AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON April 17, 201229, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

(Mark One)

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

2013

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

..................... to……………..

OR

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report _________

report……………….

Commission file number: 001-32535001 - 32535

BANCOLOMBIA S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Republic of Colombia

(Jurisdiction of incorporation or organization)

Carrera 48 # 26-85, Avenida Los Industriales

Medellín, Colombia

(Address of principal executive offices)

Alejandro Mejia Jaramillo, Investor Relations Manager

Carrera 48 # 26-85, Medellín, Colombia

Tel. +5744041837,+574 4041837, Fax. + 574 4045146, e-mail: almejia@bancolombia.com

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registeredpursuant to Section 12(b) of the Act.

| Title of each Class | Name of each exchange on which registered | |||

| American Depositary Shares | New York Stock Exchange | |||

| Preferred Shares | New York Stock Exchange* |

__________________

| * | Bancolombia’s preferred shares are not listed for trading directly, but only in connection with its American Depositary Shares, which are evidenced by American Depositary Receipts, each representing four preferred shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the

period covered by the annual report.

| Common Shares | 509,704,584 |

| Preferred Shares |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

YesxNo¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 of 15(d) of the Securities Exchange Act of 1934

1934.

Yes¨Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

YesxNo¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes¨No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “accelerated filer and large, accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filerx Accelerated filer¨Non-accelerated filer¨

(Do not check if a smaller reporting company)

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Otherx |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes¨ No¨

TABLE OF CONTENTS

| CERTAIN DEFINED TERMS | i | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | iii | |

| PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION | iv | |

| PART I | 6 | |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 6 |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE | 6 |

| ITEM 3. | KEY INFORMATION | 6 |

| A. | SELECTED FINANCIAL DATA | 6 |

| B. | CAPITALIZATION AND INDEBTEDNESS | |

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS | |

| D. | RISK FACTORS | 11 |

| ITEM 4. | INFORMATION ON THE COMPANY | |

| A. | HISTORY AND DEVELOPMENT OF THE COMPANY | |

| B. | BUSINESS OVERVIEW | |

| C. | ORGANIZATIONAL STRUCTURE | |

| D. | ||

| E. | SELECTED STATISTICAL INFORMATION | |

| ITEM | UNRESOLVED STAFF COMMENTS | |

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | |

| A. | OPERATING RESULTS | |

| B. | LIQUIDITY AND CAPITAL RESOURCES | |

| C. | RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC. | |

| D. | TREND INFORMATION | |

| E. | OFF-BALANCE SHEET ARRANGEMENTS | |

| F. | TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS | |

| G. | CRITICAL ACCOUNTING POLICIES AND ESTIMATES | |

| H. | RECENT U.S. GAAP PRONOUNCEMENTS | |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | |

| A. | DIRECTORS AND SENIOR MANAGEMENT | |

| B. | COMPENSATION OF DIRECTORS AND OFFICERS | |

| C. | BOARD PRACTICES | |

| D. | EMPLOYEES | |

| E. | SHARE OWNERSHIP | |

| ITEM 7. | MAJOR STOCKHOLDERS AND RELATED PARTY TRANSACTIONS | |

| A. | MAJOR STOCKHOLDERS | |

| B. | RELATED PARTY TRANSACTIONS | |

| C. | INTEREST OF EXPERTS AND COUNSEL | |

| ITEM 8. | FINANCIAL INFORMATION | |

| A. | CONSOLIDATED STATEMENTS AND OTHER FINANCIAL INFORMATION | |

| B. | SIGNIFICANT CHANGES | |

| ITEM 9. | THE OFFER AND | |

| A. | OFFER AND LISTING DETAILS | |

| B. | PLAN OF DISTRIBUTION | |

| C. | MARKETS | |

| D. | SELLING STOCKHOLDERS | ||

| E. | DILUTION | ||

| F. | EXPENSES OF THE ISSUE | ||

| ITEM 10. | ADDITIONAL INFORMATION | ||

| A. | SHARE CAPITAL | ||

| B. | MEMORANDUM AND ARTICLES OF ASSOCIATION | ||

| C. | MATERIAL CONTRACTS | ||

| D. | EXCHANGE CONTROLS | ||

| E. | TAXATION | ||

| F. | DIVIDENDS AND PAYING AGENTS | ||

| G. | STATEMENT BY EXPERTS | ||

| H. | DOCUMENTS ON DISPLAY | ||

| I. | SUBSIDIARY INFORMATION | ||

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | ||

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | ||

| D. | AMERICAN DEPOSITARY SHARES | ||

| PART II | |||

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | ||

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | ||

| ITEM 15. | CONTROLS AND PROCEDURES | ||

| ITEM 16. | RESERVED | ||

| A. | AUDIT COMMITTEE FINANCIAL EXPERT | ||

| B. | CORPORATE GOVERNANCE AND CODE OF ETHICS | ||

| C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | ||

| D. | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | ||

| E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | ||

| F. | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | ||

| G. | CORPORATE GOVERNANCE | ||

| H. | MINE SAFETY DISCLOSURES | ||

| PART III | |||

| ITEM 17. | FINANCIAL STATEMENTS | ||

| ITEM 18. | FINANCIAL STATEMENTS | ||

| ITEM 19. | EXHIBITS | ||

CERTAIN DEFINED TERMS

Unless otherwise specified or if the context so requires, in this annual report:

References to “ADSs” refer to our American Depositary Shares (one ADS represents four preferred shares).

References to the “Annual Report” refer to this annual report on Form 20-F.

References to “Banagrícola” refer to Banagrícola S.A., a company incorporated in Panama, and authorized to operate as a bank holding company under the laws of the Republic of El Salvador, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Banca de Inversión” refer to Banca de Inversión Bancolombia S.A. Corporación Financiera, a Subsidiary of Bancolombia S.A. organized under the laws of the Republic of Colombia that specializes in providing investment banking services.

References to “Banco Agrícola” refer to Banco Agrícola S.A., a banking institution organized under the laws of the Republic of El Salvador, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Bancolombia”, the “Bank”, “us” , “we” or “our” refer to Bancolombia S.A., a banking institution organized under the laws of the Republic of Colombia, which may also act under the name of Banco de Colombia S.A., including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Bancolombia Panamá”Panama” refer to Bancolombia Panama(Panama) S.A., a Subsidiary of Bancolombia organized under the laws of the Republic of Panama that provides a complete line of banking services mainly to Colombiannon-Panamanian customers.

References to “Banistmo” refer to Banistmo S.A., a banking institution organized under the laws of the Republic of Panama, Panama, formerly known as HSBC Bank Panama S.A., including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Central Bank” refer to the Central Bank of Colombia. (Banco de la República).

References to “Colombia” refer to the Republic of Colombia.

References to “Colombian GAAP” refer to the generally accepted accounting principles in Colombia.

References to “Colombian banking GAAP” refer to Colombian GAAP as supplemented by the applicable regulations of the SFC.

References to “Conavi” refer to Conavi Banco Comercial y de Ahorros S.A. as it existed immediately before the Conavi/Corfinsura merger (as defined below).merger.

References to the “Conavi/Corfinsura merger” refer to the merger of Conavi and Corfinsura with and into Bancolombia, with Bancolombia as the surviving entity, which took effect on July 30, 2005 pursuant to a Merger Agreement dated February 28, 2005.

References to “Congress” refer to the national congress of Colombia.

References to “Corfinsura” refer to Corporación Financiera Nacional y Suramericana S.A., as it existed immediately before the Conavi/Corfinsura merger, taking into account the effect of its spin-off of a portion of its investment portfolio effective July 29, 2005.

| i |

References to “DTF” refer to theDepósitos a Término Fijo rate, the weighted average interest rate paid by finance corporations, commercial banks and commercial financefinancing companies in Colombia for certificates of depositterm deposits with maturities of 90 days.

References to “Factoring Bancolombia” refer to Factoring Bancolombia S.A., Compañía de Financamiento, a Subsidiary of Bancolombia organized under the laws of the Republic of Colombia that specializes in accounts receivable financing.

References to “Fiduciaria Bancolombia” refer to Fiduciaria Bancolombia S.A., Sociedad Fiduciaria, a Subsidiary of Bancolombia organized under the laws of Colombia which provides trust and fund management services.

References to “Grupo Agromercantil” refer to Grupo Agromercantil Holding S.A., a company organized under the laws of the Republic of Panama, of which Bancolombia has 40% of its voting shares, and is the largest fund manager amongparent company of Banco Agromercantil of Guatemala, and its peers, including other fund managers and brokerage firms in Colombia.subsidiaries.

References to “Leasing Bancolombia” refer to Leasing Bancolombia S.A. Compañía de Financialmiento Comercial,Financiamiento, a Subsidiary of Bancolombia organized under the laws of the Republic of Colombia that specializes in leasing activities, offering a wide range of financial leases, operating leases, loans, time deposits and bonds.

References to “NYSE” refer to the New York Stock Exchange.

