UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 20-F

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year endedDecember 31, 20082013

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

or

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number1-339650-55139

QUATERRA RESOURCES INC.

(Exact name of Registrant as specified in its charter)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

1100 – 1199 West Hastings Street, Vancouver, British Columbia, Canada V6E 3T5

(Address of principal executive offices)

Scott B. Hean, Chief Financial Officer

1100 – 1199 West Hastings Street, Vancouver, British Columbia, Canada V6E 3T5

Phone (604) 681-9059 and Fax (604) 688-4670

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

________________________________

Securities registered or to be registered pursuant to Section 12(b) of the Act:None

Securities registered or to be registered pursuant to Section 12(g) of the Act:NoneCommon Shares, no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of

the period covered by the annual report.87,463,483193,479,416 common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [X] No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X]

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See

definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [X] Non-accelerated filer [ ]

| Large accelerated filer [ ] | Accelerated filer [ ] | Non-accelerated filer [X] |

Indicate by check mark which basis of accounting the registration has used to prepare the financial statements included in

this filing:

U.S. GAAP [ ]

International Financial Reporting Standards as issued by the International Accounting Standards board [X]

Other [ ]Other [X]

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

Item 17 [X][ ]

Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). [ ] Yes [X] No

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This annual report contains forward-looking statements about our operations and planned future activities within the meaning of the safe harbor for such statements under the Private Securities Litigation Reform Act of 1995. Statements that are not historical fact and relate to predictions, expectations, belief, plans, projections, objectives, assumptions, future events, or future performance may be “forward-looking statements.” Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, “plan” or similar words. You are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

our ability to finance the continued exploration of our mineral properties;

our history of losses and expectation of future losses;

our ability to obtain adequate financing for our planned explorationdevelopment activities;

uncertainty of production at our mineral exploration properties;

the lack of Proven Mineral Reserves or Probable Mineral Reserves;

the impact of governmental regulations, including environmental regulations; and

commodity price fluctuations.

These forward-looking statements are based on the beliefs of our management as well as on assumptions made by and information currently available to us at the time such statements were made. We undertake no obligation to update forward-looking statements should circumstances or estimates or opinions change.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

We prepareFinancial Information

All financial information in this annual report is prepared in accordance with International Financial Reporting Standards, (“IFRS”) as issued by International Accounting Standards Board (“IASB”). IFRS differs in some respects from United States generally accepted accounting principles, (“U.S. GAAP”), and thus our financial statements which are filed with this annual report on Form 20-F in accordance withmay not be comparable to financial statements of United States companies. The term Canadian generally accepted accounting principles (“Canadian GAAP”), refers to the accounting principles and are subject to Canadian auditingstandards before the adoption of IFRS.

Resource and auditor independence standards. They may not be comparable to financial statementsReserve Estimates

None of the United States companies,Company’s properties have Mineral Reserves. Disclosure about the Company’s exploration properties in this Annual Report on Form 20-F uses the term “Mineral Resources”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, which typically report according to United States generally accepted accounting principles (“US GAAP”). Significant differences betweenare Canadian GAAPgeological and US GAAP are described in Note 16 of our consolidated financial statements in Item 17 of this annual report.

In addition, disclosure about exploration activities and certain mining terms is different underas defined in accordance with National Instrument 43-101 (“NI 43-101”), standards of disclosure for mineral projects of the Canadian standards than underSecurities Administrators, set out in the Canadian Institute of Mining (CIM) Standards. These terms are not defined in the U.S. Securities and Exchange Commission (“SEC”) standards.(SEC) Industry Guide 7,Description of Property by Issuers Engaged or to be engaged in Significant Mining Operations, and are normally not permitted to be used in reports and registration statements filed with the SEC. Accordingly, information contained in this annual report containingAnnual Report on Form 20-F contain descriptions of our mineral deposits that may not be comparable to similar information made public by United StatesU.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws.laws and the rules and regulations thereunder.

Cautionary Note to U.S. Readers concerning estimates of Measured Mineral Resources and Indicated Mineral Resources:This Annual Report on Form 20-F may use the terms “Mineral Resources,” “Measured Mineral Resource” and “Indicated Mineral Resource.” The Company advises U.S. investors that while such terms are recognized and permitted under Canadian regulations, the SEC does not recognize them. U.S. investors are cautioned not to assume that any part or all of the Mineral Resources in these categories will ever be converted into Mineral Reserves.

- ii -

Cautionary Note to U.S. Readers concerning estimates of Inferred Mineral Resources:This Annual Report on Form 20-F may use the term “Inferred Mineral Resource.” The Company advises U.S. investors that while such a term is recognized and permitted under Canadian regulations, the SEC does not recognize it. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. U.S. investors are cautioned not to assume that any part of all of the Inferred Mineral Resources exist, or is economically or legally mineable.

EMERGING GROWTH COMPANY STATUS

The Company is an “emerging growth company” as defined in section 3(a) of the U.S. Securities Exchange Act of 1934 (as amended by the U.S. Jumpstart Our Business Startups Act (the “JOBS Act”), enacted on April 5, 2012), and the Company will continue to qualify as an “emerging growth company” until the earliest to occur of: (a) the last day of the fiscal year during which the Company has total annual gross revenues of US$1,000,000,000 (as such amount is indexed for inflation every five years by the SEC) or more; (b) the last day of the fiscal year of the Company following the fifth anniversary of the date of the first sale of common equity securities of the Company pursuant to an effective registration statement under the U.S. Securities Act of 1933, as amended; (c) the date on which the Company has, during the previous three-year period, issued more than US$1,000,000,000 in non-convertible debt; or (d) the date on which the Company is deemed to be a ‘large accelerated filer’, as defined in Rule 12b–2 of the U.S. Securities Exchange Act of 1934, as amended. The Company expects that it will continue to qualify as an emerging growth company for the foreseeable future.

GLOSSARY OF GEOLOGIC AND MINING TERMS

| Anomaly: | A geological feature distinguished by geological, geochemical or geophysical means, which is detectably different than the general surroundings and is sometimes of potential economic value. |

| Breccia: | Rock consisting of more or less angular fragments in a matrix of finer-grained material or cementing material. |

| Diamond drill: | A type of drill in which the cutting is done by abrasion using diamonds embedded in a matrix rather than by percussion. The drill cuts a core of rock which is recovered in long cylindrical sections. |

| Dilution: | Process whereby unwanted gangue or waste rock is mixed with ore during mining. |

| Epithermal: | A class of ore deposits that form generally less than 1 km from surface. These deposits, which can host economic quantities of gold, silver, copper, lead and zinc are formed as a result of the precipitation of ore minerals from up-welling hydrothermal fluids. There are several classes of epithermal deposits that are defined on the basis of fluid chemistry and resulting alteration and ore mineralogy. Fluid chemistry is largely controlled by the proximity to igneous intrusive rocks and as a result igneous fluid content. |

| Extrusive Rock: | Igneous rock that has solidified on the earth’s surface from volcanic action. |

| Fluid inclusion: | A cavity, with or without negative crystal faces, containing one or two fluid phases, and possibly one or more minute crystals, in a host crystal. If two fluid phases are present, the vapor phase (bubble) may show Brownian motion. |

| Folds: | Flexures in bedded or layered rock formed when forces are applied gradually to rocks over a long period of time. |

| Fracture: | Breaks in a rock, usually due to intensive folding or faulting. |

| Gambusino: | An individual miner working without machinery. |

| Gangue: | Term used to describe worthless minerals or rock waste mixed in with the valuable minerals. |

| Gouge: | The finely ground rock that result from the abrasion along a fault surface. |

