials, we may decide to repeat or redesign a trial or discontinue development of one or more of our product candidates. Further, actual results may vary once the final and quality-controlled verification of data and analyses has been completed. If we fail to adequately demonstrate the safety and efficacy of our products under development, we will not be able to obtain the required regulatory approvals to commercialize our product candidates.

Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards and:

| — | must meet the requirements of these authorities; |

| — | must meet requirements for informed consent; and |

| — | must meet requirements for good clinical practices. |

We may not be able to comply with these requirements in respect of one or more of our product candidates.

In addition, we rely on third parties, including Contract Research Organizations ("CROs")CROs and outside consultants, to assist us in managing and monitoring clinical trials. Our reliance on these third parties may result in delays in completing, or in failing to complete, these trials if one or more third parties fails to perform with the speed and level of competence we expect.

A failure in the development of any one of our programs or product candidates could have a negative impact on the development of the others. Setbacks in any phase of the clinical development of our product candidates would have an adverse financial impact (including with respect to any agreements and partnerships that may exist between us and other entities), could jeopardize regulatory approval and would likely cause a drop in the price of our securities.

If we are unable to successfully complete our clinical trial programs, or if such clinical trials take longer to complete than we project, our ability to execute our current business strategy will be adversely affected.

Whether or not and how quickly we complete clinical trials is dependent in part upon the rate at which we are able to engage clinical trial sites and, thereafter, the rate of enrollment of patients, and the rate at which we collect, clean, lock and analyze the clinical trial database. Patient enrollment is a function of many factors, including the design of the protocol, the size of the patient population, the proximity of patients to and availability of clinical sites, the eligibility criteria for the study, the perceived risks and benefits of the drug under study and of the control drug, if any, the efforts to facilitate timely enrollment in clinical trials, the patient referral practices of physicians, the existence of competitive clinical trials, and whether existing or new drugs are approved for the indication we are studying. Certain clinical trials are designed to continue until a pre-determined number of events have occurred to the patients enrolled. Trials such as thisSuch trials are subject to delays stemming from patient withdrawal and from lower than expected event rates and may also incur increased costs if enrollment is increased in order to achieve the desired number of events. If we experience delays in identifying and contracting with sites and/or in patient enrollment in our clinical trial programs, we may incur additional costs and delays in our development programs, and may not be able to complete our clinical trials on a cost-effective or timely basis. In addition, conducting multi-national studies adds another level of complexity and risk as we are subject to events affecting countries outside Canada.North America. Moreover, negative or inconclusive results from the clinical trials we conduct or adverse medical events could cause us to have to repeat or terminate the clinical trials. Accordingly, we may not be able to complete the clinical trials within an acceptable time frame, if at all. If we or any third party have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing clinical trials.

Additionally, we have never filed a new drug application ("NDA"New Drug Application (“NDA”), or similar application for approval in the United States or in any country for our current product candidates, which may result in a delay in, or the rejection of, our filing of an NDA or similar application. During the drug development process, regulatory agencies will typically ask questions of drug sponsors. While we endeavor to answer all such questions in a timely fashion, or in the NDA filing, some questions may not be answered by the time we file our NDA. Unless the FDA waives the requirement to answer any such unanswered questions, submission of an NDA may be delayed or rejected.

We are and will continue to be subject to stringent ongoing government regulation for our products and, our product candidates, even if we obtain regulatory approvals, for the latter.our product candidates.

The manufacture, marketing and sale of our products and product candidates are and will continue to be subject to strict and ongoing regulation, even if regulatory authorities approve any of the latter.our product candidates. Compliance with such regulation will be expensive and consume substantial financial and management resources. For example, an approval for a product may be conditioned on our agreement to conduct costly post-marketing follow-up studies to monitor the safety or efficacy of the products. In addition, as a clinical experience with a drug expands after approval because the drug is used by a greater number and more diverse group of patients than during clinical trials, side effects or other problems may be observed after approval that were not observed or anticipated during pre-approval clinical trials. In such a case, a regulatory authority could restrict the indications for which the product may be sold or revoke the product'sproduct’s regulatory approval.

