As filed with Securities and Exchange Commission on June 29, 200726, 2008

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 20062007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number 001-14714

(Exact name of Registrant as specified in its charter)

Yanzhou Coal Mining Company Limited

(Translation of Registrant’s name into English)

People’s Republic of China

(Jurisdiction of incorporation or organization)

298 South Fushan Road

Zoucheng, Shandong Province

People’s Republic of China

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class | Name of each exchange on which registered | |

| American Depositary Shares | New York Stock Exchange | |

| H Shares, par value RMB1.00 each | New York Stock Exchange* |

| * | Not for trading in the United States, but only in connection with the listing of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

2,960,000,000 Domestic Shares, par value RMB1.00 per share

1,958,400,000 H Shares, par value RMB1.00 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 x

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

PAGE NO. | ||||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| PART I | ||||

ITEM 1. | ||||

ITEM 2. | ||||

ITEM 3. | ||||

ITEM 4. | 12 | |||

ITEM 5. | ||||

ITEM 6. | 54 | |||

ITEM 7. | ||||

ITEM 8. | ||||

ITEM 9. | ||||

ITEM 10. | 74 | |||

ITEM 11. | ||||

ITEM 12. | ||||

| PART II | ||||

ITEM 13. | ||||

ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | |||

ITEM 15. | ||||

ITEM 16A. | ||||

ITEM 16B | ||||

ITEM 16C. | ||||

ITEM 16D. | ||||

ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |||

| PART III | ||||

ITEM 17. | ||||

ITEM 18. | ||||

ITEM 19. | ||||

Certain information contained in thisThis Annual Report contains forward-looking statements, which doesdo not relate to historical financial information may be deemed to constitute forward-looking statements.information. The words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “intend,” “estimate,” “project,” “believe” or similar expressions are intended to identify “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, or the Exchange Act. SuchThese statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated or projected. We wish to caution readersyou not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. These forward-looking statements include, without limitation, statements relating to:

our business prospects;

future prices and demand for our products and demand for our customers’ products;

future PRC tariff levels and export quotas for coal;

sales of our products;

the amountextent and nature of, and potential for, our future development;

estimates and recoverability of coal mine reserves potential;reserves;

production forecasts of coal;

trends in the coal industry and domestic and international coal market conditions;

the effectiveness of our cost-saving measures;ability to reduce costs and compete effectively;

future expansion plans and capital expenditures;

expected production capacity increases;

competition;

changes in legislation, regulations and policies;

estimates of proven and probable coal mine reserves;

our research and development plans; and

our dividend policy.

These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments as well as other factors we believe are appropriate in particular circumstances. However, whether actual results and developments will meet our expectations and predictions dependsdepend on a number of risks and uncertainties, which could cause actual results to differ materially from our expectations. These risks are more fully described in the section entitled “Item 3. Key Information – Risk Factors”.

Consequently, all of the forward-looking statements made in this Annual Report are qualified by thesethis cautionary statements.statement. We cannot assure you that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected effect on us, our business or operations.

Unless otherwise indicated, statistical and market trend information, as well as statements related to market position and competitive data, areis based on our internal statistics and/or estimates gathered from our own research and/or various publicly available sources.

CERTAIN DEFINITIONS AND SUPPLEMENTAL INFORMATION

As used herein,in this Annual Report, references to “Yanzhou Coal” and “the Company” refer to Yanzhou Coal Mining Company Limited, on a stand-alone basis and do not include its subsidiaries that have been consolidated into our accounts for the purposes of the consolidated financial statements. Yanzhou Coal is a joint stock limited company incorporated under the laws of the PRC in 1997, with its H Shares, American Depositary Shares and A Shares listed on the Hong Kong Stock Exchange, the New York Stock Exchange and the Shanghai Stock Exchange, respectively.

References to “we”, “our”, “Company”, “our Company” or “us” refer to Yanzhou Coal Mining Company Limited and its subsidiaries which have been consolidated into the accounts of Yanzhou Coal Mining Company Limited for the purpose of the consolidated financial statements, unless the context indicates otherwise.

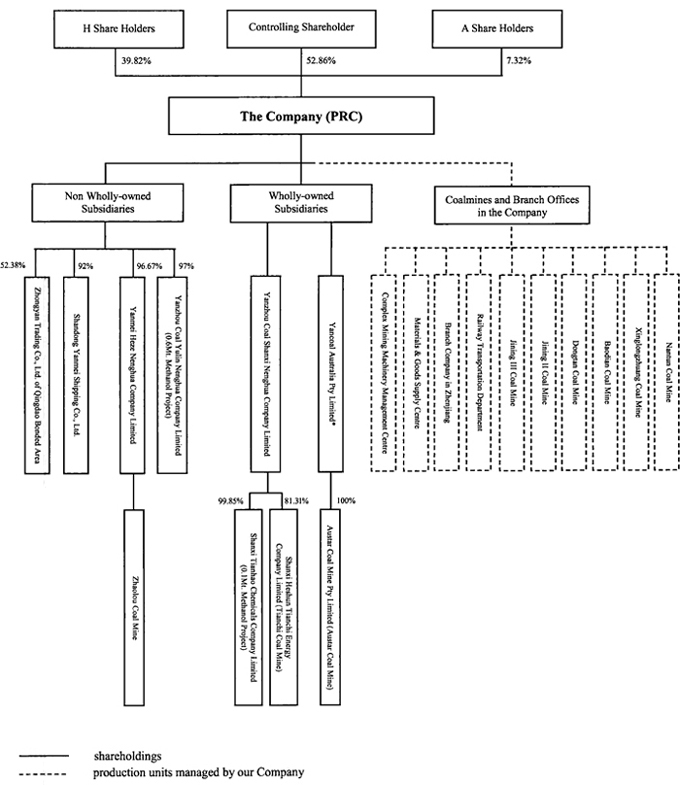

References to the “Yankuang Group” or, “Controlling Shareholder” include referencesor “Parent Company” refer to Yankuang Group Corporation Limited, a company with limited liability established under the laws of the PRC in 1996, (formerly known as Yanzhou Mining (Group) Corporation Limited) and, in respect. Yankuang Group controlled 52.86% of referencesthe Company’s total share capital of as of December 31, 2007. References to any time prior to our incorporation, are to the businesses, assets and liabilities of the Predecessor (defined below) that were not transferred

to us in the restructuring and incorporation of the Company (defined below) in 1997 and, where the context requires, includes our subsidiaries, and referencessubsidiaries. References to the “Predecessor” mean the entity that held all our assets and liabilities as well as the assets and liabilities of the Controlling Shareholder prior to the Restructuring.restructuring in 1997.

As used herein, references to “the Company”“Yulin Nenghua” refers to Yanzhou Coal MiningYulin Nenghua Company Limited, on a stand-alone basis and does not include its subsidiaries that have been consolidated into our accounts forcompany with limited liability incorporated under the purposeslaws of the consolidated financial statements. The subsidiariesPRC in 2004 and a 97% non-wholly owned subsidiary of the Company. Yulin Nenghua mainly engaged in the construction and operation of a 600,000 tonne methanol project.

“Yushuwan Coal Mine Company” refers to Shaanxi Yushuwan Coal Mine Company Limited, a joint venture among the Company, Chia Tai Energy & Chemicals Company Limited and Yushen Coal Company Limited, of which have been consolidated into our accounts for the purposeswe will hold a 41% equity interest. As of the consolidated financial statements include: Shandongdate of this Annual Report, the establishment of Yushuwan Coal Mine Company was still pending review by the relevant regulatory authorities. Yushuwan Coal Mine Company will engage in the construction and operation of Yushuwan Coal Mine in Yulin City, Shaanxi Province.

“Heze Nenghua” refers to Yanmei Shipping Co., Ltd. (“Yanmei Shipping”), Zhongyan Trading Co. Ltd.Heze Nenghua Company Limited, a company with limited liability incorporated under the laws of Qingdao Bonded Area (“Zhongyan Trading”),the PRC in 2004 and a 96.67% non-wholly owned subsidiary of the Company.

“Shanxi Nenghua” refers to Yanzhou Coal YulinShanxi Nenghua Co., Ltd. (“Yulin Nenghua”),Company Limited, a company with limited liability incorporated under the laws of the PRC in 2002 and a wholly-owned subsidiary of the Company. Shanxi Nenghua mainly engaged in the management of the Company’s investment projects in Shanxi Province.

