UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2012 | |

| OR | |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE | |

| SECURITIES EXCHANGE ACT OF 1934 | |

| OR | |

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) | |

| OF THE SECURITIES EXCHANGE ACT OF 1934 | |

¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g)

OF THE SECURITIES EXCHANGE ACT OF 1934

OR

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

OR

¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from to

Commission file number 001-14370

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

(Exact name of Registrant as specified in its charter)

BUENAVENTURA MINING COMPANY INC.

(Translation of Registrant’s name into English)

REPUBLIC OF PERU

(Jurisdiction of incorporation or organization)

CARLOS VILLARAN 790

SANTA CATALINA, LA VICTORIA,LAS BEGONIAS 415 FLOOR 19,

SAN ISIDRO, LIMA 13,27, PERU

(Address of principal executive offices)

Carlos E. Gálvez, Vice President and Chief Financial Officer

Telephone: (511) 419-2540

Facsimile: (511) 471-7349

419-2502

Address: Carlos Villarán 790, Santa Catalina, La Victoria, Lima 13, PerúLAS BEGONIAS 415 FLOOR 19,

SAN ISIDRO, LIMA 27, PERU

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | | Name of each exchange on which registered |

Common shares, nominal (par) value of ten Peruvian Nuevos Soles per share (Common Shares)(“Common Shares”)

| | New York Stock Exchange Inc.*

Lima Stock Exchange |

| | |

American Depositary Shares (ADSs)(“ADSs”) representing one Common Share each | | New York Stock Exchange Inc.٭ Lima Stock Exchange

New York Stock Exchange Inc.

|

*Not for trading but only in connection with the registration of ADSs pursuant to the requirements of the Securities and Exchange Commission.

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

| Common Shares nominal (par) value of S/.10.00 per share | 274,889,924* |

| | | 274,889,924 | * |

Investment sharesShares nominal (par) value of S/.10.00 per share | | | 744,640 | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yesx No¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes¨Nox

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

*Not for trading but only in connection with the registration of ADSs pursuant to the requirements of the Securities and Exchange Commission.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes¨ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filerx Accelerated filer¨ Non-accelerated filer¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Boardx | Other¨ |

U.S. GAAP¨ International Financial Reporting Standards as issued by Other¨

the International Accounting Standards Boardx

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 18¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes¨ Nox

TABLE OF CONTENTS

INTRODUCTION

Presentation of Financial Information

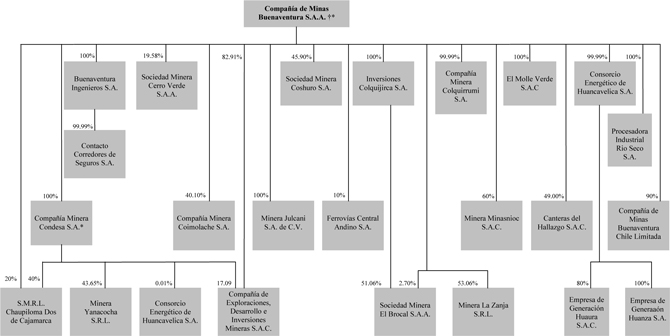

As used in this Annual Report on Form 20-F, or Annual“Annual Report,” unless the context otherwise requires, references to “we,” “us,” “our,” “Company,” “BVN” and “Buenaventura” mean Compañía de Minas Buenaventura S.A.A. and its consolidated subsidiaries. Unless otherwise specified or the context otherwise requires, references to “$,” “US$,” “Dollars” and “U.S. Dollars” are to United States Dollars, and references to “S/.,” “Nuevo Sol”“Sol” or “Nuevos Soles”“Soles” are to Peruvian Nuevos Soles, the legal currency of the Republic of Peru, or Peru.“Peru.”

Unless otherwise specified, references to a value denominated in “t” or “tons” refers to tons; references to a value denominated “DST” refers to dry short tons; the terms “g” or “gr” refer to metric grams; the terms “oz.” or “ounces” refer to troy ounces of a fineness of 999.9 parts per 1,000, equal to 31.1035 grams.

Until December 31, 2010, we presented our consolidated financial statements, which we refer to as our Financial Statements, in conformity with accounting principles generally accepted in Peru, or Peruvian“Peruvian GAAP.” Effective January 1, 2011, we changed the accounting principles governing the presentation ofbegan presenting our consolidated financial statements from Peruvian GAAP toin accordance with International Financial Reporting Standards or IFRS,(“IFRS”), as issued by the International Accounting Standards Board or the IASB.(the “IASB”).

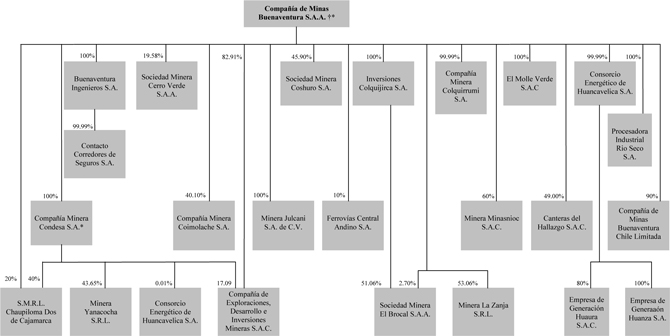

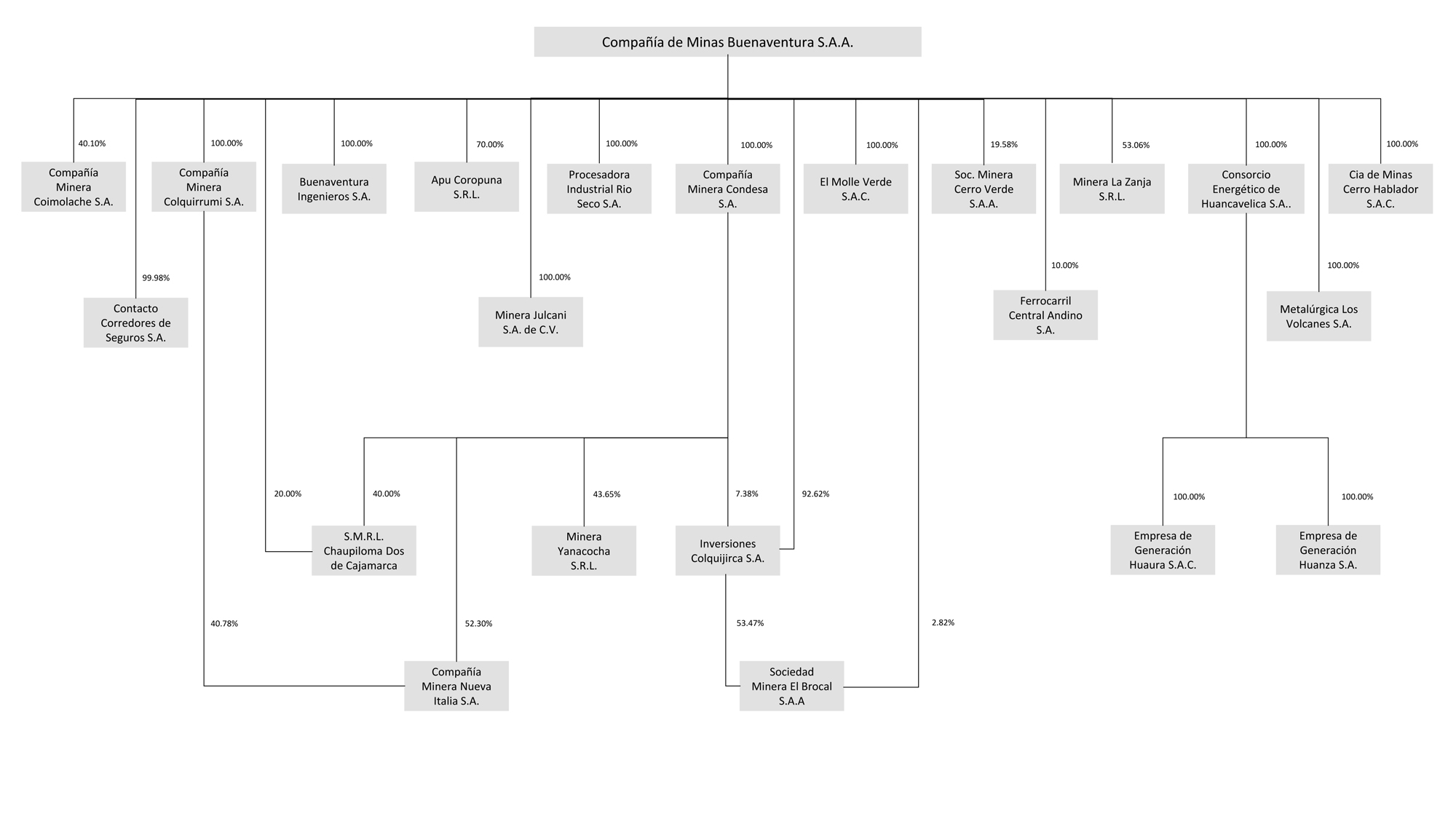

Pursuant to the rules of the United States Securities and Exchange Commission, or the SEC, this Annual Report includes certain separate financial statements and other financial information of Minera Yanacocha S.R.L., or Yanacocha,“Yanacocha,” and Sociedad Minera Cerro Verde S.A.A., or Cerro“Cerro Verde.” Yanacocha and Cerro Verde maintain their financial books and records in U.S. Dollars and present their financial statements in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP, and IFRS as issued by the IASB, respectively. See Note 9 to the Financial Statements.IASB.

