12 (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12 (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR |

OR

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2007 OR |

For the fiscal year ended December 31, 2004

OR

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OR |

Commission file number: 001-14862

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) |

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’sRegistrant's name into English)

Federative Republic of Brazil

(Jurisdiction of Incorporation or Organization)

Av. das Nações Unidas, 4777

São Paulo, SP—CEP 05477-000 Brazil

(Address of principal executive offices) (Zip code)

Carlos Fadigas

Braskem S.A.

Av. das Nações Unidas, 4777

São Paulo, SP—CEP 05477-000 Brazil

Telephone: + (55 11) 3576-9531

Fax: + (55 11) 3576-9532

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person

Title of each class | Name of Each Exchange on which Registered | |

Preferred Shares, Class A, no par value per share, each | New York Stock Exchange | |

| represented by American Depositary Receipts |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

The total number of issued shares of each class of stock of BRASKEMBraskem S.A. as of December 31, 20042007 was: 149,810,870 Common Shares, no par value per share, 298,818,675 Preferred Shares, Class A, no par value per share, and 803,066 Preferred Shares, Class B, no par value per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes  No No  If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes  No No

| ||

| ||

|

Indicate by check mark whether the Registrantregistrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrantregistrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

No

No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Accelerated Filer

Accelerated Filer  Non-accelerated Filer

Non-accelerated Filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP | International Financial Reporting Standards as issued by the International Accounting Standards Board | Other |

Indicate by check mark which financial statement item the Registrantregistrant has elected to follow follow.

Item 18

Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

No

No

INTRODUCTION

ReferencesAll references herein to the “real,” “reais” or “R$” are to Brazilianreais(plural) and to the Brazilianreal(singular), the official currency of Brazil; andBrazil. All references to “U.S. dollars,” “dollars” or “US$” are to United StatesU.S. dollars.

All references herein (i)(1) to “we,” “us” or “our company” are references to Braskem S.A. and, its consolidated subsidiaries and (ii)jointly controlled entities, and (2) to “Braskem” are references solely to Braskem S.A.

On December 31, 2004,June 27, 2008, the exchange rate forreaisinto U.S. dollars was R$2.6541.6077 to US$1.00, based on the commercial selling rate as reported by the Central Bank of Brazil (Banco Central do Brasil), or the Central Bank. The commercial selling rate was R$2.8891.7713 to US$1.00 at December 31, 2003.2007, R$2.138 to US$1.00 at December 31, 2006 and the commercial selling rate was R$2.341 to US$1.00 at December 31, 2005, in each case, as reported by the Central Bank. Thereal/U.S. dollar exchange rate fluctuates widely, and the commercial selling rate at December 31, 2003June 27, 2008 may not be indicative of future exchange rates. See “Item 3. Key Information—Exchange Rates” for information regarding exchange rates for the Brazilian currency since January 1, 2000.2003.

Solely for the convenience of the reader, we have translated some amounts included in “Item 3. Key Information—Selected Financial Information” and elsewhere in this annual report fromreaisinto U.S. dollars using the commercial selling rate as reported by the Central Bank at December 31, 20042007 of R$2.6541.7713 to US$1.00. These translations should not be considered representations that any such amounts have been, could have been or could be converted into U.S. dollars at that or at any other exchange rate. Such translations should not be construed as representations that therealamounts represent or have been or could be converted into U.S. dollars as of that or any other date.

Financial Statements

Braskem Financial Statements

We maintain our books and records inreaisreais..

Our consolidated and combined financial statements at December 31, 20042007 and 20032006 and for each of the three years ended December 31, 2004, 2003 and 20022007 have been audited, as stated in the report appearing herein, and are included in this annual report.

We prepare our consolidated financial statements in accordance with accounting practices adopted in Brazil, or Brazilian GAAP, which are based on:

Brazilian GAAP differs in significantcertain respects from accounting principles generally accepted in the United States, or U.S. GAAP. For more information about thea discussion of certain differences between Brazilian GAAP and U.S. GAAP and a reconciliation of our net income (loss) and shareholders’ equity from Brazilian GAAPrelating to U.S. GAAP,these financial statements, see note 2931 to our audited consolidated and combined financial statements included elsewhere in this annual report.

Consistent with Brazilian GAAP, our audited consolidated and combined financial statements at December 31, 20042007 and 20032006 and for the three years ended December 31, 2004, 2003 and 20022007 have been prepared in accordance with Brazilian Securities CommissionCVM Instruction No. 247/96, as amended, by Brazilian Securities Commission Instruction Nos. 269/97, 285/98 and 319/99, which we refer to collectively asor Instruction 247. Instruction 247

requires our company to proportionally consolidate proportionally jointly controlled companies that are not our subsidiaries but which we jointly control with one or more other shareholders. The U.S. GAAP reconciliation eliminates

Our consolidated financial statements reflect reclassifications in 2005 of the following items to provide a better comparison among 2006 and 2005:

Copesul Financial Statements

We have included separatePrior to March 31, 2006, we proportionally consolidated the results of Politeno Indústria e Comércio S.A., or Politeno, in our consolidated financial statements. As a result of the Politeno Acquisition described under “Item 4. Information On The Company—History and Development of Our Company—Developments Since January 1, 2005,” we have fully consolidated Politeno’s results in our consolidated financial statements and included Politeno’s results in our Polyolefins segment as from April 1, 2006. Politeno merged with and into Braskem on April 2, 2007.

Prior to March 31, 2007, we proportionally consolidated the results of Copesul—Companhia Petroquímica do Sul, or Copesul, in our consolidated financial statements. As a result of the Ipiranga Transaction described under “Item 4. Information on the Company—Ipiranga Transaction,” we have fully consolidated Copesul’s results in our consolidated financial statements and included Copesul’s results as a separate segment as from April 1, 2007.

Copesul and Ipiranga Química S.A., or Ipiranga Química, maintain their books and records inreais and prepare their consolidated financial statements in accordance with Brazilian GAAP.

Copesul Financial Statements

Prior to April 1, 2007, Copesul’s consolidated financial statements were proportionally consolidated into the Braskem’s consolidated financial statements under Brazilian GAAP, as described above under “—Braskem Financial Statements.” As a result of the Ipiranga Transaction and our obtaining effective management control over the 29.5% of the share capital of Copesul then owned by Ipiranga Petroquímica, we have fully consolidated the results of Copesul and its subsidiaries into our financial statements as from April 1, 2007. As a result of the completion of the first phase of the Petrobras Transaction, the minority interest in Copesul represents only 0.8% of the total share capital of Copesul.

We have included separate consolidated financial statements of Copesul in this annual report because Copesul constitutesconstituted a “significant” jointly controlled company, accounting for 38.8%85.0% of our income from continuing operations before income taxes in 2004.the three months ended March 31, 2007 and 96.6% in 2006. Copesul maintains its books and records inreais and prepares its financial statements in accordance with Brazilian GAAP.

Copesul’s consolidated financial statements at December 31, 20042007 and 20032006 and for each of the years ended December 31, 2004, 20032007, 2006 and 20022005 included in this annual report have been audited, as stated in the report appearing herein. Copesul’s consolidated financial statements are proportionally consolidated intoat March 31, 2008 and for each of the Braskem’s consolidated financial statements under Brazilian GAAP, as described above under “—Braskem Financial Statements.”three month periods ended March 31, 2008 and 2007 included in this annual report have not been audited.

2

Share Splits

Share Splits

On October 20, 2003, we authorized the split of all of our issued common shares, class A preferred shares and class B preferred shares into 20 shares for each issued share. This 20-for-one share split was effective on October 21, 2003. As a result of this share split, the ratio of our class A preferred shares to American DepositaryDepository Shares, or ADSs, changed from 50 class A preferred shares per ADS to 1,000 class A preferred shares per ADS.

On March 31, 2005, we authorized the reverse split of all of our issued common shares, class A preferred shares and class B preferred shares into one share for each 250 issued shares. This reverse share split became effective on May 16, 2005. In connection with this reverse share split, we authorized a change in the ratio of our ADSs uponADSs. Upon the effectiveness of our reverse share split and the ratio change, the ratio of our class A preferred shares to ADSs changed from 1,000 class A preferred shares per ADS to two class A preferred shares per ADS.

All references to numbers of shares and dividend amounts in this annual report have been adjusted to give effect to the 20-for-one share split and the one-for-250 reverse share split and the change in the ratio of our class A preferred shares to ADSs.split.

