As filed with the Securities and Exchange Commission on June 24, 200526, 2006

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

Annual Report Pursuant to SectionANNUAL REPORT PURSUANT TO SECTION 13 orOR 15(d)

15(d) ofOF THE SECURITIES EXCHANGE ACT OF 1934

For the Securities Exchange Act of 1934fiscal year ended December 31, 2005

Commission file number 001-15266

For the Fiscal Year Ended December 31, 2004

Commission File Number 001-15266

BANCO DE CHILE

(Exact name of Registrant as specified in its charter)

BANK OF CHILE

(Translation of Registrant’s name into English)

Republic of ChileREPUBLIC OF CHILE

(Jurisdiction of incorporation or organization)

Banco de Chile

Ahumada 251

Santiago, Chile

(562) 653-1111637-1111

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange | |

American Depositary Shares, each representing 600 shares of common stock, without nominal (par) value (“ADSs”) | New York Stock Exchange | |

| Shares of common stock, without nominal (par) value | New York Stock Exchange (for listing purposes only) | |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

None(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

None

Indicate the number of outstanding shares of each of the Issuer’sissuer’s classes of capital or common stock as of the close of the

period covered by the annual report:

Shares of common stock: 68,079,783,605

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17¨ Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

i

THE MERGER

On January 1, 2002, Banco de Chile merged with Banco de A. Edwards in a transaction in which Banco de Chile was the surviving corporate entity. As used in this annual report, unless the context otherwise requires, references to “Banco de Chile” relating to any date or period prior to January 1, 2002 (the effective date of the merger) are to Banco de Chile as it existed prior to the consummation of the merger, and such references relating to any date or period after January 1, 2002 are to Banco de Chile after the consummation of the merger.

PRESENTATION OF FINANCIAL INFORMATION

We prepare our audited consolidated financial statements in Chilean pesos and in accordance with generally accepted accounting principles in Chile, or Chilean GAAP, and the rules of theSuperintendencia de Bancos e Instituciones Financieras, or the Chilean Superintendency of Banks. Together, these requirements differ in certain significant respects from generally accepted accounting principles in the United States, or U.S. GAAP. References to “Chilean GAAP” in this annual report are to Chilean GAAP, as supplemented by the applicable rules of the Chilean Superintendency of Banks. See noteNote 28 to our audited consolidated financial statements contained elsewhere in this annual report for a description of the material differences between Chilean GAAP and U.S. GAAP, as they relate to us and our consolidated subsidiaries, and a reconciliation to U.S. GAAP of net income and shareholders’ equity.

Pursuant to Chilean GAAP, unless otherwise indicated, financial data for all full-year periods through December 31, 20042005 included in our audited consolidated financial statements and in the other financial information contained elsewhere in this annual report have been restated in constant Chilean pesos of December 31, 2004.

2005.

In this annual report, references to “$,” “U.S.$,” “U.S. dollars” and “dollars” are to United States dollars, references to “pesos” or “Ch$” are to Chilean pesos, and references to “UF” are to “Unidades de Fomento.” TheUnidad de Fomento, or UF is aan inflation-indexed Chilean monetary unit of account whichwith a value in Chilean pesos that is linked to and which is adjusted daily to reflect changes in the Consumer Price Index.Index of theInstituto Nacional de Estadísticas, or the Chilean National Institute of Statistics. As of December 31, 2004,2005, one UF equaled U.S.$30.9334.96 and Ch$17,317.05.17,974.81. See note 1(c)Note 1 to our audited consolidated financial statements. Percentages and certain dollar and peso amounts contained in this annual report have been rounded for ease of presentation.

This annual report contains translations of certain Chilean peso amounts into U.S. dollars at specified rates solely for your convenience. These translations should not be construed as representations that the Chilean peso amounts actually represent such U.S. dollar amounts, were converted from U.S. dollars at the rate indicated in preparing our audited consolidated financial statements or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, such U.S. dollar amounts have been translated from Chilean pesos based on the observed exchange rate, as described in “Item 3. Key Information—Selected Financial Data—Exchange Rates,” reported by theBanco Central de Chile, or the Central Bank, for December 30, 20042005 (the latest practicable date, as December 31, 20042005 was a banking holiday in Chile). The observed exchange rate on June 21, 200522, 2006 was Ch$582.55545.64 = U.S.$1.00. The rate reported by the Central Bank is based on the rate for the prior business day in Chile and is the exchange rate specified by the Chilean Superintendency of Banks for use by Chilean banks in the preparation of their financial statements. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos.

Unless otherwise specified, all references in this annual report to loans are to loans and financial leases before deduction of allowances for loan losses, and all market share data presented in this annual report are based on information published periodically by the Chilean Superintendency of Banks. Non-performing loans include loans as to which either principal or interest is overdue and loans that do not accrue interest. Restructured loans as to which no payments are overdue are not ordinarily classified as non-performing loans. Past due loans include, with respect to any loan, the portion of principal or interest that is 90 or more days

overdue; the entire outstanding balance of any loan is included in past due loans only after legal collection

proceedings have been commenced. This practice differs from that normally followed in the United States, where the amount classified as past due would include the total principal and interest on all loans which have any portion overdue. See “Item 4. Information on the Company—Selected Statistical Information—Classification of Loan Portfolio Based on the Borrower’s Payment Performance.”

Unless otherwise specified, all references to “shareholders’ equity” as of December 31 of any year are to shareholders’ equity after deducting our respective retained net income for such year, but all references to “average shareholders’ equity” for any year are to average shareholders’ equity including our respective retained net income.

Certain figures included in this annual report and in our audited consolidated financial statements have been rounded for ease of presentation. Percentage figures included in this annual report have not in all cases been calculated on the basis of such rounded figures but on the basis of such amounts prior to rounding. For this reason, percentage amounts in this annual report may vary slightly from those obtained by performing the same calculations using the figures in our audited consolidated financial statements. Certain other amounts that appear in this annual report may similarly not sum due to rounding.

MACRO-ECONOMIC AND MARKET DATA

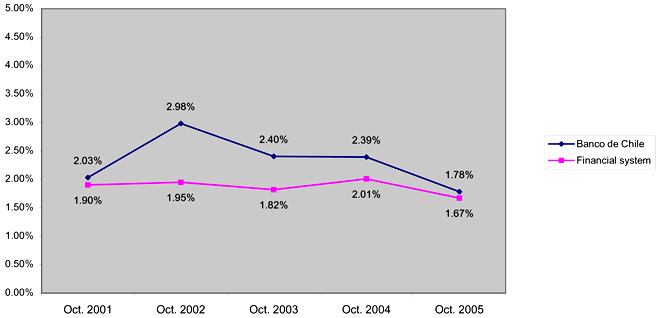

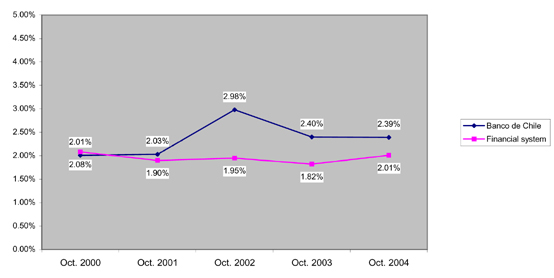

In this annual report, all macro-economic data relating to the Chilean economy is based on information published by the Central Bank. All market share and other data relating to the Chilean financial system as well as data on average return on shareholders’ equity are based on information published by the Chilean Superintendency of Banks. Information regarding the consolidated risk index of the Chilean financial system as a whole is not available. Prior to January 1, 2004, the Chilean Superintendency of Banks published the unconsolidated risk index for the financial system three times yearly in February, June and October. Since that date, this index is determined on a monthly basis by dividing allowances for loan losses by total loans, based on information provided by the Chilean Superintendency of Banks.

PART I

| Item 1. Identity of Directors, Senior Management and Advisers |

Not Applicable.

| Item 2. Offer Statistics and Expected Timetable |

Not Applicable.

SELECTED FINANCIAL DATA

The following table presents historical financial information about us as of the dates and for each of the periods indicated. The following table should be read in conjunction with, and is qualified in its entirety by reference to, our audited consolidated financial statements appearing elsewhere in this annual report. Our audited consolidated financial statements are prepared in accordance with Chilean GAAP and the rules of the Chilean Superintendency of Banks, which together differ in certain significant respects from U.S. GAAP. Note 28 to our audited consolidated financial statements provides a description of the material differences between Chilean GAAP and U.S. GAAP and a reconciliation to U.S. GAAP of net income for the years ended December 31, 2002, 2003, 2004 and 20042005 and shareholders’ equity at December 31, 20032004 and 2004.

2005.

