UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

[ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF1934 |

OR

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year endedDecember 31, 20152018

OR

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

OR

| [ ] | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report _________________________

Commission file number:001-35722

CHINA INFORMATION TECHNOLOGY,TAOPING INC.

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

British Virgin Islands

(Jurisdiction of Incorporation or Organization)

21st Floor, Everbright Bank Building

Zhuzilin, Futian District

Shenzhen, Guangdong 518040

People’s Republic of China

(Address of Principal Executive Offices)

Mr. Jiang HuaiJianghuai Lin, Chief Executive Officer

21st Floor, Everbright Bank Building

Zhuzilin, Futian District

Shenzhen, Guangdong 518040

People’s Republic of China

Tel: +86-755-88319888

Fax: + 86-755-83709333

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange On Which Registered | |

| Ordinary Shares, | NASDAQ |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report (December 31, 2015)2018): 39,331,36441,760,163 ordinary shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

| Large Accelerated Filer[ ] |

|

| Non-Accelerated Filer [X] | Emerging growth company [ ] |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP [X] | International Financial Reporting | Other [ ] | |

| Standards as issued by the International | |||

| Accounting Standards Board |

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

[ ] Item 17 [ ] Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

Annual Report on Form 20-F

Year Ended December 31, 2018

TABLE OF CONTENTS

| Page | |||

| PART I | 2 | ||

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 2 | |

| A. Directors and Senior Management | 2 | ||

| B. Advisors | 2 | ||

| C. Auditors | |||

| 2 | |||

| ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | 2 | ||

| 2 | |||

| 2 | |||

| ITEM 3. KEY INFORMATION | 2 | ||

| A. Selected Financial Data | 2 | ||

| B. Capitalization and Indebtedness | 3 | ||

| C. Reasons for the Offer and Use of Proceeds | 3 | ||

| D. Risk Factors | 3 | ||

| ITEM 4. | INFORMATION ON THE COMPANY | ||

| A. History and Development of the Company | |||

| B. Business Overview | |||

| C. Organizational Structure | |||

| D. Property, Plants and Equipment | |||

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | ||

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | ||

| A. Operating Results | 43 | ||

| B. Liquidity and Capital Resources | |||

i

ii

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITIES HOLDERS AND USE OFPROCEEDS | ||

| ITEM 15. | CONTROLS AND PROCEDURES | ||

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | ||

| ITEM 16B. | CODE OF ETHICS | ||

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | ||

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | ||

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | ||

| ITEM | |||

| ITEM | |||

| ITEM 17. FINANCIAL STATEMENTS | 81 | ||

| ITEM 18. FINANCIAL STATEMENTS | 81 | ||

| ITEM 19. EXHIBITS | |||

iii

| i |

INTRODUCTORY NOTES

Use of Certain Defined Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to:

| “ | |

| ● | ||

| “ | |

| ● | ||

|

| |

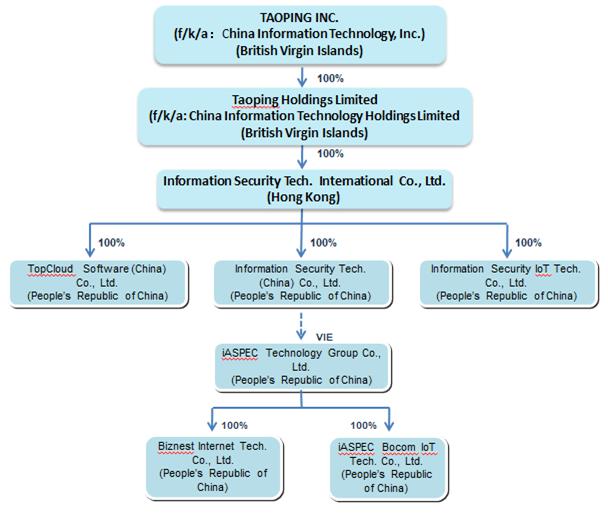

| “IST HK” are to Information Security Tech. International Co., Ltd., a Hong Kong company; | |

| ● | ||

| “ | |

| ● | ||

| “TopCloud” are to TopCloud Software Co., Ltd., a PRC company; | |

| ● | ||

| “IST” are to Information Security Technology (China) Co., Ltd., a PRC company; | |

| ● | ||

| “ISIOT” are to Information Security IoT Technology Co., Ltd., a PRC company; | |

| ● | ||

| “iASPEC” are to iASPEC | |

| ● | ||

| “Geo” are to Wuda Geoinformatics Co., Ltd., a PRC company; | |

| ● | ||

|

| |

| “Biznest” are to Biznest Internet Technology Co., Ltd., a PRC company; | |

| ● | ||

| “Bocom” are to iASPEC Bocom IoT Technology Co. Ltd., a PRC company; | |

| ● | ||

| “ | |

| ● | ||

| “BVI” are to the British Virgin Islands; | |

| ● | ||

| “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China; | |

| ● | ||

| “PRC” and “China” are to the People’s Republic of China; | |

| ● | ||

| “SEC” are to the Securities and Exchange Commission; | |

| ● | ||

| “Exchange Act” are to the Securities Exchange Act of 1934, as amended; | |

| ● | ||

| “Securities Act” are to the Securities Act of 1933, as amended; | |

| ● | ||

| “Renminbi” and “RMB” are to the legal currency of China; and | |

| ● | ||

| “U.S. dollars,” “dollars” and “$” are to the legal currency of the United States. |

Forward-Looking Information

In addition to historical information, this annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; and any statements regarding future economic conditions or performance, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements. Potential risks and uncertainties include, among other things, the possibility that third parties hold proprietary rights that preclude us from marketing our products, the emergence of additional competing technologies, changes in domestic and foreign laws, regulations and taxes, changes in economic conditions, uncertainties related to legal system and economic, political and social events in China, a general economic downturn, a downturn in the securities markets, and other risks and uncertainties which are generally set forth under Item 3 “Key information—D. Risk Factors” and elsewhere in this annual report.

1

Readers are urged to carefully review and consider the various disclosures made by us in this report and our other filings with the SEC. These reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of operations and prospects. The forward-looking statements made in this report speak only as of the date hereof and we disclaim any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes in our expectations or future events.

| 1 |

| ITEM1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

A. Directors and Senior Management

Not applicable.

Not applicable.

Not applicable.

| ITEM2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

B. Method and Expected Timetable

Not applicable.

| ITEM3. | KEY INFORMATION |

The following table presents selected financial data regarding our business. It should be read in conjunction with our consolidated financial statements and related notes contained elsewhere in this annual report and the information under Item 5 “Operating and Financial Review and Prospects.” The selected consolidated statement of income (loss) income data for the fiscal years ended December 31, 2015, 20142018, 2017, and 2013,2016, and the selected consolidated balance sheet data as of December 31, 20152018 and 20142017 have been derived from our audited consolidated financial statements that are included in this annual report beginning on page F-1. The selected consolidated statement of income (loss) income data for the fiscal years ended December 31, 20122015 and 2011,2014, and the selected consolidated balance sheet data as of December 31, 2013, 20122016, 2015 and 20112014 have been derived from our audited consolidated financial statements that are not included in this annual report.

