“strategic cooperation” means a more extensive type of cooperation arrangement, generally being longer term and involving more trade routes. It involves some joint planning mechanism, but joint planning is less extensive as compared to a strategic alliance. A strategic cooperation can take the form of one or a combination of cooperation arrangements; and

We produce financial statements in accordance with the International Financial Reporting Standards issued by the International Accounting Standards Board, or IFRS, and all financial information included in this annual report is derived from our IFRS financial statements, except as otherwise indicated. In particular, this annual report contains certain non-IFRS financial measures which are defined under “Item 5 Operating and Financial Review and Prospects” Prospects”and “Item“Item 4.B Business Overview—Our Businesses—OPC.”

Our consolidated financial statements included in this annual report comprise the consolidated statements of profit and loss, other comprehensive income (loss), changes in equity, and cash flows for the years ended December 31, 2020, 20192023, 2022 and 20182021 and the consolidated statements of financial position as of December 31, 20202023 and 2019.2022. We present our consolidated financial statements in U.S. Dollars.

expected macroeconomic trends in Israel and the US, including the expected growth in energy demand;

potential new projects and existing projects;

potential expansions (including new projects or existing projects);

its gas supply agreements;

dividend policy;

expected trends in energy consumption;

regulatory developments;

its anticipated capital expenditures, and the expected sources of funding for capital expenditures;

projections for growth and expected trends in the electricity market in Israel and the US;

the gas supply arrangements; and

the price and volumeimpact of gas available to OPC and other IPPs in Israel and the US;

War.

statements relating to Qoros:

the agreement to sell Kenon’s remaining interest in Qoros to the Majority Qoros Shareholder; and

Qoros’ expectation to renew or refinance its working capital facilities to support its continued operations and development;

statements with respect to trends in the Chinese passenger vehicle market;

Qoros’ expectation of pricing trends in the Chinese passenger vehicle market;

Qoros’ ability to increase its production capacity;

statementslitigation and arbitration relating to the investment by the Majority Shareholder in Qoros into Qoros, including the put option and the Majority Shareholder in Qoros’ obligation to assume its proportionate share of Kenon and Chery’s guarantee and pledge obligations;

Qoros.

| • | statements relating to the agreement to sell Kenon's remaining interest in Qoros to the Majority, including with respect to the timing for payments and the conditions to me in connection with the sale including the release of the pledge over Kenon’s shares in Qoros; andZIM:

|

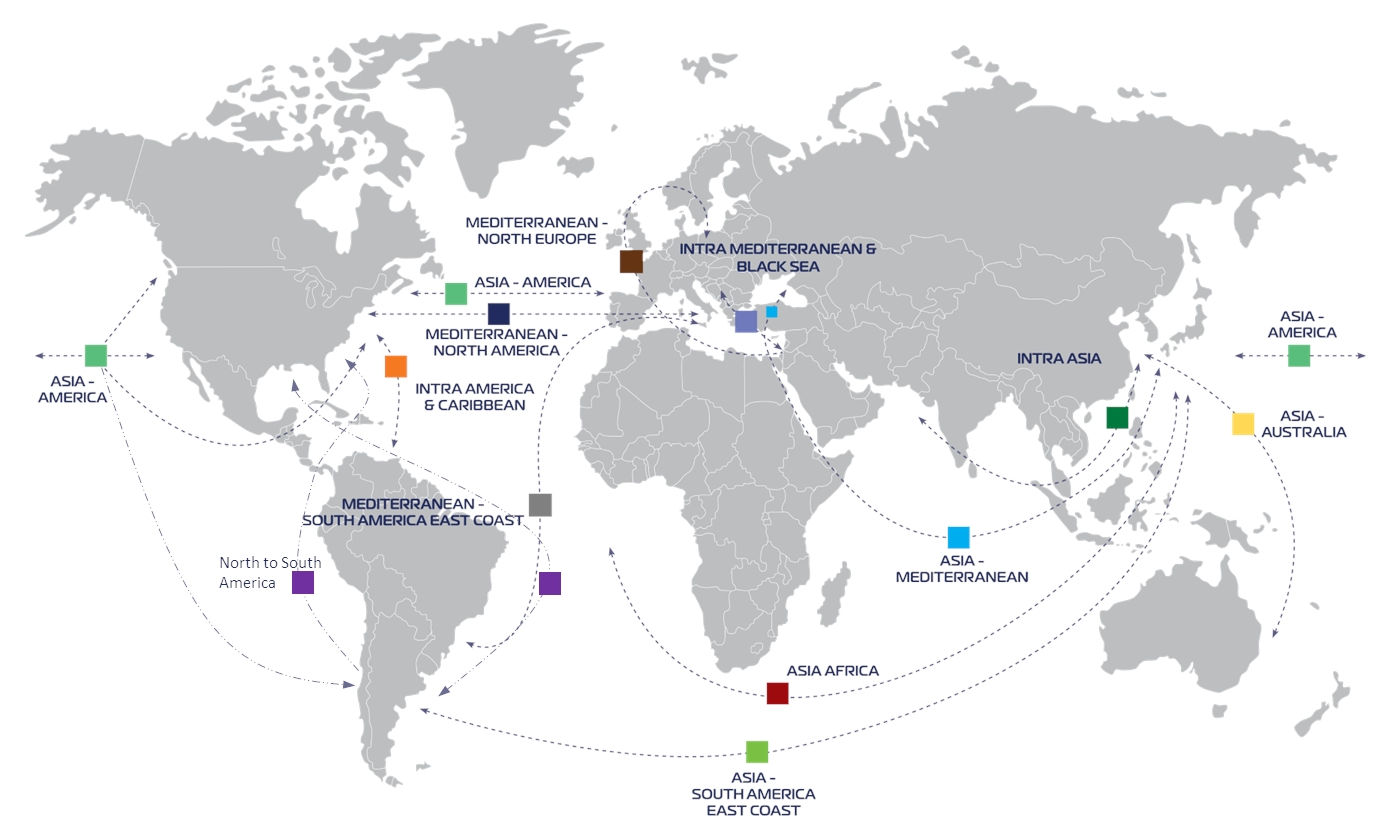

with respect to ZIM:

expectations regarding general market conditions;

expectations regarding trends related to the assumptions used in Kenon’s and ZIM’s impairment analysis with respect to Kenon’s investment in ZIM, and ZIM’s assets, respectively,global container shipping industry, including with respect to expectedfluctuations in vessel and container supply, industry consolidation, demand for containerized shipping services, bunker and alternative fuel price, freightprices, charter and freights rates, demand trends;

container values and other factors affecting supply and demand;

plans regarding ZIM’s business strategy, areas of possible expansion and expected capital spending or operating expenses;

anticipated ability to obtain additional financing in the future to fund expenditures;

expectation of modifications with respect to itsZIM’s and other shipping companies’ operating fleet and lines, including the utilization of larger vessels within certain trade zones and modifications made in light of environmental regulations;

statements with respect to International Maritime Organization, or IMO, regulations which came into effect in 2020 (“IMO 2020”) and other regulations, including the expected effectsbenefits of cooperation agreements and strategic partnerships;

formation of new alliances among global carriers, changes in and disintegration of existing alliances and collaborations, including alliances and collaborations to which ZIM is not a party to;

anticipated insurance costs;

beliefs regarding the availability of crew;

expectations regarding ZIM’s environmental and regulatory conditions, including changes in laws and regulations or actions taken by regulatory authorities, and the expected effect of such regulations;

beliefs regarding potential liability from current or future litigation;

statementsplans regarding the 2M Alliance and expected benefits of the alliance;

statementsability to pay dividends in accordance with respect to ZIM’s dividend policy; and

trends relatedexpectations regarding ZIM’s competition and ability to market conditions and the global container shipping industry, including with respect to fluctuations in container supply, industry consolidation, demand, bunker prices and charter/freights rates, including as a result of the COVID-19 pandemic.

compete effectively.

