As filed with the Securities and Exchange Commission on June 28, 2011.April 8, 2013.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20102012

Commission file number 333-08752

Fomento Económico Mexicano, S.A.B. de C.V.

(Exact name of registrant as specified in its charter)

Mexican Economic Development, Inc.

(Translation of registrant’s name into English)

United Mexican States

(Jurisdiction of incorporation or organization)

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, NL 64410 Mexico

(Address of principal executive offices)

Juan F. Fonseca

General Anaya No. 601 Pte.

Colonia Bella Vista

Monterrey, NL 64410 Mexico

(52-818) 328-6167

investor@femsa.com.mx

(Name, telephone, e-mail and/or facsimile number and

address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class: | Name of each exchange on which | |||

| American Depositary Shares, each representing 10 BD Units, and each BD Unit consisting of one Series B Share, two Series D-B Shares and two Series D-L Shares, without par value | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

2,161,177,770 | BD Units, each consisting of one Series B Share, two Series D-B Shares and two Series D-L Shares, without par value. The BD Units represent a total of 2,161,177,770 Series B Shares, 4,322,355,540 Series D-B Shares and 4,322,355,540 Series D-L Shares. | |

1,417,048,500 | B Units, each consisting of five Series B Shares without par value. The B Units represent a total of 7,085,242,500 Series B Shares. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

x Yes | ¨ No |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨ Yes | x No |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). N/A

¨ Yes | ¨ No |

Indicate by check mark whether the registrant: (1) has filed all reports required to be file by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

x Yes | ¨ No |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated filer x | Accelerated filer ¨ | Non-accelerated filer ¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | IFRS | Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

¨ Item 17 |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨ Yes | x No |

| Page | ||||||

| INTRODUCTION | 1 | |||||

| References | 1 | |||||

| Currency Translations and Estimates | 1 | |||||

| Forward-Looking Information | 1 | |||||

| ITEMS | NOT APPLICABLE | 2 | ||||

| ITEM 3. | KEY INFORMATION | 2 | ||||

| Selected Consolidated Financial Data | 2 | |||||

| Dividends | 3 | |||||

| Exchange Rate Information | 5 | |||||

| Risk Factors | 6 | |||||

| ITEM 4. | INFORMATION ON THE COMPANY | 17 | ||||

| The Company | 17 | |||||

| Overview | 17 | |||||

| Corporate Background | 18 | |||||

| Ownership Structure | 22 | |||||

| Significant Subsidiaries | 23 | |||||

| Business Strategy | 23 | |||||

| Coca-Cola FEMSA | 24 | |||||

| FEMSA Comercio | 41 | |||||

| 45 | ||||||

| Other Business | 46 | |||||

| Description of Property, Plant and Equipment | 46 | |||||

| Insurance | 48 | |||||

| Capital Expenditures and Divestitures | 48 | |||||

| Regulatory Matters | 49 | |||||

| ITEM 4A. | UNRESOLVED STAFF COMMENTS | 56 | ||||

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 56 | ||||

| Overview of Events, Trends and Uncertainties | 56 | |||||

| Recent Developments | 56 | |||||

| Operating Leverage | 57 | |||||

| 61 | ||||||

| Operating Results | 65 | |||||

| Liquidity and Capital Resources | 68 | |||||

-i-

TABLE OF CONTENTS

(continued)

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 74 | |||||

| Directors | 74 | ||||||

| Senior Management | 80 | ||||||

| Compensation of Directors and Senior Management | 82 | ||||||

| EVA Stock Incentive Plan | 82 | ||||||

| Insurance Policies | 83 | ||||||

| Ownership by Management | 83 | ||||||

| Board Practices | |||||||

i

| 84 | ||||||

| Employees | ||||||

ITEM 7. | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | |||||

| Major Shareholders | ||||||

| Related-Party Transactions | ||||||

| Voting Trust | ||||||

| Interest of Management in Certain Transactions | ||||||

| Business Transactions between Coca-Cola FEMSA, FEMSA and The Coca-Cola Company | ||||||

ITEM 8. | FINANCIAL INFORMATION | |||||

| Consolidated Financial Statements | ||||||

| Dividend Policy | ||||||

| Legal Proceedings | ||||||

| Significant Changes | ||||||

ITEM 9. | THE OFFER AND LISTING | |||||

| Description of Securities | ||||||

| Trading Markets | ||||||

| Trading on the Mexican Stock Exchange | ||||||

| Price History | ||||||

ITEM 10. | ADDITIONAL INFORMATION | |||||

| Bylaws | ||||||

| Taxation | ||||||

| Material Contracts | ||||||

| Documents on Display | ||||||

ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |||||

| Interest Rate Risk | ||||||

| Foreign Currency Exchange Rate Risk | ||||||

| Equity Risk | ||||||

| Commodity Price Risk | ||||||

-ii-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | |||||

ITEM 12A. | DEBT SECURITIES | |||||

ITEM 12B. | WARRANTS AND RIGHTS | |||||

ITEM 12C. | OTHER SECURITIES | |||||

ITEM 12D. | AMERICAN DEPOSITARY SHARES | |||||

| NOT APPLICABLE | ||||||

ITEM 15. | CONTROLS AND PROCEDURES | |||||

ITEM 16A. | AUDIT COMMITTEE FINANCIAL EXPERT | |||||

ITEM 16B. | CODE OF ETHICS | |||||

ITEM 16C. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |||||

ii

| ITEM 16D. | NOT APPLICABLE | |||||

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | |||||

| ITEM 16F. | NOT APPLICABLE | |||||

| ITEM 16G. | CORPORATE GOVERNANCE | |||||

| ITEM 16H. | NOT APPLICABLE | 123 | ||||

| ITEM 17. | NOT APPLICABLE | |||||

| ITEM 18. | FINANCIAL STATEMENTS | |||||

| ITEM 19. | EXHIBITS | |||||

iii-iii-

This annual report contains information materially consistent with the information presented in the audited financial statements and is free of material misstatements of fact that are not material inconsistencies with the information in the audited financial statements.

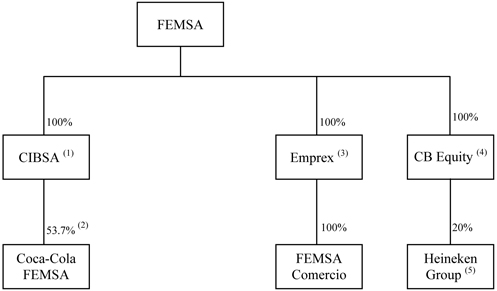

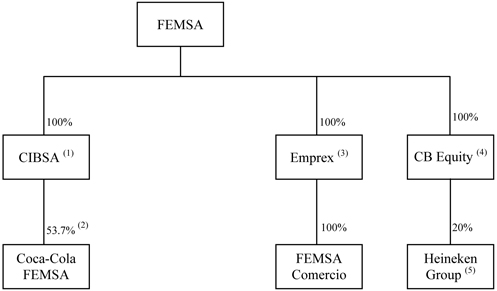

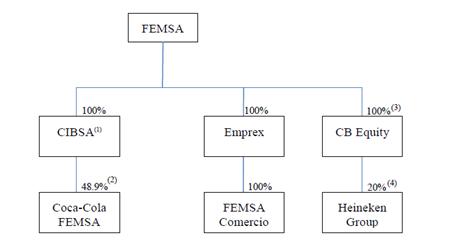

The terms “FEMSA,” “our company,” “we,” “us” and “our,” are used in this annual report to refer to Fomento Económico Mexicano, S.A.B. de C.V. and, except where the context otherwise requires, its subsidiaries on a consolidated basis. We refer to our subsidiary Coca-Cola FEMSA, S.A.B. de C.V., as “Coca-Cola FEMSA,” and our subsidiary FEMSA Comercio, S.A. de C.V., as “FEMSA Comercio.Comercio,” and our subsidiary CB Equity LLP, as “CB Equity.”

The term “S.A.B.” stands forsociedad anónima bursátil, which is the term used in the United Mexican States, or Mexico, to denominate a publicly traded company under the Mexican Securities Market Law (Ley del Mercado de Valores), which we refer to as the Mexican Securities Law.

References to “U.S. dollars,” “US$,” “dollars” or “$” are to the lawful currency of the United States of America.America (which we refer to as the United States). References to “Mexican pesos,” “pesos” or “Ps.” are to the lawful currency of Mexico. References to “euros” or “€” are to the United Mexican States, or Mexico.lawful currency of the European Economic and Monetary Union (which we refer to as the Euro Zone).

Currency Translations and Estimates

This annual report contains translations of certain Mexican peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the Mexican peso amounts actually represent such U.S. dollar amounts or could be converted into U.S. dollars at the rate indicated. Unless otherwise indicated, such U.S. dollar amounts have been translated from Mexican pesos at an exchange rate of Ps. 12.382512.9635 to US$ 1.00, the noon buying rate for Mexican pesos on December 31, 2010,2012, as published by the U.S. Federal Reserve BankBoard in its H.10 Weekly Release of New York.Foreign Exchange Rates. On MayMarch 31, 2011,2013, this exchange rate was Ps. 11.579012.3155 to US$ 1.00.See “Item 3. Key Information—Exchange Rate Information” for information regarding exchange rates since January 1, 2006.2008.

To the extent estimates are contained in this annual report, we believe that such estimates, which are based on internal data, are reliable. Amounts in this annual report are rounded, and the totals may therefore not precisely equal the sum of the numbers presented.

Per capita growth rates and population data have been computed based upon statistics prepared by theInstituto Nacional de Estadística, Geografía e Informáticaof Mexico (National Institute of Statistics, Geography and Information, which we refer to as the Mexican Institute of Statistics)INEGI), the Federal Reserve Bank of New York, the U.S. Federal Reserve Board andBanco de México (Bank of Mexico), local entities in each country and upon our estimates.

