UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20122013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ______

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

Commission file number: 001-35124

LONCOR RESOURCES INC.

(Exact Name of Registrant as Specified in Its Charter)

Ontario

(State or Other Jurisdiction of Incorporation of Organization)

1 First Canadian Place, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada

(Address of Principal Executive Offices, including Zip Code)

Contact: Geoffrey G. Farr; Phone: (416) 366-2221; Fax: (416) 366-7722; Address: 1 First Canadian Place, 100 King Street West, Suite 7070, Toronto, Ontario, M5X 1E3, Canada

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

| Common Shares | NYSE MKT LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of December 31, 2012:2013:

73,439,732 common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes¨Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes¨Nox

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YesxNo¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes¨No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer | Non-accelerated filer x |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP | ||||||

| Accounting Standards Board | x | Other | |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨Item 17¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes¨ Nox

LONCOR RESOURCES INC. - FORM 20-F

Table of Contents

| Page | |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 1 |

| CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE ESTIMATES | 2 |

| CURRENCY | |

| PART 1 | |

| Item 1. Identity of Directors, Senior Management and Advisors | |

| Item 2. Offer Statistics and Expected Timetable | |

| Item 3. Key Information | |

| A. Selected Financial Data | |

| B. Capitalization and Indebtedness | |

| C. Reason for the Offer and Use of Proceeds | |

| D. Risk Factors | |

| Item 4. Information on the Company | |

| A. History and Development of the Company | |

| B. Business Overview | |

| C. Organizational Structure | |

| D. Property, Plants and Equipment | 21 |

| Item 4A. Unresolved Staff Comments | |

| Item 5. Operating and Financial Review and Prospects | |

| A. Operating Results | |

| B. Liquidity and Capital | |

| C. Research and Development, Patents and Licenses, | |

| D. Trend Information | |

| E. Off-Balance Sheet | |

| F. Tabular Disclosure of Contractual Obligations | |

| G. Safe Harbor | |

| Item 6. Directors, Senior Management and Employees | |

| A. Directors and Senior Management | |

| B. Compensation | |

| C. Board Practices | |

| D. Employees | |

| E. Share Ownership | |

| Item 7. Major Shareholders and Related Party Transactions | |

| A. Major Shareholders | |

| B. Related Party Transactions | |

| C. Interests of Experts and Counsel | |

| Item 8. Financial Information | |

| A. Consolidated Statements and Other Financial Information | |

| B. Significant Changes |

Table of Contents

(continued)

| Page | |

| Item 9. The Offer and Listing | |

| A. Offer and Listing Details | |

| B. Plan of Distribution | |

| C. Markets | |

| D. Selling Shareholder | |

| E. Dilution | |

| F. Expenses of the Issue | |

| Item 10. Additional Information | |

| A. Share Capital | |

| B. Memorandum and Articles of Association | |

| C. Material Contracts | |

| D. Exchange Controls | |

| E. Certain United States Federal Income Tax Considerations | |

| F. Dividends and Paying Agents | |

| G. Statement By Experts | |

| H. Documents on Display | |

| I. Subsidiary Information | |

| Item 11. Quantitative and Qualitative Disclosures About Market | |

| Item 12. Descriptions of Securities Other than Equity Securities | |

| PART II | |

| Item 13. Defaults, Dividend Arrearages and | |

| Item 14. Material Modifications to the Rights of Security Holders and Use of | |

| 14.A.-D. Modifications to the Rights of Security Holders | |

| 14.E. Use of Proceeds | |

| Item 15. Controls and | |

| Item 16.A. Audit Committee Financial Expert | |

| Item 16.B. Code of | |

| Item 16.C. Principal Accountant Fees and Services | |

| Item 16.D. Exemptions from the Listing Standards for Audit Committees | |

| Item 16.E. Purchase of Equity Securities by the Issuer and Affiliated Purchasers | |

| Item 16.F. Change in Registrant's Certifying Accountant | |

| Item 16.G. Corporate Governance | |

| PART III | |

| Item 17. Financial Statements | |

| Item 18. Financial Statements | |

| Item 19. Exhibits |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Form 20-F and the documents incorporated by reference herein contains "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Actof 1995 and "forward-looking information" within the meaning of Canadian provincial securities laws (such forward-looking statements and forward-looking information are referred to herein as "forward-looking statements"). Forward-looking statements are necessarily based on a number of estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies. All statements, other than statements which are reporting results as well as statements of historical fact, that address activities, events or developments that Loncor Resources Inc. (the "Company" or "Loncor") believes, expects or anticipates will or may occur in the future (including, without limitation, statements regarding mineral resource estimates, drilling and other exploration results, potential mineralization, potential mineral resources, and the Company's exploration and development plans and objectives with respect to its projects) are forward-looking statements. These forward-looking statements reflect the current expectations or beliefs of the Company based on information currently available to the Company. Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual events or results of the Company to differ materially from those discussed in the forward-looking statements, and even if such actual events or results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: uncertainties relating to the availability and costs of financing in the future; risks related to the exploration stage of the Company's properties; the possibility that future exploration results will not be consistent with the Company's expectations; failure to establish estimated mineral resources or mineral reserves; fluctuations in gold prices and currency exchange rates; inflation; rules adopted by the U.S. Securities and Exchange Commission that may affect mining operations in the Democratic Republic of the Congo; gold recoveries being less than those indicated by the metallurgical testwork carried out to date (there(there can be no assurance that gold recoveries in small scale laboratory tests will be duplicated in large tests under on-site conditions or during production); changes in equity markets; political developments in the Democratic Republic of the Congo; lack of infrastructure; failure to procure or maintain, or delays in procuring or maintaining, permits and approvals; lack of availability at a reasonable cost or at all, of plants, equipment or labour; inability to attract and retain key management and personnel; changes to regulations or policies affecting the Company's activities; the uncertainties involved in interpreting drilling results and other geological data; the Company's history of losses and expectation of future losses; the Company's ability to acquire additional commercially mineable mineral rights; risks related to the integration of any new acquisitions into the Company's existing operations; increased competition in the mining industry; and the other risks disclosed under the heading "Risk Factors" in this Form 20-F.

Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

The mineral resource figures referred to in this Form 20-F are estimates and no assurances can be given that the indicated levels of gold will be produced. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the resource estimates included in this Form 20-F are well established, by their nature, resource estimates are imprecise and depend, to a certain extent, upon statistical inferences which may ultimately prove unreliable. If such estimates are inaccurate or are reduced in the future, this could have a material adverse impact on the Company.

Due to the uncertainty that may be attached to inferred mineral resources, it cannot be assumed that all or any part of an inferred mineral resource will be upgraded to an indicated or measured mineral resource as a result of continued exploration. Confidence in the estimate is insufficient to allow meaningful application of the technical and economic parameters to enable an evaluation of economic viability sufficient for public disclosure, except in certain limited circumstances. Inferred mineral resources are excluded from estimates forming the basis of a feasibility study.

Statements concerning actual mineral resource estimates are also deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the relevant project or property is developed. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty that mineral resources can be upgraded to mineral reserves through continued exploration.

CAUTIONARY NOTE TO U.S. INVESTORS REGARDING RESOURCE ESTIMATES

This Form 20-F, including the documents incorporated by reference herein, has been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Without limiting the foregoing, this Form 20-F, including the documents incorporated by reference herein, uses the terms "measured", "indicated" and "inferred" resources. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the U.S. Securities and Exchange Commission (the "SEC") does not recognize them. Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. U.S. investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, "inferred resources" have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the "inferred resources" will ever be upgraded to a higher category. Therefore, U.S. investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of "contained ounces" is permitted disclosure under Canadian regulations, however, the SEC normally only permits issuers to report mineral deposits that do not constitute "reserves" as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this Form 20-F or in the documents incorporated by reference, may not be comparable to information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

National Instrument 43-101 -Standards of Disclosure for Mineral Projects("NI 43-101") is a rule of the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in or incorporated by reference in this Form 20-F have been prepared in accordance with NI 43-101 and the Canadian Institute of Mining, Metallurgy and Petroleum Classification System. These standards differ significantly from the requirements of the SEC, and resource information contained herein and incorporated by reference herein may not be comparable to similar information disclosed by U.S. companies. One consequence of these differences is that "reserves" calculated in accordance with Canadian standards may not be "reserves" under the SEC standards.

U.S. investors are urged to consider closely the disclosure in the Company's Form 40-F Registration Statement, File No. 001-35124, which may be secured from the Company, or from the SEC's website at http://www.sec.gov.

CURRENCY

Unless stated otherwise or the context otherwise requires, all references in this Form 20-F to "US$" are to United States dollars and all references in this Form 20-F to "Cdn$" are to Canadian dollars.

PART 1

Item 1. Identity of Directors, Senior Management and Advisors

This Form 20-F is being filed as an annual report under the United StatesSecurities Exchange Act of 1934, as amended, (the "U.S. Exchange Act") and, as such, there is no requirement to provide any information under this item.