We and our contract manufacturers are and will continue to be required to comply with applicable current Good Manufacturing Practice ("cGMP"(“cGMP”) regulations for the manufacture of our products. These regulations include requirements relating to quality assurance, as well as the corresponding maintenance of rigorous records and documentation. Manufacturing facilities must be approved before we can use them in the commercial manufacturing of our products and are subject to subsequent periodic inspection by regulatory authorities. In addition, material changes in the methods of manufacturing or changes in the suppliers of raw materials are subject to further regulatory review and approval.

If we, or any future marketing collaborators or contract manufacturers, fail to comply with applicable regulatory requirements, we may be subject to sanctions including fines, product recalls or seizures and related publicity requirements, injunctions, total or partial suspension of production, civil penalties, suspension or withdrawals of previously granted regulatory approvals, warning or untitled letters, refusal to approve pending applications for marketing approval of new products or of supplements to approved applications, import or export bans or restrictions, and criminal prosecution and penalties. Any of these penalties could delay or prevent the promotion, marketing or sale of our products and product candidates.

If our products do not gain market acceptance, we may be unable to generate significant revenues.

Even if our products are approved for commercialization, they may not be successful in the marketplace. Market acceptance of any of our products will depend on a number of factors including, but not limited to:

| — | demonstration of clinical efficacy and safety; |

| — | the prevalence and severity of any adverse side effects; |

| — | limitations or warnings contained in the product’s approved labeling; |

| — | availability of alternative treatments for the indications we target; |

| — | the advantages and disadvantages of our products relative to current or alternative treatments; |

| — | the availability of acceptable pricing and adequate third-party reimbursement; and |

| — | the effectiveness of marketing and distribution methods for the products. |

If our products do not gain market acceptance among physicians, patients, healthcare payers and others in the medical community, which may not accept or utilize our products, our ability to generate significant revenues from our products would be limited and our financial conditions will be materially adversely affected. In addition, if we fail to further penetrate our core markets and existing geographic markets or successfully expand our business into new markets, the growth in sales of our products, along with our operating results, could be negatively impacted.

Our ability to further penetrate our core markets and existing geographic markets in which we compete or to successfully expand our business into additional countries in Europe, Asia or elsewhere is subject to numerous factors, many of which are beyond our control. Our products, if successfully developed, may compete with a number of drugs and therapies currently manufactured and marketed by major pharmaceutical and other biotechnology companies. Our products may also compete with new products currently under development by others or with products which may be less expensive than our products. We cannot assure you that our efforts to increase market penetration in our core markets and existing geographic markets will be successful. Our failure to do so could have an adverse effect on our operating results and would likely cause a drop in the price of our securities.

We maywill likely require significant additional financing, and we may not have access to sufficient capital.

We maywill likely require additional capital to pursue planned clinical trials, regulatory approvals, as well as further R&D and marketing efforts for our product candidates and potential products. Except as otherwise described in this annual report, we do not anticipate generating significant revenues from operations in the near future and we currently have no committed sources of capital.

We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or financing from other sources. Additional funding may not be available on terms which are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable for equity securities, the issuance of those securities couldwould result in dilution to our shareholders. Moreover, the incurrence of debt financingindebtedness could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness and could impose restrictions on our operations. This could render us more vulnerable to competitive pressures and economic downturns.

We anticipate that our existing working capital, including the proceeds from any sale and anticipated revenues, will be sufficient to fund our development programs, clinical trials and other operating expenses for the near future.more than 12 months following year-end. However, our future capital requirements are substantial and may increase beyond our current expectations depending on many factors including:

| — | the duration and results of our clinical trials for our various product candidates going forward; |

| — | unexpected delays or developments in seeking regulatory approvals; |

| — | the time and cost involved in preparing, filing, prosecuting, maintaining and enforcing patent claims; |

| — | other unexpected developments encountered in implementing our business development and commercialization strategies; |

| — | the outcome of litigation, if any; and |

| — | further arrangements, if any, with collaborators. |

In addition, global economic and market conditions as well as future developments in the credit and capital markets may make it even more difficult for us to raise additional financing in the future.

