UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________________

FORM 20-F

| |

| ¨ | Registration Statement Pursuant to Section 12(b) or 12(g) of The Securities Exchange Act of 1934 |

OR

| |

| ý | Annual Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 for the fiscal year ended December 31, 20152018 |

OR

| |

| ¨ | Transition Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

OR

| |

| ¨ | Shell Company Report Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 |

Commission file number 0-30752

AETERNA ZENTARIS INC.

(Exact Name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant's Name into English)

Canada

(Jurisdiction of Incorporation)

c/o Norton Rose Fulbright Canada LLP315 Sigma Drive

1 Place Ville Marie, Suite 2500Summerville, South Carolina, USA

Montréal, Quebec

Canada H3B 1R129486

(Address of Principal Executive Offices)

Philip TheodoreMichael V. Ward

Telephone: 843-900-3211843-900-3201

E-mail: ptheodore@aezsinc.commward@aezsinc.com

315 Sigma Drive Suite 302D

Summerville, South Carolina

2948329486

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | | Name of Each Exchange on Which Registered |

| Common Shares | | NASDAQ Capital Market Toronto Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the ACT: NONE

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as at the close of the period covered by the annual report: 9,928,697 16,440,760 Common Shares as at December 31, 2015.2018.

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or, or a non-accelerated filer.filer, or an emerging growth company. See definitions of "accelerated filer" andfiler," "large accelerated filer"filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨Accelerated filer ¨Non-accelerated filer ýEmerging growth company ¨

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

† The term "new or revised financial accounting standard" refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ¨ International Financial Reporting Standards as issued by the Other ¨

International Accounting Standards Board ý

If "other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Basis of Presentation

General

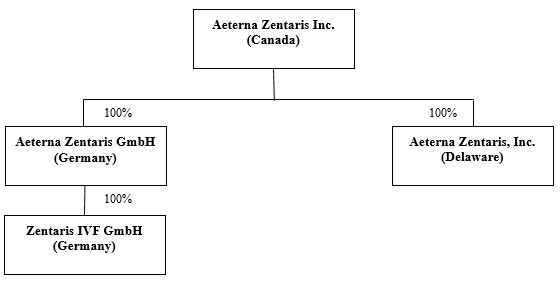

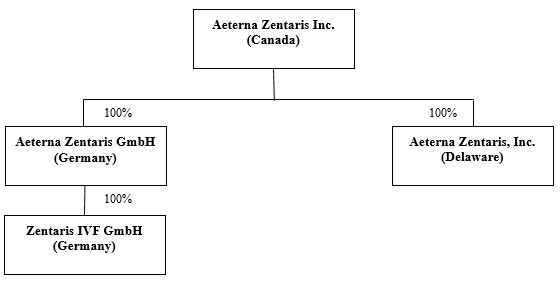

Except where the context otherwise requires, all references in this Annual Report on Form 20-F to the "Company", "Aeterna Zentaris Inc."Zentaris", "we", "us", "our" or similar words or phrases are to Aeterna Zentaris Inc. and its subsidiaries, taken together. In this Annual Report on Form 20-F, references to "$" and "US$"U.S.$" are to United States ("U.S.") dollars, references to "CAN$" are to Canadian dollars and references to "EUR" are to euros. Unless otherwise indicated, the statistical and financial data contained in this Annual Report on Form 20-F are presented as at December 31, 2015.2018.

All share, option and share purchase warrant as well as per share, option and share purchase warrant information presented in this Annual Report on Form 20-F hashave been adjusted, including proportionate adjustments being made to each option and share purchase warrant exercise price, to reflect and to give effect to a share consolidation (or reverse stock split), on November 17, 2015, of our issued and outstanding common shares on a 100-to-1 basis (the "Share Consolidation"). The Share Consolidation affected all shareholders, optionholders and warrantholders uniformly and thus did not materially affect any securityholder's percentage of ownership interest.

This Annual Report on Form 20-F also contains certain information regarding products or product candidates that may potentially compete with our products and product candidates, and such information has been primarily derived from information made publicly available by the companies developing such potentially competing products and product candidates and has not been independently verified by Aeterna Zentaris Inc.

Forward-Looking Statements

This Annual Report on Form 20-F contains forward-looking statements made pursuant to the safe harbor provisionssafe-harbor provision of the U.S. Securities Litigation Reform Act of 1995.1995, which reflect our current expectations regarding future events. Forward-looking statements can be identified by words such as: "intend," "believe," "designed to," "vision," "aimed at," "expect," "may," "should," "would," "will" and similar references. Such statementsmay include, but are not limited to statements aboutpreceded by, followed by, or that include the progress ofwords "will," "expects," "believes," "intends," "would," "could," "may," "anticipates," and similar terms that relate to future events, performance, or our research, development and clinical trials and the timing of, and prospects for, regulatory approval and commercialization of our product candidates, the timing of expected results of our studies and the anticipated results of these studies, statements about the status of our efforts to establish a commercial operation and to obtain the right to promote or sell products that we did not develop, and estimates regarding our capital requirements and our needs for, and our ability to obtain, additional financing.results. Forward-looking statements involve known risks and uncertainties, including those discussed in this Annual Report on Form 20-F, under the caption "Key Information - Risk Factors" filed with the relevant Canadian securities regulatory authorities in lieu of an annual information form and with the U.S. Securities and Exchange Commission ("SEC"). Known and unknown risks and uncertainties which could cause the Company'sour actual results to differ materially from those in the forward-looking statements. Such risks and uncertainties include, among others, our now heavy dependence on the success of Macrilen™ (macimorelin) and related out-licensing arrangements and the continued availability of funds and resources to pursue our researchsuccessfully launch the product, the ability of Aeterna Zentaris to enter into out-licensing, development, manufacturing and development ("R&D") projects,marketing and distribution agreements with other pharmaceutical companies and keep such agreements in effect, reliance on third parties for the successfulmanufacturing and timely completion of clinical studies, the risk that safety and efficacy data from anycommercialization of our Phase 3 trials may not coincideproduct candidates, potential disputes with third parties, leading to delays in or termination of the data analysis from previously reported Phase 1 and/manufacturing, development, out-licensing or Phase 2 clinical trials, the rejectioncommercialization of our product candidates, or non-acceptance of any new drug application by oneresulting in significant litigation or more regulatory authoritiesarbitration, and, more generally, uncertainties related to the regulatory process, the ability of the Company to efficiently commercialize one or more of our products or product candidates,out-license Macrilen™ (macimorelin), the degree of market acceptance onceof Macrilen™ (macimorelin), our ability to obtain necessary approvals from the relevant regulatory authorities to enable us to use the desired brand names for our products, are approved for commercialization, the abilityimpact of securities class action litigation, on our cash flow, results of operations and financial position; any evaluation of potential strategic alternatives to maximize potential future growth and stakeholder value may not result in any such alternative being pursued, and even if pursued, may not result in the Companyanticipated benefits, our ability to take advantage of business opportunities in the pharmaceutical industry, theour ability of the Company to protect itsour intellectual property, the potential of liability arising from shareholder lawsuits and general changes in economic conditions. Investors should consult the Company's quarterly and annual filings with the Canadian and United States ("U.S.") securities commissions for additional information on risks and uncertainties. Given these uncertainties relating to the forward-looking statements. Investorsand risk factors, readers are cautioned not to place undue reliance on these forward-looking statements. The Company does not undertake to update these forward-looking statements and disclaimsWe disclaim any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future results, events or developments, except ifunless required to do so by a governmental authority or applicable law.