Item 2. Offer Statistics and Expected Timetable

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

Item 3. Key Information

A. Selected Financial Data

The selected consolidated financial information set forth below for each of the threefour years ended December 31, 2013, 2012, 2011 and 2010, which is expressed in United States dollars (the Company prepares its financial statements in United States dollars), has been derived from the Company's audited consolidated financial statements as at and for the financial years ended December 31, 2013, 2012, 2011 and 2010filed as part of thisForm 20-F under Item 18.2010. Theseconsolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") issued by the International Accounting Standards Board,which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with generally accepted accounting principles in the United States ("United States GAAP").The selected consolidated financial information should be read in conjunction with the discussion in Item 5 of this Form 20-F and the said consolidated financial statements and related notes thereto.thereto filed as part of this Form 20-F under Item 18. Historical results from any prior period are not necessarily indicative of results to be expected for any future period.

| (in $000 except share data) | (in $000 except share data) | |||||||||||||||||||||||||||

| IFRS | 2012 | 2011 | 2010 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||||||||

| Revenue | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||

| Net income (loss) from operations | (2,027 | ) | 726 | (5,872 | ) | (28,038 | ) | (2,027 | ) | 726 | (5,872 | ) | ||||||||||||||||

| Net income (loss) for the year | (2,082 | ) | 533 | (5,990 | ) | (27,224 | ) | (2,081 | ) | 533 | (5,990 | ) | ||||||||||||||||

| Basic net income (loss) per share | (0.03 | ) | 0.01 | (0.14 | ) | |||||||||||||||||||||||

| Basic and diluted net income (loss) per share | (0.37 | ) | (0.03 | ) | 0.01 | (0.14 | ) | |||||||||||||||||||||

| Current assets | 11,270 | 14,931 | 10,635 | 844 | 11,270 | 14,931 | 10,635 | |||||||||||||||||||||

| Exploration and evaluation expenditures | 48,255 | 30,090 | 12,658 | 30,893 | 48,255 | 30,090 | 12,658 | |||||||||||||||||||||

| Total assets | 60,274 | 45,800 | 23,841 | 32,182 | 60,274 | 45,800 | 23,841 | |||||||||||||||||||||

| Total liabilities | 2,488 | 2,464 | 7,383 | 1,203 | 2,488 | 2,464 | 7,383 | |||||||||||||||||||||

| Net assets | 57,786 | 43,336 | 16,459 | 30,979 | 57,786 | 43,336 | 16,459 | |||||||||||||||||||||

| Share capital | 75,715 | 60,045 | 37,035 | 75,715 | 75,715 | 60,045 | 37,035 | |||||||||||||||||||||

| Shareholders' equity | 57,786 | 43,336 | 16,459 | 30,979 | 57,786 | 43,336 | 16,459 | |||||||||||||||||||||

| Weighted average common shares outstanding | 62,396 | 57,056 | 41,558 | 73,440 | 62,396 | 57,056 | 41,558 | |||||||||||||||||||||

The selected consolidated financial information set forth in the first table below for each of the two yearsyear ended December 31, 2009, and 2008, which is expressed in United States dollars (the Company prepares its financial statements in United States dollars), has been derived from the Company's audited consolidated financial statements as at and for the financial yearsyear ended December 31, 2009 and 2008.2009. Theseconsolidated financial statements were prepared in accordance with generally accepted accounting principles in Canada ("Canadian GAAP"),which differ in certain respects from the principles the Company would have followed had its consolidated financial statements been prepared in accordance with United States GAAP.

Historical results from any prior period are not necessarily indicative of results to be expected for any future period.

Since November 28, 2008 when the Company completed the acquisition of all of the outstanding shares of the private company,Loncor Resources Inc.,the Company's activities have consisted primarily of the exploration of mineral properties.Prior to this acquisition, the Company was named Nevada Bob’s International Inc. and was in the business of licensing the right to use certain trademarks.

If the Company had followed United States GAAP in respect of the two yearsyear ended December 31, 2009, and 2008, certain items in the consolidated financial statements would have been reported as set forth in the second table below.

The selected consolidated financial information in the IFRS chart above should not be compared to the information in the Canadian GAAP or United States GAAP charts below as the information was prepared using difference financial reporting standards.

| (in $000 except share data) | ||||||||

| Canadian GAAP | 2009 | 2008 | ||||||

| Revenue | $ | 1 | $ | 166 | ||||

| Net income (loss) from operations | (1,010 | ) | (406 | ) | ||||

| Net income (loss) for the year | (1,011 | ) | (371 | ) | ||||

| Basic net income (loss) per share | (0.04 | ) | (0.01 | ) | ||||

| Current assets | 1,638 | 1,633 | ||||||

| Exploration and evaluation expenditures | 4,954 | 3,958 | ||||||

| Total assets | 6,620 | 5,649 | ||||||

| Total liabilities | 3,429 | 3,788 | ||||||

| Net assets | 3,190 | 1,861 | ||||||

| Share capital | 20,341 | 18,317 | ||||||

| Shareholders' equity | 3,190 | 1,861 | ||||||

| Weighted average common shares outstanding | 28,559 | 24,712 | ||||||

(in $000 except share data)

| Canadian GAAP | 2009 | |||

| Revenue | $ | 1 | ||

| Net income (loss) from operations | (1,010 | ) | ||

| Net income (loss) for the year | (1,011 | ) | ||

| Basic net income (loss) per share | (0.04 | ) | ||

| Current assets | 1,638 | |||

| Exploration and evaluation expenditures | 4,954 | |||

| Total assets | 6,620 | |||

| Total liabilities | 3,429 | |||

| Net assets | 3,190 | |||

| Share capital | 20,341 | |||

| Shareholders' equity | 3,190 | |||

| Weighted average common shares outstanding | 28,559 | |||

(in $000 except share data)

| (in $000 except share data) | ||||||||||||

| United States GAAP | 2009 | 2008 | 2009 | |||||||||

| Revenue | $ | 1 | $ | 166 | $ | 1 | ||||||

| Net income (loss) from operations | (2,007 | ) | (2,276 | ) | (2,007 | ) | ||||||

| Net income (loss) for the year | (2,007 | ) | (2,241 | ) | (2,007 | ) | ||||||

| Basic net income (loss) per share | (0.07 | ) | (0.09 | ) | (0.07 | ) | ||||||

| Current assets | 1,638 | 1,633 | 1,638 | |||||||||

| Exploration and evaluation expenditures | - | - | - | |||||||||

| Total assets | 1,665 | 1,691 | 1,665 | |||||||||

| Total liabilities | 3,007 | 3,365 | 3,007 | |||||||||

| Net assets | (1,341 | ) | (2,097 | ) | (1,341 | ) | ||||||

| Share capital | 20,341 | 18,317 | 20,341 | |||||||||

| Shareholders' equity | (1,341 | ) | (2,097 | ) | (1,341 | ) | ||||||

| Weighted average common shares outstanding | 28,559 | 24,712 | 28,559 | |||||||||

Exchange Rates

On March 22, 2013,21, 2014, the buying rate in New York City for cable transfers in Canadian dollars, as certified for customs purposes by the Federal Reserve Bank of New York, was Cdn$US$1.00 = US$0.9781.Cdn$1.1191. The following table sets forth, for each of the years or, as applicable, months indicated, additional information with respect to the noon buying rate for Cdn$1.00. Such rates are set forth as U.S.US$1.00 in Canadian dollars per Cdn$1.00 and are based upon the rates quoted by the Federal Reserve Bank of New York.

| Rate | 2012 | 2011 | 2010 | 2009 | 2008 | 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||||||||||||||||

| Average(1) | 1.0008 | 1.0144 | 0.9659 | 0.8793 | 0.9335 | 1.03467 | 0.9996 | 0.9858 | 1.0353 | 1.1373 | ||||||||||||||||||||||||||||||

(1) The average rate means the average of the exchange rates on the last day of each month during the year.

Canadian/United States Dollar Exchange Rates for the Previous Six Months

| Rate | October 2012 | November 2012 | December 2012 | January 2013 | February 2013 | March 2013(1) | October 2013 | November 2013 | December 2013 | January 2014 | February 2014 | March 2014(1) | ||||||||||||||||||||||||||||||||||||

| High | 1.0243 | 1.0074 | 1.0162 | 1.0164 | 1.0041 | 0.9802 | 1.0454 | 1.0597 | 1.0697 | 1.1171 | 1.1137 | 1.1251 | ||||||||||||||||||||||||||||||||||||

| Low | 0.9997 | 0.9971 | 1.0042 | 0.9923 | 0.9722 | 0.9696 | 1.0282 | 1.0442 | 1.0577 | 1.0612 | 1.0952 | 1.0965 | ||||||||||||||||||||||||||||||||||||

(1) Provided for the period from March 1, 20132014 to March 22, 2013.21, 2014.

