As filed with the Securities and Exchange Commission on May 18, 2007

April 29, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

¨ | | |

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

x | | |

| þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20062009

¨ | | |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to ¨ | | |

| o | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Date of event requiring this shell company report

Commission file number 001-31914

(Exact name of Registrant as specified in its charter)

China Life Insurance Company Limited (Translation of Registrant’s name into English)

People’s Republic of China

(Jurisdiction of incorporation or organization)

16

Chaowai AvenueChaoyangFinancial Street

Xicheng District

Beijing 100020,100033, China

(Address of principal executive offices)

Yinghui Li

16 Financial Street

Xicheng District

Beijing 100033, China

Tel: (86-10) 6363-1191

Fax: (86-10) 6657-5112

Email: liyh@e-chinalife.com

(Name, Telephone, Email and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each Class class | | Name of each exchange on which registered |

| | |

| American depositary shares | | New York Stock Exchange Inc. |

| H shares, par value RMB1.00 per share | | New York Stock Exchange, Inc.*Exchange* |

| | |

| * | | Not for trading, but only in connection with the listing on the New York Stock Exchange Inc. of American depositary shares, each representing 15 H shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Indicate the number of outstanding shares of each of the issuer’s

classclasses of capital or common stock as of the close of the period covered by the annual report.

As of December 31,

2006,2009, 7,441,175,000 H shares and 20,823,530,000 A shares, par value RMB1.00 per share, were issued and outstanding. H shares are listed on the Hong Kong Stock Exchange.

Since January 9, 2007, A shares

par value RMB 1.00 per share, have beenare listed on the Shanghai Stock Exchange. Both H shares and A shares are ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

xþ Yes

o¨ NoIf this

report is an annual

report or transition report, indicate by check mark if the registrant is not required to file reports pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes¨ Yes xþ NoIndicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.xþ Yeso No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).¨o Yeso No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one)

| | | | |

| Large accelerated filerþ | | Accelerated filero | | Non-accelerated filero |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S.GAAPLarge accelerated filer xo Accelerated filer International Financial Reporting Standards as issued by the International Accounting Standards Boardþ Others¨o Non-accelerated filer ¨Indicate

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o¨ Item 17xo Item 18 If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).o Yes¨ Yes xþ No

CHINA LIFE INSURANCE COMPANY LIMITED i

FORWARD-LOOKING STATEMENTS This annual report contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements state our intentions, beliefs, expectations or predictions for the future, in particular under “Item 4. Information on the Company”, “Item 5. Operating and Financial Review and Prospects” and “Item 8. Financial Information—Embedded Value”.

The forward-looking statements include, without limitation, statements relating to:

future developments in the insurance industry in China;

| • | | future developments in the insurance industry in China; |

|

| • | | the industry regulatory environment as well as the industry outlook generally; |

|

| • | | the amount and nature of, and potential for, future development of our business; |

|

| • | | the outcome of litigation and regulatory proceedings that we currently face or may face in the future; |

|

| • | | our business strategy and plan of operations; |

|

| • | | the prospective financial information regarding our business; |

|

| • | | our dividend policy; and |

|

| • | | information regarding our embedded value. |

the industry regulatory environment as well as the industry outlook generally;

the amount and nature of, and potential for, future development of our business;

the outcome of litigation and regulatory proceedings that we currently face or may face in the future;

our business strategy and plan of operations;

the prospective financial information regarding our business;

information regarding our embedded value.

In some cases, we use words such as “believe”, “intend”, “anticipate”, “estimate”, “project”, “forecast”, “plan”, “potential”, “will”, “may”, “should” and “expect” and similar expressions to identify forward-looking statements. All statements other than statements of historical facts included in this annual report, including statements regarding our future financial position, strategy, projected costs and plans and objectives of management for future operations, are forward-looking statements. Although we believe that the expectations reflected in those forward-looking statements are reasonable, we can give no assurance that those expectations will prove to have been correct, and you are cautioned not to place undue reliance on such statements. Important factors that could cause actual results to differ materially from our expectations are disclosed under “Item 3. Key Information—Risk Factors” and elsewhere in this annual report, including in conjunction with the forward-looking statements included in this annual report. We undertake no obligation to publicly update or revise any forward-looking statements contained in this annual report, whether as a result of new information, future events or otherwise, except as required by law. All forward-looking statements contained in this annual report are qualified by reference to this cautionary statement.

1

CERTAIN TERMS AND CONVENTIONSConventions

References in this annual report to “we”, “us”, “our”

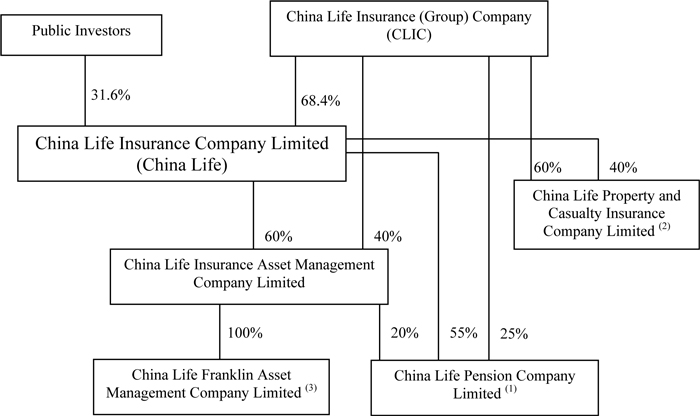

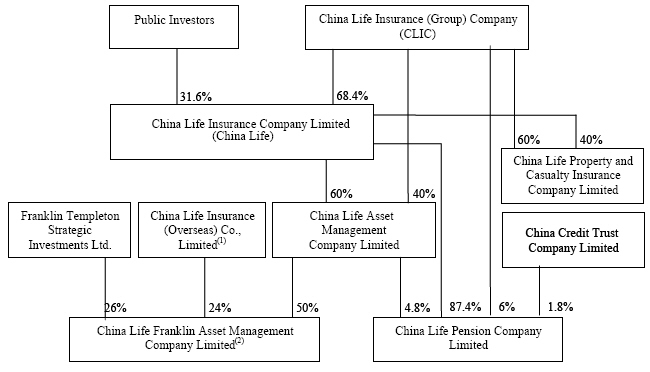

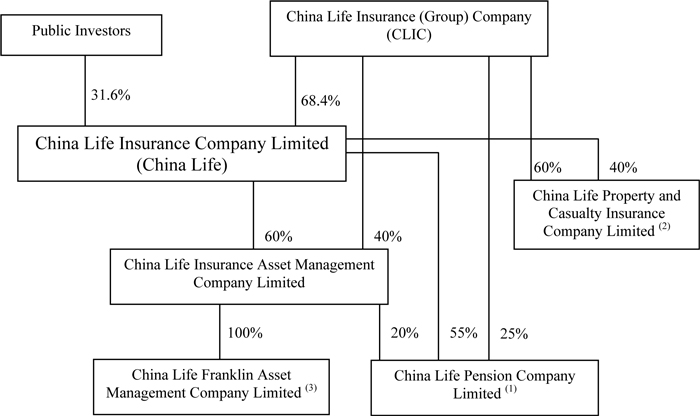

, the “Company” or “China Life” mean China Life Insurance Company Limited and, as the context may require, its subsidiaries. References to “CLIC” mean

prior to the restructuring described below, China Life Insurance Company and, as the context may require, its subsidiaries, and subsequent to the restructuring, China Life Insurance (Group) Company and, as the context may require, its subsidiaries, other than China Life. References in this annual report to “AMC” mean China Life

Insurance Asset Management Company Limited, the asset management joint venture established by us with CLIC on November 23, 2003.

References to “CLPCIC” mean China Life Property and Casualty Insurance Company Limited, the property and casualty joint venture established by us with CLIC on December 30, 2006. References to “China Life Pension” mean China Life Pension Company Limited established by us, CLIC and AMC on January 15, 2007.

The statistical and market share information contained in this annual report has been derived from government sources, including the China Insurance Yearbook

2004,2007, the China Insurance Yearbook

2005,2008, the China Insurance Yearbook

2006,2009 and other public sources. The information has not been verified by us independently. Unless otherwise indicated, market share information set forth in this annual report is based on premium information as reported by the CIRC. The reported information includes premium information that is not determined in accordance with HKFRS,

U.S. GAAP or

U.S. GAAP.References to “A share offering” mean the 1,500,000,000 ordinary domestic shares which were newly issued by us on December 26, 2006 and offered to strategic, institutional and public investors as approved by the CSRC. References to “CLIC A shares” mean the 19,323,530,000 ordinary domestic shares held by CLIC prior to the A share offering and which have been registered with the China Securities Depository and Clearing Corporation Limited as circulative A shares with restrictive trading following the A share offering. CLIC has undertaken that for a period of 36 months commencing on January 9, 2007, it will not transfer or put on trust the CLIC A shares held by it or allow such CLIC A shares to be repurchased by China Life. IFRS.

