UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20212023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

For the transition period from __________ to __________

Commission file number 001-40173

Steakholder Foods Ltd.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

Israel

(Jurisdiction of incorporation or organization)

5 David Fikes St., P.O. Box 4061

Rehovot 7638205 Israel

(Address of principal executive offices)

+

info@meatech3d.com

info@steakholderfoods.com

5 David Fikes St., Rehovot 7638205 Israel

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||

American Depositary Shares, each representing | STKH | The Nasdaq Stock Market LLC | ||||

Ordinary shares, no par value per share | ⸺ | The Nasdaq Stock Market LLC* |

| * | Listed not for trading or quotation purposes, but only in connection with the registration of American Depositary Shares representing such ordinary shares pursuant to the requirements of the Securities and Exchange Commission. The American Depositary Shares are registered under the Securities Act of 1933, as amended, pursuant to a separate registration statement on Form F-6 (File No. 333-253915). |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. As of December 31, 2021,2023, the registrant had outstanding 125,770,107251,756,047 ordinary shares, no par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | International Financial Reporting Standards as issued by the International Accounting | ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

TABLE OF CONTENTS

INTRODUCTION

| 1 | ||

| PART II | 74 | |

| ITEM 16J | Insider Trading Policies | 77 |

| ITEM 16K | Cybersecurity | 77 |

| PART III | 79 | |

i

INTRODUCTION

Certain Definitions

In this Annual Report on Form 20-F, unless the context otherwise requires:

| ● | references to “Steakholder Foods,” the “Company,” “us,” “we” and “our” refer to Steakholder Innovation Ltd. (formerly MeaTech MT Ltd. and MeaTech Ltd.) from its inception until the consummation of the January 2020 merger described herein, and Steakholder Foods Ltd. (formerly MeaTech 3D Ltd.) (the “Registrant”), an Israeli company, thereafter, unless otherwise required by the context; |

| ● | references to “ordinary shares,” “our shares” and similar expressions refer to the Registrant’s ordinary shares, no nominal (par) value per share; |

| ● | references to “ADS” refer to the American Depositary Shares listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “STKH,” each representing ten ordinary shares of the Registrant; |

| ● | references to “dollars,” “U.S. dollars,” “USD” and “$” are to United States Dollars; |

| ● | references to “NIS” are to New Israeli Shekels, the currency of the State of Israel; |

| ● | references to the “Companies Law” are to Israel’s Companies Law, 5759-1999, as amended; and |

| ● | references to the “SEC” are to the United States Securities and Exchange Commission. |

Forward-Looking Statements

This Annual Report on Form 20-F contains forward-looking statements concerning our business, operations and financial performance and condition as well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements that are not historical facts may be deemed to be forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms including “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would,” and similar expressions intended to identify forward-looking statements, but these are not the only ways these statements are identified. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. You should not put undue reliance on any forward-looking statements. Unless we are required to do so under U.S. federal securities laws or other applicable laws, we do not intend to update or revise any forward-looking statements. Readers are encouraged to consult the Company’s filings made on Form 6-K, which are periodically filed with or furnished to the SEC.

Forward-looking statements contained in this prospectus include, but are not limited to:

| ● | our estimates regarding our expenses, future revenue, capital requirements and needs for additional financing; |

● |

● |

| ● | our expectations regarding the timing for the potential commercial launch of our cultured meat technologies; |

| ● | our ability to successfully manage our planned growth, and any future acquisitions, joint ventures, collaborations or similar transactions; |

| ● | the competitiveness of the market for our cultured meat technologies; |

| ● | our ability to enforce our intellectual property rights and to operate our business without infringing, misappropriating, or otherwise violating the intellectual property rights and proprietary technology of third parties; |

| ● | our ability to predict and timely respond to preferences for alternative proteins and cultured meats and new trends; |

| ● | our ability to attract, hire and retain qualified employees and key personnel; |

| ● | security, political and economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas; and |

| ● | other risks and uncertainties, including those listed in “Item 3. —Key Information—Risk Factors.” |

ii

PART I

| ITEM 1. | Identity Of Directors, Senior Management And Advisers |

Not applicable.

| ITEM 2. | Offer Statistics And Expected Timetable |

Not applicable.

| ITEM 3. | Key Information |

A. Selected Financial Data

[Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business is subject to various risks, including those described below. You should carefully consider the risks and uncertainties described below and in our future filings with the SEC. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. Additionally, risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition, results of operations and/or prospects.

Summary of Risks Associated with our Business

Our business is subject to a number of risks of which you should be aware before a decision to invest in the ADSs.aware. You should carefully consider all the information set forth in this prospectusAnnual Report on Form 20-F and, in particular, should evaluate the specific factors set forth in the sections titled “Risk Factors” before deciding whether to invest in the ADSs.. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. Among these important risks are, but not limited to, the following:

RISKS RELATED TO OUR FINANCIAL CONDITION AND LIQUIDITY REQUIREMENTS

| ● | We expect to continue incurring significant losses for the foreseeable future. |

| ● | We may require substantial additional funds to complete our research and development activities. |

| ● | There is substantial doubt as to whether we can continue as a going concern. |

| ● | Raising additional capital may cause dilution to our existing shareholders or restrict our operations. |

RISKS RELATED TO OUR BUSINESS AND STRATEGY

| ● | We have a limited operating history to date. |

| ● | The research and development associated with alternative protein manufacturing is a lengthy process. |

| ● | We intend to engage in future acquisitions, joint ventures or collaborations, which may not be successful. |

| ● | We may not be able to successfully manage our planned growth, and if the market does not grow as we expect, we may not achieve sustainable revenues. |

| ● | Business or economic disruptions may have an adverse impact on our business. |

RISKS RELATED TO COMPETITION AND COMMERCIALIZATION OF OUR TECHNOLOGIES

| ● | We are an early-stage company with an unproven business model. |

| ● | We may suffer reputational harm due to issues with products manufactured by our licensees. |

| ● | Failure to improve our technologies may adversely affect our ability to continue to grow. |

| ● | We may face difficulties if we expand our operations into new geographic regions. |

| ● | Consumer preferences for alternative proteins in general are difficult to predict and may change. |

| ● | We have no manufacturing experience or resources, and we may have issues in obtaining raw materials. |

| ● | Litigation or legal proceedings, government investigations or other regulatory enforcement actions could subject us to civil and criminal penalties or otherwise expose us to significant liabilities. |

RISKS RELATED TO OUR OPERATIONS

| ● | We expect that a small number of customers will account for a significant portion of our revenues, and we may be exposed to the credit risks of our customers. |

| ● | If we are unable to attract and retain qualified employees, our ability to implement our business plan may be adversely affected, and we may not be able to enforce covenants not to compete under applicable employment laws. |

| ● | Insurance policies may not fully cover the risk of loss to which we are exposed. |

| ● | Our business, reputation and operations could suffer in the event of information technology system failures or a cybersecurity incident. |

| ● | Food safety and food-borne illness incidents may materially adversely affect our business. |

