GSK’s 11 CEDDs, based in Europe and the USA, are: | | | • | Biopharmaceuticals – Stevenage, UK | | | | • | Cardiovascular & Urogenital – Upper Merion, USA | | • | Centre of Excellence for External Drug Discovery – Upper Merion, USA | | • | Immuno-inflammation – Stevenage, UK | | • | Infectious Disease – Upper Merion and Research Triangle Park, USA | | |

| • | Metabolic – Research Triangle Park, USA | | | | • | Oncology – Upper Providence, USA | | | | • | Macrolide Drug Discovery – Zagreb, Croatia (acquired Pliva ResearchInstitute in May 2006) | | | | • | Neurology & Gastrointestinal Diseases – Harlow, UK | | | | • | Psychiatry – Verona, Italy | | | | • | Respiratory and Inflammation – Stevenage, UK. |

Each CEDD is responsible for identifying the targets of most relevance in its therapeutic area and building on the lead compounds transferred from MDR to produce a potential medicine. The fundamental steps in turning a lead compound into a medicine are optimising it for potency, efficacy and safety and defining the biology in animals and humans so that the medicine can be tested for effects in the right patient groups. These inventive steps are underpinned through scientific research and the application of informed judgement to develop creative solutions to the problems and challenges that inevitably arise in discovery and early development. Once a candidate compound is selected, the CEDDs are responsible for undertaking the clinical studies necessary to demonstrate ana beneficial effect sufficient to declare “proof of concept” – the first indication in patients that the new medicine works. Based on the programme’s profile of safety and efficacy a decision is then made on whether to progress the medicine into late-stage drug development, where large-scale clinical trials are conducted to confirmdevelopment. As part of GSK’s commitment towards pursuing the efficacy and safety and gain regulatory approval to commercialisebest science anywhere in the product. Duringworld, the year, 19 new projects entered Phase II clinical trials for the first time.

GSK is committed to developing clinical science to ensure the understanding of disease processes in humans and learning as much as possible about the medicines in development. The application of experimental medicine is a major opportunity for the industry to optimise the drug discovery process. Advances in clinical imaging are revolutionising experimental medicine and opening opportunities to visualise the effects of medicines in humans. In 2006, GSK opened the Clinical Imaging Centre (CIC) on the biomedical research campus of Imperial College, London. The new £46 million facility is staffed by clinical investigation research groups working with state-of-the-art magnetic resonance imaging and positron emission tomography imaging systems. Facilities include radiochemistry, biology, image analysis and neurophysiology laboratories. The formidable capabilities of the CIC are augmented through multiple, global collaborations with academic imaging centres, established by GSK over the last decade.

In addition to the nine CEDDs, GSK also created a Centre of Excellence for External Drug Discovery (CEEDD) was established in 2005. This small team is responsible forThe CEEDD has the same objective as the CEDDs: delivering compounds to the proof of concept stagemedicines into late-stage development, but does so by establishing and managing long-term strategic collaborations with biotechnology companies,biotech and small andto medium-sized pharmaceutical companies and academic institutions.companies. In 2006,2007, the CEEDD exercised its first option to bring in a compound to clinical development: XL880, an anti-cancer inhibitor from Exelixis.

As part of this same strategic intent, in 2007 GSK established foura dedicated R&D centre in Shanghai. R&D in China will focus on research into neurodegeneration with the objective of creating new collaborationsmedicines for such severe disorders as multiple sclerosis, Parkinson’s disease and currently oversees a portfolioAlzheimer’s disease. The centre will eventually direct the global discovery and development activities within its therapeutic area, from drug-target identification to late-stage clinical studies, while collaborating with research institutions elsewhere in China and other countries. Establishing R&D China reflects GSK’s commitment to ally with talented researchers wherever they are located and to further encourage within R&D the contest of 58 drug discovery projects ranging from target selection throughideas needed to human clinical trials.create new medicines. Developing medicines for patients

Progression into late-stage development (referred to at GSK as ‘medicines development’), consists of optimising both the physical product properties of the medicine, that is, the chemical steps and formulation required to manufacture and deliver it, as well as the large scale confirming studies of efficacy and safety. The former activity is the responsibility of Preclinical Development, while the latter is the responsibility of the clinical development and development operations teams. The combination of the results of these two steps into a regulatory file for submission to regulatory agencies and approval for patient use is the responsibility of the regulatory team. The integration of all steps above into a coherent project is the responsibility of the project teams, which are grouped therapeutically into Medicine Development Centres. These roles are described in more detail as follows:

| 14 | GSK Annual Report 2007 | | |

Back to Contents | | | REPORT OF THE DIRECTORS | | | Delivering the product pipeline for patients | | | | | | Business review | | Delivering the product pipeline for patients | | continued | | |

Preclinical Development (PCD) includes a wide range of activities throughout the entire medicines development process. In addition, this function is involved in the enhancement of existing products by devising more convenient formulations. Early in the development process, the metabolism and safety of compounds are evaluated in laboratory animals before testing in humans. The testing required in animals is highly regulated (see Animals and research, page 12)16). PCD researchers investigate appropriate dosage forms (for example, tablets or inhalers) and develop formulations to enhance a drug’s effectiveness and its ease of use by the patient.

Back to Contents

| Business review | | Delivering the product pipeline for patients | continued |

| |

Processes and supporting analytical methods for drug synthesis and product formulation and delivery are scaled up to meet increasing supply requirements. This leads to the technical transfer of the processes and methods to manufacturing. The new product supply process, a partnership between R&D and Global Manufacturing and Supply, ensures that a robust product is developed for large-scale commercial manufacturing and launch. In 2006, GSK redesigned the management of late-stage development by dividing the single large late-stage development organisation into three distinct, empowered entities. The first component, Medicines Development is the collection of six therapeutically aligned Medicine Development Centres (MDCs).MDCs. Each MDC has ultimate accountability for developing experimental drugs into regulatory-approved medicines for patients. The MDCs are responsible for creating value through the execution of full product development plans and ensuring strong partnerships with the rest of GSK, in particular the CEDDs and the other late-stage development groups.

The MDCs are based at the major USA and UK sites and are aligned with the following therapeutic areas: | • | Cardiovascular/Metabolic | | | | • | Infectious Diseases including Diseases of the Developing World(DDW) | | World (DDW) | | • | Musculoskeletal/Inflammation/Gastrointestinal/Urology | | | | • | Neuroscience (Psychiatry/Neurology) | | | | • | Oncology | | | | • | Respiratory |

The MDCs discharge their responsibilities through project teams for each medicine in development. These project teams are responsible for maximising the worldwide development opportunities for each product within their remit and to see that all the information needed to support the registration, safety programmes, pricing and formulary negotiations is available. Commercial input from Global Product Strategy and Commercial Operations ensures that regional marketing needs are integrated into development plans at an early stage. The second component, Development Operations drives operational excellence in medicine delivery at the study, project and portfolio level.execution of the project’s clinical studies. This is done by establishing integrated planning to ensure consistent and predictable drug project plans and supplying valued clinical developmentoperations capabilities. In 2006,2007, development operations managed clinical trials with over 30,000 active patients, handling everything from patient recruitment to data management to project planning. Development Operations is also responsible for helping to identify patients outside of traditional markets. In 2006, it identified more than 20,000 new patients, 39% of whom were outside of Western Europe and North America.

The Office of the Chief Medical Officer is the third component of late-stage development and is charged with the safety of patients involved in clinical trials, as well as the proper filing of the findings with regulatory authorities. All clinical trials sponsored by GSK, irrespective of where they take place, are conducted according to international standards of good clinical practice and applicable laws and regulations. The protocols are reviewed by the external regulatory agencies in the relevant countries where required and all protocols are considered by an ethics review committee, whose responsibilities cover the sites where the studies will take place. Safety data are routinely collected throughout development programmes and are reported to national and regional regulatory agencies in line with applicable regulations. GSK considers itsGSK’s Chief Medical Officer, working with the Global Safety Board, to beis ultimately accountable for oversight of all major decisions regarding patient safety. The GSK Global Safety Board is responsible internally for approving pivotal studies and investigating any issues related to patient safety arising during the development programme. Information from GSK clinical trials is widely and easily available at the Clinical Trial Register on theGSK’s website.

In 2006, GSK formed a dedicated pharmacogenetics group. GSK believes that pharmacogenetic research, correlating genetic data with response to medicine, will help its scientists understand how different people respond to the effects of a medicine, both those therapeutically intended and those causing adverse events. R&D is collecting DNA samples, under appropriate patient consent, in clinical studies to identify pharmacogenetic information which may help predict a patient’s response. This information is intended to define patient groups likely to gain benefit from treatment or to suffer a side effect. Pharmacogenetics promises to provide physicians with information to help them select the medicine and dose most likely to benefit the patient and, in the long run, may help to reduce pipeline attrition and improve productivity.

