Note:

| (1) | Under IFRS applicable to junior mining exploration companies, mineral exploration expenditures can be deferred on prospective properties until such time as it is determined that further exploration is not warranted, at which time the property costs are written off. During the year ended March 31, 2009, the Company retrospectively changed its accounting policy for exploration expenditures to more appropriately align itself with policies adopted by other exploration companies at a similar stage in the mining industry. Prior to the year ended March 31, 2009, the Company capitalized all such costs to mineral property interests held directly or through an investment, and only wrote down capitalized costs when the property was abandoned or if the capitalized costs were not considered to be economically recoverable. |

Exploration expenditures are now charged to earnings as they are incurred until the mineral property interest reaches the development stage. Significant costs related to mineral property acquisitions, including allocations for undeveloped mineral property interests, are capitalized until the viability of the mineral property interest is determined. When it has been established that a mineral deposit is commercially mineable and an economic analysis has been completed, the costs subsequently incurred to develop a mine on the property prior to the start of mining operations are capitalized.

The expensing of exploration costs as incurred is now consistent with US GAAP, whereby all exploration expenditures are expensed until an independent feasibility study has determined that the property is capable of economic commercial production.

Exploration expenditures are now charged to earnings as they are incurred until the mineral property interest reaches the development stage. Significant costs related to mineral property acquisitions, including allocations for undeveloped mineral property interests, are capitalized until the viability of the mineral property interest is determined. When it has been established that a mineral deposit is commercially mineable and an economic analysis has been completed, the costs subsequently incurred to develop a mine on the property prior to the start of mining operations are capitalized. |

The expensing of exploration costs as incurred is now consistent with US GAAP, whereby all exploration expenditures are expensed until an independent feasibility study has determined that the property is capable of economic commercial production. |

7

The tables below include the quarterly results for the years ended March 31, 2016 (“fiscal 2016”)2018 and 2015 (“fiscal 2015”).2017.

| (Cdn$) | Year Ended March 31, 2018 | ||||||||||||||

| Statement of Operations Data | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total | ||||||||||

| Investment and other income | $ | - | $ | 31 | $ | - | $ | - | $ | 31 | |||||

| General and administrative expenses | 31,408 | 54,402 | 31,715 | 146,098 | 263,623 | ||||||||||

| Share-based payments | - | 44,193 | - | - | 44,193 | ||||||||||

| Write-down of mineral property interests | - | - | - | 513,600 | 513,600 | ||||||||||

| Exploration costs | 1,128 | 6,910 | - | 32,929 | 40,967 | ||||||||||

| Loss (gain) on sale of discontinued operations | - | - | - | - | - | ||||||||||

| Net loss (income) according to financial statements | 32,536 | 105,474 | 31,715 | 692,627 | 862,352 | ||||||||||

| Net loss from continuing operations per common share | 0.00 | 0.02 | 0.00 | 0.07 | 0.09 | ||||||||||

| (Cdn$) | Year Ended March 31, 2017 | ||||||||||||||

| Statement of Operations Data | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total | ||||||||||

| Investment and other income | $ | - | $ | - | $ | - | $ | - | $ | - | |||||

| General and administrative expenses | 37,024 | 47,488 | 85,234 | 48,551 | 218,297 | ||||||||||

| Share-based payments | - | 131,412 | - | - | 131,412 | ||||||||||

| Write-down of mineral property interests | - | - | - | - | - | ||||||||||

| Exploration costs | 260 | - | - | 6,892 | 7,152 | ||||||||||

| Loss (gain) on sale of discontinued operations | - | - | - | - | - | ||||||||||

| Net loss (income) according to financial statements | 37,284 | 178,900 | 85,234 | 55,443 | 356,861 | ||||||||||

| Net loss from continuing operations per common share | 0.00 | 0.03 | 0.01 | 0.01 | 0.05 | ||||||||||

| (Cdn$) | Year Ended March 31, 2016 | |||||||

| Statement of Operations Data | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total | |||

| Investment and other income | $ (129,121) | $ (707) | $ -- | $ -- | $ (129,828) | |||

| General and administrative expenses | 72,420 | 46,449 | 67,409 | 36,027 |

222,305 | |||

| Share-based payments | 21,006 | -- | -- | -- | 21,006 | |||

| Write-down of mineral property interests | -- | -- | -- | -- |

-- | |||

| Exploration costs | (3,777) | 760 | -- | 1,127 | (1,890) | |||

| Loss (gain) on sale of discontinued operations | -- | -- | -- | -- |

-- | |||

| Net loss (income) according to financial statements | (39,472) | 46,502 | 67,409 | 37,154 |

111,593 | |||

| Net loss from continuing operations per common share | 0.00 | 0.00 | 0.00 | 0.00 |

0.00 | |||

| B. | Capitalization and Indebtedness |

| (Cdn$) | Year Ended March 31, 2015 | |||||||

| Statement of Operations Data | Quarter 1 | Quarter 2 | Quarter 3 | Quarter 4 | Total | |||

| Investment and other income | $ -- | $ -- | $ -- | $ -- | $ -- | |||

| General and administrative expenses | 95,672 | 93,644 | 156,335 | 59,471 |

405,122 | |||

| Share-based payments | -- | -- | -- | -- | -- | |||

| Write-down of mineral property interests | -- | -- | -- | -- |

-- | |||

| Exploration costs | 3,161 | 5,062 | (7,885) | 1,127 | 1,465 | |||

| Loss (gain) on sale of discontinued operations | 116,257 | 104,560 | 54,961 | (684,023) |

(408,245) | |||

| Net loss (income) according to financial statements | 215,090 | 203,266 | 203,411 | (623,425) |

(1,658) | |||

| Net loss (income) from continuing operations per common share | 0.01 | 0.01 | 0.00 | (0.02) |

0.00 | |||

B. CapitalizationThis Form 20-F is being filed as an annual report under the Securities Exchange Act of 1934, and Indebtednessas such, there is no requirement to provide any information under this item.

Not applicable.

C.

| C. | Reasons for the Offer and Use of Proceeds |

This Form 20-F is being filed as an annual report under the OfferSecurities Exchange Act of 1934, and Use of Proceedsas such, there is no requirement to provide any information under this item.

Not applicable.

D. Risk Factors

| D. | Risk Factors |

The following is a brief discussion of those distinctive or special characteristics of Agave’sthe Company’s operations and industry which may have a material impact on Agave’sFirst Energy’s financial performance.

Readers should carefully consider the risks and uncertainties described below before deciding whether to invest in shares of the Company’s common stock.

8

Financial Risk Factors

AgaveFirst Energy has no source of operating cash flow, has a history of operating losses and has no assets of any significance with positive financial statement carrying values.In addition, all of the Company’s projects have a financial statement value of zero. AgaveThe Company has no revenues from operations and all of its mineral property interests are in the exploration stage. The Company will not receive revenues from operations at any time in the near future, and Agavethe Company has no prior years’ history of earnings or cash flow. AgaveThe Company has not paid dividends on its shares at any time since incorporation and does not anticipate doing so in the foreseeable future. Agave’s consolidatedThe Company’s financial statements have been prepared assuming Agaveit will continue on a going-concern basis. Should funding not be obtained, this assumption will change and Agave’sthe Company’s assets may be written down to realizable values. AgaveThe Company has incurred losses since inception (deficit at March 31, 2016,2018, is $34,302,758)$35,521,971), which casts doubt on the ability of Agavethe Company to continue as a going concern. AgaveThe Company has no revenue other than interest income. A mining project can typically require ten years or more between discovery, definition, development and construction and as a result, no production revenue is expected from any of the Company’s exploration properties in the near future. All of Agave’sthe Company’s short to medium-term operating and exploration expenses must be paid from its existing cash position or external financing. At March 31, 2016, Agave2018, the Company had working capital deficit of $237,139$136,728, compared to a working capital deficit of $355,003$31,069 at March 31, 2015.2017. Working capital is defined as current assets less current liabilities.