Market Share and Other Information

We make statements in this annual report about our market share in the petrochemical industry in Brazil and our production capacity relative to that of other petrochemical producers in Brazil and Latin America. We have made these statements on the basis of information obtained from third partythird-party sources that we believe are reliable. We have calculated our Brazilian market shares with respect to specific products by dividing our domestic net sales volumes of these products by the total Brazilian domestic consumption of these products estimated by the Brazilian Association of Chemical Industry and Derivative Products (Associação Brasileira de Indústrias Químicas e de Produtos Derivados). We derive information regarding the production capacity of other companies in the Brazilian petrochemical industry and the estimated total Brazilian domestic consumption of petrochemical products principally from reports published by the Brazilian Association of Chemical Industry and Derivative Products. Although we have no reason to believe that any of this information is inaccurate in any material respect, neither we nor the initial purchasers have not independently verified the production capacity, market share, market size or similar data provided by third parties or derived from industry or general publications.

Production Capacity and Sales Volume

As used in this annual report:

Rounding

We have made rounding adjustments to reach some of the figures included in this annual report. As a result, numerical figures shown as totals in some tables may not be an arithmetic aggregationaggregations of the figures that precededprecede them.

3

CAUTIONARY STATEMENT WITH RESPECT TO FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements. Some of the matters discussed concerning our business operations and financial performance include forward-looking statements within the meaning of the Securities Act or the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act.

Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” and similar expressions are forward-looking statements. Although we believe that these forward-looking statements are based upon reasonable assumptions, these statements are subject to several risks and uncertainties and are made in light of information currently available to us.

Our forward-looking statements may be influenced by factors, including the following:

Our forward-looking statements are not guarantees of future performance, and theour actual results or other developments may differ materially from the expectations expressed in the forward-looking statements. As for the forward-looking statements that relate to future financial results and other projections, actual results will be different due to the inherent uncertainty of estimates, forecasts and projections. Because of these uncertainties, potential investors should not rely on these forward-looking statements.

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise.

4

ITEM 1. IDENTITY OF DIRECTOR, SENIOR MANAGEMENT AND ADVISER

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

Selected Financial Information

The following selected financial data hashave been derived from our consolidated and combined financial statements.

The selected financial data at December 31, 20042007 and 20032006 and for the three years ended December 31, 20042007 have been derived from our consolidated and combined financial statements included in this annual report. The selected financial data at December 31, 20022005, 2004 and 20012003 and for the yearyears ended December 31, 2001 has2004 and 2003 have been derived from our audited consolidated and combined financial statements that are not included in this annual report. The selected financial data at December 31, 2000

Prior to the Ipiranga Transaction, we owned 29.5% of the voting and total share capital of Copesul, and we were required, under Brazilian GAAP, to account for the year ended December 31, 2000 have been derived from auditedour interests in Copesul in our consolidated financial statements using the proportional consolidation method, including for the first three months of 2007. As a result of the Ipiranga Transaction and our company that are not includedobtaining effective management control over the 29.5% of the share capital of Copesul then owned by Ipiranga Petroquímica, we have fully consolidated the results of Copesul and its subsidiaries into our financial statements as from April 1, 2007. In addition, as a result of the Ipiranga Transaction, we have consolidated the results of Ipiranga Química and Ipiranga Petroquímica in this annual report.our consolidated financial statements as from April 1, 2007.

Our consolidated financial statements are prepared in accordance with Brazilian GAAP, which differs in significantcertain respects from U.S. GAAP. For a discussion of thecertain differences relating to these financial statements, and a reconciliation of our net income (loss) and shareholders’ equity from Brazilian GAAP to U.S. GAAP, see note 2931 to our audited consolidated and combined financial statements included in this annual report.

| At and for the Year Ended December 31, | ||||||||||||

| 2007(1) | 2007 | 2006 | 2005 | 2004 | 2003(2) | |||||||

| (in millions of | (in millions ofreais, except financial ratios) | |||||||||||

| US$, except | ||||||||||||

| financial | ||||||||||||

| ratios) | ||||||||||||

| Statement of Operations Data | ||||||||||||

| Brazilian GAAP: | ||||||||||||

| Net sales revenue | US$9,981.0 | R$17,679.4 | R$12,992.7 | R$13,075.1 | R$12,389.5 | R$10,300.2 | ||||||

| Cost of sales and services rendered | (8,152.8) | (14,441.0) | (10,792.1) | (10,361.7) | (9,223.0) | (8,224.6) | ||||||

| Gross profit | 1,828.2 | 3,238.4 | 2,200.6 | 2,713.4 | 3,166.5 | 2,075.6 | ||||||

| Selling, general and administrative expenses | (699.2) | (1,238.5) | (951.5) | (787.1) | (677.0) | (488.4) | ||||||

| Depreciation and amortization | (270.5) | (479.1) | (385.0) | (355.6) | (359.7) | (193.5) | ||||||

| Other operating income, net | 74.2 | 131.5 | 186.1 | 22.8 | 43.0 | 55.5 | ||||||

| Operating income before equity accounting and financial income (expense) | 932.7 | 1,652.3 | 1,050.2 | 1,593.5 | 2,172.8 | 1,449.2 | ||||||

| Results from equity accounting(3) | (60.6) | (107.3) | (28.8) | (109.8) | (107.6) | (170.5) | ||||||

| Financial expenses | (101.7) | (180.1) | (1,097.9) | (675.8) | (1,307.2) | (720.8) | ||||||

| Financial income | (64.1) | (113.5) | 159.5 | (33.6) | 68.6 | 9.2 | ||||||

| Operating income | 706.3 | 1,251.4 | 83.0 | 774.3 | 826.6 | 567.1 | ||||||

| Non-operating expenses, net | (37.9) | (67.2) | 7.1 | (25.2) | (29.8) | (4.5) | ||||||

| Income before income tax and | 668.4 | 1,184.2 | 90.1 | 749.1 | 796.8 | 562.6 | ||||||

5

This financial information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and our audited consolidated and combined financial statements included elsewhere in this annual report.Table of Contents

| At and for the Year Ended December 31, | ||||||||||||

| 2007(1) | 2007 | 2006 | 2005 | 2004 | 2003(2) | |||||||

| (in millions of | (in millions ofreais, except financial ratios) | |||||||||||

| US$, except | ||||||||||||

| financial | ||||||||||||

| ratios) | ||||||||||||

| social contribution (current and deferred) and minority interest | ||||||||||||

| Income tax and social contribution (current and deferred) | (212.8) | (377.0) | 12.8 | (177.3) | (85.1) | (121.3) | ||||||

| Income before profit sharing and minority interest | 455.6 | 807.2 | 102.9 | 571.8 | 711.7 | 441.3 | ||||||

| Profit sharing | (10.6) | (18.7) | — | — | — | — | ||||||

| Income before minority interest | 445.0 | 788.5 | 102.9 | 571.8 | 711.7 | 441.3 | ||||||

| Minority interest | (136.0) | (240.9) | (1.6) | 54.0 | (24.6) | (226.2) | ||||||

| Net income | US$309.0 | R$547.6 | R$101.3 | R$625.8 | R$687.1 | R$215.1 | ||||||

| Number of shares outstanding at year end, excluding treasury shares (in thousands): | ||||||||||||

| Common shares | 149,810 | 123,492 | 120,860 | 120,860 | 102,432 | |||||||

| Class A preferred shares | 282,223 | 231,744 | 240,393 | 240,373 | 170,379 | |||||||

| Class B preferred shares | 803 | 803 | 803 | 842 | 916 | |||||||

| Net income (loss) per share at year end | 0.71 | 1.27 | 0.28 | 1.73 | 1.90 | 0.79 | ||||||

| Net income (loss) per ADS at year end | 1.42 | 2.53 | 0.57 | 3.46 | 3.80 | 1.57 | ||||||

| Dividends declared per share: | ||||||||||||

| Common shares | 0.36 | 0.64 | — | 0.90 | 0.56 | — | ||||||

| Class A preferred shares | 0.36 | 0.64 | 0.16 | 0.90 | 0.56 | — | ||||||

| Class B preferred shares | 0.36 | 0.64 | 0.16 | 0.56 | 0.56 | — | ||||||

| Dividends declared per ADS | 0.73 | 1.29 | 0.32 | 1.80 | 1.12 | — | ||||||

| U.S. GAAP: | ||||||||||||

| Net income (loss) for the year | US$ 82.2 | R$ 145.6 | R$161.6 | R$741.2 | R$843.1 | R$378.1 | ||||||

| Basic earnings (loss) per share (weighted average): | ||||||||||||

| Common shares | 1.51 | 2.68 | 0.13 | 2.05 | 2.63 | 1.41 | ||||||

| Class A preferred shares | 1.58 | 2.79 | 0.59 | 2.05 | 2.69 | 1.37 | ||||||

| Class B preferred shares | 1.55 | 2.75 | 0.63 | 0.63 | 0.56 | 0.44 | ||||||

| Basic earnings (loss) per ADS | ||||||||||||

| (weighted average) | 3.15 | 5.58 | 1.18 | 4.10 | 5.38 | 2.74 | ||||||

| Diluted earnings (loss) per share | ||||||||||||

| (weighted average): | ||||||||||||

| Common shares | 1.56 | 2.76 | 0.13 | 1.95 | 2.40 | 1.41 | ||||||

| Class A preferred shares | 1.58 | 2.79 | 0.59 | 1.95 | 2.40 | 1.37 | ||||||

| Class B preferred shares | 1.55 | 2.75 | 0.63 | 0.63 | 0.56 | 0.44 | ||||||

| Diluted earnings (loss) per ADS (weighted average) | 3.03 | 5.36 | 1.18 | 3.90 | 4.80 | 2.40 | ||||||

