UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 2020-F

SECURITIES EXCHANGE ACT OF 1934 OR x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20082010

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report ______________

For the transition period from to

Commission file number 1-14014

| CREDICORP LTD. |

(Exact name of registrant as specified in its charter) |

| BERMUDA |

| (Jurisdiction of incorporation or organization) |

| Of our subsidiary |

| Banco de Crédito del Perú: |

| Calle Centenario 156 |

| La Molina |

| Lima 12, Perú |

| (Address of principal executive offices) |

| Alvaro Correa |

| Chief Financial Officer |

| Credicorp Ltd |

| Banco de Crédito del Perú: |

| Calle Centenario 156 |

| La Molina |

| Lima 12, Perú |

| Phone (+511) 313 2140 |

| Facsimile (+511) 313 2121 |

| (Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered |

| Common Shares, par value $5.00 per share | New York Stock Exchange |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Common Shares, par value $5.00 per share 94,382,317

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued | Other ¨ |

by the International Accounting Standards Board x |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ¨ Item 18 x¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

| TABLE OF CONTENTS | |||

| PRESENTATION OF FINANCIAL INFORMATION | 1 | ||

| CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS | 2 | ||

| PART I | |||

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 3 | |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 3 | |

| ITEM 3. | KEY INFORMATION | 3 | |

| ITEM 4. | INFORMATION ON THE COMPANY | 12 | |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | ||

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | ||

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | ||

| ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | ||

| ITEM 8. | FINANCIAL INFORMATION | ||

| ITEM 9. | THE OFFER AND LISTING | ||

| ITEM 10. | ADDITIONAL INFORMATION | ||

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | ||

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | ||

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | ||

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | ||

| ITEM 15. | CONTROLS AND PROCEDURES | ||

| ITEM 15T. | CONTROLS AND PROCEDURES | 116 | |

| ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | ||

| ITEM 16B. | CODE OF ETHICS | ||

| ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | ||

| ITEM 16D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | ||

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | ||

| ITEM 16F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | ||

| ITEM 16G. | CORPORATE GOVERNANCE | ||

| ITEM 17. | FINANCIAL STATEMENTS | ||

| ITEM 18. | FINANCIAL STATEMENTS | ||

| ITEM 19. | EXHIBITS | ||

| 122 | |||

i

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise specified or the context otherwise requires, references in this Form 20-F (also referred to as the Annual Report), to “$,” “US$,” “Dollars,” “foreign currency” or “U.S. Dollars,”Dollars” are to United States Dollars, and references to “S/.”,” “Nuevo Sol” or “Nuevos Soles” are to Peruvian Nuevos Soles and references to “foreign currency” are to U.S. Dollars.Soles. Each Nuevo Sol is divided into 100 céntimos (cents).

Credicorp Ltd. is a Bermuda limited liability company (and is referred to in this Annual reportReport as Credicorp, we, or us, and means either Credicorp as a separate entity or as an entity together with our consolidated subsidiaries, as the context may require). We maintainsmaintain our financial books and records in U.S. Dollars and present our financial statements in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB). IFRS differ in certain respects from United States Generally Accepted Accounting Principles (U.S. GAAP).

We operate primarily through our four operating segments: banking (including commercial and investment banking), insurance, pension funds, and brokerage and other. See information about operating segments in “Item 4.-Information on the Company: (A) History and Development of the Company, and (B) Business Overview”.

Our four principal operating subsidiaries are Banco de Crédito del Perú (which, together with its consolidated subsidiaries, is referred to as BCP), Atlantic Security Bank held through Atlantic Security Holding Corporation (which, together with its consolidated subsidiaries isare referred to as ASHC)ASB and ASHC, respectively), El Pacífico-Peruano Suiza Compañía de Seguros y Reaseguros (which, together with its consolidated subsidiaries, is referred to as Pacífico Peruano Suiza or PPS) and Grupo Crédito S.A. (which together with its consolidated subsidiaries is referred to as Grupo Crédito).Prima AFP. BCP’s activities include commercial banking, investment banking and retail banking. As of and for the year ended December 31, 2008,2010, BCP accounted for 75.1% of our total revenues, 87.3%84.7% of our total assets, 117.9%79.1% of our net income and 80.6%71.6% of our net equity. Unless otherwise specified, the individual financial information for BCP, ASHC, PPS and Grupo CréditoPrima AFP included in this Annual Report has been derived from the audited consolidated financial statements of each such entity. See “Item 3. Key Information—(A) Selected Financial Data” and “Item 4. Information on the Company—(A) History and Development of the Company.” We refer to BCP, ASB, PPS and Prima AFP as our main operating subsidiaries, and we refer to Grupo Crédito S.A. (Grupo Crédito) and ASHC as our two main holding subsidiaries.

“Item 3. Key Information—(A) Selected Financial Data” contains key information related to our performance. This information was obtained mainly from our consolidated financial statements as of December 31, 2004, 2005, 2006, 2007, 2008, 2009 and 2008.2010.

Our management’s criteria on foreign currency translation, for the purpose of preparing the Credicorp Consolidated Financial Statements, is described in “Item 5. Operating and Financial Review and Prospects—(A) Operating Results—(1) Critical Accounting Policies—Foreign Currency Translation.”

Some of our subsidiaries maintain their operations and balances in NuevoNuevos Soles. As a result, this Annual Report contains certain Nuevo Sol amounts translated into U.S. Dollars which is solely for the convenience of the reader. You should not construe any of these translations as representations that the Nuevo Sol amounts actually represent such equivalent U.S. Dollar amounts or could be converted into U.S. Dollars at the rate indicated as of the dates mentioned herein, or at all. Unless otherwise indicated, these U.S. Dollar amounts have been translated from Nuevos Soles at an exchange rate of S/.3.140.2.809 = US$1.00, which is the December 31, 20082010 exchange rate set by the Peruvian Superintendencia de Banca, Seguros y AFP (the Superintendency of Banks, Insurance and Pension Funds, or the SBS). The average of the bid and offered free market exchange rates published by the SBS for June 25, 2009April 20, 2011 was S/.3.024..2.818 per US$1.00. Translating amounts expressed in Nuevos Soles on a specified date (at the prevailing exchange rate on that date) may result in the presentation of U.S. Dollar amounts that are different from the U.S. Dollar amounts that would have been obtained by translating Nuevos Soles on another specified date (at the prevailing exchange rate on that different specified date). See also “Item 3. Key Information—(A) Selected Financial Data—Exchange Rates” for information regarding the average rates of exchange between the Nuevo Sol and the U.S. Dollar for the periods specified therein. The Federal Reserve Bank of New York does not publish a noon buying rate for Nuevos Soles. Our Bolivian subsidiary operates in Bolivianos, a currency that has been maintained stable over the recent years. It’s Financial Statements are also represented in U.S Dollars.

1

CAUTIONARY STATEMENT WITH RESPECT TO

Certain statements contained in this Annual Report are not historical facts, including, without limitation, certain statements made in the sections entitled “Item 3. Key Information,” “Item 4. Information on the Company,” “Item 5. Operating and Financial Review and Prospects” and “Item 11. Quantitative and Qualitative Disclosures about Market Risk,” which are forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934 (or the Exchange Act). These forward-looking statements are based on our management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in the forward-looking statements. Therefore, actual results, performance or events may be materially different from those in the forward-looking statements due to, without limitation:

general economic conditions, including in particular economic conditions in Peru;

performance of financial markets, including emerging markets;

the frequency and severity of insured loss events;

interest rate levels;

currency exchange rates, including the Nuevo Sol/U.S. Dollar exchange rate;

increasing levels of competition in Peru and other emerging markets;

changes in laws and regulations;

changes in the policies of central banks and/or foreign governments; and

general competitive factors, in each case on a global, regional and/or national basis.

See“Item “Item 3. Key Information—(D) Risk Factors,” and “Item 5. Operating and Financial Review and Prospects.”

We are not under any obligation to, and we expressly disclaimsdisclaim any such obligation to, update or alter our forward-looking statements, whether as a result of new information, future events or otherwise.

2

PART I

ITEM 1. | IDENTITY OF DIRECTORS, |

Not applicable.applicable.

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

ITEM 3. | KEY INFORMATION |

Selected Financial Data |

The following table presents a summary of our consolidated financial information at the dates and for the periods indicated. This selected financial data is presented in U.S. Dollars. You should read this information in conjunction with, and qualify this information in its entirety by reference to, the Credicorp Consolidated Financial Statements, which are also presented in U.S. Dollars.

The summary of our consolidated financial data as of, and for the years ended, December 31, 2004, 2005, 2006, 2007, 2008, 2009 and 20082010 is derived from the Credicorp Consolidated Financial Statements audited by Medina, Zaldívar, Paredes & Asociados S.C.R.L, member of Ernst & Young Global, independent registered public accountants.

