2016 Annual Report on Form 20-F |

|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

WASHINGTON, DC 20549 |

|

Form FORM 20-F

(Mark one)One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

xX ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 20142016 |

OR |

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________ |

OR |

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report _________ |

Commission file number 1-15200 |

Statoil ASA |

(Exact Name of Registrant as Specified in Its Charter) |

N/A |

(Translation of Registrant’s Name Into English) |

Norway |

(Jurisdiction of Incorporation or Organization) |

Forusbeen 50, N-4035, Stavanger, Norway |

(Address of Principal Executive Offices) Torgrim ReitanHans Jakob Hegge

Chief Financial Officer Statoil ASA Forusbeen 50, N-4035 Stavanger, Norway Telephone No.: 011-47-5199-0000 Fax No.: 011-47-5199-0050 |

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

|

Securities registered or to be registered pursuant to Section 12(b) of the Act: |

Title of Each Class | Name of Each Exchange On Which Registered |

American Depositary Shares | New York Stock Exchange |

Ordinary shares, nominal value of NOK 2.50 each | New York Stock Exchange* |

| *Listed, not for trading, but only in connection with the registration of American Depositary Shares, pursuant to the requirements of the Securities and Exchange Commission | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None |

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. |

| Ordinary shares of NOK 2.50 each 3,182,914,686 | 3,188,647,1033,245,049,411

| |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

| xX Yes ☐ No

|

|

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

| ☐ Yes xX No |

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections. |

| |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| xX Yes ☐ No

|

| |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).** |

| ☐ Yes ☐ Yes ☐ No |

**This requirement does not apply to the registrant in respect of this filing. |

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one): |

Large accelerated filer x X | Accelerated filer ☐ | Non-accelerated filer ☐ |

| | |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

U.S. GAAP ☐ | International Financial Reporting Standards as issued

by the International Accounting Standards Board x X | Other ☐ |

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. |

| Item 17 ☐ | | |

| Item 18 ☐ | | |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

| ☐ Yes xX No |

| |

| | | | | | | | | | | | | | |

Statoil, Annual Report on Form 20-F 20142016 1

2 Statoil, Annual Report on Form 20-F 20142016

| INTRODUCTION | |

| Message from Chair of the board | 3 |

| Chief executive letter | 5 |

Statoil at a glance | 6 |

| About the report | 8 |

| |

STRATEGIC REPORT | |

| 2.1 Strategy and market overview | 9 |

2.2 Business overview | 14 |

2.3 DPN - Development and Production Norway | 19 |

2.4 DPI - Development and Production International | 27 |

2.5 MMP - Marketing, Midstream and Processing | 33 |

2.6 Other group | 36 |

2.7 Corporate | 39 |

2.8 Operating and financial performance | 44 |

2.9 Liquidity and capital resources | 69 |

2.10 Risk review | 74 |

2.11 Safety, security and sustainability | 85 |

| 2.12 Our people | 90 |

| |

CORPORATE GOVERNANCE | |

3.1 Introduction | 93 |

3.2 General meeting of shareholders | 96 |

3.3 Nomination committee | 97 |

3.4 Corporate assembly | 98 |

3.5 Board of directors | 101 |

3.6 Management | 111 |

3.7 Compensation to governing bodies | 116 |

3.8 Share ownership | 124 |

3.9 External auditor | 125 |

3.10 Controls and procedures | 127 |

| |

FINANCIAL STATEMENTS AND SUPPLEMENTS | |

| 4.1 Statoil Consolidated financial statements | 129 |

| |

ADDITIONAL INFORMATION | |

5.1 Shareholder information | 203 |

5.2 Accounting standards (IFRS) and Non-GAAP measures | 216 |

5.3 Legal proceedings | 220 |

| 5.6 Terms and abbreviations | 221 |

| 5.7 Forward-looking statements | 224 |

5.8 Signature page | 225 |

5.9 Exhibits | 226 |

5.10 Cross reference to Form 20-F | 227 |

1 Introduction

Dear shareholder,

| |

2016 was a challenging year for the oil and gas industry. Across the industry, the financial results were impacted by the continued low price environment and Statoil ended up with a negative net income of USD 2.9 billion. In this situation, it is encouraging to see how well the company has delivered on its improvement programme and that the operational performance has continued to be strong. Statoil is now well positioned to for the future. The board of directors has in its work focused both on short term measurements to secure the company’s position in a challenging environment, and more long term through the work of sharpening our strategy. Protecting and enhancing shareholder value guides the board of directors in its work and priorities – short and long term. Strong safety performance is essential for the company’s operations. Last year we experienced the worst imaginable, with a fatality on a yard in South Korea and a helicopter crash outside Bergen that took 13 lives. Further, the serious incident frequency, measured as incidents per million hours worked for both Statoil employees and contractors, increased from 0.6 in 2015 to 0.8 in 2016. Together with the administration, the board of directors has focused on new steps to reinforce safety measures and get back to a positive trend to improve our safety performance. The response to the market challenge through our improvement programme delivered annualised efficiency gains of USD 3.2 billion measured against a 2013 baseline, USD 700 million above the USD 2.5 billion target. As the company moves from an improvement programme to an improvement culture, new targets are set. The board of directors have during the year worked closely with the administration to review and confirm Statoil’s sharpened strategy. Statoil has set clear principles for the development of a distinct and competitive portfolio. Statoil will develop long-term value on the | Norwegian continental shelf, deepen in core areas and develop new growth options internationally, and grow value creation in its marketing and midstream business. The company is making progress in creating a material industrial position in new energy solutions, primarily focused on offshore wind. Responding to the climate challenge and preparing Statoil for a low carbon future is an integrated part of our strategy. Concrete actions to reduce greenhouse gas emissions in the operations have been implemented, and steps have been taken to build a more resilient portfolio. The updated climate roadmap captures the new set of measurements to be implemented. Statoil remains committed to shareholder value creation and maintained the dividend during the year. A resolution is proposed to the annual general meeting to maintain the dividend at USD 0.2201 per share in the fourth quarter, and to continue the scrip dividend programme through to the third quarter of 2017. The board of directors believes the company is well prepared to deal with the current market situation and has the competence, capacity and leadership necessary to create new opportunities and long-term value for our shareholders. I would like to thank our shareholders for their continued investment, as well as the many employees of Statoil for all the dedication and commitment they show every day. Øystein Løseth Chair of the board |

1.1 About the report

Statoil's Annual Report on Form 20-F for the year ended 31 December 2014 ("Annual Report on Form

20-F") is available online at www.statoil.com.

Statoil is subject to the information requirements of the US Securities Exchange Act of 1934 applicable to foreign private issuers. In accordance with these

requirements, Statoil files its Annual Report on Form 20-F and other related documents with the Securities and Exchange Commission (the SEC). It is also

possible to read and copy documents that have been filed with the SEC at the SEC's public reference room located at 100 F Street, N.E., Washington, D.C.

20549, USA. You can also call the SEC at 1-800-SEC-0330 for further information about the public reference rooms and their copy charges, or you can

log on to www.sec.gov. The report can also be downloaded from the SEC website at www.sec.gov.

Statoil discloses on its website at www.statoil.com/en/about/corporategovernance/statementofcorporategovernance/pages/default.aspx, and in its

Annual Report on Form 20-F (Item 16G) significant ways (if any) in which its corporate governance practices differ from those mandated for US companies

under the New York Stock Exchange (the "NYSE") listing standards.

Statoil, Annual Report on Form 20-F 20142016 3

1.2 Key figures and highlights

Statoil publishes financial data in accordance with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB) and as adopted by the European Union (EU).