References to “A shares” mean the RMB ordinary shares

listed on the SSE, which

include the CLIC A shares and the 1,500,000,000 ordinary domestic shares issued pursuant to the A share offering. A shares have been listed on the

SSEShanghai Stock Exchange since January 9, 2007.

References to “China” or “PRC” mean the People’s Republic of China, excluding, for purposes of this annual report, Hong Kong, Macau and Taiwan. References to the “central government” mean the government of the PRC. References to “State Council” mean the State Council of the PRC. References to the “CIRC” mean the China Insurance Regulatory Commission. References to “MOF” or “Ministry of Finance” mean the Ministry of Finance of the PRC. References to “Ministry of Commerce” mean the Ministry of Commerce of the

PRC, which assumed the regulatory functions of the former Ministry of Foreign Trade and Economic Cooperation of the PRC, or “MOFTEC”.PRC. References to “CSRC” mean the China Securities Regulatory Commission.

References to “effective date”“PBOC” mean June 30, 2003, the effective datePeople’s Bank of China. References to “SAFE” mean the State Administration of Foreign Exchange of the restructuring underPRC. References to “SAIC” mean the restructuring agreement between CLICState Administration for Industry and us.

Commerce of the PRC.

References to “HKSE” or “Hong Kong Stock Exchange” mean The Stock Exchange of Hong Kong Limited. References to “NYSE” or “New York Stock Exchange” mean

the New York Stock

Exchange, Inc.Exchange. References to “SSE” or “Shanghai Stock Exchange” mean the Shanghai Stock Exchange.

References to “IFRS” mean the International Financial Reporting Standards as issued by the International Accounting Standards Board, references to “U.S. GAAP” mean the generally accepted accounting principles in the United States, references to “HKFRS” mean the Hong Kong Financial Reporting Standards, issued by the Hong Kong Institute of Certified Public Accountants, and references to “PRC GAAP” mean the PRC Accounting Standards for Business Enterprises (2006) applicable to companies listed in the PRC. Unless otherwise indicated, our financial information presented in this annual report has been prepared in accordance with IFRS.

References to “Renminbi” or “RMB” in this annual report mean the currency of the PRC, references to “U.S. dollars” or “US$” mean the currency of the United States of America, and references to “Hong Kong dollars”, “H.K. dollars” or “HK$” mean the currency of the Hong Kong Special Administrative Region of the PRC.

References to “U.S. GAAP” mean the generally accepted accounting principles in the United States, references to “HKFRS” mean the financial reporting standards in Hong Kong, which are effective for accounting periods commencing on or after January 1, 2005, and references to “PRC GAAP” mean the PRC Accounting Rules and Regulations for Business Enterprises and PRC Accounting System for Financial Institutions. Unless otherwise indicated, our financial information presented in this annual report has been prepared in accordance with HKFRS.2

Unless otherwise indicated, translations of RMB amounts into U.S. dollars in this annual report have been made at the rate of US$1.00 to RMB

7.8041,6.8259, the noon buying rate in

Thethe City of New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on December

29, 2006. The noon buying rate on May 11, 2007 on this basis was RMB 7.6835 to US$1.00.31, 2009. No representation is made that Renminbi amounts could have been, or could be, converted into U.S. dollars at that rate on December

29, 200631, 2009 or at all.

Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

If there is any discrepancy or inconsistency between the Chinese names of the PRC entities in this annual report and their English translations, the Chinese version shall prevail.

3

PRESENTATION OF FINANCIAL INFORMATION

We prepare our consolidated financial statements in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. These are our first annual consolidated financial statements that were prepared in accordance with IFRS as issued by the IASB. Until and including our financial statements included in our annual reports on Form 20-F for the year ended December 31, 2008, we prepared our consolidated financial statements in accordance with HKFRS, with reconciliations to U.S. GAAP. The impact of the transition to IFRS from consolidated financial statements previously prepared in accordance with HKFRS on our equity as of January 1, 2008 and December 31, 2008 and our net profit for the year ended December 31, 2008, is detailed in Note 2.1 to our consolidated financial statements included elsewhere in this annual report. Following our adoption of IFRS, as issued by the IASB, we are no longer required to reconcile our financial statements prepared in accordance with IFRS to U.S.GAAP.

As required by First Time Adoption of International Financial Reporting Standards, or IFRS 1, financial results of the year ended December 31, 2008 have been adjusted in accordance with IFRS and differ from the results reported previously.

4

| | |

| ITEM 1. | | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS. |

| | |

| ITEM 2. | | OFFER STATISTICS AND EXPECTED TIMETABLE. |

A. SELECTED FINANCIAL DATA Selected Historical Consolidated Financial Data The following tables set forth our selected consolidated financial information.information for the periods indicated. We have derived the consolidated financial information from our audited consolidated financial statements included elsewhere in this annual report.

We prepare our consolidated financial statements in accordance with IFRS as issued by the IASB. Until and including our financial statements included in our annual report on Form 20-F for the year ended December 31, 2008, we prepared our consolidated financial statements in accordance with HKFRS, with reconciliations to U.S. GAAP. As required by IFRS 1, financial results of the year ended December 31, 2008 have been adjusted in accordance with IFRS and differ from the results reported previously. See “Item 5. Operating and Financial Review and Prospects”.

We applied the accommodation provided by the SEC in respect of first-time application of IFRS and the following information is limited to our selected consolidated financial information as of and for the years ended December 31,

2004, 20052008 and

2006 from our audited consolidated financial statements included elsewhere in this annual report. For consolidated financial information as of and for the years ended December 31, 2002 and 2003, we derived the information from our audited consolidated financial statements not included in this annual report. As described below, the financial statements as of and for the year ended December 31, 2002 present the financial results of our predecessor company, CLIC, and the 2003 statements of results of operations and cash flows present the results of CLIC for the nine-month period ended September 30, 2003 together with our results for the three-month period ended December 31, 2003.For a reconciliation of our net profit and shareholders’ equity to U.S. GAAP, see Note 36 of the notes to the consolidated financial statements included elsewhere in this annual report.

We were formed on June 30, 2003 in connection with CLIC’s restructuring. In connection with the restructuring, CLIC transferred to us (1) all long-term insurance policies (policies having a term of more than one year from the date of issuance) issued on or after June 10, 1999, having policy terms approved by or filed with the CIRC on or after June 10, 1999 and either (i) recorded as a long-term insurance policy as of June��30, 2003 in a database attached to the restructuring agreement as an annex or (ii) having policy terms for group supplemental medical insurance (fund type), (2) stand-alone short-term policies (policies having a term of one year or less from the date of issuance) issued on or after June 10, 1999 and (3) all riders supplemental to the policies described in clauses (1) and (2) above, together with the reinsurance contracts specified in an annex to the restructuring agreement. We refer to these policies as the “transferred policies”. See “Item 4. Information on the Company—History and Development of the Company—Our Restructuring”. All other insurance policies were retained by CLIC. We refer to these policies as the “non-transferred policies”. We assumed all obligations and liabilities of CLIC under the transferred policies. CLIC continues to be responsible for its liabilities and obligations under the non-transferred policies following the restructuring. The restructuring was effected through a restructuring agreement entered into with CLIC on September 30, 2003, with retroactive effect to June 30, 2003. Pursuant to PRC law and the restructuring agreement, the transferred policies were transferred to us as of June 30, 2003; however, for accounting purposes, the restructuring is treated as having occurred on September 30, 2003, the date of which all of the assets to be transferred were specifically identified. Therefore, for accounting purposes, our financial statements reflected a deemed distribution of assets to CLIC and deemed assumption of liabilities by CLIC as of September 30, 2003. To give effect to the restructuring agreement, the results of operations attributable to the timing difference between the effectiveness of the restructuring under the PRC law and the effectiveness of the restructuring for accounting purposes are reflected as a capital contribution from CLIC to us as of October 1, 2003. The business constituted by the policies and assets transferred to us and the obligations and liabilities assumed by us and the business

constituted by the policies, assets, obligations and liabilities retained by CLIC were, prior to the restructuring, under common management from a number of significant aspects. Therefore, our consolidated balance sheet data as of December 31, 2002, and the consolidated income statement accounts data for the years ended December 31, 2002, present the financial results of our predecessor company, CLIC, and they will not necessarily be indicative of our future earnings, cash flows or financial position as a stand-alone company. Our consolidated balance sheet data and consolidated income statement as of and for the year ended December 31, 2003 reflect the restructuring as having occurred on September 30, 2003.

2009 only.

