UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

(Mark One)

| |

o | |

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | OR |

OR |

| x | | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | |

| For the fiscal year endedDecember 31, 20132016 |

| OR |

| | | |

OR |

| o | | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the transition period from _________________ to _________________ |

| | | OR |

OR |

| o | | |

o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| | Date of event requiring this shell company report _________________ |

Commission file number: 001-36231

|

|

| SCORPIO BULKERS INC. |

| (Exact name of Registrant as specified in its charter) |

| |

| (Translation of Registrant’s name into English) |

| |

| Republic of the Marshall Islands |

| (Jurisdiction of incorporation or organization) |

| |

| 9, Boulevard Charles III Monaco 98000 |

| (Address of principal executive offices) |

| |

Mr. Emanuele Lauro |

+377-9898-5716

377-9798-5715 9, Boulevard Charles III Monaco 98000

|

| (Name, Telephone, E-mail and/or Facsimile, and address of Company Contact Person) |

Securities registered or to be registered pursuant to section 12(b) of the Act.

|

| | |

| Title of each class | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | New York Stock Exchange |

| 7.50% Senior Notes due 2019 | | New York Stock Exchange |

Securities registered or to be registered pursuant to section 12(g) of the Act.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31,

2013,2016, there were

133,403,93175,298,676 outstanding shares of common stock, par value $0.01 per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See the definitions of “large accelerated filer” and “accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | |

| | Large accelerated filer o | | Accelerated filer ox | | Non-accelerated filer xo |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

| | |

| x | | U.S. GAAP |

| | | |

| | | International Financial Reporting Standards as issued by the international Accounting Standards Board |

| | | |

| | | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

| | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | 19 |

| | | | | 47 |

| | | | | 47 |

| | | | | 51 |

| | | | | 55 |

| | | | | 56 |

| | | | | 57 |

| | | | | 58 |

| | | | | 69 |

| | | | | 69 |

| | | | | |

| | | | 69 |

| | | | | 69 |

| | | | | 69 |

| | | | | 70 |

| | | | | 70 |

| | | | | 71 |

| | | | | 71 |

| | | | | 71 |

| | | | | 71 |

| | | | | 71 |

| | | | | 71 |

| | | | | 72 |

| | | | | |

| | | | 72 |

| | | | | 72 |

| | | | | 72 |

| | | | | 72 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Scorpio Bulkers Inc. desires to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and is including this cautionary statement in connection therewith. This document and any other written or oral statements made by the Company or on its behalf may include forward-looking statements, which reflect its current views with respect to future events and financial performance.

The Private Securities Litigation Reform Act of 1995 provides safe harbor protections for forward-looking statements in order to encourage companies to provide prospective information about their business. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical facts. This document includes assumptions, expectations, projections, intentions and beliefs about future events. These statements are intended as “forward-looking statements.” We caution that assumptions, expectations, projections, intentions and beliefs about future events may and often do vary from actual results and the differences can be material. When used in this document, the words “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “projects,” “likely,” “will,” “would,” “could” and similar expressions or phrases may identify forward-looking statements.

All statements in this document that are not statements of historical fact are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

| ● | our future operating or financial results; |

| ● | statements about planned, pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including drydocking, surveys, upgrades and insurance costs; |

| ● | the strength of world economies; |

| ● | fluctuations in interest rates; |

| ● | general drybulk market conditions, including fluctuations in charter hire rates and vessel values; |

| ● | changes in demand in the drybulk shipping industry, including the market for our vessels; |

| ● | changes in our operating expenses, including bunker prices, dry docking and insurance costs; |

| ● | changes in governmental rules and regulations or actions taken by regulatory authorities; |

| ● | potential liability from pending or future litigation; |

| ● | general domestic and international political conditions; |

| ● | potential disruption of shipping routes due to accidents or political events; |

| ● | our ability to procure or have access to financing, our liquidity and the adequacy of cash flow for our operations; |

| ● | our continued borrowing availability under our debt agreements and compliance with the covenants contained therein; |

| ● | our ability to successfully employ our existing and newbuilding drybulk vessels; |

| ● | our future capital expenditures and investments in the construction, acquisition and refurbishment of our vessels (including the amount and nature thereof and the timing of completion thereof, the delivery and commencement of operations dates, expected downtime and lost revenue); |

| ● | our expectations regarding the availability of vessel acquisitions; |

| ● | vessel breakdowns and instances of off-hire; and |

| ● | statements about drybulk shipping market trends, charter rates and factors affecting supply and demand. |

our future operating or financial results; statements about planned, pending or recent acquisitions, business strategy and expected capital spending or operating expenses, including drydocking, surveys, upgrades and insurance costs;

the strength of world economies;

stability of Europe and the Euro;

fluctuations in interest rates and foreign exchange rates;

changes in the supply of drybulk vessels, including when caused by new newbuilding vessel orders or changes to or terminations of existing orders, and vessel scrapping levels;

general drybulk shipping market conditions, including fluctuations in charter hire rates and vessel values;

changes in demand in the drybulk shipping industry, including the market for our vessels;

changes in the value of our existing vessels and proposed newbuildings;

changes in our operating expenses, including bunker prices, dry docking and insurance costs;

changes in governmental rules and regulations or actions taken by regulatory authorities;

potential liability from pending or future litigation;

general domestic and international political conditions;

potential disruption of shipping routes due to accidents or political events;

our ability to procure or have access to financing, our liquidity and the adequacy of cash flows for our operations;

our continued borrowing availability under our debt agreements and compliance with the covenants contained therein;

our ability to successfully employ our existing and newbuilding drybulk vessels;

our ability to fund future capital expenditures and investments in the construction, acquisition and refurbishment of our vessels (including the amount and nature thereof and the timing of completion thereof, the delivery and commencement of operations dates, expected downtime and lost revenue);

risks associated with vessel construction;

potential exposure or loss from investment in derivative instruments;

potential conflicts of interest involving members of our board and senior management and our significant shareholders;

our expectations regarding the availability of vessel acquisitions and our ability to complete acquisition transactions planned;

vessel breakdowns and instances of off-hire; and

drybulk shipping market trends, charter rates and factors affecting supply and demand.

We have based these statements on assumptions and analyses formed by applying our experience and perception of historical trends, current conditions, expected future developments and other factors we believe are appropriate in the circumstances. All future written and verbal forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained

in or referred to in this section. We undertake no obligation, and specifically decline any obligation, except as required by law, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this annual report might not occur.

See “Item 3. Key Information—D. Risk Factors” for a more complete discussion of these risks and uncertainties and for other risks and uncertainties. These factors and the other risk factors described in this annual report are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results. Consequently, there can be no assurance that actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements.

PART I

PART I

| |

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

|

| |

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

Unless otherwise indicated, references to “Scorpio Bulkers,” the “Company,” “we,” “our,” “us” or similar terms refer to the registrant, Scorpio Bulkers Inc., and its subsidiaries, except where the context otherwise requires. We use the term deadweight tons, or dwt, expressed in metric tons, each of which is equivalent to 1,000 kilograms, in describing the size of our vessels. Unless otherwise indicated, all references to “U.S. dollars,” “dollars,” “U.S. $”

On December 31, 2015, we effected a one-for-twelve reverse stock split. All share and “$” inper share information throughout this annual report arehas been retroactively adjusted to reflect the lawful currencyreverse stock split. The par value was not adjusted as a result of the United States of America and references to “Norwegian Kroner” and “NOK” are to the lawful currency of Norway.reverse stock split.

| |

| A. | Selected Financial Data |

The

following table summarizes our selected

consolidated financialConsolidated Statements of Operations data and

other operatingthe Consolidated Balance Sheet data

at the dates andpresented for the

periods indicated. The selected consolidated financial data in the table as ofyears ended December 31,

20132016, 2015, 2014, and for the period from March 20, 2013 (date of inception) to December 31, 2013, are derived from our audited consolidated financial

statements and notes thereto for the period from March 20, 2013 (date of inception) to December 31, 2013 included elsewhere in this annual report, which have been prepared in accordance with U.S. GAAP.Our audited consolidated statements of operations, shareholders’ equity and cash flows for the period from March 20, 2013 (date of inception) to December 31, 2013, and the consolidated balance sheet at December 31, 2013, together with the notes thereto, are included elsewhere in this annual report. The followingstatements. Such selected financial data should be read in conjunctionconnection with “Item 5. Operating and Financial Review and Prospects,” the consolidated financial statements and related notes thereto, and other financial information included elsewherecontained in this annual report.

| | Period from March

20, 2013 (date of

inception) to

December 31, 2013 | |

In thousands of US dollars except per share and share data | | | | |

Consolidated Statement of Operations Data | | | | |

Revenue: | | | | |

Vessel revenue | | $ | — | |

| | | | |

Operating expenses: | | | | |

Voyage expenses | | | — | |

Vessel operating expenses | | | — | |

Depreciation and amortization | | | — | |

General and administrative expenses | | | 5,505 | |

Total operating expenses | | | 5,505 | |

| | | | |

Operating loss | | | (5,505 | ) |

| | | | |

Other income (expense): | | | | |

Interest income | | | 341 | |

Foreign exchange loss | | | (1,135 | ) |

Other expense, net | | | (8 | ) |

Total other loss | | | (802 | ) |

| | | | |

Net loss | | $ | (6,307 | ) |

| | | | |

Loss per common share- basic and diluted(1) | | $ | (0.16 | ) |

| | | | |

Weighted-average shares outstanding- basic and diluted(1) | | | 39,925,160 | |

| | | December 31, 2013 | |

| In thousands of US dollars | | | | |

| Balance Sheet Data | | | | |

| Cash and cash equivalents | | $ | 733,896 | |

| Vessels under construction | | | 371,692 | |

| Total assets | | | 1,105,684 | |

| Total shareholders’ equity | | | 1,104,212 | |

| | | Period from

March 20,

2013 (date of

inception) to

December 31,

2013 | |

| In thousands of US dollars | | | | |

| Cash Flow Data | | | | |

| Net cash used in operating activities | | $ | (2,237 | ) |

| Net cash used in investing activities | | | (371,692 | ) |

| Net cash provided by financing activities | | | 1,107,825 | |

|

| | | | | | | | | | | | | | | |

| | Year Ended December 31, | | Period from March 20, 2013 (date of inception) to December 31, |

| | 2016 | | 2015 | | 2014 | | 2013 |

| Dollars in thousands, except per share data | | | |

| | | | |

| Consolidated Statement of Operations Data: | | | |

| | | | |

| Total vessel revenue | $ | 78,402 |

| | $ | 62,521 |

| | $ | 48,987 |

| | $ | — |

|

| Total operating expenses | 179,133 |

| | 554,130 |

| | 166,475 |

| | 5,505 |

|

| Operating loss | (100,731 | ) | | (491,609 | ) | | (117,488 | ) | | (5,505 | ) |

| Total other loss | (24,104 | ) | | (19,180 | ) | | 923 |

| | (802 | ) |

| Net loss | $ | (124,835 | ) | | $ | (510,789 | ) | | $ | (116,565 | ) | | $ | (6,307 | ) |

| | | | | | | | |

| Basic weighted average shares outstanding | 56,174 |

| | 21,410 |

| | 11,466 |

| | 3,327 |

|

| Diluted weighted average shares outstanding | 56,174 |

| | 21,410 |

| | 11,466 |

| | 3,327 |

|

| | | | |

| | | | |

| Basic loss per share | $ | (2.22 | ) | | $ | (23.86 | ) | | $ | (10.17 | ) | | $ | (1.90 | ) |

| Diluted loss per share | $ | (2.22 | ) | | $ | (23.86 | ) | | $ | (10.17 | ) | | $ | (1.90 | ) |

|

| | | | | | | | | | | | | | | |

| | As of December 31, | | Period from March 20, 2013 (date of inception) to December 31, |

| Dollars in thousands | 2016 | | 2015 | | 2014 | | 2013 |

| Consolidated Balance Sheet Data: | | | |

| | | | |

| Cash and cash equivalents | $ | 101,734 |

| | $ | 200,300 |

| | $ | 272,673 |

| | $ | 733,896 |

|

| Assets held for sale | — |

| | 172,888 |

| | 43,781 |

| | — |

|

| Vessels, net | 1,234,081 |

| | 764,454 |

| | 66,633 |

| | — |

|

| Vessels under construction | 180,000 |

| | 288,282 |

| | 866,844 |

| | 371,692 |

|

| Total assets | 1,547,157 |

| | 1,473,093 |

| | 1,321,024 |

| | 1,105,684 |

|

| Current liabilities (including current portion of bank loans) | 24,550 |

| | 124,577 |

| | 20,265 |

| | 1,472 |

|

| Bank loans | 493,793 |

| | 342,314 |

| | 29,549 |

| | — |

|

| Senior Notes | 72,199 |

| | 71,671 |

| | 71,222 |

| | — |

|

| Total liabilities | 590,542 |

| | 538,562 |

| | 121,036 |

| | 1,472 |

|

| Shareholders’ equity | 956,615 |

| | 934,531 |

| | 1,199,988 |

| | 1,104,212 |

|

Pursuant to ASU 2015-03, “Simplifying the Presentation of Debt Issuance Costs”, we reclassified unamortized debt issuance costs of $12.3 million and $3.2 million as of December 31, 2015 and 2014, respectively, from Deferred financing costs, net to a reduction in both current and non-current Bank loans, net in the Consolidated Balance Sheet.

| (1) | Diluted weighted-average shares outstanding, which would include the impact of restricted shares, for the period from March 20, 2013 (date of inception) to December 31, 2013 would be anti-dilutive since the Company is in a net loss position. As such, there is no difference between basic and diluted earnings per share for this period. |

| B. | Capitalization and Indebtedness |

Not applicable.

| |

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

The following risks relate principally to the industry in which we operate and our business in general. Other risks relate principally to the securities market and ownership of our

securities, including our common

shares.shares and our 7.50% Senior Notes due 2019, which we refer to as our Senior Notes. The occurrence of any of the events described in this section could significantly and negatively affect our business, financial condition, operating results or cash available for

the payment of dividends

on our common shares and interest on our Senior Notes, or the trading price of our

common shares.securities.

