| • | following the open season launched in 2009, TIGF intends to develop two new projects, the Artère du Béarn and phase B of the Artère de Guyenne gas pipelines.• | | The increase by 3.5 Bcf (100 Mm3) of the storage capacity at LussagnetArtère de Guyenne gas pipelines, which are scheduled to be commissioned in April,2013; and

|

| | | • | another open season launched in compliance with the authorization provided by the decree published on April 9, 2008. |

• | | The acquisition of a 26.2% interest (through its interest in Géosud) in Géométhane, an Economic Interest Grouping that owns natural gas storage in a salt cavern with a capacity of 10.5 Bcf (0.3 Bm3), located in Manosque,2010, which involved four French and Spanish transport operators including TIGF, is expected to result in the southeastcompletion of France. Athe Euskadour project to increase the storage capacity by 7 Bcf (0.2 Bm3) is under study for a commissioning scheduled in 2016.

2015. |

In addition, following the European Union adopted, on July 13, 2009,enactment of the Third Energy Package by the European Union in July 2009, which includes two directives and three regulations related to the natural gas and electricity markets. TOTAL will assess the potential impact on its gas and electricity transport, storageprovides for splitting network operations from production and supply operations, as soon asTOTAL and TIGF are reviewing adaptations to be implemented before the legislation is transposed into French law.Regarding itsmarketing business, TOTAL is mainly developing on three major European markets.

InFrance, TOTAL operates through its marketing subsidiary Total Énergie Gaz (TEGAZ) which sold

1. | GIE data (Gaz Infrastructures Europe), June 2009. |

208 Bcf of natural gas (5.9 Bm3)regulation becomes effective in 2009, compared to 229 Bcf (6.5 Bm3)France starting in 2008 and 245 Bcf (7 Bm3) in 2007. Despite a sharp decline in demand due to the economic crisis, TEGAZ posted a strong increase in sales to industrial and commercial customers, which are the subsidiary’s main market segments.

March 2012. In Spain, Cepsa Gas Comercializadora markets gas in the industrial and commercial sectors. This company is held by TOTAL (35%), CEPSA (35%) and the Algerian national oil company, Sonatrach (30%). In 2009, Cepsa Gas Comercializadora sold approximately 70 Bcf (2 Bm3) of natural gas to industrial and commercial customers, similar to 2008, compared to 59 Bcf (1.7 Bm3) in 2007.In theUnited Kingdom, TOTAL’s subsidiary Total Gas & Power Ltd markets gas and power to the industrial and commercial markets. The subsidiary is also active in gas, electricity and LNG trading worldwide. In 2009, 130 Bcf (3.7 Bm3) of natural gas was sold to industrial and commercial customers, compared to 134 Bcf (3.8 Bm3) in 2008 and 124 Bcf (3.5 Bm3) in 2007. Electricity sales amounted to 4.1 TWh in 2009, compared to 4.6 TWh in 2008 and 3.6 TWh in 2007. In 2007, TOTAL disposed of its 10% interest in Interconnector UK Ltd, a gas pipeline connecting Bacton in the United Kingdom to Zeebrugge in Belgium. This disposal did not affect TOTAL’s rights to transport gas through the pipeline.

The Americas

In theUnited States, the Group’s subsidiary Total Gas & Power North America Inc. marketed 1,586 Bcf (45 Bm3) of natural gas in 2009, compared to approximately 1,652 Bcf (46.9 Bm3) in 2008 and 1,606 Bcf (45.5 Bm3) in 2007, supplied by its own production and external sources.

InMexico, Gas del Litoral, a company in which TOTAL holds a 25% interest, sold approximately 173 Bcf (4.9 Bm3) of natural gas in 2009, its third full year of activity, similar to 2008, compared to 95 Bcf (2.7 Bm3) in 2007.

InSouth America, TOTAL owns interests in several natural gas transport companies in Argentina, Chile and Brazil, including the following:

a 15.4% interest in Transportadora de Gas del Norte (TGN), which operates a gas transport network covering the northern half of Argentina;

a 56.5% interest in the companies that own the GasAndes pipeline, which connects the TGN network to the Santiago del Chile region; and

a 9.7% interest in Transportadora Gasoducto Bolivia-Brasil (TBG), whose gas pipeline supplies southern Brazil from the Bolivian border.

Brazil. These assets represent a total integrated network of approximately 9,500 km of pipelines serving the Argentine, Chilean and Brazilian markets from gas-producing basins in Bolivia and Argentina, where the Group has natural gas reserves. The actions taken by In Argentina, in the Argentine government afterabsence of an increase in the 2001 economic crisistariff granted to utilities and the subsequent energy crisis, marked in 2007 by a severe gas shortage during the southern winter, put TOTAL’s Argentine subsidiaries in difficult financial and operational situations, even after taking into account the restructuring of TGN’s debt, which was completed in 2006. The sale of the Group’s Argentine power generation assets was completed in 2007 and procedures to protect TOTAL’s investments, initiated in 2002 with the International Center for Settlement of Investment Disputes (ISCID), are ongoing.

During 2008 and 2009, gas production in Argentina decreased substantially, reducing the export of gas to Chile and prompting commercial discussions between GasAndes and its shippers about transportation contracts and their commitments.

Due to the deterioration of TGN’s financial situation as a result of the freeze of domestic tariffs andgiven the restrictions on gas exports, TGN applied forthe Group continued to manage its assets in the most appropriate way in a suspensiondifficult operating and financial environment.

Storage of payments in December 2008, and launched a new process to restructure its debt. These decisions led the Argentinean authorities to set up a formal monitoring of TGN’s management.Asia

TOTAL markets natural gas transported through pipelines in Indonesia, Thailand and Myanmar, and,LPG

InFrance, the Group’s storage operations located in the formsouthwest are grouped under TIGF. This subsidiary operates two storage units under a negotiated scheme with a usable capacity of LNG,92 Bcf (2.6 Bm3). Highlights of 2010 included an increase in Lussagnet’s storage capacity by 3.5 Bcf (0.1 Bm3). TOTAL, through its interest in Géosud, also participates in Géométhane, an Economic Interest Grouping that owns natural gas storage in a salt cavern with a capacity of 10.5 Bcf (0.3 Bm3), located in Manosque, in southeastern France. In March 2010, the Group’s interest in Géométhane increased to Japan, South Korea, China, Taiwan and India. The Group35.5% from 26.2% following the buyback of a partner’s stake. A project is also developing its re-gasified LNG marketing business in new emerging markets.under study to increase the storage capacity by 7 Bcf (0.2 Bm3). In India, Hazira LNG Private Limited, a company in which TOTAL holds a 26%50% interest sold approximately 74 Bcf (2.1 Bm3)in South Asian LPG Limited (SALPG), a company that operates an underground import and storage LPG terminal located on the east coast of natural gasthe country. This cavern, the first of its kind in India, has a storage capacity of 60 kt. In 2010, it received 779 kt of LPG, compared to 606 kt in 2009 its fourth full yearand 535 kt in operation, compared to 87 Bcf (2.5 Bm3) in 2008 and 76 Bcf (2.2 Bm3) in 2007.2008. Liquified Natural GasIn the LNG chain, the Gas & Power division is responsible for operations downstream from liquefaction plants(1), including purchase, shipping, re-gasification storage and marketing.

Through its subsidiaries Total Gas & Power Ltd and Total Gas & Power North America Inc.,

TOTAL has entered into agreements to obtain long-term access to

1. | The Exploration & Production division is in charge of the Group’s natural gas liquefaction operations. |

LNG re-gasification capacity on the three continents that are the largest consumers of natural gas: North America (the United States and Mexico), Europe (France and the United Kingdom), and Asia (India). This diversified market presence allows the Group to access new liquefaction projects by becoming a long-term buyer of a portion of the LNG produced at the plants, thereby consolidatingstrengthening its LNG supply portfolio. Europe

InFrance, TOTAL acquired in June 2006 anTOTAL’s interest in Société du Terminal Méthanier de Fos Cavaou (STMFC). decreased to 28.03% from 28.8% in 2010 without impacting the re-gasification volumes reserved by TOTAL. This terminal is expected to havehas a re-gasification capacity of 291 Bcf/y (8.25 Bm3/y), of whichnatural gas, 79 Bcf/y (2.25 Bm3/y) of which has been reserved by TOTAL. The Group’sCommercial operations started in April 2010 and prefectorial authorities authorized the terminal to operate at full capacity in August 2010. (1) Held by TOTAL (35%), CEPSA (35%) and Sonatrach (30%). In February 2011, TOTAL signed an agreement to dispose of its 48.83% interest in STMFC’s share capital decreased to 28.8% from 30.3% in late 2009 pursuant to the provisions of the shareholders’ agreement, without impacting the re-gasification volumes reserved by TOTAL. In October 2009, the terminal was authorized by the prefectorial authorities to conduct commissioning tests and operate at reduced capacity. Commercial start-upCEPSA. The transaction is expected in the second quarter of 2010.conditioned on obtaining all requisite approvals.

