SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended DECEMBER 31, 20042005

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-14714

(Exact name of Registrant as specified in its charter)

Yanzhou Coal Mining Company Limited

(Translation of Registrant’s name into English)

People’s Republic of China

(Jurisdiction of incorporation or organization)

298 South Fushan Road

Zoucheng, Shandong Province

People’s Republic of China

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Name of each exchange on which registered | |

| American Depositary Shares | New York Stock Exchange | |

| H Shares, par value RMB1.00 each* | The Stock Exchange of Hong Kong Limited | |

| * | Not for trading in the United States, but only in connection with the listing of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

1,850,000,0002,960,000,000 Domestic Shares, par value RMB1.00 per share

1,224,000,0001,958,400,000 H Shares, par value RMB1.00 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No

| 1 | ||||

| 2 | ||||

| 3 | ||||

| PART I | ||||

ITEM 1. | 4 | |||

ITEM 2. | 4 | |||

ITEM 3. | 4 | |||

ITEM 4. | 13 | |||

ITEM 5. | ||||

ITEM 6. | ||||

ITEM 7. | ||||

ITEM 8. | ||||

ITEM 9. | ||||

ITEM 10. | ||||

ITEM 11. | ||||

ITEM 12. | ||||

| PART II | ||||

ITEM 13. | ||||

ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | |||

ITEM 15. | ||||

ITEM 16A. | ||||

ITEM 16B. | ||||

ITEM 16C. | ||||

ITEM 16D. | ||||

ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |||

| PART III | ||||

ITEM 17. | ||||

ITEM 18. | ||||

ITEM 19. | ||||

i

Certain information contained in this annual report, which does not relate to historical financial information may be deemed to constitute forward-looking statements. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “believe” or similar expressions are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, or the Exchange Act. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated or projected. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. These forward-looking statements include, without limitation, statements relating to:

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions depends on a number of risks and uncertainties, which could cause actual results to differ materially from our expectations. These risks are more fully described in the section entitled “Item 3. Key Information -– Risk Factors.”

Consequently, all of the forward-looking statements made in this annual report are qualified by these cautionary statements. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us or our business or operations.

Unless otherwise indicated, statistical and market trend information, as well as statements related to market position and competitive data, are based on our internal statistics and/or estimates gathered from our own research and/or various publicly available sources.

CERTAIN DEFINITIONS AND SUPPLEMENTAL INFORMATION

As used herein, references to “we”, “our”, “our company”Company” or “us” refer to Yanzhou Coal Mining Company Limited, unless the context indicates otherwise. References to the “Parent Company” include references to Yankuang Group Corporation Limited (formerly known as Yanzhou Mining (Group) Corporation Limited) and, in respect of references to any time prior to our incorporation, are to the businesses, assets and liabilities of the Predecessor that were not transferred to us in the Restructuring and, where the context requires, includes our subsidiaries, and references to the “Predecessor” mean the entity that held all our assets and liabilities as well as the assets and liabilities of the Parent Company prior to the Restructuring.

As used herein, “Restructuring” means our incorporation on September 25, 1997 and the transfer to us, effective as of September 25, 1997, of the principal coal mining businesses of the Predecessor and certain assets and liabilities of the Predecessor relating thereto, together with certain other businesses, assets and liabilities of the Predecessor.

References to Shares herein refer to our (i) domestic invested shares held by the Parent Company on behalf of the State, RMB1.00 par value each (the “State Legal Person Shares”), (ii) domestic invested shares other than those held by the Parent Company, RMB1.00 par value each (the “A Shares”), (iii) overseas listed foreign invested shares issued and traded in HK dollars, par value RMB1.00 each (the “H Shares”), and (iv) American Depositary Shares (“ADSs”), each of which represents 50 H Shares, collectively. The ADSs are evidenced by American Depositary Receipts (“ADRs”).

References to the “Domestic Shares” herein refer to the State Legal Person Shares and A Shares collectively.

References to the “Combined Offering” herein refer to (i) our offering of H Shares in Hong Kong in an offer for subscription, (ii) our offering of ADSs in a public offering initially in the United States and Canada, and (iii) our offering of ADSs outside the United States, Canada and the PRC and to certain professional investors in Hong Kong that purchased ADSs or H Shares other than in the Hong Kong offering. The Combined Offering was completed by us in April 1998 and resulted in the issuance by us of 850,000,000 H Shares, held in H Share and ADS form.

References to the “Directors, Supervisors and Executive Officers” herein refer to our directors, supervisors and executive officers as discussed in Item 6 herein.

References to the “Articles of Association” herein refer to our articles of association, as amended from time to time.

As used herein, “Eastern China” includes Shandong Province, Jiangsu Province, Anhui Province, Zhejiang Province, Fujian Province, Jiangxi Province and Shanghai municipality.

As used herein, “PRC Government” or “Government” or “State” means the central government of the People’s Republic of China (the “PRC” or “China”), including all political subdivisions (including provincial, municipal and other regional or local governmental entities) and instrumentalities thereof.

As used herein, “tonne” means metric tonne, equal to 1,000 kilograms or approximately 2,205 pounds in weight.

Certain mining terms used herein are defined in the “Glossary of Mining Terms” annexed as Appendix B to the registration statement on Form F-l forming part of the registration statement filed with the U.S. Securities and Exchange Commission, a copy of which may be obtained upon request.

We publish our financial statements in Renminbi yuan, the official legal tender currency of the PRC. Except as otherwise stated herein, all monetary amounts in this Form 20-F have been presented in RMB.

Our audited financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), which differ in certain material respects from generally accepted accounting principles in the United States (“U.S. GAAP”). Note 4447 to our audited financial statements provides a reconciliation of our financial statements to U.S. GAAP in accordance with Item 18 of Form 20-F.

References to the “Financial Statements” herein refer to the Financial Statements in Item 18 of this Form 20-F annual report.

Unless otherwise specified, references in this Form 20-F to “U.S. dollars” or “U.S.$” are to United States dollars, references to “HK dollars” or “HK$” are to Hong Kong dollars and references to “Renminbi” or “RMB” are to Renminbi yuan.

Solely for the convenience of the reader, certain items in this Form 20-F contain translations of Renminbi amounts into U.S. dollars. All such Renminbi translations of amounts from Renminbi to U.S. dollars have been made, except as otherwise noted, at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on December 31, 20042005 of U.S.$1.00 = RMB8.2765.RMB8.0702. No representation is made that the Renminbi amounts could have been or could be converted into U.S. dollars at that rate or at any other rate.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

| A. | Selected Financial Data |

Historical Financial Information

The following tables present our consolidated summary income statement data, balance sheet data and cash flow data as of and for the years ended December 31, 2001, 2002, 2003, and 2004 and the summary income statement data, balance sheet data and cash flow data for the year ended December 31, 2000, on a non-consolidated basis.2005. The summary balance sheet data as of December 31, 20032004 and 20042005 and income statement and cash flow data for the years ended December 31, 2002, 2003, 2004 and 20042005 have been derived from, and should be read in conjunction with, the audited financial statements included elsewhere in this report. The summary balance sheet data as of December 31, 2000, 2001, 2002 and 20022003 and income statement and cash flow data for the years ended December 31, 20002001 and 20012002 have been derived from our audited financial statements as of and for such dates and are not included in this annual report. Unless otherwise indicated, the financial statements are prepared and presented in accordance with International Financial Reporting Standards, also known as “IFRS”. For a reconciliation of our net income and owner’s equity to generally accepted accounting principles in the United States, also known as “U.S. GAAP”, see Note 4447 to the Financial Statements. In 2005, the International Accounting Standards Board issued a number of new or revised IFRS which are effective for accounting periods beginning on or after January 1, 2005. We have adopted these new IFRS in the financial statements and changed our accounting policies accordingly. See Note 47 to the Financial Statements included in Item 18.