Our consolidated financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. In 2015, we disposed of our equity interests in Geo and Zhongtian. All periods presented herein have been retroactively restated to conform with the presentation of Geo and Zhongtian as discontinued operations. The selected financial data information is only a summary and should be read in conjunction with the historical consolidated financial statements and related notes contained elsewhere herein. The financial statements contained elsewhere fully represent our financial condition and operations; however, they are not indicative of our future performance.

2

| Years Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Statement of Income Data | ||||||||||||||||||||

| Total revenue | $ | 20,578,340 | $ | 18,189,274 | $ | 10,193,590 | $ | 10,284,868 | $ | 38,634,747 | ||||||||||

| Total cost of revenue | $ | 10,924,246 | $ | 9,867,508 | $ | 7,607,190 | $ | 6,381,205 | $ | 28,146,390 | ||||||||||

| Gross profit | $ | 9,654,094 | $ | 8,321,766 | $ | 2,586,400 | $ | 3,903,663 | $ | 10,488,357 | ||||||||||

| Income (loss) from operations | $ | 168,824 | $ | (450,703 | ) | $ | (14,577,928 | ) | $ | (26,963,357 | ) | $ | (23,909,213 | ) | ||||||

| Net income (loss) attributable to TAOP-continuing operations | $ | 1,691,983 | $ | 858,605 | $ | (18,170,601 | ) | $ | (7,504,262 | ) | $ | (24,087,098 | ) | |||||||

| Net income (loss) per share-continuing operations - basic | $ | 0.04 | $ | 0.02 | $ | (0.45 | ) | $ | (0.26 | ) | $ | (0.79 | ) | |||||||

| Net income (loss) per share-continuing operations - diluted | $ | 0.04 | $ | 0.02 | $ | (0.45 | ) | $ | (0.26 | ) | $ | (0.79 | ) | |||||||

| Balance Sheet Data | ||||||||||||||||||||

| Cash and cash equivalents | $ | 1,653,260 | $ | 3,260,808 | $ | 3,752,375 | $ | 3,786,846 | $ | 6,689,848 | ||||||||||

| Working (deficiency) capital | $ | 4,865,813 | $ | (1,494,326 | ) | $ | (5,739,129 | ) | $ | (1,649,728 | ) | $ | (56,043,116 | ) | ||||||

| Total assets | $ | 41,615,814 | $ | 37,530,503 | $ | 34,286,999 | $ | 66,091,704 | $ | 179,405,809 | ||||||||||

| Total liabilities | $ | 24,011,887 | $ | 23,013,011 | $ | 21,484,751 | $ | 35,637,467 | $ | 140,827,000 | ||||||||||

| Temporary equity | $ | - | $ | - | $ | - | $ | 360,000 | $ | 1,425,000 | ||||||||||

| Total equity | $ | 17,603,927 | $ | 14,517,492 | $ | 12,802,248 | $ | 30,094,237 | $ | 37,153,809 | ||||||||||

| 2 |

Statement of Income Data Total revenue Total cost of revenue Gross profit (Loss) income from operations Net (loss) income attributable to CNIT-continuing operations Net (loss) income per share-continuing operations - basic Net (loss) income per share-continuing operations - diluted Balance Sheet Data Cash and cash equivalents Working (deficiency) capital Total assets Total liabilities Temporary equity Total equity B. Capitalization and Indebtedness Years Ended December 31, 2015 2014 2013 2012 2011 $ 10,284,868 $ 38,634,747 $ 55,419,831 $ 68,103,843 $ 99,521,202 $ 6,381,205 $ 28,146,390 $ 45,867,163 $ 54,879,870 $ 61,883,258 $ 3,903,663 $ 10,488,357 $ 9,552,668 $ 13,223,973 $ 37,637,944 $ (26,963,357 ) $ (23,909,213 ) $ (118,215,368 ) $ (85,247,288 ) $ 8,555,179 $ (9,003,233 ) $ (24,087,098 ) $ (118,511,760 ) $ (89,432,743 ) $ 6,402,501 $ (0.26 ) $ (0.79 ) $ (4.33 ) $ (3.31 ) $ 0.24 $ (0.26 ) $ (0.79 ) $ (4.33 ) $ (3.31 ) $ 0.23 $ 3,786,846 $ 6,689,848 $ 6,044,692 $ 6,836,413 $ 8,792,195 $ (1,649,728 ) $ (56,043,116 ) $ (46,779,407 ) $ 21,726,752 $ 61,896,470 $ 66,091,704 $ 179,405,809 $ 189,238,990 $ 287,421,889 $ 361,792,142 $ 35,637,467 $ 140,827,000 $ 129,059,540 $ 123,407,956 $ 109,252,456 $ 360,000 $ 1,425,000 $ 2,175,000 $ - $ - $ 30,094,237 $ 37,153,809 $ 58,004,450 $ 164,013,933 $ 252,539,686

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

An investment in our capital stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this annual report, before making an investment decision. If any of the following risks actually occurs, our business, financialcondition or results of operations could suffer. In that case, the trading price of our ordinary shares could decline, and you may lose all or part of your investment.

Risks Relating to our Business

We have a limited operating history of selling our cloud-based products and services and may be unable to achieve or sustain profitability or accuratelyreasonably predict our future results.

In early 2013, we made a strategic decision to transitiontransform our business from servicing the public sector to focusing on the private sector. Leveraging our experience and expertise in handling large-scale IT projects for the public sector, we started investing in research and development of our ownto develop software products suitable for the private sector. In 2014, continuing our business transition from the public sector to the private sector, we identified and provided cloud-based ecosystem solutions to four core markets including new media, healthcare, education, and residential community management as the four core markets on which we would focus.management. Underpinning our ecosystems are our industry-specific integrated technology platform, resource exchange, and big data services. In 2014, we predominately sold our cloud-based solutions to the Chinese new media industry. Starting from 2015, we further expanded the customer base of our cloud-based solutions to numerous industries including new media, education, government, and residential community management. In 2016, we grew our industry-specific integrated technology platform, resource exchange, and big data services to elevator IoT sectors. From May 2017, we have focused our business to provide products and services in Cloud-App-Terminal (CAT) and IoT technology based digital advertising distribution network and new media resource sharing platform in the Out-of-Home adverting market in China. As such, we have a very limited operating history of selling our cloud-based products and professional services to the private sector. Our limited operating historysector, which makes it difficult to evaluate our current business and future prospects and may increase the risk of your investment. In 2015,2018, we generated only $7.31approximately $20.2 million of revenue in our cloud-based technology (CBT) segment for customers in the education, and new media, and Out-of-Home advertising market sectors. We expect to have significant operating expenses in the future to further support and grow our business, including expanding the scope of our customer base, expanding our direct and indirect selling capabilities, pursuing acquisitions of complementary businesses, investing in our data storage and analysis infrastructure, and research and development, and increasing our international presence. As a result of our new initiatives, although we may be unable to achieve or sustain profitability or reasonably predict our future outcome. Wehad net income of $1.7 million in 2018, we cannot assure you that we will achievesustain profitability in the future, or that if we do become profitable, we will sustain profitability.future.

| 3 |

Our independent registered auditors have expressed substantial doubt about our ability to continue as a going concern.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with our financial statements included in this report which states that the financial statements were prepared assuming that we would continue as a going concern.

