As filed with the Securities and Exchange Commission on May 30, 2017April 5, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20162018

Commission file number: 001-34175

ECOPETROL S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

REPUBLIC OF COLOMBIA

(Jurisdiction of incorporation or organization)

Carrera 13 No. 36 – 24

BOGOTA – COLOMBIA

(Address of principal executive offices)

Tel. (571) 234 4000

Andrés Felipe Sánchez

Investor Relations Officer

investors@ecopetrol.com.co

Tel. (571) 234 5190

Carrera 13 N.36-24 Piso 5

7

Bogota, Colombia

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered: | |

| American Depository Shares (as evidenced by American Depository Receipts), each representing 20 common shares par value COP$609 per share | New York Stock Exchange | |

| Ecopetrol common shares par value COP$609 per share | New York Stock Exchange (for listing purposes only) |

| Title of each class | ||

| 5.875% Notes due 2023 | New York Stock Exchange |

| 4.125% Notes due 2025 | New York Stock Exchange | |

| 5.375% Notes due 2026 | New York Stock Exchange | |

| 7.375% Notes due 2043 | New York Stock Exchange | |

| 5.875% Notes due 2045 | New York Stock Exchange | |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

41,116,694,690 Ecopetrol common shares, par value COP$609 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes¨ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yesx No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

N/Ax Yes¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and large accelerated filer”“emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filerx | Accelerated filer¨ | Non-accelerated filer¨ | Emerging growth company¨ |

��

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ¨ U.S. GAAP | x International Financial Reporting Standards as issued by the International Accounting Standards Board | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨ Item 17¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

¨ Yesx No

Annual Report on Form 20-F 20162018

| 1. | Introduction | 1 | ||||

| 1.1 | About This Report | 1 | ||||

| 1.2 | Forward-looking Statements | 1 | ||||

| 1.3 | Selected Financial and Operating Data | 2 | ||||

| 2. | Strategy and Market Overview | 4 | ||||

| 2.1 | Our Corporate Strategy | 5 | ||||

| 3. | Business Overview | 6 | ||||

| 3.1 | Our History | 6 | ||||

| 3.2 | Our Corporate Structure | 7 | ||||

| 3.3 | Our Business | 9 | ||||

| 3.4 | Exploration and Production | 9 | ||||

| 3.4.1 | Exploration Activities | 9 | ||||

| 3.4.1.1 | Exploration Activities in Colombia | 9 | ||||

| 3.4.1.2 | Exploration Activities Outside of Colombia | 12 | ||||

| 3.4.2 | Production Activities | 13 | ||||

| 3.4.2.1 | Production Activities in Colombia | 14 | ||||

| 3.4.2.1.1. | Ecopetrol S.A.’s Production Activities in Colombia | 14 | ||||

| 3.4.2.1.2. | Ecopetrol S.A.’s Affiliates and Subsidiaries’ Production Activities in Colombia | 19 | ||||

| 3.4.2.2 | Production Activities Outside Colombia | 22 | ||||

| 3.4.2.3 | Marketing of Crude Oil, Natural Gas and Refined Products | 23 | ||||

| 3.4.3 | Reserves | 25 | ||||

| 3.4.4 | Joint Venture and Other Contractual Arrangements | 30 | ||||

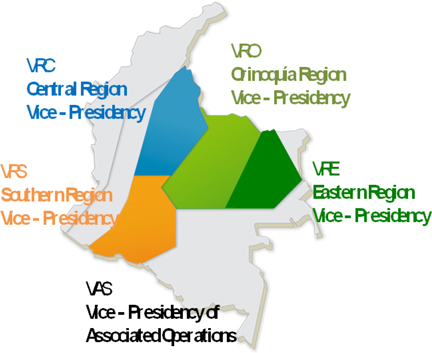

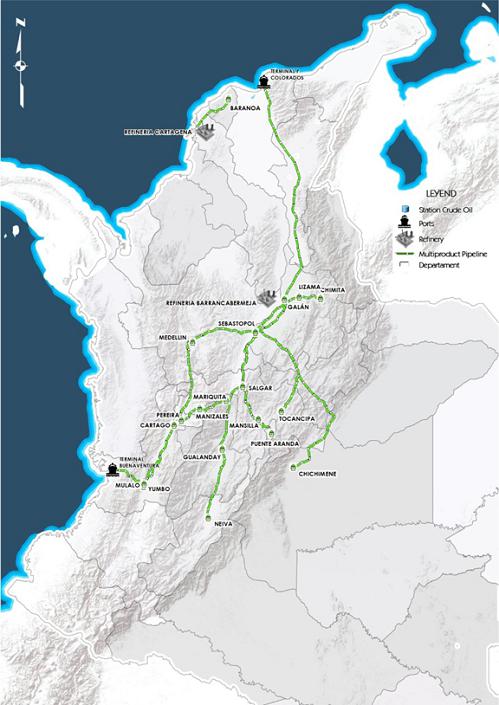

| 3.5 | Transportation and Logistics | 34 | ||||

| 3.5.1.1 | Transportation Activities | 34 | ||||

| 3.5.1.2 | Pipelines | 37 | ||||

| 3.5.1.3 | Export and Import Facilities | 39 | ||||

| 3.5.2 | Other Transportation Facilities | 39 | ||||

i

ii

iii

iv

v

vi

| 6.6 | Exchange Controls and Limitations | 130 | ||

| 6.7 | Exchange Rates | 131 | ||

| 6.8 | Major Shareholders | 132 | ||

| 6.9 | Enforcement of Civil Liabilities | 132 | ||

| 7. | Corporate Governance | 134 | ||

| 7.1 | Bylaws | 134 | ||

| 7.2 | Code of Ethics | 137 | ||

| 7.3 | Board of Directors | 138 | ||

| 7.3.1 | Board Practices | 140 | ||

| 7.3.2 | Board Committees | 141 | ||

| 7.4 | Compliance with NYSE Listing Rules | 142 | ||

| 7.5 | Management | 143 | ||

| 7.6 | Compensation of Directors and Management | 147 | ||

| 7.7 | Share Ownership of Directors and Executive Officers | 147 | ||

| 7.8 | Controls and Procedures | 147 | ||

| 8. | Financial Statements | 151 | ||

| 9. | Signature Page | 152 | ||

| 10. | Exhibits | 153 | ||

| 11. | Cross-reference to Form 20-F | 154 | ||

vii

| 1. | Introduction |

We file our Annual Report on Form 20-F and other information with the U.S. Securities and Exchange Commission.

We file reports, including annual reports on Form 20-F, and other information with the SEC pursuant to the rules and regulations of the SEC that apply to foreign private issuers. YouThe materials included in this annual report on Form 20-F may read and copy any materials filed with the SEC inbe downloaded at the SEC’s public reference room at 100 F Street, NE, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room.website: http://www.sec.gov. Any filings we make are also available to the public over the Internet at the SEC’s website at www.sec.gov and at our website at www.ecopetrol.com.co. (This URL is intended to be an inactive textual reference only. It is not intended to be an active hyperlink to our website. The information on our website, which might be accessible through a hyperlink resulting from this URL, is not and shall not be deemed to be incorporated into this annual report.)

Unless the context otherwise requires, the terms “Ecopetrol”, “we”, “us”, “our”“Ecopetrol,” “we,” “us,” “our,” or the “Company” are used in this annual report to refer to Ecopetrol S.A. and its subsidiaries on a consolidated basis.

References to the Nation in this annual report relate to the Republic of Colombia (“Colombia”), our controlling shareholder. References made to the Colombian government or the Government correspond to the executive branch including the President of Colombia, the ministries and other governmental agencies responsible for regulating our business.

This annual report on Form 20-F contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements are not based on historical facts and reflect our expectations for future events and results. Most facts are uncertain because of their nature. Words such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “should”, “plan”, “potential”, “predicts”, “prognosticate”, “project”, “target”,“anticipate,” “believe,” “could,” “estimate,” “expect,” “should,” “plan,” “potential,” “predicts,” “prognosticate,” “project,” “target,” “achieve” and “intend”,“intend,” among other similar expressions, are understood as forward-looking statements. We have made forward-looking statements that address, among other things:

| · | our exploration and production activities, including drilling; |

| · | import and export activities; |

| · | our liquidity, cash flow, and sources of funding; |

| · | our projected and targeted capital expenditures and other cost commitments and revenues; and |

| · | dates by which certain areas will be developed or will come on-stream. |

Our forward-looking statements and sensitivity analysis are not guarantees of future performance and are subject to assumptions that may prove incorrect and to risks and uncertainties that are difficult to predict. Actual results could differ materially from those expressed or forecastforecasted in any forward-looking statements as a result of a variety of factors. These factors may include, but are not limited to, the following:

| · | general economic and business conditions, including crude oil and other commodity prices, refining margins and prevailing exchange rates; |

| · | competition; |

| · | our ability to obtain financing; |

| · | our ability to find, acquire or gain access to additional reserves and our ability to develop existing reserves; |

| · | uncertainties inherent in making estimates of our reserves; |

| 1 |

| · | significant political, economic and social developments in Colombia and other countries where we do business; |

| · | natural disasters, military operations, terrorist acts, wars or embargoes; |

| · | regulatory developments, including regulations related to climate change; |

| · | receipt of government approvals and licenses; |

| · | technical difficulties; and |

| · | other factors discussed in Section 5.1 of this document as “Risk Factors.” |

All forward-looking statements attributed to us are qualified in their entirety by this cautionary statement. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason. Accordingly, readers should not place undue reliance on the forward-looking statements contained in this annual report.statements.

