| | | | |

| | 1 | | |

Use these links to rapidly review the document

TABLE OF CONTENTSContentsVale S.A. Financial Statements

As filed with the Securities and Exchange Commission on March 31, 2016April 18, 2019

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 20152018

Commission file number: 001-15030

VALE S.A.

(Exact name of Registrant as specified in its charter)

Federative Republic of Brazil

(Jurisdiction of incorporation or organization)

Luciano Siani Pires, Chief Financial Officer

phone: +55 21 3814 8888fax: +55 21 3814 88203485 5000

Avenida das Américas, 700Praia de Botafogo 186 – Bloco 8offices 701 – Loja 3181901 – Botafogo22640-10022250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | | Name of Each Exchange on Which Registered | | |||

|---|---|---|---|---|---|---|

| ||||||

| ||||||

Common shares of Vale, no par value per share | | | New York Stock Exchange* | | | |

American Depositary Shares (evidenced by American Depositary Receipts), each representing one common share of Vale | | | New York Stock Exchange | | | |

| ||||||

| ||||||

| | | New York Stock Exchange | | | |

4.375% Guaranteed Notes due 2022, issued by Vale Overseas | | | New York Stock Exchange | | | |

| | | New York Stock Exchange | | | |

8.250% Guaranteed Notes due 2034, issued by Vale Overseas | | | New York Stock Exchange | | | |

6.875% Guaranteed Notes due 2036, issued by Vale Overseas | | | New York Stock Exchange | | | |

6.875% Guaranteed Notes due 2039, issued by Vale Overseas | | | New York Stock Exchange | | | |

5.625% Notes due 2042, issued by Vale S.A. | | | New York Stock Exchange | | | |

| Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None The number of outstanding shares of each class of stock of Vale as of December 31, 12 golden shares, no par value per share |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| Yes |

| If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| Yes o No |

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. |

| Yes |

| Indicate by check mark whether the registrant has submitted electronically |

| Yes |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, |

| Large accelerated filer |

| Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

| U.S. GAAPo International Financial Reporting Standards as issued by the International Accounting Standards Board |

| If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. |

| Item 17 o Item 18o |

| If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

| Yes o No |

Page

| Form 20-F | | ii |

I. | | 1 |

Business overview | | 2 |

Selected financial data | | 16 |

Forward-looking statements | | |

Risk factors | | 19 |

II. Information on the company | | 37 |

Lines of business | | 37 |

1. Ferrous minerals | | |

2. Base metals | | |

3. Coal | | |

4. | ||

| ||

| ||

| | 63 | |

5. Other investments | | |

Reserves | | |

| | 81 |

Regulatory matters | | 83 |

III. Operating and financial review and prospects | ||

| | 88 | |

Overview | | |

Results of operations | | 96 |

Liquidity and capital resources | | |

Contractual obligations | | |

Off-balance sheet arrangements | ||

| | 114 | |

Critical accounting policies and estimates | | |

Risk management | | |

IV. Share | | 123 |

Major shareholders | | |

Related party transactions | | 126 |

Distributions | | 128 |

Trading markets | | 129 |

Depositary shares | | 130 |

Purchases of equity securities by the issuer and affiliated purchasers | | |

| 132 | ||

V. Management and employees | | 133 |

| ||

| | ||

Management compensation | | 146 |

Employees | | 149 |

VI. Additional information | | 151 |

Legal Proceedings | | 151 |

Memorandum and articles of association | | |

Shareholder debentures | | |

Exchange controls and other limitations affecting security holders | | |

Taxation | | |

Evaluation of disclosure controls and procedures | | |

Management's report on internal control over financial reporting | | |

Corporate governance | | |

Code of | | |

Principal accountant fees and services | | |

Change in registrant's certifying accountant | | 188 |

Information filed with securities regulators | | |

Exhibits | | |

Glossary | | |

Signatures | | |

i

FORM 20-F CROSS REFERENCECROSS-REFERENCE GUIDE

| Item | | Form 20-F caption | | Location in this report | | Page | | Form 20-F caption | | Location in this report | | Page |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

1 | | Identity of directors, senior management and advisers | | Not applicable | | – | | Identity of directors, senior management and advisers | | Not applicable | | – |

| | | | | | | | | | | | | |

2 | | Offer statistics and expected timetable | | Not applicable | | – | | Offer statistics and expected timetable | | Not applicable | | – |

| | | | | | | | | | | | | |

3 | | Key information | | | | Key information | | | ||||

| | 3A Selected financial data | | Selected financial data | | 14 | | 3A Selected financial data | | Selected financial data | | 16 | |

| | 3B Capitalization and indebtedness | | Not applicable | | – | | 3B Capitalization and indebtedness | | Not applicable | | – | |

| | 3C Reasons for the offer and use of proceeds | | Not applicable | | – | | 3C Reasons for the offer and use of proceeds | | Not applicable | | – | |

| | 3D Risk factors | | Risk factors | | 1 | | 3D Risk factors | | Risk factors | | 19 | |

| | | | | | | | | | | | | |

4 | | Information on the Company | | | | Information on the Company | | | ||||

| | 4A History and development of the company | | Business overview, Capital expenditures | | 16, 74 | | 4A History and development of the company | | Business overview, Capital expenditures; Information filed with securities regulators, | | 1, 81, 189 | |

| | 4B Business overview | | Business overview, Lines of business, Reserves, Regulatory matters | | 16, 25, 63, 77 | | 4B Business overview | | Business overview, Lines of business, Reserves, Regulatory matters | | 1, 37, 72, 83 | |

| | 4C Organizational structure | | Exhibit 8 | | – | | 4C Organizational structure | | Exhibit 8 | | – | |

| | 4D Property, plant and equipment | | Lines of business, Capital expenditures, Regulatory matters | | 25, 74, 77 | | 4D Property, plant and equipment | | Lines of business, Capital expenditures, Regulatory matters | | 37, 81, 83 | |

| | | | | | | | | | | | | |

4A | | Unresolved staff comments | | None | | – | | Unresolved staff comments | | None | | – |

| | | | | | | | | | | | | |

5 | | Operating and financial review and prospects | | | | Operating and financial review and prospects | | | ||||

| | 5A Operating results | | Results of operations | | 87 | | 5A Operating results | | Results of operations | | 96 | |

| | 5B Liquidity and capital resources | | Liquidity and capital resources | | 101 | | 5B Liquidity and capital resources | | Liquidity and capital resources | | 110 | |

| | 5C Research and development, patents and licenses, etc. | | Capital expenditures | | 74 | | 5C Research and development, patents and licenses, etc. | | Capital expenditures | | 81 | |

| | 5D Trend information | | Results of operations | | 87 | | 5D Trend information | | Results of operations | | 96 | |

| | 5E Off-balance sheet arrangements | | Off-balance sheet arrangements | | 104 | | 5E Off-balance sheet arrangements | | Off-balance sheet arrangements | | 114 | |

| | | Critical accounting policies and estimates | | 104 | | | Critical accounting policies and estimates | | 115 | |||

| | 5F Tabular disclosure of contractual obligations | | Contractual obligations | | 104 | | 5F Tabular disclosure of contractual obligations | | Contractual obligations | | 113 | |

| | 5G Safe harbor | | Forward-looking statements | | iv | | 5G Safe harbor | | Forward-looking statements | | 18 | |

| | | | | | | | | | | | | |

6 | | Directors, senior management and employees | | | – | | Directors, senior management and employees | | | – | ||

| | 6A Directors and senior management | | Management | | 120 | | 6A Directors and senior management | | Management | | 133 | |

| | 6B Compensation | | Management compensation | | 132 | | 6B Compensation | | Management compensation | | 146 | |

| | 6C Board practices | | Management—Board of directors | | 120 | | 6C Board practices | | Management—Board of directors | | 133 | |

| | 6D Employees | | Employees | | 134 | | 6D Employees | | Employees | | 149 | |

| | 6E Share ownership | | Major shareholders, Employees—Performance-based compensation | | 135 | | 6E Share ownership | | Major shareholders, Employees—Performance-based compensation | | 123, 150 | |

| | | | | | | | | | | | | |

7 | | Major shareholders and related party transactions | | | | Major shareholders and related party transactions | | | ||||

| | 7A Major shareholders | | Major shareholders | | 111 | | 7A Major shareholders | | Major shareholders | | 123 | |

