UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

¨ | | |

| o | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

x | | |

| þ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

OR

¨ | | For the fiscal year ended December 31, 2008 |

OR

| | |

| o | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period fromto

OR

¨ | | For the transition period fromto |

OR

| | |

| o | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report |

Date of event requiring this shell company reportCommission file number 1-13522

China Yuchai International Limited (Exact Name of Registrant as Specified in Its Charter) | | |

Not Applicable | | Bermuda |

| Not Applicable | | Bermuda |

(Translation of Registrant’s Name Into English) | | (Jurisdiction of Incorporation or |

| Into English) | | Organization) |

16 Raffles Quay #26-00

Hong Leong Building

Singapore 048581

65-6220-8411

(Address and Telephone Number of Principal Executive Offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act: | | |

Title of Each Class

| | |

| | Name of Each Exchange on Which Registered |

Title of Each Class | | Registered |

Common Stock, par value US$0.10 per share | | |

| share | | The New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31,

2006,2008, 37,267,673 shares of common stock, par value US$0.10 per share, and one special share, par value US$0.10, were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes

¨o No

xþNote

–— Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes¨o Noxþ

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | |

Large accelerated filer¨o | | Accelerated filerxþ | | Non-accelerated filer¨o |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

U.S. GAAP x

| | | | |

| U.S. GAAPþ | | International Financial Reporting Standards as issued¨o | | Other ¨ |

| |

by the International Accounting Standards Board

| | Othero |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17

¨o Item 18

xþIf this report is an annual report, indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

¨o No

xþ(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

YesYes ¨o No¨o

CHINA YUCHAI INTERNATIONAL LIMITED 1

i

Certain Definitions and Supplemental Information All references to “China,” “PRC” and the “State” in this Annual Report are references to the People’s Republic of China. Unless otherwise specified, all references in this Annual Report to “US dollars,” “dollars,” “US$” or “$” are to United States dollars; all references to “Renminbi” or “Rmb” are to Renminbi, the legal tender currency of China; all references to “S$” are to Singapore dollars, the legal tender

currency of Singapore. Unless otherwise specified, translation of amounts for the convenience of the reader has been made in this Annual Report (i) from Renminbi to US dollars at the rate of Rmb

6.85916.8343 = US$1.00, the rate quoted by the People’s Bank of China, or PBOC, on June

30, 200815, 2009 and (ii) from Singapore dollar to US dollars at the rate of S$

1.36081.4608 = US$1.00, the noon buying rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York on June

30, 2008.15, 2009. No representation is made that the Renminbi amounts or Singapore dollar amounts could have been, or could be, converted into US dollars at rates specified herein or any other rate.

Our consolidated financial statements are reported in Renminbi and prepared in conformity with accounting principles generally accepted in the United States of America, or US GAAP. Totals presented in this Annual Report may not correctly total due to rounding of numbers. References to a particular fiscal year are to the period ended December 31 of such year.

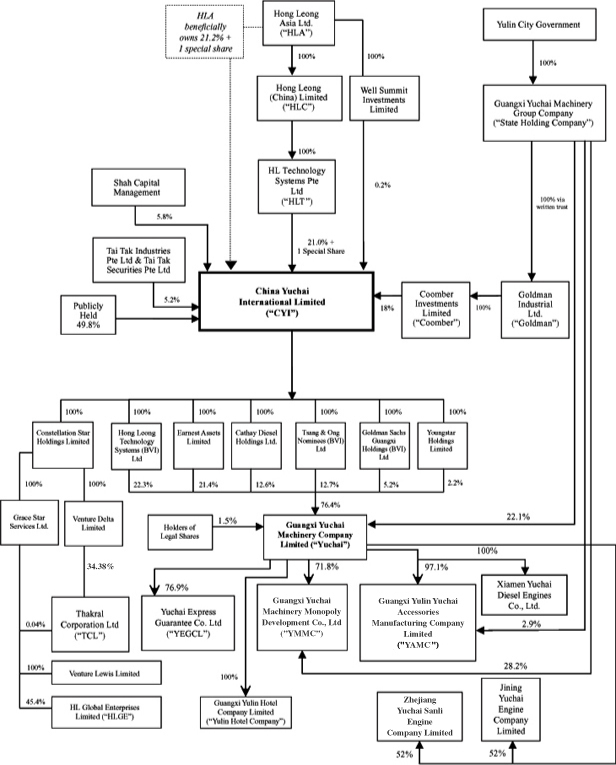

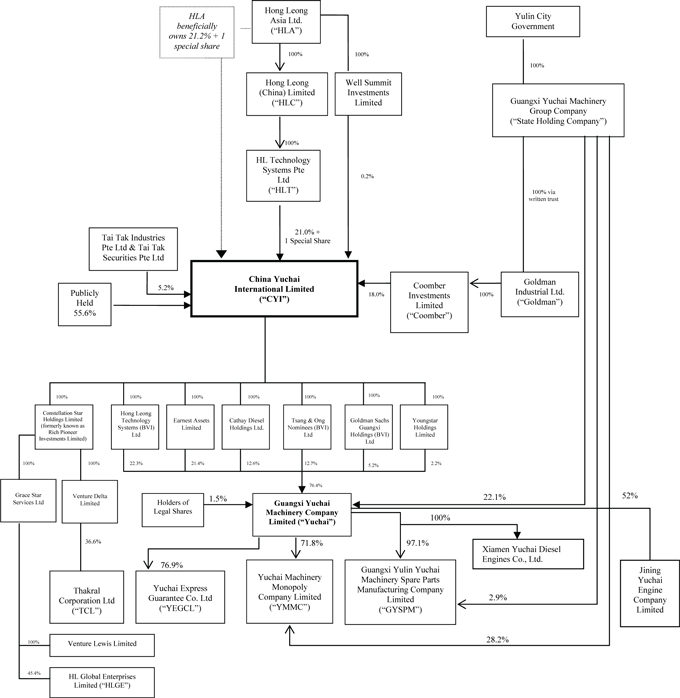

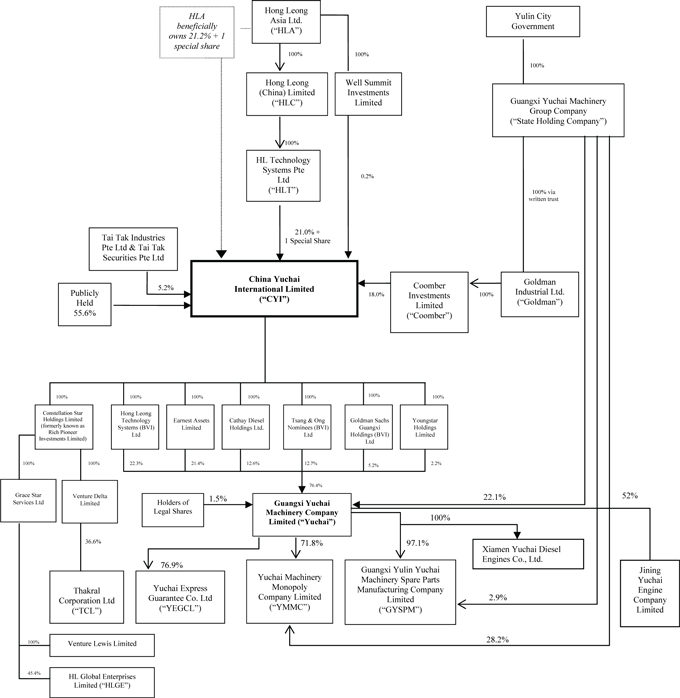

As used in this Annual Report, unless the context otherwise requires, the terms “the Company”, “CYI”, “we”, “us”, “our” and “our company” refer to China Yuchai International Limited and its subsidiaries. All references herein to “Yuchai” are to Guangxi Yuchai Machinery Company Limited and its subsidiaries and, prior to its incorporation in July 1992, to the machinery business of its predecessor, Guangxi Yulin Diesel Engine Factory, or Yulin Diesel, which was founded in 1951 and became a state-owned enterprise in 1959. In the restructuring of Yulin Diesel in July 1992, its other businesses were transferred to Guangxi Yuchai Machinery Holdings Company, also sometimes referred to as Guangxi Yuchai Machinery Group Company Limited, or the State Holding Company, which became a shareholder of Yuchai. All references to “HLGE” are to HL Global Enterprises Limited (formerly known as HLG Enterprise Limited); and all references to the “HLGE group” are to HLGE and its subsidiaries. All references to “TCL” are to Thakral Corporation Ltd; and all references to the “TCL group” are to TCL and its subsidiaries.

