indicated, information concerning exchange rates between the RMB and the U.S. dollar based on the exchange rates set forth in the H.10 statistical release of the Federal Reserve Board.

| | Noon buying rate | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Period | Period end | Average(1) | Low | High | |||||||||

| | (RMB per US$1.00) | ||||||||||||

2012 | 6.2301 | 6.2990 | 6.3879 | 6.2221 | |||||||||

2013 | 6.0537 | 6.1412 | 6.2438 | 6.0537 | |||||||||

2014 | 6.2046 | 6.1704 | 6.2591 | 6.0402 | |||||||||

2015 | 6.4778 | 6.2869 | 6.4896 | 6.1870 | |||||||||

2016 | 6.9430 | 6.6400 | 6.9580 | 6.4480 | |||||||||

December | 6.9430 | 6.9198 | 6.9580 | 6.8771 | |||||||||

2017 | |||||||||||||

January | 6.8768 | 6.8907 | 6.9575 | 6.8360 | |||||||||

February | 6.8665 | 6.8694 | 6.8821 | 6.8517 | |||||||||

March | 6.8832 | 6.8940 | 6.9132 | 6.8687 | |||||||||

April | 6.8900 | 6.8876 | 6.8988 | 6.8778 | |||||||||

May | 6.8098 | 6.8843 | 6.9060 | 6.8098 | |||||||||

June (through June 9) | 6.7970 | 6.7998 | 6.8085 | 6.7935 | |||||||||

| | Twelve months ended | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Jun. 30, 2013 | Sep. 30, 2013 | Dec. 31, 2013 | Mar. 31, 2014 | Jun. 30, 2014 | Sep. 30, 2014 | Dec. 31, 2014 | Mar. 31, 2015 | |||||||||||||||||

| | (in millions) | ||||||||||||||||||||||||

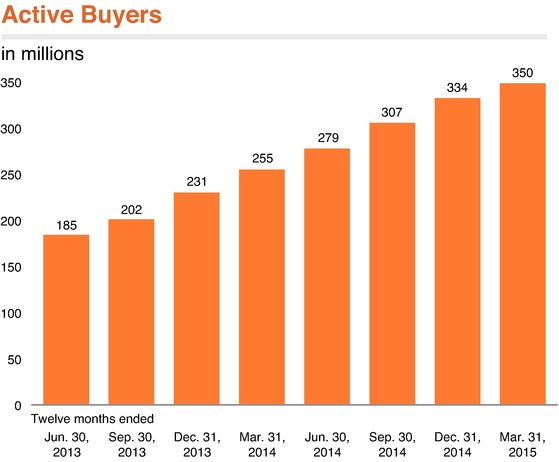

Active buyers | 185 | 202 | 231 | 255 | 279 | 307 | 334 | 350 | |||||||||||||||||

- (1)

- Annual averages are calculated using the average of the rates on the last business day of each month during the relevant year. Monthly averages are calculated using the average of the daily rates during the relevant month.

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

Risks Related to Our Business and Industry

Maintaining the trusted status of our ecosystem is critical to our success and future growth, and any failure to do so could severely damage our reputation and brand, which would have a material adverse effect on our business, financial condition and results of operations.

We have established a strong brand name and reputation for our ecosystem in China.ecosystem. Any loss of trust in our ecosystem or platformplatforms could harm our reputation and the value of our brand and result in buyers consumers, merchants, brands

and sellers ceasing to transact business on our marketplaces as well asother participants reducing thetheir activity level of their commercial activity in our ecosystem, which could materially reduce our revenue and profitability. Our ability to maintain our position as a trusted platform for online and mobile commerce is based in large part upon:

- •

- the reliability and security of our

platform;platforms as well as the commitment to high levels of service, reliability, security and data protection by the merchants, developers, logistics providers, service providers and other participants in our ecosystem; - •

- the quality, breadth and functionality of products,

and the wide range ofservices and functionswe makeand the quality, variety and appeal of content availableto participants onthrough ourplatform;platforms; - •

- the effectiveness and perceived fairness of rules governing our

marketplaces; •the qualitymarketplaces andbreadth of productsother platforms andservices offered by sellers through our marketplaces;overall ecosystem;- •

- the strength of our consumer and intellectual property rights protection measures; and

- •

- our ability to provide reliable and trusted payment and escrow services through our arrangements with Alipay.

Increased investments in our business, strategic acquisitions and investments as well as our focus on long-term performance and on maintaining the health of our ecosystem may negatively affect our margins and our net income.

We have experienced significant growth in our profit margins and net income. However, we cannot assure you that we will be able to maintain our growth at these levels, or at all. Our operating profit grew 65% from fiscal year 2016 to fiscal year 2017 but our net income decreased by 42%. Consistent with our focus on the long-term interests of our ecosystem participants, we may take actions that fail to generate positive short-term financial results, and we cannot assure you that these actions will produce long-term benefits. There can be no assurance that we will be able to sustain our net income growth rates or our margins.

We continue to increase our spending and investment in our business to support our future growth, including in expanding our core commerce offerings, such as our continuing efforts to grow Tmall Supermarket, a supermarket category for high quality fresh produce, food products and fast moving consumer goods, or FMCG; improving our technological infrastructure and cloud computing capacities; and investing in our digital media and entertainment business. All of these initiatives are crucial to the success of our business but will have the effect of increasing our costs and lowering our margins and profit, and this effect may be significant, at least in the short term. Moreover, many of our business initiatives emphasize expanding our user base and enhancing user experience, rather than initially prioritizing monetization or profitability.

Furthermore, we have made, and intend to continue to make, strategic investments and acquisitions to expand our user base and geographic coverage and add complementary offerings and technologies to further strengthen our ecosystem. For example, we expect to continue to make strategic investments and acquisitions relating to core commerce (including in connection with our new retail strategy), cloud computing and big data, digital media and entertainment, international expansion, logistics services, local services, healthcare and new technologies, such as artificial intelligence, or AI. Our strategic investments and acquisitions may adversely affect our future financial results, including by decreasing our margins and net income. For example, we believe that our continuing expansion into the digital media and entertainment sectors, including our acquisition of Youku Tudou, our international expansion, including our acquisition of a controlling stake in Lazada, and our investments and acquisitions to transform our core commerce business, such as our recent privatization of Intime, are important to our overall business but will have a negative effect on our financial results, at least in the short term. In addition, the performance of minority investments we make that are accounted for under the equity method investments may also adversely affect our net income.

We may not be able to maintain or grow our revenue or our business.

We have experienced significant growth in revenue in recent years. In particular, our revenue grew 45% from fiscal year 2014 to fiscal year 2015, 33% from fiscal year 2015 to fiscal year 2016 and 56% from fiscal year 2016 to

fiscal year 2017. Our ability to continue to generate and grow our revenue depends on a number of factors. For example, our marketing customers do not have long-term marketing commitments with us. If our services do not generate the rate of return expected or offer prices that are competitive to alternatives, marketers may reduce their spending on the marketing services we offer. See "Item 5. Operating and Financial Review and Prospects — A. Operating Results — Factors Affecting Our Results of Operations — Our Ability to Create Value for Our Users and Generate Revenue" and "— Our Monetization Model."

