Not applicable.

Item 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Item 3.KEY INFORMATION

A.[Reserved]

B.Capitalization and Indebtedness

Not applicable.

A. Selected Financial Data

The following tables set forth our selected consolidated financial data. You should read the following selected consolidated financial data in conjunction with “Item 5. Operating and Financial Review and Prospects” and our consolidated financial statements and related notes included elsewhere in this annual report. Historical results are not necessarily indicative of the results that may be expected in the future. Our financial statements have been prepared in accordance with U.S. Generally Accepted Accounting Principles, or U.S. GAAP.

The selected consolidated statements of operations data for each of the years in the three-year period ended December 31, 2017 and the consolidated balance sheet data as of December 31, 2016 and 2017 are derived from our audited consolidated financial statements appearing elsewhere in this annual report. The consolidated statements of operations data for the years ended December 31, 2013 and 2014 and the consolidated balance sheet data as of December 31, 2013, 2014 and 2015 are derived from our audited consolidated financial statements that are not included in this annual report.

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | (in USD thousands except share and per share data) | |

| Consolidated Statements of Operations: | | | | | | |

| Revenues | | | 80,473 | | | | 141,841 | | | | 203,518 | | | | 290,103 | | | | 425,636 | |

Cost of revenues(1) | | | 15,257 | | | | 26,108 | | | | 34,970 | | | | 45,287 | | | | 69,391 | |

| Gross profit | | | 65,216 | | | | 115,733 | | | | 168,548 | | | | 244,816 | | | | 356,245 | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | | |

Research and development(1) | | | 29,660 | | | | 57,832 | | | | 77,647 | | | | 105,368 | | | | 153,635 | |

Selling and marketing(1) | | | 53,776 | | | | 97,742 | | | | 120,010 | | | | 156,512 | | | | 204,435 | |

General and administrative(1) | | | 8,307 | | | | 15,803 | | | | 19,526 | | | | 26,968 | | | | 48,186 | |

| Total operating expenses | | | 91,743 | | | | 171,377 | | | | 217,183 | | | | 288,848 | | | | 406,256 | |

| Operating loss | | | (26,527 | ) | | | (55,644 | ) | | | (48,635 | ) | | | (44,032 | ) | | | (50,011 | ) |

| Financial income (expenses), net | | | (603 | ) | | | 2,144 | | | | 77 | | | | 247 | | | | (5,015 | ) |

| Other income (expenses) | | | (18 | ) | | | (14 | ) | | | (11 | ) | | | (4 | ) | | | 76 | |

| Loss before taxes on income | | | (27,148 | ) | | | (53,514 | ) | | | (48,569 | ) | | | (43,789 | ) | | | (54,950 | ) |

| Taxes on income | | | 1,572 | | | | 3,052 | | | | 2,765 | | | | 3,107 | | | | 1,323 | |

| Net loss | | | (28,720 | ) | | | (56,566 | ) | | | (51,334 | ) | | | (46,896 | ) | | | (56,273 | ) |

Basic and diluted net loss per ordinary share(2) | | | (3.33 | ) | | | (1.49 | ) | | | (1.30 | ) | | | (1.12 | ) | | | (1.24 | ) |

Weighted average number of ordinary shares used in computing basic and diluted net loss per ordinary share(2) | | | 11,597,826 | | | | 37,847,093 | | | | 39,408,928 | | | | 42,032,818 | | | | 45,552,199 | |

| | | As of December 31, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | (in USD thousands) | |

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents and short-term deposits | | | 101,258 | | | | 86,011 | | | | 109,999 | | | | 148,562 | | | | 200,612 | |

| Restricted deposits | | | 3,306 | | | | 5,909 | | | | 3,851 | | | | 931 | | | | 949 | |

| Marketable securities | | | - | | | | - | | | | - | | | | 22,742 | | | | 32,730 | |

| Total assets | | | 115,355 | | | | 118,422 | | | | 149,433 | | | | 214,684 | | | | 330,013 | |

| Deferred revenues | | | 37,184 | | | | 66,598 | | | | 104,767 | | | | 156,733 | | | | 216,811 | |

| Total shareholders’ equity (deficiency) | | | 62,296 | | | | 18,650 | | | | (3,805 | ) | | | (2,469 | ) | | | 11,320 | |

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | (in USD thousands except registered users and premium subscription data) | |

| Supplemental Financial and Operating Data: | | | | | | | | | | | | | | | |

Collections(3) | | | 98,673 | | | | 171,255 | | | | 241,687 | | | | 342,069 | | | | 483,989 | |

Free cash flow(4) | | | 1,173 | | | | (6,422 | ) | | | 14,534 | | | | 36,158 | | | | 70,683 | |