INCOME STATEMENT DATA IFRS Net Revenue Net sales of coal Domestic Export(2) Railway transportation service income Total net revenue Gross profit Operating income Income from continuing operation Interest expenses Income before income taxes Net income Net income per Share Net income per ADS Operating income per Share Income from continuing operation per ADS U.S. GAAP Net income(3) Net income per Share Net income per ADS CASH FLOW DATA IFRS Net cash provided by operating activities Depreciation Net cash used in investing activities Net cash (used in) provided by financing activities OTHER FINANCIAL DATA Operating income Less: Interest income Add: Depreciation and amortisation EBITDA(4) EBITDA margin(5) OPERATING DATA Raw coal production (’000 tonnes) Net sales (’000 tonnes) Domestic Export Total BALANCE SHEET DATA IFRS Net current assets Property, plant and equipment and land use right, net Total assets Total long-term borrowings Owners’ equity U.S. GAAP Property, plant and equipment and land use right, net Total assets Owners’ equity Number of Shares Domestic Shares H Shares (including H Shares represented by ADS) ADS Dividend per Domestic Share/H Share(6) ADS(7) As of and For the Year Ended December 31, 2000 2001 2002 2003 2004 2004 RMB RMB RMB RMB RMB U.S.$ (Amounts in millions except numbers of Shares and ADSs, and per

Share, per ADS and operating data) 2,090.7 2,599.8 3,414.0 4,337.1 7,407.0 894.9 1,509.0 2,276.2 2,799.9 2,457.2 2,947.3 356.1 — — 142.5 154.6 220.8 26.7 3,599.7 4,876.0 6,356.4 6,948.9 10,575.1 1,277.7 1,616.2 2,063.4 2,993.5 3,193.9 6,023.4 727.8 1,040.7 1,421.7 1,866.1 2,034.9 4,709.3 569.2 1,040.7 1,421.7 1,866.1 2,034.9 4,709.3 569.2 (5.0 ) (61.5 ) (117.9 ) (60.0 ) (35.9 ) (4.3 ) 1,035.7 1,360.2 1,748.2 1,974.9 4,673.3 564.6 748.4 970.9 1,222.0 1,386.7 3,154.3 381.1 0.29 0.35 0.43 0.48 1.06 0.13 14.39 17.29 21.29 24.16 53.20 6.43 0.40 0.51 0.65 0.71 1.59 0.19 20.01 25.32 32.51 35.45 79.42 9.60 918.6 1,227.6 1,325.7 1,499.2 3,272.5 395.4 0.35 0.44 0.46 0.52 1.10 0.13 17.66 21.86 23.1 26.12 55.19 6.67 1,023.2 1,610.2 2,239.7 2,701.2 4,418.4 533.9 514.2 819.6 851.1 933.8 971.9 117.4 (464.7 ) (1,948.2 ) (2,165.5 ) (1,310.3 ) (2,300.8 ) (278.0 ) (231.4 ) 618.0 345.2 (911.4 ) 1,075.4 129.9 1,040.7 1,421.7 1,866.1 2,034.9 4,709.3 569.0 (26.0 ) (39.9 ) (30.2 ) (17.8 ) (92.7 ) (11.2 ) 515.0 827.0 858.5 950.5 994.3 120.1 1,529.7 2,208.8 2,694.4 2,967.6 5,610.9 677.9 42.5 % 45.3 % 42.4 % 42.7 % 53.1 % 53.1 % 27,456 34,018 38,435 43,279 39,146 N/A 16,430 18,369 20,582 25,776 27,988 N/A 10,085 12,666 14,466 13,632 10,016 N/A 26,515 31,035 35,048 39,408 38,004 N/A 1,270.7 1,166.2 2,157.4 2,045.2 5,761.3 696.1 5,500.5 7,851.8 8,895.1 9,221.3 9,128.9 1,103.0 8,103.7 11,182.6 12,924.0 13,909.9 18,336.7 2,215.5 — 72.5 1,261.3 650.9 441.1 53.5 6,869.6 9,060.0 9,995.0 11,083.2 15,523.8 1,875.6 6,564.0 7,176.7 7,271.4 7,785.8 7,880.8 952.2 9,604.6 11,071.0 11,787.5 12,845.8 17,327.8 2,093.6 8,349.6 7,668.9 8,858.5 10,019.2 14,537.9 1,756.5 1,750.0 1,850.0 1,850.0 1,850.0 1,850.0 N/A 850.0 1,020.0 1,020.0 1,020.0 1,224.0 N/A 17.0 20.4 20.4 20.4 24.5 N/A 0.089 0.082 0.100 0.104 0.153 0.02 4.45 4.10 5.00 5.20 7.65 1.0

| As of and For the Year Ended December 31, | ||||||||||||||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2005 | |||||||||||||

| RMB | RMB | RMB | RMB | RMB | U.S.$ | |||||||||||||

| (Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) | ||||||||||||||||||

INCOME STATEMENT DATA | ||||||||||||||||||

IFRS | ||||||||||||||||||

Net Revenue | ||||||||||||||||||

Net sales of coal | ||||||||||||||||||

Domestic | 2,599.8 | 3,414.0 | 4,337.1 | 7,407.0 | 8,421.5 | 1,043.5 | ||||||||||||

Export(2) | 2,276.2 | 2,799.9 | 2,457.2 | 2,947.3 | 2,932.0 | 363.3 | ||||||||||||

Railway transportation service income | — | 142.5 | 154.6 | 220.8 | 163.4 | 20.2 | ||||||||||||

Total net revenue(3) | 4,876.0 | 6,356.4 | 6,948.9 | 10,575.1 | 11,516.9 | 1,427.1 | ||||||||||||

Gross profit | 2,063.4 | 2,993.5 | 3,193.9 | 6,023.4 | 6,228.3 | 771.8 | ||||||||||||

Interest expenses | (61.5 | ) | (117.9 | ) | (60.0 | ) | (35.9 | ) | (24.6 | ) | (3.0 | ) | ||||||

Income before income taxes | 1,360.2 | 1,748.2 | 1,974.9 | 4,673.3 | 4,420.0 | 547.7 | ||||||||||||

Net income attributable to equity holders of the Company | 970.9 | 1,222.0 | 1,386.7 | 3,154.3 | 2,881.5 | 357.1 | ||||||||||||

Net income/Earnings per Share | 0.35 | 0.43 | 0.30 | 0.66 | 0.59 | 0.07 | ||||||||||||

Net income/Earnings per ADS | 17.29 | 21.29 | 15.1 | 33.25 | 29.29 | 3.63 | ||||||||||||

Operating income per Share | 0.51 | 0.65 | 0.44 | 0.99 | 0.90 | 0.11 | ||||||||||||

Income from continuing operation per ADS | 25.32 | 32.51 | 22.16 | 49.64 | 45.18 | 5.60 | ||||||||||||

U.S. GAAP | ||||||||||||||||||

Net income(4) | 1,227.6 | 1,325.7 | 1,499.2 | 3,263.9 | 2,994.7 | 371.1 | ||||||||||||

Net income per Share | 0.44 | 0.46 | 0.33 | 0.69 | 0.61 | 0.08 | ||||||||||||

Net income per ADS | 21.86 | 23.10 | 16.32 | 34.40 | 30.44 | 3.77 | ||||||||||||

CASH FLOW DATA | ||||||||||||||||||

IFRS | ||||||||||||||||||

Net cash provided by operating activities | 1,610.2 | 2,239.7 | 2,701.2 | 4,418.4 | 3,939.3 | 488.1 | ||||||||||||

Depreciation | 819.6 | 851.1 | 920.5 | 958.7 | 952.1 | 118.0 | ||||||||||||

Net cash used in investing activities | (1,948.2 | ) | (2,165.5 | ) | (1,310.3 | ) | (2,300.8 | ) | (2,262.5 | ) | 280.4 | |||||||

Net cash (used in) provided by financing activities | 618.0 | 345.2 | (911.4 | ) | 1,075.4 | (1,009.3 | ) | (125.1 | ) | |||||||||

OTHER FINANCIAL DATA | ||||||||||||||||||

Income before income tax | 1,360.2 | 1,748.2 | 1,974.9 | 4,673.3 | 4,420.0 | 547.7 | ||||||||||||

Add: Interest expenses | 61.5 | 117.9 | 60.0 | 35.9 | 24.6 | 3.0 | ||||||||||||

Less: Interest income | 39.9 | 30.2 | 17.8 | 92.7 | 91.7 | 11.4 | ||||||||||||

Add: Depreciation and amortisation | 827.0 | 858.5 | 950.1 | 994.3 | 971.9 | 120.4 | ||||||||||||

EBITDA(5) | 2,208.8 | 2,694.4 | 2,967.2 | 5,610.8 | 5,324.8 | 659.7 | ||||||||||||

EBITDA margin(6) | 45.3 | % | 42.4 | % | 42.7 | % | 53.1 | % | 46.2 | % | 46.2 | % | ||||||

OPERATING DATA | ||||||||||||||||||

Raw coal production (‘000 tonnes) | 34,018 | 38,435 | 43,279 | 39,146 | 34,655 | N/A | ||||||||||||

Net sales (‘000 tonnes) | ||||||||||||||||||

Domestic | 18,369 | 20,582 | 25,776 | 27,988 | 25,234 | N/A | ||||||||||||

Export | 12,666 | 14,466 | 13,632 | 10,016 | 7,251 | N/A | ||||||||||||

Total | 31,035 | 35,048 | 39,408 | 38,004 | 32,485 | N/A | ||||||||||||

BALANCE SHEET DATA | ||||||||||||||||||

IFRS | ||||||||||||||||||

Total current assets | 3,221.7 | 3,873.4 | 4,430.5 | 8,319.6 | 10,951.1 | 1,357.0 | ||||||||||||