B. Capitalization and Indebtedness

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

C. Reason for the Offer and Use of Proceeds

This Form 20-F is being filed as an annual report under the U.S. Exchange Act and, as such, there is no requirement to provide any information under this item.

D. Risk Factors

There are a number of risks that may have a material and adverse impact on the future operating and financial performance of Loncor and could cause the Company's operating and financial performance to differ materially from the estimates described in forward-looking statements relating to the Company. These include widespread risks associated with any form of business and specific risks associated with Loncor's business and its involvement in the gold exploration industry.

An investment in theCompany's common shares is considered speculative and involves a high degree of risk due to, among other things, the nature of Loncor's business (which is the exploration of mineral properties), the present stage of its development and the location of Loncor's projects in the Democratic Republic of the Congo (the "DRC"). In addition to the other information presented in this Form 20-F, a prospective investor should carefully consider the risk factors set out belowand the other information thatLoncor files with the U.S. Securities and Exchange Commission (the "SEC") and with Canadian securities regulators before investing in the Company's common shares.shares. The Company has identified the following non-exhaustive list of inherent risks and uncertainties that it considers to be relevant to its operations and business plans. Such risk factors could materially affect the Company's future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Company. As well, additionaladditional risks that the Company is unaware of or that are currently believed to be immaterial may become important factors that affect the Company's business.

The Company has not generated revenues from operations, does not have a history of mining operations, and there is no assurance that it will produce revenue, operate profitably or provide a return on investment in the future.

The Company has not generated revenues from operations and there is no assurance that it will produce revenue, operate profitably or provide a return on investment in the future. The Company has only incurred operating losses, and the development of its projects is at an early stage. The Company produced a loss of US$27,224,451 for the year ended December 31, 2013, and, as of that date, the Company’s deficit was US$52,771,536 which casts substantial doubt on the Company’s ability to continue as a going concern. The Company is subject to the risks and challenges experienced by other companies at a comparable stage. These risks include, but are not limited to, continuing losses and the ability to secure adequate financing or to complete corporate transactions to meet the minimum capital required to successfully complete its projects and fund other operating expenses.

The Company's ability to continue as a going concern is dependent upon its ability to obtain the necessary financing to meet its obligations and repay liabilities arising from normal business operations when they come due. Development of the Company’s current projects to the production stage will require significant financing. Given the current economic climate, the ability to raise funds may prove difficult. The Company has no revenues and is wholly reliant upon external financing to fund such plans. There can be no assurance that such financing will be available to the Company or, if it is, that it will be offered on acceptable terms. If additional financing is raised through the issuance of equity or convertible debt securities of the Company, the interests of the Company's shareholders in the net assets of the Company may be diluted. Any failure of the Company to obtain required financing on acceptable terms could have a material adverse effect on the Company's financial condition, results of operations, liquidity, and its ability to continue as a going concern, and may require the Company to cancel or postpone planned capital investments.

The auditor’s report issued in respect of the Company’s 2013 annual consolidated financial statements contains an "Emphasis of Matter" which includes the following statement:

"Without qualifying our opinion, we draw attention to Note 2 in the consolidated financial statements which indicates the Company produced a net loss of $27,224,451 for the year ended December 31, 2013 and as of that date the Company’s accumulated deficit was $52,771,536. These conditions, along with other matters as set forth in Note 2, indicate the existence of a material uncertainty that casts substantial doubt on the Company’s ability to continue as a going concern."

The assets and operations of Loncor are subject to political, economic and other uncertainties as a result of being located in the DRC.

Loncor's projects are located in the DRC. The assets and operations of the Company are therefore subject to various political, economic and other uncertainties, including, among other things, the risks of war and civil unrest, expropriation, nationalization, renegotiation or nullification of existing licenses, permits, approvals and contracts, taxation policies, foreign exchange and repatriation restrictions, changing political conditions, international monetary fluctuations, currency controls and foreign governmental regulations that favour or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. Changes, if any, in mining or investment policies or shifts in political climate in the DRC may adversely affect Loncor's operations or profitability. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral rights, could result in loss, reduction or expropriation of entitlements. In addition, in the event of a dispute arising from operations in the DRC, the Company may be subject to the exclusive jurisdiction of foreign courts or may not be successful in subjecting foreign persons to the jurisdiction of courts in Canada. The Company also may be hindered or prevented from enforcing its rights with respect to a governmental instrumentality because of the doctrine of sovereign immunity. It is not possible for the Company to accurately predict such developments or changes in laws or policy or to what extent any such developments or changes may have a material adverse effect on the Company's operations. Should the Company's rights or its titles not be honoured or become unenforceable for any reason, or if any material term of these agreements is arbitrarily changed by the government of the DRC, the Company's business, financial condition and prospects will be materially adversely affected.

Some or all of the Company's properties are located in regions where political instability and violence is ongoing (for example, in November 2012, the M23 rebel group took over the city of Goma (Loncor's operations are located about 420 kilometres northwest of Goma and were unaffected by the M23 situation), but subsequently withdrew from Goma under international pressure). Some or all of the Company's properties are inhabited by artisanal miners. These conditions may interfere with work on the Company's properties and present a potential security threat to the Company's employees. There is a risk that activities at the Company’s properties may be delayed or interfered with, due to the conditions of political instability, violence or the inhabitation of the properties by artisanal miners. The Company uses its best efforts to maintain good relations with the local communities in order to minimize such risks.

The DRC is a developing nation emerging from a period of civil war and conflict. Physical and institutional infrastructure throughout the DRC is in a debilitated condition. The DRC is in transition from a largely state controlled economy to one based on free market principles, and from a non-democratic political system with a centralized ethnic power base, to one based on more democratic principles. There can be no assurance that these changes will be effected or that the achievement of these objectives will not have material adverse consequences for Loncor and its operations. The DRC continues to experience instability in parts of the country due to certain militia and criminal elements. While the government and United Nations forces are working to support the extension of central government authority throughout the country, there can be no assurance that such efforts will be successful.

No assurance can be given that the Company will be able to maintain effective security in connection with its assets or personnel in the DRC where civil war and conflict have disrupted exploration and mining activities in the past and may affect the Company's operations or plans in the future.

HIV/AIDS, malaria and other diseases represent a serious threat to maintaining a skilled workforce in the mining industry in the DRC. HIV/AIDS is a major healthcare challenge faced by the Company's operations in the country. There can be no assurance that the Company will not lose members of its workforce or workforce man-hours or incur increased medical costs, which may have a material adverse effect on the Company's operations.

The DRC has historically experienced relatively high rates of inflation.

The Company’s properties are in the exploration stage, and there can be no assurance that the Company’s exploration activities will result in discoveries that are commercially viable.

The Company's properties are in the exploration stage. The future development of properties found to be economically feasible will require board approval, the construction and operation of mines, processing plants and related infrastructure. As a result, Loncor is subject to all of the risks associated with establishing new mining operations and business enterprises including: the timing and cost, which can be considerable, of the construction of mining and processing facilities; the availability and costs of skilled labour and mining equipment; the availability and costs of appropriate smelting and/or refining arrangements; the need to obtain necessary environmental and other governmental approvals and permits, and the timing of those approvals and permits; and, the availability of funds to finance construction and development activities. The costs, timing and complexities of mine construction and development are increased by the remote location of the Company's properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that the Company's activities will result in profitable mining operations or that the Company will successfully establish mining operations or profitably produce gold at any of its properties.

The Company does not have a history of mining operations, and there is no assurance that it will produce revenue, operate profitably or provide a return on investment in the future.

The Company has only incurred operating losses, and the development of its projects is at an early stage. The Company's ability to continue as a going concern is dependent upon its ability to obtain the necessary financing to meet its obligations and repay liabilities arising from normal business operations when they come due.

The Company will require significant financing in order to carry out plans to develop its projects. The Company has no revenues and is wholly reliant upon external financing to fund such plans. There can be no assurance that such financing will be available to the Company or, if it is, that it will be offered on acceptable terms. If additional financing is raised through the issuance of equity or convertible debt securities of the Company, the interests of the Company's shareholders in the net assets of the Company may be diluted. Any failure of the Company to obtain required financing on acceptable terms could have a material adverse effect on the Company's financial condition, results of operations, liquidity, and its ability to continue as a going concern, and may require the Company to cancel or postpone planned capital investments.

The Company may be adversely affected by fluctuations in gold prices.

The future price of gold will significantly affect the development of Loncor's projects. Gold prices are subject to significant fluctuation and are affected by a number of factors which are beyond Loncor's control. Such factors include, but are not limited to, interest rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major gold-producing countries throughout the world. The price of gold has fluctuated widely in recent years, and future serious price declines could cause development of and commercial production from Loncor's mineral interests to be impracticable. If the price of gold decreases, projected cash flow from planned mining operations may not be sufficient to justify ongoing operations and Loncor could be forced to discontinue development and sell its projects. Future production from Loncor's projects is dependent on gold prices that are adequate to make these projects economic.