Our future revenue growth also depends on our ability to continue to grow our core commerce and other businesses, including our cloud computing business, digital media and entertainment business, as well as the businesses we have acquired or invested in and new business initiatives we may explore in the future, including in industries in which we have limited or no experience. This requires significant investments of time and resources, and our new businesses and initiatives may present new and difficult technological, operational and legal challenges. For example, as we expand our digital media and entertainment business, we may be unable to produce or license quality content on commercially reasonable terms or at all, fail to anticipate or keep up with changes in user preferences, user behavior and technological developments or fail to gain access to content distribution channels. In addition, as we expand into the online video industry we may not be able to acquire and retain users, attract marketers to purchase online marketing services on our video platforms, obtain professionally produced content at competitive prices or at all, encourage more user-generated content, or grow user acceptance and the popularity of our online video content. In addition, our expansion into new sectors will subject us to additional regulatory risks. We may also fail to identify or anticipate industry trends and competitive conditions or fail to invest sufficient resources in new growth areas. If we are unable to successfully expand and monetize our businesses, our future revenue growth may be adversely affected.

In addition, our revenue growth may slow or our revenues may decline for other reasons, including decreasing consumer spending, increasing competition and slowing growth of the China retail or China online retail industries and changes in government policies or general economic conditions. In addition, although our revenue grew at a faster rate in fiscal year 2017 than fiscal year 2016, as our revenue grows to a higher base level, our revenue growth rate may slow in the future.

If we are unable to compete effectively, our business, financial condition and results of operations would be materially and adversely affected.

We face increasingly intense competition, mainly from established Chinese Internet companies, such as Tencent, Baidu and their respective affiliates, global Internet companies, as well as certain offline retailers and e-commerce players, including those that specialize in a limited number of product categories, such as FMCG, global or regional cloud computing service providers and digital media and entertainment providers. We compete to:

- •

- attract, engage and retain consumers based on the variety and value of products and services listed on our marketplaces, the engagement of digital media and entertainment content available on our platforms, the overall user experience of our products and services and the effectiveness of our consumer protection measures;

- •

- attract and retain merchants and brands, based on our size, the size and the engagement of consumers on our platforms and the effectiveness of our products and services to help them build brand awareness and engagement, acquire and retain customers, complete transactions, expand service capabilities, protect intellectual property rights and enhance operating efficiency;

- •

- compete to attract and retain marketers, publishers and demand side platforms operated by agencies based on the reach and engagement of our media properties, the depth of our consumer data insights and the effectiveness of our branding and marketing solutions;

- •

- attract other participants of our ecosystem based on access to business opportunities created by the large scale of economic activity on our platforms, the strength of the network effect of our ecosystem, as well as tools and technologies that help them operate and grow their businesses;

- •

- optimize the usefulness of the data and technologies we provide, including data-enabled customer relationship management tools, marketing data and data science, media ecosystem for branding, cloud computing services, omni-channel solutions, the availability and quality of supporting services, including payment settlement and logistics services, and the quality of our customer service;

- •

- thrive in new industries and sectors as we acquire new businesses and expand, bringing us into competition with major players in these and other industries and sectors; and

- •

- attract motivated and capable employees, including engineers and product developers who serve critical functions in the development of our products, services and our ecosystem.

Many of our competitors generate significant traffic, have established brand recognition, significant technological capabilities and significant financial resources, and have built significant ecosystems around their core businesses, such as e-commerce, social media and gaming.

In addition, as we expand our various businesses and operations into an increasing number of international markets, including markets in which we have limited or no experience and in which we may be less well-known, such as Southeast Asia, India and Russia, we increasingly face competition from domestic and international players operating in these markets.

Our ability to compete depends on a number of other factors as well, some of which may be beyond our control, including:

- •

- the timely introduction and market acceptance of the products and services we offer, compared to those of our competitors;

- •

- our ability to innovate and develop new technologies;

- •

- our ability to maintain and enhance our leading position in retail commerce in China;

- •

- our ability to benefit from new business initiatives; and

- •

- alliances, acquisitions or consolidations within the Internet industry that may result in stronger competitors.

If we are not able to compete effectively, the level of economic activity and user engagement on our platforms may decrease significantly, which could materially and adversely affect our business, financial condition and results of operations as well as our brand.

We may not be able to maintain and improve the network effects of our ecosystem, which could negatively affect our business and prospects.

Our ability to maintain a healthy and vibrant ecosystem that creates strong network effects between buyers, sellersamong consumers, merchants and other participants is critical to our success. The extent to which we are able to maintain and strengthen these network effects depends on our ability to:

- •

- offer

asecure and openplatformplatforms for allparticipants;participants and balance the interests of these participants, including consumers, merchants, brands, service providers and others; - •

- provide tools and services that meet the evolving needs of

buyersconsumers, merchants andsellers;brands; - •

- provide a wide range of high-quality product, service and

servicecontent offerings tobuyers;consumers;

- •

- attract and retain merchants and brands of all sizes;

- •

- provide

sellersmerchants and brands with a high level of traffic flow with strong commercial intent and effective online marketing services;

- •

- further enhance the attractiveness of our mobile

platform;platforms; - •

- arrange secure and trusted payment settlement and escrow services;

- •

- coordinate fulfillment and delivery services with third-party logistics

and delivery companies;service providers; - •

- attract and retain

third partythird-party service providerswhothat are able to provide quality services on commercially reasonable terms to oursellers;merchants; - •

- maintain the quality of our customer service; and

- •

- continue adapting to the changing demands of the market.

In addition, changes we may make to enhance and improve our ecosystem and balance the needs and interests of the various participants on our ecosystem, or to comply with regulatory requirements, may be viewed positively from one participant group's perspective, (suchsuch as buyers)consumers, but may have negative effects from another group's perspective, (suchsuch as sellers).merchants. If we fail to balance the interests of all participants in our ecosystem, fewer buyers, sellersconsumers, merchants, brands and other participants may visitspend less time, mind share and resources on our marketplaces, or they mayplatforms and conduct fewer transactions or use alternative platforms, any of which could result in a material decrease in our revenue and net income.

Our operating philosophy and interest in maintaining the health of our ecosystem may negatively influence our short-term financial performance.

Consistent with our operating philosophy and focus on the long-term interests of our ecosystem participants, we may take actions that fail to generate short-term financial results, and we cannot assure you that these actions will produce long-term benefits. For example, we share a significant portion of the revenue generated from our network of third-party marketing partners, or the Taobao Affiliate Network, with such marketing partners. In addition, our efforts relating to our mobile platform have emphasized expanding our user base and enhancing user experience, rather than prioritizing monetization of user traffic on our mobile platform. We also make investments in new products, services and business initiatives that may not provide economic benefits to us in the short-term or at all.

User behavior on mobile devices is rapidly evolving, and if we fail to successfully adapt to these changes, our competitiveness and market position may suffer.

Buyers, sellers and other participants are increasingly using mobile devices in China for a wide range of purposes, including for e-commerce. While a significant and growing portion of participants access our platforms through mobile devices, this area is relatively new and developing rapidly and we may not be able to continue to increase the level of mobile access to and engagement on our marketplaces. The variety of technical and other configurations across different mobile devices and platforms increases the challenges associated with this environment. Our ability to successfully expand the use of mobile devices to access our platform is affected by the following factors:

•our ability to continue to provide compelling commerce platforms and tools in a multi-device environment;•the quality of our mobile offerings, or mobile-based payment services provided by Alipay;•our ability to successfully deploy apps on popular mobile operating systems that we do not control, such as iOS and Android;•our ability to adapt to the device standards used by third-party manufacturers and distributors; and•the attractiveness of alternative platforms.

If we are unable to attract significant numbers of new mobile buyers and increase levels of mobile engagement, our ability to maintain or grow our business would be materially and adversely affected.

We may not be able to successfully monetize traffic on our mobile platform, which could have a material adverse effect on our business.

