UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FormFORM 20-F

| ¨ | Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 20092012

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from/to

or

| ¨ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of event requiring this shell company report:

Commission file number 000–12033

TELEFONAKTIEBOLAGET LM ERICSSON

(Exact Name of Registrant as Specified in Its Charter)

LM ERICSSON TELEPHONE COMPANY

(Translation of Registrant’s Name Into English)

Kingdom of Sweden

(Jurisdiction of Incorporation or Organization)

SE-164 83 Stockholm, Sweden

(Address of Principal Executive Offices)

Roland Hagman, Vice President Group Function Financial Control

Telephone: +46 8 719 53 80, Facsimile: +46 8 719 42 22

SE-164 83 Stockholm, Sweden

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| American Depositary Shares (each representing one B share) | | The NASDAQ Stock Market LLC |

B Shares*Shares * | | The NASDAQ Stock Market LLC |

| * | Not for trading, but only in connection with the registration of the American Depositary Shares representing such B Shares pursuant to the requirements of the Securities and Exchange Commission |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report:

| | | | |

B shares (SEK 5.00 nominal value) | | 3,011,595,752 | 3,043,295,752 | |

A shares (SEK 5.00 nominal value) | | | 261,755,983 | |

C shares (SEK 1.00 nominal value) | | | 0 | |

Indicate by check mark if the registrant is a well-seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x �� No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

x Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board x Other ¨

IndicateIf “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 x¨ Item 18 ¨

IndicateIf this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

CONTENTS

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

FORM 20-F 20092012 CROSS REFERENCE TABLE

OurThis document comprises the English version of our Swedish Annual Report for 2012 and our Annual Report on Form 20-F consists offor the Swedish Annual Report for 2009, with certain adjustmentsyear ended December 31, 2012. Reference is made to comply with U.S. requirements, together withthe Form 20-F 2012 cross reference table on pages i to viii hereof and the Supplemental Information beginning on page 137, which contains certain other information required by Form 20-F. Only (i) the information in this document that is referenced in the Form 20-F 2012 cross reference table, (ii) the Supplemental Information, and (iii) the Exhibits required to be filed pursuant to the Form 20-F shall be deemed to be filed with the Securities and Exchange Commission for any purpose, including incorporation by reference into the Registration Statement on Form F-3 filed on April 23, 2012 (File No. 333-180880) and any other documents filed by us pursuant to the Securities Act of 1933, as amended, which incorporates by reference the 2012 Form 20-F. Any information herein which is set forth undernot referenced in the heading Supplemental Information. Form 20-F 2012 cross reference table or filed as an exhibit thereto shall not be deemed to be so incorporated by reference.

This annual report includes financial measures that were not calculated or presented in accordance with IFRS, and we refer to these measures as non-IFRS financial measures. Reconciliations of these non-IFRS financial measures to the most directly comparable IFRS financial measures can be found on page 234 and pages 261-265 of this annual report.

The information included on the websites that appear in the Annual Report on Form 20-F is not incorporated by reference in the report.

The following cross reference table indicates where information required by Form 20-F may be found in this document.

| | | | | | | | | | |

Form 20-F Item Heading | | Location in this documentDocument | | Page

Number | |

PART I | | | | | | |

1 | | Identity of Directors, Senior Managementmanagement and Advisersadvisers | | Not applicable

N/A | | | | |

| | | |

2 | | Offer Statisticsstatistics and Expected Timetableexpected timetable | | Not applicable

N/A | | | | |

| | | |

3 | | Key Informationinformation | | | | |

| | A

| | Selected Financial Data | | Five-Year Summary

| | 10 |

| | B

| | Capitalization and Indebtedness

| | Not applicable

| | |

| | CA

| | Reason for the Offer and Use of ProceedsSelected financial data

| | Not applicable

Five-year summary | | | 29 | |

| | | | | | Reconciliations to IFRS | | | 261-265 | |

| | | | | | Financial terminology | | | 269-270 | |

| | | | | | Supplemental information | | | | |

| | | | | | DExchange rates

| | Risk Factors

| 232 | |

| | Risk FactorsB

| | 142Capitalization and indebtedness | | N/A | | | - | |

| | C | | Reason for the offer and use of proceeds | | N/A | | | - | |

| | D | | Risk factors | | Risk factors | | | 164-176 | |

| | | |

4 | | InformationInfo on the Company

| | | | | | |

| | A | | History and development of the Company | | Our Business | | | | |

| | | | | | This is Ericsson—2012 in review | | History and Development of the Company

| 3-4 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Business Drivers 2009in 2012 | | 13 | 32-34 | |

| | | | | | Cash flow—Capital Expenditures (capex)expenditures | | 24 | 48 | |

| | | | | | Notes to the Consolidated Financial Statementsfinancial statements | | | | |

| | | | | | Note C26 Business Combinationscombinations | | 119 | 143-146 | |

| | | | | | Note C32C33 Events Afterafter the Balance Sheet Datereporting period | | 140 |

| 161-162 | | | | | | Information on the Company

| | |

| | | | | | Company History and Development

| | 167 |

| | | | | | General Facts on the Company

| | 170 |

| | B

| | Business Overview

| | Board of Directors’ Report

| | |

| | | | | | Sustainability and Corporate Responsibility

| | 35 |

| | | | | | Notes to the Consolidated Financial Statements

| | |

| | | | | | Note C3 Segment Information

| | 70 |

| | | | | | Risk Factors

| | 142 |

| | | | | | Information on the Company

| | |

| | | | | | Company History and Development

| | 167 |

| | | | | | Market Environment

| | 171 |

| | | | | | Segment Overview

| | 173 |

| | | | | | Supplemental Information

| | |

| | | | | | Operating Results

| | 219 |

| | C

| | Organizational Structure

| | Information on the Company

| | |

| | | | | | General Facts on the Company

| | 170 |

| | | | | | Supplemental Information

| | |

| | | | | | Investments

| | 232 |

| | D

| | Property, Plants and Equipment

| | Information on the Company

| | |

| | | | | | Sourcing, Manufacturing and Supply and Availability of Materials

| | 175 |

i

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

| | | | | | | | | | |

Form 20-F Item Heading | | Location in this documentDocument | | Page

Number | |

| | | | | | Supplemental information | | | | |

| | | | | | General facts on the Company | | | 231 | |

| | | | | | Company history and development | | | 232 | |

| | B | | Business overview | | Our business | | | | |

| | | | | | This is Ericsson | | | 1-2 | |

| | | | | | Group overview | | | 5-6 | |

| | | | | | Our competitive assets | | | 13 | |

| | | | | | Strategy and customers | | | 15-17 | |

| | | | | | Our portfolio | | | 18-22 | |

| | | | | | Regional development | | | 23-24 | |

| | | | | | Board of Directors’ report | | | | |

| | | | | | Business in 2012 | | | 32-34 | |

| | | | | | Financial results of operations—Seasonality | | | 39-40 | |

| | | | | | Business results—Regions | | | 50 | |

| | | | | | Business results—Segments | | | 50-57 | |

| | | | | | Material contracts | | | 59 | |

| | | | | | Sourcing and supply | | | 60 | |

| | | | | | Sustainability and corporate responsibility | | | 60-64 | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C11 Property, Plant and EquipmentC3—Segment information | | 84 | 95-101 | |

| | | | | | Note C27 Leasing

| | 124 |

| Risk factors | | | | | | Board of Directors’ Report

| | |

| | | | | | Capital Expenditures (capex)Market, technology and business risks

| | 24 |

| | | |

4A

164-172 | | Unresolved staff comments

| | Not applicable

| | |

| | | |

5

| | Operating and Financial Review and Prospects

| | | | |

| | A

| | Operating Results

| | Market Trends

| | 159 |

| | | | | | Regulatory, compliance and corporate governance risks | | | 172-175 | |

| | | | | | Corporate governance regulation and compliance | | | 180-181 | |

| | Board of Directors’ ReportC | | Organizational structure | | Supplemental information | | | | |

| | | | | | Business ResultsGeneral facts on the company

| | 25 | 231 | |

| | | | | | Supplemental InformationInvestments

| | | 260-261 | |

| | D | | Property, plants and equipment | | Our business | | | | |

| | | | | | Operating ResultsSustainability and corporate responsibility

| | 219 | 27-28 | |

| | | | | | Supplemental information | | | | |

| | | | | | Restructuring in 2008Primary manufacturing and 2009assembly facilities

| | 221 | 233 | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C1 Significant Accounting PoliciesC11—Property, plant and equipment | | 49 | 109-110 | |

| | | | | | Note C2 Critical Accounting Estimates and JudgmentsC27—Leasing | | 66 | 147-148 | |

| | | | | | Note C20 Financial Risk Management and Financial Instruments

| | 108 |

| Board of Directors’ report | | | | | | Risk Factors

| | 142 |

| | | | | | Board of Directors’ Report

| | |

| | | | | | Risk ManagementCash Flow—Capital expenditures

| | 37 | 48 | |

| | B4A

| | Liquidity and Capital ResourcesUnresolved staff comments

| | Board of Directors’ Report

| | |

| — | | | | | | Financial Position

| | 20 |

| | | | | | Cash Flow

| | 23 |

| | | | | | Capital Expenditures

| | 24 |

| | | | | | Risk Management

| | 37 |

| | | | | | Notes to the Consolidated Financial Statements

| | |

| | | | | | Note C19 Interest-bearing Liabilities

| | 107 |

| | | | | | Note C20 Financial Risk Management and Financial Instruments

| | 108 |

| | | | | | Note C25 Statement of Cash Flows

| | 117 |

| | C | | Research and Development, Patents and Licenses, etc | | Five-Year Summary | | 10 |

| | | | | | Board of Directors’ Report

| | |

| | | | | | Financial Results of Operations

| | 17 |

| | | | | | Consolidated Balance Sheet

| | 46 |

| | | | | | Information on the Company

| | |

| | | | | | Technology and Services Leadership

| | 168 |

| | D | | Trend Information | | Board of Directors’ Report | | |

| | | | | | Business Results

| | 25 |

| | | | | | Market Trends

| | 159 |

| | E | | Off-Balance Sheet Arrangements | | Board of Directors’ Report | | |

| | | | | | Sony Ericsson Borrowings Guaranteed

| | 23 |

| | | | | | Off Balance Sheet Arrangements

| | 23 |

ii

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

| | | | | | | | | | |

Form 20-F Item Heading | | Location in this documentDocument | | Page

Number | |

5 | | Operating and financial review and prospects | | | | | | |

| | A | | Operating results | | Our business | | | | |

| | | | | | Group overview | | | 5-6 | |

| | | | | | Our performance | | | 25-26 | |

| | | | | | Regional development | | | 23-24 | |

| | | | | | Five-year summary | | | 29 | |

| | | | | | Board of Directors’ report | | | | |

| | | | | | Business in 2012 | | | 32-34 | |

| | | | | | Financial results of operation | | | 38-41 | |

| | | | | | Business results—Regions | | | 50 | |

| | | | | | Business results—Segments | | | 50-57 | |

| | | | | | Board of Directors’ report | | | | |

| | | | | | Risk management | | | 59 | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C24 Contingent LiabilitiesC1—Significant accounting policies | | 117 | 75-91 | |