You should read this information in conjunction with the rest of the annual report, including our audited consolidated financial statements and the accompanying notes, and “Item 5. Operating and Financial Review and Prospects” included elsewhere in this annual report and the independent registered public accounting firm’s report.

| | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2002 RMB | | | 2003(1) RMB | | | 2004 RMB | | | 2005 RMB | | | 2006 RMB | | | 2006 US$ | |

| | | (in millions except for per share data) | |

Consolidated Income Statement Data | | | | | | | | | | | | | | | | | | |

HKFRS | | | | | | | | | | | | | | | | | | |

| | | | | | |

Revenues | | | | | | | | | | | | | | | | | | |

Gross written premiums and policy fees | | 68,769 | | | 69,334 | | | 66,257 | | | 81,022 | | | 99,417 | | | 12,739 | |

Less: premiums ceded to reinsurers | | (1,869 | ) | | (1,571 | ) | | (1,182 | ) | | (769 | ) | | (140 | ) | | (18 | ) |

| | | | | | | | | | | | | | | | | | |

Net written premiums and policy fees | | 66,900 | | | 67,763 | | | 65,075 | | | 80,253 | | | 99,277 | | | 12,721 | |

Net change in unearned premium reserves | | (476 | ) | | (547 | ) | | (67 | ) | | (215 | ) | | (430 | ) | | (55 | ) |

| | | | | | | | | | | | | | | | | | |

Net premiums earned and policy fees | | 66,424 | | | 67,216 | | | 65,008 | | | 80,038 | | | 98,847 | | | 12,666 | |

| | | | | | | | | | | | | | | | | | |

Net investment income | | 8,347 | | | 9,825 | | | 11,317 | | | 16,685 | | | 24,942 | | | 3,196 | |

Net realized gains/(losses) on financial assets | | — | | | — | | | — | | | (510 | ) | | 1,595 | | | 204 | |

Net realized gains/(losses) on investments | | 266 | | | 868 | | | (237 | ) | | — | | | — | | | — | |

Net fair value gains on assets at fair value through income (held-for-trading) | | — | | | — | | | — | | | 260 | | | 20,044 | | | 2,568 | |

Net unrealized gains/(losses) on trading assets | | (1,067 | ) | | 247 | | | (1,061 | ) | | — | | | — | | | — | |

Other income | | 338 | | | 727 | | | 1,779 | | | 1,739 | | | 1,883 | | | 241 | |

| | | | | | | | | | | | | | | | | | |

Total revenues | | 74,308 | | | 78,883 | | | 76,806 | | | 98,212 | | | 147,311 | | | 18,876 | |

| | | | | | | | | | | | | | | | | | |

| | | | | | |

Benefits, claims and expenses | | | | | | | | | | | | | | | | | | |

Insurance benefits and claims | | | | | | | | | | | | | | | | | | |

Life insurance death and other benefits | | (7,010 | ) | | (8,570 | ) | | (6,816 | ) | | (8,311 | ) | | (10,797 | ) | | (1,384 | ) |

Accident and health claims and claim adjustment expenses | | (4,053 | ) | | (4,882 | ) | | (6,418 | ) | | (6,847 | ) | | (6,999 | ) | | (897 | ) |

Increase in long-term traditional insurance contracts liabilities | | (40,541 | ) | | (39,966 | ) | | (25,361 | ) | | (33,977 | ) | | (44,238 | ) | | (5,669 | ) |

Interest credited to long-term investment type insurance contracts | | (6,783 | ) | | (6,811 | ) | | (3,704 | ) | | (4,894 | ) | | (6,386 | ) | | (818 | ) |

Interest credited to investment contracts | | (312 | ) | | (449 | ) | | (616 | ) | | (973 | ) | | (996 | ) | | (128 | ) |

Increase in deferred income | | (6,108 | ) | | (5,942 | ) | | (7,793 | ) | | (8,521 | ) | | (11,607 | ) | | (1,487 | ) |

Policyholder dividends resulting from participation in profits | | (641 | ) | | (1,207 | ) | | (2,048 | ) | | (5,359 | ) | | (17,617 | ) | | (2,257 | ) |

Amortization of deferred policy acquisition costs | | (3,832 | ) | | (5,023 | ) | | (6,263 | ) | | (7,766 | ) | | (10,259 | ) | | (1,315 | ) |

Underwriting and policy acquisition costs | | (1,661 | ) | | (1,294 | ) | | (1,472 | ) | | (1,845 | ) | | (2,415 | ) | | (309 | ) |

Administrative expenses | | (6,162 | ) | | (6,862 | ) | | (6,585 | ) | | (7,237 | ) | | (9,339 | ) | | (1,197 | ) |

Other operating expenses | | (634 | ) | | (872 | ) | | (131 | ) | | (798 | ) | | (859 | ) | | (110 | ) |

Interest expense on bank borrowings | | (7 | ) | | (7 | ) | | — | | | — | | | — | | | — | |

Statutory insurance fund | | (73 | ) | | (85 | ) | | (96 | ) | | (174 | ) | | (194 | ) | | (25 | ) |

| | | | | | | | | | | | | | | | | | |

Total benefits, claims and expenses | | (77,817 | ) | | (81,970 | ) | | (67,303 | ) | | (86,702 | ) | | (121,706 | ) | | (15,595 | ) |

| | | | | | | | | | | | | | | | | | |

Net profit/(loss) before income tax expense | | (3,509 | ) | | (3,087 | ) | | 9,503 | | | 11,510 | | | 25,605 | | | 3,281 | |

Income tax expense | | (14 | ) | | (1,180 | ) | | (2,280 | ) | | (2,145 | ) | | (5,554 | ) | | (712 | ) |

| | | | | | | | | | | | | | | | | | |

Net profit/(loss) | | (3,523 | ) | | (4,267 | ) | | 7,223 | | | 9,365 | | | 20,051 | | | 2,569 | |

| | | | | | | | | | | | | | | | | | |

Attributable to: | | | | | | | | | | | | | | | | | | |

—Shareholders of the Company | | (3,525 | ) | | (4,252 | ) | | 7,171 | | | 9,306 | | | 19,956 | | | 2,557 | |

—Minority interest | | 2 | | | (15 | ) | | 52 | | | 59 | | | 95 | | | 12 | |

Basic and diluted earnings/(loss) per share(2) | | (0.18 | ) | | (0.21 | ) | | 0.27 | | | 0.35 | | | 0.75 | | | 0.10 | |

| | | | | | | | | | | | | | | | | | |

Dividends | | — | | | — | | | — | | | 1,338 | | | 3,957 | | | 507 | |

| | | | | | |

U.S. GAAP | | | | | | | | | | | | | | | | | | |

Revenues | | 74,308 | | | 78,883 | | | 76,806 | | | 98,212 | | | 147,311 | | | 18,876 | |

Net profit/(loss) attributable to shareholders of the Company | | (2,317 | ) | | (1,287 | ) | | 7,171 | | | 9,306 | | | 19,956 | | | 2,557 | |

Net profit/(loss) per share(2) | | (0.12 | ) | | (0.06 | ) | | 0.27 | | | 0.35 | | | 0.75 | | | 0.10 | |

Net profit/(loss) per ADS(2) | | (4.63 | ) | | (2.54 | ) | | 10.72 | | | 13.91 | | | N/A | | | N/A | |

Net profit/(loss) per ADS(3) | | (1.74 | ) | | (0.95 | ) | | 4.02 | | | 5.22 | | | 11.18 | | | 1.43 | |

| | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| IFRS | | 2008 | | | 2009 | | | 2009 | |

| | | RMB | | | RMB | | | US$ | |

| | | (in millions except for per share data) | |

| | |

Consolidated Statement of Comprehensive Income | | | | | | | | | | | | |

| | |

Revenues | | | | | | | | | | | | |

| Gross written premiums | | | 265,656 | | | | 275,970 | | | | 40,430 | |

| Less: premiums ceded to reinsurers | | | (156 | ) | | | (158 | ) | | | (23 | ) |

| | | | | | | | | | |

| Net written premiums | | | 265,500 | | | | 275,812 | | | | 40,407 | |

| Net change in unearned premium reserves | | | (323 | ) | | | (735 | ) | | | (108 | ) |

| | | | | | | | | | |

| Net premiums earned | | | 265,177 | | | | 275,077 | | | | 40,299 | |

| | | | | | | | | | |

| Investment income | | | 44,946 | | | | 38,890 | | | | 5,697 | |

| Net realized gains/(losses) on financial assets | | | (5,964 | ) | | | 21,244 | | | | 3,112 | |

| Net fair value gains/(losses) on assets at fair value through income (held-for-trading) | | | (7,194 | ) | | | 1,449 | | | | 212 | |

| Other income | | | 3,420 | | | | 2,630 | | | | 385 | |

| | | | | | | | | | |

Total revenues | | | 300,385 | | | | 339,290 | | | | 49,706 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Benefits, claims and expenses | | | | | | | | | | | | |