Total current liability | 2,047.6 | 1,662.7 | 2,372.0 | 2,545.1 | 3,429.0 | 424.9 | ||||||||||||

Net current assets | 1,174.1 | 2,170.7 | 2,058.5 | 5,774.5 | 7,522.1 | 932.1 | ||||||||||||

Property, plant and equipment | 7,479.8 | 8,276.9 | 8,616.4 | 8,537.2 | 9,318.5 | 1,154.7 | ||||||||||||

Total assets | 11,182.6 | 12,924.0 | 13,909.9 | 18,336.7 | 21,254.4 | 2,633.7 | ||||||||||||

Total long-term borrowings | 72.5 | 1,261.3 | 650.9 | 441.1 | 231.8 | 28.7 | ||||||||||||

Equity attributable to equity holders of the Company | 9,060.0 | 9,995.0 | 11,083.2 | 15,523.8 | 17,618.6 | 2,183.2 | ||||||||||||

U.S. GAAP | ||||||||||||||||||

Property, plant and equipment and prepaid lease payment, net | 7,176.7 | 7,271.4 | 7,785.8 | 8,073.7 | 8,851.5 | 1,096.8 | ||||||||||||

Total assets | 11,071.0 | 11,787.5 | 12,845.8 | 17,379.1 | 20,189.4 | 2,501.7 | ||||||||||||

Equity attributable to equity holders of the Company | 7,668.9 | 8,858.5 | 10,019.2 | 14,519.3 | 16,699.8 | 2,069.3 | ||||||||||||

Number of Shares | ||||||||||||||||||

Domestic Shares | 1,850.0 | 1,850.0 | 1,850.0 | 1,850.0 | 2,960.0 | 2,960 | ||||||||||||

H Shares (including H Shares represented by ADS) | 1,020.0 | 1,020.0 | 1,020.0 | 1,224.0 | 1,958.4 | 1,958.4 | ||||||||||||

ADS | 20.4 | 20.4 | 20.4 | 24.5 | 39.2 | 39.168 | ||||||||||||

Dividend per | ||||||||||||||||||

Domestic Share/H Share(7) | 0.082 | 0.100 | 0.104 | 0.164 | 0.260 | 0.032 | ||||||||||||

ADS(8) | 4.10 | 5.00 | 5.20 | 8.20 | 13.00 | 1.611 | ||||||||||||

| (1) | The above financial highlights as of and for the year |

| (2) | Export sales constituted |

| (3) | Total net revenue is the sum of net sales of coal and railway transportation service income. |

| (4) | The net income for the |

Total assets value and owners’ equity under U.S. GAAP as at December 31, 2000, have not been restated to show the effects of the acquisition of Railway Assets accounted for as a pooling of interests (see Note 44 to the Financial Statements) as such information is not available without significant costs and effort.

| EBITDA refers to earnings before interest income, interest expense, taxes, depreciation and amortization. EBITDA should not be construed as an alternative to operating income or any other measure of performance or as an indicator of our operating performance, liquidity or cash flows generated by operating, investing and financing activities. The items of net income excluded from EBITDA are significant components in understanding and assessing our financial performance, and EBITDA does not take into account capital expenditures or changes in working capital, which could have a material impact on our operating cash flow. Our computation of EBITDA may not be comparable to other similarly titled measures of other companies. We have included the information concerning EBITDA because management believes it is a useful supplement to cash flow data as a measure of our performance. |

| EBITDA margin represents EBITDA as a percentage of our total net revenue. |

| The calculation of Dividend per Domestic Share/H Share is based on the dividend paid in the relevant year and total number of Domestic Shares and H Shares ranking for the dividend. |

| Dividend per ADS is calculated at 50 times Dividend per Domestic Share/H Share based on one ADS being equivalent to 50 H Shares. |

Exchange Rate Information

The following table sets forth, for the periods indicated, the noon buying rates for U.S. dollars in New York for cable transfers payable in Renminbi as certified for customs purposes by the Federal Reserve Bank of New York expressed in Renminbi per U.S. dollar:

| Noon Buying Rate | Noon Buying Rate | |||||||||||||||

Period | Period End | Average(1) | High | Low | Period End | Average(1) | High | Low | ||||||||

| (expressed in RMB per U.S.$) | (expressed in RMB per U.S.$) | |||||||||||||||

1999 | 8.2795 | 8.2785 | 8.2880 | 8.2770 | ||||||||||||

2000 | 8.2774 | 8.2784 | 8.2799 | 8.2768 | 8.2781 | 8.2784 | 8.2799 | 8.2768 | ||||||||

2001 | 8.2766 | 8.2772 | 8.2786 | 8.2763 | 8.2766 | 8.2772 | 8.2786 | 8.2709 | ||||||||

2002 | 8.2800 | 8.2770 | 8.2800 | 8.2699 | 8.2800 | 8.2772 | 8.2800 | 8.2700 | ||||||||

2003 | 8.2767 | 8.2771 | 8.2800 | 8.2765 | 8.2767 | 8.2771 | 8.2800 | 8.2765 | ||||||||

2004 | 8.2765 | 8.2768 | 8.2773 | 8.2764 | 8.2765 | 8.2768 | 8.2774 | 8.2764 | ||||||||

2005 | 8.0702 | 8.1826 | 8.2765 | 8.0702 | ||||||||||||

December | 8.2765 | 8.2765 | 8.2767 | 8.2765 | 8.0702 | 8.0755 | 8.0808 | 8.0702 | ||||||||

2005 | ||||||||||||||||

2006 | ||||||||||||||||

January | 8.2765 | 8.2765 | 8.2765 | 8.2765 | 8.0608 | 8.0654 | 8.0702 | 8.0596 | ||||||||

February | 8.2765 | 8.2765 | 8.2765 | 8.2765 | 8.0415 | 8.0512 | 8.0616 | 8.0415 | ||||||||

March | 8.2765 | 8.2765 | 8.2765 | 8.2765 | 8.0167 | 8.0350 | 8.0505 | 8.0167 | ||||||||

April | 8.2765 | 8.2765 | 8.2765 | 8.2765 | 8.0165 | 8.0143 | 8.0248 | 8.0040 | ||||||||

May | 8.2765 | 8.2765 | 8.2765 | 8.2765 | 8.0215 | 8.0131 | 8.0300 | 8.0005 | ||||||||

June (through June 22, 2006) | 7.9963 | 8.0060 | 8.0225 | 7.9963 | ||||||||||||

| Source: | The Noon Buying Rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. |

| (1) | Determined by averaging the rates on the last business day of each month during the respective period, except for monthly averages, which are determined by averaging the rates on each business day of the month. |

On June 24, 2005,28, 2006, the noon buying rate for Renminbi was U.S.$1.00 = RMB8.2765.RMB7.997.

B. Capitalization and Indebtedness

Not applicable.

C. Reason for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business and results of operations are dependent on coal markets, which may be cyclical.

As the majority of our revenue is derived from sales of coal and coal-related products, our business and operating results are substantially dependent on the domestic and international demand for coal. The domestic and international coal markets are cyclical and exhibit fluctuation in supply and demand from year to year and are subject to numerous factors beyond our control, including, but not limited to, the economic conditions in the PRC, the global economic conditions and fluctuations in industries with high demand for coal, such as the power and steel industries. Historically, the domesticFluctuations in supply and international markets for coal and coal-related products have at times experienced alternating periods of increased demand, causing production capacity, prices and margins to increase, followed by periods of excess supply, causing production capacity, prices and margins to decline. As a significant percentage of our sales of coal products are for power generation, a significant downturn in the power industry will also materially and adversely affect our business and results of operations. There can be no assurance that the domestic or international demand for coal will continue to grow, or that the domestic or internationalhave effects on coal markets will not experience excess supply. A significant declineprices which in demand or excess supply for coal may have a material adverse effect on our business and results of operations.

Our business relies on our major customers.

Prior to 2004, Shandong Power and Fuel Company was our largest domestic customer. For the years ended December 31, 2002 and 2003, our sales to Shandong Power and Fuel Company accounted for 13.3% and 11.3% of our total net sales in 2002 and 2003, respectively. The Shandong Power and Fuel Company had in the past purchased coal on behalf of several electric power plants in Shandong Province, including Zouxian Electric Power Plant. The Shandong Power and Fuel Company ceased to act as the central procurement center for coal on behalf of Zouxian Electric Power Plant and other electric power plants in Shandong Province after its restructuring at the end of 2003 and ceased to be our largest domestic customer.