1.3Selected Financial and Operating Data

The following table sets forth, for the periods and at the dates indicated, our selected historical financial and certain key operating data. The selected financial data has been derived from and should be read in conjunction with, and is qualified in its entirety by reference to, our consolidated audited financial statements, presented in Colombian Pesos.

Table 1 – Selected Operating Data

| Operating Information | 2016 | 2015 | 2014 | 2013 | 2012 | 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||||||||||||||||

| Oil and gas production (mboed) | 717.9 | 760.7 | 755.4 | 788.2 | 754.0 | 720.4 | 715.1 | 717.9 | 760.7 | 755.4 | ||||||||||||||||||||||||||||||

| Proved oil and gas reserves (Mmboe)(1) | 1,598 | 1,849 | 2,084 | 1,972 | 1,877 | 1,727 | 1,659 | 1,598 | 1,849 | 2,084 | ||||||||||||||||||||||||||||||

| Exploratory Wells(2) | 6 | 5 | 28 | 22 | 23 | 17 | 20 | 6 | 5 | 28 | ||||||||||||||||||||||||||||||

| Refinery Through-put (bpd)(3) | 332,751 | 234,861 | 240,484 | 283,362 | 296,340 | 375,666 | 347,483 | 332,751 | 234,861 | 240,484 | ||||||||||||||||||||||||||||||

| 1P Reserves replacement ratio | (7 | %) | 6 | % | 146 | % | 139 | % | 108 | % | 129 | % | 126 | % | (7 | )% | 6 | % | 146 | % | ||||||||||||||||||||

| (1) |

| (2) | Gross exploratory wells. |

| (3) | Refinery |

Financial Information

International Financial Reporting Standards (“IFRS”)

(Expressed in millions of Colombian Pesos, except for the net income per share and net operating income per share, which are expressed in Colombian Pesos)

Table 2 – Selected Financial Data

| Financial Information | 2016 | 2015 | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||||||||

| Revenue | 48,485,561 | 52,347,271 | 68,603,872 | 55,954,228 | 48,485,561 | 52,347,271 | 65,971,888 | |||||||||||||||||||||

| Operating income | 8,904,548 | 2,131,165 | 22,458,414 | 16,171,855 | 8,904,548 | 2,131,165 | 14,449,027 | |||||||||||||||||||||

| Net income (loss) attributable to Ecopetrol’s shareholders | 2,447,881 | (7,193,859 | ) | 11,381,386 | 7,178,539 | 2,447,881 | (7,193,859 | ) | 5,046,517 | |||||||||||||||||||

| Net operating income per share | 217 | 52 | ||||||||||||||||||||||||||

| Weighted average number of shares outstanding | 41,116,694,690 | 41,116,694,690 | ||||||||||||||||||||||||||

| Earnings(loss) per share (basic and diluted) | 59.5 | (175.0 | ) | |||||||||||||||||||||||||

| Total assets | 120,437,924 | 123,588,190 | ||||||||||||||||||||||||||

| Financial Information | 2016 | 2015 | ||||||

| Total equity | 43,560,501 | 43,100,963 | ||||||

| Subscribed and paid-in capital | 25,040,067 | 25,040,068 | ||||||

| Number of common shares | 41,116,694,690 | 41,116,694,690 | ||||||

| Dividends declared per share | 23 | - | ||||||

| Total liabilities | 76,877,423 | 80,487,227 | ||||||

| 2 |

| Financial Information | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

| Net operating income per share | 546 | 393 | 217 | 51.8 | 351.4 | |||||||||||||||

| Weighted average number of shares outstanding | 41,116,694,690 | 41,116,694,690 | 41,116,694,690 | 41,116,694,690 | 41,116,698,456 | |||||||||||||||

| Earnings (loss) per share (basic and diluted) | 277 | 175 | 59.5 | (175.0 | ) | 122.7 | ||||||||||||||

| Total assets | 124,643,498 | 117,847,412 | 118,958,977 | 123,588,190 | 110,923,851 | |||||||||||||||

| Total equity | 57,107,780 | 48,215,699 | 43,560,501 | 43,100,963 | 48,534,228 | |||||||||||||||

| Subscribed and paid-in capital | 25,040,067 | 25,040,067 | 25,040,067 | 25,040,068 | 10,279,175 | |||||||||||||||

| Number of common shares | 41,116,694,690 | 41,116,694,690 | 41,116,694,690 | 41,116,694,690 | 41,116,698,456 | |||||||||||||||

| Dividends declared per share | 225 | 89 | 23 | - | 133 | |||||||||||||||

| Total liabilities | 67,535,718 | 69,631,713 | 75,398,476 | 80,487,227 | 62,389,623 | |||||||||||||||

Our consolidated financial statements for the years ended December 31, 2014, 2015, 2016, 2017 and 20162018 were prepared in accordance with IFRS as issued by IASB. References in this annual report to IFRS mean IFRS as issued by the IASB. Our date of transition to IFRS was January 1, 2014. Our consolidated financial statements for the year ended December 31, 2015 were our first set of consolidated financial statements prepared in accordance with IFRS.

IFRS differs in certain significant aspects from the current reporting standards as in effect in Colombia (“Colombian IFRS”)), which is the accounting standard we use for local reporting purposes. As a result, our financial information presented under IFRS is not directly comparable to our financial information presented under Colombian IFRS. For a description of the differences between Colombian IFRS and IFRS, see sectionFinancial Review—Summary of Differences between Internal Reporting Policies and IFRS.

Our consolidated financial statements were consolidated line by line and all transactions and balances between subsidiaries have been eliminated. These financial statements include the financial results of all subsidiary companies controlled, directly or indirectly, by Ecopetrol S.A. See Exhibit 1 – Consolidated companies, associates and joint ventures, to our consolidated financial statements included in this annual report.

As indicated in paragraphs 9 and 18 of the International Accounting Standard 27IFRS 10 “Consolidated and Separated Financial Statements” we must present our financial information on a consolidated basis as if we were a single entity, combining the financial statements of Ecopetrol S.A. and its subsidiaries line by line, adding assets, liabilities, shareholder’s equity, revenues and expenses of similar nature, removing the reciprocal items among members of the Ecopetrol Group (“Ecopetrol Group” or “EG”) and recognizing non-controlling interest. We present our operating information on a consolidated basis.basis in accordance with IFRS.

The regulations of the SEC do not require foreign private issuers that prepare their financial statements on the basis of IFRS to reconcile such financial statements to U.S. GAAP. Accordingly, while we have in the past reconciled our consolidated financial statements prepared in accordance with Colombian Government Entity GAAP to U.S. GAAP, thosethese reconciliations are no longerhave not been presented in our filings beforeto the SEC.SEC since 2015. We do continue to provide the disclosure required under the U.S. Financial Accounting Standards Board (FASB) Accounting Standards Codification (ASC) Topic 932 “Extractive Activities—Oil and Gas” (which we refer to as ASC Topic 932), as this is required, regardless of the basis of accounting on which we prepare our financial statements. Other than as required under ASC Topic 932, any references to accounting treatments under Colombian Government Entity GAAP or U.S. GAAP relate solely to the application of Colombian Government Entity GAAP or U.S. GAAP to our historical consolidated financial statements.

In this annual report, references to “US$” or “U.S. dollars” are to United States dollars and references to “COP$,” “Colombian Peso” or “Colombian Pesos” are to Colombian Pesos, the Ecopetrol Group’s functional and presentation currency under which we prepare our consolidated financial statements. This annual report translates certain Colombian Peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such Colombian Peso amounts have been translated at the rate of COP$3,053.422,956.55 per US$1.00, which corresponds to theTasa Representativa Promedio del Mercado(TRM), or Average Representative Market Exchange Rate, for 2016.2018. Such conversion should not be construed as a representation that the Colombian Peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On May 26, 2017,April 1, 2019, the Representative Market Exchange Rate was COP$2,911.663,174.79 per US$1.00.

| 3 |

Certain figures shown in this annual report have been subject to rounding adjustments, and, accordingly, certain totals may therefore not precisely equal the sum of the numbers presented. In this annual report a billion is equal to one with nine zeros.

| 2. | Strategy and Market Overview |

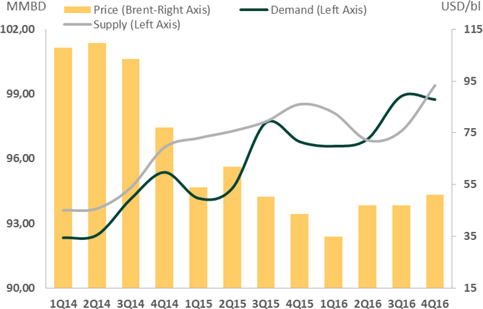

Due to market imbalances, there wasAfter experiencing a sharp contraction in crude oil price, particularly ingradual recovery during the first quarterhalf of 2016. As demand proved to sustain itself while producers implemented previously announced capital expenditure reduction decisions that encompassed the adjustments necessary under the new price environment, the market began its path towards tighter balances (see Graph 1 – Supply/Demand vs ICE Brent price evolution). Although oil prices have recovered from the lowest prices during the oil crisis, high levels of uncertainty persist indicating2018 and reaching a less than smooth recovery. Nonetheless, the changepeak in OPEC’s stance, announced at the end of September 2016 and later ratified in early December 2016, towards coordinated production cuts provided a lift that allowedOctober, the ICE Brent price suffered a downward trend in the latter part of 2018. The expectation of weaker economic growth for 2019 and a mismatch of supply and demand of crude played a fundamental role in this trend. The US government imposed sanctions on Iran in August of 2018, announcing the goal of reducing Iranian crude and condensate exports to endalmost zero. This created an expectation of a tight oil market during the year above US$55 per barrel.latter part of 2018. However, several factors did not support a strong market outlook: refining margins weakened, inventories began to pile up and production from the US, Saudi Arabia and Russia ramped up, all at the same time. Additionally, the US government provided waivers to Iranian crude importers. As a reaction to low crude prices, the OPEC+ countries agreed to cut production in order to rebalance the crude market. On the demand side, weaker economic growth in China and Europe did not favor crude oil consumption.