36

In addition,

TOTAL and EDF signed in March 2010 a letter of intent whereby TOTAL will reserve re-gasification capacity in the planned Dunkirk LNG terminal being developed by Dunkerque LNG, a wholly-owned EDF subsidiary, and will also acquire an interest in thisthe company. In the United Kingdom, TOTAL acquired in December 2006holds an 8.35% interest in the South Hook LNG re-gasification terminal project in connection with its entrythe interest held in the Qatargas 2 project. Phase 1 (371 Bcf/y representing 10.5 Bm3/y) of theThe terminal was commissioned in October 2009 for phase 1 (371 Bcf/y or 10.5 Bm3/y) and Phasein April 2010 for phase 2, expected to come onstream in the first half of 2010, is expected to increase theincreasing its overall capacity of the terminal to 742 Bcf/y (21 Bm3/y).In NorwayCroatia, as part of the Snøhvit project, in which TOTAL holds an 18.4% interest and where the first deliveries started in October 2007, the Group signed in November 2004 a purchase agreement for 35 Bcf/y (1 Bm3/y) of natural gas primarily intended for North America and Europe. To transport this LNG, TOTAL also charters the Arctic Lady, a 145,000 m3 LNG tanker that was delivered in April 2006.InCroatia, TOTAL owns an interest in Adria LNG, a company in charge of studying the construction of an LNG re-gasification terminal on Krk island, on the northern Adriatic coast. In December 2009, TOTAL’s interest increased from 25.58% to 27.36% pursuant to the withdrawal of a partner from the project. This terminal is expected to have an initial re-gasification

capacity of 353 Bcf/y (10 Bm3/y)

InMexico, which could be subsequently increased to 494 Bcf/y (14 Bm3/y).In addition, TOTAL holds a 30% interest in Gaztransport & Technigaz (GTT), which focuses mainly on the design and engineering of membrane cryogenic tanks for LNG tankers. At year-end 2009, 225 active LNG tankers were equipped with membrane tanks built under GTT licenses out of a world tonnage estimated at 344 LNG tankers.(1)

North America

InMexico, the Altamira re-gasification terminal, in which TOTAL holds a 25% interest has been operating sincein the summer ofAltamira re-gasification terminal that was commissioned in 2006. This terminal, located on the east coast of Mexico,the country, has a re-gasification capacity of 236 Bcf/y (6.7 Bm3/y). This capacity that has been entirely reserved by Gas del Litoral in which TOTAL has a 25% interest. The terminal received forty cargos in 2009, compared to forty-two in 2008 and thirty-three in 2007. In November 2009, Altamira received its first Q-Flex vessel from Qatar.

In the United States, the Sabine Pass terminal in Louisiana was inaugurated in April 2008. TOTAL has reserved re-gasification capacity of approximately353 Bcf/y (approximately 10 Bm3/y (1 Bcf/d)y) at thisthe Sabine Pass terminal (Louisiana) for a renewable 20-year period starting in April 2009, concurrent with the delivery of the Group’s first LNG cargo. As part of this agreement, TOTAL plans to supply the Sabine PassThe terminal though its LNG purchase contracts associated with its various production projects, notably in the Middle East, Norway and Western Africa.Asia

InIndia, the Hazira re-gasification terminal (TOTAL 26%), located on the west coast in the Gujarat state, was inaugurated in April 2005 with an initial2008.

InIndia, TOTAL holds a 26% interest in the Hazira terminal that has natural gas re-gasification capacity of approximately 120 Bcf/y (3.4 Bm3/y). Its capacity reached 177 Bcf/y (5 Bm3/y) after de-bottlenecking operations conducted. The terminal, located on the west coast of India in 2008. Hazirathe Gujarat state, is a merchant terminal with operations that includecover both LNG re-gasification and natural gas marketing. TOTAL has agreed to provide up to 26% of the LNG for the Hazira terminal. Due to market conditions in 2009,2010, Hazira was operated on the basis of short-term contracts, both for the sale of gas on the Indian market and the purchase of LNG from international markets. Twenty-seven cargos were delivered in 2009, compared to thirty in 2008 and twenty-eight in 2007. InChina, a context of increasing global demand for electricity, TOTAL signed in December 2008 an LNG sale agreement with CNOOC (China National Offshore Oil Company). As part of this agreement, TOTAL is expected to supply CNOOC with up to 1 Mt/y of LNG starting in 2010. The gas supplied will come from the Group’s global LNG resources. 1. | Gaztransport & Technigaz data. |

Middle East

InQatar, TOTAL signed purchase agreements in July 2006 for up to 5.2 Mt/y of LNG from the second train of Qatargas 2 over a 25-year period. This LNG is expected to be marketed principally in France, the United Kingdom and North America. The Group’s acquisition of a 16.7% interesthas developed expertise in the second train of Qatargas 2 was concluded in December 2006. LNG production from this train started in September 2009.

InYemen, TOTAL signed in July 2005 an agreement with Yemen LNG Ltd (TOTAL, 39.62%) to purchase 2 Mt/y of LNG over a 20-year period, beginning in 2009, to be delivered to the United States. LNG production from the first train of Yemen LNG started in October 2009. Construction of the second train is nearing completion for a start-up by the summer of 2010.

Africa

InAngola, TOTAL is involved in the construction of the Angola LNG plant (13.6%), comprised of a 5.2 Mt/y train, which is expected to start up in 2012. As part of this project, TOTAL signed a re-gasified natural gas purchase agreement in December 2007 for 13.6% of the quantities to be delivered to the Gulf LNG Clean Energy terminal in Mississippi in the United States.

InNigeria, as part of the expansions of the Nigeria LNG (NLNG) plant, in which the Group holds a 15% interest, TOTAL signed an LNG purchase agreement for an initial 0.23 Mt/y over a 20-year period, to which an additional 0.9 Mt/y was added when the sixth train came onstream.

As part of the project to build an additional LNG train (train 7) with a capacity of approximately 8.5 Mt/y, TOTAL signed a purchase agreement in February 2007 for 1.375 Mt/y of LNG over a 20-year period. This agreement is subject to NLNG’s final investment decision for this new train.

TOTAL also acquired a 17% interest in the Brass LNG project in July 2006. This liquefaction project calls for the construction of two liquefaction trains, each with a capacity of 5 Mt/y. In conjunction with this acquisition, TOTAL signed a preliminary agreement with Brass LNG Ltd setting forth the principal terms of an agreement to purchase approximately one-sixth of the plant’s capacity over a 20-year period. This LNG would be delivered primarily to North America and Western Europe. The purchase agreement is subject to final investment decision for the Brass LNG project.

Trading

TOTAL, through its subsidiary Total Gas & Power Ltd, has conducted trading activities primarily for spot LNG between 2001 and 2006. In 2007, this subsidiary began

receiving cargos under its long-term supply contracts with Nigeria and Norway. Since 2009, the new purchase agreements for LNG from Qatargas 2 and Yemen LNG have allowed a substantial development of the Group’s operations in LNG marketing. This mix of spot and long term LNG purchases allows TOTAL to supply its main customers around the world with gas, while retaining a certain degree of flexibility to react to market opportunities or unexpected fluctuations in supply and demand.

In 2009, Total Gas & Power Ltd purchased twenty-three contractual cargos and twelve spot cargos from Norway, Nigeria, Equatorial Guinea, Indonesia, Trinidad & Tobago, Qatar and Yemen.

Liquified Petroleum Gas

In 2009, TOTAL traded and sold nearly 4.4 Mt of LPG (butane and propane) worldwide (compared to 5.2 Mt in 2008 and 2007), including 0.9 Mt in the Middle East and Asia, approximately 0.6 Mt in Europe on small coastal trading vessels and approximately 2.8 Mt on large vessels in the Atlantic and Mediterranean regions. Approximately 40% of these quantities come from fields or refineries operated by the Group. LPG trading involved the use of four time-charters and approximately sixty spot charters.

Since January 2008, SALPG (South Asian LPG Limited, a company in which TOTAL holds a 50% interest, in partnership with Hindustan Petroleum Company Ltd) has operated the underground import and storage LPG terminal located in Visakhapatnam, on the east coast of India in the state of Andhra Pradesh. This terminal, the first of its kind in India, has a storage capacity of 60 kt. In 2009, the cavern received 606 kt of LPG, compared to 535 kt in 2008.

Electricity and Cogeneration

As a refiner and petrochemical producer, TOTAL has interests in several cogeneration facilities. Cogeneration is a process whereby the steam produced to turn turbines to generate electricity is then captured and used for industrial purposes. TOTAL also participates in another type of cogeneration, which combines power generation with water desalinationsector, especially through cogeneration and gas-fired electricity generation, as part of its strategy of pursuing opportunities throughout the gas value chain. As part of its diversification strategy for new energies, thecombined cycle power plant projects.

The Group is also involved in power generation projects to generate electricity from solar orrenewable sources and has a long-term goal of becoming a nuclear sources.Inoperator.

Electricity from conventional energy sources InAbu Dhabi, the Taweelah A1 cogeneration plant in operation since May 2003, combines powerelectricity generation and water desalination. It is owned and operated by Gulf Total Tractebel Power Cy, in which TOTAL has a 20% interest. The Taweelah A1 power plant, in operation since 2003, currently has a net power generation capacity of 1,600 MW (following the start-up of the 250 MW expansion in July 2009) and a water desalination capacity of 385,000 m3 per day. In addition, TOTAL, in partnership with the Spanish company Abengoa Solar, participated in a bidding process launched by Abu The plant’s production is sold to ADWEC (Abu Dhabi Future Energy Company (ADFEC) in early 2008Water and Electricity Company) as part of the MASDAR initiative to support new energies. This call for tenders concerns the construction of a 110 MW concentrated solar power plant.

TOTAL, together with GDF Suez, EDF and Areva, acknowledged ENEC’s (Emirates Nuclear Energy Corporation) decision, announced in December 2009, to deny the bid they made as part of the call for tenders launched for the supply of nuclear power plants. The Group pursues its objective to eventually become a recognized nuclear operator.

long-term agreement. In FranceNigeria, TOTAL has an 8.33% interest in the project to build and operate the second French EPR in Penly, in the northwest of the country, in partnership with GDF Suez and EDF.InThailand, TOTAL owns 28% of Eastern Power and Electric Company Ltd (EPEC), which has operated the combined-cycle gas-fired power plant of Bang Bo, with a capacity of 350 MW, since March 2003.