(in NOK billion, unless stated otherwise) | For the year ended 31 December |

2014 | 2013 | 2012 | 2011 | 2010 |

| | | | | | |

Financial information | | | | | |

Total revenues and other income3) | 622.7 | 634.5 | 718.2 | 670.0 | 529.9 |

Net operating income | 109.5 | 155.5 | 206.6 | 211.8 | 137.3 |

Net income | 22.0 | 39.2 | 69.5 | 78.4 | 37.6 |

Non-current finance debt | 205.1 | 165.5 | 101.0 | 111.6 | 99.8 |

Net interest-bearing debt before adjustments | 89.2 | 58.0 | 39.3 | 71.0 | 69.5 |

Total assets | 986.4 | 885.6 | 784.4 | 768.6 | 643.3 |

Share capital | 8.0 | 8.0 | 8.0 | 8.0 | 8.0 |

Non-controlling interest | 0.4 | 0.5 | 0.7 | 6.2 | 6.9 |

Total equity | 381.2 | 356.0 | 319.9 | 285.2 | 226.4 |

Net debt to capital employed ratio before adjustments | 19.0% | 14.0% | 10.9% | 19.9% | 23.5% |

Net debt to capital employed ratio adjusted | 20.0% | 15.2% | 12.4% | 21.1% | 25.5% |

Calculated ROACE based on Average Capital Employed before adjustments | 2.7% | 11.3% | 18.7% | 22.1% | 12.6% |

| | | | | | |

Operational information | | | | | |

Equity oil and gas production (mboe/day) | 1,927 | 1,940 | 2,004 | 1,850 | 1,888 |

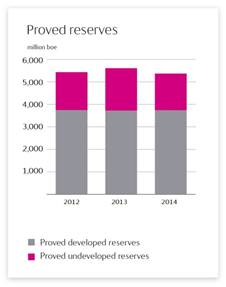

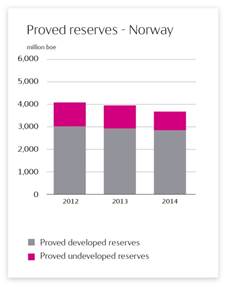

Proved oil and gas reserves (mmboe) | 5,359 | 5,600 | 5,422 | 5,426 | 5,325 |

Reserve replacement ratio (three-year average) | 0.97 | 1.15 | 1.01 | 0.90 | 0.60 |

Production cost equity volumes (NOK/boe, last 12 months) | 49 | 44 | 42 | 42 | 38 |

| | | | | | |

Share information | | | | | |

Diluted earnings per share NOK | 6.87 | 12.50 | 21.60 | 24.70 | 11.94 |

Share price at Oslo Stock Exchange on 31 December in NOK | 131.20 | 147.00 | 139.00 | 153.50 | 138.60 |

Dividend paid per share NOK 1) | 7.20 | 7.00 | 6.75 | 6.50 | 6.25 |

Dividend paid per share USD 2) | 0.97 | 1.15 | 1.21 | 1.08 | 1.07 |

Weighted average number of ordinary shares outstanding (in thousands) | 3,179,959 | 3,180,684 | 3,181,546 | 3,182,113 | 3,182,575 |

| | | | | | |

(1) | See Shareholder information section for a description of how dividends are determined and information on share repurchases. The board of directors will propose the 2014 dividend for approval at the Annual General Meeting scheduled for 19 May 2015. |

(2) | USD figure presented using the Central Bank of Norway 2014 year-end rate for Norwegian kroner, which was USD 1.00 = 7.43 NOK. The board of directors will propose the 2014 dividend for approval at the Annual General Meeting scheduled for 19 May 2015. |

(3) | Total revenues and other income for 2013 and 2012 are restated. See note 2 Significant accounting policies to the Consolidated financial statements for further details. |

4 Statoil, Annual Report on Form 20-F 20142016

Dear fellow shareholder, |

Safety and security is our top priority in Statoil. And while 2016 was a year of many achievements, we also experienced the worst thinkable. We had a contractor fatality during construction work in South Korea, and on 29 April we lost 13 colleagues when a helicopter crashed on its way from Gullfaks B to Bergen. For the year as a whole, our serious incident frequency came in at 0.8, an increase from the two previous years. We are not satisfied with this development and have taken several steps to reinforce safety measures throughout the company. In 2016, we saw oil prices below USD 30 per barrel and while prices increased towards the end of the year, our average realised liquids price was still below USD 40 per barrel for the year as a whole. We delivered our cost improvement programme above target. The next step will be to go from project mode to a culture of continuous improvement, and we have set a target of achieving USD 1 billion in additional cost improvements in 2017. By reworking solutions from reservoir to market, we have transformed our opportunity set. The break-even price for our “Next generation” portfolio of projects (those sanctioned since 2015 or planned for sanction with start up by 2022), is now at USD 27 per barrel of oil equivalent (boe). Organic capex for 2016 was USD 10.1 billion, a USD 3 billion reduction from the original guiding. Production for the full year was 1,978 mboe per day, a slight increase from 2015 due to continued high production efficiency and despite high turnaround activity. Our reserve-replacement ratio (RRR) was 93%. “High value, low carbon” is at the core of our sharpened strategy. We believe the winners in the energy transition will be the producers which can deliver at low cost and with low carbon emissions. | Statoil is pursuing a distinct and value-driven strategy: ·On the Norwegian continental shelf (NCS) we have a unique position which we will leverage further to build our future business and maximise value ·In our international upstream business, we will focus, deepen and explore further. Brazil is a core area for us, together with our position in the highly flexible US onshore business ·For the Marketing, Midstream and Processing (MMP) business area, the job is to secure flow assurance by accessing premium markets and strengthening asset-backed trading, based on a ‘capex light’ approach ·In the New Energy Solutions (NES) business area, we are building a profitable business with the long-term potential to account for 15-20% of our capex in 2030, provided that we can access and mature attractive opportunities Our commitment to long-term sustainable value creation, is in line with the principles of the UN Global Compact. We believe a low carbon footprint will make us more competitive in the future. We also believe there are attractive business opportunities in the transition to a low-carbon economy. Statoil intends to be part of this transformation in order to fulfil our purpose of turning natural resources into energy for people and progress for society. Our Climate roadmap explains how we plan to achieve this and how we will develop our business, supporting the ambitions of the Paris climate agreement. I look forward to further strengthening Statoil in 2017, pursuing the priorities set out at our Capital markets update: resetting our cost base, transforming our opportunity set and continuing to chase improvements. We have sharpened our strategy as an energy company towards 2030, and are ready to capitalise on high-value opportunities. Eldar Sætre President and Chief Executive Officer Statoil ASA |

Statoil, Annual Report on Form 20-F 20165

STATOIL AT A GLANCE

Our history

The company was founded as The Norwegian State Oil company (Statoil) in 1972, and became listed on the Oslo Børs (Norway) and New York Stock Exchange (US) in June 2001. Statoil merged with Hydro`s oil and gas division in October 2007.

Statoil is an international energy company with operations in over 30 countries. We are headquartered in Stavanger, Norway with approximately 20,500 employees worldwide. We create value through safe and efficient operations, innovative solutions and technology. Statoil’s competitiveness is founded on our values-based performance culture, with a strong commitment to transparency, cooperation and continuous operational improvement.

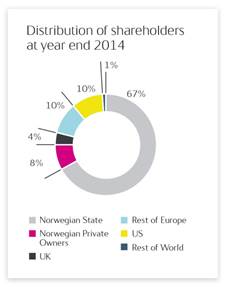

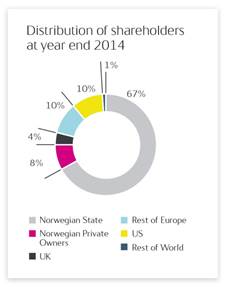

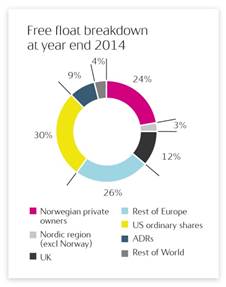

Our shareholders

The Norwegian State is the largest shareholder in Statoil, with a direct ownership interest of 67%. Its ownership interest is managed by the Norwegian Ministry of Petroleum and Energy. US investors hold 9.6%, Norwegian Private owners hold 8.9%, other European investors hold 7.1%, UK investors hold 5.1% and others hold 1.5%.

Our business areas

We have eight business areas:

·Development and Production Norway

·Development and Production International

·Development and Production USA

·Marketing, Midstream and Processing

·Technology, Projects and Drilling

·Exploration

·Global Strategy and Business Development

·New Energy Solutions

Our strategy

Statoil is an energy company committed to long-term value creation in a low carbon future. Statoil will develop and maximise the value of its unique Norwegian continental shelf position, its international oil and gas business and its growing new energy business; focusing on safety, cost and carbon efficiency. Statoil is a values based company where empowered people collaborate to shape the future of energy.