Under Chilean GAAP, the merger between Banco de Chile and Banco de A. Edwards, which were under the common control of Quiñenco S.A. from March 27, 2001, until the merger January 1, 2002, was accounted for as a “pooling of interest” on a prospective basis. As such, the historical financial statements for periods prior to the merger were not restated under Chilean GAAP. Under U.S. GAAP, we were required to restate our previously issued U.S. GAAP historical financial information to retroactively present the financial results for the merged bank as if Banco de Chile and Banco de A. Edwards had been combined throughout the periods during which common control existed. Under U.S. GAAP, the reported financial information for periods presented prior to March 27, 2001 reflects book values of Banco de A. Edwards, which had been under Quiñenco S.A.’s control since September 2, 1999. See noteNote 28 to our audited consolidated financial statements.

| At or for the year ended December 31, | At or for the year ended December 31, | |||||||||||||||||||||||||||||||||||||||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2004 | 2001 | 2002 | 2003 | 2004 | 2005 | 2005 | |||||||||||||||||||||||||||||||||||||

| (in millions of constant Ch$ as of December 31, 2004, except share data) | (in thousands of U.S.$) | (in millions of constant Ch$ as of December 31, 2005, except share data) | (in thousands of U.S.$) | |||||||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED INCOME STATEMENT DATA | ||||||||||||||||||||||||||||||||||||||||||||||||

Chilean GAAP: | ||||||||||||||||||||||||||||||||||||||||||||||||

Interest revenue | Ch$ | 604,436 | Ch$ | 549,738 | Ch$ | 714,018 | Ch$ | 439,422 | Ch$ | 543,372 | U.S.$ | 970,602 | Ch$ | 569,529 | Ch$ | 739,723 | Ch$ | 455,241 | Ch$ | 562,933 | Ch$ | 680,149 | U.S.$ | 1,322,707 | ||||||||||||||||||||||||

Interest expense | (378,881 | ) | (320,633 | ) | (333,472 | ) | (209,340 | ) | (214,900 | ) | (383,867 | ) | (332,176 | ) | (345,477 | ) | (216,876 | ) | (222,636 | ) | (310,351 | ) | (603,549 | ) | ||||||||||||||||||||||||

Net interest revenue | 225,555 | 229,105 | 380,546 | 230,082 | 328,472 | 586,735 | 237,353 | 394,246 | 238,365 | 340,297 | 369,798 | 719,158 | ||||||||||||||||||||||||||||||||||||

Provisions for loan losses | (42,101 | ) | (48,930 | ) | (104,192 | ) | (61,612 | ) | (73,512 | ) | (131,311 | ) | (40,035 | ) | (95,165 | ) | (36,867 | ) | (41,208 | ) | (22,028 | ) | (42,838 | ) | ||||||||||||||||||||||||

Total fees and income from services, net | 41,109 | 43,007 | 78,733 | 98,251 | 126,842 | 226,572 | 44,556 | 81,568 | 101,787 | 131,408 | 137,793 | 267,970 | ||||||||||||||||||||||||||||||||||||

Total other operating income (loss), net | 12,771 | 8,894 | (31,621 | ) | 98,801 | 14,509 | 25,916 | 9,214 | (32,760 | ) | 102,357 | 15,031 | 10,860 | 21,120 | ||||||||||||||||||||||||||||||||||

Total other income and expenses, net | 12,344 | 13,125 | (3,456 | ) | 14,239 | 22,434 | 40,074 | 2,939 | (15,673 | ) | (11,533 | ) | (11,037 | ) | (6,394 | ) | (12,434 | ) | ||||||||||||||||||||||||||||||

Total operating expenses | (147,882 | ) | (147,748 | ) | (256,780 | ) | (227,557 | ) | (240,302 | ) | (429,241 | ) | (153,066 | ) | (266,709 | ) | (236,426 | ) | (249,623 | ) | (276,464 | ) | (537,649 | ) | ||||||||||||||||||||||||

Loss from price-level restatement | (10,047 | ) | (6,160 | ) | (9,934 | ) | (4,137 | ) | (7,466 | ) | (13,336 | ) | (6,382 | ) | (10,292 | ) | (4,286 | ) | (7,735 | ) | (11,450 | ) | (22,267 | ) | ||||||||||||||||||||||||

Income before income taxes | 91,749 | 91,293 | 53,296 | 148,067 | 170,977 | 305,409 | 94,579 | 55,215 | 153,397 | 177,133 | 202,115 | 393,060 | ||||||||||||||||||||||||||||||||||||

Income taxes | (1,647 | ) | 1,442 | 1,194 | (14,250 | ) | (18,349 | ) | (32,776 | ) | 1,494 | 1,237 | (14,763 | ) | (19,010 | ) | (21,391 | ) | (41,600 | ) | ||||||||||||||||||||||||||||

Net income | 90,102 | 92,735 | 54,490 | 133,817 | 152,628 | 272,633 | 96,073 | 56,452 | 138,634 | 158,123 | 180,724 | 351,460 | ||||||||||||||||||||||||||||||||||||

Earnings per share(1) | 2.01 | 2.06 | 0.80 | 1.97 | 2.28 | — | ||||||||||||||||||||||||||||||||||||||||||

Dividends per share(2) | 2.07 | 2.00 | 2.07 | 0.80 | 2.03 | — | ||||||||||||||||||||||||||||||||||||||||||

Earnings per share(1) | 2.14 | 0.83 | 2.04 | 2.36 | 2.69 | 0.0052 | ||||||||||||||||||||||||||||||||||||||||||

Dividends per share(2) | 2.07 | 2.15 | 0.83 | 2.05 | 2.40 | 0.0046 | ||||||||||||||||||||||||||||||||||||||||||

Weighted average number of shares (in millions) | 44,932.70 | 44,932.70 | 68,079.78 | 68,079.78 | 66,932.68 | — | 44,932.70 | 68,079.78 | 68,079.78 | 66,932.68 | 67,091.30 | — | ||||||||||||||||||||||||||||||||||||

U.S. GAAP(3): | ||||||||||||||||||||||||||||||||||||||||||||||||

U.S. GAAP(3): | ||||||||||||||||||||||||||||||||||||||||||||||||

Interest revenue | 333,028 | 729,044 | 736,605 | 463,551 | 571,365 | 1,020,603 | 755,290 | 763,123 | 480,239 | 591,934 | 708,079 | 1,377,023 | ||||||||||||||||||||||||||||||||||||

Interest expense | (215,821 | ) | (425,130 | ) | (355,149 | ) | (209,251 | ) | (218,067 | ) | (389,524 | ) | (440,435 | ) | (367,934 | ) | (216,785 | ) | (225,917 | ) | (317,554 | ) | (617,557 | ) | ||||||||||||||||||||||||

Net interest revenue | 117,207 | 303,914 | 381,456 | 254,300 | 353,298 | 631,079 | 314,855 | 395,188 | 263,454 | 366,017 | 390,525 | 759,466 | ||||||||||||||||||||||||||||||||||||

Provisions for loan losses | (37,368 | ) | (55,242 | ) | (110,348 | ) | (28,094 | ) | (31,519 | ) | (56,301 | ) | (57,231 | ) | (114,321 | ) | (29,106 | ) | (32,653 | ) | (23,013 | ) | (44,754 | ) | ||||||||||||||||||||||||

Net income | (97 | ) | 51,517 | 17,552 | 133,658 | 146,912 | 262,422 | 53,372 | 18,184 | 138,471 | 152,202 | 168,830 | 328,327 | |||||||||||||||||||||||||||||||||||

Earnings per share(1) | (0.0 | ) | 1.15 | 0.26 | 1.96 | 2.19 | — | |||||||||||||||||||||||||||||||||||||||||

Weighted average number of total shares(4) | 23,147 | 57,587 | 68,080 | 68,080 | 66,933 | — | ||||||||||||||||||||||||||||||||||||||||||

Earnings per share(1) | 1.19 | 0.27 | 2.03 | 2.27 | 2.52 | 0.0049 | ||||||||||||||||||||||||||||||||||||||||||

Weighted average number of total shares(4) | 57,587 | 68,080 | 68,080 | 66,933 | 67,091 | — | ||||||||||||||||||||||||||||||||||||||||||

| At or for the year ended December 31, | At or for the year ended December 31, | |||||||||||||||||||||||||||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2004 | 2001 | 2002 | 2003 | 2004 | 2005 | 2005 | |||||||||||||||||||||||||

| (in millions of constant Ch$ as of December 31, 2004, except share data) | (in thousands of U.S.$) | (in millions of constant Ch$ as of December 31, 2005, except share data) | (in thousands of U.S.$) | |||||||||||||||||||||||||||||||||

CONSOLIDATED BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||||||

Chilean GAAP: | ||||||||||||||||||||||||||||||||||||

Cash and due from banks | Ch$ | 528,531 | Ch$ | 562,955 | Ch$ | 700,267 | Ch$ | 878,255 | Ch$ | 890,616 | U.S.$ | 1,590,869 | 583,223 | 725,477 | 909,872 | 922,678 | 659,308 | 1,282,177 | ||||||||||||||||||

Financial investments | 1,478,121 | 1,759,103 | 1,655,261 | 1,964,232 | 1,607,273 | 2,871,001 | 1,822,429 | 1,714,849 | 2,034,944 | 1,665,136 | 1,450,009 | 2,819,877 | ||||||||||||||||||||||||

Loans, net of allowances | 3,984,728 | 3,973,488 | 6,155,049 | 6,227,855 | 6,735,169 | 12,030,740 | 4,116,533 | 6,376,630 | 6,452,059 | 6,977,636 | 8,064,619 | 15,683,512 | ||||||||||||||||||||||||

Other assets | 196,810 | 193,432 | 384,305 | 410,808 | 416,145 | 743,342 | 200,396 | 398,141 | 425,598 | 431,125 | 518,825 | 1,008,975 | ||||||||||||||||||||||||