InNigeria, TOTAL and its partner, the state-owned NNPC (Nigerian National Petroleum Corporation), own interests in two projects to build gas-fired power plantsplant projects that are part of the government’s objectives to develop power generation and increase the share of natural gas production for domestic use:

| | | • | The Afam VI project, part of the SPDC (Shell Petroleum Development Company) joint venture in which TOTAL holds a 10% interest, concerns the development of a 630 MW combined-cycle power plant. Commercial operations started in December 2010. | | | • | The development of a new 400 MW combined-cycle power plant near the city of Obite (Niger Delta) in connection with the OML 58 gas project, part of the joint venture between NNPC and TOTAL (40%, operator). A final investment decision is expected in the first half of 2011 and commissioning is scheduled in the first half of 2013 in open cycle and in early 2014 in closed cycle. The power plant will be connected to the existing power grid through a new 108 km high-voltage transmission line. |

InThailand, TOTAL owns 28% of EPEC (Eastern Power and Electric Company Ltd), which operates the combined-cycle gas power plant of Bang Bo, with a capacity of 350 MW, in operation since 2003. The plant’s production is sold to EGAT (Electricity Generating Authority of Thailand) as part of a long-term agreement. Electricity from nuclear energy sources InFrance, TOTAL partners with EDF and other players through its 8.33% interest in the second French EPR project in Penly, in the northwest of the country, for which studies are underway. The Group continues to review other opportunities in the countries where it operates and favors partnerships with experienced, recognized nuclear operators, and is closely monitoring the impact that the serious situation in Japan may have on the development of certain nuclear projects worldwide.

37

Electricity from renewable energy sources In concentrated solar power, TOTAL (20%), in partnership with Spanish Abengoa (20%), won the call for tenders for the construction and operation for twenty years of a 109 MW concentrated solar power plant in Abu Dhabi. As part of this project, TOTAL is partnering with MASDAR through the Abu Dhabi Future Energy Company (ADFEC), which owns a 60% interest in the joint venture created for the project. Construction work started in July 2010 andstart-up is expected in the summer of 2012. The production will be sold to Abu Dhabi Water and Electricity Company (ADWEC). In wind power, TOTAL owns a 12 MW wind farm in Mardyck (near Dunkirk, France), which was commissioned in 2003. With respect to marine energy, TOTAL holds a 10%16% interest which concernsin Scotrenewables Marine Power, located in the developmentOrkney Islands in Scotland.Start-up and tests of a 630 MW combined-cycle power plant with a start-up of commercial operations scheduled for the second half of 2010. The development of a new 400 MW combined-cycle power plant near the city of Obite (Niger Delta)250 kW prototype are expected in connection with the OML 58 gas project, part of the joint venture between NNPC and TOTAL (40%, operator). Commissioning is scheduled in early 2013. The combined-cycle power plant will be connected to the existing power grid through a 108 km high-voltage transmission line.

2011.Renewable EnergySolar photovoltaicAs part of its strategy to develop energy resources to complement oil and gas, the Gas & Power divisionTOTAL continued in 20092010 to strengthen its positions in renewable energies, with a particular focus on solar-photovoltaic solar photovoltaic power, where the Group has been present since 1983.

Solar-photovoltaic power

In the photovoltaic sector based on crystalline silicon technology, TOTAL is involved in the development of the photovoltaic cells production business as well as in thedeveloping upstream operations through industrial production and downstream marketing of solar modules and systems.activities. The Group is pursuing R&D in this field through several partnerships,partnerships. Regarding channels other than crystalline silicon, TOTAL is pursuingbroadening its business portfolio through industrial and R&D programpartnerships, in particular for this technologyorganic and hasthin film technologies. The Group is also committed to developingresearch programs for solar energy storage. Production of solar-grade polysilicon In June 2010, TOTAL announced that it acquired a 25.4% interest in theU.S. start-up AE Polysilicon Corporation (AEP), which has developed a new innovativeprocess that operates continuously to produce cost-competitive solar-grade granular polysilicon. The technology developed by AEP is currently being industrialized. This production unit, the commissioning of which started in 2010, is expected to eventually have a nominal capacity equivalent to 1,800 t/y of solar-grade polysilicon. Production of photovoltaic solar technologies. Furthermore, cells TOTAL conducts projects to display solar application solutions at some Group sites, both for educational purposesholds a 50% interest in France and as part of decentralized rural electrification projects in other countries.TOTAL isPhotovoltech, a shareholder inPhotovoltech, aBelgian company specialized in manufacturing high-efficiencymulticrystalline photovoltaic cells. The Group now holds 50% of Photovoltech’s share capital, alongside GDF Suez, pursuant to the buyout in September 2009 by both companies of the 4.4% interest held by IMEC (Interuniversity MicroElectronics Centre). In 2009,2010, Photovoltech pursued its project to increaseincreased the overall production capacity of its Tirlemont (Tienen) plant (Tienen, Belgium) from 80 Mwp/y in 2009Belgium to 155 MWp/MWc/y following the installation of a third production line. Photovoltech’s sales in late 2010. In a challenging market and given the sharp decrease2010 were approximately €104 million in the price2010, an increase of cells, Photovoltech’s 2009 sales were€80 million,about 30% compared to€106 million in 2008 and€73 million in 2007.

TOTAL also plans to build an industrial photovoltaic plant in the Carling region in eastern France in partnership with GDF Suez.

TOTAL holds a 50% interest inTenesol, in partnership with EDF. Tenesol, whose headquarters are located in Lyon (France), designs, manufactures, markets and operates solar-photovoltaic power systems. Its principal markets are for network connections in France, in the French Overseas Territories and in Europe. Tenesol is also active in certain professional applications (telecommunications, oil & gas sites, etc.). Tenesol owns two solar panel manufacturing plants: Tenesol Manufacturing in South Africa, with production capacity of 60 MWp/y; and Tenesol Technologies in the Toulouse region of France, with production capacity of 50 MWp/y. 2009.

In 2009, despite strong pressure on the price of modules, Tenesol’s consolidated sales increased by nearly 30% to€249 million (compared to nearly€193 million in 2008 and€133 million in 2007), representing a marketed production of 85 MWp.Regarding R&D, TOTAL GDF Suez and Photovoltech confirmed their cooperationis continuing its partnership with the IMEC by signing an agreement in September 2009 as part(Interuniversity MicroElectronics Center), based at the University of the IIAP (IMEC Industrial Affiliation Program)Leuven (Belgium), a multi-partner program

on crystalline silicon solar cells. The objective of the IIAP is to sharply reduce the use of silicon while increasing the efficiency of cells in order to substantially lower costs of this technology.

Production of solar panels and marketing of photovoltaic solar systems TOTAL holds a 50% interest in Tenesol, a French company that designs, manufactures, markets, installs and operates solar photovoltaic systems. Tenesol owns a solar panel manufacturing plant in South Africa, the cost forannual production capacity of which increased to 85 MWp/y from 60 MWp/y in 2010, and another in France, the annual production capacity of which also increased to 85 MWp/y from 50 MWp/y. In 2010, Tenesol’s consolidated sales were approximately €304 million, an increase of about 22% compared to 2009. In November 2010, TOTAL announced the construction of a solar energy.panel production and assembly plant in French northeastern region of Moselle, which is expected to eventually have an overall capacity of 50 MWp/y.Start-up of construction work is expected in the first half of 2011 with a commissioning at year-end. The Group also conducts projects to display solar application solutions as part of decentralized rural electrification projects in a number of countries, notably in South Africa. New projects are under study in Africa and Asia. New solar technologies TOTAL has committed to developing innovative technologies to improve its portfolio of solar projects. The Group has major R&D programs through partnerships with major laboratories and international research institutes in France and abroad (including the United States, Switzerland, Belgium and Germany). In September 2009,solar organic technologies, the Group alsoacquired a stake in theU.S. start-up Konarka in 2008 and owns approximately 25%. Since 2009, Konarka has carried out research projects in cooperation with TOTAL to develop solar film on a large scale. Regarding thin-film technologies and silicon-based nano-materials, the Group partnered with LPICM (Laboratoire de Physique des Interfaces et desCouches Minces), a research unit comprised of the French National Center for Scientific Research (CNRS) and France’s Ecole Polytechnique engineering school in 2009 to set up a joint research team — named Nano PV — in the Saclay area near Paris focusing on thin-film technologies and silicon-based nano-materials.in France. TOTAL committed€8 million for the first 4-year phase.also

38

In December 2008, TOTAL acquired an interest in

entered into a U.S. start-up company,Konarka, which specializes in the development of organic solar technologies. In 2009, Konarka implemented new research projects in cooperationpartnership with the Gas & Power division and other Group Chemicals subsidiariesToulouse-basedLaboratoire d’analyse et d’architecture des systèmes (LAAS) to develop associated electrical systems. Regarding solar film on a large scale. The Group is confident in the potential of this promising technology and decided to increase its interest in Konarka to nearly 25% of the share capital in early 2010.Total Énergie Solaire, the subsidiary created in July 2008 as part of the Group’s contribution to the “Grenelle de l’environnement”, a program launched by the French government, started operatingenergy storage, TOTAL entered in 2009 with the installation of solar panels at two Group’s sites in Pau and Lacq (France). A total of five educational projects are expected to be completed in late 2010 to display different photovoltaic applications at the Group’s sites, with an overall installed capacity of between 2 MWp and 3 MWp and an investment of€15 million.