In-licensing

GSK continues to identify compounds from other companies that would enhance the portfolio and to create innovative collaborations to ensure that the Group is regarded as the partner of choice for large and small companies. The subjects of acquisitions, in-licensing, co-marketing/co-promotion, or future options arrangements in 2006 were:

• | Genmab’sHuMax-CD20(ofatumumab), anti CD20 MabThe subjects of acquisitions, in-licensing, co-marketing/co-promotion, or future options arrangements in oncology (Phase III) and rheumatoid arthritis (Phase II)2007 included: | | | | | • | HGS’LymphoStat BXenoport (XP13512, phase III for lupus erythematosus (Phase III) | | RLS and phase II for neuropathic pain) | | • | Gilead/Myogen’s ambrisentan (commercialisation, excluding USA),selective endothelin receptor antagonist for pulmonary arterialhypertension (Phase III)Sepracor (Lunesta/Lunivia (excluding USA, Canada, Mexico and Japan), plus marketing and distribution agreementfor GSK'sFlolan(in the USA) by Myogen | | GABA-A agonist, insomnia, pending EU filing) | | • | Akros/Japan Tobacco’s JTP-74057, a MEK inhibitor (preclinical) | | Synta (STA-4783, HSP70 upregulation, melanoma, sarcoma, solid tumors, phase III) | | • | ChemoCentryx – options on preclinical assets and traficet (PhaseToleRx (anti-CD3 mAb for autoimmune diseases, phase II) | | | | • | EPIX – options on discovery targetsTargacept (TC-2696 in phase II for acute post-operative pain and 5HT4 agonist (Phase I)novel leads for Central nervous system diseases) | | • | Anacor (novel candidates for viral and bacterial diseases, preclinical) | | • | OncoMed (cancer stem cell therapeutics, preclinical) | | • | Galapagos – options on discovery programmes in osteoarthritis(preclinical) | | (novel anti-bacterials and antivirals, preclinical) | | • | Kissei’s SGLT1 inhibitors for type 2 diabetes (preclinical) | | | • | Pharmacopeia – options on discovery programmes (preclinical) | | | • | Sirna’s RNAI-based therapeutics for respiratory diseases (preclinical) | | | • | Acquisition of the Pliva Research InstituteSantaris (novel antiviral agents, preclinical) |

Extending the use of existing products

Once a product is launched, it is important to establish additional ways in which patients may be helped. This can be done through investigating whether other illnesses may be treated with the product or by the development of additional, more convenient dosage forms. Some developments reflect feedback from patients and medical professionals, while others are the result of continuing research into disease and its causes.

Back to Contents

| Business review | | Delivering the product pipeline for patients | continued |

| | |

In 2006, GSK received approval in the USA for a controlled-release version ofCoreg,Coreg CR, which allows once-daily dosing for hypertension and mild to severe heart failure. The product will be launched in the USA in Q1 2007. GSK also began a novel investigation to determine whether its diabetes treatment, rosiglitazone XR is effective in Alzheimer’s Disease. The scientific basis for this programme was developed thanks to the pharmacogenetics work undertaken with rosiglitazone over the past seven years.

Managing the portfolio

Key projects reaching significant milestones are reviewed each month by the Product Management Board (PMB), which is responsible for determining if a medicine has met criteria for passing into the next phase of development. Progress of the portfolio is communicated to investors and the media at regular intervals during the year. Details of GSK’s product development pipeline are given on pages 1318 to 16.21. Risk in R&D

Pharmaceutical R&D, by its very nature, is an inherently risky venture. From the time a potential medicine is discovered until it becomes an approved medicine can take 10-15 years. Further, only one in ten molecules that starts human clinical trials ever reaches regulatory approval. The nine out of ten that fail can be discontinued for a variety of reasons, from insufficient safety thresholds to lack of efficacy to manufacturing hurdles. These discontinuations occur despite extensive predictive testing. Late-stage projects terminated during 20062007 included brecanavirAriflo for HIVCOPD andRedona odiparcil for diabetes.stroke prevention.

| GSK Annual Report 2007 | 15 | | |

Back to Contents | | | REPORT OF THE DIRECTORS | | Delivering the product pipeline for patients | | | | | | Business review | | Delivering the product pipeline for patients | | continued | | |

Research and development – vaccines

The majority of GSK’s vaccine division activities are conducted at its biologicals headquarters in Rixensart and Wavre, Belgium. These include research, clinical development, regulatory strategy, commercial strategy, scaling up, vaccine production, packaging and all other support functions. The discovery and development of a new vaccine is a complex process requiring long-term investment. In R&D over 1,500 scientists are devoted to developing new vaccines and more cost-effective and convenient combination vaccines to prevent infections that cause serious medical problems worldwide. GSKGSK’s vaccine division is also targetingdeveloping therapeutic vaccines that may prevent relapseimmunotherapeutics aimed at educating the patient’s immune system to identify and attack cancer cells in cancer patients.a highly specific manner. Thanks to the use of innovative technologies and its global business model, GSK is a fast-growing vaccine maker, delivering value by contributing to the health and well-being of people in every generation around the world. Vaccine discovery involves many collaborations with academia and the biotech industry to identify new vaccine antigens which are then expressed in yeast, bacteria or mammalian cells and purified to a very high level. This is followed by formulation of the clinical lots of the vaccine. This may involve mixing antigens with selected GSK novel proprietary adjuvant systems, which are combinations of selected adjuvants designed to enhance the immune response. The first step is to evaluate the safety and efficacy of the candidate vaccine in a preclinical setting, usually involving an animal model. The candidate vaccine is then tested in clinical trials in healthy individuals to evaluate safety and effectiveness in inducing an immune response to protect the body from infection encountered later in a natural setting (Phase(phase I/II). Large-scale field trials in healthy individuals follow to establish safety and efficacy in a cross section of the population (Phase(phase III). The results obtained during clinical trials and data regarding the development of a quality and large-scale production process and facilities are then combined into a regulatory file which is submitted to the authorities in the countries where the vaccine will be made available. After launch, post marketing studies of considerable size are set up to assess vaccination programmes and to monitor vaccine safety (Phase(phase IV). Vaccine manufacturing is particularly complex as it requires the use of innovative technologies and living micro-organisms. Sophisticated quality assurance and quality control procedures are in place to ensure both quality and safety of the vaccines and this commonly includes animal use according to health authorities’ requirements. Due to their biological nature, individual health authorities may subject vaccines to a second control to guarantee the highest quality standards. GSK has been increasing its capacity to supply vaccines across the globe by developing a uniqueits global manufacturing network based on three major regional hubs in Europe, North America(see page 26, 'Global manufacturing and Asia. After the establishment of its North American hub in 2005 through three major acquisitions, GSK further strengthened in 2006 its vaccine capabilities in both Asia and Europe:supply'). – | investing more than £100 million to set up a vaccine manufacturing site dedicated to the primary production of paediatric vaccines in Singapore | | | – | opening in Gödöllö, Hungary, its €100 million primary production facility for the manufacturing of diphtheria, tetanus and pertussis antigens used in several paediatric combinations vaccines | | | – | investing more than €500 million in its vaccine manufacturing plant in St Amand-les-Eaux, France, to increase production capacity in formulation, filing, freeze-drying and packaging. |

Diseases of the developing world

Continued investment in research into diseases that disproportionately affect the developing world is essential if there is to be a long-term improvement in the health of people who live in these regions. As part of GSK’s response to this challenge, it operates a drug discovery unit, based at Tres Cantos (Spain), primarily dedicated to finding new medicines for malaria and tuberculosis. Additional research sites in the USA and the UK are focused on discovering new medicines to treat HIV/AIDS and drug resistant bacteria, while vaccine research is conducted in Rixensart (Belgium). Medicines and vaccines that enter clinical trials are taken through development and regulatory processes by dedicated groups based in the UK, USA and Belgium. Through these R&D efforts, GSK is addressing the prevention and treatment of all three of the World Health Organization’s (WHO) top priority infectious diseases. Recently, GSK has developed scored-tablets for its key anti-retroviral products to simplify the treatment of children living with HIV. GSK currently has 1412 clinical programmes of relevance to the developing world, 7seven of which are aimed at producing vaccines and medicines for diseases that disproportionately affect developing countries.

Back to Contents

| Business review | | Delivering the product pipeline for patients | continued |

| |

Public/Private Partnerships (PPPs) remain essential to fund research where there is no commercially viable market for a potential product. GSK is a leader in working in PPPs and continues to collaborate closely with many governments, academic centres, United Nations’ agencies and other global funding bodies in this area, to maximise expertise and knowledge. This has the dual benefit of encouraging research and development and accelerating access to the medicines in the developing world. Animals and research

For ethical, regulatory and scientific reasons, research using animals remains a small but vital part of research and development of new medicines and vaccines. GSK only uses animals where there is no alternative and only in the numbers required for each test. The Group strives to exceed regulatory standards in the care and use of the animals it uses and undergoes internal and external review to assure these standards. The vast majority of the experimental methods do not use animals. GSK is actively engaged in research to develop and validate more tests that either avoid the use of animals in research or reduce the numbers needed. When animals are used in research unnecessary pain or suffering is scrupulously avoided. GSK understands that use of animals for research purposes commands a high level of public interest. The GlaxoSmithKline Public Policy Position ‘The care and ethical use of animals in research’, and further information and reports, are available on theGSK’s website www.gsk.com or from Secretariat.

| 16 | GSK Annual Report 2007 | | |

Back to Contents | | | REPORT OF THE DIRECTORS | | | Delivering the product pipeline for patients | | | | | | | Business review | | Delivering the product pipeline for patients | | continued | |

Research and development – Consumer Healthcare

The focus of R&D is to identify and develop novel products that benefit consumers in the over-the-counter (OTC), oral carehealthcare and nutritional healthcare markets. To achieve a significant increase in innovation from internal and external sources, R&D has been remodelled to deliver a more valuable pipeline of products. With this change, specific tasks that can be performed at lower cost outside the companyGSK have been transferred to external development partners. This transfer, along with other headcount reductions and savings, releases substantial funds for investment in additional innovation projects. The remodelling builds on the recently adopted Consumer Healthcare operating model whereby, for the Global brands, R&D mirrors the commercial structure, with brand-dedicated R&D teams paired with commercial brand teams and both located together at the Innovation Centres at Weybridge, UK or Parsippany, USA. GSK’s pipeline

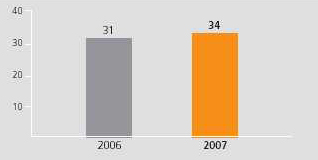

At the endbeginning of February 2007,2008, GSK had nearly 210 pharmaceutical and vaccine projects in development. Of these, 158157 are in the clinic comprising 9496 NCEs, 4137 PLEs and 2324 vaccines, compared with 118123 in 2001. In the last 12 months, 4 NCEs, 3GSK commenced 9 new vaccinesphase III clinical development programmes (including 2 vaccines) and 3 in-licenced assets entered late-stage development. GSK now has 31 major34 key assets in phase III/registration.