The report of Medina, Zaldívar, Paredes & Asociados S.C.R.L on the Credicorp Consolidated Financial Statements as of December 31, 20072009 and 20082010 and for the years ended December 31, 2006, 20072008, 2009 and 20082010 appears elsewhere in this Annual Report.

3

SELECTED FINANCIAL DATA

Year ended December 31, | Year ended December 31, | |||||||||||||||||||||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | 2008 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||||||||||||||

(U.S. Dollars in thousands, except percentages, ratios, and per common share data) | (U.S. Dollars in thousands, except percentages, ratios, and per common share data) | |||||||||||||||||||||||||||||||||||||||

| INCOME STATEMENT DATA: | ||||||||||||||||||||||||||||||||||||||||

| IFRS: | ||||||||||||||||||||||||||||||||||||||||

| Interest income | US$ | 542,842 | US$ | 612,432 | US$ | 782,002 | US$ | 1,065,974 | US$ | 1,400,334 | US$ | 782,002 | US$ | 1,065,339 | US$ | 1,382,844 | US$ | 1,312,925 | US$ | 1,471,708 | ||||||||||||||||||||

| Interest expense | (160,298 | ) | (173,159 | ) | (283,478 | ) | (432,000 | ) | (577,411 | ) | (283,478 | ) | (431,365 | ) | (561,617 | ) | (420,564 | ) | (414,121 | ) | ||||||||||||||||||||

| Net Interest income | 382,544 | 439,273 | 498,524 | 633,974 | 822,923 | 498,524 | 633,974 | 821,227 | 892,361 | 1,057,587 | ||||||||||||||||||||||||||||||

| Provision for loan losses (1) | (16,131 | ) | 6,356 | 4,243 | (28,439 | ) | (48,760 | ) | 4,243 | (28,439 | ) | (48,760 | ) | (163,392 | ) | (174,682 | ) | |||||||||||||||||||||||

| Net interest income after provision for loan losses | 366,413 | 445,629 | 502,767 | 605,535 | 774,163 | 502,767 | 605,535 | 772,467 | 728,969 | 882,905 | ||||||||||||||||||||||||||||||

| Fees and commissions from banking services | 201,474 | 206,163 | 243,778 | 324,761 | 394,247 | 243,778 | 324,761 | 394,247 | 436,819 | 524,895 | ||||||||||||||||||||||||||||||

| Net gains (loss) from sales of securities | 10,135 | 8,965 | 27,281 | 46,376 | 51,936 | 27,281 | 46,376 | 51,936 | 120,932 | 80,326 | ||||||||||||||||||||||||||||||

| Net gains on foreign exchange transactions | 24,165 | 29,286 | 41,638 | 61,778 | 108,709 | 41,638 | 61,778 | 108,709 | 87,944 | 104,169 | ||||||||||||||||||||||||||||||

| Net premiums earned | 192,672 | 218,955 | 251,261 | 297,272 | 393,903 | 251,261 | 297,272 | 393,903 | 424,682 | 480,293 | ||||||||||||||||||||||||||||||

| Other income | 8,105 | 21,571 | 26,197 | 90,022 | 37,672 | 26,197 | 90,022 | 37,672 | 74,936 | 95,145 | ||||||||||||||||||||||||||||||

| Claims on insurance activities | (154,325 | ) | (175,500 | ) | (186,522 | ) | (238,600 | ) | (341,910 | ) | (186,522 | ) | (238,600 | ) | (341,910 | ) | (286,458 | ) | (315,572 | ) | ||||||||||||||||||||

| Operating expenses | (459,928 | ) | (477,073 | ) | (585,058 | ) | (747,089 | ) | (922,299 | ) | (585,058 | ) | (747,089 | ) | (920,603 | ) | (957,110 | ) | (1,085,885 | ) | ||||||||||||||||||||

| Merger costs | (3,742 | ) | 0 | (5,706 | ) | 0 | 0 | (5,706 | ) | 0 | 0 | 0 | 0 | |||||||||||||||||||||||||||

| Income before translation result and income tax | 184,969 | 277,996 | 315,636 | 440,055 | 496,421 | 315,636 | 440,055 | 496,421 | 630,714 | 766,276 | ||||||||||||||||||||||||||||||

| Translation result | 2,040 | (9,597 | ) | 15,216 | 34,627 | (17,650 | ) | 15,216 | 34,627 | (17,650 | ) | 12,222 | ) | 24,120 | ||||||||||||||||||||||||||

| Income tax | (45,497 | ) | (73,546 | ) | (83,587 | ) | (102,287 | ) | (109,508 | ) | (83,587 | ) | (102,287 | ) | (109,508 | ) | (138,500 | ) | (187,081 | ) ) | ||||||||||||||||||||

| Net income | 141,512 | 194,853 | 247,265 | 372,395 | 369,263 | 247,265 | 372,395 | 369,263 | 504,436 | 603,315 | ||||||||||||||||||||||||||||||

Attributable to: | ||||||||||||||||||||||||||||||||||||||||

| Net income attributable to Credicorp’s equity holders | 130,747 | 181,885 | 230,013 | 350,735 | 357,756 | 230,013 | 350,735 | 357,756 | 469,785 | 571,302 | ||||||||||||||||||||||||||||||

| Minority interest | 10,765 | 12,968 | 17,252 | 21,660 | 11,507 | 17,252 | 21,660 | 11,507 | 34,651 | 32,013 | ||||||||||||||||||||||||||||||

| Number of shares as adjusted to reflect changes in capital | 79,761,475 | 79,761,475 | 79,761,475 | 79,534,485 | 79,440,484 | |||||||||||||||||||||||||||||||||||

| Net income per common share attributable to Credicorp´s equity holders (2) | 1.64 | 2.28 | 2.88 | 4.40 | 4.49 | 2.88 | 4.40 | 4.49 | 5.90 | 7.19 | ||||||||||||||||||||||||||||||

| Diluted net income per share | 2.88 | 4.40 | 4.49 | 5.90 | 7.17 | |||||||||||||||||||||||||||||||||||

| Cash dividends declared per common share | 0.80 | 1.10 | 1.30 | 1.50 | 1.50 | 1.30 | 1.50 | 1.50 | 1.70 | 1.95 | ||||||||||||||||||||||||||||||

| BALANCE SHEET DATA: | ||||||||||||||||||||||||||||||||||||||||

| IFRS: | ||||||||||||||||||||||||||||||||||||||||

| Total assets | 9,087,560 | 11,036,075 | 12,881,529 | 17,705,898 | 20,821,069 | 12,881,529 | 17,705,898 | 20,821,069 | 22,013,632 | 28,413,180 | ||||||||||||||||||||||||||||||

| Total loans (3) | 4,559,018 | 4,972,975 | 5,877,361 | 8,183,845 | 10,456,284 | 5,877,361 | 8,183,845 | 10,456,284 | 11,505,319 | 14,278,064 | ||||||||||||||||||||||||||||||

| Reserves for loan losses (1) | (271,873 | ) | (218,636 | ) | (210,586 | ) | (229,700 | ) | (248,063 | ) | (210,586 | ) | (229,700 | ) | (248,063 | ) | (376,049 | ) | (448,597 | ) | ||||||||||||||||||||

| Total deposits | 6,270,972 | 7,067,754 | 8,799,134 | 11,299,671 | 13,877,028 | 8,799,134 | 11,299,671 | 13,877,028 | 14,032,179 | 18,017,714 | ||||||||||||||||||||||||||||||

| Equity attributable to Credicorp’s equity holders | 1,065,197 | 1,190,440 | 1,396,822 | 1,676,009 | 1,689,172 | 1,396,822 | 1,676,009 | 1,689,172 | 2,316,856 | 2,873,749 | ||||||||||||||||||||||||||||||

| Minority interest | 85,253 | 101,515 | 136,946 | 139,264 | 106,933 | 136,946 | 139,264 | 106,933 | 186,496 | 56,502 | ||||||||||||||||||||||||||||||

| Net Equity | 1,150,450 | 1,291,955 | 1,533,768 | 1,815,273 | 1,796,105 | 1,533,768 | 1,815,273 | 1,796,105 | 2,503,352 | 2,930,251 | ||||||||||||||||||||||||||||||

| SELECTED RATIOS | ||||||||||||||||||||||||||||||||||||||||

| IFRS: | ||||||||||||||||||||||||||||||||||||||||

| Net interest margin (4) | 4.85 | % | 4.90 | % | 4.64 | % | 4.50 | % | 4.47 | % | ||||||||||||||||||||||||||||||

| Return on average total assets (5) | 1.50 | % | 1.81 | % | 1.92 | % | 2.29 | % | 1.86 | % | ||||||||||||||||||||||||||||||

| Return on average equity attributable to Credicorp’s equity holders (6) | 13.55 | % | 16.39 | % | 18.44 | % | 22.67 | % | 20.21 | % | ||||||||||||||||||||||||||||||

| Operating expenses as a percentage of net interest and non-interest income (7) | 49.18 | % | 46.25 | % | 50.26 | % | 50.62 | % | 40.23 | % | ||||||||||||||||||||||||||||||