This annual report contains words, such as “believe,” “expect” and “anticipate” and similar expressions that identify forward-looking statements. Use of these words reflects our views about future events and financial performance. Actual results could differ materially from those projected in these forward-looking statements as a result of various factors that may be beyond our control, including but not limited to effects on our company from changes in our relationship with or among our affiliated companies, movements in the prices of raw materials, competition, significant developments in Mexico or international economic or political conditions or changes in our regulatory environment. Accordingly, we caution readers not to place undue reliance on these forward-looking statements. In any event, these statements speak only as of their respective dates, and we undertake no obligation to update or revise any of them, whether as a result of new information, future events or otherwise.

Selected Consolidated Financial Data

This annual report includes, under Item 18,We prepared our audited consolidated balance sheets as of December 31, 2010 and 2009, the related consolidated statements of income, cash flows and changes in stockholders’ equity for the years ended December 31, 2010, 2009 and 2008. Our audited consolidated financial statements included in this annual report in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). Our date of transition to IFRS was January 1, 2011. These consolidated annual financial statements are our first financial statements prepared in accordance with MexicanIFRS. IFRS 1— “First-time Adoption of International Financial Reporting Standards, or Mexican FRS, (Normas de Información Financieraor NIF), which differStandards” has been applied in certain significant respects from accounting principles generally accepted in the United States, or U.S. GAAP.

Notespreparing these financial statements. Note 27 and 28 to our audited consolidated financial statements provide a descriptioncontains an explanation of the principal differencesour adoption of IFRS and reconciliation between Mexican FRSFinancial Reporting Standards (Normas de Información Financiera Mexicanas, or “Mexican FRS”) and U.S. GAAPIFRS as they relate to our company, together with a reconciliation to U.S. GAAP of net income, comprehensive incomeJanuary 1, 2011 and stockholders’ equity as well as U.S. GAAP consolidated balance sheets, statements of income and comprehensive income and cash flows for the same periods presented for Mexican FRS purposesDecember 31, 2011 and for the consolidated statement of changes in stockholders’ equity for the yearsyear ended December 31, 2010 and 2009. In the reconciliation to U.S. GAAP, we present our subsidiary Coca-Cola FEMSA, which is a consolidated subsidiary for purposes of Mexican FRS, under the equity method for U.S. GAAP purposes, due to the substantive participating rights of The Coca-Cola Company as a minority shareholder in Coca-Cola FEMSA for the years ended December 31, 2009 and 2008.2011.

On February 1, 2010, FEMSA and The Coca-Cola Company signed an amendment to their Shareholders’ Agreement. As a result of this amendment, FEMSA began to consolidate Cola-Cola FEMSA for U.S. GAAP purposes on this date. See Note 27A toThis annual report includes (under Item 18) our audited consolidated statements of financial statements.

Beginning on January 1, 2008, in accordance with changes to NIF B-10 under the Mexican FRS, we discontinued the use of inflation accounting for our subsidiaries that operate in “non-inflationary” countries where cumulative inflation for the three preceding years was less than 26%. Our subsidiaries in Mexico, Guatemala, Panama, Colombia and Brazil operate in non-inflationary economic environments, therefore 2010, 2009 and 2008 figures reflect inflation effects only through 2007. Our subsidiaries in Nicaragua, Costa Rica, Venezuela and Argentina operate in economic environments in which cumulative inflation during the same three-year period was 26% or greater, and we therefore continue recognizing inflationary accounting for 2010, 2009 and 2008. For comparison purposes, the figures prior to 2008 have been restated in Mexican pesos with purchasing powerposition as of December 31, 2007, taking into account local inflation for each country with reference to the consumer price index. Local currencies have been converted into Mexican pesos using official exchange rates published by the local central bank of each country. Our subsidiary in the Euro Zone operated in a non-inflationary economic environment in 2010. See Note 5 to our audited consolidated financial statements.

As a result of discontinuing inflationary accounting for subsidiaries that operate in non-inflationary economic environments, the financial statements are no longer considered to be presented in a reporting currency that comprehensively includes the effects of price level changes. Therefore, the inflationary effects of inflationary economic environments arising in 2008, 20092012 and 2010 result in a difference that must be reconciled for U.S. GAAP purposes, except for Venezuela, which is considered to be a hyperinflationary environment since2011, and January 20101, 2011, and which inflationary effects have not been reversed under U.S. GAAP. See Notes 27 and 28 to our audited consolidated financial statements.

On April 30, 2010, FEMSA announced the closing of the transaction pursuant to which FEMSA agreed to exchange 100% of its beer operations for a 20% economic interest in Heineken Holding N.V. and Heineken N.V., which, together with their respective subsidiaries, we refer to as Heineken or the Heineken Group. See “Item 4. Information on the Company—FEMSA Cerveza and Equity Method Investment in Heineken Group.” Under Mexican FRS, we have reclassified our audited consolidated balance sheets as of December 31, 2010 and 2009, the related consolidated income statements, consolidated statements of comprehensive income, and changes in stockholders’ equity and cash flows for the years ended December 31, 2010, 20092012 and 20082011. Our consolidated financial statements as of and for the year ended December 31, 2012 were prepared in accordance with IFRS. The consolidated financial statements as of and for the year ended December 31, 2011 were prepared in accordance with IFRS, but they differ from the information previously published for 2011 because they were originally presented in accordance with Mexican FRS.

Pursuant to reflect FEMSA Cerveza, S.A. de C.V. (now Cuauhtémoc Moctezuma Holding, S.A. de C.V.), which we referIFRS, the information presented in this annual report presents financial information for 2012 and 2011 in nominal terms in Mexican pesos, taking into account local inflation of any hyperinflationary economic environment and converting from local currency to as FEMSA Cerveza or Cuauhtemoc Moctezuma,Mexican pesos using the official exchange rate at the end of the period published by the local central bank of each country categorized as a discontinued

operation. However, FEMSA Cerveza is not presented as a discontinued operation under U.S. GAAP. See “Item 5. OperatingOur non-Mexican subsidiaries maintain their accounting records in the currency and Financial Review and Prospects—U.S. GAAP Reconciliation” and Notes 27 and 28 toin accordance with accounting principles generally accepted in the country where they are located. For presentation in our audited consolidated financial statements.statements, we adjust these accounting records into IFRS and reported in Mexican pesos under these standards.

The following table presents selected financial information of our company. This information should be read in conjunction with, and is qualified in its entirety by reference to, our audited consolidated financial statements, andincluding the notes to those statements. See “Item 18. Financial Statements.”thereto. The selected financial information contained herein is presented on a consolidated basis, and is not necessarily indicative of our financial position or results from operations at or for any future date or period. Under Mexican FRS, FEMSA Cerveza figures for years prior to 2010 have been reclassified and presented as discontinued operations for comparison purposes to 2010 figures. Seeperiod; see Note 23 to our audited consolidated financial statements. Under U.S. GAAP, FEMSA Cerveza figures are presented as a continuing operation.statements for our significant accounting policies.

| Selected Consolidated Financial Information Year Ended December 31, | ||||||||||||||||||||||||

| 2010(2) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||||||

(In millions of U.S. dollars and millions of Mexican pesos, except for percentages, per share data and weighted average number of shares outstanding) | ||||||||||||||||||||||||

Income Statement Data: | ||||||||||||||||||||||||

Mexican FRS:(1) | ||||||||||||||||||||||||

Total revenues | $ | 13,705 | Ps | .169,702 | Ps. | 160,251 | Ps. | 133,808 | Ps. | 114,459 | Ps.102,870 | |||||||||||||

Income from operations(3) | 1,819 | 22,529 | 21,130 | 17,349 | 14,300 | 12,431 | ||||||||||||||||||

Income taxes(4) | 457 | 5,671 | 4,959 | 3,108 | 3,931 | 3,091 | ||||||||||||||||||

Consolidated net income before discontinued operations | 1,451 | 17,961 | 11,799 | 7,630 | 8,438 | 6,685 | ||||||||||||||||||

Income from the exchange of shares with Heineken, net of taxes | 2,150 | 26,623 | — | — | — | — | ||||||||||||||||||

Net income from discontinued operations | 57 | 706 | 3,283 | 1,648 | 3,498 | 3,175 | ||||||||||||||||||

Consolidated net income | 3,658 | 45,290 | 15,082 | 9,278 | 11,936 | 9,860 | ||||||||||||||||||

Net controlling interest income | 3,251 | 40,251 | 9,908 | 6,708 | 8,511 | 7,127 | ||||||||||||||||||

Net non-controlling interest income | 407 | 5,039 | 5,174 | 2,570 | 3,425 | 2,733 | ||||||||||||||||||

Net controlling interest income before discontinued operations:(5) | ||||||||||||||||||||||||

Per series “B” share | 0.05 | 0.64 | 0.33 | 0.25 | 0.25 | 0.20 | ||||||||||||||||||

Per series “D” share | 0.07 | 0.81 | 0.42 | 0.32 | 0.32 | 0.24 | ||||||||||||||||||

Net controlling income from discontinued operations:(5) | ||||||||||||||||||||||||

Per series “B” share | 0.11 | 1.37 | 0.16 | 0.08 | 0.17 | 0.16 | ||||||||||||||||||

Per series “D” share | 0.14 | 1.70 | 0.20 | 0.10 | 0.21 | 0.20 | ||||||||||||||||||

Net controlling interest income:(5) | ||||||||||||||||||||||||

Per Series B Share | 0.16 | 2.01 | 0.49 | 0.33 | 0.42 | 0.36 | ||||||||||||||||||

Per Series D Share | 0.21 | 2.51 | 0.62 | 0.42 | 0.53 | 0.44 | ||||||||||||||||||