According to estimates of the Energy Information Administration (“EIA”), in 2018 global consumption of petroleum and other liquids fuels grew by 1.4 mmboepd while Non-OPEC petroleum and other liquid fuels supply grew by 2.5 mmboepd. On the other hand, OPEC reduced its production by 0.09 mmboepd, mainly due to unplanned crude oil disruptions which in December amounted to 2.2 mmboepd in Libya and Nigeria, Iranian sanctions and decreasing production in Venezuela.

Graph 1 – Supply/Demand Balance vs ICE Brent Price Evolution

Source: PIRAEIA: Short term Energy Group, World Oil Market Forecast (February 28, 2017)Outlook (January 15, 2019)

Although international oil prices and global demand and supply dynamics are significant factors affecting our business and financial condition, Colombia’s local economic factors have also influenced, and could continue to influence, our performance given that we conduct most of our business in Colombia.

| 4 |

The performance of Colombia’s gross domestic product (GDP) is one of the main drivers of fuel consumption in Colombia. According to the National Administrative Department of Statistics (DANE for its acronym in Spanish), during 20162018 Colombia’s GDP grew 2%2.7% in real terms, as compared to 2015.2017. The industriessectors with the greatest growth rates were financial institutions, insurance, real estateretail, manufacturing and business services, construction and manufacturing.state defense spending which had the largest contribution to national GDP. On the other hand, agricultural and cattle activities had the industry with the largest drop in growth was mining.worst performance. Local sales of liquid fuels (diesel, gasoline, jet fuel and LPG) increased by 2% mainly1.3%, boosted by increased demand for diesel and jet fuel.

Natural gas demand in Colombia grew by 5.1% in 2018 due to the increase in sales of gasoline. Gasoline domestic sales were more competitive than its substitutes due to its price decrease and fewer than expected conversions tohigher demand from natural gas fired power plants and from non-thermal demand, mainly for vehicles (NGV)household consumption.

Ecopetrol’s 2019 – 2021 (the “Business Plan”) maintains the strategic priorities set forth in the previous 2020 plan: we continue to prioritize profitable reserves and production growth, underpinned by strict capital discipline and continued focus on cost efficiency and cash flow generation. The plan seeks to maximize value generation for our shareholders with continued focus on our incumbent position in Colombia, ensuring sustainability, competitiveness and profitability.

Among other matters, the Business Plan calls for achieving the following targets by the end of 2021: (i) organic production levels between 750-770 mboed, (ii) optimum throughput of the integrated refining system at a level between 370-400 mbpd, (iii) increasing transported volumes in line with the country’s production, (iv) investing approximately US$12-15 billion during the period and (v) maintaining a robust cash position and optimal leverage levels. The Business Plan is based on a reference price of US$65/bl.

Growth in reserves and production will be supported by four levers: (i) continuing the growth of our recovery factors and underlying hydrocarbons in place in existing fields, (ii) the diversification of our exploration portfolio in Colombia, (iii) the internationalization of our operations through both organic and inorganic means, and (iv) the appraisal and development of identified unconventional hydrocarbon potential in Colombia.

We estimate that by 2021 hydrocarbons originally in place (HCIIP) associated to our assets in Colombia will be approximately 60 billion barrels compared to 55 billion barrels as of the end of 2018. This increase is expected to be supported by seismic reprocessing, reassessments of reservoirs and drilling of advanced wells, among others. Additionally, the enhanced program is expected to continue to leverage our reserve and production growth.

Growth in the exploratory portfolio in Colombia will prioritize the incorporation of short cycle resources through the strengthening of the near field exploration activity in Colombia, mainly in the Llanos and Middle Magdalena basins. Furthermore, we seek to expand our presence in high potential under-explored basins, such as Putumayo and Piedemonte, and developing the potential of our operations in the offshore Caribbean.

The internationalization lever seeks to develop and maximize the potential of the position we have built in Brazil, the U.S. Gulf Mexico and Mexico. In 2016, there were no major changesaddition, we expect to continue assessing business opportunities associated with unconventional hydrocarbon basins in naturalthe United States and other mergers and acquisition opportunities in those geographies.

We have identified unconventional hydrocarbons potential in two basins in Colombia of approximately 10 tera cubic feet of gas regulation. With respectand between 4 and 7 billion barrels of crude. In our investment plan described below, we are allocating US$500 million for the development of pilot programs between 2019 and 2021, subject to natural gas supply, in November 2016, a new regasification plant located in Cartagena became available, meaning that Colombia is now connectedgovernment approval. If successful, we would then move to the international LNG marketcommercial development of these pilots after 2021.

Our sustainability and LNG pricesgrowth are also leveraged in the concept of integration of our different segments.

We expect our midstream segment (or “transportation and logistics segment”) to continue being an important cash generator. In order to do so, the Business Plan calls for, among others, the segment to focus on improving efficiencies and synergies in our transportation system and pursuing investment opportunities in product pipelines given the increase in demand for fuels in Colombia. The Business Plan is currently projecting that our transport systems will be a reference for national gas prices.move between 1.10-1.25 million barrels of oil and products per day during the period.

In our downstream segment (or “refining, petrochemicals, and biofuels segment”), the Business Plan focuses on the use and optimization of current infrastructure in order to achieve an expected refining throughput between 370-400 mbpd and an expected refining margin between US$12-15/bl, subject to market conditions. We expect to achieve this (i) through the incorporation of synergies between the Barrancabermeja and Cartagena refineries and (ii) by capturing market opportunities associated with the implementation of the International Convention for the Prevention of Pollution from Ships (Marpol), which favors the use of fuels with lower sulfur content in maritime transport. Additionally, as we did in 2018, we expect to continue delivering low sulfur diesel of 20 parts per million (ppm) and gasoline of 100 ppm versus the Colombian regulation of 50 ppm and 300 ppm, respectively.

The low oil price environment present atFollowing the end of 2015 and the beginning of 2016 led to a revisionimplementation of our business plan 2015-2020, originally launchedtransformation program in May 2015, with a price scenario ofwe have accumulated approximately US$80 per barrel.3.3 billion in efficiencies to date. Our new 2017-2020 business planBusiness Plan is focused on value generation, profitabilitycontinuing this trend. We expect to capture savings of approximately US$1.45-2.0 billion between 2019 and financial sustainability under a price scenario of US$50 per barrel,2021, particularly: (i) capital expenditure efficiencies, (ii) revenue and allows for considerable upsides in case of potential price increases. For example, if prices were to increase to an average price of US$70 per barrel, production by 2020 could reach 830 thousand barrels equivalent per day, or 16% over the current production.margin optimization and (iii) operating expenditure efficiencies.

The three pillarsIn terms of sustainability, the Business Plan calls for integral water management, the protection of biodiversity and a continued focus on climate change, among others, all within the framework of the plan are: (i) cash flow focusUnited Nations Sustainable Development Goals 2030. We expect to invest approximately COP$2 trillion in socio-environmental projects between 2019 and cost efficiency, (ii) strict capital discipline2021. We are also seeking to reduce our energy costs by US $100 million by 2021 and (iii) profitable reserves and production growth.increase our investments in renewable energy sources through the incorporation of 60 MW of renewable photovoltaic energy to our energy matrix, which already has 43 MW of biomass generation.

Cash flow focus and cost efficiency: In 2015, we launchedWe currently expect the 2015-2020 Transformation Program (the “Transformation Program”) with a goal of increasing our efficiency and decreasing cost. The Transformation Program has allowed usBusiness Plan to decrease structural costs by US$1.5 billion compared to 2014. Such reduction has been accomplished due to the implementation of initiatives through our different business segments and corporate areas. The new business plan entails a second phase of the Transformation Program, with activities aimed to achieve excellence in project planning and execution as well as in our production, transportation, refining and marketing operations.

Capital discipline: We have preserved a rigorous level of capital discipline through the adjustment of investments and the adoption of strict controls to ensure that projects are delivered efficiently and within the expected time frame and budget. The plan calls forrequire investments of between US$12-15 billion during the 2019-2021 period, of which approximately US$13 billion between 2017 and 2020. By 2020, approximately 90% of this investment will82% would be allocated to the development of explorationupstream segment, 8% to the midstream segment, 7% to the downstream segment and production projects, while3% to other. These investments in transportation and refining will seek to improve operational integrity and reliability.exclude inorganic growth opportunities, which if materialized, could be financed through cash from operations.

