Step 3: Recommendation and matching. Through our workflow system CloudBank, under both credit-driven services and our capital-light model, we then recommend the prospective borrower’s profile along with pricing recommendation to our financial institution partners and share the results of our preliminary credit assessment with them to facilitate their final risk management and credit decision making including loan tenor, approved credit line, and other key terms of a loan product. For ICE, we only recommend prospective borrowers to financial institution partners based on the results of preliminary credit screening, and do not provide pricing recommendations.

Step 4: Final risk management and credit decision by financial institutions. The financial institution partners conduct final risk management and make their credit decisions based on their respective credit process and regulatory guidelines.

Step 5: Notice on credit line approval. Following their final risk management, each financial institution partner will respond to our workflow system indicating approval or rejection, and in the case of approval, their maximum level of credit exposure. Upon receiving the credit approval decision from financial institution partners, we pass such information to prospective borrowers through our platform.

The diagram below illustrates the step-by-step workflow and transaction process at the stage of credit line approval under the credit-driven service and our capital-light model.

For ICE, as we only recommend prospective borrowers to financial institutions after preliminary credit screening, we do not participate in the credit line approval step, and financial institutions offer their own loan products and directly notify the borrowers of their credit approval decision. The diagram below illustrates the step-by-step workflow and transaction process at the stage of credit line approval under ICE.

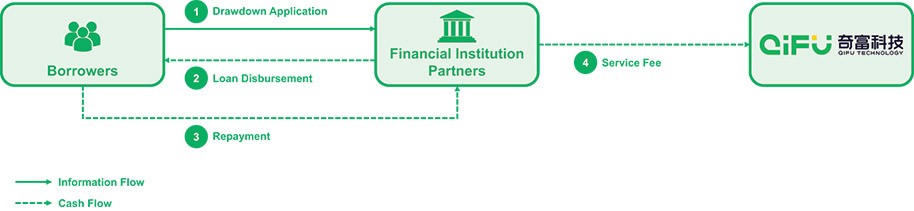

Stage 2: Loan drawdown

Once a credit line is granted, a prospective borrower may request a drawdown at any time, subject to the credit limit approved by the financial institution partner. Upon receipt of a drawdown request, the Argus Engine conducts a streamlined credit assessment to ensure the prospective borrower’s continued qualification for drawdown and notifies our financial institution partners of the drawdown request, which complete their final risk management and reach a drawdown decision. We undertake to notify the borrower the drawdown decision and the financial institution partner that is matched with the borrower will disburse loan to the borrower. Once the principal of the loan is transferred to the borrower, we recognize revenue from loan facilitation services for services provided to the financial institution partner.

82