As discussed in Note 1 to the consolidated financial statements included in this report, we have reported recurring net lossesincome as well as negativepositive cash flows from operating activities. In addition, weactivities in 2017 and 2018. We have aalso significantly reduced working capital deficit as of December 31, 2015. These factors raise substantial doubt about our ability to continue as a going concern.from the prior years. As disclosed under Item 5, “Operating and Financial Review and Prospects” and Note 1 to the consolidated financial statements, we have developed our 2015 business plan, which willwould continue to be executed in 2016.implemented for years going forward. As a result, our 2017 and 2018 profitability and operating cash flows had improved from the prior periods. However, there can be no assurance that we will be successful in achieving the goals set forth in our new business plan.strategy and business model.

3

Unfavorable economic conditions may affect the level of technology and Out-of-Home advertising spending by our customers which could cause the demand for our products and services to decline.

The revenue growth and profitability of our business rely on the overall demand by our customers for software,Out-of-Home digital advertising, display technology products, and internet related services. Our business depends on the overall economy in China and the economic and business conditions within our respective product and service sectors. If economic conditions become unstable, our existing and prospective customers may reassess their decisions to purchase our products and services. Fragile Chinese economic conditions or a reduction in Out-of-Home advertising and information technology spending by our customers could harm our business in many ways, including longer sales cycles and lower prices for our products and services. These events could have a material effect on our future revenuerevenues and earnings.

Our periodic operating results are difficult to predict and could fall below investors’ expectations or estimates by securities research analysts, which may cause the trading price of our ordinary shares to decline.

Our revenues and operating results can vary significantly from a filing period to the next due to a number of factors, many of which are outside of our control, such as fluctuations in the volume of business from our customers as a result of changes in their operations, their decisions to purchase our products and services, and currency fluctuations. Our revenues and operating results could also be affected by delays or difficulties in expanding our operational facilitiesregions and infrastructure, changes to our pricing strategies due to a competitive business environment and improper estimates of resources and time required to complete ongoing projects. Our first quarter revenues aremay be relatively low compared to the other quarters due to the Chinese New Year holiday. Moreover, our operating and financial results may vary as a result of our dependency on our customers’ budgets and spending patterns. Therefore we may not be able to reasonably estimateforecast the demand for our products and services beyond the current calendar year, which could adversely affect our business, operations, and financial condition. In addition, business volumes for specific customers are likely to vary from year to year. Thus, a major customer in one year may not remain as a major customer in the subsequent years.

These fluctuations are likely to continue in the future and operating results for any period may not be indicative of our performance in any future period. If our operating results for any filing period fall below investors’ expectations or estimates by securities research analysts, the trading price of our ordinary shares may decline.

We face risks once businesses are acquired through mergers or acquisitions and the acquired companies may not perform to our expectations, which may adversely affect our results of operations.

We face risks when we acquire other businesses. These risks include:

| difficulties in the integration of acquired operations and retention of personnel, | ||

| unforeseen or hidden liabilities, | ||

| tax, regulatory and accounting subject matters, and | ||

| inability to generate sufficient revenues to offset acquisition costs. |

Acquired companies may not perform to our expectations for various reasons, including loss of key personnel resulting changes in key customers, and our strategic focus may change.focuses. Therefore we may not realize the benefits we have previously anticipated. If we fail to integrate acquired businesses or realize expected benefits, we may lose economic returns on investments in these mergers and acquisitions and incur transaction costs causing our operating results to be materially and adversely affected.

| 4 |

If we are unable to secure additional financing or identify suitable merger or acquisition targets, we may be unable to implement our long-term business plan, develop or enhance our products and services, take advantage of future opportunities, or respond to competitive pressures on a timely manner.

Our long-term business plan includes the identification of suitable targets for horizontal or vertical mergers or acquisitions, so as to enhance overall productivity and to benefit from economies of scale. Due to the recent uncertainties in the global economic outlook and financial market stability, we may not be able to secure an adequate level of additional financing, whether through equity financing, debt financing or other sources. To raise additional capital, we may need to issue new securities, which could result in further dilution to our shareholders and significant dilution to our earnings per share. Issuance of new securities with registration rights or covenants through additional financings may be superior to the current ones that would restrict our operations and strategies. If we are unable to raise additional financing, we may be unable to implement our long-term business plan, develop or enhance our products and services, take advantage of future opportunities, or respond to competitive pressures on a timely basis, if at all. In addition, lack of additional capital could force us to substantially curtail or even cease operations.

4

We also may not be able to identify merger or acquisition targets or, after a merger or acquisition,targets. We may not be able to successfully integrate the targeted business or operations with ours.ours after a merger or acquisition. Such failure to execute our long-term business plan likely will negatively impact our results of our operations.

We generally do not have exclusive agreements with our customers and we may lose their contracts if they are not satisfied with our products and services or for other reasons.

We generally do not have exclusive agreements with our customers. As a result, we must rely on the quality of our products and services, our reputation in the industry, and favorable pricing terms to attract and retain customers. There is no assurance that we will be able to maintain and retain our relationships with current and/and or future customers. Our customers may choose to terminate their relationships with us if they are not satisfied with our services. If a substantial number of our customers choose not to continue to purchase products and services from us, it would materially and adversely affect on our business and results of operations.

If we are unable to develop and offer competitive new products and services, our future operations could be adversely affected.

Our future revenue stream, to a large degree, depends on our ability to capitalize on our technology strength and capabilities to offer new software applications and services to a broader client base. We are required to make investments in research and development to continue developing and offering new software applications and internet related products and services, and to enhance our existing software applications and internet related services to achieve market acceptance of our products and services. We may encounter potential challenges in innovation and introduction of new products services. Our development-stage software applications may not be successfully completed or, if developed, may not achieve significant customer acceptance. If we are unable to successfully define, develop, and introduce competitive new software applications, and enhance the existing ones, our future operating results would be adversely affected. Timing for software developments is difficult to predict. Timely launch of new applications and their acceptance by customers are important to our future success. A delay in the development of new applications could have a significantly adverse impact on our results of operations.