Weighted average number of shares outstanding (in millions): | ||||||||||||||||||||||||

Series B Shares | 9,246.4 | 9,246.4 | 9,246.4 | 9,246.4 | 9,246.4 | 9,246.4 | ||||||||||||||||||

Series D Shares | 8,644.7 | 8,644.7 | 8,644.7 | 8,644.7 | 8,644.7 | 8,644.7 | ||||||||||||||||||

Allocation of earnings: | ||||||||||||||||||||||||

Series B Shares | 46.11 | % | 46.11 | % | 46.11 | % | 46.11 | % | 46.11 | % | 46.11 | % | ||||||||||||

Series D Shares | 53.89 | % | 53.89 | % | 53.89 | % | 53.89 | % | 53.89 | % | 53.89 | % | ||||||||||||

U.S. GAAP:(6) | ||||||||||||||||||||||||

Total revenues | $ | 14,299 | Ps. | 177,053 | Ps. | 102,902 | Ps. | 91,650 | Ps. | 83,362 | Ps. 75,704 | |||||||||||||

Income from operations | 1,715 | 21,235 | 8,661 | 7,881 | 7,667 | 7,821 | ||||||||||||||||||

Participation in Coca-Cola FEMSA’s earnings(6) | 15 | 183 | 4,516 | 2,994 | 3,635 | 2,420 | ||||||||||||||||||

(In millions of U.S. dollars and millions of Mexican pesos, except for percentages, per share data and weighted average number of shares outstanding) Consolidated net income Less: Net income attributable to the non-controlling interest income Net income attributable to controlling interest income Net controlling interest income(5): Per Series B Share Per Series D Share Weighted average number of shares outstanding (in millions): Series B Shares Series D Shares Balance Sheet Data: Mexican FRS:(1) Total assets of continuing operations Total assets of discontinued operations Current liabilities of continuing operations Current liabilities of discontinued operations Long-term debt of continuing operations(7) Other long-term liabilities of continuing operations Non-current liabilities of discontinued operations Capital stock Total stockholders’ equity Controlling interest Non-controlling interest U.S. GAAP:(6) Total assets Current liabilities Long-term debt(7) Other long-term liabilities Non-controlling interest Controlling interest Capital stock Stockholders’ equity(8) Other information: Mexican FRS:(1) Depreciation(9) Capital expenditures(10) Operating margin(11) U.S. GAAP: Depreciation(9) Operating margin(11) Selected Consolidated Financial Information

Year Ended December 31, 2010(2) 2010 2009 2008 2007 2006 5,831 72,204 (12) 10,685 6,599 8,589 6,804 (384 ) (4,759 ) (783 ) 253 (32 ) 169 5,447 67,445 9,902 6,852 8,557 6,973 0.27 3.36 0.49 0.34 0.43 0.35 0.34 4.20 0.62 0.43 0.53 0.43 9,246.4 9,246.4 9,246.4 9,246.4 9,246.4 9,246.4 8,644.7 8,644.7 8,644.7 8,644.7 8,644.7 8,644.7 $ 18,056 Ps. 223,578 Ps. 153,638 Ps. 126,833 Ps. 114,537 Ps. 97,623 — — 72,268 71,201 68,881 62,350 2,464 30,516 37,218 35,351 28,783 22,846 — — 10,883 12,912 13,581 10,503 1,793 22,203 21,260 21,853 23,066 21,160 1,442 17,846 8,500 8,285 9,882 7,249 — — 32,216 22,738 18,453 20,007 432 5,348 5,348 5,348 5,348 5,348 12,357 153,013 115,829 96,895 89,653 78,208 9,477 117,348 81,637 68,821 64,578 56,654 2,880 35,665 34,192 28,074 25,075 21,554 $ 27,015 Ps. 334,517 Ps. 158,000 Ps. 139,219 Ps. 127,167 Ps. 116,392 2,474 30,629 23,539 23,654 18,579 14,814 1,771 21,927 24,119 19,557 16,569 18,749 3,216 39,825 10,900 9,966 8,715 8,738 6,339 78,495 1,274 505 698 166 13,216 163,641 98,168 85,537 82,606 73,925 432 5,348 5,348 5,348 5,348 5,348 19,555 242,136 99,442 86,042 83,304 74,091 $ 366 Ps. 4,527 Ps. 4,391 Ps. 3,762 Ps. 4,930 Ps. 4,954 902 11,171 9,067 7,816 5,939 5,003 13.3 % 13.3 % 13.2 % 13.0 % 12.5 % 12.1 % $ 394 Ps. 4,884 Ps. 2,786 Ps. 2,439 Ps. 2,114 Ps. 2,080 11.9 % 11.9 % 8.4 % 8.6 % 9.2 % 10.3 %

Income Statement Data: IFRS Total revenues Gross Profit Income before Income Taxes and Share of the Profit of Associates and Joint Ventures Accounted for Using the Equity Method Income taxes Consolidated net income Controlling interest net income Non-controlling interest net income Basic controlling interest net income: Per Series B Share Per Series D Share Diluted controlling interest net income: Per Series B Share Per Series D Share Weighted average number of shares outstanding (in millions): Series B Shares Series D Shares Allocation of earnings: Series B Shares Series D Shares Financial Position Data: IFRS Total assets Current liabilities Long-term debt(4) Other long-term liabilities Capital stock Total equity Controlling interest Non-controlling interest Other Information IFRS Depreciation Capital expenditures(5) Gross margin(6) Year Ended December 31, 2012(1)(2) 2012(2) 2011(3) (in millions of Mexican pesos or millions of

U.S. dollars, except share and per share data) US$ 18,383 Ps.238,309 Ps.201,540 7,814 101,300 84,296 2,124 27,530 23,552 613 7,949 7,618 2,164 28,051 20,901 1,597 20,707 15,332 567 7,344 5,569 0.08 1.03 0.77 0.10 1.30 0.96 0.08 1.03 0.76 0.10 1.29 0.96 9,246.4 9,246.4 9,246.4 8,644.7 8,644.7 8,644.7 46.11 % 46.11 % 46.11 % 53.89 % 53.89 % 53.89 % US$ 22,829 Ps.295,942 Ps.263,362 3,743 48,516 39,325 2,209 28,640 23,819 665 8,625 8,047 258 3,346 3,345 16,212 210,161 192,171 11,977 155,259 144,222 4,235 54,902 47,949 US$ 553 Ps. 7,175 Ps. 5,694 1,200 15,560 12,666 43 % 43 % 42 %

| (1) |

| Translation to U.S. dollar amounts at an exchange rate of Ps. |

| (2) | Includes results of Grupo Fomento Queretano from May 2012.See “Item 4—Information on the Company—The Company—Corporate History.” |

| (3) |

| (4) |

| Includes long-term debt minus the current portion of long-term debt. |

| Includes investments in property, plant and equipment, intangible and other |

We have historically paid dividends per BD Unit (including in the form of American Depositary Shares, or ADSs) approximately equal to or greater than 1% of the market price on the date of declaration, subject to changes in our results from operations and financial position, including due to extraordinary economic events and to the factors described in “Risk“Item 3. Key Information—Risk Factors” that affect our financial condition and liquidity. These factors may affect whether or not dividends are declared and the amount of such dividends. We do not expect to be subject to any contractual restrictions on our ability to pay dividends, although our subsidiaries may be subject to such restrictions. Because we are a holding company with no significant operations of our own, we will have distributable profits and cash to pay dividends only to the extent that we receive dividends from our subsidiaries. Accordingly, we cannot assure you that we will pay dividends or as to the amount of any dividends.

The following table sets forth for each year the nominal amount of dividends per share that we declared in Mexican pesospeso and U.S. dollar amounts and their respective payment dates for the 20062008 to 20102012 fiscal years:

Date Dividend Paid | Fiscal Year with Respect to which Dividend was Declared | Aggregate Amount of Dividend Declared | Per Series B Share Dividend | Per Series B Share Dividend | Per Series D Share Dividend | Per Series D Share Dividend | ||||||||||||||||||

May 15, 2007 | 2006 | (1) | Ps.1,485,000,000 | Ps.0.0741 | $ | 0.0069 | Ps.0.0926 | $ | 0.0086 | |||||||||||||||

May 8, 2008 | 2007 | (1) | Ps.1,620,000,000 | Ps.0.0807 | $ | 0.0076 | Ps.0.1009 | $ | 0.0095 | |||||||||||||||

May 4, 2009 and November 3, 2009(2) | 2008 | Ps.1,620,000,000 | Ps.0.0807 | $ | 0.0061 | Ps.0.1009 | $ | 0.0076 | ||||||||||||||||

May 4, 2009 | Ps.0.0404 | $ | 0.0030 | Ps.0.0505 | $ | 0.0038 | ||||||||||||||||||

November 3, 2009 | Ps.0.0404 | $ | 0.0030 | Ps.0.0505 | $ | 0.0038 | ||||||||||||||||||

May 4, 2010 and November 3, 2010(3) | 2009 | Ps.2,600,000,000 | Ps.0.1296 | $ | 0.0105 | Ps.0.1621 | $ | 0.0132 | ||||||||||||||||

May 4, 2010 | Ps.0.0648 | $ | 0.0053 | Ps.0.0810 | $ | 0.0066 | ||||||||||||||||||

November 3, 2010 | Ps.0.0648 | $ | 0.0053 | Ps.0.0810 | $ | 0.0066 | ||||||||||||||||||

Date Dividend Paid | Fiscal Year with Respect to which Dividend was Declared | Aggregate Amount of Dividend Declared | Per Series B Share Dividend | Per Series B Share Dividend | Per Series D Share Dividend | Per Series D Share Dividend | Fiscal Year with Respect to which Dividend was Declared | Aggregate Amount of Dividend Declared | Per Series B Share Dividend | Per Series B Share Dividend | Per Series D Share Dividend | Per Series D Share Dividend | ||||||||||||||||||||||||||||||||||