Our values

Open, Collaborative, Courageous and Caring.

Our dividend policy

It is Statoil's ambition to grow the annual cash dividend, measured in USD per share, in line with long term underlying earnings. Statoil announces dividends on a quarterly basis. In May 2016, the annual general meeting approved the introduction of a two-year scrip dividend programme commencing from the fourth quarter of 2015.

6Statoil, Annual Report on Form 20-F 2016

Key figures and highlights

(in USD million, unless stated otherwise) | For the year ended 31 December |

2016 | 2015 | 2014 | 2013 | 2012 |

| | | | | | |

Financial information4) | | | | | |

Total revenues and other income3) | 45,873 | 59,642 | 99,264 | 108,318 | 123,660 |

Net operating income | 80 | 1,366 | 17,878 | 26,572 | 35,808 |

Operating expenses | (9,025) | (10,512) | (11,657) | (12,669) | (10,467) |

Net income | (2,902) | (5,169) | 3,887 | 6,713 | 12,234 |

Non-current finance debt | 27,999 | 29,965 | 27,593 | 27,197 | 18,137 |

Net interest-bearing debt before adjustments | 18,372 | 13,852 | 12,004 | 9,542 | 7,057 |

Total assets | 104,530 | 109,742 | 132,702 | 145,572 | 140,921 |

Share capital | 1,156 | 1,139 | 1,139 | 1,139 | 961 |

Non-controlling interest | 27 | 36 | 57 | 81 | 121 |

Total equity | 35,099 | 40,307 | 51,282 | 58,513 | 57,468 |

Net debt to capital employed ratio before adjustments | 34.4% | 25.6% | 19.0% | 14.0% | 10.9% |

Net debt to capital employed ratio adjusted | 35.6% | 26.8% | 20.0% | 15.2% | 12.4% |

Calculated ROACE based on Average Capital Employed before adjustments | (4.7%) | (8.9%) | 3.4% | 11.3% | 18.7% |

| | | | | | |

Operational information | | | | | |

Equity oil and gas production (mboe/day) | 1,978 | 1,971 | 1,927 | 1,940 | 2,004 |

Proved oil and gas reserves (mmboe) | 5,013 | 5,060 | 5,359 | 5,600 | 5,422 |

Reserve replacement ratio (annual) | 0.93 | 0.55 | 0.62 | 1.28 | 0.99 |

Reserve replacement ratio (three-year average) | 0.70 | 0.81 | 0.97 | 1.15 | 1.01 |

Production cost equity volumes (USD/boe) | 5.0 | 5.9 | 7.6 | 7.5 | 7.2 |

| | | | | | |

Share information1) | | | | | |

Diluted earnings per share USD | (0.91) | (1.63) | 1.21 | 2.14 | 3.80 |

Share price at Oslo Børs (Norway) on 31 December in NOK | 158.40 | 123.70 | 131.20 | 147.00 | 139.00 |

Dividend per share USD 2) | 0.88 | 1.07 | 0.97 | 1.15 | 1.21 |

Weighted average number of ordinary shares outstanding (in thousands) | 3,194,880 | 3,179,443 | 3,179,959 | 3,180,684 | 3,181,546 |

| | | | | | |

1) | See section 5.1 Shareholder information for a description of how dividends are determined and information on share repurchases. |

2) | Proposed cash dividend for the second quarter of 2016. From and including the third quarter of 2015, dividends were declared in USD. Dividends in previous periods were declared in NOK. Figures for 2015 and earlier periods are presented using the Central Bank of Norway year end rates for Norwegian kroner. |

3) | Total revenues and other income for 2013 and 2012 are restated. |

4) | On 1 January 2016 Statoil changed its presentation currency from Norwegian kroner (NOK) to US dollar (USD), mainly in order to better reflect the underlying USD exposure of Statoil’s business activities and to align with industry practice. Comparative figures have been represented in USD to reflect the change. For further details, reference is made to Note 26 Change of presentation currency to the Consolidated Financial Statements. |

Statoil, Annual Report on Form 20-F 20167

2About the report

This document constitutes the Annual report on Form 20-F in accordance with the US Securities and Exchange Act of 1934 applicable to foreign private issuers. A cross reference to the Form 20-F requirements are set out in section 5.10 in this report. The Annual report on Form 20-F and other related documents are filed with the US Securities and Exchange Commission (the SEC).

Financial reporting terms used in this report are in accordance with International Financial Reporting Standards (IFRS) as adopted by the European union (EU) and also comply with IFRS as issued by the International Accounting Standards Board (IASB), effective at 31 December 2016. This document should be read in conjunction with the cautionary statement in section 5.7 Forward-looking statement.

The Statoil Annual report and Form 20-F may be downloaded from Statoil’s website at [Statoil.com/annualreport2016]. No other material on Statoil’s website forms any part of such document. References to this document or other documents on Statoil’s website are included as an aid to their location and are not incorporated by reference into this document. All of the SEC filings made available electronically by Statoil may be obtained from the SEC at 100 F Street, N.E., Washington D.CC. 20549, United States or on the SEC’s website at www.sec.gov.

8Statoil, Annual Report on Form 20-F 2016

2.1 Strategy and market overview

Our strategy for value creation and long-term growth remains firm. However, the profitability of the oil and gas industry continues to be challenged and Statoil’s financial results in 2014 were influenced by the fall in oil prices. Stricter project prioritisation and a comprehensive efficiency programme are showing progress and will improve cash flow and profitability. Our strong financial position provides a firm basis on which to balance capital investment and dividends to shareholders, which we expect to grow in line with our long term earnings.

Last year we outlined the plan to strengthen Statoil’s competitiveness, and we now reinforce our efforts and commitment to deliver on our priorities of high value growth, increased efficiency and competitive shareholder returns. Through our significant flexibility in our investment programme we believe we are well prepared for potential sustained market volatility and uncertainty.

Statoil’s ambition to reduce costs and improve efficiency was presented at the capital markets update (CMU) on 7 February 2014, targeting annual savings of USD 1.3 billion from 2016. At the CMU on 6 February 2015, Statoil announced that it will step up its efficiency programme by 30% with a

goal to realise USD 1.7 billion in annual savings from 2016.

Improvement programmes are Statoil’s response to the industrial challenges characterised by escalating cost and declining returns. More specifically, the ambition is to realise positive production effects and cost savings to improve Statoil’s financial results and cash-flows.

These forward-looking statements reflect current views about future events and are, by their nature, subject to significant risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. See the section Forward-Looking Statements for more information.

2.1 OurStatoil’s business environment

2.1.1 Market overview

Global2016 was another year of sub-par growth, with global economic GDP growth picked up only marginallyeasing from 2.6% to 2.3%. This was largely driven by the slowdown in 2014, to 2.7%OECD economies, with non-OECD economies gaining momentum over the year. In the United States, consumer spending remained healthy, but investment contracted and resulted in GDP growth decelerating from 2.6% in 2013. Growth2015 to 1.6%. Economic expansion continued at a moderate pace in OECD has been gaining momentum, driventhe Euro-zone at 1.7%, supported by the United States. Non-OECD activity slowed in 2014, but remains decentprivate consumption and supportive of overall economic growth and energy demand.

While growthhigher employment. The economy in the United States andKingdom held up well despite the United Kingdom has strengthened as laborEU Leave vote, while in contrast Japan logged relatively modest growth. Emerging markets heal and monetary policy remains very expansive,maintained their growth rate from 2015, partly due to Russia heading towards economic recovery during the recovery has been hesitant inyear. 2016 saw China's growth stabilise due to intensified stimulus efforts amidst the Eurozone and Japan. Growth in emerging countries slippedcontinued slowdown since 2012, caused by economic rebalancing. India’s GDP growth rate eased to 4.2% in 2014, reflecting both weak external demand and domestic challenges. China is still growing at a healthy pace, but continues6.6% on an intended paththe sudden demonetarisation of gradual deceleration.

large currency notes that hampered consumption. Several major forces are at play in the global economy and will continue to affect demand: softdemand, including relatively low commodity prices; persistentlyprices, low interest rates, alongside increasingly divergent monetary policies across major economies,increased policy uncertainty and weak world trade. In particular, the sharp decline in oil prices since mid-2014 has supported global economic activity and will continue to do so in 2015.

