As filed with Securities and Exchange Commission on June 29, 2007

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

forFor the fiscal year ended DECEMBERDecember 31, 20052006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-14714

(Exact name of Registrant as specified in its charter)

Yanzhou Coal Mining Company Limited

(Translation of Registrant’s name into English)

People’s Republic of China

(Jurisdiction of incorporation or organization)

298 South Fushan Road

Zoucheng, Shandong Province

People’s Republic of China

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Name of each exchange on which registered | |

| American Depositary Shares | New York Stock Exchange | |

| H Shares, par value RMB1.00 | ||

| * | Not for trading in the United States, but only in connection with the listing of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

2,960,000,000 Domestic Shares, par value RMB1.00 per share

1,958,400,000 H Shares, par value RMB1.00 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the

Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ¨ YesNo x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨ Yes ¨ No¨

i

Certain information contained in this annual report,Annual Report which does not relate to historical financial information may be deemed to constitute forward-looking statements. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimate,” “project,” “believe” or similar expressions are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, or the Exchange Act. Such statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated or projected. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. These forward-looking statements include, without limitation, statements relating to:

future prices and demand for our products and demand for our customers’ products;

future PRC tariff levels and export quotas for coal;

sales of our products;

the amount and nature of, and potential for, future development;

coal mine reserves potential;

production forecasts of coal;

trends in the coal industry and domestic and international coal market conditions;

the effectiveness of our cost-saving measures;

future expansion plans and capital expenditures;

expected production capacity increases;

competition;

changes in legislation, regulations and policies;

estimates of proven and probable coal mine reserves;

our research and development plans; and

our dividend policy.

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions depends on a number of risks and uncertainties, which could cause actual results to differ materially from our expectations. These risks are more fully described in the section entitled “Item 3. Key Information – Risk Factors.”Factors”.

Consequently, all of the forward-looking statements made in this annual reportAnnual Report are qualified by these cautionary statements. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us, or our business or operations.

Unless otherwise indicated, statistical and market trend information, as well as statements related to market position and competitive data, are based on our internal statistics and/or estimates gathered from our own research and/or various publicly available sources.

CERTAIN DEFINITIONS AND SUPPLEMENTAL INFORMATION

As used herein, references to “we”, “our”, “Company”, “our Company” or “us” refer to Yanzhou Coal Mining Company Limited and its subsidiaries which have been consolidated into the accounts of Yanzhou Coal Mining Company Limited for the purpose of the consolidated financial statements, unless the context indicates otherwise. References to the “Parent Company”“Yankuang Group” or “Controlling Shareholder” include references to Yankuang Group Corporation Limited (formerly known as Yanzhou Mining (Group) Corporation Limited) and, in respect of references to any time prior to our incorporation, are to the businesses, assets and liabilities of the Predecessor that were not transferred

to us in the Restructuringrestructuring and incorporation of the Company (defined below) in 1997 and, where the context requires, includes our subsidiaries, and references to the “Predecessor” mean the entity that held all our assets and liabilities as well as the assets and liabilities of the Parent CompanyControlling Shareholder prior to the Restructuring.

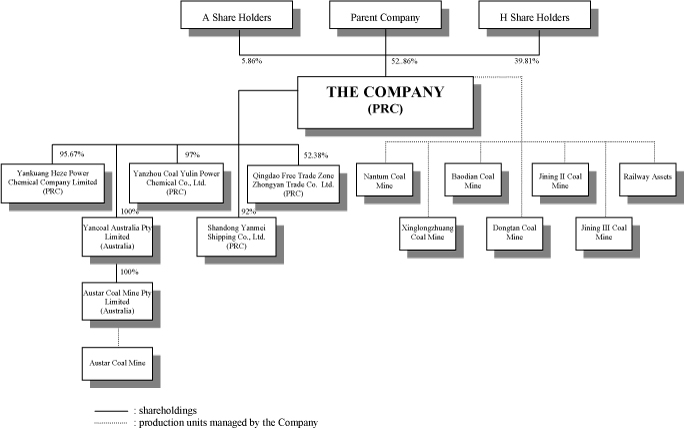

As used herein, “Restructuring” meansreferences to “the Company” refers to Yanzhou Coal Mining Company Limited on a stand-alone basis and does not include its subsidiaries that have been consolidated into our incorporation on September 25, 1997 andaccounts for the transfer to us, effective as of September 25, 1997,purposes of the principal coal mining businessesconsolidated financial statements. The subsidiaries of the Predecessor and certain assets and liabilitiesCompany which have been consolidated into our accounts for the purposes of the Predecessor relating thereto, together with certain other businesses, assetsconsolidated financial statements include: Shandong Yanmei Shipping Co., Ltd. (“Yanmei Shipping”), Zhongyan Trading Co. Ltd. of Qingdao Bonded Area (“Zhongyan Trading”), Yanzhou Coal Yulin Nenghua Co., Ltd. (“Yulin Nenghua”), Yancoal Australia Pty Limited (“Yancoal Australia”), Yanmei Shanxi Nenghua Co., Ltd. (“Shanxi Nenghua”), and liabilities of the Predecessor.Yanmei Heze Power Chemical Co., Ltd. (“Heze Nenghua”).

References to Shares herein refer to our (i) domestic invested shares held by the Parent CompanyControlling Shareholder on behalf of the State, RMB1.00 par value each (the “State Legal Person Shares”), (ii) domestic invested shares other than those held by the Parent Company,Controlling Shareholder, RMB1.00 par value each (the “A“RMB Ordinary A Shares”), (iii) overseas listed foreign invested shares issued and traded in HK dollars, par value RMB1.00 each (the “H Shares”), and (iv) American Depositary Shares (“ADSs”), each of which represents 50 H Shares, collectively. The ADSs are evidenced by American Depositary Receipts (“ADRs”).

References to the “Domestic Shares” herein refer to the State Legal Person Shares held by Yankuang Group on behalf of the State and RMB Ordinary A Shares collectively.

References to the “Combined Offering” herein refer to (i) our offering of H Shares in Hong Kong in an offer for subscription, (ii) our offering of ADSs in a public offering initially in the United States and Canada, and (iii) our offering of ADSs outside the United States, Canada and the PRC and to certain professional investors in Hong Kong that purchased ADSs or H Shares other than in the Hong Kong offering. The Combined Offering was completed by us in April 1998 and resulted in the issuance by us of 850,000,000 H Shares, held in H Share and ADS form.

References to the “Directors, Supervisors and Executive Officers” herein refer to our directors, supervisors and executive officers as discussed in Item 6 herein.

References to the “Articles of Association” herein refer to our articles of association, as amended from time to time.

As used herein, “Eastern China” includes Shandong Province, Jiangsu Province, Anhui Province, Zhejiang Province, Fujian Province, Jiangxi Province and Shanghai municipality.

As used herein, “PRC Government” or “Government” or “State” means the central government of the People’s Republic of China (the “PRC” or “China”), including all political subdivisions (including provincial, municipal and other regional or local governmental entities) and instrumentalities thereof.

As used herein, “tonne” means metric tonne, equal to 1,000 kilograms or approximately 2,205 pounds in weight.

Certain mining terms used herein are defined in the “Glossary of Mining Terms” annexed as Appendix B to the registration statement on Form F-l forming part of the registration statement filed with the U.S. Securities and Exchange Commission, a copy of which may be obtained upon request.

We publish our financial statements in Renminbi yuan, the official legal tender currency of the PRC. Except as otherwise stated herein, all monetary amounts in this Form 20-F have been presented in RMB.

Our audited financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), which differ in certain material respects from generally accepted accounting principles in the United States (“U.S. GAAP”). Note 4746 to our audited financial statements provides a reconciliation of our financial statements to U.S. GAAP in accordance with Item 18 of Form 20-F.

References to the “Financial Statements” herein refer to the Financial Statements in Item 18 of this Form 20-F annual report.

Unless otherwise specified, references in this Form 20-F to “U.S. dollars” or “U.S.$” are to United States dollars, references to “HK dollars” or “HK$” are to Hong Kong dollars and references to “Renminbi” or “RMB” are to Renminbi yuan.