- iii -

| Grade: | The concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t) or ounces per ton (oz/t). The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from throughout the deposit. |

| Hectare: | A square of 100 metres on each side. |

| Indicated Mineral Resource: |

|

| Inferred Mineral Resource: |

|

- iii -

reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. | |

| Lithology: | The physical characteristics of a rock or a rock formation. |

| Mafic: | A term used to describe ferromagnesian minerals. Rocks composed mainly of ferromagnesian minerals are correctly termed melanocratic. |

| Massive: | A term used to describe sulfide ores containing more than 50% volume of sulphide. |

| Measured Mineral | |

| Resource: | A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| Mineral Deposit or | |

| Mineralized Material: | A mineralized body which has been intersected by sufficient closely spaced drill holes and or underground sampling to support sufficient tonnage and average grade of metal(s) to warrant further exploration-development work. This deposit does not qualify as a commercially mineable ore body (Reserves), as prescribed under SEC standards, until a final and comprehensive economic, technical, and legal feasibility study based upon the test results is concluded. |

| Mineral | |

| Resource: | A Mineral Resource is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. |

| Mineral Reserve: | A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include |

- iv -

adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined. | |

| Mineralization: | Usually implies minerals of value occurring in rocks. |

| Ore: | A natural aggregate of one or more minerals which may be mined and sold at a profit, or from which some part may be profitably separated. |

| Probable Mineral | |

Reserve: | A Probable Mineral Reserve is the economically mineable part of an Indicated, and in some circumstances a Measured, Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| Properties as | |

prospects: | A property is a claim owned by a company and a prospect is a claim in which a company holds an interest. |

- iv -

| Proven Mineral Reserve: | A Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. |

| Reserve(s): | A natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit, or from which some part may be profitably separated. |

| Reverse | |

circulation drill: | A rotary percussion drill in which the drilling mud and cuttings return to the surface through the drill pipe. |

| Tailings: | Material rejected from a mill after recoverable valuable minerals have been extracted. |

GLOSSARY OF ABBREVIATIONS

| Ag: | Silver | |

| Ag gm/t: | Silver grade measured in grams per metric tonne | |

| AMR: | Advance minimum royalty payments | |

| Au: | Gold | |

| Au gm/t: | Gold grade measured in grams per metric tonne | |

| Ba: | Barium | |

| Co: | Cobalt | |

| CSAMT: | Controlled source audio-frequency magneto telluric geophysical survey | |

| Cu: | Copper | |

| EIS: | Environmental Impact Statement | |

| Fe: | Iron | |

| 43-101: | Canadian National Instrument 43-101 | |

| gpm: | gallons per minute | |

| gpt: | grams per tonne | |

| g/t: | grams per tonne | |

| IP: | Induced Polarization geophysical survey | |

| m.y: | Million years | |

| Ni: | Nickel | |

| NSR: | Net smelter return royalty | |

| Oz: | Troy ounce |

- v -

| oz/t or opt: | Ounces per ton. | |

| Pb: | Lead | |

| Pd: | Palladium | |

| PGE: | Platinum Group Element | |

| PGM: | Platinum group minerals | |

| PPB: | Parts per billion | |

| PPM: | Parts per million | |

| Pt: | Platinum | |

| S: | Sulphur | |

| TD: | Total depth of a drill hole. | |

| tpd: | Tonnes per day | |

| U3O8: | Uranium oxide known as “yellow cake”. | |

| VLF: | Very low frequency electromagnetic geophysical survey | |

| VMS: | Volcanogenic massive sulphide |

- v -

CONVERSION TABLES

| Conversion Table | ||||

| Imperial | Metric | |||

| 1 Acre | = | 0.404686 | Hectares | |

| 1 Foot | = | 0.304800 | Metres | |

| 1 Mile | = | 1.609344 | Kilometres | |

| 1 Ton | = | 0.907185 | Tonnes | |

| 1 Ounce (troy)/ton | = | 34.285700 | Grams/Tonne | |

| Precious metal units and conversion factors | Precious metal units and conversion factors | Precious metal units and conversion factors | |||||||||||||||||||

| ppb | - Part per billion | 1 | ppb | = | 0.0010 | ppm | = | 0.000030 oz/t | - Part per billion | 1 | ppb | = | 0.0010 | ppm | = | 0.000030 | oz/t | ||||

| ppm | - Part per million | 100 | ppb | = | 0.1000 | ppm | = | 0.002920 oz/t | - Part per million | 100 | ppb | = | 0.1000 | ppm | = | 0.002920 | oz/t | ||||

| oz | - Ounce (troy) | 10,000 | ppb | = | 10.0000 | ppm | = | 0.291670 oz/t | - Ounce (troy) | 10,000 | ppb | = | 10.0000 | ppm | = | 0.291670 | oz/t | ||||

| oz/t | - Ounce per ton (avdp.) | 1 | ppm | = | 1.0000 | ug/g | = | 1.000000 g/tonne | - Ounce per ton (avdp.) | 1 | ppm | = | 1.0000 | ug/g | = | 1.000000 | g/tonne | ||||

| g | - Gram | - Gram | |||||||||||||||||||

| g/tonne | - gram per metric ton | 1 | oz/t | = | 34.2857 | ppm | - gram per metric ton | 1 | oz/t | = | 34.2857 | ppm | |||||||||

| mg | - milligram | 1 | Carat | = | 41.6660 | mg/g | - milligram | 1 | Carat | = | 41.6660 | mg/g | |||||||||

| kg | - kilogram | 1 | ton (avdp.) | = | 907.1848 | kg | - kilogram | 1 | ton (avdp.) | = | 907.1848 | kg | |||||||||

| ug | - microgram | 1 | oz (troy) | = | 31.1035 | g | - microgram | 1 | oz (troy) | = | 31.1035 | g | |||||||||

- vi -

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The following table sets forth our selected consolidated financial data for the five years ended December 31, 2008 prepared in accordance with Canadian GAAP and corresponding information prepared in accordance with US GAAP. This information should be read in conjunction with our consolidated financial statements included in Item 17 this annual report.

| (Expressed in Canadian dollars) | Fiscal year ended December 31 | ||||||||||||||

| Canadian GAAP | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||

| Sales or operating revenues | Nil | Nil | Nil | Nil | Nil | ||||||||||

| Net (loss) | (6,834,181 | ) | (7,303,204 | ) | (3,830,534 | ) | (788,060 | ) | (685,952 | ) | |||||

| (Loss) per common share | (0.08 | ) | (0.09 | ) | (0.05 | ) | (0.01 | ) | (0.01 | ) | |||||

| Total assets | 34,397,289 | 24,198,211 | 17,304,544 | 5,855,847 | 3,727,071 | ||||||||||

| Net assets | 29,953,008 | 22,491,941 | 17,063,017 | 5,527,409 | 3,492,483 | ||||||||||

| Capital stock | 48,318,994 | 36,875,448 | 27,861,058 | 15,172,975 | 12,672,761 | ||||||||||

| Common shares outstanding | 87,463,483 | 83,167,005 | 78,104,820 | 65,522,200 | 57,347,200 | ||||||||||

| Dividends per common share | Nil | Nil | Nil | Nil | Nil | ||||||||||

| Fiscal year ended December 31 | |||||||||||||||

| US GAAP | 2008 | 2007 | 2006 | 2005 | 2004 | ||||||||||

| Sales or operating revenues | Nil | Nil | Nil | Nil | Nil | ||||||||||

| Net (loss) | (19,226,463 | ) | (15,217,588 | ) | (6,476,885 | ) | (1,960,598 | ) | (996,820 | ) | |||||

| (Loss) per common share | (0.22 | ) | (0.19 | ) | (0.09 | ) | (0.03 | ) | (0.02 | ) | |||||

| Total assets | 8,887,616 | 11,087,462 | 12,144,179 | 2,098,964 | 1,754,124 | ||||||||||

| Net assets | 4,625,258 | 9,381,192 | 11,866,652 | 2,976,395 | 2,115,007 | ||||||||||

| Capital stock | 48,318,994 | 36,875,448 | 27,861,058 | 15,172,975 | 12,672,761 | ||||||||||

| Common shares outstanding | 87,463,483 | 83,167,005 | 78,104,820 | 65,522,200 | 57,347,200 | ||||||||||

| Dividends per common share | Nil | Nil | Nil | Nil | Nil | ||||||||||

Exchange Rate Data

- Unless otherwise indicated, all monetary references herein are denominated in Canadian Dollars. References to “$” or “Dollars” are to Canadian Dollars and references to “US$” or “U.S. Dollars” are to United States Dollars.