Furthermore, TOTAL conducts decentralized rural electrification operations by responding to calls for tenders from authorities in several countries, notably in South Africa where KES (Kwazulu Energy Services Company), in which TOTAL holds a 35% interest, intends to equip 30,000 isolated homes. New projects are under study related to Africa, Asia and the Middle East.

In addition,Temasol, a wholly-owned subsidiary of Tenesol since the transfer in 2008 of the respective shares of Total Maroc and EDF EDEV, is involved in decentralized rural electrification projects in Morocco. Since its creation in 2001, approximately 25,500 households have been equipped and are now operated by Temasol.

Solar power storage

In November 2009, TOTAL announced the signature ofinto a research agreement with the MassachussettsMIT (Massachussetts Institute of Technology (MIT)Technology) in the United States to develop a new stationary battery technology.

Conversion of biomass TOTAL is exploring a number of avenues for developing biomass depending on the resource used (type, location, harvesting, transportation, etc.), the type of molecules and markets targeted (fuels, lubricants, petrochemicals, specialty chemicals, etc.) and the conversion processes. The Group focuses on biological and thermochemical biomass conversion processes. Biotechnologies In June 2010, TOTAL entered into a strategic partnership with Amyris Inc., aU.S. start-up specializing in biotechnologies. The Group acquired an interest in Amyris’ share capital (approximately 22% at year-end 2010) and signed a framework agreement that includes research, development, production and marketing partnerships as well as the creation of an R&D team. Amyris owns a cutting-edge industrial synthetic biological platform to create and optimize micro-organisms (yeasts, algae, bacteria) that can convert sugar into fuels and chemicals. Amyris owns research laboratories and a pilot unit in California as well as a pilot plant and a demonstration facility in Brazil. Today, the project is in the industrialization phase and production is expected tostart-up in 2012. In April 2010, the Group announced that it had acquired an interest in Coskata, a company based in Chicago that develops a technology allowing biological conversion of synthetic gas into alcohols for fuels and petrochemical usages. Coskata deployed this technology on a large scale on a demonstration unit that produces bioethanol and continues its efforts towards commercialization. In addition, the Group continues to develop a network of R&D collaborations in the field of technologies that are complementary with Amyris’ platform: deconstruction of ligno-cellulose, new biosynthesis, processes and bio-engineering for microalgae and other phototrophic organisms. DME InJapan, TOTAL is involved with eight Japanese companies in a program intended to heighten consumer awareness of DME (Di-Methyl Ether), a new generation fuel. The 80 kt/y production plant (TOTAL, 10%), located in Niigata, started up in 2009. InSweden, TOTAL is involved in the “bio-DME” European project, which is intended to test the whole DME chain, from its production using black liquor, a paper pulp residue, to its use by a fleet of trucks in four Swedish cities. Productionstart-up at the pilot plant located in Pitea is expected in the first half of 2011. Carbon capture and storage TOTAL is involved in a program to develop new stationary batteries that are designedcarbon capture and storage technologies to enablereduce the storage of solar power. This $4 million agreement over five years is partenvironmental footprint of the MIT Energy Initiative, whichGroup’s industrial projects based on fossil energy.

In partnership with the FrenchIFP Énergies Nouvelles(French Oil and New Energies Institute), TOTAL joined asis involved in an R&D program related to chemical looping combustion, a membernew process to burn solid and gas feedstock that includes carbon capture at a very low energy cost. In 2010, this partnership resulted in November 2008.Wind power

TOTAL operates a 12 MW wind farm in Mardyck (near its Flanders refinery, located in Dunkirk, France).

Marine energy

In marine energy, TOTAL acquired a 10% interest in a pilot project located offshore Santona, on the northern coast of Spain, in June 2005. The construction of a first buoy, with a capacity of 40 kW, was completed anddemonstration pilot at the buoy was launchedSolaize site (France). A large-scale pilot is expected to be commissioned in September 2008. This project2013.

The Group is intended to assess the technical and economic potential of this technology.With respect to tidal current energy, TOTAL held as of the end of 2007 a 24.9% interest in Scotrenewables Marine Power, locatedalso involved in the Orkney IslandsEU-co-funded Carbolab project that intends to validate the carbon storage technology in Scotland. Agreements bringing new partners into the company’s share capital were signed in January 2008. As a result, the Group’s participation was diluted to 16%. Scotrenewables Marine Power is developing tidal current energy converter technology. A 1/5 scale model was successfully tested offshore in 2009. Construction of a full-scale prototype is scheduled for 2010.

coal seams. Coal productionFor nearly thirty years,

TOTAL has exported steam coal for nearly thirty years from South Africa primarily to Europe and Asia. The Group also trades steam coal through its subsidiaries Total Gas & Power Ltd and Total Energy Resources (Pacific Basin). In addition, TOTAL markets coal to French customers through its subsidiary CDF Énergie.With the start-up of production on the Tumelo mine in January 2009, the subsidiary Total Coal South Africa (TCSA) owns and operates four mines in South Africa. A fifth mine is under developmentconstruction in Dorstfontein, with start-up expected at year-end 2011, and development of a sixth mine is underway in Forzando withstart-up expected in late 2011.2013. The Group is also looking intostudying several other mining development projects. The South African coal produced by TCSA or bought from third-party’s mines is exported through the port of Richard’s Bay, in which TOTAL has a 5.36%5.7% interest. In 2008, TOTAL and its partner Mmakau Mining acquired an additional 1 Mt/y of harbor handling rights through the interests they hold in the fifth phase of the port’s development.

39

TOTAL sold approximately 7.3 Mt of coal worldwide in 2009 (compared to 8.4 Mt in 2008 and 10 Mt in 2007), mainly intended for power generation, of which 3.6 Mt was South African coal. Half of this volume was sold in Europe and the other half in Asia. On the South African domestic market, sales amounted to 0.3 Mt in 2009, primarily destined for the industrial and metallurgic sectors.

DME (Di-Methyl Ether)DownstreamIn Japan, TOTAL is involved with eight Japanese companies in a program intended to heighten consumer awareness regarding this new generation fuel. The 80 kt/y DME production plant, located in Niigata (Honshu Island, Japan), started up in January 2009 (TOTAL, 10%).

As part of the consortium led by Volvo, TOTAL is involved in the “bio-DME” European project, which is intended to test the whole DME chain, from its

production from black liquor, a paper pulp residue, to its use by a fleet of trucks in four Swedish cities. This project, which includes the construction of a pilot in Pitea (Sweden), started in September 2009 and is expected to end in 2012. It is partly funded by the Swedish Energy Agency and the EU Seventh Framework Program.

In addition, the international working group established as part of the ISO standardization process for DME pursued its activities in 2009. For two years as from January 1, 2009, TOTAL will also chair the IDA (International DME Association).

DOWNSTREAM

The Downstream segment comprises TOTAL’s Refining & Marketing and Trading & Shipping divisions. TOTAL’s worldwide refining capacity was 2,363 kb/d at year end 2010, compared to 2,594 kb/ d. Ind in 2009 theand 2,604 kb/d in 2008. The Group’s worldwide refined products sales in 2010 were 3,6163,776 kb/d (including trading operations), compared to 3,616 kb/d in 2009 and 3,658 kb/d in 2008 and 3,774 kb/d in 2007.2008. TOTAL is the largest refiner/marketer in Western Europe (1), and the largestleading marketer in Africa (2). As of December 31, 2009, TOTAL’s worldwide marketing network consisted of 17,490 service stations in 2010, compared to 16,299 retail stations (compared toin 2009 and 16,425 in 2008, and 16,497 in 2007), more than 50% of which are owned by the Group. In addition, TOTAL’s refining operationsrefineries allow the Group to produce a broad range of specialty products, such as lubricants, liquefied petroleum gas (LPG), jet fuel, special fluids, bitumen, marine fuelsfuel and petrochemical feedstock. The Group is adapting its Refining business to an environment that is depressed due to weaker demand for refined products. TOTAL continues to adapt its business and improve its positions in a context of recovering demand worldwide, mainly in non-OECD countries, by focusing on three key areas: adapting its European refining system to market changes; modernizing its Port Arthur refinerymature markets in the United States and building a refinery in Jubail in Saudi Arabia.Regarding its Marketing business, the Group intends to consolidate its position in Western Europe, pursue targeted developmentssupporting growth in Africa, Asia and the growing markets of the Asia-Pacific regionMiddle East, and expand itsdeveloping specialty products business worldwide.

Consistent with

As part of the optimization of itsthe Group’s Downstream portfolio in Europe, TOTAL signed an agreement with ERGTotalErg (TOTAL 49%) was created in JanuaryOctober 2010 to create a joint venture in the Refining and Marketing business in Italy(3). “TotalErg” will be the name of this newly created company through the by merger of Total Italia and ERG Petroli. The shareholdersTotalErg has become the third largest operator in the Italian market.(3) In addition, in the United Kingdom, TOTAL offered for sale in 2010 its marketing business and the Lindsey refinery.