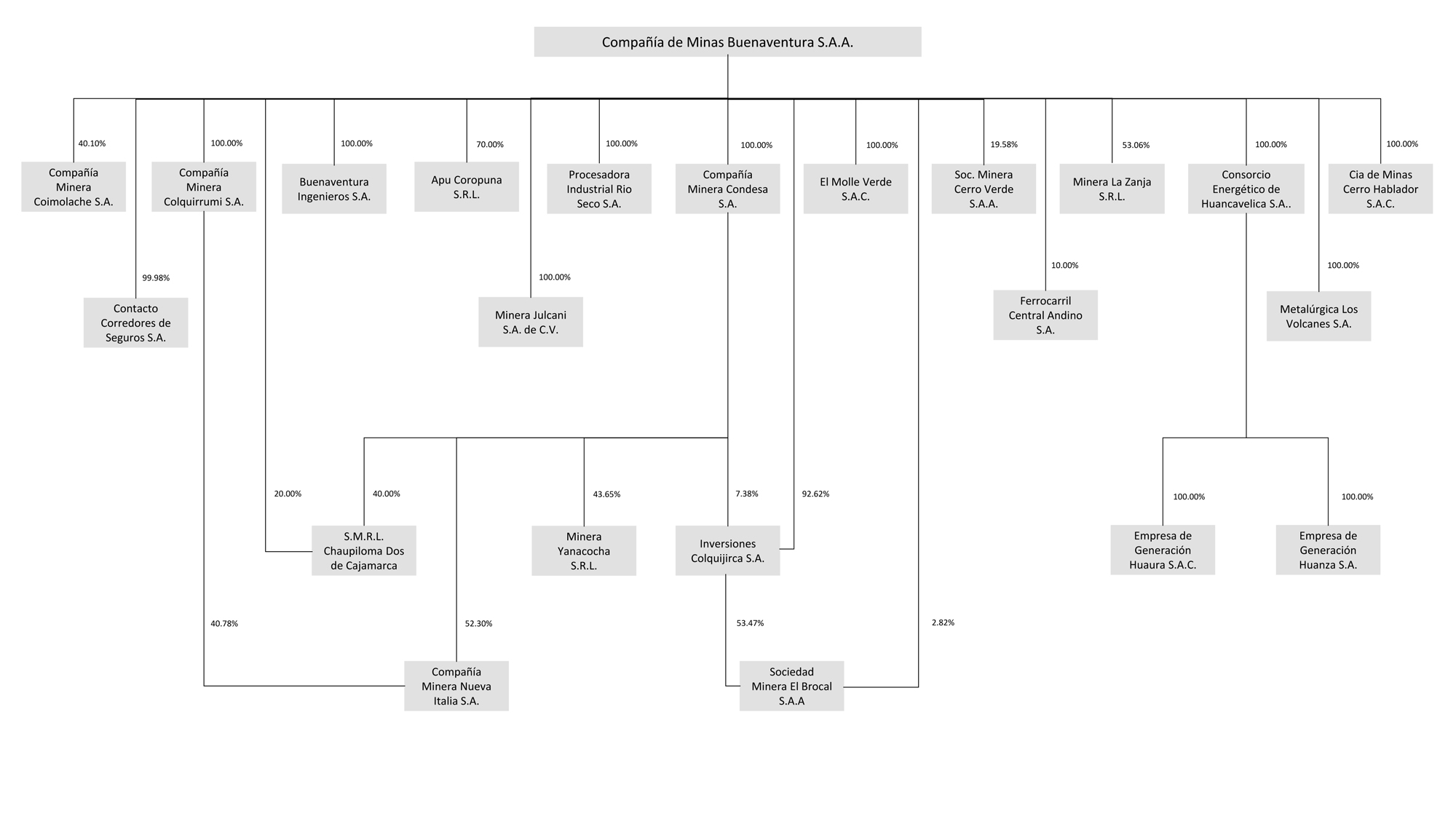

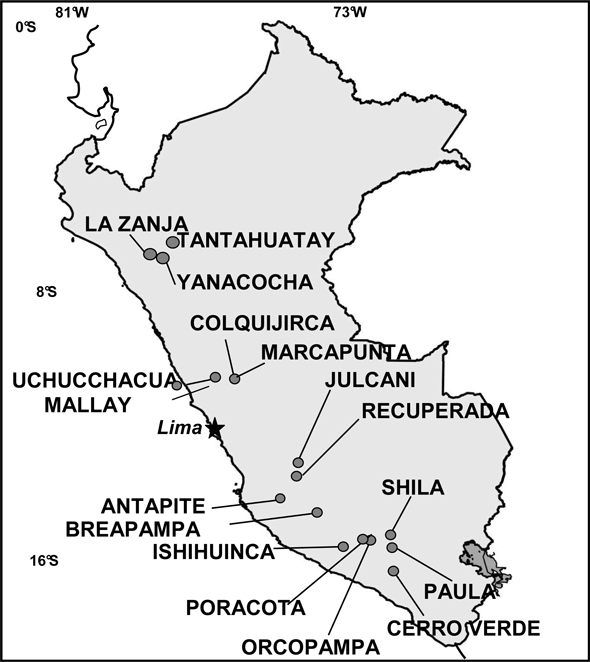

We record our investments in Yanacocha and Cerro Verde in accordance with the equity method as described in “Item 5. Operating and Financial Review and Prospects—Buenaventura—General” and Note 2.3(e)2.4(f) to the Financial Statements. Our partnership interest in Yanacocha was calculated at 43.65 percent43.65% for the years ended December 31, 20112013, 2014 and 2012.2015. As of December 31, 20112013, 2014 and 2012,2015, our equity interest in Cerro Verde was 19.35 percent and 19.58 percent, respectively.19.58%.

Forward-Looking Statements

Certain statements contained in thisThis Annual Report arecontains “forward-looking statements” as defined in the U.S. Private Securities Litigation Reform Act of 1995 and are intended to be covered by the safe harbor provided for under these sections. Our forward-looking statements are based on management’s assumptions and beliefs in light of the information currently available to it and may include, without limitation:

| · | our, Yanacocha’s and Cerro Verde’s costs and expenses; |

| · | estimates of future costs applicable to sales; |

| · | estimates of future exploration and production results; |

| · | plans for capital expenditures; |

| · | expected commencement dates of mining or metal production operations; and |

| · | estimates regarding potential cost savings and operating performance. |

The words “anticipate,” “may,” “can,” “plan,” “believe,” “estimate,” “expect,” “project,” “intend,” “likely,” “will,” “should,” “to be” and any similar expressions are intended to identify those assertions as forward-looking statements. In making any forward-looking statements, we believe that the expectations are based on reasonable assumptions. We caution readers that those statements are not guarantees of future performance and our actual results may differ materially from those anticipated, projected or assumed in the forward-looking statements. Important factors that can cause our actual results to differ materially from those anticipated in the forward-looking statements include:

| · | our, Yanacocha’s and Cerro Verde’s results of exploration; |

| · | the results of our joint ventures and our share of the production of, and the income received from, such joint ventures; |

| · | geological and metallurgical assumptions; |

| · | timing of receipt of necessary governmental permits or approvals; |

| · | inaccurate estimates of reserves orMineralized Material Not in Reserve;Reserve; |

| · | anti-mining protests or other potential issues with local community relationships; |

| · | environmental risks; and |

| · | other factors described in more detail under “Item 3. Key Information—Information — D. Risk Factors.” |

Many of the assumptions on which our forward-looking statements are based are likely to change after our forward-looking statements are made, including, for example, commodity prices, which we cannot control, and our, Yanacocha’s and Cerro Verde’s production volumes and costs, some aspects of which we may or may not be able to control. Further, we may make changes to our business plans that could or will affect our results. We do not intend to update our forward-looking statements, notwithstanding any changes in our assumptions, changes in our business plans, our actual experience or other changes, and we undertake no obligation to update any forward-looking statements more frequently than required by applicable securities laws.

PART I

ITEM 1. Identity of Directors, Senior Management and Advisers

| ITEM 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable

| ITEM 2. | Offer Statistics and Expected Timetable |

Not applicable.

ITEM 3. Key Information

| A. | Selected Financial Data |

A. Selected Financial Data

Selected Financial Information and Operating Data

The followingThis information should be read in conjunction with, and is qualified in its entirety by reference to, the Financial Statements, including the notes thereto appearing elsewhere in this Annual Report. The selected financial information as of December 31, 20112014 and 2012,2015 and for the years ended December 31, 2010, 20112013, 2014 and 2012,2015, is derived from the consolidated statementstatements of financial position, consolidated statements of incomeprofit or loss and statementconsolidated statements of other comprehensive income, respectively, included in the Financial Statements appearing elsewhere in this Annual Report. The selected financial information as of December 31, 2011 and 2012, and for the years ended December 31, 2011 and 2012 has been derived from a consolidated statement of financial position, consolidated statements of profit or loss and consolidated statements of other comprehensive income, respectively, which are not included in this Annual Report. The report of Medina,Paredes, Zaldívar, ParedesBurga & Asociados S. Civil de R.L. (a member firm of Ernst & Young Global) on our 2010, 20112013, 2014 and 20122015 Financial Statements appears elsewhere in this Annual Report.Our 2010, 2011Report. Our 2013, 2014 and 20122015 Financial Statements are prepared and presented in accordance with IFRS as issued by the IASB, which differs in certain respects from U.S. GAAP. For periods up to and including the year ended December 31, 2010, we prepared our financial statements in accordance with Peruvian GAAP. Our consolidated financial statements for the year ended December 31, 2011 were the first that we prepared in accordance with IFRS as issued by the IASB. The operating data presented below are derived from our records and has not been subject to audit. The financial information and operating data presented below should be read in conjunction with “Item 5. Operating and Financial Review and Prospects—Buenaventura,” the Financial Statements and the related notes thereto and other financial information included in this Annual Report.

| | | As of and for the year ended December 31, | |

| | | 2010 | | | 2011 | | | 2012 | |

| | | (In thousands of US$)(1) | |

| Income statement data: | | | | | | | | | | | | |

| IFRS(2) | | | | | | | | | | | | |

| Net sales | | | 1,047,885 | | | | 1,493,882 | | | | 1,496,349 | |

| Royalty income | | | 55,883 | | | | 62,742 | | | | 67,178 | |

| Total income | | | 1,103,768 | | | | 1,556,624 | | | | 1,563,527 | |

| | | | | | | | | | | | | |

| Operating costs: | | | | | | | | | | | | |

| Cost of sales, without considering depreciation and amortization | | | (347,129 | ) | | | (446,163 | ) | | | (629,492 | ) |

| Exploration in units in operation | | | (91,441 | ) | | | (109,355 | ) | | | (153,018 | ) |

| Depreciation and amortization | | | (74,864 | ) | | | (96,381 | ) | | | (123,043 | ) |

| Royalties | | | (52,270 | ) | | | (60,262 | ) | | | (37,667 | ) |

| Total operating costs | | | (565,704 | ) | | | (712,161 | ) | | | (943,220 | ) |

| Gross income | | | 538,064 | | | | 844,463 | | | | 620,307 | |

| | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | |

| Administrative expenses | | | (107,237 | ) | | | (75,170 | ) | | | (99,295 | ) |

| Exploration in non-operating areas | | | (36,105 | ) | | | (49,593 | ) | | | (95,491 | ) |

| Selling expenses | | | (9,375 | ) | | | (11,617 | ) | | | (18,090 | ) |

| Reversal (provision) for impairment of long-lived assets | | | 13,135 | | | | - | | | | (3,617 | ) |

| Excess of workers’ profit sharing | | | - | | | | (6,221 | ) | | | (2,164 | ) |

| Reimbursement of exploration expenses on projects | | | 15,013 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Other, net | | | 10,653 | | | | 2,513 | | | | 16,584 | |

| Total operating expenses | | | (113,916 | ) | | | (140,088 | ) | | | (202,073 | ) |

| Operating income | | | 424,148 | | | | 704,375 | | | | 418,234 | |

| | | | | | | | | | | | | |

| Other income (expenses), net: | | | | | | | | | | | | |

| Share in the results of associates under equity method | | | 428,885 | | | | 468,363 | | | | 464,239 | |

| Interest income | | | 8,203 | | | | 11,827 | | | | 9,486 | |

| Interest expense | | | (12,271 | ) | | | (11,823 | ) | | | (8,290 | ) |

| Net gain (loss) from currency exchange difference | | | (750 | ) | | | (675 | ) | | | 1,715 | |