| | 7B Related party transactions | | Related party transactions | | 114 | | 7B Related party transactions | | Related party transactions | | 126 | |

| | 7C Interests of experts and counsel | | Not applicable | | – | | 7C Interests of experts and counsel | | Not applicable | | – | |

| | | | | | | | | | | | | |

8 | | Financial information | | | | Financial information | | | ||||

| | 8A Consolidated statements and other financial information | | Financial statements | | F-1 | | 8A Consolidated statements and other financial information | | Financial statements | | F-1 | |

| | | Distributions | | 116 | | | Distributions | | 130 | |||

| | | Legal proceedings | | 135 | | | Legal proceedings | | 151 | |||

| | 8B Significant changes | | Not applicable | | – | | 8B Significant changes | | Not applicable | | – | |

| | | | | | | | | | | | | |

9 | | The offer and listing | | | | The offer and listing | | | ||||

| | 9A Offer and listing details | | Share price history | | 118 | | 9A Offer and listing details | | Not applicable | | – | |

| | 9B Plan of distribution | | Not applicable | | – | | 9B Plan of distribution | | Not applicable | | – | |

| | 9C Markets | | Trading markets | | 117 | | 9C Markets | | Trading markets | | 129 | |

| | 9D Selling shareholders | | Not applicable | | – | | 9D Selling shareholders | | Not applicable | | – | |

| | 9E Dilution | | Not applicable | | – | | 9E Dilution | | Not applicable | | – | |

| | 9F Expenses of the issue | | Not applicable | | – | | 9F Expenses of the issue | | Not applicable | | – | |

| | | | | | | | | | | | | |

ii

Form 20-F cross-reference guide

| Item | | Form 20-F caption | | Location in this report | | Page | | Form 20-F caption | | Location in this report | | Page |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | |

10 | | Additional information | | | | Additional information | | | ||||

| | 10A Share capital | | Memorandum and articles of association—Common shares and preferred shares | | 142 | | 10A Share capital | | Memorandum and articles of association—Common shares and golden shares | | 163 | |

| | 10B Memorandum and articles of association | | Memorandum and articles of association | | 142 | | 10B Memorandum and articles of association | | Memorandum and articles of association | | 163 | |

| | 10C Material contracts | | Lines of business, Results of operations, Related party transactions | | 25, 87, 114 | | 10C Material contracts | | Lines of business, Results of operations, Related party transactions | | 37, 96, 126 | |

| | 10D Exchange controls | | Exchange controls and other limitations affecting security holders | | 150 | | 10D Exchange controls | | Exchange controls and other limitations affecting security holders | | 171 | |

| | 10E Taxation | | Taxation | | 152 | | 10E Taxation | | Taxation | | 173 | |

| | 10F Dividends and paying agents | | Not applicable | | – | | 10F Dividends and paying agents | | Not applicable | | – | |

| | 10G Statement by experts | | Reserves | | 63 | | 10G Statement by experts | | Reserves | | 72 | |

| | 10H Documents on display | | Information filed with securities regulators | | 165 | | 10H Documents on display | | Information filed with securities regulators | | 189 | |

| | 10I Subsidiary information | | Not applicable | | – | | 10I Subsidiary information | | Not applicable | | – | |

| | | | | | | | | | | | | |

11 | | Quantitative and qualitative disclosures about market risk | | Risk management | | 109 | | Quantitative and qualitative disclosures about market risk | | Risk management | | 119 |

| | | | | | | | | | | | | |

12 | | Description of securities other than equity securities | | | | Description of securities other than equity securities | | | ||||

| | 12A Debt securities | | Not applicable | | – | | 12A Debt securities | | Not applicable | | – | |

| | 12B Warrants and rights | | Not applicable | | – | | 12B Warrants and rights | | Not applicable | | – | |

| | 12C Other securities | | Not applicable | | – | | 12C Other securities | | Not applicable | | – | |

| | 12D American Depositary Shares | | Depositary shares | | 118 | | 12D American Depositary Shares | | Depositary shares | | 130 | |

| | | | | | | | | | | | | |

13 | | Defaults, dividend arrearages and delinquencies | | Not applicable | | – | | Defaults, dividend arrearages and delinquencies | | Not applicable | | – |

| | | | | | | | | | | | | |

14 | | Material modifications to the rights of security holders and use of proceeds | | Not applicable | | – | | Material modifications to the rights of security holders and use of proceeds | | Not applicable | | – |

| | | | | | | | | | | | | |

15 | | Controls and procedures | | Evaluation of disclosure controls and procedures | | 160 | | Controls and procedures | | Evaluation of disclosure controls and procedures | | 181 |

| | | Management's report on internal control over financial reporting | | 160 | | | Management's report on internal control over financial reporting | | 181 | |||

| | | | | | | | | | | | | |

16 | | 16A Audit Committee financial expert | | Management—Fiscal Council | | 129 | ||||||

| | 16B Code of ethics | | Code of ethics and conduct | | 163 | |||||||

| | 16C Principal accountant fees and services | | Principal accountant fees and services | | 164 | |||||||

| | 16D Exemptions from the listing standards for audit committees | | Management—Fiscal Council; Corporate governance | | 129, 161 | |||||||

| | 16E Purchase of equity securities by the issuer and affiliated purchasers | | Purchases of equity securities by the issuer and affiliated purchasers | | 120 | |||||||

| | 16F Change in registrant's certifying accountant | | Not applicable | | – | |||||||

| | 16G Corporate governance | | Corporate governance | | 161 | |||||||

| | 16H Mine safety disclosure | | Not applicable | | – | |||||||

16A | | Audit Committee financial expert | | Management—Fiscal Council | | 142 | ||||||

| | | | | | | | ||||||

16B | | Code of ethics | | Code of ethical conduct | | 186 | ||||||

| | | | | | | | ||||||

16C | | Principal accountant fees and services | | Principal accountant fees and services | | 187 | ||||||

| | | | | | | | ||||||

16D | | Exemptions from the listing standards for audit committees | | Management—Fiscal Council; Corporate governance | | 142, 182 | ||||||

| | | | | | | | ||||||

16E | | Purchase of equity securities by the issuer and affiliated purchasers | | Purchases of equity securities by the issuer and affiliated purchasers | | 132 | ||||||

| | | | | | | | ||||||

16F | | Change in registrant's certifying accountant | | Change in registrant's certifying accountant | | 188 | ||||||

| | | | | | | | ||||||

16G | | Corporate governance | | Corporate governance | | 182 | ||||||

| | | | | | | | ||||||

16H | | Mine safety disclosure | | Not applicable | | – | ||||||

| | | | | | | | | | | | | |

17 | | Financial statements | | Not applicable | | – | | Financial statements | | Not applicable | | – |

| | | | | | | | | | | | | |

18 | | Financial statements | | Financial statements | | F-1 | | Financial statements | | Financial statements | | F-1 |