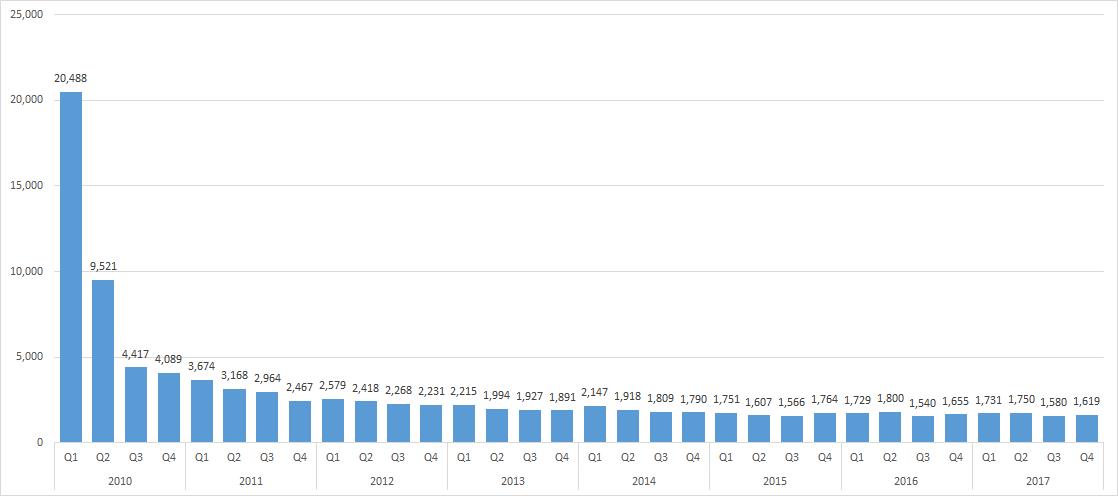

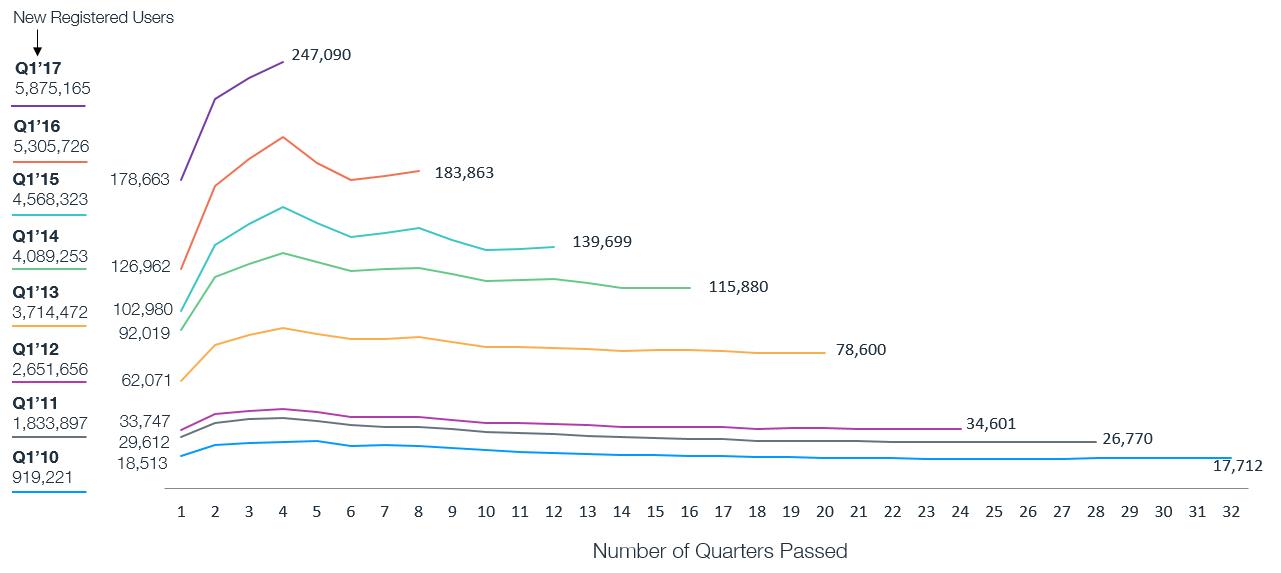

Number of registered users at period end(5) | | | 42,126,246 | | | | 57,945,346 | | | | 76,965,482 | | | | 97,358,803 | | | | 119,263,915 | |

Number of premium subscriptions at period end(6) | | | 789,753 | | | | 1,232,827 | | | | 1,767,423 | | | | 2,465,160 | | | | 3,223,036 | |

(1) Includes share-based compensation expense as follows:

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | (in USD thousands) | |

| Cost of revenues | | | 490 | | | | 1,004 | | | | 1,353 | | | | 1,798 | | | | 2,930 | |

| Research and development | | | 3,149 | | | | 6,594 | | | | 9,234 | | | | 14,543 | | | | 26,227 | |

| Selling and marketing | | | 1,185 | | | | 2,533 | | | | 3,077 | | | | 4,553 | | | | 6,585 | |

| | | | | | | | | | | | | | | | | | | | | |

| General and administrative | | | 2,230 | | | | 3,806 | | | | 5,069 | | | | 7,154 | | | | 11,958 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total share-based compensation expense | | | 7,054 | | | | 13,937 | | | | 18,733 | | | | 28,048 | | | | 47,700 | |

(2) | Basic and diluted net loss per ordinary share is computed based on the weighted average number of ordinary shares outstanding during each period. For additional information, see Notes 2t and 13 to our consolidated financial statements included elsewhere in this annual report. |

(3) | Collections is a non-GAAP financial measure that we define as total cash collected by us from our customers in a given period. Collections is calculated by adding the change in deferred revenues for a particular period to revenues for the same period. Collections consists primarily of amounts from annual and monthly premium subscriptions by registered users, which are deferred and recognized as revenues over the terms of the subscriptions and payments by our registered users for domains, which are also recognized ratably over the term of the service period. The following table reconciles revenues, the most directly comparable U.S. GAAP measure, to collections for the periods presented: |

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | (in USD thousands) | |

| Reconciliation of Revenues to Collections: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Revenues | | | 80,473 | | | | 141,841 | | | | 203,518 | | | | 290,103 | | | | 425,636 | |

| Change in long-term and short-term deferred revenues | | | 18,200 | | | | 29,414 | | | | 38,169 | | | | 51,966 | | | | 58,353 | |

| | | | | | | | | | | | | | | | | | | | | |

| Collections | | | 98,673 | | | | 171,255 | | | | 241,687 | | | | 342,069 | | | | 483,989 | |

For a description of how we use collections to evaluate our business, see “Item 5. Operating and Financial Review and Prospects—Key Financial and Operating Metrics.” We believe that this non-GAAP financial measure is useful in evaluating our business because it is a leading indicator of our revenue growth and the growth of our overall business. Nevertheless, this information should be considered as supplemental in nature and is not meant as a substitute for revenues recognized in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate collections differently or not at all, which reduces their usefulness as a comparative measure. You should consider collections along with other financial performance measures, including revenues, net cash used in operating activities, and our financial results presented in accordance with U.S. GAAP.

(4) | Free cash flow is a non-GAAP measure defined as cash flow provided by (used in) operating activities minus capital expenditures. The following table reconciles cash flow from operating activities, the most directly comparable U.S. GAAP measure, to free cash flow: |

| | | Year Ended December 31, | |

| | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | |

| | | (in USD thousands) | |

| Reconciliation of cash flow provided by (used in) operating activities to free cash flow: | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Net cash provided by (used in) operating activities | | | 4,243 | | | | (803 | ) | | | 20,876 | | | | 40,573 | | | | 83,052 | |

Capital expenditures (a) | | | (3,070 | ) | | | (5,619 | ) | | | (6,342 | ) | | | (4,415 | ) | | | (12,369 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Free cash flow | | | 1,173 | | | | (6,422 | ) | | | 14,534 | | | | 36,158 | | | | 70,683 | |

____________

| (a) | Capital expenditures consist primarily of investments in leasehold improvements for our office space and the purchase of computers and related equipment. |

For a description of how we use free cash flow to evaluate our business, see “Item 5. Operating and Financial Review and Prospects—Key Financial and Operating Metrics.” We believe that this non-GAAP financial measure is useful in evaluating our business because free cash flow reflects the cash surplus available or used to fund the expansion of our business after payment of capital expenditures relating to the necessary components of ongoing operations. Nevertheless, this information should be considered as supplemental in nature and is not meant as a substitute for net cash flows from operating activities presented in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate free cash flow differently or not at all, which reduces their usefulness as a comparative measure. You should consider free cash flow along with other financial performance measures, including revenues, net cash used in operating activities, and our financial results presented in accordance with U.S. GAAP.

(5) | Number of registered users at period end is defined as the total number of users, including those who purchase premium subscriptions, who are registered with Wix.com with a unique email address at the end of the period. Following registration, the length of time that registered users take to design and publish a website varies significantly from hours to years, and many registered users never publish a website. Our use of the term “registered user” herein is not intended to necessarily indicate a certain level of engagement or how close a registered user is to potentially publishing their website. See “—D. Risk Factors—Risks Related Our Business and Our Industry”

|

(6) | A single registered user can purchase multiple premium subscriptions. Our premium subscriptions purchased in any given period are derived from users that registered with us during that period or during prior periods. See “Item 5. Operating and Financial Review and Prospects—Overview—Premium Subscription Analysis.”

|

B. Capitalization and Indebtedness

Not applicable.

C C.Reasons for the Offer and Use of Proceeds

Not applicable.

D.Risk Factors

Our business faces significant risks. You should carefully consider all of the information set forth in this annual report and in our other filings with the United States Securities and Exchange Commission, (“or SEC,”), including the following risk factors which we facethat could materially and which are faced byadversely affect our industry.business, financial condition, operating results and growth. Our business, financial condition and results of operations could be materially and adversely affected by any of these risks. In that event, the trading price of our ordinary shares would likely decline and you might lose all or part of your investment. See “Special Note Regarding Forward-Looking Statements” on page i.

Risk Factors Summary

The following is a summary of the principal risks that could materially and adversely affect our business, financial condition, operating results and growth prospects.

Risks Related to Our Business and Our Industry

We may be unable to generate new premium subscriptions, retain existing premium subscriptions or increase the adoption of our business solutions.

Our selling and marketing activities may fail to generate new registered users or fail to increase the revenue we generate from premium subscriptions to the levels we anticipate.