Total assets | 6,188,190 | 6,488,978 | 8,894,882 | 9,481,150 | 9,649,203 | 17,235,952 | 6,722,581 | 9,215,097 | 9,822,473 | 9,996,575 | 10,692,761 | 20,794,541 | ||||||||||||||||||||||||

Deposits | 3,765,757 | 3,936,881 | 5,319,389 | 5,446,709 | 5,785,727 | 10,334,793 | 4,078,609 | 5,511,755 | 5,643,263 | 5,994,408 | 6,613,988 | 12,862,426 | ||||||||||||||||||||||||

Other interest bearing liabilities | 1,601,147 | 1,699,910 | 2,364,851 | 2,635,120 | 2,362,160 | 4,219,422 | 1,761,106 | 2,449,985 | 2,729,985 | 2,447,197 | 2,244,045 | 4,364,063 | ||||||||||||||||||||||||

Other liabilities | 400,805 | 427,509 | 570,620 | 686,253 | 826,783 | 1,476,848 | 442,900 | 590,294 | 710,487 | 856,153 | 1,059,621 | 2,060,677 | ||||||||||||||||||||||||

Total liabilities | 5,767,709 | 6,064,300 | 8,254,860 | 8,768,082 | 8,974,670 | 16,031,063 | 6,282,615 | 8,552,034 | 9,083,735 | 9,297,758 | 9,917,654 | 19,287,166 | ||||||||||||||||||||||||

Shareholders’ equity | Ch$ | 420,481 | Ch$ | 424,678 | Ch$ | 640,022 | Ch$ | 713,068 | Ch$ | 674,533 | U.S.$ | 1,204,889 | Ch$ | 439,966 | Ch$ | 663,063 | Ch$ | 738,738 | Ch$ | 698,817 | Ch$ | 775,107 | U.S.$ | 1,507,375 | ||||||||||||

U.S. GAAP(3): | ||||||||||||||||||||||||||||||||||||

U.S. GAAP(3): | ||||||||||||||||||||||||||||||||||||

Financial investments | 225,928 | 1,733,770 | 1,484,672 | 1,671,794 | 1,486,140 | 2,654,627 | 1,796,186 | 1,538,120 | 1,731,979 | 1,539,640 | 1,119,452 | 2,177,033 | ||||||||||||||||||||||||

Loans, net | 2,280,774 | 5,915,863 | 5,808,387 | 5,880,857 | 6,291,266 | 11,237,815 | 6,128,834 | 6,017,489 | 6,092,568 | 6,516,434 | 7,442,916 | 14,474,468 | ||||||||||||||||||||||||

Total assets | 2,987,107 | 9,222,042 | 8,900,762 | 9,437,600 | 9,623,775 | 17,190,531 | 9,554,036 | 9,221,189 | 9,777,354 | 9,925,518 | 10,626,463 | 20,665,609 | ||||||||||||||||||||||||

Total liabilities | 2,561,125 | 8,015,312 | 7,575,683 | 8,063,434 | 8,299,500 | 14,825,032 | 8,303,863 | 7,848,405 | 8,353,718 | 8,553,570 | 9,196,716 | 17,885,136 | ||||||||||||||||||||||||

Total shareholders’ equity | 425,982 | 1,206,730 | 1,325,079 | 1,374,166 | 1,324,275 | 2,365,499 | 1,250,172 | 1,372,782 | 1,423,636 | 1,371,948 | 1,429,747 | 2,780,471 | ||||||||||||||||||||||||

| At or for the year ended December 31, | At or for the year ended December 31, | |||||||||||||||||||||||||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | 2001 | 2002 | 2003 | 2004 | 2005 | |||||||||||||||||||||

CONSOLIDATED RATIOS | ||||||||||||||||||||||||||||||

Chilean GAAP: | ||||||||||||||||||||||||||||||

Profitability and Performance | ||||||||||||||||||||||||||||||

Net interest margin(5) | 4.27 | % | 3.87 | % | 4.52 | % | 2.75 | % | 3.84 | % | ||||||||||||||||||||

Return on average total assets(6) | 1.57 | 1.44 | 0.59 | 1.45 | 1.59 | |||||||||||||||||||||||||

Return on average shareholders’ equity(7) | 23.68 | 23.21 | 8.69 | 20.01 | 23.56 | |||||||||||||||||||||||||

Net interest margin(5) | 3.87 | % | 4.52 | % | 2.75 | % | 3.84 | % | 4.06 | % | ||||||||||||||||||||

Return on average total assets(6) | 1.44 | 0.59 | 1.45 | 1.59 | 1.75 | |||||||||||||||||||||||||

Return on average shareholders’ equity(7) | 23.21 | 8.69 | 20.01 | 23.56 | 26.66 | |||||||||||||||||||||||||

Capital | ||||||||||||||||||||||||||||||

Average shareholders’ equity as a percentage of total assets | 6.62 | 6.21 | 6.75 | 7.22 | 6.75 | |||||||||||||||||||||||||

Average shareholders’ equity as a percentage of average total assets | 6.21 | 6.75 | 7.22 | 6.75 | 6.56 | |||||||||||||||||||||||||

Bank regulatory capital as a percentage of minimum regulatory capital | 203.86 | 197.67 | 218.35 | 202.71 | 179.13 | 197.67 | 218.35 | 202.71 | 179.13 | 184.06 | ||||||||||||||||||||

Equity as a percentage of total assets | 6.50 | 6.21 | 6.75 | 7.22 | 6.75 | |||||||||||||||||||||||||

Ratio of liabilities to regulatory capital(8) | 17.46 | 18.27 | 14.10 | 15.14 | 17.20 | |||||||||||||||||||||||||

Ratio of liabilities to regulatory capital(8) | 18.27 | 14.10 | 15.14 | 17.20 | 16.69 | |||||||||||||||||||||||||

Credit Quality | ||||||||||||||||||||||||||||||

Substandard loans as a percentage of total loans(9) | 5.75 | 6.28 | 6.69 | 5.16 | 6.51 | |||||||||||||||||||||||||

Substandard loans as a percentage of total loans(9) | 6.28 | 6.69 | 5.16 | 6.51 | 4.62 | |||||||||||||||||||||||||

Past due loans as a percentage of total loans | 1.36 | 1.23 | 2.35 | 1.69 | 1.23 | 1.23 | 2.35 | 1.69 | 1.23 | 0.87 | ||||||||||||||||||||

Allowances for loan losses as a percentage of substandard loans(9) | 52.52 | 54.60 | 52.44 | 55.56 | 38.41 | |||||||||||||||||||||||||

Allowances for loan losses as a percentage of substandard loans(9) | 54.60 | 52.44 | 55.56 | 34.30 | 37.26 | |||||||||||||||||||||||||

Allowances for loan losses as a percentage of past due loans | 222.46 | 278.72 | 149.07 | 170.09 | 181.55 | 278.72 | 149.07 | 170.09 | 181.59 | 198.05 | ||||||||||||||||||||

Allowances for loan losses as a percentage of total loans | 3.02 | 3.43 | 3.51 | 2.87 | 2.23 | 3.43 | 3.51 | 2.87 | 2.23 | 1.72 | ||||||||||||||||||||

Past due amounts as a percentage of shareholders’ equity | 16.89 | 15.26 | 25.63 | 18.67 | 16.23 | |||||||||||||||||||||||||

Consolidated risk index(10) | 2.01 | 2.42 | 3.00 | 2.36 | 2.23 | |||||||||||||||||||||||||

Past due amounts as a percentage of bank regulatory capital | 15.26 | 25.63 | 18.67 | 16.23 | 12.00 | |||||||||||||||||||||||||

Consolidated risk index(10) | 2.42 | 3.00 | 2.36 | 2.23 | 1.72 | |||||||||||||||||||||||||

Operating Ratios | ||||||||||||||||||||||||||||||

Operating expenses/operating revenue | 52.92 | 52.58 | 60.04 | 53.28 | 51.15 | 52.58 | 60.20 | 53.43 | 51.29 | 53.33 | ||||||||||||||||||||

Operating expenses/average total assets | 2.57 | 2.30 | 2.76 | 2.46 | 2.50 | 2.30 | 2.77 | 2.46 | 2.51 | 2.68 | ||||||||||||||||||||

U.S. GAAP: | ||||||||||||||||||||||||||||||

Profitability and Performance | ||||||||||||||||||||||||||||||

Net interest margin(11) | 2.22 | 5.12 | 4.53 | 3.03 | 4.13 | % | ||||||||||||||||||||||||

Return on average total assets(12) | 00 | % | 0.80 | % | 0.19 | % | 1.44 | % | 1.53 | % | ||||||||||||||||||||

Net interest margin(11) | 5.12 | 4.53 | 3.03 | 4.13 | 4.29 | |||||||||||||||||||||||||