An increasing percentage of our users are accessing our marketplaces through mobile devices, a trend that we expect to continue. Our ability to monetize our mobile user traffic is critical to our business and our growth. We face a number of challenges to successfully monetizing our mobile user traffic, including:

•providing marketing services in a compelling and effective manner on mobile devices;•developing alternative sources of revenue generated from mobile access to our marketplaces;•offering a comprehensive user experience on our mobile apps; and•ensuring that the mobile services we provide are secure and trusted.

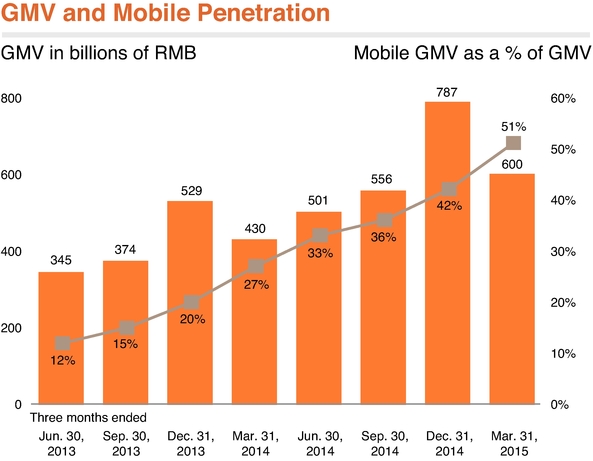

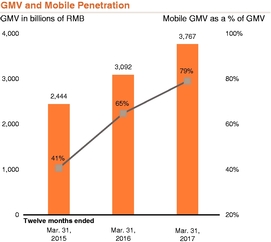

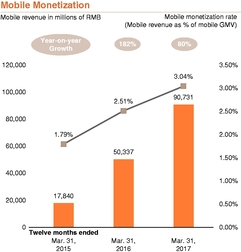

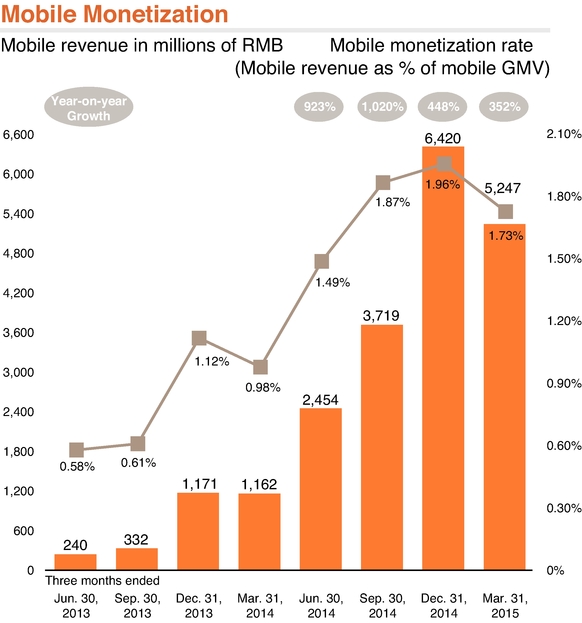

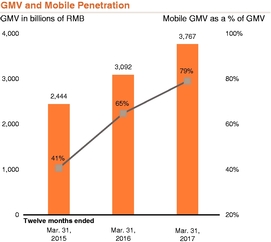

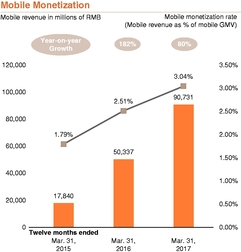

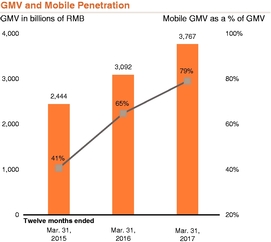

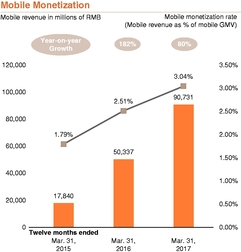

If as we experience increased use of mobile devices for mobile commerce we are unable to monetize that increased use, our business may not grow or could decline, and our revenues and net income would be materially reduced. For instance, to date we have chosen not to display as many marketing impressions on our mobile apps as compared to on our personal computer-based websites. Although we do not believe the increasing use of mobile devices to conduct commerce has had an adverse effect on our business, our rapid overall growth may make less apparent any adverse effects of this trend on our near-term financial performance. In the quarter ended March 31, 2015, our mobile GMV exceeded 50% of our total GMV for the first time, and we expect mobile GMV as a percentage of total GMV will continue to grow and that our monetization rates for mobile interfaces in the near term will remain lower than those we have achieved from websites because to date our focus has not been on maximizing mobile monetization and we have only recently begun to increasingly monetize mobile activities. Going forward we believe our financial results will become increasingly dependent on our ability to monetize the use of mobile devices to access our marketplaces. We expect this trend will have a greater effect on our business to the extent that shopping on mobile devices displaces transactions that could have occurred on personal computers.

We may not be able to maintain our culture, which has been a key to our success.

Since our founding, our culture has been defined by our mission, vision and values, and we believe that our culture has been critical to our success. In particular, our culture has helped us serve the long-term interests of our customers, attract, retain and motivate employees and create value for our shareholders. We face a number of challenges that may affect our ability to sustain our corporate culture, including:

- •

- failure to identify, attract, promote and

promoteretain people in leadership positions in our organization who share our culture, values and mission; - •

- failure to execute

aan effective management succession plan to replace our current generation of management leaders; - •

- the increasing size, complexity, geographic coverage and

geographiccultural diversity of our business and workforce; - •

- the integration of new personnel and businesses as we expand our existing businesses and acquire new businesses;

- •

- challenges of effectively incentivizing and motivating employees, including members of senior management, and in particular those who have gained a substantial amount of personal wealth

because of our initial public offering;related to share-based incentives; - •

- competitive pressures to move in directions that may divert us from our mission, vision and values;

- •

- the continued challenges of an ever-changing business environment;

- •

- the pressure from the public markets to focus on short-term results instead of long-term value creation; and

- •

- the increasing need to develop expertise in new areas of business that affect

us; and •the integration of new personnel and businesses from acquisitions.us.

If we are not able to maintain our culture or if our culture fails to deliver the long-term results we expect to achieve, our business, financial condition, results of operations and prospects could be materially and adversely affected.

If we are unable to compete effectively, our business, financial condition and results of operations would be materially and adversely affected.

We face increasingly intense competition, mainly from Chinese and global Internet companies as well as from offline retailers, particularly those establishing online marketplaces. We compete to attract, engage and retain buyers based on the variety and value of products and services listed on our marketplaces, overall user experience and convenience and availability of payment settlement and logistics services. We compete to attract and retain sellers based on our size and the engagement of buyers, and the effectiveness and value of the marketing services we offer. We also compete based on the usefulness of the services we provide, including marketing data and data science, cloud computing services, the availability of supporting services, including payment settlement and logistics services, and the quality of our customer service. In addition, we compete for motivated and effective talent and personnel, including engineers and product developers who serve critical functions in the development of our products and our ecosystem.

Our ability to compete depends on a number of other factors as well, some of which may be out of our control, including:

•the timely introduction and market acceptance of the services we offer, compared to those of our competitors;•our ability to innovate and develop new technologies;•our ability to maintain and enhance our leading position in mobile commerce in China;•our ability to benefit from new business initiatives; and•alliances, acquisitions or consolidations within the Internet industry that may result in stronger competitors.

If we are not able to compete effectively, the GMV transacted on our marketplaces and the user activity level on our platform may decrease significantly, which could materially and adversely affect our business, financial condition and results of operations as well as our brand.