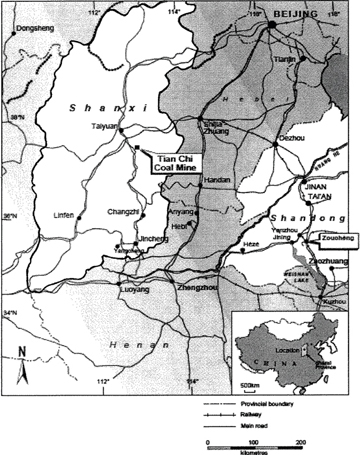

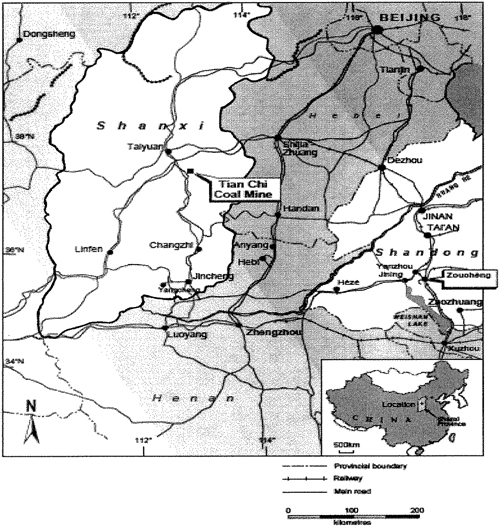

“Tianchi Energy” refers to Shanxi Heshun Tianchi Energy Company Limited, a company with limited liability incorporated under the laws of the PRC in 1999 and an 81.31% non-wholly owned subsidiary of Shanxi Nenghua. Tianchi Energy mainly engaged in the operation of Tianchi Coal Mine.

“Tianhao Chemicals” refers to Shanxi Tianhao Chemicals Company Limited, a joint stock company incorporated under the laws of the PRC in 2002 and a 99.85% non-wholly owned subsidiary of Shanxi Nenghua. Tianhao Chemicals mainly engaged in the construction and operation of a 100,000 tonne methanol project.

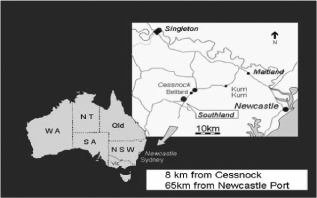

“Yancoal Australia” refers to Yancoal Australia Pty Limited, (“a company with limited liability incorporated under the laws of Australia in 2004 and a wholly-owned subsidiary of the Company. Yancoal Australia”), Yanmei Shanxi Nenghua Co., Ltd. (“Shanxi Nenghua”),Australia mainly engaged the management of the Company’s investment projects in Australia.

“Austar Company” refers to Austar Coal Mine Pty Limited, a company with limited liability incorporated under the laws of Australia in 2004 and Yanmei Heze Power Chemical Co., Ltd. (“Heze Nenghua”).a wholly-owned subsidiary of Yancoal Australia Pty Limited. Austar Company mainly engaged in the construction and operation of Austar Coal Mine.

References

“Railway Assets” refer to Sharesthe railway assets specifically used for transporting coal by the Company.

“Shares” herein refer collectively to our (i) domestic invested shares held by the Controlling Shareholder on behalf of the State, RMB1.00 par value RMB1.00 each (the “State Legal Person Shares”), (ii) domestic invested shares other than those held by the Controlling Shareholder, RMB1.00 par value RMB1.00 each (the “RMB Ordinary A Shares”), (iii) overseas listed foreign invested shares issued and traded in HK dollars, par value RMB1.00 each (the “H Shares”), and (iv) American Depositary Shares (“ADSs”(the “ADSs”), each of which representsrepresented 50 H Shares collectively.in 2007. The ADSs are evidenced by American Depositary Receipts (“ADRs”).

References to the “Domestic Shares” herein refer to the State Legal Person Shares held by Yankuang Group on behalf of the State and RMB Ordinary A Shares collectively.

References to the “Directors,“Directors, Supervisors and Executive Officers” as used herein refer to our directors, supervisors and executive officers as discussed in Item 6 herein.

References to the “Articles“Articles of Association” herein refer to our articles of association, as amended from time to time.

“Hong Kong Stock Exchange” means The Stock Exchange of Hong Kong Limited.

As used herein, “Eastern China” includes Shandong Province, Jiangsu Province, Anhui Province, Zhejiang Province, Fujian Province, Jiangxi Province and Shanghai municipality.

As used herein, “Annual Report” refers to the annual report of Yanzhou Coal Mining Company Limited, prepared on Form 20-F for the fiscal year ended December 31, 2007.

As used herein, “PRC Government” or “Government” or “State” means the central government of the People’s Republic of China (the “PRC” or “China”), including all political subdivisions (including provincial, municipal and other regional or local governmental entities) and instrumentalities thereof.

As used herein, “tonne”“Tonne” means metric tonne, equal to 1,000 kilograms or approximately 2,205 pounds in weight.pounds.

“Ex-mine” refers to an arrangement for the sale of coal where the seller delivers coal at the coal mine and the buyer arranges the transportation for the delivery of the coal from the mine and bears the related costs or expenses.

Certain mining terms used herein are defined in the “Glossary of Mining Terms” annexed, which is included as Appendix B to theour registration statement on Form F-l forming part of the registration statementthat was filed with the U.S. Securities and Exchange Commission, aCommission. A copy of whichthe “Glossary of Mining Terms” may be obtained upon request.written request to the Company.

We publish ourOur financial statements are denominated in Renminbi yuan,or RMB, the official legal tenderlawful currency of the PRC. Except as otherwise stated, herein, all monetary amounts in this Form 20-F have beenAnnual Report are presented in RMB.

Our audited financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), which differ in certain material respects from generally accepted accounting principles in as issued by the United StatesInternational Accounting Standards Board (“U.S. GAAP”IASB”). Note 46 to our audited financial statements provides a reconciliation of our financial statements to U.S. GAAP in accordance with Item 18 of Form 20-F.

References to the “Financial Statements” herein refer to the Financial Statementsfinancial statements in Item 18 of this Form 20-F annual report.Annual Report.

Unless otherwise specified, references in this Form 20-FAnnual Report to “U.S. dollars” or “U.S.$“US$” are to United States dollars, references to “HK dollars” or “HK$” are to Hong Kong dollars, references to “AUD” are to Australian dollars and references to “Renminbi” or “RMB” are to Renminbi yuan.Renminbi.

Solely for theyour convenience, of the reader, certain items in this Form 20-FAnnual Report contain translations of Renminbi amounts into U.S. dollars. All such Renminbi translations of amounts from Renminbi to U.S. dollars have been made, except as otherwise noted,stated, at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York (the “Noon Buying Rate”) on December 29, 200631, 2007 of U.S.$US$1.00 = RMB7.8041.RMB7.2946. No representation is made that the Renminbi amounts, or any other currency, could have been or could be converted into U.S. dollars at that rate or at any other rate.all.

SPECIAL NOTE ON OUR FINANCIAL INFORMATION

We make an explicit and unreserved statement of compliance with IFRS with respect to our consolidated financial statements for the years ended December 31, 2006 and 2007 included in this Annual Report. Deloitte Touche Tohmatsu, our independent registered public accounting firm, has issued an auditor’s report on our financial statements prepared in accordance with IFRS, as issued by the IASB.

In accordance with rule amendments adopted by the U.S. Securities and Exchange Commission, or the SEC, which became effective on March 4, 2008, we are not required to provide a reconciliation to generally accepted accounting principles in the United States, or U.S. GAAP.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

| ITEM 3. | KEY INFORMATION |

A. Selected Financial Data

Historical Financial Information

The following selected consolidated financial information presents data from our consolidatedbalance sheet, income statement data, consolidated balance sheet data and consolidated cash flow datastatement as of and for the years ended December 31, 2002, 2003, 2004, 2005, 2006 and 2006.2007. The following financial information should be read in conjunction with the audited financial statements included elsewhere in this report.Annual Report. Unless otherwise indicated, the financial statements are prepared and presented in accordance with International Financial Reporting Standards, also known as “IFRS”. For a reconciliation of the IFRS, as compared to generally accepted accounting principles in the United States, also known as “U.S. GAAP”, see Note 46 to the financial statements. In 2006, we have applied, for the first time, a number of new standards, amendments and interpretations (“New IFRS”) issued by the International Accounting Standards Board (the “IASB”) and the International Financial Reporting Interpretations Committee of the IASB which are either effective for accounting periods beginning on or after December 1, 2005 or January 1, 2006. Since the adoption of the new IFRS did not have a material effect on how the result for the current or prior accounting periods have been prepared and presented, no prior period adjustment was required. See Note 3 to the financial statements included in Item 18.IASB.

| As of and for the Year Ended December 31, | ||||||||||||

| 2002 | 2003 | 2004 | 2005 | 2006 | 2006 | |||||||

| RMB | RMB | RMB | RMB | RMB | U.S.$ | |||||||

(Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) | ||||||||||||

INCOME STATEMENT DATA | ||||||||||||

IFRS | ||||||||||||

Net Revenue | ||||||||||||

Net sales of coal | 6,213.9 | 6,794.3 | 10,354.3 | 11,353.5 | 11,846.9 | 1,518.0 | ||||||

