Divisional performance

Net interest income decreased $6 million or 2% in 2010 compared to 2009. Excluding the impact of the additional six weeks of St.George’s operations, net-interest income decreased 5%. The primary driver of this decrease was the reclassification of income, from net-interest income to non-interest income, to align the accounting treatment of Asgard with the approach applied to similar BT Wrap income. This decrease was offset by good deposit growth in the Private Bank during 2010.

Non-interest income increased $191 million or 15% in 2010 compared to 2009. Excluding the impact of the additional six weeks of St.George’s operations, non-interest income increased 12%. The increase was primarily driven by higher fees generated from FUM and FUA balances. Other factors driving this 12% increase are discussed below.

FUM was $42.5 billion at 30 September 2010, an increase of $0.6 billion or 1% compared to 30 September 2009, principally driven by net inflows during the year as market sentiment improved. FUM margins were down slightly over the year. Super for Life, then being distributed through St.George, Bank SA and Westpac, continued to generate very strong growth with over 200,000 customers registered and FUM doubling to over $1 billion at 30 September 2010.

FUA was $79.9 billion at 30 September 2010, an increase of $3.2 billion or 4% compared to 30 September 2009, primarily due to positive net inflows (principally on the BT Wrap platform). FUA margins were down over the year, as investors moved to lower margin equity products.

The Insurance business generated non-interest income after commission expenses of $377 million in 2010. The impact of the additional six weeks of St.George’s operations was not significant. The Life Insurance business experienced growth due to strong premium growth, with much of this arising from life policies on the Wrap platform. This was partially offset by a decline in General Insurance; while premium income was higher and cross sell continues to improve, higher claims offset growth. Lenders Mortgage Insurance was down as a result of slightly higher claims and the decision to refer mortgage insurance to a third party for all mortgages with a loan to value ratio (LVR) > 90%.

The Capital and other segment of BTFG also contributed to the improvement from 2009, with most of this due to higher interest rates boosting the return on invested capital. BTFG continued to invest its capital conservatively.

Operating expenses were $866 million in 2010, an increase of $37 million or 4% compared to 2009. Excluding the impact of the additional six weeks of St.George’s operations, operating expenses increased 1%. This increase was primarily driven by the increased number of employees in Private Bank and Advice, along with higher volume related expenses and increased advertising spend during 2010. This increase was offset by improved GST recoveries, lower non-lending losses and merger synergies.

Impairment charges on loans were $12 million in 2010, a decrease of $5 million or 29% compared to 2009. The decrease, excluding the impact of the additional six weeks of St.George, was due to lower IAPs during the year.

Income tax expense was $251 million in 2010, an increase of $38 million or 18% compared to 2009. The impact of including St.George for the full year in 2010 was not significant. This equated to an effective tax rate of 29.4% for 2010 compared to 30.4% in 2009.

New Zealand BankingRISK AND RISK MANAGEMENT

2010 v 2009

New Zealand Banking Cash Earnings were A$258 million in 2010, an increase of A$64 million or 33% compared to 2009. We believe this was a good result given the slow economic recovery in New Zealand. Contributing to the improved performance was a substantial improvement in growth of loans and deposits relative to system, and a significant reduction in impairment charges from the peak in 2009. These positives were offset by the reduction in certain customer fees from October 2009, higher funding costs and additional expenses associated with the aftermath of the Canterbury earthquake. Exchange rate movements had an A$4 million negative impact on earnings.

Net interest income was A$957 million in 2010, a decrease of A$50 million or 5% compared to 2009. Net interest income declined by 3% in NZ$ terms. The decrease was due to lower margins from higher funding costs, partially offset by growth in loans.

Loans and deposits1 grew by 4% and 6% respectively (in NZ$ terms) compared to 30 September 2009 due to the following:

§mortgage growth of 6% was achieved over the year, at 2.4 times system2. Third party originations accounted for 30% of new mortgage lending in 2010, down from 32% in 2009;

§other consumer lending was down 6% primarily due to slowing consumer spending and the impact of higher interest rates;

§business lending recorded a modest increase, up 2% over the year, particularly in Agribusiness, Corporate Banking and the Northern Regions – while system business growth declined; and

§deposit growth of NZ$1.7 billion funded 81% of loan growth driven by strong growth in term deposits.

1Loans and deposits growth was determined on a spot basis, comparing balances at 30 September 2010 to balances at 30 September 2009.

2Reserve Bank of New Zealand (RBNZ), 12 months to 30 September 2010.

Net interest margins declined 13 basis points in NZ$ terms compared to 2009, primarily due to higher retail and wholesale funding costs. Margins improved in the second half of 2010 as the mix of new business favoured higher margin products, and products were repriced more appropriately for risk and funding costs.

Non-interest income was A$277 million in 2010, a decrease of A$55 million or 17% compared to 2009. This was impacted by the change in customer fee structures introduced in October 2009, which reduced fee income by NZ$57 million over the year. Lower fee income was partially offset by improved wealth fees and higher insurance premium income.

Operating expenses were A$592 million in 2010, a decrease of A$12 million or 2% compared to 2009. In NZ$ terms, operating expenses increased by NZ$5 million or 1% compared to 2009. The bulk of the increase in expenses was due to NZ$3.5 million of expenses associated with the September 2010 Canterbury earthquake.

Investment in the front line included the opening of eight branches and a further investment in capability, including additional training in credit and customer sales systems and processes. Of the eight branches opened (six in the Auckland market), seven were community branches, which were outlets with a smaller footprint and increased self serve options.

Impairment charges on loans were A$276 million in 2010, a decrease of A$190 million or 41% compared to 2009. In NZ$ terms, impairment charges decreased by NZ$225 million or 39% compared to 2009. The reduction from the 2009 peak was due to a smaller number of large problem exposures not recurring during 2010. The improving New Zealand economy supported a stabilisation in housing delinquencies (in 2010, 90 day delinquencies were flat at 0.75%) and business lending stressed assets (in 2010 15.57% compared to 16.24% in 2009) as well as an improvement in other consumer lending delinquencies. Credit card delinquencies decreased to 0.97% in 2010, from 1.18% in 2009. Impaired assets as a percentage of Total Committed Exposures (TCE) rose early in the year to 1.27%, and remained relatively stable for the remainder of 2010.

The division had total provisions to gross loans at 30 September 2010 of 1.49%, up from 1.15% at 30 September 2009.

Income tax expense was A$106 million in 2010, an increase of A$33 million or 45% compared to 2009. This equated to an effective tax rate of 29.0% for 2010 compared to 27.1% in 2009.

Other divisionsRISK FACTORS

2010 v 2009

Cash Earnings in 2010 were $715 million, an increase of $58 million or 9% compared to 2009. Excluding the impact of the additional six weeks of St.George’s operations, Cash Earnings increased by 6%. This increase was primarily the result of lower impairment charges offset by lower net operating income.

Net interest income in 2010 was $1,065 million, a decrease of $149 million or 12% compared to 2009. The decrease was primarily driven by lower contributions from Group Treasury, compared to the exceptional gains recognised by this business in 2009, and translation impacts of the higher Australian dollar on earnings from the Pacific operations. This was partly offset by higher returns on capital.

Non-interest income was $198 million in 2010, an increase of $94 million or 90% compared to 2009. Excluding the impact of the additional six weeks of St.George’s operations, non-interest income increased by 50%. This increase was mainly a result of higher earnings from capital deals, reflecting favourable basis spreads, particularly in the first half of 2010.

Operating expenses were $189 million in 2010, an increase of $69 million or 58% compared to 2009. The increase in expenses was primarily related to additional technology project spend, higher employee incentive and shared-based payment charges and a one-off $20 million contribution to the Westpac Foundation in 2010.

Impairment charges on loans were a $55 million write-back in 2010, a decrease of $196 million compared to 2009. The impact of including St.George’s operations for the full year was insignificant. Impairment charges on loans were lower with $57 million released from the economic overlay provision (related to the construction sector) in 2010, compared to an increase of $112 million to this provision in 2009.