| Insurance benefits and claims | | | | | | | | | | | | |

| Life insurance death and other benefits | | | (89,659 | ) | | | (74,858 | ) | | | (10,967 | ) |

| Accident and health claims and claim adjustment expenses | | | (7,641 | ) | | | (7,808 | ) | | | (1,144 | ) |

| Increase in insurance contracts liabilities | | | (134,649 | ) | | | (154,372 | ) | | | (22,616 | ) |

| Investment contract benefits | | | (1,931 | ) | | | (2,142 | ) | | | (314 | ) |

| Policyholder dividends resulting from participation in profits | | | (1,671 | ) | | | (14,487 | ) | | | (2,122 | ) |

| Underwriting and policy acquisition costs | | | (24,200 | ) | | | (22,936 | ) | | | (3,360 | ) |

| Administrative expenses | | | (16,652 | ) | | | (18,719 | ) | | | (2,742 | ) |

| Other operating expenses | | | (3,409 | ) | | | (2,390 | ) | | | (350 | ) |

| Statutory insurance fund | | | (558 | ) | | | (537 | ) | | | (79 | ) |

| | | | | | | | | | |

Total benefits, claims and expenses | | | (280,370 | ) | | | (298,249 | ) | | | (43,694 | ) |

| | | | | | | | | | |

| | | | | | | | | | | | | |

| Share of results of associates | | | (56 | ) | | | 704 | | | | 103 | |

Net profit before income tax expenses | | | 19,959 | | | | 41,745 | | | | 6,116 | |

| Income tax expenses | | | (685 | ) | | | (8,709 | ) | | | (1,276 | ) |

| | | | | | | | | | |

Net profit | | | 19,274 | | | | 33,036 | | | | 4,840 | |

| | | | | | | | | | |

| Attributable to: | | | | | | | | | | | | |

| - Shareholders of the Company | | | 19,137 | | | | 32,881 | | | | 4,817 | |

| - Minority interests | | | 137 | | | | 155 | | | | 23 | |

Basic and diluted earnings per share(1) | | | 0.68 | | | | 1.16 | | | | 0.17 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Other comprehensive income/(loss) | | | | | | | | | | | | |

| Available-for-sale financial assets | | | | | | | | | | | | |

| Arising from available-for-sale securities | | | (61,622 | ) | | | 39,470 | | | | 5,782 | |

| Reclassification adjustment for gains included in profit or loss | | | 4,878 | | | | (21,040 | ) | | | (3,082 | ) |

| Impact from available-for-sale securities on other assets and liabilities | | | 11,702 | | | | (3,999 | ) | | | (586 | ) |

| Share of other comprehensive income/(loss) of associates | | | 291 | | | | (70 | ) | | | (10 | ) |

| Others | | | (3 | ) | | | — | | | | — | |

| Income tax relating to components of other comprehensive income/(loss) | | | 11,260 | | | | (3,607 | ) | | | (528 | ) |

Other comprehensive income/(loss) for the year | | | (33,494 | ) | | | 10,754 | | | | 1,575 | |

Total comprehensive income/(loss) for the year | | | (14,220 | ) | | | 43,790 | | | | 6,415 | |

| Attributable to | | | | | | | | | | | | |

| - Shareholders of the Company | | | (14,316 | ) | | | 43,626 | | | | 6,391 | |

| - Minority interests | | | 96 | | | | 164 | | | | 24 | |

(1) | Includes, through September 30, 2003, the assets, liabilities and operations retained by CLIC. | |

(2)(1) | The 20,000,000,000 shares issued to CLIC in the restructuring have been given retroactive treatment for purposes of computing per share and per ADS amounts. | Numbers for the year ended December 31, 2003 and the years ended December 31, 20042008 and December 31, 20052009 are based on the weighted average number of 20,249,798,52628,264,705,000 shares and 26,764,705,000 shares, respectively, in issue during such years. Numbers for the year ended December 31, 2006 are based on the weighted average number of 26,777,033,767 shares in issue during such year. Each ADS represents 40 H shares. Any discrepancies in the table between the amounts per share and the amounts per ADS are due to rounding. |

(3) | The ratio of ADSs to H shares was reduced from 40 H shares to 15 H shares on December 29, 2006. Accordingly, we have also calculated retroactively the net profit/(loss) per ADS based on each ADS representing 15 H shares for purposes of comparison. |

| | | | | | | | | | | | |

| | | As of December 31, |

| | | 2002 RMB | | 2003 RMB | | 2004 RMB | | 2005 RMB | | 2006 RMB | | 2006 US$ |

| | | (in millions) |

Consolidated Balance Sheet Data | | | | | | | | | | | | |

HKFRS | | | | | | | | | | | | |

| | | | | | |

Assets | | | | | | | | | | | | |

Property, plant and equipment | | 18,457 | | 12,008 | | 12,250 | | 12,710 | | 14,565 | | 1,866 |

Deferred policy acquisition costs | | 18,084 | | 24,868 | | 32,787 | | 37,741 | | 39,230 | | 5,027 |

Investments in associates | | 2,035 | | — | | — | | — | | 6,071 | | 778 |

| | | | | | |

Financial assets | | | | | | | | | | | | |

Debt securities | | 76,337 | | 70,604 | | 150,234 | | 255,554 | | 357,898 | | 45,860 |

Equity securities | | 12,171 | | 10,718 | | 17,271 | | 39,548 | | 95,493 | | 12,236 |

Term deposits | | 123,675 | | 137,192 | | 175,498 | | 164,869 | | 175,476 | | 22,485 |

Statutory deposits—restricted | | 991 | | 4,000 | | 4,000 | | 5,353 | | 5,353 | | 686 |

Policy loans | | 106 | | 116 | | 391 | | 981 | | 2,371 | | 304 |

Securities purchased under agreements to resell | | 36,388 | | 14,002 | | 279 | | — | | — | | — |

Accrued investment income | | 4,198 | | 2,875 | | 5,084 | | 6,813 | | 8,461 | | 1,084 |

| | | | | | |

Other financial assets | | 231 | | — | | — | | — | | — | | — |

Premiums receivables | | 1,757 | | 2,801 | | 3,912 | | 4,959 | | 6,066 | | 777 |

Reinsurance assets | | 1,224 | | 997 | | 1,297 | | 1,182 | | 986 | | 126 |

Other assets | | 3,587 | | 5,923 | | 3,451 | | 1,458 | | 2,212 | | 283 |

Cash and cash equivalents | | 14,529 | | 42,616 | | 27,217 | | 28,051 | | 50,213 | | 6,434 |

| | | | | | | | | | | | |

Total assets | | 313,770 | | 328,720 | | 433,671 | | 559,219 | | 764,395 | | 97,948 |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | As of December 31, |

| | | 2002 RMB | | | 2003 RMB | | 2004 RMB | | 2005 RMB | | 2006 RMB | | 2006 US$ |

| | | (in millions) |

Liabilities and equity | | | | | | | | | | | | | |

| | | | | | |

Liabilities | | | | | | | | | | | | | |

| | | | | | |

Insurance Contracts | | | | | | | | | | | | | |

Short-term insurance contracts | | | | | | | | | | | | | |

-Unearned premium reserves | | 5,036 | | | 5,382 | | 5,212 | | 5,147 | | 5,346 | | 685 |

-Reserves for claims and claim adjustment expenses | | 879 | | | 814 | | 1,215 | | 1,784 | | 2,498 | | 320 |

Long-term traditional insurance contracts | | 292,551 | | | 63,965 | | 89,698 | | 124,656 | | 172,875 | | 22,152 |

Long-term investment type insurance contracts | | 212,108 | | | 135,982 | | 191,885 | | 237,001 | | 282,672 | | 36,221 |

Deferred income | | 12,812 | | | 18,753 | | 27,603 | | 34,631 | | 41,371 | | 5,301 |

Financial liabilities | | | | | | | | | | | | | |

Investment contracts | | | | | | | | | | | | | |

-with discretionary participation feature (DPF) | | 9,241 | | | 16,720 | | 32,476 | | 42,230 | | 45,998 | | 5,894 |

-without DPF | | 2,698 | | | 2,029 | | 1,635 | | 1,872 | | 2,614 | | 335 |

Securities sold under agreements to repurchase | | 3,602 | | | 6,448 | | — | | 4,731 | | 8,227 | | 1,054 |

Annuity and other insurance balances payable | | 8,057 | | | 638 | | 2,801 | | 4,492 | | 8,891 | | 1,139 |

Premiums received in advance | | 1,767 | | | 2,407 | | 2,447 | | 2,951 | | 2,329 | | 298 |