If we are unable to keep abreast with the rapid technical changes in our industry, demand for our products and services could decline and adversely affect our revenue and growth.

Our industry is known for rapid changes in technology, frequent introductions of new applications, quick evolution of industry standards, and changes in customer demands. These conditions require continuous investments in product research and development to enhance existing products, innovate new products, and keep up with the leading edge technologies. We believe that the timely development of new products and continuous enhancements to the existing products are essential to maintain our competitive position in the marketplace. Our future success depends in part upon customer and market acceptance of our products and innovations. Failure to achieve market acceptance of our existing products and services and launch of new products could materially and adversely affect our business and results of operations.

| 5 |

Our software applications may contain defects or errors, which could decrease sales, damage our reputation, or delay deliveries of our products.

Our software products are complex and must meet the stringent technical requirements requested by our customers. In order to keep pace with the current technologies and the rapid changes in the industry standards, we must accelerate new product developments and enhancements for our existing products. Because of the complex designs and the expeditious development cycles, we cannot assure that our software products are free of errors, especially for the newly released software applications and the updates for the existing software products. If our software is not free of errors, this could potentially result in litigation, declining sales, increasing product returns and product warranty costs, and further damage to our reputation, which would adversely affect our business.

Our technology may become obsolete, which could materially adversely affect our ability to sell our products and services.

If our technology, products and services become obsolete, our business operations would be materially and adversely affected. The market in which we compete is known for rapid changes in technologies, quick evolution of industry standards, fast introductions of new products, and changes in customer demands. These market characteristics can cause the existing products to be obsolete and unmarketable. Our future success depends upon our ability to timely address the increasingly sophisticated requests from our customers to support the existing and new hardware, software, database, and networking platforms. We have to invest in research and development in order to succeed in this competitive industry and timely satisfy market demands. Research and development expenses from continuing operations were $3,446,867, $1,477,246approximately $4.8 million, $4.0 million and $2,190,074$3.0 million for the years ended December 31, 2015, 20142018, 2017, and 2013,2016, respectively.

5

We face the risk of systems interruptions and capacity constraints, possibly resulting in adverse publicity, revenue loss and erosion of customer trust.

The satisfactory performance, reliability, and availability of our network infrastructure are critical to our reputation and our ability to attract and retain customers and to maintain adequate customer service levels. We may experience temporary service interruptions for a variety of reasons, including telecommunications or power failures, fire, water damage, vandalism, computer bugs, or viruses or hardware failures. We may not be able to correct a problem in a timely manner. Any service interruption that results in the unavailability of our system or reduces its capacity could result in real or perceived public safety issues that may affect customer confidence in our services and result inafflict negative publicity that could cause us to lose customer accounts or fail to obtain new accounts. Any inability to scale our systems may cause unanticipated system disruptions, slower response times, degradation in levels of customer service, or impaired quality and speed of transaction processing. We are not certain that we will be able to project the rate or timing of increases, if any, in the use of our services to permit us to upgrade and expand our systems effectively or to efficiently integrate smoothly any newly developed or purchased modules with our existing systems.

We have a limited history with our pricing models for our CBT products and services and, as a result, we may be forced to change the prices we charge for our applications or the pricing models upon which they are based.

We have limited experience with respect to determining the optimal prices and pricing models for certain of our CBT products and services and certain geographic markets. As the markets for our applications mature, or as competitors introduce products or services that compete with ours, including bundling competing offerings with additional products or services, we may be unable to attract new customers at the same price or based on the same pricing models as we have used historically. As a result, in the future we may be required to reduce our prices, which could adversely affect our financial performance. In addition, we may offer volume price discounts based on the number of products or services purchased by a customer or the number of our applications purchased by a customer, which would effectively reduce the prices we charge for our applications.products and services. Also, we may be unable to renew existing customer agreements or enter into new customer agreements at the same prices or upon the same terms that we have historically, which could have a material and adverse effect on our financial position.

| 6 |

Security breaches may harm our business.

Our cloud-based applications involve the storage and transmission of our customers’ proprietary and confidential information, including personal or identifyingidentification information regarding their employees and customers. Any security breaches, unauthorized access, unauthorized usage, virus or similar breach or disruption could result in loss of confidential information, damage to our reputation, early termination of our contracts, litigation, regulatory investigations, indemnity obligations, or other liabilities. If our security measures are breached as a result of third-party action, employee error, malfeasance or otherwise and, as a result, someone obtains unauthorized access to customer data, our reputation will be damaged, our business may suffer and we could incur significant liability. Because the techniques used to obtain unauthorized access or sabotage computer systems change frequently, and generally are not identified until they are launched against a target, we may be unable to anticipate these hacking techniques or implement adequate preventative measures. Any or all of these issuesconcerns could negatively affect our ability to attract new customers and cause existing customers to elect not to renew or upgrade their subscriptions that result in reputational damage or subject us to third-party lawsuits, regulatory fines, or other action or liability, which could adversely affect our operating results.

If we are not able to adequately secure and protect our patent, trademark and other proprietary rights our business may be materially affected.

Under our Amended and Restated Management Services Agreement, or the MSA, among our subsidiary IST, our variable interest entity, iASPEC, and Mr. Jiang HuaiJianghuai Lin, our Chairman and Chief Executive Officer, we licensehave licensed 71 copyrighted software applications from iASPEC on an exclusive basis. To protect the intellectual property underlying these applications and our other intellectual property, we rely on a combination of copyright, trademark, and trade secret laws. We also rely on non-disclosure agreements and other confidentiality procedures and contractual provisions to protect our intellectual property rights. Some of these technologies, other than the iASPEC copyrighted software applications, are very important to our business and are not protected by copyrights or patents. It may be possible for unauthorized third parties to copy or reverse engineer our products, or otherwise obtain and use information that we regard as proprietary. Further, third parties could challenge the scope or enforceability of our copyrights. In certain foreign countries, including China where we operate, the laws do not protect our proprietary rights to the same extent as the laws of the United States. Any misappropriation of our intellectual property could have a material and adverse effect on our business and results of operations, and weoperations. We cannot assure you that the measures we take to protect our proprietary rights are adequate.

6

Claims that we infringe the proprietary rights of third parties could result in significant expenses or restrictions on our ability to sell our products and services.

Third parties may claim that our products or services infringe their proprietary rights. Any infringement claim, with or without merit, would be time-consuming and expensive to litigate or settle and could divert our management’s attention from our core business. In the event of a successful infringement claim against us, we may have to pay significant damages, incur substantial legal fees, develop costly non-infringing technology, or enter into license agreements that require us to pay substantial royalties and that may not be available on terms acceptable to us, if at all.

A significant portion of our sales are derived from a limited number of customers or related parties, and results from operations could be adversely affected and shareholder value harmed if we lose any of these customers.