AgaveFirst Energy may be unable to obtain the funds necessary to expand exploration. Agave’sThe Company’s operations consist, almost exclusively, of cash consuming activities given that all of its mineral projects are in the early exploration stage. Agave has suspended exploration activities on all of its mineral properties. AgaveThe Company will need to receive additional equity capital or other funding from the joint venture of one or more properties or the sale of one or more properties for the next year, and failing that, may cease to be economically viable. To date, the only sources of funds that have been available to the Company are the sale of equity capital or the offering by the Company of an interest in its properties to be earned by another party or parties carrying out further development thereof.

The Company does not have sufficient financial resources to fund operations for the balance of fiscal 2017.2018. The Company has been successful in the past in obtaining financing through the sale of equity securities but as an exploration stage company, it is often difficult to obtain adequate financing when required, and it is not necessarily the case that the terms of such financings will be favourable. If Agavethe Company fails to obtain additional financing on a timely basis, the Company could forfeit its mineral property interests, dilute its interests in its properties, sell one or more properties and/or reduce or terminate operations.

AgaveThe Company is continuously reviewing strategies for private placement equity financings as well as other forms of financing that would carry the Company through the next fiscal year. If a private equity financing were to be completed, it is expected that warrants may be included in the securities offered. Any such financings will result in dilution of existing shareholders.

Volatile gold and silvermetal prices and external market conditions can cause significant changes in the Company’s share price because as the prices of precious metals increase or decrease, the economic viability of the mineral properties is affected.Agave

The Company has no history of mining or current source of revenue. The Company is exploring for silver and gold,metals and historically, the prices of the common shares of junior silver and gold exploration companies are very volatile. This volatility may be partly attributed to the volatility of silver and goldmetal prices, and also to the success or failure of the Company’s exploration programs. Market, financial and economic factors not directly related to mining activities can also affect the Company’s ability to raise equity financing.

Below are the annual average, high and low prices of gold and silver from the year 2005 to 2015, and year 2016 to date.

Gold[1]

Year | Average Price per ounce (US$) | High Price per ounce (US$) | Low Price per ounce (US$) |

| 2005 | 444.74 | 536.50 | 411.10 |

| 2006 | 603.46 | 725.00 | 524.75 |

| 2007 | 695.39 | 841.10 | 608.40 |

| 2008 | 871.96 | 1011.25 | 712.50 |

| 2009 | 972.35 | 1212.50 | 810.00 |

| 2010 | 1224.53 | 1421.00 | 1058.00 |

| 2011 | 1,568.59 | 1,895.00 | 1,319.00 |

| 2012 | 1,668.98 | 1,791.75 | 1,540.00 |

| 2013 | 1,411.23 | 1,693.75 | 1,195.25 |

| 2014 | 1,266.40 | 1,385.00 | 1,142.00 |

| 2015 | 1,160.06 | 1,295.75 | 1,049.40 |

| 2016 – (Jan – July 5, 2016) | 1,226.46 | 1,366.25 | 1,077.00 |

Silver[2]

Year | Average Price per ounce (US$) | High Price per ounce (US$) | Low Price per ounce (US$) |

| 2005 | 7.22 | 9.23 | 6.39 |

| 2006 | 11.57 | 14.94 | 8.83 |

| 2007 | 13.39 | 15.82 | 11.67 |

| 2008 | 15.02 | 20.92 | 8.88 |

| 2009 | 14.66 | 19.18 | 10.51 |

| 2010 | 20.16 | 30.70 | 15.14 |

| 2011 | 35.11 | 48.70 | 26.16 |

| 2012 | 31.15 | 37.23 | 26.67 |

| 2013 | 23.84 | 32.23 | 18.61 |

| 2014 | 19.08 | 22.05 | 15.28 |

| 2015 | 15.68 | 18.23 | 13.71 |

| 2016 (Jan-July 5, 2016) | 15.98 | 20.43 | 14.06 |

Fluctuations in financial markets can negatively impact the Company’s ability to achieve sufficient funding.

Over the last decade there have been periods of significant volatility in world financial markets. The volatility can negatively impact the company’sCompany’s ability to raise sufficient equity financing to sustain operations. Future financial market volatility is likely and it should not be assumed that adequate funding will be available to the Company in amounts or at times when it is required.

Risks Associated with Mineral Exploration

Agave’sFirst Energy’s exploration efforts may be unsuccessful in locating viable mineral resources.Resource exploration is a speculative business, characterized by a number of significant risks, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral deposits but also from finding mineral deposits, which, though present, are insufficient in quantity and/or quality to return a profit from production.

9

There is no certainty that expenditures to be made by the Company on the exploration of its properties and prospects as described herein will result in discoveries of mineralized material in commercial quality and quantities.

Mineral Resource Estimates Are Only Estimates and May Not Reflect the Actual Deposits or the Economic Viability of Gold and Silver Extraction.Although the Company has carefully preparedprepares its mineral resource figures, such figures are estimates only and no assurance can be given that the indicated tonnages and grade will be achieved. There is significant uncertainty in any mineral resource estimate. Estimates of inferred resources are the least certain of the resource categories and there is no assurance that such resources can or will be upgraded to another category of resource, or that further exploration will confirm or validate such estimates. Actual deposits encountered and the economic viability of, and returns from, a deposit (if mined) may differ materially from estimates disclosed by the Company or implied by estimates of mineral resources. The estimating of mineral resources is a subjective process and the accuracy of mineral resource estimates is a function of the quantity and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting engineering and geological information. Mineral resource estimates are based on many things, including assumed commodity prices, continuity of mineralization, tonnage and grade of mineralization, metallurgy, estimated mineral recovery rates, cost of capital, mine development costs, operating costs and exchange rates. Changes in assumptions may result in a significant reduction in the reported mineral resources and thereby have a material adverse effect on the Company's results of operations and financial condition.

1 www.kitco.com Gold prices, London Fix US dollars per ounce

2www.silverinstitute.org/priceuk.php Silver prices, London Fix US dollars per ounce

Estimated mineral resources may also require downward revisions based on changes in metal prices and further exploration or development activity. This could materially and adversely affect estimates of the tonnage or grade of mineralization, estimated recovery rates or other important factors that influence mineral resource and reserve of estimates. Any reduction in estimated mineral reserves or estimated resources as a result could require material write downs in investment in the affected mining property, which could have a material and adverse effect on the Company's results of operations and financial condition.

The Company has not established the presence of any proven and probable reserves at any of its mineral properties. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves on the Company's properties. The failure to establish proven and probable reserves could severely restrict the Company's ability to successfully implement its strategies for long-term growth.

There is Uncertainty Relating to Mineral Resources.Mineral resources that are not mineral reserves do not have demonstrated economic viability. Due to the uncertainty, which may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to indicated and measured mineral resources as a result of continued exploration. If mineral resources are not upgraded to proven and probable mineral reserves, it could materially and adversely affect and/or restrict the Company's ability to successfully implement its strategies for long-term growth.

Agave’s projects have uncertain project realization values.Agave changed its accounting policy with respect to the deferral (capitalization) of exploration costs in fiscal 2009. The Company continues to defer (capitalize) acquisition costs incurred in connection with its projects on its balance sheet. Agave has written down all its properties to Nil. Although the current financial statement carrying value of each Company’s projects is zero, in the future the Company may have projects with positive financial statement carrying values. In such cases a diminution in the book value of shareholders’ equity would be the result.

AgaveFirst Energy may not be able to market minerals if any are acquired or discovered by the Company due to factors beyond the control of the Company.The marketability of minerals that could in the future be acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of milling facilities, mineral markets and processing equipment, and such other factors as government regulation, including regulation relating to royalties, allowable production, importing and exporting of minerals and environmental protection, the combination of which factors may result in the Company not receiving an adequate return on investment capital.

Environmental and Regulatory Risk Factors

Compliance with environmental regulations could affect future profitability and timeliness of operations.The current and anticipated future operations of the Company require permits from various federal, territorial and local governmental authorities. Companies engaged in the exploration and development of mines and related facilities must comply with applicable laws, regulations and permits.