As partThe Business Plan seeks to maintain leverage metrics to help us preserve our investment grade rating while allowing flexibility for specific optimizations of our capital discipline, Ecopetrol is currently engaged instructure during the divestment of non-strategic assets and the sale of minor fields, and has also defined a dividend policy as described inSection 6.2 Dividend Policy.period.

Profitable growth in production and exploration: One of the pillars of the revised business plan is the view that a strong production portfolio and a greater exploratory success will bring about profitable growth. Under a price scenario of US$50 per barrel, production should average 760 thousand barrels of oil equivalent per day by 2020, an approximately 6% growth from 2016. Approximately 94% of this production will come from the current producing assets.2.1.22019 Investment Plan

In exploration,November 2018, the plan estimates the incorporation of approximately 1,000 million barrels of contingent resources. In respect of adding reserves, we highlight the results of the exploratory campaigns in the Colombian Caribbean offshore and the Gulf of Mexico in the United States. During the period 2017 – 2020, Ecopetrol expects to add 600 million barrels of proven reserves from current fields and exploration.

Consistent with the business plan update, in November 2016, the board of directors of Ecopetrol (“Board of Directors”)Directors approved abetween US$3.5 and US$4.0 billion for the 2019 investment plan for 2017.plan. The Ecopetrol Group will continueplans to produce an average of about 715between 720 and 730 thousand barrels of oil equivalent per day during 2017. This production level lays the foundation for Ecopetrol’s expected increase in production by 2020.

Most of the investment will be in exploration and production. In refining, petrochemicals and biofuels, and transportation and logistics, investments will be made to comply with integrity and operational requirements as well as project completion.2019. The table below sets forth the details of the investment plan per business segment.

Table 3 – 20172019 Investment Plan

| Business Segment | Millions of US$(1) | % Percentage | ||||||

| Exploration | 650 | 18.6 | % | |||||

| Production | 2,200 | 62.9 | % | |||||

| Transportation and Logistics | 265 | 7.6 | % | |||||

| Refining, Petrochemicals, and Biofuels | 360 | 10.3 | % | |||||

| Others | 25 | 0.6 | % | |||||

| TOTAL | 3,500 | 100 | % | |||||

| Business Segment | Millions of US$(1) | %Percentage(2) | ||||||

| Exploration | 430-490 | 12 | % | |||||

| Production | 2,385-2,725 | 68 | % | |||||

| Midstream | 240-275 | 7 | % | |||||

| Downstream | 365-420 | 11 | % | |||||

| Others | 80-90 | 2 | % | |||||

| TOTAL | 3,500-4,000 | 100 | % | |||||

| (1) | Rounded figures. |

| Percentage over the upper range |

Exploration

In the exploration segment, US$650430-US$490 million will behas been allocated mainly to the evaluation and appraisal of discoveries and ongoing exploration effortsactivity of Ecopetrol S.A. (approximately US$460 million)44%), Hocol S.A. (“Hocol”) (approximately US$114 million)12%), Ecopetrol America Inc. (approximately US$11 million)1%), ECP Hidrocarburos Mexico (approximately 7%), Ecopetrol Costa Afuera (approximately US$44 million)3%) and Ecopetrol Brazil (approximately US$21 million)33%).

| 6 |

Production

In the production segment, US$1,9772,385-US$2,725 million will behas been allocated mainly to the execution of development and incremental production projects in theof Ecopetrol S.A. (approximately 91%) primarily at Castilla, Rubiales, Yarigui-Cantagallo,Chichimene, Apiay-Suria, Yariguí-Cantagallo, La Cira - Infantas, Tibú,Cira-Infantas, Casabe, Piedemonte Chichimene, Quifa, Provincia and Cusiana-Cupiagua fields (approximately US$1,147 million).Quifa. We have also allocated funds for our affiliates and subsidiaries as follows: US$64 millionapproximately 3% for the development, operation and maintenance of fields of Ecopetrol America Inc. in the U.S. Gulf of Mexico, US$88 millionapproximately 5% to Hocol, US$63 millionapproximately 1% to Equion and US$8 million to Savia.

Transportation and logisticsMidstream

In the transportation and logisticsmidstream segment, US$138240-US$275 million will behas been allocated to investments focused on the completion of projects such as San Fernando-Monterreysystem and transportation of heavy crude oils as well as crude oil dilution projects.operational integrity. The segment is seeking a higher efficiency in operations and maintenance practices.

Refining, petrochemicals, and biofuelsDownstream

In the refining, petrochemicals, and biofuelsdownstream segment, US$105365-US$420 million will behas been principally allocated to Reficar, US$150 million to programs to improve operations at the Barrancabermeja Refineryrefinery and Reficar through initiatives aimed to increaseat increasing revenues, improveenhancing integrity management, improving efficiency and reducereducing operational costs and US$82 million to Bioenergy.costs. The segment is seeking a higher efficiency in operations and maintenance practices. It is importantpractices in order to highlight thatmaximize the Barrancabermeja Refinery modernization plan will continue to be delayed untilvalue of the oil price environment allows investments to be made in such a major project. The mode of execution will be defined in this context, after analyzing alternatives which include a modular option in time and investment.existing assets.

| 3. | Business Overview |

We were formed in 1951 by the Colombian government asEmpresa Colombiana de Petróleos and began operating the crude oil fields at La Cira-Infantas, the oldest Colombian oil field, whosewhere production started in 1918, and the pipeline that connected that field with the Barrancabermeja Refineryrefinery and the port of Cartagena. In 1961, we assumed the direct operation of the Barrancabermeja Refineryrefinery and continued its transformation into an industrial complex. In 1974, we acquired the Cartagena Refinery (as defined below), which had been in operation since 1957. Pursuant to Decree 0062 of 1970, we were transformed into a governmental, industrial and commercial company.

In 2003 pursuant to Decree Law 1760, theAgencia Nacional de Hidrocarburos - National Hydrocarbons Agency (the “ANH”) was created and Ecopetrol´sEcopetrol’s public role as administrator and regulator of the national hydrocarbons resources was transferred to the ANH. Ecopetrol modified its organic structure and became Ecopetrol S.A., a public stock-holding corporation, one hundred percent state-owned, and continued the development of exploration and production activities in a competitive basis with autonomy over our business decisions. Since 2006, according to Law 1118, we have been evolving from a wholly state-owned entity to a mixed-economy company with private capital. This process has resulted in a substantial change in the legal framework to which we are subject and in the nature of our relationship with the Nation. Nation, as our controlling shareholder. As of March 23, 2018, pursuant to our amended bylaws, the duration of the Company is 100 years.

We carried out our initial public offering in November 2007, when our common shares becamewere listed on the Colombian Stock Exchange. Our American Depository Shares (“ADSs”) were listed on the New York Stock Exchange in 2008. Starting in August 2010, our ADSs began trading on the Toronto Stock Exchange (“TSX”) under the symbol “ECP.” On February 17, 2016, we announced our application for voluntary delisting from the TSX. On March 2,25, 2016, our ADR´sADR’s were officially delisted from the TSX. On December 7, 2017, we applied to the Alberta Securities Commission and the Ontario Securities Commission to cease our reporting requirements, due to our delisting process. On September 4, 2018, we announced that effective August 29, 2018, we had ceased to be a reporting issuer in each of the provinces of Alberta and Ontario and hence were no longer a reporting issuer in any jurisdiction in Canada. Accordingly, Ecopetrol no longer has any continuous disclosure obligations in Canada.

We operate in the following business segments: i) Exploration and Production; ii) Transportation and Logistics; and iii) Refining, Petrochemicals, and Biofuels.

Our subsidiaries, Refinería de Cartagena (Reficar)S.A. (“Reficar” or “Cartagena Refinery”), Cenit Transporte y Logistica de Hidrocarburos S.A.S. (Cenit) and OcensaOleoducto Central S.A. (Ocensa) are significant subsidiaries, as such term is defined under SEC Regulation S-X.

We have a number of directly and indirectly held subsidiaries both in Colombia and abroad. Our subsidiaries are either directly owned by us or indirectly owned by us through one or more of our other subsidiaries. As of MarchDecember 31, 2017,2018, we have eightseven directly owned and 2029 indirectly owned subsidiaries.

During 2016,2018, the following changes were made to the Ecopetrol Group’s structure:

| In |

Exhibit 8.1 to this annual report identifies our principal operating subsidiaries, their respective countries of incorporation, and our percentage ownership in each (both directly and indirectly through other subsidiaries), in each case as of March 31, 2017.

Graph 2 – Ecopetrol Corporate Structure

The stock ownership percentage listed refers to Ecopetrol S.A.’s direct and indirect participation. The data in this structure shows neither the whole ownership nor its decimal figures, so they will be used only for information purposes.

The so-called shareholding (Ecopetrol S.A.’s direct participation), affiliated, subsidiary companies are listed, as well as the stock interest of Ecopetrol S.A.’s subordinate companies.

We areIn 2017, Ecopetrol completed the divestment of its stake in Empresa de Energía de Bogotá S.A. E.S.P. EEB for a total of COP$1,124 billion. The operation was carried out in accordance with the processprocedures defined by the Law 226 of selling some1995, the Decree 2305 of our non-core shareholdings:November 13, 2014, and the Decree 2110 of December 22, 2016.

| 8 |

We currently own 100% of the total outstanding shares of Esenttia. In connection with the review of its long-term strategy, the Board of Directors decided to suspend the 2016 plan to sell Ecopetrol’s shares in Esenttia.

