(Exact name of Registrant as specified in its charter) | ||

| ||

(Translation of Registrant’s name into English) | ||

| ||

(Jurisdiction of incorporation or organization) | ||

| ||

(Address of principal executive offices) | ||

| ||

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) | ||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

American depositary shares, each representing par value US$0.001 per share* | MYND |

| ||||||

*Not for trading, but only in connection with the listing on the New York Stock Exchange of American depositary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

(Title of Class) | ||

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

(Title of Class) | ||

|

o ☐ Yes x☒ No

o

x

x

| Large accelerated filer | Accelerated filer | Non-accelerated filer | Emerging growth company | |||||||||||

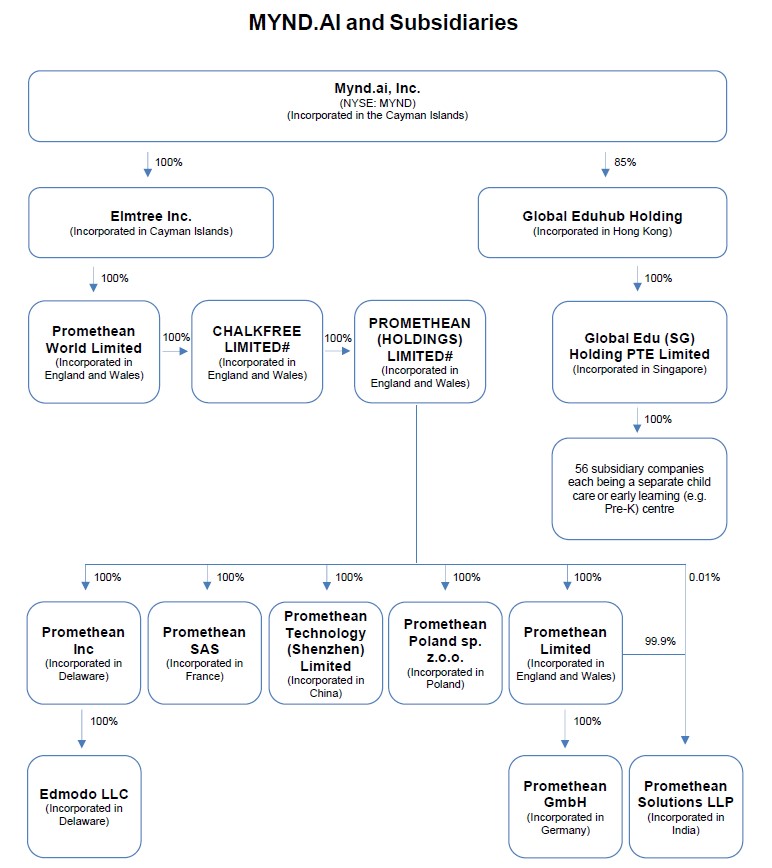

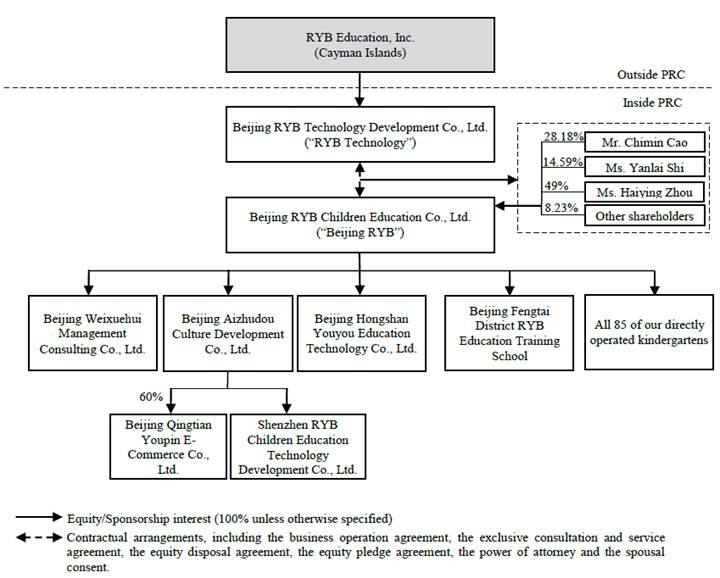

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. International Financial Reporting Standards as issued Other FORWARD-LOOKING STATEMENTS A. Reserved A. History and Development of the Company A. Operating Results A. Directors and Senior Management B. Related Party Transactions A. Disclosure Controls and Procedures ADVISORS Years Ended December 31, 2015 2016 2017 (in thousands of US$, except for share and Summary Consolidated Comprehensive Statement of Operations Data: Net revenues: Services 74,815 95,936 122,869 Products 8,043 12,577 17,934 Total net revenues 82,858 108,513 140,803 Cost of revenues: Services 70,310 85,356 101,522 Products 4,047 6,260 9,755 Total cost of revenues 74,357 91,616 111,277 Gross profit 8,501 16,897 29,526 Operating expenses: Selling expenses 1,191 1,922 1,774 General and administrative expenses 8,389 7,424 18,418 Total operating expenses 9,580 9,346 20,192 Operating (loss) income (1,079 ) 7,551 9,334 (Loss) income before income taxes (316 ) 8,231 10,592 Income tax expenses 980 2,155 3,812 (Loss) income before loss in equity method investments (1,296 ) 6,076 6,780 Loss from equity method investments — (189 ) (239 ) Net (loss) income (1,296 ) 5,887 6,541 Less: Net loss attributable to noncontrolling interest (664 ) (618 ) (574 ) Net (loss) income attributable to RYB Education, Inc. (632 ) 6,505 7,115 Less: Accretion of convertible redeemable preferred shares 2,384 — — Deemed dividends to convertible redeemable preferred shareholders 763 — — Net (loss) income attributable to ordinary shareholders of RYB Education, Inc. (3,779 ) 6,505 7,115 Net (loss) income per share attributable to ordinary shareholders of RYB Education, Inc.: Basic (0.22 ) 0.28 0.29 Diluted (0.22 ) 0.26 0.27 Weighted average shares used in calculating net (loss) income per ordinary share: Basic 16,929,789 23,163,801 24,735,445 Diluted 16,929,789 24,682,525 26,566,657 As of December 31, 2015 2016 2017 (in thousands of US$) Summary Consolidated Balance Sheet Data: Cash and cash equivalents 24,594 46,256 158,691 Total current assets 39,525 63,983 172,808 Total assets 73,834 104,410 229,738 Total current liabilities 58,339 80,287 97,022 Total liabilities 77,083 100,449 124,444 Total equity (3,249 ) 3,961 105,294 Years Ended December 31, 2015 2016 2017 (in thousands of US$) Summary Consolidated Cash Flow Data: Net cash generated from operating activities 23,808 35,053 25,099 Net cash used in investing activities (14,950 ) (12,122 ) (8,655 ) Net cash generated from financing activities 695 1,422 92,496 Exchange rate effect on cash and cash equivalents (977 ) (2,690 ) 3,666 Net increase in cash and cash equivalents and restricted cash 8,576 21,663 112,606 Cash and cash equivalents and restricted cash at beginning of year 16,389 24,965 46,628 Cash and cash equivalents and restricted cash at end of year 24,965 46,628 159,234 subsidiaries, please see Item 4C below. Applicable. and Industry affect our financial condition and results of operations. industry or the economy in general. Islands. In June 2017, we changed corporate name to Mynd.ai, Inc. 7, 2023 (the “Second Amendment”) (both the First Amendment and the Second Amendment, together with the Original Merger Agreement, are collectively referred to herein as the “Merger Agreement”). The resellers. user, and Promethean’s ActivSync USB relay that allows multiple computer devices to connect to an IFPD via USB connections where one computing device can talk directly to another connected computing device over the USB connection. See also “Introductory Notes—Forward-looking Information.” Year Ended December 31, 2015 2016 2017 US$ % US$ % US$ % (in thousands, except for percentages) Services: Tuition fees from kindergartens and play-and-learn centers 62,505 75.4 % 78,268 72.1 % 100,745 71.6 % Franchise fees 8,743 10.6 % 12,425 11.5 % 13,537 9.6 % Training and other services 3,567 4.3 % 5,243 4.8 % 7,703 5.5 % Royalty fees — — — — 884 0.6 % 74,815 90.3 % 95,936 88.4 % 122,869 87.3 % Products: Sale of educational merchandise 8,043 9.7 % 12,577 11.6 % 17,934 12.7 % Total net revenues 82,858 100 % 108,513 100 % 140,803 100 % Year Ended December 31, 2015 2016 2017 US$ % US$ % US$ % (in thousands, except for percentages) Operating expenses: Selling expenses 1,191 1.4 % 1,922 1.8 % 1,774 1.3 % General and administrative expenses 8,389 10.2 % 7,424 6.8 % 18,418 13.0 % Total operating expenses 9,580 11.6 % 9,346 8.6 % 20,192 14.3 % Year Ended December 31, 2015 2016 2017 US$ % US$ % US$ % (in