| | | | | | | | | | | | | |

19 | | Exhibits | | Exhibits | | 166 | | Exhibits | | Exhibits | | 190 |

| | | | | | | | | | | | | |

iii

I. OVERVIEW

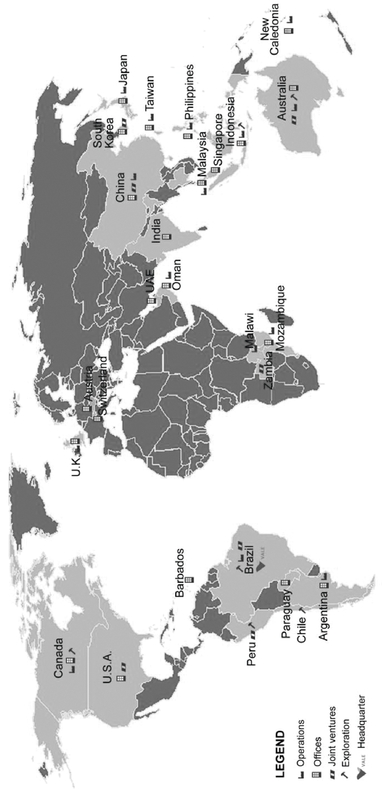

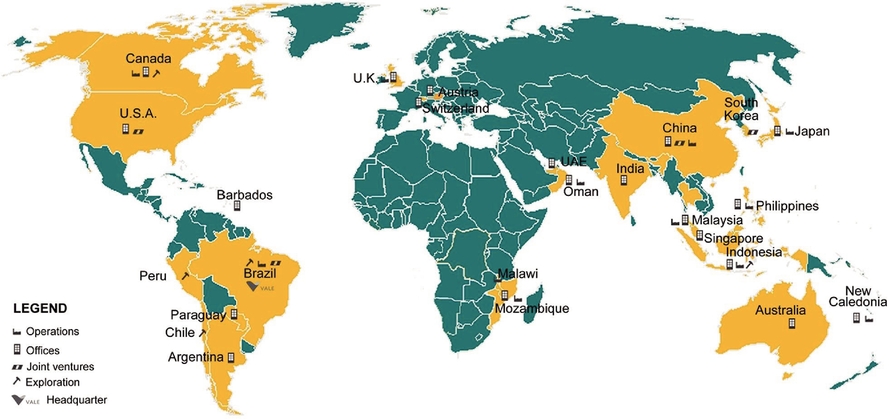

We are one of the largest metals and mining companies in the world, based on market capitalization. We are the world's largest producer of iron ore and iron ore pellets and the world's largest producer of nickel. We also produce manganese ore, ferroalloys, metallurgical and thermal coal, copper, platinum group metals (PGMs), gold, silver and cobalt. We are presently engaged in greenfield mineral exploration in five countries. We operate large logistics systems in Brazil and other regions of the world, including railroads, maritime terminals and ports, which are integrated with our mining operations. In addition, we have a distribution center to support the delivery of iron ore worldwide. Directly and through affiliates and joint ventures, we also have investments in energy and steel businesses.

In this report, references to "Vale" are to Vale S.A. References to "we," "us" or the "Company" are to Vale and, except where the context otherwise requires, its consolidated subsidiaries. References to our "ADSs" or "American Depositary Shares" are to our common American Depositary Shares (our "common ADSs"), each of which represents one common share of Vale. American Depositary Shares are represented by American Depositary Receipts ("ADRs") issued by the depositary.

Vale S.A. is a stock corporation, orsociedade por ações, that was organized on January 11, 1943 under the laws of the Federative Republic of Brazil for an unlimited period of time. Its head office is located at Praia de Botafogo 186 – offices 701-1901 – Botafogo, 22250-145 Rio de Janeiro, RJ, Brazil, and its telephone number is 55-21-3485-5000.

Unless otherwise specified, we use metric units. References to "real," "reais" or "R$" are to the official currency of Brazil, thereal (singular) orreais (plural). References to "U.S. dollars" or "US$" are to United States dollars. References to "€" are to Euros.

| | | | |

| | 1 | | |

FAILURE OF THE TAILINGS DAM AT THE CÓRREGO DO FEIJÃO MINE

On January 25, 2019, a tailings dam ("Dam I") failed at our Córrego do Feijão mine, in the city of Brumadinho, state of Minas Gerais. The failure released a flow of tailings debris, which affected our administrative area at the Córrego do Feijão mine and parts of the communities of Córrego do Feijão and Parque da Cachoeira outside of Brumadinho, reaching the nearby Paraopeba River. The dam failure resulted in nearly 300 fatalities or presumed fatalities, and also caused extensive property and environmental damage in the region. Our priority now is to provide support to those affected by the dam failure.

The causes of the accident are still uncertain and are being investigated by us and by several governmental authorities. We are providing our full cooperation to the authorities and to the investigations into the dam failure.

Dam I

The Córrego do Feijão mine is part of the Paraopeba complex, in the Southern System. Dam I was first built in 1976 by Ferteco Mineração, a company we acquired in 2001. Dam I received disposed tailings from the Córrego do Feijão and Jangada mines from 1976 until it became inactive in 2016. Dam I contained approximately 11.7 million cubic meters of iron ore tailings.

The dam was raised by building successive layers (lifts) above the tailings accumulated in the reservoir, a technique known as the "upstream" method. There are two other raising methods, the "downstream" method and the "centerline" method, in which the dam is raised by placing new layers away from the initial dam or on top of it, as opposed to over the accumulated tailings. Each of these methods presents a different risk profile.

Dam VI, another dam located at the Córrego do Feijão mine, was impacted by the tailings debris flow from the failure of Dam I. Due to the ongoing investigation into potential damages from the impact of the tailings debris, it has not received the certification of stability (Stability Condition Statement, or "DCE") required by the rules of the national mining agency, the ANM (Agência Nacional de Mineração). Dam VI is being continuously monitored.

The Jangada mine, also located in the Paraopeba complex, was not affected by the tailings debris flow, but its operations were suspended because of the closure of Feijão processing plant, which processed the run-of-mine of the Jangada mine.

Vale's response

Our senior management has been focused on emergency and long-term initiatives, with three main purposes: (i) providing assistance to victims and remediation of the affected area, (ii) determining the causes of the failure of Dam I, and (iii) preventing further accidents through improved standards and accelerated decommissioning of upstream dams.

(i) Assistance and remediation efforts

Immediately following the failure of Dam I, we contacted the local authorities and activated our Emergency Mining Dam Response Plan (Plano de Ação de Emergência de Barragens de Mineração (PAEBM)) to rescue and provide immediate humanitarian assistance to affected parties, including employees and members of the community. We also mobilized our teams to monitor the Paraopeba River basin, rescue wildlife and domestic animals and support sanitation measures. We mobilized over 400

| | | | |

| | 2 | | |

Business Overview

doctors, nurses, psychologists, social workers and volunteers to set up assistance centers for those affected. These assistance centers provided humanitarian aid, including medical, psychological and social assistance, distributed basic emergency items, including pharmaceuticals, food, potable water and clothing, and provided duplicate records (such as identification cards, marriage certificates, and birth certificates) to those who lost their homes. We also provided 40 ambulances, a support helicopter, shopping vouchers for clothing, accommodation and transportation for over 800 people.

On January 31, 2019, we presented an emergency plan to the Minas Gerais Public Prosecutor's Office, and to the state and federal environmental agencies, including containment, retention, remediation and recovery actions. The plan contemplates removing debris, installing hydraulic barriers and small dams to assist in the tailings control process, establishing water treatment stations, restoring roads and installing membrane barriers downstream to contain ultrafine sediments and protect the water system on the Paraopeba River basin.

On February 6, 2019, we entered into an agreement with various governmental authorities undertaking to gradually replace our professionals who had been providing assistance to the populations affected since the dam failure, with a team to join the health and social service teams of the city of Brumadinho. We will bear for at least six months the costs of employing 142 professionals, including doctors, nurses, psychologists, physical therapists, occupational therapists, social workers and endemic disease control agents, in addition to administrative and operational professionals, as well as logistics costs incurred by these teams.

We have donated resources to the Municipality of Brumadinho, the fire department of Minas Gerais and other entities that provided assistance to the affected parties. For those affected by the dam failure, we established a three-tiered financial assistance program, under which, we have made donations to more than 440 people. We are also providing funeral assistance and contributing to funeral expenses for each affected family. These donations are without prejudice to any right that any person affected by the dam failure may have to claim damages against us.

(ii) Determination of the causes for the failure of the dam

We are investigating the causes of the failure of Dam I. We engaged a legal advisor and technical experts to conduct an investigation into the causes of the failure of the dam. In addition, our Board of Directors established the Independent Ad Hoc Consulting Committee for Investigation (CIAEA), an independent committee to investigate and advise the Board of Directors in connection with the determination of the causes of the dam failure.

(iii) Prevention of further accidents and accelerated decommissioning of upstream dams

On January 29, 2019, we decided to accelerate our existing plan to decommission our tailings dams built using the upstream method. "Decommissioning" or "decharacterization" means reintegrating the dam and its contents into the local environment, so that the structure is effectively no longer a dam. We will determine the appropriate actions to decommission each dam safely, in accordance with the geotechnical and geographic conditions of each dam. For certain of our upstream dams, we will first convert the dam into a downstream or centerline dam and conclude the decommissioning subsequently. Some of our existing downstream or centerline dams contain smaller dikes or structures that were built using the upstream technique, and we are also planning to remove these upstream dikes or structures. At this point, we cannot predict the costs and timing for decommissioning our upstream tailings dams.