Exhibit 8.1 to this annual report identifies our principal operating subsidiaries, their respective countries of incorporation, and our percentage ownership in each (both directly and indirectly through other subsidiaries).

We are a vertically integrated oil company with a presence primarily in Colombia and with activities in Peru, Brazil, Mexico and the U.S. Gulf Coast. The Nation currently controls 88.49% of our voting capital stock. We are among the top 36 oil and gasworld’s biggest state-owned companies, in the worldranking 300 based on the Petroleum Intelligence Weekly Top 50Forbes Global 2000 Ranking - 2016.2018. We play a key role in the local Colombian hydrocarbon market.

Our exploration and production business segment includes exploration, development and production activities in Colombia and abroad. We began local exploration in 1955 and international exploration in 2006. We conduct explorationExploration and production activities are conducted directly inby Ecopetrol S.A., and through some of our subsidiaries, andas well as through joint ventures with third parties. As of December 31, 2016,2018, we were the largest operator and the largest producer of crude oil and natural gas in Colombia, maintaining the largest acreage exploration position in Colombia.

Ecopetrol is planning to incorporate about 1 billion barrels of contingent resources by 2020, through exploration activities in the following areas: (i) offshore Colombia, (ii) near field exploration in Colombia, (iii) consolidation of exploration areas outside of Colombia, such as the Gulf of Mexico, Brazil and other areas in America.

During 2016 our exploration activities focused in three work fronts: onshore Colombia, Colombia and the US Gulf of Mexico offshore and near field exploration in Colombia.

On January15, 2016 Hocol Petroleum Limited - HPL, subsidiary of Ecopetrol S.A. and owned 100% by Ecopetrol, constituted and registered before the Chamber of Commerce in Colombia the company Ecopetrol Offshore (“Ecopetrol Costa Afuera”or “ECAS”). ECAS and Hocol S.A. are subsidiaries of HPL.

ECAS´ purpose is to develop oil and gas activities in offshore Colombia by taking advantage of offshore free trade zones regime. These activities include exploration, exploitation, production, transport, distribution, export, sales and commercialization of oil and gas and any other hydrocarbon products or derivatives.

During 2016 bidding rounds were not launched by the National Hydrocarbons Agency to offer licenses for exploratory activities in Colombia.

Ecopetrol signed farmout agreements with the following companies: Parex Resouces Colombia Ltd (acquired 50% of the working interest in Convenio Playón and 50% of the working interest in Convenio de Mares), Talisman Colombia Oil & Gas Ltd (acquired 49% of the working interest in Convenio Upar) and Hupecol Operating Co LLC (acquired 100% of the working interest in CPO-11 E&P Contract).

Additionally, Ecopetrol carried out its Onshore Round 1-2016 offering working interest in the onshore blocks LLA-38, LLA-39, LLA-52, PUT 13 and VMM-32 located in Colombia.

For purposes of this exploration section, “we” refers to Ecopetrol S.A., its subsidiaries and partnerships in which Ecopetrol has an interest. Unless otherwise stated, all figures are given before deductions fordeducting royalties.

Currently we haveUnder the framework of the Business Plan, Ecopetrol is aiming to incorporate contingent resources in high reward projects concentrated in: (i) near field exploratory activity, (ii) underexplored basins, such as Putumayo and Piedemonte, (iii) offshore Colombia, and (iv) international areas such as Brazil, the U.S. Gulf of Mexico and Mexico.

Graph 3- Sedimentary Basins where Ecopetrol executes exploration activities in most of the sedimentary basins in Colombia, in which active oil and gas operations are found.

| 9 |

The following map showsDuring 2018, the basins where Ecopetrol has been conducting its main exploration activities.strategy was directed at leveraging our goal on three working fronts: onshore Colombia, offshore Caribbean, and strengthening and diversifying our exploration overseas.

Graph 3 – Sedimentary Basins3.4.1.1Exploration Activities in Colombia

Source: ANH

We conduct exploration activities in Colombia on our own and through joint ventures with regional and global oil and gas companies.

Seismic

During 2016, two 2D seismic programs were acquired in Colombia: Cardon (106.5 Km) and Nogal (44 Km).These seismic programs are intended to increase the knowledge of the Caguan-Putumayo basin.

Additionally, our subsidiary Hocol S.A. successfully completed the acquisition of 294.9 km2 of 3D seismic in the exploratory blocks GUA2 (213.5 km2) and YDSN1 (81.4 km2) in Middle Magdalena Basin and Llanos Basin, respectively.

Exploratory Wells

During 2016, onshore drilling operations were started in five wells by2018, Ecopetrol and its subsidiary Hocol S.A. in the Lower Magdalena Basin and Llanos Basin. Additionally Hocol finalizedsubsidiaries conducted drilling operations in twelve exploration wells (A3/A2) and in five appraisal wells (A1) in Colombia. Of these seventeen wells, six were successful, seven were plugged and abandoned, and four were under evaluation as of December 31, 2018. This activity was concentrated mainly in the Payero well (Piedemontefollowing basins: Eastern Plains (Llanos Orientales), Lower Magdalena Valley, Middle Magdalena Valley and foothills.

In terms of onshore Colombia, our exploration efforts were focused on searching for hydrocarbons in mature basins, near-field exploration and areas close to existing production infrastructure.

In offshore activities, we increased our participation from 50% to 100% in theFuerte Sur and Purple Angel blocks (Sinu offshore basin), which started in December 2015 and was operatedwere relinquished by Equion.Anadarko Petroleum Corporation. In termsthe case of the block Col-5 (Sinu offshore Colombia, drilling operations started atbasin), the Purple-Angel 1 well (followingANH approved the discovery announced at the Kronos-1 well in July 2015) and at the Gorgon-1 prospect. Our joint venture partner Anadarko operates both wells. On March 8, 2017, we announced the discoveryconversion of a gas presence at Purple-Angel 1.Technical Evaluation Agreement (as defined below) to an Exploration and Production Contract (as defined below), where we have a 100% participation.

The following table sets forth, for the periods indicated, the number of gross and net productive and dry exploratory wells drilled by us and our joint venture partners, and the exploratory wells drilled by third parties pursuant to sole risk contracts with us.

Table 4 – Exploratory Drilling in Colombia

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2018 | 2017 | 2016 | |||||||||||||||||||

| (number of wells) | (number of wells) | |||||||||||||||||||||||

| COLOMBIA | ||||||||||||||||||||||||

| Ecopetrol S.A. | ||||||||||||||||||||||||

| Gross Exploratory Wells | ||||||||||||||||||||||||

| Owned and operated by Ecopetrol | ||||||||||||||||||||||||

| Productive(1) | – | – | 3.0 | |||||||||||||||||||||

| Productive | – | – | – | |||||||||||||||||||||

| Dry | 1.0 | 1.0 | 9.0 | – | 1.0 | 1.0 | ||||||||||||||||||

| Total | 1.0 | 1.0 | 12.0 | – | 1.0 | 1.0 | ||||||||||||||||||

| Operated by Partner in Joint Venture | ||||||||||||||||||||||||

| Productive | – | 1.0 | 1.0 | 5.0 | 3.0 | – | ||||||||||||||||||

| Dry | – | 1.0 | 2.0 | 1.0 | 2.0 | – | ||||||||||||||||||

| Total | – | 2.0 | 3.0 | 6.0 | 5.0 | – | ||||||||||||||||||

| Operated by Ecopetrol in Joint Venture | ||||||||||||||||||||||||

| Productive | – | – | 1.0 | – | – | – | ||||||||||||||||||

| Dry | – | – | – | – | 1.0 | – | ||||||||||||||||||

| Total | – | – | 1.0 | – | 1.0 | – | ||||||||||||||||||

| Net Exploratory Wells | ||||||||||||||||||||||||

| Productive | – | 0.5 | 4.1 | 1.9 | 1.5 | – | ||||||||||||||||||

| Dry | 1.0 | 1.5 | 10.7 | 0.3 | 2.3 | 1.0 | ||||||||||||||||||

| Total | 1.0 | 2.0 | 14.8 | 2.2 | 3.8 | 1.0 | ||||||||||||||||||

| Sole Risk | ||||||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | – | 2.0 | – | – | ||||||||||||||||||

