Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX OF FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| (Mark One) | ||

o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

or | ||

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, | ||

or | ||

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | ||

or | ||

o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

Date of event requiring this shell company report | ||

Commission file number 001-32749

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Exact name of Registrant as specified in its charter)

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Translation of Registrant's name into English)

Germany

(Jurisdiction of incorporation or organization)

Else-Kröner Strasse 1, 61352 Bad Homburg, Germany

(Address of principal executive offices)

Josef Dinger, +49 6172 608 2522, Josef.Dinger@FMC-AG.com,

Else-Kröner Strasse 1, 61352 Bad Homburg, Germany

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

|---|---|---|

| American Depositary Shares representing Ordinary Shares | New York Stock Exchange | |

| Ordinary Shares, no par value | New York Stock Exchange(1) |

Securities registered or to be registered pursuant to Section 12(g) of the Act:None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:67/8% Senior Notes due 2017

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report:

Ordinary Shares, no par value: 301,446,779306,221,840

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Security Act. ý Yes o No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes ý No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filerý | Accelerated filero | Non-accelerated filero |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

ý U.S. GAAP o International Financial Reporting Standards as issued by o Other

the International Accounting Standards Board

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes ý No

| | | | Page | |||||

|---|---|---|---|---|---|---|---|---|

INTRODUCTION | ||||||||

PART I |

| |||||||

Item 1. | N/A | Identity of Directors, Senior Management and Advisors | ||||||

Item 2. | N/A | Other Statistics and Expected Timetable | ||||||

Item 3. | Key Information | |||||||

Item 4. | Information on the Company | |||||||

Item 4A. | N/A | Unresolved Staff Comments | ||||||

Item 5. | Operating and Financial Review and Prospects | |||||||

Item 6. | Directors, Senior Management and Employees | |||||||

Item 7. | Major Shareholders and Related Party Transactions | |||||||

Item 8. | Financial Information | |||||||

Item 9. | The Offer and Listing Details | |||||||

Item 10. | Additional Information | |||||||

Item 11. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

Item 12. | Description of Securities other than Equity Securities | |||||||

PART II |

| |||||||

Item 13. | N/A | Defaults, Dividend Arrearages and Delinquencies | ||||||

Item 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | |||||||

Item 15A. | Disclosure Controls and Procedures | |||||||

Item 15B. | Management's annual report on internal control over financial reporting | |||||||

Item 15C. | Attestation report of the registered public accounting firm | |||||||

Item 15D. | Changes in Internal Control over Financial Reporting | |||||||

Item 16A. | Audit Committee Financial Expert | |||||||

Item 16B. | Code of Ethics | |||||||

Item 16C. | Principal Accountant Fees and Services | |||||||

Item 16D. | N/A | Exemptions from the Listing Standards for Audit Committees | ||||||

Item 16E. | Purchase of Equity Securities by the Issuer and Affiliated Purchaser | |||||||