INDUSTRY SPECIFIC RISK FACTORS

Charter hire rates for drybulk vessels are volatile and have declined significantly since their historic highs and may remain at low levels or decrease in the future, which may adversely affect our earnings, revenue and profitability and our ability to comply with our loan covenants.

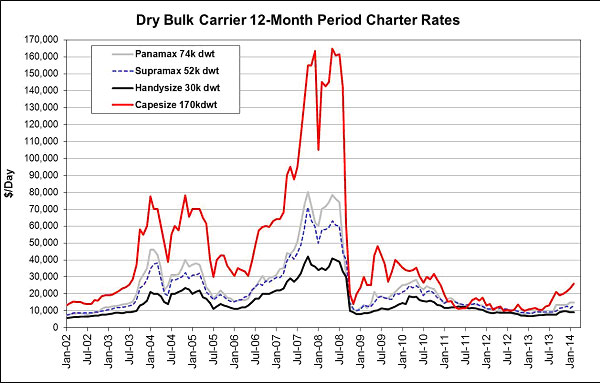

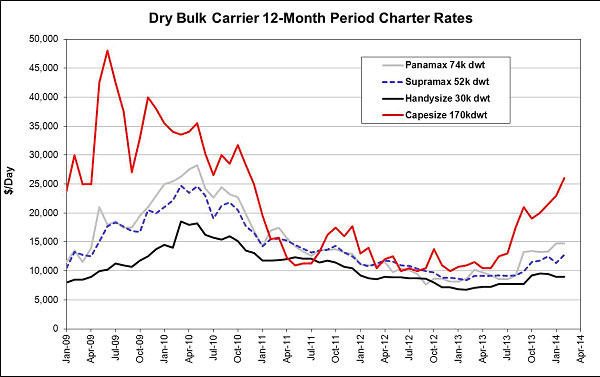

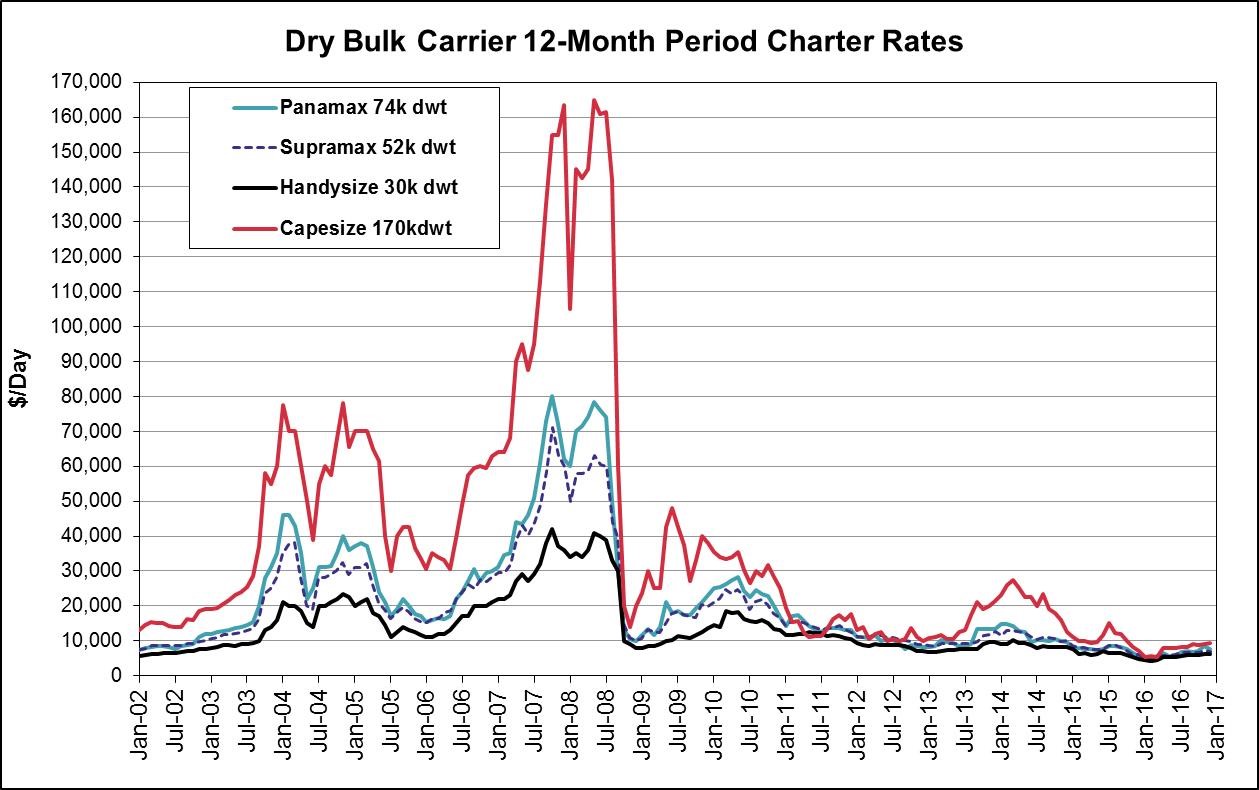

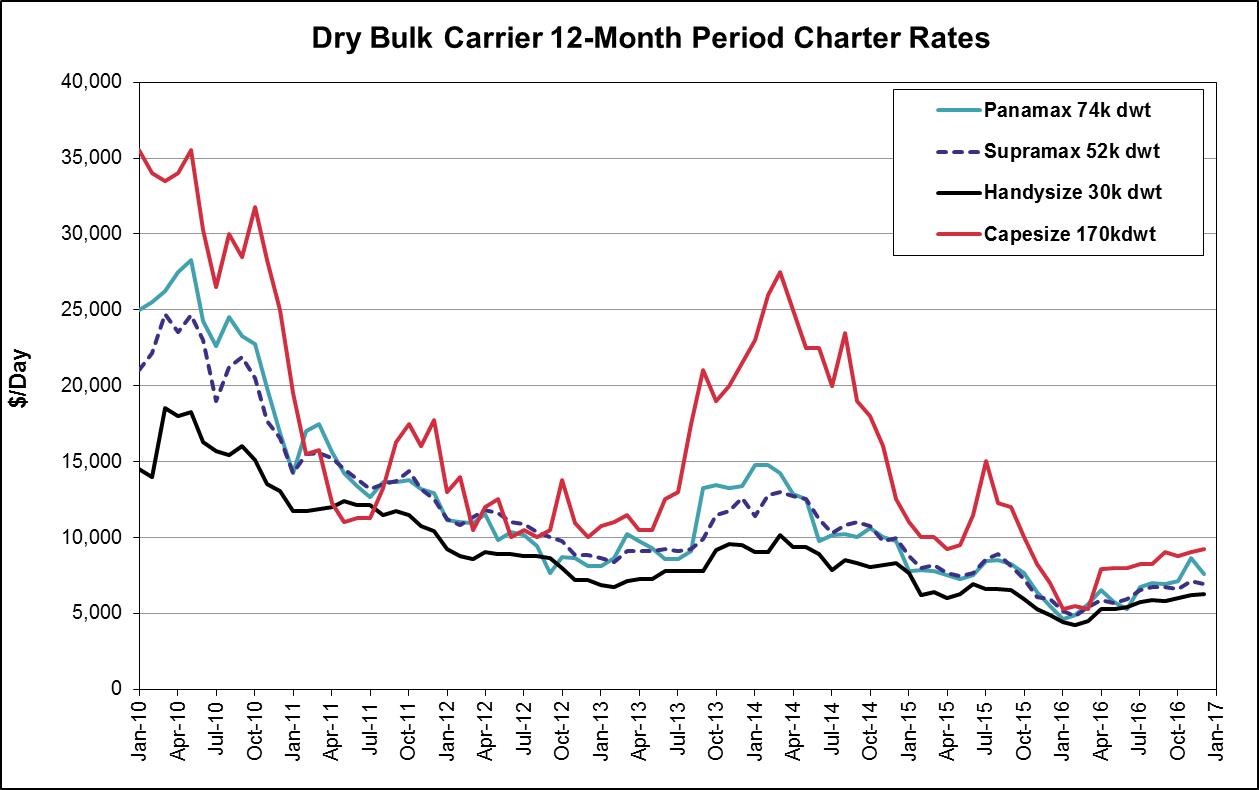

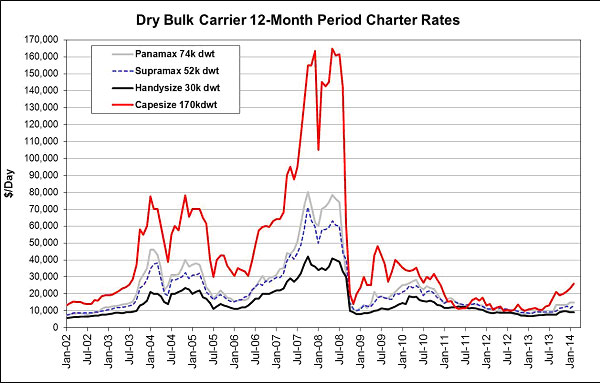

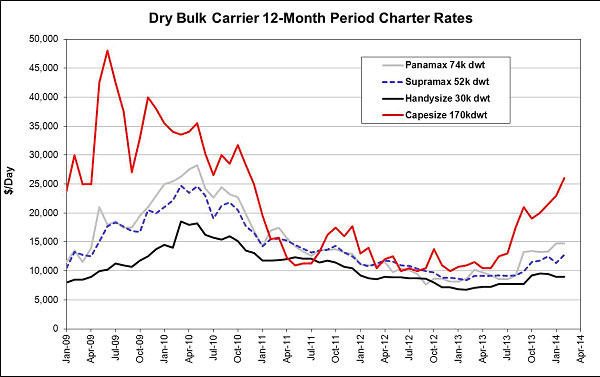

The drybulk shipping industry is cyclical with high volatility in charter hire rates and profitability. The degree of charter hire rate volatility among different types of drybulk vessels has varied widely; however, the continued downturn in the drybulk charter market has severely affected the entire drybulk shipping industry and charter hire rates for drybulk vessels have declined significantly from historically high levels.

In the past, time charter and spot market charter rates for drybulk carriers have declined below operating costs of vessels. The Baltic Dry Index, or the BDI, a daily average of charter rates for key drybulk routes published by the Baltic Exchange Limited, which has long been viewed as the main benchmark to monitor the movements of the drybulk vessel charter market and the performance of the entire drybulk shipping market, declined 94%

in 2008 from

a peakits high of

11,793almost 12,000 in May

2008 to a low of 663 in December 2008 and has remained volatile since then.

The BDI recorded a record low of 647 in February 2012. During

2013,the year ended December 31, 2016, the BDI

remained volatile, ranging fromfluctuated in a

lowrange between 290, the lowest level it has ever reached, and 1,257. As of

698 in January to a high of 2,337 in December, before endingFebruary 3, 2017, the

year at 2,277. The BDI

has since decreased to 1,481 as of March 17, 2014.was 752.

Fluctuations in charter rates result from changes in the supply of and demand for vessel capacity and changes in the supply of and demand for the major commodities carried by water internationally. Because the factors affecting the supply of and demand for vessels are outside of our control and are unpredictable, the nature, timing, direction and degree of changes in industry

conditions are also unpredictable. Since we

intend toprimarily charter all our vessels

principally in the spot market we

will beare exposed to the cyclicality and volatility of the spot market.

WeSpot market charterhire rates may fluctuate significantly based upon available charters and the supply of and demand for seaborne shipping capacity, and we may be unable to keep our vessels fully employed in these short-term

markets ormarkets. Alternatively, charter rates available in the spot market may be insufficient to enable our vessels to

be operatedoperate profitably. A significant decrease in charter rates would affect asset values and adversely affect our profitability, cash flows and ability to pay dividends, if

any.any, in the future, on our common shares, and interest on our Senior Notes. Furthermore, a significant decrease in charter rates would cause asset values to decline, or decline further, and we may have to record an impairment charge in our consolidated financial statements which could adversely affect our financial results.

