AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON April 30, 2013

APRIL 22, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

OR

| | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the fiscal year ended December 31, 2012

2015

OR

| | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the transition period from ..................... to……………..

OR

| | |

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

Date of event requiring this shell company report……………….

Commission file number: 001-32535001 - 32535

BANCOLOMBIA S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Republic of Colombia

(Jurisdiction of incorporation or organization)

Carrera 48 # 26-85, Avenida Los Industriales

Medellín, Colombia

(Address of principal executive offices)

Alejandro Mejia Jaramillo, Investor Relations Manager

Tel. +574 4041837, Fax + 574 4045146, e-mail: almejia@bancolombia.com

Carrera 48 # 26-85, Medellín, Colombia

Tel. +574 4041837, Fax. + 574 4045146, e-mail: almejia@bancolombia.com

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each Class | Name of each exchange on which registered | |

| American Depositary Shares | New York Stock Exchange |

| Preferred Shares | New York Stock Exchange* |

__________________

| * | Bancolombia’s preferred shares are not listed for trading directly, but only in connection with its American Depositary Shares, which are evidenced by American Depositary Receipts, each representing four preferred shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Not applicable

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Not applicable

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the

period covered by the annual report.

| Common Shares | 509,704,584 |

| Preferred Shares | 342,122,416452,122,416 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesx No¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 of 15(d) of the Securities Exchange Act of 1934.

Yes¨ Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes¨No¨x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See the definitions of “accelerated filer and large, accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filerxAccelerated filer¨Non-accelerated filer¨

(Do not check if a smaller reporting company)

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other x | Other ¨ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18x¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS.)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes¨No¨x

TABLE OF CONTENTS

CERTAIN DEFINED TERMS

Unless otherwise specified or if the context so requires, in this annual report:

References to “ADSs” refer to our American Depositary Shares (one ADS represents four preferred shares).

References to the “Annual Report” refer to this annual report on Form 20-F.

References to “Banagrícola” refer to Banagrícola S.A., a company incorporated in Panama, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Banca de Inversión” refer to Banca de Inversión Bancolombia S.A. Corporación Financiera, a Subsidiary of Bancolombia S.A. organized under the laws of the Republic of Colombia that specializes in providing investment banking services.

References to “Banco Agrícola” refer to Banco Agrícola S.A., a banking institution organized under the laws of the Republic of El Salvador, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Bancolombia”, the “Bank”, “us” , “we” or “our” refer to Bancolombia S.A., a banking institution organized under the laws of the Republic of Colombia, which may also act under the name of Banco de Colombia S.A., including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Bancolombia Panama” refer to Bancolombia (Panama)Panamá S.A., a Subsidiarysubsidiary of Bancolombia S.A. organized under the laws of the Republic of Panama that provides banking services to non-Panamanian customers.

References to “Banistmo” refer to Banistmo S.A., a banking institution organized under the laws of the Republic of Panama, including its subsidiaries on a consolidated basis, unless otherwise indicated or the context otherwise requires.

References to “Central Bank” refer to the Central Bank of Colombia.Colombia (Banco de la República).

References to “Colombia” refer to the Republic of Colombia.

References to “Colombian banking GAAP” refer to generally accepted accounting principles in Colombia as supplemented by the applicable regulations of the SFC.

References to “Conavi” refer to Conavi Banco Comercial y de Ahorros S.A. as it existed immediately before the Conavi/Corfinsuraits merger (as defined below).

References to the “Conavi/Corfinsura merger” refer to the merger of Conavi and Corfinsura with and into Bancolombia, with Bancolombia as the surviving entity, which took effect on July 30, 2005 pursuant to a Merger Agreement dated February 28, 2005.Bancolombia.

References to “Congress” refer to the national congress of Colombia.

References to “Corfinsura” refer to Corporación Financiera Nacional y Suramericana S.A., as it existed immediately before the Conavi/Corfinsuraits merger takingwith and into account the effect of its spin-off of a portion of its investment portfolio effective July 29, 2005.Bancolombia.

References to “DTF” refer to theDepósitos a Término Fijo rate, the weighted average interest rate paid by finance corporations, commercial banks and financing companies in Colombia for termtime deposits with maturities of 90 days.

References to “Factoring Bancolombia” refer to Factoring Bancolombia S.A. Compañía de Financamiento, a Subsidiary of Bancolombia organized under the laws of Colombia that specializes in accounts receivable financing.

References to “Fiduciaria Bancolombia” refer to Fiduciaria Bancolombia S.A. Sociedad Fiduciaria, a Subsidiary of Bancolombia organized under the laws of Colombia which provides trust and fund management services.

References to “Grupo Agromercantil” refer to Grupo Agromercantil Holding S.A., a company organized under the laws of the Republic of Panama, of which Bancolombia S.A. owns 60% of its voting shares, and is the parent company of Banco Agromercantil of Guatemala, and its subsidiaries.

References to “IRS” refer to U.S. Internal Revenue Service.

References to “Leasing Bancolombia” refer to Leasing Bancolombia S.A. Compañía de Financiamiento, a Subsidiary of Bancolombia S.A. organized under the laws of Colombia that specializes in leasing activities, offering a wide range of financial leases, operating leases, loans, time deposits and bonds.

References to “NYSE” refer to the New York Stock Exchange.

References to “peso”, “pesos” or “COP” refer to the lawful currency of Colombia.

References to “preferred shares” and “common shares” refer to our issued, outstanding and paid infully paid-in preferred and common shares, designated asacciones con dividendo preferencial sin derecho a votoandacciones ordinarias, respectively.

References to “Renting Colombia” refer to Renting Colombia S.A., a Subsidiary of Bancolombia S.A. organized under the laws of Colombia which provides operating lease and fleet management services for individuals and companies.

References to “Representative Market Rate” refer toTasa Representativa del Mercado, the U.S. dollar representative market rate, certified by the SFC. The Representative Market Rate is an economic indicator of the daily exchange rate on the Colombian market spot of currencies. It corresponds to the arithmetical weighted average of the rates for the purchase and sale of currencies by certain financial institutions (including Bancolombia) authorized to engage in foreign exchange transactions in Colombia.

References to “SEC” refer to the U.S. Securities and Exchange Commission.

References to “SMEs” refer to Small and Medium Enterprises

References to “SMMLV” refer toSalario Mínimo Mensual Legal Vigente,the effective legal minimum monthly salary in Colombia. In 2015, the effective legal minimum monthly salary in Colombia was COP 644,350.

References to “Subsidiaries” refer to entities in which Bancolombia S.A. holds, directly or indirectly, more than 50% of the outstanding voting shares.

References to “Superintendency of Finance” or “SFC” refer to the Colombian Superintendency of Finance (Superintendencia Financiera de Colombia), a technical entity under the Ministry of Finance and Public Credit (Ministerio de Hacienda y Crédito Público) with functions of inspection, supervision and control functions over the entities involved in financial activities, capital markets, insurance and any other services related to the management, use or investment of resources collected from the public.

References to “Representative Market Rate” refer toTasa Representativa del Mercado, the U.S. dollar representative market rate, certified by the SFC. The Representative Market Rate is an economic indicator of the daily exchange rate on the Colombian market spot of currencies. It corresponds to the arithmetical weighted average of the rates of purchase and sale of currencies of interbank transactions of the authorized intermediaries.

References to “Colombian banking GAAP” refer to the generally accepted accounting principles in Colombia and the special accounting regulations of the SFC.

References to “SEC” refer to the U.S. Securities and Exchange Commission.

References to “SMEs” refer to Small and Medium Enterprises.

References to “SMMLV” refer toSalario Mínimo Mensual Legal Vigente the effective legal minimum monthly salary in Colombia. In 2012, the effective legal minimum monthly salary in Colombia was COP 566,700.

References to “peso”, “pesos” or “COP” refer to the lawful currency of Colombia.

References to “Subsidiaries” refer to subsidiaries of Bancolombia in which Bancolombia holds, directly or indirectly, more than 50% of the outstanding voting shares.

References to “U.S.” or “United States” refer to the United States of America.

References to “U.S. dollar”, “USD”, and “US$” refer to the lawful currency of the United States.

References to “UVR” refer toUnidades de Valor Real, a Colombian inflation-adjusted monetary index calculated by the board of directors of the Central Bank and generally used for pricing home-mortgage loans.

References to “Valores Bancolombia” refer to Valores Bancolombia S.A. Comisionista de Bolsa, a Subsidiary of Bancolombia S.A. organized under the laws of the Republic of Colombia that provides brokerage and asset management services.

The term “billion” means one thousand million (1,000,000,000).

The term “trillion” means one million million (1,000,000,000,000).