- 1 -The following table sets forth our selected consolidated financial data for the five years ended December 31, 2013 prepared in accordance with IFRS as issued by IASB for the years ended December 31, 2013, 2012, 2011 and 2010 and Canadian GAAP for the years ended December 31, 2009. This information should be read in conjunction with our consolidated financial statements included in Item 17 of this annual report.

| Fiscal year ended December 31, | ||||||||||||

| IFRS | 2013 | 2012 | 2011 | 2010 | ||||||||

| Sales or operating revenues | Nil | Nil | Nil | Nil | ||||||||

| Net (loss) for the year | (28,817,916 | ) | (4,853,976 | ) | (11,264,539 | ) | (2,769,248 | ) | ||||

| (Loss) per common share - basic and diluted | (0.17 | ) | (0.03 | ) | (0.08 | ) | (0.02 | ) | ||||

| Total assets | 46,237,523 | 73,312,971 | 73,610,822 | 65,460,923 | ||||||||

| Net assets | 43,816,046 | 71,855,193 | 71,733,234 | 64,564,355 | ||||||||

| Capital stock | 116,135,532 | 115,816,740 | 111,923,521 | 95,800,950 | ||||||||

| Number of common shares outstanding | 193,479,416 | 162,990,836 | 152,353,283 | 136,464,161 | ||||||||

| Derivative liability - warrants | 1,191,784 | 774,673 | - | - | ||||||||

| Cash dividends per common share | NIl | Nil | Nil | Nil | ||||||||

| Fiscal year ended December 31, | |||

| Canadian GAAP(1) | 2009 | ||

| Sales or operating revenues | Nil | ||

| Net (loss) for the year | (6,988,414 | ) | |

| (Loss) per common share - basic and diluted | (0.08 | ) | |

| Total assets | 41,872,497 | ||

| Net assets | 40,993,110 | ||

| Capital stock | 63,168,843 | ||

| Number of common shares outstanding | 111,459,371 | ||

| Long-term debt | - |

(1) The adoption of IFRS by the Company did not require restatement of fiscal years prior to 2010.

Exchange Rate Data

For the past five fiscal years ended December 31, 2008,2013, the average rates (calculatedcalculated by using the average of the exchange rates on the last day of each month during the period) and for each of the previous six months, the high and low exchange rates for Canadian dollars expressed in terms of U.S. dollars (i.e., U.S. dollars required to purchase one Canadian dollar):. The information was provided by the Bank of Canada:

- 7 -

| Financial Year | Average Exchange Rate |

| 2008 | 0.9381 |

| 2007 | 0.9309 |

| 2006 | 0.8818 |

| 2005 | 0.8254 |

| 2004 | 0.7682 |

| Financial Year | Average Exchange Rate |

| 2013 | 0.9699 |

| 2012 | 0.998917 |

| 2011 | 0.988667 |

| 2010 | 1.0295 |

| 2009 | 1.14075 |

Financial Month | Exchange Rate | |

| High | Low | |

| February 2009 | 0.8203 | 0.7868 |

| January 2009 | 0.8459 | 0.7844 |

| December 2008 | 0.8360 | 0.7710 |

| November 2008 | 0.8694 | 0.7782 |

| October 2008 | 0.9428 | 0.7727 |

| September 2008 | 0.9673 | 0.9262 |

Financial Month | Exchange Rate | |

| High | Low | |

| February 2014 | 0.9130 | 0.8977 |

| January 2014 | 0.9422 | 0.8952 |

| December 2013 | 0.9454 | 0.9348 |

| November 2013 | 0.9602 | 0.9435 |

| October 2013 | 0.9724 | 0.9564 |

| September 2013 | 0.9768 | 0.9494 |

On March 24, 2009,2014, the ending exchange rate for the conversion of one U.S. dollar into one Canadian dollar was 0.81056 U.S.1.1195.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

RISK FACTORS

WeInvesting in common stock of Quaterra Resources Inc. (the “Company” or Quaterra”) involves a high degree of risk. Before deciding to purchase, hold or sell the Company’s common stock, you should carefully consider the risks described below in addition to the cautionary statements and risks described elsewhere and the other information contained in this 20-F and in the Company’s other filings with securities regulatory authorities. The risks and uncertainties described below are not the Company’s only ones. Additional risks and uncertainties not presently known to Quaterra or that Quaterra currently deems immaterial may also impair the Company’s business operations. If any of these known or unknown risks or uncertainties actually occurs with material adverse effects on Quaterra, the Company’s business, financial condition, results of operations and/or liquidity could be seriously harmed, which could cause the Company’s actual results to vary materially from recent results or from the Company’s anticipated future results. In addition, the trading price of the Company’s common stock could decline due to any of these known or unknown risks or uncertainties, and you could lose all or part of your investment.

The Company may not have sufficient funds to complete further exploration programs.

We have limited financial resources (working capital deficiency of $504,419 at December 31, 2008), doThe Company does not generate operating revenue and must finance our exploration activity by other means, including financingsuch as raising funds through the sale of equity, debt, or debt financing. Weproperty interests. The Company cannot provide any assurance that additional funding will be available for further exploration of ourthe Company’s projects or to fulfill our anticipated obligations under our existing property agreements. As reflected in Note 1of December 31, 2013, the Company had working capital deficiency of $193,943 which includes a US$600,000 loan owed to ourMr. Thomas Patton, Chairman of the board, and, as of March 24, 2014, the Company has cash on hand of approximately $700,000.

Although management is confident that it will be able to raise sufficient funds there is no assurance at the date these consolidated financial statements ourwere approved that these financing initiatives will be successful. The lack of sufficient committed funding for the next 12 months indicates a material uncertainty, which casts substantial doubt over the Company’s ability to continue as a going concernconcern. These consolidated financial statements do not include the adjustments that would result if the Company is dependentunable to continue as a going concern.

- 8 -

Management has planned levels of exploration spending on our abilitythe Company’s properties with an expectation that future capital raises would provide the necessary funding, which includes equity financing, joint venture partners’ contributions, and/or realizing the carrying amount through the sale of mineral property interests.

Future equity transactions could cause dilution of present and prospective shareholders.

Historically, the Company has financed operations through private placements. In order to obtain financing. If we failfinance future operations and development efforts, the Company may raise funds through the issuance of common shares or the securities convertible into common shares through private placements or public offerings. The common shares in these financings often are sold at a discount to obtain additional financing, wemarket prices, and the exercise price of the warrants sometimes is at or may be lower than market prices. The Company cannot predict the size of future issues of common shares or the issue of securities convertible into common shares or the effect, if any, that issues and sales of the Company’s common shares will have on the market price of its common shares. Any transaction involving the issue of common shares, or securities or convertible into common shares, could result in dilution, possibly substantial, to delaypresent and prospective holders of common shares, either at the time of the financing or cancel further explorationsubsequently when restrictions if any expire and the common shares are resold into the public markets. Similarly, the Company cannot predict the value of our properties, and we could lose allany asset sale nor its effect on the market price of our interest in our properties.its common shares.

We haveThe Company has a history of losses and expectexpects to incur losses for the foreseeable future.

We haveThe Company has incurred losses during each of the prior three periodsfive years in the amounts of $6,834,181, for the year ended December 31, 2008, $7,303,304 for the year ended December 31, 2007, and $3,830,534 for the year ended December 31, 2006.$55,194,093. As of December 31, 2008, we2013, the Company had an accumulated deficit of $28,627,483. We expect$91,799,520. Quaterra expects to continue to incur losses unless and until such time as one or more of ourthe properties enter into commercial production and generate sufficient revenues to fund ourthe Company’s continuing operations.