May 3, 2011 and November 2, 2011(4)(5) | 2010 | Ps.4,600,000,000 | Ps.0.2294 | N/a | Ps.0.28675 | N/a | ||||||||||||||||||||||||||||||||||||||||

May 3, 2011 | Ps.0.1147 | $ | 0.0099 | Ps.0.14338 | $ | 0.0124 | ||||||||||||||||||||||||||||||||||||||||

May 8, 2008 | 2007(1) | Ps.1,620,000,000 | Ps.0.0807 | $ | 0.0076 | Ps.0.1009 | $ | 0.0095 | ||||||||||||||||||||||||||||||||||||||

May 4, 2009 and November 3, 2009(2) | 2008 | Ps.1,620,000,000 | Ps.0.0807 | $ | 0.0061 | Ps.0.1009 | $ | 0.0076 | ||||||||||||||||||||||||||||||||||||||

May 4, 2009 | Ps.0.0404 | $ | 0.0030 | Ps.0.0505 | $ | 0.0038 | ||||||||||||||||||||||||||||||||||||||||

November 3, 2009 | Ps.0.0404 | $ | 0.0030 | Ps.0.0505 | $ | 0.0038 | ||||||||||||||||||||||||||||||||||||||||

May 4, 2010 and November 3, 2010(3) | 2009 | Ps.2,600,000,000 | Ps.0.1296 | $ | 0.0105 | Ps.0.1621 | $ | 0.0132 | ||||||||||||||||||||||||||||||||||||||

May 4, 2010 | Ps.0.0648 | $ | 0.0053 | Ps.0.0810 | $ | 0.0066 | ||||||||||||||||||||||||||||||||||||||||

November 3, 2010 | Ps.0.0648 | $ | 0.0053 | Ps.0.0810 | $ | 0.0066 | ||||||||||||||||||||||||||||||||||||||||

May 4, 2011 and November 2, 2011(4) | 2010 | Ps.4,600,000,000 | Ps.0.2294 | $ | 0.0199 | Ps.0.28675 | $ | 0.0249 | ||||||||||||||||||||||||||||||||||||||

May 4, 2011 | Ps.0.1147 | $ | 0.0099 | Ps.0.14338 | $ | 0.0124 | ||||||||||||||||||||||||||||||||||||||||

November 2, 2011 | Ps.0.1147 | N/a | Ps.0.14338 | N/a | Ps.0.1147 | $ | 0.0100 | Ps.0.14338 | $ | 0.0125 | ||||||||||||||||||||||||||||||||||||

May 3, 2012 and November 6, 2012(5) | 2011 | Ps.6,200,000,000 | Ps.0.3092 | $ | 0.0231 | Ps.0.3865 | $ | 0.0288 | ||||||||||||||||||||||||||||||||||||||

May 3, 2012 | Ps.0.1546 | $ | 0.0119 | Ps.0.1932 | $ | 0.0149 | ||||||||||||||||||||||||||||||||||||||||

November 6, 2012 | Ps.0.1546 | $ | 0.0119 | Ps.0.1932 | $ | 0.0149 | ||||||||||||||||||||||||||||||||||||||||

May 7, 2013 and November 7, 2013(6) | 2012 | Ps.6,684,103,000 | Ps.0.3333 | N/a | (7) | Ps. 0.4166 | N/a | |||||||||||||||||||||||||||||||||||||||

May 7, 2013 | Ps.0.1666 | N/a | Ps.0.2083 | N/a | ||||||||||||||||||||||||||||||||||||||||||

November 7, 2013 | Ps.0.1666 | N/a | Ps.0.2083 | N/a | ||||||||||||||||||||||||||||||||||||||||||

| (1) | The per series dividend amount has been adjusted for comparability purposes to reflect the 3:1 stock split effective May 25, |

| (2) | The dividend payment for 2008 was divided into two equal payments. The first payment was |

| (3) | The dividend payment for 2009 was divided into two equal payments. The first payment was |

| (4) | The dividend payment for 2010 was divided into two equal payments. The first payment was |

| (5) | The dividend payment for 2011 was divided into two equal payments. The first payment was payable on May 3, 2012 with a record date of May 2, 2012, and the second payment was payable on November 6, 2012 with a record date of November 5, 2012. |

| (6) | The dividend payment for 2012 was divided into two equal payments. The first payment will become payable on May 7, 2013 with a record date of May 6, 2013, and the second payment will become payable on November 7, 2013 with a record date of November 6, 2013. |

| (7) | The U.S. dollar |

At the annual ordinary general shareholders meeting, or AGM, the board of directors submits the financial statements of our company for the previous fiscal year, together with a report thereon by the board of directors. Once the holders of Series B Shares have approved the financial statements, they determine the allocation of our net profits for the preceding year. Mexican law requires the allocation of at least 5% of net profits to a legal reserve, which is not subsequently available for distribution, until the amount of the legal reserve equals 20% of our paid in capital stock. As of the date of this report, the legal reserve of our company is fully constituted. Thereafter, the holders of Series B Shares may determine and allocate a certain percentage of net profits to any general or special reserve, including a reserve for open-market purchases of our shares. The remainder of net profits is available for distribution in the form of dividends to our shareholders. Dividends may only be paid if net profits are sufficient to offset losses from prior fiscal years.

Our bylaws provide that dividends will be allocated among the shares outstanding and fully paid shares at the time a dividend is declared in such manner that each Series D-B Share and Series D-L Share receives 125% of the dividend distributed in respect of each Series B Share. Holders of Series D-B Shares and Series D-L Shares are entitled to this dividend premium in connection with all dividends paid by us other than payments in connection with the liquidation of our company.

Subject to certain exceptions contained in the deposit agreement dated May 11, 2007, among FEMSA, The Bank of New York, as ADS depositary, and holders and beneficial owners from time to time of our American Depositary Shares, or ADSs, evidenced by American Depositary Receipts, or ADRs, any dividends distributed to holders of our ADSs will be paid to the ADS depositary in Mexican pesos and will be converted by the ADS depositary into U.S. dollars. As a result, restrictions on conversion of Mexican pesos into foreign currencies and exchange rate fluctuations may affect the ability of holders of our ADSs to receive U.S. dollars and the U.S. dollar amount actually received by holders of our ADSs.

The following table sets forth, for the periods indicated, the high, low, average and year-end noon buying exchange rate, published by the Federal Reserve Bank of New York for cable transfers ofexpressed in Mexican pesos per U.S. dollar. The Federal Reserve Bank of New York discontinued the publication of foreign exchange rates on December 31, 2008, and therefore, the data provided for the periods beginning January 1, 2009, is based on the ratesdollar, as published by the U.S. Federal Reserve Board in its H.10 Weekly Release of Foreign Exchange Rates. The rates have not been restated in constant currency units and therefore represent nominal historical figures.

Year ended December 31, | Exchange Rate | Exchange Rate | ||||||||||||||||||||||||||||||

| High | Low | Average(1) | Year End | High | Low | Average(1) | Year End | |||||||||||||||||||||||||

2006 | 11.46 | 10.43 | 10.91 | 10.80 | ||||||||||||||||||||||||||||

2007 | 11.27 | 10.67 | 10.93 | 10.92 | ||||||||||||||||||||||||||||

2008 | 13.94 | 9.92 | 11.21 | 13.83 | Ps.13.94 | Ps.9.92 | Ps.11.21 | Ps.13.83 | ||||||||||||||||||||||||

2009 | 15.41 | 12.63 | 13.50 | 13.06 | 15.41 | 12.63 | 13.58 | 13.06 | ||||||||||||||||||||||||

2010 | 13.19 | 12.16 | 12.64 | 12.38 | 13.19 | 12.16 | 12.64 | 12.38 | ||||||||||||||||||||||||

2011 | 14.25 | 11.51 | 12.46 | 13.95 | ||||||||||||||||||||||||||||

2012 | 14.37 | 12.63 | 13.14 | 12.96 | ||||||||||||||||||||||||||||

| (1) | Average month-end rates. |

| Exchange Rate | ||||||||||||

| High | Low | Period End | ||||||||||

2009: | ||||||||||||

First Quarter | Ps.15.41 | Ps.13.33 | Ps.14.21 | |||||||||

Second Quarter | 13.89 | 12.89 | 13.17 | |||||||||

Third Quarter | 13.80 | 12.82 | 13.48 | |||||||||

Fourth Quarter | 13.67 | 12.63 | 13.06 | |||||||||

2010: | ||||||||||||

First Quarter | Ps.13.19 | Ps.12.30 | Ps.12.30 | |||||||||

Second Quarter | 13.14 | 12.16 | 12.83 | |||||||||

Third Quarter | 13.17 | 12.49 | 12.63 | |||||||||

Fourth Quarter | 12.61 | 12.21 | 12.38 | |||||||||

2011: | ||||||||||||

January | Ps.12.25 | Ps.12.04 | Ps.12.15 | |||||||||

February | 12.18 | 11.97 | 12.11 | |||||||||

March | 12.11 | 11.92 | 11.92 | |||||||||

First Quarter | 12.25 | 11.92 | 11.92 | |||||||||

April | 11.86 | 11.52 | 11.52 | |||||||||

May | 11.77 | 11.51 | 11.58 | |||||||||

June(1) | 11.87 | 11.64 | 11.87 | |||||||||

| Exchange Rate | ||||||||||||

| High | Low | Period End | ||||||||||

2011: | ||||||||||||

First Quarter | Ps.12.25 | Ps.11.92 | Ps.11.92 | |||||||||

Second Quarter | 11.97 | 11.51 | 11.72 | |||||||||

Third Quarter | 13.87 | 11.57 | 13.77 | |||||||||

Fourth Quarter | 14.25 | 13.10 | 13.95 | |||||||||

2012: | ||||||||||||

First Quarter | Ps.13.75 | Ps.12.63 | Ps.12.81 | |||||||||

Second Quarter | 14.37 | 12.73 | 13.41 | |||||||||

Third Quarter | 13.72 | 12.74 | 12.86 | |||||||||

Fourth Quarter | 13.25 | 12.71 | 12.96 | |||||||||

October | 13.09 | 12.71 | 13.09 | |||||||||

November | 13.25 | 12.92 | 12.92 | |||||||||

December | 13.01 | 12.72 | 12.96 | |||||||||

2013: | ||||||||||||

January | Ps.12.79 | Ps.12.59 | Ps.12.73 | |||||||||

February | 12.88 | 12.63 | 12.78 | |||||||||

March | 12.80 | 12.32 | 12.32 | |||||||||

First Quarter | 12.88 | 12.32 | 12.32 | |||||||||

Risks Related to Our Company

Coca-Cola FEMSA

Coca-Cola FEMSA’s business reliesdepends on its relationship with The Coca-Cola Company, and changes in this relationship may adversely affect itsCoca-Cola FEMSA’s results from operations and financial condition.