Policyholder deposits | | 592 | | | — | | — | | — | | — | | — |

Policyholder dividends payable | | 688 | | | 1,916 | | 2,037 | | 6,204 | | 26,057 | | 3,339 |

Bank borrowings | | 313 | | | — | | — | | — | | — | | — |

Provision | | 445 | | | — | | — | | — | | — | | — |

Other liabilities | | 4,716 | | | 6,732 | | 4,922 | | 4,106 | | 5,333 | | 683 |

Current income tax liabilities | | — | | | 159 | | 38 | | 525 | | 843 | | 108 |

Deferred tax liabilities | | — | | | 3,686 | | 4,371 | | 7,982 | | 19,022 | | 2,437 |

Statutory insurance fund | | 1,337 | | | 333 | | 429 | | 98 | | 114 | | 15 |

| | | | | | | | | | | | | |

Total liabilities | | 556,842 | | | 265,964 | | 366,769 | | 478,410 | | 624,190 | | 79,982 |

| | | | | | | | | | | | | |

Contingencies and commitments | | — | | | — | | — | | — | | — | | — |

| | | | | | |

Shareholders’ equity | | | | | | | | | | | | | |

Share Capital | | 4,600 | | | 26,765 | | 26,765 | | 26,765 | | 28,265 | | 3,622 |

Reserves | | 1,430 | | | 34,051 | | 31,573 | | 37,225 | | 77,368 | | 9,914 |

Retained earnings/(accumulated loss) | | (249,267 | ) | | 1,620 | | 8,192 | | 16,388 | | 34,032 | | 4,361 |

| | | | | | | | | | | | | |

Total shareholders’ equity | | (243,237 | ) | | 62,436 | | 66,530 | | 80,378 | | 139,665 | | 17,896 |

| | | | | | | | | | | | | |

Minority interest | | 165 | | | 320 | | 372 | | 431 | | 540 | | 69 |

| | | | | | | | | | | | | |

Total equity | | (243,072 | ) | | 62,756 | | 66,902 | | 80,809 | | 140,205 | | 17,966 |

| | | | | | | | | | | | | |

Total liabilities and equity | | 313,770 | | | 328,720 | | 433,671 | | 559,219 | | 764,395 | | 97,948 |

| | | | | | | | | | | | | |

| | | | | | |

U.S. GAAP | | | | | | | | | | | | | |

Total assets | | 313,592 | | | 328,720 | | 433,671 | | 559,219 | | 764,395 | | 97,948 |

Total liabilities | | 489,068 | | | 265,964 | | 366,769 | | 478,410 | | 624,190 | | 79,982 |

Shareholders’ equity | | (175,641 | ) | | 62,436 | | 66,530 | | 80,378 | | 139,665 | | 17,896 |

| | | | | | | | | | | | | |

| | | As of December 31, | |

| IFRS | | 2008 | | | 2009 | | | 2009 | |

| | | RMB | | | RMB | | | US$ | |

| | | (in millions) | |

| | |

Consolidated Statement of Financial Position | | | | | | | | | | | | |

| | |

Assets | | | | | | | | | | | | |

| Property, plant and equipment | | | 16,720 | | | | 17,467 | | | | 2,559 | |

| Investments in associates | | | 7,891 | | | | 8,470 | | | | 1,241 | |

| | | | | | | | | | | | | |

Financial assets | | | | | | | | | | | | |

| Held-to-maturity securities | | | 211,929 | | | | 235,099 | | | | 34,442 | |

| Loans | | | 17,926 | | | | 23,081 | | | | 3,381 | |

| Term deposits | | | 228,272 | | | | 344,983 | | | | 50,540 | |

| Statutory deposits—restricted | | | 6,153 | | | | 6,153 | | | | 901 | |

| Available-for-sale securities | | | 424,939 | | | | 517,499 | | | | 75,814 | |

| Securities at fair value through income | | | 14,099 | | | | 9,133 | | | | 1,338 | |

| Accrued investment income | | | 13,149 | | | | 14,208 | | | | 2,081 | |

| Premiums receivables | | | 6,433 | | | | 6,818 | | | | 999 | |

| Reinsurance assets | | | 940 | | | | 832 | | | | 122 | |

| Other assets | | | 4,957 | | | | 6,317 | | | | 925 | |

| Cash and cash equivalents | | | 34,085 | | | | 36,197 | | | | 5,303 | |

| | | | | | | | | | |

Total assets | | | 987,493 | | | | 1,226,257 | | | | 179,648 | |

| | | | | | | | | | |

| | |

Liabilities and equity | | | | | | | | | | | | |

| | |

Liabilities | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Insurance contracts | | | 662,865 | | | | 818,164 | | | | 119,862 | |

| Financial liabilities | | | | | | | | | | | | |

| Investment contracts | | | 65,063 | | | | 67,326 | | | | 9,863 | |

| Securities sold under agreements to repurchase | | | 11,390 | | | | 33,553 | | | | 4,916 | |

| Policyholder dividends payable | | | 43,178 | | | | 54,587 | | | | 7,997 | |

| Annuity and other insurance balances payable | | | 4,980 | | | | 5,721 | | | | 838 | |

| Premiums received in advance | | | 1,811 | | | | 1,804 | | | | 264 | |

| Other liabilities | | | 11,057 | | | | 11,978 | | | | 1,755 | |

| Deferred tax liabilities | | | 10,344 | | | | 16,361 | | | | 2,397 | |

| Current income tax liabilities | | | 1,668 | | | | 3,850 | | | | 564 | |

| Statutory insurance fund | | | 266 | | | | 137 | | | | 20 | |

| | | | | | | | | | |

Total liabilities | | | 812,622 | | | | 1,013,481 | | | | 148,476 | |

| | | | | | | | | | |

Shareholders’ equity | | | | | | | | | | | | |

| Share capital | | | 28,265 | | | | 28,265 | | | | 4,141 | |

| Reserves | | | 84,447 | | | | 102,787 | | | | 15,058 | |

| Retained earnings | | | 61,235 | | | | 80,020 | | | | 11,723 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Total shareholders’ equity | | | 173,947 | | | | 211,072 | | | | 30,922 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Minority interests | | | 924 | | | | 1,704 | | | | 250 | |

| | | | | | | | | | |

| | | | | | | | | | | | | |

Total equity | | | 174,871 | | | | 212,776 | | | | 31,172 | |

| | | | | | | | | | |

Total liabilities and equity | | | 987,493 | | | | 1,226,257 | | | | 179,648 | |

| | | | | | | | | | |

7

Exchange Rate Information We prepare our financial statements in Renminbi. This annual report contains translations of Renminbi amounts into U.S. dollars, and U.S. dollars into Renminbi, at RMB

7.80416.8259 to US$1.00, the noon buying rate on December

29, 200631, 2009 in the City of New York for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York. You should not assume that Renminbi amounts could actually be converted into U.S. dollars at these rates or at all.

Until July 20, 2005, the People’s Bank of ChinaPBOC had set and published daily a base exchange rate with reference primarily to the supply and demand of Renminbi against the U.S. dollar in the market during the prior day. The People’s Bank of ChinaPBOC also took into account other factors, such as the general conditions existing in the international foreign exchange markets. From 1994 to July 20, 2005, the official exchange rate for the conversion of Renminbi to U.S. dollars was generally stable. On July 21, 2005, the PRC government introduced a managed floating exchange rate system to allow the value of the Renminbi to fluctuate within a regulated band based on market supply and demand and by reference to a basket of currencies. On the same day, the value of the Renminbi appreciated by 2.0% against the U.S. dollar. Since then, the PRC government has made, and may in the future make, further adjustments to the exchange rate system. The People’s Bank of ChinaPBOC announces the closing price of a foreign currency traded against the Renminbi in the inter-bank foreign exchange market after the closing of the market on each working day, and makes it the central parity for the trading against the Renminbi on the following working day.

8

Although PRC governmental policies were introduced in 1996 to reduce restrictions on the convertibility of Renminbi into foreign currency for current account items, conversion of Renminbi into foreign exchange for capital items, such as foreign direct investments, loans or securities, requires the approval of the

State Administration for Foreign ExchangeSAFE and other relevant authorities.

The Hong Kong dollar is freely convertible into other currencies, including the U.S. dollar. Since October 17, 1983, the Hong Kong dollar has been linked to the U.S. dollar at the rate of HK$7.80 to US$1.00. The central element in the arrangements which give effect to the link is that by agreement between the Hong Kong government and the three Hong Kong banknote issuing banks, The

HongkongHong Kong and Shanghai Banking Corporation Limited, Standard Chartered Bank and the Bank of China, certificates of

indebtedness,debts, which are issued by the Hong Kong Government Exchange Fund to the banknote issuing banks to be held as cover for their banknote issues, are issued and redeemed only against payment in U.S. dollars, at the fixed exchange rate of HK$7.80 to US$1.00. When the banknotes are withdrawn from circulation, the banknote issuing banks surrender the certificates of

indebtednessdebts to the Hong Kong Government Exchange Fund and are paid the equivalent U.S. dollars at the fixed rate.