RISKS RELATED TO GOVERNMENT REGULATION

| ● | Products utilizing our technologies will be subject to regulations that could adversely affect our business and results of operations. |

| ● | Any changes in, or failure by our supplier to comply with, applicable laws, regulations or policies could adversely affect our business. |

RISKS RELATED TO OUR INTELLECTUAL PROPERTY AND POTENTIAL LITIGATION

| ● | If we are unable to obtain and maintain our intellectual property rights, we may not be able to compete effectively in our markets. |

| ● | Intellectual property rights of third parties could adversely affect our ability to successfully commercialize our products and may prevent or delay our development and commercialization. |

| ● | Patent policy and rule changes could increase uncertainties and costs. |

| ● | We may be involved in lawsuits to protect or enforce our or third party intellectual property rights. |

| ● | Our articles of association provide that unless we consent to an alternate forum, the federal district courts of the United States shall be the exclusive forum of resolution of any claims arising under the Securities Act. |

RISKS RELATED TO OUR OPERATIONS IN ISRAEL

| ● | Political, economic and military conditions in Israel could have an adverse impact on our business. |

| ● | We are exposed to fluctuations in currency exchange rates. |

| ● | Enforcing a U.S. judgment against us and our executive officers and directors, or asserting U.S. securities law claims in Israel, may be difficult. |

| ● | Our articles of association provide that unless we consent otherwise, the competent courts of Tel Aviv, Israel shall be the sole and exclusive forum for substantially all disputes between the Company and its shareholders under the Companies Law and the Israeli Securities Law. |

| ● | Your rights and responsibilities as our shareholder will be governed by Israeli law, which may differ in some respects from the rights and responsibilities of shareholders of U.S. corporations. |

| ● | Our articles of association and Israeli law could prevent a takeover that shareholders consider favorable and could also reduce the market price of our ADSs. |

RISKS RELATED TO OWNERSHIP OF THE ADSs

| ● | The ADS price may be volatile, and you may lose all or part of your investment. |

| ● | We have never paid dividends on our share capital, nor do we intend to pay dividends for the foreseeable future. |

| ● | ADS holders may not receive the same distributions or dividends as those we make to the holders of our ordinary shares. |

| ● | ADS holders do not have the same rights as our shareholders. |

| ● | ADS holders may be subject to limitations on transfer of their ADSs. |

| ● | We follow certain home country corporate governance practices instead of certain Nasdaq and Exchange Act requirements. |

| ● | If we are a “passive foreign investment company” for U.S. income tax purposes, there may be adverse tax consequences to U.S. investors. |

| ● | If we are a controlled foreign corporation, there could be adverse U.S. income tax consequences to certain U.S. holders. |

RISKS RELATED TO OUR FINANCIAL CONDITION AND LIQUIDITY REQUIREMENTS

We expect to continue incurring significant losses for the foreseeable future and may never become profitable.

We have experienced net losses in every period since the inception of MeaTech.our predecessor entity, Steakholder Innovation Ltd., or Steakholder Innovation. We anticipate that we will continue to incur significant losses for the foreseeable future as our operating expenses and capital expenditures increase substantially due to our continued investment in our research and development activities and as we hire additional employees over the coming years. These activities may prove more expensive than we anticipate. We incur significant expenses in developing our technologies. Accordingly, we may not be able to achieve or sustain profitability, and we expect to incur significant losses for the foreseeable future.

Steakholder Innovation commenced cultured meatfood technology development operations in September 2019, and we continue to be in the early stages of development of our technologies. As a result, we have not generated any revenues since inception of our cultured meatfood technology operations, and we do not expect to generate anycannot guarantee whether or when we will commence generating revenue from operations in the near term.operations. We may not be able to develop the technology for manufacturing cultured meat at all, or meet the additional technological challenges to scaling such technology up to an industrial scale from our research and development effortsfood production machines, or successfully market and licensecommercialize our technologies, once approved.technologies. In addition, there is no certainty that there will be sufficient demand to justify the production and marketing of cultured meat products.our food production machines. The market for alternative proteins in general, and cultured meats specifically, may be small or may not develop.

If cultured meats produced using our industrial-scale cultured meat manufacturing processesfood production machines do not gain wide market acceptance, we will not be able to achieve our anticipated growth, revenues or profitability and we may not be able to continue our business operations.

We willmay require substantial additional funds to complete our research and development activities and, if additional funds are not available on acceptable terms or at all, we may need to significantly scale back or cease our operations.

A significant portion of our research and development activities has been financed by the issuance of equity securities. We believe that we will continue to expend substantial resources for the foreseeable future as we work to develop our technologies. These expenditures are expected to include costs associated with research and development, and manufacturing and supply, as well as general operating expenses. In addition, other unanticipated costs may arise.

There is no certainty that we will be able to obtain funding for our research and development activities when we need it, on acceptable terms or at all. A lack of adequate funding may force us to reduce or cease all or part of our research and development activities and business operations. Our operating plan may change because of factors currently unknown to us, and we may need to seek additional funds sooner than planned, through public or private equity or debt financings or other sources, such as strategic collaborations. Such financing may result in dilution to shareholders, imposition of debt covenants and repayment obligations, or other restrictions that may adversely affect our business. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

Our future capital requirements depend on many factors, including:

| ● | our progress with current research and development activities; |

| ● | the number and characteristics of any products or manufacturing processes we develop or acquire; |

| ● | the expenses associated with our marketing initiatives; |

| ● | the timing, receipt and amount of milestone, royalty and other payments from future customers and collaborators, if any; |

| ● | the scope, progress, results and costs of researching and developing future products or improvements to existing products or manufacturing processes; |

| ● | any lawsuits related to our products or commenced against us; |

| ● | the expenses needed to attract, hire and retain skilled personnel; |

| ● | the costs associated with being a public company in the United States; and |

| ● | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing intellectual property claims, including litigation costs and the outcome of such litigation. |

If our estimates and predictions relating to any of these factors are incorrect, we may need to modify our operating plan. Additional funds may not be available to us when needed on acceptable terms, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate our manufacturing, research and development activities or other activities that may be necessary to generate revenue and achieve profitability.

There is substantial doubt as to whether we can continue as a going concern.

Our consolidated financial statements as of December 31, 20212023 contain an explanatory paragraph that states that our recurring losses from operations raise substantial doubt about our ability to continue as a going concern. Our financial statements do not include any measurement or presentation adjustment for assets or liabilities that might result if we would be unable to continue as a going concern. We have incurred operating losses since inception, have not generated any revenues and have not achieved profitable operations. Our net loss, accumulated during the development stage through December 31, 2021,2023, totaled approximately $37USD 69.8 million, and we expect to continue to incur substantial losses in future periods while we continue our research and development activities.