TABLE OF CONTENTS

GENERAL INFORMATION

Page

|

| | |

| | Page |

| Item 1. | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| | | |

| Item 3. | | |

| | | |

| | | |

| | | |

| | | |

| Item 4. | | |

| | | |

| | | |

| | | |

| | | |

| Item 4A. | | |

| Item 5. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 6. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 7. | | |

| | | |

| | | |

| | | |

| Item 8. | | |

| | | |

| | | |

| Item 9. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| | |

| | | |

| Item 10. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 11. | | |

| Item 12. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Item 13. | | |

| Item 14. | | |

| Item 15. | | |

| Item 16A. | | |

| Item 16B. | | |

| Item 16C. | | |

| Item 16D. | | |

| Item 16E. | | |

| Item 16F. | | |

| Item 16G. | | |

| Item 16H. | | |

| | | |

| | |

| Item 17. | | |

| Item 18. | | |

| Item 19. | | |

PART I

| |

| Item 1. | Identity of Directors, Senior Management and Advisers |

| |

| A. | Directors and senior management |

Not applicable.

Not applicable.

Not applicable.

| |

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| |

| B. | Method and expected timetable |

Not applicable.

| |

| A. | Selected financial data |

The consolidated statement of comprehensive income (loss) income datainformation set forth in this Item 3.A3.A. with respect to the years ended December 31, 2015, 20142018, 2017 and 20132016 and the consolidated statement of financial position datainformation as at December 31, 20152018 and 20142017 have been derived from the audited consolidated financial statements set forth in Item 18, which have been prepared in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board ("IASB"). The consolidated statement of comprehensive income (loss) income information with respect to the years ended December 31, 20122015 and 20112014 and the consolidated statement of financial position information as at December 31, 2013, 20122016, 2015 and 20112014 set forth in this Item 3.A. have been derived from our previous consolidated financial statements not included herein, and have also been prepared in accordance with IFRS, as issued by the IASB. The selected financial data should be read in conjunction with our audited consolidated financial statements and the related notes included elsewhere in this Annual Report on Form 20-F, as well as "Item 5. – Operating and Financial Review and Prospects" of this Annual Report on Form 20-F.

1The Company has not declared or paid any dividends per share during the periods covered by the selected financial data.

Consolidated Statements of Comprehensive Income (Loss) Income Information

(in thousands of USU.S. dollars, except share and per share data)

Derived from consolidated audited financial statements prepared in accordance with IFRS, as issued by the IASB

| | | | | Years ended December 31, | December 31, |

| | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

| | | $ | | $ | | $ | | $ | | $ | $ | | $ | | $ | | $ | | $ |

| Revenues | | | | | | | | | | | | | | | | | | | |

| License fees | | 24,325 |

| | 458 |

| | 497 |

| | 248 |

| | 11 |

|

| Product sales | | 2,167 |

| | — |

| | — |

| | — |

| | — |

|

| Royalty income | | 184 |

| | — |

| | — |

| | — |

| | — |

|

| Sales commission and other | | 297 |

| | — |

| | 96 |

| | 834 |

| | 250 |

| 205 |

| | 465 |

| | 414 |

| | 297 |

| | — |

|

| License fees | | 248 |

| | 11 |

| | 6,079 |

| | 1,219 |

| | 4,455 |

| |

| | | 545 |

| | 11 |

| | 6,175 |

| | 2,053 |

| | 4,705 |

| 26,881 |

| | 923 |

| | 911 |

| | 545 |

| | 11 |

|

| Operating expenses | | | | | | | | | | | |

| Cost of sales | | — |

| | — |

| | 51 |

| | 591 |

| | 212 |

| 2,104 |

| | — |

| | — |

| | — |

| | — |

|

| Research and development costs | | 17,234 |

| | 23,716 |

| | 21,284 |

| | 20,592 |

| | 24,245 |

| 2,932 |

| | 10,704 |

| | 16,495 |

| | 17,234 |

| | 23,716 |

|

| General and administrative expenses | | 11,308 |

| | 9,840 |

| | 11,091 |

| | 9,226 |

| | 10,046 |

| 8,894 |

| | 8,198 |

| | 7,147 |

| | 11,308 |

| | 9,840 |

|

| Selling expenses | | 6,887 |

| | 3,850 |

| | 1,225 |

| | 1,380 |

| | 1,909 |

| 3,109 |

| | 5,095 |

| | 6,745 |

| | 6,887 |

| | 3,850 |

|

| | | 35,429 |

| | 37,406 |

| | 33,651 |

| | 31,789 |

| | 36,412 |

| 17,039 |

| | 23,997 |

| | 30,387 |

| | 35,429 |

| | 37,406 |

|

| Loss from operations | | (34,884 | ) | | (37,395 | ) | | (27,476 | ) | | (29,736 | ) | | (31,707 | ) | |

| Finance income | | 305 |

| | 20,319 |

| | 1,748 |

| | 6,974 |

| | 6,239 |

| |

| Finance costs | | (15,649 | ) | | — |

| | (1,512 | ) | | (382 | ) | | (8 | ) | |

| Net finance (costs) income | | (15,344 | ) | | 20,319 |

| | 236 |

| | 6,592 |

| | 6,231 |

| |

| Loss before income taxes | | (50,228 | ) | | (17,076 | ) | | (27,240 | ) | | (23,144 | ) | | (25,476 | ) | |

| Income tax expense | | — |

| | (111 | ) | | — |

| | — |

| | (1,104 | ) | |

| Net loss from continuing operations | | (50,228 | ) | | (17,187 | ) | | (27,240 | ) | | (23,144 | ) | | (26,580 | ) | |

| Income (loss) from operations | | 9,842 |

| | (23,074 | ) | | (29,476 | ) | | (34,884 | ) | | (37,395 | ) |

| Settlements | | (1,400 | ) | | — |

| | — |

| | — |

| | — |

|

| Gain (loss) due to changes in foreign currency exchange rates | | 656 |

| | 502 |

| | (70 | ) | | (1,767 | ) | | 1,879 |

|

| Change in fair value of warrant liability | | 263 |

| | 2,222 |

| | 4,437 |

| | (10,956 | ) | | 18,272 |

|

| Warrant exercise inducement fee | | — |

| | — |

| | — |

| | (2,926 | ) | | — |

|

| Other finance income | | 278 |

| | 75 |

| | 150 |

| | 305 |

| | 168 |

|

| Net finance income (costs) | | 1,197 |

| | 2,799 |

| | 4,517 |

| | (15,344 | ) | | 20,319 |

|

| Income (loss) before income taxes | | 9,639 |

| | (20,275 | ) | | (24,959 | ) | | (50,228 | ) | | (17,076 | ) |

| Income tax recovery (expense) | | (5,452 | ) | | 3,479 |

| | — |

| | — |

| | (111 | ) |

| Net income (loss) from operations | | 4,187 |

| | (16,796 | ) | | (24,959 | ) | | (50,228 | ) | | (17,187 | ) |

| Net income from discontinued operations | | 85 |

| | 623 |

| | 34,055 |

| | 2,732 |

| | (487 | ) | — |

| | — |

| | — |

| | 85 |

| | 623 |

|

| Net (loss) income | | (50,143 | ) | | (16,564 | ) | | 6,815 |

| | (20,412 | ) | | (27,067 | ) | 4,187 |

| | (16,796 | ) | | (24,959 | ) | | (50,143 | ) | | (16,564 | ) |

| Other comprehensive (loss) income: | | | | | | | |

| |

| |

| Other comprehensive income (loss): | | | | | | | | | | |

| Items that may be reclassified subsequently to profit or loss: | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustments | | 1,509 |