A substantial portion of our future revenues may be dependent upon our agreements with Keryx Biopharmaceuticals, Inc. and Yakult Honsha Co. Ltd

We currently expect that a substantial portion of our future revenues may be dependent upon our strategic partnerships with Keryx Biopharmaceuticals, Inc. ("Keryx"(“Keryx”) for North America and Yakult Honsha Co. Ltd ("Yakult"Ltd. (“Yakult”) for Japan. Under these strategic partnerships, Keryx and Yakult have significant development and commercialization responsibilities with respect to the development and sale of perifosine.perifosine in their respective territories. If Keryx or Yakult were to terminate their agreements with us, fail to meet their obligations or otherwise decrease their level of efforts, allocation of resources or other commitments under their respective agreements, our future revenues and/or prospects could be negatively impacted and the development and commercialization of perifosine would be interrupted. In addition, if either Keryx or Yakult dodoes not achieve some or any of their respective development, regulatory and commercial milestones or if they do not achieve certain net sales thresholds as set forth in the agreements, we will not fully realize the expected economic benefits of thesesuch agreements. Further, the achievement of certain of the milestones under these strategic partnership agreements will depend on factors that are outside of our control and most are not expected to be achieved for several years, if at all. Any failure

to successfully maintain our strategic partnership agreements could materially and adversely affect our ability to generate revenues.

If we are unsuccessful in increasing our revenues and/or raising additional funding, we may possibly cease to continue operating as we currently do.

Although our audited consolidated financial statements as at December 31, 20102011 and December 31, 20092010 and for the years ended December 31, 2010, 20092011 and 20082010 have been prepared on a going concern basis, which contemplates the realization of assets and liquidation of liabilities during the normal course of operations, our ability to continue as a going concern is dependent on the successful execution of our business plan, which will require an increase in revenue and/or additional funding to be provided by potential investors as well as non-traditional sources of financing. Although we stated in our audited consolidated financial statements as at December 31, 20102011 and December 31, 20092010 and for the years ended December 31, 2010, 20092011 and 20082010 that management believed that the Company had, as at December 31, 2010,2011, sufficient financial resources to fund planned expenditures and other working capital needs for at least, but not limited to, the 12-month period following such date, there can be no assurance that managementmanagement’s assumptions will be able to reiterate such beliefnot change in our future financial statements.

WeSince our inception, we have had sustainedincurred losses, accumulated deficits and negative cash flows from operations since our inception.operations. We expect that this will continue throughout 2011.2012.

Additional funding may be in the form of debt or equity or a hybrid instrument depending on the needs of the investor. In light of present and future global economic and credit market conditions, we may not be able to raise additional cash resources through these traditional sources of financing. Although we are also pursuing non-traditional sources of financing with third parties, the global credit market crisis has alsomarkets may adversely affectedaffect the ability of potential third parties to pursue such transactions. We do not believe that the ability to access capital markets or these adverse conditions are likely to improve significantly in the near future.transactions with us. Accordingly, as a result of the foregoing, we continue to review traditional sources of financing, such as private and public debt or various equity financing alternatives, as well as other alternatives to enhance shareholder value including, but not limited to, non-traditional sources of financing, such as alliances with strategic partners, the sale of assets or licensing of our technology or intellectual property, a combination of operating and related initiatives or a substantial reorganization of our business. If we do not raise additional capital, we do not expect our operations to generate sufficient cash flow to fund our obligations as they come due.

There can be no assurance that we will achieve profitability or positive cash flows or be able to obtain additional funding or that, if obtained, they will be sufficient, or whether any other initiatives will be successful, such that we may continue as a going concern. There arecould be material uncertainties related to certain adverse conditions and events that could cast significant doubt on our ability to remain a going concern.

We may not achieve our projected development goals in the time-frames we announce and expect.

We set goals and make public statements regarding the timing of the accomplishment of objectives material to our success, such as the commencement, enrollment and completion of clinical trials, anticipated regulatory submission and approval dates and time of product launch. The actual timing of these events can vary dramatically due to factors such as delays or failures in our clinical trials, the uncertainties inherent in the regulatory approval process and delays in achieving manufacturing or marketing arrangements sufficient to commercialize our products. There can be no assurance that our clinical trials will be completed, that we will make regulatory submissions or receive regulatory approvals as planned or that we will be able to adhere to our current schedule for the launch of any of our products. If we fail to achieve one or more of these milestones as planned, the price of our securities would likely decline.

If we fail to obtain acceptable prices or adequate reimbursement for our products, our ability to generate revenues will be diminished.