Factors that influence demand for drybulk vessel capacity include:

| ● | supply of and demand for energy resources, commodities and industrial products; |

| ● | changes in the exploration or production of energy resources, commodities, consumer and industrial products; |

| ● | the location of regional and global exploration, production and manufacturing facilities; |

| ● | the location of consuming regions for energy resources, commodities, consumer and industrial products; |

| ● | the globalization of production and manufacturing; |

| ● | global and regional economic and political conditions, including armed conflicts and terrorist activities; embargoes and strikes; |

| ● | developments in international trade; |

| ● | changes in seaborne and other transportation patterns, including the distance cargo is transported by sea; |

| ● | environmental and other regulatory developments; |

| ● | currency exchange rates; and |

supply of and demand for energy resources, commodities and industrial products; changes in the exploration or production of energy resources, commodities, consumer and industrial products;

the location of regional and global production and manufacturing facilities;

the location of consuming regions for energy resources, commodities, consumer and industrial products;

the globalization of production and manufacturing;

global and regional economic and political conditions, including armed conflicts and terrorist activities, embargoes and strikes;

natural disasters;

disruptions and developments in international trade;

changes in seaborne and other transportation patterns, including the distance cargo is transported by sea;

environmental and other regulatory developments;

currency exchange rates; and

weather.

Factors that influence the supply of

drybulk vessel capacity include:

| ● | the number of newbuilding deliveries; |

| ● | port and canal congestion; |

| ● | the scrapping of older vessels; |

| ● | the number of vessels that are out of service, namely those that are laid-up, drydocked, awaiting repairs or otherwise not available for hire. |

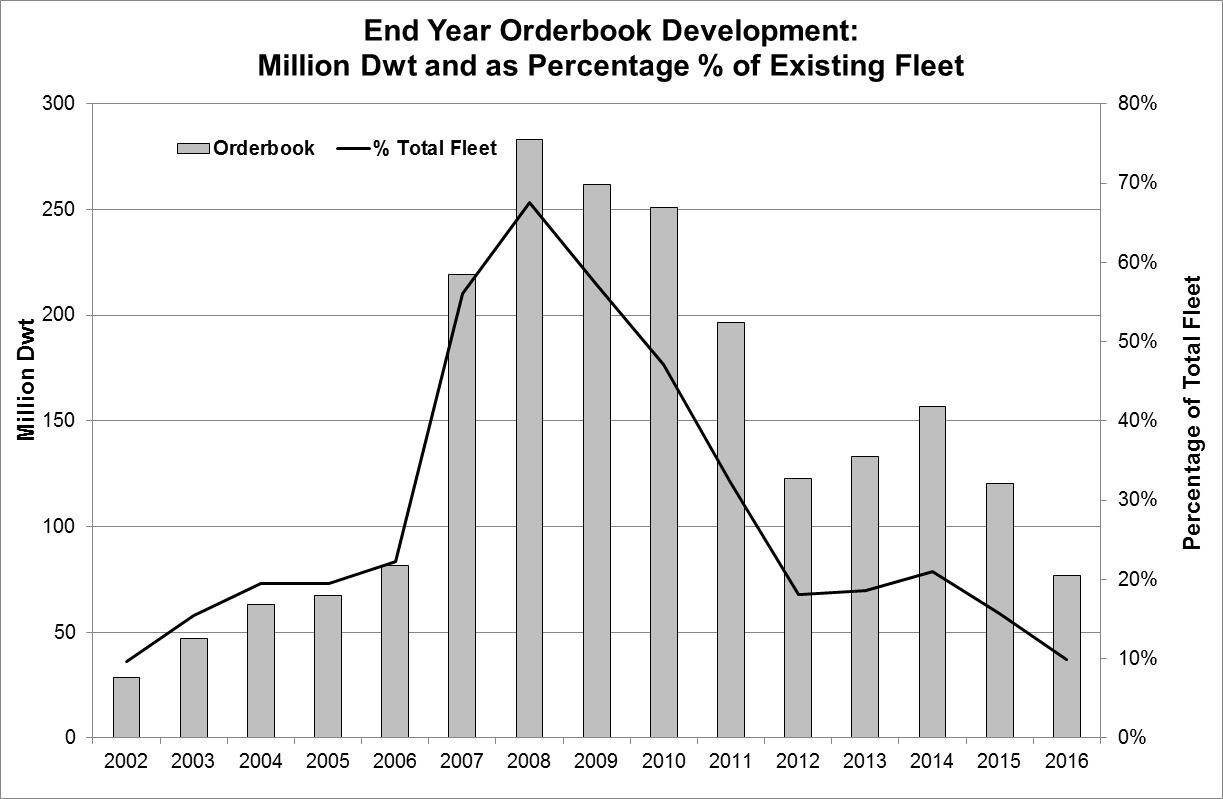

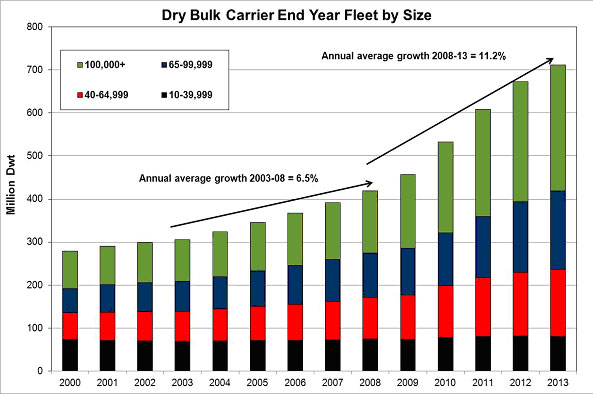

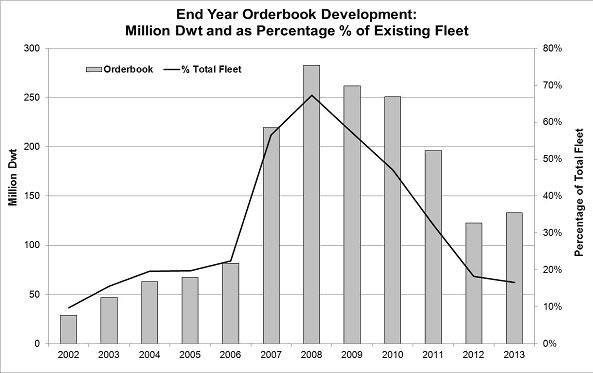

the number of newbuilding orders and deliveries, including slippage in deliveries;

the number of shipyards and ability of shipyards to deliver vessels;

port and canal congestion;

the scrapping rate of older vessels;

speed of vessel operation;

vessel casualties; and

the number of vessels that are out of service, namely those that are laid-up, drydocked, awaiting repairs or otherwise not available for hire.

In addition to the prevailing and anticipated freight rates, factors that affect the rate of newbuilding, scrapping and laying-up include newbuilding prices, secondhand vessel values in relation to scrap prices, costs of bunkers and other operating costs, costs associated with classification society surveys, normal maintenance and insurance coverage

costs, the efficiency and age profile of the existing drybulk fleet in the market and government and industry regulation of maritime transportation practices, particularly environmental protection laws and regulations. These factors influencing the supply of and demand for shipping capacity are outside of our control, and we may not be able to correctly assess the nature, timing and degree of changes in industry conditions.

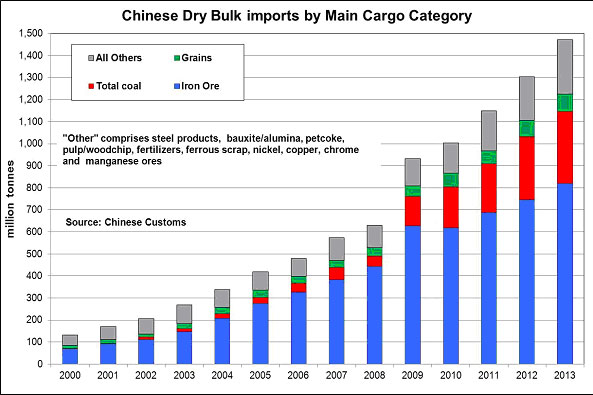

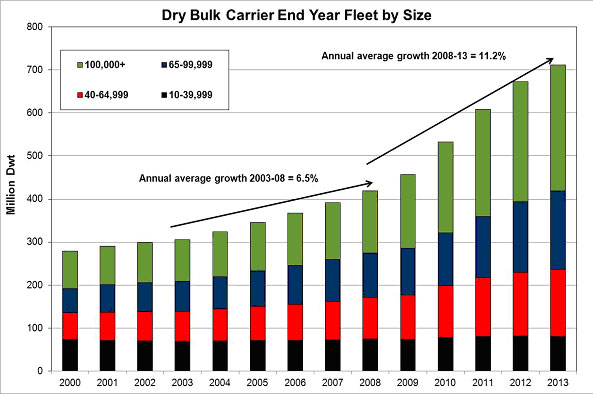

We anticipate that the future demand for our drybulk vessels will be dependent upon economic growth in the world’s economies, including China and India, seasonal and regional changes in demand, changes in the capacity of the global drybulk fleet and the sources and supply of drybulk cargo to be transported by sea.

Given the number of new drybulk carriers currently on order with the shipyards, the capacity of the global drybulk carrier fleet seems likely to increase and there can be no assurance as to the timing or extent of future economic growth. Adverse economic, political, social or other developments could have a material adverse effect on our business and operating results.

Global economic conditions may continue to negatively impact the drybulk shipping industry.

In the

current global economy, operating businesses have recently faced tightening credit, weakening demand for goods and services, weak international liquidity conditions, and declining markets.

LowerIn particular, lower demand for drybulk cargoes as well as diminished trade credit available for the delivery of such cargoes have led to decreased demand for drybulk carriers, creating downward pressure on charter rates and vessel values. The relatively weak global economic conditions have and may continue to have a number of adverse consequences for drybulk and other shipping sectors, including, among other things:

| ● | low charter rates, particularly for vessels employed on short-term time charters or in the spot market; |

| ● | decreases in the market value of drybulk vessels and limited second-hand market for the sale of vessels; |

| ● | limited financing for vessels; |

| ● | widespread loan covenant defaults; and |

| ● | declaration of bankruptcy by certain vessel operators, vessel owners, shipyards and charterers. |

low charter rates, particularly for vessels employed on short-term time charters or in the spot market;

decreases in the market value of drybulk vessels and limited second-hand market for the sale of vessels;

limited financing for vessels;

widespread loan covenant defaults; and

declaration of bankruptcy by certain vessel operators, vessel owners, shipyards and charterers.

The occurrence of one or more of these events could have a material adverse effect on our business, results of operations, cash flows and financial condition.

The current state of global financial markets and current

Weak economic conditions may adversely impactthroughout the world, in particular in China and the rest of the Asia-Pacific region, could negatively affect our results of operations, financial condition, cash flows and ability to obtain financing, and may adversely affect the market price of our common shares.

Negative trends in the global economy that emerged in 2008 continue to adversely affect global economic conditions. In addition, the world economy is currently facing a number of new challenges, recent turmoil and hostilities in various regions, including Russia, Syria, Iraq, North Africa, and North Korea. The weakness in the global economy has caused, and may continue to cause, a decrease in worldwide demand for certain goods, and, thus, shipping. Continuing economic instability could have a material adverse effect on our ability to implement our business strategy.

The United States, the European Union and other parts of the world exhibited weak economic trends. The credit markets in the United States and Europe have experienced significant contraction, deleveraging and reduced liquidity, and the U.S. federal and state governments and European authorities have implemented and are considering a broad variety of governmental action and/or

refinance our futurenew regulation of the financial markets and may implement additional regulations in the future. Securities and futures markets and the credit

facilities on acceptable terms, whichmarkets are subject to comprehensive statutes, regulations and other requirements. The Securities and Exchange Commission, or the SEC, other regulators, self-regulatory organizations and exchanges are authorized to take extraordinary actions in the event of market emergencies, and may

hindereffect changes in law or

prevent us from operating or expanding our business.interpretations of existing laws.

Global financial markets and economic conditions have been, and continue to be volatile.

Credit markets and the debt and equity capital markets have been distressed and the uncertainty surrounding the future of the global credit markets has resulted in reduced access to credit worldwide. These issues, along with significant write-offs in the financial services sector, the re-pricing of credit risk and the current weak economic conditions, have made, and will likely continue to make, it difficult to obtain additional financing.

TheIn addition, the current state of global financial markets and current economic conditions might adversely impact our ability to issue additional equity at prices which will not be dilutive to our existing shareholders or preclude us from issuing equity at all.

Also, as a result of concerns about the stability of financial markets generally and the solvency of counterparties specifically, the cost of obtaining money from the credit markets has increased as many lenders have increased interest rates, enacted tighter lending standards, refused to refinance existing debt at all or on terms similar to current debt and reduced, and in some cases ceased, to provide funding to borrowers. Due to these factors, we cannot be certain that financing will be available to the extent required, or that we will be able to refinance our future credit facilities, on acceptable terms or at all. If financing or refinancing is not available when needed, or is available only on unfavorable terms, we may be unable to meet our obligations as they come due or we may be unable to enhance our existing business, complete the acquisition of our newbuildings and additional vessel acquisitions or otherwise take advantage of business opportunities as they arise.

If economic conditions throughout the world do not improve, it may impede our results of operations, financial condition and cash flows, and may adversely affect the market price of our common shares.