Raising additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights to our technologies.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through equity offerings, debt financings, government contracts, government and/or other third-party grants or other third-party funding, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements. We will require substantial funding to fund our anticipated commercialization efforts and fund our operating expenses and other activities. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a shareholder. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we are unable to obtain funding on a timely basis, we may be required to significantly curtail our research or development program, or a part thereof, which would adversely impact our potential revenues, results of operations and financial condition.

RISKS RELATED TO OUR BUSINESS AND STRATEGY

We have a limited operating history to date and our business prospects will be dependent on our ability to meet a number of challenges.

Our business prospects are difficult to predict due to a lack of operational history, and our success will be dependent on our ability to meet a number of challenges. We are focused on developing commercial technologies to manufacture alternative foods without the need for animal butchery. If we are unable to successfully develop our alternative protein manufacturing technologies, we may not be able to achieve our anticipated growth, revenues or profitability and we may not be able to continue our business operations.

Because we have a limited operating history and we are in the early stages of development, you may not be able to evaluate our future prospects accurately. Our prospects will be primarily dependent on our ability to successfully develop industrial-scale cultured meat manufacturing technologies and processes,food production machines, and market these to our customers. If we are not able to successfully meet these challenges, our prospects, business, financial condition and results of operations could be adversely impacted.

We are wholly dependent on the success of our cultured meatfood manufacturing technologies, including our cultured steak technologies, and we have limited data on the performance of our technologies to date.

We do not currently have any products or technologies approved for sale and we are still in the early stages of development. To date, we have limited data on the ability of our technologies to successfully manufacture cultured meat,alternative proteins, towards which we have devoted substantial resources to date.resources. We may not be successful in developing our technologies in a manner sufficient to support our expected scale-ups and future growth, or at all. We expect that a substantial portion of our efforts and expenditures over the next few years will be devoted to the development of technologies designed to enable us to market industrial-scale cultured meat manufacturing processes.food production machines. We cannot guarantee that we will be successful in developing these technologies on the timeline we expect or at all. If we are able to successfully develop our cultured meat technologies, we cannot ensure that we will obtain regulatory approval or that, following approval, upon commercialization our technologies will achieve market acceptance. Any such delay or failure would materially and adversely affect our financial condition, results of operations and prospects.

To develop our cultured meat steak technology, we are developing cellular agriculture technology, such as cell lines and approaches to working with plant-based cell-growth media in a scalable process.

We are currently planning to scale up the printing process to provide us with industrial-scale capabilities. If we are unable to successfully develop our cultured meat manufacturing technologies, we may not be able to achieve our anticipated growth, revenues or profitability and we may not be able to continue our business operations.

We may evaluate various acquisitions and collaborations, including licensing or acquiring complementary technologies, intellectual property rights, or businesses. Any potential acquisition, joint venture or collaboration will entail numerous potential risks, including:

| ● | increased operating expenses and cash requirements; |

| ● | the assumption of additional indebtedness or contingent liabilities; |

| ● | assimilation of operations, intellectual property and products of an acquired company, including difficulties associated with integrating new personnel; |

| ● | the diversion of our management’s attention from our existing programs and initiatives in pursuing such a strategic merger or acquisition; |

| ● | retention of key employees, the loss of key personnel, and uncertainties in our ability to maintain key business relationships; |

| ● | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing technologies; and |

| ● | our inability to generate revenue from acquired technologies or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

In addition, if we undertake acquisitions, we may utilize our cash, issue dilutive securities, assume or incur debt obligations, incur large one-time expenses and acquire intangible assets that could result in significant future amortization expense.

Moreover, we may not be able to locate suitable acquisition or collaboration opportunities and this inability could impair our ability to grow or obtain access to technologies that may be important to the development of our business.

Our existing potential collaborations, or any future collaboration arrangements that we may enter into, may not be successful, which could significantly limit the likelihood of receiving the potential economic benefits of the collaboration and adversely affect our ability to develop and commercialize our product candidates.

We have entered into a potential collaborationcollaborations with Tiv Ta’am, which is reflected in a non-binding letter of intent. Tiv Ta’am has no obligation to collaborate with uspartner organizations, and may withdraw from the proposed collaboration at any time without any liability.

| ● | collaborators may not perform or prioritize their obligations as expected; |

| ● | collaborators may not pursue development and commercialization of any of our alternative protein manufacturing technologies or may elect not to continue or renew development or commercialization, changes in the collaborators’ focus or available funding, or external factors, such as an acquisition, that divert resources or create competing priorities; |

| ● | collaborators may provide insufficient funding for the successful development or commercialization of our alternative protein manufacturing technologies; |

| ● | collaborators could independently develop, or develop with third parties, products or technologies that compete directly or indirectly with our products or alternative protein manufacturing technologies if the collaborators believe that competitive products are more likely to be successfully developed or can be commercialized under terms that are more economically attractive than ours; |

| ● | alternative protein manufacturing technologies developed in collaborations with us may be viewed by our collaborators as competitive with their own products or technologies, which may cause collaborators to cease to devote resources to the development or commercialization of our products; |

| ● | a collaborator with marketing and distribution rights to one or more of our products or technologies that achieve regulatory approval may not commit sufficient resources to the marketing and distribution of any such product; |

| ● | disagreements with collaborators, including disagreements over proprietary rights, contract interpretation or the preferred course of development of alternative protein manufacturing technologies, may cause delays or termination of the research, development or commercialization of such technologies, may lead to additional responsibilities for us with respect to such technologies, or may result in litigation or arbitration, any of which would be time-consuming and expensive; |

| ● | collaborators may not properly maintain, protect, defend or enforce our intellectual property rights or may use our proprietary information in such a way as to invite litigation that could jeopardize or invalidate our intellectual property or proprietary information or expose us to potential litigation; |

| ● | disputes may arise with respect to the ownership of intellectual property developed pursuant to our collaborations; |

| ● | collaborators may infringe, misappropriate or otherwise violate the intellectual property rights of third parties, which may expose us to litigation and potential liability; |

| ● | collaborations may be terminated for the convenience of the collaborator and, if terminated, the development of our alternative protein manufacturing technologies may be delayed, and we could be required to raise additional capital to pursue further development or commercialization ; |

| ● | future relationships may require us to incur non-recurring and other charges, increase our near- and long-term expenditures, issue securities that dilute our existing shareholders, or disrupt our management and business; and |

| ● | we could face significant competition in seeking appropriate collaborators, and the negotiation process is time-consuming and complex. |

If our collaborations do not result in the successful development of our products, or if one of our collaborators terminates its agreement with us, we may not receive any future research funding or milestone, earn-out, royalty or other contingent payments under the collaborations. If we do not receive the funding we expect under these agreements, our development of our cultured meatalternative protein manufacturing technologies could be delayed and we may need additional resources to develop our technologies. If one of our collaborators terminates its agreement with us, we may find it more difficult to attract new collaborators and the perception of us in the business and financial communities could be adversely affected. All of the risks relating to product development, regulatory approval and commercialization described in this report apply to the activities of our collaborators.

