STATOILHYDROStatoil ANNUAL REPORT ON FORM 20-F

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark one)

_ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12 (g) |

X | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) |

_ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) |

_ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE |

Commission File No. 1-15200StatoilHydroStatoil ASA

(Exact Name of Registrant as Specified in Its Charter)

N/A

(Translation of Registrant's Name Into English)

Norway

(Jurisdiction of Incorporation or Organization)

Forusbeen 50, N-4035 Stavanger, Norway

(Address of Principal Executive Offices)

Eldar Sætre

Chief Financial OfficerStatoilHydroStatoil ASA

Forusbeen 50, N-4035

Stavanger, Norway

Telephone No.: 011-47-5199-0000

Fax No.: 011-47-5199-0050

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

American Depositary Shares | New York Stock Exchange |

*Listed, not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15 (d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the

close of the period covered by the Annual Report:

Ordinary shares of NOK 2.50 each 3,184,865,8943,183,873,643

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act Yes_X_ No__

If this report in an annual or transition report, indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes__ No_X_

Indicate by check mark whether the registrant: (1) has filed all reports to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant

was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes_X_ No__

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated nonaccelerated

filer. See definition of 'accelerated“accelerated filer and large accelerated filer'filer” in Rule 12b-2 of the Exchange Act. (Check

(Check one):

Large accelerated filer_X_ Accelerated filer__ Non-accelerated filer__

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements

included in this filing:

U.S. GAAP __ International Financial Reporting Standards as issued by the International Accounting Standards

Board _X_Other___X_ Other __

If 'Other'“Other” has been checked in response to the previous question, indicate by check mark which financial

statement item the registrant has elected to follow.

Item 17 __ Item 18 __

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes__ No _X_

StatoilHydro'sStatoil's Annual Report on Form 20-F for the year ended 31 December 20082009 ("Annual Report on Form 20-F") is available online at www.statoilhydro.com. StatoilHydrowww.statoil.com.

Statoil is subject to the information requirements of the US Securities Exchange Act of 1934 applicable to foreign private issuers. In accordance with these requirements, StatoilHydroStatoil files its Annual Report on Form 20-F and other related documents with the Securities and Exchange Commission, the SEC. It is also possible to read and copy documents that have been filed with the SEC at the SEC's public reference room located at 100 F Street, N.E., Washington, D.C. 20549, USA. You may also call the SEC at 1-800-SEC-0330 for further information about the public reference rooms and their copy charges, or you may log on to www.sec.gov. The report can also be downloaded from the SEC website at www.sec.gov.

StatoilHydroStatoil discloses on its website at www.statoilhydro.com/www.statoil.com/en/aboutstatoilhydro/aboutStatoil/corporategovernance/norwegiancodeofpractice/pages/statementofdifference.aspx,default.aspx, and in its Annual Report on Form 20-F (Item 16B) significant ways (if any) in which its corporate governance practices differ from those mandated for US companies under the New York Stock Exchange (the "NYSE") listing standards.

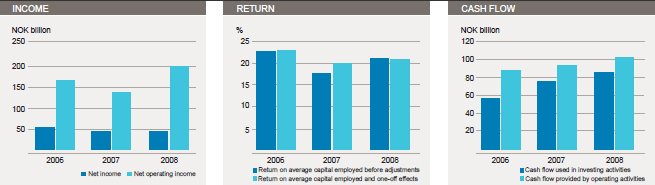

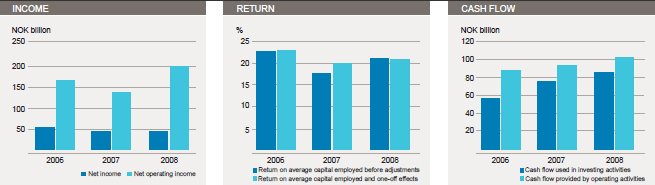

| For the year ended 31 December | |||

(in NOK billion, unless stated otherwise) | 2009 | 2008 | 2007 | 2006 |

|

|

|

|

|

Financial information |

|

|

|

|

Total revenues | 465.4 | 656.0 | 522.8 | 521.5 |

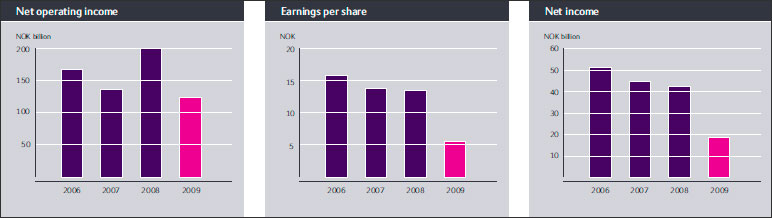

Net operating income | 121.6 | 198.8 | 137.2 | 166.2 |

Net income | 17.7 | 43.3 | 44.6 | 51.8 |

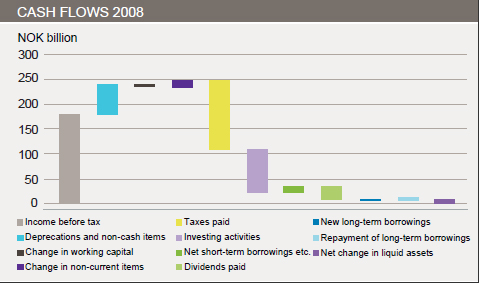

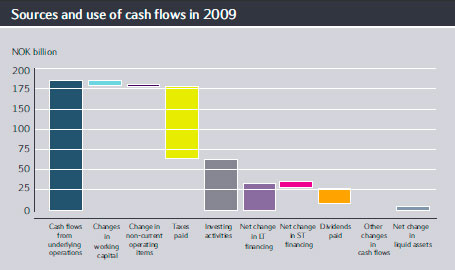

Cash flow provided by operating activities | 73.0 | 102.5 | 93.9 | 88.6 |

Cash flow used in investing activities | 75.4 | 85.8 | 75.1 | 57.2 |

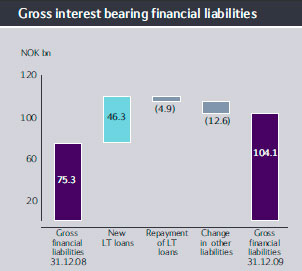

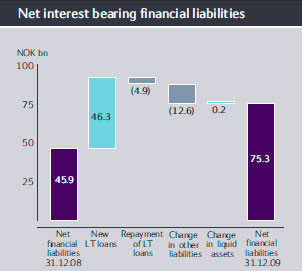

Interest-bearning debt | 104.1 | 75.3 | 50.5 | 54.8 |

Net interest-bearing debt | 75.3 | 46.0 | 25.5 | 43.8 |

Total assets | 562.8 | 579.2 | 483.1 | 458.8 |

Share Capital | 8.0 | 8.0 | 8.0 | 8.0 |

Minority Interest | 1.8 | 2.0 | 1.8 | 1.6 |

Net assets / Total equity | 200.1 | 216.1 | 179.1 | 169.4 |

Net debt to capital employed | 27.3 % | 17.5 % | 12.4 % | 20.5 % |

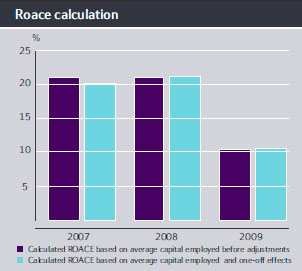

Return on average capital employed after tax | 10.4 % | 21.0 % | 17.7 % | 22.6 % |

|

|

|

|

|

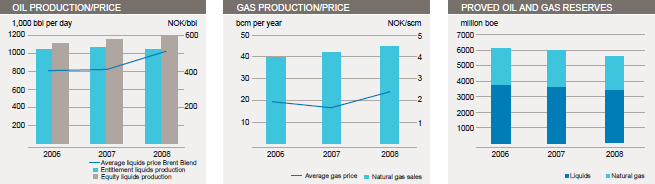

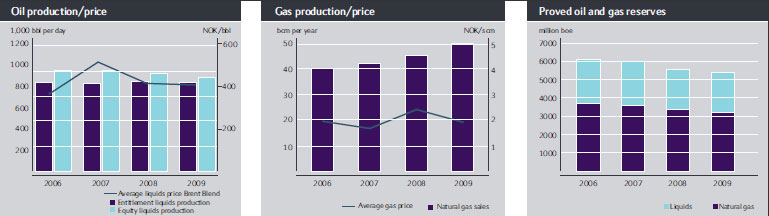

Operational information |

|

|

|

|

Equity oil and gas production (mboe/day) | 1,962 | 1,925 | 1,839 | 1,780 |

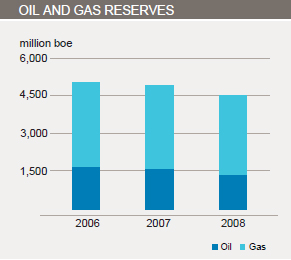

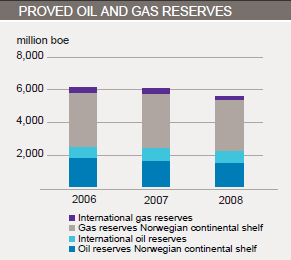

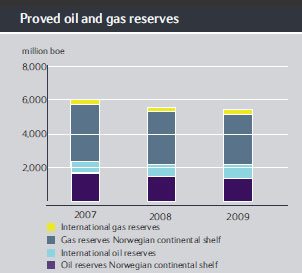

Proved oil and gas reserves (mmboe) | 5,408 | 5,584 | 6,010 | 6,101 |

Reserve replacement ratio (three-year average) | 64% | 60% | 81% | 76% |

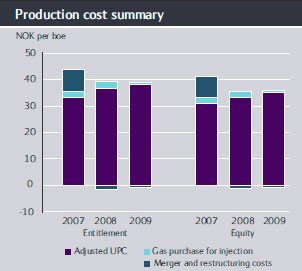

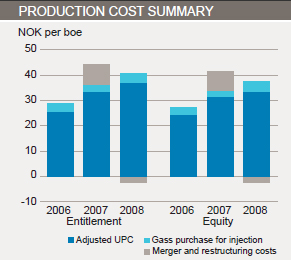

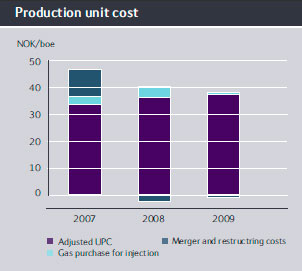

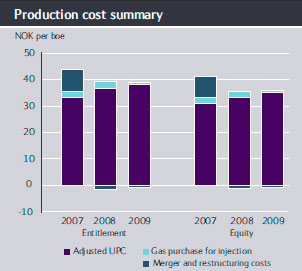

Production cost (NOK / boe equity volumes) | 35.3 | 34.6 | 41.4 | 27.3 |

|

|

|

|

|

Share information |

|

|

|

|

Ordinary and diluted earnings per share | 5.75 | 13.58 | 13.80 | 15.82 |

Share price at Oslo Stock Exchange on 31 December | 144.80 | 113.90 | 169.00 | 165.25 |

Dividend paid per share NOK (1) | 6.00 | 7.25 | 8.50 | 9.12 |

Dividend paid per share USD (2) | 1.04 | 1.26 | 1.47 | 1.58 |

Weighted average number of ordinary shares outstanding | 3,183,873,643 | 3,185,953,538 | 3,195,866,843 | 3,230,849,707 |

|

|

|

|

|

(1) See Shareholder information section for a description of how dividends are determined and information on share repurchases. | ||||

(2) USD figure presented using the Central Bank of Norway 2009 year-end rate for Norwegian kroner, which was USD 1.00 = 5.7767 NOK. | ||||

StatoilHydro

Statoil publishes financial data in accordance with IFRS. StatoilHydroStatoil did not publish financial data in accordance with IFRS in 2006 as we previously presented financial data in accordance with US GAAP. For this reason, we have not provided selected financial data for 2005 and 2004 in this Annual Report and Form 20-F 2008.Report. Selected financial data for those yearsthat year presented in accordance with US GAAP is included in our 2006 Annual Report on Form 20-F.