Negative trends in the global economy that emerged in 2008 continue to adversely affect global economic conditions. In addition, the world economy is currently facing a number of new challenges, recent turmoil and hostilities in Crimea, the Middle East, including Syria, North Korea, North Africa and other geographic areas and countries. The weakness in the global economy has caused, and may continue to cause, a decrease in worldwide demand for certain goods and, thus, shipping. Continuing economic instability could have a material adverse effect on our ability to implement our business strategy.

We face risks attendant to changes in economic environments, changes in interest rates, and instability in the banking and securities markets around the world, among other factors. Major market disruptions and the current adverse changes in market conditions and regulatory climate in the United States and worldwide may adversely affect our business or impair our ability to borrow amounts under credit facilities or any future financial arrangements. The recent and developing economic and governmental factors, together with

the possible further declines in charter rates and vessel values, may have a material adverse effect on our results of operations, financial condition or cash flows, or the trading price of our common shares.

Continued economic slowdown in the Asia Pacific region, particularly in China, may exacerbate the effect on us, as we anticipate a significant number of the port calls made by our vessels will continue to involve the loading or discharging of drybulk commodities in ports in the Asia Pacific region. Before the global economic financial crisis that began in 2008, China had one of the world’s fastest growing economies in terms of

gross domestic product, GDP, which had a significant impact on shipping demand. The growth rate of China’s GDP is estimated to have decreased

for the fourth year in a row to approximately

7.7%6.7% for the year ended December 31,

2013, as compared to 7.8%2016, which is China’s lowest growth rate for the

year ended December 31, 2012,past five years, and continues to remain below pre-2008 levels.

China has recently imposed measures to restrain lending, which may further contribute to a slowdown in its economic growth. It is possible that China and other countries in the Asia Pacific region will continue to experience slowed or even negative economic growth in the

near future. Moreover, the current economic slowdown in the economies of the United States, the European Union and other Asian countries may further adversely affect economic growth in China and elsewhere. Our business, financial condition and results of operations, ability to pay dividends, if any, as well as our future prospects, will likely be materially and adversely affected by a further economic downturn in any of these

countries.countries or geographic regions.