| Balance Sheet Data | ||||||||||||

| Brazilian GAAP: | ||||||||||||

| Cash, cash equivalents and other investments | US$1,207.5 | R$2,138.8 | R$1,961.0 | R$2,281.5 | R$1,815.6 | R$1,221.2 | ||||||

| Short-term trade accounts receivable | 845.1 | 1,497.0 | 1,594.9 | 1,493.3 | 1,630.6 | 1,241.0 | ||||||

| Short-term inventories | 1,278.3 | 2,264.3 | 1,767.3 | 1,567.4 | 1,562.4 | 1,092.3 | ||||||

| Property, plant and equipment, net | 4,744.6 | 8,404.1 | 6,688.7 | 6,364.4 | 5,830.4 | 5,090.9 | ||||||

| Total assets | 11,794.7 | 20,892.0 | 16,304.3 | 15,590.8 | 15,050.4 | 14,005.6 | ||||||

6

All per share data presented below for periods before October 21, 2003 have been adjusted to give effect to the 20-for-one share split that was effective on that date, and all per share data presented below have been further adjusted to give effect to the one-for-250 reverse share split that was effective on May 16, 2005.Table of Contents

| At and for the Year Ended December 31, | ||||||||||||||||||||||||

| 2004(1) | 2004 | 2003 | 2002 | 2001(2) | 2000 | |||||||||||||||||||

(in millions of per share and per ADS amounts and financial ratios) | (in millions ofreais, except per share , number of shares and per ADS amounts and financial ratios) | |||||||||||||||||||||||

Statement of Operations Data | ||||||||||||||||||||||||

Brazilian GAAP: | ||||||||||||||||||||||||

Net sales revenue | US$ | 4,593.1 | R$ | 12,192.0 | R$ | 10,135.8 | R$ | 7,576.6 | R$ | 4,459.5 | R$ | 2,897.5 | ||||||||||||

Cost of sales and services rendered | (3,420.1 | ) | (9,078.3 | ) | (8,089.3 | ) | (6,175.5 | ) | (3,637.6 | ) | (2,357.1 | ) | ||||||||||||

Gross profit | 1,173.0 | 3,113.7 | 2,046.5 | 1,401.1 | 821.9 | 540.4 | ||||||||||||||||||

Selling and general and administrative expenses | (244.9 | ) | (650.0 | ) | (471.9 | ) | (577.7 | ) | (210.3 | ) | (116.2 | ) | ||||||||||||

Investment in associated companies, net(3) | (34.2 | ) | (90.9 | ) | (158.2 | ) | (251.7 | ) | (214.3 | ) | (3.6 | ) | ||||||||||||

Depreciation and amortization | (135.4 | ) | (359.4 | ) | (193.5 | ) | (222.4 | ) | (111.3 | ) | (36.5 | ) | ||||||||||||

Financial expenses | (486.4 | ) | (1,291.0 | ) | (712.6 | ) | (3,481.5 | ) | (801.2 | ) | (250.0 | ) | ||||||||||||

Financial income | 22.7 | 60.3 | 9.0 | 619.6 | 294.7 | 178.6 | ||||||||||||||||||

(in millions of per share and per ADS amounts and financial ratios) (in millions ofreais, except per share, number of shares and per ADS amounts and financial ratios) Zero-rated IPI credit Other operating income (expenses) Operating income (loss) Non-operating expenses, net Income (loss) before income tax and social contribution (current and deferred) and minority interest Income tax and social contribution (current and deferred) Income (loss) before minority interest Minority interest Net income (loss) for the year or period Number of shares outstanding at year end, excluding treasury shares (in thousands): Common shares Class A preferred shares Class B preferred shares Net income (loss) per share at year end Net income (loss) per ADS at year end (4) Dividends declared per share: Common shares Class A preferred shares Class B preferred shares Dividends declared per ADS U.S. GAAP: Net income (loss) for the year Basic earnings (loss) per share (weighted average): Common shares Class A preferred shares Class B preferred shares Basic earnings (loss) per ADS (weighted average) Diluted earnings (loss) per share (weighted average)(4): Common shares Class A preferred shares Class B preferred shares Diluted earnings (loss) per ADS (weighted average)(4) Balance Sheet Data Brazilian GAAP: Cash, cash equivalents and other investments Trade accounts receivable Inventories Property, plant and equipment, net Total assets Short-term loans and financing (including current portion of long-term debt) Short-term debentures Short-term related company debt Long-term loans and financing Long-term debentures Long-term related company debt Minority interest Share capital Shareholders’ equity At and for the Year Ended December 31, 2004(1) 2004 2003 2002 2001(2) 2000

US$, except — — — 1,030.1 — — 15.7 41.6 49.7 102.6 103.3 (12.5 ) 310.5 824.3 569.0 (1,379.9 ) (117.2 ) 300.2 (11.2 ) (29.9 ) (4.8 ) (98.0 ) (120.8 ) (0.6 ) 299.3 794.4 564.2 (1,477.9 ) (238.0 ) 299.6 (29.7 ) (78.9 ) (122.9 ) (89.8 ) (77.6 ) (73.3 ) 269.6 715.5 441.3 (1,567.7 ) (315.6 ) 226.3 (9.3 ) (24.6 ) (226.2 ) 189.0 (108.9 ) 1.3 US$ 260.3 R$ 690.9 R$ 215.1 R$ (1,378.7 ) R$ (424.5 ) R$ 227.6 120,860 102,432 98,087 51,735 51,735 240,373 170,379 168,491 86,371 86,371 842 916 916 916 916 0.72 1.91 0.79 (5.15 ) (3.05 ) 1.64 1.44 3.82 1.57 (10.31 ) (6.11 ) 3.27 0.21 0.56 — — 0.43 0.86 0.21 0.56 — 0.13 0.52 0.86 0.21 0.56 — 0.13 0.52 0.52 0.42 1.12 — — 1.04 1.72 US$ 334.5 R$ 887.8 R$ 378.1 R$ (1,144.0 ) R$ (471.0 ) 1.04 2.77 1.41 (11.93 ) (6.68 ) 1.07 2.83 1.37 — — 0.19 0.51 0.44 — — 2.13 5.66 2.74 — — R$ 1.04 R$ 2.77 R$ 1.40 R$ (11.93 ) R$ (6.68 ) 1.07 2.83 1.37 — — 0.19 0.51 0.44 — — 2.13 5.66 2.74 — — US$ 668.2 R$ 1,773.8 R$ 1,184.3 R$ 821.0 R$ 513.2 R$ 708.9 515.0 1,366.9 1,216.2 959.0 484.1 231.6 578.7 1,536.1 1,071.6 889.1 667.8 163.4 2,033.3 5,397.2 5,352.9 5,296.7 4,429.7 1,969.0 5,610.6 14,892.9 13,943.5 13,898.2 9,555.3 3,748.7 668.9 1,775.6 2,759.2 2,746.1 1,966.4 331.5 1.9 5.0 349.0 32.1 26.2 — — — 0.2 8.2 88.7 — 1,149.5 3,051.2 3,615.3 3,891.6 3,101.7 861.8 440.0 1,167.9 1,143.0 1,190.2 473.6 — 43.6 115.7 177.6 189.3 626.7 0.9 76.5 203.1 554.4 433.1 738.0 27.4 1,282.0 3,403.0 1,887.4 1,845.4 1,201.6 1,203.9 1,577.6 4,187.5 2,112.6 1,821.8 1,729.0 2,267.8

(in millions of per share and per ADS amounts and financial ratios) (in millions ofreais, except per share, number of shares and per ADS amounts and financial ratios) U.S. GAAP: Total assets Shareholders’ equity Other Financial Information Brazilian GAAP: Net cash provided by (used in): Operating activities Investing activities Financing activities Capital expenditures: Property, plant and equipment Interest in other companies At and for the Year Ended December 31, 2004(1) 2004 2003 2002 2001(2) 2000

US$, except US$ 4,830.1 R$ 12,821.0 R$ 11,058.2 R$ 10,531.7 R$ 7,803.0 975.3 2,588.9 7.8 (415.2 ) 291.4 US$ 734.3 R$ 1,949.0 R$ 580.5 R$ 790.0 R$ 1,453.9 R$ 550.3 (378.5 ) (1,004.8 ) (460.4 ) (646.7 ) (862.2 ) (115.6 ) 45.0 119.5 367.8 (237.2 ) (404.9 ) (287.2 ) 162.9 432.3 214.7 419.9 318.0 18.4 8.9 23.6 71.7 13.1 1,172.3 82.6

| At and for the Year Ended December 31, | ||||||||||

| 2004 | 2003 | 2002 | 2001(2) | 2000 | ||||||

Operating Data(5): | ||||||||||

Ethylene: | ||||||||||

Domestic sales volume (in thousands of tons) | 1,098.9 | 1,047.3 | 994.8 | 1,064.8 | 1,103.8 | |||||