| For the year ended 31 December | ||

(in NOK billion, unless stated otherwise) | 2008 | 2007 | 2006 |

|

|

|

|

Financial information |

|

|

|

Total revenues | 656.0 | 522.8 | 521.5 |

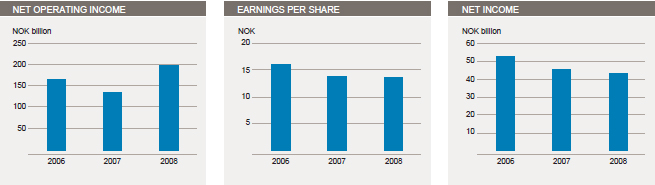

Net operating income | 198.8 | 137.2 | 166.2 |

Net income | 43.3 | 44.6 | 51.8 |

Cash flow provided by operating activities | 102.5 | 93.9 | 88.6 |

Cash flow used in investing activities | 85.8 | 75.1 | 57.2 |

Interest-bearning debt | 75.3 | 50.5 | 54.8 |

Net interest-bearing debt | 46.0 | 25.5 | 43.8 |

Total assets | 578.4 | 483.2 | 458.8 |

Net assets | 216.1 | 179.1 | 169.4 |

Share Capital | 8.0 | 8.0 | 8.0 |

Minority Interest | 2.0 | 1.8 | 1.6 |

Net debt to capital employed | 17.5 % | 12.4 % | 20.5 % |

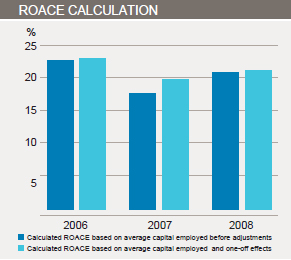

Return on average capital employed after tax | 21.3 % | 17.9 % | 22.9 % |

|

|

|

|

Operational information |

|

|

|

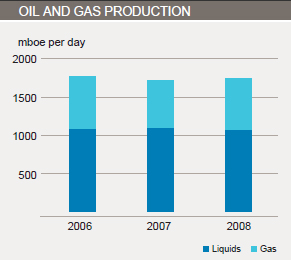

Combined equity oil and gas production (mboe/day) | 1,925 | 1,839 | 1,780 |

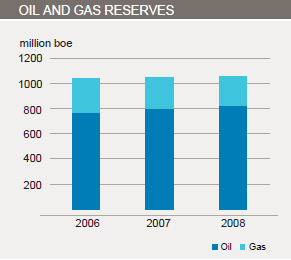

Proved oil and gas reserves (mmboe) | 5,584 | 6,010 | 6,101 |

Reserve replacement ratio (three-year average) | 60% | 81% | 76% |

Production cost (NOK / boe) | 38.1 | 44.1 | 28.4 |

|

|

|

|

Share information |

|

|

|

Ordinary and diluted earnings per share | 13.58 | 13.80 | 15.82 |

Share price at Oslo Stock Exchange on 31December | 113.90 | 169.00 | 165.25 |

Dividend paid per share NOK (1) | 7.25 | 8.50 | 9.12 |

Dividend paid per share USD (2) | 1.04 | 1.22 | 1.31 |

Weighted average number of ordinary shares outstanding | 3,185,953,538 | 3,195,866,843 | 3,230,849,707 |

|

|

|

|

(1) See Sharebolder information section for a description of how dividends are determined and share repurchases. | |||

Business development

On 21 February, Gazprom, Total

In January, we revealed our intent to merge land-based organisations and offshore installations in an over-arching production system designed to run the business more safely and predictably. The restructuring process proceeds as planned. The latest milestone is the opening of a new operations support centre at Sandsli.

Also in January, gas flowed from the Yttergryta subsea field on Åsgard in the Norwegian Sea. The field progressed from discovery to production in just 18 months. The average lead time for phaseoffshore oil and gas field developments in Norway is 15 years.

In March, we made a discovery at the Asterix gas prospect in the Norwegian Sea, which was deemed one of the Shtokman field.larger finds offshore Norway in recent years.

StatoilHydro ASAIn April, we joined forces with Norwegian power utility Statkraft to develop the 315 MW Sheringham Shoal Offshore Wind Farm off the coast of Norfolk, UK. The wind farm will have 88 turbines and Det norske oljeselskap ASA signedis planned to start production in 2011. When fully operational, its annual electricity production will be about 1.1 TWh, enough to power some 220,000 UK homes.

Also in April, we announced the acquisition of a sales and purchase agreement on 12 October for the transfer of Det norske oljeselskap's 15% interest40% stake in 50 blocks from BHP Billiton in the Goliat field to StatoilHydro ASA. The transaction has effect from 1 January 2008. Also on 12 October, StatoilHydro Petroleum AS and Det norske oljeselskap ASA agreed on a swap of minor interests in three other licences.

On 21 October, the European Commission announced that StatoilHydro has been granted permission to take over the bulkfrontier DeSoto Canyon area of the Jet retail chainUS Gulf of Mexico. DeSoto Canyon is located east of Statoil's current production operation at Independence Hub. The area has water depths of about 1,000 metres, and is a mostly unexplored region in Scandinavia currently owned and operated by ConocoPhillips.

On 12 November StatoilHydro formed a strategic alliance with Chesapeake Energy Corporation to jointly explore unconventional gas opportunities worldwide. Under this agreement we will initially acquire a 32.5% interest in Chesapeake's Marcellus shale gas acreage.

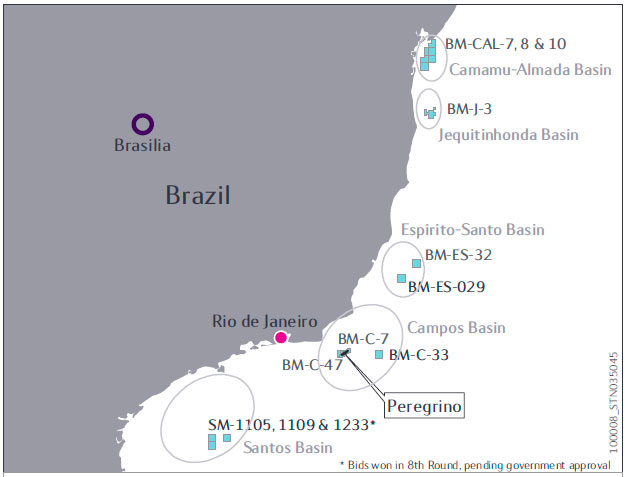

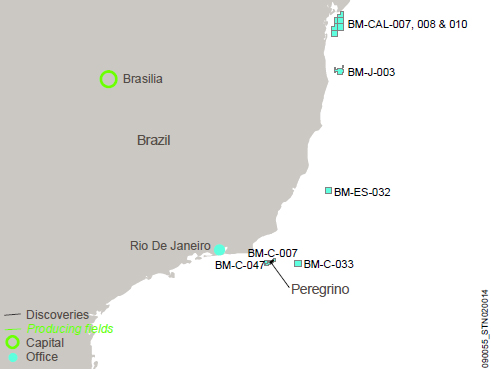

On 11 December StatoilHydro completed the full acquisitioneastern part of the Peregrino heavy-oil field offshore Brazil, after closing the deal to acquire the additional 50% stake from Anadarko and making StatoilHydro the operator.

AccessGulf of Mexico (GoM), offering advantageous early access to new areasplays.

In May

Internationally, StatoilHydrohigh bidder on 16 leases, of which 14 were joint bids with ENI Petroleum, in the Chukchi Sea Lease Sale 193 in Alaska announced on 6 February. StatoilHydro will be the operator of all 16 leases. In total, the group gained access to 20 new exploration licences during the yearTahiti field in the Gulf of Mexico, Alaska, Brazil, CanadaMexico.

An offshore worker died on 7 May after an accidental fall on the North Sea Oseberg B platform operated by Statoil, in connection with the removal of scaffolding from the drilling area on the B platform. The victim was an employee of scaffolding contractor STS. In direct response to the accident, Statoil and contractors Aibel and STS took the Faroe Islands.initiative to introduce improvements throughout the entire scaffolding industry.

In Norway, StatoilHydro was offered interests in 12June, production licenceson the Lufeng 22-1 field in the AwardsSouth China Sea was shut down. We operated the field together with partner CNOOC from 1997. Under an agreement between CNOOC and Statoil, CNOOC has taken over full responsibility for the abandonment of Predefined Areas 2007 (APA 2007)phases two and three of the field. Our Shekou operations office was closed at the end of 2009, and our activities in China are currently centred around R&D cooperation and business development.

On June 1, we were devastated by the news that three colleagues from our Rio de Janeiro office were on Air France flight 447 that disappeared over the Atlantic. Geologist Marcela Pellizzon, 29, and lawyer Gustavo Peretti, 30, both Brazilian citizens, and Norwegian lawyer Kristian Berg Andersen, 37, perished in the accident. A memorial service was held in Rio in June.

In July, first oil was tapped on the Thunder Hawk field in the Gulf of Mexico.

Also in July, the Tyrihans field in the Norwegian Continental Shelf (NCS). The company will beSea came on stream using the operator of nine ofworld's longest directly heated pipeline - some 43 kilometres long.

During the licences

Exploration activities

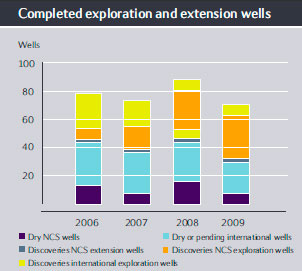

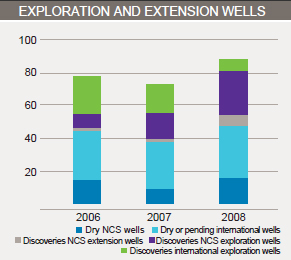

StatoilHydro delivered an extensive exploration programme2008. Of a total of 79 exploration wells completed before 31 December 2008, 40 were drilled outside the NCS. Thirty-five wells were discoveries, of which eight are located outside the NCS. An additional eight wells have been completed since 31 December 2008.

Project development

StatoilHydro maintained a high activity level in progressing projects into production. On 18 January, the plan for development and operation (PDO) of Yttergryta was submitted, only six months after the discovery was made. In 2008, StatoilHydro delivered three PDOs (Plan for Development and Operation)NCS: Yttergryta (18 January), Morvin (15 February)Gjøa and Vega fields in the Troll FieldNorth Sea. Gjøa is our largest project (27 June).

Production from Gamma Main Statfjord on the Oseberg fieldunder construction in the North Sea commencedtoday and expected to start producing in 2010. The field's semi-sub platform is Statoil's first floating installation to source electricity from the mainland, reducing CO2 emissions by about 210,000 tonnes per year. The smaller Vega deposit will tie in to Gjøa and also start producing in 2010.

In August, we set a world record on 12 April,the Ormen Lange field in the Norwegian Sea when the world's deepest remotely controlled "hot-tap" operation was completed at a sea depth of 860 metres.

In September, our Hywind pilot project - the world's first full-scale floating wind turbine - was officially inaugurated off the coast of western Norway for two years of testing. A still immature technology facing a long road to commercialisation and full-scale wind farm construction, Hywind can help floating wind turbines make a long-term contribution to meeting the world's soaring demand for energy.

Statoil CEO Helge Lund took part in a preliminary meeting at the UN headquarters in New York, in connection with preparations for the international climate summit in Copenhagen, after being appointed a member of the UN expert group for climate and energy. Statoil was the only oil company represented in the group, which consists of approximately 20 persons from different countries.

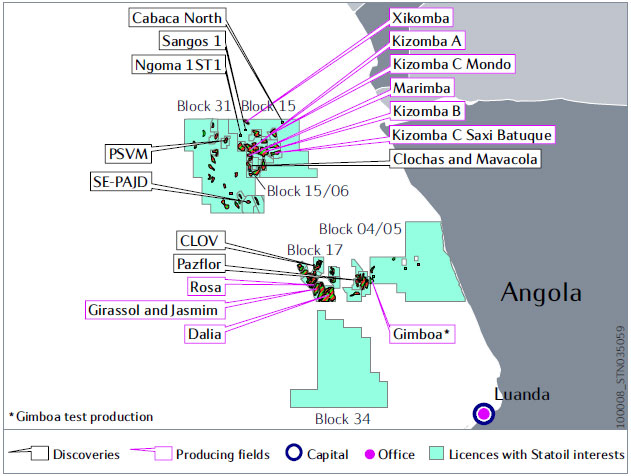

In October, we announced the nineteenth oil find on Angola's offshore Block 31. We hold a 13.3% stake in the acreage. Sonangol is concessionaire and BP operator. We are partner in nine producing Angolan fields, which contribute more than 200,000 barrels of equity production per day to our portfolio.

In November, we changed our name to Statoil and introduced our new brand identity. The Horton case - concerning Statoil's contract with Horton Investment Ltd, related to business development in Iran - was formally closed by the US authorities in November. Statoil fulfilled the conditions of agreements signed in 2006 with the US authorities to substantially strengthen our ethics and anti-corruption practices. Offshore installation of the first wellhead platform on the Statoil-operated Peregrino field in Brazil started.