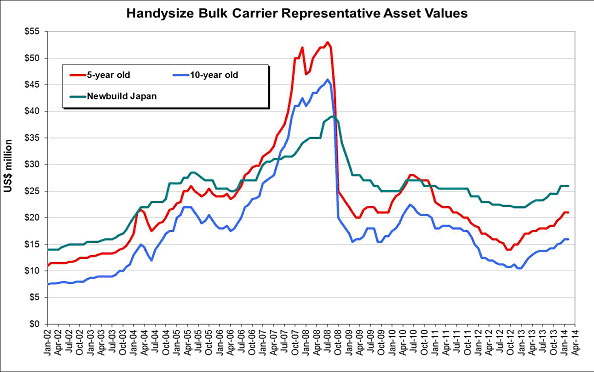

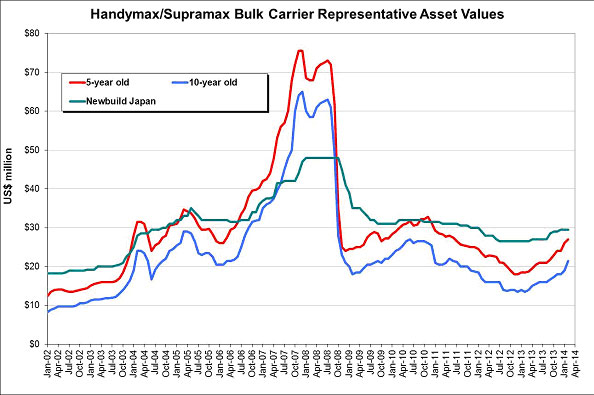

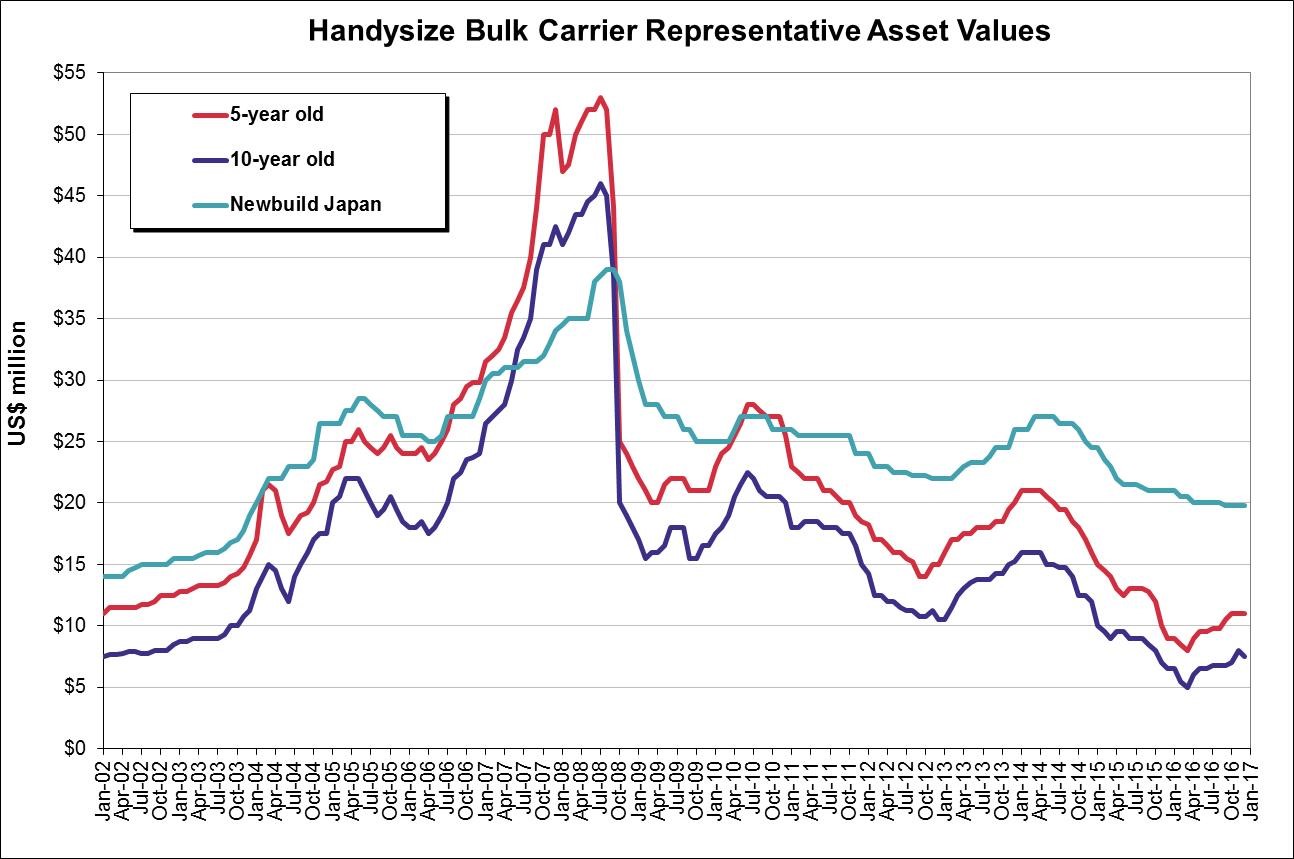

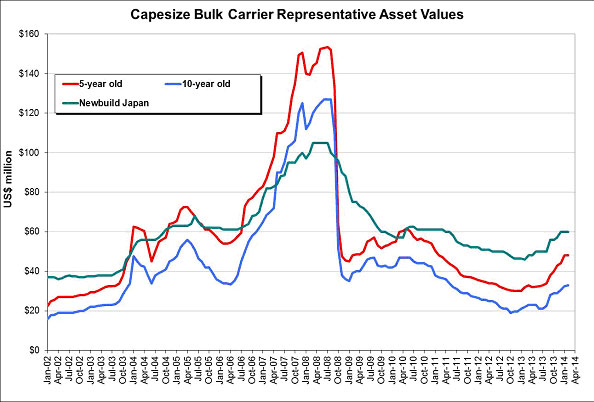

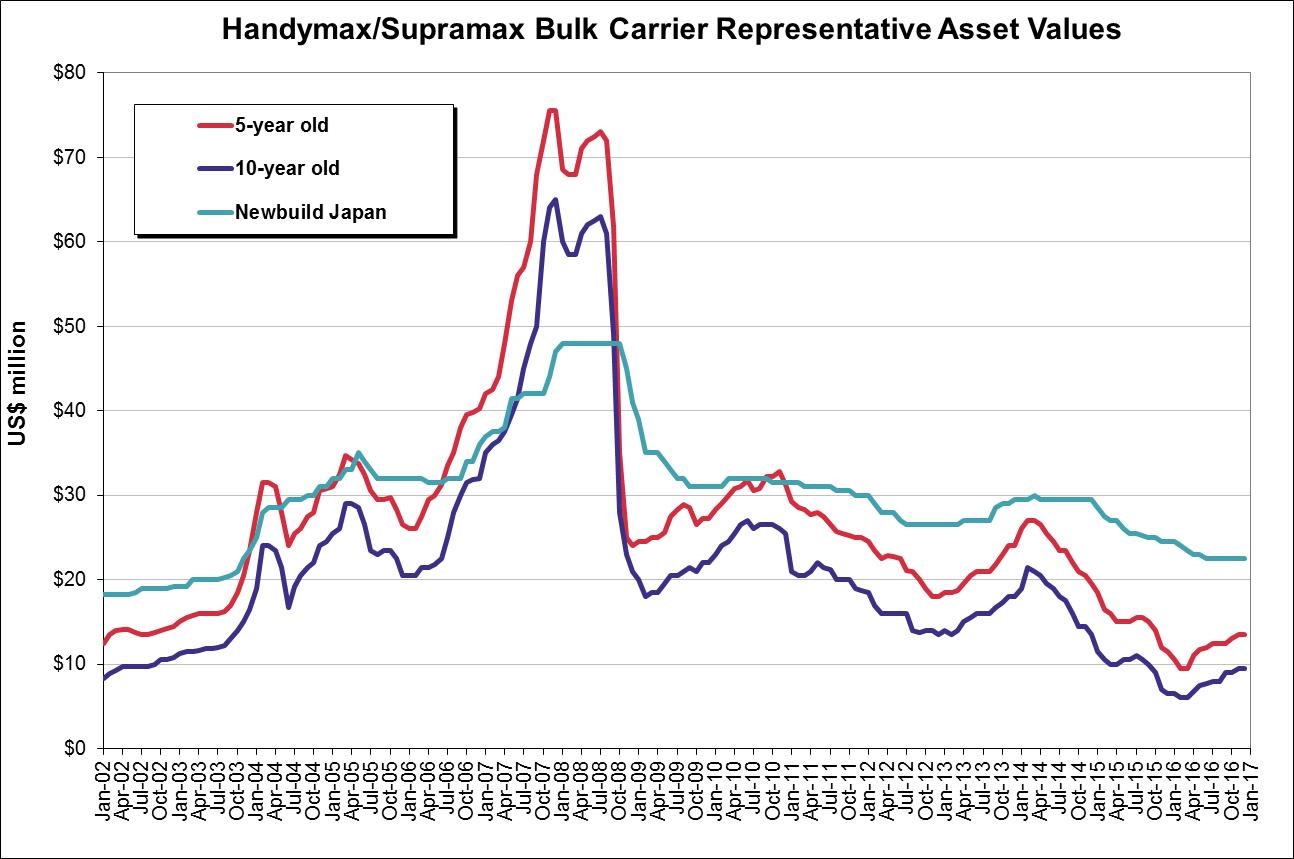

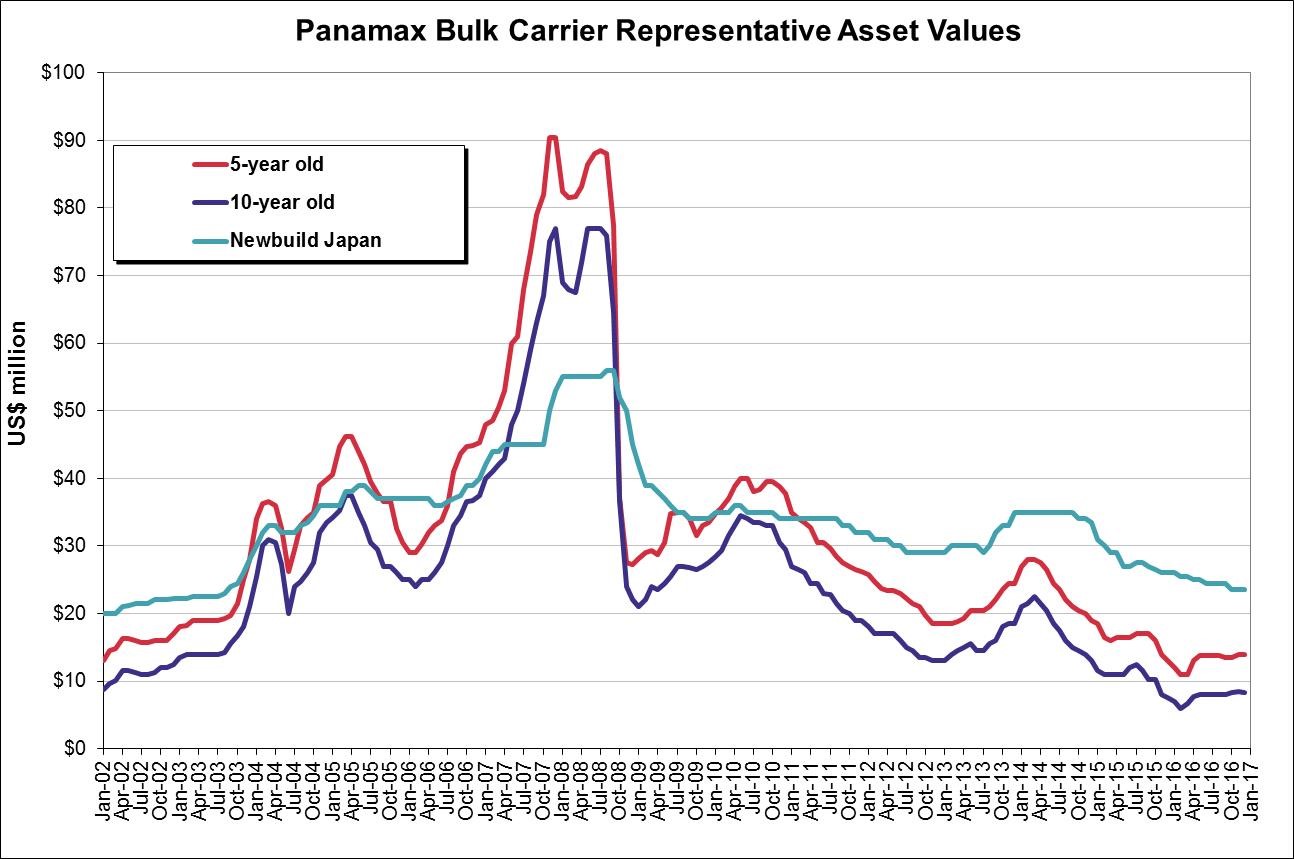

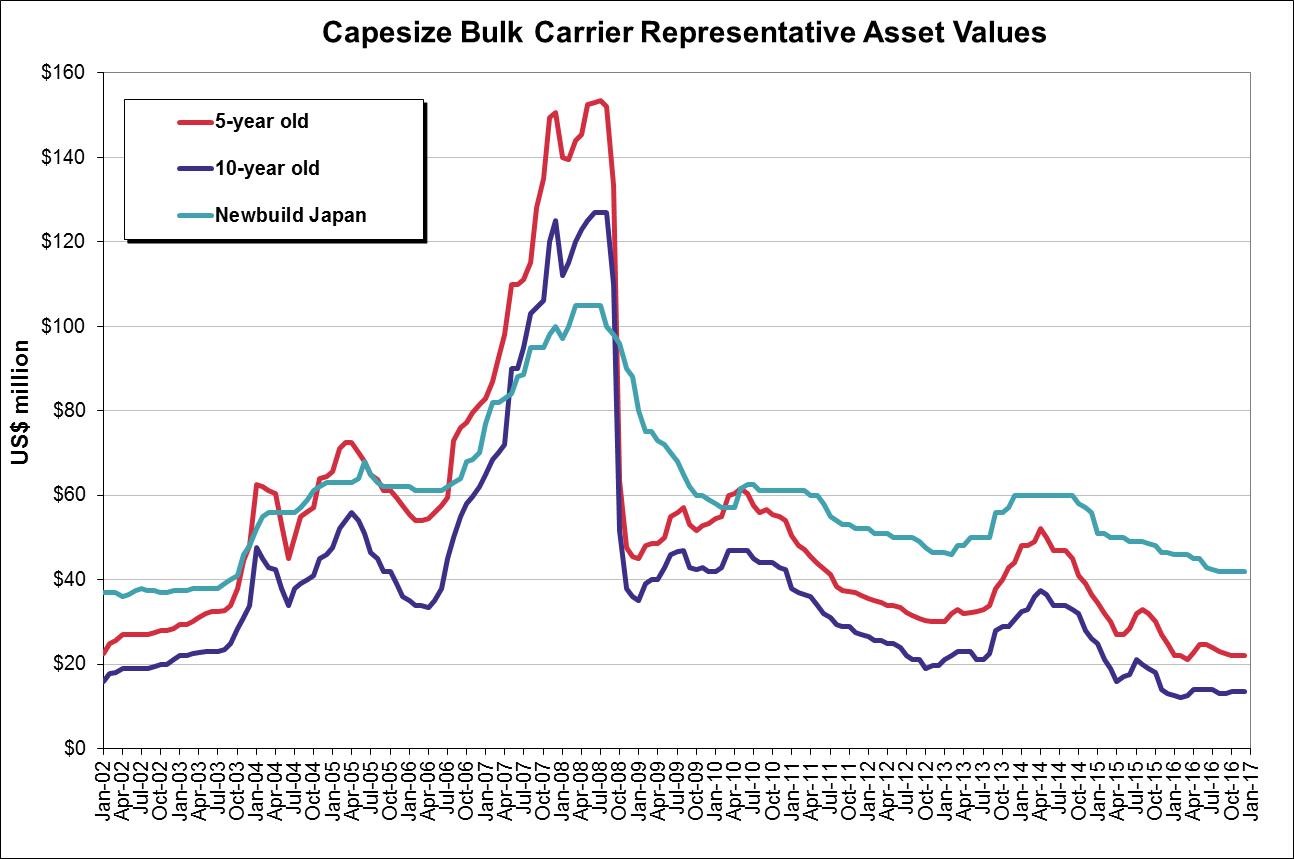

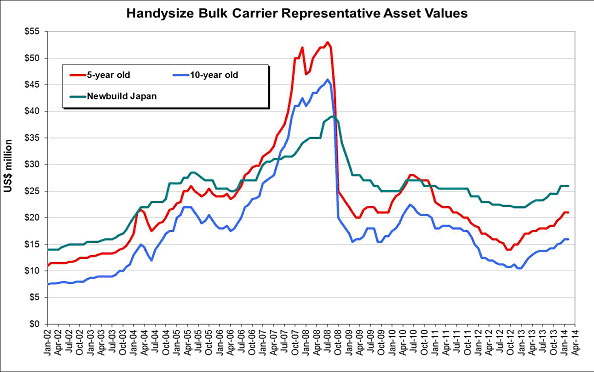

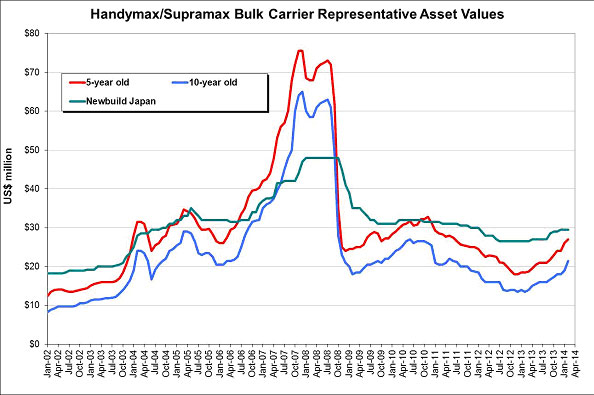

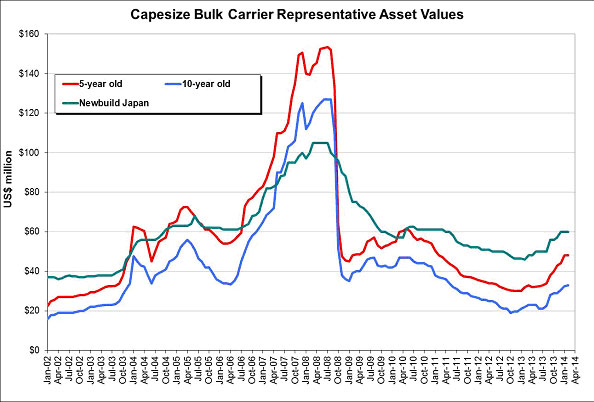

The

fair market values of our vessels

have declined and may decline

further, which could limit the amount of funds that we can borrow, cause us to breach certain financial covenants in our

future credit facilities, or result in an impairment charge, and we may incur a loss if we sell vessels following a decline in their market value.

The fair market values of drybulk

vessels, including our vessels, have generally experienced high volatility and have recently declined significantly.

Although we believe that we have contracted to purchase our initial 79 vessels, which we refer to as our Newbuilding Program, at attractive times in the cycle, theThe fair market value of our vessels may continue to fluctuate depending on a number of factors, including:

| ● | prevailing level of charter rates; |

| ● | general economic and market conditions affecting the shipping industry; |

| ● | types, sizes and ages of vessels; |

| ● | supply of and demand for vessels; |

| ● | other modes of transportation; |

| ● | governmental or other regulations; |

| ● | the need to upgrade vessels as a result of charterer requirements, technological advances in vessel design or equipment or otherwise; and |

prevailing level of charter rates; general economic and market conditions affecting the shipping industry;

types, sizes and ages of vessels;

supply of and demand for vessels;

other modes of transportation;

cost of newbuildings;

governmental or other regulations;

the need to upgrade vessels as a result of charterer requirements, technological advances in vessel design or equipment or otherwise;

technological advances; and

competition from other shipping companies and other modes of transportation.

If the fair market values of our vessels decline,

or decline further, the amount of funds we may

draw downdrawdown under

theour secured credit facilities

we expect to enter into may be limited and we may not be in compliance with certain covenants contained in

thoseour secured credit facilities, which may result in an event of default. In such circumstances, we may not be able to refinance our debt or obtain additional financing. If we are not able to comply with the covenants in our secured credit facilities, and are unable to remedy the relevant breach, our lenders could accelerate our debt and foreclose on our fleet. In addition, if we sell one or more of our vessels at a time when vessel prices have fallen,

and before we have recorded an impairment adjustment to our consolidated financial statements, the sale may be less than the vessel’s carrying value on our consolidated financial statements, resulting in a loss and a reduction in earnings.

Furthermore, if vessel values decline, we may have to record an impairment charge in our consolidated financial statements which could adversely affect our financial results.Conversely, if vessel values are elevated at a time when we wish to acquire additional vessels, the cost of such acquisitions may increase and this could adversely affect our business, results of operations, cash flow and financial condition.

Compliance with safety

A further reduction in charter rates and other

vessel requirements imposed by classification societiesmarket deterioration may require us to record impairment charges related to our long-lived assets (our vessels) and such charges may be

very costlylarge and

may adversely affecthave a material impact on our

business.The hullconsolidated financial statements.

At December 31, 2016, we had vessels and machineryvessels under construction of every commercial vessel must$1.4 billion in total on our consolidated balance sheet, representing 148% of our shareholders’ equity. Additionally, as of December 31, 2016, we had $18.6 million of installment payments due on our existing newbuilding contracts, of which $17.2 million remains to be classed bypaid.

Our vessels are assessed annually for impairment in the fourth quarter and between annual tests if an event occurs or circumstances change that would more likely than not reduce the fair value of our vessels and vessels under construction below its carrying value. As of December 31, 2016, we have determined that the estimated undiscounted future cash flows (as determined under U.S. GAAP) of our vessels exceeded the carrying value. However, if there is a

classification society authorized by its country of registry. The classification society certifies that a vessel is safe and seaworthyfurther reduction in

accordance with the applicable rules and regulations of the country of registry of the vessel and the Safety of Life at Sea Convention.A vessel must undergo annual surveys, intermediate surveys and special surveys. In lieu of a special survey, a vessel’s machineryour charter rates, we may be on a continuous survey cycle under which the machinery would be surveyed periodically over a five-year period. Every vessel is also required to be drydocked every tworecord impairment charges on our vessels and vessels under construction, which would require us to write down the carrying value of these assets to their fair value. Since vessels and vessels under construction comprise a half to five years for inspectionsubstantial portion of its underwater parts.

Compliance with the above requirements following the delivery of vessels may result in significant expense. If any vessel does not maintain its class or fails any annual, intermediate or special survey, the vessel will be unable to trade between ports and will be unemployable and uninsurable, whichour balance sheet, such charges could negativelyhave a material impact on our results of operations andconsolidated financial condition.

statements.

We are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

Our operations are subject to numerous international, national, state and local laws, regulations, treaties and conventions in force in international waters and the jurisdictions in which our vessels operate or are registered, which can significantly affect the ownership and operation of our vessels. These laws and regulations include, but are not limited to, the U.S. Oil Pollution Act of 1990, or OPA, the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, the U.S. Clean Air Act, the U.S. Clean Water Act, or the CWA, and the U.S. Maritime Transportation Security Act of 2002, or the MTSA, and regulations of the International Maritime Organization, or IMO, including the International Convention for the Prevention of Pollution from Ships of 1975,1973 (as from time to time amended and generally referred to as MARPOL) including the International Convention fordesignation of Emission Control Areas, or ECAs, thereunder, the Prevention of Marine Pollution of 1973, the IMO International Convention for the Safety of Life at Sea of 1974 (as from time to time amended and generally referred to as SOLAS), the International Convention on Civil Liability for Bunker Oil Pollution Damage, and the International Convention on Load Lines of 1966. 1966 (as from time to time amended), or the LL Convention.