Continued recovery in the United States, a gradual acceleration of activity in the Eurozone, and receding headwinds to growth among slower-growing emerging economies are expected to lift global growth in 2015 to 3%, according to Statoil’s own research. This rate, which is in line with historic trend growth, is likely to be sustained over the next 10 years, comprising 2% annual growth in the OECD economies and 5% annual growth in non-OECD economies. This means that the globally weighted, geographical point of economic gravity continues to move gradually eastwards and southwards relative to the OECD economies in Europe and North America.

The growing populations in emerging economies represent a strong long-term driver of economic development and energy demand. Global oil demand grew by 0.7a healthy 1.5 mmbbl per day in 2014. A slowdown2016. Production from non-Opec countries reacted to lower prices and declined by 0.9 mmbbl, with most of the decline taking place in Chinese oil demand growthNorth America and weaker fundamentals in Europe and Japan were the main reasons behind the five-year low result. Statoil's research suggests that the annual growth in oil demand will averageChina. However, Opec added 1.1 mmbbl per day over the medium-term. Positive growthto production. This resulted in non-OPEC supply, in particular from North America, tight oil and other liquids, will continue to putan oversupplied market throughout 2016, with storage levels moderately increasing.

The first half of 2016 saw a downward pressure ontrend in gas prices, while OPEC maintains its production of 30 mmbbl per day. The weakening of the fundamentals in global oil marketswhich reflected both market balance and the slow recovery of the OECD economies and emerging markets are expected to continue to affect markets in 2015.surrounding competitive fuels. However, prices below USD 50/bbl are expected to lead to a significant reduction in shale oil production growth and the building of global commercial oil stocks will turn to stock draws in the second half of 2015.

Due2016, markets have strengthened due to a general increase in energyrebounding commodity market and demand and the competitiveness ofresponding to weak gas in terms of cost and environmental effects, global gas demand is expected to grow. However, the increase in demand will be impacted by energy and climate policies in key regions and countries. Statoil's research suggests that gas demand will increase by 1% and 2% in Europe and in North America, respectively, during the rest of the current decade, whereas Asia will see a growth of 5%prices in the same period. Both Europe and Asia will have to depend on importsfirst half of LNG, which will help sustain a robust price level. In North America, where

a revolution in the shale industry has led to increase in proved reserves and production rates have led to historically low prices, prices are expected to gradually increase as the market situation normalises, though the level will remain below that of European and Asian gas prices.

Statoil, Annual Report on Form 20-F 20145

The global economic situation continues to be fragile, with development partly driven by uncertain political environments in key countries and regions, in addition to normal supply and demand factors. Consequently, energy prices could continue to fluctuate considerably in the short to medium-term.

Production to reserve growth continues to remain a key challenge for international oil companies. Balancing the need for short-term production growth with long-term reserve growth is key for long-term success. We believe Statoil's production development is competitive, but industry challenges exist. Increasing competition, tighter fiscal conditions, and high costs pose challenges to accessing new profitable resources. It is anticipated that international oil companies, including Statoil, will pursue a number of measures as a response. Some examples include seeking to diversify portfolios across multiple resource types (onshore and offshore, conventional and unconventional), increasing exploration activities, engaging in active portfolio management, and seeking to improve the profitability of projects and existing assets through cost efficiency programmes.

Going forward, upward pressure on capital and operational expenditures is still expected as companies combat the decline of legacy fields and tackle increasing technical challenges when developing new fields, even if adjustments in the industry undertaken as a response to lower prices could modify this pressure somewhat over the medium-term. Companies that are at the forefront of efficient resource management, as well as the effective development and utilisation of new technology, will be best equipped to meet these challenges.2016.

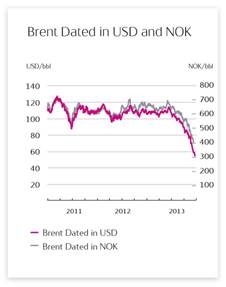

2.1.2 Oil prices and refining margins

After moreHigher than three years of relatively stable prices, 2014 sawusual volatility characterised the oil market in 2016 as it did in the previous year, with the price of dated Brent crude climb tomoving in a range between USD 11526 per barrel in June before dropping to USD 55 per barrel at the end of December. Refinery margins increased due to declining crude prices during the second half of the year.barrel.

Oil prices

The oil market is generally volatile and has been highly volatile since June 2014. The average price for dated Brent crude in 20142016 was USD 98.95/bbl,43.7 per barrel, down almost USD 10/bbl10 per barrel from 2013. Prices fluctuated between approximately USD 106/bbl and approximately USD 110/bbl from January to June, when they increased to an annual high of USD 115.31/bbl in mid-June. From here2015. The dated Brent oil price started the prices fell steadily down to USD 100/bbl in mid-August. Here the price hovered for a couple of weeks before breaking through the temporary floor of USD 100/bbl early September and falling steadily to approximately USD 77/bbl in late November. The 166th annual OPEC meeting was held on 27 November and gained a lot of attention. The decision not to cut OPEC production immediately sent the prices downwards, the Brent price endedyear on a 5 yeardownward trajectory and hit a low of USD 54.98/bbl on 31 December.26 per barrel in the second half of January. Positive market sentiment driven by healthy demand growth and significant supply disruptions pushed the price of dated Brent up to around USD 50 per barrel by the end of second quarter. The return of disrupted volumes during the summer and signs of weakening demand growth sent prices down again towards USD 40 per barrel early in August. The price of dated Brent recovered somewhat again in the third quarter after Opec and Russia agreed to come up with a plan to freeze or cut their production. The Opec meeting in late November concluded with an agreement among the members to cut joint output by 1.2 mmbbl per day effective 1 January 2017, alongside a non-Opec cut of around 0.6 mmbbl per day. The immediate effect of this announcement was an increase in the dated Brent price towards USD 53 per barrel. The futures market for Brent at the Intercontinental Exchange (ICE) was generally in backwardation up until early July when the situation shifted into contango where it remained for the rest for the year. See the section Terms and definitions for further details.throughout 2016.

The priceOver the course of 2016, North American tight oil has provided the largest share of non-Opec declines that offset continued growth in Opec production. While US WTI crude, as quoted atshale production has been in decline over much of the Cushing tank farmpast two years, productivity gains and cost reductions have accelerated, planting the seeds of future growth. Specifically, enhanced completions and extended-reach laterals have allowed producers to do more with less. Nowhere is this more evident than in Oklahoma, averaged USD 93.28/bbl in 2014, down approximately USD 3/bbl from 2013. The pricethe Permian basin of West Texas. As oil prices have increased from USD 95.57/bbl atduring the beginningcourse of the year, the Permian has recorded the largest rebound in drilling rigs. At current levels, the Permian basin is home to USD 103.72/bbl in mid-February. The price fluctuated around USD 100/bbl through May before following the increasing Brent in June when rising sharply to USD 107.53/bbl. From here the pricealmost 50% of WTI fell, and while following the Brent price downwards the decrease was periodically slower, closing the differential between WTI and Brent. The WTI price halted at a temporary floor in mid-August at a level around USD 95/bbl, before breaking through and falling rapidly with the Brent towards year-end. On 31 December the WTI price was at USD 53.05/bbl, with approximately USD 2/bbl differential to Brent

Geopolitically, the unrest in Libya continued to play a part in 2014. Political instability and frequent attacks onall oil installations by local militia led to production outages during the first half of the year. Political tension in the Ukraine in March and April led to an upward pressure on oil prices due to uncertainty. The EU and the US later imposed sanctions on Russia for their invasion of the Ukraine. In mid-June the jihadist rebel group ISIS bombed the Kirkuk-Ceyhan pipeline in Northern Iraq, marking the start of a campaign that would last throughout 2014. This fuelled concerns for supply disruptions from Iraq. As these fears receded the prices fell during late summer.