In December, Statoil and Lukoil won the technical service contract from Iraq's Ministry of Oil to develop the sizeable West Qurna 2 field in the southern part of the country. West Qurna 2 is estimated to hold 12.9 billion barrels of recoverable reserves.

We signed memorandums of understanding (MoU's) with Gazprom to import LNG into the US and trade it there. The MoU's include Gazprom getting re-gasification capacity at the Cove Point, Maryland, LNG receiving terminal. Statoil will also sell natural gas to Gazprom at various US locations, while purchasing LNG from Gazprom at Cove Point.

Finally, it was announced on 18 months afterDecember that Statoil and Chinese oil giant Sinopec will carry out joint geological studies on two deep-water blocks in the South China Sea. The agreement makes Statoil the first foreign company to work with Sinopec off the coast of China.

Our total equity output both in and outside Norway increased to some 1,950,000 barrels of oil deposit was proved. Production started from seven fieldsequivalents per day.

We carried out an extensive exploration drilling campaign on the NCS during 2008: Volve (12 February), Gulltopp (7 April), Oseberg Gamma Main Statfjord (12 April), Vigdis East (15 April), Theta Cook (26 June), Oseberg Delta (27 June)in 2009, completing 39 exploration wells, 30 wildcat wells to test new prospects and Vilje (1 August)nine appraisal wells to establish the extent and size of previous discoveries. We proved 22 new discoveries, resulting in a discovery rate of more than 70%. Most of the finds are relatively small and close to producing fields in the North Sea and Norwegian Sea, making later tie-ins possible. The most important discoveries in 2009 were Asterix, Gro, Katla and Beta West; all except Gro being Statoil-operated.

Internationally, our average daily production commenced on Mondo in Angola (1 January), Deep Water Gunashli in Azerbaijan (22 April), Saxi and Batuque offshore Angola (1 July),surpassed 500,000 boe for the Agbami in Nigeria (29 July) and South Pars in Iran (1 October).

Production

Total equity5%10% from 20072008, to 1,925 mboe512 mboe/day, and production from three new fields started during the year. We had a high level of exploration activity: six of the 29 exploration wells drilled in 2009 have been announced as discoveries, with several interesting discoveries in the US Gulf of Mexico, Canada and Angola.

The Leismer oil sands development project in Canada is well underway with production start up expected in autumn 2010. The Leismer Commercial Demonstration Plant is stage one of our total field development plan for several bitumen hubs upstream.

Our Peregrino project now towers over the surface of the sea in the Campos basin off Brazil. First oil is expected in early 2011 and production should reach its plateau of 100,000 barrels of oil equivalents per day in 2008. Total liquids andwithin the first year.

The onshore Marcellus shale gas entitlement production increased by 2% from 1.724 mboe per day in 2007 to 1,751 mboe per day in 2008.

Market

The first cargo of gas from the NCS arrivedstrategically important marketseastern US are in the USA on 21 Februaryearly stages of production and in Japan on 22 March.growing steadily.

Gas filling into the storage caverns in the Aldbrough project in the UK started in August. This is a cooperation project for natural gas storage between the British company SSE Hornsea Limited (SSEHL) and StatoilHydro.

Technology and new energy

StatoilHydro established a a research and development centre in Alberta, Canada to support the group's heavy oil business world-wide. In creating the Heavy Oil Technology Centre (HOTC), StatoilHydro will explore academic partnerships and work with government and industry institutions, just as it has done in its operations in Norway and around the world.

The most complicated well in StatoilHydro's history was successfully completed and hydrocarbons were flowing up through the well at 9910 metres. This is thus the longest producing well in the world drilled from an offshore platform. The well provides the company with valuable knowhow.

Social responsibility and sustainable development

StatoilHydro decided to build the world's first full scale floating wind turbine, and test it over a two-year period offshore Karmøy.

Production resumed on the Statfjord A platform 28 May, after four days of shutdown due to an oil leak Saturday 24 May. For safety reasons, a total of around 1,200 cubic metres of oil-containing water were pumped to sea. This was done to ensure safety on board the platform following a leak in a pipe inside one of the shafts of the installation. Oil protection equipment and oil booms were deployed to collect a thin oil film around the Statfjord A platform.

StatoilHydro submitted an external investigation report on the Libya matter to Norwegian and US authorities on 7 October. Consultancy agreements related to Norsk Hydro's earlier activities in Libya contain issues which could be problematic in relation to Norwegian and US anti-corruption legislation. The report has been submitted to the National Authority for Investigation and Prosecution of Economic and Environmental Crime in Norway (Økokrim), to the US Department of Justice (DoJ), the US Securities and Exchange Commission (SEC) and to the relevant Libyan authorities.

StatoilHydro and Indian oil company ONGC agreed on 6 February to jointly explore the potential of developing Carbon Capture and Storage (CCS), and CDM (clean development mechanism) projects in India.

Carbon injection and storage on the Snøhvit field started on 22 April. Instead of emitting the carbon dioxide (CO2) resulting from the well stream that comes from the Snøhvit field to the air, the CO2 is reinjected into the ground and stored in a formation which lies somewhat beneath the gas-bearing formations on the Snøhvit field.

StatoilHydro submitted a plan for carbon capture at Mongstad to the Ministry of Petroleum and Energy and the Ministry of the Environment. The plan addresses the most important challenges and sums up key issues associated with the technical feasibility of carbon capture at Mongstad. This is the first step along the way towards full-scale carbon capture at Mongstad.��

StatoilHydroStatoil is an integrated

oil and gasenergy company based in Norway andNorway. The company is present in approximately 40 other countries worldwide. We are the leading operator on the NCS and are also enjoyingexperiencing strong growth in our international production.

.

StatoilHydroStatoil ASA is a public limited company organised under the laws of Norway and is subject to the provisions of the Norwegian act relating to public limited liability companies (the Norwegian Public Limited Companies Act).

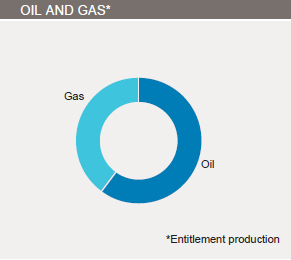

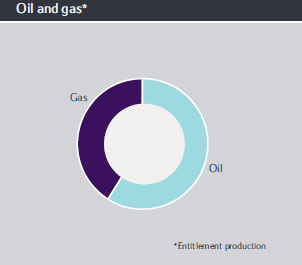

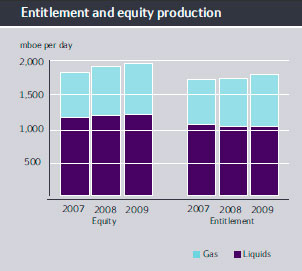

Entitlement oil and gas production outside Norway represented 17%accounted for 20% of our total output,production, which averaged 1.7511.806 mmboe per day in 2008.2009.

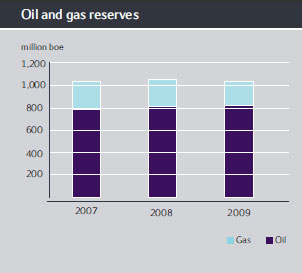

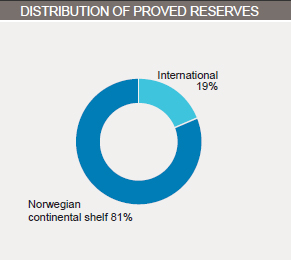

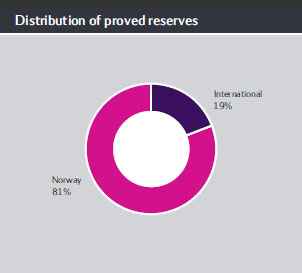

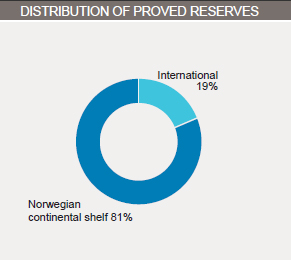

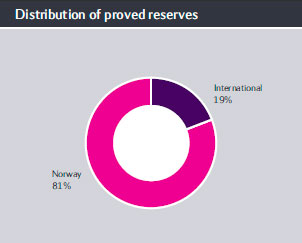

As of 31 December 2008,2009, we had proved reserves (including our share of reserves in affiliated companies of 127 mmbbl of oil) of 22012 174 mmbbl of oil and 537.8514 bcm (equivalent to 19.018.1 tcf) of natural gas, corresponding to aggregate proved reserves of 5584.5 408 mmboe.

We are represented in approximately 40 countries and are engaged in exploration and production activities in 2422 of them. As of 31 December 2008,2009, we had approximately 29,50029,000 employees.

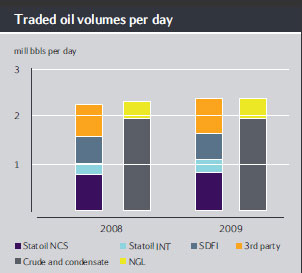

We rankare among the world's largest net sellers of crude oil and condensate and we are the second largest supplier of natural gas to the European market.

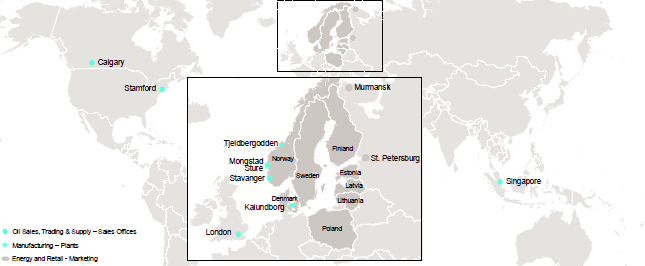

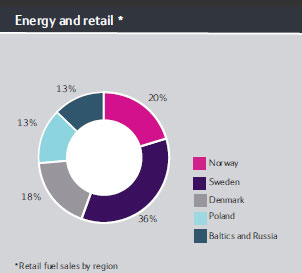

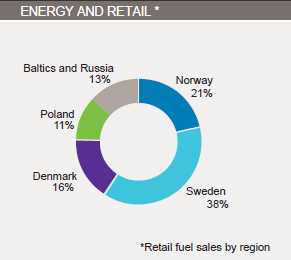

We have substantial processing and refining activities and approximately 23002000 service stations in Scandinavia, Poland, the Baltic States and Russia.

We are contributing to developingthe development of new energy resources, have ongoing activities in the fields of wind power and biofuels and are at the forefront in implementingof implementation of technologies for carbon capture and storage (CCS).

In further developing our international business, we intend to utilise our core expertise in areas such as deep waters,water, heavy oil, harsh environmentenvironments and gas value chains in order to exploit new opportunities and executedevelop high quality projects.

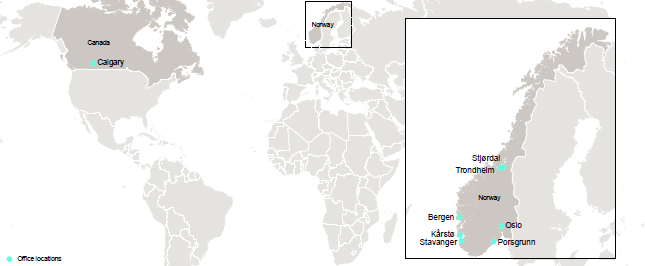

Business address

Our business address is Forusbeen 50, NO-4035N-4035 Stavanger, Norway. Our telephone number is +47 51 99 00 00. Our largest office locations in terms of the number of employees are in Stavanger, Bergen and Oslo.Oslo, Norway.