Average domestic price per ton (in R$) | 2,095 | 1,655 | 1,292 | 1,135 | 1,090 | |||||

Propylene: | ||||||||||

Domestic sales volume (in thousands of tons) | 446.8 | 403.4 | 415.2 | 421.1 | 487.7 | |||||

Average domestic price per ton (in R$) | 1,833 | 1,477 | 1,106 | 829 | 875 | |||||

Polyethylene(6): | ||||||||||

Domestic sales volume (in thousands of tons) | 498.7 | 446.1 | 491.7 | 199.3 | ||||||

Average domestic price per ton (in R$) | 2,987 | 2,567 | 2,007 | 2,114 | ||||||

Polypropylene(6): | ||||||||||

Domestic sales volume (in thousands of tons) | 418.5 | 374.9 | 395.1 | 140.4 | ||||||

Average domestic price per ton (in R$) | 3,155 | 2,689 | 1,931 | 1,969 | ||||||

PVC(7): | ||||||||||

Domestic sales volume (in thousands of tons) | 394.4 | 342.4 | 350.1 | 125.9 | ||||||

Average domestic price per ton (in R$) | 3,042 | 2,390 | 2,034 | 1,612 | ||||||

Number of employees (at period end) | 2,996 | 2,868 | 2,817 | 1,424 | 1,161 | |||||

| At and for the Year Ended December 31, | ||||||||||||

| 2007(1) | 2007 | 2006 | 2005 | 2004 | 2003(2) | |||||||

| (in millions of | (in millions ofreais, except financial ratios) | |||||||||||

| US$, except | ||||||||||||

| financial | ||||||||||||

| ratios) | ||||||||||||

| Short-term loans and financing (including current portion of long-term debt)(4) | 603.2 | 1,068.4 | 653.9 | 1,120.4 | 1,808.3 | 2,764.1 | ||||||

| Short-term debentures | 63.0 | 111.6 | 1,157.7 | 9.3 | 5.0 | 353.4 | ||||||

| Short-term related party debt | — | — | — | 3.1 | — | 5.5 | ||||||

| Long-term loans and financing(4) | 3,614.2 | 6,401.9 | 3,935.8 | 3,261.6 | 3,261.4 | 3,628.0 | ||||||

| Long-term debentures | 451.6 | 800.0 | 982.2 | 1,599.3 | 1,167.9 | 1,143.0 | ||||||

| Long-term related party debt | — | — | 4.8 | 3.0 | 115.8 | 177.6 | ||||||

| Minority interest | 337.6 | 598.0 | 21.8 | 121.2 | 203.1 | 554.4 | ||||||

| Share capital | 2,620.1 | 4,641.0 | 3,508.3 | 3,403.0 | 3,403.0 | 1,887.4 | ||||||

| Shareholders’ equity | 3,250.2 | 5,757.0 | 4,311.9 | 4,535.8 | 4,183.7 | 2,112.6 | ||||||

| U.S. GAAP | ||||||||||||

| Total assets | US$ 13,195.45 | R$ 23,373.1 | R$14,890.7 | R$13,634.0 | R$12,671.7 | R$11,058.2 | ||||||

| Shareholders’ equity | 2,840.79 | 5,031.9 | 2,966.8 | 2,918.4 | 2,439.6 | 7.8 | ||||||

| Other Financial Information | ||||||||||||

| Brazilian GAAP: | ||||||||||||

| Cash Flow Data: | ||||||||||||

| Net cash provided by (used in): | ||||||||||||

| Operating activities | US$1,351.5 | R$2,393.8 | R$405.3 | R$1,719.4 | R$1,916.0 | R$596.9 | ||||||

| Investing activities | (2,019.5) | (3,577.1) | (1,213.1) | (1,048.0) | (1,014.4) | (469.4) | ||||||

| Financing activities | 861.7 | 1,526.3 | 219.2 | (329.7) | 166.0 | 379.1 | ||||||

| Other Information: | ||||||||||||

| Capital expenditures: | ||||||||||||

| Property, plant and equipment | US$775.9 | R$1,374.4 | R$953.0 | R$930.2 | R$704.4 | R$223.7 | ||||||

| Investments in other companies | 650.2 | 1,151.7 | 222.7 | 34.0 | 23.6 | 71.7 | ||||||

| At and for the Year Ended December 31, | ||||||||||

| 2007 | 2006 | 2005 | 2004 | 2003 | ||||||

| Operating Data(5): | ||||||||||

| Ethylene: | ||||||||||

| Domestic sales volume (in thousands of tons) | 2,068.4 | 1,108.5 | 1,169.8 | 1,098.9 | 1,047.3 | |||||

| Average domestic price per ton (in R$) | 2,333 | 2,282 | 2,204 | 2,095 | 1,655 | |||||

| Propylene: | ||||||||||

| Domestic sales volume (in thousands of tons) | 945.1 | 413.0 | 497.5 | 446.8 | 403.4 | |||||

| Average domestic price per ton (in R$) | 2,164 | 2,110 | 2,132 | 1,833 | 1,477 | |||||

| Polyethylene: | ||||||||||

| Domestic sales volume (in thousands of tons) | 952.5 | 672.0 | 502.3 | 498.7 | 446.1 | |||||

| Average domestic price per ton (in R$) | 3,552 | 3,276 | 3,072 | 2,987 | 2,567 | |||||

| Polypropylene: | ||||||||||

| Domestic sales volume (in thousands of tons) | 573.3 | 453.2 | 419.9 | 418.5 | 374.9 | |||||

| Average domestic price per ton (in R$) | 3,458 | 3,344 | 3,344 | 3,155 | 2,689 | |||||

| PVC: | ||||||||||

| Domestic sales volume (in thousands of tons) | 464.9 | 400.4 | 378.9 | 394.4 | 342.4 | |||||

| Average domestic price per ton (in R$) | 2,616 | 2,518 | 2,747 | 3,042 | 2,390 | |||||

| Number of employees (at period end) | 4,783 | 3,494 | 3,262 | 2,996 | 2,868 | |||||

| (1) | Translated for convenience only using the |

7

| (2) |

| (3) | |

| (4) | |

| (5) | Including intra-company sales within |

EXCHANGE RATESExchange Rates

Prior to March 14, 2005, there were two principal foreign exchange markets in Brazil:

Most trade and financial foreign-exchange transactions were carried out on the commercial rate exchange market. The floating rate exchange market generally applied to transactions to which the commercial market rate did not apply.

On March 4, 2005, the National Monetary Council (Conselho Monetário Nacional) enacted Resolution No. 3,265, as well as additional regulations, that consolidated the two foreign exchange markets into a single foreign exchange market, effective as of March 14, 2005, in order to make foreign exchange transactions more straight-forwardstraightforward and efficient. Consequently, all foreign exchange transactions in Brazil are now carried out in this single foreign exchange market through authorized financial institutions. We cannot predict the impact of the enactment of any new regulations on the foreign exchange market.

Foreign exchange rates continue to be freely negotiated, but may be influenced from time to time by Central Bank intervention. From March 1995 through January 1999, the Central Bank allowed the gradual devaluationdepreciation of therealagainst the U.S. dollar. In January 1999, the Central Bank allowed thereal/U.S. dollar exchange rate to float freely. Since then, thereal/U.S. dollar exchange rate has been established mainly by the Brazilian interbank market and has fluctuated considerably. From December 31, 19992000 through December 31, 2004,2002, thereal devalueddepreciated by 32.6%80.6% against the U.S. dollar, and atdollar. From December 31, 2002 through December 31, 2007, therealappreciated by 49.9% against the U.S. dollar. At June 24, 2005,27, 2008, the selling rate for U.S. dollars was R$2.3871.6077 per US$1.00. In the past, the Central Bank has intervened occasionally to control unstable movements in foreign exchange rates. We cannot predict whether the Central Bank or the Brazilian government will continue to allow therealto float freely or will intervene in the exchange rate market through a currency band system or otherwise, or that the exchange market will not be volatile as a result of political or economic instability or other factors. We also cannot predict whether therealwill depreciate or appreciate in value in relation to the U.S. dollar in the future.