Compounds in phase III/registration

GSK has maintained momentum in delivering its late-stage pipeline, receiving 10 product approvals and filing 10 product applications in 2007. Currently it has 13 new product opportunities in phase III development or registration, comprising 13 new chemical entities (NCEs), 6 new vaccines and 12 product line extensions (PLEs).filed with regulators. Major NCEs and vaccines inDevelopment programmes progressed into phase III development: | | ambrisentan – for hypertensionin 2007: | | • | Lymphostat-B* – for lupusbelimumab (LymphoStat B) | | • | casopitant* – for post-operative and chemotherapy-induced vomiting and nauseaelesclomol | | • | pazopanib* – for prevention of tumour growthGSK 1838262 (XP13512) | | • | mepolizumab – for hypereosinophilic syndromeMAGE-A3 therapeutic vaccine | | • | MenACWY vaccine | | • | ofatumumab (RA) | | • | Promacta* – for patients with low platelet count(Hep C) | • | New generation ‘flu vaccine* | | • | GloborixTykerb– a new combination paediatric vaccine against hepatitis B, diphtheria, meningitis A and C+Armala(IBC) | | • | New meningitisTykerb(Head & Neck) |

| Products filed: | | • | Avodart& alpha blocker co-prescription | | • | Cervarix(USA & Japan) | | • | EnteregPOI | | • | H5N1 vaccine against meningitis C and Y and Hib*(EU) | | • | Kinrix(USA) | | • | Lamictal XR(USA) | | • | Lunivia(EU) | | • | Promacta(USA) | | • | Requip XL(USA) | | • | Rotarix(USA) | | • | Synflorix– vaccine to prevent pneumococcal disease.(EU & International) | | (* entered late-stage in the last 12 months) | | | Major NCEs and vaccines filed: | | • | Allermist/AvamysTreximet– for hay fever; US approval expected in first halfof 2007 | | • | Altabax/AltargoVolibris– for skin infections; approval expected in 2007 | • | Entereg– for post-operative ileus, approval expected in 2007 | • | Tykerb– for breast cancer; US approval expected in first half of 2007 | • | Cervarix– vaccine to prevent cervical cancer; European and | | International launches expected in second half of 2007 | • | H5N1 pandemic vaccine. | | Late-stage assets in-licensed during the last 12 months: | • | Hu-Max-CD20– for the treatment of leukaemia and non-Hodgkin’s | | lymphoma | • | gepirone ER – for major depressive disorder | • | XP13512 – for restless legs syndrome and treatment of neuropathicpain.(EU) |

In 2007, GSK expects to launch 5 majora sustained flow of new pharmaceutical products.products in the next two years. For further details of these developments, and information on other important launches/filings expected in 2007, see GSK outlook on page 44.50.

This maturity in the late stage pipeline is expected to lead to an increase in registrations in the coming years. The content of the drug development portfolio will change over time as new compounds progress from discovery to development and from development to the market. Owing to the nature of the drug development process, many of these compounds, especially those in early stages of investigation, may be terminated as they progress through development. Phase I NCEs with multiple indications are counted only once. NCEs in later phases are counted by each indication. For competitive reasons, new projects in pre-clinical development have not been disclosed and some project types may not have been identified.

GSK’s policy is to seek to obtain patent protection on all protectable inventions discovered or developed through its R&D activities. Patent protection for new active ingredients is available in all significant markets and protection can also be obtained, for example, on new pharmaceutical formulations, manufacturing processes, medical uses and special devices for administering products, see page 23.28 ‘Intellectual property’.

|

| GSK Annual Report 20062007 | 17 | 12 | |

<Back to Contents | Business review | | | | Delivering the product pipeline for patients | continued |

| | | | | Business review |

KeyDelivering the product pipeline for patients | | continued | | | |

| Key | | | † | In-license or other alliance relationship with third party | | NDA | New drug application (USA) | | | | | | | S | Date of first submission | | Phase I | Evaluation of clinical pharmacology, usually conducted in volunteers | | | | | | | A | Date of first regulatory approval (for MAA, this is the first EU approval letter) | | Phase II | Determination of dose and initial evaluation of efficacy, conducted in a small number of patients | | | | | | | AL | Date Approvable letteror Complete Response Letter received – indicates that ultimately approval can be given subject to resolution of outstanding queries | | BLA | Phase III | Large comparative study (compound versus placebo and/or established treatment) in patients to establish clinical benefit and safety.Biological License Application | | | | |

| | | | MAA | Marketing authorisation application (Europe) | | NDA | New drug application (USA) | | Phase I | Evaluation of clinical pharmacology, usually conducted in volunteers | | Phase II | Determination of dose and initial evaluation of efficacy, conducted in a small number of patients | | Phase III | Large comparative study (compound versus placebo and/or establishedtreatment) in patients to establish clinical benefit and safety. | | | |

Estimated submission dates are only disclosed where they are within 12 months of the date of the chart. This date represents the most likely year of submission where it is considered that there is a reasonably high probability of successfully meeting the date assuming the clinical data meets the expected end-points of the clinical trials. | | | | | | | | Estimated | | | | | | | | | | | submission | dates | Compound/ProductCompound | | Type | | Indication | | Phase | | MAA | | NDA |

|

|

|

|

|

|

|

|

|

|

| | Cardiovascular & Metabolic | | | | | | | | | Cardiovascular projects | | | | | | | | | | | 256073 | | high affinity nicotinic acid receptor | | dyslipidaemia | | I | | | | | | | (HM74A) agonist | | | | | | | | | 568859† | | lipoprotein-associated phospholipase A2 (Lp-PLA2) inhibitor | | atherosclerosis | | I | | | | | 813893 | | factor Xa inhibitor | | prevention of stroke in atrial fibrillation | | I | | | | | 856553 | | p38 kinase inhibitor | | atherosclerosis (also rheumatoid arthritis & chronic obstructive pulmonary disease, COPD) | | I | | | | | | rilapladib† | | Lp-PLA2 inhibitor | | atherosclerosis | | I | | | | | 501516† | | peroxisome proliferator-activator receptor (PPAR) delta agonist | | dyslipidaemia | | II | | | | | | 681323 | | p38 kinase inhibitor | | atherosclerosis (also COPD, neuropathic pain & rheumatoid arthritis)chronic obstructive pulmonary | | II | | | | | | | | disease – COPD, neuropathic pain & rheumatoid arthritis) | | | | | | | 856553 | | p38 kinase inhibitor | | atherosclerosis (also COPD, depression & rheumatoid arthritis) | | II | | | | | darapladib† | | Lp-PLA2 inhibitor | | atherosclerosis | | ll/III | | | | | Coreg CR†+ ACE inhibitor | | beta blocker + angiotensin converting enzyme inhibitor | | hypertension – fixed dose combination | | III | | N/A | 2008 | ambrisentanVolibris† | | endothelin A antagonist | | pulmonary arterial hypertension | | IIISubmitted | | 2007 | S:Mar07 | N/A | Coreg CR†+ ACE inhibitor | | beta blocker + angiotensin converting | | hypertension – fixed dose combination | | III | | N/A | | | | | enzyme inhibitor | | | | | | | | | | Arixtra | | synthetic factor Xa inhibitor | | treatment of acute coronary syndrome | | ApprovableApproved | | S:Jul06 | A:Aug07 | AL:Feb07 | Coreg CR† | | beta blocker | | hypertension & congestive heart failure – once-daily | | Approved | | N/A | | A:Oct06& Sep07 | | Metabolic projects | | | | | | | | | | | 189075†remoglifozin etabonate | | sodium dependent glucose transport (SGLT2) inhibitor | | obesity | | I | | | | | (189075)† | | inhibitor | | | | | | | | | 376501 | | PPAR gamma partial agonist | | type 2 diabetes | | I | | | | | 625019756050 | | PPAR panbile acid receptor agonist | | type 2 diabetes & metabolic syndrome | | I | | | | | otelixizumab (TRX4)† | | anti-CD3 monoclonal antibody | | type 1 diabetes | | II | | | | 189075†remoglifozin etabonate | | SGLT2 inhibitor | | type 2 diabetes | | II | | | | | 677954(189075)† | | PPAR pan agonist | | type 2 diabetes, metabolic syndrome & dyslipidaemia | | II | | | | | 869682† | | SGLT2 inhibitor | | obesity | | II | | | | | albiglutide (716155)Syncria† | | glucagon-like peptide 1 agonist | | type 2 diabetes | | II | | | | | Avandia | | PPAR gamma agonist | | atherosclerosis in type 2 diabetes | | II | | | | | | Avandamet XR | | PPAR gamma agonist + metformin | | type 2 diabetes – extended release | | III | | N/A | | 2007 | | Avandia | | PPAR gamma agonist | | prevention ofatherosclerosis in type 2 diabetes | | III | | N/A | | 2007 | | Avandia | | PPAR gamma agonist | | prevention of disease progression | | III | | N/A | | 2007 | Avandia+ simvastatin | | PPAR gamma agonist + statin | | type 2 diabetes | | III | | N/A | | 2007 | Avandaryl/AvaglimAvandia† | | PPAR gamma agonist + sulphonylurea | | type 2 diabetes – fixed dose combinationprevention of disease progression | | ApprovedSubmitted | | A:Jun06 | | A:Dec05S:Feb07 |