The ability for us and/or our partners to successfully commercialize our products will depend significantly on our ability to obtain acceptable prices and the availability of reimbursement to the patient from third-party payers, such as governmental and private insurance plans. These third-party payers frequently require companies to provide predetermined discounts from list prices, and they are increasingly challenging the prices charged for pharmaceuticals and other medical products. Our products may not be considered cost-effective, and reimbursement to the patient may not be available or sufficient to allow us or our partners to sell our products on a competitive basis. It may not be possible to negotiate favorable reimbursement rates for our products.

In addition, the continuing efforts of third-party payers to contain or reduce the costs of healthcare through various means may limit our commercial opportunity and reduce any associated revenue and profits. We expect proposals to implement similar government control to continue. In addition, increasing emphasis on managed care will continue to put pressure on the pricing of pharmaceutical and biopharmaceutical products. Cost control initiatives could decrease the price that we or any current or potential collaborators could receive for any of our products and could adversely affect our profitability. In addition, in the United States, in Canada and in many other countries, pricing and/or profitability of some or all prescription pharmaceuticals and biopharmaceuticals are subject to government control.

If we fail to obtain acceptable prices or an adequate level of reimbursement for our products, the sales of our products would be adversely affected or there may be no commercially viable market for our products.

Competition in our targeted markets is intense, and development by other companies could render our products or technologies non-competitive.

The biomedical field is highly competitive. New products developed by other companies in the industry could render our products or technologies non-competitive. Competitors are developing and testing products and technologies that would compete with the products that we are developing. Some of these products may be more effective or have an entirely different approach or means of accomplishing the desired effect than our products. We expect competition from biopharmaceutical and pharmaceutical companies and academic research institutions to increase over time. Many of our competitors and potential competitors have substantially greater product development capabilities and financial, scientific, marketing and human resources than we do. Our competitors may succeed in developing products earlier and in obtaining regulatory approvals and patent protection for such products more rapidly than we can or at a lower price.

We may not obtain adequate protection for our products through our intellectual property.

We rely heavily on our proprietary information in developing and manufacturing our product candidates. Our success depends, in large part, on our ability to protect our competitive position through patents, trade secrets, trademarks and other intellectual property rights. The patent positions of pharmaceutical and biopharmaceutical firms, including Aeterna Zentaris, are uncertain and involve complex questions of law and fact for which

important legal issues remain unresolved. Applications for patents and trademarks in Canada, the United States and in other foreign territories have been filed and are being actively pursued by us. Pending patent applications may not result in the issuance of patents and we may not be able to obtain additional issued patents relating to our technology or products. Even if issued, patents to us or our licensors may be challenged, narrowed, invalidated, held to be unenforceable or circumvented, which could limit our ability to stop competitors from marketing similar products or limit the length of term of patent protection we may have for our products. Changes in either patent laws or in interpretations of patent laws in the United States and other

countries may diminish the value of our intellectual property or narrow the scope of our patent protection. The patents issued or to be issued to us may not provide us with any competitive advantage or protect us against competitors with similar technology. In addition, it is possible that third parties with products that are very similar to ours will circumvent our patents by means of alternate designs or processes. We may have to rely on method of use and new formulation protection for our compounds in development, and any resulting products, which may not confer the same protection as claims to compounds per se.

In addition, our patents may be challenged by third parties in patent litigation, which is becoming widespread in the biopharmaceutical industry. There may be prior art of which we are not aware that may affect the validity or enforceability of a patent claim. There may also may be prior art of which we are aware, but which we do not believe affects the validity or enforceability of a claim, which may, nonetheless, ultimately be found to affect the validity or enforceability of a claim. No assurance can be given that our patents would, if challenged, be held by a court to be valid or enforceable or that a competitor'scompetitor’s technology or product would be found by a court to infringe our patents. Our granted patents could also be challenged and revoked in opposition or nullity proceedings in certain countries outside the United States. In addition, we may be required to disclaim part of the term of certain patents.