| | | | | | Note C20—Financial risk management and financial instruments—Foreign exchange risk | | | 134-136 | |

| | | | | | FRisk Factors | | Tabular Disclosure of Contractual Obligations | | Board of Directors’ Report | | |

| | | | | | Material ContractsMarket, technology and business risks

| | 33 | 164-172 | |

| | | | | | Supplemental information | | | | |

| | | | | | Operating results | | | 233-248 | |

| | B | | Liquidity and capital resources | | Board of Directors’ report | | | | |

| | | | | | Financial results of operations—Seasonality | | | 39-40 | |

| | | | | | Financial position | | | 42-46 | |

| | | | | | Cash flow | | | 47-49 | |

| | | | | | Risk Management | | | 59 | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C33 Contractual ObligationsC19—Interest-bearing liabilities | | 141 | 131-132 | |

| | | |

6

| | Directors, Senior Management and Employees | | | | | | Note C20—Financial risk management and financial instruments | | | 133-140 | |

| | | | | | Note C25—Statement of cash flows | | | 142-143 | |

| | | | | | ASupplemental information | | Directors and Senior Management | | Corporate Governance Report 2009 | | |

| | | | | | Members of the Board of DirectorsOperating results

| | 203 | 234-248 | |

| | C | | R&D, Patents and licenses, etc. | | Five-year summary | | | 29 | |

| | | | | | Members of the Group Management Team

| | 209 |

| | BOur business | | Compensation | | Board of Directors’ Report

| | |

| | | | | | Corporate GovernanceThis is Ericsson

| | 33 | 1-2 | |

| | | | | | Corporate Governance Report 2009Our competitive assets-technology leadership

| | | 13 | |

| | | | | | Board of Directors’ report | | | | |

| | | | | | Board of DirectorsFair return on R&D investment

| | 195 | 33-34 | |

| | | | | | Company ManagementBusiness in 2012

| | 207 |

| 32-34 | | | | | | Notes to the Consolidated Financial Statements

| | |

| | | | | | Note C17 Post-Employment Benefits

| | 98 |

| | | | | | Note C29 Information Regarding Members of the Board of Directors, Management and Employees

| | 126 |

| | C

| | Board Practices | | Corporate Governance Report 2009 | | |

| | | | | | Board of Directors

| | 195 |

| | | | | | Members of the Board of Directors

| | 203 |

| | | | | | Members of the Group Management Team

| | 209 |

| | | | | | Notes to the Consolidated Financial Statements

| | |

| | | | | | Note C29 Information Regarding Members of the Board of Directors, Management and Employees

| | 126 |

| | D

| | Employees | | Five-Year Summary | | 10 |

| | | | | | Board of Directors’ Report

| | |

| | | | | | Financial Resultsresults of Operationsoperations—Operating expenses | | 17 |

| 40 | | | | | | Notes to the Consolidated Financial Statements

| | |

| | | | | | Note C29 Information Regarding Members of the Board of Directors, Management and Employees

| | 126 |

| | E

| | Share Ownership | | Share Information | | |

| | | | | | Shareholders

| | 155 |

| | | | | | Corporate Governance Report 2009 | | |

| | | | | | Members of the Board of Directors

| | 203 |

| | | | | | Members of the Group Management Team

| | 209 |

iii

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

| | | | | | | | | | |

Form 20-F Item Heading | | Location in this documentDocument | | Page

Number | |

| | | | | | Consolidated financial statements | | | | |

| | | | | | Consolidated income statement | | | 70 | |

| | D | | Trend information | | Our business | | | | |

| | | | | | Market trends | | | 10-12 | |

| | | | | | Strategy and customers | | | 15-17 | |

| | | | | | Board of Directors’ report | | | | |

| | | | | | Trends and drivers | | | 31-32 | |

| | | | | | Business results—Regions | | | 50 | |

| | | | | | Business results—Segments | | | 50-57 | |

| | E | | Off-balance sheet arrangements | | Board of Directors’ report | | | | |

| | | | | | Financial position—Off-balance sheet arrangements | | | 46 | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C29 Information Regarding Members of the Board of Directors, Management and EmployeesC24—Contingent liabilities | | 126 |

| | | |

7

141-142 | | Major Shareholders and Related Party Transactions

| | | | |

| | A | | Major Shareholders | | Share Information

| | |

| | | | | | ShareholdersNote C32—Transfers of financial assets

| | 155 | 161 | |

| | BF | | Related Party TransactionsTabular disclosure of contractual obligations | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C30 Related Party TransactionsC31—Contractual obligations | | 137 |

| 161 | | C | | Interests of Experts and Counsel | | Not applicable

| | |

| | | |

86

| | Financial InformationDirectors, senior management and employees | | | | | | |

| | A | | Consolidated StatementsDirectors and Other Financial Informationsenior management

| | Consolidated Financial StatementsCorporate governance report 2012 | | 44 |

| | | | | Please see also Item 17 cross references

| | |

| | | | | | ReportMembers of Independent Registered Public Accounting Firmthe Board of Directors

| | | 196-201 | |

| | | | | | Members of the Executive Leadership Team | | | 206-211 | |

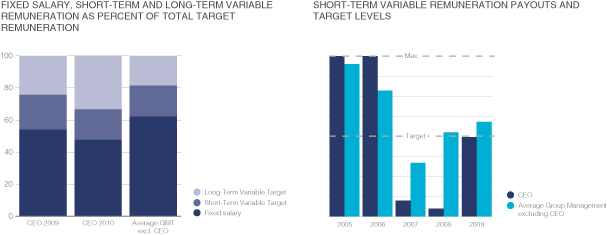

| | B | | Compensation | | Board of Directors’ report | | 43 | | |

| | | | | | Corporate governance—

Remuneration | | | 58 | |

| | | | | | Corporate Governance Report 2012 | | | | |

| | | | | | Remuneration to Board members | | | 195 | |

| | | | | | Remuneration report | | | 216-222 | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C4 Net SalesC17—Post-employment benefits | | 75 |

| 121-129 | | | | | | Board of Directors’ Report | | |

| | | | | | LegalNote C28—Information regarding members of the Board of Directors, the Group management and Tax Proceedingsemployees

| | 32 |

| 149-158 | | | | | | Supplemental Information | | |

| | | | | | Dividends

| | 222 |

| | B | | Significant ChangesC | | Board of Directors’ Reportpractices | | |

| | | | | | Post-Closing Events

| | 42 |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C32 Events afterC28—Information regarding members of the Balance Sheet DateBoard of Directors, the Group management and employees | | 140 | 149-158 | |

9

| | The Offer and Listing | | | | |

| | ACorporate governance report 2012 | | Offer and Listing Details | | Share Information | | |

| | | | | | Offer and Listing DetailsBoard of Directors

| | 153 |

| 186-190 | | B | | Plan of Distribution | | Not applicable | | |

| | C | | Markets | | Share Information | | |

| | | | | | Stock Exchange Trading

| | 152 |

| | D | | Selling Shareholders | | Not applicable | | |

| | E | | Dilution | | Not applicable | | |

| | F | | ExpensesCommittees of the Issue | | Not applicable | | |

| | | |

10Board of Directors—Audit committee

| | Additional Information | 191-193 | | | | |

| | A | | Share Capital | | Not applicable | | |

| | B | | Memorandum and Articles of Association | | Supplemental Information | | |

| | | | | | Memorandum and Articles of Association

| | 222 |

| | C | | Material Contracts | | Board of Directors’ Report | | |

| | | | | | Material Contracts

| | 33 |

iv

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

| | | | | | | | | | |

Form 20-F Item Heading | | Location in this documentDocument | | Page

Number | |

| | | | | | Committees of the Board of Directors—Remuneration committee | | | 193-195 | |

| | D | | Employees | | Our business | | | | |

| | | | | | Our people | | | 14 | |

| | | | | | Five-year summary | | | 29 | |

| | | | | | Notes to the Consolidated Financial Statementsfinancial statements | | | | |

| | | | | | Note C33 Contractual ObligationsC28—Information Regarding Members of the Board of Directors, the Group Management and Employees | | 141 | 149-158 | |

| | E | | Share ownership | | Share Information | | | | |

| | | | | | Shareholders | | | 228-230 | |

| | | | | | Corporate governance report 2012 | | | | |

| | | | | | Shareholders | | | 182-183 | |

| | | | | | Members of the Board of Directors | | | 196-201 | |

| | | | | | Members of the Executive Leadership Team | | | 206-211 | |

| | | | | | Remuneration report | | | | |

| | | | | | Total remuneration | | | 219-222 | |

| | | | | | Notes to the consolidated financial statements | | | | |

| | | | | | Note C28—Information regarding members of the Board of Directors, the Group management and employees | | | 149-158 | |

| | | |

7 | | Major shareholders and related party transactions | | | | | | |

| | A | | Major shareholders | | Corporate governance report 2012 | | | | |

| | | | | | Shareholders | | | 182-183 | |

| | | | | | Share information | | | | |

| | | | | | Shareholders | | | 228-230 | |

| | B | | Related party transactions | | Notes to the consolidated financial statements | | | | |

| | | | | | Note C29—Related party transactions | | | 158-160 | |

| | C | | Interests of experts and counsel | | N/A | | | | |

| | |

8 | | Financial information | | | | |

| | A | | Consolidated statements and other financial information | | Board of Directors’ report | | | | |