The market exchange rate of the Hong Kong dollar against the U.S. dollar continues to be determined by the forces of supply and demand in the foreign exchange market. However, against the background of the fixed rate which applies to the issue of the Hong Kong currency in the form of banknotes, as described above, the market exchange rate has not deviated materially from the level of HK$7.80 to US$1.00 since the link was first established. The Hong Kong government has stated its intention to maintain the link at that rate, and it, acting through the Hong Kong Monetary Authority, has a number of means by which it may act to maintain exchange rate stability. Exchange rates between the Hong Kong dollar and other currencies are influenced by the linked rate between the U.S. dollar and the Hong Kong dollar.

The noon buyingfollowing tables set forth various information concerning exchange rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for the periods indicated. These rates are provided solely for your convenience and are not necessarily the exchange rates we used in this annual report. The Citysource of New York for cable transfers payable in foreign currencies as certified for customs purposes bythese rates is the Federal Reserve Bank of New York until December 31, 2008. Since January 1, 2009, the Federal Reserve Bank of New York discontinued publication of foreign exchange rates. The source of the rates since January 1, 2009 is the H.10 statistical release of the Federal Reserve Board. On April 23, 2010, the exchange rates were US$1.00 to RMB7.6835RMB 6.8270 and US$1.00 to HK$7.8201, respectively, on May 11, 2007.7.7628, respectively. The following table sets forth the high and low noon buying rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each of the periods shown:

| | | | | | | | | | | | | | | | | |

| | | RMB per US$ | | | HK$ per US$ | |

| | | High | | | Low | | | High | | | Low | |

| October 2009 | | | 6.8292 | | | | 6.8248 | | | | 7.7502 | | | | 7.7495 | |

| November 2009 | | | 6.8300 | | | | 6.8255 | | | | 7.7501 | | | | 7.7495 | |

| December 2009 | | | 6.8299 | | | | 6.8244 | | | | 7.7572 | | | | 7.7495 | |

| January 2010 | | | 6.8295 | | | | 6.8258 | | | | 7.7752 | | | | 7.7539 | |

| February 2010 | | | 6.8330 | | | | 6.8258 | | | | 7.7716 | | | | 7.7619 | |

| March 2010 | | | 6.8270 | | | | 6.8254 | | | | 7.7648 | | | | 7.7574 | |

| April 2010 (through April 23, 2010) | | | 6.8275 | | | | 6.8229 | | | | 7.7672 | | | | 7.7565 | |

| | | | | | | | |

| | | Noon buying rate |

| | | RMB per US$ | | HK$ per US$ |

| | | High | | Low | | High | | Low |

November 2006 | | 7.8750 | | 7.8303 | | 7.7875 | | 7.7751 |

December 2006 | | 7.8350 | | 7.8041 | | 7.7787 | | 7.7665 |

January 2007 | | 7.8127 | | 7.7705 | | 7.8112 | | 7.7797 |

February 2007 | | 7.7632 | | 7.7410 | | 7.8141 | | 7.8041 |

March 2007 | | 7.7454 | | 7.7232 | | 7.8177 | | 7.8093 |

April 2007 | | 7.7345 | | 7.7090 | | 7.8212 | | 7.8095 |

May 2007 (through May 11, 2007) | | 7.7065 | | 7.6835 | | 7.8222 | | 7.8180 |

9

The following table sets forth the period-end

noon buying rates and the average

noon buying rates between Renminbi and U.S. dollars and between Hong Kong dollars and U.S. dollars for each of

2002, 2003, 2004, 2005, 2006,

2007, 2008, 2009 and

20072010 (through

May 11, 2007)April 23, 2010) (calculated by averaging the

noon buying rates on the last day of each month of the periods shown):

| | | | | | | | |

| | | Period-end noon buying rate | | Average noon buying rate |

| | | RMB per US$ | | HK$ per US$ | | RMB per US$ | | HK$ per US$ |

2002 | | 8.2800 | | 7.7988 | | 8.2772 | | 7.7996 |

2003 | | 8.2767 | | 7.7640 | | 8.2771 | | 7.7864 |

2004 | | 8.2765 | | 7.7723 | | 8.2768 | | 7.7899 |

2005 | | 8.0702 | | 7.7533 | | 8.1826 | | 7.7755 |

2006 | | 7.8041 | | 7.7771 | | 7.9579 | | 7.7685 |

2007 (through May 11, 2007) | | 7.6835 | | 7.8201 | | 7.7256 | | 7.8149 |

| | | | | | | | | | | | | | | | | |

| | | Period-end rate | | | Average rate | |

| | | RMB per | | | | | | | RMB per | | | | |

| | | US$ | | | HK$ per US$ | | | US$ | | | HK$ per US$ | |

| 2005 | | | 8.0702 | | | | 7.7533 | | | | 8.1826 | | | | 7.7755 | |

| 2006 | | | 7.8041 | | | | 7.7771 | | | | 7.9579 | | | | 7.7685 | |

| 2007 | | | 7.2946 | | | | 7.7984 | | | | 7.6072 | | | | 7.8008 | |

| 2008 | | | 6.8225 | | | | 7.7499 | | | | 6.9477 | | | | 7.7814 | |

| 2009 | | | 6.8259 | | | | 7.7536 | | | | 6.8295 | | | | 7.7513 | |

| 2010 (through April 23, 2010) | | | 6.8270 | | | | 7.7628 | | | | 6.8264 | | | | 7.7640 | |

B. CAPITALIZATION AND INDEBTEDNESS C. REASONS FOR THE OFFER AND USE OF PROCEEDS Our business, financial condition and results of operations can be affected materially and adversely by any of the following risk factors.

Risks Relating to Our Business Our growth is dependent on our ability to attract and retain productive agentsagents. A substantial portion of our business is conducted through our individual agents. Because of differences in productivity, a relatively small percentage of our sales agents is responsible for a disproportionately high percentage of our sales of individual products. If we are unable to retain and build on this core group of highly productive agents, our business could be materially and adversely affected. Competition for agents from insurance companies and other business institutions may also force us to increase the compensation of our agents and sales representatives, which would increase operating costs and reduce our profitability. Although we have not had difficulty in attracting and retaining productive agents in the recent past, and do not anticipate any difficulties in the future, we cannot guarantee that this will continue to be the case.

If we are unable to develop other distribution channels for our products, our growth may be materially and adversely affectedaffected.Banks

Commercial banks and banking operations of post offices are rapidly emerging as some of the fastest growing distribution channels in China. Newly established domestic and foreign-invested life insurance companies have been particularly focusing on commercial banks and banking operations of post offices as one of their main distribution channels. We do not have exclusive arrangements with any of the commercial banks and banking operations of post offices through which we sell insurance and annuity products, and thus our sales may be materially and adversely affected if one or more commercial banks or banking operations of post offices choose to favor our competitors’ products over our own. If we are unable to continue to develop our alternative distribution channels, our growth may be materially and adversely affected.

10

Agent and employee misconduct is difficult to detect and deter and could harm our reputation or lead to regulatory sanctions or litigation costscosts. Agent or employee misconduct could result in violations of law by us, regulatory sanctions, litigation or serious reputational or financial harm. Misconduct could include:

engaging in misrepresentation or fraudulent activities when marketing or selling insurance policies or annuity contracts to customers;

| • | | engaging in misrepresentation or fraudulent activities when marketing or selling insurance policies or annuity contracts to customers; |

|

| • | | hiding unauthorized or unsuccessful activities, resulting in unknown and unmanaged risks or losses; or |

|

| • | | otherwise not complying with laws or our control policies or procedures. |

hiding unauthorized or unsuccessful activities, resulting in unknown and unmanaged risks or losses; or

otherwise not complying with laws or our control policies or procedures.

We cannot always deter agent or employee misconduct, and the precautions we take to prevent and detect these activities may not be effective in all cases. We have experienced agent and employee misconduct that has resulted in litigation and administrative actions against us and these agents and employees, and in some cases criminal proceedings and convictions against the agent or employee in question. None of these actions has resulted in material losses, damages, fines or other sanctions against us. We cannot assure you, however, that agent or employee misconduct will not lead to a material adverse effect on our business, results of operations or financial condition.

Our business is dependent on our ability to attract and retain key personnel, including senior management, underwriting personnel, actuaries, information technology specialists, investment managers and other professionalsprofessionals. The success of our business is dependent to a large extent on our ability to attract and retain key personnel who have in-depth knowledge and understanding of the life insurance market in China, including members of our senior management, qualified underwriting personnel, actuaries, information technology specialists and experienced investment managers. As of the date of this annual report, we do not carry key personnel insurance for any of these personnel. We compete to attract and retain these key personnel with other life insurance companies and financial institutions, some of which may offer better compensation arrangements.