4

| Year ended December 31, | ||||||||||||||||

| 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||

(U.S. Dollars in thousands, except percentages, ratios, and per common share data) | ||||||||||||||||

| SELECTED RATIOS | ||||||||||||||||

| IFRS: | ||||||||||||||||

| Net interest margin (4) | 4.64% | 4.50% | 4.46% | 4.70% | 4.61% | |||||||||||

| Return on average total assets (5) | 1.92% | 2.29% | 1.86% | 2.19% | 2.27% | |||||||||||

| Return on average equity attributable to Credicorp’s equity holders (6) | 18.44% | 22.67% | 20.21% | 23.72% | 21.25% | |||||||||||

| Operating expenses as a percentage of net interest and non-interest income (7) | 50.26% | 50.62% | 40.27% | 46.18% | 45.75% | |||||||||||

| Operating expenses as a percentage of average assets | 4.89% | 4.88% | 4.78% | 4.47% | 4.31% | |||||||||||

| Equity attributable to Credicorp’s equity holders as a percentage of period end total assets | 10.84% | 9.47% | 8.11% | 10.52% | 10.11% | |||||||||||

| Regulatory capital as a percentage of risk weighted assets (8) | 11.98% | 12.80% | 12.33% | 14.32% | 12.51% | |||||||||||

| Total past-due loan amounts as a percentage of total loans (9) | 1.31% | 0.75% | 0.79% | 1.60% | 1.47% | |||||||||||

| Reserves for loan losses as a percentage of total loans | 3.24% | 2.58% | 2.15% | 3.08% | 2.91% | |||||||||||

| Reserves for loan losses as a percentage of total loans and other contingent credits (10) | 2.59% | 2.17% | 1.84% | 2.53% | 2.39% | |||||||||||

| Reserves for loan losses as a percentage of total past-due loans (11) | 247.85% | 343.68% | 270.72% | 191.99% | 198.04% | |||||||||||

| Reserves for loan losses as a percentage of substandard loans (12) | 78.24% | 100.45% | 112.26% | 99.45% | 103.80% | |||||||||||

Year ended December 31, | ||||||||||||||||||||

2004 | 2005 | 2006 | 2007 | 2008 | ||||||||||||||||

(U.S. Dollars in thousands, except percentages, ratios, and per common share data) | ||||||||||||||||||||

| Operating expenses as a percentage of average assets | 5.28 | % | 4.74 | % | 4.89 | % | 4.88 | % | 4.79 | % | ||||||||||

| Equity attributable to Credicorp’s equity holders as a percentage of period end total assets | 11.72 | % | 10.79 | % | 10.84 | % | 9.47 | % | 8.11 | % | ||||||||||

| Regulatory capital as a percentage of risk weighted assets (8) | 14.04 | % | 13.10 | % | 11.98 | % | 12.80 | % | 12.33 | % | ||||||||||

| Total past-due loan amounts as a percentage of total loans (9) | 3.49 | % | 1.93 | % | 1.31 | % | 0.75 | % | 0.79 | % | ||||||||||

| Reserves for loan losses as a percentage of total loans | 5.96 | % | 3.97 | % | 3.24 | % | 2.58 | % | 2.15 | % | ||||||||||

| Reserves for loan losses as a percentage of total loans and other contingent credits (10) | 4.99 | % | 3.19 | % | 2.59 | % | 2.17 | % | 1.84 | % | ||||||||||

| Reserves for loan losses as a percentage of total past-due loans (11) | 170.93 | % | 206.22 | % | 247.85 | % | 343.68 | % | 270.72 | % | ||||||||||

| Reserves for loan losses as a percentage of substandard loans (12) | 54.11 | % | 65.42 | % | 78.24 | % | 100.45 | % | 112.26 | % | ||||||||||

| (1) | Provision for loan losses and reserve for loan losses include provisions and reserves with respect to total loans and contingent credits, net of write-off recoveries. |

| (2) | We have 100 million authorized common shares. As of December 31, |

| (3) | Net of unearned interest, but prior to reserve for loan losses. In addition to loans outstanding, we had contingent loans of US$ |

| (4) | Net interest income as a percentage of average interest-earning assets, computed as the average of period-beginning and period-ending balances on a monthly basis. |

| (5) | Net income as a percentage of average total assets, computed as the average of period-beginning and period-ending balances. |

| (6) | Net income as a percentage of average equity attributable to our equity holders, computed as the average of period-beginning and period-ending balances, and calculated on a monthly basis. |

| (7) | Sum of the salaries and employee’s benefits, administrative expenses, depreciation and amortization, as a percentage of the sum of net interest income and non-interest income, less net gains from sales of securities and other income. |

| (8) | Regulatory capital calculated in accordance with guidelines by the Basel Committee on Banking Regulations and Supervisory Practices of International Settlements (or the BIS I Accord) as adopted by the SBS. See “Item 5. Operating and Financial Review and Prospects—(B) Liquidity and Capital Resources—Regulatory Capital and Capital Adequacy Ratios.” |

| (9) | Depending on the type of loan, BCP considers loans past due for corporate, large business and medium business loans after 15 days; for small and micro business loans after 30 days; and for consumer, mortgage and leasing loans after 90 |

5

| (10) | Other contingent credits primarily consist of guarantees, stand-by letters and letters of credit. See Note 19 to the Credicorp Consolidated Financial Statements. |

| (11) | Reserves for loan and contingent credit losses, as a percentage of all past-due loans, with no reduction for collateral securing such loans. Reserves for loan and contingent credit losses include reserves with respect to total loans and other credits. |

| (12) | Reserves for loan and contingent credit losses as a percentage of loans classified in categories C, D or E. See “Item 4. Information on the Company—(B) Business Overview—(12) Selected Statistical Information—(iii) Loan Portfolio—Classification of Loan Portfolio.” |

Exchange Rates

The following table sets forth the high and low month-end rates and the average and end-of-period rates for the sale of Nuevos Soles for U.S. Dollars for the periods indicated.

| Year ended December 31, | High (1) | Low (1) | Average (2) | Period-end (3) | ||||||||

| (Nominal Nuevos Soles per U.S. Dollar) | ||||||||||||

| 2006 | 3.455 | 3.195 | 3.274 | 3.195 | ||||||||

| 2007 | 3.197 | 2.998 | 3.125 | 2.998 | ||||||||

| 2008 | 3.135 | 2.751 | 2.939 | 3.135 | ||||||||

| 2009 | 3.258 | 2.853 | 3.010 | 2.889 | ||||||||

| 2010 | 2.858 | 2.788 | 2.826 | 2.808 | ||||||||

| Year ended December 31, | High (1) | Low (1) | Average (2) | Period-end (3) | ||||||||||||

| (Nominal Nuevos Soles per U.S. Dollar) | ||||||||||||||||

| 2004 | 3.500 | 3.283 | 3.410 | 3.283 | ||||||||||||

| 2005 | 3.440 | 3.249 | 3.295 | 3.420 | ||||||||||||

| 2006 | 3.455 | 3.195 | 3.274 | 3.195 | ||||||||||||

| 2007 | 3.197 | 2.998 | 3.125 | 2.998 | ||||||||||||

| 2008 | 3.135 | 2.751 | 2.939 | 3.135 | ||||||||||||

Source: Bloomberg

| (1) | Highest and lowest of the 12 month-end exchange rates for each year based on the offered rate. |

| (2) | Average of month-end exchange rates based on the offered rate. |

| (3) | End-of-period exchange rates based on the offered rate. |

The following table sets forth the high and low rates for the sale of Nuevos Soles for U.S. Dollars for the indicated months.

| High (1) | Low (1) | |||||

| (Nominal Nuevos Soles per U.S. Dollar) | ||||||

| 2010 | ||||||

| December | 2.828 | 2.800 | ||||

| 2011 | ||||||

| January | 2.806 | 2.771 | ||||

| February | 2.788 | 2.767 | ||||

| March | 2.815 | 2.767 | ||||

| April (through April 20) | 2.823 | 2.799 | ||||

Source: Bloomberg

High (1) | Low (1) | |||||||

| (Nominal Nuevos Soles per U.S. Dollar) | ||||||||

| 2008 | ||||||||

| December | 3.142 | 3.081 | ||||||

| 2009 | ||||||||

| January | 3.187 | 3.131 | ||||||

| February | 3.251 | 3.202 | ||||||

| March | 3.259 | 3.107 | ||||||

| April | 3.145 | 2.981 | ||||||

| May | 3.051 | 2.950 | ||||||

| June (through June 25) | 3.024 | 2.967 | ||||||

| (1) | Highest and lowest of the daily closing exchange rates for each month based on the offered rate. |

The average of the bid and offered free market exchange rates published by the SBS for June 25, 2009April 20, 2011 was S/.3.024..2.818 per US$1.00.

| (B) | Capitalization and Indebtedness |

Not applicable.

| (C) | Reasons for the Offer and Use of Proceeds |

Not applicable.