| | (1,158 | ) | | 1,073 |

| | (504 | ) | | (789 | ) | (260 | ) | | (1,430 | ) | | 569 |

| | 1,509 |

| | (1,158 | ) |

| Items that will not be reclassified to profit or loss: | | | | | | | | | | | | | | | | | | | |

| Actuarial gain (loss) on defined benefit plans | | 844 |

| | (1,833 | ) | | 2,346 |

| | (3,705 | ) | | (1,335 | ) | 193 |

| | 694 |

| | (1,479 | ) | | 844 |

| | (1,833 | ) |

| Comprehensive (loss) income | | (47,790 | ) | | (19,555 | ) | | 10,234 |

| | (24,621 | ) | | (29,191 | ) | 4,120 |

| | (17,532 | ) | | (25,869 | ) | | (47,790 | ) | | (19,555 | ) |

Net loss per share (basic and diluted) from continuing operations1 | | (18.17 | ) | | (29.12 | ) | | (92.41 | ) | | (117.04 | ) | | (168.75 | ) | |

Basic Net income (loss) per share from continuing operations(1) | | 0.25 |

| | (1.12 | ) | | (2.41 | ) | | (18.17 | ) | | (29.12 | ) |

Diluted Net income (loss) per share from continuing operations(1) | | 0.24 |

| | (1.12 | ) | | (2.41 | ) | | (18.17 | ) | | (29.12 | ) |

Net income per share (basic and diluted) from discontinued operations1 | | 0.03 |

| | 1.06 |

| | 115.53 |

| | 13.79 |

| | (3.09 | ) | — |

| | — |

| | — |

| | 0.03 |

| | 1.06 |

|

Net (loss) income per share (basic and diluted)1 | | (18.14 | ) | | (28.06 | ) | | 23.12 |

| | (103.22 | ) | | (171.84 | ) | |

Weighted average number of shares outstanding:1 | | | | | | | |

|

| |

|

| |

Net (loss) income per share (basic)1 | | 0.25 |

| | (1.12 | ) | | (2.41 | ) | | (18.14 | ) | | (28.06 | ) |

Net (loss) income per share (diluted)1 | | 0.24 |

| | (1.12 | ) | | (2.41 | ) | | (18.14 | ) | | (28.06 | ) |

| Weighted average number of shares outstanding: | | | | | | | | | | |

| Basic | | 2,763,603 |

| | 590,247 |

| | 294,765 |

| | 197,751 |

| | 157,513 |

| 16,440,760 |

| | 14,958,704 |

| | 10,348,879 |

| | 2,763,603 |

| | 590,247 |

|

| Diluted | | 3,424,336 |

| | 590,247 |

| | 294,765 |

| | 198,067 |

| | 157,513 |

| 17,034,812 |

| | 14,958,704 |

| | 10,348,879 |

| | 2,763,603 |

| | 590,247 |

|

| |

1 | Adjusted to reflect the November 17, 2015 100-to-1 Share Consolidation |

Consolidated Statement of Financial Position Information

(in thousands of USU.S. dollars)

Derived from consolidated financial statements prepared in accordance with IFRS, as issued by the IASB

| | | | | As at December 31, | | As at December 31, |

| | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 | | 2018 | | 2017 | | 2016 | | 2015 | | 2014 |

| | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ | | $ |

| Cash and cash equivalents | | 41,450 |

| | 34,931 |

| | 43,202 |

| | 39,521 |

| | 46,881 |

| | 14,512 |

| | 7,780 |

| | 21,999 |

| | 41,450 |

| | 34,931 |

|

| Restricted cash equivalents | | 255 |

| | 760 |

| | 865 |

| | 826 |

| | 806 |

| | 418 |

| | 381 |

| | 496 |

| | 255 |

| | 760 |

|

| Total assets | | 51,498 |

| | 47,435 |

| | 59,196 |

| | 67,665 |

| | 75,369 |

| | 25,011 |

| | 22,195 |

| | 31,659 |

| | 51,498 |

| | 47,435 |

|

| Warrant liability (current and non-current portion) | | 10,891 |

| | 8,225 |

| | 18,010 |

| | 6,176 |

| | 9,162 |

| | 3,634 |

| | 3,897 |

| | 6,854 |

| | 10,891 |

| | 8,225 |

|

| Share capital | | 204,596 |

| | 150,544 |

| | 134,101 |

| | 122,791 |

| | 101,884 |

| | 222,335 |

| | 222,335 |

| | 213,980 |

| | 204,596 |

| | 150,544 |

|

| Shareholders' equity (deficiency) | | 21,615 |

| | 14,484 |

| | 17,064 |

| | (6,695 | ) | | (4,546 | ) | |

| Shareholders' (deficiency) equity | | | 1,907 |

| | (2,783 | ) | | 6,212 |

| | 21,615 |

| | 14,484 |

|

| |

| B. | Capitalization and indebtedness |

Not applicable.

| |

| C. | Reasons for the offer and use of proceeds |

Not applicable.

D. Risk factorsAn investment in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following risks actually occurs, our business, prospects, financial condition or results of operations could suffer. In that case, the trading price, if any, of our securities could decline, and you may lose all or part of your investment.

Risks Relating to Us and Our Business

Investments in biopharmaceutical companies are generally considered to be speculative.speculative in nature.

The prospects for companies operating in the biopharmaceutical industry are uncertain, given the very nature of the industry, and, accordingly, investments in biopharmaceutical companies should be considered to be speculative assets.

We have a history of operating losses and we may never achieve or maintain operating profitability. If we are unsuccessful in generating new revenue, increasing our revenues and/or raising additional funding, we may not be able to continue as a going concern.

We have incurred, and expect to continue to incur, substantial expenses in our efforts to develop and marketcommercialize products. Consequently, we have incurred operating losses historically and in each of the last several years. As at December 31, 2015,2018, we had an accumulated deficit of approximately $271.6$310 million. Our operating losses have adversely impacted, and will continue to adversely impact, our working capital, total assets, operating cash flow and shareholders’shareholders' equity. We do not expect to reach operating profitability in the immediate future, and our operating expenses are likely to continue to represent a significant component of our overall cost profile as we continue our R&D and clinical study programs, seek regulatory approval for our product candidates and carry out commercial activities. Even if we succeed infocus on the commercialization of Macrilen™ (macimorelin). In developing, acquiring, or in-licensing new commercial products,out-licensing Macrilen™ (macimorelin), we could incur additional operating losses for at least the next several years. If we do not ultimately generate sufficient revenue from a commercialized products toproduct and achieve or maintain operating profitability, an investment in our Common Shares or other securities could result in a significant or total loss.