The growth in shale oil productionrigs in the US, came asup from 30% in early 2013. From a surprise to the market and during the third quarter it became clear that there was a growing supplypricing perspective, declining production, an abundance of oil. The paper market of crude oil saw investors leaving in an attempt to secure profit,infrastructure, and the pressure subsequently transferred to the physical market. Refinery maintenance in most regionslifting of the world coincided incrude export ban have caused most North American grades to price close to their technical refining values, reflective of the ongoing de-bottlenecking of US onshore crude pipeline infrastructure. These narrow differentials relative to global waterborne crudes have caused rail loadings to fall precipitously with all indications being that quarter, reducing demand for crude. The concerns over China’s new policies affecting demand growth materialized. The growth in Europe was still slow and with some countries on the borderline of recession there was not much support for the oil price. Oil producing and exporting countries were lookingthis trend is set to OPEC to intervene and cut their production in order to stabilize the price, but at the meeting in November, OPEC decided to maintain their current production and the prices continued their free fall. OPEC’s decision to let the market set the price of crude oil marked the change of a 30-year old price regime that may lead to higher volatility in crude pricescontinue in the years to come.

The US market was not immune to global oil market dynamics during 2014. Just as Brent crude declined significantly since peaking in June, WTI suffered similar declines. However, due to increased pipeline capacity between Cushing, OK and the US Gulf Coast, Cushing crude stocks declined significantly over 2014, leading to a narrower differential between WTI and Brent. Additional pipeline capacity entering the market in 2014 continued to ease the pipeline logistics constraints between northern US and West Texas producing areas and coastal demand regions. While there were no fundamental change in the US government’s stance regarding crude exports, crude and condensate exports, primarily to Canada, increased to levels not seen since the 1980s. These exports provided a welcome relief for producers seeking access to higher value waterborne crude markets.ahead.

Refinery margins

Refinery margins in Northwest Europe, as calculated against dated Brent2016 was a solid year for European refinery margins. Through 2015, a surplus of crude were rather weak during the first quarter. This was due in partoil had been converted to a mild winter. There was also specific strengthsurplus of products, incentivised by strong margins. By early 2016, diesel stocks were building fast and diesel margins were low. Refineries then shifted to maximise gasoline output, in the Brent market caused by trade in Forties crude,expectation of a component in the Brent, Forties, Oseberg, Ekofisk (BFOE) system that sets dated Brent. Refineries saw better margins from Russian Urals crude. Margins stayed rather weakstrong summer gasoline market. However, summer gasoline demand disappointed, leading to stocks building and sharply falling gasoline margins. Weak product prices through the secondsummer led to constrained refinery throughput and supported demand. By the fourth quarter, due to anthe gasoline market rebalanced and diesel stocks fell

6Statoil, Annual Report on Form 20-F 20142016 9

overflow of diesel imports from Russia and the US Gulf. On the other hand, naphthaagain. This caused refinery margins were quite strong on export opportunities into Asia. In the third quarter, margins improved significantly, mainly driven by gasoline. This wasto improve again in particular caused by a lack of octane components, some of which had been exported separately to China. Also, the physical Brent market started to weaken, and price differentials for other crudes came off vs. Brent. These factors continued into the fourth quarter, resultingquarter. The average margin for an upgraded refinery in margins above normalNorth West Europe was solid and in November. A major reason for this strength was that China ran its vast refining capacity at low utilization rates. They seemed to run only to cover domestic diesel demand, which was stalling. That allowed for exports from Europe for lighter products like gasoline, naphtha and LPG, for which there was demand growth. Europe saw two new refinery closures, one in Italy and one in the UK. European diesel demand was strong, partly due to an upcoming shift from heavy fuel oil to diesel as shipping fuel in the North Sea and Baltics from

1 January 2015. Stationary fuels like heating oil and heavy fuel oil experienced further declines.line with 2014, but well below 2015 margins.

2.1.3 Natural gas prices

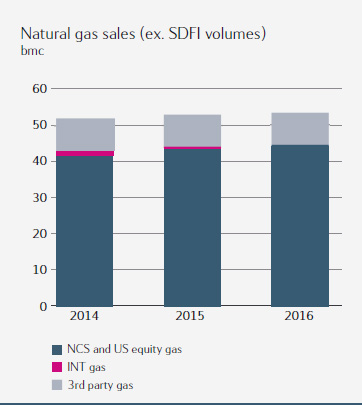

Natural gas prices declined throughout 2015 but stabilised in Europe have fallen in 2014 asthe second quarter of 2016. The fourth quarter of 2016 experienced a result of weak demand and a healthy supply picture boosted by increased LNG availability,robust price recovery due to consumption growth in Asia and Europe. Henry Hub experienced its lowest annual price in over a weakened Asian Spot LNG market. In North America prices in 2014 averaged 17% higher than in 2013.decade through 2016.

Gas prices -– Europe

The European natural gas price level was 20% lowerNBP prices fell from an average of USD 7.5/MMBtu in 2014 as prices averaged USD 8.2/mmbtu comparedfirst quarter 2015 to USD 10.3/mmbtu5.4/MMBtu in 2013. Gas consumptionfourth quarter 2015. The decline continued in EU28 declined by 12%. Domestic European production excluding Norway fell from 152 bcmfirst quarter 2016, averaging USD 4.3/MMBtu, before falling to 137 bcm.a decade low of USD 3/MMBtu in August 2016. Since August’s low point, average monthly prices have strengthened, closing 2016 at USD 6.2/MMBtu and resulting in an annual 2016 average of USD 5/MMBtu.

Norwegian pipeline exportsEU gas consumption continued to grow in 2016 as power generation responded to higher priced coal and outages of nuclear reactors in France. Furthermore, heating demand has responded to a more normal European weather pattern. EU indigenous gas production held at a record low of 125 bcm as the Dutch government revised the production limit at the Groningen field down to 24 bcm. European imports from Russia were at 102a record high of 179 bcm roughly the same as last year. Total European LNGand imports (Turkey and Israel excluded)from Norway were with 53 bcm at the same record level as last year's imports. The levelin 2015, 108 bcm. Record levels of re-exports increasedpipeline imports have been encouraged by 63%. Total liquefaction was at 329 bcma small downturn in line the production seen in the past 3 previous years. The demand growth in Asian countries, which only resulted in a marginal increase in import of LNG is no longer strong enoughdeliveries to offset the declining consumption trend in Europe. A possible restart of some Japanese nuclear power plants this year could further weaken Asian demand growth.LNG supplies into North Western Europe have diminished, whilst imports into Southern Europe remain constant.

Further increase in renewable power generation capacity impacted the power markets and gas-to-power demand fell. However, the gas-to-power segment is now close to a floor minimum level.

Gas prices - North America

Supply growth has been a regular feature of the natural gas market in recent years, but in 2014 demand was able to absorb that supply, keeping storage below normal levels. Average cashGas prices were boosted to overvolatile in 2016, falling below USD 4/mmbtu for the first time since 2010.

The race between demand and supply growth favored demand2/MMBtu early in 2014, but shifted toward supply for the remainderyear, before rising above USD 3/MMBtu at the end of the year. Production growthThe Henry Hub average of USD 2.4/MMBtu was the fastestlowest annual price in years,over a decade, down from USD 2.6/MMBtu in 2015 largely as 34 bcm was added ata result of oversupply. US gas producers responded to the wellhead. South Marcellus became the fastest growing supply basin. Cold weather in the first quarter started the year on a bullish note, driving Henry Hubfalling prices above USD 5/mmbtu and lowering inventoriesby withdrawing rigs to the lowest level in decades. Gas production fell throughout the year as a decade. Once the winterresult. Demand for gas was over, supply growth and rebuilding stocks were the main story for 2014.

The trends of 2014 continued into 2015,strong in 2016, with a weak start, with strong supply and inventories close to normal at the start of the year. By 2016 and later this decade a number of factors are expected to be more bullish: LNG export projects are expected to start up,natural gas should make gains at coal's expensereplacing coal in the power sector industrial demand is expectedand LNG exports starting from the Gulf Coast.

Global LNG prices

LNG prices fell throughout 2015 from an average of USD 7.3/MMBtu in first quarter 2015 to riseUSD 4.5/MMBtu in first quarter 2016, but stabilised in second quarter of 2016 at an average of USD 4.9/MMBtu. The second half of 2016 experienced robust price recovery to average USD 8/MMBtu in fourth quarter 2016, largely due to consumption growth in Asia and the supply side will need to turn to incrementally higher cost reserves. North American gas prices are expected to appreciateMiddle East, further intensified by lower-than-expected ramp-up of new LNG facilities as a result, though remaining below Asian and European levels.well as unplanned outages.