Solely for the convenience of the reader, certain items in this Form 20-F contain translations of Renminbi amounts into U.S. dollars. All such Renminbi translations of amounts from Renminbi to U.S. dollars have been made, except as otherwise noted, at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on December 31, 200529, 2006 of U.S.$1.00 = RMB8.0702.RMB7.8041. No representation is made that the Renminbi amounts could have been or could be converted into U.S. dollars at that rate or at any other rate.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

Historical Financial Information

The following tables presentselected financial information presents our consolidated summary income statement data, consolidated balance sheet data and consolidated cash flow data as of and for the years ended December 31, 2001, 2002, 2003, 2004, and 2005. The summary balance sheet data as of December 31, 2004 and 2005 and income statement and cash flow data for the years ended December 31, 2003, 2004 and 2005 have been derived from, and2006. The following financial information should be read in conjunction with the audited financial statements included elsewhere in this report. The summary balance sheet data as of December 31, 2001, 2002 and 2003 and income statement and cash flow data for the years ended December 31, 2001 and 2002 have been derived from our audited financial statements as of and for such dates and are not included in this annual report. Unless otherwise indicated, the financial statements are prepared and presented in accordance with International Financial Reporting Standards, also known as “IFRS”. For a reconciliation of our net income and owner’s equitythe IFRS as compared to generally accepted accounting principles in the United States, also known as “U.S. GAAP”, see Note 4746 to the Financial Statements.financial statements. In 2005,2006, we have applied, for the first time, a number of new standards, amendments and interpretations (“New IFRS”) issued by the International Accounting Standards Board issued a number(the “IASB”) and the International Financial Reporting Interpretations Committee of new or revised IFRSthe IASB which are either effective for accounting periods beginning on or after December 1, 2005 or January 1, 2005. We have adopted these2006. Since the adoption of the new IFRS indid not have a material effect on how the result for the current or prior accounting periods have been prepared and presented, no prior period adjustment was required. See Note 3 to the financial statements and changed our accounting policies accordingly. See Note 47 to the Financial Statements included in Item 18.

| As of and for the Year Ended December 31, | ||||||||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | 2006 | |||||||

| RMB | RMB | RMB | RMB | RMB | U.S.$ | |||||||

(Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) | ||||||||||||

INCOME STATEMENT DATA | ||||||||||||

IFRS | ||||||||||||

Net Revenue | ||||||||||||

Net sales of coal | 6,213.9 | 6,794.3 | 10,354.3 | 11,353.5 | 11,846.9 | 1,518.0 | ||||||

The Company(2) | 6,213.9 | 6,794.3 | 10,354.3 | 11,353.5 | 11,710.7 | 1,500.6 | ||||||

Domestic | 3,414.0 | 4,337.1 | 7,407.0 | 8,421.5 | 9,365.9 | 1,200.1 | ||||||

Export(3) | 2,799.9 | 2,457.2 | 2,947.3 | 2,932.0 | 2,344.8 | 300.5 | ||||||

Yancoal Australia | — | — | — | — | 114.4 | 14.7 | ||||||

Shanxi Nenghua | — | — | — | — | 21.8 | 2.7 | ||||||

Railway transportation service income | 142.5 | 154.6 | 220.8 | 163.4 | 160.4 | 20.5 | ||||||

| As of and For the Year Ended December 31, | As of and for the Year Ended December 31, | |||||||||||||||||||||||||||||||||||

| 2001 | 2002 | 2003 | 2004 | 2005 | 2005 | 2002 | 2003 | 2004 | 2005 | 2006 | 2006 | |||||||||||||||||||||||||

| RMB | RMB | RMB | RMB | RMB | U.S.$ | RMB | RMB | RMB | RMB | RMB | U.S.$ | |||||||||||||||||||||||||

| (Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) | (Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) | |||||||||||||||||||||||||||||||||||

INCOME STATEMENT DATA | ||||||||||||||||||||||||||||||||||||

IFRS | ||||||||||||||||||||||||||||||||||||

Net Revenue | ||||||||||||||||||||||||||||||||||||

Net sales of coal | ||||||||||||||||||||||||||||||||||||

Domestic | 2,599.8 | 3,414.0 | 4,337.1 | 7,407.0 | 8,421.5 | 1,043.5 | ||||||||||||||||||||||||||||||

Export(2) | 2,276.2 | 2,799.9 | 2,457.2 | 2,947.3 | 2,932.0 | 363.3 | ||||||||||||||||||||||||||||||

Railway transportation service income | — | 142.5 | 154.6 | 220.8 | 163.4 | 20.2 | ||||||||||||||||||||||||||||||

Total net revenue(3) | 4,876.0 | 6,356.4 | 6,948.9 | 10,575.1 | 11,516.9 | 1,427.1 | ||||||||||||||||||||||||||||||

Total net revenue(4) | 6,356.4 | 6,948.9 | 10,575.1 | 11,516.9 | 12,007.3 | 1,538.5 | ||||||||||||||||||||||||||||||

Gross profit | 2,063.4 | 2,993.5 | 3,193.9 | 6,023.4 | 6,228.3 | 771.8 | 2,993.5 | 3,193.9 | 6,023.4 | 6,228.3 | 5,817.3 | 745.4 | ||||||||||||||||||||||||

Interest expenses | (61.5 | ) | (117.9 | ) | (60.0 | ) | (35.9 | ) | (24.6 | ) | (3.0 | ) | (117.9 | ) | (60.0 | ) | (35.9 | ) | (24.6 | ) | (26.3 | ) | (3.4 | ) | ||||||||||||

Income before income taxes | 1,360.2 | 1,748.2 | 1,974.9 | 4,673.3 | 4,420.0 | 547.7 | 1,748.2 | 1,974.9 | 4,673.3 | 4,420.0 | 3,726.6 | 477.5 | ||||||||||||||||||||||||

Net income attributable to equity holders of the Company | 970.9 | 1,222.0 | 1,386.7 | 3,154.3 | 2,881.5 | 357.1 | ||||||||||||||||||||||||||||||

Net income attributable to our equity holders | 1,222.0 | 1,386.7 | 3,154.3 | 2,881.5 | 2,373.0 | 304.1 | ||||||||||||||||||||||||||||||

Net income/Earnings per Share | 0.35 | 0.43 | 0.30 | 0.66 | 0.59 | 0.07 | 0.43 | 0.30 | 0.66 | 0.59 | 0.48 | 0.06 | ||||||||||||||||||||||||

Net income/Earnings per ADS | 17.29 | 21.29 | 15.1 | 33.25 | 29.29 | 3.63 | 21.29 | 15.1 | 33.25 | 29.29 | 24.12 | 3.09 | ||||||||||||||||||||||||

Operating income per Share | 0.51 | 0.65 | 0.44 | 0.99 | 0.90 | 0.11 | 0.65 | 0.44 | 0.99 | 0.90 | 0.76 | 0.10 | ||||||||||||||||||||||||

Income from continuing operation per ADS | 25.32 | 32.51 | 22.16 | 49.64 | 45.18 | 5.60 | 32.51 | 22.16 | 49.64 | 45.18 | 37.88 | 4.85 | ||||||||||||||||||||||||

U.S. GAAP | ||||||||||||||||||||||||||||||||||||

Net income(4) | 1,227.6 | 1,325.7 | 1,499.2 | 3,263.9 | 2,994.7 | 371.1 | ||||||||||||||||||||||||||||||

Net income(5) | 1,325.7 | 1,499.2 | 3,263.9 | 2,991.1 | 2,405.8 | 308.3 | ||||||||||||||||||||||||||||||

Net income per Share | 0.44 | 0.46 | 0.33 | 0.69 | 0.61 | 0.08 | 0.46 | 0.33 | 0.69 | 0.61 | 0.49 | 0.06 | ||||||||||||||||||||||||

Net income per ADS | 21.86 | 23.10 | 16.32 | 34.40 | 30.44 | 3.77 | 23.10 | 16.32 | 34.40 | 30.41 | 24.46 | 3.13 | ||||||||||||||||||||||||

CASH FLOW DATA | ||||||||||||||||||||||||||||||||||||

IFRS | ||||||||||||||||||||||||||||||||||||

Net cash provided by operating activities | 1,610.2 | 2,239.7 | 2,701.2 | 4,418.4 | 3,939.3 | 488.1 | 2,239.7 | 2,701.2 | 4,418.4 | 3,939.3 | 3,767.2 | 482.7 | ||||||||||||||||||||||||

Depreciation | 819.6 | 851.1 | 920.5 | 958.7 | 952.1 | 118.0 | 851.1 | 920.5 | 958.7 | 952.1 | 1,062.0 | 136.1 | ||||||||||||||||||||||||

Net cash used in investing activities | (1,948.2 | ) | (2,165.5 | ) | (1,310.3 | ) | (2,300.8 | ) | (2,262.5 | ) | 280.4 | (2,165.5 | ) | (1,310.3 | ) | (2,300.8 | ) | (2,262.5 | ) | (3,625.5 | ) | (464.6 | ) | |||||||||||||

Net cash (used in) provided by financing activities | 618.0 | 345.2 | (911.4 | ) | 1,075.4 | (1,009.3 | ) | (125.1 | ) | 345.2 | (911.4 | ) | 1,075.4 | (1,009.3 | ) | (1,291.5 | ) | (165.5 | ) | |||||||||||||||||

OTHER FINANCIAL DATA | ||||||||||||||||||||||||||||||||||||

Income before income tax | 1,360.2 | 1,748.2 | 1,974.9 | 4,673.3 | 4,420.0 | 547.7 | 1,748.2 | 1,974.9 | 4,673.3 | 4,420.0 | 3,726.6 | 477.5 | ||||||||||||||||||||||||