Income tax expense was $358 million in 2010, an increase of $23 million or 7% compared to 2009. The impact of including St.George tax for the full year was not significant. This equated to an effective tax rate of 31.7% for 2010 compared to 31.7% in 2009.

Minority interests were $56 million in 2010, a decrease of $9 million, or 14% compared to 2009. Minority interests represented distributions on our hybrid equity instruments 2003 TPS and 2006 TPS, as well as other minority interests in subsidiary entities.

Risk and risk management

Risk factors

Our business is subject to risks that can adversely impact our business, results of operations, financial condition and future performance. If any of the following risks occur, our business, results of operations, financial condition or future performance could be materially adversely affected, with the result that the trading price of our securities could decline and you could lose all, or part, of your investment. You should carefully consider the risks described and the other information in this Annual Report before investing in our securities. The risks and uncertainties described below are not the only ones we may face. Additional risks and uncertainties that we are unaware of, or that we currently deem to be immaterial, may also become important factors that affect us.

Risks relating to our business

Our businesses are highly regulated and we could be adversely affected by failing to comply with existing laws and regulations or by changes in laws and regulations and regulatory policy

As a financial institution, we are subject to detailed laws and regulations in each of the jurisdictions in which we operate or obtain funding, including Australia, New Zealand and the United States. We are also supervised by a number of different regulatory authorities which have broad administrative power over our businesses. In Australia, the relevant regulatory authorities include APRA, the RBA, ASIC, ASX, ACCCAustralian Prudential Regulation Authority (APRA), Reserve Bank of Australia (RBA), Australian Securities and AUSTRAC.Investments Commission (ASIC), Australian Securities Exchange (ASX), Australian Competition and Consumer Commission (ACCC) and Australian Transaction Reports and Analysis Centre (AUSTRAC). The RBNZReserve Bank of New Zealand (RBNZ) has supervisory oversight of our New Zealand operations. In the United States we are subject to supervision and regulation by the US Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System and the SEC.U.S. Securities and Exchange Commission (SEC).

We are responsible for ensuring that we comply with all applicable legal and regulatory requirements (including accounting standards) and industry codes of practice in the jurisdictions in which we operate or obtain funding, as well as meeting our ethical standards.

Compliance risk arises from these legal and regulatory requirements. If we fail to comply with applicable laws and regulations, we may be subject to fines, penalties or restrictions on our ability to do business. An example of the broad administrative power available to regulatory authorities is the power available to APRA under the Banking Act in certain circumstances to investigate our affairs and/or issue a direction to us (such as a direction to comply with a prudential requirement, to conduct an audit, to remove a director, executive officer or employee or not to undertake transactions). Any such costs and restrictions could have a material adverse effect onadversely affect our business, reputation, prospects, financial performance or financial condition.

As with other financial services providers, we continue to face increased supervision and regulation in most of the jurisdictions in which we operate or obtain funding, particularly in the areas of funding, liquidity, capital adequacy and prudential regulation. OneFor example of this is the announcement in December 2010 by the

BCBS ofannounced a revised global regulatory capital framework known as Basel III. Basel III will, among other things, increase the required quality and quantity of capital held by banks and introduce new minimum standards for the management of liquidity risk. APRA has announced that it supports the Basel III framework and it will incorporate the framework into its prudential standards. The Basel III framework comes into effect from 1 January 2013, subject to various transitional arrangements. Further details on the Basel III framework are set out in Section 1 under ‘Information on Westpac’.

ThroughoutDuring the year ended 30 September 20112012 there havehas also been a series of other regulatory releases from authorities in the various jurisdictions in which we operate or obtain funding proposing significant regulatory change for financial institutions. This includes global OTC derivatives reform and recovery and resolution planning requirements proposed by the FSB.FSB, as well as other components of the US Dodd-Frank legislation (including the Volcker Rule) which is designed to reform the entire system for the supervision and regulation of financial firms that operate in or have a connection with the US, including foreign banks like Westpac. Other areas of potential change that could impact us include changes to accounting and reporting requirements, tax legislation, regulation relating to remuneration, consumer protection and competition legislation and bribery, and anti-money laundering and counter-terrorism financing laws. In addition, further changes may occur driven by policy, prudential or political factors.

Regulation is becoming increasingly more extensive and complex. Some areas of potential regulatory change involve multiple jurisdictions seeking to adopt a coordinated approach. Such an approach may not appropriately respond to the specific requirements of the jurisdictions in which we operate and, in addition, such changes may be inconsistently introduced across jurisdictions.

Changes may also occur in the oversight approach of regulators. It is possible that governments in jurisdictions in which we do businessoperate or obtain funding might revise their application of existing regulatory policies that apply to, or impact, Westpac’s business, including for reasons relating to national interest and/or systemic stability.

Regulatory changes and the timing of their introduction continue to evolve and we currently manage our businesses in the context of regulatory uncertainty. The nature and impact of future changes are not predictable and are beyond our control. Regulatory compliance and the management of regulatory change is an increasingly important part of our strategic planning. We expect that we will be required to increase our expenditure oncontinue to invest significantly in compliance and the management and implementation of regulatory change and, at the same time, significant management attention and resources will be required to update existing or implement new processes and procedures to comply with the new regulations.

Regulatory change may also impact our operations by requiring us to have increased levels of liquidity and higher levels of, and better quality, capital as well as place restrictions on the businesses we conduct or require us to alter our product and service offerings. If regulatory change

| | |

| 2012 WESTPAC GROUP ANNUAL REPORT | 113 |

has any such effect, it could adversely affect one or more of our businesses, restrict our flexibility, require us to incur substantial costs and impact the profitability of one or more of our business

lines. Any such costs or restrictions could have a material adverse effect onadversely affect our business, prospects, financial performance or financial condition or prospects.condition.

For further information refer to ‘Significant developments’ in Section 1 and the sections ‘Changes in accounting policy’, ‘Critical accounting assumptions and estimates’ and ‘Future developments in accounting policies’ in Note 1 to the financial statements.

Adverse credit and capital market conditions may significantly affect our ability to meet funding and liquidity needs and may increase our cost of funding

We rely on credit and capital markets to fund our business and as a source of liquidity. Our liquidity and costs of obtaining funding are related to credit and capital market conditions.

Global credit and capital markets have experienced extreme volatility, disruption and decreased liquidity in recent years. While there have been periods of stability in these markets, the environment has become more volatile and unpredictable. Recently thereThis has been particular focus onexacerbated by the potential for sovereign debt defaults and/or banking failures in Europe. Widespread unease about the strength of the European banking systemEurope which has resulted in large declinescontributed to volatility in stock prices and marked widening in credit spreads. Focus has also extended to the US following the Standard & Poor’s downgrade of the sovereign credit rating of the United States. The recent volatility in global financial markets has addedAdding to the uncertainty abouthas been a slowing in the global economic outlook andfor a number of countries, are experiencing slowing economic activity.including China and the uncertain recovery of the US economy. Our direct exposure to the affected European countries is small,immaterial, with the main riskrisks we face being damage to market confidence, spendingchanges to the access and access to, and costscost of funding and a slowing in theglobal activity of our trading partners or through other impacts on entities with whom we do business. The vulnerable nature of several sovereign nations and the associated impact on market conditions has resulted in a tightening of credit markets and wholesale funding conditions.

As of 30 September 2011,2012, approximately 41%35% of our total net funding originated from domestic and international wholesale markets, of this around 62%59% was sourced outside Australia and New Zealand.

A shift in investment preferences of businesses and consumers away from bank deposits toward other asset or investment classes would increase our need for funding from wholesale markets.relatively less stable or more expensive forms of funding.

If market conditions continue to deteriorate due to economic, financial, political or other reasons, our funding costs may be adversely affected and our liquidity and our funding and lending activities may be constrained.

If our current sources of funding prove to be insufficient, we may be forced to seek alternative financing. The availability of such alternative financing, and the terms on which it may be available, will depend on a variety of factors, including prevailing market conditions, the availability of credit, our credit ratings and credit market capacity. Even if available, the cost of these alternatives may be more expensive or on unfavourable terms, which could adversely affect our results of operations, liquidity, capital resources and financial condition. There is no assurance that we will be able to obtain adequate funding and do so at acceptable prices.prices, nor that we will be able to recover any additional costs.