This Annual Report includes certain 2007 data regarding the Company that is derived from unaudited estimated information.As of December 31,

2006,2008, 37,267,673 shares of our common stock, par value US$0.10 per share, or Common Stock, and one special share, par value US$0.10, of our Common Stock were issued and outstanding. The weighted average shares of common stock outstanding during the year was 37,267,673. Unless otherwise indicated herein, all percentage share amounts with respect to the Company are based on the weighted average number of shares of 37,267,673 for

2006.2008. As of

May 30, 2008,June 1, 2009, 37,267,673 shares of our Common Stock, and one special share, par value US$0.10, of our Common Stock were issued and outstanding.

In China, Euro III emission standards are referred to as National III emission standards and all references to “National III” emissions standards are equivalent to references to “Euro III” emission standards.

Cautionary Statements with Respect to Forward-Looking Statements We wish to caution readers that the forward-looking statements contained in this Annual Report, which include all statements which, at the time made, address future results of operations, are based upon our interpretation of factors affecting our business and operations. We believe that the following important factors, among others, in some cases have affected, and in the future could affect our

actual consolidated results and could cause our

actual consolidated results for

20072009 and beyond to differ materially from those described in any forward-looking statements made by us or on our behalf:

political, economic and social conditions in China, including the Chinese government’s specific policies with respect to foreign investment, economic growth, inflation and the availability of credit, particularly to the extent such current or future conditions and policies affect the truck and diesel engine industries and markets in China, our diesel engine customers, the demand, sales volume and sales prices for our diesel engines and our levels of accounts receivable;

| • | | political, economic and social conditions in China, including the Chinese government’s specific policies with respect to foreign investment, economic growth, inflation and the availability of credit, particularly to the extent such current or future conditions and policies affect the truck and diesel engine industries and markets in China, our diesel engine customers, the demand, sales volume and sales prices for our diesel engines and our levels of accounts receivable; |

|

| • | | the effects of unfavourable economic and market conditions and the current volatility in stock markets around the world adversely impacting the entire financial industry and capital markets resulting in a worldwide economic slowdown, on our business, operating results and growth rates; |

|

| • | | the effects of competition in the diesel engine market on the demand, sales volume and sales prices for our diesel engines; |

the effects of competition in the diesel engine market on the demand, sales volume and sales prices for our diesel engines;

the effects of existing material weaknesses in our internal control over financial reporting and our ability to implement and maintain effective internal control over financial reporting;

our ability to collect and control our levels of accounts receivable;

our dependence on the Dongfeng Automobile Company and other major diesel truck manufacturers controlled by or affiliated with the Dongfeng Automobile Company;

our ability to successfully manufacture and sell our 4108, 4110, 4110Q, 4110ZQ, 4112, 4F, 4G, 6105, 6108, 6112, 6L/6M (formerly referred to as 6113) heavy-duty diesel engines and any new products;2

| • | | the effects of existing material weaknesses in our internal control over financial reporting and our ability to implement and maintain effective internal control over financial reporting; |

|

| • | | our ability to collect and control our levels of accounts receivable; |

|

| • | | our dependence on the Dongfeng Automobile Company and other major diesel truck manufacturers controlled by or affiliated with the Dongfeng Automobile Company; |

|

| • | | our ability to successfully manufacture and sell our 4108, 4110, 4110Q, 4112, 4F, 4G, 6105, 6108, 6112, 6L/6M (formerly referred to as 6113) heavy-duty diesel engines and any new products; |

|

| • | | our ability to finance our working capital and capital expenditure requirements, including obtaining any required external debt or other financing; |

|

| • | | the effects of inflation on our financial condition and results of operations, including the effects on Yuchai’s costs of raw materials and parts and labor costs; |

|

| • | | our ability to successfully implement the Reorganization Agreement, as amended by the Cooperation Agreement (both as defined in “Item 4. Information on the Company — History and Development — Reorganization Agreement”) (See “Item 4. Information on the Company — History and Development — Cooperation Agreement”); |

|

| • | | our ability to control Yuchai and consolidate Yuchai’s financial results; |

|

| • | | the effects of China’s political, economic and social conditions on our financial condition, results of operations, business or prospects; |

|

| • | | the effects of uncertainties in the Chinese legal system, which could limit the legal protection available to foreign investors, including with respect to the enforcement of foreign judgments in China; |

|

| • | | the effects of adverse economic conditions in consumer spending patterns and its impact on the demand for the TCL group’s consumer electronics products; |

|

| • | | the effects of our disagreement with the other major shareholders of TCL over the running of TCL group’s operations and its proposed change in its strategy from consumer electronics to real estate and related infrastructure investment in the pan-Asian region; |

|

| • | | the ability of TCL to obtain shareholders and regulatory approvals for, and successfully implement, its announced strategy of repositioning its principal business from consumer electronics distribution to real estate and related infrastructure investment in the pan-Asian region; |

|

| • | | the effects of changes to the international, regional and economic climate and market conditions in countries where the HLGE group’s hospitality operations are located, as well as related global economic trends that adversely impact the travel and tourism industries; |

|

| • | | the outbreak of communicable diseases, such as the recent Influenza A (H1N1) virus and the Avian flu, if not contained, and its potential effects on the operations of the HLGE group and its business in the hospitality industry; and |

|

| • | | the impact of terrorism, terrorist events, airline strikes, hostilities between countries or increased risk of natural disasters or viral epidemics that may affect travel patterns and reduce the number of travelers and tourists to the HLGE group’s hospitality operations. |

3

the effects of inflation on our financial condition and results of operations, including the effects on Yuchai’s costs of raw materials and parts and labor costs;

our ability to successfully implement the Reorganization Agreement, as amended by the Cooperation Agreement (both as defined in “Item 4. Information on the Company — History and Development — Reorganization”);

our ability to control Yuchai and consolidate Yuchai’s financial results;

the effects of China’s political, economic and social conditions on our financial condition, results of operations, business or prospects;

the effects of uncertainties in the Chinese legal system, which could limit the legal protection available to foreign investors, including with respect to the enforcement of foreign judgments in China;

the effects of competition in the consumer electronics market and the demand for the TCL group’s consumer electronics products;

the effects of adverse economic conditions in consumer spending patterns and its impact on the demand for the TCL group’s consumer electronics;

the ability of TCL to obtain shareholder approval for, and successfully implement, its announced strategy of repositioning its principal business from consumer electronics distribution to real estate and related infrastructure investment in the pan-Asian region;

the effects of changes to the international, regional and economic climate and market conditions in countries where the HLGE group’s hospitality operations are located, as well as related global economic trends that adversely impact the travel and tourism industries;

the outbreak of communicable diseases, such as the Avian flu, if not contained, and its potential effects on the operations of the HLGE group and its business in the hospitality industry; and

the impact of terrorism, terrorist events, airline strikes, hostilities between countries or increased risk of natural disasters or viral epidemics that may affect travel patterns and reduce the number of travelers and tourists to the HLGE group’s hospitality operations.

Our actual results, performance, or achievement may differ from those expressed in, or implied by, the forward-looking statements contained in this Annual Report. Accordingly, we can give no assurances that any of the events anticipated by these forward-looking statements will transpire or occur or, if any of the foregoing factors or other risks and uncertainties described elsewhere in this Annual Report were to occur, what impact they will have on these forward-looking statements, including our results of operations or financial condition. In view of these uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. We expressly disclaim any obligation to publicly revise any forward-looking statements contained in this Annual Report to reflect the occurrence of events after the date of this Annual Report.

ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS. |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS.

ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE. |

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE.

Not Applicable.

ITEM 3. KEY INFORMATION. | KEY INFORMATION. |

Selected Financial Data

The selected financial information set forth below should be read in conjunction with, and is qualified in its entirety by reference to, “Item 5. Operating and Financial Review and Prospects” and our audited consolidated financial statements and the notes thereto included in this Annual Report. Our consolidated financial statements are prepared in conformity with US GAAP.

On May 30, 2008, the Company filed an amendment to its annual report on Form 20-F for the year ended December 31, 2005 containing the restated financial statements as of and for the year ended December 31, 2005 to reflect certain adjustments to correct accounting errors mainly at Yuchai for such period.