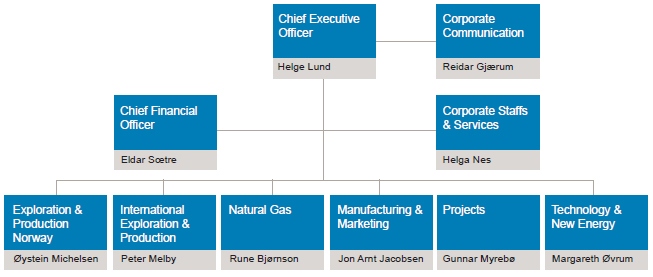

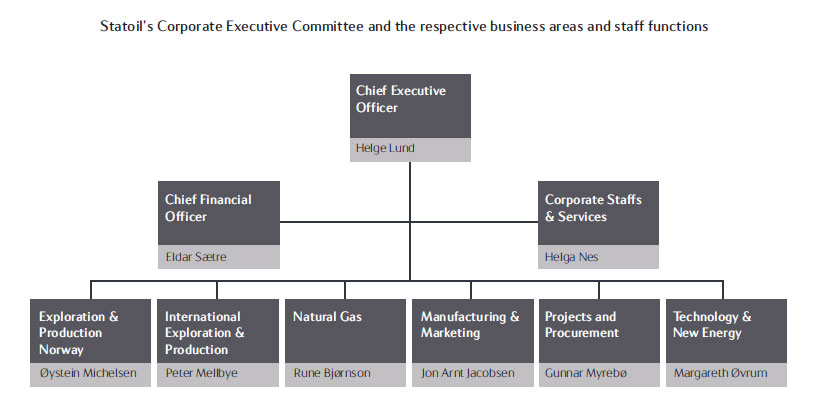

The StatoilHydroStatoil group and the main business and functionalfunction areas are presented in the following sections.

Statoil was

foundedformed in 1972 and merged with Hydro's oil and energy business in 2007. We changed our name to StatoilHydro on 1 October, 2007.

Statoil ASA (Statoil) was founded by a decision of the Norwegian Storting (parliament) and was listed on the Oslo and New York stock exchanges in 1972. As a result of Statoil's merger with the oil and energy business of Hydro (formerly Norsk Hydro), we have roots in the oil industry dating back to the 1960s when Hydro took part in the exploration of the NCS.

Statoil was incorporated as a limited liability company under the name Den norske stats oljeselskap a.s. Wholly-owned by the Norwegian State, the company's role was to be the government's commercial instrument in the development of the oil and gas industry in Norway. In 2001, the company became a public limited company listed on the Oslo and New York stock exchanges, and changed its name to Statoil ASA.

On 1 October 2007, the oil and energy assetsdivision of Hydro were(formerly Norsk Hydro) was merged with Statoil, and the company was given the temporary name of StatoilHydro ASA. On 1 November 2009, the company changed its name back to StatoilHydroStatoil ASA. Through this merger, our ability to fully realise

We have grown in parallel with the potential of the NCS was strengthened and our chances of succeeding as an international player improved. As a result of the merger, we are the largest international oil and gas company operating in water deeper than 100 metres. The financial and other information in this report reflects the development of the former Statoil and Hydro on a carry over or combined basis for all periods presented.

Our history of involvement in theNorwegian oil and gas industry, began in earnest in 1965, when we were awarded licences bywhich dates back to the late 1960s. The commencement of our operations focused primarily on the exploration, production and development of oil and gas on the Norwegian State to explore for petroleum on the NCS. We participated in the discovery of the Ekofisk field in 1969 and the Frigg field in 1971. The development of these discoveries brought us into the petroleum refining and marketing business.continental shelf (NCS) as partner.

In 1975,the 1970s, we commenced our own operations, made important discoveries and entered into oil refining operations, began at Mongstad in Norway, and in 1974, Mobil discovered the Statfjord field in the North Sea, which washave been of great significance forimportance to the further development of the Norwegian Continental Shelf (NCS). During the development of Statfjord, one of the world's largest offshore oilfields, we encountered great challenges. Statfjord came on stream in 1979 and we took over as operator eight years later. Today, we have a 44% interest in the field.NCS.

In the 1980s, both Statoilwe saw substantial growth through the development of major fields on the NCS (Statfjord, Gullfaks, Oseberg, Troll and Hydroothers). We also became a major playersplayer in the European gas market by obtainingsecuring large sales contracts for the development and operation of gas transport systems and terminals. During the same decade, we were heavily involved in manufacturing and marketing in Scandinavia, and we established a comprehensive network of service stations. We acquired Esso's service stations, refineries and petrochemical facilities in Denmark and Sweden.

The 1990s were characterised by substantial improvements in the production performance of our large fields, resulting from intense technological development on the NCS. Both Statoil and Hydro becameWe laid the base for future improvements by becoming a leading companiescompany in the fields of floating production facilities and subsea developments. Wedevelopment. The company grew strongly, expanded in new product markets and increased ourits commitment to international exploration and production through our alliance with BP. The foundations for the today's merged company were also laid with Hydro's acquisition of Saga Petroleum in 1999, and several major acquisitions in the Gulf of Mexico.production.

Since 1 October 2007,2000, our business has grown as a result of substantial investments on the NCS and acquisitions includinginternationally. Our ability to fully realise the acquisitions of oil sand leases in Canada in 2007, and the acquisitionpotential of the remaining shareNCS was strengthened through the merger with Hydro's oil and gas division, which also bolstered our global competitiveness. In recent years we have taken advantage of our competence to design and manage operations that function correctly in the Peregrino fieldenvironments they face, in Brazil completedorder to grow our upstream activities by means of other than traditional offshore production, for example threough the development of heavy oil and shale gas projects.

Although petroleum related activities on the NCS and internationally have formed the main part of our business, we have increasingly participated in 2008, for which field we also became the operator. Since October 2007 we also have had a 24% ownership shareprojects focusing on other forms of energy project, such as wind power and carbon capture and storage, in Shtokman Development AG which is responsible for phase Ianticipation of the Shtokman development a natural gas field located in the central part of the Russian sector of the Barents Sea.need to expand energy production, strengthen energy security and fight adverse climate change.

Our most recent transaction involves a strategic agreement to jointly explore unconventional gas opportunities worldwide with Chesapeake Energy Corporation, the largest US producer of natural gas. Under these agreements StatoilHydro acquired an initial 32.5% interest in Chesapeake's Marcellus shale gas acreage covering 1.8 million net acres (7300 square kilometres) in the Appalachia region of the northeastern USA. For more information of this acquisition, see report section 3.2 Operational review-International E&P.

Statements referring to

StatoilHydro'sStatoil's competitive position rely on a range of sources, including analysts' reports, independent market studies and our internal assessments of our market share.

Statements referring to StatoilHydro'sStatoil's competitive position in the Business Overview and Operational Review sections are based on what we believe to be true and, in some cases, they rely on a range of sources, including investment analysts' reports, independent market studies and our internal assessments of our market share based on publicly available information about the financial results and performance of market players.

In StatoilHydroOur strategy of long-term value creation, starts with our short-term deliveries on operations and HSE. As we are working towards our goals of continuing our strategy for profitable growth and upholding our ambition to increase equity production of oil and gas to 2012 and beyond, despite great uncertainty in the global economy and oil market.

In workingwork towards our ambition to realiseof realising the full value potential of the NCS,Norwegian Continental Shelf (NCS), we are simultaneously developing international platforms for long-term growth and we are gradually building a position within new energy. The company is well positioned to manage through the global economic downturn. A strong balance sheet and active cost management will enable the company to pursue this long term strategic direction.in renewable energy production.

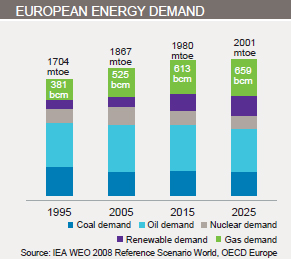

The global economy entered into recession has led to a significant reduction in energy demand in most regions. Energy prices fell significantly in the first part of the 2009, and caused a large reduction in revenues for the players in the industry. The corresponding falls in suppliers' costs have been much smaller. Thus, the industry's profitability has weakened significantly. Most energy commodity prices have showed a partial rebound during the second half of 2008. Nevertheless, energy2009 contributing to a more positive outlook for 2010.

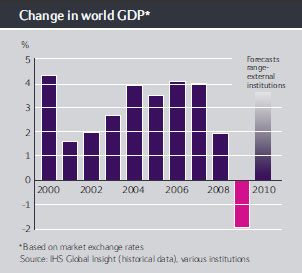

Macroeconomic outlook

After growing by more than 3% on an annual average basis during 2000-2008, the world economy in 2009 experienced the most severe recession since the Great Depression of the 1930s. Following the turbulence in the international financial system in the autumn of 2008, plunging business confidence and demand retrenchments led to a sharp contraction in global industrial production and international trade. In the first quarter of 2009 world economic activity fell by almost 4%. However, resolute and strong policy responses in all major economies stabilised the financial markets, restored general market confidence and from mid-2009 put the world economy on a moderate recovery path. China and other emerging economies in Asia provided an important stimulus to developed economies. For the year as a whole, there was a negative GDP growth of 3.4% and 1.9% for the OECD economies and the world economy, respectively.

At the beginning of 2010, the recovery of all major economies is still in progress. The rate of improvement does, however, vary across sectors and regions, as does the uncertainty of the outlook. Asia Pacific, less affected by the financial crisis and debt financed consumption, continues to grow relatively strongly, while the expansion in the United States and especially the European economies is more hesitant. This is mainly due to the household sectors' need for debt deleveraging, the high unemployment rate and the low rate of capacity utilisation in most industries. Furthermore, although the balance sheets of the financial institutions have improved during 2009, the planned banking reforms and the banks' own consolidation suggest that bank lending will continue to be restricted for some time. Overall, these forces indicate that the recovery of the world economy is expected to pickcontinue during 2010, but with a less vigorous upturn than was typical for previous business cycles.

The governments' economic rescue packages, which successfully contributed to the stabilisation and recovery in 2009, have led to severe deterioration of public finances in most OECD countries. The federal deficits of the main economies, excluding Germany, have increased from pre-crisis levels of about 1.0-2.0% of gross domestic products to an estimated 9-12% for 2010. Since these levels of public deficit are not sustainable, the outlook beyond 2010 implies a more contractive fiscal policy. This is likely to restrain the pace of economic growth beyond 2011-2012. The underlying structural global imbalances, which were among the underlying causes of the recession of 2008-2009, have been corrected only partly and temporarily. Overall, these imbalances suggest that the medium-term outlook for the world economy is still marked by uncertainty.

Energy markets and price developments

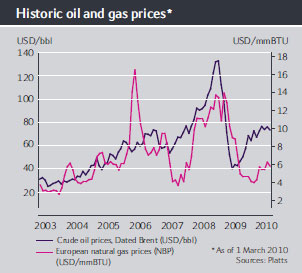

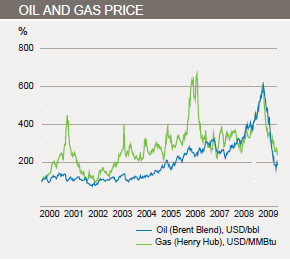

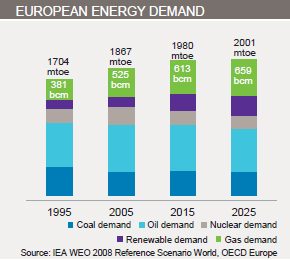

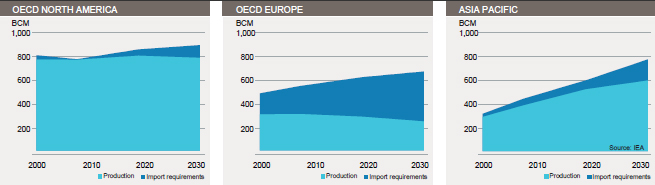

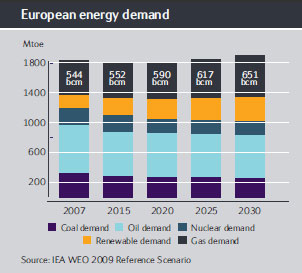

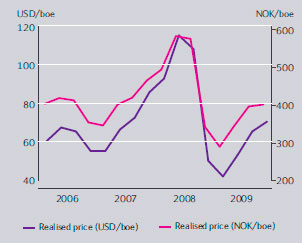

The sharp fall in world economic activity in 2008-2009 led to large reductions in energy demand in most regions of the world. Driven by a 2.1 mbd reduction in OECD oil demand, global oil demand fell by about 1.3 mbd (1.5%) from 2008 to 2009. The demand for natural gas also fell significantly in North America and Europe by 1.1 % and 6.3% (estimate), respectively. Helped by the relatively short-lived economic downturn, oil and gas demand held up reasonably well in China and non-OECD Asia. The weakness in energy demand has pushed energy prices are expecteddown to increaselevels not seen since the early 2000s.

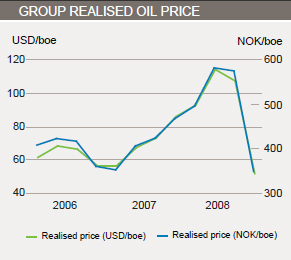

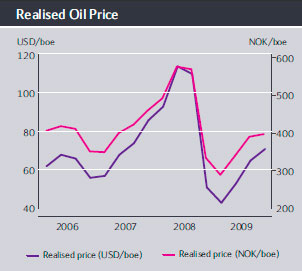

After the historical high of USD 144 per barrel (dated Brent) in the longer term.