The Company has substantially reduced exploration efforts at its projects, and there is no assurance that they will be recommenced.

As a result of the sharp decline in gold prices in 2013 and the difficult financing prospects for gold exploration companies in general and the Company in particular, the Company has substantially reduced exploration efforts at its projects in order to conserve cash. It is unlikely that the reduced exploration efforts can identify additional resources or make other substantial progress in advancing the projects. There can be no assurance that exploration will be significantly increased at the projects in the foreseeable future. Failure to conduct significant exploration activities would result in the inability to identify further development potential of the projects and could render financing more difficult to obtain, which would materially and adversely affect the Company’s financial condition.

The Company’s activities are subject to various laws and government approvals and no assurance can be given that the Company will be successful in obtaining or maintaining such approvals or that it will successfully comply with all applicable laws.

Loncor's mineral exploration activities are subject to various laws governing prospecting, mining, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although Loncor's exploration activities are currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail development.

Many of Loncor's mineral rights and interests are subject to government approvals, licenses and permits. Such approvals, licenses and permits are, as a practical matter, subject to the discretion of the DRC government. No assurance can be given that Loncor will be successful in maintaining any or all of the various approvals, licenses and permits in full force and effect without modification or revocation. To the extent such approvals are not maintained, Loncor may be delayed, curtailed or prohibited from continuing or proceeding with planned exploration of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be delayed or curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws and regulations governing operations or more stringent implementation thereof could have a substantial adverse impact on Loncor and cause increases in exploration expenses, capital expenditures or require abandonment or delays in development of mineral interests.

Exploration, development and mining involve a high degree of risk.

All of the Company's properties are in the exploration stage only. The exploration for and development of mineral deposits involves significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit, once discovered, will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Loncor not receiving an adequate return on invested capital.

There is no certainty that the expenditures made by Loncor towards the search for and evaluation of mineral deposits will result in discoveries that are commercially viable. In addition, assuming discovery of a commercial ore-body, depending on the type of mining operation involved, several years can elapse from the initial phase of drilling until commercial operations are commenced.

Mining operations generally involve a high degree of risk. Such operations are subject to all the hazards and risks normally encountered in the exploration for, and development and production of gold and other precious or base metals, including unusual and unexpected geologic formations, seismic activity, rock bursts, fires, cave-ins, flooding and other conditions involved in the drilling and removal of material as well as industrial accidents, labour force disruptions, fall of ground accidents in underground operations, unanticipated increases in gold lock-up and inventory levels at heap-leach operations and force majeure factors, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to person or property, environmental damage, delays, increased production costs, monetary losses and possible legal liability. Milling operations are subject to hazards such as equipment failure or failure of mining pit slopes and retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to the Company or to other companies within the mining industry. The Company may suffer a material adverse effect on its business if it incurs losses related to any significant events that are not covered by insurance policies.

There can be no assurance that an active market for the Company’s securities will be sustained.

The market price of the Company's securities may fluctuate significantly based on a number of factors, some of which are unrelated to the financial performance or prospects of the Company. These factors include macroeconomic developments in North America and globally, market perceptions of the attractiveness of particular industries, short-term changes in commodity prices, other precious metal prices, the attractiveness of alternative investments, currency exchange fluctuation, the political environment in the DRC and the Company's financial condition or results of operations as reflected in its financial statements. Other factors unrelated to the performance of the Company that may have an effect on the price of the securities of the Company include the following: the extent of analytical coverage available to investors concerning the business of the Company may be limited if investment banks with research capabilities do not follow the Company's securities; lessening in trading volume and general market interest in the Company's securities may affect an investor's ability to trade significant numbers of securities of the Company; the size of the Company's public float may limit the ability of some institutions to invest in the Company's securities; the Company's operating performance and the performance of competitors and other similar companies; the public's reaction to the Company's press releases, other public announcements and the Company's filings with the various securities regulatory authorities; changes in estimates or recommendations by research analysts who track the Company's securities or the shares of other companies in the resource sector; the arrival or departure of key personnel; acquisitions, strategic alliances or joint ventures involving the Company or its competitors; the factors listed in this Form 20-F under the heading "Cautionary Statement Regarding Forward-Looking Statements"; and a substantial decline in the price of the securities of the Company that persists for a significant period of time could cause the Company's securities to be delisted from any exchange on which they are listed at that time, further reducing market liquidity. If there is no active market for the securities of the Company, the liquidity of an investor's investment may be limited and the price of the securities of the Company may decline. If such a market does not develop, investors may lose their entire investment in the Company's securities.

The Company expects that it will be considered a passive foreign investment company or "PFIC".

Holders of common sharesof the Company that are U.S. taxpayers should be aware that, due to the nature of the Company's assets and the income that it expects to generate, the Company expects to be a "passive foreign investment company" ("PFIC") for the current year, and may be a PFIC in subsequent taxable years. Whether the Company will be a PFIC for the current or future taxable year will depend on the Company's assets and income over the course of each such taxable year and, as a result, cannot be predicted with certainty as of the date of this Form 20-F. Accordingly, there can be no assurance that the IRS will not challenge the determination made by the Company concerning its PFIC status for any taxable year. U.S. federal income tax laws contain rules which result in materially adverse tax consequences to U.S. taxpayers that own shares of a corporation which has been classified as a PFIC during any taxable year of such holder's holding period. A U.S. taxpayer who holds stock in a foreign corporation during any year in which such corporation qualifies as a PFIC may mitigate such negative tax consequences by making certain U.S. federal income tax elections, which are subject to numerous restrictions and limitations. Holders of the Company's common sharesare urged to consult their tax advisors regarding the acquisition, ownership, and disposition of the Company's common shares. This paragraph is only a brief summary of the PFIC rules, and is qualified in its entirety by the section below entitled "Certain United States Federal Income Tax Considerations".

The Company has a history of losses and may never achieve revenues or profitability.

The Company has incurred losses from operations since it became a mineral exploration company in November 2008 and the Company expects to incur losses from operations for the foreseeable future.

The Company had an accumulated deficit of US$25.547 million52,771,536 as of December 31, 2012.2013. The losses do not include capitalized mineral property exploration costs.

The Company expects to continue to incur losses unless and until such time as one or more of its properties enter into commercial production and generate sufficient revenues to fund continuing operations. The development of the Company's properties will require the commitment of substantial financial resources. The amount and timing of expenditures will depend on a number of factors, including the progress of ongoing exploration and development, the results of consultants' analysis and recommendations, the rate at which operating losses are incurred, and the Company's acquisition of additional properties, some of which are beyond the Company's control. There can be no assurance that the Company will ever achieve profitability.

In order to develop any of its projects the Company will need to establish the facilities and material necessary to support operations in the remote locations in which they are situated, which lack basic infrastructure.

The Company's projects are located in remote areas of the DRC, which lack basic infrastructure, including sources of power, water, housing, food and transport. In order to develop any of its projects Loncor will need to establish the facilities and material necessary to support operations in the remote locations in which they are situated. The remoteness of each project will affect the potential viability of mining operations, as Loncor will also need to establish substantially greater sources of power, water, physical plant and transport infrastructure than are currently present in the area. The transportation of equipment and supplies into the DRC and the transportation of resources out of the DRC may also be subject to delays that adversely affect the ability of the Company to proceed with its mineral projects in the country in a timely manner. Shortages of the supply of diesel, mechanical parts and other items required for the Company's operations could have an adverse effect on the Company's business, operating results and financial condition. The lack of availability of such sources may adversely affect mining feasibility and will, in any event, require Loncor to arrange significant financing, locate adequate supplies and obtain necessary approvals from national, provincial and regional governments, none of which can be assured. The Company's interests in the DRC are accessed over lands that may also be subject to the interests of third parties which may result in further delays and disputes in the carrying out of the Company's operational activities.

There is uncertainty in the estimation of mineral resources.

The mineral resource figures referred to in thisForm 20-F and in the Company's filings with the SEC and applicable Canadian securities regulatory authorities, press releases and other public statements that may be made from time to time are estimates. These estimates are imprecise and depend upon geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. There can be no assurance that these estimates will be accurate or that this mineralization could be mined or processed profitably.

The Company has not commenced commercial production on any of its properties, and has not defined or delineated any proven or probable reserves on any of its properties. Mineralization estimates for the Company's properties may require adjustments or downward revisions based upon further exploration or development work or actual production experience. In addition, the grade of ore ultimately mined, if any, may differ from that indicated by drilling results. There can be no assurance that minerals recovered in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

The resource estimates referred to in thisForm 20-F have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in the market price for gold may render portions of the Company's mineralization uneconomic and result in reduced reported mineralization. Any material reductions in estimates of mineralization, or of the Company's ability to extract this mineralization, could have a material adverse effect on the Company's results of operations or financial condition.