We may not be able to successfully manage our planned growth.

We expect to continue to make investments in our cultured meatalternative protein manufacturing technologies. We expect that our annual operating expenses will continue to increase as we invest in further research and development activities and, ultimately, sales and marketing efforts and customer service and support resources for future customers. Our failure to expand operational and financial systems in a timely or efficient manner could result in operating inefficiencies, which could increase our costs and expenses more than we had planned and prevent us from successfully executing our business plan. We may not be able to offset the costs of operation expansion by leveraging the economies of scale from our growth in negotiations with our suppliers and contract manufacturers. Additionally, if we increase our operating expenses in anticipation of the growth of our business and this growth does not meet our expectations, our financial results will be negatively impacted.

If our business grows, we will have to manage additional product design projects, materials procurement processes, and sales efforts and marketing for an increasing number of products, as well as expand the number and scope of our relationships with suppliers, distributors and end customers. If we fail to manage these additional responsibilities and relationships successfully, we may incur significant costs, which may negatively impact our operating results. Additionally, in our efforts to be first to market with new products with innovative functionality and features, we may devote significant research and development resources to products and product features for which a market does not develop quickly, or at all. If we are not able to predict market trends accurately, we may not benefit from such research and development activities, and our results of operations may suffer.

As our future development and commercialization plans and strategies develop, we expect to need additional managerial, operational, sales, marketing, financial and legal personnel. Our management may need to divert a disproportionate amount of its attention away from our day-to-day activities and devote a substantial amount of time to managing these growth activities. We may not be able to effectively manage the expansion of our operations, which may result in weaknesses in our infrastructure, operational mistakes, loss of business opportunities, failure to deliver and timely deliver our products to customers, loss of employees and reduced productivity among remaining employees. Our expected growth could require significant capital expenditures and may divert financial resources from other projects, such as the development of additional new products. If our management is unable to manage our growth effectively, our expenses may increase more than expected, our ability to generate and/or grow revenue could be reduced, and we may not be able to implement our business strategy.

If the market does not grow as we expect, we may not achieve sustainable revenues.

The marketplace for alternative protein manufacturing plants, which we expect to be our primary market, is dominated by methods that do not involve three-dimensional printing technology. If the market does not broadly accept three-dimensional printing of cultured meatsalternative protein as an alternative for conventional meat harvesting, or if it adopts three-dimensional printing based on a technology other than our proprietary bio-ink technology, we may not be able to achieve a sustainable level of revenues, and our results of operations would be adversely affected as a result. Additionally, cultivated meat is significantlyalternative proteins may be more expensive than conventional meat. If the price of cultivated meatalternative proteins remains high, this may limit the consumer demand for, and market acceptance of, products manufactured using our technologies, and we may never be able to compete successfully or generate sufficient revenue or sustained profitability.

Business or economic disruptions or global health concerns including COVID-19, may have an adverse impact on our business and results of operations.

The COVID-19 pandemic has negatively impacted the global economy, disrupted consumer spending and global supply chains, and created significant volatility and disruption of financial markets. Many countries around the world, including in Israel, haveimplemented significant governmental measures being implemented to control the spread of the virus, including temporary closure of businesses, severe restrictions on travel and the movement of people, and other material limitations on the conduct of business. To date, the impact of the pandemic on our operations has been mainly limited to a temporary closure of our facility earlier in the year, in the context of a government-mandated general lockdown, which temporary delayed certain of our development activities, while we implemented remote working and workplace protocols for our employees in accordance with government requirements. While government restrictions have recently been eased in Israel following a successful vaccination campaign, theThe extent of the impact of the COVID-19future disruptions, such as another pandemic, on our business and financial performance, including our ability to execute our near-term and long-term business strategies and initiatives in the expected time frame, will depend on future developments, including the duration and severity of the pandemic and the impacts of reopening, including possible additional waves, which are uncertain and cannot be predicted.

RISKS RELATED TO COMPETITION AND COMMERCIALIZATION OF OUR TECHNOLOGIES

We are an early-stage company with an unproven business model, which makes it difficult to evaluate our current business and future prospects.

We have no established basis to assure investors that our business strategies will be successful. We are dependent on unproven technologies and we have no basis to predict acceptance of our technologies by potential licensees and their customers. The market for cultured meatprinted alternative proteins is new and as yet untested. As a result, the revenue and income potential of our business and our market are unproven. Further, because of our limited operating history and early stage of development, and because the market for cultured meatalternative proteins is relatively new and rapidly evolving, we have limited insight into trends that may emerge and affect our business. We may make errors in predicting and reacting to relevant business trends, which could harm our business.

We may not be able to compete successfully in our highly competitive market.

The alternative protein market is expected to be highly competitive, with numerous brands and products competing for limited retailer shelf space, foodservice and restaurant customers and consumers. For us to compete successfully, we expect that the cultured meatsalternative proteins printed using our technologies will need to be competitive in taste, ingredients, texture, ease of integration into the consumer diet, nutritional claims, convenience, brand recognition and loyalty, product variety, product packaging and package design, shelf space, reputation, price, advertising and access to restaurant and foodservice customers.

Generally, the food industry is dominated by multinational corporations with substantially greater resources and operations than us.we. We cannot be certain that we will successfully compete with larger competitors that have greater financial, marketing, sales, manufacturing, distributing and technical resources than we do. Conventional food companies may acquire our competitors or launch their own competing products, and they may be able to use their resources and scale to respond to competitive pressures and changes in consumer preferences by introducing new products, reducing prices or increasing promotional activities, among other things. Competitive pressures or other factors could prevent us from acquiring market share or cause us to lose market share, which may require us to lower prices, or increase marketing and advertising expenditures, either of which would adversely affect our margins and could result in a decrease in our operating results and profitability. We cannot assure you that we will be able to maintain a competitive position or compete successfully against such sources of competition.

We may suffer reputational harm due to real or perceived quality or health issues with products manufactured by our licenseescustomers using our technology.

Any real or perceived quality or food safety concerns or failures to comply with applicable food regulations and requirements, whether or not ultimately based on fact and whether or not involving us, or even merely involving unrelated manufacturers, could cause negative publicity and reduced confidence in our company, or the industry as a whole, which could in turn harm our reputation and sales, and could adversely impact our business, financial condition and operating results. There can be no assurance that products manufactured by our licenseescustomers will always comply with regulatory standards. Although we expect that our licenseescustomers will strive to manufacture products free of pathogenic organisms, these may not be easily detected and cross-contamination can occur. We cannot assure you that this health risk will always be preempted by quality control processes.