Compliance with such laws, regulations and standards, where applicable, may require installation of costly equipment or implementation of operational changes and may affect the resale value or useful lives of our vessels. These costs could have a material adverse effect on our business, results of operations, cash flows and financial condition. A failure to comply with applicable laws and regulations may result in administrative and civil penalties, criminal sanctions or the suspension or termination of our operations. Because such conventions, laws, and regulations are often revised, we cannot predict the ultimate cost of complying with them or the impact thereof on the resale prices or useful lives of our vessels. Additional conventions, laws and regulations may be adopted which could limit our ability to do business or increase the cost of our doing business and which may materially adversely affect our operations.

For example, the International Convention for the Control and Management of Ships’ Ballast Water and Sediments, or the BWM Convention, adopted by the UN International Maritime Organization in February 2004, calls for the phased introduction of mandatory reducing living organism limits in ballast water over time (as discussed further below). In order to comply with these living organism limits, vessel owners may have to install expensive ballast water treatment systems or make port facility disposal arrangements and modify existing vessels to accommodate those systems. The BWM Convention enters in force on September 8, 2017 and while we believe that our vessels have been fitted with systems that will comply with the standards, we cannot be assured that these systems will be approved by the regulatory bodies of every jurisdiction in which we may wish to conduct our business. If they are not approved it could have an adverse material impact on our business, financial condition, and results of operations depending on the available ballast water treatment systems and the extent to which existing vessels must be modified to accommodate such systems.

Environmental laws often impose strict liability for remediation of spills and releases of oil and hazardous substances, which could subject us to liability without regard to whether we were negligent or at fault. Under OPA, for example, owners, operators and bareboat charterers are jointly and severally strictly liable for the discharge of oil within the 200-mile exclusive economic zone around the United States.

Furthermore, the 2010 explosion of theDeepwater Horizon well and the subsequent release of oil into the Gulf of Mexico, or other similar events, may result in further regulation of the shipping industry, and modifications to statutory liability schemes, which could have a material adverse effect on our business, financial condition, results of operations and cash flows. An oil spill could result in significant liability, including fines, penalties and criminal liability and remediation costs for natural resource damages under other federal, state and local laws, as well as third-party damages.We are required by various governmental and quasi-governmental agencies to obtain certain permits, licenses, and certificates with respect to our operations, and satisfy insurance and financial responsibility requirements for potential oil (including marine fuel) spills and other pollution incidents. Although we

will, when available, arrangehave insurance to cover certain environmental risks, there can be no assurance that such insurance will be sufficient to cover all such risks or that any claims will not have a material adverse effect on our business, results of operations, cash flows and financial condition and our ability to pay dividends, if any, in the

future.future, on our common shares, and interest on our Senior Notes. An over-supply of drybulk carrier capacity may prolong or further depress the current low charter rates, which may limit our ability to operate our drybulk carriers profitably.

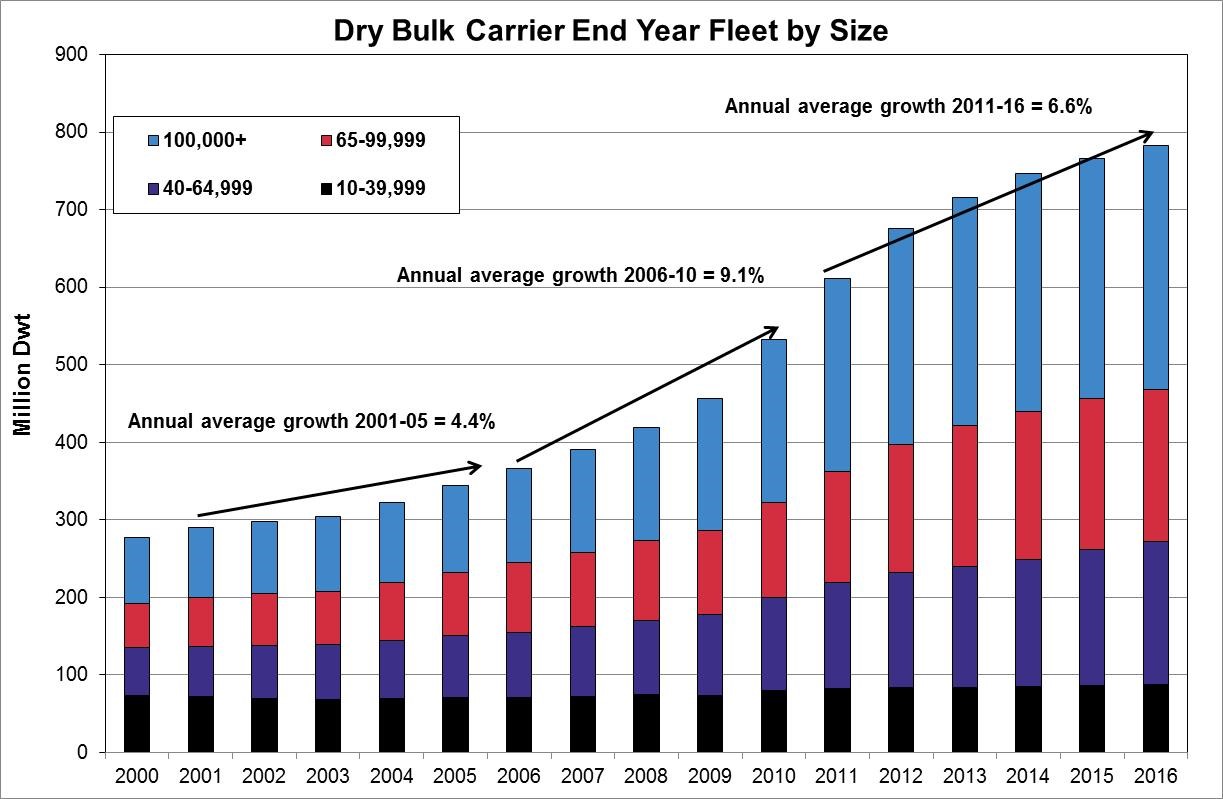

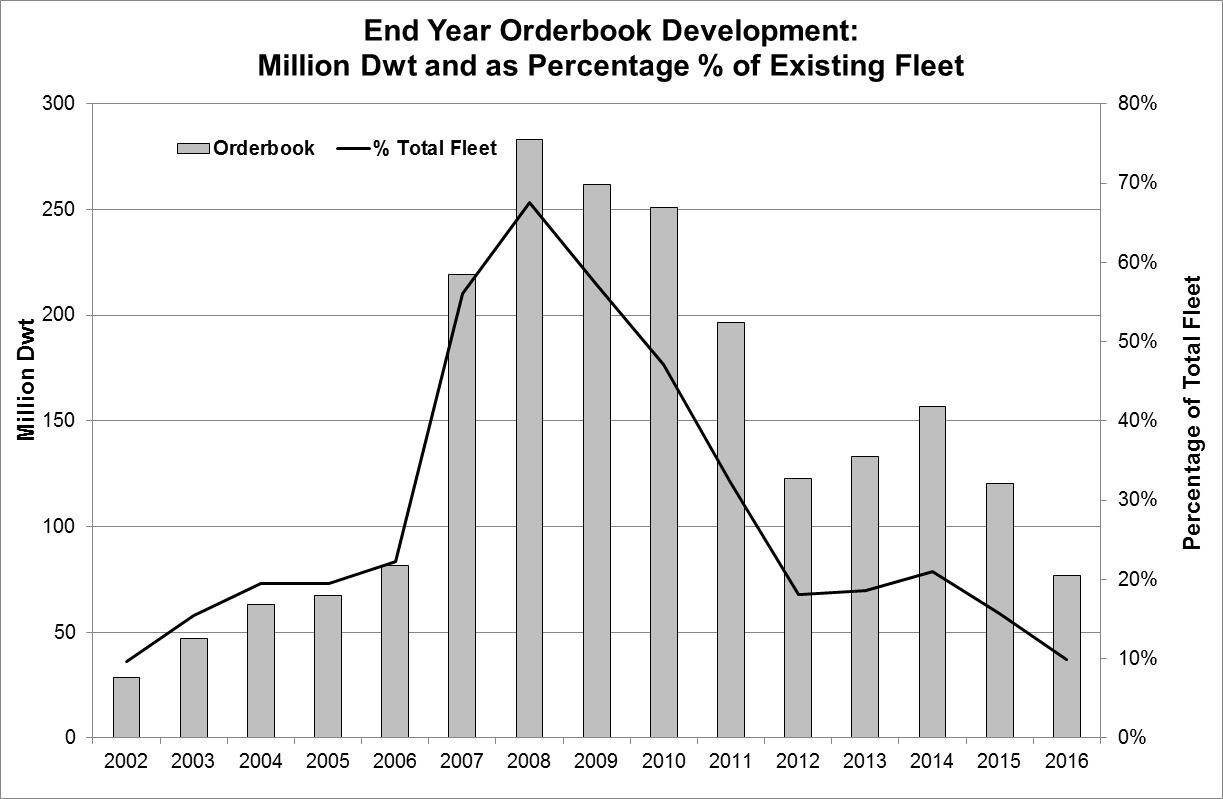

The supply of drybulk vessels has increased significantly since the beginning of 2006.

AsAccording to SSY, as of

September 2013,December 2016, newbuilding orders have been placed for approximately

15.7%9.8% of the existing fleet capacity. Vessel supply growth has been outpacing vessel demand growth over the past few years causing downward pressure on charter rates. Until the new supply is fully absorbed by the market, charter rates may continue to be under pressure due to vessel supply in the near to medium term.

Since our fleet will be employed primarily in spot market-oriented pools, voyage charters and short-term charters, we remain exposed to the spot market.World events could affect our results of operations and financial condition.

Past terrorist attacks, as well as the threat of future terrorist attacks around the world, continue to cause uncertainty in the world’s financial markets and may affect our business, operating results and financial condition. Continuing conflicts and recent developments in Russia,

Ukraine and Crimea, the Korean Peninsula,North Korea, the Middle East, including

Iran, Iraq, Syria, Egypt and North Africa, and the presence of U.S. or other armed forces in the Middle East, may lead to additional acts of terrorism and armed conflict around the world, which may contribute to further economic instability in the global financial markets. These uncertainties could also adversely affect our ability to obtain additional financing on terms acceptable to us or at all. In the past, political conflicts have also resulted in attacks on vessels, mining of waterways and other efforts to disrupt international shipping, particularly in the Arabian Gulf region. Acts of terrorism and piracy have also affected vessels trading in regions such as the South China Sea,

and the Gulf of Aden off the coast of

Somalia.Somalia and West Africa. Any of these occurrences could have a material adverse impact on our operating results, revenues and costs.

Acts of piracy on ocean-going vessels have had and may continue to have an adverse effect on our business.

Acts of piracy have historically affected ocean-going vessels trading in regions of the world such as the South China Sea, the Indian Ocean and in the Gulf of Aden off the coast of Somalia. Although the frequency of sea piracy worldwide decreased during 2012 and 2013 to its lowest level since 2009, seaSea piracy incidents continue to occur, particularly in the Gulf of Aden off the coast of Somalia, and increasingly in the Gulf of Guinea and the West Coast of Africa, with drybulk vessels particularly vulnerable to such attacks. If these piracy attacks result in regions in which our vessels are deployed being characterized as “war risk” zones by insurers as the Gulf of Aden temporarily was in May 2008, or Joint War Committee “war and strikes” listed areas, premiums payable for such coverage could increase significantly and such insurance coverage may be more difficult to obtain. In addition, crew costs, including due to employing onboard security guards, could increase in such circumstances. Furthermore, while we believe the charterer remains liable for charter payments

when a vessel is seized by pirates, the charterer may dispute this and withhold charter hire until the vessel is released. A charterer may also claim that a vessel seized by pirates was not “on-hire” for a certain number of days and is therefore entitled to cancel the charter party, a claim that we would dispute. We may not be adequately insured to cover losses from these incidents, which could have a material adverse effect on us. In addition, any detention hijacking as a result of an act of piracy against our vessels, or an increase in cost, or unavailability, of insurance for our vessels, could have a material adverse impact on our business, financial condition and results of operations.

Our vessels may call on ports located in countries that are subject to restrictions imposed by the U.S. or other governments,

thatwhich could adversely affect our reputation and the market for our common shares.