| | | | | | Legal proceedings | | | 64-65 | |

| | | | | | Consolidated financial statements | | | 70-74 | |

| | | | | | Please see also Item 17 cross references | | | | |

| | | | | | Report of independent registered public accounting firm | | | 69 | |

| | | | | | Notes to the consolidated financial statements | | | 75-162 | |

v

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

| | | | | | Supplemental information | | | | |

| | | | | | Memorandum and articles of association—Dividends | | | 249-250 | |

| | B | | Significant changes | | Board of Directors’ report | | | | |

| | | | | | Post-closing events | | | 67-68 | |

| | | | | | Notes to the consolidated financial Statements | | | | |

| | | | | | Note C33—Events after the reporting period | | | 161-162 | |

| | | |

9 | | The offer and listing | | | | | | |

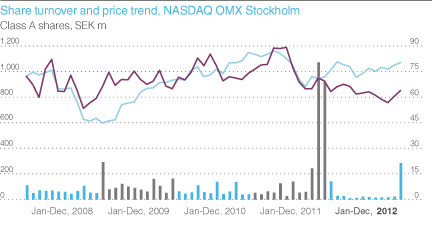

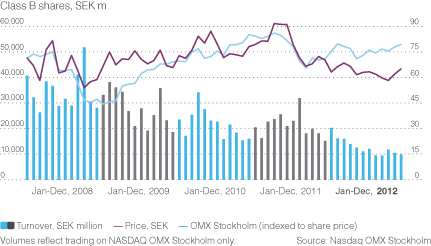

| | A | | Offer and listing details | | Share Information | | | | |

| | | | | | Offer and listing details | | | 226-228 | |

| | B | | Plan of distribution | | N/A | | | | |

| | C | | Markets | | Share Information | | | | |

| | | | | | Stock exchange trading | | | 223-224 | |

| | D | | Selling shareholders | | N/A | | | | |

| | E | | Dilution | | N/A | | | | |

| | F | | Expenses of the issue | | N/A | | | | |

| | | |

10 | | Additional information | | | | | | |

| | A | | Share capital | | N/A | | | | |

| | B | | Articles of association | | Supplemental information | | | | |

| | | | | | Memorandum and articles of association | | | 248-252 | |

| | C | | Material contracts | | Board of Directors’ report | | | | |

| | | | | | Material contracts | | | 59 | |

| | | | | | Notes to the consolidated financial statements | | | | |

| | | | | | Note C31 Contractual obligations | | | 161 | |

| | D | | Exchange Controlscontrols | | Supplemental Informationinformation | | | | |

| | | | | | Exchange Controlscontrols | | 225 | 252 | |

| | E | | Taxation | | Supplemental Informationinformation | | | | |

| | | | | | Taxation | | 225 | 252-257 | |

| | F | | Dividends and Paying Agentspaying agents | | Not applicableN/A | | | | |

| | G | | Statement by Expertsexperts | | Not applicableN/A | | | | |

| | H | | Documents on Displaydisplay | | Information on the CompanySupplemental information | | | | |

| | | | | | General Factsfacts on the Company | | 170 | 232 | |

| | I | | Subsidiary Informationinformation | | Not applicable— | | | | |

| | | |

11 | | Quantitative and Qualitative Disclosures About Market Riskqualitative disclosures

about market risk | | | | | | |

| | A | | Quantitative Informationinformation about Market Riskmarket risk | | Board of Directors’ ReportNotes to the consolidated financial statements

| | | | |

| | | Note C20—Financial risk management and financial instruments | | | 133-140 | |

| | B | | Qualitative information about market risk | | Board of Directors’ Report | | | | |

| | | Risk Managementmanagement | | 209 | 59 | |

vi

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

| | | | | | Notes to the Consolidated Financial Statementsconsolidated financial statements | | | | |

| | | | | | Note C20 C20—Financial Risk Managementrisk management and Financial Instrumentsfinancial instruments | | 108 | 133-140 | |

| | | | | | BCorporate governance report 2012 | | Qualitative Information about Market Risk

| | Board of Directors’ Report | | |

| | | | | | Risk Managementmanagement | | 209 |

| 203-206 | | | | | | Notes to the Consolidated Financial Statements

| | |

| | | | | | Note C20 Financial Risk Management and Financial Instruments

| | 108 |

| | C | | Interim Periodsperiods | | Not applicableN/A | | | | |

| | D | | Safe Harborharbor | | Not applicableN/A | | | | |

| | E | | Small Business Issuersbusiness issuers | | Not applicableN/A | | | | |

| | | |

12 | | Description of Securities Othersecurities other than Equity Securitiesequity securities | | Not applicable | | | | |

| | A | | Debt Securitiessecurities | | Not applicableN/A | | | | |

| | B | | Warrants and Rightsrights | | Not applicableN/A | | | | |

| | C | | Other Securitiessecurities | | Not applicableN/A | | | | |

| | D | | American Depositary Shares | | Supplemental Informationinformation | | | | |

| | | | | | Depositary Feesfees and Chargescharges | | 230 | 257 | |

| | |

PART II | | | | |

| | | |

13 | | Defaults, Dividend Arrearages and Delinquencies

| | Not applicable | | |

| | | |

1413

| | Material Modifications to the Rights of Security HoldersDefaults, Dividends, Arrearages and Use of ProceedsDelinquencies

| | Not applicableN/A | | | | |

| | | |

1514

| | Material modifications to the rights of security holders and use of proceeds | | N/A | | | | |

| | | |

15 | | Controls and Procedures | | | | | | |

| | A | | Disclosure Controlscontrols and Proceduresprocedures | | Corporate Governance Report 2009governance report 2012 | | | | |

| | | | | | Disclosure Controlscontrols and Proceduresprocedures | | 214 | 212-213 | |

| | B | | Management’s annual report on internal control over financial reporting | | Management’s Reportreport on Internal Control Over Financial Reportinginternal control over financial reporting | | 218 | 163 | |

| | C | | Attestation report of the registered public accounting firm | | Report of Independent Registered Public Accounting Firm | | | 69 | |

| | D | | Changes in internal control over financial reporting | | Management’s report on internal control over financial reporting | | | 163 | |

| | | |

16 | | Reserved | | | | | | |

| | | | |

| | A | | Audit Committee financial expert | | Corporate governance report 2012 | | | | |

| | | | Audit Committee—Members of the Audit committee | | | 192 | |

| | B | | Code of Ethics | | Corporate governance report 2012 | | | | |

| | | | | | Code of business ethics | | | 180-181 | |

| | | | | | Form 20-F 2012 cross reference table | | | | |

| | | | | | Part II—19—Exhibit 11 | | | viii | |

| | | | | | Board of Directors’ report | | | | |

| | | | | | Corporate governance—High ethical standards | | | 57 | |

| | C | | Principal accountant fees and services | | Supplemental information | | | | |

| | | | | | Audit committee pre-approval policies and procedures | | | 258 | |

| | | | | Notes to the consolidated financial statements | | | | |

| | | | | Note C30 Fees to auditors | | | 160 | |

v

vii

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

| | | | | | | | |

Form 20-F Item Heading | | Location in this document | | Page

Number |

| | C | | Attestation report of the registered public accounting firm | | Report of Independent Registered Public Accounting Firm | | 43 |

| | D | | Changes in internal control over financial reporting | | Corporate Governance Report 2009 | | |

| | | | | Disclosure Controls and Procedures | | 214 |

| | | |

| 16 | | Reserved | | | | |

| | A | | Audit Committee Financial Expert | | Corporate Governance Report 2009 | | |

| | | | | | The Audit Committee | | 199 |

| | B | | Code of Ethics | | Corporate Governance Report 2009 | | |

| | | | | | An Ethical Business | | 191 |

| | C | | Principal Accountant Fees and Services | | Notes to the Consolidated Financial Statements | | |

| | | | | | Note C31 Fees to Auditors | | 140 |

| | | | | | Corporate Governance Report 2009 | | |

| | | | | | Audit Committee Pre-Approval Policies and Procedures | | 200 |

| | D | | Exemptions from the Listing Standards for Audit Committees | | Corporate Governance Report 2009 | | |

| | | | | | Independence of the Directors | | 196 |

| | E | | Purchase of Equity Securities by the Issuer and Affiliated Purchasers | | Not applicable | | |

| | F | | Change in Registrant’s Certifying Accountant | | Not applicable | | |

| | G | | Corporate Governance | | Corporate Governance Report 2009 | | |

| | | | | | Independence of the Directors | | 196 |

| | | | | | Supplemental Information | | |

| | | | | | Independence Requirements | | 230 |

| | |

PART III | | | | |

| | | |

17 | | Financial Statements | | Consolidated Income Statement | | 44 |

| | | | | | Consolidated Statement of Comprehensive Income | | 45 |

| | | | | | Consolidated Balance Sheet | | 46 |

| | | | | | Consolidated Statement of Cash Flows | | 47 |

| | | | | | Consolidated Statement of Changes in Equity | | 48 |

| | | | | | Notes to the Consolidated Financial Statements | | 49 |

| | | | | | Report of Independent Registered Public Accounting Firm | | 43 |

| | | |

18 | | Financial Statements | | Not applicable | | |

| | | |

19 | | Exhibits | | | | |

| | Exhibit 1 | | Articles of Association | | |

| | Exhibit 2 | | Not applicable | | |

| | Exhibit 3 | | Not applicable | | |

| | Exhibit 4 | | Not applicable | | |

| | Exhibit 5 | | Not applicable | | |

| | Exhibit 6 | | Please see Notes to the Consolidated Financial Statements, Note C1 Significant Accounting Policies | | 49 |

vi

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

| | | | | | | | | | |

Form 20-F Item Heading | | Location in this documentDocument | | Page

Number | |

| | D | | Exemptions from the listing standards for Audit Committees | | Corporate governance report 2012 | | | | |

| | | | | | Board of Directors—Independence | | | 187 | |

| | | | | | Supplemental information | | | | |

| | | | | | Corporate governance requirements | | | 257-258 | |

| | E | | Purchase of equity securities by the issuer and affiliated purchasers | | N/A | | | | |

| | F | | Change in registrant’s certifying accountant | | N/A | | | | |

| | G | | Corporate governance | | Corporate governance report 2012 | | | | |

| | | | | | Board of Directors—Independence | | | 187 | |

| | | | Supplemental information | | | | |

| | | | | | Corporate governance requirements | | | 257-258 | |

| | |

PART III | | | | | | |

| | | |

17 | | Financial statements | | | | | | |

| | | | | | Consolidated income statement and Statement of comprehensive income | | | 70-71 | |

| | | | | | Consolidated balance sheet | | | 72 | |

| | | | | | Consolidated statement of cash flows | | | 73 | |

| | | | | | Consolidated statement of changes in equity | | | 74 | |

| | | | | | Notes to the consolidated financial statements | | | 75-162 | |

| | | | | | Report of independent registered public accounting firm | | | 69 | |

| | | |

18 | | Financial statements | | N/A | | | | |

| | | | |

| 19 | | Exhibits | | | | | | | | |

| | | | Exhibit 1 | | Articles of Association (incorporated herein by reference to Exhibit 1 to the Annual Report on Form 20-F for the year ended December 31, 2011 filed by the registrant on April 4, 2012 (File No. 000-12033)) | | | | |

| | | | Exhibit 6 | | Please see Notes to the consolidated financial statements, Note C1 Significant accounting policies | | | 75-91 | |

| | | | Exhibit 7 | | For definitions of certain ratios used in this report, please see Financial Terminologyterminology | | 234 | 269-270 | |

| | | | Exhibit 8 | | Please see Supplemental Information, Information—Investments | | 232 | 260-261 | |

| | Exhibit 9

| | Not applicable

| | |

| | Exhibit 10

| | Not applicable

| | |

| | Exhibit 11 | | Our Code of Business Ethics and Conductbusiness ethics is included on our web site at

http://www.ericsson.com/ericsson/corporateresponsibility/employees/code_businessethics.shtmlcode-of-business-ethics | | | | |

| | | | Exhibit 12 | | 302 Certifications | | | | |

| | | | Exhibit 13 | | 906 Certifications | | |

| | Exhibit 14

| | Not applicable

| | |

| | | | Exhibit 15.1 | | Consent of Independent Registered Public Accounting Firmindependent registered public accounting firm | | |

| | Exhibit 15.2

| | Consolidated Financial Statements of Sony Ericsson Mobile Communications AB

| | |

| | Exhibit 15.3

| | Consent of Independent Registered Public Accounting Firm

| | |

Note: The Company’s holding in ST-Ericsson SA meets the requirements of Rule 3-09 under Regulation S-X for the provision of separate financial statements of ST-Ericsson SA, a non-listed Swiss company that has a December 31 fiscal year end.