The number of new domestic and foreign-invested insurers is increasing at a significant pace, existingExisting insurers are expanding their operations and the number of other financial institutions is growing. As the insurance and investment businesses continue to expand in China, we expect that competition for these personnel will increase in the future. Although we have not had difficulty in attracting and retaining qualified key personnel in the past, we cannot guarantee that this will continue to be the case. If we were unable to continue to attract and retain key personnel, our financial performance could be materially and adversely affected.

We are Exposedexposed to Changeschanges in Interest Ratesinterest rates. Changes in interest rates may affect our profitabilityprofitability. Our profitability is affected by changes in interest rates. We have experienced a generally low interest rate environment for several years until October 2004, whenDuring the year 2008, in light of the global economic downturn, the PBOC reduced the interest rate on one-year termone year deposits was raisedsignificantly from 1.98%4.14% to 2.25%. In August 2006 and March 2007, in an effort to bolster the economy. The interest rate on one-year term deposits was further raised from 2.25% to 2.52% and from 2.52% to 2.79%, respectively. Due to China’s recent fast growing economy,remained unchanged in the year 2009. The Chinese government may take further measures, including further raisingreducing interest rates further, which may reduce the income we realize from our investments, affecting our profitability. In addition, as instruments in an effortour investment portfolio mature, we might have to ensure sustainable economic growth. Ifreinvest the funds we receive in investments bearing lower interest rates. However, if interest rates were to further increase in the future, surrenders and withdrawals of insurance and annuity policies and contracts may increase as policyholders seek other investments with higher perceived returns. This process may result in cash outflows requiring that we sell investment assets at a time when the prices of those assets are adversely affected by the increase in market interest rates, which may result in realized investment losses. However, if interest rates were to decline, the income we realize from our investments may decline, affecting our profitability. In addition, as instruments in our investment portfolio mature, we might have to reinvest the funds we receive in investments bearing lower interest rates.

11

For many of our long-term life insurance and annuity products, we are obligated to pay a minimum interest or crediting rate to our policyholders or annuitants, which is established when the product is priced. These products expose us to the risk that changes in interest rates may reduce our “spread”, or the difference between the rates that we are required to pay under the policies and the rate of return we are able to earn on our investments intended to support our insurance obligations. Our historical results and financial

position included in this annual report which present the historical results of CLIC through September 30, 2003, reflect the continuing performance of policies that were issued by CLIC prior to June 10, 1999. Many of these policies paid guaranteed fixed rates of return that, due to declining interest rates, came to be significantly higher than the rates of return on investment assets. From 1996 through 2002, the People’s Bank of ChinaPBOC made a series of reductions in the interest rates Chinese commercial banks could pay on their deposits. The interest rate on one-year term deposits, a key benchmark rate, was reduced eight times, from 10.98% in April 1996 to 1.98% in February 2002. As a result, CLIC experienced a significant negative spread on its guaranteed rate policies and CLIC’s results of operations continue to be adversely impacted by the effect of those interest rate cuts.

On June 10, 1999, the CIRC reduced to 2.50% the maximum guaranteed rate which life insurance companies could commit to pay on new policies and in response, CLIC adopted new pricing policies which reduced the guaranteed rates on its products to a range of between 1.50% and 2.50%. We also have shifted our mix of products to emphasize products that lessen the impact from interest rate changes, including traditional policies that are not as sensitive to interest rates and participating policies under which our customers receive a portion of our distributable earnings from participating products, as well as products having shorter terms to better match the duration of our investment portfolio. Furthermore, we have made use of the relaxation of investment restrictions applicable to us to diversify our investments. We and CLIC have not incurred negative spread on policies issued since June 10, 1999, as the average investment returns we and CLIC have been able to generate have been higher than their guaranteed rates. However, if the rates of return on our investments fall below the minimum rates we guarantee, our profitability would be materially and adversely affected.

Because of the general lack of long-term fixed income securities in the Chinese capital markets and the restrictions on the types of investments we may make, we are unable to match closely the duration of our assets and liabilities, which increases our exposure to interest rate riskrisk. Like other insurance companies, we seek to manage interest rate risk through managing, to the extent possible, the average duration of our investment assets and the insurance policy liabilities they support. Matching the duration of our assets to their related liabilities reduces our exposure to changes in interest rates, because the effect of the changes largely will be offset against each other. However, restrictions under the current PRC insurance law and regulations on the asset classes in which we may invest, as well as the limited availability of long-duration investment assets in the markets in which we invest, have resulted in the duration of our assets being shorter than that of our liabilities, particularly with respect to liabilities with durations of more than 20 years.Furthermore,years. Furthermore, the financial markets currently do not provide an effective means for us to hedge our interest rate risk through financial derivative products. We believe that, with the gradual easing of the investment restrictions imposed on insurance companies in China, our ability to match the duration of our assets to that of our liabilities will improve. We also seek to manage the risk of duration mismatch by focusing on product offerings whose maturity profiles are in line with the duration of investments available to us in the prevailing investment environment. However, until we are able to match more closely the duration of our assets and liabilities, we will continue to be exposed to interest rate changes, which may materially and adversely affect our earnings.

12

Our Investmentsinvestments are Subjectsubject to Risksrisks. We are exposed to potential investment losses if there is an economic downturn in ChinaChina.Under the current PRC insurance law,

Until November 2006, we

maywere only permitted to invest the premiums

deposits and other income we receive

only in

China, unless and until we are approvedinvestments in China. We obtained the approval to invest overseas with our foreign currency denominated

funds. We obtained approval for such overseas investmentfunds in November 2006. See “Item 4.

Information on the Company—Business Overview—Regulatory and Related Matters—Insurance Company Regulation—Regulation of investments”. However, we continued to make our investments mainly in China and as of December 31, 2009, approximately 98.8% of our total investment assets were in China. In particular, as of December 31, 2006, 52.1%2009, approximately 49.7% of our total investment assets consisted of debt securities including Chinese government bonds, Chinese government agency bonds, Chinese corporate bonds, and subordinated bonds and indebtedness;debt and 25.5%other bonds and debts as approved by relevant government agencies; and 28.6% of our total investment assets consisted of term deposits with Chinese banks, and of these deposits, 35.1%32.5% were placed with the four largest Chinese state-owned commercial banks. A serious downturn in the Chinese economy may lead to investment losses, which would reduce our earnings. Due to China’s recent fast growing economy, the Chinese government may take certain measures to slow down the economic growth, which could have an adverse impact on our earnings.

We may incur foreign exchange and other losses for our investments denominated in foreign currenciescurrencies. A portion of our investment assets

including the proceeds from our initial public offering in 2003, are held in foreign currencies. We are authorized by the CIRC to invest our assets held in foreign currencies in the overseas financial markets as permitted by the CIRC. Thus, our investment results may be subject to foreign exchange risks, as well as the volatility and various other factors of overseas capital markets, including, among others, increase in interest

rates, where we do not have previous investment experience.rates. We recorded RMB

63928 million (US$

824 million) in foreign exchange losses for the year ended December 31,

2006,2009, resulting from our assets held in foreign currencies, which were affected by the appreciation of the Renminbi. Future movements in the exchange rate of RMB against the U.S. dollar and other foreign currencies may adversely affect our results of operations and financial condition.

Under China’s existing foreign exchange control regulations, the conversion of foreign currencies into the Renminbi requires approval of relevant government agencies. We obtained an approval to settle a portion of our assets held in foreign currencies into the Renminbi in 2005, which partially reduced the foreign exchange risks we are

exposeexposed to.

We didExcept the aforementioned approval obtained in 2005, we have not

obtainobtained any approval to settle any portion of our assets held in foreign currencies into the Renminbi,

in 2006 and there is no guarantee that we will be able to obtain any such approval in the future. If we do not obtain such approval, our ability to manage our foreign exchange risks may be limited. There are few financial products available in China to hedge foreign exchange risks, which substantially limits our ability to manage our foreign exchange risks.

Defaults on our debt investments may materially and adversely affect our profitabilityprofitability. Approximately 52.1%49.7% of our investment assets as of December 31, 20062009 were comprised of debt securities. The issuers whose debt securities we hold may fail to pay or otherwise default on their obligations due to bankruptcy, a lack of liquidity, a downturn in the economy, operational failures or other reasons. Losses due to these defaults could reduce our profitability.