For the year ended December 31, 2004, Huadian Power International Corporation Limited (“Huadian”) and Shandong Luneng Hengyuan Group Company (“Shandong Luneng”) replaced Shandong Power and Fuel Company and became our largest and second largest domestic customers. For the year ended December 31, 2004, we supplied a total of 4.9 million and 1.1 million tonnes, representing 9.2% and 2.0% of our total net sales in 2004, to our top two domestic customers. A substantial portion of Huadian and Shandong Luneng’s coal purchases were supplied to Zouxian Electric Power Plant. Our sales of coal to Zouxian Electric Power Plant accounted for 12.6%, 9.6% and 9.5% of our total net sales in 2002, 2003 and 2004, respectively.

The Zouxian Electric Power Plant’s total coal requirements were approximately 5.31 million tonnes in 2004. We estimated that we supplied approximately 85.0%, 77.0% and 92.3% of the Zouxian Electric Power Plant’s coal requirements in 2002, 2003 and 2004, respectively. We believe we are likely to remain the Zouxian Electric Power Plant’s principal coal supplier because (i) we are located within close proximity to the Zouxian Electric Power Plant, (ii) the Zouxian Electric Power Plant is unable to receive railway shipments of coal other than through our own railway network and (iii) the Zouxian Electric Power Plant’s boilers were designed to use our coal. However, our ability to conclude favorable terms of sale with the Zouxian Electric Power Plant may be substantially impaired by current restrictions on price increases for coal sold to the electric power industry. Given the large percentage of our revenues derived from the supply of coal to the Zouxian Electric Power Plant, any adverse developments at the Zouxian Electric Power Plant could have an adverse impact on our results of operations.

We do not have direct export rights.

Currently, we do not have direct export rights. As a result, all of our export sales must be made through intermediary export sales companies. We use export sales service provided by the following three companies: China National Coal Industry Import and Export Corporation, Minmetals Trading Co., Ltd. and Shanxi Coal Import and Export Group Corp. (collectively, the “Export Sales Companies”). The quantity, quality, prices and final customer destination of our export sales are determined by us, the Export Sales Companies and overseas coal purchasers. As a result, we do not directly control matters such as port storage, loading, unloading and shipping processes. Although we are in the process of applying to the PRC central government, with the assistance of the Shandong provincial government, for direct export rights, there can be no assurance that we can obtain such rights. In addition, as export sales represent a significant percentage of our total sales, any material changes in the international coal market could adversely affect our export sales and results of operations.

Our business relies on short-term sales contracts and letters of intent.

Consistent with PRC coal industry practice, a substantial portion of our sales are made pursuant to sales contracts and letters of intent signed during the annual national coal trading convention in accordance with the Guidance Allocation Plan of the PRC. Approximately 85.0%, 86.0% and 88.5% of our sales in 2002, 2003 and 2004, respectively, were derived from such sales contracts and letters of intent. These sales contracts and letters of intent generally specify the quantities and timing of purchases planned over a time period generally no longer than one year. Prices with respect to purchases made under the letters of intent are generally determined at the time of sale based on mutual agreement between us and the relevant customers. Such letters of intent may not be enforceable due to their omission of certain material terms.

In the past, we and our customers have completed the majority of the transactions contemplated under such letters of intent. However, a sudden and significant increase in the proportion of unrealized sales could have a material adverse impact on our results of operations. Furthermore, as the price of coal sold pursuant to such letters of intent is generally determined at the time of sale, any significant downturn in the market price of coal could have an immediate and adverse impact on our results of operations.

Our results of operations are vulnerable to volatility in prices for coal.

Coal prices are subject to cyclical fluctuations from time to time due to imbalances between demand and supply. Fluctuations in prices directlyturn affect our operating and financial performance. We have experienced substantial price fluctuations in the past and believe that such fluctuations will continue. The average selling price of our coal products per tonne was RMB177.3 in 2002, RMB172.4 in 2003, and RMB272.3 in 2004. The primary factor affecting domestic2004 and international coal prices and coal consumption patterns is the overall supply and demand of coal.RMB349.5 in 2005. The demand for coal is primarily affected by the overall economic development and the demand for coal from the electricity generation, steel and construction industries. The supply of coal on the other hand, is primarily affected by the geographical location of the coal supplies, the volume of coal produced by the domestic and international coal suppliers, and the quality and price of competing sources of coal. Alternative fuels such as natural gas, oil and nuclear power, alternative energy sources such as hydroelectric power, and international shipping costs also have effects on the market demand for coal. AnyExcess supply of coal or significant reduction in the demand for our coal by the foreign or domestic electricity generation or steel industries may have an adverse effect on coal prices which would in turn cause a decline in our profitability. Likewise,In addition, any significant decline in domestic or export coal prices could also materially and adversely affect our business and result of operations.

Our business relies on our major customers.

Prior to 2004, Shandong Power and Fuel Company was our largest domestic customer. For the year ended December 31, 2003, our sales to Shandong Power and Fuel Company accounted for 11.3% of our total net sales in 2003. The Shandong Power and Fuel Company had in the past purchased coal on behalf of several electric power plants in Shandong Province, including Zouxian Electric Power Plant. The Shandong Power and Fuel Company ceased to act as the central procurement center for coal on behalf of Zouxian Electric Power Plant and other electric power plants in Shandong Province after its restructuring at the end of 2003 and ceased to be our largest domestic customer.

For the year ended December 31, 2004 and 2005, Huadian Power International Corporation Limited (“Huadian”) replaced Shandong Power and Fuel Company and became our largest domestic customer. For the years ended December 31, 2004 and 2005, we supplied a total of 4.9 million and 5.6 million tonnes, representing 9.2% and 13.4% of our total net sales in 2004 and 2005, to our largest domestic customer. A substantial portion of Huadian’s coal purchases was supplied to Zouxian Electric Power Plant. Our sales of coal to Zouxian Electric Power Plant accounted for 9.6%, 9.5% and 13.2% of our total net sales in 2003, 2004 and 2005, respectively.

The Zouxian Electric Power Plant’s total coal requirements were approximately 6.6 million tonnes in 2005. We estimated that we supplied approximately 77.0%, 92.3% and 83.6% of the Zouxian Electric Power Plant’s coal requirements in 2003, 2004 and 2005, respectively. We believe we are likely to remain the

Zouxian Electric Power Plant’s principal coal supplier because (i) we are located within close proximity to the Zouxian Electric Power Plant, (ii) the Zouxian Electric Power Plant is unable to receive railway shipments of coal other than through our own railway network and (iii) the Zouxian Electric Power Plant’s boilers were designed to use our coal. Given the large percentage of our revenues derived from the supply of coal to the Zouxian Electric Power Plant, any adverse developments at the Zouxian Electric Power Plant could have an adverse impact on our results of operations.

We do not have direct export rights.

Currently, we do not have direct export rights. As a result, all of our export sales must be made through intermediary export sales companies. We use export sales service provided by the following three companies: China Coal Energy Group Company, China National Minerals Import and Export Company Limited and Shanxi Coal Import and Export Group Company (collectively, the “Export Sales Companies”). The quantity, quality, prices and final customer destination of our export sales are determined by us, the Export Sales Companies and overseas coal purchasers. As a result, we do not directly control matters such as port storage, loading, unloading and shipping processes. Although we are in the process of applying to the PRC central government, with the assistance of the Shandong provincial government, for direct export rights, there can be no assurance that we can obtain such rights. If we cannot obtain such direct export rights, we will have to continue reply on the intermediary export sales companies to export our coal. In addition, as export sales represent a significant percentage of our total sales, any material changes in the international coal market could adversely affect our export sales and results of operations.

Our business relies on short-term sales contracts and letters of intent.

The PRC government undertook measures in recent years to introduce market-oriented mechanisms to the coal sale and purchase process, including for example, abolishing government-devised pricing guidance for thermal coal and other temporary price intervention measures and permit the suppliers and buyers to determine pricing through discussions. Major domestic coal suppliers and coal purchasers attend the Annual National Coal Trading Convention to negotiate and discuss the price and quantity of coal to be supplied and purchased for the coming year through the signing of letters of intent and short- and long-term supply contracts. Approximately 86.0%, 88.5% and 87.0% of our sales in 2003, 2004 and 2005, respectively, were derived from such sales contracts and letters of intent. These sales contracts and letters of intent generally specify the quantities and timing of purchases planned over a time period generally no longer than one year. Prices with respect to purchases made under the letters of intent are generally determined at the time of sale based on mutual agreement between us and the relevant customers. Such letters of intent may not be enforceable due to their omission of certain material terms. In addition, the PRC government also adopted measures to ensure adequate allocation of railway transportation capacity to major coal suppliers and buyers and to improve market efficiency by permitting direct negotiation between the suppliers and buyers.

In the past, we and our customers have completed the majority of the transactions contemplated under such letters of intent. However, a sudden and significant increase in the proportion of unrealized sales could have a material adverse impact on our results of operations. Furthermore, as the price of coal sold pursuant to such letters of intent is generally determined at the time of sale, any significant downturn in the market price of coal could have an immediate and adverse impact on our results of operations.