Return on average total assets(12) | 0.80 | 0.19 | 1.44 | 1.53 | 1.64 | |||||||||||||||||||||||||

| (1) | Earnings per share data have been calculated by dividing net income by the weighted average number of common shares outstanding during the year. |

| (2) | Dividends per share data are calculated by dividing the amount of the dividend paid by the |

| (3) | All U.S. GAAP numbers use Article 9 presentation. All U.S. GAAP figures have been calculated taking into account the U.S. GAAP adjustments set forth in |

| (4) |

| (5) | Net interest revenue divided by average interest earning assets. The average balances for interest earning assets, including interest and readjustments, have been calculated on the basis of our daily balances and on the basis of monthly balances for our subsidiaries. |

| (6) | Net income (loss) divided by average total assets. The average balances for total assets have been calculated on the basis of our daily balances and on the basis of monthly balances for our subsidiaries. |

| (7) | Net income (loss) divided by average shareholders’ equity. The average balances for shareholders’ equity have been calculated on the basis of our daily balances. |

| (8) | Total liabilities divided by bank regulatory capital. |

| (9) | See “Item 4. Information on the Company—Selected Statistical Information—Analysis of Substandard Loans and Amounts Past Due.” |

| (10) | The guidelines used to calculate our consolidated risk index were amended in 2004. As a result, our consolidated risk index as of December 31, 2004 |

| (11) | Net interest revenue under U.S. GAAP divided by average interest earning assets. |

| (12) | Net income under U.S. GAAP divided by average total assets. |

Exchange Rates

As a general matter, prior to 1989, Chilean law permitted the purchase and sale of foreign exchange only in those cases explicitly authorized by the Central Bank. TheLey Organica Constitucional del Banco Central de Chile 18.840, or the Central Bank Act, liberalized the rules that govern the purchase and sale of foreign currency. The Central Bank Act empowers the Central Bank to determine that certain purchases and sales of foreign currency specified by law must be carried out in theMercado Cambiario Formal, or the Formal Exchange Market. The Formal Exchange Market is formed by the banks and other entities so authorized by the Central Bank. The observed exchange rate for any given day equals the average exchange rate of the transactions conducted in the Formal Exchange Market on the immediately preceding banking day, as certified by the Central Bank. Even though the Central Bank is authorized to carry out its transactions at the rates it sets, it generally uses the spot rate for its transactions. Authorized transactions by other banks are generally carried out at the spot rate.

Purchases and sales of foreign exchange which may be effected outside the Formal Exchange Market can be carried out in theMercado Cambiario Informal, or the Informal Exchange Market. There are no limits imposed on the extent to which the rate of exchange in the Informal Exchange Market can fluctuate above or below the observed exchange rate. On December 30, 20042005 (the latest practicable date, as December 31, 20042005 was a banking holiday in Chile), the average exchange rate in the Informal Exchange Market was Ch$556.75512.05 per U.S.$1.00, or 0.55%0.42% lower than the published observed exchange rate of Ch$559.83514.21 per U.S.$1.00.

The following table sets forth the annual low, high, average and period-end observed exchange rate for U.S. dollars for each year beginning in 2000,2001, as reported by the Central Bank:

| Daily Observed Exchange Rate Ch$ per U.S.$(1) | Daily Observed Exchange Rate Ch$ per U.S.$(1) | |||||||||||||||||||||||

Year | Low(2) | High(2) | Average(3) | Period End(4) | Low(2) | High(2) | Average(3) | Period End(4) | ||||||||||||||||

2000 | Ch$ | 501.04 | Ch$ | 580.37 | Ch$ | 539.49 | Ch$ | 572.68 | ||||||||||||||||

2001 | 557.13 | 716.62 | 634.94 | 656.20 | Ch$ | 557.13 | Ch$ | 716.62 | Ch$ | 634.94 | Ch$ | 656.20 | ||||||||||||

2002 | 641.75 | 756.56 | 688.94 | 712.38 | 641.75 | 756.56 | 688.94 | 712.38 | ||||||||||||||||

2003 | 593.10 | 758.21 | 691.40 | 599.42 | 593.10 | 758.21 | 691.40 | 599.42 | ||||||||||||||||

2004 | 559.21 | 649.45 | 609.55 | 559.83 | 559.21 | 649.45 | 609.55 | 559.83 | ||||||||||||||||

2005 | 509.70 | 592.75 | 559.77 | 514.21 | ||||||||||||||||||||

December | 559.66 | 597.27 | 576.17 | 559.83 | 509.70 | 518.63 | 514.33 | 514.21 | ||||||||||||||||

2005 | ||||||||||||||||||||||||

2006 | ||||||||||||||||||||||||

January | 557.40 | 586.18 | 574.12 | 586.18 | 512.50 | 535.36 | 524.48 | 524.78 | ||||||||||||||||

February | 563.22 | 585.40 | 573.58 | 577.52 | 516.91 | 532.35 | 525.70 | 517.76 | ||||||||||||||||

March | 573.55 | 591.69 | 586.48 | 586.45 | 516.75 | 536.16 | 528.77 | 527.70 | ||||||||||||||||

April | 572.75 | 588.95 | 580.46 | 582.87 | 511.44 | 526.18 | 517.33 | 518.62 | ||||||||||||||||

May | 570.83 | 583.59 | 578.31 | 580.20 | 512.76 | 532.92 | 520.79 | 531.11 | ||||||||||||||||

June(5) | 580.62 | 592.75 | 587.94 | 582.55 | ||||||||||||||||||||

June(5) | 529.91 | 547.83 | 540.57 | 545.64 | ||||||||||||||||||||

Source: Central Bank.

| Source: | Central Bank. |

| (1) | Nominal amounts. |

| (2) | Exchange rates are the actual low and high, on a day-by-day basis for each period. |

| (3) | The average of monthly average rates during the year. |

| (4) | As reported by the Central Bank the first business day of the following period. |

| (5) | Period from June 1, |

The observed exchange rate on June 21, 200522, 2006 was Ch$582.55545.64 = U.S.$1.00. The Federal Reserve Bank of New York does not report a noon buying rate for Chilean pesos.

RISK FACTORS

The risks and uncertainties described below are not the only ones that we face. Additional risks and uncertainties that we do not know about or that we currently think are immaterial may also impair our business operations. Any of the following risks if they actually occur, could materially and adversely affect our business, results of operations, prospects and financial condition.

We are subject to market risks that are presented both in this subsection and in “Item 11. Quantitative and Qualitative Disclosures About Market Risk.”

Risks Relating to our Operations and the Banking Industry

WeOur U.S. branches are involved in ongoing regulatory proceedings that could result in monetary fines.subject to obligations imposed under consent orders

Beginning in September 2004, the Office of the Comptroller of the Currency, or OCC, and the Board of Governors of the Federal Reserve System by and through the Federal Reserve Bank of Atlanta, collectively,together, the Federal Reserve, conducted targeted examinations of our New York and Miami branches, respectively, to evaluate, among other things, our compliance with the U.S. Bank Secrecy Act and other U.S. anti-money laundering requirements. As a result of thesetheir examinations, the OCC and the Federal Reserve identified certain deficiencies in our internal controls, particularly in the areas of the Bank Secrecy Act and anti-money laundering compliance. As a result, on February 1, 2005, we agreed to the issuance by the OCC of a consent order, withapplicable to our New York branch, and the OCC andissuance by the Federal Reserve of a cease and desist order, with the Federal Reserve.applicable to our Miami branch. Pursuant to these orders, we have instituted an action plan whichthat includes the maintenance of programs geared towards strengthening our compliance with the Bank Secrecy Act and United StatesU.S. anti-money laundering laws. Based on the press statement issued by

On October 12, 2005, we entered into agreements with the OCC, atand separately with the timeFinancial Crimes Enforcement Network, or FinCEN, requiring a U.S.$3 million civil penalty, payable by our New York and Miami branches, to resolve allegations related to the consent order was entered into,Bank Secrecy Act, anti-money laundering compliance and related matters. Failure by us to satisfy the terms of the orders could result in additional supervisory actions against our New York and Miami branches, including the assessment of additional civil money penalties and other sanction are possible, but the likelihood, extent and amount of such actions cannot be determined at this time. We cannot assure you that these examinations will not have an adverse effect on our financial condition and results of operations.monetary penalties. See “Item 8. Financial Information—Legal Proceedings.”

The growth of our loan portfolio may expose us to increased loan losses.

From December 31, 19992001 to December 31, 2004,2005, our aggregate loan portfolio, net of interbank loans (on an unconsolidated basis) grew by 115.4%124.2% in nominal terms and 82.4%102.9% in real terms to Ch$6,659,8398,073,288 million. During the same period, our consumer loan portfolio grew by 303.0%315.0% in nominal terms and 241.3%275.7% in real terms to Ch$691,851864,144 million, each calculated in accordance with the loan classification system of the Chilean Superintendency of Banks. On a combined basis (combining Banco de Chile and Banco de A. Edwards), from December 31, 19992001 to December 31, 2004,2005, the aggregate loan portfolio of both banks, net of interbank loans (on an unconsolidated basis) grew by 32.0%39.0% in nominal terms and 12.4%25.9% in real terms to Ch$6,659,8398,073,288 million. During the same period, on a combined basis, the consumer loan portfolio of both banks grew by 136.9%123.0% in nominal terms and 100.6%101.9% in real terms to Ch$691,851864,144 million, each calculated in accordance with the loan classification system of the Chilean Superintendency of Banks. Further expansionExpansion of our loan portfolio (particularly in the lower-middle to middle income consumer and small- to medium-sized corporate business areas)retail market) may expose us to a higher level of loan losses and require us to establish higher levels of allowances for loan losses.