Add: Interest expenses | 61.5 | 117.9 | 60.0 | 35.9 | 24.6 | 3.0 | 117.9 | 60.0 | 35.9 | 24.6 | 26.3 | 3.4 | ||||||||||||||||||||||||

Less: Interest income | 39.9 | 30.2 | 17.8 | 92.7 | 91.7 | 11.4 | 30.2 | 17.8 | 92.7 | 91.7 | 94.3 | 12.1 | ||||||||||||||||||||||||

Add: Depreciation and amortisation | 827.0 | 858.5 | 950.1 | 994.3 | 971.9 | 120.4 | 858.5 | 950.1 | 994.3 | 971.9 | 1,088.2 | 139.4 | ||||||||||||||||||||||||

EBITDA(5) | 2,208.8 | 2,694.4 | 2,967.2 | 5,610.8 | 5,324.8 | 659.7 | ||||||||||||||||||||||||||||||

EBITDA margin(6) | 45.3 | % | 42.4 | % | 42.7 | % | 53.1 | % | 46.2 | % | 46.2 | % | ||||||||||||||||||||||||

EBITDA(6) | 2,694.4 | 2,967.2 | 5,610.8 | 5,324.8 | 4,746.8 | 608.2 | ||||||||||||||||||||||||||||||

EBITDA margin(7) | 42.4 | % | 42.7 | % | 53.1 | % | 46.2 | % | 39.5 | % | 39.5 | % | ||||||||||||||||||||||||

OPERATING DATA | ||||||||||||||||||||||||||||||||||||

Raw coal production (‘000 tonnes) | 34,018 | 38,435 | 43,279 | 39,146 | 34,655 | N/A | 38,435 | 43,279 | 39,146 | 34,655 | 36,051 | N/A | ||||||||||||||||||||||||

The Company(2) (‘000 tonnes) | 38,435 | 43,279 | 39,146 | 34,655 | 35,485 | N/A | ||||||||||||||||||||||||||||||

Yancoal Australia (‘000 tonnes) | — | — | — | — | 447 | N/A | ||||||||||||||||||||||||||||||

Shanxi Nenghua (‘000 tonnes) | — | — | — | — | 119 | N/A | ||||||||||||||||||||||||||||||

Net sales (‘000 tonnes) | 35,048 | 39,408 | 38,004 | 32,485 | 34,663 | N/A | ||||||||||||||||||||||||||||||

Domestic | 18,369 | 20,582 | 25,776 | 27,988 | 25,234 | N/A | ||||||||||||||||||||||||||||||

Export | 12,666 | 14,466 | 13,632 | 10,016 | 7,251 | N/A | ||||||||||||||||||||||||||||||

Total | 31,035 | 35,048 | 39,408 | 38,004 | 32,485 | N/A | ||||||||||||||||||||||||||||||

The Company(2) (‘000 tonnes) | 35,048 | 39,408 | 38,004 | 32,485 | 34,330 | N/A | ||||||||||||||||||||||||||||||

Domestic (‘000 tonnes) | 20,582 | 25,776 | 27,988 | 25,234 | 28,194 | N/A | ||||||||||||||||||||||||||||||

Export (‘000 tonnes) | 14,466 | 13,632 | 10,016 | 7,251 | 6,136 | N/A | ||||||||||||||||||||||||||||||

Yancoal Australia (‘000 tonnes) | — | — | — | — | 192 | N/A | ||||||||||||||||||||||||||||||

Shanxi Nenghua (‘000 tonnes) | — | — | — | — | 141 | N/A | ||||||||||||||||||||||||||||||

BALANCE SHEET DATA | ||||||||||||||||||||||||||||||||||||

IFRS | ||||||||||||||||||||||||||||||||||||

Total current assets | 3,221.7 | 3,873.4 | 4,430.5 | 8,319.6 | 10,951.1 | 1,357.0 | 3,873.4 | 4,430.5 | 8,319.6 | 10,951.1 | 9,871.9 | 1,265.0 | ||||||||||||||||||||||||

Total current liability | 2,047.6 | 1,662.7 | 2,372.0 | 2,545.1 | 3,429.0 | 424.9 | 1,662.7 | 2,372.0 | 2,545.1 | 3,429.0 | 3,828.0 | 490.5 | ||||||||||||||||||||||||

Net current assets | 1,174.1 | 2,170.7 | 2,058.5 | 5,774.5 | 7,522.1 | 932.1 | 2,170.7 | 2,058.5 | 5,774.5 | 7,522.1 | 6,043.9 | 774.5 | ||||||||||||||||||||||||

Property, plant and equipment | 7,479.8 | 8,276.9 | 8,616.4 | 8,537.2 | 9,318.5 | 1,154.7 | ||||||||||||||||||||||||||||||

Property, plant and equipment, net | 8,276.9 | 8,616.4 | 8,537.2 | 9,318.5 | 12,139.9 | 1,555.6 | ||||||||||||||||||||||||||||||

Total assets | 11,182.6 | 12,924.0 | 13,909.9 | 18,336.7 | 21,254.4 | 2,633.7 | 12,924.0 | 13,909.9 | 18,336.7 | 21,254.4 | 23,458.7 | 3,005.9 | ||||||||||||||||||||||||

Total long-term borrowings | 72.5 | 1,261.3 | 650.9 | 441.1 | 231.8 | 28.7 | ||||||||||||||||||||||||||||||

Equity attributable to equity holders of the Company | 9,060.0 | 9,995.0 | 11,083.2 | 15,523.8 | 17,618.6 | 2,183.2 | ||||||||||||||||||||||||||||||

Total long-term borrowing | 1,261.3 | 650.9 | 441.1 | 231.8 | 403.1 | 51.7 | ||||||||||||||||||||||||||||||

Equity attributable to our equity holders | 9,995.0 | 11,083.2 | 15,523.8 | 17,618.6 | 18,931.8 | 2,425.9 | ||||||||||||||||||||||||||||||

U.S. GAAP | ||||||||||||||||||||||||||||||||||||

Property, plant and equipment and prepaid lease payment, net | 7,176.7 | 7,271.4 | 7,785.8 | 8,073.7 | 8,851.5 | 1,096.8 | 7,271.4 | 7,785.8 | 8,073.7 | 9,279.7 | 11,860.3 | 1,519.8 | ||||||||||||||||||||||||

Total assets | 11,071.0 | 11,787.5 | 12,845.8 | 17,379.1 | 20,189.4 | 2,501.7 | 11,787.5 | 12,845.8 | 17,379.1 | 20,136.7 | 22,134.1 | 2,836.2 | ||||||||||||||||||||||||

Equity attributable to equity holders of the Company | 7,668.9 | 8,858.5 | 10,019.2 | 14,519.3 | 16,699.8 | 2,069.3 | ||||||||||||||||||||||||||||||

Equity attributable to our equity holders | 8,858.5 | 10,019.2 | 14,519.3 | 16,565.3 | 17,913.2 | 2,295.4 | ||||||||||||||||||||||||||||||

Number of Shares | ||||||||||||||||||||||||||||||||||||

Domestic Shares | 1,850.0 | 1,850.0 | 1,850.0 | 1,850.0 | 2,960.0 | 2,960 | 1,850.0 | 1,850.0 | 1,850.0 | 2,960.0 | 2,960.0 | 2,960 | ||||||||||||||||||||||||

H Shares (including H Shares represented by ADS) | 1,020.0 | 1,020.0 | 1,020.0 | 1,224.0 | 1,958.4 | 1,958.4 | 1,020.0 | 1,020.0 | 1,224.0 | 1,958.4 | 1,958.4 | 1,958.4 | ||||||||||||||||||||||||

ADS | 20.4 | 20.4 | 20.4 | 24.5 | 39.2 | 39.168 | 20.4 | 20.4 | 24.48 | 39.168 | 39.168 | 39.168 | ||||||||||||||||||||||||

Dividend per | ||||||||||||||||||||||||||||||||||||

Domestic Share/H Share(7) | 0.082 | 0.100 | 0.104 | 0.164 | 0.260 | 0.032 | ||||||||||||||||||||||||||||||