Approximately 99%Substantially all of Coca-Cola FEMSA’s sales volume in 2010 wasare derived from sales ofCoca-Cola trademark beverages. Coca-Cola FEMSA produces, markets, sells and distributesCoca-Cola trademark beverages through standard bottler agreements in certain territories in Mexico and Latin America, which we referCoca-Cola FEMSA refers to as Coca-Cola“Coca-Cola FEMSA’s territories.”See “Item 4. Information on the Company—Coca-Cola FEMSA—Coca-Cola FEMSA’s Territories.”Through its rights under theCoca-Cola FEMSA’s bottler agreements and as a large shareholder, The Coca-Cola Company has the right to participate in the process for making important decisions related to Coca-Cola FEMSA’s business.

The Coca-Cola Company may unilaterally set the price for its concentrate. In addition, under itsCoca-Cola FEMSA’s bottler agreements, Coca-Cola FEMSA is prohibited from bottling or distributing any other beverages without The Coca-Cola Company’s authorization or consent, and itCoca-Cola FEMSA may not transfer control of the bottler rights of any of its territories without prior consent offrom The Coca-Cola Company. On February 1, 2010, FEMSA’s subsidiaries signed an agreement with subsidiaries of The Coca-Cola Company to amend the shareholders agreement of Coca-Cola FEMSA. The purpose of the amendment is to set forth that the appointment and compensation of the chief executive officer and all officers reporting to the chief executive officer, as well as the adoption of decisions related to the ordinary operations of Coca-Cola FEMSA shall only require a simple majority vote of the board of directors. See “Item 4. Information on the Company—The Company—Overview.” The Coca-Cola Company may require that Coca-Cola FEMSA demonstrate its financial ability to meet its business.

The Coca-Cola Company also makes significant contributions to Coca-Cola FEMSA’s marketing expenses, although it is not required to contribute a particular amount. Accordingly, The Coca-Cola Company may discontinue or reduce such contributions at any time.

Coca-Cola FEMSA depends on The Coca-Cola Company to renew itsCoca-Cola FEMSA’s bottler agreements. In Mexico,As of December 31, 2012, Coca-Cola FEMSA has fourhad eight bottler agreements;agreements in Mexico: (i) the agreements for two territoriesMexico’s Valley territory, which expire in June 2013 and April 2016, (ii) the agreements for the other two territoriesCentral territory, which expire in August 2013, May 2015.2015 and July 2016, (iii) the agreement for the Northeast territory, which expires in September 2014, (iv) the agreement for the Bajio territory, which expires in May 2015, and (v) the agreement for the Southeast territory, which expires in June 2013. Coca-Cola FEMSA’s bottler agreements with The Coca-Cola Company will expire for Coca-Cola FEMSA’s territories in other countries as follows: Argentina in September 2014; Brazil in April 2014; Colombia in June 2014; Venezuela in August 2016; Guatemala in March 2015; Costa Rica in September 2017; Nicaragua in May 2016;2016 and Panama in November 2014. All of Coca-Cola FEMSA’s bottler agreements are automatically renewable for ten-year terms, subject to the right of either party to give prior notice that it does not wish to renew a specificthe applicable agreement. In addition, these agreements generally may be terminated in the case of material breach.See “Item 10. Additional Information—Material Contracts—Material Contracts Relating to Coca-Cola FEMSA.”Termination would prevent Coca-Cola FEMSA from sellingCoca-Cola trademark beverages in the affected territory and would have an adverse effect on Coca-Cola FEMSA’s business, financial conditions,condition, results from operations and prospects.

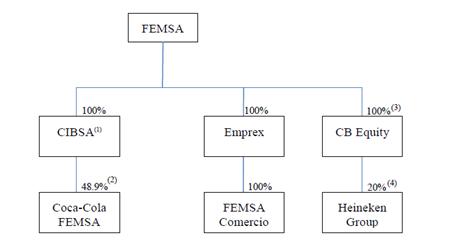

The Coca-Cola Company has significantsubstantial influence on the conduct of Coca-Cola FEMSA’s business, which may result in Coca-Cola FEMSA taking actions contrary to the interests of its remaining shareholders.

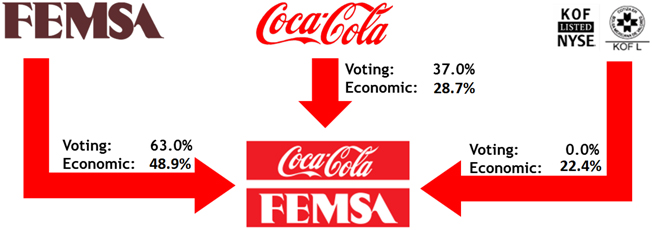

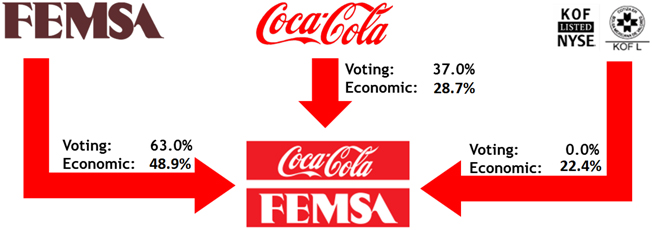

The Coca-Cola Company has significantsubstantial influence on the conduct of Coca-Cola FEMSA’s business. Currently,As of March 31, 2013, The Coca-Cola Company indirectly owns 31.6%owned 28.7% of Coca-Cola FEMSA’s outstanding capital stock, representing 37.0% of its capital stockCoca-Cola FEMSA’s shares with full voting rights. The Coca-Cola Company is entitled to appoint fourfive of Coca-Cola FEMSA’s 18maximum of 21 directors and the vote of at least two of them is required to approve certain actions by Coca-Cola FEMSA’s board of directors. On February 1, 2010,As of March 31, 2013, we and The Coca-Cola Company signed a second amendment to the shareholders agreement that confirms our power to govern the operating and financial policiesindirectly owned 48.9% of Coca-Cola FEMSA in order to exercise control over its operations in the ordinary courseFEMSA’s outstanding capital stock, representing 63.0% of business. Consequently, weCoca-Cola FEMSA’s shares with full voting rights. We are entitled to appoint 1113 of Coca-Cola FEMSA’s 18maximum of 21 directors and all of its executive officers. We and The Coca-Cola Company has the power to determine the outcome oftogether, or only we in certain protective rights, such as mergers, acquisitions, or the sale of any line of business, requiring approval by its board of directors and maycircumstances, have the power to determine the outcome of certainall actions requiring the approval of Coca-Cola FEMSA’s board of directors, and we and The Coca-Cola Company together, or only we in certain circumstances, have the power to determine the outcome of all actions requiring the approval of Coca-Cola FEMSA’s shareholders.See “Item 10. Additional Information—Material Contracts—Material Contracts Relating to Coca-Cola FEMSA.”The interests of The Coca-Cola Company may be different from the interests of Coca-Cola FEMSA’s remaining shareholders, which may result in Coca-Cola FEMSA taking actions contrary to the interests of itsCoca-Cola FEMSA’s remaining shareholders.

Coca-Cola FEMSA has significant transactions with affiliates, particularly The Coca-Cola Company, which may create the potential for conflicts of interest and could result in less favorable terms to Coca-Cola FEMSA.

Coca-Cola FEMSA engages in transactions with subsidiaries of The Coca-Cola Company, including cooperative marketing arrangements and a number of bottler agreements. In addition, Coca-Cola FEMSA has entered into cooperative marketing arrangements with The Coca-Cola Company. The transactions may create potential conflicts of interest, which could result in terms less favorable to Coca-Cola FEMSA than could be obtained from an unaffiliated third-party.

Competition could adversely affect Coca-Cola FEMSA’s financial performance.

The beverage industry in the territories in which Coca-Cola FEMSA operates is highly competitive. Coca-Cola FEMSA faces competition from other bottlers of sparkling beverages, such asPepsi products, and from producers of low cost beverages or “B brands.” Coca-Cola FEMSA also competes in different beverage categories other than sparkling beverages, such as water, juice-based beverages, teas, sport drinks and sport drinks.value-added dairy products. Although competitive conditions are different in each of Coca-Cola FEMSA’s territories, Coca-Cola FEMSA competes principally in terms of price, packaging, consumer sales promotions, customer service and product innovation.See “Item 4. Information on the Company—Coca-Cola FEMSA—Competition.”There can be no assurances that Coca-Cola FEMSA will be able to avoid lower pricing as a result of competitive pressure. Lower pricing, changes made in response to competition and changes in consumer preferences may have an adverse effect on Coca-Cola FEMSA’s financial performance.