8

The following table shows the commercial selling rate or selling rate, as applicable, for U.S. dollars for the periods and dates indicated. The information in the “Average” column represents the average of the exchange rates on the last day of each month during the periods presented.

| Reaisper U.S. Dollar | ||||||||

| Year | High | Low | Average | Period End | ||||

| 2003 | R$3.662 | R$2.822 | R$3.071 | R$2.889 | ||||

| 2004 | 3.205 | 2.654 | 2.909 | 2.654 | ||||

| 2005 | 2.762 | 2.163 | 2.413 | 2.341 | ||||

| 2006 | 2.371 | 2.059 | 2.176 | 2.138 | ||||

| 2007 | 2.156 | 1.733 | 1.948 | 1.771 | ||||

| Reaisper U.S. Dollar | ||||

| Month | High | Low | ||

| December 2007 | R$1.823 | R$1.762 | ||

| January 2008 | 1.830 | 1.741 | ||

| February 2008 | 1.768 | 1.672 | ||

| March 2008 | 1.749 | 1.670 | ||

| April 2008 | 1.753 | 1.657 | ||

| May 2008 | 1.629 | 1.695 | ||

| June 2008 (through June 27) | 1.643 | 1.595 | ||

| Reais per U.S. Dollar | ||||||||||||

Year | High | Low | Average | Period End | ||||||||

2000 | R$ | 1.985 | R$ | 1.723 | R$ | 1.835 | R$ | 1.956 | ||||

2001 | 2.801 | 1.936 | 2.353 | 2.320 | ||||||||

2002 | 3.995 | 2.271 | 2.998 | 3.533 | ||||||||

2003 | 3.662 | 2.822 | 3.071 | 2.889 | ||||||||

2004 | 3.205 | 2.654 | 2.909 | 2.654 | ||||||||

2005 (through June 24, 2005) | 2.662 | 2.387 | 2.526 | 2.387 | ||||||||

| Reais per U.S. Dollar | ||||||||||||

Month | High | Low | ||||||||||

December 2004 | R$ | 2.787 | R$ | 2.654 | ||||||||

January 2005 | 2.722 | 2.625 | ||||||||||

February 2005 | 2.632 | 2.562 | ||||||||||

March 2005 | 2.762 | 2.601 | ||||||||||

April 2005 | 2.660 | 2.520 | ||||||||||

May 2005 | 2.515 | 2.378 | ||||||||||

June 2005 (through June 24, 2005) | 2.475 | 2.370 | ||||||||||

Source:Central Bank

RISK FACTORSRisk Factors

Risks Relating to Brazil

Brazilian political and economic conditions, and the Brazilian government’s economic and other policies, may negatively affect demand for our products as well as our net sales revenue and overall financial performance.

The Brazilian economy has been characterized by frequent and occasionally extensive intervention by the Brazilian government and unstable economic cycles. The Brazilian government has often changed monetary, taxation, credit, tariff and other policies to influence the course of Brazil’s economy. The Brazilian government’s actions to control inflation and implement other policies have at times involved wage and price controls, blocking access to bank accounts, imposing capital controls and limiting imports into Brazil.

Our results of operations and financial condition may be adversely affected by factors such as:

Luiz Inácio Lula da Silva of the Workers’ Party took office as President of Brazil on January 1, 2003. The Brazilian government has adopted economic measures that are more conservative than initially expected by some observers. However, the Brazilian government may change these policies in a manner that slows the growth of the Brazilian economy, reducing demand for our products and, consequently, impairing our net sales revenue and overall financial performance. Any negative effect on our overall financial performance would also likely lead to a decrease in the market price of our class A preferred shares and the ADSs.

The Brazilian government’s actions to combat inflation may contribute significantly to economic uncertainty in Brazil and reduce demand for our products.

Historically, Brazil has experienced high rates of inflation. Inflation, as well as government efforts to combat inflation, had significant negative effects on the Brazilian economy, particularly prior to 1995. The inflation rate, as measured by the General Price Index—Internal Availability (Índice Geral de Preços—Disponibilidade Interna), reached 2,708% in 1993. Although inflation rates have been substantially lower since 1994 than in previous periods, inflationary pressures persist. Inflation rates were 10.4% in 2001, 26.4% in 2002, 7.7% in 2003 and 12.1% in 2004, as measured by the General Price Index—Internal Availability. The Brazilian government’s measures to control inflation have often included maintaining a tight monetary policy with high interest rates, thereby restricting availability of credit and reducing economic growth. Inflation, actions to combat inflation and public speculation about possible additional actions also contributed materially to economic uncertainty in Brazil and to heightened volatility in the Brazilian securities markets.

Brazil may experience high levels of inflation in future periods. Increasing prices for petroleum, the depreciation of thereal and future governmental measures seeking to maintain the value of thereal in relation to the U.S. dollar, may trigger increases in inflation in Brazil. Periods of higher inflation may slow the rate of growth of the Brazilian economy, which would lead to reduced demand for our products in Brazil and decreased

net sales revenue. Inflation also is likely to increase some of our costs and expenses, which we may not be able to pass on to our customers and, as a result, may reduce our profit margins and net income. In addition, high inflation generally leads to higher domestic interest rates, and, as a result, the costs of servicing ourreal-denominated debt may increase, causing our net income to be reduced. Inflation and its effect on domestic interest rates can, in addition, lead to reduced liquidity in the domestic capital and lending markets, which could adversely affect our ability to refinance our indebtedness in those markets. Any decline in our net sales revenue or net income and any deterioration in our financial condition would also likely lead to a decline in the market price of our class A preferred shares and the ADSs.

Fluctuations in interest rates could raise the cost of servicing our debt and negatively affect our overall financial performance.

Our financial expenses are affected by changes in the interest rates that apply to our floating rate debt. At December 31, 2004, we had R$1,175.1 million of loans and financing and debentures that were subject to the Long-Term Interest Rate, R$305.0 million of loans and financing and debentures that were subject to the CDI (Certificado Depositário Interbancário), an interbank rate, and R$1,357.6 million of loans and financing that were subject to LIBOR. The Long-Term Interest Rate (Taxa de Longo Prazo) is a Brazilian long-term interest rate that includes an inflation factor and is determined quarterly by the Central Bank. In particular, the Long-Term Interest Rate and the CDI rate have fluctuated significantly in the past in response to the expansion or contraction of the Brazilian economy, inflation, Brazilian government policies and other factors. For example, in 2004 the CDI rate increased from 16.3% per annum at December 31, 2003 to 17.8% per annum at December 31, 2004. See “Item 11. Quantitative and Qualitative Disclosures About Market Risk.” A significant increase in any of these interest rates could adversely affect our financial expenses and negatively affect our overall financial performance.

Fluctuations in the real/U.S. dollar exchange rate could increase inflation in Brazil, raise the cost of servicing our foreign currency-denominated debt and negatively affect our overall financial performance.

The exchange rate between thereal and the U.S. dollar and the relative rates of depreciation and appreciation of thereal have affected our results of operations and may continue to do so.

The Brazilian currency has devalued often during the last four decades. Throughout this period, the Brazilian government has implemented various economic plans and various exchange rate policies, including sudden devaluations, periodic mini-devaluations (during which the frequency of adjustments has ranged from daily to monthly), exchange controls, dual exchange rate markets and a floating exchange rate system. From time to time, there have been significant fluctuations in the exchange rate between the Brazilian currency and the U.S. dollar and other currencies. For example, thereal depreciated in value against the U.S. dollar by 34.3% in 2002 as compared with appreciation of 22.3% in 2003 and 8.9% in 2004.

Devaluation of thereal relative to the U.S. dollar also could result in additional inflationary pressures in Brazil by generally increasing the price of imported products and services and requiring recessionary government policies to curb demand. In addition, a devaluation of thereal could weaken investor confidence in Brazil and reduce the market price of our class A preferred shares and the ADSs. On the other hand, appreciation of thereal against the U.S. dollar may lead to a deterioration of the country’s current account and the balance of payments and may dampen export-driven growth.

We had total foreign currency-denominated debt obligations in an aggregate amount of R$4,177.8 million (US$1,573.9 million) at December 31, 2004, representing 69.6% of our indebtedness, excluding related party debt, on a consolidated basis. At December 31, 2004, we had US$461.5 million in U.S. dollar-denominated cash equivalents and other investments. At December 31, 2004, we did not have any foreign currency derivative instruments. A significant devaluation of thereal in relation to the U.S. dollar or other currencies could reduce our ability to meet debt service requirements of our foreign currency-denominated obligations, particularly as our net sales revenue is primarily denominated inreais.

In addition, any significant devaluation of thereal will increase our financial expenses as a result of foreign exchange losses that we must record. For example, the 34.3% devaluation of thereal in 2002 substantially increased our financial expenses and was a significant factor in our net loss for that year.

The prices of naphtha, our most important raw material, and of some of our other raw materials are denominated in or linked to the U.S. dollar. In 2004, 67.7% of our direct and indirect cost of sales and services were represented by the cost of naphtha. When thereal depreciates against the U.S. dollar, the cost inreais of our U.S. dollar-linked raw materials increases, and our operating income inreais decreases.