We rely on Alipay to conduct substantially all of the payment processing and all of the escrow services on our marketplaces. Alipay's business is highly regulated, and it is also subject to a range of risks. If Alipay's services are limited, restricted, curtailed or degraded in any way or become unavailable to us or our users for any reason, our business may be materially and adversely affected.

Alipay provides payment processing and escrow services that are critical to our platform through contractual arrangements with us. In the twelve months ended March 31, 2015, 75% of GMV on our China retail marketplaces was settled through Alipay, and the settlement and escrow services and convenient payment mechanisms provided by Alipay are critical factors contributing to our success and the development of our ecosystem.

We established Alipay in December 2004 to operate our payment services. In June 2010, the PBOC issued new regulations that required non-bank payment companies to obtain a license in order to operate in China. These regulations provided specific guidelines for license applications only for domestic PRC-owned entities. These regulations stipulated that, in order for any foreign-invested payment company to obtain a license, the scope of business, the qualifications of any foreign investor and any level of foreign ownership would be subject to future regulations to be issued, which in addition would require approval by the PRC State Council. Further, the regulations required that any payment company that failed to obtain a license had to cease operations by September 1, 2011. Although Alipay was prepared to submit its license application in early 2011, at that time the PBOC had not issued any guidelines applicable to license applications for foreign-invested payment companies (and no such guidelines have been issued as of the date of this annual report). In light of the uncertainties relating

to the license qualification and application process for a foreign-invested payment company, our management determined that it was necessary to restructure Alipay as a company wholly-owned by PRC nationals in order to avail Alipay of the specific licensing guidelines applicable only to domestic PRC-owned entities. Accordingly we divested all of our interest in and control over Alipay, which resulted in deconsolidation of Alipay from our financial statements. This action enabled Alipay to obtain a payment business license in May 2011 without delay and without any detrimental impact to our China retail marketplaces or to Alipay. Following the divestment of our interest in and control over Alipay, effective in the first calendar quarter of 2011, we entered into a framework agreement with Ant Financial Services (the parent company of Alipay), Alipay, SoftBank, Yahoo, Jack Ma and Joe Tsai to govern our relationship with Alipay and its parent company, Ant Financial Services. In August 2014, we entered into a share and asset purchase agreement or the 2014 SAPA, to further restructure the economic terms of our relationship with Alipay and Ant Financial Services. Pursuant to a commercial agreement we entered into with Alipay in connection with the 2011 framework agreement, as amended through August 2014, Alipay continues to provide payment services to us on terms preferential to us, which arrangement remains unchanged under the 2014 SAPA. See "Item 7. Major Shareholders and Related Party Transactions — B. Related Party Transactions — Agreements and Transactions Related to Ant Financial Services and its Subsidiaries."

Alipay's business is highly regulated, and it is also subject to a number of risks that could materially and adversely affect its ability to provide payment processing and escrow services to us, including:

•increased regulatory focus and the requirement to comply with numerous complex and evolving laws, rules and regulations;•increasing costs to Alipay, including fees charged by banks to process funds through Alipay, which would also increase our cost of revenues;•dissatisfaction with Alipay's services or lower use of Alipay by consumers and merchants;•changes to rules or practices applicable to payment card systems that link to Alipay;•leakage of customers' personal information and concerns over the use and security of any collected information;•service outages, system failures or failure to effectively scale the system to handle large and growing transaction volumes;•failure to manage funds accurately or loss of funds, whether due to employee fraud, security breaches, technical errors or otherwise; and•failure to manage business and regulatory risks.

Regulators and third parties in China have been increasing their focus on online and mobile payment services, such as those provided by Alipay, and recent regulatory and other developments could reduce the convenience or utility of Alipay users' accounts, including the following:

•In March 2014, it was reported that the PBOC had prepared a further draft of regulations relating to online and mobile payment services. The new draft of the regulations includes a number of proposed provisions relating to account management, security measures and other matters. These provisions would, if adopted, prohibit individuals from using the funds in their online and mobile payment accounts with third-party payment providers such as Alipay to make purchases in excess of RMB5,000 (US$807) in any single transaction or over RMB10,000 (US$1,613) in aggregate purchases per month. In addition, these provisions, if adopted, would limit transfers without any underlying e-commerce transaction from an individual's account with third-party payment providers to other accounts to RMB1,000 (US$161) per transaction and RMB10,000 (US$1,613) in aggregate transfers per year. If the draft regulations were to be adopted in their current or similar form, or other limits were imposed on the size or other aspects of transactions that may be processed through Alipay, the ability of buyers to pay for purchases on our marketplaces using Alipay payment accounts could be materially limited. The draft regulations, however, do not affect Alipay's escrow

•In March 2014, certain large commercial banks in China reduced their existing limits on the amounts that may be transferred by automatic payment from customers' bank accounts to their linked accounts with third-party payment services. Certain of these banks imposed lower limits on Alipay than on other payment services. These limits on payments funded through Alipay's automatic payment services range from RMB10,000 per day to RMB50,000 per day depending on the bank, while monthly transfer limits on payments funded through third-party payment companies' automatic payment services were set as low as RMB50,000 per month by certain banks. Although we believe the impact of these restrictions has not been and will not be significant in terms of the overall volume of payments processed for our China retail marketplaces, and automatic payment services represent only one of many payment mechanisms that buyers may use to settle transactions, the practices of the banks remain in flux. We cannot predict whether these and any additional restrictions could be put in place that could have a material adverse effect on our marketplaces.•In April 2014, the China Banking Regulatory Commission, or the CBRC, and the PBOC issued Joint Circular 10, which, effective June 30, 2014, will require commercial banks and other financial institutions in China to conduct additional customer verification procedures prior to establishing an automatic payment link between customers' bank accounts and their accounts with third-party payment services, such as Alipay. Once the accounts have been linked, Joint Circular 10 also requires commercial banks and other financial institutions in China to, upon the customer's request, adjust any limits imposed on the amounts that may be transferred to the linked accounts. It is unclear how commercial banks and other financial institutions will implement the additional customer verification procedures or the requirement to adjust the transfer limits.

services. Buyers on our marketplaces could continue to pay for purchases through other means, such as online bank transfers and credit cards, and continue to fund their Alipay escrow accounts. So long as payments are not made outside of the Alipay escrow system, we would continue to collect commissions on such purchases if they were made on marketplaces on which we collect commissions. The PBOC has indicated that the purpose of these provisions and other parts of the draft regulations is prudential and that final regulations, including these provisions, would be subject to public consultation and revision.

We rely on the convenience and ease of use that Alipay provides to our users. If the quality, utility, convenience or attractiveness of Alipay's services declines as a result of these limitations or for any other reason, the attractiveness of our marketplaces could be materially and adversely affected.

If we need to migrate to another third-party payment service for any reason, the transition would require significant time and management resources, and the third-party payment service may not be as effective, efficient or well-received by buyers and sellers on our marketplaces. These third-party payment services also may not provide escrow services, and we may not be able to receive commissions based on GMV transacted through these systems. In addition, we would no longer have the benefit of the terms preferential to us under our commercial agreement with Alipay and would likely be required to pay more for payment processing and escrow services than we are currently paying. There can be no assurance that we would be able to reach an agreement with an alternative online payments service on acceptable terms or at all.

Moreover, because of our close association with Alipay and overlapping user base, events that negatively affect Alipay could also negatively affect customers', regulators' and other third parties' perception of us. In addition, any actual or perceived conflict of interest between us and Alipay or any other company integral to the functioning of our ecosystem could also materially harm our reputation as well as our business and prospects.