Historically, a significant portion of our revenues have been derived from a limited number of customers.customers or related parties, whom we have identified Shenzhen Taoping New Media Co., Ltd. and its affiliates. Shenzhen Taoping New Media Co., Ltd. is controlled by Mr. Lin, our Chairman and Chief Executive Officer. For the year ended December 31, 2018, we generated about 46% of revenue from related parties. For each of the years ended December 31, 2015, 20142018, 2017 and 2013, 21%2016, approximately 23%, 17%47% and 21%72%, respectively, of our revenues of continuing operations were derived from our five largest customers.customers or related parties. The loss of any of these significant customers and related parties would adversely affect our revenues and shareholder value.

The markets for Out-of-Home digital advertising and digital security geographic, and hospital information systems markets in China are highly competitive, and wecompetitive. We may fail to compete successfully, thereby resulting in loss of customers and decline in our revenues.

The markets for Out-of-Home digital advertising and digital security geographic, and hospital information systems markets in China are intensely competitive and are characterized by frequent technological changes, evolving industry standards, and changing in customer demands. We have competition from multiple domestic competitors in each segment. Increased competition may result in price reductions, reduced margins, and inability to gain or hold market share.

We have limited insurance coverage for our operations in China.

The insurance industry in China is still atin an early stage of development. Insurance companies in China offer limited insurance products. We have determined that the risks of disruption or liability from our business, the loss or damage to our property, including our facilities, equipment and office furniture, the cost of insuring for these risks, and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we do not have any business liability, disruption, litigation or property insurance coverage for our operations in China, except for insurance on some company owned vehicles. Any uninsured occurrence of loss or damage to property, or litigation, or business disruption may result in the incurrence of substantial costs and the diversion of resources, which could have an adverse effect on our operating results.

| 7 |

We depend heavily on key personnel, and turnover of key employees and senior management could harm our business.

Our future business and results of operations significantly depend in significant part upon the continuedcontinuous contributions of ourby key technical and senior management personnel, including Jiang HuaiJianghuai Lin, our Chairman and Chief Executive Officer, Zhiqiang Zhao, our President and Interim Chief Financial Officer, Zhixiong Huang, our Chief Operating Officer and Guangzeng Chen, our Chief Technology Officer and Chief Product Officer, Guangyuan Zong, our Chief Marketing Officer and Junping Sun, our Chief InvestmentProducts Officer. They also depend in significant part upon our ability to attract and retain additional qualified management, technical, marketing, and sales, and support personnel for our operations. If we lose a key employee or if a key employee fails to perform in his or her current position, or if we are not able to attract and retain skilled employees as needed, our business could suffer. Significant turnover in our senior management could significantlylargely deplete our institutional knowledge held by our existing senior management team. We depend on the skills and abilities of these key employees in managing the technical, marketing, and sales aspects of our business, any part of which could be harmed by further turnover.

7

We may be exposed to potential risks relating to our internal controls over financial reporting.

Companies that file reports with the SEC, including us, are subject to the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or SOX 404. SOX 404 requires management to establish and maintain a system of internal control over financial reporting and annual reports on Form 10-K or Form 20-F filed under the Exchange Act that are required to contain a report from management assessing the effectiveness of a company’s internal control over financial reporting. Separately, under SOX 404, as amended by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, public companies that are large accelerated or accelerated filers must include in their annual reports on Form 10-K or Form 20-F an attestation report of their auditorsauditors’ attesting to and reporting on the management’s assessment of internal control over financial reporting. Non-accelerated filers and smaller reporting companies are not required to include an attestation report of their auditors in the annual reports.

A report of our management is included under Item 15 “Controls and Procedures” of this report. We are a non-accelerated filer and consequently, are not required to include an attestation report of our auditor in this annual report. Management believes that our internal control over financial reporting was not effective as of December 31, 2015, as a result ofhas significantly improved in 2018 to minimize material weaknesses identified as discussed in Item 15 of this report. WeAlthough we have made improvements to overcome the concern, we can provide no assurance that these material weaknesses will be remediated in a timely manner, asmanner. As a result, investors and others may lose confidence in the reliability of our financial statements.

Our holding company structure may limit the payment of dividends.

We have no direct business operations, other than our ownership of our subsidiaries. While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations dependsdepend upon the receiptreceipts of dividends or other payments from our operating subsidiaries, and other holdings, and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency, and other regulatory restrictions as discussed below. If future dividends are paid in RMB, fluctuations in the exchange rate for the conversion of RMB into U.S. dollars may reduce the amount received by the U.S. stockholders upon conversion of the dividend paymentpayments into U.S. dollars.

Chinese regulations currently permit the payment of dividends only out of accumulated profits as determined in accordance with Chinese accounting standards and regulations. Our subsidiaries in China are also required to set aside a portion of their after tax profits to fund certain reserve funds according to the Chinese accounting standards and regulations to fund certain reserve funds.regulations. Currently, our subsidiaries in China are the only sources of revenues or investment holdings for the payment of dividends. If they do not accumulate sufficient profits under Chinese accounting standards and regulations to first fundsatisfy certain reserve funds as required by the Chinese accounting standards, we will be unable to pay any dividends.

After-tax profits/losses with respect to the payment of dividends out offrom accumulated profits and the annual appropriation of after-tax profits as calculated pursuant to PRCthe Chinese accounting standards and regulations do not result in significant differences as compared to after-tax earnings as presented in our financial statements. However, there are certain differences between PRC accounting standards and regulations and U.S. GAAP, arising from different treatment of items such as amortization of intangible assets and change in fair value of contingent consideration rising from business combinations.

| 8 |

Risks Relating to our CommercialContractual Relationship with iASPEC

Mr. Lin’s association with iASPEC could pose a conflict of interest which may result in iASPEC decisions that are adverse to our business.

Mr. Jiang HuaiJianghuai Lin, our Chairman and Chief Executive Officer and the beneficial owner of 37.7%41.8% of our outstanding ordinary shares, beneficially owns 100% of the equity interests in iASPEC, from whomwhich we derived 68.2%77.4%, 42.4%78.9% and 22.5%38.4% of our revenuerevenues in the fiscal years ended December 31, 2015, 20142018, 2017 and 2013,2016, respectively, pursuant to the existing commercial arrangements. As a result, conflicts of interest may arise from time to time and these conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

8

PRC laws and regulations governing our businesses and the validity of certain of our contractual relationships with iASPEC are uncertain. If we are found to be in violation of such PRC laws and regulations, our business may be negatively affected and we may be forced to relinquish our interests in those operations.

PRC laws and regulations prohibit or restrict foreign ownership of companies that operate Internet information and content. Consequently, we conduct certain of our operations and businesses in the PRC through our variable interest entity, iASPEC and its subsidiaries. The contractual relationships with iASPEC give us effective control over iASPEC, and its wholly owned subsidiaries and enable us to obtain substantially all of the economic benefits arising from it as well as consolidate their financial results in our results of operations. Although the structure we have adopted is consistent with longstanding industry practice, and is commonly adopted by comparable companies in China, the PRC government may not agree that these arrangements comply with PRC licensing, registration or other regulatory requirements, with existing policies or with requirements or policies that may be adopted in the future.