Macroeconomic outlook

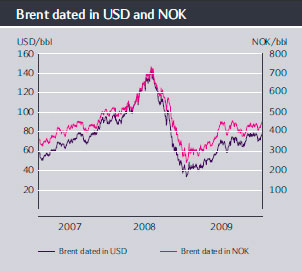

The global economy entered into recession insignsprevented oil stocks from building further. Despite the high oil stocks and comfortable spare Opec production capacity, crude oil prices started to recover in the second quarter, triggered by expectations of an emerging world economic recovery and the prospect of a cyclical downturnweaker US dollar. The upward trend in oil prices lasted throughout the year, supported by constructive macroeconomic data and relatively strong demand growth in Asian markets. By the end of 2009, prices were around USD 75 per bbl. Financial players' perceptions, portfolio optimisation and market positions were important drivers behind the 2009 oil price recovery. The average price of date d Brent in 2009 was USD 61.6 per bbl, down from USD 97.3 per bbl in 2008.

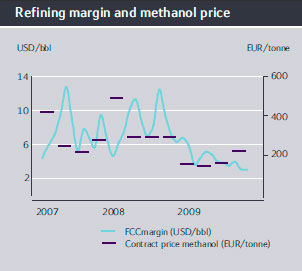

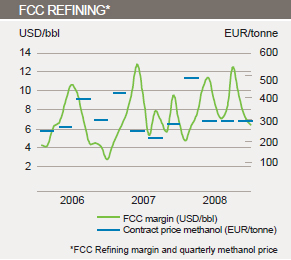

The Atlantic products' markets have also been severely hit by the economic recession. Total demand for products in the real economyUS and OECD European markets both fell by close to 0.8 million barrels per day, or more than 4%, from 2008 to 2009. Reduction in the demand for distillates, including diesel oil, gas oil and jet/kerosene accounted for about half of the total, while gasoline demand kept up relatively well in both regional markets. Lower demand for oil products led to high products stocks and downward pressure on the price differentials between oil products and crude oil. However, the relative stability of the gasoline markets led to less depressed gasoline differentials (margins), while distillate margins were evidentat their lowest since 2003-04. Thus, refineries with a high gasoline yield were somewhat sheltered from the recession, led market developments of 2008-09.

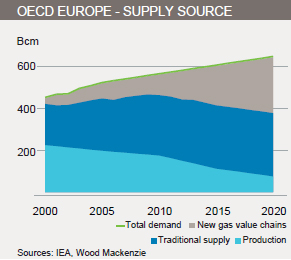

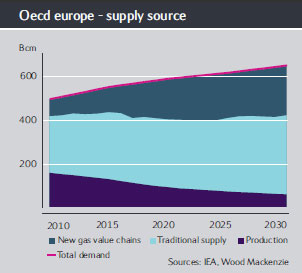

Natural gas prices (spot) in North America and Europe, which also peaked in mid-2008, fell continuously until September 2009 on the prospect of significant oversupply. This was driven by the outlook for recession-induced demand reductions, sustained US domestic production and prospects for a steep growth in the imports of LNG into the Atlantic Basic markets. Especially in the United States, market gas prices came under downward pressure due to a concern that the need for storage capacity could exceed the actual storage capacity. Prices reached a low of about USD 2.5-3.0 per million BTU in September 2009 - the lowest level since 2002-2004. Gradually, however, it became clear that as US domestic production began to slide, natural gas captured market shares from coal in power generation, the storage surplus was not growing and significant volumes of Middle East LNG supplies were directed to Asian and European markets. The reduced supply pressure put gas prices in both markets on a moderate recov ery path, and by the end of the year US prices were back at about USD 5.70 per million BTU, close to the price levels at the beginning of the year. Although US conventional production slid further through 2009, the expansion of unconventional gas production, especially the production of shale gas, continued its sharply rising trend through the year. The European market has also been affected by lower gas demand and increased supply pressure, primarily from higher volumes of NGL and European spot prices (NBP) followed a similar pattern as US spot prices. The average NBP spot prices were reduced from USD 11.43 per million BTU in 2008 to USD 4.94 per million BTU in 2009.

European electricity prices fluctuated around a level of EUR 50-60 per MWh during 2005-08 and reached a peak of almost EUR 100 per MWh immediately after the break-out of the crisis in the financial markets in the autumn of 2008. Following the sharp decline in European economic activity during the winter of 2008-09, power demand contracted by more than 6 % (estimate) relative to the year ledbefore and pushed electricity prices to a low of EUR 30-40 per MWh. Power demand recovered during the second half of the year and pulled prices up into the EUR 40-50 per MWh range.

Prices in the European carbon dioxide market, the EU Emission Trading Scheme, tend to follow the same pattern as electricity prices as that market shares the same demand-side drivers. Carbon prices have, however, been relatively stable around EUR 13-15 per tonne during 2009. The lack of a clear direction following the Copenhagen meeting on future global and regional climate policies pushed carbon prices moderately downwards in December 2009.

The outlook for energy prices over the next few years is basically linked to the prospects for a moderate recovery of the world economy. The oil market is likely to resume the pre-crisis trends of moderate demand growth, modest to stagnant growth in non-Opec production and some expansion in Opec NGL/condensate production. This also suggests that Opec's spare production capacity will gradually be reduced. However, since oil price formation is strongly influenced by falling housingfinancial players, the uncertain outlook for financial markets, geopolitical developments and the US dollar will continue to be important additional drivers. The short-term outlook for the Atlantic Basin products markets is driven by a modest demand growth and the potential for products imports from several export refineries in the Middle East and Far East. The outlook for a sustained overcapacity in refining in the Atlantic Basin may at some point lead to capacity closures in Europe.

Prospects for a rebalancing of the European and North American gas markets are related to the strength of economic recovery. On the demand side, the price-driven competition with coal will continue to be important. The outlook for a further rise in US conventional gas production at relatively low costs has reduced the potential for imports to the North American markets. The prospects for increased LNG supplies into the Atlantic Basin are expected to cap significant natural gas price increases.

Industry context

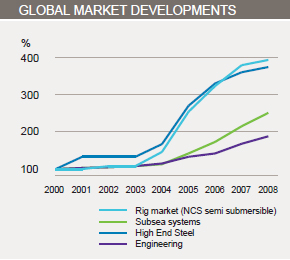

Restricted upstream access, increasingly complex resources, the climate challenge and tougher financial terms have become more evident as strategic challenges for the oil and gas industry over the last 10 years. Access to resources restricts the growth potential of oil and gas companies, with a large share of the world's remaining conventional resources held by countries with limited access for international oil companies (IOCs). National oil companies have also entered the industry contest for international resources, resulting in an industry arena that is more competitive than ever. IOCs are therefore gradually being pushed to grow their asset base by accessing hydrocarbons in more remote areas, in deeper waters and in more technologically challenging environments. As a result, the contribution made by unconventional and deepwater hydrocarbons has increased by more than 10 percentage points during the last decade to make up nearly 30% of global production capacity in 2009. There are reasons to expect this trend to continue. Another key point is the global climate challenge. Climate regulation still remains uncertain post-Copenhagen, but a potential cost impact related to future policy adjustments remains a likely outcome. In addition to the access and climate challenge, industry profitability has tightened both through increasingly stringent government terms, but recently also through the margin squeeze following the financial turmoil.

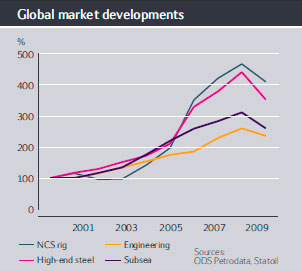

The fall in oil and gas prices in the USautumn of 2008 in the aftermath of the banking crisis took its toll on the industry in general. With average oil prices down by almost 40% in 2009 compared to 2008, revenues were severely hit. At the same time, suppliers' costs did not show a corresponding decrease. Data suggest that the cost level fell by 20-25% within capital intensive categories, while labour intensive supplies were reduced about 10%. Thus, overall industry profitability has significantly declined compared to 2008.

As a result of the margin squeeze, many companies have had to increase their borrowing, adjust their capital expenditure plans, re-evaluate their dividend policies, reduce their share buyback programmes and several European countries. The downturnincrease their focus on cost control and capital deployment efficiency through tighter prioritisation of exploration and development opportunities.

During the fourth quarter of 2008, most sources of funding dried up, and corporations with weak credit ratings had limited access to the bond market. However, the bond market recovered in 2009, especially for high-quality borrowers like the IOCs, which led to a large number of bond issues. Most of the money raised was reinforcedused to finance existing operations and capital expenditure commitments rather than merger and aquisitions activities. Global E&P spending fell by some 15 - 20% in 2009. On the NCS on the other hand, the investment level grew by 14% mainly led by new field developments which are more challenging and require more resources due to their complexity and smaller size. With a more positive market sentiment and the jump in oil prices since the second quarter of last year, there is also an expectation of increased E&P spending for next year. Industry surveys indicate that global E&P expenditures will increase by approximately 10% this year. Statistics Norway suggests that th e 2010 investment level on the NCS will be slightly lower than that of 2009. Consistent with the overall themes in the industry of cost control and capital discipline, disposals of non-core assets are back on the agenda. Several assets are currently being marketed among major oil and gas companies.

Following the financial turmoil, the drop in demand has led to refinery overcapacity and pressure on margins. This is exacerbated by the financial crisis that escalatedstart up of several export refineries in September. A vast deleveragingthe Far East and Mid-East. In the longer term, refining overcapacity in both household and corporate sector will lead to slowing growth rates in consumer spending and investments in all regions.

Global GDP growth is currently expected to be negative in 2009. Within two to three years we expect global growth to return to the long term trend, within the range of 2.5 to 4%. The impact of the policy measures and government stimulus packages is unknown and intended positive effects therefore represent considerable uncertainties for these forecasts.

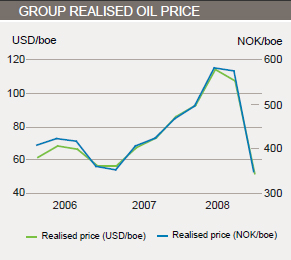

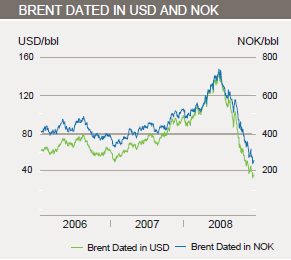

Crude oil price developments

Dated Brent entered into 2008 on a strong upward trend extending from 2007, and accelerated as financial investors increased positions in a search for more favourable yields. Strong support from a tight gasoil/diesel market and declining crude oil inventories led to an increasingly tight oil market, and the Brent dated reached a record high level of 144 USD/bbl in July 2008.

At this point an underlying tendency of slower global GDP growth and weakening product demand started to discourage investors. With a shift of both sentiment and outlook during 2008, crude oil prices were fundamentally different from the first half to the second and traded between 33 and 40 USD/bbl in December. Brent dated averaged 97.26 USD per barrel in 2008. The gas, power and EU ETS (Emission Trading Scheme) prices have broadly followed oil prices through 2008.

With the global economy deteriorating, the energy markets are expected to stay relatively weak in 2009 and possibly into 2010 and 2011. Over time as the macro economic situation improves, energy demandAtlantic basin is expected to pick uplead to capacity closures in Europe.

The increased concerns for energy security and climate change have continued to fortify policy and long-term market drivers for commercial growth in renewables. While most renewable energy pricesforms are more costly than fossil fuels are today, the competitive landscape is expected to rise.

High cost environment

In recent years, the oil industry has focused largely on growingshift as production and the resource base. Ascosts for renewable energy prices soared and the competition for resources intensified,decline, while the cost of buildingcarbon emissions is reflected in power and fuel prices. Significant amounts of public and private funding are currently going into research, development and expansion of new technologies in order to make renewables and Carbon Capture and Storage (CCS) more competitive.

Wind power is the largest single market for new energy, with prospects of increasingly higher production capacity increased steeply. The tighteninggrowth over time. Offshore wind is expected to take a significant share of the suppliertotal wind market intensifiedif several of the cost push. With reduced oil demand and falling oil prices, this high cost environment is not seen as sustainable. If the oil price remains at current low levels, we expect costsmajor countries are to be reduced going forward.achieve their renewable energy goals.