Our product delivery relies on the PRC’s railway transportation system.

Approximately 64.7%60.1%, 60.1%60.0% and 60.0%53.6% of our total net sales in 2002, 2003, 2004 and 2004,2005, respectively, were derived from sales of coal transported by the PRC’s national railway system (excluding coal sold to the Zouxian Electric Power Plant, which were transported entirely by and within our own railway network). The PRCAs the railway system has limited transportation capacity and cannot fully satisfy PRC coal transportation requirements, and discrepancies between capacity and demand for transportation exist in certain areas of the PRC. Currently, our domestic customers are mainly located in Eastern China, where the railway system is relatively advanced. While we haveWe generally utilize the national rail system to transport coal to our customers as well as major coal shipping ports in the past generally been allocated sufficient railway capacityeastern coast of China for transshipping to customers in the coastal region of China and acquired sufficient rail cars to transport our coal, we have at times experienced delays in securing necessary capacity or rail cars.overseas. No assurance can be given that we will continue to be allocated adequate railway transport capacity or acquire adequate rail cars, or that we will not experience any material delay in transporting our coal as a result of insufficient railway transport capacity or rail cars.

The coal reserve data in this annual report are only estimates.

The coal reserve data provided by us are only estimates which may differ materially from the actual in-place proven and probable reserves. Our reserves estimates may change substantially if new information subsequently becomes available. There are inherent uncertainties in estimating reserves, including many factors, assumptions and variables involved in estimating reserves that are beyond our control. Our actual results of operations may differ materially from our long-term business and operational plans derived based on the estimated coal reserve data. We can not assure you that we will not adjust our coal reserve estimates in the future, and in such event, our results of operations may be materially and adversely affected.

Competition in the PRC and the international coal industry is increasing and our business and prospects will be adversely affected if we are not able to compete effectively.

We face competition in all areas of our business. Competition in the coal industry is based on many factors, including price, production capacity, coal quality and characteristics, transportation capability and costs, blending capability and brand name. Our coal business competes in the domestic and international markets with other large domestic coal producers and certain major international coal mining companies. Some of our overseas competitors may have greater financial, marketing, distribution and other resources than we do, and more well-known brand names in the international markets. We currently compete favorably on the quality of our coal products. However, there can be no assurance that we will continue to compete favorably due to quality improvements by our competitors. Although we believe that we compete favorably with respect to transportation capability and costs, due to insufficient rail capacity for the transportation of coal from Shanxi Province and the Inner Mongolia Autonomous Region (where our principal competitors are located) to Eastern China (where demand for coal has been most strong) and the significant costs incurred in transporting coal from these regions to Eastern China, improvements in the PRC national rail network will reduce our competitive advantage in transportation. For example, the PRC Government is planning to construct additional railways to transport coal from Northern and Northwestern China to Eastern China. Accordingly, the completion of these projects may increase the supply of coal available to customers in Eastern China, which may have a material adverse impact on our results of operations.

Our operations may be affected by uncertain mining conditions.

As with all underground coal mining companies, our operations are affected by mining conditions such as a deterioration in the quality or thickness of faults and/or coal seams, pressure in mine openings, presence of gas and/or water inflow and propensity to spontaneous combustion, as well as operational risks associated with industrial or engineering activity, such as mechanical breakdowns. Although we have conducted geological investigations to evaluate such mining conditions and adapt our mining plans to address them, there can be no assurance that the occurrence of any adverse mining conditions would not result in an increase in our costs of production, a reduction of our coal output or the temporary suspension of our operations.

Underground mining is also subject to certain risks such as methane outbursts, and accidents caused by roof weakness and groundfalls. There can be no assurance that the occurrence of such events or conditions would not have a material adverse impact on our business and results of operations.

Results of our operations depend on our ability to acquire or develop new coal mines or coal reserves.

Our recoverable coal reserves decline as we produce coal. As we can only increase our existing production capacity by a limited amount, the future increase in our coal production will depend on our acquisition of new coal reserves, development of new mines or the expansion of our existing coal mines.

We acquired Jining III Coal Mine and Southland Colliery in 2001 and 2004, respectively. At present,In 2005, we further acquired 95.67% of the equity interest in Heze Nenghua from our Parent Company and are in the process of acquiring Juyecurrently developing Zhaolou Coal Mine in the Shandong ProvinceJuye Coal Field and developing other new mining projectprojects in Shaanxi Province. However, we can not give any assurance that we will be able to continue identifying suitable targets in the PRC or abroad for acquisition or acquire suitable targets on competitive terms. Nor can we assure you that we will be able to successfully develop new coal mines or expand our existing ones. In addition, weones in accordance with our development proposal or at all. Our failure to timely or successfully acquire suitable target on competitive terms, or to successfully complete the development of new coal mines or to expand our existing coal mines could encounter unforeseen problems due tohave an adverse effect on our unfamiliarity with local lawsfinancial condition and regulations, or suffer foreign exchange losses in connection with overseas investments. We cannot assure you that our overseas expansion or investments will be successful.results of operation.

The acquisition and/or the development of new mines in the PRC and overseas requires approval of the PRC government. Delay or failure in securing the relevant PRC government approvals or permits as well as any adverse change in government policies may cause a significant adjustment to our development and acquisition plans, which may materially adversely affect our profitability and growth prospects.

In addition, we could encounter unforeseen problems due to our unfamiliarity with local laws and regulations, or suffer foreign exchange losses in connection with overseas investments. We cannot assure you that our overseas expansion or investments will be successful.

We may suffer losses resulting from industry-related accidents and lack of insurance.

We operate coal mines and related facilities that may be affected by water, gas, fire or structural problems. As a result, we, like other coal mining companies, have experienced accidents that have caused property damage and personal injuries. Although we have implemented safety measures for our production facilities and provided on-the-job training for our employees, and, we have in accordance with relevant laws set aside approximately 1.8%2.0% of employees’ total remuneration for employees’ injury insurance, there can be no assurance that industry-related accidents will not occur in the future.

We do not currently maintain fire, casualty or other property insurance covering our properties, equipment or inventories, other than with respect to vehicles. In addition, we do not maintain any business interruption insurance or any third party liability insurance to cover claims in respect of personal injury, property or environmental damage arising from accidents on our properties, other than third party liability insurance with respect to vehicles. Any uninsured losses and liabilities incurred by us could have a material adverse effect on our financial condition and results of operations.

We may be required to allocate additional funds for land subsidence.

A consequence of the longwallunderground mining methods used at our mines is land subsidence above underground mining sites. Depending on the circumstances, we may relocate inhabitants from the land above the underground mining sites prior to mining those sites or we may compensate the inhabitants for losses or damages from land subsidence after the underground sites have been mined. We may also be required to make payments for restoration, rehabilitation or environmental protection of the land after the underground sites have been mined. An estimate of such costs is recognized in the period in which the obligation is identified and is charged as an expense in our income statement in proportion to the coal extracted. The payment for such costs is funded from working capital. The amount charged to income statements in 20042005 amounted to RMB313.2RMB636.6 million. The accrualprovision for land subsidence, restoration, rehabilitation and environmental costs has been determined by the directors based on the past occurrences of land subsidence. However, the accrualprovision is only an estimate. The estimate of the costs for restoration, rehabilitation or environmental protection of the land may be subject to change in the future as the actual costs become apparent and standards established by the PRC Government change from time to time. Therefore, there can be no assurance that such estimates are accurate or that our restoration, rehabilitation and relocation costs will not substantially increase in the future or that the PRC Government will not impose new fees in respect of land subsidence. Any such substantial increases or new fees could have a material adverse effect on our results of operations.

Our business operations may be adversely affected by present or future environmental regulations.

As a producer of coal products, we are subject to significant, extensive, and increasingly stringent environmental protection laws and regulations in China. These laws and regulations:

Our coal mining operations produce significant amounts of waste water, gas and solid waste materials. Currently, the PRC Government is moving toward more rigorous enforcement of applicable laws and regulations as well as the adoption and enforcement of more stringent environmental standards. Our budgeted amounts of capital expenditure for environmental regulatory compliance may not be sufficient and we may need to allocate additional funds for such purpose. If we fail to comply with current or future

environmental laws and regulations, we may be required to pay penalties or fines or take corrective actions, any of which may have a material adverse effect on our business operations and financial condition.

In addition, China is a signatory to the 1992 United Nations Framework Convention on Climate Change and the 1997 Kyoto Protocol, which are intended to limit emissions of greenhouse gases. Efforts to control greenhouse gas emission in China could result in reduced use of coal if power generators switch to sources of fuel with lower carbon dioxide emissions, which in turn could reduce the revenues of our coal business and have a material adverse effect on our results of operations.