References to “peso”, “pesos” or “COP” refer to the lawful currency of Colombia.

References to “preferred shares” and “common shares” refer to our authorizedissued outstanding and fully paid in preferred and common shares, designated asacciones preferencialescon dividendo preferencial sin derecho a votoandacciones ordinarias, respectively.

References to “Renting Colombia” refer to Renting Colombia S.A., a Subsidiary of Bancolombia organized under the laws of Colombia which provides operating lease and fleet management services for individuals and companies.

References to “Representative Market Rate” refer toTasa Representativa del Mercado, the U.S. dollar representative market rate, certified by the Superintendency of Finance.SFC. The Representative Market Rate is an economic indicator of the daily exchange rate on the Colombian market spot of currencies. It corresponds to the arithmetical weighted average of the rates of purchase and sale of currencies of interbank transactions of the authorized intermediaries.

References to “SEC” refer to the U.S. Securities and Exchange Commission.

References to “SMEs” refer to Small and Medium Enterprises.Enterprises

References to “SMMLV” refer in Spanish to “Salario Mínimo Mensual Legal Vigente”Vigente.,

The effective legal minimum monthly salary in Colombia. In 2013, the effective legal minimum monthly salary in Colombia.

References to “peso”, “pesos” or “COP” refer to the lawful currency of Colombia.Colombia was COP 589,500.

References to “Subsidiaries” refer to subsidiaries of Bancolombia in which Bancolombia holds, directly or indirectly, more than 50% or more of the outstanding voting shares.

References to “Superintendency of Finance” or “SFC” refer to the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia), a technical entity under the Ministry of Finance and Public Credit having(Ministerio de Hacienda y Crédito Público) with functions of inspection, supervision and control over the personsentities involved in financial activities, stock market,capital markets, insurance and any other services related to the management, use or investment of resources collected from the public.

Referencespublic.References to “U.S.” or “United States” refer to the United States of America.

| ii |

References to “U.S. dollar”, “USD”, and “US$” refer to the lawful currency of the United States.

References to “UVR” refer toUnidades de Valor Real, a Colombian inflation-adjusted monetary index calculated by the board of directors of the Central Bank and generally used for pricing home-mortgage loans.

References to “Valores Bancolombia” refer to Valores Bancolombia S.A. Comisionista de Bolsa, a Subsidiary of Bancolombia organized under the laws of the Republic of Colombia that provides brokerage and asset management services to over 200,000 clients.services.

The term “billion” means one thousand million (1,000,000,000).

The term “trillion” means one million million (1,000,000,000,000).

Our fiscal year ends on December 31, and references in this annual reportAnnual Report to any specific fiscal year are to the twelve-month period ended December 31 of such year.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements which may constitute forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but instead represent only the Bank’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside the Bank’s control. The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “predict”, “target”, “forecast”, “guideline”, “should”, “project” and similar words and expressions are intended to identify forward-looking statements. It is possible that the Bank’s actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements.

Information regarding important factors that could cause actual results to differ, perhaps materially, from those in the Bank’s forward-looking statements appear in a number of places in this Annual Report, principally in “Item 3. Key Information – D. Risk Factors” and “Item 5.Operating5. Operating and Financial Review and Prospects”, and include, but are not limited to: (i) changes in general economic, business, political, social, fiscal or other conditions in Colombia, or in any of the other countries where the Bank operates; (ii) changes in capital markets or in markets in general that may affect policies or attitudes towards lending; (iii) unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; (iv) inflation, changes in foreign exchange rates and/or interest rates; (v) sovereign risks; (vi) liquidity risks; (vii) increases in defaults by the Bank’s borrowers and other loan delinquencies; (viii) lack of acceptance of new products or services by the Bank’s targeted customers; (ix) competition in the banking, financial services, credit card services, insurance, asset management, remittances, business and other industries in which the Bank operates; (x) adverse determination of legal or regulatory disputes or proceedings; (xi) changes in official regulations and the Colombian government’s banking policy as well as changes in laws, regulations or policies in the jurisdictions in which the Bank does business; (xii) regulatory issues relating to acquisitions; and (xiii) changes in business strategy.

Forward-looking statements speak only as of the date they are made and are subject to change, and the Bank does not intend, and does not assume any obligation, to update these forward-looking statements in light of new information or future events arising after the date of this Annual Report.

| iii |

PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION

Accounting Principles

The Bank’s audited Consolidated Financial Statements are prepared following the accounting practices used in the preparation of the Bank’s consolidated financial statements followand the special regulations of the Superintendencia Financiera de Colombia (the “SuperintendencySFC, or, in the absence of Finance”) and generally accepted accounting principles in Colombia (collectively, “Colombian GAAP”).such regulations, Colombian banking GAAP. Together, these requirements differ in certain significant respects from generally accepted accounting principles in the United States (“U.S. GAAP”). Note 31 to the Bank’s audited consolidated financial statementsConsolidated Financial Statements included in this Annual Report provides a description of the principal differences between Colombian banking GAAP and U.S. GAAP as they relate to the Bank’s audited consolidated financial statementsConsolidated Financial Statements and provides a reconciliation of consolidated net income and consolidated stockholders’ equity for the years and dates indicated herein. References to Colombian banking GAAP in this Annual Report are to Colombian banking GAAP as supplemented by the applicable regulations of the Superintendency of Finance.SFC.

For consolidation purposes under Colombian banking GAAP, financial statements of the Bank and its Subsidiaries must be prepared under uniform accounting policies. In order to comply with this requirement, financial statements of foreign Subsidiaries were adjusted as required by Colombian regulations.