We will have no control over the products manufactured by our licensees,customers, especially once they are purchased by consumers, who may prepare these products in a manner that is inconsistent with directions or store them for excessive periods of time, which may adversely affect their quality and safety. If the products manufactured by our licensees are not perceived as safe or of high quality, then our business, results of operations and financial condition could be adversely affected.

The growing use of social and digital media increases the speed and extent that information or misinformation and opinions can be shared. Negative publicity about cultured meats produced using our technologies could seriously damage our reputation.

Failure to improve our technologies may adversely affect our ability to continue to grow.

In order to continue to grow, we expect we will need to continue to innovate by developing new technologies or improving existing ones, in ways that meet our standards for quality and will enable our eventual licenseescustomers to manufacture products that appeal to consumer preferences. Such innovation will depend on the technical capability of our staff in developing and testing product prototypes, including complying with applicable governmental regulations, and the success of our management and sales and marketing teams in introducing and marketing new technologies. Failure to develop and market new technologies may cause a negative impact on our business and results of operations.

Additionally, the development and introduction of new technologies requires substantial research, development and marketing expenditures, which we may be unable to recoup if the new technologies do not lead to products that gain widespread market acceptance. If we are unsuccessful in meeting our objectives with respect to new or improved technologies, our business could be harmed.

We may face difficulties if we expand our operations into new geographic regions, in which we have no prior operating experience.

We intend to licensecommercialize our technologies in numerous geographical markets. International operations involve a number of risks, including foreign regulatory compliance, tariffs, taxes and exchange controls, economic downturns, inflation, foreign currency fluctuations and political and social instability in the countries in which we will operate. Expansion may involve expanding into less developed countries, which may have less political, social or economic stability and less developed infrastructure and legal systems. It is costly to establish, develop and maintain international operations and develop and promote our brands in international markets. As we expand our business into other countries, we may encounter regulatory, legal, personnel, technological and other difficulties that increase our expenses and/or delay our ability to become profitable in such countries, which may have an adverse impact on our business and brand.

Consumer preferences for alternative proteins in general, and more specifically cultured meats, are difficult to predict and may change, and, if we are unable to respond quickly to new trends, our business may be adversely affected.

Our business is focused on the development and marketing of licensable cultured meatalternative protein manufacturing technologies. Consumer demand for the cultured meatsalternative proteins manufactured using these technologies could change based on a number of possible factors, including dietary habits and nutritional values, concerns regarding the health effects of ingredients and shifts in preference for various product attributes. If consumer demand for our products decreases, our business and financial condition wouldmay suffer. Consumer trends that we believe favor sales of products manufactured using our licensed technologies could change based on a number of possible factors, including a shift in preference from animal-based protein products, economic factors and social trends. A significant shift in consumer demand away from products manufactured using our technologies could reduce our sales or our market share and the prestige of our brand, which would harm our business and financial condition.

We have nolimited manufacturing experience orand resources and we expect we will incur significant costs to develop this expertise or need to rely on third parties for manufacturing.

We have nolimited manufacturing experience. In order to develop and licensecommercialize our technologies, we will need to develop, contract for or otherwise arrange for the necessary manufacturing capabilities. We may experience difficulty in obtaining adequate and timely manufacturing capacity for our proprietary cultured meatalternative protein printers and bio-inks. We do not own or lease facilities currently that could be used to manufacture any products that we might develop on an industrial scale, nor do we have the resources at this time to acquire or lease suitable facilities. If we are unable to build the necessary internal manufacturing capability or obtain this capability through third parties we will not be able to commercialize our technologies.blends. Even if we develop or obtain the necessary manufacturing capacity, if we fail to comply with regulations, to obtain the necessary licenses and knowhow or to obtain the requisite financing in order to comply with all applicable regulations and to own or lease the required facilities in order to manufacture products, we could be forced to cease operations, which would cause you to lose all of your investment.operations.

Our limited manufacturing capabilities are nascent, and if we fail to effectively develop manufacturing and production capabilities, our business and operating results and our brand reputation could be harmed.

If we are unable to develop manufacturing capacity to commence cultured chicken fatcultivated meat production, we may not be able to expedite our market entry or develop an industrial process for cultivating and producing real meat cuts. Additionally, there is risk in our ability to effectively scale production processes, if developed, to optimize manufacturing capacity for specific products and effectively manage our supply chain requirements, which involves accurately forecasting demand for each of our products and inventory needs in order to ensure we have adequate available manufacturing capacity for each such product and to ensure we are effectively managing our inventory. Our forecasts may be based on multiple assumptions that may cause our estimates to be inaccurate and affect our ability to obtain adequate manufacturing capacity (whether our own manufacturing capacity or co-manufacturing capacity) and adequate inventory supply in order to meet the demand for our products, which could prevent us from developing our industrial process and harm our business and prospects.

However, if we overestimate our demand and overbuild our capacity or inventory, we may have significantly underutilized assets, experience reduced margins, and have excess inventory which we may be required to write-down or write-off. If we do not accurately align our manufacturing capabilities and inventory supply with demand, if we experience disruptions or delays in our supply chain, or if we cannot obtain raw materials of sufficient quantity and quality at reasonable prices and in a timely manner, our business, financial condition and results of operations may be adversely affected.

If developed, our manufacturing and production operations will be subject to additional risks and uncertainties.

The interruption in, or the loss of operations at, our pilot facility, which may be caused by work stoppages, labor shortages, strikes or other labor unrest, production disruptions, product quality issues, local economic and political conditions, restrictive governmental actions, border closures, disease outbreaks or pandemics (such as COVID-19), the outbreak of hostilities, acts of war, terrorism, fire, earthquakes, severe weather, flooding or other natural disasters at one or more of these facilities, could delay, postpone or reduce production of some of our products, could impede our ability to develop an industrial process for cultivating and producing real meat cuts or could otherwise have an adverse effect on our business, results of operations and financial condition until such time as such interruption is resolved or an alternate source of production is secured.

Because we rely on a limited number of third-party suppliers, we may not be able to obtain raw materials on a timely basis or in sufficient quantities at competitive prices to produce our products or meet the demand for our products.

We rely on a limited number of vendors, a portion of which are located internationally, to supply us with raw materials. Our financial performance depends in large part on our ability to arrange for the purchase of raw materials in sufficient quantities at competitive prices. We are not assured a continued supply or pricing of raw materials. Any of our other suppliers could discontinue or seek to alter their relationship with us. We could experience similar delays in the future from any of our suppliers. Any disruption in the supply of embryonic stem cells or other raw materials would have a material adverse effect on our business if we cannot replace these suppliers in a timely manner, on commercially reasonable terms, or at all.