On March 15, 2019, the National People’s Congress approved the Foreign Investment Law, which will come into effect on January 1, 2020 and replace the existing laws regulating foreign investment in China, namely, the Sino-foreign Equity Joint Venture Enterprise Law, the Sino-foreign Cooperative Joint Venture Enterprise Law and the Wholly Foreign-invested Enterprise Law, together with their implementation rules and ancillary regulations. However, since it is relatively new, uncertainties still exist in relation to its interpretation and implementation. For instance, the Foreign Investment Law has a catch-all provision under the definition of “foreign investment” which includes investments made by foreign investors in China through means stipulated in laws or administrative regulations or other methods prescribed by the State Council. Though the Foreign Investment Law does not explicitly classify contractual arrangements as a form of foreign investment, there is no assurance that foreign investment via contractual arrangement would not be interpreted as a type of indirect foreign investment activities under the definition in the future. The State Council may in the future promulgate laws and regulations that deem investments made by foreign investors through contractual arrangements as “foreign investment,” and our VIE contractual arrangements may be subject to and be deemed to violate the market entry requirements in China. Furthermore, if future laws, administrative regulations or provisions prescribed by the State Council mandate further actions to be taken by companies with respect to existing VIE contractual arrangements, we may face substantial uncertainties as to whether we can complete such actions in a timely manner, or at all. Failure to take timely and appropriate measures to cope with any of these or similar regulatory compliance challenges could materially and adversely affect our current corporate structure and business operations.

If iASPEC or its shareholders violate our contractual arrangements with it, our business could be disrupted and we mayhave to resort to litigation to enforce our rights which may be time consuming and expensive.

Our operations are currently dependent upon our commercialcontractual relationship with iASPEC. During the fiscalrecent years, ended December 31, 2015, 2014 and 2013, we derived 68.20%, 42.4% and 22.5%a significant amount of our revenues respectively, from the provision of services to iASPEC customers. A significant portion of these revenues havehas not yet been collected. Amounts owed by iASPEC under the amended MSAManagement Services Agreement (MSA) for each quarter will be due and payable no later than the last day of the month following the end of each such quarter. Our contractual arrangements may not be as effective as direct ownership, ifownership. If iASPEC or its shareholders are unwilling or unable to perform their obligations under our commercial arrangements, with it, including payment of revenues under the MSA as they become due each quarter, we will not be able to conduct our operations in the manner currently planned. In addition, iASPEC may seek to renew these agreements on terms that are disadvantageous to us. Although we have entered into a series of agreements that provide us with substantial ability to control iASPEC, we may not succeed in enforcing our rights under them.legal rights. If we are unable to renew these agreements on favorable terms, or to enter into similar agreements with other parties, our business may not be able to operate or expand, and our operating expenses may significantly increase.

| 9 |

Uncertainties in the PRC legal system may impede our ability to enforce the commercial agreements that we have entered into with iASPEC or any arbitral award thereunder and any inability to enforce these agreements could materially and adversely affect our business and operation.

While disputes under the amended MSA and the option agreement with iASPEC are subject to binding arbitration before the Shenzhen Branch of the China International Economic and Trade Arbitration Commission, or CIETAC, in accordance with CIETAC Arbitration Rules, the agreements are governed by PRC lawlaws and an arbitration award may be challenged in accordance with PRC law.laws. For example, a claim that the enforcement of an award in our favor will be detrimental to the public interest, or that an issue does not fall within the scope of the arbitration would require us to engage in administrative and judicial proceedings to defend an award. China’s legal system is a civil law system based on written statutes, and unlike common law systems, it is a system in which decided legal cases have little value as precedent.precedent, and unlike common law systems. As a result, China’s administrative and judicial authorities have significant discretion in interpreting and implementing statutory and contractual terms, and it may be more difficult to evaluate the outcome of administrative and judicial proceedings and the level of legal protection available than in more developed legal systems. These uncertainties may impede our ability to enforce the terms of the MSA, the option agreement, and the other contracts that we may enter into with iASPEC. Any inability to enforce the MSA and option agreement or an award thereunder could materially and adversely affect our business and operation.

If iASPEC fails to comply with the confidentiality requirements of certain of its customer contracts, then iASPEC could be subject to sanctions and could lose its business license which in turn would significantly disrupt or shut down our operations.

The business and operations of iASPEC, the owner and licensor to us of the copyrighted software applications and other intellectual property that are essential to the operation of our business, is subject to Chinese contractual obligations and laws and regulations that restrict its use of security information and other information that it obtains from its customers in the public security sector. For some of its contracts with government agencies, iASPEC has agreed to keep confidential all technical and commercial secrets obtained during the performance of services under the contract. iASPEC or its shareholders could violate these contractual obligations and laws and regulations by inadvertently or intentionally disclosing confidential information or by otherwise failing to operate its business in a manner that complies with these contractual and legal obligations. A violation of these agreements could result in the significant disruption or shut down of our business or adversely affect our reputation in the market. If iASPEC or its shareholders violate these contractual and legal obligations, we may have to resort to litigation to enforce our rights under our contractual obligations with iASPEC.

This litigation could result in the disruption of our business, diversion of our resources and the incurrence of substantial costs.

All of the share capital of iASPEC is held by our major shareholder, who may cause these agreements to be amended in a manner that is adverse to us.

Our major shareholder, Mr. Jiang HuaiJianghuai Lin, owns and controls iASPEC. As a result, Mr. Lin may be able to cause our commercial arrangements with iASPEC to be amended in a manner that will be adverse to our company, or may be able to cause these agreements not to be renewed, even if their renewal would be beneficial for us. Although we have entered into an agreement that prevents the amendment of these agreements without the approval of the members of our Board other than Mr. Lin, we can provide no assurances that these agreements will not be amended in the future to contain terms that might differ from the terms that are currently in place. These differences may be adverse to our interests.

9

Our arrangements with iASPEC and its shareholders may be subject to a transfer pricing adjustmentscrutiny by the PRC tax authoritiesauthorities. Any adjustment of related party transaction pricing could lead to additional taxes, and therefore which could have an adverse effect on our income and expenses.

The tax regime in China is rapidly evolving and there is significant uncertainty for taxpayers in China as PRC tax laws may be interpreted in significantly different ways. The PRC tax authorities may assert that we or our subsidiaries or variable interest entities or their equity holders owe and/or are required to pay additional taxes on previous or future revenue or income. In particular, under applicable PRC laws, rules and regulations, arrangements and transactions among related parties, such as the contractual arrangements with our variable interest entities, may be subject to audit or challenge by the PRC tax authorities. We could face material and adverse tax consequences if the PRC tax authorities determine that our contractsagreements with iASPECthe variable interest entities and itstheir shareholders were not entered into based on arm’s length negotiations. Although our contractual arrangements are similar to other companies conducting similar operations in China, if the PRC tax authorities determine that these contracts were not entered into on an arm’s length basis,As a result, they may adjust our income and expenses for PRC tax purposes in the form of a transfer pricing adjustment. Such an adjustment may require that we pay additional PRC taxes plus applicable penalties and interest, if any.