|

|

|

|

|

|

|

|

|

|

| | Infectious Diseases | | | | | | | | | | | 565154580416 | | oral pleuromutilinribosome inhibitor | | treatment of bacterial infections | | I | | | | | 742510945237 | | oral pleuromutilintopoisomerase ll inhibitor | | treatment of bacterial infections | | I | | | | | 1349572† | | HIV integrase inhibitor | | HIV infections | | I | | | | | farglitazar | | PPAR gamma agonist | | hepatic fibrosis | | II | | | | | | sitamaquine | | 8-aminoquinoline | | treatment of visceral leishmaniasis | | II | | | | N/A | | tafenoquine† | | 8-aminoquinoline | | Plasmodium vivaxmalaria | | II | | | |

| | |

chlorproguanil, dapsone +18 | | antifolate + artemisinin | | treatment of uncomplicated malaria | | IIl | | 2008 | | N/A GSK Annual Report 2007 | artesunate (CDA)† | | | | | | | | |

Back to Contents | | | Altabax/Altargo | | topical pleuromutilin | | bacterial skin infections | | Approvable | | S:Jun06 | | AL:Dec06 | Antivirals | | | | | | | | | | | 625433 | | polymerase inhibitor | | hepatitis C | | I | | | | | 825780† | | DNA antiviral vaccine | | HIV infection | | I | | | | | 364735† | | integrase inhibitor | | HIV infection | | II | | | | | Relenza† | | neuraminidase inhibitor | | influenza prophylaxis | | Approved | | A:Aug06 | | A:Mar06 |

|

|

|

|

|

|

|

|

|

|

|

<Back to Contents

| Business review | | | | Delivering the product pipeline for patients | continued |

|

| | | | | | | | | | | | | | | | Business review | | Delivering the product pipeline for patients | | continued | | |

| | | | | | | | Estimated | | | | | | | | | | submission | dates | | Compound | | Type | | Indication | | Phase | MAA | NDA |

| | Musculoskeletal, Inflammation, Gastrointestinal & Urology | | | | | | 315234 | | monoclonal antibody | | rheumatoid arthritis | | I | | | | 768974† | | parathyroid hormone agonist | | osteoporosis | | I | | | | 962040 | | motilin receptor agonist | | delayed gastric emptying | | I | | | | 971086 | | androgen modulator | | sarcopaenia | | I | | | | 1827771 | | interleukin 1 antagonist | | rheumatoid arthritis | | I | | | | belimumab† | | anti-B lymphocyte stimulator monoclonal antibody (s.c.) | | systemic lupus erythematosus | | I | | | | pazopanib | | multi-kinase angiogenesis inhibitor | | age-related macular degeneration (also cancer indications) | | I | | | | 221149 | | oxytocin antagonist | | threatened pre-term labour | | II | | | | 232802 | | 3G-selective oestrogen receptor modulator | | treatment of menopausal symptoms | | II | | | | 274150 | | selective iNOS inhibitor | | rheumatoid arthritis | | II | | | | 681323 | | p38 kinase inhibitor (oral) | | rheumatoid arthritis (also atherosclerosis, COPD & neuropathic pain) | | II | | | | 856553 | | p38 kinase inhibitor (oral) | | rheumatoid arthritis (also atherosclerosis, COPD & depression) | | II | | | | 876008† | | corticotrophin releasing factor (CRF1) antagonist | | irritable bowel syndrome (also depression & anxiety) | | II | | | | ronacaleret† | | calcium antagonist | | osteoporosis & fracture healing | | II | | | | solabegron | | beta3 adrenergic agonist | | irritable bowel syndrome | | II | | | | solabegron | | beta3 adrenergic agonist | | overactive bladder | | II | | | | Avodart | | 5-alpha reductase inhibitor | | reduction in the risk of prostate cancer | | III | | | | Avodart+ alpha blocker | | 5-alpha reductase inhibitor + alpha blocker | | benign prostatic hyperplasia – fixed dose combination | | III | 2008 | 2009 | | belimumab† | | anti-B lymphocycte stimulator monoclonal antibody (i.v.) | | systemic lupus erythematosus | | III | | | | Bosatria(mepolizumab) | | anti-IL5 monoclonal antibody | | hypereosinophilic syndrome (also severe asthma & nasal polyposis) | | III | 2008 | 2008 | | Entrareg/Entereg† | | peripheral mu-opioid antagonist | | opioid-induced bowel dysfunction | | III | | | | ofatumumab† | | anti-CD20 human monoclonal antibody | | rheumatoid arthritis (also cancer indications) | | III | | | | Entrareg/Entereg† | | peripheral mu-opioid antagonist | | post operative ileus | | Approvable | | AL:Jul05 & | | | | | | | | | | AL:Nov06 |

| | Neurosciences | | | | | | | | | | 163090 | | 5HT1 antagonist | | depression & anxiety | | I | | | | 239512 | | histamine H3 antagonist | | dementia | | I | | | | 249320 | | monoclonal antibody | | neuronal injury | | I | | | | 424887 | | NK1 antagonist/SSRI | | depression & anxiety | | I | | | | 561679† | | CRF1 antagonist | | depression & anxiety | | I | | | | 586529† | | CRF1 antagonist | | depression & anxiety | | I | | | | 598809 | | dopamine D3 antagonist | | drug dependency | | I | | | | 618334 | | dopamine D3 antagonist | | drug dependency | | I | | | | 729327 | | AMPA receptor modulator | | schizophrenia | | I | | | | 933776 | | monoclonal antibody | | Alzheimer’s disease | | I | | | | 1014802 | | sodium channel inhibitor | | bipolar disorder | | I | | | | 1018921 | | type 1 glycine transport inhibitor | | schizophrenia | | I | | | | orvepitant | | NK1 antagonist | | depression & anxiety | | I | | | | 189254 | | histamine H3 antagonist | | narcolepsy | | II | | | | 372475† | | triple (5HT/noradrenaline/dopamine) re-uptake inhibitor | | depression | | II | | | | 468816 | | glycine antagonist | | smoking cessation | | II | | | | 649868† | | orexin antagonist | | sleep disorders | | II | | | | 681323 | | p38 kinase inhibitor | | neuropathic pain (also atherosclerosis, COPD & rheumatoid arthritis) | | II | | | | 742457 | | 5HT6 antagonist | | dementia | | II | | | | 773812 | | mixed 5HT/dopaminergic antagonist | | schizophrenia | | II | | | | 842166 | | non-cannabinoid CB2 agonist | | inflammatory pain | | II | | | | 856553 | | p38 kinase inhibitor | | depression (also atherosclerosis, COPD & rheumatoid arthritis) | | II | | | | 876008† | | CRF1 antagonist | | depression & anxiety (also irritable bowel syndrome) | | II | | | | 1838262 (XP13512)† | | voltage-gated calcium channel modulator | | migraine prophylaxis | | II | | | | 1838262 (XP13512)† | | voltage-gated calcium channel modulator | | neuropathic pain | | II | | | | casopitant | | NK1 antagonist | | depression & anxiety (also asZunrisa/Rezonicfor chemo- | | II | | | | | | | | therapy induced & postoperative nausea & vomiting) | | | | | | firategrast† | | dual alpha4 integrin antagonist (VLA4) | | multiple sclerosis | | II | | | | 1838262 (XP13512)† | | voltage-gated calcium channel modulator | | restless legs syndrome | | III | | 2008 | | Lamictal XR | | sodium channel inhibitor | | epilepsy – partial generalised tonic-clonic seizures, | | III | N/A | 2008 | | | | | | once-daily | | | | | | rosiglitazone XR | | PPAR gamma agonist | | Alzheimer’s disease | | III | | | | Lunivia† | | non-benzodiazepine GABA agonist | | insomnia | | Submitted | S:Jul07 | N/A | | Lamictal XR | | sodium channel inhibitor | | epilepsy – partial seizures, once-daily | | Approvable | N/A | AL:Sep07 | | Treximet† | | 5HT1 agonist + naproxen | | migraine – fixed dose combination | | Approvable | N/A | AL:Jun06 | | | | | | | | | | & Aug07 | | Requip Modutab/XL† | | non-ergot dopamine agonist | | Parkinson’s disease – once-daily controlled release | | Approved | A:Mar07 | AL:Dec07 | | | | | | formulation | | | | |

| | |

| GSK Annual Report 2007 | | | | | Estimated | | | 19 | | | | | | | | | | submission dates | | Compound/Product | | Type | | Indication | | Phase | | MAA | | NDA | |