Item 16F. | N/A | Change in Registrant's Certifying Accountant | ||||||

Item 16G. | Corporate Governance | |||||||

PART III |

| |||||||

Item 17. | N/A | Financial Statements | ||||||

Item 18. | Financial Statements | |||||||

Item 19. | Exhibits | |||||||

i

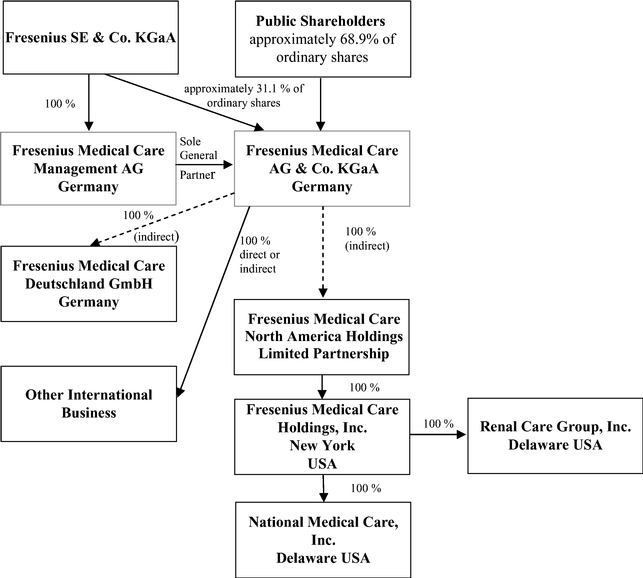

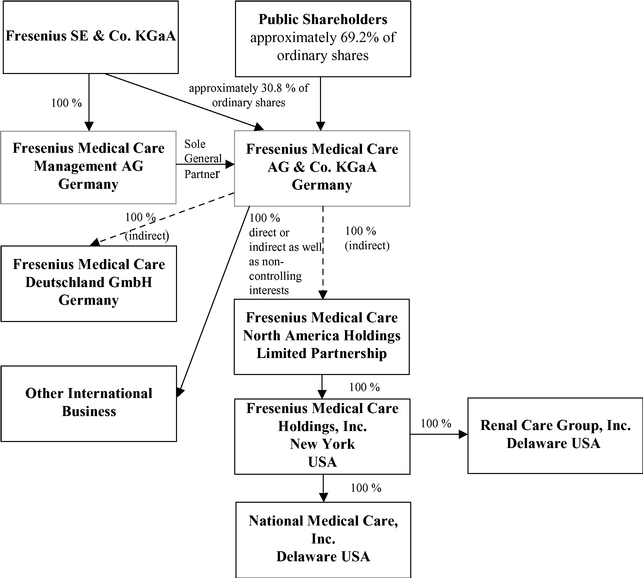

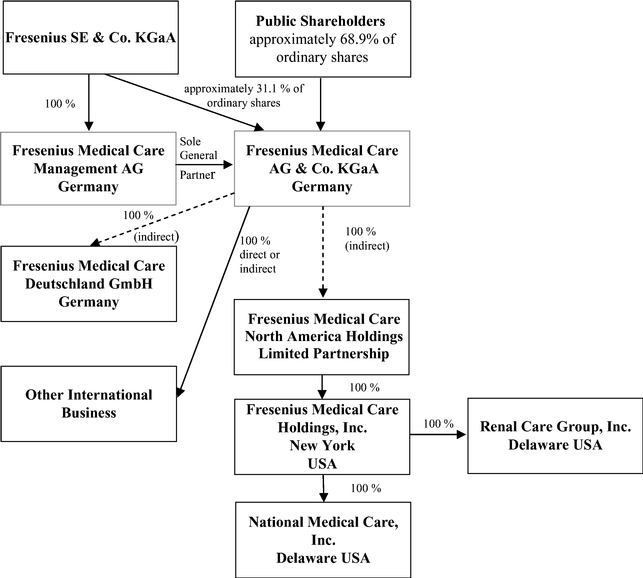

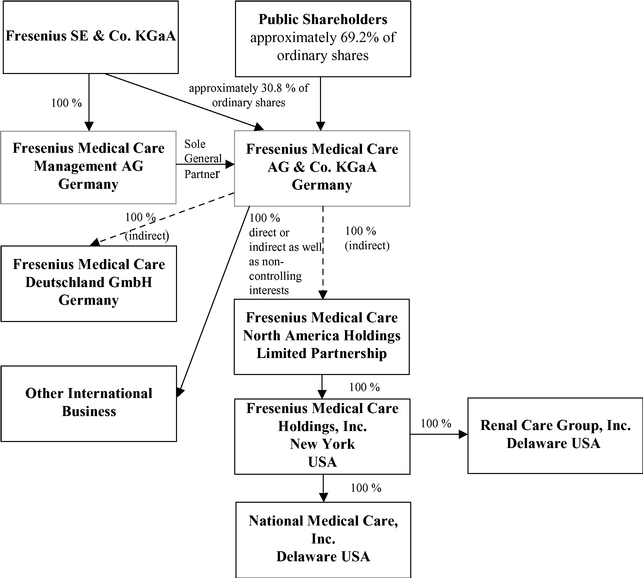

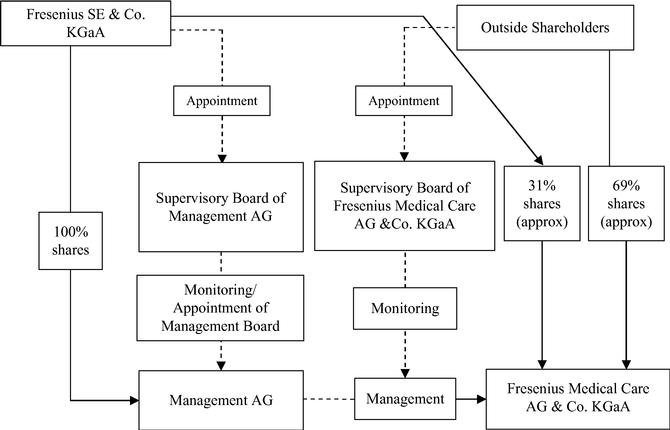

In this report, (1) the "Company" refers to both Fresenius Medical Care AG prior to the transformation of legal form discussed in Item 4.A, "Information on the Company – History and Development of the Company – History" below and to Fresenius Medical Care AG & Co. KGaA after the transformation; (2) "we", "us" and "our" refersrefer either to the Company or the Company and its subsidiaries on a consolidated basis both before and after the transformation, as the context requires; (3) "Fresenius Medical Care AG" and "FMC-AG" refersrefer to the Company as a German stock corporation before the transformation of legal form and "FMC-AG & Co. KGaA" refers to the Company as a German partnership limited by shares after the transformation and (4) "FMCH" and "D-GmbH" refer, respectively, to Fresenius Medical Care Holdings, Inc., the holding company for our North American operations and to Fresenius Medical Care Deutschland GmbH, one of our German subsidiaries. In addition, "Fresenius SE" and "Fresenius SE & Co. KGaA" refersrefer to Fresenius SE & Co. KGaA, a German partnership limited by shares resulting from the change of legal form of Fresenius SE (effective as of January 2011), a European Company (Societas Europaea) previously called Fresenius AG, a German stock corporation. Fresenius SE owns 100% of the share capital of our general partner and 94,380,382 of our ordinary shares as of February 18, 2015, 31.1%16, 2017, 30.82% based on 303,636,122306,221,840 outstanding shares, as reported herein (prior to the transformation of our legal form, it held approximately 51.8% of our voting shares).herein. In this report, we use Fresenius SE to refer to that company as a partnership limited by shares, effective on and after January 28, 2011, as well as both before and after the conversion of Fresenius AG from a stock corporation into a European Company on July 13, 2007. The phrase "Fresenius SE and its subsidiaries" refers to Fresenius SE and all of the companies of the Fresenius SE group, other than FMC-AG & Co. KGaA and the subsidiaries of FMC-AG & Co. KGaA. Each of "Management AG", "FMC Management AG" and the "General Partner" refers to Fresenius Medical Care Management AG, FMC-AG & Co. KGaA's general partner and a wholly owned subsidiary of Fresenius SE. "Management Board" and "our Management Board" refer to the members of the management board of Management AG and, except as otherwise specified, "Supervisory Board" and "our Supervisory Board" refer to the supervisory board of FMC-AG & Co. KGaA. "Ordinary shares" refers to the ordinary shares prior to the conversion in 2013 of our preference shares into ordinary shares. Following the conversion, we refer to our ordinary shares as "shares." The term "North America Segment" refers to our North America operating segment. Thesegment; the term "International"EMEA Segment" refers to the Europe, Middle East and Africa operating segment, the term "Asia-Pacific Segment" refers to our combined EMEALA (Europe, Middle East, Africa,Asia-Pacific operating segment, and the term "Latin America Segment" refers to our Latin America) and AP (Asia-Pacific)America operating segments.segment. The term "Corporate" includes certain headquarters' overhead charges, including accounting and finance, centrally managed production, asset management, quality management and procurement within our Global Manufacturing Operations& Quality and research and development.Global Research & Development departments. All references in this report to the notes to our financial statements are to the Notes to Consolidated Financial Statements included in this report.

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). When used in this report, the words "outlook," "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions are generally intended to identify forward looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, forward-looking statements are inherently subject to risks and uncertainties, many of which cannot be predicted with accuracy and some of which might not even be anticipated, and future events and actual results, financial and otherwise, could differ materially from those set forth in or contemplated by the forward-looking statements contained elsewhere in this report. We have based these forward-looking statements on current estimates and assumptions made to the best of our knowledge. By their nature, such forward-looking statements involve risks, uncertainties, assumptions and other factors which could cause actual results, including our financial condition and profitability, to differ materially positively or negatively relative to the results expressly or implicitly described in or suggested by these statements. Moreover, forward-looking estimates or predictions derived from third parties' studies or information may prove to be inaccurate. Consequently, we cannot give any assurance regarding the future accuracy of the opinions set forth in this report or the actual occurrence of the projected developments described herein. In addition, even if our future results meet the expectations expressed here, those results may not be indicative of our performance in future periods.

These risks, uncertainties, assumptions, and other factors that could cause actual results to differ from our projected results include, among others, the following:

Important factors that could contribute to such differences are noted in Item 3D, "Key Information – Risk Factors" in Item 4, "Information on the Company," under "Business Overview," in Item 5, "Operating and Financial Review and Prospects" and in Note 2018 of the Notes to Consolidated Financial Statements, "Commitments and Contingencies" included in this report.

Our business is also subject to other risks and uncertainties that we describe from time to time in our public filings. Developments in any of these areas could cause our results to differ materially from the results that we or others have projected or may project.

Our reported financial condition and results of operations are sensitive to accounting methods, assumptions and estimates that are the basis of our financial statements. The actual accounting policies, the judgments made in the selection and application of these policies, and the sensitivities of reported results to changes in accounting policies, assumptions and estimates, are factors to be considered along with our financial statements and the discussion under "Results of Operations" in Item 5 below, "Operating and Financial Review and Prospects." For a discussion of our critical accounting policies, see Item 5, "Operating and Financial Review and Prospects – Critical Accounting Policies" below in this report.

Except as otherwise specified herein, all patient and market data in this report have been derived using our internal information tool called "Market & Competitor Survey" ("MCS"). See Item 4.B, "Information on the Company – Business Overview – Renal Industry Overview.Major Markets and Competitive Position."

Item 1. Identity of Directors, Senior Management and Advisors

Not applicable

Item 2. Other Statistics and Expected Timetable

Not applicable

A. Selected Financial Data

The following table summarizes the consolidated financial information for our business for each of the years 2014 through 2010.in the five-year period ended December 31, 2016. We derived the selected financial information from our consolidated financial statements. We prepared our financial statements in accordance with accounting principles generally accepted in the United States of America and KPMG AG Wirtschaftsprüfungsgesellschaft ("KPMG"), an independent registered public accounting firm, audited these financial statements. All American Depositary Share ("ADS") and per ADS data reflect the two-for-one split of the ADSs representing our ordinary sharesOrdinary Shares and the ADSs representing our previously outstanding preference shares, which was effective December 3, 2012. As a result of the split of our ADSs, the ratio of each class of ADSs was changed from one ADS representing one share to two ADSs representing one share. (See Item4.A,Item 4.A, "Information on the Company – History and Development of the Company – History"). All per ADS amounts in the table have been restated to reflect the ADS splits. You should read this information together with our consolidated financial statements and the notes to those statements appearing elsewhere in this report and the information under Item 5, "Operating and Financial Review and Prospects." On December 1, 2016, we announced that commencing with our quarterly report to be filed for the first quarter of 2017, such financial statements and financial information will be prepared in accordance with IFRS, using the euro as our reporting currency. Please refer to our website for the historical financial data prepared in accordance with International Financial Reporting Standards ("IFRS") for the years 2012 through 2015 (http:/ /www.freseniusmedicalcare.com/en/news/details/title/fresenius-medical-care-will-focus-on-ifrs-reporting-and-discontinue-us-gaap-financial-statements/). In furnishing our web site address in this report, however, we do not intend to incorporate this or any other information on our web site into this report, and any information on our web site should not be considered to be part of this report.

| | 2014 | 2013 | 2012 | 2011 | 2010 | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | (in millions except share and per share amounts) | (in millions except share and per share amounts) | ||||||||||||||||||||||||||||||