| Total other income, net | | | 424,067 | | | | 467,692 | | | | 467,150 | |

| | | | | | | | | | | | | |

| Income before income tax | | | 848,215 | | | | 1,172,067 | | | | 885,384 | |

| Income tax | | | (123,326 | ) | | | (211,589 | ) | | | (142,594 | ) |

| Net income | | | 724,889 | | | | 960,478 | | | | 742,790 | |

| Net income attributable to non-controlling interest | | | 64,068 | | | | 101,551 | | | | 58,105 | |

| | | | | | | | | | | | | |

| Net income attributable to Buenaventura | | | 660,821 | | | | 858,927 | | | | 684,685 | |

| | | | | | | | | | | | | |

| Basic and diluted earnings per share(3)(4) | | | 2.60 | | | | 3.38 | | | | 2.69 | |

| | | | | | | | | | | | | |

| Basic and diluted earnings per ADS(3)(4) | | | 2.60 | | | | 3.38 | | | | 2.69 | |

| Dividends per share | | | 0.46 | | | | 0.56 | | | | 0.60 | |

| | | | | | | | | | | | | |

| Average number of shares outstanding | | | 254,442,328 | | | | 254,442,328 | | | | 254,232,571 | |

| | | | | | | | | | | | | |

| Statement of financial position data: | | | | | | | | | | | | |

| IFRS(2) | | | | | | | | | | | | |

| Total assets | | | 3,279,346 | | | | 3,953,549 | | | | 4,588,653 | |

| Financial obligations | | | 57,152 | | | | 106,114 | | | | 179,304 | |

| | | As of and for the year ended December 31, | |

| | | 2010 | | | 2011 | | | 2012 | |

| | | (In thousands of US$)(1) | |

| Capital stock | | | 750,540 | | | | 750,540 | | | | 750,540 | |

| Shareholders’ equity | | | 2,845,337 | | | | 3,440,479 | | | | 3,964,386 | |

| | | | | | | | | | | | | |

| Operating data (unaudited): | | | | | | | | | | | | |

| Production(5) | | | | | | | | | | | | |

| Gold (oz.) | | | 481,768 | | | | 524,101 | | | | 447,472 | |

| Silver (oz.) | | | 14,840,678 | | | | 16,724,717 | | | | 18,884,824 | |

| Proven and probable reserves(6) | | | | | | | | | | | | |

| Gold (oz.) | | | 1,772,000 | | | | 1,485,000 | | | | 1,385,000 | |

| Silver (oz.) | | | 152,161,000 | | | | 155,437,000 | | | | 154,606,000 | |

| | | As of and for the year ended December 31, | |

| | | 2015 | | | 2014 | | | 2013(6) | | | 2012(6) | | | 2011(6) | |

| | | (In thousands of US$)(1) | | | | |

| Statements of profit or loss data: | | | | | | | | | | | | | | | | | | | | |

| Continuing operations: | | | | | | | | | | | | | | | | | | | | |

| Operating income: | | | | | | | | | | | | | | | | | | | | |

| Net sales of goods | | | 864,962 | | | | 1,067,271 | | | | 1,135,836 | | | | 1,376,179 | | | | 1,314,070 | |

| Net sales of services | | | 54,488 | | | | 71,642 | | | | 79,585 | | | | 46,664 | | | | 42,023 | |

| Royalty income | | | 32,414 | | | | 36,867 | | | | 44,185 | | | | 67,178 | | | | 62,742 | |

| Total operating income | | | 951,864 | | | | 1,175,780 | | | | 1,259,606 | | | | 1,490,021 | | | | 1,418,835 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating costs: | | | | | | | | | | | | | | | | | | | | |

| Cost of sales of goods, excluding depreciation and amortization | | | (537,713 | ) | | | (533,052 | ) | | | (513,165 | ) | | | (540,504 | ) | | | (365,831 | ) |

| Cost of services, excluding depreciation and amortization | | | (52,692 | ) | | | (81,487 | ) | | | (114,120 | ) | | | (30,739 | ) | | | (15,592 | ) |

| Exploration in operating units | | | (91,520 | ) | | | (97,852 | ) | | | (101,913 | ) | | | (103,215 | ) | | | (77,994 | ) |

| Depreciation and amortization | | | (242,465 | ) | | | (208,698 | ) | | | (159,140 | ) | | | (111,025 | ) | | | (71,392 | ) |

| Mining royalties | | | (27,407 | ) | | | (28,440 | ) | | | (30,402 | ) | | | (37,496 | ) | | | (58,546 | ) |

| Total operating costs | | | (951,797 | ) | | | (949,529 | ) | | | (918,740 | ) | | | (822,979 | ) | | | (589,355 | ) |

| Gross profit | | | 67 | | | | 226,251 | | | | 340,866 | | | | 667,042 | | | | 829,480 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

| Administrative expenses | | | (86,532 | ) | | | (101,102 | ) | | | (75,118 | ) | | | (94,118 | ) | | | (68,874 | ) |

| Exploration in non-operating areas | | | (30,610 | ) | | | (50,007 | ) | | | (32,805 | ) | | | (95,491 | ) | | | (49,568 | ) |

| Selling expenses | | | (19,481 | ) | | | (16,605 | ) | | | (14,842 | ) | | | (15,491 | ) | | | (8,214 | ) |

| Excess of workers’ profit sharing | | | - | | | | - | | | | (704 | ) | | | (2,164 | ) | | | (6,221 | ) |

| Impairment loss of long-lived assets | | | (11,255 | ) | | | - | | | | - | | | | - | | | | - | |

| Other, net | | | 209 | | | | 3,059 | | | | (2,154 | ) | | | 19,172 | | | | 4,523 | |

| Total operating expenses | | | (147,669 | ) | | | (164,655 | ) | | | (125,623 | ) | | | (188,092 | ) | | | (128,354 | ) |

| Operating profit (loss) | | | (147,602 | ) | | | 61,596 | | | | 215,243 | | | | 478,950 | | | | 701,126 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other income (expenses), net: | | | | | | | | | | | | | | | | | | | | |

| Share in the results of associates under equity method | | | (173,375 | ) | | | (74,600 | ) | | | (114,145 | ) | | | 478,987 | | | | 496,769 | |

| Finance costs | | | (27,622 | ) | | | (11,318 | ) | | | (9,896 | ) | | | (8,290 | ) | | | (11,823 | ) |

| Net gain (loss) from currency exchange difference | | | (13,683 | ) | | | (8,452 | ) | | | (7,192 | ) | | | 1,855 | | | | (614 | ) |

| Gain on business combination | | | - | | | | 59,852 | | | | - | | | | - | | | | - | |

| | | As of and for the year ended December 31, | |

| | | 2015 | | | 2014 | | | 2013(6) | | | 2012(6) | | | 2011(6) | |

| | | (In thousands of US$)(1) | | | | |

| Finance income | | | 11,026 | | | | 8,408 | | | | 6,621 | | | | 9,486 | | | | 11,827 | |

| Total other income (expenses), net | | | (203,654 | ) | | | (26,110 | ) | | | (124,612 | ) | | | 482,038 | | | | 496,159 | |

| | | | | | | | | | | | | | | | | | | | | |

| Profit (loss) before income tax | | | (351,256 | ) | | | 35,486 | | | | 90,631 | | | | 960,988 | | | | 1,197,285 | |

| Current income tax | | | (14,225 | ) | | | (19,006 | ) | | | (57,328 | ) | | | (130,507 | ) | | | (168,191 | ) |

| Deferred income tax | | | (541 | ) | | | (47,006 | ) | | | (29,154 | ) | | | (12,451 | ) | | | (42,369 | ) |

| Profit (loss) from continuing operations | | | (366,022 | ) | | | (30,526 | ) | | | 4,149 | | | | 818,030 | | | | 986,725 | |

| Discontinued operations: | | | | | | | | | | | | | | | | | | | | |

| Profit (loss) from discontinued operations(7) | | | (9,523 | ) | | | (31,114 | ) | | | (83,885 | ) | | | (57,510 | ) | | | 2,159 | |

| Net profit (loss) | | | (375,545 | ) | | | (61,640 | ) | | | (79,736 | ) | | | 760,520 | | | | 988,884 | |

| Attributable to equity owners of the parent | | | (317,210 | ) | | | (76,065 | ) | | | (107,257 | ) | | | 701,100 | | | | 887,333 | |

| Attributable to non-controlling interest | | | (58,335 | ) | | | 14,425 | | | | 27,521 | | | | 59,420 | | | | 101,551 | |

| Net profit (loss) | | | (375,545 | ) | | | (61,640 | ) | | | (79,736 | ) | | | 760,520 | | | | 988,884 | |

| Basic and diluted profit (loss) per share attributable to equity holders of the parent(2)(3) | | | (1.25 | ) | | | (0.30 | ) | | | (0.42 | ) | | | 2.76 | | | | 3.49 | |

| Basic and diluted profit (loss) per ADS attributable to equity holders of the parent (2)(3) | | | (1.25 | ) | | | (0.30 | ) | | | (0.42 | ) | | | 2.76 | | | | 3.49 | |

| Basic and diluted profit (loss) per share attributable to equity holders of the parent, from continuing operations | | | (1.21 | ) | | | (0.18 | ) | | | (0.09 | ) | | | 2.98 | | | | 3.48 | |

| Dividends per share | | | - | | | | 0.03 | | | | 0.31 | | | | 0.60 | | | | 0.56 | |

| Average number of common and investment shares outstanding | | | 254,186,867 | | | | 254,186,867 | | | | 254,186,867 | | | | 254,232,571 | | | | 254,442,328 | |

| Statement of financial position data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 4,547,181 | | | | 4,672,274 | | | | 4,552,267 | | | | 4,622,447 | | | | 3,969,613 | |

| Financial obligations | | | 353,710 | | | | 383,305 | | | | 234,397 | | | | 179,304 | | | | 106,114 | |

| Capital stock | | | 750,497 | | | | 750,497 | | | | 750,497 | | | | 750,540 | | | | 750,540 | |

| Total shareholders’ equity | | | 3,389,236 | | | | 3,762,125 | | | | 3,824,421 | | | | 4,011,879 | | | | 3,470,242 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating data (unaudited): | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Production(4) | | | | | | | | | | | | | | | | | | | | |

| Gold (oz.) | | | 371,344 | | | | 438,426 | | | | 462,856 | | | | 447,472 | | | | 524,101 | |

| Silver (oz.) | | | 23,228,392 | | | | 20,119,162 | | | | 19,193,075 | | | | 18,884,824 | | | | 16,724,717 | |

| Proven and probable reserves(5) | | | | | | | | | | | | | | | | | | | | |

| Gold (oz.) | | | 1,718,455 | | | | 1,119,000 | | | | 1,036,000 | | | | 1,385,000 | | | | 1,485,000 | |

| Silver (oz.) | | | 158,608,375 | | | | 139,699,000 | | | | 136,464,000 | | | | 154,606,000 | | | | 155,437,000 | |

| (1) | Except per share, per ADS, outstanding shares and operating data. |

| (2) | Effective January 1, 2011, we changed the accounting principles governing our presentation of our consolidated financial statements from Peruvian GAAP to IFRS. Acccordingly, our financial information for the year ended December 31, 2010 has been presented in accordance with IFRS. |