OurThe Company’s exploration programs may not result in a commercial mining operation.

Mineral exploration involves significant risk because few properties that are explored contain bodies of ore that would be commercially economic to develop into producing mines. OurQuaterra’s mineral properties are without a known body of commercial ore and ourthe proposed programs are an exploratory search for ore. WeThe Company cannot provide any assurance that our current exploration programs will result in any commercial mining operation. If the exploration programs do not result in the discovery of commercial ore, wethe Company will be required to acquire additional properties and write-off all of our investments in our existing properties.

- 2 -

We doThe Company does not have Proven Mineral Reserves or Probable Mineral Reserves.

We haveThe Company has not established the presence of any Proven Mineral Reserves or Probable Mineral Reserves (as such terms are defined in National InstrumentNI 43-101 of the Canadian Securities Administrators); please refer to “Disclosure of Mineral Resources” in the Preliminary Notes to this annual report) at any of ourQuaterra’s mineral properties. WeThe Company cannot provide any assurance that future feasibility studies will establish Proven Mineral Reserves or Probable Mineral Reserves at ourQuaterra’s properties. The failure to establish Proven Mineral Reserves or Probable Mineral Reserves could restrict ourthe Company’s ability to successfully implement ourits strategies for long-term growth.

OurMineral resource estimates are subject to updates which may differ from prior estimates and adversely affect the value of the Company’s properties.

The estimating of mineralization is a subjective process and the accuracy of estimates is a function of the quantity and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any mineralization estimate, and the actual deposits encountered and the economic viability of mining a deposit may differ significantly from our estimates. From time to time, Quaterra obtains updated resource estimates and technical reports related to the Company’s mineral properties.

The Company’s future business and financial condition are dependent upon resource prices.

Resource prices have fluctuated widely, particularly in recent years, and are affected by numerous factors beyond ourthe Company’s control. These include international economic and political trends, inflation, currency exchange fluctuations, interest rates, global or regional consumption patterns, speculative activities and increased production due to new and improved extraction and production methods. These factors may negatively affect the marketability of any ore or minerals discovered at, and extracted from, ourQuaterra’s properties. If, because of a sustained decline in prices, financing were not available to meet cash operating costs, the feasibility of continuing operations would be evaluated and if warranted, would be discontinued.

Our- 9 -

The Company’s common share price has been and may continue to be subject to volatility.

U.S. and Canadian securities markets since 2008in recent years have experienced high levels of price and volume volatility, and the market price of securities of many companies have experience wide fluctuation in price which have not necessarily been related to the operating performance underlying assets values or prospects of such companies. Factors unrelated to ourQuaterra’s financial performance or prospects include macroeconomic developments in North America and globally, and market perceptions of the attractiveness of particular industries. OurThe Company’s share price, financial condition, and results of operations are all also likely to be significantly affected by short-term changes in uranium, gold, silver and copper prices. Continual fluctuations in metal prices may occur. As a result of any of these factors, the market price of ourthe Company’s shares at any given point in time may be subject to wide swings unrelated to any direct action by ourQuaterra’s operations.

Some of ourthe Company’s directors and officers may have conflicts of interest due to their involvement with other natural resource companies.

Some ourthe Company’s directors and officers are directors or officers of other natural resource or mining-related companies and these associations may give rise to conflicts of interest from time to time. As a result of these conflicts of interest, weQuaterra may miss the opportunity to participate in certain transactions, which may have a material, adverse effect on ourthe Company’s financial position.

WeThe Company may experience difficulty attracting and retaining qualified management to grow ourQuaterra’s business.

We areThe Company is dependent on the services of key executives including ourthe Chief Executive Officer and other highly skilled and experienced executives and personnel focused on advancing our corporate objectives as well as the identification of new opportunities for growth and funding. Due to ourthe Company’s relatively small size, the loss of these persons or ourthe Quaterra’s inability to attract and retain additional highly skilled employees required for our activities may have a material adverse effect on ourthe Company’s business and financial condition.

WeThe Company may be limited in ourits ability to manage growth.

Should wethe Company be successful in ourits efforts to develop mineral properties or to raise capital for such development or for the development of other mining ventures, weit may experience significant growth in operations. Any expansion of ourthe Company’s business would place demands on our management, operational capacity, and financial resources. We anticipateThe Company anticipates that weit will need to recruit qualified personnel in all areas of operations. There can be no assurance that weQuaterra will be effective in retaining our current personnel or attracting and retaining additional qualified personnel, expanding our operational capacity or otherwise managing growth. The failure to manage growth effectively could have a material adverse effect on the ourCompany’s business, financial condition and results of operations.

- 3 -

Environmental and other regulatory requirements may limit ourthe Company’s operations and increase our expenses.

OurThe Company’s operations are subject to environmental regulations promulgated by various Canadian, U.S., and Mexican government agencies. Claims and current and future operations will be governed by laws and regulations governing mineral concession acquisition, prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. Companies such as ours that engage in exploration activities often experience increased costs and delays in production and other schedules as a result of the need to comply with applicable laws, regulations and permits. Issuance of permits for ourQuaterra’s exploration activities is subject to the discretion of government authorities, and wethe Company may be unable to obtain or maintain such permits. Permits required for future exploration or development may not be obtainable on reasonable terms or on a timely basis. Existing and possible future laws, regulations and permits governing operations and activities of exploration companies, or more stringent implementation thereof, could have a material adverse impact us and cause increases in capital expenditures or require abandonment or delays in exploration.

Operating hazards associated with mining may expose usthe Company to liability.

Mining operations generally involve a high degree of risk, including hazards such as unusual or unexpected geological formations. Operations in which we havethe Company has an interest are subject to all the hazards and risks normally incidental to exploration, development and production of minerals, any of which could result in work stoppages, damage to or destruction of mines and other producing facilities, damage to or loss of life and property, environmental damage and possible legal

- 10 -

liability for any or all damage or loss. WeThe Company currently dodoes not maintain standard insurance policies on ourQuaterra’s properties. WeThe Company may become subject to liability for cave-ins and other hazards for which we cannot be fully insureinsured or against which wethe Company may elect not to insure where premium costs are disproportionate to ourthe Company’s perception of the relevant risks. For example, we arethe Company is not currently covered by any form of political risk insurance or any form of environmental liability insurance. The payment of such insurance premiums and the incurring of such liabilities would reduce the funds available for exploration activities.

OurThe Company’s properties may be subject to uncertain title.

The acquisition of title to resource properties or interest therein is a very detailed and time consuming process. Title to and the area of resource concessions may be disputed. We haveThe Company has investigated title to all of ourits mineral properties and, to the best of ourthe Company’s knowledge, title to all of ourQuaterra’s properties are in good standing. The properties may be subject to prior, and in some cases, not fully ascertainable unregistered agreements or transfers, and title may be affected by undetected defects. Title may be based upon interpretation of a country’s laws, which laws may be ambiguous, inconsistently applied and subject to reinterpretation or change.

Enforcement of judgments or bringing actions outside the United States against usthe Company and ourits directors and officers may be difficult.

We areQuaterra is organized under the lawlaws of and headquartered in British Columbia, Canada, and the majority of ourthe Company’s directors and officers are not citizens or residents of the U.S. In addition, a substantial part of ourthe Company’s assets are located outside the U.S. and Canada. As a result, it may be difficult or impossible for you to (a) enforce in courts outside the U.S. judgments against usthe Company and a majority of ourQuaterra’s directors and officers, obtained in U.S. courts based upon the civil liability provisions of U.S. federal securities laws or (b) bring in courts outside the U.S. an original action against usthe Company and ourits directors and officers to enforce liabilities based upon such U.S. securities laws.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

Our legalQuaterra was incorporated under the Company Act (British Columbia) on May 11, 1993 originally under the name Acquaterre Mineral Development Ltd. On November 30, 1993, the Company changed its name to Aquaterre Mineral Development Ltd. and commercial name isultimately became Quaterra Resources Inc. We operate as a corporation pursuant toon October 23, 1997. Quaterra’s domicile is British Columbia, Canada and the laws of the Province of British ColumbiaCompany operates under the British Columbia Business Corporations Act. We originally were incorporated on May 11, 1993 underAct SBC 2002 Chapter 57.