The Company’s exploration activities are subject to various laws governing land use, the protection of the environment, prospecting, development, commodity prices, exports, taxes, labour standards, occupational safety and health, waste disposal, toxic substances, mine safety and other matters. AgaveThe Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. The Company may be unable to obtain all permits required for exploration and development, and the costs of obtaining these permits may not be commercially reasonable. Existing laws and regulations may be modified, which could have an adverse effect on any exploration project that the Company might undertake.

10

Failure to comply with environmental and reclamation rules could result in penalties.The Company’s activities are subject to laws and regulations controlling not only mineral exploration and exploitation activities but also the possible effects of such activities upon the environment. Environmental legislation may change and make mining uneconomic or result in significant environmental or reclamation costs. Environmental legislation provides for restrictions and prohibitions and a breach of environmental legislation may result in the imposition of fines and penalties or the suspension or closure of operations. In addition, certain types of operations require the submission of environmental impact statements and approval thereof by government authorities. Environmental legislation is evolving in a manner that may mean stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their directors, officers and employees. Permits from a variety of regulatory authorities are required for many aspects of mineral exploitation activities, including closure and reclamation. Future environmental legislation could cause additional expense, capital expenditures, restrictions, liabilities and delays in the development of the Company’s properties, the extent of which cannot be predicted. In the context of environmental permits, including the approval of closure and reclamation plans, the Company must comply with standards and laws and regulations that may entail costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. The Company does not maintain environmental liability insurance.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. The Company and its employees havehas been involved in the exploration of mineral properties for many years. Currently, the operations of the Company have been limited to exploration, and no mining activity has yet been undertaken. The mining industry is heavily regulated in North America, where the Company has its operations, so that permitting is required before any work is undertaken where there is any form of land disturbance. Exploration activity undertaken in Mexico is subject to the laws and regulations established and administered by the Federal government. To date, land disturbance has been minimal and all required reclamation has been completed.

Other Risk Factors

AgaveFirst Energy is dependent on its ability to recruit and retain key personnel.The success of the activities of Agavethe Company is dependent to a significant extent on the efforts and abilities of its management. Investors must be willing to rely to a significant extent on their discretion and judgment. Agave does not maintain key employee insurance for any of its employees. AgaveThe Company has relied on and will continue to rely on consultants and others for exploration, development and technical expertise. The ability of the Company to retain employeeskey personnel and its ability to continue to pay for services are dependent upon the ability of the Company to obtain adequate financing to continue operating as a going concern.

Agave’sFirst Energy’s title to mineral property interests may be challenged.Although Agavethe Company has done a review of titles to its mineral interests, it has not obtained title insurance with respect to its properties and there is no guarantee of title. The Company has obtained a land title review and legal opinion by a Mexican law firm which affirmed Agave’s title to Nuevo Milenio. However, theCompany’s mineral properties may be subject to prior unregistered agreements or transfers or native land claims, and title may be affected by undetected defects. Agave’sThe Company’s Canadian mineral property interests consist of mineral claims, which have not been surveyed, and therefore the precise area and location of such claims or rights may be in doubt. As there are unresolved native land claim issues in British Columbia, the Company’s properties and prospects in this jurisdiction may be affected in the future. The Company’s mineral properties in British Columbia are early stage exploration and have no known mineral resources or reserves.

Agave’sFirst Energy’s directors and officers serve as directors andand/or officers of other publicly traded junior resource companies.Some of the directors and officers of Agavethe Company serve as officers and/or directors of other resource exploration companies and are engaged and will continue to be engaged in the search for additional resource opportunities on their own behalf and on behalf of other companies, and situations may arise where these directors and officers will be in direct competition with Agave.the Company. Such potential conflicts, if any, will be dealt with in accordance with the relevant provisions of British Columbia corporate and common law. In order to avoid the possible conflict of interest which may arise between the directors’ and officers’ duties to Agavethe Company and their duties to the other companies on whose boards they serve, the directors and officers of Agavethe Company expect that participation in exploration prospects offered to the directors or officers will be allocated among or between the various companies that they serve on the basis of prudent business judgement and the relative financial abilities and needs of the companies.

AgaveFirst Energy may not be able to insure certain risks which could negatively impact the Company’s operating results.In the course of exploration, development and production of mineral properties, certain risks, and in particular unanticipated geological and operating conditions as well as fires, explosions, flooding, earthquakes,

11

power outages, labour disruptions, and the inability to obtain suitable or adequate machinery, equipment or labour may occur. It is not always possible to fully insure against such risks and the Company may decide not to take out insurance against such risks as a result of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any future profitability and result in increasing costs and a decline in the value of the securities of the Company.

U.S. investors may not be able to enforce their civil liabilities against the Company or its directors, controlling persons and officers. It may be difficult for U.S. investors to bring and enforce suits against the Company. The Company is a corporation incorporated in British Columbia under the Business Corporations Act (British Columbia) and, consequently, there is a risk that Canadian courts may not enforce judgements of U.S. courts or enforce, in an original action, liabilities directly predicated upon the U.S. federal securities laws. The Company’s directors and officers are residents of Canada or other countries other than the United States and all of the Company’s assets are located outside of the United States. Consequently, it may be difficult for United States investors to affect service of process upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgements of United States courts predicated upon civil liabilities under United States securities laws. It is unlikely that an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities under U.S. securities laws.

Agave has been operating in Mexico, which has different risks than those of British Columbia, or Manitoba, Canada. Agave’s activities in Mexico may be subject not only to risks common to operations in the mining industry, but also to the political and economic uncertainties of operating in foreign jurisdictions, namely Mexico. This may result in misinterpretation of laws, unilateral modification of mining or exploration rights, operating restrictions, increased taxes or environmental regulation, any or all of which could have an adverse impact upon Agave. Agave’s operations may also be affected to varying degrees by political and economic instability, terrorism, crime, extreme fluctuations in currency exchange rates and inflation. Agave’s operations and exploration activities in Mexico are subject to Mexican federal and state laws and regulations governing protection of the environment. These laws are evolving and, as a general matter, are becoming more restrictive.

Mineral exploration and mining activities may be affected in varying degrees by political stability and government regulations relating to the mining industry and foreign investors. Any changes in regulations or shifts in political conditions are beyond the control of the Company and may adversely affect its business. Operations may be affected in varying degrees by government regulations, policies or directives with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, and repatriation of income, royalties, environmental legislation and mine safety.

Risks Relating to an Investment in the Securities of the Company

AgaveFirst Energy could be deemed a Passive Foreign Investment Company which could have negative consequences for U.S. Holders. Holders.Potential investors who are U.S. Holders (defined below) should be aware that Agavethe Company expects to be a passive foreign investment company (“PFIC”) for the current fiscal year, may have been a PFIC in prior fiscal years and may continue to be a PFIC in subsequent years. If Agavethe Company were to be treated as a PFIC, U.S. Holders of the AgaveCompany’s common shares would be subject to adverse U.S. federal income tax consequences, including a substantially increased U.S. income tax liability and an interest charge upon the sale or disposition of the AgaveCompany’s common shares and upon the receipt of distributions on the AgaveCompany’s common shares to the extent such distributions are treated as “excess distributions” under the U.S. federal income tax rules relating to PFICs. U.S. Holders could potentially mitigate such consequences by making certain elections with respect to the AgaveCompany’s common shares. U.S. Holders are urged to consult their tax advisors regarding Agave’sthe Company’s PFIC classification, the consequences to them if Agavethe Company is a PFIC, and the availability and the consequences of making certain elections to mitigate such consequences. (See Item 10 Taxation -United States Tax Consequences).

Agave’sFirst Energy’s stock price may limit its ability to raise additional capital by issuing common shares.The low price of Agave’sthe Company’s common shares also limits Agave’sthe Company’s ability to raise additional capital by issuing additional shares. There are several reasons for this effect. First, the internal policies of certain institutional investors prohibit the purchase of low-priced stocks. Second, many brokerage houses do not permit low-priced stocks to be used as collateral for margin accounts or to be purchased on margin. Third, some brokerage house policies and practices tend to discourage individual brokers from dealing in low-priced stocks. Finally, broker’s commissions on low-priced stocks usually represent a higher percentage of the stock price than commissions on higher priced stocks. As a result, Agave’sthe Company’s shareholders pay transaction costs that are a higher percentage of their total share value than if Agave’sthe Company’s share price were substantially higher.

The liquidity of Agave’sFirst Energy’s shares in the United States markets may be limited or more difficult to effectuate because AgaveFirst Energy is a “Penny Stock” issuer. Agave’sThe Company’s stock is subject to U.S. “Penny Stock” rules which make the stock more difficult for U.S. shareholders to trade on the open market. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in “penny” stocks. Penny stocks are equity securities with a price of less than US$5.00 per share, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system provided that current prices and volume information with respect to transactions in such securities is provided by the exchange or system.

The Penny Stock Rules require a broker-dealer, prior to effecting a transaction in a penny stock not otherwise exempt from such rules, to deliver a standardized risk disclosure document prepared by the SEC that provides information about penny stocks and the nature and level of risks in the penny stock market.

In addition, the Penny Stock Rules require that prior to a transaction in a penny stock not otherwise exempt from such rules the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. At the present market prices, Agave’sthe Company’s common shares will (and in the foreseeable future are

12

expected to continue to) fall within the definition of a penny stock. Accordingly, United States broker-dealers trading in Agave’sFirst Energy’s shares will be subject to the Penny Stock Rules. Rather than complying with those rules, some broker-dealers may refuse to attempt to sell penny stocks. As a result, shareholders and their broker-dealers in the United States may find it more difficult to sell their shares of Agave,the Company, if a market for the shares should develop in the United States.

The market for the Company’s stock has been subject to volume and price volatility which could negatively affect a shareholder’s ability to buy or sell the Company’s shares.The market for the common shares of the Company may be highly volatile for reasons both related to the performance of the Company or events pertaining to the industry (e.g. mineral price fluctuation/high production costs/accidents) as well as factors unrelated to the Company or its industry.

Market demand for products incorporating minerals in their manufacture fluctuates over time, resulting in a change of demand for the mineral and an attendant change in the price for the mineral. The Company’s common shares can be expected to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding the Company’s business, and changes in estimates and evaluations by securities analysts or other events or factors. In the last decade, securities markets in the United States and Canada and internationally have experienced periods of high price and volume volatility, and the market prices of securities of many companies, particularly small-capitalization companies such as the Company, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, the Company’s common shares can also be expected to be subject to volatility resulting from purely market forces over which the Company will have no control. Further, despite the existence of a market for trading the Company’s common shares in Canada, shareholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the price of the stock. The trading price of Agave’s shares has ranged between $0.05 and $4.80 in the last five calendar years.

Significant potential equity dilution. A summary of Agave’s diluted share capital at June XX, 2016 is as follows:

| Number of Warrants | Exercise Price | Expiry Date |

| 5,000,000 | $0.10 | June 16, 2017 |

| 5,000,000 |

Agave had stock options outstanding (1,490,000 at March 31, 2016 and 1,450,000 at July 5, 2016), which are exercisable at prices ranging from $0.07 to $1.60 per share (retroactively adjusted to reflect share consolidation effective October 3, 2013) as at March 31, 2016 and $0.07 as at July 5, 2016. In the money options could be exercised prior to expiry while the higher priced options may not be exercised before expiry. In either case, the outstanding options could act as an upside damper on the price of Agave’s shares. There are no shares of Agave remaining subject to hold period restrictions in Canada or the United States as of March 31, 2016 or as at July 5, 2016, as such hold restrictions have expired. At March 31, 2016 and at July 5, 2016 there were 5,000,000 warrants exercisable at an average price of $0.10. The resale of outstanding shares from the exercise of dilutive securities would have a depressing effect on the market for Agave’s shares. Dilutive securities based on the trading range of Agave’s common shares at March 31, 2016, including the warrants and the stock options noted above, collectively represent approximately 20.17% of Agave’s issued shares as at March 31, 2016.

| ITEM 4. |

| INFORMATION ON THE COMPANY |

In June 2015, the Company closed the first and final tranche of a non-brokered private placements of units at a price of $0.05 per unit by issuing an aggregate of 5,000,000 units for gross proceeds of $250,000. Each unit is comprised of one common share and one common share purchase warrant, with each warrant entitling the holder thereof to purchase one additional common share at a price of $0.10 for a term of 24 months after closing. The share purchase warrants were valued using the Black-Scholes pricing model with the following assumptions: weighted average risk free interest rate of 0.56%, volatility factor of 120% and an expected life of two years.

On December 2, 2014, the Company announced a proposed non-brokered private placement whereby it intends to offer up to 11,000,000 flow-through common shares at a price of $0.06 per flow-through common share and 9,000,000 non-flow-through units at a price of $0.05 per non-flow-through unit. Each non-flow-through unit will be comprised of one common share and one common share purchase warrant. Each whole non-flow-through warrant will entitle the holder to purchase one non-flow-through common shares at any time for a period of 24 months from the date the warrant is issued, at a price of $0.10.

There were no common shares issued during the year ended March 31, 2015.

During the year ended March 31, 2014 the Company completed, in two tranches, a non-brokered private placement for total proceeds of $1,030,000. The private placement was entirely subscribed by insiders, directors and officers of the Company. The private placement consisted of the issuance of 10,300,000 units of the Company at a price of $0.10 per Unit. Each Unit is comprised of one common share and one common share purchase warrant, each warrant entitling the holder thereof to purchase one additional common share at a price of $0.25 for a term of two years after closing. The share purchase warrants were valued using a Black-Scholes pricing model using the following assumptions: weighted average risk free interest rate of 1.08-1.18%, volatility factors ranging from 135.38% to 136.66% and an expected life of two years.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

| A. | History and Development of the Company |

The Company’s executive office is located at:

Suite 1601-675 West Hastings1206- 588 Broughton Street

Vancouver, British Columbia, Canada, V6B 1N2

Telephone: (604) 558-3908

Facsimile: (604) 687-4212

375-6005

Email: info@agavesilver.com

info@firstenergymetals.com

Website: www.agavesilver.com

The contact person in Vancouver, British Columbia, is Ronald Lang, President, CEO, and Director.www.firstenergymetals.com

The mailing address of the Company is the Company’s executive office at the address noted above. AgaveThe Company operated directly and also, until February 12, 2015, through one wholly-owned subsidiary in Mexico, Cream Minerals de Mexico, S.A. de C.V. (“Cream de Mexico”). ReferencesThe Company’s name changed from Agave Silver Corp. to “Agave” or to “the Company” include Cream de Mexico except where otherwise indicated.First Energy Metals Limited was approved on December 16, 2016, at the Company’s Annual General Meeting.

The Company’s fiscal year end is March 31.

The Company’s common shares are listed on the TSX Venture Exchange under the symbol “FE” and prior to December 20, 2016, its common shares were trading under the symbol “AGV.” AgaveThe Company was quoted on the Over the Counter Bulletin Board in the United States under the symbol “CRMXF”, until July 26, 2012 at which time Agave’sthe Company’s shares began being exclusively quoted on the OTCQB, (also under the symbol “CRMXF”), an electronic trading platform operated by the OTC Markets Group Inc. On October 3, 2013 the symbol was changed to “ASKDF” and effective May 1, 2014 the Company was listed on OTC “Pink”. The Company’s common shares are also quoted on the Frankfurt market under the symbol “DFL”“A2JC89”.

The Company was incorporated under the laws of the Province of British Columbia, Canada as Cream Silver Mines N.P.L. on October 12, 1966, with an authorized capital of 300,000 shares, each having a par value of $5.00. By Special Resolution passed on July 12, 1974, Agave cancelled its Memorandum and Articles and substituted a new Memorandum and Articles therefore providing for the limited liability of members and the increase of the authorized capital to 1,000,000 shares with a par value of $5.00 each. By Special Resolution passed September 24, 1987, Agave again altered its Memorandum, changing its name to Cream Silver Mines Ltd. in its English form and "Mines Cream Silver Ltee." in its French form and amending its authorized share capital to 3,000,000 common shares without par value. By Special Resolution passed September 15, 1994, Agave altered its Memorandum to consolidate its authorized and issued share capital of 3,000,000 common shares on a five-for-one basis into 600,000 common shares authorized, and issued common shares were consolidated from 1,870,794 common shares on a five-for-one basis into 374,158 common shares; to further increase its authorized capital to 50,000,000 common shares without par value (the "Common Shares"); and to change its name to Cream Minerals Ltd. Agave has been listed on the TSX Venture Exchange (the "TSX Venture"), formerly the Vancouver Stock Exchange (“VSE”), since June 3, 1970. The Company subsequently altered its Memorandum to increase its authorized capital to 50,000,000 common shares.

At Agave’s request, the VSE placed the Company on inactive status on August 12, 1994. Agave had requested inactive status in order to reorganize its affairs after the government of the Province of British Columbia placed Agave’s Vancouver Island mineral claims adjoining those of Westmin Resources Ltd. in moratorium, and refused to grant Agave a permit to explore these claims. The claims, in Strathcona Park on Vancouver Island, were placed in moratorium in connection with the Strathcona Park area being declared a provincial park in 1972. These actions by the provincial government left Agave with no viable project at the time and with little working capital. The claims currently remain in moratorium. Throughout the early to mid-1970s, Agave initiated several court cases seeking compensation for these claims. The matter was ultimately decided by a decision of the British Columbia Court of Appeal denying Agave’s right to compensation. Leave to appeal this decision to the Supreme Court of Canada was refused and Agave was then advised that it was without further legal recourse with respect to its Vancouver Island claims. The British Columbia Court of Appeal specifically overruled its previous decision in the Agave case. The Company reviewed its legal position in the light of this development, but has been advised that it remains bound by the previous decision.

Following Agave’s entry into inactive status, Agave embarked on a reorganization program that included a consolidation of its issued and outstanding share capital and subsequent increase of authorized capital (as described above); a restructuring of the board of directors and appointment of new officers; a review of its financial affairs which included completing two private placements for the issuance of a total of 68,000 units, each consisting of one common share and one warrant, at a price of $3.50 per unit, which raised a total of $231,000; and a review of its property holdings. During Agave’s inactive period, certain of its claim groups in British Columbia were allowed to lapse, and others were sold off. Following completion of this reorganization, Agave resumed active status on April 11, 1996.

1966. Effective March 29, 2004, theCompany Act (British(British Columbia) was replaced by theBusiness Corporations Act (British(British Columbia). TheBusiness Corporations Act (British(British Columbia) does not require a company’s Notice of Articles to contain a numerical limit on the authorized capital with respect to each class of shares. Effective September 21, 2004, the Company altered the authorized capital of the Company from 50,000,000 shares without par value to an unlimited number of shares without par value. By Special Resolution effective June 23, 2011, shareholders approved the adoption of new articles for Agave.the Company. See Item 10B – Memorandum and Articles of Association.

13

Effective October 3, 2013,February 1, 2018, the Company completed a share consolidation on the basis of ten (10)five (5) pre-consolidation common shares for one (1) post-consolidation common share. The periods presented prior to the consolidation have not been retroactively adjusted to reflect this consolidation unless otherwise stated.

Since its incorporation in 1966, the Company has been in the business of acquiring and exploring mineral properties. For most of the past three completed years, and prior thereto, the Company has been principally attempting to locate deposits of precious metals in Mexico, and the Provinces of British Columbia, Manitoba, Ontario and Manitoba, Canada.Quebec, Canada and Nevada, USA.

Mexico

The Company’sCompany had an exploration project in Mexico iscalled Nuevo Milenio, located south of Tepic in the municipality of Xalisco,Jalisco, State of Nayarit, Mexico, having denounced (staked) the property in 2000 and receiving title to the property in 2001. Mineral licenses in Mexico have a term of 50 years following which an application can be made to extend the term. Carrying costs are comprised of annual taxes of approximately $50,000. Work requirements are nominal

Between 2001 and cash payment can be made2005 and again in lieu of work requirements.

In 2001, Agave entered into anFebruary 2011, the Company conducted exploration programprograms on Nuevo Milenio. Agave explored the property until the year ended March 31, 2005, at which time it wrote it down by $1,523,030 to a nominal carrying value of $1. No acquisition costs are associated with the property, as it was denounced (staked). In 2006, the Company re-commenced exploration.

On July 24, 2009, the Company entered into an option agreement with Roca Mines Inc. (“Roca”) that would have allowed Roca to earn up to a 70% interest in the project. In order to acquire a 50% legal and beneficial interest in the Nuevo Milenio, Roca was to spend a cumulative US$12,000,000 for exploration work by July 24, 2013.

On April 30, 2010, the Company signed a letter of intent (“LOI”), pursuant to which it acquired an option from an arm's length party on the Las Habas Project, comprised of 336 hectares (“Ha”) located in the State of Sinaloa, Mexico. The LOI was for a period of three months. The proposed option agreement outlined in the LOI called for total payments of US$1 million over a 5-year period and a 2% NSR royalty, payable out of production. On June 1, 2010, Agave filed an application to denounce approximately 700 hectares adjoining the Las Habas property. The Company let the LOI lapse and has not pursued title to the adjacent 700 Ha’s. On July 22, 2010, Roca notified the Company that it was not proceeding with the option agreement and the agreement was terminated.

On December 7, 2010, Agave agreed to a bought deal financing of $5 million with the provision of an overallotment of $1 million. The terms of the bought deal were $1.60 per unit with a full warrant exercisable at $2.40 for two years from the date of closing. The Company subsequently closed the bought deal financing on December 21, 2010, and received gross proceeds of $6 million.

The Company initiated a 20,000 metre drill program in February 2011 which was completed in September 2011. Following completion of the drill program during calendar year 2011 (the “2011“2011 Drill Program”Program”), the Company engaged an independent consulting firm to prepare an independent NI 43-101-compliant resource estimate (the “2012 Report”“2012 Report”) based on review of the Company’s previously compiled exploration data as well as exploration data collected during the 2011 Drill Program. The 2012 Report was filed on SEDAR on October 2, 2012.

The board of directors initiated a review of Agave’s strategic alternatives intended to maximize shareholder value and a Special Committee of independent directors (the “Special Committee”) was appointed in the first quarter of the fiscal year. Following completion of the Independent Mineral Resource the Board upon consideration of the poor market conditions and challenging financing environment for junior resource exploration companies determined that alternatives to potentially very dilutive equity financings be considered. The review includes, but is not limited to, the sale or strategic merger of the Company, the joint venture or sale of non-core assets, or the sale or joint venture of a primary asset.

On March 25, 2013, the Company filed an independent NI 43-101 Technical Report on the Nuevo Milenio project (the “2013 Report”“2013 Report”) co-authored by Dr. Derek McBride, P.Eng, and Al Workman of Watts, Griffis and McQuatt Limited (“WGM”WGM”).The 2013 Report replaces the 2012 Report in its entirety. The 2013 Report addresses the concerns raised by the British Columbia Securities Commission with respect to the 2012 Report as outlined in the Company’s news release dated October 23, 2012.

The 2013 Report contains an updated independent mineral resource estimate on the Nuevo Milenio project (the “Mineral“Mineral Resource Estimate”Estimate”) and replaces in its entirety all previous resource estimates filed by Agave and the previous resource estimates can no longer be relied upon.

TheOn November 14, 2014, the Company entered into a share purchase agreement, dated November 14, 2014 among Frank Lang and Ferdinand Holcapek (collectively, the “Purchasers”), Cream Minerals de Mexico, S.A. de C.V. (“Cream Mexico) and the Company (the “Share Purchase Agreement”), pursuant to which the Company agreed to sell the Company’s interest in the Nuevo Milenio Property, in Nayarit State, Mexico, to the Purchasers via the sale of all of the securities of Cream Mexico held by the Company (the “Transaction”).

Pursuant to the terms of the Share Purchase Agreement the Purchasers purchased all of the Cream Mexico shares held by the Company in exchange for the aggregate sum of $686,000, payable as the forgiveness of the debts owed by the Company to Frank Lang (or other entities controlled by Frank Lang) and Ferdinand Holcapek.

The Company closed the transaction for the sale of its interest in the Nuevo Milenio project on February 12, 2015.

Canada

British Columbia

The Goldsmith Property

Prior to May 6, 2013, the Company had a 100% interest in the Goldsmith Property (“Goldsmith”) (comprised of the Goldsmith and Lucky Jack Properties) located near Kaslo, British Columbia. Small scale underground mines operated on the property in the early 1900’s. Quartz veins are contained in the intrusive rocks and contain quantities of free gold. Higher grade gold mineralization was reported in the quartz veins which range in width from a few centimetres to five metres. The Company held an option to acquire a 100% interest in the Goldsmith property. The option agreement called for the issuance of 20,000 common shares (issued) and cash payments totaling $110,000 (paid) over six years. The optionors retain a 2% Net Smelter Royalty (NSR) on all metals. The Company was able to acquire 50% of the NSR for $1,000,000 upon commencement of commercial production or sooner.

The Company wrote down the carrying value of Goldsmith Property to $Nil in fiscal 2012 as there were no plans to continue exploration. During the year ended March 31, 2014, the Company transferred title to the Goldsmith and Lucky Jack properties to the optionors.

The Kaslo Property

The 100% owned 4,000 Ha Kaslo Silver Property (“Kaslo”), a silver target, hosts eleven historic high-grade silver mineralized zones within 14 kilometres of favourable horizon. Nine high-grade silver-lead-zinc mines operated on Kaslo at various times from 1895 to 1966. The property is located 12 kilometres west of Kaslo in southern British Columbia. The Company has no plans to conduct exploration work at this time.

14

The Kootenay Lithium Project

Dr. Derek McBride, P.Geo,On October 7, 2016 the Company entered into an agreement to purchase (the “Agreement”) a 100% interest in certain mineral claims (the “Property”) covering 4,050 hectares located in the Revelstoke and Nelson Mining Divisions, southeastern British Columbia.

Under the terms of the Agreement, the Company has supervisedpurchased a 100% interest in the Company’s previousProperty by issuing 6,000,000 common shares of the Company. The Property is subject to a 2.0% Net Smelter Return (“NSR”) mineral royalty and a 24.0% Gross Overriding Royalty (“GOR”) on gemstones produced from the Property and with the option to reduce the NSR to 1.0% by paying $2,500,000.00. The Company also has the option to purchase one half (50%) of the GOR for $2,000,000.

During the year ended March 31, 2018, the Company wrote down the carrying value of Kootenay Lithium Property to $Nil as the Company does not plan to complete further exploration programs summarized above and ison the Company’s supervisor and “Qualified Person” with respect to this propertyforproperty. As such, in April 2018, the purpose of NI 43-101.Company relinquished its property’s mineral claims by not paying their annual mineral claim maintenance fees.

Manitoba

The Wine Property

Prior to April 22, 2013, the Company held a 100% interest in the Wine Claim (comprised of the Wine and Wine 1 claims) located approximately 60 kilometres south of Flin Flon, Manitoba. The Wine claim is a high grade nickel-copper target. During fiscal 2007 and in fiscal 2008, the Company entered into option agreements to acquire up to 100% interest in two mineral property interests in the Province of Manitoba, the Wine claims and the Grand Nickel Project. In March 2006, the Company entered into an option agreement, subsequently amended, to acquire 100% interest in the Wine Claim, MB 3964 and Wine 1 Claim (the “Wine” claims), all located approximately 60 km southeast of Flin Flon, Manitoba. The Company earned its interest by making payments totaling $105,000 (paid) and issuing 20,000 common shares over a 48-month period (issued). The Company also incurred required exploration expenditures on the property of $5,000 annually for four years. On completion of these obligations, the property was subject only to a 2.0% NSR royalty payable to the optionor from the production of gold, silver and all base metals and other minerals. The Company had the right to reduce the NSR royalty to 1.0% by the payment of $1,000,000 to the optionor at any time up to and including the commencement of commercial production.

During the year ended March 31, 2014 the Company sold the Wine Claim Property to the optionor for the amount of $50,000 cash.

In October 2007, the Company entered into an agreement to acquire 100% interest in the Grand Nickel Project, being the Cedar 1, MB7355 and MEL 324B claims (the “Cedar” claims), located in the Thompson Nickel Belt, approximately 40 km north-west of the town of Grand Rapids, Manitoba. After a short exploration program, the Company determined that the property did not meet its expectations, returned the property to the optionor and recorded a write-down of acquisition costs of $34,250 in fiscal 2009. The Grand Nickel project was written off in the year ended March 31, 2009.

The Blueberry Property

Ontario

In November 2009, the Company entered into an option agreement to acquire the Blueberry property from W.S. Ferreira Ltd. and the Company staked additional claims which have been appended to the option agreement. The property is located approximately 20 km north-east of Flin Flon, Manitoba. The option agreement provided for a cash payment of $100,000 ($40,000 paid) and the issuance of 40,000 shares (16,000 issued) over five years with a down payment of $10,000 (paid). The cash payments were to be made as follows: $10,000 on regulatory approval (paid), $10,000 on the first anniversary (paid), and $20,000 on each of the second (paid) to the fifth anniversary dates. The shares were to be issued as follows: 4,000 on regulatory approval (completed) and 4,000 on the first anniversary of regulatory approval (completed), and 0,000 common shares on each of the second (completed) to the fifth anniversary dates.

The Company was required to incur cumulative exploration expenditures totaling $30,000 following the date of regulatory approval, commencing with expenditures of $5,000 prior to the first anniversary date and a minimum of $5,000 annually by each anniversary date on or prior to the fifth anniversary. The total incurred to March 31, 2013 was $156,411. On completion of these obligations, the property will be subject only to a 2.0% NSR royalty payable to the optionor from the production of gold, silver and all base metals and other minerals. The Company had the right to reduce the NSR royalty to 1.0% by the payment of $1,000,000 to the optionor at any time up to and including the commencement of commercial production.

In November 2012 the Company elected not to make the required $20,000 option payment and issue 8,000 common shares to the optionor. Title to the Blueberry Property has since been transferred to the optionor. In addition, title to the Blue 1 to Blue 4 claims which were staked following the optioning of the Blueberry Property have been assigned to the optionor as these claims were appended to the original option agreement.

Ontario

Hastings Highland Property

Effective May 9, 2015 the Company and Hastings Highland Resources Limited (“Hastings”) entered into an agreement with respect to the exclusive option to earn a 90% interest in Hastings’ Limerick Township nickel-copper property located in Ontario, Canada, however the Company was unable to secure the requisite was unable to secure the requisite financing and terminated the option on September 3, 20152015.

Phyllis Cobalt Property

On February 19, 2015January 29, 2018, the Company announced that itentered into an option agreement to acquire (the “Phyllis Agreement”) a 100% interest in certain mineral claims (the “Phyllis Property”) covering 1,750 hectares located in the Kenora Mining District in northwestern Ontario.

Under the terms of the Phyllis Agreement, the Company has signed a letter agreement (the “Letter”) with Hastings Highland Resources Limited (“Hastings”) for an exclusivethe option to earnacquire a 90 percent100% interest in Hastings’ Limerick Township nickel-copper propertythe Phyllis Property by making the following option payments, common shares issuances and exploration expenditures:

| Minimum | Cumulative | |||

| Option payments | Issuance of First Energy | exploration | exploration | |

| Due Dates | ($) | common shares | expenditures | expenditure |

| ($) | ($) | |||

| On signing | 20,000 | 100,000 | Nil | Nil |

| Year 1 | 35,000 | 150,000 | 75,000 | 75,000 |

| Year 2 | 35,000 | 150,000 | 25,000 | 100,000 |

| Year 3 | 50,000 | 200,000 | 125,000 | 125,000 |

The Phyllis Property is subject to a royalty equal to 3% NSR upon commencement of commercial production. The Company will have the option to reduce the NSR to 2.0% by paying $1,000,000.

15

Quebec

Russel Graphite Property

On May 4, 2018, the Company entered into an option agreement under which the Company can earn 100% interest in the Russel Graphite Property which consists of thirty (30) mineral claims, located in Ontario, Canada (the “Property”).Gatineau area of Quebec Province.

Under the terms of the Russel Graphite Property agreement, the Company has the option to acquire a 100% interest in the Phyllis Property by making the following option payments, common shares issuances and exploration expenditures:

| (i) | $7,500 in cash and issuance of 75,000 common shares of the Company (“Common Shares”) as soon as practical following the signing of this agreement and receipt of TSX Venture Exchange approval; |

| (ii) | $10,000 in cash and issuance of 100,000 Common Shares on or before the first anniversary date of this agreement, conditional on exploration expenditures of not less than $50,000 being incurred on or before December 31, 2018; |

| (iii) | $20,000 in cash and issuance of 125,000 Common Shares on or before the second anniversary date of this Agreement, conditional on cumulative exploration expenditures of not less than $150,000 being incurred on or before January 31, 2019; and, |

| (iv) | 3% NSR with a 2% buy-out at $1 million cash for each percent. |

Nevada, USA

B. Business OverviewHighway 95 Property

On June 20, 2018, First Energy entered into an option agreement under which the Company can acquire a 100% interest in the Highway 95 Property, subject to TSX Venture Exchange approval, by making the following cash payments, issuing shares and carrying out exploration work as follows:

| (i) | $10,000 in cash and issuance of 100,000 common shares of the Company (“Common Shares”) as soon as practical following the signing of this agreement and receipt of TSX Venture Exchange approval; |

| (ii) | $20,000 in cash and issuance of 200,000 Common Shares on or before the first anniversary date of this agreement, conditional on exploration expenditures of not less than $50,000 being incurred on or before July 31, 2019; |

| (iii) | $40,000 in cash and issuance of 300,000 Common Shares on or before the second anniversary date of this Agreement, conditional on cumulative exploration expenditures of not less than $150,000 being incurred on or before July 31, 2020; and, |

| (iv) | 3% NSR with a 1% buy-out for a $1 million cash payment. |

| B. | Business Overview |

General

| (i) | Nature of Company: |

Agave has historically been a mineral exploration company. The Company is currently focused on exploration and development of Silver-Nickel-Copper properties. Agave has a portfolio, or option, of early-stage mineral exploration projects in British Columbia and Ontario that may contain silver, nickel, copper and other mineralization. These properties have been explored by a number of companies over the years, with further work being completed by Agave since their acquisition.

| (ii) | The Company has historically been a junior resource company engaged in the exploration and development of mineral properties. It currently maintains early stage exploration properties in Canada. |

| (iii) | Principal Markets: Not Applicable. |

| (iv) | Seasonality: Not Applicable. |

| (v) | Raw Materials: Not Applicable. |

| (vi) | Marketing Channels: Not Applicable. |

| (vii) | Dependence: Not Applicable. |

16

| (viii) |

Competitive Position: Not Applicable. | ||

| (ix) | Material Effect of Government Regulation: The Company’s exploration activities and its potential mining and processing operations are subject to various laws governing land use, the protection of the environment, prospecting, development, production, contractor availability, commodity prices, exports, taxes, labour standards, occupational safety and health, waste disposal, toxic substances, safety and other matters. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There is no assurance that the Company will be able to obtain all permits required for exploration, any future development and construction of mining facilities and conduct of mining operations on reasonable terms or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration or mining project which the Company might undertake. |

(vii) Material Effect of Government Regulation: The Company’s exploration activities and its potential mining and processing operations are subject to various laws governing land use, the protection of the environment, prospecting, development, production, contractor availability, commodity prices, exports, taxes, labour standards, occupational safety and health, waste disposal, toxic substances, safety and other matters. The Company believes it is in substantial compliance with all material laws and regulations which currently apply to its activities. There is no assurance that the Company will be able to obtain all permits required for exploration, any future development and construction of mining facilities and conduct of mining operations on reasonable terms or that new legislation or modifications to existing legislation, would not have an adverse effect on any exploration or mining project which the Company might undertake.

C. Organizational Structure

| C. | Organizational Structure |

Until February 12, 2015 the Company had one direct subsidiary, Cream Minerals de Mexico, S.A. de C.V., incorporated in Mexico. Unless

| D. | Property, Plant and Equipment |

Data disclosed in this Annual Report on Form 20-F, including sampling, analytical and test data, have been reviewed and verified by the context otherwise requires, references herein to the “Company” or “Agave” includes the subsidiaryCompany’s V.P. of the Company.

D. Property, PlantExploration, Dr. Muzaffer Sultan, Ph.D - Geology and Equipment

The Company has mineral exploration interests in one property: the Kaslo Property (British Columbia).Qualified Person as defined by National Instrument 43-101.

The Company’s mineral property interests in Canada are in good standing and all payments on the properties are up to date.date, except as noted above under Item 4 A.

None of the Company’s projects have known reserves, and exploration work is exploratory in nature.

Nuevo Milenio Project

The Nuevo Milenio Property, in Nayarit State, Mexico, is owned by Cream de Mexico. All interest to the Nuevo Milenio Project were sold along with the sale of the subsidiary, Cream de Mexico on February 12, 2015.

Exploration Expenditures

Expenditures incurred by the Company on Nuevo Milenio in fiscal 2016 (fiscal 2015 numbers in parentheses) include the following: assays and analysis - $Nil ($Nil); drilling – $Nil ($Nil); geological and geophysical - $Nil ($106,680); site activities - $Nil ($116,114) and travel and accommodation- $Nil ($2,984).

Exploration Projects - British Columbia, Ontario and Quebec Properties

The Company has twothree early-stage exploration projectsproperties located in Canada. The Kaslo Property is located in British Columbia, Canada. the Phyllis Property is located in Ontario and the Russel Graphite Property is located in Quebec.

The locations are shownCompany has also entered into an option agreement on June 20, 2018, under which the map below, with details ofCompany can acquire a 100% interest in the projects following.Highway 95 Property located in Nevada, USA. This option agreement is subject to TSX Venture Exchange approval.

Exploration activities on the Kaslo properties have been planned and carried out under the supervision of Dr. Derek McBride, P.Geo and is the Company’s “Qualified Person” for the purpose of NI 43-101, “Standards of Disclosure for Mineral Projects”.

(1) Kaslo Property, British Columbia

Introduction

The Kaslo property is without known mineral resources and reserves and the proposedprevious exploration programs arewere exploratory in nature. In fiscal 2012, the Company wrote down the value of the property to $nil.

Property Location and Geology

The 100% owned property encompasses nine former high-grade silver-lead-zinc historic small scale mines located in southeastern British Columbia, Canada. The various mines operated at different times during the period from 1895 to 1966. The property currently consists of 7 modified grid claims, 13 crown grants, 8 reverted crown grants, 37 two-post claims and one mining lease of three units, for a total 160 units.

In October 2004 Agave commenced a diamond drill program on Kaslo. This two-hole drill program was designed to test the lateral and down dip extensions of the high grade silver mineralization found within the strongly faulted Silver Bear shear structure. Diamond drilling was suspended after attempts to drill through the highly mineralized fault zone were unsuccessful. The initial drill hole was abandoned at 34 metres when the drill proved incapable of coring the shear zone. A second steeper angled drill hole was successful in intersecting the hanging wall of the mineralized shear structure. However, the second hole did not penetrate the entire width of the shear zone and did not intersect the high-grade footwall mineralization.

Prior drilling by Agave in 1998 returned values up to 2,271 g/t silver over 0.51 metres within a 3.25 metre interval that assayed 390.05 g/t silver from drill hole 98SB-05. The highest silver values intersected in the previous drill program were obtained from the strongest part of the shear zone tested during that program. These step-out holes intersected what appears to be broader and more intense shearing that may be related to higher-grade silver values.

Location and Access

The 4,000-hectare property is located 12 km west of the town of Kaslo in southern British Columbia. Access to the property is via Highway 31A for seven km west from Kaslo, then 4.5 km southwest along Keen Creek Road to the property boundary. The property lies along the Keen Creek Road for approximately 10 km. Logging roads and numerous old mining roads and trails, some of which are heavily overgrown, bisect the property. Power lines come to within 4 km of the property boundary, and water is abundant throughout.

Physiography

Kaslo is located in an area of rugged mountainous terrain. Topography on the property is steep with elevations ranging from 1,050 metres along the Keen Creek valley to 2,200 metres on the Gold Cure ridge.

The Keen Creek valley runs along the northwest boundary of the property, with numerous tributaries crossing the property and emptying into Keen Creek. The major tributaries, from northeast to southwest are Ben Hur, Briggs, Klawala, Kyawats and Desmond Creeks.

History

Kaslo includes nine former, small mines, which were originally discovered and worked for high-grade silver ores during the heyday of the Slocan Mining Camp at the end of the 19th century. Intermittent exploration, development and production have taken place at various locations on the property since that time, most notably in the 1920s and 1950s. The Cork-Province Mine was consolidated in 1914 and was the longest-lived producer in the camp when it closed in 1966. Five former workings, the Silver Bear, Hartford, Gibson, Gold Cure, and Bismark are situated along the Gold Cure Shear zone, which has been traced northeast across the property for 7.1 km. Five additional workings, the Black Bear, Cork, Province, Dublin and Black Fox workings lie along the parallel 4.1 km long Cork Shear zone, located in the Keen Creek valley approximately 1 km north of the Gold Cure Shear zone. Both shears are open along strike to the north and at depth.

Geophysics

Since it acquired the property, AgaveCompany’s acquisition, the Company has completed 51.7 km of VLF-EM geophysical coverage over the mineralized Cork and Gold Cure Shear zones. The geophysical surveys clearly define the location and extent of the controlling shears, as they are very conductive by nature.

In 1999, a gravity geophysical survey was conducted over the Cork North zone to define which of the several limestone beds have the best potential to host massive sulphide mineralization. Targets generated by the gravity survey have not been drill tested.

Geochemistry

Soil geochemical surveys have been completed over the length of the Cork and Gold Cure Shear zones. Linear trends of anomalous values for silver, lead and zinc in soil have been found running coincident with the shear zones. Occasionally gold, arsenic, cadmium and other elements occur with the silver, lead and zinc anomalies.

Black Bear Group(2) Phyllis Cobalt Property, Ontario

Description

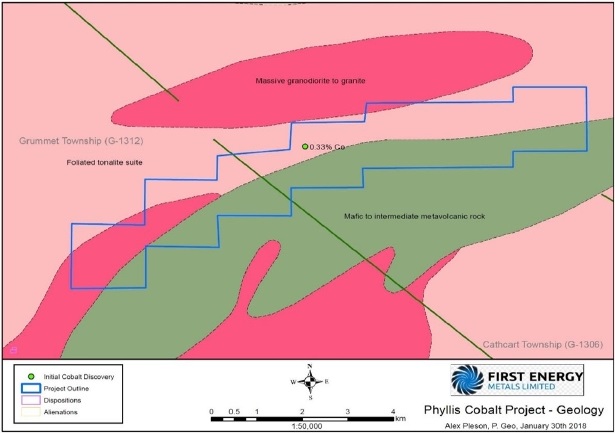

Located in the Kenora Mining District of ClaimsOntario, the property consists of 112 mineral claim units totalling 1750 hectares in Grummett and Cathcart townships. The property has year-round access 192km northwest of Thunder Bay, ON via Hwy 17 and 9km south on a gravel forestry road.

For18

Geology

The Phyllis Property claim block occupies the central portion of an ENE-WSW trending greenstone belt, consisting of Mesoarchean to Neoarchean age mafic to ultramafic rocks. These are bound by granite of varying composition -ranging from tonalite to biotite-granodiorite (Atikokan-Lakehead Sheet Map 2065) as shown in Figure 1. Recent mapping undertaken by the Ontario Geological Survey (Gulliver River Sheet, Map 3370), which includes a descriptionsmall portion of Agave’s interestthe Phyllis claims, suggests that there is a greater abundance of ultramafic metavolcanics than previously indicated. The regional foliation follows the general trend of the greenstone belt.

Mineralization

The initial cobalt discovery was made in this property, see “Kaslo Silver Property” under Item 4 above.2010 by Don Dobransky, named the “Phyllis Central” occurrence. This discovery is characterized by an 80m x 60m outcrop and appears as a fairly structureless gabbro, with the exception of an array of narrow quartz veins and veinlets, which have sharp contacts with the country rock and trend roughly NE-SW, and appear to have been intruded relatively recently. The gabbro itself is fine-to medium grained and appears highly altered. The exposed outcrop follows the northern flank of a gentle hill. Earlier excavations focussed in the uppermost parts of the topographic profile. The sampling as seen in Figure 2. This worked confirmed the presence of economic grades of cobalt mineralization up to 0.33% Co (including 1.2% Cu and 0.39% Ni).

(3) Russel Graphite, Quebec

Description

Consists of 30 mineral claims in one contiguous block totaling 1,798.06 hectares land on NTS map 31G13, located in Gatineau area of Quebec Province, approximately 50 kilometres to the north of Ottawa, Canada.

Historical

Historical geological work carried out by Gatineau Graphite Company, during 1916-1919 period, included prospecting and diamond drilling 30 short holes (reference report GM13866). Historical data from North Low showing indicate a bulk sample of 30 tons of rock produced 1,500 kilograms of high quality graphite at 38.18% graphitic carbon (Cg); 3,670 kilograms at 18.10% Cg; and 22,169 kilograms at 4.33%% Cg. Mineralization is mostly

19

associated with irregular bands of graphite along the contact of gabbro dikes in crystalline limestone. It is also found in small graphite veins within gabbroic rocks.

Location and Access

The Black Bear claimsProperty has excellent infrastructure support, is road accessible via Provincial Highway 105 from Ottawa, located 150 kilometres from Montreal; water, power and manpower available locally. Village of North Low is a small community located one kilometers to the east of the Property. It is located in a very active graphite exploration and production area, about 50 kilometres to the southwest of TIMCAL’s Lac des Iles graphite mine in Quebec which is a world class deposit with a production capacity of 25,000 tonnes of graphite annually. There are located immediately north ofseveral other graphite showings and are contiguous with the Bismark Claims. past producing mines in its vicinity.

Geology

The property is composedunderlain by suitable geological environment for flake graphite type mineralization, consisting of Metasedimentary Belt of the Grenville Province which includes quartzofeldspathic rocks, quartzite, biotite gneiss, limestone/marble, gabbro dikes, and plagioclase pyroxene. The graphite mineralization is in the form of bands and irregular veins along the contact of gabbro dikes in the crystalline limestone indicating a three-claim mining leaseskarn type mineralization related to contact metamorphism and three reverted, crown-granted mineral claims situated just 600 metres along strikemetasomatism. There are two main large flake graphite showings on the Property i.e., North Low and Russel showings.

At the Russel showing, the graphite mineralization is in the form of lenticular bands less than 1 metre thick mostly occurring as skarn type deposit at the contact of gabbro and crystalline limestone / dolomite. Historical drilling data indicates 15% Cg of 0.91 m thick (see survey in 28 paper MNR, GM- 13866). Several sections of drill holes completed for water resource down to 245 feet deep (105 feet of overburden) intersected graphite and phlogopite in

20

marble.

(4) Highway 95 Property, Nevada, USA

Description