New quotas for coal exports in the PRC may adversely affect the amount of our coal exports.

Export sales of coal accounted for 45.1%36.2%, 36.2%28.5% and 28.5%25.8% of our net sales of coal sales in 2002, 2003, 2004 and 2004,2005, respectively. Average selling prices for export coal sales are generally higher than average selling prices for domestic sales. In 2004,2005, average selling prices for export sales were RMB294.3RMB404.3 per tonne, compared to average selling prices for domestic sales of RMB264.5RMB333.7 per tonne.

In January 2004, the PRC Government promulgated new regulations, entitled “Measures for the Administration of Quotas for Coal Export,” which take effect on July 1, 2004. Under the new regulations, the National Development and Reform Commission and the Ministry of Commerce will be responsible for determining the total volume of the PRC’s export quota of coal and allocating the quota among the authorized coal exporters. Under the regulations, the National Development and Reform Commission and the Ministry of Commerce are required to announce the total export quota available for each fiscal year by not later than October 31 of the prior year. After the total available export quota has been announced, the National Development and Reform Commission and the Ministry of Commerce will accept written applications from authorized coal exporters for allocation of specific export quotas for the following year.

The new regulations did not have a material adverse effect on our export sales in 2004 and 2005 as our export agents have consistently receive export quota sufficient to satisfy our export volume. However, we are unable to predict what impact, if any, they may have on the level of our export coal sales for 2006 and later years. Article 10 of the regulations provides that, in determining the allocation of specific quotas to

authorized coal exporters, the National Development and Reform Commission and the Ministry of Commerce will refer to the exporters’ respective coal export performances in the previous year. We have been one of the largest coal exporters in China. For the years ended December 31, 2003, 2004 and 2005, our export sales of coal accounted for approximately 14.5%, 11.6% and 10.2%, respectively, of the total coal export sales in China during the same period. Although our 2004 export sales have not been affected by the new regulations, if national coal exports are reduced, the level of our export sales in future periods could be affected, which in turn could adversely affect our results of operations.

Our Parent Company may have a significant influence on us.

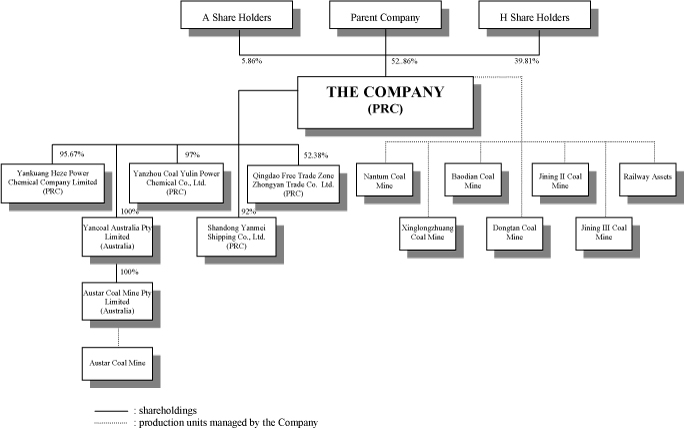

Currently,As at March 31, 2006, the Parent Company owns 54.33%owned 52.86% of our outstanding shares. Our Articles of Association provide that, in addition to any obligation imposed by law, a controlling shareholder shall not exercise its voting rights in a manner prejudicial to the interests of the shareholders generally, including voting with respect to certain enumerated matters of fundamental importance to shareholders.

In addition to being our majority shareholder, the Parent Company also provides certain materials, utilities and services to us pursuant to the materials and services supply agreement dated October 17, 1997 between us and the Parent Company (as amended by supplemental agreements dated October 30, 2001 and May 29, 2003).Any.Pursuant to the regulations of Hong Kong Stock Exchange and Shanghai Stock Exchange on on-going connected transactions and the operation developments of us and the Parent Company, we completed the review of its on-going connected transactions as required by law and entered into six new on-going connected transaction agreements (“New On-going Connected Transaction Agreements”) with the Parent Company in the first quarter 2006. It also determined the caps on the connected transactions for each New On-going Connected Transaction Agreements in each year (“the Annual Caps”) from 2006 to 2008. For details of the New On-going Connected Transactions, please see “Item 7 — Related Party Transaction.” Any material financial or operational problems experienced by the Parent Company leading to disruption of its operations could materially affect our operations and future prospects.

Our operations are subject to a number of risks relating to the PRC.

We are also subject to a number of risks relating to the PRC, including the following:

Since 1979,1997, many new laws and regulations covering general economic matters have been promulgated in the PRC. Despite this activity to develop the legal system, PRC’s system of laws is not yet complete. Even where adequate law exists, enforcement of existing laws or contracts based on existing law may be uncertain and sporadic, and it may be difficult to obtain swift and equitable enforcement or to obtain enforcement of a judgment by a court of another jurisdiction. The relative inexperience of PRC’s judiciary in many cases creates

|

Our coal operations are extensively regulated by the PRC Government and government regulations may limit our activities and adversely affect our business operations.

Our coal operations, like those of other PRC energy companies, are subject to extensive regulation established by the PRC Government. Central governmental authorities, such as the National Development and Reform Commission, the State Environmental Protection Administration, the Ministry of Land and Resources, the State Administration of Coal Mine Safety, the and the State Bureau of Taxation, and provincial and local authorities and agencies exercise extensive control over various aspects of China’s coal mining and transportation (including rail and sea transport). These controls affect the following material aspects of our operations:

We may face significant constraints on our ability to implement our business strategies or to carry out or expand our business operations. Our business may also be materially and adversely affected by future changes in certain regulations and policies of the PRC Government in respect of the coal industry. New legislation or regulations may be adopted that may materially and adversely affect our coal operations, our cost structure or the demand for our products. In addition, new legislation or regulations or different or more stringent interpretation of existing laws and regulations may also require us to substantially change our existing operations or incur significant costs.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of the Company

We, Yanzhou Coal Mining Company Limited, were established on September 25, 1997 as a PRC joint stock company with limited liability under the Company Law of the PRC (the “Company Law”). The Predecessor, formerly known as Yanzhou Mining Bureau, was established in 1973. In 1996, upon receipt of approval from the former State Economic and Trade Commission and the former Ministry of Coal Industry (“MOCI”), the Predecessor was incorporated and renamed Yanzhou Mining (Group) Corporation Limited.

Limited and subsequently renamed as Yankuang Group Corporation Limited after reorganization in 1999.

In April 2001, we were approved by the Minister of Foreign Trade and Economic Cooperation, the predecessor of the Ministry of Commerce, to convert from a joint stock company with limited liability to a Sino-foreign joint stock company with limited liability under the Company Law and the Sino-Foreign Joint Venture Law of the PRC. Our H Shares accounted for 39.8%39.82% of our outstanding shares as of December 31, 2004.2005.

Our contact information is:

|

| |

|

| |

|

| |

Our

We principally engage in underground mining, preparation and sale of coal, and railway coal transportation. We were one of the largest coal producers in Eastern China with raw coal production of approximately 34.7 million tonnes in 2005. We were also one of the largest coal exporters in the PRC in terms of sales volume with approximately 7.3 million tonnes in export sales in 2005.

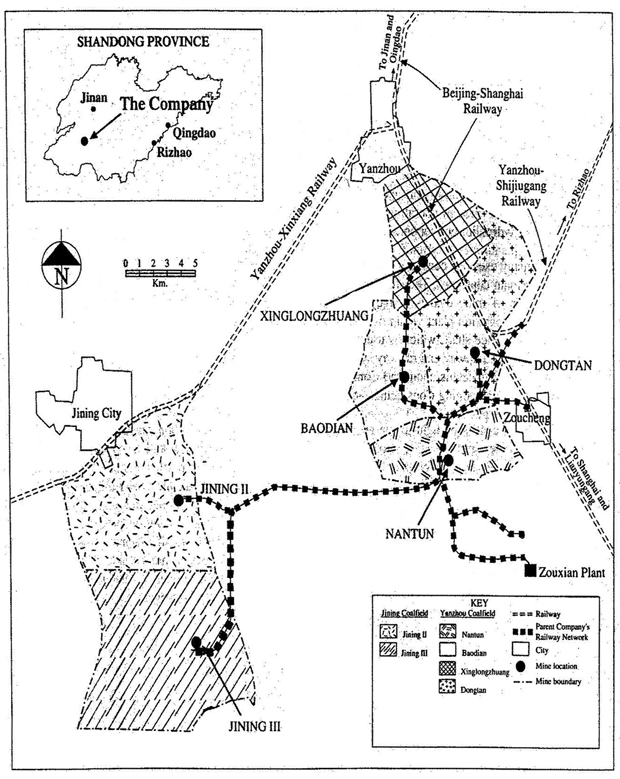

We have six coal mines includelocated in China: Nantun Mine, Xinglongzhuang Mine, Baodian Mine, Dongtan Mine, Jining II Mine and Jining III Mine, which commenced production in 1973, 1981, 1986, 1989, 1997 and 2000, respectively. Pursuant to the Asset Sale AgreementAs of Southland Colliery (“Asset Sale Agreement”) entered into between usDecember 31, 2005, our six domestic coal mines had a total in-place proven and the receivers and managers and the liquidatorsprobable reserve of Southland Coal Pty Limited in Australia,approximately 1968.4 million tonnes.