If Westpac is unable to source appropriate funding, we may also be forced to reduce our lending or begin to sell liquid securities. Such actions may adversely impact our business, results of operations,

prospects, liquidity, capital resources, andfinancial performance or financial condition.

Westpac enters into collateralised derivative positions, which may require Westpac to post additional collateral based on adverse movements in market rates, which would adversely affect Westpac’s liquidity.

For a more detailed description of liquidity risk, refer to the section ‘Liquidity Risk’ in this section and Note 27 to the financial statements.

Failure to maintain credit ratings could adversely affect our cost of funds, liquidity, competitive position and access to capital markets

Credit ratings are opinions on our creditworthiness. Our credit ratings affect the cost and availability of our funding from capital markets and other funding sources and they may be important to customers or counterparties when evaluating our products and services. Therefore, maintaining high quality credit ratings is important.

The credit ratings assigned to us by rating agencies are based on an evaluation of a number of factors, including our financial strength, and structural considerations regarding the Australian financial system.system and the credit rating of the Australian Federal Government. A credit rating downgrade could be driven by the occurrence of one or more of the other risks identified in this section or by other events including changes to the methodologies used by the rating agencies to determine ratings.

For example, Standard & Poor’s announced that it is changinghas changed its methodology for determining bank ratings and published its initial proposalsnew criteria on 6 January9 November 2011. On 20 April1 December 2011 Standard & Poor’s announced that it had received numerous comments on the proposalsupdated ratings for certain banks across the Asia-Pacific region under the revised approach and indicated that it expects to publish its final criteria first, and then take ratings actions soon afterwards in the fourth quarter 2011. On 7 October 2011, Standard & Poor’s announced that it remains on track to finalise and implement the criteria on that timetable.

On 18 May 2011, Moody’s advised us,Westpac, along with the other major Australian banks, that ourBanks, was issued a long-term, senior unsecured credit rating of AA- down from AA.

On 24 February 2012, following its review of the debt ratings of the four major Australian banks, Fitch announced that Westpac had been issued a long-term senior unsecured issuer default rating was downgraded to Aa2of AA- down from Aa1. Further, on 27 May 2011, Moody’s advised WNZL, alongAA, and in line with the other major New Zealand banks, that its long-term, senior unsecured debt rating was downgraded to Aa3 from Aa2. The outlook for both of these ratings is stable.

Risk and risk managementAustralian banks.

If we fail to maintain our current credit ratings, this could adversely affect our cost of funds and related margins, collateral requirements, liquidity, competitive position and our access to capital markets. The extent and nature of these impacts would depend on various factors, including the extent of any ratings change, whether our ratings differ among agencies (split ratings) and whether any ratings changes also impact our peers or the sector.

A systemic shock in relation to the Australian, New Zealand or other financial systems could have adverse consequences for Westpac or its customers or counterparties that would be difficult to predict and respond to

There is a risk that a major systemic shock could occur that causes an adverse impact on the Australian, New Zealand or other financial systems.

As outlined above, the financial services industry and capital markets have been, and may continue to be, adversely

| | |

114 | 2012 WESTPAC GROUP ANNUAL REPORT | |

affected by continuing market volatility and the negative outlook for global economic conditions. RecentlyDuring the first half of 2012, there has beenwas an increased focus on the potential for sovereign debt defaults and/or significant bank failures in the 17 countries comprising the Eurozone.Eurozone which exacerbated these conditions. There can be no assurance that the market disruptions in the Eurozone, including the increased cost of funding for certain Eurozone governments, will not spread, nor can there be any assurance that future assistance packages will be available or sufficiently robust to address any further market contagion in the Eurozone or elsewhere. If the situation in the Eurozone worsens, there could be serious implications for the European Union and the euro, which, if destabilised, could result in currency fluctuations and operational disruptions that negatively impact the Group.

Any such market and economic disruptions could have a material adverse effect onadversely affect financial institutions such as Westpac because consumer and business spending may decrease, unemployment may rise and demand for the products and services we provide may decline, thereby reducing our earnings. These conditions may also affect the ability of our borrowers to repay their loans or our counterparties to meet their obligations, causing us to incur higher credit losses. These events could also result in the undermining of confidence in the financial system, reducing liquidity and impairing our access to funding and impairing our customers and counterparties and their businesses. If this were to occur, our businesses,business, prospects, financial performance or financial condition and prospectsor could be adversely affected.

The nature and consequences of any such event are difficult to predict and there can be no guarantee that we could respond effectively to any such event.

Declines in asset markets could adversely affect our operations or profitability

Declines in Australian, New Zealand or other asset markets, including equity, residential and commercial property and other asset markets, could adversely affect our operations and profitability.

Declining asset prices impact our wealth management business and other asset holdings. Earnings in our wealth management business are, in part, dependent on asset values because we receive fees based on the value of securities and/or assets held or managed. A decline in asset prices could negatively impact the earnings of this division.business.

Declining asset prices could also impact customers and counterparties and the value of security we hold against loans and derivatives which may impact our ability to recover amounts owing to us if customers or counterparties were to default. It may also affect our level of provisioning which in turn impacts profitability.

Our business is substantially dependent on the Australian and New Zealand economies

Our revenues and earnings are dependent on economic activity and the level of financial services our customers require. In particular, lending is dependent on various factors including economic growth, business investment, levels of employment, interest rates and trade flows in the countries in which we operate.

We currently conduct the majority of our business in Australia and New Zealand and, consequently, our performance is influenced by the level and cyclical nature of business and home lending in these countries. These factors are in turn impacted by both domestic and international economic conditions, natural disasters and political events. A significant decrease in the Australian and New Zealand housing markets or property valuations could adversely impact our home lending activities because the ability of our borrowers to repay their loans or counterparties to honour their obligations may be affected, causing us to incur higher credit losses, or the demand for our home lending products may decline.

Adverse changes to the economic and business conditions in Australia and New Zealand and other countries such as China, India and Japan, could also adversely affect the Australian economy and customers. In particular, due to the current relationship between Australia and China in the mining and resources sectors, a slowdown in China’s economic growth could negatively impact the Australian economy and our customers. Thiseconomy. Changes in economic conditions could in turn result in reduced demand for our products and services and affect the ability of our borrowers to repay their loans. If this were to occur, it wouldcould negatively impact our business, prospects, financial performance or financial condition and prospects.condition.

An increase in defaults in credit exposures could adversely affect our results of operations, liquidity, capital resources, andfinancial performance or financial condition

Credit risk is a significant risk and arises primarily from our lending activities. The risk arises from the likelihoodpossibility that some customers and counterparties will be unable to honour their obligations to us, including the repayment of loans and interest.

Credit risk also arises from certain derivative contracts we enter into and from our dealings with, and holdings of, debt securities issued by other banks, financial institutions, companies, governments and government bodies the financial conditions of which may be impacted to varying degrees by economic conditions in global financial markets.

We hold collective and individually assessed provisions for our credit exposures. If economic conditions deteriorate, some customers and/or counterparties could experience higher levels of financial stress and we may experience a significant

increase in defaults and write-offs, and be required to increase our provisioning. Such events would diminish available capital and wouldcould adversely affect our operating results, liquidity, capital resources, andfinancial performance or financial condition.

For a discussion of our risk management procedures, including the management of credit risk, refer to the ‘Risk management’ section and Note 27 to the financial statements.

We face intense competition in all aspects of our business

The financial services industry is highly competitive. We compete, both domestically and internationally, with retail and commercial banks, asset managers, investment banking firms, brokerage firms, and other financial service firms.firms and businesses in other industries with emerging financial services aspirations. This includes specialist competitors

| | |

| 2012 WESTPAC GROUP ANNUAL REPORT | 115 |

that may not be subject to the same capital and regulatory requirements and therefore may be able to operate more efficiently.

If we are unable to compete effectively in our various businesses and markets, our market share may decline. Increased competition may also materially adversely affect our results of operations by diverting business to our competitors or creating pressure to lower margins.