ADS(8) | 4.10 | 5.00 | 5.20 | 8.20 | 13.00 | 1.611 | ||||||||||||||||||||||||||||||

(Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) Domestic Share/H Share(8) ADS(9) As of and for the Year Ended December 31, 2002 2003 2004 2005 2006 2006 RMB RMB RMB RMB RMB U.S.$ 0.10 0.104 0.164 0.260 0.220 0.028 5.00 5.20 8.20 13.00 11.0 1.410

| (1) | The above financial highlights as of and for the year 2004 represent the data resulting from the consolidation of the financial statements of Yanmei Shipping, Yulin Nenghua and Yancoal Australia . The above financial highlights as of and for the year 2005 represent the data resulting from the additional consolidation of the financial statements of |

| (2) | “The Company” does not include the subsidiaries that have been consolidated into our accounts for the purposes of the consolidated financial statements. The subsidiaries that have been consolidated into our accounts for the purposes of the consolidated financial statements include: Yanmei Shipping, Zhongyan Trading, Yulin Nenghua, Yancoal Australia, Shanxi Nenghua, and Heze Nenghua. |

| (3) | Export sales constituted |

| Total net revenue is the sum of net sales of coal and railway transportation service income. |

| EBITDA refers to earnings before interest income, interest expense, taxes, depreciation and amortization. EBITDA should not be construed as an alternative to operating income or any other measure of performance or as an indicator of our operating performance, liquidity or cash flows generated by operating, investing and financing activities. The items of net income excluded from EBITDA are significant components in understanding and assessing our financial performance, and EBITDA does not take into account capital expenditures or changes in working capital, which could have a material impact on our operating cash flow. Our computation of EBITDA may not be comparable to other similarly titled measures of other companies. We have included the information concerning EBITDA because management believes it is a useful supplement to cash flow data as a measure of our performance. |

| EBITDA margin represents EBITDA as a percentage of our total net revenue. |

| The calculation of Dividend per Domestic Share/H Share is based on the dividend paid in the relevant year and total number of Domestic Shares and H Shares ranking for the dividend. |

| Dividend per ADS is calculated at 50 times Dividend per Domestic Share/H Share based on one ADS being equivalent to 50 H Shares. |

Exchange Rate Information

The following table sets forth, for the periods indicated, the noon buying rates for U.S. dollars in New York for cable transfers payable in Renminbi as certified for customs purposes by the Federal Reserve Bank of New York expressed in Renminbi per U.S. dollar:

| Noon Buying Rate | ||||||||

Period | Period End | Average(1) | High | Low | ||||

| (expressed in RMB per U.S.$) | ||||||||

2000 | 8.2781 | 8.2784 | 8.2799 | 8.2768 | ||||

2001 | 8.2766 | 8.2772 | 8.2786 | 8.2709 | ||||

2002 | 8.2800 | 8.2772 | 8.2800 | 8.2700 | ||||

2003 | 8.2767 | 8.2771 | 8.2800 | 8.2765 | ||||

2004 | 8.2765 | 8.2768 | 8.2774 | 8.2764 | ||||

2005 | 8.0702 | 8.1826 | 8.2765 | 8.0702 | ||||

December | 8.0702 | 8.0755 | 8.0808 | 8.0702 | ||||

2006 | ||||||||

January | 8.0608 | 8.0654 | 8.0702 | 8.0596 | ||||

February | 8.0415 | 8.0512 | 8.0616 | 8.0415 | ||||

March | 8.0167 | 8.0350 | 8.0505 | 8.0167 | ||||

April | 8.0165 | 8.0143 | 8.0248 | 8.0040 | ||||

May | 8.0215 | 8.0131 | 8.0300 | 8.0005 | ||||

June (through June 22, 2006) | 7.9963 | 8.0060 | 8.0225 | 7.9963 | ||||

| Noon Buying Rate | ||||||||

Period | Period End | Average(1) | High | Low | ||||

| (expressed in RMB per U.S.$) | ||||||||

2002 | 8.2800 | 8.2772 | 8.2800 | 8.2700 | ||||

2003 | 8.2767 | 8.2771 | 8.2800 | 8.2765 | ||||

2004 | 8.2765 | 8.2768 | 8.2774 | 8.2764 | ||||

2005 | 8.0702 | 8.1826 | 8.2765 | 8.0702 | ||||

2006 | 7.8041 | 7.9723 | 8.0702 | 7.8041 | ||||

December | 7.8041 | 7.8219 | 7.8350 | 7.8041 | ||||

Period 2007 January February March April May June (through June 22, 2007) Noon Buying Rate Period End Average(1) High Low (expressed in RMB per U.S.$) 7.8041 7.9723 8.0702 7.8041 7.7714 7.7876 7.8127 7.705 7.7410 7.7502 7.7632 7.7410 7.7232 7.7369 7.7454 7.7232 7.7090 7.7247 7.7345 7.090 7.6516 7.6773 7.7065 7.6463 7.6220 7.6381 7.6680 7.6175

| Source: | The Noon Buying Rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. |

| (1) | Determined by averaging the rates on the last business day of each month during the respective period, except for monthly averages, which are determined by averaging the rates on each business day of the month. |

On June 28, 2006,22, 2007 the noon buying rate for Renminbi was U.S.$1.00 = RMB7.997.RMB7.6220

B. Capitalization and Indebtedness

Not applicable.

C. ReasonReasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business and results of operations are dependent on coal markets, which may be cyclical.

As the majority of our revenue is derived from sales of coal and coal-related products, our business and operating results are substantially dependent on the domestic and international demand for coal. The domestic and international coal markets are cyclical and exhibit fluctuation in supply and demand from year to year andyear. They are subject to numerous factors beyond our control, including, but not limited to, the economic conditions in the PRC, the global economic conditions and fluctuations in industries with high demand for coal, such as the power and steel industries. Fluctuations in supply and demand for coal have effects on coal prices, which in turn affect our operating and financial performance. We have experienced substantial price fluctuations in the past and believe that such fluctuations will continue. The average selling price of our coal products per tonne was RMB172.4 in 2003, RMB272.3RMB272.45 in 2004, RMB349.50 in 2005 and RMB349.5RMB341.77 in 2005.2006. The demand for coal is primarily affected by the overall economic development and the demand for coal from the electricity generation, steel and construction industries. The supply of coal, on the other hand, is primarily affected by the geographical location of the coal supplies, the volume of coal produced by the domestic and international coal suppliers, and the quality and price of competing sources of coal. Alternative fuels, such as natural gas, oil and nuclear power, and alternative energy sources, such as hydroelectric power, and international shipping costs also have effectsinfluences on the market demand for coal. Material changes in the international coal market may adversely affect our Company’s export sales and future operational results. Excess supply of coal or significant reduction in the demand for our coal by the foreign or domestic electricity generation or steel industries may have an adverse effect on coal prices, which would in turn cause a decline in our profitability. In addition, any significant decline in domestic or export coal prices could also materially and adversely affect our business and result of operations.

Our business relies on our major customers.

Prior to 2004, Shandong Power and Fuel Company was our largest domestic customer. For the year ended December 31, 2003, our sales to Shandong Power and Fuel Company accounted for 11.3% of our total net sales in 2003. TheIn the past, Shandong Power and Fuel Company had in the past purchased coal on behalf of several electric power plants in Shandong Province, including Zouxian Electric Power Plant. The Shandong Power and Fuel Company ceased to act as the central procurement center for coal on behalf of Zouxian Electric Power Plant and other electric power plants in Shandong Province after its restructuring at the end of 2003 and ceased to be our largest domestic customer.

For the yearyears ended December 31, 20042005 and 2005,2006, Huadian Power International Corporation Limited (“Huadian”) replaced Shandong Power and Fuel Company and became our largest domestic customer. For the years ended December 31, 20042005 and 2005,2006, we supplied a total of 4.95.6 million and 5.64.9 million tonnes, representing 9.2%13.4% and 13.4%11.3% of our total net sales in 20042005 and 2005,2006, respectively, to our largest domestic customer.Huadian. A substantial portion of Huadian’s coal purchases was supplied to Zouxian Electric Power Plant. Our sales of coal to Zouxian Electric Power Plant accounted for 9.6%9.5%, 9.5%13.2% and 13.2%11.2% of our total net sales in 2003, 2004, 2005 and 2005,2006, respectively.

The Zouxian Electric Power Plant’s total coal requirements were approximately 6.65.2 million tonnes in 2005.2006. We estimated that we supplied approximately 77.0%92.3%, 92.3%83.6% and 83.6%92.9% of the Zouxian Electric Power Plant’s coal requirements in 2003, 2004, 2005 and 2005,2006, respectively. We believe we are likely to remain the

principal coal supplier for Zouxian Electric Power Plant’s principal coal supplierPlant because (i) we are located within close proximity to the Zouxian Electric Power Plant, (ii) the Zouxian Electric Power Plant is unable to receive railway shipments of coal other than through our own railway network and (iii) the Zouxian Electric Power Plant’s boilers were designed to use our coal. Given thethat a large percentage of our revenues is derived from the supply of coal to the Zouxian Electric Power Plant, any adverse developments at the Zouxian Electric Power Plant could have an adverse impact on our results of operations.

We do not have direct export rights.

Currently, we do not have direct export rights. As a result, all of our export sales must be made through intermediary export sales companies. We use export sales serviceservices provided by the following three companies: China Coal Energy Group Company, China National Minerals Import and Export Company Limited and Shanxi Coal Import and Export Group Company (collectively, the “Export Sales Companies”). The quantity, quality, prices and final customer destination of our export sales are determined by us, the Export Sales Companies and overseas coal purchasers. As a result, we do not directly control matters such as port storage, loading, unloading and shipping processes. Although we are in the process of applying to the PRC central government,Central Government, with the assistance of the Shandong provincial government, for direct export rights, there can be no assurance that we can obtain such rights. If we cannot obtain such direct export rights, we will have to continue replyto rely on the intermediary export sales companies to export our coal. In addition, as export sales represent a significant percentage of our total sales, any material changes in the international coal market could adversely affect our export sales and results of operations.

Our business relies on short-term sales contracts and letters of intent.

The PRC governmentGovernment undertook measures in recent years to introduce market-oriented mechanisms to the coal sale and purchase process, including for example, abolishing government-devised pricing guidance for thermal coal and other temporary price intervention measures andto permit the suppliers and buyers to determine pricing through discussions. Major domestic coal suppliers and coal purchasers attend the Annual National Coal Trading Convention to negotiate and discuss the price and quantity of coal to be supplied and purchased for the coming year through the signing of letters of intent and short- and long-term supply contracts. Approximately 86.0%88.5%, 88.5%87.0% and 87.0%87.3% of our sales in 2003, 2004, 2005 and 2005,2006, respectively, were derived from such sales contracts and letters of intent. These sales contracts and letters of intent generally specify the quantities and timing of purchases planned over a time period generally no longer than one year. Prices with respect to purchases made under the letters of intent are generally determined at the time of sale based on mutual agreement between us and the relevant customers. Such letters of intent may not be enforceable due to their omission of certain material terms. In addition, the PRC governmentGovernment also adopted measures to ensure adequate allocation of railway transportation capacity to major coal suppliers and buyers and to improve market efficiency by permitting direct negotiation between the suppliers and buyers.

In the past, we and our customers have completed the majority of the transactions contemplated under such letters of intent. However, a sudden and significant increase in the proportion of unrealized sales could have a material adverse impact on our results of operations. Furthermore, as the price of coal sold pursuant to such letters of intent is generally determined at the time of sale, any significant downturn in the market price of coal could have an immediate and adverse impact on our results of operations.

Our product delivery relies on the PRC’s railway transportation system.

Approximately 60.1%60.0%, 60.0%53.6% and 53.6%50.8% of our total net sales in 2003, 2004, 2005 and 2005,2006, respectively, were derived from sales of coal transported by the PRC’s national railway system (excluding coal sold to the Zouxian Electric Power Plant which werewas transported entirely by and within our own railway network). As the railway system has limited transportation capacity and cannot fully satisfy coal transportation requirements, discrepancies between capacity and demand for transportation exist in certain areas of the PRC. Currently, our domestic customers are mainly located in Eastern China, where the railway system is relatively advanced. We generally utilize the national rail system to transport coal to our customers as well as major coal shipping ports in the eastern coast of China for transshipping to customers in the coastal region of China and overseas. No assurance can be given that we will continue to be allocated adequate railway transport capacity or acquire adequate rail cars, or that we will not experience any material delay in transporting our coal as a result of insufficient railway transport capacity or rail cars.

The coal reserve data in this annual reportAnnual Report are only estimates.

The coal reserve data provided by us are only estimates which may differ materially from the actual in-place proven and probable reserves. Our reserves estimates may change substantially if new information subsequently becomes available. There are inherent uncertainties in estimating reserves, including many factors, assumptions and variables involved in estimating reserves that are beyond our control. Our actual results of operations may differ materially from our long-term business and operational plans derived based on the estimated coal reserve data. We can notcannot assure you that we will not adjust our coal reserve estimates in the future, and in such event, our results of operations may be materially and adversely affected.

Competition in the PRC and the international coal industry is increasing and our business and prospects will be adversely affected if we are not able to compete effectively.

We face competition in all areas of our business. Competition in the coal industry is based on many factors, including price, production capacity, coal quality and characteristics, transportation capability and costs, blending capability and brand name. Our coal business competes in the domestic and international markets with other large domestic coal producers and certain major international coal mining companies.producers. Some of our overseas competitors may have greater financial, marketing, distribution and other resources than we do, and have more well-known brand names in the international markets. We currently compete favorably on the quality of our coal products. However, there can be no assurance that we will continue to compete favorably due to quality improvements by our competitors. Although weWe believe that we compete favorably with respect to transportation capability and costs due to insufficient rail capacity for the transportation of coal fromfact that our principal competitors are located mainly in Shanxi Province, Shaanxi Province and the Inner Mongolia Autonomous Region, (where our principal competitors are located) to Eastern China (where demand for coal has been most strong)where there is occasional insufficient rail capacity and the significant costs incurred in transporting coal from these regions to Eastern China, where the strongest demand for coal is. However, improvements in the PRC national rail network will reduce our competitive advantage in transportation. For example, the PRC Government is planning to construct additional railways to transport coal from Northern and Northwestern China to Eastern China. Accordingly, the completion of these projects may increase the supply of coal available to customers in Eastern China, which may have a material adverse impact on our results of operations.

Our operations may be affected by uncertain mining conditions.

As with all underground coal mining companies, our operations are affected by mining conditions such as a deterioration in the quality or thickness of faults and/or coal seams, pressure in mine openings, presence of gas and/or water inflow and propensity to spontaneous combustion, as well as operational risks associated with industrial or engineering activity, such as mechanical breakdowns. Although we have conducted geological investigations to evaluate such mining conditions and adapt our mining plans to address them, there can be no assurance that the occurrence of any adverse mining conditions would not result in an increase in our costs of production, a reduction of our coal output or the temporary suspension of our operations.

Underground mining is also subject to certain risks such as methane outbursts and accidents caused by roof weakness and groundfalls. There can be no assurance that the occurrence of such events or conditions would not have a material adverse impact on our business and results of operations.

Results of our operations depend on our ability to acquire or develop new coal mines or coal reserves.

Our recoverable coal reserves decline as we produce coal. As we can only increase our existing production capacity by a limited amount, the future increase in our coal production will depend on our acquisition ofalready developed new coal reserves, developmentacquisitions of new mines or the expansion of our existing coal mines.

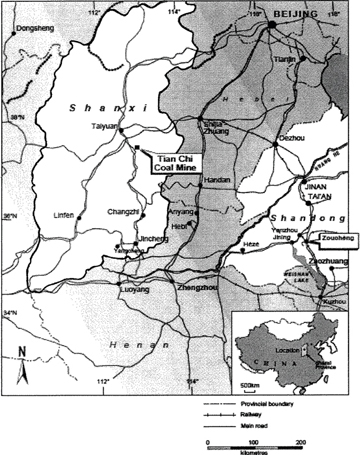

We acquired Jining III Coal Mine and Southland Colliery in 2001 and 2004, respectively. In 2005, we further acquired from our Controlling Shareholder 95.67% of the equity interest in Heze Nenghua from our Parent Company and are currently developingNenghua; Zhaolou Coal Mine in Juye Coal Field, which is owned by Heze Nenghua, is currently under construction. In November 2006 and other newFebruary 2007, our Company aggregately acquired 100% of the equity interests of Shanxi Nenghua which was held by our Controlling Shareholder and Lunan Fertilizer Plant; Tianchi Coal Mine, which is owned by Shanxi Nenghua, was put into operation in November 2006. We are also in the process of setting up the relevant company for the coal mining projectsproject in Yushuwan, Shaanxi Province. However, we can not

We cannot give any assurance that we will be able to continue identifying suitable targets in the PRC or abroad for acquisition or acquire suitable targets on competitive terms. Nor can we assure you that we will be able to successfully develop new coal mines or expand our existing ones in accordance with our development proposal or at all. Our failure to timely or successfully acquire suitable targettargets on competitive terms, or to successfully complete the development of new coal mines or to expand our existing coal mines could have an adverse effect on the results of operation and our financial condition and results of operation.condition.

The acquisition and/or the development of new mines in the PRC and overseas requiresrequire approval of the PRC government.Government. Delay or failure in securing the relevant PRC governmentGovernment approvals or permits as well as any adverse change in government policies may cause a significant adjustment to our development and acquisition plans, which may materially adversely affect our profitability and growth prospects. In addition, we could encounter unforeseen problems due to our unfamiliarity with local laws and regulations, or suffer foreign exchange losses in connection with overseas investments. We cannot assure you that our overseas expansion or investments will be successful.

We may suffer losses resulting from industry-related accidents and lack of insurance.

We operate coal mines and related facilities that may be affected by water, gas, fire or structural problems. As a result, we, like other coal mining companies, have experienced accidents that have caused property damage and personal injuries. Although we have implemented safety measures for our production facilities, and providedprovide on-the-job training for our employees, and, we have in accordance with relevant laws set aside approximately 2.0% of employees’ total remuneration for employees’ injury insurance, there can be no assurance that industry-related accidents will not occur in the future.