Our revenues and expenses may fluctuate significantly, and any failure to meet financial expectations may disappoint securities analysts or investors and result in a decline in the price or the value of our Common Shares or other securities.

We have a history of operating losses. Our revenues and expenses have fluctuated in the past and may continue to do so in the future. These fluctuations could cause our share price or the value of our other securities to decline. Some of the factors that could cause our revenues and expenses to fluctuate include but are not limited to:

the inability to complete product development in a timely manner that results in a failure or delay in receiving the required regulatory approvals to commercialize our product candidates;

the timing of regulatory submissions and approvals;

the timing and willingness of any current or future collaborators to invest the resources necessary to commercialize our product candidates;

the nature and timing of licensing fee revenues;

the outcome of litigation, including the securities class action litigation pending against us that is described elsewhere in this Annual Report on Form 20-F;

foreign currency fluctuations;

the timing of the achievement and the receipt of milestone payments from current or future collaborators; and

failure to enter into new or the expiration or termination of current agreements with collaborators.

Due to fluctuations in our revenues and expenses, we believe that period-to-period comparisons of our results of operations are not necessarily indicative of our future performance. It is possible that in some future quarters or years, our revenues and expenses will be above or below the expectations of securities analysts or investors. In this case, the price of our Common Shares and/or the value of our other securities could fluctuate significantly or decline.

Our clinical trials may not yield results that will enable us to obtain regulatory approval for our products, and a setback in any of our clinical trials would likely cause a drop in the price of our Common Shares or a decline in the value of our other securities.

We will only receive regulatory approval for a product candidate if we can demonstrate, in carefully designed and conducted clinical trials, that the product candidate is both safe and effective. We do not know whether our pending or any future clinical trials will demonstrate sufficient safety and efficacy to obtain the requisite regulatory approvals or will result in marketable products. Unfavorable data from those studies could result in the withdrawal of marketing approval for approved products or an extension of the review period for developmental products. Preclinical testing and clinical development are inherently lengthy, complex, expensive and uncertain processes and have a high risk of failure. It typically takes many years to complete testing, and failure can occur at any stage of testing. Results attained in preclinical testing and early clinical studies, or trials, may not be indicative of results that are obtained in later studies. In addition, we have limited experience in conducting and managing the clinical trials necessary to obtain regulatory approval and, accordingly, may encounter unforeseen problems and delays in the approval process. Furthermore, errors in the conduct, monitoring and/or auditing of a clinical trial, whether made by us or by a contract research organization (a “CRO”) that we retain could invalidate the results from a regulatory perspective.

None of our current product candidates has to date received regulatory approval for their intended commercial sale. We cannot market a pharmaceutical product in any jurisdiction until it has completed rigorous preclinical testing and clinical trials and passed such jurisdiction’s extensive regulatory approval process. In general, significant R&D and clinical studies are required to demonstrate the safety and efficacy of our product candidates before we can submit regulatory applications. Even if a product candidate is approved by the applicable regulatory authority, we may not obtain approval for an indication whose market is large enough to recover our investment in that product candidate. In addition, there can be no assurance that we will ever obtain all or any required regulatory approvals for any of our product candidates.

We are currently developing our product candidates based on R&D activities, preclinical testing and clinical trials conducted to date, and we may not be successful in developing or introducing to the market these or any other new products or technology. If we fail to develop and deploy new products successfully and on a timely basis, we may become non-competitive and unable to recover the R&D and other expenses we incur to develop and test new products.

Interim results of preclinical or clinical studies do not necessarily predict their final results, and acceptable results in early studies might not be obtained in later studies. Safety signals detected during clinical studies and preclinical animal studies may require us to perform additional studies, which could delay the development of the drug or lead to a decision to discontinue development of the drug. Product candidates in the later stages of clinical development may fail to show the desired safety and efficacy traits despite positive results in initial clinical testing. Results from earlier studies may not be indicative of results from future clinical trials and the risk remains that a pivotal program may generate efficacy data that will be insufficient for the approval of the drug, or may raise safety concerns that may prevent approval of the drug. Interpretation of the prior preclinical and clinical safety and efficacy data of our product candidates may be flawed and there can be no assurance that safety and/or efficacy concerns from the prior data were overlooked or misinterpreted, which in subsequent, larger studies appear and prevent approval of such product candidates.

Furthermore, we may suffer significant setbacks in advanced clinical trials, even after promising results in earlier studies. Based on results at any stage of clinical trials, we may decide to repeat or redesign a trial or discontinue development of one or more of our product candidates. Further, actual results may vary once the final and quality‑controlled verification of data and analyses has been completed. If we fail to adequately demonstrate the safety and efficacy of our products under development, we will not be able to obtain the required regulatory approvals to commercialize our product candidates.

A failure in the development of any one of our programs or product candidates could have a negative impact on the development of the others. Setbacks in any phase of the clinical development of our product candidates would have an adverse financial impact (including with respect to any agreements and partnerships that may exist between us and other entities), could jeopardize regulatory approval and would likely cause a drop in the price of our Common Shares and/or a decline in the value of our other securities.

If we are unable to successfully complete our clinical trial programs, or if such clinical trials take longer to complete than we project, our ability to execute our current business strategy will be adversely affected.

Whether or not and how quickly we complete clinical trials is dependent in part upon the rate at which we are able to engage clinical trial sites and, thereafter, the rate of enrollment of patients, and the rate at which we collect, clean, lock and analyze the clinical trial database. Patient enrollment is a function of many factors, including the design of the protocol, the size of the patient population, the proximity of patients to and availability of clinical sites, the eligibility criteria for the study, the perceived risks and benefits of the drug under study and of the control drug, if any, the efforts to facilitate timely enrollment in clinical trials, the patient referral practices of physicians, the existence of competitive clinical trials, and whether existing or new drugs are approved for the indication we are studying. Certain clinical trials are designed to continue until a pre-determined number of events have occurred to the patients enrolled. Such trials are subject to delays stemming from patient withdrawal and from lower than expected event rates and may also incur increased costs, if enrollment is increased in order to achieve the desired number of events. If we experience delays in identifying and contracting with sites and/or in patient enrollment in our clinical trial programs, we may incur additional costs and delays in our development programs, and may not be able to complete our clinical trials on a cost-effective or timely basis. In addition, conducting multi-national studies adds another level of complexity and risk as we are subject to events affecting countries other than the US and Canada. Moreover, negative or inconclusive results from the clinical trials we conduct or adverse medical events could cause us to have to repeat or terminate the clinical trials. Accordingly, we may not be able to complete the clinical trials within an acceptable time-frame, if at all. If we or any third party have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing clinical trials.

Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards and must (i) meet the requirements of these authorities; (ii) meet the requirements for informed consent; and (iii) meet the requirements for good clinical practices. We may not be able to comply with these requirements in respect of one or more of our product candidates.

Additionally, we have limited experience in filing an NDA or similar application for approval in the US or in any other country for our current product candidates, which may result in a delay in, or the rejection of, our filing of an NDA or similar application. During the drug development process, regulatory agencies will typically ask questions of drug sponsors. While we endeavor to answer all such questions in a timely fashion, some questions may not be answered in time to prevent the delay of acceptance of an NDA or the rejection of an NDA.