We may be unable to maintain and enhance our brand or maintain a consistently high level of customer care.

We may be unable to generate significant revenues from sources other than our premium subscriptions.

We are subject to risks associated with international operations, risks related to the impact of the military invasion of Ukraine by Russia, and may be unable to localize our platform on an international scale.

We are exposed to risks associated with payment processing and the provision of financial services.

We are uncertain as to the impact of the COVID-19 pandemic on our users.

We may be subject to adverse impacts of exchange rate fluctuations.

We may be susceptible to failures of our third-party hardware, software and infrastructure, including third-party data center hosting facilities, and any failure to protect against cyber-attacks.

We may fail to manage the growth of our infrastructure and headcount effectively or fail to expand our infrastructure into additional geographic locations.

We may be unable to achieve profitability in the future.

Our ability to attract users may be limited if search engines and social networking sites change their listings or policies regarding advertising or data sharing.

The small business market for our solutions may be less lucrative than projected or we may fail to effectively acquire and service small business users.

Our relatively short operating history in a developing market and our increasing efforts to sell to new customer demographics, might make it difficult to evaluate our business.

Trends in sales are not immediately reflected in full in our operating results because we recognize revenues from premium subscriptions over the term of an agreement.

Our cash balances and investment portfolio have been, and may continue to be, adversely affected by market conditions, including inflation and interest rates.

Our Convertible Notes may impact our financial results and dilute existing shareholders, and we may fail to raise the funds to settle conversions of the Convertible Notes.

We may be unable to raise capital to pursue our growth strategy.

Our acquisitions and investments may not perform as expected.

Risks Related to Our Market and Competitive Landscape

We may fail to develop and introduce new products and services, or keep up with rapid changes in design and technology.

We may be unable to hire, integrate and retain highly skilled personnel.

We may be unable to attract a more diverse customer base such as partners, mid-size, large and enterprise level companies, design professionals and tech savvy users, for which we have developed more customized solutions.

We may face increased competition in a highly competitive market.

We may be unable to maintain market share for mobile sites and applications.

The demand for our solutions and platform could decline if we do not maintain compatibility with third-party applications.

Changes to technologies used in our solutions or upgrades of operating systems and Internet browsers may impact integration and the process by which users interface with our platform.

Risks Related to Privacy, Data and Cybersecurity

The security of the data we store in our systems, including personal information or business data of our users and their users, may be breached or otherwise subjected to unauthorized access.

We may fail to comply with data privacy and protection laws and regulations, as well as our contractual data privacy and security obligations, and the use and adoption of our services may be limited due to growing awareness of data privacy and protection laws.

The use of our products may be impacted by consumer protection laws and standards of conduct implemented by private organizations.

Risks Related to Our Intellectual Property

We may be unable to obtain, maintain and protect our intellectual property rights, and may be subject to claims (i) by third parties of intellectual property infringement, (ii) claims by our contractors or employees for remuneration or royalties for assigned service invention rights and (iii) claims challenging the use of open source software and/or compliance with open source license terms.

Risks Related to Other Legal, Regulatory and Tax Matters

We may be affected by the enactment of new governmental regulations regarding the Internet, which could hinder growth in the use of the Internet and increase our costs of doing business.

We may be liable, as a provider of online services, for the activities of our registered users or the content of their websites.

We could face liability from disputes over registration and transfer of domain names.

Trade and economic sanctions and export laws may restrict our business.

Changes in tax laws could adversely affect our tax position and financial results, and U.S. states and/or other jurisdictions in which we conduct our business may seek to impose taxes on Internet sales.

We would be adversely affected if we were deemed to be an investment company under the Investment Company Act of 1940, as amended (the “1940 Act”).

We could be adversely affected by violations of anti-bribery laws.

Risks Related to our Ordinary Shares

Our share price may be volatile and may fluctuate substantially, including due to (i) any failure to meet financial guidance or repurchase our ordinary shares pursuant to our anticipated repurchase program, (ii) sales of our ordinary shares by directors, officers or large shareholders, (iii) actions of activist shareholders, (iv) our ability to maintain our foreign private issuer status, (v) risks of being treated as a controlled foreign corporation or passive foreign investment company for US federal income tax purposes and (vi) provisions of Israeli law and our articles of association that may delay, prevent or make undesirable an acquisition of all or a significant portion of our shares or assets.

Risks Relating to Our Incorporation and Location in Israel

Conditions in Israel could materially and adversely affect our business, including (i) the obligations of personnel to perform military service, (ii) differences in Israeli law compared to laws of other jurisdictions, (iii) the continued availability of local tax benefits and (iv) difficulties enforcing a U.S. judgment against us or assert U.S. securities laws claims in Israel.

For a more complete discussion of the material risks facing our business, see below.

Risks Related to Our Business and Our Industry

Our results of operations and future revenue prospects will be harmed if we are unable to attractgenerate new premium subscriptions, retain existing premium subscriptions or increase the adoption of our business solutions through new or existing users.

We primarily generate revenue through the sale of premium subscriptions and retain newadditional business solutions. The growth of our premium subscriptions base is mainly impacted by the rate at which our registered users and premium subscriptions at a sufficient rate.

The number of new registered users we attract and retain is a key factor in growing our premium subscription base, which in turn drives our revenues and collections. To date, we have grownupgrade the number of registered users and premium subscriptions through the provision of complimentary user-friendly, drag-and-dropfree web development, design and management software which can be upgradedour platform offers them to premium subscriptions with their individual branding and purchase additional business solutions tailored for more specific business needs. In addition, the growth in the number of premium subscriptions is impacted by direct sales of premium subscriptions to partners that sell our solutions on a subscription-based package with various additional solutionslarger scale to their customers.

The renewal rate of premium subscriptions also significantly impacts the overall number of premium subscriptions and, services. Approximately 60%as a result, our revenues. One of the key drivers of renewal rates is whether premium subscriptions are for longer or shorter periods than one year. Premium subscriptions renewing on a yearly or multi-year basis allow for fewer opportunities of failure to renew such subscription than monthly subscriptions, whether deliberately or through failure to update payment information upon expiration. As of December 31, 2021, yearly and multi-year premium subscription packages constituted approximately 85% of all active premium subscriptions. Substantially all of our new premium subscriptions currently renew automatically at the end of each subscription period unless premium subscribers actively cancel the automatic renewal of their subscription in any given quarteradvance or if we are generated by users who registered in earlier quarters. We therefore attribute considerable importanceunable to the continued growth of our registered user base since it is our primary source of premium subscriptions.renew their subscription. A number of factors could impact our ability to attract users in order to generate new premium subscriptions, to retain our existing premium subscriptions, and to increase revenue from such premium subscriptions including through the adoption of our business solutions. These factors include:

the quality and design of our platform compared to other similar solutions and services;

our ability to develop the required new technologies or offer new and relevant products and service offerings to our users;

a reduction in our users’ spending levels or desire to create a web presence, including due to macro-economic forces including rising levels of inflation or other global circumstances beyond our control, such as the effects of the COVID-19 pandemic;

a shift away from online commerce as restrictions imposed in connection with the COVID-19 pandemic are lifted;

our ability to attract and retain partners to sell our premium subscriptions and/or create websites for their customers on our platform, including through our efforts to develop additional product functionality and administrative back-office capabilities to allow our partners to adequately sell our products to their customers and properly manage their operations;

pricing decisions we implement for our solutions, and the pricing of our solutions and services compared to our competitors;

our ability to bundle certain solutions into an attractive subscription package and the variety of the subscription packages and business solutions we offer;

the reliability and availability of our Customer Care and account management services to provide the proper support required by our registered users and partners;

the ability of our Customer Care team to increase sales of premium subscriptions including:and business solutions to our users;

| · | the quality and design of our platform compared to other similar solutions and services; |

| · | our ability to develop new technologies or offer new products and service offerings; |

| · | the pricing of our solutions and services compared to our competitors; |

| · | the reliability and availability of our customer service; |

| · | our ability to provide value-added third-party applications, solutions and services that integrate into our solutions; |

| · | the perceived or actual security, integrity, reliability, quality or compatibility problems with our solutions, including those related to system outages, unscheduled downtime, and the impact of cyber-attacks on our registered users’ data; |

| · | unexpected increases in the cost of acquiring new registered users, beyond the year-over-year increase that we experience due to competition in certain geographies; and |

| · | our ability to expand into new geographic markets. |

the perceived or actual security, integrity, reliability, quality or compatibility problems with our solutions, including those related to system outages, unscheduled downtime, diminished website performance and loading times and the impact of cyber-attacks on our users’ data;

competitive factors affecting the software as a service, or SaaS, business market, including the competitive landscape and the strategies that may be implemented by our competitors and the ease with which a user can switch to a competitor;

unexpected increases in the cost of acquiring new registered users, beyond the year over year increase that we experience due to competition in certain geographies;

our dependence on establishing and maintaining strong brand perception;

our ability to expand into new geographic markets and localize our services, including our ability to make our product, support and communication channels available in additional languages and make our solution compliant with local laws and regulations; and

limitations or restrictions on our ability to bill our registered users on a recurring basis or the manner in which the rebilling is performed.

Our results of operations would be adversely affected if our selling and marketing activities fail to generate traffic to our website,new registered users andthat purchase premium subscriptions at the levels that we anticipateand business solutions or fail to increase the revenue we generate such traffic on a cost-effective basis.from each premium subscription to the levels we anticipate.

We acquire some of ournew registered users, who may purchase premium subscriptions and business solutions over time, through paid marketing channels, such as cost-per-click advertisements on search engines, and social networking sites and through our affiliates program, targeted and generic banner advertisements on other sites. A portion of thesites, and social network influencers who promote our platform. We also acquire new registered users through free traffic sources that lead to our platform, including online searches for our “Wix” name or organic search results for other key words relating to our business, user referrals, and word-of-mouth. If we lose access to one or more of these channels because the costs of advertising become prohibitively expensive or for other reasons, we may not be able to promote our brand effectively, which could limit our ability to grow our business.

Other premium subscriptions are acquired through these channelsthe selling and marketing activities of our sales and account management team that targets partners, who have direct relationships with potential users and may purchase a higher volume of premium subscriptions. Our selling and marketing activities also focus on increasing revenues from existing premium subscriptions over time. by offering complementary business solutions such as additional features, products and applications, including those developed by third parties.

In order to maintain our current revenues and grow our business,revenues, we need to continuously optimize and diversify our marketing campaigns and strategies, aimed at acquiring new registered users, in particular those who are more likely to purchase premium subscriptions, increase the revenue for each premium subscription acquired, including through adoption of business solutions, and premium subscriptions.in addition increase our sales efforts aimed at acquiring new partners. In the years ended December 31, 2015, 20162021, 2020 and 2017,2019, advertising expenses were $87.6$284.5 million, $113.2$282.8 million and $141.3$187.3 million, respectively, representing 36%22%, 33%29% and 29%25% of our collections,revenues, respectively. WeTo help optimize and diversify marketing campaigns online, we conduct search engine optimization and A/B testing, a marketing approach whichthat aims to identify which changes to our website will increase or maximize user interest and user acquisition.the purchase of premium subscriptions and further adoption of our business solutions. We also rely upon the assumption that historical user behavior can be extrapolated to predict future user behavior, and we structure our marketing activities in the manner that we believe is most likely to encourage the user behaviors that lead to desired future outcomes, such as purchasing premium subscriptions and adoption of business solutions to enhance such premium subscriptions. However, we may fail to accurately predict user acquisition,acquisitions or interest or to fully understand or estimate the conditions and behaviors that drove historical user behavior, in particular during turbulent global economic times that lead to inflation or supply chain challenges, and, thus, fail to generate the return on marketing we expected.expect. Even if we understand historical patterns, our predictions could be inaccurate. For example, events outside our control, such as announcements by our competitors or other third-partiesthird parties of significant business developments or the effects of the COVID-19 pandemic, have in the past adversely affected the returns we had anticipated on our marketing expenses in the short-term. AnIf any of our marketing campaigns prove less successful than anticipated in attracting registered users that purchase premium subscriptions and other business solutions, if the levels of organic or free traffic to our site decrease, if our brand perception is harmed, if our sales efforts to partners or new user demographics are unsuccessful, or if we experience an unexpected increase in the marginal acquisition cost of new registered users, we may alsonot achieve our return on investment targets within the timeframe we expect for such return on marketing investments, and our rates of premium subscription acquisitions and revenue per subscription may fail to meet market expectations, which could have ana material adverse effect on our ability to grow the numberresults of our registered usersoperations and premium subscriptions. In addition, weshare price.

We may also invest a significant portion of our marketing expenses inon more traditional advertising and promotion of our brand, including through sponsorships with City Football Group Limited the New York Yankees and others, and our nationally televised Super Bowl campaigns, theothers. The effectiveness of whichthese sales and marketing measures is more difficult to track than online marketing. If any of our marketing campaigns prove less successful than anticipated in attracting registered users and premium subscriptions, we may not achieve our return-on-investment targets, and our rate of registered user and premium subscription acquisition may fail to meet market expectations, which could have a material adverse effect on our share price.

If the security of the confidential information or personal information of our registered users and the visitors to our registered users’ websites stored in our systems is breached or otherwise subjected to unauthorized access, our reputation may be harmed and we may be exposed to liability.

Due to the nature of our business, our systems and the systems of our cloud providers with which we contract, store large amounts of personally identifiable information, credit card information, passwords and other sensitive or critical data for our registered and prospective users and the visitors of our registered users’ websites, as well as information they may view as confidential. We do not regularly monitor or review the content that our users upload and store, and, therefore, we do not control the substance of the content on our servers, which may include personal information and risks of external or internal unauthorized access or leaks exist.

We cannot be sure that the steps that we have taken to protect the security, integrity and confidentiality of the information we collect, store, or transmit will succeed in preventing inadvertent or unauthorized use or disclosure. Like many online and other companies, we have experienced attempts by third parties to circumvent the security of our systems. We have and are experiencing attempts by hackers to penetrate our internal network and hosted servers using various techniques, including tailored phishing attacks and other exploitation of known and unknown vulnerabilities. We may not be successful in identifying, blocking or otherwise preventing access to our systems, despite our security measures. Since techniques used to obtain unauthorized access change frequently, we may be unable to anticipate these techniques or to implement adequate preventative measures. Furthermore, we may be unable to promptly detect an attack, for example, in the case of an advanced persistent threat where unauthorized system access was obtained in advance and without our knowledge in preparation for a future attack. In addition, we rely on outside parties to provide physical security for our facilities, including data centers. Any physical breach of security could result in unauthorized access or damage to our systems.

If our security measures are breached because of third-party action, employee error, malfeasance or otherwise, or if design flaws in our software are exposed and exploited, and, as a result, an unauthorized party may access any of our registered users’ data or the data of the visitors of our registered users’ websites, or otherwise gain control of our platform, or if it is perceived that any unauthorized access has occurred (such as when users utilize weak passwords or their credentials are disclosed, stolen or lost), our brand may be negatively impacted, our relationships with our registered users may be damaged, our registered users may choose to cancel their premium subscriptions, and we could incur liability and be subject to regulatory investigations and fines, negatively impacting our financial performance, all of which may result in a decline of our stock price. In addition, many jurisdictions have enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data, and our agreements with certain partners require us to notify them in the event of a security incident. These mandatory disclosures regarding a security breach sometimes lead to negative publicity and may cause our registered users to lose confidence in the effectiveness of our data security measures. Any security breach, whether actual or perceived, may harm our reputation, and we could lose registered users or fail to acquire new registered users. In addition, we could be required to devote significant resources to investigate and address a security breach. A violation of data privacy laws could result in reputational harm, loss of business, legal action and / or regulatory inquiries and monetary or other penalties that could negatively impact our reputation and adversely affect our operating results and financial condition.

If our security measures fail to protect credit card details, passwords or personally identifiable information adequately, we could be liable to both our registered users and their customers for their losses (such as fraudulent credit card transactions), as well as to the vendors under our agreements with them, such that we could be subject to fines and higher transaction fees, we could face regulatory action, and our registered users and vendors could end their relationships with us, any of which could harm our business, results of operations or financial condition. There can be no assurance that the limitations of liability in our contracts would be enforceable or adequate or would otherwise protect us from any such liabilities or damages with respect to any particular claim. We also cannot assure you that our existing general liability insurance coverage and coverage for errors and omissions will continue to be available on acceptable terms or will be available in sufficient amounts to cover one or more large claims, or that the insurer will not deny coverage as to any future claim. The successful assertion of one or more large claims against us that exceeds available insurance coverage, or the occurrence of changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could have a material adverse effect on our business, financial condition and results of operations.

A decrease in renewal rates of our existing premium subscriptions could adversely impact our collections and revenues, result in delayed or lower than forecasted profitability, and harm our ability to forecast our business.

The rate at which premium subscriptions are purchased and the rate at which premium subscriptions are renewed, significantly impact the overall number of premium subscriptions and, as a result, our collections and our revenues. As of December 31, 2017, one-year, two-year and three-year subscription packages constituted approximately 82% of all premium subscriptions. One of the key drivers of renewal rates is whether premium subscriptions are for longer or shorter periods than one year. One-year subscriptions have higher renewal rates than monthly subscriptions, since there are not as many opportunities in a one-year period to fail to renew such subscription, than a monthly subscription, whether deliberately or through failure to update payment information upon expiration. If the number of premium subscriptions or renewal rates fail to meet our expectations, our profitability and future prospects may be adversely impacted. In addition, premium subscriptions currently renew automatically at the end of each subscription period unless registered users cancel their subscription in advance. Any limitation or restriction imposed on this ability to bill our registered users on a recurring basis or the manner in which the rebilling is performed, whether due to new regulations or otherwise, may significantly lower the renewal rate of our subscriptions.

If we are unable to maintain and enhance our brand, or if events occur that damage our reputation and brand, our ability to expand our base of registered users and premium subscriptions and to grow our revenues from such subscriptions may be impaired, and our business and financial results may be harmed.

Maintaining, promoting and enhancing the Wix brand is critical to expanding and retaining our base of registered users and premium subscriptions. For both registered users andthat may purchase premium subscriptions we market ourand business solutions and services primarilyover time. Our Wix brand is promoted through cost-per-click advertisements on search engines and social networking sites, participation in social networking sites, free and paid banner advertisements on other websites, and small Wix advertisements on our registered users’ websites that do not currently have a premium subscription, and through more traditional advertising such as sponsorships and television commercials. Our ability to attract additional registered users depends in part on increasing our brand recognition. In addition, our solutions and services are also marketed through free traffic sources, including customer referrals, word-of-mouth and direct searches for our “Wix” name, or web presence solutions, in search engines. The following factors and events may contribute to our inability to maintain and enhance our brand, or damage our reputation and brand:

Maintaining and enhancingAny local or global unfavorable media coverage or negative publicity about our brand will depend largely onindustry or our company, including as a result of us taking political positions which may not be seen as favorable to all audiences;

Our ability to continue to provide high-quality, well-designed, useful, reliable, secure, data privacy protective, innovative and innovativerelevant solutions and services, which we may not do successfully. Wesuccessfully or may introducenot do as successfully as our competitors;

Introduction of new solutions or terms of use that registered users do not like, whichlike;

The ability of our Customer Care team to provide customer support to our users at a highly professional level;

Our international branding efforts may negatively affectprove unsuccessful due to language barriers, an unfamiliar regulatory landscape, and cultural differences, and we may therefore be unsuccessful in establishing strong brand adoption in new markets and geographic locations;

Negative experiences our brand. Additionally, if registered users have a negative experiencewith using third-party applications and websites integrated with Wix, such an experience may affect our brand. Our Wix Arena Marketplace enables independent web designers to offer their services to registered users who engage them directly. We do not conduct any evaluation of these designers’ credentials. Our App Market enables third party independent developers to offer their applications to our registered users and premium subscribers. We conduct a limited evaluation of the developers of third party applications inincluding through our App Market, which is focused mainly on the technical functionality of applications. There is no assurance that the applications in our App Market meet security or privacy industry standards. Our reputation may be harmedincluding if any of the services provided by these independent designers and developersthey do not meet registered users’ expectations of quality, data privacy or security expectations. Maintainingsecurity;

A portion of our partners customarily builds websites for their customers using our platform and enhancingmay fail to do so successfully or to the satisfaction of their customers, which may harm our brand and reputation;

Certain third-party providers that our users rely on, may requirediscontinue their engagement with us, to make substantial investmentswhich could have an adverse effect on our reliability and these investments may not be successful. Additionally, errors,reputation;

Errors, defects, disruptions, security vulnerabilities, abuse of our system, or other performance problems with our products and platform, including the products and solutions we license from third parties, may harm our reputation and brand and adversely affect our ability to attract new users and premium subscriptions,subscribers, especially if these errors occur when we introduce new services or features, all of which may reduce our revenue.revenues;

If our social media advertisements are unappealing to certain audiences or are showcased within content that is unappealing to users, or if we remove or fail to remove content that may or may not be perceived as offensive or controversial to certain audiences, our brand and reputation may be harmed;

If we are unable to block fraudulent users from conducting their business on our platform or if we fail in blocking illegal activity, such as money laundering or drug trafficking, from taking place on our platform, our reputation and our results of operations, in particular in our online commerce offering may be harmed; and

If users, partners, or third parties with whom we work violate applicable laws or our policies, those violations could result in other liabilities for us and could harm our business. Such violations may also negatively impact our reputation and brand in ways that could cause additional harm to our business, for example creating a negative consumer or regulatory perception around the use of our products.

In recent years, increasing attention has been given to corporate activities related to environmental, social and governance (ESG) matters including increasing attention on and demands for action related to climate change and diversity, equity and inclusion matters. If we do not adapt to or comply with expectations, standards, and regulations on ESG matters as they continue to evolve, or which are perceived to have not responded appropriately to the growing concern for ESG issues, regardless of whether there is a legal requirement to do so, we may suffer from reputational damage.

We could also become the target of organized activist groups seeking to bring attention to elements of our brand, products, business model, employment practices, advertising, spokespeople, locations, countries in which we operate, organizations or matters we support, or other matters of our business in order to gain support for their interests or deter us from continuing practices with which they disagree, such that our brand, company culture or results of operations could be harmed.

