UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . .. . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number: 000-55135001-41319

POET TECHNOLOGIES INC.

|

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Jurisdiction of incorporation or organization)

1107 – 120 Eglinton Avenue East

Toronto, Ontario, M4P 1E2, Canada

(Address of principal executive offices)

Suresh Venkatesan, CEO

2550 Zanker Road1107 – 120 Eglinton Avenue East

Toronto, Ontario, M4P 1E2, Canada

San Jose, California 95131Telephone No.: 416368 9411

Tel: (408)435-2665Email: svv@poet-technologies.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:None.

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares, no par value | PTK | TSX Venture Exchange | ||

| Common Shares, no par value | POET | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act:Common Stock, no par value. None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:Not Applicable. None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Not Applicable.

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ | Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S GAAP ☐ | International Financial Reporting Standards as issued | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes No ☒

POET TECHNOLOGIES INC.FORM 20-F ANNUAL REPORTTABLE OF CONTENTS

POET TECHNOLOGIES INC.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

INTRODUCTION

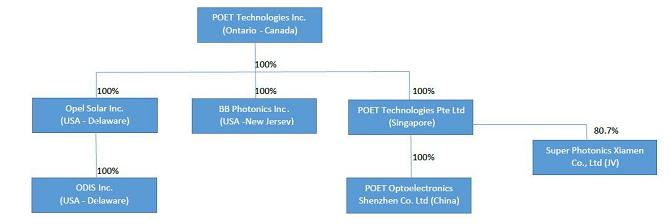

POET Technologies Inc. is organized under the Business Corporations Act (Ontario). In this Annual Report, the “Company”, “we”, “our”, “POET” and “us” refer to POET Technologies Inc. and its subsidiaries (unless the context otherwise requires). We refer you to the documents attached as exhibits hereto for more complete information than may be contained in this Annual Report. Our principal Canadian corporate offices are located at Suite 501, 121 Richmond Street West,1107, 120 Eglinton Avenue East, Toronto, Ontario M5H 2K1,M4P 1E2, Canada. Our principal operationsU.S office is located in the U.S. at 2550 Zanker Road, San Jose, CA, 95131.1605 N. Cedar Crest Boulevard, Allentown, PA, 18104. Our telephone number in Toronto is (416) 368-9411. Our telephone number in San Jose is (408) 435-2665.

We file reports and other information with the Securities and Exchange Commission (“SEC”) located at 100 F Street NE, Washington,

D.C. 20549. You may obtain copies of our filings with the SEC by accessing their website located at www.sec.gov. We also file reports under Canadian regulatory requirements on SEDAR; you may access our reports filed on SEDAR by accessing the website www.sedar.com.

This Annual Report (including the consolidated audited financial statements for the years ended December 31, 2023, 2022 and 2021 attached thereto, together with the auditors’ report thereon), and the exhibits thereto shall be deemed to be incorporated by reference as exhibits to the Registration Statement of the Company on Form F- 10, as amended (File No. 333-227873), and to be a part thereof from the date on which this report was filed, to the extent not superseded by documents or reports subsequently filed or furnished.

| Page 1 |

Business of POET Technologies Inc.

POET designs, develops, manufactures and sells integrated opto-electronic solutions for data communications, telecommunications and artificial intelligence markets. POET has developed and is marketing its proprietary POET Optical InterposerTM, a novel platform that allows the seamless integration of electronic and photonic devices onto a single chip using advanced wafer-level semiconductor manufacturing techniques. The semiconductor industry has adopted the term “Wafer-Level Chip-Scale Packaging” (or “WLCSP”) to describe similar approaches within the semiconductor industry. POET’s Optical Interposer eliminates costly components and labor-intensive assembly, alignment, and testing methods employed in conventional photonics. The cost-efficient integration scheme and scalability of the POET Optical Interposer brings value to devices or systems that integrate electronics and photonics, including high-growth areas of communications and computing, such as high-speed networking for cloud service providers and data centers, 5G networks, machine-to-machine communication, sometimes referred to as the “Internet of Things” (IoT), self-contained “edge” computing applications, such as accelerators for Artificial Intelligence – Machine Learning (AI-ML) systems and sensing applications, such as LIDAR systems for autonomous vehicles and point-of-use health care products.

On October 21, 2020, the Company signed a Joint Venture Agreement (“JVA”) establishing a joint venture company (the “JV”), Super Photonics Integrated Circuit Xiamen Co., Ltd (“SPX”) with Xiamen Sanan Integrated Circuit Co. Ltd. (“Sanan IC”) whose purpose is to assemble, test, package and sell cost-effective, high-performance optical engines based on POET’s proprietary Optical Interposer platform technology.

SPX’S capitalization will consist of a combination of committed cash, capital equipment and intellectual property from Sanan IC and intellectual property and know-how from POET, with a combined estimated value of approximately $50M. Capitalization is on-going and has not yet been completed. POET’s contribution of certain intellectual property and know-how was valued by an independent appraiser at $22.5M. Sanan IC will contribute cash of approximately $25M for capital equipment and operating expenses, with the expectation that the eventual ownership of the JV will be approximately 52% Sanan IC and 48% POET. SPX is an independent company and is operated as a true joint venture, so its financial results are not consolidated into POET’s but are reported as a gain in the value of the contribution to the JV and a gain or loss in the Company’s percentage ownership of the JV.

Sanan IC is a developerworld-class wafer foundry service company with an advanced compound semiconductor technology platform, serving the optical, RF microelectronics and power electronics markets. Sanan IC is a wholly owned subsidiary of opto-electronicSanan Optoelectronics Co., Ltd. (Shanghai Stock Exchange, SSE: 600703), the leading manufacturer of advanced ultra-high brightness LED epitaxial wafers and photonic fabrication processes and products. Photonics integration is fundamental to increasing functional scaling and lowering the cost of current photonic solutions. POET believes that its advanced opto-electronics process platform enables substantial improvements in energy efficiency, component cost and sizechips in the productionworld.

Significant progress on SPX included the registration of smart optical components,SPX, appointment of the engines driving applications rangingboard of directors and key personnel, hiring of 36 employees, completion of 5,000 square feet of temporary facilities, ordering of key capital equipment for installation and qualification and outflow of approximately $7 million from data centersSanan IC to consumer productscover initial operating and capital expenditures to military applications. Silicon Valley-based POET’s patented module-on-a-chip process, which integrates digital, high-speed analogbe contributed to the JV.

While each joint venturer has appointed one member to the Board of Directors of SPX, the company has its own governance and optical devicesmanagement structure and is operated under the laws of the Peoples Republic of China.

The Company has recognized a gain of $5,366,294 related to its contribution of intellectual property to SPX in accordance with IAS 28. The Company only recognizes a gain on the same chip,contribution of the intellectual property equivalent to the Sanan IC’s interest in SPX, the unrecognized gain of $17,127,825 will be applied against the investment and periodically realized as the Company’s ownership interest in SPX is designed to serve as an industry standardreduced. As at December 31, 2023, Sanan IC’s and the Company’s ownership interests were approximately 23.9% and 76.1% respectively.