The Company(2) | 6,213.9 | 6,794.3 | 10,354.3 | 11,353.5 | 11,710.7 | 1,500.6 | ||||||

Domestic | 3,414.0 | 4,337.1 | 7,407.0 | 8,421.5 | 9,365.9 | 1,200.1 | ||||||

Export(3) | 2,799.9 | 2,457.2 | 2,947.3 | 2,932.0 | 2,344.8 | 300.5 | ||||||

Yancoal Australia | — | — | — | — | 114.4 | 14.7 | ||||||

Shanxi Nenghua | — | — | — | — | 21.8 | 2.7 | ||||||

Railway transportation service income | 142.5 | 154.6 | 220.8 | 163.4 | 160.4 | 20.5 | ||||||

| As of and for the Year Ended December 31, | ||||||||||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | |||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||

| (Amounts in millions except Share, per Share, and per ADS data) | ||||||||||||||||||

INCOME STATEMENT DATA | ||||||||||||||||||

Total revenue | 8,541.2 | 11,977.8 | 12,447.0 | 12,944.0 | 15,110.5 | 2,017.5 | ||||||||||||

Gross sales of coal | 8,386.6 | 11,757.1 | 12,283.6 | 12,783.6 | 14,906.7 | 2,043.5 | ||||||||||||

Railway transportation service income | 154.6 | 220.8 | 163.4 | 160.4 | 203.7 | 27.9 | ||||||||||||

Transportation costs of coal | (1,592.3 | ) | (1,402.7 | ) | (930.1 | ) | (936.6 | ) | (549.8 | ) | (75.4 | ) | ||||||

Cost of sales and service provided | (3,755.0 | ) | (4,551.7 | ) | (5,288.6 | ) | (6,190.1 | ) | (7,331.9 | ) | (1,005.1 | ) | ||||||

Gross profit | 3,193.9 | 6,023.4 | 6,228.3 | 5,817.3 | 7,228.7 | 991.0 | ||||||||||||

Selling, general and administrative expenses | (1,264.8 | ) | (1,479.9 | ) | (1,918.8 | ) | (2,230.1 | ) | (2,854.7 | ) | (391.3 | ) | ||||||

Share of loss of an associate | — | — | — | — | 2.4 | 0.3 | ||||||||||||

Other income | 105.8 | 165.7 | 135.0 | 165.8 | 198.9 | 27.3 | ||||||||||||

Interest expense | (60.0 | ) | (35.9 | ) | (24.6 | ) | (26.3 | ) | (27.2 | ) | (3.7 | ) | ||||||

Profit before income taxes | 1,974.9 | 4,673.3 | 4,420.0 | 3,726.6 | 4,543.3 | 622.8 | ||||||||||||

Income taxes | (587.7 | ) | (1,518.8 | ) | (1,538.0 | ) | (1,354.7 | ) | (1,315.5 | ) | (180.3 | ) | ||||||

Profit for the year | 1,387.2 | 3,154.6 | 2,881.9 | 2,372.0 | 3,227.8 | 442.5 | ||||||||||||

Profit attributable to our equity holders | 1,386.7 | 3,154.3 | 2,881.5 | 2,373.0 | 3,230.5 | 442.9 | ||||||||||||

Earnings per Share | 0.30 | 0.66 | 0.59 | 0.48 | 0.66 | 0.09 | ||||||||||||

Earnings per ADS | 15.10 | 33.25 | 29.29 | 24.12 | 32.84 | 4.50 | ||||||||||||

Operating income per Share before income tax | 0.44 | 0.99 | 0.90 | 0.76 | 0.92 | 0.13 | ||||||||||||

Profit from continuing operation per ADS before income tax | 22.16 | 49.64 | 45.18 | 37.88 | 46.19 | 6.33 | ||||||||||||

(Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) Total net revenue(4) Gross profit Interest expenses Income before income taxes Net income attributable to our equity holders Net income/Earnings per Share Net income/Earnings per ADS Operating income per Share Income from continuing operation per ADS U.S. GAAP Net income(5) Net income per Share Net income per ADS CASH FLOW DATA IFRS Net cash provided by operating activities Depreciation Net cash used in investing activities Net cash (used in) provided by financing activities OTHER FINANCIAL DATA Income before income tax Add: Interest expenses Less: Interest income Add: Depreciation and amortisation EBITDA(6) EBITDA margin(7) OPERATING DATA Raw coal production (‘000 tonnes) The Company(2) (‘000 tonnes) Yancoal Australia (‘000 tonnes) Shanxi Nenghua (‘000 tonnes) Net sales (‘000 tonnes) The Company(2) (‘000 tonnes) Domestic (‘000 tonnes) Export (‘000 tonnes) Yancoal Australia (‘000 tonnes) Shanxi Nenghua (‘000 tonnes) BALANCE SHEET DATA IFRS Total current assets Total current liability Net current assets Property, plant and equipment, net Total assets Total long-term borrowing Equity attributable to our equity holders U.S. GAAP Property, plant and equipment and prepaid lease payment, net Total assets Equity attributable to our equity holders Number of Shares Domestic Shares H Shares (including H Shares represented by ADS) ADS Dividend per As of and for the Year Ended December 31, 2002 2003 2004 2005 2006 2006 RMB RMB RMB RMB RMB U.S.$ 6,356.4 6,948.9 10,575.1 11,516.9 12,007.3 1,538.5 2,993.5 3,193.9 6,023.4 6,228.3 5,817.3 745.4 (117.9 ) (60.0 ) (35.9 ) (24.6 ) (26.3 ) (3.4 ) 1,748.2 1,974.9 4,673.3 4,420.0 3,726.6 477.5 1,222.0 1,386.7 3,154.3 2,881.5 2,373.0 304.1 0.43 0.30 0.66 0.59 0.48 0.06 21.29 15.1 33.25 29.29 24.12 3.09 0.65 0.44 0.99 0.90 0.76 0.10 32.51 22.16 49.64 45.18 37.88 4.85 1,325.7 1,499.2 3,263.9 2,991.1 2,405.8 308.3 0.46 0.33 0.69 0.61 0.49 0.06 23.10 16.32 34.40 30.41 24.46 3.13 2,239.7 2,701.2 4,418.4 3,939.3 3,767.2 482.7 851.1 920.5 958.7 952.1 1,062.0 136.1 (2,165.5 ) (1,310.3 ) (2,300.8 ) (2,262.5 ) (3,625.5 ) (464.6 ) 345.2 (911.4 ) 1,075.4 (1,009.3 ) (1,291.5 ) (165.5 ) 1,748.2 1,974.9 4,673.3 4,420.0 3,726.6 477.5 117.9 60.0 35.9 24.6 26.3 3.4 30.2 17.8 92.7 91.7 94.3 12.1 858.5 950.1 994.3 971.9 1,088.2 139.4 2,694.4 2,967.2 5,610.8 5,324.8 4,746.8 608.2 42.4 % 42.7 % 53.1 % 46.2 % 39.5 % 39.5 % 38,435 43,279 39,146 34,655 36,051 N/A 38,435 43,279 39,146 34,655 35,485 N/A — — — — 447 N/A — — — — 119 N/A 35,048 39,408 38,004 32,485 34,663 N/A 35,048 39,408 38,004 32,485 34,330 N/A 20,582 25,776 27,988 25,234 28,194 N/A 14,466 13,632 10,016 7,251 6,136 N/A — — — — 192 N/A — — — — 141 N/A 3,873.4 4,430.5 8,319.6 10,951.1 9,871.9 1,265.0 1,662.7 2,372.0 2,545.1 3,429.0 3,828.0 490.5 2,170.7 2,058.5 5,774.5 7,522.1 6,043.9 774.5 8,276.9 8,616.4 8,537.2 9,318.5 12,139.9 1,555.6 12,924.0 13,909.9 18,336.7 21,254.4 23,458.7 3,005.9 1,261.3 650.9 441.1 231.8 403.1 51.7 9,995.0 11,083.2 15,523.8 17,618.6 18,931.8 2,425.9 7,271.4 7,785.8 8,073.7 9,279.7 11,860.3 1,519.8 11,787.5 12,845.8 17,379.1 20,136.7 22,134.1 2,836.2 8,858.5 10,019.2 14,519.3 16,565.3 17,913.2 2,295.4 1,850.0 1,850.0 1,850.0 2,960.0 2,960.0 2,960 1,020.0 1,020.0 1,224.0 1,958.4 1,958.4 1,958.4 20.4 20.4 24.48 39.168 39.168 39.168