| (3) | IncomeProfit (loss) per share has been calculated for each year as net incomeprofit (loss) divided by average number of shares outstanding during the year. As of MarchDecember 31, 2010, 20112014 and 2012,2015, we had 274,889,924 outstanding Common Shares outstanding, including 21,130,26021,174,734 treasury shares.shares as of December 31, 2014 and 2015. As of MarchDecember 31, 2010, 2011, 2012, 2013, 2014 and 2012,2015, we had 744,640 outstandingof Investment Shares outstanding, including 61,976 treasury shares as of MarchDecember 31, 2010 and 2011, and 231,733 treasury shares as of MarchDecember 31, 2012.2012, 272,963 treasury shares as of December 31, 2013, 2014 and 2015. |

| (4)(3) | We have no outstanding options, warrants or convertible securities that would have a dilutive effect on earnings per share. As a result, there is no difference between basic and diluted earnings per share or ADS. |

| (5)(4) | The amounts in this table reflect the total production of all of our consolidated subsidiaries, including Sociedad Minera El Brocal S.A.A., or El“El Brocal,” in which we owned a 53.76%54.07% controlling equity interest, and Minera La Zanja S.R.L., or La“La Zanja,” in which we owned a 53.06% controlling equity interest, in each case as of December 31, 2012.2015. The production data in this table reflect 100% of El Brocal’s and La Zanja’s production. For the years ended December 31, 2010, 2011 and 2012 to 2015, El Brocal produced 3.1 million, 2.0 million, 2.5 million 2.9 million and 2.83.7 million ounces of silver, respectively, of which our equity share was 1.21.7 million, 1.61.1 million, 1.4 million and 1.42.0 million ounces of silver, and La Zanja produced 43,727, 134,190112,387, 137,395, 143,573 and 112,387141,071 ounces of gold, respectively, of which our equity share was 23,201, 71,20159,633, 72,902, 76,180 and 59,63374,852 ounces of gold, and 38,155, 363,927387,877, 391,832, 422,395 and 387,877331,080 ounces of silver, respectively, of which our equity share was 20,245, 193,100205,808, 207,906, 224,123 and 205,808175,671 ounces of silver. |

| (6)(5) | The amounts in this table reflect the reserves of all of our consolidated subsidiaries, including El Brocal, in which we owned a 54.07% controlling equity interest, and La Zanja, in which we owned a 53.06% controlling equity interest, in each case as of December 31, 2015. The conceptual framework used to estimate proven and probable reserves for our wholly-owned mines as of December 31, 20102012 and 20112013 were reviewed by an independent consultant Algon Investment S.R.L. Algon Investment S.R.L. is in the process of reviewing the framework used to estimate proven and probable reserves for our wholly-owned minesGeomineria S.A.C. as of December 31, 2012.2014 and 2015. The conceptual framework used to estimate proven and probable reserves for El Brocal’s mines as of December 31, 20102012, 2013 and 20112014 were reviewed by an independent consultants, AMEC plc and MINTEC Inc., respectively. MINTEC Inc.consultant, which is also in the process of reviewing the conceptual framework used to estimate proven and probable reserves for El Brocal’s mines as of December 31, 2012. 2015. |

| (6) | IFRIC 20 “Stripping Costs in Production Phase of a Surface Mine” became effective January 1, 2013. Our results for the year 2012 and 2011 include adjustments in connection with the application of IFRIC 20 “Stripping Costs in the Production Phase of a Surface Mine.” |

| (7) | In 2014, we publicly announced our decision to dispose of our four non-operational mining units (Poracota, Recuperada, Antapite and Shila-Paula); as a consequence, they are presented as mining units held for sale in accordance with IFRS 5 “Non-current Assets Held for Sale and Discontinued Operations.” See Note 1(e) to the Financial Statements. For comparative purposes, we modified figures for 2010, 2011, 2012 and 2013 which were previously reported in our Form 20-F for the year ended December 31, 2013. |

Yanacocha Selected Financial Information and Operating Data

The following table presents selected financial information and operating data for Yanacocha at the dates and for each of the periods indicated. This information should be read in conjunction with, and is qualified in its entirety by reference to, Yanacocha’s audited consolidated financial statements as of December 31, 20112014 and 20122015 and for the years ended December 31, 2010, 20112013, 2014 and 2012,2015, or the Yanacocha“Yanacocha Financial Statements.” The report of Dongo-Soria Gaveglio yParedes, Zaldívar, Burga & Asociados S. Civil de R.L. (a member firm of Ernst & Young Global) on the Yanacocha 2015 Financial Statements appears elsewhere in this Annual Report. The 2014 and 2013 Annual Reports were audited by Gaveglio, Aparicio y Asociados Sociedad Civil de Responsabilidad Limitada, a member firm of PricewaterhouseCoopers Limited. The selected financial information as of December 31, 2008, 2009 and 2010 and for the yearsyear ended December 31, 2008 and 20092012 has been derived from balance sheets andYanacocha’s financial statements of income, respectively, whichthat are not included in this Annual Report. The Yanacocha Financial Statements are prepared and presented in accordance with U.S. GAAP,IFRS as issued by the IASB, which differdiffers in certain respects from IFRS. SeeU.S. GAAP, as indicated in Note 9(e.1)25 to the Yanacocha Financial Statements for a reconciliation to U.S. GAAP of net income and shareholders’ equity as of and for the years ended December 31, 2010, 2011 and 2012.Statements. The operating data presented below, which are based on 100 percent100% of Yanacocha’s production and reserves, are derived from Yanacocha’s records and have not been subject to audit. The financial information presented below should be read in conjunction with “Item 5. Operating and Financial Review and Prospects-Yanacocha,Prospects –Yanacocha,” the Yanacocha Financial Statements and the related notes thereto and other financial information included in this Annual Report.

| | | As of and for the year ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| | | (In thousands of US$)(1) | |

| | | | | | | | | | | | | | | | |

| Income statement data: | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | 1,612,618 | | | | 2,013,228 | | | | 1,778,260 | | | | 2,002,602 | | | | 2,201,815 | |

| | | | | | | | | | | | | | | | | | | | | |

| Costs and expenses: | | | | | | | | | | | | | | | | | | | | |

| Costs applicable to sales | | | (659,867 | ) | | | (671,055 | ) | | | (655,007 | ) | | | (738,336 | ) | | | (694,146 | ) |

| Depreciation, depletion and amortization | | | (169,131 | ) | | | (166,053 | ) | | | (160,424 | ) | | | (231,520 | ) | | | (252,900 | ) |

| Reclamation and remediation | | | (11,174 | ) | | | (13,016 | ) | | | (14,632 | ) | | | (19,135 | ) | | | (20,090 | ) |

| Exploration costs | | | (28,151 | ) | | | (22,968 | ) | | | (34,549 | ) | | | (66,272 | ) | | | (121,724 | ) |

| Write-down of long-lived assets | | | (442 | ) | | | (2,923 | ) | | | (312 | ) | | | (1,864 | ) | | | (17,577 | ) |

| General and administrative costs | | | (3,168 | ) | | | (3,602 | ) | | | (3,824 | ) | | | (1,281 | ) | | | (3,021 | ) |

| Other expenses | | | (71,808 | ) | | | (70,530 | ) | | | (54,208 | ) | | | (39,193 | ) | | | (109,974 | ) |

| Total operating expenses | | | (943,741 | ) | | | (950,147 | ) | | | (922,956 | ) | | | (1,097,601 | ) | | | (1,219,432 | ) |

| Operating income | | | 668,877 | | | | 1,063,081 | | | | 855,304 | | | | 905,001 | | | | 982,383 | |

| Interest expense and other | | | 3,642 | | | | (712 | ) | | | 4,263 | | | | 30,424 | | | | 6,014 | |

| Pre-tax income | | | 672,519 | | | | 1,062,369 | | | | 859,567 | | | | 935,425 | | | | 988,397 | |

| Income tax provision | | | (196,057 | ) | | | (335,293 | ) | | | (269,673 | ) | | | (293,038 | ) | | | (361,857 | ) |

| Net income before cumulative effect of change in accounting principles | | | 476,462 | | | | 727,076 | | | | 589,894 | | | | 642,387 | | | | 626,540 | |

| Cumulative effect of change in accounting principle, net | | | - | | | | - | | | | - | | | | - | | | | - | |

| Net income and comprehensive income | | | 476,462 | | | | 727,076 | | | | 589,894 | | | | 642,387 | | | | 626,540 | |

| | | | | | | | | | | | | | | | | | | | | |

| Statement of financial position data: | | | | | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 1,891,963 | | | | 2,466,500 | | | | 2,936,994 | | | | 3,787,234 | | | | 4,451,535 | |

| Total debt | | | 205,618 | | | | 178,336 | | | | 1,959 | | | | - | | | | - | |

| Partners’ equity | | | 1,212,787 | | | | 1,711,102 | | | | 2,302,145 | | | | 2,943,021 | | | | 3,570,690 | |

| Operating data (unaudited): | | | | | | | | | | | | | | | | | | | | |

| Gold produced (oz.) | | | 1,810,338 | | | | 2,058,180 | | | | 1,461,620 | | | | 1,293,123 | | | | 1,345,992 | |

| Gold proven and probable reserves (thousands of oz.) | | | 24,850 | | | | 22,362 | | | | 21,538 | | | | 20,295 | | | | 18,500 | |

| | | As of and for the year ended December 31, | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | |

| | | (In thousands of US$)(1) | |

| Statement of comprehensive income: | | | | | | | | | | | | | | | | |

| Operating income: | | | | | | | | | | | | | | | | |

| Revenue from sales (2) | | | 1,031,174 | | | | 1,165,299 | | | | 1,406,825 | | | | 2,146,641 | |

| Other operating income | | | 10,625 | | | | 30,300 | | | | 37,207 | | | | 22,861 | |

| Total gross income | | | 1,041,799 | | | | 1,195,599 | | | | 1,444,032 | | | | 2,169,502 | |

| | | | | | | | | | | | | | | | | |

| Costs applicable to sales | | | (751,736 | ) | | | (920,300 | ) | | | (991,264 | ) | | | (832,116 | ) |

| Other operating costs | | | (2,524 | ) | | | (22,422 | ) | | | (28,672 | ) | | | (22,069 | ) |

| Total operating costs | | | (754,260 | ) | | | (942,722 | ) | | | (1,019,936 | ) | | | (854,185 | ) |

| Gross profit | | | 287,539 | | | | 252,877 | | | | 424,096 | | | | 1,315,317 | |

| | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Operating expenses, net | | | (82,846 | ) | | | (77,781 | ) | | | (77,534 | ) | | | (192,869 | ) |

| Administrative expenses | | | (26,325 | ) | | | (38,262 | ) | | | (67,064 | ) | | | (70,916 | ) |

| Selling Expenses | | | (3,534 | ) | | | (4,458 | ) | | | (3,740 | ) | | | (4,498 | ) |

| Impairment loss | | | ― | | | | (541,141 | ) | | | (1,038,548 | ) | | | ― | |

| Operating profit | | | 174,834 | | | | (408,765 | ) | | | (762,790 | ) | | | 1,047,034 | |