Brazilian government exchange control policies could increase the cost of servicing our foreign currency-denominated debt and impair our liquidity

The purchase and sale of foreign currency in Brazil is subject to governmental control. In the past, the Central Bank has centralized certain payments of principal on external obligations. Many factors could cause the Brazilian government to institute more restrictive exchange control policies, including the extent of Brazil’s foreign currency reserves, the availability of sufficient foreign exchange on the date a payment is due, the size of Brazil’s debt service burden relative to the economy as a whole, Brazil’s policy towards the International Monetary Fund and political constraints to which Brazil may be subject. A more restrictive policy could increase the cost of servicing (and thereby reduce our ability to pay) our foreign currency-denominated debt obligations and other liabilities. Our foreign-currency denominated debt represented 69.6% of our indebtedness on a consolidated basis at December 31, 2004. If we fail to make payments under any of these obligations, we will be in default under those obligations, which could reduce our liquidity as well as the market price of our class A preferred shares and the ADSs.

Changes in tax laws may result in increases in certain direct and indirect taxes, which could reduce our gross margin and negatively affect our overall financial performance.

The Brazilian government regularly implements changes to tax regimes that may increase our and our customers’ tax burdens. These changes include modifications in the rate of assessments and, on occasion, enactment of temporary taxes, the proceeds of which are earmarked for designated governmental purposes. In April 2003, the Brazilian government presented a tax reform proposal, which was mainly designed to simplify tax assessments, to avoid internal disputes within and between the Brazilian states and municipalities, and to redistribute tax revenues. The tax reform proposal provided for changes in the rules governing the federal Social Integration Program (Programa de Integração Social), or PIS, the federal Contribution for Social Security Financing (Contribuição para Financiamento da Seguridade Social — COFINS), or COFINS, the Tax on the Circulation of Merchandise and Services (Imposto Sobre a Circulação de Mercadorias e Serviços), or ICMS, the Tax on Bank Account Transactions (Contribuição Provisória sobre Movimentação ou Transmissão de Valores e de Créditos e Direitos de Natureza Financeira), or CPMF, and some other taxes.

In December 2003, the Brazilian Federal Senate approved part of this tax reform proposal following its approval by the Brazilian Federal House of Representatives. Other parts of the tax reform proposal were amended by the Senate and returned to the House of Representatives for further examination. The amendments to the tax reform proposal and other items pending before the Brazilian legislature were consolidated in a Project for Constitutional Amendment (Projeto de Emenda Constitucional). We expect that the Project for Constitutional Amendment will be reviewed and submitted to a vote of the House of Representatives in the near future. Upon approval by both houses of the Brazilian legislature, the Project for Constitutional Amendment will be submitted to the President for his review and execution. If enacted, these tax reform measures will be gradually adopted beginning in 2005 and continuing through 2007. The effects of these proposed tax reform measures and any other changes that result from enactment of additional tax reforms have not been, and cannot be, quantified. However, some of these measures, if enacted, may result in increases in our overall tax burden, which could reduce our gross margin and negatively affect our overall financial performance.

Risks Relating to Our Company and the Petrochemical Industry

The cyclical nature of the petrochemical industry may reduce our net sales revenue and gross margin.

The Brazilian petrochemical industry, including the markets in which we compete, is cyclical and sensitive to changes in supply and demand that are, in turn, affected by political and economic conditions in Brazil and elsewhere. This cyclicality may reduce our net sales revenue and gross margin. In particular:

The global petrochemical industry is also cyclical. Historically, the international petrochemical markets have experienced alternating periods of limited supply, which have caused prices and profit margins to increase, followed by expansion of production capacity, which has resulted in oversupply and reduced prices and profit margins. The Brazilian petrochemical industry has become increasingly integrated with the global petrochemical industry for a number of reasons, including increased demand for, and consumption of, petrochemical products in Brazil and the ongoing integration of regional and world markets for commodity products. Pricescommodities. We establish the prices for ourthe products soldwe sell in Brazil are established with reference to international market prices. Our net sales revenue and gross margin are increasingly linked to global industry conditions that we cannot control.

We face competition from producers of polyolefins, vinyls and other petrochemical products.

We face competition in Brazil from Brazilian and international producers of polyethylene, polypropylene, vinyls and other petrochemical products. In addition, ourwe generally set the prices for our second generation products are generally set with reference to the prices charged for these products by foreign producers in international markets. We anticipate that we may experience increasingly intense competition from internationalother producers of polyolefins and vinyls products, both in Brazil and in selected foreign markets in which we sell these products. Many of our foreign competitors are substantially larger and have substantially greater financial, manufacturing, technological and marketing resources than our company.

9

We face significant competition in the polyethylene market. Rio Polímeros S.A., or Rio Polímeros, a Brazilian petrochemical company, commenced operations on June 23,of a major petrochemical plant in Brazil in 2005. The announcedmaximum annual capacity of this plant is 520,000 tons of ethylene, 75,000 tons of propylene and 540,000 tons of polyethylene (representing an increase of approximately 35% of the current total Brazilianpolyethylene. In addition, Suzano Petroquímica S.A., or Suzano, expanded its annual polypropylene production capacity of polyethylene). In addition,by 60,000 tons in July 2006, and Solvay Indupa do Brasil S.A., or Solvay, has announced that it will expandexpanded its annual polyvinylchloride, or PVC, production capacity in Brazil by 35,000 tons commencing in the second half ofDecember 2005. Actions by our competitors, including any future increases in their capacity, may make it increasingly difficult for us to maintain our domestic market share in ourthe thermoplastic products we produce (polyethylene, polypropylene and PVC).

Higher naphtha costs would increase our cost of sales and services rendered and may reduce our gross margin and negatively affect our overall financial performance.

Naphtha, a crude oil derivative, is the principal raw material of our Basic Petrochemicals Unit and Copesul and, indirectly, of our other business units. In 2004, naphthaNaphtha accounted, directly and indirectly, for approximately two-thirds76.3% of our consolidated cost of sales and services rendered.rendered in 2007. The price of naphtha supplied by Petrobras—Petróleo Brasileiro S.A.,—Petrobras, or Petrobras, is linked to the Amsterdam-Rotterdam-Antwerp market price of naphtha and to thereal/U.S. dollar exchange rate. The price of naphtha that we purchase from other international suppliers is also linked to the Amsterdam-Rotterdam-Antwerp market price. The Amsterdam-Rotterdam-Antwerp market price of naphtha fluctuates primarily based on changes in the U.S. dollar-based price of crude oil in the international markets.

During 2004,2007, the average price of naphtha in U.S. dollars increased by 22.9%, from19.7% to US$313.00676.05 per ton in December 2003 to2007 from US$387.05564.74 per ton in December 2004.2006. The U.S. dollar price of naphtha was volatile during 2004, increasing substantially between February and October before declining2007, ranging from a low of US$509.66 per ton in November andJanuary 2007 to a high of US$837.53 per ton in December of 2004. The2007. Since December 31, 2007, the price of naphtha in U.S. dollars continuedhas increased to increase after December 31, 2004, reaching US$394.861,092.85 per ton at January 31, 2005, US$416.23 per ton at February 28, 2005, US$477.43 per ton at March 31, 2005, and US$521.00 per ton at April 4, 2005. Following April 4, 2005, the price of naptha in U.S. dollars has declined to US$438.50 per ton at April 30, 2005 and US$406.00 per ton at MayJune 27, 2005.2008. The price of naphtha may increase significantlycontinue its upward trend or thereal may devaluedepreciate significantly in the future. AnAny increase in naphtha costs would reduce our gross margin and negatively affect our overall financial performance to the extent that we are unable to pass on these increased costs to our customers and could result in reduced sales volumes of our products.

We do not hedge against changes in naphtha prices, so that we are exposed to fluctuations in the price of our primary raw material.

We currently do not hedge our exposure to fluctuations in naphtha prices, which are linked to thereal/U.S. dollar exchange rate. Although we attempt to pass on increases in naphtha prices through thehigher prices offor our products, in periods of high volatility in the U.S. dollar price of naphtha or thereal/U.S. dollar exchange rate, there is usually a lag between the time that the U.S. dollar price of naphtha increases or the U.S. dollar appreciates and the time that we may effectively pass on those increased costs inreaisto our customers in Brazil. As a result, if the U.S. dollar price of naphtha increases precipitously or therealdepreciates precipitously against the U.S. dollar in the future, we may not immediately be able to pass on all of the corresponding increases in our naphtha costs to our customers in Brazil, which would likely reduce our gross margin and net income.

We depend on Petrobras to supply us with the substantial portion of our naphtha requirements.