(Amounts in millions except numbers of Shares and ADSs, and per Share, per ADS and operating data) Domestic Share/H Share(8) ADS(9) As of and for the Year Ended December 31, 2002 2003 2004 2005 2006 2006 RMB RMB RMB RMB RMB U.S.$ 0.10 0.104 0.164 0.260 0.220 0.028 5.00 5.20 8.20 13.00 11.0 1.410

| As of and for the Year Ended December 31, | ||||||||||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2007 | |||||||||||||

| RMB | RMB | RMB | RMB | RMB | US$ | |||||||||||||

| (Amounts in millions except Share, per Share, and per ADS data) | ||||||||||||||||||

CASH FLOW DATA | ||||||||||||||||||

Net cash provided by operating activities | 2,701.2 | 4,418.4 | 3,939.3 | 3,767.2 | 4,558.6 | 624.9 | ||||||||||||

Depreciation | 920.5 | 958.7 | 952.1 | 1,062.0 | 1,237.1 | 169.6 | ||||||||||||

Net cash used in investing activities | (1,310.3 | ) | (2,300.8 | ) | (2,262.5 | ) | (3,625.5 | ) | (3,790.9 | ) | (519.7 | ) | ||||||

Net cash (used in) provided by financing activities | (911.4 | ) | 1,075.4 | (1,009.3 | ) | (1,291.5 | ) | (1,018.7 | ) | (139.7 | ) | |||||||

BALANCE SHEET DATA | ||||||||||||||||||

Total current assets | 4,430.5 | 8,319.6 | 10,951.1 | 9,871.9 | 9,908.2 | 1,358.3 | ||||||||||||

Total current liabilities | 2,372.0 | 2,545.1 | 3,429.0 | 3,828.0 | 4,099.5 | 562.0 | ||||||||||||

Net current assets | 2,058.5 | 5,774.5 | 7,522.1 | 6,043.9 | 5,808.7 | 796.3 | ||||||||||||

Property, plant and equipment, net | 8,616.4 | 8,537.2 | 9,318.5 | 12,139.9 | 13,524.6 | 1,854.1 | ||||||||||||

Total assets | 13,909.9 | 18,336.7 | 21,254.4 | 23,458.7 | 26,187.4 | 3,590.0 | ||||||||||||

Total long-term bank borrowing | 400.0 | 200.0 | — | 330.0 | 258.0 | 37.5 | ||||||||||||

Equity attributable to our equity holders | 11,083.2 | 15,523.8 | 17,618.6 | 18,931.8 | 21,417.5 | 2,936.1 | ||||||||||||

Exchange Rate Information

The following table sets forth, for the periods indicated, the noon buying rates for U.S. dollars in New York for cable transfers payable in Renminbi as certified for customs purposes by the Federal Reserve Bank of New York expressed in Renminbi per U.S. dollar:

| Noon Buying Rate | ||||||||

Period | Period End | Average(1) | High | Low | ||||

| (expressed in RMB per U.S.$) | ||||||||

2002 | 8.2800 | 8.2772 | 8.2800 | 8.2700 | ||||

2003 | 8.2767 | 8.2771 | 8.2800 | 8.2765 | ||||

2004 | 8.2765 | 8.2768 | 8.2774 | 8.2764 | ||||

2005 | 8.0702 | 8.1826 | 8.2765 | 8.0702 | ||||

2006 | 7.8041 | 7.9723 | 8.0702 | 7.8041 | ||||

December | 7.8041 | 7.8219 | 7.8350 | 7.8041 | ||||

Period 2007 January February March April May June (through June 22, 2007) Noon Buying Rate Period End Average(1) High Low (expressed in RMB per U.S.$) 7.8041 7.9723 8.0702 7.8041 7.7714 7.7876 7.8127 7.705 7.7410 7.7502 7.7632 7.7410 7.7232 7.7369 7.7454 7.7232 7.7090 7.7247 7.7345 7.090 7.6516 7.6773 7.7065 7.6463 7.6220 7.6381 7.6680 7.6175

| Noon Buying Rate | ||||||||

Period | Period End | Average(1) | High | Low | ||||

| (expressed in RMB per US$) | ||||||||

2003 | 8.2767 | 8.2771 | 8.2800 | 8.2765 | ||||

2004 | 8.2765 | 8.2768 | 8.2774 | 8.2764 | ||||

2005 | 8.0702 | 8.1826 | 8.2765 | 8.0702 | ||||

2006 | 7.8041 | 7.9723 | 8.0702 | 7.8041 | ||||

2007 | 7.2946 | 7.5806 | 7.8127 | 7.2946 | ||||

December | 7.2946 | 7.3682 | 7.4120 | 7.2946 | ||||

2008 | ||||||||

January | 7.1818 | 7.2405 | 7.2946 | 7.1818 | ||||

February | 7.1115 | 7.1644 | 7.1973 | 7.1100 | ||||

March | 7.0120 | 7.0722 | 7.1110 | 7.0105 | ||||

April | 6.9870 | 6.9997 | 7.0185 | 6.9840 | ||||

May | 6.9400 | 6.9725 | 7.0000 | 6.9377 | ||||

June (through June 20, 2008) | 6.8796 | 6.9129 | 6.9633 | 6.8770 | ||||

| (1) | Determined by averaging the rates on the last business day of each month during the respective period, except for monthly averages, which are determined by averaging the rates on each business day of the month. |

On June 22, 200720, 2008 the noon buying rate for Renminbi was U.S.$US$1.00 = RMB7.6220RMB6.8796.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business and results of operations are dependent on the historically cyclical domestic and international coal markets, which may be cyclical.markets.

As the majoritysubstantially all of our revenue is derived from the sales of coal, and coal-related products, our business and operating results are substantially dependent on the domestic and international demand for coal. The domestic and international coal markets are cyclical and exhibit fluctuationexperience volatility in supply and demand from year to year. Theydemand. The coal markets are subject to numerousinfluenced by a number of factors beyond our control, including, but not limited to, the economic conditions inof the PRC theand global economic conditionseconomy and demand fluctuations in key industries withthat have high demand for coal, such as the power and steel industries.coal. Fluctuations in supply of and demand for coal have effects onaffect coal prices, which in turn affect our operatingoperational and financial performance. We have experienced substantial price fluctuations in the past and believe that such fluctuations will continue. The average selling price of our coal products was RMB349.5, RMB341.8 and RMB409.0 per tonne was RMB272.45 in 2004, RMB349.50 in 2005, 2006 and RMB341.772007, respectively. Our products have historically experienced substantial price fluctuations, and we believe that we will continue to experience volatility in 2006. pricing. In addition, as domestic coal prices have reached record-high levels in 2008, we cannot assure you that we will continue to sell our coal as profitably as at present.

The demand for coal is primarily affected by the overallglobal economic development and coal demand by power generation, chemical, metallurgy and construction materials industries. In addition, the availability and prices of alternative sources of energy to coal, such as natural gas, oil, hydropower and nuclear power as well as international shipping costs also affect demand for coal from the electricity generation, steel and construction industries.coal. The supply of coal, on the other hand, is primarily affected by the geographical location of coal reserves, the transportation capacity of coal supplies,transportation railways, the volume of coal produced by the domestic and international coal suppliers,supplies and the type, quality and price of competing sources ofcompetitors’ coal. Alternative fuels, such as natural gas, oil and nuclear power, and alternative energy sources, such as hydroelectric power, and international shipping costs also have influences on the market demand for coal. Material changesDevelopments in the international coal market may adversely affect our Company’s export sales and future operational results. ExcessA significant increase in global coal supply of coal or significant reduction in thecoal demand for our coal by foreign or domestic electricity generation or steelmetallurgy industries may have an adverse effect on coal prices, which would in turn, cause a decline inmay reduce our profitability. In addition, any significant decline in domestic or export coal prices could materiallyprofitability and adversely affect our business and resultresults of operations.

Our business reliesis dependent on our major customers.

Prior to 2004, Shandong Power and Fuel Company was our largest domestic customer. For the year ended December 31, 2003, our sales to Shandong PowerIn 2005, 2006 and Fuel Company accounted for 11.3% of our total net sales in 2003. In the past, Shandong Power and Fuel Company had purchased coal on behalf of several electric power plants in Shandong Province, including Zouxian Electric Power Plant. The Shandong Power and Fuel Company ceased to act as the central procurement center for coal on behalf of Zouxian Electric Power Plant and other electric power plants in Shandong Province after its restructuring at the end of 2003 and ceased to be our largest domestic customer.