We currently own, through six of our wholly-owned subsidiaries, 76.4% of the outstanding shares of Yuchai. Our ownership interest in Yuchai is our main operating asset. As a result, our financial condition and results of operations depend primarily upon Yuchai’s financial condition and results of operations, and the implementation of the Reorganization Agreement, as amended by the Cooperation Agreement.

Following an announcement in February 2005 by the Board of Directors of the Company of its approval of the implementation of our business expansion and diversification plan, we have looked for new business opportunities to seek to reduce our financial dependence on Yuchai. As of December 31,

2006,2008, we had a

36.6%34.4% interest in the outstanding ordinary shares of TCL and a 45.4% interest in the outstanding ordinary shares of HLGE. As of June

30, 2008, we had a 34.4%1, 2009, our interest in the outstanding ordinary shares of TCL

(as a result of issuance of additional ordinary shares by TCL pursuant to the exercise of options and

convertible securities) and a 45.4% interest in the outstanding ordinary shares of HLGE.HLGE remained unchanged. For further information on the Company’s investments in TCL and HLGE, see “Item 5. Operating and Financial Review and Prospects — Business Expansion and Diversification

Plan.”Plan”.

The selected consolidated balance sheet data as of December 31, 20052007 and 20062008 and the selected consolidated statement of operations data and selected consolidated statement of cash flows data set forth below for the years ended December 31, 2004, 20052006, 2007 and 20062008 are derived from our audited consolidated financial statements included in this Annual Report. Our selected consolidated balance sheet data set forth below as of December 31, 2002, 20032004, 2005 and 20042006 and selected consolidated statement of operations data and selected consolidated statement of cash flows data for the years ended December 31, 20022004 and 20032005 are derived from our audited consolidated financial statements not included in this Annual Report.

4

| | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2002 | | | 2003 | | | 2004 | | | 2005 | | | 2006 | | | 2006 | |

| | | Rmb | | | Rmb | | | Rmb | | | Rmb | | | Rmb | | | US$(1) | |

| | | (in thousands, except earnings per share) | |

Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | |

Revenues, net | | 3,513,047 | | | 4,569,950 | | | 5,582,095 | | | 5,816,740 | | | 6,920,528 | | | 1,008,956 | |

Gross profit | | 1,141,967 | | | 1,377,156 | | | 1,575,209 | | | 1,143,383 | | | 1,272,121 | | | 185,465 | |

Research and development costs | | (75,532 | ) | | (94,594 | ) | | (136,960 | ) | | (123,793 | ) | | (167,653 | ) | | (24,442 | ) |

Provision for uncollectible loans to a related party | | — | | | — | | | — | | | (202,950 | ) | | — | | | — | |

Operating income | | 640,307 | | | 721,411 | | | 779,929 | | | 26,020 | | | 304,479 | | | 44,391 | |

Other income/(expense), net | | 10,287 | | | (881 | ) | | 5,682 | | | 25,449 | | | 38,856 | | | 5,665 | |

Equity in losses of affiliates | | — | | | — | | | — | | | (6,032 | ) | | (22,449 | ) | | (3,273 | ) |

Earnings / (loss) before income taxes and minority interests | | 625,450 | | | 696,906 | | | 753,854 | | | (25,090 | ) | | 203,395 | | | 29,654 | |

Income taxes | | (83,242 | ) | | (112,924 | ) | | (105,165 | ) | | (10,148 | ) | | (30,466 | ) | | (4,442 | ) |

Income / (loss) before minority interests | | 542,208 | | | 583,982 | | | 648,689 | | | (35,238 | ) | | 172,929 | | | 25,212 | |

Minority interests in (income) losses of consolidated subsidiaries | | (129,775 | ) | | (145,800 | ) | | (157,292 | ) | | 2,947 | | | (61,645 | ) | | (8,987 | ) |

Net income / (loss) | | 412,433 | | | 438,182 | | | 491,397 | | | (32,291 | ) | | 111,284 | | | 16,225 | |

Basic and diluted earnings / (loss) per common share | | 11.67 | | | 12.40 | | | 13.90 | | | (0.89 | ) | | 2.99 | | | 0.44 | |

Weighted average number of shares | | 35,340 | | | 35,340 | | | 35,340 | | | 36,460 | | | 37,268 | | | 37,268 | |

| | | | | | |

Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | |

Working capital(2) | | 1,340,832 | | | 1,031,830 | | | 1,402,226 | | | 823,324 | | | 457,449 | | | 66,693 | |

Property, plant and equipment, net | | 772,968 | | | 735,641 | | | 1,158,931 | | | 1,440,712 | | | 1,795,405 | | | 261,755 | |

| | | | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2006 |

| | | Rmb | | Rmb | | Rmb | | Rmb | | Rmb | | US$(1) |

| | | (in thousands, except earnings per share) |

Total assets | | 3,985,459 | | 4,033,632 | | 5,384,248 | | 6,679,630 | | 7,961,357 | | 1,160,700 |

Long-term bank loans, excluding current installments | | 50,000 | | — | | 100,000 | | 50,000 | | 675,454 | | 98,476 |

Minority interests | | 487,491 | | 544,526 | | 724,311 | | 654,687 | | 693,296 | | 101,077 |

Total stockholders’ equity | | 2,161,903 | | 1,991,687 | | 2,483,084 | | 2,566,263 | | 2,728,399 | | 397,778 |

| | | | | | |

Consolidated Statement of Cash Flows Data: | | | | | | | | | | | | |

Net cash provided by operating activities | | 659,500 | | 1,075,274 | | 589,608 | | 234,770 | | 634,146 | | 92,452 |

Capital expenditures(3) | | 174,850 | | 372,775 | | 552,902 | | 515,359 | | 323,781 | | 47,205 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2008 |

| | | Rmb | | Rmb | | Rmb | | Rmb | | Rmb | | US$(1) |

| |

Selected Consolidated Statement of Income Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues, net | | | 5,582,095 | | | | 5,816,740 | | | | 6,920,528 | | | | 9,556,303 | | | | 10,384,022 | | | | 1,519,398 | |

| Gross profit | | | 1,575,209 | | | | 1,143,383 | | | | 1,272,121 | | | | 1,944,718 | | | | 1,822,502 | | | | 266,670 | |

| Research and development costs | | | (136,960 | ) | | | (123,793 | ) | | | (167,653 | ) | | | (153,146 | ) | | | (177,370 | ) | | | (25,953 | ) |

| Provision for uncollectible loans to a related party | | | — | | | | (202,950 | ) | | | — | | | | — | | | | — | | | | — | |

| Operating income | | | 779,929 | | | | 26,020 | | | | 304,479 | | | | 841,556 | | | | 603,907 | | | | 88,364 | |

| Other income/(expense), Net | | | 5,682 | | | | 25,449 | | | | 38,856 | | | | 53,554 | | | | 43,261 | | | | 6,329 | |

| Equity in income/(loss), net of affiliates | | | — | | | | (6,032 | ) | | | (22,449 | ) | | | 14,048 | | | | (36,573 | ) | | | (5,351 | ) |

| Earnings / (loss) before income taxes and minority Interests | | | 753,854 | | | | (25,090 | ) | | | 203,395 | | | | 783,914 | | | | 463,622 | | | | 67,837 | |

| Income taxes | | | (105,165 | ) | | | (10,148 | ) | | | (30,466 | ) | | | (68,518 | ) | | | (110,531 | ) | | | (16,173 | ) |

| Income / (loss) before minority Interests | | | 648,689 | | | | (35,238 | ) | | | 172,929 | | | | 715,396 | | | | 353,091 | | | | 51,644 | |

| Minority interests in (income) / losses of Consolidated Subsidiaries | | | (157,292 | ) | | | 2,947 | | | | (61,645 | ) | | | (189,927 | ) | | | (100,641 | ) | | | (14,726 | ) |

| Net income / (loss) | | | 491,397 | | | | (32,291 | ) | | | 111,284 | | | | 525,469 | | | | 252,450 | | | | 36,938 | |

| Basic and diluted earnings / (loss) per common share | | | 13.90 | | | | (0.89 | ) | | | 2.99 | | | | 14.10 | | | | 6.77 | | | | 0.99 | |

| Weighted average number of shares | | | 35,340 | | | | 36,460 | | | | 37,268 | | | | 37,268 | | | | 37,268 | | | | 37,268 | |