We do not control Alipay or its parent entity, Ant Financial Services, over which Jack Ma effectively controls a majority of the voting interests. Accordingly, if conflicts arise between us and Alipay or Ant Financial Services, including conflicts that could threaten our ability to continue to receive payment services on preferential terms or conflicts relating to commercial opportunities that we or Alipay or Ant Financial Services wish to pursue, such conflicts may not be resolved in our favor and could have a negative effect on our ecosystem and materially and adversely affect our business, financial condition, results of operations and prospects. Moreover, conflicts of interest may arise due to Jack Ma's role as executive chairman of our company and through his voting control over and his economic interest in Ant Financial Services, and he may not act to resolve such conflicts in our favor.

Although we rely on Alipay to conduct substantially all of the payment processing and all of the escrow services on our marketplaces, we do not have any control over Alipay. Following the divestment of our interests in and control over Alipay, effective as of the first calendar quarter of 2011, we entered into an agreement with Alipay pursuant to which Alipay provides payment services on terms that are preferential to us. The agreement, as amended through August 2014, has an initial term of 50 years from the date of the original agreement, and is automatically renewable for further periods of 50 years. Following such divestment and subsequent equity holding restructurings, an entity controlled by Jack Ma, our executive chairman, has become the general partner of Hangzhou Junhan Equity Investment Partnership, or Junhan, a PRC limited partnership, and Junao Equity Investment Partnership, or Junao, a PRC limited partnership, which are two major equity holders of Ant Financial Services. Accordingly, Jack has an economic interest in Ant Financial Services and is able to exercise the voting power of the major shareholders of Ant Financial Services. We understand that through the exercise of such voting power, Jack continues to control a substantial majority of the voting interests in Ant Financial Services.

As noted in the immediately preceding risk factor, Alipay's business is subject to a number of risks. If Alipay were not able to successfully manage these risks, its ability to continue to deliver payment services to us on preferential terms may be undermined. Furthermore, if, notwithstanding its existing obligations to us under the agreement, Alipay sought to alter the terms of the agreement and to amend the terms of its arrangements with us in order to improve its business by modifying the payment processing terms or otherwise, there is no assurance that Jack Ma, in light of his voting control over Alipay's parent, Ant Financial Services, will act in our interest. If we were to lose such preferential terms or if Alipay is unable to successfully manage its business, our ecosystem could be negatively affected, and our business, financial condition, results of operations and prospects could be materially and adversely affected.

In addition to the payment processing and escrow services provided by Alipay, Ant Financial Services provides other financial services to participants in our ecosystem, including micro-finance services through the SME loan business that we transferred to Ant Financial Services upon the completion of the restructuring of our relationship with Ant Financial Services in early February 2015, and may provide additional services in the future. Other conflicts of interest between us, on the one hand, and Alipay and Ant Financial Services, on the other hand, may arise relating to commercial or strategic opportunities or initiatives. Although we and Ant Financial Services have each agreed to certain non-competition undertakings under the 2014 SAPA, we cannot assure you that Ant Financial Services would not pursue opportunities to provide services to our competitors or other opportunities that would conflict with our interests. Jack Ma may not resolve such conflicts in our favor. Furthermore, our ability to explore alternative payment services other than Alipay for our marketplaces may be constrained due to Jack's relationship with Ant Financial Services.

In addition, we have granted share-based awards to employees of Ant Financial Services, and Junhan has made share-based awards tied to the value of Ant Financial Services to our employees. The provision of awards to our employees tied to the value of Ant Financial Services is expected to enhance our strategic and financial relationship with Ant Financial Services. See "Item 7. Major Shareholders and Related Party Transactions — B. Related Party Transactions — Agreements and Transactions Related to Ant Financial Services and its Subsidiaries — Share-based Award Reimbursement Arrangements" and "— Equity-based Awards to Our Employees by a Related Party." The share-based awards granted by Junhan to our employees resulted in expenses that are recognized by our company. Subject to the approval of our audit committee, Jack, through his role with us and his control over Junhan could be in a position to propose and promote further share-based grants that result

in additional, and potentially significant, expenses to our company. Accordingly, these and other potential conflicts of interest between us and Alipay, and between us and Jack or Junhan, may not be resolved in our favor, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

If we are not able to continue to innovate or if we fail to adapt to changes in our industry, our business, financial condition and results of operations would be materially and adversely affected.

The Internet industry is characterized by rapidly changing technology, evolving industry standards, new mobile apps, protocols and technologies, new service and product introductions, new media and entertainment content —

including user-generated content — and changing customer demands.demands and trends. Furthermore, our competitors are constantly developing innovations in Internet search, online marketing, communications, social networking, entertainment and other services, on both mobile devices and personal computers, to enhance users' online experience. We continue to invest significant resources in our infrastructure, research and development and other areas in order to enhance our platform technology and our existing products and services as well as to explore new growth strategies and introduce new high quality products and services that willto attract more participants to our marketplaces.platforms. The changes and developments taking place in our industry may also require us to re-evaluate our business model and adopt significant changes to our long-term strategies and business plan.plans. Our failure to innovate and adapt to these changes and developments would have a material adverse effect on our business, financial condition and results of operations.

For example, we derive significant revenue from mobile, and the ways users access content, interact and transact on our mobile platforms develop rapidly. We may fail to continue to offer superior user experience in order to increase or maintain the level of mobile engagement on our platforms. The variety of technical and other configurations across different mobile devices and platforms increases the challenges associated with this environment, and we may fail to develop and provide products and services that work effectively with this wide range of configurations. If we are unable to continue to attract and retain significant numbers of mobile consumers and increase or maintain levels of mobile engagement on our platforms, our ability to maintain or grow our business would be materially and adversely affected.

Our failure to manage the growth of our business and operations could harm us.

Our business has become increasingly complex as the scale, diversity and geographic coverage of our business and our workforce continue to grow. We have also significantly expanded our headcount, office facilities and infrastructure, and we anticipate that further expansion in certain areas and geographies will be required. This expansion increases the complexity of our operations and places a significant strain on our management, operational and financial resources. We must continue to hire, train and effectively manage new employees. If our new hires perform poorly or if we are unsuccessful in hiring, training, managing and integrating new employees, our business, financial condition and results of operations may be materially harmed.

Moreover, our current and planned staffing, systems, policies, procedures and controls may not be adequate to support our future operations. To effectively manage the expected growth of our operations and personnel, we will need to continue to improve our transaction processing, operational and financial systems, policies, procedures and controls, which could be particularly challenging as we acquire new operations with different and incompatible systems in new industries or geographic areas. These efforts will require significant managerial, financial and human resources. We cannot assure you that we will be able to effectively manage our growth or to implement all these systems, procedures and control measures successfully. If we are not able to manage our growth effectively, our business and prospects may be materially and adversely affected.

We face risks relating to our acquisitions, investments and alliances.