For the years ended December 31, 2005 and 2006,2007, Huadian Power International Corporation Limited (“Huadian”Huadian International”) replaced Shandong Power and Fuel Company and becamewas our largest domestic customer. For the years ended December 31, 2005 and 2006, weWe supplied a total of 5.6 million, and 4.9 million and 5.4 million tonnes representing 13.4%of coal to Huadian International in 2005, 2006 and 11.3%2007, respectively, which represented 13.7%, 11.5% and 12.2% of our total net sales of coal in 2005 and 2006, respectively, to Huadian. A substantial portionthe same periods, respectively. Substantially all of Huadian’sHuadian International’s coal purchases waswere supplied to Zouxian Electric Power Plant. OurPlant (“Zouxian Power Plant”). The portion of our coal sales, of coalconducted through Huadian International, to Zouxian Electric Power Plant accounted for 9.5%13.4%, 13.2%11.3% and 11.2%12.1% of our total net sales of coal in 2004, 2005, 2006 and 2006,2007, respectively.

Zouxian ElectricPower Plant used approximately 8.6 million tonnes of coal in 2007. We estimate that we supplied approximately 83.6%, 92.9% and 60.8% of Zouxian Power Plant’s annual coal requirement in 2005, 2006 and 2007, respectively. Our sales volume and net sales of coal generated from Zouxian Power Plant increased from 2006 to 2007. However, Zouxian Power Plant underwent a capacity expansion in the fourth quarter of 2006 and therefore, significantly increased its coal demand in 2007. As a result, the coal that we supplied decreased as a percentage of Zouxian Power Plant’s total coal requirements were approximately 5.2 million tonnesdemand in 2006. We estimated that we supplied approximately 92.3%, 83.6% and 92.9% of Zouxian Electric Power Plant’s coal requirements in 2004, 2005 and 2006, respectively.2007. We believe we are likely towill remain the principal coal supplier forto Zouxian Electric Power Plant because (i) we are located within closeour geographic proximity to Zouxian Electric Power Plant, (ii) our railway network is the only network with direct access to Zouxian Electric Power Plant is unable to receive railway shipments of coal other than through our own railway network and (iii) Zouxian Electric Power Plant’s boilers werehave been custom designed to use our coal. Giventhe type of coal that we produce. Because purchases by Zouxian Power Plant compose a large percentageportion of our revenues is derived from the supply of coal to Zouxian Electric Power Plant,revenue, any adverse developments at Zouxian Electric Power Plant could have an adverse impact onadversely affect our results of operations.

We do not have direct export rights.

Currently, we do not have direct export rights. As a result, all of our export sales must be made through intermediary export sales companies. We use export sales services provided by the following three companies: China Coal Energy Group Company, China National Minerals Import and Export Company Limited and Shanxi Coal Import and Export Group Company (collectively, the “Export Sales Companies”). The quantity, quality, prices and final customer destination of our export sales are determined by us, the Export Sales Companies and overseas coal purchasers. Although we are in the process of applying to the PRC Central Government, with the assistance of the Shandong provincial government, for direct export rights, there can be no assurance that we can obtain such rights. If we cannot obtain such direct export rights, we will have to continue to rely on intermediary export sales companies to export our coal.

Our business reliesis dependent on short-term sales contracts and letters of intent.

The PRC Government undertook measures in recent years to introduce market-oriented mechanisms to the coal saleApproximately 87.0%, 87.3% and purchase process, including for example, abolishing government-devised pricing guidance for thermal coal and other temporary price intervention measures to permit the suppliers and buyers to determine pricing through discussions. Major domestic coal suppliers and coal purchasers attend the Annual National Coal Trading Convention to negotiate and discuss the price and quantity of coal to be supplied and purchased for the coming year through the signing of letters of intent and short- and long-term supply contracts. Approximately 88.5%, 87.0% and 87.3%86.9% of our sales in 2004, 2005, 2006 and 2006,2007, respectively, were derived from such sales contracts andor letters of intent. These sales contracts and letters of intent generally specify the quantitiesquantity and timingdelivery schedule of purchases planned overfor a time periodterm generally no longer thannot exceeding one year. Prices with respect to purchases madeCoal prices under the letters of intent are generally determined subsequently at the time of sale based on mutual agreementsale. An omission of a material term may make a letter of intent unenforceable. Any changes in regulations, cost or availability of labor, raw materials or shipping and foreign exchange rates during the period between usthe formation and the relevant customers. Suchperformance of these letters of intent may not be enforceable dueaffect our ability to their omission of certain material terms. In addition,perform the PRC Government also adopted measures to ensure adequate allocation of railway transportation capacity to major coal suppliers and buyers and to improve market efficiency by permitting direct negotiation between the suppliers and buyers.contract.

In the past,

Historically, we and our customers have completed thecarried out a significant majority of the transactions contemplated under suchthe letters of intent.intent we enter into. However, a sudden and significant increase in the proportion of unperformed letters of intents or unrealized sales could have a material adverse impact on our results of operations. Furthermore, as the price of coal sold pursuant to such letters of intent is generally determined at the time of sale, any significant downturn in the market price of coal could have an immediate and adverse impact on our results of operations.

Our products may be subject to governmental price control measures, which may adversely affect our profitability.

The PRC Government has implemented a series of measures to overhaul historical mechanisms to control the purchase and pricing of coal with the aim to encourage market practices. As a result, the domestic coal industry has become increasingly market-driven since 2002.

The PRC Government continues to indirectly influence coal prices through the regulation of the closely-related power generation industry, primarily through the allocation of national railway capacities and the announcement of coal pricing policies that are intended to align the use of coal resources with national production policies. Prior to 2006, the PRC Government continued to implement temporary measures to prevent and control significant fluctuations in thermal coal prices. As a result, thermal coal contract prices for certain of our major consumers were lower than market prices during the periods these price controls were in effect. We cannot assure you that developments in governmental regulations, policies and measures will not have an adverse affect on our business and profitability.

To ensure the uninterrupted operation of power plants during the peak season for electricity demand in 2008, the provincial governments of Shandong and Shaanxi have implemented temporary measures to control the supply of thermal coal. The measures promulgated by Shandong government require (i) all existing thermal coal contracts between coal enterprises and power plants to be strictly enforced; (ii) coal producers in Shandong Province to increase their collective supply of thermal coal to power plants in Shandong Province on a monthly basis by 2.56 million tonnes in July, August and September of 2008; and (iii) the coal provided pursuant to these measures to be offered at a price that is RMB10 lower than prevailing coal prices in June 2008. The government of Shaanxi has placed a price moratorium on thermal coal until September 15, 2008. In each of the three months during which these measures will be effective, we estimate that we will provide an additional 1.5 million tonnes of coal to power plants in Shandong Province. We cannot assure you that relevant government agencies will not impose additional price restrictions, which may have a negative impact on our operations, pricing and profitability.

Our product delivery relies on the PRC’s railway transportation system.

We rely on the PRC national railway system and our railway network to delivery coal to our customers. Approximately 60.0%54.4%, 53.6%50.2% and 50.8%37.3% of our total net sales of coal in 2004, 2005, 2006 and 2006,2007, respectively, were derived from sales of coal transported byon the PRC’sPRC national railway system (excluding coal sold to Zouxian Electric Power Plant which was transported entirely by and withinon our own railway network). As the railway system hasThe limited transportation capacity and cannot fully satisfyof the national railway system is not sufficient to meet domestic coal transportation requirements, discrepancies between capacity and demand for transportation exist in certain areasrailway regulators allocate use of the PRC. Currently, ournational railway system. Our domestic customers are mainly located in Eastern China, where the railway system is relatively advanced. We generally utilizemore advanced than other parts of the national rail systemPRC. In addition to transport coal to our customers as well asrailway systems, we use major coal shipping ports inalong the eastern coast of China for transshipping to ship coal to our customers located in the coastal region of China and overseas. No assurance can be givenWe cannot assure you that we will continue to be allocated adequatesecure sufficient railway and port capacity to transport capacity or acquire adequate rail cars,our coal or that we will not experience any material delaydelays in transporting our coalproducts or substantial increases in transportation costs as a result of insufficient railway transport capacity or rail cars.capacity.

The coal reserve data in this Annual Report are only estimates.

The coal reserve data provided by us are only estimates which may differ materially from the actual in-place proven and probable reserves. Our reservesreserve estimates may change substantially if new information subsequently

becomes available. There are inherent uncertainties in estimating reserves, including manywhich require the consideration of a number of factors, assumptions and variables, involved in estimating reserves that arewhich may be beyond our control.control and cannot be ascertained despite due investigation. Our actual results of operations may differ materially from our long-term business and operational plans, which are based on the estimatedour coal reserve data.estimates. We cannot assure you that we will not adjust our coal reserve estimates downward in the future, and in such event, our results of operations may be materially and adversely affected.

Competition in the PRC and the international coal industry is increasingintensifying, and our business and prospects willwe may not be adversely affected if we are not able to continue to compete effectively.