6

| (D) | Risk Factors |

Our businesses are affected by many external and other factors in the markets in which we operate. Different risk factors can impact our businesses, and theour ability to effectively operate and our businesses and business strategies. You should consider the risk factors carefully and read them in conjunction with all the information in this document.

Our geographic location exposes us to risk related to Peruvian political and economic conditions.

Most of BCP’s, PPS’s and Prima AFP’s operations and customers are located in Peru. In addition, although ASHC is based outside of Peru, most of its customers are located in Peru. Accordingly, our results of operations and financial conditions will be dependent on the level of economic activity in Peru. Changes in economic or other policies of the Peruvian government, (whichwhich has exercised and continues to exercise a substantial influence over many aspects of the private sector)sector, could affect our results of operations and financial condition. Similarly, other political or economic developments in Peru, including government-induced effects on inflation, devaluation and economic growth could affect our operations and financial condition.

For several decades, Peru had a history of political instability that has included military coups and a succession of regimes with differing policies and programs. Past governments have frequently intervened in the nation’s economy and social structure. Among other actions, past governments have imposed controls on prices, exchange rates, local and foreign investment, and international trade. Past governments have also restricted the ability of companies to dismiss employees, expropriated private sector assets and prohibited the payment of profits to foreign investors.

During the 1980s and the early 1990s, the Sendero Luminoso (Shining Path) and the Movimiento Revolucionario Tupac Amaru (MRTA) terrorist organizations were particularly active in Peru. Although the Shining Path and MRTA were almost de-activated in the 1990s, any resumption of activities by these or other terrorist organizations may adversely affect our operations.

In July 1990, Alberto Fujimori was elected President and implemented a broad-based reform of Peru’s political system and economic and social conditions. The reform was aimed at stabilizing the economy, restructuring the national government (by reducing bureaucracy), privatizing state-owned companies, promoting private investment, eradicating corruption and bribery in the judicial system, developing and strengthening free markets, institutionalizing democratic representation, and enacting programs for the strengthening ofdesigned to strengthen basic services related to education, health, housing and infrastructure. After taking office for his third term in July 2000, under extreme protest, President Fujimori was forced to call for general elections duewhen corruption in his government was exposed to the outbreak of corruption scandals.public. Fujimori later resigned in favor of a transitory government.

human rights in connection with government-linked death squads. In 2001, Alejandro Toledo became President, ending two years of political turmoil. President Toledo retained, for the most part, the economic policies of the previous government. He focused on promoting private investment, eliminating tax exemptions, and reducing underemployment and unemployment. President Toledo also implemented fiscal austerity programs, among other proposals, in order to stimulate the economy. Despite Peru’s moderate economic growth, the Toledo administration faced public unrest spurred by the high rates of unemployment, underemployment and poverty.

In the elections held in April 2006, no presidential candidate received the required 50% or more of the votes. As a result, a second round election between the top two presidential candidates, Ollanta Humala Tasso from the Partido Unión por el Peru, or the UPP, and Alan García Pérez of the Partido Alianza Popular Revolucionaria, or APRA, was held on June 4, 2006. Although Alan García Pérez, was elected, he has no majority in Congress. President Garcíawho had previously served as President of Peru from 1985 to 1990, a period which was marked by a severe economic crisis. He is following conservative economic policieselected and has indicated a desire to avoid the mistakes of his past government.currently serves as President. The García administration has followed economic policies similar to those of the Toledo administration, which included achieving sustained economic growth, increasing exports of Peruvian goods, reducing unemployment, underemployment and poverty, reforming the tax system, fostering private investment and increasing public investment in education, public health and other social programs, while reducing overall public spending.

The Peruvian government’s economic policies during the last decade have provided the appropriate fundamentals to support the positive performance ofby the Peruvian economy. As a result, the international financial crisis hasdid not impactedimpact Peru as severely as other countries. In addition,2009 the current government has also implemented a US$3 billion anti-crisis program leading to alleviatea strong economic reactivation in 2010 when the effects of the crisis.Peruvian economy achieved an 8.8% annual growth in GDP. However, while the economic policies of recent Peruvian governments have been relatively stable, we cannot assure you that future governments might adopt different economic policies that are less favorable for the economy.

Presidential elections were held in Peru on April, 10, 2011. Under the Peruvian constitution, if no candidate receives the majority of votes in a presidential election, the two candidates with the most votes will maintain favorableface a run-off, second round election to determine the winner. In accordance with official figures, Ollanta Humala received 31.7% of valid votes, followed by Keiko Fujimori (23.6%), Pedro Pablo Kuczynski (18.5%), Alejandro Toledo (15.6%), Luis Castañeda (9.8%) and other candidates (0.8%). Because no candidate obtained more than 50% of valid votes, a second round election will be held on June 5, 2011, between Ollanta Humala and Keiko Fujimori (the daughter of former president Alberto Fujimori).

7

Neither Mr. Humala nor Ms. Fujimori is from the APRA, the political party of the current president Alan Garcia, and we do not know what economic policies.

policies either candidate would pursue if elected. The new president may pursue economic policies that would ultimately be harmful to Peruvian economic growth or to our economic and political relationships with other countries. The economic policies of the new president may have a material adverse effect on our financial condition or results of operations. Foreign exchange fluctuations and exchange controls may adversely affect our financial condition and results of operations.

Even though the functional currency of our financial statements is U.S. Dollars and our dividends are paid in U.S. Dollars, BCP, PPS and PPS,Prima AFP for local statutory purposes, prepare their financial statements and pay dividends in Nuevos Soles. The Peruvian government does not currently impose restrictions on a company’s ability to transfer U.S. Dollars from Peru to other countries, to convert Peruvian currency into U.S. Dollars or to pay dividends abroad. Nevertheless, Peru has hadimplemented restrictive exchange controls in the past,its history, and there can be no assurance that the Peruvian government will continuemight in the future consider it necessary to permitimplement restrictions on such transfers, payments or conversions without any restrictions. conversions. See “Item 10. Additional Information—(D) Exchange Controls.” In addition, depreciation of the Nuevo Sol against the U.S. Dollar would decrease the U.S. Dollar value of any dividends BCP, PPS and PPSPrima AFP pay us, which would have a negative impact on our ability to pay dividends to shareholders.

Also, a significant group of BCP’s borrowers and PPS’s insureds generate Nuevo Sol revenues from their own clients. Devaluation of the Nuevo Sol against the U.S. Dollar could negatively impact BCP’s and PPS’s clientsclients’ ability to repay loans or make premium payments. Despite any devaluation, and absent any change in foreign exchange regulations, BCP and PPS would be expected to continue to repay U.S. Dollar-denominated deposits and U.S. Dollar-denominated insurance benefits in U.S. Dollars. Therefore, any significant devaluation of the Nuevo Sol against the U.S. Dollar could have a material adverse effect on our results of operations and financial condition.

It may be difficult to serve process on or enforce judgments against us or our principals residing outside of the United States.

A significant majority of our directors and officers live outside the United States (principally in Peru). All or most of our assets and those of our principals are located outside the United States. As a result, it may not be possible for investors to effect service of process within the United States upon us or our principals to bring forth a civil suit under the United States securities laws in United States courts. We have been advised by our Peruvian counsel that liability under the United States federal securities laws may not be enforceable in original actions in Peruvian courts. Also, judgments of United States courts obtained in actions under the United States federal securities laws may not be enforceable. Similarly, BermudianBermudan counsel advised us that courts in Bermuda may not enforce judgments obtained in other jurisdictions, or entertain actions in Bermuda, including judgments predicated upon civil liability provisions of the United States federal securities law, against us or our directors or officers under the securities laws of those jurisdictions.

In addition, our bye-laws contain a broad waiver by shareholders of any claim or right of action, both individually and on our behalf, against any of our officers or directors. This waiver limits the rights of shareholders to assert claims against our officers and directors for any action taken by an officer or director. It also limits the rights of shareholders to assert claims against officers or any directors for the failure of an officer or director to take any action in the performance of his or her duties, except with respect to any matter involving any willful negligence, willful default, fraud or dishonesty on the part of the officer or director.