Although we do not expect

that our vessels will call on ports located in countries subject to sanctions and embargoes imposed by the U.S. government and other authorities or countries identified by the U.S. government or other authorities as state sponsors of terrorism, such as

Cuba, Iran, Sudan and Syria, from time to time on charterers’ instructions, our vessels may call on ports located in such countries in the future. The U.S. sanctions and embargo laws and regulations vary in their application, as they do not all apply to the same covered persons or proscribe the same activities, and such sanctions and embargo laws and regulations may be amended or strengthened over time. In 2010, the U.S. enacted the Comprehensive Iran Sanctions Accountability and Divestment Act, or CISADA, which amended the Iran Sanctions Act. Among other things, CISADA introduced limits on the ability of companies and persons to do business or trade with Iran when such activities relate to the investment, supply or export of refined petroleum or petroleum products. In 2012, President Obama signed Executive Order 13608 which prohibits foreign persons from violating or attempting to violate, or causing a violation of any sanctions in effect against Iran or facilitating any deceptive transactions for or on behalf of any person subject to U.S. sanctions. Any persons found to be in violation of Executive Order 13608 will be deemed a foreign sanctions evader and will be banned from all contacts with the United States, including conducting business in U.S. dollars. Also in 2012, President Obama signed into law the Iran Threat Reduction and Syria Human Rights Act of 2012, or the Iran Threat Reduction Act, which created new sanctions and strengthened existing sanctions. Among other things, the Iran Threat Reduction Act intensifies existing sanctions regarding the provision of goods, services, infrastructure or technology to Iran’s petroleum or petrochemical sector. The Iran Threat Reduction Act also includes a provision requiring the President of the United States to impose five or more sanctions from Section 6(a) of the Iran Sanctions Act, as amended, on a person the President determines is a controlling beneficial owner of, or otherwise owns, operates, or controls or insures a vessel that was used to transport crude oil from Iran to another country and (1) if the person is a controlling beneficial owner of the vessel, the person had actual knowledge the vessel was so used or (2) if the person otherwise owns, operates, or controls, or insures the vessel, the person knew or should have known the vessel was so used. Such a person could be subject to a variety of sanctions, including exclusion from U.S. capital markets, exclusion from financial transactions subject to U.S. jurisdiction, and exclusion of that person’s vessels from U.S. ports for up to two years.

On November 24, 2013, the P5+1 (the United States, United Kingdom, Germany, France, Russia and China) entered into an interim agreement with Iran entitled the “Joint Plan of Action” (“JPOA”)., or the JPOA. Under the JPOA it was agreed that, in exchange for Iran taking certain voluntary measures to ensure that its nuclear program is used only for peaceful purposes, the U.S. and EU would voluntarily suspend certain sanctions for a period of six months. On January 20, 2014, the U.S. and E.U. indicated that they would begin implementing the temporary relief measures provided for under the JPOA. These measures include,included, among other things, the suspension of certain sanctions on the Iranian petrochemicals, precious metals, and automotive industries from January 20, 2014 until July 20, 2014. Although it is our intention to comply withThe JPOA was subsequently extended twice.

On July 14, 2015, the

provisions of the JPOA, there can be no assurance that we will be in compliance in the future as such regulations and U.S. sanctions may be amended over time,P5+1 and the

EU announced that they reached a landmark agreement with Iran titled the Joint Comprehensive Plan of Action Regarding the Islamic Republic of Iran’s Nuclear Program, or the JCPOA, which is intended to significantly restrict Iran’s ability to develop and produce nuclear weapons for 10 years while simultaneously easing sanctions directed toward non-U.S. persons for conduct involving Iran, but taking place outside of U.S.

retainsjurisdiction and does not involve U.S. persons. On January 16, 2016, which we refer to as Implementation Day, the

authority to revokeUnited States joined the

aforementioned relief ifEU and the UN in lifting a significant number of their nuclear-related sanctions on Iran

fails to meetfollowing an announcement by the International Atomic Energy Agency, or the IAEA, that Iran had satisfied its

commitmentsrespective obligations under the

JPOA.JCPOA.

Although we believe that we are in compliance with all applicable sanctions and embargo laws and regulations, and intend to maintain such compliance, there can be no assurance that we will be in compliance in the future, particularly as the scope of certain laws may be unclear and may be subject to changing interpretations. Any such violation could result in fines or other penalties and could severely impact our ability to access U.S. capital markets and conduct our business, and could result in some investors deciding, or being required, to divest their interest, or not to invest, in us. In addition, certain institutional investors may have investment policies or restrictions that prevent them from holding securities of companies that have contracts with countries identified by the U.S. government as state sponsors of terrorism. The determination by these investors not to invest in, or to divest from, our common sharessecurities may adversely affect the price at which our common sharessecurities trade. Moreover, our charterers may violate applicable sanctions and embargo laws and regulations as a result of actions that do not involve us or our vessels, and those violations could

in turn negatively affect our reputation. In addition, our reputation and the market for our securities may be adversely affected if we engage in certain other activities, such as entering into charters with individuals or entities in countries subject to U.S. sanctions and embargo laws that are not controlled by the governments of those countries, or engaging in operations associated with those countries pursuant to contracts with third parties that are unrelated to those countries or entities controlled by their governments. Investor perception of the value of our

common sharessecurities may be adversely affected by the consequences of war, the effects of terrorism, civil unrest and governmental actions in these and surrounding countries.

Our operating results will be subject to seasonal fluctuations, which could affect our operating results.

We operate our vessels in markets that have historically exhibited seasonal variations in demand and, as a result, in charter hire rates. This seasonality may result in volatility in our operating results to the extent that we enter into new charter agreements or renew existing agreements during a time when charter rates are weaker or we operate our vessels on the spot market or index based time charters, which may result in quarter-to-quarter volatility in our operating results. The drybulk sector is typically stronger in the fall and winter months in anticipation of increased consumption of coal and other raw materials in the northern hemisphere.

The celebration of Chinese New Year in the first quarter of each year, also results in lower volumes of seaborne trade into China during this period. In addition, unpredictable weather patterns in these months tend to disrupt vessel scheduling and supplies of certain commodities. As a result, our revenues from our drybulk carriers may be weaker during the fiscal quarters ended June 30 and September 30, and, conversely, our revenues from our drybulk carriers may be stronger in fiscal quarters ended December 31 and March 31.

We are subject to international safety regulations and

requirements imposed by our classification societies and the failure to comply with these regulations

and requirements may subject us to increased liability, may adversely affect our insurance coverage and may result in a denial of access to, or detention in, certain ports.

The operation of our vessels is affected by the requirements set forth in

the International Management Code for the Safe Operation of Ships and for Pollution Prevention, or the ISM Code. The ISM Code requires ship owners, ship managers and bareboat charterers to develop and maintain an extensive “Safety Management System” that includes the adoption of a safety and environmental protection policy setting forth instructions and procedures for safe operation of vessels and describing procedures for dealing with emergencies. In addition, vessel classification societies impose significant safety and other requirements on our vessels.

The failure of a shipowner or bareboat charterer to comply with the ISM Code may subject it to increased liability, may invalidate existing insurance or decrease available insurance coverage for the affected vessels and may result in a denial of access to, or detention in, certain ports. Each of

theour vessels

that we have agreed to acquireare or will be ISM Code-certified when delivered to us. However, if we are subject to increased liability for non-compliance or if our insurance coverage is adversely impacted as a result of non-compliance, it may negatively affect our ability to pay dividends, if any, in the

future.future, on our common shares and interest on our Senior Notes. If any of our vessels are denied access to, or are detained in, certain ports as a result of non-compliance with the ISM Code, our revenues may be adversely impacted.

In addition, the hull and machinery of every commercial vessel must be classed by a classification society authorized by its country of registry. The classification society certifies that a vessel is safe and seaworthy in accordance with the applicable rules and regulations of the country of registry of the vessel and the Safety of Life at Sea Convention. The cost of maintaining our vessels’ classifications may be substantial.If any vessel does not maintain its class or fails any annual, intermediate or special survey, the vessel will be unable to trade between ports and will be unemployable and uninsurable, which could negatively impact our results of operations and financial condition. Increased inspection procedures and tighter import and export controls could increase costs and disrupt our business.

International shipping is subject to various security and customs inspection and related procedures in countries of origin and destination and trans-shipment points. Inspection procedures may result in the seizure of contents of our vessels, delays in the loading, offloading, trans-shipment or delivery and the levying of customs duties, fines or other penalties against us.

It is possible that changes to inspection procedures could impose additional financial and legal obligations on us. Changes to inspection procedures could also impose additional costs and obligations on our customers and may, in certain cases, render the shipment of certain types of cargo uneconomical or impractical. Any such changes or developments may have a material adverse effect on our business, financial condition and results of operations.