For the year ended December 31, 2005, total provision for loan losses accounted for Ch$22,028 million, or 0.29%, of total average loans.

Our loan portfolio may not continue to grow at the same or similar rate.

We cannot assure you that in the future our loan portfolio will continue to grow at historical rates. According to the Chilean Superintendency of Banks, from December 31, 19992001 to December 31, 2004,2005, the

aggregate amount of loans outstanding in the Chilean banking system (on an unconsolidated basis) grew by 49.9%48.2% in nominal terms and 26.9%34.2% in real terms to Ch$37,349,29644,243,988 million. A reversal of this rate of growth of the Chilean economy could adversely affect the rate of growth of our loan portfolio and our risk index and, accordingly, increase our required allowances for loan losses. See “Item 4. Information on the Company—Regulation and Supervision” and “Item 4. Information on the Company —Selected Statistical Information.”

Restrictions imposed by banking regulations may restrict our operations and thereby adversely affect our financial condition and results of operations.

We are subject to regulation by the Chilean Superintendency of Banks. In addition, we are subject to regulation by the Central Bank with regard to certain matters, including interest rates and foreign exchange transactions. See “Item 4. Information on the Company—Regulation and Supervision.” During the Chilean financial crisis of 1982 and 1983, the Central Bank and the Chilean Superintendency of Banks strictly controlled the funding, lending and general business matters of the Chilean banking industry.

Pursuant to theLey General de Bancos, or the General Banking Law, all Chilean banks may, subject to the approval of the Chilean Superintendency of Banks, engage in additional businesses depending on the risk of the activity and the strength of the bank. The General Banking Law also applies to the Chilean banking system a modified version of the capital adequacy guidelines issued by the Basel Committee on Banking Regulation and Supervisory Practices, or Basel Committee, and limits the discretion of the Chilean Superintendency of Banks to deny new banking licenses. There can be no assurance that regulators will not in the future impose more restrictive limitations on the activities of banks, including us, than those that are currently in effect. Any such change could have a material adverse effect on our financial condition or results of operations.

We reported a negative cash flow from operating activities for the year ended December 31, 2003, which could have an adverse effect on our ability to operate in the future.

During 2003, we reported a negative cash flow from our operations. During that year, we invested a large amount of cash in Central Bank securities in order to meet our technical reserve requirements as a result of higher current account and other demand deposits levels, resulting in negative operating cash flow. From time to time, we may need to invest large amounts of cash in order to meet regulatory requirements. Given current low interest rates, our customers tend to maintain deposits in checking accounts and in other demand deposits, which are included in the technical reserve requirement, which may also result in a need to invest more cash in highly liquid products such as Central Bank securities. Either or both of these needs may affect our cash flow from operations. We cannot assure you that we will not report a negative cash flow from operating activities in the future.

Increased competition and industry consolidation may adversely affect our operations.

The Chilean market for financial services is highly competitive. We compete with other Chilean private sector domestic and foreign banks, with Banco del Estado de Chile, a public sector bank, and with large department stores that make consumer loans to a large portion of the Chilean population. In 2002, two new private sector banks affiliated with Chile’s largest department stores began their operations, mainly as consumer and medium-sized corporate niche banks. In 2003, a new niche bank oriented at servicing corporations began its operations, and in 2004, two new retail banks commenced operations. The lower-middle to middle income portionsretail market (comprised of the Chilean populationindividuals and the small- and medium-sized companies havecompanies) has become the target marketsmarket of several banks, and competition with respect to these customers is likely to increase. As a result, net interest margins in these subsegmentssub-segments are likely to decline. Although we believe that demand for financial products and services from lower-middle to middle income individuals and from small- and medium-sized companiesthe retail market will continue to grow during the remainder of the decade, we cannot assure you that net interest margins will be maintained at their current levels.

We also face competition from non-bank competitors with respect to some of our credit products, such as credit cards and consumer loans. Non-bank competition from large department stores, private compensation funds and savings and credit associations has become increasingly significant in the consumer lending sector. In addition, we face competition from competitors such as leasing, factoring and automobile finance companies, with respect to credit products, and mutual funds, pension funds and insurance companies, with respect to savings products and mortgage loans. Currently, banks continue to be the main suppliers of leasing, factoring and mutual funds, and the insurance sales business has experienced rapid growth.growth, but we cannot assure you that they will continue to be in the future. See “Item 4. Information on the Company—Business Overview—Competition.”

The increase in competition within the Chilean banking industry in recent years hadhas led to, among other things, consolidation in the industry. For example, on August 1, 2002, Banco Santiago and Banco Santander-Chile, the then-second and third largest banks in Chile, respectively, merged creatingto create Chile’s largest bank. In 2003, Banco del Desarrollo merged with Banco Sudameris and,Sudameris; in 2004, Banco Security merged

with Dresdner Banque Nationale de Paris.Paris; and in 2005 Banco de Creditos e Inversiones merged with Banco Conosur. We expect the trends of increased competition and consolidation to continue and result in the formation of new large financial groups. Consolidation, which can result in the creation of larger and stronger banks, may adversely affect our financial condition and results of operations by decreasing the net interest margins we are able to generate and by increasing our costs of operations.

Our exposure to small businesses and lower-middle income individualscertain segments of the retail market could lead to higher levels of past due loans and subsequent charge-offs.

Although we historically emphasized banking for largethe wholesale market and medium-sized businesses,high income individuals, an increasing numberproportion of our corporate customersretail market consists of middle-sized and small companies (approximately 9.4%7.8% of the value of theour total loan portfolio at December 31, 2004) consist of small2005, including companies (those with annual sales of less thanup to Ch$3001,200 million) and, to a lesser extent, individual customersof lower income individuals (approximately 2.8% of the value of theour total loan portfolio at December 31, 2004) in the lower income2005, including individuals subsegment (annual incomewith monthly incomes between Ch$1.8 million170,000 and Ch$5.4 million)380,000). Our strategy includes increasing lending and providing other services to attract additional lower-middle income individuals and small companies asretail customers. These customers are likely to be more severely affected by adverse developments in the Chilean economy than large corporations and high-income individuals. Consequently, in the future we may experience higher levels of past due loans, which could result in higher allowances for loan losses. The levels of past due loans and subsequent write-offs may be materially higher in the future. See “Item 4. Information on the Company—Business Overview—Principal Business Activities.”

Our affiliate may be obligated to sell shares of our stock in the public market if we do not pay sufficient dividends.

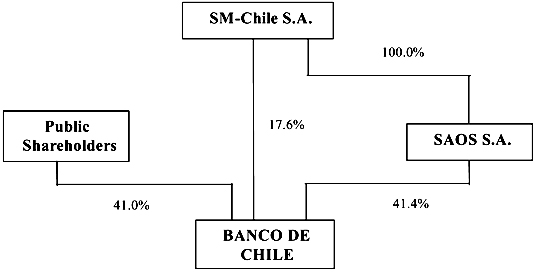

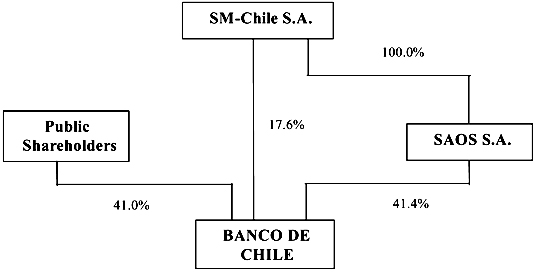

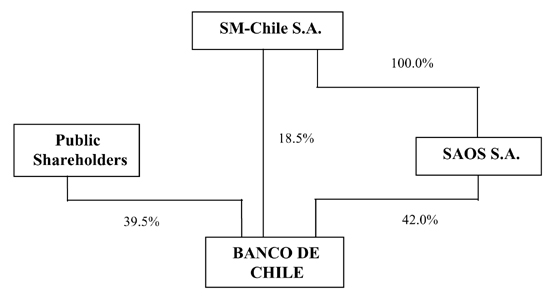

As of December 31, 2004,2005, Sociedad Administradora de la Obligacion Subordinada SAOS S.A., or SAOS, our affiliate, holds 42.0% of our shares as a consequence of our 1996 reorganization. The reorganization was partially due to our 1989 repurchase from the Central Bank of certain non-performing loans that we had previously sold to the Central Bank and later exchanged for subordinated debt without a fixed term. Under the terms of a repayment obligation in favor of the Central Bank that SAOS assumed to replace the Central Bank subordinated debt, SAOS may be required to sell some of our shares to the public. See “Item 4. Information on the Company—History and Development of the Bank—History—The 1982-1983 Economic Crisis and the Central Bank Subordinated Debt.”