| | | | | | | | | | | | | | | | | |

| Other income (expense), net: | | | | | | | | | | | | | | | | |

| Finance income | | | 673 | | | | 298 | | | | 720 | | | | 1,019 | |

| Finance costs | | | (22,734 | ) | | | (23,504 | ) | | | (18,745 | ) | | | (13,135 | ) |

| Net gain (loss) from currency exchange difference | | | (251 | ) | | | 1,142 | | | | 2,065 | | | | (1,216 | ) |

| | | | (22,312 | ) | | | (22,064 | ) | | | (15,960 | ) | | | (13,332 | ) |

| | | | | | | | | | | | | | | | | |

| Income (loss) before income tax | | | 152,522 | | | | (430,829 | ) | | | (778,750 | ) | | | 1,033,702 | |

| Income tax benefit (expense) | | | (602,717 | ) | | | 30,491 | | | | 203,471 | | | | (385,827 | ) |

| Loss for the year | | | (450,195 | ) | | | (400,338 | ) | | | (575,279 | ) | | | 647,875 | |

| | | | | | | | | | | | | | | | | |

| Comprehensive income (loss): | | | | | | | | | | | | | | | | |

| Loss for the year | | | (450,195 | ) | | | (400,338 | ) | | | (575,279 | ) | | | 647,875 | |

| Other comprehensive income (loss) to be reclassified as profit or loss in subsequent periods | | | | | | | | | | | | | | | | |

| Changes in the fair value of available-for-sale financial asset, net of tax effect | | | (757 | ) | | | (65 | ) | | | (226 | ) | | | 1,129 | |

| | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | |

| Gold sales | | | 1,070,021 | | | | 1,210,457 | | | | 1,457,646 | 1 | | | 2,201,815 | |

| Net income (loss) | | | (252,159 | ) | | | (31,914 | ) | | | 140,997 | | | | 626,540 | |

| | | | | | | | | | | | | | | | | |

| Statement of financial position: | | | | | | | | | | | | | | | | |

| IFRS | | | | | | | | | | | | | | | | |

| Total assets | | | 2,965,430 | | | | 3,483,169 | | | | 3,754,692 | | | | 4,512,803 | |

| Total financial obligations | | | ― | | | | ― | | | | ― | | | | ― | |

| Issued capital | | | 398,216 | | | | 398,216 | | | | 398,216 | | | | 398,216 | |

| Total partners’ equity | | | 2,228,825 | | | | 2,679,777 | | | | 3,080,050 | | | | 3,655,555 | |

| | | | | | | | | | | | | | | | | |

| U.S. GAAP | | | | | | | | | | | | | | | | |

| Total assets | | | 4,209,818 | | | | 4,569,497 | | | | 4,511,964 | | | | 4,541,535 | |

| Total equity | | | 3,418,989 | | | | 3,671,148 | | | | 3,711,461 | | | | 3,570,690 | |

| | | | | | | | | | | | | | | | | |

| Operating data (unaudited) | | | | | | | | | | | | | | | | |

| Gold produced (oz.) | | | 917,691 | | | | 969,944 | | | | 1,017,259 | | | | 1,345,992 | |

| Gold proven and probable reserves (thousands of oz.) | | | 17,639 | | | | 17,436 | | | | 18,345 | | | | 18,500 | |

| (1) | Except operating data.data |

| (2) | Royalties netted to sales |

Cerro Verde Selected Financial Information and Operating Data

The following table presents selected financial information and operating data for Cerro Verde atas of the datesend of and for each of the periods indicated. This information should be read in conjunction with, and is qualified in its entirety by reference to, Cerro Verde’s audited financial statements as of December 31, 20112014 and 20122015 and for the years ended December 31, 2010, 20112013, 2014 and 2012,2015, or the Cerro“Cerro Verde Financial Statements.” The selected financial information as of and for the years ended December 31, 20102011 and 2012 has been derived from a balance sheetCerro Verde’s Financial Statements that isare not included in this Annual Report. The report of Medina,Paredes, Zaldívar, ParedesBurga & Asociados S. Civil de R.L. (a member firm of Ernst & Young Global) on Cerro Verde’s financial statements appears elsewhere in this Annual Report. The Cerro Verde Financial Statements are prepared and presented in accordance with IFRS as issued by the IASB, which differs in certain respects from U.S. GAAP. Until December 31, 2010,GAAP, as indicated in Note 28 to the Cerro Verde presented its financial statements in conformity with Peruvian GAAP.Financial Statements. The operating data presented below, which are based on 100 percent100% of Cerro Verde’s production and reserves, are derived from Cerro Verde’s records and have not been subject to audit. The financial information presented below should be read in conjunction with “Item 5. Operating and Financial Review and Prospects—Cerro Verde,” the Cerro Verde Financial Statements and the related notes thereto and other financial information included in this Annual Report.

| | | As of and for the year ended December 31, | |

| | | 2010(2) | | | 2011 | | | 2012 | |

| | | (In thousands of US$)(1) | |

| Income statement data: | | | | | | | | | | | | |

| IFRS(2) | | | | | | | | | | | | |

| Net sales | | | 2,368,988 | | | | 2,520,050 | | | | 2,127,023 | |

| Total revenues | | | 2,368,988 | | | | 2,520,050 | | | | 2,127,023 | |

| Costs of sales | | | | | | | | | | | | |

| Total costs of sales | | | (645,959 | ) | | | (824,700 | ) | | | (801,571 | ) |

| Gross margin | | | 1,723,029 | | | | 1,695,350 | | | | 1,325,452 | |

| Operating expenses | | | | | | | | | | | | |

| Selling expenses | | | (76,638 | ) | | | (83,612 | ) | | | (78,674 | ) |

| Excess of workers’ profit sharing | | | (34,427 | ) | | | (21,923 | ) | | | - | |

| Expenses related to water plant | | | (4,300 | ) | | | (13,670 | ) | | | (19,606 | ) |

| Voluntary contribution | | | (41,081 | ) | | | - | | | | - | |

| Other operating expenses | | | (10,749 | ) | | | (16,865 | ) | | | (9,898 | ) |

| Total operating expenses | | | (167,195 | ) | | | (136,070 | ) | | | (108,178 | ) |

| Operating income | | | 1,555,834 | | | | 1,559,280 | | | | 1,217,274 | |

| Other income (expenses), net | | | | | | | | | | | | |

| Financial expense | | | (101 | ) | | | (165 | ) | | | (6,951 | ) |

| Financial income | | | 1,261 | | | | 1,078 | | | | 1,886 | |

| Exchange Difference, net | | | 669 | | | | 1,924 | | | | 3,149 | |

| Total other income (expenses), net | | | 1,829 | | | | 2,837 | | | | (1,916 | ) |

| | | | | | | | | | | | | |

| Profit before income tax | | | 1,557,663 | | | | 1,562,117 | | | | 1,215,358 | |

| | | | | | | | | | | | | |

| Income tax | | | (483,270 | ) | | | (483,718 | ) | | | (443,288 | ) |

| Net income | | | 1,074,393 | | | | 1,078,399 | | | | 772,070 | |

| | | | | | | | | | | | | |

| Basic and diluted earnings per share | | | 3.069 | | | | 3.081 | | | | 2.206 | |

| Dividends per share | | | 2.714 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Average number of shares outstanding | | | 350,056,012 | | | | 350,056,012 | | | | 350,056,012 | |

| | | | | | | | | | | | | |

| Statement of financial position data: | | | | | | | | | | | | |

| IFRS(2) | | | | | | | | | | | | |

| Total assets | | | 2,294,078 | | | | 3,196,597 | | | | 4,042,771 | |

| Total debt | | | - | | | | - | | | | - | |

| Capital stock | | | 990,659 | | | | 990,659 | | | | 990,659 | |

| Shareholders’ equity | | | 1,599,239 | | | | 2,677,638 | | | | 3,449,708 | |

| | | | | | | | | | | | | |

| Operating data (unaudited): | | | | | | | | | | | | |

| Production: | | | | | | | | | | | | |

| Copper (in thousands of recoverable pounds) | | | 667,363 | | | | 647,234 | | | | 594,474 | |

| Proven and probable reserves: | | | | | | | | | | | | |

| Copper (in thousands of metric tons) | | | 3,571,531 | | | | 3,977,211 | | | | 4,194,537 | |

| | | As of and for the year ended December 31, | |

| | | | 2015 | | | | 2014 | | | | 2013(2) | | | | 2012(2) | | | | 2011(2) | |

| | | (In thousands of US$)(1) | |

| Statement of comprehensive income: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Sales of goods | | | 1,115,617 | | | | 1,467,097 | | | | 1,811,488 | | | | 2,127,023 | | | | 2,520,050 | |

| Costs of sales of goods | | | (862,004 | ) | | | (797,481 | ) | | | (795,064 | ) | | | (765,789 | ) | | | (824,700 | ) |

| Gross profit | | | 253,613 | | | | 669,616 | | | | 1,016,424 | | | | 1,361,234 | | | | 1,695,350 | |

| Operating expenses | | | | | | | | | | | | | | | | | | | | |

| Selling expenses | | | (56,215 | ) | | | (54,210 | ) | | | (68,448 | ) | | | (78,674 | ) | | | (83,612 | ) |

| Excess of workers’ profit sharing | | | | | | | - | | | | - | | | | - | | | | (21,923 | ) |

| Expense related to water plant | | | | | | | - | | | | - | | | | (19,606 | ) | | | (13,670 | ) |

| Other operating (expenses), income net | | | (26,600 | ) | | | (3,629 | ) | | | 147 | | | | (9,898 | ) | | | (16,865 | ) |

| | | | (82,815 | ) | | | (57,839 | ) | | | (68,301 | ) | | | (108,178 | ) | | | (136,070 | ) |

| Operating profit | | | 170,798 | | | | 611,777 | | | | 948,123 | | | | 1,253,056 | | | | 1,559,280 | |

| Other income (expenses) | | | | | | | | | | | | | | | | | | | | |

| Finance income | | | 512 | | | | 2,443 | | | | 2,178 | | | | 1,886 | | | | 1,078 | |

| Finance costs | | | (16,010 | ) | | | (369 | ) | | | (1,843 | ) | | | (6,951 | ) | | | (165 | ) |

| Net gain (loss) from exchange differences | | | (75,770 | ) | | | 2,284 | | | | (1,858 | ) | | | 3,149 | | | | 1,924 | |

| | | | (91,268 | ) | | | 4,358 | | | | (1,523 | ) | | | (1,916 | ) | | | 2,837 | |

| | | | | | | | | | | | | | | | | | | | | |

| Profit before income tax | | | 79,530 | | | | 616,135 | | | | 946,600 | | | | 1,251,140 | | | | 1,562,117 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income tax expense | | | (46,246 | ) | | | (238,529 | ) | | | (333,338 | ) | | | (454,556 | ) | | | (483,718 | ) |

| Profit for the year | | | 33,284 | | | | 377,606 | | | | 613,262 | | | | 796,584 | | | | 1,078,399 | |

| | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted earnings per share | | | 0.095 | | | | 1.078 | | | | 1.752 | | | | 2.276 | | | | 3.081 | |