Net loss for smart optical components.

the year ended December 31, 2023 was $20,267,365. The Company currently operates at a loss. We have no revenues. Our expenses,net loss included $10,077,930 incurred for research and development activities directly or indirectly, relaterelated to the development and commercialization of the POET process or our status as a publicly traded Company. During the fiscal year ended December 31, 2015, researchOptical Interposer and POET Optical Engine products. Research and development expenses were $3,532,492 while generalincluded non-cash costs of $1,539,235 related to stock-based compensation. $10,795,155 was incurred for selling, marketing and administration expenses were $8,614,109. Included in generalwhich included non-cash costs of $2,662,209 related to stock-based compensation and administrative$1,922,140 related to depreciation and research and development are non-cash share based expensesamortization.

The Company incurred $70,182 of $4,265,704 and $552,416, respectively, relatinginterest expense, of which $53,614 was non-cash.

| Page 2 |

The Company recorded a gain on contribution of intellectual property to the fair valuejoint venture of stock based compensation. We have yet to commercialize the POET technology. To date, proceeds from the issuance of its common shares have financed$1,031,807. Additionally, the Company’s continuing operations and research and development initiatives.share of loss in joint venture was limited to $1,031,807 as required by IFRS standards.

AsThe Company’s statement of financial position as of December 31, 2015, we had over $14.5 million2023 reflects assets with a book value of $8,777,417 compared to $15,390,453 as of December 31, 2022. Thirty six percent (36%) of the book value at December 31, 2023 was in current assets consisting primarily of cash and approximately $515,000cash equivalents of accounts payable$3,019,069 compared to sixty two percent (62%) of the book value as of December 31, 2022, which consisted primarily of cash and accrued liabilities. We are confident that the current levelcash equivalents of working capital is sufficient to support the Company beyond 2016 as we work toward the goal of monetizing the POET process.$9,229,845.

Financial and Other Information

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States Dollars (“US$”, “USD” or “$”).

Cautionary Statements Regarding Forward-Looking Statements

This Annual Report on Form 20-F and other publicly available documents, including the documents incorporated herein and therein by reference contain forward-lookingforward- looking statements and information within the meaning of U.S. and Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-lookingforward- looking terminology or words, such as, “continues”, “with a view to”, “is designed to”, “pending”, “predict”, “potential”, “plans”, “expects”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, and similar expressions or variations thereon, or statements that events, conditions or results “can”, “might”, “will”, “shall”, “may”, “must”, “would”, “could”, or “should” occur or be achieved and similar expressions in connection with any discussion, expectation, or projection of future operating or financial performance, events or trends. Forward- looking statements and information are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

TheOur actual results, performance and achievements may differ materially from those expressed in, or implied by, the forward-looking statements and information in this Annual Report are subject toas a result of various risks, uncertainties and uncertainties, including those described in ITEM 3.D. “Risk Factors”,other factors, many of which are difficult to predict and generally beyond the control of the Company, including without limitation:

| we have a limited operating history; | ||

| ○ | our need for additional financing, which may not be available on acceptable terms or at all; |

| ○ | the possibility that we will not be able to compete in the highly competitive semiconductor market; |

| ○ | the risk that our objectives will not be met within the |

| ○ | research and development risks; | |

| ○ | the risks associated with successfully protecting patents and trademarks and other intellectual property; |

| ○ | the need to control costs and the possibility of unanticipated expenses; |

| manufacturing and development risks; |

| ○ | the risk that the price of our common |

| Page 3 |

| ○ | the risk that geopolitical uncertainties may negatively impact our business venture in China; | |

| ○ | the risk that shareholders’ interests will be diluted through future stock offerings, option and warrant | |

| ○ | other risks and uncertainties described in Item 3.D. “Risk Factors”. |

For all of the reasons set forth above, investors should not place undue reliance on forward-looking statements. Other than any obligation to disclose material information under applicable securities laws or otherwise as maybe required by law, we undertake no obligation to revise or update any forward-looking statements after the date hereof.

Data relevant to estimated market sizes for our technologies under development are presented in this Annual Report. These data have been obtained from a variety of published resources including published scientific literature, websites and information generally available through publicized means. The Company attempts to source reference data from multiple sources whenever possible for confirmatory purposes. Although the Company believes the foregoing data is reliable,However, the Company has not independently verified the accuracy and completeness of this data.

ITEMItem 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORSIdentity of Directors, Senior Management and Advisers

A.A. Not Applicable.required.

ITEMItem 2. OFFER STATISTICS AND EXPECTED TIMETABLEOffer Statistics and Expected Timetable

Not Applicable.required.

ITEMItem 3. KEY INFORMATIONKey Information

| A. |

The selected financial data of the Company for the years ended December 31, 2015, 2014 and 2013 was derived from the audited annual consolidated financial statements of the Company, which have been audited by Marcum LLP, independent registered public accounting firm. Selected financial data of the Company for the years ended December 31, 2012 and 2011 was derived from the consolidated financial statements of the Company, which are not included in this Annual Report.

The information contained in the selected financial data for the 2015, 2014 and 2013 years is qualified in its entirety by reference to the Company’s consolidated financial statements and related notes included under the heading “ITEM 17. Financial Statements” and should be read in conjunction with such financial statements and with the information appearing under the heading “ITEM 5.

Operating and Financial Review and Prospects.” Except where otherwise indicated, all amounts are presented in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

Since its formation, the Company has financed its operations from public and private sales of equity securities, proceeds received upon the exercise of warrants and stock options, research and development contracts from U.S. government agencies and, prior to 2012, by sales of solar energy equipment products. The Company has never been profitable, so its ability to finance operations has been dependent on equity financings. The Company believes that it will continue to rely on the sale of its equity securities to provide funds for its activities. We believe the Company is well capitalized , nevertheless the Company may effect a future financing if an appropriate opportunity presents itself. See ITEM 3.D. “Risk Factors.”

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future.

The following consolidated financial information is separated between continuing and discontinued operations.

Consolidated Statements of Operations

Under International Financial Reporting Standards

(US$)

| Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Costs and Expenses | ||||||||||||||||||||

| General and Administration | $ | 8,614,109 | $ | 9,677,705 | $ | 6,284,288 | $ | 3,023,471 | $ | 2,695,956 | ||||||||||

| Research and Development | 3,532,492 | 2,277,927 | 1,925,974 | 1,093,998 | 1,327,057 | |||||||||||||||

| Investment Income, including interest | (76,431 | ) | — | (18,371 | ) | — | (21,915 | ) | ||||||||||||

| Total Expenses | 12,070,170 | 11,955,632 | 8,191,891 | 4,117,469 | 4,001,098 | |||||||||||||||

| Loss, before the following | ||||||||||||||||||||

| Other income | — | 169,832 | 342,874 | 238,806 | 755,422 | |||||||||||||||

| Net Loss for the Period | ||||||||||||||||||||

| Loss from continuing operations | (12,070,170 | ) | (11,785,800 | ) | (7,849,017 | ) | (3,878,663 | ) | (3,245,676 | ) | ||||||||||