Patent applications relating to or affecting our business have been filed by a number of pharmaceutical and biopharmaceutical companies and academic institutions. A number of the technologies in these applications or patents may conflict with our technologies, patents or patent applications, and any such conflict could reduce the scope of patent protection which we could otherwise obtain. Because patent applications in the United States and many other jurisdictions are typically not published until eighteen months after their first effective filing date, or in some cases not at all, and because publications of discoveries in the scientific literature often lag behind actual discoveries, neither we nor our licensors can be certain that we or they were the first to make the inventions claimed in our or their issued patents or pending patent applications, or that we or they were the first to file for protection of the inventions set forth in these patent applications. If a third party has also filed a patent application in the United States covering our product candidates or a similar invention, we may have to participate in an adversarial proceeding, known as an interference, declared by the United States Patent and Trademark Office to determine priority of invention in the United States. The costs of these proceedings could be substantial and it is possible that our efforts could be unsuccessful, resulting in a loss of our U.S. patent position.

In addition to patents, we rely on trade secrets and proprietary know-how to protect our intellectual property. If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected. We seek to protect our unpatented proprietary information in part by requiring our employees, consultants, outside scientific collaborators and sponsored researchers and other advisors to enter into confidentiality agreements. These agreements provide that all confidential information developed or made known to the individual during the course of the individual'sindividual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of our employees, the agreements provide that all of the technology which is conceived by the individual during the course of employment is our exclusive property. These agreements may not provide meaningful protection or adequate remedies in the event of unauthorized use or disclosure of our proprietary information. In addition, it is possible that third parties could independently develop proprietary information and techniques substantially similar to ours or otherwise gain access to our trade secrets. If we are unable to protect the confidentiality of our proprietary information and know-how, competitors may be able to use this information to develop products that compete with our products and technologies, which could adversely impact our business.

We currently have the right to use certain technology under license agreements with third parties. Our failure to comply with the requirements of material license agreements could result in the termination of such agreements, which could cause us to terminate the related development program and cause a complete loss of our investment in that program.

As a result of the foregoing factors, we may not be able to rely on our intellectual property to protect our products in the marketplace.

We may infringe the intellectual property rights of others.

Our commercial success depends significantly on our ability to operate without infringing the patents and other intellectual property rights of third parties. There could be issued patents of which we are not aware that our products or methods may be found to infringe, or patents of which we are aware and believe we do not infringe but which we may ultimately be found to infringe. Moreover, patent applications and their underlying discoveries are in some cases maintained in secrecy until patents are issued. Because patents can take many years to issue, there may be currently pending applications of which we are unaware that may later result in issued patents that our products or methods are found to infringe. Moreover, there may be published pending applications that do not currently include a claim covering our products or methods but which nonetheless provide support for a later drafted claim that, if issued, our products or methods could be found to infringe.

If we infringe or are alleged to infringe intellectual property rights of third parties, it will adversely affect our business. Our research, development and commercialization activities, as well as any product candidates or products resulting from these activities, may infringe or be accused of infringing one or more claims of an issued patent or may fall within the scope of one or more claims in a published patent application that may subsequently issue and to which we do not hold a license or other rights. Third parties may own or control these patents or patent applications in the United States and abroad. These third parties could bring claims against us or our collaborators that would cause us to incur substantial expenses and, if successful against us, could cause us to pay substantial damages. Further, if a patent infringement suit were brought against us or our collaborators, we or they could be forced to stop or delay research, development, manufacturing or sales of the product or product candidate that is the subject of the suit.

The biopharmaceutical industry has produced a proliferation of patents, and it is not always clear to industry participants, including us, which patents cover various types of products. The coverage of patents is subject to interpretation by the courts, and the interpretation is not always uniform. In the event of infringement or violation of another party'sparty’s patent or other intellectual property rights, we may not be able to enter into licensing arrangements or make other arrangements at a reasonable cost. Any inability to secure licenses or alternative technology could result in delays in the introduction of our products or lead to prohibition of the manufacture or sale of products by us or our partners and collaborators.

Patent litigation is costly and time consuming and may subject us to liabilities.

Our involvement in any patent litigation, interference, opposition or other administrative proceedings will likely cause us to incur substantial expenses, and the efforts of our technical and management personnel will be significantly diverted. In addition, an adverse determination in litigation could subject us to significant liabilities.

We may not obtain trademark registrations.