Petrobras currently is the only Brazilian supplier of naphtha and supplied 62.3%61.1% of the naphtha consumed by our company in 2004.2007. Petrobras produces somemost of the naphtha it sells to us and imports the balance. Our production volume and net sales revenue would likely decrease and our overall financial performance would likely be negatively affected in the event of:

10

In addition, although regulatory changes have ended Petrobras’ monopoly in the Brazilian naphtha market and have allowed us to import naphtha, any reversal in the continuing deregulation of the oil and gas industry in Brazil could increase our production costs.

Our Polyolefins, Ipiranga Petroquímica and Vinyls Units depend on our Basic Petrochemicals Unit and Copesul to supply them with their ethylene and propylene requirements.

Our Basic Petrochemicals Unit is the only supplier of ethylene to our Vinyls Unit, andUnit; our Basic Petrochemicals Unit and Copesul are the only suppliers of ethylene and propylene to our Polyolefins Unit.Unit; and Copesul is the only supplier of ethylene and propylene to Ipiranga Petroquímica. Because the cost of storing ethylene and propylene is substantial and there is inadequate infrastructure in Brazil to permit the importation of large quantities of these products, our production volumes of, and net sales revenue from, vinyls and polyolefins products would decrease, and our overall financial performance would be negatively affected, in the event of:

In addition, any significant expansion of the production capacity of our Polyolefins Unit in the Southern Complex will depend on our ability to obtain additional ethylene and propylene from Copesul.

Any downgrade in the ratings of our company or our debt securities would likely result in increased interest and other financial expenses related to our borrowings and debt securities and could reduce our liquidity.

Standard & Poor’s Ratings Services, a division of The McGraw-Hill Companies, Inc., or Standard and& Poor’s, Moody’s Investors Service, or Moody’s and Fitch, Inc., or Fitch, maintain ratings of our company and our debt securities. Currently, Standard and& Poor’s, Moody’s and Fitch maintain ratings of our company on a local basis and Standard & Poor’s also maintains ratings of our company on a global basis. Standard and& Poor’s maintains a rating of our company on a local basis of “Br AA-“br AA+/Stable Outlook,” Moody’s maintains a rating of our company on a local basis of “Aa2.br/Stable Outlook” and Fitch maintains a nationallocal rating for our company of “AA-“AA (bra)./Positive Outlook.” On a global basis, Standard and& Poor’s maintains a local currency rating for our company of “BB”“BB+ (stable)” and a foreign currency rating for our company of “BB-“BB+ (stable),” whileMoody’s maintains a local currency rating for our company of “Ba1” and a foreign currency rating for our company of “Ba1” and Fitch maintains a local currency rating for our company of “BB+”/Positive Outlook” and a foreign currency rating for our company of “BB-.“BB+/Positive Outlook.” Any decision by these or other rating agencies to downgrade the ratings of our company or of our debt securities in the future would likely result in increased interest and other financial expenses relating to our borrowings and debt securities and could significantly reduce our ability to obtain such financing on satisfactory terms or in amounts required by us and our liquidity.

11

Some of our shareholders may have the ability to determine the outcome of corporate actions or decisions, which could affect the holders of our class A preferred shares and the ADSs.ADS.

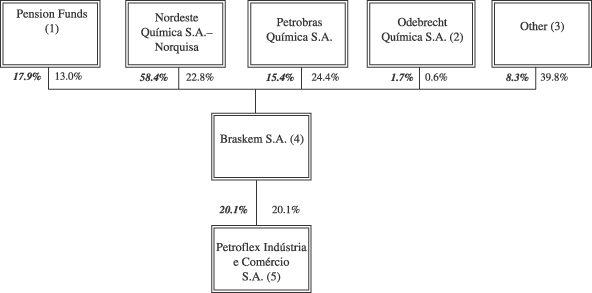

TheOdebrecht S.A., or Odebrecht, a member of a group of companies controlled by the Odebrecht family, which we refer to as the Odebrecht Group, holds, directly holds 47.5%and indirectly, 60.3% of our voting share capital and its designees currentlyPetrobras holds, directly and indirectly, 30.0% of our voting share capital. Designees of Odebrecht constitute a majority of the members of our board of directors. In addition, the Odebrecht Group owns 62.5% of the voting share capital of Nordeste Química S.A.—Norquisa, or Norquisa, which owns 25.4% of our voting share capitaldirectors, and 9.1% of our total share capital. Some of our other shareholders, consisting of PetrobrásPetrobras and Petrobras Química S.A., or Petroquisa, a subsidiary of Petrobras, and two Brazilian pension funds, have veto and other rights under shareholders agreementsthe Petrobras Shareholders’ Agreement as described under “Item 7. Major Shareholders and Related Party Transactions—Major Shareholders—Shareholders Agreements.” In addition, Petroquisa has an option to purchase up to 30% of our voting share capital, which, if exercised, would give Petroquisa substantial voting and other rights in respect of our company. As a result, the Odebrecht, Group,Petrobras and Petroquisa and these other shareholders maywill have the ability to determine the outcome of major corporate actions or decisions requiring the approval of our shareholders or our board of directors, which could affect the holders of the our class A preferred shares and the ADSs.ADS.

We may face conflicts of interest in transactions with related parties.

We maintain trade accounts receivable and current and long-term payables with some of our affiliates and other related parties, including Petrobras (which is our sole domestic supplier of naphtha), Copesul in the Southern Complex (which supplies us with ethylene and propylene), and Politeno Indústria e Comércio S.A., or Politeno (which purchases ethylene from our company). ThroughCurrently, Petrobras, through Petroquisa, Petrobras is the indirect holder of 10.0%30.0% of our voting share capital and 8.4%23.1% of our total share capital. These accounts receivable and accounts payable balances result mainly from purchases and sales of goods, which are at prices and on terms equivalent to the average terms and prices of transactions that we enter into with third parties. We also engage in financial and other transactions with some of our shareholders, such as the grant of the Petroquisa option discussed above.shareholders. These and other commercial and financial transactions between us and our affiliates could result in conflicting interests.

We may make significant acquisitions which, if not successfully integrated with our company, may adversely affect our operating results.

We may make significant acquisitions in the future, in addition to the Ipiranga Transaction, to continue our growth. Acquisitions involve risks, including the following:

If we are unable to integrate or manage acquired businesses successfully, we may not realize anticipated cost savings, revenue growth and levels of integration, which may result in reduced profitability or operating losses.

For a discussion of risks specifically pertaining to the Ipiranga Transaction, see “—Risks Relating to the Ipiranga Transaction.”

Future adjustments in tariffs on imports that compete with our products could cause us to lower our prices.

We take into account, when setting the domestic prices for our products, tariff ratescurrently benefit from tariffs imposed by the Brazilian government on imports of similar products and the products of our customers. We currently benefit

from tariffs that allow us to charge lower prices for our polyolefins and vinyls products thanin the domestic market that include a factor based on the tariffs levied on comparable imports of those products. Our margins from sales in the Brazilian market are therefore significantly higher than our margins from exports. However, the Brazilian government has in the past used import and export tariffs to effect economic policies, with the consequence that tariffs can vary considerably, especially tariffs on petrochemical products. For example, in 2004 the Brazilian government lowered the tariffs applicable to most of the thermoplastic products that we produce by 1.5%. Future adjustments of tariffs could cause us to lower our domestic prices, which would likely result in lower net sales revenue and could negatively affect our overall financial performance.

12

Our business is subject to stringent environmental regulations, and imposition of new regulations could require significant capital expenditures and increase our operating costs.

Our company, like other Brazilian petrochemical producers, is subject to stringent Brazilian federal, state and local environmental laws and regulations concerning human health, the handling and disposal of solid and hazardous wastes and discharges of pollutants into the air and water. Petrochemical producers are sometimes subject to unfavorable market perceptions as a result of the environmental impact of their business, which can have an adverse effect on their results of operations. As environmental laws become more stringent in Brazil and worldwide, the amount and timing of future expenditures required for us to remain compliant could increase substantially and could decrease the availability of funds for other capital expenditures and other purposes.

We manufacture products that are subject to the risk of fire, explosions and other hazards.

Our operations are subject to hazards, such as fires, explosions and other accidents, associated with the manufacture of petrochemicals and the storage and transportation of feedstocks and petrochemical products. These hazards can cause personal injury and loss of life, severe damage to or destruction of property and equipment and environmental damage. A sufficiently large accident at one of our plants or storage facilities could force us to suspend our operations temporarily and result in significant remediation costs and lost net sales revenue. Although we maintain insurance coverage for losses due to fire damage and for losses of income resulting from shutdowns due to fire, explosion or electrical damage, those insurance proceeds may not be available on a timely basis and may be insufficient to cover all losses.

The Brazilian antitrust authorities could impose costly or restrictive conditions on the approval of the formation of our company.