| Loss from discontinued operations, net of taxes | — | — | — | (4,685,449 | ) | (11,898,225 | ) | |||||||||||||

| Net Loss | (12,070,170 | ) | (11,785,800 | ) | (7,849,017 | ) | (8,564,112 | ) | (15,143,901 | ) | ||||||||||

| Deficit, beginning of period | (78,780,502 | ) | (66,994,702 | ) | (59,145,685 | ) | (50,442,457 | ) | (35,298,556 | ) | ||||||||||

| Divestiture of non-controlling interest | — | — | — | (139,116 | ) | — | ||||||||||||||

| Deficit, end of period | $ | (90,850,672 | ) | $ | (78,780,502 | ) | $ | (66,994,702 | ) | $ | (59,145,685 | ) | $ | (50,442,457 | ) | |||||

| Basic and Diluted Loss Per Share: | $ | (0.07 | ) | $ | (0.08 | ) | $ | (0.06 | ) | $ | (0.08 | ) | $ | (0.17 | ) | |||||

| Continuing Operations | $ | (0.07 | ) | $ | (0.08 | ) | $ | (0.06 | ) | $ | (0.04 | ) | $ | (0.04 | ) | |||||

| Discontinued Operations | — | — | — | $ | (0.04 | ) | $ | (0.13 | ) | |||||||||||

Consolidated Statements of Discontinued Operations

Under International Financial Reporting Standards(US$)

| Years Ended December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Revenue | $ | — | $ | — | $ | — | $ | 617,728 | $ | 5,122,507 | ||||||||||

| Costs and Expenses | ||||||||||||||||||||

| Cost of Goods Sold | — | — | — | 1,117,282 | 8,916,603 | |||||||||||||||

| General and Administration | — | — | — | 3,380,117 | 5,551,286 | |||||||||||||||

| Research and Development | — | — | — | 611,644 | 2,561,217 | |||||||||||||||

| Investment Income, including interest | — | — | — | (3,044 | ) | (8,374 | ) | |||||||||||||

| Total Expenses | — | — | — | 5,105,999 | 17,020,732 | |||||||||||||||

| Net Operating Income (Loss) from Discontinued Operations | — | — | — | (4,488,271 | ) | (11,898,225 | ) | |||||||||||||

| Loss on Divestiture of Subsidiaries | — | — | — | (197,178 | ) | — | ||||||||||||||

| Net Income (Loss) from Discontinued Operations | — | — | — | (4,685,449 | ) | (11,898,225 | ) | |||||||||||||

| Attributable to non-controlling interest | — | — | — | — | 107,662 | |||||||||||||||

| Attributable to equity shareholders | $ | — | $ | — | $ | — | $ | (4,685,449 | ) | $ | (11,790,563 | ) | ||||||||

Consolidated Statements of Financial Position

Under International Financial Reporting Standards

(US$)

| December 31, | ||||||||||||||||||||

| 2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

| Assets | ||||||||||||||||||||

| Cash | $ | 14,409,996 | $ | 11,287,864 | $ | 3,260,967 | $ | 1,435,762 | $ | 1,330,141 | ||||||||||

| Accounts and Other Receivable | — | — | — | 96,749 | 526,229 | |||||||||||||||

| Prepaids and Other Current Assets | 150,923 | 243,501 | 267,012 | 158,257 | 152,162 | |||||||||||||||

| Inventories | — | — | — | — | 1,426,003 | |||||||||||||||

| Marketable Securities | — | — | 397 | 426 | 415 | |||||||||||||||

| Assets Available for Sale | — | — | — | 606,413 | — | |||||||||||||||

| Investment in Opel Solar Asia Company Limited | — | — | — | — | 197,178 | |||||||||||||||

| Property and Equipment | 947,107 | 1,058,860 | 903,792 | 26,670 | 1,798,779 | |||||||||||||||

| Patents and Licenses | 426,813 | 260,721 | 125,676 | 75,550 | 198,249 | |||||||||||||||

| Total Assets | $ | 15,934,839 | $ | 12,850,946 | $ | 4,557,844 | $ | 2,399,827 | $ | 5,629,156 | ||||||||||

| Liabilities | ||||||||||||||||||||

| Accounts Payable and Accrued Liabilities | $ | 515,421 | $ | 451,724 | $ | 256,027 | $ | 231,903 | $ | 1,705,876 | ||||||||||

| Product Warranty | — | — | — | 25,899 | 25,899 | |||||||||||||||

| Disposal Group Liabilities | — | — | — | 606,413 | — | |||||||||||||||

| Deferred Energy Credit | — | — | — | — | 614,363 | |||||||||||||||

| Asset Retirement Obligation | — | — | — | — | 74,277 | |||||||||||||||

| Total Liabilities | 515,421 | 451,724 | 256,027 | 864,215 | 2,420,415 | |||||||||||||||

| Shareholders’ Equity | ||||||||||||||||||||

| Share Capital | 81,027,171 | 61,688,953 | 42,911,455 | 40,225,401 | 38,507,720 | |||||||||||||||

| Special Voting Share | — | — | — | 100 | 100 | |||||||||||||||

| Special Warrants and Shares to be Issued | — | — | — | — | 27,521 | |||||||||||||||

| Warrants | 2,013,747 | 6,458,659 | 8,135,590 | 3,850,685 | 1,813,729 | |||||||||||||||

| Contributed Surplus | 25,618,159 | 23,616,664 | 20,261,067 | 16,361,282 | 13,162,981 | |||||||||||||||

| Accumulated Other Comprehensive Income (loss) | (2,388,987 | ) | (584,552 | ) | (11,593 | ) | 243,829 | 278,263 | ||||||||||||

| Deficit | (90,850,672 | ) | (78,780,502 | ) | (66,994,702 | ) | (59,145,685 | ) | (50,442,457 | ) | ||||||||||

| Non-Controlling Interest | — | — | — | — | (139,116 | ) | ||||||||||||||

| Total Shareholders’ Equity | 15,419,418 | 12,399,222 | 4,301,817 | 1,535,612 | 3,208,741 | |||||||||||||||

| Total Liabilities and Shareholders’ Equity | $ | 15,934,839 | $ | 12,850,946 | $ | 4,557,844 | $ | 2,399,827 | $ | 5,629,156 | ||||||||||

| B. | Capitalization and |

Not Applicable.required.

| C. | Reasons for the Offer and Use of |

Not Applicable.required.

| D. | Risk Factors. |

We are subject to various risks, including those described below, which could materially adversely affect our business, financial condition and results of operations and, in turn, the value of our securities. In addition, other risks not presently known to the other information presented in this Annual Report, the following shouldus or that we currently believe to be considered carefully in evaluating the Companyimmaterial may also adversely affect our business, financial condition and its business. This Annual Report containsresults of operations, perhaps materially. The risks discussed below also include forward-looking statements and information within the meaning of U.S. and Canadian securities laws that involve risks and uncertainties. The Company’s actual results may differ materially from the results discussed in the forward-looking statements and information.information Factors that might cause such differences include those discusseddiscussed. Before making an investment decision with respect to any of our securities, you should carefully consider the following risks and uncertainties described below and elsewhere in this Annual Report. See also “Cautionary Statement Regarding Forward-Looking Statements.”

| Page 4 |

Risks Related to Our Business

As a result of our limited financial liquidity, we and our auditors have expressed substantial doubt regarding our ability to continue as a going concern.

As a result of our current limited financial liquidity, our auditors’ report for our 2023 financial statements, which is included as part of this report, contains a statement concerning our ability to continue as a going concern. Our limited liquidity could make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we may obtain and our public stock price generally.

Our continuation as a going concern is dependent upon, among other things, achieving positive cash flow from operations and, if necessary, augmenting such cash flow using external resources to satisfy our cash needs. Our plans to achieve positive cash flow primarily include engaging in offerings of securities. Additional potential sources of funds include negotiating milestone payments for non-recurring engineering services or royalties from sales of our products. These cash sources could, potentially, be supplemented by financing or other strategic agreements. However, we may be unable to achieve these goals or obtain required funding on commercially reasonable terms, or at all, and therefore may be unable to continue as a going concern.

We have a limitedhistory of large operating history, and we do not expect to become profitable in the near future.

We are a fabless semiconductor technology development company with a limited operating history. We are not profitable and have incurred losses. We continuemay not be able to incur research and development and general and administrative expenses related to our operations. We expect to continue to incur losses for the foreseeable future, and these losses may increase as we move toward the commercialization of our technology currently under development. If our POET technology platform does not achieve market acceptance, we may never become profitable. Even if we achieveor sustain profitability in the future and as a result we may not be able to sustain profitability in subsequent periods.maintain sufficient levels of liquidity.

Accordingly, it is difficult

We have historically incurred losses and negative cash flows from operations since our inception. As of December 31, 2023, we had an accumulated deficit of $214,291,025. We expect that operating losses will continue into the near term. Our revenues are not considered sufficient to evaluate our business prospects. Moreover, our prospects mustcover operating expenses. We can give no assurance that we will be considered in light ofprofitable even if we successfully commercialize or products. Failure to become and remain profitable may adversely affect the risks and uncertainties encountered by an early-stage company and competitive markets, such as the semiconductor market where market acceptanceprice of our technology is uncertain.common stock and ability to raise capital and continue operations.

As of December 31, 2023, we held $3,019,069 in cash and cash equivalents. We dependhad working capital of $716,881.

We divested our major operating asset, adopted a new “fab-light” strategy, and we plan to focus on the implementationOptical Interposer as our main business. Any or all of these decisions if incorrect may have a material adverse effect on the results of our operations, financial position and cash flows, and pose further risks to the successful operation of our business plan,over the short and long-term.

There are substantial risks associated with our adoption of a “fab-light” strategy, including the loss of revenue associated with the divested operation, the loss of control over an internal development asset, and the loss of key technical knowledge available from personnel who will no longer be employed by the Company, many of whom we may have to replace.

We have some previous experience with managing development without an internal development resource under a similar “fab-light” strategy which was not successful, and there is no guarantee that our abilitynew approach to makeoperating a company with our chosen strategy will be successful. Further, our strategy will be solely dependent on the future progressmarket acceptance and sale of Optical Interposer-based solutions, which in some cases are neither fully developed nor in qualification stages. Customers are in the initial stages of committing to a production product.

We have taken substantial measures to protect POET’s intellectual property in the Optical Interposer, including development and production with a separate third-party company which engaged no engineering personnel from our former subsidiary company DenseLight. We conducted development of component devices with a segregated team at our DenseLight facility and took measures to protect POET’s intellectual property on those developments as well. However, we cannot guarantee that all our measures to protect our intellectual property on either the POET technology. Optical Interposer or its component devices have been totally effective. In addition, we cannot guarantee that DenseLight or any other third-party that we rely on to perform development, manufacturing, packaging or testing services will perform as expected and produce the devices we will need to grow our Optical Interposer business.

There can be no assurance that our efforts will ultimately result in profits.

We have not yet commercialized the POET technology and there is no certainty that we will be able to do so.

We have not yet commercialized our POET technology, andsuccessful in addressing these or any other significant risks we may neverencounter in the divestment of DenseLight, the adoption of a “fab-light” strategy or the focus of our business solely on the Optical Interposer.

We may not be able to obtain additional capital when desired, on favorable terms or at all.

We operate in a market that makes our prospects difficult to evaluate and, to remain competitive, we will be required to make continued investments in capital equipment, facilities and technology. We expect that substantial capital will be required to continue technology and product development, to expand our contract manufacturing capacity if we need to do so. Weso and to fund working capital for anticipated growth. If we do not know whengenerate sufficient cash flow from operations or ifotherwise have the capital resources to meet our future capital needs, we will completemay need additional financing to implement our development efforts or successfully license our technology. Even if we are successful in developing a commercially useful POET platform, we will not be successful unless POET gains market acceptance. The degree of market acceptance of these products may depend on a number of factors, including:business strategy.

We have had a historyThe Company expects that it will need to raise additional capital in the future to fund more rapid expansion, respond to competitive pressures, acquire complementary businesses or technologies or take advantage of lossesunanticipated opportunities, and expectit may seek to continue to incur additional losses for the foreseeable future.

do so through public or private financing, strategic relationships or other arrangements. The Company’s primary focus is on the research and developmentability of a specific semiconductor technology, which requires the expenditure of significant amounts of cash over a relatively long time period. As at December 31, 2015, the Company’s total deficit was $90,850,672, with net losses in fiscal years 2015, 2014 and 2013 of $12,070,170, $11,785,800 and $7,849,017 respectively. There can be no assurance that the Company to secure any required financing will ever record any earnings.

We may need to obtain additional investmentdepend in part upon prevailing capital market conditions and therebusiness success. There can be no assurance that the Company will be successful in generating sufficientits efforts to secure any additional financing on terms satisfactory to Management or at all. Even if such funding is available, the Company cannot predict the size of future issues of common shares or securities convertible into common shares or the effect, if any, that future issues and sales of common shares will have on the price of the Company’s common shares.

If the Company raises additional capital through the issuance of equity securities, the percentage ownership of the Company’s existing shareholders may be reduced, and such existing shareholders may experience additional dilution in net book value per share. Any such newly-issued equity securities may also have rights, preferences or privileges senior to those of the holders of the common shares. If additional funds are raised through the incurrence of indebtedness, such indebtedness may involve restrictive covenants that impair the ability of the Company to pursue its growth strategy and other aspects of its business plan, expose the Company to greater interest rate risk and volatility, require the Company to dedicate a substantial portion of its cash flow from operations to payments on its indebtedness, thereby reducing the availability of its cash flow to continue its development.

As stated above,fund working capital and capital expenditures, increase the Company’s vulnerability to general adverse economic and industry conditions, place the Company expectsat a competitive disadvantage compared to incur losses for the foreseeable future. As of December 31, 2015, 2014 and 2013,its competitors that have less debt, limit the Company’s working capital was $14,045,498, $11,079,641ability to borrow additional funds, and $3,272,349 respectively.

The Company has no capital asset commitments. The increased working capital balance in 2015 over 2014 was due to the $12.1 million dollars raised through the exercise of stock options and warrants during the year ended December 31, 2015.

The Company’s balance sheet as at December 31, 2015 reflects assets with a book value of $15,934,839 (2014 - $12,850,946) of which 91% (2014 - 89%) or $14,560,919 (2014 - $11,531,365) is current and consists primarily of cash totaling $14,409,996 (2014 - $11,287,864). It is our intention that the Company’s liquidity and unencumbered balance sheet will allow for investments in research and development and valuable human capital which are necessary to enableotherwise subject the Company to achieve its technicalthe risks discussed under “Indebtedness” below and operational milestones

As of February 22, 2016, there were 1,116,051 warrants outstanding to purchase common shares at an average exercise price of CAD$0.23 expiring between June 22, 2016 and September 27, 2016. Should those warrants be exercised, there is a potential for an additional CAD $256,692 to be raised byheighten the Company. Whether the warrants will be exercised is dependent on a number of factors that are outsidepossible effects of the Company’s control.

Between January 1, 2016 and February 22, 2016, the Company raised $1,965,327 from the exercise of 2,686,947 warrants and 628,000 stock options.

Based on current plans and cash utilization, we believe we have sufficient liquidity to support our operations and technological programs beyond 2016, which include further development of the POET semiconductor process and increasing the POET intellectual property portfolio to enable us to exploit POET, through licenses and collaborative arrangements.

The Company has no external sources of financing such as bank lines of credit. The Company will likely require future additional financing to carry out its business plan. The current market for both debt and equity financings for companies such as the Company is challenging, and there can be no assurance that a financing, whether debt or equity, will be available on acceptable terms or at all. The failure to obtain financing on a timely basis may result in the Company having to reduce or delay one or more of its planned research, development and marketing programs and to reduce related overhead, any of which could impair the Company’s current and future value. Any additional equity financing, if obtained, may result in significant dilution to the existing shareholders at the time of such financing. The Company may also seek additional funding from other sources, including technology licensing, co-development collaborations and other strategic alliances, which, if obtained, may reduce the Company’s interest in our intellectual property. There can be no assurance, however, thatrisks discussed in these risk factors. In connection with any such alternative sourcesfuture capital raising transaction, whether involving the issuance of funding will be available.

Rapid technological change could render our technology non-competitive and obsolete.

The semiconductor industry is subject to rapid and substantial technological change. Developments by others may renderequity securities or the Company’s POET technology non-competitive, andincurrence of indebtedness, the Company may not be ablerequired to keep pace with technological developments. Competitors have developed technologiesaccept terms that compete with the functionality expectedrestrict its ability to raise additional capital for a period of the Company’s technology. Some of these technologies have an entirely different approachtime, which may limit or means of accomplishing the desired process and function than the POET process being developed byprevent the Company from raising capital at times when it would otherwise be opportunistic to do so.

The process of developing new, technologically advanced products in semiconductor manufacturing and may be more effectivephotonics products is highly complex and less costly to implement than the technologies developed by the Company.uncertain, and we cannot guarantee a positive result.

Currently, the industryThe development of new, technologically advanced products is dominated by silicon-based semiconductor technology that requires the fabrication of multiple chips for opticala complex and electrical functions. As such, manufacturers of electronic devices are accustomed to designing their products around multi-chip platforms. If more advanced silicon-based technology is developed, manufacturers may determine that maintenance of the silicon platform will be less costly to implement and utilize than alternative technologies. Also, competitors may develop other integrated circuit platforms that are easier for manufacturers to adopt.

Our researchuncertain process requiring frequent innovation, highly-skilled engineering and development efforts are focused on the POET platform,personnel and any delay in the development, or the abandonment of the POET technology, or the POET technology’s failure to achieve market acceptance, would compromise our competitive position.

We have devoted and expect to continue to devote a large amount of resources to develop new and emerging technologies and standards that can be developed into products or commercially licensed in the future. Our POET platform is a new technology which as of yet does not have an established base of application and may not be embraced for use by the semiconductor industry. Should we fail to develop commercially available products based on our POET platform, or should we fail to license POET to technology companies who in turn develop products on the platform, our research and development efforts with respect to these technologies and standards likely would have no appreciable value. In addition, if we do not correctly anticipate new technologies and standards, or if the products that we and our licensees, if any, develop based on these new technologies and standards fail to achieve market acceptance, our competitors may be better able to address market demand than we would. Furthermore, if markets for these new technologies and standards develop later than we anticipate, or do not develop at all, demand for our technologies or products that are currently in development would suffer, resulting in reduced product sales or licensing sales of these technologies, if any.

We are a relatively small company with limited resources compared to some of our current and potential competitors and we may not be able to compete effectively and increase market share.

Some of our current and potential competitors have longer operating histories, significantly greater resources, name recognition and a base ofcustomers. As a result, these competitors may have greater credibility with our potential customers. They also may be able to adoptmore aggressive pricing policies and devote greater resources to the development, promotion and licensing of their products and technologies thanwe would be able to. In addition, some of our potential competitors have likely already established sales, licensing or joint development relationships with the decision makers at our potential customers. In addition, many of what we perceive as potential customers have the capabilities to develop technology competitive to ours internally. These competitors may be able to leverage their existingrelationships to discourage their customers from buying POET products or licensing or otherwise utilizing our technology. These competitors may elect not to support our technology which could complicate and impede our sales efforts. These and other competitive pressures may prevent us from competing successfully against current or future competitors, and may materially harm our business.

We are party to an intellectual property license agreement granting a portion of certain future revenues.

The Company has a License Agreement, as amended in 2014, with the University of Connecticut (“UCONN”) whereby UCONNgranted the Company an exclusive license to the intellectual property developed by a consultant of the Company,

Dr. Geoffrey Taylor, who is also a member of the faculty at UCONN. Such a license may reduce the profitability of the Company ifand when our products reach market. The Company is obligated to pay up to $1,000,000 per year when revenues reach certainmilestonessignificant capital, as well as pay an additional 3%the accurate anticipation of certain revenue received in connection with the exploitation of the licensed intellectualproperty or sales of products to third parties other than engineering expenses received from third parties.

We will be dependent on both semiconductor manufacturers and major intellectual property licensees.

We will be dependent on semiconductor manufacturers, as licensees of our technology, to manufacturetechnological and market opto-electronic productsbased on our architecture in order to receive royalties in the future. We also depend on them to add value to our licensed technology byproviding complete POET-based solutions to meet the specific application needs of systems companies. However, the semiconductormanufacturers, if any, will not be contractually obliged to manufacture, distribute or sell devices based on our technology or to market our POET technology on an exclusive basis. Some potential semiconductor partners design, develop and/or manufacture and marketdevices based on different competing architectures, including their own, and others may do so in the future.

We anticipate that our revenue will depend in part on these major license customers, although the companies considered to be major customers and the percentage of revenue represented by each major customer may vary from period to period depending on the addition of new agreements, the timing of work performed by us and the number of products utilizing our platform technology. In addition, we cannot be certain that any of the opto-electronic manufacturers will produce products incorporating our intellectual property components or that, if production occurs, they will generate significant royalty revenue for us.

trends. We cannot assure you that we will be successful in developing relationships with semiconductor manufacturersable to identify, develop, manufacture, market or support new or enhanced products successfully or on a timely basis. Further, we cannot assure you that our new products will gain market acceptance or that we will be able to maintain relationships with semiconductor manufacturers once developed, that semiconductor device manufacturers will dedicaterespond effectively to product introductions by competitors, technological changes or emerging industry standards. We also may not be able to develop the resourcesunderlying core technologies necessary to promotecreate new products and developenhancements, license these technologies from third parties, or remain competitive in our markets.

| Page 6 |

The optical data communications industry in which we have chosen to operate is subject to significant risks, including rapid growth and volatility, dependence on rapidly changing underling technologies, market and political risks and uncertainties and extreme competition. We cannot guarantee that we will be able to anticipate or overcome any or all of these risks and uncertainties, especially as a small company operating in an environment dominated by large, well-capitalized competitors with substantially more resources.

The optical data communications industry is subject to significant operational fluctuations. In order to remain competitive, we incur substantial costs associated with research and development, qualification, prototype production capacity and sales and marketing activities in connection with products based on our POET technology or that they will manufacture products based on our POET technology in quantities sufficient to meet demand.

Our revenues will depend in part on royalties that may be received on POET-based devices,purchased, if at all, long after we have incurred such costs. In addition, the rapidly changing industry in which will likely be generated based onwe operate, thevolumes length of time between developing and priceintroducing a product to market, frequent changing customer specifications for products, customer cancellations of devices manufacturedproducts and sold bygeneral down cycles in the industry, among other things, make our semiconductor manufacturer licensees, if any. Our royalties will betherefore influenced by many of the risks faced by the semiconductor market in general. These risks include reductions in demand and reduced average selling prices. The semiconductor market is intensely competitive. It is also generally characterized by decliningaverage selling prices over the life ofprospects difficult to evaluate. As a generation of devices. The effectresult of these price decreasesfactors, it is compoundedpossible that we may not (i) generate sufficient positive cash flow from operations; (ii) raise funds through the issuance of equity, equity-linked or convertible debt securities; or (iii) otherwise have sufficient capital resources to meet our future capital or liquidity needs. There are no guarantees we will be able to generate additional financial resources beyond our existing balances.

Investors may not be able to obtain enforcement of civil liabilities against the Company.

The enforcement by investors of civil liabilities under the U.S. federal or state securities laws may be adversely affected by the fact that royalty rates decreaseseveral of the Company’s officers and directors reside outside of the U.S. and that all, or a substantial portion, of their assets and a portion of our assets, are located outside the U.S. It may not be possible for an investor to effect service of process within the U.S. on, or enforce judgments obtained in the U.S. courts against, us, certain of our subsidiaries or certain of our directors and officers based upon the civil liability provisions of U.S. federal securities laws or the securities laws of any state of the U.S. In light of the above, there is doubt as to whether a judgment of a U.S. court based solely upon the civil liability provisions of U.S. federal or state securities laws would be enforceable against the Company, certain of its subsidiaries or the Company’s directors and officers.

We have contributed a portion of our intellectual property and exclusive assembly and sales rights for certain key initial products to a joint venture company that we formed in China. Although we believe that the joint venture offers significant opportunities for growth that we might not otherwise have and solves several major known challenges, we also recognize that there are substantial risks and uncertainties associated with executing a major portion of our strategy through a joint venture, regardless of the intentions and capabilities of the parties involved.

On October 21, 2020, the Company signed a Joint Venture Agreement (“JVA”) with Sanan IC to form a joint venture company, Super Photonics Xiamen Co., Ltd. (“SPX”), which will eventually be owned 48% by the Company once SAIC is fully invested. SPX will assemble, test, package and sell certain optical engines on an exclusive basis globally and certain others on an exclusive basis in the territory of Greater China. Optical engines based on the POET Optical Interposer are expected to be a primary component of several types of optical transceivers used in data centers. The joint venture is based on the contribution by the Company of certain assembly and test know-how and other intellectual property and cash to be contributed by Sanan IC in stages, subject to meeting certain milestones, to cover all capital and operating expenses of SPX until it is self-sustaining. We cannot guarantee that SPX will meet each milestone or that Sanan IC will or will not contribute capital on schedule when and if such milestones are met, nor can we guarantee that SPX will be successful in assembling and testing optical engines, nor in the marketing and sales once the optical engines are tested and qualified by potential customers.

Because no party to the joint venture, including the Company has a control position, we are not able to consolidate revenue and expenses directly into the Company’s financial statements. The earnings or loss from the joint venture operations are included as a functionsingle line item in the financial statements and the gain or loss on the intellectual property contributed to the joint venture is reported on another. Further, even though the joint venture may appreciate in market value if successful, the Company will not be able to reflect any increase in fair value, other than adding or subtracting on a periodic basis the income or loss experienced by the joint venture in relation to the Company’s percentage ownership at the time.

| Page 7 |

The Company’s investment into “Super Photonics Xiamen” (“SPX”) is into an independent company operating as a true joint venture under the laws of volume.the Peoples Republic of China (“PRC”). There are significant governance and operational risks associated with joint ventures and with companies operating in the PRC, in general. We cannot assure youguarantee that we will be able to anticipate or overcome the risks and uncertainties of operating a joint venture company in China.

Although SPX has its own governance structure to which both parties contribute directors, most major decisions must be unanimous, which means that such decisions will require the support of the management of SPX and both of the JV partners. Although the Company has sought the support of well-known and competent legal and other professional advisors and has had a major role in the recruitment of the senior management team of SPX, the Company has no prior experience with either the operation of a joint venture or with the operation of a JV company under the laws of the PRC, so we cannot guarantee that the joint venture will be successfully managed without substantial investment in time and effort by the Company’s current management team or at all

If our customers do not qualify our products for use on a timely basis, our results of operations may suffer.

Prior to the sale of new products, our customers typically require us to “qualify” our products for use in their applications. At the successful completion of this qualification process, we refer to the resulting sales opportunity as a “design win.” Additionally, new customers often audit our manufacturing facilities and perform other evaluations during this qualification process. The qualification process involves product sampling and reliability testing and collaboration with our product management and engineering teams in the design and manufacturing stages. If we are unable to accurately predict the amount of time required to qualify our products with customers, or are unable to qualify our products with certain customers at all, then our ability to generate revenue could be delayed or our revenue would be lower than expected and we may not be able to recover the costs associated with the qualification process or with our product development efforts, which would have an adverse effect on our results of operations.

We have limited operating history in the data center market, and our business could be harmed if this market does not develop as we expect.

The initial target market for our Optical Interposer-based optical engine is the data center market for data communications within the data center and beyond. We have limited experience in selling products in this market. We may not be successful in developing a product for this market and even if we do, it may never gain widespread acceptance by large data center operators. If our expectations for the growth of the data center / datacom market are not realized, our financial condition or results of operations may be adversely affected.

Customer demand is difficult to forecast accurately and, as a result, we may be unable to match production with customer demand.

We make planning and spending decisions, including determining the levels of business that we will seek and accept, production schedules, component procurement commitments, personnel needs and other resource requirements, based on our estimates of product demand and customer requirements. Our products are typically sold pursuant to individual purchase orders. While our customers may provide us with their demand forecasts, they are typically not contractually committed to buy any quantity of products beyond firm purchase orders. Furthermore, many of our customers may increase, decrease, cancel or delay purchase orders already in place without significant penalty. The short-term nature of commitments by our expected customers and the possibility of unexpected changes in demand for their products reduce our ability to accurately estimate future customer requirements. If any of our customers decrease, stop or delay purchasing our products for any reason, we will likely have excess manufacturing capacity or inventory and our business and results of operations would be harmed.

The markets in which we operate are highly competitive, which could result in lost sales and lower revenues.

The market for optical components and modules is highly competitive and this competition could result in our existing customers moving their orders to our competitors. We are aware of a number of companies that have developed or are developing integrated optical products, including silicon photonics engines, remote light sources, pluggable components, modules and subsystems, photonic integrated circuits, among others, that compete (or may in the future compete) directly with our current and proposed product offerings.

| Page 8 |

Some of our current competitors, as well as some of our potential competitors, have longer operating histories, greater name recognition, broader customer relationships and industry alliances and substantially greater financial, technical and marketing resources than we do. We may not be able to compete successfully with our competitors and aggressive competition in the market may result in lower prices for our products and/or decreased gross margins. Any such development could have a material adverse effect on our business, financial condition and results of operations.

We depend on a limited number of suppliers and key contract manufacturers who could disrupt our business and technology development activities if they stopped, decreased, delayed or were unable to meet our demand for shipments of their products or manufacturing of our products.

We depend on a limited number of suppliers of epitaxial wafers and contract manufacturers for our Indium Phosphide (“InP”) laser developments and optical interposer production activities. Some of these suppliers are sole source suppliers. We typically have not entered into long-term agreements with our suppliers. As a result, these suppliers generally may stop supplying us materials and other components at any time. Our reliance on a sole supplier or limited number of suppliers could result in delivery problems, reduced control over technology development, product development, pricing and quality, and an inability to identify and qualify another supplier in a timely manner. Some of our suppliers that may be small or under-capitalized may experience financial difficulties that could prevent them from supplying us materials and other components. In addition, our suppliers, including our sole source suppliers, may experience manufacturing delays or shutdowns due to circumstances beyond their control such as pandemics, earthquakes, floods, fires, labor unrest, political unrest or other natural disasters. A change in supplier could require technology transfer that could require multiple iterations of test wafers. This could result in significant delays in licensing, poor demand for servicesresumption of production.

Any supply deficiencies relating to the quality or decreases in pricesquantities of materials or inequipment we use to manufacture our royalty rates will notproducts could materially and adversely affect our ability to fulfill customer orders and our results of operations. Lead times for the purchase of certain materials and equipment from suppliers have increased and, in some cases, have limited our ability to rapidly respond to increased demand, and may continue to do so in the future. To the extent we introduce additional contract manufacturing partners, introduce new products with new partners and/or move existing internal or external production lines to new partners, we could experience supply disruptions during the transition process. In addition, due to our customers’ requirements relating to the qualification of our suppliers and contract manufacturing facilities and operations, we cannot quickly enter into alternative supplier relationships, which prevent us from being able to respond immediately to adverse events affecting our suppliers.

Our international business and operations expose us to additional risks.

We have significant tangible assets located outside Canada and the United States. Conducting business outside Canada and the United States subjects us to a number of additional risks and challenges, including:

| ● | periodic changes in a specific country’s or region’s economic conditions, such as recession; | |

| ● | licenses and other trade barriers; | |

| ● | the provision of services may require export licenses; | |

| ● | environmental regulations; | |

| ● | certification requirements; | |

| ● | fluctuations in foreign currency exchange rates; | |

| ● | inadequate protection of intellectual property rights in some countries; | |

| ● | preferences of certain customers for locally produced products; | |

| ● | potential political, legal and economic instability, foreign conflicts, and the impact of regional and global infectious illnesses in the countries in which we and our customers, suppliers and contract manufacturers are located; | |

| ● | Canadian and U. S. and foreign anticorruption laws; | |

| ● | seasonal reductions in business activities in certain countries or regions; and | |

| ● | fluctuations in freight rates and transportation disruptions. |

| Page 9 |

These factors, individually or in combination, could impair our ability to effectively operate one or more of our foreign facilities or deliver our products, result in unexpected and material expenses, or cause an unexpected decline in the demand for our products in certain countries or regions. Our failure to manage the risks and challenges associated with our international business and operations could have a material adverse effect on our business.

If we fail to attract and retain key personnel, our business could suffer.

Our future success depends, in part, on our ability to attract and retain key personnel, including executive management. Competition for highly skilled technical personnel is extremely intense and we may face difficulty identifying and hiring qualified engineers in many areas of our business. We may not be able to hire and retain such personnel at compensation levels consistent with our existing compensation and salary structure. Our future success also depends on the continued contributions of our executive management team and other key management and technical personnel, each of whom would be difficult to replace. The loss of services of these or other executive officers or key personnel or the inability to continue to attract qualified personnel could have a material adverse effect on our business.

If we fail to protect, or incur significant costs in defending, our intellectual property and other proprietary rights, our business and results of operations and financial condition.could be materially harmed.

The enforceability of the Company’s patents and the Company’sOur success depends on our ability to maintain trade secrets cannot be predictedprotect our intellectual property and suchpatents or trade secrets may not provide the Company with a competitive advantage against competitors with similar products ortechnologies.

other proprietary rights. We rely on a combination of patent, andtrademark, copyright, trade secret and unfair competition laws, as well as license agreements and restrictions on disclosureother contractual provisions, to establish and protect our intellectual property and other proprietary rights. We have applied for patent registrations in the U.S. and in foreign countries, some of which have been issued. We cannot guarantee that our pending applications will be approved by the applicable governmental authorities. Moreover, our existing and future patents and trademarks may not be sufficiently broad to protect our proprietary rights or may be held invalid or unenforceable in court. A failure to obtain patents or trademark registrations or a successful challenge to our registrations in the U.S. or foreign countries may limit our ability to protect the intellectual property rights that these applications and registrations intended to cover.

Policing unauthorized use of our technology is difficult and we cannot be certain that the steps we have taken will prevent the misappropriation, unauthorized use or other infringement of our intellectual property. Any failureproperty rights. Further, we may not be able to effectively protect our intellectual property rights from misappropriation or other infringement in foreign countries where we have not applied for patent protections, and where effective patent, trademark, trade secret and other intellectual property laws may be unavailable or may not protect our proprietary rights as fully as Canadian or U.S. law. We may seek to secure comparable intellectual property protections in other countries. However, the level of protection afforded by patent and other laws in other countries may not be comparable to that afforded in Canada and the U.S.