2.2 OurStatoil’s corporate strategy

Statoil aimsis an energy company committed to growlong-term value creation in a low carbon future. Statoil creates value by turning natural resources into energy for people and enhanceprogress for society. Statoil will develop and maximise the value throughof its technology-focused upstream strategy, supplemented by selective positions inunique NCS position, its international oil and gas business and its growing new energy business, focusing on safety, cost and carbon efficiency. Statoil is a values-based company where empowered people collaborate to shape the midstream and in low-carbon technologies.future of energy.

Statoil's top priorities remain to conduct safe and reliable operations with zero harm to people and the environment, and to deliver profitable production growth through disciplined investments and prudent financial management with competitive redistribution of capital to shareholders. To succeed going forward we continue to focus strategically on the following:in turning Statoil’s vision into reality, Statoil pursues a strategy to:

· Sustaining leading exploration company performanceDeepen and prolong the NCS position

· Taking out the full value potential of the Norwegian continental shelf (NCS)

·Strengthening our global offshoreGrow material and profitable international positions

· Maximising the value of our onshore positionsProvide energy for a low-carbon future through growth in New Energy Solutions (NES)

· Creating enhanced value from midstream solutions

·Continuing portfolio management to enhance value creation

·Utilising oilFocused and gas expertisevalue-adding mid- and technology to open up new renewable energy opportunities

Statoil, Annual Report on Form 20-F 20147

Sustaining leading exploration company performance

Results from the 2014 exploration programme are a product of our focus on three exploration strategy pillars:

·Early access at scale: We focused on accessing frontier acreage over the last few years and have been an early mover in several areas. In 2014, we accessed significant acreage positions in Algeria, Australia, Colombia, New Zealand and Norway; access to new acreage in Myanmar and New Zealand are pending final approval from the respective host governments.

·Deepen core positions: We secured more acreage in potential clusters such as Brazil, the US Gulf of Mexico, and the UK continental shelf, where Statoil was awarded 12 licences. On the NCS, we continue to deepen our position by acreage Award in the Predefined Areas (APA) and to test new opportunities and maintain high focus on growth and infrastructure lead exploration (ILX) wells with significant potential.

·Drill significant targets: We continued to focus on drilling large targets, leading to the Piri-1 discovery, the fifth high-impact discovery and seventh overall in Tanzania’s Block 2.

The exploration collaboration with Rosneft in Russia has continued. Sanctions have affected the progress of our projects, however we are in continuous dialogue with authorities to ensure that we remain sanctions compliant. See section Risk review – Risk factors – Risk related to our business for further details.

To sustain leading exploration performance long-term, we aim to deepen positions in prolific basins, actively pursue play-opening opportunities, and balance a continued high activity level with selective access and focus on efficiency and capital discipline.

Taking out the full value potential of the Norwegian continental shelf (NCS)

The NCS remains a prolific and productive oil and gas province where only half of the resources have been produced.

In 2014 Statoil began production from the Gudrun field and three fast track projects (Svalin, Fram H-Nord and Vilje Sør). Valemon came on stream in the North Sea on 3 January 2015. We submitted the Plan for Development and Operations (PDO) of the Gullfaks Rimfaksdalen project in December 2014 and of the Johan Sverdrup project in February 2015. Over the next ten years, Statoil aims to bring on stream new production from a combination of:

·Developments of larger discoveries, including the Aasta Hansteen, Gina Krog, Gullfaks Rimfaksdalen, Johan Castberg and Johan Sverdrup projects, which are expected to contribute considerably to Statoil's future production.

·Developments of a number of smaller discoveries close to established infrastructure.

·Development of high value oil recovery (IOR) projects, delivering towards Statoil’s ambition of 60% average oil recovery on Statoil-operated NCS oil fields.downstream

In addition, Statoil will research, develop, and deploy technology to IOR, improving operational performancecreate opportunities and continued high production efficiency are measures to increaseenhance the value potential of Statoil’s operatedcurrent and future assets.

Strengthening our global offshore positionsDeepen and prolong the NCS position

Statoil's internationalFor more than 40 years, Statoil has explored, developed and produced oil and gas from the NCS. Statoil aims to deepen and prolong its position by accessing and maturing opportunities into valuable production. At the same time, Statoil plans to improve the reliability, efficiency and lifespan of fields already in production. The NCS represents approximately two thirds of Statoil’s equity production has increased from around 100,000 boe to around 740,000 boeat 1,235 mboe per day since the year 2000. Statoil has established a presence in a number of countries and built a strong portfolio of assets outside Norway. To further enhance the materiality of our international portfolio, we are focusing on potential offshore clusters. Clusters are areas that make a material contribution to total production and value creation, where Statoil holds operatorships and has a mix of assets in different stages of development, and where we possess considerable expertise, both below and above ground. Through the cluster focus, our goal is to achieve greater economies of scale, capture synergies and thereby increase profitability.

Our potential clusters are located in some of the most attractive basins in the industry, including:

·Brazil; where Peregrino is already operational. In the future, we will focus on further developing the Peregrino area and maturing our exploration portfolio. The PDO for the Peregrino Phase II project was submitted to Brazilian authorities in January 2015.

·Angola; where exploration potential remains and where we already have non-operated production. Statoil has taken a time-out in the Kwanza exploration drilling programme, as a consequence a rig contract was cancelled. Regarding non-operated production, the CLOV project (Block 17) was commissioned.

·Tanzania; which emerged as a new potential cluster in 2012, and where we made two additional discoveries in 2014. Planning of an LNG plant is being progressed with our partners.

·East Coast Canada; emerged as a new potential cluster in 2013 with two discoveries including the significant discovery Bay du Nord; further prospects will be tested in the Flemish Pass and adjacent areas. Statoil already has non-operated production in East Coast Canada.

·US Gulf of Mexico; where exploration potential remains and where we already have non-operated production. Investment decision was taken for the Stampede project located in the “Grand Canyon” region while oil and natural gas production started from the partner-operated Jack/St-Malo project.

Maximising the value of our onshore positions

Our onshore positions are dominated by our diverse unconventional resources portfolio in North America. It includes operated and non-operated leases in the shale gas and tight oil basins of Marcellus, Eagle Ford and Bakken in the US. In addition, we became the 100% owner and operator for two Kai Kos Dehseh (KKD) lease areas, Leismer and Corner, in the Athabasca region in Alberta, Canada after agreeing to swap oil sands assets with PTTEP in 2014. We postponed making an investment decision on the Corner expansion project.

2016.

810 Statoil, Annual Report on Form 20-F 20142016

Our priorities·Exploration: Statoil continues to be a committed NCS explorer across mature, growth and frontier areas. In 2016, Statoil participated in 14 exploration wells on the unconventional resources space include:NCS, resulting in 11 discoveries. Statoil was awarded 29 licenses in mature areas in Norway’s Awards for Predefined Areas (APA) 2016 round (result announced January 2017), 16 as operator and 13 as non-operating partner, and five licenses in frontier areas in Norway’s 23rd concession round, four as operator and one as partner

· Delivering a safeDevelopment: The Johan Sverdrup Phase 1 project is progressing in line with schedule. Production drilling started in the first quarter of 2016. Pre-sanction for Johan Sverdrup Phase 2 is scheduled for the first quarter of 2017. Statoil increased its equity interest in the UK part of the Utgard license and profitable production ramp-upsubmitted the Utgard Plan for Development and Operation (PDO) in the second quarter of 2016. The PDOs for Byrding and Trestakk were delivered and the PDO for Oseberg Vestflanken 2 was approved during 2016

· Taking careProduction: Gullfaks Rimfaksdalen came on-stream. Production started at Fram C, tied into existing infrastructure in the Fram and Troll area

Statoil has completed two share transactions resulting in a 20.1 per cent equity ownership in Lundin Petroleum AB. Lundin is our partner in several fields, including a 22.6% interest in the unitised Johan Sverdrup field development. Statoil also acquired 25% of Byrding.

By the communities we are entrustedend of 2016, Statoil had achieved CO2 emission reductions in excess of 1 million tonnes per year compared to a 2008 baseline on the NCS, primarily through better energy management and improved energy efficiency. Our 2020 target is to deliver 1.2 million tonnes of CO2 emission reductions compared to 2008. In August 2016, the Norwegian petroleum industry announced its ambition to implement CO2 reduction measures corresponding to 2.5 million tonnes on the NCS by 2030 compared to 2020. Statoil’s commitment is to deliver 2.0 million tonnes of this CO2 reduction target.

Grow material and profitable international positions

International oil and gas production represented approximately one third of Statoil’s equity production at 744 mboe per day in 2016. Statoil will continue to explore, develop, and produce oil and gas opportunities outside Norway to enhance Statoil’s upstream portfolio.

·Exploration: Statoil continues to explore internationally for oil and gas. Statoil participated in nine exploration wells internationally, of which three were discoveries, including the Baccalieu discovery in Canada. Statoil added exploration acreage in Brazil, Canada, New Zealand, Russia, the UK and the US Gulf of Mexico, accessed exploration acreage in Ireland and Turkey and entered two new countries, Mexico and Uruguay. A joint venture comprising Statoil, BP and Total was awarded Blocks 1 and 3 in the Saline Basin in Mexico, with Statoil as the operator.

·Development: Statoil strengthened its strategic partnership with Petrobras in Brazil. Construction progress continued as planned on Peregrino Phase II

· Leveraging rapid applicationProduction: Heidelberg and Julia production came on-stream in the US Gulf of Mexico and, along with operator BP and other partners, significant advances have been made towards the award of a licence extension for Azeri-Chirag Guneshli (ACG) in Azerbaijan. The In Salah southern fields in Algeria and the Corrib field in Ireland both had major ramp-ups in 2016

In Brazil, Statoil acquired a 66% interest in and became the operator license of BM-S-8, which contains a substantial part of the Carcará field. Operatorship was assumed and appraisal activities began on BM-C-33. In the US, Statoil increased its stake in the Eagle Ford field and assumed full operatorship. Statoil continued to focus its portfolio with a partial divestment of non-core Marcellus acreage and agreeing the sale of its oil sands business in Canada.

Provide energy for a low-carbon future

Statoil recognises that opportunities are increasingly available in producing low carbon energy.

In 2016 Statoil launched Statoil Energy Ventures, a USD 200 million venture capital fund dedicated to investing in attractive and ambitious growth companies in renewable energy. This fund made its first investments in United Wind Inc. and later in ChargePoint Inc., Convergent Energy and Power Inc. and Oxford Photovoltaics Ltd., and is continuing to evaluate market opportunities. Statoil has also continued to explore new technologybusiness opportunities in carbon capture and storage as well as other potential new energy markets.

·Development: The 402 MW Dudgeon Offshore Wind Park development started installation in the first quarter of 2016 and is expected to maximisebe fully commissioned by the fourth quarter of 2017

·Production: In 2016, Statoil signed a letter of intent to become operator of the Sheringham Shoal Offshore Wind Farm in January 2017; it currently produces from an installed capacity of 317 MW. Statoil has a 40% ownership stake of the Scira consortium which produces electricity from the Sheringham Shoal wind park

Statoil partnered with E.ON to develop the 385 MW Arkona wind farm offshore Germany, with start-up planned for 2019. In the US, Statoil was declared the provisional winner of the US government’s wind lease sale offshore New York, with a potential generation capacity of more than 1.8 GW.

Statoil will also start production from the world's first floating windfarm, Hywind Scotland, in the fourth quarter of 2017. Statoil's partner in the 30 MW project is Masdar, which acquired 25% of the project in January 2017. The project will also include an innovative battery storage solution, Batwind, which represents the company's first wind development with integrated energy storage.

Statoil, Annual Report on Form 20-F 201611

Statoil has delivered a feasibility study to the Norwegian government for part of a Norwegian carbon capture and storage (CCS) value chain. The scope has been to find commercial methods to inject CO2 volumes arriving via ship into an underground reservoir on the NCS. Statoil’s long experience with CO2 storage from Sleipner and Snøhvit has been valuable, finding commercial and technical means to store large volumes of third party CO2 in order to accommodate the world’s need for CCS solutions.

Focused and value-adding mid- and downstream

The prime objective for Statoil’s mid- and downstream activities is to process and transport its oil and gas production (including the Norwegian State’s petroleum) competitively to premium markets, securing maximum value realisation. The main focus is on:

·Safe and efficient operations

·Continuous improvement in operational regularity, HSE and costs

·Flow assurance and marketing of Statoil’s equity production (crude oil, natural gas, related products) and the State’s Direct Financial Interest (SDFI) volumes for maximum value creation

· High grading acreage holdingsUtilisation of the Asset Backed Trading model across commodities to strengthen current upstream positionscapture margin opportunities

· Demonstrating operational excellence and world class stakeholder managementMaintaining Statoil’s position as a leading European gas supplier

· Striving for seamless value chain integration and superior price realisationA capital lean asset structure

Creating enhanced value from midstream solutions

The dynamics of the gas markets in Europe are changing. There is a development towards a more liberalised market with new players and increased competition. Our European gas reserves are located close to the European markets, we have flexible production capabilities and transportation systems, and our commercial experience in gas sales and trading has a proved track record. This puts us in a unique position to take advantage of the evolving European gas markets.

·In the short-term, we are making considerable efforts to maximiseStrategic focus is directed at optimising the value of ourStatoil’s flexible Norwegian gas in this market.

·In the medium to long-term, we will continue to promote gas as an important part of meeting European objectives for energy securityproduction assets that supply Europe and emission reductions. We strongly believe that natural gas is the most cost-effective bridge to a low-carbon economy.

Beyond Europe, our plannedat Statoil’s midstream gas and liquids activities in North America, are progressing in step with the building of our upstream unconventional resources business. These activities encompass a mix of capacity commitments, ownership and/or operation of gathering, transportation and storage facilities,where Statoil’s onshore portfolio is developing. Statoil achieved strong marketing alliances and trading operations. They are considered important to meet our goals for flow assurance and margin capture.

Continuing portfolio management to enhance value creation

By being proactive, we intend to further enhance our portfolio in the years ahead, so that it will ultimately be more valuable, more robust and more sustainable towards 2050. The strategic focus in these endeavours will be to provide financial flexibility, access exploration acreage and unconventional resources, secure operatorships, build cluster positions, manage asset maturity, de-risk positions and demonstrate the intrinsic value of the portfolio.

Announced transactions in 2014 include the sale of interests in licences on the NCS to Wintershall, farming down a portion of our non-operated US southern Marcellus acreage to Southwestern, sale of a 10% interest in the Shah Deniz project and the South Caucasus Pipeline to BP and SOCAR and sale of the remaining interests in the Shah Deniz field and South Caucasus Pipeline to PETRONAS. These transactions further underpin our ability to release capital for profitable redeployment.

Utilising oil and gas expertise and technology to open new renewable energy opportunities

Growing demand for clean energy is creating new renewable and low-carbon technology business opportunities. Our core capabilities and expertise put us in a position to seize these opportunities in two specific areas: offshore wind and carbon value chains.

In 2014, we sanctioned the Dudgeon Offshore Windfarm off the coast of Norfolk, UK. In addition, we continued developing the proprietary Hywind floating offshore wind concept. Our ambition is to play an active role in reducing costs and making offshore wind profitable, ultimately without government subsidies or support.results across all commodities.

Developing competences within carbonResearch, development, and deployment of technology to unlock opportunities and enhance value chains represents a key opportunity for reducing carbon emissions and building new business models in the transition to a low carbon world. Statoil continues to build competence and experience in carbon capture, transportation, storage and utilisation by our engagements in the world-class Technology Centre Mongstad CO2 test site.

2.3 Our technology

We continuously develop and deploy innovative technologies to ensure safe and efficient operations and to deliver on our strategic objectives.

We believeStatoil believes that technology is a critical success factor in the business environment where we operate. In addition to requiring capital efficiency, this environment is characterised by a broad and complex opportunity set, stricter demands on our licence to operate and tougher competition. In this context, technology is increasingly important for resource access and value creation. OurStatoil’s technology development activities aim to increase access to new oil and gas resources at competitive cost, reduce field development, drilling and operating costs.