| Dividends per share | | | | | | | – | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| Weighted average number of shares outstanding | | | 350,056,012 | | | | 350,056,012 | | | | 350,056,012 | | | | 350,056,012 | | | | 350,056,012 | |

| | | | | | | | | | | | | | | | | | | | | |

| Statement of financial position data: | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Total assets | | | 7,852,692 | | | | 5,771,984 | | | | 4,828,201 | | | | 4,042,771 | | | | 3,196,597 | |

| Total financial obligations | | | 2,425,164 | | | | 452,849 | | | | 5,903 | | | | – | | | | – | |

| Issued capital | | | 990,659 | | | | 990,659 | | | | 990,659 | | | | 990,659 | | | | 990,659 | |

| Total equity, net | | | 4,498,374 | | | | 4,465,090 | | | | 4,087,484 | | | | 3,449,708 | | | | 2,677,638 | |

| | | | | | | | | | | | | | | | | | | | | |

| Operating data (unaudited): | | | | | | | | | | | | | | | | | | | | |

| Production: | | | | | | | | | | | | | | | | | | | | |

| Copper (in thousands of recoverable pounds) | | | 544,482 | | | | 500,242 | | | | 557,239 | | | | 594,474 | | | | 647,234 | |

| Proven and probable reserves: | | | | | | | | | | | | | | | | | | | | |

| Copper Ore (in thousands of tons) | | | 3,855,939 | | | | 3,953,234 | | | | 4,047,372 | | | | 4,194,537 | | | | 3,977,211 | |

| (1) | Except per share and operating datadata. |

| (2) | EffectiveIFRIC 20 became effective January 1, 2011, Cerro Verde changed the accounting principles governing the presentation of its consolidated financial statements from Peruvian GAAP to IFRS. Accordingly, Cerro Verde’s financial information2013. Our results for the year ended December 31, 2010 has been presented2012 include adjustments in accordanceconnection with IFRS.the application of IFRIC 20 “Stripping Cost in the Production Phase.” See Note 32.2 to the Cerro Verde Financial Statements. |

Exchange Rates

The following table sets forth the high and low month-end rates and the average and end-of-period offered rates for the sale of Nuevos Soles in U.S. Dollars for the periods indicated, as published by theSuperintendencia de Bancos y Seguros (Superintendent of Bank and Insurance, or the SBS). The Federal Reserve Bank of New York does not report a noon buying rate for Nuevos Soles.

Exchange Rates

(Nuevos

The following table sets forth the high and low month-end rates and the average and end-of-period offered rates for the sale of Soles per US$in U.S. Dollars for the periods indicated, as published by theSuperintendencia de Banca y Seguros (Superintendent of Bank and Insurance, or the “SBS”)(1). The Federal Reserve Bank of New York does not report a noon buying rate for Soles.

| Year | | High(2) | | | Low(2) | | | Average(3) | | | Period end(4) | |

| | | | | | | | | | | | | |

| 2008 | | | 3.141 | | | | 2.690 | | | | 2.922 | | | | 3.139 | |

| 2009 | | | 3.259 | | | | 2.853 | | | | 3.012 | | | | 2.891 | |

| 2010 | | | 2.856 | | | | 2.787 | | | | 2.826 | | | | 2.809 | |

| 2011 | | | 2.834 | | | | 2.694 | | | | 2.755 | | | | 2.697 | |

| 2012 | | | 2.710 | | | | 2.551 | | | | 2.640 | | | | 2.551 | |

| | | High(5) | | | Low(5) | | | Average(6) | | | Period end(7) | |

| 2012 | | | | | | | | | | | | |

| October | | | 2.602 | | | | 2.578 | | | | 2.588 | | | | 2.592 | |

| November | | | 2.616 | | | | 2.579 | | | | 2.599 | | | | 2.579 | |

| December | | | 2.581 | | | | 2.551 | | | | 2.568 | | | | 2.551 | |

| | | | | | | | | | | | | | | | | |

| 2013 | | | | | | | | | | | | | | | | |

| January | | | 2.578 | | | | 2.541 | | | | 2.552 | | | | 2.578 | |

| February | | | 2.587 | | | | 2.567 | | | | 2.579 | | | | 2.587 | |

| March | | | 2.604 | | | | 2.586 | | | | 2.595 | | | | 2.589 | |

Exchange Rates

(Soles per US$)(1) |

| Year | | High(2) | | | Low(2) | | | Average(3) | | | Period end(4) | |

| 2013 | | | 2.820 | | | | 2.541 | | | | 2.702 | | | | 2.796 | |

| 2014 | | | 2.990 | | | | 2.761 | | | | 2.840 | | | | 2.989 | |

| 2015 | | | 3.413 | | | | 2.983 | | | | 3.187 | | | | 3.408 | |

| 2015 | | High(5) | | | Low(5) | | | Average(6) | | | Period end(7) | |

| October | | | 3.288 | | | | 3.218 | | | | 3.250 | | | | 3.287 | |

| November | | | 3.385 | | | | 3.287 | | | | 3.339 | | | | 3.376 | |

| December | | | 3.413 | | | | 3.369 | | | | 3.385 | | | | 3.413 | |

| | | | | | | | | | | | | | | | | |

| 2016 | | | | | | | | | | | | | | | | |

| January | | | 3.471 | | | | 3.417 | | | | 3.439 | | | | 3.471 | |

| February | | | 3.538 | | | | 3.478 | | | | 3.508 | | | | 3.527 | |

| March | | | 3.522 | | | | 3.328 | | | | 3.410 | | | | 3.328 | |

| (1) | Expressed in nominal (not inflation adjusted) Nuevos Soles. |

| (2) | Highest and lowest of the twelve month-end exchange rates for each year based on the offered rate. |

| (3) | Average of month-end exchange rates based on the offered rate. |

| (4) | End of periodEnd-of-period exchange rates based on the offered rate. |

| (5) | Highest and lowest of the exchange rates based on the offered rate on the last day of each month. |

| (6) | Average of the exchange rates based on the offered rate on the last date of each day in the relevant month. |

| (7) | The exchange rate based on the offered rate on the last day of each relevant month. |

Source: SBSBloomberg

On April 25, 2013,28, 2016, the offered rate for Dollars as published by the SBS was S/.2.624 =.3.29 per US$1.00.

B. Capitalization and Indebtedness

| B. | Capitalization and Indebtedness |

Not applicable.

C. Reasons for the Offer and Use of Proceeds

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

D. Risk Factors

Factors Relating to the Company

Our financial performance is highly dependent on the performance of our partners under our mining exploration and operating agreements.