Increased competition for deposits could also increase our cost of funding and needcause us to access other types of funding. We rely on bank deposits to fund a significant portion of our balance sheet and deposits have been a relatively low cost and stable source of funding. We compete with banks and other financial services firms for such deposits. To the extent that we are not able to successfully compete for deposits, we would be forced to rely more heavily on more expensive global capital markets to fund our business, and ouror less stable forms of funding, costs would increase.or reduce lending.

We are also dependent on our ability to offer products and services that match evolving customer preferences. If we are not successful in developing or introducing new products and services or responding or adapting to changes in customer preferences and habits, we may lose customers to our competitors. This could adversely affect our results of operations,business, prospects, financial performance andor financial condition.

For more detail on how we address competitive pressures refer to the section ‘Competition’ in Section 1.

We could suffer losses due to market volatility

We are exposed to market risk as a consequence of our trading activities in financial markets and through the asset and liability management of our financial position. In our financial markets trading business, we are exposed to losses arising from adverse movements in levels and volatility of interest rates, foreign exchange rates, commodity prices, credit prices and equity prices. If we were to suffer substantial losses due to any market volatility it may adversely affect our results of operations,business, prospects, liquidity, capital resources, andfinancial performance or financial condition. For a discussion of our risk management procedures, including the management of market risk, refer to the ‘Risk management’ section.

We could suffer losses due to technology failures

The reliability and security of our information and technology infrastructure and our customer databases are crucial in maintaining our banking applications and processes. There is a risk that these information and technology systems might fail to operate properly or become disabled as a result of events that are wholly or partially beyond our control or that our security measures may prove inadequate or ineffective. Any failure of these systems could result in business interruption, loss of customers, theft of intellectual property and customer data, reputational damage and claims for compensation and regulatory investigations and penalties, which could adversely affect our results of operations andbusiness, prospects, financial performance.performance, or financial condition.

Further, our ability to develop and deliver products and services to our customers is dependent upon technology that requires periodic renewal. We are constantly managing technology projects including projects to consolidate duplicate

technology platforms, simplify and enhance our technology and operations environment, improve productivity and provide for a better customer experience. This includes our current Strategic Investment Priorities (SIPs) program. Failure to implement these projects or manage associated change effectively could result in cost overruns, a failure to achieve anticipated productivity, operational instability, reputational damage or operating technology that could place us at a competitive disadvantage and may adversely affect our results of operations.financial performance.

We could suffer losses due to operational risks

Operational risk is the risk of loss resulting from technology failure, inadequate or failed internal processes, people, and systems or from external events. As a financial services organisation we are exposed to a variety of operational risks.

Our operations rely on the secure processing, storage and transmission of confidential and other information on our computer systems and networks.networks, and the systems and networks of external suppliers. Although we implement significant measures to protect the security and confidentiality of our information, there is a risk that ourthe computer systems, software and networks on which we rely may be subject to security breaches, unauthorised access, computer viruses, external attacks or internal breaches that could have an adverse security impact and compromise our confidential information or that of our customers and counterparts. Any such security breach could result in regulatory enforcement actions, reputational damage and reduced operational effectiveness. Such events could subsequently adversely affect our business, prospects, financial condition and results of operations.performance or financial condition.

We are also highly dependent on the conduct of our employees. We could, for example, be adversely affected ifin the event of human error, results in a process errorinadequate or failed processes or if an employee engages in fraudulent conduct. While we have policies and processes to minimise the risk of human error and employee misconduct, these policies and processes may not always be effective.

Risk and risk management

Fraudulent conduct can also emerge from external parties seeking to access the banks’bank’s systems and customer’scustomers’ accounts. If systems, procedures and protocols for managing and minimising fraud fail, or are ineffective, they could lead to loss which could adversely affect our results of operations,business, prospects, reputation, financial performance, or financial condition and our reputation.condition.

Operational risks also arise when we relyWestpac relies on externala number of suppliers, both in Australia and overseas, to provide services to usit and ourits customers. Failure by these suppliers to deliver services as required could disrupt services and adversely impact Westpac’s operations, profitability or reputation.

Operational risks could impact on our operations or adversely affect demand for our products and services. Operational risks can directly impact our reputation and result in financial losses which would adversely affect our financial performance or financial condition.

For a discussion of our risk management procedures, including the management of operational risk, refer to the ‘Risk management’ section.

| | |

116 | 2012 WESTPAC GROUP ANNUAL REPORT | |

We could suffer losses due to failures in risk management strategies

We have implemented risk management strategies and internal controls involving processes and procedures intended to identify, monitor and mitigate the risks to which we are subject, including liquidity risk, credit risk, market risk (including interest rate and foreign exchange risk) and operational risk.

However, there are inherent limitations with any risk management framework as there may exist, or developemerge in the future, risks that we have not anticipated or identified or controls may not operate effectively.identified.

If any of our risk management processes and procedures prove ineffective or inadequate or are otherwise not appropriately implemented, we could suffer unexpected losses and reputational damage which could adversely affect our business, prospects, financial performance or financial condition.

For a discussion of our risk management procedures, refer to the ‘Risk management’ section.

We could suffer losses due to environmental factors

We and our customers operate businesses and hold assets in a diverse range of geographical locations. Any significant environmental change or external event (including fire, storm, flood, earthquake or pandemic) in any of these locations has the potential to disrupt business activities, impact on our operations, damage property and otherwise affect the value of assets held in the affected locations and our ability to recover amounts owing to us. In addition, such an event could have an adverse impact on economic activity, consumer and investor confidence, or the levels of volatility in financial markets.

This risk of losses due to environmental factors is also relevant to our insurance business. The frequency and severity of external events such as natural disasters is difficult to predict and it is possible that the amounts we reserve for such events may not be adequate to cover actual claims that may arise, which could adversely affect our business, prospects, financial performance or financial condition.

Reputational damage could harm our business and prospects

Our ability to attract and retain customers and our prospects could be adversely affected if our reputation is damaged.

There are various potential sources of reputational damage including potential conflicts of interest, pricing policies, failing to comply with legal and regulatory requirements, ethical issues, engagements and conduct of external suppliers, failing to comply with money laundering laws, trade sanctions and counter-terrorism finance legislation or privacy laws, litigation, information security policies, improper sales and trading practices, failing to comply with personnel and supplier policies, improper conduct of companies in which we hold strategic investments, technology failures, security breaches and risk management failures. Our reputation could also be adversely affected by the actions of the financial services industry in general or from the actions of our customers and counterparties.

Failure to appropriately address issues that could or do give rise to reputational risk could also impact the regulatory

change agenda, give rise to additional legal risk, subject us to regulatory enforcement actions, fines and penalties, or remediation costs, or harm our reputation among our customers, investors and the marketplace. This could lead to loss of business which could adversely affect our results of operations,business, prospects, financial performance or financial condition.

We could suffer losses if we fail to syndicate or sell down underwritten securities

As a financial intermediary we underwrite listed and unlisted debt and equity securities. Underwriting activities include the development of solutions for corporate and institutional customers who need capital and investor customers who have an appetite for certain investment products. We may guarantee the pricing and placement of these facilities. We could suffer losses if we fail to syndicate or sell down our risk to other market participants. This risk is more pronounced in times of market volatility.

Certain strategic decisions may have adverse effects on our business

Westpac, at times, evaluates and may undertake strategic decisions which may include business expansion. The expansion, or integration of a new business, can be complex and costly and may require Westpac to comply with additional local or foreign regulatory requirements which may carry additional risks. These decisions may, for a variety of reasons, not deliver the anticipated positive business results and could have a negative impact on our business, prospects, engagement with regulators, financial performance or financial condition.