Changes in consumer preference could reduce demand for some of Coca-Cola FEMSA’s productsproducts.

The non-alcoholic beverage industry is rapidly evolving as a result of, among other things, changes in consumer preferences. Specifically, consumers are becoming increasingly more aware of and concerned about environmental and health issues. Concerns over the environmental impact of plastic may reduce the consumption of Coca-Cola FEMSA’s products sold in plastic bottles or result in additional taxes that would adversely affect consumer demand. In addition, researchers, health advocates and dietary guidelines are encouraging consumers to reduce their consumption of certain types of beverages sweetened with sugar and high fructose corn syrup,High Fructose Corn Syrup (“HFCS”), which could reduce demand for certain of Coca-Cola FEMSA’s products. A reduction in consumer demand would adversely affect Coca-Cola FEMSA’s results from operations.results.

Water shortages or any failure to maintain existing concessions could adversely affect Coca-Cola FEMSA’s business.

Water is an essential component of all of Coca-Cola FEMSA’s products. Coca-Cola FEMSA obtains water from various sources in its territories, including springs, wells, rivers and municipal and state water companies pursuant to either contracts to obtain water or pursuant to concessions granted by governments in its various territories.territories or pursuant to contracts.

Coca-Cola FEMSA obtains the vast majority of the water used in its production pursuant to concessions to exploituse wells, which are generally granted based on studies of the existing and projected groundwater supply. Coca-Cola FEMSA’s existing water concessions or contracts to obtain water may be terminated by governmental authorities under certain circumstances and their renewal depends on receiving necessary authorizations from local and/or federal water authorities.See “Item 4. Information on the Company—Regulatory Matters—Water Supply Law.Supply.”In some of Coca-Cola FEMSA’s other territories, itsCoca-Cola FEMSA’s existing water supply may not be sufficient to meet itsCoca-Cola FEMSA’s future production needs, and the available water supply may be adversely affected by shortages or changes in governmental regulations and environmental changes.

We cannot assure you that water will be available in sufficient quantities to meet Coca-Cola FEMSA’s future production needs or will prove sufficient to meet itsCoca-Cola FEMSA’s water supply needs.

Increases in the prices of raw materials would increase Coca-Cola FEMSA’s cost of salesgoods sold and may adversely affect its results from operations.Coca-Cola FEMSA’s results.

In addition to water, Coca-Cola FEMSA’s most significant raw materials are (1) concentrate, which itCoca-Cola FEMSA acquires from affiliates of The Coca-Cola Company, (2) packaging materialssweeteners and (3) sweeteners.packaging materials. Prices for sparkling beveragesbeverages’ concentrate are determined by The Coca-Cola Company as a percentage of the weighted average retail price in local currency, net of applicable taxes. In 2005,We cannot assure you that The Coca-Cola Company decided to graduallywill not increase the price of the concentrate prices for sparkling beverages or change the manner in Brazil and Mexico. These increases were fully implemented in Brazil in 2008 and in Mexico in 2009. However, Coca-Cola FEMSA may experience further increaseswhich such price will be calculated in the future. The prices for Coca-Cola FEMSA’s remaining raw materials are driven by market prices and local availability, as well as the imposition of import duties and import restrictions and fluctuations in exchange rates. Coca-Cola FEMSA is also required to meet all of its supply needs from suppliers approved by The Coca-Cola Company, which may limit the number of suppliers available to it. Coca-Cola FEMSA’s sales prices are denominated in the local currency in each country in which it operates, while the prices of certain materials, including those used in the bottling of itsCoca-Cola FEMSA’s products, (mainlymainly resin, ingots usedpreforms to make plastic bottles, finished plastic bottles, aluminum cans and high fructose corn syrup),HFCS, are paid in or determined with reference to the U.S. dollar. These pricesdollar, and therefore may increase if the U.S. dollar appreciates against the currency of any countrythe countries in which Coca-Cola FEMSA operates, which occurredas was the case in 2008 and 2009.See2009. In 2011, the U.S. dollar did not appreciate against the currencies of most of the countries in which Coca-Cola FEMSA operated; however, in 2012, the U.S. dollar did appreciate against some of those currencies. We cannot anticipate whether the U.S. dollar will appreciate or depreciate with respect to such currencies in the future.See “Item 4. Information on the Company—Coca-Cola FEMSA—Raw Materials.”

After concentrate, packaging materials and sweeteners constitute the largest portion of Coca-Cola FEMSA’s raw material costs. Coca-Cola FEMSA’s most significant packaging raw material costs arise from the purchase of resin and plastic ingotspreforms to make plastic bottles and from the purchase of finished plastic bottles, the prices of which are tied to crude oil prices and global resin supply. The average prices that Coca-Cola FEMSA paid for resin and plastic ingotspreforms in U.S. dollars decreased significantlywere lower in 2009 and in 2010. Prices may also2012, as compared to 2011. We cannot provide any assurance that prices will not increase in future periods. During 2012, average sweetener prices, as a whole, were lower as compared to 2011 in all of the countries in which Coca-Cola FEMSA operates. From 2009 and 2010,through 2012, international sugar prices were volatile due to various factors, including shifting demands, availability and climate issues affecting production and distribution. Sugar prices inIn all of the countries in which Coca-Cola FEMSA operates, other than Brazil, sugar prices are subject to local regulations and other barriers to market entry that cause Coca-Cola FEMSA to pay in excess of international market prices for sugar. Average sweetener prices paid during 2010 were higher as compared to 2009 in all of the countries in which Coca-Cola FEMSA operates. prices.See “Item 4. Information on the Company—Coca-Cola FEMSA—Raw Materials.”

We cannot assure you that Coca-Cola FEMSA’s raw material prices will not further increase in the future. Increases in the prices of raw materials would increase Coca-Cola FEMSA’s cost of salesgoods sold and adversely affect itsCoca-Cola FEMSA’s financial performance.

Taxes could adversely affect Coca-Cola FEMSA’s business.

The countries in which Coca-Cola FEMSA operates may adopt new tax laws or modify existing lawlaws to increase taxes applicable to itsCoca-Cola FEMSA’s business. For example, in Mexico, a general tax reform became effective on January 1, 2010, pursuant to which, as applicable to Coca-Cola FEMSA,Coca-Cola-FEMSA, there was a temporary increase in the income tax rate from 28% to 30% from 2010 through 2012. This increasePursuant to an amendment issued at the end of 2012, the 30% income tax rate will be followed by a reductioncontinue to 29% for the year 2013 and a further reduction in 2014 to return to the previous rate of 28%.apply through 2013. In addition, the value added tax (VAT)(“VAT”) rate in Mexico increased in 2010 from 15% to 16%. This increase had an impact on Coca-Cola FEMSA’s results from operations due to the reduction in consumer acquisition capacity.

In Panama, there was an increase in a certain consumer tax, effective as of April 1, 2010, affecting syrups, powders and concentrate. Some of these materials are used for the production of Coca-Cola FEMSA’s sparkling beverages. These taxes increased from 6% to 10%.

In November 2012, the government of the Province of Buenos Aires adopted Law No. 14,394, which increased the tax rate applied to product sales within the Province of Buenos Aires. If the products are manufactured in plants located in the territory of the Province of Buenos Aires, Law No. 14,394 increases the tax rate from 1% to 1.75%; if the products are manufactured in any other Argentine province, the law increases the tax rate from 3% to 4%.

In Brazil, the federal taxes applied on the production and sale of beverages are based on the national average retail price, calculated based on a yearly survey of each Brazilian beverage brand, combined with a fixed tax rate and a multiplier specific for each class of presentation (glass, plastic or can). On October 1, 2012, a number of changes to the Brazilian tax rate became effective. These changes include increases in the multipliers used to calculate soft drink taxes when presented in cans or glasses. Upon effectiveness, the multiplier for cans increased from 30.0% to 31.9%, and beginning in September 2014, the multiplier will gradually increase up to 38.1% in October 1, 2018. The multiplier for glasses increased from 35.0% to 37.2%, and beginning in September 2014, the multiplier will gradually increase up to 44.4% in October 1, 2018. In addition, the amendment suspended the 50% production tax benefit that had previously applied to juice-added soft drinks, and raised the rate for such beverages to the level currently applied to cola beverages. The amendments that benefited Coca-Cola FEMSA’s Brazilian subsidiary were the reduction of the production tax on concentrate, from 27.0% to 20.0%, and the elimination of the sale tax on mineral water (sparkling or still).

Coca-Cola FEMSA’s products are also subject to certain taxes in many of the countries in which it operates. Certain countries in Central America, Brazil and Argentina also impose taxes on sparkling beverages.See “Item 4. Information on the Company—Regulatory Matters—Taxation of Sparkling Beverages.”We cannot assure you that any governmental authority in any country where Coca-Cola FEMSA operates will not impose new taxes or increase taxes on itsCoca-Cola FEMSA’s products in the future. The imposition of new taxes or increases in taxes on Coca-Cola FEMSA’s products may have a material adverse effect on Coca-Cola FEMSA’s business, financial condition, prospects and results.

Regulatory developments may adversely affect Coca-Cola FEMSA’s business.