In February 2011, TOTAL announced that it had signed an agreement calls forto sell to IPIC its 48.83% interest in CEPSA pursuant to a joint governancepublic takeover bid on the entire share capital of the company as well as the operating independence of the joint-venture. TOTAL and Erg will hold a 49% and a 51% interest, respectively.CEPSA. The transaction is subject to approval by the relevant authorities.conditioned on obtaining all requisite approvals. In operating terms in Refining & Marketing, this sale concerns mainly four refineries (Huelva, Algesiras, Tenerife, Tarragone) and some marketing activities in Spain and Portugal. RefiningAs of December 31, 2009,

TOTAL heldholds interests in twenty-four refineries (including twelveten that it operates), located in Europe, the United States, the French West Indies, Africa and China. 2009 was marked by the deteriorationHighlights of 2010 included a slight recovery of the refining environment that led to sharp declines inimproved refining margins and decreasing utilization rates in refineries worldwide.worldwide, even though margins are still recording low levels. In 2009,2010, TOTAL continued its program of selective investments in Refining focusedfocusing on three areas: pursuing major ongoing projects (Port(deep conversion at Port Arthur, coker, Jubail refinery), adapting the European refining system to structural market changes, and strengthening safety and energy efficiency. • | | | • | InWestern Europe, TOTAL’s refining capacity was 2,2822,049 kb/d in 2009,2010, accounting for more than 85% of the Group’s overall refining capacity.capacity at year-end 2010. The Group |

| operates elevennine refineries in Western Europe, and |

1. | Based on publicly available information, refining and/or sales capacities and quantities sold. |

2. | PFC Energy December 2009, based on quantities sold. |

3. | Excluding Sicilia and excluding jet fuels and AS24 payment cards. |

| | holds interests in the German refinery of Schwedt, and in four Spanish refineries through its holdinginterest in CEPSA(1)(4). and in two refineries in Italy through its interest in TotalErg. Once finalized, the Group’s disposal of its interest in CEPSA is expected to lead to a decrease of nearly 260 kb/d in TOTAL’s refining capacities in Europe. |

| | | | | •— | | InFrance,the Group continues to adapt its refining capacities and to shift the production emphasis to diesel, in a context of structural decline in demand for petroleum products demand in Europe and an increase in gasoline surpluses. |

TOTAL announced in March 2009 | | | | | In October 2010, TOTAL was authorized by a court ruling to implement its project to repurpose the Flanders site (Dunkirk refinery with a distillation capacity of 7 Mt/y). The shutdown of the refining business will lead to gradually dismantling the units. The Group confirmed its project of repurposing the site through the creation of a technical support center, a refining training school, an oil depot and business offices. |

In addition, the industrial plan started in 2009 to adapt itsthe Group’s refining base primarily by reconfiguringin France is ongoing. This plan is intended to reconfigure the Normandy refinery and rescalingrescale certain corporate departments at itsthe Paris headquarters. At the Normandy refinery, the project willis intended to upgrade the refinery and shift the production (1) Based on publicly available information, refining capacities and quantities sold. (2) PFC Energy January 2011, based on quantities sold. (3) Based on publicly available information. (4) Group’s share in CEPSA: 48.83% as of December 31, 2010.

40

emphasis to diesel. ToFor this end, anpurpose, investment program estimated at€770 millionscheduled over four years will enable TOTAL to upgraderesult in the refinery:eventual reduction of the refinery’s annual distillation capacity will be reduced to 12 Mt from 16 Mt, andupsizing the distillate hydrocracker (DHC) commissioned in 2006 will be expanded. These investments are designed to improveand improving the energy efficiency and reduceby lowering carbon dioxide emissions, while increasing the annual average diesel output by 10% and reducing gasoline surpluses by 60%. Consultation with employee representatives ended inemissions. In July 2009. Implementation of the project has started and is scheduled to last until 2013.In March 2010, the Group announced a plan to repurpose its Flanders refinery site. This plan calls for shutting down refining operations atclosed the site (capacitydisposal of 137 kb/d), developing new refining operations support and petroleum logistics activities and implementing the planned LNG terminal project in partnership with French utility EDF, for which the final investment decision is expected before summer 2010 with a view to commissioning in 2014(2). The permanent refinery shutdown will result in a gradual dismantling of units that could continue to 2013. Implementation of this project is subject to consultation with employee representative organizations. Furthermore, TOTAL pledged not to close or sell any French refinery over the next five years, with the exception of the planned repurposing of the Flanders refinery.

In December 2009, the Group signed an agreement to divest its minority interest (40%) in the Société de la Raffinerie de Dunkerque (SRD), a company specializedthat specializes in the production of bitumen and base oils, subject to the approval by the relevant authorities.

oil production. | | | | | •— | | In theUnited Kingdom, constructioncommissioning of the hydrodesulphurization (HDS) unit at the Lindsey refinery started in June 2007 on a |

| | hydrodesulphurization unit (HDS) and a steam methane reformer (SMR) to process high-sulphur crudes and to increase its low-sulphur diesel production. The HDS unit is expected to be commissioned in the first half of 2010 and is designed2011. This will result in processing up to increase the portion70% of high-sulphur crudecrudes, compared to 10% currently, and increase low-sulphur diesel production. In parallel, TOTAL announced that it offered for sale the plant can process from 10% to nearly 70%.

Lindsey refinery in 2010. |

| | | •— | | InGermany, a new desulphurizationthe HDS unit that started up in September 2009 at the Leuna refinery started upwas operated successfully in September 2009.2010. This unit is designed to supply the German market with low-sulphur heating oil. |

| | | | | •— | | In theNetherlandsItaly, TOTAL, as the majority shareholder in the Vlissingen refinery (55%), exercised its pre-emptive rights over the shares (45%TotalErg (TOTAL, 49%) of this asset that were offered for sale by Dow Chemical in June 2009. Concurrently, TOTAL received from Lukoil a binding purchase offer for these shares (45%) and sold these shares to Lukoil, which constituted the development of a new partnership between the two companies. |

| • | | InItaly, following the agreement signed in January 2010, the TotalErg joint venture will hold a 100% interest inhas operated the Rome refinery (100%) since October 2010 and holds a 25.9% interest in the Trecate refinery.

|

| | | •— | | InSpain, CEPSA has been pursuingcompleted its investment planinvestments intended to improve the conversion capacity of its refineriesthe Huelva refinery so as to meet the growing demand for middle-distillatesmiddle distillates in the Spanish market. The construction of aA hydrocracker unit, two additional distillation units (one atmospheric and one vacuum) and a desulphurization unit were inaugurated in October 2010. Distillation capacity increased to 178 kb/d from 100 kb/d. In February 2011, the Group announced the signature of an agreement with IPIC to dispose of its 48.83% interest in CEPSA. The transaction is underway at the Huelva refinery. Commissioning is currently expected in the summer of 2010. conditioned on obtaining all requisite approvals. |

• | | | • | In theUnited States, TOTAL operates the Port Arthur refinery in Texas, with a capacity of 174 kb/d. In 2008, TOTAL beganlaunched a modernization program at this refinery in 2008, whichthat includes the construction of a deep-conversiondesulphurization unit (or coker),commissioned in July 2010, a vacuum distillation unit, a desulphurizationdeep-conversion unit (or coker) and other associated units to enable the refineryunits. This project is designed to process more heavy and high-sulphur crudes and to increase production of lighter products, in particular low-sulphur distillates. Construction is ongoingcompleted and commissioning is expectedwas ongoing in the first quarter ofMarch 2011. |

| | • | | InSaudi Arabia, TOTAL and Saudi Arabian Oil Company (Saudi Aramco) created a joint venture in September 2008,Saudi Aramco Total Refining and Petrochemical Company (SATORP), to build a400 kb/d refinery in Jubail held by Saudi Aramco (62.5%) and TOTAL (37.5%). Eventually, TOTAL and Saudi Aramco each plans to retain a 37.5% interest |

1. | Group’s share in CEPSA: 48.83% as of December 31, 2009. |

2. | For additional information on the Dunkirk LNG project, see “Item 4. Business Overview—Gas & Power”. |

| | with the remaining 25% expected to be listed on the Saudi stock exchange, in late 2011, subject to approval by the relevant authorities. Signing theThe main contracts for the construction of the refinery were signed in July 2009, markedconcurrent with thestart-up of work. Commissioning is expected in 2013. |

The heavy conversion process for this refinery is designed for the processing of heavier crudes (Arabian Heavy) and for the production of fuels and lighter products that meet strict specifications, and are mainly intended for export.

• | | | The heavy conversion process of this refinery is designed for processing heavier crudes (Arabian Heavy) and producing fuels and lighter products that meet strict specifications and are mainly intended for export. | | | • | InAfrica, TOTALthe Group holds minority interests in five refineries as of December 31, 2009. In October 2009, TOTAL disposed of its 50% interest in the Indeni refinery in Zambia. In addition, TOTAL decreased its interest to 20% from 34% in Société africaine de raffinage (SAR) inSouth Africa, Senegal, in December 2009.Côte d’Ivoire, Cameroon and Gabon. |

• | | InInChina, TOTAL has a 22.4% interest in the WEPEC refinery, located in Dalian, in partnership with Sinochem and PetroChina. China, TOTAL has a 22.4% interest in the WEPEC refinery, located in Dalian, in partnership with Sinochem and PetroChina.