The preceding list is not intended to be an exhaustive list of each of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us and are only predictions based upon our current expectations and projections about future events.

There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by these forward-looking statements which are set forth in “Item 3.D Risk Factors.” Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results.

Except as required by law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement included in this annual report should not be construed as exhaustive. You should read this annual report, and each of the documents filed or incorporated by reference as exhibits to the annual report, completely, with this cautionary note in mind, and with the understanding that our actual future results may be materially different from what we expect.

is indicated in such forward-looking statements.

| ITEM 1. | Identity of Directors, Senior Management and Advisers |

| A. | Directors and Senior Management |

Not applicable.

Not applicable.

Not applicable.

| ITEM 2. | Offer Statistics and Expected Timetable |

Not applicable.

| B. | Methods and Expected Timetable |

Not applicable.

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

Our business, financial condition, results of operations, prospects and liquidity can suffer materially as a result of any of the risks described below. While we have described all of theThe risks we consider material, these risksdiscussed below are not the only ones we face. We are also subject to the same risks that affect many other companies, such as technological obsolescence, labor relations, geopolitical events, climate change and risks related to the conducting of international operations. Additional risks not known to us or that we currently consider immaterial may also adversely impact our businesses. Our businesses routinely encounter and address risks, some of which may cause our future results to be different—sometimes materially different—than we presently anticipate.

Risks Related to Our Strategy and Operations

Some of our businesses have significant capital requirements.We may raise financing or provide guarantees or collateral to make investments in or otherwise support existing or new businesses.

TheOur business plans of our businesses contemplatemay require additional financing and may seek to raise debt or equity financing which is expected to be raised from third parties. However, our businessesfinancing. Kenon may be unablealso seek to raise financing at the necessary capital from third party financing sources.

Kenon level to meet its obligations or make investments or acquisitions in its existing or new businesses. In the event that Kenon or one or more of our businesses requires capital, either in accordance with their business plans or in response to new developments or to meet operating expenses, and such businesses are unable to raise such financing, Kenon may provide such financing by (i) utilizing cash on hand, (ii) issuing equity in the form of shares or convertible instruments (through a pre-emptive offering or otherwise), (ii)(iii) raising debt financing at the Kenon level, (iv) using funds received from the operations or sales of Kenon’s otherdistributions from its interests in its businesses, (iii)(v) selling part, or all, of its interest in any of its businesses (iv) raising debt financing atand using the Kenon levelproceeds from such sales, or (v)(vi) providing guarantees or pledging collateral in support of the debt of Kenon or its businesses. To the extent that Kenon raises debt financing, any debt financing that Kenon incurs may not be on favorable terms, may impose restrictive covenants that limit how Kenon manages its investments in its businesses, and may also limit dividends or other distributions by Kenon. In addition, any equity financing, whether in the form of a sale of shares or convertible instruments, would dilute existing holders of our ordinary shares and any such equity financing could be at prices that are lower than the current trading prices.

1

Kenon may also seek to raise financing at the Kenon level to meet its obligations. Kenon is currently restricted in raising indebtedness at the Kenon level pursuant to the limitations set forth in the side letter described under “—Side letter Entered into in connection with the Repayment of the Deferred Payment Agreement. In the event that funds

Funds from its businesses or external financing aremay not be available to us to make investments we seek to make or to meet suchour obligations on reasonable terms or at all,all. Kenon may need to sell assets to fund any investments it seeks to make or to meet suchKenon’s obligations, and its ability to sell assets may be limited, particularly in light the various pledges over the shares and assets of some of Kenon’s businesses.limited. Any sales of assets may not be at attractive prices, particularly if such sales must be made quickly to meet Kenon’s obligations.quickly.

Our directors have broad discretion on the use of the capital resources for investments in our businesses or other investments or other purposes and we may make investments or acquisitions in our existing or new businesses. Kenon has provided loans and guarantees and made equity investments to support its businesses, such as investments in and guarantees of debt relating to Qoros andOPC (including equity investments in OPC,2022 and 2021), and may provide additional loans to or make other investments in or provide guarantees in support of its businesses. Kenon’s liquidity requirements will increase to the extent it makes further loans or otheradditional investments in or grants additional guarantees to support its businesses. Third partyTo the extent Kenon uses cash on hand or other available liquidity to make an investment in existing or new businesses, it will reduce amounts available for distribution to shareholders.For example, CPV requires capital for the development, construction or acquisition of existing and future projects. CPV will require additional debt and equity financing for its projects. The main source of equity has been the investors in the CPV Group (OPC is CPV’s main investor). Difficulty in obtaining the required capital amounts (and such amounts may be significant, considering the advanced projects by the CPV Group) may prevent the CPV Group from being able to execute its plans and strategy, all or with considerable delay. Additional equity financing by OPC may involve Kenon participating in equity raises of OPC. Additional financing for CPV Group may involve equity financing at the CPV Group level which would dilute OPC (to the extent OPC is not the investor), which would indirectly dilute Kenon’s interest in CPV.

Third-party financing sources for Kenon’s businesses may require Kenon to guarantee an individual business’ indebtedness and/or provide collateral, including collateral via a cross-collateralization of assets across businesses (i.e., pledging shares or assets of one of our businesses to secure debt of another of our businesses). To the extent Kenon guarantees an individual business’ indebtedness, it may divert funds received from one business to another business. We may also sell some or all of our interests in or use dividends received from any of our businesses to provide funding for another business. Additionally, if we cross-collateralize certain assets in order to provide additional collateral to a lender, we may lose an asset associated with one business in the event that a separate business is unable to meet its debt obligations. Furthermore, if Kenon provides any of its businesses with additional capital, provides any third parties with a guarantee or any indemnification rights, or a guarantee, and/or provides additional collateral, including via cross-collateralization, this could reduce our liquidity. For further information on theour capital resources and requirements of each of our businesses, see “Item 5.B Liquidity and Capital Resources.”

We face risks in connection with our strategy, which includes potential acquisitions or investments in new or existing business and we may fail to identify opportunities or consummate investments and acquisitions on favorable terms, or at all, in existing or new businesses.

Our strategy contemplates making investments or acquisitions in its existing or new businesses. Our success in executing this strategy depends on our ability to successfully identify and evaluate investment opportunities or consummate acquisitions on favorable terms.

However, the identification of suitable investment or acquisition candidates can be difficult, time-consuming and costly, and it is challenging to identify and successfully consummate investment or acquisitions that meet our objectives. As a result, we may not identify or successfully complete investment or acquisitions that we target, which may impede execution of our strategy.

We expect that any such acquisitions or other investments would be in established industries, would be substantial and that we would be actively involved in the operations and promoting the growth and development of such businesses. In addition, we do not expect that any such acquisitions or other investments would be in start-up companies or focused on emerging markets. While the foregoing set forth our current expectations as to potential investments, we are not limited to the foregoing criteria and we have broad discretion as to how we deploy our capital resources and may make investments or acquisitions that do not meet the foregoing criteria.

Our ability to consummate future investments and acquisitions may also depend on our ability to obtain any required government or regulatory approvals for such investments, including any approvals in the countries in which we may purchase assets in the future or in the United States. Our ability to consummate future investments or acquisitions may also depend on the availability of financing. See “—Disruptions in the financial markets could adversely affect Kenon or its businesses, which may not be able to obtain additional financing on acceptable terms or at all.”

Furthermore, we may face competition with other local and international companies, including financial investors, for acquisition or investment opportunities, which may result in us losing investment opportunities or increasing our cost of making investments. Some of our competitors for investments and acquisitions may have more experience in the relevant sector, greater resources and lower costs of capital, be willing to pay more for acquisitions and may be able to identify, evaluate, bid for and purchase a greater number of assets or projects under development than our resources permit.

To the extent we acquire or otherwise make investments in businesses where we do not have significant (or any) experience, we would face risks of operating in a sector with which we lack experience, which could impact the success of any such acquisition or investments.

In addition, there is no assurance that any investments we make will generate a positive return and we face the risk of losing some or all of the funds we invest.

Any funds we use to make acquisitions of a new business will reduce amounts available for investments in our existing businesses and investments in existing or new businesses will reduce amounts available for distribution to shareholders or repurchases of shares and could require us to raise debt or equity financing.

Disruptions in the financial markets could adversely affect Kenon or its businesses, which may not be able to obtain additional financing on acceptable terms or at all.

Kenon’s businesses may seek to access capital markets for various purposes, which may include raising funding for the repayment of indebtedness, acquisitions, capital expenditures andor for general corporate purposes. Kenon may seek to access the capital or lending markets to obtain financing in the future, including to support its businesses or to make new investments. The ability of Kenon’sKenon or its businesses to access capital markets, and the cost of such capital, could be negatively impacted by disruptions in those markets. Disruptions in the capital or credit markets could make it more difficult or expensive for our businesses to access the capital or lending markets if the need arises and may make financing terms for borrowers less attractive or available. Furthermore, a decline in the value of any of our businesses, which are or may be used as collateral in financing agreements, could also impact their abilityaccess to access financing. The high levels of inflation and interest rates as well as geopolitical developments including the war in Ukraine and the War in Israel have adversely impacted financial markets and the cost of debt financing and have increased volatility in financial markets.

Kenon may seek to access the capital or lending markets to obtain financing in the future, including to support its businesses. The availability of such financing and the terms thereof will beis impacted by many factors, including: (i) our financial performance, (ii) credit ratings or absence of a credit rating, (iii) the liquidity of the overall capital markets andgenerally, (iv) the state of the economy.global economy, including inflation and interest rates and (v) geopolitical events such as the Russian invasion of Ukraine and the War in Israel. There can be no assurance that Kenon or its businesses will be able to access the capital markets on acceptable terms or at all. If Kenon or its businesses deemsdeem it necessary to access financing and isare unable to do so on acceptable terms or at all, this could have a material adverse effect on our financial condition or liquidity.

We are subject to volatility in the capital markets.

Our strategy may include sales or distributions of our interests in our businesses. For example, in August 2017, OPC completed an initial public offering, or IPO, in Israel, and a listing on the TASE, and in February 2021, ZIM completed an IPO on the New York Stock Exchange,NYSE. The ability of one or NYSE. Our abilitymore of our businesses to complete a public offering, distribution or listing of one or more of our businesses is heavily dependent upon the public equity markets. Financial market conditions were volatile in 2023 and remain volatile and these conditions could become worse.

As our holdings in OPC and ZIM securities of our business are publicly traded (and to the extent any of our other holdings in companies are listed in the future), we are exposed to risks of downward movement in market prices. In addition, large holdings of securities can often be disposed only over a substantial length of time. Accordingly, under certain conditions, we may be forced to either sell our equity interest in a particular business at lower prices than expected to realizeeffect or defer such a sale, potentially for a long period of time.

We have pledged a portion of our shares in OPC to secure obligations to the buyer of the Inkia Business under the indemnification obligations in the share purchase agreement for the sale,past, and in 2020 we increased the number of pledged shares and the duration of the pledge until the end of 2021. To the extent that we are required to make payments under the indemnity obligationmay in the share purchase agreement, we may be required to sell shares in OPC and we would be subject to market conditions at the time of such sale (and the TASE regulations in relation to such sale) which could mean that we are forced to sell our shares for a lower price than we would otherwise be able to do so, particularly if we need to sell a significant amount of shares. If we do not make required payments in the event we are required to make payments under the share purchase agreement, then, in certain circumstances, the pledge can be enforced to satisfy the indemnity obligations, which would result in a loss of some or all of the pledged OPC shares.

In connection with ZIM’s IPO, we have enteredfuture enter into a lockup agreementagreements with respect to our shares in ZIM which expires on July 26, 2021, solisted companies in connection with offerings by those companies, and in some cases, we will unlikelymay be ablerequired to sell or otherwise dispose of our shares in ZIM prior to that date,enter into a lockup agreement. In addition, we are subject to limited exceptions.

securities laws restrictions on resales, including in the United States, to the extent we are an affiliate of the issuer, or hold restricted shares, the requirement to register resales with the SEC or to make sales under a relevant exemption.

We are a holding company and are dependent upon cash flows from our businesses to meet our existing and future obligations.

We are a holding company of various operating companies, and as a result,we do not conduct independent operations or possess significant assets other than investments in and advances to our businesses.businesses and our cash on hand and treasury investments. As a result, we depend on funds from our businesses or external financing to meetmake distributions, to make investments or acquisitions, to pursue our operating expensesstrategy and obligations, includingfor our operating expenses, our guarantee of the indemnification obligations under the share purchase agreement for the sale of the Inkia Business and our guarantee obligations in respect of Qoros debt.other liquidity requirements.

In addition, as Kenon’s businesses are legally distinct from it and will generally be required to service their debt and other obligations before making distributions to Kenon, Kenon’s ability to access such cash flows from its businesses may be limited in some circumstances and it may not have the ability to cause its subsidiaries and associated companies to make distributions to Kenon, even if they are able to do so. Additionally, the terms of existing and future joint venture, financing, or cooperative operational agreements and/or the laws and jurisdictions under which each of Kenon’s businesses are organized may also limit the timing and amount of any dividends, other distributions, loans or loan repayments to Kenon.

Additionally, as dividends are generally taxed and governed by the relevant authority in the jurisdiction in which each respective company is incorporated, there may be numerous and significant tax or other legal restrictions on the ability of Kenon’s businesses to remit funds to us, or to remit such funds without incurring significant tax liabilities or incurring a ratings downgrade.

We do not have the right to manage, and in some cases do not control, some of our businesses, and therefore we may not be able to realize some or all of the benefits that we expect to realize from our businesses.

As we own minority interests in Qoros and ZIM, we are subject to the operating and financial risks of these businesses, the risk that these businesses may make business, operational, financial, legal or regulatory decisions that we do not agree with, and the risk that we may have objectives that differ from those of the applicable business itself or its other shareholders. In addition, OPC’s CPV business holds minority interests in most of its operations. Our ability to control the development and operation of these investments may be limited, and we may not be able to realize some or all of the benefits that we expect to realize from these investments. For example, we may not be able to cause these businesses to make distributions to us in the amount or at the time that we may need or want such distributions.

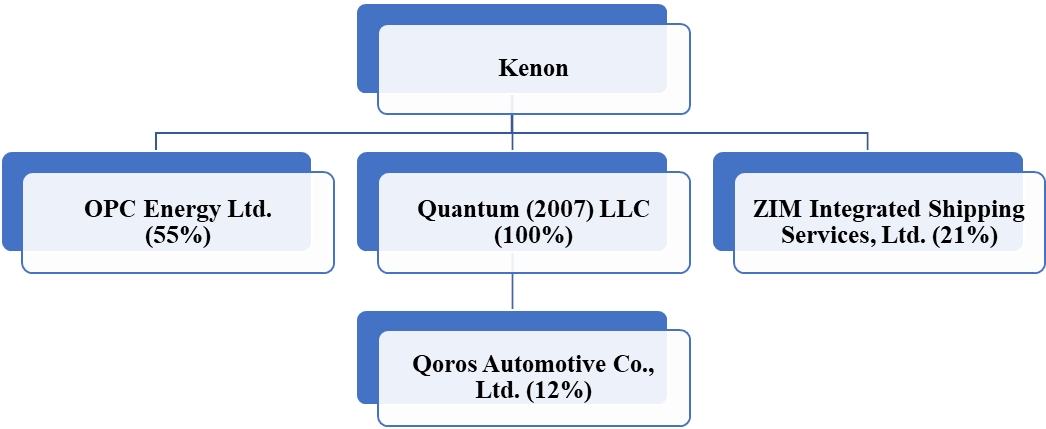

The Majority Shareholder in Qoros holds 63% of Qoros and Kenon and Chery have 12% and 25% stakes in Qoros, respectively. Kenon can appoint two of nine Qoros directors. Although we still actively participate in the management of Qoros through our 12% interest and board representatives, our right to control Qoros decreased with the Majority Shareholder in Qoros’ investments in Qoros. For further information, see “Item 4.B Business Overview—Our Businesses—Qoros —Qoros’ Investment Agreement” and “Item 4.B Business Overview—Our Businesses—Qoros—Kenon’s Sale of Half of its Remaining Interest in Qoros to the Majority Shareholder in Qoros.”

In addition, we rely on the internal controls and financial reporting controls of our businesses and theany failure ofby our businesses to maintain effective controls or to comply with applicable standards could make it difficult to comply with applicable reporting and audit standards. For example, the preparation of our consolidated financial statements requires the prompt receipt of financial statements that comply with applicable accounting standards and legal requirements from each of our subsidiaries and associated company,companies, some of whom rely on the prompt receipt of financial statements from each of their subsidiaries and associated company.companies. Additionally, in certain circumstances, we may be required to file with our annual report on Form 20-F, or a registration statement filed with the SEC, financial information of associated companies which has been audited in conformity with SEC rules and regulations and relevant audit standards. We may not, however, be able to procure such financial statements, or such audited financial statements, as applicable, from our subsidiaries and associated companies and this could render us unable to comply with applicable SEC reporting standards.

Our businesses are leveraged.

Some of our businesses are significantly leveraged and may incur additional debt financing in the future. As of December 31, 2020, 2023:

OPC had $921$1,530 million of outstanding indebtedness and OPC’s proportionate share of debt (including accrued interest) of CPV associated companies was $839 million, and

ZIM had outstanding indebtedness (mostly lease liabilities) of approximately $1.9 billion and Qoros had external loans and borrowings of RMB3.3 billion (approximately $512 million) and loans and other advances from parties related to the Majority Shareholder of RMB5.3 million (approximately $809 million).$5.9 billion.

Highly leveraged assets are inherently more sensitive to declines in earnings, increases in expenses and interest rates, and adverse market conditions. A leveraged company’s income and net assets also tend to increase or decrease at a greater rate than would otherwise be the case if money had not been borrowed. Consequently, the risk of loss associated with a leveraged company is generally greater than for companies with comparatively less debt. Additionally, some of our businesses’ assets have been pledged to secure indebtedness, and as a result, the amount of collateral that is available for future secured debt or credit support and a business’ flexibility in dealing with its secured assets may be limited. Our businesses that are leveraged use a substantial portion of their consolidated cash flows from operations to make debt service payments, thereby reducing itstheir ability to use their cash flows to fund operations, capital expenditures, or future business opportunities. Additionally, ZIM remains highly leveraged and continues to face risks associated with those of a highly leveraged company.

Our businesses will generally have to service their debt obligations before making distributions to us or to any other shareholder. In addition, many of the financing agreements relating to the debt facilities of our operating companies contain covenants and limitations, including the following:

debt service coverage ratio;

limits on the incurrence of liens or the pledging of certain assets;

limits on the incurrence of subsidiary debt;

limits on the ability to enter into transactions with affiliates, including us;

minimum liquidity and fixed charge cover ratios;

limits on the ability to pay dividends to shareholders, including us;

limits on the ability to sell assets; and

other non-financial covenants and limitations and various reporting obligations.

If any of our businesses are unable to repay or refinance their indebtedness as it becomes due, or if they are unable to comply with their covenants, wethey may decide to sell assets or to take other actions, including (i) reducing financing in the future for investments, acquisitions or general corporate purposes or (ii) dedicating an unsustainable level of our cash flow from operations to the payment of principal and interest on their indebtedness. As a result, the ability of our businesses to withstand competitive pressures and to react to changes in the various industries in which we operate could be impaired. A breach of any of our businesses’ debt instruments and/or covenants could result in a default under the relevant debt instrument(s),instruments, which could lead to an event of default. Upon the occurrence of such an event of default, the lenders could elect to declare all amounts outstanding thereunder to be immediately due and payable and, in the case of credit facility lenders, terminate all commitments to extend further credit. If the lenders accelerate the repayment of the relevant borrowings, the relevant business may not have sufficient assets to repay any outstanding indebtedness, which could result in a complete loss of that business for us. Furthermore, the acceleration of any obligation under certain debt instrument may permit the holders of other material debt to accelerate their obligations pursuant to “cross default” provisions, which could have a material adverse effect on our business, financial condition and liquidity.

As a result, our businesses’ leverage couldWe understand that Qoros continues to have a material adverse effect on our business, financial condition, resultssignificant external loans and borrowings, all of operations or liquidity.which we understand is in default and has been accelerated, and significant loans and other advances from parties related to the Majority Qoros Shareholder remain outstanding.

In addition, we have back-to-back guarantee obligations to Chery of approximately $17 million and have pledged substantially all of our interest in Qoros to support certain Qoros debt, as well as Chery’s guarantees of Qoros debt.

We face risks in relation to the Majority Shareholder in Qoros’ investment in Qoros and the agreement to sell all of Kenon'sour remaining interest in Qoros

In 2018, the Majority Shareholder in Qoros acquired 51% of Qoros from Kenon and Chery. The investment was made pursuant to an investment agreement among the Majority Shareholder in Qoros, Quantum, Wuhu Chery Automobile Investment Co., Ltd. (a subsidiary of Chery), or Wuhu Chery, and Qoros. In April 2020, Kenon sold half of its remaining12% interest in Qoros, (i.e. 12%)including risks relating to collection of the Majority Shareholderarbitration award in Qoros. As a result, connection with this agreement.

Kenon holds a 12% interest in Qoros, the Majority Shareholder in Qoros holds 63% and Chery holds 25%.Qoros.

In April 2021, Kenon agreedKenon’s subsidiary Quantum (which holds Kenon’s share in Qoros) entered into an agreement (the “Sale Agreement”) with the Majority Qoros Shareholder to sell all of its remaining interest in Qoros (i.e. 12%) to the Majority Shareholder in Qoros for a purchase price of RMB1,560 million (approximately $238 million). The sale is subject to certain conditions, including a release of the share pledge over the shares to be sold (substantially all of which have been pledged to Qoros’ lending banks), approval of the transaction by the National Development and Reform Commission and registration with the State Administration of Market Regulation.

An entity within the Baoneng Group has guaranteed the obligations of the Majority Shareholder in Qoros under this agreement.

The purchase price for Kenon's 12% stake in Qoros is payable in instalments with a deposit of 5% of the purchase price payable no later than July 31, 2021 and the final payment due by March 31, 2023. The agreement provides that the first and second payments, including the deposit (collectively representing, together with the deposit, 50% of the purchase price), will be paid into a designated account set up in the name of the Majority Shareholder in Qoros over which Quantum has joint control. According to the agreement, the transfer of these payments to Quantum will occur by the end of Q2 2022, provided that the relevant conditions are met in connection with the registration of the shares to the purchaser, subject to receipt by Quantum of collateral acceptable to it. The agreement provides that the third and fourth payments will be paid directly to Quantum.

Completion of the sale requires obtaining necessary regulatory approvals and a release of the pledge over Kenon's shares in Qoros and the registration of the transfer of such shares as well as the execution of amended documents relating to Qoros (e.g. the Joint Venture Agreement), which will require execution of relevant documentation by the relevant parties, including Qoros' shareholders.

Kenon faces risks in connection with the sale agreement, including the risk that regulatory approvals are not obtained, that the pledge over Kenon's shares is not released or that the sale is not completed for any other reason whether because conditions to the sale are not met or because the Majority Shareholder in Qoros is not able to, or otherwise does not, comply with its obligations under the agreement.

The agreement requires Kenon to transfer all of its shares representing 12% of Qoros following payment of only 50% of the total purchase price, with the remaining 50% of the purchase price to be paid in installments following the transfer of shares. Kenon's ability to enforce such payment obligations, if not paid as required, may be more limited after it has transfer title to the shares.

Kenon has put rights with respect to its remaining interest in Qoros. In the event that the Majority Shareholder in Qoros fails to pay the full amount of any payment due for the sale of Kenon's remaining interest in Qoros within sixty days after the relevant payment date, or Quantum fails to receive the full amount of the first and second payments (including the deposit) by June 30, 2022, Quantum may, at its sole election, immediately exercise the put option without any required notice period.

Substantially all of Kenon's shares in Qoros are pledged to Qoros' lenders and it is a condition to the transfer of shares that such pledge be released. To the extent that Kenon’s pledge is not released as required, this would impact Kenon’s ability to complete the sale of its remaining 12% interest in Qoros.

If the saleQoros for RMB 1.56 billion (approximately $220 million), and Baoneng Group has provided a guarantee of Kenon's remaining interest is not completed on the agreed terms or at all and if the Majority Qoros Shareholder’s obligations under the Sale Agreement. The Majority Qoros Shareholder in Qoros doesdid not purchase Kenon’s equity interest in Qoros upon exercisemake any of the put option,required payments under the Sale Agreement, and in the fourth quarter of 2021, Quantum initiated arbitral proceedings against the Majority Qoros Shareholder and Baoneng Group with China International Economic and Trade Arbitration Commission (“CIETAC”). In February 2024, CIETAC issued a final award, not subject to any conditions, in favor of Quantum. The tribunal ruled that the Majority Qoros Shareholder and Baoneng Group are obligated to pay Quantum approximately RMB 1.9 billion (approximately $268 million), comprising the purchase price set forth in the Sale Agreement (as adjusted for any reason,inflation) of approximately RMB 1.7 billion (approximately $239 million), together with pre-award and post-award interest (which will accrue until payment of the award), legal fees and expenses. Kenon intends to seek to enforce this couldaward against the Majority Qoros Shareholder and Baoneng Group since they have failed to perform their payment obligations under the award. In connection with this arbitration, Kenon has obtained a material adverse effect on Kenon.court order freezing assets of Baoneng Group at different rankings (primarily comprising equity interests in entities owning directly and indirectly listed and unlisted equity interests in various businesses).

Any value that could be realized in respect of this award is subject to significant risks and uncertainties, including the risk that Quantum may be unable to enforce the award or otherwise collect the amounts awarded or otherwise owing to it, risks relating to any action that may be taken seeking to challenge the award or enforcement of the award, risks relating to the process for enforcement of judgments in this proceeding/jurisdiction, risks relating to the financial condition of the parties subject to the award, risks related to the value in respect of any frozen assets pursuant to court orders as well as the risk of competing claims and Kenon’s ability to realize any value in respect of such assets or otherwise in connection with the award, including the risk that Kenon does not realize any value from such assets or any value that is realized is less than amounts owed to Kenon and other risks and uncertainties, which could impact Quantum’s ability to realize any value from this award.

In addition to the Sale Agreement, the Majority Qoros Shareholder was required to assume Quantum’s obligations relating to Quantum’s pledge of its remaining shares in Qoros. Baoneng Group provided a guarantee to Kenon. This guarantee provides for a number of obligations, including an obligation for Baoneng Group to reimburse Kenon in the event Quantum’s shares are foreclosed upon. Baoneng Group is required to deposit an amount sufficient in escrow to ensure sufficient collateral to avoid the banks foreclosing the Qoros shares pledged by Quantum. Baoneng Group has failed to do so after Kenon made a demand in the fourth quarter of 2021, and in November 2021, Kenon filed a claim against Baoneng Group at the Shenzhen Intermediate People’s Court relating to the breaches of the guarantee agreement by Baoneng Group, which was then transferred to the Supreme People’s Court for trial. The court proceedings are ongoing. Kenon has obtained an order freezing certain assets of Baoneng Group in connection with the litigation pursuant to a court order. There is no assurance as to the outcome of these proceedings.

Qoros has been in default under certain loan facilities for a number of years, including its RMB 1.2 billion loan facility. The lenders under Qoros’ RMB 1.2 billion loan facility have obtained a court order in respect of a payment default by Qoros, subject to Baoneng Group’s appeal against such order. The court order (when effective) would, among other things, enable the lenders to take steps to enforce pledges over Qoros’ assets and other security for the loan including the shares in Qoros pledged by its shareholders to secure the loan, including Quantum’s pledge of its 12% interest in Qoros. Accordingly, we face risks in connection with any enforcement by the lenders and the impact thereof.

Our success will beis dependent upon the efforts of our directors and executive officers.

Our success will beis dependent upon the decision-making of our directors and executive officers as well as the directors and executive officers of our businesses. The loss of any or all of our directors and executive officers could delay the implementation of our strategies or divert our directors and executive officers’ attention from our operations which could have a material adverse effect on our business, financial condition, results of operations or liquidity.

Foreign exchange rate fluctuations and controls could have a material adverse effect on our earnings and the strength of our balance sheet.

Through ourOur businesses we have facilities and generate costs and revenues in a number of geographic regions across the globe. As a result, a significant portion of our revenue and certain of our businesses’ operating expenses, assets and liabilities, are denominated in currencies other than the U.S. Dollar.Dollars. The predominance of certain currencies varies from business to business, with many of our businesses generating revenues or incurring indebtedness in more than one currency. For example, most of ZIM’s revenues and a significant portion of its expenses are denominated in the U.S. Dollar.Dollars. However, a material portion of ZIM’s expenses are denominated in local currencies. In addition, OPC is subject to exchange rate fluctuations in its operations in Israel, and a portion of its PPAs and its supply arrangements are determined by reference to the NIS:NIS to USD exchange rate. OPC's acquisitionOPC is also indirectly influenced by changes in the U.S. Dollar to NIS exchange rate, including as a result of the following factors: (i) OPC’s investment in CPV will increasewhich operates in the U.S., (ii) the expected investments in CPV’s new and existing projects and (iii) the IEC electricity tariff being partially linked to increases in fuel prices (mainly coal and gas) that are denominated in U.S. Dollars. From time to time, and in accordance with its business considerations, OPC uses currency hedging. However, there is no certainty as to the reduction of the exposure to the US dollar.

We have outstanding back-to-back guarantees to Chery of up to RMB109 million (approximately $17 million)exchange rates under such currency forwards, and OPC incurs costs in respect of certain of Qoros’ indebtedness. In addition, from time to time, we have held, and may hold, a portion of our available cash in RMB, which may expose us to RMB exchange rate fluctuations.those hedging.

Furthermore, our businesses may pay distributions or make payments to us in currencies other than the U.S. Dollar, which we must convert to U.S. Dollars prior to making any dividends or other distributions to our shareholders ifthat we decide tomay make any distributions in the future. For example, OPC pays dividends in NIS. Foreign exchange controls in countries in which our businesses operate may further limit our ability to repatriate funds from unconsolidated foreign affiliates or otherwise convert local currencies into U.S. Dollars.

Consequently, as with any international business, our liquidity, earnings, expenses, asset book value,values, and/or amount of equity may be materially affected by short-term or long-term exchange rate movements or controls. Such movements may give rise to one or more of the following risks, any of which could have a material adverse effect on our business, financial condition, results of operations or liquidity:

| • | Transaction Risk—exists where sales or purchases are denominated in overseas currencies and the exchange rate changes after our entry into a purchase or sale commitment but prior to the completion of the underlying transaction itself; |

| • | Translation Risk—exists where the currency in which the results of a business are reported differs from the underlying currency in which the business’ operations are transacted; |

Transaction Risk—exists where sales or purchases are denominated in overseas currencies and the exchange rate changes after our entry into a purchase or sale commitment but prior to the completion of the underlying transaction itself;

| • | Economic Risk—exists where the manufacturing cost base of a business is denominated in a currency different from the currency of the market into which the business’ products are sold; and |

| • | Reinvestment Risk—exists where our ability to reinvest earnings from operations in one country to fund the capital needs of operations in other countries becomes limited. |

Translation Risk—exists where the currency in which the results of a business are reported differs from the underlying currency in which the business’ operations are transacted;

Economic Risk—exists where the manufacturing cost base of a business is denominated in a currency different from the currency of the market into which the business’ products are sold; and

Reinvestment Risk—exists where our ability to reinvest earnings from operations in one country to fund the capital needs of operations in other countries becomes limited.

If our businesses do not manage their interest rate risks effectively, our cash flows and operating results may suffer.

Certain of our businesses’ indebtedness bears interest at variable, floating rates. In particular, some of this indebtedness is in the form of Consumer Price Index (or CPI)(the “CPI”)-linked, NIS-denominated bonds. We, or our businesses, may incur further indebtedness in the future that also bears interest at a variable rate or at a rate that is linked to fluctuations in a currency in the form of other than the U.S. Dollar. Although our businesses attempt to manage their interest rate risk, there can be no assurance that they will hedge such exposure effectively or at all in the future. Accordingly, increases in interest rates or changes in the CPI that are greater than changes anticipated based upon historical trends could have a material adverse effect on our or any of our businesses’ business, financial condition, results of operations or liquidity.

Risks Related to the Industries in Whichwhich Our Businesses Operate

Conditions in the global economy, and in the industries in which our businesses operate in particular, could have a material adverse effect on us.

The business and operating results of each of our businesses are affected by worldwide economic conditions, particularly conditions in the energy generation passenger vehicle, and shipping industries in which our businesses operate. The operating results and profitability of our businesses may be adversely affected by slower global economic growth,conditions, credit market crises, lower levels of consumer and business confidence, downward pressure on prices, highinflation, unemployment levels, reduced levels of capital expenditures, fluctuating commodity prices (particularly prices for electricity, natural gas, bunker, gasoline, and crude oil), bankruptcies, government deficit reduction and austerity measures, heightened volatility, uncertainties with respect to the stability of the emerging markets, increased import and export tariffs and other forms of trade protectionism, geopolitical events such as the War or the Russian invasion of Ukraine and other challengesdevelopments affecting the global economy. Volatility in global financial markets and in prices for oil and other commodities and geopolitical events could result in a deterioration of global economic conditions. As a result of deteriorating global economic conditions some of the customers ofwhich could impact our businesses have experienced,business and may experience,could lead to deterioration of their businesses,business, cash flow shortages, and/or difficulty in obtaining financing. As a result, existing or potential customers may delay or cancel plans to purchase the products and/or services of our businesses, or may not be able to fulfill their obligations to us in a timely fashion. Furthermore, the vendors, suppliers and/or partners of each of our businesses may experience similar conditions, which may impact their ability to fulfill their obligations.

In addition, the business and operating results of each of our businesses have been and may continue to be adversely affected by the effects of a widespread outbreak of contagious disease, includingsuch as the COVID-19 outbreak, which has and could continue to adversely affect the economies and financial markets of many countries, which has had and could continue to have an adverse effect on our businesses. The coronavirus outbreak has led to quarantines, cancellationFurther outbreaks and spread and new variants of events and travel, business and school shutdowns and restrictions, supply chain interruptions, increased unemployment and overall economic and financial market instability. Further spread of the coronavirusCOVID-19 could cause additional quarantines, reduction in business activity, labor shortages and other operational disruptions.

Furthermore, the War and the Russian invasion of Ukraine have led to and are expected to continue to lead to disruption, instability and volatility in global markets and industries. Our business could be negatively impacted by such conflict. The fullU.S. government and other governments in jurisdictions in which we operate have imposed severe sanctions and export controls against Russia and Russian interests and threatened additional sanctions and controls. The impact of this outbreak willthese measures, as well as potential responses to them by Russia, is currently unknown and they could adversely affect our business.

We are exposed to interest rate risk because our businesses depend on debt financing to finance operations and projects. Additionally, due to increases in inflation, certain governmental authorities responsible for administering monetary policy have increased, applicable central bank interest rates. For example, U.S. Federal Reserve raised various interest rates during 2022 including US Federal Reserve Interest on Reserve Balances to 4.4% effective December 15, 2022, with rates raised further in 2023 to over 5% as of December 31, 2023. The increase in the benchmark rate has resulted in an increase in market interest rates. Current high interest rates and any further increase in interest rates could make it difficult for us and our businesses to obtain future developments, including continuedfinancing or service existing financings on favorable terms, or at all, and thus reduce revenue and adversely affect our operating results. High interest rates could lower our or our businesses’ return on investments. Our interest expense increases to the extent interest rates rise in connection with our variable interest rate borrowings and higher interest rates also impact new and refinancings of existing fixed rate borrowings. If in the future we have a need for significant further severityborrowings, our cost of capital would reflect the outbreak of the coronavirus and the actions to contain the coronavirus or treat its impact.current interest rates. Conversely, lower interest rates have an adverse impact on our interest income.

Additionally, economic downturns may alter the priorities of governments to subsidize and/or incentivize participation in any of the markets in which our businesses operate. Slower growth or deterioration in the global economy (as a result of recent volatility in global markets, the coronavirus outbreak, trade protectionism and commodity prices, or otherwise) could have a material adverse effect on our business, financial condition, results of operations or liquidity.

We could be adversely affected by the War in Israel.

On October 7, 2023, the War broke out in Israel, which as at the date of this report is still underway. The War led to consequences and restrictions that affected the Israeli economy, which included, among other things, a decline in business activity, extensive recruitment of reservists, restrictions on gatherings in workplaces and public spaces, restrictions on the activity of the education system, and more. The impacts of the War on OPC and ZIM include considerable uncertainty with respect to macro‑economic factors in Israel as well as potential adverse effects on the credit rating of Israel and Israeli financial institutions (particularly the Israeli banking system), potential fluctuations in the currency exchange rates, particularly a strengthening of the dollar exchange rate against shekel, and instability in the Israeli capital markets. For example, in February 2024, Moody’s rating agency downgraded the State of Israel’s credit rating to A2 from A1 with a negative rating outlook and of the Israeli financial institutions, particularly the Israeli banking system (against the background of the reduction of Israel’s rating, in February 2024 the international rating company Moody’s gave notice of a reduction of the credit rating of the five large banks in Israel to a level of A3 with a negative rating outlook), which could adversely affect investments in the Israeli economy and trigger a removal of money and investments from Israel, increase the costs of the financing sources in Israel, cause a weakening of the exchange rate of the shekel against the other currencies (particularly the dollar), harm the activities of the business sector and create instability in the Israeli capital market (including increased volatility, falling prices of traded securities, and limited liquidity and accessibility).

There is a significant uncertainty as to the development of the War and its impact on us. To the extent the above risks, events or potential outcomes materialize, wholly or partly, or in a case of a worsening of the security situation, this could negatively impact both OPC’s and ZIM’s activities and the activities of OPC and ZIM customers and suppliers in Israel (including physical harm or curtailment of activities) and could also negatively impact the results of OPC and ZIM and the availability and cost of the capital and financing sources that are required by OPC and ZIM.

A deterioration of the political and security situation in Israel may have an adverse effect on the economic conditions, and could cause difficulties with respect to OPC’s operations and damage to its assets in Israel. Security and political events, such as war or an act of terror, could cause damage to the facilities used by OPC, including damage to the facilities of the power plants, construction of the power plants under construction, and additional projects, IT systems, shortage of foreign manpower and foreign experts, damage to the system for transmission of natural gas to the power plants and the grid, damage to OPC’s material suppliers (such as natural gas suppliers) or material customers, thereby adversely affecting the continuous supply of electricity to customers.

Our businesses’ operations expose us to risks associated with conditions in those markets where they operate.

Through our businesses, we operate and service customers in geographic regions around the world which exposes us to risks, including:

heightened economic volatility;

difficultyunfavorable changes in enforcing agreements, collecting receivables and protecting assets;

the possibility of encountering unfavorable circumstances from host country laws or regulations;

fluctuations in revenues, operating margins and/or other financial measures due to currency exchange rate fluctuations and restrictions on currency and earnings repatriation;

unfavorable changes in regulated electricity tariffs;

trade protection measures, import or export restrictions or other trade protection measures and/or licensing requirements and local fire and security codes and standards;requirements;

increased costs and risks of developing, staffing and simultaneouslyassociated with managing a number of operations across a number of countries as a result of language and cultural differences;countries;

issues related to occupational safety, work hazard, and adherence to local labor laws and regulations;

adverse tax developments;

geopolitical events such as military actions;

changes in the general political, social and/or economic conditions in the countries where we operate; and

the presence of corruption in certain countries.

If any of our businesses are impacted by any of the aforementioned factors, such an impact could have a material adverse effect on our business, financial condition, results of operations or liquidity.

WeOur businesses require qualified personnel to manage and operate ourtheir various businesses.

AsOur businesses require a resultnumber of our decentralized structure, we require qualified and competent management to independently direct the day-to-day business activities of each of our businesses, execute their respective business plans, and service their respective customers, suppliers and other stakeholders, in each case across numerous geographic locations. WeOur businesses must be able to retain employees and professionals with the skills necessary to understand the continuously developing needs of our customers and to maximize the value of each of our businesses. This includes developing talent and leadership capabilities in the emerging markets in which certain of our businesses operate, where the depth of skilled employees may be limited. Changes in demographics, training requirements and/or the unavailability of qualified personnel could negatively impact the ability of each of our businesses to meet these demands. In addition, the War has resulted in a significant call up of military reserves, which impacts personnel in Israel. If any of our businesses fail to trainhire and retain qualified personnel, or if they experience excessive turnover, we may experience declining sales, production/manufacturing delays or other inefficiencies, increased recruiting, training or relocation costs and other difficulties, any ofthis could impact their operations, which could have a material adverse effect on our business, financial condition, results of operations or liquidity.

Raw material shortages, supplier capacity constraints, production disruptions, supplier quality and sourcing issues or price increases could increase our operating costs and adversely impact the competitive positions of the products and/or services of our businesses.

The reliance of certain of our businesses on certain third-party suppliers, contract manufacturers and service providers, or commodity markets to secure raw materials (e.g., natural gas for OPC Israel, and CPV Group, solar panels and wind turbines for CPV Group and bunker and containers for ZIM), parts, components and sub-systems used in their products or services exposes us to volatility in the prices and availability of these materials, parts, components, systems and services. Some of these suppliers or their sub-suppliers are limited-limited or sole-sourcesole source suppliers. For more information on the risks relating to supplier concentration in relation to OPC, see “—Item 3.D Risk Factors—Risks Related to OPC— Supplier concentration may expose OPC’s Israel Operations—OPC to significant financial credit or performance risk.depends on infrastructure, securing space on the grid and infrastructure providers.”

A disruption in deliveries from these and other third-party suppliers, contract manufacturers or service providers, capacity constraints, production disruptions, price increases, or decreased availability of raw materials or commodities, including as a result of the coronavirus outbreakWar in Israel, catastrophic events or catastrophic events,global inflation, could have an adverse effect on the ability of our businesses to meet their commitments to customers or could increase their operating costs. Our businesses could encounter supply problems and may be unable to replace a supplier that is not able to meet their demand in either the short- or the long-term; these risks are exacerbated in the case of raw materials or component parts that are sourced from a single-source supplier. For example, there are only a limited number of suppliers of natural gas in Israel and the War increases risks relating to access to gas supply. Furthermore, quality and sourcing issues experienced by third-party providers can also adversely affect the quality and effectiveness of our businesses’ products and/or services and result in liability and reputational harm that could have a material adverse effect on our business, financial condition, results of operations or liquidity.

Some of our businesses must keep pace with technological changes and develop new products and services to remain competitive.

The markets in which some of our businesses operate experience rapid and significant changes as a result of the introduction of both innovative technologies and services. To meet customer needs in these areas, these businesses must continuously design new, and update existing, products and services, as well as invest in, and develop new technologies. Introducing new products and technologies requires a significant commitment to research and development that, in return, requires the expenditure of considerable financial resources that may not always result in success.

Our sales and profitability may suffer if our businesses invest in technologies that do not operate, or may not be integrated, as expected or that are not accepted into the marketplace as anticipated, or if their services, products or systems are not introduced to the market in a timely manner, in particular, compared to its competitors, or become obsolete. Furthermore, in some of these markets, the need to develop and introduce new products rapidly in order to capture available opportunities may lead to quality problems. Our operating results depend on our ability, and the ability of these businesses, to anticipate and adapt to changes in markets and to reduce the costs of producing high-quality, new and existing products and services. If we, or any of these businesses, are unsuccessful in our efforts, such a failure could have a material adverse effect on our business, financial condition, results of operations or liquidity.

Our businesses may be adversely affected by work stoppages, union negotiations, labor disputes and other matters associated with our labor force.

As of December 31, 2020,2023, OPC employed 116169 employees in Israel and 150 employees in the United States, and ZIM employed approximately 5,145 employees and Qoros employed approximately 2,6466,460 employees. Our businesses have experienced and could experience strikes, industrial unrest, work stoppages or labor disruptions as a result of the coronavirus outbreak.disruptions. Any disruptions in the operations of any of our businesses as a result of labor stoppages, strikes or other disruptions could materially and adversely affect our or the relevant businesses’ reputation and could adversely affect operations. Additionally, a work stoppage or other disruption at any one of the suppliers of any of our businesses could materially and adversely affect our operations if an alternative source of supply were not readily available. In addition, as a result of the War, OPC and ZIM may face personnel availability issues as some of their employees might be drafted as reservists, and their absence may disrupt OPC and ZIM businesses.

A disruption in our and each of our business’ information technology systems, including incidents related to cyber security, could adversely affect our business operationsoperations.

Our business operations, and the operations of our businesses, rely upon the accuracy, availability and security of information technology systems for data processing, storage and reporting. As a result, we and our businesses maintain information security policies and procedures for managing such information technology systems. However, such security measures may be ineffective and our information technology systems, or those of our businesses, may be subject to cyber-attacks. A number of companies around the world have been the subject of cyber security attacks in recent years, including in Israel where we have a large part of our businesses. For example one of ZIM’s peers experienced a major cyber-attack on its IT systems in 2017, which impacted the company’s operations in its transport and logistics businesses and resulted in significant financial loss. Other Israeli businesses are facing cyber-attack campaigns, and it is believed the attackers may be from hostile countries. These attacks are increasing and becoming more sophisticated, and may be perpetrated by computer hackers, cyber terrorists or other perpetrators of corporate espionage.

Cyber security attacks could include malicious software (malware), attempts to gain unauthorized access to data, social media hacks and leaks, ransomware attacks and other electronic security breaches of our and our business’ information technology systems as well as the information technology systems of our customers and other service providers that could lead to disruptions in critical systems, unauthorized release, misappropriation, corruption or loss of data or confidential information. In addition, any system failure, accident or security breach could result in business disruption, unauthorized access to, or disclosure of, customer or personnel information, corruption of our data or of our systems, reputational damage or litigation. We or our operating companies may also be required to incur significant costs to protect against or repair the damage caused by these disruptions or security breaches in the future, including, for example, rebuilding internal systems, implementing additional threat protection measures, providing modifications to our services, defending against litigation, responding to regulatory inquiries or actions, paying damages, providing customers with incentives to maintain the business relationship, or taking other remedial steps with respect to third parties. These cyber security threats are constantly evolving. For example, the COVID-19 pandemic and the resulting reduced staff in in offices andThe increased reliance on remote access for employees havein recent years has increased and may continue to increase the likelihood of cyber security attacks. We, therefore, remain potentially vulnerable to additional known or yet unknown threats, as in some instances, we, our businesses and our customers may be unaware of an incident or its magnitude and effects. Should we or any of our operating businesses experience a cyber-attack, this could have a material adverse effect on our, or any of our operating companies’, business, financial condition or results of operations.

Risks Related to Legal, Regulatory and Compliance Matters

We, and each of our businesses, are subject to legal proceedings and legal compliance risks.

We are subject to a variety of legal proceedings and legal compliance risks in every part of the world in which our businesses operate. We, our businesses, and the industries in which we operate, are periodically reviewed or investigated by regulators and other governmental authorities, which could lead to enforcement actions, fines and penalties or the assertion of private litigation claims and damages. Changes in laws or regulations could require us, or any of our businesses, to change manners of operation or to utilize resources to maintain compliance with such regulations, which could increase costs or otherwise disrupt operations. ProtectionistChanges in trade policies and or changes in the political and regulatory environment in the markets in which we operate, such as foreign exchange import and export controls, sanctions, tariffs and other trade barriers and price or exchange controls, could affect our businesses in several nationalsuch markets, impact our profitability and make the repatriation ofor our ability to repatriate profits, difficult, and may expose us or any of our businesses to penalties, sanctions and reputational damage. In addition, the uncertainty of the legal environment in some regions could limit our ability to enforce our rights.

The global and diverse nature of our operations means that legal and compliance risks will continue to exist and additional legal proceedings and other contingencies, the outcome of which cannot be predicted with certainty, will arise from time to time. No assurances can be made that we will be found to be operating in compliance with, or be able to detect violations of, any existing or future laws or regulations. In addition, as we hold minority interests in ZIM and Qoros, we do not control them and therefore cannot ensure that they will comply with all applicable laws and regulations. A failure to comply with or properly anticipate applicable laws or regulations could have a material adverse effect on our business, financial condition, results of operations or liquidity.

We may be subject to further governmentgovernmental regulation as a result of our regulatory status, which may adversely affectcould subject us to restrictions that could make it impractical for us to continue our strategy.business as contemplated and could have a material adverse effect on our business.

The U.S. Investment Company Act of 1940, or the “Investment Company Act,” regulates “investment companies,” which includes, entitiesin relevant part, issuers that are, or that hold themselves out as being, primarily engaged in the business of investing, reinvesting and trading in securities or that are engaged, or propose to engage, in the business of investing, reinvesting, owning, holding or trading in securities and own, or propose to acquire, investment securities (as defined in the Investment Company Act) having a value exceeding 40% of the value of the issuer’s total assets (exclusive of U.S. government securities and cash items) on an unconsolidated basis (orbasis. Pursuant to a rule adopted under the Investment Company Act, notwithstanding the 40% test described above, an issuer is excluded from the definition of investment company if no more than 45% of the value of the issuer’s total assets (exclusive of U.S. government securities and cash items) consists of, and no more than 45% of the issuer’s net income after taxes (for the last four fiscal quarters combined) is derived from, securities other than (i) U.S. government securities, (ii) securities issued employees’ securities companies, (iii) securities issued by majority-owned subsidiaries of the issuer that are not investment companies and not relying on certain exclusions from the definition of investment company and (iv) securities issued by companies that are not investment companies and are controlled primarily by the issuer through which the issuer engages in a business other than that of investing, reinvesting, owning, holding or assets, excluding interesttrading in primarily controlled companies).securities. We do not believe that we are subject to regulation under the U.S. Investment Company Act of 1940.Act. We are organized as a holding company that conducts its businesses primarily through majority owned and primarily controlled subsidiaries. MaintainingWe intend to continue to conduct our operations so that we will not be deemed to be an investment company under the Investment Company Act. However, maintaining such status may impose limits on our operations and on the assets that we and our subsidiaries may acquire or dispose of. If, at any time, we meet the definition of investment company, including as a result of a company in which we have an ownership interest ceasing to be majority owned or primarily controlled, including as a result of dispositions or dilution of interests in majority owned and primarily controlled subsidiaries, we could, among other things, be required either (a) to substantially change the manner in which we conduct our operations to avoid being required to register as an investment company, or (b) to register as an investment company under the U.S. Investment Company Act of 1940, either of which could have an adverse effect on us and the market price of our securities. If we were to be deemed an “inadvertent” investment company, we may seek to rely on Rule 3a-2 under the Investment Company Act, which provides that an issuer will not be treated as an investment company subject to the provisions of the Investment Company Act provided the issuer has the requisite intent to be engaged in a non-investment business, evidenced by the issuer’s business activities and an appropriate resolution of the issuer’s board of directors, during a one year cure period.

The Investment Company Act contains substantive legal requirements that regulate the manner in which an “investment company” is permitted to conduct its business activities. Among other things, the Investment Company Act and the rules thereunder limit or prohibit transactions with affiliates, impose limitations on the issuance of debt and equity securities, prohibit the issuance of stock options, and impose certain governance requirements. In any case, the U.S. Investment Company Act of 1940 generally only allows U.S. entities to register. If we were required to register as an investment company but failed to do so, we could be prohibited from engaging in our business in the United States or offering and selling securities in the United States or to U.S. persons, unable to comply with our reporting obligations in the United States as a foreign private issuer, subject to the delisting of the Kenon shares from the New York Stock Exchange, or the NYSE, and subject to criminal and civil actions that could be brought against us, any of which would have a material adverse effect on the liquidity and value of the Kenon shares and on our business, financial condition, results of operations or liquidity.shares.

We could be adversely affected by violations of the U.S. Foreign Corrupt Practices Act and similar anti-bribery laws outside of the United States.

The U.S. Foreign Corrupt Practices Act, or the FCPA,“FCPA”, and similar anti-bribery laws in other jurisdictions generally prohibit companies and their intermediaries from making improper payments to government officials or other persons for the purpose of obtaining or retaining business. Recent years have seen substantial anti-bribery law enforcement activity, with aggressive investigations and enforcement proceedings by both the U.S. Department of Justice and the SEC, increased enforcement activity by non-U.S. regulators, and increases in criminal and civil proceedings brought against companies and individuals. Our policies mandate compliance with the FCPA and other applicable anti-bribery laws. We operate, through our businesses, in some parts of the world that are recognized as having governmental and commercial corruption. Additionally, because many of our customers and end users are involved in construction and energy production, they are often subject to increased scrutiny by regulators. Our internal control policies and procedures may not protect us from reckless or criminal acts committed by our employees, the employees of any of our businesses, or third-party intermediaries. In the event that we believe or have reason to believe that our employees or agents have or may have violated applicable anti-corruption laws, including the FCPA, we would investigate or have outside counsel investigate the relevant facts and circumstances, which can be expensive and require significant time and attention from senior management. Violations of these laws may result in criminal or civil sanctions, inability to do business with existing or future business partners (either as a result of express prohibitions or to avoid the appearance of impropriety), injunctions against future conduct, profit disgorgements, disqualifications from directly or indirectly engaging in certain types of businesses, the loss of business permits, reputational harm or other restrictions which could disrupt our business and have a material adverse effect on our business, financial condition, results of operations or liquidity. We face risks with respect to compliance with the FCPA and similar anti-bribery laws through our acquisition of new companies and the due diligence we perform in connection with an acquisition may not be sufficient to enable us fully to assess an acquired company’s historic compliance with applicable regulations. Furthermore, our post-acquisition integration efforts may not be adequate to ensure our system of internal controls and procedures are fully adopted and adhered to by acquired entities, resulting in increased risks of non-compliance with applicable anti-bribery laws.

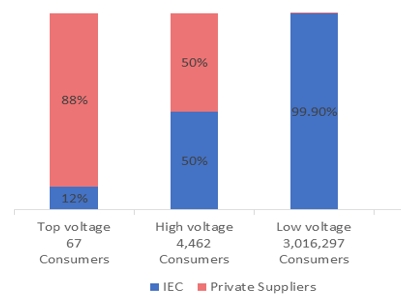

We could be adversely affected by international sanctions and trade restrictions.