We face competition in all areasaspects of our business. Competition in the coal industry is based on many factors,business, including price,pricing, production capacity, coal quality and characteristics,specifications, transportation capability and costs, blending capabilitycapacity, cost structure and brand name.recognition. Our coal business competes in the domestic and international markets with other large domestic and international coal producers. SomeOngoing consolidation in the PRC coal industry has increased the level of competition in our industry. Our overseas competitors may have greaterstronger financial, marketing, distribution and other resources than we do and have more well-known brand names with wider recognition in the domestic and international markets. We currently compete favorably on theThe quality of our coal products.products positions us favorable against our competitors. However, there can be no assurancewe cannot assure you that we will continue to compete favorably due to quality improvements by our competitors.

We also cannot assure you that the development of the PRC railway transportation network will not diminish our geographic advantage of being located in Eastern China, the area of PRC with the strongest coal demand. We believe that we competecompeted favorably with respect toon transportation capability and costs due to the fact thatbecause our principal competitors are located mainly in Shanxi Province, Shaanxi Province and the Inner Mongolia Autonomous Region, where there isare occasional insufficient rail capacity shortages and significant costs that have to be incurred in transportingto transport coal from these regions to Eastern China, where the strongest demand for coal is.China. However, improvements in the PRC national rail network will reduce our competitive advantage in transportation. For example, the PRC Government is planning to construct additional railways to transport coal from Northernnorthern and Northwesternnorthwestern China to Eastern China. Accordingly, the completion of these projects may increase the supply of coal available to customers in Eastern China, which may have a material adverse impact on our results of operations.

Our operations may be affected by uncertain mining conditions.

As with all underground coal mining companies,operations, our operations are affected by certain risks inherent in mining, conditions such as a deterioration in the quality or variations in the thickness of faults and/or coal seams, pressure in mine openings, presence of gas and/ormine water inflowdischarge, weather, flooding and propensityother natural disasters. Additionally, we are exposed to spontaneous combustion, as well as operational risks associated with industrial or engineering activity,activities, such as mechanical breakdowns.unexpected maintenance problems or equipment failures. Although we have conductedconduct geological investigations to evaluate suchon mining conditions and adapt our mining plans to address them,the mining conditions of each mine, there can be no assurance that the occurrence of any adverse mining conditions would not result in anendanger our workforce, increase in our production costs, of production, a reduction ofreduce our coal output or the temporary suspension oftemporarily suspend our operations.

Underground mining is also subject to certain risks such as fires and explosions from methane outburstsgas or coal dust, roof collapses and accidents caused by roof weakness and groundfalls. Thereground falls. We can be no assurancenot assure you that the occurrence of such events or conditions would not have a material adverse impact on our business and results of operations.

ResultsOur results of our operations depend on our ability to acquire or develop new coal mines or coal reserves.

OurThe recoverable coal reserves in our existing mines decline as we produce coal. As we can onlyour ability to significantly increase our existing production capacity by aat existing mines is limited, amount, the futureour ability to increase in our coal production will depend on the production of our alreadyrecently developed new coal reserves, acquisitions of new mines or the expansion of our existing coal mines.

We acquired Jining III Coal Mine and Southland Colliery in 2001 and 2004, respectively. In 2005, we acquired from our Controlling Shareholder 95.67% of the equity interest in Heze Nenghua;Nenghua, followed by the acquisition of the mining rights of Zhaolou Coal Mine in Juye Coal Field, which is owned bythrough Heze Nenghua in May 2008. This acquisition was approved by our shareholders and the relevant government authorities. Zhaolou Coal Mine is currently under construction.expected to commence preliminary operations in the fourth quarter of 2008. In November 2006 and February 2007,

our Company aggregately acquired 100% of the equity interestsinterest of Shanxi Nenghua, which was held by our Controlling Shareholder and Lunan Fertilizer Plant;Plant. Tianchi Coal Mine, which is owned by Shanxi Nenghua, was put into operationcommenced operations in November 2006. We are also in the process of setting up the relevantestablishing a joint venture company for thea coal mining project in Yushuwan, Shaanxi Province.

We cannot give any assuranceassure you that we will be able to continue identifyingto identify suitable acquisition targets in the PRC or abroad for acquisition or acquire suitablethese targets on competitive terms. Nor can we assure you that we willWe may not be able to successfully develop new coal mines or expand our existing ones in accordance with our development proposalplans or at all. Our failureFailure to timely or successfully acquire suitable targets on competitive terms, or to successfully complete the development of new coal mines or to expand our existing coal mines could have an adverse effect on theour results of operationoperations and our financial condition.

The acquisition and/or the development of new mines inby PRC coal companies and related licenses and permits, either within China or overseas, is subject to the PRC and overseas require approval of the PRC Government. DelayDelays in securing or failure in securingto secure the relevant PRC Government approvals, licenses or permits as well as any adverse change in government policies may cause a significant adjustment toimpair our development and acquisitionexpansion plans, which may materially and adversely affect our profitability and growth prospects.

In addition,connection with our overseas expansion, we could encounter unforeseen problems due to our unfamiliarity with local laws and regulations or suffer foreign exchange losses in connection withrelations to overseas investments. We cannot assure you that our overseas expansion or investments will be successful.

We may suffer losses resulting from industry-related accidents and lack of insurance.insurance to cover these accidents.

We operateOur coal mines and relatedoperating facilities that may be affecteddamaged by water, gas, fire or structural problems.unstable geological structures. As a result, we, like other coal mining companies, have experienced accidents that have causedresulted in property damage and personal injuries. Although we have implemented safety measures for our production facilities, and provide on-the-job safety training for our employees, and in accordance with relevant laws, set aside approximately 2.0% of employees’each employee’s total remuneration for employees’personal injury insurance, there can be no assurance that industry-related accidents will not occur in the future.

We do not currently maintain fire, casualty or other property insurance coveringfor our properties, equipment or inventories, other than with respect tofor our vehicles. In addition, we do not maintain any business interruption insurance or any third party liability insurance to cover claims in respect of personal injury, property or environmental damage arising from accidents on our properties, other than third party liability insurance with respect to vehicles. Any uninsured losses and liabilities incurred by us could have a material adverse effect on our financial condition and results of operations.

We may be required to allocate additional funds for land subsidence.

A consequence ofUnderground mining may cause the underground mining methods used at our mines is land subsidence above underground mining sites.sites to subside. Depending on the circumstances and conditions of each site, we may relocate inhabitants from the land above thecertain underground mining sites prior to the commencement of mining, those sites or we may compensate the inhabitants for any losses or damages fromcaused by land subsidence after the underground sites have been mined. We may also be required to make paymentsset aside provisions for costs associated with land subsidence, restoration, rehabilitation or environmental protection to mitigate the effects of the land after the underground sites have been mined.our mining activities. An estimate of suchthese costs is

recognized recorded in the period in which the obligation is identified and is chargeddeducted as an expense in our income statement in proportion to the coal actually extracted. Payment for suchthese costs is funded fromby working capital. The amount chargedcapital and amounted to income statementsRMB593.5 million in 2006 was RMB743.0 million.2007. The provision for land subsidence, restoration, rehabilitation and environmental protection costs has beenis determined by theour directors based on past occurrences of land subsidence. However, the provision is only an estimate. The estimate and may be adjusted to reflect the actual effects of costs for land subsidence, restoration, rehabilitation or environmental protection ofour mining activities on the land may be subject to change in the future as actual costs become apparent and standards established by the PRC Government change from time to time.above our mining sites. Therefore, there can be no assurance that such estimates are accurate or that our land subsidence, restoration, rehabilitation and environmental protection costs will not substantially increase in the future or that the PRC Government will not impose new fees in respect of land subsidence. Any such substantial increases or new feessubsidence, the occurrence of any of which could have a material adverse effect on our results of operations.

Our business operations may be adversely affected by present or future environmental regulations.

As a producer ofPRC coal products,producer, we are subject to significant, extensive and increasingly stringent environmental protection laws and regulations in China. These laws and regulations:

impose fees for the discharge of waste substances;

require the establishment of reservesprovisions for reclamation and rehabilitation;

require the payment ofimpose fines for serious environmental offences;offenses; and

allowauthorize the PRC Government at its discretion, to close any facility that failsit determines has failed to comply with orders requiring it to correct or stopenvironmental regulations and suspend operations causingthat cause excessive environmental damage.

Our coal mining operations may produce waste water, gas emission and solid waste materials. Currently, theThe PRC Government is moving toward more rigoroushas tightened enforcement of applicable laws and regulations as well as the adoption and enforcement ofadopted more stringent environmental standards. Our budgeted amounts of capital expenditure for environmental regulatory compliance may not be sufficient, and we may need to allocate additional funds for suchthis purpose. If we fail to comply with current or future environmental laws and regulations, we may be required to pay penalties or fines or take corrective actions, any of which may have a material adverse effect on our business operations and financial condition.