thousands, except for percentages) Net Revenues Services Tuition fees from kindergartens and play-and-learn centers 62,505 75.4 % 78,268 72.1 % 100,745 71.6 % Franchise fees 8,743 10.6 % 12,425 11.5 % 13,537 9.6 % Training and other services 3,567 4.3 % 5,243 4.8 % 7,703 5.5 % Royalty fees — — — — 884 0.6 % Products Sale of education merchandise 8,043 9.7 % 12,577 11.6 % 17,934 12.7 % Total net revenues 82,858 100.0 % 108,513 100.0 % 140,803 100.0 % Cost of revenues Services 70,310 84.8 % 85,356 78.6 % 101,522 72.1 % Products 4,047 4.9 % 6,260 5.8 % 9,755 6.9 % Total cost of revenues 74.357 89.7 % 91,616 84.4 % 111,277 79.0 % Gross profit 8,501 10.3 % 16,897 15.6 % 29,526 21.0 % Operating expenses Selling expenses 1,191 1.4 % 1,922 1.8 % 1,774 1.3 % General and administrative expenses 8,389 10.2 % 7,424 6.8 % 18,418 13.0 % Total operating expenses 9,580 11.6 % 9,346 8.6 % 20,192 14.3 % Operating (loss) income (1,079 ) (1.3 )% 7,551 7.0 % 9,334 6.6 % Interest income 74 0.1 % 107 0.1 % 563 0.4 % Government subsidy income 526 0.6 % 573 0.5 % 863 0.6 % Gain (loss) on disposal of subsidiaries 163 0.2 % — — (168 ) (0.1 )% (Loss) income before income taxes (316 ) (0.4 )% 8,231 7.6 % 10,592 7.5 % Income tax expenses 980 1.2 % 2,155 2.0 % 3,812 2.7 % (Loss) income before loss in equity method investments (1,296 ) (1.6 )% 6,076 5.6 % 6,780 4.8 % Loss from equity method investments — — (189 ) (0.2 )% (239 ) (0.2 )% Net (loss) income (1,296 ) (1.6 )% 5,887 5.4 % 6,541 4.6 % financial conditions. Estimates expected net realizable value is less than carrying value. estimates made. As a result, during the measurement period of Date Fair DLOM Discount Type of Valuation Purpose of Valuation (US$) November 5, 2015 3.84 15 % 18 % Retrospective To determine the fair value of share option grant; to determine the intrinsic value of the beneficial conversion feature June 22, 2017 11.67 5.5 % 16 % Cotemporaneous To determine the fair value of share option grant July 1, 2017 11.67 5.5 % 16 % Cotemporaneous To determine the fair value of share option grant Grant date November June 22, July 1, Risk-free interest rate(1) 2.26 % 2.15 % 2.31 % Expected volatility(2) 41 % 40 % 40 % Expected dividend yield(3) 0 % 0 % 0 % Expected multiples(4) 2.8 2.8/2.2 2.8/2.2 Fair value of underlying ordinary share(5) 3.84 11.67 11.67 Years Ended December 31, 2015 2016 2017 (in thousands of US$) Summary Consolidated Cash Flow: Net cash generated from operating activities 23,808 35,053 25,099 Net cash used in investing activities (14,950 ) (12,122 ) (8,655 ) Net cash generated from financing activities 695 1,422 92,496 Exchange rate effect on cash and cash equivalents (977 ) (2,690 ) 3,666 Net increase in cash and cash equivalents and restricted cash 8,576 21,663 112,606 Cash and cash equivalents and restricted cash at beginning of year 16,389 24,965 46,628 Cash and cash equivalents and restricted cash at end of year 24,965 46,628 159,234 Payment Due by Period Total Less than 1 1-3 years 3-4 years More than 4 (in thousands of US$) Operating Lease Obligations 40,580 9,971 16,709 7,323 6,577 Purchase Obligations 3,060 619 1,288 408 745 Total 43,640 10,590 17,997 7,731 7,322 Age Paul Heffernan directors. agreement. Name Ordinary Shares Exercise Price Date of Grant Date of Expiration Chimin Cao * 3.11 September 29, 2013 From November 17, 2021 to July 15, 2022 Yanlai Shi 583,460 1.08 September 11, 2009 From April 27, 2018 to May 27, 2020 * 3.11 September 29, 2013 From November 17, 2021 to July 15, 2022 887,546 2.88 November 5, 2015 November 4, 2023 * 1.58 July 1, 2017 June 30, 2025 year. Name Ordinary Shares Exercise Price Date of Grant Date of Chimin Cao 514,751 11.66 June 22, 2017 June 21, 2027 * (1) N/A March 14, 2018 March 13, 2028 Yanlai Shi 772,127 11.66 June 22, 2017 June 21, 2027 * (1) N/A March 14, 2018 March 13, 2028 Ping Wei * 11.66 June 22, 2017 June 21, 2027 * (1) N/A March 14, 2018 March 13, 2028 Directors a set of corporate governance guidelines. reference into this Annual Report. Functions: Number of % of Teaching staff in directly operated teaching facilities 3,038 61 % Other staff in directly operated teaching facilities and supporting branch offices 1,378 28 % Network support and supervision 351 7 % Research and development* 33 1 % Selling, general and administrative 194 4 % Total 4,994 100 % Ordinary Shares Class A Class B Total ordinary Percentage of Percentage Directors and Executive Officers:** Chimin Cao(1) 4,150,854 2,059,005 6,209,859 21.2 % 27.0 % Yanlai Shi(2) 1,513,547 2,059,005 3,572,552 11.7 % 23.8 % Liang Meng(3) 5,713,612 2,831,131 8,544,743 29.2 % 37.1 % Joel A. Getz — — — — — Dennis Demiao Zhu — — — — — Zhengong Chang — — — — — Ping Wei — — — — — All Directors and Executive Officers as a Group 11,378,013 6,949,141 18,327,154 60.2 % 87.0 % Principal Shareholders: Ascendent Rainbow (Cayman) Limited(4) 5,713,612 2,831,131 8,544,743 29.2 % 37.1 % Joy Year Limited(5) 4,135,854 2,059,005 6,194,859 21.2 % 26.9 % Trump Creation Limited(6) 2,108,691 — 2,108,691 7.2 % 2.3 % Bloom Star Limited(7) — 1,194,865 1,194,865 4.1 % 13.0 % RYB Education Limited(8) 300,741 864,140 1,164,881 4.0 % 9.7 % 7, 2023 (the “Second Amendment”) (both the First Amendment and the Second Amendment, together with the Original Merger Agreement, are collectively referred to herein as the “Merger Agreement”). The Merger Agreement contemplated that Best Assistant would transfer the education