Our fiscal year ends on December 31, and references in this Annual Reportannual report to

any specific fiscal year are to the twelve-month12-month period ended December 31 of

such year.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains statements which may constitute forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements are not based on historical facts but instead represent only the Bank’s belief regarding future events, many of which, by their nature, are inherently uncertain and outside the Bank’s control. The words “anticipate”, “believe”, “estimate”, “expect”, “intend”, “plan”, “predict”, “target”, “forecast”, “guideline”, “should”, “project” and similar words and expressions are intended to identify forward-looking statements. It is possible that the Bank’s actual results may differ, possibly materially, from the anticipated results indicated in or implied by these forward-looking statements.

Information regarding important factors that could cause actual results to differ, perhaps materially, from those in the Bank’s forward-looking statements appear in a number of places in this Annual Report, principally in “Item 3. Key Information – D. Risk Factors” and “Item 5. Operating and Financial Review and Prospects”, and. These factors include, but are not limited to: (i) changes in general economic, business, political, social, fiscal or other conditions in Colombia, or in any of the other countries where the Bank operates; (ii) changes in capital markets or in markets in general that may affect policies or attitudes towards lending; (iii) unanticipated increases in financing and other costs or the inability to obtain additional debt or equity financing on attractive terms; (iv) inflation, changes in foreign exchange rates and/or interest rates; (v) sovereign risks; (vi) liquidity risks; (vii) increases in defaultsdelinquencies by the Bank’s borrowers and other loan delinquencies;borrowers; (viii) lack of acceptance of new products or services by the Bank’s targeted customers; (ix) competition in the banking, financial services, credit card services, insurance, asset management, remittances, business and other industries in which the Bank operates; (x) adverse determination of legal or regulatory disputes or proceedings; (xi) changes in official regulations and the Colombian Government’sgovernment’s banking policy as well as changes in laws, regulations or policies in theother jurisdictions in which the Bank does business; (xii) regulatory issues relating to acquisitions; and (xiii) changes in business strategy.

Forward-looking statements speak only as of the date they are made and are subject to change, and the Bank does not intend, and does not assume any obligation, to update these forward-looking statements in light of new information or future events arising after the date of this Annual Report.

PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION

Accounting Principles

The accounting practices usedaudited Consolidated Financial Statements (the “Consolidated Financial Statements”) are prepared in accordance with IFRS as issued by the preparation ofIASB and the Bank’s consolidated financial statements followrelated interpretations issued by the International Financial Reporting Interpretations Committee (“IFRS-IC”) and by the Standing Interpretations Committee (SIC) related interpretations. Until December 31, 2014, we prepared our Consolidated Financial Statements following Colombian banking GAAP. Together, these requirements differ in certain significant respects from generally accepted accounting principles in the United States (“U.S. GAAP”). Note 31 to the Bank’s audited consolidated financial statementsAll 2015 and 2014 data included in this Annual Report provides a description of the principal differences between Colombian banking GAAP and U.S. GAAPreport has been prepared in accordance with IFRS as they relate to the Bank’s audited consolidated financial statements and provides a reconciliation of consolidated net income and consolidated stockholders’ equity for the years and dates indicated herein. References to Colombian banking GAAP in this Annual Report are to Colombian GAAP as supplementedissued by the applicable regulations of the SFC.IASB.

For consolidation purposes under Colombian banking GAAP, financial statements of2015, the Bank and its Subsidiaries must be prepared under uniform accounting policies. In order to comply with this requirement, financial statements of foreign Subsidiaries were adjusted as required by Colombian regulations.

In July 2009 Congress approved Law 1314 of 2009, which introduced changes in the accounting, audit and information disclosures with the aim of converging with “InternationalConsolidated Financial Reporting Standards – IFRS”, although current regulations could differ in certain subjects from those in other countries. In accordance with Decree 2784 of 2012, those regulations are effective for annual and interim fiscal years beginning after December 31, 2014.

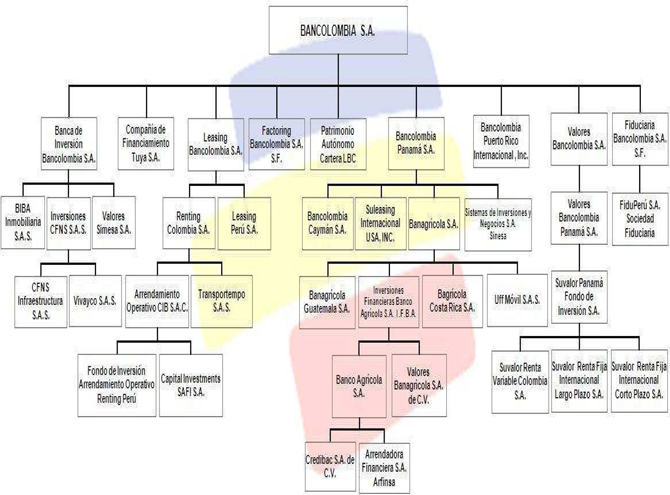

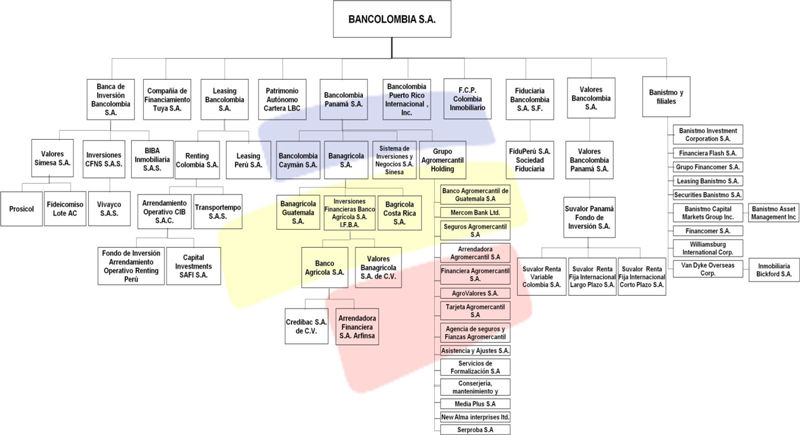

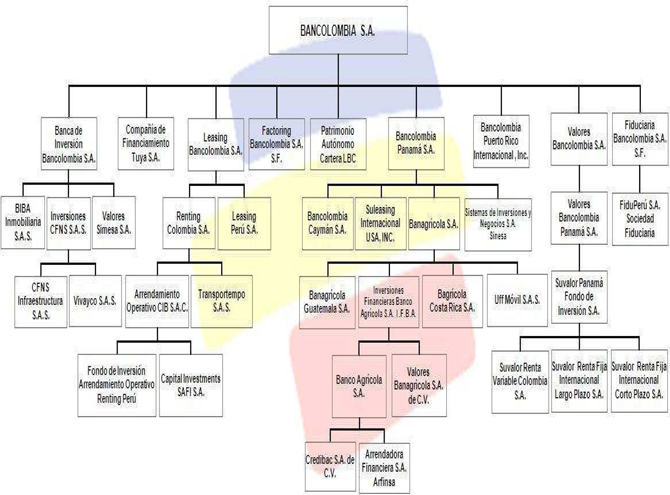

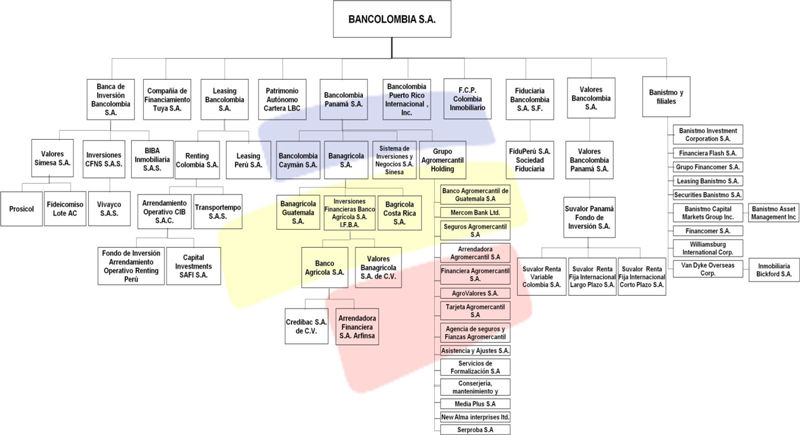

For 2012, the Bank’s consolidated financial statementsStatements include entities in which itthe Bank holds control, directly or indirectly, 50% or more of the outstanding voting rights. The Bank consolidates directly Leasing Bancolombia, Fiduciaria Bancolombia. Banca de Inversión, Tuya S.A. Compañía de Financiamiento, Bancolombia Puerto Rico Internacional Inc., Bancolombia Panamá, Valores Bancolombia, Factoring Bancolombia and Patrimonio Autónomo Cartera LBC. Some of the Bank’s Subsidiaries also consolidate their own subsidiaries. Bancolombia Panamá consolidates Bancolombia Cayman S.A., Sistema de Inversiones y Negocios S.A. Sinesa, Suleasing International USA, Inc. and Banagrícola (which, in turn, consolidates Inversiones Financieras Banco Agrícola S.A. IFBA, Banco Agrícola, Arrendadora Financiera S.A. Arfinsa, Credibac S.A. de C.V., Valores Banagrícola S.A. de C.V., Banagrícola Guatemala S.A., Bagrícola Costa Rica and UFF Móvil S.A.S.). Banca de Inversión consolidates BIBA Inmobiliaria S.A.S., Valores Simesa S.A., Inversiones CFNS S.A.S., CFNS Infraestructura S.A.S. and Vivayco S.A.S. Leasing Bancolombia consolidates Leasing Perú S.A., Renting Colombia (which, in turn, consolidates Arrendamiento Operativo CIB S.A.C., Capital Investments SAFI S.A., Fondo de Inversión en Arrendamiento Operativo Renting Perú, and Transportempo S.A.S.). Valores Bancolombia consolidates Valores Bancolombia Panamá S.A. and Suvalor Panamá Fondo de Inversión S.A. and Fiduciaria Bancolombia consolidates FiduPerú S.A. Sociedad Fiduciaria.indirectly. See “Item 4. Information on the Company – C. Selected Organizational Structure” for an organizational chart depicting Bancolombia and its subsidiaries.