viiThe Company intends to file the financial statements of ST-Ericsson SA as of and for the year ended December 31, 2012 as an amendment to this Annual Report on Form 20-F as soon as practicable after they become available.

viii

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

2009 MILESTONESTHIS IS ERICSSON

JANUARY-MARCHWe are a world-leading provider of communications networks, telecom services and support solutions.

Communication is changing the way we live and work. When one person connects, his or her world changes. With everything connected, our world changes. Ericsson plays a key role in this evolution, using innovation to empower people, business and society. We are enabling the networked society with efficient real-time solutions that allow us all to study, work and live our lives more freely, in sustainable societies.

Since the establishment of the Company in 1876, we are a leader in telecommunication and are now expanding our role into an ICT (Information and Communications Technology) solutions provider.

Our research and solutions development has made mobile communications and broadband possible. When you make a call or browse the internet on your handset, tablet or mobile PC, you will likely use one of our solutions.

Our offering comprises services, software and infrastructure, mainly for telecom operators.

Verizon Wireless chose Ericsson as one40% of two primary suppliers to build its LTE network infrastructure. Verizon Wireless will be the first operator to offer commercial LTE services in the United States. Later in the year, Metro-PCS chose Ericsson as the sole supplier of its LTE network buildout. Both operatorsworld’s mobile traffic runs through networks that are new Ericsson customers.supplied by us

China Unicom selected Ericsson to supply 3G networksWe provide solutions and services for 15 Chinese provinces and to upgrade its GSM networks to support 2G/3G interoperabilityall major telecom operators in 10 provinces.the world

The ST-Ericsson joint venture was launched as a leading supplier of semiconductors and platformsnetworks we manage for mobile devices to four of the top five handset manufacturers.operators serve about 950 million subscribers

With Ericsson as its partner for mobile learning, the BBC World Service Trust uses the creative power of media to reduce poverty and promote human rights in Bangladesh. The Financial Times reported thatWe have more than 300,000 people had already signed up to learn English over their mobile phones.33,000 granted patents, comprising one of the industry’s strongest patent portfolios.

APRIL-JUNEOUR SEGMENTS

In the first agreement of its kind in Africa, leading mobile operator Zain awarded Ericsson the management responsibility forToday, we are more than 4,000 sites across Nigeria, including110,000 people serving customers in more than 180 countries. To best reflect our business, we report four business segments:

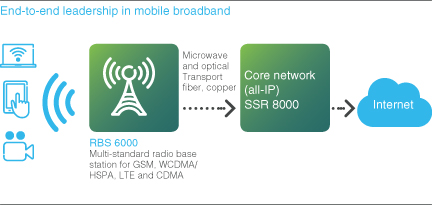

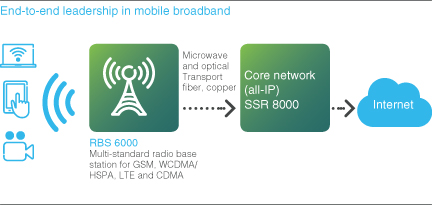

Networks

Networks provides the infrastructure that is the basis for all mobile communication. We deliver superior-performance and cost-efficient networks to ensure the best user experience.

Global Services

With 60,000 services professionals globally, we deliver managed services, consulting and systems integration, customer support, network design and optimization and network rollout.

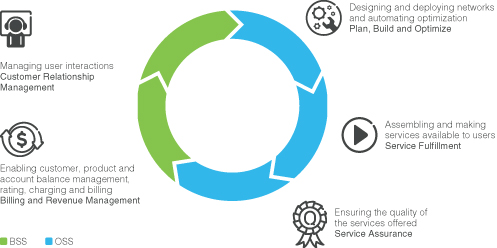

Support Solutions

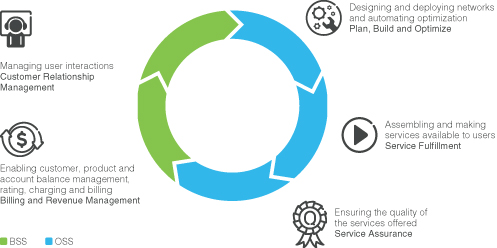

Support Solutions is the new name for former segment Multimedia and it signposts a change of direction. The segment focuses on software for operations field operationssupport systems and business support systems.systems (OSS and BSS), TV and media management, and m-commerce.

Joint venture ST-Ericsson

In support of the initiative CaringST-Ericsson offers modems and ModAps (integrated modem and application processor platforms) for Climate of the UN Global Compact, Ericsson’s CEO Carl-Henric Svanberg addressed the UN Secretary General Ban-Ki Moon during the World Business Summit on Climate Change. The message was that a modernized telecommunications infrastructure can significantly contribute to the creation of a carbon-lean economy.handset and tablet manufacturers.

OUR REGIONS

The world’s largest upgrade of a live mobile network was accomplished at a record paceWe secure an efficient go-to-market setup through ten regions. We strive for Vodafone Essar in India. Ericsson replaced more than 10,500 of the operator’s GSM radio sites in just 13 months, reaching a peak rate of one site every minuteprofitable growth through solid regional competence and without disrupting service to more than 13 million subscribers.

JULY-SEPTEMBER

Ericsson’s first major services contract in North America is also the world’s largest, valued at USD 4.5–5 billion over seven years. Operator Sprint and its 50 million customers benefit from Ericsson’s leadership and best-in-class economies of scale in network services.

Ericsson signed framework agreements worth USD 1.7 billion for 2G/3G mobile communication equipment and related services for 2009 with two major Chinese telecom operators: China Mobile and China Unicom.

All three telecom operators in China selected Ericsson to provide fixed broadband access to millions of consumers in nine provinces.

Ericsson was selectedstrong customer relationships, backed by AT&T as one of two domain suppliers of wireline access products and services. This breakthrough win for Ericsson in North America significantly accelerates AT&T’s ability to bring new broadband services to the market.

OCTOBER-DECEMBER

With the acquisition of Nortel’s CDMA and LTE business, Ericsson became the largest supplier of infrastructure and services in North America, based on Ericsson reported sales and publicly reported sales and estimated sales for Ericsson’s main competitors.

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

ShipmentsIn our ten regions, we work together with our customers to develop innovative and scalable solutions that help operators grow their revenues and reduce their costs.

Once a successful case is proven, we can roll out the same practice all over the world, sharing common processes, methods and tools. This ensures quality and efficiency.

Solutions and services often go hand-in-hand as networks become more complex and often include products from several suppliers. Operators look for long-term services partnerships with companies such as Ericsson for support in every aspect of Ericsson’s mobile broadband modules almost reached 1.5 million units. Asus, the inventor of the netbook, started to use Ericsson’s embedded modulestheir business.

We serve our customers through regional competence organized into six engagement practices: Mobile Broadband; Communication Services; Fixed Broadband and Ericsson is now a supplier to 3 of the top 5 PC manufacturers.

Ericsson announced low-cost mobile broadband for the world’s three billion GSM subscribers through a software upgrade. The EDGE evolution upgrade lets people enjoy the benefits of 3G performance – a great opportunity in countries where the mobile phone is the most affordable way to access the internet.

Swedish TV network TV4 outsourced the operation of its nationwide playout services. Addressing the broadcasting industry substantially expands Ericsson’s opportunities—not only for managed services, but also for the multimedia product portfolio.

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

2012 IN REVIEW

JANUARY

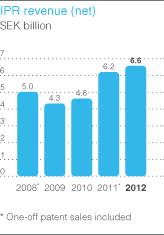

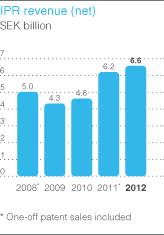

Ericsson strengthens its focus on IPR licensing, to get a fair return on R&D investments in patents development.

Any company that provides wireless connectivity will likely need a license from us.

JANUARY

Ericsson signs a deal to connect the entire vessel fleet of the world’s largest shipping company, Maersk Line, using our capabilities to enable machine-to-machine communication.

FEBRUARY

Ericsson complements the heterogeneous network offering with telecom grade Wi-Fi through acquisition of Wi-Fi company BelAir Networks, enabling operators to further improve the mobile broadband user experience.

MARCH

Ericsson widens the scope of managed services to include such services for broadcasters by announcing the acquisition of the Broadcast Services Division of Technicolor.

APRIL

SOFTBANK MOBILE signs 4G/LTE contract with Ericsson in Japan. The network will cover three major cities in the country, together accounting for 70% of the data and voice traffic. Ericsson has deployed LTE networks on five continents.

MAY

Ericsson’s efficient AIR radio base station is selected by T-Mobile as the first operator in the USA to launch this technology, which enables improvement of existing coverage and quick launch of LTE in 2013. The contract also includes consulting and systems integration and rollout services.

JUNE

At a briefing for journalists in San Francisco, Ericsson’s President and CEO Hans Vestberg discusses how the rapid increases in subscribers and data usage impact the entire ICT industry. Network quality, user experience, billing and charging models and services offerings all need to be adapted.

JULY

MTN Nigeria boosts its ability to serve subscribers and their growing data needs by becoming the first African operator to deploy Ericsson’s scalable SSR 8020 platform for wireless IP core networks. This is one of 39 SSR contracts that Ericsson won in 2012.