business of NetDragon outside of the Peoples Republic of China ("PRC") to Elmtree Inc., a Cayman Islands exempted company limited by shares and wholly-owned by Best Assistant who became a party to the Merger Agreement by executing a joinder on August 18, 2023 (“eLMTree”), and Merger Sub would merge with and into eLMTree with eLMTree continuing as the surviving company and becoming our wholly owned subsidiary (such transactions collectively, the “Merger”). Trading Price High Low US$ US$ Annual Highs and Lows 2017 (since September 27, 2017) 31.80 15.50 Quarterly Highs and Lows Fourth Quarter 2017 (since September 27, 2017) 31.80 15.50 First Quarter 2018 20.89 16.13 Second Quarter 2018 (through April 20, 2018) 17.86 16.31 Monthly Highs and Lows November 2017 30.50 15.56 December 2017 19.20 15.50 January 2018 20.33 16.43 February 2018 19.90 16.50 March 2018 20.89 16.13 April 2018 (through April 20, 2018) 17.86 16.31 ratio of our ADSs to one ADS representing 10 of our ordinary shares. Capital. reference. Contracts. Annual Report. Taxation. and their partners; FEDERAL TAXATION TO ITS PARTICULAR CIRCUMSTANCES, AND THE STATE, LOCAL, NON-U.S. AND OTHER TAX CONSIDERATIONS OF THE OWNERSHIP AND DISPOSITION OF THE ADSS OR ORDINARY SHARES. shares. credits. U.S. Holder holds the securities as capital assets. refund, provided that the required information is timely furnished to the IRS. with Respect to Foreign Financial Assets file IRS Form 8886 (Reportable Transaction Disclosure Statement). Agents. Experts. Display. SEC, and should not be relied upon. Information. expert” as defined in Item 16A of Form 20‑F. is not intended to form a part of or be incorporated by reference into this Annual Report. For the Year Ended December 2016 2017 (in thousands of US$) Audit fees(1) 240 1,520 principal auditors associated with certain financial due diligence services and other advisory services. applicable As of December 31 2016 2017 ASSETS Current assets Cash and cash equivalents 46,256 158,691 Term deposits 432 — Accounts receivable (net of allowance for doubtful accounts of $34 and $36 as of December 31, 2016 and 2017, respectively) 1,022 901 Inventories 3,043 3,549 Prepaid expenses and other current assets 9,414 9,541 Amounts due from related parties 3,816 126 Total current assets 63,983 172,808 Non-current assets Restricted cash 372 543 Property, plant and equipment, net 29,411 40,163 Goodwill 401 428 Long-term investments 378 256 Deferred tax assets 6,951 12,430 Other non-current assets 2,914 3,110 TOTAL ASSETS 104,410 229,738 LIABILITIES Current liabilities Prepayments from customers, current portion (including prepayments from customers of the consolidated VIE without recourse to the Group of $16,570 and $11,962 as of December 31, 2016 and 2017, respectively) 16,576 11,968 Accrued expenses and other current liabilities (including accrued expenses and other current liabilities of the consolidated VIE without recourse to the Group of $36,063 and $48,123 as of December 31, 2016 and 2017, respectively) 36,436 51,854 Income tax payable (including income tax payable of the consolidated VIE without recourse to the Group of $5,498 and $10,125 as of December 31, 2016 and 2017, respectively) 5,869 10,534 Deferred revenue, current portion (including deferred revenue of the consolidated VIE without recourse to the Group of $20,446 and $22,327 as of December 31, 2016 and 2017, respectively) 21,406 22,666 Total current liabilities 80,287 97,022 STATEMENTS OF OPERATIONS As of December 31 2016 2017 Non-current liabilities Prepayments from customers, non-current portion (including prepayments from customers of the consolidated VIE without recourse to the Group of $5,908, and $8,542 as of December 31, 2016 and 2017, respectively) 5,908 8,542 Deferred revenue, non-current portion (including deferred revenue of the consolidated VIE without recourse to the Group of $6,742, and $8,505 as of December 31, 2016 and 2017, respectively) 8,242 10,396 Other non-current liabilities (including other non-current liabilities of the consolidated VIE without recourse to the Group of $6,012 and $8,484 as of December 31, 2016 and 2017, respectively) 6,012 8,484 TOTAL LIABILITIES 100,449 124,444 EQUITY Golden share (par value of $0.001 per share; 1 share authorized; 1 and nil share issued and outstanding as of December 31, 2016 and 2017, respectively) — — Ordinary shares (par value of $0.001 per share; 99,999,999 shares authorized; 23,163,801 and 29,213,801 shares issued and outstanding as of December 31, 2016 and 2017, respectively) 23 29 Additional paid-in capital 36,420 129,134 Statutory reserve 2,156 2,678 Accumulated other comprehensive income 381 783 Accumulated deficit (35,472 ) (28,879 ) Total RYB Education, Inc. shareholders’ equity 3,508 103,745 Noncontrolling interest 453 1,549 TOTAL EQUITY 3,961 105,294 TOTAL LIABILITIES AND EQUITY 104,410 229,738 Years ended December 31, 2015 2016 2017 Net revenues: Services 74,815 95,936 122,869 Products 8,043 12,577 17,934 Total net revenues 82,858 108,513 140,803 Cost of revenues: Services 70,310 85,356 101,522 Products 4,047 6,260 9,755 Total cost of revenues 74,357 91,616 111,277 Gross profit 8,501 16,897 29,526 Operating expenses: Selling expenses 1,191 1,922 1,774 General and administrative expenses 8,389 7,424 18,418 Total operating expenses 9,580 9,346 20,192 Operating (loss) income (1,079 ) 7,551 9,334 Interest income 74 107 563 Government subsidy income 526 573 863 Gain (loss) on disposal of subsidiaries 163 — (168 ) (Loss) income before income taxes (316 ) 8,231 10,592 Income tax expenses 980 2,155 3,812 (Loss) income before loss in equity method investments (1,296 ) 6,076 6,780 Loss from equity method investments — (189 ) (239 ) Net (loss) income (1,296 ) 5,887 6,541 Less: Net loss attributable to noncontrolling interest (664 ) (618 ) (574 ) Net (loss) income attributable to RYB Education, Inc. (632 ) 6,505 7,115 Less: Accretion of convertible redeemable preferred shares 2,384 — — Deemed dividends to convertible redeemable preferred shareholders 763 — — Net (loss) income attributable to ordinary shareholders of RYB Education, Inc. (3,779 ) 6,505 7,115 Net (loss) income per share attributable to ordinary shareholders of RYB Education, Inc. Basic (0.22 ) 0.28 0.29 Diluted (0.22 ) 0.26 0.27 Weighted average shares used in calculating net (loss) income per ordinary share Basic 16,929,789 23,163,801 24,735,445 Diluted 16,929,789 24,682,525 26,566,657 Years ended December 31 2015 2016 2017 Net (loss) income (1,296 ) 5,887 6,541 Other comprehensive income, net of tax of nil: Change in cumulative foreign currency translation adjustments 161 (99 ) 410 Total comprehensive (loss) income (1,135 ) 5,788 6,951 Less: comprehensive loss attributable to noncontrolling interest (648 ) (630 ) (566 ) Comprehensive (loss) income attributable to RYB Education, Inc. (487 ) 6,418 7,517 RYB Education, Inc. Shareholders Accumulated Total RYB Number of Number of Additional other Education, Inc. Total golden Golden ordinary Ordinary paid-in Statutory comprehensive Accumulated shareholders’ Noncontrolling (deficit) share share Share share capital reserve income deficit equity interest equity Balance as of January 1, 2015 — — 15,800,000 16 2,512 1,367 323 (38,172 ) (33,954 ) (461 ) (34,415 ) Net loss for the year — — — — — — — (632 ) (632 ) (664 ) (1,296 ) Share-based compensation — — — — 1,929 — — — 1,929 — 1,929 Provision of statutory reserve — — — — — 421 — (421 ) — — — Accretion of convertible redeemable preferred shares — — — — — — — (2,384 ) (2,384 ) — (2,384 ) Deemed dividends to convertible redeemable preferred shareholders — — — — (763 ) — — — (763 ) — (763 ) Contribution from Mr. Chimin Cao and and Ms. Yanlai Shi (the “Founders”) — — — — 2,000 — — — 2,000 — 2,000 Repurchase of ordinary shares — — (5,684,146 ) (6 ) (19,469 ) — — — (19,475 ) — (19,475 ) Issuance of ordinary shares — — 13,047,947 13 50,211 — — — 50,224 — 50,224 Issuance of golden share 1 — — — — — — — — — — Foreign currency translation adjustments — — — — — — 145 — 145 16 161 Capital contribution from noncontrolling interest — — — — — — — — — 695 695 Disposal of subsidiaries — — — — — — — — — 75 75 Balance as of December 31, 2015 1 — 23,163,801 23 36,420 1,788 468 (41,609 ) (2,910 ) (339 ) (3,249 ) Net income (loss) for the year — — — — — — — 6,505 6,505 (618 ) 5,887 Provision of statutory reserve — — — — — 368 — (368 ) — — — Foreign currency translation adjustments — — — — — — (87 ) — (87 ) (12 ) (99 ) Capital contribution from noncontrolling interest — — — — — — — — — 1,422 1,422 Balance as of December 31, 2016 1 — 23,163,801 23 36,420 2,156 381 (35,472 ) 3,508 453 3,961 Net income (loss) for the year — — — — — — — 7,115 7,115 (574 ) 6,541 Provision of statutory reserve — — — — — 522 — (522 ) — — — Share-based payments — — — — 3,990 — — — 3,990 — 3,990 Option exercised — — 550,000 1 594 — — — 595 — 595 Return of capital — — — — (2,000 ) — — — (2,000 ) — (2,000 ) Foreign currency translation adjustments — — — — — — 402 — 402 8 410 Capital contribution from noncontrolling interest — — — — — — — — — 1,337 1,337 Disposal of non-wholly subsidiaries — — — — — — — — — 325 325 Redemption of golden share (1 ) — — — — — — — — — — Issuance of ordinary shares upon initial public offering (“IPO”) (net of issuance cost of $4,492) — — 5,500,000 5 90,130 — — — 90,135 — 90,135 Balance as of December 31, 2017 — — 29,213,801 29 129,134 2,678 783 (28,879 ) 103,745 1,549 105,294 Years ended December 31 2015 2016 2017 CASH FLOWS FROM OPERATING ACTIVITIES Net (loss) income (1,296 ) 5,887 6,541 Adjustments to reconcile net (loss) income to net cash generated from operating activities: Depreciation of property, plant and equipment 4,230 4,831 6,099 Change in allowance for doubtful accounts 109 51 — Loss on disposal of property, plant and equipment 20 6 13 Loss from equity method investments — 189 239 Net (gain) loss on disposal of subsidiaries (163 ) — 168 Share-based compensation 1,929 — 3,990 Changes in operating assets and liabilities: Accounts receivable (49 ) (365 ) 183 Inventories 256 (1,451 ) (290 ) Prepaid expenses and other current assets 67 (1,438 ) (2,110 ) Amounts due from related parties — 189 (115 ) Deferred tax assets (1,441 ) (1,687 ) (4,826 ) Other non-current assets (555 ) (560 ) (3 ) Prepayments from customers 7,005 6,678 (3,192 ) Accrued expenses and other current liabilities 5,664 10,176 10,927 Income tax payable 2,066 3,012 4,113 Deferred revenue 4,880 8,343 1,371 Amounts due to a related party (14 ) — — Other non-current liabilities 1,100 1,192 1,991 Net cash generated from operating activities 23,808 35,053 25,099 CASH FLOWS FROM INVESTING ACTIVITIES Acquisition of a business, net of cash acquired (1,031 ) — — Investments in bank deposits maturing over three months — (452 ) — Proceeds from maturity of term deposits — — 444 Purchase of long-term investments (55 ) (532 ) — Purchase of property, plant and equipment (12,080 ) (11,305 ) (11,917 ) Proceeds from disposal of subsidiaries 150 — — Cash surrendered in disposal of subsidiaries — — (168 ) Loans to related parties (6,508 ) — (1,010 ) Repayment from loans to related parties 4,423 — 3,818 Loans to third parties (517 ) — — Repayment from loans to third parties 613 — — Proceeds from disposal of property, plant and equipment 55 167 178 Net cash used in investing activities (14,950 ) (12,122 ) (8,655 ) Years ended December 31, 2015 2016 2017 CASH FLOWS FROM FINANCING ACTIVITIES Capital contribution from noncontrolling interests 695 1,422 1,337 Return of capital to Founders — — (990 ) Payment of initial public offering costs — — (3,073 ) Proceeds of exercise of options — — 595 Proceeds from issuance of ordinary shares 50,224 — — Proceeds from initial public offering — — 94,627 Payment for repurchase of ordinary shares (19,475 ) — — Payment for repurchase of convertible redeemable preferred shares (30,749 ) — — Net cash generated from financing activities 695 1,422 92,496 Exchange rate effect on cash and cash equivalents (977 ) (2,690 ) 3,666 Net increase in cash and cash equivalents, and restricted cash 8,576 21,663 112,606 Cash and cash equivalents, and restricted cash at beginning of the year 16,389 24,965 46,628 Cash and cash equivalents, and restricted cash at end of the year 24,965 46,628 159,234 Supplemental schedule of cash flow information Income taxes paid (355 ) (723 ) (4,626 ) Supplemental schedule of non-cash activities Acquisition of property, plant and equipment through deposits made 3,524 506 2,187 Acquisition of property, plant and equipment through payable — — 708 Contribution from the Founders 2,000 — — Return of capital to settle with a loan from a related party (See Note 19) — — (1,010 ) A loan due from a related party settled with return of capital (See Note 19) — — 1,010 NOTES TO CONSOLIDATED FINANCIAL STATEMENTS As of December 31, 2016 2017 Cash and cash equivalents 42,927 64,626 Prepaid expenses and other current assets 9,394 9,392 Total current assets 60,625 78,594 Total assets 99,489 133,897 Total current liabilities 78,577 92,537 Total liabilities 97,239 118,068 For the years ended December 31, 2015 2016 2017 Net revenues 81,830 107,747 140,012 Net income 2,598 7,378 17,925 Net cash provided by operating activities 24,241 32,181 25,453 Net cash used in investing activities (14,880 ) (12,119 ) (7,573 ) Net cash provided by financing activities 695 1,422 381 Effects of exchange rate changes (947 ) (2,572 ) 3,609 Estimates operations. The Company has reflected these changes in all historical periods presented and these updates have no impact on the presentation in the consolidated maturity in January 2028. The Cash Equivalents insurance limits. These deposits and funds may be redeemed upon demand and the Company does not anticipate any losses on such balances. The Company has not experienced any losses to date and believes that it is not exposed to any significant credit risk on cash and cash equivalents. Property, plant and equipment are stated at cost less accumulated depreciation. Maintenance and repairs are charged to expense when incurred. Additions and improvements that extend the economic useful life of the asset are capitalized and depreciated over the remaining useful lives of the assets. The cost and accumulated depreciation of assets sold or retired are removed from the respective accounts, and any resulting gain or loss is reflected in current earnings. Depreciation is recognized using the straight-line method in amounts considered to be sufficient to allocate the cost of the assets to operations over the estimated useful lives or lease terms, as follows: 2022, the Company did not recognize any impairment charges. During the year ended December 31, 2021, the Company recognized $1,553 of impairment charges relating to its the end user. The Years ended December 31, 2015 2016 2017 Services: Tuition fees from kindergartens and play-and-learn centers 62,505 78,268 100,745 Franchise fees 8,743 12,425 13,537 Training and other services 3,567 5,243 7,703 Royalty fees — — 884 74,815 95,936 122,869 Products: Sale of educational merchandise 8,043 12,577 17,934 Total net revenues 82,858 108,513 140,803 assets will not be realized. Current income taxes are provided for in accordance with the laws As of December 31, 2016 2017 Accounts receivable 1,056 937 Less: allowance for doubtful accounts (34 ) (36 ) Accounts receivable, net 1,022 901 As of December 31, 2016 2017 Balance at beginning of the year 36 34 Increase of the allowance for doubtful accounts — — Foreign currency adjustment (2 ) 2 Balance at end of the year 34 36 As of December 31, 2016 2017 Educational merchandise 3,043 3,549 3,043 3,549 As of December 31, 2016 2017 Prepayment for property, plant and equipment 4,287 2,304 Prepaid training and other service fees 209 2,126 Prepaid rental expenses 1,821 1,738 Staff advances 416 774 Receivables from the disposal of subsidiaries (1) 559 547 Prepayment for purchase of inventories 488 488 Prepayment for investment 720 384 Receivables from third party payment platform 85 181 Others 829 999 9,414 9,541 As of December 31, 2016 2017 Buildings 897 959 Furniture, fixture and equipment 6,967 9,475 Leasehold improvement 37,884 52,565 Motor vehicles 819 977 Total 46,567 63,976 Less: Accumulated depreciation (17,156 ) (23,813 ) 29,411 40,163 As of December 31, 2016 2017 Costs: Beginning balance 430 401 Acquisition of Tangning Garden — — Foreign Currency Adjustment (29 ) 27 Ending balance 401 428 Accumulated goodwill impairment loss — — Goodwill, net 401 428 As of December 31, 2016 2017 Rental deposits 2,914 3,110 2,914 3,110 As of December 31, 2016 2017 Salary and welfare payable 20,067 26,011 Accrued expenses 8,979 14,842 Payables for purchase of property, plant and equipment 1,907 2,550 Payables for purchase of educational merchandise 1,914 2,436 Other tax payable 684 635 Others 2,885 5,380 36,436 51,854 Series A Series B Shares Shares Total Balance as of January 1,2015 2,435 27,167 29,602 Accretion to redemption value of preferred shares 269 2,115 2,384 Repurchase of convertible redeemable preferred shares (2,704 ) (29,282 ) (31,986 ) Balance as of December 31, 2015 — — — Shares Shares issued Carrying Liquidation Series authorized and outstanding value value Series A 7,500,000 929,412 2,435 1,150 Series B 8,000,000 6,434,389 27,167 30,000 $3,067, respectively. expense (income) in the consolidated statements of operations. Number Weighted Weighted average Weighted average Aggregate of options average grant-date remaining contractual intrinsic outstanding exercise price fair value per option term (years) value Options outstanding at January 1, 2015 1,717,510 1.75 0.41 5.28 Granted 887,546 2.88 2.17 Forfeited (38,800 ) 1.52 0.34 Options outstanding at December 31, 2015 2,566,256 2.15 1.02 5.52 4,639 Forfeited (29,300 ) 1.76 0.41 Options outstanding at December 31, 2016 2,536,956 2.15 1.03 4.53 15,281 Granted 2,109,305 11.42 5.75 Exercised (550,000 ) 1.08 0.22 Forfeited (17,000 ) 2.32 0.79 Options outstanding at December 31, 2017 4,079,261 7.09 3.57 6.91 51,117 Options exercisable at December 31, 2017 2,638,379 4.59 2.24 5.50 43,585 weighted-average incremental borrowing rate was 5.03%. Grant date November 5, 2015 June 22, 2017 July 1, 2017 Risk-free interest rate 2.26 % 2.15 % 2.31 % Expected volatility 41 % 40 % 40 % Expected dividend yield 0 % 0 % 0 % Exercise multiples 2.8 2.8/2.2 2.8/2.2 Fair value of underlying ordinary share 3.84 11.67 11.67 the United Kingdom were subject to the UK corporation tax rate at 23.5% for the year ended Years ended December 31, 2015 2016 2017 Current tax expense 2,421 3,842 9,291 Deferred tax expense (1,441 ) (1,687 ) (5,479 ) 980 2,155 3,812 Years ended December 31, 2015 2016 2017 Deferred tax assets Accrued expenses 2,340 2,918 3,615 Net operating loss carry-forwards 5,637 6,306 11,337 Total deferred tax assets 7,977 9,224 14,952 Less: valuation allowance (2,256 ) (2,273 ) (2,522 ) Deferred tax assets, net 5,721 6,951 12,430 tax assets. As of December 31, Years ended December 31, 2015 2016 2017 (Loss) income before income taxes (316 ) 8,231 10,592 Income tax (benefit) expense computed at an applicable tax rate of 25% (79 ) 2,058 2,648 Permanent differences 355 80 6 Effect of income tax rate difference in other jurisdictions 482 — 909 Change in valuation allowance 222 17 249 980 2,155 3,812 Years ended December 31, 2015 2016 2017 Numerator: Net (loss) income attributable to RYB Education, Inc (632 ) 6,505 7,115 Accretion of Series A Shares 269 — — Accretion of Series B Shares 2,115 — — Deemed dividend to Series A Shares 546 — — Deemed dividend to Series B Shares 217 — — Net (loss) income attributable to ordinary shareholders for computing basic and diluted net (loss) income per ordinary share (3,779 ) 6,505 7,115 Accretion of Series A Shares 269 — — Deemed dividend to Series A Shares 546 — — Net income attributable to Series A shareholders for computing basic net income per Series A Share 815 — — Accretion of Series B Shares 2,115 — — Deemed dividend to Series B Shares 217 — — Net income attributable to Series B shareholders for computing basic net income per Series B Share 2,332 — — Denominator: Weighted average ordinary shares outstanding used in computing basic net (loss) income per ordinary share 16,929,789 23,163,801 24,735,445 Weighted average shares outstanding used in computing basic net income per Series A Share 786,817 — — Weighted average shares outstanding used in computing basic net income per Series B Share 5,447,195 — — Effect of dilutive securities Plus incremental weighted average ordinary shares from assumed conversions of options and using the treasury stock method — 1,518,724 1,831,212 Weighted average ordinary shares outstanding used in computing diluted net income per ordinary share 16,929,789 24,682,525 26,566,657 Net (loss) income per ordinary share-basic (0.22 ) 0.28 0.29 Net income per Series A Share-basic 1.04 — — Net income per Series B Share-basic 0.43 — — Net (loss) income per ordinary share-diluted (0.22 ) 0.26 0.27 Years ended December 31, 2015 2016 2017 Rental expense recorded: Ms. Zhiying Li (i) 310 294 293 310 294 293 As of December 31, 2016 2017 Amounts due from: Beijing Meihuilihe Technology Co., Ltd. (ii) 3,330 — Beijing Dongrundadi Co., Ltd. (ii) 72 — Mr. Chimin Cao (ii) 29 — Mr. Yanlai Shi (ii) 14 — Beijing Jindianshike Trading Co., Ltd. (ii) 271 — Hainan RYB (ii) 100 126 3,816 126 Years ending December 31, 2018 9,971 2019 8,902 2020 7,807 2021 7,323 2022 and thereafter 6,577 40,580 Years ending December 31, 2018 619 2019 644 2020 644 2021 408 2022 and thereafter 745 3,060 standards†standards† provided pursuant to Section 13(a) of the Exchange Act. x☐U.S. GAAP x☒

by the International Accounting Standards Boardo☐ o☐ o ☐ Item 17 o☐ Item 18o ☐ Yes x☒ Nooo☐ NoCONTENTSCONTENTS1Page INTRODUCTION 23333B. Capitalization and Indebtedness C. Reasons for the Offer and Use of Proceeds D. Risk Factors 35B. Business Overview C. Organizational Structure D. Property, Plant and Equipment 6060B. Liquidity and Capital Resources C. Research and Development, Patents and Licenses D. Trend Information E. Critical Accounting Estimates 78B. Compensation C. Board Practices D. Employees E. Share Ownership F. Disclosure of registrant’s action to recover erroneously awarded compensation 87A. Major Shareholders 88C. Interests of Experts and Counsel A. Consolidated Statements and Other Financial Information B. Significant Changes 8990101102104104104104B. Management’s Annual Report on Internal Control over Financial Reporting C. Attestation Report of the Registered Public Accounting Firm D. Changes in Internal Control Over Financial Reporting 105106106106106106106106107107107SIGNATURES 107Unless otherwise indicated and except where in this annual report on Form 20-F to:· “ADSs” are to our American depositary shares, each of which represents one Class A ordinary share;· “ADRs” are to the American depositary receipts that evidence our ADSs;· “China” or the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Hong Kong, Macau and Taiwan;· “Class A ordinary shares” are to our class A ordinary shares, par value US$0.001 per share;· “Class B ordinary shares” are to our class B ordinary shares, par value US$0.001 per share;· “ordinary shares” or “shares” are to our Class A ordinary shares and Class B ordinary shares;· “RMB” and “Renminbi” are to the legal currency of China;· “RYB,“Company,” “Mynd,” “we,” “us,” “our, company”” and “our” aresimilar references refer to RYB Education,Mynd.ai, Inc., oura company formed under the laws of the Cayman Islands, holding company, and its subsidiary, its consolidated variable interest entity, the subsidiaries of the consolidated variable interest entity and the non-enterprise entities sponsored by the consolidated variable interest entity;· “teaching facilities in our network” are to our directly operated or franchise kindergartens and play-and-learn centers that are in operation, and references to our directly operated kindergartens include facilities that are in the process of obtaining the private school operation permits or registration certificates for private non-enterprise entities but contribute to our tuition fee revenues; and· “US$,” “U.S. dollars,” “$,” and “dollars” are to the legal currency of the United States.annual report on Form 20-FAnnual Report contains forward-looking statements thatwithin the meaning of the Private Securities Litigation Reform Act of 1995 and other U.S. federal securities laws. These statements relate to our current expectations and views of future events. These statementsevents, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigations Reform Act of 1995.··· the expected growth of the early childhood education industry in China;··expectations regarding ability to attract and retain customers;franchisees, studentscustomers and their parents, business partners, or on our operating results and business generally;other stakeholders;·cash needs and financing plans;· threats;annual reportAnnual Report and the documents that we refer to in this annual reportAnnual Report and have filed as exhibits to this annual reportAnnual Report completely and with the understanding that our actual future results may be materially different from what we expect. Other sections of this annual reportAnnual Report discuss factors which could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.annual reportAnnual Report relate only to events or information as of the date on which the statements are made in this annual report.Annual Report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.ADVISERSapplicable.Applicable.A.Selected Financial DataSelected Consolidated Financial DataThe following selected consolidated statements of comprehensive income data for the years ended December 31, 2015, 2016 and 2017, selected consolidated balance sheet data as of December 31, 2016 and 2017 and selected consolidated cash flow data for the years ended December 31, 2015, 2016 and 2017 have been derived from our audited consolidated financial statements included elsewhere in this annual report. Our consolidated financial statementsoperations are prepared and presented in accordance with accounting principles generally acceptedprincipally focused in the United States of America, or ("U.S. GAAP.You should read"), Europe, the selected consolidated financialUnited Kingdom ("U.K."), and Singapore.in conjunction withon our consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report. Our historical results are not necessarily indicative of our results expected for future periods.

per share data)applicable.Ourour Businessmarket recognitionnumber of people with these skills or our failure to attract them could impede our ability to increase revenues from our existing products and services, ensure full compliance with federal, state and other applicable regulations, or launch new product offerings and would have an adverse effect on our business and financial results.brand.controlling shareholder) for development of our products, which exposes us to risks associated with doing business in that geographic area. If we are not able to continue to use those third-party contractors, our business, financial conditions, and results of operations may be adversely affected.reputationmarket share, our business, financial condition and results of operations may be adversely affected.brand recognition,existing solutions to address additional applications and markets. If we do not spend our research and development budget efficiently or effectively on compelling innovation and technologies or if we do not invest enough in R&D, our business may be harmed and we may not realize the expected benefits of our strategy. Moreover, research and development projects can be technically challenging and expensive. The nature of these research and development cycles may cause us to experience delays between the time we incur expenses associated with research and development and the time we are able to offer compelling solutions and generate revenue, if any, from such investment. As a result of R&D cycles sometimes being delayed, there is a risk that employees working on those projects could exit the business midstream resulting in further delays in order to get new hires or existing employees up to speed on the projects. Additionally, anticipated customer demand for products or solutions that we are developing could decrease after the development cycle has commenced, rendering us unable to recover substantial costs associated with the development of such product or solution. If we expend a significant amount of resources on research and development and our efforts do not lead to the successful introduction or improvement of solutions that are competitive in our current or future markets, or if we do not invest sufficiently on research and development efforts, it would harm our business, financial condition and results of operations.operatingfinancial performance. Moreover, given the rapid pace at which AI has advanced, there has been a push by legislators and even the private sector to consider regulation of AI such that it is not used in a potentially harmful way. The potential for regulation and the fears and suspicions associated with use of AI enabled products could result in customers refraining from purchasing our products which could potentially harm our business, results of operations, and financial condition.beresult in limitations on our operations which may materially and adversely affected.Our track recordaffect our business, financial condition, and results of operations.providing quality education services established “RYB ( ![]()