In addition, our suppliers manufacture their products at a limited number of facilities. A natural disaster, severe weather, fire, power interruption, work stoppage or other calamity affecting any of these facilities, or any interruption in their operations, could negatively impact our ability to obtain required quantities of raw materials in a timely manner, or at all, which could materially increase our cost and delay our timeline, and have a material effect on our business and financial condition.

Events that adversely affect our suppliers of raw materials could impair our ability to obtain raw material inventory in the quantities at competitive prices that we desire. Such events include problems with our suppliers’ businesses, finances, labor relations and/or shortages, strikes or other labor unrest, ability to import raw materials, product quality issues, costs, production, insurance and reputation, as well as local economic and political conditions, restrictive U.S. and foreign governmental actions, such as restrictions on transfers of funds and trade protection measures, including export/import duties and quotas and customs duties and tariffs, adverse fluctuations in foreign currency exchange rates, changes in legal or regulatory requirements, border closures, disease outbreaks or pandemics (such as COVID-19), acts of war, terrorism, natural disasters, fires, earthquakes, flooding, severe weather, agricultural diseases or other catastrophic occurrences. We continuously seek alternative sources of raw materials to use in our products, but we may not be successful in diversifying the raw materials we use in our products.

If we need to replace an existing supplier, there can be no assurance that supplies of raw materials will be available when required on acceptable terms, or at all, or that a new supplier would allocate sufficient capacity to us in order to meet our requirements, fill our orders in a timely manner or meet our strict quality standards.

Litigation or legal proceedings, government investigations or other regulatory enforcement actions could subject us to civil and criminal penalties or otherwise expose us to significant liabilities and have a negative impact on our reputation or business.

We operate in a constantly evolving legal and regulatory framework. Consequently, we are subject to heightened risk of legal claims, government investigations or other regulatory enforcement actions. Although we have implemented policies and procedures designed to ensure compliance with existing laws and regulations, we cannot assure you that our employees, temporary workers, contractors or agents will not violate our policies and procedures. Moreover, a failure to maintain effective control processes could lead to violations, unintentional or otherwise, of laws and regulations. Legal claims, government investigations or regulatory enforcement actions arising out of our failure or alleged failure to comply with applicable laws and regulations could subject us to civil and criminal penalties that could materially and adversely affect our product sales, reputation, financial condition and operating results. For example, in November 2020, the Israel Securities Authority, or ISA, initiated an administrative proceeding against us claiming negligent misstatement regarding certain immediate and periodic reports published by our predecessor (Ophectra) during the years 2017 and 2018, prior to the merger with MeaTech. These reports relate to Ophectra’s activities prior to establishment of the settlement fund in connection with the merger. In April 2021, following negotiations with the ISA, we agreed to settle the matter for NIS 0.7 million ($0.220.2 million). The settlement is subject to approval of the ISA’s Enforcement Committee.

RISKS RELATED TO OUR OPERATIONS

We expect that a small number of customers will account for a significant portion of our revenues, and the loss of one or more of these customers could adversely affect our financial condition and results of operations.

We do not expect to generate revenue in the short or medium term. If we are able to generate revenue, we believe that we will do so through three primary streams: (i) licensing our proprietary intellectual property to customers for the purpose of commercializing our technologies,selling alternative protein manufacturing machines, including by way of setting up and operating cultured meat production factories;three-dimensional printers; (ii) brokering the supply of materials needed in the manufacturing process; and (iii) providing consulting and implementation services to customers. These streams may arise in the context of product co-development. Under this model, we initially expect to derive a significant portion of our revenues from a few customers. Our financial condition and results of operations could be adversely impacted if any one of these customers interrupt or curtail their activities, fail to pay for the services that have been performed, terminate their cultured meat operations, or if we are unable to enter into agreements with new customers on favorable terms. The loss of customers could adversely affect our financial condition and results of operations.

We may be exposed to the credit risks of our customers, and nonpayment by these customers and other parties could adversely affect our financial position, results of operations and cash flows.

We may be subject to risks of loss resulting from nonpayment by our customers. Any material nonpayment by these entities could adversely affect our financial position, results of operations and cash flows. If customers default on their obligations to us, our financial results and condition could be adversely affected. Some of these customers may be highly leveraged and subject to their own operating and regulatory risks.

If we are unable to attract and retain qualified employees, our ability to implement our business plan may be adversely affected.

The loss of the service of our employees, such as Mr. Arik Kaufman, our Chief Executive Officer, would likely delay our achievement of product development and other business objectives, as we may not be able to find suitable individuals to replace them on a timely basis, if at all. In addition, any such departure could be viewed in a negative light by investors and analysts, which may cause the price of our ordinary sharessecurities to decline. Although we have employment agreements with our key employees, these employees could terminate their employment with us at any time on relatively short notice. We do not carry key man life insurance on any of our executive officers.

Recruiting and retaining qualified scientific, manufacturing and sales and marketing personnel will also be critical to our success. We may not be able to attract and retain these personnel on acceptable terms given the competition among high technology and life sciences companies for similar personnel. We also experience competition from universities and research institutions in attracting and retaining scientific personnel. In addition, we rely on consultants and advisors, including scientific advisors, to assist us in formulating our research and development and commercialization strategy. Our consultants and advisors may be employed by employers other than us and may have commitments under consulting or advisory contracts with other entities that may limit their availability to us.

Under applicable employment laws, we may not be able to enforce covenants not to compete.

Our employment agreements generally include covenants not to compete. These agreements prohibit our employees, if they cease working for us, from competing directly with us or working for our competitors for a limited period. We may be unable to enforce these agreements under the laws of the jurisdictions in which our employees work. For example, Israeli courts have required employers seeking to enforce covenants not to compete to demonstrate that the competitive activities of a former employee will harm one of a limited number of material interests of the employer, such as the secrecy of a company’s confidential commercial information or the protection of its intellectual property. If we cannot demonstrate that such an interest will be harmed, we may be unable to prevent our competitors from benefiting from the expertise of our former employees or consultants and our competitiveness may be diminished.

We are exposed to a risk of substantial loss due to claims that may be filed against us in the future because our insurance policies may not fully cover the risk of loss to which we are exposed.

We are exposed to the risk of having claims seeking monetary damages being filed against us, for example with regard to securities-related claims. In the event that we are required to pay damages for any such claim, we may be forced to seek bankruptcy or to liquidate because our asset base and revenue base may be insufficient to satisfy the payment of damages and any insurance that we have obtained may not provide sufficient coverage against potential liabilities.

Our business and operations would suffer in the event of information technology system failures, including security breaches.