Coca-Cola FEMSA is subject to regulation in each of the territories in which it operates. The principal areas in which Coca-Cola FEMSA is subject to regulation are water, environment, labor, taxation, health and antitrust. Regulation can also affect Coca-Cola FEMSA’s ability to set prices for its products.See “Item 4. Information on the Company—Regulatory Matters.”The adoption of new laws or regulations or a stricter interpretation or enforcement thereof in the countries in which Coca-Cola FEMSA operates may increase itsCoca-Cola FEMSA’s operating costs or impose restrictions on itsCoca-Cola FEMSA’s operations which, in turn, may adversely affect its financial condition, business and results from operations.results. In particular, environmental standards are becoming more stringent in several of the countries in which Coca-Cola FEMSA operates, and Coca-Cola FEMSA is in the process of complying with these standards, although we cannot assure you that Coca-Cola FEMSA will be able to meet any timelines for compliance established by the relevant regulatory authorities.See “Item 4. Information on the Company—Regulatory Matters—Environmental Matters.”Further changes in current regulations may result in an increase in compliance costs, which may have an adverse effect on Coca-Cola FEMSA’s future results from operations or financial condition.

Voluntary price restraints or statutory price controls have been imposed historically in several of the countries in which Coca-Cola FEMSA operates. It is currently subject toCurrently, there are no price controls on Coca-Cola FEMSA’s products in Argentina.any of the territories in which it has operations, except for those in (i) Argentina, where authorities directly supervise certain products sold through supermarkets to control inflation; and (ii) Venezuela, where the government has recently imposed price controls on certain products including bottled water. The imposition of these restrictions or voluntary price restraints in other territories may have an adverse effect on Coca-Cola FEMSA’s results from operations and financial position.See “Item 4. Information on the Company—Regulatory Matters—Price Controls.”We cannot assure you that governmental authorities in any country where Coca-Cola FEMSA operates will not impose statutory price controls or that it will not need to implement voluntary price restraints in the future.

In January 2010, the Venezuelan government amended theLey para la Defensa y Acceso a las Personas a los Bienes y Servicios(Access (Access to Goods and Services Defense Law). Any violation by a company that produces, distributes and sells goods and services could lead to fines, penalties or the confiscation of the assets used to produce, distribute and sell these goods without compensation. Although we believe that Coca-Cola FEMSA believes it is in compliance with this law, consumer protection laws in Venezuela are subject to continuing review and changes, and any such changes may have an adverse impact on Coca-Cola FEMSA.

In July 2011, the Venezuelan government passed theLey de Costos y Precios Justos (Fair Costs and Prices Law). The purpose of this law is to establish the regulations and administrative processes necessary to maintain the price stability of, and equal access to, goods and services. The law also creates the National Ministry of Costs and Prices, the main role of which is to oversee price controls and set maximum retail prices on certain consumer goods and services. Of Coca-Cola FEMSA’s products, only certain of its bottled water beverages were affected by these regulations, which mandated lower sale prices as of April 2012. Any failure to comply with this law would result in fines, temporary suspension or the closure of operations. We cannot assure you that the Venezuelan government’s future regulation of goods and services will not result in a forced reduction of prices in other of Coca-Cola FEMSA’s products, which could have a negative effect on Coca-Cola FEMSA’s results.

In May 2012, the Venezuelan government adopted significant changes to labor regulations. This amendment to Venezuela’s labor regulations could have a negative impact on Coca-Cola FEMSA’s business and operations. The principal changes that impact on Coca-Cola FEMSA’s operations are: (i) the requirement that employee terminations are now subject to governmental authorization; (ii) retroactive assessments for any modifications to Coca-Cola FEMSA’s severance payment system; (iii) the reduction of the maximum daily and weekly work hours (from 44 to 40 weekly); and (iv) the increase in obligatory weekly breaks, prohibiting any corresponding reduction in salaries.

In January 2012, the Costa Rican government approved a decree which regulates the sale of food and beverages in schools. The decree came into effect in 2012. Enforcement of this law will be gradual, from 2012 to 2014, depending on the specific characteristics of the food and beverage in question. According to the decree, the sale of specific sparkling beverages and still beverages that contain sugar, syrup or HFCS in any type of presentation in schools is prohibited. Coca-Cola FEMSA will still be allowed to sell water and certain still beverages in schools. We cannot assure you that the Costa Rican government will not further restrict sales of other of its products in schools in the future; any such further restrictions could lead to an adverse impact on Coca-Cola FEMSA.its results.

Coca-Cola FEMSA’s operations have from time to time been subject to investigations and proceedings by antitrust authorities, and litigation relating to alleged anticompetitive practices. Coca-Cola FEMSA has also been subject to investigations and proceedings on environmental and labor matters.See “Item 8. Financial Information—Legal Proceedings.”We cannot assure you that these investigations and proceedings couldwill not have an adverse effect on Coca-Cola FEMSA’s results from operations or financial condition.

Economic and political conditions in the other Latin American countries in which Coca-Cola FEMSA operates other than Mexico may have an increasingly adverse effect onadversely affect its business.

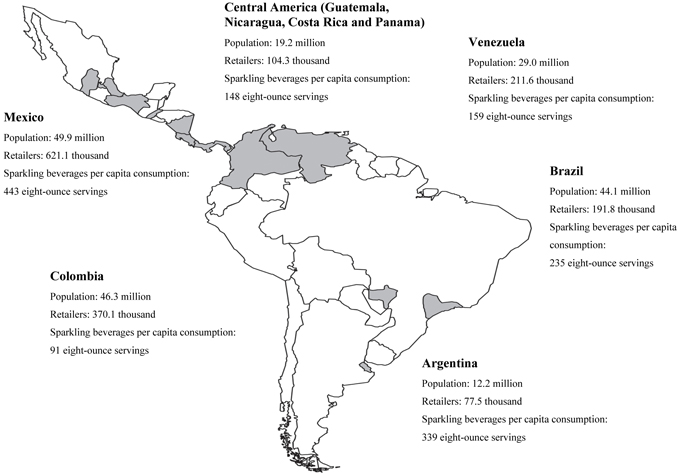

In addition to operating in Mexico, our subsidiary Coca-Cola FEMSA conducts operations in Brazil, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Venezuela Brazil and Argentina. Total revenues and income from Coca-Cola FEMSA’s combined non-Mexican operations increaseddecreased as a percentage of theirits consolidated total revenues and income from operations from 42.8% and 29.5%, respectively,63.8% in 20052011 to 62.5% and 61.3%, respectively,60.8% in 2010. As a consequence,2012; for the same non-Mexican operations, Coca-Cola FEMSA’s gross profit decreased as a percentage of its consolidated gross profit from 62.2% in 2011 to 59.3% in 2012. Given the relevance of Coca-Cola FEMSA’s non-Mexican operations, its results have been increasinglycontinue to be affected by the economic and political conditions in the countries, other than Mexico, where it conducts operations.

Coca-Cola FEMSA’s business may be affected by the general conditions of the Brazilian economy, the rate of inflation, Brazilian interest rates or exchange rates for Brazilian reais. Decreases in the growth rate of the Brazilian economy, periods of negative growth and/or increases in inflation or interest rates may result in lower demand for Coca-Cola FEMSA’s products, lower real pricing of its products or a shift to lower margin products.

Consumer demand, preferences, real prices and the costs of raw materials are heavily influenced by macroeconomic and political conditions in the other countries in which Coca-Cola FEMSA operates. These conditions vary by country and may not be correlated to conditions in Coca-Cola FEMSA’s Mexican operations. In Venezuela, Coca-Cola FEMSA continues to face exchange rate risk as well as scarcity of raw materials and restrictions with respect to the import of suchon importing raw materials. Deterioration in economic and political conditions in any of these countries would have an adverse effect on Coca-Cola FEMSA’s financial position and results fromresults.

Venezuelan political events may affect Coca-Cola FEMSA’s operations. Although Venezuela will hold elections on April 14, 2013, in light of the death of President Hugo Chavez, political uncertainty remains. We cannot provide any assurances that political developments in Venezuela, over which Coca-Cola FEMSA has no control, will not have an adverse effect on Coca-Cola FEMSA’s business, financial condition or results.

On October 7, 2012, General Otto Peréz Molina, representing thePartido Patriota(Patriot Party), was elected to the presidency in Guatemala. We cannot assure you that the elected president will continue to apply the same policies that have been applied to Coca-Cola FEMSA in the past.

Depreciation of the local currencies of the countries in which Coca-Cola FEMSA operates against the U.S. dollar may increase itsCoca-Cola FEMSA’s operating costs. Coca-Cola FEMSA has also operated under exchange controls in Venezuela since 2003, thatwhich limit theits ability to remit dividends abroad or make payments other than in local currencies and that may increase the real price paid for raw materials and services purchased in local currency. In January 2010,February 2013, the Venezuelan government announced a devaluation ofin its official exchange rate, from 4.30 to 6.30 bolivars per US$ 1.00. For further information, please see Note 3.3 and the establishment of a multiple exchange rate system of (1) 2.60 bolivarsNote 29 to US$ 1.00 for high priority categories (2) 4.30 bolivars to US$ 1.00 for non-priority categories and (3) the recognition of the existence of other exchange rates that the government shall determine. In January 2011, the

Venezuelan government announced that its only official exchange rate as of January 1, 2011 is 4.30 bolivars to US$ 1.00, althoughour audited consolidated financial statements. Future changes in the Venezuelan government continues to recognize the existence of other exchange rates that the government shall determine; FEMSA expects this devaluation may have an adverse impact on its results from operations as a result of the exchange rate as applied to Coca-Cola FEMSA’s U.S. dollar-denominated raw material costs. Futurecontrol regime, and future currency devaluationdevaluations or the imposition of exchange controls in any of the countries in which Coca-Cola FEMSA has operations could have an adverse effect on its financial position and results from operations.

During 2010, Coca-Cola FEMSA’s plant in Valencia, Venezuela, was affected by a strike for 26 days, which stopped all production at this plant. The Valencia plant is Coca-Cola FEMSA’s principal plant, producing 50% of the volume of sales in Venezuela. A final agreement was reached with the union that resulted in additional expenditures in the form of increased wages and certain improvements in work conditions for the plant’s employees.results.