We have been taking steps to decommission upstream dams since late 2015, in response to the failure of Samarco's Fundão dam. In February 2019, we announced our plan to accelerate this process and our

| | | | |

| | 3 | | |

Business Overview

decision to temporarily suspend our operations at mines and concentration plants located in areas where upstream dams are located. Also, based on our initial assessments, we determined that certain dams would not meet the requirements of new safety requirements imposed by ANM, and evacuated certain areas and relocated the population located within the Self-Rescue Zone of these dams. We expect to resume production at these mines and concentration plants in the future.

Independent Committees

Our Board of Directors has created three independent ad hoc advisory committees to support the Board in matters relating to the dam failure. All of these committees are composed of external and independent members appointed by our Board of Directors. These committees are described below.

Impacts of the failure of Dam I on Vale

The impacts of the dam failure on our operations and results of operations will be very significant, but their full scale and scope remains uncertain. Some of major impacts are described below.

(i) Freeze orders

Various Brazilian courts have ordered freezes, attachments, deposits and similar measures affecting an aggregate of R$17.6 billion (US$4.5 billion) of our financial assets, including balances in our bank accounts and judicial deposits to secure the payment of damages resulting from the dam failure. This total amount also includes common shares that we hold in treasury and that have been attached. We are also subject to a number of other proceedings and investigations related to the dam failure, which may result in additional attachment of assets and seizure of balances in our bank accounts.

(ii) Liabilities and legal proceedings

Our potential legal liabilities resulting from the dam failure are significant, and we cannot estimate the total amount at this time. We are already the subject of several investigations and legal proceedings relating to the failure of Dam I, and we expect to face other investigations and proceedings. For additional information regarding the legal proceedings relating to the failure of Dam I, seeAdditional Information—Legal proceedings. We will continue to cooperate fully with the authorities and to support the investigations into the dam failure. We will also contest any actions that we believe are unjustified.

| | | | |

| | 4 | | |

Business Overview

The proceedings are all in very early stages, and we cannot reasonably estimate the size of potential losses or settlements or the timing for decisions. We estimate that we will recognize provisions in our financial statements for the first quarter of 2019 in the amount of R$850 million (US$220 million) in connection with an ongoing public civil action brought by labor prosecutors and provisions ranging from R$1.0 billion to R$2.0 billion (US$260 million to US$520 million) in connection with our preliminary agreement with the State of Minas Gerais and other authorities. Our potential liabilities resulting from the dam failure are significant, and additional provisions are expected.

(iii) Suspension of operations

Following the dam failure, we have suspended various operations, either voluntarily or as a result of revocation of licenses or court orders. As of April 15, 2019, the estimated impact of the suspension of operations following the dam failure on our production is 92.8 million metric tons per year (including the estimated annual impact of the suspension of the Brucutu mine). Additional operations may be suspended as a result of new laws and regulations relating to the use of dams, or our inability to obtain the required licenses or the stability reports required by applicable regulations, as discussed below.

Below is a summary of operations suspended since the date of the dam failure.

(iv) New regulations

Various governmental authorities have approved or proposed new regulations relating to licensing, use and operations of dams in response to the Dam I failure. Additional rules imposing restrictions on mining operations and ancillary activities are expected. Also, new taxes, contributions or other obligations may be imposed on us as a result of the failure of Dam I or its direct or indirect impacts. These rules may affect not only our iron ore operations, but also our base metals operations in Brazil and other operations that rely on dams.

| | | | |

| | 5 | | |

Business Overview

2022. The statute also prohibits the increase, modification or construction of any dam if communities are established within its Self-Rescue Zone (Zona de Autossalvamento or "ZAS"), an area which encompasses the portion of the valley downstream of the dam where timely evacuation and intervention by the competent authorities in emergency situations is not possible. Although this statute permits the construction of new dams and the use of existing dams built using other techniques, it imposes significant restrictions on them as well. As a result, we may not be able to rely on tailings dams for new projects and expansion of existing operations.

As a result of new regulations, the licensing process for our operations may become longer and more uncertain, and our costs of monitoring and compliance are expected to increase. These additional laws and regulations may impose restrictions on our operations, require additional investments or eventually require us to suspend additional operations.

We will need to rely on alternative methods to continue operating certain of our mines and plants, particularly those that rely on tailings dams. We have studies in progress, and we have developed a pilot project, to apply a waste disposal technology that consists of filtering and stacking of partially or totally dewatered tailings, which will reduce our reliance on tailings dams in the medium and long term. These alternative technologies will cause an increase in our production costs and require additional investments in our mines and plants.

(v) Impact on reserves

As a result of the dam failure and our decision to accelerate the decommissioning of our upstream tailings dams, we are not in a position to report reserves for the Feijão, Jangada and Capim Branco mines (in the Paraopeba complex).

We are reviewing the impact on our reported reserves of the ongoing investigations and legal proceedings involving the use of dams in our mining operations and of the new rules relating to licensing, use and operations of dams, which were adopted in response to the Dam I failure. These proceedings and regulations may impact our iron ore reserves and reserves for other products for which the production process involves dams. Because alternative methods are available, particularly the dry stockpiling and dry processing technologies, we currently believe that our iron ore reserves will not be materially impacted by these new rules, but we have not concluded our analysis.

(vi) Uncertainties arising from increased safety requirements and external expert certification

Brazilian state and federal authorities are strengthening regulations on dam safety. Many regulations applicable to our mines require us to obtain independent reports and certificates from external experts on the safety and stability of our dams. External experts may be unwilling to provide these reports and certificates as a result of the uncertainties regarding the causes of the Dam I failure, the increasing risk of liability and uncertainties about interpretation of new regulations. If any of our dams is unable to comply

| | | | |

| | 6 | | |

Business Overview

with safety requirements, we may need to evacuate the area surrounding this dam, relocate communities and take other emergency actions.

(vii) Impacts on our financial performance and results of operations

We expect the failure of Dam I, and the consequences summarized above, to have extensive impact on our financial performance and results of operations. We have not yet determined the nature and amount of all the consequences. SeeOperating and financial review and prospects—Impact of the failure of Dam I at the Córrego do Feijão Mine. These will include:

| | | | |

| | 7 | | |

Business Overview

We may also need to incur additional debt to pay for assistance and remediation actions.

Temporary leave of executive officers

On March 1, 2019, our Board of Directors received a formal recommendation from the federal and state (Minas Gerais) public prosecution offices, the federal police and the civil police of Minas Gerais that we suspend certain of our employees and executive officers. In response to this recommendation, our CEO, Fabio Schvartsman, and our executive officer for Ferrous Minerals and Coal, Gerd Peter Poppinga, requested temporary leave from their positions. Our Board of Directors approved these requests on March 2, 2019, and appointed Eduardo de Salles Bartolomeo as interim chief executive officer and Claudio de Oliveira Alves as interim executive officer for Ferrous Minerals and Coal. Mark James Travers has been appointed executive officer for Base Metals, subject to obtaining the requisite visa and relocating to Brazil, as required under Brazilian law.

OPERATIONAL SUMMARY

The following table presents the breakdown of total net operating revenues attributable to each of our lines of business with continuing operations.

| | Year ended December 31, | | |||||||||||||||||

| | 2016 | | 2017 | | 2018 | | |||||||||||||

| | (US$ million) | | (% of total) | | (US$ million) | | (% of total) | | (US$ million) | | (% of total) | | |||||||

Ferrous minerals: | | | | | | | | | | | | | | ||||||

Iron ore | | 15,784 | | | 57.4 | % | | 18,524 | | | 54.5 | % | | 20,354 | | | 55.7 | % | |

Pellets | | 3,827 | | | 13.9 | | | 5,653 | | | 16.7 | | | 6,651 | | | 18.2 | | |

Ferroalloys and manganese | | 302 | | | 1.1 | | | 469 | | | 1.4 | | | 454 | | | 1.2 | | |

Other ferrous products and services | | 438 | | | 1.6 | | | 483 | | | 1.4 | | | 474 | | | 1.3 | | |

| | | | | | | | | | | | | | | ||||||

Subtotal | | 20,351 | | | 74.0 | | | 25,129 | | | 74.0 | | | 27,933 | | | 76.4 | | |

| | | | | | | | | | | | | | | ||||||

Coal | | 839 | | | 3.1 | | | 1,567 | | | 4.6 | | | 1,643 | | | 4.5 | | |

Base metals: | | | | | | | | | | | | | | ||||||

Nickel and other products(1) | | 4,472 | | | 16.3 | | | 4,667 | | | 13.7 | | | 4,610 | | | 12.6 | | |

Copper(2) | | 1,667 | | | 6.1 | | | 2,204 | | | 6.5 | | | 2,093 | | | 5.7 | | |

| | | | | | | | | | | | | | | ||||||

Subtotal | | 6,139 | | | 22.3 | | | 6,871 | | | 20.2 | | | 6,703 | | | 18.3 | | |

| | | | | | | | | | | | | | | ||||||

Other(3) | | 159 | | | 0.6 | | | 400 | | | 1.2 | | | 296 | | | 0.8 | | |

| | | | | | | | | | | | | | | ||||||

Total net operating revenues from continuing operations | | 27,488 | | | 100 | % | | 33,967 | | | 100 | % | | 36,575 | | | 100 | % | |

| | | | | | | | | | | | | | | ||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | ||||||

Ferrous minerals:

| | | | |

| | 8 | | |

Business Overview

suspended), and two in Oman. We also have a 50% stake in Samarco Mineração S.A. ("Samarco") and 25% stakes in two pellet companies in China.

Base metals:

Coal:

Logistics infrastructure:

| | | | |

| | 9 | | |

Business Overview

BUSINESS STRATEGY

The year of 2019 has been a very challenging year for us. We know that there is much to be done to address the effects of the failure of the tailings dam at the Córrego do Feijão mine. We are committed to remediating the damages caused to the city of Brumadinho and the surrounding communities. We will manage the liabilities arising from this deeply regretted event, and we are committed to learning and sharing the lessons from the dam failure. With this purpose, we are dedicated to:

Below are the highlights of our major business strategies.

Keeping our people and communities safe and restoring trust from our stakeholders

We are fully committed in addressing the effects of the failure of Dam I at the Feijão mine, with three key initiatives: (i) assistance to victims and recovery of the area affected by the rupture of the dam, (ii) determination of the causes of the dam failure, and (iii) prevention of further accidents through adoption of the highest standards and accelerated decommissioning of all upstream dams. SeeBusiness overview—Failure of the tailings dam at the Córrego do Feijão mine. We continue making every effort to provide relief and support to those affected by the dam failure and to restore the trust of our stakeholders on us. We are committed to rebuilding our reputation in Brazil and in the global mining industry.

Capital discipline

We reiterate our strong commitment to a sound balance sheet. In 2018, we completed our deleveraging process and achieved our net debt target of US$10 billion. We will allocate capital in a disciplined way, which will be key to enable us to address the effects of Dam I failure. In January 2019, our Board of Directors approved the suspension of our shareholder remuneration policy, so that no payment of dividends or interest on shareholders' equity will be made pursuant to this policy in excess of mandatory payments required by law, and we will not approve any share buyback for the time being.

Maintaining our value over volume approach for the iron ore business

In the iron ore business, we are committed to delivering the highest possible margins under the current circumstances, by managing our extensive supply chain and flexible product portfolio to cope with production constraints in the short-term. We will constantly seek better price realization, based on adjustments to our product portfolio according to market demand and supply chain optimization. We are focusing our product line to capture industry trends, improving quality and productivity, controlling costs, strengthening our logistics infrastructure of railroads, ports, shipping and distribution centers, and

| | | | |

| | 10 | | |

Business Overview

strengthening relationships with customers. Our diversified portfolio of high-quality products, strong technical marketing strategy, efficient logistics and long-standing relationships with major customers will help us overcome the immediate challenges and achieve this goal.

With the continuous increase of the share of dry processing production, from 45% in 2014 to 60% in 2018, and aimed at 70% by 2023, our reliance on new dams and dam raisings tend to reduce. To treat the tailings from wet processing, we are investing in studies and new technologies with a view to allowing us to operate certain of our mines and plants without having to rely on the use of tailings dams. In particular, we have studies in progress, and we have developed a pilot project, to apply a waste disposal technology that consists of filtering and stacking of partially or totally dewatered tailings, which will reduce our reliance on tailings dams in the medium and long term. These alternative technologies will cause an increase in our production costs and require additional investments in our mines and plants. In line with this goal, we acquired New Steel in January 2019, bringing innovative technologies for the dry beneficiation of iron ore.

We will continue to promote the Brazilian blend fines (BRBF), a product standard with silica (SiO2) content limited to 5% and lower alumina (1.5%), offering strong performance in any kind of sintering operation. We produce BRBF by blending fines from Carajás, which contain a higher concentration of iron and a lower concentration of silica in the ore, with fines from the Southern and Southeastern Systems, which contain a lower concentration of iron in the ore, but also low concentration of alumina. It is produced in our Teluk Rubiah Maritime Terminal in Malaysia and in sixteen ports in China. This process reduces the time needed to reach Asian markets and increases our distribution capillarity by allowing the use of smaller vessels. The blending strategy also permits the use of iron ore with lower concentration from the Southern and Southeastern Systems, allowing more efficient mining plans and increasing the use of dry processing methods, which in turn reduce capital expenditures, extend the life of our mines and reduce the use of water in our operations: a key flexibility to cope with the short-term challenges.

Transforming our base metals business into a significant cash generator

Our strategy for our nickel business is to complete its turnaround, continuing to review our asset utilization and optimize our operations and aiming to increase productivity and improve returns, while preserving capacity for growth based on the prospects for an electric vehicle revolution. We are the world's largest nickel producer, with large-scale, long-life and low-cost operations, a substantial resource base and diversified mining operations that produce nickel from nickel sulfide and laterite sources using advanced technology.

We have transitioned to a smaller footprint in our nickel business by calibrating investments and production to reflect current market conditions, and our nickel turnaround plan is now based on three pillars: supply chain integration, operational excellence and digital transformation. In Canada, we are optimizing the flowsheet, running a cost reduction program and improving underground mine performance at Sudbury and finalizing the ramp-up of operations at Long Harbour. In Indonesia, we are renewing truck and mine equipment, increasing efficiency of the furnaces and increasing fuel efficiency through coal conversion. In New Caledonia, we are developing a mine plan revision and a study to increase efficiency of the VNC plant. In the long term, the battery segment shows important upside potential as electric vehicle production continues to attract significant investments, which could positively affect nickel price and our nickel premiums.

A key aspect of our strategy for our copper assets in the Carajás region is to improve efficiency and asset utilization while we evaluate opportunities to increase copper production. We have plans to develop a multi-year copper expansion plan, with Salobo III being the first approved project in the pipeline.

| | | | |

| | 11 | | |

Business Overview

Concluding the ramp-up of our coal business

We have been working to increase our coal production, mainly through the ramp-up of the Moatize operations and the ramp-up of the Nacala Logistics Corridor (NLC) in Mozambique and Malawi, where we have entered into a strategic partnership with Mitsui. As we complete the ramp-up in Moatize and the NLC, we expect our costs to diminish, enhancing the competitiveness of our coal operations. Key initiatives, such as knowledge transfer from our iron ore operations, opening of new mine sections and preparation of selected mining pits for future disposals are expected to lead to higher capacity utilization, mine productivity and yields.

Enhancing corporate governance

We are committed to continuing to improve our corporate governance. Following the conversion of our class A preferred shares into common shares, in December 2017, we completed our listing on the Novo Mercado segment of the B3 exchange (formerly BM&FBovespa), the special listing segment of B3 for companies committed to the highest standards of corporate governance. In 2018, our Board of Directors revised some of our policies, including our Corporate Integrity Policy, Code of Ethical Conduct, Socio-Environmental Investment Policy, Risk Management Policy, Remuneration to Shareholders Policy and Securities Trading Policy.

In 2018, as required under Brazilian rules, we started reporting our compliance with the Code of Best Practices for Corporate Governance of the Brazilian Corporate Governance Institute (IBGC). The code is based on the "comply or explain" principle, and we currently fully comply with 80% of the practices recommended by the IBGC and partially comply with 17% of practices recommended by the code.

SIGNIFICANT CHANGES IN OUR BUSINESS

We summarize below major events related to our acquisitions, divestitures and other significant developments in our business since the beginning of 2018.

Acquisitions

Dispositions and asset sales

We are always seeking to optimize the structure of our portfolio of businesses in order to achieve the most efficient allocation of capital. We summarize below our most significant dispositions since the beginning of 2018.

| | | | |

| | 12 | | |

Business Overview

Project Financing for the Nacala Logistics Corridor

We have a partnership with Mitsui in coal assets in Mozambique. In February 2018, we concluded the agreements for a project financing for the Nacala Logistics Corridor, which connects the Moatize coal mine to the Nacala-à-Velha maritime terminal, located in Nacala, Mozambique, in the total amount of US$2.730 billion, as follows:

Vale received US$2.6 billion in proceeds, in repayment of certain shareholders loans provided for construction of NLC, net of certain commissions paid by NLC. The project financing will be repaid in 14 years with the proceeds obtained from the tariff charged by NLC in connection with its provision of coal transportation services.

| | | | |

| | 13 | | |

Business Overview

Optimizing our base metals operations in Canada

We have optimized our nickel operations across Canada, as part of an overall strategy to prioritize value over volume, reduce our atmospheric emissions and comply with local regulations. In 2018, we phased out our smelting and refining activities in Thompson, focusing our operations on nickel concentrate production. The concentrate is then shipped to our Sudbury operation to be further processed. In Sudbury, we produce copper concentrate, copper matte, copper cathodes and refined nickel. In Long Harbour, we produce nickel rounds, copper cathodes and cobalt rounds. We successfully blended nickel intermediates from Sudbury and Asia in our refinery in Wales to make higher premium products.

We will now turn our focus to the optimization of the mining assets to ensure a sustainable and value-accretive ore supply to our three concentrators in Canada:

Cobalt streaming transaction

In June 2018, we sold to Wheaton Precious Metals Corp. (Wheaton) and Cobalt 27 Capital Corp. (Cobalt 27) a combined 75% of the cobalt produced as a byproduct at our Voisey's Bay mine from January 1, 2021, which includes the ramp-down of production from the existing mine and the life-of-mine production from our underground mine expansion project. In consideration, we received US$690 million in cash from Wheaton and Cobalt 27 upon closing of the transaction on June 28, 2018, and will receive additional payments of 20%, on average, of cobalt prices upon delivery. We remain exposed to approximately 40% of future cobalt production from Voisey's Bay, through our retained interest in 25% of cobalt production and the additional payments upon delivery. These transactions enabled the development of the Voisey's Bay underground mine extension project, which will extend the mine life of Voisey's Bay.

Resumption of operations of São Luis and Tubarão I and II pellet plants

In 2018, we resumed the operations of our Tubarão I, Tubarão II and São Luis pellet plants. The operations of these plants had been suspended since 2012 due to market conditions.

| | | | |

| | 14 | | |

Business Overview

FAILURE OF SAMARCO'S TAILINGS DAM IN MINAS GERAIS

In November 2015, the Fundão tailings dams owned by Samarco S.A. failed, releasing tailings downstream, flooding certain communities and causing impacts on communities and the environment along the Doce river. The failure resulted in 19 fatalities and caused property and environmental damage to the affected areas. Samarco is a joint venture equally owned by Vale S.A. and BHP Billiton Brasil Ltda. ("BHPB").

In June 2016, Samarco and its shareholders (Vale and BHPB) created the Fundação Renova, a not-for-profit private foundation, to develop and implement (i) social and economic remediation and compensation programs and (ii) environmental remediation and compensation programs in the region affected by the dam failure.

The creation of Fundação Renova was provided for under the agreement for settlement and conduct adjustment (the "Framework Agreement") signed in March 2016 by Vale, BHPB, Samarco, the Brazilian federal government, the two Brazilian states affected by the failure (Minas Gerais and Espírito Santo) and other governmental authorities. The Framework Agreement has a 15-year term, renewable for successive one-year periods until all the obligations under the Framework Agreement have been performed. The Framework Agreement does not provide for admission of civil, criminal or administrative liability for the Fundão dam failure. The Framework Agreement provides that, within three years of the date of the agreement, the parties would review its terms to assessing the effectiveness of the ongoing remediation and compensation activities.

On June 25, 2018, Samarco, Vale and BHPB entered into a comprehensive agreement with the offices of the federal and state (Minas Gerais and Espírito Santo) prosecutors, public defenders and attorney general, among other parties, improving the governance mechanism of Fundação Renova and establishing, among other things, a process for potential revisions to the remediation programs provided under the Framework Agreement based on the findings of experts hired by Samarco to advise the MPF (Federal Prosecutor's Office) over a two-year period (the "June 2018 Agreement"). SeeAdditional information—Legal proceedings.

Under the Framework Agreement and the June 2018 Agreement, Fundação Renova must be funded by Samarco, but to the extent that Samarco is unable to fund, Vale and BHPB must ratably bear the funding requirements under the Framework Agreement. As Samarco is currently unable to resume its activities, we and BHPB have been funding the Fundação Renova and also providing funds directly to Samarco, to preserve its operations and to support Samarco's funding obligations. At this point, we cannot predict when Samarco will resume its operations.

Pursuant to the Framework Agreement, Fundação Renova and Samarco allocated R$2.1 billion to social and economic remediation and compensation programs in 2018 and have allocated R$5.3 billion to these programs since the dam failure. From 2019 to 2021, Samarco, or Vale and BHP, will provide to Fundação Renova funding based on the amounts needed to implement the projects approved for each year, subject to an annual minimum of R$800 million and an annual maximum of R$1.6 billion. Starting in 2022, Samarco will provide the necessary funding in order to complete remaining programs approved for each year.

Additionally, Fundação Renova must allocate a minimum annual amount of R$240 million over 15 years (from 2016) to the implementation of compensation programs. Under the terms of the Framework Agreement, Fundação Renova must spend an additional amount of at least R$500 million on sewage collection and treatment and solid waste disposal.

For a discussion of the legal proceedings resulting from the failure of Samarco's tailings dam, seeAdditional information—Legal proceedings.

| | | | |

| | 15 | | |

The tables below present selected consolidated financial information as of and for the periods indicated. You should read this information together with our consolidated financial statements in this annual report.

Consolidated statement of income data

| | | For the year ended December 31, | | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | ||||||||||

| | | (US$ million) | | ||||||||||||||||||

| Net operating revenues | | 35,124 | | | 23,384 | | | 27,488 | | | 33,967 | | | 36,575 | | | |||||

| Cost of goods sold and services rendered | | (22,790 | ) | | (18,751 | ) | | (17,650 | ) | | (21,039 | ) | | (22,109 | ) | | |||||

| Selling, general, administrative and other operating expenses, net | | (2,059 | ) | | (819 | ) | | (774 | ) | | (951 | ) | | (968 | ) | | |||||

| Research and evaluation expenses | | (662 | ) | | (395 | ) | | (319 | ) | | (340 | ) | | (373 | ) | | |||||

| Pre-operating and operational stoppage | | (975 | ) | | (942 | ) | | (453 | ) | | (413 | ) | | (271 | ) | | |||||

| Impairment and other results on non-current assets | | (266 | ) | | (8,708 | ) | | (1,240 | ) | | (294 | ) | | (899 | ) | | |||||

| | | | | | | | | | | | | ||||||||||

| Operating income (loss) | | 8,372 | | | (6,231 | ) | | 7,052 | | | 10,930 | | | 11,955 | | | |||||

| Non-operating income (expenses): | | | | | | | | | | | | ||||||||||

| Financial income (expenses), net | | (6,018 | ) | | (10,654 | ) | | 1,843 | | | (3,019 | ) | | (4,957 | ) | | |||||

| Equity results and other results in associates and joint ventures | | 440 | | | (794 | ) | | (911 | ) | | (82 | ) | | (182 | ) | | |||||

| | | | | | | | | | | | | ||||||||||

| Net income (loss) before income taxes | | 2,794 | | | (17,679 | ) | | 7,984 | | | 7,829 | | | 6,816 | | | |||||

| Income taxes | | (1,603 | ) | | 5,249 | | | (2,781 | ) | | (1,495 | ) | | 172 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Net income (loss) from continuing operations | | 1,191 | | | (12,430 | ) | | 5,203 | | | 6,334 | | | 6,988 | | | |||||

| Net income (loss) attributable to non-controlling interests | | (308 | ) | | (501 | ) | | (8 | ) | | 21 | | | 36 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Net income (loss) from continuing operations attributable to Vale's stockholders | | 1,499 | | | (11,929 | ) | | 5,211 | | | 6,313 | | | 6,952 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Net income (loss) from discontinued operations attributable to Vale's stockholders | | (842 | ) | | (200 | ) | | (1,229 | ) | | (806 | ) | | (92 | ) | | |||||

| Net income (loss) attributable to Vale's stockholders | | 657 | | | (12,129 | ) | | 3,982 | | | 5,507 | | | 6,860 | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | ||||||||||

| Net income (loss)attributable to non-controlling interests | | (304 | ) | | (491 | ) | | (6 | ) | | 14 | | | 36 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Net income (loss) | | 353 | | | (12,620 | ) | | 3,976 | | | 5,521 | | | 6,896 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Total cash paid to stockholders(1) | | 4,200 | | | 1,500 | | | 250 | | | 1,456 | | | 3,313 | | | |||||

Earnings (loss) per share

The table below shows our earnings (loss) per share. The earnings (loss) per share for 2014 to 2016 have been retrospectively adjusted to reflect the conversion of our Class A preferred shares into common shares, which was concluded in November 2017, as if the conversion had occurred at the beginning of the earliest year presented.

| | | For the year ended December 31, | | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | ||||||||||

| | | (US$, except as noted) | | ||||||||||||||||||

| Earnings (loss) per common share from continuing operations | | 0.29 | | | (2.30 | ) | | 1.00 | | | 1.21 | | | 1.34 | | | |||||

| Earnings (loss) per common share from discontinued operations | | (0.16 | ) | | (0.03 | ) | | (0.23 | ) | | (0.16 | ) | | (0.02 | ) | | |||||

| | | | | | | | | | | | | ||||||||||

| Earnings (loss) per common share | | 0.13 | | | (2.33 | ) | | 0.77 | | | 1.05 | | | 1.32 | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | ||||||||||

| Weighted average number of shares outstanding (in thousands)(1)(2) | | 5,197,432 | | | 5,197,432 | | | 5,197,432 | | | 5,197,432 | | | 5,182,445 | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | ||||||||||

| Distributions to stockholders per share(2)(3) | | | | | | | | | | | | ||||||||||

Expressed in US$ | | 0.81 | | | 0.29 | | | 0.05 | | | 0.28 | | | 0.64 | | | |||||

Expressed in R$ | | 1.89 | | | 0.98 | | | 0.17 | | | 0.90 | | | 2.39 | | | |||||

| | | | |

| | 16 | | |

Selected Financial Data

Balance sheet data

| | | As of December 31, | | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | 2014 | | 2015 | | 2016 | | 2017 | | 2018 | | ||||||||||

| | | (US$ million) | | ||||||||||||||||||

| Current assets | | 16,594 | | | 11,429 | | | 13,978 | | | 15,367 | | | 15,292 | | | |||||

| Non-current assets held for sale | | 3,640 | | | 4,044 | | | 8,589 | | | 3,587 | | | – | | | |||||

| Property, plant and equipment, net and intangible assets | | 84,942 | | | 59,426 | | | 62,290 | | | 63,371 | | | 56,347 | | | |||||

| Investments in associated companies and joint ventures | | 4,133 | | | 2,940 | | | 3,696 | | | 3,568 | | | 3,225 | | | |||||

| Non-current assets | | 7,180 | | | 10,653 | | | 10,461 | | | 13,291 | | | 13,326 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Total assets | | 116,489 | | | 88,492 | | | 99,014 | | | 99,184 | | | 88,190 | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | ||||||||||

| Current liabilities | | 10,626 | | | 10,438 | | | 10,142 | | | 11,935 | | | 9,111 | | | |||||

| Liabilities associated with non-current assets held for sale | | 111 | | | 107 | | | 1,090 | | | 1,179 | | | – | | | |||||

| Long-term liabilities(1) | | 22,043 | | | 15,896 | | | 19,096 | | | 20,512 | | | 19,784 | | | |||||

| Long-term debt(2) | | 27,388 | | | 26,347 | | | 27,662 | | | 20,786 | | | 14,463 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Total liabilities | | 60,168 | | | 52,788 | | | 57,990 | | | 54,412 | | | 43,358 | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | ||||||||||

| Stockholders' equity: | | | | | | | | | | | | ||||||||||

Capital stock | | 61,614 | | | 61,614 | | | 61,614 | | | 61,614 | | | 61,614 | | | |||||

| Additional paid-in capital | | (601 | ) | | (854 | ) | | (851 | ) | | (1,106 | ) | | (1,122 | ) | | |||||

| Retained earnings and revenue reserves | | (5,891 | ) | | (27,171 | ) | | (21,721 | ) | | (17,050 | ) | | (16,507 | ) | | |||||

| | | | | | | | | | | | | ||||||||||

Total Vale shareholders' equity | | 55,122 | | | 33,589 | | | 39,042 | | | 43,458 | | | 43,985 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Non-controlling interests | | 1,199 | | | 2,115 | | | 1,982 | | | 1,314 | | | 847 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Total stockholders' equity | | 56,321 | | | 35,704 | | | 41,024 | | | 44,772 | | | 44,832 | | | |||||

| | | | | | | | | | | | | ||||||||||

| Total liabilities and stockholders' equity | | 116,489 | | | 88,492 | | | 99,014 | | | 99,184 | | | 88,190 | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | |||||

| | | | | | | | | | | | | ||||||||||

| | | | |

| | 17 | | |

This annual report contains statements that may constitute forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Many of those forward-looking statements can be identified by the use of forward-looking words such as "anticipate," "believe," "could," "expect," "should," "plan," "intend," "estimate" and "potential," among others. Those statements appear in a number of places and include statements regarding our intent, belief or current expectations with respect to:

We caution you that forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those in forward-looking statements as a result of various factors. These risks and uncertainties include factors relating to (a)(i) economic, political and social issues in the countries in which we operate, (b)(ii) the global economy, (c)(iii) commodity prices, (d)(iv) financial and capital markets, (e)(v) the mining and metals businesses, which are cyclical in nature, and their dependence upon global industrial production, which is also cyclical, (f)(vi) regulation and taxation, (g)(vii) operational incidents or accidents, and (h)(viii) the high degree of global competition in the markets in which we operate. For additional information on factors that could cause our actual results to differ from expectations reflected in forward-looking statements, seeRisk factors. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments. All forward-looking statements attributed to us or a person acting on our behalf are expressly qualified in their entirety by this cautionary statement, and you should not place undue reliance on any forward-looking statement.

| | | | |

| | 18 | | |

Vale S.A. is a stock corporation, orsociedade por ações, that was organized on January 11, 1943 under the laws of the Federative Republic of Brazil for an unlimited period of time. Its head office is located at Avenida das Américas, 700 – bloco 8 – loja 318 – Barra da Tijuca, Rio de Janeiro, RJ, Brazil, and its telephone number is 55-21-3485-5000.

In this report, references to "Vale" are to Vale S.A. References to "we," "us" or the "Company" are to Vale and, except where the context otherwise requires, its consolidated subsidiaries. References to our "preferred shares" are to our preferred class A shares. References to our "ADSs" or "American Depositary Shares" include both our common American Depositary Shares (our "common ADSs"), each of which represents one common share of Vale, and our preferred class A American Depositary Shares (our "preferred ADSs"), each of which represents one class A preferred share of Vale. American Depositary Shares are represented by American Depositary Receipts ("ADRs") issued by the depositary. References to our "HDSs" or "Hong Kong Depositary Shares" include both our common Hong Kong Depositary Shares (our "common HDSs"), each of which represents one common share of Vale, and our class A preferred Hong Kong Depositary Shares (our "preferred HDSs"), each of which represents one preferred Class A share of Vale. Hong Kong Depositary Shares are represented by Hong Kong Depositary Receipts ("HDRs") issued by the depositary.

Unless otherwise specified, we use metric units.

References to "real," "reais" or "R$" are to the official currency of Brazil, the real (singular) or reais (plural). References to "U.S. dollars" or "US$" are to United States dollars. References to "CAD" are to Canadian dollars, and references to "A$" are to Australian dollars.

iv

RISKS RELATING TO DAM FAILURE

The failure of Dam I in Minas Gerais has adversely affected our business, financial condition and reputation, and the overall impact of the dam failure on us is still uncertain.

RisksOn January 25, 2019, Dam I failed, resulting in nearly 300 fatalities or presumed fatalities, in addition to personal, property and environmental damages. SeeBusiness Overview—Failure of the tailings dam at the Córrego do Feijão mine. The causes of the dam failure are uncertain and are being investigated by us and by several governmental authorities. This event has adversely affected our operations, but the overall impact of the dam failure is still uncertain.

| | | | |

| | 19 | | |

Risk Factors

| | | | |

| | 20 | | |

Risk Factors

The failure of a tailings dam or similar structure may cause severe damages, and the decommissioning of our upstream tailings dams may be long and costly.

We own a number of tailings dams and similar structures. In addition, we own stakes in companies that own a number of dams or similar structures, including Samarco and Mineração Rio do Norte S.A. (MRN). The failure of any of these structures could cause losses of lives and severe personal, property and environmental damages, and could have adverse effects on our business and reputation, as evidenced by the consequences of the failure of Dam I at Córrego do Feijão. SeeBusiness Overview—Failure of the tailings dam at the Córrego do Feijão mine. Some of our dams, and some of the dams owned by our investees, such as Samarco and MRN, were built using the "upstream" method, which presents specific stability risks.

Recently approved laws and regulations require us to decommission all of our upstream dams on a specified timetable. We are still determining the appropriate measures for decommissioning each upstream dam. This process will require significant expenditures, and the decommissioning process may take a long time. At this point, we cannot estimate the costs and timing for conclusion of the decommissioning process. We may not be able to conclude the decommissioning process for all of our upstream dams within the time-frame imposed by the new laws and regulations.

| | | | |

| | 21 | | |

Risk Factors

We are involved in legal proceedings that could have a material adverse effect on our business in the event of unfavorable outcomes.

We are involved in legal proceedings in which adverse parties have sought injunctions to suspend certain of our operations or claimed substantial amounts, including several legal proceedings and investigations relating to the failure of our Dam I and the failure of Samarco's Fundão tailings dam. The outcomes of these proceedings are uncertain and may materially and adversely affect our business, our liquidity and the value of the securities issued by us or our subsidiaries. SeeAdditional information—Legal proceedings.

Our obligations and potential liabilities arising from the failure of a tailings dam owned by Samarco in Minas Gerais could negatively impact our business, our financial conditions and our reputation.

In November 2015, the Fundão tailings dam owned by Samarco failed, causing fatalities and environmental damage in the surrounding area. The failure of Samarco's tailings dam has adversely affected and will continue to affect our business, and the full impact is still uncertain and cannot be estimated. Below is a discussion of the main effects of the dam failure on our business.

| | | | |

| | 22 | | |

Risk Factors

EXTERNAL RISKS

Our business is exposed to the cyclicality of global economic activity and requires significant investments of capital.

As a mining company, we are a supplier of industrial raw materials. Industrial production tends to be the most cyclical and volatile component of global economic activity, which affects demand for minerals and metals. At the same time, investment in mining requires a substantial amount of funds in order to replenish reserves, expand and maintain production capacity, build infrastructure, and preserve the environment.environment, prevent fatalities and occupational hazards and minimize social impacts. Sensitivity to industrial production, together with the need for significant long-term capital investments, are important sources of risk for our financial performance and growth prospects.

Adverse economic developmentsAlso, we may not be able to adjust production volume in China could have a negative impact on our revenues, cash flow and profitability.

China has been the main drivertimely or cost-efficient manner in response to changes in demand. Lower utilization of globalcapacity during periods of weak demand for minerals and metals over the last few years. In 2015, Chinese demand represented 69% of global demand for seaborne iron ore, 51% of global demand for nickel and 46% of global demand for copper. The percentagemay expose us to higher unit production costs since a significant portion of our net operating revenues attributablecost structure is fixed in the short-term due to salesthe capital intensity of mining operations. In addition, efforts to customers in China was 35.5% in 2015. Therefore, any contractionreduce costs during periods of China's economic growthweak demand could result in lowerbe limited by labor regulations or previous labor or government agreements. Conversely, during periods of high demand, our ability to rapidly increase production capacity is limited, which could prevent us from meeting demand for our products. Moreover, we may be unable to complete expansions and greenfield projects in time to take advantage of rising demand for iron ore, nickel or other products. When demand exceeds our production capacity, we may meet excess customer demand by purchasing iron ore fines, iron ore pellets or nickel from joint ventures or unrelated parties processing and reselling it, which would increase our costs and narrow our operating margins. If we are unable to satisfy excess customer demand in this way, we may lose customers. In addition, operating close to full capacity may expose us to higher costs, including demurrage fees due to capacity restraints in our logistics systems.

The prices for our products leadingare subject to lower revenues, cash flowvolatility, which may adversely affect our business.

Global prices for metals are subject to significant fluctuations and profitability. Poor performanceare affected by many factors, including actual and expected global macroeconomic and political conditions, regional and sectorial factors, levels of supply and demand, the availability and cost of substitutes, inventory levels, technological developments, regulatory and international trade matters, investments by commodity funds and others and actions of participants in the Chinese real estate sector, the largest consumer of carbon steel in China, would also negatively impact our results.

Our business may be adversely affected by declines in demandcommodity markets. Sustained low market prices for and prices of the products we sell may result in the suspension of certain of our customers produce, including steel (forprojects and operations, decrease in our iron oremineral reserves, impairment of assets, and coal business), stainless steel (formay adversely affect our nickel business), copper wire (for copper)cash flows, financial position and agricultural commodities (for our fertilizer nutrients business).results of operations.

| | | | |

| | 23 | | |

Risk Factors

Demand for our iron ore, coal and nickel products depends on global demand for steel. Iron ore and iron ore pellets, which together accounted for 62.2%73.8% of our 20152018 net operating revenues, are used to produce carbon steel. Nickel, which accounted for 18.3%8.8% of our 20152018 net operating revenues, is used mainly to produce stainless and alloy steels. Demand for steel depends heavily on global economic conditions, but it also depends on a variety of regional and sectorial factors. The prices of different steels and the performance of the global steel industry are highly cyclical and volatile, and these business cycles in the steel industry affect demand and prices for our products. In addition, vertical backward integration of the steel and stainless steel industries and the use of scrap could reduce the global seaborne trade of iron ore and primary nickel. The demand for copper is affected by the demand for copper wire, and a sustained decline in the construction industry could have a negative impact on our copper business. The demand for fertilizers is

We are mostly affected by prices of agricultural commodities in the international and Brazilian markets, and a sustained decline in the price of one or more agricultural commodities could negatively impact our fertilizer nutrients business.

The prices we charge, including prices for iron ore, nickel, copper, coal and fertilizers, are subject to volatility.

Our iron ore prices are based on a variety of pricing options, which generally use spot price indices as a basis for determining the customer price. Our prices for nickel and copper are based on reported prices for these metals on commodity exchanges such as the London Metal Exchange ("LME") and the New York Mercantile Exchange ("NYMEX"). Our prices and revenues for these products are consequently volatile, which may adversely affect our cash flow. Global prices for metals are subject to significant fluctuations and are affected by many factors, including actual and expected global macroeconomic and political conditions, levels of supply and demand, the availability and cost of substitutes, inventory levels, investments by commodity funds and others and actions of participants in the commodity markets. A continuous decrease in the market prices for the products we sell may result in the suspension of certain of our projects and operations, decrease in our mineral reserves and the impairment of assets, and it would adversely affect our financial position and results of operations.

In 2015, prices of steelmaking raw materials, such as iron ore, coal and nickel, decreased as supply grew more than demand. Additionally, copper prices dropped as a result of lower demand, in spite of some disruptions in supply.

We are most exposed to movements in iron ore prices. For example, a price reduction of US$1 per dry metric ton unit ("dmt") in the average iron ore price would have reduced our operating income for the year ended December 31, 20152018 by approximately US$320340 million. Average iron ore prices decreased 59%significantly changed in the last twofive years, from US$135 per dmt in 2013 to US$9797.0 per dmt in 2014, and US$55.5 per dmt in 2015, US$58.5 per dmt in 2016, US$71.3 per dmt in 2017 and US$69.5 per dmt in 2018, according to the average Platts IODEX (62% Fe CFR China). On FebruaryMarch 29, 20162019, the year to dateyear-to-date average Platts IODEX iron ore price was US$44.1087.05 per dmt. In addition to reduced demand for iron ore, an excess in supply has adversely affected our prices since 2014 and may grow with the expected conclusion of certain iron ore projects in coming years.