AUGUST

Italian operator FASTWEB signs a seven-year IT managed services contract with Ericsson. It includes data center consolidation and transformation, as well as managed operations for its IT infrastructure. Ericsson extends the scope of managed services from telecoms to data centers.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

SEPTEMBER

Ericsson partners in the Social Good Summit 2012 in New York, discussing how mobile broadband can be used to help tackle global challenges such as poverty and climate change.

OCTOBER

Ericsson is selected to implement a new LTE network for Vivo, a subsidiary of Telefônica, helping meet user demand for connectivity and mobile broadband services in Brazil. Ericsson has an LTE market share of more than 50% in Latin America.

NOVEMBER

Ericsson holds its annual Investor Day, focusing on profitable growth and how the company is transforming into a leading ICT solutions provider in telecoms.

NOVEMBER

The new Ericsson Mobility Report is launched, stating that “Traffic in mobile networks continues to grow at an impressive rate worldwide, driven by uptake of smart devices and apps.” This is a recurrent report on network traffic and market trends, based on data traffic measurements in live networks globally and on internal forecasts.

DECEMBER

Ericsson announces that Volvo Car Group will use Ericsson’s Connected Vehicle Cloud to allow drivers, passengers and their cars to connect to services available in the cloud. Drivers and passengers can access applications for information, navigation and entertainment from a screen in the car.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

2009 SNAPSHOTGROUP OVERVIEW

THIS IS ERICSSON

Founded in 1876, Ericsson is a leading provider of communications networks, related services and multimedia solutions. Through our joint ventures ST-Ericsson and Sony Ericsson, we are also a major provider of handsets. Our experience building networks in more than 175 countries gives us unique customer and consumer insights, and our extensive portfolio of telecommunicationsfour business segments provide solutions and intellectual property (patents) offer a true business advantage. We are committed to working with our customers and partners to expand the borders ofservices which in combination create an industry-leading telecommunications for the benefit of people everywhere.

Our operations have been divided into segments that create competitive advantage and best meet the needs of our global customer base.portfolio.

| | | | | | |

Segment | | NETWORKS | | Technology leadership, a broad product portfolioGLOBAL SERVICES

| | SUPPORT SOLUTIONS |

| | | |

| | Headed by Johan Wibergh | | Headed by Magnus Mandersson | | Headed by Per Borgklint |

| | | |

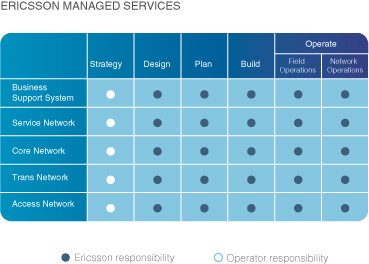

| | We develop and scale enabledeliver superior-performance network infrastructure for 2G/GSM, 3G/WCDMA/HSPA & CDMA, and 4G/LTE with solutions for: • Radio access, based on multi-standard radio base station RBS 6000 • IP and transport; IP Edge routing based on SSR 8000 and transport solutions based on fiber and microwave • Core network; switching and IMS solutions based on the Ericsson Blade System platform. | | Globally, 60,000 service professionals deploy and operate networks, and integrate solutions to excelallow operators to monetize increasing data traffic and ensure high user experience in meetingnetworks. We use global processes, methods and tools to ensure quality and efficiency in the coverage, capacitynetworks. Global Services include: • Professional Services; consulting and systems integration, managed services, network evolution needs of fixeddesign and mobile operators. We provide products for all major standardsoptimization as well as all essential elements of a network on an end-to-end solutions basis.customer support SERVICES• Network Rollout.

| | Expertise in network design, rollout, integration, operationWe develop and customer support, combined with a global structure and robust local capabilities, enables us to understand and respond to the unique challenges of each customer. As a result we are able to capitalize on the trend for operators to outsource a broader range of activities.deliver software solutions for:

Innovative application platforms, service delivery• Operations and Business Support Systems (OSS and BSS); enabling management of networks and services, customer interaction and revenue management solutions, combined with leading content developer and application provider relationships, enable Ericsson to help customers create exciting and differentiating multimedia services.

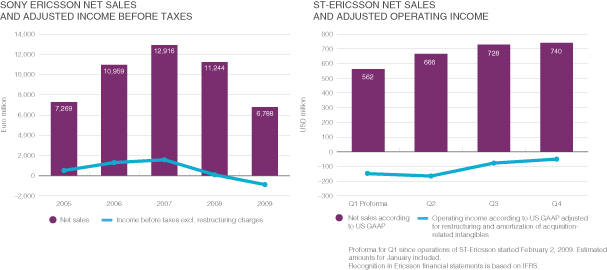

The complementary strength of Sony Ericsson further enhances our consumer perspective for superior end-to-end offerings. Sony Ericsson offers exciting consumer experience through phones, accessories, content and applications.

ST-Ericsson represents the link between infrastructure and handsets in Ericsson’s offering. They provide a market-leading portfolio of wireless platforms and semiconductors.

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

Performance

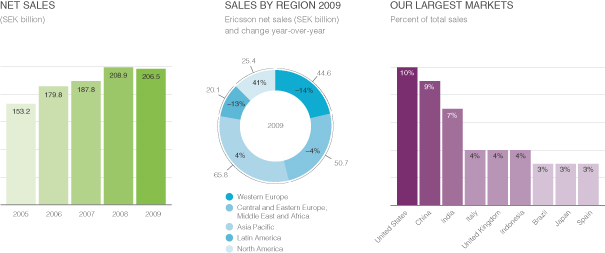

In a progressively more challenging environment during• M-Commerce; software solutions and hosted services to enable mobile financial services and global interoperability.

|

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

ST-ERICSSON*

Headed by Didier Lamouche

A 50/50 joint venture with STMicroelectronics, ST-Ericsson offers modems and ModAps (integrated modem and application processor platforms) for leading handset and tablet manufacturers.

STMicroelectronics announced in October its intention to exit as a shareholder in ST-Ericsson. Ericsson is presently exploring various strategic options for the future of ST-Ericsson assets.

Ericsson continues to believe that the modem technology, which it originally contributed to the JV, has a strategic value for the wireless industry.

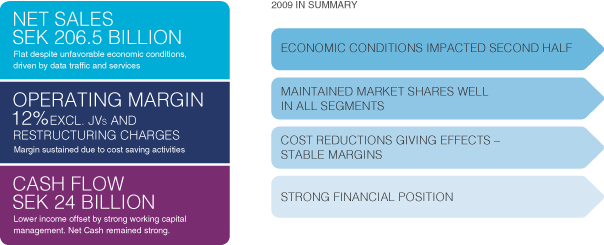

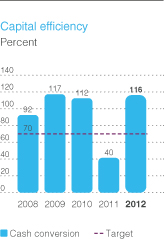

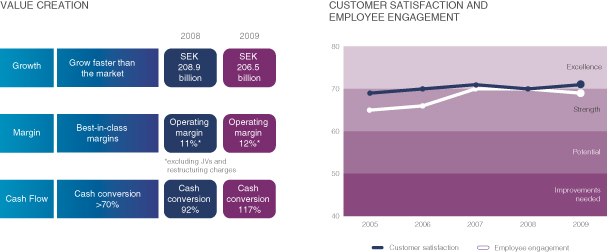

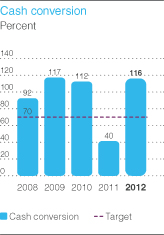

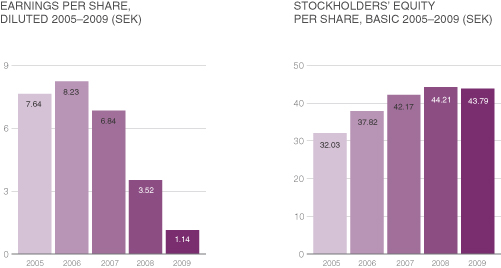

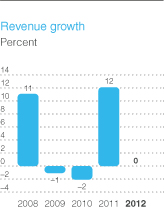

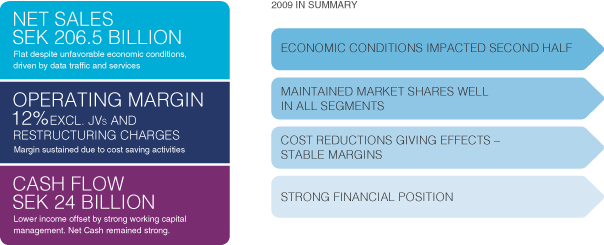

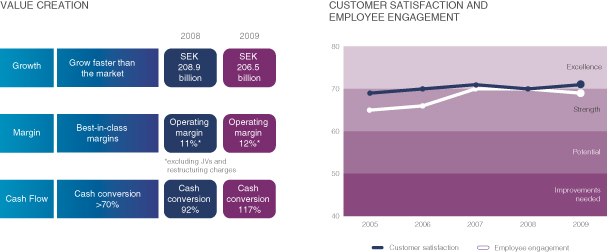

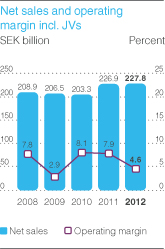

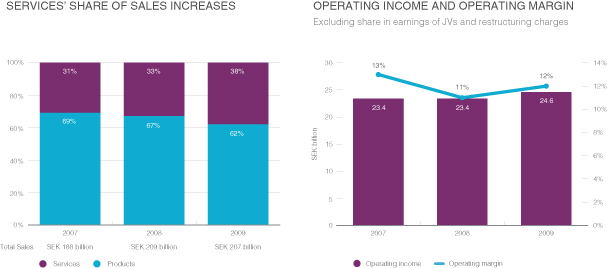

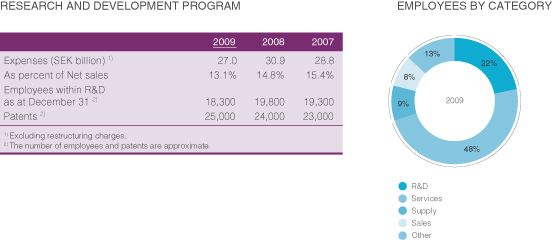

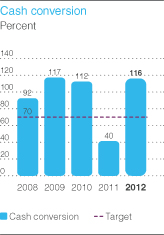

| * | The Ericsson share of ST Ericsson’s results is accounted for according to the year, Ericsson’s market shares were well maintained, adjusted operating margin1) was slightly improved, and cash conversion was well above target.Grow faster than the market

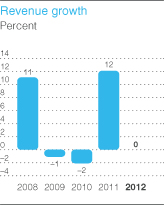

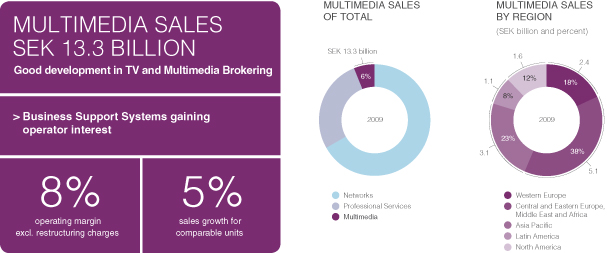

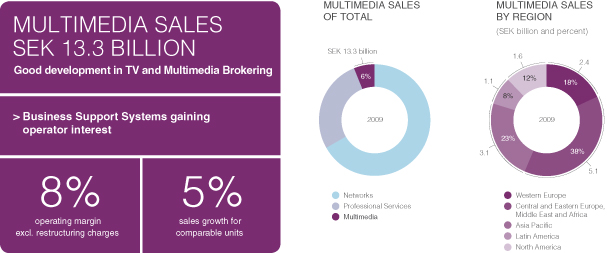

In the economic slowdown, the market for GSM/WCDMA network equipment and related services is estimated to have declined by more than 10%. Ericsson’s sales for comparable units were down 9%, adjusted for currency effects2). A decline in Networks in line with the market was partly offset by an increase in Professional Services, driven by strong growth in managed services. Reported Multimedia sales increased by 5% for comparable units. The Multimedia market is still too fragmented to make relevant overall market growth estimates.