In 2004, we acquired the entire interest in the Southland Collierycoal mine located in liquidationNew South Wales of Australia (“Southland”) from independent third parties and completed the transfer on December 24, 2004. We subsequently renamed Southland Collierycoal mine as Austar Coal Mine. We have also established two wholly-owned subsidiaries in Australia, namely Yancoal Australia Pty Limited (“Yancoal”) and Austar Coal Mine Pty Limited (“Austar”), in 2004 for our future operations of Southland. We expect to complete the upgrade of the coal mining and production system as well as the testing and commissioning of the relevant coal mining and production system in Austar Coal Mine and to begin production in the third quarter of 2006.

In 2005, we acquired 95.67% equity interest in Yankuang Heze Power Chemical Company Limited (“Heze Nenghua”) from the Parent Company. The principal activities of Heze Nenghua are to conduct the initial mining preparation of the Zhaolou, Wanfu and other coal mines at the Juye Coalfield including obtaining the approvals for the coal mine projects, applying for the necessary exploration rights for coal and preparing for the construction of the coal mines. As ofat December 31, 2004, our domestic six mines2005, Heze Nenghua has commenced construction works for the Zhaolou coal mine. Pursuant to a supplemental agreement dated June 28, 2005 entered between us and the Parent Company, the Parent Company irrevocably undertook that we shall have the right to acquire the mining rights of Zhaolou coal mine and Wanfu coal mine from the Parent Company within twelve months from the respective dates on which such mining rights are obtained by the Parent Company for a total in-place proven and probable reserve of approximately 2,004.3 million tonnes.

We are engaged in underground mining, preparation and sale of coal, and providing railway coal transportation services. We were one ofconsideration to be determined based on valuations conducted by independent qualified PRC valuers. The valuations should also be endorsed by the largest coal producers in Eastern China with raw coal production of approximately 39.2 million tonnes in 2004. We were also one of the largest suppliers of export coal in theapplicable PRC in terms of sales volume with approximately 10.0 million tonnes in export sales in 2004.

government authorities.

We have successfully developed a mechanized comprehensive caving method and have developed mining equipment suitable for medium to thick coal seam extraction. The patented mechanized comprehensive caving method is one of the most advanced mining technologies in the world. We continue to improve our proprietary caving method for internal use or license to third party mining companies.

The location of a coal mine affects its competitiveness due to the significant costs of coal transport. We believe that our mines are well-situated given the rapid economic growth of Eastern China, the insufficient supply of coal produced in this region and the substantial costs involved in transporting coal to Eastern China from major coal-producing provinces such as Shaanxi Province, Shanxi Province and Inner Mongolia Autonomous Region. In 2002, 2003, 2004 and 2004, 27.7%2005, 35.2%, 35.2%47.4% and 47.4%49.5%, respectively, of our total net sales were derived from sales to customers within Shandong Province. Our largest end-user, Huadian’s Zouxian Electric Power Plant, accounted for 12.6%9.6%, 9.6%9.5% and 9.5%13.2% of our total net sales in 2002, 2003, 2004 and 2004,2005, respectively. Net sales to customers located in the rapidly growing Yangtze delta region, encompassing Shanghai Municipality, Jiangsu Province and Zhejiang Province, were 18.3%20.3%, 20.3%16.9% and 16.9%15.1% of our total net sales in 2002, 2003, 2004 and 2004,2005, respectively. Exports, principally to Japan, accounted for 44.0%35.4%, 35.4%27.9% and 27.9%25.5% of our total net sales in 2002, 2003, 2004 and 2004,2005, respectively. We did not record any sales from Austar Coal Mine for 2004.

this reporting period as it was still under reconstruction and upgrade.

The principal coal reserves in our mines consist of prime quality, low-sulphur coal, capable of yielding a product with an ash content as low as 6%. We sell thermal coal, which is suitable for large-scale electric power generation, as well as semi-soft coking coal, which is used in metallurgical production. Our primary customers include electric power plants and metallurgical mills located in Eastern China and the areas along the Beijing-Hangzhou Grand Canal, which are generally more economically developed than other areas of China, and foreign enterprises located in East Asia. Of our total net sales in 2002, 2003, 2004 and 2004, 24.0%2005, 20.5%, 20.5%20.1% and 20.1%20.4%, respectively, were sales to PRC electric utility customers, with the remainder representing sales principally to metallurgical companies, chemical manufacturing companies and fuel supply companies. Our major domestic customers include Huadian, Shandong Luneng, Shanghai Baosteel Group Corporation and Dongguan Shijie Fuel Company. Relationships between us and our key customers are stable.

In 2004,2005, we generated total net sales operating income and net income attributable to equity holders of RMB10,575.1 million, RMB4,709.3the Company of RMB11,516.9 million and RMB3,154.3RMB2,881.5 million, respectively.

Share Reform Plan

As background, beginning in May 2005, the PRC government and the PRC securities regulatory and supervisory authorities started to implement share reforms for shares of domestically listed companies in the PRC in order to eliminate the split share treatment of shares of listed companies in the PRC. Under such split share system, domestic shares are either tradable or non-tradable. In adopting the share reforms, the PRC government and the PRC securities regulatory and supervisory authorities have implemented an interest-balanced mechanism between the holders of non-tradable shares and tradable shares. Pursuant to the share reform policies in the PRC, holders of non-tradable shares could, subject to approvals by the relevant government authorities and consents by the holders of domestically listed and tradable shares, convert their non-tradable shares into shares freely tradable on the domestic stock exchanges in the PRC. In return for approving such share conversion, the holders of the tradable shares will receive certain numbers of shares and relevant commitments made by holders of non-tradable shares. Upon consummation of the share reforms, all non-tradable shares, issued in the PRC, of PRC domestically listed companies will be freely tradable on the PRC domestic stock exchanges.

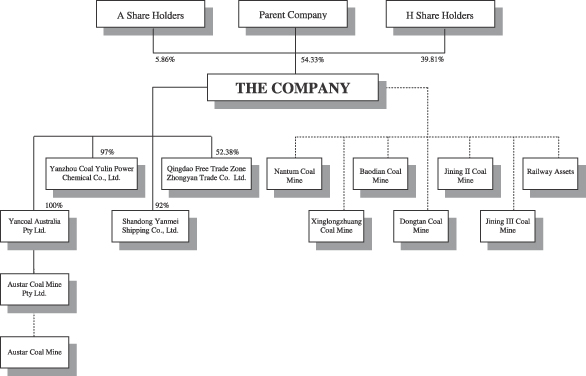

Organizational StructureWe have tradable shares issued in the PRC, or A Shares, which are listed on the Shanghai Stock Exchange as well as non-tradable shares which are held by our Parent Company, our controlling shareholder. We also have overseas listed foreign invested shares, or H Shares, which are listed on the Hong Kong Stock Exchange as well as ADSs, representing the H Shares, which are listed on the New York Stock Exchange. At present or under the PRC government policies, the A Shares and the non-tradable shares issued in the PRC are a separate class of shares and at present are not freely convertible into H Shares or ADSs. Pursuant to relevant regulations relating to share reforms in the PRC and the relevant securities laws and regulations, the share reform plan only involves the tradability of non-tradable shares into tradable shares in the PRC and the only shareholders who are entitled to participate in the shareholders’ meeting to approve the proposed share reform plan proposed by our Parent Company are the Holders of A shares and our Parent Company.

Our share reform plan was implemented on March 31, 2006. Our Parent Company paid a consideration of 2.5 non-tradable shares to each Holder of A Shares for every ten A Shares held by such Holder of A Shares whose name appeared on the register of member of A Shares on March 30, 2006 in exchange for the right to list and trade the non-tradable shares of the Parent Company on the Shanghai Stock Exchange. Our Parent Company did not offer similar consideration to the Holders of H Shares and Holders of ADSs of the Company. For more details of the changes of our shareholding structure as a result of implementation of the share reform plan, see “Item 9 – Offering and Listing.”