We also attempt to protect our intellectual property, rights would diminish or eliminateincluding our trade secrets and know-how, through the competitive advantages that we derive fromuse of trade secret and other intellectual property laws, and contractual provisions. We enter into confidentiality and invention assignment agreements with our employees and independent consultants. We also use non-disclosure agreements with other third parties who may have access to our proprietary technology. We cannot assure youtechnologies and information. Such measures, however, provide only limited protection, and there can be no assurance that our confidentiality and non-disclosure agreements will not be breached, especially after our employees end their employment, and that our trade secrets will not otherwise become known by competitors or that we will be ablehave adequate remedies in the event of unauthorized use or disclosure of proprietary information. Unauthorized third parties may try to adequately protectcopy or reverse engineer our technologyproducts or otherportions of our products, otherwise obtain and use our intellectual property, from third-party infringementor from misappropriation in the U.S. and abroad. Any patent licensed by usmay independently develop similar or issued to us could be challenged, invalidatedequivalent trade secrets orcircumvented or rights granted thereunder may not provide a competitive advantage to us. Furthermore, patent

applications that know-how. If we file may not result in issuance of a patent or, if a patent is issued, the patent may not be issued in a form that is advantageous to us. Despite our effortsfail to protect our intellectual property rights, others may independently develop similar products, duplicate our products or design around our patents and other rights. proprietary rights, or if such intellectual property and proprietary rights are infringed or misappropriated, our business, results of operations or financial condition could be materially harmed.

In addition, it is difficultthe future, we may need to monitor compliance with, and enforce,take legal actions to prevent third parties from infringing upon or misappropriating our intellectual property on a worldwide basis in a cost-effective manner. In jurisdictions where foreign laws provide lessor from otherwise gaining access to our technology. Protecting and enforcing our intellectual property protection than affordedrights and determining their validity and scope could result in significant litigation costs and require significant time and attention from our technical and management personnel, which could significantly harm our business. We may not prevail in such proceedings, and an adverse outcome may adversely impact our competitive advantage or otherwise harm our financial condition and our business.

| Page 10 |

We may be involved in intellectual property disputes in the U.S.future, which could divert management’s attention, cause us to incur significant costs and abroad,prevent us from selling or using the challenged technology.

Participants in the markets in which we sell our technology orproducts have experienced frequent litigation regarding patent and other intellectual property mayrights. There can be compromised,no assurance that third parties will not assert infringement claims against us, and we cannot be certain that our businessproducts would not be materially adversely affected.

We may occasionally become involved in administrative proceedings, lawsuits or other proceedings if others allege that we infringefound infringing on their intellectual property rights. Some of these claims could subject us to significant liability for damages and invalidate our property rights. If successful, such claims could impair our ability to collect royalties or license fees or could force us or our customers to:

Our failure to protect our proprietary rights, or the costs of protecting these rights, may harm our ability to compete.

Our success depends in part on our ability to obtain patents and licenses and to preserve other intellectual property rights covering our products and development and testing tools. To that end, we have obtained certain domestic and foreign patents and intendof others. Regardless of their merit, responding to continue to seek patents on our inventions when appropriate. The process of seeking patent protectionsuch claims can be time consuming, divert management’s attention and expensive.

We cannot ensure the following:

resources and may cause us to incur significant expenses. Intellectual property rights are uncertain and adjudication of such rights involves complex legal and factual questions. We may be unknowingly infringing on the proprietary rights of others and may be liable for that infringement, whichclaims against us could result in significant liability for us. We may receive correspondencea requirement to license technology from third parties alleging infringementothers, discontinue manufacturing or selling the infringing products, or pay substantial monetary damages, each of their intellectual property rights. could result in a substantial reduction in our revenue and could result in losses over an extended period of time.

If we are foundfail to infringeobtain the proprietary rights of others, we could be forcedright to either seek a license touse the intellectual property rights of others or alterthat are necessary to operate our technologies so that they no longer infringe the proprietary rights of others. A license could be very expensivebusiness, and to obtain or may not be available at all. Similarly, changing our processes to avoid infringing the rights of others may be costly or impractical.

We would be responsible for any patent litigation costs. Our License Agreement with UCONN does not provide for indemnification of the Company by UCONN. If we were to become involved in a dispute regardingprotect their intellectual property, whether ours or thatour business and results of another company, we may have to participate in legal proceedings in the United States Patent and Trademark Office or in the United States or Canadian courts to determine any or all of the following issues: patent validity, patent infringement, patent ownership or inventorship. These types of proceedings mayoperations will be costly and time consuming for us, even if we eventually prevail. If we do not prevail, we might be forced to pay significant damages, obtain a license, if available, or stop making a certain product. adversely affected.

From time to time, we may prosecute patentchoose to or be required to license technology or intellectual property from third parties in connection with the development of our products. We cannot assure you that third party licenses will be available to us on commercially reasonable terms, if at all. Generally, a license, if granted, would include payments of up-front fees, ongoing royalties or both. These payments or other terms could have a significant adverse impact on our results of operations. Our inability to obtain a necessary third-party license required for our product offerings or to develop new products and product enhancements could require us to substitute technology of lower quality or performance standards, or of greater cost, either of which could adversely affect our business. If we are not able to obtain licenses from third parties, if necessary, then we may also be subject to litigation to defend against othersinfringement claims from these third parties. Our competitors may be able to obtain licenses or cross-license their technology on better terms than we can, which could put us at a competitive disadvantage.

Failure to comply with requirements to design, implement and maintain effective internal control over financial reporting could have a materially adverse impact on our financial reporting and our business. We are required to have our internal controls over financial reporting audited under Section 404(b) of the Sarbanes-Oxley Act.

Preparing our consolidated financial statements involves a number of complex manual and automated processes, which are dependent upon individual data input or review and require significant management judgment. One or more of these elements may result in errors that may not be detected and could result in a material misstatement of our consolidated financial statements. The Sarbanes-Oxley Act in the U.S. requires, among other things, that as a publicly traded company we disclose whether our internal control over financial reporting and disclosure controls and procedures are effective. Until December 31, 2021 we qualified as an “emerging growth company” under the JOBS Act, and, as a result, were exempted from certain SEC reporting requirements, including those requiring registrants to include an auditor’s report regarding the Company’s internal controls as part of such litigation,registrant’s periodic reports. Our “emerging growth company” status expired on December 31, 2021. The report of our auditors regarding the effectiveness of our internal controls over disclosure and financial reporting as of December 31, 2023 is attached as an exhibit to this annual report.

| Page 11 |

Our internal control over financial reporting cannot guarantee that no accounting errors exist or that all accounting errors, no matter how immaterial, will be detected because a control system, no matter how well designed and operated, can provide only reasonable, but not absolute assurance that the control system’s objectives will be met. If we are unable to implement and maintain effective internal control over financial reporting, our ability to accurately and timely report our financial results could be adversely impacted. This could result in late filings of our annual and quarterly reports under the Securities Act (Ontario) and the Securities Exchange Act of 1934 (the “Exchange Act”), restatements of our consolidated financial statements, a decline in our stock price, suspension or delisting of our common shares by the TSX Venture Exchange (“TSXV”), or other partiesmaterial adverse effects on our business, reputation, results of operations or financial condition.