In exchange for assuming the Central Bank indebtedness, SAOS received from SM-Chile S.A., a holding company that controls us and SAOS, 63.6% of our shares as collateral for this indebtedness. As a result of our merger with Banco de A. Edwards, the percentage of our shares held by SAOS decreased to 42.0%. As a result of the share dividend paid in May 2006, the percentage further decreased to 41.4%. Dividends received from us are the sole source of SAOS’s revenue, which it must apply to repay this indebtedness. However, under SAOS’s agreement with the Central Bank, we have no obligation to distribute dividends to our shareholders. To the extent distributed dividends are not sufficient to pay the amount due on this indebtedness, SAOS is permitted to maintain a cumulative deficit balance with the Central Bank that

SAOS commits to pay with future dividends. If the cumulative deficit balance exceeds an amount equal to 20% of our capital and reserves, the Central Bank may require SAOS to sell a sufficient number of shares of our stock owned by SAOS to pay the entire accumulated deficit amount. As of May 2, 2005,2006, SAOS maintained a deficit balance with the Central Bank of Ch$27,90510,480 million, equivalent to 5.4%1.67% of our capital and reserves. As of the same date, Ch$104,155125,250 million would have represented 20.0% of our capital and reserves. If from time to time in the future our shareholders decide to retain and capitalize all or part of our annual net income in order to finance our future growth, and to distribute stock dividends among our shareholders, the Central Bank may require us to pay the portion of the net income corresponding to shares owned by SAOS in cash to SAOS. If we distribute stock dividends and the Central Bank does not require us to pay that portion in cash, the shares received by SAOS must be sold by SAOS within the following 12 months. The shareholders of SM-Chile will have a right of first refusal with respect to that sale.

We are unable to determine the likelihood that the Central Bank would require SAOS to sell shares of our common stock or that SAOS will otherwise be required to sell any stock dividends distributed by us, nor can we determine the number of such shares SAOS may be required to sell. If SAOS is required to sell shares of our stock in the public market, that sale could adversely affect the prevailing market price of our stock.

Our results of operations are affected by interest rate volatility.

Our results of operations depend to a great extent on our net interest revenue, which represented 69.9%71.3% of our operating revenue in 2004.2005. Changes in market interest rates could affect the interest rates earned on our interest-earning assets differently from the interest rates paid on our interest-bearing liabilities, leading to a reduction in our net interest revenue. Interest rates are highly sensitive to many factors beyond our control, including the reserve policies of the Central Bank, deregulation of the financial sector in Chile, domestic and international economic and political conditions and other factors. Any volatility in interest rates could have a material adverse effect on our financial condition or results of operations. The average annual short-term interest rate (based on the rate paid by Chilean financial institutions) for 90 to 360 day deposits was 1.94% in 2002, 1.76% in 2003, and 1.07% in 2004.2004 and 1.89% in 2005. The average long-term interest rate based on the Chilean Central Bank’s eight-year duration bonds was 4.54% in 2002, 3.96% in 2003, and 3.52% in 2004.2004 and 2.54% in 2005. See “Item 5. Operating and Financial Review and Prospects—Operating Results—Overview—Inflation” and “Item 5. Operating and Financial Review and Prospects —Overview—— Operating Results—Overview—Interest Rates.”

Operational problems or errors can have a material adverse impact on our business, financial condition and results of operations.

We, like all large financial institutions, are exposed to many operational risks, including the risk of fraud by employees and outsiders, failure to obtain proper internal authorizations, failure to properly document transactions, equipment failures and errors by employees. Although we maintain a system of operational controls, there can be no assurance that operational problems or errors will not occur and that their occurrence will not have a material adverse impact on our business, financial condition and results of operations.

Risks Relating to our ADSs

Our principal shareholders may have interests that differ from those of our other shareholders and their significant share ownership may have an adverse effect on the future market price of our ADSs and shares.

As of December 31, 2004,May 11, 2006, LQ Inversiones Financieras S.A., a holding company beneficially owned by Quiñenco S.A., beneficially owned approximately 51.57%50.29% of our outstanding voting rights. These principal shareholders are in a position to elect a majority of the members of our board of directors, direct our management and control substantially all matters that are to be decided by a vote of the shareholders, including fundamental corporate transactions.

Actions by our principal shareholders with respect to the disposition of the shares or ADSs they beneficially own, or the perception that such actions may occur, may adversely affect the trading price of our shares on the various stock exchanges on which they are listed and, consequently, the market price of the ADSs.

There may be a lack of liquidity and a limited market for our shares and ADSs.

We merged with Banco de A. Edwards, a Chilean Bank, effective as of January 1, 2002. Prior to the merger, there was no public market for our shares outside Chile or for our ADSs. While our ADSs have been listed on the New York Stock Exchange, or NYSE, since the first quarter of 2002, there can be no assurance that an active trading market for our ADSs will be sustained. During 2004,2005, a daily average of 6,2377,696 American Depositary Receipts, or ADRs, were traded on the NYSE. Although our shares are traded on the Santiago

Stock Exchange, the Valparaiso Stock Exchange and the Chilean Electronic Stock Exchange, the market for our shares in Chile is small and illiquid. At December 31, 2004,2005, approximately 12.0%12.87% of our outstanding shares are held by shareholders other than our principal shareholders, including SM-Chile and SAOS.

If an ADS holder withdraws the underlying shares from the ADR facility, the small size of the market and its low liquidity in general, and our concentrated ownership in particular, may impair the ability of the ADS holder to sell the shares in the Chilean market in the amount and at the price and time such holder desires, and could increase the volatility of the price of our ADSs.

You may be unable to exercise preemptive rights.

TheLey Sobre Sociedades Anonimas No. 18,046 and theReglamento de Sociedades Anonimas, or the Chilean Corporations Law and its regulations require that whenever we issue new common stock for cash, we grant preemptive rights to all of our shareholders (including holders of ADSs) to purchase a sufficient number of shares to maintain their existing ownership percentage. Such an offering would not be possible unless a registration statement under the Securities Act of 1933, as amended, or the Securities Act, were effective with respect to such rights and common stock or an exemption from the registration requirements thereunder were available.

We may elect not to make a registration statement available with respect to the preemptive rights and the common stock, in which case you may not be able to exercise your preemptive rights. If a registration statement is not filed, the depositary will sell such holders’ preemptive rights and distribute the proceeds thereof if a premium can be recognized over the cost of any such sale.

Developments in other emerging markets may adversely affect the market price of the ADSs and shares.

The market price of the ADSs may be adversely affected by declines in the international financial markets and adverse world economic conditions. The market for Chilean securities is, to varying degrees, influenced by economic and market conditions in other emerging market countries, especially those in Latin America. Although economic conditions are different in each country, investors’ reactions to developments in one country can affect the securities markets and the securities of issuers in other countries, including Chile. Developments in other countries may adversely affect the market price of the ADSs.

In the past, Chile has imposed controls on foreign investment and repatriation of investments that affected an investment in, and earnings from, our ADSs.

Equity investments in Chile by persons who are not Chilean residents have historically been subject to various exchange control regulations that restrict the repatriation of the investments and earnings therefrom. In April 2001, the Central Bank eliminated most of the regulations that affected foreign investors, although foreign investors still have to provide the Central Bank with information related to equity investments and must conduct such operations within the Formal Exchange Market. Additional Chilean restrictions applicable to holders of our ADSs, the disposition of the shares underlying them or the repatriation of the proceeds from such disposition or the payment of dividends may be imposed in the future, and we cannot advise you as to the duration or impact of such restrictions if imposed.

If for any reason, including changes in Chilean law, the depositary were unable to convert Chilean pesos to U.S. dollars, investors would receive dividends and other distributions, if any, in Chilean pesos.

We are required to withhold for tax purposes 35% of any dividend we pay to you.

Owners of ADSs are entitled to receive dividends on the underlying shares to the same extent as the holders of shares. Dividends received by holders of ADSs will be paid net of foreign currency exchange fees and expenses of the depositary and will be subject to Chilean withholding tax of up to 35% of the dividend,

which we will withhold and pay to the Chilean tax authorities. Any dividend distributions made in property (other than common stock) will be subject to the same Chilean tax rules as cash dividends. See “Item 10. Additional Information—Taxation—Chilean Tax Considerations.”

Risks Relating to Chile

Currency fluctuations could adversely affect the value of our ADSs and any distributions on the ADSs.

The Chilean government’s economic policies and any future changes in the value of the Chilean peso against the U.S. dollar could affect the dollar value of our common stock and our ADSs. The peso has been subject to large devaluations in the past and could be subject to significant fluctuations in the future. In the period from December 31, 1998 to December 31, 2004,2005, the value of the U.S. dollar relative to the Chilean peso increased approximately 0.24%, as compared to an 8.2%11.36% decrease in value in the period from December 31, 19942004 to December 31, 1998.

2005.

Chilean trading in the shares underlying our ADSs is conducted in pesos. Cash distributions with respect to our shares of common stock are received in Chilean pesos by the depositary, which then converts such amounts to U.S. dollars at the then-prevailing exchange rate for the purpose of making payments in respect of our ADSs. If the value of the Chilean peso falls relative to the U.S. dollar, the dollar value of our ADSs and any distributions to be received from the depositary will be reduced. In addition, the depositary will incur customary currency conversion costs (to be borne by the holders of our ADSs) in connection with the conversion and subsequent distribution of dividends or other payments. See “Item 10. Additional Information—Exchange Controls.”

Our results of operations may be affected by fluctuations in the exchange rates between the peso and the U.S. dollar despite our policy and Chilean regulations relating to the general avoidance of material exchange rate mismatches. In order to reduce the effect of exchange rate mismatches we enter into forward exchange transactions. As of December 31, 2005, the net position of our foreign currency denominated assets and Chilean peso-denominated assets, which contain repayment terms linked to changes in foreign currency exchange rates, exceeded our foreign currency denominated liabilities and Chilean peso-denominated liabilities, which contain repayment terms linked to changes in foreign currency exchange rates, by Ch$26,451 million, or 4.5% of our paid-in capital and reserves.