In addition, China is a signatory to the 1992 United Nations Framework Convention on Climate Change and the 1997 Kyoto Protocol, which are intended to limit emissionsgreenhouse gas emissions. On March 14, 2006, the PRC Government released the outline of greenhouse gases. Effortsthe Eleventh Five-Year Plan for National Economic and Social Development that sets goals to decrease the amount of energy consumed per unit of GDP by 20 percent and to reduce the emission of certain major pollutants by 10 percent. If efforts to reduce energy consumption and control greenhouse gas emission in China could result in reduced use ofreduce coal if power generators switch to sources of fuel with lower carbon dioxide emissions, which in turn could reduce the revenues ofconsumption, our coalrevenue would decrease and our business and have a material adverse effect on our results of operations.would be adversely affected.

NewPRC quotas for coal exports in the PRC may adversely affect the amountlevel of our coal exports.export sales.

ExportOur export sales of coal(not including the sales by Yancoal Australia) accounted for 28.5%25.8%, 25.8%19.5% and 20.8%4.3% of our net sales of coal in 2004, 2005, 2006 and 2006,2007, respectively. Average selling prices for overseas coal sales are generally higher than average selling prices for domestic sales. In 2006, average selling prices for export sales were RMB388.59 per tonne, compared to average selling prices for domestic sales of RMB331.31 per tonne.

In January 2004, the PRC Government promulgated new regulations,a regulation entitled “Measures for the Administration of Quotas for Coal Export,” which took effectbecame effective on July 1, 2004. UnderPursuant to the new regulations,regulation, the National Development and Reform Commission and the Ministry of Commerce will be responsible for determiningdetermine the total volume of the PRC’s export quota of coal and allocatingallocate the quota among the authorized coal exporters. UnderThe announcement of the regulations, the National Development and Reform Commission and the Ministry of Commerce are required to announce the total export quota available for each fiscal year by notmust be made no later than October 3131st of the prior year. After the total available export quota has been announced, the National Development and Reform Commission and the Ministry of Commerce will acceptbegin accepting written applications from authorized coal exporters for an allocation of specific export quotas for the following year.year’s quota.

The new regulationsThis regulation did not have a material adverse effect on our export sales in 2005 and 2006 as2007 because our export agents have consistentlyhistorically received an allocation of the export quota sufficient to satisfy our export volume. However, we are unable to predict what impact, if any, theythe export quota may have on the level of our export coal

sales for 2007in 2008 and later years. Article 10 of the regulations provides that, in determining the allocation of specific quotas to authorized coal exporters, the National DevelopmentIn 2005, 2006 and Reform Commission and the Ministry of Commerce will refer to the exporters’ respective coal export performances in the previous year. We have been one of the largest coal exporters in China. For the years ended December 31, 2004, 2005 and 2006,2007, our export sales of coal (not including the sales by Yancoal Australia’s overseas sales of coal)Australia) accounted for approximately 11.6%10.2%, 10.2%9.9% and 9.9%3.2%, respectively, of the PRC’s total coal export sales in China duringexport. If the same period. Although our export sales have not been affected by the new regulations, ifquota for national coal exports areis reduced, the level of our export sales in future periods could be affected, which in turn could adversely affect our results of operations.

We do not have an export permit and consequently, do not have direct export rights for our coal. As a result, all of our export sales must be made through intermediary export agents. We use export agent services provided by China Coal Energy Group Company, China National Minerals Import and Export Company Limited and Shanxi Coal Import and Export Group Company (collectively, the “Export Agency Companies”). The volume, coal specifications, pricing and final destination of our export sales are determined collectively by us, the Export Agency Companies and our overseas customers. Although we have applied to the PRC Central Government for direct export rights with the assistance of the Shandong provincial government, there can be no assurance that we can obtain such rights. If we cannot obtain an export permit granting us direct export rights, we will have to continue to rely on export agents to export our coal.

OurThe Controlling Shareholder mayShareholder’s operations have a significant influenceimpact on us.

As of December 31, 2006,2007, the Controlling Shareholder owned 52.86% of our outstanding shares. Our Articles of Association provide that, in addition to any obligation imposed by law, a controlling shareholder shall not exerciseshares and thereby its voting rights in a manner prejudicial to the interests of the shareholders generally, including voting with respect to certain enumerated matters of fundamental importance to shareholders.

operations have significance impact on us. Pursuant to the regulations of Hong Kong Stock Exchange and Shanghai Stock Exchange on continuing connected transactions and the actual operations of us and the Controlling Shareholder, we completed the necessary review procedures for our continuing connected transactions as required by law and continued or entered into six new continuing connected transaction agreements (“New Continuing Connected Transaction Agreements”), including the materialsProvision of Materials and water supply agreement, electricity supply agreement, laborWater Supply Agreement, Provision of Electricity Agreement, Provision of Labor and service agreement, equipment maintenanceServices Agreement, Provision of Equipment Maintenance and repair works agreement, productsRepair Works Agreement, Provision of Products and materials agreementServices Agreement and administrative serviceProvision of Administrative Services for pension fundPension Fund and retirement benefits agreement,Retirement Benefits Agreement with the Controlling Shareholder in the first quarter of 2006. We also determined the annual caps for each New Continuing Connected Transaction Agreements for 2006 to 2008. For details on the execution of the New Continuing Connected Transactions, please see “Item 77. — Major Shareholders and Related Party Transaction”. Any material financial or operational problemsdevelopments experienced by the Controlling Shareholder which leadslead to the disruption of its operations or impairs its ability to perform the Continuing Connected Transactions could materially affect our operations and future prospects.

Our operations are subject toaffected by a number of risks relating to the PRC.

WeA significant majority of our assets and operations are alsolocated in the PRC, as such, we are subject to a number of risks relating to the PRC, including, but not limited to, the following:

The central and local governments of the PRC continue to supporthave historically supported the continued development and operation of the PRC coal industryindustry. A change in China. If the PRC Government changes its current policies that are currently beneficialfavorable to us may adversely affect the flexibility that we may face significant constraints onhave and our flexibility and ability to expand our business operations or to maximizeincrease our profitability.

Under current PRC regulatory requirements, our projectscapital expenditure allocated for the development of new coal minesmine projects require PRC Government approval. If any of our important projects requiredapprovals. Failure to obtain timely approval for our growth or cost reduction are not approved, or are not approved on a timely basis,projects may adversely affect our financial condition and operating performances could beresults.

On July 21, 2005, China adopted a managed floating exchange rate system to allow the value of the Renminbi to fluctuate within a regulated band based on market supply and demand with reference to a basket of currencies. Fluctuations in exchange rates may adversely affected.affect the value of our net assets, earnings and any declared dividends when translated or converted into U.S. dollars or Hong Kong dollars. RMB fluctuations mainly affect (a) our income from coal exports denominated in foreign currencies; (b) the conversion of foreign currency deposits; and (c) our costs of imported equipment and fittings.

The PRC Government has been reforming, and is expected towill continue to reform itsthe PRC economic system. ManyA number of the reforms are unprecedented or experimental and are expectedmay be subject to be refinedrefinement and improved.adjustments. Other political, economic and social factors canthat affect us may also lead to further readjustmentbe modified by reform measures, and we may be adversely affected by the effect of the reform measures. This refining and readjustment process may not always have a positive effect on our operations.these reforms. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions and by changes in the policies of the PRC Government such asincluding, but not limited to, changes in laws and regulations (or the interpretation thereof), imposition of additional restrictions on related to, measures to control inflation, tax policies and rates, currency conversion restrictions and reduction in tariff protection and other import restrictions.

On July 21, 2005, the People’s Bank of China, or PBOC, announced the Renminbi is no longer effectively linked to US dollars but instead is allowed to trade in a tight 0.3% band against a basket of foreign currencies. Any further appreciation of Renminbi in the future will increase the cost of our export sales, reduce our account receivables denominated in foreign currencies and adversely affect our financial condition and results of operations. On

|

Since 1997, many newthe PRC Government has promulgated a series of laws and regulations covering general economic matters have been promulgated inrelated to the PRC.overall development of the PRC economy. Despite this activityefforts to develop the PRC legal system, PRC’s system of lawsit is continuously evolving.evolving and the enforcement and interpretation of certain laws remains uncertain. Even where adequate law exists, enforcement of existing laws or contracts may be uncertaininconsistent and arbitrary, and it may be difficult to obtain swift and equitable enforcement or to obtain enforcement of a judgment by a court of another jurisdiction. The lack of precedents in PRC’s judiciary creates additional uncertainty as to the possible outcome of any litigation. In addition, interpretation of statutes and regulations may be subject to evolving government policies and political changes.

A new Labor Contract Law of the PRC became effective on January 1, 2008, which imposes more stringent requirements for signing labor contracts, paying remuneration, stipulating probation and penalties and terminating labor contracts. We cannot assure you that efforts taken to comply with the requirements of this new Labor Contract Law will not adversely affect our business or operations.

Our coal operations are extensively regulated by the PRC Government and government regulations may limit our activities and adversely affect our business operations.

Our coal operations, like those of other PRC energy companies, are subject to extensive regulations establishedregulation by the PRC Government. CentralNational governmental authorities, such as the National Development and Reform Commission, the State Environmental Protection Administration, the Ministry of Land and Resources, the State Administration of Coal Mine Safety and the State Bureau of Taxation andas well as corresponding provincial and local authorities and agencies exercise extensive control over various aspects of China’s coalthe mining and transportation (including rail and sea transport). These controls affect of coal in China. Oversight from these authorities and agencies affects the following material aspects of our operations:

the exploration, exploitation, use and granting of mining rights and licensing;rights;

rehabilitation of land surrounding mining sites after mining is completed;;

recovery rate requirements;

pricing of our transportcoal transportation services;

industry-specific taxes and fees;fees for our industry and levies imposed by government authorities, as promulgated from time to time;

targetapplication of our capital investments;

export quotas and procedures;

pension funds appropriation;fund appropriations;

waivers of certain import tariffs on our supplies;preferential tax treatment; and

environmental and safety standards.

We may face significant constraints onAs a result, our ability to implementexecute our business strategies or to carry out or expand our business operations may be limited. We may experience substantial delays in obtaining regulatory approvals, permits and licenses in connection with our business operations. Our business may also be materially and adversely affected by future changes in certainthe PRC Government’s regulations and policies of the PRC Government in respect ofrelated to the coal industry. NewThe adoption of new legislation or regulations, may be adopted thator the new interpretation of existing legislation or regulations, may materially and adversely affect our coal operations, our cost structure or the demand for our products. In addition, new legislation or regulations or different or more stringent interpretationThe occurrence of existing laws and regulationsany of the foregoing may also requirecause us to substantially change our existing operations or incur significant costs.

ITEM 4. INFORMATION ON THE COMPANY

| ITEM 4. | INFORMATION ON THE COMPANY |

A. History and Development of our Company

The Company, Yanzhou Coal Mining Company Limited was established on September 25, 1997 as a PRC joint stock company with limited liability under the Company Law of the PRC (the “Company Law”). The Predecessor formerly known asof our Company, Yanzhou Mining Bureau, was established in 1973. In 1996, upon receipt of1976. Upon the approval from the former State Economic and Trade Commission and the former Ministry of Coal Industry

(“MOCI”), in 1996, the Predecessor was incorporated and renamedunder the name Yanzhou Mining (Group) Corporation Limited and subsequently, renamed as Yankuang Group Corporation Limited after undergoing reorganization in 1999.

In April 2001,January 1999, we were approved by the Minister of Foreign Trade and Economic Cooperation, the predecessor of the Ministry of Commerce, to convert from a joint stock company with limited liability to a Sino-foreign joint stock company with limited liability under the Company Law and the Sino-Foreign Joint Venture Law of the PRC. Our H Shares accounted for 39.82% of our total outstanding shares as of December 31, 2006.2007.

Our contact information is:

• Business address: | 298 Fushan South Road | |

| Zoucheng, Shandong Province | ||

| People’s Republic of China | ||

• Telephone number: | (86) 537 538 2319 | |

• Website: | ||

We principallyprimarily engage in the underground mining, preparation and sale of coal andas well as the railway transportation for coal products. Weof coal. In 2007, we believe we were the largest coal producers and coal exportersproducer in Eastern China in 2006. China.

In 2006,2007, we hadproduced approximately 35.6 million tonnes of raw coal, production of approximately 36.1 million tonnes, including 35.532.8 million tonnes by the Company, 0.41.6 million tonnes by Yancoal Australia and 0.11.2 million tonnes by Shanxi Nenghua. We also exported 6.3sold 35.1 million tonnes of coal in 2007, of which 32.5 million tonnes was sold by the Company. In the same year, Yancoal Australia sold 1.4 million tonnes of coal, and Shanxi Nenghua sold 1.2 million tonnes of coal. In 2007, we had overseas coal sales of 3.2 million tonnes of coal, including 6.11.7 million tonnes of export sales by the Company and 0.21.4 million tonnes by the overseas sales of coal sales by Yancoal Australia.

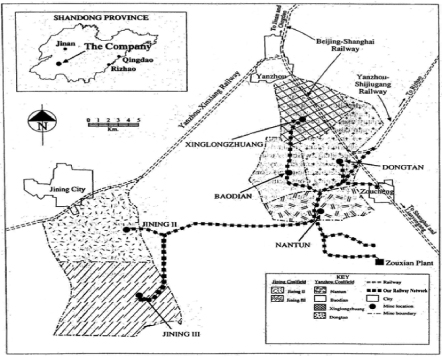

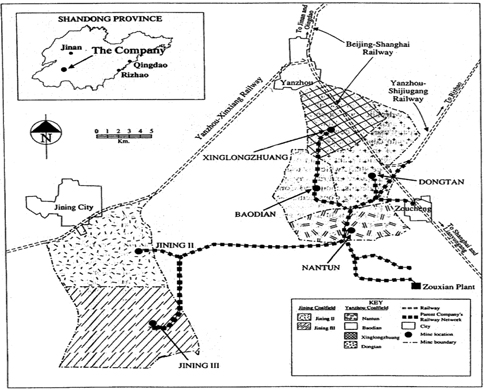

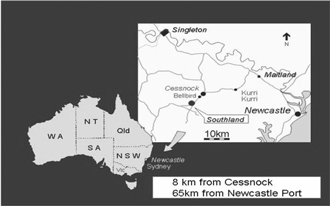

The Company has six coal mines located in China:Shandong Province: Nantun, Xinglongzhuang, Baodian, Dongtan, Jining II and Jining III (collectively, “Six Coal Mines”), which commenced production in 1973, 1981, 1986, 1989, 1997 and 2000, respectively. As of December 31, 2006,2007, the six domestic coal mines of the CompanySix Coal Mines had a totalan estimated collective in-place proven and probable reserve base of approximately 1,933.01,898.6 million tonnes. Not included in this estimate are the reserves of Yancoal Australia’s Austar Coal Mine, Shanxi Nenghua’s Tianchi Coal Mine and Heze Nenghua’s Zhaolou Coal Mine. Yancoal Australia and Shanxi Nenghua commenced production in the fourth quarter of 2006 and held recoverable reserves of approximately 50.0 million tonnes and Shanxi Nenghua had recoverable reserves of 30.129.2 million tonnes of coal, respectively. As of the date of this Annual Report, Zhaolou Coal Mine has yet to commence production and probable reserveshad an estimated recoverable coal reserve of 66.1approximately 106.0 million tonnes.

We have successfully developed and introduced into our operations a full set of equipment that is capable of a comprehensive mechanized comprehensive caving method and have developed mining equipment suitable forprocess designed to extract coal from medium to thick coal seam extraction.seams. The technology content of this patented mechanized comprehensive caving method is one of the most advanced mining technologies in the world.meets leading international technology standards. We intend to continue to improve our proprietary caving method for our internal use orand for license to third party mining companies.licensing.

The location of a coal mine affects its competitiveness due to the significant costs of transporting coal transport.make the location of coal mines a significant competitive factor. We believe that the locations of our mines are well-situatedenhance our competitiveness given the rapid economic growth of Eastern China, the insufficient supply of coal produced in thisthe Eastern China region and the substantial costs involved in transporting coal to Eastern China from other major coal-producing provinces such as Shaanxi Province, Shanxi Province and Inner Mongolia Autonomous Region.Region to Eastern China. Net sales of coal represent our invoiced value of coal sold and are net of returns, discounts, sales taxes, transportation costs, port fees and various miscellaneous fees relating to sales if the invoiced value includes transportation costs to our customers. In 2004, 2005, 2006 and 2006, 47.4%2007, we generated 50.2%, 49.5%55.2% and 54.5%64.3%, respectively, of our total net sales were derivedof coal from sales to customers within Shandong Province. Our largest end-user, Huadian’send customer, Zouxian Electric Power Plant of Huadian International, accounted for 9.5%13.4%, 13.2%11.3% and 11.2%12.1% of our total net sales of coal in 2004, 2005, 2006 and 2006,2007, respectively. Net sales to customers located in the rapidly growing Yangtze delta region, encompassing Shanghai Municipality, Jiangsu Province and Zhejiang Province, comprised 16.9%composed 15.3%, 15.1%13.8% and 13.6%13.3% of our total net sales of coal in 2004, 2005, 2006 and 2006,2007, respectively. Our overseas sales, includingwhich include the export sales of the Company and the overseas sales of Yancoal Australia, principally to Japan, accounted for 27.9%25.8%, 25.5%20.7% and 20.5%8.9% of our total net sales of coal in 2004, 2005, 2006 and 2006,2007, respectively.