We have filed applications for trademark registrations in connection with our product candidates in various jurisdictions, including the United States. We intend to file further applications for other possible trademarks for our product candidates. No assurance can be given that any of our trademark applications will be registered in the United States or elsewhere, or that the use of any registered or

unregistered trademarks will confer a competitive advantage in the marketplace. Furthermore, even if we are successful in our trademark registrations, the FDA and regulatory authorities in other countries have their own process for drug nomenclature and their own views concerning appropriate proprietary names. The FDA and other regulatory authorities also have the power, even after granting market approval, to request a company to reconsider the name for a product because of evidence of confusion in the marketplace. No assurance can be given that the FDA or any other regulatory authority will approve of any of our trademarks or will not request reconsideration of one of our trademarks at some time in the future. The loss, abandonment, or cancellation of any of our trademarks or trademark applications could negatively affect the success of the product candidates to which they relate.

Our revenues and expenses may fluctuate significantly, and any failure to meet financial expectations may disappoint securities analysts or investors and result in a decline in the price of our securities.

We have a history of operating losses. Our revenues and expenses have fluctuated in the past and are likely to do so in the future. These fluctuations could cause our share price to decline. Some of the factors that could cause our revenues and expenses to fluctuate include but are not limited to:

| — | the inability to complete product development in a timely manner that results in a failure or delay in receiving the required regulatory approvals to commercialize our product candidates; |

| — | the timing of regulatory submissions and approvals; |

| — | the timing and willingness of any current or future collaborators to invest the resources necessary to commercialize our product candidates; |

| — | the revenue available from royalties derived from our strategic partners; |

| — | licensing fees revenues; |

| — | tax credits and grants (R&D); |

| — | the outcome of litigation, if any; |

| — | changes in foreign currency fluctuations; |

| — | the timing of achievement and the receipt of milestone payments from current or future collaborators; and |

| — | failure to enter into new or the expiration or termination of current agreements with collaborators. |

Due to fluctuations in our revenues and expenses, we believe that period-to-period comparisons of our results of operations are not necessarily indicative of our future performance. It is possible that in some future quarter or quarters, our revenues and expenses will be above or below the expectations of securities analysts or investors. In this case, the price of our securities could fluctuate significantly or decline.

We will not be able to successfully commercialize our product candidates if we are unable to make adequate arrangements with third parties for such purposes.

We currently have a lean sales and marketing staff. In order to commercialize our product candidates successfully, we need to make arrangements with third parties to perform some or all of these services in certain territories.

We contract with third parties for the sales and marketing of our products. Our revenues will depend upon the efforts of these third parties, whose efforts may not be successful. If we fail to establish successful marketing and sales capabilities or to make arrangements with third parties for such purposes, our business, financial condition and results of operations will be materially adversely affected.

If we had to resort to developing a sales force internally, the cost of establishing and maintaining a sales force would be substantial and may exceed its cost effectiveness. In addition, in marketing our products, we would likely compete with many companies that currently have extensive and well-funded marketing and sales operations. Despite our marketing and sales efforts, we may be unable to compete successfully against these companies.

We are currently dependent on strategic partners and may enter into future collaborations for the research, development and commercialization of our product candidates. Our arrangements with these strategic partners may not provide us with the benefits we expect and may expose us to a number of risks.

We are dependent on, and rely upon, strategic partners to perform various functions related to our business, including, but not limited to, the research, development and commercialization of some of our product candidates. Our reliance on these relationships poses a number of risks.

We may not realize the contemplated benefits of such agreements nor can we be certain that any of these parties will fulfill their obligations in a manner which maximizes our revenue. These arrangements may also require us to transfer certain material rights or issue our equity, voting or other securities to corporate partners, licensees and others. Any license or sublicense of our commercial rights may reduce our product revenue.

These agreements also create certain risks. The occurrence of any of the following or other events may delay product development or impair commercialization of our products:

| — | not all of our strategic partners are contractually prohibited from developing or commercializing, either alone or with others, products and services that are similar to or competitive with our product candidates and, with respect to our strategic partnership agreements that do contain such contractual prohibitions or restrictions, prohibitions or restrictions do not always apply to our partners’ affiliates and they may elect to pursue the development of any additional product candidates and pursue technologies or products either on their own or in collaboration with other parties, including our competitors, whose technologies or products may be competitive with ours; |

| — | our strategic partners may under-fund or fail to commit sufficient resources to marketing, distribution or other development of our products; |

| — | we may not be able to renew such agreements; |

| — | our strategic partners may not properly maintain or defend certain intellectual property rights that may be important to the commercialization of our products; |