Our ability to pay dividends to shareholders and to pay corporate expenses may be adversely affected by the ability of our subsidiaries to pay dividends to us.

As a holding company, our ability to make dividend payments, if any, and to pay corporate expenses will depend upon the receipt of dividends and other distributions from our operating subsidiaries. Our principal operating subsidiaries are BCP, PPS, ASHCASB and Grupo Crédito.Prima AFP. If our subsidiaries do not have funds available, or are otherwise restricted from paying us dividends, we may be limited in our ability to pay dividends to shareholders. Currently, there are no restrictions on the ability of BCP, ASHC, PPS or Grupo Crédito to pay dividends abroad. In addition, our right to participate in the distribution of assets of any subsidiary, upon any subsidiary’s liquidation or reorganization (and thus the ability of holders of our securities to benefit indirectly from such distribution), is subject to the prior claims of creditors of that subsidiary, except where we are considered aan unsubordinated creditor of the subsidiary. Accordingly, our securities will effectively be subordinated to all existing and future liabilities of our subsidiaries, and holders of our securities should look only to our assets for payments.

8

A deterioration in the quality of our loan portfolio may adversely affect our results of operations.

Given that a significant percentage of our revenues are related to banking activities, a deterioration of loan quality may have an adverse impact on our financial condition and results of operations. On the one hand, loan portfolio risk associated with lending to certain economic sectors or clients in certain market segments can be mitigated through adequate diversification policies. On the other hand, our pursuit of opportunities in which we can charge higher interest rates, thereby increasing revenues, may reduce diversification of theour loan portfolio and expose us to greater credit risk. We believe that significant opportunities exist in middle market, and consumer lending and microfinance in Peru. We also believe that we can, on average, charge higher interest rates on such loans as compared with interest charged on loans in our core corporate banking business, made primarily to clients that operate in industrial and commercial economic sectors.

Accordingly, our strategy includes a greater emphasis on middle market, and consumer loans and microfinance, as well as continued growth of our loan portfolio in general. An increase in theour portfolio’s exposure to these areas could be accompanied by greater credit risk. TheSuch a greater credit risk iswould not only due tobe affected by the speed and magnitude of the increase, but also toby the shift to lending to the middle market and consumerthese sectors, which have higher risk profiles compared with loans to large corporate customers. Given the changing composition of our loan portfolio, historical loss experience may not be indicative of future loan loss experience.

Because we are subject to banking regulation and supervision in Peru, Bolivia, the Cayman Islands, Panama and the United States of America and Panama, changes to the regulatory framework in any of these countries or changes in tax laws could adversely affect our business.

We are mainly subject to extensive supervision and regulation through the SBS’s consolidated supervision regulations, which overseeregulate all of our subsidiaries and offices including those located outside Peru. The SBS and the Banco Central de Reserva, or the Central Bank, supervise and regulate BCP’s operations. Peru’s constitution and the SBS’s statutory charter grant the SBS the authority to oversee and control banks and other financial institutions. The SBS and the Central Bank have general administrative responsibilities over BCP, including designation of capitalization and reserve requirements. In past years, the Central Bank has, on numerous occasions, changed the deposit reserve requirements applicable to Peruvian commercial banks as well as the rate of interest paid on deposit reserves and the amount of deposit reserves on which no interest is payable by the Central Bank. Such changes in the supervision and regulation of BCP may adversely affect our results of operations and financial condition. See “Item 4. Information on the Company—(B) Business Overview—(11) Supervision and Regulation—(ii) BCP.” Furthermore, changes in regulation related to consumer protection may also affect our business.

On February 15, 2011, the Peruvian government enacted Law 29663, which partially modifies the country’s income tax regime by subjecting to taxation in Peru capital gains derived from an indirect transfer of shares and expanding the type of income that will qualify as Peruvian-source income. Under the new law, any transfer of shares of a company not domiciled in Peru will be subject to Peruvian income tax if, at any point during the 12 months prior to the transfer, the market value of the shares of a Peruvian domiciled company that is directly or indirectly owned by the non-Peruvian domiciled company represents 50% or more of the market value of the shares representing the equity capital of the non-Peruvian domiciled company. This change became effective on February 16, 2011.

At the same time, two new obligations were imposed on Peruvian domiciled companies: (i) each Peruvian domiciled company is now required to report to the Peruvian Tax Administration (SUNAT) transfers of its own shares or transfers of the shares of the non-Peruvian domiciled company that is the owner of its shares, and (ii) each Peruvian domiciled company is now responsible for the income tax not paid by a non-Peruvian domiciled transferor that is directly or indirectly linked to the domiciled company (whether by means of control, management or equity participation) in connection with the transfer of the domiciled company’s shares. The effectiveness of the obligations mentioned in (i) and (ii) above is subject to additional enactments by the Peruvian government. Credicorp does not believe that the rules adopted by the Peruvian government to implement this new law will have a material impact on the company, its subsidiaries or its shareholders, but until final rules are enacted we cannot assure you that the new law will not have a material adverse effect on the company, its subsidiaries or its shareholders.

We are also regulated by the United States Federal Reserve System, which shares its regulatory responsibility with the State of Florida Department of Banking and Finance - Office of Financial Regulation.Regulation, with respect to BCP’s Miami agency, and by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority, Inc. (FINRA), with respect to Credicorp Securities, a U.S. broker dealer. Similarly, we are regulated by other governmental entities in other jurisdictions. In the Cayman Islands, we are subject to the supervision and regulation of the Cayman Islands Monetary Authority, or CIMA, while in Bolivia, we are subject to the supervision of the Financial System Supervisory Authority (or FSSA or ASFI in Spanish) that has assumed all regulatory functions held previously be the Superintendency of Banks and Financial Entities and regulations established by the Central BankSuperintendency of Bolivia.Pensions, Securities and Insurance. In Panama, we are subject to the supervision of the Superintendency of Banks and the regulatory framework set forth in the Decree Law 9 of February 25, 1998. Changes in the supervision and regulation of our subsidiaries in other countries may adversely affect our results of operations and financial condition.

Our banking operations in Bolivia expose us to risk related to Bolivian political and economic conditions.

Banco de Crédito de Bolivia, or BCB, is BCP’s commercial bank in Bolivia. Most of BCB’s operations and customers are located in Bolivia. Accordingly, our results of operations and financial conditions depend on the level of economic activity in Bolivia. While Bolivia’s macroeconomic indicators have generally been positive over the last several years, including a steady growth rate and increasingly international reserves, inflation has increased, primarily due to rising international food prices. At the same time, the country of Bolivia continues to experience a volatile political environment and a reduction in private investment activity We expect to face some increased costs as a result of inflation, exchange rate revaluation and also relevant some regulatory changes that could impact our earnings. In this environment, the key is to control costs and expenses, increase efficiency and maintain a prudent and proactive risk management. Any material negative effect on BCB’s operations or financial results could have a material adverse effect on Credicorp’s own results of operations.

9

Changes to insurance regulations in Peru may impact the ability of our insurance subsidiary to underwrite and price risk effectively, and may adversely affect our operating performance and financial condition.

Our insurance business is carried out by our subsidiary PPS. The insurance business is subject to regulation by the SBS. Insurance regulationregulations in Peru is an area of constantfrequently change. New legislation or regulations may adversely affect PPS’s ability to underwrite and price risks accurately, which in turn would affect underwriting results and business profitability. PPS is unable to predict whether and to what extent new laws and regulations that would affect its business will be adopted in the future. PPS is also unable to predict the timing of any such adoption and whatthe effects any new laws or regulations would have on its operations, profitability and financial condition.

The Group also assumes reinsurance risk in the normal course of business for non-life insurance contracts when applicable. Premiums and claims on assumed reinsurance are recognized as revenue or expenses in the same manner as they would be if the reinsurance were considered direct business, taking into account the product classification of the reinsured business.

Our operating performance and financial condition depend on PPS’s ability to underwrite and set premium rates accurately for a full spectrum of risks. PPS must generate sufficient premiums to offset losses, loss adjustment expenses and underwriting expenses so it may earn a profit. to be profitable.

To price premium rates accurately, PPS must:

collect and analyze a substantial volume of data;

develop, test and apply appropriate rating formulae;

closely monitor changes in trends in a timely fashion; and

project both severity and frequency with reasonable accuracy.

If PPS fails to assess accurately the risks that it assumes or does not accurately estimate its retention, it may fail to establish adequate premium rates. Failure to establish adequate premium rates could reduce income and have a materially adverse effect on its operating results or financial condition. Moreover, there is inherent uncertainty in the process of establishing property and casualty loss reserves. Reserves are estimates based on actuarial and statistical projections at a given point in time of what PPS ultimately expects to pay out on claims and the cost of adjusting those claims, based on the facts and circumstances then known. Factors affecting these projections include, among others, changes in medical costs, repair costs and regulation. Any negative effect on PPS could have a material adverse effect on our results of operations and financial condition.

Regulatory changes to the private pension fund system in Peru could impact our earnings and adversely affect our operating performance.

Prima AFP manages our Pension Fund Administration business. In Peru, private pension fund managers are closely regulated by the SBS. Under the current regulatory framework, we collect commissions based on the salary of each subscriber to our pension funds. This commission-based system could be modified or eliminated by regulations that require pension fund managers to charge fees based on the balance of funds under their control. Any regulations requiring us to use a different methodology to calculate fees could negatively impact our performance.

We are facing increased competition that may impede our growth.

BCP has experienced increased competition, including increased pressure on margins. This is primarily a result of the presence of the following:

Highly liquid commercial banks in the market;

Local and foreign investment banks with substantial capital, technology, and marketing resources; and

Local pension funds that lend to BCP’s corporate customers through participation in those customers’ securities issues.

Larger Peruvian companies have gained access to new sources of capital through local and international capital markets, and BCP’s existing and new competitors have increasingly made inroads into the higher margin, middle market and retail banking sectors. Such increased competition, with entrants who may have greater access to capital at lower costs, has affected BCP’s loan growth as well as reduced the average interest rates that BCP can charge its customers.

10

Competitors may also appropriate greater resources to, and be more successful in, the development of technologically advanced products and services that may compete directly with BCP’s products and services. Such competition would adversely affect the acceptance of BCP’s products and/or lead to adverse changes in the spending and saving habits of BCP’s customer base. If competing entities are successful in developing products and services that are more effective or less costly than the products and services developed by BCP, BCP’s products and services may be unable to compete successfully. BCP may not be able to maintain its market share if it is not able to match its competitors’ loan pricing or keep pace with their development of new products and services. Even if BCP’s products and services prove to be more effective than those developed by other entities, such other entities may be more successful in marketing their products and services than BCP because of their greater financial resources, higher sales and marketing capacity andor other similar factors. BCP may not be able to maintain its market share if it is not able to match its competitors’ loan pricing or keep pace with their development of new products and services. Any negative impact on BCP could have a materially adverse effect on our results of operations and financial condition.

Fluctuation and volatility of capital markets and interest rates may decrease our net income.

We may suffer losses related to the investments by BCP, ASCH, PPS, Grupo Crédito and other subsidiaries in fixed income and equity securities, and to their respective positions in currency markets, because of changes in market prices, defaults, fluctuations in market interest rates or exchange rates or other reasons. A downturn in the capital markets may result in a decline in the value of our positions and lead us to register net losses due to the decline in the value of these positions. Additionally,losses. In addition, a downturn in the capital markets could also lead to volatile prices and negative net revenues from trading positions, caused by volatility in prices in the financial markets, even in the absence of a general economic downturn.

Fluctuations in market interest rates, or changes in the relative structure between short-term interest rates and long-term interest rates, could cause a decrease in interest rates charged on interest-earning assets, relative to interest rates paid on interest-bearing liabilities. Such an occurrence could adversely affect our financial condition by causing a decrease in net interest income.

11

| ITEM 4. | INFORMATION ON THE COMPANY |

| (A) | History and Development of the Company |

We are a limited liability company that was incorporated in Bermuda on October 20, 1995 to act as a holding company, coordinate the policy and administration of our subsidiaries, and engage in investing activities. Our principal activity is to coordinate and manage the business plans of our subsidiaries in an effort to implement universal banking services and develop our insurance business, focusing on Peru and Bolivia along with limited investments in other countries of the region. We conduct our financial services business exclusively through our subsidiaries. Our registered address is Clarendon House, 2 Church Street, Bermuda. The management and administrative office (i.e., principal place of business) in Peru of our subsidiary, Banco de Crédito del Perú, is located at Calle Centenario 156, La Molina, Lima 12, Peru, and the phone number is 51-1-313-2000.

We are the largest financial services holding company in Peru and are closely identified with our principal subsidiary, BCP, the country’s largest bank and the leading supplier of integrated financial services in Peru.

We are engaged principally in commercial banking (including trade finance, corporate financecommercial and leasing services)investment banking), insurance (including commercial property, transportation and marine hull, automobile, life, health and underwriting insurance), pension funds (including private pension fund underwriting insurance)management services), and investment bankingbrokerage and other (including brokerage, trust, custody and securitization services, asset management and proprietary trading and investment). As of December 31, 2008,2010, our total assets were US$20.828.4 billion and our net equity was US$1.82.9 billion. Our net income attributable to our equity holders in 20072009 and 20082010 was US$350.7469.8 million and US$357.8571.3 million, respectively. See “Item 3. Key Information—(A) Selected Financial Data” and “Item 5. Operating and Financial Review and Prospects.”

For management purposes, the Group is organized into four operating segments based on products and services. According to IFRS, an operating segment is a component of an entity that engages in business activities from which it may earn revenues and incur expenses; whose operating results are regularly reviewed by the entity’s chief who makes decisions about resources allocation for the segment and assesses its performance; and for which discrete financial information is available. We conduct our financial services business through our operating segments as follows:

Banking: principally handling loans, credit facilities, deposits and current accounts, and providing investment banking services, including corporate finance, both for corporate and institutional customers. Banking also includes handling deposits consumer loans and credit cards facilities for individual customers.

Insurance: including commercial property, transportation and marine hull, automobile, life, health and pension fund underwriting insurance.

Pension funds: providing private pension fund management services to contributors.

Brokerage and others: including the structuring and placement of primary market issues and the execution and trading of secondary market transactions. This segment also includes offers of local securitization structuring to corporate entities, management of mutual funds and other services.

The following table gives certain financial information about us by principal business segments as of and for the year ended December 31, 20082010 (See Note 26 to the Credicorp Consolidated Financial Statements):

| As of and for the Year ended December 31, 2010 | ||||||||||||

Total Revenues | Operating Income | Total Assets | ||||||||||

| (U.S. Dollars in millions) | ||||||||||||

| Banking | US$ | 2,042 | US$ | 1,037 | US$ | 25,597 | ||||||

| Insurance | 578 | 232 | 1,716 | |||||||||

| Pension fund | 87 | 0 | 258 | |||||||||

| Brokerage and others | 50 | (47 | ) | 482 | ||||||||

| Credicorp | US$ | 2,757 | US$ | 1,222 | US$ | 28,413 | ||||||

| Asset Under Management | - | - | US$ | 16,212 | ||||||||

12

As of and for the Year ended December 31, 2008 | ||||||||||||

Total Revenues | Operating Income | Total Assets | ||||||||||

| (U.S. Dollars in millions) | ||||||||||||

| Commercial Banking | US$ | 1,797 | US$ | 804 | US$ | 19,168 | ||||||

| Insurance | 469 | 118 | 1,231 | |||||||||

| Pension Fund Administration | 71 | 0 | 224 | |||||||||

| Investment Banking and others | 50 | (47 | ) | 198 | ||||||||

| Credicorp | US$ | 2,387 | US$ | 875 | US$ | 20,821 | ||||||

We conduct our commercial banking and investment banking activities primarily through BCP, the largest (in terms of total assets, loans, deposits, net equity and net income) full-service Peruvian commercial bank, and ASHC, a diversified financial services company.ASB private banking and asset management firm. We conduct our pension fund business through Prima AFP and our insurance activities through PPS, which is the second largest Peruvian insurance company in terms of premiums, fees and net income. You should note that the term “Peruvian commercial bank,” “Peruvian insurance company” and other similar terms used in this Annual Report do not include the assets, results or operations of any foreign parent company or foreign subsidiary of such Peruvian company.

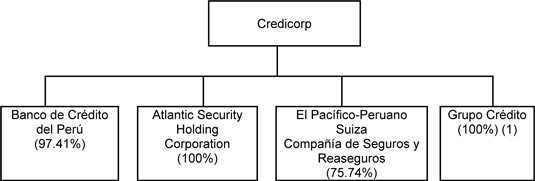

We were formed in 1995 for the purpose of acquiring, through an exchange offer, the common shares of BCP, ASHC and PPS. Pursuant to this exchange offer, in October 1995 we acquired 90.1% of BCP, 98.2% of ASHC and 75.8% of PPS. We acquired the remaining 1.8% outstanding shares of ASHC in March 1996, pursuant to another exchange offer. See “Item 4. Information on the Company—(C) Organizational Structure.”

In December 1995, we purchased 99.99% of Inversiones Crédito (whose name has changed to Grupo de Crédito), a non-financial entity with assets of US$335.9376.9 million as of December 2008. Grupo de Crédito’s main subsidiary is Prima AFP.2009.

In August 1997, we acquired 39.5% of BCB from BCP for US$9.2 million. In July 1998, we acquired 94.86% of Banco de La Paz, a Bolivian bank with US$52.1 million in assets, which we subsequently merged with BCB in January 1999. During this time, we also increased our beneficial ownership in BCB to 55.79%, which left BCP with ownership of the remaining 44.21%. In November 2001, however, BCP bought back 55.53% of our interest in BCB for US$31.5 million. As of December 31, 2008,2010, BCB operated 6366 branches and 181176 ATMs located throughout Bolivia. BCB’s results have been consolidated in the BCP financial statements since the date of its acquisition by BCP in November 1993.

In 1997, we acquired Banco Tequendama, a Colombian banking enterprise. In 2002, we sold Banco Tequendama’s Venezuelan branches. In March 2005, we then sold Banco Tequendama to a Colombian bank. While this sale was publicly announced in October 2004 and became effective on January 1, 2005, it was not completed until March 2005 after all required approvals were obtained from the Colombian authorities. We did not record any significant gain or loss as a result of this transaction.

In March 2002, we made a tender offer for outstanding BCP shares for S/.1.80 per share, approximately equal to the book value of such shares, disbursing directly and through our subsidiary PPS an amount of approximately US$35.3 million. As a result of the tender offer, our equity stake in BCP increased from 90.6% to 97.0% (including shares held by PPS).

In December 2002, BCP acquired Banco Santander Central Hispano-Perú, or BSCH-Perú, (BSCH-Perú) for US$50.0 million. Since that date, BSCH-Perú has been included in BCP’s consolidated financial statements. On December 31, 2002, BSCH-Perú had total assets of US$975.2 million, total loans of US$719.4 million and deposits of US$659.0 million. BSCH-Perú was merged into BCP on February 28, 2003.

In March 2003, BCP added to its 55% stake by acquiring for US$17.0 million the remaining 45% of the equity shares of Solución Financiera de Crédito del Perú S.A. (or Solució(Solución) from Banco de Crédito e Inversiones de Chile (or BCI)(BCI) and other foreign shareholders. As a result, Solución once again became a BCP wholly-owned subsidiary. In March 2004, substantially all of Solución’s assets and liabilities were absorbed into BCP’s Peruvian banking operations. Solución’s net income in 2003 was US$7.6 million, and it had, as of February 28, 2004, a loan portfolio of US$88.4 million, with a 3.0% past-due ratio.

In 2003, BCP converted Banco de Crédito Overseas Limited or BCOL,(BCOL), its offshore bank in the Bahamas, into a vehicle to conduct investments and sold it to ASHC. ASHC then consolidated BCOL into its operations during 2004. In accordance with our policy regarding holdings of equity interests in non-financial companies, we then caused certain long-term equity interests that were previously held by BCOL to be transferred to BCP and then in turn transferred to Grupo Crédito. In April 2004, PPS sold substantially all of its holdings of our equity shares to ASHC (s(eeSee “Item 7. Major Shareholders and Related Party Transactions—(A) Major Shareholders”).

In March 2004, PPS acquired 100% of Novasalud Perú S.A. – Entidad Prestadora de Salud or Novasalud EPS, which is one of three private health insurance providers in Peru,(Novasalud EPS) for US$6.5 million. PPS then merged Novasalud EPS with Pacífico S.A. Entidad Prestadora de Salud (or Pací(Pacífico Salud), a subsidiary of PPS.

In 1997, we acquired Banco Tequendama, a Colombian banking enterprise. In 2002, we sold Banco Tequendama’s Venezuelan branches. In March 2005, we then sold Banco Tequendama to a Colombian bank. While this sale was publicly announced in October 2004 and became effective on January 1, 2005, it was not completed until March 2005 after all required approvals were obtained from the Colombian authorities. We did not record any significant gain as a result of this transaction.

In February 2005, we were authorized by Peruvian regulatory authorities to establish Prima AFP, of which Grupo Crédito is the main shareholder. Prima AFP started operations in August 2005.

In August 2006, Prima AFP acquired Unión Vida AFP, which is a pension fund operating in the Peruvian market. Prima AFP’s acquisition of Unión Vida AFP, which was formerly held by Grupo Santander Perú S.A., was a strategic move toward consolidation as part of its efforts to gain a leading position in the pension fund market. This acquisition enabled Prima AFP to position itself as the second ranking company in terms of market share terms (affiliates(defined as the amount of affiliates and assets under corporate management), with the second highest returns and the lowest commission for affiliates (who invest a portion of their salary each month). The merger between Prima AFP and Unión Vida AFP was consummated in December 2006.

13

In 2006, Prima AFP incurred significant merger expenses relative to its size, reaching the end of the year with losses of US$20.7 million. However, Prima AFP had a net income of US$11.225.5 million during 2008,2010, with 1,045,4101,124,457 affiliates and US$9,765 million of funds under management of US$4,865 million.its management.

In November 2006, we bought PPS’s remaining 1.02% of BCP shares, generating goodwill, with respectvalued at approximately US$7.2 million, from to the minority interest acquired we acquired (0.25%) of approximately US$7.2 million..

In October 2009, BCP acquired from the Cooperative for Assistance and Relief Everywhere Inc. (CARE) – Perú, all the shares that this entity owned of Empresa Financiera Edyficar S.A. (Edyficar), representing 77.12% of Edyficar’s capital stock. In accordance with Peruvian legal requirements in effect at the time, BCP made a public offering to Edyficar’s minority shareholders to acquire the remaining 22.66% of the company’s stock. The total purchase price for the acquisition was US$96.1 million, including related direct acquisition costs. As of December 31, 2010 BCP owned 99.79% of Edyficar.

In October 2010 the Credicorp group acquired American Life Insurance Company (ALICO)’s 20.1% and 38% stakes in PPS and Pacifico Vida, respectively. Pacifico Vida's shares were acquired through Credicorp Ltd. and its subsidiary, Grupo Credito, acquired PPS's shares. Consequently, at the conclusion of this transaction, Credicorp and its subsidiary Grupo Credito held 97.26% of Pacifico Seguros, and jointly controlled 100% of Pacifico Vida. The total investment amounted to approximately US$174 million, making it the largest transaction ever completed in the Peruvian insurance market. The acquisition will permit the Credicorp group to realize synergies in its decision making process and through the integration of all its insurance business lines. The closer proximity between companies will also allow PPS to improve its value proposition to customers, who seek integral insurance solutions. On April 28, 2011, Credicorp transferred its 38% stake in Pacifico Vida to PPS. As a result of that transfer, PPS now directly owns 100% of the shares of Pacifico Vida. This transfer will have no effect on Credicorp’s consolidated financial statements.

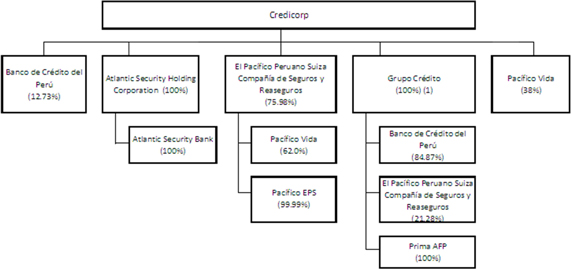

In November 2010, Credicorp's Board of Directors approved the transfer of 84.9% of BCP´s total shares to Grupo Crédito S.A. (its Peruvian wholly owned subsidiary) through a capital contribution, in order to facilitate Credicorp's future investments in Peru without modifying the controlling structure of BCP. The transaction was authorized by the Peruvian Superintendency of Banking, Insurance and Private Pension Fund Administrators. Under the new structure, Credicorp directly holds 12.7% of BCP's total shares and, in conjunction with its subsidiary Grupo Crédito, continues to control the same 97.6% of such shares without modifying the internal governance structure. Before this change in ownership structure, dividends to Credicorp from its Peruvian subsidiaries, such as BCP, were remitted abroad and had to be remitted back to Peru when capital for new investments in the country were required. With the new structure, Grupo Crédito, which acts as the local holding for some of Credicorp's investments in Peru (Prima AFP, PPS and others), will manage Credicorp's future Peruvian investments, and directly transfer the dividends to Credicorp when it is required to do so under Credicorp's dividend policy. This modified organizational structure will not affect the way Credicorp and BCP manage their day-to-day operations, and Credicorp’s dividend policy has not changed as a result of this transaction

The following tables show our organization and the organization of our principal subsidiaries as of December 31, 20082010 and their relative percentage contribution to our total assets, total revenues, net income and net equity at the same date (see “—(C) Organizational Structure”):

14

As of and for the Year ended December 31, 2008 (1) | As of and for the Year ended December 31, 2010 (1) | ||||||||||||||||||||||||

| Total Assets | Total Revenue | Net Income (Loss) | Net Equity | Total Assets | Total Revenue | Net Income (Loss) | Net Equity | ||||||||||||||||||

| Banco de Crédito del Perú | 87.3 | % | 75.1 | % | 117.9 | % | 80.6 | % | 88.9% | 69.8% | 87.7% | 70.8% | |||||||||||||

| Atlantic Security Holding Corporation | 4.9 | % | 1.1 | % | -14.1 | % | 5.5 | % | 3.5% | 5.5% | 6.8% | 8.5% | |||||||||||||

| El Pacífico-Peruano Suiza Compañía de Seguros y Reaseguros (2) | 5.9 | % | 20.4 | % | -5.9 | % | 4.3 | % | 6.0% | 21.2% | 12.8% | 11.5% | |||||||||||||

| Grupo Crédito (3) | 1.5 | % | 3.4 | % | 5.2 | % | 13.9 | % | |||||||||||||||||

| Prima AFP | 0.9% | 3.1% | 4.6% | 6.5% | |||||||||||||||||||||

| Others | 0.4 | % | 0.0 | % | -3.1 | % | -4.3 | % | 0.6% | 0.3% | -11.9% | 2.7% | |||||||||||||

| (1) | Percentages determined based on the Credicorp Consolidated Financial Statements. |

| (2) | Includes PPS and Pacífico Vida. |

| (3) |

| Includes Credicorp Ltd., CCR Inc., Credicorp Securities Inc. and others. |

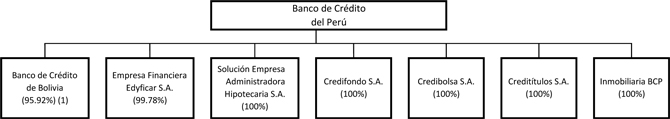

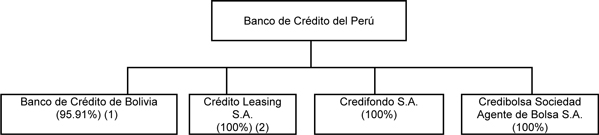

The following tables show the organization of BCP and its principal subsidiaries as of December 31, 2008:2010

As of and for the Year ended December 31, 2010 (2) | |||||||||

Total Assets | Total Revenue | Net Income (Loss) | Net Equity | ||||||

| Banco de Crédito del Perú | 92.2% | 88.4% | 84.6% | 79.0% | |||||

| Banco de Crédito de Bolivia | 4.4% | 4.2% | 4.2% | 4.8% | |||||

| Empresa Financiera Edyficar S.A. | 1.8% | 5.0% | 3.9% | 2.6% | |||||

| Solución Empresa Administradora Hipotecaria S.A. | 0.3% | 0.2% | 0.7% | 0.5% | |||||

| Credifondo S.A. | 0.1% | 1.6% | 4.6% | 1.3% | |||||

| Credibolsa Sociedad Agente de Bolsa S.A. | 0.1% | 0.3% | 0.8% | 0.8% | |||||

| Others (3) | 1.0% | 0.2% | 1.2% | 10.9% | |||||

As of and for the Year ended December 31, 2008 (3) | ||||||||||||||||

Total Assets | Total Revenue | Net Income (Loss) | Net Equity | |||||||||||||

| Banco de Crédito del Perú | 93.0 | % | 89.9 | % | 85.5 | % | 84.3 | % | ||||||||

| Banco de Crédito de Bolivia | 5.0 | % | 6.6 | % | 10.1 | % | 8.1 | % | ||||||||

| Crédito Leasing S.A. | 1.3 | % | 1.5 | % | 0.2 | % | 1.7 | % | ||||||||

| Financiera de Crédito Solución | 0.2 | % | 0.2 | % | 0.0 | % | 0.6 | % | ||||||||

| Credifondo S.A. | 0.1 | % | 1.2 | % | 2.0 | % | 1.9 | % | ||||||||

| Credibolsa Sociedad Agente de Bolsa S.A. | 0.1 | % | 0.4 | % | 0.9 | % | 0.9 | % | ||||||||

| Others (4) | 0.3 | % | 0.2 | % | 1.3 | % | 2.5 | % | ||||||||

| (1) |

| (2) |

| Percentages determined based on BCP’s consolidated financial statements as of and for the year ended December 31, |

| Includes Creditítulos S.A., Inmobiliaria BCP and others. |

| (B) | Business Overview |

(1) Introduction – Review of 2010

General

We conduct our business operations through four different operating segments: Banking (which includes BCP, ASHC, BCB, Edyficar, and other minor financial subsidiaries), Insurance (which includes Pacífico Peruano Suiza and its subsidiaries), Pension funds (which includes Prima AFP), and Brokerage and other (which include principally Credifondo, Credibolsa, and others).

15

Our total assets grew to US$20.828.4 billion as of December 31, 2008,2010, a 17.6%29.1% increase from the US$17.722.0 billion in assets we held as of December 31, 2007, as2009. Our increase in total assets was a result of strong growth (22.9%) in deposits that supported the expansion of our loan business.growth. Loans grew by 24.2% in 2010 (compared to 9.9% in 2009, 27.8% in 2008 (compared toand 39.2% in 2007, 18.2% in 2006)2007), following the progressexpansion of the Peruvian economy, (whichwhich had a GDP growth rate of 9.8%8.8% in 2008). As part2010. Our past-due and under legal collection loan ratio decreased to 1.44% by the end of our provision policy, provision for loan losses net of recoveries increased by 71.5% to US$48.8 million2010 (compared to US$28.4 million in 2007). Our past-due loansa ratio of 1.60% at the end of 2009 and 0.79% at the end of 2008 was consistent with that of 2007 (0.75%) and2008). We had a coverage ratio of 270.7%198.0% (i.e., reserves for loans as a percentage of past-due loans). Finally,, and our return on average net equity decreased slightly yet remained at a profitable level of 20.2%to 22.2% in 20082010 (compared to 22.7%23.7% in 2007)2009).

Banking segment

BCP

The main drivers behind BCP’s performance were: (i) solid

| · | the 20.3% growth in its net interest income after provision for loan losses, which reflects the 14.9% expansion of interest income on loans and the moderate increase of 1.0% in interest expenses due to the adequate control and asset & liability management; |

| · | the 13.8% increase in other income mainly as a result of higher banking services commissions (+25.5%) and net gain on foreign exchange transactions (+17.2%), which offset the contraction of 49.5% in net gain on sales of securities that in 2009 was extraordinarily high due to the purchase-sale of sovereign and global bonds; and |

| · | the significant rise in translation gains from US$7.6 million in 2009 to US$23.3 million in 2010. |

Performance in net interest income resulting from significant loan portfolio expansion across all segments and products, (ii) a considerablethese areas enabled BCP to offset the company’s 6.5% increase in non-financial income derived fromprovisions and 14.3% increase in operating expenses. The higher operating expenses were a result of BCP’s salary, employee benefits and, to a lesser degree, administrative expenses. These higher operating expenses were exacerbated by the raise2.8% appreciation of fees and commissionsthe Nuevo Sol against the U.S. dollar over the year, as well as higher gains on foreign exchange transactions and on salesa significant portion of securities and (iii) expansion of its network with an appropriate expenditure control.BCP’s operating expenses are denominated in local currency.

The average daily balances of BCP’s corporate and middle marketwholesale banking loans grew significantly, by 40.6%27.7% in 2010 as a result of the revival of previously postponed corporate investment plans and 30.2%, respectively, from 2007. This growth was driven by expanding domestic demand along with dynamic business at all levels (sector, industry, region and segments).the rising level of corporate inventories in Peru. As a result, BCP continued to lead the Peruvian financial system with a market share of 48.1%46.5% for the corporate segment and 37.1%34.1% for the middle market.market (higher than the 46.0% and 33.3% market shares obtained in 2009, respectively).

BCP’s retail banking portfolio continued its successupward trend and grew 42.9%23.2% in 2008, reaching an average daily balance of US$3,390.2010. In terms of growth and yields, BCP’s consumerSME loans were theits best performing product, reaching 72% growthgrowing by 30.1% (measured in average daily balances) to a total volume of US$618 million,2.2 billion, followed by loans to small companiesmortgages which grew 54%21.6% to US$1,127 million. Credit cards1.9 billion. Consumer loans grew 36%, reaching16.9% to US$384972 million, while mortgage creditscredit cards expanded 27%15.0%, totaling US$1,260580 million.