We have incurred, and expect to continue to incur, substantial expenses, and we have made, and expect to continue to make, substantial financial commitments to establish a commercial operation. There can be no assurance how quickly, if ever, we will realize a profit from our commercial operation.

Our business strategy is to become a specialty biopharmaceutical company with commercial operations to market and sell products that we may develop, acquire or in‑license. To that end, our commercial operations consist of 21 full-time sales representatives, who provide services pursuant to our agreement with a contract sales organization, and our sales-management employees. We have to date incurred, and expect to continue to incur, substantial expenses, and we have made, and expect to continue to make, substantial financial commitments to build out our commercial operations. Establishing a commercial operation is expensive and time-consuming, and there can be no assurance how quickly, if ever, we will realize a profit from our commercial operations. Factors that may inhibit our efforts to realize a profit from our commercial operations include:

our inability to recruit, train and retain adequate numbers of effective sales and marketing personnel and representatives;

the inability of our sales personnel to obtain access to or to persuade adequate numbers of physicians to prescribe our products or the products that we in-license or co-promote;

the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and

unforeseen costs and expenses associated with creating an independent sales and marketing organization.

Our financial viability depends, in part, on our ability to acquire, in-license or otherwise obtain the right to sell other products. If we are unable to do so, our business, financial condition and results of operations may be materially adversely affected.

In connection with our strategy to further transform the Company into a commercially operating specialty biopharmaceutical organization, we may enter into commercial arrangements with third parties, including but not limited to promotion, co-promotion, acquisition or in-licensing agreements, in efforts to establish and expand our commercial revenue base. These business activities entail numerous operational and financial risks, including:

the difficulty or inability to secure financing to acquire or in-license products;

the incurrence of substantial debt or dilutive issuances of securities to pay for the acquisition or in-licensing of new products;

the disruption of our business and diversion of our management’s time and attention;

higher than expected development, acquisition or in-license and integration costs;

exposure to unknown liabilities; and

the difficulty in locating products that are in our targeted therapeutic areas and that are compatible with other products in our portfolio.

We can provide no assurance that we will be able to identify potential product candidates or strategic commercial partners or, if we identify such product candidates or partners, that any related commercial arrangements will be consummated on terms that are favorable to us. To the extent that we are successful in entering into any strategic commercial arrangements, including promotional, co-promotional or marketing agreements, or acquisition or in-licensing agreements with third parties, we cannot provide any assurance that any resulting initiatives or activities will be successful. To the extent that any related investments in such arrangements do not yield the expected benefits, our business, financial condition and results of operations may be materially adversely affected.

We have limited resources to identify and execute the procurement of additional products and to integrate them into our current commercial operations. The failure to successfully integrate the personnel and operations of businesses that we may acquire or of products that we may in-license in the future with our existing operations, business and products could have a material adverse effect on our operations and results. We compete with larger pharmaceutical companies and other competitors in our efforts to acquire, in-license, and/or obtain the right to market and/or detail new products. Our competitors likely will have access to greater financial resources than us and may have greater expertise in identifying and evaluating new opportunities. Moreover, we may devote resources to potential acquisition, in-licensing, promotion or co-promotion opportunities that are never completed, or we may fail to realize the anticipated benefits of such efforts.

We will require significant additional financing, and we may not have access to sufficient capital.

We will require significant additional capital to fund our commercial operations and may require additional capital to pursue planned clinical trials and regulatory approvals, as well as further R&D and marketing efforts for our product candidates and potential products. We do not anticipate generating significant revenues from operations in the near future, and we currently have no committed sources of capital.

We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or CROs or from other sources, including, without limitation, through at-the-market offerings and issuances of Common Shares. Additional funding may not be available on terms that are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable or exercisable for equity securities (collectively, “Convertible Securities”), the issuance of those securities would result in dilution to our shareholders. Moreover, the incurrence of debt financing or the issuance of dividend-paying preferred shares, could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness or the payment of dividends on such preferred shares and could impose restrictions on our operations and on our ability to make certain expenditures and/or to incur additional indebtedness, which could render us more vulnerable to competitive pressures and economic downturns.

We anticipate that our cash and cash equivalents as at December 31, 2015 will be sufficient to fund our commercial operations, development programs, clinical trials and other operating expenses at least through December 31, 2016. However, our future capital requirements are substantial and may increase beyond our current expectations depending on many factors, including:

the duration of, changes to and results of our clinical trials for our various product candidates going forward;

unexpected delays or developments in seeking regulatory approvals;

the time and cost involved in preparing, filing, prosecuting, maintaining and enforcing patent claims;

unexpected developments encountered in implementing our business development and commercialization strategies;

the potential addition of commercialized products to our portfolio;

lower sales commission than expected;

the outcome of litigation, including the securities class action litigation pending against us that is described elsewhere in this Annual Report on Form 20-F; and

further arrangements, if any, with collaborators.

In addition, global economic and market conditions as well as future developments in the credit and capital markets may make it even more difficult for us to raise additional financing in the future.

If we are unsuccessful in generating new revenues, increasing our revenues and/or raising additional funding, we may possibly cease to continue operating as we currently do.

We have incurred sustained operating losses, deficits and negative cash flows from operating activities over the past several years, and we expect that we will continue to do so for an extended period.

Our ability to continue as a going concern is dependent on the successful execution of our business plan, which will require an increase in revenue and/or additional funding to be provided by potential investors and/or non-traditional sources of financing. In 2018, our primary source of liquidity was the $24.0 million licensing payment received from Strongbridge Biopharma plc in January 2018.

We stated in our management’s discussion and analysis of financial condition and results of operations for the year ended 2018 that we expect existing cash balances and operating cash flows will provide us with adequate funds to support our current operating plan for at least twelve months. There can be no assurance, however, that weunplanned capital requirements or other future events, will achieve profitabilitynot require us to seek debt or positive cash flows or be able to obtain additional funding orequity financing and, if so required, that

if obtained, they it will be sufficient, or whether any other initiatives will be successful such that we may continue as a going concern. There could also be material uncertainties relatedavailable on terms acceptable to certain adverse conditions and events that could impact our ability to remain a going concern. If the going concern assumptions were deemed no longer appropriate for our consolidated financial statements, adjustments to the carrying value of assets and liabilities, reported expenses and consolidated statement of financial position classifications would be necessary. Such adjustments could be material.us, if at all.

Additional funding may be in the form of debt or equity or a hybrid instrument depending on our needs, the demands of investors and market conditions. Depending on the prevailing global economic and credit market conditions, we may not be able to raise additional liquiditycash through these traditional sources of financing. Although we may also pursue non-traditional sources of financing with third parties, the global equity and credit markets may adversely affect the ability of potential third parties to pursue such transactions with us. Accordingly, as a result of the foregoing, we continue to review traditional sources of financing, such as private and public debt or various equity financing alternatives, as well as other alternatives to enhance shareholder value, including, but not limited to, non-traditional sources of financing, such as strategic alliances with third parties, the sale of assets or licensing of our technology or intellectual property, a combination of operating and related initiatives or a substantial reorganization of our business.

There can be no assurance that we will achieve profitability or positive cash flows or be able to obtain additional funding or that, if obtained, the additional funding will be sufficient, or whether any other initiatives will be successful such that we may continue as a going concern. If we do not ultimately achieve operating profitability, an investment in our Common Shares or other securities could result in a significant or total loss. There could also be material uncertainties related to certain adverse conditions and events that could impact our ability to remain a going concern. If the going concern assumptions were deemed no longer appropriate for our consolidated financial statements, adjustments to the carrying value of assets and liabilities, reported expenses and consolidated statement of financial position classifications would be necessary. Such adjustments could be material.

If we are unable to successfully commercialize or out-license Macrilen™ (macimorelin), or if we experience significant delays in doing so, our business would be materially harmed, and the future and viability of our Company could be imperiled.

Our principal focus is on the licensing and development of Macrilen™ (macimorelin) and we currently do not have any other product. The Company is a party to a license and assignment agreement with a subsidiary of Novo Nordisk A/S (“Novo”) to carry out development, manufacturing, registration and commercialization of Macrilen™ (macimorelin) in the U.S. and Canada (the “License and Assignment Agreement”). The Company continues to explore licensing opportunities worldwide.

The commercial success of Macrilen™ (macimorelin) depends on several factors, including the following:

receipt of approvals from foreign regulatory authorities;

successfully contracting with qualified third-party suppliers to manufacture Macrilen™ (macimorelin);

developing appropriate distribution and marketing infrastructure and arrangements for our product;

launching and growing commercial sales of the product;

out-licensing Macrilen™ (macimorelin) to third parties; and

acceptance of the product in the medical community, among patients and with third party payers.

If we are unable to successfully achieve any of these factors, our business, financial condition and results of operations may be materially adversely affected.

Our revenues and expenses may fluctuate significantly, and any failure to meet financial expectations may disappoint securities analysts or investors and result in a decline in the price or the value of our Common Shares or other securities.

We have a history of operating losses. Our revenues and expenses have fluctuated in the past and may continue to do so in the future. These fluctuations could cause our share price or the value of our other securities to decline. Some of the factors that could cause our revenues and expenses to fluctuate include but are not limited to:

the timing and willingness of any current or future collaborators to invest the resources necessary to commercialize Macrilen™ (macimorelin);

not obtaining necessary regulatory approvals from the U.S. Food and Drug Administration ("FDA"), European Medicines Agency ("EMA") and other agencies that may delay or prevent us from obtaining approval of a pediatric indication for Macrilen™ (macimorelin), which may affect the price of our securities;

the timing of regulatory submissions and approvals;

the nature and timing of licensing fee revenues;

the outcome of litigation, including the securities class action litigation pending against us that is described elsewhere in this Annual Report on Form 20-F;

foreign currency fluctuations;

the timing of the achievement and the receipt of milestone payments from current or future licensing partners; and

failure to enter into new or the expiration or termination of current agreements with suppliers who manufacture Macrilen™ (macimorelin).

Due to fluctuations in our revenues and expenses, we believe that period-to-period comparisons of our results of operations are not necessarily indicative of our future performance. It is possible that in some future periods, our revenues and expenses will be above or below the expectations of securities analysts or investors. In this case, the price of our Common Shares and the value of our other securities could fluctuate significantly or decline.

If we are unable to successfully complete the pediatric clinical trial program for Macrilen™ (macimorelin), or if such clinical trial takes longer to complete than we project, our ability to execute any related business strategy will be adversely affected.

If we experience delays in identifying and contracting with sites and/or in-patient enrollment in our pediatric clinical trial program for Macrilen™ (macimorelin), we may incur additional costs and delays in our development programs, and may not be able to complete our clinical trials on a cost-effective or timely basis. In addition, conducting multi-national studies adds another level of complexity and risk as we are subject to events affecting countries other than the U.S. and Canada. Moreover, negative or inconclusive results from the clinical trials we conduct or adverse medical events could cause us to have to repeat or terminate the clinical trials. Accordingly, we may not be able to complete the pediatric clinical trial within an acceptable time-frame, if at all. If we or our contract resource organization (a "CRO") have difficulty enrolling a sufficient number of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing clinical trials.

Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards and must, among other requirements:

meet the requirements of these authorities from multiple countries and jurisdictions and their related statutes, regulations, and guidances;

meet the requirements for informed consent;

meet the requirements for institutional review boards; and

meet the requirements for good clinical practices

We are currently dependent on certain strategic relationships with third parties for the development, manufacturing and licensing of Macrilen™ (macimorelin) and we may enter into future collaborations for the development, manufacturing and licensing of Macrilen™ (macimorelin).

We are currently dependent on certain strategic relationships with third parties for the development, manufacturing and licensing of Macrilen™ (macimorelin), and may enter into future collaborations for the development, manufacturing and licensing of Macrilen™ (macimorelin). Our arrangements with these third parties may not provide us with the benefits we expect and may expose us to a number of risks.

Currently, we are dependent on Novo to commercialize Macrilen™ (macimorelin) in the U.S and Canada. Most of our potential revenue consists of contingent payments, including regulatory milestones and royalties on the sale of Macrilen™ (macimorelin). The milestone and royalty revenue that we may receive under this collaboration will depend upon Novo’s ability to successfully introduce, market and sell Macrilen™ (macimorelin) in the United States. If Novo does not devote sufficient time and resources to its collaboration arrangement with us, we may not realize the potential commercial benefits of the arrangement, and our results of operations may be materially adversely affected.

Our reliance on relationships with Novo and other potential third parties poses a number of risks. We may not realize the contemplated benefits of such agreements nor can we be certain that any of these parties will fulfill their obligations in a manner which maximizes our revenue. These arrangements may also require us to transfer certain material rights to third parties. These agreements create certain additional risks. The occurrence of any of the following or other events may delay or impair commercialization of Macrilen™ (macimorelin):

in certain circumstances, third parties may assign their rights and obligations under these agreements to other third parties without our consent or approval;

the third parties may cease to conduct business for financial or other reasons;

we may not be able to renew such agreements;

the third parties may not properly maintain or defend certain intellectual property rights that may be important to the commercialization of Macrilen™ (macimorelin);

the third parties may encounter conflicts of interest, changes in business strategy or other issues which could adversely affect their willingness or ability to fulfill their obligations to us (for example, pharmaceutical companies historically have re-evaluated their priorities following mergers and consolidations, which have been common in this industry);

delays in, or failures to achieve, scale-up to commercial quantities, or changes to current raw material suppliers or product manufacturers (whether the change is attributable to us or the supplier or manufacturer) could delay clinical studies, regulatory submissions and commercialization of Macrilen™ (macimorelin); and

disputes may arise between us and the third parties that could result in the delay or termination of the manufacturing or commercialization of Macrilen™ (macimorelin), resulting in litigation or arbitration that could be time-consuming and expensive, or causing the third parties to act in their own self-interest and not in our interest or those of our shareholders.

| |

| i. | In addition, the third parties can terminate our agreements with them for a number of reasons based on the terms of the individual agreements that we have entered into with them. If one or more of these agreements were to be terminated, we would be required to devote additional resources to manufacturing and commercializing Macrilen™ (macimorelin), which would likely cause a drop in the price of our Common Shares. |

We may be unsuccessful in consummating further out-licensing arrangements for MacrilenTM (macimorelin) on favorable terms and conditions, or we may be significantly delayed in doing so.