| Musculoskeletal, Inflammation, Gastrointestinal & Urology | | | | | | | | 221149 | | oxytocin antagonist | | threatened pre-term labour | | I | | | | | | 232802 | | 3G-selective oestrogen receptor modulator | | treatment of menopausal symptoms | | I | | | | | | 267268 | | vitronectin integrin antagonist | | age-related macular degeneration | | I | | | | | | 315234 | | monoclonal antibody | | rheumatoid arthritis | | I | | | | | | 366074† | | potassium channel opener | | overactive bladder | | I | | | | | | 751689† | | calcium antagonist | | osteoporosis | | I | | | | | | 768974† | | parathyroid hormone agonist | | osteoporosis | | I | | | | | | relacatib† | | cathepsin K inhibitor | | osteoporosis & osteoarthritis (also bone metastases) | | I | | | | | | 274150 | | selective iNOS inhibitor | | rheumatoid arthritis (also migraine) | | II | | | | | | 681323 | | p38 kinase inhibitor (oral) | | rheumatoid arthritis (also atherosclerosis, COPD | | II | | | | | | | | | | & neuropathic pain) | | | | | | | | 856553 | | p38 kinase inhibitor (oral) | | rheumatoid arthritis (also atherosclerosis & COPD) | | II | | | | | | 876008† | | corticotrophin releasing factor (CRF1) antagonist | | irritable bowel syndrome (also depression & anxiety) | | II | | | | | | casopitant | | NK1 antagonist | | overactive bladder (also depression & anxiety, | | II | | | | | | | | | | chemotherapy induced & postoperative nausea & vomiting) | | | | | | | | dutasteride+ testosterone | | 5-alpha reductase inhibitor + testosterone | | hypogonadism – fixed dose combination | | II | | | | | | HuMax-CD20 | | human monoclonal antibody | | rheumatoid arthritis (chronic lymphocytic leukaemia | | II | | | | | | (ofatumumab)† | | | | & non-Hodgkin’s lymphoma) | | | | | | | | mepolizumab | | anti-IL5 monoclonal antibody | | eosinophilic esophagitis (also severe asthma & nasal polyposis) | | II | | | | | | rosiglitazone XR | | PPAR gamma agonist | | rheumatoid arthritis (also Alzheimer’s disease) | | II | | | | | | solabegron | | beta3 adrenergic agonist | | irritable bowel syndrome | | II | | | | | | solabegron | | beta3 adrenergic agonist | | overactive bladder | | II | | | | | | Avodart+ alpha blocker | | 5-alpha reductase inhibitor + alpha blocker | | benign prostatic hyperplasia – fixed dose combination | | III | | | | | | Avodart | | 5-alpha reductase inhibitor | | reduction in the risk of prostate cancer | | III | | | | | | belimumab† | | anti-B lymphocycte stimulator monoclonal antibody | | systemic lupus erythematosus | | III | | | | | | Entereg/Entrareg† | | peripheral mu-opioid antagonist | | opioid induced bowel dysfunction | | III | | | | | | mepolizumab | | anti-IL5 monoclonal antibody | | hypereosinophilic syndrome (also severe asthma & nasal polyposis) | | III | | | | | | Entereg/Entrareg† | | peripheral mu-opioid antagonist | | post operative ileus | | Approvable | | | | AL:Jul05 & | | | | | | | | | | | | AL:Nov06 | | Boniva/Bonviva† | | bisphosphonate | | treatment of postmenopausal osteoporosis – i.v. injection | | Approved | | A:Mar06 | | A:Jan06 | |

| Neurosciences | | | | | | | | | | | | 163090 | | 5HT1 antagonist | | depression & anxiety | | I | | | | | | 189254 | | histamine H3 antagonist | | dementia | | I | | | | | | 239512 | | histamine H3 antagonist | | dementia | | I | | | | | | 561679† | | CRF1 antagonist | | depression & anxiety | | I | | | | | | 588045 | | 5HT1 antagonist | | depression & anxiety | | I | | | | | | 598809 | | dopamine D3 antagonist | | drug dependency | | I | | | | | | 729327 | | AMPA receptor modulator | | schizophrenia | | I | | | | | | 823296 | | NK1 antagonist | | depression & anxiety | | I | | | | | | 274150 | | selective iNOS inhibitor | | migraine (also rheumatoid arthritis) | | II | | | | | | 372475† | | triple (5HT/noradrenaline/dopamine) re-uptake inhibitor | | depression | | II | | | | | | 468816 | | glycine antagonist | | smoking cessation | | II | | | | | | 649868† | | orexin antagonist | | sleep disorders | | II | | | | | | 681323 | | p38 kinase inhibitor | | neuropathic pain (also atherosclerosis, COPD & | | II | | | | | | | | | | rheumatoid arthritis) | | | | | | | | 683699† | | dual alpha4 integrin antagonist (VLA4) | | multiple sclerosis | | II | | | | | | 742457 | | 5HT6 antagonist | | dementia | | II | | | | | | 773812 | | mixed 5HT/dopaminergic antagonist | | schizophrenia | | II | | | | | | 842166 | | non-cannabinoid CB2 agonist | | inflammatory pain | | II | | | | | | 876008† | | CRF1 antagonist | | depression & anxiety (also irritable bowel syndrome) | | II | | | | | | casopitant | | NK1 antagonist | | depression & anxiety (also overactive bladder, | | II | | | | | | | | | | chemotherapy induced & postoperative nausea & vomiting) | | | | | | | | talnetant | | NK3 antagonist | | schizophrenia | | II | | | | | | gepirone ER† | | 5HT1a agonist | | major depressive disorder, once-daily | | III | | | | 2007 | | Lamictal XR | | sodium channel inhibitor | | epilepsy – partial generalised tonic-clonic seizures, once-daily | | III | | N/A | | 2007 | | rosiglitazone XR | | PPAR gamma agonist | | Alzheimer's disease (also rheumatoid arthritis) | | III | | | | | | Lamictal XR | | sodium channel inhibitor | | epilepsy – partial seizures, once-daily | | Submitted | | N/A | | S:Nov06 | | Requipextended release | | non-ergot dopamine agonist | | restless legs syndrome | | Submitted | | N/A | | S:Oct06 | | Requip Modutab/XL 24 hour† | | non-ergot dopamine agonist | | Parkinson’s disease – once-daily controlled release formulation | | Submitted | | S:Dec05 | | S:Feb07 | | Trexima† | | 5HT1 agonist + naproxen | | migraine – fixed dose combination | | Approvable | | N/A | | AL:Jun06 | | Wellbutrin XL† | | noradrenaline/dopamine re-uptake inhibitor | | seasonal affective disorder | | Approved | | N/A | | A:Jun06 | | Wellbutrin XL/XR† | | noradrenaline/dopamine re-uptake inhibitor | | depression | | Approved | | A:Dec06 | | A:Aug03 | |

<

Back to Contents | Delivering the product pipeline for patients | | | | | | Business review | | Delivering the product pipeline for patients | | continued | |

| | | | | | | Estimated | | | | | | | | | submission | dates | | Compound | | Type | | Indication | Phase | MAA | NDA |

| | Oncology | | | | | | | | | 461364 | | polo-like kinase inhibitor | | cancer | I | | | | 690693 | | AKT kinase inhibitor | | cancer | I | | | | 923295† | | centromere-associated protein E (CENP-E) | | cancer | I | | | | | | inhibitor | | | | | | | Armala(pazopanib) | | multi-kinase angiogenesis inhibitor | | colorectal cancer | I | | | iboctadekin†+ rituximab | | lL18 immunomodulator + anti-CD20 | | non-Hodgkin’s lymphoma | I | | | | | | monoclonal antibody | | | | | | | totrombopag† | | thrombopoietin agonist | | thrombocytopaenia | I | | | | 1363089 (XL-880)† | | C-met kinase inhibitor | | papillary renal cell carcinoma, gastric cancer and head & neck squamous cell carcinoma | II | | | | ofatumumab† | | anti-CD20 human monoclonal antibody | | relapsed diffuse large B cell lymphoma | II | | | | Armala(pazopanib) | | multi-kinase angiogenesis inhibitor | | non-small cell lung cancer | II | | | | Armala(pazopanib) | | multi-kinase angiogenesis inhibitor | | ovarian cancer | II | | | | Armala(pazopanib) | | multi-kinase angiogenesis inhibitor | | sarcoma | II | | | | Armala(pazopanib) + | | multi-kinase angiogenesis inhibitor + ErbB-2 | | metastatic breast cancer | II | | | | Tyverb/Tykerb | | and epidermal growth factor receptor | | | | | | | | | (EGFR) dual kinase inhibitor | | | | | | | Armala(pazopanib + | | multi-kinase angiogenesis inhibitor + ErbB-2 | | other cancers | II | | | | Tyverb/Tykerb | | and EGFR dual kinase inhibitor | | | | | | | Revolade/Promacta† | | thrombopoietin agonist | | chemotherapy-induced thrombocytopaenia | II | | | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | head & neck squamous cell carcinomas | II | | | | | | | | (unresectable disease) | | | | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | refractory inflammatory breast cancer | II | | | | Armala(pazopanib) | | multi-kinase angiogenesis inhibitor | | renal cell cancer | III | | | | Armala(pazopanib) + | | multi-kinase angiogenesis inhibitor + ErbB-2 | | inflammatory breast cancer | III | | | | Tyverb/Tykerb | | and EGFR dual kinase inhibitor | | | | | | | elesclomol (STA-4783)† | | oxidative stress inducer | | metastatic melanoma | III | | | | Hycamtin | | topoisomeraseI inhibitor | | ovarian cancer first-line therapy | III | | | | ofatumumab† | | anti-CD20 human monoclonal antibody | | refractory chronic lymphocytic leukaemia | III | 2008 | 2008 | | | | | | (also rheumatoid arthritis) | | | | | ofatumumab† | | anti-CD20 human monoclonal antibody | | refractory follicular lymphoma (also rheumatoid arthritis) | III | | | | Revolade/Promacta† | | thrombopoietin agonist | | hepatitis C | III | | | | Revolade/Promacta† | | thrombopoietin agonist | | long-term idiopathic thrombocytopaenic purpura | III | 2008 | 2008 | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | breast cancer, adjuvant therapy | III | | | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | breast cancer, brain metastases | III | | | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | breast cancer, first-line therapy | III | | | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | head & neck squamous cell carcinomas (resectable disease) | III | | | | Zunrisa/Rezonic | | NK1 antagonist | | chemotherapy induced & postoperative nausea & | III | 2008 | 2008 | | | | | | vomiting (also depression & anxiety) | | | | | Revolade/Promacta† | | thrombopoietin agonist | | short-term idiopathic thrombocytopaenic purpura | Submitted | 2008 | S:Dec07 | | Hycamtin | | topoisomerase I inhibitor (oral) | | small cell lung cancer, second-line therapy | Approved | S:May07 | A:Oct07 | | Tyverb/Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | refractory breast cancer | Approved | S:Oct06 | A:Mar07 |