The Company has not established the presence of any proven or probable reserves at any of its properties. There can be no assurance that subsequent testing or future studies will establish proven and probable reserves on such properties. The failure to establish proven and probable reserves on such properties could severely restrict the Company's ability to successfully implement its strategies for long-term growth.

There is uncertainty relating to inferred mineral resources.

There is a risk that the inferred mineral resources referred to in thisForm 20-F cannot be converted into mineral reserves as the ability to assess geological continuity is not sufficient to demonstrate economic viability. Due to the uncertainty that may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration.

The Company is exposed to a heightened degree of risk due to the lack of property diversification.

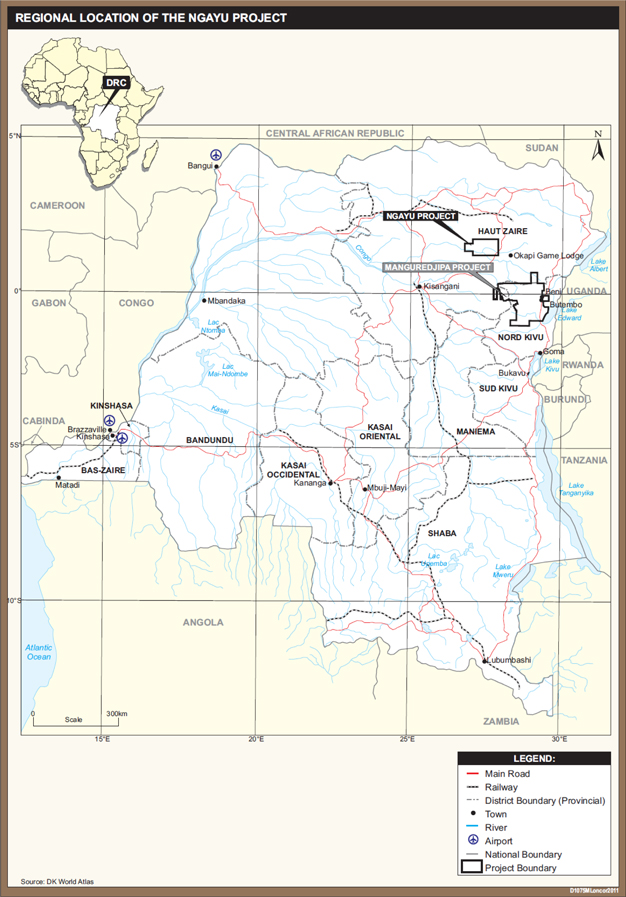

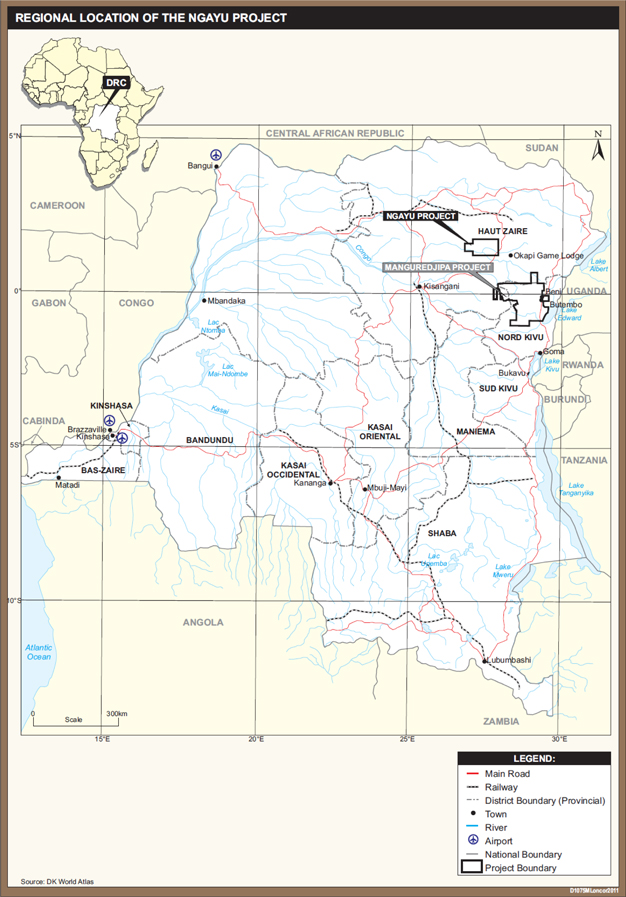

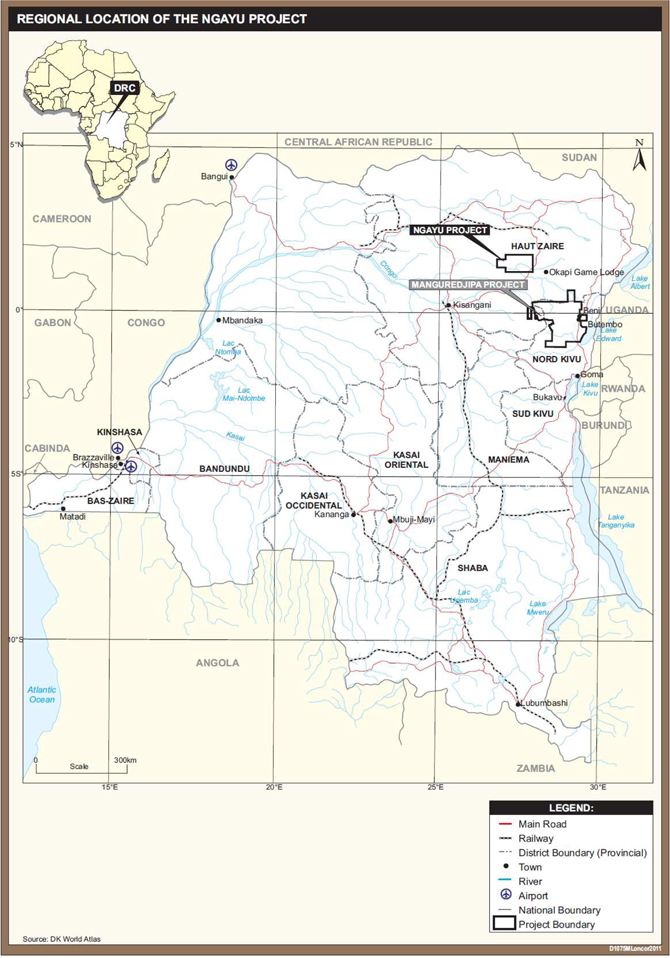

The Ngayu and North Kivu projects account for all of the Company's mineral properties. Any adverse development affecting the progress of either of these projects may have a material adverse effect on the Company's financial performance and results of operations.

Negative market perception of junior mineral exploration companies could adversely affect the Company.

Market perception of junior mineral exploration companies such as the Company may shift such that these companies are viewed less favourably. This factor could impact the value of investors' holdings and the ability of the Company to raise further funds, which could have a material adverse effect on the Company's business, financial condition and prospects.

The SEC has adopted rules that may affect mining operations in the DRC.

The Company’s business is subject to evolving corporate governance and public disclosure regulations that have increased both the Company’s compliance costs and the risk of noncompliance, which could have an adverse effect on the Company’s stock price.

The Company is subject to changing rules and regulations promulgated by a number of United States and Canadian governmental and self-regulated organizations, including the SEC, the Canadian Securities Administrators, the New York Stock Exchange, the Toronto Stock Exchange, and the International Accounting Standards Board. These rules and regulations continue to evolve in scope and complexity and many new requirements have been created in response to laws enacted by the United States Congress, making compliance more difficult and uncertain. For example, on July 21, 2010, the United States Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act, which resultedis expected to result in the SEC adopting rules that will require the Company to disclose on an annual basis, beginning in 2014, certain payments made by the Company, its subsidiaries or entities controlled by it, to the U.S. government and foreign governments, including sub-national governments. The SEC has also adopted rules under the Dodd Frank Act that will require a company filing reports with the SEC to disclose on an annual basis, beginning in 2014, whether certain “conflict minerals” necessary to the functionality or production of a product manufactured by such company originated in the DRC or any adjoining country. The Company currently holds properties located in the DRC. It is possible that the new SEC rules regarding conflict minerals could adversely affect the value of the minerals mined in the DRC, which may impact the value of the Company’s interests in those properties. The Company’s efforts to comply with the Dodd-Frank Act, the rules and regulations promulgated thereunder, and other new rules and regulations have resulted in, and are likely to continue to result in, increased general and administration expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

The Company is not insured to cover all potential risks.

Although the Company maintains directors and officers insurance and insurance on its premises in Toronto, Canada, its insurance does not cover all the potential risks associated with its operations, including industrial accidents, damages to equipment and facilities, labour disputes, pollution, unusual or unexpected geological conditions, rock bursts, ground or slope failures, cave-ins, fires, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods, earthquakes and other environmental occurrences. In addition, Loncor may elect not to obtain coverage against these risks because of premium costs or other reasons, and where coverage is maintained, losses may exceed policy limits. Losses from these events may cause Loncor to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

The Company’s operations may be adversely affected by environmental hazards on the properties and related environmental regulations.

All phases of Loncor's operations are subject to environmental regulation. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on behalf of the Company and may cause material changes or delays in the Company's intended activities. There is no assurance that future changes in environmental regulation, if any, will not adversely affect Loncor's operations. Environmental hazards may exist on the properties on which Loncor holds interests which are unknown to Loncor at present and which have been caused by previous owners or operators of the properties. Reclamation costs are uncertain and planned expenditures may differ from the actual expenditures required.

The Company is a foreign corporation and all of the Company’s directors and officers except one director are outside the United States, which makes enforcement of civil liabilities difficult.

The Company is organized under the laws of the Province of Ontario in Canada, and its principal executive office is located in Toronto, Canada. All of the Company's directors and officers except one director, and all of the experts referred to in this Form 20-F, reside outside of the United States, and all or a substantial portion of their assets, and a substantial portion of the Company's assets, are located outside of the United States. As a result, it may be difficult for investors in the United States or otherwise outside of Canada to bring an action against directors, officers or experts who are not resident in the United States or in other jurisdictions outside Canada. It may also be difficult for an investor to enforce a judgment obtained in a United States court or a court of another jurisdiction of residence predicated upon the civil liability provisions of federal securities laws or other laws of the United States or any state thereof or the equivalent laws of other jurisdictions outside Canada against those persons or the Company.

The Company’s business depends on its ability to identify and acquire commercially mineable mineral rights, and there can be no assurances that it will be successful in such efforts.

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any anticipated level of recovery of ore reserves will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Estimates of reserves, resources, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

Loncor's future growth and productivity will depend, in part, on its ability to identify and acquire additional commercially mineable mineral rights, and on the costs and results of continued exploration and development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to: establish ore reserves through drilling and metallurgical and other testing techniques; determine metal content and metallurgical recovery processes to extract metal from the ore; and construct, renovate or expand mining and processing facilities.

In addition, if the Company discovers ore, it would take several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change. As a result of these uncertainties, there can be no assurance that the Company will successfully acquire additional commercially mineable (or viable) mineral rights.

Litigation may adversely affect the Company’s financial position, results of operations or the Company’s project development operations.

The Company may from time to time be involved in various legal proceedings. While the Company believes it is unlikely that the final outcome of any such proceedings will have a material adverse effect on the Company's financial position or results of operation, defence and settlement costs can be substantial, even with respect to claims that have no merit. Due to the inherent uncertainty of the litigation process, there can be no assurance that the resolution of any particular legal matter will not have a material adverse effect on the Company's future cash flow, results of operations or financial condition.

Future hedging activities may result in selling products at a price lower than could have otherwise been received.

The Company has not entered into forward contracts or other derivative instruments to sell gold that it might produce in the future. Although the Company has no near term plans to enter such transactions, it may do so in the future if required for project financing. Forward contracts obligate the holder to sell hedged production at a price set when the holder enters into the contract, regardless of what the price is when the product is actually mined. Accordingly, there is a risk that the price of the product is higher at the time it is mined than when the Company entered into the contracts, so that the product must be sold at a price lower than could have been received if the contract was not entered. There is also the risk that the Company may have insufficient gold production to deliver into forward sales positions. The Company may enter into option contracts for gold to mitigate the effects of such hedging.

Increased sales of the Company’s common shares by shareholders could lower the marketplace of the shares.

Sales of a large number of the Company's common shares in the public markets, or the potential for such sales, could decrease the trading price of such shares and could impair Loncor's ability to raise capital through future sales of common shares. Loncor has previously completed private placements at prices per share which are lower than the current market price of its common shares. Accordingly, a number of the Company's shareholders have an investment profit in the Company's common shares that they may seek to liquidate.

Fluctuations in currency could have a material impact on the Company’s financial statements.

The Company uses the United States dollar as its functional currency. Fluctuations in the value of the United States dollar relative to other currencies (including the Canadian dollar) could have a material impact on the Company's consolidated financial statements by creating gains or losses. No currency hedge policies are in place or are presently contemplated.

The loss of key management personnel or the inability to recruit additional qualified personnel may adversely affect the Company’s business.

The success of the Company depends on the good faith, experience and judgment of the Company's management and advisors in supervising and providing for the effective management of the business and the operations of the Company. The Company is dependent on a relatively small number of key personnel, the loss of any one of whom could have an adverse effect on the Company. The Company currently does not have key person insurance on these individuals. The Company may need to recruit additional qualified personnel to supplement existing management and there is no assurance that the Company will be able to attract such personnel.

The Company may not be able to compete with current and potential exploration companies, some of whom have greater resources and technical facilities.

The natural resource industry is intensely competitive in all of its phases. Significant competition exists for the acquisition of properties producing, or capable of producing, gold or other metals. The Company competes with many companies possessing greater financial resources and technical facilities than itself. The Company may also encounter increasing competition from other mining companies in its efforts to hire experienced mining professionals. CompetitionAs well, there is competition for exploration resources at all levels, is currently very intense, particularly affecting the availability of manpower, drill rigs and helicopters. Increased competition could also adversely affect the Company's ability to attract necessary capital funding or acquire suitable producing properties or prospects for mineral exploration in the future.

Certain directors and officers may be in a position of conflict of interest with respect to the Company due to their relationship with other resource companies.

A number of directors and officers of the Company also serve as directors and/or officers of other companies involved in the exploration and development of natural resource properties. As a result, conflicts may arise between the obligations of these individuals to the Company and to such other companies.

The Company has never paid and has no plans to pay dividends.

The Company has not paid out any cash dividends to date and has no plans to do so in the immediate future. As a result, an investor’s return on investment in the Company’s common shares will be solely determined by his or her ability to sell such shares in the secondary market.

The Company may not be able to maintain its listing on the NYSE MKT LLC (the “NYSE MKT”).

The Company received a notification from the NYSE MKT LLC ("NYSE MKT") in March 2014 that it is no longer in compliance with certain NYSE MKT listing standards (reference is made to the Company’s press release dated March 10, 2014). The Company has until April 2, 2014 to submit a plan to regain compliance. The Company may choose not to submit a plan, but if a plan is submitted, there is no guarantee that the plan will be accepted or if the Company will be able to comply with the plan and regain compliance. If the plan is accepted and the Company is not in compliance with the continued listing standards at the end of the plan period or the Company does not make progress consistent with the plan during the period, then the NYSE MKT may initiate delisting proceedings. If the Company’s common shares are delisted from the NYSE MKT, shareholders will not be able to trade its common shares on NYSE MKT and certain federal and state securities law exemptions for its common shares would no longer be available. Consequently, the trading market for the Company’s securities in the United States will be limited.

Item 4. Information on the Company

A. History and Development of the Company

The Company is a corporation governed bywhich was formed under the Ontario Business Corporations Act. on August 24, 1993. The head office and registered office of the Company is located at 1 First Canadian Place, Suite 7070, 100 King Street West, Toronto, Ontario, M5X 1E3, Canada. The telephone number of such office is (416) 366-2221.

On November 28, 2008, the Company completed the acquisition (the "Acquisition") of all of the outstanding shares of the private company,Loncor Resources Inc. ("Old Loncor"). Also onNovember 28, 2008, immediately following this acquisition, the Company amalgamated with Old Loncor and, pursuant to the amalgamation, changed its name from Nevada Bob's International Inc. to Loncor Resources Inc. As a result of this acquisition, thethe business of theCompany is the exploration of mineral properties in the DRC. Prior tothis acquisition,, theCompany was in the business of licensing the right to use (a) the Nevada Bob's trademarks in connection with operating retail golf stores internationally, excluding the United Kingdom, Europe, Canada and the United States, and (b) certain other golf-related, non-Nevada Bob's trademarks internationally, including the United Kingdom, Europe, Canada and the United States.

In September 2009, the Company completed a non-brokered private placement of 3,000,000 common shares at a price of Cdn$0.75 per share for proceeds to the Company of Cdn$2,250,000.

In October 2009, the Company announced the appointment of Peter Cowley as President and Chief Executive Officer of the Company. Mr. Cowley was also appointed to the board of directors of the Company. Kevin Baker stepped down as President and Chief Executive Officer, but remainsremained a non-executive director of the Company.Company until March 2014. Arnold Kondrat was appointed Executive Vice President of the Company and relinquished the title of Chairman of the Board of the Company. In connection with Mr. Cowley's appointment as a director of the Company, Geoffrey Farr stepped down as a director of the Company but remains Corporate Secretary of the Company.