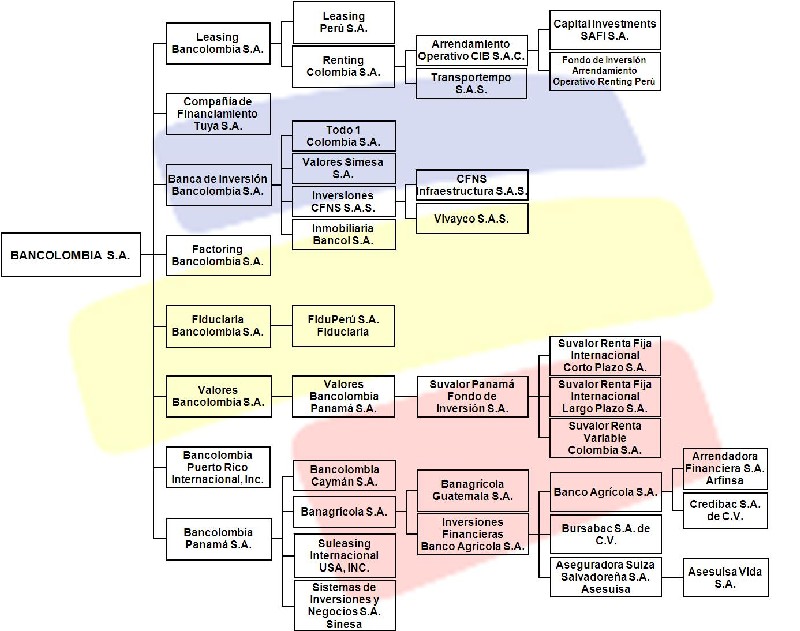

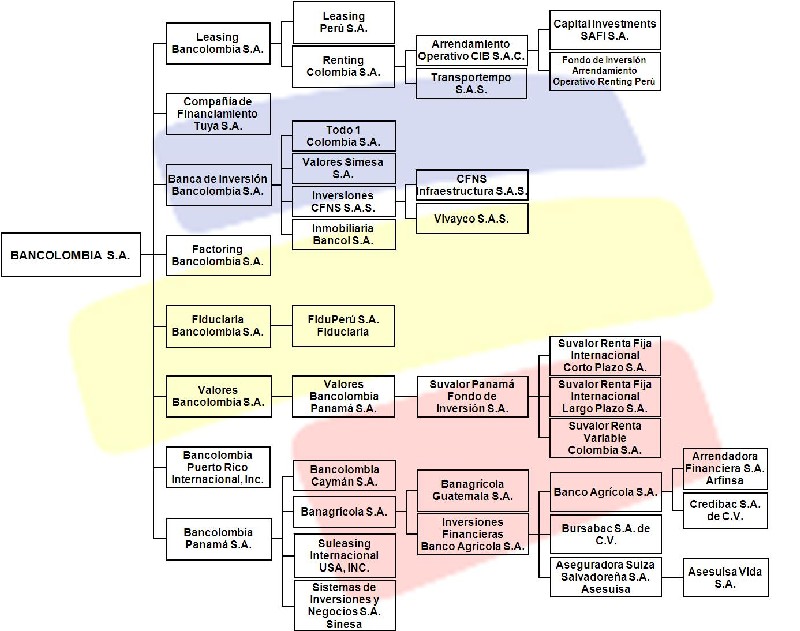

For 2011,2013, the Bank’s consolidated financial statementsConsolidated Financial Statements include companiesentities in which it holds, directly or indirectly, 50% or morea majority of the outstanding voting shares.rights. The Bank consolidates directly Leasing Bancolombia S.A. Compañía de Financiamiento,, Fiduciaria Bancolombia S.A. Sociedad Fiduciaria,, Banca de Inversión, Bancolombia S.A. Corporación Financiera, Compañía de Financiamiento Tuya S.A., Bancolombia Puerto Rico Internacional Inc,Inc., Bancolombia PanamáPanama S.A., Valores Bancolombia S.A. Comisionista de Bolsa, Factoring Bancolombia S.A. Compañía de Financiamiento.Financiamiento, FCP Fondo Colombia Inmobiliario S.A., Patrimonio Autónomo Cartera LBC and Banistmo S.A. Some of the Bank’s Subsidiaries also consolidate their own subsidiaries. Bancolombia Panamá S.A.Panama consolidates Bancolombia Cayman S.A., Sistema de Inversiones y Negocios S.A. Sinesa, Suleasing International USA, Inc. and Banagrícola S.A. (which, in turn, consolidates Inversiones Financieras Banco Agrícola S.A. IFBA, Banco Agrícola, S.A., Arrendadora Financiera S.A. Arfinsa, Credibac S.A. de C.V., BursabacValores Banagrícola S.A. de C.V., Banagrícola Guatemala S.A., Aseguradora Suiza Salvadoreña S.A. Asesuisa(1)and Asesuisa Vida S.A.(1))Bagrícola Costa Rica). Banca de Inversión consolidates withBIBA Inmobiliaria Bancol S.A.S.A.S., Valores Simesa S.A., Inversiones CFNS S.A.S., Todo Uno Colombia S.A., (which, in turn, consolidates CFNS Infraestructura S.A.S. and, Vivayco S.A.S. The Bank’s Subsidiaryand Uff Móvil S.A.S.). Leasing Bancolombia S.A. Compañía de Financiamiento consolidates Leasing Perú S.A., Renting Colombia S.A. (which, in turn, consolidates Arrendamiento Operativo CIB S.A.C., Capital Investments SAFI S.A., Fondo de Inversión en Arrendamiento Operativo Renting Perú, Capital Investments SAFI S.A., and Transportempo S.A.S.). The Bank’s Subsidiary Valores Bancolombia S.A. Comisionista de Bolsa consolidates Valores Bancolombia PanamáPanama S.A. and Suvalor PanamáPanama Fondo de Inversión S.A. and the Bank’s Subsidiary Fiduciaria Bancolombia S.A. Sociedad Fiduciaria consolidates FiduPerú S.A. Sociedad Fiduciaria.Fiduciaria and Banistmo consolidates Banistmo Investment Corporation S.A., Financiera Flash S.A., Grupo Financomer S.A., Financomer S.A., Leasing Banistmo S.A., Seguros Banistmo S.A., Securities Banistmo S.A., Banistmo Capital Markets Group Inc., Banistmo Asset Management Inc., Anavi Investment Corporation S.A., Williamsburg International Corp., Van Dyke Overseas Corp., M.R.C. Investment Corp., Inmobiliaria Bickford S.A., Desarrollo del Oriente S.A., Bien Raices Armuelles S.A. , Steens Enterpresies S.A., Ordway Holdings S.A. and Inversiones Castan S.A. See “Item 4. Information on the Company – C. Selected Organizational Structure” for an organizationorganizational chart depicting Bancolombia and its subsidiaries.

Currencies

The Bank maintains accounting records in Colombian pesos. The audited consolidated financial statementsConsolidated Financial Statements of Bancolombia S.A. as of December 31, 2011,2013, and 20102012 and for the three years ended December 31, 20112013 (collectively, including the notes thereto, the “Financial Statements”) contained in this Annual Report are expressed in pesos.

This Annual Report translates certain peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such peso amounts have been translated at the rate of COP 1,942.701,926.83 per USD 1.00, which corresponds to the Representative Market Rate calculated on December 31, 20112013 the last business day of the year. The Representative Market Rate is computed and certified by the Superintendency of Finance, the Colombian banking regulator,SFC, on a daily basis and represents the weighted average of the buy/sell foreign exchange rates negotiated on the previous day by certain financial institutions authorized to engage in foreign exchange transactions (including Bancolombia S.A.)Bancolombia). The Superintendency of FinanceSFC also calculates and certifies the average Representative Market Rate for each month for purposes of preparing financial statements and converting amounts in foreign currency to Colombian pesos. Such conversion should not be construed as a representation that the peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On April 13, 2012,28, 2014, the Representative Market Rate was COP 1,778.781,942.37 per USD 1.00.

_____________________________

| iv |

Rounding Comparability of Data

Certain monetary amounts, percentages and other figures included in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

This Annual Report refers to certain websites as sources for certain information contained herein. Information contained in or otherwise accessible through these websites is not a part of this Annual Report. All references in this Annual Report to these and other internet sites are inactive textual references to these URLs, or “uniform resource locators”, and are for your informational reference only.

The Bank maintains an internet site atwww.grupobancolombia.com. www.grupobancolombia.com. In addition, certain of the Bank’s Subsidiaries referred to in this Annual Report maintain separate internet sites. For example, Banco Agrícola maintains an internet site atwww.bancoagricola.com. www.bancoagricola.com. Information included on or accessible through Bancolombia’s internet site or the internet site of any of the Subsidiaries of the Bank is not part of this Annual Report.

| v |

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | SELECTED FINANCIAL DATA |

The selected consolidated financial data as of December 31, 20112013 and 2010,2012, and for each of the three fiscal years in the period ended December 31, 20112013 set forth below has been derived from the Bank’s audited consolidated financial statementsConsolidated Financial Statements included in this Annual Report. The selected consolidated financial data as of December 31, 2009, 20082011, 2010 and 2007,2009, and for each of the two fiscal years in the period ended December 31, 20082010 set forth below have been derived from the Bank’s audited consolidated financial statementsConsolidated Financial Statements for the respective periods, which are not included herein.

The selected consolidated financial data should be read in conjunction with the Bank’s consolidated financial statements,Consolidated Financial Statements, related notes thereto, and the reports of the Bank’s independent registered public accounting firms.

Differences Between Colombian banking GAAP and U.S. GAAP Results

The Bank’s consolidated financial statementsConsolidated Financial Statements have been prepared in accordance with Colombian banking GAAP, which are the accounting principles and policies that are summarized in “Note 2. Summary of Significant Accounting Policies” to the Bank’s Consolidated Financial Statements included in this Annual Report. These accounting principles and policies differ in some significant respects from U.S. GAAP.

Consolidated net income attributable to the controlling interest under U.S. GAAP for the year ended December 31, 20112013 was COP 1,043,6361,415,635 million (compared with COP 1,544,7611,633,563 million for fiscal year 20102012 and COP 1,172,5241,043,636 million for fiscal year 2009)2011). A reconciliation of consolidated net income and consolidated stockholders’ equity under U.S. GAAP is included in “Note 31. Differences between Colombian Accounting Principles for Banks and U.S. GAAP” to the Consolidated Financial Statements included in this Annual Report.

| As of and for the year ended December 31, | As of and for the year ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2011(1) | 2011 | 2010 | 2009 | 2008 | 2007(8)(10) | 2013(1) | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||||||||||||||||||||

| (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | |||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED STATEMENT OF OPERATIONS: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Colombian GAAP: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Colombian banking GAAP: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Interest income | USD | 3,060,480 | COP | 5,945,594 | COP | 4,960,640 | COP | 6,427,698 | COP | 6,313,743 | COP | 4,810,408 | USD | 4,219,721 | COP | 8,130,684 | COP | 7,661,883 | COP | 5,945,594 | COP | 4,960,640 | COP | 6,427,698 | ||||||||||||||||||||||||

| Interest expense | (1,051,118 | ) | (2,042,006 | ) | (1,571,581 | ) | (2,625,416 | ) | (2,753,341 | ) | (2,002,090 | ) | (1,620,342 | ) | (3,122,126 | ) | (2,894,860 | ) | (2,042,006 | ) | (1,571,581 | ) | (2,625,416 | ) | ||||||||||||||||||||||||

| Net interest income | 2,009,362 | 3,903,588 | 3,389,059 | 3,802,282 | 3,560,402 | 2,808,318 | 2,599,379 | 5,008,558 | 4,767,023 | 3,903,588 | 3,389,059 | 3,802,282 | ||||||||||||||||||||||||||||||||||||

| Provisions for loans and accrued interest losses, net of recoveries(2) | (307,004 | ) | (596,417 | ) | (512,585 | ) | (1,103,595 | ) | (1,155,262 | ) | (617,868 | ) | ||||||||||||||||||||||||||||||||||||

| Provisions for loans, finance leases and accrued interest losses, net of recoveries (2) | (603,415 | ) | (1,162,679 | ) | (1,072,520 | ) | (596,417 | ) | (512,585 | ) | (1,103,595 | ) | ||||||||||||||||||||||||||||||||||||

| Provision for foreclosed assets and other assets, net of recoveries | (1,178 | ) | (2,288 | ) | (35,130 | ) | (49,779 | ) | 22,095 | 20,833 | (35,250 | ) | (67,921 | ) | (38,353 | ) | (2,288 | ) | (35,130 | ) | (49,779 | ) | ||||||||||||||||||||||||||

| Net interest income after provisions | 1,701,180 | 3,304,883 | 2,841,344 | 2,648,908 | 2,427,235 | 2,211,283 | 1,960,714 | 3,777,958 | 3,656,150 | 3,304,883 | 2,841,344 | 2,648,908 | ||||||||||||||||||||||||||||||||||||

| Fees and income from services and other operating income, net | 1,214,713 | 2,359,821 | 2,115,970 | 1,886,949 | 1,964,084 | 1,510,129 | 1,430,578 | 2,756,481 | 2,640,137 | 2,359,821 | 2,115,970 | 1,886,949 | ||||||||||||||||||||||||||||||||||||

| Operating expenses | (1,856,357 | ) | (3,606,348 | ) | (3,098,479 | ) | (2,895,145 | ) | (2,639,997 | ) | (2,271,418 | ) | (2,407,726 | ) | (4,639,280 | ) | (4,162,382 | ) | (3,606,348 | ) | (3,098,479 | ) | (2,895,145 | ) | ||||||||||||||||||||||||

| Net operating income | 1,059,536 | 2,058,356 | 1,858,835 | 1,640,712 | 1,751,322 | 1,449,994 | 983,566 | 1,895,159 | 2,133,905 | 2,058,356 | 1,858,835 | 1,640,712 | ||||||||||||||||||||||||||||||||||||

| Net non-operating income excluding minority interest | 44,993 | 87,406 | 99,293 | 93,232 | 31,888 | 12,058 | 28,247 | 54,427 | 40,938 | 87,406 | 99,293 | 93,232 | ||||||||||||||||||||||||||||||||||||

| Minority interest (loss) | (5,843 | ) | (11,351 | ) | (13,217 | ) | (15,081 | ) | (18,511 | ) | (13,246 | ) | (9,012 | ) | (17,364 | ) | (5,723 | ) | (11,351 | ) | (13,217 | ) | (15,081 | ) | ||||||||||||||||||||||||

| Income before income taxes | 1,098,686 | 2,134,411 | 1,944,911 | 1,718,863 | 1,764,699 | 1,448,806 | 1,002,801 | 1,932,222 | 2,169,120 | 2,134,411 | 1,944,911 | 1,718,863 | ||||||||||||||||||||||||||||||||||||

| Income taxes | (242,197 | ) | (470,517 | ) | (508,417 | ) | (462,013 | ) | (474,056 | ) | (361,883 | ) | (216,467 | ) | (417,095 | ) | (467,074 | ) | (470,517 | ) | (508,417 | ) | (462,013 | ) | ||||||||||||||||||||||||

| Net income | USD | 856,489 | COP | 1,663,894 | COP | 1,436,494 | COP | 1,256,850 | COP | 1,290,643 | COP | 1,086,923 | USD | 786,334 | COP | 1,515,127 | COP | 1,702,046 | COP | 1,663,894 | COP | 1,436,494 | COP | 1,256,850 | ||||||||||||||||||||||||

| Weighted average of Preferred and Common Shares outstanding | 787,827,003 | 787,827,003 | 787,827,003 | 787,827,003 | 758,313,771 | 851,827,000 | 845,531,918 | 787,827,003 | 787,827,003 | 787,827,003 | ||||||||||||||||||||||||||||||||||||||

| Basic and Diluted net income per share | 1.09 | 2,112 | 1,823 | 1,595 | 1,638 | 1,433 | USD | 0.92 | COP | 1,779 | COP | 2,013 | COP | 2,112 | COP | 1,823 | COP | 1,595 | ||||||||||||||||||||||||||||||

| Basic and Diluted net income per ADS(10) | 4.35 | 8,448 | 7,292 | 6,380 | 6,552 | 5,732 | ||||||||||||||||||||||||||||||||||||||||||

| Basic and Diluted net income per ADS | 3.69 | 7,116 | 8,052 | 8,448 | 7,292 | 6,380 | ||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per share | 708 | 669 | 637 | 624 | 568 | 776 | 754 | 708 | 669 | 637 | ||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per share(stated in U.S. Dollars) | 0.36 | 0.35 | 0.31 | 0.28 | 0.28 | |||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per share(stated in U.S. dollars) | 0.40 | 0.43 | 0.36 | 0.35 | 0.31 | |||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per ADS | 2,832 | 2,675 | 2,547 | 2,496 | 2,272 | 3,104 | 3,016 | 2,832 | 2,675 | 2,547 | ||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per ADS (stated in U.S. Dollars) | 1.46 | 1.40 | 1.25 | 1.11 | 1.13 | |||||||||||||||||||||||||||||||||||||||||||

| Cash dividends declared per ADS (stated in U.S. dollars) | 1.61 | 1.71 | 1.46 | 1.40 | 1.25 | |||||||||||||||||||||||||||||||||||||||||||

| U.S. GAAP: | ||||||||||||||||||||||||||||||||||||||||||||||||

| Net income attributable to the controlling interest | USD | 537,209 | COP | 1,043,636 | (6) | COP | 1,544,761 | (6) | COP | 1,172,524 | (6) | COP | 849,920 | COP | 1,015,644 | USD | 734,696 | COP | 1,415,635 | (6) | COP | 1,633,563 | (6) | COP | 1,043,636 | (6) | COP | 1,544,761 | (6) | COP | 1,172,524 | |||||||||||||||||

| Total basic and Diluted net income per common share(7) | 0.68 | 1,325 | 1,961 | 1,488 | 1,079 | 1,339 | ||||||||||||||||||||||||||||||||||||||||||

| Total basic and Diluted net income per ADS (7) (9) | 2.73 | 5,300 | 7,844 | 5,952 | 4,316 | 5,356 | ||||||||||||||||||||||||||||||||||||||||||

| Basic and Diluted net income per common share (5) | 0.86 | 1,662 | 1,932 | 1,325 | 1,961 | 1,488 | ||||||||||||||||||||||||||||||||||||||||||

| Basic and Diluted net income per ADS (5) (6) | 3.45 | 6,648 | 7,728 | 5,300 | 7,844 | 5,952 | ||||||||||||||||||||||||||||||||||||||||||

| (1) | Amounts stated in U.S. dollars have been converted at the rate of COP |

| (2) | Represents the provision for |

| (3) |

| The weighted average of preferred and common shares outstanding for fiscal |

| Refer to |

| Basic and diluted net income per ADS for any period is defined as basic and diluted net income per share multiplied by four as each ADS is equivalent to four preferred shares of Bancolombia. Basic and diluted net income per ADS should not be considered in isolation, or as a substitute for net income, as a measure of operating performance or as a substitute for cash flows from operations or as a measure of liquidity. |

| As of and for the year ended December 31, | ||||||||||||||||||||||||

| 2011(1) | 2011 | 2010 | 2009 | 2008 | 2007(3) | |||||||||||||||||||

| (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | ||||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||||||||||||||||||

| Colombian GAAP: | ||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||

| Cash and due from banks | USD | 3,509,707 | COP | 6,818,307 | COP | 5,312,398 | COP | 4,983,569 | COP | 3,870,927 | COP | 3,618,619 | ||||||||||||

| Overnight funds | 468,775 | 910,690 | 842,636 | 2,388,790 | 1,748,648 | 1,609,768 | ||||||||||||||||||

| Investment securities, net | 5,125,954 | 9,958,191 | 8,675,762 | 8,914,913 | 7,278,276 | 5,774,251 | ||||||||||||||||||

| Loans and financial leases, net | 30,151,771 | 58,575,846 | 46,091,877 | 39,610,307 | 42,508,210 | 36,245,473 | ||||||||||||||||||

| Accrued interest receivable on loans and financial leases, net | 226,071 | 439,189 | 317,532 | 338,605 | 505,658 | 398,560 | ||||||||||||||||||

| Customers’ acceptances and derivatives | 381,580 | 741,296 | 784,888 | 205,367 | 272,458 | 196,001 | ||||||||||||||||||

| Accounts receivable, net | 523,491 | 1,016,985 | 797,715 | 806,885 | 828,817 | 716,106 | ||||||||||||||||||

| Premises and equipment, net | 835,081 | 1,622,311 | 1,174,625 | 992,041 | 1,171,117 | 855,818 | ||||||||||||||||||

| Premises and equipment under operating leases, net | 710,381 | 1,380,057 | 1,006,108 | 843,054 | 726,262 | 488,333 | ||||||||||||||||||

| Foreclosed assets, net | 27,381 | 53,194 | 70,277 | 80,668 | 24,653 | 32,294 | ||||||||||||||||||

| Prepaid expenses and deferred charges, net | 404,312 | 785,456 | 319,864 | 185,811 | 132,881 | 137,901 | ||||||||||||||||||