|

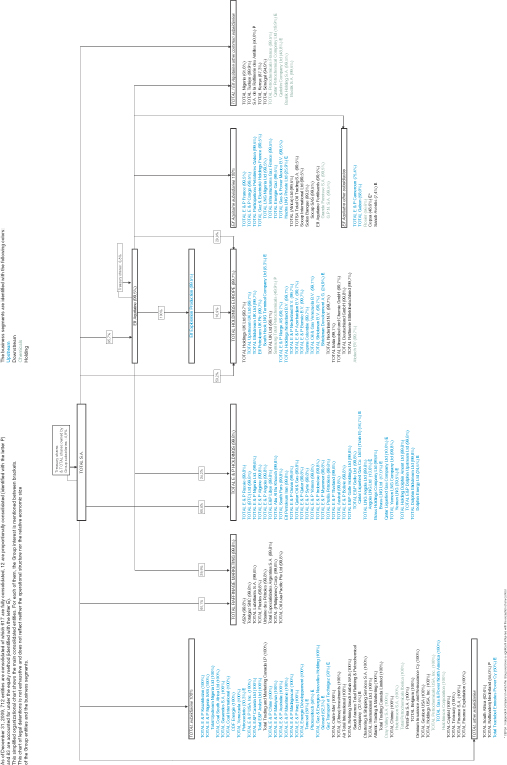

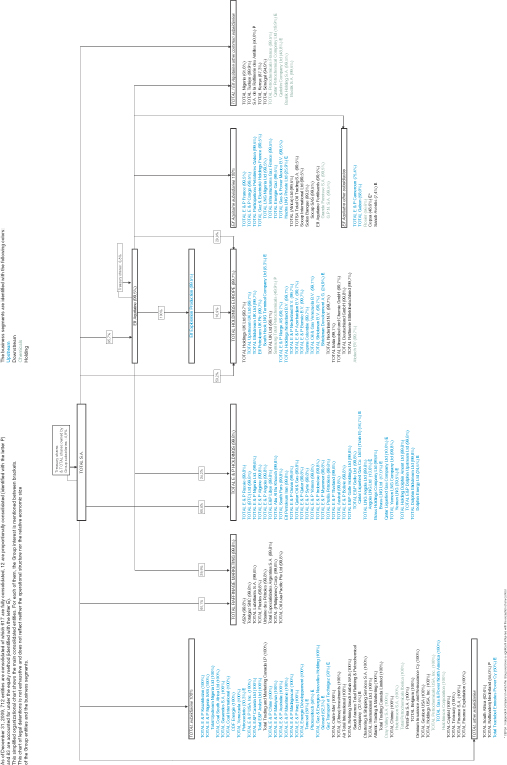

Crude oil refining capacity The table below sets forth TOTAL’s daily crude oil refining capacity (a): | | | | | | | | As of December 31, (kb/d) | | 2009 | | 2008 | | 2007 | Refineries operated by the Group | | | | | | | Normandy (France) | | 338 | | 339 | | 331 | Provence (France) | | 158 | | 158 | | 158 | Flanders (France) | | 137 | | 137 | | 141 | Donges (France) | | 230 | | 230 | | 230 | Feyzin (France) | | 117 | | 117 | | 117 | Grandpuits (France) | | 101 | | 101 | | 101 | Antwerp (Belgium) | | 350 | | 350 | | 350 | Leuna (Germany) | | 230 | | 230 | | 227 | Rome (Italy)(b) | | 64 | | 64 | | 63 | Lindsey — Immingham (United Kingdom) | | 221 | | 221 | | 221 | Vlissingen (Netherlands)(c) | | 81 | | 81 | | 81 | Port Arthur, Texas (United States) | | 174 | | 174 | | 174 | Sub-total | | 2,201 | | 2,202 | | 2,194 | Other refineries in which the Group has an interest(d) | | 393 | | 402 | | 404 | Total | | 2,594 | | 2,604 | | 2,598 |

| | | | | | | | | | | | | | | As of December 31, (kb/d) | | 2010 | | | 2009 | | | 2008 | | Refineries operated by the Group | | | | | | | | | | | | | | | | Normandy (France) | | | 199 | | | | 338 | | | | 339 | | | | | Provence (France) | | | 158 | | | | 158 | | | | 158 | | | | | Flanders (France) | | | — | | | | 137 | | | | 137 | | | | | Donges (France) | | | 230 | | | | 230 | | | | 230 | | | | | Feyzin (France) | | | 117 | | | | 117 | | | | 117 | | | | | Grandpuits (France) | | | 101 | | | | 101 | | | | 101 | | | | | Antwerp (Belgium) | | | 350 | | | | 350 | | | | 350 | | | | | Leuna (Germany) | | | 230 | | | | 230 | | | | 230 | | | | Rome (Italy)(b) | | | — | | | | 64 | | | | 64 | | | | | Lindsey — Immingham (United Kingdom) | | | 221 | | | | 221 | | | | 221 | | | | Vlissingen (Netherlands)(c) | | | 81 | | | | 81 | | | | 81 | | | | | Port Arthur, Texas (United States) | | | 174 | | | | 174 | | | | 174 | | | | Sub-total | | | 1,861 | | | | 2,201 | | | | 2,202 | | | | Other refineries in which the Group has an interest(d) | | | 502 | | | | 393 | | | | 402 | | | | Total | | | 2,363 | | | | 2,594 | | | | 2,604 | | | |

(a) | | | | (a) | | For refineries not 100% owned by TOTAL, the indicated capacity shown represents TOTAL’s share of the site’s overall refining capacity of the refinery.capacity. |

| (b) | | TOTAL’s interest iswas 71.9%. until September 30, 2010. |

| (c) | | TOTAL’s interest is 55%. |

| (d) | | TOTAL has interests ranging from 16.7%12% to 50% in twelvefourteen refineries (five in Africa, four in Spain, two in Italy, one in Germany, one in Martinique and one in China). Since October 1, 2010, including the Group’s share in the Rome and Trecate refineries through its interest in TotalErg. TOTAL disposed of its 50% interest in the Indeni refinery in Zambia in 2009 and of its 55.6% interest in the Luanda refinery in Angola in 2007.2009. |

41

The table below sets forth by product category TOTAL’s net share of refined quantities produced at the Group’s refineries (a): | | | | | | | | (kb/d) | | 2009 | | 2008 | | 2007 | Gasoline | | 407 | | 443 | | 501 | Jet fuel(b) | | 186 | | 208 | | 208 | Diesel and heating oils | | 851 | | 987 | | 964 | Heavy fuel oils | | 245 | | 257 | | 254 | Other products | | 399 | | 417 | | 412 | Total | | 2,088 | | 2,312 | | 2,339 |

| | | | | | | | | | | | | | | (kb/d) | | 2010 | | | 2009 | | | 2008 | | | Gasoline | | | 345 | | | | 407 | | | | 443 | | | | Avgas and jet fuel(b) | | | 168 | | | | 186 | | | | 208 | | | | | Diesel and heating oils | | | 775 | | | | 851 | | | | 987 | | | | | Heavy fuels | | | 233 | | | | 245 | | | | 257 | | | | | Other products | | | 359 | | | | 399 | | | | 417 | | | | Total | | | 1,880 | | | | 2,088 | | | | 2,312 | | | |

(a) | | | | (a) | | Including TOTAL’sequity share of refineries in CEPSA.which the Group holds interests. |

| (b) | | Avgas, jet fuel and kerosene. |

The tabletables below setsset forth the utilization rate of the Group’s refineries(a): | | | | | | | | | | | | | 2009 | | | 2008 | | | 2007 | | Crude | | 78 | % | | 88 | % | | 87 | % | Crude and other feedstock | | 83 | % | | 91 | % | | 89 | % |

| | | | | | | | | | | | | | | | | 2010 | | | 2009 | | | 2008 | | On crude and other feedstock(a)(b) | | | | | | | | | | | | | | | | France | | | 64 | % | | | 77 | % | | | 89 | % | | | | Rest of Europe | | | 85 | % | | | 88 | % | | | 93 | % | | | | Americas | | | 83 | % | | | 77 | % | | | 88 | % | | | | Asia | | | 81 | % | | | 80 | % | | | 76 | % | | | | Africa | | | 76 | % | | | 77 | % | | | 79 | % | | | Net share of CEPSA and TotalErg(c) | | | 94 | % | | | 93 | % | | | 106 | % | | | Average | | | 77 | % | | | 83 | % | | | 91 | % | | |

(a) | | | | (a) | | Including TOTAL’sequity share of refineries in CEPSA.which the Group holds interests. | | (b) | | Crude + crackers’ feedstock/capacity and distillation at the beginning of the year. | | (c) | | For TotalErg: calculation of the utilization rate based on production and prorated capacity. |

In 2009, TOTAL had to reduce the utilization rate of its refineries to adapt to weaker demand. In particular, the Port Arthur, Lindsey and Flanders refineries as well as a distillation unit at the Normandy refinery were temporarily shut down for economic reasons.