| Total | – | – | – | 2.0 | – | – | ||||||||||||||||||

| Equion | ||||||||||||||||||||||||

| ECAS | ||||||||||||||||||||||||

| Gross Exploratory Wells | ||||||||||||||||||||||||

| Productive | – | – | – | |||||||||||||||||||||

| Dry | – | – | – | |||||||||||||||||||||

| Total | – | – | – | |||||||||||||||||||||

| Hocol | ||||||||||||||||||||||||

| Gross Exploratory Wells | ||||||||||||||||||||||||

| Productive | 1.0 | 1.0 | – | |||||||||||||||||||||

| Dry | – | – | 4.0 | |||||||||||||||||||||

| Total | 1.0 | 1.0 | 4.0 | |||||||||||||||||||||

| Net Exploratory Wells | ||||||||||||||||||||||||

| Productive | 0.5 | 0.5 | – | |||||||||||||||||||||

| Dry | – | – | 3.0 | |||||||||||||||||||||

| Total | 0.5 | 0.5 | 3.0 | |||||||||||||||||||||

| 10 |

| For the year ended December 31, | ||||||||||||

| 2018 | 2017 | 2016 | ||||||||||

| (number of wells) | ||||||||||||

| Productive | – | – | – | |||||||||

| Dry | – | 1.0 | – | |||||||||

| Total | – | 1.0 | – | |||||||||

| Net Exploratory Wells(2) | ||||||||||||

| Productive | – | – | – | |||||||||

| Dry | – | 0.5 | – | |||||||||

| Total | – | 0.5 | – | |||||||||

| Equion | ||||||||||||

| Gross Exploratory Wells | ||||||||||||

| Productive | – | – | – | |||||||||

| Dry | – | – | – | |||||||||

| Total | – | – | – | |||||||||

| Hocol | ||||||||||||

| Gross Exploratory Wells | ||||||||||||

| Productive | 1.0 | – | 1.0 | |||||||||

| Dry | 4.0 | 1.0 | – | |||||||||

| Total | 5.0 | 1.0 | 1.0 | |||||||||

| Net Exploratory Wells(2) | ||||||||||||

| Productive | 1.0 | – | 0.5 | |||||||||

| Dry | 3.2 | 1.0 | – | |||||||||

| Total | 4.2 | 1.0 | 0.5 | |||||||||

| A dry well or hole is an exploratory well found to be incapable of producing either crude oil or natural gas in sufficient quantities to justify completion as a crude oil or natural gas well. |

| (2) | Net exploratory wells |

Ecopetrol drilled six successful wells in Colombia in 2018: (i) Jaspe 6D, where Ecopetrol holds a 30% working interest, and Frontera as the operator holds the remaining 70% at the Quifa block, (ii) Andina-1, where Ecopetrol holds a 50% working interest, and Parex Resources as the operator holds the remaining 50% at the Capachos block, (iii) Rex NE-02 ST-1, where Ecopetrol holds a 30% working interest, and Occidental Petroleum Corporation as the operator holds the remaining 70% at the Cosecha block, (iv) Andina-2, where Ecopetrol holds a 50% working interest, and Parex Resources as the operator holds the remaining 50% at the Capachos block, (v) Cosecha C-01, where Ecopetrol holds a 30% working interest, and Occidental Petroleum Corporation as the operator holds the remaining 70% at the Cosecha block and (vi) Arrecife-1, where our subsidiary Hocol owns a 100% working interest in the VIM-8 block.

Seven wells located in the Eastern plains (Llanos Orientales) and foothills were plugged and abandoned as follows: (i) Payero E-1 ST-1, where Ecopetrol holds a 20% working interest through our subsidiary Hocol, Repsol a 30% working interest and Total a 50% working interest, with Equion as operator in the Niscota block, (ii) Ocelote 500, operated by our subsidiary Hocol who holds a 100% working interest in the Guarrojo block, (iii) Ocelote 510, operated by our subsidiary Hocol who holds a 100% working interest in the Guarrojo block, (iv) Ocelote 520, operated by our subsidiary Hocol who holds a 100% working interest in the Guarrojo block, (v) Jaspe-7D, where Ecopetrol holds a 30% working interest and Frontera Energy Group as the operator holds a 70% working interest in the Quifa block, (vi) the Chipiron Far North-01 sole risk contract from Occidental Petroleum Corporation in the Chipiron block, (vii) the Pulpo-1 sole risk contract from Occidental Petroleum Corporation in the Rondon block.

In addition, four appraisal wells were drilled as of December 31, 2018, and are currently under evaluation: (i) Cira-7000 located at La Cira Infantas block, operated by Occidental Petroleum Corporation, which holds a 52% working interest in partnership with Ecopetrol, holding the remaining 48% working interest, (ii) Capachos Sur-2 located at the Capachos Block, operated by Parex Resources, which holds a 50% working interest in partnership with Ecopetrol, holding the remaining 50%, (iii) Coyote-2 located at the Mares Block, operated by Parex Resources, which holds a 50% working interest in partnership with Ecopetrol, holding the remaining 50% and (iv) Bufalo-1 located at VMM-32 block, operated by us, where we hold a 51% working interest in partnership with CPVEN, which holds the remaining 49%.

| 11 |

Ecopetrol drilled two wells in 2016: (i) Chimú-1 St-1 well, where Ecopetrol holds a 100% working interest at Caño Sur Block, which was a dry well, and (ii) Boranda well, in which Ecopetrol holds a 50% working interest and Parex holds the remaining 50% working interest, as block operator. As of March 30, 2017 we announced that the presence of crude was discovered at this well.Seismic

OurIn Colombia our subsidiary Hocol S.A. drilled three wellsacquired a total of 337 km of 2D in 2016: (i) Payero E1 well, located at Niscota Blockthe SN 15 block and operated by Equión. Total holds a 50% working interest, Repsol holds a 30% working interest and Hocol S.A. holds a 20% working interest, this well was declared temporarily suspended; (ii) Bullerengue Sur-1 well, located at SSJN1 Block. Hocol S.A. holds a 50% working interest and Lewis Energy holdsthrough our joint venture partner, Ismocol-Joshi-Parko, 60 km2 of 3D were acquired over the remaining 50%, this one is a productive well, and (iii) Pegaso well, located at CPO 16 Block where Hocol S.A. holds a 100% working interest, this well was under evaluation as of December 31, 2016.Palagua-Caipal field.

Furthermore, Ecopetrol purchased three additional 3D seismic surveys for a total of 292.5 km2 in the Putumayo basin to improve the subsurface coverage and imaging of the basin.

3.4.1.2Exploration Activities Outside Colombia

Our international exploration strategy is focused onaims to expand and renew our exploration portfolio in basins with remaining long term potential, diversify our risks and improve the possibilities of increasing our crude oil and natural gas reserves. Key aspects of this strategy might include participating in bidding rounds to secure blocks available for exploration and entering into joint ventures with international and regional oil companies. We believe exploring outside Colombia allows us to diversify our riskscompanies that bring operational experience and improvetechnology into the possibilities of increasing our crude oil and natural gas reserves.consortium.

In partnership with BP and CNOOC, Ecopetrol was awarded the block Pau-Brazil in the Santos Basin in Brazil during the Pre-Salt 5th bidding round, organized by the National Agency of Petroleum, Natural Gas and Biofuels (ANP). Moreover, Ecopetrol is awaiting approval from the ANP to access a 10% working interest in offshore block Saturno, also located in the Santos basin, which is operated by Shell (who holds a 45% working interest) in partnership with Chevron (who holds the remaining 45% working interest). With respectthe participation in these two deep water blocks, Ecopetrol has managed to obtain a position in the pre-salt play in Brazil. In order to advance our seismic data outsideprevious commitments in Brazil, we will continue with regional studies in the Ceará, Potiguar and Sergipe Blocks.

As part of Colombia, during 2016,the committed exploration plan in our current assets of the Equatorial Margin (CE-M-715 in the Ceará Basin, POT-M-567 in Potiguar and FZA-M-320 in Foz do Amazonas), both geology and geophysics work and technical maturation activities were carried out to help obtain a deeper understanding of the prospective potential in these provinces.

Additionally our subsidiary, Ecopetrol Brasil bought 854 Km2America Inc., was awarded the Green Canyon 404, 405, 448 and 492 blocks in the Gulf of seismic data on the Potiguar basin, POT-M-567, in which Ecopetrol Brasil holds a 100% working interest.Mexico during Lease Sale 251.

WithWe secured the approval of the National Hydrocarbons Commission (CNH) for the exploration plan through our partnership with PEMEX in respect of block 8 (October) and Petronas-block 6 (November). The exploration plan for block 6 considers purchasing seismic, geological and geophysical analysis, seismic interpretation and drilling of the first exploration well in Mexico in 2020 and the exploration plan for block 8 considers seismic licensing, processing and the interpretation required to ouridentify the potential prospects in the block.

During the course of 2018, Ecopetrol and its partners did not carry out any exploratory drilling outside of Colombia, during 2016, we have undertaken deep water exploratory drilling in the U.S. Gulf Coast in association with our business partners. The following table sets forth information on our exploratory drilling in the years 2016, 2015 and 2014.Colombia.

| 12 |

The following table sets forth information on our exploratory drilling for the periods indicated.