In 2004, we had 11 functional departments, namelyaddition to the Secretariatstatutory undertakings, our Parent Company also undertook that (1) the original non-tradable Shares held by the Parent Company would be subject to a trading moratorium of 48 months from the date of the Boardimplementation of Directors, Departmentthe share reform plan; (2) it will, in accordance with the relevant governmental procedures, assign part of Coordination, Departmentits operations including coal and electricity operations together with new projects which are in line with our Company’s development strategies to us in 2006 and support our Company in the implementation of Human Resources, Departmentsuch assignment to enhance the operational results of Financial Planning, Departmentthe Company and to minimize the connected transaction and competition between Yankuang Group and us. We will be invited to invest in the coal liquefaction project which is being developed by Yankuang Group for co-development; and (3) all related expenses arising from the share reform plan would be borne by our Parent Company.

Our assets, liabilities, ownership interest, total share capital and net profit remain unchanged upon implementation of Production Technology, Department of Safety Inspection, Electrical Engineering and Power Department, Ventilation and Dust Elimination Department, Geological Survey Department and Technical Center.

the share reform plan.

Capital Expenditures / Recent Developments

Our principal sources of cash have been cash from operations, the proceeds from issuance of new Shares and bank loans. Our principal capital expenditures have been for the acquisition of property, plant and equipment. During 2002, 2003, 2004 and 2004,2005, our total capital expenditures were RMB2,107.2 million, RMB1,328.1 million, RMB1,057.5 million and RMB1,057.5RMB1,290.5 million, respectively. For more information, please see “Item 5 -– Operating and Financial Review and Prospects -– B. Liquidity and Capital Resources.”

In an effort to expand the scale of our coal mine assets, we continue to explore opportunities to acquire new coal mines. We entered into the Asset Sale Agreement (filed with this Form 20-F as Exhibit 4.1) with the receivers and managers and the liquidators of Southland Coal Pty Limited in October 2004, pursuant to which we acquired the entire Southland colliery formerly owned by Southland Coal Pty Limited (“Southland Colliery”) in liquidation. The aggregate consideration for the acquisition is AUD32.0 million. As we acquired Southland Colliery from the liquidator of Southland Coal Pty Limited, the Asset Sale Agreement does not contain the customary indemnities, representations and warranties ordinarily contained in an asset purchase and sale agreement entered into with a solvent vendor. We completed the assets transfer on December 24, 2004. We subsequently renamed Southland Colliery as Austar Coal Mine.

Under the Asset Sale Agreement, the aggregate consideration consists of three parts. On December 24, 2004, we paid AUD20,000,000 to the vendor upon completion of the transfer. We are required to pay the Additional Payment in the amount of AUD4,000,000 to the vendor when the exploration license is granted to Austar Coal Mine Pty Limited over the Additional Tenement Area (“Additional Exploration License”). We are also required to pay a Royalty Payment of AUD2.00 per tonne for the first four million tonnes of saleable coal produced by us at the Austar Coal Mine.

We plan to commencecommenced the reconstruction, expansion of production capacity and technology upgrade at Austar Coal Mine in 2005 and we expect to resume the production ofat the Austar Coal Mine in the third quarter of 2006. We planThe reconstruction, expansion and technology upgrade at the Austar Coal Mine is expected to spend acost approximately AUD161.0 million. As of December 31, 2005, we have spent an aggregate total of approximately RMB112.0AUD76.6 million capital expenditures on the reconstruction, expansion and technology of Austar Coal Mine. For more details of Austar Coal Mine, see “-“– D. Property, Plants and Equipment -– Austar Coal Mine.”

Establishment of Subsidiaries

During the reporting period, we established Yanzhou Coal Yulin Power Chemical Co., Ltd. (“Yanzhou Yulin Power Chemical”), a subsidiary in which we own 97% of shares, located in Yulin City, Shaanxi Province. Yanzhou Yulin Power Chemical is currently constructing chemical production facilities with annual production capacities of 600,000 tonnes of ethanol and 200,000 tonnes of acetic acid, and ancillary facilities. Through On December 31, 2005, the noon buying rate for AUD was U.S.$1.00 = AUD0.7342.

We also commenced the construction at Zhaolou Coal Mine in 2004 and we expect to complete the construction of the Zhaolou Coal Mine in December 2007. The construction at the Zhaolou Coal Mine is expected to cost approximately RMB 2,364.7 million and we have invested RMB776.0spent an aggregate total of approximately

RMB476.6 million in Yanzhou Yulin Power Chemical.

Duringon the reporting period, we established a wholly-owned subsidiary, Yancoal Australia Pty Limited, in Sydney, Australia for the purposeconstruction and development of holding our investments in Australia, particularly our interestsZhaolou Coal Mine as at Austar Coal Mine. As of December 31, 2004, Yancoal Australia Pty Limited has injected share capital AUD30 million in Austar2005. For more details of Zhaolou Coal Mine, Pty Limited, which is responsible for the productionsee “—D. Property, Plants and operation of AustarEquipment—Zhaolou Coal Mine.

Our H Shares Placement

We entered into a Placing and Underwriting Agreement (filed with this Form 20-F as Exhibit 4.1) with BNP Paribas Peregrine Capital Limited on July 7, 2004, pursuant to which we placed 204,000,000 new H shares, par value RMB1.00 each, at a price of HK$8.30 per share (the “Placing”). The net proceeds of the Placing were HK$1,656.3 million (approximately RMB1,756.9 million). The new H Shares were placed to more than six independent professional and institutional investors located in Hong Kong, Europe and the United States. We used the net proceeds to invest in two new coal mine projects in Shandong Province and Shaanxi Province, and the methanol project in Shaanxi Province.

The Placing shares were listed on the Hong Kong Stock Exchange on July 15, 2004. Our total share capital increased to 3,074 million shares from 2,870 million shares, and the percentage of our listed share capital to our total share capital increased from 41.81% to 45.67%.

”

B. Business Overview

Principal Products and Services

We are engaged in underground mining, preparing and selling coal and provision of railway transportation services.

Coal Production

We produce prime quality, low-sulphur coal capable of yielding a product with an ash content as low as 6%. Our products consist principally of thermal coal, which is suitable for large-scale electric power generation, as well as semi-soft coking coal, which is used in metallurgical production. The following table sets out the ash and sulphur content, calorific value and principal applications of the various types of coal produced by us:

| Sulphur content | Ash Content | Calorific Value | Washed | Principal Application | ||||||

| % | % | (megajoule/ kilogram) | ||||||||

No.1 Clean Coal | 0.4 | 7-8

| 26-28

| Yes | High-quality metallurgical production | |||||

No.2 Clean Coal | 0.5 | 8-10

| 26-28

| Yes | Metallurgical production; construction; production of liquidize coal | |||||

No.3 Clean Coal | 0.6 | 9-16

| 24-26

| Yes | Metallurgical production; electric power generation; coal chemical production | |||||

Lump Coal | 0.6 | 12-14

| 25-26

| Yes | Construction; power generation; coal for oven application | |||||

Screened Raw Coal | 0.6 | 18-27

| 24-26

| No | Power generation | |||||

Mixed Coal | 0.6 | 22-30

| 18-22

| Yes | Power generation | |||||

The following table sets out our principal coal products based on sales volume and net coal sales in the years ended December 31, 2002, 2003, 2004 and 2004.2005.

Year Ended December 31, | ||||||||||||

| 2002 | 2003 | 2004 | ||||||||||

| Sales Volume | Net Sales | Sales Volume | Net Sales | Sales Volume | Net Sales | |||||||

| (‘000 tonnes) | (RMB million) | (‘000 tonnes) | (RMB million) | (‘000 tonnes) | (RMB million) | |||||||

No. 1 Clean Coal | 422.5 | 100.1 | 513.8 | 128.2 | 631.3 | 220.5 | ||||||

No. 2 Clean Coal | 6,086.4 | 1,245.9 | 6,729.2 | 1,287.6 | 6,329.2 | 2,013.5 | ||||||

No. 3 Clean Coal | 12,369.0 | 2,300.1 | 11,952.7 | 2,126.3 | 11,861.9 | 3,484.0 | ||||||

Lump Coal | — | — | 583.4 | 130.3 | 752.3 | 284.3 | ||||||

Screened Raw Coal | 12,628.6 | 2,213.4 | 13,937.5 | 2,499.4 | 14,936.6 | 3,867.5 | ||||||

Mixed Coal and others | 3,541.5 | 354.5 | 5,690.9 | 622.5 | 3,492.6 | 484.5 | ||||||

Total | 35,048.0 | 6,214.0 | 39,407.5 | 6,794.3 | 38,003.9 | 10,354.3 | ||||||

| Year Ended December 31, | ||||||||||||

| 2003 | 2004 | 2005 | ||||||||||

| Sales Volume | Net Sales | Sales Volume | Net Sales | Sales Volume | Net Sales | |||||||

| (‘000 tonnes) | (RMB million) | (‘000 tonnes) | (RMB million) | (‘000 tonnes) | (RMB million) | |||||||