Currencies

The Bank maintains accounting records in pesos.pesos, which is the functional and presentation currency of the Bank. The audited consolidated financial statements of BancolombiaConsolidated Financial Statements as of December 31, 2012,2015 and 20112014, and January 1, 2014, for threethe years ended December 31, 2012 (collectively, including the notes thereto, the “Financial Statements”)2015 and 2014 contained in this Annual Report are expressed in millions of pesos.

This Annual Report translates certain pesopesos amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such peso amounts have been translated at the rate of COP 1,768.233,149.47 per USD 1.00, which corresponds to the Representative Market Rate calculated on December 31, 20122015 the last business day of the year. The Representative Market Rate is computed and certified by the SFC, the Colombian banking regulator, on a daily basis and represents the weighted average of the buy/sell foreign exchange rates negotiated on the previous day by certain financial institutions authorized to engage in foreign exchange transactions (including Bancolombia). The SFC also calculates and certifies the average Representative Market Rate for each month for purposes of preparing financial statements and converting amounts in foreign currency to pesos. Such conversion should not be construed as a representation that the peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On April 29, 2013,21, 2016, the Representative Market Rate was COP 1,833.702,899.92 per USD 1.00.

Rounding Comparability of Data

Certain monetary amounts, percentages and other figures included in this Annual Report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be the arithmetic aggregation of the figures that precede them, and figures expressed as percentages in the text may not total 100% or, as applicable, when aggregated may not be the arithmetic aggregation of the percentages that precede them.

ThisThe Bank maintains an internet site at http://www.grupobancolombia.com/. In addition, certain of the Bank’s Subsidiaries referred to in this Annual Report refers to certain websites as sources for certain information contained herein. Information contained inmaintain separate internet sites. For example, Banco Agrícola and Banistmo maintain internet sites at http://www.bancoagricola.com/ and http://www.banistmo.com/, respectively.Information included on or otherwise accessible through these websitesBancolombia’s internet site or the internet site of any of the Subsidiaries of the Bank is not a part of this Annual Report. All references in this Annual Report to these and other internet sites are inactive textual references to these URLs, or “uniform resource locators”, and are for your informational reference only.

The Bank maintains an internet site atwww.grupobancolombia.com. In addition, certain of the Bank’s Subsidiaries referred to in this Annual Report maintain separate internet sites. For example, Banco Agrícola maintains an internet site atwww.bancoagricola.com. Information included on or accessible through Bancolombia’s internet site or the internet site of any of the Subsidiaries of the Bank is not part of this Annual Report.iv

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| A. | SELECTED FINANCIAL DATA |

The selected consolidated financial data as of December 31, 20122015 and 2011, and for each of the three fiscal years in the period ended December 31, 2012 set forth below has been derived from the Bank’s audited consolidated financial statements included in this Annual Report. The selected consolidated financial data as of December 31, 2010, 2009 and 2008,2014, and for each of the two fiscal years in the period ended December 31, 20092015 set forth below havehas been derived from the Bank’s audited consolidated financial statements for the respective periods, which are notConsolidated Financial Statements under IFRS included herein.in this Annual Report.

The selected consolidated financial data should be read in conjunction with the Bank’s consolidated financial statements,Consolidated Financial Statements, related notes thereto, and the reports of the Bank’s independent registered public accounting firms.

Differences Between Colombian banking GAAP and U.S. GAAP Results

| | | As of and for the year ended December 31, | |

| | | 2015 | | | 2015 | | | 2014 | |

| | | (in millions of COP and thousands of USD, except per share

and per ADS amounts) | |

| CONSOLIDATED STATEMENT OF INCOME: | | | | | | | | | | | | |

| Total interest and valuation income | | USD | 3,578,267 | | | COP | 11,269,644 | | | COP | 9,172,163 | |

| Interest expenses | | | (1,282,102 | ) | | | (4,037,941 | ) | | | (3,164,611 | ) |

| Net margin and valuation on financial instruments | | | 2,296,165 | | | | 7,231,703 | | | | 6,007,552 | |

| Credit impairment charges on loans and financial leases, net. | | | (529,511 | ) | | | (1,667,680 | ) | | | (843,597 | ) |

| Allowances for credit losses on off balance sheet credit instruments | | | (2,356 | ) | | | (7,421 | ) | | | (25,608 | ) |

| Net interest and valuation income after provisions for loans, financial leases and off-balance sheet credit instruments | | | 1,764,298 | | | | 5,556,602 | | | | 5,138,347 | |

| Total other operating income | | | 1,135,848 | | | | 3,577,320 | | | | 3,084,942 | |

| Total operating expenses | | | (1,872,787 | ) | | | (5,898,287 | ) | | | (5,118,695 | ) |

| Profit before tax | | | 1,027,359 | | | | 3,235,635 | | | | 3,104,594 | |

| Income tax | | | (206,146 | ) | | | (649,250 | ) | | | (737,676 | ) |

| Profit for the year from continuing operations | | | 821,213 | | | | 2,586,385 | | | | 2,366,918 | |

| Net income from discontinued operations | | | 7,148 | | | | 22,513 | | | | 62,867 | |

| Net income | | | 828,361 | | | | 2,608,898 | | | | 2,429,785 | |

| Net income attributable to equity holders of the parent company | | USD | 799,782 | | | COP | 2,518,890 | | | COP | 2,387,086 | |

| Non-controlling interest | | | 28,579 | | | | 90,008 | | | | 42,699 | |

| | | | | | | | | | | | | |

| Weighted average of Preferred and Common Shares outstanding(1) | | | | | | | 961,827,000 | | | | 941,936,589 | |

| Basic and Diluted net income per share(1) | | | 851 | | | | 2,680 | | | | 2,591 | |

| From continued operations | | | 843 | | | | 2,656 | | | | 2,524 | |

| From discontinued operations | | | 8 | | | | 24 | | | | 67 | |

| Basic and Diluted net income per ADS | | | 3,404 | | | | 10,720 | | | | 10,364 | |

| From continuing operations | | | 3,373 | | | | 10,624 | | | | 10,096 | |

| From discontinued operations | | | 30 | | | | 96 | | | | 268 | |

| Cash dividends declared per share | | | | | | | 888 | | | | 830 | |

| Cash dividends declared per share (stated in US Dollars) | | | | | | | 0.28 | | | | 0.26 | |

| Cash dividends declared per ADS | | | | | | | 3,552 | | | | 3,320 | |

| Cash dividends declared per ADS (stated in US Dollars) | | | | | | | 1.13 | | | | 1.05 | |

The Bank’s consolidated financial statements have been prepared in accordance with Colombian banking GAAP, which are the accounting principles and policies that are summarized in “Note 2. Summary of Significant Accounting Policies” to the Bank’s Financial Statements included in this Annual Report. These accounting principles and policies differ in some significant respects from U.S. GAAP.

Consolidated net income attributable to the controlling interest under U.S. GAAP for the year ended December 31, 2012 was COP 1,633,563 million (compared with COP 1,043,636 million for fiscal year 2011 and COP 1,544,761 million for fiscal year 2010). A reconciliation of consolidated net income and consolidated stockholders’ equity under U.S. GAAP is included in “Note 31. Differences between Colombian Accounting Principles for Banks and U.S. GAAP” to the Financial Statements included in this Annual Report.

| | | As of and for the year ended December 31, | |

| | | 2012(1) | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | |

| CONSOLIDATED STATEMENT OF OPERATIONS: | | | | | | | | | | | | | | | | | | | | | | | | |

| Colombian banking GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest income | | USD | 4,333,081 | | | COP | 7,661,883 | | | COP | 5,945,594 | | | COP | 4,960,640 | | | COP | 6,427,698 | | | COP | 6,313,743 | |

| Interest expense | | | (1,637,151 | ) | | | (2,894,860 | ) | | | (2,042,006 | ) | | | (1,571,581 | ) | | | (2,625,416 | ) | | | (2,753,341 | ) |

| Net interest income | | | 2,695,930 | | | | 4,767,023 | | | | 3,903,588 | | | | 3,389,059 | | | | 3,802,282 | | | | 3,560,402 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Provisions for loans, finance leases and accrued interest losses, net of recoveries (2) | | | (606,550 | ) | | | (1,072,520 | ) | | | (596,417 | ) | | | (512,585 | ) | | | (1,103,595 | ) | | | (1,155,262 | ) |

| Provision for foreclosed assets and other assets, net of recoveries(3) | | | (21,690 | ) | | | (38,353 | ) | | | (2,288 | ) | | | (35,130 | ) | | | (49,779 | ) | | | 22,095 | |

| Net interest income after provisions | | | 2,067,690 | | | | 3,656,150 | | | | 3,304,883 | | | | 2,841,344 | | | | 2,648,908 | | | | 2,427,235 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Fees and income from services and other operating income, net(4) | | | 1,493,095 | | | | 2,640,137 | | | | 2,359,821 | | | | 2,115,970 | | | | 1,886,949 | | | | 1,964,084 | |

| Operating expenses | | | (2,353,981 | ) | | | (4,162,382 | ) | | | (3,606,348 | ) | | | (3,098,479 | ) | | | (2,895,145 | ) | | | (2,639,997 | ) |

| Net operating income | | | 1,206,804 | | | | 2,133,905 | | | | 2,058,356 | | | | 1,858,835 | | | | 1,640,712 | | | | 1,751,322 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net non-operating income excluding minority interest | | | 23,153 | | | | 40,938 | | | | 87,406 | | | | 99,293 | | | | 93,232 | | | | 31,888 | |

| Minority interest (loss) | | | (3,237 | ) | | | (5,723 | ) | | | (11,351 | ) | | | (13,217 | ) | | | (15,081 | ) | | | (18,511 | ) |

| Income before income taxes | | | 1,226,720 | | | | 2,169,120 | | | | 2,134,411 | | | | 1,944,911 | | | | 1,718,863 | | | | 1,764,699 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income taxes | | | (264,150 | ) | | | (467,074 | ) | | | (470,517 | ) | | | (508,417 | ) | | | (462,013 | ) | | | (474,056 | ) |

| Net income | | USD | 962,570 | | | COP | 1,702,046 | | | COP | 1,663,894 | | | COP | 1,436,494 | | | COP | 1,256,850 | | | COP | 1,290,643 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Weighted average of Preferred and Common Shares outstanding(5) | | | | | | | 845,531,918 | | | | 787,827,003 | | | | 787,827,003 | | | | 787,827,003 | | | | 787,827,003 | |

| Basic and Diluted net income per share(5) | | | 1.14 | | | | 2,013 | | | | 2,112 | | | | 1,823 | | | | 1,595 | | | | 1,638 | |

| Basic and Diluted net income per ADS | | | 4.55 | | | | 8,052 | | | | 8,448 | | | | 7,292 | | | | 6,380 | | | | 6,552 | |

| Cash dividends declared per share | | | | | | | 754 | | | | 708 | | | | 669 | | | | 637 | | | | 624 | |

| Cash dividends declared per share(stated in U.S. Dollars) | | | | | | | 0.43 | | | | 0.36 | | | | 0.35 | | | | 0.31 | | | | 0.28 | |

| Cash dividends declared per ADS | | | | | | | 3,016 | | | | 2,832 | | | | 2,675 | | | | 2,547 | | | | 2,496 | |

| Cash dividends declared per ADS (stated in U.S. Dollars) | | | | | | | 1.71 | | | | 1.46 | | | | 1.40 | | | | 1.25 | | | | 1.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP:(6) | | | | | | | | | | | | | | | | | | | | | | | | |

| Net income attributable to the controlling interest | | USD | 923,841 | | | COP | 1,633,563 | (6) | | COP | 1,043,636 | (6) | | COP | 1,544,761 | (6) | | COP | 1,172,524 | (6) | | COP | 849,920 | |

| Basic and Diluted net income per common share (7) | | | 1.09 | | | | 1,932 | | | | 1,325 | | | | 1,961 | | | | 1,488 | | | | 1,079 | |

| Basic and Diluted net income per ADS (7) (8) | | | 4.37 | | | | 7,728 | | | | 5,300 | | | | 7,844 | | | | 5,952 | | | | 4,316 | |

| (1) | Amounts stated in U.S. dollars have been converted at the rate of COP 1,768.23 per USD 1.00, which is the Representative Market Rate calculated on December 31, 2012 (the last business day of 2012), as reported by the SFC. Such translation should not be construed as representations that the Colombian pesos amount represent, or have been or could be converted into, United States at that or any other rate. |

| (2) | Represents the provision for loans, accrued interest losses and other receivables, net and recovery of charged-off loans. Includes a provision for accrued interest losses amounting to COP 48,085 million, COP 31,852 million, COP 33,540 million, COP 46,840 million and COP 58,721 million for the years ended December 31, 2012, 2011, 2010, 2009 and 2008, respectively. |

| (3) | Represents the provision for foreclosed assets and other assets and the recovery of provisions for foreclosed assets and other assets. |

| (4) | Represents the total fees and income from services, net and total other operating income. |

| (5) | The weighted average of preferred and common shares outstanding for the fiscal year 2012 includes 335,827,334ended December 31, 2015 reflects 452,122,416 preferred shares and 509,704,584 common shares, and for the fiscal years 2011, 2010, 2009 and 2008, includes 278,122,419year ended December 31, 2014 reflects 432,232,005 preferred shares and 509,704,584 common shares. |

| (6) | Refer to “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP” of our Financial Statements included in this Annual Report. |

| (7) | Net income per share under U.S. GAAP is presented on the basis of net income available to common stockholders divided by the weighted average number of common shares outstanding (509,704,584 for 2012, 2011, 2010, 2009 and 2008). See “Note 31. Differences Between Colombian Accounting Principles for Banks and U.S. GAAP”. |

| (8) | Basic and diluted net income per ADS for any period is defined as basic and diluted net income per share multiplied by four as each ADS is equivalent to four preferred shares of Bancolombia. Basic and diluted net income per ADS should not be considered in isolation, or as a substitute for net income, as a measure of operating performance or as a substitute for cash flows from operations or as a measure of liquidity. |

CONSOLIDATED BALANCE SHEETSTATEMENT OF FINANCIAL POSITION

| | | As of the year ended December 31, | |

| | | 2012(1) | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (in millions of COP and thousands of USD(1), except per share and per American Depositary Share (“ADS”) amounts) | |

| CONSOLIDATED BALANCE SHEET | | | | | | | | | | | | | | | | | | | | | | | | |

| Colombian banking GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash and due from banks | | USD | 4,040,207 | | | COP | 7,144,015 | | | COP | 6,818,307 | | | COP | 5,312,398 | | | COP | 4,983,569 | | | COP | 3,870,927 | |

| Funds sold and securities purchased under agreements to resell | | | 579,722 | | | | 1,025,082 | | | | 910,690 | | | | 842,636 | | | | 2,388,790 | | | | 1,748,648 | |

| Investment securities, net | | | 7,099,931 | | | | 12,554,311 | | | | 9,958,191 | | | | 8,675,762 | | | | 8,914,913 | | | | 7,278,276 | |

| Loans and financial leases, net | | | 37,743,416 | | | | 66,739,040 | | | | 58,575,846 | | | | 46,091,877 | | | | 39,610,307 | | | | 42,508,210 | |

| Accrued interest receivable on loans and financial leases, net | | | 296,364 | | | | 524,041 | | | | 439,189 | | | | 317,532 | | | | 338,605 | | | | 505,658 | |

| Customers’ acceptances and derivatives | | | 442,824 | | | | 783,014 | | | | 741,296 | | | | 784,888 | | | | 205,367 | | | | 272,458 | |

| Accounts receivable, net | | | 703,112 | | | | 1,243,263 | | | | 1,016,985 | | | | 797,715 | | | | 806,885 | | | | 828,817 | |

| Premises and equipment, net | | | 758,780 | | | | 1,341,698 | | | | 1,622,311 | | | | 1,174,625 | | | | 992,041 | | | | 1,171,117 | |

| Premises and equipment under operating leases, net | | | 1,239,617 | | | | 2,191,928 | | | | 1,380,057 | | | | 1,006,108 | | | | 843,054 | | | | 726,262 | |

| Foreclosed assets, net | | | 47,968 | | | | 84,818 | | | | 53,194 | | | | 70,277 | | | | 80,668 | | | | 24,653 | |

| Prepaid expenses and deferred charges, net | | | 437,121 | | | | 772,930 | | | | 785,456 | | | | 319,864 | | | | 185,811 | | | | 132,881 | |

| Goodwill | | | 323,133 | | | | 571,373 | | | | 679,861 | | | | 750,968 | | | | 855,724 | | | | 1,008,639 | |

| Other assets | | | 1,181,377 | | | | 2,088,947 | | | | 1,697,648 | | | | 1,185,977 | | | | 922,265 | | | | 1,093,850 | |

| Reappraisal of assets | | | 481,793 | | | | 851,920 | | | | 783,989 | | | | 764,529 | | | | 736,366 | | | | 612,683 | |

| Total assets | | USD | 55,375,365 | | | COP | 97,916,380 | | | COP | 85,463,020 | | | COP | 68,095,156 | | | COP | 61,864,365 | | | COP | 61,783,079 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Liabilities and stockholders’ equity: | | | | | | | | | | | | | | | | | | | | | | | | |

| Deposits | | USD | 36,284,150 | | | COP | 64,158,720 | | | COP | 52,434,492 | | | COP | 43,538,967 | | | COP | 42,149,330 | | | COP | 40,384,400 | |

| Borrowings(3) | | | 2,981,235 | | | | 5,271,508 | | | | 7,458,926 | | | | 5,250,587 | | | | 4,039,150 | | | | 5,947,925 | |

| Other liabilities | | | 9,545,815 | | | | 16,879,197 | | | | 16,576,242 | | | | 11,358,462 | | | | 8,643,056 | | | | 9,333,909 | |

| Stockholder’ equity | | | 6,564,165 | | | | 11,606,955 | | | | 8,993,360 | | | | 7,947,140 | | | | 7,032,829 | | | | 6,116,845 | |

| Total liabilities and stockholders’ equity | | USD | 55,375,365 | | | COP | 97,916,380 | | | COP | 85,463,020 | | | COP | 68,095,156 | | | COP | 61,864,365 | | | COP | 61,783,079 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP: | | | | | | | | | | | | | | | | | | | | | | | | |

| Stockholders’ equity attributable to the controlling interest | | USD | 6,303,190 | | | COP | 11,145,490 | (2) | | COP | 8,589,202 | (2) | | COP | 8,069,346 | | | COP | 7,095,266 | | | COP | 6,422,815 | |

| Stockholders’ equity per share(4) (5) | | | 7,455 | | | | 13,182 | | | | 10,902 | | | | 10,243 | | | | 9,006 | | | | 8,153 | |

| Stockholders’ equity per ADS(4) (5) | | | 29,820 | | | | 52,728 | | | | 43,608 | | | | 40,972 | | | | 36,024 | | | | 32,612 | |

| | | As of December 31, | |

| | | USD

2015 | | | 2015 | | | 2014 | |

| | | | | | | | | | |

| | | (in millions of COP and thousands of USD, except per share and per

ADS amounts) | |

| CONSOLIDATED STATEMENT OF FINANCIAL POSITION | | | | | | | | | | | | |

| Assets: | | | | | | | | | | | | |

| Cash and cash equivalents | | USD | 5,904,998 | | | COP | 18,597,614 | | | COP | 13,466,783 | |

| Financial assets investments | | | 4,533,405 | | | | 14,277,824 | | | | 12,784,223 | |

| Derivative financial instruments | | | 756,371 | | | | 2,382,168 | | | | 1,448,845 | |

| Loans and advances to customers | | | 46,236,554 | | | | 145,620,639 | | | | 115,173,653 | |

| Allowance for loan and lease losses | | | (1,666,551 | ) | | | (5,248,755 | ) | | | (4,789,257 | ) |

| Assets held for sale and inventories | | | 619,408 | | | | 1,950,808 | | | | 97,744 | |

| Investment in associates and joint ventures | | | 173,537 | | | | 546,549 | | | | 1,349,697 | |

| Investment property | | | 477,873 | | | | 1,505,046 | | | | 1,114,180 | |

| Premises and equipment, net | | | 1,029,240 | | | | 3,241,562 | | | | 2,646,321 | |

| Goodwill and Intangible assets, net | | | 2,251,888 | | | | 7,092,255 | | | | 4,585,849 | |

| Deferred tax | | | 54,130 | | | | 170,482 | | | | 187,737 | |

| Other assets | | | 900,683 | | | | 2,836,675 | | | | 1,564,106 | |

| Total assets | | USD | 61,271,536 | | | COP | 192,972,867 | | | COP | 149,629,881 | |

| | | | | | | | | | | | | |

| Liabilities and stockholders' equity: | | | | | | | | | | | | |

| Deposit from customers | | | 38,673,817 | | | | 121,802,028 | | | | 94,769,319 | |

| Borrowings from other financial institutions | | | 6,261,747 | | | | 19,721,184 | | | | 13,852,284 | |

| Debt securities in issue | | | 6,171,154 | | | | 19,435,865 | | | | 14,527,403 | |

| Other liabilities | | | 3,685,024 | | | | 11,605,871 | | | | 9,114,395 | |

| Stockholder' equity | | | 6,479,794 | | | | 20,407,919 | | | | 17,366,480 | |

| | | | | | | | | | | | | |

| Total liabilities and stockholders' equity | | USD | 61,271,536 | | | COP | 192,972,867 | | | COP | 149,629,881 | |

| | | | | | | | | | | | | |

| Stockholders' equity per share(1) | | | 6,736 | | | | 21,214 | | | | 18,436 | |

| Stockholders' equity per ADS(1) | | | 26,943 | | | | 84,856 | | | | 73,743 | |

| (1) | Amounts stated in U.S. dollars have been converted at the rate of COP 1,768.23 per USD 1.00, which is the Representative Market Rate calculated on December 31, 2012, the last business day of the year, as reported by the SFC. Such conversions should not be construed as representations that the peso amounts represent, or have been or could be converted into, United States dollars at the Representative Market Rate or any other rate. |

| (2) | Refer to “Note 31, Differences between Colombian Accounting Principles for Banks and U.S. GAAP” to the Financial Statements included in this Annual Report. |

| (3) | Includes interbank borrowing, development and other domestic banks. |

| (4) | On February 6, 2012, Bancolombia issued 63,999,997 preferred shares in a public offering, 43,543,793 preferred shares were issued in a local preemptive rights offering, at a price of COP 26,000 per share and in the offering outside of Colombia, 5,114,051 ADSs, representing 20,456,204 preferred shares were issued at a price of USD 60 per ADS. |

| (5) | The weighted average (rounded to the nearest million) of preferred and common shares outstanding was 845962 million for the fiscal year ended December 31, 20122015, and 788942 million for the fiscal year ended December 31, 2011, 2010, 2009 and 2008.2014. Stockholders’ equity per share is equal to stockholders’ equity under U.S. GAAPIFRS divided by the weighted average of preferred and common shares outstanding, stockholders’outstanding. Stockholders’ equity per ADS is equal to stockholders’ equity per share multiplied by four preferred shares of Bancolombia (each ADS is equivalent torepresents four preferred shares of Bancolombia). |

| | Stockholders’ equity per share and stockholders’ equity per ADS should not be considered in isolation, or as a substitute for net income, as a measure of operating performance or as a substitute for cash flows from operations or as a measure of liquidity. The non-GAAP financial measures described in this footnote are not a substitute for the GAAP measures of financial performance. Shouldperformance and should not be considered as an alternate measure of stockholders’ equity as determined on a consolidated basis using amounts derived from the consolidated balance sheetstatement of financial position prepared in accordance with Colombian banking GAAP.IFRS. |

See ―“Item 8. Financial Information – A. Consolidated Statements and Other Financial Information – A.3. Dividend Policy”, for information about the dividends declared per share in both pesos and U.S. dollars during the fiscal years ended December 31, 2012, 2011, 2010, 20092015 and 2008.

2014.

SELECTED RATIOS

| | | As of and for the year ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (Percentages, except for operating data) | |

| SELECTED RATIOS:(1) | | | | | | | | | | | | | | | | | | | | |

| Colombian banking GAAP: | | | | | | | | | | | | | | | | | | | | |

| Profitability ratios: | | | | | | | | | | | | | | | | | | | | |

| Net interest margin(2) | | | 6.49 | | | | 6.17 | | | | 6.38 | | | | 7.22 | | | | 7.64 | |

| Return on average total assets(3) | | | 1.92 | | | | 2.20 | | | | 2.27 | | | | 2.01 | | | | 2.34 | |

| Return on average stockholders’ equity(4) | | | 15.97 | | | | 20.22 | | | | 19.71 | | | | 19.59 | | | | 23.68 | |

| Efficiency Ratio: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses as a percentage of interest, fees, services and other operating income | | | 56.19 | | | | 57.58 | | | | 56.28 | | | | 50.89 | | | | 47.79 | |

| Capital ratios: | | | | | | | | | | | | | | | | | | | | |

| Period-end stockholders’ equity as a percentage of period-end total assets | | | 11.85 | | | | 10.52 | | | | 11.67 | | | | 11.37 | | | | 9.90 | |

| Period-end regulatory capital as a percentage of period-end risk- weighted assets(5) | | | 15.77 | | | | 12.46 | | | | 14.67 | | | | 13.23 | | | | 11.24 | |

| Credit quality data: | | | | | | | | | | | | | | | | | | | | |

| Non-performing loans as a percentage of total loans(6) | | | 1.76 | | | | 1.52 | | | | 1.91 | | | | 2.44 | | | | 2.35 | |

| “C”, “D” and “E” loans as a percentage of total loans(9) | | | 3.96 | | | | 3.82 | | | | 4.32 | | | | 5.11 | | | | 4.40 | |

| Allowance for loan and accrued interest losses as a percentage of non-performing loans | | | 268.96 | | | | 306.94 | | | | 274.36 | | | | 241.08 | | | | 224.53 | |

| Allowance for loan and accrued interest losses as a percentage of “C”, “D” and “E” loans(7) | | | 119.30 | | | | 121.69 | | | | 121.45 | | | | 115.25 | | | | 120.21 | |

| Allowance for loan and accrued interest losses as a percentage of total loans | | | 4.72 | | | | 4.65 | | | | 5.24 | | | | 5.89 | | | | 5.29 | |

| | | | | | | | | | | | | | | | | | | | | |

| OPERATING DATA: | | | | | | | | | | | | | | | | | | | | |

| Number of branches(8) | | | 993 | | | | 952 | | | | 921 | | | | 889 | | | | 890 | |

| Number of employees(9) | | | 24,820 | | | | 24,126 | | | | 22,992 | | | | 21,201 | | | | 19,728 | |

| | | As of and for the year ended December 31, | |

| | | 2015 | | | 2014 | |

| | | (Percentages, except for operating data) | |

| SELECTED RATIOS:(1) | | | | | | | | |

| Profitability ratios: | | | | | | | | |

| Net interest margin and valuation from continuing operations(2) | | | 5.25 | | | | 5.30 | |

| Return on average total assets from continuing operations(3) | | | 1.53 | | | | 1.72 | |

| Return on average stockholders‘ equity(4) | | | 13.62 | | | | 14.81 | |

| Efficiency ratio: | | | | | | | | |

| Operating expenses to net operating income from continuing operations | | | 54.57 | | | | 56.30 | |

| Operating expenses to average total assets from continuing operations | | | 3.62 | | | | 3.80 | |

| Operating expenses to productive assets from continuing operations | | | 4.28 | | | | 4.51 | |

| Capital ratios: | | | | | | | | |

| Technical capital to risk weighted assets(5) | | | 12.46 | | | | N/A | (6) |

| Credit quality data: | | | | | | | | |

| Past due loans to total loans | | | 2.98 | | | | 2.62 | |

| “C”, “D” and “E” loans as a percentage of total loans | | | 3.95 | | | | 3.81 | |

| Allowances to past due loans(7) | | | 115.16 | | | | 145.55 | |

| Allowance for loan and lease losses as a percentage of “C”, “D” and “E” loans | | | 87.00 | | | | 100.09 | |

| Allowance for loan and lease losses as a percentage of total loans | | | 3.43 | | | | 3.81 | |

| OPERATING DATA: | | | | | | | | |

| Number of branches(8) | | | 1,274 | | | | 1,070 | |

| Number of employees (9) | | | 34,390 | | | | 30,158 | |

| (1) | RatiosAverage balances used to calculate the ratios shown above have been calculated as follows: for the year ended December 31, 2015, for each month, the actual month-end balances were established. The average consolidated balance for such period is the average of such month-end balances. The Bank has calculated on the basisaverage balances using quarterly book balances for the year ended December 31, 2014 as we believe such balances are representative of our operations and it would be too costly to produce average balances using monthly averages.balances under IFRS. |

| (2) | Net interest income divided by average interest-earning assets. |

| (3) | Net income and valuation on financial instruments divided by average total assets. |

| (4) | Net income and valuation on financial instruments divided by average stockholders’ equity. |

| (5) | For an explanation of risk-weighted assets and Technical Capital, see “ItemItem 4. Information“Information on the Company – B. Business Overview – B.8. SupervisionB.8 –Supervision and RegulationRegulation” and Item 5“Operation and Financial Review and Prospects - B. Liquidity and Capital Resources –B.1. Liquidity and Funding - Capital Adequacy Requirements”Adequacy". |

| (6) | Non-performing loans are small business loans that are past due 30 days or more, mortgage and consumer loans that are past due 60 days or more and commercial loans that are past due 90 days or more. (Each category includes financial leases.)N/A: not applicable. The Bank’s consolidated capital adequacy was computed considering balance accounts under IFRS as of December 31, 2015. |

| (7) | The decrease in this coverage ratiovariation is explainedmainly generated by the formationinclusion of PDLs during the year, which was faster than the pace of increase in allowances in the balance sheet.See “Item 4. Information on the Company – E. Selected Statistical Information – E.3. Loan Portfolio – Classification of theGrupo Agromercantil’s loan portfolio and Credit Categories for a description of ‘C’, ‘D’ and ‘E’ Loans”.at fair value during 2015. |

| (8) | Number of branches includes branches of the Bank’s Subsidiaries. For some subsidiaries, the central office is considered a branch. Representative offices are included. |

| (9) | The number of employees includes employees of the Bank’s consolidated Subsidiaries. |

Exchange Rates

On March 27, 2013,31, 2016, the Representative Market Rate was COP 1,832.203,000.63 per USDU.S. dollar 1.00. The Federal Reserve Bank of New York does not report a rate for pesos; the SFC calculates the Representative Market Rate based on the weighted average of the buy/sell foreign exchange rates quoted daily by certain financial institutions, including Bancolombia, for the purchase and sale of U.S. dollars.

The following table sets forth the low and high peso per U.S. dollar exchange rates and the peso/U.S. dollar representative market rate on the last day of the month, for each of the last six months:

| Recent exchange rates of pesos per U.S. dollars |

| Month | | Low | | | High | | | Period-End | |

| | | | | | | | | | |

| March 2013 | | | 1,797.28 | | | | 1,832.20 | | | | 1,832.20 | |

| February 2013 | | | 1,776.20 | | | | 1,818.54 | | | | 1,814.28 | |

| January 2013 | | | 1,758.45 | | | | 1,779.84 | | | | 1,775.65 | |

| December 2012 | | | 1,768.23 | | | | 1,813.73 | | | | 1,768.23 | |

| November 2012 | | | 1,813.72 | | | | 1,828.80 | | | | 1,813.72 | |

| October 2012 | | | 1,795.40 | | | | 1,831.25 | | | | 1,831.25 | |

| Recent exchange rates of pesos per U.S. dollars |

| Month | | Low | | | High | | | Period-End | |

| | | | | | | | | | |

| March 2016 | | | 3,000.63 | | | | 3,268.86 | | | | 3,000.63 | |

| February 2016 | | | 3,306.00 | | | | 3,434.89 | | | | 3,319.80 | |

| January 2016 | | | 3,203.86 | | | | 3,375.80 | | | | 3,287.31 | |

| December 2015 | | | 3,131.95 | | | | 3,356.00 | | | | 3,149.47 | |

| November 2015 | | | 2,819.63 | | | | 3,142.11 | | | | 3,142.11 | |

| October 2015 | | | 2,855.74 | | | | 3,061.85 | | | | 2,897.83 | |

Source: SFC.

The following table sets forth the peso/U.S. dollar representative market rateRepresentative Market Rate on the last day of the year and the average peso/U.S. dollar representative market rate (calculated by using the average of the Representative Market Rates on the last day of each month during the year) for each of the five most recent financial years.

| Peso/USD 1.00 | Representative Market Rate | | Period | | | Period-End | | | | Average | | | Period-End | | | Average | |

| | | | | | | | | | | | | | |

| 2015 | | | | 3,149.47 | | | | 2,773.43 | |

| 2014 | | | | 2,392.46 | | | | 2,019.38 | |

| 2013 | | | | 1,926.83 | | | | 1,881.04 | |

| 2012 | | | 1,768.23 | | | | 1,798.08 | | | | 1,768.23 | | | | 1,798.08 | |

| 2011 | | | 1,942.70 | | | | 1,852.83 | | | | 1,942.70 | | | | 1,852.83 | |

| 2010 | | | 1,913.98 | | | | 1,901.67 | | |

| 2009 | | | 2,044.23 | | | | 2,179.64 | | |

| 2008 | | | 2,243.59 | | | | 1,993.80 | | |

Source: SFC.

| B. | CAPITALIZATION AND INDEBTEDNESS |

Not applicable.

| C. | REASONS FOR THE OFFER AND USE OF PROCEEDS |

Not applicable.

Investors should consider the following risks and uncertainties, and the other informationfactors presented in this Annual Report. In addition, the factorsinformation referred to below, as well as all other information presented in this Annual Report, should be considered by investors when reviewing any forward-looking statements contained in this Annual Report, in any document incorporated by reference in this Annual Report, in any of the Bank’s future public filings or press releases, or in any future oral statements made by the Bank or any of its officers or other persons acting on its behalf. If any of the following risks occur, the Bank’s business, results of operations and financial condition, its ability to raise capital and its ability to access funding could be materially and adversely affected. These risk factors should not be considered a complete list of potential risks that may affect Bancolombia.

Risk Factors Relating to Colombia and Other Countries Where the Bank Operates.

Changes in economic and political conditions in Colombia, and El Salvador, Panama, Guatemala or in the other countries where the Bank operates may adversely affect the Bank’s financial condition and results of operations.

The Bank’s financial condition, results of operations and asset quality are significantly dependent on the macroeconomic and political conditions prevailing in Colombia, El Salvador, Panama, Guatemala and the other jurisdictions in which the Bank operates. Accordingly, decreases in the growth rate, periods of negative growth, increases in inflation, changes in policy, or future judicial interpretations of policies involving exchange controls and other matters such as (but not limited to) currency depreciation, inflation, interest rates, taxation, banking laws and regulations and other political or economic developments in or affecting Colombia, El Salvador or the othersuch jurisdictions where the Bank operates may affect the overall business environment and may in turn impact the Bank’s financial condition and results of operations.

In particular, the Governmentsgovernments of Colombia, Panama, Guatemala and El Salvador have historically exercised substantial influence on their economies, and their policiesthey are likely to continue to implement policies that will have an important effectimpact on Colombianthe business and Salvadorianresults of operations of the entities in such countries (including the Bank), market conditions and prices and rates of return on securities of local issuers (including the Bank’s securities). Potential changes in laws, public policies and regulations may cause instability and volatility in Colombia, Panama, Guatemala and itsEl Salvador, and their respective markets.

Future developments in Governmentgovernment policies could impair the Bank’s business or financial condition or the market value of its securities.

The economies of the countries wherein which the Bank operates are vulnerable to external effects that could be caused by significant economic difficulties experienced by their major regional trading partners or by more general “contagion”contagion effects, which could have a material adverse effect on such countries economic growth in these countries and their ability to service their public debt.

A significant decline in the economic growth or a sustained economic downturn of any of Colombia’s, or El Salvador’s, Panama’s or Guatemala’s major trading partners (i.e., the European Union, the United States, China Venezuela and Ecuadorother Latin American countries for Colombia and the United States and European Union for El Salvador)Salvador and Panama) could have a material adverse impact on Colombia’s, and El Salvador’s, Guatemala’s and Panama’s balance of trade and remittances inflows, resulting in lower economic growth.

Deterioration in the economic and political situation of neighboring countries could affect the national stability or the Colombian economy of Colombia, Panama, El Salvador and Guatemala by disrupting Colombia’stheir diplomatic or commercial relationships with theseneighboring countries. PoliticalAny future tensions between Colombia and Venezuela in recent years have produced lower trade levels that have adversely impacted economic activity. Although relations with Venezuela have improved significantly with the current Government, the possibility of any further resurgence in tensions between the two countries may cause political and economic uncertainty, instability, market volatility, lowerlow confidence levels and higher risk aversion by investors and market participants that may negatively affect economic activity in Colombia and El Salvador.any of those jurisdictions.

A contagion effect, in which an entire region or class of investment is disfavored by international investors, could negatively affect Colombia and El Salvador or other economies where the bankBank operates, (i.e., Panama, Cayman Islands, Peru and Puerto Rico), as well as the market prices and liquidity of securities issued or owned by the Bank.

Any additional taxes resulting from changes to tax regulations or the interpretation thereof in Colombia, El Salvador, Panama, Guatemala or other countries wherein which the Bank operates, could adversely affect the Bank’s consolidated results.

Uncertainty relating to tax legislation poses a constant risk to the Bank. Changes in legislation, regulation and jurisprudence can affect tax burdens by increasing tax rates and fees, creating new taxes, limiting stated expenses and deductions, and eliminating incentives and non-taxed income. Notably, the Colombian and Salvadorian Governmentsgovernments have significant fiscal deficits that may result in future tax increases. Additional tax regulations could be implemented that could requirerequiring the Bank to make additional tax payments and negatively affecting its results of operations and cash flow. In addition, national or local taxing authorities may not interpret tax regulations in the same way that the Bank does. Differing interpretations could result in future tax litigation and associated costs.

Exchange rate volatilityfluctuations may adversely affect the Colombian economy, the market price of ourthe Bank’s ADSs, and the dividends payable to holders of the Bank’s ADSs.

Colombia has adopted a floating exchange rate system. The Colombian Central Bank maintains the power to intervene in the exchange market in order to consolidate or dispose of international reserves, and to control any volatility in the exchange rate. From time to time, including during 2015, there have been significant fluctuations in the exchange rate between the Colombian peso and the U.S. dollar. Unforeseen events in the international markets, fluctuations in interest rates, volatility of the oil price in the international markets, or changes in capital flows, may cause exchange rate instability that could generate sharp movements in the value of the peso. Given that a portion of ourthe Bank’s assets and liabilities are denominated in, or indexed to, foreign currencies, especially the U.S. dollar, sharp movements in exchange rates may negatively impact the Bank’s results. In addition, exchange rate fluctuations may adversely impact the value of dividends paid to holders of the Bank’s ADSs as well as the market price and liquidity of ADSs.

Colombia has experienced several periods of violence and instability and such instabilitythat could affect the economy and the Bank.

Colombia has experienced several periods of criminal violence over the past four decades, primarily due to the activities of guerilla groups and drug cartels. In response, the Colombian Government has implemented various security measures and has strengthened its military and police forces by creating specialized units, and currentlygovernment is in the process of negotiating a peace treaty with the Revolutionary Armed Forces of Colombia (Fuerzas Armadas Revolucionarias de Colombia or “FARC”) (FARC). Despite these efforts, drug-related crime and guerilla activity continue to exist in Colombia. These activities, their possible escalation and the violence associated with them may have a negative impact on the Colombian economy or on the Bank in the future. The Bank’s business or financial condition and the market value of the Bank’s securities and any dividends distributed by it, could be adversely affected by rapidly changing economic and social conditions in Colombia and by the Colombian Government’sgovernment’s response to such conditions.

Risk Factors Relating to the Bank’s Business and the Banking Industry

Our financial results may be negatively affected by changes to accounting standards.

We report our results and financial position in accordance with IFRS as issued by the International Accounting Standards Board (IASB). Changes to IFRS or interpretations thereof may cause our future reported results and financial position to differ from current expectations, or historical results to differ from those previously reported due to the adoption of accounting standards on a retrospective basis. Such changes may also affect our regulatory capital and ratios. We monitor potential accounting changes and when these are finalized by the IASB, we determine the potential impact and disclose significant future changes in our financial statements. Currently, there are a number of issued but not yet effective IFRS changes, as well as potential IFRS changes, some of which could be expected to impact our reported results, financial position and regulatory capital in the future. For example, IFRS 9, when fully adopted, will require us to record loans at inception net of expected losses instead of recording credit losses on an incurred loss basis.

Our financial results may be negatively affected by changes to assumptions supporting the value of our goodwill.

The goodwill that we have recognized on the respective balance sheets of our operating segments is tested for impairment at least annually. Our impairment test in respect of the assets recognized as of December 31, 2015 indicated that our respective goodwill balances are not impaired. The impairment test is based on assumptions regarding estimated earnings, discount rates and long-term growth rates impacting the recoverable amount of each segment and on estimates of the carrying amounts of the segments to which the goodwill relates. If the estimated earnings and other assumptions in future periods deviate from the current outlook, the value of the goodwill in any one or more of our businesses may become impaired in the future, giving rise to losses in the income statement.

Changes in banking laws and regulations in Colombia and in other jurisdictions wherein which the Bank operates could adversely affect the Bank’s consolidated results.

Changes in banking laws and regulations, or in their official interpretation, in Colombia and in other jurisdictions wherein which the Bank operates, may have a material effect on the Bank’s business and operations. Since banking laws and regulations change frequently, they could be adopted, enforced or interpreted in a manner that may have an adverse effect on the Bank’s business.

Although Bancolombia currently complies with applicable capital requirements, there can be no assurance that future regulation will not change or require Bancolombia or its subsidiaries to seek additional capital. Moreover, regulators in other jurisdictions have not reached consensus as to the appropriate level of capitalization for financial services institutions. Regulators in the jurisdictions wherein which Bancolombia operates may alter the current regulatory capital requirements to which Bancolombia is subject and thereby require equity increases that could dilute existing stockholders, lead to required asset sales or adversely impact the return on stockholders’ equity and/or the market price of the Bank’s common and preferred shares.

In 2012, a new regulation relating to capital adecquacy requirements (Decree 1771 of 2012) was issued. For further details on the changes set forth in the new regulations, see“Item 4. Information on the Company – B. Business Overview - B.8 Supervision and Regulation - capital adecquacy requirements”.

BankingFurthermore, banking laws and regulations accounting standards and corporate disclosure applicable tomay create new types of financial entities whose services could compete with the segments or services offered by the Bank, and, therefore, its subsidiaries differ from those in the United States and other countries.