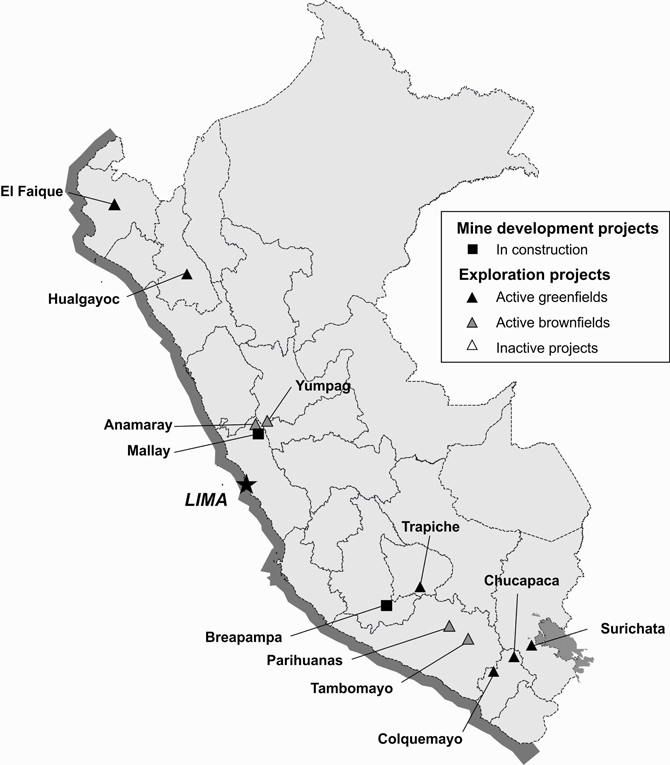

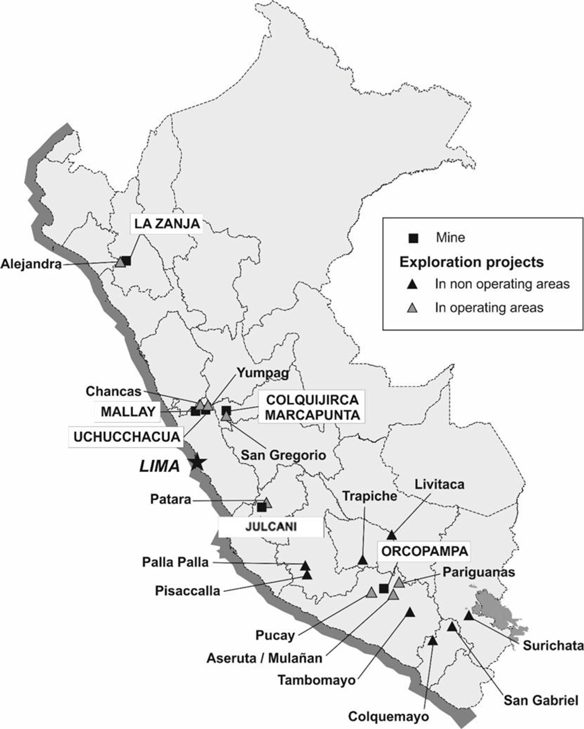

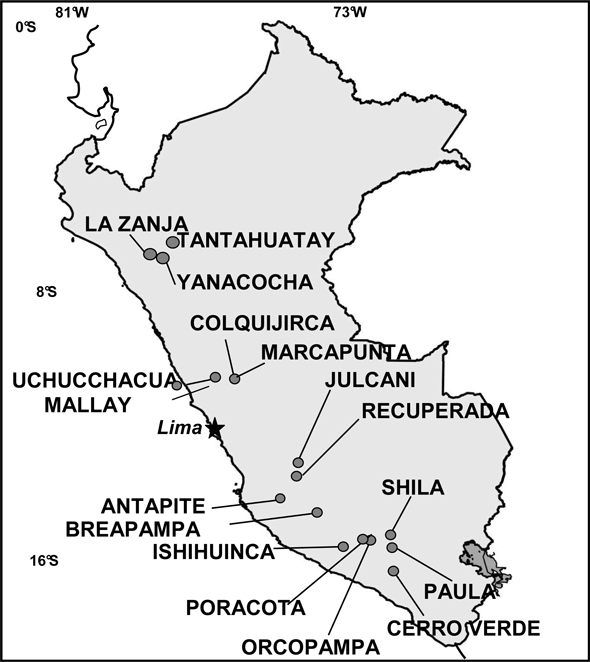

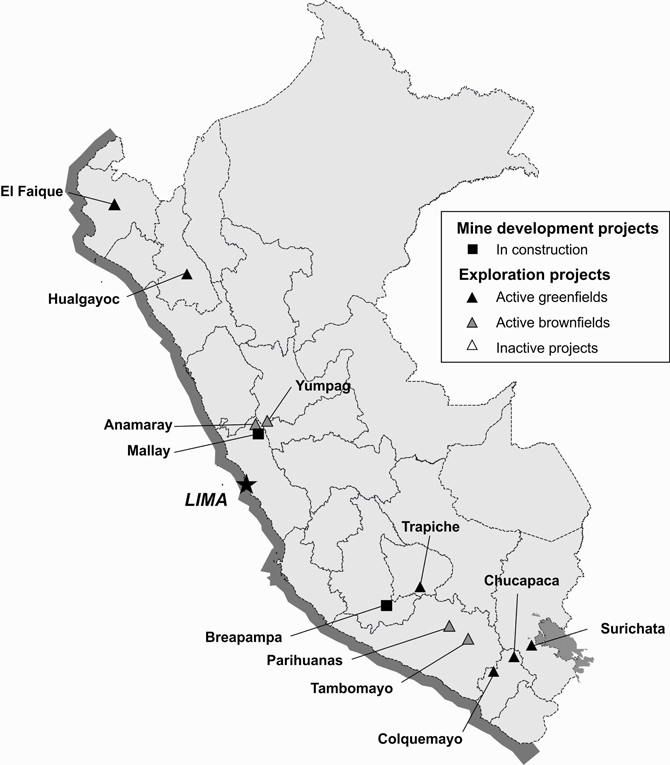

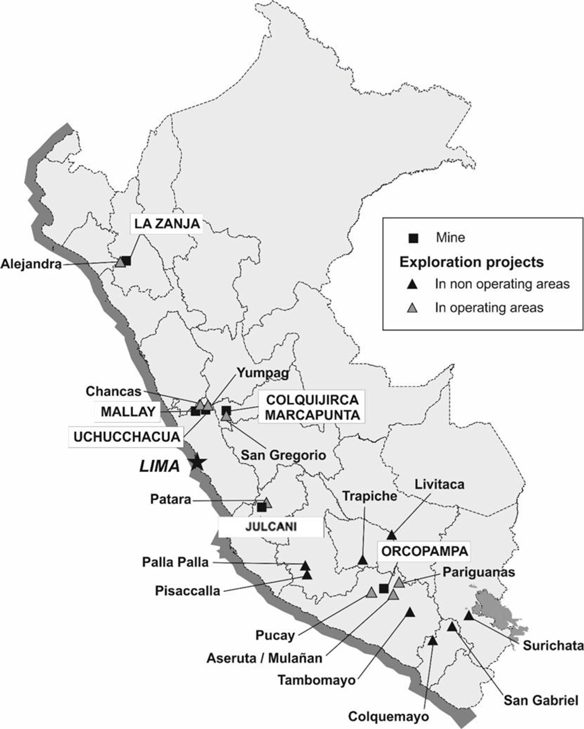

Our participation in joint venture mining exploration projects and mining operations with other experienced mining companies is an integral part of our business strategy. Our partners, co-venturers and other shareholders in these projects generally contribute capital to cover the expenses of the joint venture or provide critical technological, management and organizational expertise. The results of these projects can be highly dependent upon the efforts of our joint venture partners and we rely on them to fulfill their obligations under our agreements. For example, our Yanacocha joint venture with Newmont Mining Corporation, a Delaware corporation, or Newmont Mining, is dependent upondepends on Newmont Peru Limited, Peruvian Branch, or Newmont“Newmont Peru,” to provide management and other expertise to the Yanacocha project. If our counterparts do not carry out their obligations to us or to third parties, or any disputes arise with respect to the parties’ respective rights and obligations, the value of our investment in the applicable project could be adversely affected and we could incur significant expense in enforcing our rights or pursuing remedies. There can be no assuranceWe cannot assure you that our current or future partners will fulfill their obligations under our agreements. In addition, we may be unable to exert control over strategic decisions made in respect of such properties.For example, we currently depend on Newmont Peru to conduct operations at Yanacocha and the Conga project, and shouldshould Yanacocha be unable to continue with the current development plan at the Conga project, our mining partners in this project may reprioritize and reallocate capital to development alternatives. See “Item 4. Information on the Company—Company – Yanacocha” and “Item 4. Information on the Company—Buenaventura—Company – Buenaventura – B. Business Overview—Overview – Exploration.”

Our financial performance is highly dependent on the prices of gold, silver, copper and other metals.

The results of our operations are significantly affected by the market price of specific metals, which are cyclical and subject to substantial price fluctuations. Our revenues are derived primarily from the sale of ore concentrates containing gold and silver; the revenues of Yanacocha, in which we have a material equity investment, are derived primarily from the sale of gold and silver;silver, and the revenues of Cerro Verde, in which we have a material equity investment, are derived primarily from copper sales. The prices that we, Yanacocha and Cerro Verde obtain for gold, silver, copper and ore concentrates containing such metals, as applicable, are directly related to world market prices for such metals. Such prices have historically fluctuated widely and are affected by numerous factors beyond our control, including (i) the overall demand for and worldwide supply of gold, silver, copper and other metals,metals; (ii) levels of supply and demand for a broad range of industrial products; (iii) the availability and price of competing commodities,commodities; (iv) international economic trends,and political trends; (v) currency exchange fluctuations (specifically, the U.S. Dollar relative to other currencies); (vi) expectations with respect to the rate of inflation,inflation; (vii) interest rates; (viii) actions of commodity markets participants, consumptionparticipants; and demand patterns and(ix) global or regional political events in major producing countries. or economic crises.

We have in the past engaged in hedging activities, such as forward sales and option contracts, to minimize our exposure to fluctuations in the prices of gold, silver and other metals; however, we and our wholly-owned subsidiaries no longer hedge the price at which our gold and silver will be sold. In addition, neither Yanacocha nor Cerro Verde engages in hedging activities. As a result, the prices at which we, Yanacocha and Cerro Verde sell gold, silver, copper and ore concentrates, as applicable, are fully exposed to the effects of changes in prevailing market prices.Seeprices. See “Item 11. Quantitative and Qualitative Disclosures About Market Risk” and Note 2833 to the Financial Statements. For information on gold and silver prices for each of the years in the five-year period ended December 31, 2011,2015, see “Item 4. Information on the Company—Buenaventura—Company – Buenaventura – B. Business Overview—SalesOverview –Sales of Metal Concentrates.”

On December 31, 2012,2015 and March 31, 2013 and April 24, 2013,2016, the morning fixing price for gold on the London Bullion Market was US$1,664per ounce, US$1,6021,060.25 per ounce and US$1,4511,233.6 per ounce, respectively. On December 31, 20122015 and March 31, 2013,2016, the afternoon fixing spot price of silver on the London market, or London“London Spot,” was US$29.95per13.82 per ounce and US$28.64per15.38 per ounce, respectively. On December 31, 20122015 and March 31, 2013,2016, the London Metal Exchange Settlement price for copper was US$7,915,4,702 per metric ton and US$7,582,4,855.5, per metric ton, respectively.

The world market prices of gold, silver and copper have historically fluctuated widely and there is no assurance that the prices for these metals will continue to maintain their current high historical levels.widely. We cannot predict whether metal prices will rise or fall in the future. A continued decline in the market price of one or more of these metals could adversely impact our revenues, net income and cash flows and adversely affect our ability to meet our financial obligations.

In addition, sustained low If prices of gold, silver and/or copper pricesshould decline below our cash costs of production and remain at such levels for any sustained period, we could determine that it is not economically feasible to continue production at any or all of our mines. We may also curtail or suspend some or all of our exploration activities, with the result that our depleted reserves are not replaced. This could further reduce revenues further through production declines due to cessation of the mining of deposits,by reducing or portions of deposits, that have become uneconomic at the then-prevailing market price; reduce or eliminateeliminating the profit that we currently expect from reserves; halt or delay the development of new projects; reduce funds available for exploration; and reduce existing reserves by removing ores from reserves that can no longer be economically processed at prevailing prices.reserves. Such declines in price and/or reductions in operations could also cause significant volatility in our financial performance and adversely affect the trading prices of our Common Shares and ADSs.

Economic, mining and other regulatory policies of the Peruvian government, as well as political, regulatory and economic developments in Peru, may have an adverse impact on our, Yanacocha’s and Cerro Verde’s businesses.

Our, Yanacocha’s and Cerro Verde’s activities in Peru require us to obtain mining concessions or provisional permits for exploration and processing concessions for the treatment of mining ores from the Peruvian Ministry of Energy and Mines or MEM.(the “MEM”). Under Peru’s current legal and regulatory regime, these mining and processing rights are maintained by meeting a minimum annual level of production or investment and by the annual payment of a concession fee. A fine is payable for the years in which minimum production or investment requirements are not met. Although we are, and Yanacocha and Cerro Verde have informed us that they are, current in the payment of all amounts due in respect of mining and processing concessions, failure to pay such concession fees, processing fees or related fines for two consecutive years could result in the loss of one or more mining rights and processing concessions, as the case may be.

Mining companies are also required to pay the Peruvian government mining royalties and/or mining taxes. See “Item 4. Information on the Company—Buenaventura—Company – Buenaventura – B. Business Overview—Overview – Regulatory Framework—Framework – Mining Royalties and Taxes.” There can be no assuranceWe cannot assure you that the Peruvian government will not impose additional mining royalties or taxes in the future or that such mining royalties or taxes will not have an adverse effect on our, Yanacocha’s or Cerro Verde’s results of operations or financial condition. Future regulatory changes, changes in the interpretation of existing regulations or stricter enforcement of such regulations, including changes to our concession agreements, may increase our compliance costs and could potentially require us to alter our operations. We cannot assure you that future regulatory changes will not adversely affect our business, financial condition or results of operations.

Environmental and other laws and regulations may increase our costs of doing business, restrict our operations or result in operational delays.

Our, Yanacocha’s and Cerro Verde’s exploration, mining and milling activities, as well our and Yanacocha’s smelting and refining activities, are subject to a number of Peruvian laws and regulations, including environmental laws and regulations.

Additional matters subject to regulation include, but are not limited to, concession fees, transportation, production, water use and discharges, power use and generation, use and storage of explosives, surface rights, housing and other facilities for workers, reclamation, taxation, labor standards, mine safety and occupational health.

We anticipate additional laws and regulations will be enacted over time with respect to environmental matters. The development of more stringent environmental protection programs in Peru could impose constraints and additional costs on our, Yanacocha’s and Cerro Verde’s operations and require us, Yanacocha and Cerro Verde to make significant capital expenditures in the future. Although we believe that we are substantially in compliance, and Yanacocha and Cerro Verde have advised us that they are substantially in compliance, with all applicable environmental regulations, there can be no assurancewe cannot assure you that future legislative or regulatory developments will not have an adverse effect on our, Yanacocha’s or Cerro Verde’s business or results of operations. See “Item 4. Information on the Company—Buenaventura—Company – Buenaventura – B. Business Overview—Overview – Regulatory Framework—Framework – Environmental Matters” and “—Permits” and “Item 4. Information on the Company—Yanacocha—Company – Yanacocha – B. Business Overview—Overview – Regulation, Permit and Environmental Matters.”