Limitation on Independent Registered Public Accounting Firm’s Liability

The liability of PricewaterhouseCoopers (an Australian partnership which we refer to as PwC Australia), with respect to claims arising out of its audit report included in this Annual Report, is subject to the limitations set forth in the Professional Standards Act 1994 of New South Wales, Australia, as amended (the ‘ProfessionalProfessional Standards Act’)Act) and The Institute of Chartered Accountants in Australia (NSW) Scheme adopted by The Institute of Chartered Accountants in Australia (ICAA) and approved by the New South Wales Professional Standards Council pursuant to the Professional Standards Act (the ‘NSW Accountants Scheme’) or, in relation to matters occurring on or prior to 7 October 2007, the predecessor scheme. The current NSW Accountants Scheme expires on 7 October 2013 unless further extended or replaced.

The Professional Standards Act and the NSW Accountants Scheme may limit the liability of PwC Australia for damages with respect to certain civil claims arising in, or governed by the laws of, New South Wales directly or vicariously from anything done or omitted in the performance of its professional services for us, including, without limitation, its audits of our financial statements, to the lesser of (in the case of audit services) ten times the reasonable charge for the service provided and a maximum liability for audit work of $75 million or, in relation to matters occurring on or prior to 7 October 2007, $20 million. The limit does not apply to claims for breach of trust, fraud or dishonesty.

In addition there is equivalent professional standards legislation in place in other states and territories in Australia and amendments have been made to a number of Australian

| 2012 WESTPAC GROUP ANNUAL REPORT | 117 |

federal statutes to limit liability under those statutes to the same extent as liability is limited under state and territory laws by professional standards legislation.

These limitations of liability may limit recovery upon the enforcement in Australian courts of any judgment under US or other foreign laws rendered against PwC Australia based on or related to its audit report on our financial statements. Substantially all of PwC Australia’s assets are located in Australia. However, the Professional Standards Act and the NSW Accountants Scheme have not been subject to judicial consideration and therefore how the limitation will be applied by the courts and the effect of the limitation on the enforcement of foreign judgments are untested.

Risk managementRISK MANAGEMENT

Our vision is to be one of the world’s great companies, helping our customers, communities and people to prosper and grow.

Along with maintaining a clear customer-centric focus, effectiveEffective risk management is one of the keys to achieving this goal. It is a key component of our ‘one team’ environment and influences our customer experiences and public perceptions, our financial performance, reputation and shareholder expectations, and thus our future success. We regard managing risk to be a fundamental activity, performed at all levels of the Group.

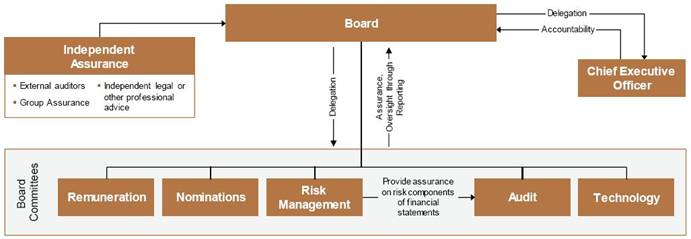

Our risk management strategy is approved by our Board and implemented through the CEO and the executive management team.

The BRMC has been delegated the responsibility for approving and maintaining an effective risk management framework. For further information regarding the role and responsibilities of the BRMC and other Board committees in managing risk, refer to ‘Corporate governance – Risk management’ in Section 1.

The CEO and executive management team are responsible for implementing the risk management strategy and frameworks and for developing policies, controls, processes and procedures for identifying and managing risk in all of Westpac’s activities.

We follow a ‘Three Lines of Defence’ philosophy for risk management. As outlined in the ‘Corporate governance’ section our approach to managing risk is that ‘risk is everyone’s business’ and that responsibility and accountability for risk begins with the business units that originate the risk.

For a comprehensive discussion of the risks to which Westpac is exposed, and its policies to manage these risks, refer to ‘Corporate governance – Risk management’ in Section 1 and Note 27 to the financial statements.

Credit riskCREDIT RISK

Credit risk is the risk of financial loss where a customer or counterparty fails to meet their financial obligations.

The extension of credit is underpinned by the Group’s Principles of Responsible Lending. This is reflected in our commitment to comply with all local legislation, codes of practices and relevant guidelines and obligations to market our products responsibly and stay in touch with the expectations of customers and the community.

We have a well-established framework and supporting policies for managing the credit risk associated with lending across our business divisions. The framework and policies encompass all stages of the credit cycle - cycle—origination, evaluation, approval, documentation, settlement, on-goingongoing administration and problem management. For example, we have established product-based standards for lending to individuals, with key controls including minimum loan repayment to income ratioserviceability standards and maximum loan to security value ratio.ratios. We offer residential property loans to both owner-occupiers and investors at both fixed and variable rates, secured by a mortgage over the subject property or other acceptable collateral. Where we lend to higher loan to value ratios we typically also require lender’slenders mortgage insurance. Similarly, we have established criteria for business, commercial, corporate and institutional lending, which can vary by industry segment. In this area we focus on the performance of key financial risk ratios, including interest coverage, debt serviceability and balance sheet structure. When providing finance to smaller business, commercial and corporate borrowers we typically obtain security, such as a chargemortgage over property and/or a general security agreement over business assets and/or real estate.assets. For larger corporates and institutions we typically also require compliance with selected financial ratios and undertakings and may hold security. In respect of commercial property lending we maintain loan origination and on-goingongoing risk management standards, including specialised management for higher value loans. We consider factors such as the nature, location, quality and expected demand for the asset, tenancy profile and experience and quality of management. We actively monitor the Australian and New Zealand property markets and the composition of our commercial property loan book across the Group.

Refer to Note 27 to the financial statements for details of our credit risk management policies.

Risk and risk management

Provisions for impairment charges on loans

For information on the basis for determining the provision for impairment charges on loans refer to ‘Critical accounting assumptions and estimates’ in Note 1 to the financial statements.

Credit risk concentrations

We monitor our credit portfolio to manage risk concentrations. At 30 September 2011,2012, our exposure to consumers comprised 71% (2010(2011: 71%, 2010: 69%, 2009 64%) of our on-balance sheet loans and 57% (2011: 56% (2010 57%, 2009 54%2010: 57%) of total credit commitments. At 30 September 2011,2012, 91% (2010 89%(2011: 91%, 20092010: 89%) of our exposure to consumers was supported by residential real estate mortgages. The consumer category includes investment property loans to individuals, credit cards, personal loans, overdrafts and lines of credit. Our consumer credit risks are diversified, with substantial consumer market share in every state and territory in Australia, New Zealand and the Pacific region. Moreover, these customers service their debts with incomes derived from a wide range of occupations, in city as well as country areas.

Exposures to businesses, government and other financial institutions are classified into a number of industry clusters based on groupings of related Australian and New Zealand Standard Industrial Classification (ANZSIC) codes and are monitored against industry risk limits. The level of industry

118 | 2012 WESTPAC GROUP ANNUAL REPORT | |

risk is measured and monitored on a dynamic basis. Exposures are actively managed from a portfolio perspective, with risk mitigation techniques used to regularly re-balance the portfolio. We also control the concentration risks that can arise from large exposures to individual borrowers.

| 2012 WESTPAC GROUP ANNUAL REPORT | 119 |

Cross-border outstandings

Cross-border outstandings are loans, placements with banks, interest earning investments and monetary assets denominated in currencies other than the borrower’s local currency. They are grouped on the basis of the country of domicile of the borrower or the ultimate guarantor of the risk. The table below excludes irrevocable letters of credit, amounts of which are immaterial. The relevant foreign denominated currencies have been converted at the closing spot exchange rate used in the financial statements.