On March 4, 1997, the name Aquaterre Mineral Development Ltd. Company increased its authorized capital from 20,000,000 common shares without par value to 100,000,000 common shares without par value.

On October 23, 1997, we changed our name to Quaterra Resources Inc.the Company consolidated its issued and consolidated ourun-issued share capital on the basis of five pre-consolidation shares for one post-consolidation share, and increased its authorized capital to 100,000,000 common shares without par value.

On August 3, 1998, the Company cancelled its previous form of Articles and adopted a new form of Articles.

On April 25, 2005, the Company completed the transition procedures in accordance with the Business Corporations Act (British Columbia), (the “New Act”).

On June 17, 2005, the Company increased the number of common shares which were authorized to issue to an unlimited number of common shares and, on June 13, 2005, cancelled its former Articles and adopted new Articles to take advantage of provisions of the New Act. The New Act was adopted in British Columbia on March 29, 2004 replacing the Company Act (the “Former Act”). The New Act requires the provisions formerly required in the Memorandum to be in the Company’s Articles. The New Act eliminates the requirement for a five-for-one split.Memorandum.

Our principal place of businessThe Company’s registered office is located at 1710 – 1177 West Hastings Street, Vancouver, B.C. V6E 2L3. Telephone (604) 641-2764. The Company’s head office is located at 1100 – 1199 West Hastings Street, Vancouver, British Columbia, Canada V6E 3T5 and3T5. Telephone: (604) 684-9384, Facsimile: (604) 641-2740. The Company’s website is www.quaterra.com.We are not including the information contained on our telephone number is (604) 681-9059. Our registered agent in the Provincewebsite as part of, British Columbia is Jeffrey T.K. Fraser Law Corp., Suite 950, 1199 West Hastings Street, Vancouver, British Columbia, Canada, V6E 3T5. Our agent for service of process in the United States is CT Corporation System 520 Pike Street, Suite 985, Seattle, WA 98101.or incorporating it by reference into, this Annual Report on Form 20-F.

- 411 -

Since our incorporation, substantially all our capital has been deployed to development of our exploration stage business. We have not undertaken any material mergers or acquisitions other than in the ordinary course of business. There have been no public takeover offers by third parties with respect to our shares and we have made no public takeover offers with respect to another company’s shares.

B. Business Overview

We areOn January 1, 2011, the Company entered into an exploration stage company focusedoption agreement with North Exploration LLC to acquire 41 mining claims in White Pine County, Nevada, known as Butte Valley property. The Company can earn a 100% interest in the claims by making staged payments totaling US$1 million. The Company has an option at any time to purchase the property for the difference between US$1 million and the sum of amounts previously paid or if the full amounts have been paid under the above the sum of US$1. The property is subject to 2.5% NSR upon commencement of commercial production of which 1% can be bought down for US$1 million.

On February 7, 2011 Quaterra completed a private placement of 3,293,407 units for gross proceeds of US$6.0M (C$5,994,000) received from Goldcorp pursuant to the IFA. Each unit consisted of one common share and one-half of one share purchase warrant with an exercise price of $2.27 per full warrant expiring February 7, 2013.

On April 27, 2011, Quaterra completed the purchase of the Yerington property from Arimetco, Inc. Assets purchased include 4.2 square miles of patented claims and fee mineral properties centered on explorationthe former Anaconda open pit copper mine containing an historic resource estimate in excess of four billion pounds of copper, and development8,600 acre feet per year of water rights. This property, together with 9.3 and 13.2 square miles of unpatented claims at Yerington and nearby MacArthur respectively, provides the Company with a significant land position in the center of a copper camp. Quaterra has paid the remaining cash acquisition cost and has released 250,000 common shares of the Company stock previously issued and under escrow.

On May 12, 2011, pursuant to its January 1, 2011 option, Quaterra announced its acquisition of the Butte Valley porphyry copper prospect, located in White Pine County, Nevada. The property consists of approximately 45 square miles of mineral propertiesrights obtained by optioning and staking a total of 1,483 unpatented U.S. lode claims.

On May 26, 2011, the Company entered into a mining lease with an option to purchase agreement with Majuba Mining Ltd. to earn an interest in North America. We currently are exploringcertain unpatented mining claims in Lyon County, Nevada, for copper, uranium, molybdenum,US$1.61 million. The Company is required to incur a total of US$300,000 exploration work on or before the third anniversary and precious metalsany difference between the actual expenditures and US$300,000 is required to be paid in the United States and Mexico. Our exploration efforts are directedevent that less than US$300,000 is so expended. The project is subject to 3% NSR upon commencing commercial production of which 1% can be bought at propertiesUS$1,500,000.

On June 15, 2011, the Company entered into an option agreement with potential to host large base metal, precious metal, and uranium deposits. When identifying prospects, we consider the following criteria: infrastructure; environment and location that is favorable for building a mine; large tonnage and/or high grade potential; significant, unrealized upside; and opportunityNevada Alaska Mining Co., Inc. to acquire a 100% interest under reasonable terms.in certain mining claims in Esmeralda County, Nevada for US$1 million over ten years. A 2% NSR is required upon commercial production.

We made several acquisitions during the year. On July 22, 2008, we acquired4, 2011, Quaterra announced that it has finalized an option agreement with La Cuesta International, Inc. (LCI) to acquire a 100% interest in the Cave Peak molybdenumMicroondas prospect fromlocated in Zacatecas State, Mexico, about 17 kilometers south-southeast of Rio Grande. Quaterra has the right to earn a 100% interest in the property by making semi-annual lease/pre-production payments and paying a 1% Net Smelter Return royalty (“NSR”) payment that is capped at US$5 million. A portion of the property carries an uncapped 2% NSR royalty. Quaterra, at its option, may issue to LCI 20,000 common shares or its cash equivalent on or before June 12, 2012.

On August 1, 2011, the Company entered into an option agreement with a private owner to acquire a 100% interest in certain mining claims situated in Lyon County, Nevada for US$500,000. The Company has an option at any time to purchase the property for the difference between US$500,000 and the sum of the amount previously paid.

On October 20, 2011, Quaterra added two properties to the Goldcorp IFA: El Calvo gold, located in the central Mexican state of San Luis Potosi, and Microondas gold-silver, located in Zacatecas State, of Texas. The prospect covers three breccia pipes, one of which contains significant molybdenum mineralization. Mexico.

On September 30, 2008 we completedOctober 26, 2011, as contemplated by their June 17, 2010 agreement, Quaterra entered into a joint venture agreement with EXMINGrande Portage Resources Ltd. for the Herbert Glacier gold project located near Juneau, Alaska. Grande Portage has acquired a 65% interest and the Company retains a 35% interest in this project. Each party has agreed to bear its proportionate share of costs for the further exploration and development of the project.

On March 21, 2012, Quaterra entered into an Amended and Restated Investment Framework Agreement (“ARIFA”) with Goldcorp Inc. (“Goldcorp”) of Vancouver, B.C. This agreement extends the IFA entered into with Goldcorp on EXMIN’s East Durango concession. We haveJanuary 29, 2010 through the first quarter of 2013.

- 12 -

On April 12, 2012 received $2.48 million from Goldcorp to fund additional exploration on certain properties in Mexico by issuing 4 million shares at the price of $0.62 per share.

On October 2, 2012, the Company sold its Butte Valley copper project to Freeport-McMoRan Exploration Corporation of Phoenix, Arizona for gross proceeds of US$2 million.