Despite the implementation of security measures, our internal computer systems and those of our contractors and consultants are vulnerable to damage from computer viruses, unauthorized access, natural disasters, terrorism, war and telecommunication and electrical failures. While we have not experienced any such system failure, accident or security breach to date, if such an event were to occur and cause interruptions in our operations, causing our business to suffer. To the extent that any disruption or security breach were to result in a loss of or damage to our data or applications, or inappropriate disclosure of confidential or proprietary information, we could incur liability and the further development of our product could be delayed.

A cybersecurity incident, other technology disruptions or failure to comply with laws and regulations relating to privacy and the protection of data relating to individuals could negatively impact our business, our reputation and our relationships with customers.

We use computers in substantially all aspects of our business operations. We also use mobile devices, social networking and other online activities to connect with our employees, suppliers and co-manufacturers. Such uses give rise to cybersecurity risks, including security breaches, espionage, system disruption, theft and inadvertent release of information. Our business involves the storage and transmission of numerous classes of sensitive and/or confidential information and intellectual property, including suppliers’ information, private information about employees and financial and strategic information about us and our business partners. Further, as we pursue new initiatives that improve our operations and cost structure, potentially including acquisitions, we may also be expand and improve our information technologies, resulting in a larger technological presence and corresponding exposure to cybersecurity risk. If we fail to assess and identify cybersecurity risks associated with new initiatives or acquisitions, we may become increasingly vulnerable to such risks. Additionally, while we have implemented measures to prevent security breaches and cyber incidents, our preventative measures and incident response efforts may not be entirely effective. The theft, destruction, loss, misappropriation, or release of sensitive and/or confidential information or intellectual property, or interference with our information technology systems or the technology systems of third parties on which we rely, could result in business disruption, negative publicity, brand damage, violation of privacy laws, loss of customers, potential liability and competitive disadvantage all of which could have a material adverse effect on our business, financial condition or results of operations.

In addition, we are subject to laws, rules and regulations in the United States, the European Union and other jurisdictions relating to the collection, use and security of personal information and data. Such data privacy laws, regulations and other obligations may require us to change our business practices and may negatively impact our ability to expand our business and pursue business opportunities. We may incur significant expenses to comply with the laws, regulations and other obligations that apply to us. Additionally, the privacy- and data protection-related laws, rules and regulations applicable to us are subject to significant change. Several jurisdictions have passed new laws and regulations in this area, and other jurisdictions are considering imposing additional restrictions. Privacy- and data protection-related laws and regulations also may be interpreted and enforced inconsistently over time and from jurisdiction to jurisdiction. Any actual or perceived inability to comply with applicable privacy or data protection laws, regulations, or other obligations could result in significant cost and liability, litigation or governmental investigations, damage our reputation, and adversely affect our business.

Disruptions in the worldwide economy may adversely affect our business, results of operations and financial condition.

The global economy can be negatively impacted by a variety of factors such as the spread or fear of spread of contagious diseases (such as the COVID-19 pandemic), man-made or natural disasters, actual or threatened war, terrorist activity, political unrest, civil strife and other geopolitical uncertainty. Such adverse and uncertain economic conditions may impact consumer demand for alternative proteins, in general, and clean meats specifically, which may in turn impact manufacturer and retailer demand for our technologies. In addition, our ability to manage normal commercial relationships with suppliers may suffer. Consumers may shift purchases to lower-priced or other perceived value offerings during economic downturns as a result of various factors, including job losses, inflation, higher taxes, reduced access to credit, change in government economic policy and international trade disputes. In particular, consumers may reduce the amount of cultured meatalternative proteins that they purchase in favor of conventional meat, or other alternative proteins, which may have lower retail prices, which could indirectly affect our results of operations. Manufacturer and retailers may become more conservative in response to these conditions and seek to delay commencing cultured marketalternative protein manufacturing operations or reduce existing operations. Our results of operations will depend upon, among other things, the financial condition of our business customers and our ability to supply them with the means to manufacture products that appeal to consumers at the right price. Decreases in demand for the products manufactured by our customers would put downward pressure on margins and would negatively impact our financial results. Prolonged unfavorable economic conditions or uncertainty may result in end consumers making long-lasting changes to their discretionary spending behavior on a more permanent basis, which may likewise have an indirect adverse effect on our sales and profitability.

Food safety and food-borne illness incidents may materially adversely affect our business by exposing us to lawsuits, product recalls or regulatory enforcement actions, increasing our operating costs and reducing demand for our product offerings.

Selling food for human consumption involves inherent legal and other risks, and there is increasing governmental scrutiny of and public awareness regarding food safety. Unexpected side effects, illness, injury or death related to allergens, food-borne illnesses or other food safety incidents caused by products we sell, or involving our suppliers or co-manufacturers, could result in the discontinuance of sales of these products or our relationships with such suppliers or co-manufacturers, or otherwise result in increased operating costs, regulatory enforcement actions or harm to our reputation. Shipment of adulterated or misbranded products, even if inadvertent, can result in criminal or civil liability. Such incidents could also expose us to product liability, negligence or other lawsuits, including consumer class action lawsuits. Any claims brought against us may exceed or be outside the scope of our existing or future insurance policy coverage or limits. Any judgment against us that is more than our policy limits or not covered by our policies or not subject to insurance would have to be paid from our cash reserves, which would reduce our capital resources.

The occurrence of food-borne illnesses or other food safety incidents could also adversely affect the price and availability of affected ingredients, resulting in higher costs, disruptions in supply and a reduction in our sales. Furthermore, any instances of food contamination or regulatory noncompliance, whether or not caused by our actions, could compel us, our suppliers, our distributors or our customers, depending on the circumstances, to conduct a recall in accordance with FDA regulations, comparable state laws or foreign laws such as those of the European Union and the United Kingdom. Food recalls could result in significant losses due to their costs, the destruction of product inventory, lost sales due to the unavailability of the product for a period of time and potential loss of existing distributors or customers and a potential negative impact on our ability to attract new customers due to negative consumer experiences or because of an adverse impact on our brand and reputation. The costs of a recall could exceed or be outside the scope of our existing or future insurance policy coverage or limits.

In addition, food companies have been subject to targeted, large-scale tampering as well as to opportunistic, individual product tampering, and we, like any food company, could be a target for product tampering. Forms of tampering could include the introduction of foreign material, chemical contaminants and pathological organisms into consumer products as well as product substitution. FDA regulations require companies like us to analyze, prepare and implement mitigation strategies specifically to address tampering (i.e., intentional adulteration) designed to inflict widespread public health harm. If we do not adequately address the possibility, or any actual instance, of intentional adulteration, we could face possible seizure or recall of our products and the imposition of civil or criminal sanctions, which could materially adversely affect our business, financial condition and operating results.

Non-compliance with environmental, social, and governance, or ESG, practices could harm our reputation, or otherwise adversely impact our business, while increased attention to ESG initiatives could increase our costs.

Companies across industries are facing increasing scrutiny from a variety of stakeholders related to their ESG and sustainability practices. Certain market participants, including institutional investors and capital providers, are increasingly placing importance on the impact of their investments and are thus focusing on corporate ESG practices, including the use of third-party benchmarks and scores to assess companies’ ESG profiles in making investment or voting decisions, and engaging with companies to encourage changes to their practices. Unfavorable ESG ratings could lead to increased negative investor sentiment towards us or our industry. If we do not comply with investor or shareholder expectations and standards in connection with our ESG initiatives or are perceived to have not addressed ESG issues within our company, our business and reputation could be negatively impacted and our share price could be materially and adversely affected, as well as our access to and cost of capital.

While we may, at times, engage in voluntary initiatives (such as voluntary disclosures, certifications, or goals, among others) or commitments to improve the ESG profile of our company and/or products, such initiatives or achievements of such commitments may not have the desired effect and may be costly.

In addition, we may commit to certain initiatives or goals but not ultimately achieve such commitments or goals due to factors that are both within or outside of our control. Moreover, actions or statements that we may take based on expectations, assumptions, or third-party information that we currently believe to be reasonable may subsequently be determined to be erroneous or be subject to misinterpretation. Even if this is not the case, our current actions may subsequently be determined to be insufficient by various stakeholders, and we may be subject to investor or regulator engagement on our ESG initiatives and disclosures, even if such initiatives are currently voluntary. In addition, increasing ESG-related regulation, such as the SEC’s climate disclosure proposal, may also result in increased compliance costs or scrutiny.

Expectations around a company’s management of ESG matters continues to evolve rapidly, in many instances due to factors that are out of our control. To the extent ESG matters negatively impact our reputation, it may also impede our ability to compete as effectively to attract and retain employees or customers, which may adversely impact our operations.

RISKS RELATED TO GOVERNMENT REGULATION

We expect that products utilizing our technologies will be subject to regulations that could adversely affect our business and results of operations.

The manufacture and marketing of food products is highly regulated. We, our suppliers and licensees,customers, may be subject to a variety of laws and regulations. These laws and regulations apply, directly or indirectly, to many aspects of our business, including the manufacture, composition and ingredients, packaging, labeling, distribution, advertising, sale, quality and safety of food products, as well as the health and safety of our employees and the protection of the environment.

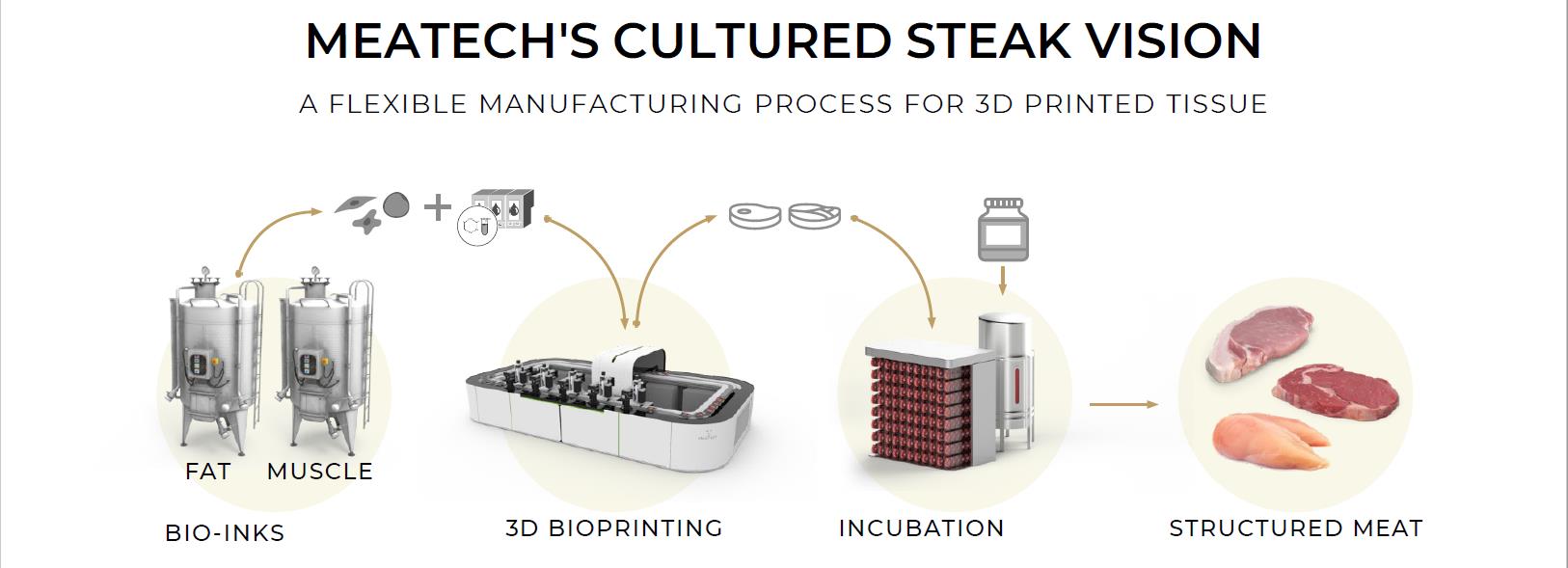

We are focused on developing a novel, proprietary three-dimensional bioprinterprinters to deposit layers of cells (including stem cells and differentiated stem cells), scaffolding, and cell nutrients in a three-dimensional form ofprint structured cultured meat. The cultured meat, in turn, will be produced by our customers. Peace of Meat intends to produce cultured avian fat that is anticipated to be used as an ingredient, inter alia, in the production of finished cultured poultry. Neither we nor Peace of Meatfood. We do not intend to manufacture, distribute and sell branded cultured-meat end products for consumer consumption.

For the reasons discussed below, we ourselves do not expect to be directly regulated by the FDA for United States compliance purposes but will apply FDA’s food contact substance standards or analogous foreign regulations when developing our three-dimensional bioprinter.printers. Specifically, we intend to licensesell our production technology,machines, as well as provide associated products and services to food processing and food retail companies through a B2B model. From a regulatory perspective, in the United States, we expect companies manufacturing finishedproducts that include cultured meat products to be subject to regulation by various government agencies, including the FDA, U.S. Department of Agriculture,the USDA, the U.S. Federal Trade Commission, or FTC, Occupational Safety and Health Administration and the Environmental Protection Agency, as well as the requirements of various state and local agencies and laws, such as the California Safe Drinking Water and Toxic Enforcement Act of 1986. We likewise expect these products to be regulated by equivalent agencies outside the United States by various international regulatory bodies.