Statement of Operations Data: | ||||||||||||||||||||||||||||||||

Net revenues(a) | $ | 15,832 | $ | 14,610 | $ | 13,800 | $ | 12,570 | $ | 11,844 | ||||||||||||||||||||||

Revenue | $ | 17,911 | $ | 16,738 | $ | 15,832 | $ | 14,610 | $ | 13,800 | ||||||||||||||||||||||

Cost of revenues | 10,836 | 9,872 | 9,199 | 8,418 | 8,009 | 12,131 | 11,407 | 10,836 | 9,872 | 9,199 | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Gross profit | 4,996 | 4,738 | 4,601 | 4,152 | 3,835 | 5,780 | 5,331 | 4,996 | 4,738 | 4,601 | ||||||||||||||||||||||

Selling, general and administrative | 2,645 | 2,391 | 2,223 | 2,002 | 1,823 | 3,045 | 2,895 | 2,644 | 2,382 | 2,187 | ||||||||||||||||||||||

Gain on sale of dialysis clinics | (1 | ) | (9 | ) | (36 | ) | (5 | ) | — | |||||||||||||||||||||||

Research and development | 122 | 126 | 112 | 111 | 97 | 162 | 140 | 122 | 126 | 112 | ||||||||||||||||||||||

Income from equity method investees | (25 | ) | (26 | ) | (17 | ) | (31 | ) | (9 | ) | (65 | ) | (31 | ) | (25 | ) | (26 | ) | (17 | ) | ||||||||||||

Other operating expenses | — | — | 100 | — | — | — | — | — | — | 100 | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating income | 2,255 | 2,256 | 2,219 | 2,075 | 1,924 | 2,638 | 2,327 | 2,255 | 2,256 | 2,219 | ||||||||||||||||||||||

Investment gain | — | — | 140 | — | — | — | — | — | — | 140 | ||||||||||||||||||||||

Interest expense, net | 411 | 409 | 426 | 297 | 280 | 406 | 391 | 411 | 409 | 426 | ||||||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ��� | |

Income before income taxes | 1,844 | 1,847 | 1,933 | 1,778 | 1,644 | 2,232 | 1,936 | 1,844 | 1,847 | 1,933 | ||||||||||||||||||||||

Net income attributable to shareholders of FMC-AG & Co. KGaA | $ | 1,045 | $ | 1,110 | $ | 1,187 | $ | 1,071 | $ | 979 | $ | 1,243 | $ | 1,029 | $ | 1,045 | $ | 1,110 | $ | 1,187 | ||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average ordinary shares outstanding | 302,339,124 | 301,877,304 | 301,139,652 | 299,012,744 | 296,808,978 | |||||||||||||||||||||||||||

Basic earnings per Ordinary share | $ | 3.46 | $ | 3.65 | $ | 3.89 | $ | 3.54 | $ | 3.25 | ||||||||||||||||||||||

Basic earnings per Ordinary ADS(b) | 1.73 | 1.83 | 1.94 | 1.77 | 1.62 | |||||||||||||||||||||||||||

Fully diluted earnings per Ordinary share | 3.45 | 3.65 | 3.87 | 3.51 | 3.24 | |||||||||||||||||||||||||||

Fully diluted earnings per Ordinary ADS(b) | 1.73 | 1.83 | 1.93 | 1.75 | 1.62 | |||||||||||||||||||||||||||

Dividends declared and paid per Ordinary share (€)(c) | 0.77 | 0.75 | 0.69 | 0.65 | 0.61 | |||||||||||||||||||||||||||

Dividends declared and paid per Ordinary share ($)(c) | 0.93 | 1.03 | 0.89 | 0.93 | 0.77 | |||||||||||||||||||||||||||

Weighted average shares outstanding | 305,748,381 | 304,440,184 | 302,339,124 | 301,877,304 | 301,139,652 | |||||||||||||||||||||||||||

Basic earnings per share | $ | 4.07 | $ | 3.38 | $ | 3.46 | $ | 3.65 | $ | 3.89 | ||||||||||||||||||||||

Basic earnings per ADS | 2.04 | 1.69 | 1.73 | 1.83 | 1.94 | |||||||||||||||||||||||||||

Fully diluted earnings per share | 4.06 | 3.38 | 3.45 | 3.65 | 3.87 | |||||||||||||||||||||||||||

Fully diluted earnings per ADS | 2.03 | 1.69 | 1.73 | 1.83 | 1.93 | |||||||||||||||||||||||||||

Dividends declared and paid per share (€)(b) | 0.80 | 0.78 | 0.77 | 0.75 | 0.69 | |||||||||||||||||||||||||||

Dividends declared and paid per share ($)(b) | 0.91 | 0.87 | 0.93 | 1.03 | 0.89 | |||||||||||||||||||||||||||

| | 2014 | 2013 | 2012 | 2011 | 2010 | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | (in millions except share and per share amounts) | (in millions except share and per share amounts) | ||||||||||||||||||||||||||||||

Balance Sheet Data at December 31: | ||||||||||||||||||||||||||||||||

Working capital | $ | 3,247 | $ | 2,733 | $ | 2,957 | $ | 1,432 | $ | 1,363 | $ | 2,214 | $ | 2,619 | $ | 3,030 | $ | 2,481 | $ | 2,713 | ||||||||||||

Total assets | 25,447 | 23,120 | 22,326 | 19,533 | 17,095 | 26,934 | 25,365 | 25,170 | 22,799 | 21,998 | ||||||||||||||||||||||

Total long-term debt (excluding current portion) | 9,080 | 7,747 | 7,842 | 5,495 | 4,310 | 7,203 | 7,853 | 9,014 | 7,681 | 7,709 | ||||||||||||||||||||||

Shareholders' equity | 10,028 | 9,485 | 9,207 | 8,061 | 7,524 | 11,457 | 10,496 | 10,028 | 9,485 | 9,207 | ||||||||||||||||||||||

Capital Stock – Preference shares – Nominal Value | — | — | 4 | 4 | 4 | — | — | — | — | 4 | ||||||||||||||||||||||

Capital Stock – Ordinary shares – Nominal Value | 385 | 382 | 375 | 372 | 369 | |||||||||||||||||||||||||||

Capital Stock – Nominal Value | 380 | 387 | 385 | 382 | 375 | |||||||||||||||||||||||||||

We conduct our business on a global basis in various currencies, although our operations are located principally in the United States ("U.S")U.S. and Germany. We prepare our consolidated financial statements, from which we derived the selected financial data above, utilizing the U.S. dollar as our reporting currency. We have converted the balance sheets of our non-U.S. dollar denominated operations into U.S. dollars at the exchange rates prevailing at the balance sheet date. Revenues and expenses are translated at the average exchange rates for the respective period, as shown. For information regarding the exchange rates used in preparing our consolidated financial statements, see Item 11, "Quantitative and Qualitative Disclosures About Market Risk – Management of Foreign Exchange and Interest Rate Risks – Foreign Exchange Risks."

D. Risk Factors

Before you invest in our securities, you should be aware that the occurrence of any of the events described in the following risk factors or elsewhere in this report, and other events that we have not predicted or assessed could have a material adverse effect on our results of operations, financial condition and business. If the events described below or other unpredicted events occur, then the trading price of our securities could decline and you may lose all or part of your investment.

Risks Relating to Regulatory Matters.

A changeWe operate in a highly regulated industry such that the potential for legislative reform provides uncertainty and potential threats to our operating models and results.

The delivery of healthcare services and products is highly regulated in most of the countries in which we operate. Proposals for legislative reform in these countries are often introduced to improve access to care, address quality of care issues and manage costs of the healthcare system. In the U.S. government, the Trump Administration and the 115th Congress have publicly announced their intention to pursue, and may enact, significant changes to existing health care programs. Certain health insurance provisions of ACA, if not many more ACA provisions, are likely targets for change. Changes of this nature could have significant effects on our businesses, both positive and negative, but the outcomes are impossible to predict.

Changes in reimbursement and/or governmental regulations for dialysishealth care could materially decrease our revenues and operating profit.