Our cross-border outstandings to borrowers in countries that individually represented in excess of 0.75% of Group total assets as at 30 September in each of the past three years were as follows:

(in $millions unless otherwise indicated) | Governments and Official Institutions | Banks and Other Financial Institutions | Other (Primarily Commercial and Industrial) | Total | % of Total Assets | | Governments and

Official Institutions | | Banks and Other

Financial

Institutions | | Other (Primarily

Commercial

and Industrial) | | Total | | %

of Total

Assets |

2012 | | | | | | | | | | | |

Australia | | | 22 | | 2,393 | | 3,110 | | 5,525 | | 0.8% |

2011 | | | | | | | | | | | | | | | |

United States | - | 16,014 | 1,557 | 17,571 | 2.6% | | - | | 16,014 | | 1,557 | | 17,571 | | 2.6% |

Australia | 12 | 7,504 | 4,022 | 11,538 | 1.7% | | 12 | | 7,504 | | 4,022 | | 11,538 | | 1.7% |

United Kingdom | 10 | 6,711 | 446 | 7,167 | 1.1% | | 10 | | 6,711 | | 446 | | 7,167 | | 1.1% |

2010 | | | | | | | | | | | | | | | |

Australia | 7 | 5,353 | 3,172 | 8,532 | 1.4% | | 7 | | 5,353 | | 3,172 | | 8,532 | | 1.4% |

2009 | | | | | | |

United States | - | 2,030 | 2,637 | 4,667 | 0.8% | |

Australia | 1 | 1,613 | 4,866 | 6,480 | 1.1% | |

United Kingdom | - | 4,092 | 590 | 4,682 | 0.8% | |

Impaired assets among cross-border outstandings were $224$125 million as at 30 September 2011 (20102012 (2011: $224 million, 2010: $136 million, 2009 $6 million).

Annual Report 2011120

| 1212012 WESTPAC GROUP ANNUAL REPORT

| |

Liquidity riskRISK AND RISK MANAGEMENT

LIQUIDITY RISK

Liquidity risk is the risk that we will be unable to fund our assets and meet our obligations as they come due, without incurring unacceptable losses. This could potentially arise as a result of mismatched cash flows generated by the Group’s banking business. Liquidity risk is managed through our BRMC-approved liquidity framework.

Refer to Note 27 to the financial statements for a more detailed discussion of our liquidity risk management policies.

Westpac debt programs and issuing shelves

Access in a timely and flexible manner to a diverse range of debt markets and investors is provided by the following programs and issuing shelves as at 30 September 2011:2012:

Program Limit |

| Issuer(s) |

| Program/Issuing Shelf Type |

|

|

|

|

|

Australia | | | | |

No limit | | WBC | | Debt Issuance Program |

| | | | |

Euro Market | | | | |

USD 2.5 billion | | WBC | | Euro Transferable Certificate of Deposit Program |

USD 20 billion | | WBC/WSNZL1 | | Euro Commercial Paper and Certificate of Deposit Program |

USD 70 billion | | WBC | | Euro Medium Term Note Program for the Issuance of Debt Instruments |

USD 7.5 billion | | WSNZL1 | | Euro Medium Term Note Program for the Issuance of Debt Instruments |

EUR 5USD 20 billion

| | WSNZLWBC2

| | Global Covered Bond Program |

EUR 5 billion | | WSNZL3 | | Global Covered Bond Program |

| | | | |

Japan | | | | |

JPY 750 billion | | WBC | | Samurai shelf |

JPY 750 billion | | WBC | | Uridashi shelf |

| | | | |

United States | | | | |

USD 45 billion | | WBC | Section 4(2)

| US Commercial Paper Program |

USD 10 billion | | WSNZL1 | Section 4(2)

| US Commercial Paper Program |

USD 35 billion | | WBC | | US MTN Program |

USD 10 billion | | WSNZL1 | | US MTN Program |

USD 15 billion | | WBC (NY Branch) | | Medium Term Deposit Notes |

No limit | | WBC (NY Branch) | | Certificate of Deposit Program |

No limit | | WBC | | US Securities and Exchange Commission registered shelf |

No limit | | WBC | | US Securities and Exchange Commission registered shelf for retail MTNs |

| | | | |

New Zealand | | | | |

No limit | | WNZL | | Medium Term Note and Registered Certificate of Deposit Program |

| | | | |

1 Notes issued under this program by Westpac Securities NZ Limited, London branch are guaranteed by Westpac New Zealand Limited, its parent company.

2 Notes issued under this program are guaranteed by BNY Trust Company of Australia Limited as trustee of the Westpac Covered Bond Trust.

3Notes issued under this program by Westpac Securities NZ Limited, London branch are guaranteed by Westpac New Zealand Limited, its parent company, and Westpac NZ Covered Bond Limited.

| | |

| 2012 WESTPAC GROUP ANNUAL REPORT | 122121

| Westpac Group

|

Risk and risk management

Market riskMARKET RISK

Market risk is the risk of an adverse impact on earnings resulting from changes in market factors, such as foreign exchange rates, interest rates, commodity prices and equity prices. This includes interest rateMarket risk in the banking book – the risk to interest income from a mismatch between the duration of assets and liabilities that arises in the normal course of businessboth trading and banking book activities.

Our trading activities are conducted in our Financial Markets and Group Treasury businesses. Financial Market’s trading book activity represents dealings that encompass book running and distribution activity. Group Treasury’s trading activity represents dealings that include the management of interest rate, FXforeign exchange (FX) and credit spread risk associated with wholesale funding, liquid asset portfolios and FX repatriations.

Refer to Note 27 to the financial statements for a more detailed discussion of our market risk management policies.

The table below depicts the aggregate Value at Risk (VaR), by risk type, for the six months ended 30 September 2011,2012, 31 March 20112012 and 30 September 2010:2011:

| | 30 September 2011 | | 31 March 2011 | | 30 September 2010 | |

| | High | | Low | | Average | | High | | Low | | Average | | High | | Low | | Average | |

Six months ended | | $m | | $m | | $m | | $m | | $m | | $m | | $m | | $m | | $m | |

Interest rate risk | | 40.9 | | 16.5 | | 28.4 | | 32.9 | | 12.8 | | 20.9 | | 25.6 | | 11.2 | | 18.0 | |

Foreign exchange risk | | 8.4 | | 0.9 | | 3.4 | | 8.0 | | 0.8 | | 3.3 | | 5.0 | | 1.0 | | 2.5 | |

Equity risk | | 1.7 | | 0.3 | | 0.6 | | 0.9 | | 0.2 | | 0.4 | | 0.9 | | 0.3 | | 0.5 | |

Commodity risk1 | | 6.6 | | 1.1 | | 3.5 | | 3.4 | | 1.2 | | 2.0 | | 3.3 | | 1.3 | | 1.9 | |

Other market risks2 | | 24.9 | | 16.6 | | 20.6 | | 23.2 | | 19.1 | | 21.7 | | 27.5 | | 15.8 | | 19.3 | |

Diversification effect | | n/a | | n/a | | (21.9 | ) | n/a | | n/a | | (19.8 | ) | n/a | | n/a | | (17.0 | ) |

Net market risk | | 50.0 | | 25.8 | | 34.6 | | 44.6 | | 19.9 | | 28.5 | | 35.9 | | 17.1 | | 25.2 | |

| | 30 September 2012 | | | 31 March 2012 | | 30 September 2011 | |

| | High | | Low | | Average | | | High | | Low | | Average | | High | | Low | | Average | |

Six months ended | | $m | | $m | | $m | | | $m | | $m | | $m | | $m | | $m | | $m | |

| | | | | | | | | | | | | | | | | | | | |

Interest rate risk | | 23.5 | | 10.5 | | 17.1 | | | 29.0 | | 14.8 | | 19.7 | | 40.9 | | 16.5 | | 28.4 | |

Foreign exchange risk | | 7.5 | | 0.8 | | 2.6 | | | 8.0 | | 1.6 | | 4.1 | | 8.4 | | 0.9 | | 3.4 | |

Equity risk | | 1.1 | | 0.2 | | 0.6 | | | 1.8 | | 0.4 | | 0.5 | | 1.7 | | 0.3 | | 0.6 | |

Commodity risk1 | | 2.4 | | 1.0 | | 1.7 | | | 5.1 | | 1.7 | | 3.2 | | 6.6 | | 1.1 | | 3.5 | |

Other market risks2 | | 20.7 | | 7.8 | | 15.2 | | | 21.6 | | 14.9 | | 18.0 | | 24.9 | | 16.6 | | 20.6 | |

Diversification effect | | n/a | | n/a | | (10.6) | | | n/a | | n/a | | (14.4) | | n/a | | n/a | | (21.9) | |