| | Respiratory | | | | | | | | | 656933 | | interleukin 8 antagonist | | cystic fibrosis | I | | | | 835726 | | histamine H1/H3 dual antagonist (oral) | | allergic rhinitis | I | | | | 1004723 | | histamine H1/H3 dual antagonist (intranasal) | | allergic rhinitis | I | | | | 2190914 (AM-103)† | | 5 lipoxygenase activating protein (FLAP) inhibitor | | respiratory diseases | I | | | | 159797† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a glucocorticoid agonist | II | | | | 159802† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a glucocorticoid agonist | II | | | | 256066 | | PDE IV inhibitor (inhaled) | | COPD | II | | | | 256066 | | PDE IV inhibitor (inhaled) | | asthma | II | | | | 256066 | | PDE IV inhibitor (intranasal) | | allergic rhinitis | II | | | | 573719 | | muscarinic acetylcholine antagonist | | COPD | II | | | | 642444† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a glucocorticoid agonist | II | | | | 679586 | | monoclonal antibody | | severe asthma | II | | | | 681323 | | p38 kinase inhibitor (oral) | | COPD (also atherosclerosis, neuropathic pain & | II | | | | | | | | rheumatoid arthritis) | | | | | 685698 | | glucocorticoid agonist | | asthma, also COPD & asthma in combination with a long-acting beta2 agonist (also as Avamys/Veramyst for allergic rhinitis) | II | | | | 856553 | | p38 kinase inhibitor (oral) | | COPD (also atherosclerosis, depression & rheumatoid arthritis) | II | | | | 870086 | | novel glucocorticoid agonist | | asthma | II | | | | 961081† | | muscarinic antagonist, beta2 agonist | | COPD | II | | | | darotropium (233705) | | muscarinic acetylcholine antagonist | | COPD | II | | | | mepolizumab | | anti-IL5 monoclonal antibody | | severe asthma & nasal polyposis (also hypereosinophilic syndrome) | II | | | | Avamys/Veramyst | | glucocorticoid agonist | | allergic rhinitis | Approved | A:Jan08 | A:Apr07 |

| | |

| 20 | GSK Annual Report 2007 | | |

Back to Contents | | | REPORT OF THE DIRECTORS | | | Delivering the product pipeline for patients | continued |

|

| | | | | | | | | Estimated | | | | | | | | | | | | | submission dates | | | Compound/Product | | Type | | Indication | | Phase | | MAA | | NDA | |

| | Oncology | | | | | | | | | | | | | 559448† | | thrombopoietin agonist | | thrombocytopaenia | | I | | | | | | | 626616† | | human kinase inhibitor | | chemoprotection | | I | | | | | | | pazopanib | | vascular endothelial growth factor | | non-small cell lung cancer & colorectal cancer | | I | | | | | | | | | (VEGF) tyrosine kinase inhibitor | | (in combination with other treatment regimens) | | | | | | | | | relacatib† | | cathepsin K inhibitor | | bone metastases (also osteoporosis & osteoarthritis) | | I | | | | | | | pazopanib +Tykerb | | VEGF tyrosine kinase inhibitor + ErbB-2 and epidermal growth factor receptor (EGFR) dual kinase inhibitor | | breast cancer | | II | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | pazopanib +Tykerb | | VEGF tyrosine kinase inhibitor + ErbB-2 | | other cancers | | II | | | | | | | | | and EGFR dual kinase inhibitor | | | | | | | | | | | Promacta(eltrombopag)† | | thrombopoietin agonist | | chemotherapy induced thrombocytopaenia | | II | | | | | | | Promacta(eltrombopag)† | | thrombopoietin agonist | | hepatitis C | | II | | | | | | | casopitant | | NK1 antagonist | | chemotherapy induced & postoperative* nausea & | | III | | | | | | | | | | | vomiting (*USA only) | | | | | | | | | | | | | (also overactive bladder, depression & anxiety) | | | | | | | | | HuMax-CD20 | | human monoclonal antibody | | chronic lymphocytic leukaemia & non-Hodgkin’s | | III | | | | | | | (ofatumumab)† | | | | lymphoma (also rheumatoid arthritis) | | | | | | | | | Hycamtin | | topo-isomerase I inhibitor | | ovarian cancer first-line therapy | | III | | | | | | | Hycamtin | | topo-isomerase I inhibitor | | small cell lung cancer second-line therapy – | | III | | 2007 | | 2007 | | | | | | | oral formulation | | | | | | | | | pazopanib | | VEGF tyrosine kinase inhibitor | | renal cell cancer | | III | | | | | | | Promacta(eltrombopag)† | | thrombopoietin agonist | | long-term idiopathic thrombocytopaenic purpura | | III | | | | | | | Promacta(eltrombopag)† | | thrombopoietin agonist | | short-term idiopathic thrombocytopaenic purpura | | III | | | | 2007/08 | | | Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | breast cancer, adjuvant therapy | | III | | | | | | | Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | breast cancer, first-line therapy | | III | | | | | | | Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | head & neck squamous cell carcinomas | | III | | | | | | | Tykerb | | ErbB-2 and EGFR dual kinase inhibitor | | refractory breast cancer | | Submitted | | S:Oct06 | | S:Sep06 | | | Arranon/Atriance | | guanine arabinoside prodrug | | acute lymphoblastic leukaemia & lymphomas | | Approved | | S:May06 | | A:Oct05 | | | Hycamtin | | topo-isomerase I inhibitor | | cervical cancer, second-line therapy | | Approved | | A:Nov06 | | A:Jun06 | |

| | Respiratory | | | | | | | | | | | | | 256066 | | PDE IV inhibitor (inhaled) | | COPD | | I | | | | | | | 573719 | | muscarinic acetylcholine antagonist | | COPD | | I | | | | | | | 679586 | | monoclonal antibody | | severe asthma | | I | | | | | | | 961081† | | muscarinic antagonist, beta2 agonist | | COPD | | I | | | | | | | 159797† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a | | II | | | | | | | | | | | glucocorticoid agonist | | | | | | | | | 159802† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a | | II | | | | | | | | | | | glucocorticoid agonist | | | | | | | | | 233705 | | muscarinic acetylcholine antagonist | | COPD | | II | | | | | | | 256066 | | PDE IV inhibitor (inhaled) | | asthma | | II | | | | | | | 256066 | | PDE IV inhibitor (intranasal) | | allergic rhinitis | | II | | | | | | | 597901† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a | | II | | | | | | | | | | | glucocorticoid agonist | | | | | | | | | 642444† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a | | II | | | | | | | | | | | glucocorticoid agonist | | | | | | | | | 678007† | | long-acting beta2 agonist | | COPD, also COPD & asthma in combination with a | | II | | | | | | | | | | | glucocorticoid agonist | | | | | | | | | 681323 | | p38 kinase inhibitor (oral) | | COPD (also atherosclerosis, neuropathic pain & | | II | | | | | | | | | | | rheumatoid arthritis) | | | | | | | | | 685698 | | glucocorticoid agonist | | asthma & COPD in combination with a long-acting | | II | | | | | | | | | | | beta2 agonist (also asAvamys/Allermistfor allergic rhinitis) | | | | | | | | | 784568 | | glucocorticoid agonist (intranasal) | | allergic rhinitis | | II | | | | | | | 799943 | | glucocorticoid agonist | | asthma & COPD in combination with a long-acting | | II | | | | | | | | | | | beta2 agonist | | | | | | | | | 856553 | | p38 kinase inhibitor (oral) | | COPD (also atherosclerosis & rheumatoid arthritis) | | II | | | | | | | 870086 | | novel glucocorticoid agonist | | asthma | | II | | | | | | | mepolizumab | | anti-IL5 monoclonal antibody | | severe asthma & nasal polyposis (also hypereosinophilic | | II | | | | | | | | | | | syndrome & eosinophilic esophagitis) | | | | | | | | | Avamys/Allermist | | glucocorticoid agonist | | allergic rhinitis | | Submitted | | S:Jul06 | | S:Jun06 | | | Seretide/Advair | | beta2 agonist/inhaled corticosteroid | | COPD – mortality claim | | Submitted | | S:Sep06 | | S:Oct06 | | | Ariflo | | PDE IV inhibitor (oral) | | COPD | | Approvable | | | | AL:Oct03 | | | Seretide | | beta2 agonist/inhaled corticosteroid | | asthma – initial maintenance therapy | | Approved | | A:Jul06 | | N/A | | | Seretide/Advair | | beta2 agonist/inhaled corticosteroid | | asthma – non-CFC inhaler | | Approved | | A:Jun00 | | A:Jun06 | |