The exercise of our option to purchase part or all of the equity interests in or assets of iASPEC under the option agreement might be subject to approval by the PRC government, and ourgovernment. Our failure to obtain this approval may impair our ability to substantially control iASPEC and could result in actions by iASPEC that conflict with our interests.

Our option agreement with iASPEC gives our Chinese operating subsidiary, IST, the option to purchase all or part of the equity interests in or assets of iASPEC, however,iASPEC. However, the option may not be exercised by IST, if exercise of the exerciseoption would violate any applicable laws and regulations in China or cause any license or permit held by andIST that is necessary for the operation of iASPEC to be cancelled or invalidated. Under theChinese laws, of China, if a foreign entity, throughin which a foreign investment company that it invests in,has invested, acquires a domestic related company China’sthat are under common control, Chinese regulations regardinggoverning mergers and acquisitions would technically apply to the transaction. Application of these regulations requires an examination and approval of the transaction by China’sthe Chinese Ministry of Commerce, or MOFCOM, or its local counterparts. Also, an appraisal of the equity or assets to be acquired is mandatory. However, Guangdong Jin Di Law Firm Sichuan Office, our local PRC counsel has advised us that Shenzhen and other local counterparts of MOFCOM hold the viewadvised us that such a transaction would not require their approval.

| 10 |

Therefore, we do not believe at this time that an approval and an appraisal are required for IST to exercise its option to acquire iASPEC in Shenzhen. In light of the different views on this issue, however, it is possible that the central MOFCOM office in Beijing will issue a standardized opinion imposing the requirements for approval and appraisal requirement.appraisal. If we are not able to purchase the equity or assets of iASPEC, then we will lose a substantial portion of our ability to control iASPEC and our ability to ensure that iASPEC will act in our interests.

Our right to elect a majority of the members on iASPEC’s Board of Directors and other provisions of the MSA may be viewed by iASPEC’s customers as a change in control of iASPEC, which could subject iASPEC to sanctions and loss of its business license, which in turn would significantly disrupt or possibly terminate our operations.

Our commercial arrangement with iASPEC gives us the right to designate two Chinese citizens to serve as senior managers of iASPEC, serve on iASPEC’s Board of Directors and assist in managing the business and operations of iASPEC. In addition, iASPEC will require the affirmative vote of the majority of the our Board of Directors, as well as at least one non-insider director, for completing certain material actions with respect to iASPEC, including, but not limited to: (a) the nomination, appointment, election or replacement of any board members; (b) the distribution of any dividend or profits; (c) any merger, division, change of corporate form, dissolution or liquidation; (d) any reimbursement of net losses or other payments or transfers of funds from IST to iASPEC; (e) the formation or disposition of a subsidiary or the acquisition or disposition of any interest in any other entity; and (f) the encumbrance of any assets under any lien not in the ordinary course of business. However, fulfillment of certain Police-use Geographic Information Systems, or PGIS, contracts with PRC Government customers is restricted to entities, such as iASPEC, that possess the necessary PRC government licenses and approvals, and any change in control may be viewed under PRC law as creating a new entity. If iASPEC’s government customers view these MSA provisions as a change in control of iASPEC or as evidence of iASPEC’s failure to operate its business in a manner that complies with its contractual obligations or with related laws and regulations, such a perception could result in the cancellation or invalidation of iASPEC’s licenses and permits. A loss by iASPEC of its licenses and permits could result in the significant disruption or possible termination of our business or adversely affect our reputation in the market.

Risks Relating to Doing Business in China

Changes in the economic and political policies of the PRC government could have a material and adverse effect on our business and operations.

10

We conduct substantially all our business operations in China. Accordingly, our results of operations, financial condition, and prospects are significantly dependent on economic and political developments in China. China’sChinese economy differs from the economies of developed countries in many aspects, including the level of development, growth rate, and degree of government control over foreign exchange, and allocation of resources. While China’sChinese economy has experienced significant growth in the past 30 years, the growth has been uneven across different regions and periods and among various economic sectors in China. We cannot assure you that China’sChinese economy will continue to grow, or that if there is growth, such growth will be steady and uniform, or that if there is a slowdown, such slowdown will not have a negative effect on itsour business and results of operations.

The PRC government exercises significant controlcontrols over China. Accordingly, our results of operations, financial condition, and prospects are significantly dependent on economic and political developments in China. Certain measures adopted by the PRC government may restrict loans to certain industries, such as changes in the statutory deposit reserve ratio and lending guidelines for commercial banks by the People’s Bank of China, or PBOC. These current and future government actions could materially affect our liquidity, access to capital, and ability to operate our business.

The global financial markets experienced significant disruptions in 2008 andthat caused the United States, Europe, and other economies wentgoing into recession. Since 2012, growth of the Chinese economy has slowed down. The PRC government has implemented various measures to encourage economic growth and guide the allocation ofallocate resources. Some of these measures may benefit the overall PRC economy, but may also have a negative effect on us. Our financial condition and results of operation could be materially and adversely affected by government control over capital investments or changes in tax regulations that are applicable to us. In addition, any stimulus measures designed to boost the Chinese economy may contribute to higher inflation, which could adversely affect our results of operations and financial condition. See “Risks Relating to Doing Business in China - Future inflation in China may inhibit our ability to conduct business in China.”

Uncertainties with respect to the PRC legal system could limit the legal protections available to you and us.

We conduct substantially all of our business through our operating subsidiaries in the PRC. Our operating subsidiaries are generally subject to laws and regulations applicable to foreign investments in China and, in particular, laws applicable to foreign invested entities established in the PRC, or FIEs. The PRC legal system is based on written statutes, and prior court decisions may be cited for reference but have limited precedential value. Since 1979, a series of new PRC laws and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. However, since the PRC legal system continues to evolve rapidly, the interpretations of many laws, regulations, and rules are not always uniform, and enforcement of these laws, regulations, and rules involve uncertainties, which may limit legal protections available to you and us. In addition, any litigation in China may be protracted and result in substantial costs and diversion of resources and management attention. In addition, all of our executive officers and most of our directors are residents of China and not of the United States, and substantially all the assets of these persons are located outside the United States. As a result, it could be difficult for investors to affect service of process in the United States or to enforce a judgment obtained in the United States against our Chinese operations and subsidiaries.

| 11 |

You may have difficulty enforcing judgments against us.