5

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2008 |

| | | Rmb | | Rmb | | Rmb | | Rmb | | Rmb | | US$ (1) |

| | | | | | | | | | | (in thousands) | | | | | | | | |

Selected Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Working capital(2) | | | 1,402,226 | | | | 823,324 | | | | 457,449 | | | | 1,028,732 | | | | 1,027,660 | | | | 150,368 | |

| Property, plant and equipment, net | | | 1,158,931 | | | | 1,440,712 | | | | 1,795,405 | | | | 2,158,246 | | | | 2,149,290 | | | | 314,485 | |

| Trade accounts and bills receivable, net | | | 875,565 | | | | 1,178,853 | | | | 1,480,918 | | | | 3,107,785 | | | | 2,537,681 | | | | 371,315 | |

| Short-term bank loans | | | 430,000 | | | | 812,835 | | | | 1,009,134 | | | | 819,164 | | | | 1,068,675 | | | | 156,369 | |

| Trade accounts payable | | | 1,089,717 | | | | 1,800,443 | | | | 2,132,798 | | | | 2,509,962 | | | | 2,612,928 | | | | 382,326 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2008 |

| | | Rmb | | Rmb | | Rmb | | Rmb | | Rmb | | US$ (1) |

| | | | | | | | | | | (in thousands) | | | | | | | | |

| Total assets | | | 5,384,248 | | | | 6,679,630 | | | | 7,961,357 | | | | 9,579,184 | | | | 9,712,678 | | | | 1,421,166 | |

| Long-term bank loans | | | 100,000 | | | | 50,000 | | | | 675,454 | | | | 767,929 | | | | 254,529 | | | | 37,243 | |

| Minority interests | | | 724,311 | | | | 654,687 | | | | 693,296 | | | | 849,527 | | | | 974,046 | | | | 142,524 | |

| Total stockholders’ equity | | | 2,483,084 | | | | 2,566,263 | | | | 2,728,399 | | | | 3,294,465 | | | | 3,430,825 | | | | 502,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year ended December 31, |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2008 |

| | | Rmb | | Rmb | | Rmb | | Rmb | | Rmb | | US$(1) |

| | | | | | | | | | | (in thousands) | | | | | | | | |

Selected Consolidated Statement of Cash Flows Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net cash provided by operating activities | | | 589,608 | | | | 234,770 | | | | 634,146 | | | | 84,554 | | | | 632,686 | | | | 92,575 | |

Capital expenditures(3) | | | 552,902 | | | | 515,359 | | | | 323,781 | | | | 265,258 | | | | 480,333 | | | | 70,282 | |

| | |

| (1) | | The Company’s functional currency is the U.S. dollar and its reporting currency is Renminbi. The functional currency of Yuchai is Renminbi. Translation of amounts from Renminbi to USU.S. dollars is solely for the convenience of the reader. Translation of amounts from Renminbi to U.S. dollars has been made at the rate of Rmb 6.85916.8343 = US$1.00, the rate quoted by the People’s Bank of China at the close of business on June 30, 2008.15, 2009. No representation is made that the Renminbi amounts could have been, or could be, converted into U.S. dollars at that rate or at any other rate prevailing on June 30, 200815, 2009 or any other date. The rate quoted by the People’s Bank of China at the close of business on December 29, 200631, 2008 was Rmb 7.80876.8346 = US$1.00. The Renminbi has appreciated against the U.S. dollar since December 29, 2006. |

|

| (2) | | Current assets less current liabilities. |

|

| (3) | | Purchase of property, plant and equipment lease prepayments and payment for construction in progress. |

Dividends6

Dividends

Our principal source of cash flow has historically been our share of the dividends, if any, paid to us by Yuchai, as described under “Item 5. Operating and Financial Review and Prospects — Liquidity and Capital Resources.”

In May 1993, in order to finance further expansion, Yuchai sold shares to the Company, or Foreign Shares, and became a Sino-foreign joint stock company.

Chinese laws and regulations applicable to a Sino-foreign joint stock company require that before Yuchai distributes profits, it must (i) recover losses in previous years; (ii) satisfy all tax liabilities; and (iii) make contributions to the statutory reserve fund in an amount equal to 10% of net income for the year determined in accordance with generally accepted accounting principles in the PRC, or PRC GAAP. However, the allocation of statutory reserve fund will not be further required once the accumulated amount of such fund reaches 50.0% of the registered capital of Yuchai.

Any determination by Yuchai to declare a dividend will be at the discretion of Yuchai’s shareholders and will be dependent upon Yuchai’s financial condition, results of operations and other relevant factors. Yuchai’s Articles of Association provide that dividends shall be paid once a year. To the extent Yuchai has foreign currency available, dividends declared by shareholders at a shareholders’ meeting to be paid to holders of Foreign Shares (currently only us) will be payable in foreign currency, and such shareholders will have priority thereto. If the foreign currency available is insufficient to pay such dividends, such dividends may be payable partly in Renminbi and partly in foreign currency. Dividends allocated to holders of Foreign Shares may be remitted in accordance with the relevant Chinese laws and regulations. In the event that the dividends are distributed in Renminbi, such dividends may be converted into foreign currency and remitted in accordance with the relevant Chinese laws, regulations and policies.

The following table sets forth a five-year summary of dividends we have paid to our shareholders as well as dividends paid to us by Yuchai:

| | | | |

| | | | Dividend paid by Yuchai |

| Financial | | Dividend paid by the Company

to its shareholders in the financial year | | to the Company(1)

for the financial year |

| Year | | (per share) | | (in thousands) |

| 2004 | | Nil | | Rmb 231,309 (US$27,906)(2) |

| 2005 | | US$0.39 | | Rmb 72,282 (US$9,039)(3) |

| 2006 | | US$0.02(4) | | Rmb 72,284 (US$9,598)(5) |

| 2007 | | US$0.10(6) | | Rmb 108,313 (US$15,811)(7) |

| 2008 | | US$0.10(8) | | Nil |

| | |

Period

(1) | | Dividend paid by the Company

to its shareholders

(per share)

| | Dividend paid by Yuchai

to the Company(1)

(in thousands)

|

2002

| | US$0.19 | | Rmb 245,766 (US$29,694)(2) |

2003

| | US$2.08 | | Rmb 61,433 (US$7,422) |

2004

| | Nil

| | Rmb 231,309 (US$27,906)(3) |

2005

| | US$0.39

| | Rmb 72,282 (US$9,039)(4) |

2006

| | US$0.02(5) | | Rmb 72,284 (US$9,598) (6) |

2007

| | US$0.10(7) | | Not yet declared |

(1) | Dividends paid by Yuchai to us, as well as to other shareholders of Yuchai, were declared in Renminbi and paid in US dollars (as shown in parentheses) based on the exchange rates at local designated foreign exchange banks on the respective payment dates. For dividends paid for 2002, 2003, 2004, 2005, 2006 and 2006,2007, the exchange rate used was Rmb 8.2767 = US$1.00, Rmb 8.2767 = US$1.00, Rmb 8.2765 = US$1.00, Rmb 7.9967 = US$1.00, and Rmb 7.5310 = US$1.00 and Rmb 6.8357 = US$1.00 respectively. |

|

| (2) | The dividend declared for 2002 by Yuchai was paid to us in 2003 following the execution of the July 2003 Agreement (as defined in “Item 4. Information on the Company — History and Development — Reorganization Agreement”).

|

(3) | The dividend declared for 2004 by Yuchai was paid to us in 2005 following the execution of the Reorganization Agreement. Agreement (as defined in “Item 4. Information on the Company-History and Development-Reorganization Agreement”). |

(4) |

| (3) | | On June 26, 2006, Yuchai declared a dividend to all shareholders in respect of the fiscal year ended December 31, 2005 and the amount attributable to the Company was Rmb 72.3 million (US$9.0 million).million. We received this dividend on July 28, 2006. |

(5) |

| (4) | | On December 4, 2006, we declared an interim dividend of US$0.02 per ordinary share to all shareholders in respect of the fiscal year ended December 31, 2006. This dividend was paid to the shareholders on December 28, 2006. |

(6) |

| (5) | | The dividend declared for 2006 by Yuchai was paid to us on September 17, 2007. |

(7) |

| (6) | | On September 28, 2007, we declared a second interim dividend of US$0.10 per ordinary share amounting to US$3.7 million to all shareholders in respect of the fiscal year ended December 31, 2006. This dividend was paid to the shareholders on October 24, 2007. |

|

| (7) | | The dividend declared for 2007 by Yuchai was paid to us on August 22, 2008. |

|

| (8) | | On August 25, 2008, we declared an interim dividend of US$0.10 per ordinary share amounting to US$3.7 million to all shareholders in respect of the fiscal year ended December 31, 2007. This dividend was paid to the shareholders on September 19, 2008. |

7

Historical Exchange Rate Information On December 29, 2006,31, 2008, the PBOC rate was Rmb 6.8346 = US$1.00. On June 15, 2009, the PBOC rate was Rmb 6.8343 = US$1.00.