StatoilHydroStatoil's strategy is

continuingto profitably grow its strategy for value creation and growth and upholding its ambition to increase the equity production oflong term oil and gas up to 2012, despite great uncertaintyproduction while gradually building a position in the global economy and the oil market.

Overall strategic direction

Our overall long-term strategy remains unchanged, and we are taking firm action to manoeuvre through the current turmoil. StatoilHydro's strategy is to create shareholder value as an upstream-oriented, and technology-based energy company. This strategy can be summarised as:

InShort term priorities are to conduct safe and efficient operations and to deliver production growth in line with our guidance. We are transforming the short term,way we work on the NCS in order to realise the full value potential of our main focus will be on delivering on our production targets and managingpositions there. We continue tight management of our cost base. This means delivering high operational performance, with a strong focus on HSE.Retaining financial flexibility remains important for us. In the longer term, our focus ispriorities are to developoptimise, mature and execute the current project portfolio, with qualitytaking into account the dynamic economic environment, the globalisation of gas markets and the politically imposed framework and regulatory measures aimed at a competitive cost to enable us to grow profitably.mitigating the risk of adjustment costs induced by climate change.

LeveragingUtilising our capabilities

Gaining access to sufficient petroleum resources is increasingly challenging. We are seeking new opportunities in demanding areas requiring the full use of our legacy competence in technology and capabilities of high potential in which StatoilHydroStatoil has experience and competitive advantages and the experience to face challenges and capture opportunities:advantage:

Responding to the climate challenge

Our ambition is to be an industry leader in carbon efficiency in terms of having a low climate impact in each of the activities in which we are engaged. We aim to create value by seeking low-carbon and energy-efficient competitive solutions in all areas of our business. Responding to the climate challenge in an effective manner will give our company a competitive advantage in the future.

Maximising value creation from upstream access opportunities

We will use exploration as a key growth tool to secure long term growth of reserves, production and value. This is consistent with maximising the long-term value of the NCS and with leveraging our core competencies to build, mature and deliver profitable growth outside Norway. We will continue to optimise our exploration portfolio, balancing frontier-, growth- and infrastructure led exploration.

We will continue selective business development activities to optimise the portfolio.

Maximising long-term value creation on the NCSNorwegian continental shelf (NCS)StatoilHydro has a unique position on the NCS, where we operate 39 fields and produce more than three mmboe per day of production. We have a strong presence in all NCS regions and operate around one-third of the NCS's expected reserves. We expect that our asset base, experience and technical leadership will enable us to fully utilise these resources. We anticipate the NCS portfolio will continue to be a core activity area, income generator and technology base for many years to come. We believe that significant exploration potential remains and we aim to maintain our position as the main industrial architect.industry player on the NCS.

We are focused on improvingcontinuously work to improve our HSE performance regularity and drillingour cost and operational efficiency and we planas well as implementing measures for improved hydrocarbon recovery (IHR). We see a structural shift in our non-sanctioned project portfolio from a few large, complex projects to use Improved Oil Recovery (IOR) measures and other operational best practices to maximise the potentiala high number of our assets. We intend to highgrade our portfolio, through acquisitions and divestments.mainly smaller projects or sub-sea tie-backs. This demands a high level of standardised technical concepts as well as simplified development processes.

Building and delivering profitable international growth

Our strategy is to deliver profitable international growth in the short and medium term from existing positions, while creating new opportunities for long-term value creation. We will utilise our core expertise in areas such as deep waters, harsh environments, heavy oil and the gas value chain to pursue attractive business opportunities around the world. Statoil's history as a state oil company gives us a competitive advantage in understanding host countries' needs and requirements and in working with them to develop the resource base to their benefit while creating value for our shareholders.

We anticipate that StatoilHydro'sStatoil's future growth beyond 2012mainly will take place mainly outside the NCS. Our short-short to medium-term focus is on delivering and maturing a high qualityhigh-quality project portfolio to a high quality and on time and within budget. After the merger, we are a stronger company with increased capacity and a larger resource pool of finances and employees, well positioned to pursue further international growth. In the longer term, we expect that our international asset base will transform the structure and profile of our company, allowingallow us to grow and become more diversified, both in geographical terms and in types of production.

We will use our core expertise in areas such as deep waters, harsh environments and heavy oil and gas value chains to pursue new business opportunities around the world. We have already demonstrated this through our acquisition of the oil sands position in Canada, the Peregrino field in Brazil, and the US shale gas position - all of which represent new challenges and opportunities for us to apply our technology and experience. For a description of these acquisitions see Section 3.2 Operational Review - International E&P.

We will continously seek to high grade our portfolio, for instance as we have done in our long term partnership with Sonatrach on Cove Point, and our acquisition of the remaining 50% of Peregrino and its operatorship. StatoilHydro's history as a national oil company (NOC) also gives us a competitive advantage in developing new cooperative models with other NOCs that are seeking partners for developing their resource bases.

Developing profitable midstream and downstream positionsStatoilHydro's ambitionStatoil's strategy is to develop projects and production into produce oil and gas where we see a potential for attractive returns and value added to the upstream positions. Compared with many of our peers, wevalue. We have a strong upstream focus in terms of our total value and asset base. Furthermore, we also havebase, complemented by a sizeable mid-midstream and downstream portfolio in relationrelated to the marketing, trading, refining and storage of oil and gas products. We seek to capture synergies from our upstream positions and the market characteristics.

We anticipate further globalisation of the gas markets, and changes in the location of our oil and gas production. We also expect changes in consumption patterns in the aftermath of the financial crisis and as a result of the introduction of greenhouse gas mitigation measures by the authorities. We will monitor our midstream and downstream activities and adjust in a timely manner to meet the needs of markets and of our upstream positions to optimise our portfolio and maintain shareholder value.

Creating a platform for newrenewable energy solutionsproduction and productioncarbon capture and storage

Our ambition in this areastrategy for renewable energy production and carbon management is to utilise existing core capabilities and current business positions to create profitable positions in renewable energy, prioritising offshore wind projects while keeping track of opportunities in other other areas through technology and selective investments.

We are building a profitable businessportfolio of near-shore and off-shore wind farms and we are developing technology for large-scale deep water offshore wind power generation. In this context, our participation in Sheringham Shoal UK wind farm was an important milestone achieved in 2009 as was the preparation for the Forewind consortium on the Dogger Bank development to which we were awarded rights in 2010. Off the south-west coast of Norway we are piloting a prototype of the world's first full-scale floating wind turbine, Hywind, which is designed to be placed at water depths between 120 and 700 metres.

In addition, we reduce emissions of greenhouse gases from our production. StatoilHydro is a leading industry player infossil energy production through carbon capture and storage. We are looking for opportunities for commercially sound investments in renewable energy, particularly in wind and sustainable biofuels, where we can exploit our offshore experience and fuel marketing know-how. We aim to build a portfolio of near-shore wind parks and develop technology for large scale offshore wind power generation.

Using exploration as a key enabler for value creation

Consistent with the strategies for maximising the long-term value of the NCS as well as building and delivering profitable international growth, StatoilHydro's ambition is to develop upstream projects and production in oil and gas where we see attractive returns, both in Norway and internationally. Our exploration strategy is key to this and is based on gaining access to high-potential basins globally and targeting multiple blocks in high-focus areas.

Our exploration strategy can be divided into three categories:

Frontier exploration aims at proving new fields in areas where the petroleum system remains unproven.

Growth exploration involves exploring for fields with stand-alone potential in areas where the petroleum system is known. We have a strong strategic focus on being an active operator with a view to shaping the future direction of our business.

Infrastructure-led exploration seeks to provide resources to existing infrastructure in a timely manner.storage (CCS).

Using technological innovation and implementation as a key business enablerStatoilHydro aims to build even stronger industry positions, and technologyTechnology is a key enabler for achieving this goal and forin terms of Statoil realising our key strategies. The merger strengthened us significantly in the area of technology, providing us with a platform to further exploit our technical base. One example is the world class technology used on Troll and Gullfaks, where extended, multilateral and smart wells drain previously unrecoverable resources.

its goals as an internationally competitive energy company. Our ambition is to attain distinctiveness and industrial leadership in six specific technologies:

Based on our history of technological achievements, we actively seek to master demanding and long-range multiphase transport

Technology makes a decisive contributioninnovation and implementation is critical to success in allmany of our activities, such as inenabling field development in frontier deep waters and Arctic areas, the production of heavy oil, production, subsalt exploration for hydrocarbons trapped below salt, and managing environmental and climateclimate-related issues. Our ambition is alsoIn addition, to stayenable sustainable energy provision in the long term, we aim to remain competitive in a broad range of core and emerging technologies, along the energy provision value chain, including offshore wind and sustainable biofuel.

We aim to maintain the right course to capture future business opportunities and to develop smarter solutions to explore for and to produce energy in cost effective and environmentally friendly ways.

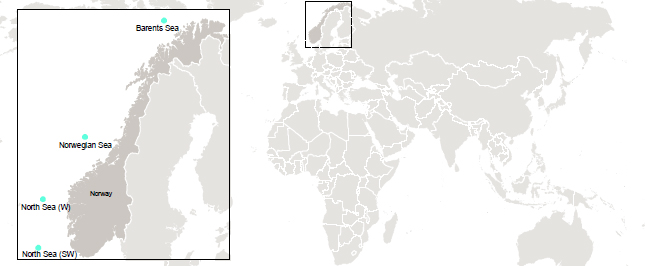

Exploration & Production Norway

(EPN) consists of our exploration, field development and production operations on the NCS.

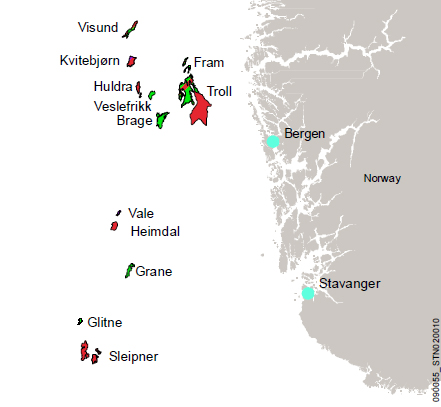

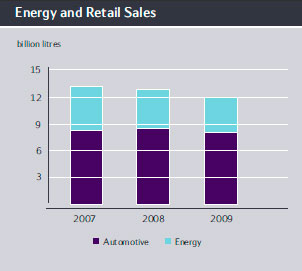

EPNExploration & Production Norway (EPN) is the operator of 42 developed fields that collectively produced more than threeon the NCS. Statoil's equity and entitlement production on the NCS was 1,450 mmboe per day in 2008,2009, which representedwas about 80%75% of theStatoil's total production. Acting as an operator, EPN is responsible for approximately 75% of all oil and gas production fromat the NCS. . In 2008,2009, our average daily production of oil and natural gas liquids (NGL) production was 824784 mboe and our average daily gas production was 101.3105.9 mmcm (37.1(3.7 bcf), totalling 1.461 mmboe per day..

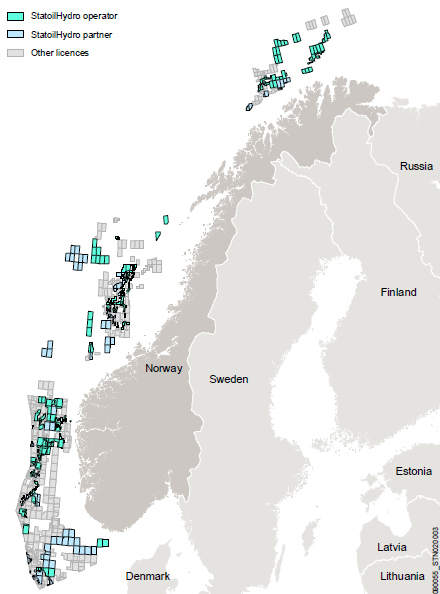

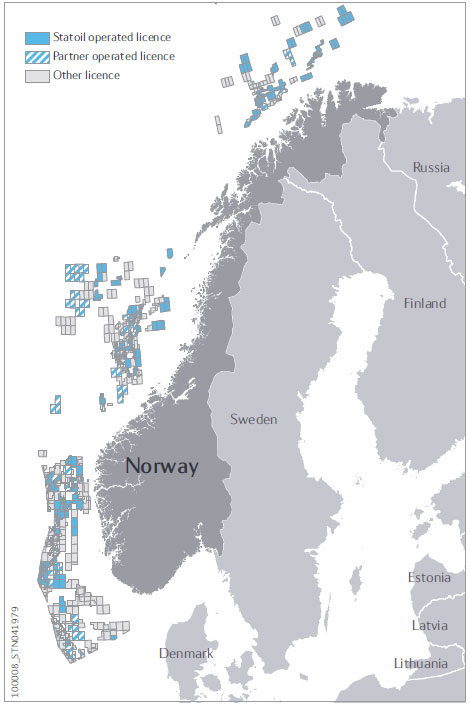

We have ownership interests in exploration acreage throughout the licensed parts of the NCS, both within and outside our core production areas. We participate in 346219 licences on the NCS and are an operator for 174162 of them.

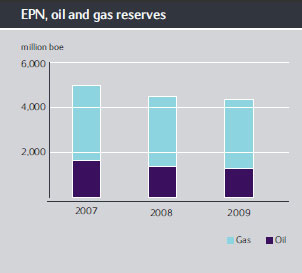

As of 31 December 2008,2009, EPN had proved reserves of 1,3961,351 mmbbl of crude oil and 498480 bcm (17.58(16,9 tcf) of natural gas, which represents an aggregate of 4,5294,369 mmboe.

.

.

Several factors are expectedE&P Norway's strategy is to

contribute to StatoilHydro's equity production on the NCS, including increased production and drilling efficiency, more cost-effective operations, and improved recovery from existing fields.

Other important measures include development of new discoveries, the proving of new resources through intensive exploration activity, increased access to new licences, enhanced focus on health, safety and the environment (HSE), and optimal use of existing infrastructure.

Our overall strategy on the NCS is defined as:

Maintaining current production level

As several fields on the NCS are maturing and production declines, high priority will be given to the implementation of measures to increase productionfields. The main measures in this context are more efficient drilling, increased regularityfields and improved oil recovery (IOR).

Higher regularity is expected to be achieved through improved well work, better reservoir management, de-bottleneckingthe optimal use of export infrastructure, improved planning of turnarounds and fewer topside plant failures.

Additional production is expected to be achieved by means of new capacity, including ramp-ups on Ormen Lange and Snøhvit, new field developments and implementation of IOR measures.

Tie-ins to existing infrastructure on fields that are in decline and/or have reached a critical point in their technical life will also have high priority. A well-balanced asset portfolio on the NCS with respect to regions and maturity is necessary to sustain total oil and gas production at current levels.

We need to achieve optimal development and exploitation of our existing portfolio in order to secure a solid foundation for future growth through continued high exploration activity. Active infrastructure-led exploration is a key factor in extending the life of the infrastructure in the tail-end production phase. However, access to new, prospective acreage is also necessary to maintain a high production level in the longer term.

One of our ambitions is to become one of the leading players in the Arctic by 2020. Considering the long lead times of field developments, a near-term opening of new acreage is imperative. Succeeding in new field developments in the northern areas of the NCS is a priority for StatoilHydro. Important efforts are currently underway to maintain stable operations in the Snøhvit LNG project, and to support a timely and robust development of the Goliat oil field. However, new high-quality exploration acreage remains a critical prerequisite for long-term success. To meet our ambitions in the northern area, we have to feasibly mitigate challenges in a range of areas - including geology and technology.

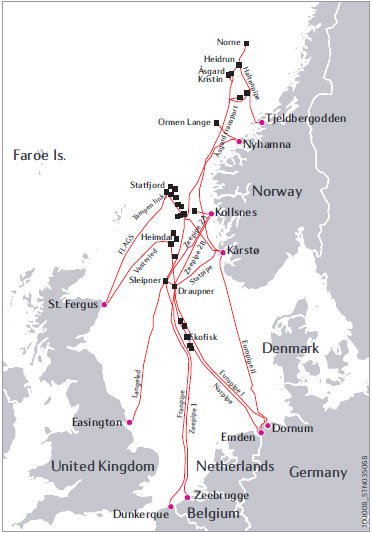

Gas positionThe proportion of natural gas from our NCS portfolio is increasing. We have a flexible transportation system, with six different landing points on the European Continent / UK and flexibility in terms of gas deliveries from large gas producing fields such as Troll and Oseberg.

Safe and efficient operations are essential to our business

All activities in StatoilHydroStatoil are conducted with higha great focus on HSE in order to prevent harm to people and the environment. The implementation of Integrated Operations (IO) is expected to enhanceincrease economic value through higher production, higher regularity and cost reductions. Upgrading and modification programmes for offshore installations are also planned with a view to maintaining safe and efficient operations.

OurThrough our ongoing efforts to introduce one common operating modelfinalise the implementation of integrated operations and common work processes on all our installations on the NCS will enable uswe aim to utilizeutilise best practices and optimise usagethe use of our total resources to ensure safe and efficient operation.

UnitMaintaining a high production costslevel

Several fields on the NCS are maturing and production is declining. High priority will therefore be given to more efficient drilling operations, improved regularity and increased hydrocarbon recovery (IHR).

High regularity is expected to be achieved through efficient well work, better reservoir management, de-bottlenecking of export infrastructure and efficient turnarounds.

It is important to utilise unused capacity in existing infrastructure. Active near-field exploration is a key factor in extending fields' lifetime and initiating cost-effective tail-end production on fields that are in decline and/or have been onreached a rising trendcritical point with respect to profitability.

Optimal development and exploitation of our existing portfolio is necessary in recent years,order to secure a solid foundation for future activities through continued active maturation of the project portfolio and high exploration level. New field developments are in line withgeneral more challenging than before either in terms of complexity, smaller size or profitability. Hence these projects require more resources per barrel than before.

Access to new, prospective acreage is also necessary in order to maintain a high production level in the industry development. StatoilHydro's managementlonger term. One of our ambitions is implementing measures to contain future cost inflation.become one of the leading players in the Arctic by 2020. Considering the long lead times for field developments, it is a pre-requisite in the near term to open new acreage. Succeeding in new field developments in the northern areas of the NCS is a priority for Statoil. Important efforts are currently under way to maintain stable operations in the Snøhvit LNG project, and to support timely and robust development of the Goliat oilfield. However, new high-quality exploration acreage remains a critical prerequisite for long-term success. To meet our ambitions in the far north, we have to address challenges in a range of areas - including geology and technology.

Gas position

The climate challengeproportion of natural gas from our NCS portfolio is increasing. We have a flexible transportation system, with six different landing points on the European Continent/UK and flexibility in terms of gas deliveries from large gas-producing fields such as Troll and Oseberg.

Energy efficiency and carbon emissions

E&P Norway aims to maintain and strengthen the NCS's position as the most energy-efficient petroleum region in the world. We intend to push for energy efficiency in our dailyday-to-day operations and evaluate new field developments fromin a long termlong-term perspective with regard to energy and the environment. E&P Norway also plans to also put more effortseffort into developing a more energy efficientenergy-efficient supply chain with a life cycle perspective.

Industrial architect forIndustry leader on the NCS

We seek towill maintain a stable relationship with suppliers, competitors, government and other stakeholders. The NCS is an arena for world-class innovation and technological development. StatoilHydroStatoil is a leader in the deployment of new technology, including drilling and subsea technology, new solutions for reducing costs and the use of new technology for developing discoveries. As the largest operator on the NCS, we are leaders in the development of optimal area solutions and the overall development of the NCS.

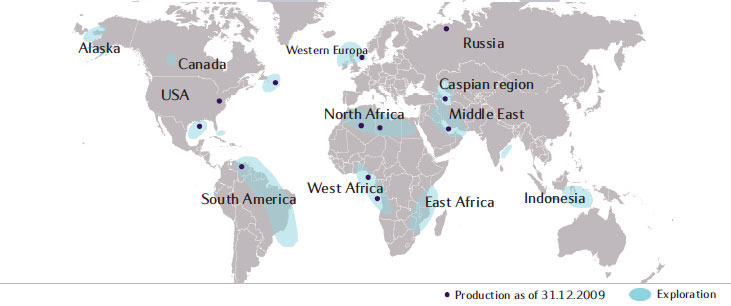

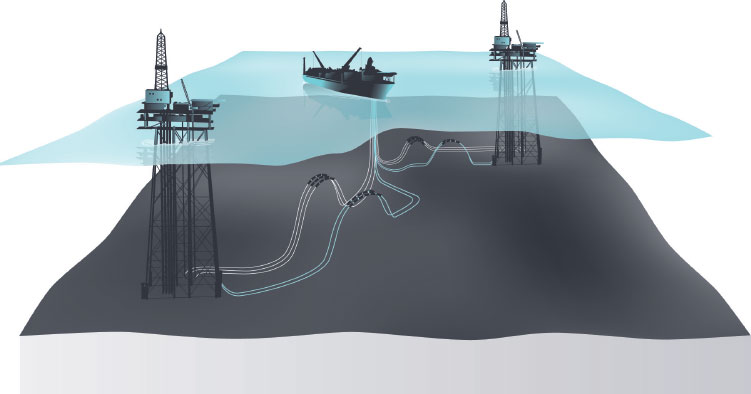

International Exploration & Production (INT) is responsible for exploration, development and production of oil and gas outside the Norwegian Continental Shelf. INT will provide a major part of StatoilHydro's future production growth.continental shelf.

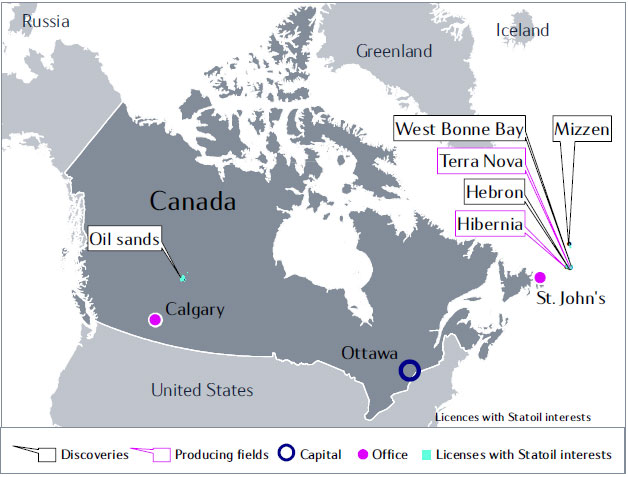

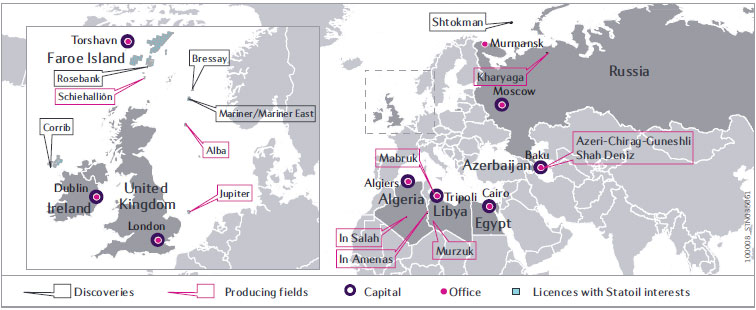

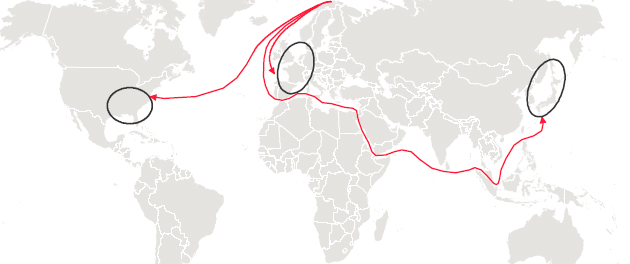

In 20082009, the business area hadwas engaged in production fromin 12 countries: Canada, the USA, Venezuela, Algeria, Angola, Libya, Nigeria, the UK, Azerbaijan, Russia, Iran and China. In 20082009, INT produced 24%26% of StatoilHydro'sStatoil's total equity production of oil and gas, and INT's share is expected to increase significantly in the future.

We have exploration licences in North America (Canada and the USA), Latin America (Brazil, Cuba and Venezuela), Africa (Algeria, Angola, Egypt, Libya, Morocco, Mozambique, Nigeria and Tanzania), the European and Caspian and Russian area (Denmark, the(the Faroes, Ireland, the UK and Azerbaijan), and the Middle East and Asia (Iran, India and Indonesia).

The main sanctioned development projects in which we are involved are in Canada, the USA, Brazil Angola and Ireland,Angola, and we believe we are well positioned for further growth through a substantial pre-sanctioned project portfolio that remains to be sanctioned.including the latest addition, the West Qurna 2 in Iraq. In January 2010 Statoil and Lukoil signed the development and production contract for West Qurna 2 with Iraqi authorities.

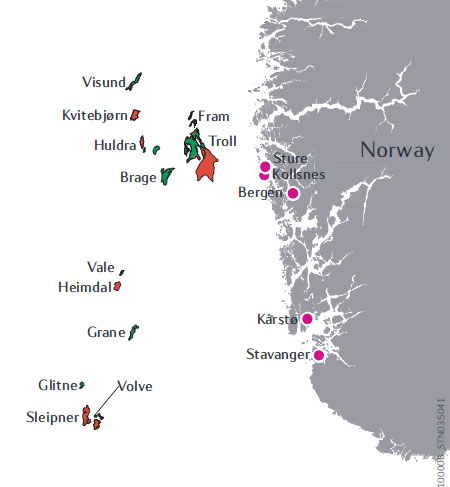

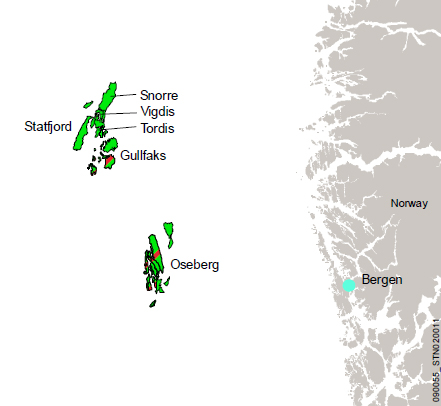

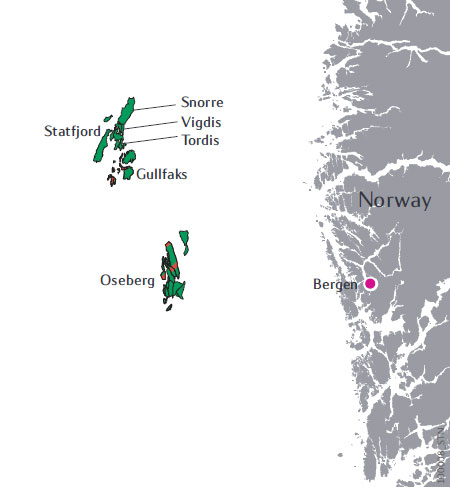

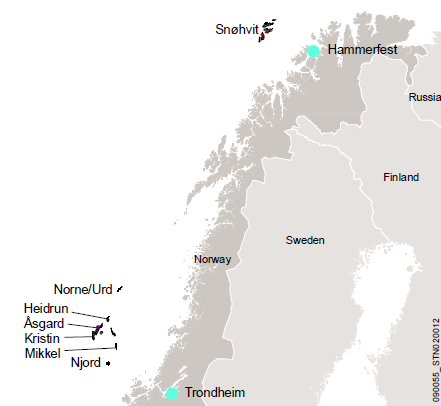

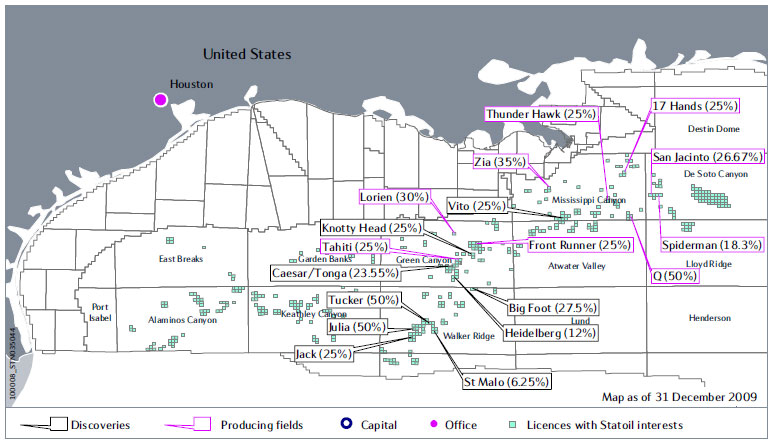

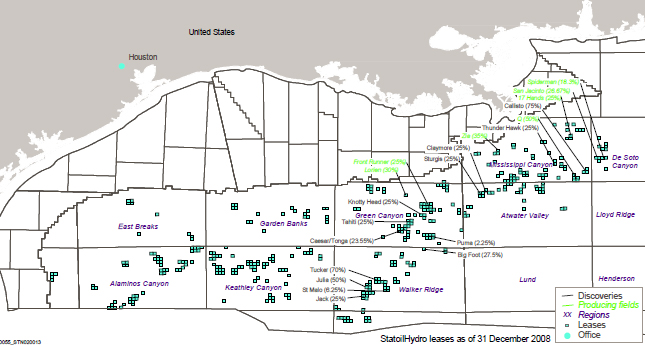

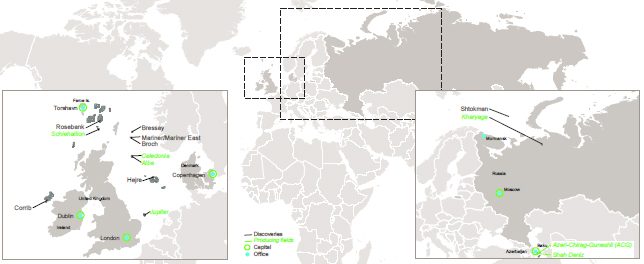

The map shows our exploration and production areas.

Our four focus areas Our long-term upstream growth ambition will mainly be achieved by

growing internationally. Growth is being pursued throughdeveloping our international portfolio of assets into profitable growth.- deep waters, harsh environments, gas value chains and heavy oil.

These focus areas all draw upon our existingon the strong technical and project execution skills we have acquired through our experience fromon the NCS.Norwegian continental shelf. We access resources by establishing new resourcesgrowth platforms with the potential of becoming new focus areas; through advanced exploration activities and high-grading of exploration prospects, focused business development and long-term partnerships with national oilenergy companies.

Iraq is our latest new platform and we have succeeded in establishing a foothold in competition with other companies. It is one of the countries in the world with the highest remaining hydrocarbon production potential, and it has been closed for foreign investment for more than 30 years. Statoil has entered into a partnership with Lukoil, one of the largest onshore operators in the world.

Our international access strategy has increased the scale of our operations in terms of produced volumes, reserves and technological and geographical breadth. We aim to build a robust, diverse and long-life portfolio with significant optionality and flexibility.

INT's near-term focus is on delivering on the production targets for 2012 communicated to the financial markets. Recent acquisitions have also given us significant operatorships that arewhich can increase our opportunities in the exploration and planning phases, as well as the major Peregrino development project.future.

Major efforts are being made on making the transition from being a mainly North Sea player towards becoming a world class international operator. Over the last few years, StatoilHydro has built up a large resource base. We are working continuously to develop our inventory of projects into producing assets by looking at innovative technical and commercial solutions.

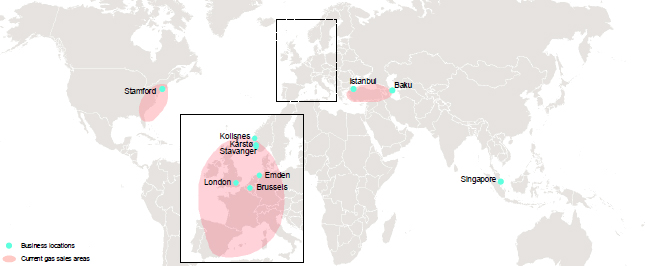

The Natural Gas

(NG) business area is responsible for StatoilHydro'sStatoil's transportation, processing and marketing of pipeline gas and LNG worldwide, including the development of additional processing, transportation and storage capacity.

NGNatural Gas (NG) is also responsible for marketing gas supplies originating from the Norwegian State'sstate's direct financial interest (SDFI). In total, we account for approximately 80% of all Norwegian gas exports and are responsible for the technical operationoperations of the majority of the export pipelines and onshore plants in the processing and transportation systemssystem for Norwegian gas (Gassled)(Gassled*).

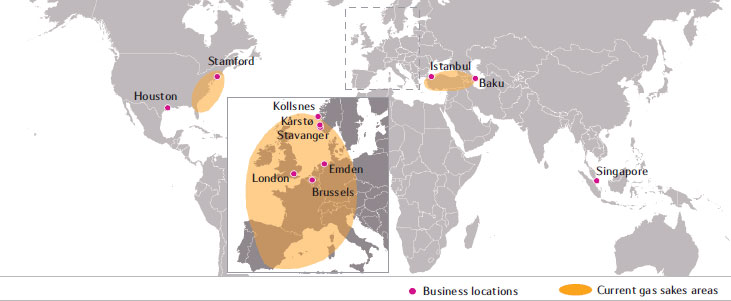

NG's business is conducted from three locations in Norway (Stavanger, Kårstø and Kollsnes) and from offices in Belgium, the UK, Germany, Turkey, Singapore, Azerbaijan and the US.USA (Houston and Stamford).

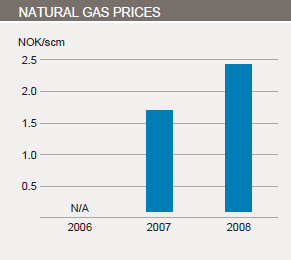

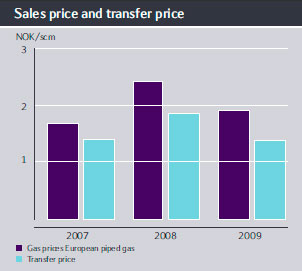

In 2008,2009, we sold 37.038.7 bcm (1.31(1.37 tcf) of natural gas from the NCSNorwegian Continental Shelf (NCS) on our own behalf, in addition to approximately 32.035.3 bcm (1.13(1.25 tcf) of NCS gas on behalf of the Norwegian State. StatoilHydro'sstate. Statoil's total European gas sales, including third party gas, were 76.8amounted to 79.5 bcm (2.71(2.81 tcf) in 2008.2009. That makes us the second largest gas supplier into Europe, with a market share of around 15% inof the European gas market.

From our international positions, (mainlymainly Azerbaijan and the US),USA, we sold 4.15.3 bcm (0.4(0.19 tcf) of gas in 2008,2009, 3.2 bcm (0.11 tcf) of which 2.3 bcm (0.1 tcf) was entitlement gas.

We have a significant interest in the NCS pipeline system owned by Gassled, which is the world's largest offshore gas pipeline transportation system, totalling approximately 7800 kilometres. This network links gas fields on the NCS with processing plants on the Norwegian mainland, as well as terminals at six landing points located in France, Germany, Belgium and the United Kingdom, providing us with flexible access to customers throughout Europe.

*This system is owned by Gassled where Statoil has a 32.1% ownership.

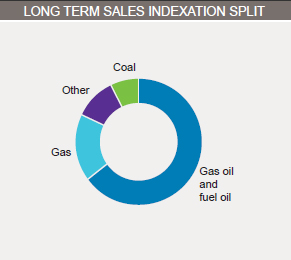

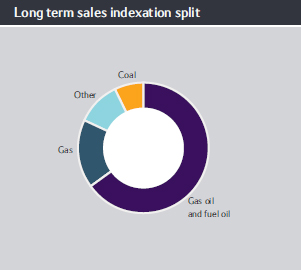

NG's strategy is to maximise the value of our long-term sales business,

improve ourincrease value creation through portfolio optimisation and trading activities, and to establish new gas value chains.

NG's main task is to maximise value creation in markets that are constantly changing and deregulating, the European market in particular, by making active use of the new opportunities offered and managing risk within acceptable parameters.

We have a large European long-term gas sales contract portfolio and are continuously evaluatingevaluate midstream and downstream opportunities in order to take further advantage of our existing infrastructure, access to supplies, and experience innatural gas marketing of natural gas.experience. Our downstream strategies may differ from region to region depending on our particular position in the area and the nature of the market in question.

In Europe, we endeavourare endeavouring to achieve greater efficiency fromin our existing supply portfolio, to update and refine our commercial relationshipsrelations with key customers, and to establish new positions that will improve thedelivery flexibility ofin our operations. Through balancing, optimisation andfrom field to customer, trading activities, and sales directly to large industrial customers, we plan towill continue to create additional value on top of our long-term sales business.

Natural gas is the focus of many exploration and business development activities carried out by both INT and EPN. A large proportion of the exploration activities on the NCS are focused on gas, and a number of INT projects focus on accessing international gas reserves.