As part of our product development and commercialization strategy, we are evaluating out-licensing opportunities for MacrilenTM (macimorelin) in addition to the License and Assignment Agreement. If we elect to collaborate with third parties in respect of MacrilenTM (macimorelin), we may not be able to negotiate a collaborative arrangement for MacrilenTM (macimorelin) on favorable terms and conditions, if at all. Should any partner fail to successfully commercialize MacrilenTM (macimorelin), our business, financial condition and results of operations may be adversely affected.

We may require significant additional financing, and we may not have access to sufficient capital.

We may require significant additional capital to fund our commercial operations and may require additional capital to pursue planned clinical trials and regulatory approvals. Although we have capital from the License and Assignment Agreement, we do not anticipate generating significant revenues from operations in the near future other than from the License and Assignment Agreement, and we currently have no committed sources of capital.

We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or from other sources, including, without limitation, through at-the-market offerings and issuances of Common Shares. Additional funding may not be available on terms that are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable or exercisable for equity securities, the issuance of those securities would result in dilution to our shareholders. Moreover, the incurrence of debt financing or the issuance of dividend-paying preferred shares, could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness or the payment of dividends on such preferred shares and could impose restrictions on our operations and on our ability to make certain expenditures and/or to incur additional indebtedness, which could render us more vulnerable to competitive pressures and economic downturns.

Our future capital requirements are substantial and may increase beyond our current expectations depending on many factors, including:

the duration of changes to and results of our clinical trials for any future products going forward;

unexpected delays or developments in seeking regulatory approvals;

the time and cost involved in preparing, filing, prosecuting, maintaining and enforcing patent claims;

unexpected developments encountered in implementing our business development and commercialization strategies;

the potential addition of commercialized products to our portfolio;

the outcome of current and future litigation, including the securities class action litigation pending against us that is described elsewhere in this Annual Report on Form 20-F; and

further arrangements, if any, with collaborators.

In addition, global economic and market conditions as well as future developments in the credit and capital markets may make it even more difficult for us to raise additional financing in the future.

We are and will be subject to stringent ongoing government regulation for our products and our product candidates, even if we obtain regulatory approvals for the latter.

The manufacture, marketing and sale of our products and product candidatesMacrilen™ (macimorelin) are and will be subject to strict and ongoing regulation, even if regulatory authorities approve any ofwith marketing approval by the latter.FDA and EMA for Macrilen™ (macimorelin). Compliance with such regulation will be expensive and consume substantial financial and management resources. For example, anthe EMA approval for a product may bemacimorelin was conditioned on our agreement to conduct costly post-marketing follow-up studies to monitor the safety or efficacy of the products.product. In addition, as clinical experience with a drug expands after approval because the drug is used by a greater number and more diverse group of patients than during clinical trials, side effects or other problems may be observed after approval that were not observed or anticipated during pre-approval clinical trials. In such a case, a regulatory authority could restrict the indications for which the product may be sold or revoke the product’sproduct's regulatory approval.

We and our contract manufacturers will be required to comply with applicable currentCurrent Good Manufacturing Practice regulations for the manufacture of our products.current or future products and other regulations. These regulations include requirements relating to quality assurance, as well as the corresponding maintenance of rigorous records and documentation. Manufacturing facilities must be approved before we can use them in the commercial manufacturing of our productsa product and are subject to subsequent periodic inspection by regulatory authorities. In addition, material changes in the methods of manufacturing or changes in the suppliers of raw materials are subject to further regulatory review and approval.

If we, or if any future marketing collaborators or contract manufacturers, fail to comply with applicable regulatory requirements, we may be subject to sanctions including fines, product recalls or seizures and related publicity requirements, injunctions, total or partial suspension of production, civil penalties, suspension or withdrawals of previously granted regulatory approvals, warning or untitled letters, refusal to approve pending applications for marketing approval of new products or of supplements to approved applications, complete withdrawal of a marketing application, exclusion from government healthcare programs, import or export bans or restrictions, andand/or criminal prosecution and penalties. Any of these penalties could delay or prevent the promotion, marketing or sale of our products and product candidates.a product.

Even if we receivewith marketing approval for our product candidates, MacrilenTM (macimorelin),such product approvalsapproval could be subject to restrictions or withdrawals. Regulatory requirements are subject to change.

On December 20, 2017, the FDA granted marketing approval in the United States for Macrilen™ (macimorelin) to be used in the diagnosis of patients with adult growth hormone deficiency ("AGHD") and on January 16, 2019, the EMA granted marketing approval in Europe for macimorelin for the diagnosis of AGHD. Regulatory authorities generally approve products for particularspecified indications. If an approval is for a limited indication, this limitation reduces the size of the potential market for that product. Product approvals, once granted, are subject to continual review and periodic inspections by regulatory authorities. Our operations and practices are subject to regulation and scrutiny by the USU.S. government, as well as governments of any other countries in which we do business or conduct activities. Later discovery of previously unknown problems or safety issues and/or failure to comply with domestic or foreign laws, knowingly or unknowingly, can result in various adverse consequences, including, among other things, a possible delay in the approval or refusal to approve a product, warning or untitled letters, fines, injunctions, civil penalties, recalls or seizures of products and related publicity requirements, total or partial suspension of production, import or export bans or restrictions, refusal of the government to renew marketing applications, complete withdrawal of a marketing

application, criminal prosecution and penalties, suspension or withdrawals of previously granted regulatory approvals, withdrawal of an approved product from the market and/or exclusion from government healthcare programs. Such regulatory enforcement could have a direct and negative impact on the product for which approval is granted, but also could have a negative impact on the approval of any pending applications for marketing approval of new drugs or supplements to approved applications.

Because we operate in a highly regulated industry, regulatory authorities could take enforcement action against us in connection with our licensees' or our licensees’ or collaborators’collaborators', business and marketing activities for various reasons.

From time to time, new legislation is passed into law that could significantly change the statutory provisions governing the approval, manufacturing, and marketing of products regulated by the U.S. Food and Drug Administration ("FDA")FDA, EMA and other health authorities. Additionally, regulations and guidance are often revised or reinterpreted by health agencies in ways that may significantly affect

our business and our products.Macrilen™ (macimorelin). It is impossible to predict whether further legislative changes will be enacted, or whether regulations, guidance, or interpretations will change, and what the impact of such changes, if any, may be.

Healthcare reform measures could hinder or prevent the commercial success of oura product candidates and adversely affect our business.

The business prospects and financial condition of pharmaceutical and biotechnology companies are affected by the efforts of governmental and third-party payers to contain or reduce the costs of healthcare. The U.S. government and other governments have shown significant interest in pursuing healthcare reform and reducing healthcare costs. Any government-adopted reform measures could cause significant pressure on the pricing of healthcare products and services, including Macrilen™ (macimorelin), both in the U.S. and internationally, as well as the amount of reimbursement available from governmental agencies and other third-party payers. If reimbursement for Macrilen™ (macimorelin) is substantially less than we expect, our revenue prospects could be materially and adversely impacted.