We do not currently maintain fire, casualty or other property insurance covering our properties, equipment or inventories, other than with respect to vehicles. In addition, we do not maintain any business interruption insurance or any third party liability insurance to cover claims in respect of personal injury, property or environmental damage arising from accidents on our properties, other than third party liability insurance with respect to vehicles. Any uninsured losses and liabilities incurred by us could have a material adverse effect on our financial condition and results of operations.

We may be required to allocate additional funds for land subsidence.

A consequence of the underground mining methods used at our mines is land subsidence above underground mining sites. Depending on the circumstances, we may relocate inhabitants from the land above the underground mining sites prior to mining those sites or we may compensate the inhabitants for losses or damages from land subsidence after the underground sites have been mined. We may also be required to make payments for land subsidence, restoration, rehabilitation or environmental protection of the land after the underground sites have been mined. An estimate of such costs is

recognized in the period in which the obligation is identified and is charged as an expense in our income statement in proportion to the coal extracted. The paymentPayment for such costs is funded from working capital. The amount charged to income statements in 2005 amounted to RMB636.62006 was RMB743.0 million. The provision for land subsidence, restoration, rehabilitation and environmental costs has been determined by the directors based on the past occurrences of land subsidence. However, the provision is only an estimate. The estimate of the costs for land subsidence, restoration, rehabilitation or environmental protection of the land may be subject to change in the future as the actual costs become apparent and standards established by the PRC Government change from time to time. Therefore, there can be no assurance that such estimates are accurate or that our land subsidence, restoration, rehabilitation and relocationenvironmental protection costs will not substantially increase in the future or that the PRC Government will not impose new fees in respect of land subsidence. Any such substantial increases or new fees could have a material adverse effect on our results of operations.

Our business operations may be adversely affected by present or future environmental regulations.

As a producer of coal products, we are subject to significant, extensive, and increasingly stringent environmental protection laws and regulations in China. These laws and regulations:

impose fees for the discharge of waste substances;

require the establishment of reserves for reclamation and rehabilitation;

require the payment of fines for serious environmental offences; and

allow the PRC Government, at its discretion, to close any facility that fails to comply with orders requiring it to correct or stop operations causing environmental damage.

Our coal mining operations may produce significant amounts of waste water, gas and solid waste materials. Currently, the PRC Government is moving toward more rigorous enforcement of applicable laws and regulations as well as the adoption and enforcement of more stringent environmental standards. Our budgeted amounts of capital expenditure for environmental regulatory compliance may not be sufficient and we may need to allocate additional funds for such purpose. If we fail to comply with current or future

environmental laws and regulations, we may be required to pay penalties or fines or take corrective actions, any of which may have a material adverse effect on our business operations and financial condition.

In addition, China is a signatory to the 1992 United Nations Framework Convention on Climate Change and the 1997 Kyoto Protocol, which are intended to limit emissions of greenhouse gases. Efforts to control greenhouse gas emission in China could result in reduced use of coal if power generators switch to sources of fuel with lower carbon dioxide emissions, which in turn could reduce the revenues of our coal business and have a material adverse effect on our results of operations.

New quotas for coal exports in the PRC may adversely affect the amount of our coal exports.

Export sales of coal accounted for 36.2%28.5%, 28.5%25.8% and 25.8%20.8% of our net sales of coal in 2003, 2004, 2005 and 2005,2006, respectively. Average selling prices for exportoverseas coal sales are generally higher than average selling prices for domestic sales. In 2005,2006, average selling prices for export sales were RMB404.3RMB388.59 per tonne, compared to average selling prices for domestic sales of RMB333.7RMB331.31 per tonne.

In January 2004, the PRC Government promulgated new regulations, entitled “Measures for the Administration of Quotas for Coal Export,” which taketook effect on July 1, 2004. Under the new regulations, the National Development and Reform Commission and the Ministry of Commerce will be responsible for determining the total volume of the PRC’s export quota of coal and allocating the quota among the authorized coal exporters. Under the regulations, the National Development and Reform Commission and the Ministry of Commerce are required to announce the total export quota available for each fiscal year by not later than October 31 of the prior year. After the total available export quota has been announced, the National Development and Reform Commission and the Ministry of Commerce will accept written applications from authorized coal exporters for allocation of specific export quotas for the following year.

The new regulations did not have a material adverse effect on our export sales in 20042005 and 20052006 as our export agents have consistently receivereceived export quota sufficient to satisfy our export volume. However, we are unable to predict what impact, if any, they may have on the level of our export coal

sales for 20062007 and later years. Article 10 of the regulations provides that, in determining the allocation of specific quotas to authorized coal exporters, the National Development and Reform Commission and the Ministry of Commerce will refer to the exporters’ respective coal export performances in the previous year. We have been one of the largest coal exporters in China. For the years ended December 31, 2003, 2004, 2005 and 2005,2006, our export sales of coal (not including Yancoal Australia’s overseas sales of coal) accounted for approximately 14.5%11.6%, 11.6%10.2% and 10.2%9.9%, respectively, of the total coal export sales in China during the same period. Although our export sales have not been affected by the new regulations, if national coal exports are reduced, the level of our export sales in future periods could be affected, which in turn could adversely affect our results of operations.

Our Parent CompanyControlling Shareholder may have a significant influence on us.

As at Marchof December 31, 2006, the Parent CompanyControlling Shareholder owned 52.86% of our outstanding shares. Our Articles of Association provide that, in addition to any obligation imposed by law, a controlling shareholder shall not exercise its voting rights in a manner prejudicial to the interests of the shareholders generally, including voting with respect to certain enumerated matters of fundamental importance to shareholders.

In addition to being our majority shareholder, the Parent Company also provides certain materials, utilities and services to us pursuant to the materials and services supply agreement dated October 17, 1997 between us and the Parent Company (as amended by supplemental agreements dated October 30, 2001 and May 29, 2003).PursuantPursuant to the regulations of Hong Kong Stock Exchange and Shanghai Stock Exchange on on-goingcontinuing connected transactions and the operation developmentsactual operations of us and the Parent Company,Controlling Shareholder, we completed the necessary review of its on-goingprocedures for our continuing connected transactions as required by law and entered into six new on-goingcontinuing connected transaction agreements (“New On-goingContinuing Connected Transaction Agreements”), including the materials and water supply agreement, electricity supply agreement, labor and service agreement, equipment maintenance and repair works agreement, products and materials agreement and administrative service for pension fund and retirement benefits agreement, with the Parent CompanyControlling Shareholder in the first quarter of 2006. ItWe also determined the annual caps on the connected transactions for each New On-goingContinuing Connected Transaction Agreements in each year (“the Annual Caps”) fromfor 2006 to 2008. For details of the New On-goingContinuing Connected Transactions, please see “Item 7 — Major Shareholders and Related Party Transaction.”Transaction”. Any material financial or operational problems experienced by the Parent Company leadingControlling Shareholder which leads to disruption of its operations could materially affect our operations and future prospects.

Our operations are subject to a number of risks relating to the PRC.

We are also subject to a number of risks relating to the PRC, including the following:

The central and local governments of the PRC governments continue to support the development and operation of the coal industry in China. If the PRC Government changes its current policies that are currently beneficial to us, we may face significant constraints on our flexibility and ability to expand our business operations or to maximize our profitability.

Under current PRC regulatory requirements, our projects for the development of new coal mines require PRC Government approval. If any of our important projects required for our growth or cost reduction are not approved, or are not approved on a timely basis, our financial condition and operating performances could be adversely affected.

The PRC Government has been reforming, and is expected to continue to reform its economic system. Many of the reforms are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of the reform measures. This refining and readjustment process may not always have a positive effect on our operations. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions and by changes in policies of the PRC Government such as changes in laws and regulations (or the interpretation thereof), imposition of additional restrictions on currency conversion and reduction in tariff protection and other import restrictions.

On July 21, 2005, the People’s Bank of China, or PBOC, which are set daily based onannounced the previous day’s PRC interbank foreign exchange market rate and current exchange rates on the world financial markets. Since 1994, the official exchange rate for the conversion of Renminbi to U.S. dollars has generally been stable. On July 21, 2005, however, PBOC announced a reform of its exchange rate system. Under the reform, Renminbi is no longer effectively linked to US dollars but instead is allowed to trade in a tight 0.3% band against a basket of foreign currencies. Any further appreciation of Renminbi in the future will increase the cost of our export sales, reduce our account receivables denominated in foreign currencies and adversely affect our financial condition and results of operations. On the other hand, any devaluation of the Renminbi may adversely affect the value of, and dividends payable on, our H shares and ADSs in foreign currencies since we receive our revenues and denominate our profits in Renminbi. Our financial condition and operating performance may also be affected by changes in the value of certain currencies other than Renminbi in which our earnings and obligations are denominated. In particular, a devaluation of the Renminbi is likely to increase the portion of our cash flow required to satisfy our foreign currency-denominated obligations.

the other hand, any devaluation of the Renminbi may adversely affect the value of, and dividends payable on, our H Shares and ADSs in foreign currencies since we receive our revenues and denominate our profits in Renminbi. Our financial condition and operating performance may also be affected by changes in the value of certain currencies other than Renminbi in which our earnings and obligations are denominated. In particular, a devaluation of the Renminbi is likely to increase the portion of our cash flow required to satisfy our foreign currency-denominated obligations. |

Since 1997, many new laws and regulations covering general economic matters have been promulgated in the PRC. Despite this activity to develop the legal system, PRC’s system of laws is not yet complete.continuously evolving. Even where adequate law exists, enforcement of existing laws or contracts based on existing law may be uncertain and sporadic,arbitrary, and it may be difficult to obtain swift and equitable enforcement or to obtain enforcement of a judgment by a court of another jurisdiction. The relative inexperiencelack of precedents in PRC’s judiciary in many cases creates additional uncertainty as to the possible outcome of any litigation. In addition, interpretation of statutes and regulations may be subject to evolving government policies reflecting domesticand political changes.

Our coal operations are extensively regulated by the PRC Government and government regulations may limit our activities and adversely affect our business operations.

Our coal operations, like those of other PRC energy companies, are subject to extensive regulationregulations established by the PRC Government. Central governmental authorities, such as the National Development and Reform Commission, the State Environmental Protection Administration, the Ministry of Land and Resources, the State Administration of Coal Mine Safety, the and the State Bureau of Taxation, and provincial and local authorities and agencies exercise extensive control over various aspects of China’s coal mining and transportation (including rail and sea transport). These controls affect the following material aspects of our operations:

exploration, exploitation and mining rights and licensing;

rehabilitation of mining sites after mining is completed;

pricing of our transport services;

industry-specific taxes and fees;

target of our capital investments;

export quotas and procedures;

pension funds appropriation;

waivers of certain import tariffs on our supplies; and

environmental and safety standards.

We may face significant constraints on our ability to implement our business strategies or to carry out or expand our business operations. Our business may also be materially and adversely affected by future changes in certain regulations and policies of the PRC Government in respect of the coal industry. New legislation or regulations may be adopted that may materially and adversely affect our coal operations, our cost structure or the demand for our products. In addition, new legislation or regulations or different or more stringent interpretation of existing laws and regulations may also require us to substantially change our existing operations or incur significant costs.

ITEM 4. INFORMATION ON THE COMPANY

A. History and Development of theour Company

We,The Company, Yanzhou Coal Mining Company Limited, werewas established on September 25, 1997 as a PRC joint stock company with limited liability under the Company Law of the PRC (the “Company Law”). The Predecessor, formerly known as Yanzhou Mining Bureau, was established in 1973. In 1996, upon receipt of approval from the former State Economic and Trade Commission and the former Ministry of Coal Industry (“MOCI”), the Predecessor was incorporated and renamed Yanzhou Mining (Group) Corporation Limited and subsequently renamed as Yankuang Group Corporation Limited after reorganization in 1999.

In April 2001, we were approved by the Minister of Foreign Trade and Economic Cooperation, the predecessor of the Ministry of Commerce, to convert from a joint stock company with limited liability to a Sino-foreign joint stock company with limited liability under the Company Law and the Sino-Foreign Joint Venture Law of the PRC. Our H Shares accounted for 39.82% of our outstanding shares as of December 31, 2005.2006.

Our contact information is:

| • Business address: | 298 Fushan South Road, Zoucheng, Shandong Province, PRC | |

| • Telephone number: | (86) 537 538 2319 | |

| • Website: | http://www.yanzhoucoal.com.cn/mygsbak/index.asp | |

We principally engage in underground mining, preparation and sale of coal, and railway transportation for coal transportation.products. We were one of the largest coal producers and coal exporters in Eastern China within 2006. In 2006, we had raw coal production of approximately 34.736.1 million tonnes, in 2005. We were also one of the largest coal exporters in the PRC in terms of sales volume with approximately 7.3including 35.5 million tonnes in exportby the Company, 0.4 million tonnes by Yancoal Australia and 0.1 million tonnes by Shanxi Nenghua. We also exported 6.3 million tonnes of coal, including 6.1 million tonnes by the Company and 0.2 million tonnes by the overseas sales in 2005.of coal by Yancoal Australia.

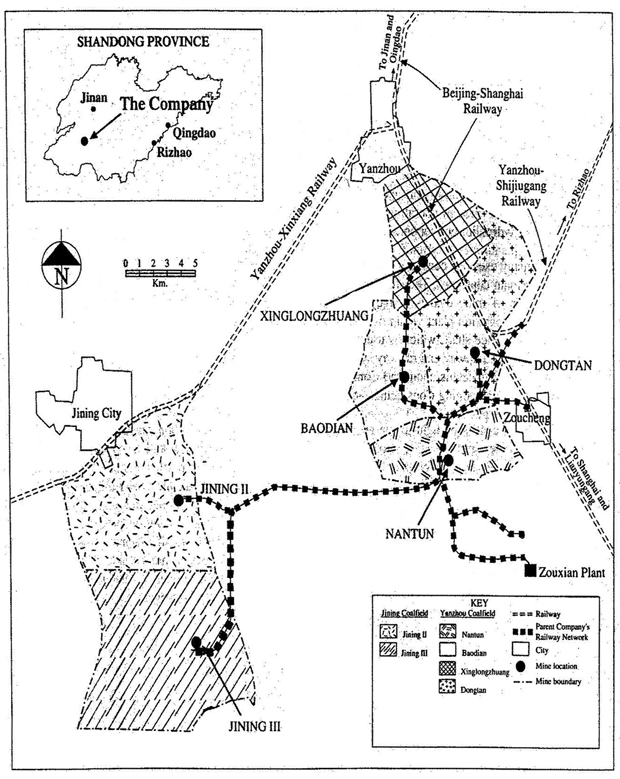

We haveThe Company has six coal mines located in China: Nantun, Mine, Xinglongzhuang, Mine, Baodian, Mine, Dongtan, Mine, Jining II Mine and Jining III, Mine, which commenced production in 1973, 1981, 1986, 1989, 1997 and 2000, respectively. As of December 31, 2005, our2006, the six domestic coal mines of the Company had a total in-place proven and probable reserve of approximately 1968.41,933.0 million tonnes.

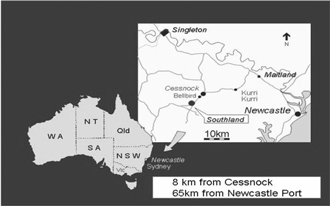

In 2004, we acquired the entire interest in the Southland coal mine located in New South Walestonnes and Shanxi Nenghua had recoverable reserves of Australia (“Southland”) from independent third parties30.1 million tonnes, and completed the transfer on December 24, 2004. We subsequently renamed Southland coal mine as Austar Coal Mine. We have also established two wholly-owned subsidiaries in Australia, namely Yancoal Australia Pty Limited (“Yancoal”) and Austar Coal Mine Pty Limited (“Austar”), in 2004 for our future operationsprobable reserves of Southland. We expect to complete the upgrade of the coal mining and production system as well as the testing and commissioning of the relevant coal mining and production system in Austar Coal Mine and to begin production in the third quarter of 2006.

In 2005, we acquired 95.67% equity interest in Yankuang Heze Power Chemical Company Limited (“Heze Nenghua”) from the Parent Company. The principal activities of Heze Nenghua are to conduct the initial mining preparation of the Zhaolou, Wanfu and other coal mines at the Juye Coalfield including obtaining the approvals for the coal mine projects, applying for the necessary exploration rights for coal and preparing for the construction of the coal mines. As at December 31, 2005, Heze Nenghua has commenced construction works for the Zhaolou coal mine. Pursuant to a supplemental agreement dated June 28, 2005 entered between us and the Parent Company, the Parent Company irrevocably undertook that we shall have the right to acquire the mining rights of Zhaolou coal mine and Wanfu coal mine from the Parent Company within twelve months from the respective dates on which such mining rights are obtained by the Parent Company for a consideration to be determined based on valuations conducted by independent qualified PRC valuers. The valuations should also be endorsed by the applicable PRC government authorities.66.1 million tonnes.

We have successfully developed a mechanized comprehensive caving method and have developed mining equipment suitable for medium to thick coal seam extraction. The patented mechanized comprehensive caving method is one of the most advanced mining technologies in the world. We continue to improve our proprietary caving method for internal use or for license to third party mining companies.

The location of a coal mine affects its competitiveness due to the significant costs of coal transport. We believe that our mines are well-situated given the rapid economic growth of Eastern China, the insufficient supply of coal produced in this region and the substantial costs involved in transporting coal to Eastern China from major coal-producing provinces such as Shaanxi Province, Shanxi Province and Inner Mongolia Autonomous Region. In 2003, 2004, 2005 and 2005, 35.2%2006, 47.4%, 47.4%49.5% and 49.5%54.5%, respectively, of our total net sales were derived from sales to customers within Shandong Province. Our largest end-user, Huadian’s Zouxian Electric Power Plant, accounted for 9.6%9.5%, 9.5%13.2% and 13.2%11.2% of our total net sales in 2003, 2004, 2005 and 2005,2006, respectively. Net sales to customers located in the rapidly growing Yangtze delta region, encompassing Shanghai Municipality, Jiangsu Province and Zhejiang Province, were 20.3%comprised 16.9%, 16.9%15.1% and 15.1%13.6% of our total net sales in 2003, 2004, 2005 and 2005,2006, respectively. Exports,Our overseas sales, including the export sales of the Company and the overseas sales of Yancoal Australia, principally to Japan, accounted for 35.4%27.9%, 27.9%25.5% and 25.5%20.5% of our total net sales in 2003, 2004, 2005 and 2005,2006, respectively. We did not record any sales from Austar Coal Mine for this reporting period as it was still under reconstruction and upgrade.

The principal coal reserves in our mines consist of prime quality, low-sulphur coal, capable of yielding a product with an ash content as low as 6%. We sell thermal coal, which is suitable for large-scale electric power generation, as well as semi-soft coking coal, which is used in metallurgical production. Our primary customers include electric power plants and metallurgical mills located in Eastern China and the areas along the Beijing-Hangzhou Grand Canal, which are generally more economically developed than other areas of China, and foreign enterprises located in East Asia. Of our total net sales in 2003, 2004, 2005 and 2005, 20.5%2006, 20.1%, 20.1%20.4% and 20.4%22.5%, respectively, were sales to PRC electric utility customers, with the remainder representing sales principally to metallurgical companies, chemical manufacturing companies and fuel supply companies. Our major domestic customers include Huadian, Shandong Luneng, Shanghai Baosteel Group Corporation and Dongguan Shijie Fuel Company. Relationships between us and our key customers are stable.

In 2005,2006, we generated total net sales of RMB12,007.3 million, and net income attributable to our equity holders of the Company of RMB11,516.9 million and RMB2,881.5 million, respectively.was RMB2,373.0 million.

Share Reform PlanSetting up Yulin Nenghua

As background, beginningIn 2004, we established Yulin Nenghua in May 2005, the PRC government and the PRC securities regulatory and supervisory authorities started to implement share reforms for shares of domestically listed companiesYulin City in Shaanxi Province in the PRC by injecting RMB776 million of capital. The registered capital of Yulin Nenghua is RMB800 million. The main business of Yulin Nenghua is the operation and construction of a methanol facility with 600,000 tonnes of annual capacity. It is currently expected that the methanol facility of Yulin Nenghua will commence operations in order2008.

Acquisition of Austar Coal Mine

On December 24, 2004, we acquired the entire interest in the Southland Coal Mine located in New South Wales of Australia. Southland Coal Mines was subsequently renamed Austar Coal Mine. In 2004, we also established two wholly-owned subsidiaries in Australia, namely Yancoal Australia and Austar Coal Mine Pty Limited (“Austar”). Austar Coal Mine was put into operation on October 16, 2006.

Acquisition of Heze Nenghua

On December 7, 2005, we acquired 95.67% equity interest in Heze Nenghua. The principal activities of Heze Nenghua are to eliminateexploit coal resources at the split share treatment of shares of listed companiesJuye coalfield in Shandong Province in the PRC. Under such split share system, domestic shares are either tradable or non-tradable. In adoptingAs of December 31, 2006, Heze Nenghua has commenced construction works for the share reforms, the PRC government and the PRC securities regulatory and supervisory authorities have implemented an interest-balanced mechanism between the holdersZhaolou Coal Mine.

Implementation of non-tradable shares and tradable shares. Pursuant to the share reform policies in the PRC, holders of non-tradable shares could, subject to approvals by the relevant government authorities and consents by the holders of domestically listed and tradable shares, convert their non-tradable shares into shares freely tradable on the domestic stock exchanges in the PRC. In return for approving such share conversion, the holders of the tradable shares will receive certain numbers of shares and relevant commitments made by holders of non-tradable shares. Upon consummation of the share reforms, all non-tradable shares, issued in the PRC, of PRC domestically listed companies will be freely tradable on the PRC domestic stock exchanges.Share Reform

We have tradable shares issued in the PRC, or A Shares, which are listed on the Shanghai Stock Exchange as well as non-tradable shares which are held by our Parent Company, our controlling shareholder.Controlling Shareholder. We also have overseas listed foreign invested shares, or H Shares, which are listed on the Hong Kong Stock Exchange as well as ADSs, representing the H Shares, which are listed on the New York Stock Exchange. At present, or under the PRC governmentGovernment policies, the A Shares and the non-tradable shares issued in the PRC are a separate class of shares and at present are not freely convertible into H Shares or ADSs.

On January 24, 2006, the Company, on behalf of the Controlling Shareholder, announced a proposed share reform plan to the holders of the Company’s A Shares whereas all the Controlling Shareholder’s non-tradable shares would be converted into A Shares (the “Proposed Share Reform Plan”). Under the Proposed Share Reform Plan, the Controlling Shareholder, as the only holder of the Company’s non-tradable shares, would pay, as consideration for the Proposed Share Reform Plan, 2.5 non-tradable shares for every 10 shares held by any holder of the Company’s A Shares whose name appeared on the register of members of A Shares on March 30, 2006. Pursuant to relevant regulations relating toPRC share reforms in the PRCreform regulations and the relevant PRC securities laws and regulations, only holders of the share reform plan only involves the tradability of non-tradable shares into tradable shares in the PRCCompany’s A Shares and the only shareholders who areControlling Shareholder were entitled to participate in the shareholders’ meeting to approve the proposed share reform plan proposed by our Parent Company are the Holders of A shares and our Parent Company.

Our share reform plan was implemented on March 31, 2006. Our Parent Company paid a consideration of 2.5 non-tradable shares to each Holder of A Shares for every ten A Shares held by such Holder of A Shares whose name appeared on the register of member of A Shares on March 30, 2006 in exchange for the right to list and trade the non-tradable shares of the Parent Company on the Shanghai Stock Exchange. Our Parent CompanyProposed Share Reform Plan. The Controlling Shareholder did not offer a similar consideration to the Holders of H Shares and Holders of ADSsholders of the Company. For more details ofH shares.

The Proposed Share Reform Plan was subsequently implemented by our Company on March 31, 2006 after approvals from the changes of our shareholding structure as a result of implementation ofrelevant shareholders at the share reform plan, see “Item 9 – Offeringshareholders’ meeting and Listing.”

In addition to the statutory undertakings, our Parent Company also undertook that (1) thePRC government authorities were obtained. The original non-tradable Sharesshares held by the Parent Company would be subject to a trading moratorium of 48 months from the date of the implementation of the share reform plan; (2) it will, in accordance with the relevant governmental procedures, assign part of its operations including coal and electricity operations together with new projects which are in line with our Company’s development strategies to us in 2006 and support our Company in the implementation of such assignment to enhance the operational results of the Company and to minimize the connected transaction and competition between Yankuang Group and us. We will be invited to invest in the coal liquefaction project which is being developed by Yankuang Group for co-development; and (3) all related expenses arising from the share reform plan would be borne by our Parent Company.

Controlling Shareholder have been floated since April 3, 2006. Our assets, liabilities, ownership interest, total share capital and net profit remain unchanged upon implementation of the share reform plan.Proposed Share Reform Plan.

Special undertakings pursuant to the Share Reform Plan made by Yankuang Group and the performance of such undertakings are detailed as follows:

Special Undertakings | Performance of Undertakings | |||||

| (1) | The original non-tradable shares held by Yankuang Group will be subject to a trading moratorium of 48 months from the date of completion of the share reform plan. | The original non-tradable shares of the Company held by Yankuang Group have not been traded. | ||||

Special Undertakings | Performance of Undertakings | |||||

| (2) | Yankuang Group will, in accordance with the relevant governmental procedure, transfer part of its operations, including coal and electricity operations, together with new projects which are in line with the Company’s development strategies to the Company in 2006 to enhance the operational results of the Company and to minimize connected transactions and competition between Yankuang Group, and the Company. Further, the Company will be invited to invest in a coal liquefaction project which is being developed by Yankuang Group for co-development. | Yankuang Group has transferred part of its coal operations to the Company. Please refer to the section headed “Acquisition of Connected Asset” for details of this transfer. Yankuang Group has also started relevant preliminary works for the assignment of other projects. The Company will make disclosures as and when appropriate in accordance with the supervisory regulations. | ||||

| (3) | The Yankuang Group will be responsible for all the costs incurred in connection with the implementation of the Share Reform Plan. | The undertaking has been fulfilled. | ||||

Acquisition of Shanxi Nenghua