As filed with the Securities and Exchange Commission on December 21, 2011April 29, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DCD.C. 20549

FORM 20-F

| ¨ | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| x | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

EXCHANGE ACT OF 1934

For the yearsixteen months ended AugustDecember 31, 20112014

or

| ¨ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from orto

| ¨ | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number: 000-30354

City Telecom (H.K.)Hong Kong Television Network Limited

(Exact nameName of registrantRegistrant as Specified in its Charter)

Hong Kong Special Administrative Region,

The People’s Republic of China

(Jurisdiction of Incorporation or Organization)

Level 39, Tower 1, Metroplaza13th Floor, Trans Asia Centre

No. 223 Hing Fong Road18 Kin Hong Street

Kwai Chung, New Territories

Hong Kong

(Address of Principal Executive Offices)

Mr.Ms. Wong Nga Lai, Ni QuiaqueAlice

12th13th Floor, Trans Asia Centre

No.18 Kin Hong Street

Kwai Chung, New Territories

Hong Kong

Telephone : (852) 3145 60686888

Facsimile : (852) 2199 84458354

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title Of Each Class | | Name Of Each Exchange On Which Registered |

American Depositary Shares, each representing 20 Ordinary Shares par value HK$0.10 per share | | The Nasdaq Stock Market LLC |

| |

Ordinary Shares, par value HK$0.10 per share*Shares* | | The Nasdaq Stock Market LLC* |

Securities registered or to be registered pursuant to Section 12(g) of the Act:SECURITIESREGISTEREDORTOBEREGISTEREDPURSUANTTO SECTION 12(G)OFTHE ACT:

NoneNONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:SECURITIESFORWHICHTHEREISAREPORTINGOBLIGATIONPURSUANTTO SECTION 15(D)OFTHE ACT:

NoneNONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 771,911,853809,016,643 Ordinary Shares, par value HK$0.10 per shareShares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨Yes ¨ No¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer¨ Accelerated filerx Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ International Financial Reporting Standards as issued x Other ¨

| | | | |

US GAAP ¨

| | International Financial Reporting Standards as issued x

by the International Accounting Standards Board by the International Accounting Standards Board

| | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has selected to follow. Item 17 ¨ Item 18¨

If this report is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

| * | Not for trading, but only in connection with the registration of the American Depositary Shares |

ContentsTABLE OF CONTENTS

i

ii

Use of defined and technical termsUSE OF DEFINED TERMS

Except as otherwise indicated by the context, references in this annual report to:

“Android” are to the operating system for mobile devices produced by Google.

“Apple Device” are to the electronic devices designed and produced by Apple Inc. including iPhone and iPad.

“ADSL” are to the asymmetric digital subscriber line technology;

“Articles” are to the Company’s existing Memorandum and Articles;

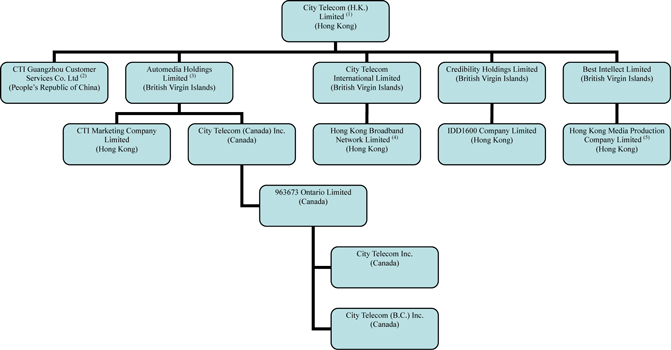

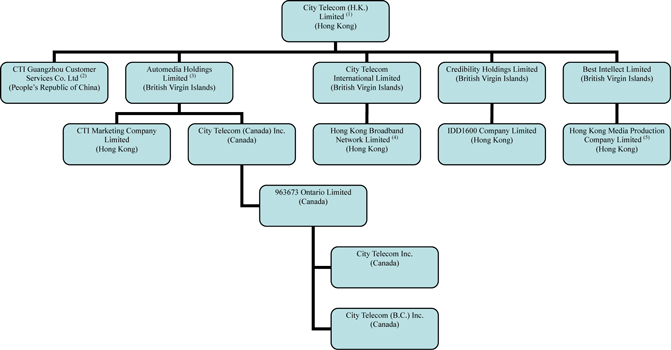

“City Telecom” or the “Company” are to City Telecom (H.K.) Limited;

“Category 5e copper wiring” are to certain network cabling commonly used for Ethernet network;

“Ethernet” are to a family of computer networking technology for local area networks;

“fiscal year” or “fiscal” are to the Company’s fiscal year ended August 31 for the year referenced;

“FMIC” are to an interconnection charge for circuit-switched traffic between a fixed network operator and a mobile network operator.

“FTNS business” are to our business segment in which we provide fixed telecommunications network services, including dial up and broadband Internet access services, local VoIP services, IP-TV services and corporate data services;

“FTNS Licenses” are to the licenses issued by the Hong Kong regulatory authorities for fixed telecommunications network services;

“GPON” are to Gigabit Passive Optical Network;

“Group” are to the Company and its subsidiaries;

“Hong Kong Companies Ordinance” are to Chapter 32 of the laws of Hong Kong;

“HKBA” or the “Hong Kong Broadcasting Authority” are to an independent statutory body established by the Hong Kong government for the regulation of the broadcasting industry in Hong Kong;

“HKBN” are to Hong Kong Broadband Network Limited, a wholly owned subsidiary of the Company;

“HKFRSs” are to Hong Kong Financial Reporting Standards issued by the Hong Kong Institute of Certified Public Accountants;

“HKMA” or “Hong Kong Monetary Authority” are to the government authority in Hong Kong responsible for maintaining monetary and banking stability in Hong Kong;

“HKSE Listing Rules” are to Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited;

“IDD business” are to our business segment in which we provide international direct dialing telecommunications services, including international long distance call services;

“IFRSs” are to International Financial Reporting Standards, as issued by the International Accounting Standards Board;

“Internet” are to the most common global system of interconnected computer networks with a standard protocol suite;

“IP” are to Internet Protocol, the most commonly used set of rules for dispatching data across the Internet;

“IP-TV services” are to pay-television services through Internet Protocol;

| | |

“Articles” | | are to the Company’s Memorandum and Articles of Association; |

| |

“Broadcasting Ordinance” | | are to the Broadcasting Ordinance (Chapter 562 of the laws of Hong Kong); |

| |

“CA” | | are to the Communications Authority, a unified Hong Kong regulatory body for the broadcasting and the telecommunications sectors, which has taken over the functions and responsibilities of the HKBA and the Hong Kong Telecommunications Authority since April 1, 2012; |

| |

“Centre” | | are to the Television and Multimedia Production Centre under construction in Tseung Kwan O Industrial Estate in Hong Kong; |

| |

“DTMB” | | are to Digital Terrestrial Multimedia Broadcast, a standard widely adopted in the PRC, Hong Kong and Macau for the transmission of television to mobile and fixed terminals; |

| |

“Exchange Act” | | are to the Securities Exchange Act of 1934, as amended; |

| |

“fiscal 2010” | | are to the period of twelve months from September 1, 2009 to August 31, 2010; |

| |

“fiscal 2011” | | are to the period of twelve months from September 1, 2010 to August 31, 2011; |

| |

“fiscal 2012” | | are to the period of twelve months from September 1, 2011 to August 31, 2012; |

| |

“fiscal 2013” | | are to the period of twelve months from September 1, 2012 to August 31, 2013; |

| |

“fiscal 2014” | | are to the period of sixteen months from September 1, 2013 to December 31, 2014; |

| |

“free TV license” | | are to a domestic free television programme service licence issued under the Broadcasting Ordinance |

| |

“FTNS Business” | | are to our former business segment in which we provided fixed telecommunications network services, including dial-up and broadband Internet access services, local VoIP services, IP-TV services and corporate data services; |

| |

“Group” | | are to the Company and its subsidiaries; |

| |

“Guangzhou Agreement” | | are to the sale and purchase agreement dated April 19, 2012 entered into by the Company and Metropolitan Light (HK) Company Limited, a company incorporated in Hong Kong and a wholly-owned subsidiary of Metropolitan Light Company Limited; |

| |

“Hong Kong Companies Ordinance” | | are to Chapter 622 of the laws of Hong Kong; |

| |

“HKBA” or the “Hong Kong Broadcasting Authority” | | are to an independent statutory body established by the Hong Kong government for the regulation of the broadcasting industry in Hong Kong; |

| |

“HKBN” | | are to Hong Kong Broadband Network Limited, a former wholly-owned subsidiary of the Company; |

| |

“HKMA” or “Hong Kong Monetary Authority” | | are to the government authority in Hong Kong responsible for maintaining monetary and banking stability in Hong Kong; |

| |

“HKSE” | | are to The Stock Exchange of Hong Kong Limited; |

| |

“HKSE Listing Rules” | | are to Rules Governing the Listing of Securities on the HKSE; |

| |

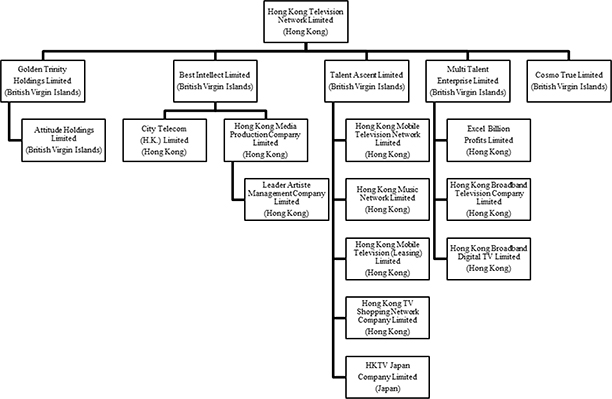

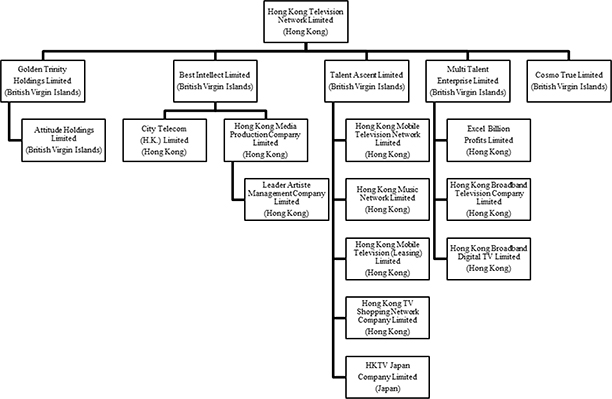

“HKTV” or the “Company” | | are to Hong Kong Television Network Limited; |

| |

“IDD Business” | | are to our former business segment in which we provided international direct dialing telecommunications services, including international long distance call services; |

| | |

| |

“IFRS” | | are to International Financial Reporting Standards, as issued by the International Accounting Standards Board; |

| |

“Mobile TV Acquisition” | | are to our acquisition on December 20, 2013 of the entire issued share capital of the Target Company pursuant to an option exercised by the Company under an agreement dated August 16, 2013 entered into between the Company and the Vendor; |

| |

“Mobile TV Spectrum” | | are to the frequency at 678 – 686 MHz and microwave link in the frequency range of 7910 – 7920 MHz for the provision of broadcast-type mobile television services; |

| |

“Multimedia Business” | | are to our business in which we provide multimedia production and distribution and other multimedia related services, including the offer of television programming through our OTT platform, our online shopping operation, multimedia and drama productions, content distribution and other related services; |

| |

“Nasdaq” | | are to The Nasdaq Stock Market LLC; |

| |

“OTT” | | are to Over-The-Top, which is the delivery of multimedia content over the Internet; |

| |

“Sarbanes-Oxley Act” | | are to the Sarbanes-Oxley Act of 2002; |

| |

“SEC” | | are to the Securities and Exchange Commission; |

| |

“Securities Act” | | are to the Securities Act of 1933, as amended; |

| |

“Supplementary Financial Information” | | are to the Company’s unaudited financial information relating to the twelve months ended August 31, 2014 and four months ended December 31, 2014; |

| |

“Talents” | | are to all individuals employed by us, including the directors of the Company; |

| |

“Target Company”or“HKMTV” | | are to Hong Kong Mobile Television Network Limited (formerly China Mobile Hong Kong Corporation Limited), a company incorporated in Hong Kong with limited liability and, prior to the Mobile TV Acquisition, a wholly-owned subsidiary of the Vendor; |

| |

“Telecom Group Agreement” | | are to the sale and purchase agreement dated March 31, 2012 entered into between the Company and Metropolitan Light Company Limited in relation to the disposal of 100% of the issued share capital of City Telecom International Limited, Credibility Holdings Limited and Automedia Holdings Limited; |

| |

“Telecom Business” | | are to the disposed businesses, which include the FTNS Business and IDD Business; |

| |

“Unified Carrier License” | | are to a unified carrier licence issued by the Communications Authority to the Target Company; |

| |

“Vendor” | | are to China Mobile Hong Kong Company Limited, a company incorporated in Hong Kong with limited liability and an wholly-owned subsidiary of China Mobile Limited, a company listed on the New York Stock Exchange and the main board of the HKSE; and |

| |

“we”, “us” or “our” | | are to Hong Kong Television Network Limited and/or its subsidiaries, as the context requires. |

“ISR” or “international simple resale” are to a telecommunication methodology by which operators are allowed to pool traffic to a particular destination and send it down an international leased line, whereby such operator is able to charge its customers a per-minute fee while itself pays a lower fixed charged for leased line rental;

“Metro Ethernet” are to a computer network that covers a metropolitan area and that is based on the Ethernet standard;

“Mbps” are to megabits per second;

“Next Generation Network” are to our broadband packet-based fixed-line telecommunication network which utilizes Metro Ethernet and GPON technologies;

“OFTA” or the “Office of the Telecommunications Authority” are to an independent statutory body established by the Hong Kong government for the regulation of the telecommunications industry in Hong Kong;

“PNETS Licenses” are to licenses issued by the Hong Kong regulatory authorities for the public non-exclusive telecommunications services;

“Talents” are to all individuals employed by our Group including the directors of our Company;

“UC License” are to the Unified Carrier License issued by the Hong Kong regulatory authorities for fixed and mobile telecommunication services;

“USC” are to universal service contribution made to PCCW-HKT, a local carrier in Hong Kong, as specified in an arrangement established by OFTA of Hong Kong, in order to fund the network development costs for certain remote areas in Hong Kong;

“US GAAP” are to the Generally Accepted Accounting Principles in the United States;

“Video-On-Demand” are to systems which allow users to select and watch/listen to video or audio content on demand;

“VDSL” are to the very-high-bit-rate digital subscriber line technology; and

“VoIP” are to voice over internet protocol.

Currency translationCURRENCY TRANSLATION

We publish our consolidated financial statements in Hong Kong dollars. In this annual report, references to “Hong Kong dollars” or “HK$” are to the currency of Hong Kong, and references to “U.S. dollars” or “US$” are to the currency of the United States. This annual report contains translations of Hong Kong dollar amounts into U.S. dollar amounts solely for your convenience. Unless otherwise indicated, the translations have been made at US$1.00 = HK$7.7876,7.7531, which was the exchange rate set forth in the H.10 statistical release of the Federal Reserve Board on AugustDecember 31, 2011.2014. On December 9, 2011April 24, 2015, the exchange rate was US$1.00 = HK$7.7817.7.7499. You should not construe these translations as representations that the Hong Kong dollar amounts actually represent such U.S. dollar amounts or could have been or could be converted into U.S. dollars at the rates indicated or at any other rates.

Note regarding forward-looking statementsPRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, the financial information in this annual report has been prepared in accordance with IFRS. The significant IFRS accounting policies applied to our financial information in this annual report have been applied consistently.

NO INCORPORATION OF WEBSITE INFORMATION

The content of our website does not form part of this annual report.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that are, by their nature, subject to significant risks and uncertainties. These include statements with respect to City Telecom and our plans, strategies and beliefs and other statements that are not historical facts.beliefs. These statements can be identified by the use of forward-looking terminology such as “may”, “will”, “expect”, “anticipate”, “intend”, “estimate”, “continue”, “plan”, “predict”, “project” or other similar words. TheAll statements other than statements of historical fact included in this annual report, including statements regarding our future financial position, strategy, projects costs and plans and objectives of management for future operations, are based on management’s assumptions and beliefs in light of the information currently available to us.forward-looking statements.

These assumptions involve risks and uncertainties which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievementsthose expressed or implied by such forward looking statements. Potential risks and uncertainties include, without limitation:include:

technological changes;

our ability to identify and implement other business plans for the development of our Multimedia Business after the rejection on our application for a free TV license by the government of Hong Kong and the unfavorable reply from the CA for the adoption of DTMB as the transmission standard for the proposed mobile television service in the absence of a free TV license;

our ability to evaluate and introduce different distribution channels, platforms and approaches to distribute our completed programs;

our ability to introduce new services to the market and the popularity of those new services to the market;

our ability to integrate and manage our strategic acquisitions;

changes in our regulatory environment, including changes in rules and policies promulgated by regulatory agencies from time to time;environment;

increasing competition in the telecommunications, Internet access, local VoIP, pay-televisionmultimedia market, including the television programming and corporate data markets;

content production market in Hong Kong and the international content licensing and distribution market;

increasing competition in the online shopping market;

viewer preferences regarding self-produced and purchased content;

consumer viewing and purchasing habits;

the benefits we expect to derive from our Next Generation Network, which utilize Metro Ethernet and GPON technologies,the Centre under construction in the Tseung Kwan O Industrial Estate in Hong Kong, on which we have been making significant capital investments;intend to resume construction depending on business developments, the result of our applications for a free TV license and the outcome of the judicial review relating to our mobile TV license;

the stability and continued development of the telecommunications network of our abilityprior Telecom Business, to maintain growthwhich the Company is granted a 20-year indefeasible right of use and successfully introduce new services;

which is intended to form one of the main channels of distribution in Hong Kong for the Company’s television and multimedia content;

the continued development and stability of our technological infrastructure, a platform through which our local and international telecommunications, Internet access, local VoIP, IP-TV and corporate data services are offered;

contrary to our telecommunications business with 19 years operational track record, our business expansion intolimited experience in multimedia production, content distribution and free TV subject to license grant, is a new line ofthe online shopping business, for us, for which we lack direct experience, thereby making forecasting much more difficult; and

changes in technology; and

changes in the localHong Kong and global economic environment.environments.

When considering such forward-looking statements, you should keep in mind the factors described in Item 3 “Key information — risk factors”Risk Factors” and other cautionary statements appearing in Item 5 “Operating and financial reviewFinancial Review and prospects”Prospects” of this annual report. Such risk factors and statements describe circumstances that could cause actual results to differ materially from those contained in any forward-looking statement. Additionally, new risk factors can emerge from time to time, and it is not possible for us to predict all such risk factors, nor can we assess the impact of all such risk factors to differ materially from those contained in any forward-looking statements. Given these risks and uncertainties, you should not place undue reliance on forward-looking statements as a prediction of actual results.

Special note on our financial information presentedAll forward-looking statements included in this annual report are based on information available to us on the date of this annual report. We undertake no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this annual report.

PART I

Our consolidated

| ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable

| ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable

A. Selected Financials

Historical financial statementsinformation

The following table presents our selected historical financial data as of and for the yearstwelve months ended August 31, 2008, 2009, 2010, 2011, 2012 and 2011 included in this annual report on Form 20-F have been prepared in accordance with IFRSs as issued by the International Accounting Standards Board, or the IASB. Pursuant to the requirement under IFRS 1: First-Time Adoption of International Financial Reporting Standards, or IFRS 1, the date of our transition to IFRSs was September 1, 2007, which is the beginning of the earliest period for which we presented full comparative information in our consolidated financial statements in our annual report for the year ended August 31, 2009. With due regard to our accounting policies in previous periods2013, and the requirements of IFRS 1, we have concluded that no adjustments were required to the amounts reported under HKFRSs as of September 1, 2007 or in respect of the yearsixteen months ended AugustDecember 31, 2008.

In accordance with rule amendments adopted by the U.S. Securities and Exchange Commission, or the SEC, which became effective on March 4, 2008, we are not required to provide reconciliation to U.S. GAAP.

PART I

ITEM 1 IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2 OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3 KEY INFORMATION

A. | Selected financial data |

City Telecom’s historical financial information

The following table presents selected historical financial data of our Company as of and for each of the years in the five-year period ended August 31, 2011.2014. Except for amounts presented in U.S. dollars, the selected historical consolidated income statement data and other financial data for the yearstwelve months ended August 31, 2009, 20102012 and 20112013 and the sixteen months ended December 31, 2014, and the selected historical consolidated balance sheet data as of August 31, 20102013 and 2011December 31, 2014, set forth below are derived from, should be read in conjunction with, and are qualified in their entirety by reference to our audited consolidated financial statements, including the related notes, included elsewhere in this annual report on Form 20-F.report. The selected historical consolidated income statement data for the yearstwelve months ended August 31, 20072010 and 20082011 and the selected historical consolidated balance sheet data as of August 31, 2007, 20082010, 2011 and 20092012 set forth below are derived from our audited consolidated financial statements that are not included in this annual report on Form 20-F.report. Our consolidated financial statements have been prepared in accordance with InternationalIFRS.

You should read the selected financial data in conjunction with our consolidated financial statements and related notes and Item 5 “Operating and Financial Reporting Standards, orReview and Prospects” included elsewhere in this annual report. Our historical results do not necessarily indicate our expected results for any future periods.

Pursuant to a resolution of the Board dated August 29, 2014, the Company’s financial year end date has been changed from August 31 to December 31 in order to unify the financial year-end dates of the Company and its subsidiaries and align with the business cycle of the Group’s potential customers in the retail e-commerce industry and the multimedia advertising industry. Accordingly, the accompanying consolidated financial statements, and the selected financial information below, for the current financial period cover a period of sixteen months from September 1, 2013 to December 31, 2014. As the fiscal 2010 through fiscal 2013 figures are not directly comparable with those of the current financial period, financial information for the twelve months ended August 31, 2014 and the four months ended December 31, 2014 prepared in accordance with IFRS, as issued byhas been presented to enhance comparability. This supplementary financial information has not been audited. For further information, see Note 1 to the International Accounting Standards Board.consolidated financial statements included elsewhere in this annual report.

Selected consolidated income statement data:

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended August 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2011 | |

| | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | US$ | |

| | | (Amounts in thousands except per share data and number of ordinary shares) | |

Revenue: | | | | | | | | | | | | | | | | | | | | |

- FTNS business | | | 1,011,038 | | | | 1,230,880 | | | | 1,356,098 | | | | 1,484,324 | | | | 190,601 | |

- IDD business | | | 291,943 | | | | 247,359 | | | | 218,589 | | | | 197,134 | | | | 25,314 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating revenue | | | 1,302,981 | | | | 1,478,239 | | | | 1,574,687 | | | | 1,681,458 | | | | 215,915 | |

| | | | | | | | | | | | | | | | | | | | |

Network costs and costs of sales: | | | | | | | | | | | | | | | | | | | | |

- FTNS business | | | (103,524 | ) | | | (107,670 | ) | | | (144,347 | ) | | | (177,302 | ) | | | (22,767 | ) |

- IDD business | | | (74,843 | ) | | | (67,459 | ) | | | (50,945 | ) | | | (35,013 | ) | | | (4,496 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total network costs and costs of sales | | | (178,367 | ) | | | (175,129 | ) | | | (195,292 | ) | | | (212,315 | ) | | | (27,263 | ) |

| | | | | | | | | | | | | | | | | | | | |

Other operating expenses | | | (966,094 | ) | | | (1,037,964 | ) | | | (1,105,604 | ) | | | (1,097,164 | ) | | | (140,886 | ) |

| | | | | |

Interest expense, net | | | (59,541 | ) | | | (50,258 | ) | | | (10,863 | ) | | | (2,993 | ) | | | (384 | ) |

Other income/(expense), net | | | 9,393 | | | | 36,671 | | | | (3,383 | ) | | | 3,883 | | | | 499 | |

Income taxes benefit/(expense) | | | 16,818 | | | | (38,730 | ) | | | (42,679 | ) | | | (58,954 | ) | | | (7,570 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 125,190 | | | | 212,829 | | | | 216,866 | | | | 313,915 | | | | 40,311 | |

| | | | | | | | | | | | | | | | | | | | |

Basic earnings per share (cents) | | | 19.7 | | | | 32.4 | | | | 30.7 | | | | 40.8 | | | | 5.2 | |

Diluted earnings per share (cents) (note 1) | | | 19.0 | | | | 31.8 | | | | 29.4 | | | | 39.6 | | | | 5.1 | |

Dividends per share attributable to the year (cents) | | | 6.0 | | | | 19.0 | | | | 20.0 | | | | 30.0 | | | | 3.9 | |

Weighted average number of ordinary shares | | | 634,015 | | | | 657,201 | | | | 706,605 | | | | 768,807 | | | | 768,807 | |

Diluted weighted average number of ordinary shares (note 2) | | | 657,997 | | | | 668,384 | | | | 736,616 | | | | 792,799 | | | | 792,799 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve

months

ended

August 31,

2010 | | | Twelve

months

ended

August 31,

2011 | | | Twelve

months

ended

August 31,

2012 | | | Twelve

months

ended

August 31,

2013 | | | Twelve

months

ended

August 31,

2014 | | | Four

months

ended

December 31,

2014 | | | Sixteen

months

ended

December 31,

2014 | | | Sixteen

months

ended

December 31,

2014 | |

| | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | US$ | |

| | | (in thousands, except per share data) | |

Continuing operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Turnover | | | — | | | | — | | | | 3,762 | | | | 7,802 | | | | 1,391 | | | | 21,636 | | | | 23,027 | | | | 2,970 | |

Cost of sales | | | — | | | | — | | | | (6,006 | ) | | | (15,706 | ) | | | (560 | ) | | | (27,207 | ) | | | (27,767 | ) | | | (3,581 | ) |

Valuation gains on investment properties | | | — | | | | — | | | | 18,200 | | | | 43,400 | | | | 1,800 | | | | 2,100 | | | | 3,900 | | | | 503 | |

Other operating expenses | | | (21,932 | ) | | | (23,481 | ) | | | (104,960 | ) | | | (201,514 | ) | | | (245,581 | ) | | | (98,218 | ) | | | (343,799 | ) | | | (44,344 | ) |

Other income/(loss), net | | | (7,696 | ) | | | 3,456 | | | | 19,920 | | | | 128,909 | | | | 117,702 | | | | 29,907 | | | | 147,609 | | | | 19,038 | |

Finance costs, net | | | (21,289 | ) | | | (7,303 | ) | | | (2,455 | ) | | | (4,860 | ) | | | (5,751 | ) | | | (2,016 | ) | | | (7,767 | ) | | | (1,002 | ) |

Impairment losses/ write off of assets | | | — | | | | — | | | | — | | | | — | | | | (32,000 | ) | | | — | | | | (32,000 | ) | | | (4,127 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss before taxation | | | (50,917 | ) | | | (27,328 | ) | | | (71,539 | ) | | | (41,969 | ) | | | (162,999 | ) | | | (73,798 | ) | | | (236,797 | ) | | | (30,543 | ) |

Income tax (expenses)/ credit | | | (5,611 | ) | | | (4,782 | ) | | | (2,281 | ) | | | 1,659 | | | | (145 | ) | | | (60 | ) | | | (205 | ) | | | (26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loss from continuing operations | | | (56,528 | ) | | | (32,110 | ) | | | (73,820 | ) | | | (40,310 | ) | | | (163,144 | ) | | | (73,858 | ) | | | (237,002 | ) | | | (30,569 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Discontinued operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Profit from discontinued operations (net of tax) | | | 273,394 | | | | 346,025 | | | | 3,771,694 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Loss)/profit for the period | | | 216,866 | | | | 313,915 | | | | 3,697,874 | | | | (40,310 | ) | | | (163,144 | ) | | | (73,858 | ) | | | (237,002 | ) | | | (30,569 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Attributable to: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Equity shareholders of the Company | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

-Continuing operations | | | (56,528 | ) | | | (32,110 | ) | | | (71,406 | ) | | | (40,310 | ) | | | (163,144 | ) | | | (73,858 | ) | | | (237,002 | ) | | | (30,569 | ) |

-Discontinued operations | | | 273,394 | | | | 346,025 | | | | 3,771,694 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 216,866 | | | | 313,915 | | | | 3,700,288 | | | | (40,310 | ) | | | (163,144 | ) | | | (73,858 | ) | | | (237,002 | ) | | | (30,569 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-controlling interest | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

-Continuing operations | | | — | | | | — | | | | (2,414 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

-Discontinued operations | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | — | | | | — | | | | (2,414 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Loss)/profit for the period | | | 216,866 | | | | 313,915 | | | | 3,697,874 | | | | (40,310 | ) | | | (163,144 | ) | | | (73,858 | ) | | | (237,002 | ) | | | (30,569 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic (loss)/earnings per share (cents) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

-Continuing and discontinued operations | | | 30.7 | | | | 40.8 | | | | 471.9 | | | | (5.0 | ) | | | (20.2 | ) | | | (9.1 | ) | | | (29.3 | ) | | | (3.8 | ) |

-Continuing operations | | | (8.0 | ) | | | (4.1 | ) | | | (9.0 | ) | | | (5.0 | ) | | | (20.2 | ) | | | (9.1 | ) | | | (29.3 | ) | | | (3.8 | ) |

-Discontinued operations | | | 38.7 | | | | 44.9 | | | | 480.9 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Diluted (loss)/earnings per share (cents)(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

-Continuing and discontinued operations | | | 29.4 | | | | 39.6 | | | | 465.1 | | | | (5.0 | ) | | | (20.2 | ) | | | (9.1 | ) | | | (29.3 | ) | | | (3.8 | ) |

-Continuing operations | | | (7.7 | ) | | | (4.1 | ) | | | (9.0 | ) | | | (5.0 | ) | | | (20.2 | ) | | | (9.1 | ) | | | (29.3 | ) | | | (3.8 | ) |

-Discontinued operations | | | 37.1 | | | | 43.7 | | | | 474.1 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Selected consolidated balance sheet data:

| | | | As of August 31, | | | August 31,

2010 | | August 31,

2011 | | August 31,

2012 | | August 31,

2013 | | August 31,

2014 | | December 31,

2014 | | December 31,

2014 | |

| | | 2008 HK$ | | 2009 HK$ | | 2010 HK$ | | 2011 HK$ | | 2011 US$ | | | HK$ | | HK$ | | HK$ | | HK$ | | HK$ | | HK$ | | US$ | |

| | | (Amounts in thousands) | | | (in thousands) | |

Total assets | | | 2,093,410 | | | | 1,790,408 | | | | 2,251,549 | | | | 2,264,462 | | | | 290,778 | | | | 2,251,549 | | | 2,264,462 | | | 3,537,356 | | | 3,833,047 | | | 4,098,256 | | | 3,938,437 | | | 507,982 | |

| | | | | | | | | | | | | | | | | | | | | | |

10-year senior notes due 2015 | | | (683,242 | ) | | | (162,586 | ) | | | — | | | | — | | | | — | | |

Long-term bank loan - unsecured | | | — | | | | — | | | | (123,567 | ) | | | — | | | | — | | |

Long-term bank loan – unsecured | | | | (123,567 | ) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Finance lease obligations – non-current portion | | | (255 | ) | | | (530 | ) | | | (393 | ) | | | (288 | ) | | | (37 | ) | | | (393 | ) | | | (288 | ) | | | (160 | ) | | | (70 | ) | | | — | | | | — | | | | — | |

Derivative financial instrument | | | — | | | | — | | | | (11,293 | ) | | | (11,564 | ) | | | (1,485 | ) | | | (11,293 | ) | | | (11,564 | ) | | | (9,663 | ) | | | (5,181 | ) | | | (1,340 | ) | | | — | | | | — | |

Finance lease obligations – current portion | | | (121 | ) | | | (202 | ) | | | (212 | ) | | | (105 | ) | | | (13 | ) | | | (212 | ) | | | (105 | ) | | | (85 | ) | | | (90 | ) | | | — | | | | — | | | | — | |

Other liabilities | | | (377,185 | ) | | | (398,563 | ) | | | (427,545 | ) | | | (455,124 | ) | | | (58,443 | ) | | | (427,545 | ) | | | (455,124 | ) | | | (44,055 | ) | | | (577,084 | ) | | | (929,621 | ) | | | (883,276 | ) | | | (113,925 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | (1,060,803 | ) | | | (561,881 | ) | | | (563,010 | ) | | | (467,081 | ) | | | (59,978 | ) | | | (563,010 | ) | | | (467,081 | ) | | | (53,963 | ) | | | (582,425 | ) | | | (930,961 | ) | | | (883,276 | ) | | | (113,925 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets | | | 1,032,607 | | | | 1,228,527 | | | | 1,688,539 | | | | 1,797,381 | | | | 230,800 | | | | 1,688,539 | | | | 1,797,381 | | | | 3,483,393 | | | | 3,250,622 | | | | 3,167,295 | | | | 3,055,161 | | | | 394,057 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Share capital | | | 65,062 | | | | 66,418 | | | | 76,500 | | | | 77,191 | | | | 9,912 | | | | 76,500 | | | | 77,191 | | | | 80,902 | | | | 80,902 | | | | — | | | | — | | | | — | |

Share premium | | | 670,717 | | | | 681,208 | | | | 1,074,997 | | | | 1,083,495 | | | | 139,131 | | |

Reserves | | | 296,828 | | | | 480,901 | | | | 537,042 | | | | 636,695 | | | | 81,757 | | |

Other statutory capital reserves | | | | 1,096,068 | | | | 1,107,261 | | | | 1,188,012 | | | | 1,188,012 | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | |

Share capital and other statutory reserves | | | | 1,172,568 | | | | 1,184,452 | | | | 1,268,914 | | | | 1,268,914 | | | | 1,268,914 | | | | 1,268,914 | | | | 163,665 | |

Other reserves | | | | 515,971 | | | | 612,929 | | | | 2,214,479 | | | | 1,981,708 | | | | 1,898,381 | | | | 1,786,247 | | | | 230,392 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholders’ equity | | | 1,032,607 | | | | 1,228,527 | | | | 1,688,539 | | | | 1,797,381 | | | | 230,800 | | | | 1,688,539 | | | | 1,797,381 | | | | 3,483,393 | | | | 3,250,622 | | | | 3,167,295 | | | | 3,055,161 | | | | 394,057 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other financial data:

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended August 31, | |

| | | 2008 HK$ | | | 2009 HK$ | | | 2010 HK$ | | | 2011 HK$ | | | 2011 US$ | |

| | | (Amounts in thousands) | |

EBITDA (note 3) | | | 377,964 | | | | 508,058 | | | | 469,437 | | | | 594,059 | | | | 76,283 | |

Net cash inflow from operating activities | | | 381,991 | | | | 536,771 | | | | 485,340 | | | | 585,899 | | | | 75,235 | |

Net cash outflow from investing activities | | | (147,750 | ) | | | (176,488 | ) | | | (306,254 | ) | | | (414,189 | ) | | | (53,186 | ) |

Net cash (outflow)/inflow from financing activities | | | (345,978 | ) | | | (561,292 | ) | | | 178,307 | | | | (343,112 | ) | | | (44,059 | ) |

Capital expenditures (note 4) | | | 211,684 | | | | 286,734 | | | | 344,844 | | | | 449,196 | | | | 57,681 | |

We believe that the most directly comparable measure to EBITDA is net cash provided by operating activities. The following table reconciles our net cash inflow from operating activities, the most directly comparable financial measure calculated and presented in accordance with IFRSs, to our definition of EBITDA on a consolidated basis for the years ended 2008, 2009, 2010 and 2011.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Twelve

months

ended

August 31,

2010 | | | Twelve

months

ended

August 31,

2011 | | | Twelve

months

ended

August 31,

2012 | | | Twelve

months

ended

August 31,

2013 | | | Twelve

months

ended

August 31,

2014 | | | Four

months

ended

December 31,

2014 | | | Sixteen

months

ended

December 31,

2014 | | | Sixteen

months

ended

December 31,

2014 | |

| | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | US$ | |

| | | (in thousands) | |

Net cash (outflow)/inflow from operating activities | | | 485,340 | | | | 585,899 | | | | 181,924 | | | | (356,804 | ) | | | (241,404 | ) | | | (49,662 | ) | | | (291,066 | ) | | | (37,542 | ) |

Net cash (outflow)/inflow from investing activities | | | (306,254 | ) | | | (414,189 | ) | | | 3,681,791 | | | | (1,781,342 | ) | | | (120,577 | ) | | | 627,835 | | | | 507,258 | | | | 65,426 | |

Net cash inflow/(outflow) from financing activities | | | 178,307 | | | | (343,112 | ) | | | (2,191,749 | ) | | | 403,762 | | | | 322,129 | | | | (65,116 | ) | | | 257,013 | | | | 33,150 | |

Capital expenditure(2) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Continuing operations | | | — | | | | 51,255 | | | | 178,750 | | | | 37,708 | | | | 18,621 | | | | 50,096 | | | | 68,717 | | | | 8,863 | |

- Discontinued operations | | | 344,844 | | | | 397,941 | | | | 283,643 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

- Interim dividend declared | | | 49,725 | | | | 115,605 | | | | 119,674 | | | | — | | | | — | | | | — | | | | — | | | | — | |

- Final dividend proposed after balance sheet date | | | 103,275 | | | | 115,787 | | | | 121,352 | | | | — | | | | — | | | | — | | | | — | | | | — | |

- Special dividend declared | | | — | | | | — | | | | 2,022,542 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended August 31, | |

| | | 2008 HK$ | | | 2009 HK$ | | | 2010 HK$ | | | 2011 HK$ | | | 2011

US$ | |

| | | (Amounts in thousands) | |

EBITDA | | | 377,964 | | | | 508,058 | | | | 469,437 | | | | 594,059 | | | | 76,283 | |

Depreciation and amortization | | | (210,051 | ) | | | (206,241 | ) | | | (199,029 | ) | | | (218,197 | ) | | | (28,018 | ) |

Interest expense, net | | | (59,541 | ) | | | (50,258 | ) | | | (10,863 | ) | | | (2,993 | ) | | | (384 | ) |

Income taxes benefit/(expense) | | | 16,818 | | | | (38,730 | ) | | | (42,679 | ) | | | (58,954 | ) | | | (7,570 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 125,190 | | | | 212,829 | | | | 216,866 | | | | 313,915 | | | | 40,311 | |

Depreciation and amortization | | | 210,051 | | | | 206,241 | | | | 199,029 | | | | 218,197 | | | | 28,018 | |

Amortization of deferred expenditure | | | 33,777 | | | | 53,160 | | | | 48,621 | | | | 37,873 | | | | 4,863 | |

Income taxes (benefit)/expense | | | (16,818 | ) | | | 38,730 | | | | 42,679 | | | | 58,954 | | | | 7,570 | |

Interest income | | | (15,596 | ) | | | (4,869 | ) | | | (11,372 | ) | | | (3,366 | ) | | | (432 | ) |

Interest element of finance lease | | | 34 | | | | 27 | | | | 42 | | | | 30 | | | | 4 | |

Interest, amortization and exchange difference on senior notes | | | 72,640 | | | | 49,214 | | | | 6,069 | | | | — | | | | — | |

Interest on other borrowings | | | 3,428 | | | | 885 | | | | 3,260 | | | | 3,473 | | | | 446 | |

Amortization of upfront cost on bank loan | | | — | | | | — | | | | 192 | | | | 182 | | | | 23 | |

Interest expense on bank loan | | | — | | | | — | | | | 1,379 | | | | 1,152 | | | | 148 | |

Change in fair value of derivative financial instruments | | | — | | | | — | | | | 11,293 | | | | 271 | | | | 35 | |

| | | | | | | | | | | | | | | | | | | | |

Write-off of upfront costs upon settlement of long-term bank loan | | | — | | | | — | | | | — | | | | 1,251 | | | | 161 | |

Realized gain on long term bank deposit | | | (1,185 | ) | | | — | | | | — | | | | — | | | | — | |

Loss/(gain) on disposal of fixed assets | | | 1,431 | | | | 1,016 | | | | (1,375 | ) | | | 1,008 | | | | 129 | |

Equity settled share-based transaction | | | 4,204 | | | | 4,768 | | | | 5,347 | | | | 4,652 | | | | 597 | |

Realized loss on derivatives financial instruments | | | 1,039 | | | | — | | | | — | | | | — | | | | — | |

Realized and unrealized gain on other financial assets | | | (3,284 | ) | | | (189 | ) | | | — | | | | — | | | | — | |

(Gain)/loss on extinguishment of senior notes | | | (2,582 | ) | | | (31,371 | ) | | | 9,650 | | | | — | | | | — | |

Taxation paid | | | (4,250 | ) | | | (1,732 | ) | | | (3,013 | ) | | | (3,012 | ) | | | (387 | ) |

Change in long term receivable and prepayments | | | 1,346 | | | | (505 | ) | | | 917 | | | | 1,073 | | | | 138 | |

Change in working capital, net | | | (27,434 | ) | | | 8,567 | | | | (44,244 | ) | | | (49,754 | ) | | | (6,389 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net cash inflow from operating activities | | | 381,991 | | | | 536,771 | | | | 485,340 | | | | 585,899 | | | | 75,235 | |

| | | | | | | | | | | | | | | | | | | | |

Operating data:

| | | | | | | | | | | | | | | | |

| | | As of and for the year ended August 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | |

FTNS subscriptions: | | | | | | | | | | | | | | | | |

- Broadband Internet access | | | 316,000 | | | | 391,000 | | | | 526,000 | | | | 590,000 | |

- Local VoIP | | | 329,000 | | | | 382,000 | | | | 431,000 | | | | 476,000 | |

- IP-TV | | | 156,000 | | | | 170,000 | | | | 153,000 | | | | 181,000 | |

Total | | | 801,000 | | | | 943,000 | | | | 1,110,000 | | | | 1,247,000 | |

Registered international telecommunications accounts (note 5) | | | 2,336,000 | | | | 2,383,000 | | | | 2,445,000 | | | | 2,488,000 | |

IDD outgoing minutes (in thousands) | | | 574,000 | | | | 487,000 | | | | 464,000 | | | | 412,000 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | August 31,

2010 | | | August 31,

2011 | | | August 31,

2012 | | | August 31,

2013 | | | August 31,

2014 | | | December 31,

2014 | |

| | | (in thousands) | |

Number of ordinary shares issued and fully paid (in thousands of shares) | | | 764,997 | | | | 771,912 | | | | 809,017 | | | | 809,017 | | | | 809,017 | | | | 809,017 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Notes:

| (1) | Diluted (loss)/earnings per share is computed by dividing (loss)/profit for the net incomeyear by the diluted weighted average number of ordinary shares at the end ofduring the year. |

| (2) | The diluted weighted average number of ordinary shares have been computed after adjusting for the effects of all dilutive potential ordinary shares. |

(3) | EBITDA for any period means, without duplication, net income for such period, plus the following to the extent deducted in calculating such net income: interest expense, income taxes, depreciation and amortization expense (excluding any such non-cash charge to the extent it represents an accrual of or reserve for cash charges in any future period or amortization of a prepaid cash expense that was paid in a prior period not included in the calculation), less interest income. EBITDA is not a measure of performance under IFRSs. We believe that EBITDA is an additional measure utilized by investors in determining a borrower’s ability to meet debt service requirements. However, EBITDA does not represent, and should not be used as a substitute for, net earnings or cash flows from operations as determined in accordance with IFRSs, and EBITDA is not necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. In addition, our definition of EBITDA may differ from that of other companies. |

(4) | Capital expenditures represent additions to fixed assets and include non-cash transactions. |

(5) | Registered accounts refer to international telecommunications customers that have a valid account. Account holders may or may not be active users of our services. |

Selected Consolidated Income Statement:

| | | | |

| | For the year ended August 31, | |

| | 2007

HK$

| |

| | (Amounts in thousands except per share data) | |

HKFRS

| | | | |

| |

Revenues:

| | | | |

Fixed telecommunications network services

| | | 816,800 | |

International telecommunications services

| | | 324,470 | |

| | | | |

Total operating revenue

| | | 1,141,270 | |

| | | | |

Network costs and costs of sales:

| | | | |

Fixed telecommunications network services

| | | (103,795 | ) |

International telecommunications services

| | | (110,796 | ) |

| | | | |

Total network costs and costs of sales

| | | (214,591 | ) |

Other operating expenses

| | | (834,104 | ) |

| | | | |

Income from operations

| | | 92,575 | |

Interest expense, net

| | | (64,833 | ) |

Other income, net

| | | 3,149 | |

Income taxes expense

| | | (2,026 | ) |

| | | | |

Net income

| | | 28,865 | |

Basic earnings per share (cents)

| | | 4.7 | |

Diluted earnings per share (cents) (note 1)

| | | 4.6 | |

Dividends declared per share (cents)

| | | 8.0 | |

Weighted average number of shares

| | | 614,840 | |

Diluted weighted average number of shares (note 2)

| | | 631,319 | |

| | | | |

| |

| | For the year ended August 31, | |

| | 2007

HK$

| |

| | (Amounts in thousands except per share data) | |

U.S. GAAP

| | | | |

Total operating revenue

| | | 1,141,270 | |

Total operating expenses

| | | (1,048,695 | ) |

Net income

| | | 28,865 | |

Basic earnings per share (cents)

| | | 4.7 | |

Diluted earnings per share (cents) (note 1)

| | | 4.6 | |

Dividends declared per share (cents)

| | | 8.0 | |

Weighted average number of shares

| | | 614,840 | |

Diluted weighted average number of shares (note 2)

| | | 631,319 | |

Selected Consolidated Balance Sheet Data:

| | | | |

| | As of August 31, | |

| | 2007

HK$

| |

| | (Amounts in thousands) | |

HKFRS

| | | | |

Total assets

| | | 2,161,133 | |

Debt

| | | (952,593 | ) |

Finance lease obligation

| | | (1,210 | ) |

Other liabilities

| | | (303,448 | ) |

| | | | |

Total liabilities

| | | (1,257,251 | ) |

| | | | |

Net assets employed

| | | 903,882 | |

| | | | |

Share capital

| | | 61,650 | |

Share premium

| | | 622,433 | |

Reserves

| | | 219,799 | |

| | | | |

Total shareholders’ equity

| | | 903,882 | |

| | | | |

| |

| | As of August 31, | |

| | 2007

HK$

| |

| | (Amounts in thousands) | |

U.S. GAAP

| | | | |

Total assets

| | | 2,189,086 | |

Total liabilities

| | | (1,279,587 | ) |

Net shareholders’ equity

| | | 909,499 | |

Other Financial Data:

| | | | |

| | For the year ended August 31, | |

| | 2007

HK$

| |

| | (Amounts in thousands) | |

HKFRS

| | | | |

EBITDA (note 3)

| | | 353,827 | |

Net cash provided by operating activities

| | | 383,999 | |

Net cash provided by investing activities

| | | 114,053 | |

Net cash used in financing activities

| | | (109,504 | ) |

Capital expenditures (note 4)

| | | 132,250 | |

We believe that the most directly comparable measure to EBITDA is net cash provided by operating activities. The following table reconciles our net cash provided by operating activities under HKFRS to our definition of EBITDA on a consolidated basis for fiscal 2007.

| | | | |

| | For the year ended August 31

2007

HK$

(Amounts in thousands)

| |

EBITDA(note 3)

| | | 353,827 | |

Depreciation and amortization

| | | (258,103 | ) |

Interest expense, net

| | | (64,833 | ) |

Income taxes expense

| | | (2,026 | ) |

| | | | |

Net income

| | | 28,865 | |

Depreciation and amortization

| | | 258,103 | |

Amortization of deferred expenditure

| | | 15,580 | |

Income taxes expense

| | | 2,026 | |

Interest income

| | | (22,671 | ) |

Interest, amortization and exchange difference on senior notes

| | | 89,879 | |

Other borrowing costs

| | | (739 | ) |

Loss on disposal of fixed assets

| | | 1,714 | |

Equity settled share-based transaction

| | | 5,727 | |

Realized and unrealized loss on derivatives financial instruments

| | | 806 | |

Unrealized gain on other investments

| | | (1,887 | ) |

Taxation paid

| | | (2,171 | ) |

Change in long term receivable

| | | 5,600 | |

Change in working capital, net

| | | 3,167 | |

| | | | |

Net cash flow provided by operating activities

| | | 383,999 | |

| | | | |

Operating Data:

| | | | |

| | As of and for the year ended August 31, | |

| | 2007 | |

FTNS Subscriptions:

| | | | |

Broadband Internet Access

| | | 247,000 | |

Local VoIP

| | | 308,000 | |

IP-TV

| | | 128,000 | |

| | | | |

Total

| | | 683,000 | |

| | | | |

Registered international telecommunications accounts (note 5)

| | | 2,331,000 | |

IDD outgoing minutes (in thousands)

| | | 659,000 | |

Notes:

(1) | Diluted earnings per share is computed by dividing the net income by the diluted weighted average number of ordinary shares at the end of the year. |

(2) | The diluted weighted average number of shares have been computed after adjusting for the effects of all dilutive potential ordinary shares. |

(3) | EBITDA for any period means, without duplication, net income for such period, plus the following to the extent deducted in calculating such net income: interest expense, income taxes, depreciation and amortization expense (excluding any such non cash charge to the extent it represents an accrual of or reserve for cash charges in any future period or amortization of a prepaid cash expense that was paid in a prior period not included in the calculation), less interest income. EBITDA is not a measure of performance under HKFRS or U.S. GAAP. We believe that EBITDA is an additional measure utilized by investors in determining a borrower’s ability to meet debt service requirements. However, EBITDA does not represent, and should not be used as a substitute for, net earnings or cash flows from operations as determined in accordance with HKFRS or U.S. GAAP, and EBITDA is not necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. In addition, our definition of EBITDA may differ from that of other companies. |

(4) | Capital expenditures represent additions to fixed assets and include non-cash transactions. |

(5) | Registered accounts refer to international telecommunications customers that have a valid account. Account holders may or may not be active users of our services. |

Exchange rate information

The Hong Kong dollar is freely convertible into other currencies (including the U.S. dollar). Since 1983, the Hong Kong dollar has been officially linked to the U.S. dollar and the current rate is US$1.00 to HK$7.80. Despite the efforts of the HKMA to keep the official exchange rate stable, the market exchange rate of the Hong Kong dollar against the U.S. dollar continues to beis influenced by the forces of supply and demand in the foreign exchange markets. Furthermore, the official exchange rate is itself subject to fluctuations and can be reset in circumstances where the secondary foreign exchange markets move beyond the HKMA’s ability to back the official rate with foreign reserves.

Exchange rates between the Hong Kong dollar and other currencies are influenced by the rate between the U.S. dollar and the Hong Kong dollar.

As of April 24, 2015, the exchange rate between the Hong Kong dollar and the U.S. dollar was 7.7499. The following table sets forth the average, high, low and period-end exchange rate between the Hong Kong dollar and the U.S. dollar (in Hong Kong dollars per U.S. dollar) for the fiscal periods indicated:

| | | | | | | | | | | | | | | | |

| | | Average | | | High | | | Low | | | Period-end | |

| | | (note)

HK$ | | | HK$ | | | HK$ | | | HK$ | |

Fiscal 2007 | | | 7.8029 | | | | 7.8289 | | | | 7.7665 | | | | 7.7968 | |

Fiscal 2008 | | | 7.7915 | | | | 7.8159 | | | | 7.7497 | | | | 7.8036 | |

Fiscal 2009 | | | 7.7550 | | | | 7.8094 | | | | 7.7495 | | | | 7.7505 | |

Fiscal 2010 | | | 7.7646 | | | | 7.8040 | | | | 7.7495 | | | | 7.7781 | |

Fiscal 2011 | | | 7.7776 | | | | 7.8087 | | | | 7.7506 | | | | 7.7876 | |

June 2011 | | | 7.7850 | | | | 7.7976 | | | | 7.7767 | | | | 7.7814 | |

July 2011 | | | 7.7892 | | | | 7.7964 | | | | 7.7802 | | | | 7.7942 | |

August 2011 | | | 7.7965 | | | | 7.8087 | | | | 7.7876 | | | | 7.7876 | |

September 2011 | | | 7.7943 | | | | 7.8040 | | | | 7.7830 | | | | 7.7840 | |

October 2011 | | | 7.7774 | | | | 7.7884 | | | | 7.7634 | | | | 7.7641 | |

November 2011 | | | 7.7809 | | | | 7.7957 | | | | 7.7679 | | | | 7.7730 | |

December 2011 (through December 9, 2011) | | | 7.7727 | | | | 7.7817 | | | | 7.7676 | | | | 7.7817 | |

| | | | | | | | | | | | | | | | |

| | | Average(1) | | | High | | | Low | | | Period-end | |

| | | HK$ | | | HK$ | | | HK$ | | | HK$ | |

Fiscal 2010 | | | 7.7646 | | | | 7.8040 | | | | 7.7495 | | | | 7.7781 | |

Fiscal 2011 | | | 7.7776 | | | | 7.8087 | | | | 7.7506 | | | | 7.7876 | |

Fiscal 2012 | | | 7.7670 | | | | 7.8040 | | | | 7.7532 | | | | 7.7560 | |

Fiscal 2013 | | | 7.7559 | | | | 7.7654 | | | | 7.7493 | | | | 7.7544 | |

October 2014 | | | 7.7572 | | | | 7.7645 | | | | 7.7541 | | | | 7.7551 | |

November 2014 | | | 7.7543 | | | | 7.7572 | | | | 7.7519 | | | | 7.7548 | |

December 2014 | | | 7.7541 | | | | 7.7616 | | | | 7.7509 | | | | 7.7531 | |

January 2015 | | | 7.7531 | | | | 7.7563 | | | | 7.7508 | | | | 7.7529 | |

February 2015 | | | 7.7551 | | | | 7.7584 | | | | 7.7517 | | | | 7.7559 | |

March 2015 | | | 7.7584 | | | | 7.7686 | | | | 7.7534 | | | | 7.7540 | |

April 2015 (through April 24, 2015) | | | 7.7509 | | | | 7.7525 | | | | 7.7495 | | | | 7.7499 | |

Note:

Note:(1) | The average rates on the last business day of each month during the relevant fiscal year period or the average rates for each business day during the relevant monthly period. |

Source: For all periods prior to January 1, 2009, theThe exchange rate refers to noon buying rate as reported by the Federal Reserve Bank of New York. For periods beginning on or after January 1, 2009, the exchange rate refers to the exchange rate as set forth in the H.10 statistical release of the Federal Reserve Board.

B. Capitalization and indebtedness

B. | Capitalization and indebtedness |

Not applicable.

C. | Reasons for the offer and use of proceeds |

Not applicable

You should carefully considerC. Reasons for the risks described belowoffer and use of proceeds

Not applicable

D. Risk factors

In addition to the other information contained in this annual report before making an investment decision.on Form 20-F, you should carefully consider the following risk factors. If any of the possible events described below occurs, our business, financial condition, results of operations or prospects could be adversely affected. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us, or that we currently deem immaterial, may also impairadversely affect us.

Risks Relating to Our Business and Operations

Our application for a free TV license in Hong Kong was rejected and although our judicial review was successful, we may not ultimately receive a license.

In 2009, we submitted an application for a free TV license to the HKBA. On October 15, 2013, the Chief Executive in Council announced that it had rejected our application. As a result, we are not able to operate domestic free television program services in Hong Kong. On April 11, 2014, we submitted a new application for a free TV license, which is being considered by the CA. On January 6, 2014, we filed an application for leave to apply for judicial review in respect of the Chief Executive’s denial of our first application and the substantive hearing was conducted from August 27 to 29, 2014. The court’s judgment was handed down on April 24, 2015, quashing the Chief Executive’s denial of our application for a free TV license and directing the government to pay our legal fees and expenses in relation to the judicial review. The application was remitted to the Chief Executive in Council for reconsideration.

The Chief Executive in Council, after reconsidering our application, may again reject our application. Even if we again apply for judicial review of the new denial, that could be a protracted and costly process and one which is not successful in the end. We may not ultimately receive a license. As we had planned on domestic free television being one of the major distribution channels for our self-produced television content and the primary source of our advertising revenue, any failure to obtain a free TV license will make us more reliant on the other distribution channels we have been exploring, such as our mobile TV services, and developing, such as our OTT and Online Shopping Business.

Depending on the progress we make in obtaining a free TV license, we may at some point cease pursuing the domestic free television business in Hong Kong, which could have a material adverse effect on our business, operations.prospects and financial condition.

Our application to use the widely adopted DTMB standard to provide mobile TV services in Hong Kong using the license of our subsidiary was rejected by the CA, and our judicial review may not be successful.

By acquiring the Target Company in December 2013, we acquired a license to provide mobile TV services in Hong Kong. In April 2014, however, we suspended the launch of mobile TV services after being denied permission by the CA to provide the services using the DTMB transmission standard without also having a free tv license. As a consequence, we have reduced the scale of our workforce in the creative and production teams, and we suspended the filming of new television programs The High Court granted us leave to apply for judicial review, and the substantive hearing was conducted on November 26 and 27, 2014, with the judgment reserved to be handed down at a later date. As noted above, we have submitted a new application for a free TV license, and our first application for a free TV license may be reconsidered by the Chief Executive in Council in light of the outcome of the judicial review of his denial of that application. This free TV license, if granted, would enable us to use the DTMB transmission standard, but we may not ultimately receive the license. Subject to feedback from viewers, to the result of the Chief Executive’s reconsideration of our first application for a free TV license, to the result of the CA’s consideration of our second application for a free TV license, and to the result of the judicial review on our provision of mobile TV services, we may adjust the direction and pace of our content and will consider resuming content production. We cannot assurewill also continue to explore opportunities to extend the reach of our content to Hong Kong people using different platforms. Given the uncertainties relating to our licenses, there can be no assurance that we will in fact resume content production or extend the reach of our content.

As we had planned on our mobile TV services being one of the major distribution channels for our self-produced television content and a significant source of our advertising revenue, our failure to gain permission to provide mobile TV services in Hong Kong using an acceptable transmission standard will make us more reliant on the other distribution channels we have been developing, such as our OTT platform, and on other business development, such as our online shopping business. If we lose the judicial review in respect of our provision of mobile TV services, we may be responsible for the government’s costs incurred in the process. Even if the judicial review is successful, we will not necessarily be granted permission to use the DTMB transmission standard or another standard acceptable to us; a successful judicial review may merely mean that the CA will be required to reconsider our plan to use the DTMB transmission standard in light of the outcome of the judicial review.

If we do not make real progress in the near future toward permission to provide mobile TV service in Hong Kong using an acceptable transmission standard, we may cease pursuing the mobile TV business in Hong Kong, which may have a material adverse effect on our business, prospects and financial condition.

We have a limited operating history in our Multimedia Business, which makes it difficult to evaluate our business.

Our Multimedia Business includes our offer of free television programming through our OTT platform, our online shopping business, multimedia and drama productions, and content distribution and licensing, as well as artiste management services. We launched our OTT platform, HKTV Mall, in November 2014 and our online shopping business in February 2015. As a result, we have a limited operating history in the Multimedia Business for you to evaluate our business, financial performance and prospects. Our historical results, which were largely based on the Telecom Business that we disposed of in May 2012, are not indicative of our future performance. To date, we have not achieved significant revenue or profitability in our Multimedia Business and, going forward, we may not be able to generate significant revenue or achieve profitability.

We may not be able to implement our business plans and expansion strategies successfully.

We may not be able to implement our business plans and expansion strategies successfully. Our business plans include strengthening our position in the multimedia and television industry, in part through the expansion of our OTT platform, as well as expanding our online presence with our online shopping business. Our business plans and strategies have been formulated based on a number of assumptions, including successful cooperation with our business partners, and are expected to place substantial demands on our managerial, operational, financial and other resources.

The success of our business plans and expansion strategies depends on a number of factors, including our ability to:

build our infrastructure on schedule and within budget;

produce high-quality content appealing to our customers within budget;

source merchants with products and services which are appealing to our customers and have attractive pricing and sufficient inventory for ready availability for delivery to our customers in their required timeframe;

generate revenue through advertising, online shopping operations, content licensing and distribution, content production, artiste management and other multimedia-related platforms;

develop effective marketing channels in Hong Kong and international markets; and

maintain effective operational cost and quality control.

The failure to achieve any of the events discussedabove could increase our costs of operation and investment. We may not be able to manage our operations efficiently to compete successfully in our existing markets or any new markets that we may enter, which may materially and adversely affect our business, prospects, financial condition and results of operations.

Our OTT and Online Shopping Businesses may not be profitable.

We have refined our business plan to focus primarily on the development of our OTT and online shopping businesses. On November 19, 2014, we officially announced the launch of the HKTV Mall – an OTT platform integrating entertainment and a one-stop online shopping platform in Hong Kong. The first phase was to launch the OTT platform with about 18 hours of broadcasting content, including self-produced drama series, variety and infotainment programs and purchased content. After the trial run on December 17, 2014, our online shopping mall was formally launched on February 2, 2015. This platform can be accessed through multiple Internet-connected devices, such as smart phones running on Android, iOS and Windows, tablet computers, personal computers, smart TV sets, Android TV boxes and game consoles. For the sixteen months ended December 31, 2014, we incurred a loss of HK$237.0 million. We may incur substantial expenditure in connection with these endeavors before we can generate significant revenue from our OTT and online shopping businesses. As a result, our OTT and online shopping businesses may not be able to become profitable in the risk factors below or any other events that has not been so identified will not occur. If they do,future.

The construction and development of the Centre is subject to a number of risks beyond our business, financial condition or results of operations could be materially adversely affected.control.

Risks relating to our businessWe started building the Centre on land granted by Hong Kong Science and operations

Technology Parks Corporation in the Tseung Kwan O Industrial Estate in February 2012. In light of the intense competition inrejection of our target markets,application for a free TV license, we cannot assure you that our revenues and net profit will continue to grow.

We derive our total revenues from our FTNShave suspended the construction of the Centre. Depending on business and our IDD business. Our FTNS business primarily consists of broadband Internet access, local VoIP, IP-TV and corporate data services, while our IDD business primarily consists of direct dial, international calling cards and mobile call forwarding services. Our total revenues increased by 6.8% to HK$1,681.5 million in fiscal 2011 from HK$1,574.7 million in fiscal 2010, and our net profit increased by 44.8% to HK$313.9 million in fiscal 2011 from HK$216.9 million in fiscal 2010. The increase in net profit in fiscal 2011 was primarily due to increased contribution from our FTNS business and finance cost savings of HK$15.9 million as adevelopments, the result of the full year impactChief Executive’s reconsideration of our first application for a free TV license, the result of the repurchase and redemptionCA’s consideration of our outstanding 10-year senior notes in fiscal 2010.

Although revenue fromsecond application for a free TV license and the outcome of the judicial review relating to our FTNSmobile TV license, we may resume the construction of the Centre to support our business increased by 9.5% in fiscal 2011,development. We have obtained an extension of time for development of the Centre to February 28, 2017. If we cannot assure you thatdo not resume the construction of the Centre, we will be ableunable to maintain such revenue and profit growth. The increase in revenue of our FTNS business was primarily duerecover the investment made to an increase in our broadband subscription base by 12.2% as a result of our “Member-Get-Member” marketing campaigns between November 2009 to August 2010, which reduced the price for our symmetric 100 Mbps service by half to HK$99 per month, in exchange for an enlarged customer base and a subsequent increasedate in the price for the same service following the termination of the “Member-Get-Member” marketing campaigns since September 1, 2010. We cannot assure you whether our revenues and net profit will continue to grow as a result of such price increase due to intense competition in our industry. The growth of our subscription base will depend on our ability to continue to expand our network coverage and to operate in a highly competitive market.

Further, revenue from our IDD business decreased by 9.8% in fiscal 2011. The decrease was primarily due to a decrease in the total number of airtime minutes by 11.2%. On our IDD service, our strategy is to focus on cash flow rather than market share. Due to increasing competition, we expect our IDD business will continue to experience pressure on tariff rates and to contribute to a smaller portion of our revenue and net profit over time.

Our ability to continue to grow our total revenues and net profit in the rapidly evolving telecommunications industry depends on many factors, including our ability to accurately identify and respond to demand for new services, success in developing new services on a timely basis, quality and cost competitiveness of our services, effectiveness of our sales and marketing efforts, and the number and nature of competitors in a given market segment. The global economic uncertainty has resulted in decreased consumer confidence and overall slower economic activity,project, which may dampen the demand for broadband services or affect our customers’ ability to continue with existing services. We cannot assure you that we can maintain the current level of revenue growth and profitability.

Given the pace of change in the telecommunications industry and the characteristics of our target markets, we cannot assure you that our FTNS business will continue to be profitable.

The main target market for our FTNS business is Hong Kong. The Hong Kong telecommunications industry is highly competitive. The intense competition could result in price reductions, reduced gross margins or loss of market share, any of which could adversely affect our future growth and profitability. We expect competition to continue to increase for the following reasons:

Increasing liberalization of the telecommunications industry in Hong Kong may continue to attract new local and foreign entrants and broaden the variety of telecommunications services available in the market, thereby increasing the overall level of competition in our industry.

The Hong Kong government may continue to issue new wireless and wire-line FTNS Licenses. For instance, 270 PNETS Licenses had been issued in Hong Kongtotaled HK$156.3 million as of December 31, 2010 for2014.

If we do resume the provisionconstruction and development of “external telecommunications services” (as defined in OFTA’s Determination asthe Centre, the success of December 30, 1998). Somethe project will be subject to a number of risks beyond our control, including:

the possibility of construction delays or cost overruns due to inclement weather, labor or material shortages, work stoppages, market inflation or delayed regulatory approvals;

the possibility of discovering previously undetected defects or problems; and

natural disasters, social disorder and other extraordinary events.

The occurrence of any of these licenses are held by subsidiaries of major foreign telecommunications providers, which have competitive advantages over us due to their global presence , financial resourcesevents could further delay the construction and size.

Around December 31, 2007, Television Broadcasts Limited and Asia Television Limited, commonly known as TVB and ATV, respectively, the only two licensed domestic free television program broadcasters in Hong Kong, launched their digital terrestrial television services and have since broadened such services to cover an increasingly large percentagedevelopment of the viewing publicCentre or increase construction costs, which may in Hong Kong. As of December 13, 2011, their services offeredturn have a total of 11 free channels in both standard and high definition. This improvement in the quality of free television may result in a reduction in the number of subscribers for pay-television services.

As some of our main competitors have longer operating histories and others are subsidiaries of large business conglomerates, they may have greater financial, technical, marketing and other resources; a more sophisticated infrastructure; better brand recognition; and a larger subscription base and may be able to devote more human and financial resources to research and development, network improvement and marketing than we can. Our competitive position varies significantly by service type because each service is characterized by a different market. If we cannot compete effectively in a major market, our business, operating results and financial condition could be adversely affected.

Our services may become obsolete if we cannot address the changing needs of our customers.