On December 31, 2008, the noon buying rate was Rmb 6.8225 = US$1.00. On June 15, 2009, the noon buying rate was Rmb 6.8302 = US$1.00.

The following tables set forth certain information concerning exchange rates between Renminbi and US dollars based on the noon buying rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York

was Rmb 7.8041 = US$1.00. On December 31, 2007, the noon buying rate was Rmb 7.2946 = US$1.00. On June 30, 2008, the noon buying rate was Rmb 6.8591 = US$1.00.The following tables set forth certain information concerning exchange rates between Renminbi and US dollars for the periods indicated:

| | | | | | | | | |

| | | Noon Buying Rate(1)

(Rmb per US$1.00) | |

| Period | | High | | | Low | |

| December 2008 | | | 6.8842 | | | | 6.8225 | |

| January 2009 | | | 6.8403 | | | | 6.8225 | |

| February 2009 | | | 6.8470 | | | | 6.8241 | |

| March 2009 | | | 6.8438 | | | | 6.8240 | |

| April 2009 | | | 6.8361 | | | | 6.8180 | |

| May 2009 | | | 6.8326 | | | | 6.8176 | |

| June 2009 | | | 6.8371 | | | | 6.8264 | |

| | | | | | | | | | | | | | | | | |

| | | Noon Buying Rate(1)

(Rmb per US$1.00) |

| Period | | Period End | | Average(2) | | High | | Low |

| 2004 | | | 8.2765 | | | | 8.2768 | | | | 8.2774 | | | | 8.2764 | |

| 2005 | | | 8.0702 | | | | 8.1734 | | | | 8.2765 | | | | 8.0702 | |

| 2006 | | | 7.8041 | | | | 7.9579 | | | | 8.0702 | | | | 7.8041 | |

| 2007 | | | 7.2946 | | | | 7.5806 | | | | 7.8127 | | | | 7.2946 | |

| 2008 | | | 6.8225 | | | | 6.9193 | | | | 7.2946 | | | | 6.7800 | |

| 2009 (through June 15, 2009) | | | 6.8361 | | | | 6.8325 | | | | 6.8470 | | | | 6.8176 | |

8

| | | | |

| | | Noon Buying Rate(1)

(Rmb per US$1.00) |

Period | | High | | Low |

November 2007 | | 7.4582 | | 7.3800 |

December 2007 | | 7.4120 | | 7.2946 |

January 2008 | | 7.2946 | | 7.1818 |

February 2008 | | 7.1973 | | 7.1100 |

March 2008 | | 7.1075 | | 7.0105 |

April 2008 | | 7.0185 | | 6.9840 |

May 2008 | | 7.0000 | | 6.9377 |

June 2008 | | 6.9633 | | 6.8591 |

| | | | | | | | |

| | | Noon Buying Rate(1)

(Rmb per US$1.00) |

Period | | Period End | | Average(2) | | High | | Low |

2002 | | 8.2800 | | 8.2772 | | 8.2800 | | 8.2765 |

2003 | | 8.2767 | | 8.2771 | | 8.2800 | | 8.2765 |

2004 | | 8.2765 | | 8.2768 | | 8.2774 | | 8.2764 |

2005 | | 8.0702 | | 8.1734 | | 8.2765 | | 8.0702 |

2006 | | 7.8041 | | 7.9579 | | 8.0702 | | 7.8041 |

2007 | | 7.2946 | | 7.5806 | | 7.8127 | | 7.2946 |

2008 (through June 30, 2008) | | 6.8951 | | 7.0152 | | 7.2946 | | 6.8591 |

| | |

| (1) | | The noon buying rate in New York for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. Since April 1994, the noon buying rate has been based on the rate quoted by the PBOC. As a result, since April 1994, the noon buying rate and the PBOC rate have been substantially similar. The PBOC rate at the end of 2006 was Rmb 7.8087, compared with Rmb 7.9579 for the noon buying rate (average) for the year ended December 31, 2006. The PBOC rate at the end of 2007 was Rmb 7.0000,7.2946, compared with RmbRMB 7.5806 for the noon buying rate (average) for the year ended December 31, 2007. The PBOC rate at the end of 2008 was Rmb 6.8346, compared with Rmb 6.9193 for the noon buying rate (average) for the year ended December 31, 2008. |

|

| (2) | | Determined by averaging the rates on the last business day of each month during the relevant period. |

Risk Factors

Risks relating to our shares and share ownership

Our controlling shareholder’s interests may differ from those of our other shareholders.

Our controlling shareholder, Hong Leong Asia Ltd., or Hong Leong Asia, indirectly owns 7,913,769, or 21.2%, of the outstanding shares of our Common Stock, as well as a special share that entitles it to elect a majority of our directors. Hong Leong Asia controls us through its wholly-owned subsidiary, Hong Leong (China) Limited, or Hong Leong China, and through HL Technology Systems Pte Ltd, or HL Technology, a wholly-owned subsidiary of Hong Leong China. HL Technology owns approximately 21.0% of the outstanding shares of our Common Stock and is, and has since August 2002 been, the registered holder of the special share. Hong Leong Asia also owns, and has since May 2005 owned, through another wholly-owned subsidiary, Well Summit Investments Limited, approximately 0.2% of the outstanding shares of our Common Stock. Hong Leong Asia is a member of the Hong Leong Investment Holdings Pte Ltd., or Hong Leong Investment, group of companies. Prior to August 2002, we were controlled by Diesel Machinery (BVI) Limited, or Diesel Machinery, which, until its dissolution, was a holding company controlled by Hong Leong China and was the prior owner of the special share. Through HL Technology’s stock ownership and the rights accorded to the Special Share under our bye-laws and various agreements among shareholders, Hong Leong Asia is able to effectively approve and effect most corporate transactions. See “Item 7. Major Shareholders and Related Party Transactions — Related Party Transactions — Shareholders Agreement.” In addition, our shareholders do not have cumulative voting rights. There can be no assurance that Hong Leong Asia’s actions will be in the best interests of our other shareholders. See also “Item 7. Major Shareholders and Related Party Transactions — Major Shareholders.”

We may experience a change of control as a result of sale or disposal of shares of our Common Stock by our controlling shareholders.

As described above, HL Technology, a subsidiary of Hong Leong Asia, owns 7,831,169 shares of our Common Stock, as well as the special share. If HL Technology reduces its shareholding to less than 7,290,000 shares of our Common Stock, our Bye-Laws provide that the special share held by HL Technology will cease to carry any rights, and Hong Leong Asia may as a result cease to have control over us. See “Item 7. Major Shareholders and Related Party Transactions — Major Shareholders — The Special Share.” If HL Technology sells or disposes of all of the shares of our Common Stock, we cannot determine what control arrangements will arise as a result of such sale or disposal (including changes in our management arising therefrom), or assess what effect those control arrangements may have, if any, on our financial condition, results of operations, business, prospects or share price.

In addition, certain of our financing arrangements have covenants requiring Hong Leong Asia to retain ownership of the special share and that we remain a principal subsidiary (as defined in such arrangements) of Hong Leong Asia. A breach of that covenant may require us to pay all outstanding amounts under those financing arrangements. There can be no assurance that we will be able to pay such amounts or obtain alternate financing.

9

The market price for our Common Stock may be volatile.

In recent periods, there has been volatility in the market price for our Common Stock. The market price could fluctuate substantially in the future in response to a number of factors, including:

| • | | our interim operating results; |

|

| • | | the availability of raw materials used in our engine production, particularly steel and cast iron; |

|

| • | | the public’s reaction to our press releases and announcements and our filings with the Securities and Exchange Commission; |

|

| • | | changes in financial estimates or recommendations by stock market analysts regarding us, our competitors or other companies that investors may deem comparable; |

|

| • | | operating and stock price performance of our competitors or other companies that investors may deem comparable; |

|

| • | | changes in general economic conditions, especially the impact of the global financial crisis on economic growth; |

|

| • | | future sales of our Common Stock in the public market, or the perception that such sales could occur; or |

|

| • | | the announcement by us or our competitors of a significant acquisition. |

As a result of the global financial crisis, global stock markets have experienced extreme price and volume fluctuations. This volatility has had a significant effect on the market prices of securities issued by many companies for reasons unrelated to their operating performance. These broad market fluctuations may materially adversely affect our stock price.