| — | our strategic partners may encounter conflicts of interest, changes in business strategy or other issues which could adversely affect their willingness or ability to fulfill their obligations to us (for example, pharmaceutical companies historically have re-evaluated their priorities following mergers and consolidations, which have been common in recent years in this industry); |

| — | delays in, or failures to achieve, scale-up to commercial quantities, or changes to current raw material suppliers or product manufacturers (whether the change is attributable to us or the supplier or manufacturer) could delay clinical studies, regulatory submissions and commercialization of our product candidates; and |

| — | disputes may arise between us and our strategic partners that could result in the delay or termination of the development or commercialization of our product candidates, resulting in litigation or arbitration that could be time-consuming and expensive, or causing our strategic partners to act in their own self-interest and not in our interest or those of our shareholders or other stakeholders. |

In addition, our strategic partners can terminate our agreements with them for a number of reasons based on the terms of the individual agreements that we have entered into with them. If one or more of these agreements were to be terminated, we would be required to devote additional resources to developing and commercializing our product candidates, seek a new partner or abandon this product candidate which would likely cause a drop in the price of our securities.

We have entered into important strategic partnership agreements relating to certain of our product candidates for various indications. Detailed information on our research and collaboration agreements is available in our various reports and disclosure documents filed with the Canadian securities regulatory authorities and filed with or furnished to the United States Securities and Exchange Commission ("SEC"(“SEC”), including the documents incorporated by reference ininto this Annual Report on Form 20-F. See, for example, Note 255 to our audited consolidated balance sheetsfinancial statements as at December 31, 2011 and December 31, 2010 and 2009 and our audited consolidated statements of operations, changes in shareholders' equity, accumulated other comprehensive income and deficit, comprehensive loss and cash flows for each of the years in the three-year period ended December 31, 2011 and 2010 included in this Annual Report on Form 20-F.

We have also entered into a variety of collaborative licensing agreements with various universities and institutes under which we are obligated to support some of the research expenses incurred by the university laboratories and pay royalties on future sales of the products. In turn, we have retained exclusive rights for the worldwide exploitation of results generated during the collaborations.

In particular, we have entered into an agreement with the Tulane Educational Fund ("Tulane"(“Tulane”), which provides for the payment by us of single-digit royalties on future worldwide net sales of cetrorelix, and including Cetrotide®Cetrotide®. Tulane is also entitled to receive a low double-digit participation payment on any lump-sum, periodic or other cash payments received by us from sub-licensees (see Note 25 to our audited consolidated balance sheets as at December 31, 2010 and 2009 and our audited consolidated statements of operations, changes in shareholders' equity, accumulated other comprehensive income and deficit, comprehensive loss and cash flows for each of the years in the three-year period ended December 31, 2010 included in this Annual Report on Form 20-F).sub-licensees.

We rely on third parties to conduct, supervise and monitor our clinical trials, and those third parties may not perform satisfactorily.

We rely on third parties such as CROs, medical institutions and clinical investigators to enroll qualified patients and conduct, supervise and monitor our clinical trials. Our reliance on these third parties for clinical development activities reduces our control over these activities. Our reliance on these third parties, however, does not relieve us of our regulatory responsibilities, including ensuring that our clinical trials are conducted in accordance with Good Clinical Practice guidelines and the investigational plan and protocols contained in an Investigational New Drug (“IND”) application, or comparable foreign regulatory submission. Furthermore, these third parties may also have relationships with other entities, some of which may be our competitors. In addition, they may not complete activities on schedule, or may not conduct our pre-clinicalpreclinical studies or clinical trials in accordance with regulatory requirements or our trial design. If these third parties do not successfully carry out their contractual duties or meet expected deadlines, our efforts to obtain regulatory approvals for, and commercialize, our product candidates may be delayed or prevented.

In carrying out our operations, we are dependent on a stable and consistent supply of ingredients and raw materials.

There can be no assurance that we, our contract manufacturers or our partners, will be able, in the future, to continue to purchase products from our current suppliers or any other supplier on terms similar to current terms or at all. An interruption in the availability of certain raw materials or

ingredients, or significant increases in the prices paid by us for them, could have a material adverse effect on our business, financial condition, liquidity and operating results.

The failure to perform satisfactorily by third parties upon which we rely to manufacture and supply products may lead to supply shortfalls.