In the USU.S. and in other jurisdictions there have been, and we expect that there will continue to be, a number of legislative and regulatory proposals aimed at changing the healthcare system, such as proposals relating to the pricing of healthcare products and services in the USU.S. or internationally, the reimportation of drugs into the USU.S. from other countries (where they are then sold at a lower price), and the amount of reimbursement available from governmental agencies or other third party payers. For example,Furthermore, the pricing of pharmaceutical products, in general, and specialty drugs, in particular, has been a topic of concern in the U.S. Congress, where hearings on the topic have been held, and has been a topic of speeches given by political figures, including President Donald Trump. Additionally, in the U.S., states have also passed legislation and proposed bills that are aimed at drug manufacturers are requiredpricing transparency, which will likely impact drug pricing. There can be no assurance as to have a national rebate agreement with the Departmenthow this scrutiny on pricing of Health and Human Services in order to obtain state Medicaid coverage, which requires manufacturers to pay a rebate on drugs dispensed to Medicaid patients.pharmaceutical products will impact future pricing of Macrilen™ (macimorelin).

The Patient Protection and Affordable Care Act and the Healthcare and Education Affordability Reconciliation Act of 2010 (collectively, the “ACA”"ACA") may havehas had far-reaching consequences for most healthcare companies, including specialty biopharmaceutical companies like us. For example, if reimbursement for our product candidates is substantially less than we expect, our revenue prospects could be materially and adversely impacted.

Regardless of the impactThe future of the ACA is, however, uncertain. Since January 2017, the U.S. Congress has proposed various bills to revise the ACA. Additionally, President Donald Trump has suggested similar action and enacted Executive Orders to curtail the ACA and its impacts on us,healthcare in the US government and other governments have shown significant interest in pursuingU.S. We cannot predict the ultimate content, timing or effect of any healthcare reform legislation, or potential legislation, regulation, and reducing healthcare costs. Any government-adopted reform measures could cause significant pressureorders or their impact on the pricing of healthcare products and services, including our product candidates, in the US and internationally, as well as the amount of reimbursement available from governmental agencies and other third-party payers.us.

In addition, on September 27, 2007, the Food and Drug Administration Amendments Act of 2007 was enacted, givinggives the FDA enhanced post-market authority, including the authority to require post-marketing studies and clinical trials, labeling changes based on new safety information, and compliance with risk evaluations and mitigation strategies approved by the FDA. The FDA’sFDA's exercise of this authority may result in delays or increased costs during the period of product development, clinical trials and regulatory review and approval, which may also increase costs related to complying with new post-approval regulatory requirements, and increase potential FDA restrictions on the sale or distribution of approved products.

If we or our licensees market products or interact with health care practitioners in a manner that violates healthcare fraud and abuse laws, we or our licensees may be subject to civil or criminal penalties, including exclusion from participation in government healthcare programs.

As a pharmaceutical company, even though we do not provide healthcare services or receive payments directly from or bill directly to Medicare, Medicaid or other third-party payers for our products,current product, certain federal and state healthcare laws and regulations pertaining to fraud and abuse are and will be applicable to our business. We and our licensees are subject to healthcare fraud and abuse regulation by both the federal government and the states in which we conduct our business.

The laws that may affect our and our licensee's ability to operate include the federal healthcare program anti-kickback statute, which prohibits, among other things, knowingly and willfully offering, paying, soliciting, or receiving remuneration to induce, or in return for, the purchase, lease, order, or arrangement for the purchase, lease or order of any healthcare item or service reimbursable under Medicare, Medicaid or other federally financed healthcare programs. This statute applies to arrangements between pharmaceutical manufacturers and prescribers, purchasers and formulary managers. Although there are a number of statutory exceptions and regulatory safe harbors protecting certain common activities, the exceptions and safe harbors are drawn narrowly, and practices that involve remuneration intended to induce prescribing, purchases or recommendations may be subject to scrutiny if they do not qualify for an exception or safe harbor.

Federal false claims laws prohibit any person from knowingly presenting, or causing to be presented, a false claim for payment to the federal government, or knowingly making, or causing to be made, a false statement to get a false claim paid. Pharmaceutical companies have been prosecuted under these laws for a variety of alleged promotional and marketing activities, such as providing free product to customers with the expectation that the customers would bill federal programs for the product; reporting to pricing services inflated average wholesale prices that were then used by federal programs to set reimbursement rates; engaging in off-label promotion that caused claims to be submitted to Medicaid for non-covered off-label uses; and submitting inflated best price information to the Medicaid Drug Rebate Program.

The Health Insurance Portability and Accountability Act of 1996 also created prohibitions against healthcare fraud and false statements relating to healthcare matters. The healthcare fraud statute prohibits knowingly and willfully executing a scheme to defraud any healthcare benefit program, including private payers. The false statements statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services.

In addition, there has been a recent trend of increased federal and state regulation of payments made to physicians. The ACA, through the Physician Payment Sunshine Act, imposed new requirements on manufacturers of drugs, devices, biologics and medical supplies for which payment is available under Medicare, Medicaid or the Children’sChildren's Health Insurance Program (with certain exceptions) to report annually to the Centers for Medicare and Medicaid Services (“CMS”("CMS") information related to payments or other “transfers"transfers of value”value" made to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, and applicable manufacturers and group purchasing organizations to report annually to CMS ownership and investment interests held by physicians (as defined above) and their immediate family members and payments or other “transfers"transfers of value”value" to such physician owners and their immediate family members. Manufacturers are required to report such data to the government by the 90th calendar day of each year.

The majority of states also have statutes or regulations similar to these federal laws, which apply to items and services reimbursed under Medicaid and other state programs, or, in several states, apply regardless of the payer. In addition, some states have laws that require pharmaceutical companies to adopt comprehensive compliance programs. For example, under California law, pharmaceutical companies must comply with both the April 2003 Office of Inspector General Compliance Program Guidance for Pharmaceutical Manufacturers and the PhRMA Code on Interactions with Healthcare Professionals, as amended. Certain states also mandate the tracking and reporting of gifts, compensation, and other remuneration paid by us to physicians and other healthcare providers.

Although compliance programs can mitigate the risk of investigation and prosecution for violations of these laws, the risks cannot be entirely eliminated. Any action against us or our licensees for violation of these laws, even if we successfully defend against it, could cause us to incur significant legal expenses, cause reputational harm and divert our management’smanagement's attention from the operation of our business. Moreover, achieving and sustaining compliance with applicable federal and state laws may prove costly.

Because of the breadth of these laws and the narrowness of the safe harbors, it is possible that some of our business activities could be subject to challenge under one or more of such laws. The ACA also made several important changes to the federal Anti-Kickback Statute,anti-kickback statute, false claims laws, and healthcare fraud statute by weakening the intent requirement under the anti-kickback and healthcare fraud statutes that may make it easier for the government or whistleblowers to charge such fraud and abuse violations. A person or entity no longer needs to have actual knowledge of this statute or specific intent to violate it. In addition, the ACA provides that the government may assert that a claim including items or services resulting from a violation of the federal anti-kickback statute constitutes a false or fraudulent claim for purposes of the false claims statutes. In addition, the ACA increases penalties for fraud and abuse violations. If our past, present or future operations are found to be in violation of any of the laws described above or other similar governmental regulations to which we are subject, we may be subject to significant civil, criminal and administrative penalties, damages, fines, imprisonment, exclusion from government funded healthcare programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business and negatively impact our financial results.

If our products doMacrilen™ (macimorelin) does not gain market acceptance, we may be unable to generate significant revenues.

Even if our products are approved for commercialization, they may not be successful in the marketplace.