In 2009, five refineries underwent major turnarounds.

| | | | | | | | | | | | | | | | | 2010 | | 2009 | | 2008 | On crude(a)(b) | | | | | | | | | | | | | | | Average | | | 73 | % | | | 78 | % | | | 88 | % | | |

| | | | (a) | | Including equity share of refineries in which the Group holds interests. | | (b) | | Crude/capacity and distillation at the beginning of the year. |

TOTAL is one of the leading marketers in Western Europe (1). The Group is also the largest marketer in Africa, with a market share of nearly 10%14%(2). TOTAL markets a wide range of specialty products, which it produces from its refineries and other facilities. TOTAL is among the leading companies in the specialty products market(3), in particular for lubricants, LPG, jet fuel, special fluids, bitumen, and marine fuels, with products marketed in approximately 150 countries(4). 1.

| Based on publicly available information, quantities sold. Portfolio: France, Benelux, United Kingdom, Germany, Italy and, through CEPSA, Spain and Portugal. |

2. | PFC Energy December 2009, based on quantities sold. |

3. | Based on publicly available information, quantities sold. |

4. | Including through national distributors. |

In Europe, as of December 31, 2009, TOTAL has a network of 10,82512,062 service stations in France, Belgium, the Netherlands, Luxembourg, Germany and the United Kingdom, Italy,as well as Spain and Portugal through its interest in CEPSA Spain(48.83%) and Portugal. Italy through its interest in TotalErg (49%). TOTAL also hasoperates a network of more than 540579 AS24-branded service stations dedicated to commercial transporters. TOTAL is among the leaders in Europe for fuel-payment cards, with approximately 3.5 million cards issued in twenty-eight European countries. In France,, the TOTAL-branded network benefits from a largewide number of service stations and a diverse selection of products (such as theBonjourconvenience stores and car washes). Elf-branded service stations offer quality fuels at prices that are particularly competitive. As of December 31, 2009, nearly 2,300Nearly 2,100 TOTAL-branded service stations and 281280 Elf-branded service stations were operatingare operated in France. TOTAL also markets fuels at nearly 1,8001,900 Elan-branded serviceretail stations, generally located in rural areas.In Western Europe, TOTAL continued in 20092010 its efforts to optimize its Marketing business.• | | | • | InItaly, the agreement signed between TOTALTotalErg was created in October 2010 and ERG in January 2010 to create the TotalErg joint venture will enable the Group to becomebecame the third marketing operator in Italylargest marketer with a retailnetwork market share of nearly 13%(1)(5) and more than 3,4003,200 service stations. | | | • | InFrance, TOTAL started to implement the project to adapt oil logistics operations in January 2010. Closure of the Pontet and Saint Julien oil depots is ongoing. Hauconcourt’s operations were transferred to the Raffinerie du Midi company on October 1, 2010. Transfer of the Mans oil depot’s operations and divesting of the Ouistreham oil depot are scheduled in the first half of 2011. |

• | | | | | | In January 2010, TOTAL also closed the disposal of half of its share (50%) in Société des Dépôts Pétroliers de Corse. |

| | | • | In theFranceUnited Kingdom,TOTAL announced in JanuarySeptember 2010 a restructuring plan of its petroleum product logistics operations. This plan callsintention to offer for outsourcing the operations of five depots to specialized logistics companies, closing the Pontet depot and doubling the capacity of the Port-la-Nouvelle depot. Implementation of this project is subject to consultation with employee representative organizations.sale its marketing business, except for certain specialties (lubricants, etc.). |

TOTAL signed in July 2009 an agreement to acquire thirty-seven service stations. In October 2009,

(1) Based on publicly available information, quantities sold. Scope: France, Benelux, United Kingdom, Germany, Italy, and, through CEPSA, Spain and Portugal. (2) Market share for the markets where the Group also signed an agreement to dispose of thirty-four service stations located in Corsica. These transactions have been approved by the relevant authorities. In January 2010, TOTAL also finalized the disposal of half of its share (50%) in Société des Dépôts Pétroliers de Corse.operates, based on publicly available information, quantities sold. (3) Based on publicly available information, quantities sold. (4) Including via national distributors. (5) PFC Energy, Unione Petrolifera, based on quantities sold.

42

In July 2009, the Group inaugurated a logistic platform in Rouen designed to supply Europe and

other continents with lubricants and grease. This investment is intended to improve the competitiveness of the Lubricants business line.

• | | InPortugal, since TOTAL and CEPSA merged their oil marketing businesses in 2008, TOTAL has had a leading position in the country with a market share of nearly 11%(2), a network of 300 service stations and a strengthened position in the specialty products market. |

InNorthern, Central andEastern Europe, the Group is developing its positions primarily in the specialty products market. In 2009,2010, TOTAL continued to expand its direct presence in the growing markets of Eastern Europe, in particular for lubricants. The Group intends to accelerate the growth of its specialty products business in Russia and Ukraine through the development of its direct presence in these markets since 2008.

AS24, which is presentactive in twenty-twotwenty-five European countries, and in Russia, continued to expand its network in 20092010 by opening new marketing outlets, in Europe, in particular in threetwo new countries (Croatia, Bulgaria, Republic of Macedonia)(Sweden and Serbia). During the next few years, theThe AS24 network is expected to continue to grow and expand to other countries in Europe, the Caucasus and the Mediterranean Basin. Africa & the Middle EastAs of December 31, 2009,

TOTAL is the leading marketer of petroleum products inon the African continent, with a market share of nearly 10%14%.(3)(1), over Following the acquisition of marketing and logistics assets in Kenya and Uganda in 2009, the Group runs more than 3,600 service stations in more than forty countries and operates two major networks in South Africa and Nigeria. As part of the optimization of its portfolio, the Group divested its subsidiary in Benin in December 2010. TOTAL also has a large presence in the Mediterranean Basin, principally in Turkey, Morocco and Tunisia. In the Middle East, the Group is active mainly in the specialty products market and is pursuing its growth strategy in the region, notably through the production and marketing of lubricants. In 2009, the Group continued to strengthen its positions on the African continent. In the second quarter of 2009, TOTAL completed the acquisition of marketing and logistics assets in Kenya and Uganda. The transaction covers 165 service stations, aviation products distribution as well as several logistics sites and a lubricant manufacturing plant.

Asia-PacificAs of December 31, 2009,

At year-end 2010, TOTAL was present in nearly twenty countries in the Asia-Pacific region, primarily in the specialty products market. The Group is developing 1. | PFC Energy, Unione Petrolifera, based on quantities sold. |

2. | Based on publicly available information, quantities sold. |

3. | PFC Energy December 2009, based on quantities sold. |

its position as a fuel marketer in the region, in particular in China, andChina. TOTAL operates networksservice stations in Pakistan, the Philippines, Cambodia, Indonesia, and Cambodia. TOTAL is also a significant player in the Pacific Islands. In addition, five service stations opened in Indonesia in 2009. In China, the Group has approximately 110 service stations as of December 31, 2009, following two joint venture agreements signed in 2005 by TOTAL and Sinochem to develop a network of 500operated nearly 130 service stations in the Beijing and Shanghai areas.2010 through two TOTAL/Sinochem joint ventures. In Vietnam, TOTAL continues to strengthen its position in the specialty products market. After the acquisition of an LPG marketing company in December 2008, theThe Group finalized in December 2009 the acquisition of lubricants assets, making TOTALbecame one of the leaders ofin the Vietnamese lubricants market.The Americas

Inmarket due to the acquisitions of lubricants assets at year-end 2009.

Americas InLatin Americaand theCaribbean, TOTAL is active in nearly twenty countries, primarily in the specialty products market. In the Caribbean, the Group holds a significant position in the fuel distribution business, thatwhich was strengthened by the acquisition in the second half of 2008 of marketing and logistics assets in Puerto Rico, Jamaica and the Virgin Islands. In North America, TOTAL markets lubricants and is continuing to grow with the signature in Decemberacquisition at year-end 2009 of an agreement to acquire lubricant assets in the province of Quebec in Canada.Sales of refined products The table below sets forth TOTAL’s volumessales of refined petroleum products sold by geographic arearegion(a): | | | | | | | | | (kb/d) | | 2009 | | 2008 | | 2007 | | France | | 808 | | 822 | | 846 | | Europe excluding France(a) | | 1,245 | | 1,301 | | 1,432 | | United States | | 118 | | 147 | | 162 | (b) | Africa | | 281 | | 279 | | 286 | | Rest of world | | 189 | | 171 | | 167 | | Total excluding Trading | | 2,641 | | 2,720 | | 2,893 | (b) | Trading | | 975 | | 938 | | 881 | | Total including trading | | 3,616 | | 3,658 | | 3,774 | (b) |

| | | | | | | | | | | | | | | (kb/d) | | 2010 | | | 2009 | | | 2008 | | | France | | | 725 | | | | 808 | | | | 822 | | | | | | | | | | | | | | | | Europe, excluding France(a) | | | 1,204 | | | | 1,245 | | | | 1,301 | | | | | | | | | | | | | | | | | United States | | | 65 | | | | 118 | | | | 147 | | | | | | | | | | | | | | | | | Africa | | | 292 | | | | 281 | | | | 279 | | | | | | | | | | | | | | | | | Rest of world | | | 209 | | | | 189 | | | | 171 | | | | | | | | | | | | | | | | Total excluding Trading | | | 2,495 | | | | 2,641 | | | | 2,720 | | | | | | | | | | | | | | | | | Trading | | | 1,281 | | | | 975 | | | | 938 | | | | | | | | | | | | | | | | Total including trading | | | 3,776 | | | | 3,616 | | | | 3,658 | | | | | | | | | | | | | | | |

(a) | | | | (a) | | Including TOTAL’s share in CEPSA.CEPSA and, as from October 1, 2010, in TotalErg. |

(b) | The amount is different from that in TOTAL’s 2007 Form 20-F due to a change in the calculation method for sales of the Port Arthur refinery. |

The table below sets forth the number of service stations in TOTAL’s network by geographic area(a): | | | | | | | | | As of December 31, | | 2009 | | | 2008 | | 2007 | France | | 4,606 | (b) | | 4,782 | | 4,992 | Europe excluding France and CEPSA | | 4,485 | | | 4,541 | | 4,762 | CEPSA(c) | | 1,734 | | | 1,811 | | 1,680 | Africa | | 3,647 | | | 3,500 | | 3,549 | Rest of world | | 1,827 | | | 1,791 | | 1,514 | Total | | 16,299 | | | 16,425 | | 16,497 |

| | | | | | | | | | | | | | | As of December 31, | | 2010 | | | 2009 | | | 2008 | | | France | | | 4,272 | (b) | | | 4,606 | (b) | | | 4,782 | | | | | | | | | | | | | | | | CEPSA and TotalErg(c) | | | 4,958 | | | | 1,734 | | | | 1,811 | | | | | | | | | | | | | | | | | Europe, excl. France, CEPSA and TotalErg | | | 2,832 | | | | 4,485 | | | | 4,541 | | | | | | | | | | | | | | | | | Africa | | | 3,570 | | | | 3,647 | | | | 3,500 | | | | | | | | | | | | | | | | | Rest of world | | | 1,858 | | | | 1,827 | | | | 1,791 | | | | | | | | | | | | | | | | Total | | | 17,490 | | | | 16,299 | | | | 16,425 | | | | | | | | | | | | | | | |

(a) | | | | (a) | | Excluding AS24-branded service stations. |

| (b) | | Of which nearly 2,3002,100 TOTAL-branded service stations, nearly 281280 Elf-branded service stations and more than 1,8001,900 Elan-branded service stations. |

| (c) | | Including all1,737 CEPSA-branded service stations within the CEPSA network.and, as from October 1, 2010, 3,221 TotalErg-branded service stations. |

TOTAL is presentactive in the biodiesel and biogasoline biofuel sectors. In 2009,2010, TOTAL produced and blended 560549 kt of ethanol(1)(2) in gasoline at twelveits European refineries(3) (compared to 560 kt in (1) Market share for the markets where the Group operates, based on publicly available information, quantities sold. (2) Including ethanol from ETBE(compared toEthyl-Tertio-Buthyl-Ether) and methanol form MTBE (Methyl-Tertio-Butyl-Ether). (3) Including the Algesiras and Huelva refineries (CEPSA).