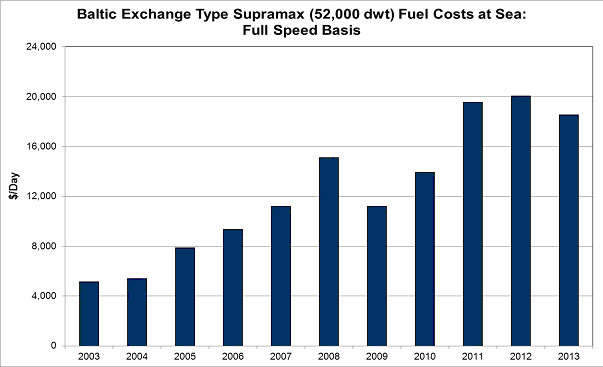

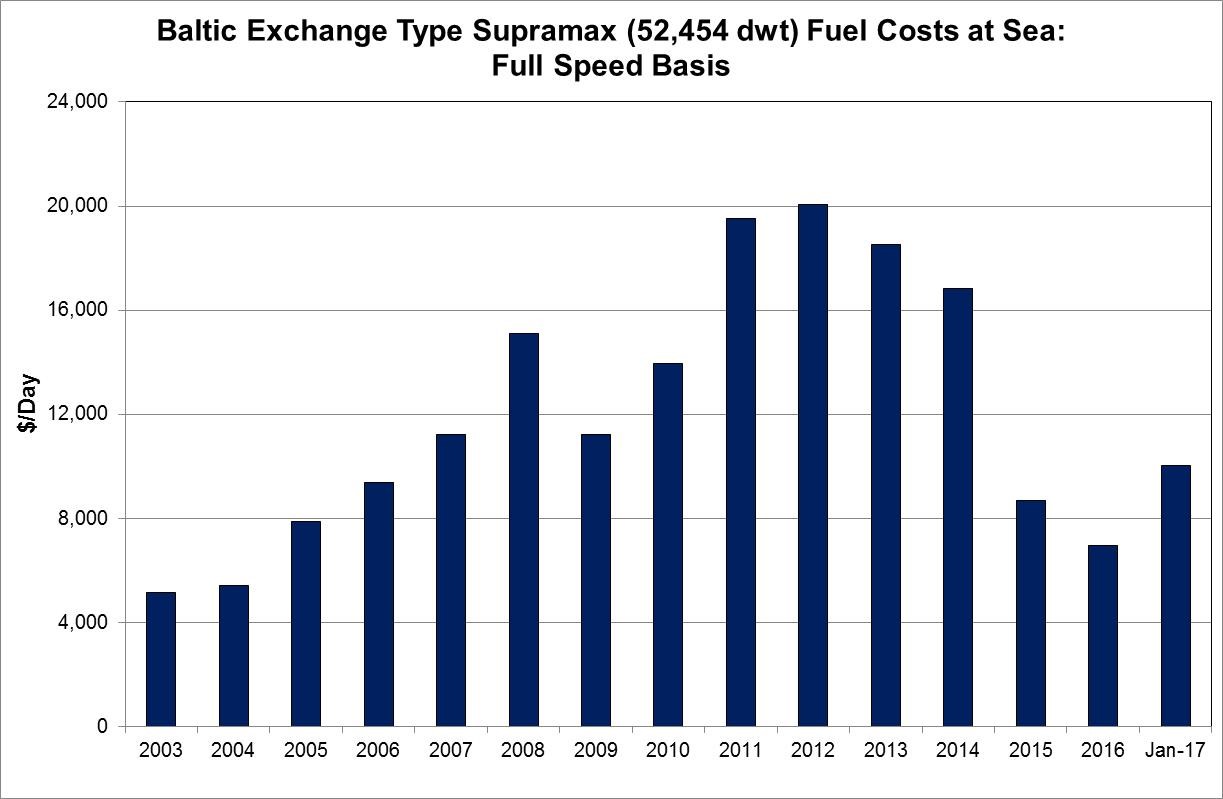

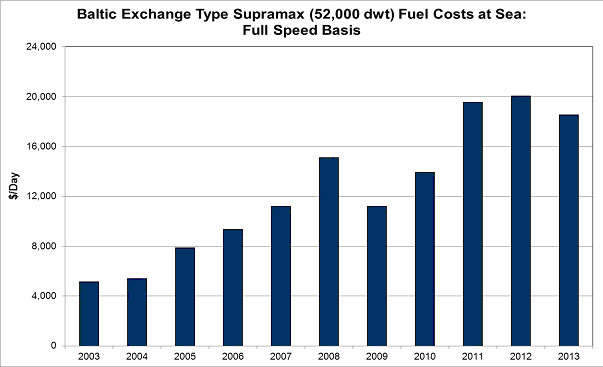

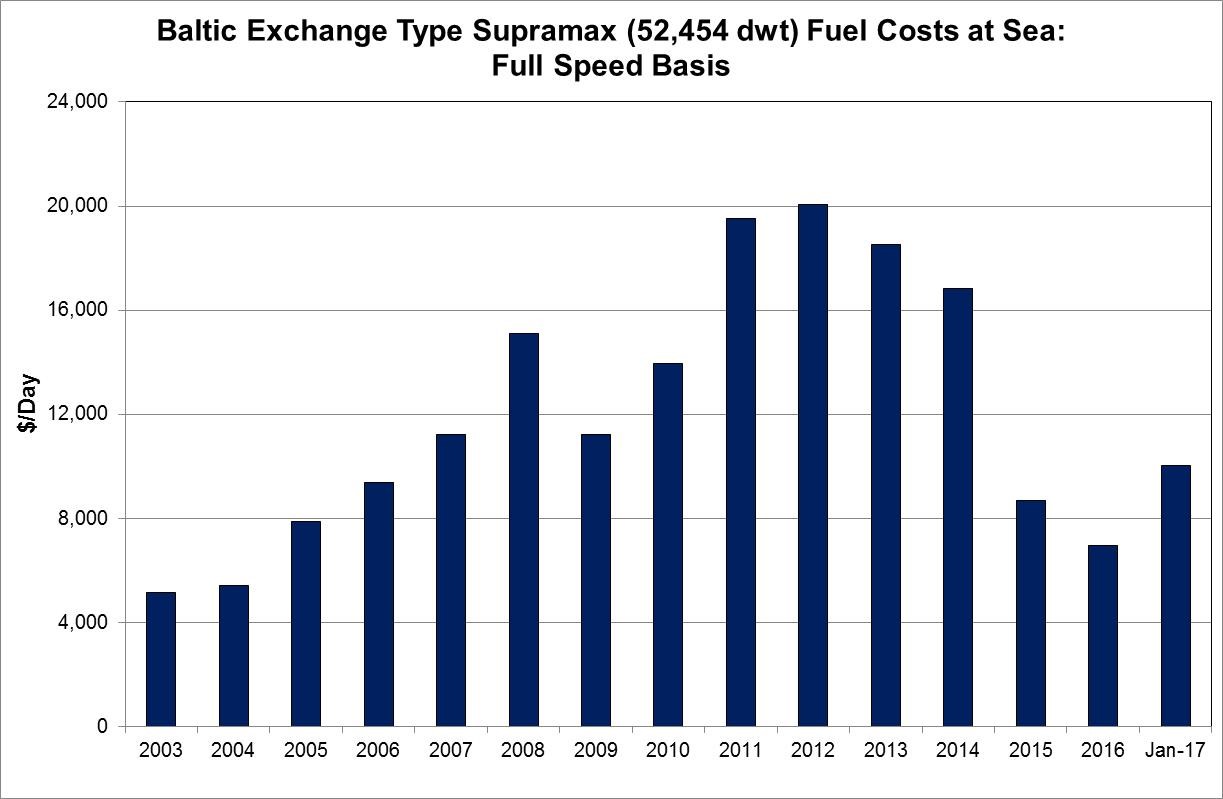

Rising fuel, or bunker, prices may adversely affect our profits.

Since we primarily employ our vessels in the spot market or in spot market-oriented pools, we expect that fuel, or bunkers, will be typically the largest expense in our shipping operations for our vessels. While we believe that we will experience a competitive advantage as a result of increased bunker prices due to the greater fuel efficiency of our vessels compared to the average global fleet, changes in the price of fuel may adversely affect our profitability. The operationprice and supply of fuel is unpredictable and fluctuates based on events outside our control, including geopolitical developments, supply and demand for oil and gas, actions by the Organization of the Petroleum Exporting Countries, or OPEC, and other oil and gas producers, war and unrest in oil producing countries and regions, regional production patterns and environmental concerns. Further, fuel may become much more expensive in the future, which may reduce our profitability and the competitiveness of our business compared to other forms of transportation.

We operate drybulk carriersvessels worldwide and as a result, our business has certain uniqueinherent operational risks, which may reduce our revenue or increase our expenses, and we may not be adequately covered by insurance.

The international shipping industry is an inherently risky business involving global operations. Our vessels and their cargoes are at risk of being damaged or lost because of events such as marine disasters, bad weather, mechanical failures, human error, environmental accidents, war, terrorism, piracy and other circumstances or events. In addition, transporting cargoes across a wide variety of international jurisdictions creates a risk of business interruptions due to political circumstances in foreign countries, hostilities, labor strikes and boycotts, the potential for changes in tax rates or policies, and the potential for government expropriation of our vessels. Any of these events may result in loss of revenues, increased costs and decreased cash flows to our customers, which could affectimpair their ability to make payments to us under our earnings and cash flow.charters.

Furthermore, Thethe operation of certain vessel types, such as drybulk carriers, has certain unique risks. With a drybulk carrier, the cargo itself and its interaction with the vessel can be an operational risk. By their nature, drybulk cargoes are often heavy, dense, easily shifted, and react badly to water exposure. In addition, drybulk carriers are often subjected to battering treatment during unloading operations with grabs, jackhammers (to pry encrusted cargoes out of the hold) and small bulldozers. This treatment may cause damage to the vessel. Vessels damaged due to treatment during unloading procedures may be more susceptible to breach at sea. Hull breaches in drybulk carriers may lead to the flooding of the vessels’ holds. If a drybulk carrier suffers flooding in its forward holds, the bulk cargo may become so dense and waterlogged that its pressure may buckle the vessel’s bulkheads, leading to the loss of a vessel. If we are unable to adequately maintain our vessels, we may be unable to prevent these events. Any of these circumstances or events may have a material adverse effect on our business, results of operations, cash flows, financial condition and ability to pay dividends.dividends, if any, in the future, on our common shares, and interest on our Senior Notes. In addition, the loss of any of our vessels could harm our reputation as a safe and reliable vessel owner and operator.

Rising fuel, or bunker, prices may adversely affect our profits.

Since we primarily employ our vessels in the spot market or in spot market-oriented pools, we expect that fuel, or bunkers, will be typically the largest expense in our shipping operations for our vessels. While we believe that we will experience a competitive advantage as a result of increased bunker prices due to the greater fuel efficiency of our vessels compared to the average global fleet, changes in the price of fuel may adversely affect our profitability. The price and supply of fuel is unpredictable and fluctuates based on events outside our control, including geopolitical developments, supply and demand for oil and gas, actions by the Organization of the Petroleum Exporting Countries, or OPEC, and other oil and gas producers, war and unrest in oil producing countries and regions, regional production patterns and environmental concerns. Further, fuel may become much more expensive in the future, which may reduce our profitability.

Our business has inherent operational risks, which may not be adequately covered by insurance.

Our vessels and their cargoes are at risk of being damaged or lost because of events such as marine disasters, bad weather, mechanical failures, human error, environmental accidents, war, terrorism, piracy and other circumstances or events. In addition, transporting cargoes across a wide variety of international jurisdictions creates a risk of business interruptions due to political circumstances in foreign countries, hostilities, labor strikes and boycotts, the potential for changes in tax rates or policies, and the potential for government expropriation of our vessels. Any of these events may result in loss of revenues, increased costs and decreased cash flows to our customers, which could impair their ability to make payments to us under our charters.

In the event of a casualty to a vessel or other catastrophic event, we will rely on our insurance to pay the insured value of the vessel or the damages incurred. We procure insurance for the vessels in our fleet against those risks that we believe the shipping industry commonly insures against. These insurances include marine hull and machinery insurance, protection and indemnity insurance, which include pollution risks and crew insurances, and war risk insurance. Currently, the amount of coverage for liability for pollution, spillage and leakage available to us on commercially reasonable terms through protection and indemnity associations and providers of excess coverage is

$1$1.0 billion per vessel per occurrence.

We

will procurehave procured hull and machinery insurance, protection and indemnity insurance, which includes environmental damage and pollution insurance coverage, and war risk insurance for our fleet. We do not maintain for our vessels insurance against loss of hire, which covers business interruptions that result from the loss of use of a vessel. We may not be adequately insured against all risks. We may not be able to obtain adequate insurance coverage for our fleet in the future, and we may not be able to obtain certain insurance

coverages.coverage. The insurers may not pay particular claims. Our insurance policies may contain deductibles for which we will be responsible and limitations and exclusions which may increase our costs or lower our revenue. Moreover, insurers may default on claims they are required to pay.

We cannot assure you that we will be adequately insured against all risks or that we will be able to obtain adequate insurance coverage at reasonable rates for our vessels in the future. For example, in the past more stringent environmental regulations have led to increased costs for, and in the future may result in the lack of availability of, insurance against risks of environmental damage or pollution. Additionally, our insurers may refuse to pay particular claims. Any significant loss or liability for which we are not insured could have a material adverse effect on our financial condition.

Maritime claimants could arrest or attach one or more of our vessels, which could interrupt our cash flow.

flows.

Crew members, suppliers of goods and services to a vessel, shippers of cargo, lenders, and other parties may be entitled to a maritime lien against a vessel for unsatisfied debts, claims or damages. In many jurisdictions, a claimantmaritime lien holder may seek to obtain security for

enforce its

claimlien by arresting

or attaching a vessel through foreclosure proceedings. The arrest or attachment of one or more of our vessels could interrupt our cash

flowflows and require us to pay large sums of money to have the arrest or attachment lifted. In addition, in some jurisdictions, such as South Africa, under the “sister ship” theory of liability, a claimant may arrest both the vessel

whichthat is subject to the claimant’s maritime lien and any “associated” vessel, which is any vessel owned or controlled by the same owner. Claimants could attempt to assert “sister ship” liability against one vessel in our fleet for claims relating to another of our vessels.

Governments could requisition our vessels during a period of war or emergency,

resulting in a losswhich could negatively impact our business, financial condition, results of

earnings.operations, and available cash.

A government could requisition one or more of our vessels for title or for hire. Requisition for title occurs when a government takes control of a vessel and becomes

herits owner, while requisition for hire occurs when a government takes control of a vessel and effectively becomes

herits charterer at dictated charter rates. Generally, requisitions occur during periods of war or emergency, although governments may elect to requisition vessels in other circumstances. Although we would be entitled to compensation in the event of a requisition of one or more of our vessels, the amount and timing of payment would be uncertain. Government requisition of one or more of our vessels may negatively impact our revenues.

Failure to comply with the U.S. Foreign Corrupt Practices Act could result in fines, criminal penalties,

chartercontract terminations and an adverse effect on our business.

We

may operate in a number of countries throughout the world, including countries known to have a reputation for corruption. We are committed to doing business in accordance with applicable anti-corruption laws and have adopted a code of business conduct and ethics which is consistent and in full compliance with the U.S. Foreign Corrupt Practices Act of 1977, or the FCPA. We are subject, however, to the risk that we, our affiliated entities or our or their respective officers, directors, employees and agents may take actions determined to be in violation of such anti-corruption laws, including the FCPA. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties and curtailment of operations in certain jurisdictions, and might adversely affect our business, results of operations or financial condition. In addition, actual or alleged violations could damage our reputation and ability to do business. Furthermore, detecting, investigating, and resolving actual or alleged violations is expensive and can consume significant time and attention of our senior management.

COMPANY SPECIFIC RISK FACTORS

We are a recently formed company with a limited history of operations.

We

are a recentlywere formed

companyin March 2013 and have a limited performance record, operating history and historical financial statements upon which you can evaluate our operations or our ability to implement and achieve our business strategy. We cannot assure you that we will be successful in implementing our business strategy. In addition, while our Chief Executive Officer and the management teams of our commercial and technical managers have experience operating drybulk carriers, other members of our senior management, who have experience operating tanker and other classes of vessels,

do not have

limited experience operating drybulk carriers. We believe that the experience of our senior management in the ownership and operation of tanker vessels, which require significant technical expertise to operate and are subject to heightened regulatory oversight and more rigorous vetting procedures from charterers than drybulk carriers, provides our management team with the expertise and qualifications to manage drybulk carriers, however we cannot assure you that they will be able to successfully operate our fleet.

We

will not generate significant revenue until we take delivery of the vessels we have agreed to acquire or identify and acquire other vessels.We have entered into construction contracts for 79 newbuilding vessels, with scheduled deliveries to us between the second quarter of 2014 and the third quarter of 2016 and have chartered in 17 vessels which are currently operated in a Scorpio Group Pool (defined later). We will not generate significant revenue until the second quarter of 2014. However,cannot assure you that we will continue to incur expenses related to the supervision of these newbuildings, costs related to any efforts to identify other vessels for acquisition, interest expense for the outstanding debt we expect to incur and general administrative expenses, including those related to being a public company. As a result, we will incur losses and are unlikely to be able to pay dividends during the period priorraise funds sufficient to meet our future capital and operating needs.

We cannot assure you that our available liquidity will be sufficient to meet our ongoing capital and operating needs.

We are exposed to the

deliverycyclicality and volatility of

onespot market charterhire rates, which have fluctuated, and may continue to fluctuate, significantly based upon available charters and the supply of and demand for seaborne shipping capacity. If charter rates available in the spot market are insufficient to enable our vessels to operate profitably it could adversely affect our available liquidity, profitability, cash flows, and financial results. Furthermore, a prolonged period of depressed charter rates or

more ofa significant decrease in charter rates may negatively impact our liquidity position and may cause our vessel values to decline, which could, among other things, affect our ability to comply with the