Table 5 – Exploratory Drilling Outside Colombia

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2018 | 2017 | 2016 | |||||||||||||||||||

| (number of wells) | (number of wells) | |||||||||||||||||||||||

| INTERNATIONAL | ||||||||||||||||||||||||

| Ecopetrol America Inc. | ||||||||||||||||||||||||

| Gross Exploratory Wells | ||||||||||||||||||||||||

| Productive | 1.0 | – | 2.0 | – | – | 1.0 | ||||||||||||||||||

| Dry | – | 1.0 | 3.0 | – | 2.0 | – | ||||||||||||||||||

| Total | 1.0 | 1.0 | 5.0 | – | 2.0 | 1.0 | ||||||||||||||||||

| Net Exploratory Wells | ||||||||||||||||||||||||

| Productive | 0.2 | – | 0.7 | – | – | 0.2 | ||||||||||||||||||

| Dry | – | 0.5 | 0.5 | – | 0.6 | – | ||||||||||||||||||

| Total | 0.2 | 0.5 | 1.2 | – | 0.6 | 0.2 | ||||||||||||||||||

| Ecopetrol Óleo e Gás do Brasil Ltda. | ||||||||||||||||||||||||

| Gross Exploratory Wells | – | – | – | |||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | – | – | – | – | ||||||||||||||||||

| Total | – | – | – | – | – | – | ||||||||||||||||||

| Net Exploratory Wells | ||||||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | – | – | – | – | ||||||||||||||||||

| Total | – | – | – | – | – | – | ||||||||||||||||||

| Ecopetrol Germany | ||||||||||||||||||||||||

| Gross Exploratory Wells | – | – | – | |||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | 2.0 | – | – | – | ||||||||||||||||||

| Total | – | – | 2.0 | – | – | – | ||||||||||||||||||

| Net Exploratory Wells | ||||||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | 0.2 | – | – | – | ||||||||||||||||||

| Total | – | – | 0.2 | – | – | – | ||||||||||||||||||

| Savia Perú | ||||||||||||||||||||||||

| Gross Exploratory Wells | – | – | – | |||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | – | – | – | – | ||||||||||||||||||

| Total | – | – | – | – | – | – | ||||||||||||||||||

| Net Exploratory Wells | ||||||||||||||||||||||||

| Productive | – | – | – | – | – | – | ||||||||||||||||||

| Dry | – | – | – | – | – | – | ||||||||||||||||||

| Total | – | – | – | – | – | – | ||||||||||||||||||

| A dry well or hole is an exploratory well found to be incapable of producing either crude oil or natural gas in sufficient quantities to justify completion as a crude oil or natural gas well. |

| (2) | Net exploratory wells are calculated according to our percentage of ownership in these wells. |

| (3) | None of our international wells were |

As set forthSeismic

Our subsidiary, Ecopetrol Brazil, purchased 874 km of 2D (spectrum survey) and 5,441 km2 3D (CGG and PGS) to evaluate the structures of Saturno, Titan and Ferradura (Round 15), as well as the blocks Uirapuru (Round 4) and Pau Brazil (Round 5), all of them located in the table above, in 2016, our subsidiary Ecopetrol America Inc. drilled inpre-salt play over the United States Gulf of Mexico the Warrior exploratory well, in which Ecopetrol America Inc. holds a 20% working interestSantos and our partners Anadarko (operator) holds a 65% working interest and MCX Gulf of Mexico LLC holds the remaining 15% working interest. The well was declared productive. This oil discovery is the result of our new exploratory strategy, which includes partnerships with leading companies to diversify risk, undertake further exploration activities and increase contingent resources. The Warrior well is the fifth oil discovery of the Ecopetrol Group in this prosperous oil region and contributes with increasing our contingent resources.Campos basins.

Ecopetrol AmericaHidrocarburos Mexico Inc. also drilledprocured a successful appraisal well in Leon discovery (León large 60,076 km 2D seismic survey and 11,009 km2 BP4) of 3D seismic data (surveys: Campeche Sur, Campeche Somero and Tabasco), operated by Repsol, which holds a 60% working interest. Ecopetrol America Inc. holdsto evaluate the remaining 40% working interest.The result of this well adds contingent resources to those initially discovered with the León 1 exploratory well in 2014.

During 2016, Ecopetrol S.A. did not participate in bidding roundsSalina basin in the Gulf of Mexico.

With regards to ECP Oil and Gas Germany GmbH´s operations in Angola, we reached an agreement with our partners on the terms upon which we will withdraw from Block 38/11 and Block 39/11. This agreement was sent for approval of the National Concessionaire, Sonangol EP, followed by the issuance of a decree from the Ministry of Petroleum. We expect the withdrawal process to be concluded by mid-year of 2017.

Our consolidated average production was 717.9 thousand boepd in 2016, a decrease of approximately 43 thousand boepd as compared to 2015. This decrease is mainly the result of the natural production decline of our fields and a reduction in the upstream investments during 2016, as a consequence of the drop in oil prices.

| 13 |

Our consolidated average production was 720.4 thousand boepd in 2018, an increase of approximately 5 thousand boepd as compared to 2017. This increase is mainly the result of an increase in upstream investments during 2018.

The following table summarizes the results of our oil and gas production activities for the periods indicated:

Table 6 – Ecopetrol Group’s Oil and Gas Production

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2018 | 2017 | 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oil | Gas(1) | Total | Oil | Gas(1) | Total | Oil | Gas(1) | Total | Oil | Gas(1) | Total | Oil | Gas(1) | Total | Oil | Gas(1) | Total | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (thousand boepd) | (thousand boepd) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total production in Colombia(2) | 582.5 | 123.3 | 705.8 | 619.2 | 130.4 | 749.6 | 610.9 | 133.3 | 744.2 | 578.4 | 125 | 703.4 | 577.3 | 121.6 | 698.9 | 582.5 | 123.3 | 705.8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total International production(3) | 9.6 | 2.5 | 12.1 | 7.3 | 3.8 | 11.1 | 8.6 | 2.6 | 11.2 | 14.1 | 2.9 | 17.0 | 13.6 | 2.6 | 16.2 | 9.6 | 2.5 | 12.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total production of Ecopetrol Group | 592.1 | 125.8 | 717.9 | 626.5 | 134.2 | 760.7 | 619.5 | 135.9 | 755.4 | 592.5 | 127.9 | 720.4 | 590.9 | 124.2 | 715.1 | 592.1 | 125.8 | 717.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) | Conversion between mcfpd and boepd is performed at 5,700 mcfpd to 1 boepd. |

| (2) | Total production in Colombia corresponds to Ecopetrol S.A., Hocol and Equion. |

| (3) | Total International production corresponds to Savia Perú and Ecopetrol America Inc. |

3.4.2.1 Production Activities in Colombia

3.4.2.1.1Ecopetrol S.A.’s Production Activities in Colombia

For the year ended December 31, 2016,2018, Ecopetrol S.A. was the largest participant in the Colombian hydrocarbons industry, accounting for approximately 62%63% of crude oil production (according to calculations made by Ecopetrol based on information from the Ministry of Mines and Energy) and approximately 61%66% of natural gas production (according to calculations made by Ecopetrol based on information from the Ministry of Mines and Energy). Also during 2016,2018, Ecopetrol S.A. carried out development drilling mainly in the OrienteEastern and Orinoquia regions, drilling 133528 development wells; 83wells (226 of those through direct operations and 50302 through joint ventures.ventures).

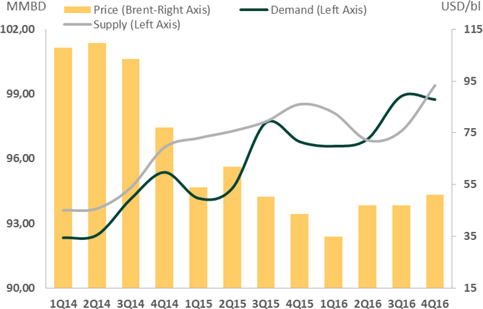

In terms of operational structure, Ecopetrol S.A. manages its production operations through a regional organization. Since July 1, 2014, three regional Vice-Presidencies were created: Central, Orinoquia and Southern. After the company took over the operations of the Rubiales field in July of 2016, a new Vice-Presidency, the Eastern Region, was incorporated to this scheme. Our operating assets are distributed in the following regions:

| · | Central Region: comprising |

| · | Orinoquía Region: comprising |

| · | Southern Region: comprising |

| · | Eastern Region: comprising |

A fifth Vice-Presidency, the Vice-Presidency of Associated Operations, is responsible for all of the production activities in which a partner is involved, regardless of the location of such activities in Colombia. This Vice- Presidency is comprised of 137126 fields with active production in 2016.2018.

The map below indicatesshows the locations of Ecopetrol S.A´sS.A.’s operations with production information for each of our administrative regions followingdescribed in the subsequentfollowing paragraphs.

| 14 |

Graph 4 – Ecopetrol S.A. Operations in Colombia

Note: VAS is thea countrywide Vice-presidency.

Crude Oil Production

The average daily production of crude oil in Colombia by Ecopetrol S.A. (excluding its subsidiaries), was 552.1548.7 mbod in 2016, 34.12018, 3.7 mbod lowerhigher than in 2015,2017, which represents a year-to-year decreaseincrease of 6%0.7%.

However, it is important to highlight that since July of 2016 we took over the operations of the Rubiales and Cusiana fields. A plan was set up with more than two years in advance, which allowed us to successfully transition between operators, without technical, operational or communities’ issues in any of the two fields. In the case of the Rubiales field, it is important to highlight that we restarted investments in the asset with new development drilling during the last quarter of the year 2016, which helped us mitigate the production decline observed during 2015.