If our reputation is harmed, we may be unable to sell our products through partners who may be less inclined to offer our services to their customers. If we fail to successfully promote and maintain the Wix brand or if we incur excessive expenses in this effort, our business and our financial results may be adversely affected.

If we could be subjectfail to claims regardingmaintain a consistently high level of Customer Care, our brand, business and financial results may be adversely affected.harmed.

If we failWe believe our focus on customer care is critical to developretaining, expanding and introduce new productsfurther penetrating our user base, as well as converting registered users into purchasing premium subscriptions and services and keep up with rapid changes in design and technology,adopting our business may be materially adversely affected.

Our future success will depend on our ability to improvesolutions. As a result, we have invested in the look, function, performancequality, training and reliabilityexpansion of our solutionsCustomer Care operations and services, including integrating services by third parties. The development of new and upgraded solutions and new service offerings involves a significant amount of time for our research and development team, as it can take our developers months to update, code and test new and upgraded solutions and integrate them into our platform. Further, our design team spends a significant amount of time and resourcescall center personnel in order to incorporate various design elements, such as customized colors, fonts, content and other features into our new and upgraded solutions. The introduction of these new and upgraded design features, solutions and services also involves a significant amount of marketing spending. We must also manage our existing offerings, as we continually test, support, and market these solutions and applications. Furthermore, our ability to attract new users and increase revenue from existing users depends in part on our ability to increase adoption and usagemany of our products. global locations.

In 2020, as part of our response to COVID-19 restrictions, we shifted our Customer Care workforce to work remotely or in a hybrid model, which may in the future result in negative impacts on the productivity of such workforce.

If we are unable to successfully enhanceincrease the scale and maintain a consistently high level of customer care we, may lose existing registered users, may be unable to increase conversion of registered users to premium subscribers or increase our sales of business solutions to our existing productspremium subscribers, and may not see a return on our investment in our Customer Care operations. If we fail to meet evolving user requirementsmaintain adequate customer care and increase adoption and usageease the use of our products, or ifplatform’s functionality in accordance with our efforts to increase the usage ofusers’ needs, our products are more expensive than we expect, or if our solutions fail to achieve widespread acceptance, our revenuesreputation, financial results and competitive position couldbusiness prospects may be materially harmed.

Our future prospects may be adversely affected.

We depend on highly skilled personnel to enhance our product and grow our business, andaffected if we are unable to hire, integrate and retaingenerate revenues from sources other than our personnel, we may not be able to address competitive challenges and continuepremium subscription packages, which comprise a majority of our rapid growth.Creative Subscriptions Revenue.

Our future success and ability to maintain effective growth will depend upon our continued ability to hire, integrate and retain highly skilled personnel, including senior management, engineers, designers, developers, product managers, finance and legal personnel and customer support representatives. In addition to hiringCreative Subscriptions Revenue, we generate Business Solutions Revenue from additional products and integratingservices that are offered to all of our users to enhance their digital presence, including email services provided by Google Workspace, applications sold through our App Market or elsewhere on our platform or platforms operated by our subsidiaries, Ascend by Wix, Wix Answers, Wix Logo Maker, and from revenue sharing agreements we have for sale of payments services through Payments by Wix, paid ad campaigns and shipping services. We cannot offer any assurances that the Business Solutions Revenue will continue to grow at a similar pace as in prior years or that sales of applications or other value-added solutions and services we may offer in the future will be a significant part of our revenues. Material changes in our agreements with certain providers may significantly affect our ability to generate revenues from sources associated with such providers. If we do not succeed in selling these solutions, our future prospects may be adversely affected.

Our business is susceptible to risks associated with international operations and the use of our platform in various countries, including in emerging markets, as well as our ability to localize our platform in such countries.

We currently have users worldwide, and we expect to continue to increase the volume of our operations worldwide in the future. However, our operations in various countries subject us to risks which may include:

difficulties related to contract enforcement, including our terms of use;

compliance with foreign laws and regulations applicable to cross-border operations including export controls;

customization of our services and business solutions to be compliant with local laws and regulations applicable to our users and their customers;

monitoring changes and addressing conflicting laws in areas such as consumer protection, anti-money laundering and copyright;

lower levels of internet use in certain geographical locations;

data privacy and data localization laws that may require, for example, that user data and data of our users’ consumers be stored and processed in a designated territory;

tax consequences, including the complexities of foreign value-added tax (or other tax) systems and restrictions on the repatriation of earnings;

personnel culture differences and varying economic and political climates such as the military invasion of Ukraine by Russia;

currency exchange rates and restrictions related to foreign exchange controls;

different sources of competition;

uncertainties and instability in European and global markets and increased regulatory costs and challenges and other adverse effects caused by the United Kingdom’s withdrawal from the European Union;

different customer spending levels, in particular in light of the ongoing COVID-19 pandemic, rising inflation and other global economic trends; and

lower levels of credit card use, access to online payment methods, and increased payment risks.

These factors, or other factors, may cause our international costs of doing business to exceed our expectations and may also require significant management attention and financial resources. Any negative impact from our international business efforts could adversely affect our business, results of operations and financial condition.

We are in the process of localizing our products in certain territories, including the languages and currencies we use, expanding our systems to accept payments in forms that are common in those targeted markets and tailoring our Customer Care, to provide our users with a local experience and cater to their specific needs. We intend to continue our international expansion efforts, including through partners who can assist us to penetrate new employees,markets. To achieve our goals, we must continue to focus onhire and train experienced personnel to staff and manage our international expansion. Our international expansion efforts may be slow or unsuccessful to the extent that we experience difficulties in recruiting, training, managing and retaining qualified personnel with international experience, language skills and cultural competencies in the geographic markets we target, or if we were to engage with a partner who is not appropriately qualified to operate in local markets. In addition, the expansion of our best employees who fosterexisting international operations and promoteentry into additional international markets, in particular in emerging markets, has required, and will continue to require, significant management attention and financial resources. We may also face pressure to lower our innovative corporate culture.prices to compete in emerging markets, which could adversely affect revenue derived from our international operations.

Our efforts to also expand our presence in certain emerging markets presents challenges that are different from those associated with more developed international markets. In order to remain competitive, we mustparticular, regulations limiting the use of local credit cards and foreign currency could constrain our growth in certain countries. For example, regulations in certain countries do not permit recurring charges on credit cards. We have established subsidiaries in certain foreign jurisdictions and may continue to developexpand into new solutions, applicationsjurisdictions to facilitate local payments, and enhancementsmay be subject to local regulations in such respective jurisdictions. Countries or states may be subject to governmental sanctions, or sanctions established by payment processing or other companies, which could restrict our existing platform, which requireability to charge users. Additionally, in emerging markets we may face the risk of rapidly changing government policies, including with respect to bank transfers and various payment methods, including offline methods, and we may encounter sudden currency devaluations. Currency controls in emerging countries may make it hard for us to competerepatriate bookings or profits that we generated in a particular country.

These and other factors associated with many other companies for software developers with high levelsour international operations could impair our growth prospects and adversely affect our business, operating results and financial condition.

Our operations in and connected to Ukraine may be materially impacted on a long-term basis as a result of experiencethe ongoing war initiated by Russia in designing, developingUkraine, and managing cloud-based software. Our principal researchour business, financial condition and development activities are conductedresults of operations may be materially adversely affected by any negative impact on the global economy resulting from our headquartersthe war in Tel Aviv, Israel, andUkraine.

We have had operations in Ukraine since 2013. As of the year ended December 31, 2021, we face significant competition for suitably skilled developersengaged 871 contractors in this region. We also engage a team of developers in Ukraine either directly or through a third-party service organization, and directly with local subcontractors, and we have engaged aas well as 11 employees. Our Ukraine team of local developers in Lithuania in order to benefit from the significant pool of talent that is more readily available in each of those markets. Many larger companies expend considerably greater amountsmembers are primarily focused on employee recruitment and may be able to offer more favorable compensation and incentive packages than us. If we cannot attract or retain sufficient skilled research and development marketing, operationsactivities and customer service professionals,Customer Care, with approximately 56% of such team members in engineering roles and approximately 44% in Customer Care roles. As a result of the military invasion of Ukraine by Russian forces that began on February 24, 2022, some of our business, prospectsUkraine team members have relocated to other countries and resultssome have relocated within Ukraine, with many unable to fully perform all or some of operations could be materially adversely affected. In particular, we have experienced a competitive hiring environment in Israel, where we are headquartered.their work duties.

If we loseOur business continuity plan includes the servicesrelocation of anyteam members that are critical to our operations, reassigning work to other geographies within our global footprint, accelerating hiring in locations outside of the region, and monitoring the developing situation to protect the safety of our key personnelpeople and failtheir families and handle potential impacts to manage a smooth transitionour development infrastructure and our ability to new personnel, our business could suffer. We do not carry key person insurance on any of our executive officers or other key personnel. We have entered into employmentdeliver products and services agreements withto our executive officers and key employeesusers. However, there is no assurance that contain non-compete covenants. Despiteour continuity plans will fully address these agreements, weissues, which may not be able to retain these officers and employees. If we cannot enforce the non-compete covenants, we may be unable to prevent our competitors from benefiting from the expertise of our former employees or prevent our employees from establishing their own competing ventures, either of which could materially adversely affect our business, operating results and results of operations. In addition, we have grown significantly in recent years and itfinancial condition. Moreover, our Ukrainian team members currently working from other countries may be harderdeemed to retain employees that seek to work athave established a smaller organization.

Furthermore, many of our employees may expect to receive significant proceeds from sales of our equitypermanent establishment in the public markets after their equity compensation has fully vested. A drop in share price due to market fluctuations may reduce their motivation to continue to work for us. Competition for highly skilled personnel is intense, particularly in the software industry. We may need to invest significant amounts of cash and equity to attract and retain new employees, and we may never realize returns on these investments. If we are not able to effectively hire and retain employees, our ability to achieve our strategic objectives will be adversely impacted, and our business will be harmed.

In addition, due to our rapid growth which has raised the profile of our company, our employees may be increasingly targeted for recruitment by competitors and other companies in the technology industry, which may make it more difficult for us to retain employees and/or increase retention costs.

We are subject to privacy and data protection laws and regulations, including the EU General Data Protection Regulation, as well as contractual privacy and data protection obligations, which could affect our efficiency and our marketing activities. Our failure to comply with these laws, regulations or obligations, or any future laws, regulations, or obligations could subject us to sanctions and damages and could harm our reputation and business.

We hold certain personal data of our registered users, primarily, email address, geo-location, usage data, password and additional information, and may hold certain personal data of the visitors to our registered users’ websites. We also collect billing information, such as credit card numbers, full names, billing address and phone numbers of our registered users and their customers. With respect to the credit card data, we have implemented data security standards, operating rules and certification requirements in accordance with PCI Data Security Standards and we have maintained PCI compliance level 1 certification since February 2013. Our Wix Hive API captures a variety of actions, activities and other data relating to the visitors of our registered users’ websites, such as contact information, messages, purchases, bookings and more. Such data relating to the visitor activity of each website are stored and managed in a centralized database dedicated to that website, and can be accessed by installed apps and through the dashboard of the owner of such website.

We are subject to the privacy and data protection laws and regulations adopted by Israel, Europe and US and potentially, other jurisdictions. Where the local data protection and privacy laws of a jurisdiction apply, we may be required to register our operations in that jurisdiction or make changes to our business so that registered users’ data is only collected and processed in accordance with applicable local law. Privacy laws restrict our storage, use, processing, disclosure, transfer and protection of personal information, including credit card data obtained in relation to our registered users, and possibly the visitors of our registered users’ websites. We strive to comply with all applicable laws, regulations, policies and legal obligations, as well as with certain industry standards (including voluntary third-party certification bodies such as TRUSTe) relating to privacy and data protection. We are also subject to privacy and data security-related obligations deriving from our privacy policy and terms of use with our registered users,locations, and we may be liableor may become subject to third partiestax and other regulations in the event we are deemed to have wrongfully processed personal data.such countries as well as in Ukraine.

The regulatory framework for privacyAdditionally, the conflict between Ukraine and data security issues worldwide is currently in flux and is likelyRussia has led to remain so forsanctions being levied by the foreseeable future. In particular,United States, the European Union, has traditionally taken a broader view as to what is considered personal informationthe United Kingdom, and has imposed greater obligations under their privacyother countries against Russia, Belarus, and data protection laws. For example,certain regions in Ukraine, which could impact our business for an unknown period of time.

Although the European Union adopted a new General Data Protection Regulation in April 2016, which replaced the European Data Protection Directiveseverity, duration and includes more stringent obligations for online businesses. The approved regulation is due to become applicable on May 25, 2018 and will replace, to a large extent, the data protection laws of each European Union member state. The General Data Protection Regulation will result in more stringent requirements for data processors and controllers. Such requirements will include more fulsome disclosures about the processing of personal information, data retention limits and deletion requirements, mandatory notification in the case of a data breach and elevated standards regarding valid consent in some specific cases of data processing. The General Data Protection Regulation also includes substantially higher penalties for failure to comply, inter alia, a fine up to 20 million EUR or up to 4%geographic scope of the annual worldwide turnover, whichever is greater, can be imposed. When these lawsongoing war are highly unpredictable, the war in Ukraine could materially disrupt our operations in and regulations come into effect,connected to Ukraine and other parts of the more stringent requirements on privacy user notifications and data handling will require us to adapt our business and incur additional costs.

In addition, effective as of September 1, 2015,world affected by the Russian parliament adopted a set of amendments to the Russian Federal Law on Personal Data, stating that personal data pertaining to Russian citizens must be stored in databases located in Russia. We continue to monitor the implementation of these legislative changes.

In general, privacy concerns are becoming more widely acknowledged and may cause our users to resist providing the personal data necessary to allow them to use our platform effectively. Our users’ customers may also resist providing personal data to our users due to privacy concerns. Measures we have implemented in order to protect user data, including those of our users’ customers, may not alleviate all potential privacy concerns and threats.

A failure by us or a third-party contractor providing services to us to comply with applicable privacy and data security laws, regulations, self-regulatory requirements or industry guidelines, or our terms of use with our registered users, may result in sanctions, statutory or contractual damages or litigation and may subject as to reputational harm. These proceedings or violations could force us to spend money in defense or settlement of these proceedings, result in the imposition of monetary liability, restrict or block access to our services from a certain territory, incur additionalwar, divert management resources,attention, increase our costs of doing business, and adversely affect our reputation and the demand for our solutions. Government agencies and regulators have reviewed, are reviewing and will continue to review, the personal data practices of online media companies including their privacy and security policies and practices. The FTCmay disrupt future planned development in particular has approved consent decrees resolving complaints and their resulting investigations into the privacy and security practices of a number of online social media companies. The possible outcome of such reviews may result in changes to our products and policies. If we are unable to comply with any such reviews or decrees that result in recommendations or binding changes, or if the recommended changes result in degradation of our products, our business could be harmed. Governmental agencies may also request or take registered user data for national security or informational purposes, and also can make data requests in connection with criminal or civil investigations or other matters, which could harm our reputation and our business.Ukraine.

We are exposed to risks, including security risks, associated with credit cardpayment processing and debit cardthe provision of financial services, particularly in relation to payment processing.transactions processed through Wix Payments, which may subject us to regulatory requirements, contractual obligations, and other risks that could be costly and difficult to comply with or that could harm our business.

We accept payments from our users, primarily through credit and debit card transactions and alternative payment methods, and provideare subject to a portalnumber of risks related to our ability to receive payments from our users, including (i) interchange and other fees paid by us, which may increase over time and may require us to either increase the prices we charge for registeredour products or experience an increase in our operating expenses; (ii) potential failures of our billing systems to automatically charge our premium subscribers’ credit cards on a timely basis or at all; and (iii) restrictions on our ability to collect payments from our users, such as under the second Payment Services Directive, or PSD2, which requires strong customer authentication for certain transactions imposing operational complexity which our users may want to avoid.

In addition, we facilitate payment collection by our users from their users through Payments by Wix, which enables our users to submitaccept payments for goods and services sold online to their customers, from a variety of payment information for processing. providers, on major credit and debit cards. This includes Wix Payments, our proprietary payment service, as well as third-party payment processors.

We are subject to a number of risks related to our ability to receive payments from our users, and our facilitation of payment processing of our users from their users, including:

if our users are unable to collect payments from their users, we could lose revenues or cause our users to lose revenues which could harm our business and reputation;

if we are unable to maintain our chargeback rate at acceptable levels, in particular during turbulent economic times, our credit card fees for chargeback transactions or our fees for other credit and debit card payments, including:transactions or issuers may increase, issuers may terminate their relationship with us, or we may face fines from the issuers;

| ·• | we pay interchangeincreased costs and diversion of management time and effort and other fees, resources to deal with user onboarding and fraudulent transactions or chargeback disputes, which may increase over time and may require usin an economic downturn if users become insolvent, bankrupt or otherwise unable to either increase the prices we charge for our products or experience an increase in our operating expenses;fulfill their commitments; |

| · | if our billing systems fail to work properly and, as a result, we do not automatically charge our premium subscriptions’ credit cards on a timely basispotential fraudulent or otherwise illegal activity by our users, their users, developers, employees or at all, we could lose revenues; |

| · | if we are unable to maintain our chargeback rate at acceptable levels, our credit card fees for chargeback transactions, or our fees for other credit and debit card transactions or issuers, may increase, issuers may terminate their relationship with us, or we may face fines from the issuers; and |

| · | we are reliant on third parties such as gateways, payment service providers and acquiring banks which may face down time and thus affect our cash flow. |

Our billing system interfaces with a number of different gateway providers that link to a number of different payment card processors based on the jurisdiction and other factors. In connection with this system, we have implemented data security standards, operating rules and certification requirements in accordance with Payment Card Industry, or PCI, Data Security Standards in connection with internal control requirements under Israeli law and we have maintained PCI compliance level 1 certification since February 2013. There can be no assurance that our billing system data security standards, or those of our third-party service providers, will adequately comply with the billing standards of any future jurisdiction in which we seek to market our service offering. Further, if there is unauthorized access to the credit card and other payment information we collect, store and transmit, we could face legal liability, as well as the possibility of liability to banks or other third parties, including pursuantwhich could lead to increased liability, in particular with respect to our agreements with payment service providers. Our billing systems depend on the efficacy of secure transmission protocols and related technologies. We cannot be sure that the steps we take to ensure the security of the collection and transmission of credit card and other payment information will be sufficient.Wix Payments operations;

10

our reliance on third parties such as gateways, payment service providers and acquiring banks, which may face down time and thus affect our cash flow;We are

restrictions on funds or required reserves related to payments; and

additional disclosure requirements, including new reporting regulations and new credit card associated rules.

Depending on how Payments by Wix evolves, we may currently, or in the future, be subject to the ruleslaws and regulations, adoptedeither in existing or new jurisdictions, relating to our payment facilitation services and provision of financial services, including with respect to foreign exchange, anti-money laundering, counter-terrorist financing, banking and import and export restrictions. In some jurisdictions, the application or interpretation of these laws and regulations is not clear. In certain cases, such as under Wix Payments, we act as a payment facilitator for our users, pursuant to which we are required to monitor our users’ activity to ensure their compliance with certain standards applied by the payment card networks,network or the payment providers we are partnered with. We may fail to appropriately monitor our users’ activity and be subject to liability.

Our efforts to comply with these laws, regulations, and standards could be costly and result in diversion of management time and effort and may still not guarantee compliance. In the event that we are found to be in violation of any such legal or regulatory requirements, we may be subject to monetary fines or other penalties such as Visaa cease and MasterCard and Central Banks, and ifdesist order, or we failmay be required to adheremake changes to their rules and regulations, we would be in breachour platform, any of our contractual obligations to payment processors and acquiring banks, which could subject us to damageshave an adverse effect on our business, financial condition and liability and could eventually prevent us from processing or accepting credit card payments. results of operations.

The payment card networks, such as Visa and MasterCard, have also adopted rules and regulations that apply to all merchants who process and accept credit cards for payment of goods and services.services, and have discretion to both set and interpret the rules and may do so with little or no prior notice. We are obligated to comply with these rules and regulations as part of the contracts we enter into with payment processors and acquiring banks. The rules and regulations adopted by the payment card networks include the Payment Card IndustryPCI Data Security Standards, or PCI DSS. Under the PCI DSS, we are required to adopt and implement internal controls over the use, storage and security of payment card data to help prevent fraud. If we fail to comply with the rules and regulations adopted by the payment card networks, including the PCI DSS, we would be in breach of our contractual obligations to payment processors and merchant banks.banks, which may include indemnification clauses. Such failure to comply may subject us and/or our users to fines, penalties, damages, higher transaction fees, and civil liability, and could eventually prevent us or our users from processing or accepting debit and credit cards, or could lead to a loss of payment processor partners. We also cannot guarantee that such compliance will prevent illegal or improper use of our payments systems or the theft, loss or misuse of the debit or credit card data of registered users or participants or regulatory or criminal investigations. A failure to adequately control fraudulent credit card transactions would result in significantly higher credit card-related costs and any increases in our credit card and debit card fees could adversely affect our results of operations. Moreover, any such illegal or improper payments could harm our reputation and may result in a loss of service for our registered users, which would adversely affect our business, operating results and financial condition.

If we failA regional or global health epidemic or pandemic, such as the COVID-19 pandemic and its variants, may have a material adverse impact on our users and could harm our operations and business results.

A regional or global health epidemic or pandemic, such as the ongoing COVID-19 pandemic and its variants, as well as the duration and implementation of measures attempting to maintaincontain and mitigate the effects of the virus, including travel restrictions, quarantines, shutdowns and restrictions on trade, and residual impacts of a consistently high levelhealth crisis may continue to disrupt our operations and the operations and business results of customer service, our brand, businessusers and financial results may be harmed.our users of users.

We believemodified our focusoperational practices in response to the COVID-19 pandemic including shifting the majority of our employees to a primarily hybrid work model, limiting business travel and shifting many events to a virtual format, and we continue to adapt our operational practices in response to local conditions or as required by government authorities or as we determine is warranted. To date these modified operational practices have not materially impacted our productivity or efficiency, but our ability to continue product development, marketing efforts, sales efforts with our partners and other aspects of our business could be impacted in the future. In addition, our management team has spent, and may continue to spend, significant time, attention, and resources monitoring the COVID-19 pandemic and the associated impacts, including the economic impact on customer supportour business and on our workforce.