We have acquired and invested in a large number and a diverse range of businesses, technologies, services and products in recent years, including investments of varying sizes in equity investees and joint ventures, and we have a number of pending investments and acquisitions that are subject to closing conditions. See "Item 5. Operating and Financial Review and Prospects — A. Operating Results — Recent Investment, Acquisition and Strategic Alliance Activities." We expect to continue to evaluate and consider a wide array of potential strategic transactions as part of our overall business strategy, including business combinations, acquisitions and dispositions of businesses, technologies, services, products and other assets, as well as strategic investments and alliances. At any given time

we may be engaged in discussing or negotiating a range of these types of transactions. These transactions involve significant challenges and risks, including:

- •

- difficulties in integrating into our operations the diverse and large number of personnel, operations, products, services, technology, internal controls and financial reporting of companies we acquire, and any unanticipated expenses relating to business integration;

- •

- disruption of our ongoing business, distraction of our management and employees and increase of our expenses;

- •

- departure of skilled professionals as well as the loss of established client relationships of the businesses we invest in or acquire;

- •

- for investments over which we may not obtain management and operational control, we may lack influence over the controlling partner or shareholder, which may prevent us from achieving our strategic goals in these investments;

- •

- regulatory requirements and compliance risks as well as publicity risks that we may become subject to, including as a result of acquisitions of businesses in new industries or geographic areas or otherwise, especially for acquisitions of companies which are subject to heightened regulatory requirements and scrutiny;

- •

- actual or alleged misconduct or non-compliance by us or any company we acquire or invest in (or by its affiliates), whether before, during or after our acquisition or investment, which may lead to negative publicity, litigation, government inquiry or investigations against these companies or against us;

- •

- unforeseen or hidden liabilities or additional operating losses, costs and expenses that may adversely affect us following our acquisitions or investments;

- •

- potential impairment charges or write-offs due to the changes in the fair value of our investments or acquired companies as a result of market volatility or other reasons that we may or may not control, particularly with respect to public investee companies, such as Alibaba Pictures, the market value of which investment has been significantly lower than its carrying value for an extended period of time; such that, if the fair value of our investment in this or other equity investee companies remains below its carrying value for a significantly longer period of time, we may need to write down the carrying value to its fair value, which could have a material adverse effect on our financial results;

- •

- regulatory hurdles including in relation to the anti-monopoly and competition laws, rules and regulations of China and other jurisdictions in connection with any proposed investments and acquisitions, including, in the case of the exercise of our option in the future to acquire an equity interest in Ant Financial Services, PRC regulations pertaining to non-bank payment companies and other relevant financial services;

- •

- the risk that any of our pending or other future proposed acquisitions and investments fails to close, including as a result of political and regulatory challenges and protectionist policies; and

- •

- challenges in maintaining or further growing our acquired businesses, or achieving the expected benefits of synergies and growth opportunities in connection with these acquisitions and investments, such as our acquisition of Youku Tudou and a controlling stake in Lazada and our recent privatization of Intime.

We have concluded a number of significant acquisitions and investments in recent years, and we have limited experience in integrating major acquisitions. As our acquisition and investment activity continues at a rapid pace, with a large number and a diverse range of target companies, we and our management will continue to face significant challenges, including unanticipated ones, in integrating these businesses into our existing businesses.

We may face challenges in expanding our international and cross-border businesses and operations.

As we expand our international and cross-border businesses into an increasing number of international markets, such as Southeast Asia, India and Russia, we will face risks associated with expanding into markets in which we have limited or no experience and in which we may be less well-known. We may be unable to attract a sufficient number of customers and other participants, fail to anticipate competitive conditions or face difficulties in operating effectively in these new markets. The expansion of our international and cross-border businesses will also expose us to risks inherent in operating businesses globally, including:

- •

- inability to recruit international and local talent and challenges in replicating or adapting our company policies and procedures to operating environments different than that of China;

- •

- lack of acceptance of our product and service offerings;

- •

- challenges and increased expenses associated with staffing and managing international and cross-border operations and managing an organization spread over multiple jurisdictions;

- •

- trade barriers, such as import and export restrictions, customs duties and other taxes, competition law regimes and other trade restrictions, as well as other protectionist policies;

- •

- differing and potentially adverse tax consequences;

- •

- increased and conflicting regulatory compliance requirements;

- •

- challenges caused by distance, language and cultural differences;

- •

- increased costs to protect the security and stability of our information technology systems, intellectual property and personal data, including compliance costs related to data localization laws;

- •

- availability and reliability of international and cross-border payment systems and logistics infrastructure;

- •

- exchange rate fluctuations; and

- •

- political instability and general economic or political conditions in particular countries or regions.

As we expand further into new regions and markets, these risks could intensify, and efforts we make to expand our international and cross-border businesses and operations may not be successful. Failure to expand our international and cross-border businesses and operations could materially and adversely affect our business, financial condition and results of operations.

Transactions conducted through our international and cross-border platforms may be subject to different customs, taxes and rules and regulations, and we may be adversely affected by the complexity of and developments in customs and import/export laws, rules and regulations in the PRC and other jurisdictions. For example, effective as of April 8, 2016, the Notice on Tax Policies of Cross-Border E-Commerce Retail Importation, or the New Cross-Border E-commerce Tax Notice, replaced the previous system for taxing consumer goods imported into the PRC and introduced a 17% value-added tax, or VAT, on most products sold through e-commerce platforms and consumption tax on high-end cosmetics. See "Item 4. Information on the Company — B. Business Overview — Regulation — Tax Regulations."

In addition, changes to trade policies, treaties and tariffs in the jurisdictions in which we operate, or the perception that these changes could occur, could adversely affect our international and cross-border operations, our financial condition and results of operations. For example, the U.S. administration under President Donald Trump has advocated greater restrictions on trade generally and significant increases on tariffs on goods imported into the United States, particularly from China.

We rely on Alipay to conduct substantially all of the payment processing and all of the escrow services on our marketplaces. If Alipay's services are limited, restricted, curtailed or degraded in any way or become unavailable to us or our users for any reason, our business may be materially and adversely affected.

Given the significant transaction volume on our platforms, Alipay provides convenient payment processing and escrow services to us through contractual arrangements on preferential terms. These services are critical to our platforms and the development of our ecosystem. In the twelve months ended March 31, 2017, approximately 72% of GMV on our China retail marketplaces was settled through Alipay's escrow and payment processing services. We rely on the convenience and ease of use that Alipay provides to our users. If the quality, utility, convenience or attractiveness of Alipay's services declines for any reason, the attractiveness of our marketplaces could be materially and adversely affected.

Alipay's business is subject to a number of risks that could materially and adversely affect its ability to provide payment processing and escrow services to us, including:

- •

- dissatisfaction with Alipay's services or lower use of Alipay by consumers and merchants;

- •

- increasing competition, including from other established Chinese Internet companies, payment service providers and companies engaged in other financial technology services;

- •

- changes to rules or practices applicable to payment systems that link to Alipay;

- •

- breach of customers' personal information and concerns over the use and security of information collected from customers;

- •

- service outages, system failures or failure to effectively scale the system to handle large and growing transaction volumes;

- •

- increasing costs to Alipay, including fees charged by banks to process transactions through Alipay, which would also increase our cost of revenues;

- •

- negative news about and social media coverage on Alipay, its business or its products and service offerings; and

- •

- failure to manage funds accurately or loss of funds, whether due to employee fraud, security breaches, technical errors or otherwise.

In addition, certain commercial banks in China impose limits on the amounts that may be transferred by automated payment from customers' bank accounts to their linked accounts with third-party payment services. Although we believe the impact of these restrictions has not been and will not be significant in terms of the overall volume of payments processed for our China retail marketplaces, and automated payment services linked to bank accounts represent only one of many payment mechanisms that consumers may use to settle transactions, we cannot predict whether these and any additional restrictions that could be put in place would have a material adverse effect on our marketplaces.

Alipay's business is highly regulated and faces challenges in managing its regulatory risks. Alipay is required to comply with numerous complex and evolving laws, rules and regulations. In particular, regulators and third parties in China have been increasing their focus on online and mobile payment services, and recent regulatory and other developments could reduce the convenience or utility of Alipay users' accounts. In addition, as Alipay expands its businesses and operations into more international markets, it will become subject to additional legal and regulatory risks and scrutiny. Furthermore, our commercial arrangements with Alipay may be subject to anti-competition challenges. See "— We and Ant Financial Services are subject to a broad range of laws and regulations, and future laws and regulations may impose additional requirements and other obligations on our business or otherwise that could materially and adversely affect our business, financial condition and results of operations," and "Item 4. Information on the Company — B. Business Overview — Regulation — Regulation Applicable to Alipay."

If we needed to migrate to another third-party payment service or significantly expand our relationship with other third-party payment services, the transition would require significant time and management resources, and the third-party payment service may not be as effective, efficient or well-received by consumers and merchants on our marketplaces. These third-party payment services also may not provide escrow services, and we may not be able to receive commissions based on GMV transacted through these systems. We would also receive less, or lose entirely, the benefit of the commercial agreement with Ant Financial Services and Alipay, which provides us with preferential terms, and would likely be required to pay more for payment processing and escrow services than we currently pay. There can be no assurance that we would be able to reach an agreement with an alternative online payment service on acceptable terms or at all.

We do not control Alipay or its parent entity, Ant Financial Services, over which Jack Ma effectively controls a majority of the voting interests. If conflicts that could arise between us and Alipay or Ant Financial Services are not resolved in our favor, they could have a negative effect on our ecosystem and materially and adversely affect our business, financial condition, results of operations and prospects.

Although we rely on Alipay to conduct substantially all of the payment processing and all of the escrow services on our marketplaces, we do not have any control over Alipay. Alipay provides payment services to us on preferential terms pursuant to our long-term commercial agreement with Ant Financial Services and Alipay. Following the divestment and subsequent equity holding restructuring related to Ant Financial Services, an entity controlled by Jack Ma, our executive chairman, became the general partner of Hangzhou Junhan Equity Investment Partnership, or Junhan, a PRC limited partnership, and Junao Equity Investment Partnership, or Junao, a PRC limited partnership, which are two major equity holders of Alipay's parent, Ant Financial Services. Accordingly, Jack has an economic interest in Ant Financial Services and is able to exercise the voting power of the equity interest in Ant Financial Services held by Junhan and Junao. We understand that through the exercise of this voting power, Jack continues to control a substantial majority of the voting interests in Ant Financial Services.

If Alipay were not able to successfully manage the risks relating to its business, its ability to continue to deliver payment services to us on preferential terms may be undermined. Furthermore, if for any reason, Alipay sought to amend the terms of its agreements and arrangements with us, there is no assurance that Jack Ma, in light of his voting control over Alipay's parent, Ant Financial Services, would act in our interest. If we were to lose the preferential terms with Alipay or if Alipay is unable to successfully manage its business, our ecosystem could be negatively affected, and our business, financial condition, results of operations and prospects could be materially and adversely affected.

Ant Financial Services also provides other financial services to participants in our ecosystem, including wealth management, lending, insurance and credit system, and may provide additional services in the future. Other conflicts of interest between us, on the one hand, and Alipay and Ant Financial Services, on the other hand, may arise relating to commercial or strategic opportunities or initiatives. Although we and Ant Financial Services have each agreed to certain non-competition undertakings, Ant Financial Services may provide services to our competitors from time to time and we cannot assure you that Ant Financial Services would not pursue other opportunities that would conflict with our interests. Jack Ma may not resolve these conflicts in our favor. Furthermore, our ability to explore alternative payment services other than Alipay for our marketplaces may be constrained due to Jack's relationship with Ant Financial Services.

In addition, we grant share-based awards to employees of Ant Financial Services, and Junhan grants share-based awards tied to the value of Ant Financial Services to our employees. The provision of awards to our employees tied to the value of Ant Financial Services is intended to enhance our strategic and financial relationship with Ant Financial Services. See "Item 7. Major Shareholders and Related Party Transactions — B. Related Party Transactions — Agreements and Transactions Related to Ant Financial Services and its Subsidiaries — Equity-based Award Arrangements." The share-based awards granted by Junhan to our employees result in expenses that are recognized by our company. Subject to the approval of our audit committee, Jack, through his role with us and his control over Junhan, could be in a position to propose and promote further share-

based grants that result in additional, and potentially significant, expenses to our company. Accordingly, these and other potential conflicts of interest between us and Ant Financial Services or Alipay, and between us and Jack or Junhan or Junao, may not be resolved in our favor, which could have a material adverse effect on our business, financial condition, results of operations and prospects.

Moreover, because of our close association with Ant Financial Services and overlapping user base, events that negatively affect Ant Financial Services could also negatively affect customers', regulators' and other third parties' perception of us. In addition, any actual or perceived conflict of interest between us and Ant Financial Services or any other company integral to the functioning of our ecosystem could also materially harm our reputation as well as our business and prospects.

Our business generates and processes a large amount of data, and the improper use or disclosure of such data could harm our reputation as well as have a material adverse effect on our business and prospects.

Our marketplacesbusiness, including our cloud computing business, generates and platform generate and processprocesses a large quantity of personal, transaction, demographic and behavioral data. We face risks inherent in handling and protecting large volumes of data and in protecting the security of such data. In particular, we face a number of challenges relating to data from transactions and other activities on our platform,platforms, including:

- •

- protecting the data in and hosted on our system, including against attacks on our system by outside parties or fraudulent behavior or improper use by our employees;

- •

- addressing concerns related to privacy and sharing, safety, security and other factors; and

- •

- complying with applicable laws, rules and regulations relating to the collection, use, storage, transfer, disclosure

orand security of personal information, including any requests from regulatory and government authorities relating tosuchthis data.

The PRC regulatory and enforcement regime with regard to data security and data protection is evolving. According to the Cybersecurity Law, which was promulgated by the National People's Congress Standing Committee on November 7, 2016 and took effect as of June 1, 2017, as network operators we are obligated to provide technical assistance and support for public security and national security authorities to protect national security or assist with criminal investigations. In addition, the Cybersecurity Law provides that personal information and important data collected and generated by an operator of critical information infrastructure in the course of its operations in the PRC must be stored in the PRC, and the law imposes additional data security and privacy protection obligations on network operators. Further, on July 1, 2015, the National People's Congress Standing Committee promulgated the National Security Law, or the New National Security Law, which took effect on the same date and replaced the former National Security Law promulgated in 1993 and covers various types of national security including technology security and information security. See "Item 4. Information on the Company — B. Business Overview — Regulation — Regulation of Internet Security." Compliance with the Cybersecurity Law, the New National Security Law, as well as additional laws and regulations that PRC regulatory bodies may enact in the future, may result in additional expenses to us and subject us to negative publicity which could harm our reputation with users and negatively affect the trading price of our ADSs. There are also uncertainties with respect to how the Cybersecurity Law and the New National Security Law will be implemented in practice. PRC regulators, including the Ministry of Industry and Information Technology, or the MIIT, and the Cyberspace Administration of China, or the Cyberspace Administration, have been increasingly focused on regulation in the areas of data security and data protection. We expect that these areas will receive greater attention and focus from regulators, as well as attract continued or greater public scrutiny and attention going forward, which could increase our compliance costs and subject us to heightened risks and challenges associated with data security and protection. If we are unable to manage these risks, we could become subject to penalties, including fines, suspension of business and revocation of required licenses, and our reputation and results of operations could be materially and adversely affected.