Most of our assets are located outside of the United States and most of our current operations are conducted in the PRC. In addition, most of our directors and officers are nationals and residents of countries other than the United States. A substantial portion of the assets of these persons is located outside the United States. As a result, it may be difficult for you to effectaffect service of process within the United States upon these persons. It may also be difficult for you to enforce in U.S. courtscourts’ judgments on the civil liability provisions of the U.S. federal securities laws against us and our officers and directors, most of whom are not residents in the United States and the substantial majority of whosetheir assets are located outside of the United States. In addition, there is uncertainty as to whether the courts of the PRC would recognize or enforce judgments of U.S. courts. Our counsel as to PRC law has advised us that the recognition and enforcement of foreign judgments are provided for under the PRC Civil Procedures Law. Courts in China may recognize and enforce foreign judgments in accordance with the requirements of the PRC Civil Procedures Law based on treaties between China and the country where the judgment is made or on reciprocity between jurisdictions. China does not have any treaties or other arrangements that provide for the reciprocal recognition and enforcement of foreign judgments with the United States. In addition, according to the PRC Civil Procedures Law, courts in the PRC will not enforce a foreign judgment against us or our directors and officers, if they decide that the judgment violates basic principles of PRC law or national sovereignty, security, or the public interest. So it is uncertain whether a PRC court would enforce a judgment rendered by a court in the United States.

11

The PRC government exerts substantial influence over the manner in which we must conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulationregulations and state ownership. Our ability to operate in China may be harmed by changes in itsChinese laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property, and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions, in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations.

Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures.

The enforcement of the PRC labor contract law may materially increase our costs and decrease our net income.

China adopted a new Labor Contract Law, effective on January 1, 2008, and issued its implementation rules, effective on September 18, 2008. The Labor Contract Law and related rules and regulations impose more stringent requirements on employers with regard to, among others, minimum wages, severance payment and non-fixed-term employment contracts, time limits for probation periods, as well as the duration and the times that an employee can be placed on a fixed-term employment contract. Due to the limited period of effectiveness of the Labor Contract Law and its implementation rules and regulations, and the lack of clarity with respect to their implementation and potential penalties and fines, it is uncertain how they will impact our current employment policies and practices. In particular, compliance with the Labor Contract Law and its implementation rules and regulations may increase our operating expenses. In the event that we decide to terminate some of our employees or otherwise change our employment or labor practices, the Labor Contract Law and its implementation rules and regulations may also limit our ability to effect those changes in a manner that we believe to be cost-effective or desirable, and could result in a material decrease in our profitability.

If we fail to obtain or maintain all licenses and approvals required to operate our businesses in the PRC, our business and operations may be adversely affected.

Fulfillment of certain PGIS contracts with PRC government customers is restricted to entities possessing the necessary government licenses and approvals which our subsidiary IST does not have. We currently perform Police-use Geographic Information Systems contracts through iASPEC, which possesses the requisite licenses and approvals, pursuant to our MSA with iASPEC, whereby iASPEC exclusively engages IST as its subcontractor to provide iASPEC with outsourcing services (to the extent that those services do not violate any special governmental permits held by iASPEC and do not involve the improper transfer of any sensitive confidential governmental or other data). If the PRC government determines that we are operating without the requisite licenses we may become subject to administrative penalties or an order to discontinue our business operations, both of which could have a material adverse effect on our business and results of operations.

Future inflation in China may inhibit our ability to conduct business in China.

In recent years,

According to the Chinese economy has experienced periodsNational Bureau of rapid expansionStatistics of China, the annual average percent changes in the consumer price index in China for 2016, 2017 and highly fluctuating rates of inflation. During2018 were 2.0%, 1.6% and 2.1%, respectively. Although we have not been materially affected by inflation in the past, ten years,we can provide no assurance that we will not be affected in the ratefuture by higher rates of inflation in China has beenChina. For example, certain operating costs and expenses, such as employee compensation and office operating expenses may increase as a result of higher inflation. Additionally, because a substantial portion of our assets consists of cash and cash equivalents, high as 5.9%inflation could significantly reduce the value and as low as -0.8% . These factors have led to the adoption by the Chinese government, from time to time,purchasing power of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the Chinese government to impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China, and thereby harm the market for our products and our company.these assets.

Restrictions on currency exchange may limit our ability to receive and use our sales effectively.

The majority of our sales will be settled in RMB, and any future restrictions on currency exchanges may limit our ability to use revenue generated in RMB to fund any future business activities outside of China or to make dividend or other payments in U.S. dollars. Although the Chinese government introduced regulations in 1996 to allow greater convertibility of the RMB for current account transactions, significant restrictions still remain, including primarily the restriction that FIEs may only buy, sell, or remit foreign currencies after providing valid commercial documents atto those banks in China authorized to conduct foreign exchange business. In addition, conversion of RMB for capital account items, including direct investment and loans, isare subject to governmental approval in China, and requires companies are required to open and maintain separate foreign exchange accounts for capital account items. We cannot be certain that the Chinese regulatory authorities will not impose more stringent restrictions on the convertibility of the RMB.

12

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of our ordinary shares will be indirectly affected by the foreign exchange rate between the U.S. dollar and RMB, and between those currencies and other currencies in which our sales may be denominated. Appreciation or depreciation in the value of the RMB relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business or results of operations. Fluctuations in the exchange rate will also affect the relative value of any dividend we issue that will be exchanged into U.S. dollars, as well as earnings from and the value of, any U.S. dollar-denominated investments we make in the future.

| 12 |

Since July 2005, the RMB has no longer been pegged to the U.S. dollar. Although the People’s Bank of China regularly intervenes in the foreign exchange market to prevent significant short-term fluctuations in the exchange rate, the RMB may appreciate or depreciate significantly in value against the U.S. dollar in the medium to long term. Moreover, it is possible that in the future PRC authorities may lift restrictions on fluctuations in the RMB exchange rate and lessen intervention in the foreign exchange market.

Very limited hedging transactions are available in China to reduce our exposure to the exchange rate fluctuations. To date, we have not entered into any hedging transactions. While we may enter into hedging transactions in the future, the availability and effectiveness of these transactions may be limited, and welimited. We may not be able to successfully hedge our exposure at all. In addition, our foreign currency exchange losses may be magnified by PRC exchange control regulations that restrict our ability to convert RMB into foreign currencies.

Restrictions under PRC law on our PRC subsidiaries’ ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or acquisitions that could benefit our business, pay dividends to you, and otherwise fund and conduct our business.

Substantially all of our sales are earned by our PRC subsidiaries. However, PRC regulations restrict the ability of our PRC subsidiaries to make dividends and other payments to their offshore parent companies. PRC legal restrictions permit payments of dividends by our PRC subsidiaries only out of their accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiaries are also required under PRC laws and regulations to allocate at least 10% of their annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of their registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances, or cash dividends. Any limitations on the ability of our PRC subsidiaries to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Failure to comply with