Net market risk | | 38.9 | | 16.8 | | 26.6 | | | 41.2 | | 25.7 | | 31.1 | | 50.0 | | 25.8 | | 34.6 | |

1 Includes electricity risk.

2 Includes prepayment risk and credit spread risk (exposure to movements isin generic credit rating bands).

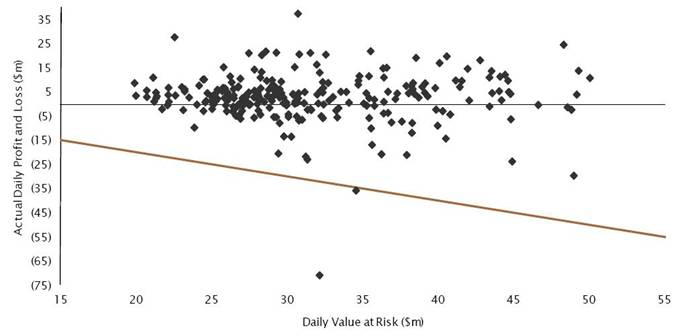

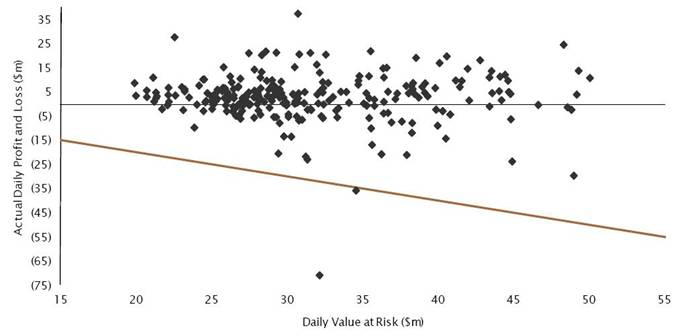

The graph below compares the actual profit and loss from trading activities on a daily basis to VaR over the reporting period:

Each point on the graph represents one day’s profit or loss from trading activities. The result is placed on the graph relative to the associated VaR utilisation. The downward sloping line represents the point where a loss is equal to VaR utilisation. Therefore any point below the line represents a back-test exception (i.e. where the loss is greater than VaR).

Annual Report 2011

| | |

122123 | 2012 WESTPAC GROUP ANNUAL REPORT | |

Operational risk and compliance riskRISK AND RISK MANAGEMENT

OPERATIONAL RISK AND COMPLIANCE RISK

Operational risk arises from inadequate or failed internal processes and systems, human error or misconduct, or from external events. It also includes, among other things, technology risk, model risk and outsourcing risk.

The way operational risk is managed has the potential to positively or negatively impact our customers, our financial performance and our reputation.

Operational risk includes compliance risk. Compliance risk is the risk of legal or regulatory sanction, and financial or reputationreputational loss, arising from our failure to abide by the compliance obligations required of us.

Compliance is focused on meeting our legal and regulatory obligations in each of the jurisdictions in which we operate. Non-compliance can result in legal or regulatory sanction and financial and/or reputational loss. Refer to the Corporate Governance report in Section 1 for information on our management of operational and compliance risk.

The Group’s Operational Risk Management Framework assistsand Compliance Management Framework assist all divisions to achieve their objectives through the effective identification, measurement, management and monitoring of their operational risks. The Framework definesFrameworks define the principles, policies and processes, systems, and roles and responsibilities that we use to meet our obligations under the law, based on the letter and spirit of the regulatory standards that apply to the Group. The Framework isFrameworks are underpinned by a culture of individual accountability and responsibility, based on a Three Lines of Defence model. This is discussed in further detail in Note 27 to the financial statements.

Other risksOTHER RISKS

Business risk

The risk associated with the vulnerability of a line of business to changes in the business environment.

Environmental, social and governance risks

The risk of damage to Westpac’s reputation or financial performance due to failure to recognise or address material existing or emerging sustainability-related environmental, social or governance issues.

The Group has in place a Risk Management Framework plusthat is supported by a suite of key supporting publicpolicies and position statements (e.g. principlesstatements. These include the Principles for doing business, responsible lending, our approach to dealing with variousDoing Business, Principles for Responsible Lending, ESG sensitive business sectors)Credit Risk Policy and internal policies setting out requirements for the recognitionSustainable Supply Chain Policy, many of which are publicly available. The Framework was reviewed and management of these risks from the multiple perspectives of the Group’s general business operations (e.g. supply chain management) and alsoupdated in our key credit and lending activities (e.g. ESG-related credit risk) and investment management activities (e.g. 2012.

Westpac is also a signatory to a number of voluntary principles-based frameworks that guide the integration of ESG-related issues into investment analysis. These include the Equator Principles covering project finance activities and the United Nations Principles for Responsible Investment a voluntary principles-based framework guiding the integration of ESG-related issues intocovering investment analysis).analysis.

Equity risk

The potential for financial loss arising from movements in the value of our direct and indirect equity investments.

The Group’s direct equity risks result from our involvement in underwriting capital raisings undertaken by our customers, trading in equity derivatives, holdings of direct equity investments, asset warehousing, any other strategic investments that the Group may choose to make from time to time and the potential for exposure via obligations to our various employee defined benefits superannuation funds. Our indirect equity risk is primarily related to the potential for equity market volatility to impact on fee income that is based on the size of funds under management and administration.

The Group has in place various policies, limits and controls to manage these risks and the conflicts of interest that can potentially arise.

Insurance risk

The risk of not being able to meet insurance claims (related to insurance subsidiaries).misestimation of the expected cost of insured events, volatility in the number or severity of insured events, and misestimation of the cost of incurred claims.

Subsidiaries within the Group’s BT Financial Group undertake life insurance, general insurance and lender’slenders mortgage insurance. They are governed by independent boards and are subject to separate regulatory oversight and controls. These subsidiaries have comprehensive reinsurance arrangements in place to transfer risk and protect against catastrophic events. They are capitalised to a level that exceeds the minimum required by the relevant regulator.

Related entity (contagion) risk

The risk that problems arising in other Westpac Group members compromise the financial and operational position of the ADI in the Westpac Group.

The Group has in place a Risk Management Framework and a suite of supporting policies and procedures governing the control of dealings with, and activities that may be undertaken by, Group members. Controls include the measurement, approval and monitoring of, and limitations on, the extent of intra-group credit exposures and other forms of parent entity support, plus requirements related to control of Group badging, product distribution, promotional material, service-level agreements and managing potential conflicts of interest.

| | |

| 2012 WESTPAC GROUP ANNUAL REPORT | 123 |

Reputation risk

The risk to earnings or capital arising from negative public opinion resulting from the loss of reputation or public trust and standing.

Risk and risk management

Reputation risk can arise from gaps between current and/or emerging stakeholder perceptions and expectations relative to our current or planned activities, performance or behaviours. It can affect the Group’s brands and businesses positively or negatively. Stakeholder perceptions can include (but are not limited to) views on financial performance, quality of products or services, quality of management, leadership and governance, history and heritage and our approach to sustainability, social responsibility and ethical behaviour.

We have a Risk Management Framework and key supporting policies in place covering the way we manage reputation risk as one of our key risks across the Group, including the setting of risk appetite and roles and responsibilities for risk identification, measurement and management, monitoring and reporting.

Special purpose entitiesSPECIAL PURPOSE ENTITIES

We are associated with a number of special purpose entities (also known as special purpose vehicles or SPVs) in the ordinary course of business, primarily to provide funding and financial services products to our customers.

SPVs are typically set up for a single, pre-defined purpose, have a limited life and generally are not operating entities nor do they have employees. The most common form of SPV structure involves the acquisition of financial assets by the SPV that are funded by the issuance of securities to external investors (securitisation). Repayment of the securities is determined by the performance of the assets acquired by the SPV.

Under A-IFRS, an SPV is consolidated and reported as part of the Group if it is controlled by the parent entity in line with AASB 127 Consolidated and Separate Financial Statements or deemed to be controlled in applying UIG Interpretation 112 Consolidation –— Special Purpose Entities. The definition of control is based on the substance rather than the legal form. Refer to Note 1 to the financial statements for a description of how we apply the requirements to evaluate whether to consolidate SPVs.