In addition, pursuant to our data sharing agreement with AlipayAnt Financial Services and other participants in our ecosystem,Alipay, which sets forth data security and confidentiality protocols, and subject to relevant legal requirements and limitations, we share certainhave agreed to a broad sharing of data with AlipayAnt Financial Services through a data sharing platform that we own and operate. Cainiao Network, Koubei and Alibaba Pictures have also entered into agreements with us to participate in the data sharing platform. We also grant expressly limited access to specified data on our data platform to certain other participants in our ecosystem whothat provide services to sellers,merchants and consumers, such as marketing affiliates, retail operationaloperating partners, logistics service providers, mobile app developers, independent software vendors, or ISVs, cloud developers, marketing affiliates and various professional service providers. These ecosystem participants face the same challenges inherent in handling and protecting large volumes of data and in protecting the security of such data. Any systems failure or security breach or lapse on our part or on the part of any of our ecosystem participants that results in the release of user data could harm our reputation and brand and, consequently, our business, in addition to exposing us to potential legal liability.

As we expand our operations into international markets, we will be subject to additional laws in other jurisdictions where we operate and where our sellers, buyersmerchants, consumers, users, customers and other participants are located. The laws, rules and regulations of other jurisdictions, such as the United States and Europe, may be more comprehensive, detailed and nuanced in their scope, and impose more stringent or conflicting requirements and penalties than those in China, complianceChina. Complying with whichlaws and regulations for an increasing number of jurisdictions could require significant resources and costs. Our privacycontinued expansion into cloud computing services, both within China and overseas, will also increase the number of users and the amount of data hosted on our system, as well as increase the number of jurisdictions in which we have information technology systems. This, as well as the increasing number of new legal requirements in various jurisdictions, such as the Russian Data Localization Law, which came into effect on September 1, 2015, and the European Union General Data Protection Regulation, which will come into effect in May 2018, present increased challenges and risks in relation to policies and practicesprocedures relating to data collection, storage, transfer, disclosure, protection and privacy. Our privacy policies concerning the collection, use and disclosure of userpersonal data are posted on our websites. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any regulatory requirements or privacy protection-related laws, rules and regulations could result in adverse publicity or proceedings or actions against us by governmental entities or others. These proceedings or actions maycould subject us to significant penalties and negative publicity, require us to change our business practices, increase our costs and severely disrupt our business.

We may not be able to maintain or grow our revenue or our business.

We primarily derive our revenue from online marketing services, commissions based on transaction value derived from certain of our marketplaces and fees from the sale of memberships on our wholesale marketplaces, and we have experienced significant growth in revenue in recent years. In particular, our revenue grew 52% from fiscal year 2013 to fiscal year 2014 and 45% from fiscal year 2014 to fiscal year 2015. Our marketing customers are typically brand owners, distributors and merchants who are sellers on our marketplaces. Marketing customers do not have long-term marketing commitments with us. The price a merchant is willing to pay for online marketing services generally depends on its expected GMV, profit margins and lifetime value of customers derived from such marketing investment. If those services do not generate the rate of return the seller expects or rates that are competitive to alternatives, the seller may reduce its spending on the marketing services we offer. In addition, as we currently are monetizing mobile GMV at a lower rate than GMV generated through personal computer interfaces, our revenue growth rate may be affected by the increasing proportion of mobile GMV in our overall GMV. Furthermore, our efforts to improve user experience may also adversely affect our revenue growth and financial results in the near term.

Sellers on Tmall and Juhuasuan are required to pay a commission typically ranging from 0.3% to 5% of GMV settled through Alipay depending on the product category. If less GMV is transacted through such marketplaces or more GMV is generated from product categories with lower commission rates, or if more transactions are settled directly between buyers and sellers without using Alipay's payment processing and escrow services, the commissions we receive from transactions would decrease.

For our wholesale marketplaces, we primarily derive revenues from membership fees. Potential changes in our strategy for monetizing our wholesale marketplaces could result in prolonged reductions in revenue from those marketplaces.

Our future revenue growth may also depend on our ability to grow our other businesses, including our cloud computing business and the businesses we have acquired or invested in and new business initiatives we may explore in the future. In particular, we face risks associated with expanding into industries in which we have limited or no experience. For example, as we expand our entertainment business, we may be unable to produce or license quality content on commercially reasonable terms or at all, fail to anticipate or keep up with changes in user preferences, user behavior and technological developments or fail to gain access to content distribution channels. In addition, our expansion into the entertainment industry will subject us to additional regulatory risks, such as permit requirements and regulations over content in the PRC. If we are unable to successfully monetize and expand these businesses, our future revenue growth may be adversely affected.

In addition, our revenue growth may slow or our revenues may decline for other reasons, including decreasing consumer spending, increasing competition, slowing growth of the China retail or China online retail industry and changes in government policies or general economic conditions. In addition, our revenue growth rate will likely decline as our revenue grows to higher levels.

Increased investments in our business may negatively affect our margins and our net income.

We have experienced significant growth in our profit margins and net income. For example, our operating profit and net income grew 132% and 171%, respectively, from fiscal year 2013 to fiscal year 2014. However, we cannot assure you that we will be able to maintain our growth at these levels, or at all. For example, our operating profit declined by 7% and net income only grew 4% from fiscal year 2014 to fiscal year 2015.

Furthermore, we have made, and intend to continue to make, strategic investments and acquisitions to expand our user base, enhance our cloud computing business, add complementary products and technologies and further strengthen our ecosystem. For example, we expect to continue to make strategic investments and acquisitions relating to mobile, entertainment, cloud computing and big data, logistics services, local commerce, category expansion, healthcare, as well as the Internet of things. Our strategic investments and acquisitions may affect our future financial results, including by decreasing our margins and net income. For example, our acquisitions,

including UCWeb, OneTouch and AutoNavi, resulted in an increase of expenses, but we do not expect they will materially increase our revenue in the short term. Historically, our costs have increased each year due to these factors and we expect to continue to incur increasing costs, which may be greater than we anticipate. Increases in our costs may materially and adversely affect our business and profitability and there can be no assurance that we will be able to sustain our net income growth rates or our margins.

Failure to maintain or improve our technology infrastructure could harm our business and prospects.

We are constantly upgrading our marketplaces and platformplatforms to provide increased scale, improved performance for both online and mobile use of our platform and additional built-in functionality and additional capacity for our cloud computing services.capacity. Adopting new products and maintaining and upgrading our ecosystemtechnology infrastructure, including our data centers, cloud operating systems and big data analytics platform, require significant investments of time and resources, including adding new hardware, updating software and recruiting and training new engineering personnel. MaintainingAny failure to maintain and improvingimprove our technology infrastructure require significant levels of investment. Adverse consequences could includeresult in unanticipated system disruptions, slower response times, impaired quality of buyers' and sellers'users' experiences and delays in reporting accurate operating and financial information. For example, on Singles Day, there is significantly higher than normal activity on our marketplaces that our systems must handle. In addition, much of the software and interfaces we use are internally developed and proprietary technology. If we experience problems with the functionality and effectiveness of our software or platforms, or are unable to maintain and constantly improve our technology infrastructure to handle our business needs, our business, financial condition, results of operation and prospects, as well as our reputation, could be materially and adversely affected.

The successful operation of our business depends upon the performance and reliability of the Internet infrastructure in China and other countries in which we operate.

Our business depends on the performance and reliability of the Internet infrastructure in China and other countries in which we operate. Substantially all of our computer hardware and a majority of our cloud computing services are currently located in China. Almost all access to the Internet in China is maintained through state-ownedstate-

owned telecommunication operators under the administrative control and regulatory supervision of the Ministry of Industry and Information Technology of China.MIIT. In addition, the national networks in China are connected to the Internet through state-owned international gateways, which are the only channels through which a domestic user can connect to the Internet outside of China. We may face similar or other limitations in other countries in which we operate. We may not have access to alternative networks in the event of disruptions, failures or other problems with the Internet infrastructure in China or elsewhere. In addition, the Internet infrastructure in the countries in which we operate may not support the demands associated with continued growth in Internet usage.