In February 2010, the Company completed a brokered private placement financing involving the issuance of 8,166,500 units of the Company at a price of Cdn$1.25 per unit for aggregate gross proceeds of Cdn$10,208,125. Each such unit was comprised of one common share of the Company and one-half of one common share purchase warrant of the Company, with each full warrant entitling the holder to purchase one common share of the Company at a price of Cdn$1.45 for a period of 24 months. GMP Securities L.P. as lead agent, together with CI Capital Markets Inc. and Salman Partners Inc., acted as the Company's agents in connection with this financing.

Also in February 2010, the Company completed a non-brokered private placement financing involving the issuance toan affiliate(" ("Newmont") of Newmont Mining Corporation of 4,000,000 units of the Company at a price of Cdn$1.25 per unit for aggregate gross proceeds of Cdn$5,000,000. The units issued under this financing had the same terms as the units issued under the February 2010 brokered private placement.In December 2010, Newmont exercised the 2,000,000 warrants that it had acquired under the said February 2010 non-brokered private placement, resulting in the issuance by the Company to Newmont of 2,000,000 common shares of the Company at a price of Cdn$1.45 per share for gross proceeds to the Company of Cdn$2,900,000.

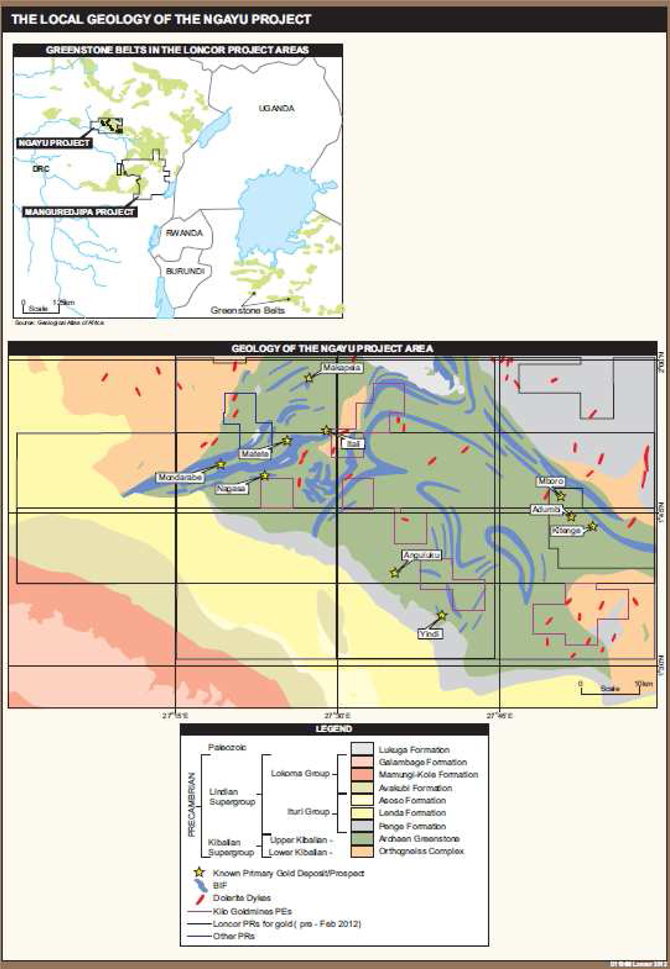

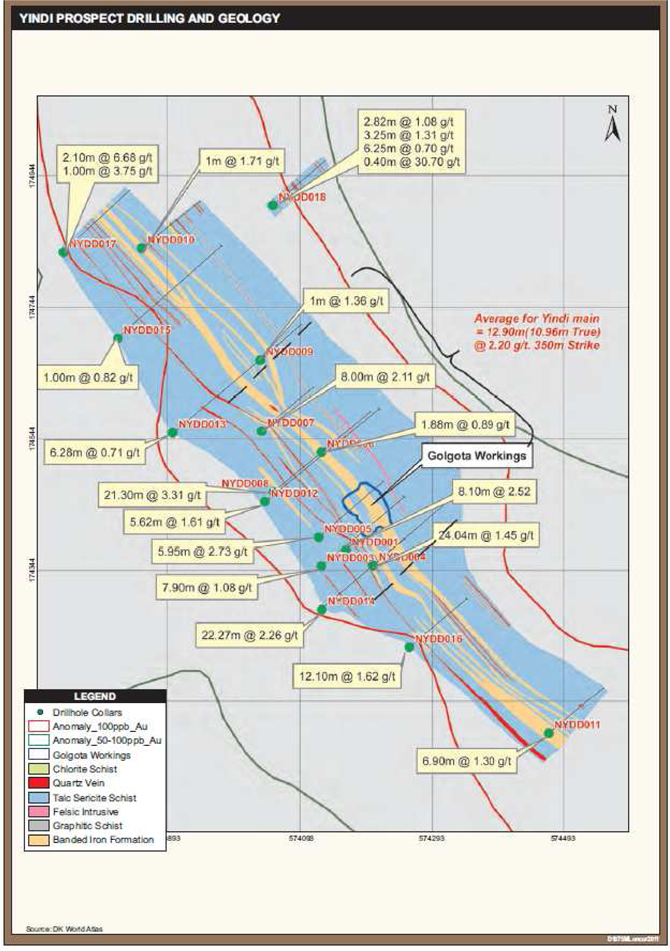

The Company established the main Ngayu exploration camp in early 2010 at the Yindi prospect, located in the southwest corner of the Ngayu gold project area.