We utilise a range of tools forcosts, and CO2 and other greenhouse gas emissions. Statoil’s technology efforts focus on the development of new technologies where choice of tool is dependent on strategic importance of technology for us and our position related to Intellectual property. Our toolbox includes:

·In-house research and development (R&D)following priority areas:

· Collaborative development projects with our major suppliers

·Project related development as part of our field development activities

·Direct investment in technology start-up companies through our Statoil technology invest venture activities

·Invitation to open innovation challenges as part of Statoil Innovate

Statoil, Annual Report on Form 20-F 20149

Our track record demonstrates our ability to overcome significant technical challenges through the development and deployment of innovative technologies. Our technology strategy, "Putting technology to work", supports our business strategy and strengthens our position as a technology-driven upstream company. It is based on three main principles:

·Prioritising business-critical technologies

·Strengthening our licence to operate

·Expanding our capabilities

Prioritising business-critical technologiesBusiness-critical technologies: - in order to deliver on our strategic objectives we have increased our focus on upstreamUpstream technologies are prioritised, primarily in the areas of Exploration, Reservoir, and Drilling and Well.Well, and Subsea Production Systems. Statoil’s main focus has been on cost reduction, for example Statoil’s simplified subsea production concept Cap-XTM has been developed to enable possible future development projects in the Barents Sea

·Strengthening ourStatoil’s licence to operateoperate: -Statoil has strengthened its commitment to sustainability. For the oil & gas and new energy value chains, technology development is concentrated on increased energy efficiency for power generation and reduced CO2 emissions. For renewables, technological improvements to reduce cost in the areas of construction and maintenance for both fixed and floating offshore wind applications is a priority

·Expanding Statoil’s capabilities: Statoil continues its broader research efforts for both the oil and gas value chain and new value chains. Work is conducted both in-house and in collaboration with academia, research institutes and suppliers and through venture activities

·Capturing the value of digitalisation: Statoil is exploring the opportunities of digitalisation in the energy industry. In 2016, the focus has been determining the optimal approach to accelerate digitalisation to capture a greater value potential

At the capital markets update (CMU) on 7 February 2017, Statoil shared its sharpened strategy to respond to the changing business context. Geopolitical shifts, challenges in accessing new oil and gas resources, changing market dynamics, digitalisation and a global transition towards a low carbon economy are increasing uncertainty and volatility. This change in outlook drives the need to build a more resilient, diverse and option-rich portfolio, delivered by an agile organisation that embraces change and empowers its people. To deliver on the sharpened strategy and fulfill the strategic intent of “high value, low carbon”, Statoil will continue to build opportunities to optimise its portfolio around the following pillars:

·Norwegian continental shelf – Build on unique position to maximise and develop long-term value

·International Oil & Gas – Focus geographically to deepen core areas and develop growth options

·New Energy Solutions – Create a new material industrial position

·Midstream and Marketing – Secure market access and grow value creation through cycles

The following strategic principles guide Statoil in shaping a robust, balanced and distinct portfolio:

12Statoil, Annual Report on Form 20-F 2016

1.Cash generation capacity

Generating positive cash flows from operations, even at low oil and gas prices, in order to maintain our licencesustain dividend and investment capacity through the cycle.

2.Capex flexibility

Having sufficient flexibility in organic capital expenditure to operate we continuously focus on technologies for safe, reliablebe able to respond to market downturns and efficient operations. As part of our focus on sustainability issues we are committed to developing and implementing energy-efficient and environmentally sustainable solutions.avoid value destructive decisions.

3.Capture value from cycles

Expanding our capabilities - success in a highly competitive environment requiresEnsuring the ability and capacity to build on ouract counter-cyclically to capture value through the cycles.

4.Low-carbon advantage

Maintaining competitive advantages, stimulate innovationadvantage as a leading company in carbon efficient oil and takegas production, while building a long-term view on selected potentially high-impact technology ventures. Of particular importance is our collaborative way of working with partners and suppliers on a global basis.low carbon business to capture new opportunities in the energy transition.

In 2014 we qualified a record number of new technologies for internal use and implementation on our operating assets. In addition we met our target for implementation of proved technologies with high value creation impact across multiple assets.

2.4 Group outlook

OurStatoil’s plans address the current environment while continuing to invest in high-quality projects. We reinforce ourStatoil continues to reiterate its efforts and commitment to deliver on ourits priorities of high value growth,creation, increased efficiency and competitive shareholder return.

· Organic capital expenditures for 20152017 (i.e. excluding acquisitions, capital leases and other investments with significant different cash flow pattern), are estimated at around USD 1811 billion compared to USD 19.6 billion in 2014.

· Statoil willintends to continue to mature theits large portfolio of exploration assets and estimates a total exploration activity level atof around USD 3.21.5 billion for 2015,2017, excluding signature bonuses.bonuses

· Statoil expects to deliver achieve an additional USD 1 billion in efficiency improvements with pre-tax cash flow effects in 2017 for a total of around USD 1.74.2 billion from 2016.

· OurStatoil’s ambition is to maintain ROACE (Return on Average Capital Employed) at 2013 level adjusted for price and currency level, and to keep our the unit of production cost in the top quartile of ourits peer group.group

· For the period 2014 - 2016 – 2020, organic production growth is expected to come from new projects resulting in around 2%3% CAGR (Compound Annual Growth Rate) from a 2014 level rebased for divestments.

· The equity production development for 20152017 is estimated to be around 2% CAGR from a 20144-5% above the 2016 level rebased for divestments.

· Scheduled maintenanceactivity is estimated to reduce quarterly production by approximately 10 mboe per day in the first quarter of 2017. In total, maintenance is estimated to reduce equity production by around 4530 mboe per day for the full fiscal year 2015, of2017, which is lower than the majority is liquids.2016 impact

· Indicative PSA (Production Sharing Agreement) effecteffects from Production sharing agreements (PSA-effect) and US royalties are estimated to be around 160150 mboe per day in 20152017 based on an oil price of USD 6040 per barrel and 190165 mboe per day based on an oil price of USD 10070 per barrel.barrel

· Deferral of gas production to create future value, gas off-take, timing of new capacity coming on stream and operational regularity represent the most significant risks related to the foregoing production guidance.guidance

These forward-looking statements reflect current views about future events and are, by their nature, subject to significant risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. See theFor further information, see section 5.7 Forward-Looking Statements for more information. Statements.

10Statoil, Annual Report on Form 20-F 20142016 13

3Business overview2.2 BUSINESS OVERVIEW

3.1 Our historyHistory

O

n 18 September 1972, Statoil was formed in 1972 by a decision of the Norwegian parliament and listed on the stock exchanges in Oslo and New York in 2001.

Statoil was incorporated as a limited liability company under the name Den norske stats oljeselskap AS on 18 September 1972. AsAS. Being a company wholly owned 100% by the Norwegian State, Statoil's initial role was to be the government's commercial instrument in the development of the oil and gas industry in Norway.

In 2001, the company became a public limited company listed on the Oslo and New York stock exchanges, and it changed its name to Statoil ASA.

Statoil has grown Growing in parallel with the Norwegian oil and gas industry, which dates back to the late 1960s. Initially, ourStatoil’s operations werehave primarily been focused on exploration, development and production of oil and gas on the Norwegian continental shelf (NCS), as a partner..

InDuring the 1970s,1980s, Statoil commenced its own operations, made important discoveries and began oil refining operations, which have been of great importance togrew substantially through the further development of the NCS.

Statoil grew substantially in the 1980s through the development of large fields on the NCS (Statfjord, Gullfaks, Oseberg, Troll and others). Statoil also became a major player in the European gas market by securingentering into large sales contracts for the development and operation of gas transport systems and terminals. During the same decade, we wereStatoil was involved in manufacturing and marketing in Scandinavia and established a comprehensive network of service stations. This line of business was fully divested in 2012.

In 2001, Statoil was listed on the Oslo and New York stock exchanges and became a public limited company under the name Statoil ASA, 67% majority owned by the Norwegian State. Since 2000, our business has grown as a result ofthen, substantial investments both on the NCS and internationally. Our ability to fully realise the potential of the

NCS was strengthened through theinternationally, have grown our business. The merger with Hydro's oil and gas division on 1 October 2007.