<Back to Contents

| Business review | | Delivering the product pipeline for patients | continued |

|

| | | | | | | | | | | | | | Business review | | Delivering the product pipeline for patients | | continued | | |

| | | | | | | Estimated | | | | | | | | | submission | dates | | Vaccine | | Type | | Indication | Phase | MAA | BLA |

| | Paediatric Vaccines | | | | | | | | | Hib-MenCY-TT | | conjugated | | Neisseria meningitisgroups C & Y disease & | III | | | | | | | | Haemophilus influenzaetype b disease prophylaxis | | | | | MenACWY-TT | | conjugated | | Neisseria meningitisgroups A, C, W & Y disease | III | | | | | | | | prophylaxis | | | | | Infanrix-IPV/Kinrix | | subunit – inactivated | | diptheria, tetanus, pertussis + poliomyelitis prophylaxis (booster-5th dose) | Submitted | | S:Apr07 | | Synflorix | | conjugated | | Streptococcus pneumoniaedisease and non-typeable | Submitted | S:Dec07 | | | | | | | Haemophilus influenzaeprophylaxis for children | | | | | Rotarix† | | live attenuated (oral) | | rotavirus-induced gastroenteritis prophylaxis | Approved | A:Feb06 | S:Jun07 | | Other Vaccines | | | | | | | | | Cytomegalovirus | | recombinant | | cytomegalovirus infection prophylaxis | I | | | | HIV | | recombinant | | HIV infection prophylaxis | I | | | | S. pneumoniaeadult | | recombinant – conjugated | | Streptococcus pneumoniaedisease prophylaxis | l | | | | Dengue fever | | attenuated tetravalent vaccine | | Dengue fever prophylaxis | ll | | | | Epstein-Barr virus† | | recombinant | | EBV infection prophylaxis | ll | | | | Hepatitis E virus† | | recombinant | | hepatitis E prophylaxis | ll | | | | Mosquirix | | recombinant | | malaria prophylaxis | ll | | | | Tuberculosis | | recombinant | | tuberculosis prophylaxis | II | | | | Varicella Zoster virus | | recombinant | | Varicella Zoster prevention | II | | | | Flu pandemic† | | H5N1 inactivated split – monovalent | | pandemic influenza prophylaxis | III | 2008 | | | | | (Quebec) | | | | | | | Flu pre-pandemic† | | H5N1 inactivated split – monovalent | | pandemic influenza prophylaxis | III | 2008 | 2008 | | | | (Quebec) | | | | | | New generation flu vaccine | | inactivated split – trivalent | | seasonal influenza prophylaxis for the elderly | III | | | | Simplirix | | recombinant | | genital herpes prophylaxis | lll | | | | Boostrix | | subunit | | adult booster for diphtheria, tetanus & pertussis | Submitted | | S:Feb08 | | Flu pandemic† | | H5N1 inactivated split – monovalent | | pandemic influenza prophylaxis | Submitted | S:Feb07 | | | | | (Dresden) | | | | | | | Flu pre-pandemic† | | H5N1 inactivated split – monovalent | | pandemic influenza prophylaxis | Submitted | S:Jan07 | | | | | (Dresden) | | | | | | | Cervarix† | | recombinant | | human papilloma virus infection prophylaxis | Approved | A:Sep07 | AL:Dec07 | | Antigen Specific Cancer Immunotherapeutic (ASCI) | | | | | | | MAGE-A3 ASCI | | recombinant | | treatment of melanoma | II | | | | MAGE-A3 ASCI | | recombinant | | treatment of non-small cell lung cancer | III | | |

| | |

| GSK Annual Report 2007 | | | | | Estimated | 21 | | | | | | | | | | submission dates | |

Back to Contents Compound/Product | | Type | | Indication | | Phase | | MAA | | NDA | |

| Paediatric Vaccines | | | | | | | | | | | | MenACWY-TT | | conjugated | | Neisseria meningitisgroups A, C, W & Y disease | | II | | | | | | | | | | | prophylaxis | | | | | | | | Globorix | | conjugated | | diptheria, tetanus, pertussis, hepatitis B,Haemophilus | | lll | | 2007 | | | | | | | | influenzaetype b disease,Neisseria meningitisgroups | | | | | | | | | | | | A & C disease prophylaxis | | | | | | | | Hib-MenCY-TT | | conjugated | | Neisseria meningitisgroups C & Y disease & | | III | | | | | | | | | | Haemophilus influenzaetype b disease prophylaxis | | | | | | | | Infanrix-IPV | | subunit – inactivated | | diptheria, tetanus, pertussis + poliomyelitis prophylaxis | | III | | | | 2007 | | | | | | (booster 5th dose) | | | | | | | | Synflorix | | conjugated | | Streptococcus pneumoniaedisease and non-typeable | | lll | | 2007 | | | | | | | | Haemophilus influenzaeprophylaxis for children | | | | | | | | Priorix-Tetra | | live attenuated | | measles, mumps, rubella & varicella prophylaxis | | Approved | | A:Jul06 | | | | Rotarix† | | live attenuated – oral | | rotavirus induced gastroenteritis prophylaxis | | Approved | | A:Feb06 | | 2007 | |

| Other Vaccines | | | | | | | | | | | | HIV | | recombinant | | HIV infection prophylaxis | | l | | | | | | S. pneumoniaeelderly | | recombinant – conjugated | | Streptococcus pneumoniaedisease prophylaxis | | l | | | | | | Dengue fever | | attenuated tetravalent vaccine | | Dengue fever prophylaxis | | ll | | | | | | Epstein-Barr virus† | | recombinant | | EBV infection prophylaxis | | ll | | | | | | Hepatitis E virus† | | recombinant | | hepatitis E prophylaxis | | ll | | | | | | Mosquirix | | recombinant | | malaria prophylaxis | | ll | | | | | | Tuberculosis | | recombinant | | tuberculosis prophylaxis | | II | | | | | | Varicella Zoster virus | | recombinant | | Varicella Zoster prevention | | II | | | | | | New generation ‘flu vaccine | | inactivated split-trivalent | | seasonal influenza prophylaxis for the elderly | | III | | | | | | Simplirix | | recombinant | | genital herpes prophylaxis | | lll | | | | | | Daronrix | | inactivated whole-aluminium salt – | | pandemic influenza prophylaxis | | Submitted | | S:Dec05 | | | | | | monovalent | | | | | | | | | | ‘Flu pre-pandemic | | H5N1 inactivated split- monovalent | | pandemic influenza prophylaxis | | Submitted | | S:Jan07 | | | | Cervarix† | | recombinant | | human papilloma virus infection prophylaxis | | Submitted | | S:Mar06 | | 2007 | | FluLaval | | inactivated split | | influenza prophylaxis | | Approved | | 2007 | | A:Oct06 | |

| Pharmaccines | | | | | | | | | | | | P501 | | recombinant | | treatment of prostate cancer | | l | | | | | | MAGE-A3 | | recombinant | | treatment of non-small cell lung cancer & melanoma | | ll | | | | | |

<Back to Contents

| Business review | | | | Being the best place for the best people to do their best work | | | |

| | | Business review | | Being the best place for the best people to do their best work | | | |

GlaxoSmithKline people

GlaxoSmithKline is committed to creating the best place for the best people to do their best work to deliver the Group’s business strategy. The Group employs over 100,000 people in more than 117 countries.

| | | GSK employs over 100,000 people in more than 100 countries and is committed to creating the best place for the best people to do their best work. | | |

Recruitment, talent management and leadership development

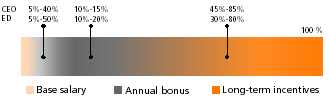

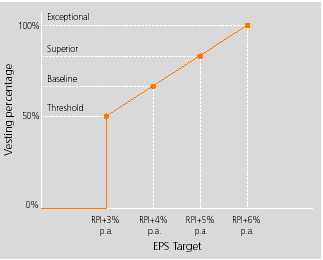

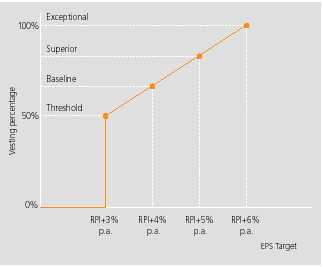

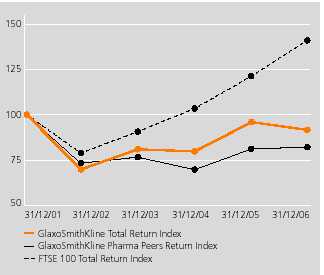

Attracting and recruiting the best people in the industry is critical to enhancing and sustaining GSK’s performance. The Group’s Talent Solutions recruiters in the USA and UKRecruiters across GSK are focused on pro-active identificationactively targeting the best talent and assessing their fit with the organisation for many key roles. GSK seeks to recruit people with the highest level of talented external candidatesintegrity. Interview questions with specific ethical and integrity components have been developed for key jobs.inclusion in the standard interview questionnaire during 2008. The annual performance and development planning (PDP) process ensures that employees set business alignedbusiness-aligned objectives and behavioural goals. PDPs are reviewed throughout the year, culminating with an end of year review that is factored into compensation decisions. The annual talent management cycle identifies the highest performing people in each business and function and key talent is developed through tailored management and leadership programmes, (for more detail see the Group’s Corporate Responsibility Report), exposure to top management through programmes such as the Chief Executive Forum and stretch assignments. A pool of potential successors is identified for each Vice-President position and other critical roles inthroughout the organisation.Group. Performance and reward

Reward systems are designed to support a culture of high performance and to attract and retain the best people. Performance based pay and bonuses, share awards and share options align employee interests with the meeting of business targets. Communication and employee involvement

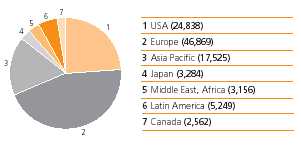

The Group conducts a Global Leadership Survey (GLS) every two years. The most recent survey was conducted in 2006 among more than 10,000 managers to gauge opinions on critical issues such as culture and confidence in the Group’s future. Scores on morale and engagement have steadily increased since 2002 and compare very favourably with global benchmarks (42 top-ranked companies). In the 2006 survey, 90% of managers were “proud‘proud to be part of GlaxoSmithKline”GSK’ and 86% would “gladly‘gladly refer a friend or family member to work for GlaxoSmithKline”GSK’. Each business and function develops action plans to address areas for improvement based on results from the GLS and other surveys. The Group also consults employees on changes that affect them and discusses developments in the businessesbusiness with a European Employee Consultation Forum and similar bodies in countries where this is national practice. In 2006 in the UK, a new national consultation forum was created. The UK Information and Consultation Forum is made up of 15 elected employee representatives and seven management representatives. It meets regularly so that employee views can be taken into account before major changes affecting all employees are implemented. Employee numbers by region  Business ethics and reputation

Performance with integrity is central to operating at GSK. The 2006 GLS showed 91% believe that “people in their department show commitment to performance with integrity”and 82% agree that they “can report unethical practices without fear of reprisal”. To engage a wider range of managers, the half-day workshop on Ethical Decision-making (attended by 479 leaders in 2005) has been extended to three e-learning modules, which are being implemented across the businesses. So far, over 400 people have completed at least one of the three modules.

Maintaining Standards

GSK expects employees to meet high ethical standards in all aspects of business by conducting activities with honesty and integrity, adhering to corporate responsibility principles and complying with applicable laws and regulations. GSK audits its operationsThe 2006 GLS showed 91% believed that ‘people in their department showed commitment to ensure relevant standards expected, such as those in marketingperformance with integrity’ and 82% agreed that they ‘can report unethical practices without fear of reprisal’. A half-day workshop on Ethical Decision-making has now been extended to three e-learning modules, which are reached or exceeded.being implemented across GSK.

Commitment to the GSK Code of Conduct is reinforced each year by a senior management certification programme, and in 2006each year over 12,000 managers certifiedcertify that they hadhave complied with “Performance‘Performance with Integrity”Integrity’ principles. The PDP process includes an assessment of how well employees have implemented the GSK Spirit, the principles usedaudits its operations regularly to define GSK’s culture. This may have a significant impact on bonus payments and may also affect future career development. In this way the Group holds employees accountable for delivering performance with highensure that relevant standards, of integrity to protect and enhance GSK’s reputation.such as those in marketing practices, are reached or exceeded.

Diversity

The diversity and inclusion initiatives focus on improving performance by responding to the diverse needs of employees, customers and external stakeholders.performance. In the fifth year of the annual Multicultural Marketing and Diversity Awards, 14 teams from aroundaward winning projects repeatedly demonstrated the world highlighted innovative activities that demonstrated business impact.value of understanding diverse perspectives and leveraging those differences to make a positive difference in the workplace, with customers and in the communities served. In 2006,2007, the global management population was 63.7%63% male and 36.3%37% female. For more details on diversity measures, see the Employment Practices section of theGroup’s Corporate Responsibility report. The Group is committed to employment policies free from discrimination against existing or potential staff on the grounds of age, race, ethnic and national origin, gender, sexual orientation, faith or disability. GSK is committed to offering people with disabilities access to the full range of recruitment and career opportunities. Every effort is made to retain and support employees who become disabled while working with the Group. HealthHealthy high performance

Healthy, energised and well-being

Healthyengaged employees together with healthy and healthysustainable ways of working contribute to the sustained performance of the Group. Global policies on employee health are supported by mandatory standards that integrate employee health and safety and environmental requirements. These standards are applied to all the Group’s facilities and operations worldwide.

A commitment to flexible working through flexi-time, tele-conferencing, remote working and flexible work schedules, recognises that employees work best in an environment that helps them integrate their work and personal lives. During 2006, theThe Group’s Employee Health Management function developed ais actively delivering and implementing team and personal resilience programmeprogrammes which are now available in 13 languages. In 2007, in partnership with the Group’s Leadership and Development function, Energy for Performance training has now been translated into 11 languages and adoptedintroduced in 12 countries.order to improve further the potential of employees.

| 22 |

| GSK Annual Report 20062007 | 17 | |

<Back to Contents | Business review | | | | Improving access to medicines | | |

| | | | | Business review | | Improving access to medicines | | | |

| | | GSK is committed to contributing to health improvements in a sustainable manner. In the developing world, this includes not-for-profit pricing, community investment programmes and other innovative solutions, while in the developed world the focus is on patient assistance programmes. | | |

Access to healthcare in the developing world Access to healthcare in developing countries remains a major challenge to the global community. The problem, which is rooted in poverty, demands a significant mobilisation of political will, additional resources and a true spirit of partnership. GSK continues to play a vital role, through its commitment to R&D into diseases particularly prevalent in the developing world, through its programme of preferential pricingnot-for-profit prices for its anti-retrovirals (ARVs), anti-malarials and vaccines, through its community investment programmes (see page 19)24) and through its willingness to seek innovative solutions, such as voluntary licencinglicensing arrangements. Preferential pricing programme

GSK has offered its vaccines to key organisations for vaccination programmes in developing countries at preferential prices for over 20 years. The Group also sets a single not-for-profit price for each of its ARVs and anti-malarials to a wide range of customers in the Least Developed Countries (UN definition) and sub-Saharan Africa, as well as Country Coordinating Mechanism-projects fully funded by the Global Fund to Fight AIDS, TB, and Malaria and the US President’s Emergency Plan for AIDS Relief (PEPFAR). In July 2006, GSK introduced two new ARVs,KivexaandTelzir, to its not-for-profit offering and reduced prices to GSK’s abacavir-containing products by up to 30%. GSK is committed to contributing to health improvements in a sustainable manner. The prices for its ARVs and anti-malarials are therefore set at levels at which no profit is made, but direct costs are covered, allowing supply to be sustained for as long as required. During 2006,2007, GSK shipped to developing countries over 2713 million tablets of not-for-profit-pricedCombivirand nearly 5972 million tablets of not-for-profit-pricedEpivir. Some of ourGSK’s licensees are now supplying key markets in a more significant way. The offer of not-for-profit prices requires a sustainable framework, combining GSK’s commitment to preferential pricing with commitments from governments of the developed world to avoid price referencing against preferentially priced medicines and from all governments to help prevent product diversion. GSK has taken steps to minimise the threat of diversion with the registration of specific access packs or access tablets (differentiated red tablet as opposed to the traditional white) for its key ARVs. GSK isremains the only companyGroup to have registered its ARVs under the European Union’s Anti-Diversion Regulation. Innovative solutions

GSK has shown industry leadership in granting voluntary licences to eight generic companies for the manufacture and supply of ARVs to both the public and private sectors in sub-Saharan Africa. GSK is also a leader in collaborating in Public-Private Partnerships to enable new drug discovery and development to take place more effectively. Looking ahead

GSK will continue to build on its product, pricing and partnership commitments to help improve healthcare in the developing world. However, a significant increase in funding from the global community is still needed. It is also important to maintain incentives for R&D through protection of intellectual property. While much has been achieved, sustainable progress will only occur if the significant barriers that stand in the way of better access to healthcare are tackled as a shared responsibility by all sectors of global society – governments, international agencies, charities, academic institutions, the pharmaceutical industry and others. Access to medicines in the developed world Programmes in the USA

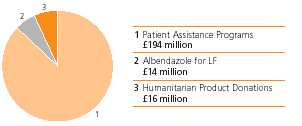

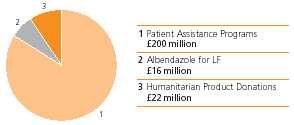

GSK is working to provide meaningful access to medicines for people with limited financial resources and without prescription drug insurance. In 2006, 2007 marked the launch of GSK’s US patient assistance programmes provided $370 million worth of medicines, valued at wholesale acquisition cost, to 402,000 qualifying low income US residents. GSK has worked to expand itsnewest patient assistance programme, and created “GSK Access” to include thoseGSK Access, for eligible patients enrolled in Medicare Part D. BeginningD prescription drug plans. Enrolment in 2007, GSK Access will help eligible Part-D-enrolled patients who have spent at least $600 of their own money during the current year on outpatient medicinesthis new programme was encouraged through a multi-million dollar national advertising campaign in major magazines and may qualify to receive GSK medicines free.newspapers.