We may decide to change our policy regarding exchange rate mismatches. Regulations that limit such mismatches may also be amended or eliminated. Greater exchange rate mismatches will increase our exposure to the devaluation of the peso, and any such devaluation may impair our capacity to service foreign-currency obligations and may, therefore, materially and adversely affect our financial condition and results of operations. Notwithstanding the existence of general policies and regulations that limit material exchange rate mismatches, the economic policies of the Chilean government and any future fluctuations of the peso against the U.S. dollar could adversely affect our financial condition and results of operations.

Inflation could adversely affect the value of our ADSs and financial condition and results of operations.

Although Chilean inflation has moderated in recent years, Chile has experienced high levels of inflation in the past. High levels of inflation in Chile could adversely affect the Chilean economy and, indirectly, the value of our ADSs. The annual rate of inflation (as measured by changes in the Consumer Price Index and as reported by theInstituto Nacional de Estadisticas, or the Chilean National Institute of Statistics) during the last five years ended December 31, 20042005 and the first five months of 20052006 was:

Year | Inflation (Consumer Price Index) | Inflation (Consumer Price Index) | ||||

2000 | 4.5 | % | ||||

2001 | 2.6 | 2.6 | % | |||

2002 | 2.8 | 2.8 | ||||

2003 | 1.1 | 1.1 | ||||

2004 | 2.4 | 2.4 | ||||

2005 (through May 31) | 1.4 | % | ||||

| Source: Chilean National Institute of Statistics | ||||||

2005 | 3.7 | |||||

2006 (through May 31) | 1.5 | % | ||||

Source: Chilean National Institute of Statistics

Although we currently benefit from inflation in Chile due to the structure of our assets and liabilities (i.e., we have a significant amount of deposits that are not indexed to the inflation rate and do not accrue interest while a significant portion of our loans are indexed to the inflation rate), our operating results and the value of our ADSs in the future may be adversely affected by changing levels of inflation, and Chilean inflation could change significantly from the current level.

Our growth and profitability depend on the level of economic activity in Chile.

A substantial amount of our loans are to borrowers doing business in Chile. Accordingly, the recoverability of these loans, in particular, our ability to increase the amount of loans outstanding and our results of operations and financial condition, in general, are dependent to a significant extent on the level of economic activity in Chile. The Chilean economy has been influenced, to varying degrees, by economic conditions in other emerging market countries. We cannot assure you that the Chilean economy will continue to grow in the future or that future developments in or affecting the Chilean economy will not materially and adversely affect our business, financial condition or results of operations. Furthermore, although our operations (with the exception of our branches in New York and Miami, our trade services subsidiary in Hong Kong and our three representative offices located in Buenos Aires, Sao Paulo and Mexico City) are currently limited to Chile, we may in the future pursue a strategy of expansion into other Latin American countries. The potential success of such strategy will depend in part on political, social and economic developments in such countries.

Chile has corporate disclosure and accounting standards different from those you may be familiar with in the United States.

The accounting, financial reporting and securities disclosure requirements in Chile differ from those in the United States. Accordingly, the information about us available to you will not be the same as the information available to shareholders of a U.S. company.

There are also important differences between Chilean and U.S. accounting and financial reporting standards. As a result, Chilean financial statements and reported earnings generally differ from those that would be reported based on U.S. accounting and reporting standards. See noteNote 28 to our audited consolidated financial statements.

As a regulated financial institution, we are required to submit to the Chilean Superintendency of Banks unaudited unconsolidated balance sheets and income statements, excluding any note disclosure, prepared in accordance with Chilean GAAP on a monthly basis. The Chilean Superintendency of Banks

makes this information public within approximately three months of receipt. The Chilean Superintendency of Banks also makes summary financial information available within three weeks of receipt. Such disclosure differs in a number of significant respects from information generally available in the United States with respect to U.S. financial institutions.

Chilean disclosure requirements for publicly listed companies differ from those in the United States in some significant respects. In addition, although Chilean law imposes restrictions on insider trading and price manipulation, the Chilean securities markets are not as highly regulated and closely supervised as the U.S. securities markets.

Chilean law provides for fewer and less well-defined shareholders’ rights.

Our corporate affairs are governed by ourestatutos, or bylaws, and the laws of Chile. Under such laws, our shareholders may have fewer or less well-defined rights than they might have as shareholders of a corporation incorporated in a U.S. jurisdiction. For example, our shareholders would not be entitled to appraisal rights in the event of a merger or other business combination undertaken by us.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. These statements appear throughout this annual report, including, without limitation, under “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” Examples of such forward-looking statements include:

Words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “target,” “estimate,” “project,” “potential,” “predict,” “forecast,” “guideline,” “could,” “may,” “will,” “should” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. These statements may relate to (1) our asset growth and financing plans, (2) trends affecting our financial condition or results of operations and (3) the impact of competition and regulations, but are not limited to such topics. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ materially from those described in such forward-looking statements included in this annual report as a result of various factors (including, without limitation, the actions of competitors, future global economic conditions, market conditions, foreign exchange rates and operating and financial risks), many of which are beyond our control. The occurrence of any such factors not currently expected by us would significantly alter the results set forth in these statements.

Factors that could cause actual results to differ materially and adversely include, but are not limited to:

You should not place undue reliance on forward-looking statements, which speak only as of the date that they were made. This cautionary statement should be considered in connection with any written or oral forward-looking statements that we may issue in the future. We do not undertake any obligation to release publicly any revisions to such forward-looking statements after the filing of this annual report to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

HISTORY AND DEVELOPMENT OF THE BANK

Overview

Our bank wasWe were founded in 1893, and we believe that we have been, for much of our recent history, among the largest and most profitable Chilean banks in terms of return on assets and shareholders’ equity. We are engaged primarily in commercial banking in Chile, providing general banking services to a diverse customer base that includes large corporations small and mid-sized businesses and individuals.

Our legal name is Banco de Chile, and weChile. We are organized as a banking corporation under the laws of the Republic of Chile and are licensed by the Chilean Superintendency of Banks to operate as a commercial bank. Our principal executive offices are located at Ahumada 251, Santiago, Chile. Our telephone number is +56 (2) 653-1111637-1111 and our website is www.bancochile.cl. Our registered agent in the United States is Banco de Chile, New York Branch. Its office isBranch, located at 535 Madison Avenue, 9th Floor, New York, New York 10022; its10022, telephone number is +1 (212) 758-0909.

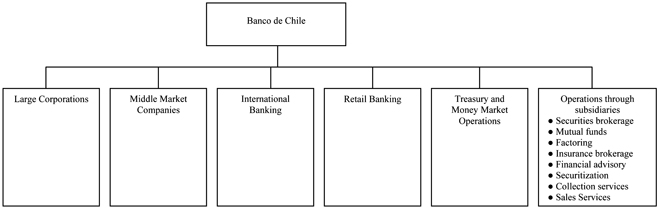

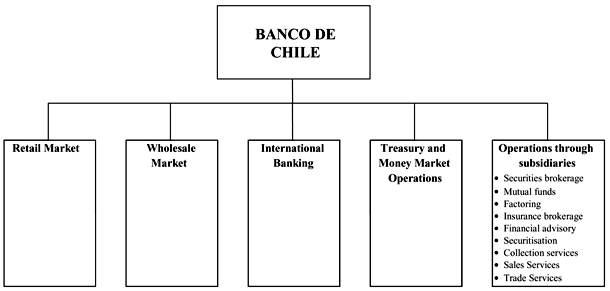

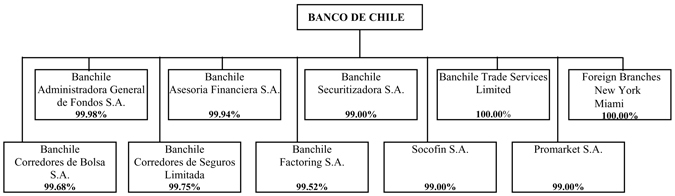

We are a full-service financial institution providing, directly and indirectly through our subsidiaries and affiliates, a wide variety of credit and non-credit products and services to all segments of the Chilean financial market. Our operations are organized in sixfive principal business areas:

Our corporate banking services for corporate customers include commercial loans, including working capital facilities and trade finance, foreign exchange, capital market services, cash management and non-credit services such as payroll and payment services. We also provideservices, as well as a wide range of treasury and risk management products to our corporate customers, and weproducts. We provide our individual customers with credit cards, residential mortgage, auto and consumer loans, as well as traditional deposit services such as checking and savings accounts and time deposits.

We offer international banking services through our branches in New York and Miami, our trade services subsidiary in Hong Kong, representative offices in Buenos Aires, Sao Paulo and Mexico City and a worldwide network of correspondent banks. In addition to our commercial banking operations, through our subsidiaries, we offer a variety of non-banking financial services including securities brokerage, mutual fund management, financial advisory services, factoring, insurance brokerage, securitization and collection and sales services.