While many of the policies underlying Colombian banking regulations are similar to those underlying regulations applicable to banks in other countries, including those in the United States, Colombian regulations can differ in a number of material respects. For example, capital adequacy requirements for banks under Colombian regulations differ from those under U.S. regulations and may differ from those in effect in other countries. The Bank prepares its annual audited financial statements in accordance with Colombian banking GAAP, which differs from U.S. GAAP and International Financial Reporting Standards (“IFRS”). Thus, Colombian financial statements and reported earnings may differ from those of companies in other countriesresults in these and other respects. Some of the differences affecting earnings and stockholders’ equity include, but are not limited to the accounting treatment for restructuring, loan origination fees and costs, equity tax, securitization, fair value adjustment in debt securities, deferred income taxes and the accounting treatment for business combinations. Moreover, under Colombian banking GAAP, allowances for non-performing loans are computed by establishing each non-performing loan’s individual inherent risk using criteria established by the SFC that differ from those used under U.S. GAAP. See “Item 4. Information on the Company – E. Selected Statistical Information – E.4. Summary of Loan Loss Experience – Allowance for Loan Losses”.

The Colombian Government is currently undertaking a review of present regulations relating to accounting, audit, and information disclosure, with the intention of seeking convergence with international standards. Nevertheless, current regulations continue to differ in certain respects from those in other countries. In addition, theresegments or services may be less publicly available information about the Bank than is regularly published by or about U.S. issuers or issuers in other countries and any changes in those regulations would become effective in 2015.adversely affected.

The Bank is subject to regulatory inspections, examinations, inquiries or audits in Colombia and in other countries wherein which it operates, and any sanctions, fines and other penalties resulting from such inspections and audits could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

The Bank is subject to comprehensive regulation and supervision by the banking authorities of Colombia, El Salvador, Guatemala, Panama and the other jurisdictions in which the Bank operates. These regulatory authorities have broad powers to adopt regulations and impose other requirements affecting or restricting virtually all aspects of the Bank’s capitalization, organization and operations, including the imposition of anti-money laundering measures and the authority to regulate the terms and conditions of credit that can be appliedextended by banks. In the event of non-compliance with applicable regulations, the Bank could be subject to fines, sanctions or the revocation of licenses or permits to operate its business. In Colombia, for instance, in the eventif the Bank encounters significant financial problems or becomes insolvent or in danger of becoming insolvent, banking authorities would have the power to take over the Bank’s management and operations. In addition, the supervisory authorities of Colombia and El Salvador have reached an agreement for consolidated supervision which allows them to perform transnational inspection processes. Any sanctions, fines and other penalties resulting from non-compliance with regulations in Colombia, El Salvador, Guatemala, Panama and in the other jurisdictions wherein which the Bank operates could materially and adversely affect the Bank’s business, financial condition, results of operations and reputation.

An increase in constitutional public interest actions (acciones populares), class actions (acciones de grupo) and other legal actions involving claims for significant monetary awards against financial institutions may affect the Bank’s businesses and results of operations.

Under the Colombian Constitution, individuals may initiate constitutional public interest or class actions to protect their collective or class rights, respectively. Colombian financial institutions, including the Bank, have experienced a substantial increase in the aggregatehigh number of these actions. The great majority of such actions have been related to fees, financial services and interest rates, and their outcome is uncertain. Pursuant to lawLaw 1425 of 2010, monetary awards for plaintiffs in constitutional actions or class actions were eliminated as of January 1, 2011. Nevertheless, individuals continue to have the right to initiate these actions against the Bank.

Future restrictions on interest rates or banking fees could negatively affect the Bank’s profitability.

In the future, regulations in the jurisdictions where the Bank operates could impose limitations regarding interest rates or fees charged by the Bank. Any such limitations could materially and adversely affect the Bank’s results of operations and financial situation.

In the past, there have been disputes in Colombia among commercial businesses, payment service providers and banks regarding credit card interbank exchange fees (tarifa interbancaria de intercambio). Although such disputes have been resolved, the Superintendency of Industry and Commerce and mayhas the authority to initiate new investigations relating to such fees. This possibilityAny new investigations may lead to requirements that the Bank applies additional decreases, which in turn could impact the Bank’s financial results.

Furthermore, pursuant to article 62 of lawLaw 1430 of 2010 Congress granted the GovernmentColombian government has power and authority to establish and define criteria and formulas applicable to the calculation of banking fees and charges and define maximum limits. In 2011, the government used such authority to define maximum limits to banking fees and charges. On December 20, 2011 the Government used the authority granted by law 1430 of 2010 and enacted Decree 4809 of 2011 in which it set forth caps to the bank fees that may be charged on ATM withdrawals through ATMs outside their ownof each bank’s respective networks. Currently, there is a regulatory initiative that eliminates fees that banks may charge on ATM withdrawals.

Currently, an initiativeAdditionally, in past years, there have been regulatory initiatives regarding banking fees. Although such initiatives were not approved by Congress in the past, there are new initiatives pursuing similar restrictions on banking fees. If a law regarding banking fees is being discussed in Congress,enacted, the Bank might be prohibited from charging for certain services or types of transactions to its clients, which could have a negative effect on our results of operations and has been approved in its first debate out of four needed for it to become a law. If the law were enacted banks would need to cease charging transactional and service fees from those individuals whose income is equal or under two SMMLV, provided that this benefit would only apply to one savings account per individual. However, the likelihood of this initiative becoming a law is uncertain given that there have been two similar unsuccessful initiatives discussed in Congress in recent years.financial condition.

In addition, recent Law 1555 of 2012 prohibits prepayment penalties for loans worth less than 880 SMMLV, (mortgageand prepayment of mortgage loans are excluded).is allowed with no penalties without regard to the amount of the loan.

Further limitsAlso, In December 2015, Congress enacted a law that orders banks to transfer funds in inactive bank accounts to an education financing public entity. In case the accountholder withdraws its funds, banks must pay them with its own funds, and then request reimbursement from the education financing public entity.

Colombian tax haven regulation could adversely affect the Bank’s business and financial results.

Decree 1966 of 2014 modified by Decree 2095 of 2014, designates 37 jurisdictions as tax havens for Colombian tax purposes (although neither Panama nor other countries in which the Bank operates, were included on this list). As a result of the tax haven regulation the Bank’s clients who are residents in such jurisdictions would be subject to (i) higher withholding tax rates including a higher withholding rate on interest and dividends derived from investments in the Colombian securities market, (ii) the transfer pricing regime and its reporting duties, (iii) enhanced ability on the part of Colombian authorities to qualify a conduct as abusive under tax regulations, (iv) non-deductibility of payments made to such residents or regulations regarding banking feesentities located in tax havens, unless the required tax amount has been withheld and uncertainties with respect thereto,(v) additional information disclosure requirements, any of which could have a negative effectimpact on ourBancolombia’s business and financial results.

In order to avoid Panama’s designation as a tax haven, Colombia and Panama signed a memorandum of understanding which establishes that both countries will negotiate a treaty for the avoidance of double taxation. This treaty is expected to include provisions regarding the exchange of information between Colombian and Panamanian tax authorities. The deadline for execution of the treaty was September 30, 2015, which was extended to November 30, 2015, but as of date there is no known consequence for not executing such treaty within the deadline. Failure to execute a treaty, or the designation of Panama as a tax haven, could result in a negative impact on the Bank’s customer base and, therefore, a potential negative impact on the Bank’s results of operations and financial condition.

The Bank and most of its subsidiariesSubsidiaries are subject to the U.S. Foreign Account Tax Compliance Act of 2010.

Bancolombia and most of its subsidiaries are considered foreign financial institutions (“FFIs”) under the Foreign Account Tax Compliance Act of 2010 (“FATCA”) (see “Item 4. Information on the Company – B. Business Overview – B.8. Supervision and Regulation – International regulations applicable to Bancolombia and its subsidiaries”). Given the size and the scope of our group’sthe Bank’s international operations, we intend to take all necessary steps to comply with FATCA (including entering into agreements with the U.S. tax authority)authorities and transmitting the reports).

However, if the GroupBank cannot enter into such agreements or satisfy the requirements thereunder, certain payments to Bancolombia or its subsidiariesSubsidiaries may be subject to withholding under FATCA. The possibility of such withholding and the need for accountholders and investors to provide certain information may adversely affect our results of operations and financial condition. In addition, entering into agreements with the IRS, and compliance with the terms of such agreements and with FATCA and any regulations or other guidance promulgated thereunder or any legislation promulgated under an intergovernmental agreement (“IGA”) may increase our compliance costs. We are currently in the process of estimating the costs and commercial impact of implementing FATCA compliance on a group widegroup-wide level. Because legislationLegislation and regulations implementing FATCA and the related IGAs in the countries where we operatein which the Bank operates remain under development, and the IGAs remain under development,reporting dates vary depending on the jurisdiction. As a result, the future impact of this law onand the Bancolombia Groupaccuracy of the first reports of the Bank and its Subsidiaries is still uncertain.