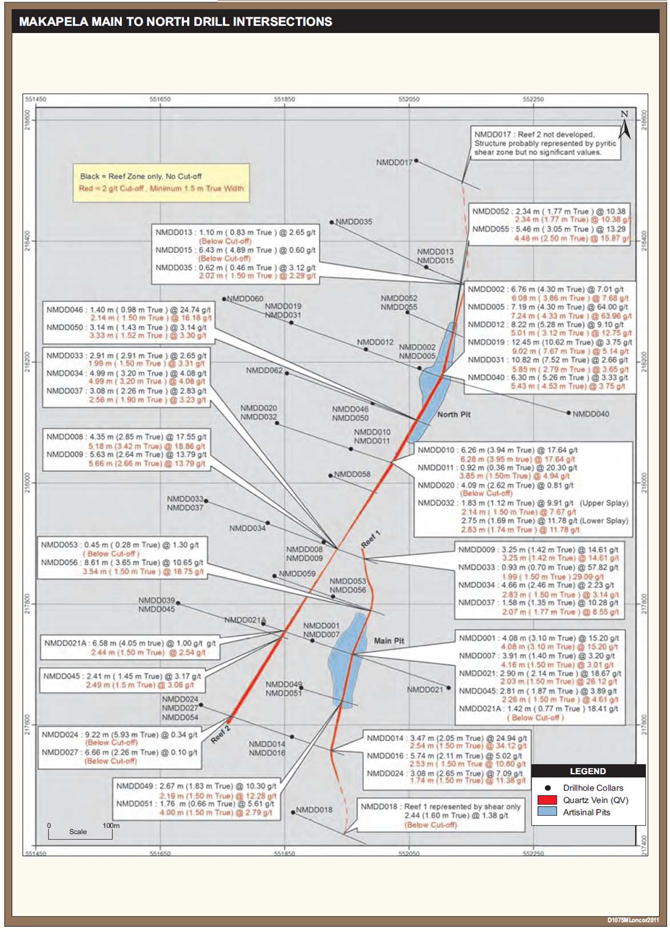

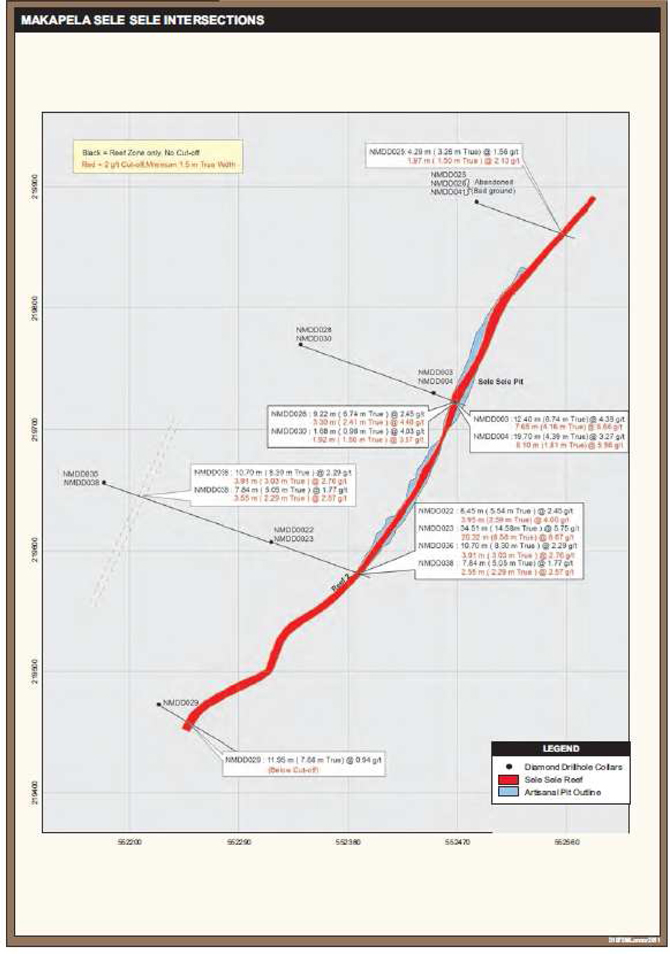

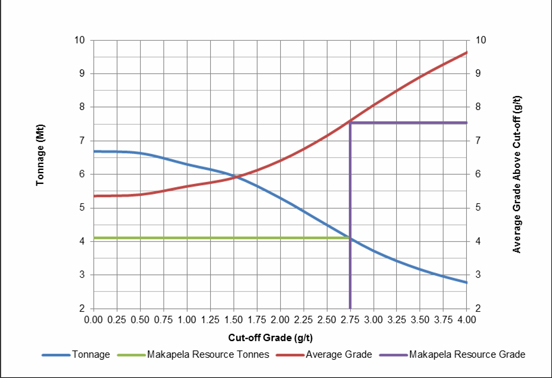

In June 2010, the Company announced initial assay results from the Makapela prospect at the Company's Ngayu gold project. A core drilling program at Makapela commenced in November 2010 with the objective of testing along strike and at depth the sub vertical, vein mineralized system being exploited by the artisanal miners at the Main, North and Sele Sele pits which returned significant results from channel sampling. Drill results at Makapela have since been announced by the Company via a number of press releases in 2011 and 2012.

Exploration at the Itali prospect at the Company's Ngayu gold project commenced during the third quarter of 2010 and continued during 2011.2010. The Itali prospect is located about 10 kilometres south of Makapela. In January 2012, the Company announced the results of its first drill hole at the Itali prospect. Additional drill results at the Itali prospect were announced by the Company in October 2012.

In December 2010, the Company completed a non-brokered private placement with Newmont involving the issuance by the Company to Newmont of 2,000,000 units of the Company at a price of Cdn$1.95 per unit for aggregate gross proceeds of Cdn$3,900,000. Each such unit was comprised of one common share of the Company and one-half of one common share purchase warrant of the Company. Each full warrant was exercisable into one additional common share of the Company at a price of Cdn$2.30 until December 2012 (these warrants expired in December 2012 without being exercised).

In February 2011, the Company and Newmont entered into a technology consultation services agreement pursuant to which Newmont agreed to make available to Loncor, at Loncor’s reasonable request, exploration consultation services to assist Loncor in the exploration of Loncor's Ngayu gold project.

Also in February 2011, the Company completed concurrent brokered and non-brokered private placement equity financings. Pursuant to a “bought deal” private placement financing conducted by a syndicate of investment dealers, the Company issued 8,500,000 common shares of the Company at a price of Cdn$2.35 per share, resulting in aggregate gross proceeds of Cdn$19,975,000. The Company also issued, by way of non-brokered private placement, to Newmont, 1,700,000 common shares of the Company at a price of Cdn$2.35 per share for aggregate proceeds of Cdn$3,995,000.

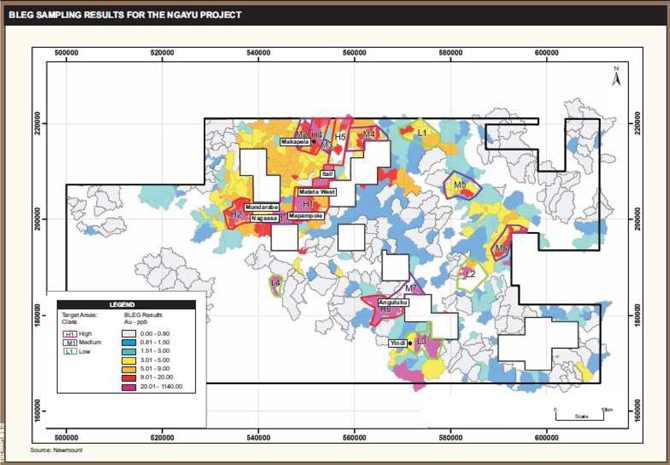

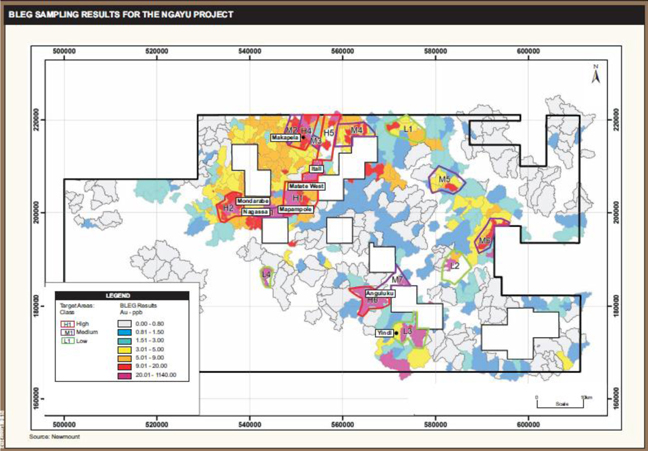

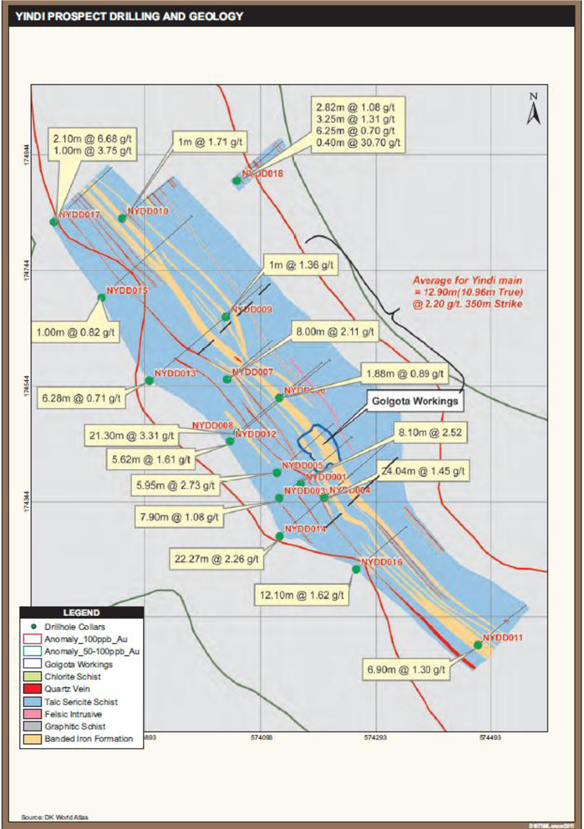

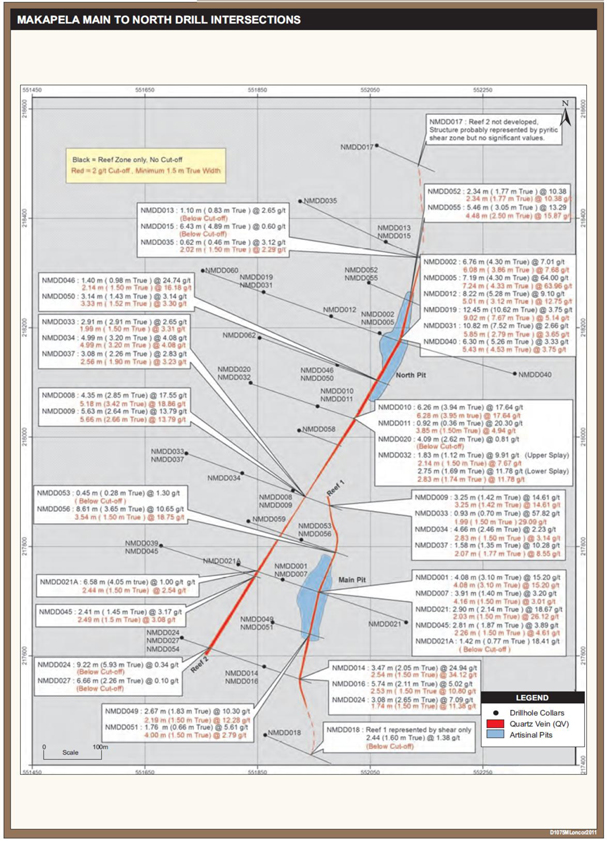

In April 2011, the Company’s common shares commenced trading on the NYSE MKT LLC (formerly called NYSE Amex LLC). The Company retained its primary listing on the TSX Venture Exchange.