We cannot assure you that political or social developments in any of the countries in which Coca-Cola FEMSA has operations, and over which it haswe have no control, will not have a corresponding adverse effect on the economic situation andglobal market or on Coca-Cola FEMSA’s business, financial condition or results from operations.results.

Weather conditions may adversely affect Coca-Cola FEMSA’s results.

Lower temperatures and higher rainfall may negatively impact consumer patterns, which may result in lower per capita consumption of Coca-Cola FEMSA’s beverage offerings. Additionally, adverse weather conditions may affect road infrastructure in the territories in which Coca-Cola FEMSA operates and may limits itslimit Coca-Cola FEMSA’s ability to sell and distribute its products, thus affecting its results.

Coca-Cola FEMSA now conducts business in countries in which it has not previously operated and that present different or greater risks than certain countries in Latin America.

As a result of the acquisition of 51% of the outstanding shares of the Coca-Cola Bottlers Philippines, Inc. (“CCBPI”), Coca-Cola FEMSA has expanded its geographic reach from Latin America to include the Philippines. The Philippines presents different risks than the risks Coca-Cola FEMSA faces in Latin America. Coca-Cola FEMSA has not previously conducted business in CCPBI’s territories. Coca-Cola FEMSA now faces competitive pressures that are different than those Coca-Cola FEMSA has historically faced. In the Philippines, Coca-Cola FEMSA is the only beverage company competing across categories, and it faces significant competition in each category. In addition, the per capita income of the population in Philippines is lower than the average per capita income in the countries in which Coca-Cola FEMSA currently operates, and the distribution and marketing practices in the Philippines differ from Coca-Cola FEMSA’s results from operations. As was the case in Mexico, Colombia, Venezuelahistorical practices. Coca-Cola FEMSA may have to adapt its marketing and Central America in 2010, adverse weather conditions affecteddistribution strategies to compete effectively. Coca-Cola FEMSA’s sales in certain regions of these territories.inability to compete effectively may have an adverse effect on its future results.See “Item 4. Information on the Company—The Company—Recent Acquisitions.”

FEMSA Comercio

Competition from other retailers in Mexico could adversely affect FEMSA Comercio’s business.

The Mexican retail sector is highly competitive. FEMSA participates in the retail sector primarily through FEMSA Comercio. FEMSA Comercio’s OXXO convenience stores face competition on a regional basis from small-format stores like 7-Eleven, Super Extra, Super City, Círculo K stores and Circle K stores. OXXO convenience stores also face competition fromother numerous small chains of retailers across Mexico.Mexico, from other regional small format retailers to small informal neighborhood stores. In the future, OXXOparticular, small informal neighborhood stores can sometimes avoid regulatory oversight and taxation, enabling them to sell certain products at below market prices. In addition, these small informal neighborhood stores could improve their technological capabilities so as to enable credit card transactions and electronic payment of utility bills, which would diminish FEMSA Comercio’s competitive advantage. FEMSA Comercio may face additional competition from other retailers that do not currently participate in the convenience store sector or from new market entrants. Increased competition may limit the number of new locations available to FEMSA Comercio and require FEMSA Comercio to modify its product offering or pricing. In addition, consumers may prefer alternative products or store formats offered by competitors. As a result, FEMSA Comercio’s results from operations and financial position may be adversely affected by competition in the future.

Sales of OXXO convenience stores may be adversely affected by changes in economic conditions in Mexico.

Convenience stores often sell certain products at a premium. The convenience store market is thus highly sensitive to economic conditions, since an economic slowdown is often accompanied by a decline in consumer purchasing power, which in turn results in a decline in the overall consumption of FEMSA Comercio’s main product categories. During periods of economic slowdown, OXXO stores may experience a decline in traffic per store and purchases per customer, and this may result in a decline in FEMSA Comercio’s resultsresults.

Taxes could adversely affect FEMSA Comercio’s business.

Mexico may adopt new tax laws or modify existing laws to increase taxes applicable to FEMSA Comercio’s business. For example, a general tax reform became effective on January 1, 2010, pursuant to which, as applicable to FEMSA Comercio, there was a temporary increase in the income tax rate from operations.28% to 30% from 2010 through 2012. Pursuant to an amendment issued at the end of 2012, the 30% income tax rate will continue to apply through 2013. In addition, the VAT rate in Mexico increased in 2010 from 15% to 16%. If the VAT rate increases, it could cause lower traffic or ticket figures for FEMSA Comercio.

FEMSA Comercio may not be able to maintain its historic growth rate.

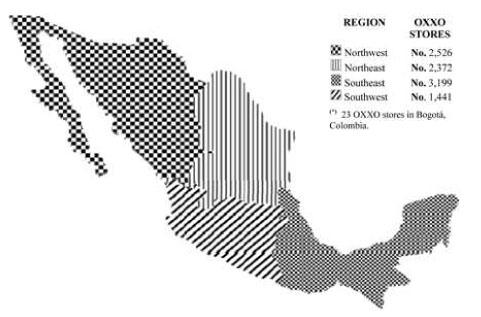

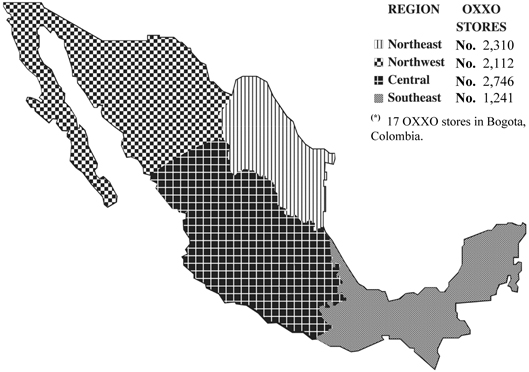

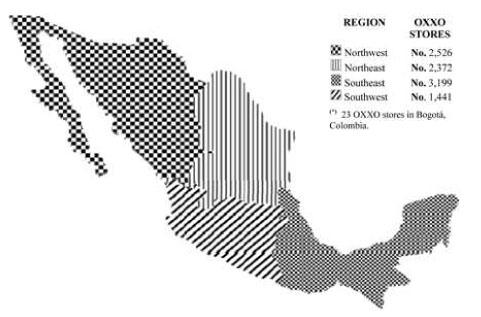

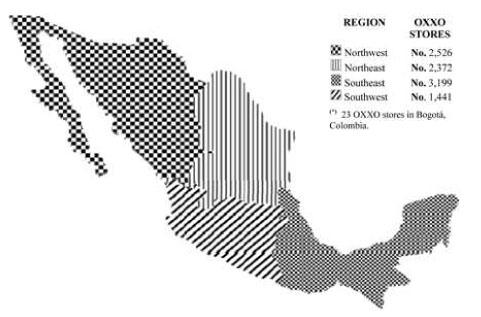

FEMSA Comercio increased the number of OXXO stores at a compound annual growth rate of 14.8%13.6% from 20062008 to 2010.2012. The growth in the number of OXXO stores has driven growth in total revenue and operating incomeresults at FEMSA Comercio over the same period. As the overall number of stores increases, percentage growth in the number of OXXO stores is likely to decrease. In addition, as convenience store penetration in Mexico grows, the number of viable new store locations may decrease, and new store locations may be less favorable in terms of same store sales, average ticket and store traffic. As a result, FEMSA Comercio’s future results from operations and financial condition may not be consistent with prior periods and may be characterized by lower growth rates in terms of total revenue and operating income.results. In Colombia, FEMSA Comercio may not be able to maintain similar historic growth rates to those in Mexico.

FEMSA Comercio’s business may be adversely affected by an increase in the crime rateof insecurity in Mexico.

In recent years, crime rates have increased,remained high, particularly in the north of Mexico, and there has been a particular increase in drug-related crime and other organized crime. Although FEMSA Comercio has stores across the majority of the Mexican territory, the north of Mexico represents an important region in FEMSA Comercio’s operations. An increase in crime rates could negatively affect sales and customer traffic, increase security expenses incurred in each store, result in higher turnover of personnel or damage to the perception of the OXXO brand, each of which could have an adverse effect on FEMSA Comercio’s business.

FEMSA Comercio’s business may be adversely affected by changes in information technology.

FEMSA Comercio invests aggressively in information technology (which we refer to as IT) in order to maximize its value generation potential. Given the rapid speed at which FEMSA Comercio adds new services and products to its commercial offerings, the development of information technologyIT systems, hardware and software needs to keep pace with the growth of the business. If these systems became unstable or if planning for future information technologyIT investments were inadequate, it could affect FEMSA Comercio’s business by reducing the flexibility of its value proposition to consumers or by increasing its operating complexity, either of which could adversely affect FEMSA Comercio’s revenue-per-store trends.

FEMSA Comercio’s business could be adversely affected by a failure, interruption, or breach of our IT system.

FEMSA Comercio’s business relies heavily on its advanced IT system to effectively manage its data, communications, connectivity, and other business processes. Although we constantly improve our IT system and protect it with advanced security measures, it may still be subject to defects, interruptions, or security breaches such as viruses or data theft. Such a defect, interruption, or breach could adversely affect FEMSA Comercio’s results or financial position.

FEMSA Comercio’s business may be adversely affected by an increase in the price of electricity.

The performance of FEMSA Comercio’s stores would be adversely affected by increases in the price of utilities on which the stores depend, such as electricity. Although the price of electricity in Mexico has remained stable recently, it could potentially increase as a result of inflation, shortages, interruptions in supply, or other reasons, and such an increase could adversely affect our results or financial position.

Risks Related to Our Holding of Heineken N.V. and Heineken Holding N.V. Shares

FEMSA willdoes not control Heineken N.V.’s and Heineken Holding N.V.’s decisions.