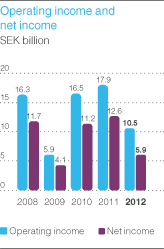

Best-in-class operating margins

Operating margin, excluding JV results and restructuring, improved slightly to 12% (11%) despite lower volumes and remained the highest among major listed competitors. Multimedia showed the greatest improvement, up significantly from breakeven levels in 2008.

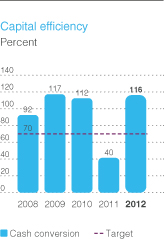

Cash conversion of more than 70%

Cash conversion was well above the target at 117% (92%), reflecting management’s ongoing focus on improving working capital efficiency as well as a lower level of turnkey projects.

KEY DEVELOPMENTSequity method.

|

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

LETTER FROM THE CEO

2012 was a year of growth in Global Services and Support Solutions, but more challenging for Networks. We have extended our leadership in several key growth areas and taken important steps in executing our strategy.

Our mission is “Innovating to empower people, business and society.”

Two billion subscribers supported by Ericsson 24 hours a day, 7 days a week.

Ericsson provides managed services to network operators which together serve 370 million subscribers.

1) | Excluding restructuring charges and share in earnings of JVs. |

2) | The impact of foreign currency is calculated based on exchange rate changes in 2009 compared to 2008. Releases under hedge accounting in 2008 and 2009 have also been excluded. |

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

North America set to become Ericsson’s largest and fastest growing market.

Ericsson’s presence in North America elevated—Chief Technology Officer relocated to Silicon Valley.

Ericsson is the only supplier selected to participate in all major 4G/LTE projects.

A new brand launched with the value proposition: “Innovating to Empower”.

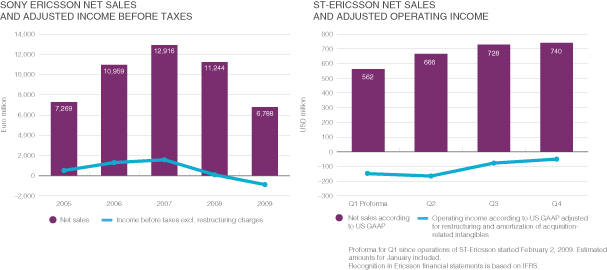

Both joint ventures make progress on returning to report profits.

| | |

FINANCIAL RESULTS IN SHORT | | |

| |

NET SALES

| | NET CASH |

| |

SEK 206.5 billion

| | SEK 36.1 billion (Dec. 31, 2009)

|

| |

OPERATING INCOME*

| | |

| |

SEK 24.6 billion

| | EARNINGS PER SHARE

|

| |

OPERATING MARGIN*

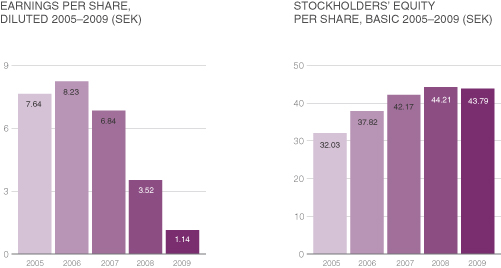

| | SEK 1.14 |

| |

12 percent

| | |

| |

|

DEAR SHAREHOLDERS

We can look back at 2012 in which the strong growth of mobile data continued across the world and 4G/LTE launches started across all regions. Broadband is a transformative technology that is already improving quality of life, productivity and sustainability globally. During the year we have clearly seen how the world is moving towards our vision of a networked society, and over time, this will create new business opportunities for Ericsson and our customers.

Executing our strategy

The work to leverage our strength in the growth areas mobile broadband, managed services and operations and business support solutions (OSS and BSS) has continued with both selective acquisitions and divestments to enhance and streamline the portfolio.

Key acquisitions in the year that have contributed to strengthening our leadership include BelAir in the area of mobile broadband, ConceptWave and Telcordia in the area of OSS and BSS as well as Technicolor’s broadcast services division in the area of managed services.

In addition we completed the divestment of our share in Sony Ericsson and launched a new strategy for Support Solutions.

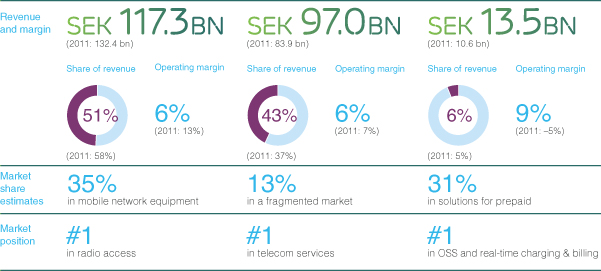

Our R&D and services investments form the foundation for the long-term strength of the company. Despite a challenging year for Networks, we remain almost the size of number two and three combined in the market when it comes to installed base of radio base stations and we have maintained a strong market share also in mobile network equipment. Global Services outperformed the market and solidified its leadership. In the fragmented telecom services market, Ericsson held a 13% market share for 2012, well ahead of its closest competitor.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

* | Excluding restructuring charges and share in earnings of JVs |

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

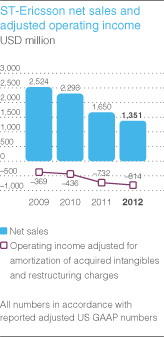

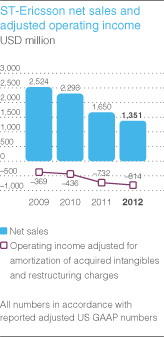

LETTER FROM THE CEOOur joint venture ST-Ericsson had a tough year. Following the announcement of STMicroelectronics’ intention to exit as a shareholder, Ericsson will, together with STMicroelectronics, continue to explore various strategic options for ST-Ericsson assets. We continue to believe that the modem technology which we originally contributed to the JV has a strategic value to the wireless industry.

Performance in 2012

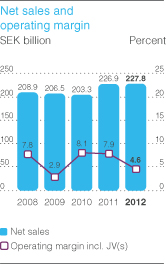

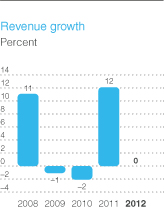

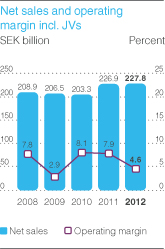

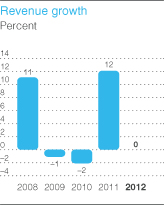

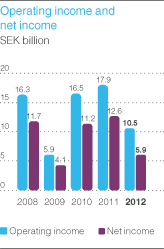

Sales in 2012 were flat compared to 2011, despite a challenging year for Networks.

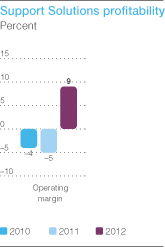

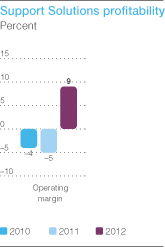

Global Services contributed with both sales growth and stable operating profitability, and Support Solutions went from making losses in 2011 to achieving profitability.

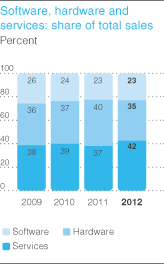

Global Services and Support Solutions together represented close to 50% of Group sales, compared to 42% in 2011, highlighting the ongoing transformation into an ICT company combining services, software and hardware, into industry-leading solutions.

Profitability has been under pressure during the year due to operating losses in ST-Ericsson, the ongoing network modernization projects in Europe as well as the underlying business mix, with a higher share of coverage projects than capacity projects. Improving profitability has been a key priority throughout the year and we have taken actions globally to reduce costs and improve efficiency.

Throughout 2012 North America was our strongest region, driven by continued mobile broadband investments and a high demand for services. Our second largest region was North East Asia where sales grew in Japan, though not fully offsetting the lower sales of GSM in China and 3G in Korea.

Financial strength

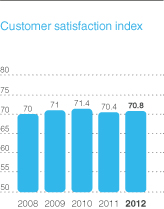

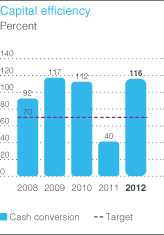

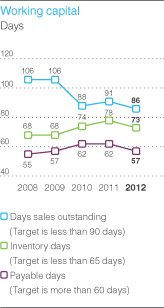

We continue to have high focus on capital efficiency. We ended the year with strong cash flow, full-year cash conversion well above target and maintained our strong net cash position.

Financial strength allows us to make selective acquisitions to capture opportunities to consolidate the market, gain market share and fill portfolio gaps when relevant, and provide a good return to shareholders. It is also a competitive advantage in our customer relationships.

The Board of Directors proposes a dividend for 2012 of SEK 2.75 (2.50) per share.

Sustainability and Corporate Responsibility

Ericsson is strongly committed to sustainability and corporate responsibility.

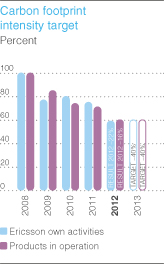

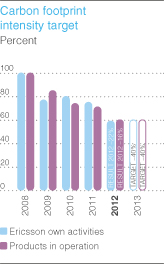

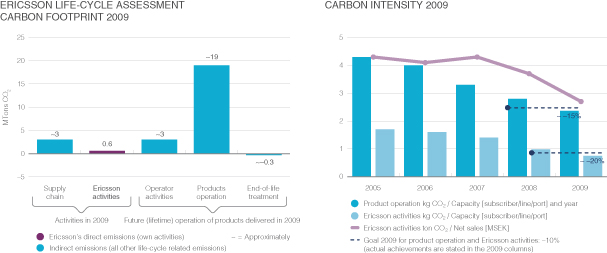

Focus remains on reducing our carbon footprint and in 2012 we exceeded our target. We see an increasing interest from customers in driving energy efficiency in their networks, and using broadband to shape the low-carbon economy of the future.

We continue to advocate the use of broadband to enable access to education, better health and livelihood through our partnerships and programs such as Connect To Learn and Ericsson Response.

Responsibility and high governance standards guide all Ericsson employees in all parts of the world. Our aim is to be the trusted partner to all of our stakeholders and as such we put strong focus on evolving our governance framework with further integration of sustainability and corporate responsibility principles.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

Our Code of Business Ethics was updated during the year to reflect our ongoing commitment to respect human rights and the new UN Guiding Principles on Business and Human Rights.

During 2012 we also signed the World Economic Forum’s Partnering Against Corruption Initiative, enhanced our anti-corruption program and broadened our whistle blower procedure.

Strong long-term drivers

We build our strength on the combination of our core assets: technology leadership, services leadership and global scale. We have strong and long-standing customer relationships and highly skilled and engaged employees. I have worked in this company for 24 years and the dedication and professionalism that Ericsson employees demonstrate never cease to impress me.

Our focus on profitable growth remains. While the macroeconomic and political uncertainty continues in certain regions, the industry fundamentals remain attractive. We have a strong portfolio, position and capabilities to continue to support our customers in a transforming ICT market and look forward to a year of leveraging our leadership position and continuing our journey into the networked society.

Hans Vestberg

LOOKING BACK

Dear fellow shareholders,

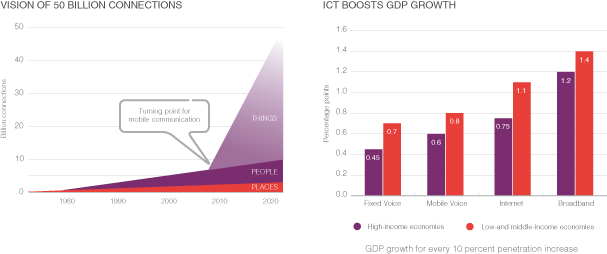

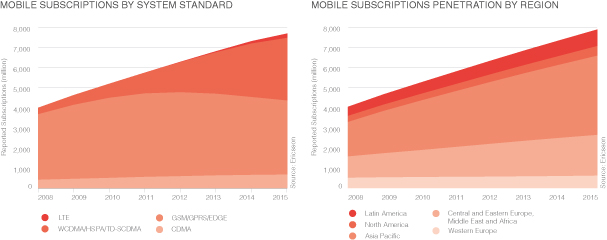

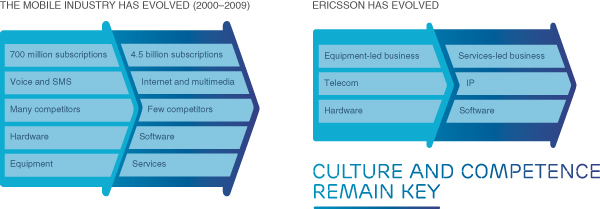

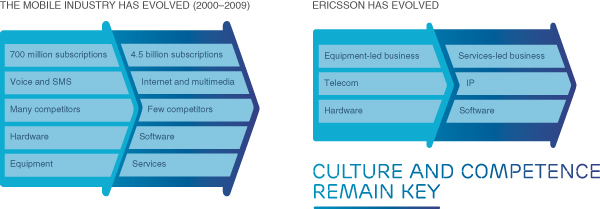

While the current economic environment affects all parts of society the longer-term fundamentals for our industry remain solid. Over the past decade the number of mobile subscriptions in the world has grown from some 700 million to over 4.5 billion. Mobile telephony is reaching a penetration beyond all expectations. Ten years ago it was all 2G; today 3G is the prevailing technology, mobile broadband is a reality and telecom is literally changing the world.

Ericsson has played a vital role in bringing the benefits of mobile broadband to the majority of the world’s population. What we do greatly improves people’s lives and society at large—in short, what we do shapes people’s lives and the world around us. One of my strongest memories is from the day we launched the network in Dertu, one of the Millennium Villages. Their chief, one of the camel drivers, came up to me and said, “Today our village is reborn”. People are now able to share ideas and information and accomplish things that were not possible before.

In the past ten years the telecom industry and Ericsson have transformed; from focus on voice to focus on internet, from hardware to software and from providing network equipment to providing solutions including services.

During the same period, many of our competitors have been forced to leave the arena and new ones have entered. We work harder than ever to outperform them and match our customers’ needs.

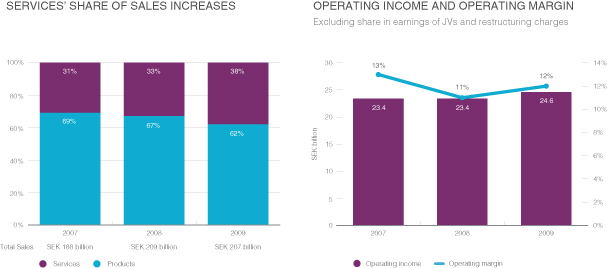

We have extended our leadership in mobile communications by building a highly successful services business which today accounts for almost 40 percent of our total Group sales. With less hardware, increased network complexity, and the move to all-IP, today is very much about making it work and supporting our customers in running and maintaining networks and realizing business models and rollout plans. During 2009 we captured additional strategic contracts in the services area and we now manage networks with 370 million subscribers.

The acquisition of Nortel’s CDMA business during 2009, on the heels of important breakthrough contract wins in North America, positioned Ericsson as the leading provider of telecoms technology and services in the United States and Canada. We have also firmly established ourselves in Silicon Valley where much of the internet development takes place.

We also gained strategic contracts for the radio standard LTE (Long-Term Evolution) which offers even greater network speeds and in December 2009 we passed another significant milestone with the worlds’ first commercial launch of an LTE network in Sweden.

“IN THE PAST TEN YEARS THE TELECOM INDUSTRY AND ERICSSON HAVE TRANSFORMED.”

The industry has changed and our ability to change with it, and indeed to lead the change, is perhaps our most important asset. New and compelling challenges lie ahead and as a company Ericsson must continue to drive the transformation of our industry.

My years as President and CEO of Ericsson have been the best of my professional career. Telecom is one of the most exciting industries to work in—so dynamic, challenging and competitive. I truly believe that telecom

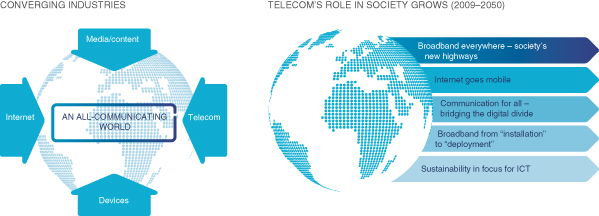

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

and the entire Information and Communication Technology (ICT) sector, particularly broadband networks, will form the backbone of the digital 21st century infrastructure, helping industries with the necessary reductions in their carbon footprint.

In closing, I will continue to follow and be involved in Ericsson’s development in my role as a Board member. I am proud and grateful to have had the opportunity to be at the helm of this great company and I will remember all the extraordinary people I have had the honor to work with, customers, partners and colleagues alike.

Carl-Henric Svanberg

Former President and CEO

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

“IN THIS SEA OF CONNECTIVITY WE TAKE THE ROLE OF NAVIGATOR.”

LOOKING FORWARD

Dear shareholders,

2009 was a year of mixed trends and with varied operator investment behavior. Some markets were impacted by the financial climate while others continued to show growth.

Our Group sales for the full year, however, were flat and the operating margin increased slightly. Despite the challenging economic environment we maintained market shares, cash flow was good and our financial position remained strong. During the year we undertook significant cost reduction activities. These, in combination with large losses in our joint ventures, affected our earnings negatively. However, cost reductions will result in reduced cost base going forward and our joint ventures remain on track to return to profit.

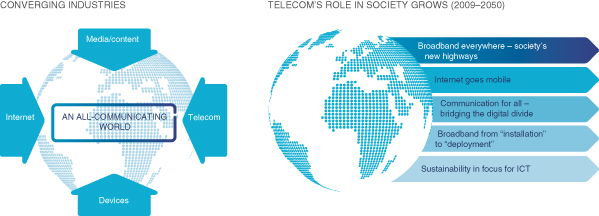

It is now 2010 and we have a new decade ahead of us. A decade of new opportunities and new challenges. Telecoms is no longer about voice only. We do not just connect places and people. We also connect machines and devices. We connect the developing world to the developed world, rural areas to urban areas. Telecoms is the nervous system of the world.

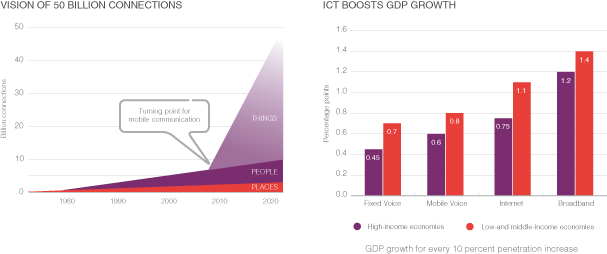

In Ericsson we have a vision for this new decade—that there will be 50 billion connected devices. We will connect people with for example heart problems to remote monitoring systems so they can stay in the comfort of their homes, and we will connect our cars and trucks to smart road systems for safer driving and better fuel economy. Broadband networks will be the backbone of our smart cities, where houses will be connected so we can monitor and manage power consumption.

In this world the challenge will lie in dealing with the complexity of connecting all these devices. And we cannot fail. Patients must be able to rely on their health monitoring services. Transport companies must be sure that they can minimize gas consumption by smart routing and up-to-date traffic information.

In this sea of connectivity we take the role of navigator. We must support our customers and show them the way. This will require us to always put our customers first. Always have the best competence and drive innovation throughout the customer relationship.

Our business is about both technology and services. We have to be consultants; we have to be able to develop complex network management systems, we have to be able to integrate systems and solutions from many different suppliers and vendors. In addition, we should be able to deliver the best revenue management solutions and multimedia applications the consumers have ever seen. Everything must be based on IP software.

This new decade requires a lot from us. We will have to change our ways of working. Our success will be determined by our ability to see beyond technology, stay ahead of our customers and solve problems before they even arise.

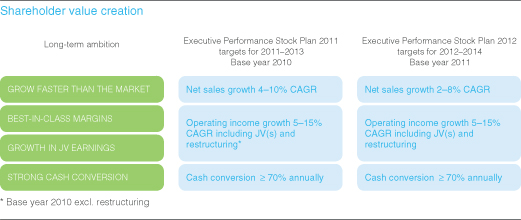

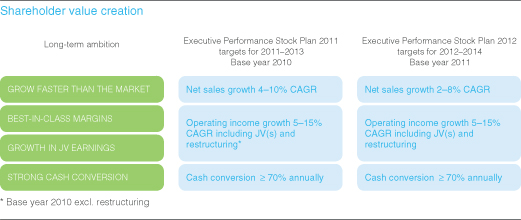

In preparing ourselves to be successful in this new decade, we will need to continuously adjust to changing economic and competitive conditions while staying the course to our longer-term objectives. We will continue to proactively take actions to safeguard our financial position, leading technology and customer relationships. In order to drive shareholder value we focus on four financial targets; we want to grow the Company faster than the market, maintain best-in-class operating margins, have a healthy cash generation and grow earnings in the JVs.

ERICSSON ANNUAL REPORT ON FORM 20-F 2009

We have exciting developments ahead. The future will require us to be agile, brave and focused on performance in all we do.

I am proud and honored to lead Ericsson into a new decade where we will undoubtedly break new ground. Even more people and devices will share information across the world.

Hans Vestberg

President and CEO

ERICSSON ANNUAL REPORT ON FORM 20-F 20092012

MARKET TRENDS

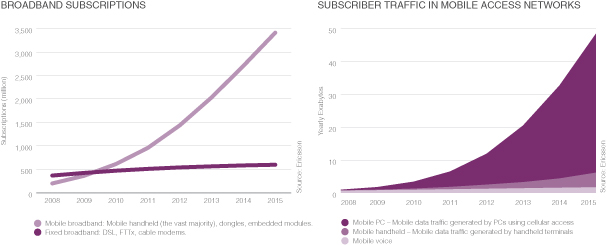

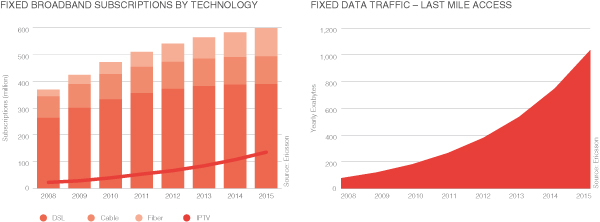

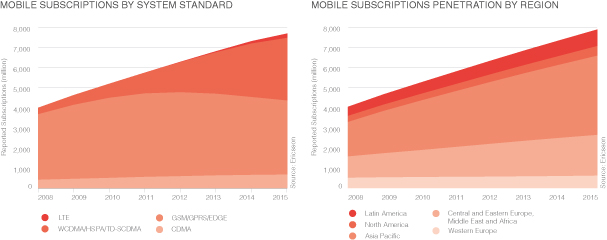

Everything is going mobile. The uptake of mobile broadband, driven by increasing use of smartphones, tablets and apps is driving change for people, business and society.

Market trends 2012

USERS

Higher demand for data capacity due to:

Smartphone uptake acceleration

Increasing use of mobile broadband

Changing lifestyle with mobility and cloud-based services.

OPERATORS

Focus on:

Superior-performance broadband networks

Increasing efficiency through transformation and outsourcing

Creating new value streams from networks.

THE NETWORKED SOCIETY

In the networked society, connectivity will be the starting point for new ways of innovating, collaborating and socializing. It’s about creating freedom, empowerment and opportunity that will transform industries and society while helping find solutions to some of the greatest challenges facing our planet.

When one person connects, his or her world changes. With everything connected, our world changes. We believe ICT will be a fundamental driver of this transformation. For our customers the networked society will offer opportunities to expand their existing businesses, and to engage in new business areas, such as cloud services and industry-specific services.

Operators’ revenue growth and potential for efficiencies will steer their investments going forward. As a result, although the total addressable telecom market is growing at a modest pace, our portfolio momentum areas—mobile broadband, managed services as well as OSS and BSS—are set for higher growth.

Fundamentally, we believe the market is strong, fueled by higher smartphone penetration and growing mobile data usage. As a market leader, we understand the possibilities—and have the ability to drive rethinking, reinvention and innovation of our industry.

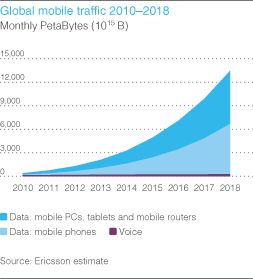

In 2012, mobile data traffic doubled. We expect it will continue to grow at a high rate in the coming years. The main driver is the change in user behavior, leading to increasing user expectations on network and application performance. Demand for greater mobile data capacity will also affect how operators choose to develop and operate networks and services.

CHANGING USER BEHAVIOR

The rapid increase in mobile data traffic will, in the coming years, be fuelled by three trends: increased smartphone uptake, the increasing use of mobile broadband, and the breakthrough of cloud-based services.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

Smartphone uptake is accelerating

While voice traffic is increasing at a steady rate, mobile data traffic is increasing exponentially. This increase is driven largely by smartphone use. Clearly phones are no longer simply for talking and texting—most of the time spent on a smartphone is dedicated to activities such as watching videos, playing games, shopping and engaging in social media.

Today 15–20% of the worldwide installed base of mobile phone subscriptions use smartphones—the number of smartphone subscriptions was 1.1 billion at the end of 2012 and we estimate that it will reach 3.3 billion by the end of 2018.

Mobile broadband use is increasing

People and businesses increasingly demand good network coverage, high-speed and high-quality broadband access at all times.

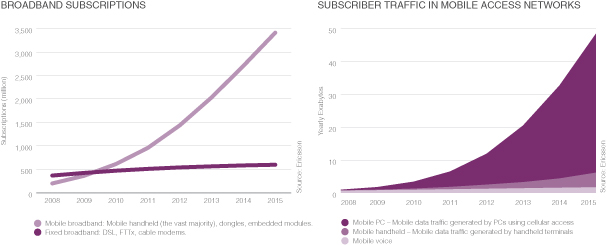

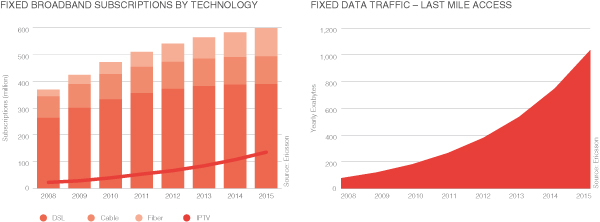

The number of mobile broadband subscriptions is increasing rapidly, from approximately 1.5 billion in 2012, to an estimated 6.5 billion in 2018. As the number of subscriptions increases, so does the data volume per subscription. By the end of 2018, we estimate that both mobile PCs and smartphones will generate four times as much data per device per month as today. Global mobile data traffic is estimated to grow twelve-fold between 2012 and 2018.

The largest contributor to increased data traffic is video, which is also watched on smartphones and tablets. Online video now constitutes on average 25–40% of traffic in mobile networks.

With the increasing use of ‘apps’, coverage is expected everywhere. But, when a user runs an app that requires higher performance (e.g. throughput) than needed for voice, the actual coverage area for the app will be smaller than that for voice.

In a network, every app has its own coverage area; a video application has a smaller coverage area than a music-streaming app which in turn has a smaller coverage area than voice.

Understanding of app coverage is therefore essential in order for operators to make the right investments in a network.

Cloud for availability everywhere

For many businesses and individuals, content is delivered as a cloud service—that is, as a service over the internet. Users see the benefits of accessing applications and data from any computer, phone or tablet anywhere, and at any time. Often they choose not to own the content but to stream it, gaining access to movies, TV, music and much more. Cloud-based services add to the demand for mobile capacity.

CHANGING OPERATOR NEEDS

The changes in how people, businesses and society at large operate, use the internet and interact will demand greater speed, capacity, quality of service and operational efficiency. To meet these demands, operators are upgrading their networks, revising how they can increase their operational efficiency and how they should best monetize the increased data traffic.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

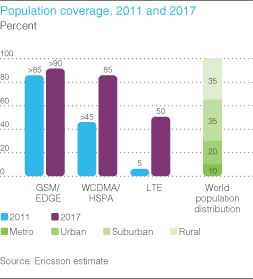

Focus on superior-performance broadband networks

As user demand for coverage, speed and quality increases, superior-performance networks have become a key differentiator for operators. 3G/HSPA coverage is expected to increase from over 50% of the world’s population today, to 85% by the end of 2017. We anticipate that by 2017, half the world’s population will be covered by 4G/LTE networks. Operators come to Ericsson to expand network coverage and to upgrade networks for higher speed and capacity. To maintain superior performance there is also a continuous need for network tuning and optimization as traffic increases.

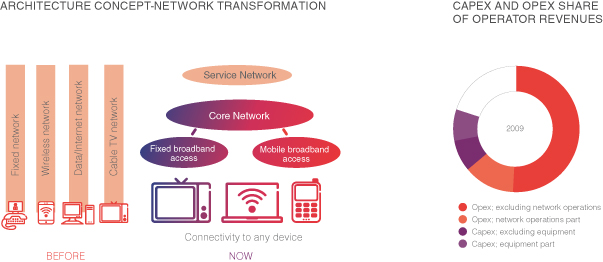

Focus on operational efficiency

To improve efficiency and reduce cost, operators increasingly choose to outsource the network and field operations, allowing them to focus on strategy, marketing and customer care. In a managed services project, Ericsson transforms the customer’s operations and implements our processes, methods and tools.

Monetizing data traffic

The demands created by mobile connectivity present new opportunities for operators. They are developing business models to monetize the increasing data use, with tiered pricing plans aligned to user needs, based for example on volume, time or speed. Increasingly, quality of service is becoming a differentiator for operators, as some focus on pure network development and others choose to be providers of premium services such as media, m-commerce and mobile finance.

Ericsson Operations Support Systems (OSS) enable the monitoring and optimization of the performance of operators’ increasingly complex networks and services, while our Business Support Systems (BSS) enable monetization of services and enhance their customer interaction capabilities.

ERICSSON ANNUAL REPORT ON FORM 20-F 2012

OUR COMPETITIVE ASSETS

The unique combination of core assets drives our performance throughout the business.

TECHNOLOGY LEADERSHIP

Combining superior performance and thought leadership