| Goodwill | 349,957 | 679,861 | 750,968 | 855,724 | 1,008,639 | 977,095 | ||||||||||||||||||

| As of and for the year ended December 31, | ||||||||||||||||||||||||

| 2011(1) | 2011 | 2010 | 2009 | 2008 | 2007(3) | |||||||||||||||||||

| (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | ||||||||||||||||||||||||

| Other assets | 873,860 | 1,697,648 | 1,185,977 | 922,265 | 1,093,850 | 580,642 | ||||||||||||||||||

| Reappraisal of assets | 403,556 | 783,989 | 764,529 | 736,366 | 612,683 | 520,788 | ||||||||||||||||||

| Total assets | USD | 43,991,877 | COP | 85,463,020 | COP | 68,095,156 | COP | 61,864,365 | COP | 61,783,079 | COP | 52,151,649 | ||||||||||||

| Liabilities and stockholders’ equity: | ||||||||||||||||||||||||

| Deposits | USD | 26,990,525 | COP | 52,434,492 | COP | 43,538,967 | COP | 42,149,330 | COP | 40,384,400 | COP | 34,374,150 | ||||||||||||

| Borrowings(4) | 3,839,463 | 7,458,926 | 5,250,587 | 4,039,150 | 5,947,925 | 4,851,246 | ||||||||||||||||||

| Other liabilities | 8,532,580 | 16,576,242 | 11,358,462 | 8,643,056 | 9,333,909 | 7,726,983 | ||||||||||||||||||

| Stockholder’ equity | 4,629,309 | 8,993,360 | 7,947,140 | 7,032,829 | 6,116,845 | 5,199,270 | ||||||||||||||||||

| Total liabilities and stockholders’ equity | USD | 43,991,877 | COP | 85,463,020 | COP | 68,095,156 | COP | 61,864,365 | COP | 61,783,079 | COP | 52,151,649 | ||||||||||||

| U.S. GAAP: | ||||||||||||||||||||||||

| Stockholders’ equity attributable to the controlling interest | USD | 4,421,270 | COP | 8,589,202 | (2) | COP | 8,069,346 | (2) | COP | 7,095,266 | COP | 6,422,815 | COP | 5,937,554 | ||||||||||

| Stockholders’ equity per share(5) | 5,612 | 10,902 | 10,243 | 9,006 | 8,153 | 7,830 | ||||||||||||||||||

| Stockholders’ equity per ADS(5) | 22,447 | 43,608 | 40,972 | 36,024 | 32,612 | 31,320 | ||||||||||||||||||

CONSOLIDATED BALANCE SHEET

| As of the year ended December 31, | ||||||||||||||||||||||||

2013(1) | 2013 | 2012 | 2011 | 2010 | 2009 | |||||||||||||||||||

| (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | ||||||||||||||||||||||||

| CONSOLIDATED BALANCE SHEET | ||||||||||||||||||||||||

| Colombian banking GAAP: | ||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||

| Cash and due from banks | USD | 5,930,695 | COP | 11,427,441 | COP | 7,144,015 | COP | 6,818,307 | COP | 5,312,398 | COP | 4,983,569 | ||||||||||||

| Funds sold and securities purchased under agreements to resell | 2,066,194 | 3,981,205 | 1,025,082 | 910,690 | 842,636 | 2,388,790 | ||||||||||||||||||

| Investment securities, net | 7,165,028 | 13,805,790 | 12,554,311 | 9,958,191 | 8,675,762 | 8,914,913 | ||||||||||||||||||

| Loans and financial leases, net | 44,318,393 | 85,394,012 | 66,739,040 | 58,575,846 | 46,091,877 | 39,610,307 | ||||||||||||||||||

| Accrued interest receivable on loans and financial leases, net | 290,929 | 560,572 | 524,041 | 439,189 | 317,532 | 338,605 | ||||||||||||||||||

| Customers’ acceptances and derivatives | 312,643 | 602,409 | 783,014 | 741,296 | 784,888 | 205,367 | ||||||||||||||||||

| Accounts receivable, net | 797,796 | 1,537,218 | 1,243,263 | 1,016,985 | 797,715 | 806,885 | ||||||||||||||||||

| Premises and equipment, net | 1,137,452 | 2,191,677 | 1,341,698 | 1,622,311 | 1,174,625 | 992,041 | ||||||||||||||||||

| Premises and equipment under operating leases, net | 1,515,017 | 2,919,181 | 2,191,928 | 1,380,057 | 1,006,108 | 843,054 | ||||||||||||||||||

| Foreclosed assets, net | 53,749 | 103,565 | 84,818 | 53,194 | 70,277 | 80,668 | ||||||||||||||||||

| Prepaid expenses and deferred charges, net | 358,585 | 690,932 | 772,930 | 785,456 | 319,864 | 185,811 | ||||||||||||||||||

| Goodwill, net | 1,862,750 | 3,589,203 | 571,373 | 679,861 | 750,968 | 855,724 | ||||||||||||||||||

| Other assets | 1,344,234 | 2,590,110 | 2,088,947 | 1,697,648 | 1,185,977 | 922,265 | ||||||||||||||||||

| Reappraisal of assets | 738,480 | 1,422,926 | 851,920 | 783,989 | 764,529 | 736,366 | ||||||||||||||||||

| Total assets | USD | 67,891,945 | COP | 130,816,241 | COP | 97,916,380 | COP | 85,463,020 | COP | 68,095,156 | COP | 61,864,365 | ||||||||||||

| Liabilities and stockholders’ equity: | ||||||||||||||||||||||||

| Deposits | USD | 44,921,752 | COP | 86,556,579 | COP | 64,158,720 | COP | 52,434,492 | COP | 43,538,967 | COP | 42,149,330 | ||||||||||||

| Borrowings(3) | 6,491,539 | 12,508,092 | 5,271,508 | 7,458,926 | 5,250,587 | 4,039,150 | ||||||||||||||||||

| Other liabilities | 9,995,028 | 19,258,724 | 16,879,197 | 16,576,242 | 11,358,462 | 8,643,056 | ||||||||||||||||||

| Stockholder’ equity | 6,483,626 | 12,492,846 | 11,606,955 | 8,993,360 | 7,947,140 | 7,032,829 | ||||||||||||||||||

| Total liabilities and stockholders’ equity | USD | 67,891,945 | COP | 130,816,241 | COP | 97,916,380 | COP | 85,463,020 | COP | 68,095,156 | COP | 61,864,365 | ||||||||||||

| U.S. GAAP: | ||||||||||||||||||||||||

| Stockholders’ equity attributable to the controlling interest | USD | 6,303,905 | COP | 12,146,554 | (2) | COP | 11,145,490 | (2) | COP | 8,589,202 | COP | 8,069,346 | COP | 7,095,266 | ||||||||||

| Stockholders’ equity per share(4) | 7,400 | 14,259 | 13,182 | 10,902 | 10,243 | 9,006 | ||||||||||||||||||

| Stockholders’ equity per ADS(4) | 29,601 | 57,036 | 52,728 | 43,608 | 40,972 | 36,024 | ||||||||||||||||||

| (1) | Amounts stated in U.S. dollars have been converted at the rate of COP |

| (2) | Refer to “Note 31, Differences between Colombian Accounting Principles for Banks and U.S. GAAP” to the Consolidated Financial Statements included in this Annual Report. |

| (3) |

| Includes other interbank borrowing, development and other domestic banks. |

| The |

See “Item―“Item 8. Financial Information – A. Consolidated Statements and Other Financial Information – A.3. Dividend Policy”, for information about the dividends declared per share in both pesos and U.S. dollars during the fiscal years ended in December 31, 2013, 2012, 2011, 2010 2009, 2008 and 2007.2009.

| As of and for the year ended December 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007(10)(11) | ||||||||||||||||

| (Percentages, except for operating data) | ||||||||||||||||||||

| SELECTED RATIOS:(1) | ||||||||||||||||||||

| Colombian GAAP: | ||||||||||||||||||||

| Profitability ratios: | ||||||||||||||||||||

| Net interest margin(2) | 6.17 | 6.38 | 7.22 | 7.64 | 7.60 | |||||||||||||||

| Return on average total assets(3) | 2.20 | 2.27 | 2.01 | 2.34 | 2.52 | |||||||||||||||

| Return on average stockholders’ equity(4) | 20.22 | 19.71 | 19.59 | 23.68 | 26.13 | |||||||||||||||

| Efficiency Ratio: | ||||||||||||||||||||

| Operating expenses as a percentage of interest, fees, services and other operating income | 57.58 | 56.28 | 50.89 | 47.79 | 52.60 | |||||||||||||||

| Capital ratios: | ||||||||||||||||||||

| Period-end stockholders’ equity as a percentage of period-end total assets | 10.52 | 11.67 | 11.37 | 9.90 | 9.97 | |||||||||||||||

| Period-end regulatory capital as a percentage of period-end risk-weighted assets(5) | 12.46 | 14.67 | 13.23 | 11.24 | 12.67 | |||||||||||||||

| Credit quality data: | ||||||||||||||||||||

| Non-performing loans as a percentage of total loans(6) | 1.52 | 1.91 | 2.44 | 2.35 | 1.77 | |||||||||||||||

| “C”, “D” and “E” loans as a percentage of total loans(9) | 3.82 | 4.32 | 5.11 | 4.40 | 3.10 | |||||||||||||||

| Allowance for loan and accrued interest losses as a percentage of non-performing loans | 306.94 | 274.36 | 241.08 | 224.53 | 223.67 | |||||||||||||||

| Allowance for loan and accrued interest losses as a percentage of “C”, “D” and “E” loans(9) | 121.69 | 121.45 | 115.25 | 120.21 | 127.38 | |||||||||||||||

| Allowance for loan and accrued interest losses as a percentage of total loans | 4.65 | 5.24 | 5.89 | 5.29 | 3.95 | |||||||||||||||

| OPERATING DATA: | ||||||||||||||||||||

| Number of branches(7) | 952 | 921 | 889 | 890 | 888 | |||||||||||||||

| Number of employees(8) | 24,126 | 22,992 | 21,201 | 19,728 | 24,836 | |||||||||||||||

SELECTED RATIOS

| As of and for the year ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| (Percentages, except for operating data) | ||||||||||||||||||||

| SELECTED RATIOS:(1) | ||||||||||||||||||||

| Colombian banking GAAP: | ||||||||||||||||||||

| Profitability ratios: | ||||||||||||||||||||

| Net interest margin(2) | 5.48 | 6.49 | 6.17 | 6.38 | 7.22 | |||||||||||||||

| Return on average total assets(3) | 1.37 | 1.92 | 2.20 | 2.27 | 2.01 | |||||||||||||||

| Return on average stockholders’ equity(4) | 12.76 | 15.97 | 20.22 | 19.71 | 19.59 | |||||||||||||||

| Efficiency Ratio: | ||||||||||||||||||||

| Operating expenses as a percentage of interest, fees, services and other operating income | 59.75 | 56.19 | 57.58 | 56.28 | 50.89 | |||||||||||||||

| Capital ratios: | ||||||||||||||||||||

| Period-end stockholders’ equity as a percentage of period-end total assets | 9.55 | 11.85 | 10.52 | 11.67 | 11.37 | |||||||||||||||

| Period-end regulatory capital as a percentage of period-end risk- weighted assets(5) | 10.61 | 15.77 | 12.46 | 14.67 | 13.23 | |||||||||||||||

| Credit quality data: | ||||||||||||||||||||

| Non-performing loans as a percentage of total loans(6) | 1.82 | 1.76 | 1.52 | 1.91 | 2.44 | |||||||||||||||

| “C”, “D” and “E” loans as a percentage of total loans | 4.11 | 3.96 | 3.82 | 4.32 | 5.11 | |||||||||||||||

| Allowance for loan and accrued interest losses as a percentage of non-performing loans | 253.33 | 268.96 | 306.94 | 274.36 | 241.08 | |||||||||||||||

| Allowance for loan and accrued interest losses as a percentage of “C”, “D” and “E” loans(7) | 112.27 | 119.30 | 121.69 | 121.45 | 115.25 | |||||||||||||||

| Allowance for loan and accrued interest losses as a percentage of total loans | 4.62 | 4.72 | 4.65 | 5.24 | 5.89 | |||||||||||||||

| OPERATING DATA: | ||||||||||||||||||||

| Number of branches(8) | 1,090 | 993 | 952 | 921 | 889 | |||||||||||||||

| Number of employees(9) | 28,759 | 24,820 | 24,126 | 22,992 | 21,201 | |||||||||||||||

| (1) | Ratios were calculated on the basis of monthly averages. |

| (2) | Net interest income divided by average interest-earning assets. |

| (3) | Net income divided by average total assets. |

| (4) | Net income divided by average stockholders’ equity. |

| (5) | For an explanation of risk-weighted assets and Technical Capital, see “Item 4. Information on the Company – B. Business Overview – |

| (6) | Non-performing loans are small business loans that are |

| (7) |

| balance sheet. See “Item 4. Information on the Company – E. Selected Statistical Information – E.3. Loan Portfolio – Classification of the loan portfolio and Credit Categories for a description of “C”, “D” and “E” Loans”. |

| The |

Exchange Rates

On March 30, 2011,31, 2014, the Representative Market Rate was COP 1,792.071,969.45 per USD 1.00. The Federal Reserve Bank of New York does not report a rate for pesos; the Superintendency of FinanceSFC calculates the Representative Market Rate based on the weighted average of the buy/sell foreign exchange rates quoted daily by certain financial institutions, including Bancolombia, for the purchase and sale of U.S. dollars.

The following table sets forth the low and high peso per U.S. dollar exchange rates and the peso/U.S. dollar Representative Market Raterepresentative market rate on the last day of the month, for each of the last six months:

| Recent exchange rates of pesos per U.S. dollars | ||||||||||||

| Month | Low | High | Period End | |||||||||

| March 2012 | 1,758.03 | 1,792.07 | 1,792.07 | |||||||||

| February 2012 | 1,766.85 | 1,805.98 | 1,766.85 | |||||||||

| January 2012 | 1,801.88 | 1,942.70 | 1,805.98 | |||||||||

| December 2011 | 1,920.16 | 1,949.56 | 1,942.70 | |||||||||

| November 2011 | 1,871.49 | 1,967.18 | 1,948.51 | |||||||||

| October 2011 | 1,862.84 | 1,972.76 | 1,871.49 | |||||||||

Source: Superintendency of Finance.

| Recent exchange rates of pesos per U.S. dollars | ||||||||||||

| Month | Low | High | Period-End | |||||||||

| March 2014 | 1,965.32 | 2,052.51 | 1,969.45 | |||||||||

| February 2014 | 2,022.68 | 2,054.90 | 2,046.75 | |||||||||

| January 2014 | 1,924.79 | 2,021.10 | 2,021.10 | |||||||||

| December 2013 | 1,921.22 | 1,948.48 | 1,926.83 | |||||||||

| November 2013 | 1,901.22 | 1,932.77 | 1,931.88 | |||||||||

| October 2013 | 1,879.46 | 1.894.06 | 1,889.16 | |||||||||

| Source: SFC. | ||||||||||||

The following table sets forth the peso/U.S. dollar representative market rate on the last day of the year and the average peso/U.S. dollar representative market rate (calculated by using the average of the Representative Market Rates on the last day of each month during the year) for each of the five most recent financial years.

| Peso/USD 1.00 | ||||||||

| Representative Market Rate | ||||||||

| Period | Period End | Average | ||||||

| 2011 | 1,942.70 | 1,852.83 | ||||||

| 2010 | 1,913.98 | 1,901.67 | ||||||

| 2009 | 2,044.23 | 2,179.64 | ||||||

| 2008 | 2,243.59 | 1,993.80 | ||||||

| 2007 | 2,014.76 | 2,069.21 | ||||||

Source: Superintendency of Finance.

| Peso/USD 1.00 | ||||||||

| Representative Market Rate | ||||||||

| Period | Period-End | Average | ||||||

| 2013 | 1,926.83 | 1,881.04 | ||||||

| 2012 | 1,768.23 | 1,798.08 | ||||||

| 2011 | 1,942.70 | 1,852.83 | ||||||

| 2010 | 1,913.98 | 1,901.67 | ||||||

| 2009 | 2,044.23 | 2,179.64 | ||||||

| Source: SFC. | ||||||||

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

| D. | RISK FACTORS |

Investors should consider the following risks and uncertainties, and the other informationfactors presented in this Annual Report. In addition, the factorsinformation referred to below, as well as all other information presented in this Annual Report, should be considered by investors when reviewing any forward-looking statements contained in this Annual Report, in any document incorporated by reference in this Annual Report, in any of the Bank’s future public filings or press releases, or in any future oral statements made by the Bank or any of its officers or other persons acting on its behalf. If any of the following risks occur, the Bank’s business, results of operations and financial condition, its ability to raise capital and its ability to access funding could be materially and adversely affected. These risk factors should not be considered a complete list of potential risks that may affect Bancolombia.

Risk Factors Relating to Colombia and Other Countries Where the Bank Operates.

Changes in economic and political conditions in Colombia, and El Salvador, Panama or in the other countries where the Bank operates may adversely affect the Bank’s financial condition and results of operations.

The Bank’s financial condition, results of operations and asset quality are significantly dependent on the macroeconomic and political conditions prevailing in Colombia, El Salvador, Panama and the other jurisdictions in which the Bank operates. Accordingly, decreases in the growth rate, periods of negative growth, increases in inflation, changes in policy, or future judicial interpretations of policies involving exchange controls and other matters such as (but not limited to)among others, currency depreciation, inflation, interest rates, taxation, banking laws and regulations and other political or economic developments in or affecting Colombia, El Salvador or the othersuch jurisdictions where the Bank operates may affect the overall business environment and may in turn impact the Bank’s financial condition and results of operations.

In particular, the governments of Colombia, and El Salvador and Panama have historically exercised substantial influence on their economies, and their policiesthey are likely to continue to implement policies that will have an important effectimpact on Colombian and Salvadorianthe entities in such countries (including the Bank), market conditions, prices and rates of return on securities of local issuers (including the Bank’s securities). Potential changes in laws, public policies and regulations, may cause instability and volatility in Colombia EL Salvador, Panama and itstheir respective markets.

Future developments in government policies could impair the Bank’s business or financial condition or the market value of its securities.securities

The economies of the countries wherein which the Bank operates are vulnerable to external effects that could be caused by significant economic difficulties experienced by their major regional trading partners or by more general “contagion”contagion effects, which could have a material adverse effect on such contriescountries economic growth and their ability to service their public debt.

A significant decline in the economic growth or a sustained economic downturn of any of Colombia’s, or El Salvador’s or Panama´s major trading partners (i.e., the United States, China,Venezuela and Ecuador for Colombia and the United States for El Salvador)Salvador and Panama) could have a material adverse impact on Colombia’s, and El Salvador’s and Panama’s balance of trade and remittances inflows, resulting in lower economic growth.

Deterioration in the economic and political situation of neighboring countries could affect the national stability of Colombia or the Colombian economy by disrupting Colombia’s diplomatic or commercial relationships with these countries. Political tensions between Colombia and Venezuela in recent years have produced lower trade levels that have adversely impacted economic activity. Although relations with Venezuelaother countries have improved significantly since President Juan Manuel Santos Calderón took office in August 2010,with the current government, the possibility of any further resurgence in tensions between the two countries may cause political and economic uncertainty, instability, market volatility, lowerlow confidence levels and higher risk aversion by investors and market participants that may negatively affect economic activity in Colombia, El Salvador and El Salvador.Panama.

A contagion effect, in which an entire region or class of investment is disfavored by international investors, could negatively affect Colombia, and El Salvador and Panama or other economies where the bankBank operates, (i.e., Panama, Cayman Islands, Peru and Puerto Rico), as well as the market prices and liquidity of securities issued or owned by the Bank.

Any additional taxes resulting from changes to tax regulations or the interpretation thereof in Colombia, El Salvador, Panama or other countries where the Bank operates, could adversely affect the Bank’s consolidated results.

Uncertainty relating to tax legislation poses a constant risk to the Bank. Changes in legislation, regulation and jurisprudence can affect tax burdens by increasing tax rates and fees, creating new taxes, limiting stated expenses and deductions, and eliminating incentives and non-taxed income. Notably, the Colombian and Salvadorian governments have significant fiscal deficits that may result in future tax increases. Additional tax regulations could be implemented that could require the Bank to make additional tax payments, negatively affecting its results of operations and cash flow. In addition, national or local taxing authorities may not interpret tax regulations in the same way that the Bank does. Differing interpretations could result in future tax litigation and associated costs.

Further, the Colombian Government has announced that it is working on a draft bill of law to reform the Colombian tax code, which would be submitted to the Colombian Congress for its approval some time during 2012. As of March 30, 2012, a draft of the tax bill has not been disclosed to the public. Therefore, it is difficult to predict if changes would substantially affect results of operation and financial conditions.

Exchange rate volatilityfluctuations may adversely affect the Colombian economy, the market price of ourthe Bank’s ADSs, and the dividends payable to holders of the Bank’s ADSs.

Colombia has adopted a floating exchange rate system. The Colombian Central Bank maintains the power to intervene in the exchange market in order to consolidate or dispose of international reserves, and to control any volatility in the exchange rate. From time to time, there have been significant fluctuations in the exchange rate between the Colombian peso and the U.S. dollar. Unforeseen events in the international markets, fluctuations in interest rates or changes in capital flows, may cause exchange rate instability that could generate sharp movements in the value of the peso. Given that a portion of our assets and liabilities are denominated in, or indexed to, foreign currencies, especially the U.S. dollar, sharp movements in exchange rates may negatively impact the Bank’s results. In addition, exchange rate fluctuations may adversely impact the value of dividends paid to holders of the Bank’s ADSs as well as the market price and liquidity of ADSs.

Colombia has experienced several periods of violence and instability, and such instability could affect the economy and the Bank.

Colombia has experienced several periods of criminal violence over the past four decades, primarily due to the activities of guerilla groups and drug cartels. In response, the Colombian government has implemented various security measures and has strengthened its military and police forces by creating specialized units.units, and currently is in the process of negotiating a peace treaty with the Revolutionary Armed Forces of Colombia (Fuerzas Armadas Revolucionarias de Colombia) (“FARC”). In addition, in late 2012, the Colombian government commenced a new peace process with the FARC in Colombia. Despite these efforts, drug-related crime and guerilla activity continue to exist in Colombia. These activities, their possible escalation and the violence associated with them may have a negative impact on the Colombian economy or on the Bank in the future. The Bank’s business or financial condition and the market value of the Bank’s securities and any dividends distributed by it, could be adversely affected by rapidly changing economic and social conditions in Colombia and by the Colombian government’s response to such conditions.

Risk Factors Relating to the Bank’s Business and the Banking Industry

Instability ofChanges in banking laws and regulations in Colombia and in other jurisdictions wherein which the Bank operates could adversely affect the Bank’s consolidated results.

Changes in banking laws and regulations, or in their official interpretation, in Colombia and in other jurisdictions wherein which the Bank operates, may have a material effect on the Bank’s business and operations. Since banking laws and regulations change frequently, they could be adopted, enforced or interpreted in a manner that may have an adverse effect on the Bank’s business.

AlthoughIn August 2013 the regulation relating to capital adequacy requirements (Decree 1771 of 2012) was implemented and Bancolombia currently complies with applicable capital requirements,requirements. However, there can be no assurance that future regulation will not change or require Bancolombia or its subsidiaries to seek additional capital.

Moreover, the various regulators in the worldother jurisdictions have not reached consensus as to the appropriate level of capitalization for financial services institutions. Regulators in the jurisdictions wherein which Bancolombia operates may alter the current regulatory capital requirements to which Bancolombia is subject and thereby require equity increases that could dilute existing stockholders, lead to required asset sales or adversely impact the return on stockholders’sstockholders’ equity and/or the market price of the Bank’s common and preferred shares.

Furthermore, the Colombian government has presented to Congress an initiative to create a new type of financial institution that will have the sole purpose of offering electronic deposits and payments in order to promote financial inclusion. If the law is enacted this could create a new competitive environment that could adversely affect the Bank’s business and profitability.

Banking regulations, accounting standards and corporate disclosure applicable to the Bank and its subsidiaries differ from those applicable in the United States and other countries.

While many of the policies underlying Colombian banking regulations are similar to those underlying regulations applicable to banks in other countries, including those in the United States, Colombian regulations can differ in a number of material respects. For example, capital adequacy requirements for banks under Colombian regulations differ from those under U.S. regulations and may differ from those in effect in other countries. The Bank prepares its annual audited financial statementsConsolidated Financial Statements in accordance with Colombian banking GAAP, which differs in certain significant respects from U.S. GAAP and International Financial Reporting Standards (“IFRS”). Thus, Colombian financial statements and reported earnings may differ from those of companies in other countries in these and other respects. Some of the differences affecting earnings and stockholders’ equity include, but are not limited to the accounting treatment for restructuring, loan origination fees and costs, equity tax, securitization, fair value adjustment in debt securities, deferred income taxes and the accounting treatment for business combinations. Moreover, under Colombian banking GAAP, allowances for non-performing loans are computed by establishing each non-performing loan’s individual inherent risk using criteria established by the Superintendency of FinanceSFC that differ from those used under U.S. GAAP. See “Item 4. Information on the Company – E. Selected Statistical Information – E.4. Summary of Loan Loss Experience – Allowance for Loan Losses”.

The Colombian government is currently undertaking a review of present regulations relating to accounting, audit, and information disclosure, with the intention of seeking convergence with international standards. Nevertheles, current regulations continue to differ in certain respects from those in other countries. In addition, there may be less publicy available information about the Bank than is regulary published by or about U.S issuers or issuers in other countries.

The Bank is subject to regulatory inspections, examinations, inquiries or audits in Colombia and in other countries wherein which it operates, and any sanctions, fines and other penalties resulting from such inspections and audits could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

The Bank is subject to comprehensive regulation and supervision by the banking authorities of Colombia, El Salvador, Panama and the other jurisdictions in which the Bank operates. These regulatory authorities have broad powers to adopt regulations and impose other requirements affecting or restricting virtually all aspects of the Bank’s capitalization, organization and operations, including the imposition of anti-money laundering measures and the authority to regulate the terms and conditions of credit that can be applied by banks. In the event of non-compliance with applicable regulations, the Bank could be subject to fines, sanctions or the revocation of licenses or permits to operate its business. In Colombia, for instance, in the eventif the Bank encounters significant financial problems or becomes insolvent or in danger of becoming insolvent, banking authorities would have the power to take over the Bank’s management and operations. In addition, the supervisory authorities of Colombia and El Salvador have reached an agreement for consolidated supervision which allows them to perform transnational inspection processes Any sanctions, fines and other penalties resulting from non-compliance with regulations in Colombia, El Salvador, Panama and in the other jurisdictions wherein which the Bank operates could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

An increase in constitutional public interest actions (acciones populares), class actions (acciones de grupo) and other legal actions involving claims for significant monetary awards against financial institutions may affect the Bank’s businesses and results of operations.

Under the Colombian Constitution, individuals may initiate constitutional public interest or class actions to protect their collective or class rights, respectively. Until 2010, Colombian financial institutions, including the Bank, have experienced a substantial increase in the aggregate number of these actions. The great majority of such actions have been related to fees, financial services and interest rates, and their outcome is uncertain. Pursuant to law 1425 of 2010, monetary awards for plaintiffs in constitutional actions or class actions were eliminated as of January 1, 2011. Nevertheless, individuals continue to have the right to initiate constitutional or classthese actions against the Bank.

Future restrictions on interest rates or banking fees could negatively affect the Bank’s profitability.

In the future, regulations in the jurisdictions where the Bank operates could impose limitations regarding interest rates or fees charged by the Bank. Any such limitations could materially and adversely affect the Bank’s results of operations and financial position. . situation.

In the past, there have been disputes in Colombia among merchants,commercial businesses, payment servicesservice providers and banks regarding interchange fees.

credit card interbank exchange fees (tarifa interbancaria de intercambio). Although such disputes have been resolved, the Superintendency of Industry and Commerce and Industry mayhas the authority to initiate new investigations relating to the interchangesuch fees. This possibilityAny new investigations may lead to requirements that the Bank agree to additional decreases, which in turn could impact the Bank’s financial results.

Furthermore, pursuant to article 62 of lawLaw 1430 of 2010, Congress granted the Colombian government power and authority to establish and define criteria and formulas applicable to the calculation of banking fees and charges and the authority to define maximum limits to banking fees and charges. On December 20, 2011 the Governmentgovernment used the authority granted by lawLaw 1430 of 2010 and established inenacted Decree 4809 of 2011 in which it set forth caps tothe bank fees that may be charged on ATM withdrawals outside of each bank’s respective networks.

As of the date of this Annual Report, an initiative regarding banking fees is being discussed in Congress, and has been approved in its second debate out of four needed for it to become a law. If the law is enacted in its current form, however banks would be required cease charging transactional and service fees banks can charge on withdrawals done from ATMs outside their own networks. those individuals whose income is equal or under two SMMLV, provided that this benefit would only apply to one savings account per individual. The likelihood of this initiative becoming a law is uncertain given that there have been two similar unsuccessful initiatives discussed in Congress in recent years and the two pending debates would have to be completed before June 2014.

In addition, Law 1555 of 2012 prohibits prepayment penalties for loans worth less than 880 SMMLV (mortgage loans are excluded).

Further limits or regulations regarding banking fees, and uncertainties with respect thereto could have a negative effect on our results of operations and financial condition.

Colombian tax haven regulation could adversely affect the Bank’s business and financial results.

Decree 2193 of 2013 designates 44 jurisdictions as tax havens for Colombian tax purposes. It also excludes temporarily seven countries, including Panama while the colombian government negotiates tax information exchange agreements with each of them. If Panama and Colombia do not sign a tax information exchange agreement before August 2014, Panama would be considered as a tax haven under Colombian tax regulations. As a result, the Bank’s clients in Panama who are residents in such jurisdiction would be subject to the following regulations: (i) higher withholding tax rates including a higher withholding rates over financial yields derived from investments in the Colombian securities market), (iii) the transfer pricing regime and its reporting duties, (iii) residing in a tax haven serves as an assumption for Colombian authorities to qualify a conduct as abusive under tax regulations, (iv) payments made to residents or entities located in tax havens are not considered as costs or deduction, unless the respective withholding tax has been applied, and (v) other additional information disclosure requirements, which could have a negative impact on Bancolombia’s business and financial results.

The Bank and most of its subsidiaries are subject to the U.S. Foreign Account Tax Compliance Act of 2010.

Bancolombia and most of its subsidiaries are considered foreign financial institutions (“FFIs”) under the Foreign Account Tax Compliance Act of 2010 (the “FATCA”) (see “Item 4. Information on the Company – B. Business Overview – B.8. Supervision and Regulation – International regulations applicable to Bancolombia and its subsidiaries”). Given the size and the scope of the Bank´s international operations, we intend to take all necessary steps to comply with FATCA (including entering into agreements with the U.S. tax authorities). However, if the Bank cannot enter into such agreements or satisfy the requirements thereunder, certain payments to Bancolombia or its Subsidiaries may be subject to withholding under the FATCA. The possibility of such withholding and the need for accountholders and investors to provide certain information may adversely affect our results of operations and financial condition. In addition, entering into agreements with the Internal Revenue Service (“IRS”), compliance with the terms of such agreements and with the FATCA, any regulations or other guidance promulgated thereunder or any legislation promulgated under an intergovernmental agreement (“IGA”) may increase our compliance costs. We are currently in the process of implementing FATCA compliance on a group wide level. Because legislation and regulations implementing the FATCA in the countries in which we operate and the IGAs remain under development, the future impact of this law on the Bank is still uncertain.

The Bank is subject to credit risk, and estimating exposure to credit risk involves subjective and complex judgments.

A number of our products expose the Bank to credit risk, including loans, financial leases, lending commitments and derivatives.

The Bank estimates and establishes reserves for credit risk and potential credit losses. This process involves subjective and complex judgments, including projections of economic conditions and assumptions on the ability of our borrowers to repay their loans. This process is also subject to human error as the Bank’s employees may not always be able to assign an accurate credit rating to a client, which may result in the Bank’s exposure to higher credit risksrisk than indicated by the Bank’s risk rating system. The Bank may not be able to timely detect these risks before they occur, or due to limited resources or available tools,infrastructure, the Bank’s employees may not be able to effectively implement its credit risk management system, which may increase its exposure to credit risk. Moreover, the Bank’s failure to continuously refine its credit risk management system may result in a higher risk exposure for the Bank, which could materially and adversely affect its results of operations and financial position.

Overall, if the Bank is unable to effectively control the level of non-performing or poor credit quality loans in the future, or if its loan loss reserves are insufficient to cover future loan losses, the Bank’s financial condition and results of operations may be materially and adversely affected.

In addition, the amount of the Bank’s non-performing loans may increase in the future as a result of factors beyond the Bank’s control, such as changes in the income levels of the Bank’s borrowers, increases in the inflation rate or an increase in interest rates, the impact of macroeconomic trends and political events affecting Colombia orand other jurisdictions wherein which the Bank operates or has exposure, or events affecting specific industries. Any of these developments could have a negative effect on the quality of the Bank’s loan portfolio, causing the Bank to increase provisions for loan losses and resulting in reduced profits or in losses.

The Bank is subject to credit risksrisk with respect to its non-traditional banking businesses including investing in securities and entering into derivatives transactions.

Non-traditional sources of credit risk can arise from, among other things: investing in securities of third parties, entering into derivative contracts under which counterparties have obligations to make payments to the Bank, and executing securities, futures, currency or commodity trades from the Bank’s proprietary trading desk that fail to settle at the required time due to non-delivery by the counterparty or systems failure by clearing agents, exchanges, clearing houses or other financial intermediaries. Any significant increases in exposure to any of these non-traditional risks, or a significant decline in credit quality or the insolvency of any of the counterparties, could materially and adversely affect the Bank’s results of operations and financial position.

The Bank is exposed to risks associated with the mortgage loan market.

Bancolombia is a leader in the Colombian mortgage loan market. Colombia’s mortgage loan market is highly regulated and has historically been affected by various macroeconomic factors although during the past yearsfactors. Although interest rates have decreased, during recent years, periods of sustained high interest rates have historically discouraged customers from borrowing and have resulted in increased defaults in outstanding loans and deterioration in the quality of assets.

| 15 |

The Bank is subject to concentration of default risks in its loan portfolio. Problems with one or more of its largest borrowers may adversely affect its financial condition and results of operations.

As of December 31, 2011,2013, the aggregate outstanding principal amount of the Bank’s 2520 largest borrowing relationships,credit exposures, on a consolidated basis, represented approximately 14.93%7.3% of the loan portfolio, of the Bank and no single borrowing relationshipexposure represented more than 1.76%1% of the loan book. Also, 100% of those loans were corporate loans and 100% of these relationships were classified as “A”. However, problems with one or more of the Bank’s largest borrowers could materially and adversely affect its results of operations and financial position. For more information,position, see “Item 4. Information on the Company – E. Selected Statistical Information – E.3. Loan Portfolio – Borrowing Relationships”.