As of December 31, 2004,2005, we had:

According to information published by the Chilean Superintendency of Banks, as of December 31, 2004,2005, we were the second largest private bank in Chile in terms of total loans (excluding interbank loans) with a market share of 17.8%18.25%.

We are headquartered in Santiago, Chile and, as of December 31, 2004,2005, had 9,36510,157 employees and delivered financial products and services through a nationwide network of 224248 branches and 1,0011,258 ATMs that form part of a network of 3,1814,807 ATMs operated by Redbanc S.A., a company owned by us and 13 other private sector financial institutions.

History

We were established in 1893 as a result of the merger of Banco Nacional de Chile, Banco Agricola and Banco de Valparaiso, which created the largest privately held bank in Chile. We believe that we remained the largest private bank in Chile until mid-2002.1996. Beginning in the early 1970s, the Chilean government assumed control of a majority of Chilean banks and all but one of the foreign banks operating at the time closed their branches and offices in Chile. Throughout this era, we remained privately owned, with the Chilean government owning participating shares which it sold to private investors in 1975. We developed a well-recognized name in Chile and expanded our operations in foreign markets where we developed an extensive network of correspondent banks. In the early twentieth century, we established a representative office in London, which we maintained until 1985, when our European operations were moved to Frankfurt. The Frankfurt office was closed in 2000, when our foreign operations were centralized at the New York branch. In 1987 and 1988, we established four subsidiaries to provide the full range of financial products and services permitted by the General Banking Law and in 1999, we established our insurance brokerage and factoring subsidiaries.

Merger with Banco de A. Edwards

On December 6, 2001, our shareholders approved the merger with Banco de A. Edwards, which became effective on January 1, 2002. Banco de A. Edwards had been listed on the NYSE since 1995, and in January 2002, we were listed on the NYSE under the symbol BCH. During 2002, our shares were also listed on the Latin American Stock Exchange of the Madrid Stock Exchange, or Latibex, and the London Stock Exchange, or LSE.

We concluded the merger process at the end of 2002 with the consolidation of a new corporate structure and the integration of our technological platforms. In 2001 and 2002, we incurred merger related costs of approximately Ch$15,10315,639 million and Ch$31,97333,108 million, respectively. No further costs related to the merger have been incurred since 2002.

Neos Projectand Related Projects

In 2003, we developed the groundwork for “Neos,” our technological innovation platform project which was established to improvethat provides information necessary for designing specific value proposals for every market subsegment and that simultaneously improves the quality of our service and increaseincreases efficiency. During 2004, we concluded the

initial phases of “Neos,” which consisted of implementing a new management control platform

which that will support internal administration, a customer relationship management system, which will initially manage client service requirements and global client information, and a new accounting system.

During 2005, we successfully concluded the implementation of the Enterprise Resource Planning system, which, in its orientation towards self-service applications, provides human resources solutions. We also deployed a Customer Relationship Management, or CRM, service platform in all our retail branches and call centers. It will mainly permit preventive functions, the management of commercial campaigns and the tracking of credit approvals. From 20052006 to 2007, we will launchcontinue replacing credit card and cashier systems and will introduce more sophisticated customer relationship management systemsCRM functions, such as the automation of sales and a core banking system that will manage our main assetspost-sales procedures and liabilities.

the substitution of the checking account and deposit taking systems.

The 1982-1983 Economic Crisis and the Central Bank Subordinated Debt

During the 1982-1983 economic crisis, the Chilean banking system experienced significant instability requiring that the Central Bank and the Chilean government provide assistance to most Chilean private sector banks, including us. During this period, we experienced significant financial difficulties. In 1985 and 1986, we increased our capital and sold shares representing 88% of our capital to more than 30,000 new shareholders. As a result, no single shareholder held a controlling stake in our company. In 1987, the Chilean Superintendency of Banks returned the control and administration of the bank to our shareholders.

Subsequent to the crisis, like most major Chilean banks, we sold certain of our non-performing loans to the Central Bank at face value on terms that included a repurchase obligation. The repurchase obligation was later exchanged for subordinated debt of each participating bank issued in favor of the Central Bank. In 1989, pursuant to Law No. 18,818, banks were permitted to repurchase the portfolio of non-performing loans for a price equal to the economic value of such loans, provided that the bank assume a subordinated obligation equal to the difference between the face value and economic value of such loans. In November 1989, we repurchased our portfolio of non-performing loans from the Central Bank and assumed the Central Bank’s subordinated debt relating to our non-performing loans.

The original repayment terms of our Central Bank subordinated debt, which at December 31, 1989 equaled approximately Ch$1,049,1981,114,606 million, or U.S.$1,7502,168 million, required that a certain percentage of our income before provisions for the subordinated debt be applied to repay this obligation. The Central Bank subordinated debt did not have a fixed maturity, and payments were made only to the extent that we earned income before provisions for the subordinated debt. In 1993 we applied 72.9% of our income before provisions for the Central Bank subordinated debt to the repayment of this debt. In 1994 we applied 67.6% and in 1995 we applied 65.8% of our income before provisions for the Central Bank subordinated debt to the repayment of this debt.

In November 1996, pursuant to Law No. 19,396, our shareholders approved a reorganization by which Banco de Chile was converted to a holding company named SM-Chile. In turn, SM-Chile organized a new wholly owned banking subsidiary named Banco de Chile to which it contributed all of its assets and liabilities other than the Central Bank subordinated debt. SM-Chile then created SAOS, a second wholly owned subsidiary that, pursuant to a prior agreement with the Central Bank, assumed a new repayment obligation in favor of the Central Bank that replaced the Central Bank subordinated debt in its entirety.

This Central Bank indebtedness, for which SAOS is solely responsible and for which there is no recourse to us or SM-Chile, was equal to the unpaid principal of the Central Bank subordinated debt that it replaced but had terms that differed in some respects, the most important of which included a rescheduling of the debt for a term of 40 years providing for equal annual installments and a pledge of our shares as collateral for such debt. The Central Bank indebtedness bears interest at a rate of 5.0% per year and is denominated in UF. See “Item 5. Operating and Financial Review and Prospects—Operating Results—Overview—Inflation—UF-denominated Assets and Liabilities” for a further explanation of UF.

In exchange for assuming the Central Bank indebtedness, SAOS received from SM-Chile, a holding company that beneficially owns usSAOS and SAOS,us, 63.6% of our shares as collateral for this indebtedness. As a result of our merger with Banco de A. Edwards, the percentage of our shares held by SAOS decreased to 42.0%. As a result of the share dividend paid in May 2006, the percentage further decreased to 41.4%. Dividends received from us are the sole source of SAOS’s revenue, which it must apply to repay this indebtedness. However, under SAOS’s agreement with the Central Bank, we have no obligation to distribute dividends to our shareholders. To the extent distributed dividends are not sufficient to pay the amount due on

this indebtedness, SAOS is permitted to maintain a cumulative deficit balance with the Central Bank that SAOS commits to pay with future dividends. If the cumulative deficit balance exceeds an amount equal to 20% of our paid-in capital and reserves, the Central Bank may require SAOS to sell a sufficient number of shares of our stock owned by SAOS to pay the entire accumulated deficit amount. As of May 2, 2005,2006, SAOS maintained a deficit balance with the Central Bank of Ch$27,90510,480 million, equivalent to 5.4%1.67% of our paid-in capital and reserves. As of the same date, Ch$104,155125,250 million would have represented 20.0% of our paid-in capital and reserves. See “Item 3. Key Information—Risk Factors—Risks Relating to our Operations and the Banking Industry—AnIndustry.” Our affiliate of ours may be obligated to sell shares of our stock in the public market if we do not pay sufficient dividends.”

If from time to time in the future our shareholders decide to retain and capitalize all or part of our annual net income in order to finance our future growth, and to distribute stock dividends among our shareholders, the Central Bank may require us to pay the portion of the net income corresponding to shares owned by SAOS in cash to SAOS. If we distribute stock dividends and the Central Bank does not require us to pay that portion in cash, the shares received by SAOS must be sold by SAOS within the following 12 months. The shareholders of SM-Chile will have a right of first refusal with respect to that sale.

Capital Expenditures

The following table reflects our capital expenditures in each of the three years ended December 31, 2002, 2003, 2004 and 2004:2005:

| For the Year Ended December 31, | |||||||||

| 2002 | 2003 | 2004 | |||||||

| (in millions of constant Ch$ as of December 31, 2004) | |||||||||

Computer equipment | Ch$ | 7,844 | Ch$ | 3,503 | Ch$ | 6,849 | |||

Furniture, machinery and installations | 3,585 | 2,560 | 4,635 | ||||||

Real estate | 662 | 608 | 397 | ||||||

Vehicles | 329 | 304 | 429 | ||||||

Subtotal | 12,420 | 6,975 | 12,310 | ||||||

Software | 3,352 | 4,518 | 7,544 | ||||||

Total | Ch$ | 15,772 | Ch$ | 11,493 | Ch$ | 19,854 | |||

| For the Year Ended December 31, | |||||||||

| 2003 | 2004 | 2005 | |||||||

| (in millions of constant Ch$ as of December 31, 2005) | |||||||||

Computer equipment | Ch$ | 3,629 | Ch$ | 7,096 | Ch$ | 8,206 | |||

Furniture, machinery and installations | 2,652 | 4,802 | 7,381 | ||||||