13

Unless we are permitted to invest in a broader range of asset classes, our ability to improve our rate of investment return will be limitedlimited. Our premiums

and deposits have grown rapidly during the last three years. As a Chinese life insurance company we are subject to significant restrictions under current PRC insurance law and regulations on the asset classes in which we are permitted to invest. Until 2004, Chinese life insurance companies were allowed to invest their funds only in Chinese bank deposits,

Chinese government bonds, domestic corporate bonds and securities investment funds. These asset classes historically have yielded a comparatively low return on investment. Since 2004, the investment channels of Chinese life insurance companies have been broadened to permit investment in

convertiblebank deposits, Chinese government bonds,

specifiedChinese government agency bonds, corporate bonds, subordinated

indebtednessbonds and

debt, other bonds

issuedand debt as approved by

qualified commercial banks and insurance companies; overseasrelevant government agencies, policy loans, Chinese securities investment

of foreign currency denominated funds,

in qualified term deposits, debt securities andRMB-denominated common shares

of Chinesecompanies listed on specified overseasPRC stock exchanges; direct investment in shares of companies listed on the Chinese securities market, which are denominated and traded in Renminbi; and direct investment in equity interest of non-listed commercial Chinese banks, as well asexchanges, indirect investments in Chinese infrastructure projects, equity interests of non-listed Chinese commercial banks, repurchase and resale agreements, overseas investments and other investment channels as approved by the State Council, all subject to various limitations. See “Item 4. Information on the Company—Business Overview—Regulatory and Related Matters—Insurance Company Regulation—Regulation of investments”. If the asset classes in which we are permitted to invest do not further expand in the future, we will be limited in our ability to improve our rate of return, which may materially and adversely impact our profitability. Our investment yields decreased for the three years prior to 2004, resulting in a decrease in the amount distributed for our participating products. A further decline in the future could adversely affect the attractiveness of our investment-type products, which compose a large portion of our business.

The PRC securities markets are still emerging markets, which may expose us to risks of loss from our investments therethere. We had RMB 95,493179,405 million (US$12,23626,283 million) invested in equity securities, among which RMB 165,835 million (US$24,295 million) were invested in PRC securities markets, including securities investment funds and shares traded on the securities markets in China, as of December 31, 2006.2009. These securities investment funds are primarily invested in equity securities that are issued by Chinese companies and traded on China’s securities exchanges. Some of our investments in securities investment funds are publicly traded, but we also invest in non-publicly traded securities investment funds. Beginning in March 2005, we are also permitted to directly invest in shares traded on the securities markets in China. The PRC securities markets are characterized by companies with relatively small market capitalizations and low trading volumes, and by evolving regulatory, accounting and disclosure requirements. For example, Chinese listed companies are required to adopt the new accounting standards issued by MOF effective from January 1, 2007, and the share reform in connection with the conversion of non-tradable state-owned shares into tradable shares is still in progress. This may from time to time result in significant price volatility, unexpected losses or lack of liquidity. These factors could cause us to incur losses on our publicly traded investments. In addition, the PRC securities markets have recently experienced, and may experience in the future, significant price volatility. Also, as one of the largest institutional investors in China, we may from time to time hold significant positions in many securities in which we invest, and any decision to sell or any perception in the market that we are a major seller of a security could adversely affect the liquidity and market price of that security.

Investments in new investment channels may not lead to improvements in our rate of investment return or we may incur losses.

As a Chinese life insurance company, we are subject to significant restrictions under current PRC insurance law and regulations on the asset classes in which we are permitted to invest. We understand that the CIRC is considering opening further investment channels to insurance companies. We will consider these alternative ways of investing once they become available to us. However, these new or potential investment channels are still undergoing evolving regulatory requirements. In addition, our experience with these new investment channels, especially overseas channels, might be limited. These factors could cause us to incur losses for our investments in these new investment channels or limit our ability to improve our rate of investment return.

14

Differences in future actual claimsoperating results from the assumptions used in pricing and establishing reserves for our insurance and annuity products may materially and adversely affect our earningsearnings. Our earnings depend significantly upon the extent to which our actual

claimsoperating results are consistent with the

relevant assumptions used in setting the prices for our products and establishing the

liabilitiesreserves in our financial

statements for our obligations for future policy benefits and claims.statements. Our assumptions include those for

investment returns,discount rate, mortality, morbidity, expenses and

persistency,lapse rate, as well as

certain macro-economic

factors such as inflation.factors. To the extent that trends in actual

claims resultsexperiences are less favorable than our underlying assumptions used in establishing these

liabilities,reserves, and these trends are expected to continue in the future, we could be required to increase our

liabilities.reserves. Any such increase could have a material adverse effect on our profitability and, if significant, our financial condition.

Any material impairment in our solvency margin could change our customers’ or our business associates’ perception of our financial health, which in turn could adversely affect our sales, earnings and operations.We establish the

liabilitiesreserves for obligations

forof future

policy benefits and claimspolicies based on the expected payout of benefits, calculated through the use of assumptions for

investment returns,discount rate, mortality, morbidity, expenses and

persistency,lapse rate, as well as certain

macroeconomic factors such as inflation.macro-economic factors. These assumptions are based on our previous experience

and data published by other Chinese life insurers, as well as judgments made by the management. These assumptions may deviate from our actual experience, and,

as a result, we cannot determine precisely the amounts which we will ultimately pay to settle these liabilitiesreserves or when these payments will need to be made. These amounts may vary from the estimated amounts, particularly when those payments may not occur until well into the future. The discount rate assumption is affected by certain factors, such as further macro-economy, monetary and exchange rate policies, capital market results and availability of investment channels to invest our insurance funds. We evaluate our liabilities periodically, based on changes inreview and update the assumptions used to evaluate the reserves periodically, and establish the liabilities, as well asreserves for insurance policies based on such assumptions. Standards with respect to the calculation and presentation of reserves are still evolving, and any changes in the future may also impact our actual policy benefitsearnings and claims results.presentations of financial statements. We record changes in our liabilitiesreserves in the period the liabilitiesreserves are established or re-estimated. If the liabilitiesreserves originally established for future policy benefits prove inadequate or excessive, we must increase our liabilitiesreserves established for future policy benefits, which may have a material adverse effect on our earnings and our financial condition.

We have data available for a shorter period of time than do insurance companies operating in some other countries and, as a result, less claims experience on which to base some of the assumptions used in establishing our reserves. For a discussion of how we establish our assumptions for mortality, morbidity and

lapses,lapse rate, see “Item 5. Operating and Financial Review and Prospects—Critical Accounting Policies”. Given the limited nature of this experience, it is possible that our actual claims could vary significantly from the assumptions used.

Our risk management and internal reporting systems, policies and procedures may leave us exposed to unidentified or unanticipated risks, which could materially and adversely affect our businesses or result in losseslosses. Our policies and procedures to identify, monitor and manage risks may not be fully effective. Many of our methods of managing risk and exposures are based upon our use of observed historical market behavior or statistics based on historical models. As a result, these methods may not predict future exposures, which could be significantly greater than what the historical measures indicate. Other risk management methods depend upon the evaluation of information regarding markets, customers or other matters that is publicly available or otherwise accessible to us, which may not always be accurate, complete, up-to-date or properly evaluated. In addition, a significant portion of business information needs to be centralized from our many branch offices. Management of operational, legal and regulatory risks requires, among other things, policies and procedures to record properly and verify a large number of transactions and events, and these policies and procedures may not be fully effective. Failure or the ineffectiveness of these systems could materially and adversely affect our business or result in losses.

15

We are likely to offer a broader and more diverse range of insurance and investment products in the future as the insurance market in China continues to develop. At the same time, we anticipate that the relaxing of regulatory restraints will result in our being able to invest in a significantly broader range of asset classes. The combination of these factors will require us to continue to enhance our risk management capabilities and is likely to increase the importance of our risk management policies and procedures to our results of operations and financial condition. If we fail to adapt our risk management policies and procedures to our changing business, our business, results of operations and financial condition could be materially and adversely affected.

Catastrophes could materially reduce our earnings and cash flowflow. We could in the future experience catastrophic losses that may have an adverse impact on the business, results of operations and financial condition of our insurance business. Catastrophes can be caused by various events, including terrorist attacks, earthquakes, hurricanes, floods, fires and epidemics, such as severe acute respiratory syndrome, or SARS.

For example, the snow disaster in South China and Wen Chuan earthquake in 2008 increased our current claims payments. In 2008, our claims payments for the snow disaster and for the earthquake were approximately RMB 11.916 million (US$1.747 million) and RMB 153 million (US$22 million), respectively.

We establish liabilities for claims arising from a catastrophe only after assessing the exposure and damages arising from the event.

We cannot be certain that the liabilities we establish after the assessment will be adequate to cover actual claims. We do not currently carry catastrophe reinsurance to reduce our catastrophe exposure. Such an event could have a material adverse effect on us.

Current or future litigation and regulatory procedures could result in financial losses or harm our businessesbusinesses.Class Action Litigations