On December 28, 2012, Quaterra completed a private placement of 6,541,571 units at the price of US$0.35 per unit for gross proceeds of US$2,289,550. Each unit consisted of one common share and one share purchase warrant with an exercise price of US$0.53 per warrant expiring December 28, 2014.

On March 20, 2013, the Company entered into an exclusive exploration agreement with Desert Pearl Farms, LLC for an option to purchase the surface rights, mineral rights and surface water rights to the Hunewill Ranch property in Lyon County, Nevada. To earn the exclusive right to conduct mineral exploration on the property, the Company is required to make annual payment of US$1,480,000 over a period of 8 years. The Company has the option to purchase the property at any time during the 8-yr period (Option Period).

On March 28, June 5 and July 4, 2013, the Company borrowed a total of US$800,000 unsecured loans at an interest rate of 10% per annum from its Chairman of the board, Mr. Thomas Patton. As of December 31, 2013, US$200,000 was repaid and the balance of US$600,000 was amended on March 18, 2014 to a demand basis with a 40-day notice period.

On June 10, 2013, Quaterra and Goldcorp entered into an amendment agreement with respect to the Investment Framework Agreement (IFA) dated January 29, 2010. This amendment agreement extended the expiration for designation of Advanced Properties to January 2016 from January 2014 and also modified certain earn-in requirements after a property has been selected as an Advanced Property: 1) Lowered spending requirement to earn a 75% interest in EXMIN’s East Durango property. The East Durango property consists2% NSR royalty to $1 million over first three years (from $2 million over two years); 2) Lowered the minimum annual expenditure requirement after three years to $250,000 thousand from $1 million; 3) allowed Goldcorp to pool expenditures from other projects to one project to meet the earn-in requirement described above.

On July 29, 2013, the Company received an acquisition bonus of US$1,000,000 ($1,038,000) from Freeport-McMoRan related to the sale of the 11,181 hectare Tecolote concession which abutsButte Valley property in October 2012.

Effective July 31, 2013, the Company implemented changes to management and is directly northcomposition of Quaterra’s Mirasol-Americas projects. the Board of Directors

On September 13, 2013, Quaterra completed a private placement of 29,810,000 units at the price of US$0.10 per unit for gross proceeds of US$2,981,000. Each unit consisted of one common share and one share purchase warrant with an exercise price of US$0.15 per warrant expiring September 13, 2016.

On September 19, 2013, Quaterra sold three properties (Sabino, Marijo, and El Calvo) in central Mexico to Goldcorp. for a total cash consideration of US$375,000. Quaterra retained a 2% net smelter returns royalty (“NSR”) on each of the three properties capped at USD$2,000,000 per property.

On November 24, 2008 we secured12, 2013, the Company entered into an exclusive exploration and option agreement with Yerington Mining LLC for a property known as Yerington Mining property located in Lyon County, Nevada. To earn the Willow Creek Discovery Group, LLCrights to acquire 100%conduct mineral exploration on the property, the Company is required to make an annual payment of US$200,000 (2013 payment made) in the Willow Creek porphyry molybdenum prospectfirst two years and then US$100,000 on each anniversary date until November 12, 2021. These payments also provide the Company the exclusive right to purchase the property during this 8 year period (the option period).

On November 19, 2013, the Company entered into an amendment agreement with La Cuesta International, Inc. with respect to the Santo Domingo property, pursuant to which the Company issued 347,150 common shares in southwestern Montana. Willow Creek is a North American assetsatisfaction of two property payments.

On November 19, 2013, the Company entered into an amendment agreement with La Cuesta International, Inc. with respect to the Microondas property, pursuant to which the Company issued 321,430 common shares in a major mineral belt where we have the opportunity to earn a 100% interest and make a significant near-term discovery in an area with excellent infrastructuresatisfaction of two property payments.

For more information about our business, please refer to Item 4.D “Property, Plants and Equipment” below.

- 13 -

C. Organizational Structure

- 5 -Inter-corporate Relationships

| Note | Quaterra Alaska, Inc. is 100% owned by Quaterra Resources Inc. and holds | |

| Note | Quaterra International Limited is 100% owned by Quaterra Resources Inc. and QTA International Nieves Limited is 100% owned by Quaterra International Limited. | |

| Note 3: | Minera Agua Tierra S.A. de C.V. is 100% owned by | |

| Note | Minera Stockwork de Plata, S.A. de C.V. is 100% owned by QTA International Nieves Limited and holds the following claims: Reduccion Crestones, Las Americas, Americas, Mirasol, Cerro Blanco, Jaboncillo, Carolina, Falcon, Los Azafranes, Sara, Onix, Marijo, Coyote 4, Tajo, Crestones and Inde. | |

| Note 5: | Quaterra Blackberry Nieves (BVI) JV Corp. is |

- 14 -

Note 6: | Minera Cerro Gregorio, SA de CV is 100% owned by Quaterra Blackberry Nieves (BVI) JV Corp. and holds |

D. Property, Plants and Equipment

GENERAL DEVELOPMENT OF THE BUSINESS

MacArthur, Nevada, USA

Acquisition and Staking of Mineral Claims

The MacArthur property consists of 897 unpatented lode claims totaling approximately 18,533 acres on lands administered by the US Bureau of Land Management (“BLM”). The total reflects the addition of 345 claims transferred from Quaterra’s wholly owned subsidiary, Singatse Peak Services LLC (SPS) to Quaterra’s MacArthur project in July 2012. A significant number of the claims are held by means of a mineral lease with option to purchase, executed on August 27, 2005 and subsequently amended. The agreement gives Quaterra the right to purchase the claims from North Exploration LLC (“North”) by making 3 annual payments of $524,000 (option balance) plus interest at the rate of 6% per annum by January 15, 2013. The second of these three annual payments was paid January 11, 2012. The third payment was renegotiated on December 14, 2012 to defray the final option balance by making a $100,000 payment plus $31,440 in interest prior to January 15, 2013 to extend the lease and option to January 15, 2014. The final payment was subsequently spilt and delayed to July 1, 2014 for US$212,000 with the payment of $36,940 interest to be paid on March 31, 2014 and the reaming US$212,000 plus interest by January 15, 2015. Quaterra’s purchase is subject to a two percent Net Smelter Return (NSR) royalty with a royalty buy down option of $1,000,000 to purchase one percent of the NSR, leaving a perpetual one percent NSR. The agreement with North is in good standing.

Expenditures to Date

Acquisition costs incurred by the Company to December 31, 2013 were $3,363,308 (2012 - $3,077,838) and exploration expenditures were $19,501,476 (2012 - $18,783,675) for a total of $22,864,784 (2012 - $21,861,513).

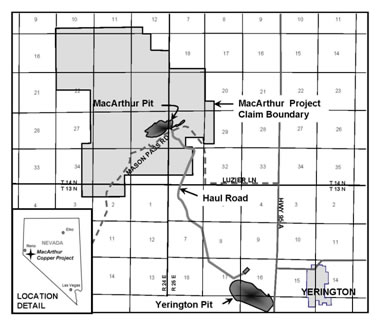

Location, Access and Infrastructure

The MacArthur Copper Project is located near the geographic center of Lyon County, Nevada, USA along the northeastern flank of the Singatse Range approximately seven miles northwest of the town of Yerington, Nevada. The project is accessible from Yerington by approximately five miles of paved roads and two miles of maintained gravel road. A 100-foot wide gravel haul road that accessed the MacArthur open pit copper mine during the 1990s leads 5 miles south to the Yerington Mine. Beyond the MacArthur pit area are several existing historic two-track dirt roads that provide access throughout the property. Topographic coverage is on US Geological Survey “Mason Butte” and “Lincoln Flat” 7.5’ topographic quadrangles. The nearest major city is Reno, Nevada approximately 75 miles to the northwest.

History

The MacArthur project has been the subject of exploration and drilling by several operators who have contributed to the current database of more than 740 holes totaling approximately 282,000 feet. During the late 1940s, Consolidated Copper Mines attracted the interest of the US Bureau of Mines to conduct 7,680 feet of trenching in 1948 and followed up with the completion eight core holes for 3,414 feet in 1950. The Anaconda Company (“Anaconda”) began investigations at MacArthur including 33 shallow drill holes during 1955, 1956, and 1957. In 1963, Bear Creek Mining Company (“Bear Creek”) optioned claims and drilled at least fourteen air rotary holes, the deepest to 663 feet. At least four holes for 1,237 feet were drilled to satisfy claim staking location work. During 1967 to 1968, The Superior Oil Company optioned the claims formerly held by Bear Creek and drilled eleven holes as rotary pre-collar, core finish, for 13,116 feet testing the concept that a deep primary sulfide-bearing porphyry copper ore shell might underlie the MacArthur oxide mineralization heretofore tested no deeper than 663 feet. During the early 1970s, Anaconda conducted an extensive trenching and rotary drilling program consisting of more than 280 rotary holes totaling approximately 56,000 feet over and adjacent to the present day MacArthur pit.

Metech Pty. Ltd., of Perth, Australia was commissioned to prepare an ore reserve and mining planning study of the MacArthur deposit in 1989 The Metech study initiated the purchase of the Anaconda Yerington district properties by Arimetco International (“Arimetco”). Arimetco mined a total of six million tons at an estimated grade of 0.36 % total copper using open pit methods from the MacArthur deposit in the period of 1995 to 1998. Due to financial difficulties resulting

- 15 -

primarily from the low price of copper, Arimetco sought protection under Chapter 11 of the U. S. bankruptcy Code in January 1997 and suspended all operations in 2000. After Arimetco’s departure, the mining claims over the deposit were allowed to expire. No consistent, large-scale mining has occurred on the site.

Quaterra acquired the MacArthur property in August, 2005. The acquisition was motivated by Quaterra’s belief in the potential of the property to host a copper deposit capable of sustaining a large run-of-mine heap leach operation using a solution extraction/electrowinning (SXEW) process for low cost production. The Company initiated exploration drilling in April 2007 and by November 2011, completed a total of 203,775 feet of drilling in 402 holes on the property. The drilling program has defined a widespread blanket of acid soluble copper oxide and chalcocite mineralization above primary copper mineralization that is believed to be the fringes of a major copper porphyry system.

Geology

The MacArthur copper deposit forms part of the Yerington mining district which includes at least three, large, porphyry copper deposits (Yerington, Ann Mason, Bear), as well as two large IOCG deposits (Pumpkin Hollow, and Minnesota). Mineralization ranges from disseminated porphyry copper occurrences to skarn, limestone replacement, and vein type deposits.

The Yerington area is underlain by early Mesozoic volcanic and sedimentary rocks now exposed along uplands in the Singatse Range in the west and the Wassuk Range to the east. These Mesozoic rocks were intruded by two Middle Jurassic batholiths, an older granodiorite (Yerington Batholith) and younger quartz monzonite (Bear Quartz Monzonite) that comprise the majority of outcropping rocks in the district. The batholiths were themselves intruded by another Middle Jurassic quartz monzonite event moderately to steeply north dipping quartz-biotite-hornblende porphyry dike swarms, associated with copper mineralization, striking north-northwesterly across the entire mining district. The Mesozoic section is overlain by Early to Middle Tertiary volcanics deposited ash flow tuffs prior to the advent of normal, faulting associated with Late Tertiary basin-and-range extension that displaced and tilted all of the above-mentioned rocks. These faults dip east and are curved, concave upward, so that the dip of the fault flattens eastward. Net displacements are in an east-west direction. The geologic section is completed by post-faulting conglomerates and alluvium.

At MacArthur, the older granodiorite underlies most of the northern and western parts of the Company’s claim block. Along the east part of the claim block quartz monzonite is dominant and underlies the MacArthur pit. In bench walls at the MacArthur Pit, the quartz monzonite hosts conspicuous light brown limonite alteration banding (averaging 4 to 6 per foot) sub-parallel to the steeply north dipping, west-northwest trending quartz porphyry dikes. Along the eastern portions of the property, including the eastern third of the MacArthur pit, quartz monzonite assumes a light gray color due to widespread sodic-calcic alteration. A “border-phase quartz monzonite” commonly lies at the contact between the granodiorite and the quartz monzonite. The border-phase quartz monzonite is finer-grained than the quartz monzonite and has more abundant potassium feldspar.

Quartz porphyry dikes that host a large portion of the primary copper mineralization at Anaconda’s Yerington mine are associated with all copper occurrences in the district. The porphyry dikes at MacArthur are classified by dominate mafic minerals into quartz biotite porphyry and quartz hornblende porphyry, each subdivided further based on composition and alteration. Dikes contain feldspar crystals and either hornblende or biotite crystals set in an aphanitic matrix. The structures are typically ridge-formers with widths to 50 feet, dip steeply to the north, and follow a penetrative north-northwest (S60°E to S80°E) structural fabric. Narrow (<10 feet) fine grained, post porphyry andesite dikes follow the same NNW structural fabric.

Both Jurassic and Tertiary age andesite dikes in the walls of the MacArthur Pit can be traced from bench to bench and projected across the pit floors. The Jurassic dikes are commonly very fine grained, dactylitic plagioclase-bearing porphyries that pinch and swell as they fill fractures and intrude the hornblende and biotite quartz porphyry dikes. Tertiary hornblende andesite dikes are similar, but coarser grained than the Jurassic andesite dikes, containing abundant, acicular, black hornblende phenocrysts and occasionally plagioclase phenocrysts. Mid-Tertiary ash flow tuff units unconformably overlay the Mesozoic intrusive rocks in the southeast and western margins of the property.

Mineralization

The MacArthur deposit is part of a large, partially defined porphyry copper system that has been complicated by complex faulting and possible post-mineral tilting. Events leading to the current geometry and distribution of known mineralization include 1) emplacement of primary porphyry copper mineralization; 2) supergene enrichment resulting in the formation of a widespread, tabular zone of secondary chalcocite mineralization below outcrops of totally oxidized rocks called a leached

- 16 -

cap; 3) oxidation of outcropping and near-surface parts of this chalcocite blanket, as well as oxidation of the primary porphyry sulfide system coupled with partial remobilization of copper to form the upper zone of oxide copper now exposed in the MacArthur pit and throughout the MacArthur property. Oxide, chalcocite, and primary copper mineralization on the MacArthur property is hosted in both granodiorite and quartz monzonite, and in lesser amounts within quartz biotite-hornblende (monzonite) porphyry dikes, all of middle Jurassic age. Oxide copper is also hosted in northwest striking andesite dikes less than one to ten feet wide with contacts forming favorable loci for mineralization. Andesite dikes make up less than approximately one to two percent of the host rocks on the property. Fracturing and ground preparation supplied the passage ways for the copper to migrate.

Copper oxide minerals are exposed throughout Quaterra’s MacArthur property, particularly in MacArthur pit walls as primarily green and greenish-blue chrysocolla CuSiO3.2H20 along with black neotocite, aka copper wad (Cu, Fe, Mn) SiO2, azurite Cu3(OH2)(CO3) and malachite Cu2(OH2)CO3, while tenorite (CuO) was identified with the electron microprobe (Schmidt, 1996). Copper-enriched limonite was identified by Anaconda as the mineral delafossite (CuFeO2). Chalcocite has been identified in drill holes below the MacArthur pit and in drilling throughout the property. The sulfides digenite (Cu9S5) and covellite (CuS) have been identified petrographically in drill cuttings from the western part of the property. The oxide copper mineralization is strongly fracture controlled, coating joint and fracture surfaces and within shears and faults. Both green and black copper oxides are frequently found on 1-5 millimeter fractures, as coatings and selvages and may be mixed with limonite. The fractures trend overall N60°W to N80°W (bearing 300° to 280° azimuth) and generally dip to the north. Limited turquoise is found on the property, mainly in one- to five-millimeter veinlets. On a minor scale, oxide copper mineralization replaces feldspar phenocrysts in the igneous host units, favoring andesite.

A significant amount of chalcocite has been intersected in drillholes. Chalcocite is seen on drill chips or drill core coating pyrite and chalcopyrite as weak to strong coatings and is strongest when occurring around the MacArthur fault. Chalcopyrite is present as disseminations and veinlets, with or without chalcocite. As much of the historic drilling was stopped at shallow (<400 foot) depths, the scope and extent of chalcopyrite mineralization have not been fully defined.

Both copper oxide and chalcocite mineralization occur over approximately 9,000 feet east-west by 4,500 feet north-south. Copper oxides are structurally controlled coating fractures, joint surfaces, and developed as green or black “streaks” within shears and faults over several feet. Chalcocite may similarly be seen as grayish “streaks” within shears. Oxide mineralization exhibits a generally flat-lying geometry extending with good continuity 150 feet below surface and less continuously up to 600 feet below surface. Chalcocite mineralization generally occurs as flat-lying zones 50 feet or more in thickness, mixed with or below oxide mineralization.

Primary chalcopyrite mineralization occurs irregularly with chalcocite and as porphyry style disseminations or as veinlets in quartz monzonite associated with potassic alteration below both the oxide and chalcocite mineralization. Quaterra’s drilling program in the Gallagher area has delineated a zone of chalcopyrite mineralization that extends over a north-south distance of 2,500 feet. The primary sulfide zone has a defined width of 500 feet and extends to a depth of approximately 650 feet.

Porphyry copper style sulfide mineralization below the low-angle MacArthur fault zone at the North Porphyry Target has been defined over a distance of 2,500 feet between holes QM-68 and QM-164. Veinlet and disseminated primary chalcopyrite mineralization intercepted at a depth of 485 feet in QM-68 assayed 1.19% copper over a thickness of 110 feet. The same zone in QM-70 averaged 0.82% copper over a thickness of 60 feet at a depth of 420 feet and correlates to a thickness of 15 feet averaging 1.20% at a depth of 770 feet in hole QM-72. QM-100 intersected the sulfide mineralization with 0.58% copper over 65 feet. Approximately 1,000 feet to the north, hole QM-164 intercepted 64 feet of disseminated chalcopyrite mineralization in sodic altered granodiorite averaging 1.31% copper at a depth of 1,673 feet. The intercept includes a high grade zone of 29 feet averaging 2.21% . Mineralized zones within potassic halos in holes QM-165 to the west and in QM-163 to the east are consistent with those that could fringe a porphyry copper center.

Exploration and Drilling Results

Quaterra acquired the digitized Anaconda exploration and drilling data package in August 2006 and commenced a review of the deposit geology and mineralization model using Datamine software. The data was used to assess the required drilling and sampling to complete a technical report on the MacArthur Project with the objective of preparing a NI 43-101 compliant resource estimate.

The lateral zonation of supergene copper minerals visible at the surface, a possible chalcocite blanket to the north of the pit, and a large, pervasive phyllic alteration zone to the north and west of the mine workings, all suggested to Quaterra that the MacArthur deposit could have a potential for growth; both in the form of copper oxides and as primary sulfides in a related porphyry system.

- 17 -

In April 2007, the Company commenced a drilling program to twin approximately 10% of the shallow holes that defined the previously explored copper oxide mineralization at MacArthur and to identify extensions of copper oxide and chalcocite mineralization in the vicinity of the open pit. The 20-month drilling program totaled 80,100 feet in 173 holes including 23,900 feet of core in 49 holes and 56,200 feet of reverse circulation drilling in 124 holes. The drilling successfully targeted a deeper chalcocite zone in step-out holes from the pit, expanded the known oxide mineralization, and encountered a large, underlying tabular blanket of mixed oxide-chalcocite mineralization that overlies primary chalcopyrite mineralization verified by deeper drillholes in the western and northern margins of the drilled area.

Drilling on the MacArthur project was suspended through most of 2009 pending receipt of a Plan of Operations (POO) drilling permit. On October 28th the Company received the approval of the MacArthur POO and the BLM Record of Decision with a Finding of No Significant Impact (FONSI). The POO environmental assessment anticipates a total surface disturbance of 200 acres as a result of drilling activities throughout much of the project area.

Quaterra initiated a second phase of reverse circulation and deep core drilling in early December 2009. Completed in August 2010, the program tested the northern extension to higher grade acid soluble copper mineralization on 500 foot centers northwest of the pit in-filled on 500 ft centers an undrilled area west of the pit. In the southern Gallagher area, the program confirmed a band of continuous near surface oxide mineralization ranging in thickness from 15 to 60 feet over a distance of 1,900 feet between holes QM-155 and 156.

Three deep holes tested IPR anomalies to the north and northwest of the MacArthur pit where earlier drill holes intersected ore grade porphyry copper style sulfide mineralization below the low-angle MacArthur fault zone over a strike length of 1,000 feet. Hole QM-100, located 1,400 feet north of QM-68, intercepted porphyry-style chalcopyrite/biotite-chlorite veining at a depth 1,203 feet that assayed 0.58% copper over a thickness of 65 feet below the shallow-dipping MacArthur fault zone. QM-109, spotted on an IPR anomaly, failed to reach projected depth due to fractured, caving ground while QM-99 intersected massive pyrite impregnated breccia and scattered zones of secondary biotite and chlorite alteration; common elements of a porphyry system.

A total of 81,560 feet were drilled in 153 holes including 69,890 feet in 147 RC holes and 11,760 feet in 6 core holes during the 2011 drilling program. The program had the twin goals of enlarging and upgrading the status of the inferred resources through step-out and infill drilling and exploring for primary sulfide mineralization related to a copper porphyry system at depth.

The infill program encountered high grades of continuous chalcocite and copper oxide mineralization in zones averaging 40 feet or more in thickness along the western and northern margins of the deposit in the area referred to as the “Ridge Zone”. To test the high-angle mineralized structures that form an important component of the acid-soluble copper deposit, the program was completed on 250-foot centers in areas with higher grade potential and encountered some of the highest grades and best intercepts of acid soluble copper mineralization ever drilled on the property. Hole QM-187, drilled 2,000 feet north of the MacArthur pit, intersected 90 feet of predominantly chalcocite mineralization averaging 1.66% total copper (TCu) starting at a depth of 310 feet. This intercept includes 40 feet assaying 3.49% TCu. Hole QM-180 along the northwestern margin of the zone intercepted 40 feet averaging 1.37% TCu at a depth of 360 feet.

Exploration for a deep porphyry system at MacArthur intercepted one of the best primary copper intercepts yet identified on the project with 64 feet of disseminated chalcopyrite mineralization in sodic altered granodiorite averaging 1.31% TCu at a depth of 1,673 feet. The intercept includes a high grade zone of 29 feet averaging 2.21% TCu. QM-164 also intercepted a shallower zone of both vein and disseminated chalcopyrite at a depth of 685 feet that averages 0.34% TCu over a thickness of 96.5 feet. QM-164 extended the mineralized zone identified in QM-100 a distance of 1,000 feet to the north where it remains open for extension.

Geophysics

Quaterra Resources contracted three surveys at the MacArthur project in 2011 and 2012. A borehole geophysical survey and a surface IP/resistivity (IPR) survey were carried out by Zonge International in 2011. A detailed helicopter magnetic survey was flown by Geosolutions Pty. Ltd. in 2012. These surveys supplement previous geophysical work on the property that includes: a 2009 IPR survey carried out by Zonge; a 2007 helicopter magnetic survey carried out by EDCON-PRJ; a series of historic aeromagnetic surveys (1966 to 1975) available in analog form from the Anaconda Archives; and a series of historic IPR surveys (1963 – 1964) carried out by Kennecott Exploration Services/Bear Creek Mining Company and Superior Oil.

- 18 -