43

2009 and 425 kt in 20082008) and 350 kt in 2007) and 1,8702,023 kt of VOME (3)(1) in diesel at fifteenits European refineries (4)(2) and several oil depots (compared to 1,870 kt in 2009 and 1,470 kt in 2008 and 880 kt in 2007)2008). TOTAL, in partnership with the leading companies in this area, is developing second generation biofuels derived from biomass. The Group is also participating in French, European and international bioenergy development programs. In this framework, the Group announced in 2009 that it would participate in the BioTfueL research project intended to develop a technology to transform biomass into biodiesel. In April 2009, the Group announced that it had acquired an interest in Gevo, a U.S. company developing a portfolio of bioproducts intended for the transportation fuel and chemicals markets. Gevo is developing an innovative technology to convert sugars derived from biomass into higher alcohols and hydrocarbons.

The Group is also involved in Futurol, ana R&D project for cellulosic bioethanol, which intends to develop and promote on an industrial scale a production process for bioethanol by fermentation of lignocellulosicnon-food ligno-cellulosic biomass. 1.

| Including ethanol from ETBE (Ethyl-Tertio-Buthyl-Ether). |

2. | Including the Algeciras and Huelva refineries (CEPSA). |

3. | VOME: Vegetable-Oil-Methyl-Ester. |

4. | Including the Algeciras, Huelva and Tarragona refineries (CEPSA). |

Hydrogen and electric mobility For several years, TOTAL has been involved in research and testing programs for fuel cell and hydrogen fuel technologies. The Group is a founding member of the industrial groupEuropean Industry Grouping for a Fuel Cell and Hydrogen Joint Technology Initiative created in 2007 to participate in the European Joint Technology Initiative to promote the development of hydrogen technology.research in the field.In 2009,2010, as part of the Clean Energy Partnership Berlin project, TOTAL builtinaugurated a new prototype hydrogen fueling station. Construction of a second hydrogen fueling station in Germany. Three other service stations of the Group are marketing hydrogen in Germany and Belgium.In Germany, theis underway.

The Group is also involved in a demonstration project for marketing electricity atin four TOTAL-branded service stations in Berlin, in partnership with the utility company Vattenfall. In 2010, TOTAL inaugurated the first of twelve prototype electric fueling stations in the area of Brussels in Belgium. The Trading & Shipping division: sells and markets the Group’s crude oil production;

provides a supply of crude oil for the Group’s refineries;

| | | • | sells and markets the Group’s crude oil production; |

| | | • | provides a supply of crude oil for the Group’s refineries; | | • | imports and exports the appropriate petroleum products for the Group’s refineries to be able to adjust their production to the needs of local markets; | | • | charters appropriate ships for these activities; and | | • | undertakes trading on various derivatives markets. |

imports and exports the appropriate petroleum products for the Group’s refineries to be able to adjust their production to the needs of local markets;

charters appropriate ships for these activities; and

undertakes trading on various derivatives markets.

Although theThe Trading & Shipping division’s main focus is serving the Group, its know-how andGroup. In addition, the expertise acquired also allowallows this division to extend itsthe scope of operationsits activities beyond meeting the strict needs of the Group.

its primary focus. Trading & Shipping’s worldwide activities are conducted through various wholly-owned subsidiaries, including TOTSA Total Oil Trading S.A., Total International Ltd, Socap International Ltd, Atlantic Trading & Marketing Inc., Total Trading Asia Pte, Total Trading and Marketing Canada L.P., Total Trading Atlantique S.A. and Chartering & Shipping Services S.A. TOTAL is one of the world’s largest traders of crude oil and refined products on the basis of volumes traded. The table below sets forth selected information with respect to TOTAL’sthe worldwide sales and source of supply of crude oil of the Group’s Trading division for each of the last three years. (1) VOME: Vegetable-Oil-Methyl-Ester. (2) Including CEPSA’s Algesiras, Huelva and Tarragona refineries in Spain and TotalErg’s Rome and Trecate refineries in Italy.

44

SupplyTrading division’s supply and sales of crude oil | | | | | | | | For the year ended December 31, (kb/d, except %) | | 2009 | | 2008 | | 2007 | Sales of crude oil | | 3,679 | | 3,839 | | 4,194 | Sales to Group Refining & Marketing division(a) | | 1,771 | | 1,995 | | 2,042 | Share of sales to external customers | | 1,908 | | 1,844 | | 2,152 | Sales to external customers/total sales | | 52% | | 48% | | 51% | Supply of crude oil | | 3,679 | | 3,839 | | 4,194 | Share of production sold(b)(c) | | 1,310 | | 1,365 | | 1,502 | Purchased from external suppliers | | 2,370 | | 2,474 | | 2,692 | Production sold/total supply | | 36% | | 36% | | 36% |

| | | | | | | | | | | | | | | For the year ended December 31, (kb/d) | | 2010 | | | 2009 | | | 2008 | | Worldwide liquids production | | | 1,340 | | | | 1,381 | | | | 1,456 | | | | | | | | | | | | | | | | | Purchased by the Trading division from the Group’s Exploration & Production division | | | 1,044 | | | | 1,054 | | | | 1,102 | | | | | | | | | | | | | | | | | Purchased by the Trading division from external suppliers | | | 2,084 | | | | 2,351 | | | | 2,495 | | | | | | | | | | | | | | | | Total of Trading division’s supply(a) | | | 3,128 | | | | 3,405 | | | | 3,597 | | | | | | | | | | | | | | | | | Sales of Trading division to Group Refining & Marketing division | | | 1,575 | | | | 1,752 | | | | 1,994 | | | | | | | | | | | | | | | | | Sales of Trading division to external customers | | | 1,553 | | | | 1,653 | | | | 1,603 | | | | | | | | | | | | | | | | Total of Trading division’s sales(a) | | | 3,128 | | | | 3,405 | | | | 3,597 | | | | | | | | | | | | | | | |

(a) | Excluding share of CEPSA. | |

(b)(a) | | Including condensates and natural gas liquids. |

(c) | Including TOTAL’S proportionate share of joint ventures production. |

The Trading division operates extensively on physical and derivatives markets, both organized and over the counter. In connection with its trading business,activities, TOTAL, like most other oil companies, uses derivative energy instruments (futures, forwards, swaps, options) to adjust its exposure to fluctuations in the price of crude oil and refined products. These transactions are entered into with various counterparties. For additional information concerning Trading & Shipping’s derivatives, see Notes 30 (Financial instruments related to commodity contracts) and 31 (Market risks) to the Consolidated Financial Statements. All of TOTAL’s trading operationsactivities are subject to strict internal controls and trading limits. Throughout 2009,2010, the Trading division maintained a level of activity similar to the levels attainedthose recorded in 2009 and 2008, and 2007,with trading physical volumes of crude oil and refined products amounting to an average of approximately 5 Mb/d. In 2009,2010, the main market benchmarks were characterizedindicators extended the trends recorded since mid-2009. Theyear-on-year evolution was marked by increased crude and diesel spot prices, a strong contango(1): | | | | | | | | | | | | | | | | | | | | | | | | 2009 | | 2008 | | 2007 | | min 2009 | | | max 2009 | | Brent ICE — 1st Line(a) | | ($/b) | | 62.73 | | 98.52 | | 72.67 | | 39.6 | | (Feb. 11 | ) | | 79.7 | | (Oct. 14 | ) | Brent ICE — 12th Line(b) | | ($/b) | | 70.43 | | 102.19 | | 73.24 | | 48.3 | | (Feb. 11 | ) | | 86.4 | | (Nov. 24 | ) | Contango time structure (12th-1st) | | ($/b) | | 7.70 | | 3.59 | | 0.57 | | 3.8 | | (Aug. 07 | ) | | 15.2 | | (Jan. 02 | ) | Gasoil ICE — 1st Line(c) | | ($/t) | | 522.20 | | 920.65 | | 637.84 | | 361.3 | | (Feb. 24 | ) | | 653.8 | | (Oct. 15 | ) | VLCC Ras Tanura Chiba — BITR(c) | | ($/t) | | 10.43 | | 24.09 | | 13.93 | | 6.3 | | (May 05 | ) | | 17.9 | | (Jan. 08 | ) |