The following chart summarizes Ecopetrol S.A.’s average daily crude oil production in Colombia by Region, prior to deducting royalties, for the periods indicated.

| 15 |

Table 7 – Ecopetrol S.A.’s Average Daily Crude Oil Production in Colombia by Region Vice-Presidency

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2018 | 2017 | 2016 | |||||||||||||||||||

| (thousand bpd) | (thousand bpd) | |||||||||||||||||||||||

| Central Region | ||||||||||||||||||||||||

| 1) La Cira – Infantas | 19.1 | 22.9 | 24.6 | 28.1 | 22.6 | 19.1 | ||||||||||||||||||

| 2) Casabe | 17.8 | 21.9 | 22.0 | 13.9 | 15.9 | 17.8 | ||||||||||||||||||

| 3) Yarigui | 16.6 | 17.8 | 16.7 | 14.4 | 14.5 | 16.6 | ||||||||||||||||||

| 4) Other | 21.3 | 23.7 | 21.0 | 17.3 | 18.5 | 21.3 | ||||||||||||||||||

| Total Central Region | 74.8 | 86.3 | 84.3 | 73.7 | 71.5 | 74.8 | ||||||||||||||||||

| Orinoquía Region | ||||||||||||||||||||||||

| 1) Castilla | 121.3 | 122.5 | 104.4 | 113.9 | 114.1 | 121.3 | ||||||||||||||||||

| 2) Chichimene | 74.0 | 78.0 | 56.2 | 67.7 | 70.5 | 74.0 | ||||||||||||||||||

| 3) Cupiagua | 11.3 | 14.0 | 16.4 | 8.3 | 9.6 | 11.3 | ||||||||||||||||||

| 4) Other | 18.3 | 21.1 | 26.0 | 25.5 | 24.3 | 18.3 | ||||||||||||||||||

| Total Orinoquía Region | 224.9 | 235.6 | 203.0 | 215.4 | 218.5 | 224.9 | ||||||||||||||||||

| Eastern Region | ||||||||||||||||||||||||

| 1) Rubiales(1) | 61.5 | 0 | 0 | 119.5 | 118.7 | 61.5 | ||||||||||||||||||

| 2) Caño Sur(2) | 0.4 | 0 | 0 | 3.2 | 1.4 | 0.4 | ||||||||||||||||||

| Total Eastern Region | 61.9 | 0 | 0 | 122.7 | 120.1 | 61.9 | ||||||||||||||||||

| Southern Region | ||||||||||||||||||||||||

| 1) San Francisco | 6.5 | 8.1 | 9.2 | 6.0 | 6.2 | 6.5 | ||||||||||||||||||

| 2) Huila Area | 7.4 | 7.8 | 8.2 | |||||||||||||||||||||

| 2) Huila Area(3) | 3.5 | 3.1 | 7.4 | |||||||||||||||||||||

| 3) Tello | 4.4 | 4.5 | 4.3 | 3.6 | 3.9 | 4.4 | ||||||||||||||||||

| 4) Other | 9.4 | 11.0 | 11.8 | 11.7 | 12.2 | 9.4 | ||||||||||||||||||

| Total Southern Region | 27.7 | 31.4 | 33.5 | 24.8 | 25.4 | 27.7 | ||||||||||||||||||

| Associated Operations | ||||||||||||||||||||||||

| 1) Rubiales(1) | 41.4 | 94.3 | 104.3 | – | – | 41.4 | ||||||||||||||||||

| 2) Quifa | 19.6 | 24.2 | 33.0 | 21.2 | 18.8 | 19.6 | ||||||||||||||||||

| 3) Caño Limon | 23.3 | 25.6 | 30.0 | 25.3 | 22.2 | 23.3 | ||||||||||||||||||

| 4) Cusiana(3) | 2.6 | 5.2 | 7.0 | |||||||||||||||||||||

| 4) Cusiana(4) | – | – | 2.6 | |||||||||||||||||||||

| 5) Other | 75.9 | 83.6 | 84.6 | 65.6 | 68.5 | 75.9 | ||||||||||||||||||

| Total Associated Operations | 162.8 | 232.9 | 258.9 | 112.1 | 109.5 | 162.8 | ||||||||||||||||||

| Total average daily crude oil production Ecopetrol S.A. (Colombia) | 552.1 | 586.2 | 579.7 | 548.7 | 545.0 | 552.1 | ||||||||||||||||||

| (1) | In the first half of 2016, the Rubiales field was part of the Vice-Presidency of Associated Operations. Since July 1, 2016, it |

| (2) | In the first half of 2016, the Caño Sur field was part of the Orinoquia Region. Since July 1, 2016, it |

| (3) | Huila Area: some assets were reclassified and are reported under Other in the Southern Region. |

| (4) | In the first half of 2016, the Cusiana field was part of the Vice-Presidency of Associated Operations. Since July 3, 2016, it |

Table 8 – Ecopetrol S.A. Production per Type of Crude

| 2016 (mbod) | Year-on-Year ∆ (%) | 2015 (mbod) | Year-on-Year ∆ (%) | 2014 (mbod) | 2018 (mbod) | Year-on- Year ∆(%) | 2017 (mbod) | Year-on- Year ∆(%) | 2016 (mbod) | |||||||||||||||||||||||||||||||

| Light | 44.6 | (0.0 | )% | 44.6 | 0.2 | % | 44.5 | 40.7 | (4.0 | )% | 42.4 | (4.9 | )% | 44.6 | ||||||||||||||||||||||||||

| Medium | 161.5 | (13.7 | )% | 187.1 | (5.8 | )% | 198.6 | 154.4 | 1.8 | % | 151.6 | (6.1 | )% | 161.5 | ||||||||||||||||||||||||||

| Heavy | 346.0 | (2.4 | )% | 354.5 | 5.3 | % | 336.6 | 353.6 | 0.7 | % | 351.0 | 1.4 | % | 346.0 | ||||||||||||||||||||||||||

| Total | 552.1 | (5.8 | )% | 586.2 | 1.1 | % | 579.7 | 548.7 | 545.0 | 552.1 | ||||||||||||||||||||||||||||||

Ecopetrol S.A.’s crude oil production during 20162018 consisted of approximately 37%36% light and medium crudes and 63%64% heavy crudes. In 2015,2017, approximately 40%36% of the crude oil production consisted of light and medium crudes and 64% consisted of heavy crudes. In 2016, approximately 37% of the crude oil production corresponded to light and medium crudes and 60%63% to heavy crudes. During 2014, production distribution was approximately 42% of light and medium crudes and 58% of heavy crudes.

Natural Gas Production

In 2016,2018, the average daily production of natural gas by Ecopetrol S.A. reached 116.0112.5 mboed, including natural gas liquids (“NGLs”), corresponding to a 4% decrease1.4% increase in comparison to 20152017 production.

We have three main natural gas production fields, Guajira, Cusiana and Cupiagua. In the Guajira field, we have partnered with Chevron who operates the field. The development of Cusiana field had a change in participation, because Tauramena joint venture expired on July 3, 2016. The Tauramena block is part of the Cusiana unified exploitation plan. As a consequence of the termination of the Tauramena joint venture, Ecopetrol´sEcopetrol’s participation increased from 63.4% to 97.8%, and Ecopetrol assumed the operation of the Cusiana unified exploitation plan. Ecopetrol S.A. is the operator of the Cupiagua field.field and other wells previously under the Recetor contract that were transferred from Equion to Ecopetrol as a result of the full return of the Recetor Field to Ecopetrol on May 29, 2017.

| 16 |

Of our total natural gas production during the year ended December 31, 2016,2018, approximately 29%20% was supplied from the Guajira field, 25%31% from the Cusiana field, 25%24% from the Cupiagua field and the remaining 21%25% from other fields.

The following table sets forth Ecopetrol S.A.’s average daily natural gas production in Colombia, including NGLs, prior to deducting royalties, for the years ended on December 31, 2016, 20152018, 2017 and 2014.2016.

Table 9 – Ecopetrol S.A.’s Average Daily Natural Gas Production in Colombia

| For the year ended December 31, | For the year ended December 31, | |||||||||||||||||||||||

| 2016 | 2015 | 2014 | 2018 | 2017 | 2016 | |||||||||||||||||||

| (thousand boepd) | (thousand boepd) | |||||||||||||||||||||||

| COLOMBIA | ||||||||||||||||||||||||

| Central Region | ||||||||||||||||||||||||

| 1) La Cira – Infantas | 0.17 | 0.12 | 0.16 | 0.16 | 0.15 | 0.17 | ||||||||||||||||||

| 2) Provincia | 3.09 | 3.75 | 4.00 | 1.96 | 2.41 | 3.09 | ||||||||||||||||||

| 3) Yarigui | 0.56 | 0.56 | 0.50 | 0.42 | 0.48 | 0.56 | ||||||||||||||||||

| 4) Gibraltar | 6.32 | 5.52 | 5.57 | 6.87 | 7.16 | 6.32 | ||||||||||||||||||

| 4) Other | 1.60 | 1.51 | 1.02 | 1.86 | 2.02 | 1.60 | ||||||||||||||||||

| Total Central Region | 11.74 | 11.46 | 11.25 | 11.27 | 12.22 | 11.74 | ||||||||||||||||||

| Orinoquía Region | ||||||||||||||||||||||||

| 1) Cupiagua | 28.72 | 24.09 | 22.80 | 26.97 | 25.29 | 28.72 | ||||||||||||||||||

| 2) Cusiana(1) | 15.98 | 0.00 | 0.00 | 34.73 | 31.97 | 15.98 | ||||||||||||||||||

| 2) Other | 1.44 | 1.18 | 1.37 | |||||||||||||||||||||

| 3) Other | 2.80 | 2.44 | 1.44 | |||||||||||||||||||||

| Total Orinoquía Region | 46.14 | 25.27 | 24.17 | 64.5 | 59.70 | 46.14 | ||||||||||||||||||

| Southern Region | ||||||||||||||||||||||||

| 1) Huila Area | 0.64 | 0.85 | 1.14 | 0.13 | 0.10 | 0.64 | ||||||||||||||||||

| 2) Tello | 0.35 | 0.35 | 0.26 | 0.11 | 0.22 | 0.35 | ||||||||||||||||||