Risks relating to our company and our business

The diesel engine business in China is dependent in large part on the performance of the Chinese and the global economy, as well as Chinese government policy. As a result, our financial condition, results of operations, business and prospects could be adversely affected by slowdowns in the Chinese and the global economy, as well as Chinese government policies affecting our business.

Our operations and performance depend significantly on worldwide economic conditions. During periods of economic expansion, the demand for trucks, construction machinery and other applications of diesel engines generally increases. Conversely, uncertainty about current global economic conditions or adverse changes in the economy could lead to a significant decline in the diesel engine industry which is generally adversely affected by a decline in demand. As a result, the performance of the Chinese economy will likely affect, to a significant degree, our financial condition, results of operations, business and prospects. For example, the various austerity measures taken by the Chinese government from time to time to regulate economic growth and control inflation have in prior periods significantly weakened demand for trucks in China, and may have a similar effect in the future. In particular, austerity measures that restrict access to credit and slow the rate of fixed investment (including infrastructure development) adversely affect demand for, and production of, trucks and other commercial vehicles. Uncertainty and adverse changes in the economy could also increase costs associated with developing our products, increase the cost and decrease the availability of potential sources of financing, and increase our exposure to material losses from our investments, any of which could have a material adverse impact on our financial condition and operating results.

As widely reported, financial markets in the United States, Europe and Asia have been experiencing extreme disruption, including, among other things, extreme volatility in security prices, severely diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations of others. Although recent data suggests that the rate of contraction in the world economy is slowing, there is still a lot of uncertainty over the global economy and its recovery prospects. Weak economic conditions in our target markets, or a reduction in automobile spending even if economic conditions improve, would likely adversely impact our business, operating results and financial condition in a number of ways, including longer sales cycles, lower prices for our products and reduced unit sales. Our revenues and gross margins are based on certain levels of consumer and corporate spending.

10

The current conditions make it difficult for our customers, our vendors and us to accurately forecast and plan future business activities. If our projections of these expenditures fail to materialize due to reductions in consumer or corporate spending as a result of uncertain conditions in the macroeconomic environment, our revenues and gross margins could be adversely affected. As a result of the current tightening of credit in financial markets, our customers and suppliers may experience serious cash flow problems and as a result, may modify, delay or cancel plans to purchase our products. Any inability of current and/or potential customers to pay us for our products may adversely affect our earnings and cash flow. The global financial crisis has had an adverse impact on China’s economic growth as reflected in the fall in growth rates from 9% and 6.8% in the third and fourth quarters of 2008 respectively, to a multi-year growth rate of 6.1% in the first quarter ended March 31, 2009 according to the National Bureau of Statistics. The Chinese government has officially set growth rate targets for 2009 at 8%, which is regarded as the minimum growth rate required to prevent mass unemployment leading to social unrest, whereas the World Bank’s recent forecast for China’s gross domestic product growth for 2009 is 7.2%. The Chinese government on November 10, 2008 announced a 4 trillion yuan stimulus package to maintain economic stability and development through spending on infrastructure projects and in March 2009 at the 11th National People’s Congress, further outlined a package of measures to drive economic growth. In addition, it was announced that a total of Rmb 908 billion of the central government investments in 2009 would be spent on key infrastructure construction, technology innovation, environmental protection and low-income housing. The measures being adopted by the Chinese government to ensure continued economic growth are in the early stages of implementation and would require time to have an effect on the economy. There is no assurance that such stimulus measures will be successful in achieving their aim. Uncertainty and adverse changes in the economy could also increase costs associated with developing our products, increase the cost and decrease the availability of potential sources of financing, and increase our exposure to material losses from our investments. Additionally, our stock price could decrease if investors have concerns that our business, financial condition and results of operations will be negatively impacted by a worldwide macroeconomic downturn. We are unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions in the U.S. and other countries. If these conditions deteriorate further or do not show improvement, we may experience material adverse impact to our business and operating results.

The business and prospects for the diesel engine industry, and thus the business and prospects of our company, may also be adversely affected by Chinese government policy. For example, in 1998, the Chinese government announced a major initiative to boost consumer demand through investments in infrastructure projects and increased availability of bank credit. As a result, demand for trucks and other commercial vehicles, and thus demand for diesel engines, continued to increase from 2002 to 2004. The sales for commercial vehicles increased by 14.2% and 22.2% in 2006 and 2007 respectively due to the strong economic growth achieved and continued investment in infrastructure building by the Chinese government.(Source: China Automotive Industry Newsletter for 2006 and 2007). In the first half of 2008, sales for commercial vehicles continued to increase but began slowing down in the second half of the year. As at December 31, 2008, the overall sales of commercial vehicles had reduced by approximately 5.25 % compared to 2007. This was due to the effects of the global financial crisis in the third quarter of 2008 and also the implementation of the National III emission standard which resulted in advanced purchase of vehicles in the first half of 2008.(Source: China Automotive Industry Newsletter for 2008)However, we cannot assure you that the Chinese government will not change its policy in the future to de-emphasize the use of diesel engines, and any such change will adversely affect our financial condition, results of operations, business or prospects. For example, the Chinese government has from time to time introduced measures to avoid overheating in certain sectors of the economy, including tighter bank lending policies and increases in bank interest rates. See “— Risks relating to Mainland China — Adverse changes in the economic policies of the Chinese government could have a material adverse effect on the overall economic growth of Mainland China, which could reduce the demand for our products and adversely affect our competitive position.”

Our financial condition, results of operations, business and prospects may be adversely affected if we are unable to implement the Reorganization Agreement and the Cooperation Agreement. We own 76.4% of the outstanding shares of Yuchai, and one of our primary sources of cash flow continues to be our share of the dividends, if any, paid by Yuchai and investment earnings thereon. As a result of the agreement reached with Yuchai and its related parties pursuant to the July 2003 Agreement, we discontinued legal and arbitration proceedings initiated by us in May 2003 relating to difficulties with respect

11

to our investment in Yuchai. In furtherance of the terms of the July 2003 Agreement, we, Yuchai and Coomber Investments Limited, or Coomber, entered into the Reorganization Agreement in April 2005, as amended in December 2005 and November 2006, and agreed on a restructuring plan for our company intended to be beneficial to our shareholders. In June 2007, we, along with Yuchai, Coomber and the State Holding Company, entered into the Cooperation Agreement. The Cooperation agreement amends certain terms of the Reorganization Agreement and as so amended, incorporates the terms of the Reorganization Agreement. Pursuant to the amendments to the Reorganization Agreement, the Company has agreed that the restructuring and spin-off of Yuchai will not be effected, and, recognizing the understandings that have been reached between the Company and the State Holding Company to jointly undertake efforts to expand the business of Yuchai, the Company will not seek to recover the anti-dilution fee of US$20 million that was due from Yuchai. See “Item 4. Information on the Company — History and Development — Reorganization Agreement.” No assurance can be given as to when the business expansion requirements relating to Yuchai as contemplated by the Reorganization Agreement and the Cooperation Agreement will be fully implemented, or that implementation of the Reorganization Agreement and the Cooperation Agreement will effectively resolve all of the difficulties faced by us with respect to our investment in Yuchai.

In addition, the Reorganization Agreement contemplates the continued implementation of our business expansion and diversification plan adopted in February 2005. One of the goals of this business expansion and diversification plan is to reduce our financial dependence on Yuchai. Thus far, we have acquired strategic stakes in TCL and HLGE. See “Item 5. Operating and Financial Review and Prospects — Business Expansion and Diversification Plan.” Nonetheless, no assurance can be given that we will be able to successfully expand and diversify our business. We may also not be able to continue to identify suitable acquisition opportunities, or secure funding to consummate such acquisitions or successfully integrate such acquired businesses within our operations. Any failure to implement the terms of the Reorganization Agreement and Cooperation Agreement, including our continued expansion and diversification, could have a material adverse effect on our financial condition, results of operations, business or prospects. Additionally, although the Cooperation Agreement amends certain provisions of the Reorganization Agreement and also acknowledges the understandings that have been reached between us and the State Holding Company to jointly undertake efforts to expand and diversify the business of Yuchai, no assurance can be given that we will be able to successfully implement those efforts or as to when the transactions contemplated therein will be consummated.

We have and may continue to experience disagreements and difficulties with the Chinese shareholders in Yuchai. Although we own 76.4% of the outstanding shares of Yuchai, and believe we have proper legal ownership of our investment and a controlling financial interest in Yuchai, in the event there is a dispute with Yuchai’s Chinese shareholders regarding our investment in Yuchai, we may have to rely on the Chinese legal system for remedies. The Chinese legal system may not be as effective as compared to other more developed countries such as the United States. See “— Risks relating to Mainland China — The Chinese legal system embodies uncertainties which could limit the legal protection available to foreign investors.” We have in the past experienced problems from time to time in obtaining assistance and cooperation of Yuchai’s Chinese shareholders in the daily management and operation of Yuchai. We have, in the past also experienced problems from time to time in obtaining the assistance and cooperation of the State Holding Company in dealing with other various matters, including the implementation of corporate governance procedures, the payment of dividends, the holding of Yuchai board meetings and the resolution of employee-related matters. Examples of these problems are described elsewhere in this Annual Report. The July 2003 Agreement, the Reorganization Agreement and the Cooperation Agreement are intended to resolve certain issues relating to our share ownership in Yuchai and the continued corporate governance and other difficulties which we have had with respect to Yuchai. As part of the terms of the Reorganization Agreement, Yuchai agreed that it would seek the requisite shareholder approval prior to entering into any material

transactions (including any agreements or arrangements with parties related to Yuchai or any of its shareholders) and that it would comply with its governance requirements. Yuchai also acknowledged and affirmed the Company’s continued rights as majority shareholder to direct the management and policies of Yuchai through Yuchai’s Board of Directors. Yuchai’s Articles of Association have been amended and such amended Articles of Association entitle the Company to elect nine of Yuchai’s 13 directors, thereby reaffirming the Company’s right to effect all major decisions relating to Yuchai. However, Yuchai’s amended Articles of Association are not yet effective pending approval of the Ministry of Commerce, PRC. While Yuchai has affirmed the Company’s continued rights as Yuchai’s majority shareholder and authority to direct the management and policies of Yuchai, no assurance can be given that disagreements and difficulties with Yuchai’s management and/or Yuchai’s Chinese shareholders will not recur, including implementation of the Reorganization Agreement and the Cooperation Agreement, corporate governance matters or related party transactions. Such disagreements and difficulties could ultimately have a material adverse impact on our consolidated financial position, results of operations and cash flows.

12

We have identified material weaknesses in our internal control over financial reporting and have been required to restate our historical financial statements in the past. We cannot assure you that additional material weaknesses will not be identified in the future. Our failure to implement and maintain effective internal control over financial reporting could result in material misstatements in our financial statements which could require us to restate financial statements in the future, or cause us not to be able to provide timely financial information, which may cause investors to lose confidence in our reported financial information and have a negative effect on our stock price.In Amendment No. 1 to our Annual Report on Form 20-F for the year ended December 31, 2005, we

We restated our consolidated financial statements for the year ended December 31, 2005, and reported material weaknesses in our internal control over financial reporting and concluded that as of December 31, 2005,

2006 and 2007, our disclosure controls and procedures were

not effective and as of December 31, 2006 and 2007, our internal control over financial reporting was not effective. In addition, in connection with management’s

ongoing assessment of the effectiveness of our internal control over financial reporting for the period covered by this Annual Report, management has identified material weaknesses in our internal control over financial reporting and has concluded that as of December 31,

2006,2008, our disclosure controls and procedures and internal control over financial reporting were not effective.

Our current independent registered public accounting firm has expressed an adverse opinion on the effectiveness of our internal control over financial reporting as of December 31, 2008. See “Item

15T15 — Controls and Procedures.”

Despite our efforts to ensure the integrity of our financial reporting process, we cannot assure you that additional material weaknesses or significant deficiencies in our internal control over financial reporting will not be identified in the future.

Although the assessment by the Company’s management of the effectiveness of the Company’s internal control over financial reporting as of December 31, 2007 is continuing, the Company’s management currently expects to disclose one or more material weaknesses in its internal control over financial reporting.Any failure to maintain or improve existing controls or implement new controls could result in additional material weaknesses or significant deficiencies and cause us to fail to meet our periodic reporting obligations which in turn could cause our shares to be de-listed or suspended from trading on the NYSE. In addition, any such failure could result in material misstatements in our financial statements and adversely affect the results of annual management evaluations regarding the effectiveness of our internal control over financial reporting. Any of the foregoing could cause investors to lose confidence in our reported financial information, leading to a decline in our share price.

Our exposure to the Dongfeng Group has had, and could continue to have, a material adverse effect on our business, financial condition and results of operation. Our sales are concentrated among the Dongfeng Group which includes the Dongfeng Automobile Company, one of the largest state-owned automobile companies in China, and other major diesel truck manufacturers controlled by or affiliated with the Dongfeng Automobile Company. In

2006,2008, sales to the Dongfeng Group accounted for

21.7%18.8% of our total net revenues, of which sales to our two largest customers, Liuzhou Dongfeng Automobile and Hubei Dongfeng Automobile, accounted for

9.9%.5.5% and 2.2%, respectively. Although we consider our relationship with the Dongfeng Group to be good, the loss of one or more of the companies within the Dongfeng Group as a customer would have a material adverse effect on our financial condition, results of operations, business or prospects.

In addition, we are dependent on the purchases made by the Dongfeng Group from us and have exposure to their liquidity arising from the high level of accounts receivable from them. We cannot assure you that the Dongfeng Group will be able to repay all the money they owe to us. In addition, the Dongfeng Group may not be able to continue purchasing the same volume of products from

our companyus which would reduce our overall sales volume.

The Dongfeng Group also competes with us in the diesel engine market in China. Although we believe that the companies within the Dongfeng Group generally make independent purchasing decisions based on end-user preferences, we cannot assure you that truck manufacturers affiliated with the Dongfeng Automobile Company will not preferentially purchase diesel engines manufactured by companies within the Dongfeng Group over those manufactured by us.

13

Competition in China from other diesel engine manufacturers may adversely affect our financial condition, results of operations, business or prospects. The diesel engine industry in China is highly competitive. We compete with many other China domestic companies, most of which are state-owned enterprises. Some of our competitors have formed joint ventures with or have technology assistance relationships with foreign diesel engine manufacturers or foreign engine design consulting firms and use foreign technology that is more advanced than ours. We expect competition to intensify as a result of:

improvements in competitors’ products;

| • | | improvements in competitors’ products; |

|

| • | | increased production capacity of competitors; |

|

| • | | increased utilization of unused capacity by competitors; and |

|

| • | | price competition. |

increased production capacity of competitors;

increased utilization of unused capacity by competitors; and

In addition, if restrictions on the import of motor vehicles and motor vehicle parts into China are reduced, foreign competition could increase significantly.

In the medium-duty diesel engine market, our 6108 medium-duty engine, introduced in 1997, has been competing with the 6110 medium-duty engine offered by our competitors. We cannot assure you, however, that we will be able to maintain or improve our current market share or develop new markets for our medium-duty diesel engines.

Based on current industry trends, although there is a perceived shift in the market demand from medium-duty engines to heavy-duty diesel engines, general credit tightening by banks may however affect this trend. In 2006, 6108 medium-duty engine sales volumes declined 53.1% compared to its sales in 2005. In 2007,

however,our 6108 medium-duty engine sales volumes improved approximately

85%41.0% compared to its sales in 2006.

In 2008, 6108 medium-duty engines sales volumes decreased approximately 4.7% compared to its sales in 2007. With the improved highway road system as a result of the Chinese government’s investment in infrastructure, truck market sales growth is trending towards heavy-duty engines.

In the heavy-duty diesel engine market, we introduced the 6112 heavy-duty engine in late 1999. Due to a delay in the commercial production of the 6112 engine, however, we were not able to benefit from the competitive advantages of an early entry into the China domestic market for heavy-duty engines. Moreover, the market for heavy-duty diesel engines in China is price-sensitive. We commenced engine development of the 6L heavy-duty engine (formerly referred to as 6113) in 2003 and introduced the 6M heavy-duty engine family for heavy-duty trucks and passenger buses in 2004. We cannot assure you that our 6112, 6L or 6M heavy-duty engines will be able to compete successfully in the heavy-duty diesel engine market in China with the existing producers or any new entrants.

In the light-duty diesel engine market, our

4-Series engines (which include 4108, 4110 and 4112 light-duty

enginesengines) introduced in 2000 were met with weak consumer demand due to strong competition and a high pricing structure. Yuchai’s first sales of the 4F engines occurred in March 2005. Yuchai expects growth of this new engine to strengthen over the next few years and become a significant contributor to

its sales

growth for Yuchai.growth. Although there had been an increase in sales of our 4-Series engines from 2003 to 2007, this has been primarily due to the average selling price of the 4-Series engines being lower than the medium and heavy-duty diesel engines, thereby making the 4-Series more affordable to the buyers especially due to the credit tightening by banks in China. In

2006, the 4-Series engines continued a healthy growth of 18.5% over 2005 in unit sales amid increasing selling price pressure due to strong growth in light-duty engine truck sectors and the Chinese government’s subsidy to the agriculture sector. In 2007, the 4-Series engines had a growth of approximately

56%38.7% in unit sales over 2006.

In 2008, however, the unit sales of 4-series engines fell slightly by 1.8% over 2007 partially due to the global financial crisis in the last quarter of 2008. We cannot assure you that we will be able to continue to improve our market share for light-duty diesel engines, and we may, in the future, decide to cease production of one or more of the models we are currently producing.

Our long-term business prospects will depend largely upon our ability to develop and introduce new or improved products at competitive prices. Our competitors in the diesel engine markets may be able to introduce new or improved engine models that are more favorably received by customers. Competition in the end-useend-user markets, mainly the truck market, may also lead to technological improvement and advances that render our current products obsolete at an earlier than expected date, in which case we may have to depreciate or impair our production equipment more rapidly than planned. Failure to introduce or delays in the introduction of new or improved products at competitive prices could have a material adverse effect on our financial condition, results of operations, business or prospects.

14

Our financial condition, results of operations, business or prospects may be adversely affected to the extent we are unable to continue our sales growth or adequately manage our growth. We have achieved consistent growth in net sales during the last five fiscal years, with net sales increasing by

4.2%38.1% from

20042006 to Rmb

5,816.79,556.3 million in

20052007 and by

19.0%8.7% from 2007 to Rmb

6,920.510,384.0 million

(US$1,009.0 million) in

2006.2008. We cannot assure you that we can continue to increase our net sales or maintain our present level of net sales. For example, during 2005, we increased production capacity to approximately 290,000 units after the completion of our second foundry and the new 6L and 6M heavy-duty engines lines, and we may not be able to increase our net sales commensurate with our increased levels of production capacity. Moreover, our future growth is dependent in large part on factors beyond our control, such as the continued economic growth in China.

The global financial crisis has had an adverse impact on the economic growth outlook for China and in response, the Chinese government, on November 10, 2008 announced a 4 trillion yuan stimulus package with an aim to maintain economic stability and development through spending on infrastructure projects. In March 2009, at the 11th National People’s Congress, the Chinese government further outlined a package of measures to drive economic growth. In addition, the Chinese government also announced that a total of Rmb 908 billion of the central government investments in 2009 would be spent on key infrastructure construction, technology innovation, environmental protection and low-income housing. There is no assurance that such stimulus measures will be sufficient or successful to ensure continued economic growth of the same levels prior to the global financial crisis. We are unable to predict the likely duration and severity of the current disruption in financial markets and adverse economic conditions in the U.S. and other countries.

In addition, we cannot assure you that we will be able to properly manage any future growth, including:

obtaining the necessary supplies, including the availability of raw materials;

| • | | obtaining the necessary supplies, including the availability of raw materials; |

|

| • | | hiring and training skilled production workers and management personnel; |

|

| • | | manufacturing and delivering products for increased orders in a timely manner; |

|

| • | | maintaining quality standards and prices; |

|

| • | | controlling production costs; and |

|

| • | | obtaining adequate funding on commercially reasonable terms for future growth. |

hiring and training skilled production workers and management personnel;

manufacturing and delivering products for increased orders in a timely manner;

maintaining quality standards and prices;

controlling production costs; and

obtaining adequate funding on commercially reasonable terms for future growth.

Furthermore, we have acquired in the past, and may acquire in the future, equity interests in engine parts suppliers and logistics and marketing companies. If we are unable to effectively manage or assimilate these acquisitions, our financial condition, results of operations, business or prospects could be adversely affected. See “Item 4. Information on the Company — Company—Business Overview — Manufacturing.”

The diesel engine business in China is dependent in large part on the performance of the Chinese economy, as well as Chinese government policy. As a result, our financial condition, results of operations, business and prospects could be adversely affected by slowdowns in the Chinese economy, as well as Chinese government policies affecting our business.

During periods of economic expansion, the demand for trucks, construction machinery and other applications of diesel engines generally increases. Conversely, during economic slowdowns the diesel engine industry is generally adversely affected by a decline in demand. As a result, the performance of the Chinese economy will likely affect, to a significant degree, our financial condition, results of operations, business and prospects. For example, the various austerity measures taken by the Chinese government from time to time to regulate economic growth and control inflation have in prior periods significantly weakened demand for trucks in China, and may have a similar effect in the future. In particular, austerity measures that restrict access to credit and slow the rate of fixed investment (including infrastructure development) adversely affect demand for, and production of, trucks and other commercial vehicles. These adverse market conditions, together with increased competition in the diesel engine market, result in various degrees of financial and marketing difficulties for diesel engine producers, including our company.

The business and prospects for the diesel engine industry, and thus the business and prospects of our company, may also be adversely affected by Chinese government policy. For example, in 1998, the Chinese government announced a major initiative to boost consumer demand through investments in infrastructure projects and increased availability of bank credit. As a result, demand for trucks and other commercial vehicles, and thus demand for diesel engines, continued to increase from 2002 to 2004. In 2005, however, sales for trucks and other commercial vehicles declined by approximately 1.0% due to a credit tightening policy by the Chinese government. In 2006, sales for commercial vehicles increased 14.2% due to the strong economic growth achieved and continued investment in infrastructure building by the Chinese government.(Source: China Automotive Industry Newsletter for 2006). In 2007, sales for commercial vehicles increased by approximately 26.0% due to the continued economic growth in China.(Source: China Automotive Industry Newsletter for 2007) However, we cannot assure you that the Chinese government will not change its policy in the future to de-emphasize the use of diesel engines, and any such change will adversely affect our financial condition, results of operations, business or prospects. For example, the Chinese government has from time to time introduced measures to avoid overheating in certain sectors of the economy, including tighter bank lending policies and increases in bank interest rates. See “— Risks relating to Mainland China — Adverse changes in the economic policies of the Chinese government could have a material adverse effect on the overall economic growth of Mainland China, which could reduce the demand for our products and adversely affect our competitive position.”

If we are not able to continuously improve our existing engine products and develop new diesel engine products or successfully enter into other market segments, we may become less competitive, and our financial condition, results of operations, business and prospects will be adversely affected.As the Chinese automotive industry continues to develop, we will have to continuously improve our existing engine products, develop new diesel engine products and diversify into other market segments in order to remain competitive. As a result, our long-term business prospects will largely depend upon our ability to develop and introduce new or improved products at competitive prices as well as the success of any entry into new market segments. Future products may utilize different technologies and different market segments may require knowledge of markets that we do not currently possess. Moreover, our competitors may be able to introduce new or improved engine models that are more favorably received by customers than our products. Any failure by our company to introduce, or any delays in the introduction of, new or improved products at competitive prices or any delay or failure to enter into other market segments could have a material adverse effect on our financial condition, results of operations, business or prospects.

As the Chinese automotive industry continues to develop, we will have to continuously improve our existing engine products, develop new diesel engine products and enter into new market segments in order to remain competitive. As a result, our long-term business prospects will largely depend upon our ability to develop and introduce new or improved products at competitive prices and enter into new market segments. Future products may utilize different technologies and may require knowledge of markets that we do not currently possess. Moreover, our competitors may be able to introduce new or improved engine models that are more favorably received by customers than our products or enter into new markets with an early-entrant advantage. Any failure by our companyus to introduce, or any delays in the introduction of, new or improved products at competitive prices or entering into new market segments could have a material adverse effect on our financial condition, results of operations, business or prospects.

15

On April 10, 2007, Yuchai signed a Cooperation Framework Agreement with Zhejiang Geely Holding Group Co., Ltd (“Geely”) and Zhejiang Yinlun Machinery