Our and Yanacocha’s ability to successfully obtain key permits and approvals to explore for, develop and successfully operate mines will likely depend on our and Yanacocha’s ability to do so in a manner that is consistent with the creation of social and economic benefits in the surrounding communities. Our and Yanacocha’s ability to obtain permits and approvals and to successfully operate in particular communities or to obtain financing may be adversely impacted by real or perceived detrimental events associated with our orand Yanacocha’s activities or those of other mining companies affecting the environment, human health and safety or the surrounding communities. Delays in obtaining or failure to obtain government permits and approvals may adversely affect our and Yanacocha’s operations, including our and Yanacocha’s ability to explore or develop properties, commence production or continue operations.

Our metals exploration efforts are highly speculative in nature and may not be successful.

Precious metals exploration, particularly gold exploration, is highly speculative in nature, involves many risks and frequently is unsuccessful. There can be no assuranceWe cannot assure you that our, Yanacocha’s or Cerro Verde’s metals exploration efforts will be successful. Once mineralization is discovered, it may take a number of years from the initial phases of drilling before production is possible, during which time the economic feasibility of production may change. Substantial expenditures are required to establish proven and probable ore reserves through drilling, to determine metallurgical processes to extract the metals from the ore and, in the case of new properties, to construct mining and processing facilities. As a result of these uncertainties, no assurance can be givenwe cannot assure you that our or Yanacocha’s exploration programs will result in the expansion or replacement of current production with new proven and probable ore reserves.

We base our estimates of proven and probable ore reserves and estimates of future cash operating costs largely on the interpretation of geologic data obtained from drill holes and other sampling techniques, and feasibility studies. Advanced exploration projects have no operating history upon which to base estimates of proven and probable ore reserves and estimates of future cash operating costs. Such estimates are, to a large extent, based upon the interpretation of geologic data obtained from drill holes and other sampling techniques, and feasibility studies which derive estimates of cash operating costs based upon anticipated tonnage and grades of ore to be mined and processed, the configuration of the ore body, expected recovery rates of the mineral from the ore, comparable facility and equipment operating costs, anticipated climatic conditions and other factors. As a result, it is possible that actual cash operating costs and economic returns based upon proven and probable ore reserves may differ significantly from those originally estimated. Moreover, significant decreases in actual over expected prices may mean reserves, once found, will be uneconomical to produce. It is not unusual in new mining operations to experience unexpected problems during the start-up phase. See “Item 4. Information on the Company—Buenaventura—Company – Buenaventura – D. Property, Plants and Equipment—Equipment – Our Properties—Properties – Reserves,” “—Yanacocha—“– Yanacocha – D. Property, Plants and Equipment—Equipment – Yanacocha’s Properties—Properties – Reserves” and “Item 5. Operating and Financial Review and Prospects—Prospects – Cerro Verde—Verde – A. Operating Results” for the price per ounce used by us, Yanacocha and Cerro Verde, respectively, to calculate our respective proven and probable reserves.

Increased operating costs could affect our profitability.

Costs at any particular mining location frequently are subject to variation due to a number of factors, such as changing ore grade, changing metallurgy and revisions to mine plans in response to the physical shape and location of the ore body. In addition, costs are affected by the price of commodities, such as fuel and electricity, as well as by the price of labor. Commodity costs are at times subject to volatile price movements, including increases that could make production at certain operations less profitable. Reported costs may be affected by changes in accounting standards. A material increase in costs at any significant location could have a significant effect on our profitability.

Our business is capital-intensive and we may not be able to finance necessary capital expenditures required to execute our business plans.

Precious metals exploration requires substantial capital expenditures for the exploration, extraction, production and processing stages and for machinery, equipment and experienced personnel. Our estimates of the capital required for our projects may be preliminary or based on assumptions we have made about the mineral deposits, equipment, labor, permits and other factors required to complete our projects. If any of these estimates or assumptions change, the actual timing and amount of capital required may vary significantly from our current anticipated costs. In addition, we may require additional funds in the event of unforeseen delays, cost overruns, design changes or other unanticipated expenses. We may also incur debt in future periods or reduce our holdings of cash and cash equivalents in connection with funding future acquisitions, existing operations, capital expenditures or in pursuing other business opportunities. Our ability to meet our payment obligations will depend on our future financial performance, which will be affected by financial, business, economic and other factors, many of which we are unable to control. There can be no assurance that we or Yanacocha will generate sufficient cash flow and/or that we will have access to sufficient external sources of funds in the form of outside investment or loans to continue exploration activities at the same or higher levels than in the past or that we will be able to obtain additional financing, if necessary, on a timely basis and on commercially acceptable terms.

Estimates of proven and probable reserves are subject to uncertainties and the volume and grade of ore actually recovered may vary from our estimates.

The proven and probable ore reserve figures presented in this Annual Report are our, Yanacocha’s and Cerro Verde’s estimates, and there can be no assurance that the estimated levels of recovery of gold, silver, copper and certain other metals will be realized. Such estimates depend on geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which may prove to be materially inaccurate. Actual mineralization or formations may be different from those predicted. As a result, reserve estimates may require revision based on further exploration, development activity or actual production experience, which could materially and adversely affect such estimates. No assurance can be given that our, Yanacocha’s or Cerro Verde’s mineral resources constitute or will be converted into reserves. Market price fluctuations of gold, silver and other metals, as well as increased production costs or reduced recovery rates, may render proven and probable ore reserves containing relatively lower grades of mineralization uneconomic to exploit and may ultimately result in a restatement of proven and probable ore reserves. Moreover, short-term operating factors relating to the reserves, such as the processing of different types of ore or ore grades, could adversely affect our or Yanacocha’s profitability in any particular accounting period. See “Item 4. Information on the Company—Buenaventura—Company – Buenaventura – D. Property, Plants and Equipment—Equipment – Our Properties—Reserves” and “Item 4. Information on the Company—Company – D. Property, Plants and Equipment—Yanacocha—Equipment – Yanacocha – Yanacocha’s Properties—Properties – Reserves.”

We and Yanacocha may be unable to replace reserves as they become depleted by production.

As we and Yanacocha produce gold, silver, zinc and other metals, we and Yanacocha deplete our respective ore reserves for such metals. To maintain production levels, we and Yanacocha must replace depleted reserves by exploiting known ore bodies and locating new deposits. Exploration for gold, silver and the other metals produced is highly speculative in nature. Our and Yanacocha’s exploration projects involve significant risks and are often unsuccessful. Once a site is discovered with mineralization, we and Yanacocha may require several years between initial drilling and mineral production, and the economic feasibility of production may change during such period. Substantial expenditures are required to establish proven and probable reserves and to construct mining and processing facilities. Based on the current recovery rate and estimated gold production levels in 2012, Yanacocha’s proven and probable reserves as of December 31, 2012 will be depleted by 2015 unless Yanacocha continues to add to its reserves. As a result, thereThere can be no assurance that current or future exploration projects will be successful and there is a risk that our depletion of reserves will not be offset by new discoveries. See “Item “Item��4. Information on the Company—Buenaventura—Company – Buenaventura – B. Business Overview—Exploration,” “—Yanacocha—“– Yanacocha – B. Business Overview—Overview – Exploration,” “—“– D. Property, Plants and Equipment—Equipment – Reserves,” “—“– Yanacocha’s Properties—Properties – Reserves” and “Item 5. Operating and Financial Review and Prospects—Prospects – Cerro Verde—Verde – A. Operating Results” for a summary of our, Yanacocha’s and Cerro Verde’s estimated proven and probable reserves as of December 31, 2012.2015.

Our operations are subject to risks, many of which are not insurable.

The business of mining, smelting and refining gold, silver, copper and other metals is generally subject to a number of risks and hazards, including industrial accidents, labor disputes, unavailability of materials and equipment, unusual or unexpected geological conditions, changes in the regulatory environment, environmental hazards and weather and other natural phenomena such as earthquakes, most of which are beyond our control. Such occurrences could result in damage to, or destruction of, mining properties or production facilities, personal injury or death, environmental damage, delays in mining, monetary losses and possible legal liability. We, Yanacocha, and Cerro Verde each maintain insurance against risks that are typical in the mining industry in Peru and in amounts that we, Yanacocha and YanacochaCerro Verde believe to be adequate but which may not provide adequate coverage in certain circumstances. No assurance can be given that such insurance will continue to be available at economically feasible premiums or at all. Insurance against certain risks (including certain liabilities for environmental pollution or other hazards as a result of exploration and production) is not generally available to us or Yanacocha or to other companies within the industry.

Increases in equipment costs, energy costs and other production costs, disruptions in energy supply and shortages in equipment and skilled labor may adversely affect our results of operations.

In recent years, there has been a significant increase in mining activity worldwide in response to increased demand and significant increases in the prices of natural resources. The opening of new mines and the expansion of existing minesones has led to increased demand for, and increased costs and shortages of, equipment, supplies and experienced personnel. These cost increases have significantly increased overall operating and capital budgets of companies like ours, and continuing shortages could affect the timing and feasibility of expansion projects.

Energy represents a significant portion of our production costs. Our principal energy sources are electricity, purchased petroleum products, natural gas and coal. An inability to procure sufficient energy at reasonable prices or disruptions in energy supply could adversely affect our profits, cash flow and growth opportunities. Our production costs are also affected by the prices of commodities we consume or use in our operations, such as sulfuric acid, grinding media, steel, reagents, liners, explosives and diluents. The prices of such commodities are influenced by supply and demand trends affecting the mining industry in general and other factors outside our control and such prices are at times subject to volatile movements. Increases in the cost of these commodities or disruptions in energy supply could make our operations less profitable, even in an environment of relatively high copper, gold or silver prices. Increases in the costs of commodities that we consume or use may also significantly affect the capital costs of new projects.

We may be adversely affected by labor disputes.

Our ability to achieve our goals and objectives is dependent, in part, on maintaining good relations with our employees. A prolonged labor disruption at any of our material properties could have a material adverse impact on our results of operations. We, Compañía Minera Coimolache S.A., or “Coimolache,” Yanacocha and Cerro Verde have all experienced strikes or other labor-related work stoppages in the past. Most recently, weIn June 2015, El Brocal experienced a 15-daytwo-day work stoppage at our Orcopampa mine due to strikesits concentrator plant in Huaraucaca in connection with the negotiation of salary and the collective bargaining agreement. Subsequently, in May and June 2015, we experienced a strike at the Uchucchacua mine that lasted for twenty-nine days and a further 9-day work stoppage at Orcopampa due to strikes in October 2012. was staged by workers’ and contractors’ unions claiming unsuitable working conditions.

As of December 31, 2012,2015, unions represented approximately 54 percent39% of the employees of our permanent employees.mining companies on a consolidated basis. Although we consider our relationsrelationship with our employees to be positive, there can be no assurance that we will not experience strikes or other labor-related work stoppages that could have a material adverse effect on our operations and/or operating results in the future.

Our, Yanacocha and Yanacocha’sCerro Verde’s operations are subject to political and social risks.