In the ordinary course of business, we have established or sponsored the establishment of SPVs in relation to securitisation, as detailed below. Capital is held, as appropriate, against all SPV-related transactions and exposures.

Asset securitisationASSET SECURITISATION

Through our rated loan securitisation programs we package our equitable interests in loans (principally housing mortgage loans) as securities which are sold to investors. We provide arm’s length interest rate swaps and liquidity facilities to the programs in accordance with relevant prudential guidelines. We have no obligation to repurchase any securitisation securities, other than in certain circumstances (excluding loan impairment) where there is a breach of representation or warranty within 120 days of the initial sale (except in respect of our program in New Zealand which imposes no such time limitation). We may remove loans from the program where they cease to conform with the terms and conditions of the securitisation programs or through a program’s clean-up features.

As at 30 September 2011,2012, own assets securitised through a combination of privately or publicly placed issues to Australian, New Zealand, European and United States investors was $11.4$10.1 billion (2010 $12.0(2011: $11.4 billion).

Under A-IFRS substantially all of the SPVs involved in our loan securitisation programs are consolidated by the Group.

Refer to Note 31 to the financial statements for further details.

Customer funding conduitsCUSTOMER FUNDING CONDUITS

We arrange financing for certain customer transactions through a commercial paper conduit that provides customers with access to the commercial paper market. As at 30 September 2011,2012, we administered one significant conduit (2010(2011: one), that was created prior to 1 February 2003, with commercial paper outstanding of $2.8$2.6 billion (2010 $2.4(2011: $2.8 billion). We provide a letter of credit facility as credit support to the commercial paper issued by the conduit. This facility is a variable interest in the conduit that we administer and represents a maximum exposure to loss of $284$266 million as at 30 September 2011 (2010 $2442012 (2011: $284 million). The conduit is consolidated by the Group.

Refer to Note 31 to the financial statements for further details.

Structured finance transactionsSTRUCTURED FINANCE TRANSACTIONS

We are involved with SPVs to provide financing to customers or to provide financing to the Group. Any financing arrangements to customers are entered into under normal lending criteria and are subject to our normal credit approval processes. The assets arising from these financing activities are generally included in receivables due from other financial institutions or available-for-sale securities. The liabilities arising from these financing activities are generally included in payables due to other financial institutions, debt issues or financial liabilities designated at fair value. Exposures in the form of guarantees or undrawn credit lines are included within contingent liabilities and credit-related commitments.

| | |

124 | 2012 WESTPAC GROUP ANNUAL REPORT | |

Off-balance sheet arrangements

OFF-BALANCE SHEET ARRANGEMENTS

Wealth management activity

Refer to Note 37 to the financial statements for details of our wealth management activities.

Other off-balance sheet arrangements

Refer to Note 35 to the financial statements for details of our superannuation plans.

Financial reportingFINANCIAL REPORTING

Internal control over financial reporting

The US Congress passed the Public Company Accounting Reform and Investor Protection Act in July 2002, which is commonly known as the Sarbanes OxleySarbanes-Oxley Act of 2002 (SOX). SOX is a wide ranging piece of US legislation concerned largely with financial reporting and corporate governance. We are obligated to comply with SOX by virtue of being a foreign registrant with the SEC and we have established procedures designed to ensure compliance with all applicable requirements of SOX.

Disclosure controls and procedures

Our management, with the participation of our CEO and CFO, evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined in Rule 13a-15(e) under the US Securities Exchange Act of 1934)1934) as of 30 September 2011.2012.

Based upon this evaluation, our CEO and CFO have concluded that the design and operation of our disclosure controls and procedures were effective as of 30 September 2011.2012.

Management’s Report on internal control over financial reporting

Rule 13a–15(a)13a-15(a) under the US Securities Exchange Act of 1934 requires us to maintain an effective system of internal control over financial reporting. Please refer to the sections headed ‘Management’s report on internal control over financial reporting’ and ‘Report of independent registered public accounting firm’ in Section 3 for those reports.

Changes in our internal control over financial reporting

There has been no change in our internal control over financial reporting (as defined in Rule 13a-15(f) of the US Securities Exchange Act of 1934)1934) for the year ended 30 September 20112012 that has been identified that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

| | |

| 2012 WESTPAC GROUP ANNUAL REPORT | 126125

| Westpac Group

|

Other Westpac business informationOTHER WESTPAC BUSINESS INFORMATION

Employees

EMPLOYEES

The number of employees in each area of business as at 30 September1:

| | 2011 | | 2010 | | 2009 | |

Westpac RBB | | 10,441 | | 11,663 | | 11,751 | |

WIB | | 3,194 | | 3,139 | | 3,065 | |

St.George Banking Group | | 4,998 | | 5,518 | | 5,227 | |

BTFG | | 4,239 | | 4,316 | | 3,949 | |

New Zealand Banking | | 4,575 | | 4,698 | | 4,510 | |

Other | | 10,359 | | 9,628 | | 8,530 | |

Total employees | | 37,806 | | 38,962 | | 37,032 | |

| | 2012 | | 2011² | | 2010² | |

AFS | | | | | | | |

Westpac RBB | | 10,171 | | 10,940 | | 11,860 | |

St.George | | 5,106 | | 5,190 | | 5,614 | |

BTFG | | 3,898 | | 3,709 | | 3,750 | |

WIB | | 1,751 | | 1,707 | | 1,782 | |

Westpac New Zealand | | 4,691 | | 4,660 | | 4,782 | |

Other | | 10,058 | | 11,600 | | 11,174 | |

Total employees | | 35,675 | | 37,806 | | 38,962 | |

1 The number of employees includes core and implied FTE (including FTE working on merger integration projects). Core FTE includes full-time and pro-rata part-time staff. Implied FTE includes overtime, temporary and contract staff.

22011 and 2010 FTE restated for changes in business structure.

2012 v 2011

Total FTE decreased by 2,131 compared to 30 September 2011. This decrease is primarily driven by the delivery of productivity initiatives primarily as a result of the creation of AFS and Group Services divisions.

Specifically, the movement comprised:

§a net decrease of 664 FTE across AFS due to benefits realised from the establishment of the AFS division and delivery of productivity program benefits of 858 FTE, partly offset by investment in Bank of Melbourne (124 FTE) as well as additional FTE to support expanded planner network (90 FTE);

§a net decrease of 1,542 FTE across other businesses mainly from productivity program benefits. This includes a reorganisation of external supplier arrangements whereby 971 FTE were reclassified, partially offset by on-boarding 501 FTE for mortgage processing activities and an increase in FTE to support regulatory change and compliance programs;

§an increase of 44 FTE in WIB directly attributable to increased presence in Asia and additional staff to support investment in target segments including natural resources and agribusiness; and

§an increase of 31 FTE in Westpac New Zealand mainly to support projects.

2011 v 2010

Total FTE decreased by 1,156 compared to 30 September 2010. This decrease is primarily driven by continuous productivity and restructuring initiatives across various business units.

Specifically, the movement comprised:

§ a net decrease of 1,2221,385 FTE in Westpac RBBacross AFS as a result of continuous productivity initiatives across Retail and Commercial Banking and Customer Service and business restructures within the Group;

§a decreaseGroup, partly offset by an increase of 520 FTE in St.George Banking Group as a result of productivity initiatives and business restructures within the Group. Included within the 520 FTE reduction is a 161 FTE increase for new customer facing employees associated with the Bank of Melbourne;

§ a decrease of 123122 FTE in Westpac New Zealand Banking as a result of productivity initiatives and business restructures within the Group; and

§ ana net increase of 709351 FTE in other businesses driven by project demand predominantly related to the SIPs program, business restructures within the Group and the direct employment of IT support staff previously supplied by an external vendor.vendor, partially offset by productivity initiatives.

2010 v 2009PROPERTY

Total FTE increased by 1,930 in 2010 compared to 30 September 2009. This increase was primarily driven by Westpac’s investment in technology and other projects.

Specifically, the movement comprised: