Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Class A Ordinary Shares, nominal value P$1.00 each | 683,856,600 |

Class B Ordinary Shares, nominal value P$1.00 each |

|

Class C Ordinary Shares, nominal value P$1.00 each |

|

Class D Ordinary Shares, nominal value P$1.00 each | 841,666,658 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

xYes ¨o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

xYes ¨o No

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | Accelerated filer |

Non-accelerated filer | Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o¨

†Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP | International Financial Reporting Standards as issued | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o¨ Item 17 ¨ oItem 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o¨ Yes x No

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o¨ Yes ¨o No

TABLE OF CONTENTS

Page | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

PURCHASES OF EQUITY SECURITIES BY THE COMPANY AND AFFILIATED PURCHASERS |

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

PRESENTATION OF FINANCIAL INFORMATION

Telecom Argentina S.A. is a company incorporated under the laws of Argentina. As used in this Annual Report on Form 20-F (the “Form 20-F” or “Annual Report”), the terms “the Company,” “Telecom,” “we,” “us,” and “our” refer to Telecom Argentina S.A. and its consolidated subsidiaries as of December 31, 2018.2020. Unless otherwise stated, references to the financial results of “Telecom” are to the consolidated financial results of Telecom Argentina and its consolidated subsidiaries. Telecom is primarily engaged in the provision of fixed and mobile telecommunications services, cable televisiondata services, Internet services and broadbandcable television services.

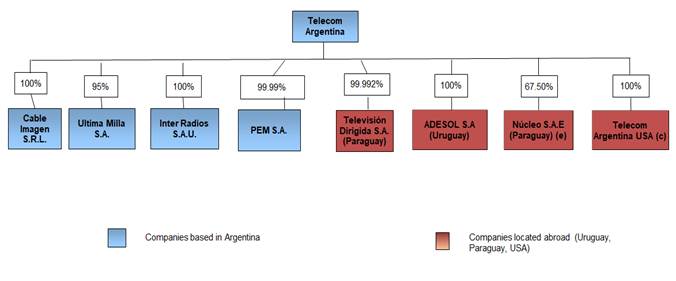

The term “Telecom Argentina” refers to Telecom Argentina S.A., excluding its subsidiaries. Telecom Argentina is engaged in the provision of telecommunication services in Argentina. The term “Cablevisión” refers to Cablevisión S.A., together with its consolidated subsidiaries, dissolved without liquidation as a result of the Merger.subsidiaries. The term “Merger” refers to the merger between Telecom and Cablevisión, with Telecom as surviving entity, effective as of January 1, 2018. Telecom’s most2018, through which Cablevisión was merged with and into Telecom Argentina, with Telecom Argentina being the surviving entity. As of December 31, 2020, Telecom Argentina’s significant subsidiaries were Núcleo S.A.E, PEM S.A.U, Cable Imagen S.R.L., Televisión Dirigida S.A., Adesol S.A., AVC Continente Audiovisual S.A., Inter Radios S.A.U., Telecom Argentina USA Inc. and Micro Sistemas S.A.U. For further information on our significant subsidiaries, see Exhibit 8.1 to this Annual Report.

Our consolidated financial statements as of December 31, 2018 were Núcleo (Núcleo S.A.E., a subsidiary engaged in the provision of mobile telecommunication services in Paraguay), PEM S.A. (investments), CV Berazategui S.A. (closed-circuit television services), Cable Imagen S.R.L. (closed-circuit television services), Televisión Dirigida S.A. (cable television services in Paraguay), Adesol S.A. (holding company in Uruguay), Ultima Milla S.A. (services for telecommunications), AVC Continente Audiovisual S.A. (broadcasting services), Inter Radios S.A.U. (broadcasting services)2020 and Telecom Argentina USA Inc. (telecommunication services in the United States).

Our Consolidated Financial Statements as of December 31, 2018 and 20172019 and for the years ended December 31, 2018, 20172020, 2019 and 2016,2018, and the notes thereto (the “Consolidated Financial Statements”) are set forth on pages F-1 through F-106F-90 of this Annual Report.

Our Consolidated Financial Statements, which are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and, have been approved by resolution of the Board of Directors’ meeting held on March 7, 20199, 2021 and have been audited by an independent registered public accounting firm.

Due to the high level of inflation prevailing in Argentina during the last three years,period 2016-2018, management analyzed the parameters established by IAS 29 “Financial reporting in hyperinflationary economies” - paragraph 3, which describe the conditions to consider an economy as hyperinflationary, and concluded that, with respect to Argentina, such conditions have been met for accounting periods ending after July 1, 2018. Therefore, we have restated our Consolidated Financial Statements and the financial information for all the periods reported in this Annual Report based on certain price indexes to take into account the effect of inflation in Argentina. The Consolidated Financial Statements and the financial information included in this Annual Report for all the periods reported are presented on the basis of constant Argentine pesosPesos as of December 31, 20182020 (“current currency”). See “—Risk factors—Factors—Risk RelatedRelating to Argentina—Inflation could accelerate, causing adverse effects on the economy and negatively impacting Telecom’s margins”,margins and/or ratios,” “Item 5—Operating and Financial Review and Prospects—Economic and Political Developments in Argentina”Factors Affecting Results of Operations” and Note 1.e) to our Consolidated Financial Statements.

Telecom Argentina and its subsidiaries maintain their accounting records and prepare their financial statements in Argentine Pesos, which is their functional currency, except for Núcleo and itsother subsidiaries and TVD (Guaraníes),in Paraguay, which use Guaraníes as their functional currency, Telecom Argentina USA, (U.S. dollars)which uses U.S. dollars as its functional currency, and Adesol (Uruguayan pesos).and other subsidiaries incorporated under the laws of Uruguay, which use Uruguayan Pesos as their functional currency. Our Consolidated Financial Statements include the results of these subsidiaries translatedconverted into Argentine Pesos. Assets and liabilities are translated at year-end exchange rates and income and expenses accounts at average exchange rates for each year presented, as restated in terms of the current currency by applying an average index to take into account the effect of inflation in Argentina.

Certain financial information contained in this Annual Report has been presented in U.S. dollars. This Annual Report contains translations of various Argentine Peso amounts into U.S. dollars at specified rates solely for convenience of the reader. You should not construe these translations as representations by us that the Argentine Peso amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated. Except as otherwise specified, all references to “US$,” “U.S. dollars” or “dollars” are to United States dollars, references to “EUR,” “euro” or “€” are to the lawful currency of the member states of the European Union and references to “P$,” “Argentine Pesos,” “$” or “pesos”“Pesos” are to Argentine Pesos. Unless otherwise indicated, we have translated the Argentine Peso amounts using a rate of P$37.70 =84.15= US$1.00, the U.S. dollar ask rate published by the Banco de la Nación Argentina (Argentine National Bank) on December 31, 2018.30, 2020. On March 19, 2019,22, 2021, the exchange rate was P$40.50 =91.57= US$1.00. As a result of fluctuations in the Argentine peso/Peso/U.S. dollar exchange rate, the exchange rate at such date may not be indicative of current or future exchange rates. Consequently, these translations should not be construed as a representation that the pesoPeso amounts represent, or have been or could be converted into, U.S. dollars at that or any other rate. See “Item 3—Key Information—Exchange Rates”,Rates,” and “Item 3—Key Information—Risk Factors—Risks Relating to Argentina—Devaluation of the pesoArgentine Peso and foreign exchange controls may adversely affect our results of operations, our capital expenditure programexpenditures and theour ability to service our liabilities and transfer funds abroad.pay dividends.”

|

|

For the purposes of this Annual Report, “billion” means a thousand million.

Certain amounts and ratios contained in this Annual Report (including percentage amounts) have been rounded up or down to facilitate the summation of the tables in which they are presented. The effect of this rounding is not material. These rounded amounts and ratios are also included within the text of this Annual Report.

The Securities and Exchange Commission maintains an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange Commission. Telecom Argentina’s telephone number is 54-11-4968-4000, and its principal executive offices are located in Alicia Moreau de Justo 50, (C1107AAB) Buenos Aires, Argentina. Our internet address is www.telecom.com.ar. The contents of our website and other websites referred to herein are not part of this Annual Report.

This Annual Report contains certain terms that may be unfamiliar to some readers. You can find a Glossary of these terms on page 5 of this Annual Report.

Telecom’s Consolidated Financial Statements and the selected financial data included in this Annual Report have been prepared on a consolidated basis, as restated in terms of the current currency to take into account the effect of inflation in Argentina.

| PRESENTATION OF FINANCIAL INFORMATION | TELECOM ARGENTINA S.A. |

Our financial statement data as of and for the years ended December 31, 2017 and 2016prior are not comparable with our financial statement data as of and for the year ended December 31, 2018 and any date and period thereafter because of the Merger, which was consummated on January 1, 2018 (the “Merger Effective Date”). Effective as of the Merger Effective Date, Cablevisión merged into Telecom Argentina. The Merger is part of a global process of convergence in the provision of fixed and mobile telecommunications services, video and internet distribution known as “quadruple play.” We have accounted for the Merger as a business combination using the acquisition method of accounting under IFRS 3 to account for assets and liabilities of Telecom Argentina as of January 1, 2018. The Merger constituted a “reverse acquisition,” pursuant to which Cablevisión (the legal absorbed entity) was considered the accounting acquirer and Telecom Argentina (the surviving entity) was considered the accounting acquiree (See Item 5 “Operating and Financial Review and Prospects”). acquiree. Accordingly, the financial statements of Telecominformation for periods prior to the Merger Effective Date reflect the historical financial information of Cablevisión, as restated in terms ofand the current currency to take into account the effect of inflation in Argentina. The information as of and for the year ended December 31, 2018 and the following years incorporates, based on the figures corresponding to Cablevisión, the effect of applying the acquisition method to Telecom Argentina to its fair value in accordance with IFRS 3 and the operations of Telecom Argentina as from January 1, 2018. Such figures areAll such financial information is presented in this Annual Report restated in termscurrent currency as of the current currencyDecember 31, 2020 to take into account the effect of inflation in Argentina.

The factorsfinancial information as of and for the years ended December 31, 2017 and earlier that were consideredwas previously reported in determining thatour annual reports on Form 20-F for the years ended December 31, 2017 and earlier reflect the financial information of Telecom Argentina, accounting acquiree in the Merger. Therefore, such financial information is not directly comparable to the financial information as of and for the years ended December 31, 2017 and earlier included in the 2018 and 2019 Annual Reports, this Annual Report and any other subsequent annual report, which reflect the financial information of Cablevisión should be treated as(the absorbed entity), considered the accounting acquirer in the Merger were:

(i) the relative voting rights in the surviving entity (55% for the former shareholders of Cablevisión and 45% for the former shareholders of Telecom);

(ii) the composition of the board of directors in the surviving entity and other committees (audit, supervisory and executive);

(iii) the relative fair value assigned to Cablevisión and Telecom; and

(iv) the composition of the key senior management of the surviving entity.

For more information, see Notes 1.c), 4.a) and 27.a) to our Consolidated Financial Statements.Merger.

PRESENTATION OF FINANCIAL INFORMATION | TELECOM ARGENTINA S.A. |

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking statements. Certain information included in this Annual Report contains information that is forward-looking, including, but not limited to:

| · | our expectations for our future performance, revenues, income, earnings per share, capital expenditures, dividends, liquidity and capital structure; |

· our expectations for our future performance, revenues, income, earnings per share, capital expenditures, dividends, liquidity and capital structure;

| · | the implementation of our business strategy; |

| · | the changing dynamics and growth in the telecommunications and cable markets in Argentina, Paraguay, Uruguay and the United States; |

| · | our outlook for new and enhanced technologies; |

| · | the effects of operating in a competitive environment; |

| · | industry conditions; |

| · | the outcome of certain legal proceedings; |

| · | regulatory and legal developments; and |

| · | other factors identified or discussed under “Item 3—Key Information—Risk Factors”. |

· the synergies expected from the Merger;

· the implementation of our business strategy;

· the changing dynamics and growth in the telecommunications and cable markets in Argentina, Paraguay and Uruguay;

· our outlook for new and enhanced technologies;

· the effects of operating in a competitive environment;

· industry conditions;

· the outcome of certain legal proceedings;

· regulatory and legal developments; and

· other factors identified or discussed under “Item 3—Key Information—Risk Factors.”

This Annual Report contains certain forward-looking statements and information relating to Telecom that are based on current views, expectations, estimates and projections of our Management and information currently available to Telecom. These statements include, but are not limited to, statements made in “Item 3—Key Information—Risk Factors,” “Item 5—Operating and Financial Review and Prospects” under the captions “Critical Accounting Policies” and “Trend Information,” “Item 8—Financial Information—Legal Proceedings” and other statements about Telecom’s strategies, plans, objectives, expectations, intentions, capital expenditures, and assumptions and any other statementsstatement contained in this Annual Report that areis not a historical facts.fact. When used in this document, the wordsterms “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “will,” “may” and “should” and other similar expressions are generally intended to identify forward-looking statements.

These Forward-looking statements reflect the current views of the management of the Company with respect to future events. They are not guarantees of future performance and involve certain risks and uncertainties that are difficult to predict. In addition, certain forward-looking statements are based upon assumptions as to future events that may not prove to be accurate.

Many factors could cause actual results, performance or achievements of Telecom to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements. These factors include, among others:

· our ability to successfully implement our business strategy and to achieve synergies resulting from the Merger;

· our ability to introduce new products and services that enable business growth;

· uncertainties relating to political and economic conditions in Argentina, Paraguay and Uruguay;

· inflation, the devaluation of the peso, the Guaraní and the Uruguayan peso and exchange rate risks in Argentina, Paraguay and Uruguay;

· restrictions on the ability to exchange Argentine or Uruguayan pesos or Paraguayan guaraníes into foreign currencies and transfer funds abroad;

· the manner in which the Argentine government regulates Law No. 27,078, the Argentina Digital Law or “LAD,” as amended by Decree No. 267/15, as well as the impact of the new Telecommunications Law, which has not yet been submitted to Congress;

| · | our ability to successfully implement our business strategy and to achieve synergies; |

| · | our ability to introduce new products and services that enable business growth; |

| · | our ability to service our debt and fund our working capital requirements; |

| · | uncertainties relating to political and economic conditions in Argentina, Paraguay, United States and Uruguay; |

| · | the impact of political and economic developments on demand for securities of Argentine companies; |

| · | inflation, the devaluation of the Peso, the Guaraní and the Uruguayan Peso and exchange rate risks in Argentina, Paraguay and Uruguay; |

| · | restrictions on the ability to exchange Argentine or Uruguayan Pesos or Paraguayan Guaraníes into foreign currencies and transfer funds abroad; |

| FORWARD-LOOKING STATEMENTS | TELECOM ARGENTINA S.A. |

· the creditworthiness of our actual or potential customers;

· nationalization, expropriation and/or increased government intervention in companies;

| · | the impact of additional currency and exchange measures or restrictions on our ability to access the international capital markets and our ability to repay our dollar-denominated indebtedness; |

· technological changes;

| · | the creditworthiness of our actual or potential customers; |

· the impact of legal or regulatory matters, changes in the interpretation of current or future regulations or reform and changes in the legal or regulatory environment in which we operate;

| · | nationalization, expropriation and/or increased government intervention in companies; |

· the effects of increased competition;

| · | technological changes; |

· reliance on content produced by third parties;

| · | the impact of legal or regulatory matters, changes in the interpretation of current or future regulations or reform and changes in the legal or regulatory environment in which we operate, including regulatory developments such as sanctions regimes in other jurisdictions (e.g., the United States) which impact on our suppliers; |

· increasing cost of our supplies;

| · | the effects of increased competition; |

· inability to finance on reasonable terms capital expenditures required to remain competitive;

| · | reliance on content produced by third parties; |

· fluctuations, whether seasonal or in response to adverse macro-economic developments, in the demand for advertising; and

| · | increasing cost of our supplies; |

| · | inability to finance on reasonable terms capital expenditures required to remain competitive; |

· our capacity to compete and develop our business in the future.

| · | fluctuations, whether seasonal or in response to adverse macro-economic developments, in the demand for advertising; |

| · | our capacity to compete and develop our business in the future; |

| · | the impact of increased national or international restrictions on the transfer or use of telecommunications technology; and |

| · | the effects of a pandemic or epidemic and any measures and policies adopted by governments to combat its effects, including mandatory lockdowns and other restrictions. |

Many of these factors are macroeconomic and regulatory in nature and therefore beyond the control of the Company’s management. Should one or more of these risks or uncertainties materialize, or underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, intended, planned or projected. The Company does not intend and does not assume any obligation to update the forward-looking statements contained in this Annual Report.

These forward-looking statements are based upon a number of assumptions and other important factors that could cause our actual results, performance or achievements to differ materially from our future results, performance or achievements expressed or implied by such forward-looking statements. Readers are encouraged to consult the Company’s filings made on Form 6-K, which are periodically filed with or furnished to the United States Securities and Exchange Commission.

FORWARD-LOOKING STATEMENTS | TELECOM ARGENTINA S.A. |

The following explanations are not provided as or intended to be technical definitions, but only to assist the general reader to understand certain terms used in this Annual Report.

2G (second-generation mobile system): Second-generation protocols using digital encoding and includes GSM, D-AMPS (TDMA) and CDMA. These protocols support high bit rate voice and limited data communications.

3G (third-generation mobile system): Third-generation mobile service, designed to provide high speed data, always-on data access, and greater voice capacity. 3G networks allow the transfer of both voice data services (telephony, messaging) and non-voice data (such as downloading Internet information, exchanging email, and instant messaging). The high data speeds, measured in Mbps, are significantly higher than 2G, and 3G networks technology enable full motion video, high-speed Internet access and video-conferencing.videoconferencing. 3G technology standards include UMTS, based on WCDMA technology (quite often the two terms are used interchangeably), and CDMA2000.

4G (fourth-generation mobile system): Fourth-generation mobile service using the LTE technology (Long Term Evolution technology).

Access5G (fifth-generation mobile system): (or The next major phase of mobile telecommunications standards. 5G is a complete redesign of network architecture with the flexibility and agility to support upcoming service opportunities. It delivers higher speeds, higher capacity, extremely low latency and greater reliability.

AccessesAccess (or )Accesses): Connection provided by Telecom Argentina to Internet services.

ADS:American Depositary Shares issued by JP Morgan, listed on the New York Stock Exchange, each representing rights to five (5) Class B Shares under a Deposit Agreement.

ADSL (Asymmetric Digital Subscriber Line): A type of digital subscriber line technology (DSL); a data communications technology that enables faster data transmission over copper lines than a conventional voiceband modem can provide.

AFIP (Administración Federal de Ingresos Públicos): The Argentine federal tax authority.

AFJP (Administradoras de Fondos de Jubilaciones y Pensiones): Private entities that were in charge of managing the funds of the Private Pension and Retirement System established by Law No. 24,241, until its nationalization in November 2008 pursuant to Law No. 26,425.

AFTIC (Autoridad Federal de Tecnologías de la Información y de las Comunicaciones): The decentralized and autonomous agency in the scope of the PEN appointed as the Regulatory AuthorityENACOM in the LAD. AFTIC was replaced by the ENACOM.

AMBA (Area Metropolitana Buenos Aires): An area comprising the Autonomous city of Buenos Aires and the greater Buenos Aires area.area, which constitutes the most densely populated region of Argentina. Telephone calls within the area are considered local.

Analog:A mode of transmission or switching that is not digital, e.g., the representation of voice, video or other not in digital form.

ANSES:The Argentine administrator of social security pension and retirement benefits.

ANSES —FGS: The Fondo de Garantía y Sustentabilidad del Sistema Integrado Previsional Argentino managed by ANSES.

Antitrust Authority: The Argenting enforcing authority of the antitrust statutes comprising Argentine Law 25,156, as amended, modified or supplemented from time to time, and its related decrees, resolutions and statutes, which currently is the Argentine Secretaría de Comercio Interior with the technical assistance of the CNDC.

Argentine GAAP: Generally Accepted Accounting Principles in Argentina, which we used before the adoption of IFRS.

ARBU (Average Revenue Billed per User): The average monthly revenue billed per user of our fixed telephony services, calculated by dividing total monthly basic charges and traffic revenue by weighted-average number of fixed telephony lines in service during the relevant measurement period.

GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

ARPU (Average Revenue per User): The average monthly revenue per user of our mobile telephony, broadbandInternet and cable television services, calculated by dividing total revenue (including revenue earned from cable and broadbandInternet subscription fees, mobile telephony subscription fees, cable premium services, pay-per-view fees and additional outlets but excluding mainly handset, out collect (wholesale) roaming, cell site rental and activation fee revenue) by weighted-average number of subscribers of each service during the relevant measurement period.

ASPO (Aislamiento Social Preventivo y Obligatorio): the mandatory and preventive social isolation measure imposed by the Argentine government.

Auction Terms and Conditions: Terms and Conditions approved by SC Resolution No. 38/14 for the awarding of frequency bands.

Backbone:Main connection network (mainly by fiber optics) that connect local areas.

BADLAR: Buenos Aires Deposits of Large Amount Rate.

Basic Telephone Services: Services or BTS: The supply of fixed telecommunications links that form part of the public telephone network, or are connected to such network, and the provision of local and long-distance telephone service (domestic and international).

BCBA (Bolsa de Comercio de Buenos Aires): The Buenos Aires Stock Exchange is a qualified entity according to articleSection 32 of Law No. 26,831, which acts by delegation of BYMA (Bolsas y Mercados Argentinos).

BCRA (Banco Central de la República Argentina): The Central Bank of Argentina.

Broadband: Services characterized by a transmission speed of 2 Mbps or more. These services include interactive services such as video telephone/video conferencing (both point-to-point and multipoint); video monitoring; interconnection of local networks; file transfer; high-speed fax; e-mail for moving images or mixed documents; Broadband videotext; video on demand and retrieval of sound programs or fixed and moving images.

Broadcasting:Simultaneous transmission of information to all Nodes and terminal equipment of a network.

BYMA (Bolsas y Mercados Argentinos S.A.): The stock market formed by a spin-off of certain assets of the MERVAL relating to its stock market operations and capital contributions on the Buenos Aires Stock Exchange. Effective April 17, 2017, the listing of all securities listed on MERVAL were automatically transferred to BYMA, as successor of MERVAL’s activities.stock exchange.

Cablevisión:Cablevisión S.A., together with its consilidatedconsolidated subsidiaries, disolveddissolved without liquidation as a result of the Merger.

Carrier: Company that makes available the physical telecommunication network.

Caja de Valores S.A: Argentine depository that custodies both public and private trading securities.

CDMA (Code Division Multiple Accesses): A digital wireless technology used in radio communication for transmission between a mobile handset and a radio base station. It enables the simultaneous transmission and reception of several messages, each of which has a coded identity to distinguish it from the other messages.

Cell:Geographical portion of the territory covered by a base transceiver station.

Cellular:A technique used in mobile radio technology to use the same spectrum of frequencies in one network multiple times. Low power radio transmitters are used to cover a “Cell” (i.e., a limited area) so that the frequencies in use can be reused without interference for other parts of the network.

Channel:The portion of a communications system that connects a source to one or more destinations. Also called circuit, line, link or path.

Churn: The termination of a mobile telephony, cable television or broadbandInternet services customer’s account. The churn rate is determined by calculating the total number of disconnected customers of each of our mobile telephony, cable television and broadbandInternet services over a given period as a percentage of the initial number of customers for such services as of the beginning of the applicable measurement period. Because most of our mobile telephony services are provided under the Personal trademark,brand, historical average monthly churn rates for mobile telephony services customers, included in this Annual Report for comparative purposes, reflect Telecom’s operations prior to the consummation of the Merger.

|

|

CNC (Comisión Nacional de Comunicaciones): The Argentine National Communications Commission, which was replaced by the AFTIC, which was replaced by the ENACOM (in December 2015).

CNDC (Comisión Nacional de Defensa de la Competencia): Argentine Antitrust Commission.

| GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

CNV (Comisión Nacional de Valores): The Argentine National Securities Commission.

CONATEL:National Communications Commission of Paraguay.

Convergence Products: The purpose of the Merger is to enable Telecom to efficiently offer, in line with the trend both at a national and international level, technological convergence products between media and telecommunications services, in a separate or independent basis, to provide voice, data, sound and image services, both fixed and wireless, in a single product or groups of products for the benefit of consumers of such multiple individual services.

COSO: Committee of Sponsoring Organizations of the Treadway Commission.

CPI: Consumer Price Index.

CPP (Calling Party Pays):Customer / Subscriber / Access: The system whereby a client of any of the party placingservices we provide. A single subscriber may contract for multiple services, and we believe that it is more useful to count the number of accesses a callsubscriber has contracted for, than to merely count the number of our subscribers. For example, a mobile handsetsubscriber that has fixed line telephony service and broadband service is counted as two subscribers rather than the mobile subscriber pays for the air time charges for the call.

as one subscriber.

CVH:Cablevisión Holding S.A.

D-AMPS (Digital-Advanced Mobile Phone Service): It is a digital version of AMPS (Advanced Mobile Phone Service), the original Analog standard for mobile telephone service in the United States.

Decree No. 267/15:Digital: Decree that modifies some aspects of the LAD and Audiovisual Communication Services Law published in the Official Gazette on January 4, 2016. This Decree was subsequently amended by Decree No. 1,340/16 issued by PEN and published in the Official Gazette on January 2, 2017.

Digital:A mode of representing a physical variable such as speech using digits 0 and 1 only. The digits are transmitted in binary form as a series of pulses. Digital networks are rapidly replacing the older Analog ones. Digital networks allow for higher capacity and higher flexibility through the use of computer-related technology for the transmission and manipulation of telephone calls. Digital systems offer lower noise interference and can incorporate encryption as a protection from external interference.

DWDM (Dense Wavelength Division Multiplexing): Technology for multiplying and transmitting different wavelengths along a single optical fiber contemporaneously.

ENACOM (Ente Nacional de Comunicaciones): or the Regulatory Authority: Argentine Communications Body within the scope of the Ministerio de Modernización, acting as Regulatory Authorityregulatory authority as of the date of this Annual Report. The ENACOM absorbed the functions of AFTIC.

ENTel (Empresa Nacional de Telecomunicaciones): National Telecommunications Company which operated the telecommunications system in Argentina prior to the Transfer Date.

Personal Envíos: Personal Envíos S.A.

Fiber Optic: Thin glass, silica or plastic wires, building the infrastructure base for data transmission. A Fiber Optic cable contains several individual fibers, and each of them is capable of driving a signal (light impulse) at unlimited bandwidth. Fiber Optics are usually employed for long-distance communication: it can transfer “heavy” data loads, and the signal reaches the recipient, protected from possible disturbances along the way. The driving capacity of Fiber Optics is higher than the traditional copper cable ones.

Fintech: Fintech Telecom LLC.

FTT (Fiber to the …): Fixed assets: It is the term used to indicate any network architecture that uses fiber optic cables in partial or total substitutionIncludes PP&E, Intangible assets, Goodwill and Rights of traditional copper cables used in telecommunications access networks. The various technological solutions differ in the point of the distribution network where the fiber connection is made, with respect to the end-user’s location.use assets.

|

|

FTTC (Fiber to the Curb or Fiber to the Cabinet): In the case of FTTC the fiber connection reaches the equipment (distribution cabinet) located on the pavement, from where copper connections are run to the customer.

FTTH (Fiber to the Home): In the case of FTTH the fiber connection terminates inside the customer premises.

GCL: General Corporations Law.

GDP: Gross Domestic Product.

GPON: Gigabit-capable Passive Optical Network. A flexible optical fiber access network capable of supporting the bandwidth requirements of business and residential services. GPON systems are characterized, in general, by an optical line termination (“OLT”) system and an optical network unit (ONU) or optical network termination (“ONT”) with a passive optical distribution network interconnecting them. There is, in general, a one-to-many relationship between the OLT and the ONU/ONTs, respectively.

| GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

GPRS (General Packet Radio Service): An enhanced second-generation mobile technology used to transmit data over mobile networks. GPRS transmits and receives packets of data in bursts instead of using continuous open radio channels, and it is used to add faster data transmission speed to GSM networks. GPRS is packet-based rather than circuit-based technology.

GSM (Global System for Mobile Communications): A standard for digital mobile technology used worldwide, which works on 900 MHz and 1,800 MHz band.

IASB: International Accounting Standards Board.

HFC (Hybrid Fiber-Coaxial): Network that incorporates both optical fiber and coaxial cable to create a broadband network.

ICT (Information and Communication Technology): Broad area concerned with information technology, telecommunications networking and services and other aspects of managing and processing information, especially in large organizations.

ICT services (Information and Communication Technology services): Services to transport and distribute signals or data, such as voice, text, video and images, provided or requested by third-party users, through telecommunications networks. Each service is subject to its specific regulatory framework.

IFC:International Finance CorporationCorporation.

IFRS: International Financial Reporting Standards as issued by the International Accounting Standards Board.

IGJ (Inspección General de Justicia): General Board of Corporations.

INDEC (Instituto Nacional de Estadísticas y Censos): The Argentine National Statistics and Census Institute.

IoT: Internet of Things.

IP (Internet Protocol): A set of communications protocols for exchanging data over the Internet.

ISP (InternetISP: Internet Service Provider): Providers.

IRU: A vendor who provides access to the Internet and World Wide Web.Indefeasible Rights of Use.

IT: Information Technology.

LAD (Ley Argentina Digital): Law No. 27,078, Argentina’s Digital Law.

Law No. 25,561 (Ley de Emergencia Económica y Reforma del Régimen Cambiario): See “Public Emergency Law.”

Law No. 26,831 (Ley de Mercado de Capitales): Argentine Capital Markets Law.

List of Conditions: The Privatization Regulations, including the Pliego de Bases y Condiciones, was approved by Decree No. 62/90, as amended. Pursuant to the List of Conditions, Telecom Argentina was required to comply with rate regulations and meet certain minimum annual standards regarding the expansion of its telephone system and improvements in the quality of its service to maintain and extend the exclusivity of its non-expiring license to provide fixed-line public telecommunications services and Basic Telephone Services in the Northern Region of Argentina. After the market was opened to competition, the outstanding obligations that continueare in force were the rate regulations and those related to the quality of service; the obligations related to the expansion of the network are no longer required.in force.

|

|

Merger:Merger between Telecom Argentina and Cablevisión, effective as of January 1, 2018.

MERVAL (Mercado de Valores de Buenos Aires S.A.): Securities Market of Buenos Aires S.A. On April 17, 2017, BYMA, a stock market authorized by CNV who succeeded to the MERVAL, started the automatic transfer of all the species listed in the MERVAL to BYMA. BYMA was created as a result of the spin-off (escisión) of some of the assets of the MERVAL and the capital contribution by the BCBA of its participation in Caja de Valores S.A., the clearing house for securities traded in that market.

M2M: Machine to Machine, information exchange between two remote machines.

MBOU: Mb per user per month.

MMS (Mobile Multimedia Services): Represent an evolution of the SMS and the Enhanced Messaging Service (“EMS”) using various mono-medial elements (text, design, photos, video-clips and audio), which are synchronized and combined allowing them to be packed together and sent to GSM-GPRS platforms.

| GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

Mobile service: A mobile telephone service provided by means of a network of interconnected low-powered base stations, each of which covers one small geographic cell within the total cellular system service area.

Modem: Modulator/Demodulator. A device that modulates digital data to allow their transmission on Analog channels, generally consisting of telephone lines.

Multimedia: A service involving two or more communications media (e.g., voice, video, text, etc.) and hybrid products created through their interaction.

NDF (Non Deliverable Forward) Agreement: A generic term for a set of derivatives that covers national currency transactions including foreign exchange forward swaps, cross currency swaps and coupon swaps in nonconvertible or highly restricted currencies. The common characteristics of these contracts are that they involve no exchange of principal, are fixed at a predetermined price and are typically settled in U.S. dollars (or sometimes in Euros) at the prevailing spot exchange rate taken from an agreed source, time, and future date.

Network:An interconnected collection of elements. In a telephone network, these consist of switches connected to each other and to customer equipment. The transmission equipment may be based on fiber optic or metallic cable or point-to-point radio connectors.

Node:Topological network junction, commonly a switching center or station.

Nortel:Nortel Inversora S.A., the direct parent company of Telecom Argentina S.A. until November 30, 2017, when it was absorbed by Telecom Argentina pursuant to the Reorganization.

Northern Region: the Argentine government’s privatization program as set forth in the State Reform Law approved in August 1989 and subsequent decrees, the “Privatization Regulations” provided for the division of the Argentine telecommunications network operated by ENTel into two regions, the northern region (the “Northern Region”) and the southern region (the “Southern Region”) of Argentina. Additionally, these two regions are set forth in Decree No. 1,461/93, which ratified the Resolution No. 575/93 which approved the list of conditions for the public offer for the provision of mobile telecommunication services.

OTT (Over the Top): Over the Top applications or services are those services that bypass traditional network distribution approaches and run over, or on top of, internet networks. OTT refers, in general, to content from a third-party that is delivered to an end-user over the internet that is not provided directly by end-user Internet Service Provider.

Outsourcing:Hiring outsiders to perform various telecommunications services, which may include planning, construction, or hosting of a network or specific equipment belonging to a company.

Packs: Packages integrated by SMS and minutes that can be purchased or added to those plans that recharge credit.

PBU (Prestación Básica Universal Obligatoria): Compulsory universal telecommunication service established by Decree No. 690/20 and regulated by ENACOM Resolution No. 1,467/20.

PCS (Personal Communications Service): A mobile communications service with systems that operate in a manner similar to cellular systems.

|

|

PEN (Poder Ejecutivo Nacional): The executive branch of the Argentine government.

Penetration:The measurement of the take-up of services. As of any date, the penetration is calculated by dividing the number of subscribers by the population to which the service is available and expressed as a percentage.

Personal: Telecom Personal S.A. Until November 30, 2017, Telecom Argentina owned 100% of Personal. Commencing December 1, 2017, pursuant to the Reorganization, mobile services provided by Personal have been provided by Telecom Argentina.

Pesification: Modification of the exchange rate by the Argentine government pursuant to the Public Emergency Law.

Platform: The total input, including hardware, software, operating equipment and procedures, for producing (production platform) or managing (Management platform) a particular service (service platform).

Presubscription of Long-Distance Service:PP&E: The selection by the customer of internationalProperty, plant and domestic long-distance telecommunications services from a long-distance telephone service operator.equipment.

Price Cap: Rate regulation mechanism applied to determine rate discounts based on a formula made up by the U.S. Consumer Price Index and an efficiency factor. The mentioned factor was established initially in the List of Conditions and afterwards in different regulations by the SC.

| GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

Privatization Regulations: The Argentine government’s privatization program as set forth in the State Reform Law approved in August 1989 and subsequent decrees.

Public Emergency Law:Pulse: The Public Emergency and Foreign Exchange System Reform Law No. 25,561 adopted by the Argentine government on January 6, 2002, as amended by Law No. 25,790, Law No. 25,820, Law No. 25,972, Law No. 26,077, Law No. 26,204, Law No. 26,339, Law No. 26,456, Law No. 26,563, Law No. 26,729, Law No. 26,896 and Law No. 27,200, which was in effect until December 31, 2017. Among others, the Public Emergency Law granted the PEN the power to set the exchange rate between the peso and foreign currencies and to issue regulations related to the foreign exchange market and to renegotiate public service agreements. The Public Emergency Law ceased to be effective on December 31, 2017.

Pulse:Unit on which the rate structure of the regulated fixed line services is based.

Quadruple play: Means the integration of fixed and mobile telecommunication services as well as pay television and Internet services.

RECPAM (Resultado por exposición a los cambios en el poder adquisitivo de la moneda): Restatement Adjustment Gain (Loss).

Regulatory Bodies: Collectively or individually, the ENACOM, the AFTIC, the SC and the CNC.

Reorganization:Corporate reorganization pursuant to which Telecom Argentina absorbed Sofora, Nortel and Telecom Personal.

Roaming:A function that enables mobile subscribers to use the service on networks of operators other than the one with which they signed their initial contract. The roaming service is active when a mobile device is used in a foreign country (included in the GSM network).

Satellite:Satellites are used, among other things, for links with countries that cannot be reached by cable to provide an alternative to cable and to form closed user networks.

SBT (Servicio Básico Telefónico): Basic Telephone Service.

SC (Secretaría de Comunicaciones): The Argentine Secretary of Communications, which was replaced by the AFTIC and subsequently by the ENACOM.

SCMA(Servicio de Comunicaciones Móviles Avanzadas): Mobile Advanced Communications Service.

SEC:The Securities and Exchange Commission of the United States of America.

|

|

Service Provider: The party that provides end users and content providers with a range of services, including a proprietary, exclusive or third-party service center.

SMS (Short Message Service): Short text messages that can be received and sent through GSM-network connected mobile phones. The maximum text length is 160 alpha-numerical characters.

Sofora:Sofora Telecomunicaciones S.A., the indirect parent company of Telecom Argentina S.A. through its participation in Nortel until November 30, 2017, when it was absorbed by Telecom Argentina pursuant to the Reorganization.

Southern Region: See “Northern RegionRegion”.”

SRMC (Servicios de Radiocomunicaciones Móviles Celular): Cellular Mobile Radiocommunications Service.

STM (Servicio Telefónico Móvil): Mobile Telephone Service.

SU Fund: Universal Service Fiduciary Fund.

TDMA (Time Division Multiple Accesses): A technology for digital transmission of radio signals between, for example, a mobile handset and a radio base station. TDMA breaks signals into sequential pieces of defined length, places each piece into an information conduit at specific intervals and then reconstructs the pieces at the end of the conduit.

Telecom Argentina USA: Telecom Argentina USA, Inc., a corporation organized under the laws of the State of Delaware.

Telecom Italia: Telecom Italia S.p.A.

Telefónica:Telefónica de Argentina S.A.

Telintar:Telecomunicaciones Internacionales de Argentina Telintar S.A.

Terms and Conditions: See “Auction“Auction Terms and Conditions.Conditions”.”

TLRD (Terminación Llamada Red Destino): Termination charges from third parties’ mobile networks.

TMF Administration Trust / TMF Trust Company: Administration Trust – Telecom Argentina’s refinancing plan agreed with TMF Trust Co.

| GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

Transfer Date: November 8, 1990, the date on which Telecom Argentina commenced operations upon the transfer from the Argentine government of the telecommunications system in the Northern Region of Argentina that was previously owned and operated by ENTel.

Tuves Paraguay: Tuves Paraguay S.A.

UMTS (Universal Mobile Telecommunications System): Third-generation mobile communication standard.

Universal Service: The availability of Basic Telephone Service, or access to the public telephone network via different alternatives, at an affordable price to all persons within a country or specified area.

URSEC (Unidad Reguladora de Servicios de Comunicaciones): Uruguayan Regulatory Authority.

UVA (Unidad de Valor Adquistivo): Purchasing Value Unit.

Value Added Services (VAS): Services that provide a higher level of functionality than the basic transmission services offered by a telecommunications network such as video streaming, “Personal Video”,Video,” “Nube Personal” (Cloud services), M2M (Machine to Machine communication), social networks, “Personal Messenger”,Messenger,” content and entertainment (SMS subscriptions and content, games, music, etc.), MMS and voice mail.

VLG Argentina: VLG S.A.U., an Argentine corporation that is a shareholder of Telecom Argentina and controlled by CVH. (formerly known as VLG Argentina, LLC).

W de Argentina Inversiones/WAI: W de Argentina Inversiones S.A., a former shareholder of Telecom Argentina.

Wi-Max (Worldwide Interoperability for Microwave Access): A technology that allows mobile access to Broadband telecommunications networks. It is defined by the Wi-Max Forum, a global consortium formed by major companies in the field of fixed and mobile telecommunications, which has the purpose to develop, test and promote the interoperability of systems.

GLOSSARY OF TERMS | TELECOM ARGENTINA S.A. |

ITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLE

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| KEY INFORMATION |

Selected Financial Data

SelectedThe following table presents certain selected consolidated financial data. It is to be read in conjunction with the rest of this Annual Report, in particular, the sections “Presentation of Financial DataInformation”, “Item 4 —Information on the Company” and “Item 5—Operating and Financial Review and Prospects,” and the Consolidated Financial Statements. The selected consolidated income statement data for the years ended December 31, 2020, 2019 and 2018 and the selected consolidated financial position data as of December 31, 2020 and 2019 are derived from, and are qualified in their entirety by reference to our Consolidated Financial Statements.

The selected consolidated income statement data for the years ended December 31, 2018, 2017 and 2016 and the selected consolidated financial position data as of December 31, 2018 and 2017 have been preparedrestated pursuant to IAS 29 to reflect the effect of hyperinflation in accordance with IFRS as issued byArgentina. As a result of such restatement, the IASB and have been derived from our Consolidated Financial Statements included elsewhere in this Annual Report.

Our Consolidated Financial Statements and the financial information included elsewhere in this Annual Report have been restated in terms of the current currency in accordance with IFRS. The Consolidated Financial Statements and theselected financial information included in this Annual Report for all the periodsdiffer from previously reported are presented on the basis of constant Argentine pesosfinancial information.

The selected consolidated financial position data as of December 31, 2018. Due to the high level of inflation prevailing in Argentina in the last few years, the Company’s Management analyzed the conditions established by IAS 29 paragraph 3 to consider an economy as hyperinflationary. Based on the analysis made in 2018, the Company’s Management considers that there is evidence to consider Argentina’s economy as “hyperinflationary” under IAS 29 for accounting periods ending after July 1, 2018. See “Presentation of Financial Information,” “—Risk factors—Risk Related to Argentina—Inflation could accelerate, causing adverse effects on the economy and negatively impacting Telecom’s margins”, “Item 5—Operating and Financial Review and Prospects—Economic and Political Developments in Argentina” and Note 1.e) to the Consolidated Financial Statements.

Telecom’s Consolidated Financial Statements and the selected financial data included in this Annual Report have been prepared on a consolidated basis.

Our financial statement data as of and for the years ended December 31, 2017 and 2016 are not comparable with our financial statement data as of and for the year ended December 31, 2018 because of the Merger, which was consummated on January 1, 2018. Effective as of the Merger Effective Date, Cablevisión merged into Telecom Argentina. We have accounted for the Merger as a business combination using the acquisition method of accounting under IFRS 3 “Business Combination” (“IFRS 3”) to account for assets and liabilities of Telecom as of January 1, 2018. The Merger constituted a “reverse acquisition,” pursuant to which Cablevisión (the legal absorbed entity) was considered the accounting acquirer and Telecom Argentina (the surviving entity) was considered the accounting acquire (See Item 5 “Operating and Financial Review and Prospects”). Accordingly, the financial statements of Telecom for periods prior to the Merger Effective Date reflect the historical financial information of Cablevisión, as restated in terms of the current currency to take into account the effect of inflation in Argentina. The information as of and for the year ended December 31, 2018 incorporates, based on the figures corresponding to Cablevisión, the effect of applying the acquisition method to Telecom Argentina to its fair value in accordance with IFRS 3 and the operations of Telecom Argentina as from January 1, 2018. Such figures are presented in this Annual Report restated in terms of the current currency to take into account the effect of inflation in Argentina.

The factors that were considered in determining that Cablevisión should be treated as the accounting acquirer in the Merger were:

(i) the relative voting rights in the surviving entity (55% for the former shareholders of Cablevisión and 45% for the former shareholders of Telecom);

(ii) the composition of the board of directors in the surviving entity and other committees (audit, supervisory and executive);

(iii) the relative fair value assigned to Cablevisión and Telecom; and

(iv) the composition of the key senior management of the surviving entity.

For more information, see Note 1.c), 4.a) and 27.a) to our Consolidated Financial Statements.

Accordingly, the financial and operating data for periods prior to the Merger Effective Date reflect the information of Cablevisión.

|

|

You should read the information below in conjunction with our Consolidated Financial Statements and the notes thereto, as well as “Presentation of Financial Information” and “Item 5—Operating and Financial Review and Prospects.”

The summary financial data as of and for each of the two years ended December 31, 2015 and 2014 havehas not been presented as theseit cannot be provided on a restated basis without unreasonable effort or expense.

PART I - ITEM 3 KEY INFORMATION — SELECTED FINANCIAL DATA | TELECOM ARGENTINA S.A. |

CONSOLIDATED SELECTED INCOME STATEMENT AND FINANCIAL POSITION DATA

| 2020 | 2019 | 2018 | 2017 | 2016 (8) | |||||||||||||||||||||||

|

| 2018 |

| 2017 (8) |

| 2016 (8) |

| ||||||||||||||||||||

|

| (P$ million, except per share and |

| (P$ million, except per share and per ADS data in P$) | |||||||||||||||||||||||

INCOME STATEMENT DATA |

|

|

|

|

|

|

| ||||||||||||||||||||

Total revenues |

| 168,046 |

| 66,649 |

| 60,405 |

| 301,596 | 322,686 | 351,948 | 139,586 | 126,510 | |||||||||||||||

Operating costs (without depreciation, amortization and impairment of PP&E) |

| (111,678 | ) | (42,536 | ) | (40,206 | ) | ||||||||||||||||||||

Operating costs — depreciation,amortization and impairment of PP&E and intangible assets |

| (35,111 | ) | (9,804 | ) | (7,883 | ) | ||||||||||||||||||||

| Operating costs (without depreciation, amortization and impairment of fixed assets) | (198,708 | ) | (217,744 | ) | (233,892 | ) | (89,085 | ) | (84,205 | ) | |||||||||||||||||

| Operating costs – depreciation, amortization and impairment of fixed assets | (82,594 | ) | (83,439 | ) | (73,535 | ) | (20,533 | ) | (16,510 | ) | |||||||||||||||||

Operating income |

| 21,257 |

| 14,309 |

| 12,316 |

| 20,294 | 21,503 | 44,521 | 29,968 | 25,795 | |||||||||||||||

Other, net (1) |

| (18,559 | ) | 1,066 |

| 4,245 |

| (17,147 | ) | (7,506 | ) | (38,870 | ) | 2,232 | 8,890 | ||||||||||||

Income tax benefit (expense) |

| 2,838 |

| (5,516 | ) | (6,015 | ) | ||||||||||||||||||||

Net income |

| 5,536 |

| 9,859 |

| 10,546 |

| ||||||||||||||||||||

| Income tax (expense) benefit | (8,251 | ) | (19,290 | ) | 5,943 | (11,553 | ) | (12,597 | ) | ||||||||||||||||||

| Net (loss) income | (5,104 | ) | (5,293 | ) | 11,594 | 20,647 | 22,088 | ||||||||||||||||||||

Other Comprehensive (Loss) Income, net of tax |

| 1,317 |

| (713 | ) | (1,567 | ) | (1,822 | ) | (2,927 | ) | 3,142 | (1,481 | ) | (3,282 | ) | |||||||||||

Total Comprehensive Income |

| 6,853 |

| 9,146 |

| 8,979 |

| ||||||||||||||||||||

Total Comprehensive Income attributable to Telecom Argentina |

| 6,425 |

| 9,090 |

| 8,922 |

| ||||||||||||||||||||

| Total Comprehensive (Loss) Income | (6,926 | ) | (8,220 | ) | 14,736 | 19,166 | 18,806 | ||||||||||||||||||||

Total Comprehensive (Loss) Income attributable to Telecom Argentina | (7,200 | ) | (8,438 | ) | 13,458 | 19,035 | 18,686 | ||||||||||||||||||||

Total Comprehensive Income attributable to Non-controlling Interest |

| 428 |

| 56 |

| 57 |

| 274 | 218 | 1,278 | 131 | 120 | |||||||||||||||

Number of shares outstanding at year-end (in millions of shares) (2) |

| 2,154 |

| 0.120 |

| 0.120 |

| 2,154 | 2,154 | 2,154 | 0.120 | 0.120 | |||||||||||||||

Net income per share (basic and diluted) (3) |

| 2.46 |

| 8.21 |

| 8.83 |

| ||||||||||||||||||||

Net income per ADS (4) |

| 12.30 |

| n/a |

| n/a |

| ||||||||||||||||||||

| Net (loss) income per share attributable to Telecom Argentina (basic and diluted) (3) | (2.65 | ) | (2.78 | ) | 5.15 | 17.21 | 18.49 | ||||||||||||||||||||

| Net (loss) income per ADS (4) | (13.25 | ) | (13.89 | ) | 25.76 | n/a | n/a | ||||||||||||||||||||

Dividends per share (5) |

| 13.38 |

| 23,083 |

| 13,025 |

| 11.94 | 22.64 | 28.02 | 48,344 | 27,278 | |||||||||||||||

Dividends per ADS (6) |

| 66.90 |

| n/a |

| n/a |

| 59.7 | 113.17 | 140.12 | n/a | n/a | |||||||||||||||

|

|

|

|

|

|

|

| ||||||||||||||||||||

FINANCIAL POSITION DATA |

|

|

|

|

|

|

| ||||||||||||||||||||

Current assets |

| 33,487 |

| 10,626 |

| n/a |

| 53,263 | 69,129 | 70,134 | 22,255 | n/a | |||||||||||||||

PP&E and Intangible assets |

| 210,346 |

| 50,336 |

| n/a |

| ||||||||||||||||||||

| PP&E, Intangible assets and Rights of Use Assets | 442,661 | 460,223 | 440,528 | 105,422 | n/a | ||||||||||||||||||||||

Goodwill |

| 120,449 |

| 31,954 |

| n/a |

| 251,908 | 252,052 | 252,262 | 66,923 | n/a | |||||||||||||||

Other non-current assets |

| 7,456 |

| 1,154 |

| n/a |

| 4,222 | 5,693 | 15,627 | 2,416 | n/a | |||||||||||||||

Total assets |

| 371,738 |

| 94,070 |

| n/a |

| 752,054 | 787,097 | 778,551 | 197,016 | n/a | |||||||||||||||

Current liabilities |

| 53,445 |

| 18,621 |

| n/a |

| 106,050 | 117,056 | 111,934 | 38,999 | n/a | |||||||||||||||

Non-current liabilities |

| 89,380 |

| 20,421 |

| n/a |

| 257,149 | 248,214 | 187,200 | 42,768 | n/a | |||||||||||||||

Total liabilities |

| 142,825 |

| 39,042 |

| n/a |

| 363,199 | 365,270 | 299,134 | 81,767 | n/a | |||||||||||||||

Total equity |

| 228,913 |

| 55,028 |

| n/a |

| 388,855 | 421,827 | 479,417 | 115,249 | n/a | |||||||||||||||

Equity attributable to Telecom Argentina |

| 225,686 |

| 54,182 |

| n/a |

| 382,456 | 415,335 | 472,659 | 113,476 | n/a | |||||||||||||||

Equity attributable to Non-controlling Interest |

| 3,227 |

| 846 |

| n/a |

| 6,399 | 6,492 | 6,758 | 1,773 | n/a | |||||||||||||||

|

|

|

|

|

|

|

| ||||||||||||||||||||

Total Capital Stock (7) |

| 2,169 |

| 1,200 |

| n/a |

| 2,154 | 2,154 | 2,169 | 1,200 | n/a | |||||||||||||||

(1)Other, net includes Earnings from associates, Debt financial expenses and Other financial results, net.

| (1) | Other, net includes Earnings (losses) from associates, Debt financial expenses and Other financial results, net. |

| (2) | Number of ordinary shares outstanding at year-end (excludes treasury shares for the year ended December 31, 2018). For the years ended December 31, 2017 and 2016, the Company has divided the net income attributable to the shareholders of the Controlling Company of each period based on 1,184,528,406 ordinary shares, which arise as a result of multiply 120,000 ordinary shares of Cablevisión outstanding for such years by the exchange ratio established in the pre-merger commitment (1 ordinary share of Cablevisión for each 9,871.07005 new shares of Telecom Argentina). |

| (3) | Calculated based on the weighted average number of ordinary shares outstanding during each period (2,153,688,011 ordinary shares for the years 2020, 2019 and 2018 and 1,184,528,406 ordinary shares for the years 2017 and 2016). For the years ended December 31, 2017 and 2016, the Company has divided the net income attributable to the shareholders of the Controlling Company of each period based on 1,184,528,406 ordinary shares, which arise as a result of multiply 120,000 ordinary shares of Cablevisión outstanding for such years) by the exchange ratio established in the pre-merger commitment (1 ordinary share of Cablevisión for each 9,871.07005 new shares of Telecom Argentina). |

(2)Number of ordinary shares outstanding at year-end (excludes treasury shares). For the years ended December 31, 2017 and 2016, the Company has divided the net income attributable to the shareholders of the Controlling Company of each period based on 1,184,528,406 ordinary shares, which arise as a result of multiply 120,000 ordinary shares of Cablevisión outstanding for such years by the exchange ratio established in the pre-merger commitment (1 ordinary share of Cablevisión for each 9,871.07005 new shares of Telecom Argentina).

(3)Calculated based on the weighted average number of ordinary shares outstanding during each period (2,153,688,011 ordinary shares for the year 2018, 1,184,528,406 ordinary shares for the years 2017 and 2016). For the years ended December 31, 2017 and 2016, the Company has divided the net income attributable to the shareholders of the Controlling Company of each period based on 1,184,528,406 ordinary shares, which arise as a result of multiply 120,000 ordinary shares of Cablevisión outstanding for such years) by the exchange ratio established in the pre-merger commitment (1 ordinary share of Cablevisión for each 9,871.07005 new shares of Telecom Argentina).

(4)Calculated based on the equivalent in ADSs to the weighted average number of ordinary shares outstanding during each period (430,737,602 ADSs for the year2020, 2019 and 2018 and 236,905,681 ADSs for the years 2017 and 2016).

| (5) | Dividends per share translated into U.S. dollars amounts to US$0.14, US$0.27, US$0.35, US$1,237.69 and US$819.70 as of December 31, 2020, 2019, 2018, 2017 and 2016 respectively. The translation into U.S. dollar was made using the ask rate published by the Banco de la Nación Argentina (National Bank of Argentina) prevailing as of the date when dividends were available to Telecom Argentina’ shareholders. |

| (6) | Dividends per ADS translated into U.S. dollars amounts to US$0.72, US$1.35 and US$1.77 as of December 31, 2020, 2019 and 2018, respectively. The translation into U.S. dollar was made using the ask rate published by the Banco de la Nación Argentina (National Bank of Argentina) prevailing as of the date when dividends were available to Telecom Argentina’ shareholders. |

| (7) | Ordinary shares of P$1 of nominal value each. |

(5)Dividends per share translated into U.S. dollars amounts to US$0.35; US$1,237.69 and US$819.70 as of December 31, 2018, 2017 and 2016 respectively. The translation into US Dollar was made using the ask rate published by the Banco de la Nación Argentina (National Bank of Argentina) prevailing as of the date when dividends were available to Telecom Argentina’ shareholders.

(6)Dividends per ADS translated into U.S. dollars amounts to US$1.77 as of December 31, 2018. The translation into US Dollar was made using the ask rate published by the Banco de la Nación Argentina (National Bank of Argentina) prevailing as of the date when dividends were available to Telecom Argentina’ shareholders.

(7)Ordinary shares of P$1 of nominal value each.

(8)Comparatives Comparative figures as of December 31, 2017 and 2016 arise from the consolidated financial statements of Telecom as of December 31, 2018.

2018, which have been restated in current currency as of December 31, 2020 to consider the effect of inflation in accordance to the requirements of IAS 29.

PART I - ITEM 3 KEY INFORMATION — SELECTED FINANCIAL DATA | TELECOM ARGENTINA S.A. |

OTHER SELECTED DATA

|

| 2018 |

| 2017 |

| 2016 |

| 2020 | 2019 | 2018 | 2017 | 2016 | |||||||||||||||

Number of fixed telephony services lines (thousands)(1) |

| 3,544 |

| 12.7 |

| 7.7 |

| 2,821 | 3,183 | 3,544 | 12.7 | 7.7 | |||||||||||||||

ARBU (in P$/month) (national + international) (5) |

| 270.8 |

| 23.7 |

| 21.3 |

| 574.3 | 602.0 | 567.2 | 49.7 | 44.7 | |||||||||||||||

| Number of Fibertel IP fixed telephony services lines (thousands) | 347 | 121 | 25 | n/a | n/a | ||||||||||||||||||||||

Internet access (thousands) |

| 4,110 |

| 2,318 |

| 2,166 |

| 4,146 | 4,123 | 4,138 | 2,318 | 2,166 | |||||||||||||||

ARPU Internet (in P$/month) (6) |

| 762.0 |

| 890.1 |

| 738.8 |

| 1,271.0 | 1,441.5 | 1,595.8 | 1,864.2 | 1,547.4 | |||||||||||||||

Personal Mobile telephony services lines (thousands) |

| 18,316 |

| n/a |

| n/a |

| 18,433 | 18,932 | 18,316 | n/a | n/a | |||||||||||||||

ARPU Personal (in P$/month) (7) |

| 213.9 |

| n/a |

| n/a |

| 436.2 | 431.7 | 448.0 | n/a | n/a | |||||||||||||||

MBOU Personal (in Mb per user/month) (2) |

| 2,771.2 |

| n/a |

| n/a |

| 3,984.7 | 3,411.4 | 2,771.2 | n/a | n/a | |||||||||||||||

IDEN telephony services lines (thousands) |

| 314.3 |

| 716.6 |

| n/a |

| ||||||||||||||||||||

ARPU IDEN (in P$/month) (8) |

| 329.8 |

| 348.9 |

| n/a |

| ||||||||||||||||||||

Núcleo’s customers (thousands)(3) |

| 2,387 |

| n/a |

| n/a |

| 2,351 | 2,373 | 2,409 | n/a | n/a | |||||||||||||||

ARPU Núcleo (in P$/month) (9) |

| 206.3 |

| n/a |

| n/a |

| ||||||||||||||||||||

| ARPU Núcleo (in P$/month) (8) | 450.5 | 472.4 | 432.1 | n/a | n/a | ||||||||||||||||||||||

MBOU Núcleo (in Mb per user/month) (2) |

| 4,927.7 |

| n/a |

| n/a |

| 7,433.6 | 6,754.4 | 4,927.7 | n/a | n/a | |||||||||||||||

Cable TV subscribers (thousands) |

| 3,454 |

| 3,503 |

| 3,528 |

| 3,543 | 3,517 | 3,532 | 3,503 | 3,528 | |||||||||||||||

ARPU Cable TV (in P$/month) (10) |

| 854.3 |

| 835.4 |

| 759.7 |

| ||||||||||||||||||||

| ARPU Cable TV (in P$/month) (9) | 1,382.2 | 1,586.6 | 1,789.2 | 1,749.7 | 1,591.1 | ||||||||||||||||||||||

Headcount (4) |

| 25,343 |

| 11,384 |

| 10,236 |

| 23,254 | 23,728 | 25,343 | 11,384 | 10,236 | |||||||||||||||

(1)Includes lines customers, own usage, public telephony and Integrated Services Digital Network (“ISDN”) channels.

| (1) | Includes lines customers, own usage, public telephony and Integrated Services Digital Network (“ISDN”) channels. |

| (2) | Correspond to customers with consumption higher than 10Mb. |

| (3) | Including Wi-Max Internet customers. |

| (4) | Including temporary employees, if any. |

| (5) | Includes P$86.1, P$244.4, P$347.6, P$35.2 and P$34 related to the restatement in current currency as of December 31, 2020 in accordance to IAS 29 as of December 31, 2020, 2019, 2018, 2017 and 2016, respectively. |

| (6) | Includes P$190.8, P$571.3, P$971.5, P$1,320.5 and P$1,175.8 to the restatement in current currency as of December 31, 2020 in accordance to IAS 29 as of December 31, 2020, 2019, 2018, 2017 and 2016, respectively. |

| (7) | Includes P$63.3, P$175.3 and P$273.8 related to the restatement in current currency as of December 31, 2020 in accordance to IAS 29 as of December 31, 2020, 2019 and 2018, respectively. |

| (8) | Includes P$67.5, P$191.7 and P$265 related to the restatement in current currency as of December 31, 2020 in accordance to IAS 29 as of December 31, 2020, 2019 and 2018. |

| (9) | Includes P$206.5, P$626.5, P$1,098.6, P$1,239.4 and P$1,209 related to the restatement in current currency as of December 31, 2020 in accordance to IAS 29 as of December 31, 2020, 2019, 2018, 2017 and 2016, respectively. |

(2)Correspond to customers with consumption higher than 10Mb.

| PART I - ITEM 3 KEY INFORMATION — SELECTED FINANCIAL DATA | TELECOM ARGENTINA S.A. |

(3)Including Wi-Max Internet customers.

(4)Including temporary employees, if any.

(5)Includes 51.5, 9.2 and 10.6 related to the effect of inflation adjustment under IAS29 as of December 31, 2018, 2017 and 2016, respectively.

(6)Includes 138.7, 346.4 and 367.2 related to the effect of inflation adjustment under IAS29 as of December 31, 2018, 2017 and 2016, respectively.

(7)Includes 39.9 related to the effect of inflation adjustment under IAS29 as of December 31, 2018.

(8)Includes 62.7 and 135.8 related to the effect of inflation adjustment under IAS29 as of December 31, 2018 and 2017, respectively.

(9)Includes 39.2 related to the effect of inflation adjustment under IAS29 as of December 31, 2018.

(10)Includes 158.1, 325.1 and 377.6 related to the effect of inflation adjustment under IAS29 as of December 31, 2018, 2017 and 2016, respectively.

Exchange Rates

The following tables show, for the periods indicated, certain information regarding the exchange rates for U.S. dollars, expressed in nominal pesosPesos per dollar (ask price published by Banco de la Nación Argentina). See “Item 10—Additional Information—Foreign Investment and Exchange Controls in Argentina.”Argentina”.

|

| Average(1) |

| End of Period |

|

|

|

|

|

|

|

Year Ended December 31, 2016 |

| 14.99 |

| 15.89 |

|

Year Ended December 31, 2017 |

| 16.73 |

| 18.65 |

|

Year Ended December 31, 2018 |

| 29.26 |

| 37.70 |

|

Month Ended October 31, 2018 |

| 37.06 |

| 35.95 |

|

Month Ended November 30, 2018 |

| 36.48 |

| 37.72 |

|

Month Ended December 31, 2018 |

| 37.83 |

| 37.70 |

|

Month Ended January 31, 2019 |

| 37.39 |

| 37.35 |

|

Month Ended February 28, 2019 |

| 38.40 |

| 39.15 |

|

March 2019 (through March 19, 2019) |

| 40.87 |

| 40.50 |

|

(1)Yearly data reflect average of month-end rates.Monthly data reflect average of day-end rates.

| Average(1) | End of Period | |||||||

| Year Ended December 31, 2016 | 14.99 | 15.89 | ||||||

| Year Ended December 31, 2017 | 16.73 | 18.65 | ||||||

| Year Ended December 31, 2018 | 29.26 | 37.70 | ||||||

| Year Ended December 31, 2019 | 49.31 | 59.89 | ||||||

| Year Ended December 31, 2020 | 71.61 | 84.15 | ||||||

| March 2021 (through March 22, 2021) | - | 91.57 | ||||||

| (1) | Yearly data reflect average of month-end rates. |

Sources: Banco de la Nación Argentina

Capitalization and Indebtedness

Not applicable.

|

|

Reasons for the Offer and Use of Proceeds

Not applicable.

Risk Factors

This section is intended to be a summary of more detailed discussions contained elsewhere in this Annual Report. The risks described below are not the only ones that we face. Additional risks that we do not presently consider material, or of which we are not currently aware, may also affect us. Our business, results of operations, financial condition and cash flows could be materially and adversely affected if any of these risks materialize and, as a result, the market price of our shares and our ADSs could decline. You should carefully consider these risks with respect to an investment in Telecom Argentina. This section is divided in two sub-sections: the “Risk Factors Summary”, which provides a brief summary of our Risk Factors and “Detailed Risk Factors”, providing detailed information in relation to each Risk Factor identified.

| ü | Risk Factors Summary |

The following summarizes the main risks to which we are subject. You should carefully consider all of the information discussed below in “Item 3. Key Information—Detailed Risk Factors” in this annual report for a comprehensive description of these and other risks.

Risks Relating to Argentina

| · | Devaluation of the Argentine Peso and foreign exchange controls may adversely affect our results of operations, our capital expenditures and our ability to service our liabilities and pay dividends. |

| · | Economic and political developments in Argentina, and future policies of the Argentine government may affect the economy as well as the operations of the telecommunications industry, including Telecom Argentina. |

| · | Inflation could accelerate, causing adverse effects on the economy and negatively impacting Telecom’s margins and/or ratios. |

| · | The Argentine government may exercise greater intervention in private sector companies, including Telecom Argentina. |

| · | Argentina’s economy contracted in 2020, 2019 and 2018 and may contract in the future due to international and domestic conditions which may adversely affect our operations. |