We receive reimbursement for our healthcare services from both public, government-sponsored payors and private, commercial payors. A large portion of our businesses is reimbursed by government payors, in particular the Medicare and Medicaid program in the U.S. For the year ended December 31, 2014,2016, approximately 31%32% of our consolidated revenues resulted from Medicare and Medicaid reimbursement. Legislative changes or changes in government reimbursement practice may affect the reimbursement rates for the services we provide, as well as the scope ofThe Medicare and Medicaid coverage. A decreaseprograms change their payment methodologies and funding from time to time in ways that are driven by changes in statute, economic conditions, or policy. For example, a 2% reduction to Medicare or Medicaid reimbursement rates or covered services could havepayments due to the Budget Control Act of 2011 ("BCA") and

subsequent activity in Congress, a material adverse$1.2 trillion sequester (across-the-board spending cuts) in discretionary programs, took effect on April 1, 2013 and continues in force. In addition, options to restructure the Medicare program in the direction of a defined-contribution, "premium support" model and to shift Medicaid funding to a block grant or per capita arrangement, with greater flexibility for the states, are also likely to be considered. Changes in payment methodologies and funding or payment requirements of (without limitation) the End-Stage Renal Disease Prospective Payment System, the Physician Fee Schedule, the Clinical Laboratory Fee Schedule, and the Ambulatory Surgical Center Payment System may have material effects on our business, financial condition and resultsoperating results. We have very little opportunity to influence or predict the magnitude of operations.those changes. For further information regarding Medicare and Medicaid reimbursement, see Item 4B, "Information on the Company – Business Overview – Regulatory and Legal Matters – Reimbursement" and Item 5, "Operating and Financial Review and Prospects – Overview."

The utilization Government reimbursement programs generally pay less than private insurance. As a result, the payments we receive from private payors generate a substantial portion of ESAs could materially impactthe profits we report. In 2016, approximately43% of our consolidated Health Care revenues were attributable to private payors and hospitals in the North America Segment. Therefore, if the private payors in the North America Segment reduce their payments for our services, or if we experience a material shift in our revenue mix toward Medicare or Medicaid reimbursement, then our revenue, cash flow and operating profit. An interruption of supply orearnings would materially decrease. Over the last few years, we have generally been able to implement modest annual price increases for private insurers and integrated care organizations, but. there can be no assurance that we can achieve future price increases from private insurers and integrated care organizations offering private insurance coverage to our inability to obtain satisfactory terms for ESAs could reduce our revenues and operating profit.

Erythropoietin stimulating agents, or ESAs, are sold in the U.S. by Amgen Inc., under the brand names Epogen® (epoeitin alfa) and Aranesp® (darbepoetin alfa). Our current non-exclusive ESA sourcing and supply contract with Amgen covers the period from January 1, 2015 to December 31, 2018. In addition, limited quantities of Mircera® (epoetin beta) are available to us for the purpose of performing a

commercial pilot of this FDA-approved ESA manufactured by Hoffmann-La Roche. Under the Medicare end stage renal disease ("ESRD") prospective payment system ("ESRD PPS") effective January 1, 2011, payment for ESAs is generally included in the bundled rate; previously, it was reimbursed separately.patients. Any of the following developmentsevents, among others, could materially adversely affecthave a material adverse effect on our operating results:

If we do not comply with the many governmental regulations applicable to our business, we could be excluded from government healthcare reimbursement programs or our authority to conduct business could be terminated, either of which would result in a material decrease in our revenue.

Our operations in both our health care services business and our products business are subject to extensive governmental regulation in virtually every country in which we operate. We are also subject to other laws of general applicability, including antitrust laws. The applicable regulations, which differ from country to country, cover areas that include:

Failure to comply with one or more of these laws or regulations may give rise to a number of legal consequences. These include, in particular, loss or suspension of federal certifications, loss or suspension of licenses under the laws of any state or governmental authority from which we generate substantial revenues, monetary and administrative penalties, increased costs for compliance with government orders, complete or partial exclusion from government reimbursement programs, refunds of payments received from government payors and government health care program beneficiaries due to failures to meet applicable requirements or complete or partial curtailment of our authority to conduct business. Any of these consequences could have a material adverse impact on our business, financial condition and results of operations.

The Company's medical devices and drug products are subject to detailed, rigorous and frequently changing regulation by the U.S. Food and Drug Administration ("FDA"), and numerous other national, supranational, federal and state authorities. These regulations include, among other things, regulations regarding product approvals, manufacturing practices, product labeling and promotion, quality control, quality assurance, and post-marketing safety reporting, including adverse event reporting and reporting of certain field actions. We cannot assure that all necessary regulatory approvals for new products or product improvements will be granted on a timely basis or at all. In addition, the Company's facilities and procedures and those of its suppliers are subject to periodic inspection by the FDA and other regulatory authorities. The FDA and comparable regulatory authorities outside the U.S. may suspend, revoke, or adversely amend the authority necessary for manufacture, marketing, or sale of our products and those of our suppliers. The Company and its suppliers must incur expense and spend time and effort to ensure compliance with these complex regulations, and if such compliance is not maintained, they could be subject to significant adverse administrative and judicial enforcement actions in the future. These possible enforcement actions could include warning letters, injunctions, civil penalties, seizures of the Company's products, and criminal prosecutions as well as dissemination of information to the public about such enforcement actions. These actions could result in, among other things, substantial modifications to the Company's business practices and operations; refunds; a total or partial shutdown of production while the alleged violation is remedied; and withdrawals or suspensions of current products from the market. Any of these events, in combination or alone, could disrupt the Company's business and have a material adverse effect on the Company's business, financial condition and results of operations. For a discussion of open FDA warning letters, see "Regulatory and Legal Matters – Regulatory Overview – Product Regulation – Medical Devices.FDA Warning Letters."

We rely upon the Company's management structure, regulatory and legal resources and the effective operation of our compliance programs to direct, manage and monitor our operations to comply with government regulations. If employees were to deliberately, recklessly or inadvertently fail to adhere to these regulations, then our authority to conduct business could be terminated and our operations could be

significantly curtailed. Any such terminations or reductions could materially reduce our sales. If we fail to identify in our diligence process or to promptly remediate any non-compliant business practices in companies that we acquire, we could be subject to penalties, claims for repayment or other sanctions. Any such terminations or reductions could materially reduce our sales, with a resulting material adverse effect on our business, financial condition and results of operations.

By virtue of this regulatory environment, our business activities and practices are subject to extensive review by regulatory authorities and private parties, and continuing audits, subpoenas, other inquiries, claims and litigation relating to the Company's compliance with applicable laws and regulations. We may not always be aware that an inquiry or action has begun, particularly in the case of "qui tam" or "whistle blower""whistle-blower" actions brought by private plaintiffs under the False Claims Act, which are initially filed under seal. We are the subject of a number of governmental inquiries and civil suits by the federal government and private plaintiffs. For information about certain of these pending investigations and lawsuits, see Note 2018 of the Notes to our Consolidated Financial Statements, "Commitments and Contingencies – Other Litigation and Potential Exposures.Exposures," included in this report.

In addition, there may be future legislative or regulatory changes that affect FDA procedures or decision making for approving medical device or drug products. Any such legislation or regulations, if enacted or promulgated, could result in a delay or denial of regulatory approval for our products. If any of our products do not receive regulatory approval, or there is a delay in obtaining approval, this also could have a material adverse effect on our business, financial condition and results of operations.

If we are unable to protect our information technology security systems against cyber-attacks or prevent other privacy or data security incidents that result in security breaches that disrupt our operations or result in the unintended dissemination of sensitive personal information or proprietary or confidential information, we could be exposed to significant regulatory fines or penalties, liability or reputational damage, or experience a material adverse effect on our results of operations, financial position, and cash flows.

We routinely process, store and transmit large amounts of data in our operations, including sensitive personal information as well as proprietary or confidential information relating to our business or third-parties. We may be subject to breaches of the information technology security systems we use.

A cyber-attack may penetrate our security controls and misappropriate or compromise sensitive personal information or proprietary or confidential information, including such information which is stored or transmitted on the systems used by certain of our products, to create system disruptions, cause shutdowns, or deploy viruses, worms, and other malicious software programs that attack our systems. Any failure to keep our information technology systems and our patients' and customers' sensitive information secure from attack, damage, loss or unauthorized disclosure or access, whether as a result of our action or inaction or that of our business associates or vendors, could adversely affect our reputation and operations and also expose us to mandatory public disclosure requirements, litigation and governmental enforcement proceedings, material fines, penalties and/or remediation costs, and compensatory, special, punitive and statutory damages, consent orders and other adverse actions, any of which could adversely affect our business, results of operations, financial condition or liquidity.

As we increase the amount of personal information that we store and share digitally, our exposure to these data security and related cyber-attack risks increases, including the risk of undetected attacks, damage, loss or unauthorized disclosure or access, and the cost of attempting to protect against these risks also increases. We have implemented security technologies, processes and procedures to protect our confidential data; however, there are no assurances that such measures will be effective against all types of breaches.

We operate in many different jurisdictions and we could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-corruption laws.

The U.S. Foreign Corrupt Practices Act ("FCPA") and similar worldwide anti-corruption laws generally prohibit companies and their intermediaries from making improper payments to public officials for the purpose of obtaining or retaining business. Our internal policies mandate compliance with these anti-corruption laws. We operate many facilities throughout the United States and other parts of the world. Our decentralized system has thousands of persons employed by many affiliated companies, and we rely on our management structure, regulatory and legal resources and effective operation of our compliance program to direct, manage and monitor the activities of these employees. Despite our training, oversight and compliance programs, we cannot assure you that our internal control policies and procedures always will protect us from deliberate, reckless or inadvertent acts of our employees or agents that contravene the Company's compliance policies or violate applicable laws. Our continued expansion, including in developing countries, could increase the risk of such violations in the future. Violations of these laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our results of operations or financial condition. The Company has received communications alleging conduct in countries outside the U.S. and Germany that may violate the FCPA or other anti-bribery laws. The Audit and Corporate Governance Committee of the Company's Supervisory Board is conducting an investigationinvestigations with the assistance of independent counsel. The Company voluntarily advised the U.S. Securities and Exchange Commission ("SEC") and the U.S. Department of Justice ("DOJ"). The Company's investigationinvestigations and dialogue with the SEC and DOJ are ongoing. The Company has received a subpoena from the SEC requesting additional documents and a request from the DOJ for copies of the documents provided to the SEC. The Company is cooperating with the requests. Conduct has been identified that may result in monetary penalties or other sanctions under the FCPA or other anti-bribery laws. In addition, the Company's ability to conduct business in certain jurisdictions could be negatively impacted. The Company has previously recorded a non-material accrual for an identified matter. Given the current status of the investigations and remediation activities, the Company cannot reasonably estimate the range of possible loss that may result from identified matters or from the final outcome of the investigations or remediation activities. See "Item 15B. Management's annual report on internal control over financial reporting" and Note 2018 of the Notes to our Consolidated Financial Statements, "Commitments and Contingencies – Other Litigation and Potential Exposures.Exposures," included in this report.

If our joint ventures violate the law, our business could be adversely affected.

A number of the dialysis clinics and health care centers that we operate are owned, or managed, by joint ventures in which one or more hospitals, physicians or physician practice groups hold an interest. Physician owners, who are usually nephrologists, may also provide medical director services and physician owners may refer patients to those centers or other centers we own and operate or to other physicians who refer patients to those centers or other centers we own and operate. WhileBecause our relationships with physicians are governed by the federal and state anti-kickback statutes, we have structured our joint venturesventure arrangements to comply with many of the criteria for safe harbor protection under the U.S. Federal Anti- Kickback Statute,Anti-Kickback Statute; however, our investments in these joint venture arrangements do not satisfy all elements of such safe harbor. While we have established comprehensive compliance policies, procedures and programs to ensure ethical and compliant joint venture business operations, if one or more of our joint ventures were found to be in violation of the Anti-Kickback Statute, the Stark Law or other similar laws worldwide, we could be required to restructure or terminate them. We also could be required to repay to Medicare amounts received by the joint ventures pursuant to any prohibited referrals, and we could be subject to criminal and monetary penalties and exclusion from Medicare, Medicaid and other U.S. federal and state healthcare programs. Imposition of any of these penalties could have a material adverse effect on our business, financial condition and results of operations. In 2015, we received subpoenas from the U.S. Attorneys for Colorado and New York requesting information pertaining to certain of our joint venture dialysis facilities. See Note 18 of the Notes to our Consolidated Financial Statements, "Commitments and Contingencies – Other Litigation and Potential Exposures," included in this report.

Table of ContentsRisks Relating to Our Business

ProposalsThe utilization of ESAs could materially impact our operating profit. An interruption of supply or our inability to obtain satisfactory terms for healthcare reform, or relating to regulatory approvals,ESAs could decreasereduce our revenues and operating profit.

ManyErythropoietin stimulating agents ("ESAs") are synthetically engineered hormones that stimulate the production of the countriesred blood cells used to treat anemia in which we operate have been considering proposals to modify their current healthcare systems to improve access to health care and to control costs. Policymakersdialysis patients. ESAs are manufactured for sale in the U.S. by Amgen Inc., under the brand names Epogen® (epoeitin alfa) and elsewhere are also considering reforms thatAranesp® (darbepoetin alfa) and Hoffmann-La Roche under the brand name Mircera®.

Any of the following developments could change the methodology used to reimburse providers of health care services. We cannot predict whether and when these reform proposals will be adopted in countries in which we operate or what impact they might have on us. In the U.S., automatic across-the-board spending cuts over nine fiscal years (2013-2021), projected to total $1.2 trillion for all Federal government programs went into effect on March 1, 2013. Medicare payments to providers and suppliers are subject to these reductions, but these reductions are limited to one adjustment of no more than 2 percent through 2021. Any decrease in spending or other significant changes in state funding in countries in which we operate, particularly significant changes in the U.S. Medicare and Medicaid programs, could reduce our sales and profitability and have a material adverse effect onmaterially adversely affect our business, financial condition and results of operations.operations: (i) a reduction of the current overfill amount in ESA vials that we currently use (liquid medications, including certain ESAs in vial containers, typically include a small overfill amount to ensure that the fill volume can be extracted from the vial as administered to the patient), (ii) an interruption of supply of ESAs, or (iii) material increases in the utilization of ESAs for patients for whom the cost of EPO is included in a bundled reimbursement rate.

If we fail to estimate, price for and manage our medical costs in an effective manner, the profitability of our value-based products and services could decline and could materially and adversely affect our results of operations, financial position and cash flows.

Through our value-based agreements and health insurance products, we assume the risk of both medical and administrative costs for certain patients in return for fixed periodic payments from governmental and commercial insurers. We currently participate in various value-based programs, including (i) CMS's Bundled Payments for Care Improvement ("BPCI") program and Comprehensive End-Stage Renal Disease ("ESRD") Care initiative, (ii) Medicare Advantage chronic special needs plans and (iii) capitation agreements with commercial insurers in which FMCH receives a fixed fee to cover all or a defined portion of the medical costs of a defined population of patients. See Item 4, "Information on the Company – Business Overview – Regulatory and Legal Matters – Reimbursement" and "– Healthcare reform:" and Item 5, "Operating and Financial Review and Prospects – Financial Condition and Results of Operations – Overview" for information regardingadditional information.

BPCI program, in whole or in part. CMS relied on our business, our efforts to mitigate some of its effects, and the anticipated effects ofauthority granted by the Patient Protection and Affordable Care Act (Pub.L. 111-148), as amended by the Health Care and Education Reconciliation Act (Pub.L. 111-152) (collectively, "ACA") to implement this project. Congress is expected to consider repeal or revision of ACA, and the posture of CMS in the Trump Administration toward projects of this sort may differ from that of the Obama Administration. Such changes may affect the project's future prospects in ways which we currently cannot quantify or predict.

In addition, there may be legislative or regulatory proposals that could affect FDA procedures or decision-making for approving medical device or drug products. Any such legislation or regulations, if enacted or promulgated, could result in a delay or denial of regulatory approval for our products. If any ofinsured population characteristics. Failure to adequately price our products do not receive regulatory approval, or there is a delayestimate the costs of providing benefits to our beneficiaries, or effectively manage our operating expenses, may result in obtaining approval, this also could have a material adverse effect on our results of operations, financial position, and cash flows. There is also the possibility that Medicare Advantage Special Needs plans will not be re-authorized by Congress. Without Congressional action, these plans will expire on December 31, 2018. If the Special Needs plans are not re-authorized, our insurance business financial condition and results of operations.

In the United States, the ACA authorized state and federal health care exchanges to provide greater access to private health insurance coverage. These exchanges went into effect in 2014, and it is not yet known how the insurance coverage available through the exchanges will impact reimbursement for health care services, if at all. There cancould be no assurance that we can achieve future price increases from private insurers and managed care organizations offering coverage through the federal and state health care exchanges that are comparable to those we have historically received. Any reductions in reimbursement from private insurers and managed care organizations could materially and adversely impact our operating results.

Moreover, further changes in the U.S. healthcare reforms may be debated by Congress. Whether significant changes in policy will resultimpacted.

Risks Relating to Our Business

A significant portion of our North America Segment profits is dependent on the servicesestablished. If we provide to a minority of our patients who are covered by private insurance.

Government reimbursement programs generally paycomplete care for less than private insurance. Medicare only pays us 80%the baseline, we retain the difference. If the cost of complete care exceeds the Medicare allowable amount (the patient, Medicaid or secondary insurance being responsible forbaseline, we owe the remaining 20%), and Medicaid rates are comparable. As a result,payor the payments we receive from private payors generate a substantial portion of the profits we report. We estimate that Medicare and Medicaid are the primary payors for approximately 77% of the patients to whom we provide care in North America but that for 2014, we derived 51% of our North America Segment Health Care net revenues (amounting to 31% of our worldwide revenue) from Medicare and Medicaid. Therefore, if the private payors who pay for the care of the other 23% of our North America segment's patients reduce their payments for our services, or if we experience a material shift in our revenue mix toward Medicare or Medicaid reimbursement, then our revenue, cash flow and earnings would materially decrease.

Over the last few years, we have generally been able to implement modest annual price increases for private insurers and managed care organizations, but government reimbursement has remained flat or has been increased at rates below typical consumer price index ("CPI") increases. On November 6, 2014 the Centers for Medicare and Medicaid Service ("CMS") issued the final rule updating the ESRD PPS for 2015, pursuant to which the base rate was revised from $239.02 for 2014 to $239.43 for 2015. This change reflects a wage index budget-neutrality adjustment factor of 1.001729. See "Item 4. Information on the Company – Regulatory and Legal Matters – Reimbursement – U.S. – Budget Control Act and American Taxpayer Relief Act". There can be no assuranceThe reserves that we can achieve future price increases from private insurersestablish for health insurance policy benefits and managed care organizations comparable to those we have historically received. With increased governmental reformother contractual rights and regulatory activity, reimbursement from private insurers may be subject to downward pressurebenefits are based upon assumptions and judgments concerning a number of factors, including trends in the coming years. The advent of the federal and state health care exchanges may also negatively impact reimbursement from private insurance. Any reductionscosts, expenses, general economic conditions and other factors. To the extent the actual claims experience is less favorable than estimated based on our underlying assumptions, our incurred losses would increase and future earnings could be adversely affected.

Our profitability is dependent in reimbursement from private insurers and managed care organizations could materially and adversely impact our operating results. Any reduction inpart upon our ability to attract private pay patients to utilize ourcontract on favorable terms with hospitals, physicians and other health care services relativeproviders. The failure to historical levelsmaintain or to secure cost-effective health care provider contracts may result in a loss of beneficiaries or higher medical costs, which could adversely impactaffect our operating results. Any of the following events, among others, could have a material adverse effect on our operating results:business.

We are exposed to product liability, patent infringement and other claims which could result in significant costs and liability which we may not be able to insure on acceptable terms in the future.

Healthcare companies are typically subject to claims alleging negligence, product liability, breach of warranty, malpractice and other legal theories that may involve large claims and significant defense costs whether or not liability is ultimately imposed. Healthcare products may also be subject to recalls and patent infringement claims which, in addition to monetary penalties, may restrict our ability to sell or use our products. We cannot assure that such claims will not be asserted against us; for example, that significant adverse verdicts will not be reached against us for patent infringements or that large scale recalls of our products will not become necessary. In addition, the laws of some of the countries in which we operate provide legal rights to users of pharmaceutical products that could increase the risk of product liability claims. Product liability and patent infringement claims, other actions for negligence or breach of contract and product recalls or related sanctions could result in significant costs. These costs could have a material adverse effect on our business, financial condition and results of operations. See Note 2018 of the Notes to Consolidated Financial Statements, "Commitments and Contingencies.Contingencies," included in this report.

While we have been able to obtain liability insurance in the past to partially cover our business risks, we cannot assure that such insurance will be available in the future either on acceptable terms or at all.all, or that our insurance carriers will not dispute their coverage obligations. In addition, FMCH, our largest subsidiary, is partially self-insured for professional, product and general liability, auto liability and worker's compensation claims, up to pre-determined levels above which our third-party insurance applies. A successful claim in excess of the limits of our insurance coverage could have a material adverse effect on our business, results of operations and financial condition. Liability claims, regardless of their merit or eventual outcome, also may have a material adverse effect on our business and reputation, which could in turn reduce our sales and profitability.

The Company is vigorously defending a patent infringement lawsuit and certain wrongful death and personal injury lawsuits alleging inadequate labeling and warnings for certain of our dialysate concentrate products. See Note 20 of the Notes to Consolidated Financial Statements, "Legal and Regulatory Matters – Commercial Litigation". While we believe we have valid defenses to these claims, an adverse determination in any of these matters could have a material adverse effect on the Company's business, financial condition and results of operations.

Our growth depends, in part, on our ability to continue to make acquisitions.

The healthcare industry has experienced significant consolidation in recent years, particularly in the dialysis services sector. Our ability to make future acquisitions depends, in part, on our available financial resources and could be limited by restrictions imposed by the United States or other countries' competition laws or under our credit documents. If we make future acquisitions, we may need to incur additional debt or assume significant liabilities, either of which might increase our financial leverage and cause the prices

of our debt securities to decline. In addition, any financing that we might need for future acquisitions might be available to us only on terms that restrict our business. Acquisitions that we complete are also subject to risks relating to, among other matters, integration of the acquired businesses (including combining the acquired company's infrastructure and management information systems with ours, harmonization of its marketing, patient service and logistical procedures with ours and, potentially, reconciling divergent corporate and management cultures), possible non-realization of anticipated synergies from the combination, potential loss of key personnel or customers of the acquired companies, and the risk of assuming unknown liabilities not disclosed by the seller or not uncovered during due diligence. If we are not able to effect acquisitions on reasonable terms, there could be an adverse effect on our business, financial condition and results of operations.

We also compete with other health care companies in seeking suitable acquisition targets. The continuing consolidation of dialysis providers and combinations of dialysis providers with dialysis product manufacturers and other consolidation in the health care industry generally could affect future growth, including growth of our product sales. If we are not able to continue to effect acquisitions on reasonable terms, especially in the international area, this could have an adverse effect on our business, financial condition and results of operations.

We face specific risks from international operations.

We operate dialysis clinics in more than 45 countries and sell a range of products and services to customers in more than 120 countries. Our international operations are subject to a number of risks, including but not limited to the following:

International growth and expansion into emerging markets such as China, Eastern Europe, the Middle East and Africa, could cause us difficulty due to greater regulatory barriers than in the United States or Western Europe, the necessity of adapting to new regulatory systems, and problems related to entering new markets with different economic, social, legal and political systems and conditions. For example, unstable political conditions or civil unrest could negatively impact our operations and sales in a region or our ability to collect receivables or reimbursements or operate or execute projects in a region.

Any one or more of these or other factors could increase our costs, reduce our revenues, or disrupt our operations, with possible material adverse effects on our business, financial condition and results of operations.

We could be adversely affected if we experience shortages of components or material price increases from our suppliers.

The Company'sOur purchasing strategy is aimed at developing partnerships with strategic suppliers through long-term contracts and at the same time ensuring, where reasonably practicable, that it haswe have at least two sources for all supply and price-critical primary products (dual sourcing, multiple sourcing). To prevent loss of suppliers, we monitor our supplier relationships on a regular basis. Suppliers which are integral to our procurement functions are subject to performance and risk analyses. Through constant market analyses, a

demands-based design of supplier relationships and contracts, as well as the use of financial instruments, we seek to mitigate disruptive component shortages and potential price increases. If the Company is unable to counteract the risk of bottleneck situations at times of limited availability of components and other materials in spite of its purchasing strategy in combination with ongoing monitoring of market developments, this could result in delays in production and hence have an adverse effect on the Company's results of operations. Similarly, material price increases by suppliers could also adversely affect the Company's result of operations.

If physicians and other referral sources cease referring patients to our dialysishealth care service businesses and clinics or cease purchasing or prescribing our dialysis products, our revenues would decrease.

In providing dialysis services within our health care business, we depend upon patientspatients' choosing our clinicshealth care facilities as the location for their treatments.care. Patients may select a clinic based, in whole or in part, on the recommendation of their physician. We believe that physicians and other clinicians typically consider a number of factors when recommending a particular dialysis facility, pharmacy, physician practice, vascular surgery center or vascular accessurgent care center to an ESRD patient, including, but not limited to, the quality of care at a clinic, the competency of a clinic's staff, convenient scheduling, and a clinic's location and physical condition. Physicians may change their facility recommendations at any time, which may result in the movement of new or existing patients to competing clinics, including clinics established by the physicians themselves. At most of our clinics, a relatively small number of physicians often account for the referral of all or a significant portion of the patient base. Our dialysis business also depends on recommendations by hospitals, managed care plans and other healthcare institutions. If a significant number of physicians, hospitals or other healthcare institutions cease referring their patients to our clinics;clinics, this would reduce our health care revenue and could materially adversely affect our overall operations.

The decision to purchase or prescribe our dialysis products and other services or competing dialysis products and other services will be made in some instances by medical directors and other referring physicians at our dialysis clinics and by the managing medical personnel and referring physicians at other dialysis clinics, subject to applicable regulatory requirements. A decline in physician recommendations or recommendations from other sources for purchases of our products or ancillary services would reduce our dialysis product and other services revenue, and would materially adversely affect our business, financial condition and results of operations.

Our pharmaceutical product business could lose sales to generic drug manufacturers or new branded drugs.

Our branded pharmaceutical product business is subject to significant risk as a result of competition from manufacturers of generic drugs and other new competing medicines or therapies. Through the end of 2013, we were obligated to make certain minimum annual royalty payments under certain of our pharmaceutical product license agreements, regardless of our annual sales of the licensed products. Thereafter, the Company is required to determine their minimum purchase requirements for the subsequent year on a yearly basis. Any of the expiration or loss of patent protection for one of our products, the "at-risk" launch by a generic manufacturer of a generic version of one of our branded pharmaceutical products or the launch of new branded drugs that compete with one or more of our products could result in the loss of a major portion of sales of that branded pharmaceutical product in a very short time period, which could materially and adversely affect our business, financial condition and results of operations.

Our competitors could develop superior technology or otherwise impact our sales.

We face numerous competitors in both our health care services business and our dialysis products business, some of which may possess substantial financial, marketing or research and development resources. Competition and especially new competitive developments could materially adversely affect the future pricing and sale of our products and services. In particular, technological innovation has historically been a significant competitive factor in the dialysis products business. The introduction of new products by competitors could render one or more of our products or services less competitive or even obsolete.

Global economic conditions as well as further disruptions in financial markets may have an adverse effect on our businesses.

Although there has been some improvement in the global economyCurrent and financial markets since the market deterioration of the global economy and tightening of the financial markets, the overall global economic outlook remains uncertain and currentfuture economic conditions could adversely affect our business and our profitability. Among other things, the potential decline in federal and state revenues that may result from such conditions may create additional pressures to contain or reduce reimbursements for our services from public payors around the world, including Medicare, Medicaid in the United States and other government sponsored programs in the United States and other countries around the world.

Job losses or slow improvement in the unemployment rate in the United States may result in a smaller percentage of our patients being covered by an employer group health plan and a larger percentage being covered by lower paying Medicare and Medicaid programs. Employers and individuals who obtain insurance through exchanges established under the ACA might also begin to select more restrictive commercial plans with lower reimbursement rates. To the extent that payors are negatively impacted by a decline in the economy, we may experience further pressure on commercial rates, a further slowdown in collections and a reduction in the amounts we expect to collect.

We depend on the financial markets for access to capital, as do our renal product customers and commercial healthcare insurers. Limited or expensive access to capital could make it more difficult for these customers to do business with us, or to do business generally, which could adversely affect our businesses.

In addition, uncertainty in the financial markets could adversely affect the variable interest rates payable under our credit facilities or could make it more difficult to obtain or renew such facilities or to obtain other forms of financing in the future. Any or all of these factors, or other consequences of the continuation, or worsening, of domestic and global economic conditions which cannot currently be predicted, could continue to adversely affect our businesses and results of operations.

Any material disruption in federal government operations and funding could have a material adverse effect on our revenues, earnings, cash flows and financial condition.

A substantial portion of our revenues is dependent on federal healthcare program reimbursement, and any disruptions in federal government operations could have a material adverse effect on our revenues, earnings and cash flows. If the U.S. government defaults on its debt, there could be broad macroeconomic effects that could raise our cost of borrowing funds, and delay or prevent our future growth and expansion. Any future federal government shutdown, U.S. government default on its debt and/or failure of the U.S. government to enact annual appropriations could have a material adverse effect on our revenues, earnings and cash flows. Additionally, disruptions in federal government operations may negatively impact regulatory approvals and guidance that are important to our operations, and create uncertainty about the pace of upcoming health care regulatory developments.

If we are unable to attract and retain skilled medical, technical and engineering personnel, we may be unable to manage our growth or continue our technological development.

Our continued growth in the health care business will depend upon our ability to attract and retain skilled employees, such as highly skilled nurses and other medical personnel. Competition for those employees is intense. Moreover, we believe that future success in the provider business will be significantly dependent on our ability to attract and retain qualified physicians to serve as employees of or consultants to our health care services businesses. If we are unable to achieve that goal or if doing so requires us to bear increased costs this could adversely impact our growth and results of operations.

Our dialysis products business depends on the development of new products, technologies and treatment concepts to be competitive. Competition is also intense for skilled engineers and other technical research and development personnel. If we are unable to obtain and retain the services of key personnel, the ability of our officers and key employees to manage our growth would suffer and our operations could suffer in other respects. These factors could preclude us from integrating acquired companies into our operations, which could increase our costs and prevent us from realizing synergies from acquisitions. Lack of skilled research and development personnel could impair our technological development, which would increase our costs and impair our reputation for production of technologically advanced products.

Diverging views of fiscal authorities could require us to make additional tax payments.

We are subject to ongoing tax audits in the U.S., Germany and other jurisdictions. We could potentially receive notices of unfavorable adjustments and disallowances in connection with certain of these audits. If we are unsuccessful in contesting unfavorable determinations we could be required to make additional tax payments, which could have a material adverse impact on our results of operations and

operating cash flow in the relevant reporting period. See Item 5, "Operating and Financial Review and Prospects – B.IV. Liquidity and Capital Resources – Liquidity" as well as Note 20 of the Notes to Consolidated Financial Statements, "Commitments and Contingencies – Legal and Regulatory Matters.Resources."

Risks Relating to our Securities

Our indebtedness may limit our ability to pay dividends or implement certain elements of our business strategy.

At December 31, 2014,2016, we had consolidated debt of $9,532$8,572 million and consolidated total shareholders' equity of $10,028$11,457 million. Our debt could have significant consequences to our operations and our financial condition. For example, it could require us to dedicate a substantial portion of our cash flow from operations, as well as the proceeds of certain financings and asset dispositions, to payments on our indebtedness, thereby reducing the availability of our cash flow and such proceeds to fund working capital, capital expenditures and for other general corporate purposes.

In October 2012, we entered into a syndicated Credit Agreement, which was amended in November 2014 (the "Amended 2012 Credit Agreement"). Our Amended 2012 Credit Agreement, the indentures relating to our senior notes ("Senior NotesNotes") and our accounts receivable securitization program (the "A/R Facility") include covenants that require us to maintain certain financial ratios or meet other financial tests. Under our Amended 2012 Credit Agreement and the A/R Facility, we are obligated to maintain a maximumour consolidated leverage at or below an established maximum ratio (ratio of consolidated net funded debt to consolidated EBITDA) as these terms are defined in the respective financing agreements.

Our Amended 2012 Credit Agreement and the indentures related to our Senior Notes include other covenants which, among other things, restrict or could have the effect of restricting our ability to dispose of assets, incur debt, pay dividends and other restricted payments, create liens or make investments or acquisitions. These covenants may otherwise limit our activities. The breach of any of the covenants could result in a default and acceleration of the indebtedness under the credit agreement or the indentures, which could, in turn, create additional defaults and acceleration of the indebtedness under the agreements relating to our other long-term indebtedness which would have an adverse effect on our business, financial condition and results of operations.

Fresenius SE owns 100% of the shares in the General Partner of our Company and is able to exercise management control of FMC-AG & Co. KGaA.

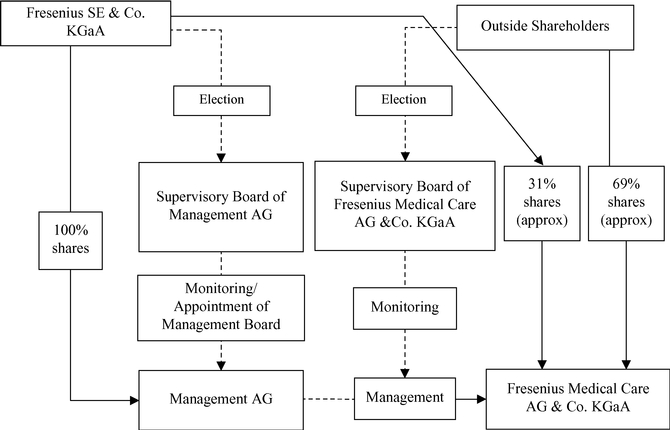

Fresenius SE owns approximately 31.1%30.82% of our outstanding ordinary shares, excluding treasury shares we held, as of February 18, 2015.16, 2017. Fresenius SE also owns 100% of the outstanding shares of Management AG, the General Partner of the Company. As the sole shareholder of the General Partner, Fresenius SE has the sole right to elect the supervisory board of the General Partner which, in turn, appoints the General Partner's Management Board. The Management Board of the General Partner is responsible for the management of the Company. Through its ownership of the General Partner, Fresenius SE is able to exercise de facto management control of FMC-AG & Co. KGaA, even though it owns less than a majority of our outstanding voting shares. Such de facto control limits public shareholder influence on management of the Company and precludes a takeover or change of control of the Company without Fresenius SE's consent, either or both of which could adversely affect the price of our shares.

Because we are not organized under U.S. law, we are subject to certain less detailed disclosure requirements under U.S. federal securities laws.

Under the pooling agreement that we have entered into for the benefit of non-relatedpublic holders of our Ordinary shares (including, in each case, holders of American Depositary Receipts representing beneficial ownership of such shares), we have agreed to file quarterly reports with the SEC to prepare annual and quarterly financial statements in accordance with U.S. generally accepted accounting principles ("G.A.A.P."), and to file information with the SEC with respect to annual and general meetings of our shareholders. The pooling agreement originally required that we prepare our annual and quarterly financial statements filed with the SEC in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). It was amended in June 2016 to provide that we may prepare such financial statements in accordance with U.S. GAAP or IFRS and, commencing with our report for the first quarter of 2017, we will prepare such financial statements in accordance with IFRS with the euro as our reporting currency. The pooling agreement also requires that the supervisory board of Management AG, our General Partner, include at least two members who do not have any substantial business or professional relationship with Fresenius SE, Management AG or FMC-AG & Co. KGaA and its affiliates and requires the consent of those independent directors to certain transactions between us and Fresenius SE and its affiliates.

We are a "foreign private issuer," as defined in the SEC's regulations, and consequently we are not subject to all of the same disclosure requirements applicable to domestic companies. We are exempt from the SEC's proxy rules, and our annual reports contain less detailed disclosure than reports of domestic

issuers regarding such matters as management, executive compensation and outstanding options, beneficial ownership of our securities and certain related party transactions. Also, our officers, directors and beneficial owners of more than 10% of our equity securities are exempt from the reporting requirements and short – swing profit recovery provisions of Section 16 of the Exchange Act. We are also generally exempt from most of the governance rules applicable to companies listed on the New York Stock Exchange (including("NYSE"), including the obligation to maintain a compensation committee of independent directors),directors, other than the obligation to maintain an audit committee in accordance with Rule 10A – 3 under the Exchange Act and to provide an annual affirmation(and, if required, quarterly) affirmations of our compliance. These limits on available information about our company and exemptionsWe must, however, disclose the significant ways in which the governance standards that we follow differ from those applicable to U.S. companies under the NYSE governance rules. Exemptions from many governance rules applicable to U.S. domestic issuers may adversely affect the market prices for our securities. See Item 16G, "Corporate Governance."

Item 4. Information on the Company

A. History and Development of the Company

General

Fresenius Medical Care AG & Co. KGaA, ("FMC-AG & Co. KGaA" or the "Company"), is a partnership limited by shares (Kommanditgesellschaft auf Aktien or "KGaA"), formerly known as Fresenius Medical Care AG, ("FMC-AG"), a German stock corporation (Aktiengesellschaft or "AG") organized under the laws of Germany.

The Company was originally incorporated on August 5, 1996 as a stock corporation and transformed into a partnership limited by shares upon registration on February 10, 2006. FMC-AG & Co. KGaA is registered with the commercial register of the local court (Amtsgericht) of Hof an der Saale, Germany, under the registration number HRB 4019. Our registered office (Sitz)(Sitz) is Hof an der Saale, Germany. Our registered business address is Else-Kröner-Strasse 1, 61352 Bad Homburg, Germany, telephone +49-6172-609-0.

History

On September 30, 1996, we completed a series of transactions to consummate an Agreement and Plan of Reorganization entered into on February 4, 1996 by Fresenius SE (then Fresenius AG) and W.R. Grace & Co. which we refer to as the "Merger" elsewhere in this report. Pursuant to that agreement, Fresenius SE contributed Fresenius Worldwide Dialysis, its global dialysis business, including its controlling interest in Fresenius USA, Inc., in exchange for 105,630,000 FMC-AG Ordinary shares.Shares. Thereafter, we acquired:

On February 10, 2006, the Company completed the transformation of its legal form under German law as approved by its shareholders during the Extraordinary General Meeting ("EGM") held on August 30, 2005. Upon registration of the transformation of legal form in the commercial register of the local court in Hof an der Saale, on February 10, 2006, Fresenius Medical Care AG's legal form was changed from a German AG to a KGaA with the name Fresenius Medical Care AG & Co. KGaA. The Company as a KGaA is the same legal entity under German law, rather than a successor to the stock corporation. Management AG, a subsidiary of Fresenius SE, which was the majority voting shareholder of FMC-AG prior to the transformation, is the general partner of FMC-AG & Co. KGaA. Shareholders in FMC-AG & Co. KGaA participated in all economic respects, including profits and capital, to the same extent and (except as modified by the first share conversion described below) with the same number of shares in FMC-AG & Co. KGaA as they held in FMC-AG prior to the transformation. Upon effectiveness of the transformation of legal form, the share capital of FMC-AG became the share capital of FMC-AG & Co. KGaA, and persons who were shareholders of FMC-AG became shareholders of the Company in its new legal form.

Prior to the effectiveness of the transformation, and as approved by the EGM and by a separate vote of FMC-AG's former preference shareholders, the Company offered holders of its non-voting Preference shares (including preference shares represented by American Depositary Shares (ADSs)) the opportunity to convert their shares into Ordinary shares, which was accepted by the holders of approximately 96% of the outstanding Preference shares. Preference shares that were not converted remained outstanding and became Preference shares of FMC-AG & Co. KGaA in the transformation.