As part of our corporate reorganization process that began in 2001, we merged with each of OPP Química, Trikem, Proppet S.A., or Proppet, and Nitrocarbono S.A., or Nitrocarbono, and we acquired Polialden. We closed these transactions, as permitted by Brazilian law, subject to the final approval of the Brazilian antitrust authorities. We have submitted the terms and conditions of these transactions to the Brazilian antitrust authorities. These antitrust authorities will determine whether these transactions negatively impact competitive conditions in the markets in which we compete or whether they would negatively affect consumers in these markets. Although two of the three Brazilian antitrust authorities have issued non-binding opinions recommending the unconditional approval of these corporate reorganization transactions, the third and governing antitrust authority continues to review this matter and may disagree with these opinions and impose conditions or performance commitments on our company. Any adverse decision by the Brazilian antitrust authorities could materially adversely affect our business and negatively affect our overall financial performance.

Unfavorable outcomes in pending litigation may reduce our liquidity and negatively affect our financial performance and financial condition.

We are involved in numerous tax, civil and labor disputes involving significant monetary claims. If unfavorable decisions are rendered in one or more of these lawsuits, we could be required to pay substantial amounts, which could materially adversely affect our financial condition and results of operations. For some of these lawsuits, we have not established any provision on our balance sheet or have established provisions only for part of the amounts in question, based on our judgments aboutor opinions of our legal counsel as to the likelihood of winning these lawsuits.

The principal lawsuits for which we have not established provisions or have established only partial provisions include the following:

13

In addition, we and some of our subsidiaries believe that our chances of success are remote in a series of lawsuits in which we challenged the constitutionality of an increase in the federal Contribution for Social Security Financing (Contribuição para Financiamento da Seguridade Social—COFINS), or COFINS, tax rate. For a description of the legal bases of these suits, see “Item 8. Financial Information—Legal Proceedings—Tax Proceedings.” We had established total provisions of R$320.650.6 million at December 31, 20042007 for all of our lawsuits relating to the Social Integration Program (Programa de Integração Social), or PIS, and COFINS, including separate lawsuits challenging the basis of calculation of PIS and COFINS. Because we have deposited only R$62.523.8 million of this amount with the courts, we would be required, in the event we and our subsidiaries receive final, unfavorable decisions, to pay the remaining amounts for which we have not made deposits.

We are also parties to a number of lawsuits seeking tax credits that we believe the Brazilian tax authorities have disallowed or limited in violation of the Brazilian Constitution and/or applicable law. In some cases wherein which we have received favorable lower court decisions, we have used these credits to offset other tax obligations and have established provisions in an equivalent amount until a final decision is rendered (adjusting theserendered. These provisions totaled R$1,145.8 million at December 31, 2007, as adjusted based on the SELIC (Sistema Especial de Liquidação e de Custódia—SELIC), or SELIC interest rate). These provisions totaled R$904.5 million at December 31, 2004.rate. If we ultimately lose any of these lawsuits, we would be required to pay the tax obligations we had previously offset with those credits, which could materially reduce our liquidity. We believe that losses related to some of these lawsuits are reasonably possible.

For more information about our legal proceedings, see “Item 8. Financial Information—Legal Proceedings.”

Risks Relating to the Ipiranga Transaction

We may experience difficulties in integrating Copesul, Ipiranga Química and Ipiranga Petroquímica and, therefore, may fail to achieve the anticipated benefits from the Ipiranga Transaction.

On March 18, 2007, we entered into agreements with Ultrapar Participações S.A., or Ultrapar, and Petrobras under which, among other things, we acquired control of Ipiranga Química and Ipiranga Petroquímica, and indirect control of the 29.5% of Copesul’s share capital owned by Ipiranga Petroquímica. To complete the transfer of these shares, we entered into a series of transactions comprising the Ipiranga Transaction. For a discussion of these transactions, see “Item 4. Information on the Company—Ipiranga Transaction.” As a result of the substantial completion of the Ipiranga Transaction:

14

Upon the final completion of the fourth phase of the Ipiranga Transaction, we will own shares of Refinaria de Petróleo Ipiranga S.A., or RPI, representing 33.3% of total share capital and voting share capital of RPI.

Integration of Copesul, Ipiranga Química and Ipiranga Petroquímica with our operations will be a complex, costly and time-consuming process. Risks and challenges that may impair our ability to achieve the anticipated benefits of the Ipiranga Transaction include:

If we are unable to successfully respond to these risks and challenges, we may experience higher than expected operating costs or fail to achieve the anticipated benefits of the Ipiranga Transaction.

We have incurred a substantial amount of indebtedness in connection with the Ipiranga Transaction, which could limit our operating flexibility.

The total purchase price to our company of the shares of Ipiranga Química that we have acquired and the shares of RPI that we will acquire from Ultrapar in the Ipiranga Transaction was R$1,489.1 million. In addition, as part of the Ipiranga Transaction:

To finance the Ipiranga Transaction, we incurred: (1) US$1,200.0 million under an unsecured credit agreement, which we refer to as the Acquisition Credit Agreement, with three financial institutions; (2) US$312.5 million under an export prepayment credit facility; and (3) US$61.0 million under two short-term financing transactions. In addition, as a result of the Ipiranga Transaction, we consolidate the indebtedness of Ipiranga Química and Copesul into our financial statements. As of December 31, 2007, we had R$8,381.9 million of outstanding indebtedness, excluding related party debt.

The substantial increase in our outstanding debt could limit our operating flexibility, including among others, in the following respects:

15

In addition, the principal amount of each disbursement under the Acquisition Credit Agreement is payable on or prior to the second anniversary of such disbursement. Any inability to refinance amounts borrowed under this agreement on satisfactory terms, if at all, would have a material adverse effect on our results of operations and financial condition.

The Brazilian antitrust authorities could impose costly or restrictive conditions on the approval of the Ipiranga Transaction.

The Ipiranga Transaction is subject to the final approval of the Brazilian antitrust authorities. However, Brazilian law permits us to consummate these transactions prior to receiving this final approval, unless the Administrative Council for Economic Defense(Conselho Administrativo de Defesa Econômica), or CADE, issues a writ of prevention blocking a transaction or requires the parties to enter into an agreement permitting the effects of the transaction to be reversed which, by its terms, delays the consummation of the transaction. Our company, together with Ultrapar and Petrobras, submitted the terms and conditions of the Ipiranga Transaction for review by the antitrust authorities in April 2007. The antitrust authorities will determine whether these transactions negatively impact competitive conditions in the markets in which we compete or adversely affect consumers in these markets.

In April 2007, CADE issued a writ of prevention relating to the Ipiranga Transaction, which, among other things, prevented our exercise of strategic management control over Ipiranga Química and Ipiranga Petroquímica. In issuing the writ of prevention, CADE stated that the purpose of the writ of prevention was to guarantee that the Ipiranga Transaction could be reversed in the event that CADE so determined following its review of the Ipiranga Transaction. In April 2007, CADE revoked this writ of prevention upon the agreement of our company to execute an agreement designed to preserve the reversibility of the Ipiranga Transaction, which we refer to as the Reversibility Agreement. Under the Reversibility Agreement, we agreed to preserve all of the assets acquired in the Ipiranga Transaction until CADE makes a final determination with respect to the Ipiranga Transaction, and we are permitted to effectively own and manage these assets pending this final determination.

Any action by the Brazilian antitrust authorities to fail to approve the Ipiranga Transaction or to impose conditions or performance commitments on our company as part of the approval process for the Ipiranga Transaction could materially and adversely affect our business, negatively affect our financial performance and prevent our company from achieving the anticipated benefits of the Ipiranga Transaction.

In November 2007, we entered into the Petrobras Investment Agreement relating to the Petrobras Transaction described in “Item 4. Information on the Company—Petrobras Transaction.” Although we believe that the Petrobras Transaction is not subject to the final approval of the Brazilian antitrust authorities, because the Petrobras Transaction is a follow-on transaction to the Ipiranga Transaction and does not involve any change of control of our company or Petrobras, we and Petrobras submitted the terms and conditions of the Petrobras Transaction to the Brazilian antitrust authorities in December 2007. If the Brazilian antitrust authorities do not agree with our analysis, the failure to approve the Petrobras Transaction or any action taken by these authorities to impose conditions or performance commitments on our company as part of the approval process for the Petrobras Transaction prevent our company from achieving the anticipated benefits of the Petrobras Transaction.

We cannot predict when CADE will take final action with respect to the Ipiranga Transaction and the Petrobras Transaction.

Risks Relating to Brazil

Brazilian political and economic conditions, and the Brazilian government’s economic and other policies, may negatively affect demand for our products as well as our net sales revenue and overall financial performance.

The Brazilian economy has been characterized by frequent and occasionally extensive intervention by the Brazilian government and unstable economic cycles. The Brazilian government has often changed monetary, taxation, credit, tariff and other policies to influence the course of Brazil’s economy. The Brazilian government’s actions to control inflation and implement other policies have at times involved wage and price controls, blocking access to bank accounts, imposing capital controls and limiting imports into Brazil.

16

Our results of operations and financial condition may be adversely affected by factors such as: